UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of March 2024

Commission File Number 001-41801

Cheche Group Inc.

8/F, Desheng Hopson Fortune Plaza

13-1 Deshengmenwai Avenue

Xicheng District, Beijing 100088, China

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Exhibit Index

| Exhibit 99.1 | — | Investor Presentation |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Cheche Group Inc. | ||

| By: |

/s/ Lei Zhang |

|

| Name: | Lei ZHANG | |

| Title: | Director and Co-Chief Executive Officer | |

| Date: March 7, 2024 | ||

2

Exhibit 99.1

Leading Insurtech Company Technology Enables Better Lives CHECHE GROUP M ISSON Making insurance transactions easier to provide better well - being and value for our customers and partners V ISION Diversified risk protection for millions of customers V ALUE Customers first Genuine and reliable Collaboration for mutual success 2

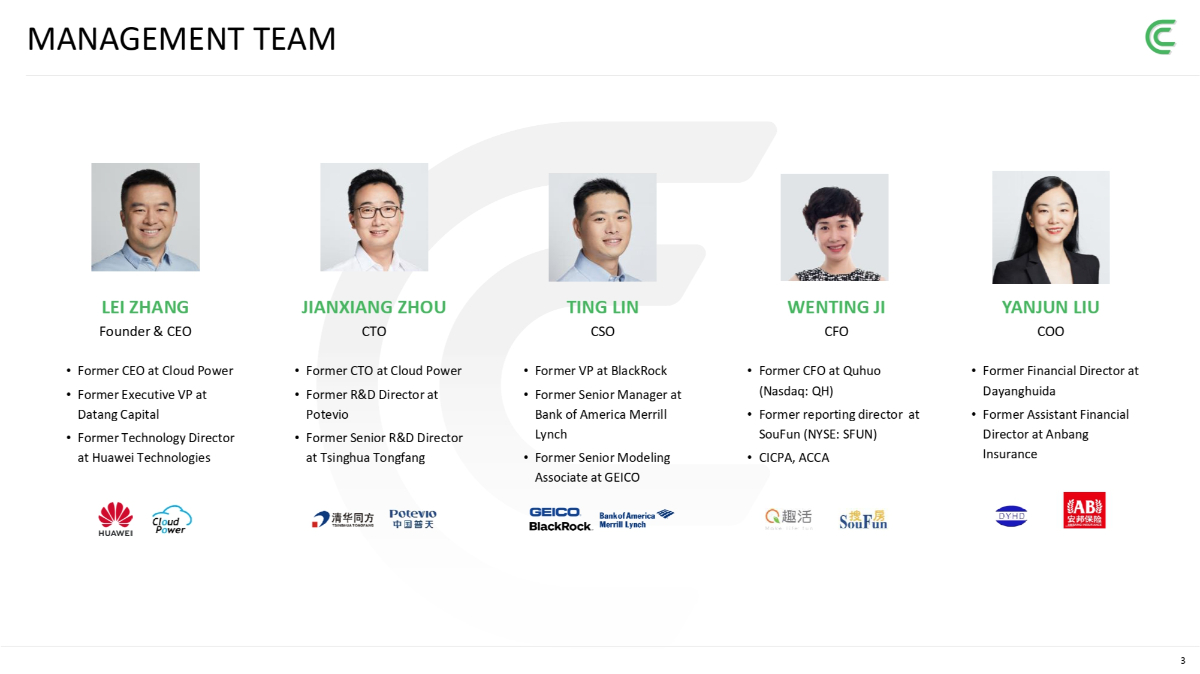

• Former CEO at Cloud Power • Former Executive VP at Datang Capital • Former Technology Director at Huawei Technologies LEI ZHANG Founder & CEO MANAGEMENT TEAM JIANXIANG ZHOU CTO • Former CTO at Cloud Power • Former R&D Director at Potevio • Former Senior R&D Director at Tsinghua Tongfang TING LIN CSO • Former VP at BlackRock • Former Senior Manager at Bank of America Merrill Lynch • Former Senior Modeling Associate at GEICO WENTING JI CFO • Former CFO at Quhuo (Nasdaq: QH) • Former reporting director at SouFun (NYSE: SFUN) • CICPA, ACCA YANJUN LIU COO • Former Financial Director at Dayanghuida • Former Assistant Financial Director at Anbang Insurance 3 INVESTMENT HIGHLIGHTS LARGE MARKET OPPORTUNITIES Well - positioned to capture further momentum from continued growth and evolution of digital insurance transformation markets and the new energy industry, especially the NEV sector 1 2 MARKET LEADER Leading digital auto insurance distribution and services platform in China 3 DATA - DRIVEN TECHNOLOGY PLATFORM Advanced technology infrastructure and comprehensive data insights enabling differentiated, customized products 4 UNIQUE ACCESS TO EXTENSIVE INDUSTRY ECOSYSTEM PARTNERS Largest referral partner base among non - insurance companies with large number of insurance partners, quotes, contracts and vehicles insured that generate great value and power 5 STRONG FINANCIAL PROFILE Substantial top line growth with expanding margin underpinned by market leadership 6 4 VISIONARY MANAGEMENT TEAM Proven industry leaders with long track record of driving innovation and managing sustainable growth including a focus on ESG Note: All metrics as of September 30, 2023 1.

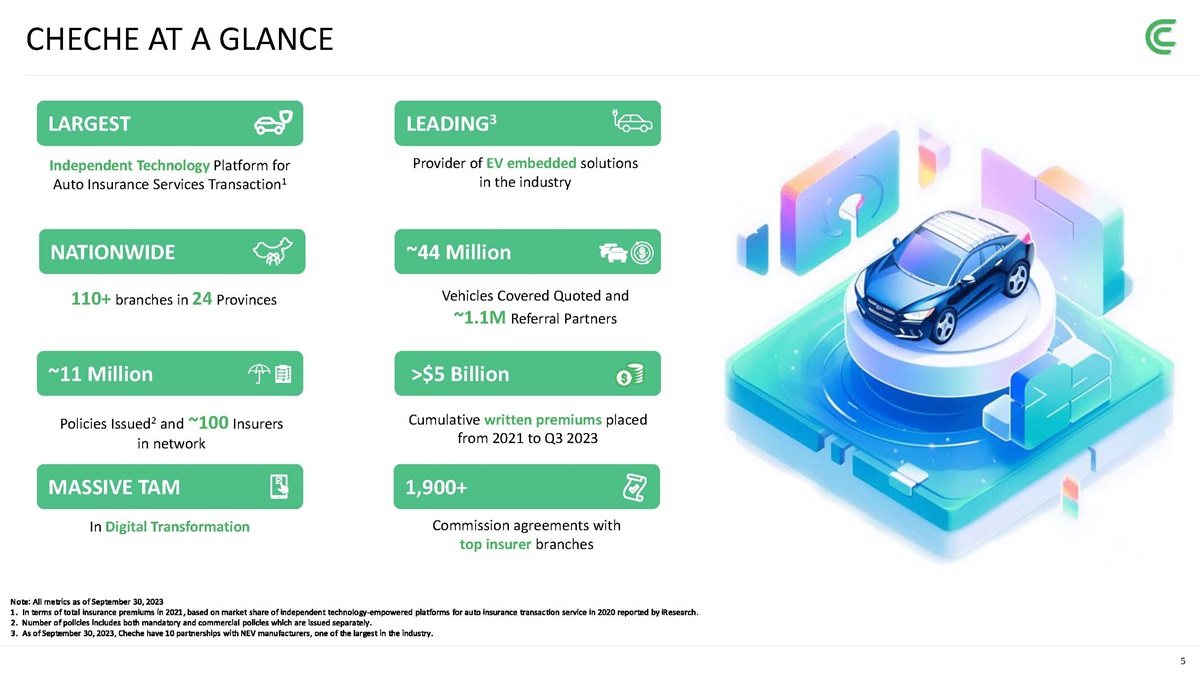

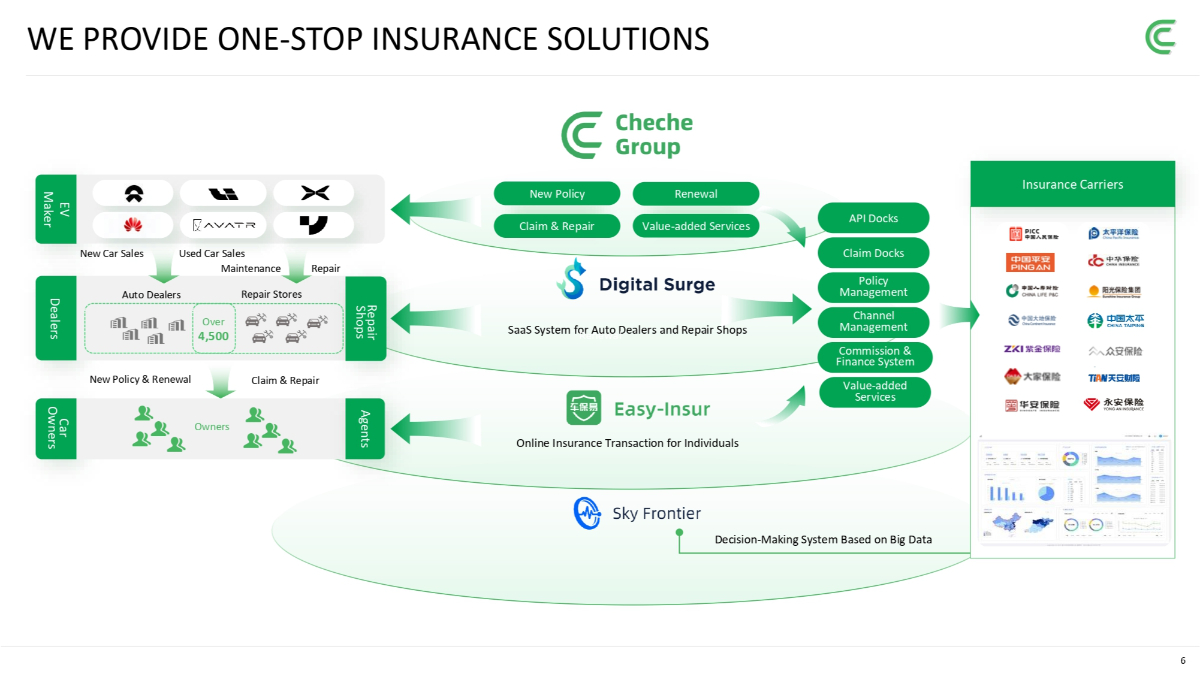

In terms of total insurance premiums in 2021, based on market share of independent technology - empowered platforms for auto insurance transaction service in 2020 reported by iResearch. 2. Number of policies includes both mandatory and commercial policies which are issued separately. 3. As of September 30, 2023, Cheche have 10 partnerships with NEV manufacturers, one of the largest in the industry. CHECHE AT A GLANCE LARGEST Independent Technology Platform for Auto Insurance Services Transaction 1 ~11 Million Policies Issued 2 and ~100 Insurers in network Cumulative written premiums placed from 2021 to Q3 2023 ~$5 Billion LEADING 3 Provider of EV embedded solutions in the industry In Digital Transformation MASSIVE TAM Commission agreements with top insurer branches 1,900+ 110+ branches in 24 Provinces NATIONWIDE ~44 Million Vehicles Covered Quoted and ~1.1M Referral Partners 5 New Policy Renewal Claim & Repair Value - added Services SaaS System for Auto Dealers and Repair Shops Online Insurance Transaction for Individuals EV Maker Dealers Auto Dealers Repair Stores Over 4,500 Car Owner s Owners Agents API Docks Policy Management Claim Docks Channel Management Commission & Finance System Value - added Services Insurance Carriers Decision - Making System Based on Big Data Repai r Shops New Car Sales Used Car Sales Maintenance Repair New Policy & Renewal Claim & Repair WE PROVIDE ONE - STOP INSURANCE SOLUTIONS 6

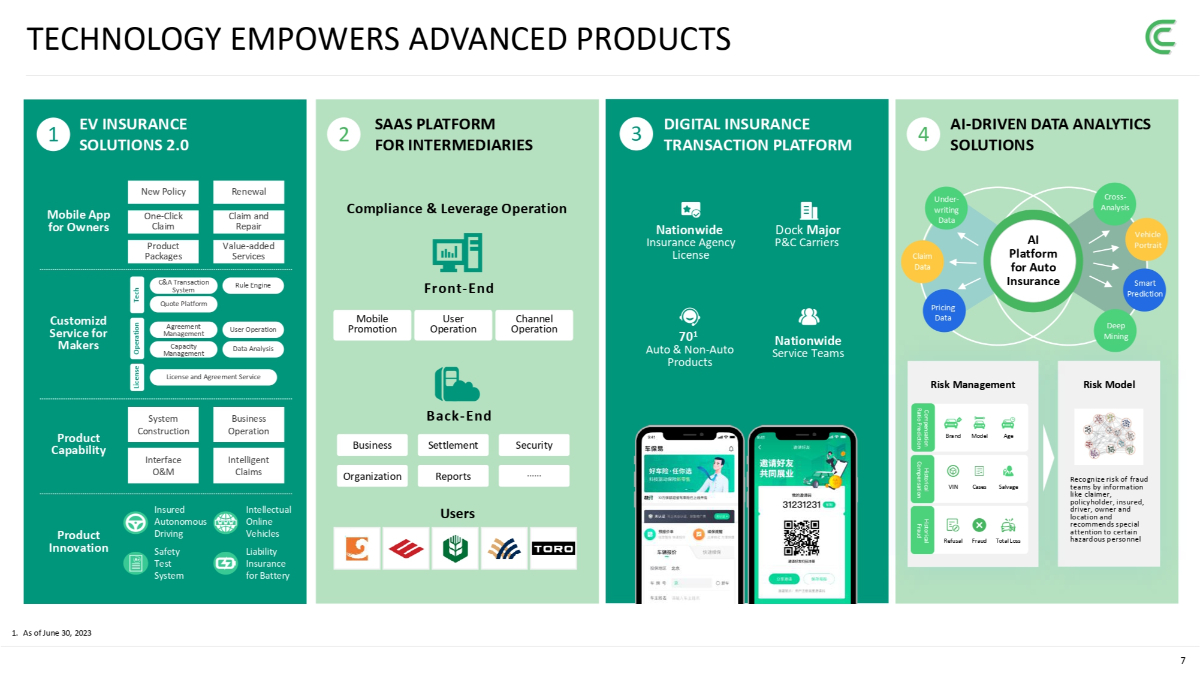

2 SAAS PLATFORM FOR INTERMEDIARIES Compliance & Leverage Operation Back - End Business Settlement Security Organization Reports Mobile Promotion User Operation Channel Operation Front - End Users 4 AI - DRIVEN DATA ANALYTICS SOLUTIONS 1 EV INSURANCE SOLUTIONS 2.0 Mobile App for Owners New Policy Renewal One - Click Claim Claim and Repair Product Packages Value - added Services Customizd Service for Makers C&A Transaction System Quote Platform Rule Engine Agreement Management Capacity Management User Operation Data Analysis License and Agreement Service Tech License Operation Product Capability System Construction Business Operation Interface O&M Intelligent Claims Product Innovation Insured Autonomous Driving Safety Test System Intellectual Online Vehicles Liability Insurance for Battery AI Platform for Auto Insurance Under - writing Data Claim Data Pricing Data Cross - Analysis Vehicle Portrait Smart Prediction Deep Mining Risk Model Risk Management Brand Model Age VIN Cases Salvage Refusal Fraud Total Loss Recognize risk of fraud teams by information like claimer, policyholder, insured, driver, owner and location and recommends special attention to certain hazardous personnel Compensation Historical Ratio Prediction Compensation Historical Fraud TECHNOLOGY EMPOWERS ADVANCED PRODUCTS 1.

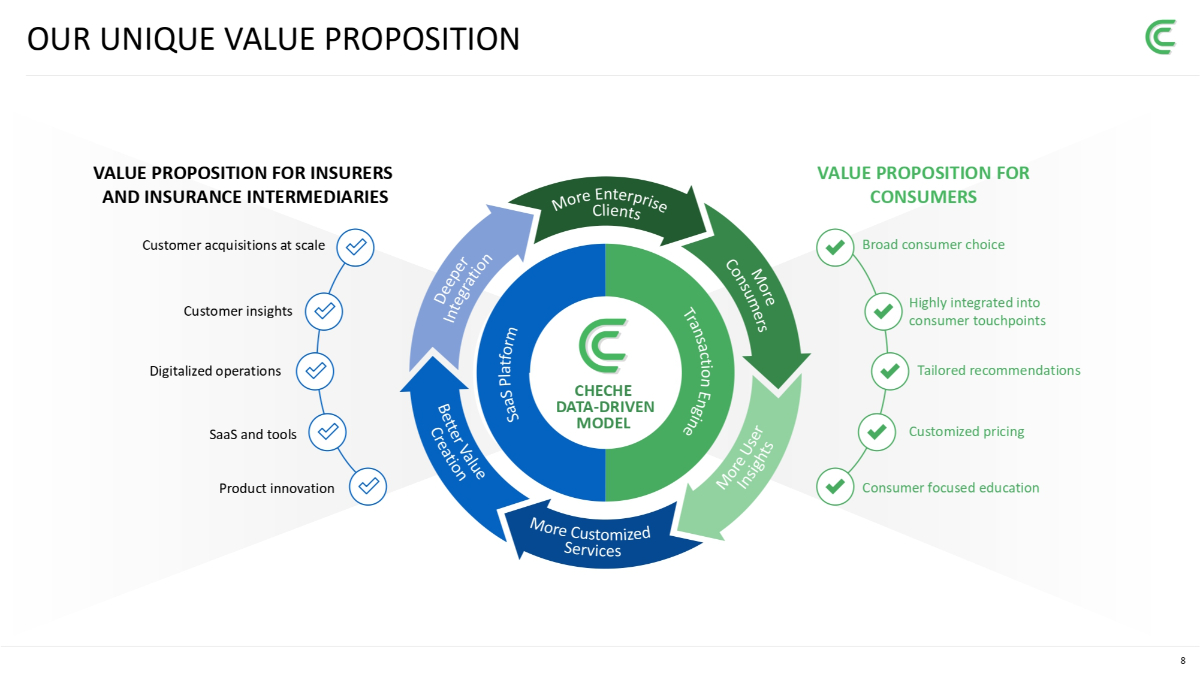

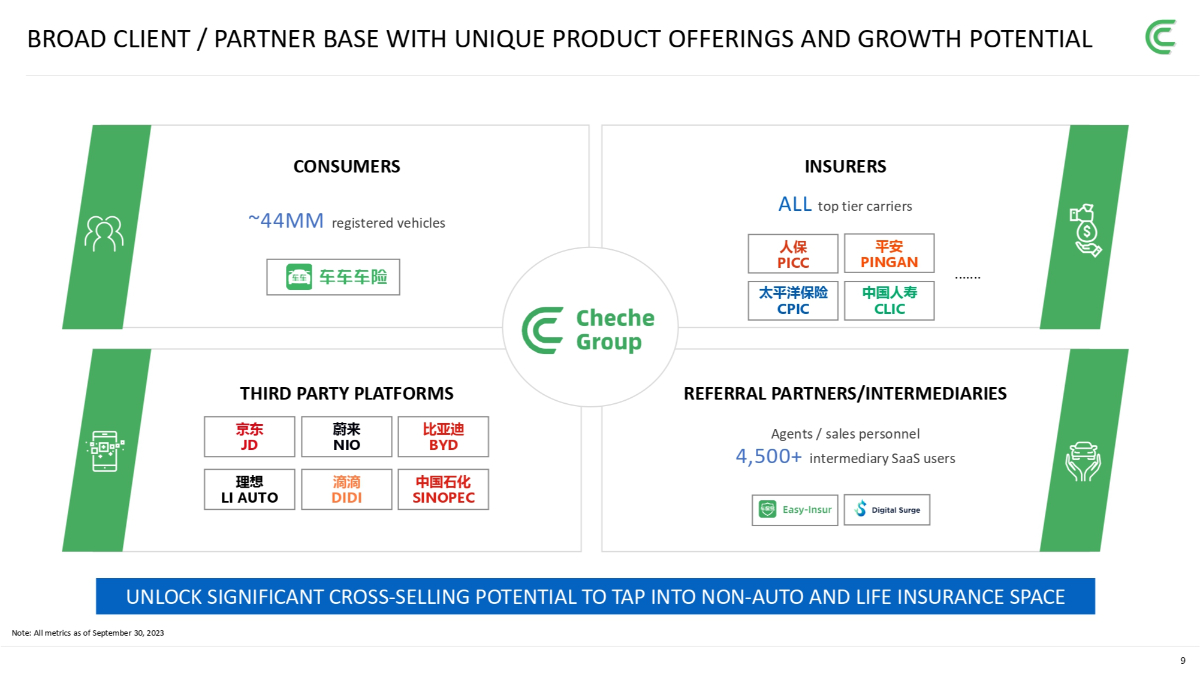

As of June 30, 2023 3 DIGITAL INSURANCE TRANSACTION PLATFORM Nationwide Insurance Agency License 70 1 Auto & Non - Auto Products Nationwide Service Teams 7 Dock Major P&C Carriers VALUE PROPOSITION FOR CONSUMERS VALUE PROPOSITION FOR INSURERS AND INSURANCE INTERMEDIARIES Customer acquisitions at scale Customer insights SaaS and tools Digitalized operations Product innovation Broad consumer choice Highly integrated into consumer touchpoints Customized pricing Tailored recommendations Consumer focused education CHECHE DATA - DRIVEN MODEL 8 OUR UNIQUE VALUE PROPOSITION BROAD CLIENT / PARTNER BASE WITH UNIQUE PRODUCT OFFERINGS AND GROWTH POTENTIAL CONSUMERS THIRD PARTY PLATFORMS REFERRAL PARTNERS/INTERMEDIARIES ~44MM registered vehicles INSURERS ALL top tier carriers Agents / sales personnel 4,500+ intermediary SaaS users UNLOCK SIGNIFICANT CROSS - SELLING POTENTIAL TO TAP INTO NON - AUTO AND LIFE INSURANCE SPACE ࠢн૦ BYD 噺 NIO цА JD З֡ऐԖ SINOPEC ࢅࢅ DIDI ࣂ㖸 LI AUTO .......

ъҐ PICC ٴ، PINGAN З֡ъح CLIC 9 מٴࡎҐ CPIC Note: All metrics as of September 30, 2023

Customers include market disrupting EV newcomers, traditional auto manufacturers and joint venture EV makers. BUILD EMBEDDED INSURANCE SOLUTIONS FOR 10+ EV MAKERS . . . 10 2022 2030 2014 2020 ONLINE & DIGITIZED INSURANCE SMART INSURANCE ECOSYSTEM 1 Million+ Referral Partners 4,500+ Insurance Intermediaries ~100 Insurance Companies 400+ Third Party Platforms 10+ Top EV Makers Industry Platforms TRANSITION FROM DIGITAL TO SMART INSURANCE Auto Insurance Marketplace Digital Surge Cheche Guardian Easy Insur Ecosystem Partners Sky Frontier Sky Dome Cheche Management Assistant Note: All metrics as of September 30, 2023 11 PERSONAL - MOBILITY INSURANCE 3 STAGES OF EVOLUTION OF AUTO INSURANCE MARKET 12 The evolution of the broader personal - mobility - insurance ecosystem will have both immediate and long - term impacts.

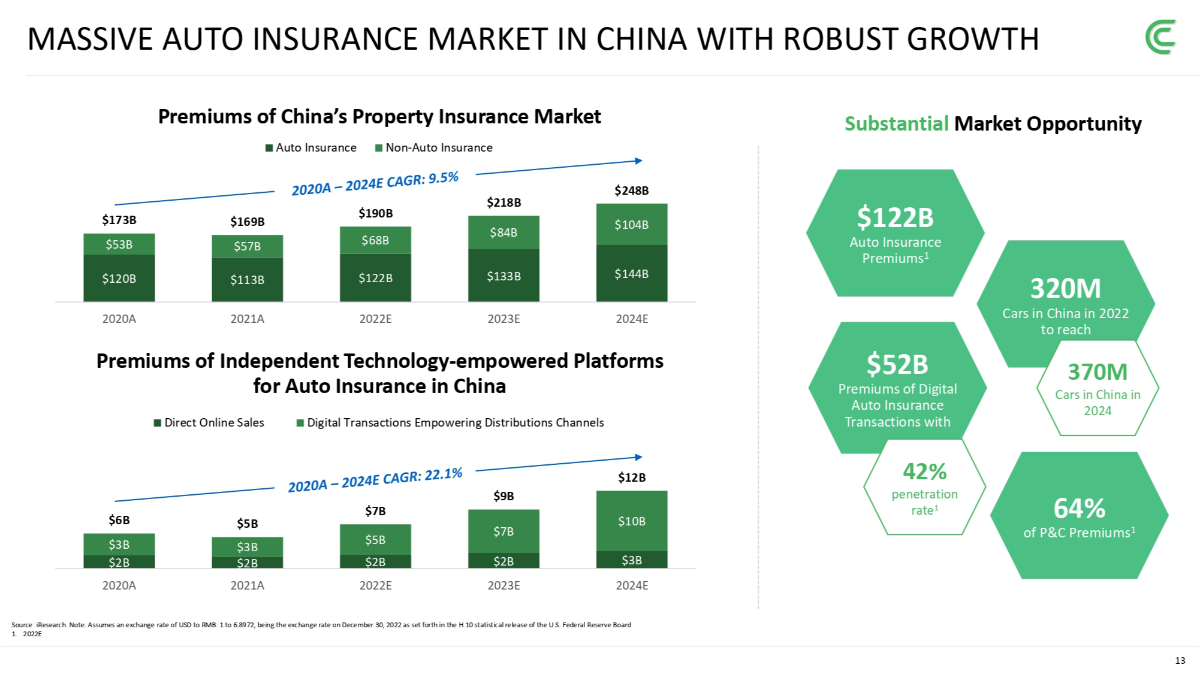

Auto Insurance Affected by OEMs • L0 - L2 vehicles become mainstream passenger cars • L3 vehicles start to show up – 2025 Distribution Limited Influence on Product Design • Connected vehicles enable in - car sales and UBI • Start to cooperate with OEMs Liability of L3 Vehicles Alters Between Human and System • L3 vehicles take over increasing market share 2025 – 2040 Product Design Accurate Delineation between Personal and Commercial Exposures • Legal challenges emerge as precedents are set • OEM entry begin 2040 – New Ecosystem Automated Taxis Reduce Auto Ownerships • L3 vehicles become market leaders • L4 vehicles ownership shifts from personal to business Continued Integration of Personal and Commercial Products and Coverages for L3 Vehicles $120B $113B $122B $133B $144B $53B $57B $68B $84B $104B $173B $169B $190B $218B $248B Premiums of China’s Property Insurance Market Auto Insurance Non - Auto Insurance 320M Cars in China in 2022 to reach 370M Cars in China in 2024 MASSIVE AUTO INSURANCE MARKET IN CHINA WITH ROBUST GROWTH $122B Auto Insurance Premiums 1 64% of P&C Premiums 1 Source: iResearch.

Note: Assumes an exchange rate of USD to RMB: 1 to 6.8972, being the exchange rate on December 30, 2022 as set forth in the H.10 statistical release of the U.S. Federal Reserve Board 1.

2022E Substantial Market Opportunity $52B Premiums of Digital Auto Insurance Transactions with 42% penetration rate 1 $2B $2B $2B $2B $3B $3B $3B $5B $7B $10B $6B $5B $7B $9B $12B 2020A 2021A 2022E 2023E 2024E 2020A 2021A 2022E 2023E 2024E Premiums of Independent Technology - empowered Platforms for Auto Insurance in China Direct Online Sales Digital Transactions Empowering Distributions Channels 13 2,366 2,225 2,003 1,859 1,778 1,667 1,493 1,328 272 500 573 655 57 148 323 536 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% 0 500 1,000 1,500 2,000 2,500 3,000 2017A 2018A 2019A 2020A 2021A 2022A 2023E 2024E 2017A – 2024E Domestic NEV Sales Estimation ICEV EV PHEV NEV Penetration Rate Penetration Rate of New Energy Vehicles (NEVs) in China reached 30%, three years ahead of expectations GROWING ELECTRICAL AUTO MARKET IN CHINA 2024E NEV Industry 47% Penetration Rate in China 33% Sales Growth in China 30% Sales Growth Globally 10.4M Sales Volume in China 18M Sales Volume Globally (In 10,000) Source: CICC Research Institution 14 In 2023, China’s auto exports ranked first in the world.

Cheche will offer localized insurance system, product design and business consultation services to facilitate the globalization of China’s EVs. MIDDLE EAST Negotiated with local sovereign fund and made visits INTERNATIONAL EXPLORATION FOLLOWING THE CHINESE EVs SOUTHEAST ASIA Work on SaaS program with leading insurtech companies SOUTH AMERICA Explore device/auto insurance programs with Mexican partners NORTH AMERICA Cooperate with insurtech incubator in Connecticut 15 3.3M 4.0M Q3'22 Q3'23 50k+ New Referral Partners 1 Q3 2023 BUSINESS GROWTH 1.

As of September 30, 2023.

4,500 Insurance Intermediaries 1,900 Insurance Company Contracts Q3’23 Highlights $598M $773M Q3'22 Q3'23 Policy Transaction Scale Policy Transaction Volume (Policies) 16 Three Months Ended September 30, Nine Months Ended September 30, 2023 2023 2022 2023 2023 2022 In Millions (USD) (RMB) (RMB) (USD) (RMB) (RMB) (¥ / $) $334 ¥2,434 ¥1,905 $113 ¥823 ¥745 Net Revenues ($320) (¥2,337) (¥1,810) ($108) (¥785) (¥715) Cost of Revenues $13 ¥97 ¥95 $5 ¥38 ¥30 Gross Profit ($30) (¥216) (¥197) ($12) (¥87) (¥60) Operating Expenses 1 ($1) (¥8) ¥13 ($1) (¥7) ¥3 Other Income (Expense) and Income Tax Credit ($17) (¥128) (¥89) ($8) (¥55) (¥28) Net Income (Loss) ($4) (¥28) (¥56) ($0) (¥1) (¥16) Adj. Net Income (Loss) 2 THIRD QUARTER FINANCIAL SUMMARY 17 1. Operating Expense in Q3 2023 included RMB 33.4M of share - based compensation expense with RMB 20.4M of selling and marketing expenses; RMB 10.3M of general and administrative expenses; and RMB 2.7M of research and development expenses. Operating expenses in Q3 2022 included RMB 2.7M of share - based compensation expenses with RMB 0.9M of selling and marketing expenses; RMB 1.7M of general and administrative expenses; and RMB 0.1M of research and development expenses. 2. Cheche defines adjusted net loss as net loss adjusted for the impact of share - based compensation expenses, amortization of intangible assets, and changes in fair value of amounts due to a related party related to the acquisition of Cheche Insurance Sales & Services Co., Ltd. (previously named Fanhua Times Sales and Service Co., Ltd), change in fair value of warrants, and listing related professional service fees. Adjusted net loss per share, basic and diluted, is calculated as adjusted net loss divided by weighted - average ordinary shares outstanding.

SOCIAL RESPONSIBILITIES LOW CARBON Paperless policy + clean energy CHARITY Co - build 3 elementary schools to improve rural education SOCIAL VISION Contribute to national social security system 18 THANK YOU Technology Enables Better Lives NASDAQ Code: CCG