UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of March 2024

Commission File Number: 001-41247

SunCar Technology Group Inc.

(Translation of registrant’s name into English)

c/o Shanghai Feiyou Trading Co., Ltd.

Suite 209, No. 656 Lingshi Road

Jing’an District, Shanghai, 200072

People’s Republic of China

Tel: (86) 138-1779-6110

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Management Presentation

SunCar Technology Group Inc. (the “Company”) (NASDAQ: SDA), a Cayman Islands exempted company, announced on March 4, 2024 that it will present at the upcoming Citizens JMP Technology Conference taking place in San Francisco on Tuesday, March 5, 2024.

A webcast can be accessed at https://wsw.com/webcast/jmp62/sdaww/1831130.

A copy of the Company’s management presentation is furnished hereto as Exhibit 99.1.

Financial Statements and Exhibits

Exhibits.

| Number | ||

| 99.1 | Management Presentation |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| SunCar Technology Group Inc. | ||

| Date March 5, 2024 | By: | /s/ Zaichang Ye |

| Name: | Zaichang Ye | |

| Title: | Chief Executive Officer | |

| (Principal Executive Officer) | ||

Exhibit 99.1

March 2024 SunCar – Leading Technology Platform For B2B Automotive Services and eInsurance Citizens JMP Technology Conference Presentation This document contains forward - looking statements regarding SunCar Technology Group Inc . , a Cayman Islands exempted company, NASDAQ Ticker Symbol : SDA (the “Company”) . We base these forward - looking statements on our expectations and projections about future events, which we derive from the information currently available to us . Such forward - looking statements relate to future events or our future performance, including : our financial performance and projections ; our growth in revenue and earnings ; and our business prospects and opportunities . You can identify forward - looking statements by those that are not historical in nature, particularly those that use terminologies such as “may,” “should,” “expects,” “anticipates,” “contemplates,” “estimates,” “believes,” “plans,” “projected,” “predicts,” “potential,” or “hopes” or the negative of these or similar terms . In evaluating these forward - looking statements, you should consider various factors, including : our ability to change the direction of the Company ; our ability to keep pace with new technology and changing market needs ; and the competitive environment of our business . These and other factors may cause our actual results to differ materially from any forward - looking statement . Forward - looking statements are only predictions . The forward - looking events discussed in this document and other statements made from time to time by us or our representatives, may not occur, and actual events and results may differ materially and are subject to risks, uncertainties and assumptions about us . We are not obligated to publicly update or revise any forward - looking statement, whether as a result of uncertainties and assumptions, the forward - looking events discussed in this document and other statements made from time to time by us or our representatives might not occur, except as required by the applicable law, regulations and rules .

Company Profile

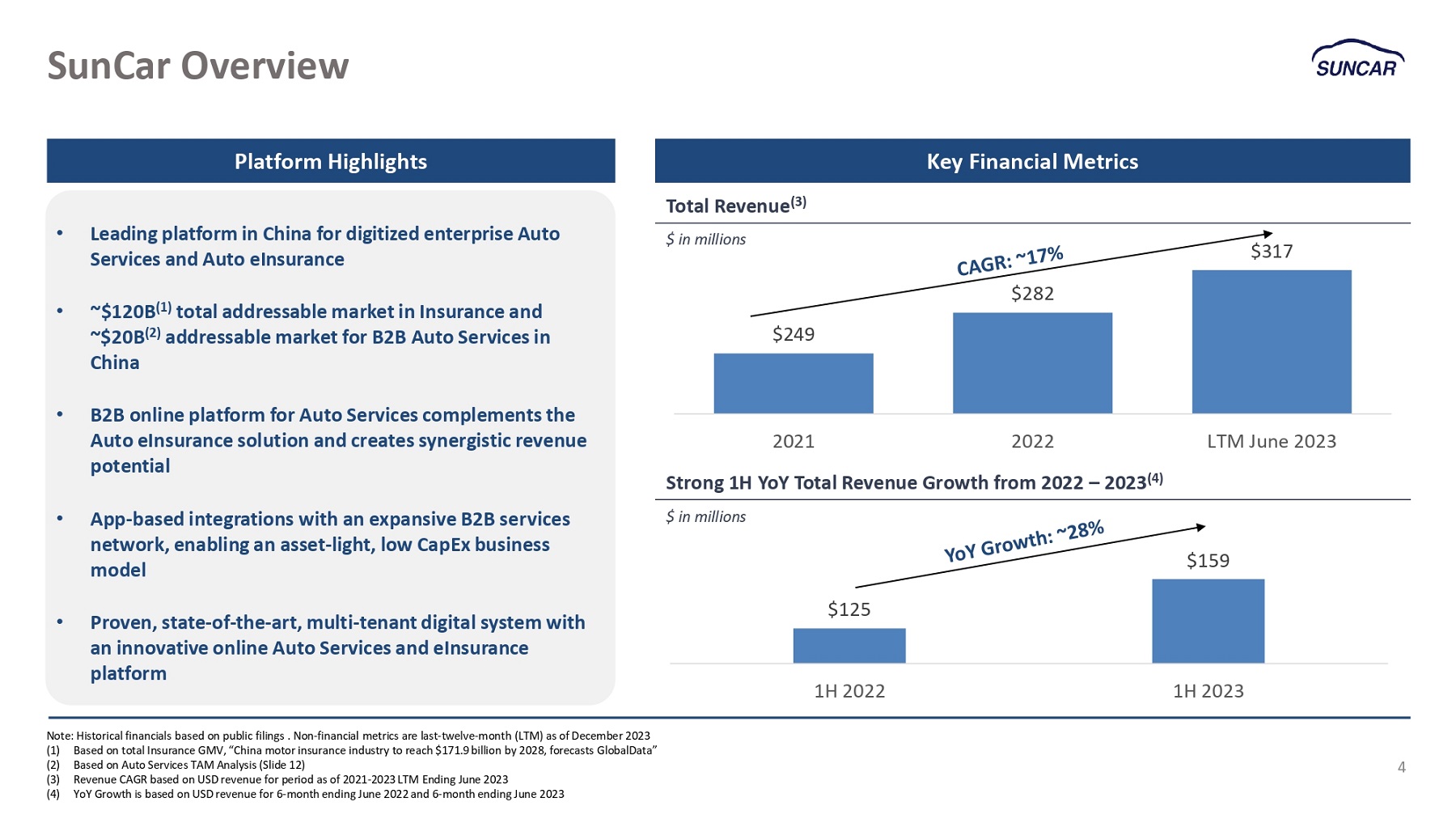

Cautionary Statement Concerning Forward Looking Statements $249 $282 $317 2021 2022 Strong 1H YoY Total Revenue Growth from 2022 – 2023 (4) LTM June 2023 SunCar Overview 4 Platform Highlights Key Financial Metrics Total Revenue (3) • Leading platform in China for digitized enterprise Auto Services and Auto eInsurance • ~$120B (1) total addressable market in Insurance and ~$20B (2) addressable market for B2B Auto Services in China • App - based integrations with an expansive B2B services network, enabling an asset - light, low CapEx business model • Proven, state - of - the - art, multi - tenant digital system with an innovative online Auto Services and eInsurance platform • B2B online platform for Auto Services complements the Auto eInsurance solution and creates synergistic revenue potential $125 $159 1H 2022 1H 2023 $ in millions $ in millions Note: Historical financials based on public filings .

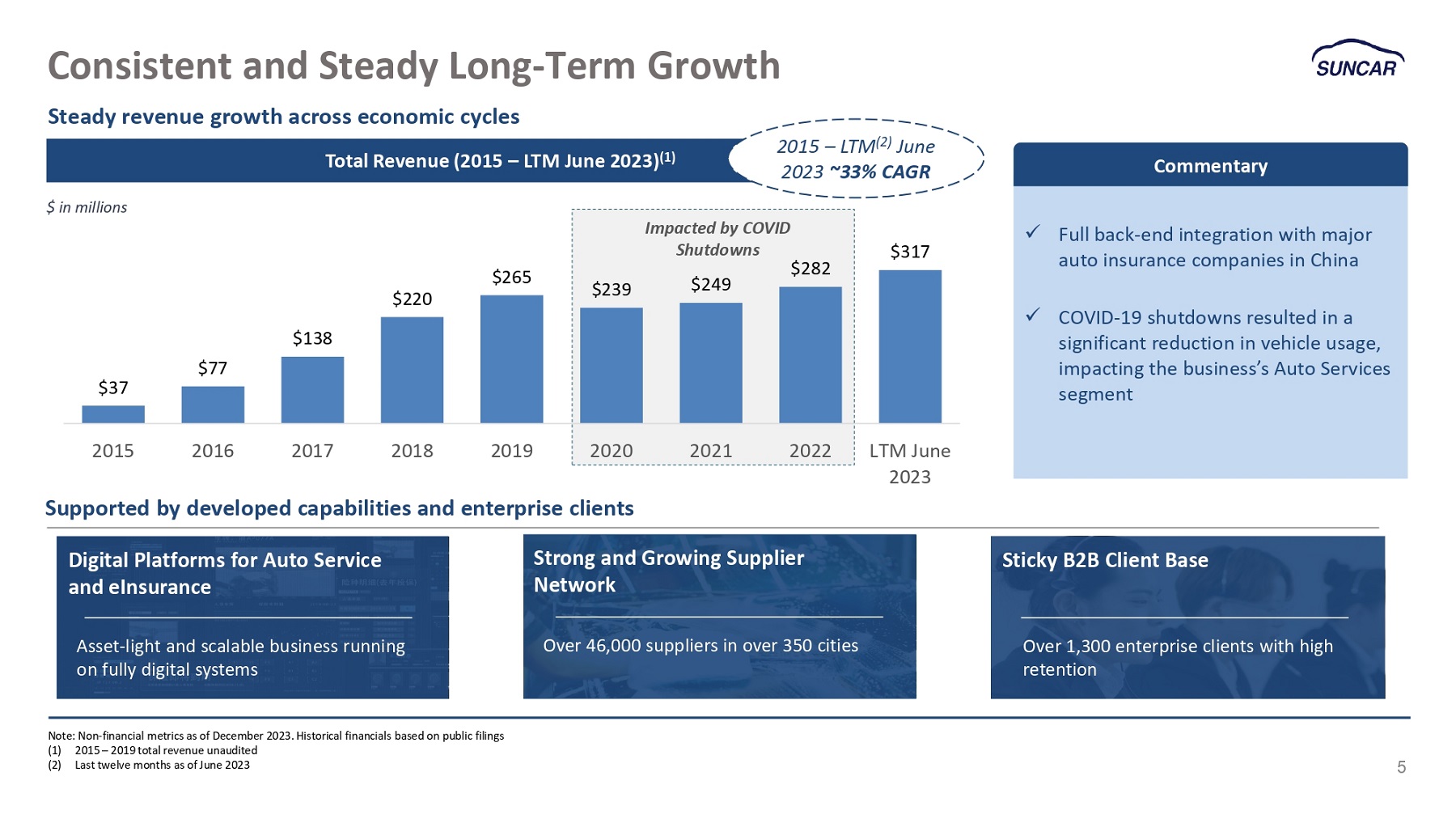

Non - financial metrics are last - twelve - month (LTM) as of December 2023 (1) Based on total Insurance GMV, “China motor insurance industry to reach $171.9 billion by 2028, forecasts GlobalData” (2) Based on Auto Services TAM Analysis (Slide 12) (3) Revenue CAGR based on USD revenue for period as of 2021 - 2023 LTM Ending June 2023 (4) YoY Growth is based on USD revenue for 6 - month ending June 2022 and 6 - month ending June 2023 Impacted by COVID Shutdowns $37 $77 $138 $220 $265 $239 $249 $282 $317 2021 2022 LTM June 2023 Consistent and Steady Long - Term Growth Steady revenue growth across economic cycles 5 Total Revenue (2015 – LTM June 2023) (1) 2015 – LTM (2) June 2023 ~33% CAGR 2015 2016 2017 2018 2019 2020 Supported by developed capabilities and enterprise clients Digital Platforms for Auto Service and eInsurance Asset - light and scalable business running on fully digital systems Strong and Growing Supplier Network Over 46,000 suppliers in over 350 cities Sticky B2B Client Base Over 1,300 enterprise clients with high retention $ in millions Note: Non - financial metrics as of December 2023.

Historical financials based on public filings (1) 2015 – 2019 total revenue unaudited (2) Last twelve months as of June 2023 x Full back - end integration with major auto insurance companies in China x COVID - 19 shutdowns resulted in a significant reduction in vehicle usage, impacting the business’s Auto Services segment Commentary One Stop Solution for Auto Services and eInsurance 6 One Stop Auto Services Solution for Enterprise Clients SunCar Capability Demands from enterprise clients Nationwide coverage Full services Online digital systems Validated quality and economies of scale ▪ Full geographic coverage to serve end customers across China ▪ Services offered to both vehicles and vehicle owners ▪ Digitalized service package embedded into enterprise clients’ apps ▪ Quality service at competitive prices ▪ Significant economy of scale as number of service increases One Stop Auto eInsurance Technology Platform SunCar Capability Industry pain points Online insurance with optimal cost Automated on - demand services Transparent and efficient ▪ High marketing & sales cost ▪ Ability to customize and optimize insurance for end customers ▪ Opaque insurance pricing restricts price optimization ▪ Time consuming, inefficient and manual application process 2 - minute turnaround Mr. Zaizhang Ye Co - Founder, Chairman & CEO • 23 years management & entrepreneurship experience • 15 years of Auto Service experience Our management has experience in the Auto Services and Insurance industry with a deep understanding and innovative mindsets regarding industry value chain and client needs Mr. Zhunfu Lei Co - Founder, CTO Ms. Saiye Gu Co - Founder, COO Mr. Bohong Du Co - Founder, CFO Passionate, Experienced and Innovative Management Team 7 Mr. Stanley Yang CSO Ms. Jennifer Jiang IRD

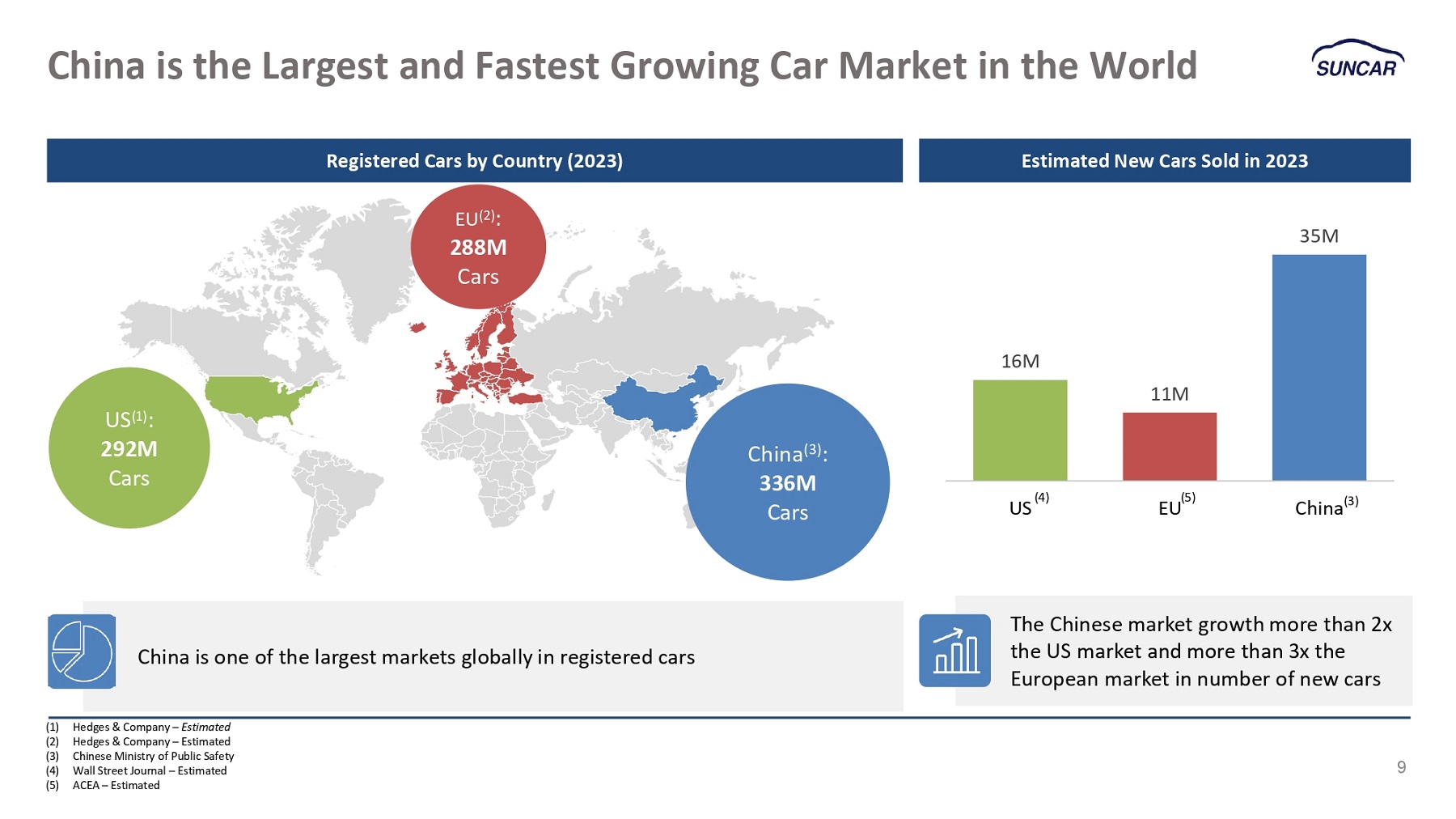

Auto Services and Insurance Markets in China China is one of the largest markets globally in registered cars China is the Largest and Fastest Growing Car Market in the World (1) Hedges & Company – Estimated (2) Hedges & Company – Estimated (3) Chinese Ministry of Public Safety (4) Wall Street Journal – Estimated (5) ACEA – Estimated 9 16M 11M 35M (4) US EU China Registered Cars by Country (2023) Estimated New Cars Sold in 2023 The Chinese market growth more than 2x the US market and more than 3x the European market in number of new cars China (3) : 336M Cars US (1) : 292M Cars EU (2) : 288M Cars (5) (3)

• As the largest passenger vehicle market in the world, China’s high car ownership rate generates huge market potential for China’s B2B Auto Services market • SunCar’s technology platform streamlines and improves large enterprises’ ability to offer Auto Services to end customers Commentary B2B Auto Services Market in China 10 B2B Services B2C Services SunCar focuses on B2B services for cars and car owners Integrated Automobile Services Market SunCar is China’s Largest Fully Digital B2B Auto Service Platform B2B Auto Services Market in China (cont’d) 11 % of Cars Receiving Car Services 30% 25% 20% $18B $15B $12B $150 24B 20B 16B 200 Average Annual Value / End Customer 30B 25B 20B 250 Commentary • Potential upside as the percentage of car owners receiving car services through SunCar platform significantly increase • Opportunity to expand given entrenched relationship and experience with some of the largest banking and insurance clients in China Auto Services TAM # of Total Cars in China 2026E (1) % of Car Owners receiving Car Services (2) Total Auto Services End Customers in China Average Annual Value per Eligible End Customer (2) Total Addressable Market (2026E) SunCar’s Current Auto Services Revenue (2) ~400M 25% ~100M ~$200 ~$ 20B $208M Auto Services TAM Sensitivity (1) Estimates assume 7% CAGR based on a 3 - year average growth of total cars in China from 2020 to 2022.

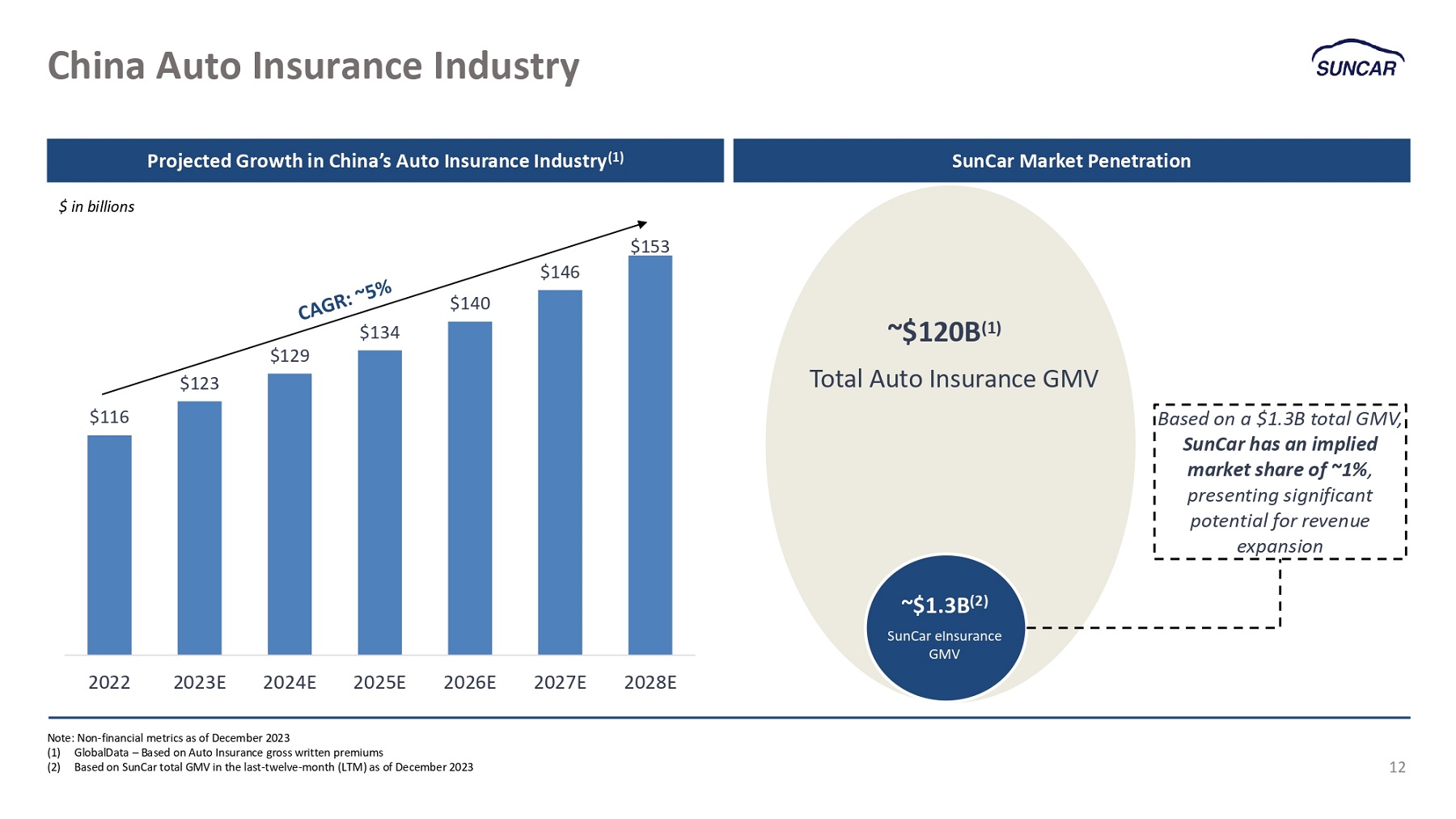

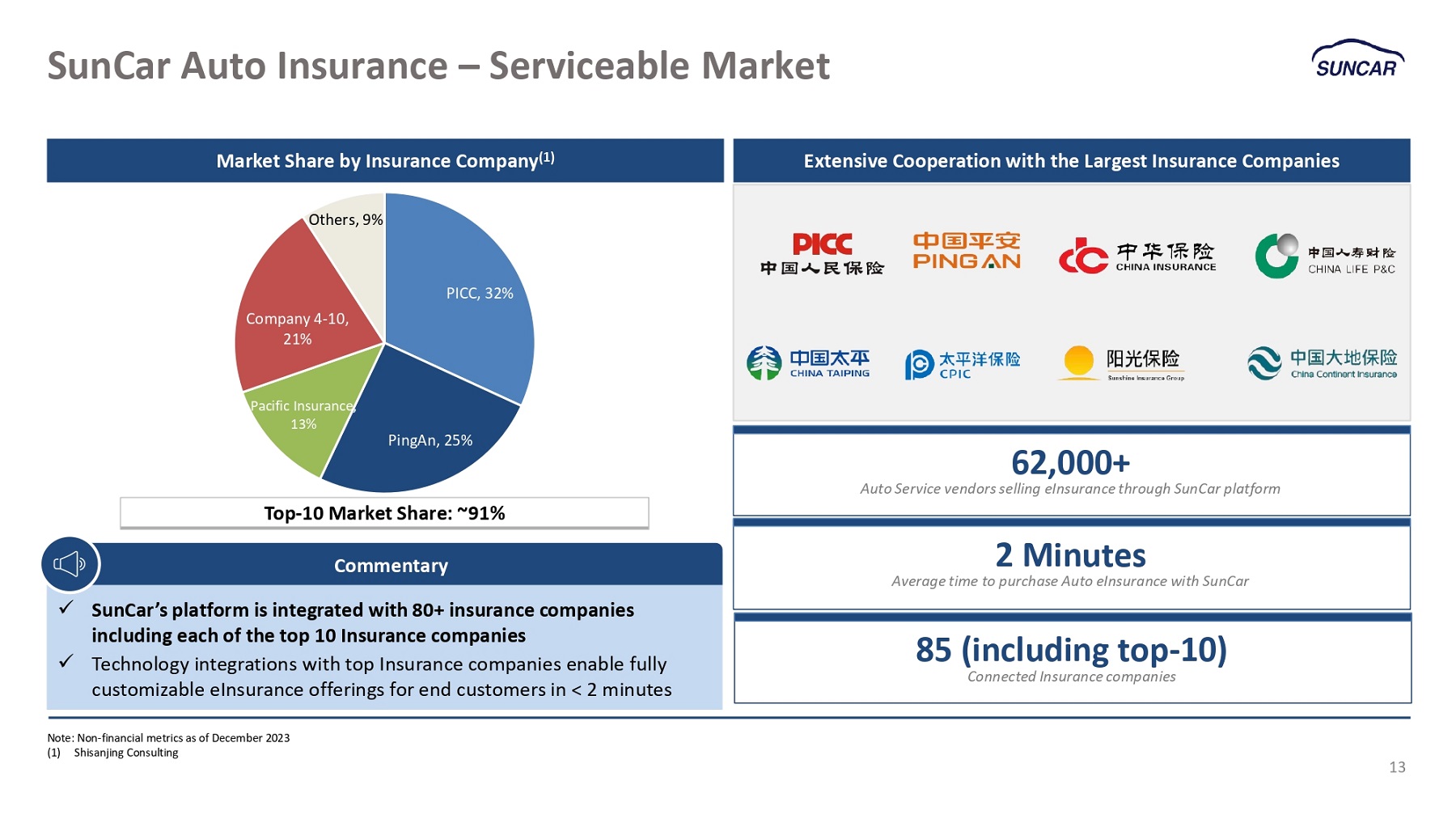

(2) Management guidance (3) Implied market share calculated as SunCar’s Current revenue on an LTM basis ending June 2023 divided by total addressable market in 2026E Implied Market Share based on current revenue (3) ~1% $116 $123 $129 $134 $140 $153 $146 2022 2023E 2024E 2025E 2026E Note: Non - financial metrics as of December 2023 (1) GlobalData – Based on Auto Insurance gross written premiums (2) Based on SunCar total GMV in the last - twelve - month (LTM) as of December 2023 2027E 2028E China Auto Insurance Industry 12 ~$120B (1) Total Auto Insurance GMV $ in billions Based on a $1.3B total GMV, SunCar has an implied market share of ~1% , presenting significant potential for revenue expansion ~$1.3B (2) SunCar eInsurance GMV Projected Growth in China’s Auto Insurance Industry (1) SunCar Market Penetration SunCar Auto Insurance – Serviceable Market Note: Non - financial metrics as of December 2023 (1) Shisanjing Consulting Extensive Cooperation with the Largest Insurance Companies 62,000+ Auto Service vendors selling eInsurance through SunCar platform 2 Minutes Average time to purchase Auto eInsurance with SunCar 85 (including top - 10) Connected Insurance companies Pacific Insurance, 13% PingAn, 25% PICC, 32% Company 4 - 10, 21% Others, 9% Top - 10 Market Share: ~91% Commentary x SunCar’s platform is integrated with 80+ insurance companies including each of the top 10 Insurance companies x Technology integrations with top Insurance companies enable fully customizable eInsurance offerings for end customers in < 2 minutes 13 Market Share by Insurance Company (1)

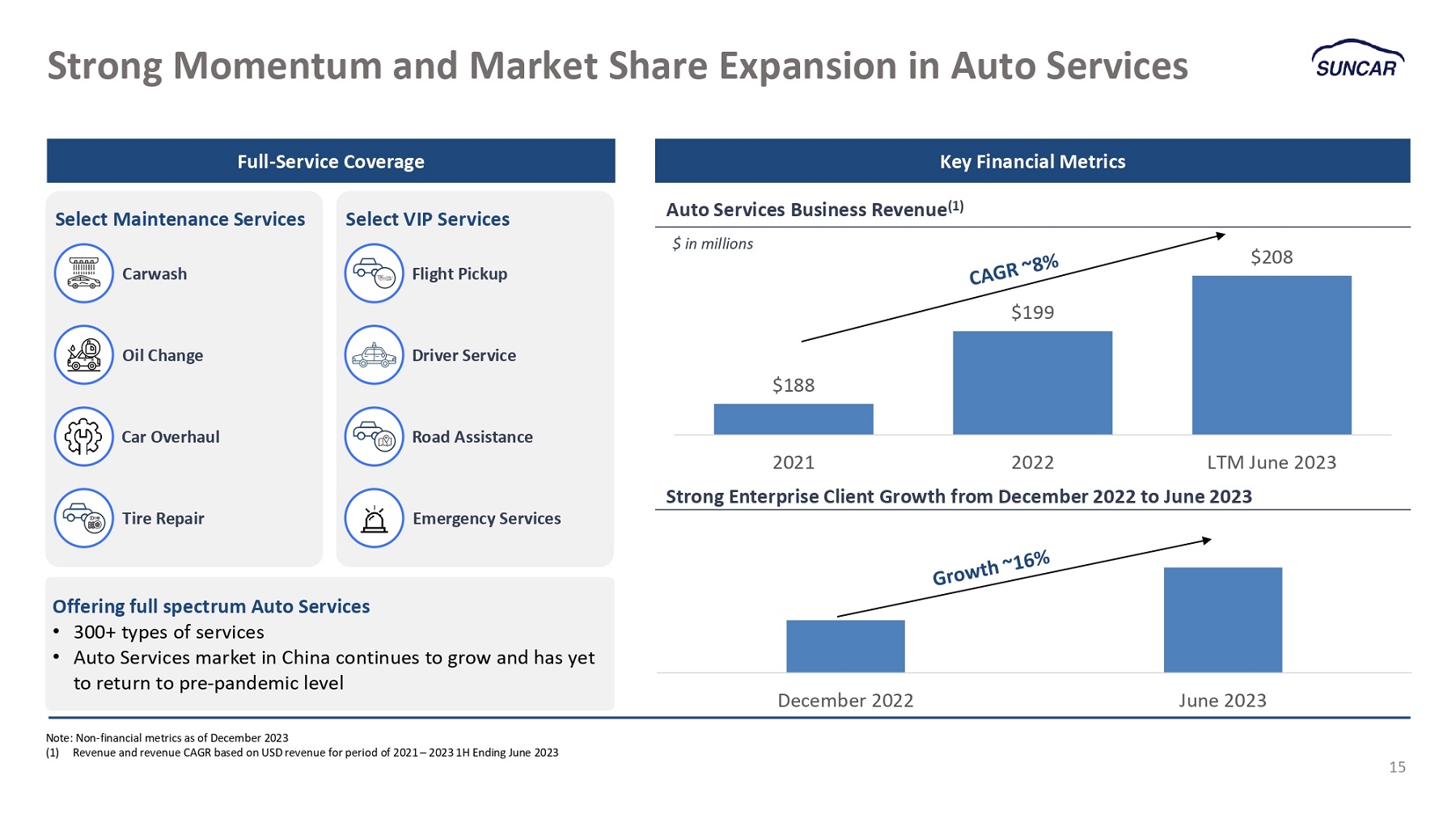

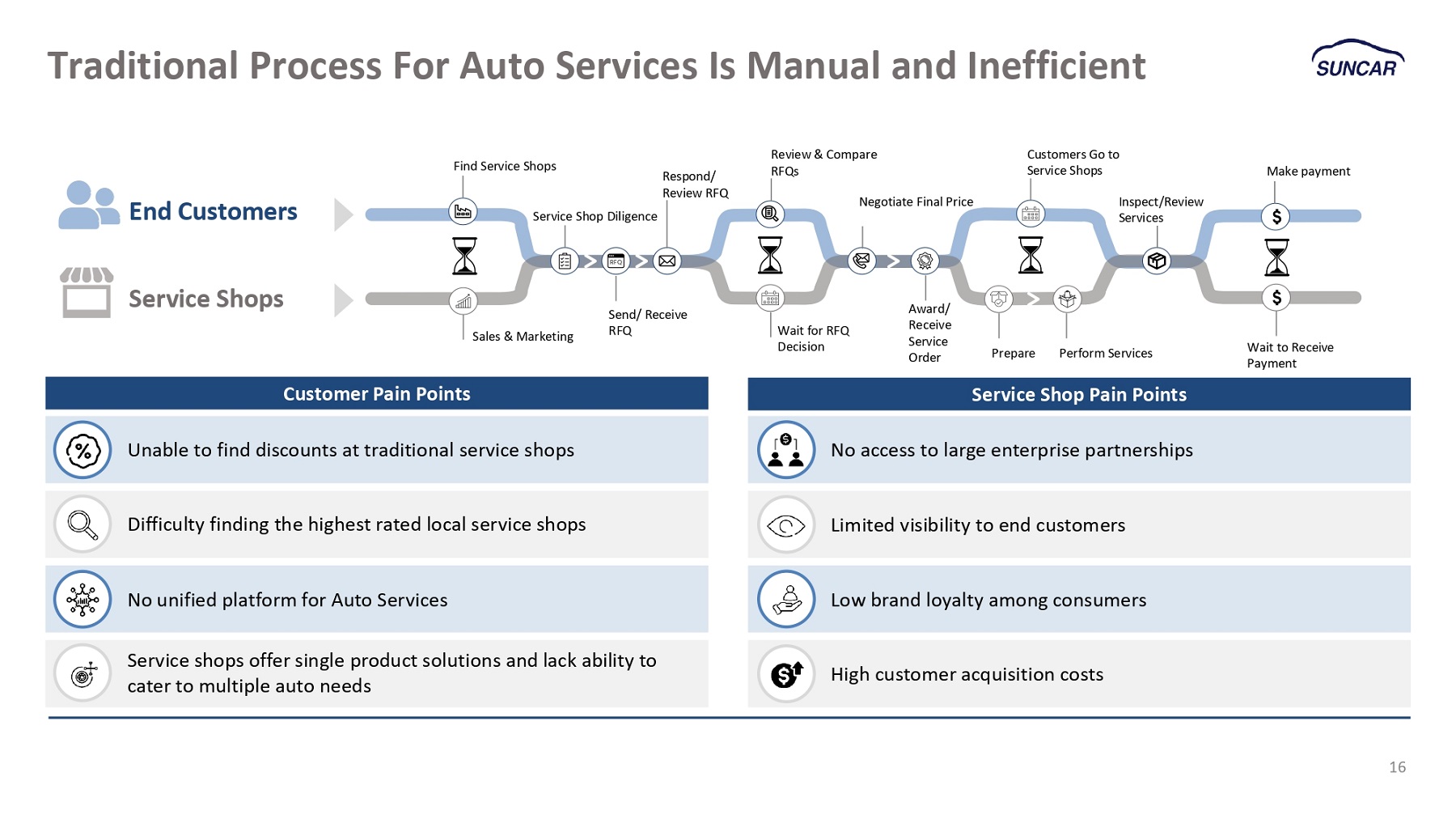

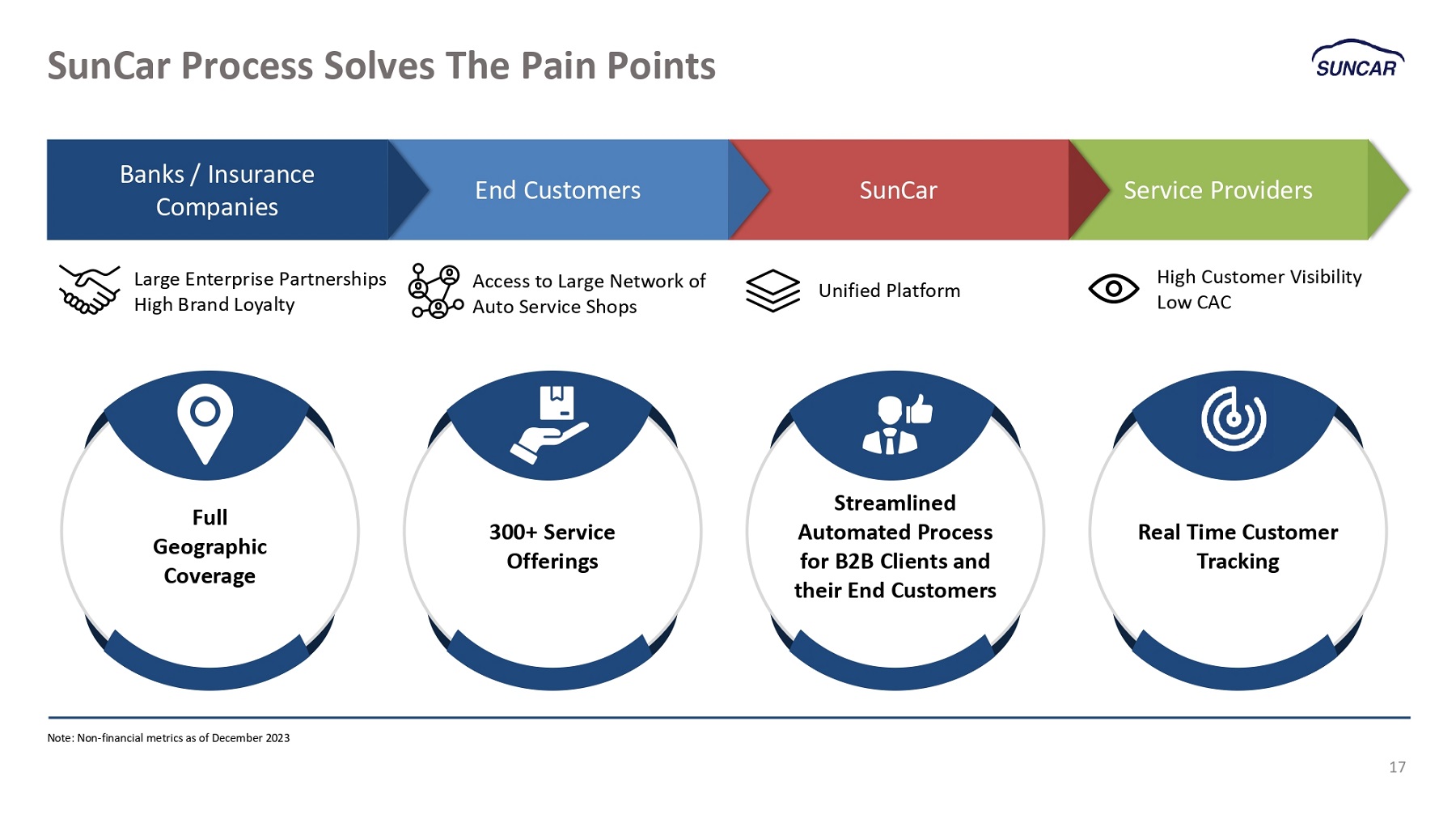

Digitized Platform for Auto - Services December 2022 June 2023 $188 $199 $208 2021 2022 LTM June 2023 Strong Enterprise Client Growth from December 2022 to June 2023 Strong Momentum and Market Share Expansion in Auto Services 15 Full - Service Coverage Key Financial Metrics Offering full spectrum Auto Services • 300+ types of services • Auto Services market in China continues to grow and has yet to return to pre - pandemic level Select Maintenance Services Select VIP Services Carwash Flight Pickup Oil Change Driver Service Emergency Services Road Assistance Tire Repair Car Overhaul Auto Services Business Revenue (1) Note: Non - financial metrics as of December 2023 (1) Revenue and revenue CAGR based on USD revenue for period of 2021 – 2023 1H Ending June 2023 $ in millions Traditional Process For Auto Services Is Manual and Inefficient Customer Pain Points Service Shop Pain Points End Customers Service Shops Find Service Shops Sales & Marketing RFQ Send/ Receive RFQ Service Shop Diligence Respond/ Review RFQ Review & Compare RFQs Negotiate Final Price Wait for RFQ Decision Award/ Receive Service Order Customers Go to Service Shops Prepare Perform Services Inspect/Review Services Wait to Receive Payment Make payment 16 Unable to find discounts at traditional service shops Difficulty finding the highest rated local service shops No unified platform for Auto Services Service shops offer single product solutions and lack ability to cater to multiple auto needs No access to large enterprise partnerships Limited visibility to end customers Low brand loyalty among consumers High customer acquisition costs

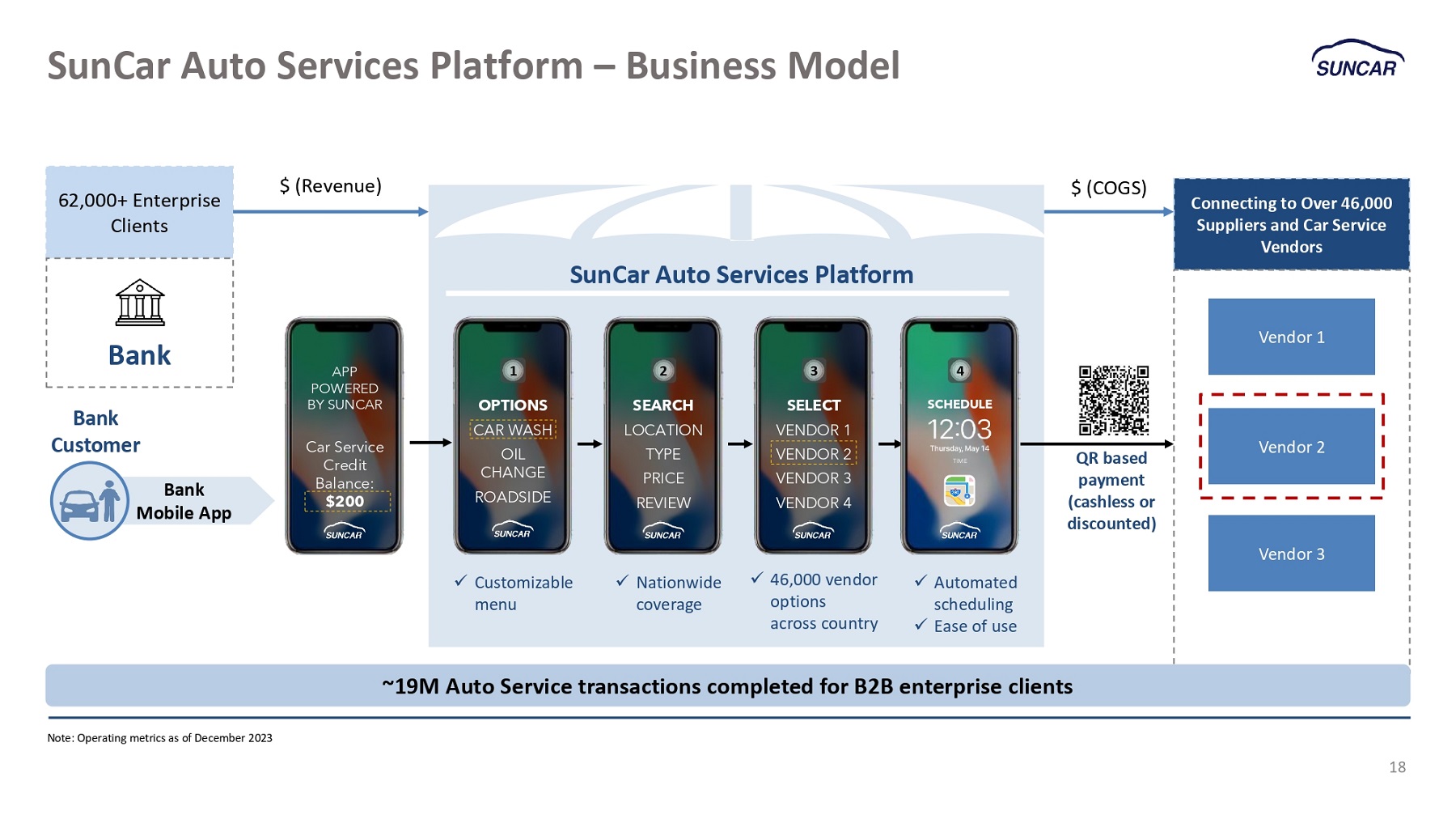

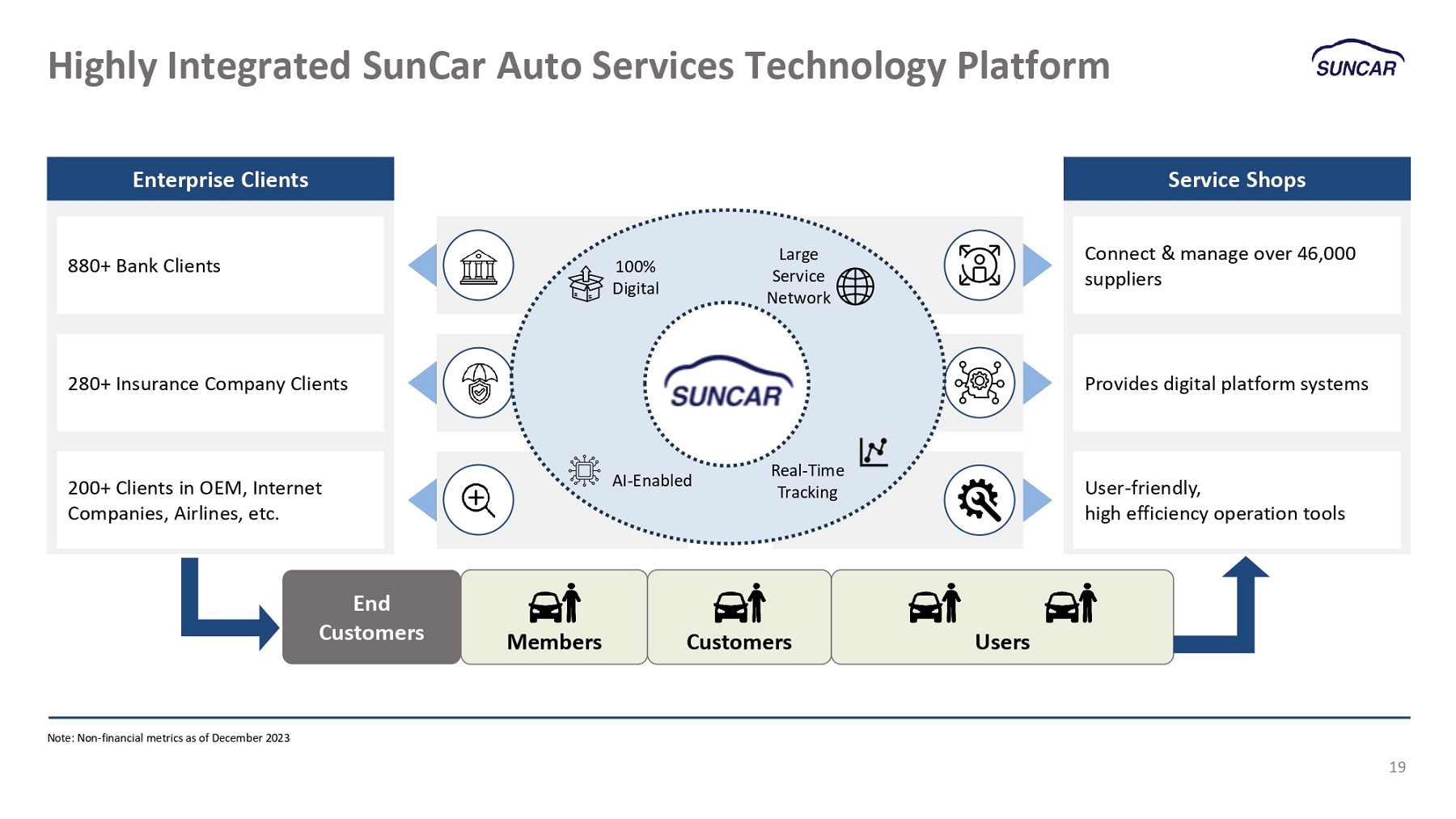

17 SunCar Process Solves The Pain Points Banks / Insurance Companies End Customers SunCar Service Providers Full Geographic Coverage 300+ Service Offerings Streamlined Automated Process for B2B Clients and their End Customers Large Enterprise Partnerships High Brand Loyalty Access to Large Network of Auto Service Shops Unified Platform High Customer Visibility Low CAC Real Time Customer Tracking Note: Non - financial metrics as of December 2023 SunCar Auto Services Platform – Business Model Note: Operating metrics as of December 2023 18 Connecting to Over 46,000 Suppliers and Car Service Vendors 62,000+ Enterprise Clients Bank Bank Customer SunCar Auto Services Platform $ (Revenue) $ (COGS) Vendor 1 Vendor 2 Vendor 3 x Customizable menu x Nationwide coverage x 46,000 vendor options across country x Automated scheduling x Ease of use QR based payment (cashless or discounted) Bank Mobile App APP POWERED BY SUNCAR Car Service Credit Balance: $200 OPTIONS CAR WASH OIL CHANGE ROADSIDE SEARCH LOCATION TYPE PRICE REVIEW SELECT VENDOR 1 VENDOR 2 VENDOR 3 VENDOR 4 1 2 3 SCHEDULE 4 TIME ~19M Auto Service transactions completed for B2B enterprise clients Highly Integrated SunCar Auto Services Technology Platform Note: Non - financial metrics as of December 2023 19 Enterprise Clients Service Shops Connect & manage over 46,000 suppliers Provides digital platform systems User - friendly, high efficiency operation tools 880+ Bank Clients 280+ Insurance Company Clients 200+ Clients in OEM, Internet Companies, Airlines, etc. End Customers Members Customers Users Large Service Network Real - Time Tracking AI - Enabled 100% Digital

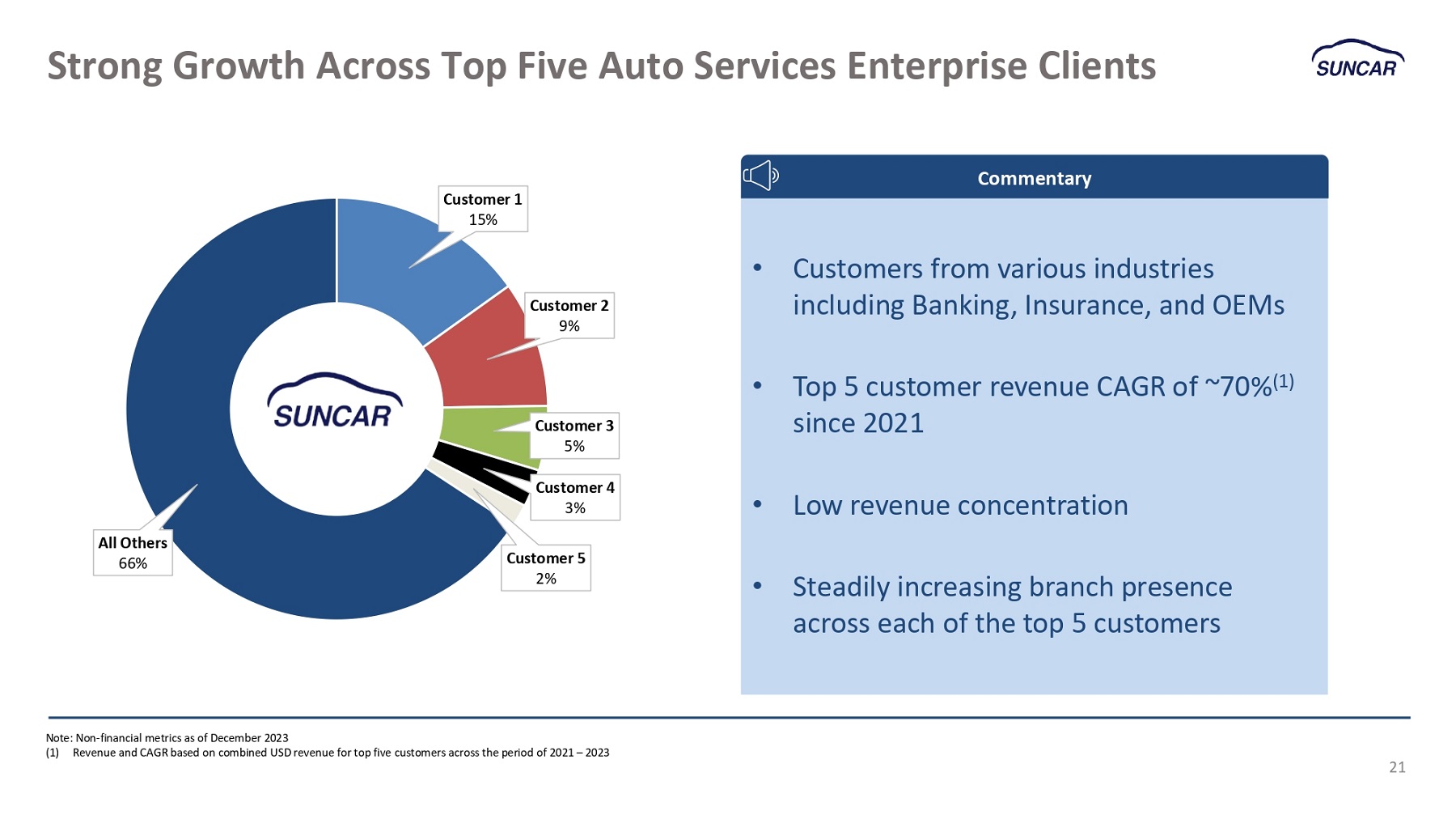

Marquee Enterprise Clients with Significant Land and Expand Opportunities 20 SunCar’s nationwide reach has created significant opportunity to land and expand across large banking, insurance, and other organizations across China >880 Banks >280 Insurance Companies >200 Enterprise Clients in OEM, Internet Operator, Airline, etc… Note: Non - financial metrics as of December 2023 Strong Growth Across Top Five Auto Services Enterprise Clients Customer 1 15% Customer 2 9% Customer 3 5% Customer 4 3% Customer 5 2% All Others 66% Note: Non - financial metrics as of December 2023 (1) Revenue and CAGR based on combined USD revenue for top five customers across the period of 2021 – 2023 • Customers from various industries including Banking, Insurance, and OEMs • Top 5 customer revenue CAGR of ~70% (1) since 2021 • Low revenue concentration • Steadily increasing branch presence across each of the top 5 customers Commentary 21

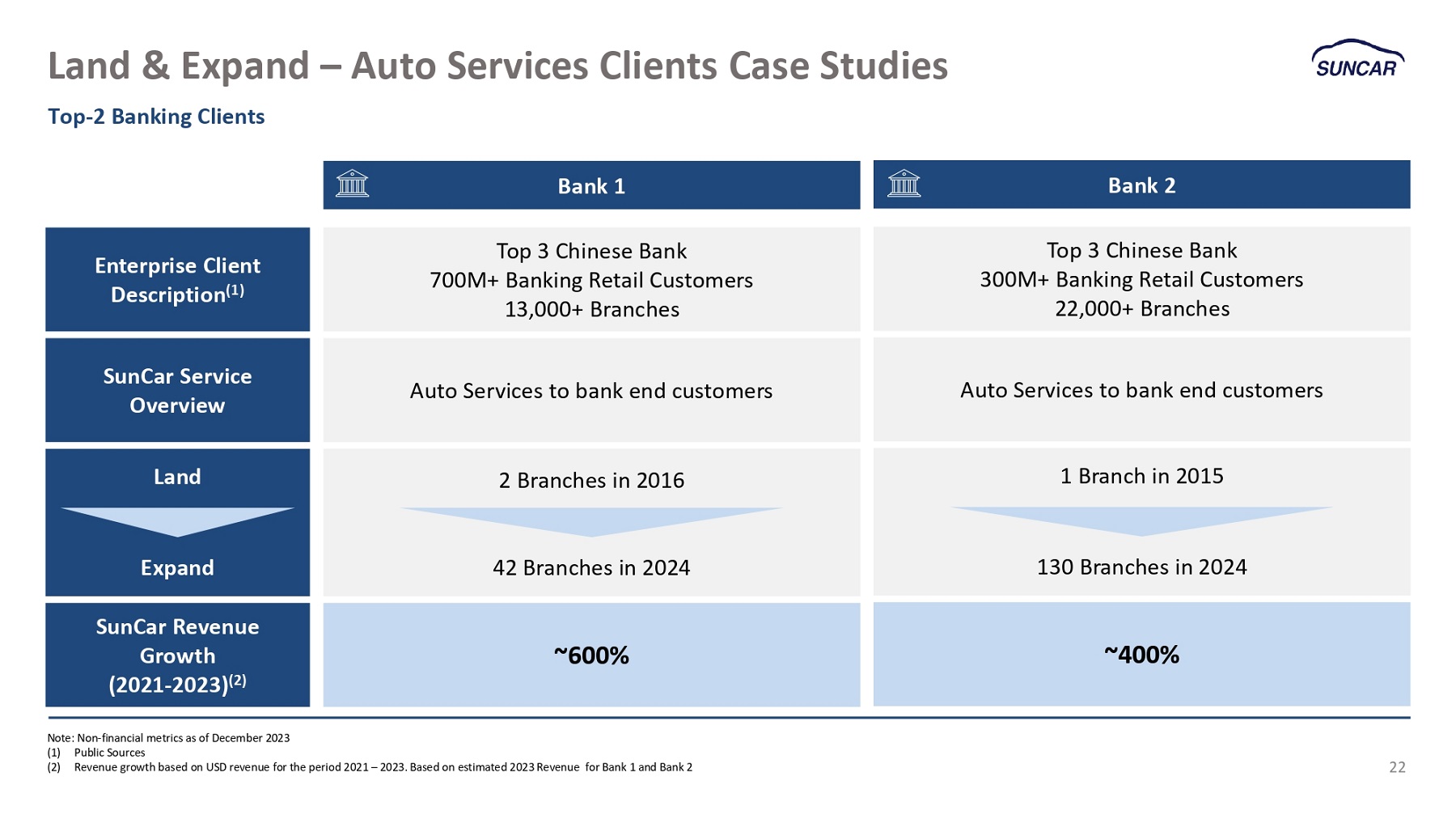

Land & Expand – Auto Services Clients Case Studies Top - 2 Banking Clients Note: Non - financial metrics as of December 2023 (1) Public Sources (2) Revenue growth based on USD revenue for the period 2021 – 2023. Based on estimated 2023 Revenue for Bank 1 and Bank 2 22 Enterprise Client Description (1) SunCar Service Overview Land Expand SunCar Revenue Growth (2021 - 2023) (2) Top 3 Chinese Bank 300M+ Banking Retail Customers 22,000+ Branches Auto Services to bank end customers 1 Branch in 2015 130 Branches in 2024 ~400% Bank 1 Top 3 Chinese Bank 700M+ Banking Retail Customers 13,000+ Branches Auto Services to bank end customers 2 Branches in 2016 42 Branches in 2024 ~600% Bank 2 SunCar Auto Service Platform – Growth Strategy 23 Expansion of the Types and Volume of Auto Services Expand with Existing Enterprise Clients International Expansion Through M&A Opportunities Regional Expansion

Technology Enabled Auto eInsurance

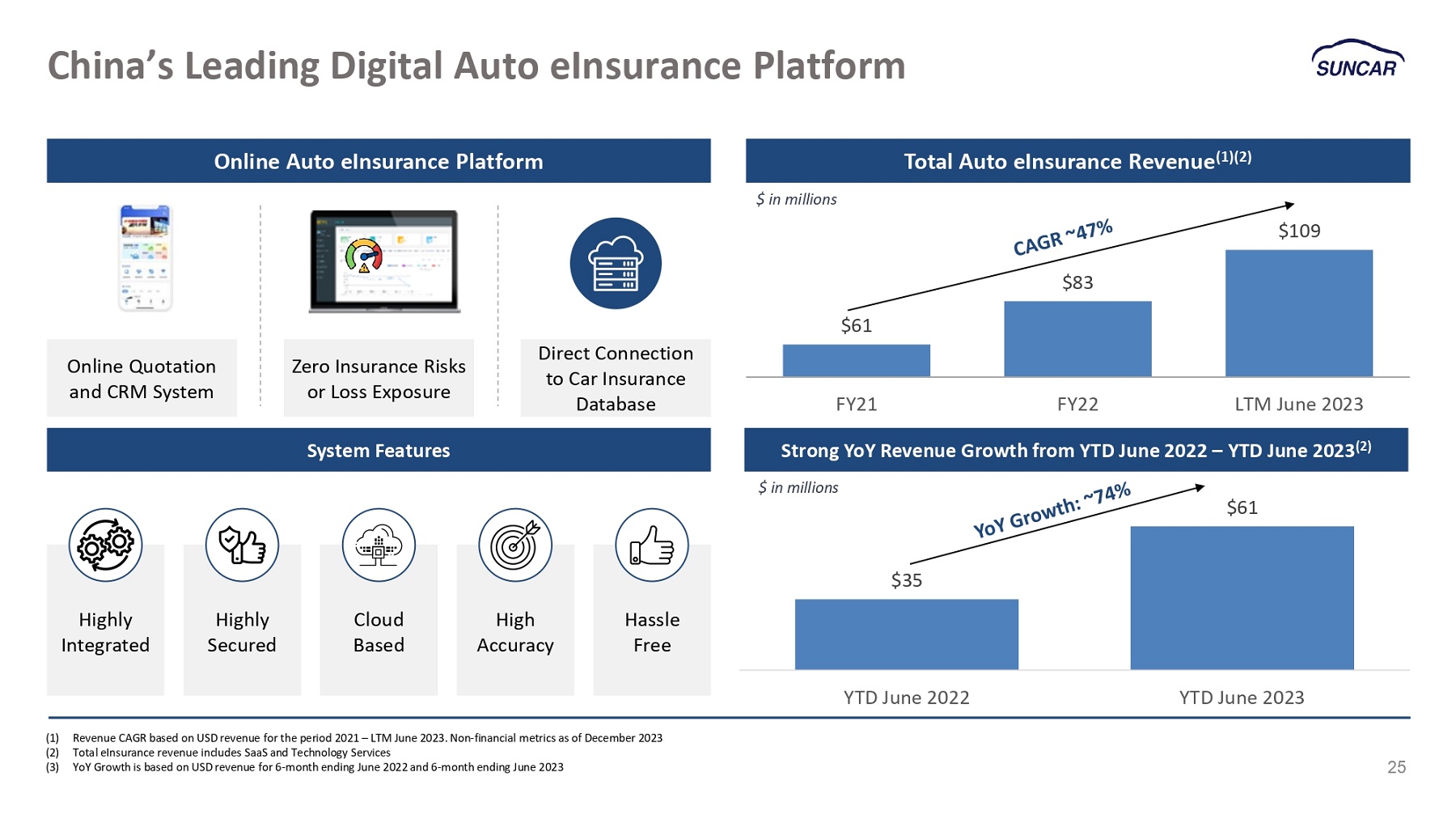

China’s Leading Digital Auto eInsurance Platform (1) Revenue CAGR based on USD revenue for the period 2021 – LTM June 2023. Non - financial metrics as of December 2023 (2) Total eInsurance revenue includes SaaS and Technology Services (3) YoY Growth is based on USD revenue for 6 - month ending June 2022 and 6 - month ending June 2023 25 Online Quotation and CRM System Zero Insurance Risks or Loss Exposure Direct Connection to Car Insurance Database System Features Highly Integrated Highly Secured Cloud Based High Accuracy Hassle Free $61 $83 $109 FY21 FY22 LTM June 2023 $35 $61 YTD June 2022 YTD June 2023 Strong YoY Revenue Growth from YTD June 2022 – YTD June 2023 (2) Online Auto eInsurance Platform Total Auto eInsurance Revenue (1)(2) $ in millions $ in millions SunCar’s Platform Offers Complete Insurance Lifecycle 26 Fully Digital User - Friendly Robust Product Offering Innovative and Efficient 2 Minutes to get Full Policy

SunCar Auto eInsurance Platform – Business Model Note: Operating metrics as of December 2023 27 Back - end Tech Integration App - Based eInsurance Solution Insurers 62,000+ Sales Partners Sales Partners Service Providers Car Owner Car Owner Connects With Sales Partner Sales Partner provides Insurance Quote Highly Personalized Plan NEV Manufacturers E - Insurance Policy Delivered SunCar Insurance Platform Commission & Tech Services (Revenue ) Policy Premiums ($) paid to Insurance Company *SunCar does not underwrite Auto Insurance and hence has zero risk and exposure to Auto Insurance losses Connecting with 85+ Insurers Across 600+ Branches APP - BASED E - INSURANCE POLICY EXECUTION SunCar’s Modern Technology Stack 28 SunCar Cloud Applications Platform Integration Infrastructure AI Task Scheduling | Hybrid Cloud | High Security SunCar Multi - Tenant Platform Enterprise Clients API docking, front - end plug - in and module integration OEM and Emerging NEV Companies Innovative and full - service car owner interface Internal Operation Staff Automated, comprehensive, data driven operation platform Service Providers User friendly, high efficiency management and operation tools Technology Driven 200+ Tech staff 134 IP registered 5 Top IT Awards Managing Complexity – 40+ sub systems, 700+ customized service package, 1,100+ APP connected Highly Configurable – infrastructure and backend solution provided by SunCar to enterprise clients for seamless plug - and - play Note: Non - financial metrics as of December 2023

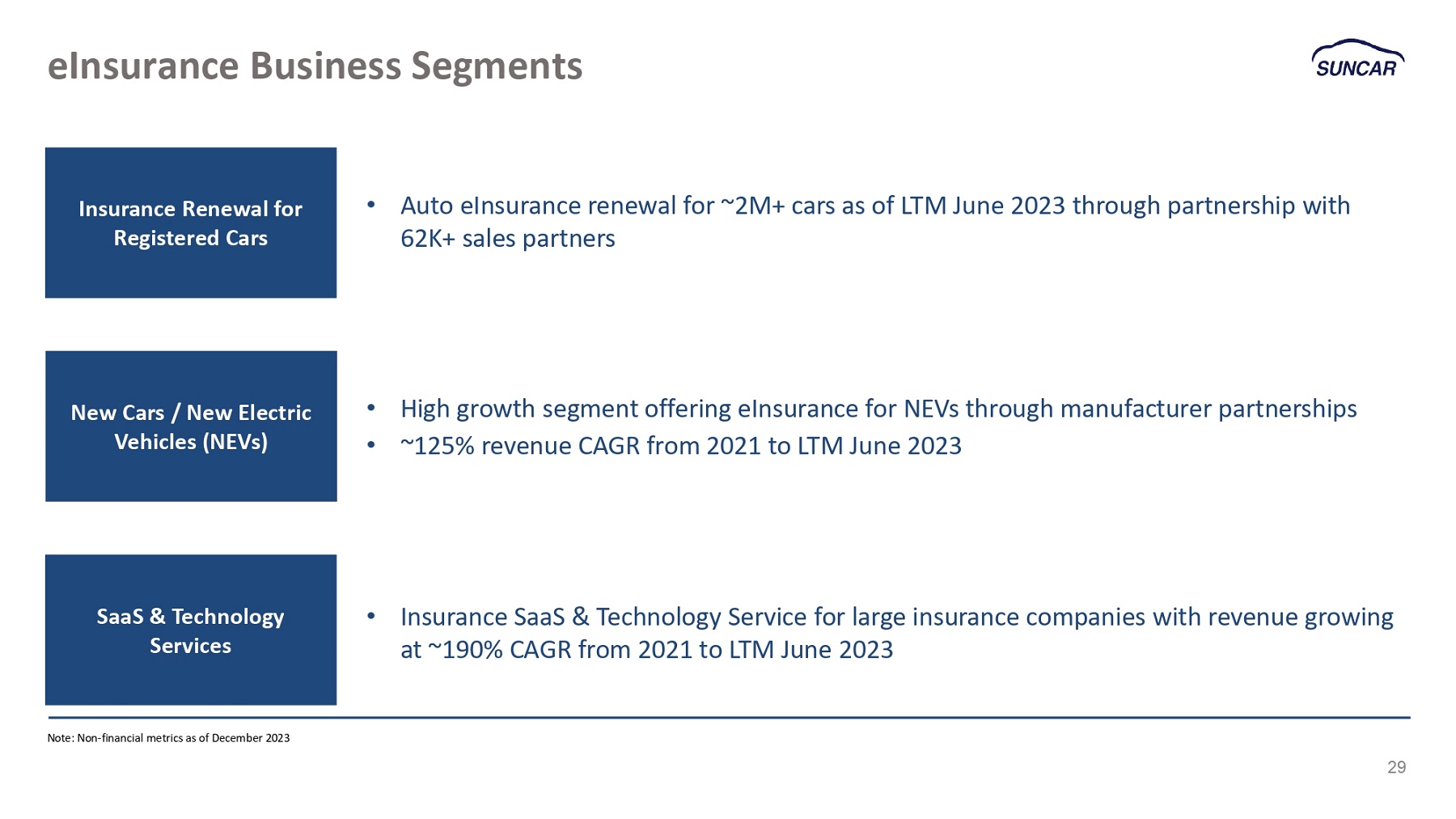

eInsurance Business Segments Note: Non - financial metrics as of December 2023 29 Insurance Renewal for Registered Cars New Cars / New Electric Vehicles (NEVs) SaaS & Technology Services • Auto eInsurance renewal for ~2M+ cars as of LTM June 2023 through partnership with 62K+ sales partners • High growth segment offering eInsurance for NEVs through manufacturer partnerships • ~125% revenue CAGR from 2021 to LTM June 2023 • Insurance SaaS & Technology Service for large insurance companies with revenue growing at ~190% CAGR from 2021 to LTM June 2023 NEV OEM Sales Partners Overview • Engaging with mainstream NEV clients • Direct cooperation with NEV manufacturing clients providing a full - spectrum eInsurance solution Select NEV Manufacturing Sales Partners New Car / NEV Insurance Driving Significant Growth Note: Non - financial metrics as of December 2023 (1) The China Project: https://thechinaproject.com/2023/05/18/chinas - top - 15 - electric - vehicle - companies/ (2) Revenue growth based on USD revenue for the period 2021 – 2023 Top 10 Largest Chinese EV Provider (1) Auto eInsurance for NEVs Relationship Started in 2021 ~100k cars insured (2023) ~200% Top 10 Largest Chinese EV Provider (1) Auto eInsurance for NEVs Relationship Started in 2020 ~367k cars insured (2023) ~290% Sales Partner Description Service Overview Land Expand SunCar Revenue Growth (2021 - 2023) (2) EV Company 1 EV Company 2 30 SunCar’s Insurance Platform – Growth Strategy 31 International Expansion Through M&A Opportunities Regional Expansion for all Registered Vehicles Exploding Demand for EV Sales in China Higher Volume - based Commissions With the Continuous Expansion of Car Ownership in China

Financial Summary

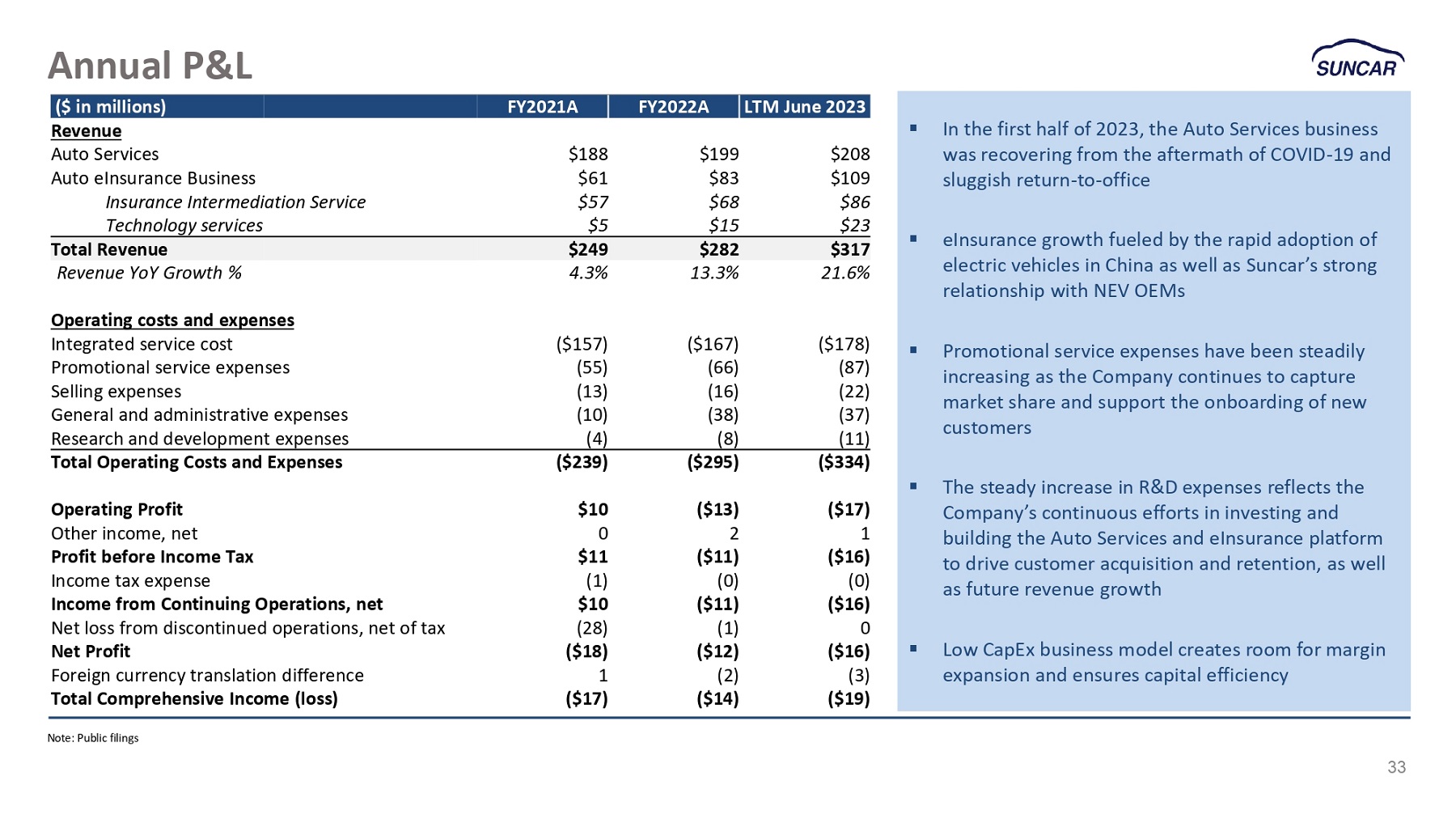

▪ In the first half of 2023, the Auto Services business was recovering from the aftermath of COVID - 19 and sluggish return - to - office ▪ eInsurance growth fueled by the rapid adoption of electric vehicles in China as well as Suncar’s strong relationship with NEV OEMs ▪ Promotional service expenses have been steadily increasing as the Company continues to capture market share and support the onboarding of new customers ▪ The steady increase in R&D expenses reflects the Company’s continuous efforts in investing and building the Auto Services and eInsurance platform to drive customer acquisition and retention, as well as future revenue growth ▪ Low CapEx business model creates room for margin expansion and ensures capital efficiency Annual P&L Note: Public filings 33 LTM June 2023 FY2022A FY2021A ($ in millions) Revenue $208 $199 $188 Auto Services $109 $83 $61 Auto eInsurance Business $86 $68 $57 Insurance Intermediation Service $23 $15 $5 Technology services $317 $282 $249 Total Revenue 21.6% 13.3% 4.3% Revenue YoY Growth % Operating costs and expenses ($178) ($167) ($157) Integrated service cost (87) (66) (55) Promotional service expenses (22) (16) (13) Selling expenses (37) (38) (10) General and administrative expenses (11) (8) (4) Research and development expenses ($334) ($295) ($239) Total Operating Costs and Expenses ($17) ($13) $10 Operating Profit 1 2 0 Other income, net ($16) ($11) $11 Profit before Income Tax (0) (0) (1) Income tax expense ($16) ($11) $10 Income from Continuing Operations, net 0 (1) (28) Net loss from discontinued operations, net of tax ($16) ($12) ($18) Net Profit (3) (2) 1 Foreign currency translation difference ($19) ($14) ($17) Total Comprehensive Income (loss)

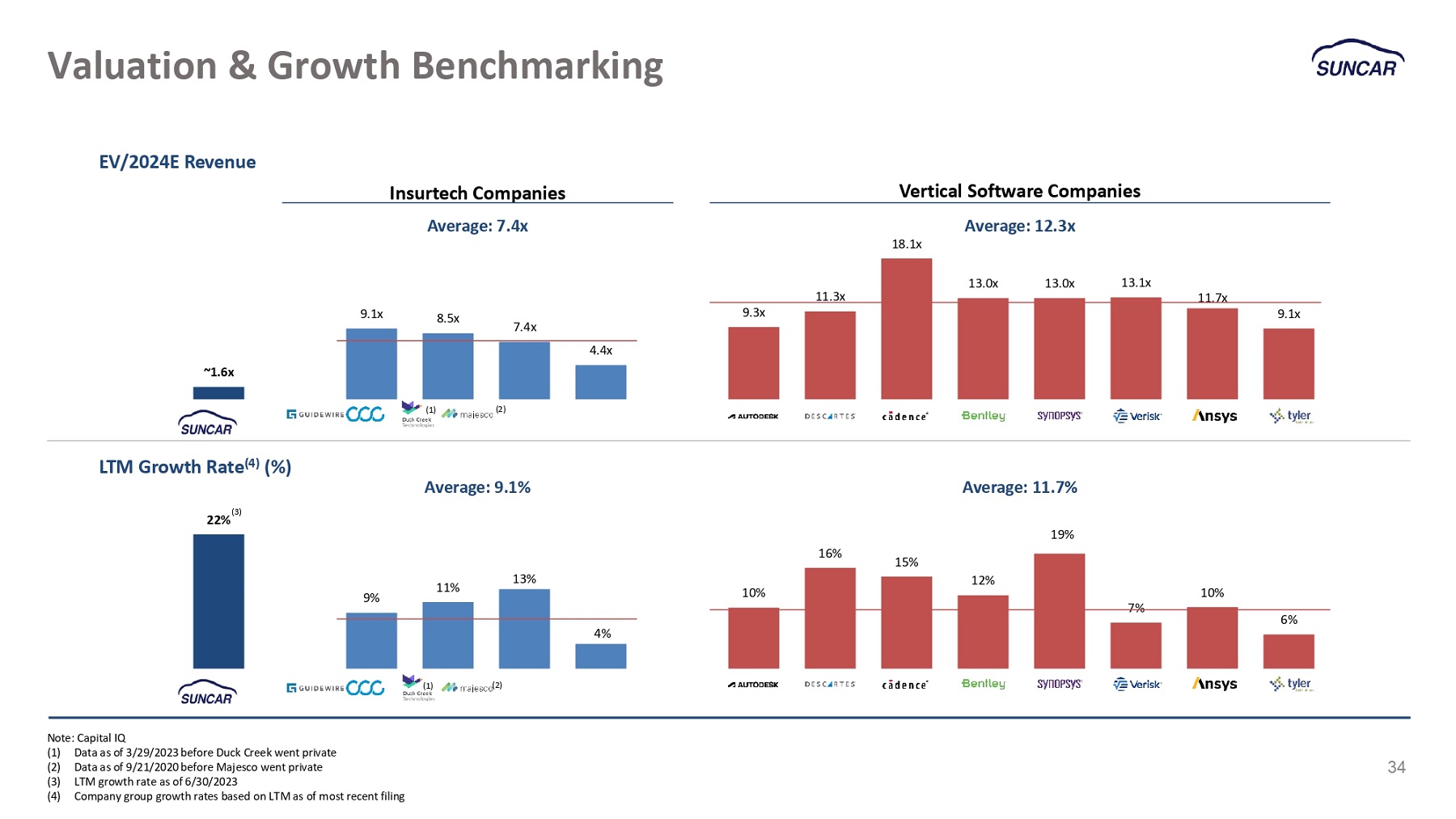

~1.6x 9.1x 8.5x 7.4x 4.4x 9.3x 11.3x Vertical Software Companies Average: 12.3x 18.1x 13.0x 13.0x 13.1x 11.7x 9.1x LTM Growth Rate (4) (%) Valuation & Growth Benchmarking 34 Insurtech Companies Average: 7.4x EV/2024E Revenue (3) 22% 9% 11% 13% 4% 10% 16% 15% 12% 19% 7% 10% 6% Average: 9.1% Average: 11.7% Note: Capital IQ (1) Data as of 3/29/2023 before Duck Creek went private (2) Data as of 9/21/2020 before Majesco went private (3) LTM growth rate as of 6/30/2023 (4) Company group growth rates based on LTM as of most recent filing (1) (2) (1) (2)

Thank you www.SunCartech.com