UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 27, 2024

AGBA GROUP HOLDING LIMITED

(Exact Name of Registrant as Specified in its Charter)

| British Virgin Islands | 001-38909 | N/A | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) | (I.R.S. Employer Identification No.) |

|

AGBA Tower 68 Johnston Road Wanchai, Hong Kong SAR |

N/A | |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code: +852 3601 8363

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Ordinary Shares, $0.001 par value | AGBA | NASDAQ Capital Market | ||

| Warrants, each warrant exercisable for one-half of one Ordinary Share for $11.50 per full share | AGBAW | NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure

On February 27, 2024, AGBA Group Holding Limited (“AGBA”) (i) issued a press release dated February 27, 2024, and (ii) uploaded an Investor Presentation dated February 27, 2024 to its corporate website www.agba.com. The materials attached as Exhibits 99.1 and 99.2 are incorporated by reference herein.

The information furnished under this Item 7.01, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that section and shall not be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Securities Act”) or the Exchange Act, except as otherwise expressly stated by specific reference in any such filing.

Forward-Looking Statements

This current report on Form 8-K, including the exhibit furnished herewith, contains forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other statements that are other than statements of historical facts. When the Company uses words such as “may,” “will,” “intend,” “should,” “believe,” “expect,” “anticipate,” “project,” “estimate” or similar expressions that do not relate solely to historical matters, it is making forward-looking statements. Forward-looking statements are not guarantees of future performance and involve risks and uncertainties that may cause the actual results to differ materially from the AGBA’s expectations discussed in the forward-looking statements. These forward-looking statements, by their nature, require AGBA to make certain assumptions and necessarily involve known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied in these forward-looking statements, including without limitation the successful and timely completion and the commercialization of the products referred to herein. Information contained in forward-looking statements is based upon certain material assumptions that were applied in drawing a conclusion or making a forecast or projection, including perceptions of historical trends, current conditions and expected future developments, as well as other considerations that are believed to be appropriate in the circumstances. These assumptions are considered to be reasonable based on currently available information, but investors are cautioned that these assumptions regarding future events, many of which are beyond its control, may ultimately prove to be incorrect since they are subject to risks and uncertainties that affect AGBA and its business. Investors are further are cautioned not to place undue reliance upon any forward-looking statements in this current report on Form 8-K. Additional factors are discussed in AGBA’s filings with the SEC, which are available for review at www.sec.gov. AGBA undertakes no obligation to publicly revise these forward-looking statements to reflect events or circumstances that arise after the date hereof.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| Exhibit No. | Description | |

| 99.1 | Press Release dated February 27, 2024 | |

| 99.2 | AGBA Investor Presentation | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| AGBA GROUP HOLDING LIMITED | |||

| By: | /s/ Shu Pei Huang, Desmond | ||

| Name: | Shu Pei Huang, Desmond | ||

| Title: | Acting Group Chief Financial Officer | ||

| Dated: February 27, 2024 | |||

2

Exhibit 99.1

AGBA Group is Positioned For Hong Kong’s Rebounding Macro Environment with Business Refinements and Growth Strategies

HONG KONG, Feb. 27, 2024 (GLOBE NEWSWIRE) -- The year 2023 posed significant macro-economic challenges for Hong Kong and China, particularly in relation to the Chinese real estate and financial markets. As an open economy heavily reliant on tourism, exports, and financial markets, Hong Kong faced a difficult year.

However, there are now emerging signs of a recovery in the macro environment for both China and Hong Kong. The annual Chinese New Year celebrations in Hong Kong this year witnessed a record number of visitors from Mainland China, indicating an upswing in spending, including on financial products and services. Alongside these cyclical tailwinds, Hong Kong is experiencing structural growth driven by demographic factors and the increasing demand for its products and services from the Greater Bay Area (GBA).

AGBA Group Holding Limited (“AGBA” or the “Company”), the leading one-stop financial supermarket in Hong Kong, is strategically positioned to capitalize on Hong Kong’s return to growth. The challenges faced in 2023 prompted successful changes to AGBA’s business model, resulting in increased focus and efficiency. The implementation of significant cost-cutting measures is expected to reduce normalized operating expenses to a level for strong growth and profitability.

With its enhanced and streamlined business model, AGBA is well-prepared for growth in 2024. Growth will be further supported by the recent securing of substantial funds through a successful equity private placement in February 2024, in addition to completing and planning asset sales of non-core activities.

These strategic initiatives have positioned AGBA as a formidable player in the market and facilitated the establishment of exciting and successful new partnerships. These collaborations are anticipated to further enhance AGBA’s growth potential and consolidate its position as an industry leader.

Various factors contributing to a substantial decline in AGBA’s share price since its listing on Nasdaq in 2022. There now exists a notable disconnect between the current share price and the underlying business value. Given the improved macro environment and the growth prospects stemming from AGBA’s refined business model, closing this valuation gap presents significant upside potential for existing and new shareholders.

Mr. Wing-Fai Ng, Group President, AGBA Group Holding Limited said “We have actively adapted to the changing landscape and taken bold steps to position ourselves for growth. Our efforts to streamline operations and forge strategic partnerships have strengthened our position in the market. As we look ahead to 2024, we remain singularly focused on capturing growth while containing operating costs. Furthermore, we are optimistic about the potential realization of our expansion to Singapore, following our clients’ footsteps, this year”

An updated investor presentation on our website provides valuable insights into AGBA’s forward-thinking approach. Please visit the official links below: www.agba.com/ir.

# # #

About AGBA Group:

Established in 1993, AGBA Group Holding Limited (NASDAQ: “AGBA”) is a leading one-stop financial supermarket based in Hong Kong offering the broadest set of financial services and healthcare products in the Guangdong-Hong Kong-Macao Greater Bay Area (GBA) through a tech-led ecosystem, enabling clients to unlock the choices that best suit their needs. Trusted by over 400,000 individual and corporate customers, the Group is organized into four market-leading businesses: Platform Business, Distribution Business, Healthcare Business, and Fintech Business.

For more information about AGBA, please visit www.agba.com

Media and Investor Relations Contact:

|

Ms. Bethany Lai media@agba.com/ ir@agba.com +852 5529 4500

|

|

Social Media Channels: agbagroup LinkedIn | Twitter | Instagram | Facebook | YouTube

|

Safe Harbor Statement

This press release contains forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other statements that are other than statements of historical facts. When the Company uses words such as “may,” “will,” “intend,” “should,” “believe,” “expect,” “anticipate,” “project,” “estimate” or similar expressions that do not relate solely to historical matters, it is making forward-looking statements. Forward-looking statements are not guarantees of future performance and involve risks and uncertainties that may cause the actual results to differ materially from the Company’s expectations discussed in the forward-looking statements. These statements are subject to uncertainties and risks including, but not limited to, the following: the Company’s goals and strategies; the Company’s future business development; product and service demand and acceptance; changes in technology; economic conditions; the outcome of any legal proceedings that may be instituted against us following the consummation of the business combination; expectations regarding our strategies and future financial performance, including its future business plans or objectives, prospective performance and opportunities and competitors, revenues, products, pricing, operating expenses, market trends, liquidity, cash flows and uses of cash, capital expenditures, and our ability to invest in growth initiatives and pursue acquisition opportunities; reputation and brand; the impact of competition and pricing; government regulations; fluctuations in general economic and business conditions in Hong Kong and the international markets the Company plans to serve and assumptions underlying or related to any of the foregoing and other risks contained in reports filed by the Company with the SEC, the length and severity of the recent coronavirus outbreak, including its impacts across our business and operations. For these reasons, among others, investors are cautioned not to place undue reliance upon any forward-looking statements in this press release. Additional factors are discussed in the Company’s filings with the SEC, which are available for review at www.sec.gov. The Company undertakes no obligation to publicly revise these forward–looking statements to reflect events or circumstances that arise after the date hereof.

3

Exhibit 99.2

Investor Presentation February 2024

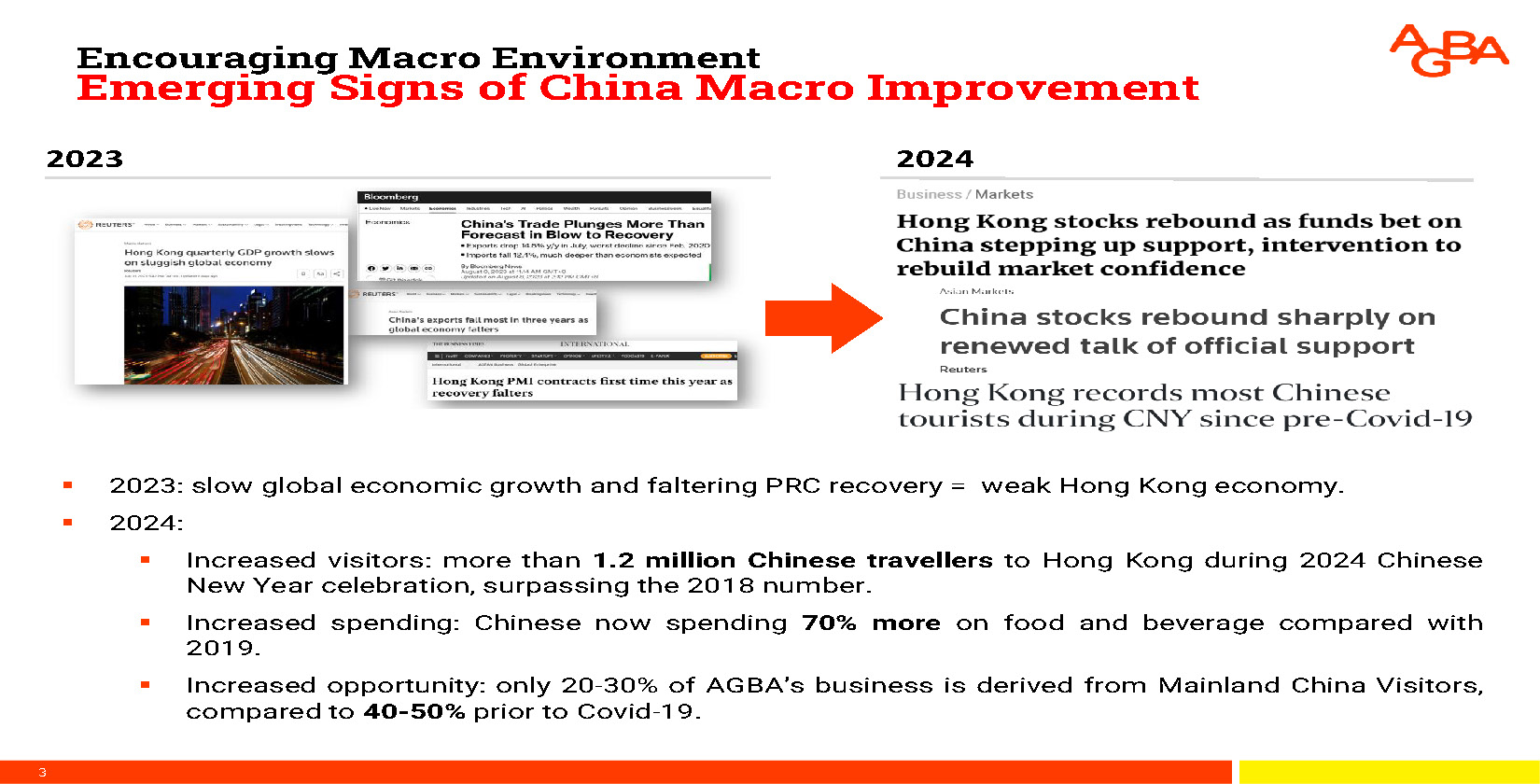

Exciting Opportunities Ahead Encouraging Macro Environment ▪ 2023 was a tough year for Hong Kong and China. ▪ Current macro environment bolstered by emerging signs of a China recovery. ▪ Plus, support from structural growth from demographics, GBA. AGBA Is Well Positioned For Growth ▪ Response to external challenges: simplify business model and material cost cuts. ▪ Raised substantial funds for growth (equity private placement, asset sales). ▪ Exciting and successful new partnerships. Substantial Value to be Unlocked ▪ Various (technical) factors combined to drive our share price decline. ▪ Disconnect between share price and underlying business value. ▪ Opens up substantial valuation gap / upside. 2 Encouraging Macro Environment Emerging Signs of China Macro Improvement 2023 2024 ▪ 2023: slow global economic growth and faltering PRC recovery = weak Hong Kong economy.

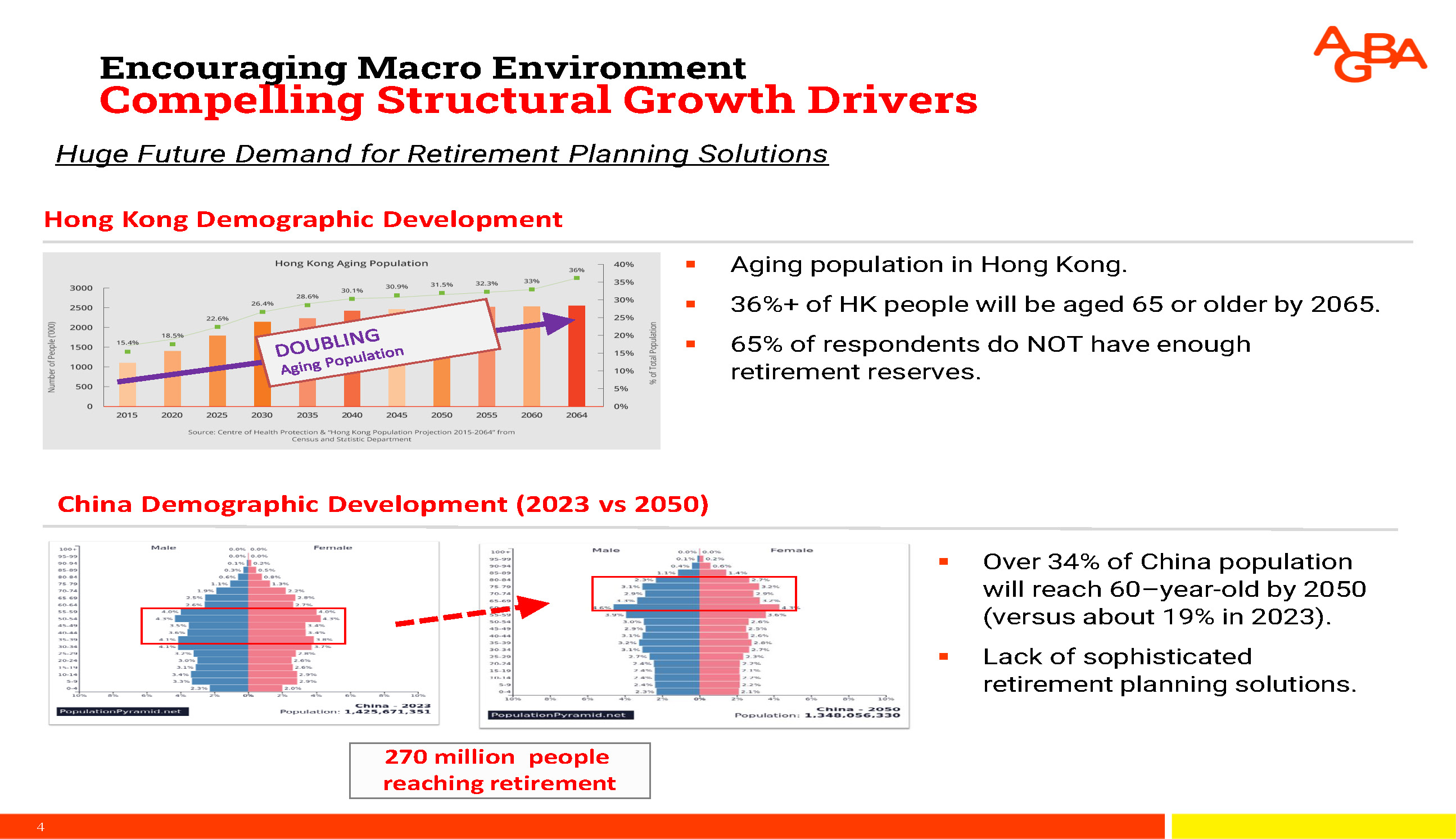

▪ 2024: ▪ Increased visitors: more than 1.2 million Chinese travellers to Hong Kong during 2024 Chinese New Year celebration, surpassing the 2018 number. ▪ Increased spending: Chinese now spending 70% more on food and beverage compared with 2019. ▪ Increased opportunity: only 20 - 30% of AGBA’s business is derived from Mainland China Visitors, compared to 40 - 50% prior to Covid - 19. 3 Encouraging Macro Environment Compelling Structural Growth Drivers China Demographic Development (2023 vs 2050) Huge Future Demand for Retirement Planning Solutions Hong Kong Demographic Development ▪ Aging population in Hong Kong.

▪ 36%+ of HK people will be aged 65 or older by 2065. ▪ 65% of respondents do NOT have enough retirement reserves. ▪ Over 34% of China population will reach 60 – year - old by 2050 (versus about 19% in 2023). ▪ Lack of sophisticated retirement planning solutions.

4 270 million people reaching retirement Encouraging Macro Environment Compelling Structural Growth Drivers Surging (Greater Bay Area Driven) Insurance and Investment Volumes Hong Kong Investment Industry ▪ Chinese investors are generally diversifying away from cash and real estate deposits towards other asset classes, but onshore assets have low risk adjusted returns compared to Hong Kong. ▪ Expansion of middle class and emergence of younger, technologically savvy generations looking for better investment options. Hong Kong Insurance Industry ▪ Greater Bay Area visitors are attracted to Hong Kong life insurance products because of lower pricing (typically 30 - 50% cheaper), higher claim success (50% in China versus 90% in Hong Kong) and better overall service level (one day underwriting). ▪ Plus: sophisticated product design, currency options and linkage to international markets. 5 ▪ In response to external macro - challenges, we simplified our business model in 2023.

▪ Focus on independent financial advisor channel, tune down non - core projects. ▪ Simplified business model drives substantial efficiencies in middle - and back - office. ▪ The implementation of significant cost - cutting measures is expected to reduce normalized operating expenses to a level for strong growth and profitability. ▪ Primarily achieved through reductions in staff during the last part of 2023 and early 2024. ▪ Room for additional savings in IT and operations. AGBA is Well Positioned for Growth Lean and Efficient Business Model 6 AGBA is Well Positioned for Growth Raised Substantial Growth Funding 2024 Private Placement ▪ USD 5 million raised in February 2024.

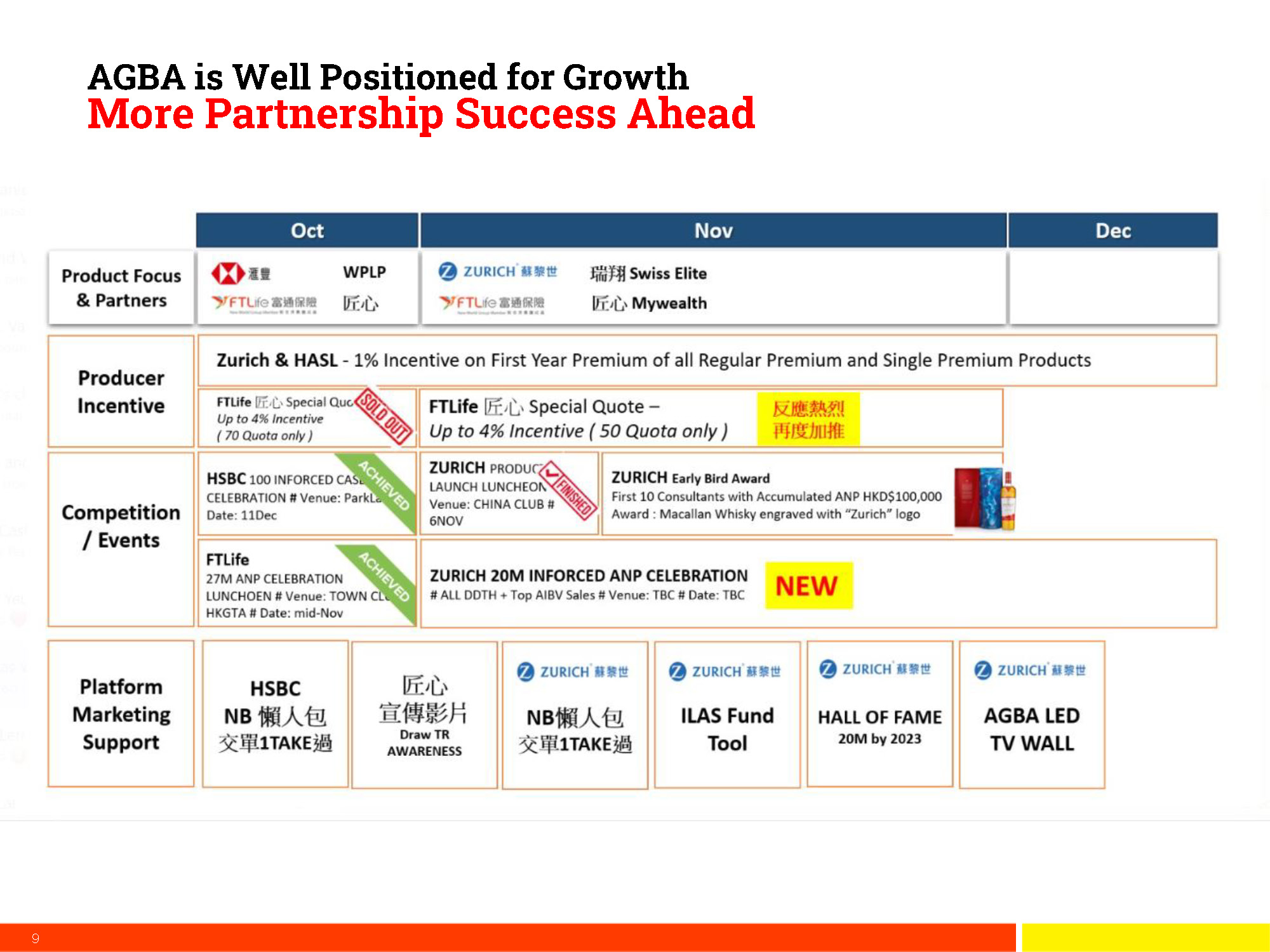

▪ Bringing in institutional investor plus support from management team. ▪ Raised at premium to current market price. 2024 Asset Sales ▪ Sale of non - core assets fast and controllable way to raise funds. ▪ USD 2 million completed in February 2024. ▪ Expect to sell further assets within the next 1 - 3 months. 7 1 Jul 2023 Jan 2023 Official Kick - off “Back To Glory” 2023 Annual Product Theme ILAS Re - activation Sales competition; Focus Group, etc… New Product Launch Exclusive Brokerage Distributor for HSBC 150 ILAS Product All - level Engagement Activities Segmented Roadshows & Platform Marketing Support Daily roadshow, Sales Tools/ Tips, Incentive, ATL promotion, etc… Jun 2022 Ubiquitous Implementation Approach AGBA is Well Positioned for Growth Successful Partnership with HSBC Life ▪ 50%+ of Consultants sold HSBC Life plan within first 3 months ▪ 100+ Roadshows conducted within the first 3 months ▪ Record Breaking performed better than provider’s in - house channels 8 AGBA is Well Positioned for Growth More Partnership Success Ahead 9

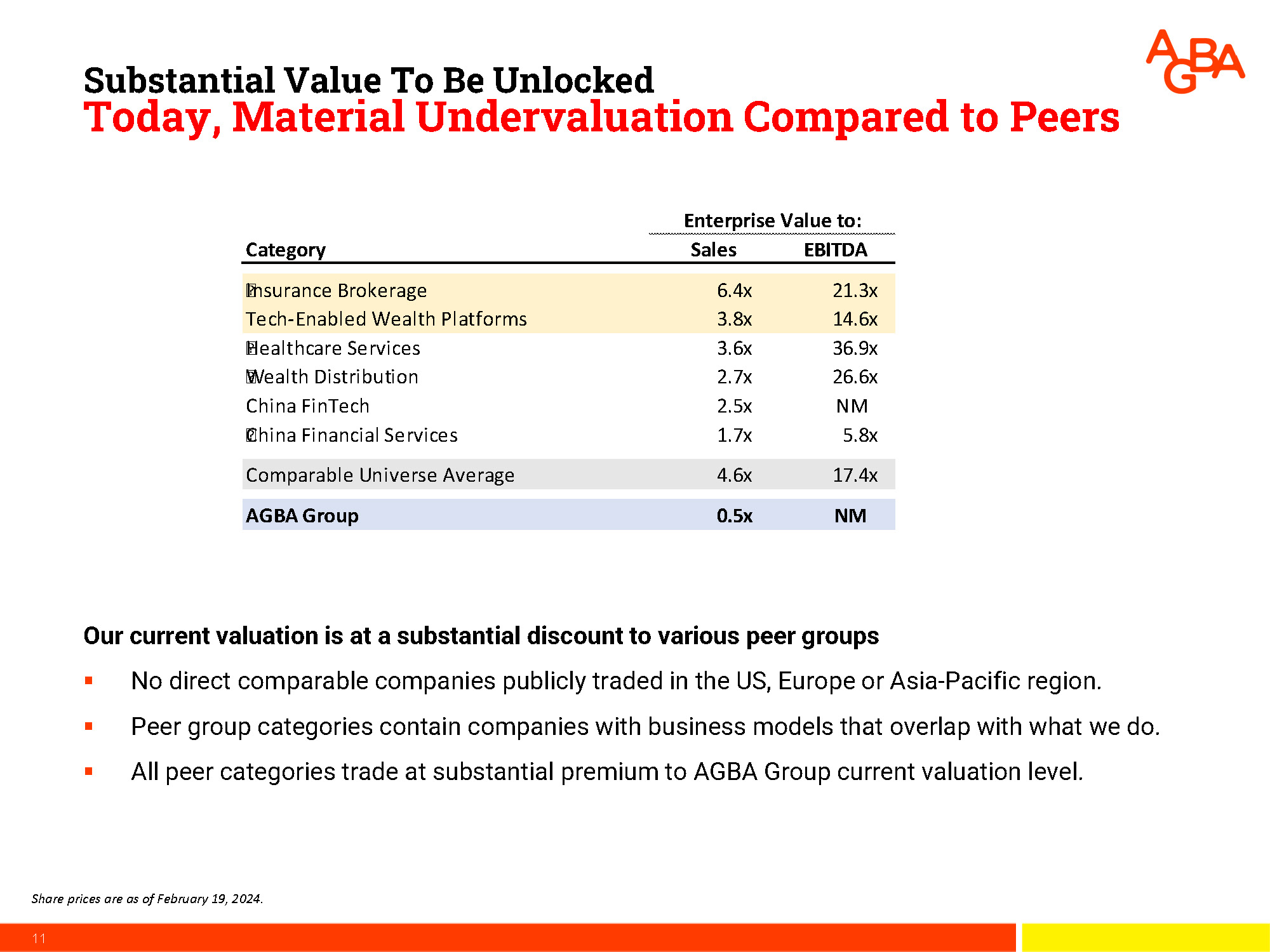

1 ▪ End of 2022 , delayed DeSPAC process led to immediate share price challenges. ▪ Delays due to increased SPAC scrutiny and US/China tensions. ▪ Highly uncommon 50% share price “crash” before listing (November 2022). ▪ Early 2023 , general macro - economic and geo - political headwinds drove further decline. ▪ Slow emergence of China / Hong Kong from Covid - 19, weak initial recovery after. ▪ Ongoing weakness of Chinese economy and ripple effects into Hong Kong. ▪ Throughout 2023 , limited free float increased vulnerability to suspected short attacks. ▪ Several abnormal trading volume spikes (multiples of free shares). ▪ Notified regulators of specific suspected naked short attacks. AGBA Share Price: decline of about 95% since time of public listing. 14.00 12.00 10.00 8.00 6.00 4.00 2.00 0.00 Substantial Value To Be Unlocked 10 Various Factors Combined to Share Price Decline Our current valuation is at a substantial discount to various peer groups ▪ No direct comparable companies publicly traded in the US, Europe or Asia - Pacific region.

▪ Peer group categories contain companies with business models that overlap with what we do. ▪ All peer categories trade at substantial premium to AGBA Group current valuation level. Share prices are as of February 19, 2024. 11 Substantial Value To Be Unlocked Today, Material Undervaluation Compared to Peers EBITDA Sales Category 21.3x 6.4x Insurance Brokerage 14.6x 3.8x Tech - Enabled Wealth Platforms 36.9x 3.6x Healthcare Services 26.6x 2.7x Wealth Distribution NM 2.5x China FinTech 5.8x 1.7x China Financial Services 17.4x 4.6x Comparable Universe Average NM 0.5x AGBA Group Enterprise Value to:

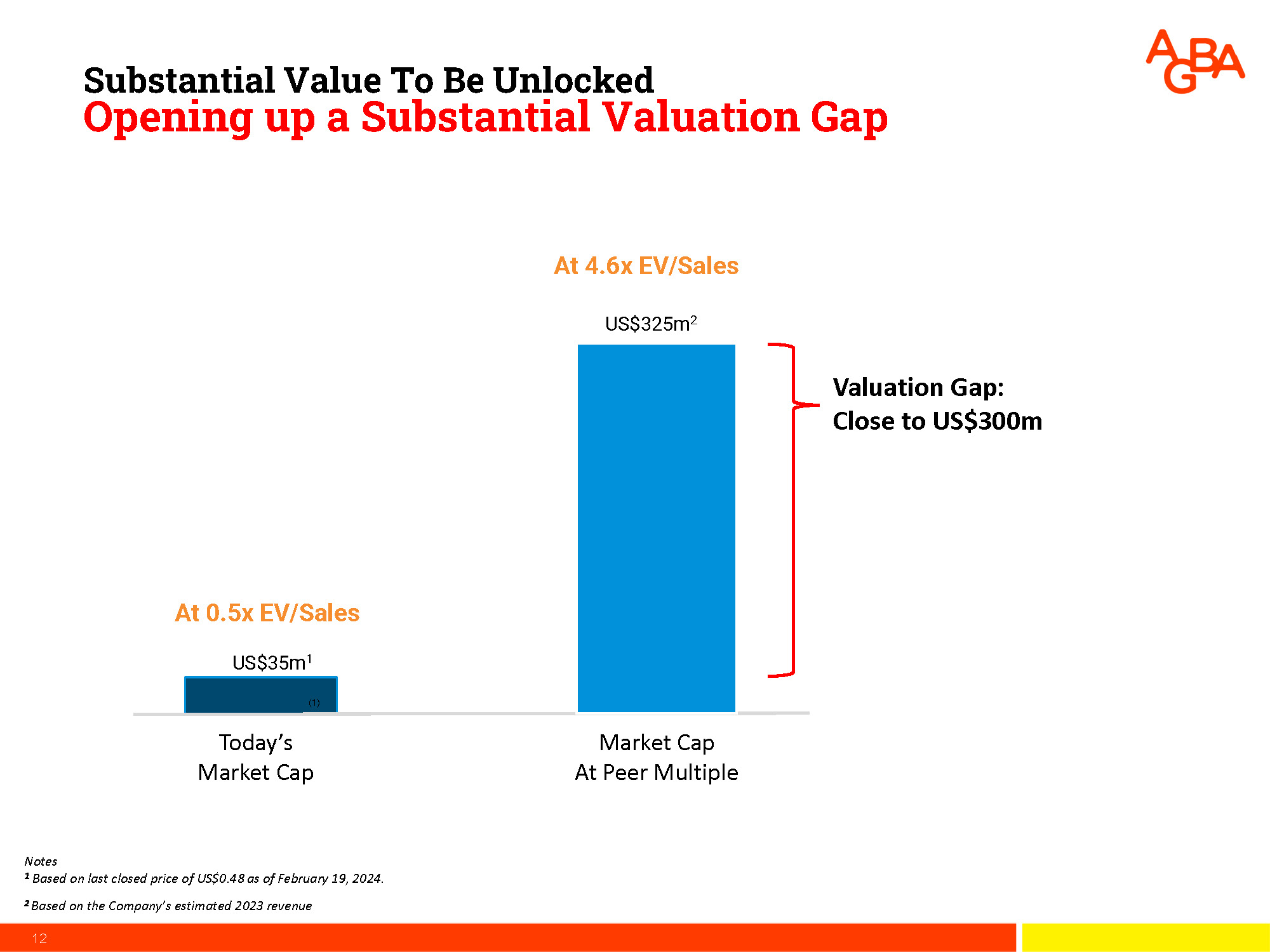

Notes 1 Based on last closed price of US$0.48 as of February 19, 2024. 2 Based on the Company’s estimated 2023 revenue (1) At 4.6x EV/Sales US$325m 2 Valuation Gap: Close to US$300m At 0.5x EV/Sales US$35m 1 Substantial Value To Be Unlocked Opening up a Substantial Valuation Gap Today’s Market Cap 12 Market Cap At Peer Multiple Exciting Opportunities Ahead 1.

Appendix

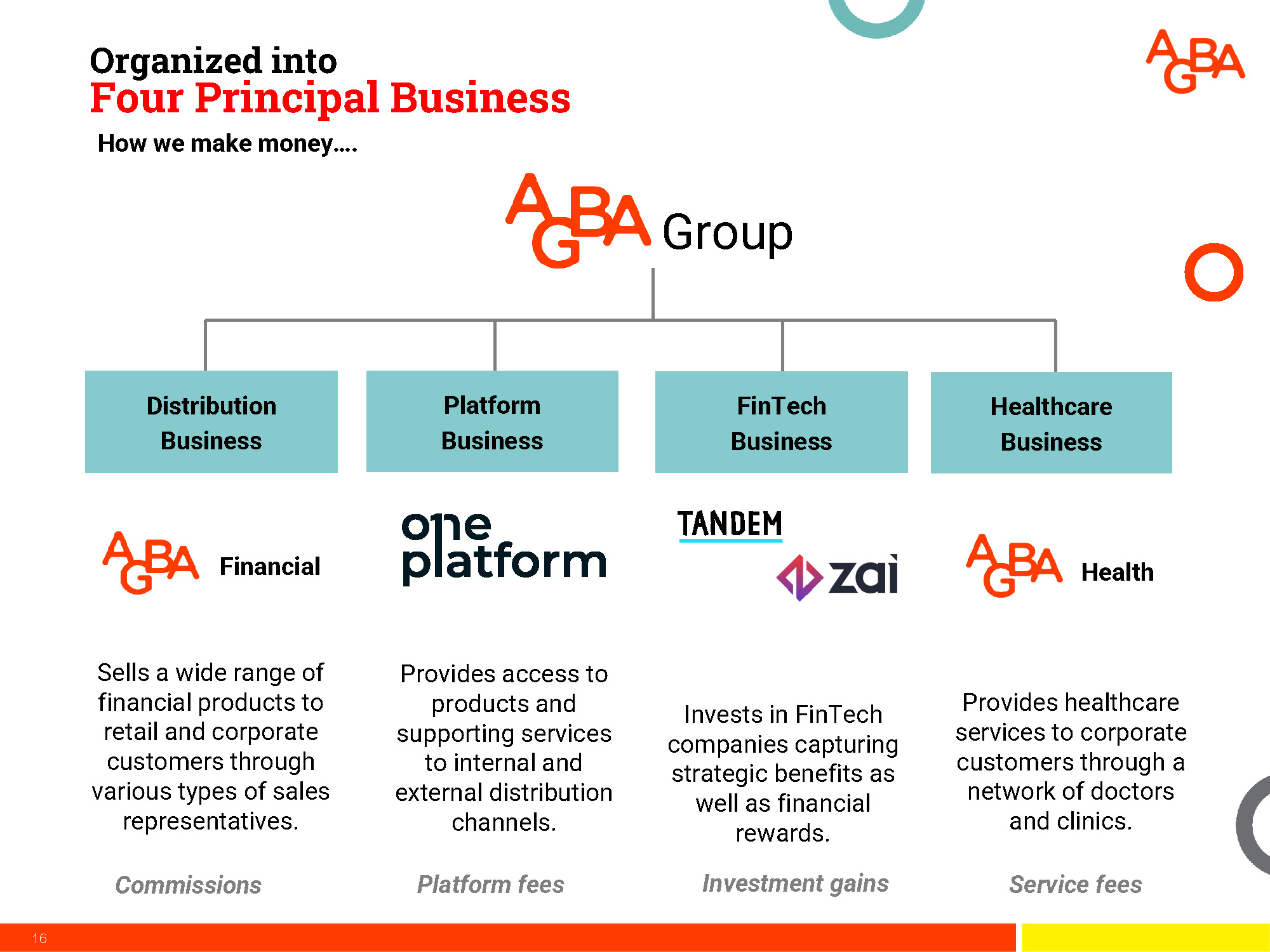

Encouraging Macro Environment. 2. Well Positioned for Growth. 3. Substantial Value to be Unlocked. 13 ~1,200 financial advisors ~200,000 customers 1 st Largest Independent Financial Advisor in Hong Kong 3 rd ~800 affiliated clinics ~US$100m projected normalized revenue Operating Track Record 30 Years Major Shareholder Mr. Richard Tsai Workforce 1,500 Products Insurance: 700+ Investment: 1,800+ Product Vendors (100+ in total) Group Largest Healthcare Brand in Hong Kong ~1,200 doctors and specialists ~300,000 corporate and Individual customers (1) Source: various internal and external studies We are a One - Stop Financial Supermarket 15 Organized into Four Principal Business How we make money….

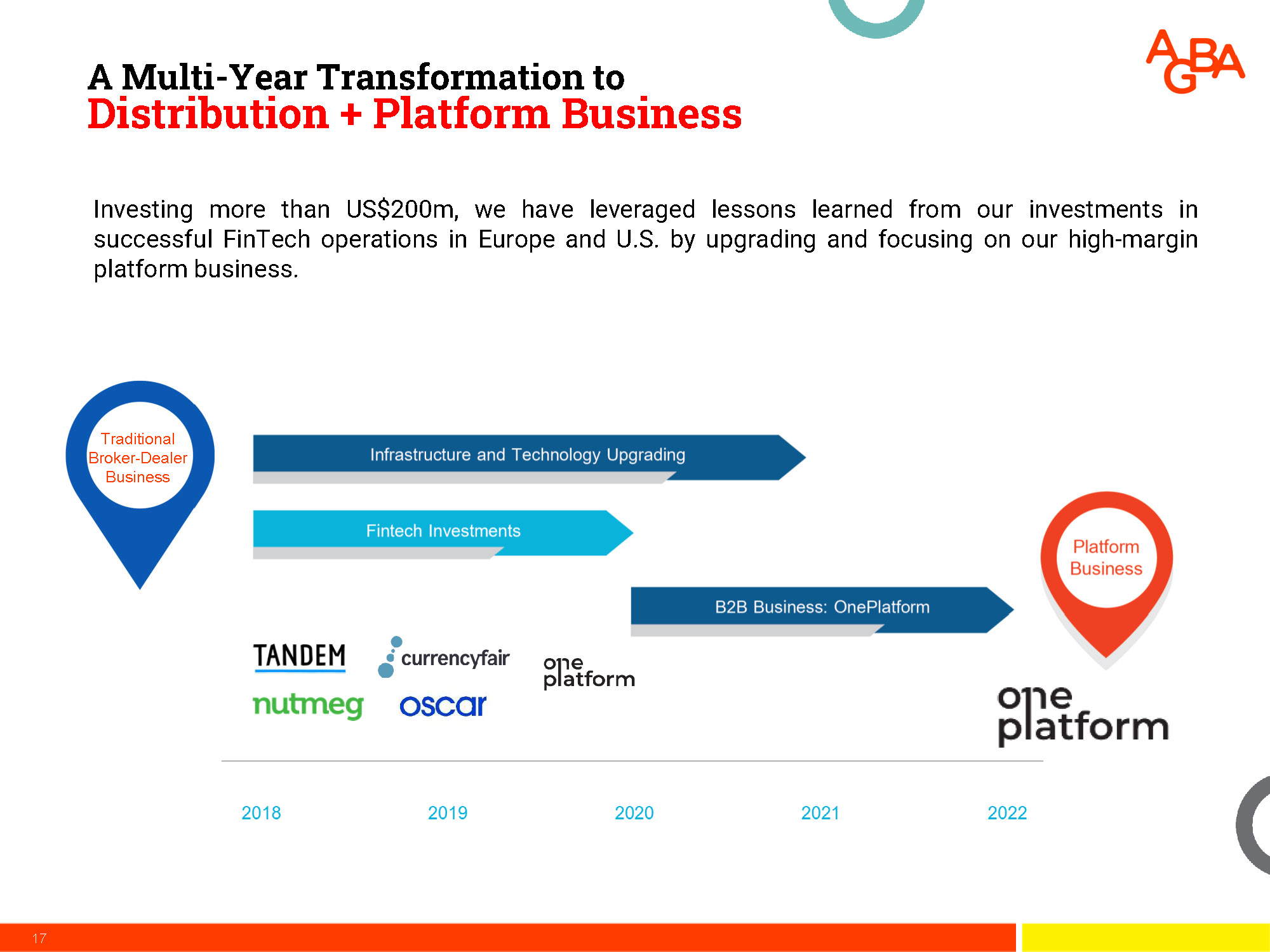

Group Distribution Business Sells a wide range of financial products to retail and corporate customers through various types of sales representatives. FinTech Business Invests in FinTech companies capturing strategic benefits as well as financial rewards. Investment gains Financial Health Commissions Platform fees Service fees Provides access to products and supporting services to internal and external distribution channels. Platform Business Healthcare Business Provides healthcare services to corporate customers through a network of doctors and clinics. 16 A Multi - Year Transformation to Distribution + Platform Business Investing more than US $ 200 m, we have leveraged lessons learned from our investments in successful FinTech operations in Europe and U . S . by upgrading and focusing on our high - margin platform business . Traditional Broker - Dealer Business 17

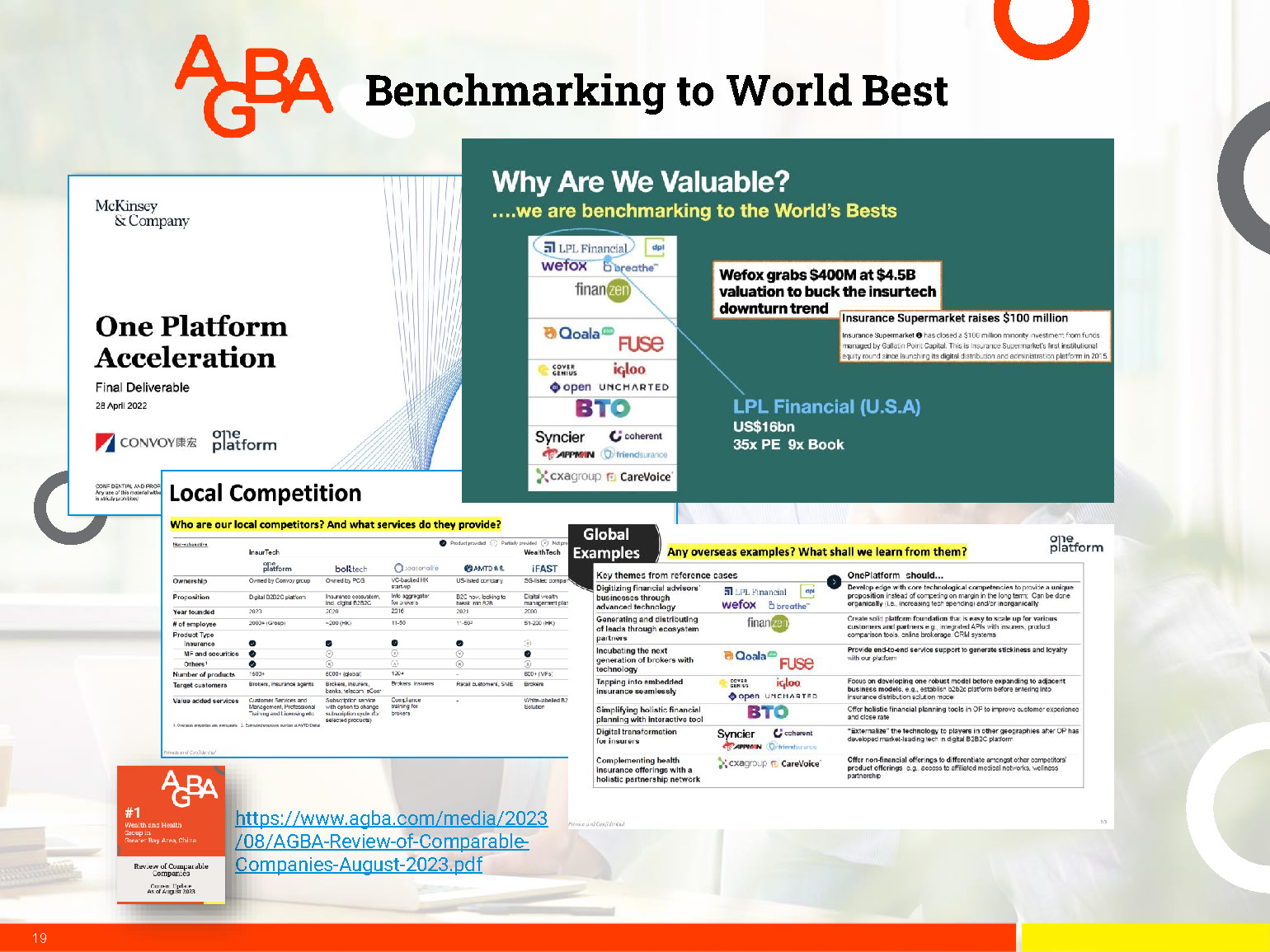

Group Key Investment Highlights 1. Unique product and service offerings: - B2C: market leading portfolio of wealth and health products - B2B: tech - enabled broker - dealer management platform for advisors 2. Large end - markets with strong macro - economic growth drivers 3. Compelling business model economics 4. Significant unrealized value of fintech and healthcare franchise 5. Experienced management team 18 Benchmarking to World Best https://www.agba.com/media/2023 /08/AGBA - Review - of - Comparable - Companies - August - 2023.pdf 19 19

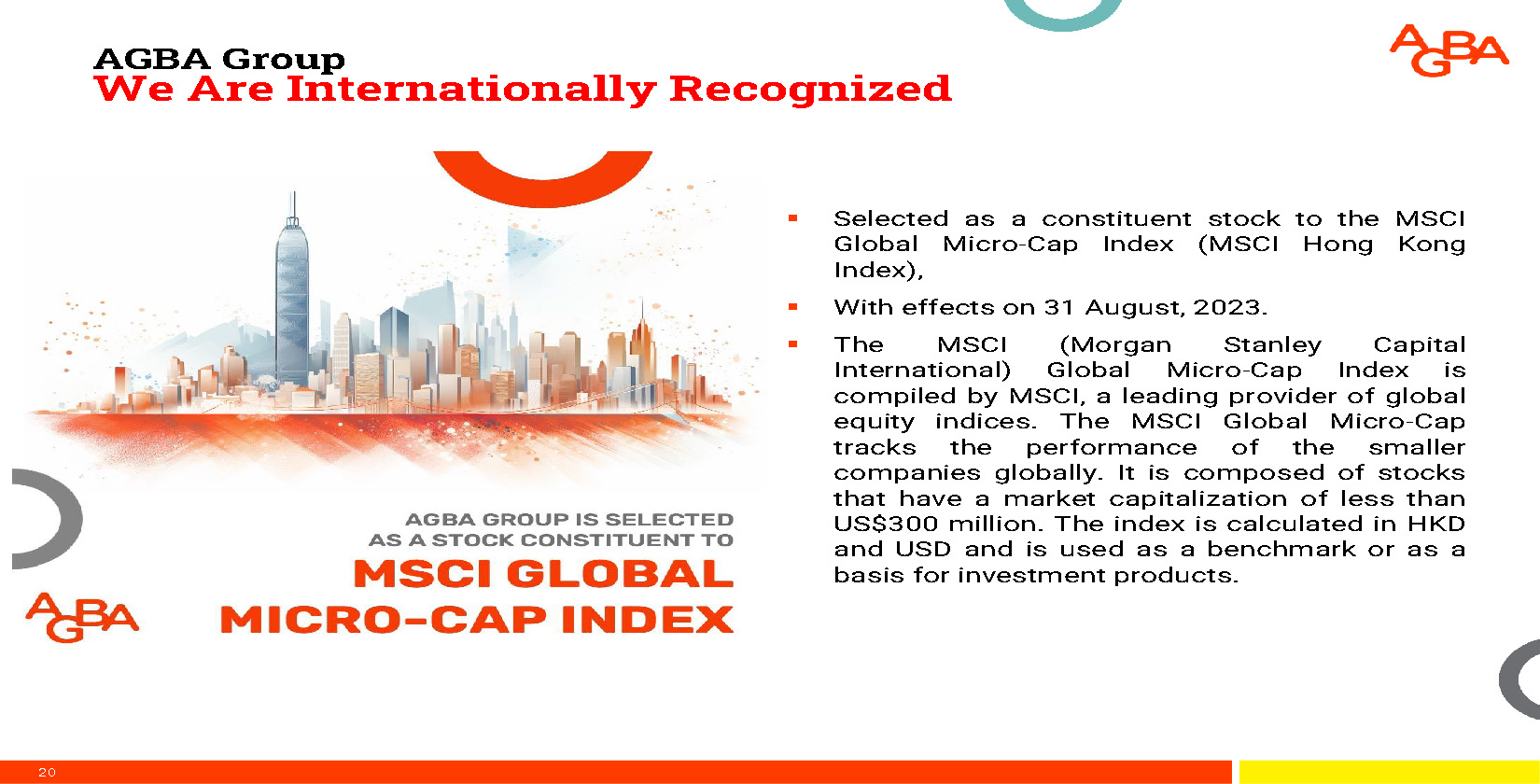

▪ Selected as a constituent stock to the MSCI Global Micro - Cap Index (MSCI Hong Kong Index), ▪ With effects on 31 August, 2023 . ▪ The MSCI (Morgan Stanley Capital International) Global Micro - Cap Index is compiled by MSCI, a leading provider of global equity indices . The MSCI Global Micro - Cap tracks the performance of the smaller companies globally . It is composed of stocks that have a market capitalization of less than US $ 300 million . The index is calculated in HKD and USD and is used as a benchmark or as a basis for investment products .

AGBA Group We Are Internationally Recognized 20 International Expansion Growth and Innovation in Financial Services Industry ▪ Announced in April 2023 , AGBA entered into agreement to acquire 100 % of Sony Life Financial Advisers, a Singapore based financial adviser and insurance broker . The acquisition will be completed by May 2024 . ▪ Along with AGBA expansion into the Greater Bay Area, this marks AGBA’s first foray into South - East Asia and a key milestone . ▪ We are excited about the opportunities that lie ahead with the addition of Sony Life joining us, and we have high expectations for new revenue growth . ▪ We have great visions to be the only RIA in the region that will operate in both Hong Kong and Singapore – two of the world’s biggest wealth management hubs .

21 21 AGBA Bolsters Board Expertise to Drive Growth and Innovation in Financial Services Industry ▪ Over the next 6 months, AGBA intends to redomicile itself to the United States and become a fully - fledged domestic corporation . ▪ Further along our "follow our customers" growth plan, we are also open to merging with or acquiring a significant Registered Investment Advisor (RIA) in North America . ▪ OnePlatform continues to broaden its product offering now to include ‘alternative investment’ assets from private equity and hedge funds around the world . ▪ Mr . Bob Diamond was appointed as Chairman of AGBA Board . He is also the Founding Partner and Chief Executive Officer of Atlas Merchant Capital .

21 22 ▪ Mr. Richard Tsai is the largest shareholder of AGBA. ▪ The Tsai Family is one of the wealthiest and most respected families in Asia ▪ Mr . Tsai is the Chairman of Fubon Financial and Fubon Group of companies ▪ Fubon Financial is one of the largest home - grown financial institution in Asia with a market value in excess of US $ 30 bn and assets of almost US $ 400 bn ▪ He has been in the forefront in investing and developing in technologies, fintech and healthcare globally Backed by Impeccable Shareholder 23 Respected and Reputable Ongoing Comprehensive Disclosures www.agba.com/ir 24

THANK YOU For further information, please visit www.agba.com @agbagroup Investor Relation Enquires: ir@agba.com +852 5529 4500 Contact us: AGBA Group Holding Limited AGBA Tower, 68 Johnston Road, Wan Chai, Hong Kong