FORM

6-K

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

dated February 7, 2024

BRASILAGRO

– COMPANHIA BRASILEIRA DE PROPRIEDADES AGRÍCOLAS

(Exact Name as Specified in its Charter)

BrasilAgro – Brazilian Agricultural Real Estate Company

(Translation of Registrant’s Name)

1309 Av. Brigadeiro Faria Lima, 5th floor, São Paulo, São Paulo 01452-002, Brazil

(Address of principal executive offices)

Gustavo Javier Lopez,

Administrative Officer and Investor Relations Officer,

Tel. +55 11 3035 5350, Fax +55 11 3035 5366, ri@brasil-agro.com

1309 Av. Brigadeiro Faria Lima, 5th floor

São Paulo, São Paulo 01452-002, Brazil

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Material Fact

BRASILAGRO – COMPANHIA BRASILEIRA DE PROPRIEDADES AGRÍCOLAS

Publicly-Held Company with Authorized Capital

Corporate Taxpayer’s ID (CNPJ/MF) No. 07.628.528/0001-59 State Registry

(NIRE) 35.300.326.237

MONITORING OF THE AGRICULTURAL OPERATIONS ESTIMATES

2023/2024 HARVEST YEAR

A BrasilAgro – Companhia Brasileira de Propriedades Agrícolas (B3: AGRO3) (NYSE: LND), leader in Brazil in the acquisition, development and sale of rural properties with high potential for appreciation, informs its shareholders and the market in general its estimates and updates of the agricultural operations for the 2023/2024 harvest year.

Planted area per culture (hectare)

Production per culture (tons)

Due to high volatility in corn prices, which pressured margins, we changed the planted area mix for the 2023/24 crop year in relation to the initial budget. We plan to reduce total planted area by 7% in relation to initial estimates. Compared to the previous crop year, planted area increased 10%.

With the reduction in planted area, we estimate a 17% decrease in our grain and cotton production compared to initial estimates. As for corn cultivars, apart from the reduction in area, our productivity in Bahia also decreased due to irregular rainfall, which affected crops in their vegetative stage, resulting in lower productivity.

|

|

Sugarcane

In December, we concluded sugarcane harvest, harvesting 2 million tons of sugarcane, corresponding to 79.07 tons of cane per hectare (TCH).

As reported in the previous crop year, a fire destroyed a part of our sugarcane fields at the São José Farm, which affected the development of sugarcane in these areas and, consequently, the production potential of the crop. We also registered losses in sugarcane production in Bolivia in 2022/23 due to the intense drought that affected the region soon after planting.

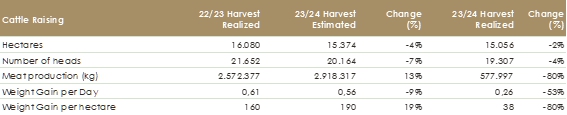

Cattle Raising

Due to the lack of rainfall, pasture availability decreased and hence, we expect meat production to be approximately 25% lower than initial estimates.

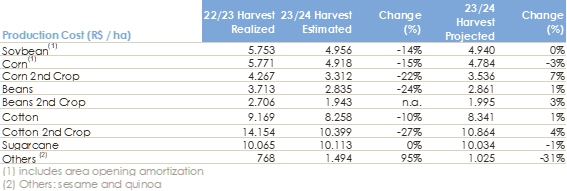

Production costs (R$/ha)

It is noteworthy that the estimates are hypothetical data and do not constitute a promise of performance. For more information about our operating estimates see the respective section of our Reference Form.

São Paulo, February 7th, 2024.

Gustavo Javier Lopez

CFO & IRO

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Date: February 7, 2024 | By: | /s/ Gustavo Javier Lopez | |

| Name: | Gustavo Javier Lopez | ||

| Title: | Administrative

Officer and Investor Relations Officer |

||

3