UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or Section 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 5, 2024

Power & Digital Infrastructure Acquisition II Corp.

(Exact name of registrant as specified in its charter)

| Delaware | 001-441151 | 86-2962208 | ||

| (State or other jurisdiction of incorporation or organization) |

(Commission File Number) | (I.R.S. Employer Identification Number) |

321 North Clark Street, Suite 2440

Chicago, IL 60654

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Registrant’s telephone number, including area code: (312) 262-5642

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation to the registrant under any of the following provisions:

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbols | Name of each exchange on which registered | ||

| Units, each consisting of one share of Class A Common Stock and one-half of one redeemable warrant | XPDBU | The Nasdaq Stock Market LLC | ||

| Class A common stock, par value $0.0001 per share | XPDB | The Nasdaq Stock Market LLC | ||

| Warrants included as part of the units, each whole warrant exercisable for one share of Class A Common Stock at an exercise price of $11.50 | XPDBW | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On February 5, 2024, Power & Digital Infrastructure Acquisition II Corp. (“XPDB”), XPDB Merger Sub, LLC, a Delaware limited liability company (“Merger Sub”) and Montana Technologies, LLC, a Delaware limited liability company (“Montana”) entered into that certain First Amendment to Agreement and Plan of Merger (the “Amendment”), amending that certain Agreement and Plan of Merger, dated June 5, 2023, by and among XPDB, Merger Sub and Montana (the “Business Combination Agreement”), to, among other things, (i) amend the definition of Aggregate Transaction Proceeds and (ii) reduce the Aggregate Transaction Proceeds condition from $85 million to $50 million.

The foregoing summary of the Amendment does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Amendment filed as Exhibit 10.1 hereto and incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

Furnished herewith as Exhibit 99.1 and incorporated into this Item 7.01 by reference is the investor presentation to be presented to certain potential investors in connection with the Business Combination.

The information set forth below under this Item 7.01, including the exhibits attached hereto, is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the United States Securities Act of 1933 (the “Securities Act”) or the Exchange Act, except as expressly set forth by specific reference in such filing.

Forward-looking Statements

Certain statements in this communication (“Communication”) may be considered “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995 and within the meaning of the federal securities laws with respect to the proposed business combination between XPDB and Montana, including statements regarding the benefits of the proposed business combination, the anticipated timing of the proposed business combination, the likelihood and ability of the parties to successfully consummate the proposed business combination, the amount of funds available in the trust account as a result of shareholder redemptions or otherwise, the impact, cost and performance of the AirJouletm technology once commercialized, the services offered by Montana and the markets in which Montana operates, business strategies, debt levels, industry environment, potential growth opportunities, the effects of regulations. These forward-looking statements generally are identified by the words “believe,” “predict,” “project,” “potential,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “forecast,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “should,” “will be,” “will continue,” “will likely result,” and similar expressions (including the negative versions of such words or expressions).

Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this document, including but not limited to: (i) the risk that the proposed business combination may not be completed in a timely manner or at all, which may adversely affect the price of XPDB securities; (ii) the risk that the proposed business combination may not be completed by XPDB’s business combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by XPDB; (iii) the failure to satisfy the conditions to the consummation of the proposed business combination, including the approval of the proposed business combination by XPDB’s stockholders, the satisfaction of the minimum aggregate transaction proceeds amount following redemptions by XPDB’s public stockholders and the receipt of certain governmental and regulatory approvals; (iv) the failure to obtain financing to complete the proposed business combination and to support the future working capital needs of Montana; (v) the effect of the announcement or pendency of the proposed business combination on Montana’s business relationships, performance, and business generally; (vi) risks that the proposed business combination disrupts current plans of Montana and potential difficulties in Montana’s employee retention as a result of the proposed business combination; (vii) the outcome of any legal proceedings that may be instituted against XPDB or Montana related to the agreement and the proposed business combination; (viii) changes to the proposed structure of the business combination that may be required or appropriate as a result of applicable laws or regulations or as a condition to obtaining regulatory approval of the business combination; (ix) the ability to maintain the listing of XPDB’s securities on the NASDAQ; (x) the price of XPDB’s securities, including volatility resulting from changes in the competitive and highly regulated industries in which Montana plans to operate, variations in performance across competitors, changes in laws and regulations affecting Montana’s business and changes in the combined capital structure; (xi) the ability to implement business plans, forecasts, and other expectations after the completion of the proposed business combination, including the possibility of cost overruns or unanticipated expenses in development programs, and the ability to identify and realize additional opportunities; (xii) the enforceability of Montana’s intellectual property, including its patents, and the potential infringement on the intellectual property rights of others, cyber security risks or potential breaches of data security; and (xiii) other risks and uncertainties set forth in the section entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in XPDB’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K that are available on the website of the Securities and Exchange Commission (the “SEC”) at www.sec.gov and other documents filed, or to be filed with the SEC by XPDB, including the Registration Statement. The foregoing list of factors is not exhaustive. There may be additional risks that neither XPDB or Montana presently know or that XPDB or Montana currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. You should carefully consider the foregoing factors and the other risks and uncertainties that will be described in XPDB’s definitive proxy statement contained in the Registration Statement (as defined below), including those under “Risk Factors” therein, and other documents filed by XPDB from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and XPDB and Montana assume no obligation and, except as required by law, do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Neither XPDB nor Montana gives any assurance that either XPDB or Montana will achieve its expectations.

Additional Information about the Proposed Transaction and Where to Find It

In connection with the proposed business combination, XPDB has filed a registration statement on Form S-4 (the “Registration Statement”) that includes a proxy statement/prospectus of XPDB. The Form S-4 is now effective, having been declared effective by the SEC on January 17, 2024. The definitive proxy statement/final prospectus and other relevant documents were mailed to all XPDB stockholders on January 18, 2024 and will be mailed to all XPDB stockholders as of February 8, 2024, the record date established for voting on the proposed business combination and the other matters to be voted upon at a meeting of XPDB’s stockholders to be held to approve the proposed business combination and other matters (the “Special Meeting”). XPDB may also file other documents regarding the proposed business combination with the SEC. The definitive proxy statement/final prospectus contains important information about the proposed business combination and the other matters to be voted upon at the Special Meeting and may contain information that an investor will consider important in making a decision regarding an investment in XPDB’s securities. Before making any voting decision, investors and security holders of XPDB and other interested parties are urged to read the Registration Statement and the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC in connection with the proposed business combination as they become available because they will contain important information about the proposed business combination.

Investors and security holders are able to obtain free copies of the definitive proxy statement/final prospectus and all other relevant documents filed or that will be filed with the SEC by XPDB through the website maintained by the SEC at www.sec.gov, or by directing a request to XPDB, 321 North Clark Street, Suite 2440, Chicago, IL 60654 or by contacting Morrow Sodali LLC, XPDB’s proxy solicitor, for help, toll-free at (800) 662-5200 (banks and brokers can call collect at (203) 658-9400).

INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Participants in the Solicitation

XPDB, Montana and certain of their respective directors, executive officers may be deemed participants in the solicitation of proxies from XPDB’s stockholders with respect to the proposed business combination. A list of the names of those directors and executive officers of XPDB and a description of their interests in XPDB is set forth in XPDB’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. Additional information regarding the interests of those persons and other persons who may be deemed participants in the proposed business combination may be obtained by reading the Registration Statement. The documents described in this paragraph are available free of charge at the SEC’s website at www.sec.gov, or by directing a request to XPDB, 321 North Clark Street, Suite 2440, Chicago, IL 60654. Additional information regarding the names and interests of such participants will be contained in the Registration Statement for the proposed business combination when available.

No Offer and Non-Solicitation

This Communication is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the potential transaction and shall not constitute an offer to sell or a solicitation of an offer to buy the securities of XPDB, Montana or the combined company, nor shall there be any sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended.

Item 9.01 Financial Statements and Exhibits.

(d)

| Exhibit | Description | |

| 10.1 | First Amendment to Agreement and Plan of Merger, dated as of February 5, 2024, by and among Power & Digital Infrastructure Acquisition II Corp., XPDB Merger Sub, LLC and Montana Technologies, LLC. | |

| 99.1 | Investor Presentation, dated February 5, 2024. | |

| 104 | Cover Page Interactive Data File (embedded within Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: February 5, 2024

| POWER & DIGITAL INFRASTRUCTURE ACQUISITION II CORP. | ||

| By: | /s/ Patrick C. Eilers | |

| Name: | Patrick C. Eilers | |

| Title: | Chief Executive Officer | |

4

Exhibit 10.1

FIRST AMENDMENT TO

AGREEMENT AND PLAN OF MERGER

This FIRST AMENDMENT TO AGREEMENT AND PLAN OF MERGER (this “First Amendment”) is entered into as of February 5, 2024, by and among Power & Digital Infrastructure Acquisition II Corp., a Delaware corporation (“Parent”), XPDB Merger Sub, LLC, a Delaware limited liability company (“Merger Sub” and, together with Parent, the “Parent Parties”), and Montana Technologies, LLC, a Delaware limited liability company (the “Company” and, together with Acquiror and Merger Sub, the “Parties”). Capitalized terms used but not defined herein shall have the meanings assigned to such terms in the Agreement (as defined herein).

RECITALS

WHEREAS, the Parties entered into that certain Agreement and Plan of Merger, dated as of June 5, 2023 (as may be amended, modified or supplemented from time to time, the “Agreement”); and

WHEREAS, the Parties desire to amend the Agreement in accordance with Section 9.13 thereof as set forth herein.

NOW THEREFORE, in consideration of the mutual agreements contained herein and for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, and intending to be legally bound hereby, the Parties hereby agree as follows:

AGREEMENT

1. Amendment.

(a) The definition of “Aggregate Transaction Proceeds” in Exhibit A of the Agreement is hereby deleted in its entirety and replaced with the following definition:

“Aggregate Transaction Proceeds” means an amount equal to the sum of (without duplication): (i) the aggregate cash available to the Company, its Subsidiaries and any joint venture majority- or co-controlled by the Company, including CAMT Climate Solutions Ltd. and any joint venture majority- or co-controlled by the Company formed by the Company, on the one hand, and General Electric Company or any of its Subsidiaries, on the other hand (“Controlled Joint Ventures”); plus (ii) the aggregate amount of all irrevocable and unconditional binding commitments (other than those conditions that by their terms will be satisfied concurrently with the Closing) (1) by one or more persons (other than the Company or its Subsidiaries) to provide funding or make capital contributions to any Controlled Joint Venture and (2) by one or more persons (other than the Company or any of its Subsidiaries or Controlled Joint Ventures) for financing of facilities or equipment of the Company, its Subsidiaries or the Controlled Joint Ventures; plus (iii) the aggregate cash actually received by the Company or Parent following the date of the Agreement and concurrently with or prior to the Closing in connection with the issuance and sale by the Company or Parent of Equity Interests of the Company or Parent; provided that, such aggregate cash received by Parent described in this clause (iii) shall only be included as Aggregate Transaction Proceeds if (x) such amount is subject to any redemption rights by Parent Stockholders, to the extent Parent has provided the Parent Stockholders an opportunity to redeem their shares of Parent Class A Common Stock in connection with the Transactions and such Parent Stockholders are no longer legally entitled (pursuant to the terms of the Organizational Documents of Parent and the applicable deadlines imposed by Parent on the Parent Stockholders for such redemption) to, and Parent does not otherwise permit such Parent Stockholders to, redeem such shares but giving effect to such redemption and any and all reversals of elections to redeem shares of Parent Class A Common Stock by Parent Stockholders or (y) such amount is not subject to any redemption rights by Parent Stockholders; plus (iv) amounts available for borrowing under any indebtedness of the Company (including, for the avoidance of doubt, indebtedness that is evidenced by notes, bonds, debentures, credit agreements and/or similar instruments); plus (v) the aggregate amount on deposit in the Trust Account (after, for the avoidance of doubt, giving effect to any redemptions of shares of Parent Class A Common Stock by stockholders of Parent but before release of any other funds, including in satisfaction of Parent Transaction Expenses and Company Transaction Expenses).

(b) Section 6.2(d) of the Agreement is hereby deleted in its entirety and replaced with the following:

(d) Transaction Proceeds. The Aggregate Transaction Proceeds shall be equal to or greater than $50,000,000; provided that, upon receiving proceeds from the Capital Raise equal to or in excess of such amount, this condition shall no longer apply.

2. Confirmation. All other provisions of the Agreement shall, subject to the amendments expressly set forth in Section 1 of this First Amendment, continue unmodified, in full force and effect and constitute legal and binding obligations of the Parties in accordance with their terms. This First Amendment is limited precisely as written and shall not be deemed to be an amendment to any other term or condition of the Agreement or any of the documents referred to in the Agreement. This First Amendment forms an integral and inseparable part of the Agreement.

3. References. Each reference to “this Agreement,” “hereof,” “herein,” “hereunder,” “hereby” and each other similar reference contained in the Agreement shall, effective from the date of this Amendment, refer to the Agreement as amended by this Amendment. Notwithstanding the foregoing, references to the date of the Agreement and references in the Agreement, as amended by this Amendment, to “the date hereof,” “the date of this Agreement” and other similar references shall in all instances continue to refer to June 5, 2023.

4. Incorporation by Reference. Each of the provisions of Section 9.3 (Notices), Section 9.4 (Severability), Section 9.5 (Binding Effect; Assignment), Section 9.6 (No Third Party Beneficiaries), Section 9.7 (Section Headings), Section 9.8 (Consent to Jurisdiction, Etc.), Section 9.9 (Entire Agreement), Section 9.10 (Governing Law), Section 9.11 (Specific Performance), Section 9.12 (Counterparts), Section 9.13 (Amendment; Modification; Waiver), Section 9.16 (No Recourse) and Section 9.17 (Construction) of the Agreement are incorporated by reference into this First Amendment and shall apply, mutatis mutandis, to this Amendment.

[Signature Page Follows]

IN WITNESS WHEREOF, the Parties have caused this First Amendment to Agreement and Plan of Merger to be executed as of the date first above written.

| POWER & DIGITAL INFRASTRUCTURE ACQUISITION II CORP. | ||

| By: | /s/ Patrick C. Eilers | |

| Name: | Patrick C. Eilers | |

| Title: | Chief Executive Officer | |

| XPDB MERGER SUB, LLC | ||

| By: | /s/ Patrick C. Eilers | |

| Name: | Patrick C. Eilers | |

| Title: | Chief Executive Officer | |

| MONTANA TECHNOLOGIES, LLC | ||

| By: | /s/ Matt Jore | |

| Name: | Matt Jore | |

| Title: | Chief Executive Officer | |

[Signature Page to First Amendment to Agreement and Plan of Merger]

Exhibit 99.1

SUSTAINABLY MEETING THE CHALLENGES OF COMFORT COOLING / HVAC AND WATER SUPPLY Basis of Presentation These presentation materials (“Presentation Materials”) are provided for informational purposes only and have been prepared to assist interested parties in a proposed private placement in making their own evaluation with respect to an investment in connection with a potential business combination among Montana Technologies LLC ("Montana Technologies“ or “MT”), Power & Digital Infrastructure Acquisition II Corp . ("XPDB") and the other parties thereto and related transactions (the "Potential Business Combination") and for no other purpose . By accepting, reviewing or reading these Presentation Materials, you will be deemed to have agreed to the obligations and restrictions set out below . No Offer or Solicitation These Presentation Materials and any oral statements made in connection with these Presentation Materials do not constitute an offer to sell, or a solicitation of an offer to buy, or a recommendation to purchase, any securities in any jurisdiction, or the solicitation of any vote, consent or approval in any jurisdiction in connection with the Potential Business Combination or any related transactions, nor shall there be any sale, issuance or transfer of any securities in any jurisdiction where, or to any person to whom, such offer, solicitation or sale may be unlawful under the laws of such jurisdiction . These Presentation Materials do not constitute either advice or a recommendation regarding any securities . No offering of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933 , as amended (the "Securities Act") or an exemption therefrom . No Representations and Warranties No representations or warranties, express, implied or statutory, are given in, or in respect of, these Presentation Materials, and no person may rely on the information contained in these Presentation Materials . Any data on past performance or modeling contained herein is not an indication as to future performance . This data is subject to change . Each recipient agrees and acknowledges that these Presentation Materials are not intended to form the basis of any investment decision by such recipient and do not constitute investment, tax or legal advice . Recipients of these Presentation Materials are not to construe its contents, or any prior or subsequent communications from or with XPDB, Montana Technologies, or their respective representatives as investment, legal or tax advice . Each recipient should seek independent third party legal, regulatory, accounting and/or tax advice regarding these Presentation Materials . In addition, these Presentation Materials do not purport to be all - inclusive or to contain all of the information that may be required to make a full analysis of Montana Technologies or the Potential Business Combination . Recipients of these Presentation Materials should each make their own evaluation of Montana Technologies, and of the relevance and adequacy of the information and should make such other investigations as they deem necessary . XPDB and Montana Technologies assume no obligation to update the information in these Presentation Materials . Each recipient also acknowledges and agrees that the information contained in these Presentation Materials (i) is preliminary in nature and is subject to change, and any such changes may be material and (ii) should be considered in the context of the circumstances prevailing at the time and has not been, and will not be, updated to reflect material developments which may occur after the date of these Presentation Materials . To the fullest extent permitted by law, in no circumstances will Montana Technologies, XPDB, or any of their respective subsidiaries, stockholders, affiliates, representatives, partners, directors, officers, employees, advisers or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of these Presentation Materials, its contents, its omissions, reliance on the information contained within it or on opinions communicated in relation thereto or otherwise arising in connection therewith . These Presentation Materials discuss trends and markets that Montana Technologies' leadership team believes will impact the development and success of Montana Technologies based on its current understanding of the marketplace and each recipient acknowledges this information is preliminary in nature and subject to change . Industry and Market Data Industry and market data used in these Presentation Materials, including information about Montana Technologies' total addressable market, has been obtained from third - party industry publications and sources as well as from research reports prepared for other purposes . Neither XPDB nor Montana Technologies has independently verified the data obtained from these sources and cannot assure you of the reasonableness of any assumptions used by these sources or the data's accuracy or completeness .

DISCLAIMERS Forward Looking Statements Certain statements in these Presentation Materials may be considered “forward - looking statements” as defined in the Private Securities Litigation Reform Act of 1995 and within the meaning of the federal securities laws with respect to the proposed business combination between XPDB and Montana Technologies, including statements regarding the benefits of the proposed business combination, the anticipated timing of the proposed business combination, the likelihood and ability of the parties to successfully consummate the proposed business combination, the amount of funds available in the trust account as a result of shareholder redemptions or otherwise, the impact, cost and performance of the AirJoule ® technology once commercialized, the services offered by Montana Technologies and the markets in which Montana Technologies operates, business strategies, debt levels, industry environment, potential growth opportunities, the effects of regulations and XPDB’s or Montana Technologies’ projected future results . These forward - looking statements generally are identified by the words “believe,” “predict,” “project,” “potential,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “forecast,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “should,” “will be,” “will continue,” “will likely result,” and similar expressions (including the negative versions of such words or expressions) . Forward - looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties . Many factors could cause actual future events to differ materially from the forward - looking statements in this document, including but not limited to : (i) the risk that the proposed business combination may not be completed in a timely manner or at all, which may adversely affect the price of XPDB securities ; (ii) the risk that the proposed business combination may not be completed by XPDB’s business combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by XPDB ; (iii) the failure to satisfy the conditions to the consummation of the proposed business combination, including the approval of the proposed business combination by XPDB’s stockholders, the satisfaction of the minimum aggregate transaction proceeds amount following redemptions by XPDB’s public stockholders and the receipt of certain governmental and regulatory approvals ; (iv) the failure to obtain financing to complete the proposed business combination and to support the future working capital needs of Montana Technologies ; (v) the effect of the announcement or pendency of the proposed business combination on Montana Technologies’ business relationships, performance, and business generally ; (vi) risks that the proposed business combination disrupts current plans of Montana Technologies and potential difficulties in Montana Technologies’ employee retention as a result of the proposed business combination ; (vii) the outcome of any legal proceedings that may be instituted against XPDB or Montana Technologies related to the agreement and the proposed business combination ; (viii) changes to the proposed structure of the business combination that may be required or appropriate as a result of applicable laws or regulations or as a condition to obtaining regulatory approval of the business combination ; (ix) the ability to maintain the listing of the XPDB’s securities on the NASDAQ ; (x) the price of XPDB’s securities, including volatility resulting from changes in the competitive and highly regulated industries in which Montana Technologies plans to operate, variations in performance across competitors, changes in laws and regulations affecting Montana Technologies’ business and changes in the combined capital structure ; (xi) the ability to implement business plans, forecasts, and other expectations after the completion of the proposed business combination, including the possibility of cost overruns or unanticipated expenses in development programs, and the ability to identify and realize additional opportunities ; (xii) the enforceability of Montana Technologies’ intellectual property, including its patents, and the potential infringement on the intellectual property rights of others, cyber security risks or potential breaches of data security ; and (xiii) other risks and uncertainties set forth in the section entitled “Risk Factors” and “Cautionary Note Regarding Forward - Looking Statements” in XPDB’s Annual Reports on Form 10 - K, Quarterly Reports on Form 10 - Q and Current Reports on Form 8 - K that are available on the website of the Securities and Exchange Commission (the “SEC”) at www . sec . gov and other documents filed, or to be filed with the SEC by XPDB, including the Registration Statement on Form S - 4 initially filed by XPDB with the SEC on August 8 , 2023 (as the same may be amended, the “Registration Statement”) . The foregoing list of factors is not exhaustive . There may be additional risks that neither XPDB or Montana Technologies presently know or that XPDB or Montana Technologies currently believe are immaterial that could also cause actual results to differ from those contained in the forward - looking statements . You should carefully consider the foregoing factors and the other risks and uncertainties that will be described in XPDB’s definitive proxy statement contained in the Registration Statement (as defined below), including those under “Risk Factors” therein, and other documents filed by XPDB from time to time with the SEC . These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward - looking statements . Forward - looking statements speak only as of the date they are made . Readers are cautioned not to put undue reliance on forward - looking statements, and XPDB and Montana Technologies assume no obligation and, except as required by law, do not intend to update or revise these forward - looking statements, whether as a result of new information, future events, or otherwise . Neither XPDB nor Montana Technologies gives any assurance that either XPDB or Montana Technologies will achieve its expectations .

DISCLAIMERS Trademarks These Presentation Materials contain trademarks, service marks, trade names and copyrights of third parties, which are the property of their respective owners . The use or display of third parties' trademarks, service marks, trade names or products in these Presentation Materials are not intended to, and do not imply, a relationship with XPDB or Montana Technologies, an endorsement or sponsorship by or of XPDB or Montana Technologies, or a guarantee that Montana Technologies or XPDB will work or will continue to work with such third parties . Solely for convenience, the trademarks, service marks, trade names and copyrights referred to in these Presentation Materials may appear without the TM, SM, R or C symbols, but such references are not intended to indicate, in any way, that XPDB, Montana Technologies, or the any third - party will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks, trade names and copyrights . Financial Information The financial information and data contained in this Presentation is unaudited and does not conform to Regulation S - X promulgated under the Securities Act . Accordingly, such information and data may be adjusted in or may be presented differently in any proxy statement or registration statement to be filed by XPDB with the SEC . Additional Information about the Proposed Transaction and Where to Find It In connection with the proposed business combination, XPDB has filed with the SEC the Registration Statement , which includes a preliminary prospectus and preliminary proxy statement of XPDB . The definitive proxy statement/final prospectus and other relevant documents were sent as of January 18 , 2024 to all XPDB stockholders for voting on the proposed business combination and the other matters to be voted upon at a meeting of XPDB’s stockholders to be held to approve the proposed business combination and other matters (the “Special Meeting”) . XPDB may also file other documents regarding the proposed business combination with the SEC . The definitive proxy statement/final prospectus will contain important information about the proposed business combination and the other matters to be voted upon at the Special Meeting and may contain information that an investor will consider important in making a decision regarding an investment in XPDB’s securities . Before making any voting decision, investors and security holders of XPDB and other interested parties are urged to read the Registration Statement and the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC in connection with the proposed business combination as they become available because they will contain important information about the proposed business combination . Investors and security holders will also be able to obtain free copies of the definitive proxy statement/final prospectus and all other relevant documents filed or that will be filed with the SEC by XPDB through the website maintained by the SEC at www . sec . gov, or by directing a request to XPDB, 321 North Clark Street, Suite 2440 , Chicago, IL 60654 , or by contacting Morrow Sodali LLC, XPDB’s proxy solicitor, for help, toll - free at ( 800 ) 662 - 5200 (banks and brokers can call collect at ( 203 ) 658 - 9400 ) . INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN . ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE . Participants in the Solicitation XPDB, Montana Technologies and certain of their respective directors and executive officers may be deemed participants in the solicitation of proxies from XPDB’s stockholders with respect to the proposed business combination . A list of the names of those directors and executive officers of XPDB and a description of their interests in XPDB is set forth in XPDB’s Annual Reports on Form 10 - K, Quarterly Reports on Form 10 - Q and Current Reports on Form 8 - K . Additional information regarding the interests of those persons and other persons who may be deemed participants in the proposed business combination may be obtained by reading the Registration Statement . The documents described in this paragraph are available free of charge at the SEC’s website at www . sec . gov, or by directing a request to XPDB, 321 North Clark Street, Suite 2440 , Chicago, IL 60654 .

DISCLAIMERS Risk Factors For a non - exhaustive description of the risks relating to an investment in a private placement in connection with the Potential Business Combination please review "Risk Factors" at the end of this presentation . Changes and Additional Information in Connection with SEC Filings The information in these Presentation Materials has not been reviewed by the SEC and certain information may not comply in certain respects with SEC rules . As a result, the information in the Registration Statement may differ from these Presentation Materials to comply with SEC rules . The Registration Statement will include substantial additional information about Montana Technologies and XPDB not contained in these Presentation Materials . Once filed, the information in the Registration Statement will update and supersede the information presented in these Presentation Materials . INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE POTENTIAL BUSINESS COMBINATION OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN . ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE . Interests of XPDB’s Directors and Officers in the Merger In addition to the interests of XPDB’s directors and officers described in XPDB’s Annual Reports on Form 10 - K, Quarterly Reports on Form 10 - Q and Current Reports on Form 8 - K, certain members of the board of directors and executive officers of XPDB, the Sponsor, including its directors and executive officers, and their affiliates have interests in the Potential Business Combination that are different from, or in addition to, those of XPDB stockholders generally . In particular : 1 . Patrick Eilers, the Chief Executive Officer of XPDB and a member of its board of directors, serves as an advisor to Montana Technologies 2 . XPDB will have the right to appoint two members of the initial board of directors following the Business Combination, one of whom will be Patrick Eilers 3 . TEP Montana, LLC, an affiliate of Mr .

Eilers, is a minority investor in Montana Technologies with board observation rights DISCLAIMERS Slide 6 Montana Technologies | February 2024 • Over 30 years of experience successfully founding and leading innovative product - based companies • Founded Core Innovation, predecessor to Montana Technologies • Previously founded Jore Corporation, a power tool and accessories manufacturer that exceeded ~$50 million annual revenue • Led Jore Corporation through a successful IPO MONTANA TECHNOLOGIES Matt Jore Montana Technologies, Founder & CEO • Over 24 years investing experience in energy transition; including renewables, energy efficiency, thermal power generation, and batteries • Founded Transition Equity Partners, LLC in 2020 • XPDI I and XPDI II, CEO • Previously BlackRock, Managing Director of the Energy & Power Private Equity practice • Former Managing Director, Madison Dearborn Partners, LLC EXPERIENCED TEAM WITH A STRONG TRACK RECORD • Managing Director, XMS Capital Partners, LLC • CFO, XPDI • Leads M&A execution activities at XMS Capital Partners • Heads XMS fairness opinion committee • Previously worked at Morgan Stanley, assuming various roles within corporate finance, M&A, and administrative practices of the Firm Pat Eilers XPDB, CEO Montana Technologies, Board Chair Jim Nygaard XPDB, CFO Stu Porter Montana Technologies, Board Member • Chairman / CEO Denham Capital and Global Energy and Mining Private Equity Fund • 35 Years of Investment Experience across Renewables, Oil & Gas & Mining • Largest Shareholder and Chairman of the Board of Montana Technologies • Past Experience: Cargill, Goldman Sachs, Harvard Management Company • Over 25 years of financial, operational and technical experience • Founder of Doxey Capital, a private investment and advisory services firm • Former Managing Director for Talara Capital and a member of the firm’s investment committee • Previously worked at Denham Capital, J.M.

Huber Corporation, and Aquila Energy Capital Corporation Jeff Gutke Montana Technologies, CFO Slide 7 Montana Technologies | February 2024 TRANSACTION SUMMARY • Montana Technologies, through its proprietary AirJoule ® units, has created a transformational technology that provides significant energy efficiency gains in heating, ventilation, and air conditioning (“HVAC”) and atmospheric water generation applications – Addresses two of the world’s most problematic issues: 1) demand for energy - efficiency and 2) water stress • Power & Digital Infrastructure Acquisition II Corp. (Nasdaq: "XPDB") is a blank - check company focused on clean tech solutions, s upported by long - time energy investor, Pat Eilers (Transition Equity Partners, LLC), and professionals from global advisory firm XMS Capital P art ners, LLC, led by Ted Brombach • Montana Technologies and XPDB are combining to raise capital and continue executing on a commercialization strategy with key glo bal partners – Recently announced joint commercialization agreement with _________ and proposed 50 / 50 joint venture with – Existing supply agreement with ____________ and joint venture proposed with • $500 million Pro Forma Enterprise Value at $10.00 per share (1) – Represents a highly attractive entry valuation relative to market opportunities, peer group metrics, and significant recent a nno uncements – Montana Technologies shareholders are rolling 100% of their equity into the combined company • Montana Technologies expects to raise $50 million of PIPE capital (2) , which will fully fund operations through commercialization, production, and deployment XPDB has identified Montana Technologies as a highly differentiated and scalable technology provider that is developing solutions to provide a cleaner energy future across two enormous addressable markets – HVAC and water 1. Excludes earnout provision of up to $200 million at $10.00 per share that may be earned by certain of Montana Technologies’ e xis ting shareholders within 5 years after closing based on annualized EBITDA milestones expected from completion of new production ca pac ity. 2. Reflects $50mm Minimum Cash Provision, which includes all sources.

Slide 8 Montana Technologies | February 2024 INVESTMENT HIGHLIGHTS • Transformational Technology: Reduces electricity costs up to 75% for HVAC and hot water, and can eliminate refrigerants – AirJoule ® pulls PFAS - free water out of the air most efficiently, compared to other similar devices • Leading Global Partnerships: – Partnerships help accelerate manufacturing of materials and key components as well as provide product validation and commercialization • Capital Efficient and Highly Scalable Business Model: ~$25 million capex investment (shared by JVs) expected to generate ~$100 million EBITDA per line when full capacity is sold – Montana Technologies expects to self - fund additional lines through capital - efficient production • Large Addressable Market: ~$355 billion HVAC and ~$100 billion atmospheric water harvesting markets – Scaling to base case production lines would represent a de minimis proportion of the ~$455 billion market • Key Components Plan: Efficient delivery of proprietary technology for OEM assembly – Flexible commercial arrangements to provide selected components up to full system modules • Strong Management and Industry Expertise: Team supported by some of the nation’s leading scientists in this area – Deep bench of experience across commercialization, finance, operations, and research Slide 9 Montana Technologies | February 2024 Milestone Summary Description Date Close business combination ▪ XPDB and MT expect to complete business combination March 2024 Solidifies go - to - market strategy; additional technological validation ▪ GE Vernova and MT establish a 50 / 50 joint venture, to commercialize AirJoule ® in the Americas, Australia, and Africa January 25, 2024 Enhances commercialization and development prospects; additional technological validation ▪ Carrier and MT enter into a joint commercialization agreement and Carrier conditionally commits $10mm in growth equity to accelerate development January 8, 2024 Technology unveiled on global stage ▪ MT unveils table top demonstration unit at COP28 Climate Change Conference in Dubai December 2023 Enhanced Board expertise ▪ MT announces plans to nominate Paul Dabbar, former Under Secretary of Science at the U.S. Department of Energy, to Board of Directors post - business combination November 28, 2023 Further technological validation ▪ United States Department of Energy and MT announce breakthrough in HVAC and water harvesting technology November 9, 2023 Detailed business overview, strategy, and risk factors ▪ XPDB files preliminary prospectus August 9, 2023 Business combination announced at $500mm Pro Forma Enterprise Value ▪ XPDB and MT announce merger to commercialize AirJoule ® technology and accelerate decarbonization of HVAC systems and water supply June 5, 2023 INCREASED VALUE PROPOSITION SINCE ANNOUNCEMENT SIGNIFICANT COMMERCIAL DEVELOPMENTS THAT FURTHER VALIDATE TECHNO LOGY AND ENHANCE UNDERLYING BUSINESS MODEL AND GO - TO - MARKET STRATEGY Slide 10 Montana Technologies | February 2024 MOFs are highly adsor b ent coatings , engineered to capture specific molecules (in this case, water vapor) ▪ Montana Technologies has engineered a proprietary MOF coating (MTMOF1) that can hold more than half its weight in water vapor Thermal constraints have limited the potential of MOFs in historical dehumidification efforts ▪ Heat generated by adsorption cycle and additional heat required to desorb the MOF are problematic for cooling applications AirJoule ® solves the energetics issue, resulting in an unprecedented reduction in energy consumption for dehumidification ▪ P ropriet a ry pressure swing system integrates adsorption and desorption functions, so the heat of adsorption can be used to assist desorption under vacuum, eliminating the need for additional energy THE TECHNOLOGY BREAKTHROUGH HOW AIRJOULE ® ENABLES COMMERCIALIZATION OF METAL ORGANIC FRAMEWORKS (“MOF S ”) 1.

Based on internal calculations of expected performance.

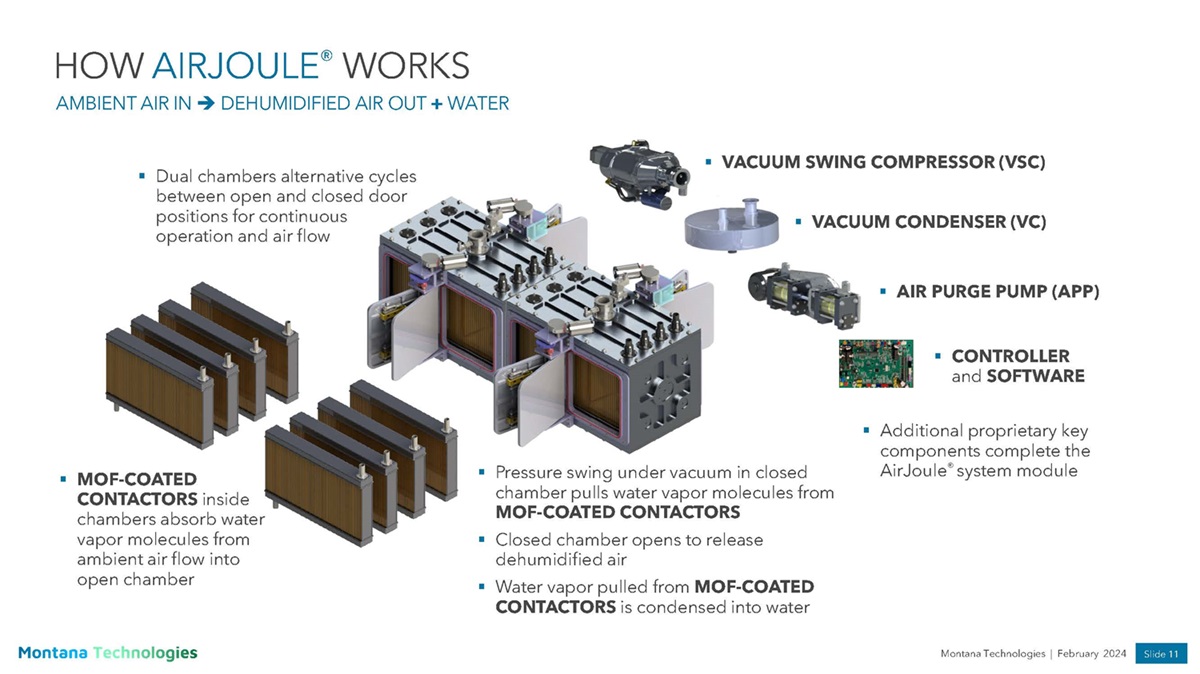

AirJoule ® can be integrated into HVAC systems for dehumidification and also operate as standalone atmospheric water generation units, with both applications resulting in up 80 – 90 % energy reduction relative to conventional systems (1) Conventional Dehumidification Technology Vapor Compression Systems that Utilize Refrigerants Typical Energy Consumption: 450 WH/L AirJoule ® Dehumidification Technology MOF - Coated Contactors + Pressure Swing Under Vacuum Expected Energy Consumption: 45 – 90 WH/L Slide 11 Montana Technologies | February 2024 HOW AIRJOULE ® WORKS AMBIENT AIR IN DEHUMIDIFIED AIR OUT + WATER ▪ MOF - COATED CONTACTOR S inside chambers absorb water vapor molecules from ambient air flow into open chamber ▪ AIR PURGE PUMP (APP) ▪ VACUUM SWING COMPRESSOR (VSC) ▪ VACUUM CONDENSER (VC) ▪ CONTROLLER and SOFTWARE ▪ Pressure swing under vacuum in closed chamber pulls water vapor molecules from MOF - COATED CONTACTORS ▪ Closed chamber opens to release dehumidified air ▪ Water vapor pulled from MOF - COATED CONTACTORS is condensed into water ▪ Dual chambers alternative cycles between open and closed door positions for continuous operation and air flow ▪ Additional proprietary key components complete the AirJoule ® system module Slide 12 Montana Technologies | February 2024 Example Atmospheric Water Generator Form Factor Example Rooftop HVAC Form Factor AIRJOULE ® PRODUCT APPLICATIONS – “ AIRJOULE ® INSIDE” AIRJOULE ® SYSTEM MODULES ARE INTEGRATED INTO BOTH HVAC AND ATMOSPHERIC WA TER GENERATOR FORM FACTORS

Slide 13 Montana Technologies | February 2024 Next - Gen HVAC Technology Existing Atmospheric Water Generation Conventional HVAC Technology Metal Organic Framework (“MOF”) with energy - efficient pressure swing system Vapor compression refrigerant systems / hybrid desiccant Vapor compression refrigerant systems / hybrid desiccant (1) Vapor compression refrigerant systems Technology Dehumidification Cooling Heating Water Heating Atmospheric Water Harvesting 4 – 11x (3) Up to 2x (2) None Baseline for relative comparison Performance Improvement Over Baseline – MRE (Moisture Removal Efficiency) 45 – 90 WH/L (4) As low as 277 WH/L (2) 315 – 450 WH/L (1) 350 – 450 WH/L Efficiency – WH/L (Watt - Hours/Liter) No refrigerants Utilizes refrigerants Utilizes refrigerants (1) Utilizes refrigerants Refrigerants Selected Industry Participants AirJoule ® provides unprecedented moisture removal efficiency for dehumidification, cooling, heating, and atmospheric water generation, as compared to other technologies, old and new Key Takeaways Applications AIRJOULE ® COMPARATIVE ANALYSIS 1. Management believes most atmospheric water generation technologies use vapor compression refrigerant systems. However, SOURCE Global (https://www.source.co/) is a solar - powered system and does not utilize refrigerants, but with limited water output. 2. Management’s belief based on representations of Next - Gen HVAC Technology (https://mojavehvac.com/wp - content/uploads/2023/09/ArctiDry - spec - sheet - Proposed - Final.pdf). 3. Based on a technical assessment conducted by an independent national laboratory. 4. Based on internal calculations of expected performance. Source: Publicly available information from company filings, company websites, and press releases.

Slide 14 Montana Technologies | February 2024 Proprietary Key Components: 1. MOF - Coated Contactor , 2. Vacuum Swing Compressor , 3. Vacuum Condenser , 4. Air Purge Pump , 5 . Controller and Software HVAC “AirJoule ® Inside” Air - to - Water Systems AirJoule ® Finished Units AirJoule tm Commercial Industrial Transportation Residential Water Sales MOF - Coated Contactors MOF Supply Agreement AirJoule ® System Modules JVs Other Proprietary Key Component s Suppliers Various Tier 2/3 Industry Participants CATL / MT JV Asia , Europe MONTANA TECHNOLOGIES (IP) XPDB ($) Global MOF Supplier 1. 3 . 2 . 4. Capital ($) Industrial Dehumidification “AirJoule ® Inside” Water Heater OEMs “AirJoule ® Inside” GE / MT JV Americas, Africa, and Australia AIRJOULE ® GLOBAL MANUFACTURING ECOSYSTEM IP IP 5 . SUPPLIERS MANUFACTURING JV’S MT JV CUSTOMERS END MARKET CUSTOMERS Slide 15 Montana Technologies | February 2024 KEY COMPONENTS PLAN BUSINESS MODEL (1) DELIVER MOF - COATED CONTACTORS AND OTHER KEY COMPONENTS, ALONG WI TH COMPLETE SYSTEM DESIGN AND IP LICENSE UNDER “KEY COMPONENTS PLAN” 1.

Illustrative. Based on management estimates, resulting from estimates provided by global suppliers. MOF - Coated Contactor Unit Economics ~$287 Sales Price ~$187 Production Cost ~$100 35% Gross Margin per Coated Contactor AirJoule ® Key Components Unit Economics (Prototype 5: 5 - Ton Equivalent System) 8 Average Number of Contactors ~$800 Gross Margin from Contactors ~$400 Other Components Production Cost + Mark - up on Other Key Components ( - ) Overhead: SG&A and Royalties ~$800 EBITDA per Key Components of AirJoule ® Primary Revenue Generator MOF - Coated Contactors (Standard AirJoule ® System Module will have Approximately 8 Contactors) Secondary Revenue Generators Other Key Components: Vacuum Swing Compressor, Vacuum Condenser, Air Purge Pump, Controller, and Software System Revenue Generator AirJoule ® System Module: Adds Chambers, Doors, and Other Components to Complete Fully Functional Unit Slide 16 Montana Technologies | February 2024 Coated Contactor Production Line Economics FINANCIAL VALUE PROPOSITION (1)(2) Illustrative De - SPAC Valuation Framework Assuming 3 and 6 Production Lines 50 / 50 Joint Venture ~$25 million Production Line Total CapEx ~1,000,000 units Contactors per Line per Year 6 Production 3 Production $100 Mark - up per Contactor Lines Lines ~$100 million Joint Venture Annualized EBITDA ~$300 million ~$150 million ~$50 million MT Share of EBITDA per Line (3) 1.

Illustrative. Based on management estimates, resulting from estimates provided by global suppliers. 2. Montana Technologies’ joint venture with CATL provides for a 50/50 ownership split and 50/50 sharing of profits in various co unt ries, but provides a 60/40 split of profits in favor of CATL with respect to sales in China. That 50/50 split can be adjusted over time based on the respective capital contributions to the joint venture entity from the parties. 3. It is expected that the total value of other key components will cover incremental overhead expenses, including SG&A and roya lty costs. 4. Data from FactSet; as of February 2, 2024. 20.0x 15.0x 10.0x Illustrative Fully Distributed EBITDA Multiple ~$150 million ~$150 million ~$150 million 3 Production Lines – Annualized EBITDA ~$3.0 billion ~$2.3 billion ~$1.5 billion Implied Fully Distributed Enterprise Value 83% 78% 67% Implied Discount Relative to $500 million (Pro Forma Enterprise Value) 6.0x 4.5x 3.0x Multiple of $500 million ~$300 million ~$300 million ~$300 million 6 Production Lines – Annualized EBITDA ~$6.0 billion ~$4.5 billion ~$3.0 billion Implied Fully Distributed Enterprise Value 88% 84% 77% Implied Discount Relative to $700 million (Pro Forma Enterprise Value + $200 million Earnout) 8.6x 6.4x 4.3x Multiple of $700 million Selected HVAC Comparables (4) Average 2024E EBITDA: 13.7x Average 2022 - 2025 CAGR: 8% (Includes Carrier, Daikin, Johnson Controls, Lennox, Munters, and Trane) Selected Water - Related Comparables (4) Average 2024E EBITDA: 17.2x Average 2022 - 2025 CAGR: 10% (Includes Ecolab, Watts, and Xylem)

Slide 17 Montana Technologies | February 2024 TRANSACTION OVERVIEW PRELIMINARY PRO FORMA VALUATION PRELIMINARY SOURCES AND USES % $ ($ in millions) 72.6% $413 XPDB Shares at $10.00 18.6% $106 Cash Held in Trust at $10.00 Per Share (1) 8.8% $50 Private Placement Proceeds (2) 100.0% $569 Total Sources 72.6% $413 Equity Consideration to Existing Shareholders at $10.00 (3) 23.9% $136 Cash to Balance Sheet 3.5% $20 Estimated Transaction Expenses 100.0% $569 Total Uses ($ and shares in millions, except per share data) $10.00 Share Price 63.6 Pro Forma Shares Outstanding (4) $636 Pro Forma Equity Value ($136) Less: Pro Forma Cash Balance $500 Pro Forma Enterprise Value 1. Reflects current value of trust, excluding overcapitalization and assuming no redemptions. 2. Assumes $50 million private placement at $8.50 per share ($50 million minimum cash provision may include in - kind cash contributi ons to JVs). 3. Excludes earnout provision of up to $200 million at $10.00 per share that may be earned by existing shareholders within 5 yea rs after closing based on annualized EBITDA milestones expected from completion of new production capacity. 4. Includes 10.6 million shares held by public shareholders, 5.9 million shares from expected private placement (estimate based on $8.50 purchase price), 41.3 million shares issued to Montana Technologies existing shareholders and 5.8 million XPDB sponsor shares. XPDB s pon sor shares exclude 1.4 million shares subject to earnout.

APPENDIX Appendix

Slide 18 Montana Technologies | February 2024 INVESTMENT HIGHLIGHTS • Transformational Technology: Reduces electricity costs up to 75% for HVAC and hot water, and can eliminate refrigerants – AirJoule ® pulls PFAS - free water out of the air most efficiently, compared to other similar devices • Leading Global Partnerships: – Partnerships help accelerate manufacturing of materials and key components as well as provide product validation and commercialization • Capital Efficient and Highly Scalable Business Model: ~$25 million capex investment (shared by JVs) expected to generate ~$100 million EBITDA per line when full capacity is sold – Montana Technologies expects to self - fund additional lines through capital - efficient production • Large Addressable Market: ~$355 billion HVAC and ~$100 billion atmospheric water harvesting markets – Scaling to base case production lines would represent a de minimis proportion of the ~$455 billion market • Key Components Plan: Efficient delivery of proprietary technology for OEM assembly – Flexible commercial arrangements to provide selected components up to full system modules • Strong Management and Industry Expertise: Team supported by some of the nation’s leading scientists in this area – Deep bench of experience across commercialization, finance, operations, and research All references to the "company," "we," "us" or "our" refer to Montana Technologies and its consolidated subsidiaries prior to the Potential Business Combination . The risks presented below are non - exhaustive descriptions of certain of the general risks related to the business of Montana Technologies and XPDB and the Potential Business Combination, and such list is not exhaustive . The list below has been prepared solely for purposes of inclusion in these Presentation Materials and not for any other purpose . You should carefully consider these risks and uncertainties and should carry out your own diligence and consult with your own financial and legal advisors concerning the risks presented by the Potential Business Combination . Risks relating to the business of Montana Technologies, the Potential Business Combination and the business of XPDB following the consummation of the Potential Business Combination will be disclosed in future documents filed or furnished by Montana Technologies or XPDB with the SEC, including the documents filed or furnished in connection with the Potential Business Combination . The risks presented in such filings will be consistent with SEC filings typically relating to a public company, including with respect to the business and securities of Montana Technologies and XPDB and the Potential Business Combination, and may differ significantly from, and be more extensive than, those presented below . Risks Related to Our Business and Our Industry • We have not yet commenced planned business line activities and have a limited operating history, which may make it difficult to evaluate the prospects for our future viability . There is no assurance that we will successfully execute our proposed strategy . • We will initially depend on revenue generated from a single product and in the foreseeable future will be significantly dependent on a limited number of products . • We face significant barriers in our attempts to deploy our technology and may not be able to successfully develop our technology . If we cannot successfully overcome those barriers, it could adversely impact our business and operations . • Our commercialization strategy relies heavily on our relationships with BASF, CATL and other third parties and partners who may have interests that diverge from ours and who may not be easily replaced if our relationships terminate, which could adversely impact our business and financial condition . • Demand for our products may not grow or may grow at a slower rate than we anticipate . • Our financial results depend on successful project execution and may be adversely affected by cost overruns, failure to meet customer schedules, failure of our suppliers or partners to fulfill their obligations to us or other execution issues . • COVID - 19 and any future widespread public health crisis could negatively affect various aspects of our business, make it more difficult for us to meet our obligations to our future customers and result in reduced demand for our products . • Any financial or economic crisis, or perceived threat of such a crisis, including a significant decrease in consumer confidence, may materially and adversely affect our business, financial condition and results of operations . • Manufacturing issues not identified prior to design finalization, long - lead procurement and/or fabrication could potentially be realized during production or fabrication and may impact our deployment cost and schedule, which could adversely impact our business . • Our sales and profitability may be impacted by, and we may incur liabilities as a result of, warranty claims, product defects, recalls, improper use of our products, or our failure to meet performance guarantees or customer safety standards . • Increased scrutiny of environmental, social and governance (“ESG”) matters, including our completion of certain ESG initiatives, could have an adverse effect on our business, financial condition and results of operations, result in reputational harm and negatively impact the assessments made by ESG - focused investors when evaluating us . • Physical and transition risks arising from climate change, including risks posed by the increased frequency or severity of natural and catastrophic events and regulations or policies related to climate change, may negatively impact our business and operations . • Our business and current and future production facilities are subject to liabilities and operating restrictions arising from environmental, health and safety laws, regulations, and permits . We will be subject to environmental, health and safety laws and regulations in multiple jurisdictions, which impose substantial compliance requirements on our operations . Our operating costs could be significantly increased in order to comply with new or more stringent regulatory standards in the jurisdictions in which we operate . • We expect to be dependent on a limited number of customers and end markets . A decline in revenue from, or the loss of, any significant customer, could have a material adverse effect on our financial condition and operating results .

RISK FACTORS • We may depend on sole - source and limited - source suppliers for key components and products . If we are unable to source these components and products on a timely basis or at acceptable prices, we will not be able to deliver our products to our customers and production time and production costs could increase, which may adversely affect our business . • We may face supply chain competition, including competition from businesses in other industries, which could result in insufficient inventory and negatively affect our results of operations . • We are subject to risks associated with changing technology, product innovation, manufacturing techniques, operational flexibility and business continuity, which could place us at a competitive disadvantage . • We expect to incur research and development costs and devote resources to identifying and commercializing new products, which could reduce our profitability and may never result in revenue to us . • Our long - term success will depend ultimately on implementing our business strategy and operational plan, as well as our ability to generate revenues, achieve and maintain profitability and develop positive cash flows . • We may lack sufficient funds to achieve our planned business objectives . Our ability to continue as a going concern is dependent on (i) continued financial support from our shareholders and other related parties, (ii) raising capital via external financing and/or (iii) attaining profitable operations . We may seek to raise further funds through equity or debt financing, joint ventures, production sharing arrangements or other means . Any inability to access the capital or financial markets may limit our ability to fund our ongoing operations and execute our business plan to pursue investments that we may rely on for future growth . • Actual capital costs, operating costs, production and economic returns may differ significantly from those we have anticipated and future development activities may not result in profitable operations . • Our long - term success depends, in part, on our ability to negotiate and enter into sales agreements with, and deliver our products to, customers on commercially viable terms . There can be no assurance that we will be successful in securing such agreements . • Exchange rate fluctuations may materially affect our results of operations and financial condition . • If we fail to retain our key personnel or if we fail to attract additional qualified personnel, we may not be able to achieve our anticipated level of growth and our business could suffer . • We may face significant competition from established companies with longer operating histories, customer incumbency advantages, access to and influence with governmental authorities and more capital resources than we do . • Any failure by our management to properly manage our growth could have a material adverse effect on our business, operating results and financial condition . • Damage to our reputation or brand image could adversely affect our business . • The occurrence of significant events against which we may not be fully insured could have a material adverse effect on our business, financial condition and results of operations . • The threat of global economic, capital markets and credit disruptions pose risks to our business . • Inflation may increase our operating costs . • Our business may be adversely affected by force majeure events outside of our control, including labor unrest, civil disorder, war, subversive activities or sabotage, extreme weather conditions, fires, floods, explosions or other catastrophes or epidemics . • If the estimates and assumptions we use to determine the size of our total addressable market are inaccurate, our future growth rate may be affected and the potential growth of our business may be limited . Risks Related to Legal, Compliance and Regulations • There are risks associated with operating in foreign countries, including those related to economic, social and/or political instability, and changes of law affecting foreign companies operating in that country . In particular, we may suffer reputational harm due to our business dealings in certain countries that have previously been associated, or perceived to have been associated, with human rights issues . Increased scrutiny and changing expectations from investors regarding ESG considerations may result in the decrease of the trading price of our securities . • Our business may require numerous permits, licenses and other approvals from various governmental agencies, and the failure to obtain or maintain any of them, or delays in obtaining them, could materially adversely affect us . • Our failure to comply with applicable anti - corruption, anti - bribery, anti - money laundering, antitrust, foreign investment and similar laws and regulations could negatively impact our reputation and results of operations . • Our business could be adversely affected by trade wars, trade tariffs or other trade barriers .

RISK FACTORS Risks Related to Intellectual Property and Technology • Our patent applications may not result in issued patents, and our issued patents may not provide adequate protection, which may have a material adverse effect on our ability to prevent others from commercially exploiting products similar to ours . • Our failure to protect our intellectual property rights may undermine our competitive position, and litigation to our intellectual property rights may be costly . • We may need to defend ourselves against claims that we infringe, have misappropriated or otherwise violate the intellectual property rights of others, which may be time - consuming and would cause us to incur substantial costs . Third - party claims that we are infringing on intellectual property, whether successful or not, could subject us to costly and time - consuming litigation or expensive licenses, and our business could be adversely affected . • Cyber - attacks or a failure in our information technology and data security infrastructure could adversely affect our business and operations . • A number of foreign countries do not protect intellectual property rights to the same extent as the United States . Therefore, our intellectual property rights may not be as strong or as easily enforced outside of the United States and efforts to protect against the infringement, misappropriation or unauthorized use of our intellectual property rights, technology and other proprietary rights may be difficult and costly outside of the United States . Furthermore, legal standards relating to the intellectual property rights are uncertain and any changes in, or unexpected interpretations of, intellectual property laws may compromise our ability to enforce our patent rights, trade secrets and other intellectual property rights . • We rely on licenses to use the intellectual property rights of third parties, which are incorporated into our products, services and offerings . Risks Related to Being a Public Company • The market price of shares of our common stock may be volatile or may decline regardless of our operating performance . You may lose some or all of your investment . • Since the redemption by XPDB’s public stockholders, there may be increased volatility in the trading of XPDB common stock due to a lower public float . • We do not intend to pay dividends on our common stock for the foreseeable future . • If securities or industry analysts do not publish research or reports about our business or publish negative reports, the market price of our common stock could decline . • Our ability to timely raise capital in the future may be limited, or may be unavailable on acceptable terms, if at all . Our failure to raise capital when needed could harm our business, operating results and financial condition . Debt issued to raise additional capital may reduce the value of our common stock . • Our issuance of additional shares of common stock or convertible securities could make it difficult for another company to acquire us, may dilute your ownership of us and could adversely affect our stock price . • Future sales, or the perception of future sales, of our common stock by us or our existing stockholders in the public market following the closing of the Potential Business Combination could cause the market price for our common stock to decline . • The requirements of being a public company, including compliance with the reporting requirements of the Exchange Act, the requirements of the Sarbanes - Oxley Act and the requirements of the Nasdaq, may strain our resources, increase our costs and require additional attention of management, and we may be unable to comply with these requirements in a timely or cost - effective manner . • We are an “emerging growth company . ” The reduced public company reporting requirements applicable to emerging growth companies may make our common stock less attractive to investors . • Our management has limited experience in operating a public company . • Changes to, or changes to interpretations of, the U . S . federal, state, local or other jurisdictional tax laws could have a material adverse effect on our business, financial condition and results of operations . Risks Related to the Potential Business Combination • XPDB’s stockholders will have a reduced ownership and voting interest after the Potential Business Combination and will exercise less influence over management . • The market price of shares of the post - combination company’s common stock after the Potential Business Combination may be affected by factors different from those currently affecting the prices of shares of XPDB Class A common stock . • XPDB has not obtained an opinion from an independent investment banking firm, and consequently, there is no assurance from an independent source that the merger consideration is fair to its stockholders from a financial point of view .

RISK FACTORS • If the Potential Business Combination’s benefits do not meet the expectations of financial analysts, the market price of our common stock may decline . • There can be no assurance that the post - combination company’s common stock will be approved for listing on the Nasdaq or that the post - combination company will be able to comply with the continued listing standards of the Nasdaq . • The consummation of the Potential Business Combination is subject to a number of conditions and if those conditions are not satisfied or waived, the Merger Agreement may be terminated in accordance with its terms and the Potential Business Combination may not be completed . • The parties to the merger agreement may amend the terms of the merger agreement or waive one or more of the conditions to the closing of the Potential Business Combination, and the exercise of discretion by our directors and officers in agreeing to changes to the terms of or waivers of closing conditions in the merger agreement may result in a conflict of interest when determining whether such changes to the terms of the merger agreement or waivers of conditions are appropriate and in the best interests of our stockholders . • Termination of the merger agreement could negatively impact Montana Technologies and XPDB . • Montana Technologies will be subject to business uncertainties and contractual restrictions while the Potential Business Combination is pending . • XPDB’s directors and officers may have interests in the Potential Business Combination different from the interests of XPDB’s stockholders . • Montana Technologies’ directors and officers may have interests in the Potential Business Combination different from the interests of Montana Technologies’ equity holders . • The Sponsor may have interests in the Potential Business Combination different from the interests of XPDB’s stockholders . • Because Montana Technologies will become a publicly traded company through the Potential Business Combination rather than an underwritten initial public offering, the scope of due diligence conducted may be different from that conducted by an underwriter in an underwritten initial public offering . • The Potential Business Combination will result in changes to the board of directors that may affect our strategy . • The merger agreement contains provisions that may discourage other companies from trying to acquire Montana Technologies for greater merger consideration . • The merger agreement contains provisions that may discourage XPDB from seeking an alternative business combination . • The unaudited pro forma condensed combined financial information included in this proxy statement/prospectus is preliminary and the actual financial condition and results of operations after the Potential Business Combination may differ materially . • XPDB and Montana Technologies will incur transaction costs in connection with the Potential Business Combination . • XPDB’s stockholders will have their rights as stockholders governed by the post - combination company’s organizational documents . • The Sponsor has agreed to vote in favor of each of the proposals presented at the Special Meeting, regardless of how XPDB’s public stockholders vote . • XPDB’s and Montana Technologies’ ability to consummate the Potential Business Combination, and the operations of the post - combination company following the Potential Business Combination, may be materially adversely affected by the recent coronavirus (COVID - 19 ) pandemic . • BofA Securities, Inc . (“BofA”), one of the underwriters in XPDB’s IPO, along with Barclays Capital Inc . , was to be compensated, in part, on a deferred basis for already - rendered underwriting services in connection with XPDB’s IPO, yet it waived such compensation without any consideration from XPDB and, effective as of June 20 , 2023 , resigned and withdrew from its role in the Potential Business Combination . As a result, BofA disclaims any responsibility for this proxy statement/prospectus and will not be associated with the disclosure or underlying business analysis related to the Potential Business Combination, which could result in an increased number of XPDB’s stockholders voting against the Potential Business Combination or seeking to redeem their shares for cash . RISK FACTORS