UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 30, 2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report:

Commission File Number:

LEDDARTECH HOLDINGS INC.

(Exact name of Registrant as specified in its charter)

| Not applicable | Quebec, Canada | |

| (Translation of Registrant’s name into English) | (Jurisdiction of incorporation or organization) |

LeddarTech Inc.

4535, boulevard Wilfrid-Hamel, Suite 240

Quebec G1P 2J7, Canada

(418) 653-9000

(Address of principal executive offices)

4535, boulevard Wilfrid-Hamel, Suite 240

Quebec G1P 2J7, Canada

(514) 605-6574

david.torralbo@leddartech.com

(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common shares, without par value | LDTC | Nasdaq Stock Market LLC | ||

| Warrants to purchase common shares | LDTCW | Nasdaq Stock Market LLC |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 28,770,982 common shares issued and outstanding as of December 21, 2023, immediately after the consummation of the business combination described herein.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☐ No ☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer, or an emerging growth company. See definition of “accelerated filer,” “large accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer | ☒ |

| Emerging growth company | ☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ | International Financial Reporting Standards as issued by the International Accounting Standards Board ☒ | Other ☐ |

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

TABLE OF CONTENTS

EXPLANATORY NOTE

On June 12, 2023, LeddarTech Holdings Inc., a company incorporated under the laws of Canada (“Newco”) entered into the Business Combination Agreement, as amended on September 25, 2023 (the “BCA”), by and among Newco, Prospector Capital Corp., a Cayman Islands exempted company (“Prospector”), and LeddarTech Inc., a corporation existing under the laws of Canada (“LeddarTech”).

On December 21, 2023 (the “Closing Date”), as contemplated in the BCA, Prospector, LeddarTech and Newco completed a series of transactions:

| ● | Prospector continued as a corporation existing under the laws of Canada (the “Continuance” and Prospector as so continued, “Prospector Canada”); |

| ● | Prospector Canada and Newco amalgamated (the “Prospector Amalgamation” and Prospector Canada and Newco as so amalgamated, “Amalco”); |

| ● | the preferred shares of LeddarTech converted into common shares of LeddarTech and, on the terms and subject to the conditions set forth in a plan of arrangement (the “Plan of Arrangement”), Amalco acquired all of the issued and outstanding common shares of LeddarTech from LeddarTech’s shareholders in exchange for common shares of Amalco having a negotiated aggregate equity value of $200 million (valued at $10.00 per share) plus an amount equal to the aggregate exercise price of LeddarTech’s outstanding “in the money” options immediately prior to the Prospector Amalgamation (the “Share Exchange”) plus additional Amalco “earnout” shares (with the terms set forth in the BCA); |

| ● | LeddarTech and Amalco amalgamated (the “Company Amalgamation” and LeddarTech and Amalco as so amalgamated, the “Company”); and |

| ● | in connection with the Company Amalgamation, the securities of Amalco converted into an equivalent number of corresponding securities in the Company (other than as described in the BCA with respect to the Prospector Class B ordinary shares) and each of LeddarTech’s equity awards (other than options to purchase LeddarTech’s class M shares) were cancelled for no compensation or consideration and LeddarTech’s equity plans were terminated (and the options to purchase LeddarTech’s class M shares became options to purchase common shares of the Company (the “Company Common Shares” or the “Common Shares”)). |

The Continuance, the Prospector Amalgamation, the Share Exchange, the Company Amalgamation and the other transactions contemplated by the BCA are hereinafter referred to as the “Business Combination” and the closing of the Business Combination, the “Closing”.

On June 12, 2023, concurrently with the execution of the BCA, LeddarTech entered into a subscription agreement (the “Subscription Agreement”) with certain investors, including investors who subsequently joined the Subscription Agreement (the “PIPE Investors”), pursuant to which the PIPE Investors agreed to purchase secured convertible notes of LeddarTech (the “PIPE Convertible Notes”) in an aggregate principal amount of at least US$43.0 million (the “PIPE Financing”). PIPE Investors in certain tranches of the PIPE Convertible Notes received at the time of issuance of such notes warrants to acquire Class D-1 preferred shares of LeddarTech (the “Class D-1 Preferred Shares” and the warrants, the “PIPE Warrants”). All of the PIPE Warrants were exercised, and the Class D-1 Preferred Shares issued upon exercise of the PIPE Warrants entitled the PIPE Investors to receive approximately 8,553,434 Common Shares upon the closing of the Business Combination. Accordingly, the PIPE Investors held approximately 42.8% of the 20 million LeddarTech common shares outstanding immediately prior to the Closing. The PIPE Convertible Notes are convertible into the number of Common Shares determined by dividing the then-outstanding principal amount by the conversion price of US$10.00 per Common Share. The PIPE Financing closed on the Closing Date after the Business Combination.

Prior to the Closing Date, holders of an aggregate of 855,440 Prospector Class A ordinary shares, par value $0.0001 per share (the “Prospector Class A Shares”) representing approximately 39% of the total Prospector Class A Shares then outstanding, exercised their right to redeem those shares for approximately US$10.93 per share, or a total of approximately $9.3 million paid from Prospector’s trust account (the “SPAC Redemption”) in accordance with the terms of Prospector’s amended and restated memorandum and articles of association, as amended.

Following the SPAC Redemption, and as part of a series of related steps in connection with the consummation of the Business Combination, Prospector distributed 1,338,616 Prospector Class A Shares to the holders on the Closing Date of the 1,338,616 Prospector Class A Shares that were not redeemed in connection with the Business Combination. Such distribution was not made with respect to any other Prospector or LeddarTech shares issued and outstanding prior to or upon consummation of the Business Combination.

On the Closing Date, the following securities issuances were made by the Company to Prospector’s securityholders following the SPAC Redemption and in connection with the above-referenced share distribution: (i) each outstanding Prospector Class A Share was exchanged for one Company Common Share, (ii) each outstanding non-voting special share of Prospector, a new class of shares in the capital of Prospector convertible into Prospector Class A Shares, was exchanged for one non-voting special share of the Company and (iii) each outstanding warrant of Prospector (the “Prospector Warrants”), which includes 965,749 Prospector Warrants that were issued upon conversion of the amount accrued under Prospector’s convertible note with the Sponsor to finance Prospector’s transaction costs in connection with its initial business combination, was assumed by the Company and became a warrant of the Company (“Company Warrant” or “Warrant”).

On the Closing Date, following the SPAC Redemption and the foregoing issuances, LeddarTech’s shareholders immediately prior to the consummation of the Business Combination, including investors in the PIPE Financing, received Company Common Shares pursuant to the BCA representing approximately 69.5% of the Company Common Shares outstanding immediately following consummation of the Business Combination.

On December 22, 2023, the Common Shares and Warrants became listed on The Nasdaq Global Market (“Nasdaq”) under the symbols “LDTC” and “LDTCW”, respectively.

ABOUT THIS ANNUAL REPORT

Unless otherwise indicated and unless the context otherwise requires, “we,” “us,” “our,” “LeddarTech” or “the Company”, at all times prior to consummation of the Business Combination, refers to LeddarTech Inc. and its consolidated subsidiaries, and at all times following consummation of the Business Combination, refers to LeddarTech Holdings Inc. and its consolidated subsidiaries.

IMPORTANT INFORMATION ABOUT IFRS

Our financial statements are prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board and referred to in this Annual Report as “IFRS.”

INDUSTRY AND MARKET DATA

The industry and market data relating to our business included in this Annual Report is based on our internal estimates and research, as well as publications, research, surveys and studies conducted by independent third parties not affiliated to us. Industry publications, studies and surveys generally state that they were prepared based on sources believed to be reliable, although there is no guarantee of accuracy. While we believe that each of these studies and publications is reliable, we have not independently verified the market and industry data provided by third-party sources. In addition, while we believe our internal research is reliable, such research has not been verified by any independent source. We note that assumptions underlying industry and market data are subject to risks and uncertainties, including those discussed under “Cautionary Note Regarding Forward-Looking Statements” and “Item 3.D Risk Factors” of this Annual Report.

TRADEMARKS, TRADE NAMES AND SERVICE MARKS

We and our subsidiaries and affiliates own or have rights to trademarks, trade names and service marks that they use in connection with the operation of their respective businesses. In addition, their names, logos and website names and addresses are their trademarks or service marks, including, but not limited to, LeddarVision™, LeddarSense™ and VayaVision™. Other trademarks, trade names and service marks appearing in this Annual Report are the property of their respective owners. Solely for convenience, in some cases, the trademarks, trade names and service marks referred to in this Annual Report are listed without the applicable ®, ™ and SM symbols, but they will assert, to the fullest extent under applicable law, their rights to these trademarks, trade names and service marks.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements in this Annual Report on Form 20-F (including the information incorporated by reference herein, this “Annual Report”) that do not directly or exclusively relate to historical facts constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Our forward-looking statements include, but are not limited to, statements regarding our or our management team’s expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not a forward-looking statement. Forward-looking statements in this Annual Report and in any document incorporated by reference in this Annual Report may include, but are not limited to, statements about:

| ● | the benefits of the Business Combination; |

| ● | the Company’s financial performance following the Business Combination; |

| ● | our ability to raise additional capital; |

| ● | our ability to comply with the covenants in our debt financing agreements; |

| ● | our ability to enter into a forbearance agreement, waiver or amendment with, or obtain other relief from, our lenders under our debt instruments; |

| ● | changes in the Company’s strategy, future operations, financial position, estimated revenues and losses, projected costs, projects, prospects, and plans; |

| ● | expansion plans and opportunities; and |

| ● | the outcome of any known and unknown litigation and regulatory proceedings. |

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this Annual Report. Although we believe that the expectations reflected in such forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. These statements involve known and unknown risks and are based upon a number of assumptions and estimates which are inherently subject to significant uncertainties and factors relating to our operations and business environment, including those discussed under the section titled “Item 3.D Risk Factors” below, all of which are difficult to predict and many of which are beyond our control. Actual results may differ materially from those expressed or implied by such forward-looking statements. We undertake no obligation to publicly update or revise any forward-looking statements contained in this Annual Report, or the documents incorporated by reference in this Annual Report, to reflect any change in our expectations with respect to such statements or any change in events, conditions or circumstances upon which any such statement is based.

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

| A. | [Reserved.] |

| B. | Capitalization and Indebtedness |

Not applicable.

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

| D. | Risk Factors |

An investment in our securities carries a significant degree of risk. You should carefully consider the following risks and other information in this Annual Report, including our consolidated financial statements and related notes in connection with your ownership of our securities. If any of the events described below occur, our business and financial results could be materially adversely affected. This could cause the trading price of our securities to decline, perhaps significantly, and you therefore may lose all or part of your investment. The risks set out below are not exhaustive and do not comprise all of the risks associated with an investment in the Company. Additional risks and uncertainties not currently known to us or which we currently deem immaterial may also have a material adverse effect on our business, financial condition and results of operations.

References in this section to “we,” “us,” “our,” the “Company” or “LeddarTech” refer to LeddarTech Inc. and its subsidiaries prior to the consummation of the Business Combination, and LeddarTech Holdings Inc. and its subsidiaries subsequent to consummation of the Business Combination, unless the context otherwise requires or indicates otherwise.

Risks Relating to LeddarTech’s Business

LeddarTech’s recent transition from a sensory hardware-focused development business model to a sensory software-focused development business model means that effectively we are a “pre-revenue” business, and the transition makes evaluating LeddarTech’s business and future prospects difficult and may increase the risk of your investment.

In fiscal 2022, LeddarTech transitioned its business activities into an automotive software business model pursuant to which it is developing and marketing raw data fusion and perception software solutions. Prior to this transition in its business plan, LeddarTech’s costs and revenues were principally related to the development, production and sale of hardware and sensor components. LeddarTech has a limited operating history under this new business model, and is operating in a rapidly evolving market. As a result, there is limited historical financial information that investors can use in evaluating LeddarTech’s business, strategy, operating plan, results, and prospects. Furthermore, LeddarTech has not yet successfully commercialized its software solutions.

We have an unproven business model in a new market and face significant challenges in a rapidly evolving industry. LeddarTech’s prospects may be considered speculative and any failure to commercialize LeddarTech’s strategic plans would have an adverse effect on LeddarTech’s operating results and business, harm LeddarTech’s reputation and could result in substantial liabilities that exceed LeddarTech’s resources.

We have a limited operating history under LeddarTech’s new unproven business model and LeddarTech’s operations are subject to all of the risks inherent in the establishment of a new business enterprise, including a lack of operating history under LeddarTech’s new business model. We cannot be certain that LeddarTech’s business strategy will be successful or that we will be solvent at any particular time. LeddarTech’s likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays frequently encountered in connection with the establishment of any company. If we fail to address any of these risks or difficulties adequately, LeddarTech’s business will likely suffer. Because of the numerous risks and uncertainties associated with developing and commercializing LeddarTech’s raw data fusion and perception software solutions, we are unable to predict the extent of any future losses or when we will become profitable, if ever. We may never become profitable and you may never receive a return on an investment in LeddarTech’s securities. An investor in LeddarTech’s securities must carefully consider the substantial challenges, risks and uncertainties inherent in the attempted development and commercialization of procedures and products in the sensory software industries. We may never successfully commercialize LeddarTech’s LeddarVision™ solutions and LeddarTech’s business may fail.

We have incurred significant operating losses and net cash outflows since inception, and it is uncertain when, if ever, we will generate meaningful revenue and profitability under LeddarTech’s new business model.

LeddarTech had an accumulated deficit of $480.3 million as at September 30, 2023, and, for the fiscal years ended September 30, 2023 and September 30, 2022, incurred a net loss of $51.4 million and $73.4 million, respectively. LeddarTech realized net cash outflows related to operating and investing activities for the fiscal year ended September 30, 2023 amounting to $36.7 million and $11.2 million, respectively, and for the year ended September 30, 2022 amounting to $38.1 million and $12.0 million, respectively. As of December 31, 2023, after giving effect to the completion of the PIPE Financing and the Business Combination, the Company had approximately $70.8 million of indebtedness outstanding. See “Item 5. Operating and Financial Review and Prospects—Liquidity and capital management.” The Company is currently dependent on its shareholders and lenders to fund its operations, including the development of its technology. We have devoted most of LeddarTech’s financial resources to research and development activities. We expect to continue to incur substantial and increased expenses, losses and negative cash flows as we expand our development activities and progress with the commercialization of our products.

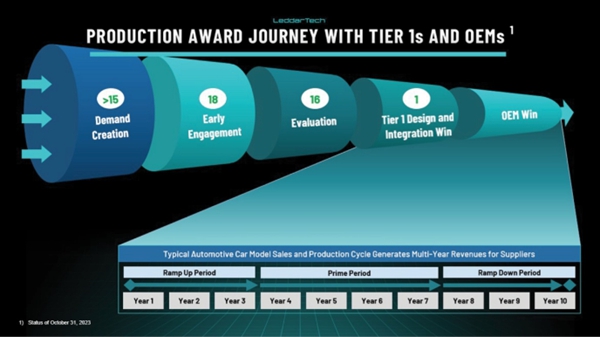

We have not achieved any OEM design wins, and while we have invested significant time, funds and efforts seeking OEM and Tier 1 selection of our solutions, our solutions ultimately may not be chosen for use in production models. If we fail to achieve OEM design wins after incurring substantial expenditures in these efforts, our future business, results of operations and financial condition would be adversely affected.

We invest significant effort and money developing our sensory software solutions to support ADAS or AD applications, developed by OEMs or automotive system integrators that are direct suppliers to OEMs (“Tier 1” suppliers), which we intend to be incorporated in one or more specific vehicle models to be produced by the OEMs. We refer to the selection by a Tier 1 supplier of our software for inclusion in such ADAS or AD applications, for the purposes of submitting such applications to an OEM, as a “Tier 1 design and integration win.” We use the term “OEM design win” to refer to the selection by an OEM of our software, whether directly from us for integration in the ADAS or AD applications developed by the OEM, or through selection of a Tier 1 supplier’s ADAS or AD application integrating our software, for incorporation in specific vehicle models with identified SOPs. There is no assurance that a Tier 1 design and integration win will develop into an OEM design win.

We could expend significant resources pursuing, but fail to achieve, either a Tier 1 design and integration win or an OEM design win. While we are in various stages of discussion with Tier 1 suppliers and OEMs, we have not yet achieved an OEM design win, and there is no assurance that these assessments will result in either a Tier 1 design and integration win or an OEM design win in the future.

After an OEM design win, it is typically difficult for a product or technology that did not receive the design win to displace the winner until the OEM issues a new request for quotation because an OEM will generally not change complex technology already integrated in its systems until a vehicle model is revamped. In addition, the firm with the winning design may have an advantage with the OEM going forward because of the established relationship between the winning firm and the OEM, which would make it more difficult for that firm’s competitors to win the designs for other production models. If we fail to win a significant number of OEM design competitions in the future, then our business, results of operations, and financial condition would be adversely affected.

Because we have not yet achieved an OEM design win, we cannot be certain as to our revenue model and anticipated pricing terms, whether royalty fees on a per unit basis, fees for engineering services and software licensing, data streams and other revenue sources. Additionally, future contracts with OEMs and Tier 1 suppliers may have certain contractual rights to cancel or delay their orders under certain circumstances. Such cancelations or delays could materially and adversely affect our ability to generate revenue (which could in turn affect our ability to raise needed capital on reasonable terms), diminish supplier or customer willingness to enter into transactions with us and have other adverse effects that may decrease our long-term viability. If our products are not successfully developed or commercialized, including because of a lack of capital, if we do not achieve broad market acceptance of our products and services, or if we cannot agree on attractive pricing terms with our target customers, we will not achieve profitability and our business may fail.

Even if we achieve OEM design wins, prospective customers may not purchase our solutions in any certain quantity, at any certain price or at all, and there may be significant delays between the time we achieve either a Tier 1 design and integration win or an OEM design win and the time a contract for production is agreed to and we are able to realize revenue. Any failure to obtain OEM and Tier 1 customers for our solutions and services, whether following Tier 1 design and integration wins, OEM design wins or otherwise, would materially adversely affect our business, results of operations and financial condition.

If we achieve an OEM design win, any resulting contracts with customers may not require them to purchase our solutions in any certain quantity or at any certain price, and our sales could be less than we forecast if a vehicle model for which we achieved an OEM design win is unsuccessful (including for reasons unrelated to our solutions), if an OEM decides to discontinue or reduce production of a vehicle model or of the use of our solutions in a vehicle model, or if we face downward pricing pressure. As a result, achieving OEM design wins is not a guarantee of revenue, and our sales may not correlate with the achievement of additional OEM design wins. Moreover, pricing estimates are made at the time of a request for quotation by an OEM, so that worsening market or other conditions between the time of a request for quotation and an order for our solutions may require us to sell our solutions for a lower price than we initially expected. We may also face pricing pressures from our customers as a result of their restructuring, consolidation, and cost-cutting initiatives or as a result of increased competition. As a particular solution matures and unit volumes increase, we also generally expect its average selling price (“ASP”) to decline. If we are not able to introduce solutions with additional features and functionality at higher price points to offset price reductions, then our business, results of operations, and financial condition would be adversely affected.

Furthermore, our solutions are technologically complex, incorporate many technological innovations, and are typically subject to significant safety testing, and OEMs generally must make significant commitments of resources to test and validate our solutions before including them in any particular vehicle model. Our low-level sensor fusion and perception technology controls supports ADAS and autonomous driving solutions control of various vehicle functions including engine, transmission, safety, steering, navigation, acceleration, and braking and therefore must be integrated effectively with the other systems of the vehicle developed by the OEM, our Tier 1 customers, and other suppliers, and we may be unable to achieve the requisite level of interoperability in a vehicle model for our solutions to be implemented even after an OEM design win. We expect the integration cycles of our solutions with new OEMs to be approximately one to three years after an OEM design win, depending on the OEM and the complexity of the solution. These integration cycles result in our investment of resources prior to realizing any revenue from a vehicle model. An OEM may choose to cancel production of the vehicle model for which we achieved the OEM design win or cancel or postpone the vehicle model.

In connection with any OEM design wins, we would expect to receive preliminary estimates from OEMs of their anticipated production volumes for the models relating to those design wins. Those estimates may be revised significantly by the OEMs, potentially multiple times, and may not be representative of future production volumes associated with those OEM design wins, which could be significantly higher or lower than estimated. Furthermore, long development cycles or vehicle model cancellations or postponements would adversely affect our business, results of operations, and financial condition.

Our financial statements contain disclosure regarding the significant doubt about our ability to continue as a going concern. Our ability to execute our business plan, to fund our operations and to continue as a going concern depends on our ability to raise capital and the continuous support of our creditors.

Prior to 2022, we had been focused on research and development activities with a view to developing advanced detection and ranging systems and solutions based on light (“LiDAR”). As of September 30, 2023, we had an accumulated deficit of approximately $480.3 million. We do not know whether or when we will become profitable. Our losses have resulted principally from disbursements made in development and discovery activities. The opinion of our independent registered public accounting firm on our audited financial statements as of and for the year ended September 30, 2023 contains an explanatory paragraph regarding substantial doubt about our ability to continue as a going concern. We expect to continue to incur losses for the foreseeable future.

LeddarTech has limited sources of available liquidity and if it does not raise additional capital is expected to operate under an alternative operating plan. A reduction in LeddarTech’s operating costs may materially adversely affect LeddarTech in a number of ways.

LeddarTech has limited sources of liquidity. See “Item 5. Operating and Financial Review and Prospects—Liquidity and capital management,” and our historical combined financial statements and the accompanying notes included elsewhere in this Annual Report.

If LeddarTech does not raise additional capital in sufficient amounts LeddarTech will need to reduce its operating costs to ensure sufficient liquidity for its operations and to comply with the requirements of its debt obligations.

The Company has developed a flexible and scalable cost management plan to be implemented to the extent deemed necessary and appropriate so that LeddarTech can maintain operating costs at targeted levels (through strict cost control and budgeting discipline) to ensure operating costs will not exceed anticipated available liquidity. The cost management plan includes the possibility of significant reduction in product development expenditures, significant headcount reductions, and compensation adjustments. The extent to which the cost management plan would need to be implemented will be dependent upon several factors, including scope and terms of any forbearance agreement, waiver, amendment to, or relief from, the minimum cash covenant applicable to LeddarTech and the amount and extent to which the Company is able to raise additional capital in a timely manner, if at all.

It is expected that LeddarTech will need to implement the cost management plan to some degree if it is not successful in its efforts to raise additional capital, and depending on the level of relief from the minimum cash covenant LeddarTech is able to negotiate with its lender. Implementation of the cost management plan, if necessary, may materially adversely affect LeddarTech in a number of ways, and would exacerbate risks to which LeddarTech is already subject. For example, a reduction in product development expenditures and headcount reductions may materially limit LeddarTech’s ability to complete, test and offer to the market a comprehensive suite of integrated features and services, and if LeddarTech is only able to offer a limited suite of features and services, it will be less likely to realize the full revenue and profitability potential of its solutions and less able to effectively compete in its targeted markets. Implementation of the cost management plan may also significantly reduce the number of Tier 1 and OEM customers that LeddarTech would be able to support, which in turn would be expected to have a material adverse effect on its revenue and potential profitability. See “— Any significant reduction in headcount as part of the Implementation of the Company’s cost management plan may have a material adverse effect on LeddarTech’s operations and future prospects” and “— We operate in a highly competitive, dynamic and rapidly changing market and compete against a large number of established competitors and new market entrants, some of whom have substantially greater resources.” Implementation of the cost management plan also may adversely affect LeddarTech’s ability to retain skilled software engineers and other key employees. See “— If we are unable to attract, retain, and motivate key employees, then our business, results of operations, and financial condition would be adversely affected.” Further, a reduction in headcount across LeddarTech may adversely affect LeddarTech’s ability to timely prepare and publish accurate financial information, develop effective internal controls over financial reporting and remediate existing significant deficiencies and material weaknesses (or identify significant deficiencies and material weaknesses in the future). See “— Risks Relating to this Offering and Ownership of Our Securities — We have identified material weaknesses in our internal control over financial reporting, and we may identify additional material weaknesses in the future.” In connection with any cost reduction plans or activities, the Company will be required to incur cash and non-cash expenses.

LeddarTech’s liquidity position will be further constrained by the requirement to maintain a minimum cash balance of at least $5.0 million. If LeddarTech is not able to maintain compliance with the minimum cash balance requirements, its debt obligations may be declared due and payable at a time when LeddarTech does not have sufficient resources to repay such debt obligations.

Pursuant to the terms of the Desjardins Credit Facility, LeddarTech is required to maintain a minimum cash balance of $5.0 million.

LeddarTech may be unable to comply with the minimum cash balance requirement, absent an agreement by the lender to further amend, waive or otherwise provide relief from this minimum cash covenant, unless it raises additional capital and/or implements its cost management plan. If LeddarTech is unable to enter into a forbearance agreement, waiver or amendment with, or obtain other relief from, Desjardins, or following receipt of any such relief is nonetheless unable to comply with its terms, and as a result LeddarTech were to fail to comply with such minimum cash balance requirements, Desjardins would have the right to declare the Desjardins Term Loan to be due and payable, and if it elected to do so, approximately $59.4 million aggregate principal amount of indebtedness of LeddarTech (including the convertible notes issued in the PIPE Financing) would also be subject to acceleration. While LeddarTech may seek additional financing to avoid or cure such an outcome or seek from Desjardins further forbearance, waiver or other relief from such requirements, there is no assurance that it would be able to do so on commercially reasonable terms, or at all. In such circumstances, LeddarTech’s ability to continue as a going concern would be materially and adversely affected and investors in LeddarTech’s common shares could lose all or a substantial part of their investment.

Any significant reduction in headcount as part of the implementation of the Company’s cost management plan may have a material adverse effect on LeddarTech’s operations and future prospects.

Pursuant to the Company’s cost management plan, in the event the Company does not raise sufficient additional capital, we expect that LeddarTech will reduce its employee headcount. Such headcount reduction would result in a substantial decrease in the number of Company employees to the extent the cost management plan is fully implemented. The extent of any headcount reduction will be based primarily on management’s assessment of available liquidity, key operating and business needs, and prevailing conditions at the time. Any significant reduction in headcount has the potential to materially adversely affect our operations and future operating results, including by:

| ● | delaying our ability to timely deliver operational software solutions to our target customers; |

| ● | impairing our ability to obtain requisite industry certifications, which would then need to be obtained by the Tier 1 or OEM customer; |

| ● | restricting our ability to calibrate and configure our software solutions for more than one set of sensor types, which may make our solutions less appealing to our customers and delay our ability to sell our software solutions to a broad range of Tier 1 and OEM customers; |

| ● | delaying our ability to expand the domain capabilities of our software solutions, such as being able to market our software solution for use in snow conditions without additional software capabilities being added to our solutions, which we would be unable to do on the same timeframe as if we had not reduced our headcount; and |

| ● | further limiting our revenue opportunities due to the fact that a reduced headcount would constrain our ability to service a desired number of Tier 1 and OEM customers. |

Each of these potential consequences of any headcount reductions could adversely affect the marketability of our software solutions and the timing and extent of our ability to generate revenue. Additionally, significant headcount reductions may adversely impact our accounting and finance function, and make it more difficult to remediate existing significant deficiencies and material weaknesses. Reductions in headcount also will result in immediate severance and other cash costs, which could be significant and may therefore reduce the effectiveness and objectives of our cost management plan in the short-term. Realization of any of these consequences of a headcount reduction could materially adversely affect our business, results of operations, and financial condition.

We invest significantly in research and development, and to the extent our research and development efforts are unsuccessful, our competitive position would be negatively impacted and our business, results of operations and financial condition would be adversely affected.

To compete successfully, we must maintain successful research and development efforts, develop new solutions, and improve our existing solutions, all ahead of competitors. We are focusing our research and development efforts across several key emerging technologies, including computer vision, software-defined radar and solid-state LiDAR, low-level sensor fusion, and the LeddarVision™ Front — Entry-Level, LeddarVision™ Premium Surround and LeddarVision™ Parking systems. These are ambitious initiatives, and we cannot guarantee that all of these efforts will deliver the benefits we anticipate or be homologated as expected. We must make research and development investments based on our views of the most promising approaches to address future customer needs in rapidly evolving markets, and we cannot be certain that we will target out research and development investments appropriately, or correctly anticipate the manner in which these markets will evolve. To the extent our research and development efforts do not produce timely improvements in utility, accuracy, safety, cost and operational efficiency, our competitive position will be harmed. We do not expect all of our research and development investments to be successful. Some of our efforts to develop and market new solutions may fail, and the solutions we invest in and develop may be rejected by regulators or may not be well received by customers, who may adopt competing technologies. We make significant investments in research and development, and our investments at times may not contribute to our future operating results for several years, if at all, and such contributions at times may not meet our expectations or even cover the costs of such investments, which would adversely affect our business, results of operations, and financial condition.

We have incurred material charges in connection with our decision to exit our modules and components business, and may incur additional charges related to the related exit activities in the future.

In connection with the Company’s transition to a pure-play automotive software business model, the Company is exiting its modules and components business. In connection with this decision, the Company incurred restructuring costs of approximately $1.8 million during the FY2023. During the same period, the Company wrote down inventory by approximately $2.3 million and recorded an onerous contract loss of approximately $1.4 million. The Company may incur additional charges in connection with the exit from its modules and components business.

Our historical financial information, historical financial results and operating and business history, which were achieved under our prior sensory hardware-focused business model, may not be representative of our future results under a sensory software-focused business model.

The historical combined financial information included in this Annual Report may not be meaningful to an understanding of our results of operations, financial position, and cash flows in the future or what they would have been had we been pursuing our sensory software-focused business model strategy during the years presented. Our historical financial data presented in this Annual Report includes costs of our business under our prior sensory hardware-focused business strategy, which may not, however, reflect the expenses we would have incurred had we pursued our current sensory software-focused business model during the years presented. Actual costs that may have been incurred if we had pursued our sensory software-focused business model would depend on a number of factors, including the extent of research and development costs, data acquisition and storage costs, and other strategic decisions. See “Item 5. Operating and Financial Review and Prospects” and our historical combined financial statements and the accompanying notes included elsewhere in this Annual Report.

If we determine that our goodwill or intangible assets have become impaired, we could incur significant charges that would have a material adverse effect on our results of operations and financial condition.

As of September 30, 2023, the amounts of goodwill and intangible assets on our consolidated balance sheet subject to future impairment testing were $7.3 million and $43.4 million, respectively. Pursuant to IAS 36, we capitalize costs for product development projects. Initial capitalization of costs is based on management’s judgment that the Company can demonstrate the existence of a market for the product developed and that it will have the technical and financial capacity to complete the project until commercialization. Therefore, we conduct regular tests to determine if impairment has occurred. If the testing performed indicates that impairment has occurred, we are required to record a non-cash impairment charge for the difference between the carrying value of intangible assets and the implied fair value of the intangible assets in the period the determination is made. This testing of intangible assets for impairment requires us to make significant estimates about our future performance and cash flows, as well as other assumptions. These estimates can be affected by numerous factors, including changes in economic, industry or market conditions; changes in business operations; changes in competition; or potential changes in the price of Company Common Shares and LeddarTech’s market capitalization. Changes in these factors, or changes in actual performance compared with estimates of our future performance, could affect the fair value of goodwill or other intangible assets, which may result in an impairment charge. We cannot accurately predict the amount or timing of any impairment of assets. Should the value of our goodwill or other intangible assets become impaired, we could incur significant charges that would have a material adverse effect on our results of operations and financial condition.

If we are unable to develop and introduce new solutions and improve existing solutions in a cost-effective and timely manner, then our competitive position would be negatively impacted and our business, results of operations, and financial condition would be adversely affected.

Our business, results of operations, and financial condition depend on our ability to complete development of our raw data fusion and perception software solutions for the automotive market and to develop and introduce new and enhanced solutions that incorporate and integrate the latest technological advancements in sensing and perception technologies, software and hardware, and camera, radar, LiDAR, mapping, and AI technologies to satisfy evolving customer, regulatory, and safety rating requirements. For example, we will need to complete the development in a cost-effective manner of new generations of our LeddarVision™ Front — Entry-Level and LeddarVision™ Surround View Solution, each of which are important components of our planned approach to address the ADAS consumer and off-road vehicle markets. This Annual Report contains descriptions of our current expectations regarding the time frame in which we expect to have our software solutions deployed by our Tier 1 customers. These time periods are subject to significant uncertainty. We may encounter significant unexpected technical and production challenges, or delays in completing the development of these and other solutions and ramping production in a cost-efficient manner. The development of these and other new and enhanced solutions requires us to invest resources in research and development and also requires that we:

| ● | design innovative, accurate, and safety- and comfort-enhancing functions that differentiate our solutions from those of our competitors; |

| ● | continuously improve the reliability of, and reduce and ultimately remove the requirement for human intervention with, our ADAS and autonomous driving technology; |

| ● | cooperate effectively on new designs and development with our customers, suppliers and partners; |

| ● | respond effectively to technological changes and product announcements by our competitors; and |

| ● | adjust to changing customer requirements, market conditions, and regulatory and rating standards quickly and cost-effectively. |

If we must significantly reduce our operating costs, we could experience delays in completing development of our solutions. If there are delays in, or if we fail to complete when expected or at all, our existing and new development programs, we may not be able to satisfy our customers’ requirements, achieve either Tier 1 design and integration wins or OEM design wins with our target customers, or achieve market acceptance of our solutions, and our business, results of operations, and financial condition would be adversely affected.

We operate in a highly competitive, dynamic and rapidly changing market and compete against a large number of established competitors and new market entrants, some of whom have substantially greater resources.

The markets for sensing technology applicable to the ADAS and AD industries are highly competitive, dynamic and rapidly changing. Our future success will depend on our ability to remain a leader in our targeted markets by continuing to develop and protect from infringement low-level sensor fusion and perception software in a timely manner and to stay ahead of existing and new competitors. Our competitors are numerous and they compete with us directly by offering sensor software and indirectly by attempting to solve some of the same challenges with different technology. We face competition from sensor fusion and perception software companies, Tier 1 suppliers and other technology and automotive supply companies, and OEMS, and most of our principal competitors have significantly greater resources than we do. In the automotive market, our competitors have commercialized both LiDAR and non-LiDAR-based ADAS technology that has achieved market adoption, strong brand recognition and may continue to improve. Other competitors are working towards commercializing ADAS and autonomous driving technology and either by themselves, or with a publicly announced partner, have substantial financial, marketing, research and development and other resources. Some of our existing and prospective customers in the ADAS and AD markets have announced development efforts or made acquisitions directed at creating their own sensing technologies, which would compete with our solutions. We cannot be certain how close these competitors may be to commercializing autonomous driving systems or novel ADAS applications.

If our target customers purchase a competing solution from any of our competitors, it may be difficult to displace such competitor with our solutions until the OEM issues a new request for quotation because an OEM will generally not change complex technology already integrated in its systems until a vehicle model is revamped. Accordingly, it is important that the Company achieve both Tier 1 design and integration wins and OEM design wins with its target customers quickly. If we must significantly reduce our operating costs, we could experience delays in completing development of our solutions, and suffer significant competitive disadvantage.

Additionally, increased competition may result in pricing pressure and reduced margins and may impede our ability to increase the sales of our products or cause us to lose market share, any of which will adversely affect our business, results of operations and financial condition.

We expect that a substantial portion of future revenue will come from a small number of OEMs and Tier 1 customers, and the loss of or a significant reduction in sales to, one or more of major Tier 1 customers and/or the discontinued incorporation of our solutions by one or more major OEMs in their vehicle models, would materially adversely affect our business, results of operations and financial condition.

We seek to supply OEMs with the LeddarVision™ platform directly or through our arrangements with Tier 1 suppliers, which are direct suppliers to OEMs. See “— Even if we achieve OEM design wins, prospective customers may not purchase our solutions in any certain quantity, at any certain price or at all, and there may be significant delays between the time we achieve either a Tier 1 design and integration win or an OEM design win and the time a contract for production is agreed to and we are able to realize revenue. Any failure to obtain OEM and Tier 1 customers for our solutions and services, whether following Tier 1 design and integration wins, OEM design wins or otherwise, would materially adversely affect our business, results of operations and financial condition.”

We believe our business, results of operations, and financial condition for the foreseeable future will likely depend on sales to a relatively small number of Tier 1 customers and the incorporation of our solutions by a relatively small number of OEMs in their vehicle models. In the future, our target OEM and Tier 1 customers may decide not to purchase our solutions or may alter their purchasing patterns, and OEMs may discontinue incorporation of our solutions in their vehicle models, including as a result of a transition to in-house solutions or solutions provided by our competitors, or their individual or aggregate production levels may decline due to a number of factors, including supply chain challenges and macroeconomic conditions. Further, the amount of revenue attributable to any single OEM or Tier 1 customer, or our OEM and Tier 1 customer concentration generally, may fluctuate in any given period. In the event we achieve OEM design wins in the future, the loss of one or more key OEM or Tier 1 customers, a reduction in sales to any key OEM or Tier 1 customer, the discontinued or decreased incorporation of our solutions by a key OEM, or our inability to attract new significant Tier 1 customers and OEMs would negatively impact our revenue and adversely affect our business, results of operations, and financial condition.

We have entered into strategic collaborations, but not yet signed commercial agreements, with two Tier 1 suppliers. If we fail to sign commercial agreements with those prospective customers, or to subsequently achieve an OEM design win with such customers, our future business, results of operations and financial condition would be adversely affected.

We are in various stages of discussion with Tier 1 suppliers and OEMs, covering more than 30 design win opportunities. As a result of such discussions, we have publicly announced strategic collaborations with Trimble Inc. (“Trimble”) and FICOSA ADAS S.L. (“Ficosa”), each a leading Tier 1 supplier in the automotive industry. Trimble has recently announced an agreement to transfer its agricultural technology business (the division with which LeddarTech has a strategic collaboration) to a joint venture with AGCO Corp. Upon completion of their transaction, it is expected that AGCO will own 85% of the joint venture, with Trimble retaining the remaining 15%. It is not clear at this time how the change in ownership of this business will affect LeddarTech’s strategic collaboration. See “Business.” We have not yet entered into commercial agreements with any Tier 1 supplier or OEM, and there is no assurance that these strategic collaborations will result in either commercial agreements or OEM design wins.

In the event we execute commercial agreements with prospective customers, such agreements may have contractual rights to cancel or delay orders, or the timeframe for development and integration of our software may be extended beyond the timing provided for in such agreements, potentially resulting in the agreements expiring without generating revenue or achieving OEM design wins. Any subsequent renegotiation of such agreements may result in terms less favorable to us. Such cancelations, delays, expirations and renegotiations could materially and adversely affect our ability to generate revenue (which could in turn affect our ability to raise needed capital on reasonable terms), diminish supplier or customer willingness to enter into transactions with us and have other adverse effects that may decrease our long-term viability. See “— We have not achieved any OEM design wins, and while we have invested significant time, funds and efforts seeking OEM and Tier 1 selection of our solutions, our solutions ultimately may not be chosen for use in production models. If we fail to achieve OEM design wins after incurring substantial expenditures in these efforts, our future business, results of operations and financial condition would be adversely affected.”

Product integration could face complications or unpredictable difficulties, which may adversely impact customer adoption of our products and our financial performance.

Our products are designed to function as part of a system, and therefore are to be integrated with other sensing technologies, software products and customer applications. Required integration efforts can be time consuming and costly and there is no guarantee that results will be satisfactory to the end customer. These challenges are even more present in the automotive sector where components are subject to as much as several years of product and design validation before they are fitted into a vehicle program. While the Company expects to work with system integrators which lend their experience to these workstreams, there is no guarantee that unforeseen delays or setback would not arise that would impair our ability to launch with key programs across our sectors of focus.

Our business may suffer from claims relating to, among other things, actual or alleged defects in our solutions. If our solutions actually or allegedly fail to perform as expected, publicity related to these claims could harm our reputation and decrease demand for our solutions or increase regulatory scrutiny of our solutions.

Our software products are complex and, from time to time, have had, and could have or could be alleged to have, defects in design, security vulnerabilities or other errors, failures, or other issues of not functioning in accordance with their specifications or as expected. Some errors or defects in our solutions have been, and could be, initially undetected and only discovered after they have been tested, commercialized, and deployed by customers. Alleged or actual defects in any of our solutions could result in adverse publicity for us, warranty claims, litigation against us, legal expenses and damages, our customers never being able to commercialize technology incorporating our solutions, negative publicity for our customers, and other consequences. Errors, defects, or security vulnerabilities could result in serious injury to or death of the end users of vehicles incorporating our solutions, or those in the surrounding area, including as a result of traffic accidents and collisions. If that is the case, we would incur significant additional development costs and product recall, repair, or replacement costs.

If any of our solutions are or are alleged to be defective, we may be required to participate in a recall involving such solutions. Each vehicle manufacturer has its own practices regarding product recalls and other product liability actions relating to its suppliers. However, as suppliers become more integrally involved in the vehicle design process, OEMs may look to their direct and indirect suppliers for contribution when faced with recalls and product liability claims. OEMs also require their suppliers to guarantee or warrant their products and bear the costs of repair and replacement of such products under new vehicle warranties. Depending on the terms under which we supply products to a Tier 1 customer or OEM, a vehicle manufacturer may attempt to hold us responsible for some or all of the repair or replacement costs of defective products under new vehicle warranties when the OEM asserts that the solution supplied did not perform as warranted. Our potential liability may increase to the extent that OEMs increasingly purchase our products directly, as opposed to incorporating our solutions through indirect purchases from our Tier 1 customers. Product liability, warranty, and recall costs would have an adverse effect on our business, results of operations, and financial condition. In addition, product liability claims present the risk of protracted litigation, legal fees, and diversion of management’s attention from the operation of our business, even if our defense of these claims is ultimately successful.

Furthermore, the automotive industry in general is subject to significant litigation claims due to the potentially severe consequences of traffic collisions or other accidents. As a provider of solutions related to, among other things, preventing traffic collisions and other accidents, we could be subject to litigation for traffic collisions or other accidents, even if our solutions or their features or the failure thereof did not cause any particular traffic collision or accident. We expect in the future that our technology will be involved in accidents resulting in death or personal injury, and such accidents where our solutions or their features are involved may be the subject of significant public attention. There also remains significant uncertainty in the legal implications to providers of emerging ADAS and AD technologies of traffic collisions or other accidents involving such technologies, particularly given variations in legal and regulatory regimes that are emerging in different jurisdictions, and we may become liable for losses that exceed the current industry norms as the regulatory and legal landscape develops.

Publicity regarding claims involving our solutions can also have an adverse effect on our reputation and the reputation for low-level sensor fusion technology, and the ADAS and AD solutions utilizing such technology, which could decrease consumer demand for vehicles incorporating these technologies. Further, enhanced publicity surrounding such claims may also increase the regulatory scrutiny of our platforms, which could have a material adverse effect on our ability to complete our business plans.

Although we intend to use disclaimers, limitations of liability, and similar provisions in our agreements with our customers, there is no assurance that any or all of these provisions will prove to be effective barriers to product liability claims. In addition, although we intend to procure and maintain product liability insurance in respect of our software solutions, there is no assurance that such insurance will be adequate to cover any or all of our potential losses as a result of large deductibles and broad exclusions. The cost of such insurance may substantial, and there can be no assurance that such insurance will be available in adequate amounts or on acceptable terms, or at all. Our insurers may also discontinue our insurance coverage, and we may be unable to find replacement insurance on acceptable terms, or at all.

If we are unable to overcome our limited sensory fusion solutions sales history and are unable establish and maintain confidence in our long-term business prospects among our customer prospects and within our industry or are subject to negative publicity, then our future business, results of operations and financial condition would be adversely affected.

OEMs and Tier 1 customers may be less likely to purchase our sensor fusion solutions if they are not convinced that our business will succeed or that our service and support and other operations will continue in the long term.

Similarly, suppliers and other third parties will be less likely to invest time and resources in developing business relationships with us if they are not convinced that our business will succeed. Accordingly, in order to build and maintain our business, we must maintain confidence among OEMs, Tier 1 customers, suppliers, analysts, ratings agencies and other parties in our products, long-term financial viability and business prospects. Maintaining such confidence may be particularly complicated by certain factors including those that are largely outside of our control, such as customer unfamiliarity with low-level sensor fusion solutions, any delays in scaling production, delivery and service operations to meet demand, competition and uncertainty regarding the future of ADAS and autonomous vehicles or our other services and our production and sales performance compared with market expectations.

We are highly dependent on the services of our senior executive officers and loss of key personnel could impair our success.

We are highly dependent on our senior executive officers, including Frantz Saintellemy, our President and Chief Executive Officer. Mr. Saintellemy and other members of our executive team are highly active in our management and allocate a significant amount of time to our company. The loss of Messrs. Saintellemy or other members of our executive team would adversely affect our business because their loss could make it more difficult to, among other things, compete with other market participants, manage our R&D activities and retain existing customers or cultivate new ones, particularly if any such departure occurs while LeddarTech is operating under its cost management plan. Negative public perception of, or negative news related to, Mr. Saintellemy and other members of our executive team may adversely affect our brand, relationship with customers or standing in the industry.

If we are unable to attract, retain, and motivate key employees, then our business, results of operations, and financial condition would be adversely affected.

Hiring and retaining qualified executives, developers, engineers, technical staff, and sales representatives are critical to our business. The competition for highly skilled employees in our industry is increasingly intense. Competitors for technical talent increasingly seek to hire our employees. Changes in the interpretation and application of employment-related laws to our workforce practices may also result in increased operating costs and less flexibility in how we meet our changing workforce needs. To help attract, retain, and motivate qualified employees, we intend to use employee incentives such as share-based awards. Our employee hiring and retention also depend on our ability to build and maintain a diverse and inclusive workplace culture and be viewed as an employer of choice. If our share-based or other compensation programs and workplace culture cease to be viewed as competitive, our ability to attract, retain, and motivate employees would be weakened, which would harm our results of operations. Equity compensation has been, and will continue to be, an important part of our future compensation strategy and a significant component of our future expenses, which we expect to increase over time. Moreover, sustained declines in our stock price can reduce the retention value of our share-based awards. If we do not effectively hire, onboard, retain, and motivate key employees, then our business, results of operations, and financial condition would be adversely affected.

Unplanned changes in our management team can also disrupt our business. Our management and senior leadership team has significant industry experience, and their knowledge and relationships would be difficult to replace. Leadership changes may occur from time to time, and we cannot predict whether significant unplanned resignations will occur or whether we will be able to recruit qualified personnel. In addition, the relationships and reputation that members of our management and key leadership have established and maintain with our target Tier 1 and OEM customers contribute to our ability to maintain strong relationships with key partners and to identify new business opportunities.

As part of growing our business, we may make acquisitions. If we fail to successfully select, execute or integrate our acquisitions, then our business, results of operations and financial condition could be materially adversely affected, and our stock price could decline.

From time to time, we may undertake acquisitions to add new products and technologies, acquire talent, gain new sales channels or enter into new markets or sales territories. In addition to possible shareholder approval, we may need approvals and licenses from relevant government authorities for the acquisitions and to comply with any applicable laws and regulations, which could result in increased delay and costs, and may disrupt our business strategy if we fail to do so. Furthermore, acquisitions and the subsequent integration of new assets, businesses, key personnel, customers, vendors and suppliers require significant attention from our management and could result in a diversion of resources from our existing business, which in turn could have an adverse effect on our operations. Acquired assets or businesses may not generate the financial results we expect. Acquisitions could result in the use of substantial amounts of cash, dilutive issuances of equity securities, the occurrence of significant goodwill impairment charges, amortization expenses for other intangible assets and exposure to potential unknown liabilities of the acquired business. Moreover, the costs of identifying and consummating acquisitions may be significant.

To date, we have limited experience with acquisitions and the integration of acquired technology and personnel. Failure to successfully identify, complete, manage and integrate acquisitions could materially and adversely affect our business, financial condition and results of operations and could cause our stock price to decline.

Continued pricing pressures and customer cost reduction initiatives may result in lower than anticipated margins, or losses, which may adversely affect our business.

Cost-cutting initiatives adopted by our customers often result in increased downward pressure on pricing. We expect that our agreements with customers may require step-downs in pricing over the term of the agreement or, if commercialized, over the period of production. In addition, our customers may reserve the right to terminate their supply contracts for convenience, which enhances their ability to obtain price reductions. Automotive OEMs also possess significant leverage over their suppliers because the automotive component supply industry is highly competitive, serves a limited number of customers and has a high fixed cost base. We expect to be subject to substantial continuing pressure from customers and suppliers to reduce the price of our products. It is possible that pricing pressures beyond our expectations could intensify as customers pursue restructuring, consolidation and cost-cutting initiatives. If we are unable to generate sufficient production cost savings in the future to offset price reductions, our gross margin and profitability would be adversely affected.

The Company will need to raise additional funds to meet its capital requirements, and such funds may not be available on commercially reasonable terms, or at all, which could materially and adversely affect LeddarTech’s business, results of operations or financial condition and its ability to continue as a going concern.

LeddarTech will need to raise additional capital to, among other things, conduct research and development, and to complete development, testing, qualification, and marketing of its solutions, including its Surround View Solution (LVS-2+). If LeddarTech is not successful in raising additional capital, it is expected that it will need to implement a cost management plan that could have a number of material adverse effects on its business, operations and profitability. See “— LeddarTech has limited sources of available liquidity and if it does not raise additional capital is expected to operate under an alternative operating plan. A reduction in LeddarTech’s operating costs may materially adversely affect LeddarTech in a number of ways.” LeddarTech’s future capital requirements may be uncertain and actual capital requirements may be different from those it currently anticipates. LeddarTech may seek equity or debt financing to finance a portion of its future capital expenditures. Such financing might not be available to it in a timely manner or on terms that are acceptable, or at all.

LeddarTech’s ability to obtain the necessary financing to carry out its business plan is subject to a number of factors, including general market conditions and investor acceptance of its business plan. These factors may make the timing, amount, terms and conditions of such financing unattractive or unavailable to it. In particular, recent disruptions in the financial markets and volatile economic conditions could affect its ability to raise capital. LeddarTech’s future capital needs and other business reasons could require it to sell additional equity or debt securities or obtain a credit facility. The sale of additional equity or equity-linked securities could dilute its shareholders. The issuance of debt securities and incurrence of additional indebtedness would result in increased debt service obligations. Holders of any debt securities or preferred shares will have rights, preferences and privileges senior to those of holders of its common shares in the event of liquidation. Any financial or other restrictive covenants from any debt securities would restrict its operations or its ability to pay dividends to its shareholders.

We are affected by fluctuations in currency exchange rates, including those in connection with recent inflationary trends in the United States of America (“United States” or “U.S.”), Canada, and globally.

We are exposed to adverse as well as beneficial movements in currency exchange rates. Our functional currency is the Canadian dollar, and we incur financial expenses in connection with fluctuations in value due to foreign exchange differences between our monetary assets and liabilities denominated in U.S. dollars and other currencies. Our financial results are reported in Canadian dollars and a substantial portion of our payroll and other operating expenses are accrued in New Israel Shekels and U.S. dollars. A weakened Canadian dollar will increase the cost of expenses such as payroll, utilities, tax, marketing expenses, and capital expenditures. We anticipate that we will realize a substantial portion of our revenue in U.S. dollars. A decline in the value of the U.S. dollar relative to the Canadian dollar could adversely affect our reported revenue. Changes in exchange rates would adversely affect our business, results of operations, and financial condition.

Global or regional conditions can adversely affect our business, results of operations, and financial condition.

We have testing, research and development, sales and other operations in several other countries, and some of our business activities are concentrated in one or more geographic areas. As a result, our business, operating results, and financial condition, including our ability to test, design, develop, or sell products, and the demand for our solutions, are at times adversely affected by a number of global and regional factors outside of our control.

Adverse changes in global or regional economic conditions periodically occur, including recession or slowing growth, changes, or uncertainty in fiscal, monetary, or trade policy, higher interest rates, tighter credit, inflation, lower capital expenditures by businesses including on IT infrastructure, increases in unemployment and lower consumer confidence and spending. Adverse changes in economic conditions can significantly harm demand for our solutions and make it more challenging to forecast our operating results and make business decisions, including regarding prioritization of investments in our business. An economic downturn or increased uncertainty may also lead to increased credit and collectability risks, higher borrowing costs or reduced availability of capital markets, reduced liquidity, adverse impacts on our suppliers, failures of counterparties including financial institutions and insurers, asset impairments and declines in the value of our financial instruments.