UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 26, 2023

| MODULAR MEDICAL, INC. |

| (Exact name of registrant as specified in its chapter) |

| Nevada | 001-41277 | 87-0620495 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) | (IRS Employer Identification No.) |

| 10740 Thornmint Road, San Diego, California | 92127 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (858) 800-3500

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading symbol(s) | Name of each exchange on which registered | ||

| Common Stock | MODD | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Cautionary Note Regarding Forward-Looking Statements

This Current Report on Form 8-K includes information that may constitute forward-looking statements. These forward-looking statements are based on current beliefs, assumptions and expectations of Modular Medical, Inc. (the “Company”) regarding future events, which in turn are based on information currently available to the Company. By their nature, forward-looking statements address matters that are subject to risks and uncertainties. Forward looking statements include, without limitation, statements relating to projected industry growth rates, the Company’s current growth rates and the Company’s present and future cash flow position. A variety of factors could cause actual events and results, as well as the Company’s expectations, to differ materially from those expressed in or contemplated by the forward-looking statements. Risk factors affecting the Company are discussed in detail in the Company’s filings with the Securities and Exchange Commission. The Company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except to the extent required by applicable securities laws.

Item 7.01. Regulation FD Disclosure.

On December 26, 2023, the Company posted an investor presentation (the “Investor Presentation”) to its website (www.modular-medical.com). The information on the Company’s website is not incorporated by reference into this Current Report on Form 8-K and should not be considered part of this document. The website address is included in this Current Report on Form 8-K as an inactive textual reference only.

A copy of the Investor Presentation is attached hereto as Exhibit 99.1. The Company expects to use the Investor Presentation, in whole or in part, and possibly with modifications, in connection with presentations to investors, brokers, analysts, and others.

The information in this Item 7.01 and in Exhibit 99.1 is summary information that is intended to be viewed in the context of the Company’s Securities and Exchange Commission (“SEC”) filings and other public announcements that the Company may make, by press release or otherwise, from time to time. The Company undertakes no duty or obligation to publicly update or revise the information contained in the Investor Presentation, except as required by law. Any such updating may be made through the filing of other reports or documents with the SEC, through press releases, or through other disclosure.

The information provided under this Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, is “furnished” and shall not be deemed “filed” with the SEC or incorporated by reference in any filing under the Securities Exchange Act or 1934 or the Securities Act of 1933.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits:

| Exhibit No. | Description | |

| 99.1 | Investor Presentation dated December 26, 2023 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| MODULAR MEDICAL, INC. | ||

| Date: December 26, 2023 | By: | /s/ James E. Besser |

| James E. Besser | ||

| Chief Executive Officer | ||

2

Exhibit 99.1

Investor Presentation . NASDAQ:MODD

2 | Forward Looking Statements, Other Disclaimers . This presentation includes forward - looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended; Section 21E of the Securities Exchange Act of 1934, as amended; and the safe harbor provision of the U.S. Private Securities Litigation Reform Act of 1995. Forward - looking statements contained in this presentation may be identified by the use of words such as: “believe,” “expect,” “anticipate,” “project,” “should,” “plan,” “will,” “may,” “intend,” “estimate,” predict,” “continue,” and “potential,” or, in each case, their negative or other variations or comparable terminology referencing future periods. Examples of forward - looking statements include, but are not limited to, statements regarding our financial outlook and guidance, short and long - term business performance and operations, future revenues and earnings, regulatory developments, legal events or outcomes, ability to comply with complex and evolving regulations, market conditions and trends, new or expanded products and offerings, growth strategies, underlying assumptions, and the effects of any of the foregoing on our future results of operations or financial condition. Forward - looking statements are not historical facts and are not assurances of future performance. Rather, these statements are based on our current expectations, beliefs, and assumptions regarding future plans and strategies, projections, anticipated and unanticipated events and trends, the economy, and other future conditions, including the impact of any of the aforementioned on our future business. As forward - looking statements relate to the future, they are subject to inherent risk, uncertainties, and changes in circumstances and assumptions that are difficult to predict, including some of which are out of our control. Consequently, our actual results, performance, and financial condition may differ materially from those indicated in the forward - looking statements. These risks and uncertainties include, but are not limited to, “Risk Factors” identified in our filings with the Securities and Exchange Commission, including, but not limited to, our most recently filed Annual Report on Form 10 - K, Quarterly Reports on Form 10 - Q, and any amendments thereto. Even if our actual results, performance, or financial condition are consistent with forward - looking statements contained in such filings, they may not be indicative of our actual results, performance, or financial condition in subsequent periods. This presentation is not an offer to sell or a solicitation of an offer to purchase securities by the Company. Any such offer or solicitation, if any, will only be made by means of offering documents (e.g., prospectus, offering memorandum, subscription agreement and or similar documents) and only in jurisdictions where permitted by law. Certain information contained herein has been provided by or obtained from third - party sources and has not been independently audited or verified by the Company. The Company makes no representation or warranty, express or implied as to the accuracy or completeness of information contained in this document, and nothing contained in this document is, or shall be relied upon as, a promise or representation by the Company. This presentation is not intended for any commercial purpose but strictly for educational or informational purposes only. Please note that some photographs and images appearing in this presentation are not necessarily those of the Company or accurate representations of its products or operations, but may be stock images, third - party operations, product mock - ups, and/or may have been edited for competitive or confidentiality reasons. Any third - party images not owned by the Company are used for non - commercial, illustrative and educational ‘fair use’ purposes only. All images and trademarks are the property of their respective owners.

3 | Modular Medical is a development stage medical device company seeking to produce a next generation insulin pump to expand access to a higher standard of glycemic management for people with diabetes. Founded by Paul DiPerna, founder of Tandem Diabetes (TNDM) and original designer of its popular t:slim pump. 30 - year veteran of the medical device industry. Corporate Overview . Large portfolio of patented technology makes insulin pumps easy to learn, use, and afford. MODD1 : Anticipated FDA submission January 2024 Addressable Market : $3 Billion unmet market need Headquarters : San Diego, CA NASDAQ : MODD 4 | Insulin Pumps Represent the gold standard in glycemic control.

Better outcomes, better patient health, lower A1C. (Market share leaders: Medtronic, Tandem, Insulet) Outcomes Better outcomes lead to systemic savings: fewer trips to ER, reduced comorbidities. Saves $10k/patient year (40%) even after cost of pump. Limitations Feature - heavy and complex systems have hampered adoption. These products are for “superusers.” Prohibitive for many to learn and manage. Cost Constraint Expense of current offerings has placed them out of reach of many patients and insurance plans. Difficult reimbursement, large out of pocket expense. Current Market . 1 in 4 Healthcare dollars in the US are spent on diabetes and diabetes related complications. Only 1 in 3 Americans with type 1 diabetes use a pump. This number has been materially unchanged for 15 years. Only 8% of insulin dependent Americans with type 2 diabetes use a pump. This number is just starting to rise. Only 21% of T1D’s reach ADA guidelines for glycemic control. Overall outcomes have not been getting better. 1 1. Meaghan St. Charles et al. Value Health. Jul - Aug 2009 2.

State of Type 1 Diabetes Management and Outcomes from the T1D Exchange 2016 - 2018 5 | US Market Size . 27 million people with diabetes. 3.6 million require daily insulin (1.6M Type 1, 2.0M Type 2). Pumps CGM MDI 670,464 1,718,919 2,908,056 Pumps CGM Patient Estimates (2020) MDI Patients estimates device type and therapy are for T1D and T2D combined. MDI defined as needing rapid acting and long - acting insulin. Other T2D not included are those on generic orals or diet and exercise only. 2020 National Diabetes Report (CDC). Seagrove Partners LLC, HCP Perspectives August 2021 Precision Xtract September 2018 Only 20% of insulin dependent people with diabetes use a pump for insulin delivery. 80% rely on multiple daily injections (MDI). Continuous glucose monitors (CGM) have nearly 3X the user base of pumps.

6 | Abbott Freestyle Libre made continuous glucose monitoring easier and more affordable. This expanded the product category and doubled its size. We believe the insulin pump market is ready for a similar transition. FreeStyle Libre vs. Dexcom Revenue 0 100 200 300 500 400 600 700 800 4Q20 2Q16 4Q16 2Q17 4Q17 2Q18 4Q18 2Q19 4Q19 2Q20 Dexcom FreeStyle Libre “In short, Flash Glucose Monitoring is fundamentally trying to take something that is more “professional” (i.e., traditional CGM) and make it more accessible to the masses. In consumer - packaged goods, examples of this strategy include home espresso makers (Keurig), cleaning products (e.g., dilatable floor cleaners, spray cleaners, wipes, toilet wands), and teeth whitening (e.g., whitening strips). In these cases, the new innovation completely changed the entire category ; we look forward to seeing if Flash Glucose Monitoring does something similar in diabetes . ” Kelly Close, 2014 Encouraging Adoption . Revenue (Millions of USD)

7 | 1.2M T1D MDI 28% of T1D MDI ($1.37B) 25% of T2D MDI ($1.63B) $3B US market of almost pumpers. 1.6M T2D MDI *Seagrove Partners LLC, HCP Perspectives August 2021. HCPs fairly consistently indicated that about 25% of their MDI population are “almost pumpers”, meaning that they have considered going on a pump, understand pump therapy benefits, but want something simpler that doesn’t have all the "bells and whistles”...* 8 | What are almost pumpers asking for ? Seagrove Partners LLC, HCP Perspectives August 2021 Precision Xtract September 2018 Bottom line: “I cannot spend more time managing my diabetes.” 45% expressed a desire to go on pump Make it easy for me Make it easy for my doctor Make it easy to get coverage Make it easy to share my data with my care team

9 | MODD1 Insulin Delivery for Almost Pumpers . Eliminate trade offs to expand the market. No external controller required No charging or battery replacement Removable Push button to bolus 90 - day reusable pump 3 - day cartridge Only patch pump with full sized 3ml reservoir. Latest low power Bluetooth, Near Field Communications (NFC) and mobile app for ease of pairing and data - connectivity Currently under research and development, not available for investigational use or sale *Testing is currently in progress Same accuracy as leading pumps*. Smoothest, most continuous basal administration in the industry*.

10 | MODD Technology Designed to Provide Precision and Safety . MODD Pumping Mechanism Disposable Cartridge Rotating Cam Precision micro - dosing limits excessive insulin exposure and preserves insulin molecule integrity* Can be used with the latest ultra rapid insulins* More continuous insulin delivery with small increments as needed, not locked into five - minute intervals like other pumps 8 family patents underway to provide a sustainable competitive advantage Ultra high - volume major components make low cost manufacturing a reality for the first time in the industry 50% lower cost of goods than leading patch pump Currently under research and development, not available for investigational use or sale *Testing is currently in progress 11 | Simple Design Enables Automated, High - Volume Manufacturing . Insulet Omnipod MODD1

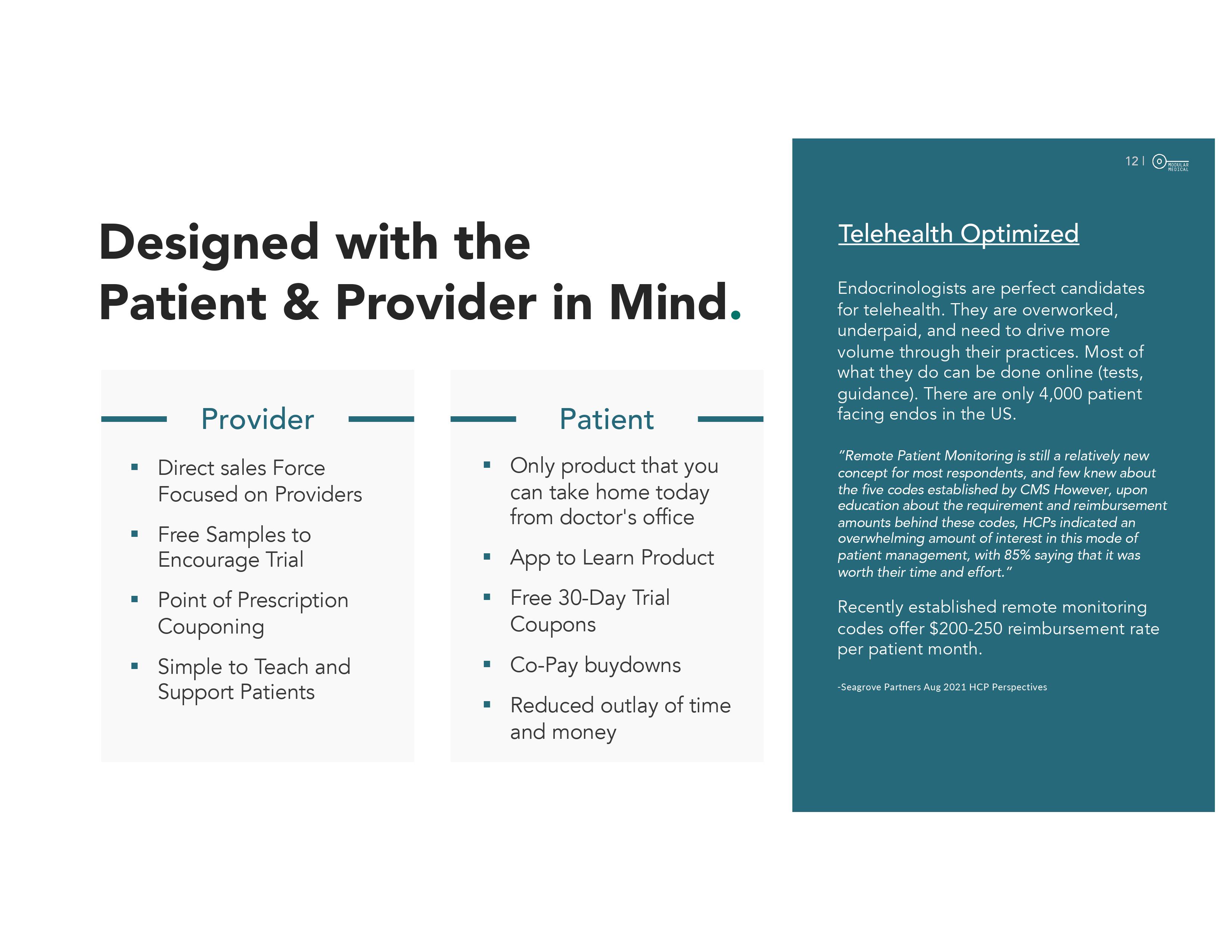

12 | Telehealth Optimized Endocrinologists are perfect candidates for telehealth. They are overworked, underpaid, and need to drive more volume through their practices. Most of what they do can be done online (tests, guidance). There are only 4,000 patient facing endos in the US. ”Remote Patient Monitoring is still a relatively new concept for most respondents, and few knew about the five codes established by CMS However, upon education about the requirement and reimbursement amounts behind these codes, HCPs indicated an overwhelming amount of interest in this mode of patient management, with 85% saying that it was worth their time and effort.” Recently established remote monitoring codes offer $200 - 250 reimbursement rate per patient month. - Seagrove Partners Aug 2021 HCP Perspectives Provider ■ Direct sales Force Focused on Providers ■ Free Samples to Encourage Trial ■ Point of Prescription Couponing ■ Simple to Teach and Support Patients Patient ■ Only product that you can take home today from doctor's office ■ App to Learn Product ■ Free 30 - Day Trial Coupons ■ Co - Pay buydowns ■ Reduced outlay of time and money Designed with the Patient & Provider in Mind .

13 | Payor Preferred . Our products are designed to attain preferential reimbursement and avoid the coverage pitfalls many other pumps have experienced. National Payor Survey Retained ISA to perform National Payors Survey on 1/3 of all commercial lives in US (50 million lives) Payor Benefits: ■ 20% Discount vs Insulet (PODD) Provides Preferred Status ■ Designed to use PBM codes as a disposable ■ No New Code: Reimbursed at Launch ■ Saves Provider $1,032/Patient/Year vs Omnipod Survey data 1 shows that a product with Gen - 1 features set at 10 - 20% discount to Omnipod will gain equivalent or preferential reimbursement at launch. “I would say that if they could come in with an average monthly cost of, say, 20% less than Omnipod…we would make this our preferred.” - IDN Data shows that discounting and rebates have been uncommon and small in insulin pumps. 5% is currently the largest in the space. “We expect that the manufacturer will come to the table, probably with an access rebate [of approx . 5 % ] . This is based on the fact that Medtronic has already come to us with this kind of rebate . ” - National Health Plan Payors showed an interest in a simple product that was less expensive. “I like the simplicity and so as a consequence, it’s attractive to me mostly because I’m very price sensitive. I don’t think there’s any meaningful evidence basis for all those fancy and high - tech products.” - Regional Health Plan 1. Primary research, Precision Xtract, Modular Medical Insulin Pump Rapid - Pulse Payer Assessment, June 2019.

14 | Unit Economics .

90 Day Re - Usable Price: FREE Cost: $34 3 Day Disposable Price: $34.4 * Cost: $7.68 First month: 1 Re - Usable + 10 Disposables Price: $344 Cost: $34 + $76.80 = $110.80 Gross Profit: $233.20 68 % Profit Margin Subsequent 2 Months: 10 Disposables Price: $344 Cost: $76.80 = $76.80 Gross Profit: $267.20 78 % Profit Margin Profitable From the First Sale *Omnipod CPT code with 20% discount Costs based on internal estimates 15 | Business Model . New microfluidics technology allows for low - cost pumping of insulin. New design philosophy makes product simple enough for provider driven sales. Enables a classic pharma style business model And a more rapid path to profitability. $4,128 Revenue Per Patient/Year 1 75 % Gross Margins 20 % Operating Margin at ~2% Market Share 36,000 Users = 1% of US insulin Dependent Market $3.0B Expansion of Market $148M Recurring Revenue from 1% share 1. Based on 20% discount to published CPT codes for Omnipod. 2. Calculation based on Omnipod US data from SGP 2019 diabetes bluebook and internal cost estimates.

16 | 2024 Q1 Q2 Q3 Q4 Timeline . Approval: 510(k) Predicate device approval pathway for FDA label. Same label as Omnipod. Testing is based on benchtop tests , no human trials required (no insulin pump has done pre - approval human trials) Submission: First FDA meeting was held in Nov. 2019. Second meeting was Mar. 2020. FDA submission expected January 2024 . Anticipated 6 - month review period. Testing/Prepare Submit to the FDA FDA Review Period ~6 Months Anticipated FDA Approval “Soft” Launch Commercial Launch 17 | 3 1 MODD 1 (Basal with user Bolus) 2 MODD 1+ (Cell phone controlled adjusted by algorithm) MODD 2 (Autonomous, multiple chamber, drug revenue) Product Roadmap . The Path to the Artificial Pancreas Currently under research and development, not available for investigational use or sale

18 | Cell Phone Controlled In Development 50% complete CGM Integration Allows algorithms to adjust basal rate for meals and exercise. Ease of Use Same modular design and ease of use as MODD1, with enhanced control functionality. 2 - Factor Authentication Allows use of user's own cell phone as controller. No dedicated controller required. Enhanced Modular Patch Pump: Cell Phone Controlled In Development MODD1+ . Currently under research and development, not available for investigational use or sale 19 | As Controller CGM Integration Allows Algorithms to Adjust Basal Rate For Meals and Exercise Ease of Use Same Modular design and ease of use as Pivot G - 1, with enhanced control functionality.

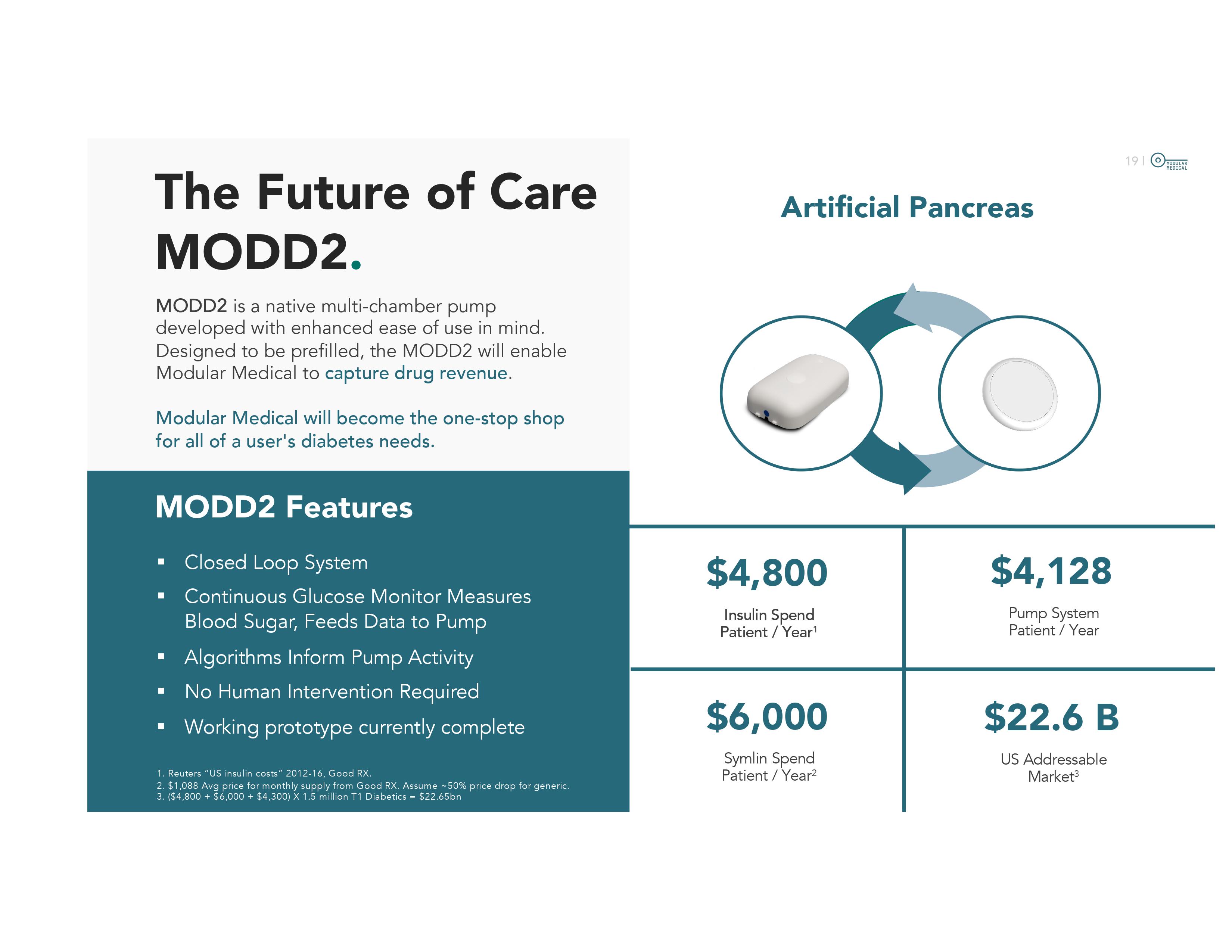

Enhanced Modular Patch Pump: Cell Phone Controlled 2 Factor Authentication Allows use of Cellphone Artificial Pancreas MODD2 is a native multi - chamber pump developed with enhanced ease of use in mind. Designed to be prefilled, the MODD2 will enable Modular Medical to capture drug revenue . Modular Medical will become the one - stop shop for all of a user's diabetes needs. The Future of Care MODD2 . MODD2 Features ■ Closed Loop System ■ Continuous Glucose Monitor Measures Blood Sugar, Feeds Data to Pump ■ Algorithms Inform Pump Activity ■ No Human Intervention Required ■ Working prototype currently complete $4,800 Insulin Spend Patient / Year 1 $6,000 Symlin Spend Patient / Year 2 $4,128 Pump System Patient / Year $22.6 B US Addressable Market 3 1. Reuters “US insulin costs” 2012 - 16, Good RX. 2. $1,088 Avg price for monthly supply from Good RX. Assume ~50% price drop for generic. 3. ($4,800 + $6,000 + $4,300) X 1.5 million T1 Diabetics = $22.65bn 20 | $156B spent annually in diabetes healthcare costs 3 $1 in $4 global diabetes spending occurs in this region 2 60 MILLION people have diabetes in Europe 1 1 WHO – Europe Regional Office website; 2.

International Diabetes Federation Atlas, 2017; 3. IDF, 2015 EU: Single - Payors Want Lower Overall Costs . Hesitant to Pay Upfront for Durables 3 European countries in Top 10 countries for highest number of children and adolescents with T1D 2 European single payor systems avoid upfront costs, instead preferring low initial cost and a strong relationship between cost and health outcomes Pumps have had limited success in UK and Germany UK guidelines mandate pump usage for all pediatric T 1 D patients, yet only 1 / 3 use pumps due to scarce NHS funding . Current funding would buy MODD pumps for all UK pediatric diabetics . $ 25 - 30 million annual opportunity with no direct sales force needed . Low pump penetration outside of Germany and UK . Green - field opportunity Modular Medical Confidential & Proprietary 21 | Industry Validation Manufacturing and design collaboration with Phillips - Medisize, a $4 billion annual revenue corporation.

Former CEO of Insulet, Duane DeSisto, joined Board of Directors. Collaboration with Glooko for patient data upload - download. Glooko’s platform has been deployed in 8,000 clinical locations in 30 countries.

22 | Recent Developments in the Insulin Pump Market . Tandem Diabetes purchased AMF’s Sigi Patch Pump in December 2022 for 62M CHF (approx. $69M USD) and 129.6M CHF (approx.

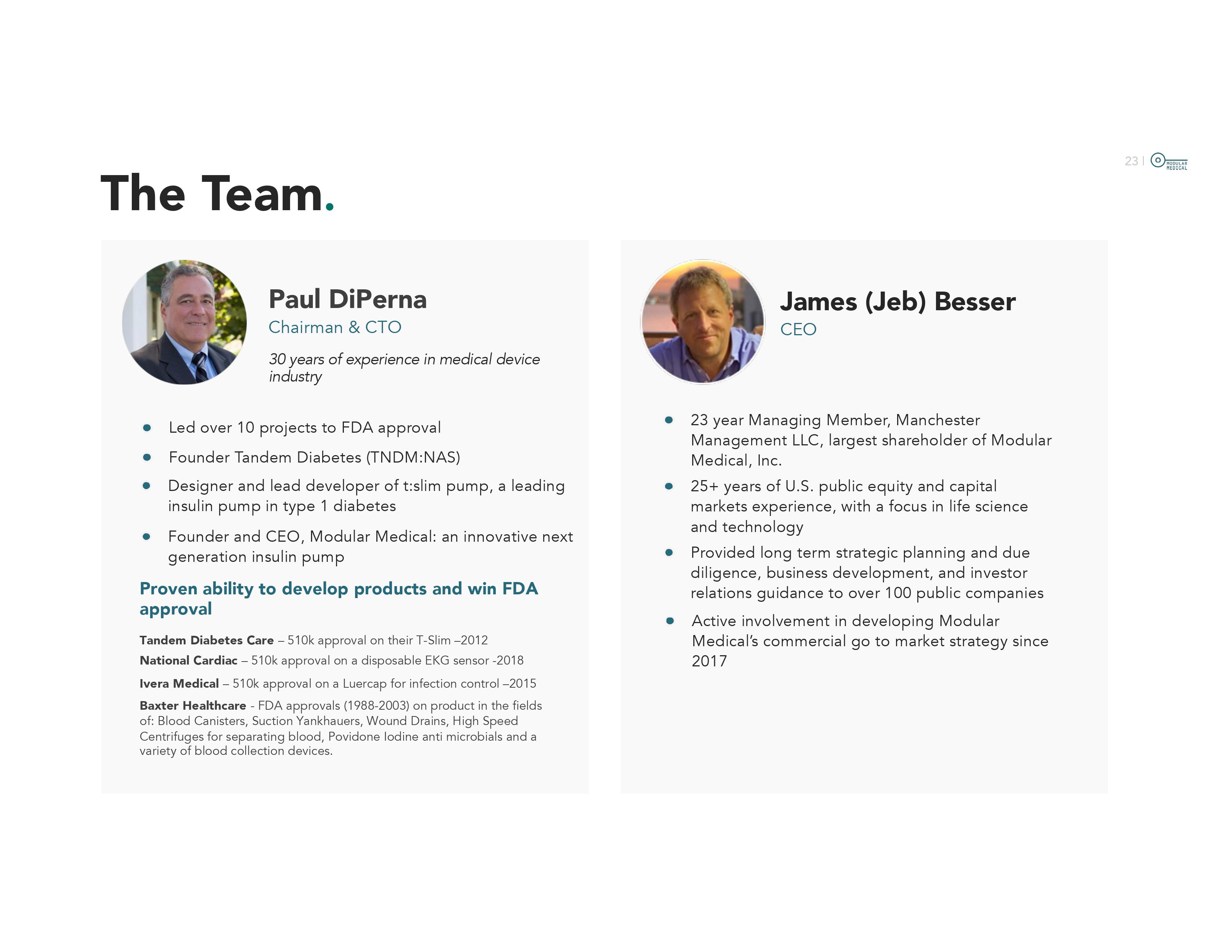

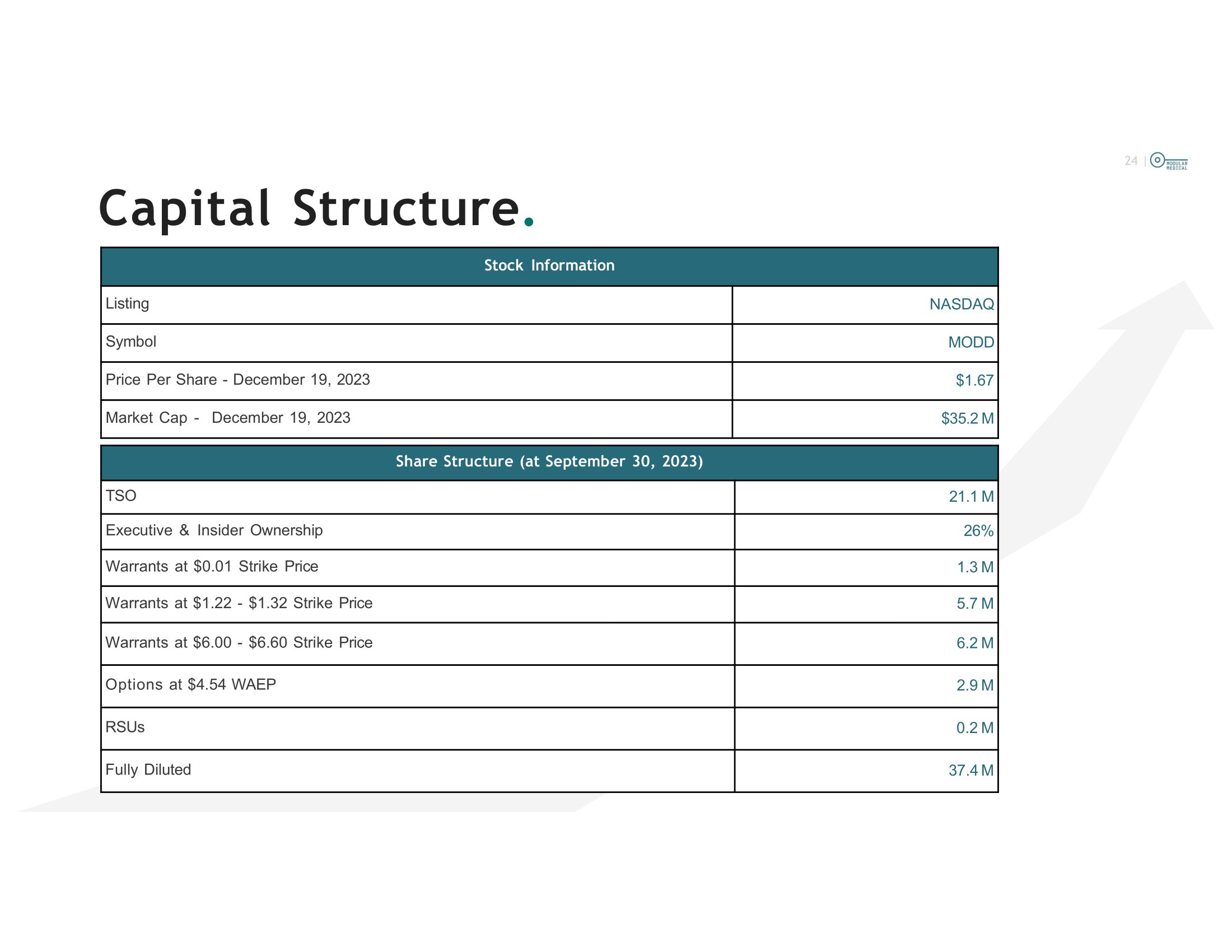

143M USD) in milestones and earnouts First pre - clearance purchase of an insulin pump company since 2010 (Roche purchased SNAP!) for $170M Tandem guided on the call to a late 2026 or early 2027 submission On May 19 th , 2023 FDA cleared the Beta - Bionics Pump and I - Let algorithm for management of diabetes First new platform pump clearance for full featured electronic pump since the Tandem T - slim indicates regulatory emphasis on ease of use Medtronic announced the acquisition of EOFlow on May 25th, 2023 for $738M USD EOFlow is very similar to a first generation Omnipod that is not approved in the US 23 | The Team . Paul DiPerna Chairman & CTO 30 years of experience in medical device industry Led over 10 projects to FDA approval Founder Tandem Diabetes (TNDM:NAS) Designer and lead developer of t:slim pump, a leading insulin pump in type 1 diabetes Founder and CEO, Modular Medical: an innovative next generation insulin pump Proven ability to develop products and win FDA approval Tandem Diabetes Care – 510k approval on their T - Slim – 2012 National Cardiac – 510k approval on a disposable EKG sensor - 2018 Ivera Medical – 510k approval on a Luercap for infection control – 2015 Baxter Healthcare - FDA approvals (1988 - 2003) on product in the fields of: Blood Canisters, Suction Yankhauers, Wound Drains, High Speed Centrifuges for separating blood, Povidone Iodine anti microbials and a variety of blood collection devices. James (Jeb) Besser CEO 23 year Managing Member, Manchester Management LLC, largest shareholder of Modular Medical, Inc. 25+ years of U.S. public equity and capital markets experience, with a focus in life science and technology Provided long term strategic planning and due diligence, business development, and investor relations guidance to over 100 public companies Active involvement in developing Modular Medical’s commercial go to market strategy since 2017 24 | Share Structure (at September 30, 2023) 21.1 M TSO 26% Executive & Insider Ownership 1.3 M Warrants at $0.01 Strike Price 5.1 M Warrants at $1.22 - $1.32 Strike Price 6.2 M Warrants at $6.00 - $6.60 Strike Price 2.9 M Options at $4.54 WAEP 0.2 M RSUs 37.6 M Fully Diluted Stock Information NASDAQ Listing MODD Symbol $1.67 Price Per Share - December 19, 2023 $35.2 M Market Cap - December 19, 2023 Capital Structure .

25 | Investor Relations ir@modular - medical.com NASDAQ:MODD 26 | Appendix .

27 | 200 units/2mL 300 units/3mL 300 units/3mL 300 units/3mL Reservoir Size Pump: $0 Disposables: $437/month (PBM Pricing) Pump: $4,600 Disposables: $148/month Pump: $4,200 Disposables: $134/month Pump: $0 3 - Day Disposables: $349/month (PBM Pricing) Pump Cost No Yes No Yes Monitorable Via Cell Phone Yes No No No External Controller Required Handset Charging Required Battery Required Charger Required No Charger/Single - use disposable battery provided Charger/Battery No No No Yes Easy to Learn No Yes Yes Yes Remove & Reattach Modular Medical Tandem Diabetes Care Medtronic (MiniMed) Insulet T1D Insulin Pump Comparisons (US Market) .

Currently under research and development, not available for investigational use or sale 28 | Enhanced Modular Patch Pump: Cell Phone Controlled 2 Factor Authentication Allows use of Cellphone As Controller CGM Integration Allows Algorithms to Adjust Basal Rate For Meals and Exercise Ease of Use Same Modular design and ease of use as Pivot G - 1, with enhanced control functionality. Artificial Pancreas Artificial Pancreas Will Be Multi - Chamber . ■ FDA has established 70% Time In Range “no human intervention” standard for AP. ■ “Control IQ” study published in NE Journal of medicine barely reached 70% despite announcing meals, sleep, and exercise. ■ Prominent KOL’s and Algo designers feel 70% TIR without intervention is out of reach with insulin alone: the Artificial Pancreas will have to be multiple liquid. ■ Multiple liquid will require small, simple, affordable pumps. Complexity and cost are multiplied. Legacy technology is not well suited. ■ MODD well positioned to be first to market with viable multi - chamber product.

■ Closed Loop System ■ Continuous Glucose Monitor Measures Blood Sugar, Feeds Data to Pump ■ Algorithms Inform Pump Activity ■ No Human Intervention Required MODD2 Pump CGM MODD2 Features Currently under research and development, not available for investigational use or sale 29 | MODD Clinical Advisors . Bruce Bode, MD: Among the top tier of insulin and insulin pump kols in the world (atlanta, practicing) Orville Kolterman, MD: Led the development of symlin (pramlintide) and byetta / bydureon (exenatide) at amylin pharmaceuticals (san diego, practicing) Poul Strange, MD: Led and participated in the development of several insulin products and insulin delivery devices (new jersey, not practicing) ENDOCRINOLOGY Virginia Valentine CDCES: Recent winner of the outstanding educator of the year from the ADA, author and editor. Board chairperson (new mexico, practicing) Davida Kruger NP: Former chair at the ADA research foundation, multiple award winner, former editor at numerous publications (detroit, practicing) Gary Scheiner CDCES: Award winning author of 6 books on diabetes. Founder of integrated diabetes (philadelphia, practicing) Neesha Ramchandani NP: Focused on technology use, particularly in urban pediatrics (bronx, practicing) Diane Herbert CDCES: Former VP clinical services at livongo. Published author and frequent speaker (philadelphia, practicing) Chris Sadler PA: Award - winning previous president of the american society of endocrine pas (san diego, not practicing) CDCES, NP, PA Lutz Heinemann: Founder of the profile institute for metabolic research, author of hundreds of publications on diabetes technology, and managing editor of the journal of diabetes science and technology PHD