UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report:

For the transition period from _________ to _____________.

Commission file number: 333-226308

Color Star Technology Co., Ltd.

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

Cayman Islands

(Jurisdiction of incorporation or organization)

80 Broad Street, 5th Floor

New York, NY 10005

(Address of principal executive offices)

Louis Luo

Chief Executive Officer

(929) 317-2699

80 Broad Street, 5th Floor

New York, NY 10005

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Class A Ordinary Shares, par value $0.04 | ADD | Nasdaq Capital Market |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: As of June 30, 2023, there were 16,191,012 Class A ordinary shares, par value $0.04 per share issued and outstanding.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ Accelerated filer ☐ Non-accelerated filer ☒ Emerging growth company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☒ | International Financial Reporting Standards as issued by the International Accounting Standards Board ☐ | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement Item the registrant has elected to follow: ☐ Item 17 ☐ Item 18

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

COLOR STAR TECHNOLOGY CO., LTD.

FORM 20-F ANNUAL REPORT

TABLE OF CONTENTS

INTRODUCTORY NOTE

Unless otherwise indicated and except where the context otherwise requires, references in this annual report on Form 20-F to:

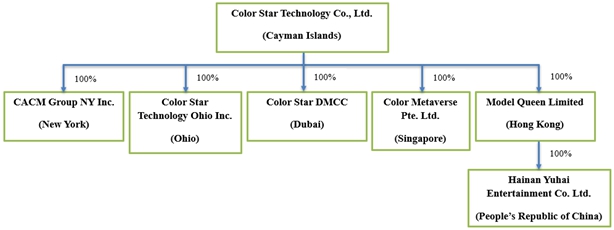

| ● | “we,” “us,” “our,” “Color Star,” or “the Company,” refers to Color Star Technology Co., Ltd., a Cayman Islands exempted company, its predecessor entities and its subsidiaries; |

| ● | “Baytao” refers to Baytao LLC; |

| ● | “CACM” refers to CACM Group NY, Inc. |

| ● | “China” or “PRC” refers to People’s Republic of China, and for the purpose of this annual report, excludes Taiwan, Hong Kong and Macau; |

| ● | “Color Metaverse” refers to Color Metaverse Pte. Ltd.; |

| ● | “Color World” refers to the ColorWorld Metaverse platform; |

| ● | “HK$” refers to Hong Kong dollars, the lawful currency of Hong Kong; |

| ● | “Hong Kong” or “HK” or “Hong Kong S.A.R.” refers to the Hong Kong Special Administrative Region of the PRC; |

| ● | “RMB” or “Renminbi” refers to the legal currency of China and “$,” “dollars,” “US$” or “U.S. dollars” refers to the legal currency of the United States. |

Our financial statements are expressed in U.S. dollars, which is our reporting currency. Certain of our financial data in this annual report on Form 20-F is translated into U.S. dollars solely for the reader’s convenience. We make no representation that any Renminbi, Hong Kong dollars or U.S. dollar amounts could have been, or could be, converted into U.S. dollars, Hong Kong dollars, or Renminbi, as the case may be, at any particular rate, at the rate stated above, or at all.

FORWARD-LOOKING STATEMENTS

This report contains “forward-looking statements” for purposes of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 that represent our beliefs, projections and predictions about future events. All statements other than statements of historical fact are “forward-looking statements,” including any projections of earnings, revenue or other financial items, any statements of the plans, strategies and objectives of management for future operations, any statements concerning proposed new projects or other developments, any statements regarding future economic conditions or performance, any statements of management’s beliefs, goals, strategies, intentions and objectives, and any statements of assumptions underlying any of the foregoing. Words such as “may”, “will”, “should”, “could”, “would”, “predicts”, “potential”, “continue”, “expects”, “anticipates”, “future”, “intends”, “plans”, “believes”, “estimates” and similar expressions, as well as statements in the future tense, identify forward-looking statements.

These statements are necessarily subjective and involve known and unknown risks, uncertainties and other important factors that could cause our actual results, performance or achievements, or industry results, to differ materially from any future results, performance or achievements described in or implied by such statements. Actual results may differ materially from expected results described in our forward-looking statements, including with respect to correct measurement and identification of factors affecting our business or the extent of their likely impact, and the accuracy and completeness of the publicly available information with respect to the factors upon which our business strategy is based or the success of our business. Given these uncertainties, you should not place undue reliance on these forward-looking statements.

Forward-looking statements should not be read as a guarantee of future performance or results, and will not necessarily be accurate indications of whether, or the times by which, our performance or results may be achieved. Forward-looking statements are based on information available at the time those statements are made and management’s belief as of that time with respect to future events, and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. Important factors that could cause such differences include, but are not limited to, those factors discussed under the headings “Risk Factors”, “Operating and Financial Review and Prospects,” and elsewhere in this report.

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not Applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not Applicable.

ITEM 3. KEY INFORMATION

3.A. Reserved

3.B. Capitalization and Indebtedness

Not Applicable.

3.C. Reasons for the Offer and Use of Proceeds

Not Applicable.

3.D. Risk Factors

An investment in our ordinary shares involves a high degree of risk. You should carefully consider the risks and uncertainties described below together with all other information contained in this annual report, including the matters discussed under the headings “Forward-Looking Statements” and “Operating and Financial Review and Prospects” before you decide to invest in our ordinary shares. We are a holding company with substantial operations in Singapore and are subject to a legal and regulatory environment that in many respects differs from the United States. If any of the following risks, or any other risks and uncertainties that are not presently foreseeable to us, actually occur, our business, financial condition, results of operations, liquidity and our future growth prospects could be materially and adversely affected.

Risks Related to Our Business and Industry

We have a limited operating history with our current business model, which makes it difficult to predict our prospects and our business and financial performance.

We have a short operating history with our current business model focusing on providing online entertainment performances, online education services, and metaverse services and products. We transitioned from a concrete business company to our current business model in 2020, and further began to explore the metaverse industry in January 2022. Our limited history of operating under the current business model may not serve as an adequate basis for evaluating our prospect and operating results, including gross billings, net revenues, cash flows and operating margins. We have encountered, and may continue to encounter in the future, risks, challenges and uncertainties associated with operating in compound industries including entertainment, education and metaverse, such as building and managing reliable and secure IT systems and infrastructure, addressing regulatory compliance and uncertainty, engaging, training and retaining high quality employees such as our teaching staff and IT support staff, and improving and expanding our education content offering. If we do not manage these risks successfully, our operating and financial results may differ materially from our expectations and our business and financial performance may suffer.

We may require additional capital, including to fund potential acquisitions and capital expenditures, which may not be available on terms acceptable to us or at all and which depends on many factors beyond our control.

To support our growing business, we must have sufficient capital to continue to make significant investments in our platform and product offerings. If we raise additional funds through the issuance of equity, equity-linked or debt securities, those securities may have rights, preferences or privileges senior to those of our common stock, and our existing stockholders may experience dilution. Any debt financing secured by us in the future could involve restrictive covenants relating to our capital-raising activities and other financial and operational matters, which may make it more difficult for us to obtain additional capital and to pursue business opportunities. Any refinancing of our indebtedness could be at significantly higher interest rates, require additional restrictive financial and operational covenants, or require us to incur significant transaction fees, issue warrants or other equity securities, or issue convertible securities. These restrictions and covenants may restrict our ability to finance our operations and engage in, expand, or otherwise pursue our business activities and strategies. Our ability to comply with these covenants and restrictions may be affected by events beyond our control, and breaches of these covenants and restrictions could result in a default and an acceleration of our obligations under a debt agreement. If we raise additional funds through collaborations and licensing arrangements, we might be required to relinquish significant rights to our technologies or our solutions under development, or grant licenses on terms that are not favorable to us, which could lower the economic value of those programs to us.

We evaluate financing opportunities from time to time, and our ability to obtain financing will depend, among other things, on our development efforts, business plans and operating performance and the condition of the capital markets at the time we seek financing and to an extent, subject to general economic, financial, competitive, legislative, regulatory and other factors that are beyond our control. We cannot be certain that additional financing will be available to us on favorable terms, or at all. If we are unable to obtain adequate financing or financing on terms satisfactory to us, when we require it, our ability to continue to support our business growth and to respond to business challenges could be significantly limited, and our business, financial condition and results of operations could be adversely affected.

Our business, results of operations and financial condition may be adversely affected by global public health epidemics, including the strain of coronavirus known as COVID-19.

Our business could be adversely affected by infectious disease outbreaks, such as the COVID-19 pandemic, which has spread rapidly across the globe, resulting in adverse economic conditions and business disruptions. In reaction to this outbreak, governments worldwide have imposed varying degrees of preventative and protective actions, such as temporary travel bans, forced business closures, and stay-at-home orders, all in an effort to reduce the spread of the virus. Since this outbreak, business activities in many countries have been disrupted by a series of emergency quarantine measures taken by the government.

As a result, our operations in the U.S. have been materially affected. New York, where our U.S. operations are based, were affected by COVID-19, which led to measures taken by the New York government trying to contain the spread of COVID-19, such as reduction on the number of people in gathering and travel restrictions. Additional travel and other restrictions may be put in place to further control the outbreak in U.S. Accordingly, our operation and business may be adversely affected as the results of the wide-spread pandemic. Management may have to adjust or change our business plan in response to the prolonged pandemic and change of social behavior. For the fiscal year ended June 30, 2023, our management does not believe the COVID-19 pandemic had materially adversely affected the Company’s financial condition and operating results because our operations were primarily conducted via online platform and App.

The extent to which COVID-19 negatively impacts our future business cannot be accurately predicted. We believe that the coronavirus outbreak and the measures taken to control it may have a negative impact on not only our business, but economic activities globally. These uncertainties may impede our ability to conduct our daily operations and could materially affect our business, financial condition and results of operations, and as a result affect our stock price and create more volatility.

If we are unable to operate Color World as planned, our results of operation will be significantly impacted.

We launched Color World on October 15, 2020. It began as an app that offered celebrity-led courses, online performances and other related products. In January 2022, Color World was transformed into the current version, a metaverse with “artificial intelligence + celebrity entertainment” as its core features. Since transforming into a metaverse platform, Color World has been inviting many global superstar celebrities to join the platform to expand on the celebrity content by creating more celebrity masterclasses, online virtual performances, celebrity merchandise, games and so on. We are keep adding new modules to Color World in order to enrich the metaverse communities. In the future, we plan to add more virtual locations as well as digital products. Due to the change of application scenarios, services provided and business model of Color World, we cannot guarantee to operate the platform as successfully as before and may face difficulties to operate the platform as we expected due to reasons beyond our control, such as user acceptance, future regulations and intense competition. If the current version of Color World cannot be accepted by the market or as profitable as we estimated, there could be a material adverse effect on our business, results of operations and financial condition.

We must also continue to enhance and improve our technology infrastructure. These efforts may require us to develop or license increasingly complex technologies. In addition, new technologies developed and introduced by competitors could render our services and technologies obsolete if we are unable to update or modify our own technology. Developing and integrating new technologies into our existing platform and infrastructure could be expensive and time-consuming. Furthermore, any new features and functions may not achieve market acceptance. We may not succeed in implementing new technologies or may incur substantial costs in doing so. Our platform and services must achieve high levels of market acceptance in order for us to recoup our investments. Our platform and services could fail to attain sufficient market acceptance for many reasons, including:

| ● | we may fail to predict market demand accurately and to provide services that meet this demand in a timely fashion; |

| ● | our marketing efforts may be inefficient and fail to attract the potential users; |

| ● | celebrities that we recruit on our platforms may not like, find useful or agree with any changes; |

| ● | there may be defects, errors or failures on our platform; |

| ● | there may be negative publicity about our platforms’ performance or effectiveness; and |

| ● | there may be competing services or technologies introduced or anticipated to be introduced by our competitors. |

In addition, the size of our user base and our users’ level of engagement across our services are critical to our success. If people do not perceive our services to be useful, reliable, and trustworthy, we may not be able to attract or retain users or otherwise maintain or increase the frequency and duration of their engagement. If our platform and services or technologies do not achieve adequate acceptance in the market, our competitive position, results of operations and financial condition could be materially and adversely affected.

Failure to successfully implement our business strategy or effectively respond to changes in market dynamics may cause our future financial results to suffer.

We, from time to time, make significant investments and other decisions in connection with our long-term business development strategy. In order to expand the breadth and depth of our current business, we may enter industries which differ from our current operations and where we have less expertise. If we are not able to successfully implement our business strategies and effectively respond to changes in market dynamics, our future financial results will suffer.

In January 2022, we transformed Color World into the current version, a metaverse with “artificial intelligence + celebrity entertainment” as its core features. We expect this will be a complex, evolving, and long-term initiative that will involve the development of new and emerging technologies, continued investment in privacy, safety, and security efforts, and collaboration with other companies, developers, partners, and other participants. However, the metaverse may not develop in accordance with our expectations, and market acceptance of features or services we build for the metaverse is uncertain. We may be unsuccessful in our research and service development efforts, including if we are unable to develop relationships with key participants in the metaverse or develop services that operate effectively with metaverse technologies, products, systems, networks, or standards. Our metaverse efforts may also divert resources and management attention from other areas of our business. As our metaverse efforts evolve, we may be subject to a variety of existing or new laws and regulations in international jurisdictions, including in the areas of privacy and e-commerce, which may delay or impede the development of our services, increase our operating costs, require significant management time and attention, or otherwise harm our business. As a result of these or other factors, our metaverse strategy and investments may not be successful in the foreseeable future, or at all, which could adversely affect our business, reputation, or financial results.

Our success relies on the continuing efforts of our senior management team and qualified key personnel, and our business may be harmed if we are unable to retain or motivate them.

Our business operations depend on the continued services of our senior management team and qualified key personnel, particularly our executive officers and the senior management of Color Metaverse, our wholly owned subsidiary.

Although we have provided different incentives to our senior management team, we cannot assure you that we can continue to retain their services. One or more of our key executives may be unable or unwilling to continue in their present positions. Meanwhile, we have also provided attractive compensation packages to our qualified key personnel. However, we may not be able to hire and retain these personnel at compensation levels consistent with our existing compensation and salary structure. Some of the companies with which we compete for qualified and skilled personnel have greater resources than we have and may be able to offer more attractive terms of employment. In addition, we invest significant time and resources in training our employees, which increases their value to competitors who may seek to recruit them.

If we are unable to retain the services of our senior management team or qualified key personnel, we may not be able to find suitable replacements or may incur significant expenses in finding such replacements, thus our future growth may be constrained, our business may be severely disrupted and our results of operations and financial condition may be materially and adversely affected. In addition, although we have entered into confidentiality and non-competition agreements with our senior management team and qualified key personnel, there is no assurance that any member of our senior management team or any of our qualified key personnel will not join a competitor. In the event that any dispute arises between us, on one hand, and any of our senior management and qualified key personnel, on the other hand, we may have to incur substantial costs and expenses in order to enforce such agreements, or we may be unable to enforce them at all.

If we are unable to recruit celebrities as planned or if they do not perform according to the agreements we have with them, the operation of our education business will be negatively impacted.

Professional artists and producers that we have begun recruiting as the celebrities, formerly mainly as “star teachers,” help us build and maintain the quality of our education and services, as well as our brand and reputation. Our ability to continue to attract recruit the instructors with the necessary experience and qualifications is a key factor in the success of our operations. We seek to continue hiring experienced and successful professionals in music, film, sports, animation, television, presentations, dance, art and other entertainment industries whom are able to follow our education service protocols and deliver effective instructions based on the agreements we have with them. The market for the recruitment of these professionals is competitive, and we must also provide continued training to ensure that our instructors stay abreast of changes in student demands, teaching methodologies and other necessary changes.

In order to recruit these industry professionals as instructors on our platform, we must provide candidates with competitive compensation packages. Although we have not experienced major difficulties in recruiting or training qualified instructors thus far, we cannot guarantee we will be able to continue to recruit, train and retain a sufficient number of qualified instructors in the future, which may have a material adverse effect on our business, financial condition and results of operations.

If we are unable to reach a critical mass of subscribers, our revenues may not be sufficient to cover the costs of our recruitment of Star Teachers.

We are obligated to pay each of our star teachers on a case-by-case basis depending on the results of our negotiations. Some Star Teachers will accept fixed payments following a predefined schedule, whereas others may instead request a revenue sharing payment model whereby we will need to distribute to the star teachers a percentage of the net income earned from generated sales, licensing or other revenue from their courses on our platform, including a pro rata share of our subscription fees, or a hybrid of the two. If we are unable to generate enough revenue from our subscription fees from our users to cover our star teachers’ recruitment costs, our results of operations and financial condition could be materially and adversely affected.

Our education service revenue model depends on developing a subscriber base of users. If we fail to reach a critical mass of subscribers, our net revenues may not be sufficient, and we may not be able to implement our business plan.

We expect to generate revenue primarily from the fees we collect from our users. It is critical for us to enroll subscribers in a cost-effective manner. Some of the factors, many of which are largely beyond our control, could prevent us from successfully increasing subscriptions in a cost-effective manner, or at all. These factors include, among other things, (i) reduced interest in the products and services we offer; (ii) negative publicity or perceptions regarding us, or electronic education services in general; (iii) the emergence of alternative technologies not offered by us; (iv) the inability of subscribers to pay the fees; (v) increasing market competition, particularly price reductions by competitors that we are unable or unwilling to match; and (vi) adverse changes in relevant government policies or general economic conditions. If one or more of these factors reduce market demand for our services, our subscriber base may not materialize as anticipated or our costs associated with subscriber acquisition and retention could increase, or both, any of which could materially affect our ability to grow our gross billings and net revenues. These developments could also harm our brand and reputation, which would negatively impact our ability to establish or expand our business.

We expect to rely heavily on information and technology to operate our existing and future products and services, and any cybersecurity incident or other disruption to our technology infrastructure could result in the loss of critical confidential information or adversely impact our reputation, business or results of operations.

Our ability to attract and retain customers and to compete effectively depends in part upon the satisfactory performance and reliability of our technology network, including the ability to provide features of services that are important to our customers and to protect our confidential business information and the information provided by our customers. We also rely on our technology to maintain and process various operating and financial data that are essential to the day-to-day operation of our business and formulation of our development strategies. Our business operations and growth prospects depend on our ability to maintain and make timely and cost-effective enhancements and upgrades to our technology system and to introduce innovative additions that can meet changing operational needs in future. Therefore, we expect to continue to invest in advanced information technology and any equipment to enhance operational efficiency and reliability as we grow. Accordingly, any errors, defects, disruptions or other performance problems with our IT infrastructure could damage our reputation, decrease user satisfaction and retention, adversely impact our ability to attract new users and expand our service and product offerings, and materially disrupt our operations. If any of these occur, our business operations, reputation and prospects could be harmed.

If our security measures are breached or fail and result in unauthorized disclosure of data by our employees or our third-party agents, we could lose existing subscribers, fail to attract new subscribers and be exposed to protracted and costly litigation.

Maintaining platform security is of critical importance to our subscribers because the platform stores and transmits proprietary and confidential information, which may include sensitive personally identifiable information that may be subject to stringent legal and regulatory obligations. We face an increasing number of threats to our IT infrastructure, including unauthorized activity and access by our employees or third-party agents, system viruses, worms, malicious code and organized cyber-attacks, which could breach our security and disrupt our business. We hope to introduce data security and confidentiality protocols into the cooperation agreements we enter into with third-party sales agents with whom we share prospective subscribers’ contact information. As we expand, we hope to invest in improving our technology security initiatives, information technology risk management and disaster recovery plans to prevent unauthorized access of confidential or sensitive personal information by our employees and third-party sales agents in the process of engaging prospective subscribers.

These measures, however, may not be as effective as we anticipate. In addition, there is no assurance that our third-party sales agents will comply with contractual and legal requirements with respect to data privacy when they collect data from our prospective customers. If our security measures are breached or fail as a result of third-party action, employee error, malfeasance or otherwise, we could be subject to liability or our business could be interrupted, potentially over an extended period of time. Any or all of these issues could harm our reputation, adversely affect our ability to attract and enroll prospective subscribers, cause prospective subscribers not to enroll or stay enrolled, or subject us to third-party lawsuits, regulatory fines or other action or liability. Further, any reputational damage resulting from breach of our security measures could create distrust of our company by prospective subscribers or investors. We may be required to expend significant management time and additional resources to protect against the threat of these disruptions and security breaches or to alleviate problems caused by such disruptions or breaches.

Privacy concerns could limit our ability to collect and leverage our user data and disclosure of user data could adversely impact our business and reputation.

In the ordinary course of our business and in particular in connection with conducting sales and marketing activities with our existing and prospective subscribers as well as the utilization of our AI-powered platform programs, we collect and utilize data supplied by our users. We currently face certain legal obligations regarding the manner in which we treat such information. Increased regulation of data utilization practices, including self-regulation or findings under existing laws that limit our ability to collect, transfer and use data, could have an adverse effect on our business. In addition, if we were to disclose data about our users in a manner that was objectionable to them, our business reputation could be adversely affected, and we could face potential legal claims that could impact our operating results.

Specifically, the Personal Data Protection Act 2012 of Singapore sets out data protection obligations which all organizations are required to comply with in undertaking activities relating to the collection, use or disclosure of personal data. A failure to comply with any of the above can subject an organization to a fine per breach of up to S$1 million (US$739,645) or 10% of the organization’s annual turnover in Singapore, whichever is higher. In the event of a data breach involving any personal data in an organization’s possession or control, the Personal Data Protection Act 2012 requires the organization to reasonably and expeditiously assess the data breach, and notify the Personal Data Protection Commission of the data breach if it is assessed to be one that: (a) is likely to result in significant harm or impact to the individuals to whom the information relates, or (b) involves personal data of 500 or more individuals. In addition to notifying the Personal Data Protection Commission, organizations are also required to notify the affected individuals if the data breach is one that is likely to result in significant harm or impact to the affected individuals.

Although the substantial part of our operations are based in Singapore and the U.S., our app Color World is available to download in China and part of our users are PRC citizens, which may subject us to certain laws and regulations in China, and expose us to legal and operational risks associated with our operations in China. The regulatory framework for the collection, use, safeguarding, sharing, transfer and other processing of personal information and important data worldwide is rapidly evolving in PRC and is likely to remain uncertain for the foreseeable future. Regulatory authorities in China have implemented and are considering a number of legislative and regulatory proposals concerning data protection. For example, the PRC Cybersecurity Law, which became effective in June 2017, established China’s first national-level data protection for “network operators,” which may include all organizations in China that connect to or provide services over the internet or other information network. The PRC Data Security Law, which was promulgated by the Standing Committee of PRC National People’s Congress, or the SCNPC, on June 10, 2021 and became effective on September 1, 2021, outlines the main system framework of data security protection. For more details regarding PRC regulations applicable to us, please see “Item 4-Information on the Company-Regulations-China.”

As uncertainties remain regarding the interpretation and implementation of these laws and regulations, we cannot assure you that we will comply with such regulations in all respects and we may be ordered to rectify or terminate any actions that are deemed illegal by regulatory authorities. We may also become subject to fines and/or other sanctions which may have material adverse effect on our business, operations and financial condition.

Internationally, we may become subject to additional and/or more stringent legal obligations concerning our treatment of customer and other personal information, such as laws regarding data localization and/or restrictions on data export. Failure to comply with these obligations could subject us to liability, and to the extent that we need to alter our business model or practices to adapt to these obligations, we could incur additional expenses.

We face regulatory risks and uncertainties with respect to the licensing requirement for the online transmission of internet audio-visual programs in China.

On December 20, 2007, the National Radio and Television Administration f/k/a known as the State Administration of Press Publication Radio Film and Television, or SAPPRFT, and the Ministry of Industry and Information Technology, or the MIIT, jointly promulgated the Administrative Provisions on Internet Audio Visual Program Services, or the Audio Visual Program Provisions, which became effective on January 31, 2008 and were amended on August 28, 2015. Among other things, the Audio Visual Program Provisions stipulate that no entities or individuals may provide Internet audio-visual program services without a License for Online Transmission of Audio-Visual Programs issued by SAPPRFT or completing the relevant filing with SAPPRFT or its local bureaus, and only state-owned or state-controlled entities are eligible to apply for a License for Online Transmission of Audio Visual Programs. On April 1, 2010, SAPPRFT promulgated the Provisional Implementations of Tentative Categories of Internet Audio Visual Program Services, or the Categories, which clarified the scope of Internet audio-visual programs services, which was amended on March 10, 2017. According to the Categories, there are four categories of Internet audio-visual program services which are further divided into seventeen sub-categories. Sub-category No. 3 to the second category covers the making and editing of certain specialized audio-visual programs concerning, among other things, educational content, and broadcasting such content to the general public online. Sub-category No. 5 of the first category and sub-category No. 7 of the second category cover the live broadcasting of important political, martial, economic, social, cultural, sports activities or events or general social or community cultural activities, sports games and other organized activities. However, there are still significant uncertainties relating to the interpretation and implementation of the Audio Visual Program Provisions, in particular, the scope of “internet audio-visual programs.” See “Regulations Relating to Online Transmission of Audio-Visual Programs.”

We plan to deliver our courses in live streaming format worldwide. Our users communicate and interact live with each other via our virtual learning community. The audio and video data will likely be transmitted through the platforms between specific recipients instantly without any further redaction. We believe the nature of the raw data we transmit will distinguish us from general providers of internet audio-visual program services, such as the operator of online video websites, and the provision of the Audio-Visual Program Provisions are not applicable with regard to our offering of the courses. However, we cannot assure you that the competent PRC government authorities will not ultimately take a view contrary to our opinion. In addition, we also plan to offer video recordings of live streaming courses and certain other audio-video contents on our electronic platforms to our students as supplementary course materials on our platforms. If the government authorities determine that our offering of the courses fall within the relevant category of Internet audio-visual program services under the Categories, we may be required to obtain the License for Online Transmission of Audio Visual Programs.

The Categories describe “Internet audio-visual program services” in a very broad, vague manner and are unclear as to whether electronic courses, whether delivered in a live streaming format or through video recordings, fall into the definition of audio-visual programs. We have made inquiries to the relevant bureaus of SAPPRFT and were informed that online educational content provided through live streaming or recorded courses does not fall within the scope of internet audio-visual programs, the transmission of which does not require a License for Online Transmission of Audio-Visual Programs. We cannot assure you that the PRC government will not ultimately take a view that live streaming or recorded courses or any other content offered on our platforms are subject to the Audio Visual Program Provisions. We currently do not hold a license for Online Transmission of Audio Visual Programs, and since we are not a state-owned or state-controlled entity, we are not eligible to apply for such license. If the PRC government determines that our content should be considered as “internet audio- visual programs” for the purpose of the Audio-Visual Program Provisions, we may be required to obtain a license for Online Transmission of Audio Visual Programs. We are, however, not eligible apply for such license since we are not a state-owned or state-controlled entity. If this were to occur, we may be subject to penalties, fines, legal sanctions or an order to suspend the provision of our live streaming courses. As of the date of this annual report, we have not received any notice of warning or been subject to penalties or other disciplinary action from the relevant governmental authorities regarding the lack of a License for Online Transmission of Audio Visual Programs in conducting of our business.

Our failure to obtain and maintain approvals, licenses or permits in China applicable to our business could have a material adverse impact on our business, financial conditions and results of operations in the future.

As we plan to deliver our courses in live streaming format worldwide, including in China, we may be subject to various regulations by a number of PRC regulatory authorities, such as the SAIC, the Cyberspace Administration of China, the MITT, the National Radio and Television Administration, and the State Council Information Office, the Ministry of Civil Affairs, and the Ministry of Human Resources and Social Welfare. We may be required in the future to obtain additional government approvals, licenses and permits in connection with our operations.

By way of example, depending upon regulatory interpretation, under the current PRC laws and regulations, the provision of our educational content through our electronic platform may be considered “online publishing” and may require us to obtain an Internet Publishing License, which we currently do not have.

As of the date of this annual report, we have not received any notice of warning or been subject to penalties or other disciplinary action from the relevant governmental authorities regarding the lack of any the above-mentioned approvals, licenses or permits. However, we cannot guarantee that the government authorities will not impose any penalties or sanctions on us in the future, which may include warnings, fines, mandates to remedy any violations, confiscation of the gains derived from the services for which approvals, licenses or permits are required, and/or an order to cease to provide such services. In addition, we cannot guarantee that the government will not promulgate new laws and regulations that require additional licenses, permits and/or approvals for the operation of any of our existing or future business. If we are unable to obtain such licenses, permits, or approvals in a timely fashion, we could be subject to penalties and operational disruption and our financial condition and results of operations could be adversely affected.

We face intense competition which could adversely affect our results of operations and market share.

We operate in a highly competitive and fragmented industry that is sensitive to price, content (i.e., curriculum) and quality of service. Some of our competitors may have more financial resources, longer operating histories, larger customer bases and greater brand recognition than we do, or they are controlled or subsidized by foreign governments, which enables them to obtain or raise capital and enter into strategic relationships more easily. We also compete with leading domestic supplier companies based on a number of factors including business model, operational capabilities, cost control and service quality, as well as in-house delivery capabilities to serve their logistics needs and compete with us.

We are also subject to other risks and uncertainties that affect many other businesses, including but not limited to:

| ● | Increasing costs, the volatility of costs and funding requirements and other legal mandates for employee benefits, especially pension and healthcare benefits; |

| ● | The increasing costs of compliance with federal, state and foreign governmental agency mandates; |

| ● | Any impacts on our business resulting from new domestic and international government laws and regulation; |

| ● | Market conditions in the childhood education industry or the economy as a whole; |

| ● | Market acceptance of our new service and growth initiatives; |

| ● | Announcements of the introduction of new products and services by our competitors; |

| ● | The impact of technology developments on our operations and on demand for our products and services; |

| ● | Developments concerning current or future strategic collaborations; and |

| ● | Widespread outbreak of an illness or any other communicable disease, or any other public health crisis such as we are currently experiencing with the COVID-19 pandemic. |

If we are unable to respond to these changing market conditions, our business and financial results may be materially affected.

We may be unable to fund any significant up-front and/or guaranteed payment cash requirements associated with our live music streaming rights, which could result in the inability to secure and retain such streaming rights and may limit our operating flexibility, which may adversely affect our business, operating results and financial condition.

In order to secure event and festival live music streaming rights or hold concerts, we may be required to fund significant up-front and/or guaranteed payment cash requirements to artists or festival or event promoters prior to the event or festival taking place. If we do not have sufficient cash on hand or available capacity to advance the necessary cash for any given artist, event or festival, we would not be able to retain the rights for that artist, festival or event, such counter parties may be able to terminate their content acquisition agreements with us, and as a result our business, financial condition and results of operations may be adversely affected.

We may be unsuccessful in developing our original content.

We plan to continue to produce original classes, covering various areas such as singing and dancing, etc. We believe that a positive reputation with users concerning our original content is important in attracting and retaining users. To the extent our content is perceived as low quality, offensive or otherwise not compelling to users, our ability to establish and maintain a positive reputation may be adversely impacted. If the original content we produce does not attract new users, we may not be able to cover our expenses to produce such programs, and our business, financial condition and results of operations may be adversely affected.

As we continue to develop our original content, we will become responsible for higher production costs and other expenses. We may also take on risks associated with production, such as completion and key talent risk. To the extent we do not accurately anticipate costs or mitigate risks, or if we become liable for content we acquire, produce, license and/or distribute, our business may suffer. Litigation to defend these claims could be costly and the expenses and damages arising from any liability or unforeseen production risks could harm our results of operations. We may not be indemnified against claims or costs of these types and we may not have insurance coverage for these types of claims.

We face competition for users’ attention and time.

The market for entertainment video content is intensively competitive and subject to rapid change. We compete against other entertainment video providers, such as (i) interactive on-demand audio content and pre-recorded entertainment, (ii) broadcast radio providers, including terrestrial and Internet radio providers, (iii) cable, satellite and Internet television and movie content providers, (iv) video gaming providers and (v) other sources of entertainment for our users’ attention and time. These content and service providers pose a competitive threat to the extent existing or potential users choose to consume their content or use their services rather than our content or our services. The online marketplace for live music and music-related content may rapidly evolve and provide users with a number of alternatives or new access models, which could adversely affect our business, financial condition and results of operations.

Our services and software are highly technical and may contain undetected software bugs or vulnerabilities, which could manifest in ways that could seriously harm our reputation and our business.

Our services and software are highly technical and complex. Our services or any other products we may introduce in the future, may contain undetected software bugs, hardware errors, and other vulnerabilities. These bugs and errors can manifest in any number of ways in our products, including through diminished performance, security vulnerabilities, malfunctions, or even permanently disabled products. We have a practice of regularly updating our products and some errors in our products may be discovered only after a product has been used by users, and may in some cases be detected only under certain circumstances or after extended use. Any errors, bugs or other vulnerabilities discovered in our code or backend after release could damage our reputation, drive away users, allow third parties to manipulate or exploit our software (including, for example, providing mobile device users a means to suppress advertisements without payment and gain access to features only available to the ad-supported service), lower revenue and expose us to claims for damages, any of which could seriously harm our business. Additionally, errors, bugs, or other vulnerabilities may-either directly or if exploited by third parties-affect our ability to make accurate royalty payments.

We also could face claims for product liability, tort or breach of warranty. Defending a lawsuit, regardless of its merit, is costly and may divert management’s attention and seriously harm our reputation and our business. In addition, if our liability insurance coverage proves inadequate or future coverage is unavailable on acceptable terms or at all, our business could be seriously harmed.

Our business depends on a strong developing brand, and any failure to create, maintain, protect and enhance our brand would hurt our ability to attract and/ or expand our base of users.

Maintaining, protecting and enhancing our brand is critical to expanding our base of users and star teachers, and will depend largely on our ability to continue to develop and provide an innovative and high-quality experience for our users and to attract more celebrities to work with us, which we may not do successfully. Our brands may be impaired by a number of other factors, including any failure to keep pace with technological advances on our platform or with our services, slower load times for our services, a decline in the quality or quantity of the content available on our services, a failure to protect our intellectual property rights or any alleged violations of law, regulations, or public policy. If we do not successfully maintain a strong brand, our business could be harmed.

We are at risk of attempts at unauthorized access to our services, and failure to effectively prevent and remediate such attempts could have an adverse impact on our business, operating results, and financial condition. Unauthorized access to our services may cause us to misstate key performance indicators, which once discovered, corrected, and disclosed, could undermine investor confidence in the integrity of our key performance indicators and could cause our stock price to drop significantly.

We may be impacted by attempts by third parties to manipulate and exploit our software for the purpose of gaining unauthorized access to our service. For example, there might be instances of third parties seeking to provide mobile device users a means to suppress advertisements without payment and gain access to features only available to the ad-supported services. If in the future we fail to successfully detect and address such issues, it may have artificial effects on our key performance indicators, such as content hours, content hours per MAU (Monthly Active User), and MAUs, which underlie, among other things, our contractual obligations with advertisers, as well as harm our relationship with them. This may impact our results of operations, particularly with respect to margins on our ad-supported segment, by increasing our ad-supported cost of revenue without a corresponding increase to our ad-supported revenue, which could seriously harm our business. Additionally, unlike our ad-supported users, individuals using unauthorized versions of our application are unlikely to convert to premium subscribers. Moreover, once we detect and correct such unauthorized access and any key performance indicators it affects, investor confidence in the integrity of our key performance indicators could be undermined. These could have a material adverse impact on our business, operating results and financial condition.

If we are forced to cancel or postpone all or part of a scheduled concert, our business may be adversely impacted, and our reputation may be harmed.

We incur a significant amount of up-front costs when we plan and prepare for an online concert. Accordingly, if a planned concert is canceled, we would lose a substantial amount of sunk costs, fail to generate the anticipated revenue and may be forced to issue refunds for tickets sold. If we are forced to postpone a concert or event, we would incur substantial additional costs in connection with our having to stage the event on a new date, may have reduced attendance and revenue and may have to refund money to ticketholders. In addition, any cancellation or postponement could harm both our reputation and the reputation of the particular concert or event. We could be compelled to cancel or postpone all or part of an event or concert for many reasons, including such things as low attendance, adverse weather conditions, technical problems, issues with permitting or government regulation, incidents, injuries or deaths at that event or concert, as well as extraordinary incidents, such as pandemics, terrorist attacks, mass-casualty incidents and natural disasters or similar events.

A deterioration in general economic conditions and its impact on consumer and business spending, particularly by customers in our targeted millennial generation demographic, could adversely affect our revenue and financial results.

Our business and financial results are influenced significantly by general economic conditions, in particular, those conditions affecting discretionary consumer spending and corporate spending. During economic slowdowns and recessions, many consumers could reduce their discretionary spending. An economic downturn can result in reduced ticket revenue and lower customer spending.

We depend on relationships with key event promoters, sponsor and marketing partners, executives, managers and artists, and adverse changes in these relationships could adversely affect our business, financial condition and results of operations.

Our business is particularly dependent upon personal relationships, as promoters and executives within entertainment companies such as ours leverage their network of relationships with artists, agents, managers and sponsor and marketing partners to secure the rights to the performers and events that are critical to our success. Due to the importance of those industry contacts, the loss of any of our officers or other key personnel who have relationships with these artists, agents or managers could adversely affect our venue management and event promotion businesses. While we have hiring policies and procedures and conduct background checks of our promoters, executives, managers and artists, they may engage in or may have in the past engaged in conduct we do not endorse or that is otherwise improper, which may result in reputational harm to us. Also, to the extent artists, agents and managers we have relationships with are replaced with individuals with whom our officers or other key personnel do not have relationships, our competitive position and financial condition could be adversely affected.

We may be accused of infringing upon intellectual property rights of third parties.

From time to time, we may be in the future subject to legal proceedings and claims in the ordinary course of business, including claims of alleged infringement and other violations of the trademarks, copyrights, patents and other intellectual property or proprietary rights of third parties.

We may not be able to successfully defend against such claims, which may result in a limitation on our ability to use the intellectual property subject to these claims and also might require us to enter into settlement or license agreements, pay costly damage awards or face an injunction prohibiting us from using the affected intellectual property in connection with our services. Defending ourselves against intellectual property claims, whether they are with or without merit or are determined in our favor, results in costly litigation and may divert the attention of our management and technical personnel from the rest of our business.

In addition, music, Internet, technology, and media companies are frequently subject to litigation based on allegations of infringement, misappropriation, or other violations of intellectual property rights. Many companies in these industries, including many of our competitors, have substantially larger patent and intellectual property portfolios than we do, which could make us a target for litigation as we may not be able to assert counterclaims against parties that sue us for patent, or other intellectual property infringement. In addition, various “non-practicing entities” that own patents and other intellectual property rights often attempt to aggressively assert claims in order to extract value from technology companies. Further, from time to time we may introduce new products and services, including in territories where we currently do not have an offering, which could increase our exposure to patent and other intellectual property claims from competitors and non-practicing entities. It is difficult to predict whether assertions of third-party intellectual property rights or any infringement or misappropriation claims arising from such assertions will substantially harm our business, operating results, and financial condition. If we are forced to defend against any infringement or misappropriation claims, whether they are with or without merit, are settled out of court, or are determined in our favor, we may be required to expend significant time and financial resources on the defense of such claims. Furthermore, an adverse outcome of a dispute may require us to pay significant damages, which may be even greater if we are found to have willfully infringed upon a party’s intellectual property; cease exploiting copyrighted content that we have previously had the ability to exploit; cease using solutions that are alleged to infringe or misappropriate the intellectual property of others; expend additional development resources to redesign our solutions; enter into potentially unfavorable royalty or license agreements in order to obtain the right to use necessary technologies, content, or materials; indemnify our partners and other third parties; and/or take other actions that may have material effects on our business, operating results, and financial condition.

Changes in how network operators handle and charge for access to data that travel across their networks could adversely impact our business.

We will rely upon the ability of consumers to access our service through the Internet. Changes in laws or regulations that adversely affect the growth, popularity or use of the Internet, including laws impacting net neutrality, could decrease the demand for our service and increase our cost of doing business. To the extent that network operators implement usage-based pricing, including meaningful bandwidth caps, or otherwise try to monetize access to their networks by data providers, we could incur greater operating expenses and our subscriber acquisition and retention could be negatively impacted.

The success of our business and operations depends, in part, on the integrity of our systems and infrastructures, as well as affiliate and third-party computer systems, Wi-Fi and other communication systems. System interruption and the lack of integration and redundancy in these systems and infrastructures may have an adverse impact on our business, financial condition and results of operations.

System interruption and the lack of integration and redundancy in the information systems and infrastructures, both of our own systems and other computer systems and of affiliate and third-party software, Wi-Fi and other communications systems service providers on which we rely, may adversely affect our ability to operate websites, process and fulfill transactions, respond to user inquiries and generally maintain cost-efficient operations. Such interruptions could occur by virtue of natural disaster, malicious actions such as hacking or acts of terrorism or war, or human error. In addition, the loss of some or all of certain key personnel could require us to expend additional resources to continue to maintain our software and systems and could subject us to systems interruptions.

Although we maintain up to date information technology systems and network infrastructures for the operation of our businesses, techniques used to gain unauthorized access to private networks are constantly evolving, and we may be unable to anticipate or prevent unauthorized access to our systems and data.

Privacy concerns could limit our ability to leverage our subscriber data and compliance with privacy regulations could result in significant expense.

In the ordinary course of business and in particular in connection with merchandising our service to our users, we collect and utilize data supplied by our users. We may face certain legal obligations regarding the manner in which we treat such information. Other businesses have been criticized by privacy groups and governmental bodies for attempts to link personal identities and other information to data collected on the Internet regarding users’ browsing and other habits. Increased regulation of data utilization practices, including self-regulation or findings under existing laws, that limit our ability to use collected data, could have an adverse effect on our business. As our business evolves and as we expand internationally, we may become subject to additional and/or more stringent legal obligations concerning our treatment of user information, and to the extent that we need to alter our business model or practices to adapt to these obligations, we could incur significant expenses.

In addition, we cannot fully control the actions of third parties who may have access to the user data we collect and the user data collected by our third-party vendors. We may be unable to monitor or control such third parties and the third parties having access to our website in their compliance with the terms of our privacy policies, terms of use, and other applicable contracts, and we may be unable to prevent unauthorized access to, or use or disclosure of, user information. Any such misuse could hinder or prevent our efforts with respect to growth opportunities and could expose us to liability or otherwise adversely affect our business. In addition, these third parties may become the victim of security breaches or have practices that may result in a breach, and we could be responsible for those third-party acts or failures to act.

Any failure, or perceived failure, by us or the prior owners of acquired businesses to maintain the privacy of data relating to our users (including disclosing data in a manner that was objectionable to our users), to comply with our posted privacy policies, our predecessors’ posted policies, laws and regulations, rules of self-regulatory organizations, industry standards and contractual provisions to which we or they may be bound, could result in the loss of confidence in us, or result in actions against us by governmental entities or others, all of which could result in litigation and financial losses, and could potentially cause us to lose users, advertisers, revenue and employees.

We do not have insurance coverage that is customary and standard for companies of comparable size in comparable industries

As of the date of this annual report, we have not obtained sufficient insurance coverage that is customary and standard for companies of comparable size in comparable industries, such as any liability insurance and insurance for losses and interruptions caused by terrorist attacks, military conflicts, and wars, which could subject us to significant financial losses. The realization of any of these risks could cause a material adverse effect on our business, financial condition, results of operations, and cash flows.

Risks Related to the Ownership of Our Ordinary Shares

If we fail to comply with the continued listing requirements of Nasdaq, we would face possible delisting, which would result in a limited public market for our shares and make obtaining future debt or equity financing more difficult for us.

On December 22, 2022, the Nasdaq Listing Qualifications Staff of The NASDAQ Stock Market LLC (“Nasdaq”) notified the Company that the minimum bid price per share for its ordinary shares has been below $1.00 for a period of 30 consecutive business days and the Company therefore no longer meets the minimum bid price requirements set forth in Nasdaq Listing Rule 5550(a)(2). The notification received had no immediate effect on the listing of the Company’s ordinary shares on Nasdaq.

On January 24, 2023, Nasdaq determined that for the last 10 consecutive business days, from December 22, 2022 to January 6, 2023, the closing bid price of the Company’s ordinary shares has been at $1.00 per share or greater. Accordingly, the Company has regained compliance with Listing Rule 5550(a)(2), and considers this matter now closed.

Nasdaq Listing Rule 5550(a)(2) requires listed securities to maintain a minimum bid price of $1.00 per share, and Nasdaq Listing Rule 5810(c)(3)(A) provides that a failure to meet the minimum bid price requirement exists if the deficiency continues for a period of 30 consecutive business days. There can be no assurance that the Company will be able to maintain the compliance with the Nasdaq rules. If we fail to comply with the Bid Price Requirement or any other listing rules when required in the future, we could be subject to suspension and delisting proceedings. If our securities lose their status on The Nasdaq Capital Market, our securities would likely trade in the over-the-counter market. If our securities were to trade on the over-the-counter market, selling our securities could be more difficult because smaller quantities of securities would likely be bought and sold, transactions could be delayed, and security analysts’ coverage of us may be reduced. In addition, in the event our securities are delisted, broker-dealers have certain regulatory burdens imposed upon them, which may discourage broker-dealers from effecting transactions in our securities, further limiting the liquidity of our securities. These factors could result in lower prices and larger spreads in the bid and ask prices for our securities. Such delisting from The Nasdaq Capital Market and continued or further declines in our share price could also greatly impair our reputation and ability to raise additional necessary capital through equity or debt financing, and could significantly increase the ownership dilution to shareholders caused by our issuing equity in financing or other transactions.

The price of our ordinary shares historically has been volatile, which may affect the price at which you could sell the ordinary shares.

Our ordinary shares are listed on the Nasdaq Capital Market under the symbol “ADD.” The market price for the ordinary shares has varied between a high closing price of $5.60 on July 21, 2022 and a low closing price of $0.69 on December 16, 2022 in the 12-month period ended on June 30, 2023. The price herein refers to the closing price after completion of the reverse share split price. This volatility may affect the price at which you could sell the ordinary shares. The ordinary share price are likely to continue to be volatile and subject to significant price and volume fluctuations in response to market and other factors, including the following:

| ● | variations in our revenues, earnings and cash flows; |

| ● | announcements of new investments, acquisitions, strategic partnerships or joint ventures by us or our competitors; |

| ● | announcements of new offerings, solutions and expansions by us or our competitors; |

| ● | changes in financial estimates by securities analysts; |

| ● | detrimental adverse publicity about us, our services or our industry; |

| ● | announcements of new regulations, rules or policies relevant for our business; |

| ● | additions or departures of key personnel; |

| ● | release of lockup or other transfer restrictions on our outstanding equity securities or sales of additional equity securities; and |

| ● | potential litigation or regulatory investigations. |

Any of these factors may result in large and sudden changes in the volume and price at which our ordinary shares will trade.

In the past, shareholders of public companies have often brought securities class action suits against those companies following periods of instability in the market price of their securities. If we were to be involved in a class action suit, it could divert a significant amount of our management’s attention and other resources from our business and operations and require us to incur significant expenses to defend the suit, which could harm our results of operations. Any such class action suit, whether or not successful, could harm our reputation and restrict our ability to raise capital in the future. In addition, if a claim is successfully made against us, we may be required to pay significant damages, which could have a material adverse effect on our financial condition and results of operations.

We do not intend to pay dividends on our ordinary shares for the foreseeable future, but if we intend to do so our holding company structure may limit the payment of dividends to our stockholders.

While we have no current intention of paying dividends, should we decide in the future to do so, as a holding company, our ability to pay dividends and meet other obligations depends upon the receipt of dividends or other payments from our operating subsidiaries and other holdings and investments. In addition, our operating subsidiaries, from time to time, may be subject to restrictions on their ability to make distributions to us, including as a result of restrictive covenants in loan agreements, restrictions on the conversion of local currency into U.S. dollars or other hard currency and other regulatory restrictions as discussed below. If future dividends are paid in local currencies, fluctuations in the exchange rate for the conversion of local currencies into U.S. dollars may reduce the amount received by U.S. stockholders upon conversion of the dividend payment into U.S. dollars.

The governing legislation for the distribution of dividends in Singapore is the Companies Act 1967 of Singapore, or the Companies Act. Under Section 403 of the Companies Act, a Singapore company is only allowed to pay dividends out of profits and there are certain restrictions on the use of profits for the purposes of dividend declaration. Firstly, any profits of a company applied towards the purchase of its shares pursuant to the share buyback provisions under the Companies Act cannot be payable as dividends to the shareholders. However, the foregoing restriction does not apply to any part of the proceeds received by the company from a sale or disposal of its treasury shares where the sums that were utilized to purchase those treasury shares initially came out of profits in the first place. Finally, any gains derived from the sale of treasury shares cannot be payable as dividends to the shareholders of the company.

We may be subject to penny stock regulations and restrictions and you may have difficulty selling our ordinary shares.

The SEC has adopted regulations which generally define so-called “penny stocks” to be an equity security that has a market price less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exemptions. If our ordinary shares becomes a “penny stock”, we may become subject to Rule 15g-9 under the Exchange Act, or the “Penny Stock Rule”. This rule imposes additional sales practice requirements on broker-dealers that sell such securities to persons other than established customers and “accredited investors” (generally, individuals with a net worth in excess of $1,000,000 or annual incomes exceeding $200,000, or $300,000 together with their spouses). For transactions covered by Rule 15g-9, a broker-dealer must make a special suitability determination for the purchaser and have received the purchaser’s written consent to the transaction prior to sale. As a result, this rule may affect the ability of broker-dealers to sell our securities and may affect the ability of purchasers to sell any of our securities in the secondary market.

For any transaction involving a penny stock, unless exempt, the rules require delivery, prior to any transaction in a penny stock, of a disclosure schedule prepared by the SEC relating to the penny stock market. Disclosure is also required to be made about sales commissions payable to both the broker-dealer and the registered representative and current quotations for the securities. Finally, monthly statements are required to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stock.

There can be no assurance that our ordinary shares will qualify for exemption from the Penny Stock Rule. In any event, even if our ordinary shares were exempt from the Penny Stock Rule, we would remain subject to Section 15(b)(6) of the Exchange Act, which gives the SEC the authority to restrict any person from participating in a distribution of penny stock, if the SEC finds that such a restriction would be in the public interest.

If securities or industry analysts do not publish research or reports about our business, or if they adversely change their recommendations regarding the ordinary shares, the market price for the ordinary shares and trading volume could decline.

The trading market for our ordinary shares will be influenced by research or reports that industry or securities analysts publish about our business. If industry or securities analysts decide to cover us and in the future downgrade our ordinary shares, the market price for our ordinary shares would likely decline. If one or more of these analysts cease to cover us or fail to regularly publish reports on us, we could lose visibility in the financial markets, which in turn could cause the market price or trading volume for our ordinary shares to decline.

Techniques employed by short sellers may drive down the market price of our ordinary shares.

Short selling is the practice of selling securities that the seller does not own but rather has borrowed from a third party with the intention of buying identical securities back at a later date to return to the lender. The short seller hopes to profit from a decline in the value of the securities between the sale of the borrowed securities and the purchase of the replacement shares, as the short seller expects to pay less in that purchase than it received in the sale. As it is in the short seller’s interest for the price of the security to decline, many short sellers publish, or arrange for the publication of, negative opinions regarding the relevant issuer and its business prospects in order to create negative market momentum and generate profits for themselves after selling a security short. These short attacks have, in the past, led to selling of shares in the market.