UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 13, 2023

VICARIOUS SURGICAL INC.

(Exact name of registrant as specified in its charter)

| Delaware | 001-39384 | 87-2678169 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) | (IRS Employer Identification No.) |

| 78 Fourth Avenue | ||

| Waltham, Massachusetts | 02451 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (617) 868-1700

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Class A common stock, par value $0.0001 per share | RBOT | The New York Stock Exchange | ||

| Warrants to purchase one share of Class A common stock, each at an exercise price of $11.50 per share | RBOT WS | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02. | Results of Operations and Financial Condition. |

On November 13, 2023, Vicarious Surgical Inc. (the “Company”) issued a press release announcing its results for the third quarter ended September 30, 2023 and providing a business update.

A copy of the press release issued on November 13, 2023 is furnished as Exhibit 99.1 hereto.

The information in this Current Report on Form 8-K (including Exhibit 99.1) shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

| Item 7.01. | Regulation FD Disclosure. |

The Company has updated its investor presentation (the “Presentation”), which its senior management intends to use from time to time when interacting with investors and analysts, among others. The Presentation is available on the Company’s website at https://investor.vicarioussurgical.com/events-and-presentations/. A copy of the Presentation is also attached hereto as Exhibit 99.2.

The information in this Current Report on Form 8-K (including Exhibit 99.2) shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

| Item 9.01 | Financial Statements and Exhibits. |

| (d) | Exhibits. |

| Exhibit No. | Description | |

| 99.1 | Press Release of Vicarious Surgical Inc. dated November 13, 2023. | |

| 99.2 | Investor Presentation. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| VICARIOUS SURGICAL INC. | ||

| By: | /s/ Adam Sachs | |

| Name: | Adam Sachs | |

| Title: | President and Chief Executive Officer | |

Date: November 13, 2023

2

Exhibit 99.1

Vicarious Surgical Reports Third Quarter 2023 Financial Results

WALTHAM, Mass.-- (BUSINESS WIRE) – November 13, 2023 – Vicarious Surgical Inc. (“Vicarious Surgical” or the “Company”) (NYSE: RBOT, RBOT WS), a next-generation robotics technology company seeking to improve patient outcomes as well as both the cost and efficiency of surgical procedures, today announced financial results for the quarter ended September 30, 2023. Management will host a corresponding conference call at 4:30 p.m. ET today, November 13, 2023.

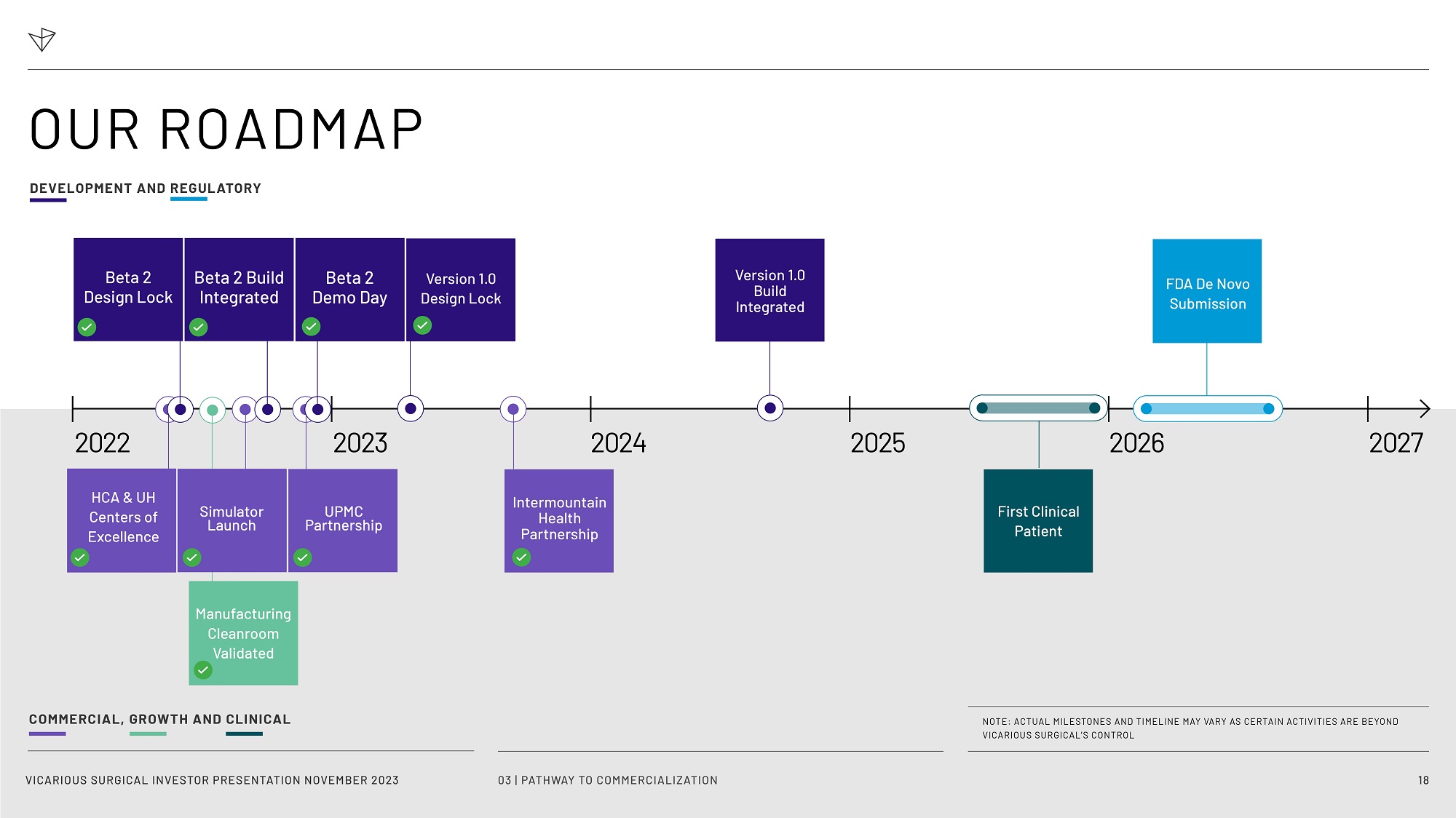

“The third quarter brought several successes for our business, but also introduced new challenges as we focused on the build and integration of our Version 1.0 System,” said Adam Sachs, Co-founder and Chief Executive Officer. “While we were pleased with our ability to extend our cash runway through an equity follow-on offering and make meaningful progress on our individual sub-system builds, the impact from recent market-driven cost cutting initiatives combined with certain integration challenges have compelled us to revise our development schedule. We now expect to complete the Version 1.0 System build and integration during the Fall of 2024, and consequently anticipate a De Novo submission around early to mid 2026. Although there is still work ahead, we remain confident that our differentiated technology will allow us to revolutionize surgical robotics and transform the standard of care.”

Third Quarter 2023 Financial Results

| ● | Operating expenses were $21.4 million for the third quarter of 2023, compared to $22.2 million in the corresponding prior year period, an decrease of 4%. |

| ● | R&D expenses for the third quarter of 2023 were $13.0 million, compared to $12.1 million in the third quarter of 2022. |

| ● | General and administrative expenses for the third quarter of 2023 were $6.9 million, compared to $8.1 million in the third quarter of 2022. |

| ● | Sales and marketing expenses for the third quarter of 2023 were $1.4 million, compared to $1.9 million in the third quarter of 2022. |

| ● | GAAP net loss for the third quarter was $15.7 million, equating to a net loss per share of $0.10, as compared to a GAAP net loss of $24.7 million, equating to a net loss per share of $0.20 for the same period of the prior year. Adjusted net loss for the third quarter was $20.4 million, equating to a net loss of $0.12 per share, as compared to an adjusted net loss of $21.7 million, or a net loss of $0.18 per share, for the same period of the prior year. |

| ● | The company had $110 million in cash, cash equivalents and short-term investments as of September 30, 2023, including $47 million in gross proceeds from the August equity follow-on offering. Excluding these gross proceeds, cash burn for the third quarter of 2023 was $16.8 million. |

| ● | The Company narrowed its FY 2023 cash burn guidance range to $60-$65 million and initiated preliminary FY 2024 cash burn guidance of $40-$55 million. |

Conference Call

Vicarious Surgical will host a conference call at 4:30 p.m. ET on Monday, November 13, 2023, to discuss its third quarter 2023 financial results. Investors interested in listening to the conference call may do so by dialing +1 (404) 975 4839 for domestic callers or +1 (929) 526 1599 for international callers, and using access code: 083118. A live and archived webcast of the event will be available at https://investor.vicarioussurgical.com.

About Vicarious Surgical

Founded in 2014, Vicarious Surgical is a next generation robotics company, developing a unique disruptive technology with the multiple goals of substantially increasing the efficiency of surgical procedures, improving patient outcomes, and reducing healthcare costs. The Company’s novel surgical approach uses proprietary human-like surgical robots to transport surgeons inside the patient to perform minimally invasive surgery. The Company is led by an experienced team of technologists, medical device professionals and physicians, and is backed by technology luminaries including Bill Gates, Vinod Khosla’s Khosla Ventures, Innovation Endeavors, Jerry Yang’s AME Cloud Ventures, Sun Hung Kai & Co. Ltd and Philip Liang’s E15 VC. The Company is headquartered in Waltham, Massachusetts. Learn more at www.vicarioussurgical.com.

Use of Non-GAAP Financial Measures

In addition to providing financial measurements that have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”), Vicarious Surgical provides additional financial metrics that are not prepared in accordance with U.S. GAAP (“non-GAAP”). The non-GAAP financial measures included in this press release are Adjusted Net Loss and Adjusted Net Loss Per Share (“Adjusted EPS”, and together with Adjusted Net Loss, “Non-GAAP Financial Measures”). The Company presents Non-GAAP Financial Measures in order to assist readers of its consolidated financial statements in understanding the core operating results that its management uses to evaluate the business and for financial planning purposes. Vicarious Surgical’s Non-GAAP financial measures provide an additional tool for investors to use in comparing its financial performance over multiple periods.

Adjusted Net Loss and Adjusted EPS are key performance measures that Vicarious Surgical’s management uses to assess its operating performance. These Non-GAAP Financial Measures facilitate internal comparisons of Vicarious Surgical’s operating performance on a more consistent basis. Vicarious Surgical uses these performance measures for business planning purposes and forecasting. Vicarious Surgical believes that the Non-GAAP Financial Measures enhance an investor’s understanding of Vicarious Surgical’s financial performance as it is useful in assessing its operating performance from period-to-period, by excluding certain items that Vicarious Surgical believes are not representative of its core business.

The Non-GAAP Financials Measures may not be comparable to similarly titled measures of other companies because they may not calculate this measure in the same manner. Adjusted Net Loss and Adjusted EPS are not prepared in accordance with U.S. GAAP and should not be considered in isolation of, or as an alternative to, measures prepared in accordance with U.S. GAAP. When evaluating Vicarious Surgical’s performance, you should consider the Non-GAAP Financial Measures alongside other financial performance measures prepared in accordance with U.S. GAAP, including net loss.

The Non-GAAP Financial Measures do not replace the presentation of Vicarious Surgical’s U.S. GAAP financial results and should only be used as a supplement to, not as a substitute for, Vicarious Surgical’s financial results presented in accordance with U.S. GAAP. In this press release, Vicarious Surgical has provided a reconciliation of Adjusted Net Loss to net loss, the most directly comparable U.S. GAAP financial measure, and the calculation for Adjusted EPS.

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. The company’s actual results may differ from its expectations, estimates, and projections and, consequently, you should not rely on these forward-looking statements as predictions of future events. All statements other than statements of historical facts contained herein, including without limitation the quotations of our Chief Executive Officer regarding Vicarious Surgical’s opportunity, among other things, are forward-looking statements that reflect the current beliefs and expectations of management. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from those discussed in the forward-looking statements. Most of these factors are outside Vicarious Surgical’s control and are difficult to predict. Factors that may cause such differences include, but are not limited to: changes in applicable laws or regulations; the ability of Vicarious Surgical to raise financing in the future; the success, cost and timing of Vicarious Surgical’s product and service development activities; the potential attributes and benefits of Vicarious Surgical’s product candidates and services; Vicarious Surgical’s ability to obtain and maintain regulatory approval for the Vicarious System on the timeline it expects, and any related restrictions and limitations of any approved product; the size and duration of human clinical trials for the Vicarious Surgical; Vicarious Surgical’s ability to identify, in-license or acquire additional technology; Vicarious Surgical’s ability to maintain its existing license, manufacture, supply and distribution agreements and scale manufacturing of the Vicarious Surgical System and any future product candidates to commercial quantities; Vicarious Surgical’s ability to compete with other companies currently marketing or engaged in the development of products and services that Vicarious Surgical is currently marketing or developing, as well as with the use of open surgeries; the size and growth potential of the markets for Vicarious Surgical’s product candidates and services, and its ability to serve those markets, either alone or in partnership with others; the pricing of Vicarious Surgical’s product candidates and services and reimbursement for medical procedures conducted using its product candidates and services; the company’s ability to meet its estimates regarding expenses, revenue, capital requirements, cash runway and needs for additional financing; Vicarious Surgical’s financial performance; Vicarious Surgical’s intellectual property rights, its ability to protect or enforce these rights, and the impact on its business, results and financial condition if it is unsuccessful in doing so; economic downturns, political and market conditions and their potential to adversely affect Vicarious Surgical’s business, financial condition and results of operations; the impact of COVID-19 on Vicarious Surgical’s business; and other risks and uncertainties indicated from time to time in Vicarious Surgical’s filings with the SEC. Vicarious Surgical cautions that the foregoing list of factors is not exclusive. The company cautions readers not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Vicarious Surgical does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based.

VICARIOUS SURGICAL INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(in thousands, except per share data)

| Three

Months Ended September 30, |

Nine

Months Ended September 30, |

|||||||||||||||

| 2023 | 2022 | 2023 | 2022 | |||||||||||||

| Operating expenses: | ||||||||||||||||

| Research and development | $ | 13,040 | $ | 12,120 | $ | 39,110 | $ | 32,023 | ||||||||

| Sales and marketing | 1,401 | 1,912 | 5,027 | 4,625 | ||||||||||||

| General and administrative | 6,911 | 8,130 | 20,988 | 22,820 | ||||||||||||

| Total operating expenses | 21,352 | 22,162 | 65,125 | 59,468 | ||||||||||||

| Loss from operations | (21,352 | ) | (22,162 | ) | (65,125 | ) | (59,468 | ) | ||||||||

| Other income (expense): | ||||||||||||||||

| Change in fair value of warrant liabilities | 4,703 | (3,038 | ) | 3,705 | 75,291 | |||||||||||

| Interest and other income | 946 | 494 | 3,463 | 603 | ||||||||||||

| Interest expense | (1 | ) | (31 | ) | (3 | ) | (89 | ) | ||||||||

| Income/(loss) before income taxes | (15,704 | ) | (24,737 | ) | (57,960 | ) | 16,337 | |||||||||

| Provision for income taxes | - | - | - | - | ||||||||||||

| Net income/(loss) | $ | (15,704 | ) | $ | (24,737 | ) | $ | (57,960 | ) | $ | 16,337 | |||||

| Net income/(loss) per share of Class A and Class B common stock, basic | $ | (0.10 | ) | $ | (0.20 | ) | $ | (0.43 | ) | $ | 0.14 | |||||

| Net income/(loss) per share of Class A and Class B common stock, diluted | $ | (0.10 | ) | $ | (0.20 | ) | $ | (0.43 | ) | $ | 0.12 | |||||

| Weighted average shares, basic | 155,141,393 | 121,965,277 | 136,194,179 | 121,201,693 | ||||||||||||

| Weighted average shares, diluted | 155,141,393 | 121,965,277 | 136,194,179 | 131,102,132 | ||||||||||||

| Other comprehensive income/(loss): | ||||||||||||||||

| Net unrealized income/(loss) on investments | 41 | - | (89 | ) | - | |||||||||||

| Other comprehensive income/(loss) | 41 | - | (89 | ) | - | |||||||||||

| Comprehensive net income/(loss) | $ | (15,663 | ) | $ | (24,737 | ) | $ | (58,049 | ) | $ | 16,337 | |||||

VICARIOUS SURGICAL INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

(in thousands, except share and per share data)

| September 30, | December 31, | |||||||

| 2023 | 2022 | |||||||

| Assets | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 59,113 | $ | 116,208 | ||||

| Short-term investments | 51,076 | $ | - | |||||

| Prepaid expenses and other current assets | 3,222 | 4,196 | ||||||

| Total current assets | 113,411 | 120,404 | ||||||

| Restricted cash | 936 | 936 | ||||||

| Property and equipment, net | 5,889 | 6,586 | ||||||

| Right-of-use assets | 11,669 | 12,273 | ||||||

| Other long-term assets | 146 | 92 | ||||||

| Total assets | $ | 132,051 | $ | 140,291 | ||||

| Liabilities and Stockholders’ Equity | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 1,529 | $ | 1,731 | ||||

| Accrued expenses | 5,267 | 5,808 | ||||||

| Lease liabilities, current portion | 1,007 | 838 | ||||||

| Current portion of equipment loans | - | 16 | ||||||

| Total current liabilities | 7,803 | 8,393 | ||||||

| Lease liabilities, net of current portion | 14,060 | 14,832 | ||||||

| Warrant liabilities | 2,316 | 6,021 | ||||||

| Total liabilities | 24,179 | 29,246 | ||||||

| Stockholders’ equity: | ||||||||

| Class A Common stock | 15 | 11 | ||||||

| Class B Common stock | 2 | 2 | ||||||

| Additional paid-in capital | 227,545 | 172,673 | ||||||

| Accumulated other comprehensive loss | (89 | ) | - | |||||

| Accumulated deficit | (119,601 | ) | (61,641 | ) | ||||

| Total stockholders’ equity | 107,872 | 111,045 | ||||||

| Total liabilities and stockholders’ equity | $ | 132,051 | $ | 140,291 | ||||

VICARIOUS SURGICAL INC.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(in thousands, except share and per share data)

Adjusted net loss and Adjusted EPS

| Three

Months Ended September 30, |

Six

Months Ended September 30, |

|||||||||||||||

| 2023 | 2022 | 2023 | 2022 | |||||||||||||

| Net income/(loss) | $ | (15,704 | ) | $ | (24,737 | ) | $ | (57,960 | ) | $ | 16,337 | |||||

| Change in fair value of warrant liabilities | 4,703 | (3,038 | ) | 3,705 | 75,291 | |||||||||||

| Adjusted net loss | (20,407 | ) | (21,699 | ) | (61,665 | ) | (58,954 | ) | ||||||||

| Adjusted EPS, basic and diluted | $ | (0.12 | ) | $ | (0.18 | ) | $ | (0.45 | ) | $ | (0.49 | ) | ||||

| Weighted average shares, basic and diluted | 155,141,393 | 121,965,277 | 136,194,179 | 121,201,693 | ||||||||||||

Investor Contact

Kaitlyn Brosco

Vicarious Surgical

Kbrosco@vicarioussurgical.com

Marissa Bych

Gilmartin Group

Marissa@gilmartinir.com

Media Inquiries

media@vicarioussurgical.com

Exhibit 99.2

INVESTOR PRESENTATION NOVEMBER 2023

Abby Mayo for Matter Health 0 0 | SUMMA R Y VICARIOUS SURGICAL INVESTOR PRESENTATION NOVEMBER 2023 2 DISCLAIMER This presentation includes “forward - looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. The company’s actual results may differ from its expectations, estimates, and projections and, consequently, you should not rely on these forward - looking statements as predictions of future events. All statements other than statements of historical facts contained herein are forward - looking statements that reflect the current beliefs and expectations of management. These forward - looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from those discussed in the forward - looking statements. Most of these factors are outside Vicarious Surgical’s control and are difficult to predict. Factors that may cause such differences include, but are not limited to: the ability to recognize the benefits of Vicarious Surgical’s business combination, which may be affected by, among other things, competition and its ability to grow and manage growth profitably and retain its key employees; the ability to maintain the listing of Vicarious Surgical’s Class A common stock on the New York Stock Exchange; the success, cost and timing of Vicarious Surgical’s product and service development activities; the commercialization and adoption of Vicarious Surgical’s initial product candidates and the success of Vicarious Surgical’s single - port surgical robot, called the Vicarious Surgical System, and any of Vicarious Surgical’s future product candidates and service offerings; the potential attributes and benefits of the the Vicarious Surgical System and any of Vicarious Surgical’s other product and service offerings once commercialized; Vicarious Surgical’s ability to obtain and maintain regulatory authorization for the the Vicarious Surgical System and its product and service offerings, and any related restrictions and limitations of any authorized product or service offering; changes in U.S. and foreign laws; Vicarious Surgical’s ability to identify, in license or acquire additional technology; Vicarious Surgical’s ability to maintain its license agreements and manufacturing arrangements; Vicarious Surgical’s ability to compete with other companies currently marketing or engaged in the development of products and services for use in ventral hernia repair procedures and additional surgical applications; the size and growth potential of the markets for the the Vicarious Surgical System and any of Vicarious Surgical’s future product and service offerings, and its ability to serve those markets once commercialized, either alone or in partnership with others; Vicarious Surgical’s estimates regarding expenses, future revenue, capital requirements and needs for additional financing; Vicarious Surgical’s ability to raise financing in the future; Vicarious Surgical’s financial performance; Vicarious Surgical’s intellectual property rights and how failure to protect or enforce these rights could harm its business, results of operations and financial condition; economic downturns and political and market conditions beyond the control of Vicarious Surgical and their potential to adversely affect Vicarious Surgical’s business, financial condition and results of operations; the anticipated continued impact of the COVID - 19 pandemic on Vicarious Surgical’s business; and other risks and uncertainties indicated from time to time in Vicarious Surgical’s filings with the SEC. Vicarious Surgical cautions that the foregoing list of factors is not exclusive. The company cautions readers not to place undue reliance upon any forward - looking statements, which speak only as of the date made. Vicarious Surgical does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward - looking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. All surgical images contained within this presentation are sourced from cadaveric procedures.

0 0 | SUMMA R Y VICARIOUS SURGICAL INVESTOR PRESENTATION NOVEMBER 2023 3 KEY INVESTMENT HIGHLIGHTS 1 VICARIOUS SURGICAL ESTIMATES FROM DATA SOURCED FROM LSI MARKET SIZE ANALYSIS 2022 DATA AND PUBLIC FILINGS. ASSUMES $3,319 REVENUE PER PROCEDURE CURRENTLY REALIZED BY LEGACY ROBOTIC COMPANY. 2 PARTNERSHIPS FOR PURPOSE OF DEVELOPMENT, VERIFICATION AND VALIDATION, CLINICAL TRIALS, AND TRAINING 3 INCLUDES ADDITIONAL FEATURES EXPECTED AFTER INITIAL LAUNCH AND NECESSARY REGULATORY APPROVAL OF THESE FEATURES. AUTOMATED PATIENT PROTECTION IS VICARIOUS SURGICAL’S TERM FOR A SET OF FUTURE FEATURES LEVERAGING THE ARCHITECTURE OF THE VICARIOUS SURGICAL PLATFORM, DESIGNED TO ENHANCE PATIENT SAFETY GROWING $150B MARKET THAT IS 96% UNPENETRATED BY ROBOTIC SURGERY 1 WITH STRONG EXISTING REIMBURSEMENT UNPRECEDENTED PARTNERSHIPS WITH LEADING HEALTHCARE SYSTEMS 2 PROPRIETARY DECOUPLED ACTUATOR TECHNOLOGY ENABLES UNPARALLELED FUNCTIONALITY UNIQUE PLATFORM ARCHITECTURE DESIGNED FOR FUTURE AUTOMATED PATIENT PROTECTION 3 SURGERY TODAY 1 VICARIOUS SURGICAL ESTIMATES FROM DATA SOURCED FROM LSI MARKET SIZE ANALYSIS 2022 DATA AND PUBLIC FILINGS.

ASSUMES $3,319 REVENUE PER PROCEDURE CURRENTLY REALIZED BY LEGACY ROBOTIC COMPANY. 2 VICARIOUS SURGICAL ESTIMATES FROM LSI MARKET DATA. 2022 DATA 3 DHARAP SB, BARBANIYA P, NAVGALE S. INCIDENCE AND RISK FACTORS OF POSTOPERATIVE COMPLICATIONS IN GENERAL SURGERY PATIENTS. CUREUS. 2022 NOV 1;14(11):E30975. DOI: 10.7759/CUREUS.30975. PMID: 36465229; PMCID: PMC9714582. 4 5 Million 2 ABDOMINAL ROBOTIC - ADDRESSABLE WORLDWIDE PER YEAR 96% Manual 1 1 i n 3 PROCEDURES HAVE SURGICAL COMPLICATIONS 3 $150 Billion Procedures 1 INITIAL MARKET OPPORTUNITY: ~4 % ROB O TI C AD OPTIO N DU E T O: • HIGH COST • LIMITE D A CCES S + C A P ABILITY • DIFFICU L T Y O F US E + T R AINING • HERNIA • GYNECOLOGY • GALLBLADDER • GASTROINTESTINAL 0 0 | SUMMA R Y 4 VICARIOUS SURGICAL INVESTOR PRESENTATION NOVEMBER 2023 VICARIOUS SURGICAL INVESTOR PRESENTATION NOVEMBER 2023 5 T H E VICARIOU S SURGICA L S Y S TEM 01

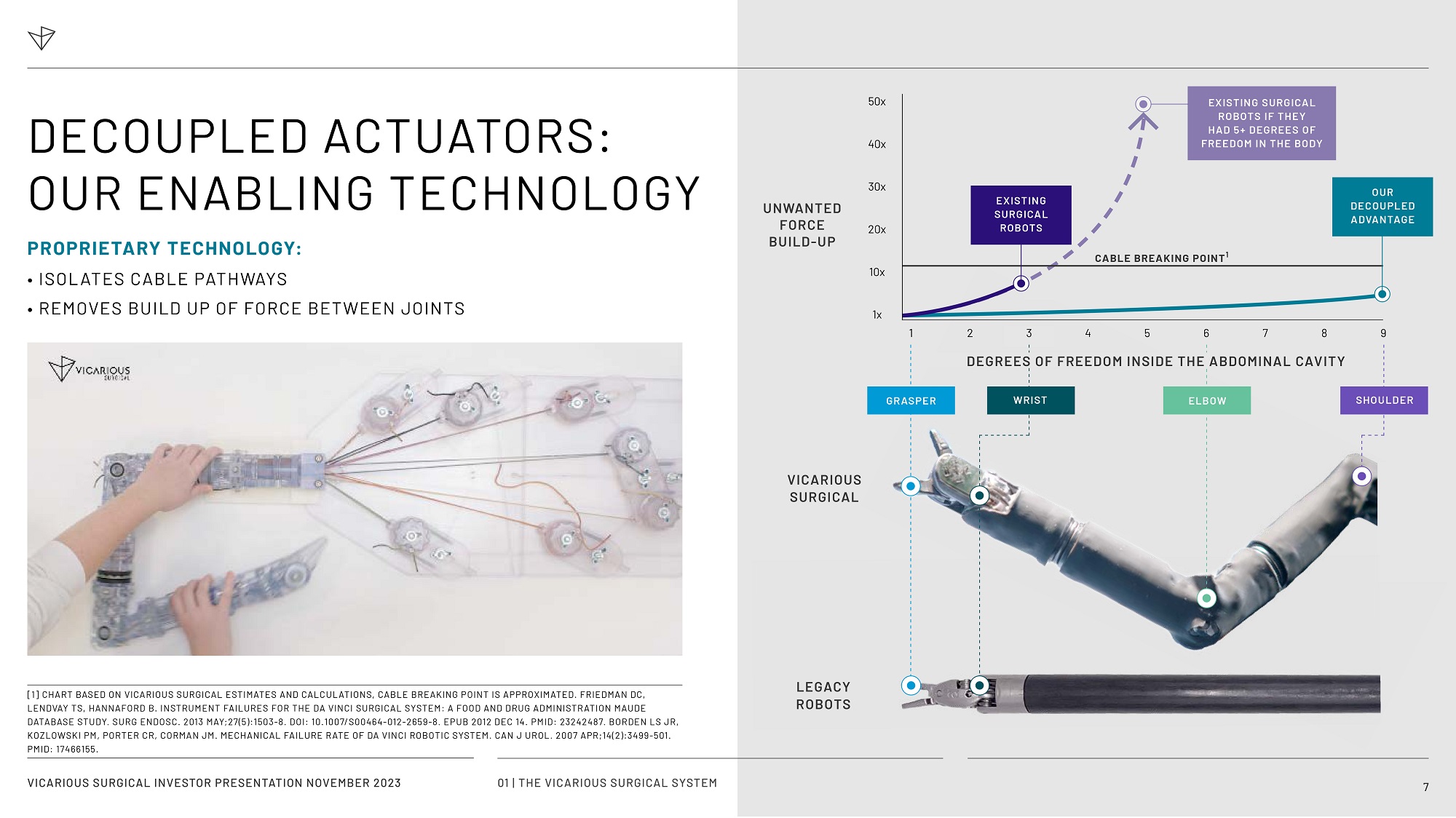

VICARIOUS SURGICAL INVESTOR PRESENTATION NOVEMBER 2023 6 0 1 | TH E VI C ARIOU S SURGI C A L S Y S TEM THE SYSTEM 1 VICARIOUS SURGICAL SYSTEM IS CAPABLE OF TROCAR SIZES AS LOW AS 1.2CM. CURRENT DISPOSABLES REQUIRE 1.8CM TROCAR. 2 INCLUDES ADDITIONAL FEATURES EXPECTED AFTER INITIAL LAUNCH AND NECESSARY REGULATORY APPROVAL OF THESE FEATURES. OUR DECOUPLED TECHNOLOGY UNIQUELY BENEFITS THE PATIENT, SURGEON, AND HOSPITAL • MINIMALLY INVASIVE VIA 1.8CM SINGLE PORT 1 • ENHANCED DEXTERITY AND EXPANSIVE RANGE OF MOTION • SHOULDERS, ELBOW, AND WRIST INTRA - ABDOMINAL • 13 DEGREES OF FREEDOM PER ARM (INCLUDING 9 FROM WITHIN ABDOMEN) • 360 ƒ VISUALIZATION WITH 3D ANATOMICAL MAPPING AND REALTIME MULTIMODAL FLUORESCENT IMAGING 2 • UNPARALELLED SENSING OF FORCE AND POSITION OUR SURGEON CONSOLE 1.8CM 1 VICARIOUS SURGICAL ROBOT TROCAR SIZE OUR PATIENT CART 1 UN W ANTED FORCE BUILD - UP 1x 50x 20x 2 3 4 5 6 7 8 9 40x 30x 10x EXISTING SURGICAL ROBOTS IF THEY H A D 5 + DEGREE S OF FREED O M I N TH E B O D Y DECOUPLED ACTUATORS: OUR ENABLING TECHNOLOGY PROPRIETARY TECHNOLOGY: • ISOLATES CABLE PATHWAYS • REMOVES BUILD UP OF FORCE BETWEEN JOINTS CABLE BREAKING POINT 1 EXISTING SURGI C AL ROBOTS OUR DECOUPLED ADVANTAGE VI C ARIOUS SURGICAL LE G A C Y RO B O T S [1] CHART BASED ON VICARIOUS SURGICAL ESTIMATES AND CALCULATIONS, CABLE BREAKING POINT IS APPROXIMATED.

FRIEDMAN DC, LENDVAY TS, HANNAFORD B. INSTRUMENT FAILURES FOR THE DA VINCI SURGICAL SYSTEM: A FOOD AND DRUG ADMINISTRATION MAUDE DATABASE STUDY. SURG ENDOSC. 2013 MAY;27(5):1503 - 8. DOI: 10.1007/S00464 - 012 - 2659 - 8. EPUB 2012 DEC 14. PMID: 23242487. BORDEN LS JR, KOZLOWSKI PM, PORTER CR, CORMAN JM. MECHANICAL FAILURE RATE OF DA VINCI ROBOTIC SYSTEM. CAN J UROL. 2007 APR;14(2):3499 - 501. PMID: 17466155.

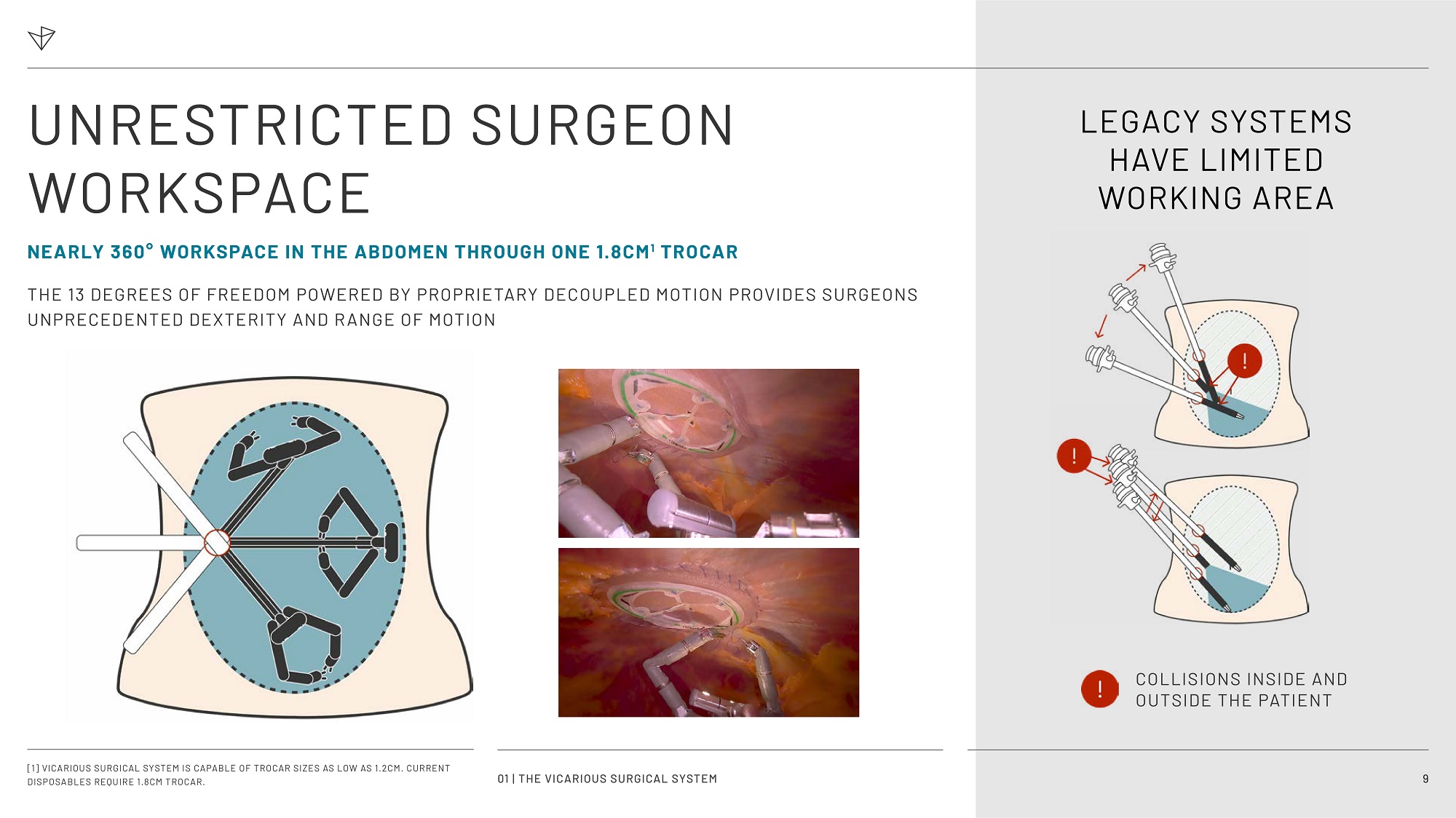

DEGREES OF FREEDOM INSIDE THE ABDOMINAL CAVITY GRASPER ELBOW SHOULDER WRIST 0 1 | TH E VI C ARIOU S SURGI C A L S Y S TEM 7 VICARIOUS SURGICAL INVESTOR PRESENTATION NOVEMBER 2023 ONE SMALL INCISION 0.5 - 1.5cm INCISIONAL COMPLICATION R A T E 20% 10% 1.8cm INCISION SIZE MINIMIZING PATIENT COMPLICATIONS THROUGH 1.8CM TROCAR 1 • <2.0CM INCISION ABILITY TO UTILIZE OBTURATOR • >2.0CM INCISION REQUIRES SCALPEL • OBTURATOR DRIVES COMPLICATION RATES DOWN BY SEPARATING MUSCLE FIBERS RATHER THAN CUTTING SCALPEL OBTURATOR 1 VICARIOUS SURGICAL SYSTEM IS CAPABLE OF TROCAR SIZES AS LOW AS 1.2CM. CURRENT DISPOSABLES REQUIRE 1.8CM TROCAR. 2 INCISIONAL COMPLICATION DEFINED AS OCCURRENCE OF POST - OPERATIVE HERNIA. BASED ON VICARIOUS SURGICAL’S EXTRAPOLATION OF DATA FROM VARIOUS STUDIES: (1) HERNANDEZ - GR ANADOS P ET AL, INCISIONAL HERNIA PREVENTION AND USE OF MESH, A NARR ATIVE REVIEW, 2018. (2) MARKS JM ET AL, SINGLE INCISION L APAROSCOPIC CHOLECYSTECTOMY IS ASSOCIATED WITH IMPROVED COSMESIS SCORING AT THE COST OF SIGNIFICANTLY HIGHER HERNIA R ATES, 2013 3 PRESENTED FOR ILLUSTRATIVE PURPOSES ONLY AND REPRESENTS ESTIMATED INCISIONAL COMPLICATION RATE BASED ON EXTRAPOLATION OF COMPLICATION RATE DATA OBSERVED IN STUDIES OF POST - OPERATIVE HERNIAS IN INCISIONS MADE USING MULTI - PORT, SINGLE - PORT AND OPEN SURGERY PROCEDURES . THIS DATA IS NOT BASED ON, AND DOES NOT REFLECT CLINICAL TRIAL OR OTHER DATA OBSERVED IN PROCEDURES USING THE VICARIOUS SURGICAL SYSTEM . ACTUAL INCISION COMPLICATION RATES AND OTHER SAFETY DATA OBSERVED IN CLINICAL TRIALS OF THE VICARIOUS SURGICAL SYSTEM MAY VARY SIGNIGICANTLY . 10+cm 2.5cm EXISTING MU L TI - PORT THE VICARIOUS SURGICAL SYSTEM 3 OTHER SINGLE PORT COMPLICATION RATES AS A FUNCTION OF INCISION SIZE 2 OBTURATOR UTILIZATION SCALPEL UTILIZATION 1% OPEN SURGERY 8 0 1 | TH E VI C ARIOU S SURGI C A L S Y S TEM VICARIOUS SURGICAL INVESTOR PRESENTATION NOVEMBER 2023 UNRESTRICTED SURGEON WORKSPACE NEARLY 360 ƒ WORKSPACE IN THE ABDOMEN THROUGH ONE 1.8CM 1 TROCAR THE 13 DEGREES OF FREEDOM POWERED BY PROPRIETARY DECOUPLED MOTION PROVIDES SURGEONS UNPRECEDENTED DEXTERITY AND RANGE OF MOTION LEGACY SYSTEMS HAVE LIMITED WORKING AREA COLLISIONS INSIDE AND OUTSIDE THE PATIENT 0 1 | TH E VI C ARIOU S SURGI C A L S Y S TEM [1] VICARIOUS SURGICAL SYSTEM IS CAPABLE OF TROCAR SIZES AS LOW AS 1.2CM.

CURRENT DISPOSABLES REQUIRE 1.8CM TROCAR. 9

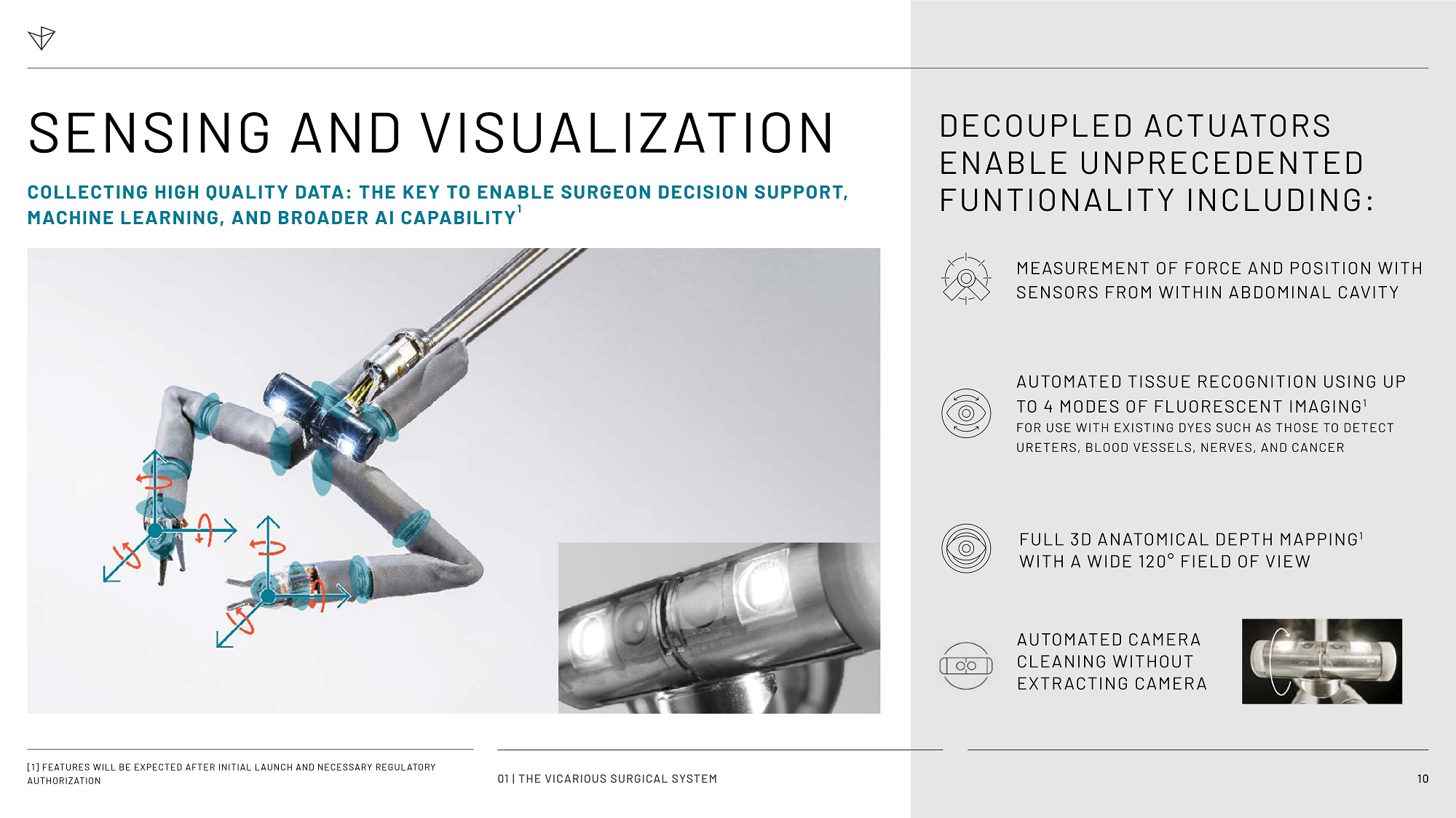

SENSING AND VISUALIZATION COLLECTING HIGH QUALITY DATA: THE KEY TO ENABLE SURGEON DECISION SUPPORT, MACHINE LEARNING, AND BROADER AI CAPABILITY 1 0 1 | TH E VI C ARIOU S SURGI C A L S Y S TEM 10 MEASUREMENT OF FORCE AND POSITION WITH SENSORS FROM WITHIN ABDOMINAL CAVITY DECOUPLED ACTUATORS ENABLE UNPRECEDENTED FUNTIONALITY INCLUDING: AUTOMATED TISSUE RECOGNITION USING UP TO 4 MODES OF FLUORESCENT IMAGING 1 FOR USE WITH EXISTING DYES SUCH AS THOSE TO DETECT URETERS, BLOOD VESSELS, NERVES, AND CANCER FULL 3D ANATOMICAL DEPTH MAPPING 1 WITH A WIDE 120 ƒ FIELD OF VIEW AUTOMATED CAMERA CLEANING WITHOUT EXTRACTING CAMERA [1] FEATURES WILL BE EXPECTED AFTER INITIAL LAUNCH AND NECESSARY REGULATORY AUTHORIZATION 11 0 1 | TH E VI C ARIOU S SURGI C A L S Y S TEM ATTRACTIVE COST MODEL • Capital equipment is primarily non - robotic as movement is ge n e r a t ed f r om within t h e a b do m en • Cost of goods of capital equipment is expected to be significantly l o w er than c om p e ting p r oduct s 1 • Decoupled actuators enable high force capability and excellent d e x t erity with p oly m er cabl e s • Polymer fiber cables allow for 3D printed and injection molded parts • Enables sterile portions of system to be fully disposable or reusable • Exchangeable tool tips enhance economies of scale 2 1 COMPANY ESTIMATED BASED ON QUOTED PRODUCTION PARTS FROM VICARIOUS SURGICAL SUPPLIER 2 INCLUDES ADDITIONAL FEATURES EXPECTED AFTER INITIAL LAUNCH AND NECESSARY REGULATORY APPROVAL OF THESE FEATURES.

ADVANCED ENGINEERING ENABLES COMPETITIVE COST ADVANTAGE ON BOTH CAPITAL EQUIPMENT AND INSTRUMENTS CAPITAL EQUIPMENT INSTRUMENTS VICARIOUS SURGICAL INVESTOR PRESENTATION NOVEMBER 2023 12 FUTUR E OF SURGERY 02

TRANSFORMING ROBOTICS TO BECOME THE STANDARD OF CARE 1 DHARAP SB, BARBANIYA P, NAVGALE S. INCIDENCE AND RISK FACTORS OF POSTOPERATIVE COMPLICATIONS IN GENERAL SURGERY PATIENTS. CUREUS. 2022 NOV 1;14(11):E30975. DOI: 10.7759/CUREUS.30975. PMID: 36465229; PMCID: PMC9714582. 2 INCLUDES ADDITIONAL FEATURES EXPECTED AFTER INITIAL LAUNCH AND NECESSARY REGULATORY APPROVAL OF THESE FEATURES. AUTOMATED PATIENT PROTECTION IS VICARIOUS SURGICAL’S TERM FOR A SET OF FUTURE FEATURES LEVERAGING THE ARCHITECTURE OF THE VICARIOUS SURGICAL PLATFORM, DESIGNED TO ENHANCE PATIENT SAFETY. 13 THE VICARIOUS SURGICAL PLATFORM IS DESIGNED TO REDUCE SURGICAL COMPLI C A TIONS , CURRENT L Y 1 I N 3 T O D A Y 1 ADVANCED SENSING AND VISUALIZATION LESS INVASIVE UNRESTRICTED DEXTERITY AND ACCESS ATTRACTIVE VALUE 0 2 | FUTUR E O F SURGE R Y EFFICIENT PROCEDURES B y identifying k e y s tructu r e s, w e can r e m o v e t h e n eed f or d e tailed di s section f or ex p osu r e o f critical s tructu r e s REDUCED ERRORS AND ACCIDENTS By alerting the surgeon when they are deviating from the intended surgical plan or approaching critical anatomy, we can help ensure increased safety throughout the procedure PROCEDURAL AUTOPILOT With advanced instrumentation and anatomical identification, the platform can follow the surgeons plan, helping to reduce surgeon workload and increase surgeon confidence VICARIOUS SURGICAL INVESTOR PRESENTATION NOVEMBER 2023 AUTOMATED PATIENT PR O TE C TION 2 THE FUTURE WE ARE BUILDING PIONEERING AUTOMATED PATIENT PROTECTION 1 TO GENERATE IMPROVED PATIENT OUTCOMES BUILDING TOWARDS PROCEDURAL AUTOMATION PROCEDU R AL AUTOMATION Our pl a t f orm is uniquely engi n ee r ed t o deli v er r eliabl e , r e p e a table re sults th r ough futu r e “ au t opil o t” au t om a tion UNIQUE SYSTEM ARCHITECTURE De c oupled actu a t o r s enable unprecedented functionality , sensing, a n d visualiz a tion CLINICALLY RELEVANT DATA Sensing a n d visualiz a tion p r o vid e s s p ecific a n d hig h - quality d a ta AC TIONABLE INSIGHTS Utilize unique a n d high quality p r o c edur al d a ta t o aug m ent su r geon decision making a n d ge n e r a t e e n ha n c ed p a tient outcomes 14 0 2 | FUTUR E O F SURGE R Y [1] FEATURES EXPECTED AFTER INITIAL LAUNCH AND NECESSARY REGULATORY AUTHORIZATION.

AUTOMATED PATIENT PROTECTION IS VICARIOUS SURGICAL’S TERM FOR A SET OF FUTURE FEATURES LEVERAGING THE ARCHITECTURE OF THE VICARIOUS SURGICAL PLATFORM, DESIGNED TO ENHANCE PATIENT SAFETY. VICARIOUS SURGICAL INVESTOR PRESENTATION NOVEMBER 2023 VICARIOUS SURGICAL INVESTOR PRESENTATION NOVEMBER 2023 15 P A TH W A Y T O COMMERCIALIZATION 03

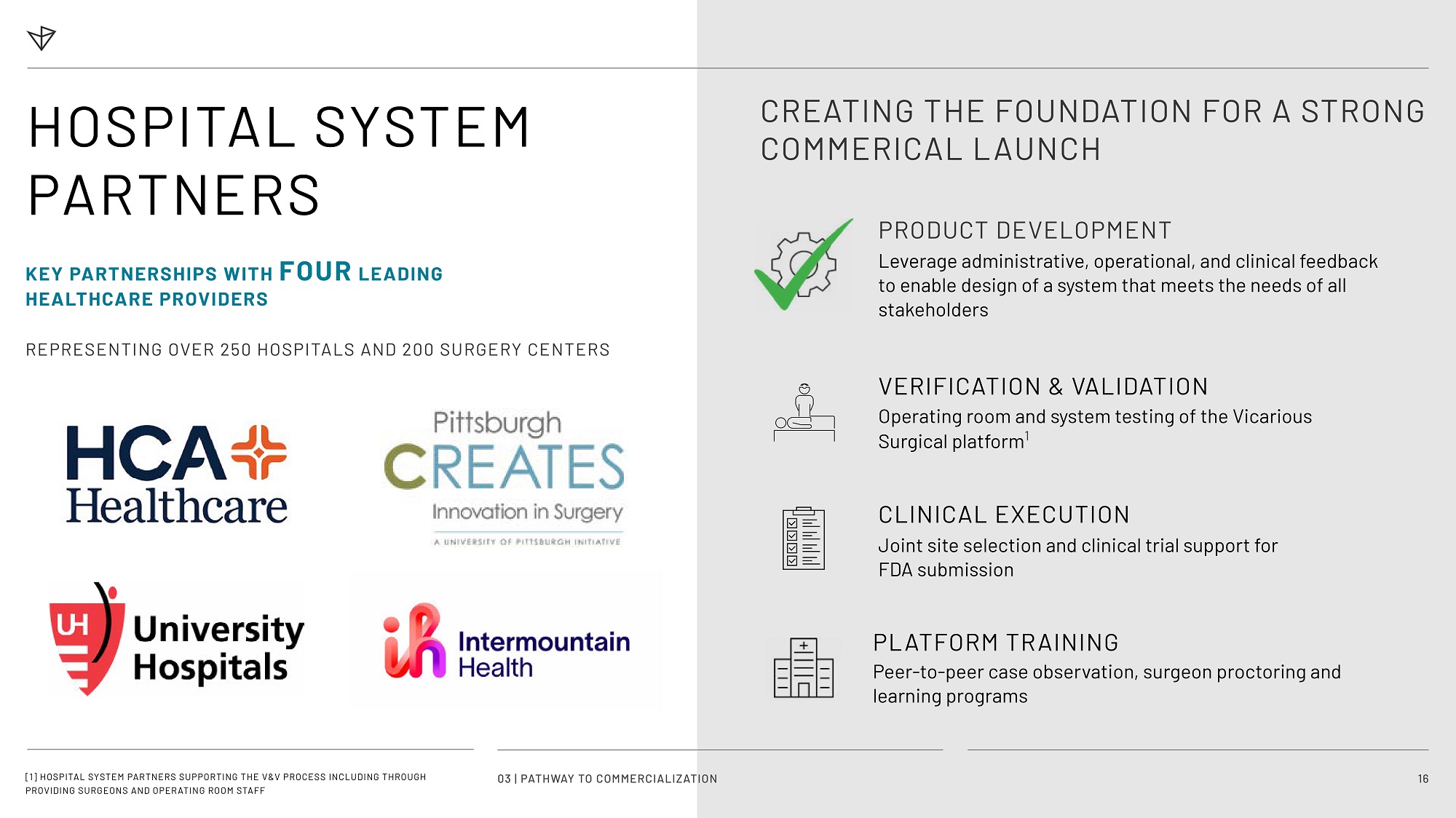

HOSPITAL SYSTEM PARTNERS KEY PARTNERSHIPS WITH FOUR LEADING HEALTHCARE PROVIDERS REPRESENTING OVER 250 HOSPITALS AND 200 SURGERY CENTERS CREATING THE FOUNDATION FOR A STRONG COMMERICAL LAUNCH CLINICAL EXECUTION Joint si t e selection a n d clinical trial sup p o r t f or F D A submi s sion PLATFORM TRAINING P ee r - t o - peer case obse r v a tio n , su r geon p r oc t oring a n d l e arning p rogr ams VERIFICATION & VALIDATION Operating room and system testing of the Vicarious Su r gical pl a t f orm 1 PRODUCT DEVELOPMENT Leverage administrative, operational, and clinical feedback to enable design of a system that meets the needs of all stakeholders [1] HOSPITAL SYSTEM PARTNERS SUPPORTING THE V&V PROCESS INCLUDING THROUGH PROVIDING SURGEONS AND OPERATING ROOM STAFF 0 3 | P A TH W A Y T O COMMERCIALIZ A TION 16 1 COLORECTAL, SMALL BOWEL, BARIATRIC, ESOPHAGEAL, BARIATRIC, STOMACH (NON - ENDOSCOPIC), LSI WW 2022 DATA 2 VICARIOUS SURGICAL ESTIMATES FROM LSI WW 2022 DATA, INCLUDES SOME PATIENTS WHO CHOSE TO NOT HAVE HERNIAS REPAIRED WITH LEGACY TECHNIQUES 3 LSI WW 2022 DATA 4 HYSTERECTOMY, OOPHORECTOMY, COLPOPEXY, ENDOMETRIOSIS LSI WW 2022 DATA 5 INCLUDES INCISIONAL HERNIA AND UMBILICAL, VICARIOUS SURGICAL ESTIMATES FROM LSI WW 2022 DATA, INCLUDES SOME PATIENTS WHO CHOSE TO NOT HAVE HERNIAS REPAIRED WITH LEGACY TECHNIQUES 6 VICARIOUS SURGICAL ESTIMATES FROM DATA SOURCED FROM LSI MARKET SIZE ANALYSIS 2022 DATA AND PUBLIC FILINGS.

ASSUMES $3,319 REVENUE PER PROCEDURE CURRENTLY REALIZED BY LEGACY ROBOTIC COMPANY. 7 VICARIOUS SURGICAL ESTIMATES FROM LSI MARKET DATA. 2022 DATA ADDRESSABLE PROCEDURES TARGET L A UNCH 17 VICARIOUS SURGICAL INVESTOR PRESENTATION NOVEMBER 2023 0 3 | P A TH W A Y T O COMMERCIALIZ A TION I N DI C A TIO N PATHWAY VALUE OF INITIAL MARKET $15 0 Billion 6 4 5 Million ABDOMINAL PROCEDURES ADDRESSABLE BY VICARIOUS SURGICAL 7 ~6.8M ALL OTHER HERNIA 2 (~1.5M US) SALPINGO - OOPHORECTOMIES & OOPHORECTOMIES (0.7M) HYSTERECTOMIES (2.2M) ENDOMETRIOSIS (2.0M) ~5.6M GYNECOLOGY 4 (~1.4M US) SACROCOLPOPEXY (0.7M) ~3.9M VENTRAL HERNIA 5 (~0.9M US) 1 ~15.0M G I PROCEDURES (~3.1M US) ESOPHAGEAL: (0.3M) STOMACH & INTESTINAL: (5.4M) COLORECTAL: (4.2M) APPENDECTOMIES: (3.8M) BARIATRIC: (0.9M) PANCREATIC: (0.4M) ~13.8M G ALLB L ADDER PROCEDURES 3 (~2.6M US) CHOLECYSTECTOMIES: (10.6M) OTHER GALLBLADDER & BILIARY: (3.2M)

0 3 | P A TH W A Y T O COMMERCIALIZ A TION 18 20 2 3 NOTE: ACTUAL MILESTONES AND TIMELINE MAY VARY AS CERTAIN ACTIVITIES ARE BEYOND VICARIOUS SURGICAL’S CONTROL F D A De N o v o Submission Fi r s t Clinical Patient V e r sion 1 . 0 D e sign Lock H C A & UH C en t e r s o f E x c elle n c e Manu f acturing Cleanroom Validated Simul a t or Launch DEVELOPMENT AND REGULATORY COMMERCIAL, GROWTH AND CLINICAL 2024 2025 2026 2027 B eta 2 D e sign Lock B e ta 2 B uild Integrated 2022 UPMC Partnership In t er m ountain Health Partnership V e r sion 1 . 0 Build Integrated B e ta 2 De m o D a y VICARIOUS SURGICAL INVESTOR PRESENTATION NOVEMBER 2023 OUR ROADMAP T E A M A N D IN V E S T O R S 04 VICARIOUS SURGICAL INVESTOR PRESENTATION NOVEMBER 2023 19

0 4 | OU R TEA M A N D IN V E S T ORS VICARIOUS SURGICAL INVESTOR PRESENTATION NOVEMBER 2023 20 EXPERIENCED MANAGEMENT TEAM CO - FOUNDER, CHIEF TECHNOLOGY OFFICER SAMMY KHALIFA CO - FOUNDER, CHIEF EXECUTIVE OFFICER ADAM SACHS CHIEF FINANCIAL OFFICER BILL KELLY CHIEF OPERATING OFFICER JOHN MAZZOLA VP OF PRODUCT DESIGN AND COMMERCIALIZATION MICHAEL PRATT CO - FOUNDER, CHIEF MEDICAL OFFICER BARRY GREENE EXPERIENCED BOARD AND ADVISORS SEASONED IN V E S T OR S 1 Bill G a t e s EXECUTIVE CHAIRMAN DAVID STYKA BOARD DIRECTOR DAVID HO BOARD DIRECTOR SAMMY KHALIFA BOARD DIRECTOR ADAM SACHS BOARD DIRECTOR BEVERLY HUSS BOARD DIRECTOR DONALD TANG BOARD DIRECTOR RIC FULOP F or m er O p e r a tional L e ader a t Auris N o t ed HI V / AIDS R e se a r ch er; T i m e “Man o f th e Y e ar” 1996 TECHNOLOGY ADVISOR PAUL HERMES F or m er H e ad o f Medt r onic R o b o tics P r og r am BOARD DIRECTOR VICTORIA CARR - BRENDEL [1] PRESENTED SOLELY FOR THE PURPOSE OF ILLUSTRATING THE COMPANY’S CORPORATE HISTORY AS IT RELATES TO INVESTMENT AND THE CURRENT STOCKHOLDER BASE, AND DOES NOT IN ALL CASES REFLECT THE COMPANY’S PRINCIPAL STOCKHOLDERS. WE MAKE NO REPRESENTATION AS TO SUCH INVESTORS’ CONTINUED INVESTMENT IN THE COMPANY IN THE FUTURE OR THEIR PARTICIPATION IN ANY SECURITIES OFFERING BY THE COMPANY. 0 4 | OU R TEA M A N D IN V E S T ORS 21 VICARIOUS SURGICAL INVESTOR PRESENTATION NOVEMBER 2023 VICARIOUS SURGICAL INVESTOR PRESENTATION NOVEMBER 2023 T H AN K Y OU 78 F ou r th A v enue W altha m , MA, 024 5 1 vicariou s su r gical . c om +1.617.868.1700 VICARIOUS SURGICAL 22