FORM

6-K

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

dated November 7, 2023

BRASILAGRO

– COMPANHIA BRASILEIRA DE PROPRIEDADES AGRÍCOLAS

(Exact Name as Specified in its Charter)

BrasilAgro – Brazilian Agricultural Real Estate Company

(Translation of Registrant’s Name)

1309 Av. Brigadeiro Faria Lima, 5th floor, São Paulo, São Paulo 01452-002, Brazil

(Address of principal executive offices)

Gustavo Javier Lopez,

Administrative Officer and Investor Relations Officer,

Tel. +55 11 3035 5350, Fax +55 11 3035 5366, ri@brasil-agro.com

1309 Av. Brigadeiro Faria Lima, 5th floor

São Paulo, São Paulo 01452-002, Brazil

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Material Fact

BRASILAGRO – COMPANHIA BRASILEIRA DE PROPRIEDADES AGRÍCOLAS

Publicly-Held Company with Authorized Capital

Corporate Taxpayer’s ID (CNPJ/MF) No. 07.628.528/0001-59

State Registry (NIRE) 35.300.326.237

MONITORING OF THE AGRICULTURAL OPERATIONS ESTIMATES

2023/2024 HARVEST YEAR

BrasilAgro – Companhia Brasileira de Propriedades Agrícolas (B3: AGRO3) (NYSE: LND), leader in Brazil in the acquisition, development and sale of rural properties with high potential for appreciation, informs its shareholders and the market in general its estimates and updates of the agricultural operations for the 2023/2024 harvest year.

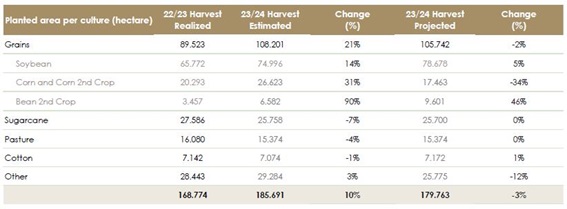

Planted area per culture (hectare)

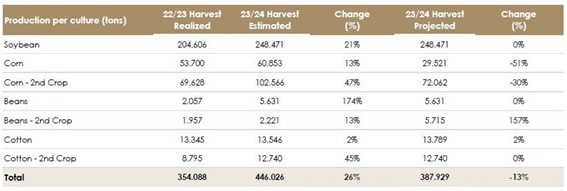

Production per culture (tons)

Due to the high volatility in corn price, which compressing the margins, we changed the mix of planted area. To mitigate operational losses, we reduce the corn area (1st and 2nd crop) by 9,200 hectares, this reduction was partially offset by an increase in soybeans and beans areas, crops that have better margins.

|

|

As a result, we plan to reduce the planted area by 3% compared to the initial estimate. Therefore, we plan to reduce grains and cotton production by 13% compared to the initial estimate. In comparison to the last season, the total planted area grew 6.5%.

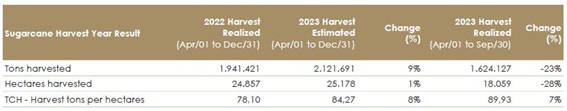

Sugarcane

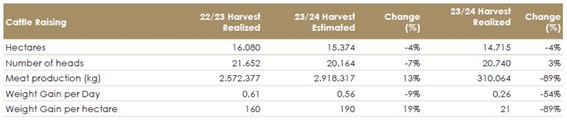

Cattle Raising

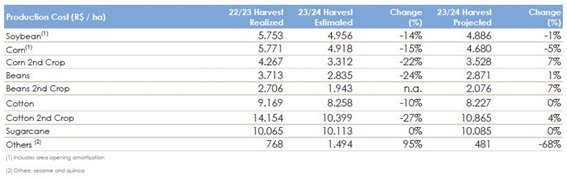

Production costs (R$/ha)

It is noteworthy that the estimates are hypothetical data and do not constitute a promise of performance. For more information about our operating estimates see the respective section of our Reference Form.

São Paulo, November 7th, 2023.

Gustavo Javier Lopez

CFO & DRI

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Date: November 7, 2023 | By: | /s/ Gustavo Javier Lopez | |

| Name: | Gustavo Javier Lopez | ||

| Title: | Administrative

Officer and Investor Relations Officer |

||

3