UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the month of: September 2023 (Report No. 4)

Commission file number: 001-38610

ALARUM TECHNOLOGIES LTD.

(Translation of registrant’s name into English)

30 HaArba’a Street Tel-Aviv (P.O.Box 174)

Tel-Aviv, 6473926 Israel

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

CONTENTS

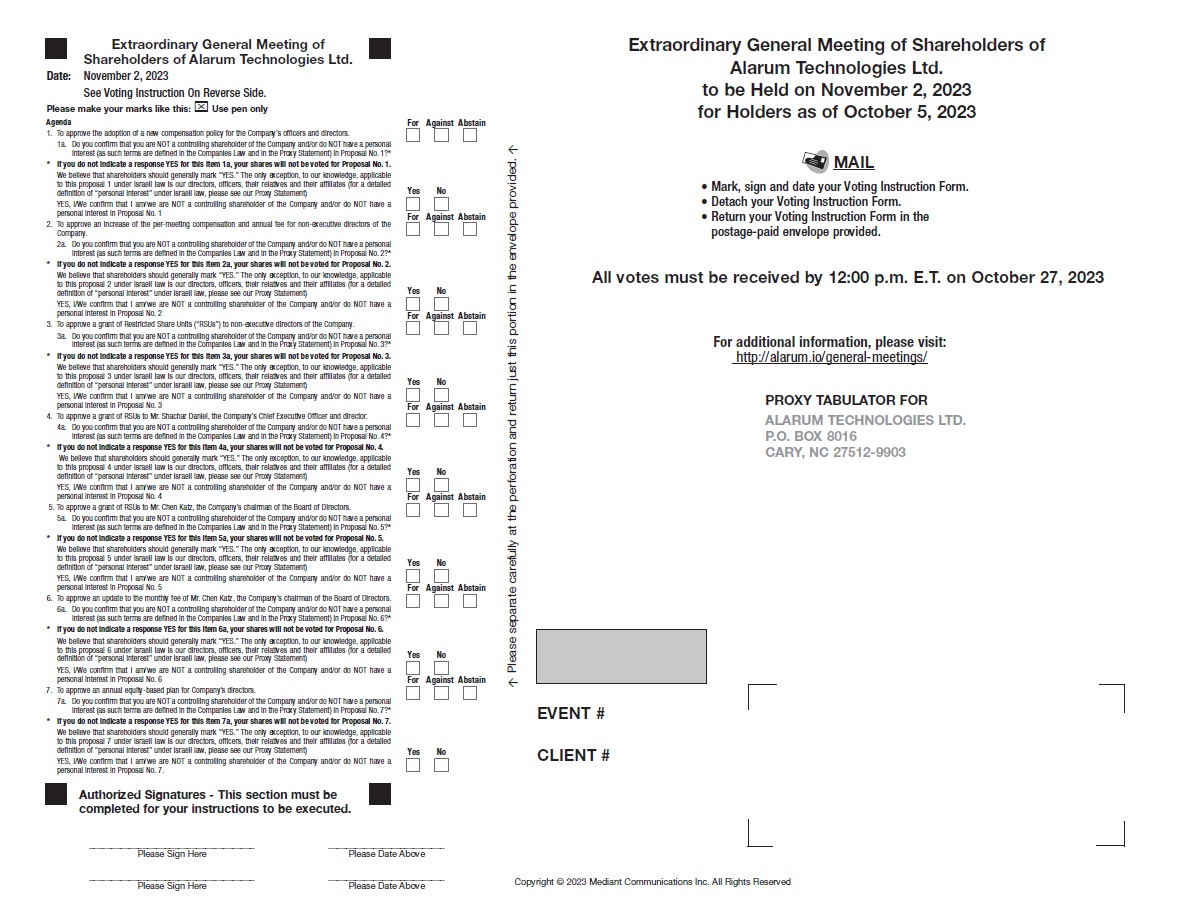

Attached hereto and incorporated by reference herein is Alarum Technologies Ltd.’s (the “Registrant”) (i) Notice of an Extraordinary General Meeting of Shareholders to be held on November 2, 2023, at 3:00 p.m. Israel time (the “Meeting”), Proxy Statement and Proxy Card for the Meeting, and (ii) voting instruction form which will be sent to holders of American Depositary Shares by The Bank of New York Mellon.

Only shareholders of record who hold Ordinary Shares, no par value, or holders of American Depositary Shares representing Ordinary Shares, of the Registrant at the close of business on October 5, 2023, will be entitled to notice of and to vote at the Meeting and any postponements or adjournments thereof.

This report on Form 6-K is incorporated by reference into the registration statements on Form S-8 (File Nos. 333-233510, 333-239249, 333-250138, 333-258744, 333-267586 and 333-274585) and Form F-3 (File Nos. 333-233724, 333-235368, 333-236030, 333-233976, 333-237629, 333-253983, 333-267580 and 333-274604) of the Registrant, filed with the Securities and Exchange Commission, to be a part thereof from the date on which this report is submitted, to the extent not superseded by documents or reports subsequently filed or furnished.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

Alarum Technologies Ltd. |

||

| Date: September 28, 2023 | By | /s/ Hagit Gal |

| Name: | Hagit Gal | |

| Title: | Corporate Legal Counsel | |

2

Exhibit 99.1

ALARUM TECHNOLOGIES LTD.

NOTICE OF AN EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS

Notice is hereby given that an Extraordinary General Meeting of Shareholders (the “Meeting”) of Alarum Technologies Ltd. (the “Company”) will be held at the Company’s counsel’s offices at 28 HaArba’a Street, Hagag Tower, North Building, 34th Floor, Tel Aviv, Israel, on November 2, 2023, at 3:00 p.m. Israel time.

The Company is a Dual Company, as such term is defined in the Israeli Companies Regulations (Relief for Public Companies Traded on Stock Markets Outside of Israel), 4760 – 2000.

The following matters are on the agenda for the Meeting:

| 1. | To approve the adoption of a new compensation policy of the Company’s officers and directors. |

| 2. | To approve an increase of the per-meeting compensation and annual fee for non-executive directors of the Company. |

| 3. | To approve a grant of Restricted Share Units (“RSUs”) to non-executive directors of the Company. |

| 4. | To approve a grant of RSUs to Mr. Shachar Daniel, the Company’s Chief Executive Officer and director. |

| 5. | To approve a grant of RSUs to Mr. Chen Katz, the Company’s Chairman of the Board of Directors. |

| 6. | To approve an update to the monthly fee of Mr. Chen Katz, the Company’s Chairman of the Board of Directors. |

| 7. | To approve an annual equity-based plan for the Company’s directors. |

Our board of directors (the “Board of Directors”) recommends that you vote in favor of the proposed resolutions, which are described in the attached proxy statement.

Shareholders of record at the close of business on October 5, 2023 (the “Record Date”), are entitled to notice of and to vote at the Meeting, either in person or by appointing a proxy to vote in their stead at the Meeting (as detailed below).

A form of proxy for use at the Meeting is attached to the proxy statement, and a voting instruction form, together with a return envelope, will be sent to holders of American Depositary Shares representing the Company’s ordinary shares, no par value (the “ADSs” and “Ordinary Shares”, respectively). By appointing “proxies,” shareholders and ADS holders may vote at the Meeting whether or not they attend. If a properly executed proxy in the attached form is received by the Company at least 4 hours prior to the Meeting, all of the Ordinary Shares represented by the proxy shall be voted as indicated on the form. ADS holders should return their voting instruction form by the date set forth therein. Subject to applicable law and the rules of the Nasdaq Stock Market, in the absence of instructions, the Ordinary Shares represented by properly executed and received proxies will be voted “FOR” all of the proposed resolutions to be presented at the Meeting for which the Board of Directors recommends a vote “FOR”. Shareholders and ADS holders may revoke their proxies or voting instruction form (as applicable) at any time before the deadline for receipt of proxies or voting instruction form (as applicable) by filing with the Company (in the case of holders of Ordinary Shares) or with the Bank of New York Mellon (in the case of holders of ADSs) a written notice of revocation or duly executed proxy or voting instruction form (as applicable) bearing a later date.

Shareholders registered in the Company’s shareholders register in Israel and shareholders who hold Ordinary Shares through members of the Tel Aviv Stock Exchange may also vote through the attached proxy by completing, dating, signing and mailing the proxy to the Company’s offices no later than November 2, 2023, at 11:00 a.m. Israel time, and must also provide the Company with a copy of their identity card, passport or certification of incorporation, as the case may be.

Shareholders who hold shares through members of the Tel Aviv Stock Exchange and intend to vote their Ordinary Shares either in person or by proxy must deliver the Company, no later than November 2, 2023, at 11:00 a.m. Israel time, an ownership certificate confirming their ownership of the Company’s Ordinary Shares on the Record Date, which certificate must be approved by a recognized financial institution, as required by the Israeli Companies Regulations (Proof of Ownership of Shares for Voting at General Meeting), 5760-2000, as amended.

Alternatively, shareholders who hold Ordinary Shares through members of the Tel Aviv Stock Exchange may vote electronically via the electronic voting system of the Israel Securities Authority no later than November 2, 2023, at 9:00 a.m. (six hours before the time of the Meeting). You should receive instructions about electronic voting from the Tel Aviv Stock Exchange member through which you hold your Ordinary Shares.

ADS holders should return their proxies by the date set forth on their voting instruction form.

If you are a beneficial owner of shares registered in the name of a member of the Tel Aviv Stock Exchange and you wish to vote, either by appointing a proxy, or in person by attending the Meeting, you must deliver to the Company a proof of ownership in accordance with the Israeli Companies Law, 5759-1999 and the Israeli Companies Regulations (Proof of Ownership of Shares for Voting at General Meetings), 5760-2000. Detailed voting instructions are provided in the proxy statement.

| Sincerely, | |

| Chen Katz | |

| Chairman of the Board of Directors | |

| September 28, 2023 |

Exhibit 99.2

ALARUM TECHNOLOGIES LTD.

TEL-AVIV, ISRAEL

PROXY STATEMENT

EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON NOVEMBER 2, 2023

The enclosed proxy is being solicited by the board of directors (the “Board of Directors”) of Alarum Technologies Ltd. (the “Company”) for use at the Company’s extraordinary general meeting of shareholders (the “Meeting”) to be held on November 2, 2023, at 3:00 p.m. Israel time, or at any adjournment or postponement thereof.

Upon the receipt of a properly executed proxy in the form enclosed, the persons named as proxies therein will vote the ordinary shares, no par value, of the Company (the “Ordinary Shares”) covered thereby in accordance with the directions of the shareholders executing the proxy. In the absence of such directions, and except as otherwise mentioned in this proxy statement, the Ordinary Shares represented thereby will be voted in favor of each of the proposals described in this proxy statement.

Two or more shareholders present, personally or by proxy, holding not less than 15% (fifteen percent) of the Company’s outstanding Ordinary Shares, shall constitute a quorum for the Meeting. If within half an hour from the time the Meeting is convened a quorum is not present, the Meeting shall stand adjourned until November 2, 2023, at 5:00 p.m. Israel time. If a quorum is not present at the second meeting within half an hour from the time appointed for such meeting, any number of shareholders present personally or by proxy shall be deemed a quorum, and shall be entitled to deliberate and to resolve in respect of the matters for which the Meeting was convened. Abstentions and broker non-votes are counted as Ordinary Shares present for the purpose of determining a quorum.

Pursuant to the Israeli Companies Law, 5759-1999 (the “Companies Law”), each of the Proposals described hereinafter requires the affirmative vote of the Company’s shareholders holding at least a majority of the Company’s Ordinary Shares present, in person or by proxy, and voting on the matter, provided that either (i) such a majority includes at least the majority of the votes of shareholders who are not controlling shareholders or do not have personal interest in the approval of the transaction (abstentions will not be taken into account); or (ii) the total number of votes against such proposal among the shareholders mentioned in clause (i) above does not exceed two percent (2%) of the total voting rights in the Company (a “Special Majority”).

As defined under the Companies Law, “personal interest” means: (1) a shareholder’s personal interest in the approval of an act or a transaction of the Company, including (i) the personal interest of any of his or her relatives (which includes for these purposes foregoing shareholder’s spouse, siblings, parents, grandparents, descendants, and spouse’s descendants, siblings, and parents, and the spouse of any of the foregoing); (ii) a personal interest of a corporation in which a shareholder or any of his/her aforementioned relatives serve as a director or the chief executive officer, owns at least 5% of its issued share capital or its voting rights or has the right to appoint a director or chief executive officer; and (iii) a personal interest of an individual voting via a power of attorney given by a third party (even if the empowering shareholder has no personal interest), and the vote of an attorney-in-fact shall be considered a personal interest vote if the empowering shareholder has a personal interest, and all with no regard as to whether the attorney-in-fact has voting discretion or not, but (2) excludes a personal interest arising solely from the fact of holding shares in the Company.

As defined under the Companies Law, a “controlling shareholder” is any shareholder that has the ability to direct the Company’s activities (other than by means of being a director or office holder of the Company). A person is presumed to be a controlling shareholder if he or she holds or controls, by himself or together with others, one half or more of any one of the “means of control” of a company; in the context of a transaction with an interested party, a shareholder who holds 25% or more of the voting rights in the company if no other shareholder holds more than 50% of the voting rights in the company, is also presumed to be a controlling shareholder. “Means of control” is defined as any one of the following: (i) the right to vote at a general meeting of a company, or (ii) the right to appoint directors of a company or its chief executive officer. As of the date of this Proxy Statement, we are not aware of any controlling shareholders as defined above, and therefore believe that, other than our directors, officers and their relatives, none of our shareholders should have a personal interest in the proposed resolutions herein. Thus, we believe all other shareholders should indicate “YES” in the appropriate place on the proxy card, voting instruction form or in their electronic or telephonic submission, so as to indicate that they do not have a personal interest with respect to the proposals herein, where applicable.

In case Proposal 1 (adoption of a compensation policy) will be approved, Proposals 2, 3, 4, 5, 6 and 7 will require the affirmative vote of shareholders present at the Meeting, in person or by proxy, and holding Ordinary Shares of the Company amounting in the aggregate to at least a majority of the votes actually cast by shareholders with respect to such proposals (a “Simple Majority”).

In accordance with the Companies Law, and regulations promulgated thereunder, any shareholder of the Company holding at least 1% of the outstanding voting rights of the Company for the Meeting may submit to the Company (contact details below), no later than October 5, 2023, a proposed additional agenda item for the Meeting.

Shareholders or ADS holders wishing to express their position on an agenda item for this Meeting may do so by submitting a written statement (a “Position Statement”) to the Company (contact details below). Any Position Statement received will be furnished to the Securities and Exchange Commission (“SEC”) on a Report on Form 6-K and will be made available to the public on the SEC’s website at www.sec.gov and in addition at www.magna.isa.gov.il or https://maya.tase.co.il. Position Statements should be submitted to the Company no later than October 23, 2023. A shareholder is entitled to contact the Company directly and receive the text of the proxy card and any Position Statement. The Board of Directors’ response to the Position Statement will be submitted no later than October 27, 2023.

Contact details: Alarum Technologies Ltd., c/o Mr. Shai Avnit, Chief Financial Officer, at 30 HaArba’a Street, 6473926 Israel, P. O. Box 174, e-mail address: shai.avnit@alarum.io.

One shareholder or more holding Ordinary Shares which reflect 5% or more of the Company’s share capital and voting rights (2,920,608 Ordinary Shares), as of September 28, 2023, and whoever holds 5% of the Company’s share capital and voting rights is entitled to examine the proxy and voting material.

It is noted that there may be changes on the agenda after publishing the Proxy Statement, and there may be Position Statements which can be published. Therefore, the most updated agenda will be furnished to the SEC on a Report on Form 6-K and will be made available to the public on the SEC’s website at www.sec.gov.

PROPOSAL 1

APPROVAL OF ADOPTION OF A NEW COMPENSATION POLICY OF THE COMPANY’S OFFICERS AND DIRECTORS

Pursuant to the Companies Law, all public Israeli companies are required to adopt a written compensation policy for their officers and directors, which addresses certain items prescribed by the Companies Law and serves as a flexible framework for officers and director compensation.

On September 26, 2019, the Company’s shareholders approved a compensation policy for the Company’s officers and directors for a period of three years, which was then after amended and approved by the Company’s shareholders on September 15, 2020 (the “Previous Policy”). As of September 15, 2023, the Previous Policy has expired, and a new policy has not been approved since.

On September 13, 2023, the Compensation Committee of the Board of Directors (the “Compensation Committee”) and the Board of Directors, reviewed the terms of the Previous Policy in depth. After considering the growth in the Company’s business and achievements since the Previous Policy was last adopted, the successful completion by the Company of a private placement on September 14, 2023, in the aggregate gross amount of $ 4,250,000 (the “Private Placement”) and the Company’s most recent financial results for the second quarter of 2023, which presented continuous improvement of key financial metrics, such as revenues, Adjusted EBITDA and operating cashflows, and further to comparing different components of compensation to companies similar to the Company, using a benchmark analysis performed by an independent consultant, the Compensation Committee and the Board of Directors approved and recommended to the shareholders of the Company to approve the adoption of a new compensation policy, for a period of three years following shareholders’ approval, in the form attached hereto as Exhibit A (the “New Policy”).

The proposed New Policy is designed to promote retention and motivation of directors and officers, incentivize superior individuals’ excellence, align the interests of the Company’s directors and executive officers with the long-term performance of the Company and provide a risk management tool.

Pursuant to the proposed New Policy, the compensation that may be granted to an officer may include: a base salary, annual performance bonus, special bonuses, equity-based compensation, benefits and termination of employment or service providers arrangements, indemnification, exemption and liability insurance coverage and other customary terms.

When considering the adoption of the New Policy, the Compensation Committee and Board of Directors considered various factors, including: (i) relevant provisions set forth in the Companies Law and regulations applicable to companies such as ours; (ii) market practices, competitive markets and the best interest of the Company and our shareholders; (iii) the advancement of the Company’s objectives, the Company’s business environment, its business plan and its long-term strategy; (iv) variable compensation; (v) the need to create appropriate incentives for directors and officers; and (vi) the Company’s achievements in the short and long term as mentioned above.

The Compensation Committee and the Board of Directors also considered the Company’s risk management, size and the nature of its operations, and reviewed various data and information they deemed relevant.

The shareholders of the Company are requested to adopt the following resolution:

“RESOLVED, to adopt the New Policy for the Company’s officers and directors, in the form attached as Exhibit A to the Proxy Statement.”

The approval of proposal 1, as described above, requires the affirmative vote of a Special Majority.

Please note that we consider it highly unlikely that any of our shareholders has a personal interest in this proposal. However, as required under Israeli law, the enclosed form of proxy requires that you specifically indicate whether you are, or are not, a controlling shareholder or have a personal interest in this proposal. Without indicating to this effect, we will not be able to count your vote with respect to this proposal.

The Board of Directors unanimously recommends that the shareholders vote FOR the above proposal.

PROPOSAL 2

TO APPROVE AN INCREASE OF THE PER-MEETING COMPENSATION AND ANNUAL FEE FOR NON-EXECUTIVE DIRECTORS

On September 13, 2023, the Compensation Committee, and the Board of Directors, approved, and recommend that the Company’s shareholders approve, an increase of the per-meeting fee and annual fee to which each of the Company’s Non-Executive Directors (as defined below) shall be effective as of September 13, 2023. The following members of the Board of Directors are the Company’s non-executive directors, other than the Company’s Chairman: Mr. Yehuda Halfon, Ms. Rakefet Remigolski, Mr. Moshe Tal and Mr. Avi Rubinstein (the “Non-Executive Directors”).

Currently, in accordance with the Israeli law requirements and the Previous Policy, the cash fees paid to each of our Non-Executive Directors include an annual fee of up to NIS 30,000 (approximately US$7,8411), and NIS1,500 (approximately US$3922) as a per-meeting fee.

We undertake regular reviews of the fees paid to non-executive directors to ensure that the Company maintains the ability to pay Non-Executive Directors remuneration at a level that is commensurate with market rates and as necessary to attract and retain directors of the appropriate level of experience and expertise. The level of remuneration for our Non-Executive Directors was previously determined in 2019. Since then, there have been considerable additional demands placed on directors due to increased corporate and regulatory requirements and considering our directors’ average time commitment, the market rate needed to attract and qualified members, the nature of the role and growth in the Company’s business in recent years, we believe that an increase in remuneration is fair and reasonable in all the relevant circumstances relating to the Company’s affairs, the nature, extent and liabilities associated with service as a Non-Executive Director or otherwise by reference to prevailing corporate governance standards and practices.

Therefore, our Compensation Committee and Board of Directors consider it appropriate that all of the Non-Executive Directors, either currently serving or who will be appointed in the future, be compensated, through a compensation mechanism that will take into account the time, attention and expertise required by such directors, and that will set a solid foundation for attracting directors with the appropriate skills and experience applicable to the Company’s industry and needs.

For the above reasons, the Compensation Committee and the Board of Directors recommend that the Company’s shareholders approve an increase of the per-meeting fee, to which each of the Company’s Non-Executive Directors shall be entitled, to NIS2,500 (approximately US$6533) (the “New Per-Meeting Fee”) and an increase of the annual fee, to which each of the Company’s Non-Executive Directors shall be entitled, to NIS60,000 (approximately US$15,6824) (the “New Annual Fee”).

The New Per-Meeting Fee and the New Annual Fee will be paid on a quarterly basis, in U.S. dollars or in NIS, plus VAT, if applicable, shall apply to the Non-Executive Directors effective as of September 13, 2023, or to such non-executive directors that will be appointed in the future, effective from their respective appointment.

The proposed increases to the New Per-Meeting Fee and New Annual Fee are consistent with the Israeli law requirements and the New Policy, and following the reasons detailed above, the Compensation Committee’s and the Board of Directors’ believe that the approval of this proposal 2 is in the best interest of the Company.

| 1 | All US dollar amounts in this Proxy Statement are based on an exchange rate of US$1: NIS3.826, on September 14, 2023. |

| 2 | See footnote 1 above. |

| 3 | See footnote 1 above. |

| 4 | See footnote 1 above. |

The shareholders of the Company are requested to adopt the following resolution:

“RESOLVED, to approve an increase of the per-meeting fee and annual fee, to which each of the Non-Executive Directors shall be entitled, as set forth in the Proxy Statement.”

In case Proposal 1 will not be approved, the approval of this proposal 2, as described above, requires the affirmative vote of a Special Majority.

In case Proposal 1 is approved, the approval of this proposal 2, as described above, requires the affirmative vote of a Simple Majority.

Please note that we consider it highly unlikely that any of our shareholders is a controlling shareholder or has a personal interest in this proposal. However, as required under Israeli law, the enclosed form of proxy requires that you specifically indicate whether you are, or are not, a controlling shareholder or have a personal interest in this proposal. Without indicating to this effect – we will not be able to count your vote with respect to this proposal.

The Board of Directors unanimously recommends that the shareholders vote FOR the above proposal.

PROPOSAL 3

TO APPROVE A GRANT OF RESTRICTED SHARE UNITS TO NON-EXECUTIVE DIRECTORS OF THE COMPANY

On September 13, 2023, (the “Date of Grant”), the Compensation Committee and the Board of Directors, approved and recommended that the Company’s shareholders approve, a grant of Restricted Share Units, which will be settled in Ordinary Shares of the Company (“RSUs”), to the Non-Executive Directors, under the Company’s Amended and Restated Global Incentive Plan (the “Global Incentive Plan”).

The Compensation Committee and the Board of Directors believe it is in the best interests of the Company to grant RSUs, under the Global Incentive Plan, to Mr. Moshe Tal, Mr. Avi Rubinstein, Mr. Yehuda Halfon and Ms. Rakefet Remigolski, as follows (the “Grant of RSUs to Non-Executive Directors”):

| Name | Title | Previous Options Granted | RSUs Suggested for Grant | |||

| Yehuda Halfon | Independent Director | 105,000 (in case exercised into Ordinary Shares, will be equal to 10,500 ADSs) | 75,000 (in case settled in Ordinary Shares, will be equal to 7,500 ADSs) | |||

| Rakefet Remigolski | Independent Director | 105,000 (in case exercised into Ordinary Shares, will be equal to 10,500 ADSs) | 75,000 (in case settled in Ordinary Shares, will be equal to 7,500 ADSs) | |||

| Moshe Tal | Independent Director | 105,000 (in case exercised into Ordinary Shares, will be equal to 10,500 ADSs) | 75,000 (in case settled in Ordinary Shares, will be equal to 7,500 ADSs) | |||

| Avi Rubinstein | Director | 369,996 (in case exercised into Ordinary Shares, will be equal to 37,000 ADSs) | 75,000 (in case settled in Ordinary Shares, will be equal to 7,500 ADSs) | |||

| Total | 684,996 (in case exercised into Ordinary Shares, will be equal to 68,500 ADSs) | 300,000 (in case settled in Ordinary Shares, will be equal to 30,000 ADSs) |

The Grant of RSUs to Non-Executive Directors is subject to a standard vesting of three years, as follows (the “Vesting Schedule”): (i) 1/6 of the RSUs granted will vest on April 19, 2024 (the “First Installment”); and (ii) 1/12 of the granted RSUs will vest each quarter for 10 quarters, following the First Installment. In the event of termination of engagement between the Company and any of the Non-Executive Directors, any unvested RSUs at the time of such termination shall be automatically cancelled. It is hereby clarified that the Vesting Schedule may be accelerated upon the occurrence of special events, as defined in the Global Incentive Plan and the New Policy.

The value of Grant of RSUs to Non-Executive Directors and its terms are within the frame and principles of the New Policy (brought for approval as Proposal 1 in this Proxy Statement), representing an amount of NIS95,554 (approximately $24,9755), and on annual bases approximately NIS 31,851 (approximately $8,3256).

The RSUs are granted in accordance with the capital gain track of Section 102 of the Israeli Income Tax Ordinance, 1961.

In making its recommendation with regard to the approval of the Grant of RSUs to Non-Executive Directors, the Compensation Committee and the Board of Directors each have considered all relevant considerations and discussed all matters required under the Companies Law and the regulations promulgated thereunder and also considered, among others: (i) the position, responsibilities, background and experience of each of the Non-Executive Directors; (ii) that the RSUs granted to Non-Executive Directors reflect a fair and reasonable value for each of the Non-Executive Directors’ services, commitment and contribution to the Company’s growth and achievements in the short and long term; and (iii) that the Grant of RSUs to Non-Executive Directors is in accordance with the New Policy (brought for approval as Proposal 1 in this Proxy Statement).

| 5 | See footnote 1 above. |

| 6 | See footnote 1 above. |

The shareholders of the Company are requested to adopt the following resolution:

“RESOLVED, to grant Mr. Moshe Tal, Mr. Avi Rubinstein, Mr. Yehuda Halfon and Ms. Rakefet Remigolski, RSUs, as set forth in this Proxy Statement.”

In case Proposal 1 will not be approved, the approval of this proposal, as described above, requires the affirmative vote of a Special Majority.

In case Proposal 1 is approved, the approval of this proposal 3, as described above, requires the affirmative vote of a Simple Majority.

Please note that we consider it highly unlikely that any of our shareholders is a controlling shareholder or has a personal interest in this proposal. However, as required under Israeli law, the enclosed form of proxy requires that you specifically indicate whether you are, or are not, a controlling shareholder or have a personal interest in this proposal. Without indicating to this effect – we will not be able to count your vote with respect to this proposal.

The Board of Directors unanimously recommends that the shareholders vote FOR the above proposal.

PROPOSAL 4

TO APPROVE A GRANT OF RESTRICTED SHARE UNITS TO MR. SHACHAR DANIEL, THE COMPANY’S CHIEF EXECUTIVE OFFICER AND DIRECTOR

On the Date of Grant, the Compensation Committee, and the Board of Directors, approved and recommended that the Company’s shareholders approve, a grant of RSUs to Mr. Shachar Daniel, the Company’s Chief Executive Officer and Director, under the Global Incentive Plan.

The recommended grant consists of 300,000 RSUs (equal to 30,000 ADSs), to be granted to Mr. Daniel (the “Grant of RSUs to Mr. Daniel”). The value of the Grant of RSUs to Mr. Daniel and its terms are in line with the New Policy (brought for approval as Proposal 1 in this Proxy Statement). The value of the proposed Grant of RSUs to Mr. Daniel, amounts, as of September 14, 2023, to a total of approximately NIS382,217 (approximately US$99,9007), and on an annual basis, approximately NIS 127,406 (approximately $33,3008).

Together with the outstanding options to purchase 1,080,000 Ordinary Shares of the Company (equal to 108,000 ADSs), granted to Mr. Daniel in aggregate in the past, Mr. Daniel’s holdings resulting from the exercise of such options and the Grant of RSUs to Mr. Daniel, will be equal to approximately 2.36% of the Company’s issued and outstanding share capital on a fully diluted basis as of the date of this Proxy Statement.

The Grant of RSUs to Mr. Daniel is in accordance with the Vesting Schedule. In the event of termination of engagement between the Company and Mr. Daniel, any unvested RSUs at the time of such termination shall be automatically cancelled. It is hereby clarified that the Vesting Schedule may be accelerated upon the occurrence of special events, as defined in the Global Incentive Plan and the New Policy.

The RSUs are granted in accordance with the capital gain track of Section 102 of the Israeli Income Tax Ordinance, 1961.

In making its recommendation with regard to the approval of the Grant of RSUs to Mr. Daniel, the Compensation Committee and the Board of Directors each have considered all relevant considerations and discussed all matters required under the Companies Law and the regulations promulgated thereunder and also considered, inter alia: (i) the position, responsibilities, background and experience of Mr. Daniel; (ii) that the Grant of RSUs to Mr. Daniel reflects a fair and reasonable value for the Mr. Daniel’s contribution and achievements as the Company’s Chief Executive Officer, including the recent completion of the Private Placement and the Company’s most recent financial results for the second quarter of 2023, which presented continuous improvement of key financial metrics such as revenues, Adjusted EBITDA and operating cashflows; and (iii) that the Grant of RSUs to Mr. Daniel is in accordance with the New Policy (brought for approval as Proposal 1 in the Proxy Statement).

The shareholders of the Company are requested to adopt the following resolution:

“RESOLVED, to grant Mr. Shachar Daniel RSUs, as set forth in the Proxy Statement.”

In case Proposal 1 will not be approved, the approval of this proposal, as described above, requires the affirmative vote of a Special Majority.

In case Proposal 1 is approved, the approval of this proposal 4, as described above, requires the affirmative vote of a Simple Majority.

Please note that we consider it highly unlikely that any of our shareholders is a controlling shareholder or has a personal interest in this proposal. However, as required under Israeli law, the enclosed form of proxy requires that you specifically indicate whether you are, or are not, a controlling shareholder or have a personal interest in this proposal. Without indicating to this effect - we will not be able to count your vote with respect to this proposal.

The Board of Directors unanimously recommends a vote FOR on the above proposal.

| 7 | See footnote 1 above. |

| 8 | See footnote 1 above. |

PROPOSAL 5

TO APPROVE A GRANT OFRESTRICTEED SHARE UNITES TO MR. CHEN KATZ, THE COMPANY’S CHAIRMAN

On the Date of Grant, the Compensation Committee and the Board of Directors, respectively, approved and recommended that the Company’s shareholders to approve, a grant of RSUs to Mr. Chen Katz, the Company’s Chairman of the Board of Directors (the “Chairman”), under the Global Incentive Plan.

The Company wishes to grant 50,000 RSUs to the Chairman (equal to 5,000 ADSs) under the Global Incentive Plan, (the “Grant of RSUs to Mr. Katz”).

The value of the Grant of RSUs to Mr. Katz is in accordance with the New Policy (brought for approval as Proposal 1 in this Proxy Statement). The value of the proposed Grant of RSUs to Mr. Katz, amounts to a total of approximately NIS63,703 (approximately US$16,6509), and on annual bases approximately NIS 21,234 (approximately $5,55010).

Together with the outstanding options to purchase 540,000 Ordinary Shares of the Company (equal to 54,000 ADSs) granted to Mr. Katz in aggregate in the past, and together with 100,000 RSUs recently granted to Mr. Katz, by approving the Grant of RSUs to Mr. Katz, Mr. Katz’s holdings resulting from the exercise of such options and the Grant of RSUs to Mr. Katz, will be equal to approximately 1.18% of the Company’s issued and outstanding share capital on a fully diluted basis as of the date of this Proxy Statement.

The Grant of RSUs to Mr. Katz is in accordance with the Vesting Schedule. In the event of termination of engagement between the Company and Mr. Katz, any unvested RSUs at the time of such termination shall be automatically cancelled. It is hereby clarified that the Vesting Schedule may be accelerated upon the occurrence of special events, as defined in the Global Incentive Plan and the New Policy.

The RSUs are granted in accordance with the capital gain track of Section 102 of the Israeli Income Tax Ordinance, 1961.

In making its recommendation with regard to the approval of the Grant of RSUs to Mr. Katz, the Compensation Committee and the Board of Directors each have considered all relevant considerations and discussed all matters required under the Companies Law and the regulations promulgated thereunder and also considered, inter alia: (i) the position, responsibilities, background and experience of the grantee; (ii) that the RSUs granted to Mr. Katz reflect a fair and reasonable value for the Mr. Katz’s services and contribution to the Company’s operations and financial position, playing a pivotal role in providing leadership, guidance, and strategic vision that significantly impact the Company’s growth and stability. and (iii) that the Grant of RSUs to Mr. Katz is in accordance with the New Policy (brought for approval as Proposal 1 in this Proxy Statement).

The shareholders of the Company are requested to adopt the following resolution:

“RESOLVED, to grant Mr. Katz RSUs, as set forth in this Proxy Statement.”

In case Proposal 1 will not be approved, the approval of this proposal, as described above, requires the affirmative vote of a Special Majority.

In case Proposal 1 is approved, the approval of this proposal 5, as described above, requires the affirmative vote of a Simple Majority.

Please note that we consider it highly unlikely that any of our shareholders is a controlling shareholder or has a personal interest in this proposal. However, as required under Israeli law, the enclosed form of proxy requires that you specifically indicate whether you are, or are not, a controlling shareholder or have a personal interest in this proposal. Without indicating to this effect – we will not be able to count your vote with respect to this proposal.

The Board of Directors unanimously recommends that the shareholders vote FOR the above proposal.

| 9 | See footnote 1 above. |

| 10 | See footnote 1 above. |

PROPOSAL 6

TO APPROVE AN UPDATE TO THE MONTHLY FEE OF MR. CHEN KATZ, THE COMPANY’S CHAIRMAN OF THE BOARD OF DIRECTORS

Background

Under the Companies Law and the Israeli Securities Authority’s position statements, arrangements concerning compensation of a company’s chairman, in accordance with the terms of the compensation policy, require the approval by the Compensation Committee, the Board of Directors and the Company’s shareholders, in a Simple Majority (as defined above), in that order11.

Since his appointment as chairman of the Board of Directors of the Company, Mr. Katz has made a significant contribution to the Company’s business and growth. The Compensation Committee and the Board of Directors believe that Mr. Katz performs a significant role in the planning, establishment, and implementation of the Company’s business model, and will continue to play a key role in the Company’s pursuit to enhance its business and growth opportunities.

The current monthly fee paid to Mr. Katz, as previously approved by the Company’s shareholders four (4) years ago, is in the amount of NIS30,000 (approximately US$7,80012). The Compensation Committee and the Board of Directors suggest increasing Mr. Katz’s monthly fee to NIS40,000, in compliance to the increase in his scope of services by 20% (approx. US$10,50013), effective as of September 13, 2023 (the “New Monthly Fee for Mr. Katz”).

In making its recommendation with regard to the approval of the New Monthly Fee for Mr. Katz, the Compensation Committee and the Board of Directors have considered all relevant considerations and discussed all matters required under the Companies Law and the regulations promulgated thereunder, and also considered, among others: (i) the responsibilities and duties performed by Mr. Katz since his appointment in 2019, and the importance of Mr. Katz to the future growth of the Company; (ii) that the New Monthly Fee for Mr. Katz is in accordance with the New Policy (brought for approval as Proposal 1 in the Proxy Statement); (iii) the expected increase in the scope of Mr. Katz’s activities to promote the Company’s goals and business objectives, including certain investor relations involvement; and (iv) the fact that Mr. Katz’s monthly fee was last approved over four (4) years ago.

The shareholders of the Company are requested to adopt the following resolution:

“RESOLVED, to approve an update to the monthly fee of Mr. Katz, the Company’s Active Chairman of the Board of Directors, as set forth in the Proxy Statement.”

In case Proposal 1 will not be approved, the approval of this proposal, as described above, requires the affirmative vote of a Special Majority.

In case Proposal 1 is approved, the approval of this proposal 6, as described above, requires the affirmative vote of a Simple Majority.

Please note that we consider it highly unlikely that any of our shareholders is a controlling shareholder or has a personal interest in this proposal. However, as required under Israeli law, the enclosed form of proxy requires that you specifically indicate whether you are, or are not, a controlling shareholder or have a personal interest in this proposal. Without indicating to this effect – we will not be able to count your vote with respect to this proposal.

The Board of Directors unanimously recommends that the shareholders vote FOR the above proposal.

| 11 | and in case there is no valid compensation policy - a Special majority. |

| 12 | See footnote 1 above. |

| 13 | See footnote 1 above. |

PROPOSAL 7

TO APPROVE AN ANNUAL EQUITY-BASED PLAN FOR THE COMPANY’S DIRECTORS

On September 13, 2023, the Compensation Committee and the Board of Directors, approved and recommended that the Company’s shareholders approve an annual equity-based plan for the Company’s members of the Board of Directors, under the Company’s Global Incentive Plan, as follows:

Once a year, in a date close to the date of the annual general meeting of the Company, the Compensation Committee and the Board of Directors may, without the need of further approval of the Company’s shareholders, grant each member of the Board of Directors, other than a director who is also serving as the Company’s Chief Executive Officer or a Subordinate Office Holder (as defined in the New Policy), equity-based compensation under the Company’s Global Incentive Plan, in an annual fair value (calculated on the basis of accepted valuation methods (such as Black & Scholes / Intermediate)) which will not exceed NIS 1,800,000 (the “Annual Equity-based Plan”). The Annual Equity-based Plan terms will be as stated in the New Policy (brought for approval as Proposal 1 in the Proxy Statement) and as follows:

| ● | Vesting Schedule: (i) 1/6 of the equity-based compensation granted will vest at least 6 months from the date of grant, on such date that is closest to either April 19, July 19, October 19 or January 19, as applicable; and (ii) 1/12 of the granted equity-based compensation will vest each quarter for 10 quarters, following the first installment mentioned in section (i) above. In the event of termination of engagement between the Company and any of the Non-Executive Directors, any unvested equity-based compensation at the time of such termination shall be automatically cancelled, unless otherwise accelerated as described below. |

| ● | Acceleration Mechanism: The Compensation Committee and the Board of Directors may allow immediate acceleration for any unvested award granted to an office holder, upon a Change of Control Event (as defined in the Global Incentive Plan and the New Policy) or following termination of services of the office holder. |

| ● | Exercise Price: The exercise price of the equity-based compensation shall not be less than (i) the share price at the date of grant; or (ii) the average price of the last 30 trading days share price, prior to the grant date, as decided by the Compensation Committee and the Board of Directors. |

| ● | Expiration date - up to ten (10) years from the date of grant. |

| ● | The grant of equity-based compensation will be granted, to the extent applicable, under section 102 of the Income Tax Ordinance. |

The Compensation Committee and the Board of Directors believe it is in the best interests of the Company to approve and to implement the Annual Equity-based Plan, under the Global Incentive Plan.

The values and terms of grants under the Annual Equity-based Plan are within the frame and principles of the New Policy (brought for approval as Proposal 1 in this Proxy Statement).

In making its recommendation with regard to the approval of the Annual Equity-based Plan, the Compensation Committee and the Board of Directors each have considered all relevant considerations and discussed all matters required under the Companies Law and the regulations promulgated thereunder and also considered, among others: (i) the position, responsibilities, background and experience of each of the Company’s directors; (ii) that the Annual Equity-based Plan reflect a fair and reasonable value for each of the Non-Executive Directors’ services and expected commitment in the long term; and (iii) that the Annual Equity-based Plan is in accordance with the New Policy (brought for approval as Proposal 1 in this Proxy Statement).

The shareholders of the Company are requested to adopt the following resolution:

“RESOLVED, to approve the Annual Equity-based Plan, as set forth in this Proxy Statement.”

In case Proposal 1 will not be approved, the approval of this proposal, as described above, requires the affirmative vote of a Special Majority.

In case Proposal 1 is approved, the approval of this proposal 7, as described above, requires the affirmative vote of a Simple Majority.

Please note that we consider it highly unlikely that any of our shareholders is a controlling shareholder or has a personal interest in this proposal. However, as required under Israeli law, the enclosed form of proxy requires that you specifically indicate whether you are, or are not, a controlling shareholder or have a personal interest in this proposal. Without indicating to this effect – we will not be able to count your vote with respect to this proposal.

The Board of Directors unanimously recommends that the shareholders vote FOR the above proposal.

Your vote is important! Shareholders are urged to complete and return their proxies promptly in order to, among other things, ensure action by a quorum and to avoid the expense of additional solicitation. If the accompanying proxy is properly executed and returned in time for voting, and a choice is specified, the shares represented thereby will be voted as indicated thereon. EXCEPT AS MENTIONED OTHERWISE IN THIS PROXY STATEMENT, IF NO SPECIFICATION IS MADE, THE PROXY WILL BE VOTED IN FAVOR OF EACH OF THE PROPOSALS DESCRIBED IN THIS PROXY STATEMENT. Shareholders who hold shares of the Company through members of the TASE and who wish to participate in the Meeting, in person or by proxy, are required to deliver proof of ownership to the Company, in accordance with the Israeli Companies Regulations (Proof of Ownership of a Share for Purposes of Voting at General Meetings), 5760-2000. Such shareholders wishing to vote by proxy are requested to attach their proof of ownership to the enclosed proxy.

Proxies and all other applicable materials should be sent to the Company’s office at 30 HaArba’a Street, P. O. Box 174, Tel-Aviv 6473926, Israel.

ADDITIONAL INFORMATION

The Company is subject to the informational requirements of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”), as applicable to foreign private issuers. Accordingly, the Company files reports and other information with the SEC. All documents which the Company will file on the SEC’s EDGAR system will be available for retrieval on the SEC’s website at http://www.sec.gov. As a Dual Company (as defined in the Israeli Companies Regulations (Concessions for Public Companies Traded on Stock Markets Outside of Israel), 5760-2000), the Company also files reports with the Israel Securities Authority. Such reports can be viewed on the Israel Securities Authority distribution website at http://www.magna.isa.gov.il and the TASE website at http://www.maya.tase.co.il.

As a foreign private issuer, the Company is exempt from the rules under the Exchange Act prescribing certain disclosure and procedural requirements for proxy solicitations. In addition, the Company is not required under the Exchange Act to file periodic reports and financial statements with the SEC as frequently or as promptly as other companies incorporated in states within the United States whose securities are registered under the Exchange Act. The Notice of the Annual and Extraordinary General Meeting of Shareholders and the proxy statement have been prepared in accordance with applicable disclosure requirements in the State of Israel.

YOU SHOULD RELY ONLY ON THE INFORMATION CONTAINED IN THIS PROXY STATEMENT OR THE INFORMATION FURNISHED TO YOU IN CONNECTION WITH THIS PROXY STATEMENT WHEN VOTING ON THE MATTERS SUBMITTED TO SHAREHOLDER APPROVAL HEREUNDER. THE COMPANY HAS NOT AUTHORIZED ANYONE TO PROVIDE YOU WITH INFORMATION THAT IS DIFFERENT FROM WHAT IS CONTAINED IN THIS DOCUMENT. THIS PROXY STATEMENT IS DATED SEPTEMBER 28, 2023. YOU SHOULD NOT ASSUME THAT THE INFORMATION CONTAINED IN THIS DOCUMENT IS ACCURATE AS OF ANY DATE OTHER THAN SEPTEMBER 28, 2023, AND THE DISCLOSURE OF THIS DOCUMENT TO SHAREHOLDERS SHOULD NOT CREATE ANY IMPLICATION TO THE CONTRARY.

| By Order of the Board of Directors | |

| Alarum Technologies Ltd. | |

| Chen Katz, Chairman of the Board of Directors |

EXHIBIT A

Alarum Technologies Ltd.

(“the Company”)

Compensation Policy for Company’s Office Holders

Dated: November 2, 2023

1. Introduction

| 1.1 | Pursuant to the provisions of the Companies Law, 1999 (hereafter – the “Companies Law”), on September 13, the Company’s compensation committee of the board of directors (the “Compensation Committee”) and the Company’s board of directors (the “Board of Directors”), respectively, approved a compensation policy (hereafter – the “Policy”) with respect to the terms of service and / or employment of Company’s office holders (hereafter - the “Office Holder”). |

| 1.2 | The provisions of the Policy shall be subject to the provisions of any cogent law applicable to the Company and its Office Holders in any territory. |

| 1.3 | The underlying principles and purposes of the Policy are as follows: (a) promoting the Company’s goals, its work plan and its policy for the long-term; (b) compensating and providing incentives to office holders, while considering the risks that the Company’s activities involve; (c) adjusting the compensation package to the size of the Company and the nature and scope of its activities; (d) creating incentives that are suitable to Company’s office holders by compensating those entitled for compensation under the Policy in accordance with their positions, areas of responsibility and contribution to the development of the Company’s business, the promotion of its targets and the maximization of profits in the short and long-term, taking into account, among other things, the need to recruit and retain qualified, highly-skilled officers in a global and competitive market; and (e) adjusting the compensation of office holders to the contribution of the office holder to the achievement of the Company’s goals. |

| 1.4 | This Policy is a multi-annual policy that will be effective for a period of five (3) years from the date of its approval. This policy shall be brought forward for re-approval by the Company’s compensation committee of the Board of Directors (the “Compensation Committee”), the Company’s Board of Directors and the general meeting of its shareholders after five (3) years have elapsed since the date of approval thereof and so forth, unless any changes need to be made to the Policy in accordance with the law and/or in accordance with the Company’s needs. |

| 1.5 | Without derogating from the provisions set out in Section 1.4 above, the Company’s Compensation Committee and Board of Directors shall examine, from time to time, whether the compensation that is granted under this policy, does, indeed, comply with the terms of this policy and the parameters set therein for each Company office holder. |

| 1.6 | This Policy is based, among other things, on the Company’s assessments as to the competitive environment in which it operates and the challenge it faces in recruiting and retaining high-quality officers in such an environment; it is also based on employment terms generally accepted in public companies operating in the Company’s area of activity and on existing employment agreements between the Company and its office holder, which – in order to remove any doubt – this policy cannot change and does not create a commitment between the company and its office holders. |

| 1.7 | For the avoidance of doubt, any compensation of office holders (as defined below), which are controlling shareholders (as the meaning of “control” is defined in the Companies Law- 5759-1999) (the “Companies Law”), if applicable, may require additional approvals under applicable law. |

2. The Policy

| 2.1 | Definitions |

“Applicable Law” shall mean any applicable law, rule, regulation, statute, extension order, judgment, order or decree of any federal, state or local governmental, regulatory or adjudicative authority or agency, of any jurisdiction, and the rules and regulations of any stock exchange or trading or quotation system on which the securities of the Company are then traded, listed or quoted.

“Board of Directors” means the Board of Directors of the Company.

“Change of Control Event” means (i) acquisition (including an exchange) of more than 50% of the share capital of the Company by non-Affiliate holder, or a sale (including an exchange) of all or substantially all of the shares of the Company to any person, or a purchase by a shareholder of the Company or by an Affiliate of such shareholder of all the shares of the Company held by all or substantially all other shareholders or by other shareholders who are not Affiliated with such acquiring party; (ii) a sale of all or substantially all of the assets of the Company; and (iii) a merger (including, a reverse merger and a reverse triangular merger), consolidation amalgamation or like transaction of the Company with or into another corporation. It is clarified that the Company’s Board of Directors will be entitled to change the definition of “Change of Control Event” at any time.

“Committee” means the Compensation Committee of the Board, within the meaning of the Companies Law.

“Companies Law” means the Israeli Companies Law, 5759-1999 together with the regulations promulgated thereunder, all as amended from time to time.

“Office Holder” or “Executive” means as set forth in the Companies Law. To the extent that an Office Holder’s or an Executive’s engagement or service is not through employment relations with the Company or any Affiliate thereof, then this Policy shall apply, with the necessary changes and any reference to basic and/or gross salary shall apply to the respective consultation and/or service fees, which shall be calculated as the basic and/or gross salary defined pursuant to this Policy, as may be amended from time to time, multiplied by 1.4.

“Subordinate office holder” Office holder subordinate reporting directly to the CEO.

“Foreign office holder” Office holder in the position of CEO or subordinate office holder who his / her residency is outside of Israel.

“Terms of Office and Engagement” means as defined in the Companies Law.

Terms not otherwise defined herein shall have the meaning ascribed to them in the Companies Law unless the context dictates otherwise. To the extent any provision herein conflicts with the conditions of any Applicable Law, the provisions of the Applicable Law shall prevail over this Policy and the Board is empowered hereunder to interpret and enforce such prevailing provisions. Whenever the context may require, any pronoun shall include the corresponding masculine, feminine and neuter forms. The words “include”, “includes” and “including” shall be deemed to be followed by the phrase “without limitation”. References to any law or regulation, rule, or ordinance, including any section or other part thereof, shall refer to that as amended from time to time and shall include any successor law. The use of captions and titles in this Policy is for the convenience of reference only and shall not affect the meaning of any provision of this Policy.

Nothing in this Policy shall confer upon any person, including, any Executive, any rights, entitlements, benefits or remedies whatsoever, including any right or entitlement to any compensation, remuneration or benefits of any kind or nature or to interfere with or limit in any way the right and authority of the Company or any its Affiliates to determine any compensation, remuneration or benefits or to terminate the service or employment of any Executive. The Terms of Office and Engagement of an Executive shall only be as set in an agreement between such Executive and the Company or its Affiliates or in a written undertaking of the Company or its Affiliates or in a resolution of the relevant organ of the Company or such Affiliate setting forth the Terms of Office and Engagement and their applicability to the relevant Executive, and, in each case, as prescribed by Applicable Law. No representation or warranty is made by the Company in adopting this Policy, and no custom or practice shall be inferred from this Policy or the implementation thereof, which is specific and applied on a case-by-case basis.

To the extent that after the date on which this Policy is approved in accordance with the Companies Law, relief is granted as to the mandatory or minimum requirements prescribed by Applicable Law to be included in a Compensation Policy as of the date hereof, or any limitation contained in this Policy is more stringent than that required by Applicable Law, than such relief or less stringent limitation shall be deemed incorporated by reference into this Policy notwithstanding anything else to the contrary, unless otherwise determined by the Board.

Terms of Office and Engagement of any Executive that were in effect prior to the date of adoption of this Policy, and were in compliance with prior compensation policies or Company practices, will remain in effect even if those may not be in compliance, in full or in part, with this Policy.

| 2.2 | Components of the Policy |

In accordance with the Policy, the compensation of the Company’s Office Holders shall be based on all or some of the following components:

| 2.2.1 | Basic salary component– refers to the monthly salary of that employee, excluding any social benefits and related benefits, and in respect to compensation paid as consultancy fee or equivalent (to a non-employee Office Holder) – the monthly gross consultation fees, excluding VAT (if applicable). |

| 2.2.2 | Social and related benefits - social benefits as prescribed by local law (pension savings, contributions towards severance pay, contributions towards training fund, vacation pay, sick leave, recreation pay, etc.) and related benefits, such as company vehicle/vehicle maintenance, telephone expenses, laptop, meals at the workplace, gifts on public holidays, etc. |

| 2.2.3 | Variable cash compensation (bonus) – short and medium-term compensation, which includes annual bonuses, which are based on results and achievement of targets. The Company may also determine that a certain Office Holder will be paid discretionary annual / one-time / special bonuses, considering his/her contribution to the Company and the restrictions placed under this policy. |

| 2.2.4 | Variable equity-based compensation– equity-based payment or another long-term compensation (subject to the existence of valid long-term compensation plans and provided that the Company decides to award such compensation). |

(the components in sections 2.2.3 and 2.2.4 above shall be referred together hereafter as: “variable components”).

At the time of approval of the compensation package of an Office Holder, the Compensation Committee and Board of Directors of the Company shall assess the compliance of each of those components and of the total cost of employment and/or consultancy fee with the criteria set out in this plan.

Any deviation of up to 10% from the ratios and caps set forth in this policy shall not be deemed as a deviation from this Policy.

The Company may determine that an office holder’s salary shall be linked to a certain currency or index (regarding basic salary, benefits, and other related benefits).

| 2.3 | Parameters for reviewing compensation terms |

Generally, some or all of the following parameters will be considered when reviewing the compensation terms of an Office Holder:

| 2.3.1 | Education, skills, expertise, tenure (specifically in the Company and in the Office Holder’s field of expertise in general), professional experience and achievements of the Office Holder; |

| 2.3.2 | The role of the Office Holder, his areas of responsibility and his employment or services terms under previous wage agreements entered into with this Office Holder; |

| 2.3.3 | The Office Holder’s contribution to the Company’s business, the achievement of its strategic goals and implementation of its work plans, the maximization of its profits and the enhancement of its strength and stability. |

| 2.3.4 | The extent of responsibility delegated to the Office Holder. |

| 2.3.5 | The Company’s need to recruit or retain an Office Holder with unique skills, knowledge, or expertise. |

| 2.3.6 | Whether a material change has been made to the role or function of the Office Holder, or to the Company’s requirements regarding this Office Holder. |

| 2.3.7 | The size of the Company and the nature of its activities. |

| 2.3.8 | As to service and employment terms that include retirement grants – the term of service or employment of the Office Holder, the terms of his service and employment over the course of this period, the Company’s performances in the said period, the Office Holder’s contribution to the achievement of the Company’s goals and the circumstances of the retirement. |

| 2.3.9 | (a) The market conditions of the industry in which the Company operates at any relevant time, including the Office Holder’s salary or consultation fee compared to the salaries or consultation fees of other office holders working in similar positions (or in position of comparable level) in companies whose characteristics are similar to those of the Company in terms of its activity (as described in section 2.3.1 below); (b) the availability of suitable candidates that can serve as Office Holders in the Company, the recruitment and retainment of the Office Holders and the need to offer an attractive compensation package in a global competitive market; and (c) changes in the Company’s area of activity and in the scope and complexity of its activities. |

| 2.4 | Payroll review |

| 2.4.1 | For the purpose of determining the payroll that can be offered to an Office Holder upon recruitment, the Company will review from time to time the payroll generally accepted in the relevant markets for similar positions in companies, which are similar to the Company in terms of its area of activity/scope of activity/complexity of activity/market value/revenues and other relevant parameters (if such companies exist). |

| 2.4.2 | The payroll review will be conducted by the Company itself, or by an external advisor, at the Company’s discretion, after the Compensation Committee has issued its recommendations regarding this matter. |

| 2.5 | Basic salary, benefits, and other related benefits |

| 2.5.1 | The basic salary of an Office Holder shall be determined taking into account the parameters described in section 2.3 above and the conclusions of the payroll review described in section 2.4 above (should such a review be conducted). |

| 2.5.2 | The basic salary shall be in absolute numbers and will include additional costs as requires by applicable law and according to Office Holders position (such as a Company vehicle etc.). |

The Compensation Committee and the Board of Directors may decide to exchange basic salary with equity-based compensation, either in whole or in part, by issuing Restricted Shares (“RS”) or Restricted Shares Units (“RSU”) or options to purchase Ordinary Shares (“Options”) which may be granted in the minimum par value per share and allowed under applicable law and may be vested on a monthly basis, in accordance with applicable law.

In such case the calculation of the RS or RSU or Options value in comparison to the basic salary will be times 1.25 of the basic salary for the relevant month.

| 2.5.3 | In any case, the basic monthly gross salary, or alternatively, the monthly services fees (as defined above) shall not exceed the maximum amount set out below (linked to the Consumer Price Index commencing June 2023): |

| Position* | Maximum basic monthly gross salary* | |||

| Active Chairperson of the Board of Directors (“Active Chairperson”)** | NIS | 90,000 | ||

| Company’s CEO (“CEO”) | NIS | 90,000 | ||

| Subordinate Office Holders | NIS | 80,500 | ||

| Foreign office Holder | USD | 25,000 | ||

| * | The amounts presented above are in respect of a full-time position (other than the Active Chairperson); those amounts shall change in proportion to the scope of position of the Office Holder. |

| ** | Unless the Active Chairperson hold another position in the Company, in which case he will not be entitled to a double compensation. |

| 2.5.4 | Social benefits14, related benefits, reimbursement of expenses |

The Terms of Office and Engagement of an Executive will include benefits or entitlements mandated by Applicable Law and may include benefits generally acceptable in the local market or industry or generally available to other employees of the Company (or any applicable Affiliate or division) in accordance with Company policies, including (without limitation) the following benefits listed below. For avoidance of doubt, Executives who are based outside of Israel may receive other similar, comparable, or customary benefits as applicable in the relevant jurisdiction in which they are employed.

| (a) | Pension, including 401K |

| (b) | Education Fund |

| (c) | Severance pay |

| (d) | Managers insurance |

| (e) | Medical insurance (including vision and dental) and life insurance, including with respect to immediate family members |

| (f) | Disability insurance |

| (g) | Leased car or company car, as well as bearing the cost of related expenses or reimbursement thereof, or the value of the use thereof, including the gross up of car use value, or transportation allowance. |

| (h) | Telecommunication and electronic devices and communication expenses, including (without limitation) cellular telephone and other devices, personal computer/laptop, Internet, or the value of the use thereof. |

| (i) | Paid vacation and the number of vacation days that may be accrued, including, if applicable, the redemption thereof |

| (j) | Sick days |

| (k) | Holiday and special occasion gifts |

| (l) | Recuperation pay |

| (m) | Expense reimbursement (including domestic and international travel expenses and per diem payments) |

| (n) | Payments for meals during working hours, according to the Company’s policy for all employees |

| (o) | Payments or participation in relocation and related costs and expenses |

| (p) | Loans or advances (subject to Applicable Law) |

| (q) | Professional or academic courses or studies |

| 14 | As to an office holder that has entered into engagement with the Company whereby no employer-employee relationship exists, the Company may pay the social benefits described above on top of his monthly fee in lieu of the said expenses. |

| (r) | Newspaper or online subscriptions |

| (s) | Professional membership dues or subscription fees |

| (t) | Exculpation and indemnification to the fullest extent permitted by Applicable Law |

| (u) | Directors’ and officers’ liability insurance, to the fullest extent permitted by Applicable Law. |

| 2.5.5 | Any of the above benefits may include gross up of taxes and/or mandatory payments required to be made by Applicable Law. |

| 2.5.6 | Insurance, indemnification, and exemption |

D&O Insurance

| 2.5.6.1 | The Company’s Office Holders, as may be from time to time, shall be entitled to benefit from coverage provided by liability insurance of directors and Office Holders, which the Company will purchase from time to time (the “D&O Insurance”). |

| 2.5.6.2 | The D&O insurance and any extension, renewal or replacement of the D&O Insurance, may be approved by the Committee alone (and the Board of Directors, if required by law), if the insurance policy meets the following criteria and provided that the engagement with the insurer is entered into under market conditions and will not have a material effect on the Company’s profitability, its assets or liabilities: |

| a. | The limit of insurer’s liability under the insurance policy (including Side “A” coverage) shall not exceed US$50,000,000 (fifty million U.S. Dollars) per claim and during the insurance period covered by that policy, plus reasonable litigation expenses in excess of the abovementioned limit. |

| b. | The total annual premium that the Company will pay to an insurance company for the Office Holders liability insurance as described above, shall be (i) determined by the Company’s Compensation Committee and after consulting with an insurance expert; and in market conditions and in an immaterial cost at the time of purchasing; or (ii) Shall not exceed a total of $1,000,000. |

| c. | the Committee has determined that the sums are reasonable considering the Company’s exposures covered under such policy, the scope of cover and the market conditions, and that the D&O Insurance is on market terms and shall not have a material impact on the Company’s profitability, assets, or liabilities. |

| 2.5.6.3 | Run Off Coverage- Upon circumstances to be approved by the Committee (and, if required by law, by the Board), the Company shall be entitled to enter into a “run off” Insurance Policy of up to seven (7) years, with the same insurer or any other insurance (the “Run Off Coverage”). The limit of liability of the insurer shall not exceed US$30 million per claim and in the aggregate for the term of the policy, the premium for the insurance period shall not exceed 400% of the last paid annual premium and the deductible (except for extraordinary matters as prescribed in the D&O Insurance, such as lawsuits against the Company pursuant to securities laws and/or lawsuits to be filed in the US/Canada) shall not exceed US$150,000 per claim. The Run Off Coverage, as well as the limit of liability and the premium for each extension or renewal, shall be approved by the Committee which shall determine whether the sums are reasonable considering the Company’s exposures, the scope of coverage and market conditions and if the Run Off Coverage reflects then prevailing market conditions, and, provided, further, that the Run Off Coverage shall not materially affect the Company’s profitability, assets or liabilities. |

| 2.5.6.4 | The insurance policy may include an entity cover that will cover the Company itself in case of lawsuits filed against it under the securities law (whether those lawsuits are filed only against the Company and whether they are filed against the Company and Office Holder thereof or an Office Holder in its related companies). Such cover will be subject to priorities for payment of any insurance benefits according to which the rights of the Directors and Officers to receive indemnity from the Insurer’s take precedence over the right of the Company itself. |

| 2.5.6.5 | In this section 2.5.6.2, if the overages do not exceed 10%, this will not be considered as an exemption of the Policy. |

Indemnification and Exemption

| 2.5.6.3 | The Company’s Office Holders may be entitled to an indemnification arrangement in accordance with arrangements that are normally acceptable and subject to the provisions of the law and the Company’s articles of association. The overall amount of indemnification per event to each office holder and to all office holders together, individually or in aggregate, shall not exceed the greater of: (i) 25% of the effective shareholders’ equity of the Company; or (ii) $5 million (the maximum indemnification amount). |

For that purpose, the “effective shareholders’ equity of the Company” means the amount of the Company’s shareholders’ equity in accordance with the last consolidated audited or reviewed financial statements of the Company (as applicable) at the time of actual payment of the indemnification. It is hereby clarified that the indemnification shall be paid in excess of any amount paid under the liability insurance of directors and office holders, which the Company has purchased or will purchase from time to time.

| 2.5.6.4 | Company Office Holders may be entitled to an exemption arrangement in accordance with arrangements that are normally acceptable and subject to the provisions of the law and the Company’s articles of association. |

| 2.6 | Compensation in connection with termination of employment |

| 2.6.1 | Advance Notice Period |

| 2.6.1.1 | An Office Holder may be entitled to advance notice period or payment in lieu of advance notice period, as follows: |

Active Chairperson: up to 6 months advance notice period.

CEO: up to 6 months advance notice period.

Subordinate Office Holder: up to 6 months advance notice period.

Foreign Office Holder: up to 6 months advance notice period.

| 2.6.1.2 | Over the course of the advance notice period, the Office Holder shall continue to do his job in the Company at the request of the Company, unless the Company decides that he will not do so, in which case the Office Holder may be entitled to continue and receive over the advance notice period all employment and service terms, which were agreed upon in his employment agreement. |

| 2.6.1.3 | The service or employment terms of the Office Holders may include a provision whereby the Company may terminate the services or employment of the Office Holder without an advance notice period in cases which deny eligibility for severance pay according to the law, including the following cases: (a) conviction of an offence involving moral turpitude; (b) an Office Holder who will conduct himself in a disloyal and/or unreliable and/or dishonest manner in his relations with the Company and/or while carrying out actions on its behalf and/or will harm the Company’s reputation; (c) in case the Office Holder will breach the confidentiality duty towards the Company and/or his duty to protect the Company rights which were developed due to or as part of his work at the Company; (d) Any other case in which the Company is legally entitled to refrain from payment of severance pay. |

| 2.6.3 | Retirement Terms |

| 2.6.3.1 | The retirement terms of Office Holders shall be determined by the Compensation Committee and the Board of Directors, in accordance with the following table, while considering, among other things, the parameters set out in section 2.3 above, the terms of service and employment over the course of this period, his contribution to the achievement of the Company’s and the circumstances of the retirement: |

| Position | Validation of the right from termination of employment / services date | |

| Active Chairperson | Up to 6 months gross salary | |

| CEO | Up to 6 months gross salary | |

| Subordinate Office Holder | Up to 6 months gross salary |

| 2.7 | Annual Bonus |

In addition to the basic salary, the compensation package of Company’s Office Holders may include eligibility to an annual bonus that is based on measurable targets and to an annual discretionary bonus (hereafter jointly: “the annual bonus”).

For the purpose of this Annual bonus section, whenever the term “salary” is used, it means (i) in the case of an employed Office Holder – the gross salary as paid to the Office Holder in the month before the grant of such bonus, including any social benefits and related benefits as detailed in section 2.5.4 and 2.5.5 herein, and in any case for the benefit of the employee; and (ii) in the case of Office Holder with no employer-employee relationship – the fee paid to the office holder in the month before the grant of such bonus, excluding VAT (if applicable).

| 2.7.1 | Components of the annual bonus |

The Company may grant an Office Holder an annual bonus up to the maximum annual bonus as described in the table in section 2.7.7 below, based on the compensation plan which will be approved by the compensation committee and the Board of Directors for each year in advance.

At the end of each year, the Compensation Committee and Board of Directors will review the office holders’ meeting their measurable targets to determine that component of the annual bonus, which is based on measurable targets.

The Compensation Committee and Board of Directors may determine to pay only part of the component of the annual bonus, which is based on measurable targets, if the office holder meets only some of the targets.

The Compensation Committee and the Board of Directors may decide to change the measurable targets at any time during the year if the change is for the best interest of the Company and for special circumstances (for example: change of job description, regulatory changes, other material events), that the Compensation Committee and Board of Directors believes that justify making such change (including retroactive change).

According to the rates stated below, the components for each of the Office Holders of the annual bonus will be:

| (i) | Measurable Targets (from the categories in the list below); |

| (ii) | Discretionary Bonus (according to the limitations set forth herein). |

| Position | Measurable Targets | Discretionary Bonus | ||

| Active Chairperson/ CEO | 0-100% | 0-25% (by Committee and Board of Directors), see section 2.7.3(1) below | ||

| Subordinate Office holders | 0-100% | 0-100% (by CEO), see section 2.7.3(2) below. |

| 2.7.2 | Measurable Targets (Company and Personal) |

Set forth below are several suggested criteria for the annual bonus that is based on measurable targets. It should be clarified that this list is not a closed and binding list. The Compensation Committee and the Board of Directors may consider adding or removing some of those criteria, considering the role of each office holder, his areas of responsibility and the Company’s activity.

A bonus that is based on meeting principal and personal performance metrics that are quantified and set out in the Company’s work plan and attributed to the relevant office holder. These performance metrics may include, among other things:

Active Chairperson and CEO Measurable Targets Criteria

| (a) | Sales and marketing targets. |