United States

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) or (g) OF THE SECURITIES EXCHANGE ACT OF 1934

or

☒ ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended March 31, 2023.

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to ____________.

☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number 001-38490

HIGHWAY HOLDINGS LIMITED

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English)

British Virgin Islands

(Jurisdiction of incorporation or organization)

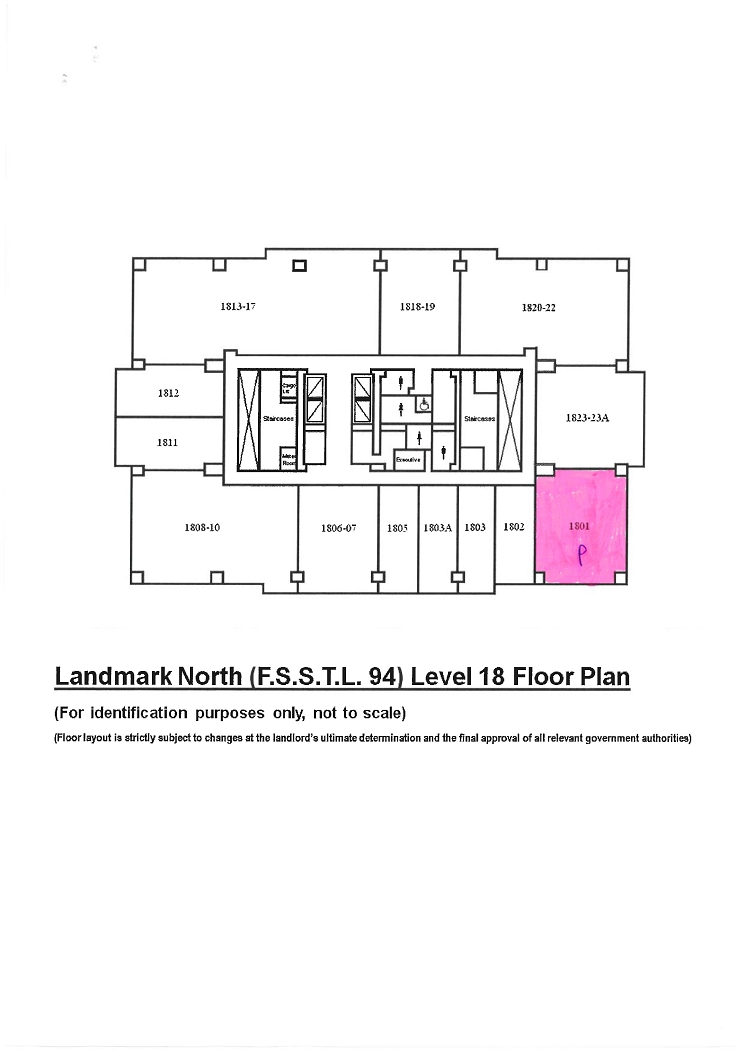

Suite 1801, Level 18, Landmark North 39 Lung Sum Avenue

Sheung Shui

New Territories, Hong Kong

(Address of principal executive offices)

Roland Kohl

Chief Executive Officer

Suite 1801, Level 18, Landmark North

39 Lung Sum Avenue

Sheung Shui

New Territories, Hong Kong

telephone: (852) 2344-4248

fax: (852) 2343-4976

roland.kohl@highwayholdings.com

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Common Shares, $0.01 par value per share | HIHO | NASDAQ Capital Market | ||

| Preferred Share Purchase Rights | N/A | NASDAQ Capital Market |

Securities registered or to be registered pursuant

to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 4,086,825 Common Shares were outstanding as of March 31, 2023.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer ☒ | ||

| Emerging growth company ☐ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registration has used to prepare the financial statements included in this filing:

| U.S. GAAP ☒ | International Financial Reporting Standards as issued by the International Accounting Standards Board ☐ | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow: ☐ Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒ This annual report contains forward-looking statements that involve risks and uncertainties.

TABLE OF CONTENTS

FORWARD - LOOKING STATEMENTS

All statements other than statements of historical facts are forward-looking statements. These forward-looking statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements.

You can identify these forward-looking statements by words or phrases such as “may,” “will,” “expect,” “is expected to,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “are likely to” or other similar expressions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements include, but are not limited to:

| ● | the Company’s goals and strategies; |

| ● | the Company’s expansion plans in Myanmar, including the operation of its manufacturing and assembly facilities at its new Myanmar factory; |

| ● | the Company’s business development, financial condition and results of operations; |

| ● | the Company’s anticipated business activities and the expected impact of these actions on its results of operations and financial condition; |

| ● | expected changes in the Company’s revenues and certain cost or expense items; |

| ● | the demand for, and market acceptance of, the Company’s products and services; |

| ● | changes in the Company’s relationships with its major customers; |

| ● | political, regulatory or economic changes in Hong Kong, Shenzhen, China, and Myanmar, such as the recent unrest in Myanmar, that affect the Company, including currency exchange rates, labor laws and worker relations, changing governmental rules and regulations, and structural factors affected manufacturing operators in general; |

| ● | the impact of the ongoing war between Russia and Ukraine on the Company, its customers and its supply chain; |

| ● | the impact of the novel coronavirus, COVID-19, on the business and operations of both the Company and on the Company’s customers; |

| ● | the impact of Germany’s recently enacted Supply Chain Due Diligence Act and similar global human and environmental rights regulations on market for products manufactured at the Company’s facilities in Myanmar; and |

| ● | general economic and business conditions affecting the Company’s major customers. |

You should read this annual report and the documents that we refer to in this annual report thoroughly and with the understanding that our actual future results may be materially different from and worse than what we expect. We qualify all of our forward-looking statements by these cautionary statements. Other sections of this annual report, including the section titled “Risk Factors” beginning on page 2, include additional factors that could adversely impact our business and financial performance. Moreover, we operate in an evolving environment. New risk factors and uncertainties emerge from time to time and it is not possible for our management to predict all risk factors and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

You should not rely upon forward-looking statements as predictions of future events. Except as required by law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise Highway Holdings Limited is a British Virgin Islands holding company that operates through various controlled subsidiaries.

CONVENTIONS

Unless the context indicates otherwise, all references herein to “the Company,” “we,” “us” or “our” refer collectively to Highway Holdings Limited and its subsidiaries, including its 84% owned subsidiary in Myanmar. References to “China” or “PRC” are to the mainland of the People’s Republic of China, excluding Hong Kong, whereas references to “Hong Kong” are to the Hong Kong Special Administrative Region of the People’s Republic of China. References to “Myanmar” are to the Republic of the Union of Myanmar. Unless otherwise stated, all references to “dollars” or $ are to United States dollars. “RMB,” “Renminbi” or “yuan” are references to the legal currency of China. “MMK” or “Kyat” are to the legal currency of Myanmar. The U.S. Securities and Exchange Commission is referred to in this Annual Report as the “SEC.”

The Company prepares its consolidated financial statements in accordance with accounting principles generally accepted in the United States of America and publish our financial statements in United States dollars.

PART I

Item 1. Identity of Directors, Senior Management and Advisers

Not Applicable

Item 2. Offer Statistics and Expected Timetable

Not Applicable

Item 3. Key Information

RISK FACTORS

The Company’s business and operations involve numerous risks, some of which are beyond the Company’s control, which may affect future results and the market price of the Company’s Common Shares. Investors should take into accounts the risks described below, and the other information contained in this Annual Report, when evaluating an investment in the Company.

Risks Related To Doing Business In China And Myanmar.

The Military Coup In Myanmar Has Negatively Affected, And May Continue to Negatively Impact, the Company’s Operations In Myanmar. The Company operates two manufacturing and assembly facilities, one of which is located in Yangon, Myanmar. The Myanmar facility generated 42% of the Company’s revenues in the fiscal year ended March 31, 2023. On February 1, 2021, Myanmar’s military seized control of the government, declared a state of emergency for the upcoming year, and reportedly placed the country’s civilian leader under house arrest. The U.S. State Department has concluded that the military takeover in Myanmar constituted a coup d’état. The military’s takeover resulted in widespread civil unrest, including in the area of Yangon in which the Company’s facilities are located, the devaluation of the Kyat, disruption to the existing banking system, and other restrictions. The civil unrest caused the Company’s Myanmar facility to be closed for about two weeks in March 2021. While no closure was caused by civil unrest in fiscal years 2022 and 2023, and operations at the Myanmar factory have mostly returned to the pre-takeover levels, the future impact of the military takeover on the Company’s operations in Myanmar remains uncertain as of the date of this report. Any loss of property or interruption of the Company’s operations resulting from political instability, civil unrest or changes in law or policy enacted by the military government could have a significant negative impact on the Company’s business operations, earnings and cash flow.

In Response To Recently Enacted Global Human and Environmental Rights Regulations Enacted In Germany And Pending in other Jurisdictions, The Company’s Customers May Prohibit Or Limit The Manufacture Of Their Products In Myanmar, Which Will Negatively Affect The Company’s Operations In Myanmar. Germany recently enacted the Supply Chain Due Diligence Act (Lieferkettensorgfaltsgesetz), which requires certain larger German manufacturers to take actions to identify and prevent suspected human rights and environmental law violations committed abroad in their supply chains, including by their direct and indirect suppliers. Germany’s new law went into effect on January 1, 2023. In order to comply with this law, German manufacturers may stop purchasing products from foreign suppliers (such as the Company) that are based in countries with bad human rights records. The European Union and various social responsibility organizations also are considering similar laws. During the fiscal years ended March 31, 2023 and 2022, revenues generated from the Company’s operations in Yangon, Myanmar, represented 42% and 47%, respectively, of the Company’s total revenues. Since the military coup in February 2021, Myanmar has been listed as one of the world’s worst human rights offenders. As a result of these social responsibility regulations and Myanmar’s human rights record, one of the Company’s larger European customers no longer accepts products manufactured by the Company at its Yangon factory. Other clients may also refuse to have their products manufactured at the Company’s Myanmar facility. In addition, China’s human rights record may cause German manufacturers to refuse to purchase products manufactured in China as well. In the event that the Company’s customers further limit or prohibit the Company from manufacturing their products in Myanmar or China, the Company’s operations and financial condition will be significantly and adversely affected. No assurance can be given that the Company’s customers will not, in the future, withdraw their work from Myanmar or China or refuse to permit their future orders from being completed at the Company’s Myanmar or Shenzhen facilities.

Changes in Labor Laws, Environmental Regulation, Safety Regulation and Business Practices, and Operating Costs in China, and in Shenzhen In Particular, Have Significantly Increased The Costs And Burdens Of Doing Business And Could Continue To Negatively Impact The Company’s Operations And Profitability. In the past, foreign-owned enterprises, such as the Company and its subsidiaries, have established manufacturing/assembly facilities in China because of China’s lower labor costs, lower facilities costs, less stringent regulations, and certain other benefits provided to foreign entities. These benefits are no longer available to most companies operating in Shenzhen, including in particular foreign-owned entities. In fact, the costs and burdens on foreign-owned companies appear to be significantly greater than on local Chinese-owned companies. The cost of operating a manufacturing business in Shenzhen have increased significantly, and the amount of governmental inspections and intrusion have further increased the costs and burdens of operating in China. These factors have significantly increased the cost of doing business in China in the past few years and have caused some of the Company’s customers to source their products from other original equipment manufacturers (“OEMs”) outside of China that have a lower cost structure than the Company has. The increased costs of manufacturing and the increased regulatory burdens have adversely affected the Company’s net sales and gross margins and may continue to do so in the future. While the Company is trying to offset the increasing costs and burdens of doing business in China (primarily by increasing automation and moving labor-intensive activities to Myanmar), no assurance can be given that in the longer term the Company will be able to continue to operate in China and/or remain viable under the new and evolving business or regulatory conditions in China.

In Response To Recently Enacted Data Security Law and Personal Information Protection Law in China, The Company May Face Additional Scrutiny From Its Operations In China. In the fall of 2021, China enacted two laws — the Data Security Law and the Personal Information Protection Law. The Data Security Law sets up a framework that classifies data collected and stored in China based on its potential impact on Chinese national security and regulates its storage and transfer depending on the data’s classification level. The Personal Information Protection Law is China’s comprehensive legislation regulating the protection of personal information. The Cyberspace Administration of China (“CAC”) has published the Administration Measures for Cyber Data Security that authorizes the relevant government authorities to conduct a cybersecurity review on a range of activities that affect or may affect national security, including listings in foreign countries by companies that possess personal data of more than one million users. We do not collect, process or use personal information of entities or individuals other than what is necessary for our business and do not disseminate such information. We do not operate mobile apps and we do not possess information on more than a million entities/individuals. Although we believe we currently are not required to obtain clearance from the CAC under the Administration Measures for Cybersecurity Review, we face uncertainties as to the interpretation or implementation of such regulations or rules, and if required, whether such clearance can be timely obtained, or at all. While we do not believe that our Chinese subsidiary is subject to cybersecurity review or requires prior approval of the CAC or the China Securities Regulatory Commission (the “CSRC”), uncertainties still exist and the current laws, regulations or policies in China could change in the future. Any future action by the Chinese government expanding the categories of industries and companies whose foreign securities offerings are subject to review by the CSRC or the CAC could significantly limit or completely hinder our ability to offer or continue to offer securities to overseas investors and could cause such securities to significantly decline in value or to become worthless. Failure to comply with these laws may lead to fines and penalties from the Chinese government and could have a significant negative impact on Company’s business operations. On March 31, 2023 the CSRC’s new Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies and certain supporting guidelines (collectively the “New Overseas Listing Rules”) went into effect. Among other things, these new regulations provide that certain PRC domestic companies seeking to offer and list securities, either directly or indirectly, in overseas markets, must file with the CSRC an application for an overseas offering or listing. Currently, we do not believe that any effective laws or regulations in the PRC explicitly require us to seek approval from the CSRC or any other PRC governmental authorities in order to offer and sell our securities in the U.S. However, since the New Overseas Listing Rules are newly published and there is substantial uncertainty surrounding the implementation and enforcement thereof, we cannot assure you that, if required, we would be able to complete the filings and/or fully comply with the relevant new rules, on a timely basis or at all.

Changing Internal Fiscal, Regulatory and Political Changes Continue to Negatively Affect The Company’s Operations in China. Many of the Company’s key functions, including tool design and manufacturing, engineering, administration, and automated manufacturing, are conducted from the Company’s facilities in China. As a result, the Company’s operations and assets are affected by the political, economic, legal and other uncertainties associated with doing business in China. Changes in policies by the Chinese government to its laws, regulations, or the interpretation thereof, the imposition of confiscatory taxation, restrictions on imports and sources of supply, currency re-valuations, or the expropriation of private enterprises, could materially adversely affect the Company. For example, foreign-owned enterprises, including the Company, have been subject to numerous governmental inspections and have been subjected to additional burdensome regulations and, on occasion, to cash penalties and fines. Certain of the recent actions by Chinese government authorities appear to be intended to force the Company, and other foreign businesses, out of Shenzhen, China. While the Company has, to date, been able to continue its operations in China despite these changes and additional burdens, no assurance can be given that the increasing regulations and the more restrictive government policies will not, in the future, cause the Company’s operations to become financially untenable or otherwise materially affect its business, operations and financial condition.

Political Or Trade Controversies Between China And The United States Could Harm The Company’s Operating Results Or Depress The Company’s Stock Price. Relations between the U.S. and China have during the past few years been strained as a result of various economic and geopolitical disputes between the countries. These political and economic issues have resulted in tariffs being imposed by both China and the U.S. and have resulted in the imposition of restrictions on the import/export of certain products. Although the Company’s sales to the U.S. were not substantial during the last fiscal year, and the Company does not import raw materials from the U.S., the political tensions between the two countries could negatively affect the Company’s operations in China and its ability to transact with U.S. customers. No assurance can be given that these, and any other future controversies will not negatively affect the Company’s business and operations in China. In addition, the political and trade friction between the U.S. and China could adversely affect the prevailing market price for the Company’s Common Shares. The Company, whose shares are publicly listed on the U.S. Nasdaq stock market, could be perceived in China to be an American company and, as such, could face persecution in various forms from the government. Similarly, because the Company operates in Shenzhen, China, the Company could be perceived to be a Chinese company by U.S. investors. These trade or political disputes between the U.S. and China could affect U.S. investors’ perception of China-based manufacturing companies listed on U.S. stock markets, which could adversely affect the Company’s stock price.

Increased Wages And The Other Costs Of Labor in China Have a Material Negative Impact The Company’s Operations And Continue to Increase Its Operating Costs. Wages in China in general, and in Shenzhen in particular, have significantly increased during the past few years. Increases in wages has also resulted in increases in employer contributions for various mandatory social welfare benefits for Chinese employees that are based on percentages of their salaries. These increases in the cost of labor will continue to increase the Company’s operating costs, will reduce the Company’s gross margins, and may continue to result in the loss of customers who may seek, and are able to obtain, comparable products and services in lower-cost regions of the world or from certain local Chinese companies that receive governmental support of subsidies.

The Company May Be Subject To Significant Employee Termination Payment Obligations In China. Under China’s labor laws, the Company’s local employees are entitled to receive significant employment termination payments if the Company terminates their employment. Although the Company has been reducing the amount of this potential liability by not replacing its Shenzhen factory employees who resign or otherwise leave, any mass layoff could trigger the sudden payment of the entire severance payment obligation. While the Company has been accruing these severance payments as a liability on its financial statements (as of March 31, 2023, the Company accrued $1,193,000 of severance liabilities), the sudden obligation to pay all of these accrued amounts could result in a significant decrease in the Company’s cash reserves.

The Company’s Shenzhen, China, Leases Could Subject the Company To Substantial Future Risks and Costs. The Company’s engineering, research and development, and its automated manufacturing facilities are currently still located in Long Hua, Shenzhen, China. In February 2023 the Company extended its leases for much of this facility until February 28, 2026 (the Company has also reduced the amount of space it now leases in Shenzhen to reflect its decreased operations in China). Due the increasing rental rates and changes in the local regulatory environment that disfavors manufacturing facilities, it is uncertain if the Company will be able to renew its lease in 2026 on acceptable terms, or at all. In the event that the Company cannot, or does not renew its Shenzhen lease, the Company will incur significant costs to relocate its facilities, and its operations could be significantly disrupted. In addition, the termination of the Shenzhen leases may require the Company to terminate or relocate its Shenzhen employees, which events would trigger the Company’s significant severance payment obligations to its remaining China-based employees.

The Company’s Myanmar Subsidiary Faces Various Risks Related To Its Operations In That Underdeveloped Country. The Company’s labor-intensive manufacturing operations are currently conducted in Yangon, Myanmar (formerly Burma). The Company currently owns 84% of Kayser Myanmar Manufacturing Company Ltd. (“Kayser Myanmar”), a foreign company authorized to operate in Myanmar. Kayser Myanmar operates from a factory facility in Yangon. The Company has also transferred a substantial portion of its non-automated manufacturing equipment from its Shenzhen, China, operations to the Kayser Myanmar facilities in order to enable the Myanmar company to assemble and manufacture more of the Company’s products in Myanmar. However, operating in an underdeveloped country such as Myanmar is subject to numerous risks and uncertainties. These risks include labor relations issues (including strikes), lack of infrastructure, uncertain rules and regulations, unpredictable access to utilities (including electricity), cultural and political issues with local governmental authorities, antiquated banking systems, and the lack of international financing expertise. As discussed above, as a result of the enactment of the Supply Chain Due Diligence Act (Lieferkettensorgfaltsgesetz), one of the Company’s larger European customers no longer purchases products manufactured by the Company at its Yangon factory. Other clients may also refuse to have their products manufactured at the Company’s Myanmar assembly facility. The operations in Myanmar also are subject to the currency risks associated with the Myanmar Kyat (MMK), the official currency of that country. Myanmar recently permitted the exchange rate between the Kyat and the U.S. dollar to fluctuate, which fluctuations could materially change the cost of operating in Myanmar. No assurance can be given that unfavorable currency fluctuations will not occur in the future.

Uncertain Legal System and Application of Laws May Adversely Affect The Company’s Properties And Operations In Both China And Myanmar. The legal systems of China and Myanmar are often unclear and are continually evolving, and there can be no certainty as to the application of laws and regulations in particular instances. While China has an increasingly comprehensive system of laws, the application of these laws by the existing regional and local authorities is often in conflict and subject to inconsistent interpretation, implementation and enforcement. New laws and changes to existing laws occur quickly, sometimes unpredictably, and often arbitrarily. As is the case with all businesses operating in both China and Myanmar, the Company often is also required to comply with informal laws and trade practices imposed by local and regional administrators. Local taxes and other charges are levied depending on the local needs for tax revenues and may not be predictable or evenly applied. These local and regional taxes/charges and governmentally imposed business practices often affect the Company’s cost of doing business and require the Company to constantly modify its business methods to both comply with these local rules and to lessen the financial impact and operational interference of such policies. While the Company has, to date, been able to increase its compliance with the regulations and operate within the newly enforced rules and business practices, no assurance can be given that it will continue to be able to do so in the future. The judiciary systems in China and Myanmar are relatively inexperienced in enforcing the laws that govern businesses, thereby making it difficult, if not impossible, to obtain swift and equitable enforcement of violations of law against the Company.

The Company’s Operations In Myanmar Are Dependent Upon Its Leased Factory Complex In Yangon, Myanmar, And The Loss Or Interference With That Lease Would Materially, And Adversely, Affect The Company’s Operations In Myanmar. On March 29, 2019 Kayser Myanmar entered into a 50-year lease for an approximately 6,900 square meter (1.67 acres) factory estate in Yangon. Kayser Myanmar advanced $950,000 to the landlord as a prepayment of rent under the lease (at currency conversion rate in effect at that time, the prepayment represents approximately 12 years of rental payments), and has spent approximately $600,000 on refurbishing the complex and building one new factory building and a new office building at the site. Accordingly, this new facility represents a significant long-term investment by the Company in its operations in Myanmar. All of Kayser Myanmar’s operations are now being conducted at this new facility. Any interference or interruption of Kayser Myanmar’s right to operate at this new facility, or a challenge to the existence or validity of the 50-year lease, including as a result of a dispute with the landlord or because of any actions or regulations by Myanmar governmental, administrative or taxation authorities, could materially negatively affect the Company’s investment in the new factory and its ability to operate in Myanmar.

The Company Has Substantial Assets In Myanmar, And Any Action By The Government To Expropriate Or Restrict Those Assets Would Materially Harm The Company. Myanmar has only recently permitted non-Myanmar businesses to operate in Myanmar. The laws governing foreign businesses regulate both the manner in which such foreign entities can operate as well as the ownership of assets by foreign entities. The laws and regulations under which foreign businesses can operate and own assets are still being developed and are changing. As a result, there is substantial uncertainty in operating in Myanmar and in owning equipment, machinery and inventory (the Company currently does not own any real estate, but it does hold a long-term lease on its factory in Myanmar). Furthermore, the status of the laws prohibiting expropriation are uncertain since the military seized control of the government in early 2021. No assurance can be given that Myanmar will not in the future adopt laws, or take actions, that affect the Company’s Myanmar assets and properties.

Labor Shortages and Employee Turnover May Negatively Affect The Company’s Operations and Profitability. One of the principal economic advantages of locating the Company’s operations in China and Myanmar has been the availability of low-cost labor. Due to the enormous growth in manufacturing in China, workers’ higher salary expectations, and the after-effects of China’s one-child policy, the Company has recently had difficulty in filling its lower cost labor needs in China. Due in part to these wage increases and labor shortages, the Company has stopped most of its labor-intensive manufacturing in China and now uses its Shenzhen facilities mostly for engineering, tool manufacturing, design, automated manufacturing, and administrative purposes. Since these functions are performed by higher paid professional employees, the Company’s exposure to the labor issues in China has been reduced. However, the cost and risks of hiring and training new employees has shifted to Myanmar where the Company now performs most of its labor-intensive manufacturing in Myanmar. Myanmar also observes an extended new year’s celebration each year in April during which the Company’s factories are closed and all workers temporarily leave. Because many of the Myanmar factory workers are migrant workers who live far from the Company’s Yangon factory, many do not return after the holidays, as a result of which labor turnover can be high at times. The Company is required to annually hire, and train, new workers.

Import Duties and Restrictions May Negatively Affect The Company’s Operations and Liquidity. China is increasingly regulating and monitoring imports of raw materials and parts by manufacturers in China, which regulations make it more burdensome and expensive to import the materials that the Company needs to manufacture its products. The Company now also has to operate under import customs contracts in Myanmar, or under bonded warehouse arrangements, in order to be able to import goods into Myanmar without paying taxes or duties. Failure by the Company or by third parties who perform transportation services for the Company to comply with the import regulations can lead to financial penalties on the Company, to additional restrictions on import activities, and could even result in the prohibition of future duty-free import/exports by the Company. Any such prohibition would adversely affect the Company’s business and operations. No assurance can be given that the Company or its transportation service providers will or will be able to fully comply with the increased import regulations.

The Increasing Rate of Inflation, Particularly In Myanmar, May Negatively Impact Our Operations. The rate of inflation in Myanmar has noticeably increased during the past few years. Inflation in Myanmar was estimated to be more than 16% per annum during the past fiscal year and appears to be at the same level this year. As a result, employee compensation and other operating expenses in Myanmar could significantly increase. Although the rate of inflation in China has been relatively modest recently, we can provide no assurance that our operations in China and Hong Kong will not be affected in the future by higher rates of inflation. Inflation could materially affect our financial performance by increasing our operating costs and expenses, including employee compensation and the cost of raw materials. Additionally, because a substantial portion of our assets from time to time consists of cash and cash equivalents and short-term investments, high inflation could significantly reduce the value and purchasing power of these assets.

The Chinese Government Exerts Substantial Influence Over The Manner In Which We Must Conduct Our Business Activities And May Intervene Or Influence Our Operations At Any Time, Which Could Result In A Material Change In Our Operations And The Value Of Our Common Stock. The Chinese government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to securities regulation, data protection, cybersecurity and other matters. The central or local governments of these jurisdictions may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations. Our business may be subject to various government and regulatory interference in the province in which we operate. We may incur increased costs necessary to comply with existing and newly adopted laws and regulations or penalties for any failure to comply. Our operations could be adversely affected, directly or indirectly, by existing or future laws and regulations relating to our business or industry. Given recent statements by the Chinese government indicating an intent to exert more oversight and control over offerings that are conducted overseas and/or foreign investment in China-based issuers, any such action could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or become worthless.

Our Ability To Transfer Funds From Our China Subsidiary is Limited by The Laws of China. We conduct our operations in China through Nissin Metal and Plastic (Shenzhen) Company Limited (“Nissin PRC”), a wholly-owned subsidiary that is registered in China. Under our current corporate structure, Highway Holdings Limited may need dividend payments or other distributions from Nissin PRC to fund any cash and financing requirements we may have. In respect of the transfer of earnings from Nissin PRC to Highway Holdings Limited, under applicable Chinese laws and regulations our Chinese subsidiary is permitted to pay dividends to us only out of its accumulated profits, if any, determined in accordance with Chinese accounting standards and regulations. Nissin PRC primarily generates its revenue in RMB, which is not freely convertible into other currencies. As a result, any restriction on currency exchange may limit the ability of our Chinese subsidiary to use its RMB revenues to pay dividends to us. The Chinese government may continue to strengthen its capital controls, and more restrictions and substantial vetting process may be put forward by State Administration of Foreign Exchange (the “SAFE”) for cross-border transactions falling under both the current account and the capital account. In addition, the Enterprise Income Tax Law of China and its implementation rules provide that a withholding tax rate of up to 10% will be applicable to dividends payable by Chinese companies to non-Chinese-resident enterprises unless otherwise exempted. To date, profits generated by Nissin PRC have mostly been reinvested in the Shenzhen factory’s operations, and we have not relied on dividends or other distributions from Nissin PRC to fund our operations outside of China. However, any limitation on the ability of Nissin PRC to pay dividends or make other kinds of payments to us in the future could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our business, pay dividends, or otherwise fund and conduct our business.

Risks Related To The Company’s Operations, Structure And Strategy.

The Company Faces On-Going Risks Related To The COVID-19 Outbreak, Particularly At Its Shenzhen, China Facility. The outbreak of the coronavirus (COVID-19) pandemic has, since early 2020, impacted the Company’s operations in China and in Myanmar. During the past three years, the COVID-19 pandemic forced the Company to close its factories in both Shenzhen, China, and Yangon, Myanmar, on several occasions. In December 2022, the Chinese government abruptly eased its strict zero-COVID-19 policies. Although the exact longer-term impact of the easing of the COVID-19 restrictions is not yet known, the sudden lifting of the COVID-19 regulations resulted in a significant increase in number of people in China who have contracted COVID-19, including many of the Company’s employees at the Company’s Shenzhen, China facility. The sudden increase in COVID-19 cases has resulted in a large increase absenteeism at the Shenzhen, China, facility in early 2023, which has in turn negatively impacted production at that facility this year. The future impact of the spread of COVID-19 on the Company’s operations in Shenzhen is unknown. In addition, the increase in COVID-19 related illnesses in China also has impacted the Company’s China-based vendors and suppliers, which could also impact the operations at the Shenzhen facility. The reduction in operations at the Shenzhen facility as result of the spread of COVID-19 in China may materially adversely affect our operating and financial results in a manner that is not currently known to us. Reduced operations by the third-party suppliers of parts and components due to the COVID-19 pandemic would likewise negatively affect our operations and could result in lost sales, higher prices and manufacturing delays. The outbreak of COVID-19 in both Shenzhen, China, and Yangon, Myanmar, currently is under control, and work is currently continuing as usual at the Company’s factories in both of these locations. However, any future closures or other restrictions, including travel restrictions, imposed as a result of COVID-19 may materially adversely affect our operating and financial results in a manner that is not currently known to us. Closures of the facilities of our third-party suppliers of parts and components due to the COVID-19 pandemic would likewise negatively affect our operations and could result in lost sales, higher prices and manufacturing delays.

The Company Is Financially Dependent On A Few Major Customers. During the years ended March 31, 2023 and 2022 the Company’s aggregate sales to its three largest customers accounted for approximately 84.8% and 76.6% of net sales respectively. While there are material benefits to limiting its customer base to a few, large, well-established and financially strong customers, having fewer customers also has significant risks. The Company’s success will depend to a significant extent on maintaining its major customers and on the businesses of its major customers. The Company could be materially adversely affected if it loses one or more of its major customers or if the business and operations of its existing major customers declines.

In addition, a substantial portion of the Company’s sales to its major customers are made on credit, which exposes the Company to the risk of significant revenue loss if a major customer is unable to honor its credit obligations to the Company. Any material delay in being paid by its larger customers, or any default by a major customer on its obligations to the Company would significantly and adversely affect the Company’s liquidity. As of March 31, 2023 and 2022, accounts receivable from the four customers with the largest receivable balances at year-end represented, in the aggregate, 90.5% and 88.1% of the total outstanding receivables, respectively. While most of the accounts receivable outstanding as of March 31, 2023 were from well-established long-time customers, 30.2% of those accounts receivable represented sales to a new customer with whom the Company first conducted business in fiscal 2022 and, therefore, does not have an established credit history. The Company also has extended a $1 million credit facility to this new U.S.-based early stage company, which facility is being used to fund the manufacture by the Company of products for this new U.S. customer. The inability or delay by that customer to fully or promptly repay the amounts drawn down on that credit facility could materially affect the Company’s financial condition.

Interruptions In Supplies Provided By The Company’s Third-Party Suppliers, Including Due To The COVID-19 Pandemic And The Ongoing War In Ukraine, May Subject The Company To External Procurement Risks That Negatively Affect Its Business. The Company depends on third-party suppliers for its raw materials and many of its components. Any disruptions to the Company’s supply chain, significant increase in component costs, or shortages of critical components, could adversely affect the Company’s business and result in lost sales, customer dissatisfaction and increased costs. Such a disruption could occur as a result of any number of events, including, but not limited to, an extended closure of or any slowdown at our supplier’s plants or shipping delays due to efforts to limit the spread of COVID-19 or implementation of post-COVID-19 policies or practices, war and economic sanctions against third parties, including those arising from the ongoing war between Russia and Ukraine, market shortages due to surge in demand for any particular part or component, increases in prices or impact of inflation, the imposition of regulations, quotas or embargoes on components, transportation delays or other failures affecting the supply chain and shipment of materials and finished goods.

Fluctuating Shipping Costs And Disruptions In Shipping Could Materially And Adversely Affect Our Business And Operating Results. Our foreign based customers purchase the products that we manufacture for them in China and Myanmar based on an expectation of timely delivery at a reasonable transportation cost. Generally, we ship our products from the ports in Hong Kong, Shenzhen, China and Yangon, Myanmar to their final destinations, and our customers bear the transportation costs of their products. Certain of our customers also transport their products by air. During the past few years, the shipping costs and availability of shipping containers have fluctuated wildly. Until recently, there was a global shipping and logistics crisis resulting in lengthy port wait times and a very significant spike in shipping costs. While shipping costs have moderated and returned to pre-COVID-19 levels, shipping costs remain volatile. Delays in the transportation of products and significant increases in shipping costs could adversely affect our customers production schedules and production costs. These factors, in turn could cause our customers to consider using suppliers closer to their facilities or even manufacturing those products themselves at their own domestic facilities. The loss of customers because of international transportation disruptions and cost fluctuations could have a material adverse effect on our business and operating results. No assurance can be given that our customers will continue to purchase our products if the delays in delivery and major shipping price increases return.

Transactions Between The Company And Its Subsidiaries May Be Subject To Scrutiny By Various Tax Authorities And Could Expose The Company To Additional Taxes. The Company operates through various subsidiaries in various countries. These subsidiaries make inter-company purchases at various prices. Under China’s enterprise income tax law, all such inter-company transactions have to be made on an arm’s-length basis and are subject to scrutiny as transfer pricing transactions between related parties. Transactions between the various subsidiaries located inside and outside of China must also meet China’s transfer pricing documentation requirements that include the basis for determining pricing between the related entities, as well as the computation methodology. The Company could face material and adverse consequences if the Chinese tax authorities determine that transactions between the Company’s various subsidiaries do not represent arm’s-length pricing regulations and, therefore, that such transactions are deemed to be structured to avoid taxes. Such a determination could result in increased tax liabilities of the affected subsidiaries and potentially subject the Company to late payment interest and other penalties.

The Company Is Highly Dependent Upon Its Executive Officers And Its Other Managers. The Company is highly dependent upon Roland Kohl, the Company’s Chief Executive Officer, and its other officers and managers. Although the Company has signed employment contracts with Mr. Kohl and certain of its other key officers/managers, no assurance can be given that those employees will remain with the Company during the terms of their employment agreements. The loss of the services of any of the foregoing persons would have a material adverse effect on the Company’s business and operations. The Company owns a $2,000,000 life insurance policy issued to insure the Company’s in the event of Mr. Kohl’s death. Mr. Kohl is the primary contact between the Company and certain of its larger customers, particularly those based in Germany. Accordingly, the resignation, retirement or other departure of Mr. Kohl from the Company could have a material negative impact on the Company’s relationship with these customers and on the Company’s ability to retain these clients.

The Company Faces Significant Competition From Numerous Larger, Better Capitalized, and International Competitors. The Company competes against numerous manufacturers for all of its current products. Such competition arises from both third-party manufacturers and from the in–house manufacturing capabilities of existing customers. Many of the larger, international competitors also operate competing facilities in Shenzhen, China, while others have also established manufacturing facilities in other low-cost manufacturing countries, which have given those competitors the ability to shift their manufacturing to those locations whenever costs at those other locations are cheaper. Many of our competitors have achieved substantial market share and many have lower cost structures and greater manufacturing, financial or other resources than we do. If we are unable to provide comparable manufacturing services and high-quality products at a lower cost than the other companies in our market, our net sales could decline.

During The Course Of The Audits Of Our Consolidated Financial Statements, We And Our Independent Registered Public Accounting Firms Identified Material Weaknesses In Our Internal Control Over Financial Reporting. If We Fail To Re-Establish And Maintain An Effective System Of Internal Control Over Financial Reporting, Our Ability To Accurately And Timely Report Our Financial Results Or Prevent Fraud May Be Adversely Affected, And Investor Confidence And The Market Price Of Our Common Shares May Be Adversely Impacted. We are subject to reporting obligations under the U.S. securities laws. Section 404 of the Sarbanes-Oxley Act of 2002 requires every public company to include a management report on such company’s internal control over financial reporting in its annual report, which report contains management’s assessment of the effectiveness of our internal control over financial reporting.

We and our independent registered public accounting firms, in connection with the preparation and external audit of our consolidated financial statements for the year ended March 31, 2023, identified material weaknesses related to internal control over financial reporting in respect of our operations in Myanmar. Following the identification of the material weaknesses and other control deficiencies, we have taken measures and plan to continue to take measures in an attempt to remedy these deficiencies. However, the implementation of these measures has not yet, and may not in the future, fully address the material weakness and deficiencies in our internal control over financial reporting.

Our management has concluded that our internal control over financial reporting was not effective as of March 31, 2023, and the following material weaknesses were identified: (i) We have not maintained sufficient internal controls over cash related controls at our Myanmar operations, which pertain to the maintenance of records in reasonable detail to accurately and fairy reflect and record cash transactions. Since the military coup in Myanmar, substantially all of our Myanmar operations are conducted through cash transactions due to governmental policies and the lack of a sophisticated financial system. Although financial transactions in Myanmar are conducted primarily with cash, the effects of poor cash controls were mitigated by the fact that, at any time, we only maintained a small balance of cash in Myanmar; (ii) We do not have sufficient and skilled accounting personnel in the Group with an appropriate level of technical accounting knowledge and experience in the application of accounting principles generally accepted in the United States commensurate with our financial reporting requirements; and (iii) We do not have appropriate and adequate policies and procedures in place in the Group to evaluate the proper accounting and disclosures of key transactions and documents. See “Item 15. Controls and Procedures—Management’s Annual Report on Internal Control over Financial Reporting.” Failure to correct these material weaknesses or failure to discover and address any other control deficiencies could result in inaccuracies in our consolidated financial statements and could also impair our ability to comply with applicable financial reporting requirements and make related regulatory filings on a timely basis. As a result, our business, financial condition, results of operations and prospects, as well as the trading price of our common shares, may be materially and adversely affected.

Fluctuations in Foreign Currency Exchange Rates Will Continue to Affect the Company’s Operations and Profitability. Because the Company engages in international trade and operates using four different currencies, the Company is subject to the risks of foreign currency exchange rate fluctuations. The Company’s operations are based in the PRC, Hong Kong and in Myanmar. However, because most the Company’s customers are located outside of these markets (primarily in Europe), the Company makes and/or receives payments in various currencies (including U.S. dollars, Hong Kong dollars and RMB), and pays its expenses in U.S. dollars, RMB, Hong Kong dollars, and MMK. As a result, the Company is exposed to the risks associated with possible foreign currency controls, currency exchange rate fluctuations or devaluations. For example, the Company realized a currency exchange gain of $32,000 and a currency exchange loss of $24,000 in the fiscal years ended March 31, 2023 and 2022, respectively. Notwithstanding its exposure to currency conversion rate fluctuations, the Company does not attempt to hedge its currency exchange risks and, therefore, will continue to experience certain gains or losses due to changes in foreign currency exchange rates. The Company does attempt to limit its currency exchange rate exposure in certain of its OEM contracts through contractual provisions, which may limit, though not eliminate, these currency risks. No assurance can be given that the Company will not suffer future currency exchange rate losses that will materially impact the Company’s financial results and condition.

The Company is Exposed to Significant Worldwide Political, Economic, Legal And Other Risks Related To Its International Operations. The Company is incorporated in the British Virgin Islands, has administrative offices for its subsidiaries in Hong Kong, and has all of its manufacturing facilities in China and Myanmar. The Company sells its products to customers in China, Europe, Hong Kong, North America and elsewhere in Asia. As a result, its operations are subject to significant political and economic risks and legal uncertainties, including changes in international and domestic customs regulations, changes in tariffs, trade restrictions, trade agreements and taxation, changes in economic and political conditions and in governmental policies, difficulties in managing or overseeing foreign operations, and wars, civil unrest, acts of terrorism and other conflicts. The occurrence or consequences of any of these factors may restrict the Company’s ability to operate in the affected region and decrease the profitability of the Company’s operations in that region.

Acquisitions Or Strategic Investments May Not Be Successful And May Harm The Company’s Operating Results. The Company has in the past acquired, invested in, or entered into strategic arrangements with other companies in China and elsewhere (including elsewhere in Asia, Europe or even in North or Central America). In order to expand its business, the Company believes that it may, once again, have to expand its operations in countries other than China and Myanmar, which may include the need to acquire and/or invest in foreign businesses or entities. Such acquisitions or strategic investments could have a material adverse effect on the Company’s business and operating results because of:

| ● | The assumption of unknown liabilities, including employee obligations. |

| ● | The Company could incur significant expenses related to bringing the financial, accounting and internal control procedures of the acquired business into compliance with U.S. GAAP financial accounting standards and the Sarbanes Oxley Act of 2002. |

| ● | The Company’s operating results could be impaired as a result of restructuring or impairment charges related to amortization expenses associated with intangible assets. |

| ● | The Company could experience significant difficulties in successfully integrating any acquired operations, technologies, customers’ products and businesses with its operations. |

| ● | To the extent that the Company uses is cash resources to acquire or establish any future foreign operations, the Company’s cash reserves could be depleted. |

| ● | Future acquisitions could divert the Company’s management’s attention to other business concerns. |

| ● | The Company may not be able to hire the key employees necessary to manage or staff the acquired enterprise operations. |

| ● | The restrictions on the transfer of funds across borders or repatriation of earnings. |

Risks Related To Regulatory Oversight And The Company’s Charter.

Certain Legal Consequences of Incorporation in the British Virgin Islands. The Company is incorporated under the laws of the British Virgin Islands, and its corporate affairs are governed by its Amended and Restated Memorandum of Association and Articles of Association and by the BVI Business Companies Act of the British Virgin Islands. Principles of law relating to such matters as the validity of corporate procedures, the fiduciary duties of the Company’s management, directors and controlling shareholders and the rights of the Company’s shareholders differ from those that would apply if the Company were incorporated in a jurisdiction within the U.S. Further, the rights of shareholders under British Virgin Islands law are not as clearly established as the rights of shareholders under legislation or judicial precedent in existence in most U.S. jurisdictions. Thus, the public shareholders of the Company may have more difficulty in protecting their interests in the face of actions of the management, directors or controlling shareholders than they might have as shareholders of a corporation incorporated in a U.S. jurisdiction. In addition, there is doubt that the courts of the British Virgin Islands would enforce, either in an original action or in an action for enforcement of judgments of U.S. courts, liabilities that are predicated upon the securities laws of the U.S.

The Company’s Rights Plan, And Certain Provisions of Its Amended and Restated Memorandum And Articles of Association May Discourage a Change of Control. In April 2018, the Company adopted a shareholder rights plan (the “Rights Plan”) that provides for the issuance of one right (“Right”) for each of our outstanding common shares. The Rights are designed to assure that all shareholders receive fair and equal treatment in the event of any proposed takeover and to guard against partial tender offers, open market accumulations, undisclosed voting arrangements and other abusive or coercive tactics to gain control of the Company or the Board of Directors without paying all shareholders a control premium. The Rights will cause substantial dilution to a person or group that acquires 15% or more of the Common Shares on terms not approved by our board of directors. The Rights Plan may discourage, delay or prevent a change in control of the Company or management that shareholders may consider favorable.

Some provisions of the Company’s Amended and Restated Memorandum and Articles of Association also may discourage, delay or prevent a change in control of the Company or management, including provisions that (1) provide that a meeting of shareholders can be called only by the Company’s Board of Directors, Chairman of the Board, Chief Executive Officer, or President and not by shareholders; (2) provide that directors of the Company may be removed only for cause, and only by the affirmative vote of the holders of at least two-thirds in voting power of the Series A Preferred Shares and a majority of the outstanding common shares; and (3) require a vote of at least two-thirds in voting power of the outstanding shares to amend these and certain other provisions of the Amended and Restated Memorandum and Articles of Association.

These provisions could make it more difficult for a third party to acquire the Company, even if the third party’s offer may be considered beneficial by many shareholders. As a result, shareholders may be limited in their ability to obtain a premium for their shares.

It May be Difficult to Serve the Company with Legal Process or Enforce Judgments Against the Company’s Management or the Company. The Company is a British Virgin Islands holding corporation with subsidiaries in Hong Kong, Myanmar and China. Substantially, all of the Company’s assets are located in the PRC, Hong Kong and Myanmar, and no assets, employees or operations are located in the U.S. In addition, all of the Company’s officers and directors reside outside of the U.S. It may not be possible to effect service of process within the United States or elsewhere outside the PRC, Myanmar or Hong Kong upon the Company’s directors, or executive officers, including effecting service of process with respect to matters arising under United States federal securities laws or applicable state securities laws. Neither the PRC nor Myanmar have treaties providing for the reciprocal recognition and enforcement of judgments of courts with the United States and many other countries. As a result, recognition and enforcement in the PRC or Myanmar of judgments of a court in the United States or many other jurisdictions in relation to any matter, including securities laws, may be difficult or impossible. Enforcement of a foreign judgment in Hong Kong or the British Virgin Islands may also be limited or affected by applicable bankruptcy, insolvency, liquidation, arrangement and moratorium, or similar laws relating to or affecting creditors’ rights generally, and will be subject to a statutory limitation of time within which proceedings may be brought.

Risks Related To Our Common Shares.

Volatility Of Market Price Of the Company’s Shares. The markets for equity securities have been volatile, and the price of the Company’s Common Shares has been and could continue to be subject to material fluctuations in response to quarter to quarter variations in operating results, news announcements, trading volume, general market trends both domestically and internationally, currency movements and interest rate fluctuations.

Exemptions Under The Exchange Act As A Foreign Private Issuer. The Company is a foreign private issuer within the meaning of rules promulgated under the U.S. Securities Exchange Act of 1934 (the “Exchange Act”). As such, and though its Common Shares are registered under Section 12(b) of the Exchange Act, it is exempt from certain provisions of the Exchange Act applicable to United States public companies including: the rules under the Exchange Act requiring the filing with the Commission of quarterly reports on Form 10-Q or current reports on Form 8-K; the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations with respect to a security registered under the Exchange Act; the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and establishing insider liability for profits realized from any “short-swing” trading transaction (i.e., a purchase and sale, or sale and purchase, of the issuer’s equity securities within six months or less), and the provisions of Regulation FD aimed at preventing issuers from making selective disclosures of material information. In addition, certain provisions of the Sarbanes-Oxley Act of 2002 do not apply to the Company. Because of the exemptions under the Exchange Act and Sarbanes-Oxley Act applicable to foreign private issuers, shareholders of the Company are not afforded the same protections or information generally available to investors in public companies organized in the United States.

While The Company Has In The Past Paid Dividends, No Assurance Can Be Given That The Company Will Declare Or Pay Cash Dividends In The Future. The Company’s policy has been to pay a cash dividend at least once a year to all holders of its Common Shares, subject to its profitability and cash position. The Company declared two dividend payments for a total of $0.20 per share in the fiscal year ended March 31, 2023 (a $0.15 per share dividend that was paid on October 7, 2022, and a $0.05 per share dividend that was paid on January 5, 2023). In addition, the Company paid a $0.10 per share dividend on July 12, 2023 to its shareholders. Dividends are declared and payable at the discretion of the Board of Directors and depend upon, among other things, the Company’s results of operations, the anticipated future earnings of the Company, the success of the Company’s business activities, the Company’s capital requirements, and the general financial conditions of the Company. Although the Company has annually paid dividends to its shareholders in the past, the Company does not expect to pay dividends during periods when the Company’s operations have not been profitable, or when the Company expects to use a material amount of its financial resources for long-term capital investments. In addition, the Company may cease making dividend payments in the event that the Company determines that retaining funds may be necessary to achieve other corporate goals, such as expanding its operations or acquiring other businesses. Accordingly, no assurance can be given that the Company will pay dividends in the future. If the Company does not pay a cash dividend, the Company’s shareholders will not realize a return on their investment in the Common Shares except to the extent of any appreciation in the value of the Common Shares.

Risk of Cybersecurity Breaches Could Adversely Affect Our Business, Revenues and Competitive Position. Security breaches and other disruptions could compromise the Company’s information and expose the Company to liability, which would cause the Company’s business and reputation to suffer. In the ordinary course of the Company’s business, the Company stores sensitive data, including business information and regarding its customers, suppliers and business partners, in the Company’s networks. The secure maintenance and transmission of this information is critical to the Company’s operations. Despite the Company’s security measures, its information technology and infrastructure may be vulnerable to attacks by hackers or breached due to employee error, malfeasance or other disruptions. Any such breach could compromise the Company’s networks and the information stored there could be accessed, publicly disclosed, lost or stolen. Any such access, disclosure or other loss of information could result in legal claims or proceedings, regulatory penalties, disrupt the Company’s operations, and damage the Company’s reputation, which could adversely affect its business, revenues and competitive position.

Uncertainty Under The Holding Foreign Companies Accountable Act That May Result In Future Delisting. On December 18, 2020, the Holding Foreign Companies Accountable Act (“HFCAA”) was enacted. Pursuant to the HFCAA, if the Public Company Accounting Oversight Board (United States), or PCAOB, is unable to inspect an issuer’s auditors for three consecutive years, the issuer’s securities are prohibited to trade on a U.S. stock exchange. The PCAOB has determined that registered public accounting firms headquartered in Hong Kong are subject to the HFCAA’s provisions. On June 22, 2021, United States Senate passed the Accelerating Holding Foreign Companies Accountable Act, which, if enacted, would decrease the number of “non-inspection years” from three years to two years, and thus, would reduce the time before our securities may be prohibited from trading or delisted if the PCAOB determines that it cannot inspect or investigate completely our auditor. On July 21, 2022 the SEC notified us that our prior registered public accounting firm, Centurion ZD CPA & Co. (“Centurion”), is a PCAOB-Identified Firm because Centurion is based in Hong Kong. On May 3, 2023 we appointed ARK Pro CPA & Co (“ARK”) as our new independent registered public accounting firm to replace Centurion. Both Centurion and ARK are headquartered in Hong Kong, which may expose us to delisting if Centurion and ARK cannot be inspected by the PCAOB. As a result, the SEC would prohibit our securities from being traded on a national securities exchange or through any other method that is within the jurisdiction of the SEC, including through over-the-counter trading, if the PCAOB was unable to inspect our auditors. On August 26, 2022, the PCAOB announced that it had signed a Statement of Protocol (the “Statement of Protocol”) with the CSRC and the Ministry of Finance of China under which the PCAOB will be given complete access to audit work papers and other information so that it may inspect and investigate PCAOB-registered accounting firms headquartered in China and Hong Kong. On December 15, 2022, the PCAOB Board determined that the PCAOB was able to secure complete access to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong and voted to vacate its previous determinations to the contrary. However, should Chinese authorities obstruct or otherwise fail to facilitate the PCAOB’s access in the future, the PCAOB Board will consider the need to issue a new determination. Whether the PCAOB will continue to be able to satisfactorily conduct inspections of PCAOB-registered public accounting firms headquartered in China and Hong Kong is subject to uncertainty and depends on a number of factors out of our, and our auditor’s, control. In the event it is later determined that the PCAOB is unable to inspect or investigate completely our auditors because of a position taken by an authority in Hong Kong or China, then such lack of inspection could cause trading in our securities to be prohibited under the HFCAA.

The Audit Report Included In Our Annual Report on Form 20-F Filed With The SEC Is Prepared By Auditors Who Are Not Inspected Fully By The PCAOB, And As Such, Investors Are Deprived Of The Benefits Of Such Inspection. Our auditor, ARK, is currently based in Hong Kong, and is required to undergo regular inspections by the PCAOB as an auditor of companies that are publicly traded in the United States and a firm registered with the PCAOB. While the PCAOB has determined on December 15, 2022 that the PCAOB was able to secure complete access to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong, whether the PCAOB will continue to be able to satisfactorily conduct inspections of PCAOB-registered public accounting firms headquartered in China and Hong Kong is subject to uncertainty and depends on a number of factors out of our, and our auditor’s, control. In the event it is later determined that the PCAOB is unable to inspect or investigate completely our auditors because of a position taken by an authority in Hong Kong or China, our auditor and its audit work would not be able to be inspected independently and fully by the PCAOB.

Inspections of other auditors conducted by the PCAOB outside Hong Kong have at times identified deficiencies in those auditors’ audit procedures and quality control procedures, which may be addressed as part of the inspection process to improve future audit quality. Should the PCAOB be prevented from inspecting our auditor’s audits and its quality control procedures, investors may be deprived of the benefits of PCAOB inspections and may lose confidence in our reported financial information and procedures and the quality of our financial statements.

Item 4. Information on the Company

Highway Holdings Limited is a manufacturing company that produces a wide variety of high-quality products mostly for large, global original equipment manufacturers - from simple parts and components to sub-assemblies and finished products. The Company’s administrative offices are located in Hong Kong, and its manufacturing facilities are located in Shenzhen in the People’s Republic of China, and in Yangon, Myanmar. The Chinese manufacturing operations are conducted by Nissin Metal and Plastic (Shenzhen) Company Limited (“Nissin PRC”), a foreign owned subsidiary that is registered in China (this type of foreign owned company is commonly known as a “Wholly Foreign Owned Enterprise” (a “WFOE”)). The Myanmar operations are conducted through Kayser Myanmar Manufacturing Company Ltd. (“Kayser Myanmar”), a company registered to operate as a foreign company in Myanmar that is 84% owned by the Company. Highway Holdings Limited has three Hong Kong-based wholly-owned operating subsidiaries (Nissin Precision Metal Manufacturing Limited; Kayser Limited; and Golden Bright Plastic Manufacturing Company Limited). Kayser Limited and Golden Bright Plastic Manufacturing Company Limited are our primary sales organizations, Nissin Precision Metal Manufacturing Limited is the parent company of Nissin PRC, and Kayser Limited is the 84% owner of Kayser Myanmar.

History and Development of the Company.

Overview. Highway Holdings Limited is a holding corporation that was incorporated on July 20, 1990 as a limited liability International Business Company under the British Virgin Islands International Business Companies Act, 1984 (the (“IBCA”). Effective on January 1, 2007, the British Virgin Islands repealed the IBCA, and simultaneously with such repeal, the Company was automatically re-registered under the BVI Business Companies Act, 2004, BVI’s corporate law that replaced the IBCA. In May 2018, the Company amended its Memorandum and Articles of Association to conform to the IBCA. Our website is www.highwayholdings.com (the information contained in our website is not a part of this Annual Report on Form 20-F and no portion of such information is incorporated herein). The SEC maintains a website at http://www.sec.gov that contains reports and other information, including this Annual Report on Form 20-F.

As of the date of this Annual Report, Highway Holdings Limited conducts all of its operations through five wholly-owned or controlled subsidiaries that carry out the Company’s business from Hong Kong, from, the Company’s principal design and manufacturing factory in Shenzhen, China, and from the manufacturing and assembly facility in Yangon, Myanmar, that is owned by its 84% owned subsidiary.

The Company began its operations in 1990 in Hong Kong as a metal stamping company. In 1991, the Company transferred the metal stamping operations to a factory in Long Hua, Shenzhen, China. From 1991 until the reorganization that commenced in 2011, the Company’s metal stamping and other operations were conducted pursuant to agreements entered into between certain Chinese companies set up by the local government and the Shenzhen City Baoan District Foreign Economic Development Head Company and its designees (collectively, the “BFDC”) (the agreements, collectively the “BFDC Agreements”). Under the BFDC Agreements, the Company’s Long Hua, Shenzhen, operations were provided with both manufacturing facilities and labor by affiliates of local government instrumentalities, for which the Company paid management fees based on a negotiated sum per factory worker, and other charges, as well as rent for the factory complex. The BFDC Agreements have been terminated, and since 2016 the Company now operates in Shenzhen, China, through Nissin PRC.

Manufacturing and Assembly Operations-- Myanmar Manufacturing Complex. The Company originally established its operations in Shenzhen, China to take advantage of the low cost of operations in China, including in particular the low cost of labor. However, as the overall costs of operating a manufacturing facility in Shenzhen increased, the cost advantages of operating in China were significantly eroded. Simultaneously, the administrative and regulatory burdens of operating in China significantly increased. More recently, the Chinese regulatory agencies have required companies operating in Shenzhen to automate and to operate as technology centers, rather than traditional manufacturing factories. As a result, the Company’s Shenzhen facilities are currently primarily used for designing, tooling, engineering, and administrative activities, and all of its manufacturing consist of automated manufacturing. The more labor-intensive operations have been moved to the Company’s Yangon, Myanmar facilities.

As a result of the increasing costs and burdens of operating in Shenzhen, and in order to lower its manufacturing costs and to remain competitive with OEMs who operate in low labor cost locations outside of China, the Company developed a two-pronged strategy:

a. In order to increase its production efficiency and reduce costs in Shenzhen, the Company now manufactures products in China primarily through automation with automated, or semi-automated equipment. As a result, the Company’s manufacturing labor force in China has now been reduced to approximately 30 workers. The Shenzhen facility is also the primary center of the Company’s product design and development, as well as the tooling for new products.