| Delaware | 001-32550 | 88-0365922 | ||||||||||||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

||||||||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

| Common Stock, $0.0001 Par Value | WAL | New York Stock Exchange | ||||||||||||

|

Depositary Shares, Each Representing a 1/400th Interest in a Share of

4.250% Fixed-Rate Reset Non-Cumulative Perpetual Preferred Stock, Series A

|

WAL PrA | New York Stock Exchange | ||||||||||||

| 99.1 | ||||||||

| 99.2 | ||||||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |||||||

| WESTERN ALLIANCE BANCORPORATION | ||||||||

| (Registrant) | ||||||||

| /s/ Dale Gibbons | ||||||||

| Dale Gibbons | ||||||||

| Executive Vice President and | ||||||||

| Chief Financial Officer | ||||||||

| Date: | January 24, 2023 | |||||||

| Western Alliance Bancorporation |  |

|||||||

| One East Washington Street | ||||||||

| Phoenix, AZ 85004 | ||||||||

| www.westernalliancebancorporation.com | ||||||||

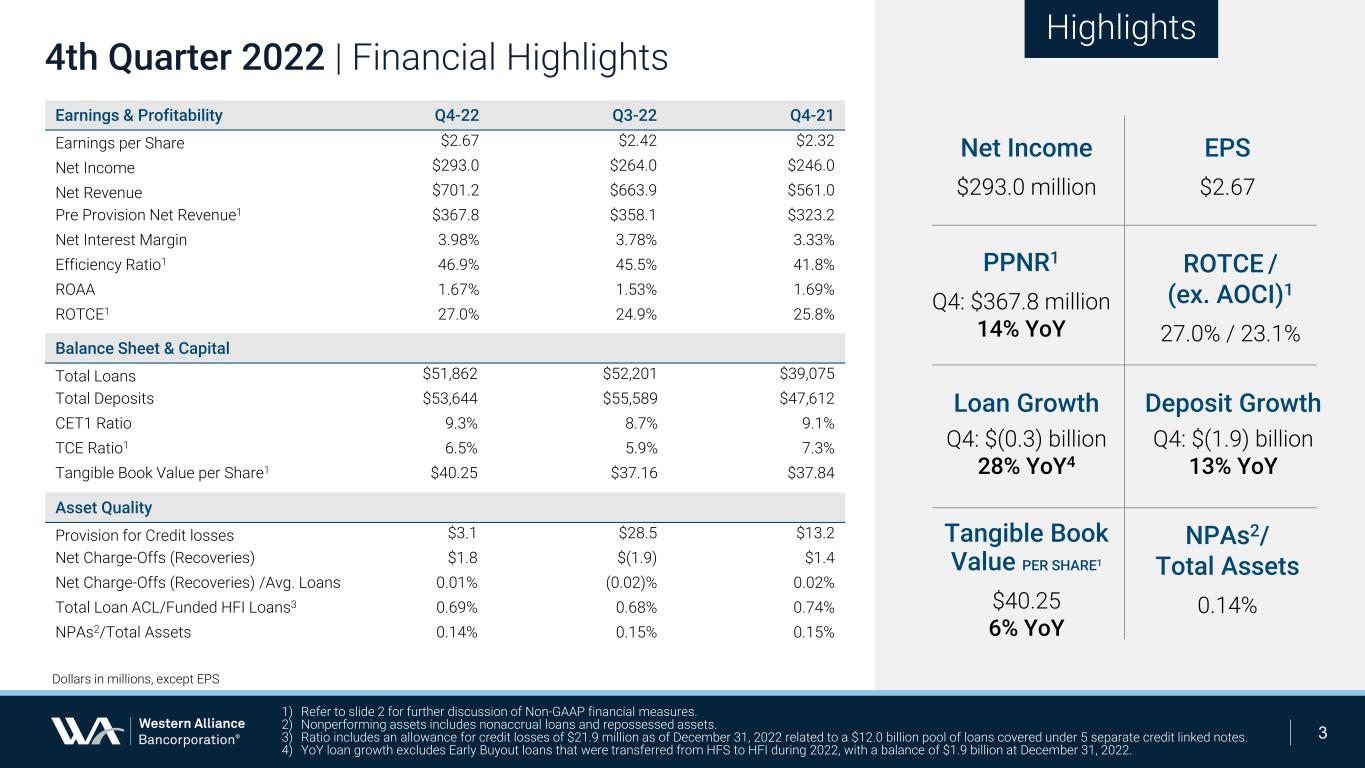

Fourth Quarter Highlights: | ||||||||||||||||||||||||||||||||

| Net income | Earnings per share | PPNR1 |

Net interest margin | Efficiency ratio1 |

Book value per common share |

|||||||||||||||||||||||||||

| $293.0 million | $2.67 | $367.8 million | 3.98% | 46.9% | $46.47 | |||||||||||||||||||||||||||

|

$40.251, excluding

goodwill and intangibles

|

||||||||||||||||||||||||||||||||

| CEO COMMENTARY: | ||||||||||||||||||||||||||

|

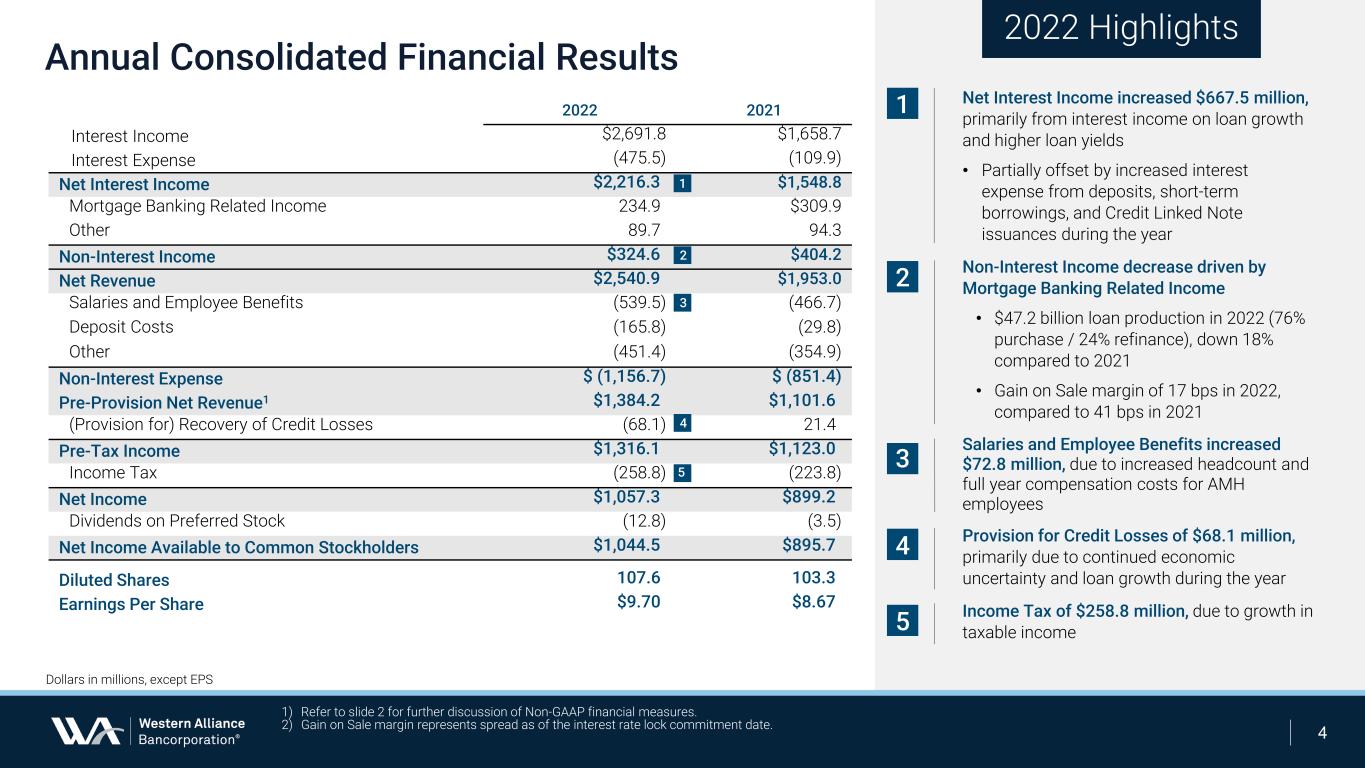

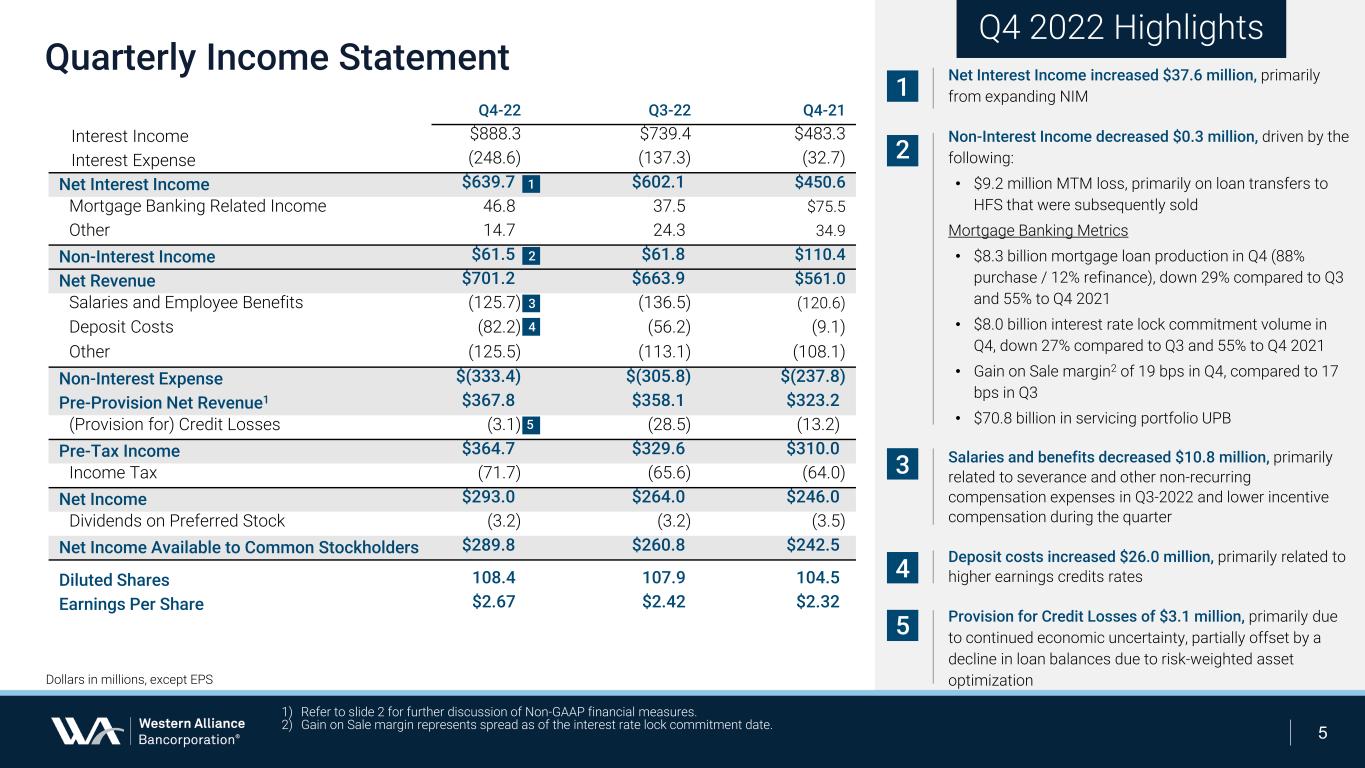

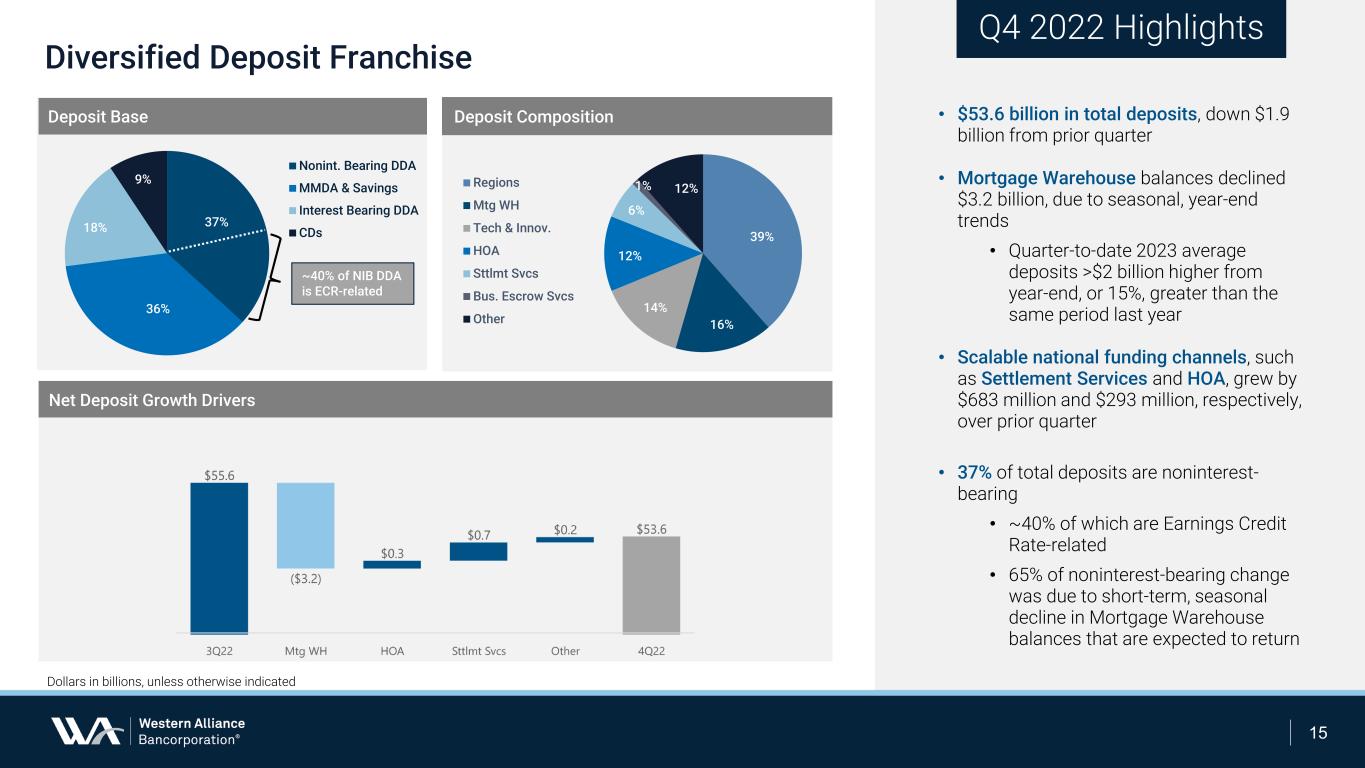

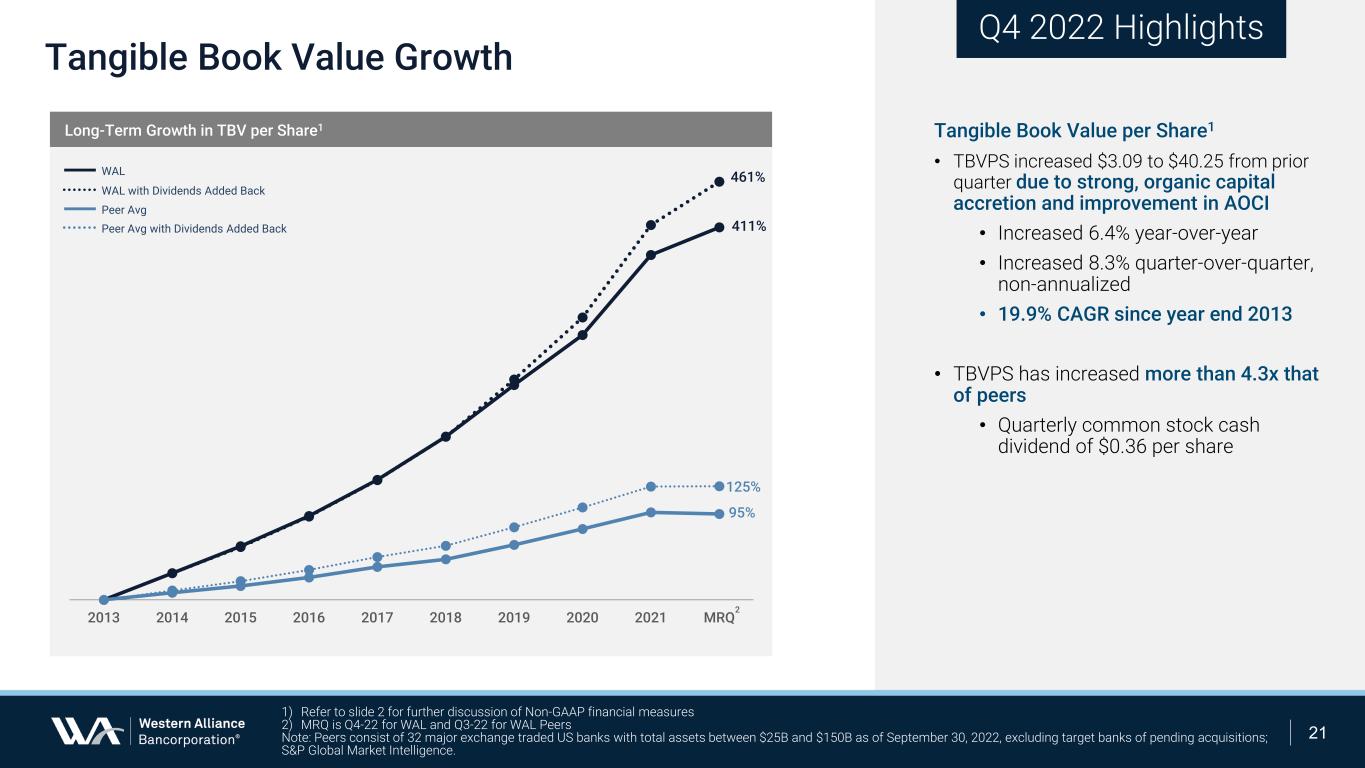

“Western Alliance’s diversified, national commercial business strategy drove the strong momentum that was sustained throughout the year, closing out the fourth quarter with record revenues, earnings and tangible book value as we thoughtfully deployed liquidity into sound organic growth,” said Kenneth A. Vecchione, President and Chief Executive Officer. “We achieved a record $293.0 million in net income and earnings per share of $2.67 for the quarter, an increase of 15.1% from the prior year, while tangible book value per share rose 6.4% year-over-year to $40.25. Quarterly deposits declined $1.9 billion, primarily driven by short-term seasonal tax and insurance escrow deposit outflows in our Mortgage Warehouse Group. These seasonal factors have already reversed since year end, with quarter-to-date 2023 average total deposit balances up more than $2.4 billion."

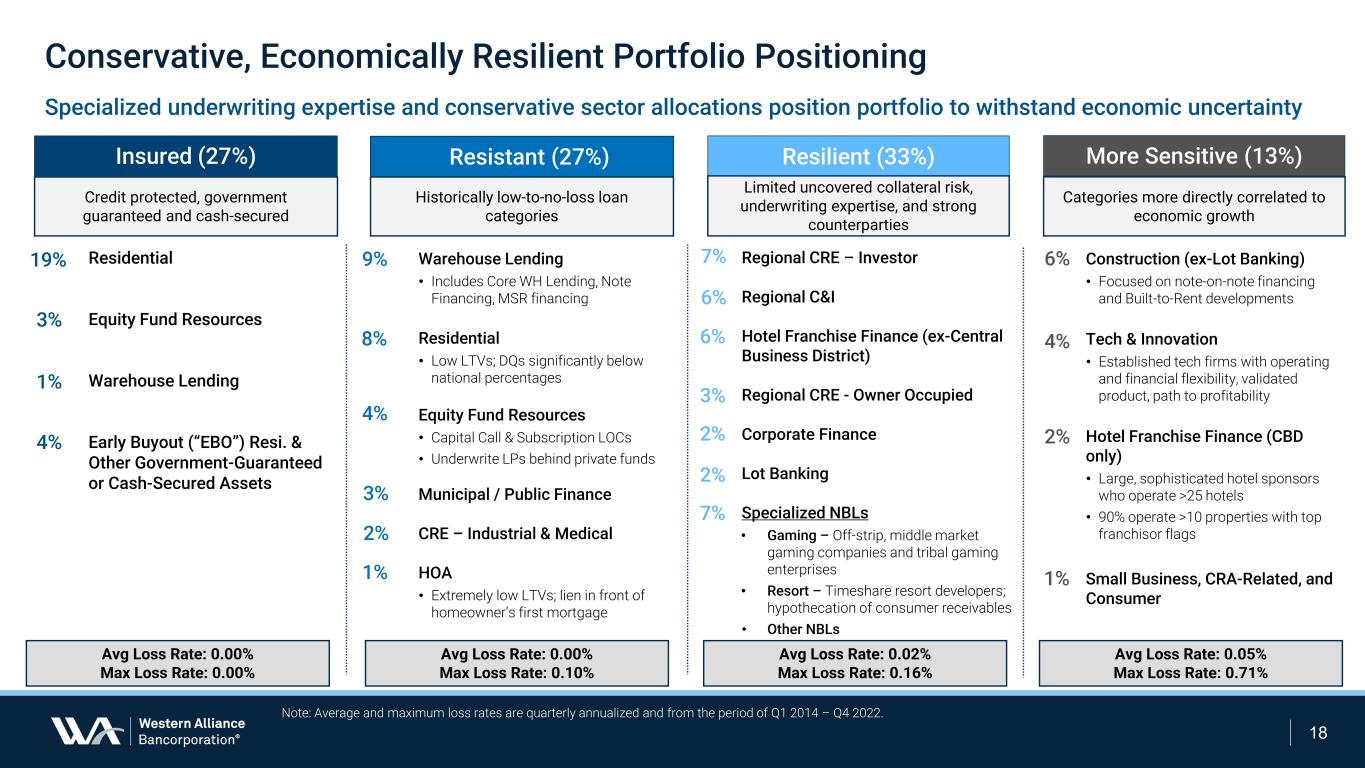

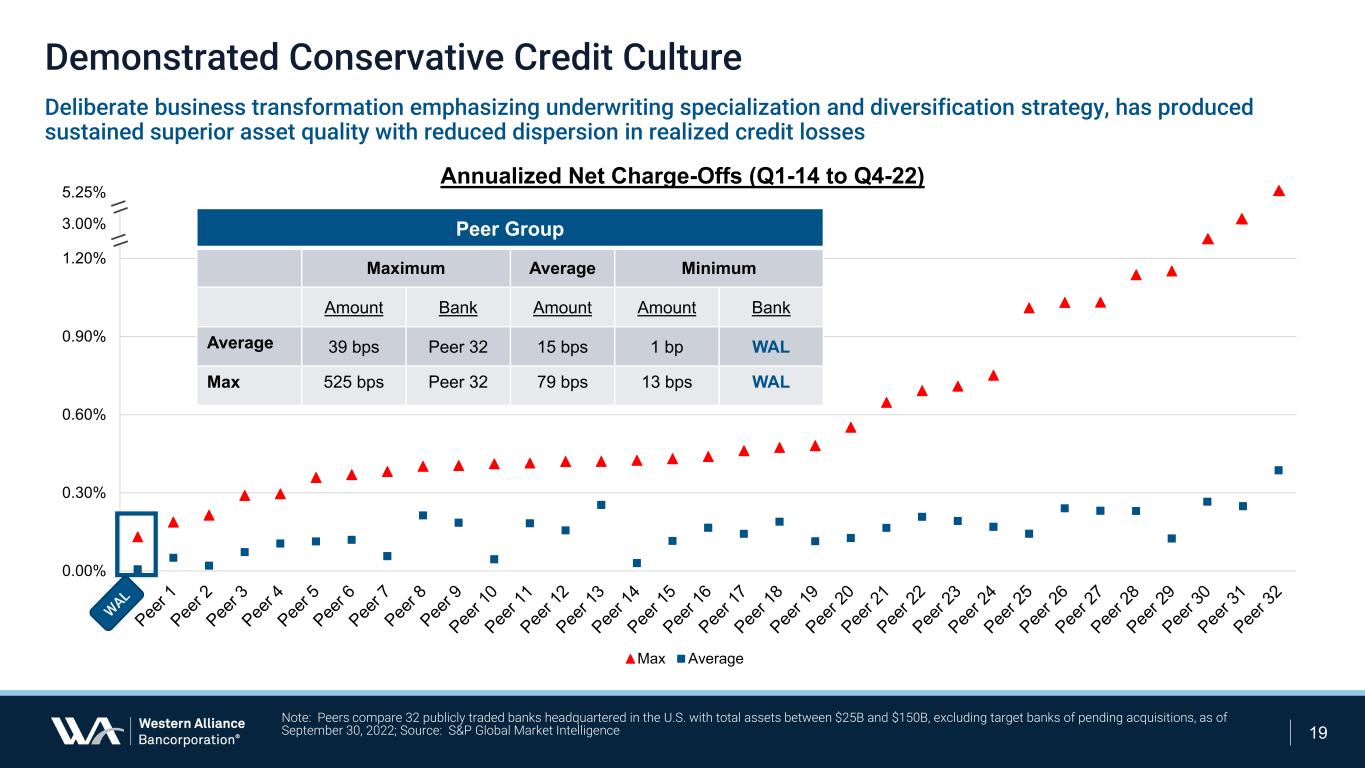

“Western Alliance’s full year results are a direct reflection of our collaborative culture and flexible business model that strongly position us to sustain our earnings trajectory into 2023, all while continuing our focus on asset quality. Net charge-offs for the year totaled a modest $1.5 million, with a non-performing assets to total assets ratio of 0.14% at the end of the year. Our growing net interest income during the year drove an increase in earnings as PPNR climbed 25.7% over the prior year to $1.4 billion, with net income of $1.1 billion and earnings per share up 11.9% to $9.70.”

| ||||||||||||||||||||||||||

| Acquisition of Digital Disbursements and AmeriHome Mortgage Company: | ||||||||||||||||||||||||||

On January 25, 2022, the Company completed its acquisition of Digital Settlement Technologies LLC, doing business as Digital Disbursements, a digital payments platform for the class action legal industry. On April 7, 2021, the Company completed its acquisition of Aris Mortgage Holding Company, LLC, the parent company of AmeriHome Mortgage Company, LLC ("AmeriHome"). The Company's results include the financial results of Digital Disbursements and AmeriHome beginning on the acquisition dates noted. | ||||||||||||||||||||||||||

| LINKED-QUARTER BASIS | FULL YEAR | ||||

| FINANCIAL HIGHLIGHTS: | |||||

| FINANCIAL POSITION RESULTS: | ||

| LOANS AND ASSET QUALITY: | ||

| KEY PERFORMANCE METRICS: | ||

| Dec 31, 2022 | Sep 30, 2022 | Dec 31, 2021 | ||||||||||||||||||

| Non-interest bearing | 36.7 | % | 44.8 | % | 44.9 | % | ||||||||||||||

| Savings and money market | 36.2 | 34.6 | 36.3 | |||||||||||||||||

| Interest-bearing demand | 17.7 | 15.0 | 14.5 | |||||||||||||||||

| Certificates of deposit | 9.4 | 5.6 | 4.3 | |||||||||||||||||

| Western Alliance Bancorporation and Subsidiaries | ||||||||||||||||||||||||||||||||||||||

| Summary Consolidated Financial Data | ||||||||||||||||||||||||||||||||||||||

| Unaudited | ||||||||||||||||||||||||||||||||||||||

| Selected Balance Sheet Data: | ||||||||||||||||||||||||||||||||||||||

| As of December 31, | ||||||||||||||||||||||||||||||||||||||

| 2022 | 2021 | Change % | ||||||||||||||||||||||||||||||||||||

| (in millions) | ||||||||||||||||||||||||||||||||||||||

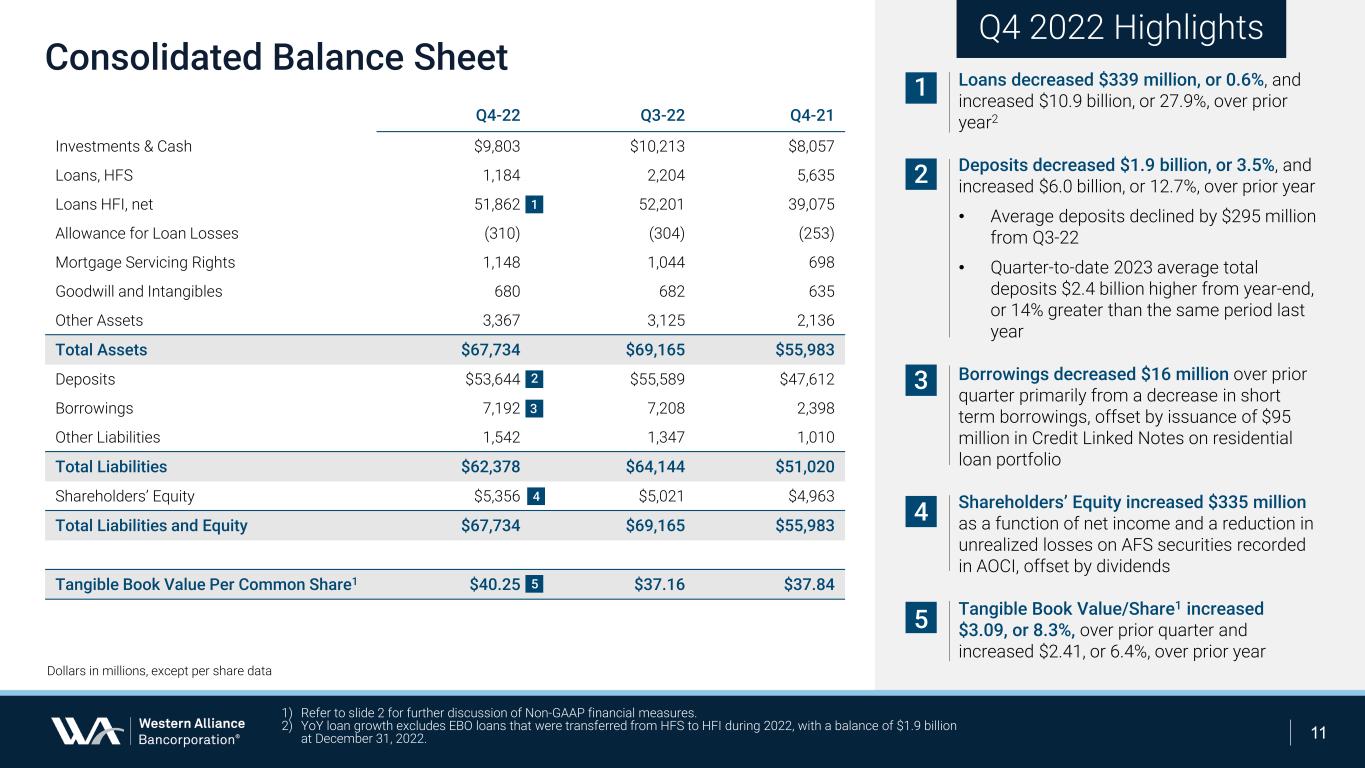

| Total assets | $ | 67,734 | $ | 55,983 | 21.0 | % | ||||||||||||||||||||||||||||||||

| Loans held for sale | 1,184 | 5,635 | (79.0) | |||||||||||||||||||||||||||||||||||

| HFI loans, net of deferred fees | 51,862 | 39,075 | 32.7 | |||||||||||||||||||||||||||||||||||

| Investment securities | 8,760 | 7,541 | 16.2 | |||||||||||||||||||||||||||||||||||

| Total deposits | 53,644 | 47,612 | 12.7 | |||||||||||||||||||||||||||||||||||

| Borrowings | 6,299 | 1,502 | NM | |||||||||||||||||||||||||||||||||||

| Qualifying debt | 893 | 896 | (0.3) | |||||||||||||||||||||||||||||||||||

| Stockholders' equity | 5,356 | 4,963 | 7.9 | |||||||||||||||||||||||||||||||||||

| Tangible common equity, net of tax (1) | 4,383 | 4,035 | 8.6 | |||||||||||||||||||||||||||||||||||

| Common equity Tier 1 capital | 5,073 | 4,068 | 24.7 | |||||||||||||||||||||||||||||||||||

| Selected Income Statement Data: | ||||||||||||||||||||||||||||||||||||||

| For the Three Months Ended December 31, | For the Year Ended December 31, | |||||||||||||||||||||||||||||||||||||

| 2022 | 2021 | Change % | 2022 | 2021 | Change % | |||||||||||||||||||||||||||||||||

| (in millions, except per share data) | (in millions, except per share data) | |||||||||||||||||||||||||||||||||||||

| Interest income | $ | 888.3 | $ | 483.3 | 83.8 | % | $ | 2,691.8 | $ | 1,658.7 | 62.3 | % | ||||||||||||||||||||||||||

| Interest expense | 248.6 | 32.7 | NM | 475.5 | 109.9 | NM | ||||||||||||||||||||||||||||||||

| Net interest income | 639.7 | 450.6 | 42.0 | 2,216.3 | 1,548.8 | 43.1 | ||||||||||||||||||||||||||||||||

| Provision for (recovery of) credit losses | 3.1 | 13.2 | (76.5) | 68.1 | (21.4) | NM | ||||||||||||||||||||||||||||||||

| Net interest income after provision for credit losses | 636.6 | 437.4 | 45.5 | 2,148.2 | 1,570.2 | 36.8 | ||||||||||||||||||||||||||||||||

| Non-interest income | 61.5 | 110.4 | (44.3) | 324.6 | 404.2 | (19.7) | ||||||||||||||||||||||||||||||||

| Non-interest expense | 333.4 | 237.8 | 40.2 | 1,156.7 | 851.4 | 35.9 | ||||||||||||||||||||||||||||||||

| Income before income taxes | 364.7 | 310.0 | 17.6 | 1,316.1 | 1,123.0 | 17.2 | ||||||||||||||||||||||||||||||||

| Income tax expense | 71.7 | 64.0 | 12.0 | 258.8 | 223.8 | 15.6 | ||||||||||||||||||||||||||||||||

| Net income | 293.0 | 246.0 | 19.1 | 1,057.3 | 899.2 | 17.6 | ||||||||||||||||||||||||||||||||

| Dividends on preferred stock | 3.2 | 3.5 | (8.6) | 12.8 | 3.5 | NM | ||||||||||||||||||||||||||||||||

| Net income available to common stockholders | $ | 289.8 | $ | 242.5 | 19.5 | $ | 1,044.5 | $ | 895.7 | 16.6 | ||||||||||||||||||||||||||||

| Diluted earnings per common share | $ | 2.67 | $ | 2.32 | 15.1 | $ | 9.70 | $ | 8.67 | 11.9 | ||||||||||||||||||||||||||||

| Western Alliance Bancorporation and Subsidiaries | ||||||||||||||||||||||||||||||||||||||

| Summary Consolidated Financial Data | ||||||||||||||||||||||||||||||||||||||

| Unaudited | ||||||||||||||||||||||||||||||||||||||

| Common Share Data: | ||||||||||||||||||||||||||||||||||||||

| At or For the Three Months Ended December 31, | For the Year Ended December 31, | |||||||||||||||||||||||||||||||||||||

| 2022 | 2021 | Change % | 2022 | 2021 | Change % | |||||||||||||||||||||||||||||||||

| Diluted earnings per common share | $ | 2.67 | $ | 2.32 | 15.1 | % | $ | 9.70 | $ | 8.67 | 11.9% | |||||||||||||||||||||||||||

| Book value per common share | 46.47 | 43.78 | 6.1 | |||||||||||||||||||||||||||||||||||

| Tangible book value per common share, net of tax (1) | 40.25 | 37.84 | 6.4 | |||||||||||||||||||||||||||||||||||

| Average common shares outstanding (in millions): |

||||||||||||||||||||||||||||||||||||||

| Basic | 108.0 | 103.9 | 4.0 | 107.2 | 102.7 | 4.4 | ||||||||||||||||||||||||||||||||

| Diluted | 108.4 | 104.5 | 3.7 | 107.6 | 103.3 | 4.2 | ||||||||||||||||||||||||||||||||

| Common shares outstanding | 108.9 | 106.6 | 2.1 | |||||||||||||||||||||||||||||||||||

| Selected Performance Ratios: | ||||||||||||||||||||||||||||||||||||||

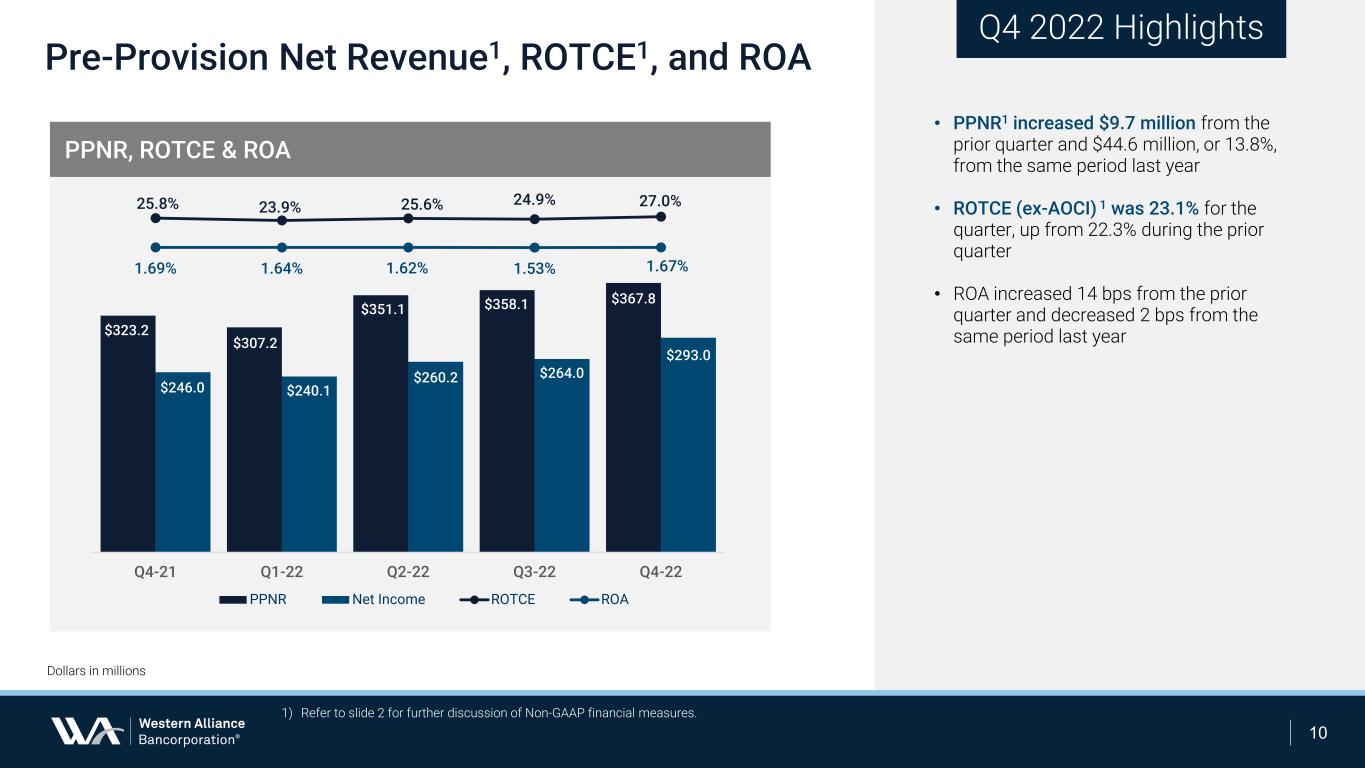

| Return on average assets (2) | 1.67 | % | 1.69 | % | (1.2) | % | 1.62 | % | 1.83 | % | (11.5) | % | ||||||||||||||||||||||||||

| Return on average tangible common equity (1, 2) | 27.0 | 25.8 | 4.7 | 25.4 | 26.2 | (3.1) | ||||||||||||||||||||||||||||||||

| Return on average tangible common equity, excluding AOCI (1, 2) | 23.1 | 26.0 | (11.2) | 23.1 | 26.6 | (13.2) | ||||||||||||||||||||||||||||||||

| Net interest margin (2) | 3.98 | 3.33 | 19.5 | 3.67 | 3.41 | 7.6 | ||||||||||||||||||||||||||||||||

| Efficiency ratio - tax equivalent basis (1) | 46.9 | 41.8 | 12.2 | 44.9 | 42.9 | 4.7 | ||||||||||||||||||||||||||||||||

| Loan to deposit ratio | 96.7 | 82.1 | 17.8 | |||||||||||||||||||||||||||||||||||

| Asset Quality Ratios: | ||||||||||||||||||||||||||||||||||||||

| Net charge-offs (recoveries) to average loans outstanding (2) | 0.01 | % | 0.02 | % | (50.0) | % | 0.00 | % | 0.02 | % | NM | |||||||||||||||||||||||||||

| Nonaccrual loans to funded HFI loans | 0.16 | 0.19 | (15.8) | |||||||||||||||||||||||||||||||||||

| Nonaccrual loans and repossessed assets to total assets | 0.14 | 0.15 | (6.7) | |||||||||||||||||||||||||||||||||||

| Allowance for loan losses to funded HFI loans | 0.60 | 0.65 | (7.7) | |||||||||||||||||||||||||||||||||||

| Allowance for loan losses to nonaccrual HFI loans | 364 | 348 | 4.6 | |||||||||||||||||||||||||||||||||||

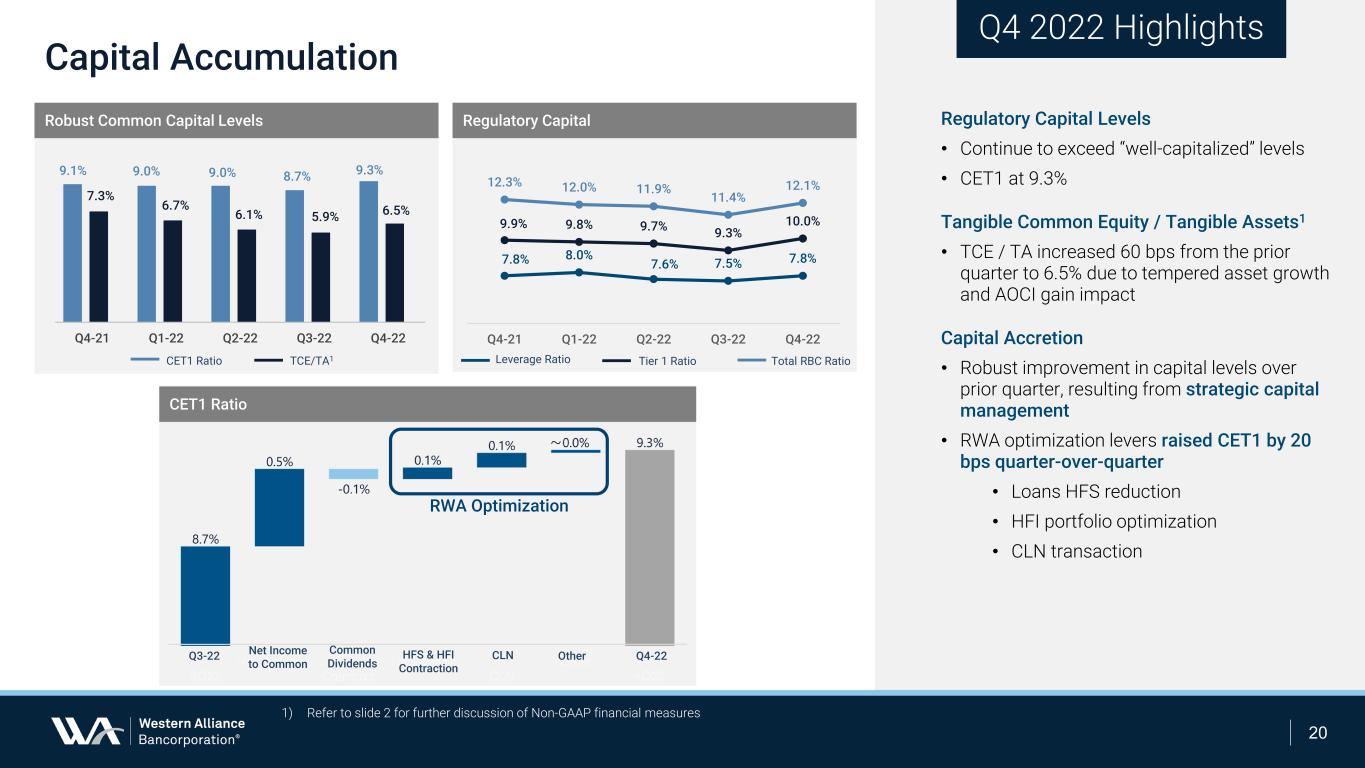

| Capital Ratios: | ||||||||||||||||||||

| Dec 31, 2022 | Sep 30, 2022 | Dec 31, 2021 | ||||||||||||||||||

| Tangible common equity (1) | 6.5 | % | 5.9 | % | 7.3 | % | ||||||||||||||

| Common Equity Tier 1 (3) | 9.3 | 8.7 | 9.1 | |||||||||||||||||

| Tier 1 Leverage ratio (3) | 7.8 | 7.5 | 7.8 | |||||||||||||||||

| Tier 1 Capital (3) | 10.0 | 9.3 | 9.9 | |||||||||||||||||

| Total Capital (3) | 12.1 | 11.4 | 12.3 | |||||||||||||||||

| Western Alliance Bancorporation and Subsidiaries | ||||||||||||||||||||||||||

| Condensed Consolidated Income Statements | ||||||||||||||||||||||||||

| Unaudited | ||||||||||||||||||||||||||

| Three Months Ended December 31, | Year Ended December 31, | |||||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||||||||||||

| (dollars in millions, except per share data) | ||||||||||||||||||||||||||

| Interest income: | ||||||||||||||||||||||||||

| Loans | $ | 785.1 | $ | 438.6 | $ | 2,393.4 | $ | 1,488.8 | ||||||||||||||||||

| Investment securities | 89.4 | 43.7 | 272.6 | 164.7 | ||||||||||||||||||||||

| Other | 13.8 | 1.0 | 25.8 | 5.2 | ||||||||||||||||||||||

| Total interest income | 888.3 | 483.3 | 2,691.8 | 1,658.7 | ||||||||||||||||||||||

| Interest expense: | ||||||||||||||||||||||||||

| Deposits | 157.6 | 12.8 | 276.4 | 47.5 | ||||||||||||||||||||||

| Qualifying debt | 9.1 | 9.2 | 35.0 | 33.1 | ||||||||||||||||||||||

| Borrowings | 81.9 | 10.7 | 164.1 | 29.3 | ||||||||||||||||||||||

| Total interest expense | 248.6 | 32.7 | 475.5 | 109.9 | ||||||||||||||||||||||

| Net interest income | 639.7 | 450.6 | 2,216.3 | 1,548.8 | ||||||||||||||||||||||

| Provision for (recovery of) credit losses | 3.1 | 13.2 | 68.1 | (21.4) | ||||||||||||||||||||||

| Net interest income after provision for credit losses | 636.6 | 437.4 | 2,148.2 | 1,570.2 | ||||||||||||||||||||||

| Non-interest income: | ||||||||||||||||||||||||||

| Net gain on loan origination and sale activities | 25.4 | 73.2 | 104.0 | 326.2 | ||||||||||||||||||||||

| Net loan servicing revenue (expense) | 21.4 | 2.3 | 130.9 | (16.3) | ||||||||||||||||||||||

| Service charges and fees | 5.9 | 7.1 | 27.0 | 28.3 | ||||||||||||||||||||||

| Commercial banking related income | 5.5 | 4.9 | 21.5 | 17.4 | ||||||||||||||||||||||

| Income from equity investments | 4.2 | 5.2 | 17.8 | 22.1 | ||||||||||||||||||||||

| Gain on recovery from credit guarantees | 3.0 | 7.2 | 14.7 | 7.2 | ||||||||||||||||||||||

| Gain on sales of investment securities | 0.1 | 8.3 | 6.8 | 8.3 | ||||||||||||||||||||||

| Fair value loss adjustments on assets measured at fair value, net | (9.2) | (0.8) | (28.6) | (1.3) | ||||||||||||||||||||||

| Other | 5.2 | 3.0 | 30.5 | 12.3 | ||||||||||||||||||||||

| Total non-interest income | 61.5 | 110.4 | 324.6 | 404.2 | ||||||||||||||||||||||

| Non-interest expenses: | ||||||||||||||||||||||||||

| Salaries and employee benefits | 125.7 | 120.6 | 539.5 | 466.7 | ||||||||||||||||||||||

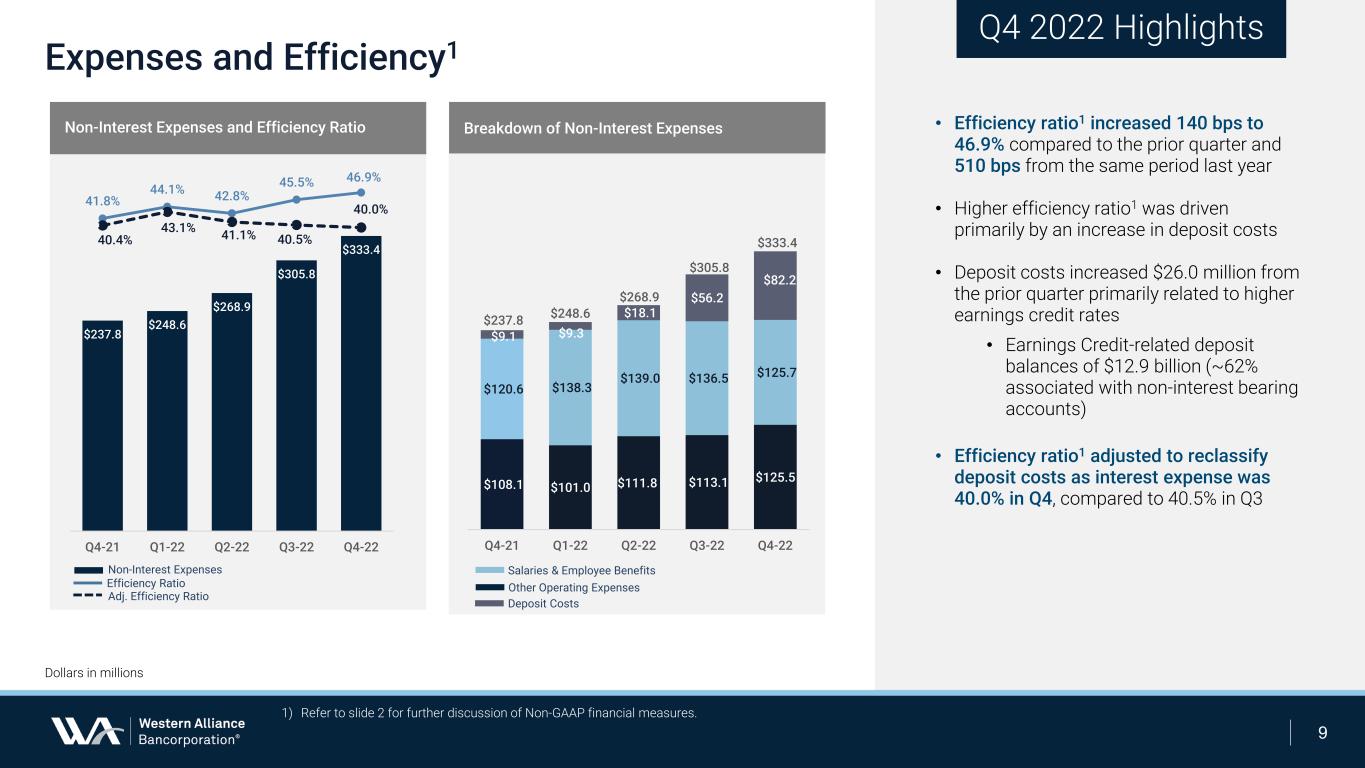

| Deposit costs | 82.2 | 9.1 | 165.8 | 29.8 | ||||||||||||||||||||||

| Legal, professional, and directors' fees | 26.0 | 20.8 | 99.9 | 58.6 | ||||||||||||||||||||||

| Data processing | 23.9 | 17.9 | 83.0 | 58.2 | ||||||||||||||||||||||

| Occupancy | 15.8 | 12.4 | 55.5 | 43.8 | ||||||||||||||||||||||

| Loan servicing expenses | 14.8 | 15.6 | 55.5 | 53.5 | ||||||||||||||||||||||

| Insurance | 8.9 | 7.1 | 31.1 | 23.0 | ||||||||||||||||||||||

| Business development and marketing | 7.3 | 6.1 | 22.1 | 13.5 | ||||||||||||||||||||||

| Loan acquisition and origination expenses | 4.4 | 8.6 | 23.1 | 28.8 | ||||||||||||||||||||||

| Loss on extinguishment of debt | — | 5.9 | — | 5.9 | ||||||||||||||||||||||

| Net gain on sales and valuations of repossessed and other assets | (0.3) | (0.4) | (0.7) | (3.5) | ||||||||||||||||||||||

| Acquisition and restructure expenses (recoveries) | — | (3.2) | 0.4 | 15.3 | ||||||||||||||||||||||

| Other | 24.7 | 17.3 | 81.5 | 57.8 | ||||||||||||||||||||||

| Total non-interest expense | 333.4 | 237.8 | 1,156.7 | 851.4 | ||||||||||||||||||||||

| Income before income taxes | 364.7 | 310.0 | 1,316.1 | 1,123.0 | ||||||||||||||||||||||

| Income tax expense | 71.7 | 64.0 | 258.8 | 223.8 | ||||||||||||||||||||||

| Net income | 293.0 | 246.0 | 1,057.3 | 899.2 | ||||||||||||||||||||||

| Dividends on preferred stock | 3.2 | 3.5 | 12.8 | 3.5 | ||||||||||||||||||||||

| Net income available to common stockholders | $ | 289.8 | $ | 242.5 | $ | 1,044.5 | $ | 895.7 | ||||||||||||||||||

| Earnings per common share: | ||||||||||||||||||||||||||

| Diluted shares | 108.4 | 104.5 | 107.6 | 103.3 | ||||||||||||||||||||||

| Diluted earnings per share | $ | 2.67 | $ | 2.32 | $ | 9.70 | $ | 8.67 | ||||||||||||||||||

| Western Alliance Bancorporation and Subsidiaries | ||||||||||||||||||||||||||||||||

| Five Quarter Condensed Consolidated Income Statements | ||||||||||||||||||||||||||||||||

| Unaudited | ||||||||||||||||||||||||||||||||

| Three Months Ended | ||||||||||||||||||||||||||||||||

| Dec 31, 2022 | Sep 30, 2022 | Jun 30, 2022 | Mar 31, 2022 | Dec 31, 2021 | ||||||||||||||||||||||||||||

| (in millions, except per share data) | ||||||||||||||||||||||||||||||||

| Interest income: | ||||||||||||||||||||||||||||||||

| Loans | $ | 785.1 | $ | 657.0 | $ | 516.6 | $ | 434.7 | $ | 438.6 | ||||||||||||||||||||||

| Investment securities | 89.4 | 75.9 | 59.3 | 48.0 | 43.7 | |||||||||||||||||||||||||||

| Other | 13.8 | 6.5 | 3.7 | 1.8 | 1.0 | |||||||||||||||||||||||||||

| Total interest income | 888.3 | 739.4 | 579.6 | 484.5 | 483.3 | |||||||||||||||||||||||||||

| Interest expense: | ||||||||||||||||||||||||||||||||

| Deposits | 157.6 | 77.6 | 27.1 | 14.1 | 12.8 | |||||||||||||||||||||||||||

| Qualifying debt | 9.1 | 8.9 | 8.6 | 8.4 | 9.2 | |||||||||||||||||||||||||||

| Borrowings | 81.9 | 50.8 | 18.9 | 12.5 | 10.7 | |||||||||||||||||||||||||||

| Total interest expense | 248.6 | 137.3 | 54.6 | 35.0 | 32.7 | |||||||||||||||||||||||||||

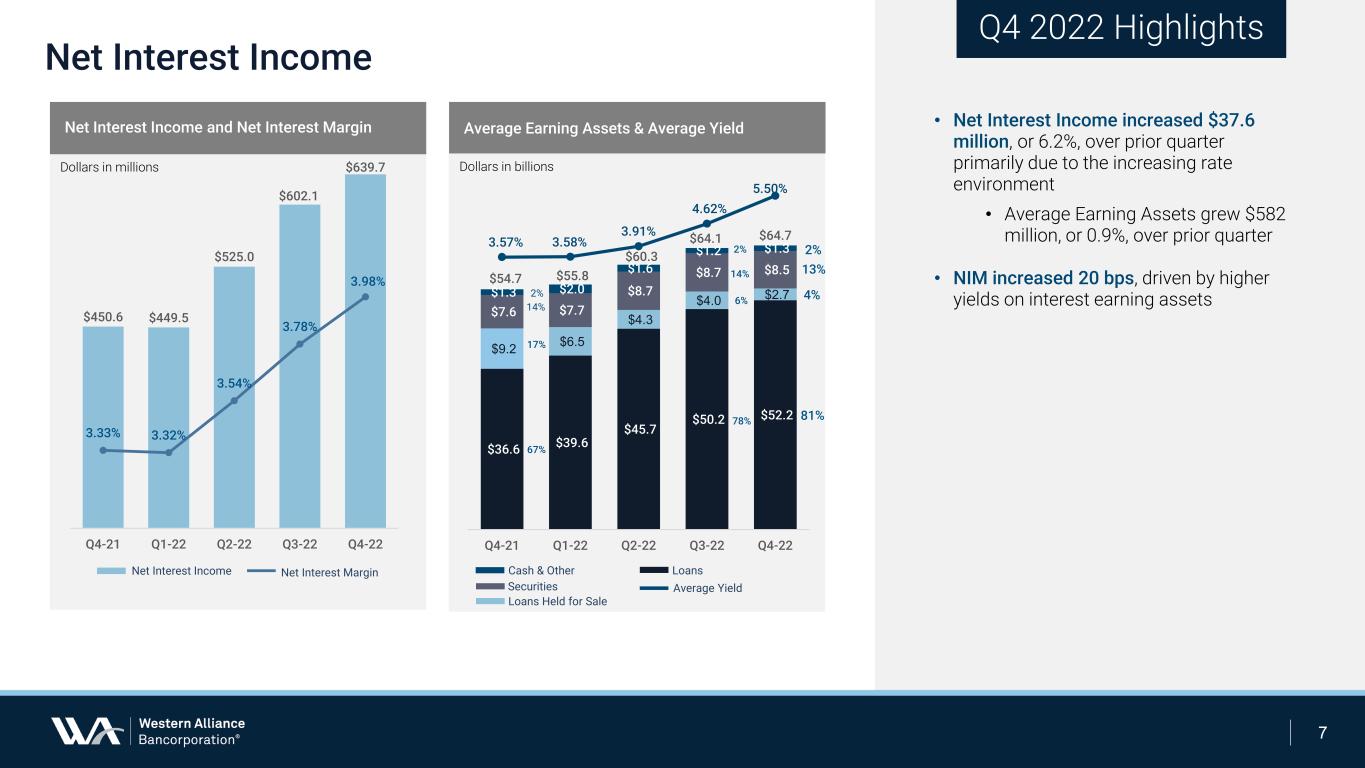

| Net interest income | 639.7 | 602.1 | 525.0 | 449.5 | 450.6 | |||||||||||||||||||||||||||

| Provision for credit losses | 3.1 | 28.5 | 27.5 | 9.0 | 13.2 | |||||||||||||||||||||||||||

| Net interest income after provision for credit losses | 636.6 | 573.6 | 497.5 | 440.5 | 437.4 | |||||||||||||||||||||||||||

| Non-interest income: | ||||||||||||||||||||||||||||||||

| Net gain on loan origination and sale activities | 25.4 | 14.5 | 27.2 | 36.9 | 73.2 | |||||||||||||||||||||||||||

| Net loan servicing revenue | 21.4 | 23.0 | 45.4 | 41.1 | 2.3 | |||||||||||||||||||||||||||

| Service charges and fees | 5.9 | 6.5 | 7.6 | 7.0 | 7.1 | |||||||||||||||||||||||||||

| Commercial banking related income | 5.5 | 5.1 | 5.8 | 5.1 | 4.9 | |||||||||||||||||||||||||||

| Income from equity investments | 4.2 | 4.3 | 5.2 | 4.1 | 5.2 | |||||||||||||||||||||||||||

| Gain on recovery from credit guarantees | 3.0 | 0.4 | 9.0 | 2.3 | 7.2 | |||||||||||||||||||||||||||

| Gain (loss) on sales of investment securities | 0.1 | — | (0.2) | 6.9 | 8.3 | |||||||||||||||||||||||||||

| Fair value loss adjustments on assets measured at fair value, net | (9.2) | (2.8) | (10.0) | (6.6) | (0.8) | |||||||||||||||||||||||||||

| Other | 5.2 | 10.8 | 5.0 | 9.5 | 3.0 | |||||||||||||||||||||||||||

| Total non-interest income | 61.5 | 61.8 | 95.0 | 106.3 | 110.4 | |||||||||||||||||||||||||||

| Non-interest expenses: | ||||||||||||||||||||||||||||||||

| Salaries and employee benefits | 125.7 | 136.5 | 139.0 | 138.3 | 120.6 | |||||||||||||||||||||||||||

| Deposit costs | 82.2 | 56.2 | 18.1 | 9.3 | 9.1 | |||||||||||||||||||||||||||

| Legal, professional, and directors' fees | 26.0 | 24.8 | 25.1 | 24.0 | 20.8 | |||||||||||||||||||||||||||

| Data processing | 23.9 | 21.8 | 19.7 | 17.6 | 17.9 | |||||||||||||||||||||||||||

| Occupancy | 15.8 | 13.9 | 13.0 | 12.8 | 12.4 | |||||||||||||||||||||||||||

| Loan servicing expenses | 14.8 | 15.2 | 14.7 | 10.8 | 15.6 | |||||||||||||||||||||||||||

| Insurance | 8.9 | 8.1 | 6.9 | 7.2 | 7.1 | |||||||||||||||||||||||||||

| Business development and marketing | 7.3 | 5.0 | 5.4 | 4.4 | 6.1 | |||||||||||||||||||||||||||

| Loan acquisition and origination expenses | 4.4 | 5.8 | 6.4 | 6.5 | 8.6 | |||||||||||||||||||||||||||

| Net (gain) loss on sales and valuations of repossessed and other assets | (0.3) | (0.2) | (0.3) | 0.1 | (0.4) | |||||||||||||||||||||||||||

| Loss on extinguishment of debt | — | — | — | — | 5.9 | |||||||||||||||||||||||||||

| Acquisition and restructure expenses (recoveries) | — | — | — | 0.4 | (3.2) | |||||||||||||||||||||||||||

| Other | 24.7 | 18.7 | 20.9 | 17.2 | 17.3 | |||||||||||||||||||||||||||

| Total non-interest expense | 333.4 | 305.8 | 268.9 | 248.6 | 237.8 | |||||||||||||||||||||||||||

| Income before income taxes | 364.7 | 329.6 | 323.6 | 298.2 | 310.0 | |||||||||||||||||||||||||||

| Income tax expense | 71.7 | 65.6 | 63.4 | 58.1 | 64.0 | |||||||||||||||||||||||||||

| Net income | 293.0 | 264.0 | 260.2 | 240.1 | 246.0 | |||||||||||||||||||||||||||

| Dividends on preferred stock | 3.2 | 3.2 | 3.2 | 3.2 | 3.5 | |||||||||||||||||||||||||||

| Net income available to common stockholders | $ | 289.8 | $ | 260.8 | $ | 257.0 | $ | 236.9 | $ | 242.5 | ||||||||||||||||||||||

| Earnings per common share: | ||||||||||||||||||||||||||||||||

| Diluted shares | 108.4 | 107.9 | 107.7 | 106.6 | 104.5 | |||||||||||||||||||||||||||

| Diluted earnings per share | $ | 2.67 | $ | 2.42 | $ | 2.39 | $ | 2.22 | $ | 2.32 | ||||||||||||||||||||||

| Western Alliance Bancorporation and Subsidiaries | ||||||||||||||||||||||||||||||||

| Five Quarter Condensed Consolidated Balance Sheets | ||||||||||||||||||||||||||||||||

| Unaudited | ||||||||||||||||||||||||||||||||

| Dec 31, 2022 | Sep 30, 2022 | Jun 30, 2022 | Mar 31, 2022 | Dec 31, 2021 | ||||||||||||||||||||||||||||

| (in millions) | ||||||||||||||||||||||||||||||||

| Assets: | ||||||||||||||||||||||||||||||||

| Cash and due from banks | $ | 1,043 | $ | 1,610 | $ | 1,886 | $ | 2,602 | $ | 516 | ||||||||||||||||||||||

| Investment securities | 8,760 | 8,603 | 8,802 | 8,277 | 7,541 | |||||||||||||||||||||||||||

| Loans held for sale | 1,184 | 2,204 | 2,803 | 4,762 | 5,635 | |||||||||||||||||||||||||||

| Loans held for investment: | ||||||||||||||||||||||||||||||||

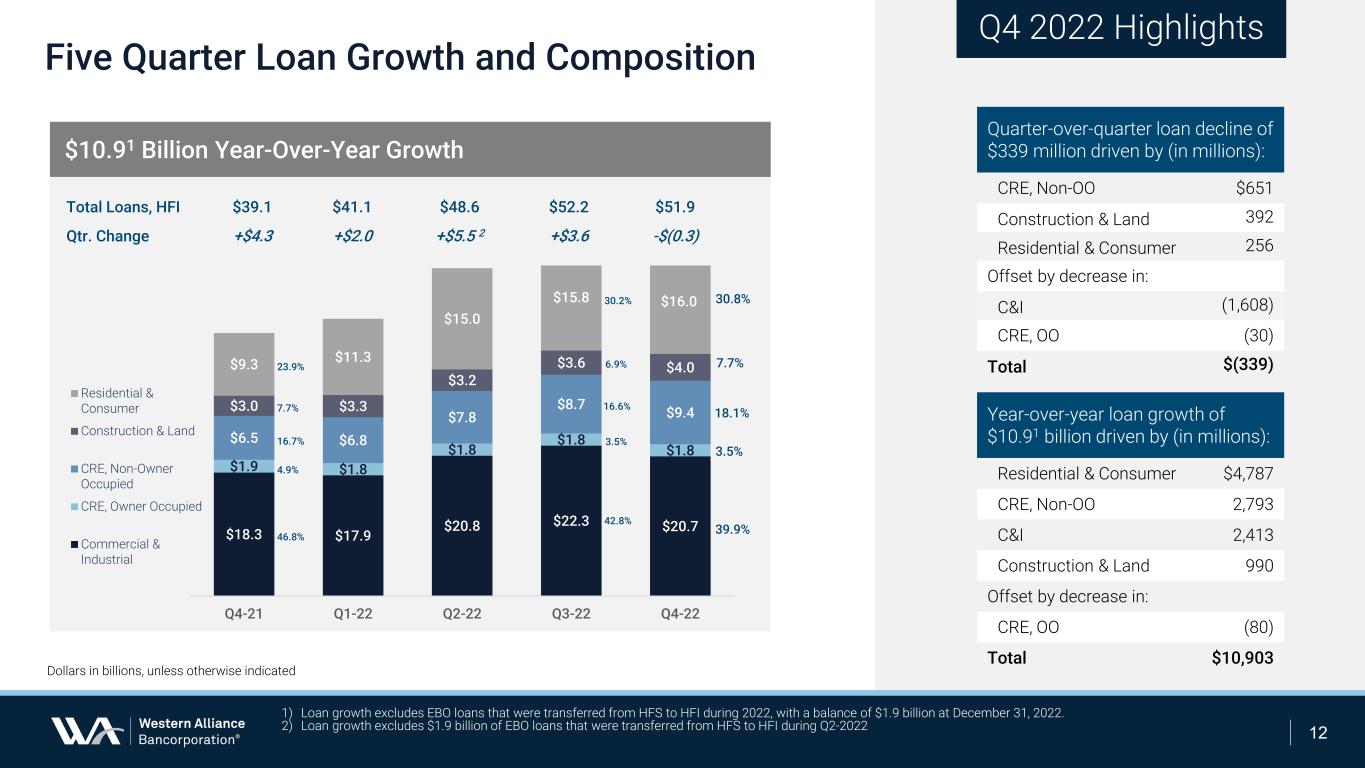

| Commercial and industrial | 20,710 | 22,318 | 20,754 | 17,862 | 18,297 | |||||||||||||||||||||||||||

| Commercial real estate - non-owner occupied | 9,319 | 8,668 | 7,775 | 6,849 | 6,526 | |||||||||||||||||||||||||||

| Commercial real estate - owner occupied | 1,818 | 1,848 | 1,848 | 1,805 | 1,898 | |||||||||||||||||||||||||||

| Construction and land development | 4,013 | 3,621 | 3,231 | 3,278 | 3,023 | |||||||||||||||||||||||||||

| Residential real estate | 15,928 | 15,674 | 14,908 | 11,270 | 9,282 | |||||||||||||||||||||||||||

| Consumer | 74 | 72 | 56 | 55 | 49 | |||||||||||||||||||||||||||

| Loans HFI, net of deferred fees | 51,862 | 52,201 | 48,572 | 41,119 | 39,075 | |||||||||||||||||||||||||||

| Allowance for loan losses | (310) | (304) | (273) | (258) | (252) | |||||||||||||||||||||||||||

| Loans HFI, net of deferred fees and allowance | 51,552 | 51,897 | 48,299 | 40,861 | 38,823 | |||||||||||||||||||||||||||

| Mortgage servicing rights | 1,148 | 1,044 | 826 | 950 | 698 | |||||||||||||||||||||||||||

| Premises and equipment, net | 276 | 237 | 210 | 196 | 182 | |||||||||||||||||||||||||||

| Operating lease right-of-use asset | 163 | 131 | 136 | 142 | 133 | |||||||||||||||||||||||||||

| Other assets acquired through foreclosure, net | 11 | 11 | 12 | 12 | 12 | |||||||||||||||||||||||||||

| Bank owned life insurance | 182 | 181 | 180 | 179 | 180 | |||||||||||||||||||||||||||

| Goodwill and other intangibles, net | 680 | 682 | 695 | 698 | 635 | |||||||||||||||||||||||||||

| Other assets | 2,735 | 2,565 | 2,206 | 1,897 | 1,628 | |||||||||||||||||||||||||||

| Total assets | $ | 67,734 | $ | 69,165 | $ | 66,055 | $ | 60,576 | $ | 55,983 | ||||||||||||||||||||||

| Liabilities and Stockholders' Equity: | ||||||||||||||||||||||||||||||||

| Liabilities: | ||||||||||||||||||||||||||||||||

| Deposits | ||||||||||||||||||||||||||||||||

| Non-interest bearing demand deposits | $ | 19,691 | $ | 24,926 | $ | 23,721 | $ | 23,520 | $ | 21,353 | ||||||||||||||||||||||

| Interest bearing: | ||||||||||||||||||||||||||||||||

| Demand | 9,507 | 8,350 | 8,387 | 8,268 | 6,924 | |||||||||||||||||||||||||||

| Savings and money market | 19,397 | 19,202 | 19,026 | 18,553 | 17,279 | |||||||||||||||||||||||||||

| Certificates of deposit | 5,049 | 3,111 | 2,578 | 1,818 | 2,056 | |||||||||||||||||||||||||||

| Total deposits | 53,644 | 55,589 | 53,712 | 52,159 | 47,612 | |||||||||||||||||||||||||||

| Borrowings | 6,299 | 6,319 | 5,210 | 833 | 1,502 | |||||||||||||||||||||||||||

| Qualifying debt | 893 | 889 | 891 | 893 | 896 | |||||||||||||||||||||||||||

| Operating lease liability | 185 | 149 | 151 | 155 | 143 | |||||||||||||||||||||||||||

| Accrued interest payable and other liabilities | 1,357 | 1,198 | 1,132 | 1,524 | 867 | |||||||||||||||||||||||||||

| Total liabilities | 62,378 | 64,144 | 61,096 | 55,564 | 51,020 | |||||||||||||||||||||||||||

| Stockholders' Equity: | ||||||||||||||||||||||||||||||||

| Preferred stock | 295 | 295 | 295 | 295 | 295 | |||||||||||||||||||||||||||

| Common stock and additional paid-in capital | 2,058 | 2,049 | 1,990 | 1,979 | 1,879 | |||||||||||||||||||||||||||

| Retained earnings | 3,664 | 3,413 | 3,192 | 2,973 | 2,773 | |||||||||||||||||||||||||||

| Accumulated other comprehensive (loss) income | (661) | (736) | (518) | (235) | 16 | |||||||||||||||||||||||||||

| Total stockholders' equity | 5,356 | 5,021 | 4,959 | 5,012 | 4,963 | |||||||||||||||||||||||||||

| Total liabilities and stockholders' equity | $ | 67,734 | $ | 69,165 | $ | 66,055 | $ | 60,576 | $ | 55,983 | ||||||||||||||||||||||

| Western Alliance Bancorporation and Subsidiaries | ||||||||||||||||||||||||||||||||

| Changes in the Allowance For Credit Losses on Loans | ||||||||||||||||||||||||||||||||

| Unaudited | ||||||||||||||||||||||||||||||||

| Three Months Ended | ||||||||||||||||||||||||||||||||

| Dec 31, 2022 | Sep 30, 2022 | Jun 30, 2022 | Mar 31, 2022 | Dec 31, 2021 | ||||||||||||||||||||||||||||

| (in millions) | ||||||||||||||||||||||||||||||||

| Allowance for loan losses | ||||||||||||||||||||||||||||||||

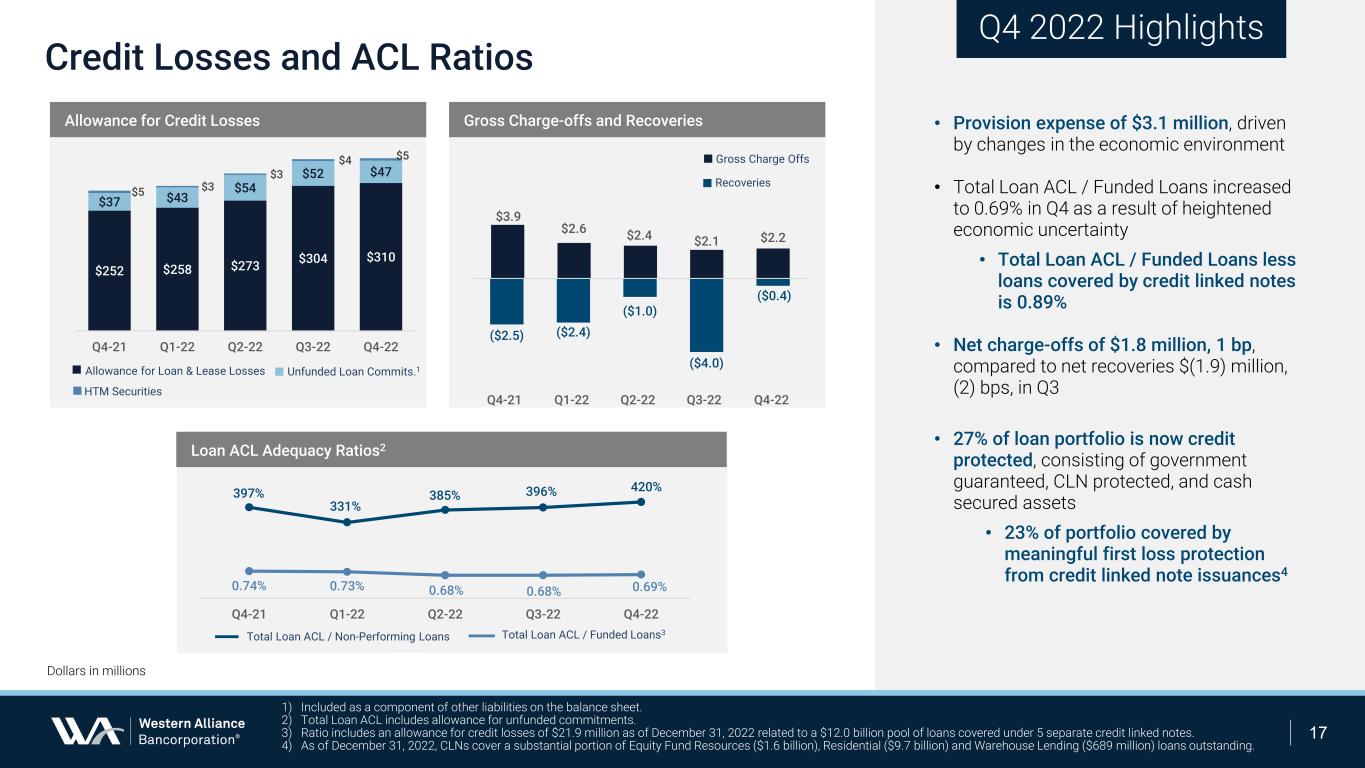

| Balance, beginning of period | $ | 304.1 | $ | 273.2 | $ | 257.6 | $ | 252.5 | $ | 246.9 | ||||||||||||||||||||||

| Provision for credit losses (1) | 7.4 | 29.0 | 17.0 | 5.3 | 7.0 | |||||||||||||||||||||||||||

| Recoveries of loans previously charged-off: | ||||||||||||||||||||||||||||||||

| Commercial and industrial | 0.3 | 3.8 | 0.8 | 2.4 | 1.8 | |||||||||||||||||||||||||||

| Commercial real estate - non-owner occupied | — | 0.1 | — | — | 0.3 | |||||||||||||||||||||||||||

| Commercial real estate - owner occupied | 0.1 | — | 0.1 | — | — | |||||||||||||||||||||||||||

| Construction and land development | — | 0.1 | — | — | — | |||||||||||||||||||||||||||

| Residential real estate | — | — | 0.1 | — | 0.4 | |||||||||||||||||||||||||||

| Consumer | — | — | — | — | — | |||||||||||||||||||||||||||

| Total recoveries | 0.4 | 4.0 | 1.0 | 2.4 | 2.5 | |||||||||||||||||||||||||||

| Loans charged-off: | ||||||||||||||||||||||||||||||||

| Commercial and industrial | 1.1 | 2.1 | 2.4 | 2.6 | 3.8 | |||||||||||||||||||||||||||

| Commercial real estate - non-owner occupied | — | — | — | — | — | |||||||||||||||||||||||||||

| Commercial real estate - owner occupied | 0.5 | — | — | — | — | |||||||||||||||||||||||||||

| Construction and land development | 0.6 | — | — | — | — | |||||||||||||||||||||||||||

| Residential real estate | — | — | — | — | 0.1 | |||||||||||||||||||||||||||

| Consumer | — | — | — | — | — | |||||||||||||||||||||||||||

| Total loans charged-off | 2.2 | 2.1 | 2.4 | 2.6 | 3.9 | |||||||||||||||||||||||||||

| Net loan charge-offs (recoveries) | 1.8 | (1.9) | 1.4 | 0.2 | 1.4 | |||||||||||||||||||||||||||

| Balance, end of period | $ | 309.7 | $ | 304.1 | $ | 273.2 | $ | 257.6 | $ | 252.5 | ||||||||||||||||||||||

| Allowance for unfunded loan commitments | ||||||||||||||||||||||||||||||||

| Balance, beginning of period | $ | 52.1 | $ | 53.8 | $ | 43.3 | $ | 37.6 | $ | 32.1 | ||||||||||||||||||||||

| (Recovery of) provision for credit losses (1) | (5.1) | (1.7) | 10.5 | 5.7 | 5.5 | |||||||||||||||||||||||||||

| Balance, end of period (2) | $ | 47.0 | $ | 52.1 | $ | 53.8 | $ | 43.3 | $ | 37.6 | ||||||||||||||||||||||

| Components of the allowance for credit losses on loans | ||||||||||||||||||||||||||||||||

| Allowance for loan losses | $ | 309.7 | $ | 304.1 | $ | 273.2 | $ | 257.6 | $ | 252.5 | ||||||||||||||||||||||

| Allowance for unfunded loan commitments | 47.0 | 52.1 | 53.8 | 43.3 | 37.6 | |||||||||||||||||||||||||||

| Total allowance for credit losses on loans | $ | 356.7 | $ | 356.2 | $ | 327.0 | $ | 300.9 | $ | 290.1 | ||||||||||||||||||||||

| Net charge-offs (recoveries) to average loans - annualized | 0.01 | % | (0.02) | % | 0.01 | % | 0.00 | % | 0.02 | % | ||||||||||||||||||||||

| Allowance ratios | ||||||||||||||||||||||||||||||||

| Allowance for loan losses to funded HFI loans (3) | 0.60 | % | 0.58 | % | 0.56 | % | 0.63 | % | 0.65 | % | ||||||||||||||||||||||

| Allowance for credit losses to funded HFI loans (3) | 0.69 | 0.68 | 0.67 | 0.73 | 0.74 | |||||||||||||||||||||||||||

| Allowance for loan losses to nonaccrual HFI loans | 364 | 338 | 321 | 283 | 346 | |||||||||||||||||||||||||||

| Allowance for credit losses to nonaccrual HFI loans | 420 | 396 | 385 | 331 | 397 | |||||||||||||||||||||||||||

| Western Alliance Bancorporation and Subsidiaries | ||||||||||||||||||||||||||||||||

| Asset Quality Metrics | ||||||||||||||||||||||||||||||||

| Unaudited | ||||||||||||||||||||||||||||||||

| Three Months Ended | ||||||||||||||||||||||||||||||||

| Dec 31, 2022 | Sep 30, 2022 | Jun 30, 2022 | Mar 31, 2022 | Dec 31, 2021 | ||||||||||||||||||||||||||||

| (in millions) | ||||||||||||||||||||||||||||||||

| Nonaccrual loans and repossessed assets | ||||||||||||||||||||||||||||||||

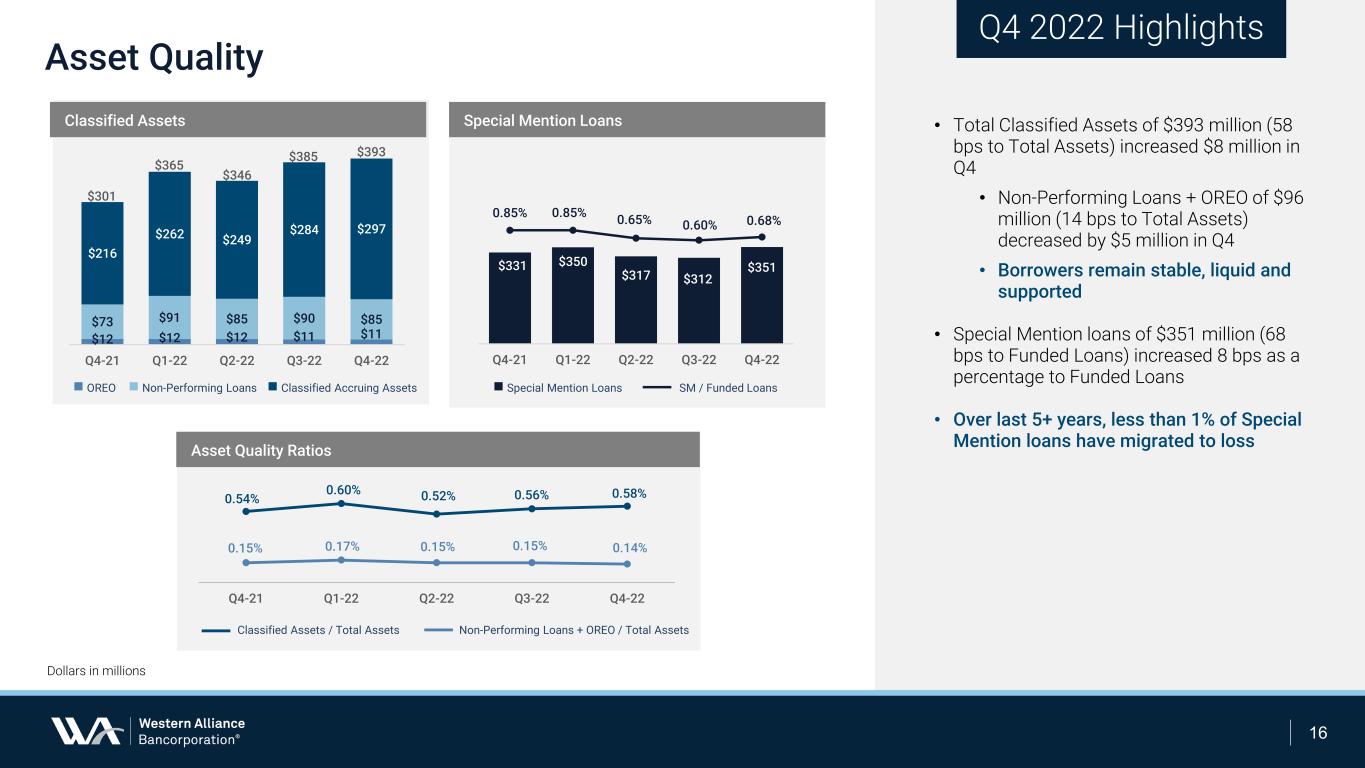

| Nonaccrual loans | $ | 85 | $ | 90 | $ | 85 | $ | 91 | $ | 73 | ||||||||||||||||||||||

| Nonaccrual loans to funded HFI loans | 0.16 | % | 0.17 | % | 0.17 | % | 0.22 | % | 0.19 | % | ||||||||||||||||||||||

| Repossessed assets | $ | 11 | $ | 11 | $ | 12 | $ | 12 | $ | 12 | ||||||||||||||||||||||

| Nonaccrual loans and repossessed assets to total assets | 0.14 | % | 0.15 | % | 0.15 | % | 0.17 | % | 0.15 | % | ||||||||||||||||||||||

| Loans Past Due | ||||||||||||||||||||||||||||||||

| Loans past due 90 days, still accruing (1) | $ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||||||||||||||

| Loans past due 90 days, still accruing to funded HFI loans | — | % | — | % | — | % | — | % | — | % | ||||||||||||||||||||||

| Loans past due 30 to 89 days, still accruing (2) | $ | 70 | $ | 56 | $ | 117 | $ | 58 | $ | 53 | ||||||||||||||||||||||

| Loans past due 30 to 89 days, still accruing to funded HFI loans | 0.13 | % | 0.11 | % | 0.24 | % | 0.14 | % | 0.13 | % | ||||||||||||||||||||||

| Other credit quality metrics | ||||||||||||||||||||||||||||||||

| Special mention loans | $ | 351 | $ | 312 | $ | 317 | $ | 350 | $ | 331 | ||||||||||||||||||||||

| Special mention loans to funded HFI loans | 0.68 | % | 0.60 | % | 0.65 | % | 0.85 | % | 0.85 | % | ||||||||||||||||||||||

| Classified loans on accrual | $ | 280 | $ | 268 | $ | 232 | $ | 253 | $ | 216 | ||||||||||||||||||||||

| Classified loans on accrual to funded HFI loans | 0.54 | % | 0.51 | % | 0.48 | % | 0.61 | % | 0.55 | % | ||||||||||||||||||||||

| Classified assets | $ | 393 | $ | 385 | $ | 346 | $ | 365 | $ | 301 | ||||||||||||||||||||||

| Classified assets to total assets | 0.58 | % | 0.56 | % | 0.52 | % | 0.60 | % | 0.54 | % | ||||||||||||||||||||||

| Western Alliance Bancorporation and Subsidiaries | ||||||||||||||||||||||||||||||||||||||

| Analysis of Average Balances, Yields and Rates | ||||||||||||||||||||||||||||||||||||||

| Unaudited | ||||||||||||||||||||||||||||||||||||||

| Three Months Ended | ||||||||||||||||||||||||||||||||||||||

| December 31, 2022 | September 30, 2022 | |||||||||||||||||||||||||||||||||||||

| Average Balance |

Interest | Average Yield / Cost |

Average Balance |

Interest | Average Yield / Cost |

|||||||||||||||||||||||||||||||||

| ($ in millions) | ($ in millions) | |||||||||||||||||||||||||||||||||||||

| Interest earning assets | ||||||||||||||||||||||||||||||||||||||

| Loans held for sale | $ | 2,659 | $ | 37.8 | 5.63 | % | $ | 3,993 | $ | 49.0 | 4.87 | % | ||||||||||||||||||||||||||

| Loans held for investment: | ||||||||||||||||||||||||||||||||||||||

| Commercial and industrial | 21,654 | 349.3 | 6.45 | 21,551 | 282.1 | 5.25 | ||||||||||||||||||||||||||||||||

| CRE - non-owner occupied | 9,077 | 148.8 | 6.51 | 8,128 | 111.4 | 5.44 | ||||||||||||||||||||||||||||||||

| CRE - owner occupied | 1,830 | 24.4 | 5.39 | 1,839 | 23.3 | 5.12 | ||||||||||||||||||||||||||||||||

| Construction and land development | 3,798 | 80.2 | 8.38 | 3,471 | 59.5 | 6.80 | ||||||||||||||||||||||||||||||||

| Residential real estate | 15,803 | 143.5 | 3.60 | 15,125 | 130.9 | 3.43 | ||||||||||||||||||||||||||||||||

| Consumer | 71 | 1.1 | 6.26 | 63 | 0.8 | 5.32 | ||||||||||||||||||||||||||||||||

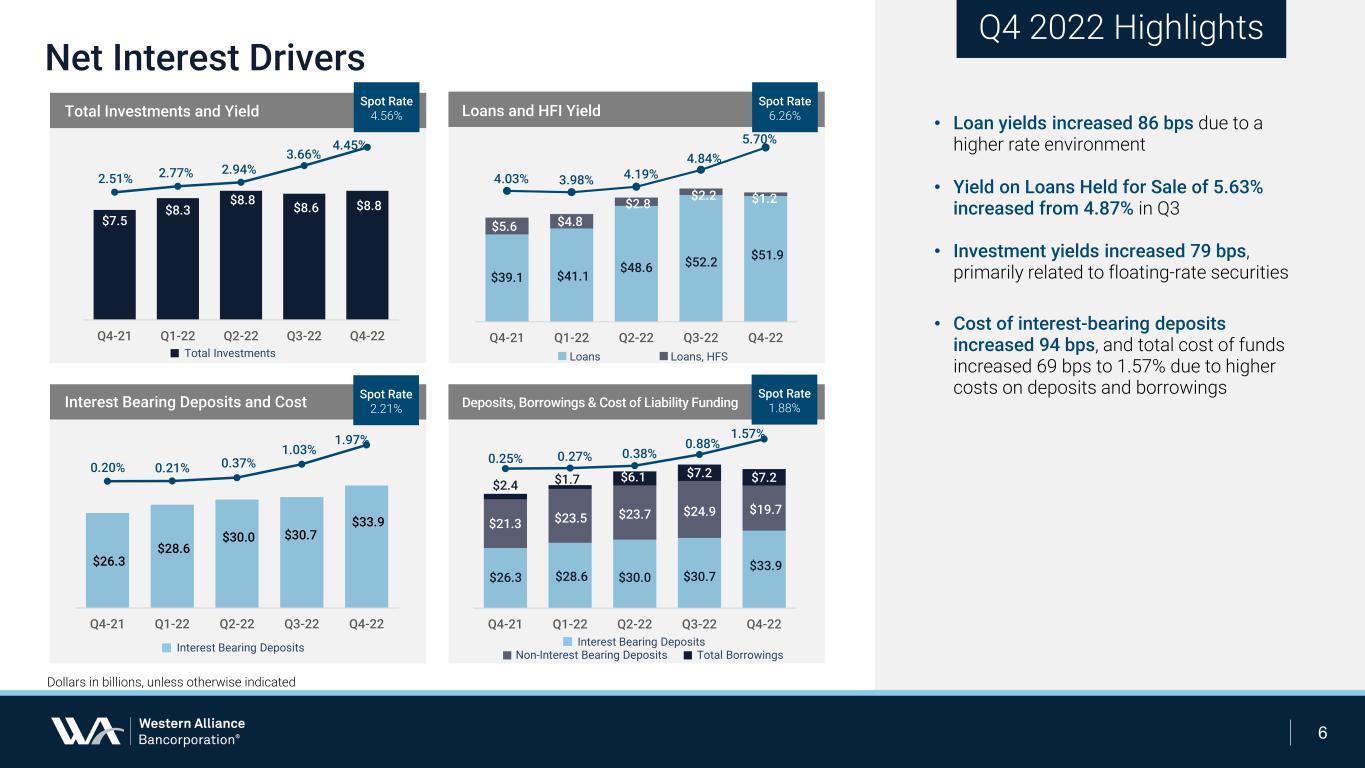

| Total HFI loans (1), (2), (3) | 52,233 | 747.3 | 5.70 | 50,177 | 608.0 | 4.84 | ||||||||||||||||||||||||||||||||

| Securities: | ||||||||||||||||||||||||||||||||||||||

| Securities - taxable | 6,397 | 68.4 | 4.25 | 6,680 | 56.4 | 3.35 | ||||||||||||||||||||||||||||||||

| Securities - tax-exempt | 2,068 | 21.0 | 5.07 | 2,047 | 19.5 | 4.73 | ||||||||||||||||||||||||||||||||

| Total securities (1) | 8,465 | 89.4 | 4.45 | 8,727 | 75.9 | 3.66 | ||||||||||||||||||||||||||||||||

| Cash and other | 1,361 | 13.8 | 4.02 | 1,239 | 6.5 | 2.07 | ||||||||||||||||||||||||||||||||

| Total interest earning assets | 64,718 | 888.3 | 5.50 | 64,136 | 739.4 | 4.62 | ||||||||||||||||||||||||||||||||

| Non-interest earning assets | ||||||||||||||||||||||||||||||||||||||

| Cash and due from banks | 289 | 242 | ||||||||||||||||||||||||||||||||||||

| Allowance for credit losses | (308) | (282) | ||||||||||||||||||||||||||||||||||||

| Bank owned life insurance | 181 | 180 | ||||||||||||||||||||||||||||||||||||

| Other assets | 4,613 | 4,100 | ||||||||||||||||||||||||||||||||||||

| Total assets | $ | 69,493 | $ | 68,376 | ||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities | ||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits: | ||||||||||||||||||||||||||||||||||||||

| Interest-bearing transaction accounts | $ | 8,754 | $ | 43.6 | 1.98 | % | $ | 8,466 | $ | 24.5 | 1.15 | % | ||||||||||||||||||||||||||

| Savings and money market | 18,651 | 88.0 | 1.87 | 18,515 | 44.5 | 0.95 | ||||||||||||||||||||||||||||||||

| Certificates of deposit | 4,260 | 26.0 | 2.42 | 2,843 | 8.6 | 1.19 | ||||||||||||||||||||||||||||||||

| Total interest-bearing deposits | 31,665 | 157.6 | 1.97 | 29,824 | 77.6 | 1.03 | ||||||||||||||||||||||||||||||||

| Short-term borrowings | 5,440 | 54.8 | 3.99 | 4,136 | 27.0 | 2.59 | ||||||||||||||||||||||||||||||||

| Long-term debt | 1,240 | 27.1 | 8.68 | 1,228 | 23.8 | 7.69 | ||||||||||||||||||||||||||||||||

| Qualifying debt | 890 | 9.1 | 4.08 | 891 | 8.9 | 3.94 | ||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | 39,235 | 248.6 | 2.51 | 36,079 | 137.3 | 1.51 | ||||||||||||||||||||||||||||||||

| Interest cost of funding earning assets | 1.52 | 0.84 | ||||||||||||||||||||||||||||||||||||

| Non-interest-bearing liabilities | ||||||||||||||||||||||||||||||||||||||

| Non-interest-bearing demand deposits | 23,729 | 25,865 | ||||||||||||||||||||||||||||||||||||

| Other liabilities | 1,296 | 1,282 | ||||||||||||||||||||||||||||||||||||

| Stockholders’ equity | 5,233 | 5,150 | ||||||||||||||||||||||||||||||||||||

| Total liabilities and stockholders' equity | $ | 69,493 | $ | 68,376 | ||||||||||||||||||||||||||||||||||

| Net interest income and margin (4) | $ | 639.7 | 3.98 | % | $ | 602.1 | 3.78 | % | ||||||||||||||||||||||||||||||

| Western Alliance Bancorporation and Subsidiaries | ||||||||||||||||||||||||||||||||||||||

| Analysis of Average Balances, Yields and Rates | ||||||||||||||||||||||||||||||||||||||

| Unaudited | ||||||||||||||||||||||||||||||||||||||

| Three Months Ended | ||||||||||||||||||||||||||||||||||||||

| December 31, 2022 | December 31, 2021 | |||||||||||||||||||||||||||||||||||||

| Average Balance |

Interest | Average Yield / Cost |

Average Balance |

Interest | Average Yield / Cost |

|||||||||||||||||||||||||||||||||

| ($ in millions) | ($ in millions) | |||||||||||||||||||||||||||||||||||||

| Interest earning assets | ||||||||||||||||||||||||||||||||||||||

| Loans held for sale | $ | 2,659 | $ | 37.8 | 5.63 | % | $ | 9,159 | $ | 70.3 | 3.04 | % | ||||||||||||||||||||||||||

| Loans held for investment: | ||||||||||||||||||||||||||||||||||||||

| Commercial and industrial | 21,654 | 349.3 | 6.45 | 17,087 | 169.5 | 4.01 | ||||||||||||||||||||||||||||||||

| CRE - non-owner-occupied | 9,077 | 148.8 | 6.51 | 6,209 | 70.0 | 4.48 | ||||||||||||||||||||||||||||||||

| CRE - owner-occupied | 1,830 | 24.4 | 5.39 | 1,971 | 24.2 | 4.96 | ||||||||||||||||||||||||||||||||

| Construction and land development | 3,798 | 80.2 | 8.38 | 3,016 | 43.9 | 5.78 | ||||||||||||||||||||||||||||||||

| Residential real estate | 15,803 | 143.5 | 3.60 | 8,282 | 60.3 | 2.89 | ||||||||||||||||||||||||||||||||

| Consumer | 71 | 1.1 | 6.26 | 44 | 0.4 | 3.85 | ||||||||||||||||||||||||||||||||

| Total HFI loans (1), (2), (3) | 52,233 | 747.3 | 5.70 | 36,609 | 368.3 | 4.03 | ||||||||||||||||||||||||||||||||

| Securities: | ||||||||||||||||||||||||||||||||||||||

| Securities - taxable | 6,397 | 68.4 | 4.25 | 5,443 | 25.6 | 1.86 | ||||||||||||||||||||||||||||||||

| Securities - tax-exempt | 2,068 | 21.0 | 5.07 | 2,175 | 18.1 | 4.12 | ||||||||||||||||||||||||||||||||

| Total securities (1) | 8,465 | 89.4 | 4.45 | 7,618 | 43.7 | 2.51 | ||||||||||||||||||||||||||||||||

| Other | 1,361 | 13.8 | 4.02 | 1,274 | 1.0 | 0.31 | ||||||||||||||||||||||||||||||||

| Total interest earning assets | 64,718 | 888.3 | 5.50 | 54,660 | 483.3 | 3.57 | ||||||||||||||||||||||||||||||||

| Non-interest earning assets | ||||||||||||||||||||||||||||||||||||||

| Cash and due from banks | 289 | 253 | ||||||||||||||||||||||||||||||||||||

| Allowance for credit losses | (308) | (256) | ||||||||||||||||||||||||||||||||||||

| Bank owned life insurance | 181 | 179 | ||||||||||||||||||||||||||||||||||||

| Other assets | 4,613 | 2,767 | ||||||||||||||||||||||||||||||||||||

| Total assets | $ | 69,493 | $ | 57,603 | ||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities | ||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits: | ||||||||||||||||||||||||||||||||||||||

| Interest-bearing transaction accounts | $ | 8,754 | $ | 43.6 | 1.98 | % | $ | 5,918 | $ | 1.7 | 0.11 | % | ||||||||||||||||||||||||||

| Savings and money market accounts | 18,651 | 88.0 | 1.87 | 17,215 | 9.1 | 0.21 | ||||||||||||||||||||||||||||||||

| Certificates of deposit | 4,260 | 26.0 | 2.42 | 2,074 | 2.0 | 0.38 | ||||||||||||||||||||||||||||||||

| Total interest-bearing deposits | 31,665 | 157.6 | 1.97 | 25,207 | 12.8 | 0.20 | ||||||||||||||||||||||||||||||||

| Short-term borrowings | 5,440 | 54.8 | 3.99 | 2,815 | 2.4 | 0.35 | ||||||||||||||||||||||||||||||||

| Long-term debt | 1,240 | 27.1 | 8.68 | 565 | 8.3 | 5.81 | ||||||||||||||||||||||||||||||||

| Qualifying debt | 890 | 9.1 | 4.08 | 978 | 9.2 | 3.72 | ||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | 39,235 | 248.6 | 2.51 | 29,565 | 32.7 | 0.44 | ||||||||||||||||||||||||||||||||

| Interest cost of funding earning assets | 1.52 | 0.24 | ||||||||||||||||||||||||||||||||||||

| Non-interest-bearing liabilities | ||||||||||||||||||||||||||||||||||||||

| Non-interest-bearing demand deposits | 23,729 | 22,487 | ||||||||||||||||||||||||||||||||||||

| Other liabilities | 1,296 | 913 | ||||||||||||||||||||||||||||||||||||

| Stockholders’ equity | 5,233 | 4,638 | ||||||||||||||||||||||||||||||||||||

| Total liabilities and stockholders' equity | $ | 69,493 | $ | 57,603 | ||||||||||||||||||||||||||||||||||

| Net interest income and margin (4) | $ | 639.7 | 3.98 | % | $ | 450.6 | 3.33 | % | ||||||||||||||||||||||||||||||

| Western Alliance Bancorporation and Subsidiaries | ||||||||||||||||||||||||||||||||||||||

| Analysis of Average Balances, Yields and Rates | ||||||||||||||||||||||||||||||||||||||

| Unaudited | ||||||||||||||||||||||||||||||||||||||

| Year Ended | ||||||||||||||||||||||||||||||||||||||

| December 31, 2022 | December 31, 2021 | |||||||||||||||||||||||||||||||||||||

| Average Balance |

Interest | Average Yield / Cost |

Average Balance |

Interest | Average Yield / Cost |

|||||||||||||||||||||||||||||||||

| ($ in millions) | ($ in millions) | |||||||||||||||||||||||||||||||||||||

| Interest earning assets | ||||||||||||||||||||||||||||||||||||||

| Loans held for sale | $ | 4,364 | $ | 180.3 | 4.13 | % | $ | 5,476 | $ | 174.4 | 3.18 | % | ||||||||||||||||||||||||||

| Loans held for investment: | ||||||||||||||||||||||||||||||||||||||

| Commercial and industrial | 20,082 | 1,002.8 | 5.05 | 14,979 | 624.8 | 4.26 | ||||||||||||||||||||||||||||||||

| CRE - non-owner occupied | 7,769 | 416.4 | 5.37 | 5,829 | 271.3 | 4.67 | ||||||||||||||||||||||||||||||||

| CRE - owner occupied | 1,841 | 93.2 | 5.16 | 2,030 | 97.7 | 4.92 | ||||||||||||||||||||||||||||||||

| Construction and land development | 3,426 | 229.1 | 6.69 | 2,790 | 160.0 | 5.74 | ||||||||||||||||||||||||||||||||

| Residential real estate | 13,771 | 468.5 | 3.40 | 5,129 | 158.9 | 3.10 | ||||||||||||||||||||||||||||||||

| Consumer | 61 | 3.1 | 5.07 | 39 | 1.7 | 4.43 | ||||||||||||||||||||||||||||||||

| Total HFI loans (1), (2), (3) | 46,951 | 2,213.1 | 4.74 | 30,796 | 1,314.4 | 4.32 | ||||||||||||||||||||||||||||||||

| Securities: | ||||||||||||||||||||||||||||||||||||||

| Securities - taxable | 6,324 | 195.3 | 3.09 | 5,284 | 95.8 | 1.81 | ||||||||||||||||||||||||||||||||

| Securities - tax-exempt | 2,067 | 77.3 | 4.68 | 2,137 | 68.9 | 4.05 | ||||||||||||||||||||||||||||||||

| Total securities (1) | 8,391 | 272.6 | 3.48 | 7,421 | 164.7 | 2.46 | ||||||||||||||||||||||||||||||||

| Other | 1,574 | 25.8 | 1.64 | 2,718 | 5.2 | 0.19 | ||||||||||||||||||||||||||||||||

| Total interest earning assets | 61,281 | 2,691.8 | 4.45 | 46,411 | 1,658.7 | 3.65 | ||||||||||||||||||||||||||||||||

| Non-interest earning assets | ||||||||||||||||||||||||||||||||||||||

| Cash and due from banks | 260 | 293 | ||||||||||||||||||||||||||||||||||||

| Allowance for credit losses | (280) | (261) | ||||||||||||||||||||||||||||||||||||

| Bank owned life insurance | 180 | 178 | ||||||||||||||||||||||||||||||||||||

| Other assets | 3,948 | 2,487 | ||||||||||||||||||||||||||||||||||||

| Total assets | $ | 65,389 | $ | 49,108 | ||||||||||||||||||||||||||||||||||

| Interest-bearing liabilities | ||||||||||||||||||||||||||||||||||||||

| Interest-bearing deposits: | ||||||||||||||||||||||||||||||||||||||

| Interest-bearing transaction accounts | $ | 8,331 | $ | 78.8 | 0.95 | % | $ | 4,751 | $ | 5.9 | 0.13 | % | ||||||||||||||||||||||||||

| Savings and money market accounts | 18,518 | 158.6 | 0.86 | 15,814 | 33.1 | 0.21 | ||||||||||||||||||||||||||||||||

| Certificates of deposit | 2,772 | 39.0 | 1.40 | 1,850 | 8.5 | 0.46 | ||||||||||||||||||||||||||||||||

| Total interest-bearing deposits | 29,621 | 276.4 | 0.93 | 22,415 | 47.5 | 0.21 | ||||||||||||||||||||||||||||||||

| Short-term borrowings | 3,424 | 92.1 | 2.69 | 1,206 | 8.2 | 0.68 | ||||||||||||||||||||||||||||||||

| Long-term debt | 1,008 | 72.0 | 7.14 | 373 | 21.1 | 5.65 | ||||||||||||||||||||||||||||||||

| Qualifying debt | 893 | 35.0 | 3.92 | 827 | 33.1 | 4.00 | ||||||||||||||||||||||||||||||||

| Total interest-bearing liabilities | 34,946 | 475.5 | 1.36 | 24,821 | 109.9 | 0.44 | ||||||||||||||||||||||||||||||||

| Interest cost of funding earning assets | 0.78 | 0.24 | ||||||||||||||||||||||||||||||||||||

| Non-interest-bearing liabilities | ||||||||||||||||||||||||||||||||||||||

| Non-interest-bearing demand deposits | 24,133 | 19,416 | ||||||||||||||||||||||||||||||||||||

| Other liabilities | 1,211 | 837 | ||||||||||||||||||||||||||||||||||||

| Stockholders’ equity | 5,099 | 4,034 | ||||||||||||||||||||||||||||||||||||

| Total liabilities and stockholders' equity | $ | 65,389 | $ | 49,108 | ||||||||||||||||||||||||||||||||||

| Net interest income and margin (4) | $ | 2,216.3 | 3.67 | % | $ | 1,548.8 | 3.41 | % | ||||||||||||||||||||||||||||||

| Western Alliance Bancorporation and Subsidiaries | ||||||||||||||||||||||||||

| Operating Segment Results | ||||||||||||||||||||||||||

| Unaudited | ||||||||||||||||||||||||||

| Balance Sheet: | ||||||||||||||||||||||||||

| Consolidated Company | Commercial | Consumer Related | Corporate & Other | |||||||||||||||||||||||

| At December 31, 2022: | (dollars in millions) | |||||||||||||||||||||||||

| Assets: | ||||||||||||||||||||||||||

| Cash, cash equivalents, and investment securities | $ | 9,803 | $ | 12 | $ | — | $ | 9,791 | ||||||||||||||||||

| Loans held for sale | 1,184 | — | 1,184 | — | ||||||||||||||||||||||

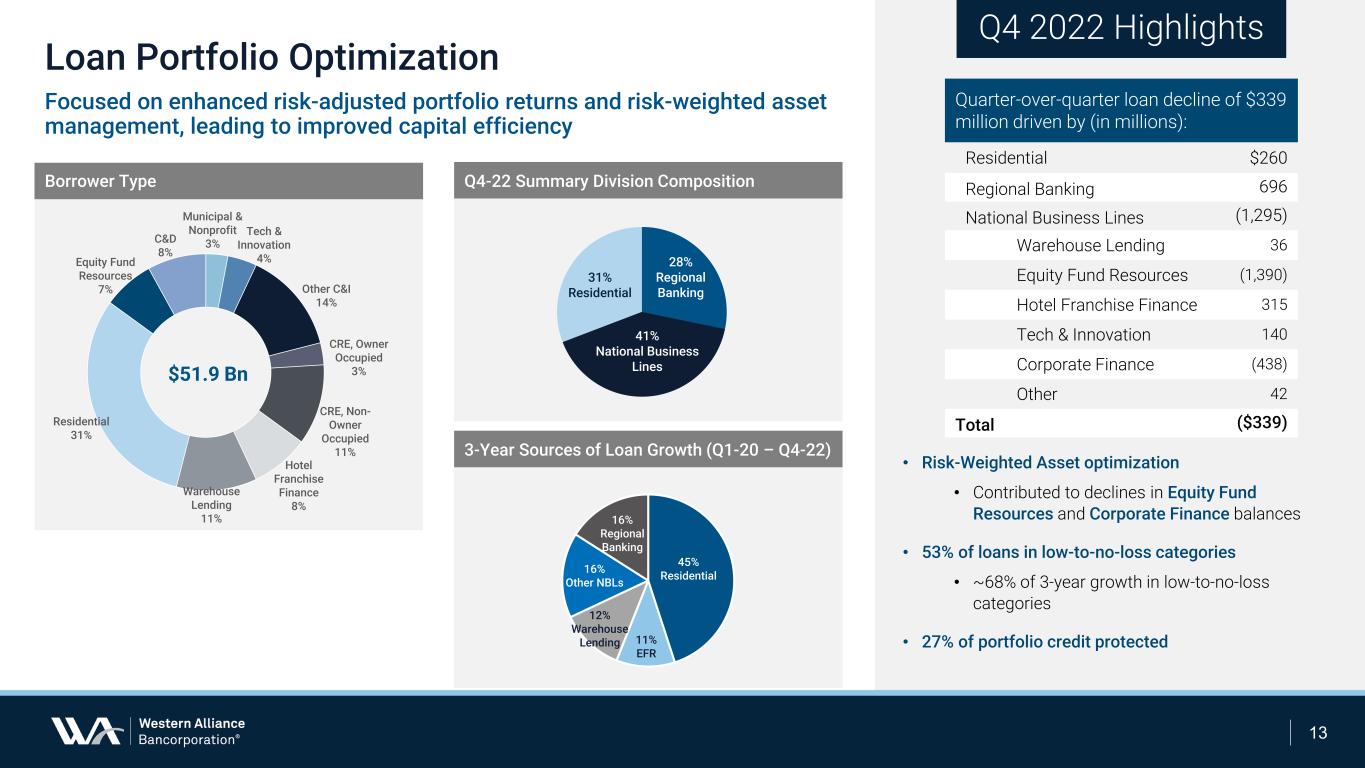

| Loans, net of deferred fees and costs | 51,862 | 31,414 | 20,448 | — | ||||||||||||||||||||||

| Less: allowance for credit losses | (310) | (262) | (48) | — | ||||||||||||||||||||||

| Total loans | 51,552 | 31,152 | 20,400 | — | ||||||||||||||||||||||

| Other assets acquired through foreclosure, net | 11 | 11 | — | — | ||||||||||||||||||||||

| Goodwill and other intangible assets, net | 680 | 293 | 387 | — | ||||||||||||||||||||||

| Other assets | 4,504 | 435 | 2,180 | 1,889 | ||||||||||||||||||||||

| Total assets | $ | 67,734 | $ | 31,903 | $ | 24,151 | $ | 11,680 | ||||||||||||||||||

| Liabilities: | ||||||||||||||||||||||||||

| Deposits | $ | 53,644 | $ | 29,494 | $ | 18,492 | $ | 5,658 | ||||||||||||||||||

| Borrowings and qualifying debt | 7,192 | 27 | 340 | 6,825 | ||||||||||||||||||||||

| Other liabilities | 1,542 | 83 | 656 | 803 | ||||||||||||||||||||||

| Total liabilities | 62,378 | 29,604 | 19,488 | 13,286 | ||||||||||||||||||||||

| Allocated equity: | 5,356 | 2,684 | 1,691 | 981 | ||||||||||||||||||||||

| Total liabilities and stockholders' equity | $ | 67,734 | $ | 32,288 | $ | 21,179 | $ | 14,267 | ||||||||||||||||||

| Excess funds provided (used) | — | 385 | (2,972) | 2,587 | ||||||||||||||||||||||

| No. of offices | 56 | 46 | 8 | 2 | ||||||||||||||||||||||

| No. of full-time equivalent employees | 3,365 | 671 | 785 | 1,909 | ||||||||||||||||||||||

| Income Statement: | ||||||||||||||||||||||||||

| Three Months Ended December 31, 2022: | (in millions) | |||||||||||||||||||||||||

| Net interest income | $ | 639.7 | $ | 428.0 | $ | 216.4 | $ | (4.7) | ||||||||||||||||||

| Provision for (recovery of) credit losses | 3.1 | (5.9) | 8.2 | 0.8 | ||||||||||||||||||||||

| Net interest income (expense) after provision for credit losses | 636.6 | 433.9 | 208.2 | (5.5) | ||||||||||||||||||||||

| Non-interest income | 61.5 | 8.7 | 49.2 | 3.6 | ||||||||||||||||||||||

| Non-interest expense | 333.4 | 122.1 | 187.6 | 23.7 | ||||||||||||||||||||||

| Income (loss) before income taxes | 364.7 | 320.5 | 69.8 | (25.6) | ||||||||||||||||||||||

| Income tax expense (benefit) | 71.7 | 76.1 | 16.3 | (20.7) | ||||||||||||||||||||||

| Net income (loss) | $ | 293.0 | $ | 244.4 | $ | 53.5 | $ | (4.9) | ||||||||||||||||||

| Year Ended December 31, 2022: | (in millions) | |||||||||||||||||||||||||

| Net interest income | $ | 2,216.3 | $ | 1,546.3 | $ | 854.1 | $ | (184.1) | ||||||||||||||||||

| Provision for (recovery of) credit losses | 68.1 | 47.2 | 21.1 | (0.2) | ||||||||||||||||||||||

| Net interest income (expense) after provision for credit losses | 2,148.2 | 1,499.1 | 833.0 | (183.9) | ||||||||||||||||||||||

| Non-interest income | 324.6 | 59.7 | 247.2 | 17.7 | ||||||||||||||||||||||

| Non-interest expense | 1,156.7 | 463.5 | 630.1 | 63.1 | ||||||||||||||||||||||

| Income (loss) before income taxes | 1,316.1 | 1,095.3 | 450.1 | (229.3) | ||||||||||||||||||||||

| Income tax expense (benefit) | 258.8 | 260.5 | 107.1 | (108.8) | ||||||||||||||||||||||

| Net income (loss) | $ | 1,057.3 | $ | 834.8 | $ | 343.0 | $ | (120.5) | ||||||||||||||||||

| Western Alliance Bancorporation and Subsidiaries | ||||||||||||||||||||||||||

| Operating Segment Results | ||||||||||||||||||||||||||

| Unaudited | ||||||||||||||||||||||||||

| Balance Sheet: | ||||||||||||||||||||||||||

| Consolidated Company | Commercial | Consumer Related | Corporate | |||||||||||||||||||||||

| At December 31, 2021: | (dollars in millions) | |||||||||||||||||||||||||

| Assets: | ||||||||||||||||||||||||||

| Cash, cash equivalents, and investment securities | $ | 8,057 | $ | 13 | $ | 82 | $ | 7,962 | ||||||||||||||||||

| Loans held for sale | 5,635 | — | 5,635 | — | ||||||||||||||||||||||

| Loans, net of deferred fees and costs | 39,075 | 25,092 | 13,983 | — | ||||||||||||||||||||||

| Less: allowance for credit losses | (252) | (226) | (26) | — | ||||||||||||||||||||||

| Total loans | 38,823 | 24,866 | 13,957 | — | ||||||||||||||||||||||

| Other assets acquired through foreclosure, net | 12 | 12 | — | — | ||||||||||||||||||||||

| Goodwill and other intangible assets, net | 635 | 295 | 340 | — | ||||||||||||||||||||||

| Other assets | 2,821 | 254 | 1,278 | 1,289 | ||||||||||||||||||||||

| Total assets | $ | 55,983 | $ | 25,440 | $ | 21,292 | $ | 9,251 | ||||||||||||||||||

| Liabilities: | ||||||||||||||||||||||||||

| Deposits | $ | 47,612 | $ | 30,467 | $ | 15,363 | $ | 1,782 | ||||||||||||||||||

| Borrowings and qualifying debt | 2,398 | — | 353 | 2,045 | ||||||||||||||||||||||

| Other liabilities | 1,010 | 233 | 138 | 639 | ||||||||||||||||||||||

| Total liabilities | 51,020 | 30,700 | 15,854 | 4,466 | ||||||||||||||||||||||

| Allocated equity: | 4,963 | 2,588 | 1,596 | 779 | ||||||||||||||||||||||

| Total liabilities and stockholders' equity | $ | 55,983 | $ | 33,288 | $ | 17,450 | $ | 5,245 | ||||||||||||||||||

| Excess funds provided (used) | — | 7,848 | (3,842) | (4,006) | ||||||||||||||||||||||

| No. of offices | 58 | 50 | 7 | 1 | ||||||||||||||||||||||

| No. of full-time equivalent employees | 3,139 | 628 | 1,173 | 1,338 | ||||||||||||||||||||||

| Income Statement: | ||||||||||||||||||||||||||

| Three Months Ended December 31, 2021: | (in millions) | |||||||||||||||||||||||||

| Net interest income | $ | 450.6 | $ | 332.8 | $ | 185.6 | $ | (67.8) | ||||||||||||||||||

| Provision for (recovery of) credit losses | 13.2 | 4.9 | 7.6 | 0.7 | ||||||||||||||||||||||

| Net interest income (expense) after provision for credit losses | 437.4 | 327.9 | 178.0 | (68.5) | ||||||||||||||||||||||

| Non-interest income | 110.4 | 16.9 | 76.5 | 17.0 | ||||||||||||||||||||||

| Non-interest expense | 237.8 | 106.5 | 119.5 | 11.8 | ||||||||||||||||||||||

| Income (loss) before income taxes | 310.0 | 238.3 | 135.0 | (63.3) | ||||||||||||||||||||||

| Income tax expense (benefit) | 64.0 | 56.9 | 32.6 | (25.5) | ||||||||||||||||||||||

| Net income (loss) | $ | 246.0 | $ | 181.4 | $ | 102.4 | $ | (37.8) | ||||||||||||||||||

| Year Ended December 31, 2021: | (in millions) | |||||||||||||||||||||||||

| Net interest income | $ | 1,548.8 | $ | 1,181.7 | $ | 603.4 | $ | (236.3) | ||||||||||||||||||

| (Recovery of) provision for credit losses | (21.4) | (30.6) | 11.0 | (1.8) | ||||||||||||||||||||||

| Net interest income (expense) after provision for credit losses | 1,570.2 | 1,212.3 | 592.4 | (234.5) | ||||||||||||||||||||||

| Non-interest income | 404.2 | 65.1 | 317.6 | 21.5 | ||||||||||||||||||||||

| Non-interest expense | 851.4 | 415.9 | 413.9 | 21.6 | ||||||||||||||||||||||

| Income (loss) before income taxes | 1,123.0 | 861.5 | 496.1 | (234.6) | ||||||||||||||||||||||

| Income tax expense (benefit) | 223.8 | 206.6 | 120.1 | (102.9) | ||||||||||||||||||||||

| Net income (loss) | $ | 899.2 | $ | 654.9 | $ | 376.0 | $ | (131.7) | ||||||||||||||||||

| Western Alliance Bancorporation and Subsidiaries | ||

| Reconciliation of Non-GAAP Financial Measures | ||

| Unaudited | ||

| Pre-Provision Net Revenue by Quarter: | |||||||||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| 12/31/2022 | 9/30/2022 | 6/30/2022 | 3/31/2022 | 12/31/2021 | |||||||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||||||||

| Net interest income | $ | 639.7 | $ | 602.1 | $ | 525.0 | $ | 449.5 | $ | 450.6 | |||||||||||||||||||

| Total non-interest income | 61.5 | 61.8 | 95.0 | 106.3 | 110.4 | ||||||||||||||||||||||||

| Net revenue | $ | 701.2 | $ | 663.9 | $ | 620.0 | $ | 555.8 | $ | 561.0 | |||||||||||||||||||

| Total non-interest expense | 333.4 | 305.8 | 268.9 | 248.6 | 237.8 | ||||||||||||||||||||||||

| Pre-provision net revenue (1) | $ | 367.8 | $ | 358.1 | $ | 351.1 | $ | 307.2 | $ | 323.2 | |||||||||||||||||||

| Less: | |||||||||||||||||||||||||||||

| Provision for credit losses | 3.1 | 28.5 | 27.5 | 9.0 | 13.2 | ||||||||||||||||||||||||

| Income tax expense | 71.7 | 65.6 | 63.4 | 58.1 | 64.0 | ||||||||||||||||||||||||

| Net income | $ | 293.0 | $ | 264.0 | $ | 260.2 | $ | 240.1 | $ | 246.0 | |||||||||||||||||||

| Efficiency Ratio by Quarter: | |||||||||||||||||||||||||||||

| Total non-interest expense | $ | 333.4 | $ | 305.8 | $ | 268.9 | $ | 248.6 | $ | 237.8 | |||||||||||||||||||

| Divided by: | |||||||||||||||||||||||||||||

| Total net interest income | 639.7 | 602.1 | 525.0 | 449.5 | 450.6 | ||||||||||||||||||||||||

| Plus: | |||||||||||||||||||||||||||||

| Tax equivalent interest adjustment | 9.0 | 8.5 | 8.2 | 8.0 | 8.4 | ||||||||||||||||||||||||

| Total non-interest income | 61.5 | 61.8 | 95.0 | 106.3 | 110.4 | ||||||||||||||||||||||||

| $ | 710.2 | $ | 672.4 | $ | 628.2 | $ | 563.8 | $ | 569.4 | ||||||||||||||||||||

| Efficiency ratio - tax equivalent basis (2) | 46.9 | % | 45.5 | % | 42.8 | % | 44.1 | % | 41.8 | % | |||||||||||||||||||

| Tangible Common Equity: | |||||||||||||||||||||||||||||

| 12/31/2022 | 9/30/2022 | 6/30/2022 | 3/31/2022 | 12/31/2021 | |||||||||||||||||||||||||

| (dollars and shares in millions) | |||||||||||||||||||||||||||||

| Total stockholders' equity | $ | 5,356 | $ | 5,021 | $ | 4,959 | $ | 5,012 | $ | 4,963 | |||||||||||||||||||

| Less: | |||||||||||||||||||||||||||||

| Goodwill and intangible assets | 680 | 682 | 695 | 698 | 635 | ||||||||||||||||||||||||

| Preferred stock | 295 | 295 | 295 | 295 | 295 | ||||||||||||||||||||||||

| Total tangible common equity | 4,381 | 4,044 | 3,969 | 4,019 | 4,033 | ||||||||||||||||||||||||

| Plus: deferred tax - attributed to intangible assets | 2 | 3 | 2 | 2 | 2 | ||||||||||||||||||||||||

| Total tangible common equity, net of tax | $ | 4,383 | $ | 4,047 | $ | 3,971 | $ | 4,021 | $ | 4,035 | |||||||||||||||||||

| Total assets | $ | 67,734 | $ | 69,165 | $ | 66,055 | $ | 60,576 | $ | 55,983 | |||||||||||||||||||

| Less: goodwill and intangible assets, net | 680 | 682 | 695 | 698 | 635 | ||||||||||||||||||||||||

| Tangible assets | 67,054 | 68,483 | 65,360 | 59,878 | 55,348 | ||||||||||||||||||||||||

| Plus: deferred tax - attributed to intangible assets | 2 | 3 | 2 | 2 | 2 | ||||||||||||||||||||||||

| Total tangible assets, net of tax | $ | 67,056 | $ | 68,486 | $ | 65,362 | $ | 59,880 | $ | 55,350 | |||||||||||||||||||

| Tangible common equity ratio (3) | 6.5 | % | 5.9 | % | 6.1 | % | 6.7 | % | 7.3 | % | |||||||||||||||||||

| Common shares outstanding | 108.9 | 108.9 | 108.3 | 108.3 | 106.6 | ||||||||||||||||||||||||

| Tangible book value per share, net of tax (3) | $ | 40.25 | $ | 37.16 | $ | 36.67 | $ | 37.13 | $ | 37.84 | |||||||||||||||||||

| Western Alliance Bancorporation and Subsidiaries | ||

| Reconciliation of Non-GAAP Financial Measures | ||

| Unaudited | ||

| Return on Average Tangible Common Equity: | |||||||||||||||||||||||||||||

| Three Months Ended | |||||||||||||||||||||||||||||

| 12/31/2022 | 9/30/2022 | 6/30/2022 | 3/31/2022 | 12/31/2021 | |||||||||||||||||||||||||

| (in millions) | |||||||||||||||||||||||||||||

| Net income available to common shareholders | $ | 289.8 | $ | 260.8 | $ | 257.0 | $ | 236.9 | $ | 242.5 | |||||||||||||||||||

| Divided by: | |||||||||||||||||||||||||||||

| Average stockholders' equity | 5,232.6 | 5,149.6 | 5,021.4 | 4,988.9 | 4,637.6 | ||||||||||||||||||||||||

| Less: | |||||||||||||||||||||||||||||

| Average goodwill and intangible assets | (681.3) | (694.1) | (697.3) | (679.3) | (610.4) | ||||||||||||||||||||||||

| Average preferred stock | (294.5) | (294.5) | (294.5) | (294.5) | (294.5) | ||||||||||||||||||||||||

| Average tangible common equity | $ | 4,256.8 | $ | 4,161.1 | $ | 4,029.6 | $ | 4,015.1 | $ | 3,732.7 | |||||||||||||||||||

| Average accumulated other comprehensive loss (income) ("AOCI") | 725.7 | 483.5 | 355.7 | 56.7 | (34.4) | ||||||||||||||||||||||||

| Average tangible common equity, excluding AOCI | $ | 4,982.5 | $ | 4,644.6 | $ | 4,385.4 | $ | 4,071.8 | $ | 3,698.3 | |||||||||||||||||||

| Return on average tangible common equity (1) | 27.0 | % | 24.9 | % | 25.6 | % | 23.9 | % | 25.8 | % | |||||||||||||||||||

| Return on average tangible common equity, excluding AOCI (1) | 23.1 | % | 22.3 | % | 23.5 | % | 23.6 | % | 26.0 | % | |||||||||||||||||||

| Year Ended December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| (in millions) | |||||||||||

| Net income available to common shareholders | $ | 1,044.5 | $ | 895.7 | |||||||

| Divided by: | |||||||||||

| Average stockholders' equity | 5,099.0 | 4,033.8 | |||||||||

| Less: | |||||||||||

| Average goodwill and intangible assets | (688.0) | (528.6) | |||||||||

| Average preferred stock | (294.5) | (81.5) | |||||||||

| Average tangible common equity | $ | 4,116.4 | $ | 3,423.7 | |||||||

| Average accumulated other comprehensive loss (income) ("AOCI") | 407.5 | (56.9) | |||||||||

| Average tangible common equity, excluding AOCI | $ | 4,523.9 | $ | 3,366.7 | |||||||

| Return on average tangible common equity (1) | 25.4 | % | 26.2 | % | |||||||

| Return on average tangible common equity, excluding AOCI (1) | 23.1 | % | 26.6 | % | |||||||

| Non-GAAP Financial Measures Footnotes | ||||||||||||||||||||||||||

| (1) | We believe this non-GAAP measurement is a key indicator of the earnings power of the Company. | |||||||||||||||||||||||||

| (2) | We believe this non-GAAP ratio provides a useful metric to measure the efficiency of the Company. | |||||||||||||||||||||||||

| (3) | We believe this non-GAAP metric provides an important metric with which to analyze and evaluate financial condition and capital strength. In addition, we believe that use of tangible equity and tangible assets improves the comparability to other institutions that have not engaged in acquisitions that resulted in recorded goodwill and other intangibles. | |||||||||||||||||||||||||