Document

Exhibit 99.1

For Immediate Release

Star Equity Holdings Reports 2025 Third Quarter Results

OLD GREENWICH, CT - November 13, 2025 - Star Equity Holdings, Inc. (Nasdaq: STRR and STRRP) ("Star" or the "Company") formerly, Hudson Global, Inc. (Nasdaq: HSON and HSONP), a diversified holding company, announced today financial results for the third quarter ended September 30, 2025.

2025 Third Quarter Summary

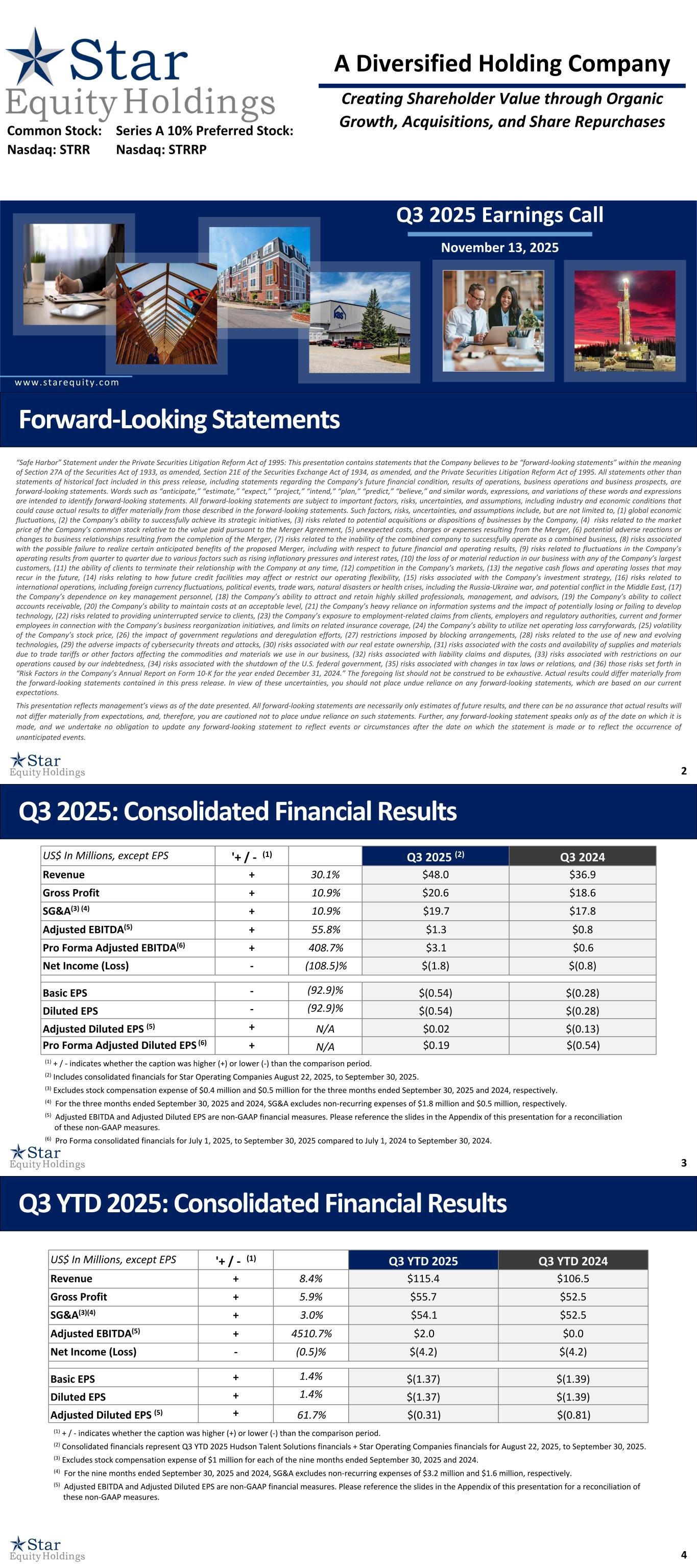

•Revenue of $48.0 million increased 30.1% from the third quarter of 2024.

•Gross profit $20.6 million increased 10.9% from the third quarter of 2024.

•Net loss was $1.8 million, or $0.54 per diluted share, compared to net loss of $0.8 million, or $0.28 per diluted share, for the third quarter of 2024. Adjusted net income per diluted share (non-GAAP measure)* was $0.02 compared to adjusted net loss per diluted share of $0.13 in the third quarter of 2024. Pro forma adjusted net income per diluted share was $0.19 compared to pro forma adjusted net loss per diluted share of $0.54 in the third quarter of 2024.

•Adjusted EBITDA (non-GAAP measure)* increased to $1.3 million versus adjusted EBITDA of $0.8 million in the third quarter of 2024; pro forma adjusted EBITDA was $3.1 million versus $0.6 million in the third quarter of 2024.

•Total cash including restricted cash was $18.5 million at September 30, 2025.

Jeff Eberwein, CEO of Star, noted, “Third quarter results reflect the impact of our recent merger, with revenue, gross profit, and Adjusted EBITDA all increasing year over year, largely due to the inclusion of the acquired company’s results beginning August 22, 2025. Adjusted net income per diluted share was $0.02 in Q3 2025, compared to a loss of $0.13 in Q3 2024 marking a turnaround in bottom-line profitability and an encouraging early signal of the combined company’s earnings potential.”

Jake Zabkowicz, Global CEO of Hudson Talent Solutions ("HTS"), added, “Our Business Services segment continued to perform well despite a challenging macroeconomic backdrop. Both third quarter and year-to-date gross profit increased slightly compared to last year, even as the broader talent acquisition industry has contracted in 2025 versus 2024. This outperformance demonstrates the resilience of our business model and the strength of our client relationships. I’m also proud that HTS was named to the Baker’s Dozen for the 17th consecutive year, achieving our highest-ever overall ranking, and recognized as number one in the Asia-Pacific region for the third consecutive year. These distinctions reflect our consistent performance, global reach, and unwavering focus on delivering excellence for our clients.”

Rick Coleman, COO of Star, added, “Our Building Solutions segment delivered strong performance, capitalizing on the rebound in commercial construction demand while navigating continued softness in residential markets. The performance underscores our ability to adapt to evolving industry dynamics and flex our orientation towards higher-growth markets.

Our Energy Services segment achieved particularly strong results despite a broader slowdown across the energy sector. The strong performance was driven by exceptional sales execution, disciplined cost management, and strategic capital investments in ADT’s drilling tool inventory and service capabilities. These initiatives not only increased sales and utilization rates but also enhanced our market positioning and customer satisfaction."

Mr. Eberwein concluded, “Following the recent merger, we are operating from a stronger, more diversified platform with increased scale, broader end-market exposure, and improved operating leverage. The integration is progressing well, and we are already realizing efficiencies across shared services. Across all our operating segments, we are focused on operational excellence, prudent capital allocation, and a disciplined approach to growth. We believe that our stock price remains undervalued, and in the third quarter we repurchased approximately 8% of our outstanding shares. Our Board of Directors also authorized a new share repurchase program, reinforcing our confidence in the long-term value of the business and our commitment to growing value per share.

Looking ahead, we are well positioned to drive long-term shareholder value through a balanced mix of organic growth, disciplined capital allocation, and accretive acquisitions. We continue to evaluate acquisition opportunities that align with our diversified holding company strategy, focusing on scalable, cash-generating businesses with strong management teams and sustainable competitive advantages. Together, these efforts are strengthening Star's foundation for sustainable, profitable expansion.”

* The Company provides non-GAAP measures as a supplement to financial results based on accounting principles generally accepted in the United States ("GAAP"). Adjusted EBITDA, EBITDA, adjusted net income or loss, and adjusted net income or loss per diluted share are defined in the segment tables at the end of this release and a reconciliation of such non-GAAP measures to the most directly comparable GAAP measures is included within such segment tables.

Segment Highlights

As a result of the Merger (as defined below), reported results for the third quarter 2025 Building Solutions and Energy Services segments reflect activity from August 22, 2025 through September 30, 2025.

Building Solutions

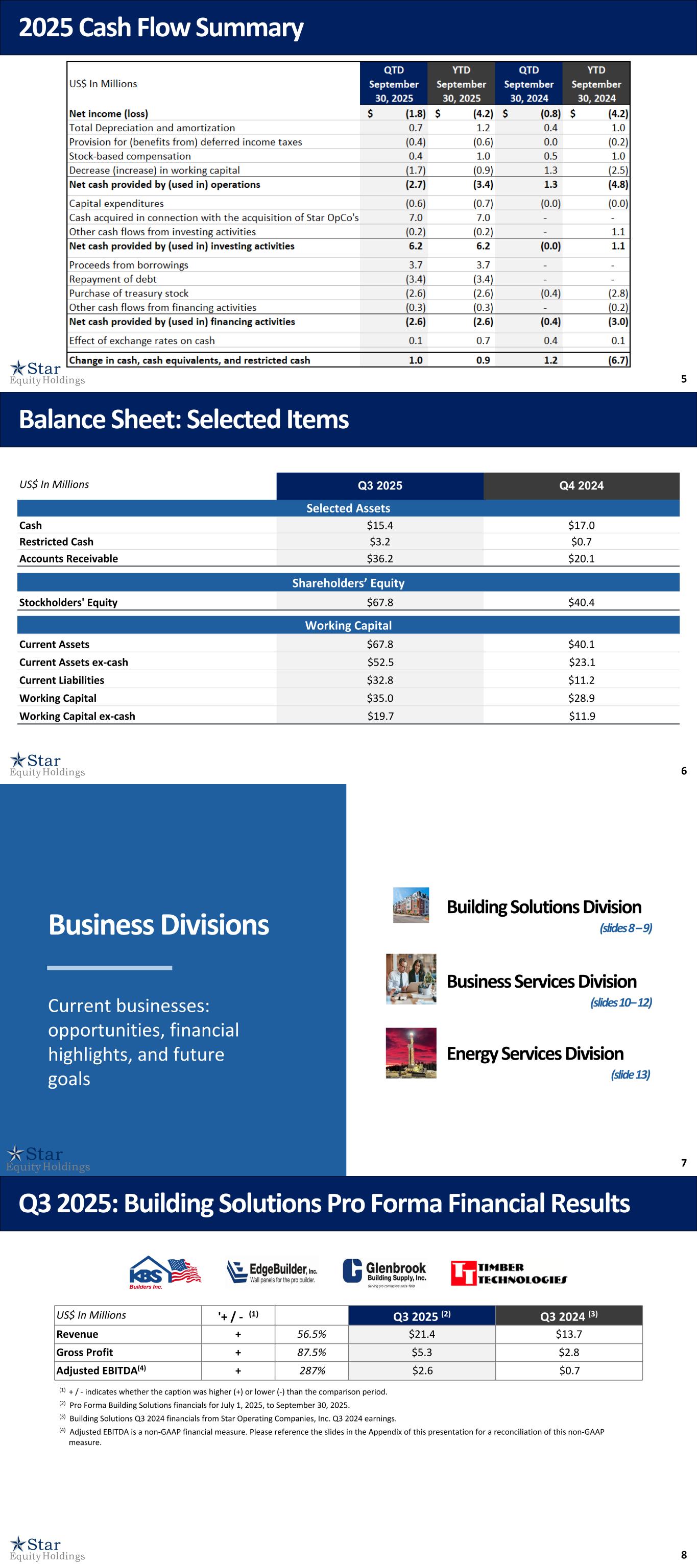

Third quarter Building Solutions revenue was $9.6 million and gross profit was $1.7 million. Adjusted EBITDA was $0.6 million.

Pro forma ("PF")(1) Building Solutions revenue was $21.4 million, up from $13.7 million in the third quarter of 2024, and PF gross profit was $5.3 million versus $2.8 million in the prior year quarter. PF adjusted EBITDA was $2.6 million, up from adjusted EBITDA of $0.7 million a year ago.

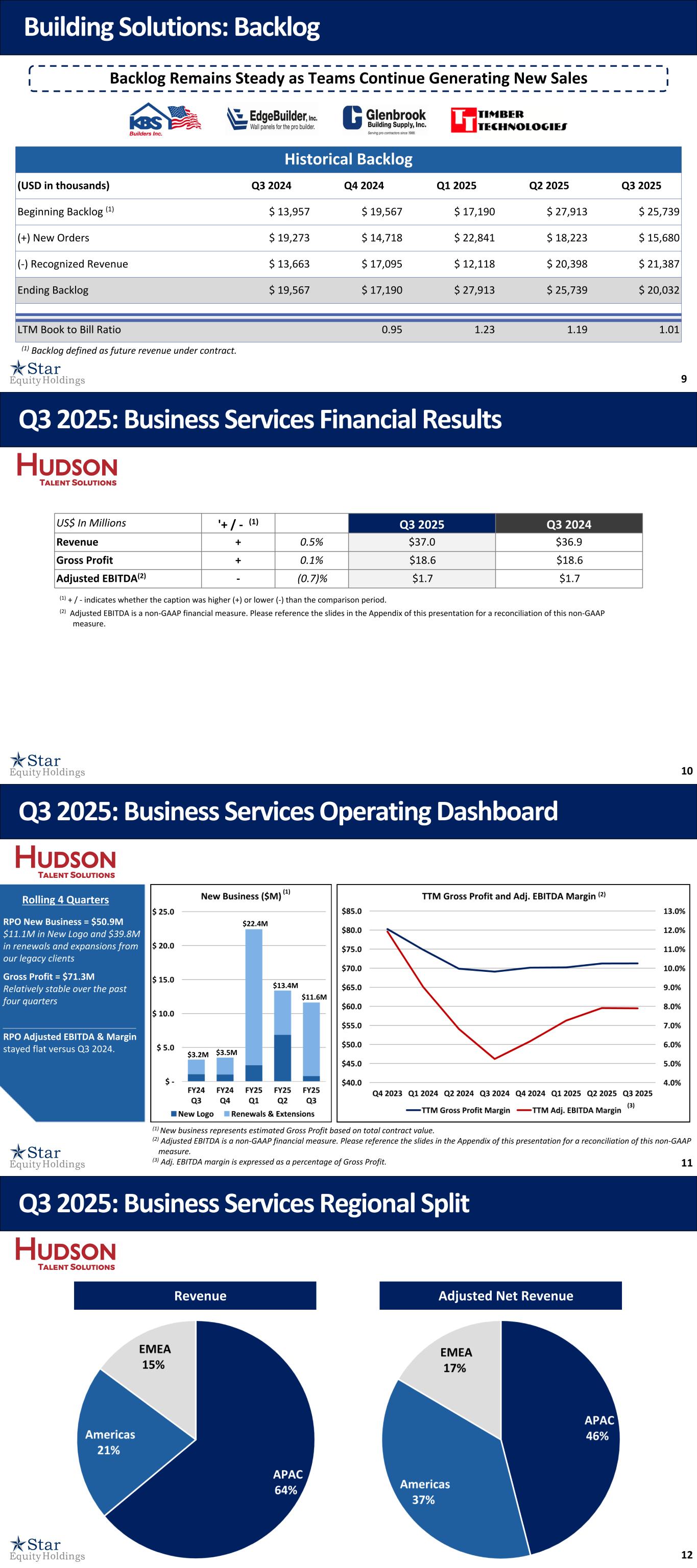

Building Solutions quarter-end backlog was $20.0 million, and the trailing 12-month book-to-bill ratio was 1.01.

Business Services

Third quarter 2025 Business Services revenue was $37.0 million, up from $36.9 million in the prior year quarter, while gross profit of $18.6 million was flat versus a year ago. Business Services adjusted EBITDA was $1.7 million, which was flat versus last year's third quarter.

Regionally, APAC and Americas gross profit grew 9% and 5%, respectively. This growth was offset by EMEA, where gross profit declined by 25%.

Energy Services

Third quarter 2025 Energy Services revenue was $1.3 million. Gross profit was $0.3 million. Energy Services adjusted EBITDA was $0.1 million in the third quarter.

PF Energy Services revenue for the third quarter of 2025 was $3.7 million and PF gross profit was $1.5 million. Third quarter 2025 PF adjusted EBITDA was $1.0 million.

(1) Pro forma Building Solutions and Energy Services results for the full third quarter of 2025 as opposed to August 22, 2025 through September 30, 2025. These results are compared to Building Solutions division results from Star Operating Companies, Inc. for the third quarter of 2024. No comparison is provided for Energy Services as that division did not exist at Star Operating Companies, Inc. until March 2025.

Corporate Costs

In the third quarter of 2025, the Company's corporate costs were $1.2 million, up from $0.9 million in the prior year quarter. Corporate costs in the third quarter of 2025 and 2024 excluded non-recurring expenses of $1.3 million and $0.1 million, respectively. The increase in non-recurring expenses was primarily driven by the Merger.

Liquidity and Capital Resources

The Company ended the third quarter of 2025 with $18.5 million in cash, including $3.2 million in restricted cash. The Company used $2.7 million in cash flow from operations during the third quarter of 2025 compared to using $1.3 million in cash flow from operations in the third quarter of 2024.

Share Repurchase Program

As announced previously, the Company completed its $5 million common stock share repurchase program authorized in August 2023. In addition, the Company's Board of Directors authorized a new $3 million repurchase program in September 2025.

The Company has repurchased approximately $10 million worth of common stock since 2020, including a recent block purchase of approximately 8% of its outstanding shares, and continues to view share repurchases as an attractive use of capital.

NOL Carryforward

As of December 31, 2024, Star had $240 million of usable net operating losses (“NOL”) in the U.S., which the Company considers to be a very valuable asset for its stockholders. In order to protect the value of the NOL for all stockholders, the Company has a rights agreement and charter amendment in place that limit beneficial ownership of Star common stock to 4.99%. Stockholders who wish to own more than 4.99% of Star common stock, or who already own more than 4.99% of Star common stock and wish to buy more, may only acquire additional shares with the Board’s prior written approval.

Conference Call/Webcast

The Company will conduct a conference call today, Thursday, November 13, 2025 at 10:00 a.m. ET to discuss this announcement. Individuals wishing to listen can access the webcast on the investor information section of the Company's web site at www.starequity.com.

If you wish to join the conference call, please use the dial-in information below:

•Toll-Free Dial-In Number: (833) 890-6161

•International Dial-In Number: (412) 504-9848

The archived call will be available on the investor relations section of the Company's website at www.starequity.com.

About Star Equity Holdings, Inc.

Star Equity Holdings, Inc. is a diversified holding company that seeks to build long-term shareholder value by acquiring, managing, and growing businesses with strong fundamentals and market opportunities. Its current structure comprises four segments: Building Solutions, Business Services, Energy Services, and Investments. For more information visit www.starequity.com.

On August 22, 2025, the Company completed its previously announced acquisition of Star Operating Companies, Inc. (“Star Operating”, formerly known as Star Equity Holdings, Inc.), pursuant to the Agreement and Plan of Merger, dated as of May 21, 2025 (the “Merger Agreement”), by and among the Company, Star Operating and HSON Merger Sub, Inc., a wholly owned subsidiary of the Company (“Merger Sub”). Upon the terms and subject to the conditions of the Merger Agreement, on August 22, 2025, at the effective time of the merger pursuant to the Merger Agreement (the “Merger”), Merger Sub merged with and into Star Operating, with Star Operating continuing as the surviving corporation of the Merger as a wholly owned subsidiary of the Company. Effective September 5, 2025, the Company changed (i) its name to Star Equity Holdings, Inc. and (ii) its trading symbols on Nasdaq to STRR and STRRP.

Building Solutions

The Building Solutions division operates in three niches: (i) modular building manufacturing; (ii) structural wall panel and wood foundation manufacturing, including building supply distribution operations; and (iii) glue-laminated timber (glulam) column, beam, and truss manufacturing.

Business Services

The Business Services division provides flexible and scalable recruitment solutions to a global clientele, servicing organizations at all levels, from entry-level positions to the C-suite. The division focuses on mid-market and enterprise organizations worldwide, partnering consultatively with talent acquisition, HR, and procurement leaders to build diverse, high-impact teams and drive business success.

Energy Services

The Energy Services division engages in the rental, sale, and repair of downhole tools used in the oil and gas, geothermal, mining, and water-well industries.

Investments

The Investments division manages and finances the Company’s real estate assets as well as its investment positions in private and public companies.

Investor Relations:

The Equity Group

Lena Cati

(212) 836-9611

lcati@theequitygroup.com

Forward-Looking Statements

This press release contains statements that the Company believes to be “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact included in this press release, including statements regarding the Company’s future financial condition, results of operations, business operations and business prospects, are forward-looking statements. Words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “predict,” “believe,” and similar words, expressions, and variations of these words and

expressions are intended to identify forward-looking statements. All forward-looking statements are subject to important factors, risks, uncertainties, and assumptions, including industry and economic conditions that could cause actual results to differ materially from those described in the forward-looking statements. Such factors, risks, uncertainties, and assumptions include, but are not limited to, (1) global economic fluctuations, (2) the Company’s ability to successfully achieve its strategic initiatives, (3) risks related to potential acquisitions or dispositions of businesses by the Company, (4) risks related to the market price of the Company’s common stock relative to the value paid pursuant to the Merger Agreement, (5) unexpected costs, charges or expenses resulting from the Merger, (6) potential adverse reactions or changes to business relationships resulting from the completion of the Merger, (7) risks related to the inability of the combined company to successfully operate as a combined business, (8) risks associated with the possible failure to realize certain anticipated benefits of the proposed Merger, including with respect to future financial and operating results, (9) risks related to fluctuations in the Company’s operating results from quarter to quarter due to various factors such as rising inflationary pressures and interest rates, (10) the loss of or material reduction in our business with any of the Company’s largest customers, (11) the ability of clients to terminate their relationship with the Company at any time, (12) competition in the Company’s markets, (13) the negative cash flows and operating losses that may recur in the future, (14) risks relating to how future credit facilities may affect or restrict our operating flexibility, (15) risks associated with the Company’s investment strategy, (16) risks related to international operations, including foreign currency fluctuations, political events, trade wars, natural disasters or health crises, including the Russia-Ukraine war, and potential conflict in the Middle East, (17) the Company’s dependence on key management personnel, (18) the Company’s ability to attract and retain highly skilled professionals, management, and advisors, (19) the Company’s ability to collect accounts receivable, (20) the Company’s ability to maintain costs at an acceptable level, (21) the Company’s heavy reliance on information systems and the impact of potentially losing or failing to develop technology, (22) risks related to providing uninterrupted service to clients, (23) the Company’s exposure to employment-related claims from clients, employers and regulatory authorities, current and former employees in connection with the Company’s business reorganization initiatives, and limits on related insurance coverage, (24) the Company’s ability to utilize net operating loss carryforwards, (25) volatility of the Company’s stock price, (26) the impact of government regulations and deregulation efforts, (27) restrictions imposed by blocking arrangements, (28) risks related to the use of new and evolving technologies, (29) the adverse impacts of cybersecurity threats and attacks, (30) risks associated with our real estate ownership, (31) risks associated with the costs and availability of supplies and materials due to trade tariffs or other factors affecting the commodities and materials we use in our business, (32) risks associated with liability claims and disputes, (33) risks associated with restrictions on our operations caused by our indebtedness, (34) risks associated with the shutdown of the U.S. federal government, (35) risks associated with changes in tax laws or relations, and (36) those risks set forth in “Risk Factors in the Company’s Annual Report on Form 10-K for the year ended December 31, 2024.” The foregoing list should not be construed to be exhaustive. Actual results could differ materially from the forward-looking statements contained in this press release. In view of these uncertainties, you should not place undue reliance on any forward-looking statements, which are based on our current expectations. These forward-looking statements speak only as of the date of this press release. The Company assumes no obligation, and expressly disclaims any obligation, to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Financial Tables Follow

STAR EQUITY HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share amounts)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

September 30, |

|

Nine Months Ended

September 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Revenues: |

|

|

|

|

|

|

|

| Building Solutions |

$ |

9,603 |

|

|

$ |

— |

|

|

$ |

9,603 |

|

|

$ |

— |

|

| Business Services |

37,038 |

|

|

36,853 |

|

|

104,445 |

|

|

106,456 |

|

| Energy Services |

1,318 |

|

|

— |

|

|

1,318 |

|

|

— |

|

| Investments |

— |

|

|

— |

|

|

— |

|

|

— |

|

| Total revenues |

47,959 |

|

|

36,853 |

|

|

115,366 |

|

|

106,456 |

|

|

|

|

|

|

|

|

|

| Cost of revenues: |

|

|

|

|

|

|

|

| Building Solutions |

7,919 |

|

|

— |

|

|

7,919 |

|

|

— |

|

| Business Services |

18,408 |

|

|

18,250 |

|

|

50,782 |

|

|

53,908 |

|

| Energy Services |

972 |

|

|

— |

|

|

972 |

|

|

— |

|

| Investments |

33 |

|

|

— |

|

|

33 |

|

|

— |

|

| Total cost of revenues |

27,332 |

|

|

18,250 |

|

|

59,706 |

|

|

53,908 |

|

|

|

|

|

|

|

|

|

| Gross profit |

20,627 |

|

|

18,603 |

|

|

55,660 |

|

|

52,548 |

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

| Salaries and related |

16,135 |

|

|

14,908 |

|

|

45,317 |

|

|

44,399 |

|

| Office and general |

4,819 |

|

|

2,823 |

|

|

10,176 |

|

|

8,164 |

|

| Marketing and promotion |

913 |

|

|

971 |

|

|

2,814 |

|

|

2,627 |

|

| Depreciation and amortization |

404 |

|

|

358 |

|

|

932 |

|

|

1,042 |

|

| Total operating expenses |

22,271 |

|

|

19,060 |

|

|

59,239 |

|

|

56,232 |

|

| Operating loss |

(1,644) |

|

|

(457) |

|

|

(3,579) |

|

|

(3,684) |

|

| Non-operating income (expense): |

|

|

|

|

|

|

|

| Interest (expense) income, net |

81 |

|

|

93 |

|

|

206 |

|

|

280 |

|

| Other income / (expense), net |

48 |

|

|

(184) |

|

|

(209) |

|

|

(318) |

|

| Loss before income taxes |

(1,515) |

|

|

(548) |

|

|

(3,582) |

|

|

(3,722) |

|

| Provision for income taxes |

249 |

|

|

298 |

|

|

626 |

|

|

463 |

|

| Net loss |

(1,764) |

|

|

(846) |

|

|

(4,208) |

|

|

(4,185) |

|

| Dividend on Series A perpetual preferred stock |

(67) |

|

|

— |

|

|

(67) |

|

|

— |

|

| Net loss attributable to common shareholders |

$ |

(1,831) |

|

|

$ |

(846) |

|

|

$ |

(4,275) |

|

|

$ |

(4,185) |

|

| Loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

$ |

(0.54) |

|

|

$ |

(0.28) |

|

|

$ |

(1.37) |

|

|

$ |

(1.39) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

$ |

(0.54) |

|

|

$ |

(0.28) |

|

|

$ |

(1.37) |

|

|

$ |

(1.39) |

|

| Loss per share, attributable to common shareholders |

|

|

|

|

|

|

|

Basic |

$ |

(0.56) |

|

|

$ |

(0.28) |

|

|

$ |

(1.39) |

|

|

$ |

(1.39) |

|

Diluted |

$ |

(0.56) |

|

|

$ |

(0.28) |

|

|

$ |

(1.39) |

|

|

$ |

(1.39) |

|

| Weighted-average shares outstanding: |

|

|

|

|

|

|

|

Basic |

3,263 |

|

|

2,975 |

|

|

3,082 |

|

|

3,009 |

|

Diluted |

3,263 |

|

|

2,975 |

|

|

3,082 |

|

|

3,009 |

|

|

|

|

|

|

|

|

|

| Dividends declared per share of Series A perpetual preferred stock |

$ |

0.025 |

|

|

$ |

— |

|

|

$ |

0.025 |

|

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| STAR EQUITY HOLDINGS, INC. |

| CONDENSED CONSOLIDATED BALANCE SHEETS |

| (in thousands, except per share amounts) |

| (unaudited) |

|

|

|

|

|

|

|

September 30,

2025 |

|

December 31,

2024 |

| ASSETS |

|

|

|

|

| Current assets: |

|

|

|

|

| Cash and cash equivalents |

|

$ |

15,368 |

|

|

$ |

17,011 |

|

| Restricted cash, current |

|

1,209 |

|

|

476 |

|

| Investments in equity securities |

|

2,721 |

|

|

— |

|

| Accounts receivable, less allowance for expected credit losses of $346 and $391, respectively |

|

36,239 |

|

|

20,093 |

|

|

|

|

|

|

| Inventories, net |

|

7,746 |

|

|

— |

|

| Prepaid and other |

|

4,562 |

|

|

2,560 |

|

|

|

|

|

|

| Total current assets |

|

67,845 |

|

|

40,140 |

|

| Property and equipment, net of accumulated depreciation of $5,678 and $1,668, respectively |

|

18,374 |

|

|

242 |

|

| Operating lease right-of-use assets |

|

9,953 |

|

|

1,024 |

|

| Goodwill |

|

5,969 |

|

|

5,703 |

|

| Intangible assets, net of accumulated amortization of $4,618 and $3,897, respectively |

|

1,871 |

|

|

2,491 |

|

| Long-term investments |

|

953 |

|

|

— |

|

| Notes receivable, net of current portion |

|

6,787 |

|

|

— |

|

| Deferred tax assets, net |

|

3,406 |

|

|

2,648 |

|

| Restricted cash, non-current |

|

1,949 |

|

|

180 |

|

| Other assets |

|

33 |

|

|

155 |

|

|

|

|

|

|

| Total assets |

|

$ |

117,140 |

|

|

$ |

52,583 |

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

| Current liabilities: |

|

|

|

|

| Accounts payable |

|

$ |

5,515 |

|

|

$ |

1,789 |

|

| Accrued salaries, commissions, and benefits |

|

7,569 |

|

|

4,306 |

|

| Accrued expenses and other current liabilities |

|

9,306 |

|

|

4,375 |

|

| Short-term debt |

|

6,431 |

|

|

— |

|

| Deferred revenue |

|

3,425 |

|

|

129 |

|

| Operating lease obligations, current |

|

564 |

|

|

623 |

|

|

|

|

|

|

| Total current liabilities |

|

32,810 |

|

|

11,222 |

|

| Income tax payable |

|

97 |

|

|

93 |

|

| Operating lease obligations |

|

9,473 |

|

|

441 |

|

| Long-term debt, net of current portion |

|

6,522 |

|

|

— |

|

| Other liabilities |

|

467 |

|

|

399 |

|

|

|

|

|

|

| Total liabilities |

|

49,369 |

|

|

12,155 |

|

| Commitments and contingencies |

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

Series A Preferred stock, $0.001 par value; 10,000 shares authorized: 2,691 and 0 shares issued and outstanding, respectively |

|

3 |

|

|

— |

|

|

Common stock, $0.001 par value, 20,000 shares authorized; 5,026 and

4,033 shares issued; 3,436 and 2,750 shares outstanding, respectively

|

|

5 |

|

|

4 |

|

| Additional paid-in capital |

|

527,311 |

|

|

494,209 |

|

| Accumulated deficit |

|

(434,225) |

|

|

(430,017) |

|

| Accumulated other comprehensive loss, net of applicable tax |

|

(1,397) |

|

|

(2,717) |

|

Treasury stock, 1,590 and 1,283 shares, respectively, at cost |

|

(23,926) |

|

|

(21,051) |

|

| Total stockholders’ equity |

|

67,771 |

|

|

40,428 |

|

| Total liabilities and stockholders’ equity |

|

$ |

117,140 |

|

|

$ |

52,583 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| STAR EQUITY HOLDINGS, INC. |

| SEGMENT ANALYSIS - QUARTER TO DATE |

| RECONCILIATION OF ADJUSTED EBITDA |

| (in thousands) |

| (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| For The Three Months Ended September 30, 2025 |

|

Building Solutions |

|

Business Services |

|

Energy Services |

|

Investments |

|

Corporate |

|

Total |

| Revenue, from external customers |

|

$ |

9,603 |

|

|

$ |

37,038 |

|

|

$ |

1,318 |

|

|

$ |

53 |

|

|

$ |

(53) |

|

|

$ |

47,959 |

|

Gross profit |

|

$ |

1,684 |

|

|

$ |

18,630 |

|

|

$ |

346 |

|

|

$ |

20 |

|

|

$ |

(53) |

|

|

$ |

20,627 |

|

| Net loss |

|

|

|

|

|

|

|

|

|

|

|

$ |

(1,764) |

|

| Provision from income taxes |

|

|

|

|

|

|

|

|

|

|

|

249 |

|

| Interest income, net |

|

|

|

|

|

|

|

|

|

|

|

(81) |

|

Total depreciation and amortization |

|

|

|

|

|

|

|

|

|

|

|

666 |

|

EBITDA (loss) (1) |

|

$ |

495 |

|

|

$ |

797 |

|

|

$ |

140 |

|

|

$ |

(6) |

|

|

$ |

(2,356) |

|

|

(930) |

|

| Non-operating expense (income), including corporate administration charges |

|

— |

|

|

207 |

|

|

(24) |

|

|

33 |

|

|

(264) |

|

|

(48) |

|

| Stock-based compensation expense |

|

5 |

|

|

227 |

|

|

— |

|

|

— |

|

|

137 |

|

|

369 |

|

Interest income (2) |

|

— |

|

|

— |

|

|

— |

|

|

144 |

|

|

— |

|

|

144 |

|

| Non-recurring severance and professional fees |

|

65 |

|

|

460 |

|

|

12 |

|

|

— |

|

|

1,263 |

|

|

1,800 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA (loss) (1) |

|

$ |

565 |

|

|

$ |

1,691 |

|

|

$ |

128 |

|

|

$ |

171 |

|

|

$ |

(1,220) |

|

|

$ |

1,335 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For The Three Months Ended September 30, 2024 |

|

|

|

Business Services |

|

|

|

|

|

Corporate |

|

Total |

| Revenue, from external customers |

|

|

|

$ |

36,853 |

|

|

|

|

|

|

$ |

— |

|

|

$ |

36,853 |

|

Gross profit |

|

|

|

$ |

18,603 |

|

|

|

|

|

|

$ |

— |

|

|

$ |

18,603 |

|

| Net loss |

|

|

|

|

|

|

|

|

|

|

|

$ |

(846) |

|

| Provision for income taxes |

|

|

|

|

|

|

|

|

|

|

|

298 |

|

| Interest income, net |

|

|

|

|

|

|

|

|

|

|

|

(93) |

|

Total depreciation and amortization |

|

|

|

|

|

|

|

|

|

|

|

358 |

|

EBITDA (loss) (1) |

|

|

|

$ |

705 |

|

|

|

|

|

|

$ |

(988) |

|

|

(283) |

|

| Non-operating expense (income), including corporate administration charges |

|

|

|

459 |

|

|

|

|

|

|

(275) |

|

|

184 |

|

| Stock-based compensation expense |

|

|

|

216 |

|

|

|

|

|

|

265 |

|

|

481 |

|

| Non-recurring expenses |

|

|

|

323 |

|

|

|

|

|

|

134 |

|

|

457 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA (loss) (1) |

|

|

|

$ |

1,703 |

|

|

|

|

|

|

$ |

(864) |

|

|

$ |

839 |

|

(1) Non-GAAP earnings before interest, income taxes, and depreciation and amortization (“EBITDA”) and non-GAAP earnings before interest, income taxes, depreciation and amortization, non-operating income (expense), stock-based compensation expense, and other non-recurring severance and professional fees (“Adjusted EBITDA”) are presented to provide additional information about the Company's operations on a basis consistent with the measures which the Company uses to manage its operations and evaluate its performance. Management also uses these measurements to evaluate capital needs and working capital requirements. EBITDA and Adjusted EBITDA should not be considered in isolation or as a substitute for operating income, cash flows from operating activities, and other income or cash flow statement data prepared in accordance with generally accepted accounting principles or as a measure of the Company's profitability or liquidity. Furthermore, EBITDA and Adjusted EBITDA as presented above may not be comparable with similarly titled measures reported by other companies.

(2) The Company allocates all corporate interest income to the Investments Division.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| STAR EQUITY HOLDINGS, INC. |

| SEGMENT ANALYSIS - YEAR TO DATE (continued) |

| RECONCILIATION OF ADJUSTED EBITDA |

| (in thousands) |

| (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| For The Nine Months Ended September 30, 2025 |

|

Building Solutions |

|

Business Services |

|

Energy Services |

|

Investments |

|

Corporate |

|

Total |

| Revenue, from external customers |

|

$ |

9,603 |

|

|

$ |

104,445 |

|

|

$ |

1,318 |

|

|

$ |

53 |

|

|

$ |

(53) |

|

|

$ |

115,366 |

|

Gross profit |

|

$ |

1,684 |

|

|

$ |

53,663 |

|

|

$ |

346 |

|

|

$ |

20 |

|

|

$ |

(53) |

|

|

$ |

55,660 |

|

| Net loss |

|

|

|

|

|

|

|

|

|

|

|

$ |

(4,208) |

|

| Provision from income taxes |

|

|

|

|

|

|

|

|

|

|

|

626 |

|

| Interest income, net |

|

|

|

|

|

|

|

|

|

|

|

(206) |

|

Total depreciation and amortization |

|

|

|

|

|

|

|

|

|

|

|

1,194 |

|

EBITDA (loss) (1) |

|

$ |

495 |

|

|

$ |

1,255 |

|

|

$ |

140 |

|

|

$ |

(6) |

|

|

$ |

(4,478) |

|

|

(2,594) |

|

| Non-operating expense (income), including corporate administration charges |

|

— |

|

|

1,243 |

|

|

(24) |

|

|

33 |

|

|

(1,043) |

|

|

209 |

|

| Stock-based compensation expense |

|

5 |

|

|

635 |

|

|

— |

|

|

— |

|

|

358 |

|

|

998 |

|

Interest income (2) |

|

— |

|

|

— |

|

|

— |

|

|

144 |

|

|

— |

|

|

144 |

|

| Non-recurring expenses |

|

65 |

|

|

982 |

|

|

12 |

|

|

— |

|

|

2,167 |

|

|

3,226 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA (loss) (1) |

|

$ |

565 |

|

|

$ |

4,115 |

|

|

$ |

128 |

|

|

$ |

171 |

|

|

$ |

(2,996) |

|

|

$ |

1,983 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For The Nine Months Ended September 30, 2024 |

|

|

|

Business Services |

|

|

|

|

|

Corporate |

|

Total |

| Revenue, from external customers |

|

|

|

$ |

106,456 |

|

|

|

|

|

|

$ |

— |

|

|

$ |

106,456 |

|

Gross profit |

|

|

|

$ |

52,548 |

|

|

|

|

|

|

$ |

— |

|

|

$ |

52,548 |

|

| Net loss |

|

|

|

|

|

|

|

|

|

|

|

$ |

(4,185) |

|

| Provision for income taxes |

|

|

|

|

|

|

|

|

|

|

|

463 |

|

| Interest income, net |

|

|

|

|

|

|

|

|

|

|

|

(280) |

|

Total depreciation and amortization |

|

|

|

|

|

|

|

|

|

|

|

1,042 |

|

EBITDA (loss) (1) |

|

|

|

$ |

283 |

|

|

|

|

|

|

$ |

(3,243) |

|

|

(2,960) |

|

| Non-operating expense (income), including corporate administration charges |

|

|

|

1,095 |

|

|

|

|

|

|

(777) |

|

|

318 |

|

| Stock-based compensation expense |

|

|

|

647 |

|

|

|

|

|

|

399 |

|

|

1,046 |

|

| Non-recurring expenses |

|

|

|

798 |

|

|

|

|

|

|

840 |

|

|

1,638 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA (loss) (1) |

|

|

|

$ |

2,823 |

|

|

|

|

|

|

$ |

(2,781) |

|

|

$ |

42 |

|

(1) Non-GAAP earnings before interest, income taxes, and depreciation and amortization (“EBITDA”) and non-GAAP earnings before interest, income taxes, depreciation and amortization, non-operating (income) expense, stock-based compensation expense, and other non-recurring expenses (“Adjusted EBITDA”) are presented to provide additional information about the Company's operations on a basis consistent with the measures which the Company uses to manage its operations and evaluate its performance. Management also uses these measurements to evaluate capital needs and working capital requirements. EBITDA and Adjusted EBITDA should not be considered in isolation or as a substitute for operating income, cash flows from operating activities, and other income or cash flow statement data prepared in accordance with generally accepted accounting principles or as a measure of the Company's profitability or liquidity. Furthermore, EBITDA and Adjusted EBITDA as presented above may not be comparable with similarly titled measures reported by other companies.

(2) The Company allocates all corporate interest income to the Investments Division.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| STAR EQUITY HOLDINGS, INC. |

| SEGMENT ANALYSIS - QUARTER TO DATE |

RECONCILIATION OF PRO FORMA ADJUSTED EBITDA |

| (in thousands) |

| (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| For The Three Months Ended September 30, 2025 |

|

Building Solutions |

|

Business Services |

|

Energy Services |

|

Investments |

|

Corporate |

|

Total |

Pro forma revenue, from external customers (1) |

|

$ |

21,386 |

|

|

$ |

37,038 |

|

|

$ |

3,712 |

|

|

$ |

156 |

|

|

$ |

(156) |

|

|

$ |

62,136 |

|

Pro forma gross profit (1) |

|

$ |

5,263 |

|

|

$ |

18,630 |

|

|

$ |

1,538 |

|

|

$ |

81 |

|

|

$ |

(156) |

|

|

$ |

25,356 |

|

Pro forma net loss |

|

|

|

|

|

|

|

|

|

|

|

$ |

(1,852) |

|

| Provision from income taxes |

|

|

|

|

|

|

|

|

|

|

|

249 |

|

Interest expense, net |

|

|

|

|

|

|

|

|

|

|

|

5 |

|

Total depreciation and amortization |

|

|

|

|

|

|

|

|

|

|

|

1,449 |

|

Pro forma EBITDA (loss) (1)(2) |

|

$ |

2,507 |

|

|

$ |

797 |

|

|

$ |

1,023 |

|

|

$ |

73 |

|

|

$ |

(4,549) |

|

|

(149) |

|

| Non-operating expense (income), including corporate administration charges |

|

— |

|

|

207 |

|

|

(24) |

|

|

(261) |

|

|

(264) |

|

|

(342) |

|

| Stock-based compensation expense |

|

11 |

|

|

227 |

|

|

— |

|

|

— |

|

|

190 |

|

|

428 |

|

Interest income (3) |

|

— |

|

|

— |

|

|

— |

|

|

336 |

|

|

— |

|

|

336 |

|

| Non-recurring expenses |

|

99 |

|

|

460 |

|

|

12 |

|

|

264 |

|

|

1,985 |

|

|

2,820 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pro forma adjusted EBITDA (loss) (1)(2) |

|

$ |

2,617 |

|

|

$ |

1,691 |

|

|

$ |

1,011 |

|

|

$ |

412 |

|

|

$ |

(2,638) |

|

|

$ |

3,093 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For The Three Months Ended September 30, 2024 |

|

Building Solutions |

|

Business Services |

|

|

|

Investments |

|

Corporate |

|

Total |

Pro forma revenue, from external customers (1) |

|

$ |

13,663 |

|

|

$ |

36,853 |

|

|

|

|

$ |

156 |

|

|

$ |

(156) |

|

|

$ |

50,516 |

|

Pro forma gross profit (1) |

|

$ |

2,846 |

|

|

$ |

18,603 |

|

|

|

|

$ |

127 |

|

|

$ |

(156) |

|

|

$ |

21,420 |

|

Pro forma net loss |

|

|

|

|

|

|

|

|

|

|

|

$ |

(2,816) |

|

| Provision from income taxes |

|

|

|

|

|

|

|

|

|

|

|

280 |

|

| Interest income, net |

|

|

|

|

|

|

|

|

|

|

|

(134) |

|

Total depreciation and amortization |

|

|

|

|

|

|

|

|

|

|

|

1,393 |

|

Pro forma EBITDA (loss) (1)(2) |

|

$ |

534 |

|

|

$ |

705 |

|

|

|

|

$ |

423 |

|

|

$ |

(2,939) |

|

|

(1,277) |

|

| Non-operating expense (income), including corporate administration charges |

|

— |

|

|

459 |

|

|

|

|

221 |

|

|

(275) |

|

|

405 |

|

| Stock-based compensation expense |

|

5 |

|

|

216 |

|

|

|

|

— |

|

|

318 |

|

|

539 |

|

Interest income (3) |

|

— |

|

|

— |

|

|

|

|

356 |

|

|

— |

|

|

356 |

|

| Non-recurring expenses |

|

145 |

|

|

323 |

|

|

|

|

(338) |

|

|

455 |

|

|

585 |

|

Pro forma adjusted EBITDA (loss) (1)(2) |

|

$ |

684 |

|

|

$ |

1,703 |

|

|

|

|

$ |

662 |

|

|

$ |

(2,441) |

|

|

$ |

608 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Pro forma Building Solutions, Energy Services, and Investments results for the full third quarter of 2025 as opposed to August 22, 2025 through September 30, 2025. These results are compared to Building Solutions and Investments division results from Star Operating Companies, Inc. for the third quarter of 2024. No comparison is provided for Energy Services as that division did not exist at Star Operating Companies, Inc. until March 2025.

(2) Pro forma Non-GAAP earnings before interest, income taxes, and depreciation and amortization (“EBITDA”) and non-GAAP earnings before interest, income taxes, depreciation and amortization, non-operating (income) expense, stock-based compensation expense, and other non-recurring expenses (“Adjusted EBITDA”) are presented to provide additional information about the Company's operations on a basis consistent with the measures which the Company uses to manage its operations and evaluate its performance. Management also uses these measurements to evaluate capital needs and working capital requirements. EBITDA and Adjusted EBITDA should not be considered in isolation or as a substitute for operating income, cash flows from operating activities, and other income or cash flow statement data prepared in accordance with generally accepted accounting principles or as a measure of the Company's profitability or liquidity. Furthermore, EBITDA and Adjusted EBITDA as presented above may not be comparable with similarly titled measures reported by other companies.

(3) The Company allocates all corporate interest income to the Investments Division.

STAR EQUITY HOLDINGS, INC.

INCOME PER DILUTED SHARE

(in thousands, except per share amounts)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted |

|

Diluted Shares |

|

Per Diluted |

| For The Three Months Ended September 30, 2025 |

|

Net Loss |

|

Outstanding |

|

Share (1) |

| Net loss |

|

$ |

(1,764) |

|

|

3,263 |

|

|

$ |

(0.54) |

|

| Non-recurring expenses |

|

1,833 |

|

|

3,263 |

|

|

0.56 |

|

|

|

|

|

|

|

|

Adjusted net income (2) |

|

$ |

69 |

|

|

3,263 |

|

|

$ |

0.02 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted |

|

Diluted Shares |

|

Per Diluted |

| For The Three Months Ended September 30, 2024 |

|

Net Loss |

|

Outstanding |

|

Share (1) |

| Net loss |

|

$ |

(846) |

|

|

2,975 |

|

|

$ |

(0.28) |

|

| Non-recurring expenses |

|

457 |

|

|

2,975 |

|

|

0.15 |

|

|

|

|

|

|

|

|

Adjusted net loss (2) |

|

$ |

(389) |

|

|

2,975 |

|

|

$ |

(0.13) |

|

STAR EQUITY HOLDINGS, INC.

PRO FORMA INCOME PER DILUTED SHARE

(in thousands, except per share amounts)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted |

|

Diluted Shares |

|

Per Diluted |

| For The Three Months Ended September 30, 2025 |

|

Net Loss |

|

Outstanding |

|

Share (1) |

Pro forma net loss (3) |

|

$ |

(1,852) |

|

|

3,675 |

|

|

$ |

(0.50) |

|

Pro forma non-recurring expenses |

|

2,559 |

|

|

3,675 |

|

|

0.70 |

|

Pro forma adjusted net income (2)(3) |

|

$ |

707 |

|

|

3,675 |

|

|

$ |

0.19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted |

|

Diluted Shares |

|

Per Diluted |

| For The Three Months Ended September 30, 2024 |

|

Net Loss |

|

Outstanding |

|

Share (1) |

Pro forma net loss (3) |

|

$ |

(2,816) |

|

|

3,719 |

|

|

$ |

(0.76) |

|

Pro forma non-recurring expenses |

|

806 |

|

|

3,719 |

|

|

0.22 |

|

Pro forma adjusted net loss (2)(3) |

|

$ |

(2,010) |

|

|

3,719 |

|

|

$ |

(0.54) |

|

(1) Amounts may not sum due to rounding.

(2) Adjusted net income or loss per diluted share are Non-GAAP measures defined as reported net income or loss and reported net income or loss per diluted share before items such as acquisition-related costs and non-recurring expenses after tax that are presented to provide additional information about the Company's operations on a basis consistent with the measures that the Company uses to manage its operations and evaluate its performance. Management also uses these measurements to evaluate capital needs and working capital requirements. Adjusted net income or loss per diluted share should not be considered in isolation or as substitutes for net income or loss and net income or loss per share and other income or cash flow statement data prepared in accordance with generally accepted accounting principles or as measures of the Company's profitability or liquidity. Further, adjusted net income or loss and adjusted net income or loss per diluted share as presented above may not be comparable with similarly titled measures reported by other companies.

(3) Pro forma Building Solutions, Energy Services, and Investments results for the full third quarter of 2025 as opposed to August 22, 2025 through September 30, 2025. These results are compared to Building Solutions and Investments division results from Star Operating Companies, Inc. for the third quarter of 2024. No comparison is provided for Energy Services as that division did not exist at Star Operating Companies, Inc. until March 2025.