We continue to demonstrate the resilience of our business model as we generate profits, invest in our business, return capital to shareholders, and outperform the global bedding industry. TEMPUR SEALY INTERNATIONAL, INC., TPX “ “ 1

2 History of market share gains across global omnichannel distribution Seasoned, well-aligned management with proven track record Legacy of strong value creation via capital allocation including share buybacks and acquisitions The leading vertically integrated global bedding company with iconic brands and extensive manufacturing capabilities Over the long term, the bedding industry has consistently grown through ASP and unit expansion Investment Thesis

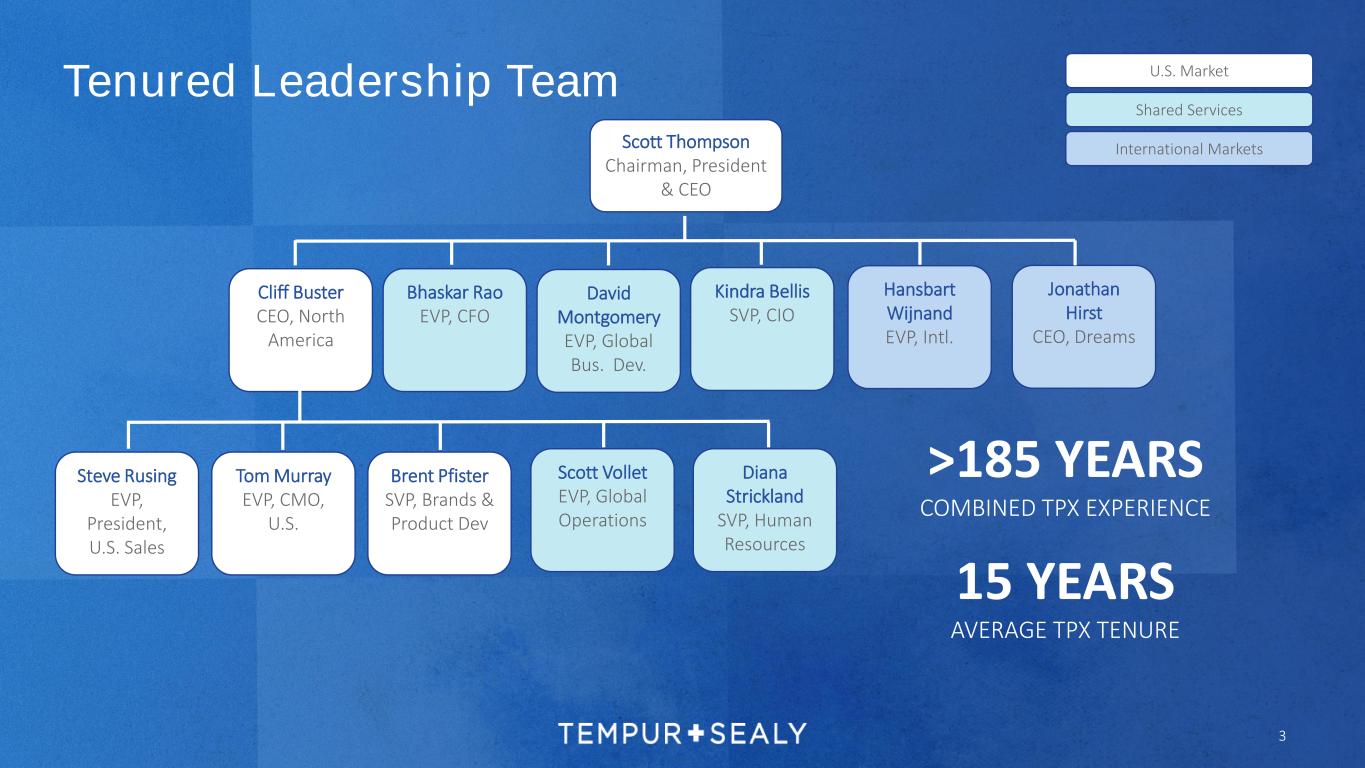

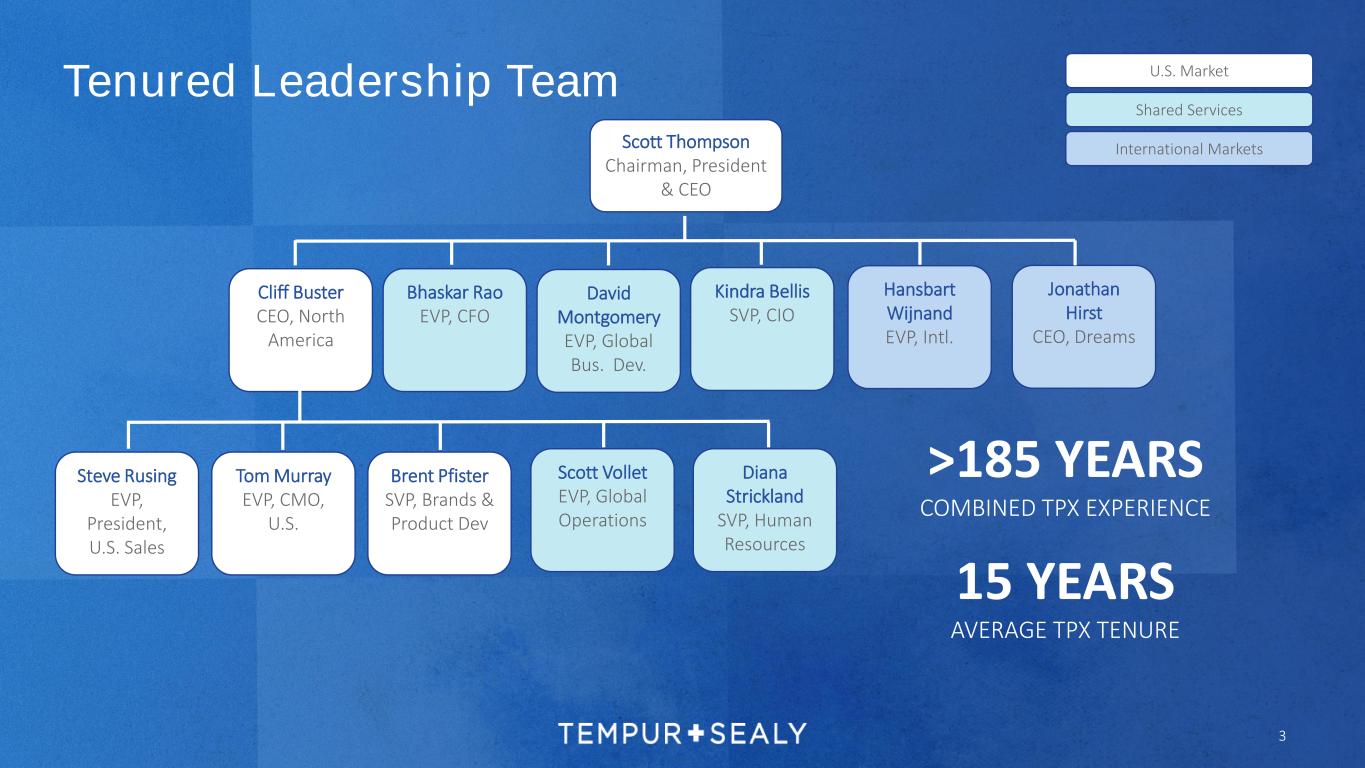

3 U.S. Market International Markets Tenured Leadership Team >185 YEARS COMBINED TPX EXPERIENCE 15 YEARS AVERAGE TPX TENURE Shared Services Scott Thompson Chairman, President & CEO Bhaskar Rao EVP, CFO Cliff Buster CEO, North America Diana Strickland SVP, Human Resources Kindra Bellis SVP, CIO David Montgomery EVP, Global Bus. Dev. Scott Vollet EVP, Global Operations Jonathan Hirst CEO, Dreams Hansbart Wijnand EVP, Intl. Steve Rusing EVP, President, U.S. Sales Brent Pfister SVP, Brands & Product Dev Tom Murray EVP, CMO, U.S.

4 Experienced Team’s Value Creation Since management change in 2015, sales have increased 57%, adjusted EBITDA2 has nearly doubled, and GAAP EPS has increased more than 7.5x under current leadership Current TPX Management Track Record Since 2015 (in millions, except percentages, multiples, and per common share amounts) Trailing Twelve Months Ended December 31, 2015 Trailing Twelve Months Ended September 30, 2023 CAGR Total Growth Net Sales $3,151 $4,942 6% 57% Net Income $65 $393 26% 509% Adjusted Net Income2 $200 $428 10% 114% Adjusted EBITDA2 $456 $877 9% 92% GAAP EPS $0.26 $2.21 32% 758% Adjusted EPS2 $0.80 $2.42 15% 203%

Award-Winning Products Spanning Key Retail Price Points VALUE PREMIUM $1,800 – $6,450 $2,200 – $9,000 $300 – $3,500 Private Label 5

Leading Manufacturing Capabilities • 71 manufacturing facilities • 16 million square feet of manufacturing & distribution operations R&D Innovation • 75,000 square feet of research & development • 4 state-of-the art product-testing locations Wholly owned (32) Joint Venture (8) Licensee (27)Tempur-Pedic® Facility (4) World-Class Manufacturing Capabilities 34 NORTH AMERICAN FACILITIES | 37 INTERNATIONAL FACILITIES Albuquerque, NM 6

• Significant worldwide sales growth • Highly profitable and expanding rapidly • Direct customer relationships Ecommerce • Luxury Tempur-Pedic®, Dreams, and multi-branded showroom experiences • Operate over 750 stores worldwide and expanding direct customer relationships • Unlocks addressable market, driving incremental profitability Company- Owned Stores • Third-party retailers are our largest distribution channel • Significant private label opportunity • Valued supplier, win-win relationships Wholesale 7 Successful Global Omni Distribution Platform

North American Omnichannel Distribution Wholesale E-commerce Owned Retail Stores OEM Alternative Channels Consumers THIRD PARTIES 8 • Costco • Sam's Club • Wayfair • Amazon

New Product Initiatives 9

WHAT COMFORT SHOULD BE™ STEARNS & FOSTER® • Expanding the universe of innerspring customers represents a significant long-term growth opportunity with high ASP and margin opportunity. • 2023’s comprehensive relaunch of products and new brand positioning began our journey to $1 Billion. • New technologies, features and benefits to enhance comfort and solidify our position as a category leader in innersprings • Modern, designer-inspired aesthetics differentiated by collection to stand out at retail • Innovative and aesthetically appealing products to resonate with both RSAs and consumers THE STEARNS & FOSTER DIFFERENCE: EXCEPTIONAL HAND-CRAFTED COMFORT Stearns & Foster® – What Comfort Should Be™ 10

WHAT COMFORT SHOULD BE™ STEARNS & FOSTER® • Strong Retailer Advocacy - >20% floor model expansion • New products delivered strong growth in a challenging macro environment • Lux Estate and Reserve models delivered the highest growth • Investments in advertising to increase brand awareness drove substantial growth in brand search • Substantial growth in e-commerce revenue following dot-com launch in mid-2022 • 2024 will be a period of optimizing slot mix at retail to maximize revenue opportunities • Future product line expansion and adjacent categories will further drive long-term growth Post-launch results across both retail and e-commerce are positive: Stearns & Foster® – What Comfort Should Be™ 11

• The number two selling mattress brand in America3 • Repeat J.D. Power Award Winner3 • In-Store Mattress Purchases – 2017, 2019, 2020, 2021, 2022 • Online Mattress Purchases - 2021, 2022, 2023 Tempur-Pedic® The most highly recommended brand in America. 12

• Continued focus on innovating around core consumer needs to drive success. • Building on over 30 years of innovation, the Tempur line focuses on three key needs: Tempur-Pedic® – Deep, Undisturbed Sleep® 13 4

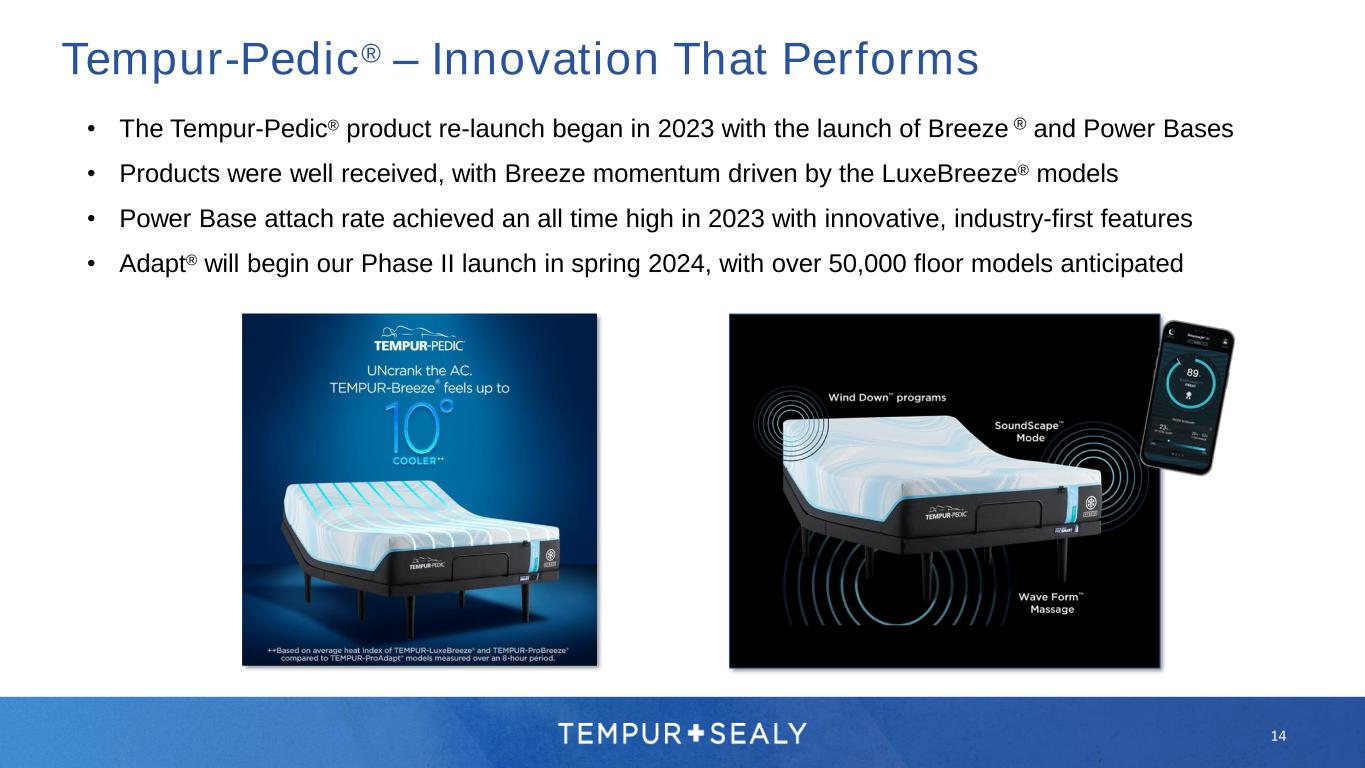

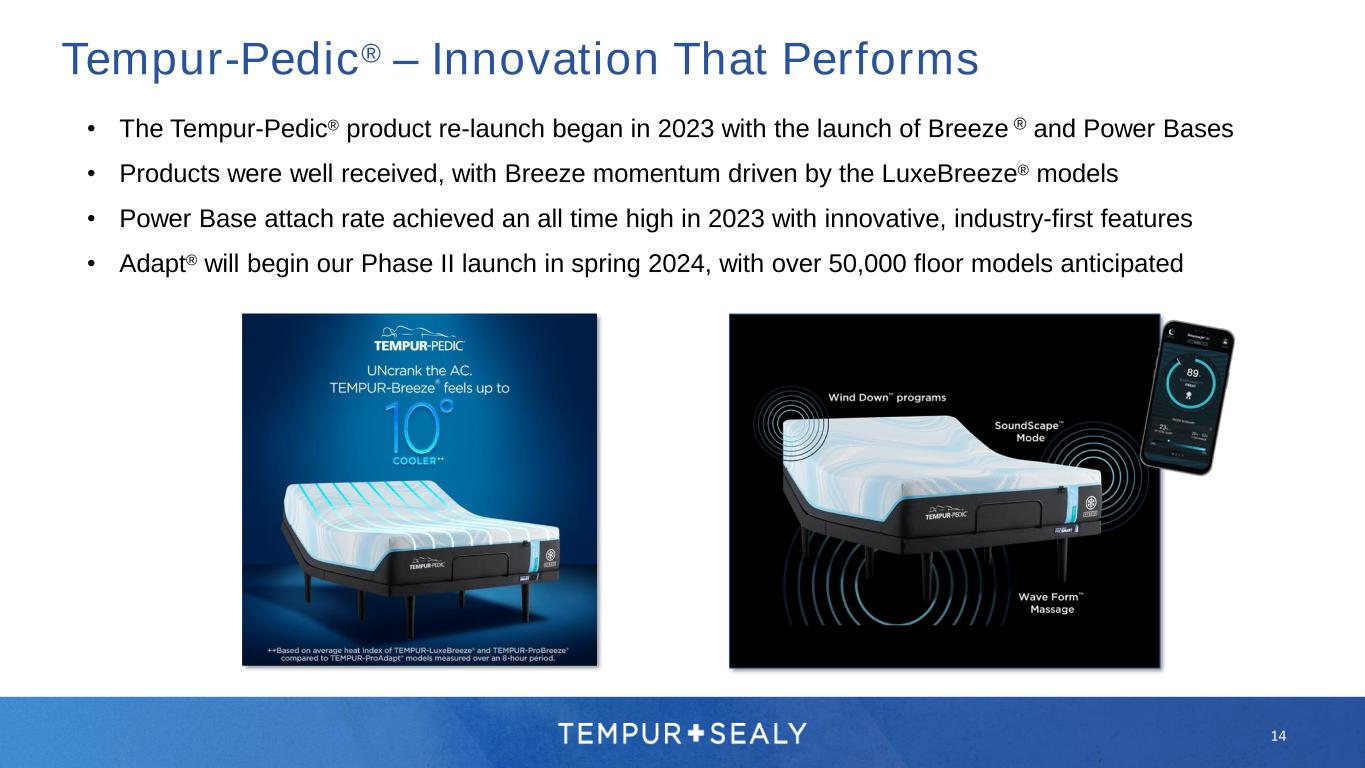

• The Tempur-Pedic® product re-launch began in 2023 with the launch of Breeze ® and Power Bases • Products were well received, with Breeze momentum driven by the LuxeBreeze® models • Power Base attach rate achieved an all time high in 2023 with innovative, industry-first features • Adapt® will begin our Phase II launch in spring 2024, with over 50,000 floor models anticipated Tempur-Pedic® – Innovation That Performs 14

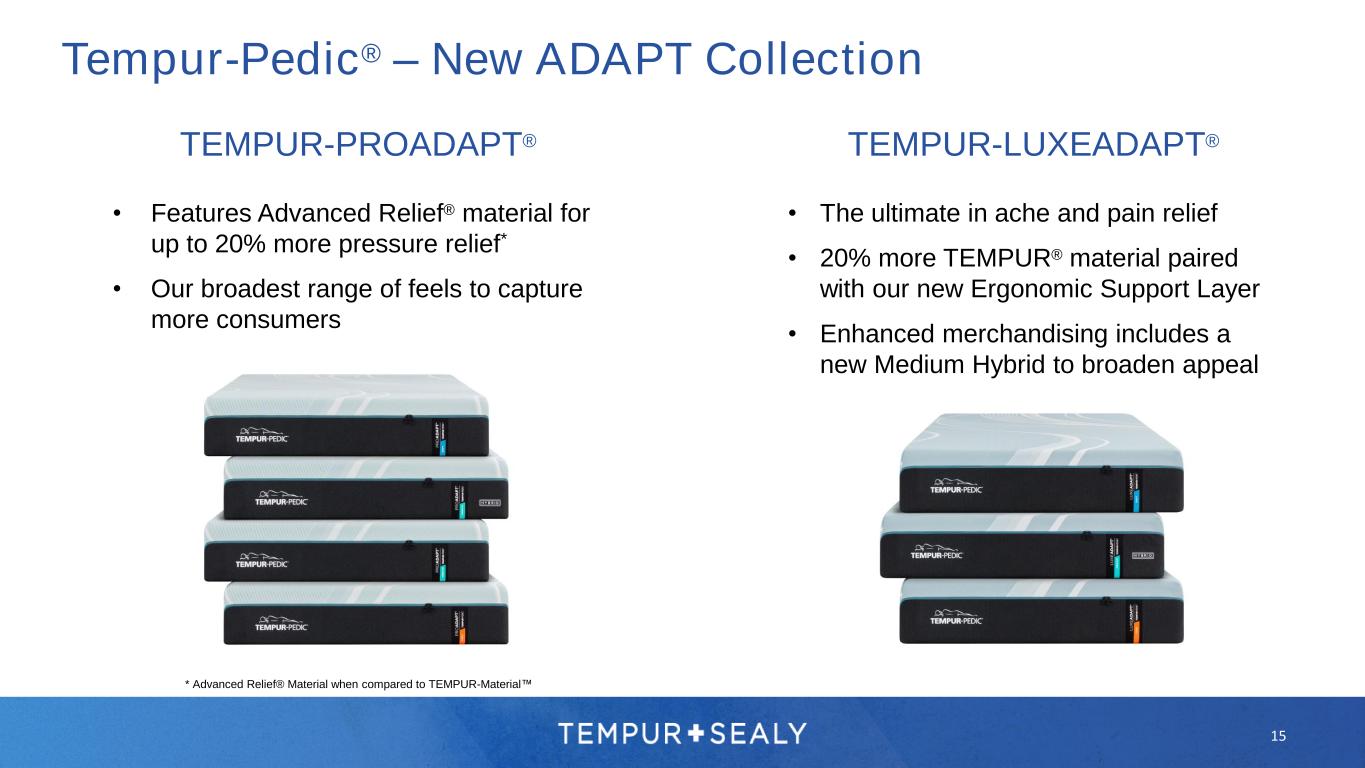

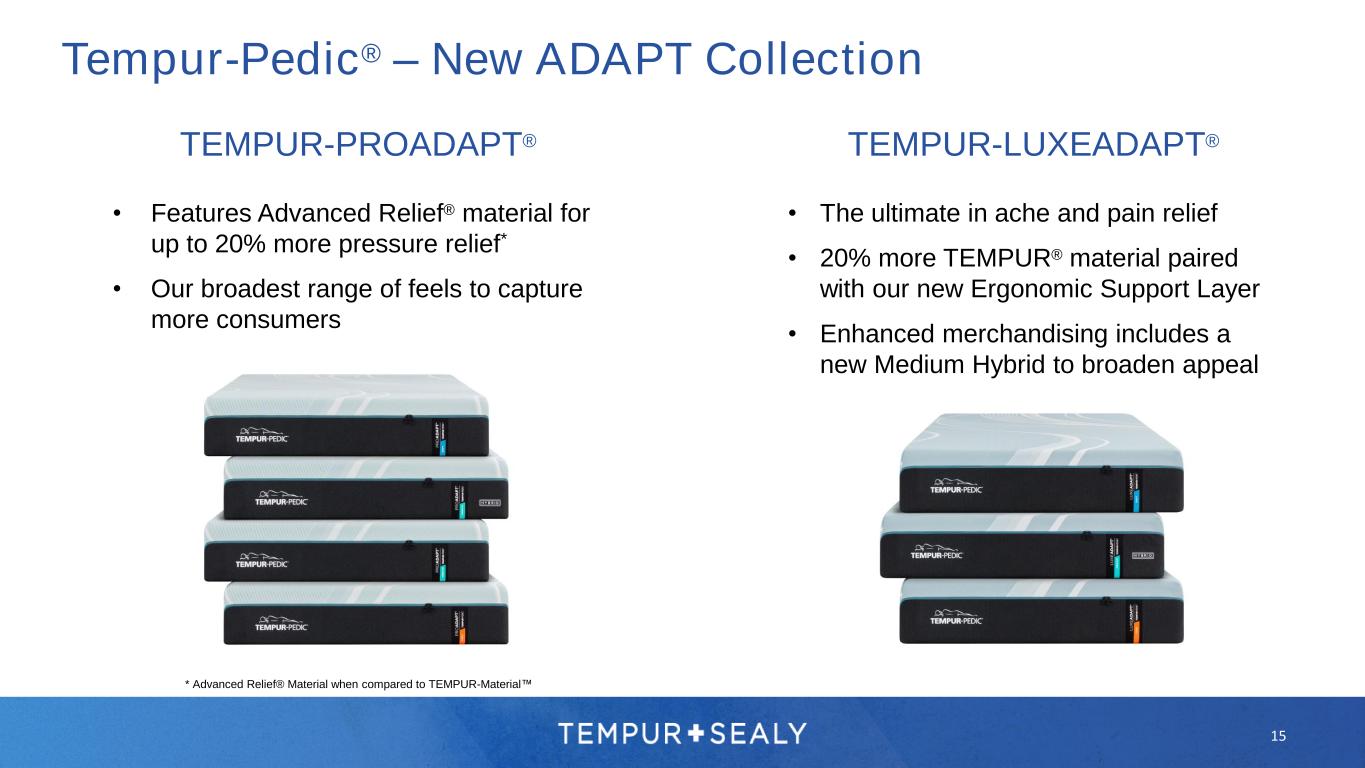

Tempur-Pedic® – New ADAPT Collection • The ultimate in ache and pain relief • 20% more TEMPUR® material paired with our new Ergonomic Support Layer • Enhanced merchandising includes a new Medium Hybrid to broaden appeal TEMPUR-LUXEADAPT® • Features Advanced Relief® material for up to 20% more pressure relief* • Our broadest range of feels to capture more consumers TEMPUR-PROADAPT® * Advanced Relief® Material when compared to TEMPUR-Material™ 15

New TEMPUR-PROADAPT® • Features Advanced Relief® material for up to 20% more pressure relief • Best selling family • Our broadest range of feels to capture more consumers 16

New TEMPUR-LUXEADAPT® • 20% more TEMPUR® material paired with our new Ergonomic Support Layer • The ultimate in ache and pain relief • Enhanced merchandising includes a new Medium Hybrid to broaden appeal 17

New TEMPUR-ACTIVEBREEZE® • New “halo” product • Dual Zone Climate Control allows each sleeper to personalize climate • ActiveAir Technology®, a patent-pending design that moves air evenly across the entire sleep surface • Powered by Sleeptracker-AI® 18

Operations 19

Operational Initiatives Leveraging Scale to Drive Cost Efficiency and Optionality Through Sourcing Competitive RFQ efforts to derive savings from key inputs - springs, textiles, foam and chemicals Expanding supply chains globally to increase competition among suppliers Exploring alternative suppliers and products to lower costs, reduce manufacturing complexity and drive new innovation Product cost improvements with existing product changes and new product development initiatives Component resourcing (supplier and/or location) and minor design changes for quality / cost improvements Cross-functional design for manufacturing (Sealy PosturePedic 2025, Cube) Capitalizing on workforce management to drive manufacturing productivity Build to stock inventories; partnering with key retailers on peak season demand/production to level load production 20

Operational Initiatives Driving logistics productivity across Tempur Sealy’s fleet, ocean transportation and warehousing Further optimization of Tempur Sealy’s transportation fleet, reducing usage of third-party carriers Routing/scheduling optimization to lower fleet miles – cost and environmental impacts Continue emphasis on merged loads (Sealy and Tempur) to drive efficient deliveries to customers Partnering with customers to drive efficiencies within the supply chain Reusing pallets; optimizing product return loads and backhauls; customer and plant location optimization Significant ocean transport rate decreases realized post-pandemic. Further exploring lane rate optimization 21

Crawfordsville, Indiana 750,000 sq ft facility to enhance our ability to service our customers by ensuring product availability to meet increased demand in the premium sector, creating shorter lead times and reduced per unit logistics cost in the Northeast market 22

Crawfordsville Equipment High Bay StorageTank Farm 23

24 International Markets – TEMPUR Brand Overview TEMPUR sold in 90+ countries • 22 countries served through wholly owned subsidiaries, the rest by third- party distributors Selling direct via own stores and online channels, and wholesale via furniture and bedding retailers Key markets include Germany, UK, France, South Korea, Japan, and China Wholly-owned Third-party distributors

25 International Markets – TEMPUR Brand Historical Strategy & Performance • Focus on price points above $3,000 • Investments within narrow boundaries • Highly complex and individualized SKUs, and therefore highly complex and individualized manufacturing process Strategy 2023+ • Continue to grow segment at the cutting edge of sleep technology • Broadening our product assortment to address a wider range of consumer needs • Seeding markets for growth with incremental advertising and launch investments • Simplified SKU build, and therefore simplified manufacturing process

26 International Markets – TEMPUR Brand Go-Forward Strategy – Mattresses • Leveraging proven innovation that has met with success in the U.S. • Innovations: • Next generation/higher performance Tempur foams • Cooling yarns • Washable TEMPUR quilting • High airflow 3D fabric • To increase efficiency / reduce cost: • Full assortment build on common component platform • Using late-stage dedication assembly process

27 International Markets – TEMPUR Brand Go-Forward Strategy: Mattresses - Simplified SKU build Historical 2023 Common component platform: Late dedication:

28 International Markets – Historical Segment Go-Forward Strategy: Mattresses – Cutting Edge Sleep Technology • Continue to appeal to historical segment, better channel/customer differentiation

29 International Markets – Broadening Assortment Go-Forward Strategy: Mattresses – Wider range of consumer needs • Targeting new consumers

30 International Markets – New Pillows Go-Forward Strategy • Continue to grow sales of most advanced pillows while broadening product offering

31 International Markets – New Bed Bases Go-Forward Strategy • Continue to grow sales of most advanced bases while broadening product offering TEMPUR ONE™/EASE™ TEMPUR ARC™

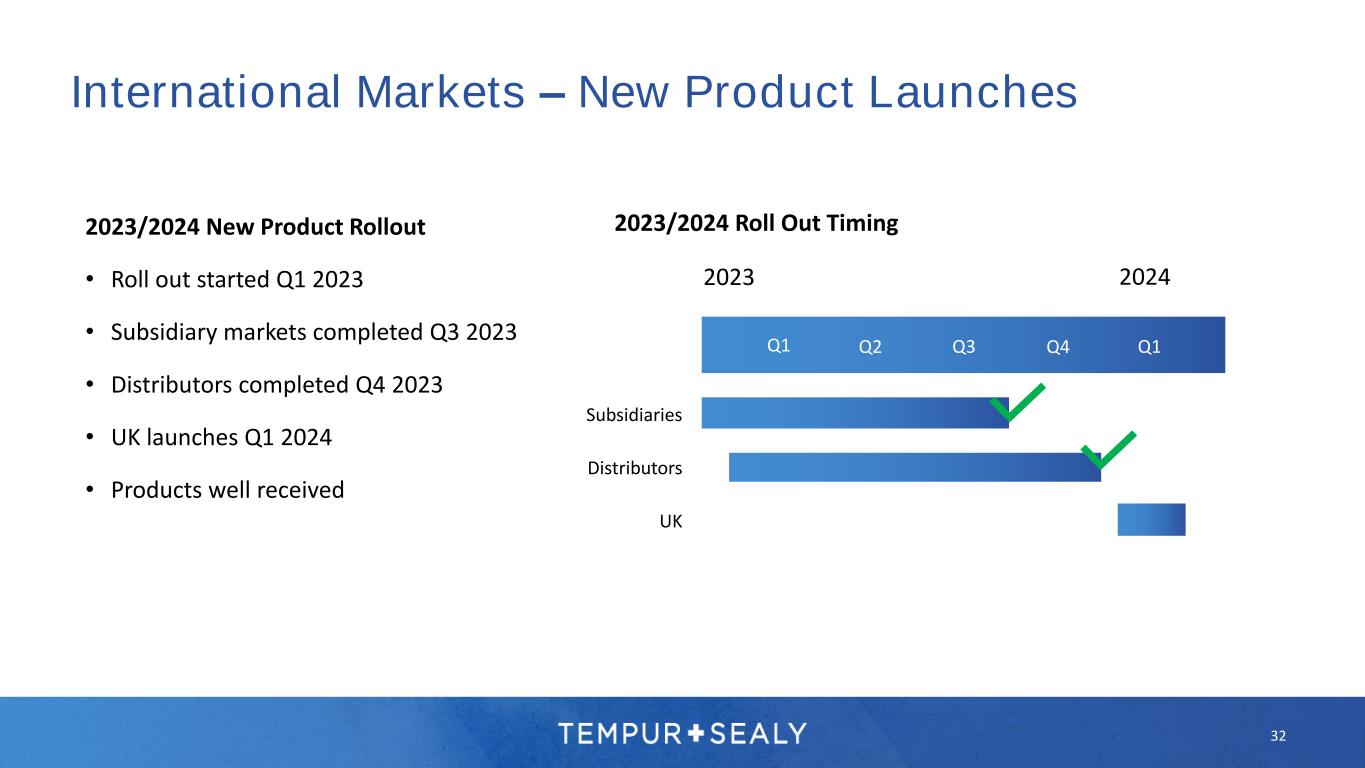

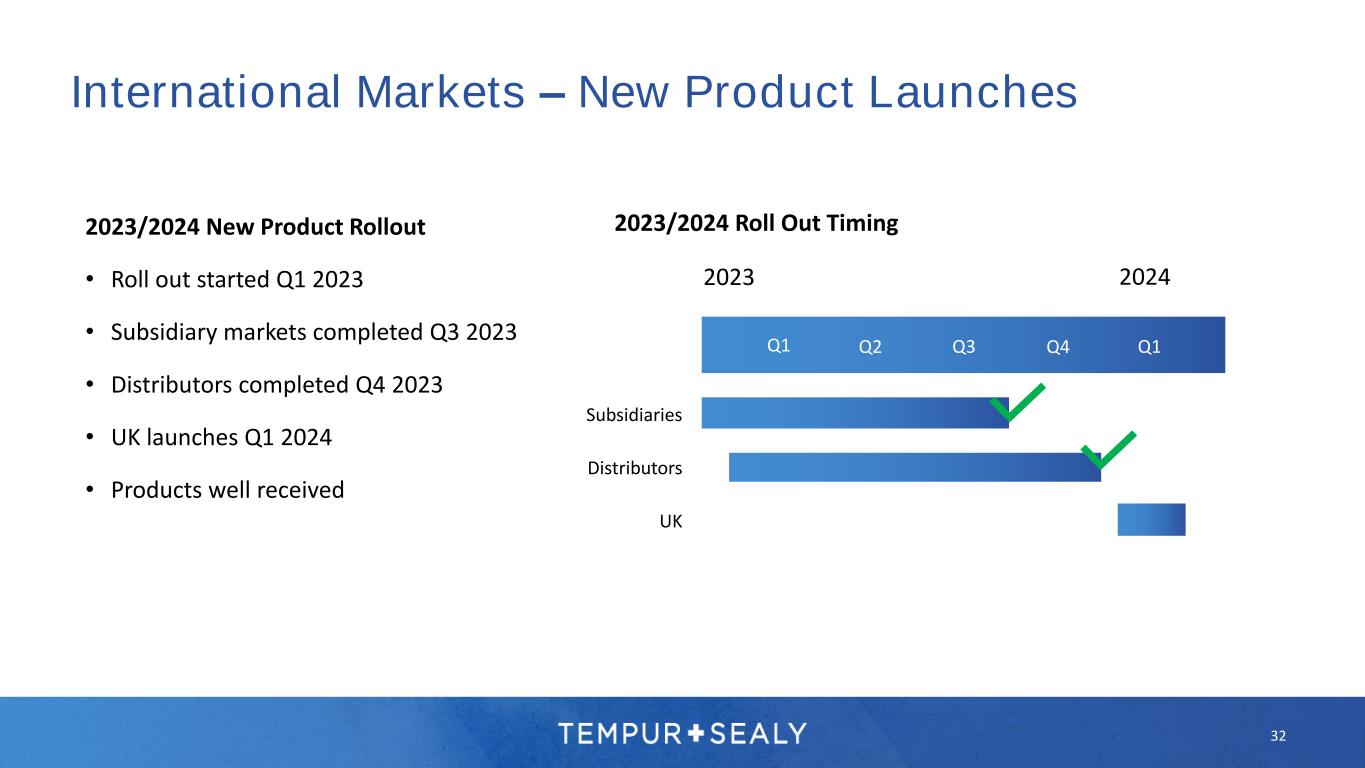

32 International Markets – New Product Launches 2023/2024 New Product Rollout • Roll out started Q1 2023 • Subsidiary markets completed Q3 2023 • Distributors completed Q4 2023 • UK launches Q1 2024 • Products well received Q1 Q4Q3Q2 Subsidiaries Distributors UK 2023/2024 Roll Out Timing Q1 2023 2024

Third Quarter and Trailing Twelve Month Performance Sales by Type 33 69% 10% 8% 13% TTM 3Q’23 Sales North America Wholesale North America Direct-to- Consumer International Wholesale International Direct-to- Consumer Three Months Ended Trailing Twelve Months Ended (in millions, except percentages and per common share amounts) September 30, 2023 September 30, 2022 % Change September 30, 2023 September 30, 2022 % Change Net Sales $1,277.1 $1,283.3 -0.5% $4,942.3 $5,093.4 -3.0% Net Income $113.3 $132.7 -14.6% $392.7 $529.8 -25.9% Adjusted Net Income2 $136.8 $137.8 -0.7% $427.9 $547.6 -21.9% GAAP EPS $0.64 $0.75 -14.7% $2.21 $2.83 -21.9% Adjusted EPS2 $0.77 $0.78 -1.3% $2.42 $2.93 -17.4%

Environmental, Social, & Governance 34

35 History of market share gains across global omnichannel distribution Seasoned, well-aligned management with proven track record Legacy of strong value creation via capital allocation including share buybacks and acquisitions The leading vertically integrated global bedding company with iconic brands and extensive manufacturing capabilities Over the long term, the bedding industry has consistently grown through ASP and unit expansion Investment Thesis

For more information, please email: investor.relations@tempursealy.com 36 Thank you for your interest in Tempur Sealy International

37 Forward-Looking Statements Use of Non-GAAP Financial Measures In this investor presentation and certain of its press releases and SEC filings, the Company provides information regarding adjusted net income, EBITDA, and adjusted EBITDA, adjusted EPS, which are not recognized terms under U.S. Generally Accepted Accounting Principles (“GAAP”) and do not purport to be alternatives to net income and earnings per share as a measure of operating performance. The Company believes these non-GAAP measures provide investors with performance measures that better reflect the Company’s underlying operations and trends, including trends in changes in margin and operating expenses, providing a perspective not immediately apparent from net income and operating income. The adjustments management makes to derive the non-GAAP measures include adjustments to exclude items that may cause short-term fluctuations in the nearest GAAP measure, but which management does not consider to be the fundamental attributes or primary drivers of the Company’s business. The Company believes that exclusion of these items assists in providing a more complete understanding of the Company’s underlying results from continuing operations and trends, and management uses these measures along with the corresponding GAAP financial measures to manage the Company’s business, to evaluate its consolidated and business segment performance compared to prior periods and the marketplace, to establish operational goals and management incentive goals, and to provide continuity to investors for comparability purposes. Limitations associated with the use of these non-GAAP measures include that these measures do not present all the amounts associated with the Company’s results as determined in accordance with GAAP. These non-GAAP measures should be considered supplemental in nature and should not be construed as more significant than comparable measures defined by GAAP. Because not all companies use identical calculations, these presentations may not be comparable to other similarly titled measures of other companies. For more information regarding the use of these non-GAAP financial measures, please refer to the reconciliations on the following pages and the Company’s SEC filings. EBITDA and Adjusted EBITDA A reconciliation of the Company’s GAAP net income to EBITDA and adjusted EBITDA per credit facility (which we refer to in this investor presentation as adjusted EBITDA) is provided on the subsequent slides. Management believes that the use of EBITDA and adjusted EBITDA per credit facility provides investors with useful information with respect to the Company’s operating performance and comparisons from period to period as well as the Company’s compliance with requirements under its credit agreement. Adjusted Net Income and Adjusted EPS A reconciliation of the Company’s GAAP net income to adjusted net income and a calculation of adjusted EPS are provided on subsequent slides. Management believes that the use of adjusted net income and adjusted EPS also provides investors with useful information with respect to the Company’s operating performance and comparisons from period to period. Forward-looking Adjusted EPS is a non-GAAP financial measure. The Company is unable to reconcile this forward-looking non-GAAP measure to EPS, its most directly comparable forward-looking GAAP financial measure, without unreasonable efforts, because the Company is currently unable to predict with a reasonable degree of certainty the type and extent of certain items that would be expected to impact EPS in 2023. This investor presentation contains statements relating to the Company’s share repurchase targets, the Company’s expectations regarding net sales and adjusted EPS for 2023 and subsequent periods and the Company’s expectations for increasing sales growth, product launches, channel growth, acquisitions, including the pending acquisition of Mattress Firm, cost efficiencies, fleet optimization and commodities outlook, and expectations regarding supply chain disruptions, the macroeconomic environment and COVID-related disruptions. Any forward-looking statements contained herein are based upon current expectations and beliefs and various assumptions. There can be no assurance that the Company will realize these expectations, meet its guidance, or that these beliefs will prove correct. Numerous factors, many of which are beyond the Company’s control, could cause actual results to differ materially from any that may be expressed herein as forward-looking statements. These potential risks include the factors discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, and in the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2023. There may be other factors that may cause the Company’s actual results to differ materially from the forward-looking statements. The Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date on which such statement is made. Note Regarding Historical Financial Information: In this investor presentation we provide or refer to certain historical information for the Company. For a more detailed discussion of the Company’s financial performance, please refer to the Company’s SEC filings. Note Regarding Trademarks, Trade Names, and Service Marks: TEMPUR®, Tempur-Pedic®, the Tempur-Pedic & Reclining Figure Design®, TEMPUR-Adapt®, TEMPUR-ProAdapt®, TEMPUR-LuxeAdapt®, TEMPUR-PRObreeze°™, TEMPUR-LUXEbreeze°™, TEMPUR-Cloud®, TEMPUR-Contour™, TEMPUR-Rhapsody™, TEMPUR-Flex®, THE GRANDBED BY Tempur- Pedic®, TEMPUR-Ergo®, TEMPUR-UP™, TEMPUR-Neck™, TEMPUR-Symphony™, TEMPUR-Comfort™, TEMPUR-Traditional™, TEMPUR-Home™, Sealy®, Sealy Posturepedic®, Stearns & Foster®, COCOON by Sealy™, SealyChill™, and Clean Shop Promise® are trademarks, trade names, or service marks of Tempur Sealy International, Inc., and/or its subsidiaries. All other trademarks, trade names, and service marks in this presentation are the property of the respective owners.

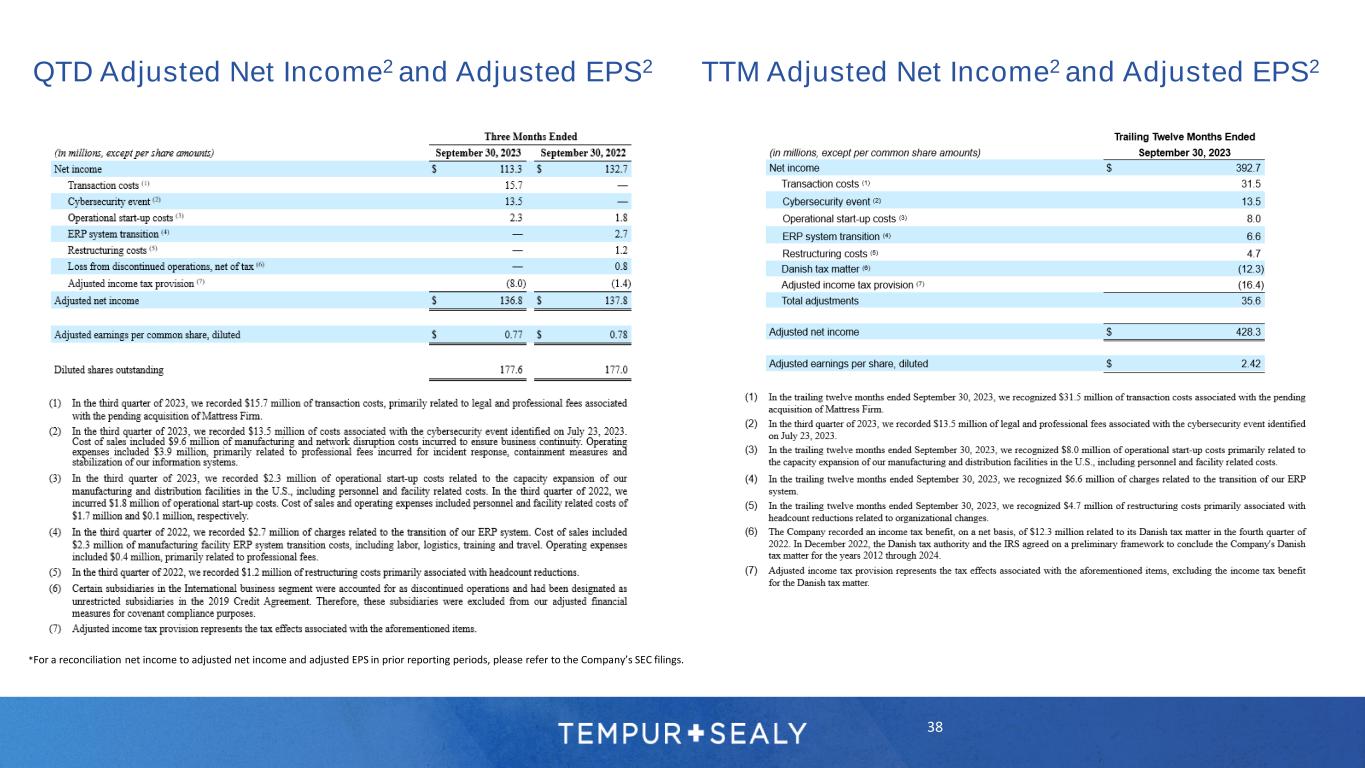

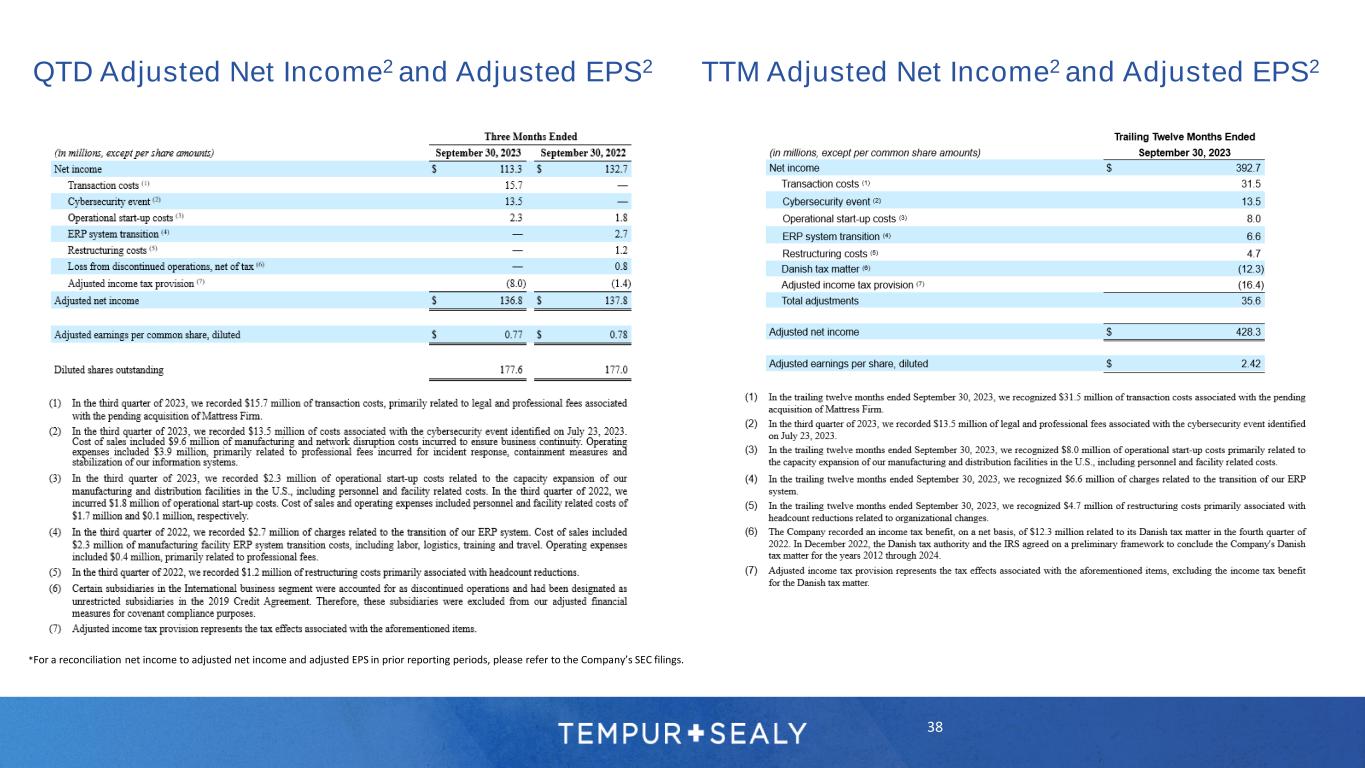

38 QTD Adjusted Net Income2 and Adjusted EPS2 *For a reconciliation net income to adjusted net income and adjusted EPS in prior reporting periods, please refer to the Company’s SEC filings. TTM Adjusted Net Income2 and Adjusted EPS2

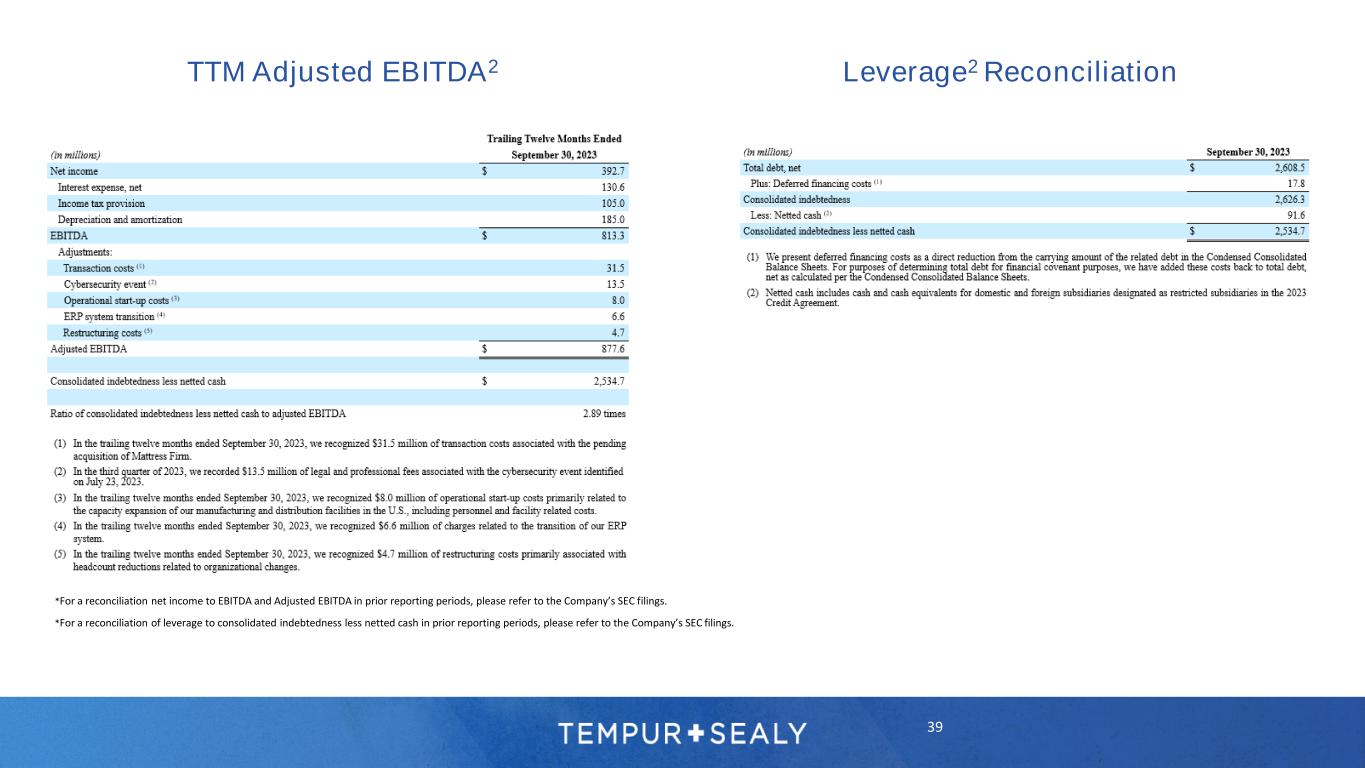

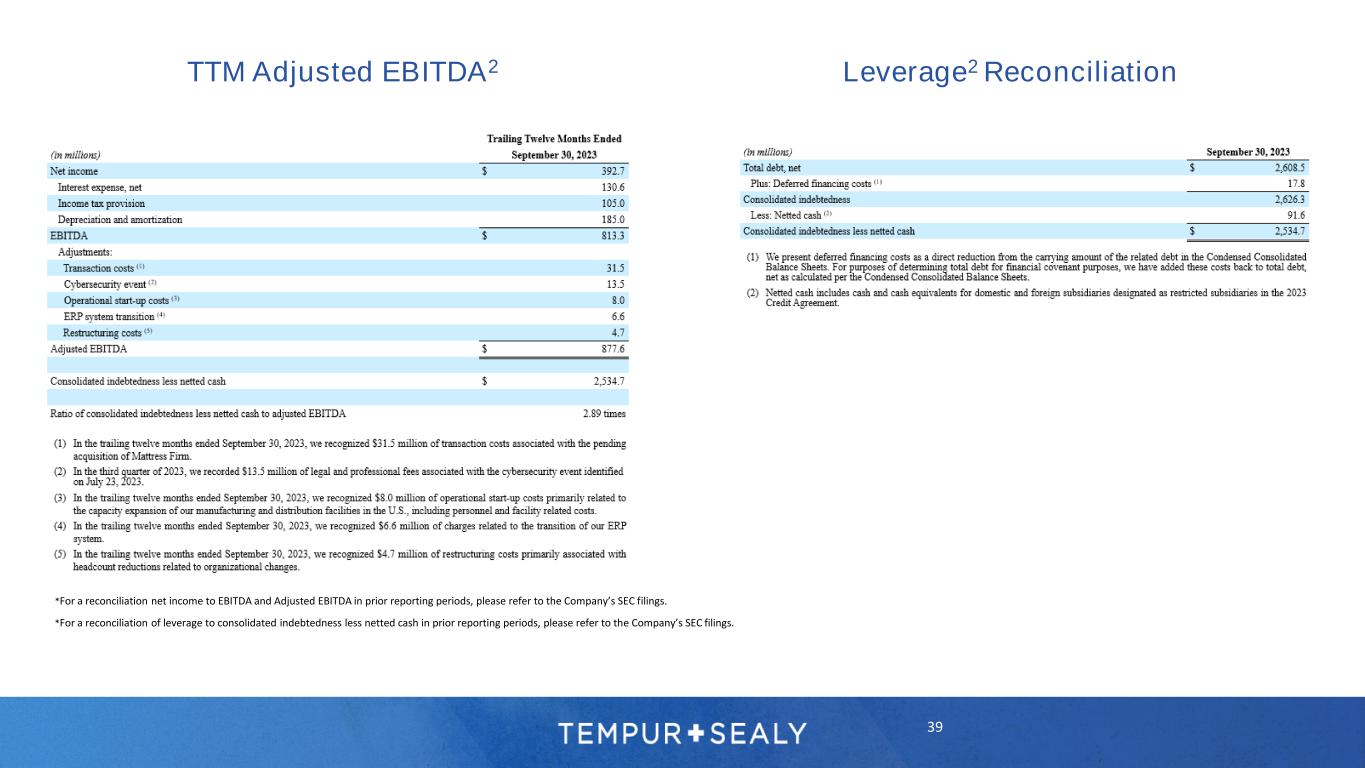

TTM Adjusted EBITDA2 39 *For a reconciliation net income to EBITDA and Adjusted EBITDA in prior reporting periods, please refer to the Company’s SEC filings. Leverage2 Reconciliation *For a reconciliation of leverage to consolidated indebtedness less netted cash in prior reporting periods, please refer to the Company’s SEC filings.

40 1 Management estimates 2 Adjusted net income, EBITDA, adjusted EBITDA and adjusted EPS are non-GAAP financial measures. Please refer to the “Use of Non-GAAP Financial Measures” on a previous slide for more information regarding the definitions of adjusted net income, EBITDA, adjusted EBITDA, and adjusted EPS, including the adjustments (as applicable) from the corresponding GAAP information. Please refer to “Forward-Looking Statements” on a previous slide. 3 For J.D. Power 2023 award information, visit jdpower.com/awards. Tempur-Pedic received the highest score among mattresses purchased in-store in the J.D. Power 2019-2022 Mattress Satisfaction Reports, which measures customer satisfaction with their in-store mattress purchase experience. Visit jdpower.com/awards for more details. Tempur-Pedic received the highest score among mattresses purchased online in the J.D. Power 2021-2023 U.S. Mattress Satisfaction Studies, which measures customers' satisfaction with their online mattress purchase experience. Visit jdpower.com/awards for more details. 4 Bed raises once approximately 12 degrees in response to snoring. This may reduce snoring in otherwise healthy individuals who snore due to body positioning. Footnotes