Fourth Quarter Results January 29, 2026 Exhibit 99.2

FORWARD-LOOKING STATEMENT This presentation contains statements, including statements regarding economic and geopolitical uncertainty, including uncertainty regarding trade policy developments, trends in labor demand and the future strengthening of such demand, the impact of AI on labor markets, the Company’s financial outlook, outlook for our business in the regions in which we operate as well as key countries within those regions, the Company’s strategic initiatives and technology investments, including transformation programs and the use of AI to drive innovation, the ability of our PowerSuite platform to develop and deploy our AI capabilities at scale, and the positioning of future growth for our brands, that are forward-looking in nature and, accordingly, are subject to risks and uncertainties regarding the Company’s expected future results. The Company’s actual results may differ materially from those described or contemplated in the forward-looking statements due to numerous factors. These factors include those found in the Company’s reports filed with the SEC, including the information under the heading “Risk Factors” in its Annual Report on Form 10-K for the year ended December 31, 2024, which information is incorporated herein by reference. The Company assumes no obligation to update or revise any forward-looking statements. We reference certain non-GAAP financial measures, which we believe provide useful information for investors. We include a reconciliation of these measures, where appropriate, to GAAP on the Investor Relations section of our website at manpowergroup.com.

Fourth Quarter and 2025 Highlights Delivered solid performance in the fourth quarter, driven by broad-based market stabilization and enterprise demand Sequential improvement in revenue growth and profitability through 2025, exiting the year with momentum in core markets including France and the US Growth in Manpower for three consecutive quarters, six in the US, while Experis has seen sequential quarterly improvement in the rate of revenue decline Moving from AI use cases to scaled commercial impact, including improving recruiter precision and productivity and scaling the use of agentic AI coding assistants delivered by Experis in the US Ongoing cost-out initiatives resulted in a 4% constant currency year-over-year reduction in SG&A during the quarter 2026 currently trending towards an important inflection point for the business, with a clear path toward sustainable organic revenue and margin growth

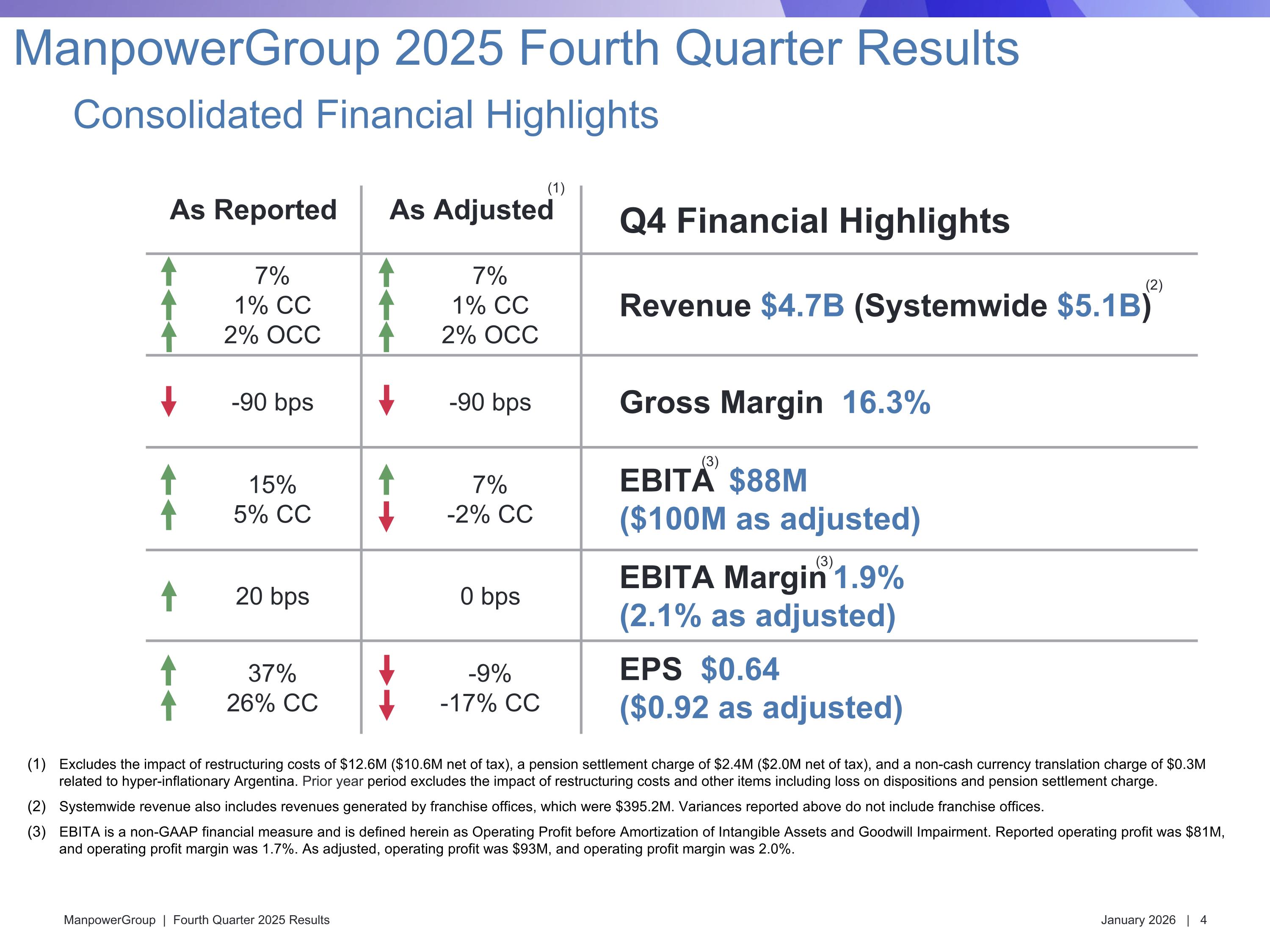

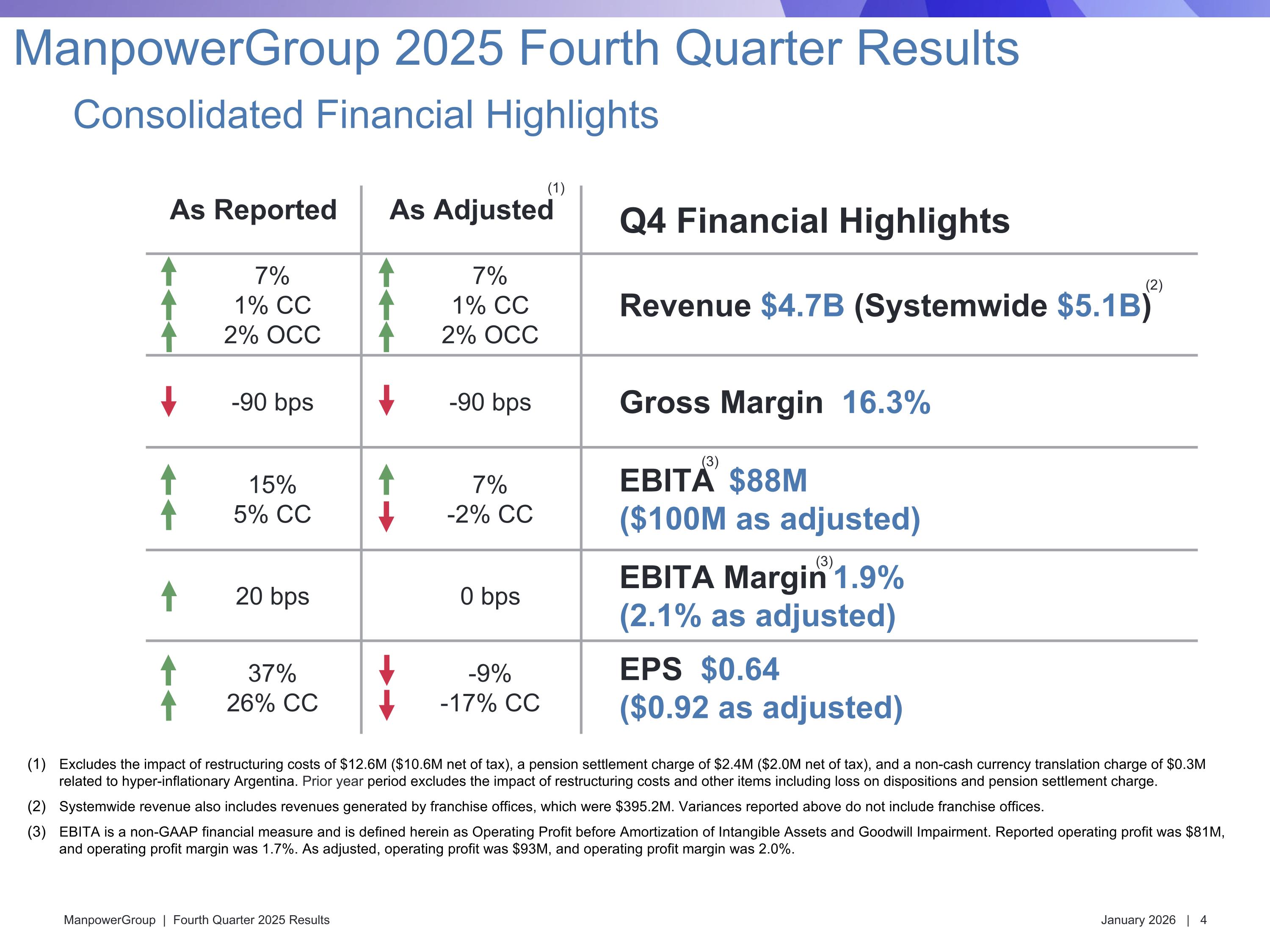

As Reported As Adjusted Q4 Financial Highlights 7% 1% CC 2% OCC 7% 1% CC 2% OCC Revenue $4.7B (Systemwide $5.1B) -90 bps -90 bps Gross Margin 16.3% 15% 5% CC 7% -2% CC EBITA $88M ($100M as adjusted) 20 bps 0 bps EBITA Margin 1.9% (2.1% as adjusted) 37% 26% CC -9% -17% CC EPS $0.64 ($0.92 as adjusted) Excludes the impact of restructuring costs of $12.6M ($10.6M net of tax), a pension settlement charge of $2.4M ($2.0M net of tax), and a non-cash currency translation charge of $0.3M related to hyper-inflationary Argentina. Prior year period excludes the impact of restructuring costs and other items including loss on dispositions and pension settlement charge. Systemwide revenue also includes revenues generated by franchise offices, which were $395.2M. Variances reported above do not include franchise offices. EBITA is a non-GAAP financial measure and is defined herein as Operating Profit before Amortization of Intangible Assets and Goodwill Impairment. Reported operating profit was $81M, and operating profit margin was 1.7%. As adjusted, operating profit was $93M, and operating profit margin was 2.0%. (3) (3) Consolidated Financial Highlights ManpowerGroup 2025 Fourth Quarter Results (1) (2)

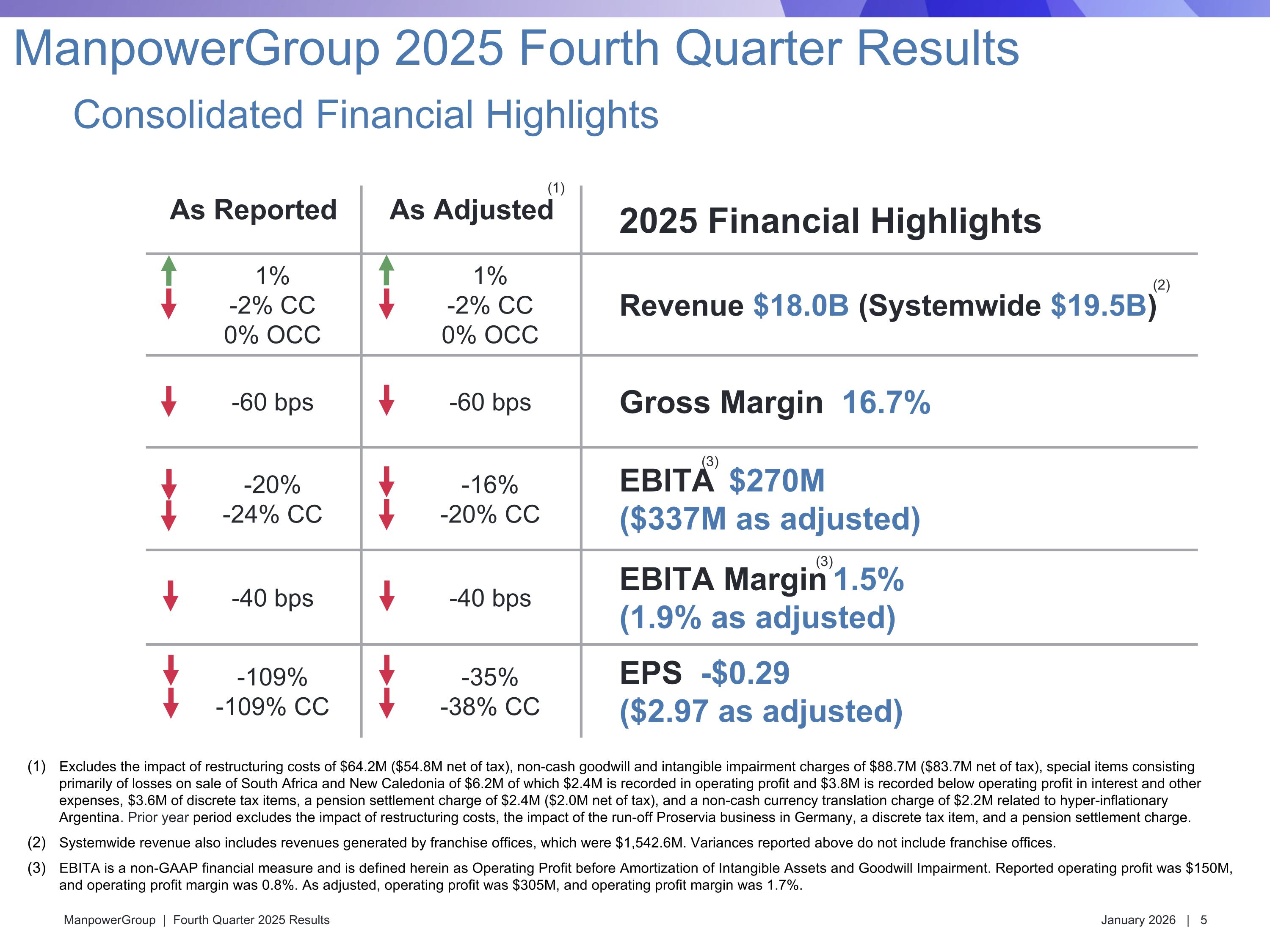

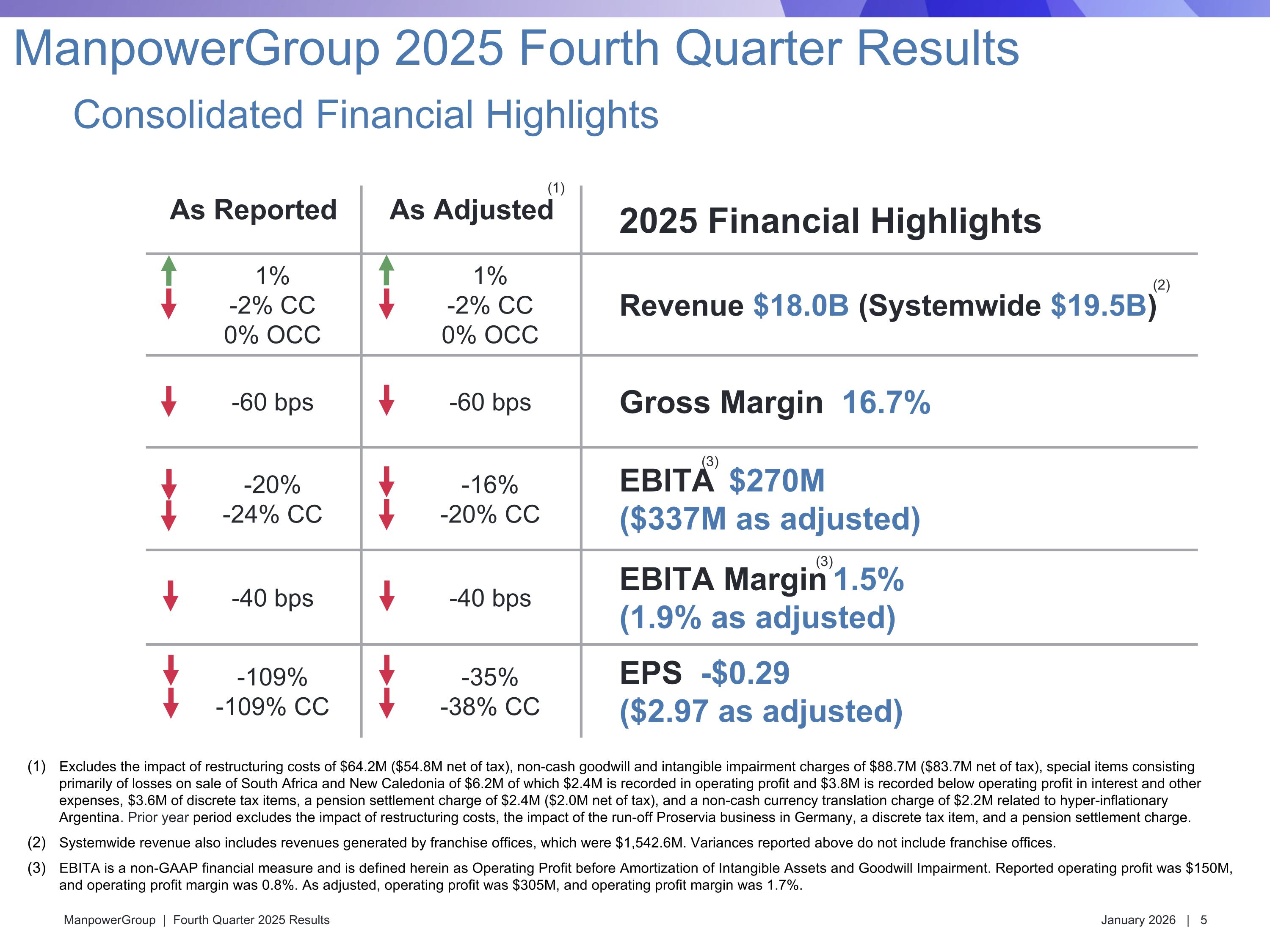

As Reported As Adjusted 2025 Financial Highlights 1% -2% CC 0% OCC 1% -2% CC 0% OCC Revenue $18.0B (Systemwide $19.5B) -60 bps -60 bps Gross Margin 16.7% -20% -24% CC -16% -20% CC EBITA $270M ($337M as adjusted) -40 bps -40 bps EBITA Margin 1.5% (1.9% as adjusted) -109% -109% CC -35% -38% CC EPS -$0.29 ($2.97 as adjusted) Excludes the impact of restructuring costs of $64.2M ($54.8M net of tax), non-cash goodwill and intangible impairment charges of $88.7M ($83.7M net of tax), special items consisting primarily of losses on sale of South Africa and New Caledonia of $6.2M of which $2.4M is recorded in operating profit and $3.8M is recorded below operating profit in interest and other expenses, $3.6M of discrete tax items, a pension settlement charge of $2.4M ($2.0M net of tax), and a non-cash currency translation charge of $2.2M related to hyper-inflationary Argentina. Prior year period excludes the impact of restructuring costs, the impact of the run-off Proservia business in Germany, a discrete tax item, and a pension settlement charge. Systemwide revenue also includes revenues generated by franchise offices, which were $1,542.6M. Variances reported above do not include franchise offices. EBITA is a non-GAAP financial measure and is defined herein as Operating Profit before Amortization of Intangible Assets and Goodwill Impairment. Reported operating profit was $150M, and operating profit margin was 0.8%. As adjusted, operating profit was $305M, and operating profit margin was 1.7%. (3) (3) Consolidated Financial Highlights ManpowerGroup 2025 Fourth Quarter Results (1) (2)

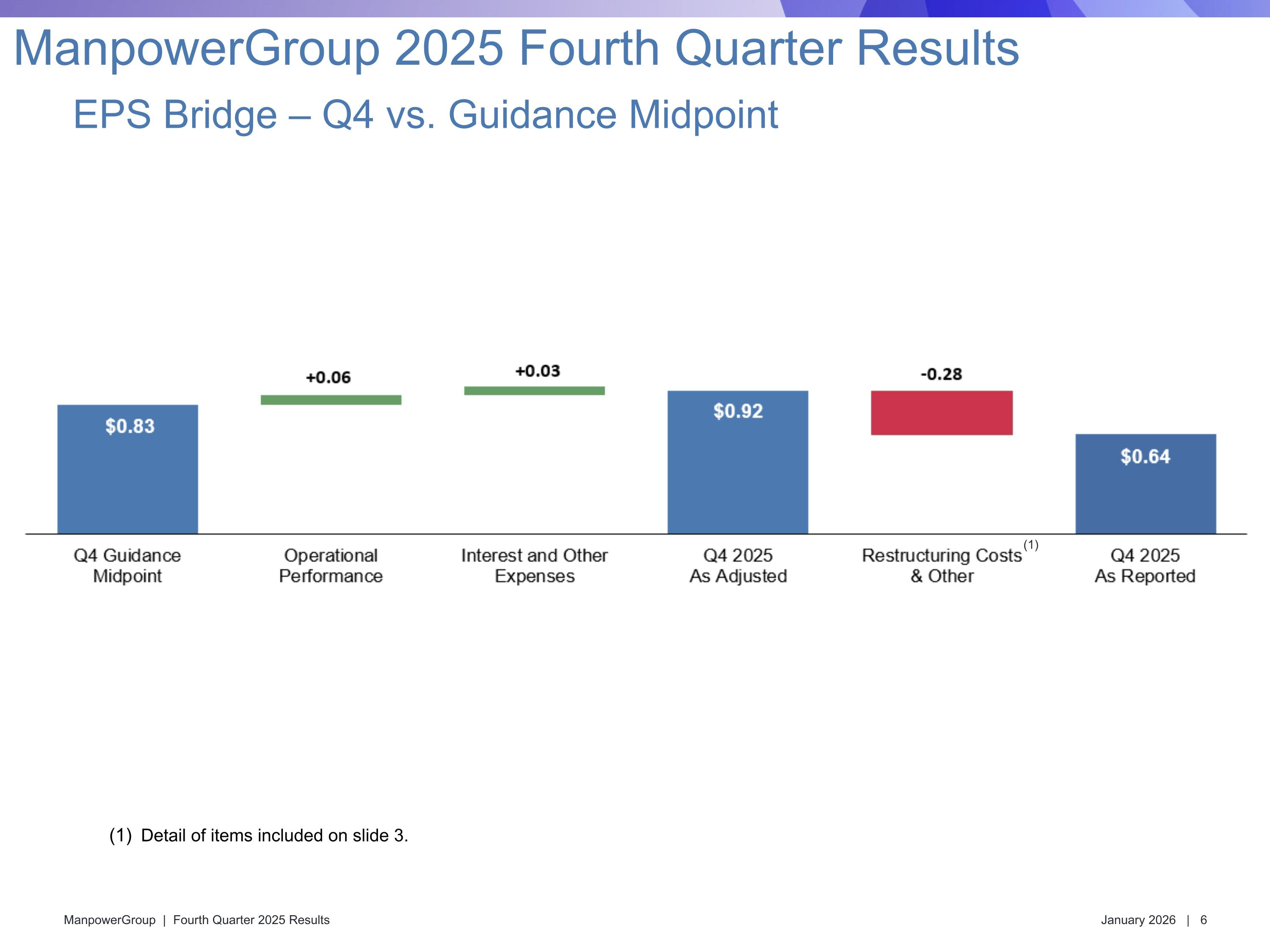

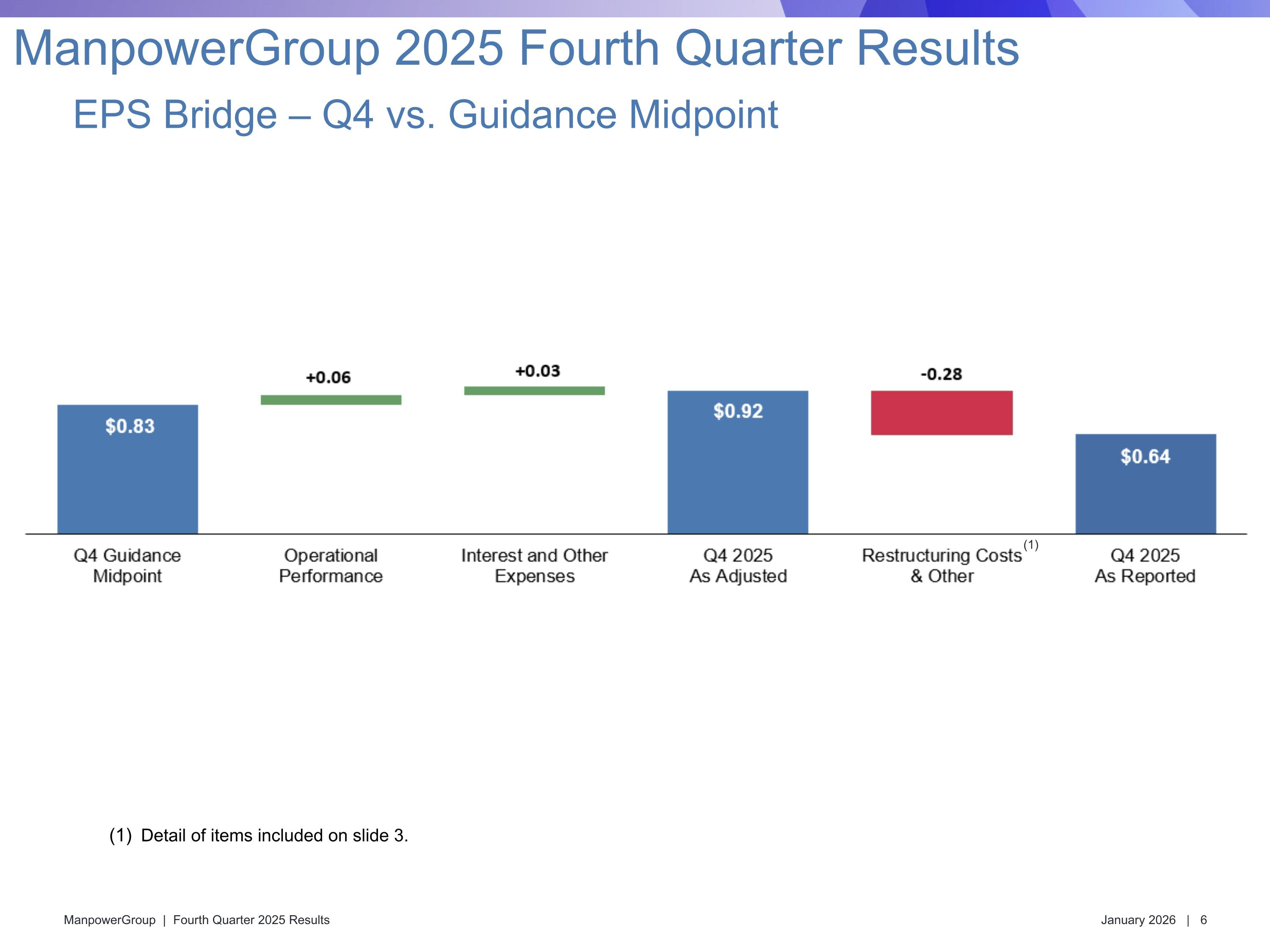

EPS Bridge – Q4 vs. Guidance Midpoint ManpowerGroup 2025 Fourth Quarter Results (1) Detail of items included on slide 3.

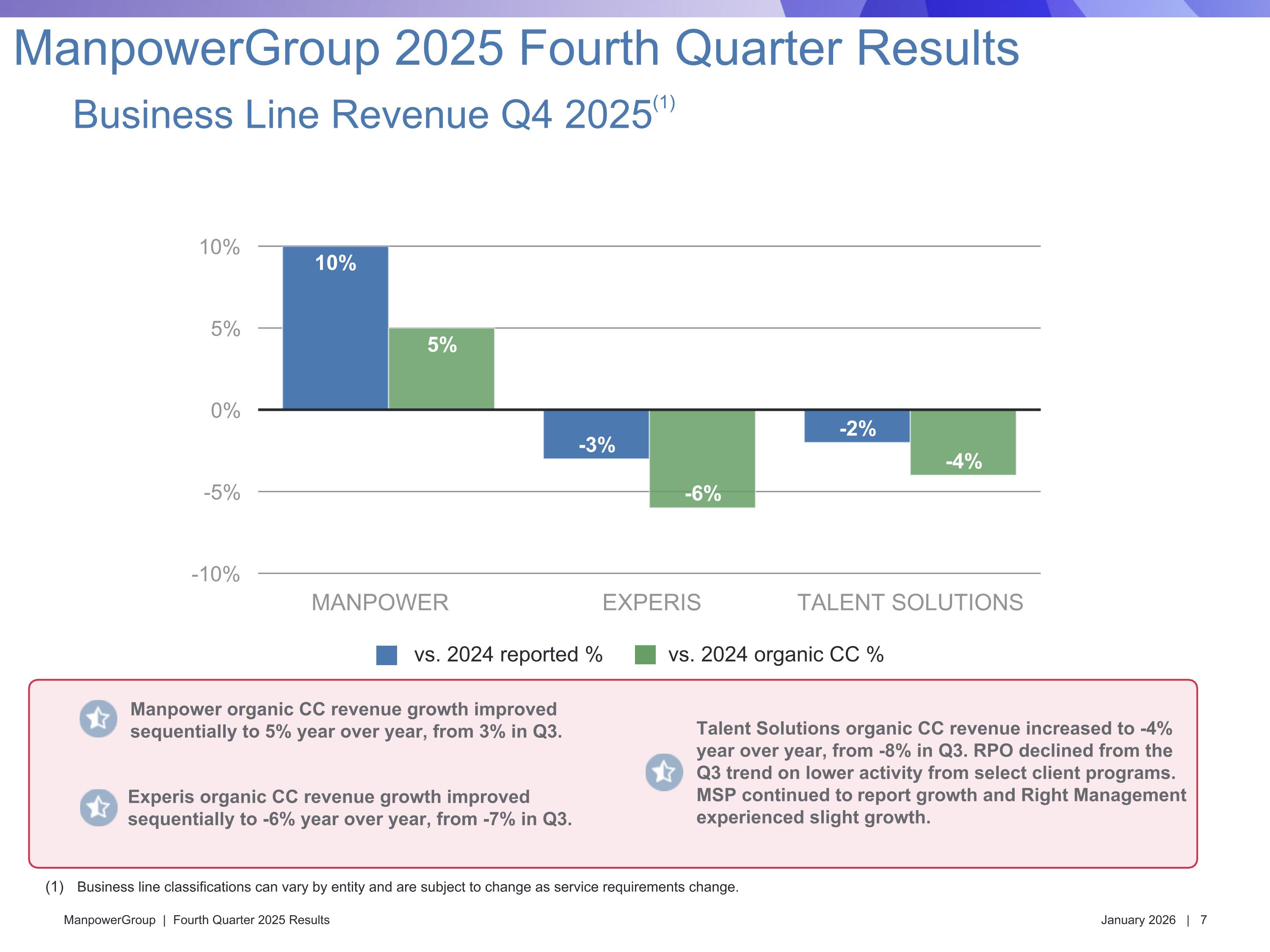

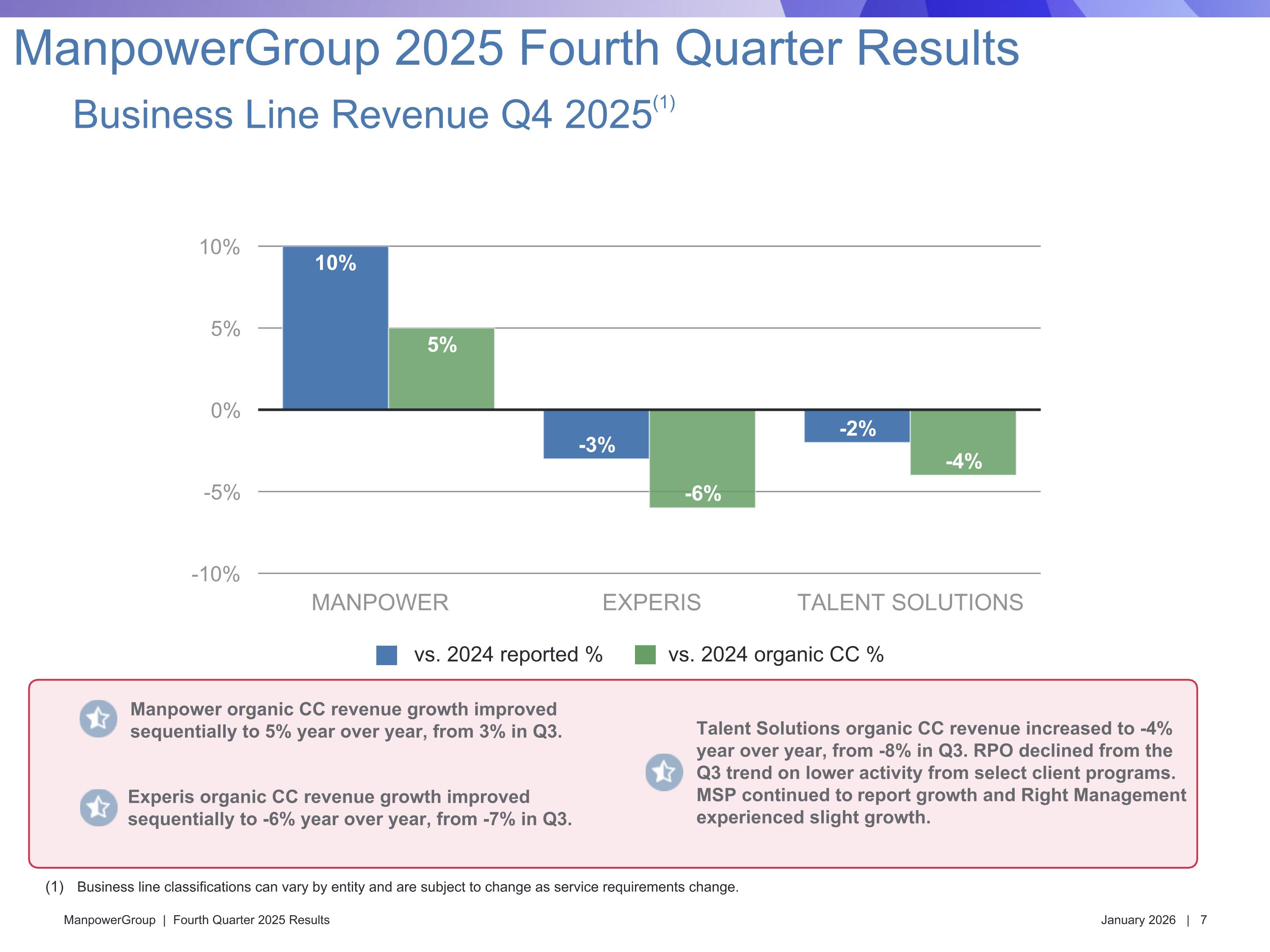

Manpower organic CC revenue growth improved sequentially to 5% year over year, from 3% in Q3. Talent Solutions organic CC revenue increased to -4% year over year, from -8% in Q3. RPO declined from the Q3 trend on lower activity from select client programs. MSP continued to report growth and Right Management experienced slight growth. Experis organic CC revenue growth improved sequentially to -6% year over year, from -7% in Q3. Business line classifications can vary by entity and are subject to change as service requirements change. MANPOWER EXPERIS TALENT SOLUTIONS Business Line Revenue Q4 2025(1) vs. 2024 reported % vs. 2024 organic CC % ManpowerGroup 2025 Fourth Quarter Results

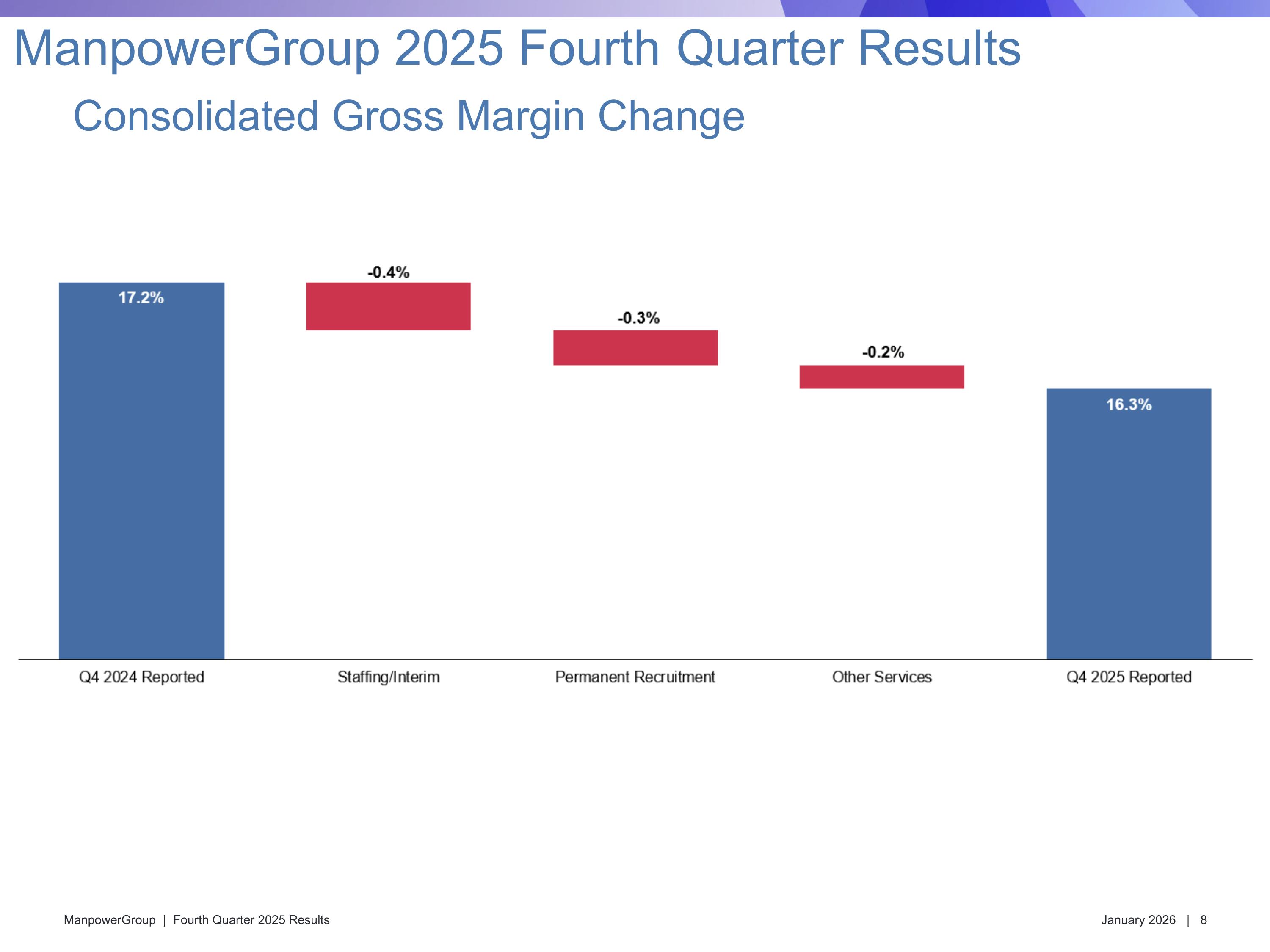

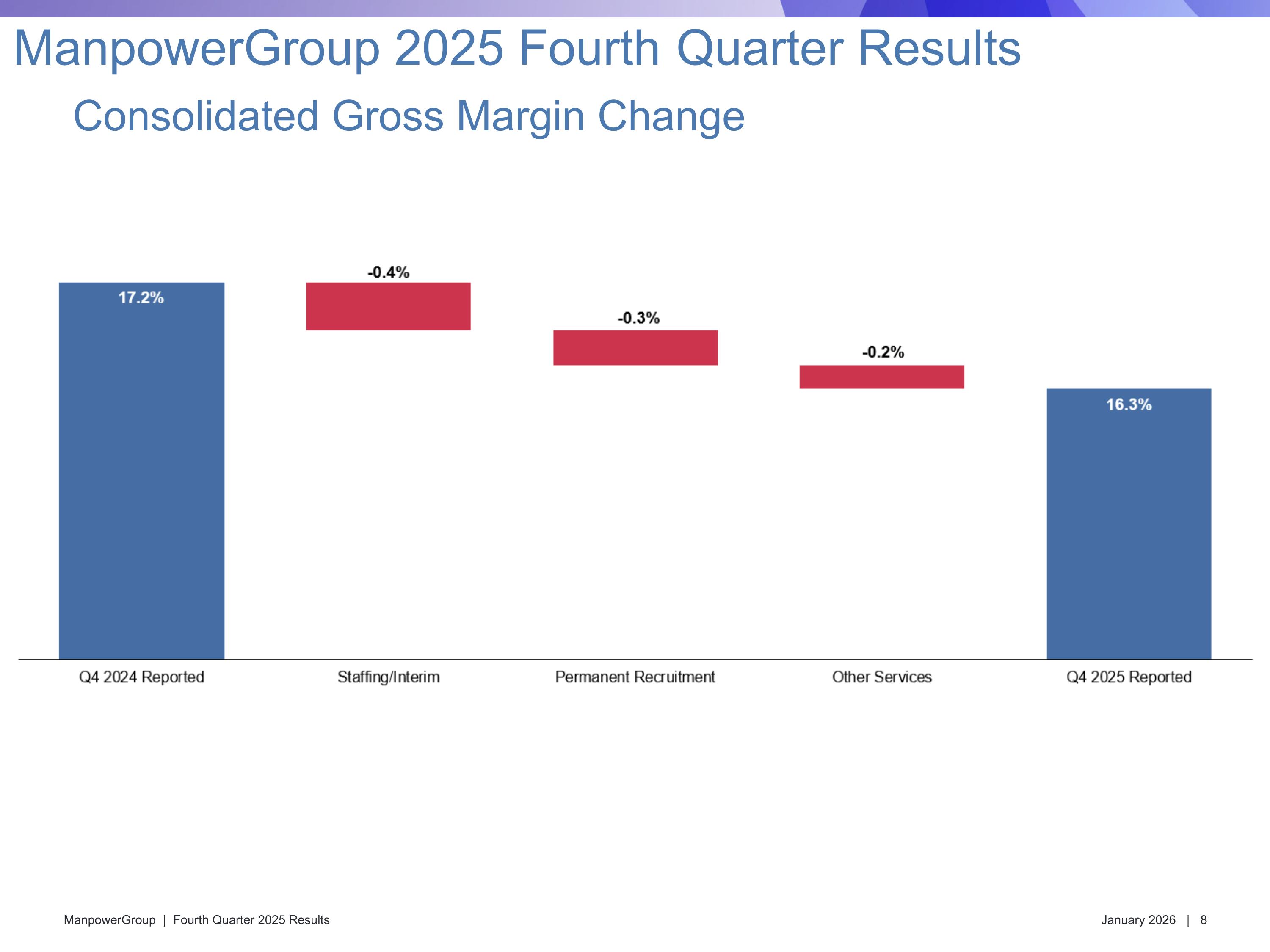

Consolidated Gross Margin Change ManpowerGroup 2025 Fourth Quarter Results

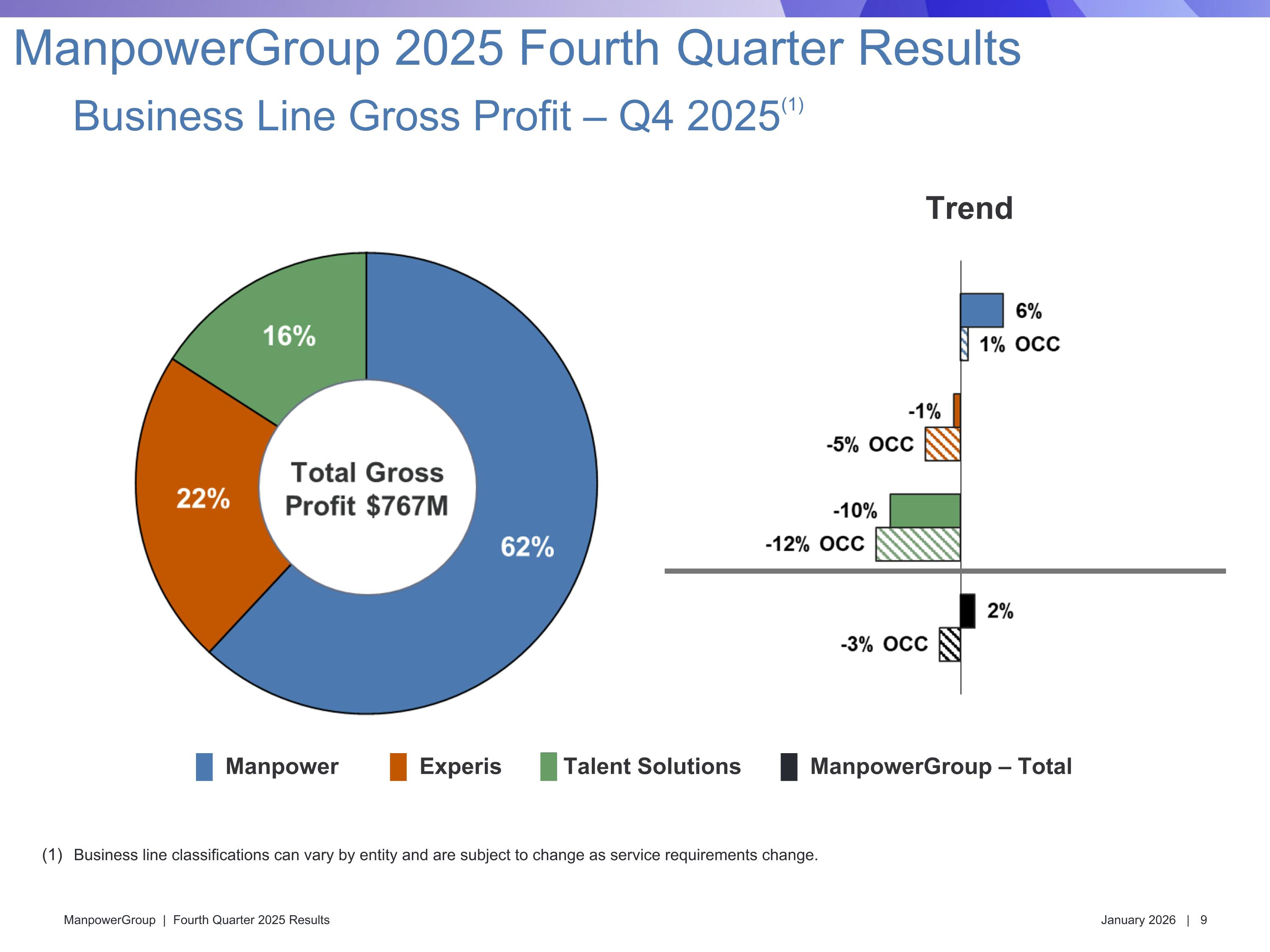

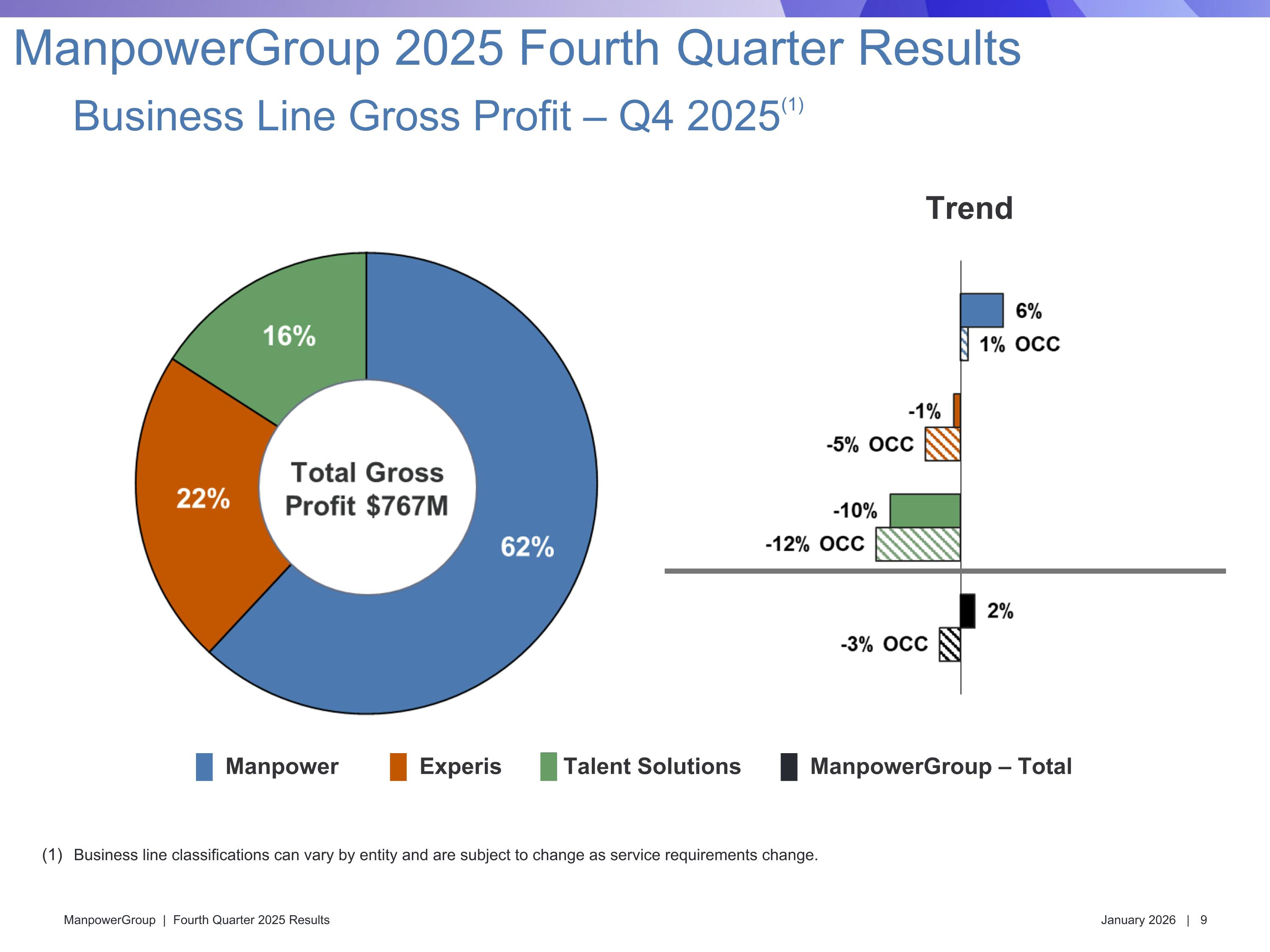

Business line classifications can vary by entity and are subject to change as service requirements change. Business Line Gross Profit – Q4 2025(1) ManpowerGroup 2025 Fourth Quarter Results █ Manpower █ Experis █ Talent Solutions █ ManpowerGroup – Total Trend

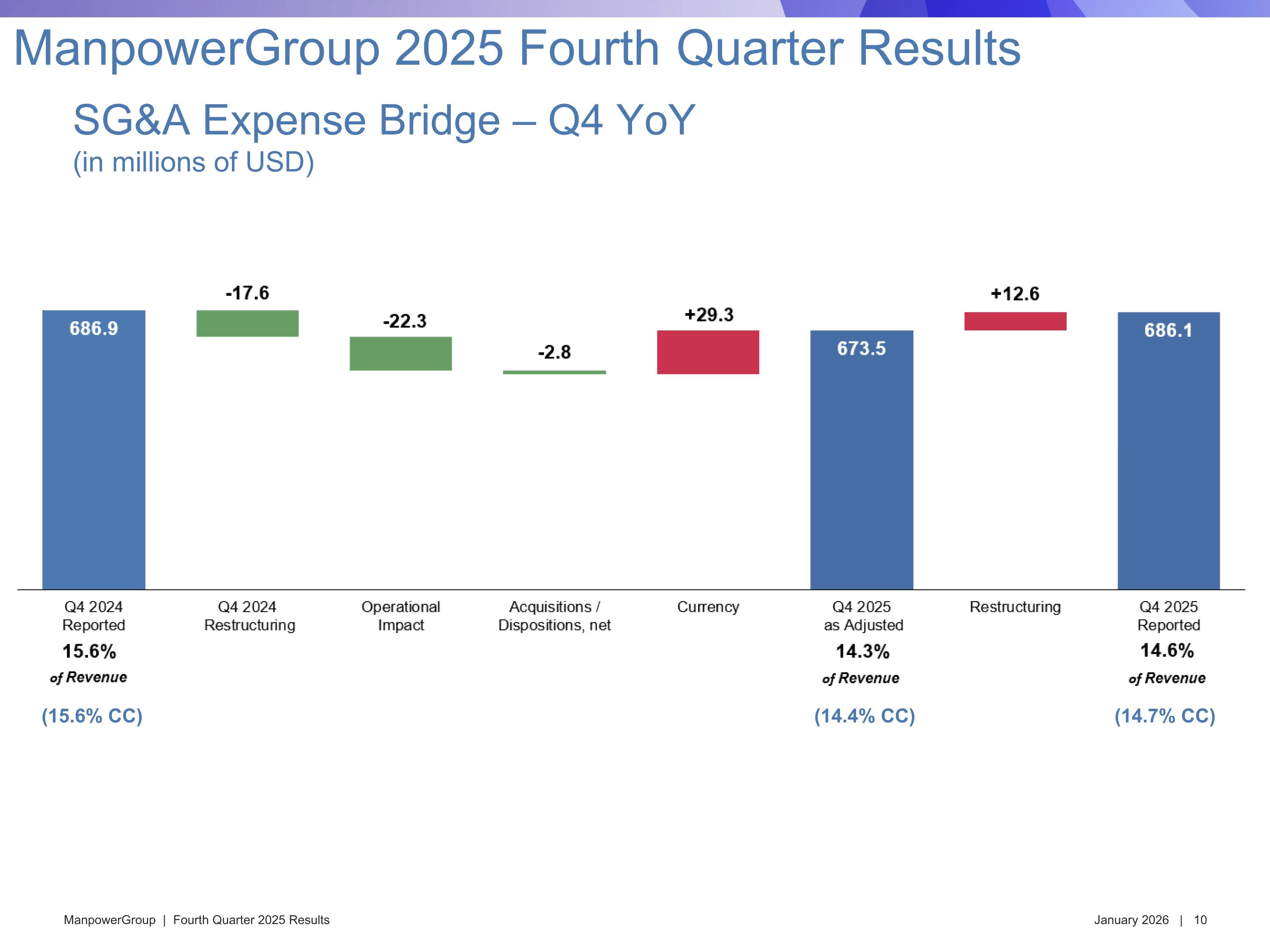

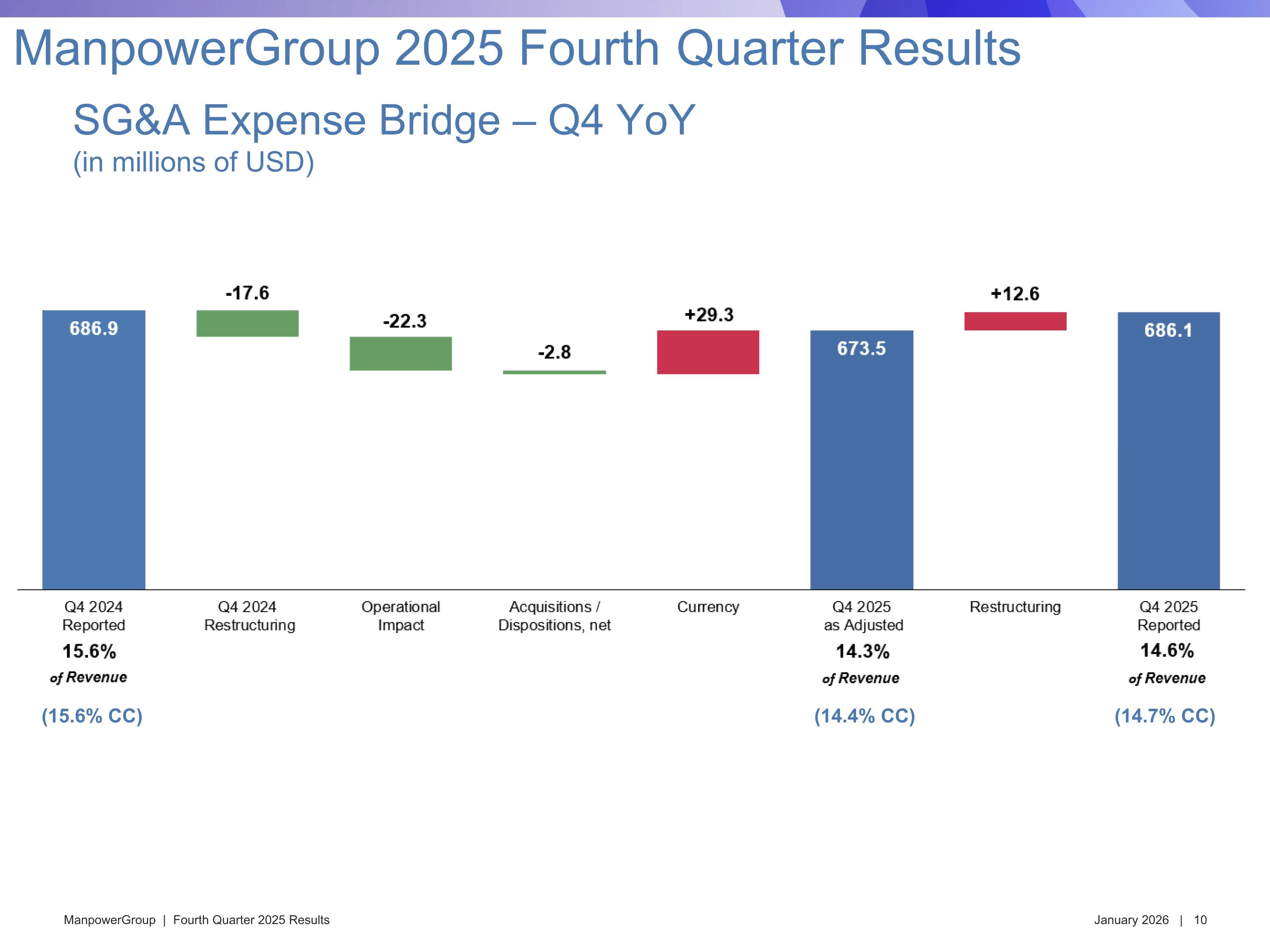

(14.7% CC) (15.6% CC) SG&A Expense Bridge – Q4 YoY(in millions of USD) ManpowerGroup 2025 Fourth Quarter Results (14.4% CC)

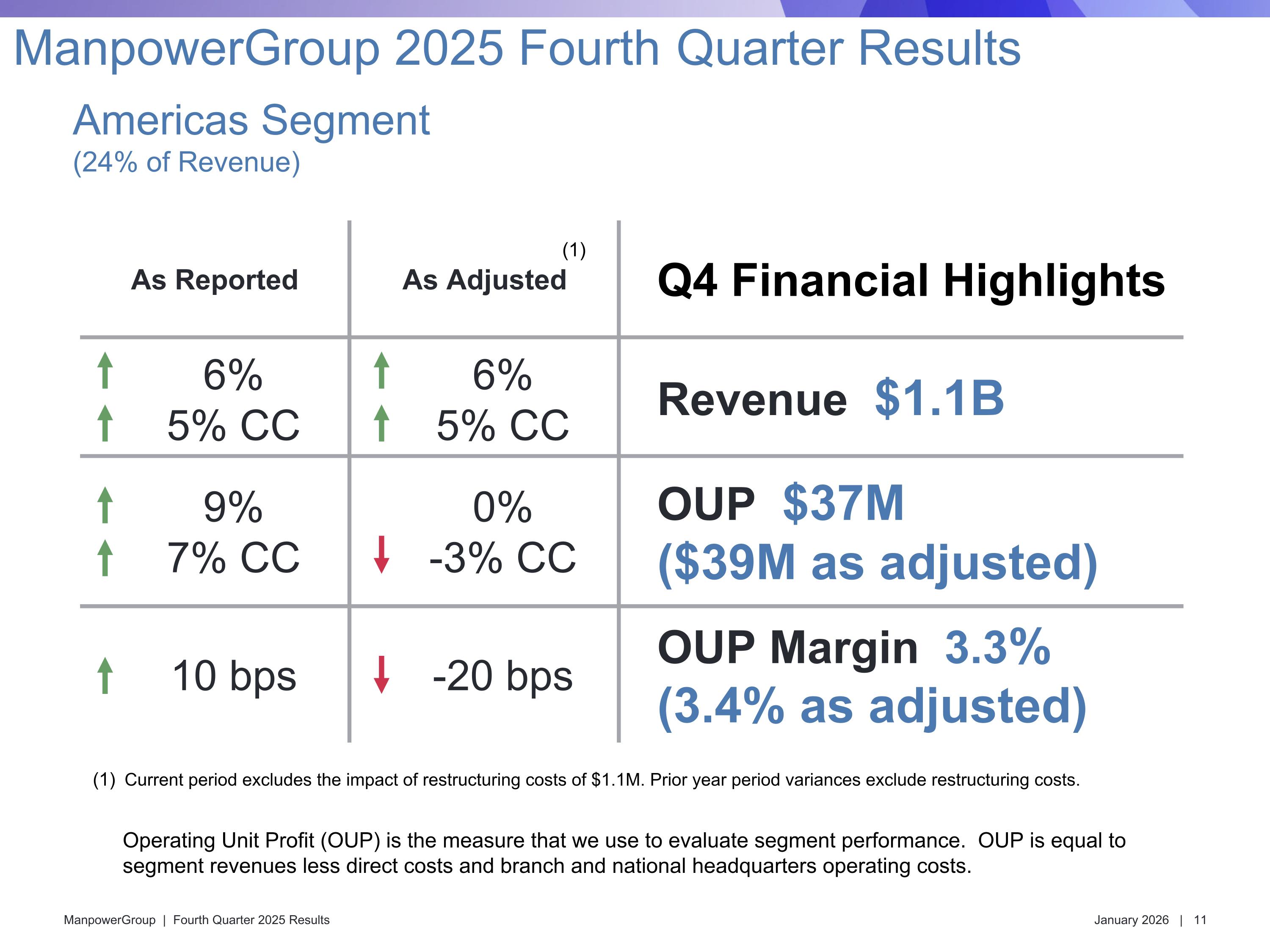

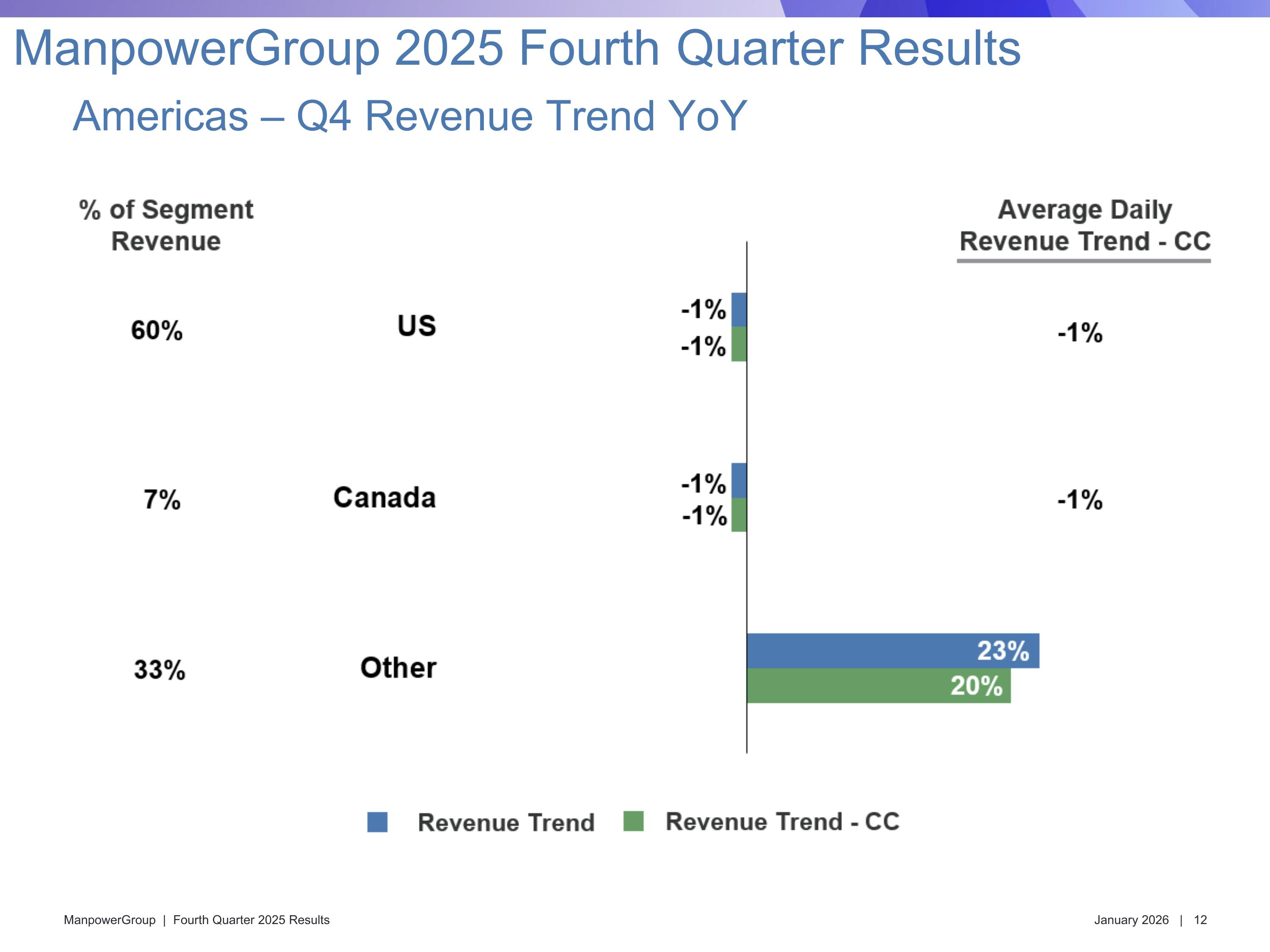

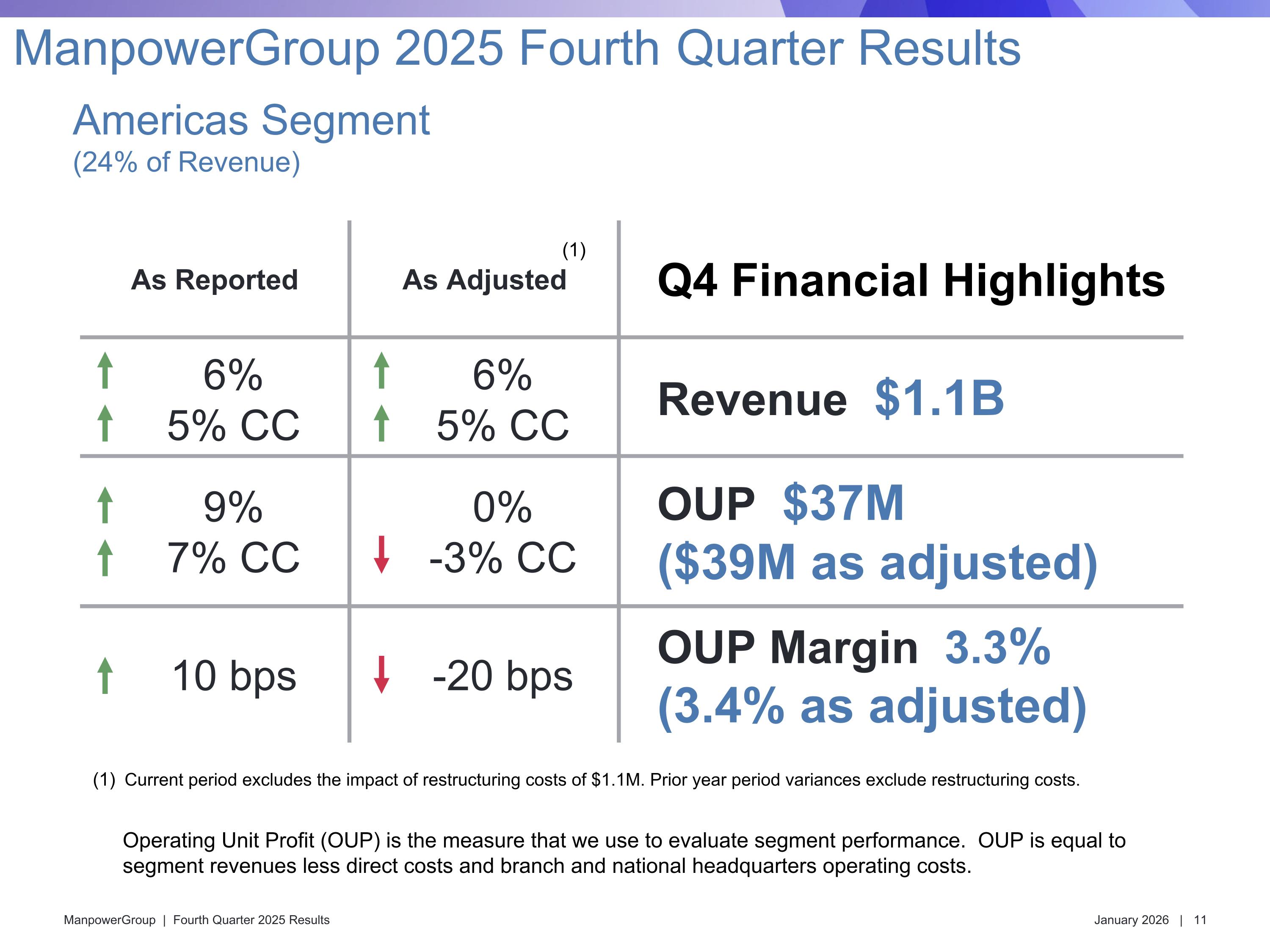

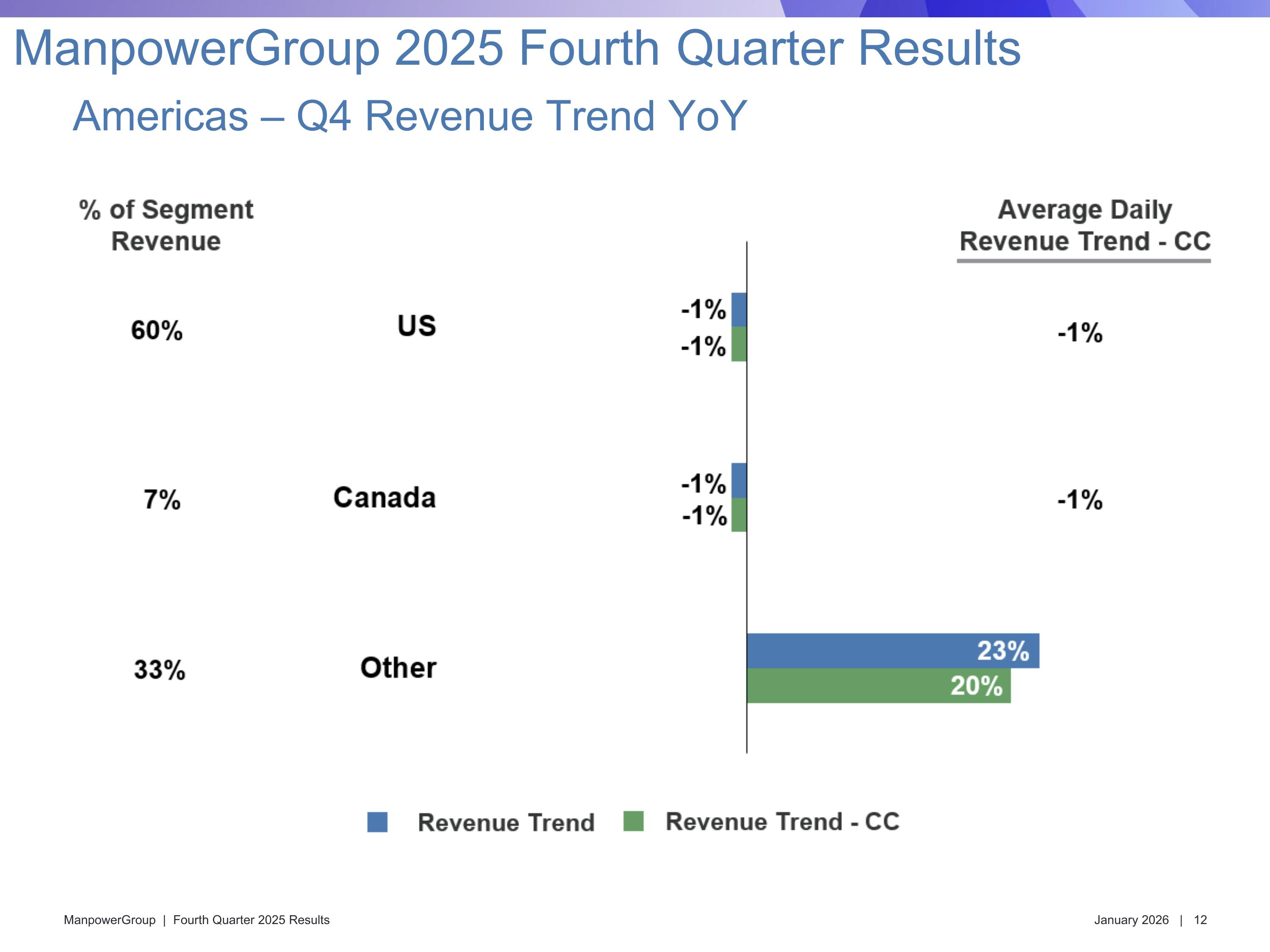

As Reported As Adjusted Q4 Financial Highlights 6% 5% CC 6% 5% CC Revenue $1.1B 9% 7% CC 0% -3% CC OUP $37M ($39M as adjusted) 10 bps -20 bps OUP Margin 3.3% (3.4% as adjusted) Americas Segment(24% of Revenue) ManpowerGroup 2025 Fourth Quarter Results Operating Unit Profit (OUP) is the measure that we use to evaluate segment performance. OUP is equal to segment revenues less direct costs and branch and national headquarters operating costs. Current period excludes the impact of restructuring costs of $1.1M. Prior year period variances exclude restructuring costs. (1)

Americas – Q4 Revenue Trend YoY ManpowerGroup 2025 Fourth Quarter Results

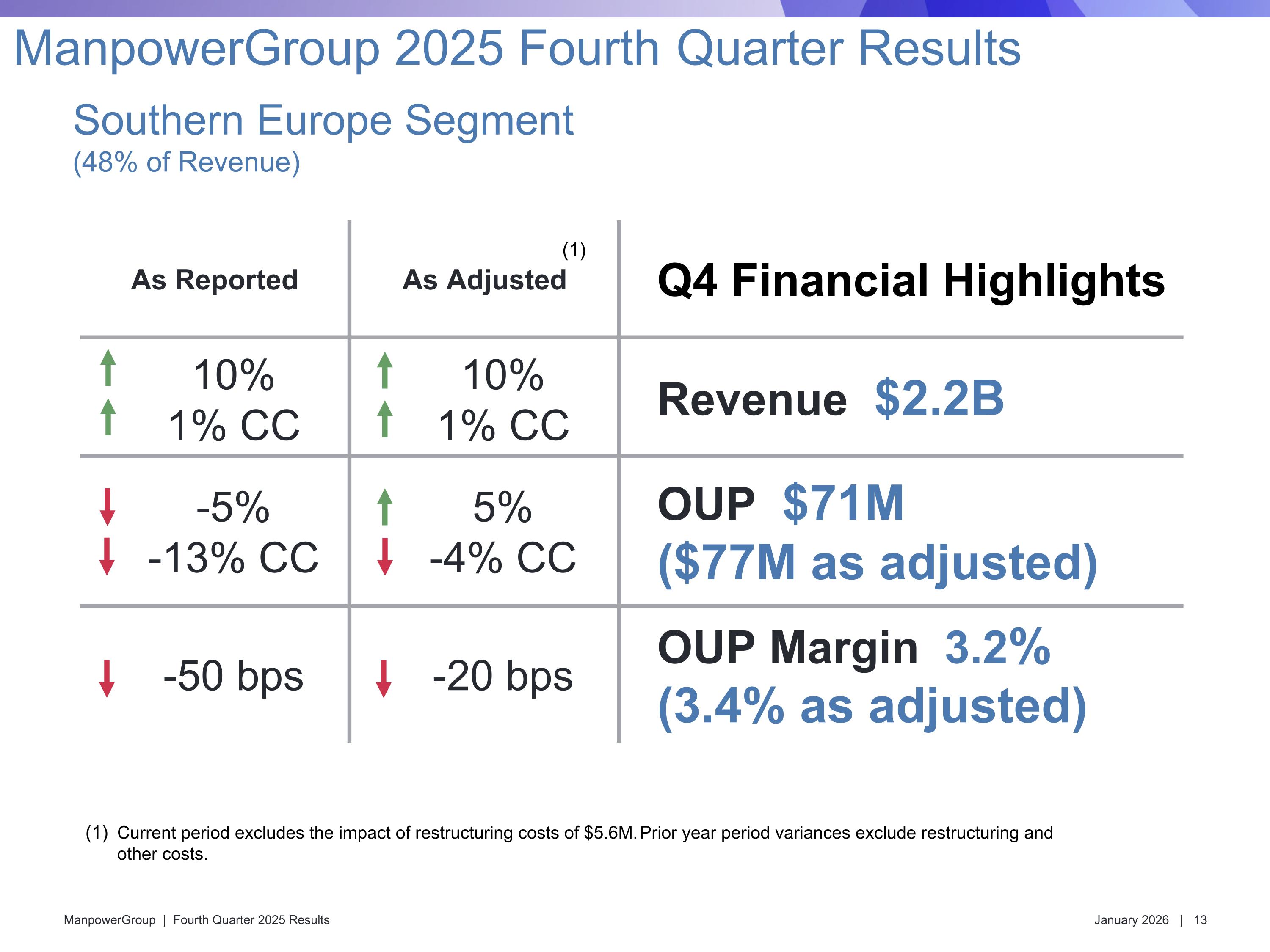

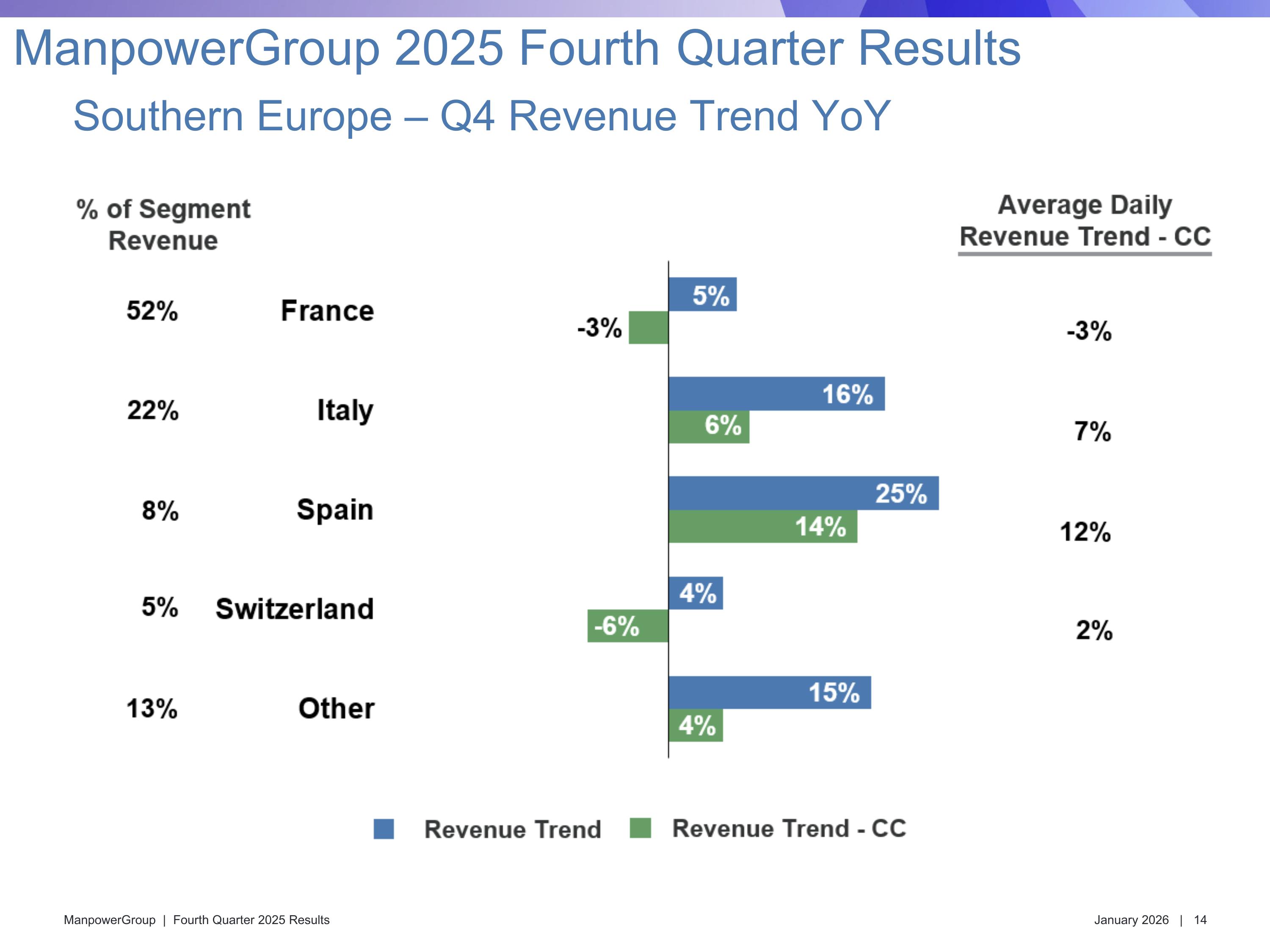

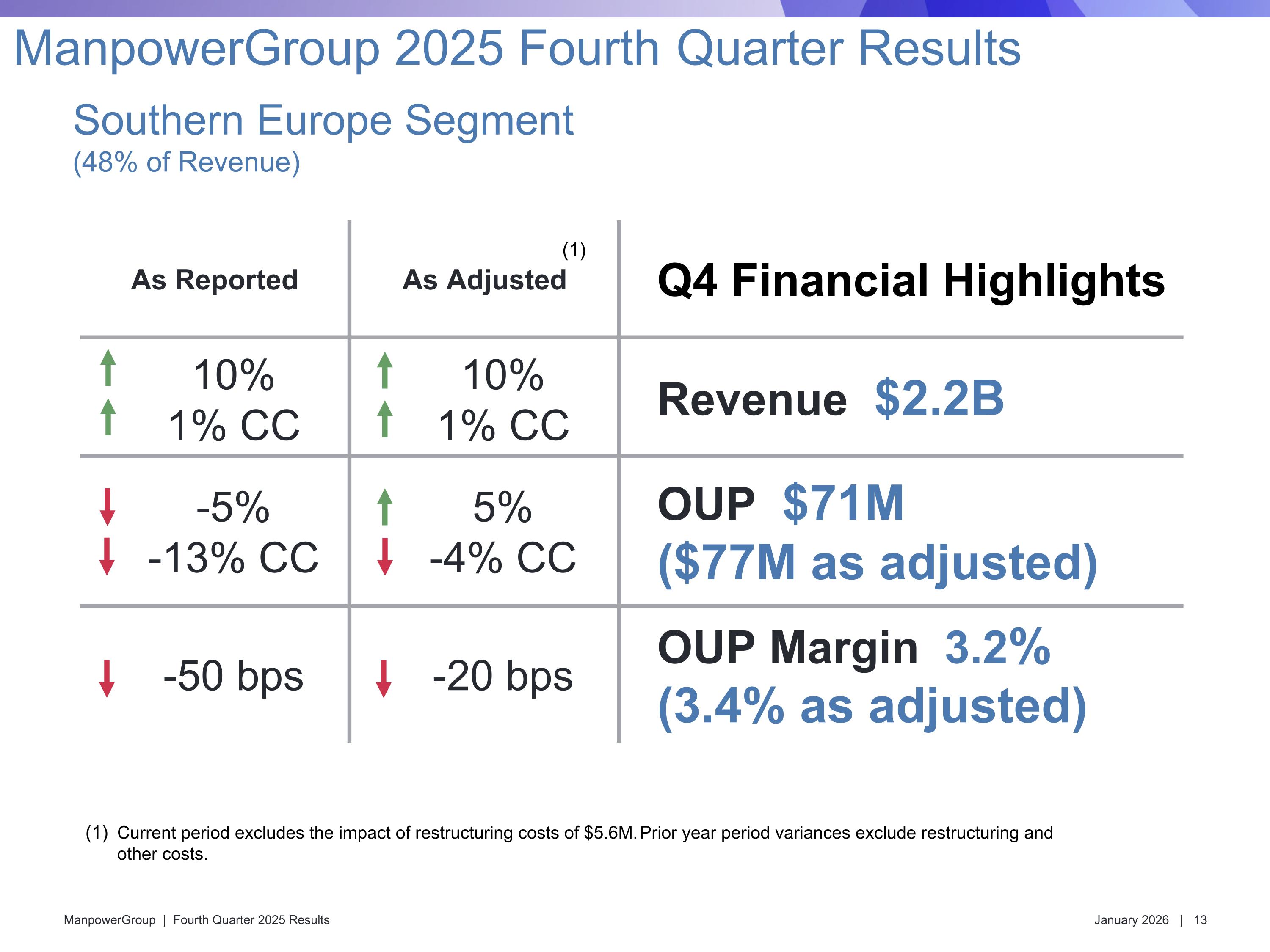

As Reported As Adjusted Q4 Financial Highlights 10% 1% CC 10% 1% CC Revenue $2.2B -5% -13% CC 5% -4% CC OUP $71M ($77M as adjusted) -50 bps -20 bps OUP Margin 3.2% (3.4% as adjusted) Southern Europe Segment(48% of Revenue) ManpowerGroup 2025 Fourth Quarter Results (1) Current period excludes the impact of restructuring costs of $5.6M. Prior year period variances exclude restructuring and other costs.

Southern Europe – Q4 Revenue Trend YoY ManpowerGroup 2025 Fourth Quarter Results

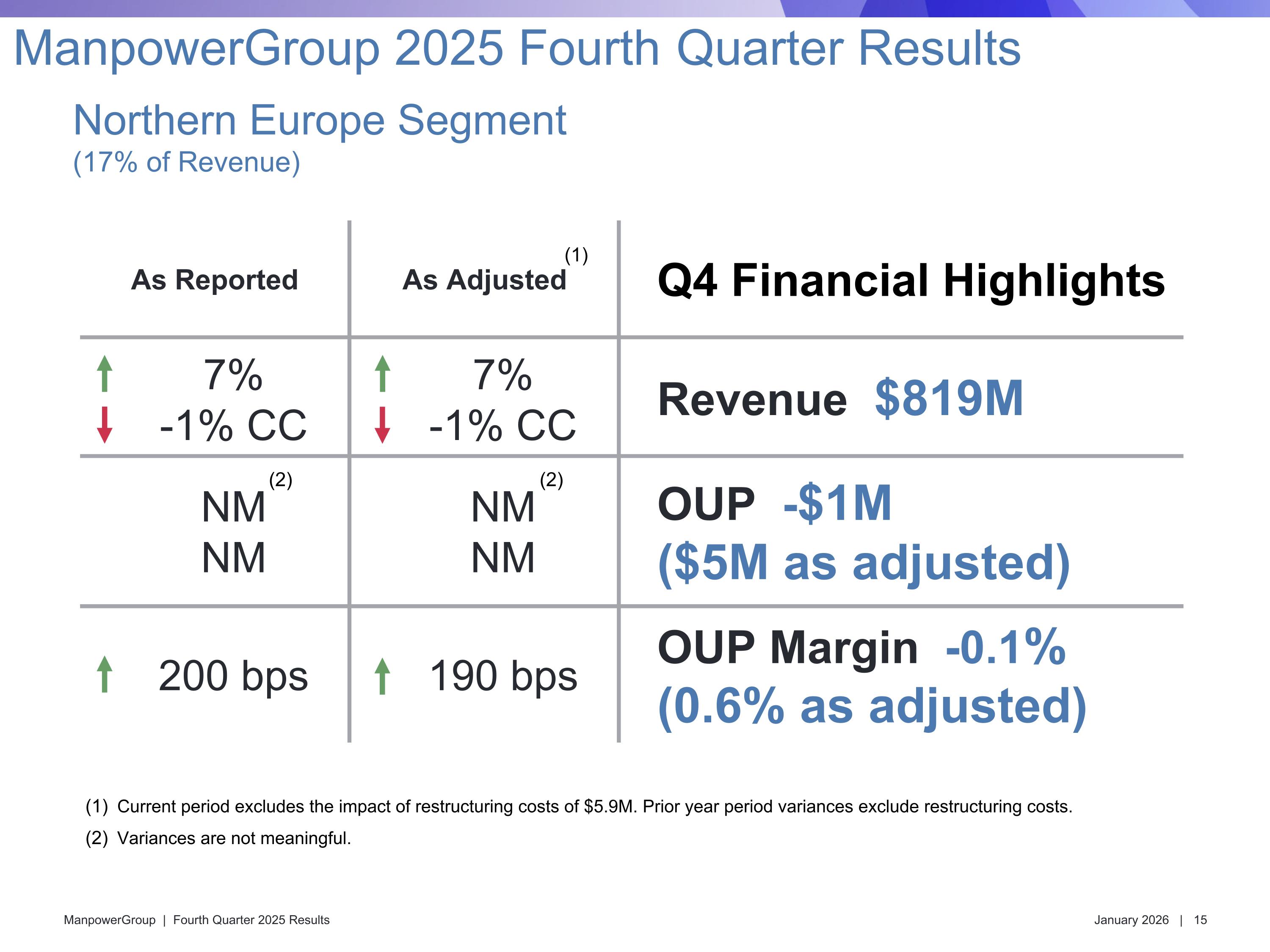

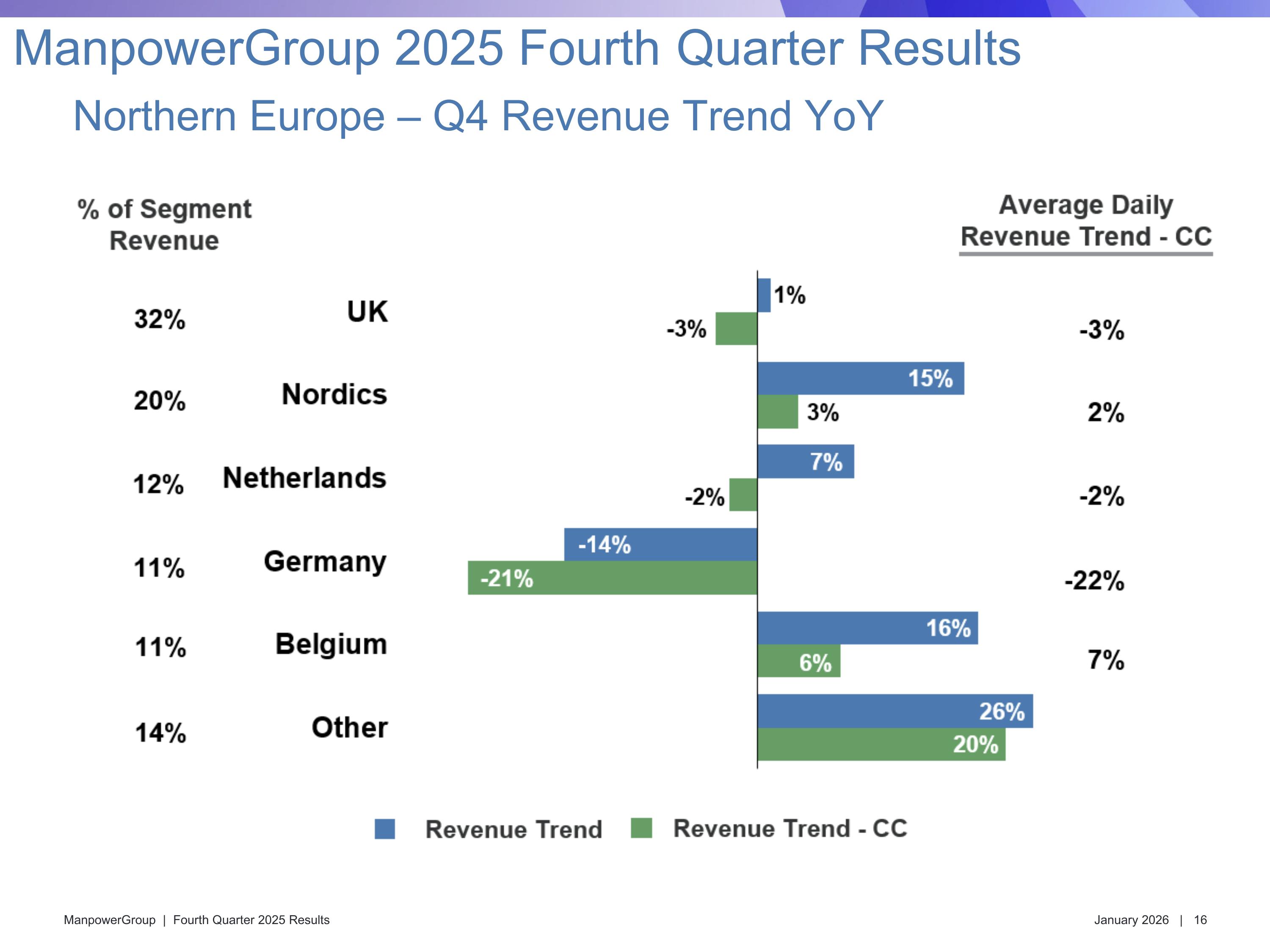

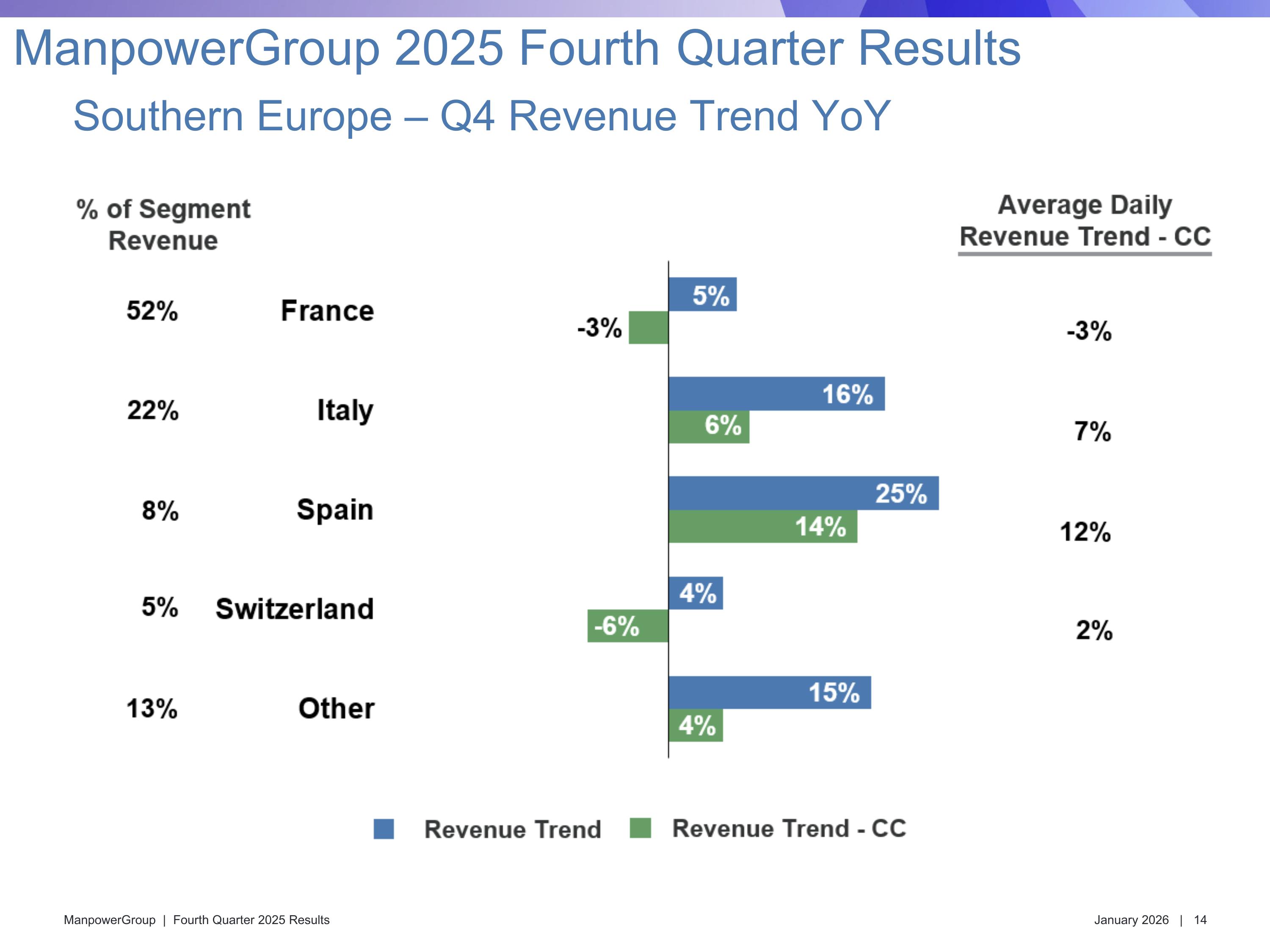

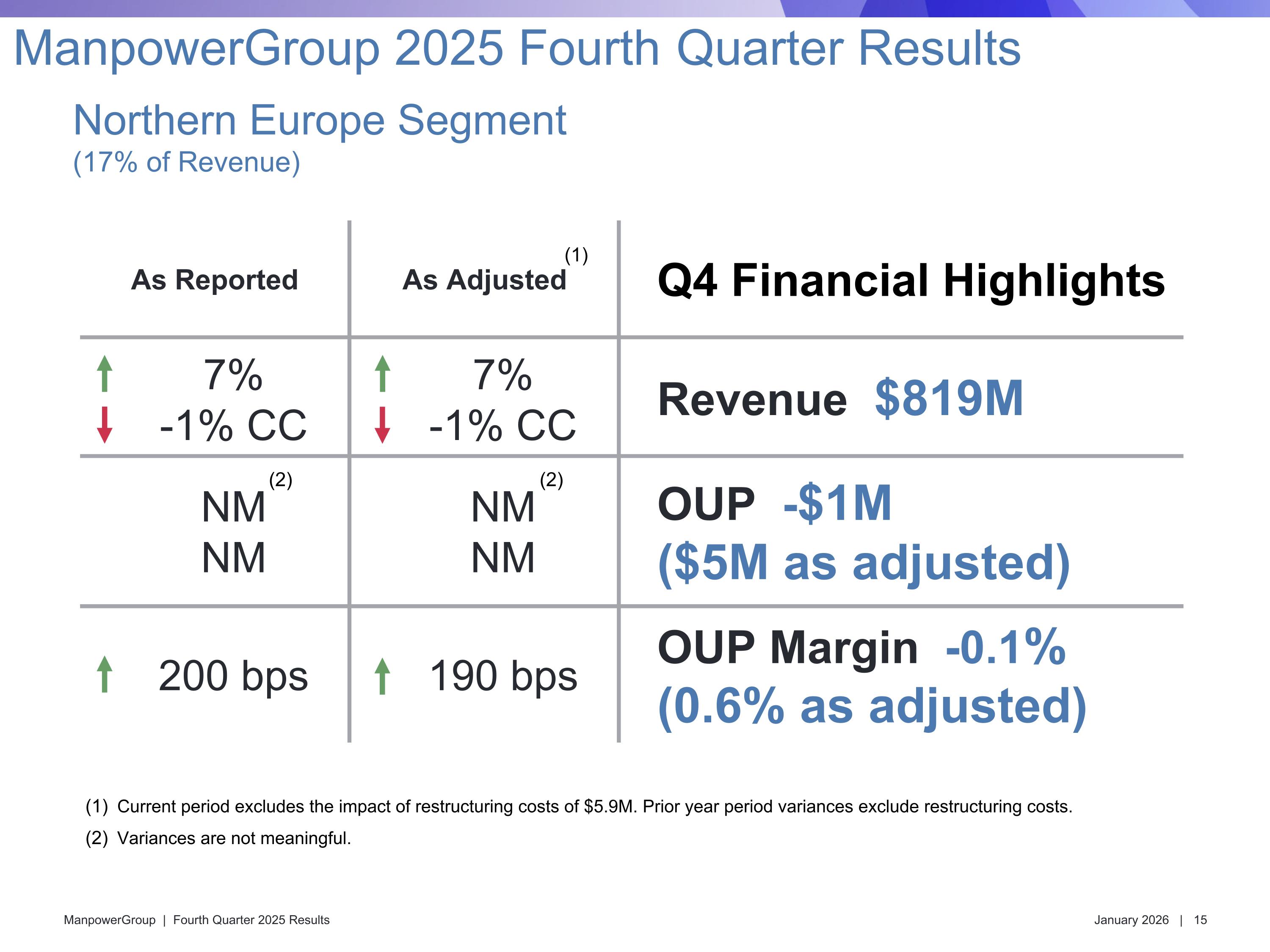

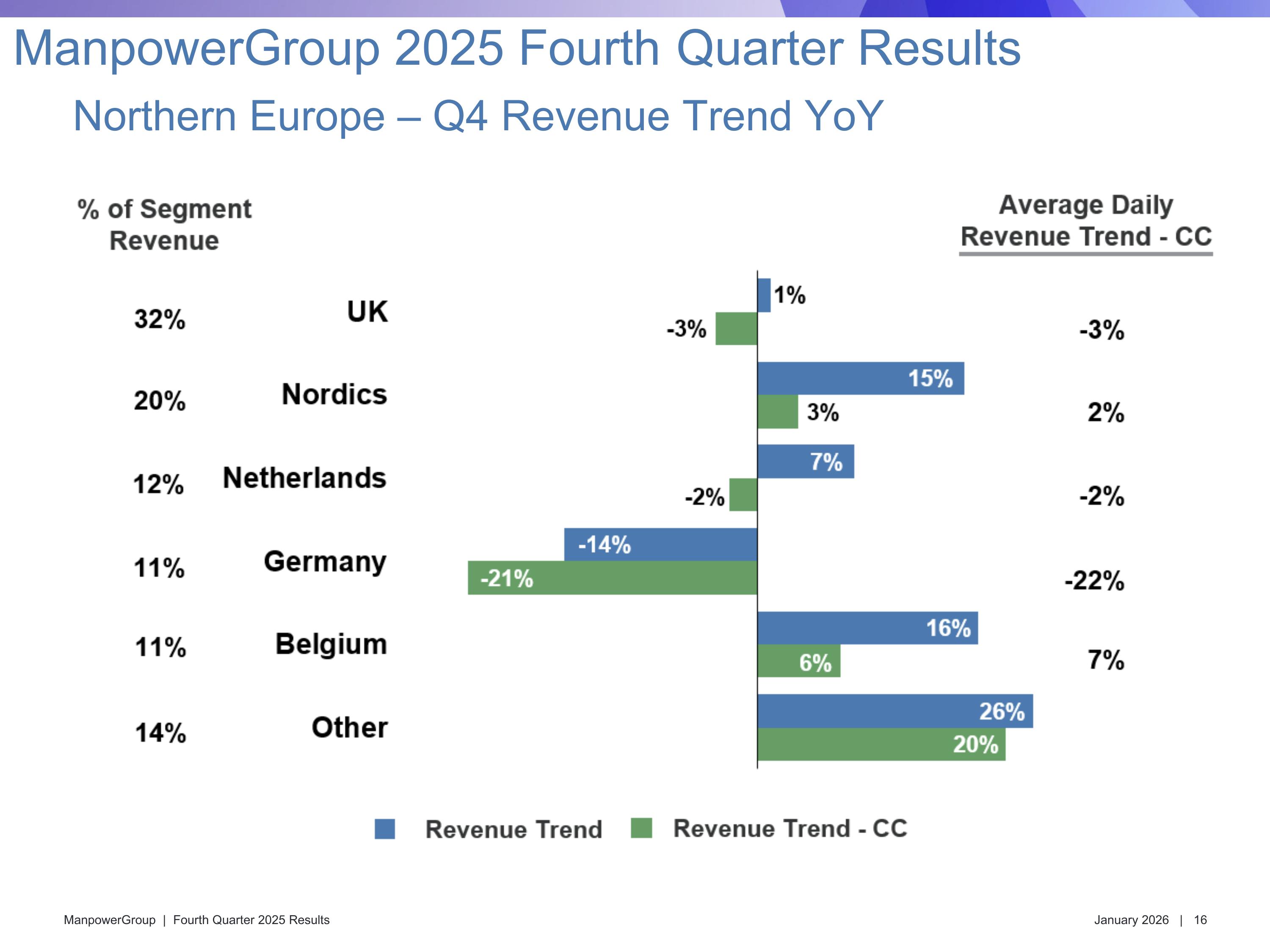

As Reported As Adjusted Q4 Financial Highlights 7% -1% CC 7% -1% CC Revenue $819M NM NM NM NM OUP -$1M ($5M as adjusted) 200 bps 190 bps OUP Margin -0.1% (0.6% as adjusted) Northern Europe Segment(17% of Revenue) ManpowerGroup 2025 Fourth Quarter Results (1) Current period excludes the impact of restructuring costs of $5.9M. Prior year period variances exclude restructuring costs. Variances are not meaningful. (2) (2)

Northern Europe – Q4 Revenue Trend YoY ManpowerGroup 2025 Fourth Quarter Results -28%

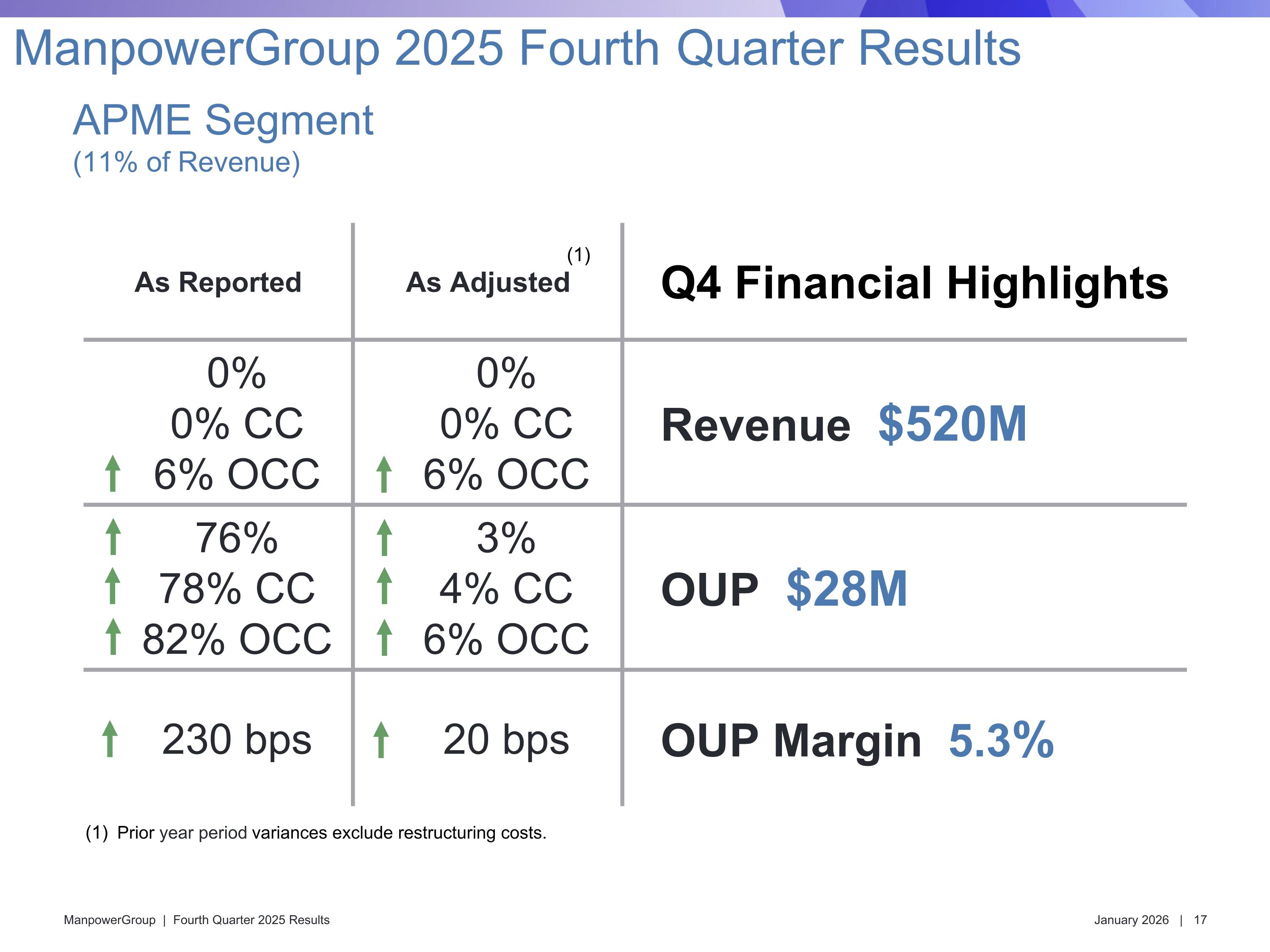

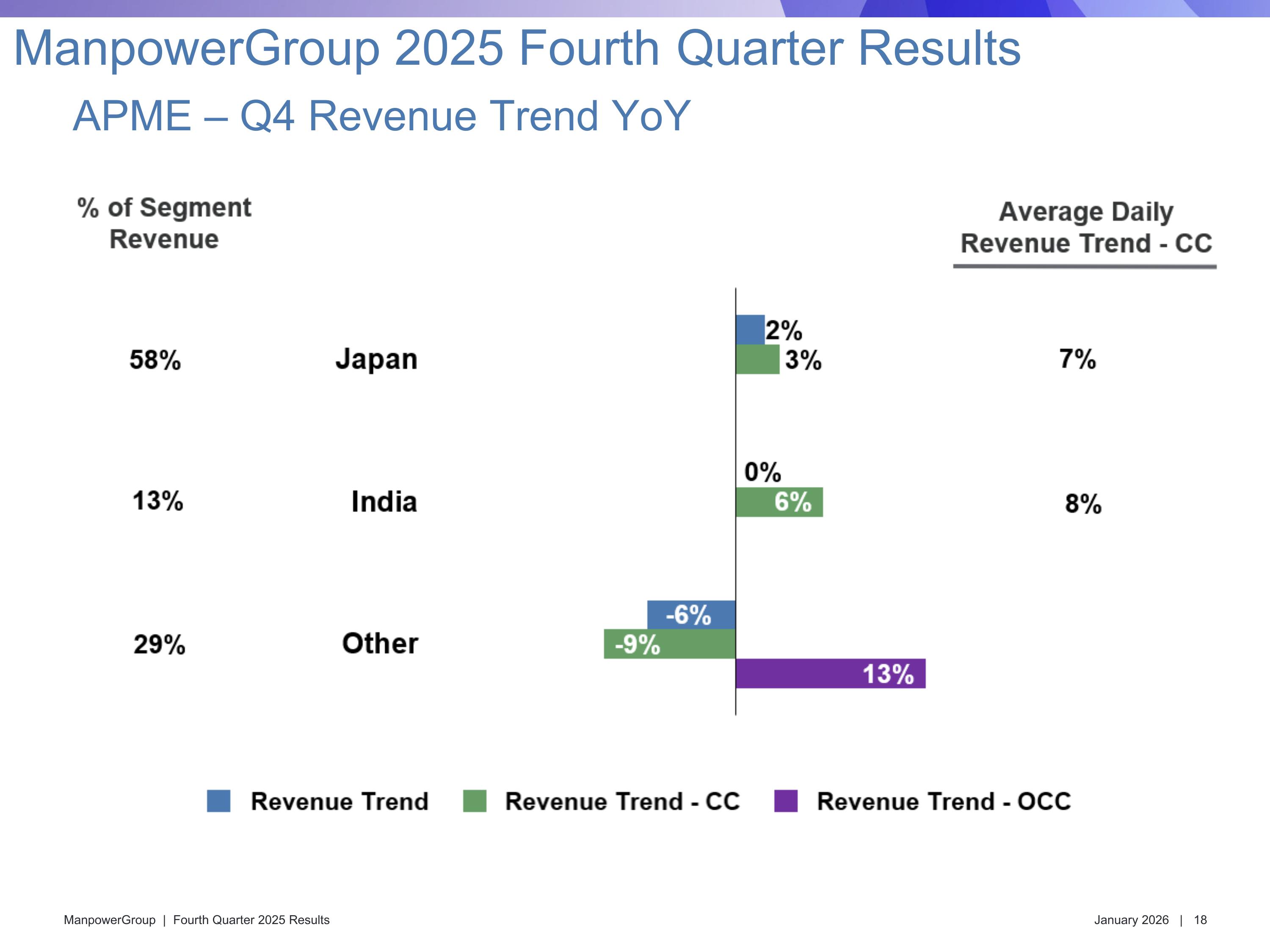

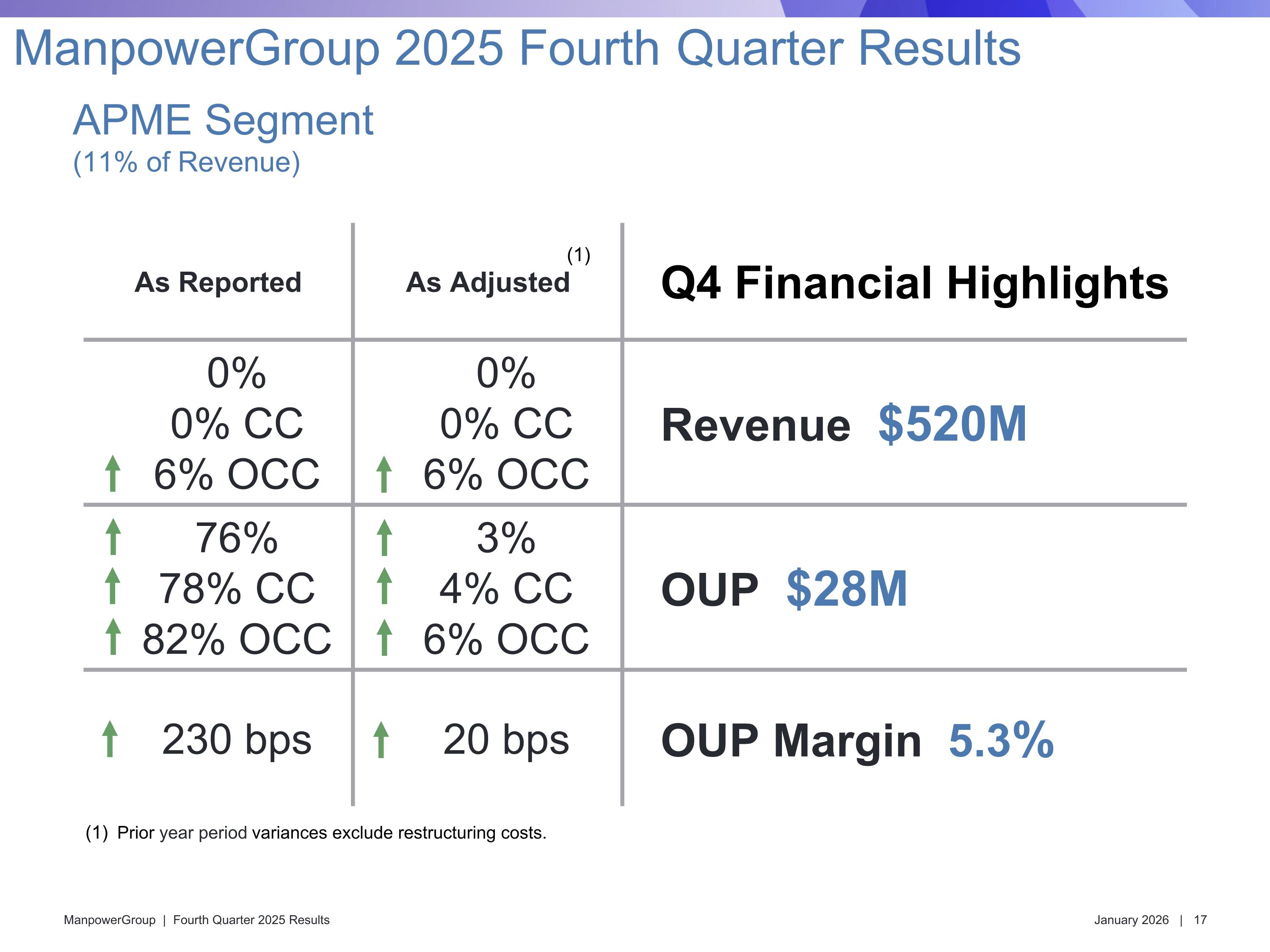

As Reported As Adjusted Q4 Financial Highlights 0% 0% CC 6% OCC 0% 0% CC 6% OCC Revenue $520M 76% 78% CC 82% OCC 3% 4% CC 6% OCC OUP $28M 230 bps 20 bps OUP Margin 5.3% APME Segment(11% of Revenue) ManpowerGroup 2025 Fourth Quarter Results (1) Prior year period variances exclude restructuring costs.

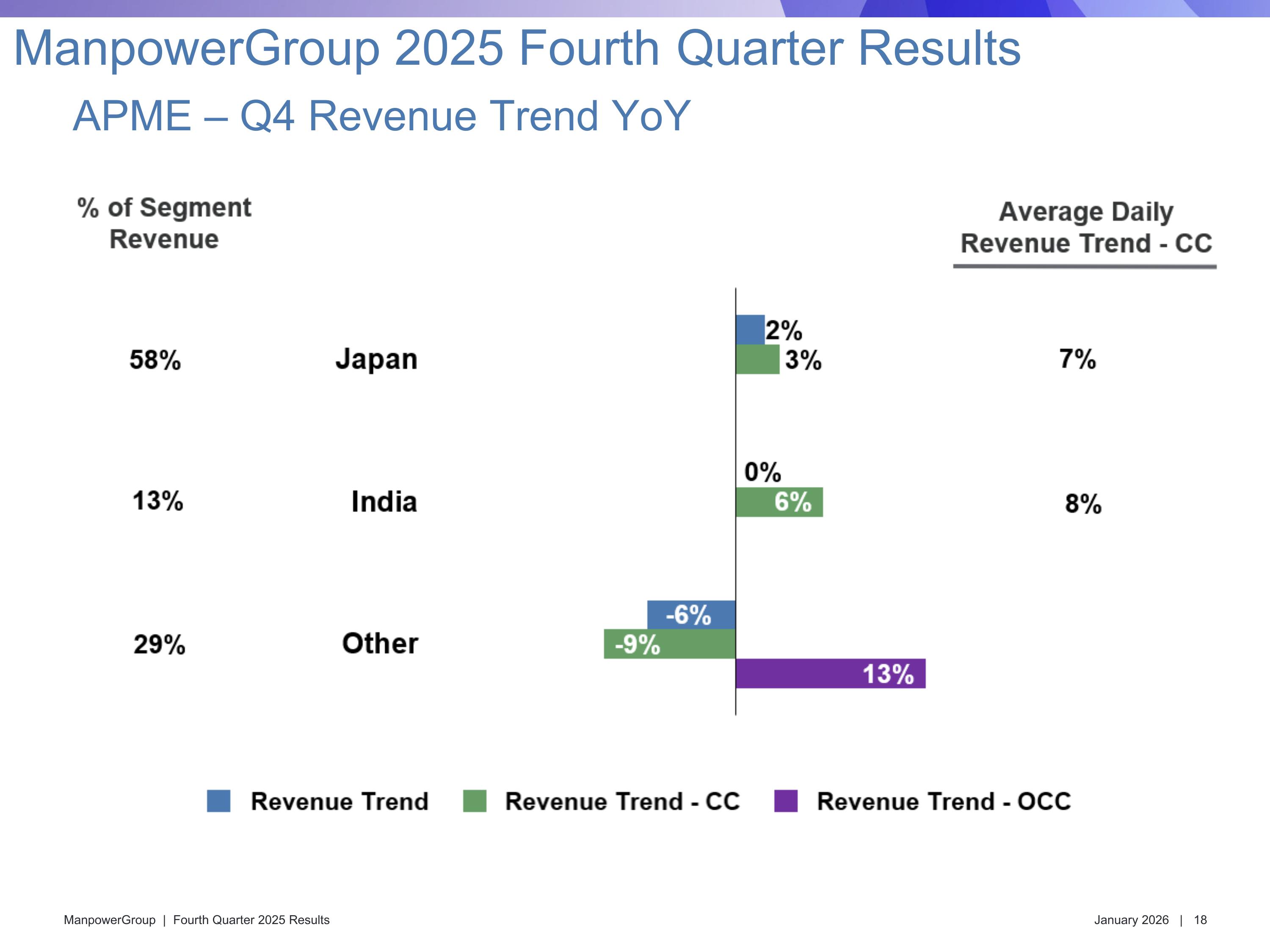

APME – Q4 Revenue Trend YoY ManpowerGroup 2025 Fourth Quarter Results

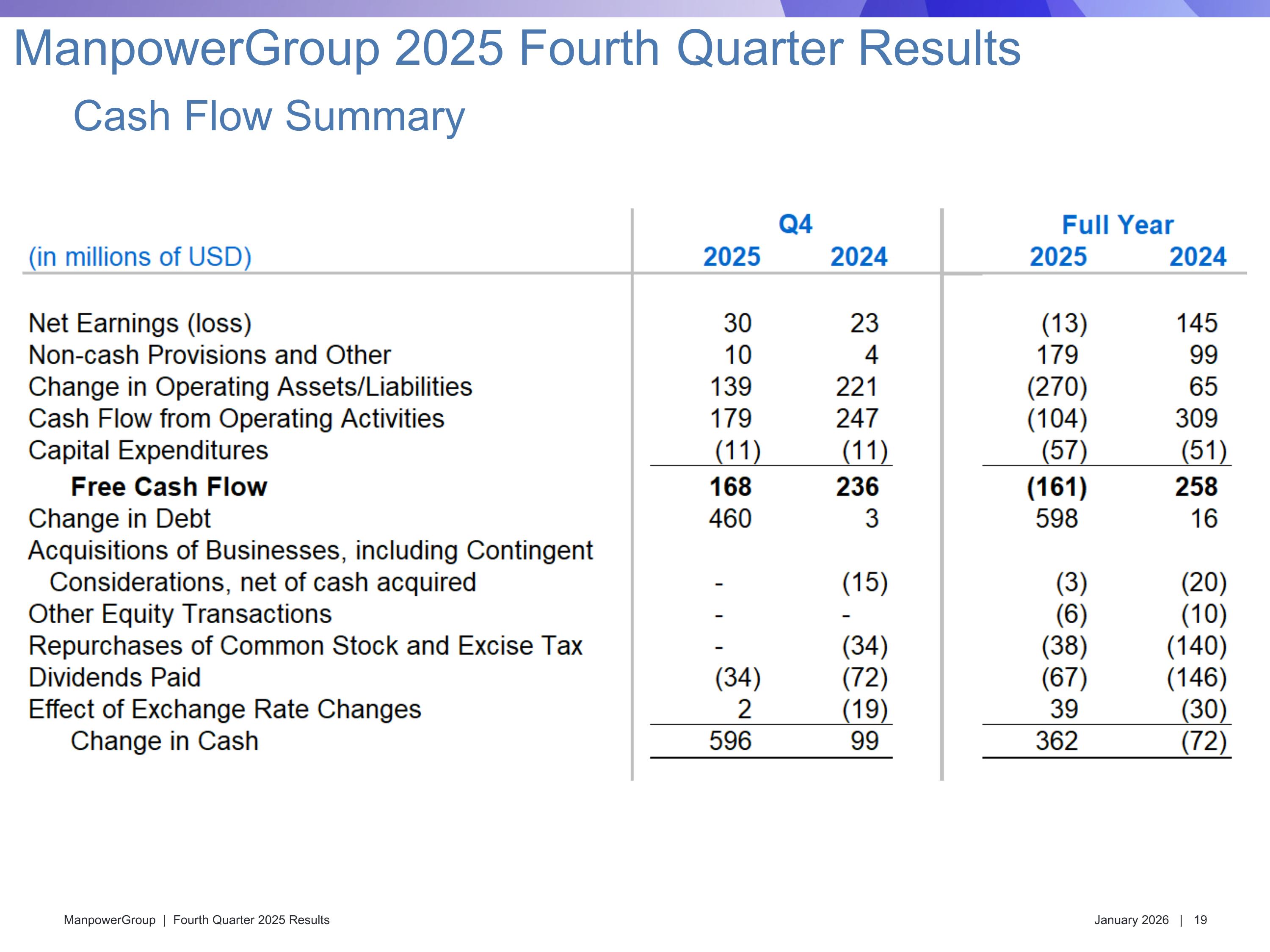

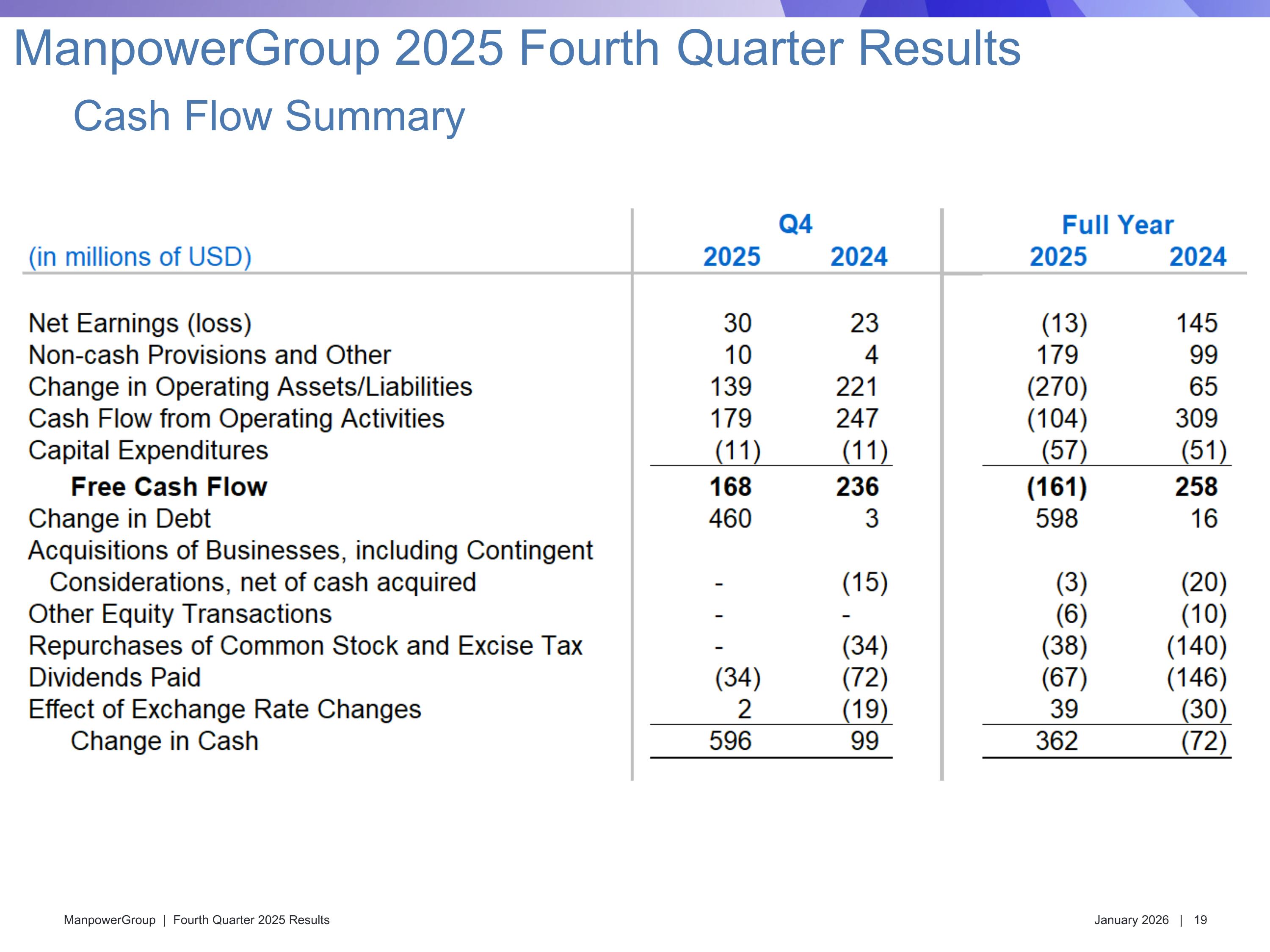

Cash Flow Summary ManpowerGroup 2025 Fourth Quarter Results

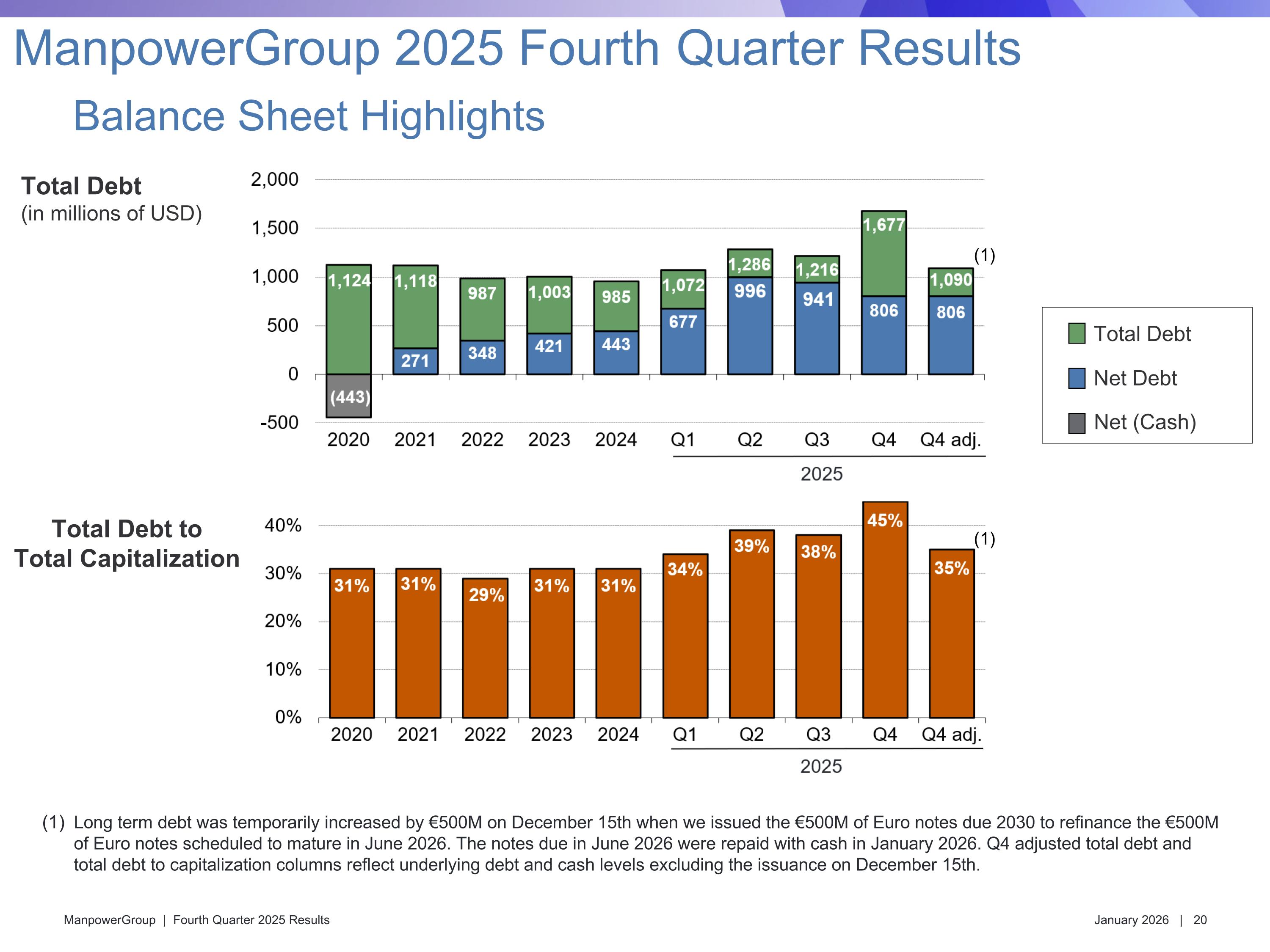

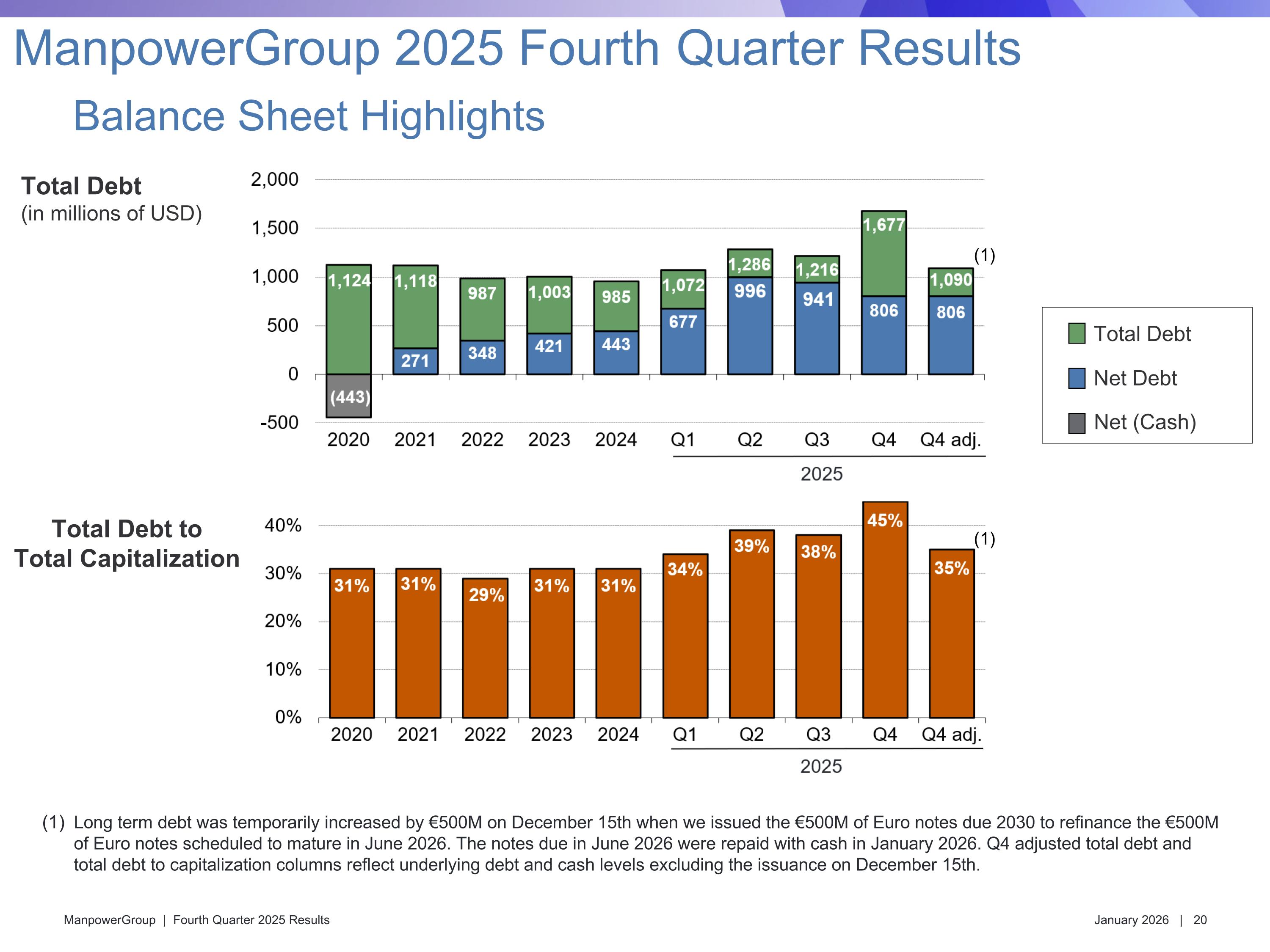

Total Debt (in millions of USD) Total Debt to Total Capitalization Total Debt Net Debt Net (Cash) Balance Sheet Highlights ManpowerGroup 2025 Fourth Quarter Results Long term debt was temporarily increased by €500M on December 15th when we issued the €500M of Euro notes due 2030 to refinance the €500M of Euro notes scheduled to mature in June 2026. The notes due in June 2026 were repaid with cash in January 2026. Q4 adjusted total debt and total debt to capitalization columns reflect underlying debt and cash levels excluding the issuance on December 15th. (1) (1)

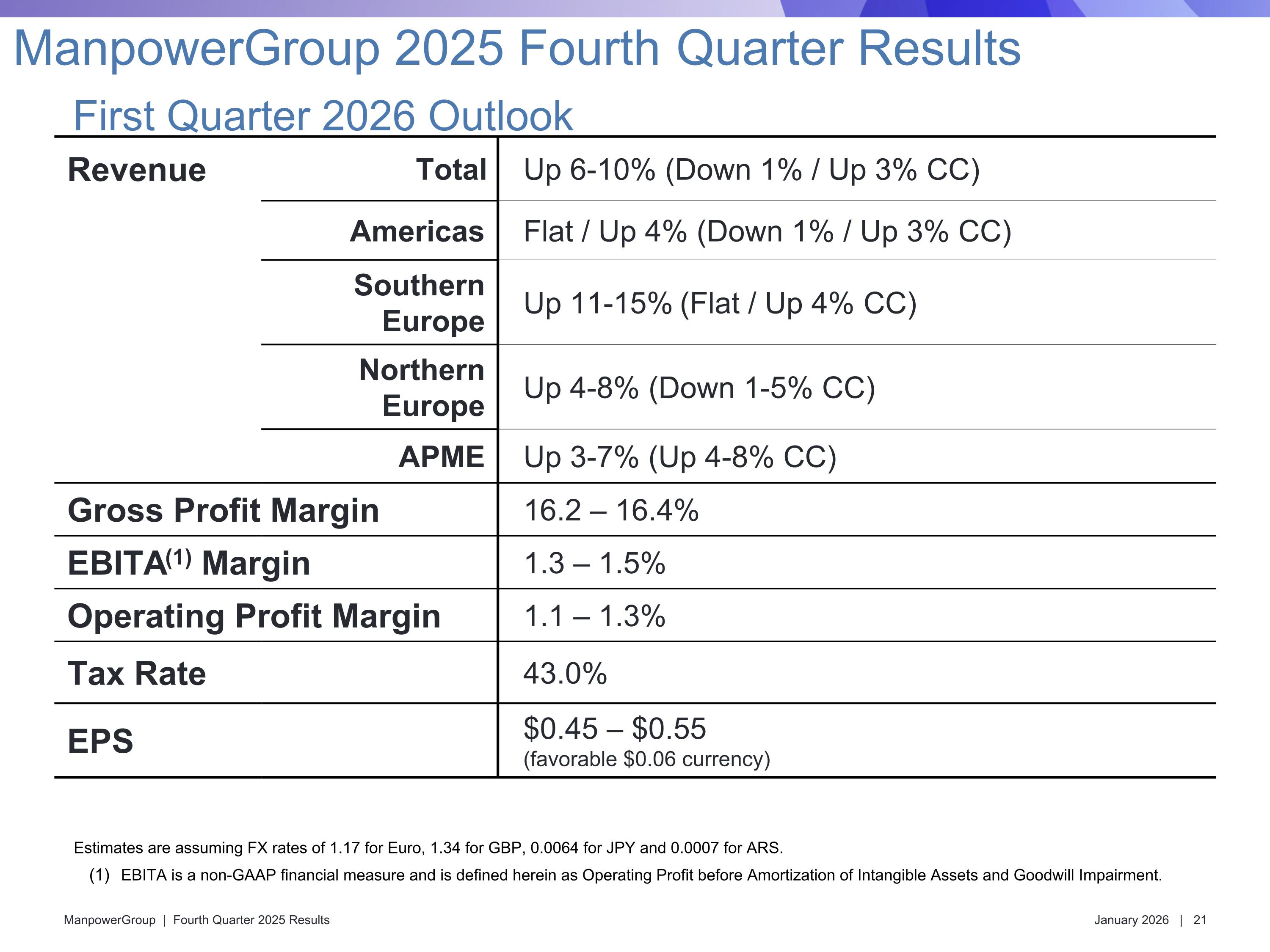

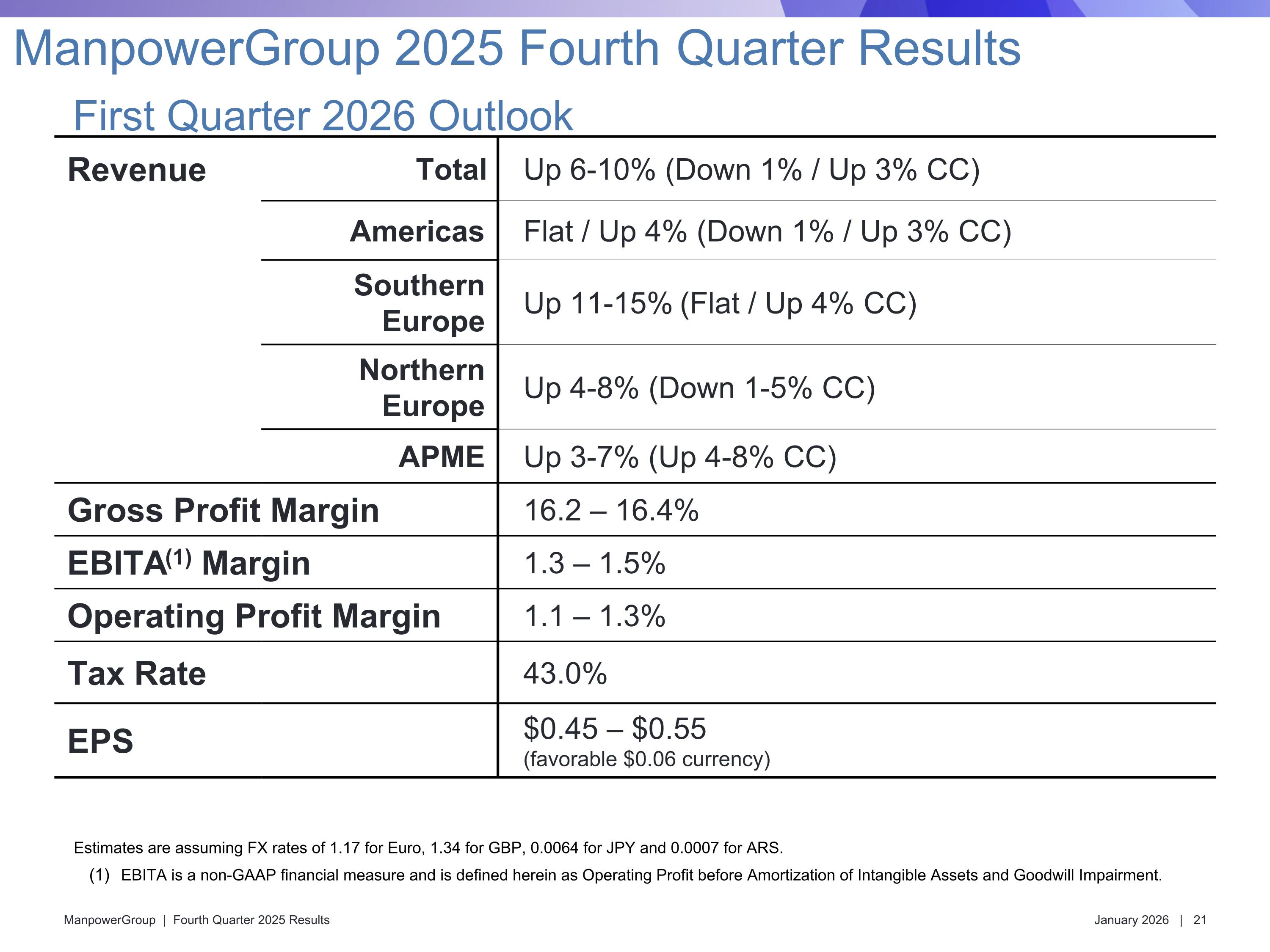

ManpowerGroup 2025 Fourth Quarter Results First Quarter 2026 Outlook Revenue Total Up 6-10% (Down 1% / Up 3% CC) Americas Flat / Up 4% (Down 1% / Up 3% CC) Southern Europe Up 11-15% (Flat / Up 4% CC) Northern Europe Up 4-8% (Down 1-5% CC) APME Up 3-7% (Up 4-8% CC) Gross Profit Margin 16.2 – 16.4% EBITA(1) Margin 1.3 – 1.5% Operating Profit Margin 1.1 – 1.3% Tax Rate 43.0% EPS $0.45 – $0.55 (favorable $0.06 currency) Estimates are assuming FX rates of 1.17 for Euro, 1.34 for GBP, 0.0064 for JPY and 0.0007 for ARS. EBITA is a non-GAAP financial measure and is defined herein as Operating Profit before Amortization of Intangible Assets and Goodwill Impairment.

Appendix

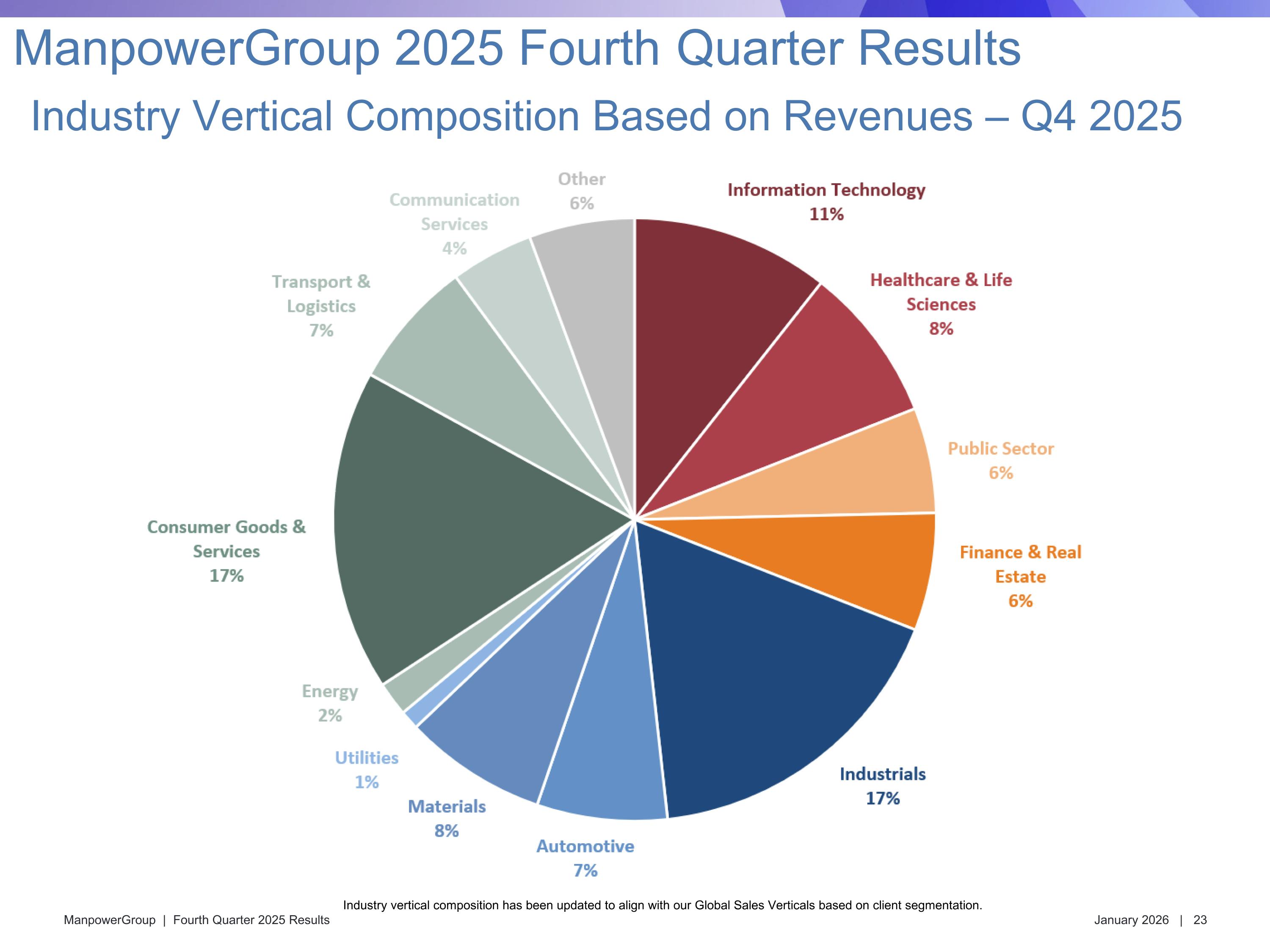

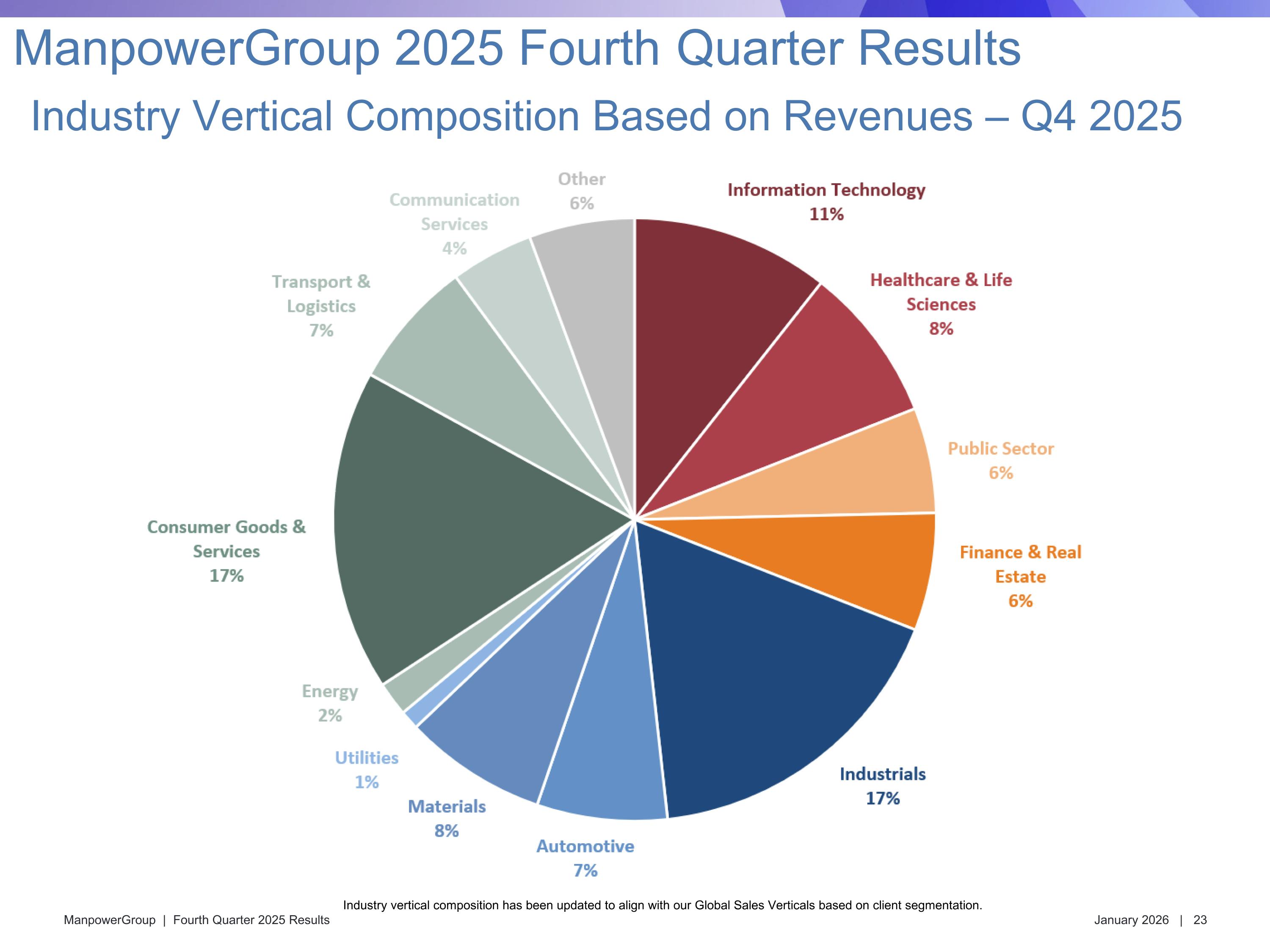

Industry Vertical Composition Based on Revenues – Q4 2025 ManpowerGroup 2025 Fourth Quarter Results Industry vertical composition has been updated to align with our Global Sales Verticals based on client segmentation.

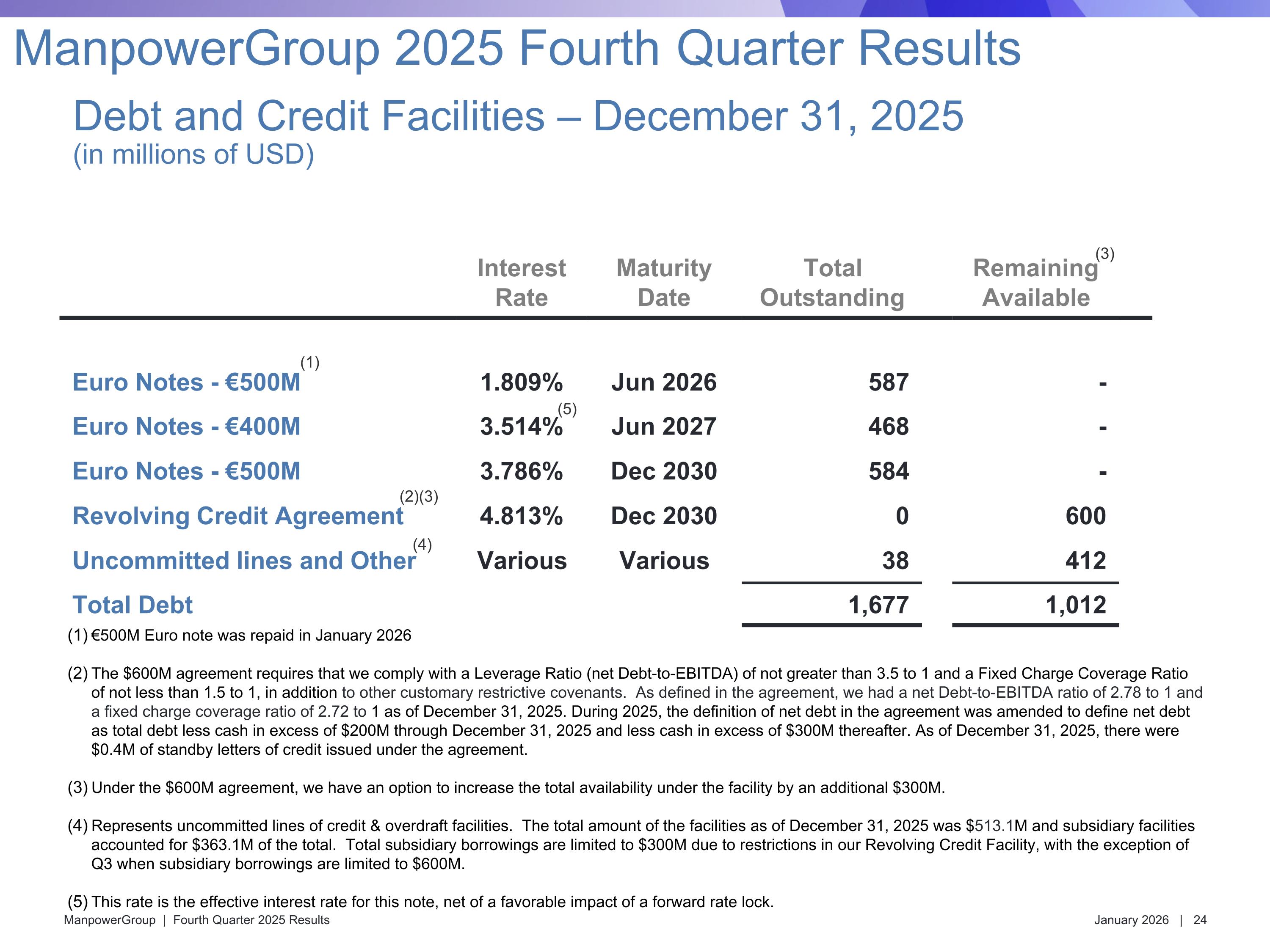

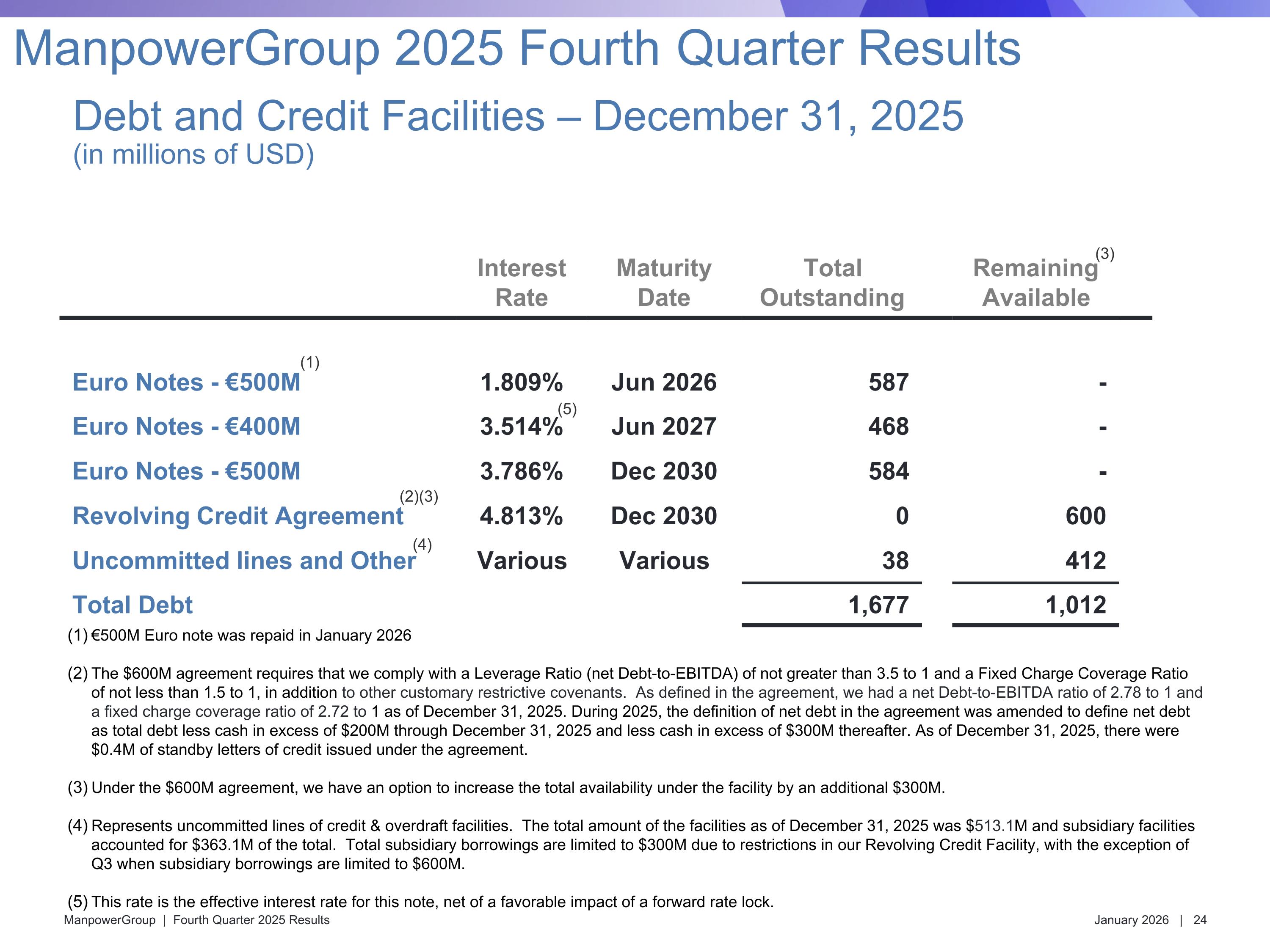

Interest Rate Maturity Date Total Outstanding Remaining Available Euro Notes - €500M 1.809% Jun 2026 587 - Euro Notes - €400M 3.514% Jun 2027 468 - Euro Notes - €500M 3.786% Dec 2030 584 - Revolving Credit Agreement 4.813% Dec 2030 0 600 Uncommitted lines and Other Various Various 38 412 Total Debt 1,677 1,012 (4) (2)(3) (5) (3) Debt and Credit Facilities – December 31, 2025(in millions of USD) ManpowerGroup 2025 Fourth Quarter Results €500M Euro note was repaid in January 2026 The $600M agreement requires that we comply with a Leverage Ratio (net Debt-to-EBITDA) of not greater than 3.5 to 1 and a Fixed Charge Coverage Ratio of not less than 1.5 to 1, in addition to other customary restrictive covenants. As defined in the agreement, we had a net Debt-to-EBITDA ratio of 2.78 to 1 and a fixed charge coverage ratio of 2.72 to 1 as of December 31, 2025. During 2025, the definition of net debt in the agreement was amended to define net debt as total debt less cash in excess of $200M through December 31, 2025 and less cash in excess of $300M thereafter. As of December 31, 2025, there were $0.4M of standby letters of credit issued under the agreement. Under the $600M agreement, we have an option to increase the total availability under the facility by an additional $300M. Represents uncommitted lines of credit & overdraft facilities. The total amount of the facilities as of December 31, 2025 was $513.1M and subsidiary facilities accounted for $363.1M of the total. Total subsidiary borrowings are limited to $300M due to restrictions in our Revolving Credit Facility, with the exception of Q3 when subsidiary borrowings are limited to $600M. This rate is the effective interest rate for this note, net of a favorable impact of a forward rate lock. (1)