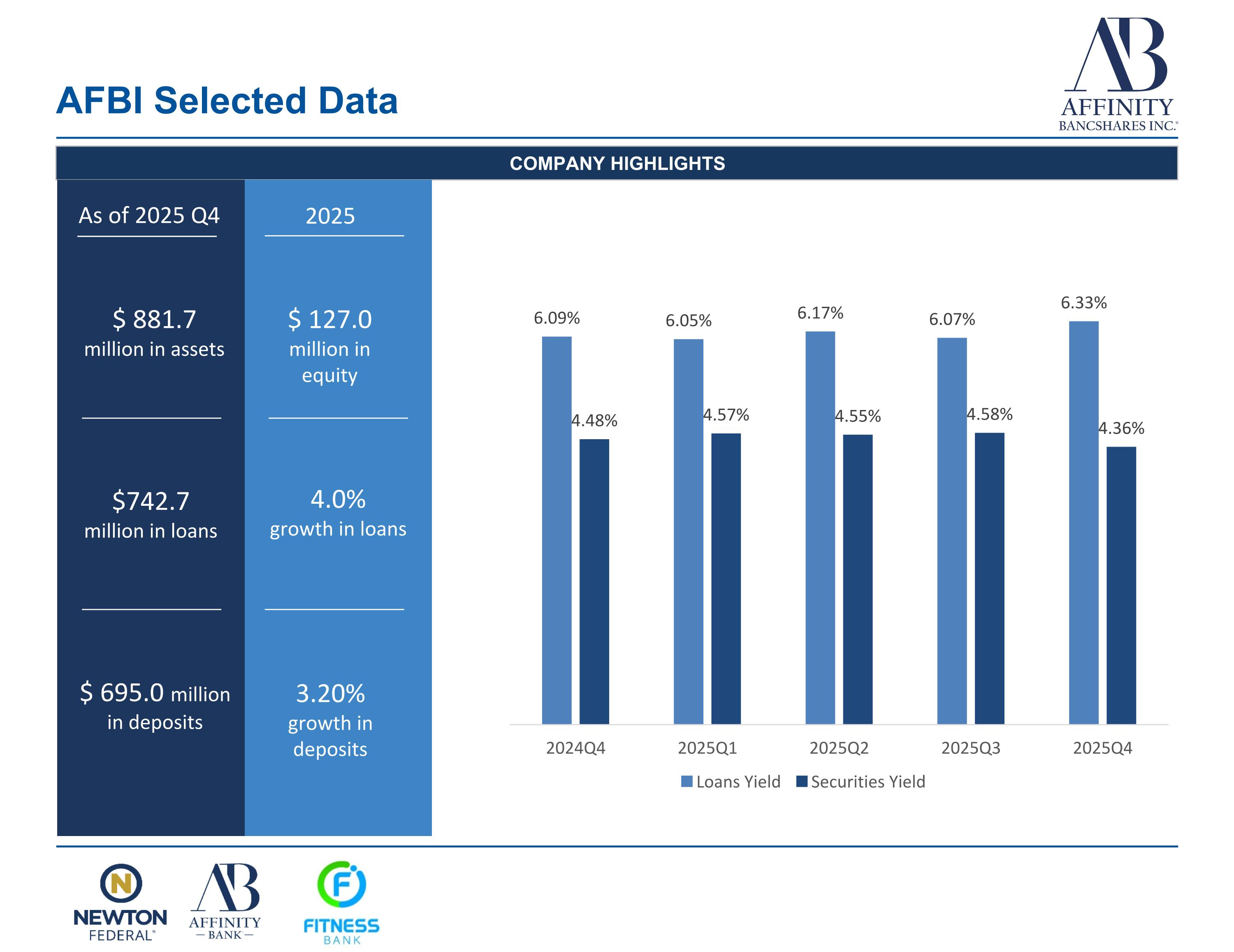

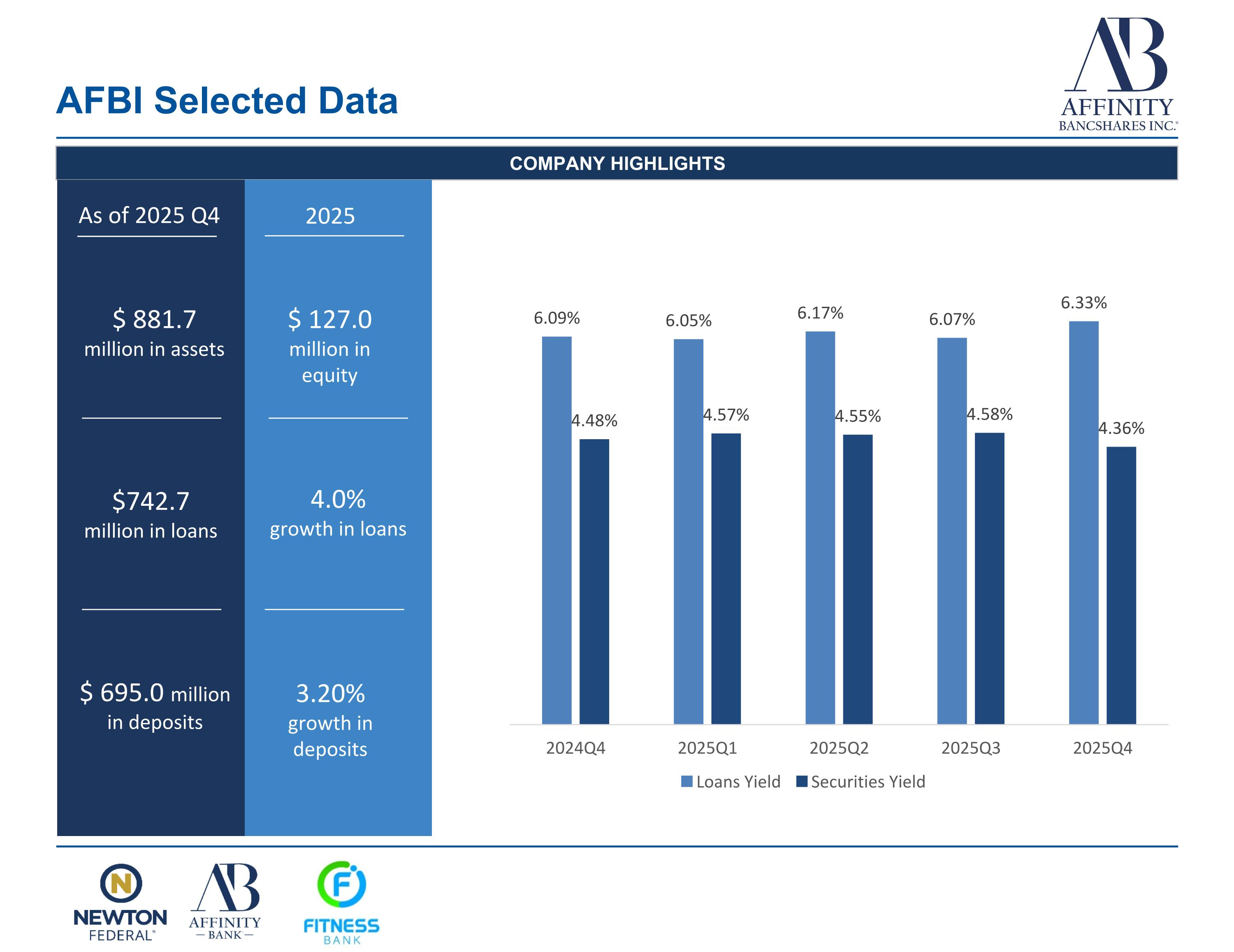

AFBI Selected Data COMPANY HIGHLIGHTS $ 881.7 million in assets $742.7 million in loans $ 695.0 million in deposits 4.0% growth in loans 3.20% growth in deposits $ 127.0 million in equity As of 2025 Q4 2025

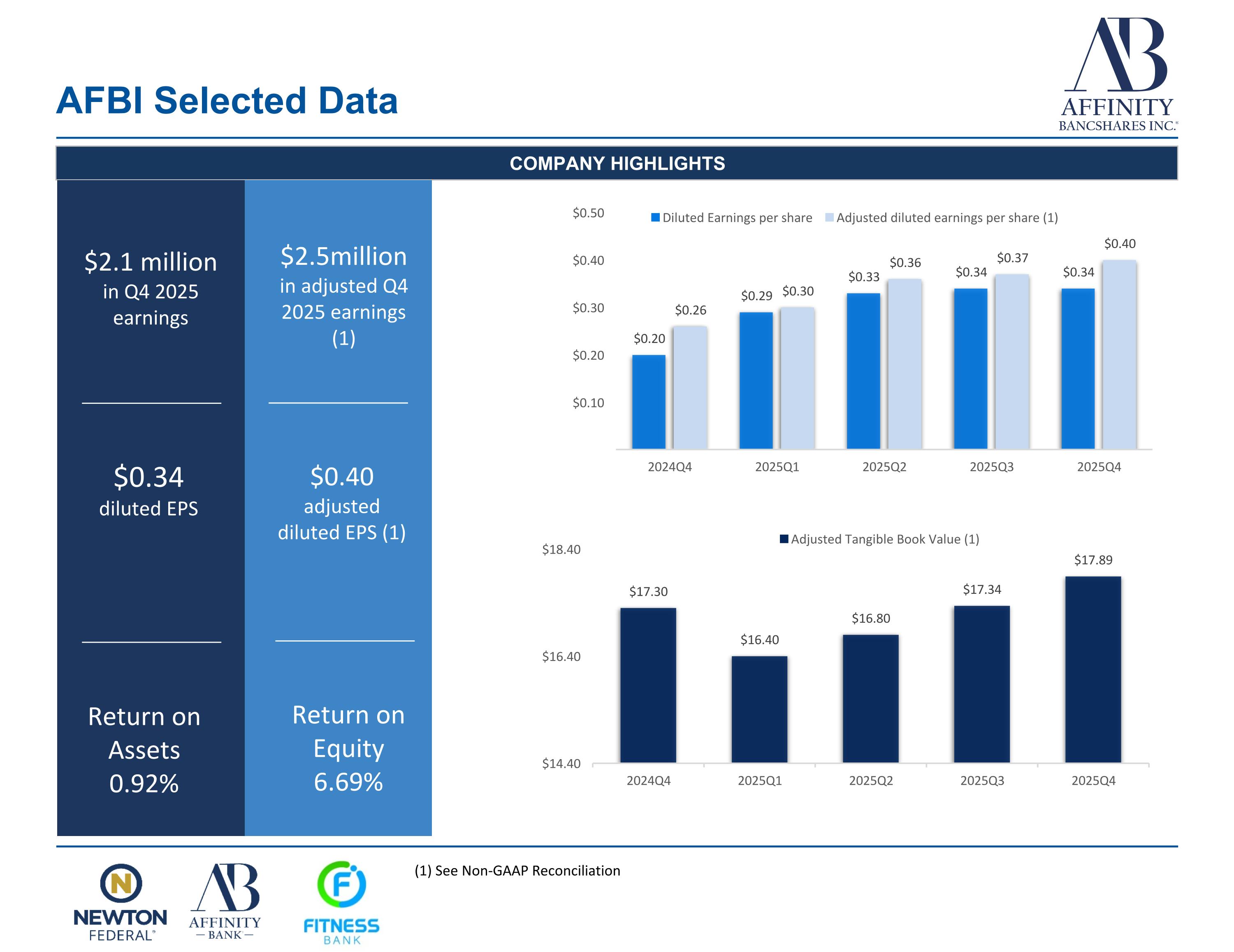

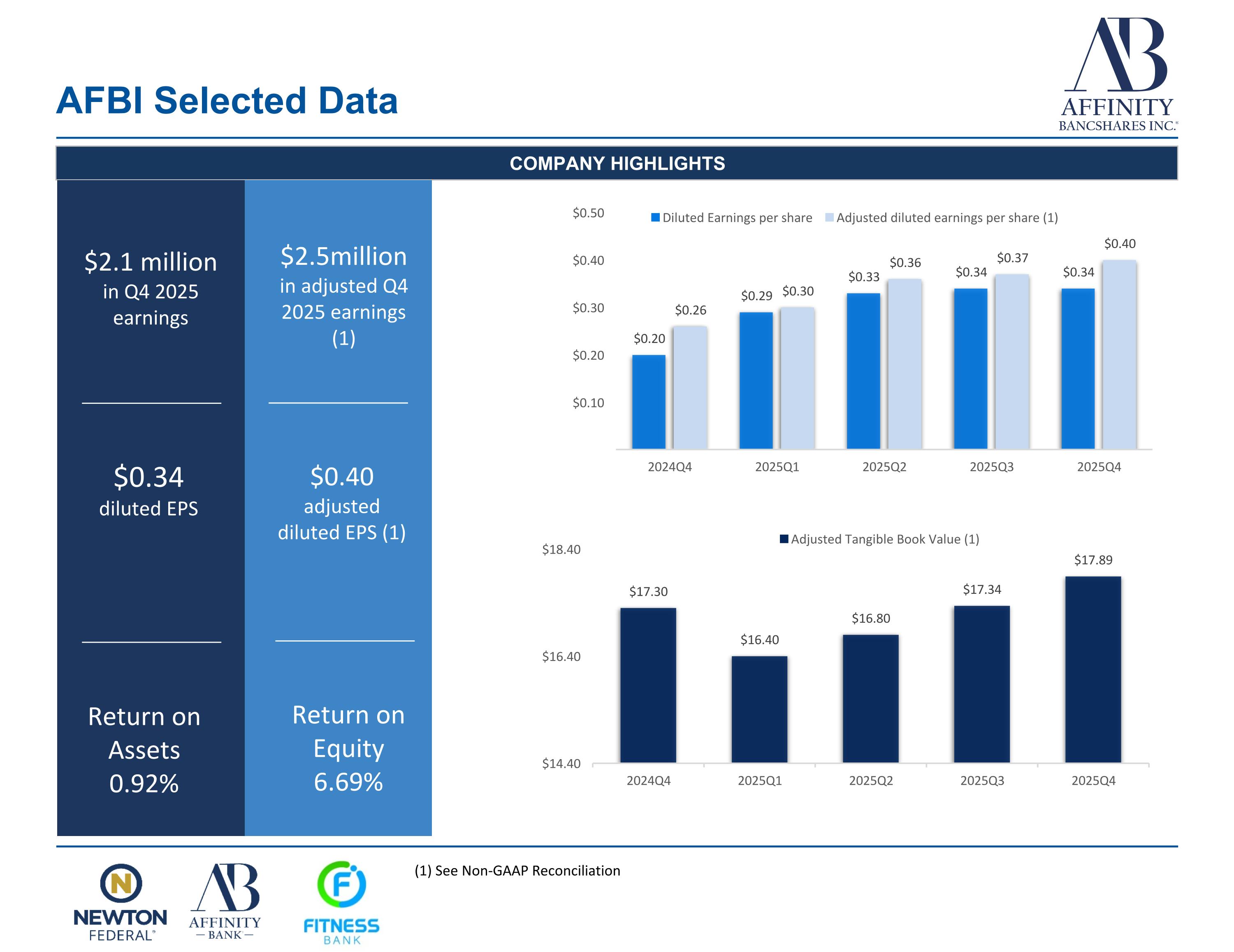

AFBI Selected Data COMPANY HIGHLIGHTS $2.5million in adjusted Q4 2025 earnings (1) $2.1 million in Q4 2025 earnings $0.34 diluted EPS (1) See Non-GAAP Reconciliation $0.40 adjusted diluted EPS (1) Return on Assets 0.92% Return on Equity 6.69%

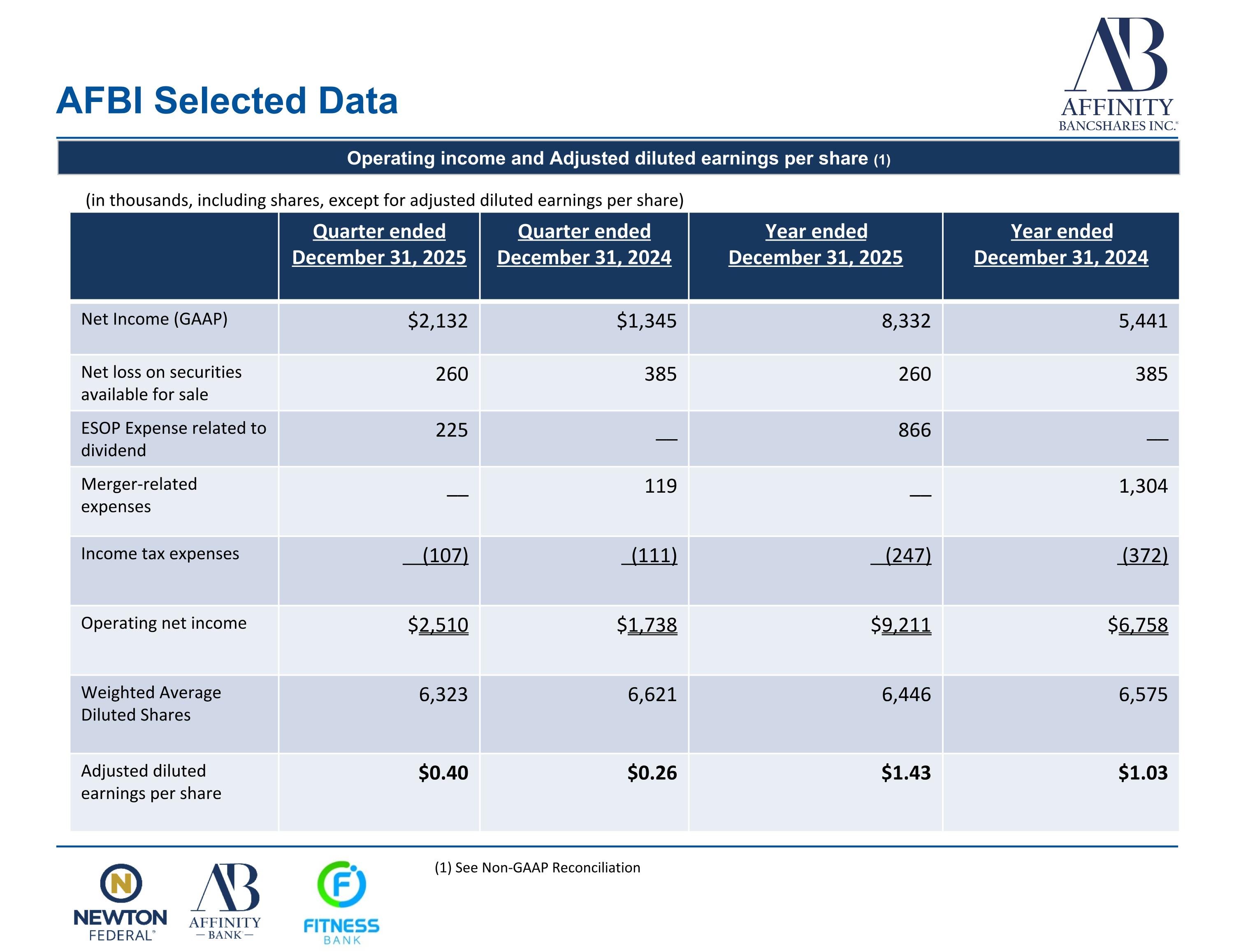

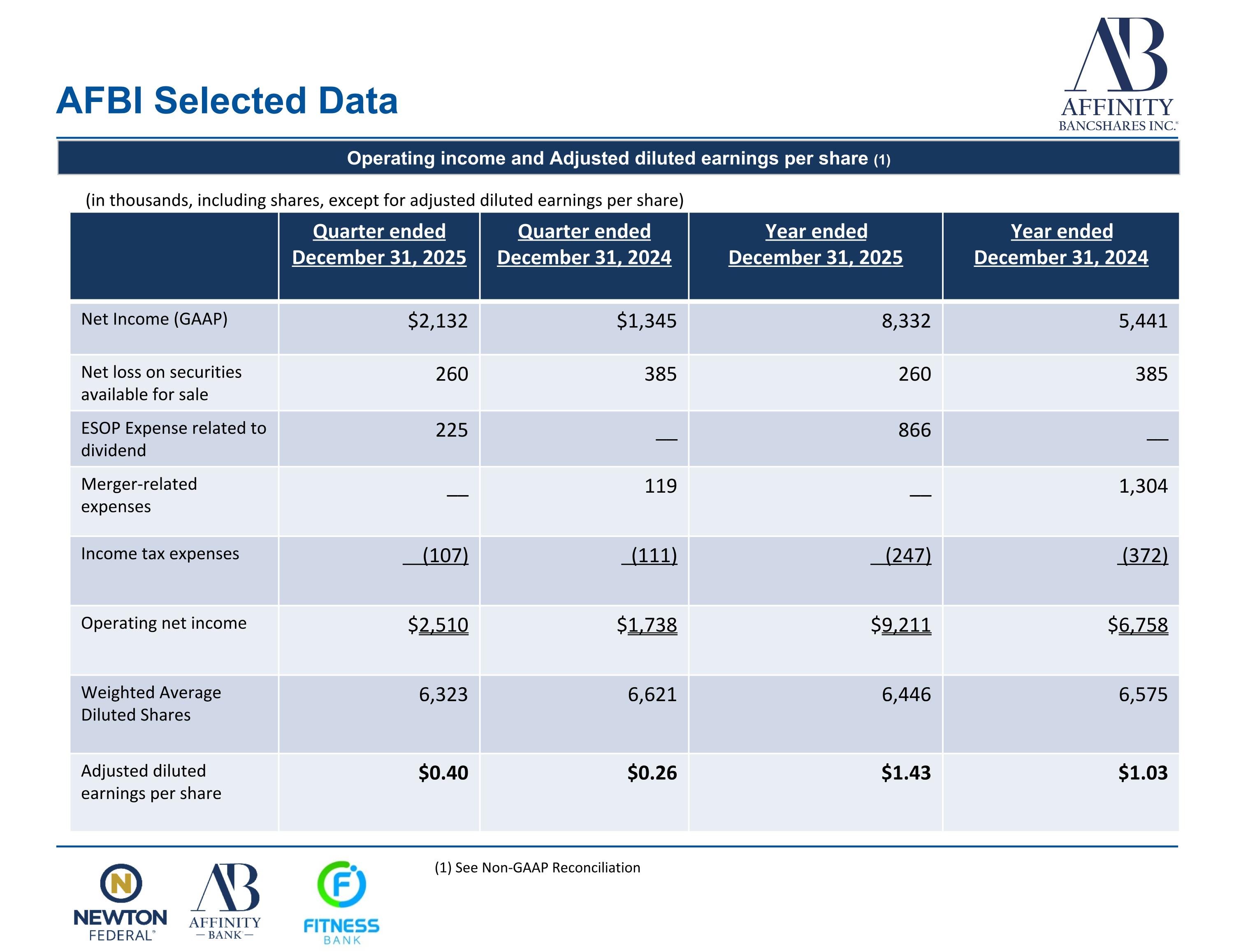

AFBI Selected Data Operating income and Adjusted diluted earnings per share (1) Quarter ended December 31, 2025 Quarter ended December 31, 2024 Year ended December 31, 2025 Year ended December 31, 2024 Net Income (GAAP) $2,132 $1,345 8,332 5,441 Net loss on securities available for sale 260 385 260 385 ESOP Expense related to dividend 225 __ 866 __ Merger-related expenses __ 119 __ 1,304 Income tax expenses (107) (111) (247) (372) Operating net income $2,510 $1,738 $9,211 $6,758 Weighted Average Diluted Shares 6,323 6,621 6,446 6,575 Adjusted diluted earnings per share $0.40 $0.26 $1.43 $1.03 (in thousands, including shares, except for adjusted diluted earnings per share) (1) See Non-GAAP Reconciliation

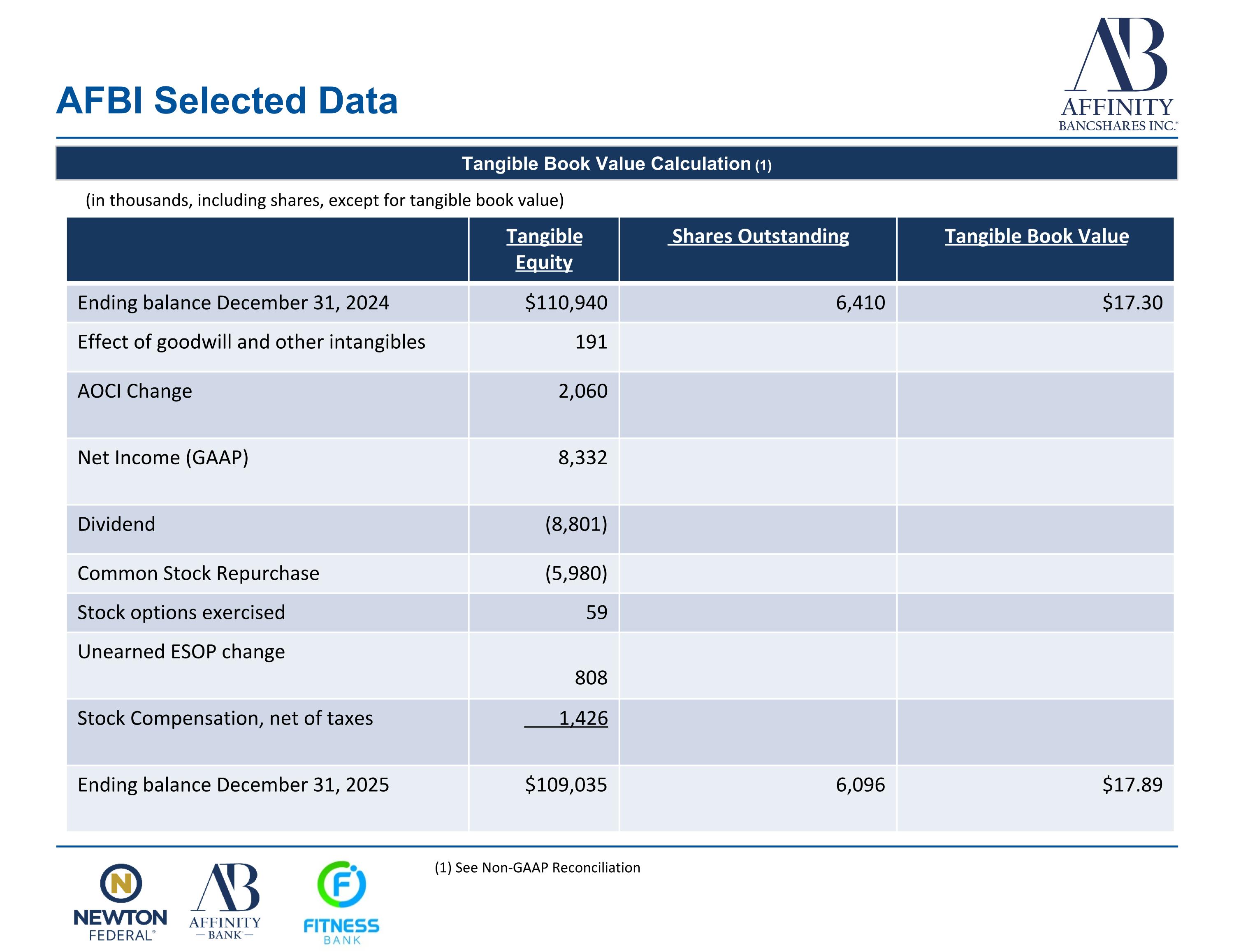

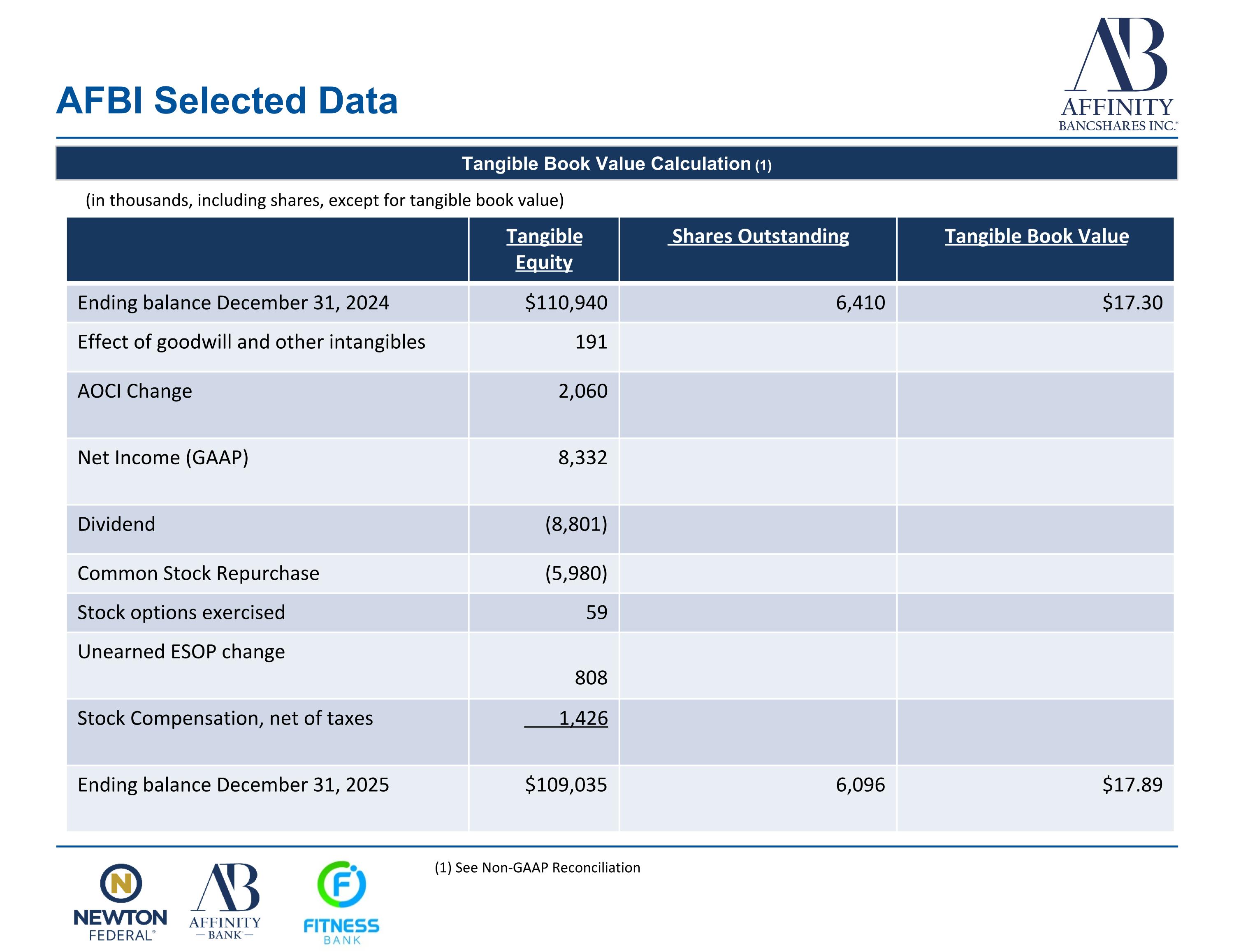

AFBI Selected Data Tangible Book Value Calculation (1) Tangible Equity Shares Outstanding Tangible Book Value Ending balance December 31, 2024 $110,940 6,410 $17.30 Effect of goodwill and other intangibles 191 AOCI Change 2,060 Net Income (GAAP) 8,332 Dividend (8,801) Common Stock Repurchase (5,980) Stock options exercised 59 Unearned ESOP change 808 Stock Compensation, net of taxes 1,426 Ending balance December 31, 2025 $109,035 6,096 $17.89 (in thousands, including shares, except for tangible book value) (1) See Non-GAAP Reconciliation

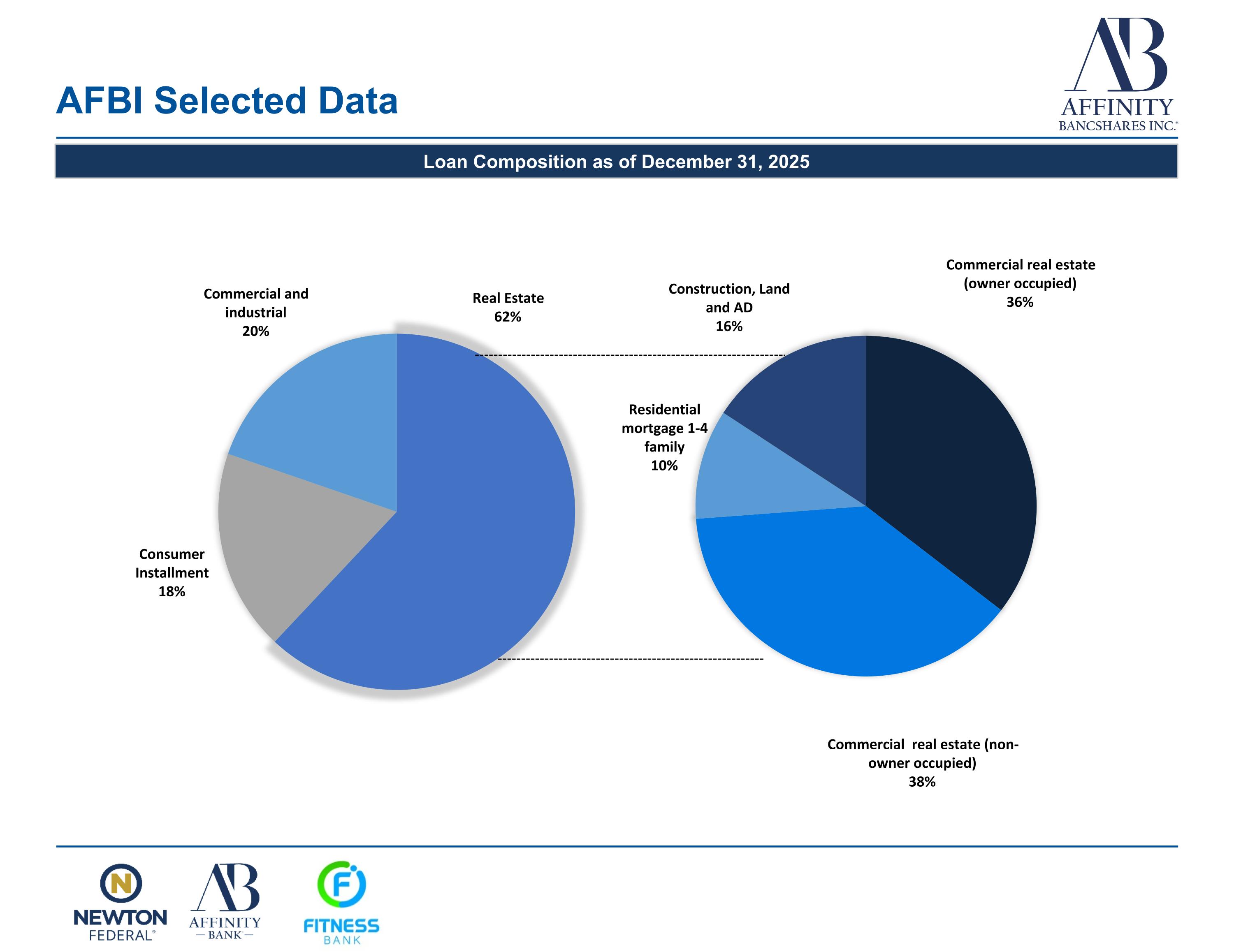

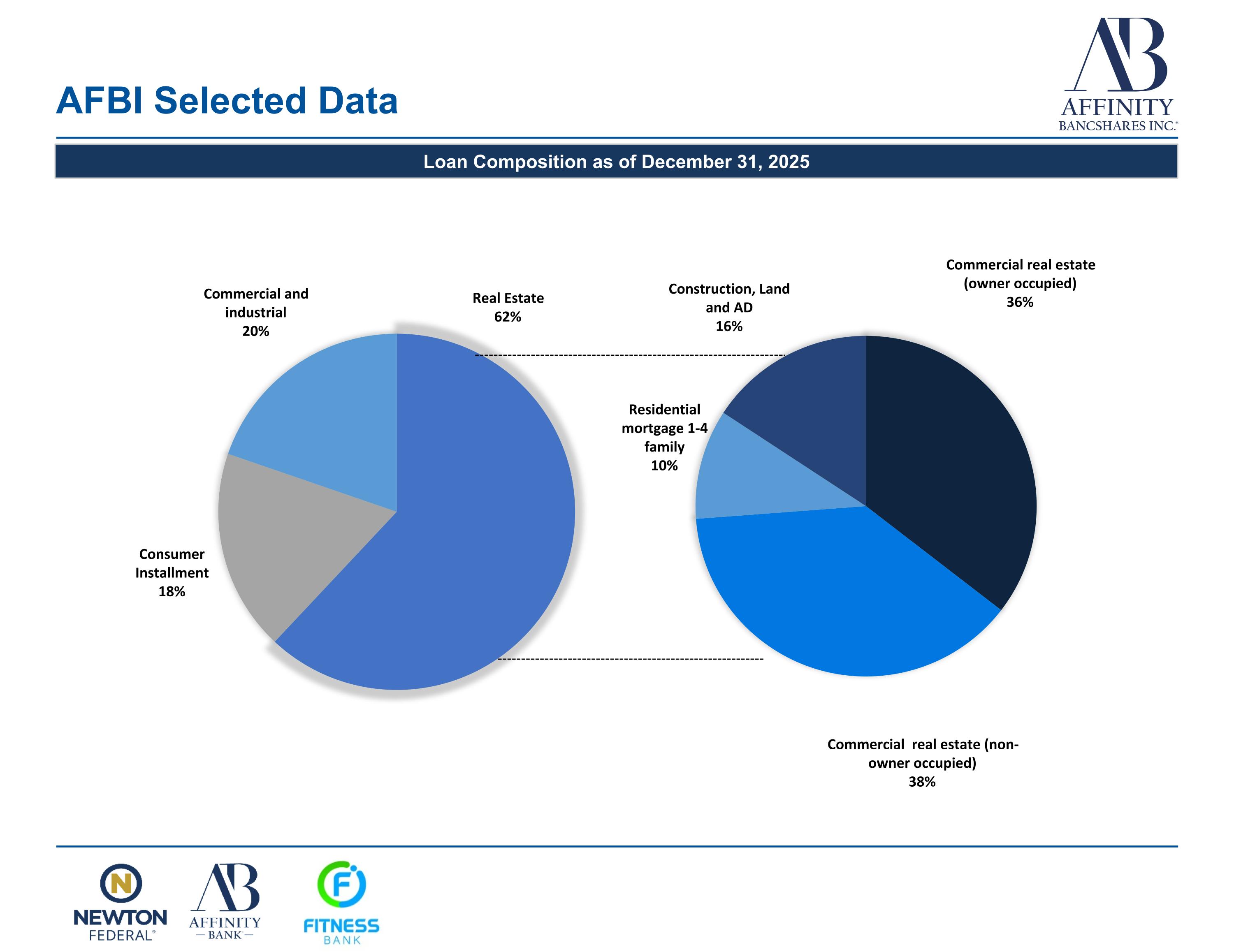

AFBI Selected Data Loan Composition as of December 31, 2025

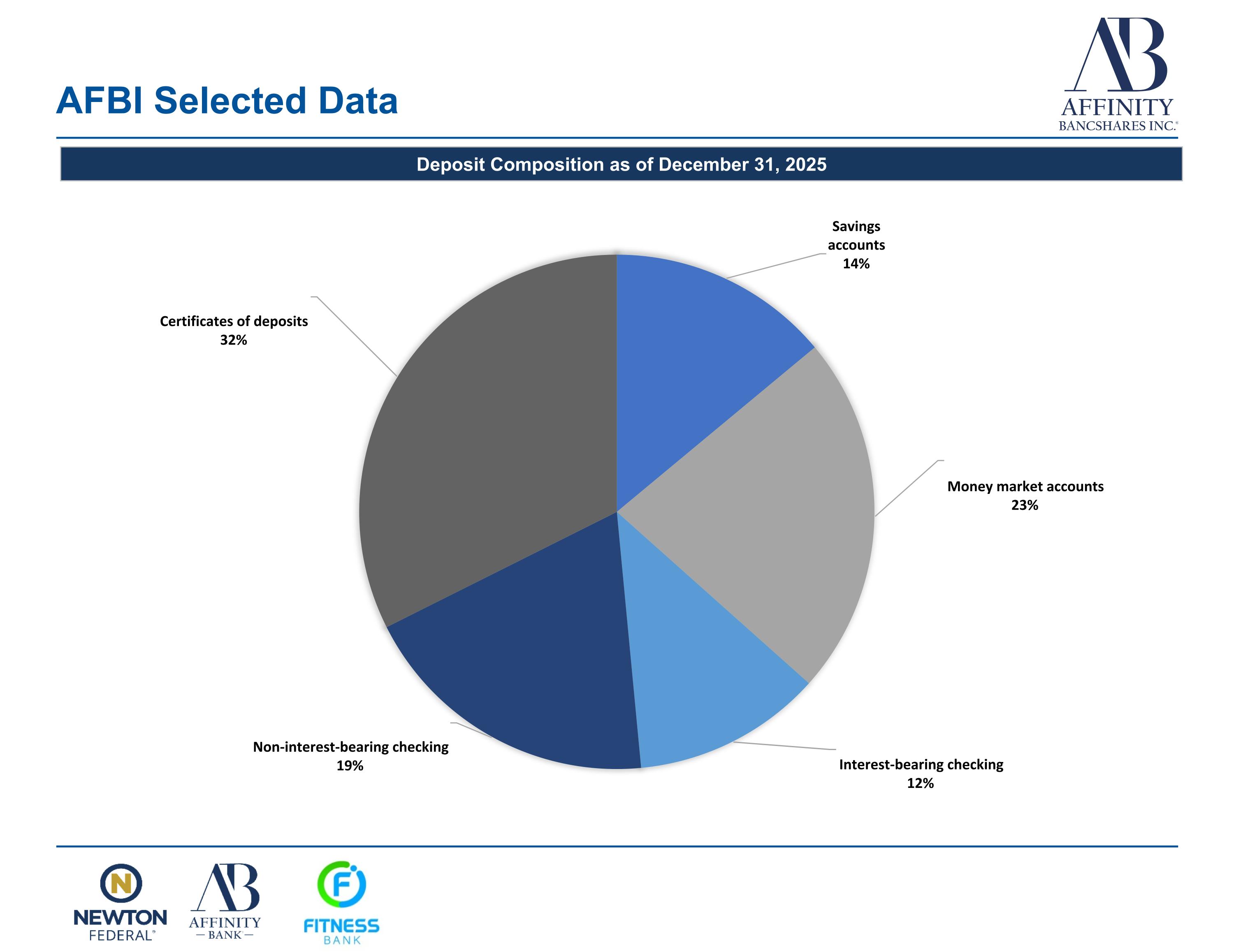

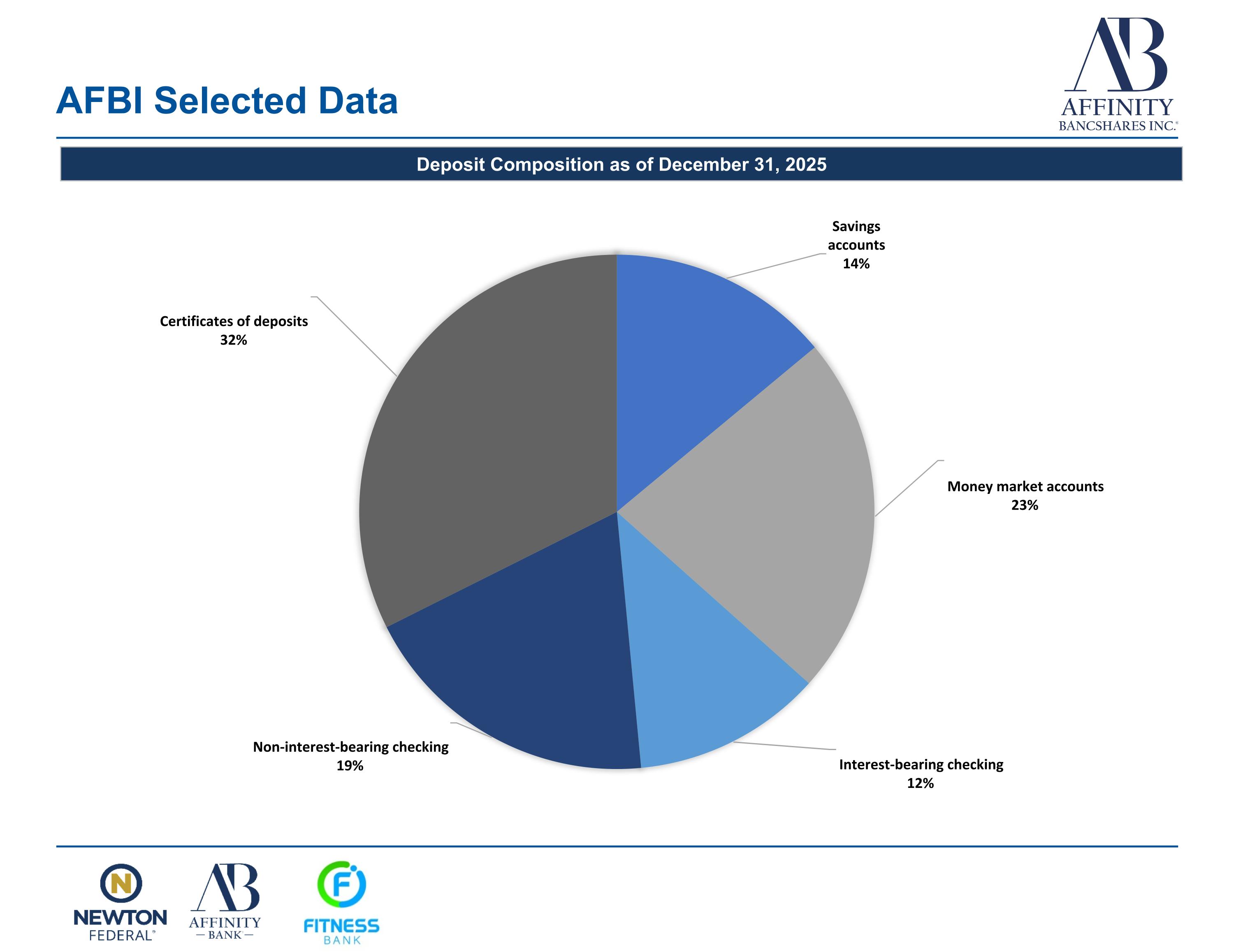

AFBI Selected Data Deposit Composition as of December 31, 2025

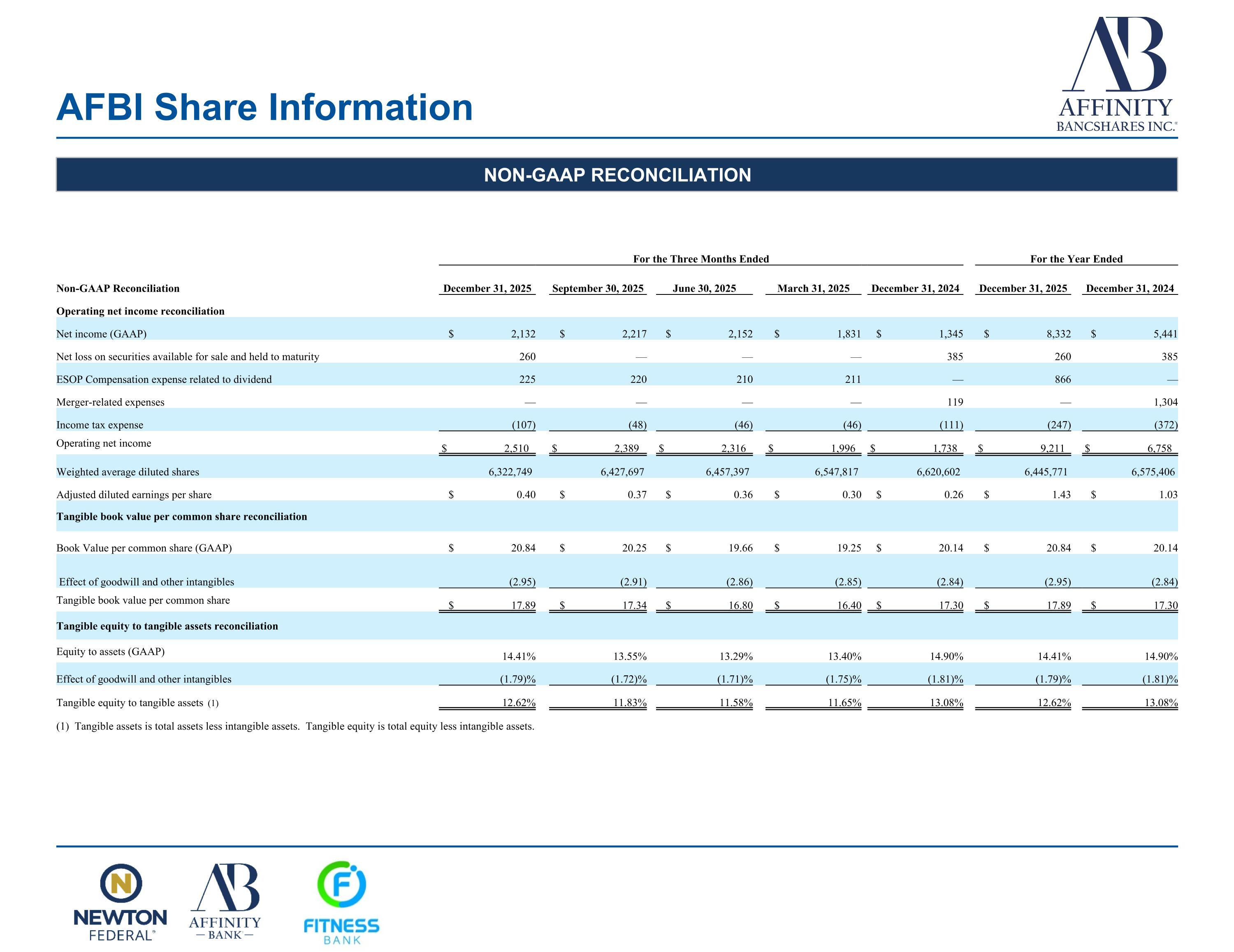

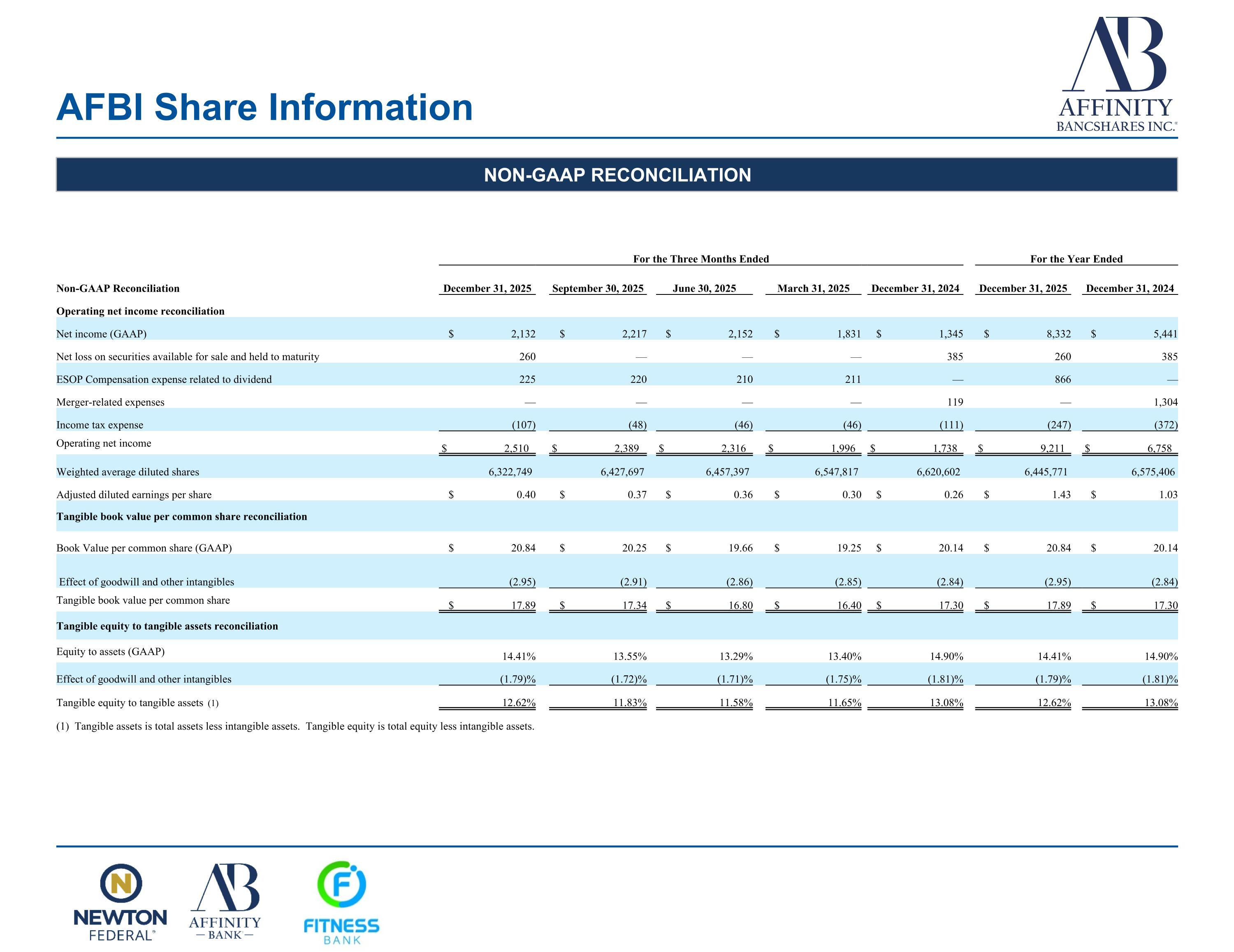

AFBI Share Information NON-GAAP RECONCILIATION For the Three Months Ended For the Year Ended Non-GAAP Reconciliation December 31, 2025 September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 December 31, 2025 December 31, 2024 Operating net income reconciliation Net income (GAAP) $ 2,132 $ 2,217 $ 2,152 $ 1,831 $ 1,345 $ 8,332 $ 5,441 Net loss on securities available for sale and held to maturity 260 — — — 385 260 385 ESOP Compensation expense related to dividend 225 220 210 211 — 866 — Merger-related expenses — — — — 119 — 1,304 Income tax expense (107) (48) (46) (46) (111) (247) (372) Operating net income $ 2,510 $ 2,389 $ 2,316 $ 1,996 $ 1,738 $ 9,211 $ 6,758 Weighted average diluted shares 6,322,749 6,427,697 6,457,397 6,547,817 6,620,602 6,445,771 6,575,406 Adjusted diluted earnings per share $ 0.40 $ 0.37 $ 0.36 $ 0.30 $ 0.26 $ 1.43 $ 1.03 Tangible book value per common share reconciliation Book Value per common share (GAAP) $ 20.84 $ 20.25 $ 19.66 $ 19.25 $ 20.14 $ 20.84 $ 20.14 Effect of goodwill and other intangibles (2.95) (2.91) (2.86) (2.85) (2.84) (2.95) (2.84) Tangible book value per common share $ 17.89 $ 17.34 $ 16.80 $ 16.40 $ 17.30 $ 17.89 $ 17.30 Tangible equity to tangible assets reconciliation Equity to assets (GAAP) 14.41% 13.55% 13.29% 13.40% 14.90% 14.41% 14.90% Effect of goodwill and other intangibles (1.79)% (1.72)% (1.71)% (1.75)% (1.81)% (1.79)% (1.81)% Tangible equity to tangible assets (1) 12.62% 11.83% 11.58% 11.65% 13.08% 12.62% 13.08% (1) Tangible assets is total assets less intangible assets. Tangible equity is total equity less intangible assets.