CoastalSouth Bancshares, Inc. Third Quarter 2025 Investor Presentation October 20, 2025 January 20, 2026 Fourth Quarter 2025 Investor Presentation Exhibit 99.2

Disclosures Forward Looking Statements Statements in this Investor Presentation regarding future events and our expectations and beliefs about our future financial performance and financial condition, as well as trends in our business and markets, constitute “forward-looking statements” within the meaning of, and subject to the protections of, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are not historical in nature and may be identified by references to a future period or periods by the use of the words “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “project,” “outlook,” or words of similar meaning, or future or conditional verbs such as “will,” “would,” “should,” “could,” or “may.” The forward-looking statements in this Investor Presentation should not be relied on because they are based on current information and on assumptions that we make about future events and circumstances that are subject to a number of known and unknown risks and uncertainties that are often difficult to predict and beyond our control. As a result of those risks and uncertainties, and other factors, our actual financial results in the future could differ, possibly materially, from those expressed in or implied by the forward-looking statements contained in this Investor Presentation and could cause us to make changes to our future plans. Factors that might cause such differences include, but are not limited to: the impact of current and future economic conditions, particularly those affecting the financial services industry, including the effects of declines in the real estate market, high unemployment rates, inflationary pressures, elevated interest rates and slowdowns in economic growth, as well as the financial stress on borrowers as a result of the foregoing; potential impacts of any adverse developments in the banking industry, including any impacts on customer confidence, deposit outflows, liquidity and the regulatory response thereto; changes in the interest rate environment, including changes to the federal funds rate; changes in prices, values and sales volumes of residential and commercial real estate; competition in our markets that may result in increased funding costs or reduced earning assets yields, thus reducing margins and net interest income; interest rate fluctuations, which could have an adverse effect on the Company’s profitability; a breach in security of our information systems, including the occurrence of a cyber-attack incidents or deficiencies in cyber security; risks related to potential acquisitions; government actions or inactions, including a prolonged shutdown of the federal government, tariffs, or trade wars (including reduced consumer spending, lower economic growth or recession, reduced demand for U.S. exports, disruptions to supply chains, and decreased demand for other banking products and services), legislation or regulatory changes which could adversely affect the ability of the consolidated Company to conduct business combinations or new operations; changes in tax laws; significant turbulence or a disruption in the capital or financial markets and the effect of a fall in stock market prices on our investment securities; the effects of war or other conflicts, domestic civil unrest and tyranny, and changes in the overall geopolitical landscape; and adverse results from current or future litigation, regulatory examinations or other legal and/or regulatory actions, including as a result of the Company’s participation in and execution of government programs. Therefore, the Company can give no assurance that the results contemplated in the forward-looking statements will be realized. Additional information regarding these and other risks and uncertainties to which our business and future financial performance are subject is contained in the section titled “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” in the Company’s final prospectus filed pursuant to Rule 424(b)(4) under the Securities Act of 1933, as amended, filed with the Securities and Exchange Commission (the “SEC”) on July 2, 2025 (Registration No. 333-287854), relating to our initial public offering, and in other documents that we file with the SEC from time to time, which are available on the SEC’s website, http://www.sec.gov. In addition, our actual financial results in the future may differ from those currently expected due to additional risks and uncertainties of which we are not currently aware or which we do not currently view as, but in the future may become, material to our business or operating results. Due to these and other possible uncertainties and risks, readers are cautioned not to place undue reliance on the forward-looking statements contained in this Investor Presentation or to make predictions based solely on historical financial performance. Any forward-looking statement speaks only as of the date on which it is made, and we do not undertake any obligation to update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law. All forward-looking statements, express or implied, included in this Investor Presentation are qualified in their entirety by this cautionary statement.

Disclosures Non-GAAP Financial Measures In addition to results presented in accordance with U.S. generally accepted accounting principles (“GAAP”), this Investor Presentation contains certain non-GAAP financial measures. The Company believes that providing certain non-GAAP financial measures provides investors with information useful in understanding our financial performance, performance trends and financial position. Our management uses these measures for internal planning and forecasting purposes and we believe that our presentation and discussion, together with the accompanying reconciliations, allows investors, security analysts and other interested parties to view our performance and the factors and trends affecting our business in a manner similar to management. These non-GAAP measures should not be considered a substitute for GAAP measures and we strongly encourage investors to review our consolidated financial statements in their entirety and not to rely on any single financial measure to evaluate the Company. Non-GAAP financial measures have inherent limitations, are not uniformly applied and are not audited. Because non-GAAP financial measures are not standardized, it may not be possible to compare these financial measures with other companies’ non-GAAP financial measures having the same or similar names. The delivery of this Investor Presentation will not, under any circumstances, create an implication that there has been no change in the affairs of the Company since the date of this Investor Presentation. The Company is not making any implied or express representation or warranty as to the accuracy or completeness of the information summarized herein or made available in connection with any further investigation of the Company. The Company expressly disclaims any and all liability which may be based on such information, errors therein or omission therefrom.

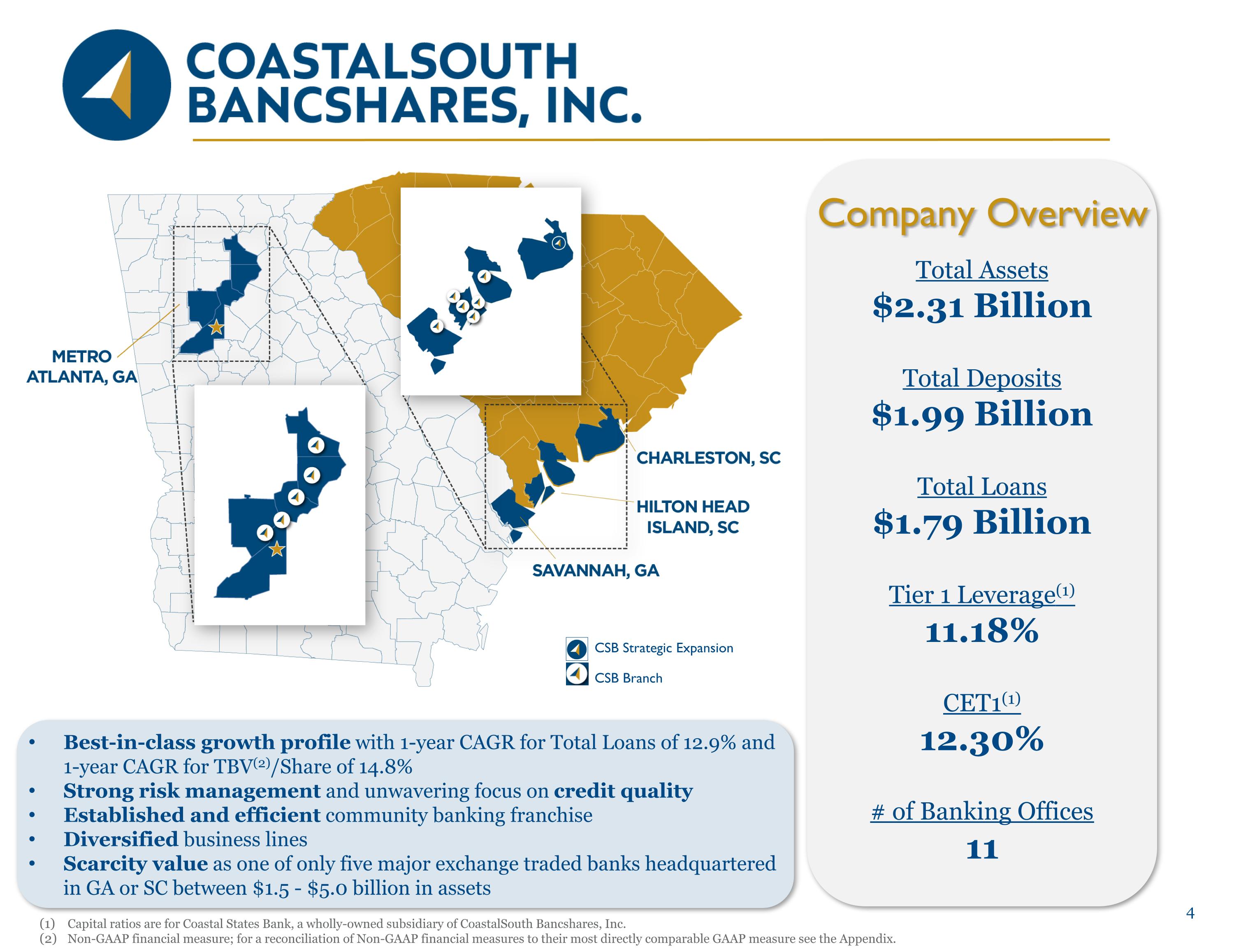

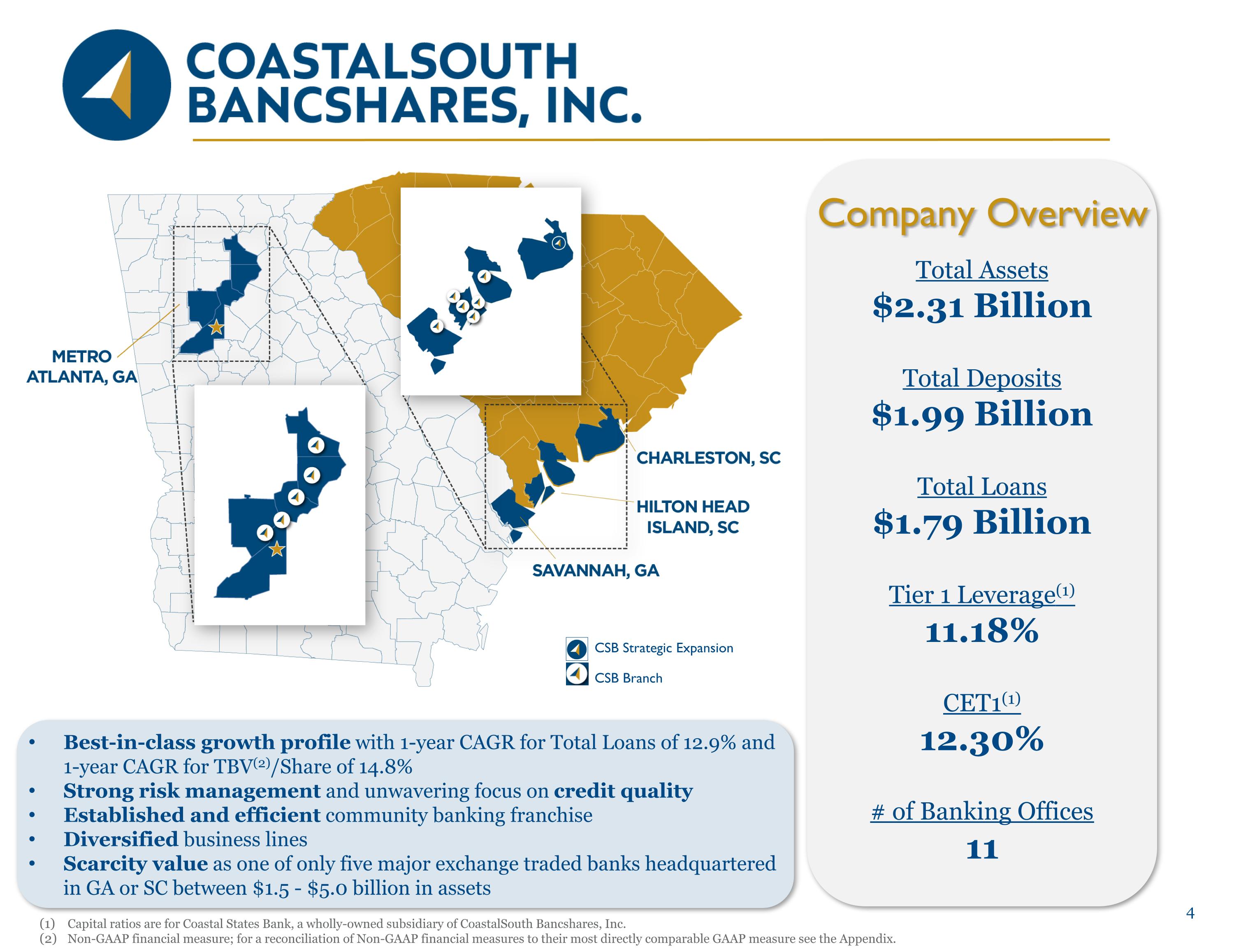

Company Overview Total Assets $2.31 Billion Total Deposits $1.99 Billion Total Loans $1.79 Billion Tier 1 Leverage(1) 11.18% CET1(1) 12.30% # of Banking Offices 11 Best-in-class growth profile with 1-year CAGR for Total Loans of 12.9% and 1-year CAGR for TBV(2)/Share of 14.8% Strong risk management and unwavering focus on credit quality Established and efficient community banking franchise Diversified business lines Scarcity value as one of only five major exchange traded banks headquartered in GA or SC between $1.5 - $5.0 billion in assets Capital ratios are for Coastal States Bank, a wholly-owned subsidiary of CoastalSouth Bancshares, Inc. Non-GAAP financial measure; for a reconciliation of Non-GAAP financial measures to their most directly comparable GAAP measure see the Appendix. CSB Strategic Expansion CSB Branch

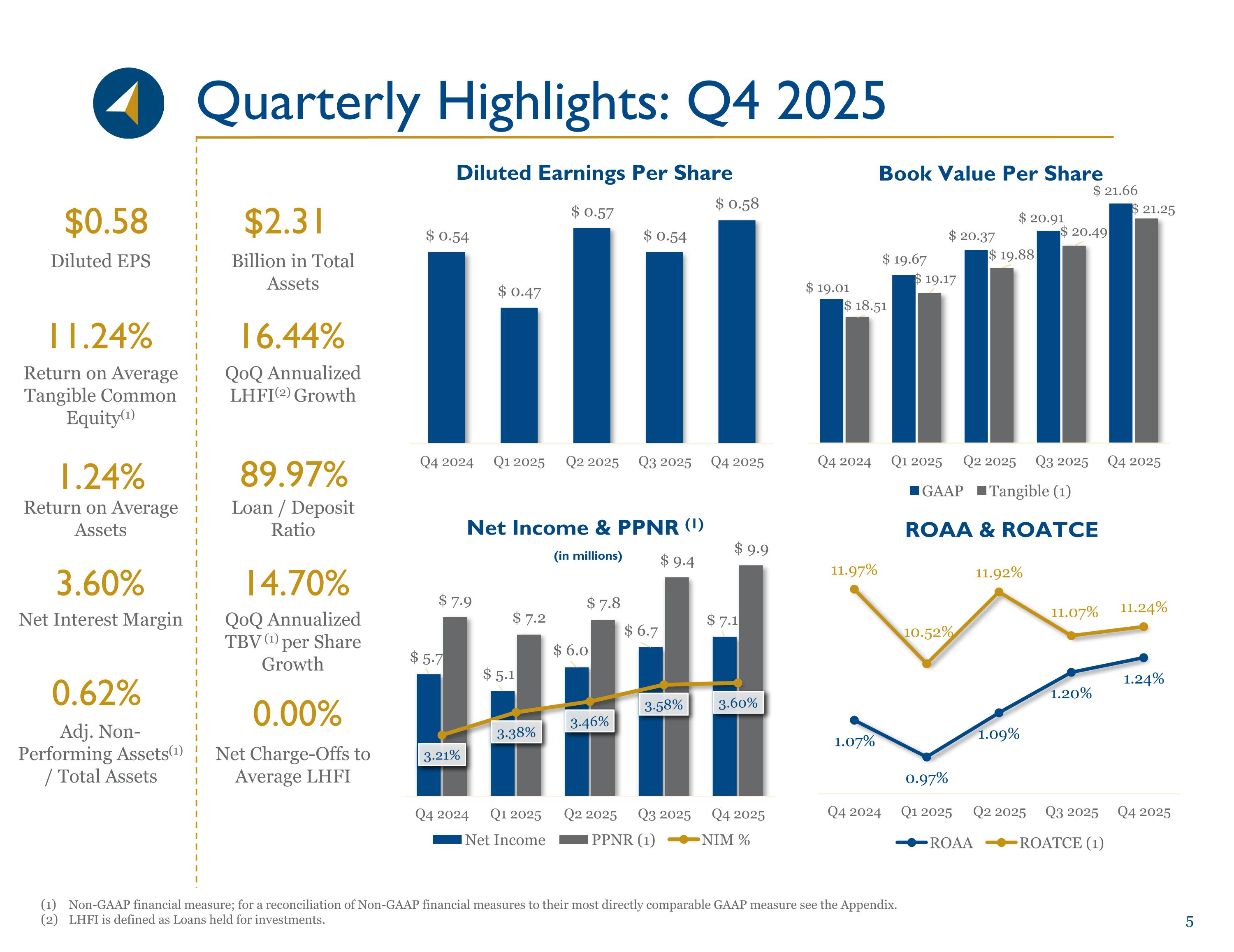

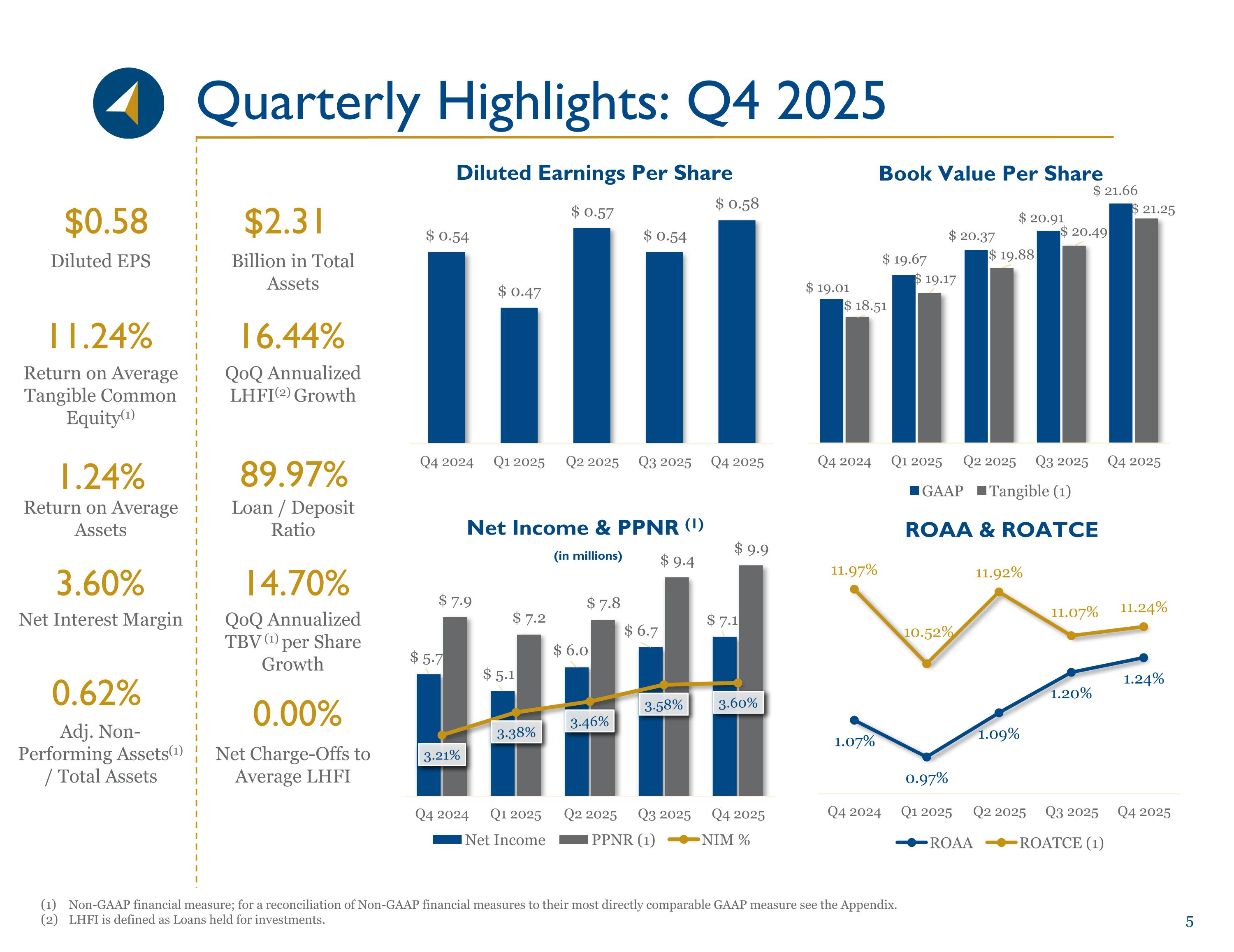

Diluted EPS Return on Average Tangible Common Equity(1) Return on Average Assets Net Interest Margin Adj. Non-Performing Assets(1) / Total Assets Quarterly Highlights: Q4 2025 Non-GAAP financial measure; for a reconciliation of Non-GAAP financial measures to their most directly comparable GAAP measure see the Appendix. LHFI is defined as Loans held for investments. Billion in Total Assets QoQ Annualized LHFI(2) Growth Loan / Deposit Ratio QoQ Annualized TBV (1) per Share Growth Net Charge-Offs to Average LHFI $0.58 3.60% 14.70% $2.31 16.44% 89.97% 0.62% 11.24% 0.00% 1.24%

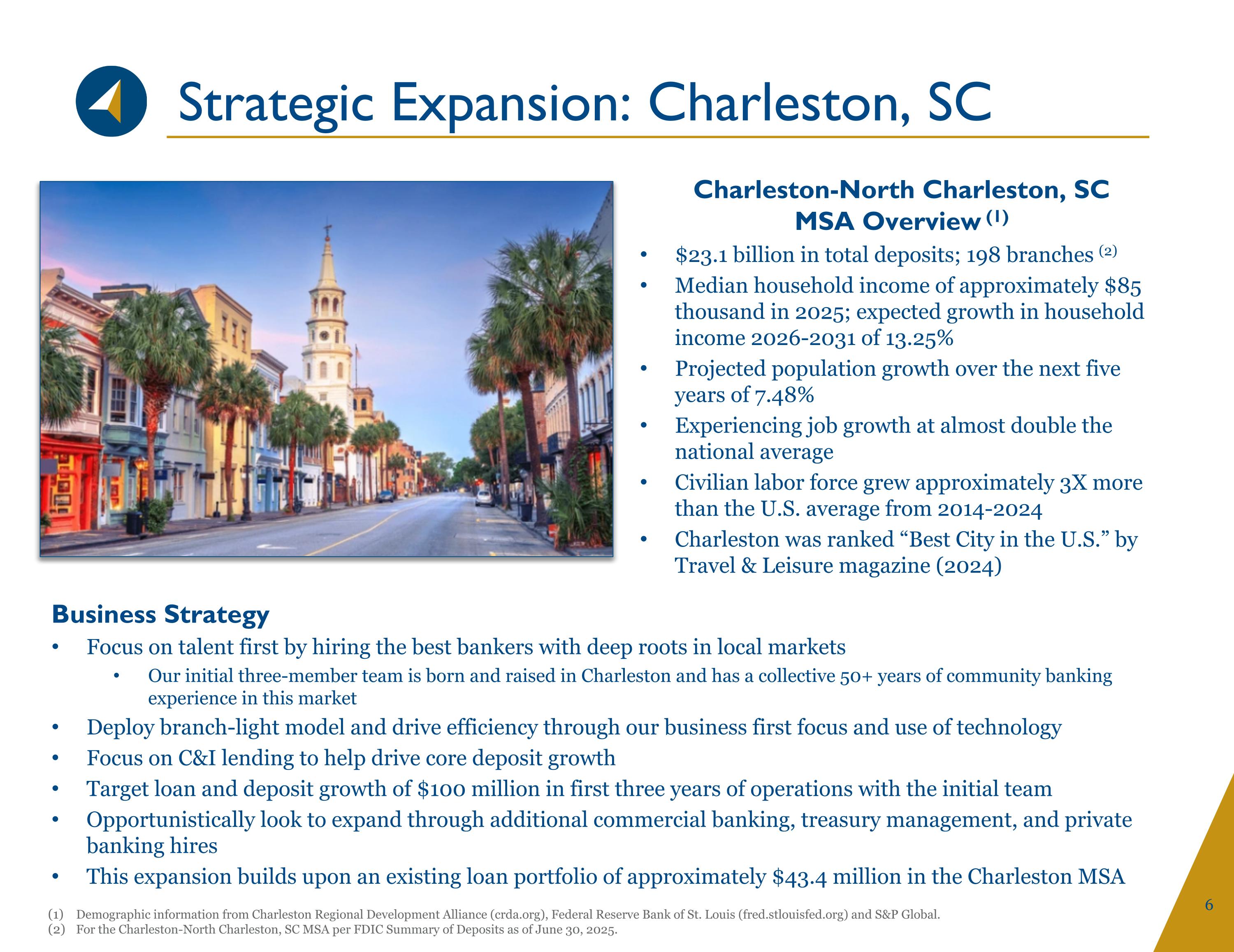

Strategic Expansion: Charleston, SC Charleston-North Charleston, SC MSA Overview (1) $23.1 billion in total deposits; 198 branches (2) Median household income of approximately $85 thousand in 2025; expected growth in household income 2026-2031 of 13.25% Projected population growth over the next five years of 7.48% Experiencing job growth at almost double the national average Civilian labor force grew approximately 3X more than the U.S. average from 2014-2024 Charleston was ranked “Best City in the U.S.” by Travel & Leisure magazine (2024) Business Strategy Focus on talent first by hiring the best bankers with deep roots in local markets Our initial three-member team is born and raised in Charleston and has a collective 50+ years of community banking experience in this market Deploy branch-light model and drive efficiency through our business first focus and use of technology Focus on C&I lending to help drive core deposit growth Target loan and deposit growth of $100 million in first three years of operations with the initial team Opportunistically look to expand through additional commercial banking, treasury management, and private banking hires This expansion builds upon an existing loan portfolio of approximately $43.4 million in the Charleston MSA Demographic information from Charleston Regional Development Alliance (crda.org), Federal Reserve Bank of St. Louis (fred.stlouisfed.org) and S&P Global. For the Charleston-North Charleston, SC MSA per FDIC Summary of Deposits as of June 30, 2025.

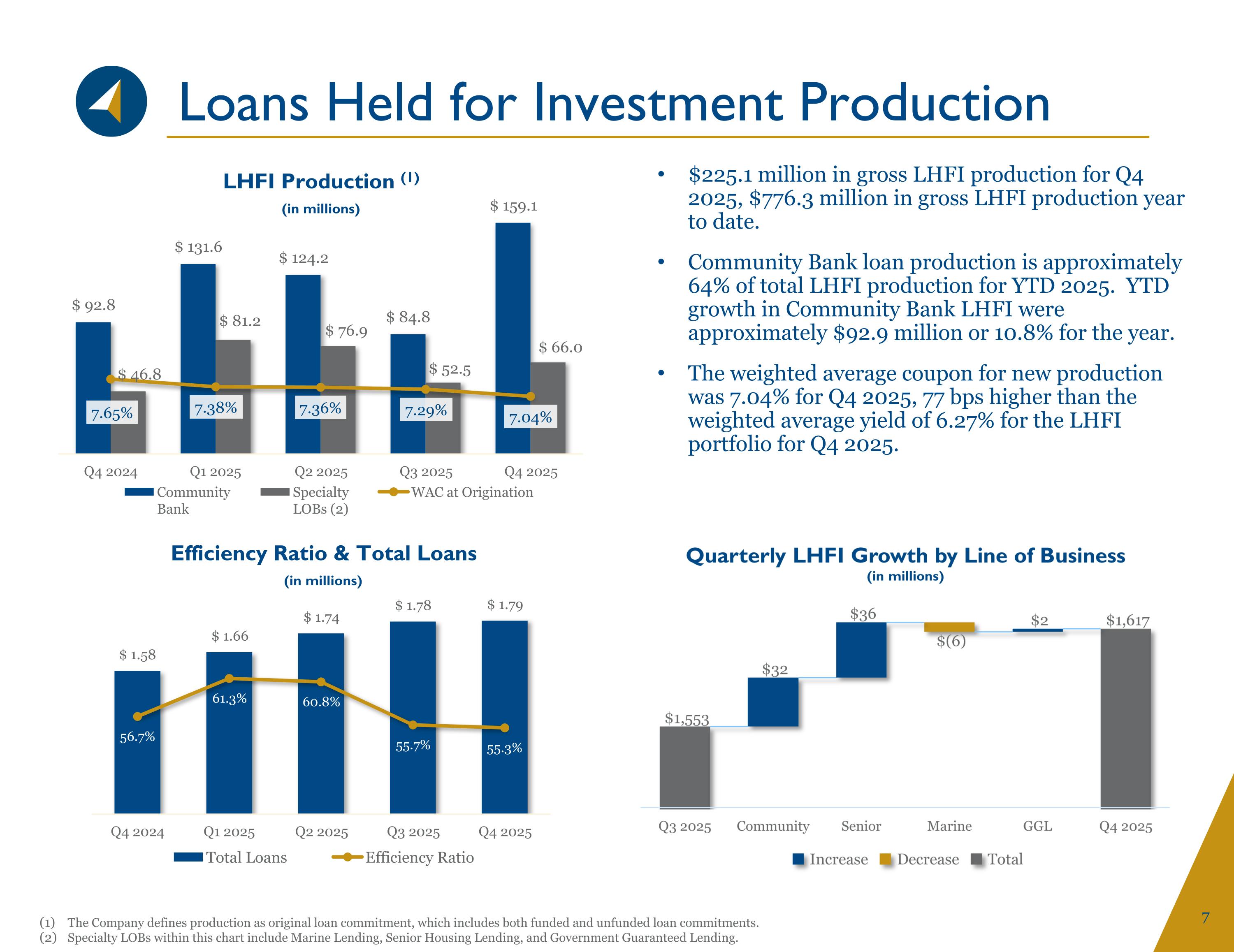

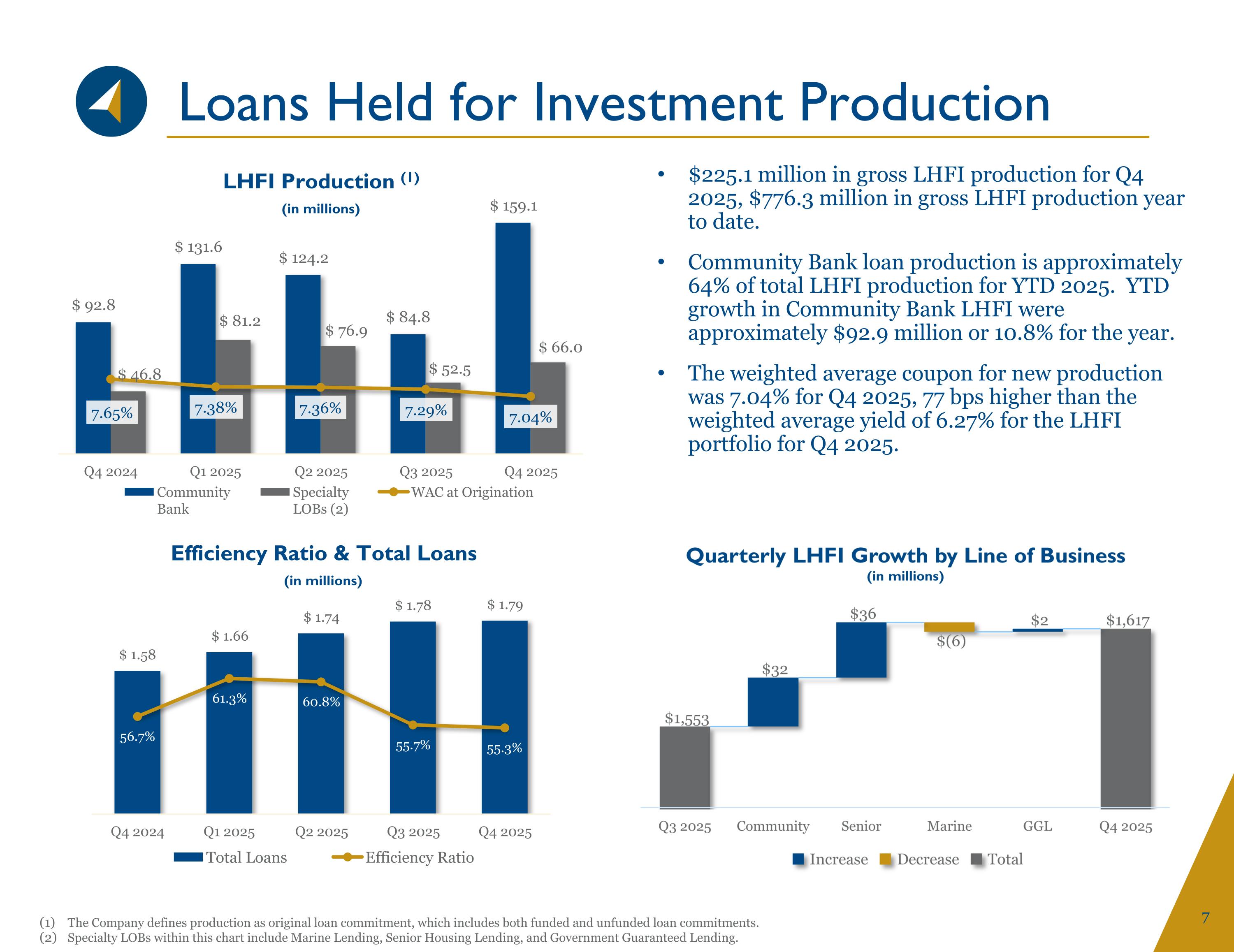

Loans Held for Investment Production $225.1 million in gross LHFI production for Q4 2025, $776.3 million in gross LHFI production year to date. Community Bank loan production is approximately 64% of total LHFI production for YTD 2025. YTD growth in Community Bank LHFI were approximately $92.9 million or 10.8% for the year. The weighted average coupon for new production was 7.04% for Q4 2025, 77 bps higher than the weighted average yield of 6.27% for the LHFI portfolio for Q4 2025. The Company defines production as original loan commitment, which includes both funded and unfunded loan commitments. Specialty LOBs within this chart include Marine Lending, Senior Housing Lending, and Government Guaranteed Lending.

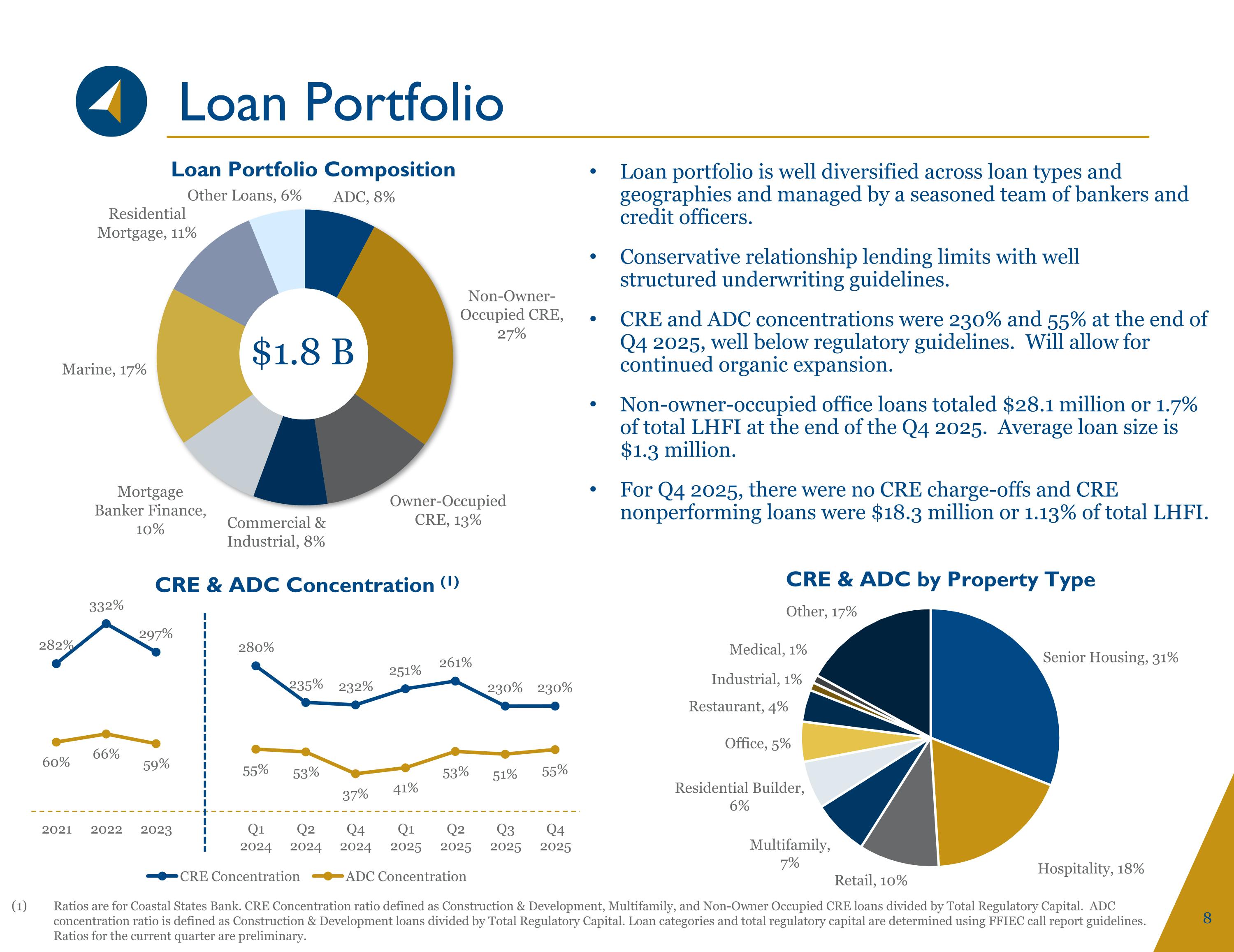

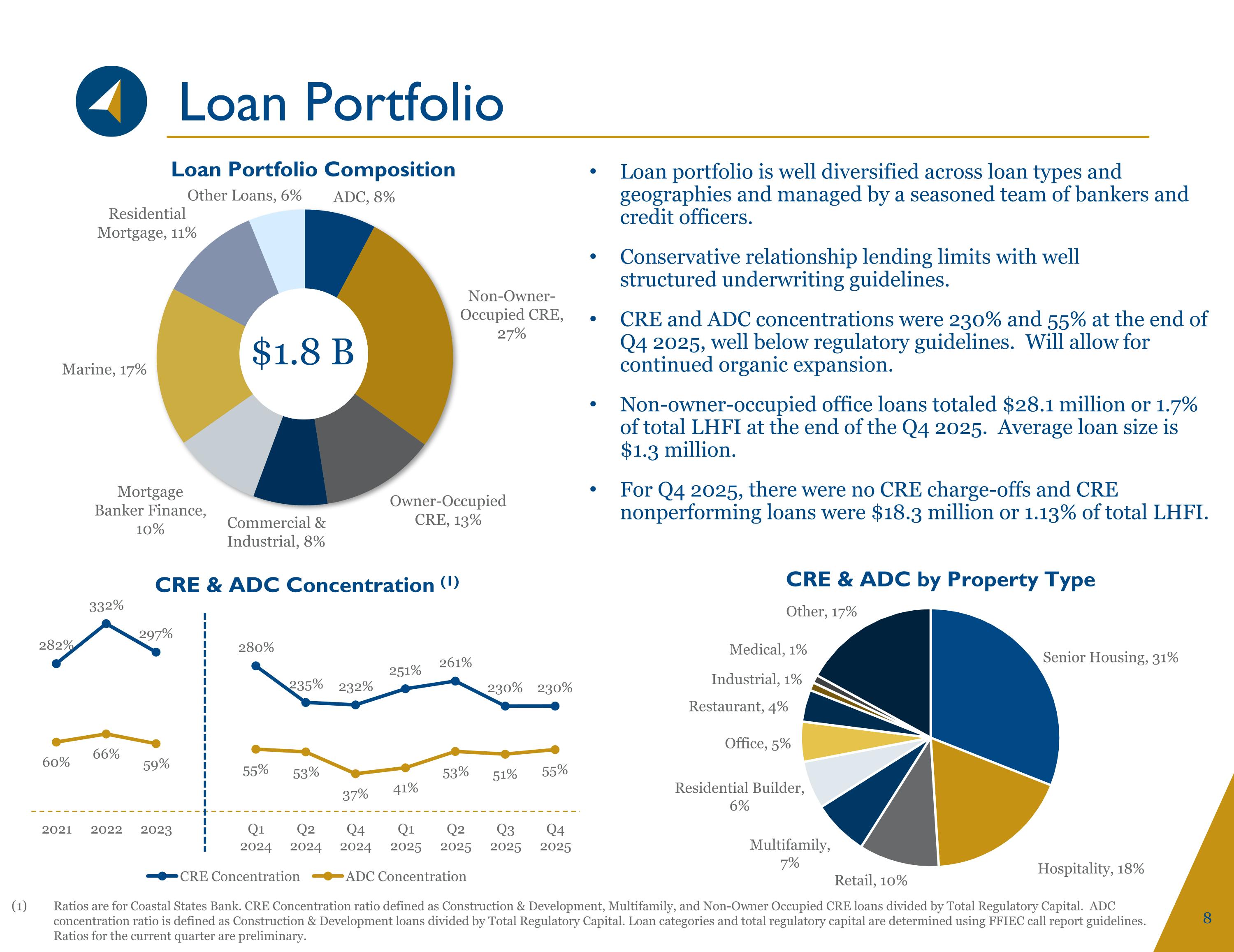

Loan Portfolio Loan portfolio is well diversified across loan types and geographies and managed by a seasoned team of bankers and credit officers. Conservative relationship lending limits with well structured underwriting guidelines. CRE and ADC concentrations were 230% and 55% at the end of Q4 2025, well below regulatory guidelines. Will allow for continued organic expansion. Non-owner-occupied office loans totaled $28.1 million or 1.7% of total LHFI at the end of the Q4 2025. Average loan size is $1.3 million. For Q4 2025, there were no CRE charge-offs and CRE nonperforming loans were $18.3 million or 1.13% of total LHFI. Ratios are for Coastal States Bank. CRE Concentration ratio defined as Construction & Development, Multifamily, and Non-Owner Occupied CRE loans divided by Total Regulatory Capital. ADC concentration ratio is defined as Construction & Development loans divided by Total Regulatory Capital. Loan categories and total regulatory capital are determined using FFIEC call report guidelines. Ratios for the current quarter are preliminary. $1.8 B

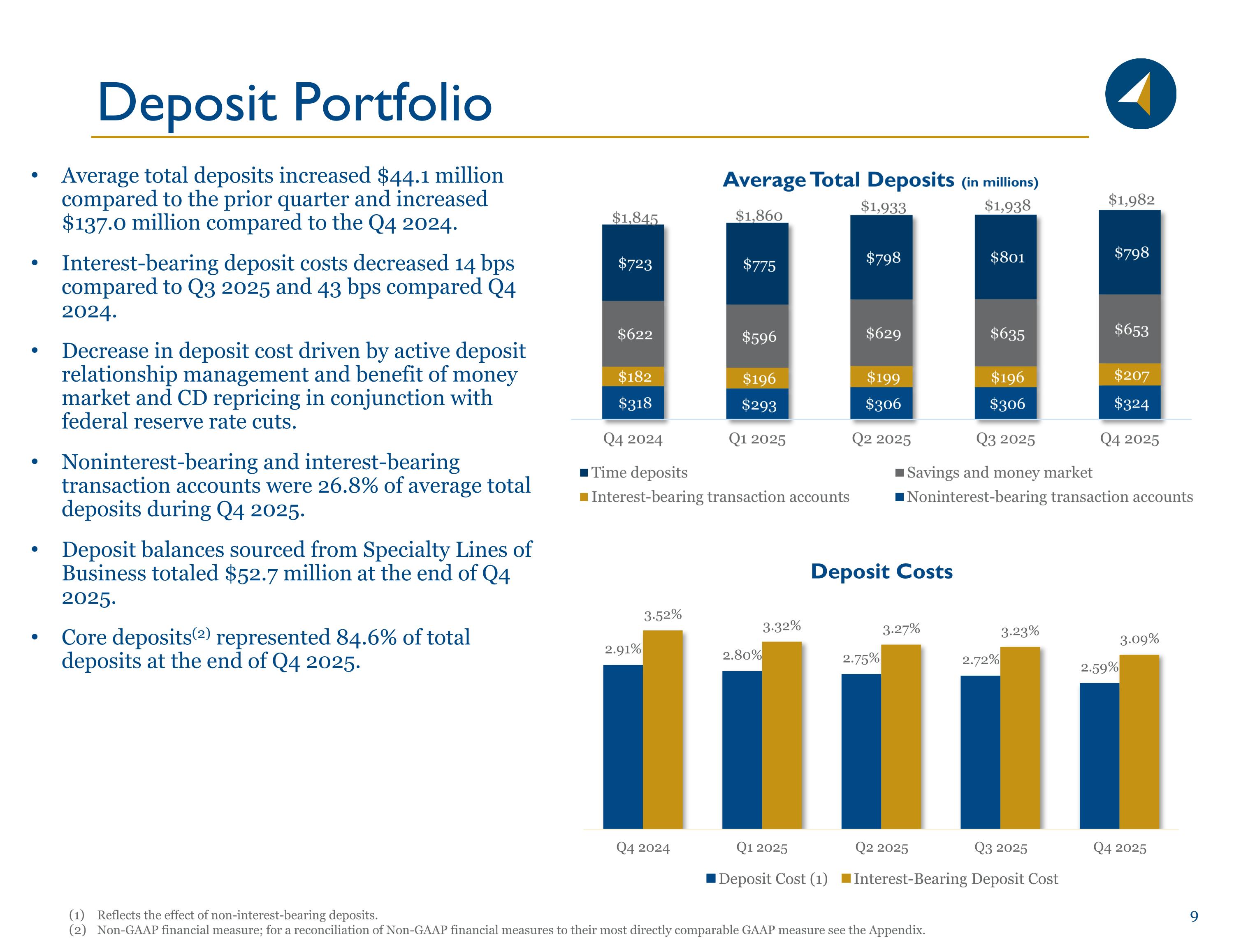

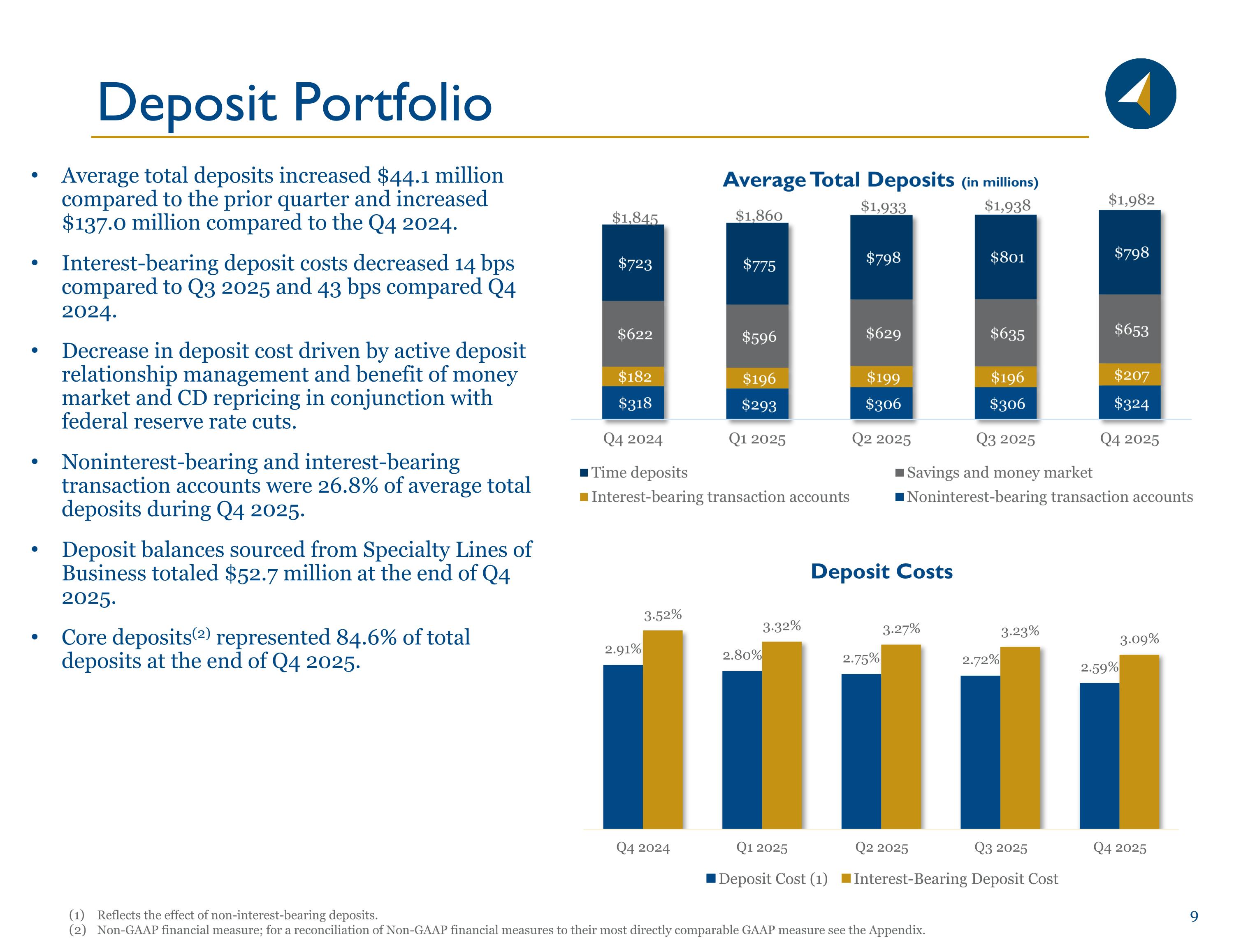

Deposit Portfolio Reflects the effect of non-interest-bearing deposits. Non-GAAP financial measure; for a reconciliation of Non-GAAP financial measures to their most directly comparable GAAP measure see the Appendix. Average total deposits increased $44.1 million compared to the prior quarter and increased $137.0 million compared to the Q4 2024. Interest-bearing deposit costs decreased 14 bps compared to Q3 2025 and 43 bps compared Q4 2024. Decrease in deposit cost driven by active deposit relationship management and benefit of money market and CD repricing in conjunction with federal reserve rate cuts. Noninterest-bearing and interest-bearing transaction accounts were 26.8% of average total deposits during Q4 2025. Deposit balances sourced from Specialty Lines of Business totaled $52.7 million at the end of Q4 2025. Core deposits(2) represented 84.6% of total deposits at the end of Q4 2025.

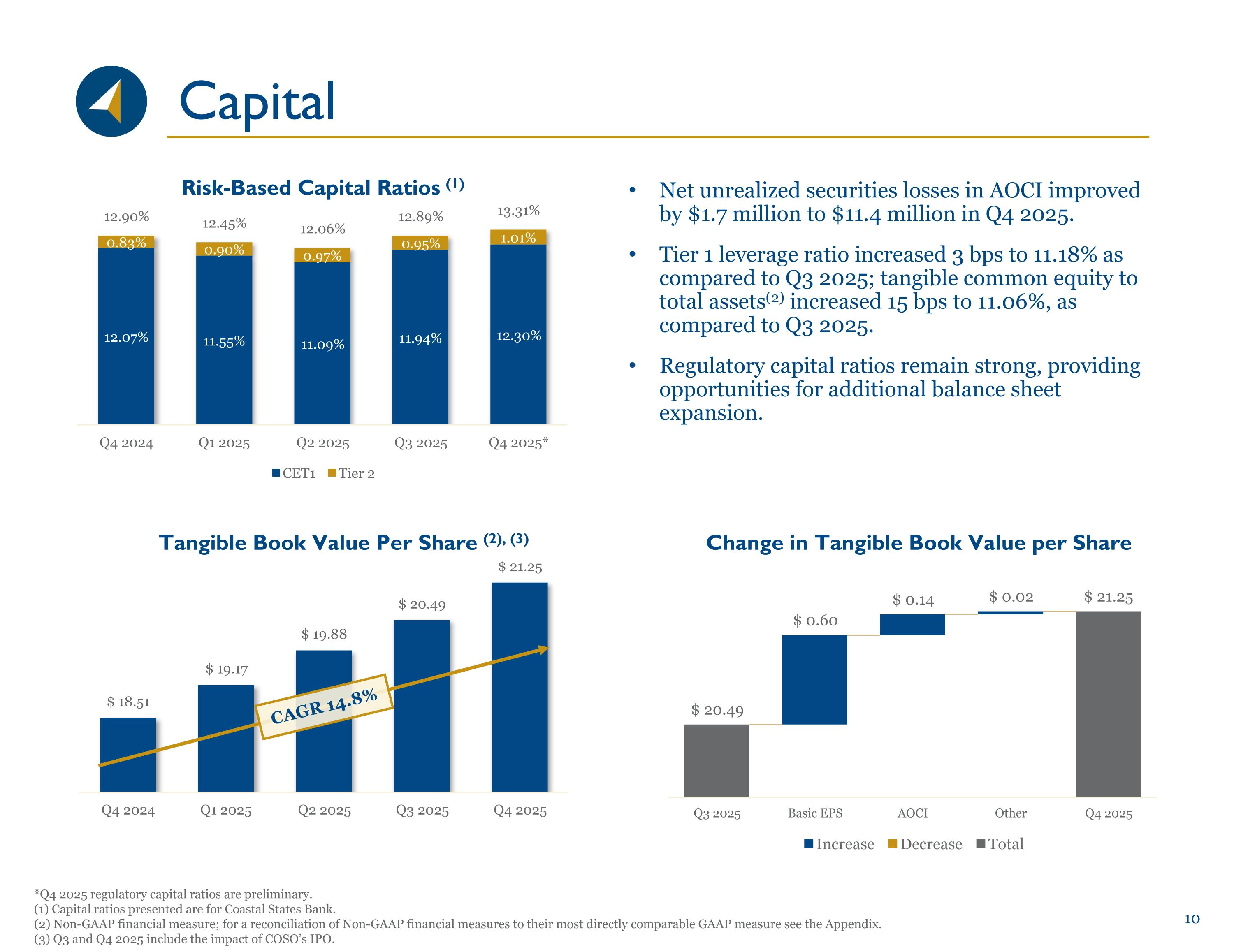

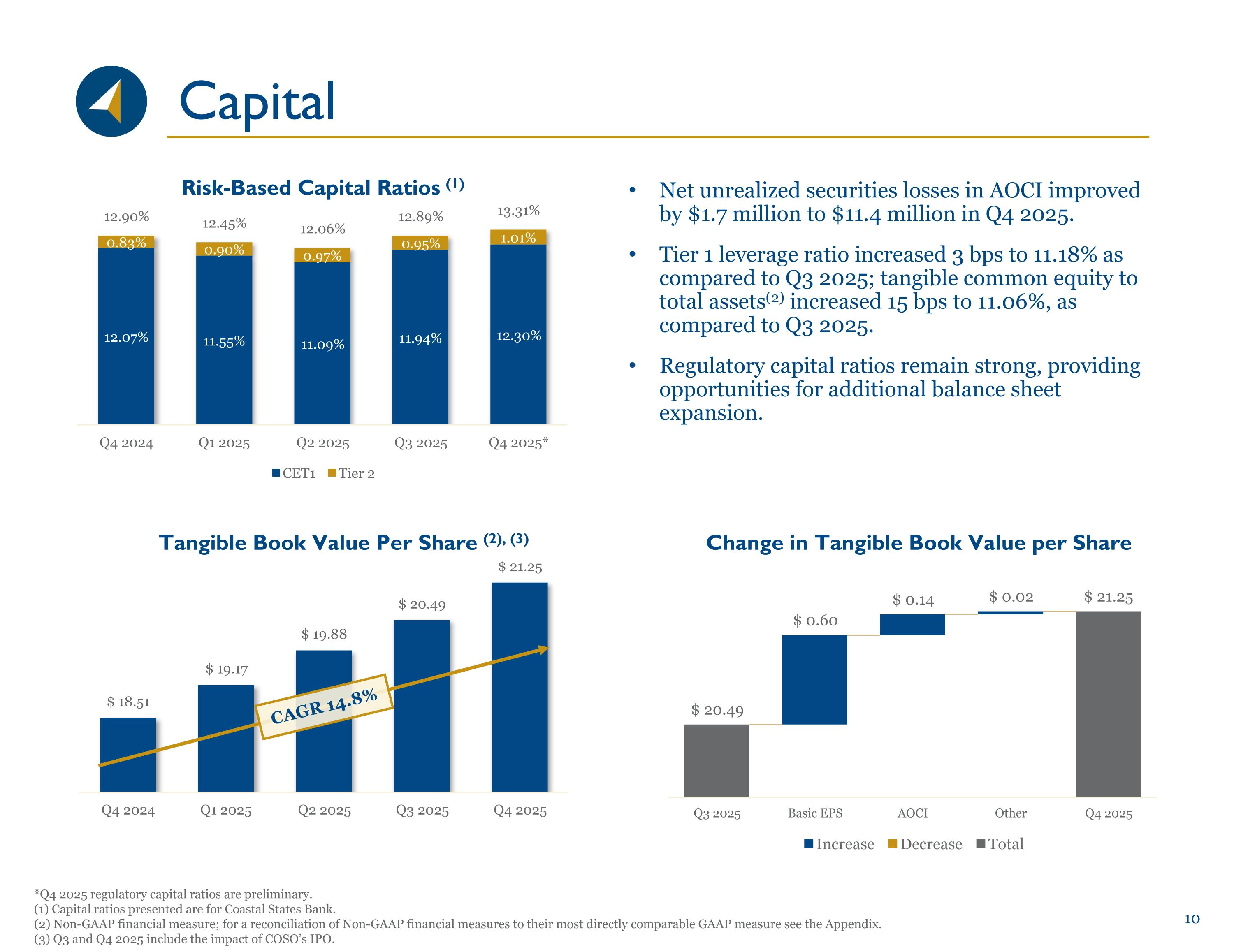

Capital *Q4 2025 regulatory capital ratios are preliminary. (1) Capital ratios presented are for Coastal States Bank. (2) Non-GAAP financial measure; for a reconciliation of Non-GAAP financial measures to their most directly comparable GAAP measure see the Appendix. (3) Q3 and Q4 2025 include the impact of COSO’s IPO. Net unrealized securities losses in AOCI improved by $1.7 million to $11.4 million in Q4 2025. Tier 1 leverage ratio increased 3 bps to 11.18% as compared to Q3 2025; tangible common equity to total assets(2) increased 15 bps to 11.06%, as compared to Q3 2025. Regulatory capital ratios remain strong, providing opportunities for additional balance sheet expansion. CAGR 14.8%

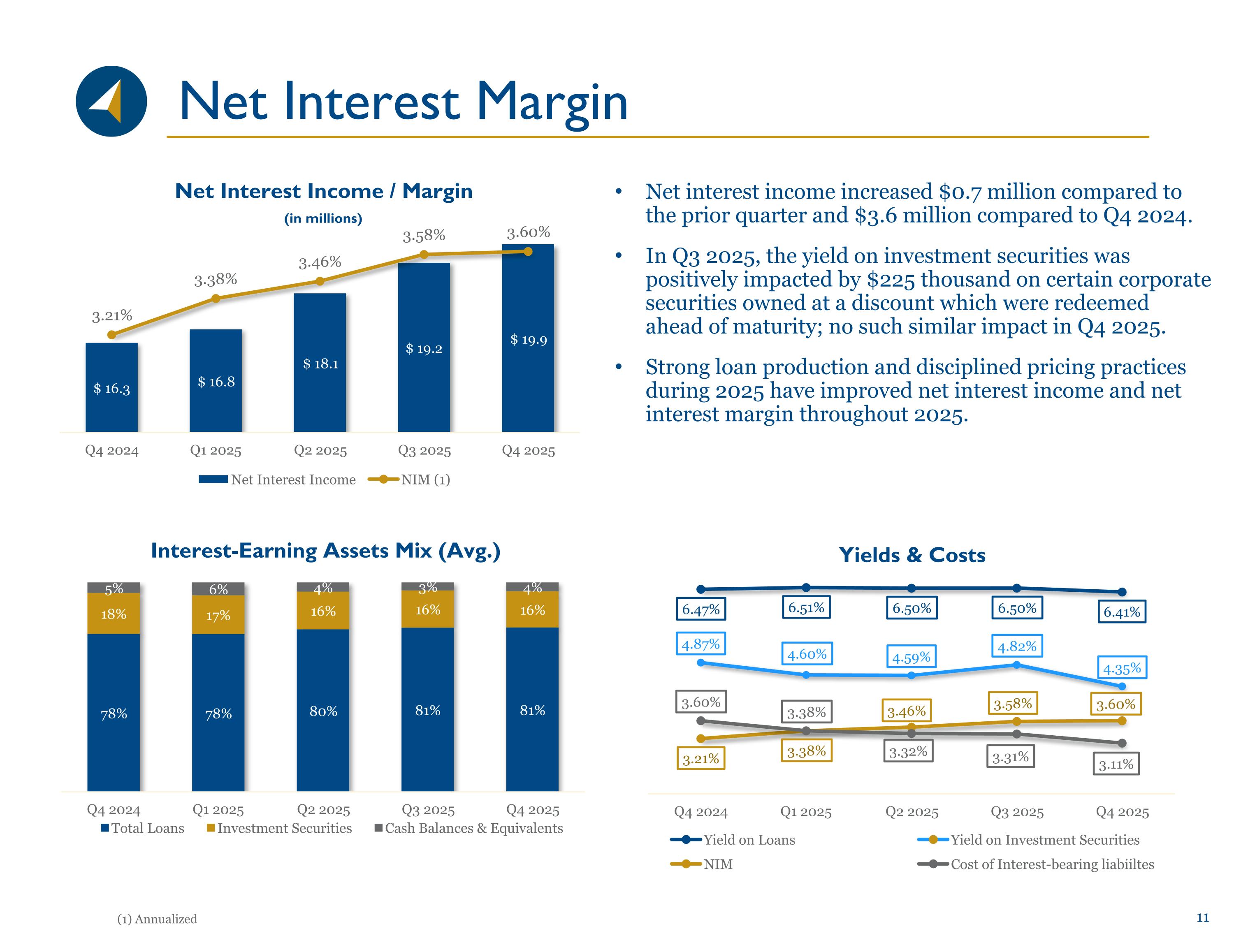

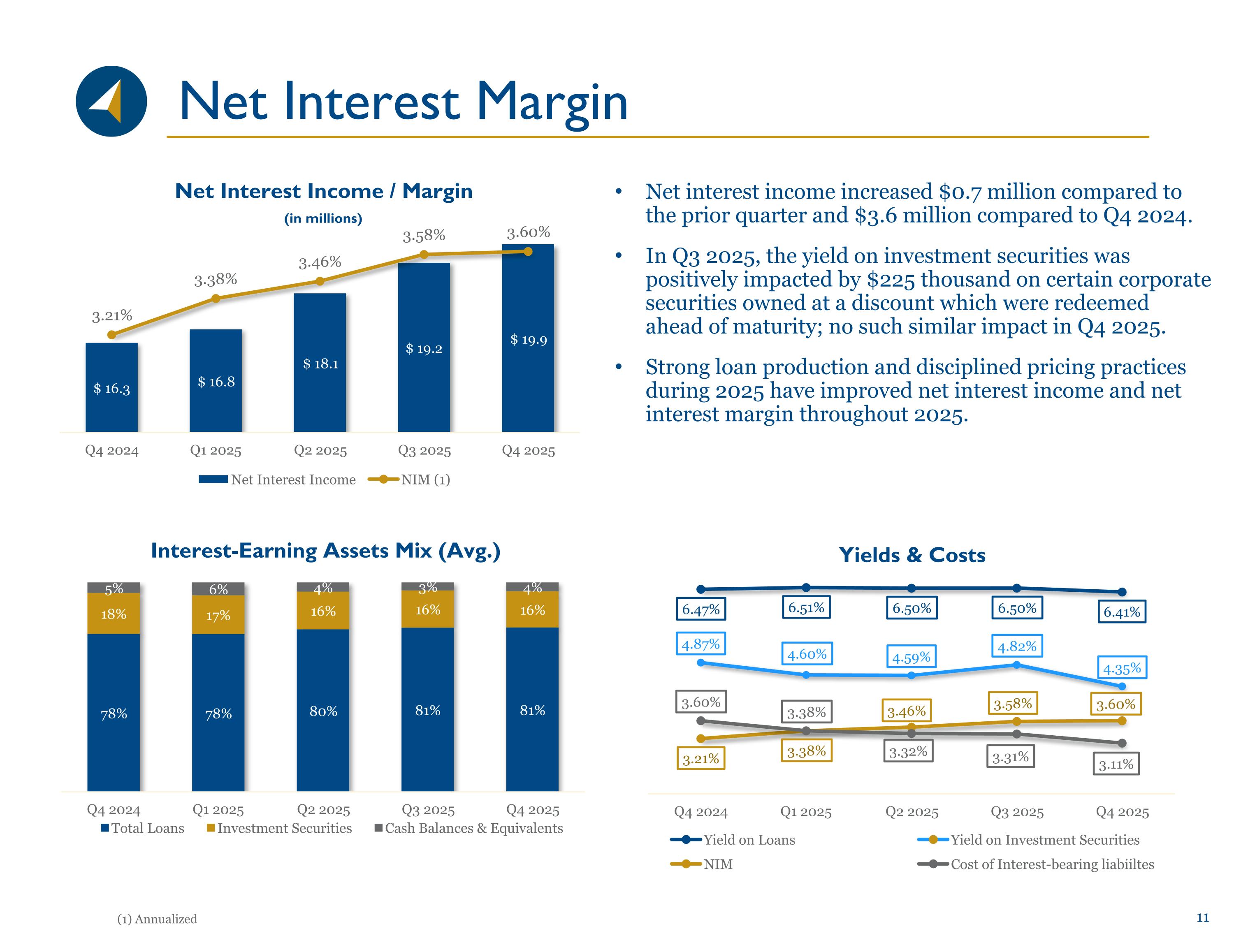

Net Interest Margin (1) Annualized Net interest income increased $0.7 million compared to the prior quarter and $3.6 million compared to Q4 2024. In Q3 2025, the yield on investment securities was positively impacted by $225 thousand on certain corporate securities owned at a discount which were redeemed ahead of maturity; no such similar impact in Q4 2025. Strong loan production and disciplined pricing practices during 2025 have improved net interest income and net interest margin throughout 2025.

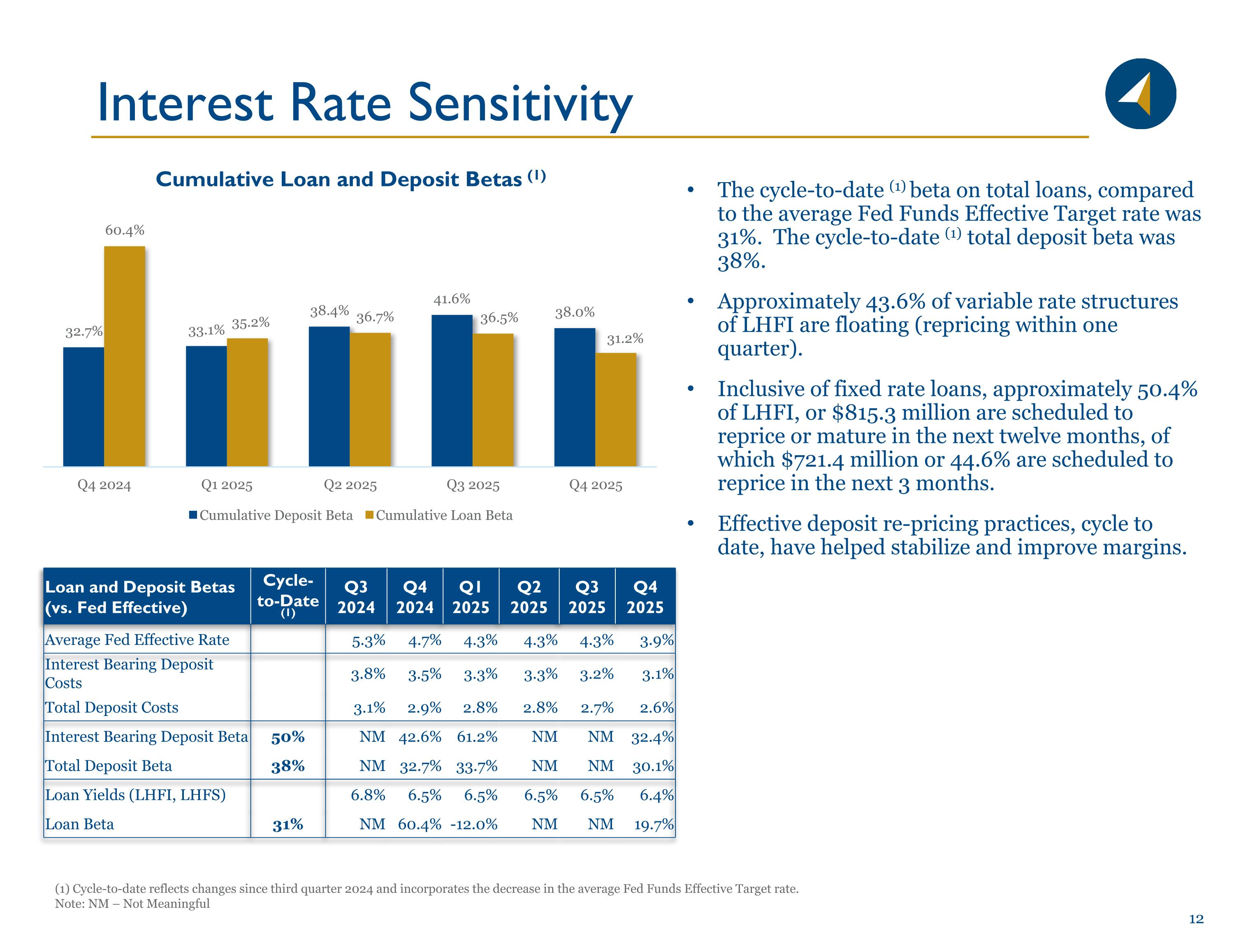

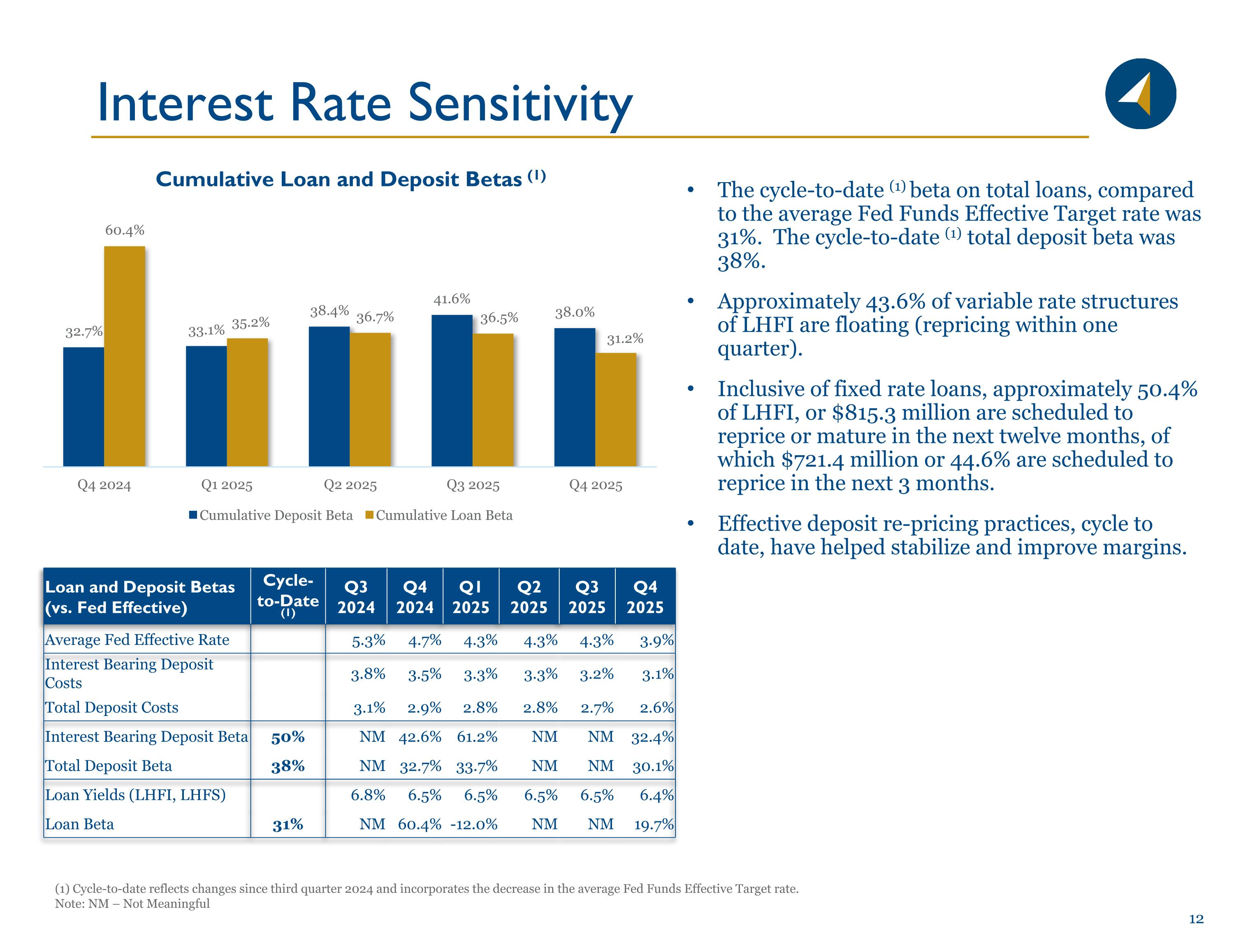

Interest Rate Sensitivity (1) Cycle-to-date reflects changes since third quarter 2024 and incorporates the decrease in the average Fed Funds Effective Target rate. Note: NM – Not Meaningful The cycle-to-date (1) beta on total loans, compared to the average Fed Funds Effective Target rate was 31%. The cycle-to-date (1) total deposit beta was 38%. Approximately 43.6% of variable rate structures of LHFI are floating (repricing within one quarter). Inclusive of fixed rate loans, approximately 50.4% of LHFI, or $815.3 million are scheduled to reprice or mature in the next twelve months, of which $721.4 million or 44.6% are scheduled to reprice in the next 3 months. Effective deposit re-pricing practices, cycle to date, have helped stabilize and improve margins. Loan and Deposit Betas(vs. Fed Effective) Cycle-to-Date (1) Q3 2024 Q4 2024 Q1 2025 Q2 2025 Q3 2025 Q4 2025 Average Fed Effective Rate 5.3% 4.7% 4.3% 4.3% 4.3% 3.9% Interest Bearing Deposit Costs 3.8% 3.5% 3.3% 3.3% 3.2% 3.1% Total Deposit Costs 3.1% 2.9% 2.8% 2.8% 2.7% 2.6% Interest Bearing Deposit Beta 50% NM 42.6% 61.2% NM NM 32.4% Total Deposit Beta 38% NM 32.7% 33.7% NM NM 30.1% Loan Yields (LHFI, LHFS) 6.8% 6.5% 6.5% 6.5% 6.5% 6.4% Loan Beta 31% NM 60.4% -12.0% NM NM 19.7%

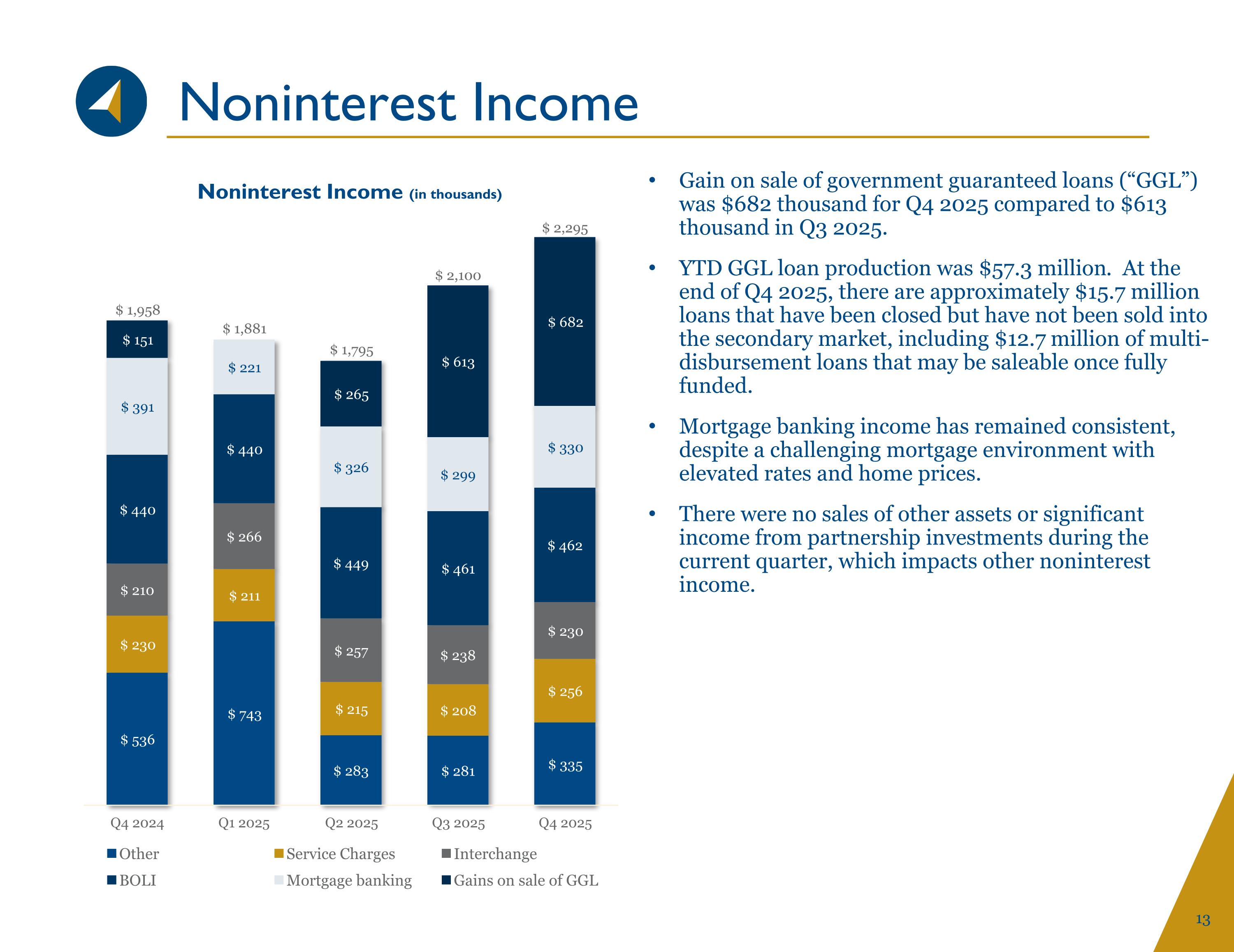

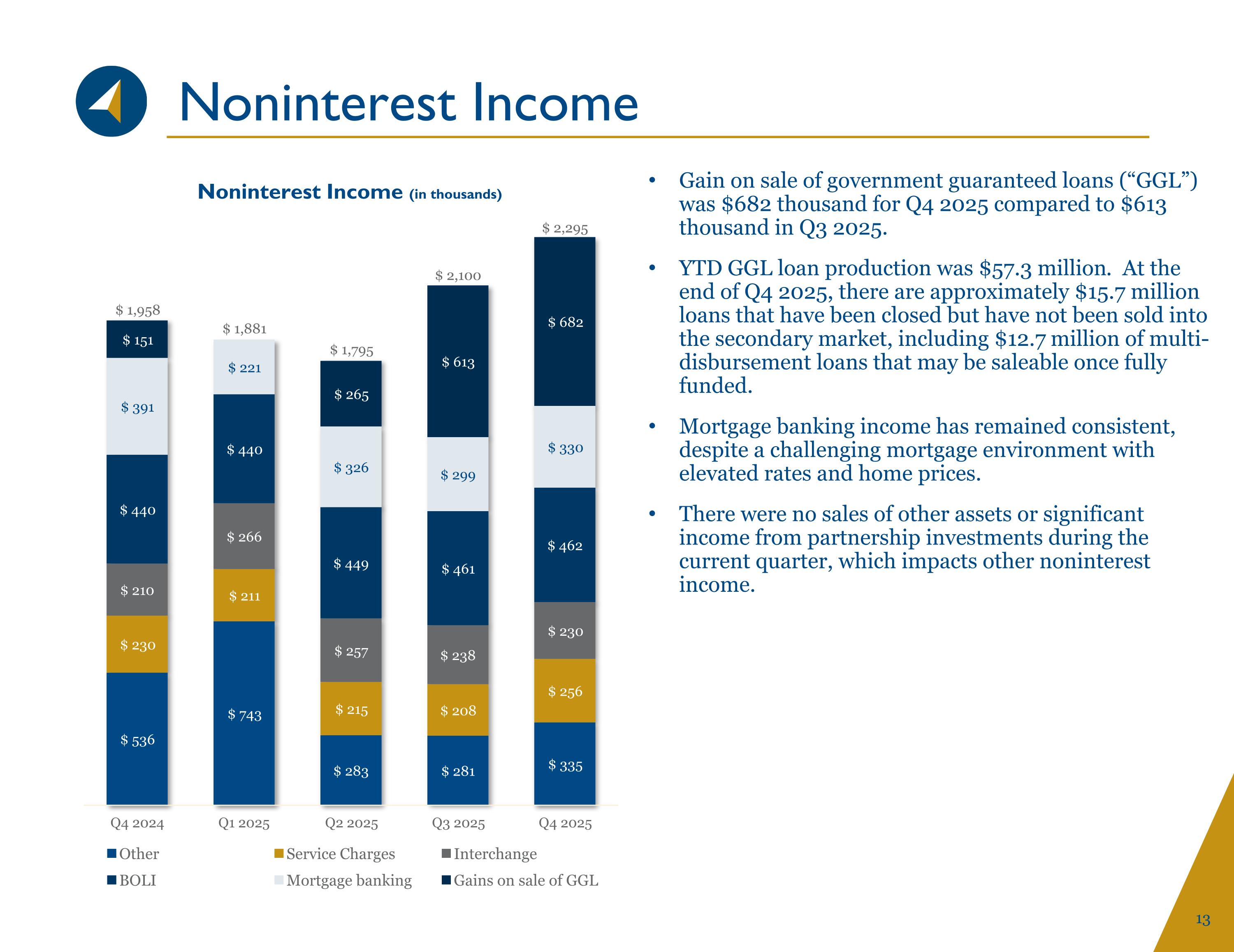

Noninterest Income Gain on sale of government guaranteed loans (“GGL”) was $682 thousand for Q4 2025 compared to $613 thousand in Q3 2025. YTD GGL loan production was $57.3 million. At the end of Q4 2025, there are approximately $15.7 million loans that have been closed but have not been sold into the secondary market, including $12.7 million of multi-disbursement loans that may be saleable once fully funded. Mortgage banking income has remained consistent, despite a challenging mortgage environment with elevated rates and home prices. There were no sales of other assets or significant income from partnership investments during the current quarter, which impacts other noninterest income.

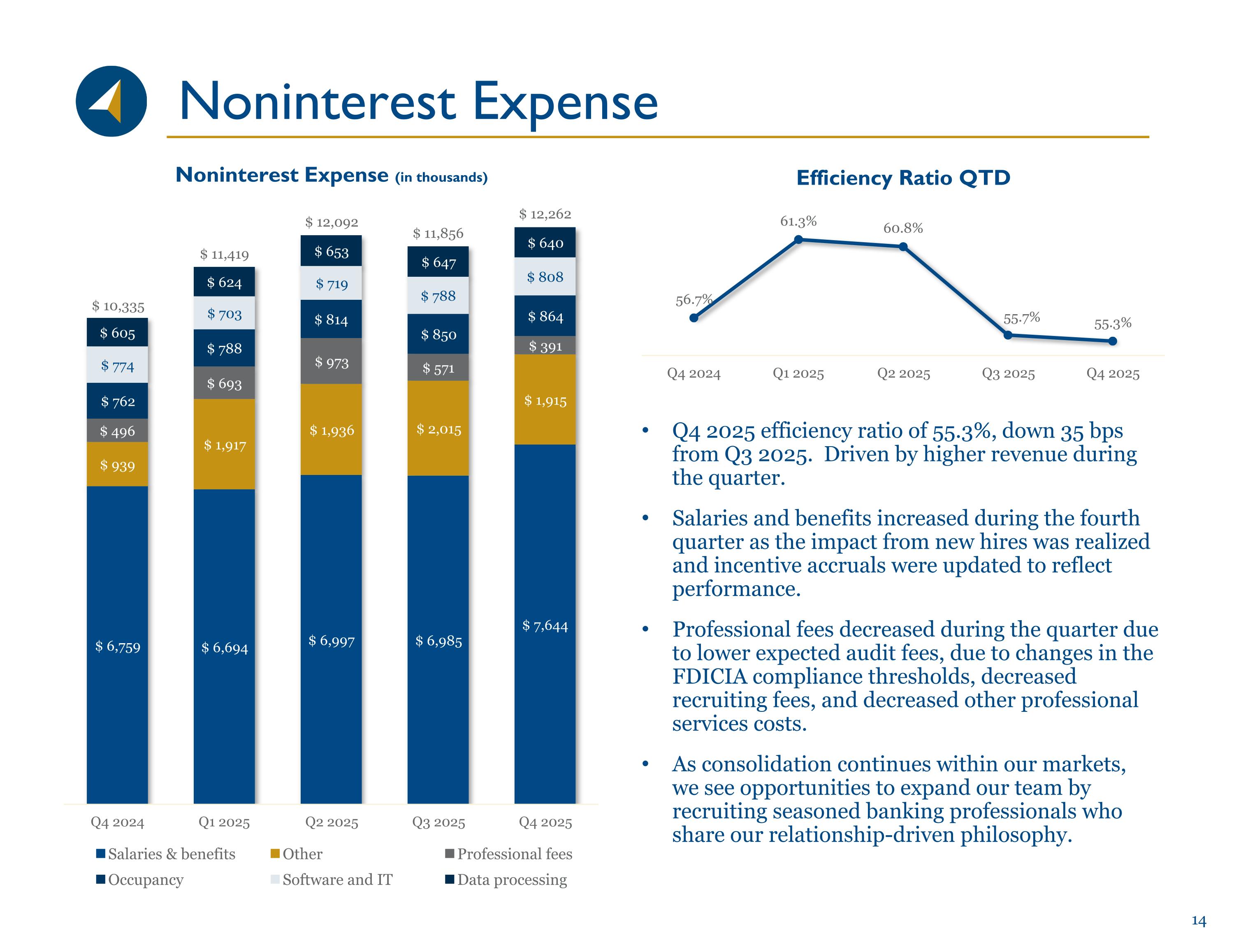

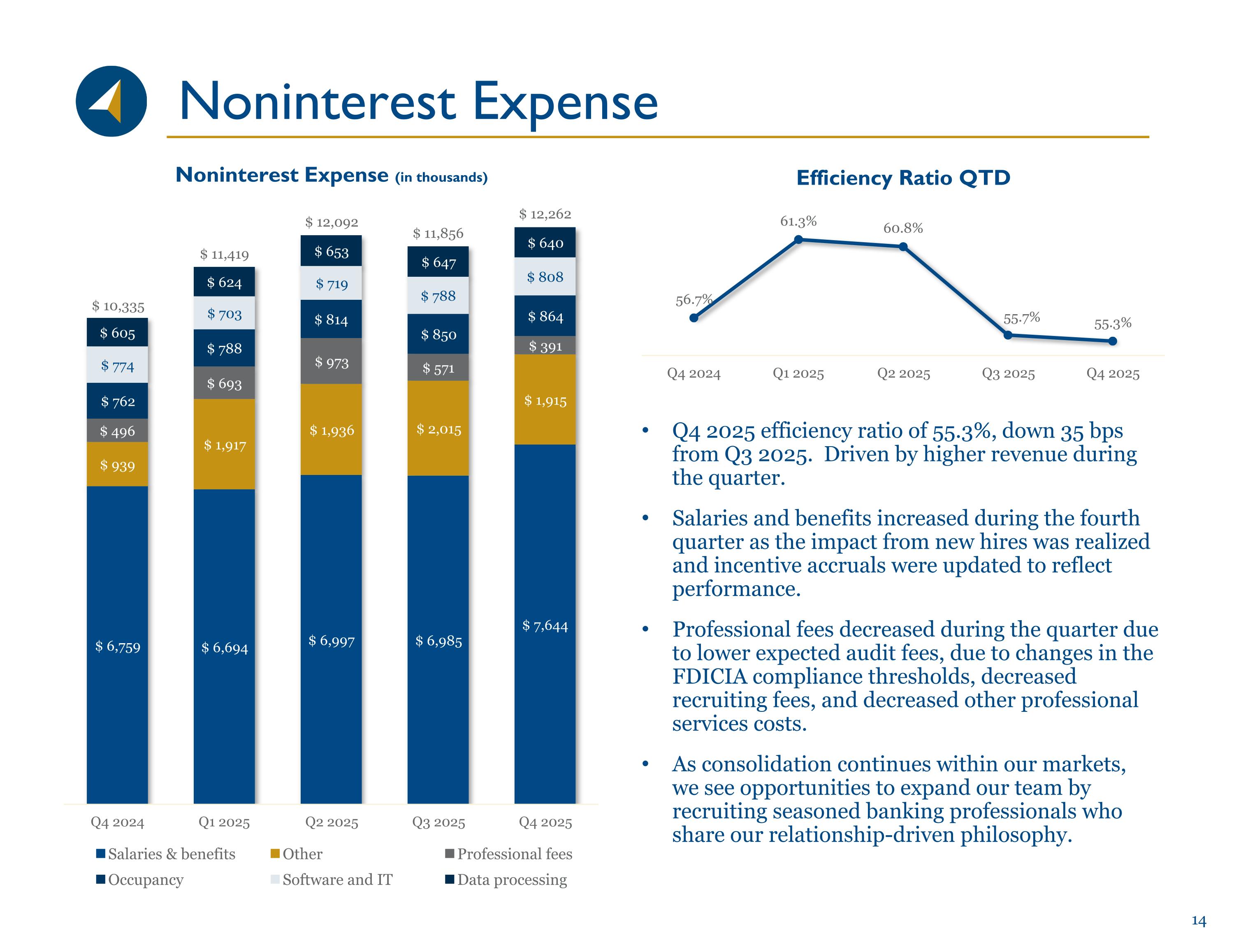

Noninterest Expense Q4 2025 efficiency ratio of 55.3%, down 35 bps from Q3 2025. Driven by higher revenue during the quarter. Salaries and benefits increased during the fourth quarter as the impact from new hires was realized and incentive accruals were updated to reflect performance. Professional fees decreased during the quarter due to lower expected audit fees, due to changes in the FDICIA compliance thresholds, decreased recruiting fees, and decreased other professional services costs. As consolidation continues within our markets, we see opportunities to expand our team by recruiting seasoned banking professionals who share our relationship-driven philosophy.

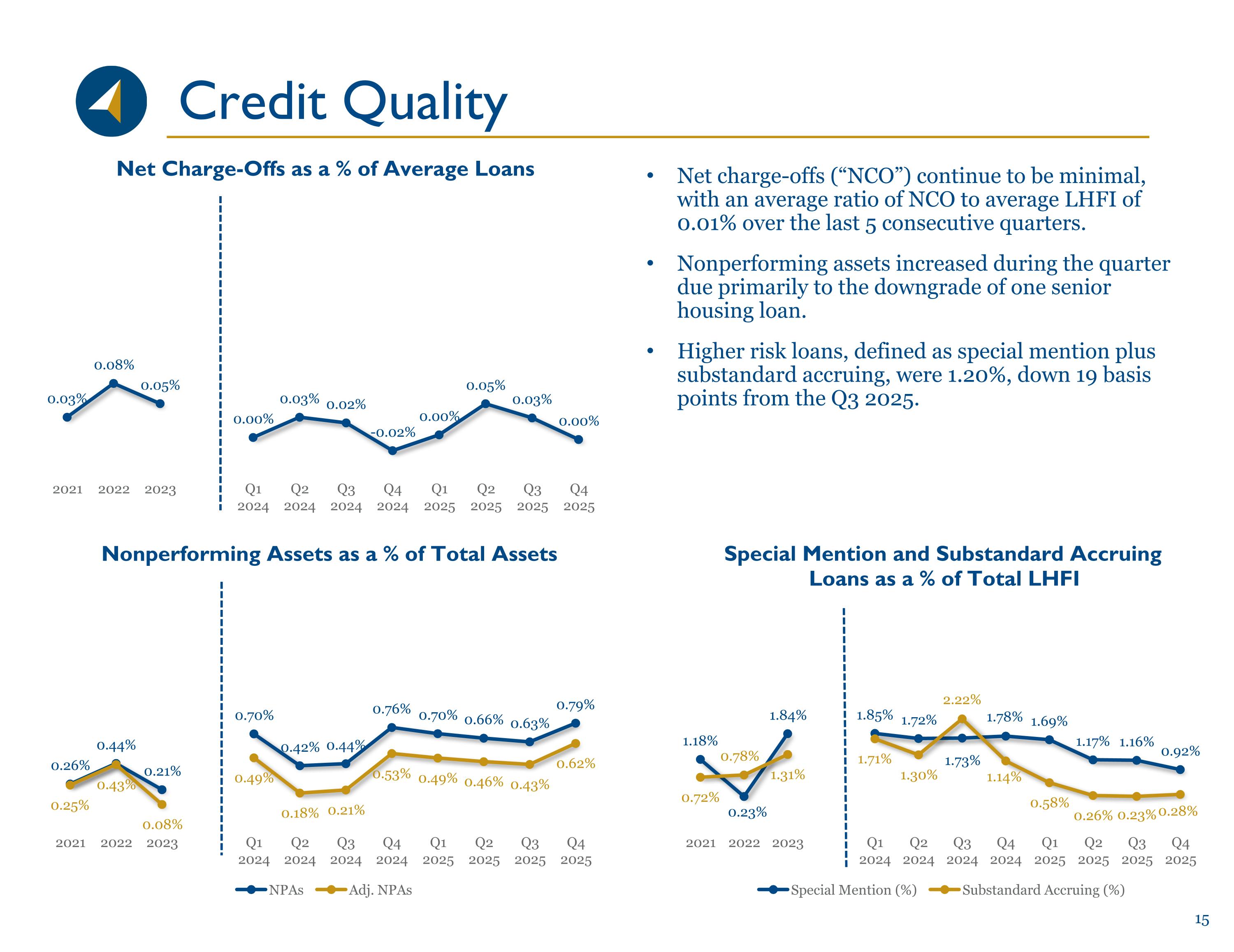

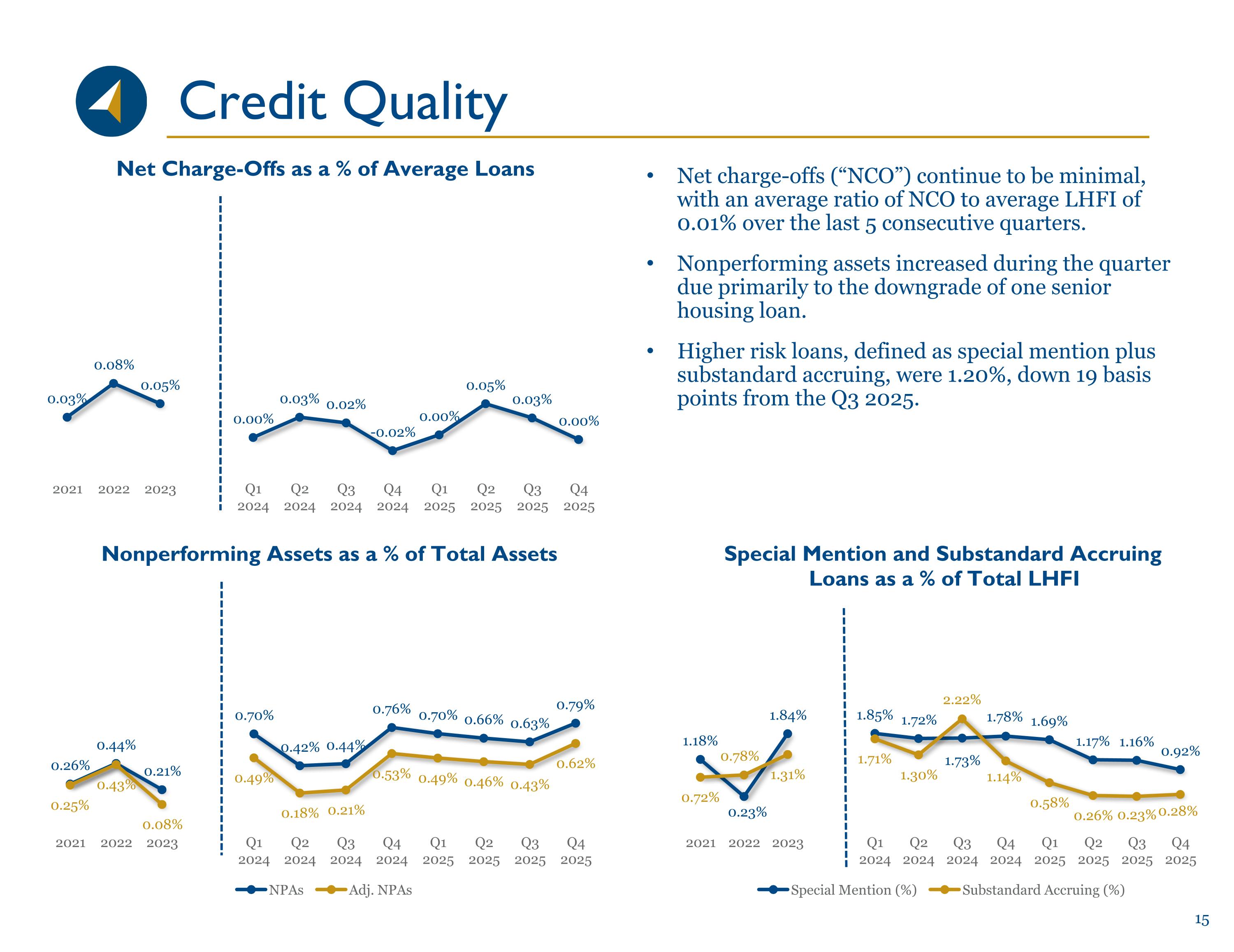

Credit Quality Net charge-offs (“NCO”) continue to be minimal, with an average ratio of NCO to average LHFI of 0.01% over the last 5 consecutive quarters. Nonperforming assets increased during the quarter due primarily to the downgrade of one senior housing loan. Higher risk loans, defined as special mention plus substandard accruing, were 1.20%, down 19 basis points from the Q3 2025.

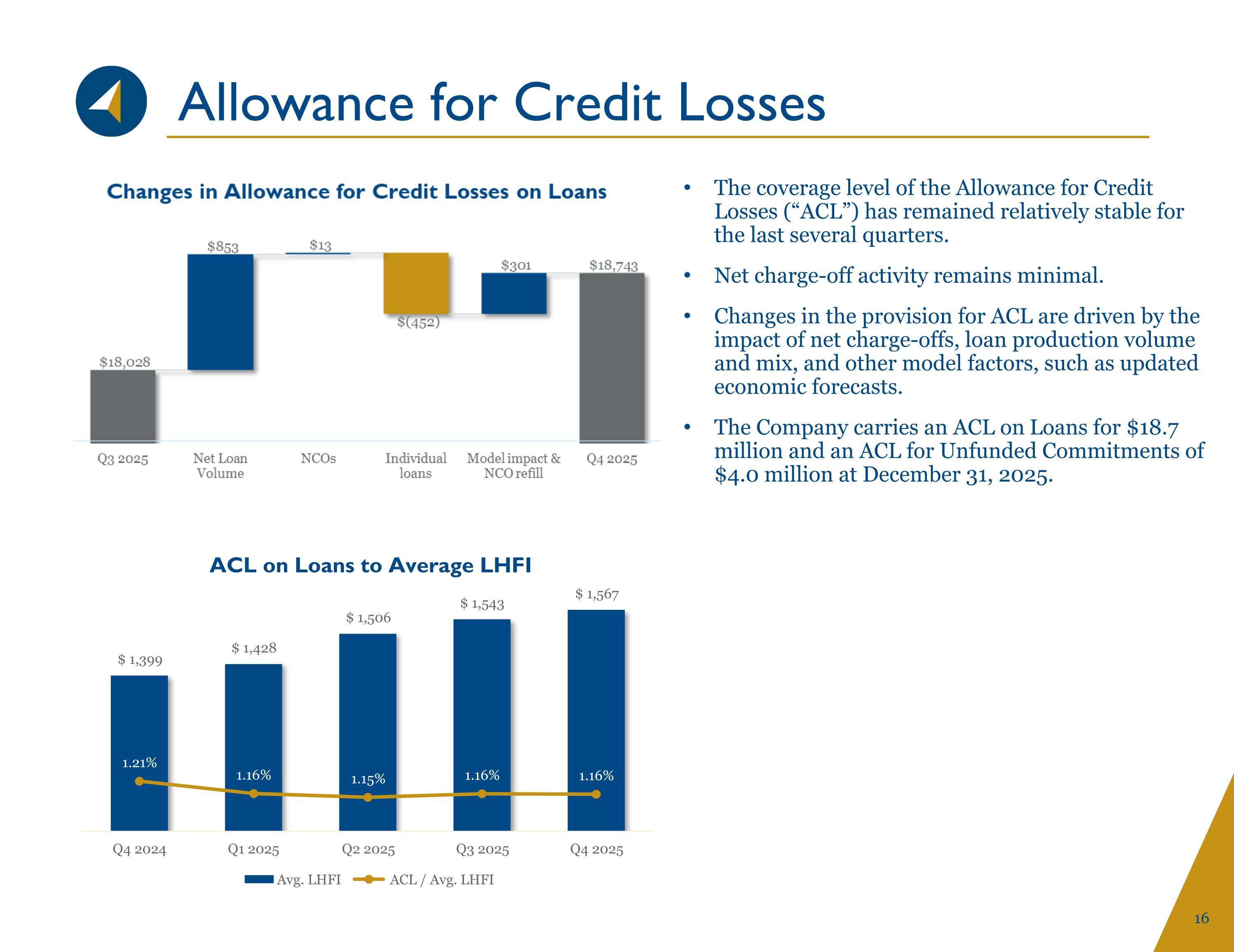

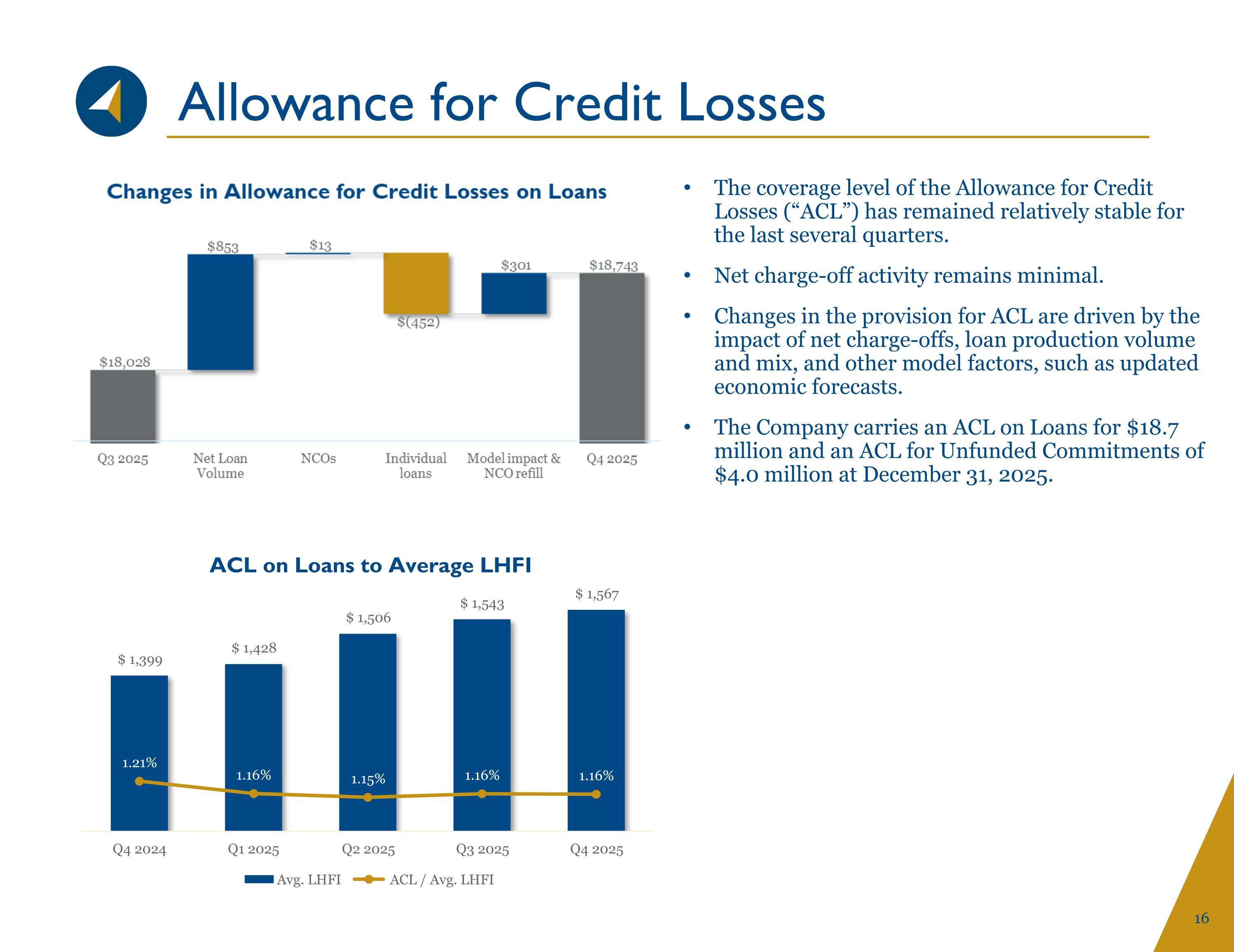

Allowance for Credit Losses The coverage level of the Allowance for Credit Losses (“ACL”) has remained relatively stable for the last several quarters. Net charge-off activity remains minimal. Changes in the provision for ACL are driven by the impact of net charge-offs, loan production volume and mix, and other model factors, such as updated economic forecasts. The Company carries an ACL on Loans for $18.7 million and an ACL for Unfunded Commitments of $4.0 million at December 31, 2025.

Appendix

Core Operating Principles We believe that by focusing on our five core values outlined below, we can create meaningful relationships between our Bank, team members, clients, and our communities Each of these relationships is critical to our financial success and supports our capacity to drive shareholder value Key drivers of COSO’s success include: Unwavering commitment to hiring the best local bankers Valuing entrepreneurial culture, ensuring daily actions are aligned with vision and values Communicating clearly and candidly Providing exceptional service and innovative solutions

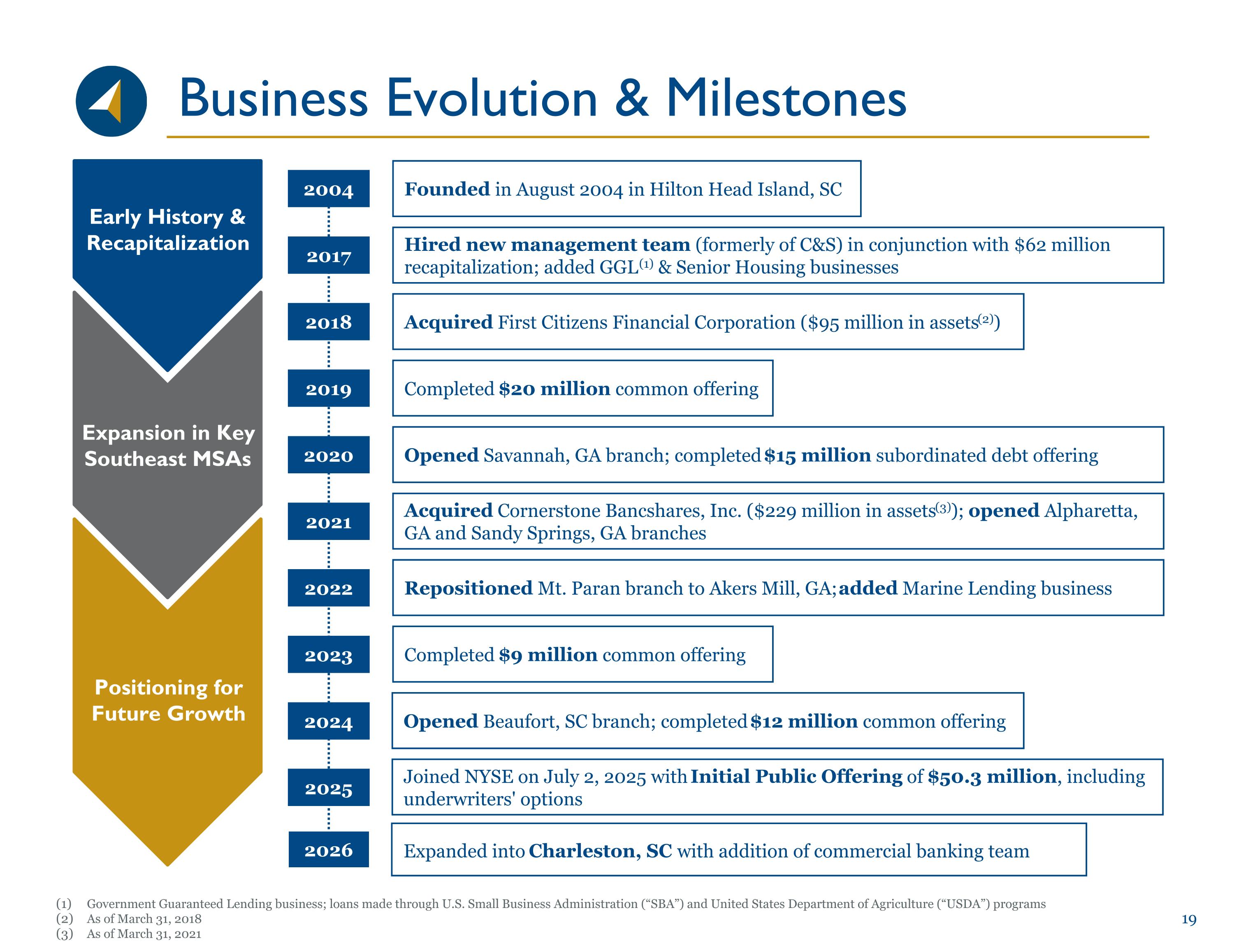

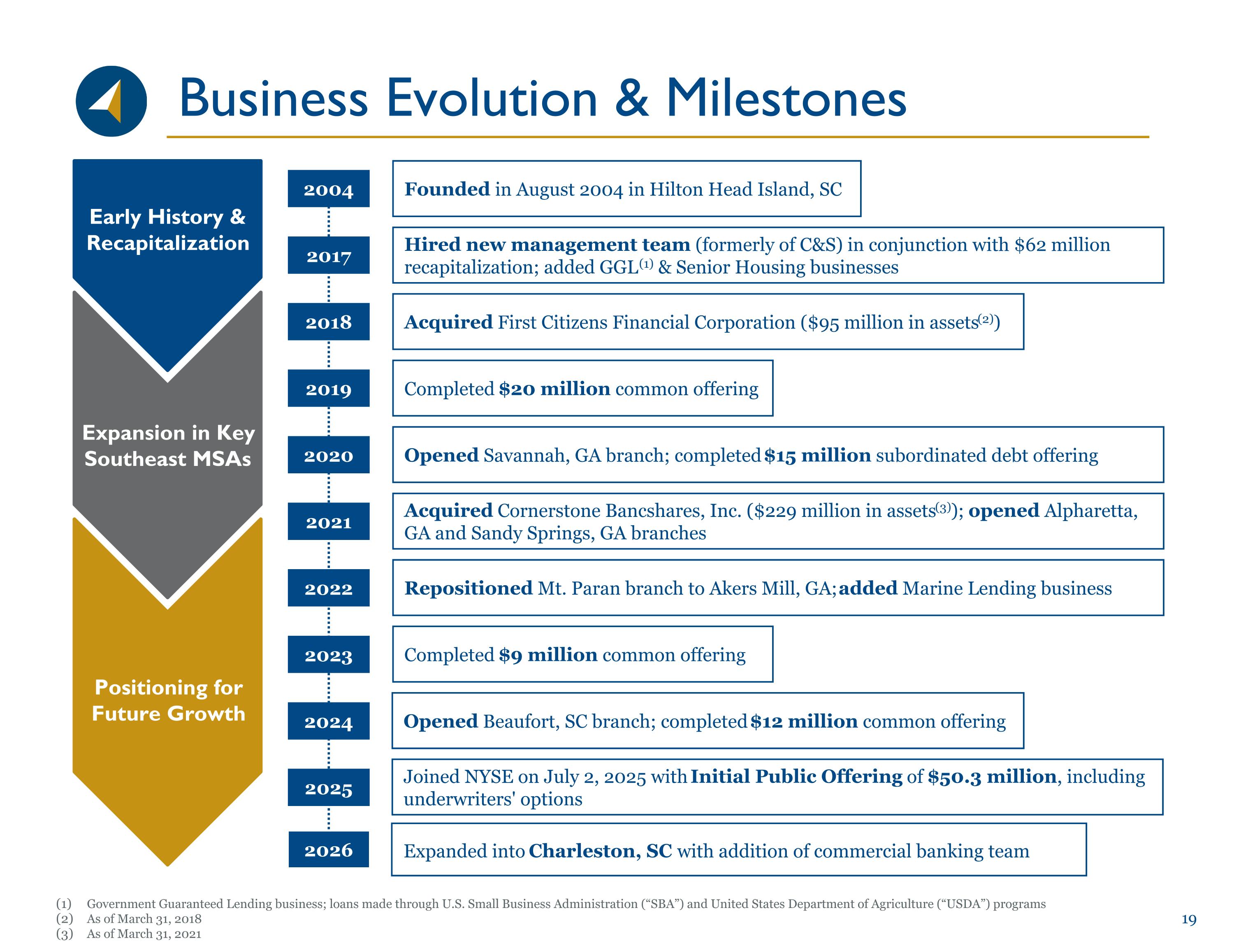

Business Evolution & Milestones Government Guaranteed Lending business; loans made through U.S. Small Business Administration (“SBA”) and United States Department of Agriculture (“USDA”) programs As of March 31, 2018 As of March 31, 2021 Early History & Recapitalization Expansion in Key Southeast MSAs Positioning for Future Growth Founded in August 2004 in Hilton Head Island, SC Opened Savannah, GA branch; completed $15 million subordinated debt offering Hired new management team (formerly of C&S) in conjunction with $62 million recapitalization; added GGL (1) & Senior Housing businesses Acquired First Citizens Financial Corporation ($95 million in assets (2)) Completed $20 million common offering 2004 2017 2018 2019 2020 Acquired Cornerstone Bancshares, Inc. ($229 million in assets (3)); opened Alpharetta, GA and Sandy Springs, GA branches Repositioned Mt. Paran branch to Akers Mill, GA; added Marine Lending business 2021 2022 Completed $9 million common offering 2023 Opened Beaufort, SC branch; completed $12 million common offering 2024 Joined NYSE on July 2, 2025 with Initial Public Offering of $50.3 million, including underwriters' options 2025 2026 Expanded into Charleston, SC with addition of commercial banking team

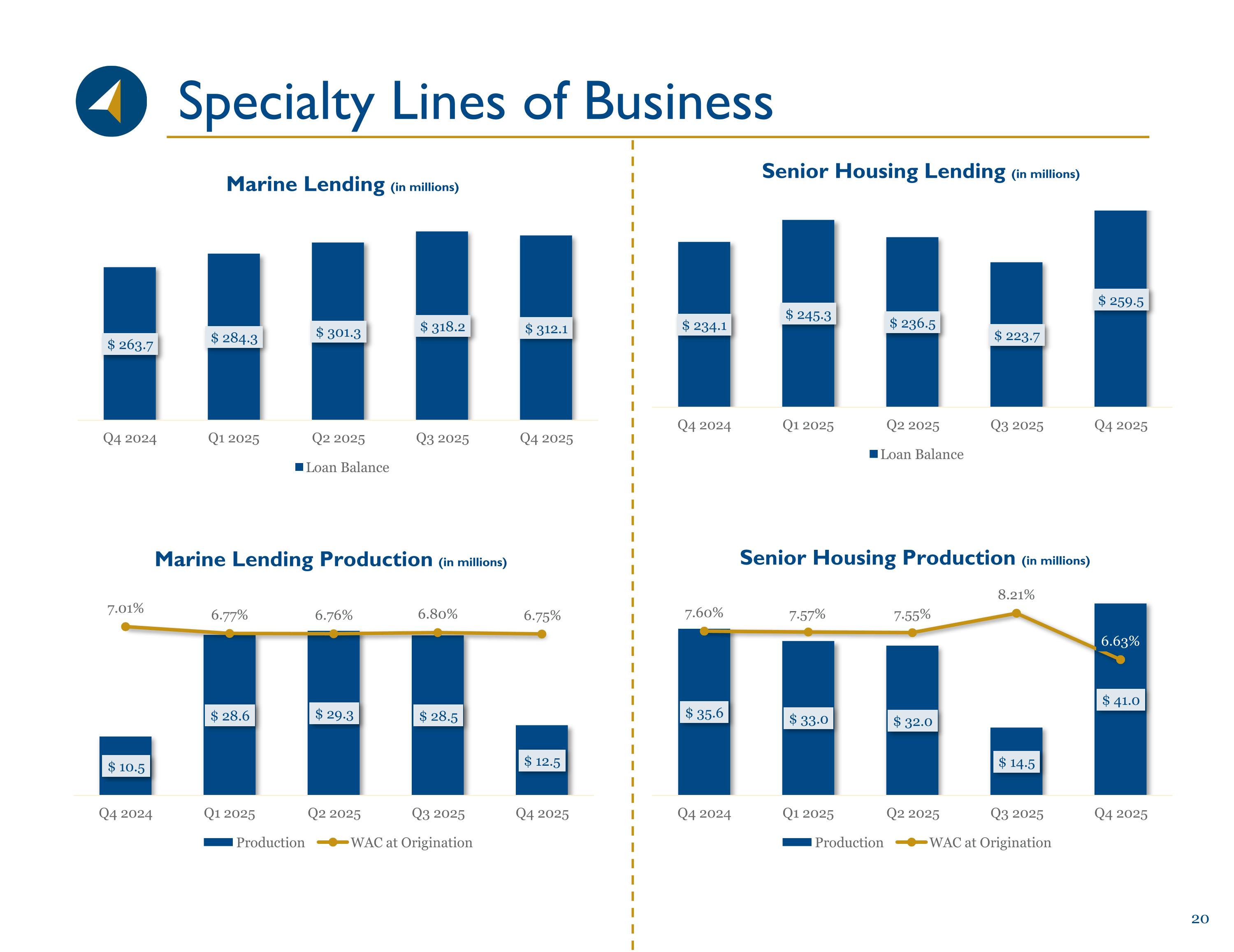

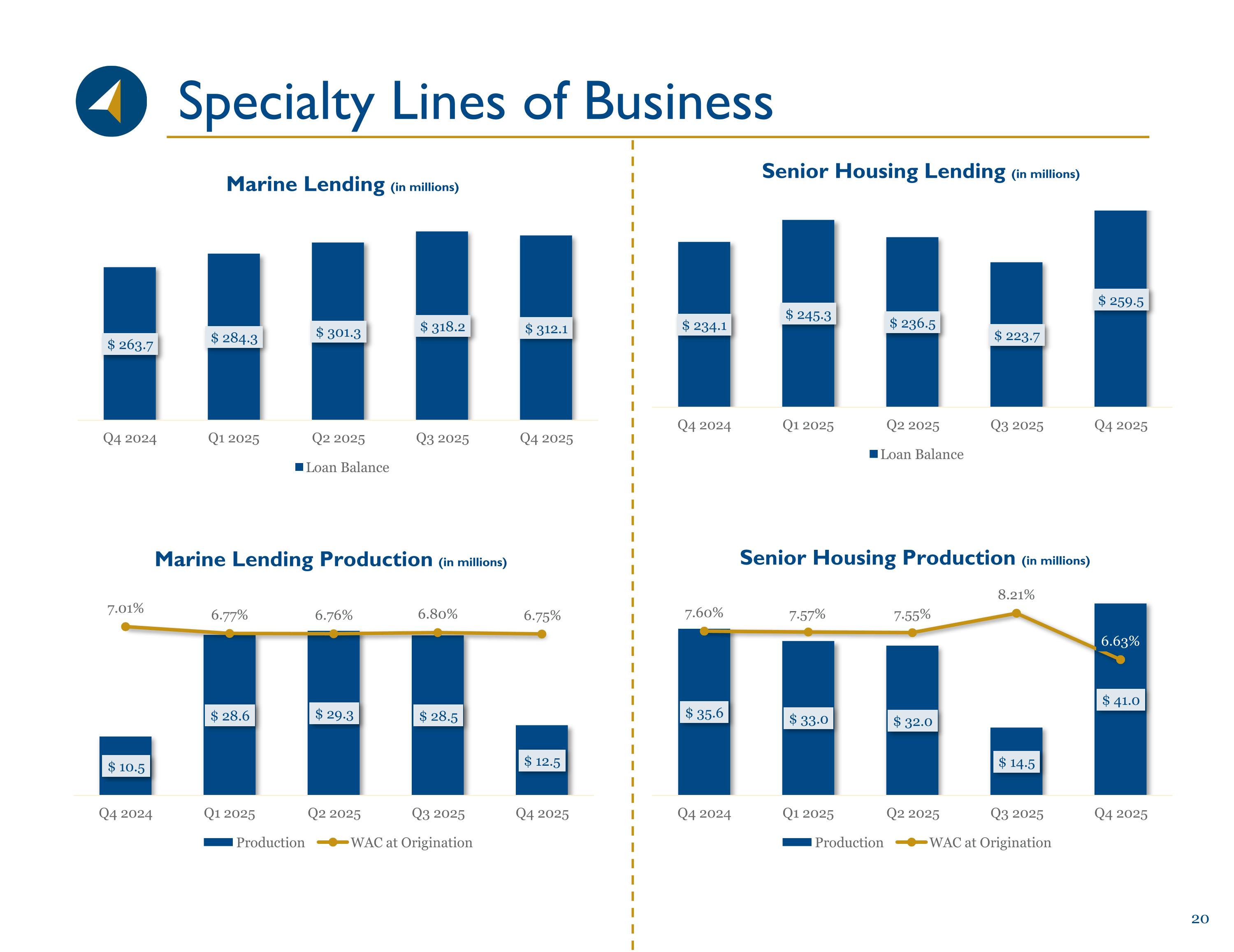

Specialty Lines of Business

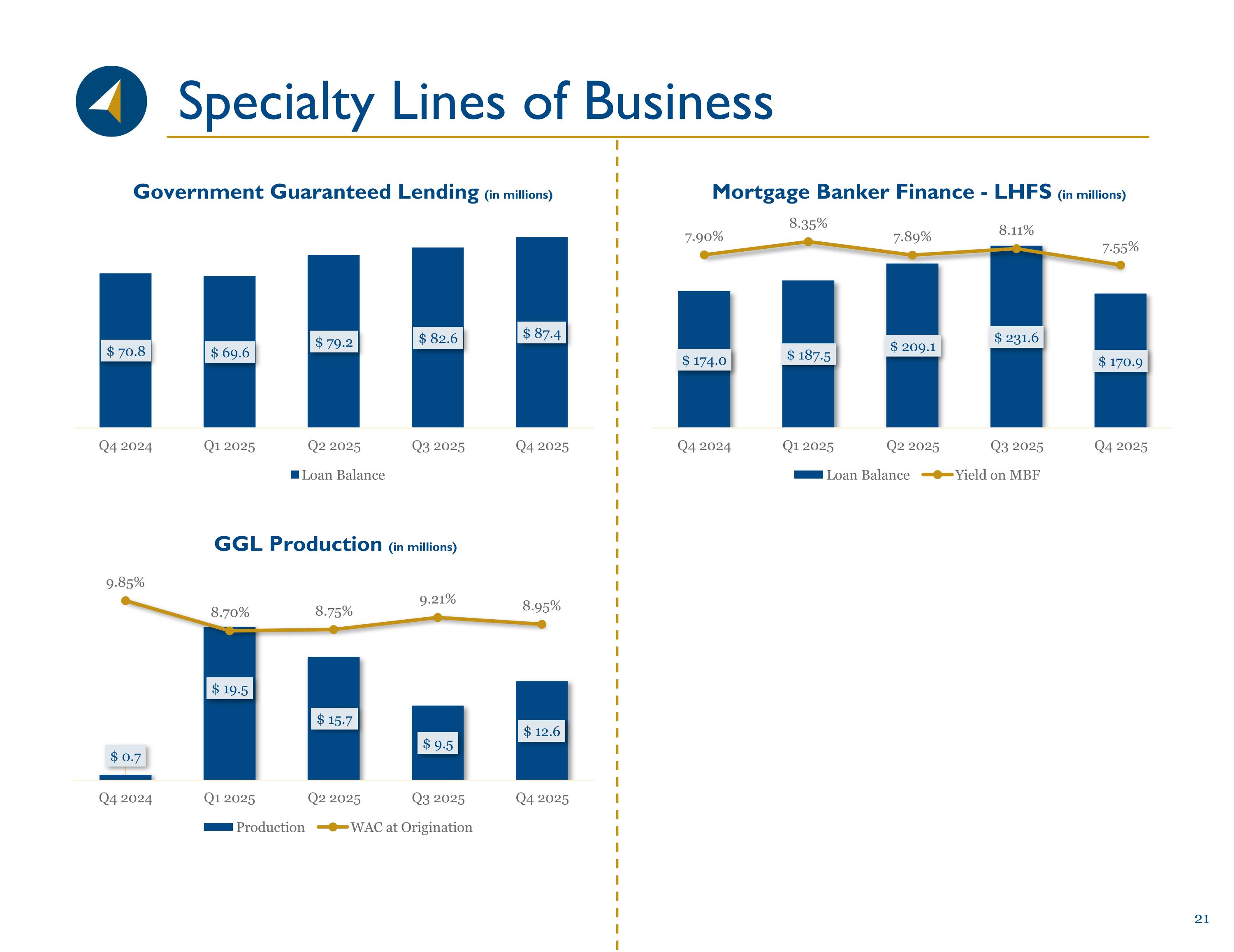

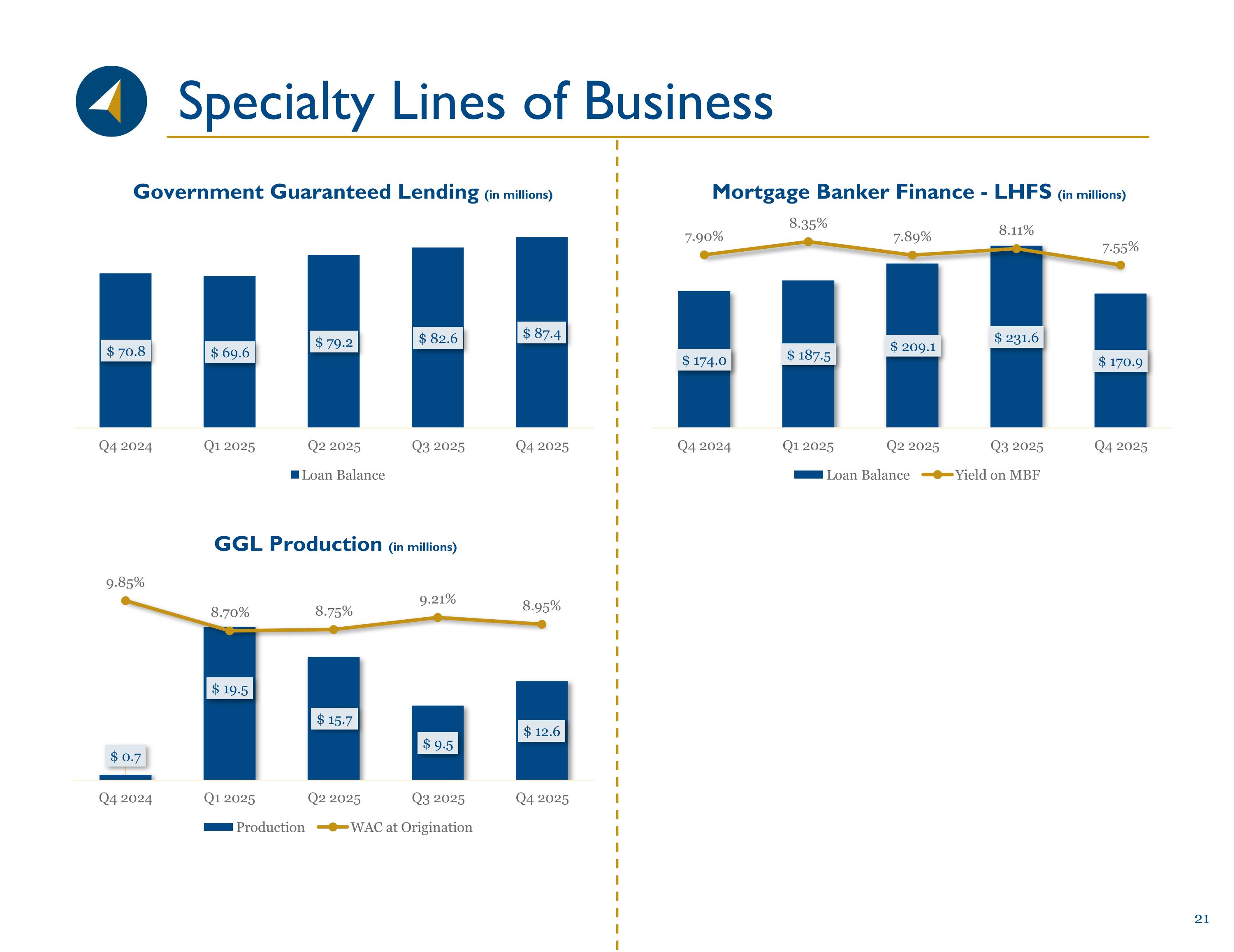

Specialty Lines of Business

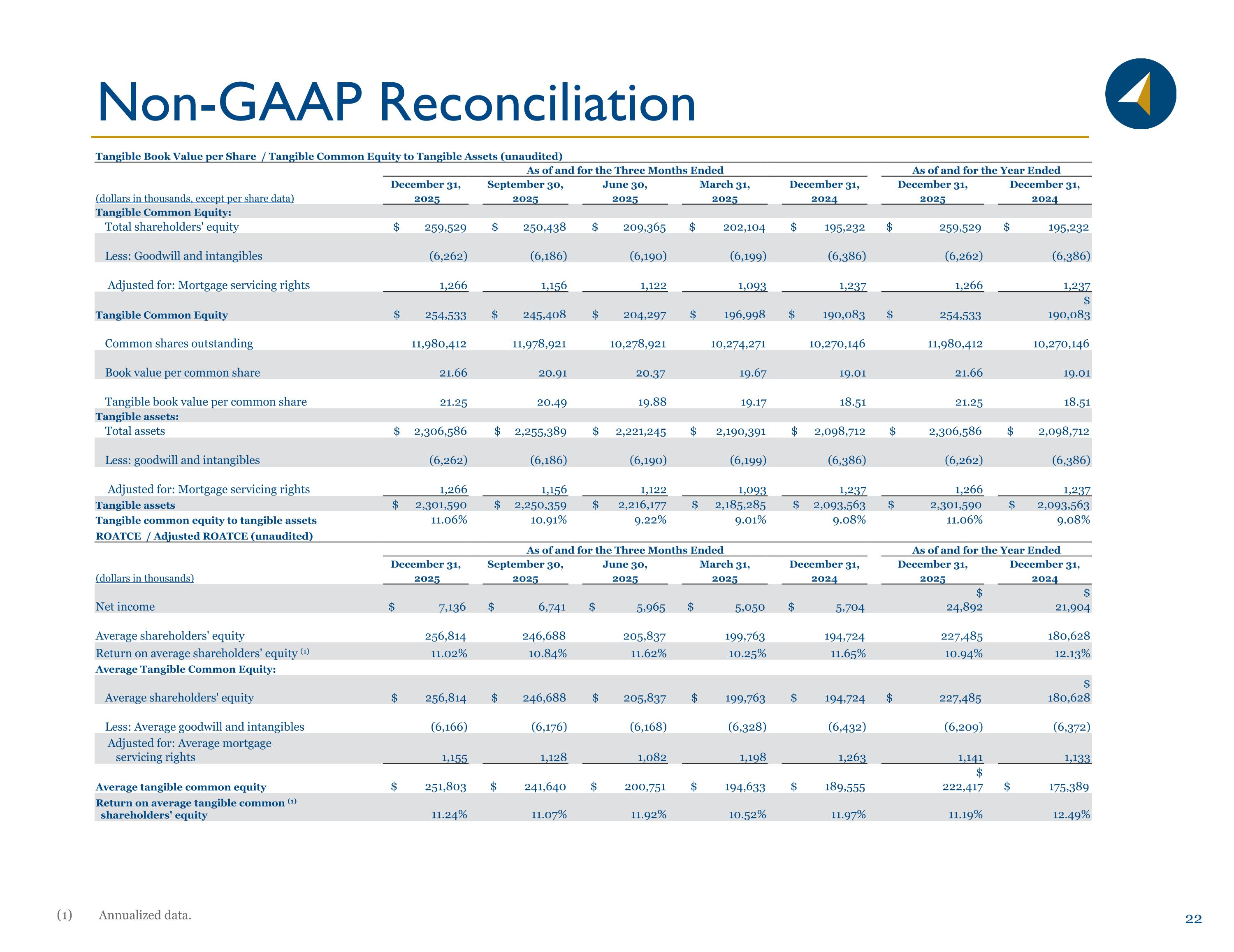

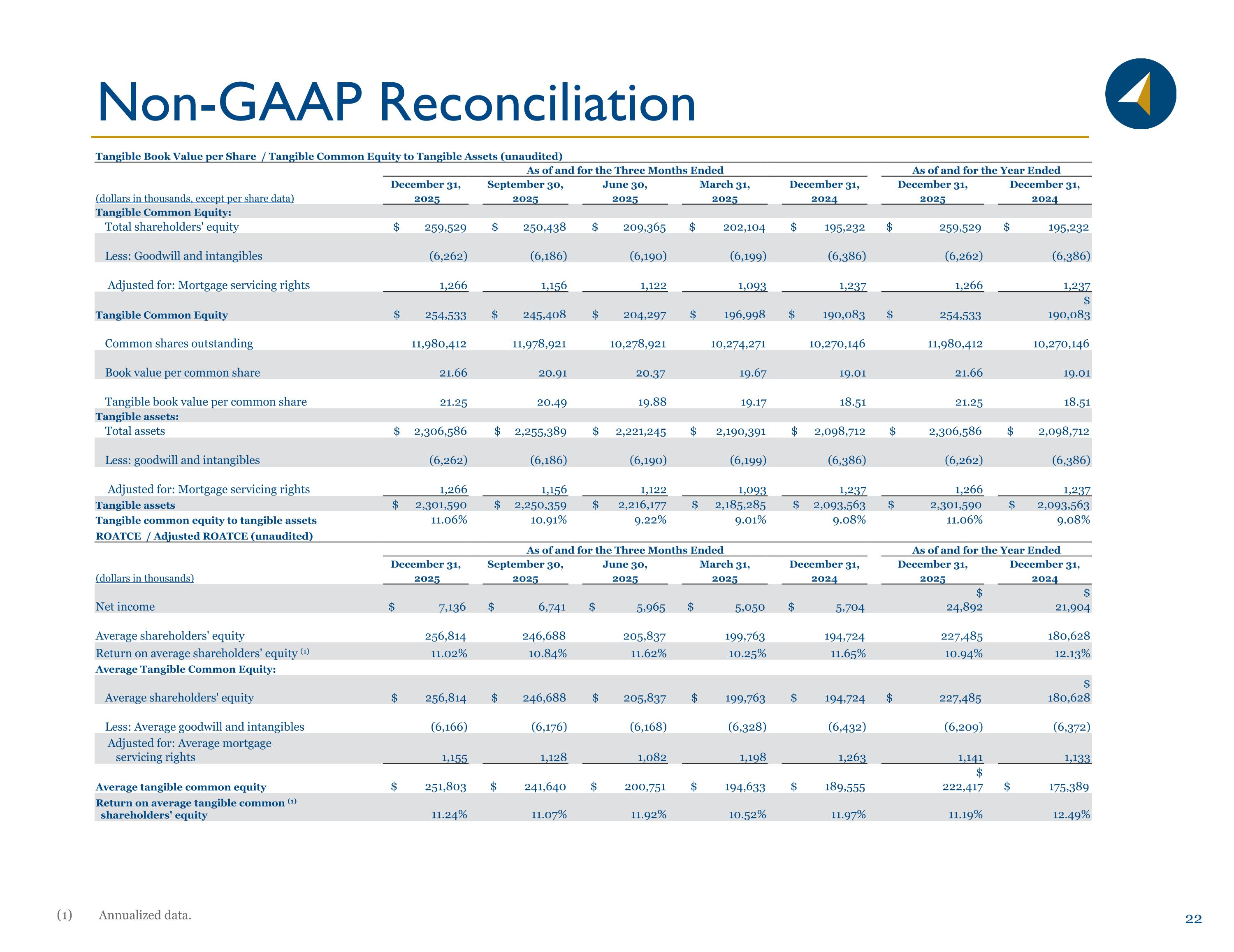

Non-GAAP Reconciliation Annualized data. Tangible Book Value per Share / Tangible Common Equity to Tangible Assets (unaudited) As of and for the Three Months Ended As of and for the Year Ended December 31, September 30, June 30, March 31, December 31, December 31, December 31, (dollars in thousands, except per share data) 2025 2025 2025 2025 2024 2025 2024 Tangible Common Equity: Total shareholders' equity $ 259,529 $ 250,438 $ 209,365 $ 202,104 $ 195,232 $ 259,529 $ 195,232 Less: Goodwill and intangibles (6,262) (6,186) (6,190) (6,199) (6,386) (6,262) (6,386) Adjusted for: Mortgage servicing rights 1,266 1,156 1,122 1,093 1,237 1,266 1,237 Tangible Common Equity $ 254,533 $ 245,408 $ 204,297 $ 196,998 $ 190,083 $ 254,533 $ 190,083 Common shares outstanding 11,980,412 11,978,921 10,278,921 10,274,271 10,270,146 11,980,412 10,270,146 Book value per common share 21.66 20.91 20.37 19.67 19.01 21.66 19.01 Tangible book value per common share 21.25 20.49 19.88 19.17 18.51 21.25 18.51 Tangible assets: Total assets $ 2,306,586 $ 2,255,389 $ 2,221,245 $ 2,190,391 $ 2,098,712 $ 2,306,586 $ 2,098,712 Less: goodwill and intangibles (6,262) (6,186) (6,190) (6,199) (6,386) (6,262) (6,386) Adjusted for: Mortgage servicing rights 1,266 1,156 1,122 1,093 1,237 1,266 1,237 Tangible assets $ 2,301,590 $ 2,250,359 $ 2,216,177 $ 2,185,285 $ 2,093,563 $ 2,301,590 $ 2,093,563 Tangible common equity to tangible assets 11.06% 10.91% 9.22% 9.01% 9.08% 11.06% 9.08% ROATCE / Adjusted ROATCE (unaudited) As of and for the Three Months Ended As of and for the Year Ended December 31, September 30, June 30, March 31, December 31, December 31, December 31, (dollars in thousands) 2025 2025 2025 2025 2024 2025 2024 Net income $ 7,136 $ 6,741 $ 5,965 $ 5,050 $ 5,704 $ 24,892 $ 21,904 Average shareholders' equity 256,814 246,688 205,837 199,763 194,724 227,485 180,628 Return on average shareholders' equity (1) 11.02% 10.84% 11.62% 10.25% 11.65% 10.94% 12.13% Average Tangible Common Equity: Average shareholders' equity $ 256,814 $ 246,688 $ 205,837 $ 199,763 $ 194,724 $ 227,485 $ 180,628 Less: Average goodwill and intangibles (6,166) (6,176) (6,168) (6,328) (6,432) (6,209) (6,372) Adjusted for: Average mortgage servicing rights 1,155 1,128 1,082 1,198 1,263 1,141 1,133 Average tangible common equity $ 251,803 $ 241,640 $ 200,751 $ 194,633 $ 189,555 $ 222,417 $ 175,389 Return on average tangible common (1) shareholders' equity 11.24% 11.07% 11.92% 10.52% 11.97% 11.19% 12.49%

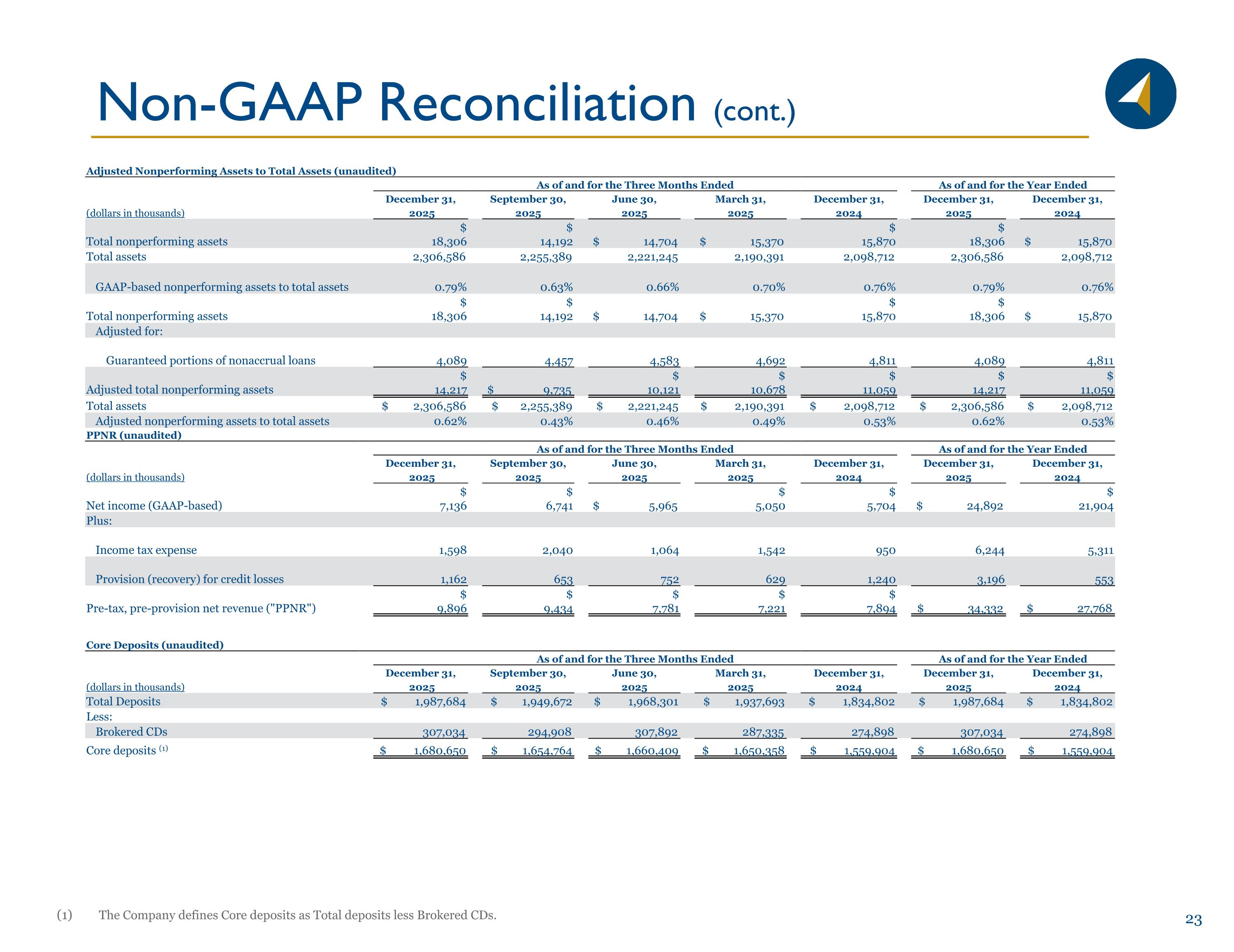

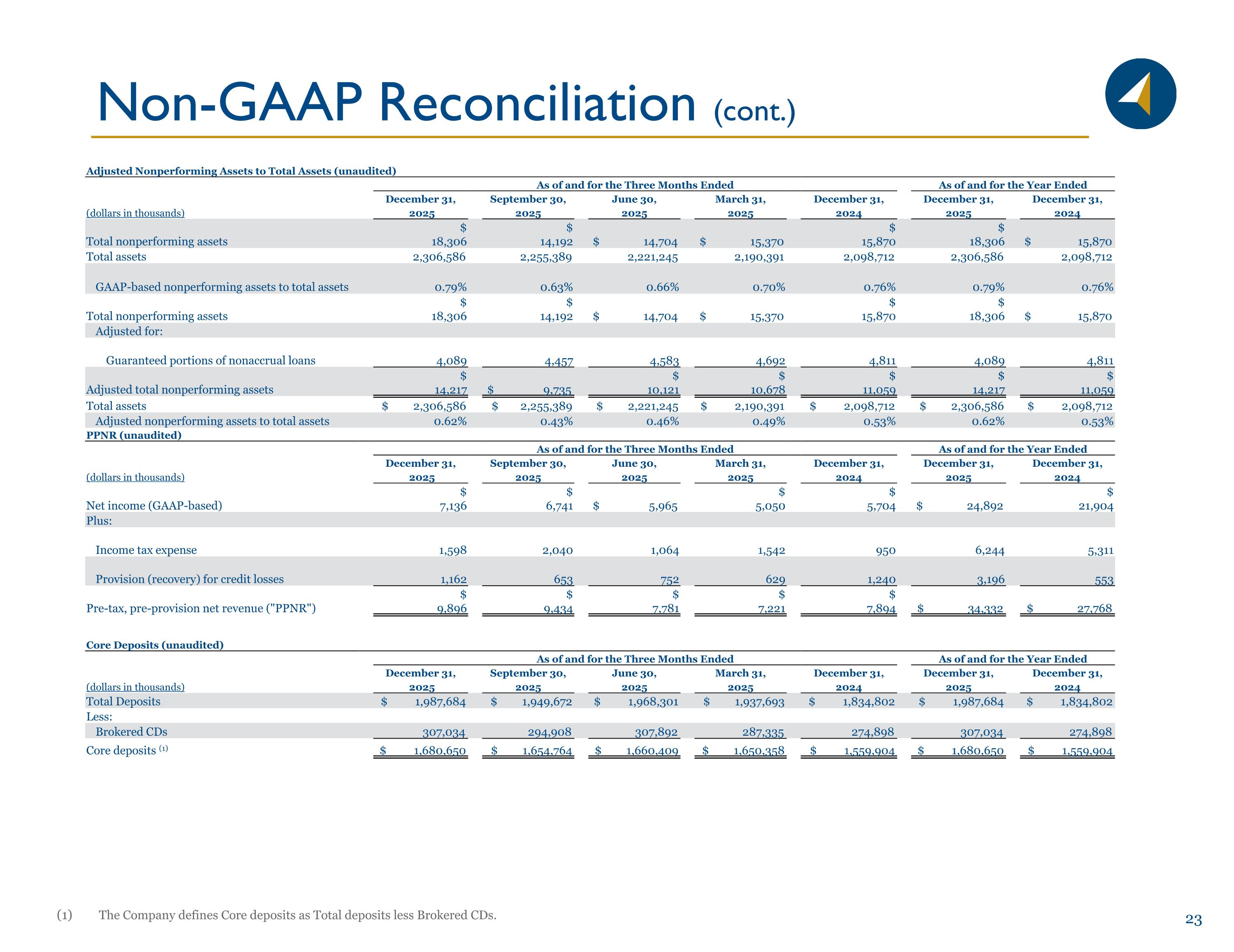

Non-GAAP Reconciliation (cont.) The Company defines Core deposits as Total deposits less Brokered CDs. Adjusted Nonperforming Assets to Total Assets (unaudited) As of and for the Three Months Ended As of and for the Year Ended December 31, September 30, June 30, March 31, December 31, December 31, December 31, (dollars in thousands) 2025 2025 2025 2025 2024 2025 2024 Total nonperforming assets $ 18,306 $ 14,192 $ 14,704 $ 15,370 $ 15,870 $ 18,306 $ 15,870 Total assets 2,306,586 2,255,389 2,221,245 2,190,391 2,098,712 2,306,586 2,098,712 GAAP-based nonperforming assets to total assets 0.79% 0.63% 0.66% 0.70% 0.76% 0.79% 0.76% Total nonperforming assets $ 18,306 $ 14,192 $ 14,704 $ 15,370 $ 15,870 $ 18,306 $ 15,870 Adjusted for: Guaranteed portions of nonaccrual loans 4,089 4,457 4,583 4,692 4,811 4,089 4,811 Adjusted total nonperforming assets $ 14,217 $ 9,735 $ 10,121 $ 10,678 $ 11,059 $ 14,217 $ 11,059 Total assets $ 2,306,586 $ 2,255,389 $ 2,221,245 $ 2,190,391 $ 2,098,712 $ 2,306,586 $ 2,098,712 Adjusted nonperforming assets to total assets 0.62% 0.43% 0.46% 0.49% 0.53% 0.62% 0.53% PPNR (unaudited) As of and for the Three Months Ended As of and for the Year Ended December 31, September 30, June 30, March 31, December 31, December 31, December 31, (dollars in thousands) 2025 2025 2025 2025 2024 2025 2024 Net income (GAAP-based) $ 7,136 $ 6,741 $ 5,965 $ 5,050 $ 5,704 $ 24,892 $ 21,904 Plus: Income tax expense 1,598 2,040 1,064 1,542 950 6,244 5,311 Provision (recovery) for credit losses 1,162 653 752 629 1,240 3,196 553 Pre-tax, pre-provision net revenue ("PPNR") $ 9,896 $ 9,434 $ 7,781 $ 7,221 $ 7,894 $ 34,332 $ 27,768 Core Deposits (unaudited) As of and for the Three Months Ended As of and for the Year Ended December 31, September 30, June 30, March 31, December 31, December 31, December 31, (dollars in thousands) 2025 2025 2025 2025 2024 2025 2024 Total Deposits $ 1,987,684 $ 1,949,672 $ 1,968,301 $ 1,937,693 $ 1,834,802 $ 1,987,684 $ 1,834,802 Less: Brokered CDs 307,034 294,908 307,892 287,335 274,898 307,034 274,898 Core deposits (1) $ 1,680,650 $ 1,654,764 $ 1,660,409 $ 1,650,358 $ 1,559,904 $ 1,680,650 $ 1,559,904