UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 14, 2026

EMERGENT BIOSOLUTIONS INC.

(Exact name of registrant as specified in its charter)

| Delaware | 001-33137 | 14-1902018 | ||

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) | (I.R.S. Employer Identification No.) |

300 Professional Drive,

Gaithersburg, Maryland 20879

(Address of principal executive offices, including zip code)

(240) 631-3200

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d- 2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e- 4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

||

| Common stock, $0.001 par value per share | EBS | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company. ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01. | Regulation FD Disclosure. |

As previously announced, on January 14, 2026, Joseph C. Papa, president and chief executive officer of Emergent BioSolutions Inc., will present at the 44th Annual J.P. Morgan Healthcare Conference. Mr. Papa will present the slides furnished as Exhibit 99.1 to this Current Report on Form 8-K, which are incorporated herein by reference.

The information contained in this Item 7.01, including Exhibit 99.1, is being “furnished” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that Section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”). The information contained in this Item 7.01, including Exhibit 99.1, shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act or into any filing or other document pursuant to the Exchange Act, except as otherwise expressly stated in any such filing.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits:

| Exhibit |

Description |

|

| 99.1 | Emergent BioSolutions Inc. Investor Presentation, dated January 14, 2026 | |

| 104 | Cover Page Interactive Date File (embedded within the Inline XBRL document) | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: January 14, 2026

| EMERGENT BIOSOLUTIONS INC. | ||

| By: | /s/ RICHARD S. LINDAHL |

|

| Name: | Richard S. Lindahl | |

| Title: | Executive Vice President, Chief Financial Officer | |

Exhibit 99.1 Combating Public Health Threats for Communities Around the World th 44 Annual J.P. Morgan Healthcare Conference Joe Papa President and Chief Executive Officer January 14, 2026 1 1

Safe Harbor Statement/Trademarks This presentation includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. All statements, other than statements of historical fact, including statements regarding the future performance of the Company or any of our businesses, our business strategy, future operations, future investments and business development opportunities, future financial position, future revenues and earnings, future leverage ratios, our ability to achieve the objectives of our restructuring initiatives and divestitures, including our future results, projected costs, prospects, plans and objectives of management, are forward-looking statements. We generally identify forward-looking statements by using words like “anticipate,” “believe,” “can” “continue,” “could,” “estimate,” “expect,” “confident,” “commit,” “forecast,” “future,” “outlook,” “goal,” “intend,” “may,” “plan,” “position,” “possible,” “potential,” “predict,” “project,” “should,” “target,” “will,” “would,” and similar expressions or variations thereof, or the negative thereof, but these terms are not the exclusive means of identifying such statements. These forward-looking statements are based on our current intentions, beliefs, assumptions and expectations regarding future events based on information that is currently available. You should realize that if underlying assumptions prove inaccurate or unknown risks or uncertainties materialize, actual results could differ materially from our expectations. Readers are, therefore, cautioned not to place undue reliance on any forward-looking statement contained herein. Any such forward-looking statement speaks only as of the date of this presentation, and, except as required by law, we do not undertake any obligation to update any forward-looking statement to reflect new information, events or circumstances. There are a number of important factors that could cause our actual results to differ materially from those indicated by such forward-looking statements, including, among others, the availability of USG funding for contracts related to procurement of our medical countermeasure (“MCM”) products, including CYFENDUS® (Anthrax Vaccine Adsorbed, Adjuvanted), previously known as AV7909, and ACAM2000® (Smallpox (Vaccinia) Vaccine, Live), CNJ-016® (Vaccinia Immune Globulin Intravenous (Human) (VIGIV)), BAT® (Botulism Antitoxin Heptavalent (A,B,C,D,E,F,G)-(Equine)), BioThrax® (Anthrax TM Vaccine Adsorbed) Ebanga (ansuvimab-zykl) and/or TEMBEXA® among others, as well as contracts related to development of medical countermeasures; our ability to meet our commitments to quality and compliance in all of our manufacturing operations; our ability to negotiate additional USG procurement or follow-on contracts for our MCM products that have expired or will be expiring; the commercial availability and impact of a generic and competitive marketplace on future sales of NARCAN® (naloxone HCl) Nasal Spray and over-the-counter NARCAN® Nasal Spray; our ability to perform under our contracts with the USG, including the timing of and specifications relating to deliveries; the ability of our contractors and suppliers to maintain compliance with current good manufacturing practices and other regulatory obligations; our ability to negotiate new or further commitments related to the collaboration and deployment of capacity toward future commercial manufacturing related to our Bioservices and under existing Bioservices contracts; our ability to collect reimbursement for raw materials and payment of service fees from our Bioservices customers; the results of pending government investigations and their potential impact on our business; our ability to satisfy the conditions of our litigation settlement agreements, and the potential impact of such agreements, including the funds to resolve the related litigation, on our business; our ability to comply with the operating and financial covenants required by (i) our term loan facility under a credit agreement, dated August 30, 2024, among the Company, the lenders from time to time party thereto and OHA Agency LLC, as administrative agent, (ii) our revolving credit facility under a credit agreement, dated September 30, 2024, among the Company, certain subsidiary borrowers, the lenders from time to time party thereto and Wells Fargo, National Association, as Agent, and (iii) our 3.875% Senior Unsecured Notes due 2028; our ability to maintain adequate internal control over financial reporting and to prepare accurate financial statements in a timely manner; our ability to maintain sufficient cash flow from our operations to pay our substantial debt, both now and in the future; our ability to invest in our business operations as a result of our current indebtedness; the impact of our share and debt repurchase programs; the procurement of our product candidates by USG entities under regulatory authorities that permit government procurement of certain medical products prior to United States Food and Drug Administration marketing authorization, and corresponding procurement by government entities outside the United States; [our ability to realize the expected benefits of the sale of our travel health business to Bavarian Nordic, the sale of our Drug Product facility in Baltimore-Camden to Bora Pharmaceuticals Injectables Inc., a subsidiary of Bora Pharmaceuticals Co., Ltd., the sale of RSDL® to BTG International Inc., a subsidiary of SERB Pharmaceuticals and the sale of our Baltimore-Bayview drug substance manufacturing facility to Syngene International, and any other divestitures or restructuring activities;] the success of our commercialization, marketing and manufacturing capabilities and strategy; our ability to identify and acquire companies, businesses, products or product candidates that satisfy our selection criteria; our ability to attract and retain qualified personnel; our ability to adequately secure and protect our intellectual property rights; the impact of cybersecurity incidents, including the risks from the 2 unauthorized access, interruption, failure or compromise of our information systems or those of our business partners, collaborators or other third parties; and the accuracy of our estimates regarding future revenues, expenses, capital requirements and need for additional financing. The foregoing sets forth many, but not all, of the factors that could cause actual results to differ materially from our expectations in any forward-looking statement. In addition, other risks and uncertainties not presently known to us or that we currently believe to be immaterial could affect the accuracy of any forward looking statements. Readers should consider this cautionary statement, as well as the risks identified in our periodic reports filed with the Securities and Exchange Commission, when evaluating our forward-looking statements. 2

Company Overview 3

We Help Prepare for Today’s Health Challenges and Tomorrow’s Threats* Our mission is to protect and save lives. $775 - $835M 11 11 2025 Revenue Guidance Products Biodefense/MCM Contract Mods & Product Orders YTD Global Strategic Partner 900+ Naloxone Market to governments, NGOs and Leadership Employees biopharma innovators *Previously reported Company data, as of 10/29/25 4

Experienced and Trusted Management Team Experienced and Trusted Management Team Coleen Glessner Simon Lowry, M.D. Richard Lindahl Joseph Papa EVP, Quality, Ethics EVP, Chief Financial Officer Chief Medical Officer, Head of President and CEO and Compliance Research and Development Paul Williams Jessica Perl Stephanie Duatschek Michelle Pepin Bill Hartzel SVP, General Counsel and SVP, Products Business SVP, Chief Global Strategy & SVP, Chief Human SVP, Manufacturing & Gov’t Affairs Corporate Secretary Franchise Development Officer Resources Officer and Bioservices 5

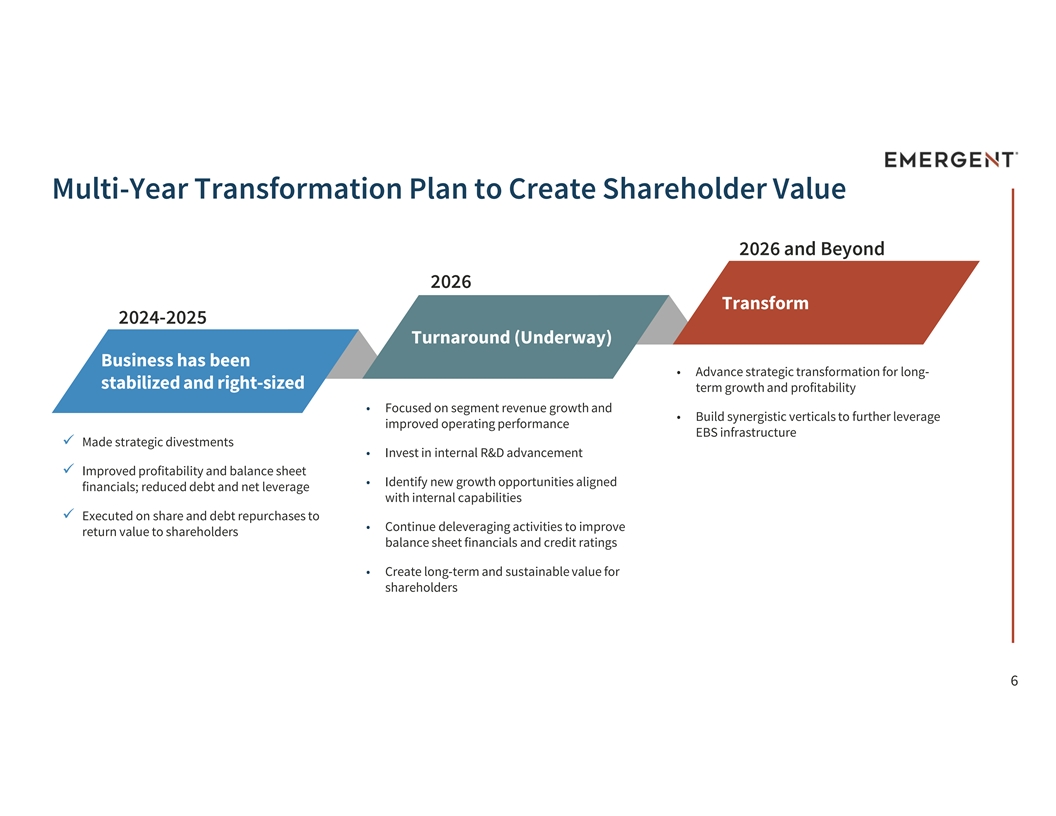

Multi-Year Transformation Plan to Create Shareholder Value 2026 and Beyond 2026 Transform 2024-2025 Turnaround (Underway) Business has been • Advance strategic transformation for long- stabilized and right-sized term growth and profitability • Focused on segment revenue growth and • Build synergistic verticals to further leverage improved operating performance EBS infrastructure ü Made strategic divestments • Invest in internal R&D advancement ü Improved profitability and balance sheet • Identify new growth opportunities aligned financials; reduced debt and net leverage with internal capabilities ü Executed on share and debt repurchases to • Continue deleveraging activities to improve return value to shareholders balance sheet financials and credit ratings • Create long-term and sustainable value for shareholders 6 6

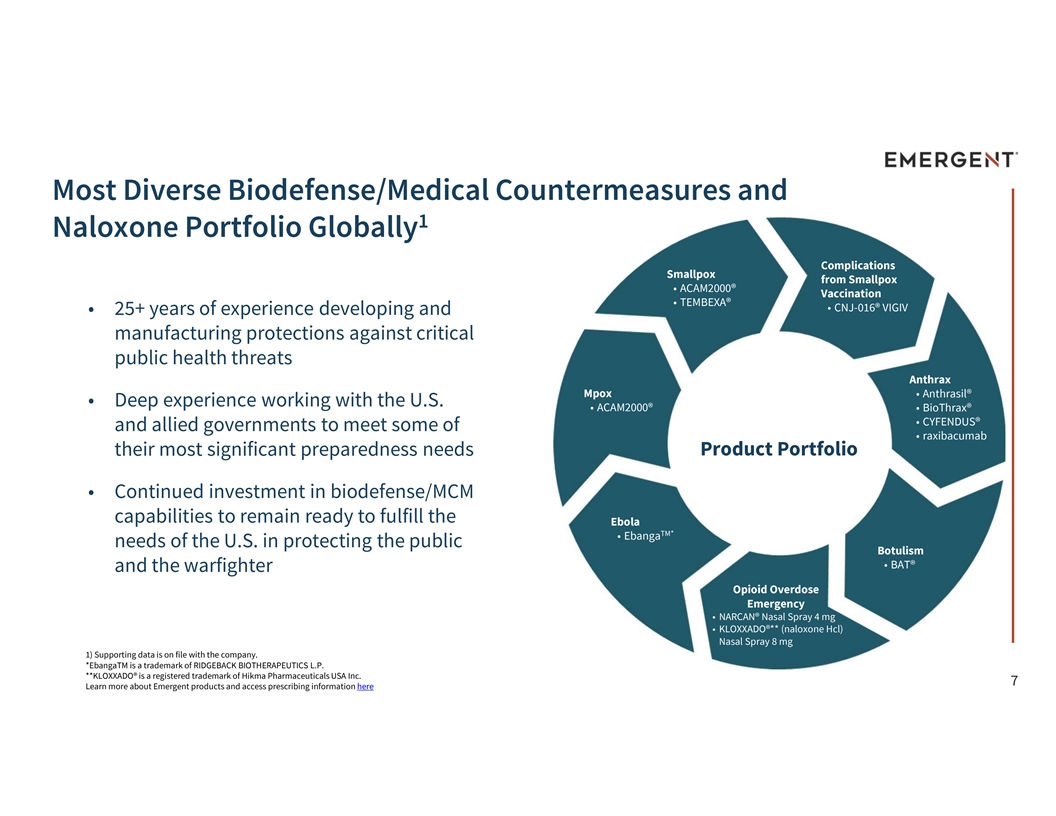

Most Diverse Biodefense/Medical Countermeasures and 1 Naloxone Portfolio Globally Complications Smallpox from Smallpox • ACAM2000® Vaccination • TEMBEXA® • CNJ-016® VIGIV • 25+ years of experience developing and manufacturing protections against critical public health threats Anthrax Mpox • Anthrasil® • Deep experience working with the U.S. • ACAM2000® • BioThrax® • CYFENDUS® and allied governments to meet some of • raxibacumab their most significant preparedness needs Product Portfolio • Continued investment in biodefense/MCM capabilities to remain ready to fulfill the Ebola TM* • Ebanga needs of the U.S. in protecting the public Botulism • BAT® and the warfighter Opioid Overdose Emergency • NARCAN® Nasal Spray 4 mg • KLOXXADO®** (naloxone Hcl) Nasal Spray 8 mg 1) Supporting data is on file with the company. *EbangaTM is a trademark of RIDGEBACK BIOTHERAPEUTICS L.P. **KLOXXADO® is a registered trademark of Hikma Pharmaceuticals USA Inc. 7 Learn more about Emergent products and access prescribing information here

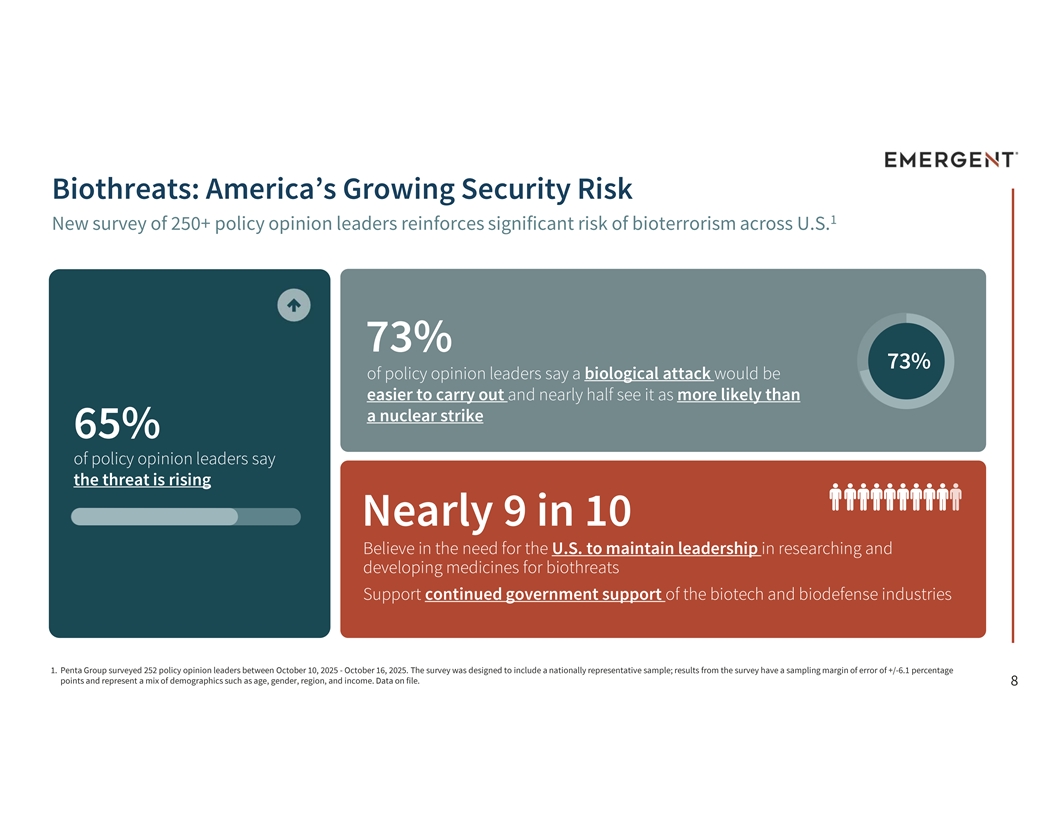

Biothreats: America’s Growing Security Risk 1 New survey of 250+ policy opinion leaders reinforces significant risk of bioterrorism across U.S. 73% 73% of policy opinion leaders say a biological attack would be easier to carry out and nearly half see it as more likely than a nuclear strike 65% of policy opinion leaders say the threat is rising Nearly 9 in 10 Believe in the need for the U.S. to maintain leadership in researching and developing medicines for biothreats Support continued government support of the biotech and biodefense industries 1. Penta Group surveyed 252 policy opinion leaders between October 10, 2025 - October 16, 2025. The survey was designed to include a nationally representative sample; results from the survey have a sampling margin of error of +/-6.1 percentage points and represent a mix of demographics such as age, gender, region, and income. Data on file. 8

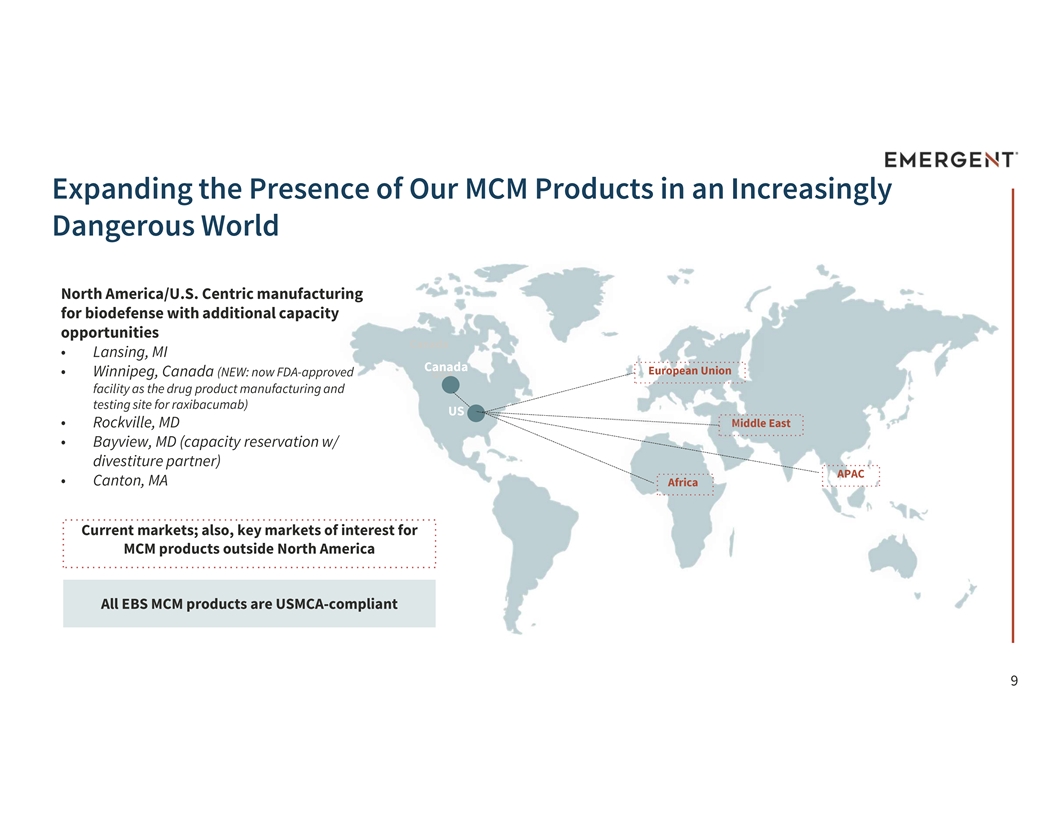

Expanding the Presence of Our MCM Products in an Increasingly Dangerous World North America/U.S. Centric manufacturing for biodefense with additional capacity opportunities Canada • Lansing, MI Canada European Union • Winnipeg, Canada (NEW: now FDA-approved USA facility as the drug product manufacturing and testing site for raxibacumab) US Middle East • Rockville, MD • Bayview, MD (capacity reservation w/ divestiture partner) APAC • Canton, MA Africa Current markets; also, key markets of interest for MCM products outside North America All EBS MCM products are USMCA-compliant 9

MCM Business: Supporting U.S. and International Governments' Biodefense Readiness and Supply Resilience Consistent and ongoing engagement with U.S. and international governments Global Strategic Partner to governments, NGOs and biopharma innovators International orders represent 34% of total MCM revenues in the first nine months ending Sept 30, 2025* 11 U.S. Biodefense/MCM Contract Modifications & Product Orders* No disruptions during USG shut down *Previously reported Company data, as of 10/29/25 10

Heightened Efforts to Combat the Opioid Overdose Epidemic President Trump signed an Executive Order (Dec. 2025) designating illicit fentanyl and its core precursor chemicals as Weapons of Mass Destruction. CDC prelim data predicts 76,516 drug overdose deaths -24.5% (8 in 10 are caused by an opioid) for the 12 months ending in April 2025.This is a 24.5% decline in U.S. 1 overdose deaths compared to the previous year. PHAC data shows Canadian opioid deaths -22% A naloxone vending machine at at lowest observed level since 2020 and 2 UM Health-West Community down 22% YoY. Clinic, pictured Aug. 12, 2025. 1. https://www.cdc.gov/nchs/nvss/vsrr/drug-overdose-data.htm 11 2. https://health-infobase.canada.ca/substance-related-harms/opioids-stimulants/

Naloxone Business: Leading With Purpose to Help Save Lives NEW: FDA approves OTC NARCAN® Nasal Spray to be packaged in new carrying case–a unique option/solution to increase accessibility–COMING SOON! • While many factors are driving the reduction in opioid overdose deaths since 2023-2024, third-party sources have associated the timing and introduction of OTC NARCAN® Nasal 1 Spray with this decline • Market-leading offerings, e.g. NARCANDirect®, continue to command differentiated capabilities; platform now features KLOXXADO® Nasal Spray 8 mg, Wall Units and Convenience Kits • Continuing to invest in solutions to drive access, as well awareness initiatives • Continued partnership with National Safety Council (NSC); received the NSC Green Cross Advocate for Safety Award, alongside Amazon • Received Corporate Hero Award from Victoria’s Voice Foundation • $50+B in total reported opioid settlement dollars; ongoing support from Federal and State support programs 1. Washington Post, Opinion | Purdue Pharma’s $7.4 billion settlement should go toward Narcan 12

Multiple Growth Opportunities Ahead We plan to Strong cash & invest to enable liquidity position sustainable, long-term enables additional growth. internal programs Expanding U.S. and external & international Exploring potential for business MCM orders and government-funded development opportunities In 2025, Obtained R&D development opportunities (ongoing) KLOXXADO® Nasal programs. (ongoing) Spray U.S. and Canada exclusive In 2025, completed Selectively evaluating commercial rights; Rocketvax strategically suitable additional line investment & external programs. extensions for pursuit of strategic naloxone business relationship 13

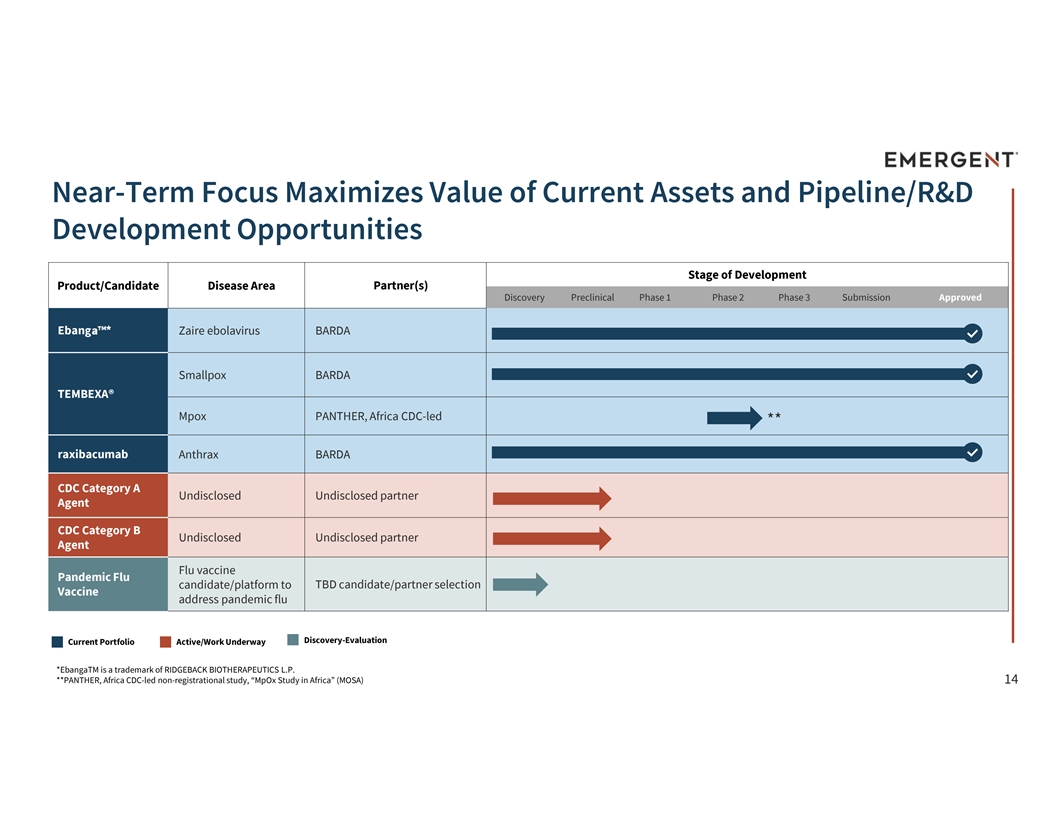

Near-Term Focus Maximizes Value of Current Assets and Pipeline/R&D Development Opportunities Stage of Development Product/Candidate Disease Area Partner(s) Discovery Preclinical Phase 1 Phase 2 Phase 3 Submission Approved Ebanga * Zaire ebolavirus BARDA Smallpox BARDA TEMBEXA® Mpox PANTHER, Africa CDC-led ** raxibacumab Anthrax BARDA CDC Category A Undisclosed Undisclosed partner Agent CDC Category B Undisclosed Undisclosed partner Agent Flu vaccine Pandemic Flu TBD candidate/partner selection candidate/platform to Vaccine address pandemic flu Discovery-Evaluation Current Portfolio Active/Work Underway *EbangaTM is a trademark of RIDGEBACK BIOTHERAPEUTICS L.P. **PANTHER, Africa CDC-led non-registrational study, “MpOx Study in Africa” (MOSA) 14

Financials 15

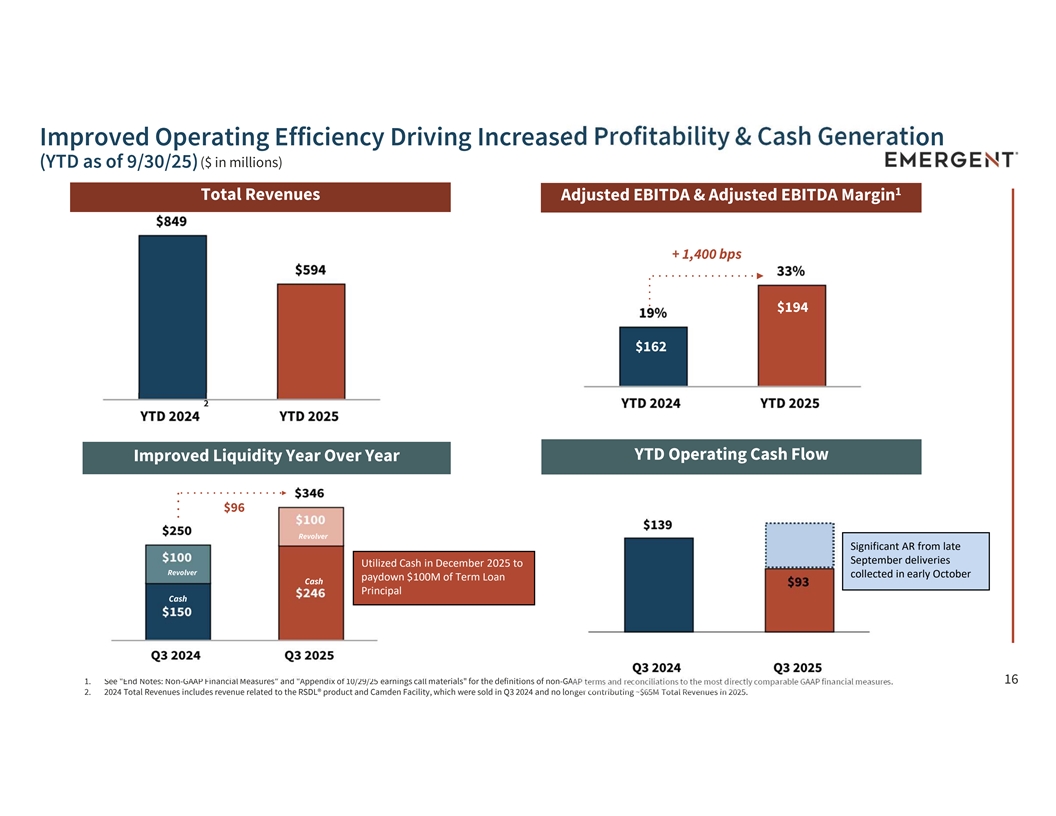

Improved Operating Efficiency Driving Increased Profitability & Cash Generation (YTD as of 9/30/25) ($ in millions) 1 Total Revenues Adjusted EBITDA & Adjusted EBITDA Margin + 1,400 bps $194 $162 2 YTD Operating Cash Flow Improved Liquidity Year Over Year $96 Revolver Significant AR from late September deliveries Utilized Cash in December 2025 to Revolver collected in early October paydown $100M of Term Loan Cash Principal Cash 1. See End Notes: Non-GAAP Financial Measures and Appendix of 10/29/25 earnings call materials for the definitions of non-GAAP terms and reconciliations to the most directly comparable GAAP financial measures. 16 2. 2024 Total Revenues includes revenue related to the RSDL® product and Camden Facility, which were sold in Q3 2024 and no longer contributing ~$65M Total Revenues in 2025.

$100M Term Loan Paydown on December 29, 2025 Gross Debt of $593M, ($275M) or (32%) versus year end 2023 Net Debt of $448M ($309M) or (41%) versus year end 2023 ($100M) Term Loan Paydown ü Used existing Balance Sheet Cash on December 2025 th December 29 to paydown $100M of Term Loan Principal Versus 2023 YE Gross Debt: ($275M), (32%) Net Det: ($309M), (41%) ü Net Leverage remains at 2.1x, down significantly from prior periods ü Maintaining strong cash position for future capital allocation initiatives 1 Targeting a Net Leverage Ratio of 2.0x – 3.0x Adjusted EBITDA going forward 17 1. Excludes potential acquisitions and represents current core business structure

Capital Allocation Priorities During 2026 Turnaround Period (YTD as of 9/30/25) Growth Investments Share Repurchase Debt Repayment $100M Term Loan Paydown December 2025 12 Month $50M Share International MCM growth 1 Net Debt $448M, a 19% reduction vs. Q3 Repurchase Program ending 2024 March 2026 Internal R&D Investments 1 Net Leverage 2.1x 2.3M Shares repurchased for Additional business development $15.8M through Q3 Initiated $30M Bond Repurchase opportunities Program starting August 2025 Repurchased $6.9M of EBS' Unsecured Bonds for $5.8M through Q3 18 1. See End Notes: Non-GAAP Financial Measures and Appendix of 10/29/25 earnings call materials for the definitions of non-GAAP terms and reconciliations to the most directly comparable GAAP financial measures.

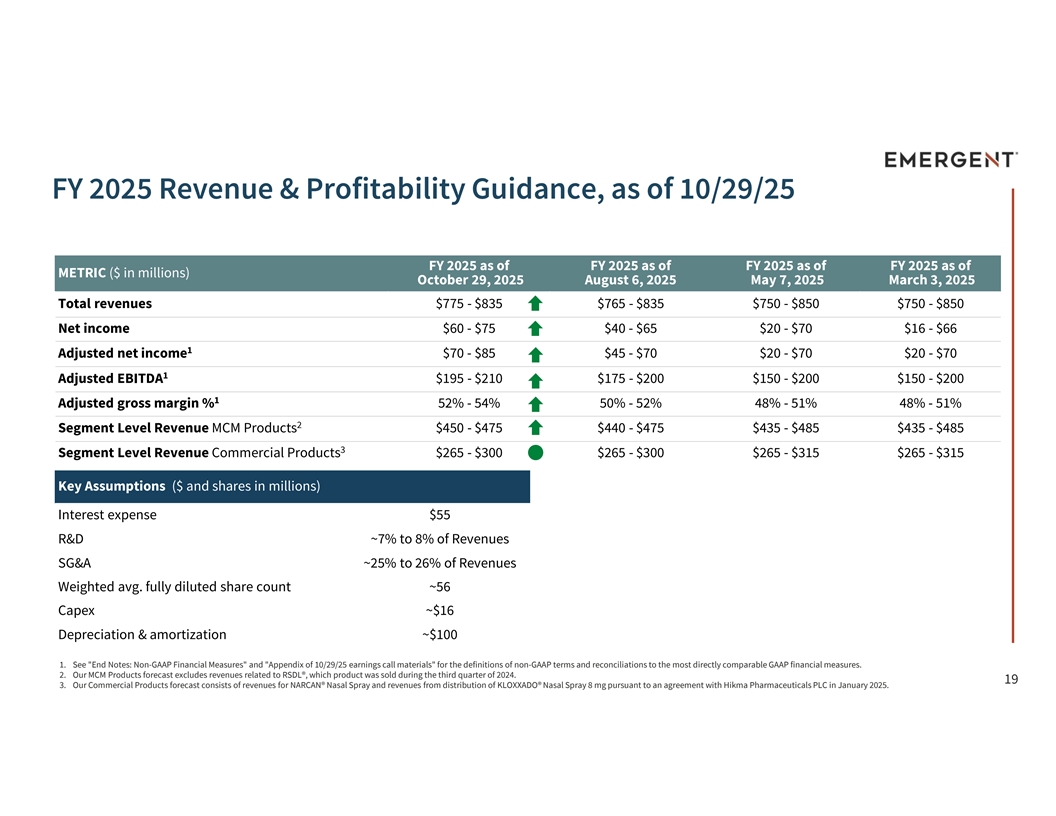

FY 2025 Revenue & Profitability Guidance, as of 10/29/25 FY 2025 as of FY 2025 as of FY 2025 as of FY 2025 as of METRIC ($ in millions) October 29, 2025 August 6, 2025 May 7, 2025 March 3, 2025 Total revenues $775 - $835 $765 - $835 $750 - $850 $750 - $850 Net income $60 - $75 $40 - $65 $20 - $70 $16 - $66 1 Adjusted net income $70 - $85 $45 - $70 $20 - $70 $20 - $70 1 Adjusted EBITDA $195 - $210 $175 - $200 $150 - $200 $150 - $200 1 Adjusted gross margin % 52% - 54% 50% - 52% 48% - 51% 48% - 51% 2 Segment Level Revenue MCM Products $450 - $475 $440 - $475 $435 - $485 $435 - $485 3 Segment Level Revenue Commercial Products $265 - $300 $265 - $300 $265 - $315 $265 - $315 Key Assumptions ($ and shares in millions) Interest expense $55 R&D ~7% to 8% of Revenues SG&A ~25% to 26% of Revenues Weighted avg. fully diluted share count ~56 Capex ~$16 Depreciation & amortization ~$100 1. See End Notes: Non-GAAP Financial Measures and Appendix of 10/29/25 earnings call materials for the definitions of non-GAAP terms and reconciliations to the most directly comparable GAAP financial measures. 2. Our MCM Products forecast excludes revenues related to RSDL®, which product was sold during the third quarter of 2024. 19 3. Our Commercial Products forecast consists of revenues for NARCAN® Nasal Spray and revenues from distribution of KLOXXADO® Nasal Spray 8 mg pursuant to an agreement with Hikma Pharmaceuticals PLC in January 2025.

Summary • On track with turnaround phase of multi-year plan • Reduced debt by $100M in December 2025 with continued focus on capital allocation strategies to drive value for stakeholders • Increased gross margin & profit follow through from 2024, generated through restructuring actions and improved utilization across manufacturing network • Executing on key turnaround actions to drive our business forward o Strong performance for naloxone business; launched new solutions Continue to meet U.S. government expectations for MCM o preparedness efforts; ongoing international engagement • Pursuing organic and inorganic growth initiatives and creating shareholder value • Ongoing commitment to the highest standards of patient safety, quality and compliance a cross the enterprise 2 20 0

www.emergentbiosolutions.com 21