Worthington Steel Investor Presentation | December 2025 Exhibit 99.3

Safe Harbor Statement Selected statements contained in this release constitute “forward-looking statements,” as that term is used in the Private Securities Litigation Reform Act of 1995 (the “Act”). The Company wishes to take advantage of the safe harbor provisions included in the Act. Forward-looking statements reflect the Company’s current expectations, estimates or projections concerning future results or events. These statements are often identified by the use of forward-looking words or phrases such as “believe,” “anticipate,” “may,” “could,” “should,” “would,” “intend,” “plan,” “will,” “likely,” “expect,” “estimate,” “project,” “position,” “strategy,” “target,” “aim,” “seek,” “foresee” and similar words or phrases. These forward-looking statements include, without limitation, statements relating to: future or expected cash positions, liquidity and ability to access financial markets and capital; outlook, strategy or business plans; the anticipated benefits of the Company’s separation from Worthington Enterprises, Inc. (the “Separation”); the expected financial and operational performance of, and future opportunities for, the Company following the Separation; the tax treatment of the Separation transaction; the leadership of the Company following the Separation; future or expected growth, growth potential, forward momentum, performance, competitive position, sales, volumes, cash flows, earnings, margins, balance sheet strengths, debt, financial condition or other financial measures; pricing trends for raw materials and finished goods and the impact of pricing changes; the ability to improve or maintain margins; expected demand or demand trends for the Company or its markets; additions to product lines and opportunities to participate in new markets; expected benefits from transformation and innovation efforts; the ability to improve performance and competitive position at the Company’s operations; anticipated working capital needs, capital expenditures and asset sales; anticipated improvements and efficiencies in costs, operations, sales, inventory management, sourcing and the supply chain and the results thereof; projected profitability potential; the ability to make acquisitions and the projected timing, results, benefits, costs, charges and expenditures related to acquisitions, joint ventures, headcount reductions and facility dispositions, shutdowns and consolidations; projected capacity and the alignment of operations with demand; the ability to operate profitably and generate cash in down markets; the ability to capture and maintain market share and to develop or take advantage of future opportunities, customer initiatives, new businesses, new products and new markets; expectations for Company and customer inventories, jobs and orders; expectations for the economy and markets or improvements therein; expectations for generating improving and sustainable earnings, earnings potential, margins or shareholder value; effects of judicial rulings; the ever-changing effects of the novel coronavirus (“COVID-19”) pandemic and the various responses of governmental and nongovernmental authorities thereto on economies and markets, and on our customers, counterparties, employees and third-party service providers; and other non-historical matters. Because they are based on beliefs, estimates and assumptions, forward-looking statements are inherently subject to risks and uncertainties that could cause actual results to differ materially from those projected. Any number of factors could affect actual results, including, without limitation, those that follow: our ability to successfully realize the anticipated benefits of the Separation; the effect of conditions in national and worldwide financial markets, including inflation, increases in interest rates and economic recession, and with respect to the ability of financial institutions to provide capital; the impact of tariffs, the adoption of trade restrictions affecting the Company’s products or suppliers, a United States withdrawal from or significant renegotiation of trade agreements, the occurrence of trade wars, the closing of border crossings, and other changes in trade regulations or relationships; changing oil prices and/or supply; product demand and pricing; changes in product mix, product substitution and market acceptance of the Company’s products; volatility or fluctuations in the pricing, quality or availability of raw materials (particularly steel), supplies, transportation, utilities, labor and other items required by operations (especially in light of Russia’s invasion of Ukraine); effects of sourcing and supply chain constraints; the outcome of adverse claims experience with respect to workers’ compensation, product recalls or product liability, casualty events or other matters; effects of facility closures and the consolidation of operations; the effect of financial difficulties, consolidation and other changes within the steel, automotive, construction and other industries in which the Company participates; failure to maintain appropriate levels of inventories; financial difficulties (including bankruptcy filings) of original equipment manufacturers, end-users and customers, suppliers, joint venture partners and others with whom the Company does business; the ability to realize targeted expense reductions from headcount reductions, facility closures and other cost reduction efforts; the ability to realize cost savings and operational, sales and sourcing improvements and efficiencies, and other expected benefits from transformation initiatives, on a timely basis; the overall success of, and the ability to integrate, newly acquired businesses and joint ventures, maintain and develop their customers, and achieve synergies and other expected benefits and cost savings therefrom; capacity levels and efficiencies, within facilities, within major product markets and within the industries in which the Company participates as a whole; the effect of disruption in the business of suppliers, customers, facilities and shipping operations due to adverse weather, casualty events, equipment breakdowns, labor shortages, interruption in utility services, civil unrest, international conflicts (especially in light of Russia’s invasion of Ukraine), terrorist activities or other causes; changes in customer demand, inventories, spending patterns, product choices, and supplier choices; risks associated with doing business internationally, including economic, political and social instability (especially in light of Russia’s invasion of Ukraine), foreign currency exchange rate exposure and the acceptance of the Company’s products in global markets; the ability to improve and maintain processes and business practices to keep pace with the economic, competitive and technological environment; the effect of inflation, interest rate increases and economic recession, as well as potential adverse impacts as a result of the Inflation Reduction Act of 2022, which may negatively impact the Company’s operations and financial results; deviation of actual results from estimates and/or assumptions used by the Company in the application of its significant accounting policies; the level of imports and import prices in the Company’s markets; the impact of environmental laws and regulations or the actions of the United States Environmental Protection Agency or similar regulators which increase costs or limit the Company’s ability to use or sell certain products; the impact of increasing environmental, greenhouse gas emission and sustainability regulations and considerations; the impact of judicial rulings and governmental regulations, both in the United States and abroad, including those adopted by the United States Securities and Exchange Commission (“SEC”) and other governmental agencies as contemplated by the Coronavirus Aid, Relief and Economic Security (CARES) Act, the Consolidated Appropriations Act, 2021, the American Rescue Plan Act of 2021, and the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010; the effect of healthcare laws in the United States and potential changes for such laws, which may increase the Company’s healthcare and other costs and negatively impact the Company’s operations and financial results; the effect of tax laws in the United States and potential changes for such laws, which may increase the Company's costs and negatively impact its operations and financial results; cyber security risks; the effects of privacy and information security laws and standards; and other risks described from time to time in the Company’s filings with the SEC, including those described in “Part I – Item 1A. – Risk Factors” of the Company’s Annual Report on Form 10-K for the fiscal year ended May 31, 2024 and its subsequent filings with the SEC. Forward-looking statements should be construed in the light of such risks. The Company notes these factors for investors as contemplated by the Act. It is impossible to predict or identify all potential risk factors. Consequently, you should not consider the foregoing list to be a complete set of all potential risks and uncertainties. Readers are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date made. The Company does not undertake, and hereby disclaims, any obligation to update any forward-looking statements, whether as a result of new information, future developments or otherwise, except as required by applicable law.

Investment Highlights 2. Long-standing customer relationships focused on value creation and best-in-class service delivery 1. Well-positioned to capitalize on opportunities from expected growth in electricity usage to support data center growth and vehicle electrification combined with the modernization and expansion of the electric grid 3. Strong balance sheet and ample liquidity to pursue attractive growth opportunities via strategic capital investments and/or value-enhancing acquisitions Experienced management team with a track record of delivering value and driving success through the Worthington Business System 4.

+ Building A Differentiated Steel Processing Company Worthington Steel founded in 1955 with a focus on providing custom processed steel First public stock offering in 1968 Established market leading joint ventures to bring additional value to our customers Steel Pickling Company Introduction of Worthington Business System Worthington Steel begins driving value as a standalone company Introduction of the Worthington Philosophy and Profit Sharing Rapid growth powered by innovation with unique culture focused on the “Golden Rule” Codified safety program Strategic acquisitions to expand Worthington’s core competencies and enter attractive end-markets BlankLight® Assets Strip Steel Assets 1955 1960s 1970s – 1980s 1992 1996 2007 2010s 2020s 2023 Automotive Components Nagold, Germany 1971 Worthington Steel changed its name to Worthington Industries to reflect new areas of business 2025

Value-added Metals Processing Company TTM Financial Metrics2 Volume Delivered (tons) 3.7M Direct / Toll (tons) 2.3M / 1.4M Net Sales $3.3B Adjusted EBITDA / Margin $252M / 7.7% Free Cash Flow $72.5M Capex / % of sales $128.2M / 3.9% Dividend (Annualized Rate) $0.64 1955 Founded Columbus, OH Headquarters 37 Locations1 ~6,000 Employees1 ~$1.7B4 Market Capitalization To be the preeminent leader in the markets we serve, boldly driving the metals industry toward a sustainable future as the most trusted, most innovative and most value-added metals processing partner in North America and beyond. OUR VISION 1 Includes JV people & locations; 2 TTM ended November 30, 2025; 3 Excludes pro-rata share of unconsolidated JVs; 4 As of November 30, 2025. Net Sales by End-Market2,3

We Occupy a Unique Position in the Steel Supply Chain Worthington Steel Operations Mills Service Centers Melt Hot Roll Coil (HRC) Hot Roll Conversion Pickling / scale removal Hot dip galvanizing Specialty Processing Specialty cold rolling, temper pass, annealing, heavy gauge and configured blanking Electrical steel lamination manufacturing Tailor welded solutions Dimensional Processing Slitting to Width Cutting to Length Warehouse/ Distribute Customized, Value-added Solutions ~90% of shipments run through at least two value-added processes Make-to-Order, Contract-Based End-to-End Supply Chain Management WHY WE WIN What Differentiates Worthington Steel from Competitors Across the Steel Supply Chain Customized value-added services

Building on Market Leadership Position Blue-Chip Customer Recognition and Accolades Note: Rankings based on management estimates. Global Manufacturer of Electrical Steel Laminations and Cores #3 #1 Producer of Tailor Welded Blanks in North America #1 Trader of Steel Futures by Volume Among North American Service Centers #1 Network of Independent Picklers in North America #1 Independent Producer of Hot Dipped Galvanized Steel in North America #2 Independent Flat Rolled Service Center in Mexico Supplier of the Year 2020, 2021, 2023 & 2024 2021 Schaeffler Supplier Excellence Award, 2025 Americas Region Supply Chain Award 2021-2024 Partner Level Supplier and inducted into 10-year Hall of Fame 2020 Raw Material Supplier of the Year 2022 Global Supplier Award in "Lead Electric Propulsion" Zero PPM Award for Manufacturing Excellence 2023 Supplier of the Year 2022, 2024 Tata AutoComp Systems 2024 Supplier Award for Synergy

Joint Ventures Wholly Owned Network and Services to Deliver Added Value to Customers 1 Includes Worthington Steel’s consolidated and unconsolidated joint ventures. 37 Manufacturing Facilities Primarily Located in North America1 Key Operations Strategically Located Proximate to Suppliers and Customers Expertise in Optimizing SupplyChains and Minimizing Total Landed Cost 90% of Sales in North America; 10% of Sales in Asia and Europe

Joint Ventures Expand Our Processing Capabilities and Reach Note: Volumes shown are total tons shipped from the fiscal year ended May 31, 2025, presented on a 100% basis. 1 Worthington Samuel Coil Processing. TWB (55%) Partner: BaoSteel Tailor welded products for the automotive industry Operates 11 facilities in US, Canada, Mexico Growth Initiative – Introduced new product (hot formed tailored blanks) 250k Direct Tons 125k Toll Tons Partner: Serviacero Pickling, heavy gauge blanking, and slitting Operates 3 steel processing facilities in Mexico Growth Initiative – Investing in new slitter in central Mexico facility (Queretaro, MX) Serviacero Worthington (50%) 400k Direct Tons 100k Toll Tons Partner: Cleveland-Cliffs A cold-rolled, hot-dipped coating line producing galvanized, galvannealed and aluminized products Single facility in Michigan Growth Initiative – Added Type 1 aluminized capability Spartan Steel Coating (52%) 425k Toll Tons Partner: Samuel, Son & Co. Pickling and slitting for the automotive, fabrication and appliance markets Operates 1 pickling facility in Ohio WSCP1 (63%) 450k Toll Tons

Sitem acquisition strengthens our electrical steel business globally A European Leader in Electrical Steel Laminations Established in 1974, headquartered in Trevi, Italy 700 employees in 6 facilities across Italy, Switzerland, France and Slovakia Acquired Capabilities and Synergy Opportunities Accelerates entry into European xEV traction motor market Access to advanced capabilities: Tooling, automation, adhesives and die-casting Additional potential synergies from enhanced commercial and supply chain cooperation Deal Snapshot Acquired 52% ownership through share purchase, capital injection, and contribution our Nagold, Germany, facility with immediate operational control Clear path to increased long-term ownership

Agriculture Combines Grain bins Center pivot irrigation Hay bailers Auger, chain, blades and plow components Construction Metal buildings Garage doors & rail systems Corrugated steel pipe Metal framing Strut and conduit Fencing Energy Transformer cores for power distribution Generators, including large scale & home power generation Racking and mounts for solar applications Truck / Trailer Wheel rims Frames Suspensions Trailer components Drivetrain Automotive Traction motors for BEVs/hybrids including trucks Automatic transmissions for hybrids / ICE Frames and chassis Seat rails Body structure Near term outlook for key markets served by Worthington Steel Note: BEVs = battery electric vehicles; Hybrids = full and mild hybrids and contain both traction motors and internal combustion engines; ICE = internal combustion engine vehicles. Note: Market trend data sources include: Agriculture (TBD); Construction - AIA, Dodge and Government Sources; Heavy Truck - S&P Platts, FTR, ACT Research; Agriculture - Purde-CME Ag Barometer, AEM, Ag Commodity Markets, Government Sources.

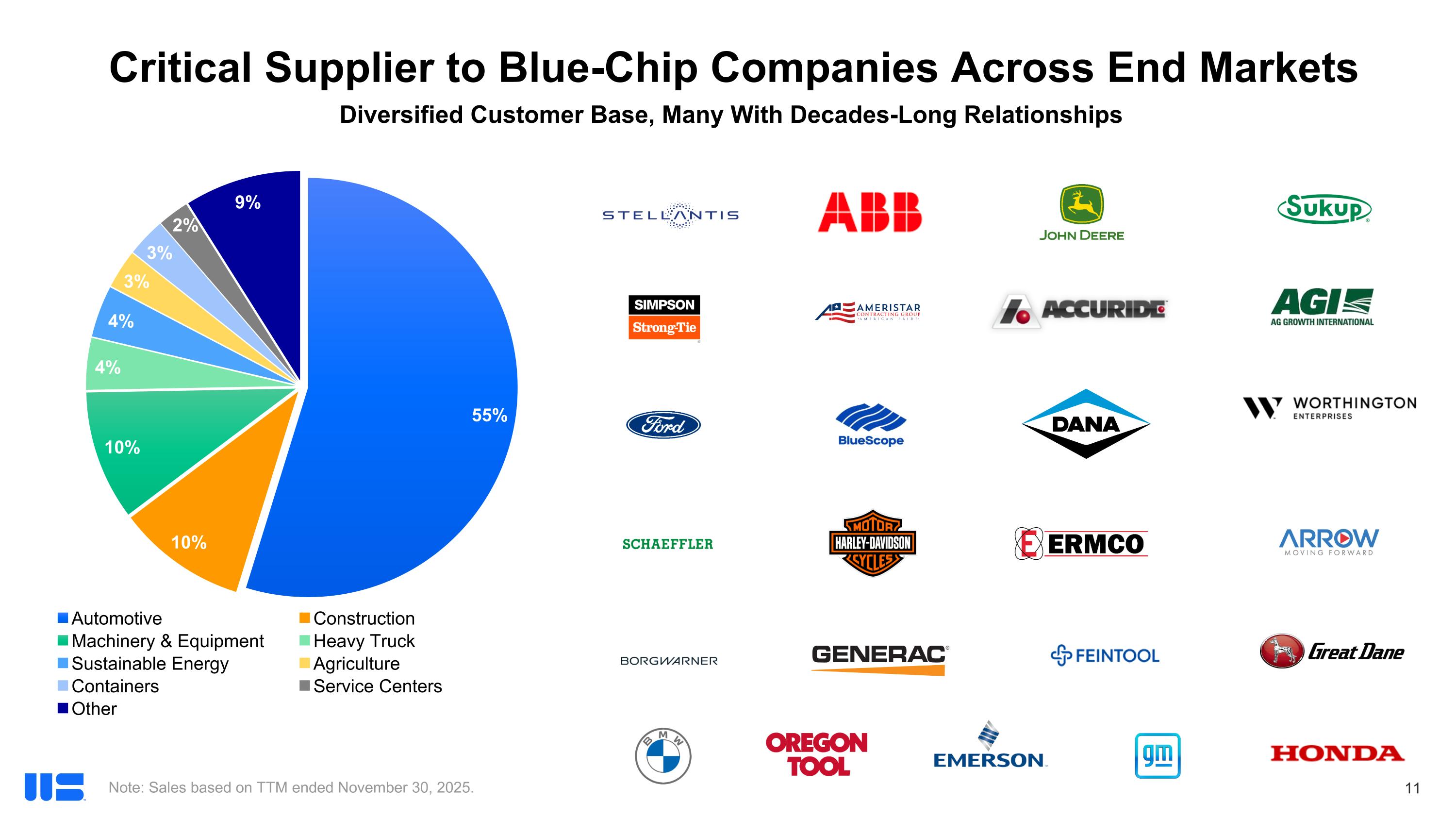

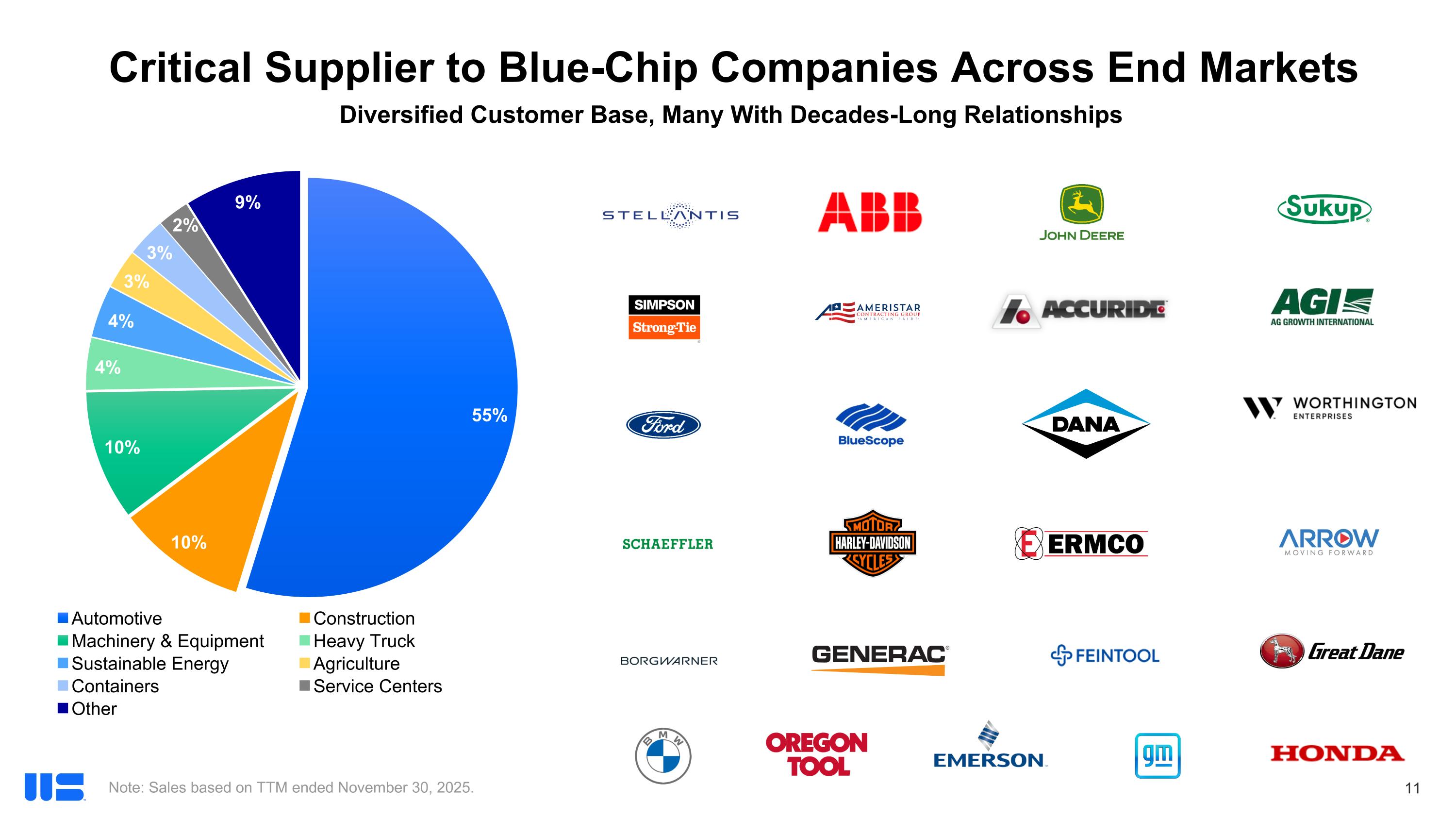

Diversified Customer Base, Many With Decades-Long Relationships Critical Supplier to Blue-Chip Companies Across End Markets Note: Sales based on TTM ended November 30, 2025.

Our Strategy and Operating Model

Proven Worthington Business System embedded in growth plans Executing on our investments in the rapidly growing electrical steel market Strategically expanding our capacity for highly technical electrical steel products to meet demand for infrastructure improvements and electric vehicles (including hybrid and battery electric vehicles) Growing through strategic initiatives/capex, new products and acquisitions Filling our existing capacity, meeting customer needs and capitalizing on attractive growth opportunities Optimizing our business utilizing proven transformation processes Improving our base business to increase margin, reduce working capital and maximize capacity

TRANSFORMATION Leveraging Lean Practices and Technology Systematic approach to business improvement Optimizing working capital Maximizing capacity and reducing waste Predictive analytics and automation enhance efficiency, reduce downtime and improve safety INNOVATION Tailored Customer Solutions Cross-functional teams Sophisticated supply chain management Price risk management Metallurgical expertise for customized solutions ACQUISITION Adding Capabilities for Above-Market Growth Energy transition: Tempel provides direct exposure to global decarbonization efforts, power grid modernization and expansion Automotive lightweighting: Acquisition of Shiloh BlankLight® expanded offerings for fuel-efficiency, cost reduction and part consolidation Worthington Business System is the Foundation for Driving Improved Profitability Our people-first Philosophy is rooted in the Golden Rule: We treat our employees, customers, suppliers and shareholders as we would like to be treated

Customized End-to-End Supply Chain Solutions Strategic Operating Footprint Price Risk Management Experienced Technical Team Unique Mix of Processing Capabilities Entrenched Customer Relationships Beginning with Material from our Mill Partners Worthington Steel Offers a Wide Range of Value-Added Processing Capabilities and Services Serving Customers Across Attractive End Markets Our Differentiated Business Model Drives Worthington Steel Forward

Results Innovation: Product Improvements That Meet Changing Customer Needs for Lightweighting Since 2000, we have successfully launched more than 500 lightweighting production parts “Voice of Customer” Approach to New Product Development Driving Market Share Gains and Improved Customer Intimacy Continued Enhancements to Core Offerings At the Forefront of EV Battery Box Design Hot Stamped Door Ring Advanced, High-strength Tailor Welded Frame Rails Capitalizes on lightweighting and part consolidation trends Adopted by most North American light duty truck manufacturers Upper / LowerBattery Covers Deep Drawn Battery Tray A leading supplier to North Americanautomotive producers Innovative product solution in development

Goal: Reduce Excess Working Capital While Maintaining Inventory for High-Growth Products Case Study: Our Transformation Strengthens Customer Relationships Our customer faced high capital costs and limited floor space tied up in slow-turn inventory Growth was constrained by lack of space for higher-demand products We hosted a joint kaizen event to identify ways to optimize inventory across both organizations Collaborated to implement a more transparent, responsive ordering system Our customer reduced working capital by 61% in one month and ensured supply for critical products We improved visibility, strengthened demand planning and deepened a strategic relationship

Well Positioned to Capitalize on Key End Market Trends Worthington Steel Product Offering Key Trends Worldwide transition to electric vehicles and OEM push for lightweighting innovation supporting automotive steel demand Electrification, AI and data center growth creates demand for our products Upgrading aging infrastructure and electrical grid in the U.S. will require a significant amount of steel Market Growth Drivers >70% of passenger vehicles sold globally in 2030 expected to be battery or hybrid 7.7% Projected CAGR through 2034 $1 Trillion infrastructure bill signed in 2021 Decarbonization of Transportation Energy Growth Infrastructure Tailored Blanks Electrical Steel Laminations EV Traction Motors Automotive Frames Electrical Steel Laminations Transformer Cores Galvanized Steel Electrical Steel Laminations Transformer Cores Drainage Culvert / Renewables Sources: 1 S&P Global Mobility, E-Motor Production Forecast, June 2025, includes mid- and full-hybrids; 2 Global Market Insights. (February 2025). Transformer Market Size, Industry Share Report 2025–2034; 3 White House (Inflation Reduction Act Guidelines, January 2023). 1 3

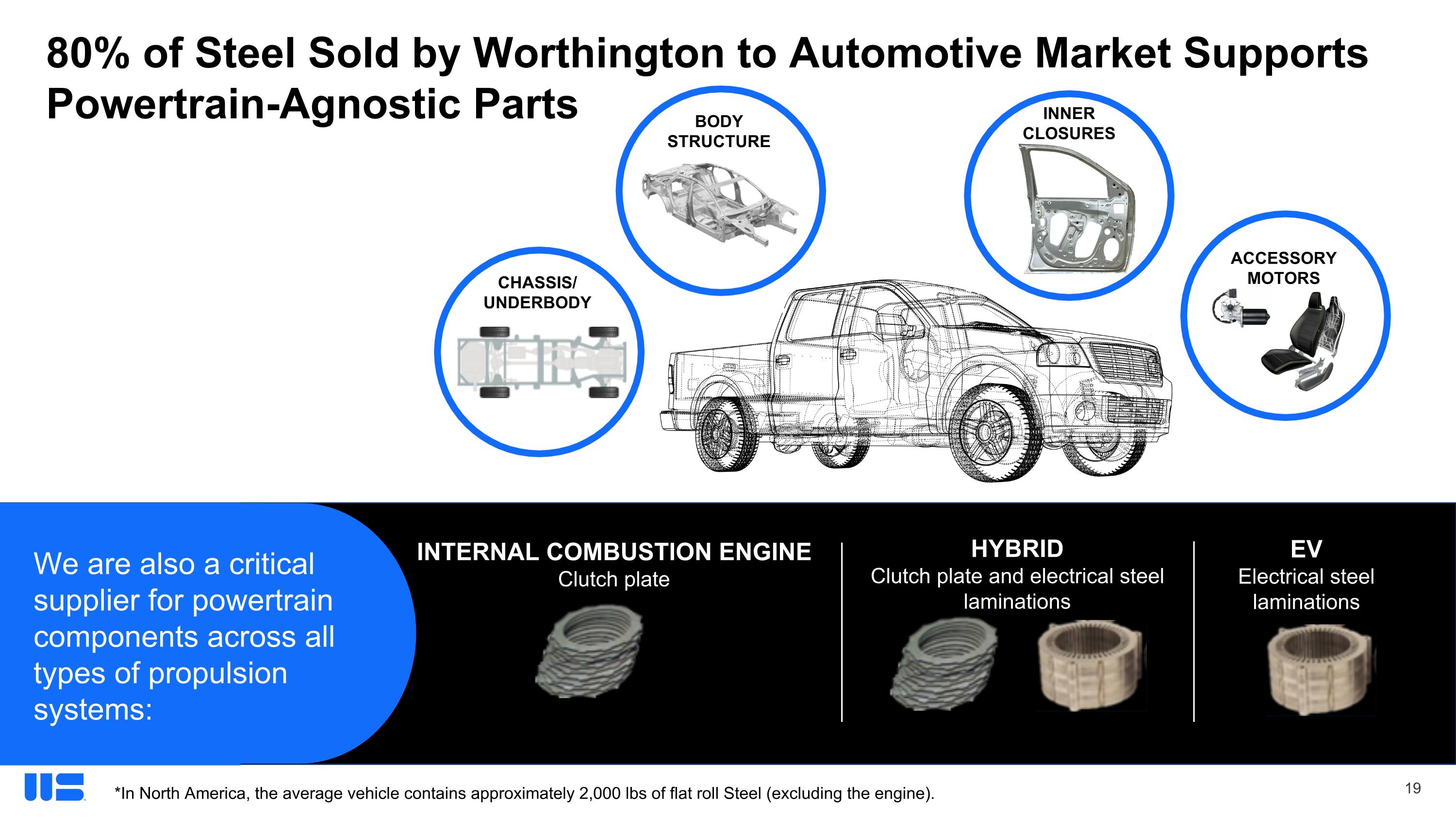

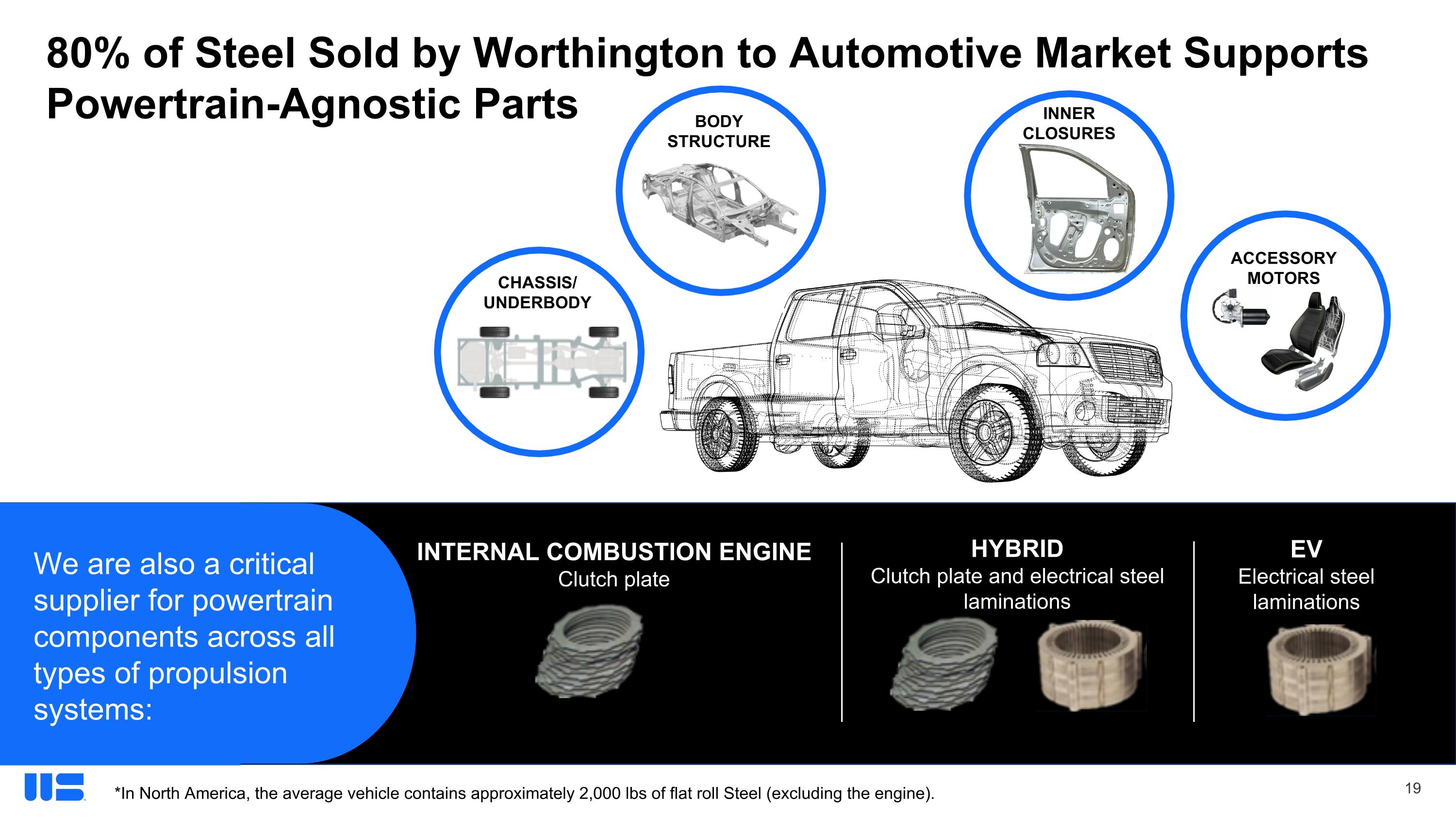

HYBRID Clutch plate and electrical steel laminations 80% of Steel Sold by Worthington to Automotive Market Supports Powertrain-Agnostic Parts *In North America, the average vehicle contains approximately 2,000 lbs of flat roll Steel (excluding the engine). ACCESSORY MOTORS CHASSIS/ UNDERBODY INNER CLOSURES BODY STRUCTURE INTERNAL COMBUSTION ENGINE Clutch plate EV Electrical steel laminations We are also a critical supplier for powertrain components across all types of propulsion systems:

Focused Strategic Investments in Electrical Steel Expanding existing xEV production capacity Total expected capex = $85M (~60% spent through 11/30/25) Building expansion complete Initial five presses installed; five more expected (exact timing tied to commercial milestones) Targeting start of production for early CY 2026 Adding capacity to existing core-making operation to help customers close 2-year backlog on transformer orders Total expected capex = $85M (~90% spent through 11/30/25) Awarded enough new business to fill 50% of the additional capacity Targeting start of production for early CY 2026 Expect Steady State EBITDA Margins to Be Accretive Mexico: Increase Motor Lamination Capacity to Meet Growing xEV Demand Canada: Increase Transformer Core Making Capacity to Meet Demand

M&A Is a Key Part of Our Strategy BlankLight® Assets Strip Steel Assets Automotive Components Nagold, GER Select Acquisitions Investment Criteria Well-run, successful companies with strong management teams Culture aligns with Our Philosophy Accretive to earnings per share in a short period of time and increases overall EBITDA margin Opportunities to increase value through Transformation and synergy capture Strengthen our business in current markets or provide access to new, attractive and more niche markets

Key Financial Metrics

Resilient Financial Performance Despite Commodity Volatility Net Sales ($M) & Volumes (M Tons) Adjusted EBITDA ($M) & Margin (%) Estimated Holding G/(L)1 ($49) ($3) ($10) $18 Note: FY is fiscal year ended May 31. TTM ended November 30, 2025. 1 Estimated Inventory Holding Gains or Losses in respective period.

How Worthington Steel Mitigates Volatility in Steel Pricing Worthington Business System to manage inventory Deployed to drive inventory lower within carbon flat-rolled locations; opportunities remain Inventory down 16% on a tons basis Use firm-priced contracts where possible to lock in margin Customers choose contract mechanisms that best fit their business Mirror customer and supplier contract mechanisms (e.g., buy/sell on quarterly CRU) ~100% of contracts are mirrored Utilize steel futures when fixed pricing is not offered by a mill We Minimize Steel Holding Gains and Losses Note: Fiscal year ended May 31. Worthington Business System Helps Drive Down Inventory Transformation Launch Advanced Analytics Lean Flow Baseline Historical Hot-Rolled Steel Price ($/ton)

RECENT EXAMPLES Pathway to Margin Expansion Strategy to Achieve 10%+ Adj. EBITDA Margin Target Levers to Improve Profitability Focus onhigh margin products Drive out waste and reduce costs Introduce higher margin new products and processes Acquire margin accretive businesses 10%+ Note: Sitem Acquisition Closed June 3, 2025; just after the close of FY25. Applying Transformation to corporate functions Expanding electrical steel capabilities in Canada and Mexico Licensed ablation technology to open new opportunities for TWB Sitem acquisition strengthens global presence for electrical steel

Strong Cash Flow Supports Growth Initiatives Note: FY is fiscal year ended May 31. TTM ended November 30, 2025. 1 Operating Working Capital defined as accounts receivable plus inventory minus accounts payable. Operating Cash Flow ($M) Operating Working Capital1 ($M) Capex ($M) $45 $103 $130 $128 Steel Price ($/ton) $890 $870 $750 $830

Capital Investments to Strengthen and Grow Market Position Capital Expenditures ($M) Capex (% of Sales) 0.9% 1.3% 3.0% 4.2% Strategic Capital Investments Increasing Lightweighting Capabilities/Capacity Laser Welding: support lightweighting targets for new Battery EV models Ablation: produce Hot Formed Tailored Blanks for automotive lightweighting applications Investing in Electrical Steel Capacity/Capability Transformer Core Lamination Expansion: adding capacity and capability in Canada xEV Focus Factory: expanding electrical steel lamination offering in Mexico Maintenance Capital Category includes equipment, information technology, new headquarters, and environmental, health & safety Philosophy toward maintenance spending is to maintain key assets in market ready condition Expect FY 2026 capital expenditures of approximately $110 Million

Capital Structure Supports Growth Initiatives Note: Fiscal 2026 Second Quarter ended November 30, 2025; 1 Trailing Twelve Month Net Leverage defined as Net Debt at period end divided by Trailing Twelve Month Adjusted EBITDA; 2 Total Liquidity defined as undrawn availability on ABL facility plus cash. Balance Sheet Summary ($M) Total Debt $182 (-) Cash $90 Net Debt $92 Trailing Twelve Month Adjusted EBITDA $252 Trailing Twelve Month Net Leverage1 0.37x Total Liquidity2 $396 Accomplished initial goal for a strong balance sheet at Spin Date Expect to maintain a flexible capital structure with modest leverage and ample liquidity Current credit facility consists of: $550M ABL facility, maturing in 2028 Goal is to maintain sufficient liquidity and flexibility to execute on our business strategy Pursue high-return organic growth opportunities Target strategic accretive acquisitions Return capital to shareholders

How We Drive Shareholder Value

Disciplined Framework Designed to Drive Shareholder Value Organic Growth Strategic M&A Shareholder Return Maintain operations in market ready condition Grow capacity to meet electrical steel and lightweighting demand Pursue high IRR capacity additions Target acquisition opportunities that are expected to be immediately accretive to earnings Leverage track record and skill set to integrate bolt-on opportunities and realize synergies Focus on maximizing shareholder return Expect to pay a modest dividend Long-term intention to pursue opportunistic share buybacks …and Maintain Ample Liquidity and Financial Flexibility to Support Strategic Initiatives and Resiliency Through the Cycle

More than 200 Combined Years of Experience Managing Through Steel Price Cycles and Shifting Macroeconomic Climates with Proven Ability to Execute M&A Experienced Management Team to Drive Strategy CLIFF LARIVEY President, Flat-Rolled Steel Processing BILL WERTZ VP & Chief Information Officer GEOFF GILMORE President & Chief Executive Officer JEFF KLINGLER Executive VP & Chief Operating Officer TIM ADAMS VP & Chief Financial Officer JOE HEUER VP & General Counsel MELISSA DYKSTRA VP of Corporate Communications & Investor Relations BRAD KERN SVP of Operations NIKKI BALLINGER VP of Human Resources STEVE WITT Corporate Controller

Investment Highlights 2. Long-standing customer relationships focused on value creation and best-in-class service delivery 1. Well-positioned to capitalize on opportunities from expected growth in electricity usage to support data center growth and vehicle electrification combined with the modernization and expansion of the electric grid 3. Strong balance sheet and ample liquidity to pursue attractive growth opportunities via strategic capital investments and/or value-enhancing acquisitions Experienced management team with a track record of delivering value and driving success through the Worthington Business System 4.

Appendix

Reconciliation of Non-GAAP Financial Measures These materials present certain financial measures that are not calculated in accordance with U.S. generally accepted accounting principles, or GAAP. Management believes these non-GAAP measures provide useful supplemental information on the performance of the Company’s ongoing operations and should not be considered as an alternative to the comparable GAAP measure. Additionally, management believes these non-GAAP measures allow for meaningful comparisons and analysis of trends in the Company’s business and enable investors to evaluate operations and future prospects in the same manner as management. A reconciliation of each non-GAAP measure to its most directly comparable GAAP measure is outlined below. The following provides an explanation of each non-GAAP measure presented in these materials: Adjusted EBITDA is defined as Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization, and consists of EBITDA (calculated by adding or subtracting, as appropriate, interest expense, income tax expense and depreciation and amortization to/from net earnings attributable to Worthington Steel), which is further adjusted to exclude impairment and restructuring charges (gains) as well as other items that management believes are not reflective of, and thus should not be included when evaluating the performance of its ongoing operations. Separation costs - direct and incremental costs incurred in connection with the Separation from Worthington Enterprises, Inc. (the “Former Parent”), including audit, legal, and other fees paid to third-party advisors as well as direct and incremental costs associated with the separation of shared corporate functions which are not part of the Company’s ongoing operations. Tax indemnification adjustment - tax and indemnification adjustments reported in income tax expense and miscellaneous income, net, related to an indemnification agreement with the former owners of Tempel. These adjustments are the result of a first quarter fiscal 2025 favorable tax ruling. The indemnification agreement, which was entered into with the former Tempel owners at the time the Company acquired Tempel, provides protection to the Company from rulings by tax authorities through the acquisition date. Pension settlement gain - pension lift-out transaction to transfer a portion of the total projected benefit obligation of the Tempel pension plan to a third-party insurance company, which resulted in a pre-tax non-cash gain reported in miscellaneous income, net, is excluded as it is not part of the Company’s ongoing operations. Gain on land sale - sale of unused land on the campus of the Tempel subsidiary in China, which resulted in a pre-tax gain in miscellaneous income, net, is excluded as it is not part of the Company’s ongoing operations. Gain on Sitem group purchase derivative - mark-to-market gain on the economic (non-designated) foreign currency exchange contract entered into related to the purchase price for Sitem Group, which resulted in a pre-tax gain in miscellaneous income, net, and is excluded as it is not part of the Company’s ongoing operations. Acquisition completion bonus payment - consists of the one-time bonus payment paid to key individuals upon the successful acquisition closing of Sitem Group. The acquisition completion bonus payment was included within SG&A expense. Other loss, net - net loss recognized in miscellaneous income (expense), net, for damage as a result of a small, quickly contained incident at Tempel’s subsidiary in Canada. Please see the Earnings Release for a further description of the gross amounts. Adjusted EBITDA Margin is calculated by dividing Adjusted EBITDA by net sales. Free Cash Flow is defined as operating cash flows less capital expenditures. For additional information with respect to Worthington Steel, please refer to our most recent Form 10-K.