EX-99.1

Worthington Enterprises Reports Second Quarter Fiscal 2026 Results

COLUMBUS, Ohio (December 16, 2025) – Worthington Enterprises Inc. (NYSE: WOR), a designer and manufacturer of market-leading consumer and building products that improve everyday life by elevating spaces and experiences, today reported results for its fiscal 2026 second quarter ended November 30, 2025.

Recent Developments and Second Quarter Highlights (all comparisons to the second quarter of fiscal 2025):

•

Net sales were $327.5 million, an increase of 19%.

•

Net earnings decreased 3% to $27.0 million, while adjusted net earnings increased 7% to $32.5 million and adjusted EBITDA grew 8% to $60.5 million.

•

Earnings per share (“EPS”) – diluted was relatively flat compared to the prior year quarter, while adjusted EPS – diluted increased to $0.65 from $0.60 per share.

•

Operating cash flow increased 5% to $51.5 million, while free cash flow improved 15% to $39.1 million.

•

Repurchased 250,000 common shares for $13.7 million leaving 5,015,000 common shares remaining on the company’s share repurchase authorization.

•

Declared a quarterly dividend of $0.19 per common share payable on March 27, 2026, to shareholders of record at the close of business on March 13, 2026.

•

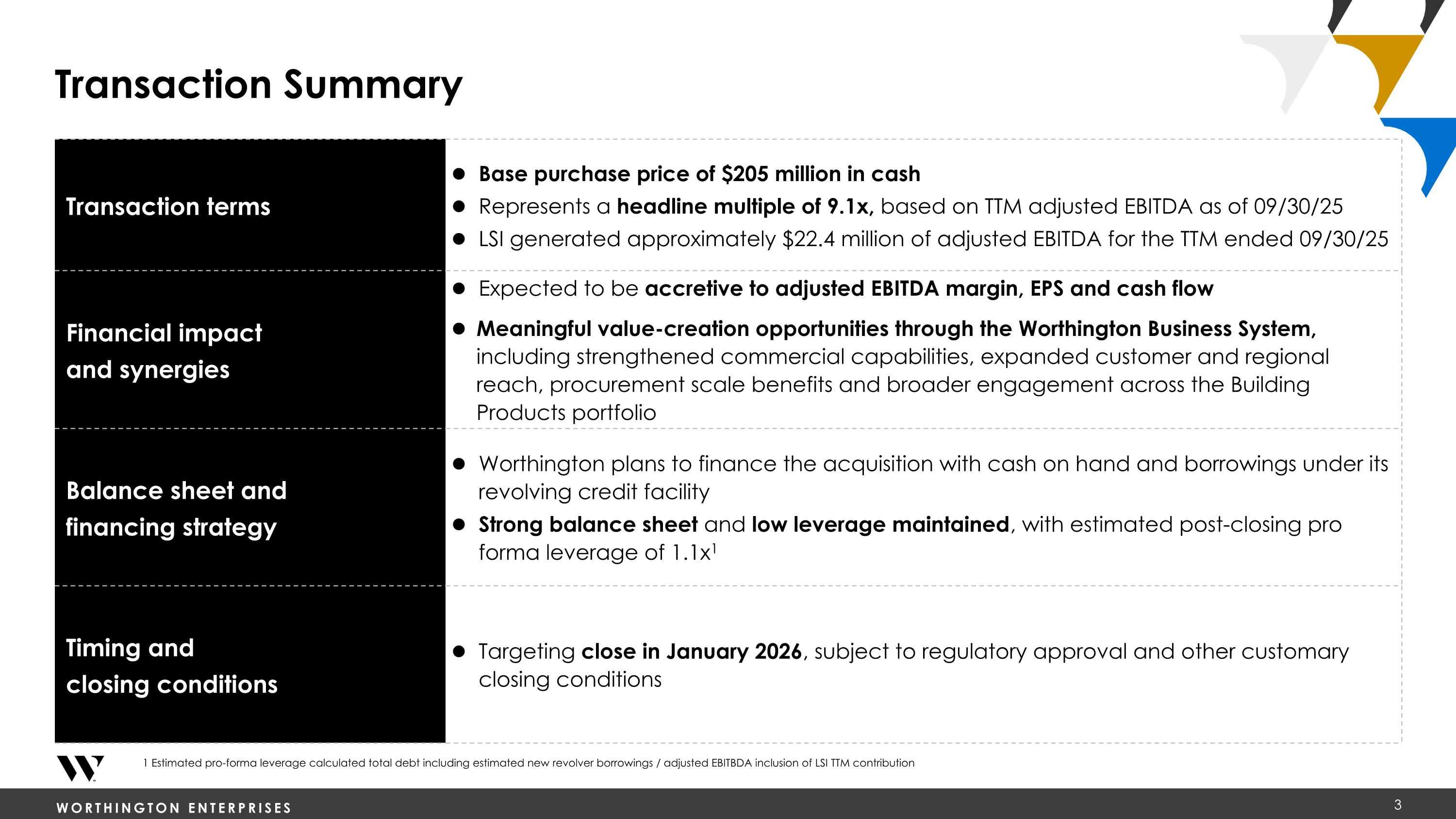

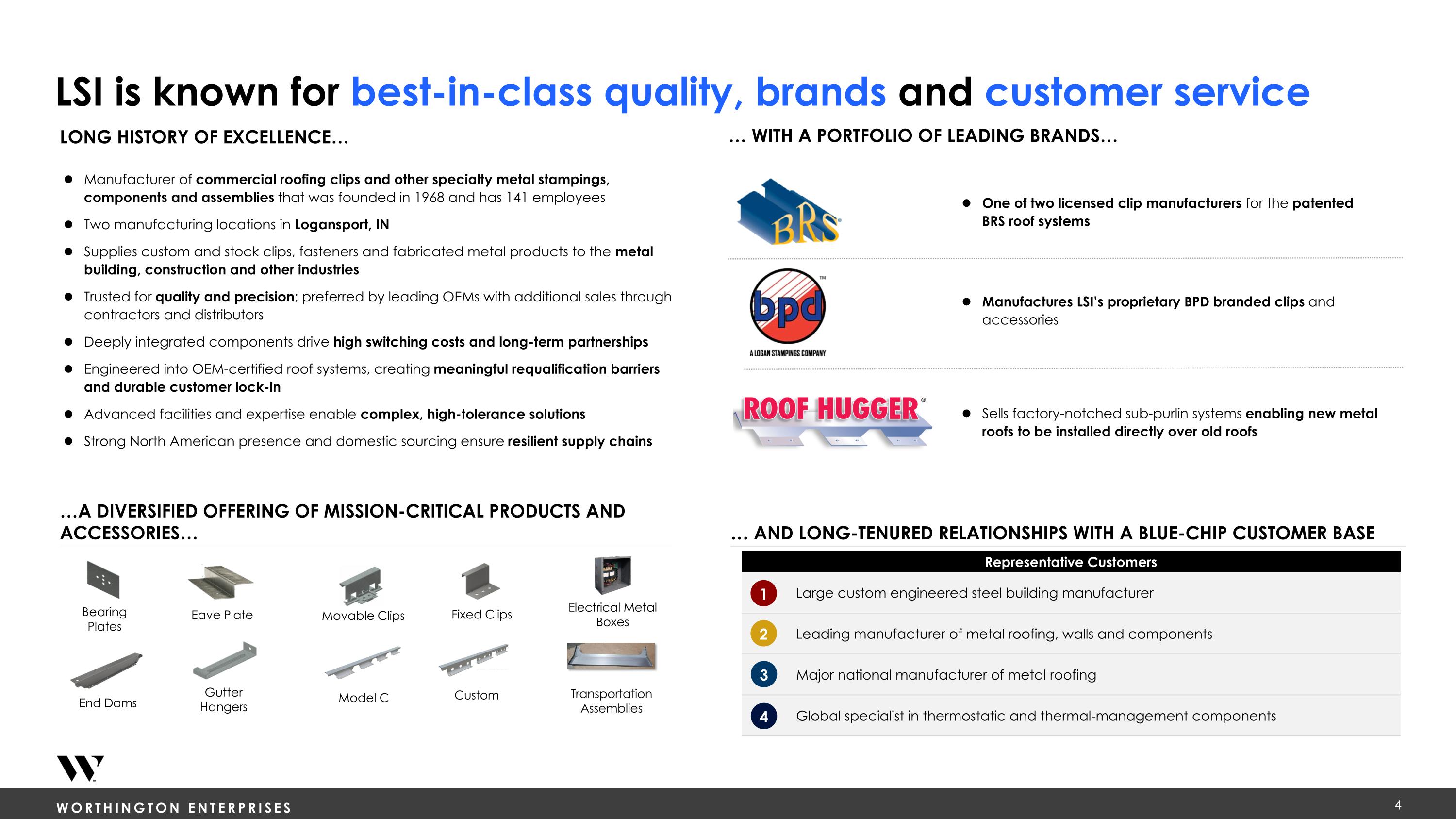

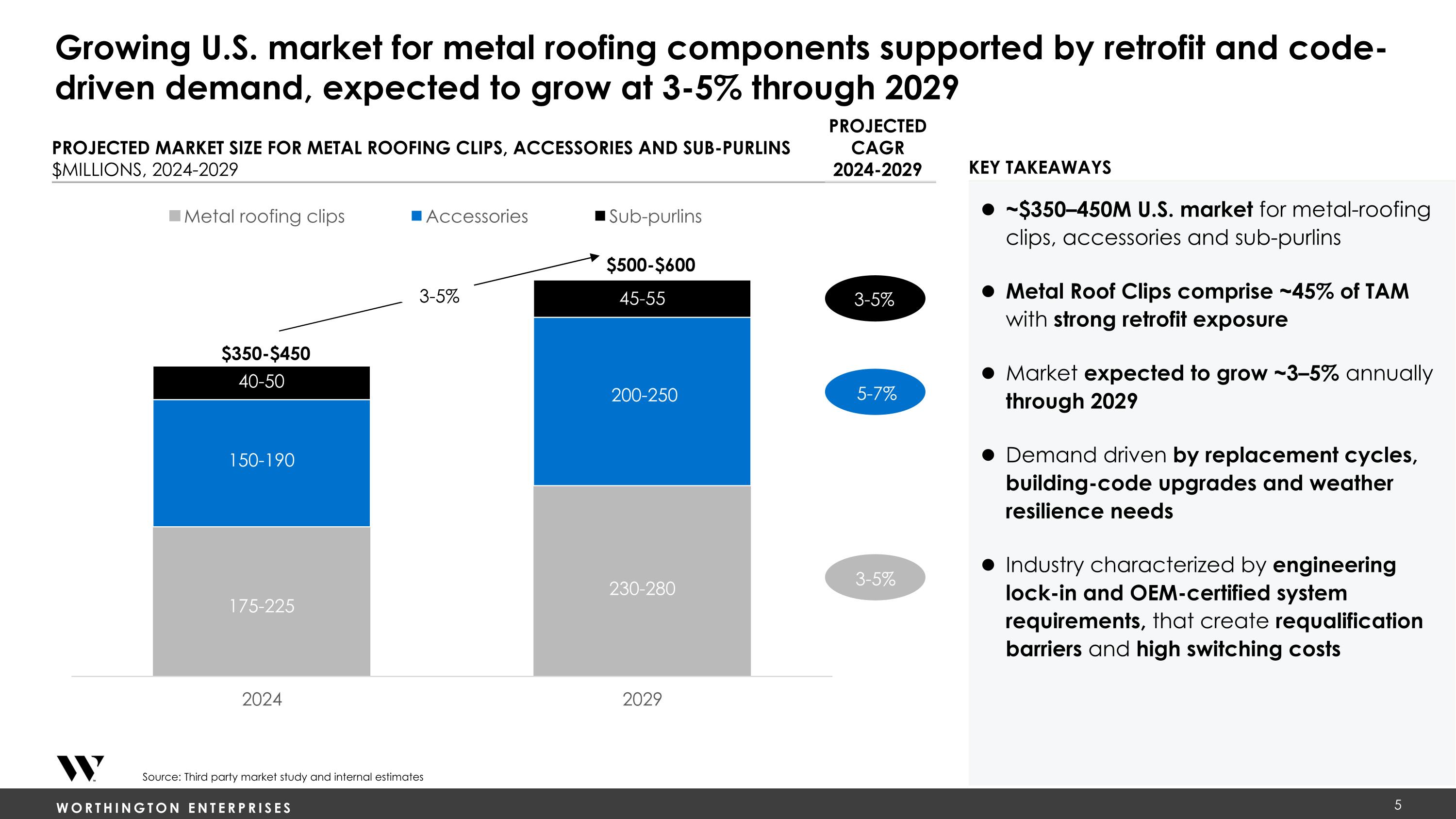

Announced the signing of an agreement on December 16, 2025, to acquire LSI Group, a leading manufacturer of commercial metal roof clips, accessories and retrofit systems, for approximately $205 million. The transaction is expected to close in January 2026, subject to regulatory approval and other customary closing conditions.

“We delivered solid financial results for the quarter, achieving year-over-year growth in net sales, adjusted EPS and EBITDA, and free cash flow,” said Worthington Enterprises President and CEO Joe Hayek. “Strong growth in Building Products drove higher sales and earnings, while our Consumer Products team delivered steady results in a cautious consumer environment. Our team continues to execute well as we advance our strategy to drive sustainable growth and long-term shareholder value.”

Worthington Enterprises

December 16, 2025

Page 2

Financial highlights for the current year and prior year quarters are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(U.S. dollars in millions, except per share amounts)

|

|

2Q 2026 |

|

|

2Q 2025 |

|

GAAP Financial Measures |

|

|

|

|

|

|

Net sales |

|

$ |

327.5 |

|

|

$ |

274.0 |

|

Operating income |

|

|

12.3 |

|

|

|

3.5 |

|

Earnings before income taxes |

|

|

|

|

|

|

35.8 |

|

|

|

37.1 |

|

Net earnings |

|

|

27.0 |

|

|

|

28.0 |

|

EPS – diluted |

|

|

0.55 |

|

|

|

0.56 |

|

Net cash provided by operating activities |

|

|

|

|

|

|

51.5 |

|

|

|

49.1 |

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Financial Measures (1) |

|

|

|

|

|

|

Adjusted operating income |

|

$ |

13.9 |

|

|

$ |

6.1 |

|

Adjusted EBITDA |

|

|

60.5 |

|

|

|

56.2 |

|

Adjusted net earnings |

|

|

|

|

|

|

32.5 |

|

|

|

30.2 |

|

Adjusted EPS – diluted |

|

|

0.65 |

|

|

|

0.60 |

|

Free cash flow |

|

|

39.1 |

|

|

|

33.9 |

|

(1)

Refer to the “Use of Non-GAAP Financial Measures and Definitions” section of this release for additional information regarding the use of non-GAAP financial measures, including reconciliations to the most comparable GAAP measures.

Consolidated Quarterly Results

Net sales for the second quarter of fiscal 2026 increased $53.4 million, or 19.5%, over the prior year quarter to $327.5 million, driven by higher volumes within Building Products, including contributions from Elgen Manufacturing (“Elgen”), which was acquired on June 18, 2025.

Operating income increased $8.7 million to $12.3 million, driven by higher volumes within Building Products, compared to $3.5 million in the prior year quarter. Excluding restructuring and other expense, operating income increased $7.8 million in the quarter to $13.9 million.

Miscellaneous (income) expense was unfavorable by $4.2 million, primarily due to the divestment of the company’s 49% interest in the Sustainable Energy Solutions (“SES”) joint venture’s composite business on October 16, 2025, and the related mark-to-market loss on the securities received as consideration.

Equity income decreased $5.4 million over the prior year quarter to $29.1 million, on lower contributions from ClarkDietrich, which were down $5.6 million, partially offset by higher contributions from WAVE, which were up $1.7 million.

Income tax expense was $8.8 million in the second quarter of fiscal 2026 compared to $9.1 million in the prior year quarter. The decrease was driven by lower pre-tax earnings. Tax expense in the second quarter of fiscal 2026 reflects an estimated annual effective rate of 24.1% in both the current and prior year quarter.

Worthington Enterprises

December 16, 2025

Page 3

Balance Sheet and Cash Flow

The company ended the quarter with cash of $180.3 million, a decrease of $69.8 million from May 31, 2025, primarily driven by the purchase of Elgen. During the second quarter of fiscal 2026, the company generated operating cash flow of $51.5 million, of which $12.4 million was invested in capital expenditures, resulting in free cash flow of $39.1 million, up from $33.9 million in the prior year quarter. Capital expenditures in the current year quarter included approximately $5.8 million related to ongoing facility modernization projects.

Total debt at quarter end was $305.3 million, consisting entirely of long-term debt, an increase of $2.4 million from May 31, 2025, primarily due to the remeasurement of the company’s euro denominated notes. The company had no borrowings under its revolving credit facility as of November 30, 2025, leaving $500.0 million available for future use.

Quarterly Segment Results

Consumer Products generated net sales of $119.9 million in the current year quarter, an increase of $3.2 million, or 2.7%, over the prior year quarter, driven by favorable product mix, partially offset by lower volumes. Adjusted EBITDA was relatively flat at $15.3 million, as the impact of favorable product mix was offset by higher conversion costs and slightly lower volumes.

Building Products generated net sales of $207.5 million in the current year quarter, an increase of $50.2 million, or 31.9%, over the prior year quarter. The increase was driven by higher overall volume, including contributions from Elgen. Adjusted EBITDA increased $5.8 million to $53.0 million, primarily due to volume growth in the wholly owned businesses, partially offset by lower overall contributions of equity income.

Outlook

“Across the company, we remain focused on delivering for our customers, investing in opportunities that fit our strategy and advancing the long-term value of Worthington Enterprises,” Hayek said. “As we enter the back half of our fiscal year, which is typically a seasonally stronger period, we are excited about the opportunities ahead. Today, we announced the signing of an agreement to acquire LSI Group. LSI is a leader in the metal roofing components space and is a great example of our growth strategy of acquiring and building leaders in attractive niche markets.”

Conference Call

The company will review fiscal 2026 second quarter results during its quarterly conference call on December 17, 2025, at 8:30 a.m. Eastern Time. Details regarding the conference call can be found on the company website at www.WorthingtonEnterprises.com.

About Worthington Enterprises

Worthington Enterprises (NYSE: WOR) is a designer and manufacturer of market-leading brands that improve everyday life by elevating spaces and experiences. The company operates with two primary business segments: Building Products and Consumer Products. The Building Products segment includes cooking, heating, cooling and water solutions, architectural and acoustical grid ceilings and metal framing and accessories. The Consumer Products segment provides solutions for the tools, outdoor living and celebrations categories. Product brands within the Worthington Enterprises portfolio include Balloon Time®, Bernzomatic®, Coleman® (propane cylinders), CoMet®, Elgen, Garden Weasel®, General®, HALO™, Hawkeye™, Level5 Tools®, Mag Torch®, NEXI™, Pactool International®, PowerCore™, Ragasco®, Well-X-Trol® and XLite™, among others.

Worthington Enterprises

December 16, 2025

Page 4

Headquartered in Columbus, Ohio, Worthington Enterprises and its joint ventures employ approximately 6,000 people throughout North America and Europe.

Founded in 1955 as Worthington Industries, Worthington Enterprises follows a people-first Philosophy with earning money for its shareholders as its first corporate goal. Worthington Enterprises achieves this outcome by empowering its employees to innovate, thrive and grow with leading brands in attractive markets that improve everyday life. The company engages deeply with local communities where it has operations through volunteer efforts and The Worthington Companies Foundation, participates actively in workforce development programs and reports annually on its corporate citizenship and sustainability efforts. For more information, visit worthingtonenterprises.com.

Safe Harbor Statement

Selected statements contained in this release constitute “forward-looking statements,” as that term is used in the Private Securities Litigation Reform Act of 1995 (the “Act”). The company wishes to take advantage of the safe harbor provisions included in the Act. Forward-looking statements reflect the company’s current expectations, estimates or projections concerning future results or events. These statements are often identified by the use of forward-looking words or phrases such as “believe,” “expect,” “anticipate,” “may,” “could,” “should,” “would,” “intend,” “plan,” “will,” “likely,” “estimate,” “project,” “position,” “strategy,” “target,” “aim,” “seek,” “foresee” and similar words or phrases. These forward-looking statements include, without limitation, statements relating to: future or expected cash positions, liquidity and ability to access financial markets and capital; outlook, strategy or business plans future or expected growth, growth potential, forward momentum, performance, competitive position, sales, volumes, cash flows, earnings, margins, balance sheet strengths, debt, financial condition or other financial measures; pricing trends for raw materials and finished goods and the impact of pricing changes; the ability to improve or maintain margins; expected demand or demand trends for the company or its markets; additions to product lines and opportunities to participate in new markets; expected benefits from transformation and innovation efforts; the ability to improve performance and competitive position at the company’s operations; anticipated working capital needs, capital expenditures and asset sales; anticipated improvements and efficiencies in costs, operations, sales, inventory management, sourcing and the supply chain and the results thereof; projected profitability potential; the ability to make acquisitions and the projected timing, results, benefits, costs, charges and expenditures related to acquisitions, joint ventures, headcount reductions and facility dispositions, shutdowns and consolidations; projected capacity and the alignment of operations with demand; the ability to operate profitably and generate cash in down markets; the ability to capture and maintain market share and to develop or take advantage of future opportunities, customer initiatives, new businesses, new products and new markets; expectations for company and customer inventories, jobs and orders; expectations for the economy and markets or improvements therein; expectations for generating improving and sustainable earnings, earnings potential, margins or shareholder value; effects of judicial rulings; effects of pandemics and widespread health crises and the various responses of governmental and nongovernmental authorities thereto on economies and markets, and on the company’s customers, counterparties, employees and third-party service providers; and other non-historical matters.

Because they are based on beliefs, estimates and assumptions, forward-looking statements are inherently subject to risks and uncertainties that could cause actual results to differ materially from those projected. Any number of factors could affect actual results, including, without limitation, those that follow: the effect of conditions in national and worldwide financial markets, including inflation, increases in interest rates and economic recession, and with respect to the ability of financial institutions to provide capital; the impact of tariffs, the adoption of trade restrictions affecting the company’s products or suppliers, a United States withdrawal from or significant renegotiation of trade agreements, the occurrence of trade wars, the closing of border crossings, and other changes in trade regulations or relationships; changing oil prices and/or supply; product demand and pricing; changes in product mix, product substitution and market acceptance of the company’s products; volatility or fluctuations in the pricing, quality or availability of raw materials (particularly steel), supplies, transportation, utilities, labor and other items required by operations; effects of sourcing and supply chain constraints; the outcome of adverse claims experience with respect to workers’ compensation, product recalls or product liability, casualty events or other matters; effects of facility closures and the consolidation of operations; the effect of financial difficulties, consolidation and other changes within the steel, automotive, construction and other industries in which the company participates; failure to maintain appropriate levels of inventories; financial difficulties (including bankruptcy filings) of original equipment manufacturers, end-users and customers, suppliers, joint venture partners and others with whom the company does business; the ability to realize targeted expense reductions from headcount reductions, facility closures and other cost reduction efforts; the ability to realize cost savings and operational, sales and sourcing improvements and efficiencies, and other expected benefits from transformation initiatives, on a timely basis; the overall success of, and the ability to integrate, newly-acquired businesses and joint ventures, maintain and develop their customers, and achieve synergies and other expected benefits and cost savings therefrom; capacity levels and efficiencies, within facilities, within major product markets and within the industries in which the company participates as a whole; the effect of disruption in the business of suppliers, customers, facilities and shipping operations due to adverse weather, casualty events, equipment breakdowns, labor shortages, interruption in utility services, civil unrest, international conflicts, terrorist activities or other causes; changes in customer demand, inventories, spending patterns, product choices, and supplier choices; risks associated with doing business internationally, including economic, political and social instability, foreign currency exchange rate exposure and the acceptance of the company’s products in global markets; the ability to improve and maintain processes and business practices to keep pace with the economic, competitive and technological environment; the effect of inflation, interest rate increases and economic recession, which may negatively impact the company’s operations and financial results; deviation of actual results from estimates and/or assumptions used by the company in the application of its significant accounting policies; the level of imports and import prices in the company’s markets; the impact of environmental laws and regulations or the actions of the United States Environmental Protection Agency or similar regulators which increase costs or limit the company’s ability to use or sell certain products; the impact of increasing environmental, greenhouse gas emission and sustainability regulations and considerations; the impact of judicial rulings and governmental regulations, both in the United States and abroad, including those adopted by the United States Securities and Exchange Commission and other governmental agencies as contemplated by the Coronavirus Aid, Relief and Economic Security (CARES) Act, the Consolidated Appropriations Act, 2021, the American Rescue Plan Act of 2021, and the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010; the effect of healthcare laws in the United States and potential changes for such laws, which may increase the company’s healthcare and other costs and negatively impact the company’s operations and financial results; the effects of tax laws in the United States and potential changes for such laws, which may increase the company’s costs and negatively impact the company’s operations and financial results; cyber security risks; the effects of privacy and information security laws and standards; and other risks described from time to time in the company’s filings with the United States Securities and Exchange Commission, including those described in “Part I – Item 1A.

Worthington Enterprises

December 16, 2025

Page 5

– Risk Factors” of the company’s Annual Report on Form 10-K for the fiscal year ended May 31, 2025.

Worthington Enterprises

December 16, 2025

Page 6

Forward-looking statements should be construed in the light of such risks. The company notes these factors for investors as contemplated by the Act. It is impossible to predict or identify all potential risk factors. Consequently, readers should not consider the foregoing list to be a complete set of all potential risks and uncertainties. Readers are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date made. The company does not undertake, and hereby disclaims, any obligation to update any forward-looking statements, whether as a result of new information, future developments or otherwise, except as required by applicable law.

WORTHINGTON ENTERPRISES, INC.

CONSOLIDATED STATEMENTS OF EARNINGS

(In thousands, except per common share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Six Months Ended |

|

|

|

November 30, |

|

|

November 30, |

|

|

|

2025 |

|

|

2024 |

|

|

2025 |

|

|

2024 |

|

Net sales |

|

$ |

327,452 |

|

|

$ |

274,046 |

|

|

$ |

631,159 |

|

|

$ |

531,354 |

|

Cost of goods sold |

|

|

242,823 |

|

|

|

199,987 |

|

|

|

464,246 |

|

|

|

394,800 |

|

Gross profit |

|

|

84,629 |

|

|

|

74,059 |

|

|

|

166,913 |

|

|

|

136,554 |

|

Selling, general and administrative expense |

|

|

70,721 |

|

|

|

67,918 |

|

|

|

141,286 |

|

|

|

133,954 |

|

Restructuring and other expense, net |

|

|

1,644 |

|

|

|

2,620 |

|

|

|

4,120 |

|

|

|

3,778 |

|

Operating income (loss) |

|

|

12,264 |

|

|

|

3,521 |

|

|

|

21,507 |

|

|

|

(1,178 |

) |

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

Miscellaneous income (expense), net |

|

|

(4,130 |

) |

|

|

65 |

|

|

|

(4,286 |

) |

|

|

551 |

|

Interest expense, net |

|

|

(1,472 |

) |

|

|

(1,033 |

) |

|

|

(1,535 |

) |

|

|

(1,522 |

) |

Equity in net income of unconsolidated affiliates |

|

|

29,118 |

|

|

|

34,556 |

|

|

|

65,775 |

|

|

|

70,048 |

|

Earnings before income taxes |

|

|

35,780 |

|

|

|

37,109 |

|

|

|

81,461 |

|

|

|

67,899 |

|

Income tax expense |

|

|

8,751 |

|

|

|

9,100 |

|

|

|

19,611 |

|

|

|

15,882 |

|

Net earnings |

|

|

27,029 |

|

|

|

28,009 |

|

|

|

61,850 |

|

|

|

52,017 |

|

Net loss attributable to noncontrolling interest |

|

|

(299 |

) |

|

|

(251 |

) |

|

|

(626 |

) |

|

|

(496 |

) |

Net earnings attributable to controlling interest |

|

$ |

27,328 |

|

|

$ |

28,260 |

|

|

$ |

62,476 |

|

|

$ |

52,513 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding |

|

|

49,160 |

|

|

|

49,464 |

|

|

|

49,212 |

|

|

|

49,475 |

|

Earnings per share attributable to controlling interest |

|

$ |

0.56 |

|

|

$ |

0.57 |

|

|

$ |

1.27 |

|

|

$ |

1.06 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted |

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding |

|

|

49,762 |

|

|

|

50,138 |

|

|

|

49,895 |

|

|

|

50,264 |

|

Earnings per share attributable to controlling interest |

|

$ |

0.55 |

|

|

$ |

0.56 |

|

|

$ |

1.25 |

|

|

$ |

1.04 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash dividends declared per common share |

|

$ |

0.19 |

|

|

$ |

0.17 |

|

|

$ |

0.38 |

|

|

$ |

0.34 |

|

CONSOLIDATED BALANCE SHEETS

WORTHINGTON ENTERPRISES, INC.

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

November 30, |

|

|

May 31, |

|

|

|

2025 |

|

|

2025 |

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

180,288 |

|

|

$ |

250,075 |

|

Receivables, less allowances of $1,130 and $907, respectively |

|

|

207,320 |

|

|

|

215,824 |

|

Inventories |

|

|

|

|

|

|

Raw materials |

|

|

98,611 |

|

|

|

80,522 |

|

Work in process |

|

|

8,201 |

|

|

|

9,408 |

|

Finished products |

|

|

91,629 |

|

|

|

79,463 |

|

Total inventories |

|

|

198,441 |

|

|

|

169,393 |

|

Income taxes receivable |

|

|

25,616 |

|

|

|

12,720 |

|

Prepaid expenses and other current assets |

|

|

37,117 |

|

|

|

37,358 |

|

Total current assets |

|

|

648,782 |

|

|

|

685,370 |

|

Investment in unconsolidated affiliates |

|

|

119,222 |

|

|

|

129,262 |

|

Operating lease assets |

|

|

39,586 |

|

|

|

22,699 |

|

Goodwill |

|

|

412,764 |

|

|

|

376,480 |

|

Other intangibles, net of accumulated amortization of $96,736 and $88,887, respectively |

|

|

219,056 |

|

|

|

190,398 |

|

Other assets |

|

|

25,284 |

|

|

|

20,717 |

|

Property, plant and equipment: |

|

|

|

|

|

|

Land |

|

|

8,727 |

|

|

|

8,703 |

|

Buildings and improvements |

|

|

135,134 |

|

|

|

132,742 |

|

Machinery and equipment |

|

|

390,637 |

|

|

|

372,798 |

|

Construction in progress |

|

|

50,427 |

|

|

|

33,326 |

|

Total property, plant and equipment |

|

|

584,925 |

|

|

|

547,569 |

|

Less: accumulated depreciation |

|

|

296,286 |

|

|

|

277,343 |

|

Total property, plant and equipment, net |

|

|

288,639 |

|

|

|

270,226 |

|

Total assets |

|

$ |

1,753,333 |

|

|

$ |

1,695,152 |

|

|

|

|

|

|

|

|

Liabilities and equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

104,779 |

|

|

$ |

103,205 |

|

Accrued compensation, contributions to employee benefit plans and related taxes |

|

|

29,396 |

|

|

|

43,864 |

|

Dividends payable |

|

|

9,776 |

|

|

|

9,172 |

|

Other accrued items |

|

|

46,013 |

|

|

|

34,478 |

|

Current operating lease liabilities |

|

|

8,472 |

|

|

|

6,014 |

|

Income taxes payable |

|

|

634 |

|

|

|

109 |

|

Total current liabilities |

|

|

199,070 |

|

|

|

196,842 |

|

Other liabilities |

|

|

57,574 |

|

|

|

53,364 |

|

Distributions in excess of investment in unconsolidated affiliate |

|

|

106,363 |

|

|

|

103,767 |

|

Long-term debt |

|

|

305,255 |

|

|

|

302,868 |

|

Noncurrent operating lease liabilities |

|

|

31,942 |

|

|

|

17,173 |

|

Deferred income taxes |

|

|

90,106 |

|

|

|

82,901 |

|

Total liabilities |

|

|

790,310 |

|

|

|

756,915 |

|

Shareholders' equity - controlling interest |

|

|

962,599 |

|

|

|

937,187 |

|

Noncontrolling interest |

|

|

424 |

|

|

|

1,050 |

|

Total equity |

|

|

963,023 |

|

|

|

938,237 |

|

Total liabilities and equity |

|

$ |

1,753,333 |

|

|

$ |

1,695,152 |

|

WORTHINGTON ENTERPRISES, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Six Months Ended |

|

|

|

November 30, |

|

|

November 30, |

|

|

|

2025 |

|

|

2024 |

|

|

2025 |

|

|

2024 |

|

Operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings |

|

$ |

27,029 |

|

|

$ |

28,009 |

|

|

$ |

61,850 |

|

|

$ |

52,017 |

|

Adjustments to reconcile net earnings to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

13,764 |

|

|

|

11,927 |

|

|

|

26,850 |

|

|

|

23,757 |

|

Provision for (benefit from) deferred income taxes |

|

|

561 |

|

|

|

2,682 |

|

|

|

3,518 |

|

|

|

(2,855 |

) |

Bad debt expense |

|

|

230 |

|

|

|

2,069 |

|

|

|

209 |

|

|

|

2,061 |

|

Equity in net income of unconsolidated affiliates, net of distributions |

|

|

5,108 |

|

|

|

4,268 |

|

|

|

4,927 |

|

|

|

7,721 |

|

Net loss (gain) on sale of assets |

|

|

3,012 |

|

|

|

(508 |

) |

|

|

3,012 |

|

|

|

(526 |

) |

Stock-based compensation |

|

|

3,326 |

|

|

|

5,937 |

|

|

|

6,753 |

|

|

|

9,862 |

|

Unrealized loss on investment in marketable securities |

|

|

1,243 |

|

|

|

- |

|

|

|

1,243 |

|

|

|

- |

|

Changes in assets and liabilities, net of impact of acquisitions: |

|

|

|

|

|

|

|

|

|

|

|

|

Receivables |

|

|

6,736 |

|

|

|

(18,636 |

) |

|

|

20,843 |

|

|

|

9,530 |

|

Inventories |

|

|

3,120 |

|

|

|

7,836 |

|

|

|

(12,697 |

) |

|

|

1,430 |

|

Accounts payable |

|

|

1,969 |

|

|

|

447 |

|

|

|

(9,977 |

) |

|

|

(12,646 |

) |

Accrued compensation and employee benefits |

|

|

(4,079 |

) |

|

|

(2,021 |

) |

|

|

(14,478 |

) |

|

|

(13,466 |

) |

Other operating items, net |

|

|

(10,501 |

) |

|

|

7,043 |

|

|

|

527 |

|

|

|

13,314 |

|

Net cash provided by operating activities |

|

|

51,518 |

|

|

|

49,053 |

|

|

|

92,580 |

|

|

|

90,199 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

Investment in property, plant and equipment |

|

|

(12,432 |

) |

|

|

(15,161 |

) |

|

|

(25,627 |

) |

|

|

(24,790 |

) |

Acquisitions, net of cash acquired |

|

|

- |

|

|

|

731 |

|

|

|

(92,235 |

) |

|

|

(88,156 |

) |

Proceeds from sale of assets, net of selling costs |

|

|

- |

|

|

|

1,616 |

|

|

|

- |

|

|

|

13,385 |

|

Investment in non-marketable equity securities, net of distributions |

|

|

(55 |

) |

|

|

(40 |

) |

|

|

(55 |

) |

|

|

(2,040 |

) |

Net cash used by investing activities |

|

|

(12,487 |

) |

|

|

(12,854 |

) |

|

|

(117,917 |

) |

|

|

(101,601 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Financing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

Dividends paid |

|

|

(9,623 |

) |

|

|

(8,969 |

) |

|

|

(18,199 |

) |

|

|

(17,085 |

) |

Repurchase of common shares |

|

|

(13,695 |

) |

|

|

(8,079 |

) |

|

|

(19,954 |

) |

|

|

(14,882 |

) |

Proceeds from issuance of common shares, net of tax withholdings |

|

|

(2,269 |

) |

|

|

(3,893 |

) |

|

|

(5,821 |

) |

|

|

(7,051 |

) |

Principal payments on long-term obligations |

|

|

(278 |

) |

|

|

- |

|

|

|

(476 |

) |

|

|

- |

|

Net cash used by financing activities |

|

|

(25,865 |

) |

|

|

(20,941 |

) |

|

|

(44,450 |

) |

|

|

(39,018 |

) |

Increase (decrease) in cash and cash equivalents |

|

|

13,166 |

|

|

|

15,258 |

|

|

|

(69,787 |

) |

|

|

(50,420 |

) |

Cash and cash equivalents at beginning of period |

|

|

167,122 |

|

|

|

178,547 |

|

|

|

250,075 |

|

|

|

244,225 |

|

Cash and cash equivalents at end of period |

|

$ |

180,288 |

|

|

$ |

193,805 |

|

|

$ |

180,288 |

|

|

$ |

193,805 |

|

WORTHINGTON ENTERPRISES, INC.

SEGMENT INFORMATION

(Dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Six Months Ended |

|

|

|

November 30, |

|

|

November 30, |

|

|

|

2025 |

|

|

2024 |

|

|

2025 |

|

|

2024 |

|

Net sales |

|

|

|

|

|

|

|

|

|

|

|

|

Consumer Products |

|

$ |

119,924 |

|

|

$ |

116,748 |

|

|

$ |

238,862 |

|

|

$ |

234,343 |

|

Building Products |

|

|

207,528 |

|

|

|

157,298 |

|

|

|

392,297 |

|

|

|

297,011 |

|

Consolidated |

|

$ |

327,452 |

|

|

$ |

274,046 |

|

|

$ |

631,159 |

|

|

$ |

531,354 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

|

|

|

|

|

|

|

|

|

|

|

|

Consumer Products |

|

$ |

15,288 |

|

|

$ |

15,484 |

|

|

$ |

31,435 |

|

|

$ |

33,259 |

|

Building Products |

|

|

52,997 |

|

|

|

47,185 |

|

|

|

110,790 |

|

|

|

86,914 |

|

Total reportable segments |

|

|

68,285 |

|

|

|

62,669 |

|

|

|

142,225 |

|

|

|

120,173 |

|

Other (1) |

|

|

(1,311 |

) |

|

|

262 |

|

|

|

(2,973 |

) |

|

|

(892 |

) |

Unallocated Corporate |

|

|

(6,496 |

) |

|

|

(6,718 |

) |

|

|

(13,714 |

) |

|

|

(14,632 |

) |

Consolidated |

|

$ |

60,478 |

|

|

$ |

56,213 |

|

|

$ |

125,538 |

|

|

$ |

104,649 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA margin |

|

|

|

|

|

|

|

|

|

|

|

|

Consumer Products |

|

|

12.7 |

% |

|

|

13.3 |

% |

|

|

13.2 |

% |

|

|

14.2 |

% |

Building Products |

|

|

25.5 |

% |

|

|

30.0 |

% |

|

|

28.2 |

% |

|

|

29.3 |

% |

Consolidated |

|

|

18.5 |

% |

|

|

20.5 |

% |

|

|

19.9 |

% |

|

|

19.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity income by unconsolidated affiliate |

|

|

|

|

|

|

|

|

|

|

|

|

WAVE (2) |

|

$ |

26,296 |

|

|

$ |

24,564 |

|

|

$ |

58,681 |

|

|

$ |

52,466 |

|

ClarkDietrich (2) |

|

|

4,133 |

|

|

|

9,730 |

|

|

|

10,067 |

|

|

|

18,474 |

|

Other (1) |

|

|

(1,311 |

) |

|

|

262 |

|

|

|

(2,973 |

) |

|

|

(892 |

) |

Consolidated |

|

$ |

29,118 |

|

|

$ |

34,556 |

|

|

$ |

65,775 |

|

|

$ |

70,048 |

|

(1)

Other includes the equity earnings of Taxi Workhorse, LLC and the SES joint venture.

(2)

Equity income contributed by WAVE and ClarkDietrich is included in Building Products segment results.

WORTHINGTON ENTERPRISES, INC.

GAAP / NON-GAAP RECONCILIATIONS

(Dollars in thousands, except per share amounts)

For more information on the non-GAAP measures, refer to the “Use of Non-GAAP Financial Measures and Definitions” section of this release.

Consolidated Results – Adjusted Earnings per Share – Diluted

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended November 30, 2025 |

|

|

|

|

|

Earnings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Before |

|

|

Income |

|

|

|

|

|

|

|

|

Operating |

|

|

Income |

|

|

Tax |

|

|

Net |

|

|

Diluted |

|

|

Income |

|

|

Taxes |

|

|

Expense |

|

|

Earnings (1) |

|

|

EPS (1) |

|

GAAP |

$ |

12,264 |

|

|

$ |

35,780 |

|

|

$ |

8,751 |

|

|

$ |

27,328 |

|

|

$ |

0.55 |

|

Restructuring and other expense, net (2) |

|

1,644 |

|

|

|

1,644 |

|

|

|

(404 |

) |

|

|

1,240 |

|

|

|

0.02 |

|

Loss on partial sale of investment in SES (3) |

|

- |

|

|

|

2,950 |

|

|

|

- |

|

|

|

2,950 |

|

|

|

0.06 |

|

Unrealized loss on investment in marketable securities |

|

- |

|

|

|

1,243 |

|

|

|

(301 |

) |

|

|

942 |

|

|

|

0.02 |

|

Non-GAAP |

$ |

13,908 |

|

|

$ |

41,617 |

|

|

$ |

9,456 |

|

|

$ |

32,460 |

|

|

$ |

0.65 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended November 30, 2024 |

|

|

|

|

|

Earnings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Before |

|

|

Income |

|

|

|

|

|

|

|

|

Operating |

|

|

Income |

|

|

Tax |

|

|

Net |

|

|

Diluted |

|

|

Income |

|

|

Taxes |

|

|

Expense |

|

|

Earnings (1) |

|

|

EPS (1) |

|

GAAP |

$ |

3,521 |

|

|

$ |

37,109 |

|

|

$ |

9,100 |

|

|

$ |

28,260 |

|

|

$ |

0.56 |

|

Restructuring and other expense, net |

|

2,620 |

|

|

|

2,620 |

|

|

|

(639 |

) |

|

|

1,981 |

|

|

|

0.04 |

|

Non-GAAP |

$ |

6,141 |

|

|

$ |

39,729 |

|

|

$ |

9,739 |

|

|

$ |

30,241 |

|

|

$ |

0.60 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended November 30, 2025 |

|

|

|

|

|

Earnings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Before |

|

|

Income |

|

|

|

|

|

|

|

|

Operating |

|

|

Income |

|

|

Tax |

|

|

Net |

|

|

Diluted |

|

|

Income |

|

|

Taxes |

|

|

Expense |

|

|

Earnings (1) |

|

|

EPS (1) |

|

GAAP |

$ |

21,507 |

|

|

$ |

81,461 |

|

|

$ |

19,611 |

|

|

$ |

62,476 |

|

|

$ |

1.25 |

|

Restructuring and other expense, net (2) |

|

4,120 |

|

|

|

4,120 |

|

|

|

(781 |

) |

|

|

3,339 |

|

|

|

0.07 |

|

Loss on partial sale of investment in SES (3) |

|

- |

|

|

|

2,950 |

|

|

|

- |

|

|

|

2,950 |

|

|

|

0.06 |

|

Unrealized loss on investment in marketable securities |

|

- |

|

|

|

1,243 |

|

|

|

(301 |

) |

|

|

942 |

|

|

|

0.02 |

|

Non-GAAP |

$ |

25,627 |

|

|

$ |

89,774 |

|

|

$ |

20,693 |

|

|

$ |

69,707 |

|

|

$ |

1.40 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended November 30, 2024 |

|

|

|

|

|

Earnings |

|

|

|

|

|

|

|

|

|

|

|

Operating |

|

|

Before |

|

|

Income |

|

|

|

|

|

|

|

|

Income |

|

|

Income |

|

|

Tax |

|

|

Net |

|

|

Diluted |

|

|

(Loss) |

|

|

Taxes |

|

|

Expense |

|

|

Earnings (1) |

|

|

EPS (1) |

|

GAAP |

$ |

(1,178 |

) |

|

$ |

67,899 |

|

|

$ |

15,882 |

|

|

$ |

52,513 |

|

|

$ |

1.04 |

|

Restructuring and other expense, net |

|

3,778 |

|

|

|

3,778 |

|

|

|

(928 |

) |

|

|

2,850 |

|

|

|

0.06 |

|

Non-GAAP |

$ |

2,600 |

|

|

$ |

71,677 |

|

|

$ |

16,810 |

|

|

$ |

55,363 |

|

|

$ |

1.10 |

|

Consolidated Results – Adjusted EBITDA

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Six Months Ended |

|

|

|

November 30, |

|

|

November 30, |

|

|

|

2025 |

|

|

2024 |

|

|

2025 |

|

|

2024 |

|

Net earnings (GAAP) |

|

$ |

27,029 |

|

|

$ |

28,009 |

|

|

$ |

61,850 |

|

|

$ |

52,017 |

|

Plus: Net loss attributable to noncontrolling interest |

|

|

299 |

|

|

|

251 |

|

|

|

626 |

|

|

|

496 |

|

Net earnings attributable to controlling interest |

|

|

27,328 |

|

|

|

28,260 |

|

|

|

62,476 |

|

|

|

52,513 |

|

Interest expense, net |

|

|

1,472 |

|

|

|

1,033 |

|

|

|

1,535 |

|

|

|

1,522 |

|

Income tax expense |

|

|

8,751 |

|

|

|

9,100 |

|

|

|

19,611 |

|

|

|

15,882 |

|

EBIT (4) |

|

|

37,551 |

|

|

|

38,393 |

|

|

|

83,622 |

|

|

|

69,917 |

|

Restructuring and other expense, net |

|

|

1,644 |

|

|

|

2,620 |

|

|

|

4,120 |

|

|

|

3,778 |

|

Loss on partial sale of investment in SES (2) |

|

|

2,950 |

|

|

|

- |

|

|

|

2,950 |

|

|

|

- |

|

Unrealized loss on investment in marketable securities (3) |

|

|

1,243 |

|

|

|

- |

|

|

|

1,243 |

|

|

|

- |

|

Adjusted EBIT (4) |

|

|

43,388 |

|

|

|

41,013 |

|

|

|

91,935 |

|

|

|

73,695 |

|

Depreciation and amortization |

|

|

13,764 |

|

|

|

11,927 |

|

|

|

26,850 |

|

|

|

23,757 |

|

Stock-based compensation (5) |

|

|

3,326 |

|

|

|

3,273 |

|

|

|

6,753 |

|

|

|

7,197 |

|

Adjusted EBITDA (non-GAAP) |

|

$ |

60,478 |

|

|

$ |

56,213 |

|

|

$ |

125,538 |

|

|

$ |

104,649 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings margin (GAAP) |

|

|

8.3 |

% |

|

|

10.2 |

% |

|

|

9.8 |

% |

|

|

9.8 |

% |

Adjusted EBITDA margin (non-GAAP) |

|

|

18.5 |

% |

|

|

20.5 |

% |

|

|

19.9 |

% |

|

|

19.7 |

% |

(1)

Excludes the impact of noncontrolling interest.

(2)

Reflects the loss incurred in connection with divestment of the company’s 49% interest in the composite assets of its SES joint venture on October 16, 2025. In exchange for the company’s interest in the divested assets, it received common shares in both Hexagon Composites and Hexagon Purus.

(3)

Reflects the unrealized loss associated with the marketable securities noted in footnote (2) above.

(4)

EBIT and adjusted EBIT are non-GAAP financial measures. However, these measures are not used by management to evaluate the company's performance, engage in financial and operational planning, or to determine incentive compensation. Instead, they are included as subtotals in the reconciliation of net earnings to adjusted EBITDA, which is a non-GAAP financial measure used by management.

(5)

Excludes $2.7 million of stock-based compensation reported in restructuring and other expense, net in the company’s consolidated statement of earnings for the three and six months ended November 30, 2024 related to the accelerated vesting of certain outstanding equity awards upon retirement of a key employee.

Consolidated Results - Free Cash Flow

The following tables provide a reconciliation of net cash provided by operating activities to free cash flow and the calculation of operating cash flow conversion to free cash flow conversion for the three and six months ended November 30, 2025 and 2024.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Six Months Ended |

|

|

|

November 30, |

|

|

November 30, |

|

|

|

2025 |

|

|

2024 |

|

|

2025 |

|

|

2024 |

|

Net cash provided by operating activities (GAAP) |

|

$ |

51,518 |

|

|

$ |

49,053 |

|

|

$ |

92,580 |

|

|

$ |

90,199 |

|

Investment in property, plant, and equipment |

|

|

(12,432 |

) |

|

|

(15,161 |

) |

|

|

(25,627 |

) |

|

|

(24,790 |

) |

Free cash flow (non-GAAP) |

|

$ |

39,086 |

|

|

$ |

33,892 |

|

|

$ |

66,953 |

|

|

$ |

65,409 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings attributable to controlling interest (GAAP) |

|

$ |

27,328 |

|

|

$ |

28,260 |

|

|

$ |

62,476 |

|

|

$ |

52,513 |

|

Adjusted net earnings attributable to controlling interest (non-GAAP) |

|

$ |

32,460 |

|

|

$ |

30,241 |

|

|

$ |

69,707 |

|

|

$ |

55,363 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating cash flow conversion (GAAP) (1) |

|

|

189 |

% |

|

|

174 |

% |

|

|

148 |

% |

|

|

172 |

% |

Free cash flow conversion (non-GAAP) |

|

|

120 |

% |

|

|

112 |

% |

|

|

96 |

% |

|

|

118 |

% |

(1)

Operating cash flow conversion is defined as net cash provided by operating activities divided by net earnings attributable to controlling interest.

WORTHINGTON ENTERPRISES, INC.

USE OF NON-GAAP FINANCIAL MEASURES AND DEFINITIONS

NON-GAAP FINANCIAL MEASURES. These materials include certain financial measures that are not calculated and presented in accordance with accounting principles generally accepted in the United States (“GAAP”). Non-GAAP financial measures typically exclude items that management believes are not reflective of, and thus should not be included when evaluating the performance of the company’s ongoing operations. Management uses these non-GAAP financial measures to evaluate ongoing performance, engage in financial and operational planning, and determine incentive compensation. Management believes these non-GAAP financial measures provide useful supplemental information regarding the performance of the company’s ongoing operations and should not be considered as an alternative to the comparable GAAP financial measure. Additionally, management believes these non-GAAP financial measures allow for meaningful comparisons and analysis of trends in the company’s businesses and enables investors to evaluate operations and future prospects in the same manner as management.

The following provides an explanation of each non-GAAP financial measure presented in these materials:

Adjusted operating income (loss) is defined as operating income (loss) excluding the items listed below, to the extent naturally included in operating income (loss).

Adjusted net earnings is defined as net earnings attributable to controlling interest excluding the after-tax effect of the excluded items outlined below.

Adjusted EPS – diluted is defined as adjusted net earnings divided by diluted weighted-average common shares outstanding for the applicable period.

Adjusted EBITDA is the measure by which management evaluates segment performance and overall profitability. EBITDA is defined as earnings before interest, taxes, depreciation, and amortization. Adjusted EBITDA excludes additional items including, but not limited to, those listed below, as well as other items that management believes are not reflective of, and thus should not be included when evaluating the performance of ongoing operations. Adjusted EBITDA also excludes stock-based compensation due to its non-cash nature, which is consistent with how management assesses operating performance and determines incentive compensation. At the segment level, adjusted EBITDA includes expense allocations for centralized corporate back-office functions that exist to support the day-to-day business operations. Public company and other governance costs are held at the corporate level within the unallocated corporate and other category.

Adjusted EBITDA margin is calculated by dividing adjusted EBITDA by net sales.

Free cash flow is a non-GAAP financial liquidity measure that is used by the company to assess its ability to generate cash beyond what is required for its business operations and capital expenditures. The company defines free cash flow as net cash flows from operating activities less investment in property, plant, and equipment.

Free cash flow conversion is a non-GAAP financial measure that is used by the company to measure how much of its adjusted net earnings attributable to controlling interest is converted into cash. The company defines free cash flow conversion as free cash flow divided by adjusted net earnings.

EXCLUSIONS FROM NON-GAAP FINANCIAL MEASURES

Management believes it is useful to exclude the following items from its non-GAAP financial measures for its own and investors’ assessment of the business for the reasons identified below. Additionally, management may exclude other items from non-GAAP financial measures that do not occur in the ordinary course of the company’s ongoing business operations and note them in the reconciliation from net earnings to the non-GAAP financial measure adjusted EBITDA.

•

Impairment charges are excluded because they do not occur in the ordinary course of the company’s ongoing business operations, are inherently unpredictable in timing and amount, and are non-cash, which management believes facilitates the comparison of historical, current and forecasted financial results.

•

Restructuring activities consists of established programs that are intended to fundamentally change the company’s operations, and as such are excluded from its non-GAAP financial measures. The company’s restructuring programs may include closing or consolidating production facilities or moving manufacturing of a product to another location, realignment of the management structure of a business unit in response to changing market conditions or general rationalization of headcount. The company’s restructuring activities generally give rise to employee-related costs, such as severance pay, and facility-related costs, such as exit costs and gains or losses on asset disposals but may include other incremental costs associated with the company’s restructuring activities. Restructuring and other expense, net, may also include other nonrecurring items included in operating income but incremental to the company’s normal business activities. These items are excluded because they are not part of the ongoing operations of the company’s underlying business.

•

Loss on partial sale of investment in SES is excluded because it does not occur in the normal course of business and is inherently unpredictable in timing and amount.

•

Unrealized losses on marketable equity securities represents the net impact of unrealized losses resulting from mark-to-market adjustments on the company’s marketable equity securities. The company excludes this activity because it is not reflective of on-going operating activity and does not provide a meaningful evaluation of operating performance.