☐

|

REGISTRATION STATEMENT PURSUANT TO SECTION 12 OF THE SECURITIES EXCHANGE ACT OF 1934 |

☒

|

ANNUAL REPORT PURSUANT TO SECTION 13(a) OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

Canada |

6029 |

13-1942440 |

||

|

(Province or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

Title of each class |

Trading Symbol |

Name of each exchange on which registered |

||

Common Shares |

CM |

New York Stock Exchange |

☒

Annual Information Form |

☒

Audited annual financial statements |

Common Shares |

926,610,598 |

|||

Class A Preferred Shares: |

||||

Series 47 |

18,000,000 |

|||

Series 54 |

750,000 |

1 |

||

Series 55 |

800,000 |

1 |

||

Series 56 |

600,000 |

|||

Series 57 |

500,000 |

|||

Series 58 |

500,000 |

1 |

||

Series 59 |

500,000 |

1 |

||

Series 60 |

450,000 |

1 |

||

Series 61 |

150,000 |

|||

Series 62 |

750,000 |

1 |

||

Series 63 |

450,000 |

1 |

||

1 |

The Series 54, 55, 58, 59, 60, 62 and 63 Class A Preferred Shares (NVCC) are held by a consolidated entity, CIBC LRCN Limited Recourse Capital Trust, in connection with the issuance of Limited Recourse Capital Notes (NVCC) (subordinated indebtedness) (“LRCNs”) by series: CAD$750 million principal amount of 4.000% LRCNs Series 2, CAD$800 million principal amount of 7.150% LRCNs Series 3, CAD$500 million principal amount of 6.987% LRCNs Series 4, USD$500 million principal amount of 6.950% LRCNs Series 5, CAD$450 million principal amount of 6.369% LRCNs Series 6, USD$750 million principal amount of 7.000% LRCNs Series 7 and CAD$450 million principal amount of 5.898% LRCNs Series 8, respectively. The Series 54, 55, 58, 59, 60, 62 and 63 Class A Preferred Shares are distributable to holders of such notes upon certain events. |

• |

Entire document |

• |

Section 2 |

• |

Section 3 |

• |

Section 5 |

Date: December 4, 2025 |

CANADIAN IMPERIAL BANK OF COMMERCE |

|||||

By: |

/s/ Harry Culham |

|||||

Harry Culham |

||||||

President and Chief Executive Officer |

||||||

By: |

/s/ Robert Sedran |

|||||

Robert Sedran |

||||||

Senior Executive Vice-President and |

||||||

Chief Financial Officer |

||||||

Exhibit |

Description of Exhibit |

|

B.3(a) |

Annual Information Form |

|

B.3(b) |

Audited consolidated financial statements for the year ended October 31, 2025 excerpted from pages 101-102 and 109-179 of the 2025 Annual Report of Canadian Imperial Bank of Commerce (“CIBC”) and the report of independent registered public accounting firm (PCAOB ID: 1263) to shareholders with respect to the report on financial statements related to the consolidated balance sheets as at October 31, 2025 and 2024, and the consolidated statements of income, comprehensive income, changes in equity and cash flows for the years then ended and the report of independent registered public accounting firm (PCAOB ID: 1263) on internal control over financial reporting under standards of the Public Company Accounting Oversight Board (United States) as of October 31, 2025 from pages 106-108 of the 2025 Annual Report of CIBC |

|

B.3(c) |

Management’s discussion and analysis excerpted from pages 1-100 of CIBC’s 2025 Annual Report |

|

B.3(d) |

Other Pages of CIBC’s 2025 Annual Report incorporated in Annual Information Form |

|

B.6(a)(1) |

Certifications required by Rule 13a-14(a)

|

|

B.6(a)(2) |

Certifications required by Rule 13a-14(b) and Section 1350 of Chapter 63 of Title 18 of the United States Code |

|

D.9 |

Consent of Independent Registered Public Accounting Firm |

|

97 |

CIBC’s SEC Clawback Policy |

|

101 |

Interactive Data File (formatted as Inline XBRL) |

|

104 |

Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101 |

|

Exhibit B.3(a): Annual Information Form

Canadian Imperial Bank of Commerce

ANNUAL INFORMATION FORM

December 3, 2025

TABLE OF CONTENTS

| 2 |

||||

| 3 |

||||

| 3 |

||||

| 3 |

||||

| 3 |

||||

| 3 |

||||

| 3 |

||||

| 4 |

||||

| 4 |

||||

| 4 |

||||

| 4 |

||||

| 4 |

||||

| 5 |

||||

| 6 |

||||

| 6 |

||||

| 6 |

||||

| 6 |

Certain Conditions of the Class A Preferred Shares as a Class |

|||

| 7 |

||||

| 7 |

||||

| 7 |

||||

| 7 |

||||

| 8 |

||||

| 8 |

||||

| 8 |

||||

| 9 |

Escrowed Securities and Securities Subject to Contractual Restriction on Transfer |

|||

| 9 |

||||

| 9 |

||||

| 9 |

||||

| 9 |

||||

| 10 |

||||

| 10 |

||||

| 10 |

||||

| 10 |

||||

| 10 |

||||

| 10 |

||||

| 10 |

||||

| 10 |

||||

| 10 |

||||

| 10 |

||||

| 12 |

||||

| 12 |

||||

| 12 |

||||

| 13 |

||||

| 15 |

||||

CIBC 2025 Annual Information Form 1

A NOTE ABOUT FORWARD-LOOKING STATEMENTS

From time to time, we make written or oral forward-looking statements within the meaning of certain securities laws, including in this Annual Information Form, in other filings with Canadian securities regulators or the U.S. Securities and Exchange Commission and in other communications. All such statements are made pursuant to the “safe harbour” provisions of, and are intended to be forward-looking statements under applicable Canadian and U.S. securities legislation, including the U.S. Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, statements made about our operations, business lines, financial condition, risk management, priorities, targets and sustainability commitments (including with respect to our sustainability ambitions and our environmental, social and governance (ESG) related activities), ongoing objectives, strategies, the regulatory environment in which we operate and outlook for calendar year 2026 and subsequent periods. Forward-looking statements are typically identified by the words “believe”, “expect”, “anticipate”, “intend”, “estimate”, “forecast”, “target”, “predict”, “commit”, “ambition”, “goal”, “strive”, “project”, “objective” and other similar expressions or future or conditional verbs such as “will”, “may”, “should”, “would” and “could”. By their nature, these statements require us to make assumptions, including the economic assumptions set out in this Annual Information Form, and are subject to inherent risks and uncertainties that may be general or specific. Given the potential negative economic impacts tied to the actual and proposed U.S. imposition of tariffs on Canada and other countries and their countermeasures, the softening labour market and uncertain political conditions in the U.S., the continuing impact of hybrid work arrangements and high interest rates on the U.S. real estate sector, and the war in Ukraine and conflict in the Middle East on the global economy, financial markets, and our business, results of operations, reputation and financial condition, there is inherently more uncertainty associated with our assumptions as compared to prior periods. A variety of factors, many of which are beyond our control, affect our operations, performance and results, and could cause actual results to differ materially from the expectations expressed in any of our forward-looking statements. These factors include: trade policies and tensions, including tariffs; inflationary pressures in the U.S.; global supply-chain disruptions; geopolitical risk, including from the war in Ukraine and conflict in the Middle East; the impact of post-pandemic hybrid work arrangements; credit, market, liquidity, strategic, insurance, operational, reputation, conduct and legal, regulatory and environmental risk; currency value and interest rate fluctuations, including as a result of market and oil price volatility; the effectiveness and adequacy of our risk management and valuation models and processes; legislative or regulatory developments in the jurisdictions where we operate, including the Organisation for Economic Co-operation and Development Common Reporting Standard, and regulatory reforms in the United Kingdom and Europe, the Basel Committee on Banking Supervision’s global standards for capital and liquidity reform, and those relating to bank recapitalization legislation and the payments system in Canada; amendments to, and interpretations of, risk-based capital guidelines and reporting instructions, and interest rate and liquidity regulatory guidance; exposure to, and the resolution of, significant litigation or regulatory matters, our ability to successfully appeal adverse outcomes of such matters and the timing, determination and recovery of amounts related to such matters; the effect of changes to accounting standards, rules and interpretations; changes in our estimates of reserves and allowances; changes in tax laws; changes to our credit ratings; political conditions and developments, including changes relating to economic or trade matters such as tariffs; the possible effect on our business of international conflicts, such as the war in Ukraine and conflict in the Middle East, and terrorism; natural disasters, disruptions to public infrastructure and other catastrophic events; the occurrence of public health emergencies and any related government policies and actions; reliance on third parties to provide components of our business infrastructure; potential disruptions to our information technology systems and services; increasing cyber security risks, which may include theft or disclosure of assets, unauthorized access to sensitive information, or operational disruption; social media risk; losses incurred as a result of internal or external fraud; anti-money laundering; the accuracy and completeness of information provided to us concerning clients and counterparties; the failure of third parties to comply with their obligations to us and our affiliates or associates; intensifying competition from established competitors and new entrants in the financial services industry, including through internet and mobile banking; technological change, including the use of data and artificial intelligence (AI) in our business; the heavy reliance on AI-related capital spending for U.S. growth and the uncertain employment impacts from its adoption; global capital market activity; changes in monetary and economic policy; general business and economic conditions worldwide, as well as in Canada, the U.S. and other countries where we have operations, including increasing Canadian household debt levels and global credit risks; climate change and other ESG-related risks, including our ability to implement various sustainability-related initiatives internally and with our clients under expected time frames and our ability to scale our sustainable finance products and services; our success in developing and introducing new products and services, expanding existing distribution channels, developing new distribution channels and realizing increased revenue from these channels; changes in client spending and saving habits; our ability to attract and retain key employees and executives; our ability to successfully execute our strategies and complete and integrate acquisitions and joint ventures; the risk that expected benefits of an acquisition, merger or divestiture will not be realized within the expected time frame or at all; and our ability to anticipate and manage the risks associated with these factors. This list is not exhaustive of the factors that may affect any of our forward-looking statements. These and other factors should be considered carefully and readers should not place undue reliance on our forward-looking statements. Any forward-looking statements contained in this Annual Information Form represent the views of management only as of the date hereof and are presented for the purpose of assisting our shareholders and financial analysts in understanding our financial position, objectives and priorities and anticipated financial performance as at and for the periods ended on the dates presented, and may not be appropriate for other purposes. We do not undertake to update any forward-looking statement that is contained in this Annual Information Form or in other communications except as required by law.

CIBC 2025 Annual Information Form 2

INFORMATION INCORPORATED BY REFERENCE

Certain disclosures in this Annual Information Form (AIF) are incorporated by reference from CIBC’s 2025 Annual Report for the year ended October 31, 2025. The table below identifies pages from the 2025 Annual Report which are incorporated by reference into this AIF. The 2025 Annual Report is available on SEDAR+ at www.sedarplus.com.

| AIF Item | 2025 Annual Report – Page Reference | |

| CORPORATE STRUCTURE |

||

| Intercorporate Relationships |

174 | |

| DESCRIPTION OF THE BUSINESS |

||

| The CIBC Organization |

1–100 | |

| Environmental and Social Policies |

50, 79 | |

| Risk Factors |

42–81 | |

| GENERAL DEVELOPMENT OF THE BUSINESS |

4, 13 | |

|

DIVIDENDS |

155–157 | |

| CAPITAL STRUCTURE |

155–157 | |

| DIRECTORS AND OFFICERS |

||

| Directors and Board Committees |

187 | |

| LEGAL PROCEEDINGS AND REGULATORY ACTIONS |

169–171 | |

| TRANSFER AGENT AND REGISTRAR |

186 | |

| FEES FOR SERVICES PROVIDED BY SHAREHOLDERS’ AUDITOR |

93 | |

|

GLOSSARY |

94–100 | |

Unless otherwise specified, this AIF presents information as at October 31, 2025.

Name, Address and Incorporation

Canadian Imperial Bank of Commerce (CIBC) is a diversified financial institution governed by the Bank Act (Canada), which constitutes its charter. CIBC was formed through the amalgamation of The Canadian Bank of Commerce and Imperial Bank of Canada in 1961. The Canadian Bank of Commerce was originally incorporated as Bank of Canada by special act of the legislature of the Province of Canada in 1858. Subsequently, the name was changed to The Canadian Bank of Commerce and it opened for business under that name in 1867. Imperial Bank of Canada was incorporated in 1875 by special act of the Parliament of Canada and commenced operations in that year. The address of the registered and head office of CIBC is 81 Bay Street, CIBC SQUARE, Toronto, Ontario, Canada, M5J 0E7.

Information about the intercorporate relationships among CIBC and its significant subsidiaries is provided in Note 25 to the consolidated financial statements included in the 2025 Annual Report.

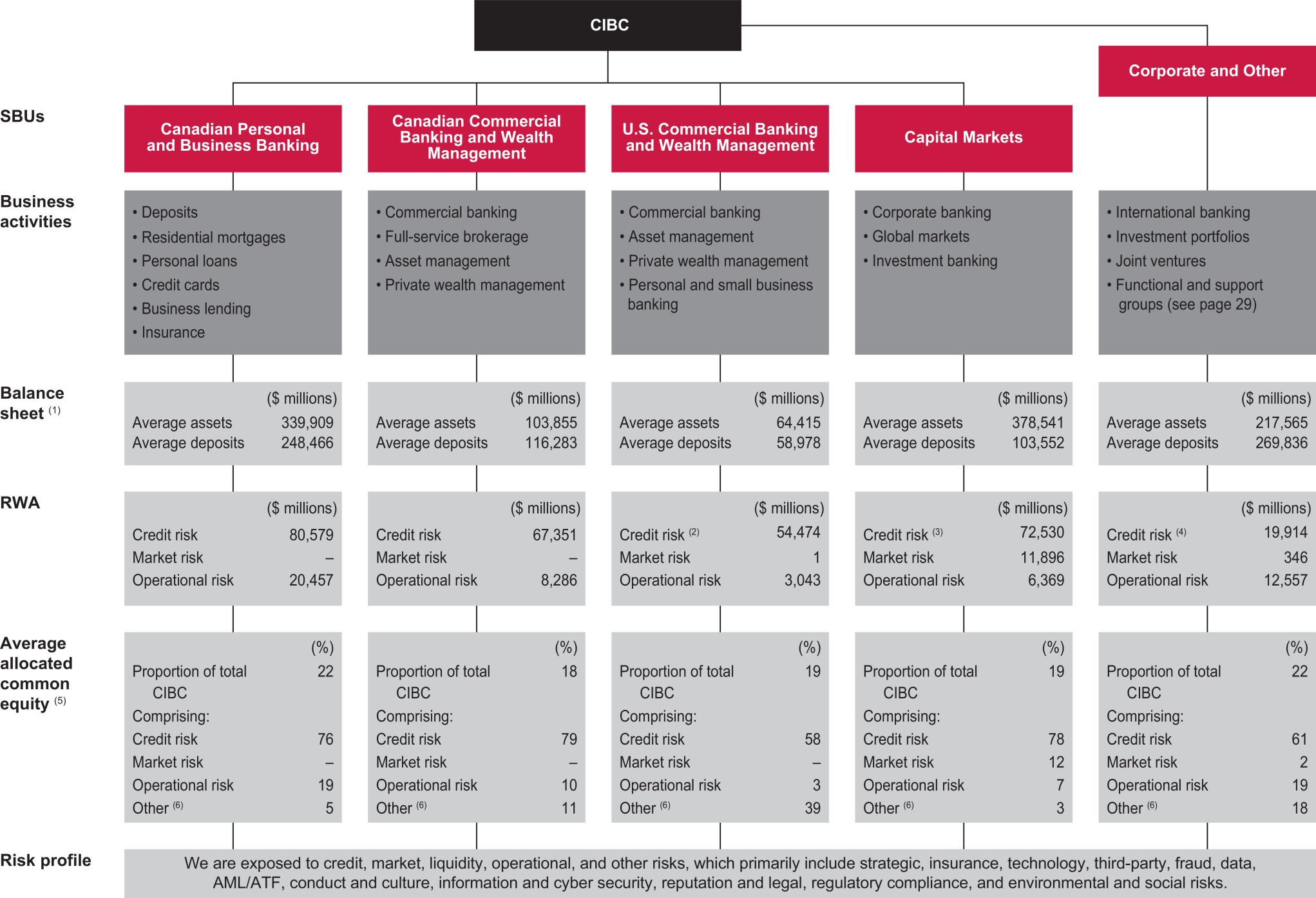

CIBC is a leading North American financial institution. CIBC serves its clients through four main strategic business units (SBUs): Canadian Personal and Business Banking, Canadian Commercial Banking and Wealth Management, U.S. Commercial Banking and Wealth Management, and Capital Markets.

Canadian Personal and Business Banking provides clients across Canada with financial solutions, services and advice through our dedicated team members in banking centres and contact centres, as well as leading mobile and online banking platforms to help make their ambitions a reality.

Canadian Commercial Banking and Wealth Management provides high-touch, relationship-oriented banking and wealth management services to middle-market companies, entrepreneurs, high-net-worth individuals and families across Canada. Our offering also includes an online brokerage platform for retail clients and asset management services for institutional investors.

U.S. Commercial Banking and Wealth Management provides tailored, relationship-oriented banking and wealth management solutions across the U.S., focusing on middle-market and mid-corporate companies, entrepreneurs, high-net-worth individuals and families, as well as operating private and small business banking services in strategic markets across the U.S.

Capital Markets provides integrated global markets products and services, investment banking and corporate banking solutions, and top-ranked research to our clients around the world. Leveraging the capabilities of our differentiated platform, Capital Markets also delivers multi-currency payments and innovative solutions for clients across our bank.

CIBC 2025 Annual Information Form 3

Corporate and Other includes the following functional groups – Technology, Infrastructure and Innovation, Risk Management, People, Culture and Brand, and Finance and Enterprise Strategy, as well as other support groups. The expenses of these functional and support groups are generally allocated to the business lines within the SBUs. Corporate and Other also includes the results of CIBC Caribbean Bank Limited and other portfolio investments, as well as other income statement and balance sheet items not directly attributable to the business lines. Information about CIBC’s business lines and functional groups is provided in the 2025 Annual Report on pages 1 to 100.

A more complete description of services provided by Canadian Personal and Business Banking, Canadian Commercial Banking and Wealth Management, U.S. Commercial Banking and Wealth Management, and Capital Markets can be found in the 2025 Annual Report on pages 17 to 28.

External reporting changes were made in 2025, which affected the results of our SBUs. See the “External reporting changes” section in our 2025 Annual Report on page 2 for additional details.

CIBC was the fifth largest Canadian chartered bank in terms of market capitalization as at October 31, 2025.

Growth decelerated in Canada in 2025 as the economy was hit by elevated tariffs in some sectors and uncertainty over trade relations with the U.S. Although population growth was slowing, weak hiring resulted in an upward drift in the unemployment rate. Inflation remained close to the Bank of Canada’s 2% target rate, allowing the central bank to further lower its policy rate during the year to support growth ahead. Lower interest rates supported a strong year for equities and capital market activity, a mid-year upturn in housing starts, and moderate growth in mortgage and personal loans. Growth in business loans decelerated due to the impact of economic uncertainty on investment spending. The U.S. economy has remained stronger than Canada’s helped by a boom in capital spending for artificial intelligence, but has been impacted by slowing population growth that has held back job creation. While core inflation has yet to come back to target, the central bank resumed cutting interest rates in the wake of a modest upturn in unemployment.

Environmental and Social Policies

Additional information about our environmental policies and environmental and social risk can be found under “Management of risk – Top and emerging risks – Climate risk” and “Management of risk – Other risks – Environmental and social risk” on page 50 and page 79, respectively, of the 2025 Annual Report. Furthermore, CIBC’s Sustainability and Climate Reports and Public Accountability Statement summarize our commitment to our stakeholders and highlight the activities we are undertaking to achieve our sustainability ambitions.

These reports are available on our website at https://www.cibc.com/en/about-cibc/corporate-responsibility.html.

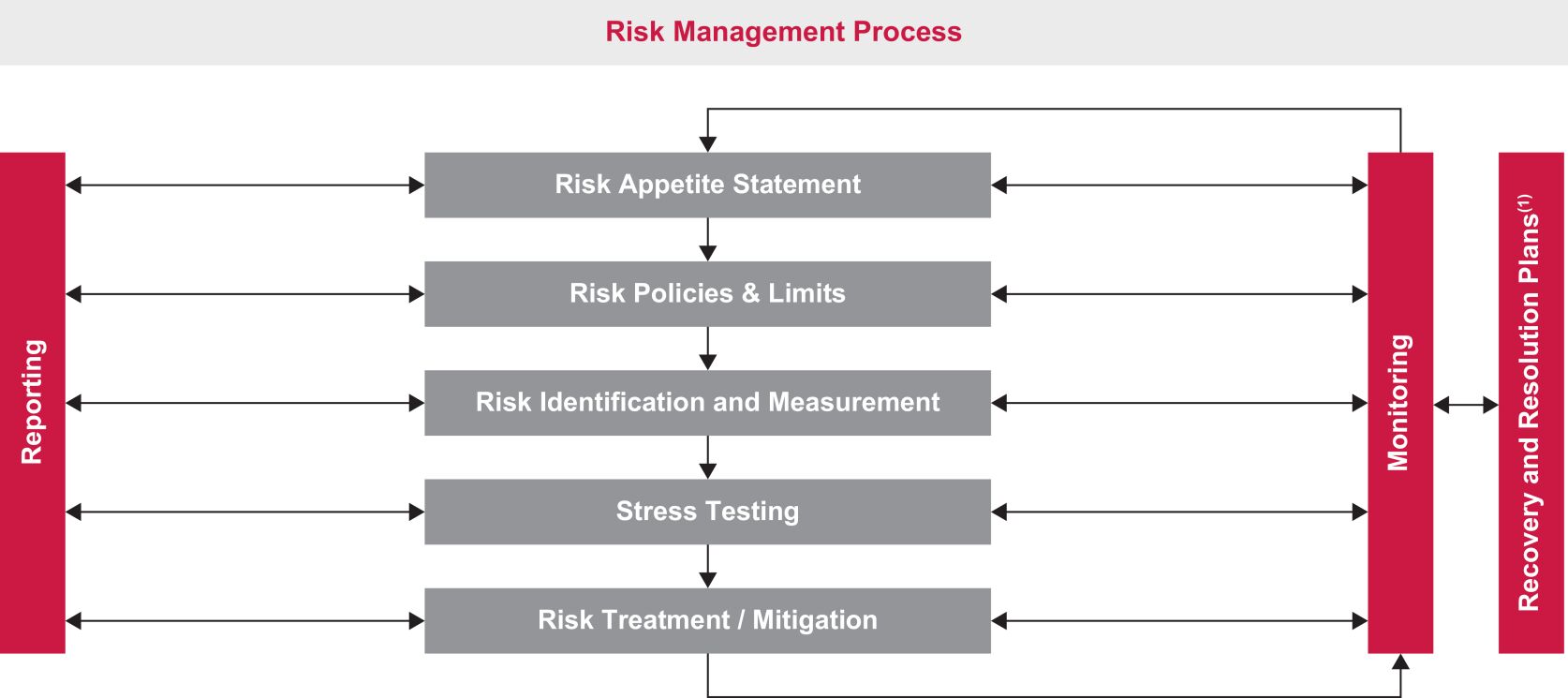

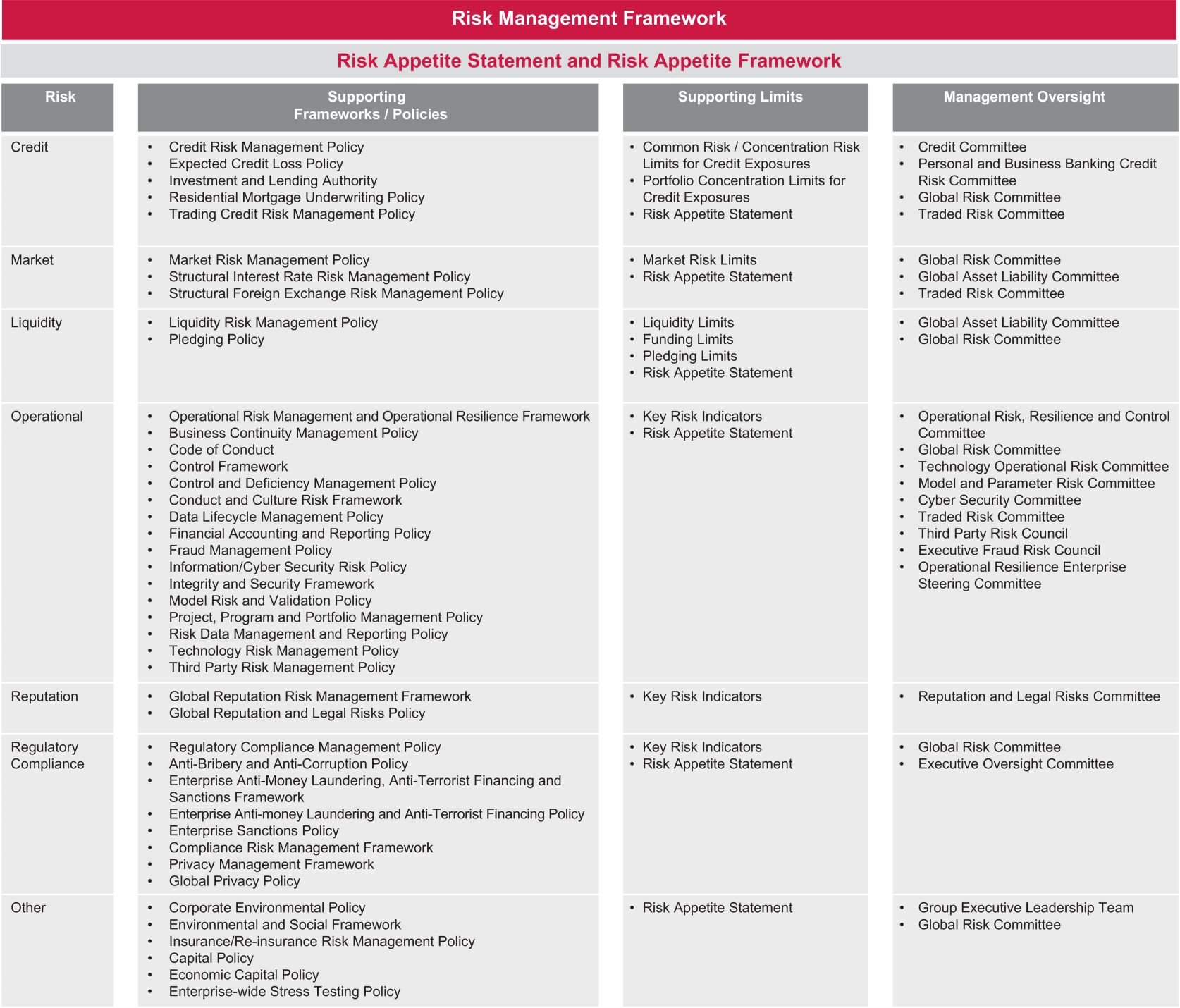

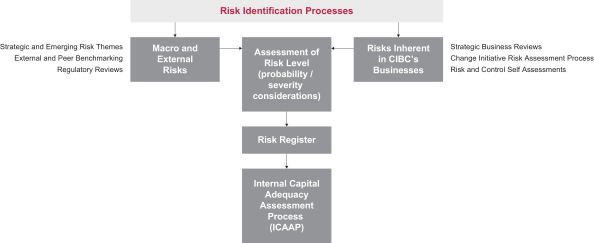

A discussion of risk factors related to CIBC and its business, and the steps taken to manage those risks appears throughout the 2025 Annual Report and in particular under the heading “Management of risk” on pages 42 to 81.

GENERAL DEVELOPMENT OF THE BUSINESS

At CIBC, our goal is to deliver superior client experience and top-tier shareholder returns while maintaining our financial strength.

As discussed in the “Overview” section in the 2025 Annual Report, CIBC has reported a scorecard of financial measures to evaluate and report on our progress to external stakeholders. These measures, for which CIBC has set through the cycle targets, which we currently define as three to five years, assuming a normal business environment and credit cycle, can be categorized into four key areas:

| 1. | Earnings Growth |

| • | Our target was an adjusted(1) diluted earnings per share (EPS) growth rate of 7% to 10% through the cycle. Going forward, we will continue to target an adjusted diluted EPS growth rate of 7% to 10% through the cycle. |

| 2. | Operating Leverage |

| • | Our target was to deliver positive adjusted operating leverage. Going forward, we will continue to target positive adjusted operating leverage through the cycle. |

| 3. | Shareholder Profitability and Return — Return on Common Shareholders’ Equity (ROE) / Dividend Payout Ratio / Total Shareholder Return (TSR) |

| • | Our target was an adjusted ROE of 15%+. Going forward, we will continue to target adjusted ROE of 15%+ through the cycle. |

| • | Our target was an adjusted dividend payout ratio in the range of 40% to 50% of earnings to common shareholders. Going forward, we will continue to target an adjusted dividend payout ratio of 40% to 50% through the cycle. |

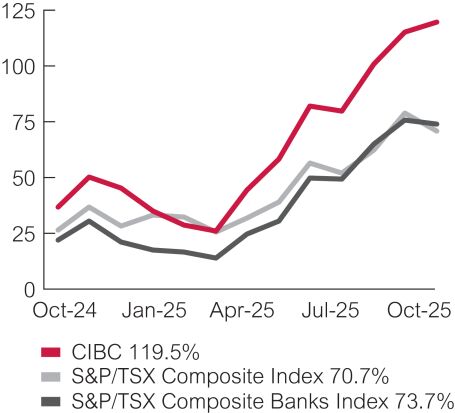

| • | We continue to have an objective to deliver a TSR that exceeds the industry average, which we have defined as the Standard & Poor’s (S&P)/Toronto Stock Exchange (TSX) Composite Banks Index, over rolling three- and five-year periods. |

| 4. | Balance Sheet Strength |

| • | Our target was to actively manage our capital to maintain a strong and efficient capital base while supporting our business and returning capital to our shareholders. Going forward, we will continue to maintain a strong buffer to regulatory requirements. |

| • | The Liquidity Coverage Ratio (LCR) standard requires that, absent a situation of financial stress, the value of the ratio be no lower than 100%. |

| (1) | Adjusted measures are non-GAAP measures. For additional information and a reconciliation of reported results to adjusted results, where applicable, see the “Non-GAAP measures” section starting on page 13 of the 2025 Annual Report, available on SEDAR+ at www.sedarplus.com. |

CIBC 2025 Annual Information Form 4

Fiscal 2025 saw decelerating Canadian economic growth with higher unemployment, elevated tariffs in some sectors, and geopolitical pressures. This was offset by strong but volatile financial markets and stimulative monetary policy. In spite of these challenges, we delivered strong performance across all of our SBUs.

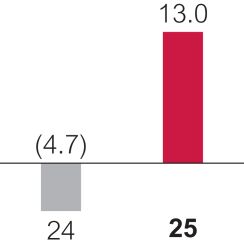

| 1. | Earnings Growth |

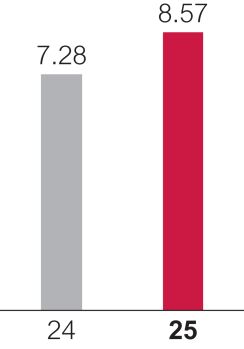

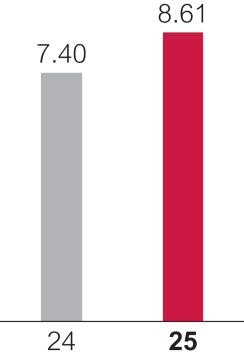

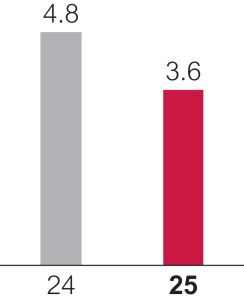

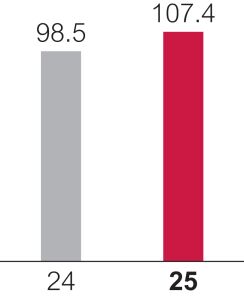

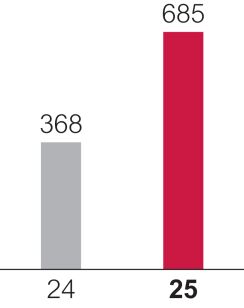

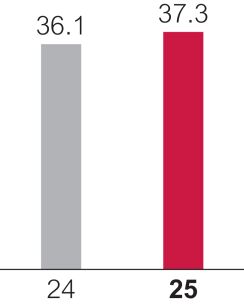

Reported diluted EPS was $8.57 in 2025, compared with $7.28 in 2024, up 18%. Reported diluted EPS was $5.17 in 2023.

| 2. | Operating Leverage |

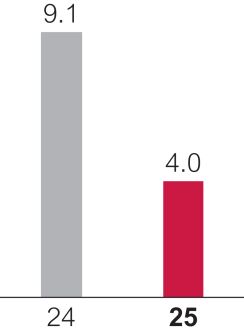

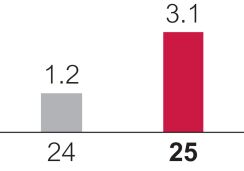

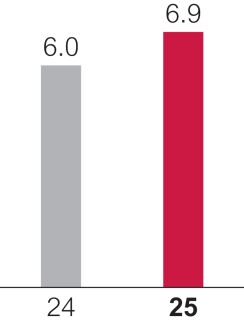

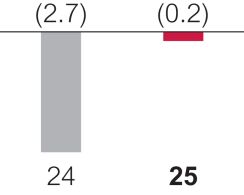

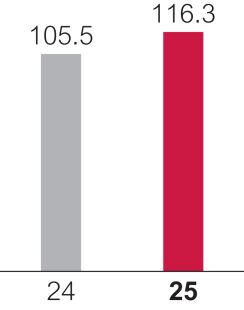

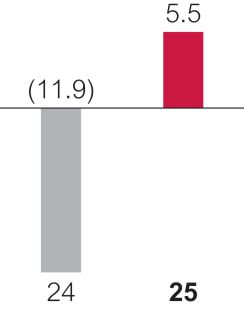

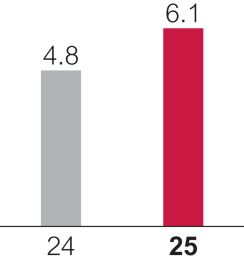

Reported operating leverage(1) was 4.0% in 2025, compared with 9.1% in 2024 and (5.2)% in 2023.

| 3. | Shareholder Profitability and Return — Return on Common Shareholders’ Equity / Dividend Payout Ratio / Total Shareholder Return |

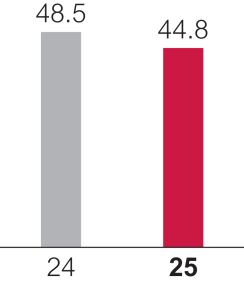

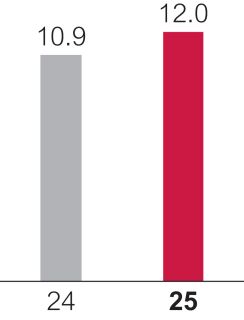

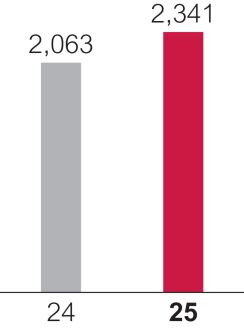

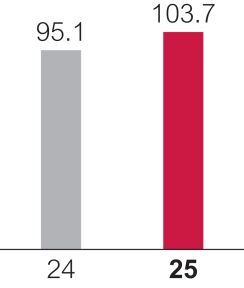

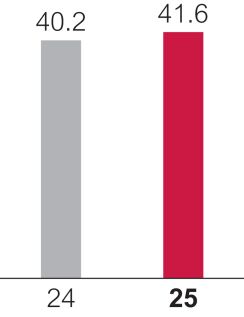

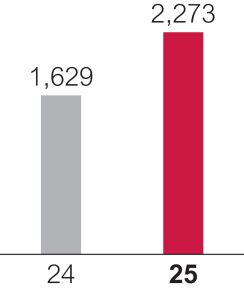

In 2025, reported ROE(1) of 14.3% was up from 13.4% in 2024. Reported ROE was 10.3% in 2023.

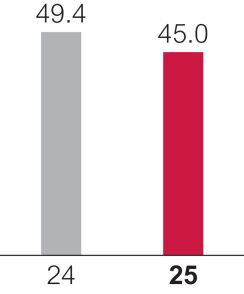

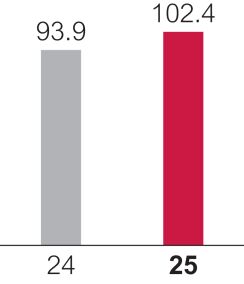

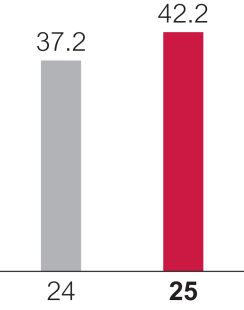

CIBC’s 2025 reported dividend payout ratio(1) was 45.0%, compared with 49.4% in 2024. The reported dividend payout ratio was 66.5% in 2023.

CIBC’s rolling TSR for the three years ended October 31, 2025 was 119.5%, compared with 73.7% for the S&P/TSX Composite Banks Index. For the five years ended October 31, 2025, our TSR was 199.8%, which was above the S&P/TSX Composite Banks Index of 159.1%.

| 4. | Balance Sheet Strength |

At the end of 2025, CIBC’s Common Equity Tier 1 (CET1) ratio(2) was 13.3%, compared with 13.3% in 2024 and 12.4% in 2023, well above the current regulatory requirement set by OSFI of 11.5%.

For the quarter ended October 31, 2025, our three-month daily average liquidity coverage ratio (LCR)(2) was 132% compared to 129% for the same period last year. LCR(2) was 135% in 2023. It measures unencumbered high-quality liquid assets (HQLA) that can be converted into cash to meet liquidity needs for a 30-calendar-day liquidity stress scenario.

CIBC has a common share dividend policy of maintaining a balance between the distribution of profits to shareholders and the need to retain capital for safety and soundness, and to support growth of the businesses. In the context of this overall policy, CIBC’s key criteria for considering dividend increases are the current payout ratio compared to the target, and its view on the sustainability of the level of current earnings through the cycle. Going forward, CIBC will continue to target an adjusted dividend payout ratio of 40% to 50%.

The cash dividends declared and paid per share for each class of CIBC shares and restrictions on the payment of dividends can be found on pages 155 to 157 of the 2025 Annual Report.

| (1) | Certain additional disclosures for these specified financial measures have been incorporated by reference and can be found in the “Financial Highlights” and “Glossary” sections on page 4 and page 94, respectively, of the 2025 Annual Report, available on SEDAR+ at www.sedarplus.com. |

| (2) | CET1 and LCR are calculated pursuant to OSFI’s Capital Adequacy Requirements (CAR) Guideline and OSFI’s Liquidity Adequacy Requirements (LAR) Guideline, respectively, which are both based on the Basel Committee on Banking Supervision (BCBS) standards. Certain additional disclosures for these specified financial measures have been incorporated by reference and can be found in the “Capital management” and “Liquidity risk” sections on page 31 and page 70, respectively, of the 2025 Annual Report, available on SEDAR+ at www.sedarplus.com. |

CIBC 2025 Annual Information Form 5

The following summary of CIBC’s capital structure is qualified in its entirety by CIBC’s by-laws and the actual terms and conditions of such shares. Additional detail on CIBC’s capital structure is provided on pages 37 to 40 and pages 155 to 157 of the 2025 Annual Report.

CIBC’s authorized common share capital consists of an unlimited number of common shares without nominal or par value. The holders of common shares are entitled to receive dividends as and when declared by the Board of Directors of CIBC (the Board), subject to the preference of holders of preferred shares. A holder of common shares is entitled to notice of and to attend all shareholders’ meetings, except meetings at which only holders of a specified class or series of shares are entitled to vote, and for all purposes will be entitled to one vote for each common share held. In the event of liquidation, dissolution or winding-up of CIBC, after payment of all outstanding deposits and debts and subject to the preference of any shares ranking senior to the common shares, the holders of common shares will be entitled to a pro rata distribution of the remaining assets of CIBC. The holders of common shares have no pre-emptive, subscription, redemption or conversion rights. The rights, preferences and privileges of the common shares are subject to the rights of the holders of preferred shares.

Description of Preferred Shares

CIBC is authorized to issue an unlimited number of Class A Preferred Shares and Class B Preferred Shares without nominal or par value, issuable in series, with such rights, privileges, restrictions and conditions as the Board may determine, provided that, for each class of preferred shares, the maximum aggregate consideration for all outstanding shares, at any time does not exceed $10 billion. The following series of Class A Preferred Shares(1) are currently outstanding: Series 47, 54, 55, 56, 57, 58, 59, 60, 61, 62 and 63. No Class B Preferred Shares are currently outstanding.

| (1) | Non-cumulative 5-Year Fixed Rate Reset Class A Preferred Shares Series 54, 55, 58, 59, 60, 62 and 63 (NVCC) (Preferred Shares Series 54, 55, 58, 59, 60, 62 and 63) are held by a consolidated entity, CIBC LRCN Limited Recourse Trust (the Limited Recourse Trust). |

The Bank Act (Canada) requires that banks maintain adequate capital in relation to their operations. The Superintendent of Financial Institutions (the Superintendent) establishes capital adequacy requirements for issuances of regulatory capital by banks. These requirements include that all regulatory capital must be able to absorb losses in a failed financial institution. Effective January 1, 2013, in accordance with capital adequacy requirements adopted by the Superintendent, non-common capital instruments issued after January 1, 2013, including preferred shares, must include non-viability contingent capital (NVCC) provisions, providing for the full and permanent automatic conversion (an NVCC Automatic Conversion) of such non-common capital instruments into common shares upon the occurrence of certain trigger events relating to financial viability (the NVCC Provisions) in order to qualify as regulatory capital.

The following describes certain general terms and conditions of the preferred shares.

Certain Conditions of the Class A Preferred Shares as a Class

The following is a summary of certain provisions attached to the Class A Preferred Shares as a class.

Priority

The Class A Preferred Shares of each series of Class A Preferred Shares rank on a parity with every other series of Class A Preferred Shares and rank in priority to the Class B Preferred Shares and the common shares of CIBC with respect to the payment of dividends and on the distribution of assets in the event of the liquidation, dissolution or winding-up of CIBC, provided that an NVCC Automatic Conversion as contemplated under the NVCC Provisions applicable to a series of Class A Preferred Shares has not occurred.

Restrictions on Creation of Additional Class A Preferred Shares

In addition to any shareholder approvals required by applicable law, the approval of the holders of the Class A Preferred Shares given in the manner described under “Modification” below, is required for any increase in the maximum aggregate consideration for which the Class A Preferred Shares may be issued and for the creation of any shares ranking prior to or on a parity with the Class A Preferred Shares.

Modification

Approval of amendments to the provisions of the Class A Preferred Shares as a class and any other authorization required to be given by the holders of Class A Preferred Shares may be given by a resolution carried by an affirmative vote of not less than 662/3% of the votes cast at a meeting at which the holders of 10% of the outstanding Class A Preferred Shares are present or represented by proxy or, if no quorum is present at such meeting, at an adjourned meeting at which the shareholders then present would form the necessary quorum.

Rights on Liquidation

In the event of the liquidation, dissolution or winding-up of CIBC, provided that an NVCC Automatic Conversion as contemplated under the NVCC Provisions applicable to a series of Class A Preferred Shares has not occurred, the holders of the Class A Preferred Shares will be entitled to receive an amount equal to the price at which such shares are issued together with such premium, if any, as shall have been provided for with respect to the Class A Preferred Shares of any series, together with all declared and unpaid dividends, before any amount is paid or any assets of CIBC are distributed to the holders of any shares ranking junior to the Class A Preferred Shares. Upon payment to the holders of the Class A Preferred Shares of the amounts so payable to them, they will not be entitled to share in any further distribution of the assets of CIBC. If an NVCC Automatic Conversion as contemplated under the NVCC Provisions applicable to a series of Class A Preferred Shares has occurred, all of the Class A Preferred Shares of such series shall have been converted into common shares of CIBC in accordance with a pre-determined conversion formula specified at the time of issuance of the Class A Preferred Shares of such series and will rank on parity with all other common shares of CIBC.

Voting Rights

Subject to the provisions of the Bank Act (Canada), the directors of CIBC are empowered to set voting rights, if any, for each series of Class A Preferred Shares.

CIBC 2025 Annual Information Form 6

Contingent Conversion of Certain Series of Class A Preferred Shares

All of CIBC’s currently outstanding Class A Preferred Shares were issued after January 1, 2013 and, accordingly, contain NVCC Provisions in their respective share terms and conditions. The number of common shares into which such Class A Preferred Shares would be converted upon an NVCC Automatic Conversion will be determined in accordance with a pre-determined conversion formula specified at the time of issuance of such Class A Preferred Shares.

Description of Limited Recourse Capital Notes

CIBC has outstanding CAD$750 million principal amount of 4.000% Limited Recourse Capital Notes Series 2 due January 28, 2082 (NVCC) (subordinated indebtedness), CAD$800 million principal amount of 7.150% Limited Recourse Capital Notes Series 3 due July 28, 2082 (NVCC) (subordinated indebtedness), CAD$500 million principal amount of 6.987% Limited Recourse Capital Notes Series 4 due July 28, 2084 (NVCC) (subordinated indebtedness), USD$500 million principal amount of 6.950% Limited Recourse Capital Notes Series 5 due January 28, 2085 (NVCC) (subordinated indebtedness), CAD$450 million principal amount of 6.369% Limited Recourse Capital Notes Series 6 due April 28, 2085 (NVCC) (subordinated indebtedness), USD$750 million principal amount of 7.000% Limited Recourse Capital Notes Series 7 due October 28, 2085 (NVCC) (subordinated indebtedness) and CAD$450 million principal amount of 5.898% Limited Recourse Capital Notes Series 8 due January 28, 2086 (NVCC) (subordinated indebtedness), collectively referred to as the “Notes”, which are reported as equity on the consolidated balance sheet, and carry the standard NVCC provisions necessary for them to qualify as Tier 1 regulatory capital under Basel III.

The following describes certain general terms and conditions of the Notes.

Certain Conditions of the Limited Recourse Capital Notes

The following is a summary of certain provisions attached to the Notes.

Priority

The Notes are junior, subordinated, unsecured indebtedness of CIBC and will rank subordinate to all of CIBC’s deposit liabilities and all other indebtedness (including all of CIBC’s other unsecured and subordinated indebtedness) from time to time issued and outstanding, except for such indebtedness which by its terms ranks equally in right of payment with, or is subordinate to, the Notes.

Limited Recourse

In the event of a non-payment by CIBC of the principal amount of, interest on, or redemption price for, the Notes when due, the sole remedy of holders of the Notes shall be the delivery of the Preferred Shares Series 54, 55, 58, 59, 60, 62 and 63, which are held in the Limited Recourse Trust and carry the standard NVCC provisions as described above.

Voting Rights

None, other than in certain limited circumstances.

Bank Act (Canada) Restrictions Related to Share Ownership

The Bank Act (Canada) contains restrictions on the issue, transfer, acquisition, beneficial ownership and voting of all shares of a chartered bank. By way of summary, no person, or persons acting jointly or in concert, shall be a major shareholder of a bank if the bank has equity of $12 billion or more (which would include CIBC). A person is a major shareholder of a bank where: (i) the aggregate of the shares of any class of voting shares beneficially owned by that person, by entities controlled by that person and by any person associated or acting jointly or in concert with that person (as contemplated by the Bank Act (Canada)) is more than 20% of that class of voting shares; or (ii) the aggregate of the shares of any class of non-voting shares beneficially owned by that person, by entities controlled by that person and by any person associated or acting jointly or in concert with that person (as contemplated by the Bank Act (Canada)) is more than 30% of that class of non-voting shares. No person, or persons acting jointly or in concert, shall have a significant interest in any class of shares of a bank, including CIBC, unless the person first receives the approval of the Minister of Finance (Canada). For purposes of the Bank Act (Canada), a person has a significant interest in a class of shares of a bank where the aggregate of any shares of the class beneficially owned by that person, by entities controlled by that person and by any person associated or acting jointly or in concert with that person (as contemplated by the Bank Act (Canada)) exceeds 10% of all of the outstanding shares of that class of shares of such bank.

In addition, the Bank Act (Canada) prohibits a bank, including CIBC, from recording in its securities register the transfer or issuance of shares of any class to His Majesty in right of Canada or of a province, an agent or agency of His Majesty, a government of a foreign country or any political subdivision of a foreign country, or an agent or agency of a foreign government. The Bank Act (Canada) also suspends the exercise of any voting rights attached to any share of a bank, including CIBC, that is beneficially owned by His Majesty in right of Canada or of a province, an agency of His Majesty, a government of a foreign country or any political subdivision of a foreign country, or any agency thereof.

CIBC funds its operations with client-sourced deposits, supplemented with a wide range of wholesale funding.

CIBC’s principal approach aims to fund its consolidated balance sheet with deposits primarily raised from personal and commercial banking channels. CIBC maintains a foundation of relationship-based core deposits, whose stability is regularly evaluated through internally developed statistical assessments.

We routinely access a range of short-term and long-term secured and unsecured funding sources diversified by geography, depositor type, instrument, currency and maturity. We raise long-term funding from existing programs including covered bonds, asset securitizations and unsecured debt.

Credit ratings assigned by external agencies impact CIBC’s ability to raise capital and funding in wholesale markets and related borrowing costs. Adverse movements in CIBC’s credit ratings could potentially result in higher financing costs, increased collateral pledging requirements and reduced access to capital markets. CIBC regularly reviews the impact of ratings downgrades and maintains liquidity buffers to ensure preparedness for continuity of operations under adverse conditions.

Additional information relating to CIBC’s liquidity management and credit ratings is available on pages 70 to 77 of the 2025 Annual Report under the heading “Management of risk – Liquidity risk”.

CIBC 2025 Annual Information Form 7

The table below provides the ratings for CIBC’s Class A Preferred Shares, Limited Recourse Capital Notes and debt obligations as at December 3, 2025:

| DBRS Limited (Morningstar DBRS) |

Fitch Ratings, Inc. (Fitch) |

Moody’s Investors Service, Inc. (Moody’s) |

Standard & Poor’s Ratings Services (S&P) |

|||||

|

Deposit/Counterparty(1) |

AA | AA | Aa2 | A+ | ||||

|

Senior debt(2) |

AA | AA |

Aa2 | A+ | ||||

|

Bail-in senior debt(3) |

AA(L) | AA- |

A2 | A- | ||||

|

Subordinated indebtedness |

A(H) | A |

Baa1 | A- | ||||

|

Subordinated indebtedness – NVCC(4) |

A(L) | A |

Baa1 | BBB+ | ||||

|

Limited recourse capital notes – NVCC(4)(5) |

BBB(H) | BBB+ |

Baa3 | BBB- | ||||

|

Preferred shares – NVCC(4)(5) |

Pfd-2 | BBB+ |

Baa3 | P-2(L) | ||||

|

Short-term debt |

R-1(H) | F1+ |

P-1 | A-1 | ||||

|

Outlook |

Stable |

Stable |

Stable | Stable | ||||

| (1) | Morningstar DBRS Long-Term Issuer Rating; Fitch Long-Term Deposit Rating and Derivative Counterparty Rating; Moody’s Long-Term Deposit and Counterparty Risk Assessment Rating; S&P’s Issuer Credit Rating. |

| (2) | Includes senior debt issued on or after September 23, 2018 which is not subject to bail-in regulations. |

| (3) | Comprises liabilities which are subject to conversion under the bail-in regulations. |

| (4) | Comprises instruments which are treated as NVCC in accordance with OSFI’s CAR Guideline. |

| (5) | Morningstar DBRS rating does not apply to limited recourse capital notes and associated preferred shares issued in USD. Fitch rating only applies to limited recourse capital notes and associated preferred shares issued in USD. |

The ratings should not be construed as a recommendation to buy, sell or hold CIBC securities. Ratings may be revised or withdrawn at any time by the respective rating agencies.

Definitions of rating categories are available on the respective rating agencies’ websites and are outlined in Appendix A. More detailed explanations of the various rating categories may be obtained directly from the rating agencies.

As is common practice, CIBC has paid fees charged by all four of the above-noted rating agencies for their rating services and, to certain of the rating agencies, for other services during the last two years. CIBC reasonably expects that such payments will continue to be made for services in the future.

CIBC maintains a listing of its common shares on the TSX and the New York Stock Exchange. CIBC maintains a listing of its Class A Preferred Shares on the TSX.

| (1) | From time to time, securities of CIBC may be listed on other stock exchanges or quotation systems by investors, brokers or others without the consent or involvement of CIBC. This section does not include debt instruments that are deposits. |

| 2024 | 2025 | |||||||||||||||||||||||||||||||||||||||||||||||

| Nov. | Dec. | Jan. | Feb. | Mar. | Apr. | May | Jun. | Jul. | Aug. | Sep. | Oct. | |||||||||||||||||||||||||||||||||||||

| Common Shares |

|

|||||||||||||||||||||||||||||||||||||||||||||||

| High | $ | 92.17 | $ | 95.50 | $ | 93.31 | $ | 89.72 | $ | 87.97 | $ | 87.00 | $ | 96.45 | $ | 97.04 | $ | 102.02 | $ | 107.13 | $ | 113.51 | $ | 117.13 | ||||||||||||||||||||||||

| Low | $ | 87.38 | $ | 89.06 | $ | 88.10 | $ | 81.26 | $ | 78.89 | $ | 76.17 | $ | 86.53 | $ | 91.94 | $ | 96.53 | $ | 97.81 | $ | 105.01 | $ | 111.29 | ||||||||||||||||||||||||

| Volume (thousands) | 54,174 | 111,840 | 77,423 | 57,001 | 115,988 | 100,617 | 57,430 | 77,279 | 65,807 | 45,770 | 67,664 | 62,819 | ||||||||||||||||||||||||||||||||||||

| Preferred Shares Series 41 |

|

|||||||||||||||||||||||||||||||||||||||||||||||

| High | $ | 25.00 | $ | 25.20 | $ | 25.00 | Redeemed January 31, 2025 | |||||||||||||||||||||||||||||||||||||||||

| Low | $ | 24.52 | $ | 24.62 | $ | 24.93 | ||||||||||||||||||||||||||||||||||||||||||

| Volume (thousands) | 163 | 1,395 | 4,228 | |||||||||||||||||||||||||||||||||||||||||||||

| Preferred Shares Series 43 |

|

|||||||||||||||||||||||||||||||||||||||||||||||

| High | $ | 24.70 | $ | 24.93 | $ | 24.85 | $ | 24.76 | $ | 24.85 | $ | 24.90 | $ | 24.98 | $ | 25.13 | $ | 25.00 | Redeemed July 31, 2025 | |||||||||||||||||||||||||||||

| Low | $ | 24.38 | $ | 24.35 | $ | 24.53 | $ | 24.37 | $ | 24.55 | $ | 24.00 | $ | 24.60 | $ | 24.92 | $ | 24.94 | ||||||||||||||||||||||||||||||

| Volume (thousands) | 4,297 | 5,227 | 2,116 | 3,725 | 20,882 | 12,457 | 3,850 | 39,079 | 74,678 | |||||||||||||||||||||||||||||||||||||||

| Preferred Shares Series 47 |

|

|||||||||||||||||||||||||||||||||||||||||||||||

| High | $ | 25.35 | $ | 25.53 | $ | 25.54 | $ | 25.55 | $ | 25.56 | $ | 25.36 | $ | 25.53 | $ | 25.70 | $ | 25.75 | $ | 25.92 | $ | 25.85 | $ | 26.17 | ||||||||||||||||||||||||

| Low | $ | 24.97 | $ | 25.20 | $ | 25.01 | $ | 25.25 | $ | 25.15 | $ | 24.01 | $ | 25.09 | $ | 25.31 | $ | 25.40 | $ | 25.59 | $ | 25.38 | $ | 25.39 | ||||||||||||||||||||||||

| Volume (thousands) | 610 | 151 | 404 | 415 | 318 | 101 | 200 | 116 | 156 | 213 | 466 | 241 | ||||||||||||||||||||||||||||||||||||

| (1) | Data from TMX Money. |

CIBC sold one issue of subordinated indebtedness during the year ended October 31, 2025, which is not listed or quoted on an exchange:

| • | $1.25 billion 4.15% Debentures due April 2, 2035 (NVCC) (subordinated indebtedness) were issued on April 2, 2025, at a price of 99.857%. |

CIBC 2025 Annual Information Form 8

Escrowed Securities and Securities Subject to Contractual Restriction on Transfer

The following securities were held in escrow or subject to contractual restriction on transfer as at October 31, 2025.

| Designation of class | Number of securities held in escrow or that are subject to a contractual restriction on transfer |

Percentage of class | ||||||

| Preferred Shares Series 54 (1) |

750,000 | 3.198 | % | |||||

| Preferred Shares Series 55 (1) |

800,000 | 3.412 | % | |||||

| Preferred Shares Series 58 (1) |

500,000 | 2.132 | % | |||||

| Preferred Shares Series 59 (1) |

500,000 | 2.132 | % | |||||

| Preferred Shares Series 60 (1) |

450,000 | 1.919 | % | |||||

| Preferred Shares Series 62 (1) |

750,000 | 3.198 | % | |||||

| Preferred Shares Series 63 (1) |

450,000 | 1.919 | % | |||||

| (1) | The Preferred Shares Series 54, 55, 58, 59, 60, 62, and 63 are held by the Limited Recourse Trust in connection with the issuance of the Limited Recourse Capital Notes. The Preferred Shares Series 54, 55, 58, 59, 60, 62, and 63 are distributable to holders of such Notes upon certain events. See “Certain Conditions of the Limited Recourse Capital Notes – Limited Recourse” section above. |

Directors and Board Committees

Information concerning the directors and board committees of CIBC is found on page 187 of the 2025 Annual Report.

All of the directors have held their principal occupation indicated on page 187 of the 2025 Annual Report for the past five years with the exception of the following:

| (i) | Marianne Harrison was President and Chief Executive Officer of John Hancock Life Insurance Company, the U.S. division of Toronto-based Manulife Financial Corporation from 2017 to 2023. |

| (ii) | Mark W. Podlasly was a member of the advisory board of the Manitoba Government – Crown Services from 2021 to 2023. |

| (iii) | Mary Lou K. Maher was the Canadian Managing Partner, Quality and Risk Management of KPMG Canada, and Global Head of Inclusion and Diversity of KPMG International from December 2017 to February 2021. |

Directors are elected annually. Under the Bank Act (Canada) and CIBC’s by-laws, a director’s term expires at the close of the next annual meeting of shareholders, which is scheduled for April 16, 2026.

The following are CIBC’s executive officers, their titles and their municipalities of residence, as at December 3, 2025:

| Name | Title | Municipality of Residence |

||

| Harry Culham | President and Chief Executive Officer, CIBC | Toronto, Ontario, Canada | ||

| Christian Exshaw | Senior Executive Vice-President and Group Head, Capital Markets | Toronto, Ontario, Canada | ||

| Frank Guse | Senior Executive Vice-President, Chief Risk Officer | Toronto, Ontario, Canada | ||

| Christina Kramer | Senior Executive Vice-President and Chief Administrative Officer | Toronto, Ontario, Canada | ||

| Kevin Li | Senior Executive Vice-President and Group Head, U.S. Region and President and CEO, CIBC Bank USA | Chicago, IL, United States | ||

| Hratch Panossian | Senior Executive Vice-President and Group Head, Personal and Business Banking | Toronto, Ontario, Canada | ||

| Susan Rimmer | Senior Executive Vice-President and Group Head, Commercial Banking and Wealth Management | Toronto, Ontario, Canada | ||

| Stephen Scholtz | Senior Vice-President, Global Chief Legal Officer | Etobicoke, Ontario, Canada | ||

| Robert Sedran | Senior Executive Vice-President, Chief Financial Officer and Enterprise Strategy | Toronto, Ontario, Canada | ||

| Sandy Sharman | Senior Executive Vice-President and Group Head, People, Culture and Brand | Toronto, Ontario, Canada | ||

| Amy South | Executive Vice-President, Office of the CEO and Chief of Staff | Toronto, Ontario, Canada |

All of the executive officers have held their present position or another executive position in CIBC for more than five years.

Shareholdings of Directors and Executive Officers

To CIBC’s knowledge, as at October 31, 2025, the directors and executive officers of CIBC as a group, beneficially owned, directly or indirectly, or exercised control or direction over less than 1% of the outstanding common shares of CIBC or CIBC Caribbean Bank Limited.

CIBC 2025 Annual Information Form 9

Corporate Cease Trade Orders or Bankruptcies

To CIBC’s knowledge, in the last 10 years, no director or executive officer of CIBC is or has been a director, chief executive officer or chief financial officer of a company that: (i) while that person was acting in that capacity, was the subject of a cease trade or similar order or an order that denied the company access to any exemption under securities legislation, for a period of more than 30 consecutive days; or (ii) was subject to such an order that was issued, after that person ceased to be a director or chief executive officer or chief financial officer, and which resulted from an event that occurred while that person was acting in the capacity as director, chief executive officer or chief financial officer. To CIBC’s knowledge, in the last 10 years, no director or executive officer of CIBC is or has been a director or executive officer of a company that, while that person was acting in that capacity or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets.

To CIBC’s knowledge, no director or executive officer of CIBC: (i) has been subject to any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority, or (ii) has been subject to any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable investor in making an investment decision.

To CIBC’s knowledge, in the last 10 years, no director or executive officer has become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or was subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the director or executive officer.

To CIBC’s knowledge, no director or executive officer of CIBC or its subsidiaries has an existing or potential material conflict of interest with CIBC or any of its subsidiaries.

LEGAL PROCEEDINGS AND REGULATORY ACTIONS

A description of significant legal proceedings to which CIBC is a party is provided under the heading “Contingent liabilities and provisions” on pages 169 to 171 of the 2025 Annual Report.

INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS

To CIBC’s knowledge, no director or executive officer of CIBC, or any of their associates has any material interest, directly or indirectly, in any transaction within the three most recently completed financial years that has materially affected or is reasonably expected to materially affect CIBC.

The addresses for CIBC’s transfer agent and registrar are provided on page 186 of the 2025 Annual Report.

Ernst & Young LLP, Chartered Professional Accountants, Licensed Public Accountants, Toronto, Ontario, audited our Annual Consolidated Financial Statements, which comprise the consolidated balance sheets as of October 31, 2025 and October 31, 2024 and the related consolidated statements of income, comprehensive income, changes in equity, and cash flows for the years then ended, including the related notes and the effectiveness of our internal control over financial reporting as of October 31, 2025. Ernst & Young LLP is the independent public accountant with respect to the Bank within the context of the CPA Code of Professional Conduct of the Chartered Professional Accountants of Ontario and the rules and regulations adopted by the U.S. Securities and Exchange Commission (SEC) and the Public Company Accounting Oversight Board (United States).

The Audit Committee Mandate as approved by the Board is included in Appendix B. The members of the Audit Committee are listed below. Each member of the Audit Committee is independent and financially literate as defined by Canadian securities laws. At least one member of the Audit Committee has been designated by the Board as an “audit committee financial expert” as defined by the rules of the SEC.

This section describes the education and experience of CIBC’s Audit Committee members that is relevant to the performance of their responsibilities.

Each member of the Audit Committee is currently, or has previously been, responsible for a significant business operation. This experience is often in the capacity of president, chief executive officer, chief financial officer, chief operating officer, or as an advisor or consultant. Given the breadth and complexity of a financial institution’s accounting issues, the Audit Committee members participate from time to time in internal or external sessions related to accounting matters or developments. Travel and attendance costs are paid by CIBC. Further detail on the education and experience of each Audit Committee member is set out below.

CIBC 2025 Annual Information Form 10

Michelle L. Collins

Ms. Collins has been President of Cambium LLC since 2007. Cambium is a Chicago-based business and financial advisory firm that serves small and medium-sized businesses. She has 30 years of experience in corporate governance, investment banking, and private equity. She also has significant corporate board experience, having served as a director for several publicly traded companies across a wide range of industries. Ms. Collins is a director of CIBC Bancorp USA Inc. and CIBC Bank USA and chair of their Audit Committees. She is a Board member of Global Risk Institute, the Advisory Boards of Svoboda Capital Partners, LLC, and Cedar Street Asset Management. Ms. Collins serves on several philanthropic and non-profit boards, including the Griffin Museum of Science and Industry and Navy Pier, Inc., and is the former chair of the Board of Trustees of National Louis University. Ms. Collins received the Daniel H. Burnham Award for Distinguished Leadership in 2024 from the Chicagoland Chamber of Commerce in recognition for her remarkable accomplishments and contributions to the community. She received the Bertha Honoré Palmer Making History award for distinction in civic leadership in 2023 and is a past recipient of the Outstanding Leader Award for Business from the YWCA in recognition of her distinguished career in business, her community involvement and willingness to take on leadership positions on impacting women’s lives and racial justice. Ms. Collins holds a Bachelor of Arts degree in Economics from Yale University and a Master of Business Administration degree from Harvard Graduate School of Business.

Marianne Harrison

Ms. Harrison is the former President and Chief Executive Officer of John Hancock Life Insurance Company, the U.S. division of Toronto-based Manulife Financial Corporation, a role she retired from in April 2023. Ms. Harrison brings deep finance and accounting expertise, developed over almost 40 years in the financial industry including roles as Auditor for PwC, CFO of Wealth Management for TD Bank Group and Corporate Controller for Manulife Financial Corporation. Approximately half of her career was spent in finance and accounting roles and the other half in general management leading various businesses. In her role as President and CEO of both John Hancock and Manulife Canada, she was responsible for all aspects of profit and loss, which allowed her to acquire strong strategic leadership and management expertise. Ms. Harrison also brings substantial expertise in risk management, gained throughout her career in financial services and as an active member of the Segment Risk Committee while serving as President and CEO of John Hancock and Manulife Canada. Ms. Harrison earned her bachelor’s degree from the University of Western Ontario and a diploma in accounting from Wilfrid Laurier University. She is a Chartered Accountant and in 2016 was elected a Fellow of the Profession, the highest designation for professional achievement conferred by the Chartered Professional Accountants of Ontario.

Mary Lou Maher (Chair of the Audit Committee)

Ms. Maher was Canadian Managing Partner, Quality and Risk, KPMG Canada from 2017 to February 2021. She was also Global Head of Inclusion and Diversity KPMG International for the same period. Ms. Maher was with KPMG since 1983, in various executive and governance roles including Chief Financial Officer and Chief Human Resources Officer. Ms. Maher was a member of the World Economic Forum focused on Human Rights — the business perspective, and has served on other not-for-profit boards, including as Chair of Women’s College Hospital and member of CPA Ontario Council. She is a member of the Canadian Public Accountability Board. Ms. Maher created KPMG Canada’s first ever National Diversity Council and was the executive sponsor of pride@kpmg. Ms. Maher received the Wayne C. Fox Distinguished Alumni Award from McMaster University in recognition of her work on inclusion and diversity, was inducted into the Hall of Fame for the WXN 100 Top Most Powerful Women in Canada, received a Lifetime Achievement Award from Out on Bay Street (Proud Strong), and the Senior Leadership Award for Diversity from the Canadian Centre for Diversity and Inclusion. Ms. Maher completed the Competent Board for ESG Program. Ms. Maher holds a Bachelor of Commerce degree from McMaster University and holds the designation of FCPA, FCA.

Mark W. Podlasly

Mr. Podlasly, a member of the Cook’s Ferry Indian Band, Nlaka’pamux Nation in British Columbia, is the Chief Executive Officer at the First Nations Major Projects Coalition, a national 180 Indigenous nation collective that seeks ownership of major projects such as pipelines, electric utilities and mining support infrastructure. Mr. Podlasly counsels Indigenous governments across Canada on the establishment of trusts to invest revenues from resource development. He is Chair of the First Nations (Pacific Trails Pipeline) Group Limited Partnership (pipelines) and a Trustee of Nlaka’pamux Nation Legacy Trust. He is an Advisor to Public Matters, sits on the advisory board of Canada 2020, a Fellow at the Public Policy Forum of Canada, and a Director of the Development Partners Institute. In 2017, Mr. Podlasly was awarded the Governor General of Canada’s Meritorious Service Medal for Indigenous leadership in establishing Teach For Canada — Gakinaamaage, a non-profit organization that works with northern First Nations to recruit and support committed teachers. He has advised many leading international companies on corporate education, strategy, leadership and globalization programs. Mr. Podlasly is a regular speaker at global business and governance events. Mr. Podlasly holds a Bachelor of Arts degree from Trinity Western University, a Master of Public Administration from Harvard University and is a member of the Institute of Corporate Directors with the designation ICD.D.

Martine Turcotte

Ms. Turcotte was Vice Chair, Québec of BCE Inc. and Bell Canada from 2011 to 2020. She was Chief Legal Officer of BCE from 1999 to 2008 and of Bell Canada from 2003 to 2008 and she was Executive Vice-President and Chief Legal and Regulatory Officer of BCE and Bell Canada from 2008 to 2011. Ms. Turcotte has more than 25 years of strategic, legal and regulatory experience. In addition to the directorship in Empire Company Limited/Sobeys Inc., Ms. Turcotte is a member of the Board of Directors of Canadian Institute for Advanced Research (CIFAR), a member of the Board of Directors of the Institute for Governance of Private and Public Organizations (IGOPP) and she is a McGill Governor Emerita. Ms. Turcotte is a past recipient of the Canadian General Counsel Lifetime Achievement award, was inducted into the Hall of Fame of the Top 100 Most Powerful Women in Canada, received the title of Advocatus Emeritus from the Québec Bar Association for professional excellence, and was awarded both the Queen’s Gold and Diamond Jubilee Medals in recognition of her contributions to Canada. Ms. Turcotte is the former Chair of the Judicial Compensation and Benefits Commission. Ms. Turcotte holds a Bachelor degree in Civil Law and Common Law from McGill University and a Master of Business Administration degree from the London Business School.

CIBC 2025 Annual Information Form 11

PRE-APPROVAL POLICIES AND PROCEDURES

The Audit Committee has adopted the CIBC Policy on the Scope of Services of the Shareholders’ Auditor (the Scope of Services Policy) to provide a consistent approach for the engagement of the shareholders’ auditor. The Scope of Services Policy requires that work performed by the shareholders’ auditor for CIBC or its subsidiaries be pre-approved by the Audit Committee, along with the related fee for that work. The Audit Committee may establish pre-approval policies and procedures that are specific to a particular service. Under the Scope of Services Policy, the shareholders’ auditor will only perform audit, audit-related and tax work, and other work if pre-approved by the Audit Committee. The Audit Committee may approve exceptions to the Scope of Services Policy if it determines that such an exception is in the overriding best interests of CIBC, and the exception does not impair the independence of the shareholders’ auditor. However, certain non-audit activities set out in the Scope of Services Policy are generally prohibited and will not be considered for exception from the Policy. On a quarterly basis, the Audit Committee is presented with a summary report of all engagements of the shareholders’ auditor that are currently underway or have been completed since the prior quarter’s report, including engagements entered into pursuant to pre-approved limits. The summary report will describe the nature of each engagement, confirm that each engagement is in compliance with the Scope of Services Policy and state the fees received by the shareholders’ auditor for each engagement. The Scope of Services Policy also sets out ongoing relationship standards and requires that the shareholders’ auditor annually certify compliance with the Policy.

FEES FOR SERVICES PROVIDED BY SHAREHOLDERS’ AUDITOR

The information on professional service fees paid to the shareholders’ auditor is provided on page 93 of the 2025 Annual Report.

Additional information with respect to CIBC, including directors’ and officers’ remuneration and indebtedness, principal holders of CIBC’s securities and securities authorized for issuance under equity compensation plans, where applicable, is contained in CIBC’s management proxy circular for its most recent annual meeting of shareholders that included in its proceedings the election of directors. Additional financial information is provided in the 2025 Annual Report. These documents, as well as additional information relating to CIBC, are available on SEDAR+ at www.sedarplus.com.

For a description of Canadian bank resolution powers and the consequent risk factors attaching to certain liabilities of CIBC, reference is made to “Regulatory capital and total loss absorbing capacity (TLAC) requirements” on page 33 and “Outstanding share data” on page 39 of the 2025 Annual Report and https://www.cibc.com/content/dam/about_cibc/investor_relations/pdfs/debt_info/canadian-bail-in-website-disclosure-en.pdf. The information on our website does not form a part of this AIF.

CIBC 2025 Annual Information Form 12

Rating Definitions

Morningstar DBRS

| Short-term debt |

Rating: R-1 (high) |

Short-term debt ratings provide an opinion on the risk that an issuer will not meet its short-term financial obligations in a timely manner. Short-term debt rated R-1 (high) is of the highest credit quality, indicative of an entity with an exceptionally high capacity to repay its short-term financial obligations. R-1 is the highest of six short-term debt rating categories. The R-1 and R-2 categories are further denoted with “high”, “middle” and “low” subcategories.

| Long-term issuer rating |

Rating: AA | |

| Senior debt(1) |

Rating: AA | |

| Bail-in senior debt(2) |

Rating: AA (low) |

Long-term issuer and senior debt ratings provide an assessment of the risk that an issuer will not be able to meet its financial obligations in accordance with the terms under which an obligation has been issued. Credit ratings are based on quantitative and qualitative considerations relevant to the issuer, and the relative ranking of claims. Issuers and senior debt rated AA is ranked in the second highest of 10 categories. It is considered to be of superior credit quality, with capacity for payment considered to be high. The credit quality of issuers and obligations rated AA differs from the highest AAA category only to a small degree and is unlikely to be significantly susceptible to future events. The AA category is further denoted by the subcategories “high” and “low”. The absence of a “high” or “low” indicates a rating in the middle of the category.

| Subordinated indebtedness |

Rating: A (high) | |

| Subordinated indebtedness – NVCC |

Rating: A (low) |

Long-term debt rated A is ranked in the third highest of 10 categories. It is considered to be of good credit quality, with substantial capacity for payment. The A category is further denoted by the subcategories “high” and “low”. The absence of a “high” or “low” indicates a rating in the middle of the category.

| Limited recourse capital notes – NVCC |

Rating: BBB (high) |

Long-term debt rated BBB is ranked in the fourth highest of 10 categories. It is considered to be of adequate credit quality with acceptable capacity for payment. The BBB category is further denoted by the subcategories “high” and “low”. The absence of a “high” or “low” indicates a rating in the middle of the category.

| Preferred shares – NVCC |

Rating: Pfd-2 |

Preferred share ratings provide an assessment of the risk that an issuer will not be able to meet its dividend and principal obligations in accordance with the terms under which the preferred shares have been issued. Preferred shares rated Pfd-2 are of good credit quality with substantial protection of dividends and principal. A Pfd-2 rating is the second highest of six categories for preferred shares. Each category is further denoted by the subcategories “high” and “low”. The absence of a “high” or “low” indicates a rating in the middle of the category.

Fitch

| Short-term debt |

Rating: F1+ |

The F1 category is for obligations of the highest short-term credit quality and indicates the strongest intrinsic capacity to meet near-term obligations. The F1 rating is the highest of seven categories used for short-term debt; a “+” may be added to indicate very strong capacity to meet near-term obligations.

| Derivative counterparty rating |

Rating: AA | |

| Senior debt(1) Issuer default rating |

Rating: AA Rating: AA- |

|

| Bail-in senior debt(2) |

Rating: AA- |

Derivative counterparty ratings reflect a bank’s relative vulnerability to default, due to an inability to pay on any derivative contract with third-party, non-government counterparties. Ratings of individual securities or financial obligations of a corporate issuer address relative vulnerability to default on an ordinal scale. In addition, for financial obligations in corporate finance, a measure of recovery given default on that liability is also included in the rating assessment. Issuer default ratings (IDR) opine on an entity’s relative vulnerability to default on financial obligations. The threshold default risk addressed by the IDR is generally that of the financial obligations whose non-payment would best reflect the uncured failure of that entity. AA is the second highest of 11 rating categories for long-term obligations and indicates an assessment of very low default risk. This rating indicates a very strong capacity for payment of financial commitments that is not significantly susceptible to foreseeable events.

| Subordinated indebtedness |

Rating: A | |

| Subordinated indebtedness – NVCC |

Rating: A |

The A category is the third highest of the rating categories for long-term obligations and indicates an assessment of low default risk. The capacity for payment is considered strong but may be more susceptible to adverse business or economic conditions than that of higher rating categories.

| Limited recourse capital notes – NVCC |

Rating: BBB+ | |

| Preferred shares – NVCC |

Rating: BBB+ |

The BBB category is the fourth highest of the rating categories for long-term obligations and indicates an assessment of low default risk. The capacity for payment is considered adequate but adverse business or economic conditions are more likely to impair the capacity for payment.

The designation “+” or “-” may be used to denote relative position within certain major long-term rating categories, while the absence of such a modifier indicates a rating in the middle of the category.

| (1) | Includes senior debt issued on or after September 23, 2018 which is not subject to bail-in regulations. |

| (2) | Comprises liabilities that are subject to conversion under the bail-in regulations. |

CIBC 2025 Annual Information Form 13

Moody’s

| Short-term debt |

Rating: P-1 |

Short-term debt ratings are assessments of an issuer’s ability to repay obligations with an original maturity of 13 months or less. Moody’s has four categories of short-term ratings with the P-1 category being the highest credit quality. Borrowers rated P-1 have a superior ability to repay short-term debt obligations.

| Counterparty risk rating |

Rating: Aa2 | |

| Senior debt(1) |

Rating: Aa2 |

Counterparty risk ratings (CRR) are opinions of the ability of entities to honour their non-debt financial liabilities to unrelated counterparties such as derivatives and sale and repurchase transactions. CRRs also reflect the expected financial losses not covered by collateral, in the event such liabilities are not honoured.

Long-term debt ratings assess both the likelihood of default on contractual payments and the expected loss in the event of default on obligations with an original maturity of 11 months or more.

The Aa rating category is the second highest of nine categories and includes obligations judged to be high quality and subject to very low credit risk.

| Bail-in senior debt(2) |

Rating: A2 |

The A rating category is the third highest of nine categories and includes obligations judged to be upper medium grade and subject to low credit risk.

| Subordinated indebtedness |

Rating: Baa1 | |

| Subordinated indebtedness – NVCC |

Rating: Baa1 | |

| Limited recourse capital notes – NVCC |

Rating: Baa3 | |

| Preferred shares – NVCC |

Rating: Baa3 |

The Baa rating category is the fourth highest of nine categories on the long-term rating scale and includes obligations judged to be medium grade and subject to moderate credit risk and as such may possess certain speculative characteristics.

The modifiers 1, 2 and 3 are used with certain long-term rating categories to indicate that an obligation ranks in the higher, middle or lower range of the rating category respectively.

S&P

| Short-term debt |

Rating: A-1 |

The A-1 category is the highest of six categories used by S&P for short-term debt. An obligation rated A-1 indicates that the borrower’s capacity to meet its financial commitment with respect to the obligation is strong.

| Issuer credit rating |

Rating: A+ | |

| Senior debt(1) Bail-in senior debt(2) Subordinated indebtedness |

Rating: A+ Rating: A- Rating: A- |

Issuer credit ratings are a forward-looking opinion about an obligor’s overall creditworthiness. This opinion focuses on the obligor’s capacity and willingness to meet its financial commitments as they come due. It does not apply to any specific financial obligation, as it does not take into account the nature of and provisions of the obligation, its standing in bankruptcy or liquidation, statutory preferences, or the legality and enforceability of the obligation. Issue or debt ratings are a forward-looking opinion about the creditworthiness of an obligor with respect to a specific financial obligation, a specific class of financial obligations, or a specific financial program (including ratings on medium-term note programs and commercial paper programs). It takes into consideration the creditworthiness of guarantors, insurers, or other forms of credit enhancement on the obligation and takes into account the currency in which the obligation is denominated.

The A rating category is the third highest of 10 categories used by S&P for long-term debt obligations. Although the obligor’s ability to meet its financial commitment is strong, obligations rated A are somewhat more vulnerable to the negative effects of changes in circumstances and economic conditions when compared to obligations in higher rating categories.

| Subordinated indebtedness – NVCC Limited recourse capital notes – NVCC |

Rating: BBB+ Rating: BBB- |

The BBB rating category is the fourth highest of 10 categories used by S&P for long-term debt obligations. The obligor’s ability to meet its financial commitment is adequate, however, adverse economic conditions or changes in circumstances are more likely to lead to a weakening of this capacity.

A “+” or “-” may be used to denote the relative standing of a rating within each category.

| Preferred shares – NVCC (Canadian Preferred Share Scale) |

Rating: P-2 (low) |

P-2 is the second highest of the eight categories used by S&P in its Canadian Preferred Share Scale, which is a forward-looking opinion about the creditworthiness of the issuer with respect to a specific preferred share obligation issued in Canada. A “high” or “low” modifier may be used to indicate the relative standing of a credit within a particular rating category, while the absence of such a modifier indicates a rating in the middle of the category.

| (1) | Includes senior debt issued on or after September 23, 2018 which is not subject to bail-in regulations. |

| (2) | Comprises liabilities that are subject to conversion under the bail-in regulations. |

CIBC 2025 Annual Information Form 14

Canadian Imperial Bank of Commerce

Audit Committee Mandate

| 1. | Purpose |

| (1) | The primary functions of the Audit Committee (the “Committee”) are to: (i) fulfill its responsibilities for reviewing the integrity of CIBC’s financial statements and related management’s discussion and analysis (MD&A); (ii) monitor the system of internal control, including internal control over financial reporting; (iii) monitor CIBC’s compliance with legal and regulatory requirements; (iv) select the external auditors for shareholder approval; (v) review the qualifications, independence and audit quality of the external auditor; (vi) oversee the performance of the internal audit function; (vii) oversee the processes and controls around Environmental, Social and Governance (ESG) disclosures in the Annual Report, Sustainability Report, Climate Report and other material ESG disclosure documents; and (viii) act as the audit committee for certain federally regulated subsidiaries. |

| 2. | Responsibilities |

| (1) | Financial Reporting |

The Committee will be responsible for overseeing senior management concerning the establishment and maintenance of a system of processes and controls to ensure the integrity, accuracy and reliability of financial information. The Committee will review and recommend Board approval of:

| (a) | the annual audited consolidated financial statements of CIBC, the related MD&A and the external auditors’ report on the consolidated financial statements; |

| (b) | the interim consolidated financial statements of CIBC, the related MD&A and the external auditors’ review report on the interim consolidated financial statements; and |

| (c) | the Annual Information Form of CIBC, the Form 40-F of CIBC, and financial disclosure in a news release disclosing financial results. |

The Committee will review other material financial disclosures that are required by law to be reviewed by the Audit Committee, including those that are requested by regulators, and will periodically review select information provided to rating agencies and analysts relating to earnings guidance.

| (2) | Review Considerations |

In conducting its review of the annual consolidated financial statements or the interim consolidated financial statements, and the related MD&A, the Committee will:

| (a) | meet with management and the external auditors to discuss the financial statements and MD&A; |