UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 2, 2025

Owens & Minor, Inc.

(Exact Name of Registrant as Specified in its Charter)

| Virginia | 001-09810 | 54-1701843 | ||

| (State or other jurisdiction of incorporation or organization) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

| 10900 Nuckols Road, Suite 400 | ||

| Glen Allen, Virginia | 23060 | |

| (Address of principal executive offices) | (Zip Code) |

| Post Office Box 27626, | ||

| Richmond, Virginia | 23261-7626 | |

| (Mailing address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code (804) 723-7000

(Former name or former address, if changed since last report.)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

||

| Common Stock, $2 par value per share | OMI | New York Stock Exchange |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01. | Regulation FD Disclosure. |

On December 2, 2025, Owens & Minor, Inc. (the “Company”) issued a press release announcing that members of its management team are scheduled to participate in two upcoming investor conferences. The Company has prepared a presentation to use at the Bank of America Leveraged Finance Conference. The Company is furnishing the press release and investor presentation attached hereto as Exhibits 99.1 and 99.2, respectively, pursuant to Item 7.01 of Form 8-K.

In accordance with General Instruction B.2 of Form 8-K, the information in this Item 7.01, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| Exhibit Number |

Exhibit Title or Description | |

| 99.1 | Press Release of the Company, dated December 2, 2025 (furnished pursuant to Item 7.01). | |

| 99.2 | Bank of America Leveraged Finance Conference Presentation dated December 2, 2025 (furnished pursuant to Item 7.01). | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Owens & Minor, Inc. | ||||||

| Date: December 2, 2025 | By: | /s/ Heath H. Galloway |

||||

| Heath H. Galloway Executive Vice President, General Counsel and Corporate Secretary |

||||||

Exhibit 99.1

Owens & Minor to Present at Upcoming Investor Conferences on December 2, 2025

RICHMOND, VA — December 2, 2025 — Owens & Minor, Inc. (NYSE: OMI) announced today that members of its management team are scheduled to participate in two upcoming investor conferences.

Citi 2025 Global Healthcare Conference

On Tuesday, December 2, 2025, Ed Pesicka, the Company’s President and Chief Executive Officer, and Will Parrish, the Company’s Vice President of Strategy, Corporate Development, & Investor Relations, are scheduled to participate in a fireside chat at 2:30 P.M. ET and host one-on-one investor meetings at the conference in Miami, Florida.

Please visit the “Events & Presentations” section of the “Investor Relations” page on the Owens & Minor website available at https://investors.owens-minor.com at least 10 minutes in advance to register for the live webcast of the discussion. A replay of the webcast can be accessed following the presentation at the link provided above.

Bank of America Leveraged Finance Conference

On Tuesday, December 2, 2025, Jon Leon, the Company’s Executive Vice President and Chief Financial Officer, and Alex Miller, the Company’s Vice President of Tax & Treasury, are scheduled to host one-on-one investor meetings at the conference in Boca Raton, Florida.

About Owens & Minor

Owens & Minor, Inc. (NYSE: OMI) is a Fortune 500 global healthcare solutions company providing essential products and services that support care from the hospital to the home. For over 100 years, Owens & Minor and its affiliated brands, Apria®, Byram® and HALYARD*, have helped to make each day better for the patients, providers, and communities we serve. Powered by more than 20,000 teammates worldwide, Owens & Minor delivers comfort and confidence behind the scenes so healthcare stays at the forefront. Owens & Minor exists because every day, everywhere, Life Takes Care™. For more information about Owens & Minor and our affiliated brands, visit owens-minor.com or follow us on LinkedIn and Instagram.

CONTACT:

Investors

Alpha IR Group

Jackie Marcus or Nick Teves

OMI@alpha-ir.com

Media

Stacy Law

media@owens-minor.com

OMI-CORP

OMI-IR

Source: Owens & Minor, Inc.

Bank of America Leveraged Finance Conference December 2, 2025 Exhibit 99.2

Safe Harbor This presentation is intended to be disclosure through methods reasonably designed to provide broad, non-exclusionary distribution to the public in compliance with the SEC’s Fair Disclosure Regulation. This presentation contains certain “forward-looking” statements made pursuant to the Safe Harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, the statements in this release regarding our future prospects and performance, including our expectations with respect to our financial performance, our 2025 financial results, the proposed sale of the Products & Healthcare Service business will not be consummated in a timely manner or at all, as well as statements related to our expectations regarding the performance of our business following the completion of the proposed sale, our cost saving initiatives, future indebtedness and growth, industry trends, as well as statements related to our expectations regarding the performance of our business, including our ability to address macro and market conditions. Forward-looking statements involve known and unknown risks and uncertainties that may cause our actual results in future periods to differ materially from those projected or contemplated in the forward-looking statements. Investors should refer to Owens & Minor’s Annual Report on Form 10-K for the year ended December 31, 2024, filed with the SEC on February 28, 2025, including the section captioned “Item 1A. Risk Factors,” as applicable, and subsequent quarterly reports on Form 10-Q and current reports on Form 8-K filed with or furnished to the SEC, for a discussion of certain known risk factors that could cause the Company’s actual results to differ materially from its current estimates. These filings are available at www.owens-minor.com. Given these risks and uncertainties, Owens & Minor can give no assurance that any forward-looking statements will, in fact, transpire and, therefore, cautions investors not to place undue reliance on them. Owens & Minor specifically disclaims any obligation to update or revise any forward-looking statements, whether as a result of new information, future developments or otherwise. This presentation contains financial measures that are not calculated in accordance with U.S. generally accepted accounting principles (GAAP). In general, the measures exclude items and charges that (i) management does not believe reflect Owens & Minor, Inc.’s (the Company) core business and relate more to strategic, multi-year corporate activities; or (ii) relate to activities or actions that may have occurred over multiple or in prior periods without predictable trends. Management uses these non-GAAP financial measures internally to evaluate the Company’s performance, evaluate the balance sheet, engage in financial and operational planning and determine incentive compensation. Management provides these non-GAAP financial measures to investors as supplemental metrics to assist readers in assessing the effects of items and events on its financial and operating results and in comparing the Company’s performance to that of its competitors. However, the non-GAAP financial measures used by the Company may be calculated differently from, and therefore may not be comparable to, similarly titled measures used by other companies. The non-GAAP financial measures disclosed by the Company should not be considered substitutes for, or superior to, financial measures calculated in accordance with GAAP, and the financial results calculated in accordance with GAAP and reconciliations to those financial statements set forth above should be carefully evaluated.

Key Investment Highlights The sale of P&HS segment positions the company as a pure-play in the attractive home-based care business with a singular focus – capital allocation, strategic priorities, and execution are no longer split Retaining higher-margin Patient Direct business enables Company to generate improved and more consistent cash flow and to prioritize debt repayment in the near-term while investing in technology to lower our cost to serve and improve the customer experience Through our acquisitions of Byram in 2017 and Apria in 2022, we have built a platform that is a leader in the home-based care space with diversified payor relationships, broad product offerings, and a coast-to coast network, all of which gives us the reach and infrastructure to provide support for patients across multiple chronic conditions throughout the country The Company is well positioned for long term growth due to widespread and growing prevalence of chronic conditions, aging demographic trends, the continuing shift of healthcare outside of the hospital, and other attractive organic opportunities like our recently announced preferred provide agreement with Optum

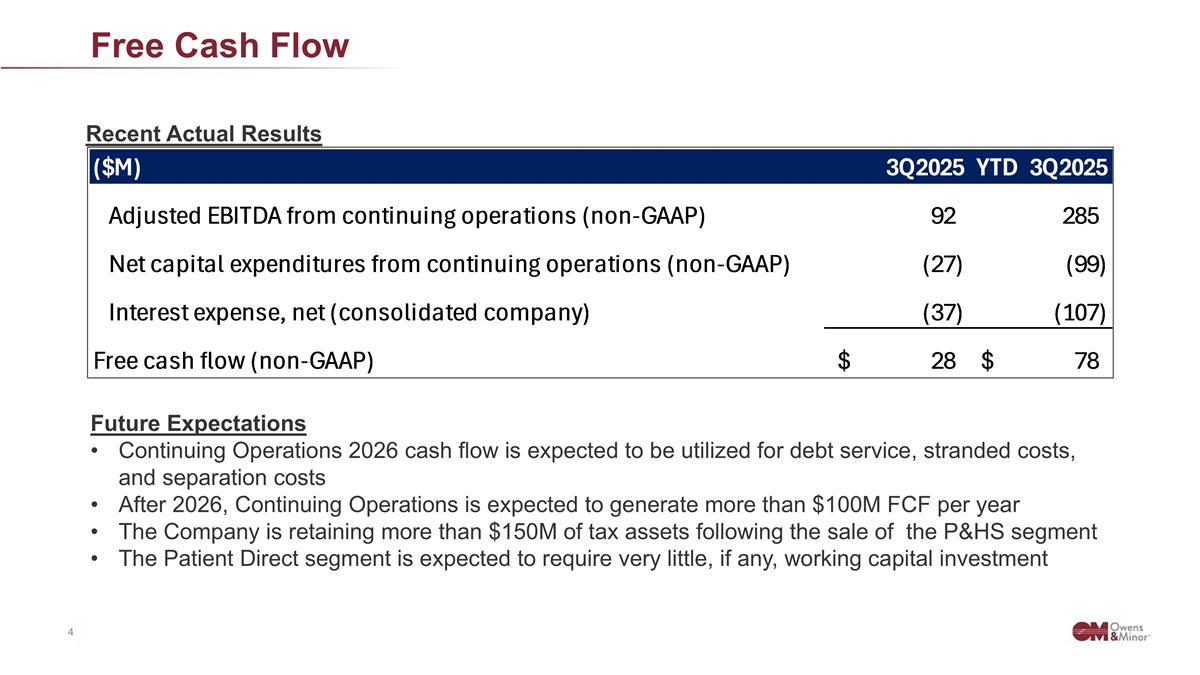

Free Cash Flow Recent Actual Results Future Expectations Continuing Operations 2026 cash flow is expected to be utilized for debt service, stranded costs, and separation costs After 2026, Continuing Operations is expected to generate more than $100M FCF per year The Company is retaining more than $150M of tax assets following the sale of the P&HS segment The Patient Direct segment is expected to require very little, if any, working capital investment ($M) 3Q2025 YTD 3Q2025 Adjusted EBITDA from continuing operations (non-GAAP) 92.174000000000007 284.827 Net capital expenditures from continuing operations (non-GAAP) -27.192 -99.480999999999995 Interest expense, net (consolidated company) -36.664999999999999 -,107.8 Free cash flow (non-GAAP) $28.317 $78.266000000000005 ($M) 3Q2025 YTD 3Q2025 Adjusted EBITDA from continuing operations (non-GAAP) 92.174000000000007 284.827 Net capital expenditures from continuing operations (non-GAAP) -27.192 -99.480999999999995 Interest expense, net (consolidated company) -36.664999999999999 -,107.8 Free cash flow (non-GAAP) $28.317 $78.266000000000005

Updates & Reminders on the P&HS Sale Process Closing remains on track for 1Q2026 or possibly by end of year 2025; separation planning is well underway with strong and involved partnership from Platinum team on a daily basis $280M of current maturities noted in our form 10-Q for 3Q2025 represents on-balance sheet debt anticipated to be repaid in connection with the sale and is net of customary adjustments in the terms of the Purchase Agreement, including adjustments for cash, debt-like items, working capital, and intercompany obligations related to the Company’s AR securitization As of 3Q2025, cash investment in working capital is not required to meet working capital target – 9/30/2025 working capital balance exceeded target Expect to remain comfortably compliant with financial covenants at divestiture close Deal terms include up $115M combined between potential temporary supplier guarantees (non-cash) and up-to $65 of cash separation costs - any supplier guaranty potentiality falls away ~13 months post close