EX-99.1

Exhibit 99.1

EXHIBIT 99.1

November 2025 Investor Presentation Novonix TM

Important Notice and Disclaimers The information contained in this presentation (the “Presentation”) has been prepared by NOVONIX Limited (ACN 157 690 830) (“the Company” or “NOVONIX”) solely for information purposes and the Company is solely responsible for the contents of this Presentation. It is intended to be a summary of certain information relating to the Company as at the date of the Presentation and does not purport to be a complete description of NOVONIX or contain all the information necessary to make an investment decision. Accordingly, this Presentation is not intended to, and should not, form the basis for any investment, divestment or other financial decision with respect to the Company. Any reproduction or distribution of the Presentation, in whole or in part, or the disclosure of its contents, without prior consent of the Company, is prohibited. Not an Offer This Presentation does not constitute, nor does it form part of an offer to sell or purchase, or the solicitation of an offer to sell or purchase, any securities of the Company. This Presentation may not be used in connection with any offer or solicitation by anyone in any jurisdiction in which such offer or solicitation is not permitted by law or in which the person making the offer or solicitation is not qualified to do so or to any person to whom it is unlawful to make such offer or solicitation. Any offering of securities will be made only by means of a registration statement (including a prospectus) filed with the U.S. Securities and Exchange Commission (the “SEC”), after such registration statement becomes effective, or pursuant to an exemption from, or in a transaction not subject to, the registration requirements under the U.S. Securities Act of 1933, as amended. No such registration statement has become effective, as of the date of this Presentation. Cautionary Note Regarding Forward-Looking Statements This Presentation contains forward-looking statements about the Company and the industry in which it operates. Forward-looking statements can generally be identified by use of words such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” or “would,” or other similar expressions. Examples of forward-looking statements in this report include, among others, statements we make regarding our progress and timing of meeting our target production capacity and scaling and commencement of commercial production at our facilities, production and shipping timelines, the increasing demand of customers, target or required pricing, potential future offtake, supply, or other agreements or renewals, projected or expected performance of our materials, the impacts of economic uncertainty, tariffs, and other legislation on our timely achievement of targets and customer milestones, our ability to obtain or maintain and benefit from additional government funding and other support, including tax credits or abatements from federal, state and local authorities, our expectations of the benefit of the ITC trade case ruling and tariffs imposed on China, improving and growing our battery testing equipment and research and development services offerings, our continued investment in and efforts to commercialize our cathode synthesis technology, our receipt of future proceeds from the convertible debentures offering, any potential risks to US national security, energy security, or defense, and our efforts to help localize the battery supply chain for critical materials and play a leading role in the transition to cleaner energy solutions. We have based such statements on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. Such forward-looking statements involve and are subject to known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the timely deployment and scaling of our furnace technology, our ability to meet the technical specifications and demand of our existing and future customers, the accuracy of our estimates regarding market size, current and future customer demand, and our expenses, future revenue, capital requirements, needs and access for additional financing, the availability and impact of government support, our ability to develop and commercialize our cathode materials and produce them at volumes with acceptable performance, yields and costs and without substantial delays or operational problems, our ability to obtain patent rights effective to protect our technologies and processes and successfully defend any challenges to such rights and prevent others from commercializing such technologies and processes, and regulatory developments in the United States, Australia and other jurisdictions. These and other factors that could affect our business and results are included in the Risk Factors section of this Presentation and in our filings with the U.S. Securities and Exchange Commission (“SEC”), including the Company’s annual report on Form 20-F. Copies of these filings may be obtained by visiting our Investor Relations website at www.novonixgroup.com or the SEC's website at www.sec.gov. Industry and Market Data This Presentation contains estimates and information concerning our industry and our business, including estimated market size and projected growth rates of the markets for our products. Unless otherwise expressly stated, we obtained this industry, business, market, and other information from reports, research surveys, studies and similar data prepared by third parties, industry, and general publications, government data and similar sources. This Presentation also includes certain information and data that is derived from internal research. While we believe that our internal research is reliable, such research has not been verified by any third party. Estimates and information concerning our industry and our business involve a number of assumptions and limitations. Although we are responsible for all of the disclosure contained in this Presentation and we believe the third-party market position, market opportunity and market size data included in this Presentation are reliable, we have not independently verified the accuracy or completeness of this third-party data. Information that is based on projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate is necessarily subject to a high degree of uncertainty and risk due to a variety of factors, which could cause results to differ materially from those expressed in these publications and reports. Trademarks, Service Marks and Trade Names Throughout this Presentation, there are references to various trademarks, service marks and trade names that are used in the Company’s business. “NOVONIX,” the NOVONIX logo and other trademarks or service marks of NOVONIX appearing in this Presentation are the property of NOVONIX or its subsidiaries. Solely for convenience, the trademarks, service marks and trade names referred to in this Presentation are listed without the ® or ™ symbol, as applicable, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their right thereto. All other trademarks, trade names and service marks appearing in this Presentation are the property of their respective owners.

Our Team Novonix TM

Introductions: Team NOVONIX Mike O’Kronley, CEO background Over 30 years of automotive experience including 15 years in the Lithium-ion battery and battery materials space. Has led 9 plant startups including both brownfield and greenfield projects. Possesses a strong technical foundation in engineering as well as extensive experience in manufacturing, operations, and scaling critical minerals Holds both bachelor’s and master’s degrees in engineering from the University of Michigan. Has held pivotal roles at Ascend Elements, A123 Systems, Metaldyne Corp., and Robert Bosch. ASX: NVX | Nasdaq: NVX Investor Presentation, November 2025

Introductions: Team NOVONIX Robert Long, CFO +25 years of financial and operational leadership. CPA with extensive experience in mergers and acquisitions, strategic planning, and cross-functional leadership. Proven record of enhancing profitability, optimizing capital structure, and leading strategic growth across private and public enterprises. Holds a bachelor’s degree in Accounting and Finance from the University of Tennessee at Chattanooga. Former Senior leader at Sanofi, Shaw Industries, and Chattem holding titles of EVP/CFO and President & CEO over multi-site operations. Dwayne Johnson, COO +30 years of manufacturing and capital project leadership. Has overseen +$500 million in capital investments and led the launch of 10 greenfield manufacturing facilities. Proven record of delivering growth through operational efficiency, scalability, and performance excellence. Holds B.S. and M.S. degrees in Chemical Engineering from Case Western Reserve University and an MBA in Finance. Former Vice President of Strategy, Capital Projects, and Operations at EMT. Kimberly Heimert, CLRO +30 years of law, finance, infrastructure investment leadership Held senior legal and leadership roles at the U.S. Department of Energy, U.S. DFC, and Africa50, helping scale $880 million in infrastructure. Proven record of advancing sustainable growth through strategic governance, enterprise risk oversight, and disciplined capital deployment. Holds a J.D. from Harvard Law School, graduating cum laude, and a Mini-MBA for General Counsels from Harvard Business School. Former CEO of Energy Transition Advisory Group, advising governments and investors on critical minerals, infrastructure, and energy transition strategy.

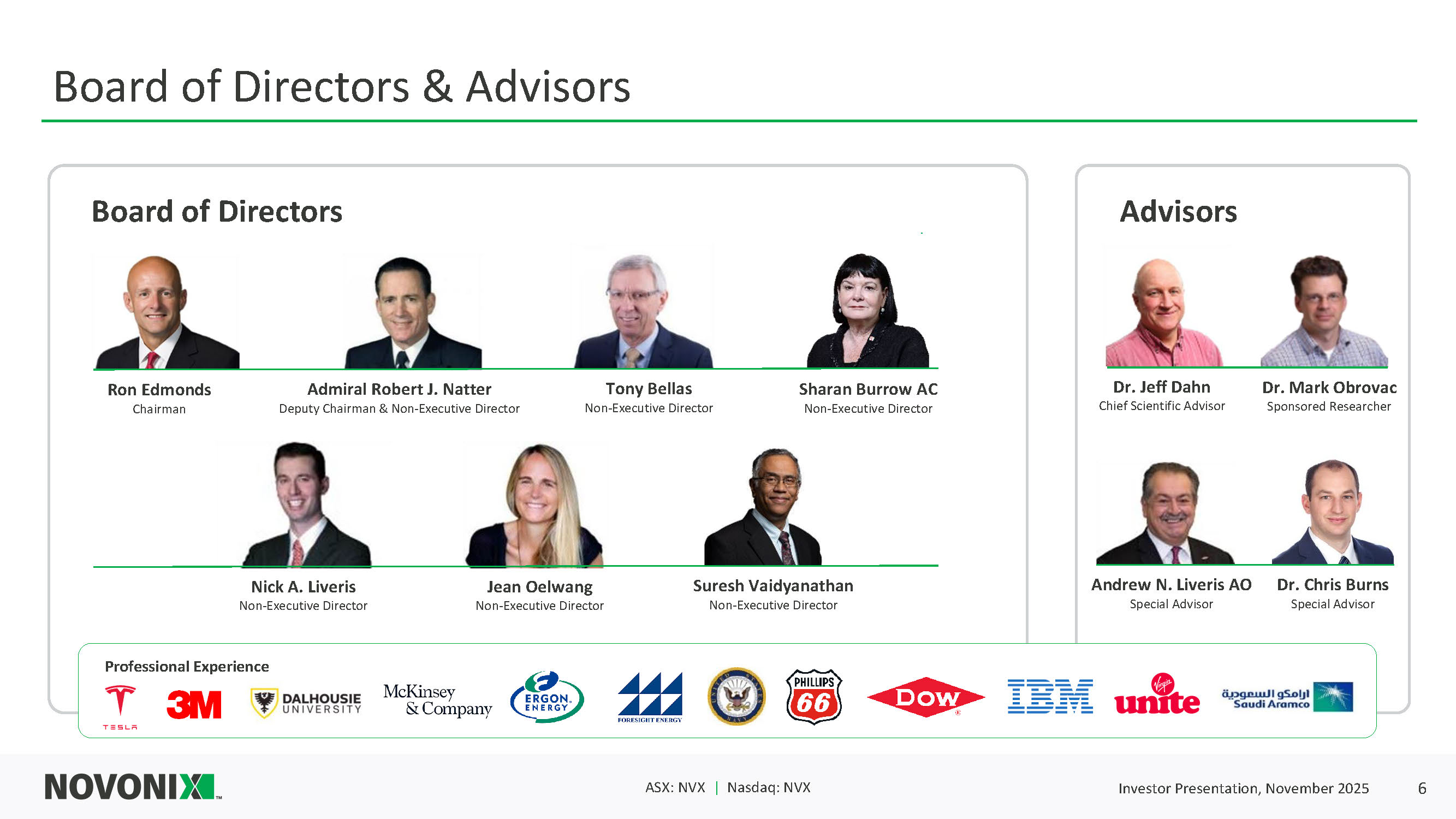

Board of Directors & Advisors Board of Directors Advisors Ron Edmonds Chairman Admiral Robert J. Natter Deputy Chairman & Non-Executive Director Tony Bellas Non-Executive Director Sharan Burrow AC Non-Executive Director Dr. Jeff Dahn Chief Scientific Advisor Dr. Mark Obrovac Sponsored Researcher Nick A. Liveris Non-Executive Director Jean Oelwang Non-Executive Director Suresh Vaidyanathan Non-Executive Director Andrew N. Liveris AO Special Advisor Dr. Chris Burns Special Advisor Professional Experience

About NOVONIX

Complementing Lines of Business Leading domestic supplier of battery- grade synthetic graphite First large-scale and sustainable production to advance North American battery supply chain Strategically positioned to accelerate clean energy transition through proprietary technology, advanced R&D and partnerships Commercializing patented cathode synthesis technology Process technology minimizes environmental impact while producing high performance materials Pilot line producing cathode samples with total production capacity of up to 10 tpa Provides industry-leading Ultra-High Precision Coulometry cell testing equipment Offers R&D Services with in-house pilot line, cell testing, and expertise to accelerate customer development programs

NOVONIX is America’s Solution for Synthetic Graphite Why NOVONIX? Most advanced producer of synthetic graphite in North America and one of the only U.S.-based companies commercializing a domestic alternative We are production ready and preparing to deliver mass production samples to our lead customer, Panasonic Energy, in 2025 Feedstock Advantage – Strategic partnership with Phillips 66, ensuring a stable, domestic raw material supply chain and reducing waste Proprietary furnace technology far superior to traditional graphitization processes, with lower energy usage and environmental impact and does not depend on any Chinese equipment, IP, or know-how Proudly headquartered in Chattanooga, TennesseeKey Strategic Relationships Tier 1 Customer* Agreements Technology Agreements & Strategic Investors Strategic Suppliers U.S. Federal Government Supporters * Agreements require final product qualification.

The Market

The Graphite Problem: A Threat to U.S. National Security Chinese Dominance China is the world’s largest producer and exporter of graphite with ~95% imported from China.1 On December 1, 2023, China imposed export controls on certain graphite items and further tightened these controls in December 20242 and again in October 2025. These controls have since been suspended until November 2026. Synthetic graphite is on the U.S. Geological Survey’s Critical Minerals List—underscoring its economic and national security importance. An enormous risk to US energy security and defense. Benchmark Minerals Intelligence Anode Price Assessment April 2025 https://source.benchmarkminerals.com/article/china-tightens-graphite-export-controls-to-the-us Acheson furnace (used in China to synthesize graphite) exhausting smoke and gasses.

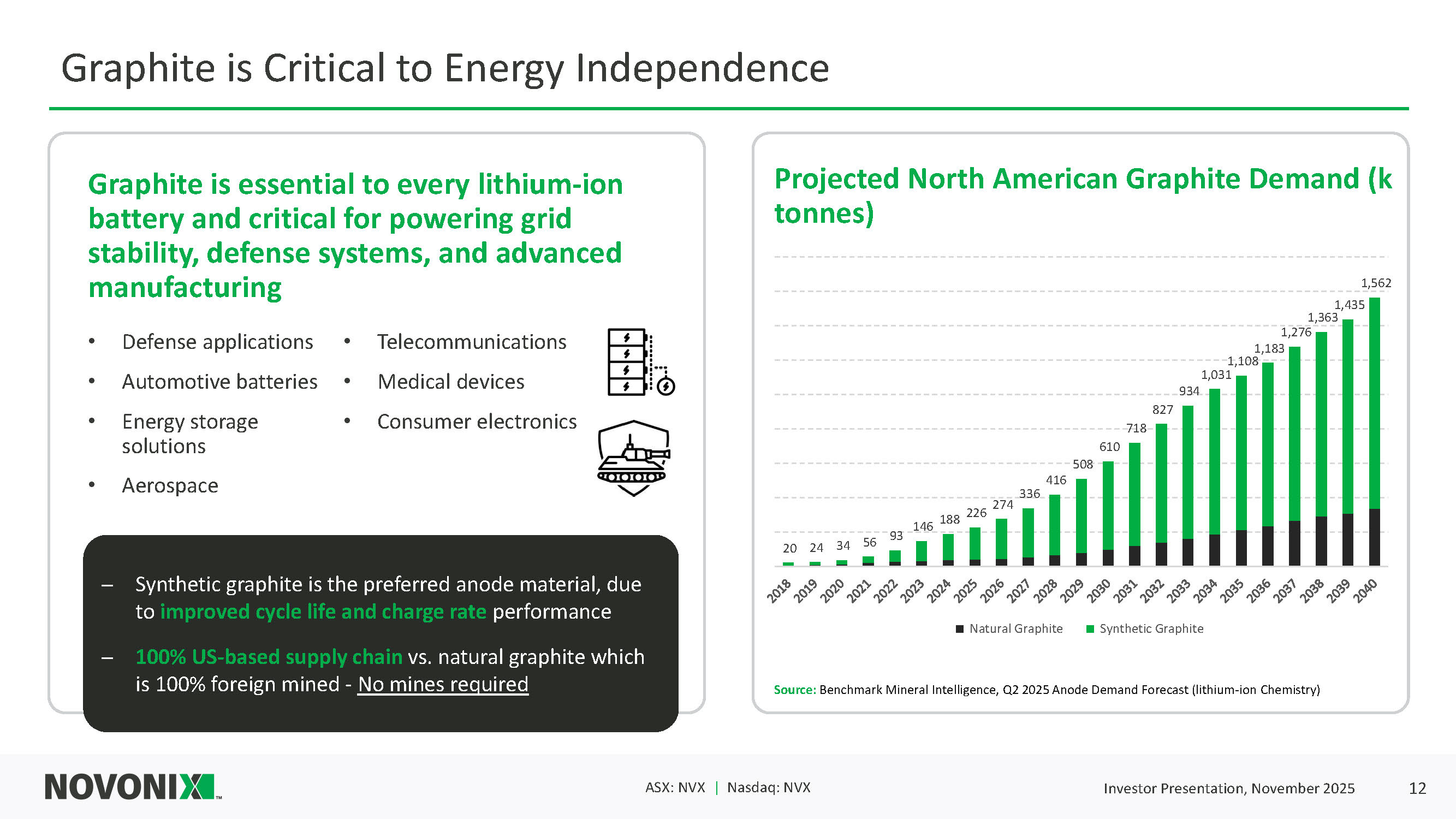

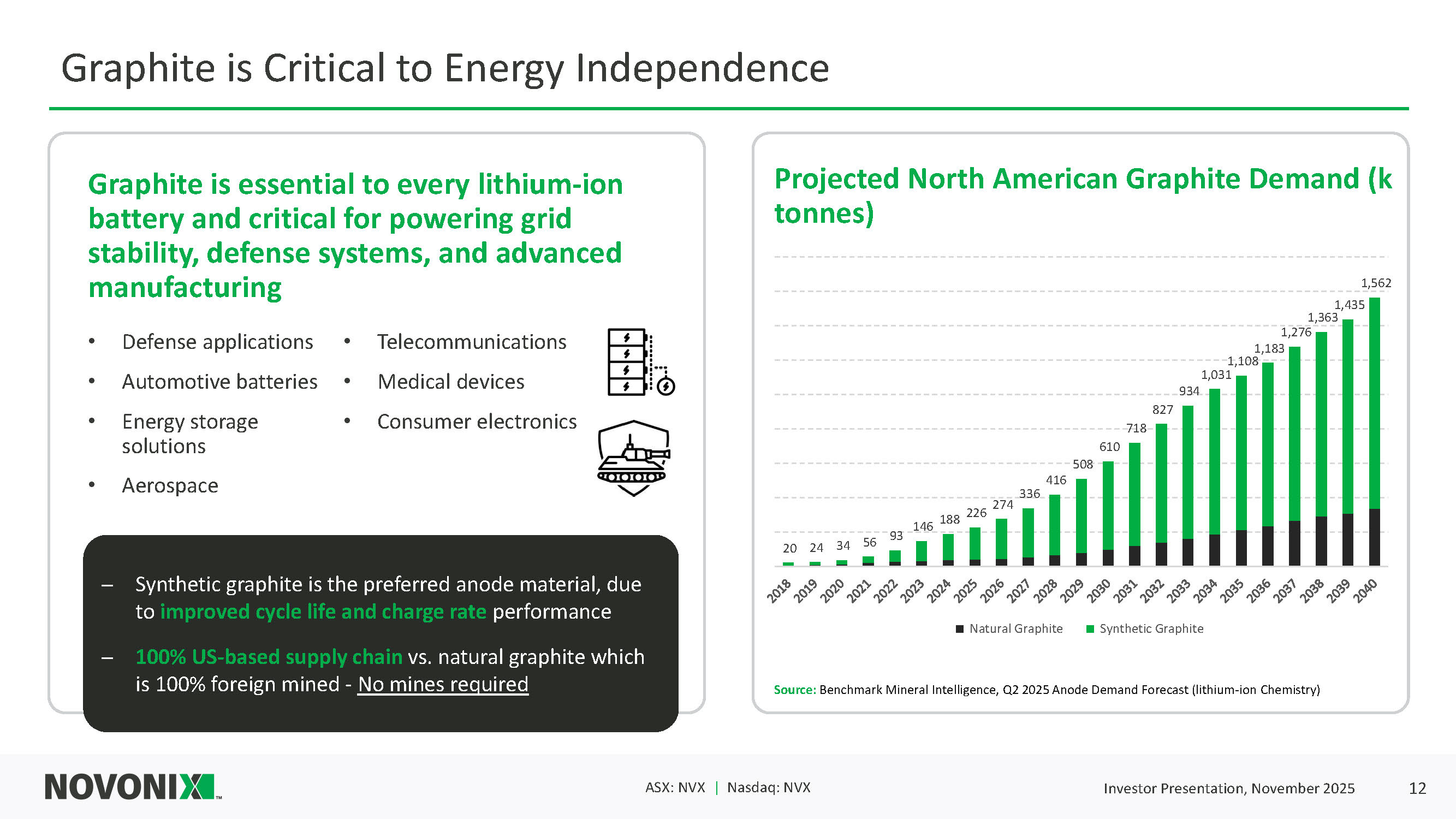

Graphite is Critical to Energy Independence Graphite is essential to every lithium-ion battery and critical for powering grid stability, defense systems, and advanced manufacturing Projected North American Graphite Demand (k tonnes) Defense applications Automotive batteries Energy storage solutions Aerospace Telecommunications Medical devices Consumer electronics Synthetic graphite is the preferred anode material, due to improved cycle life and charge rate performance ─ 100% US-based supply chain 20 24 34 56 93 146 188 226 274 336 416 508 610 718 827 934 1,031 1,108 1,183 1,276 1,363 ,1435 1,562, Source: Benchmark Mineral Intelligence, Q2 2025 Anode Demand Forecast (lithium-ion Chemistry)

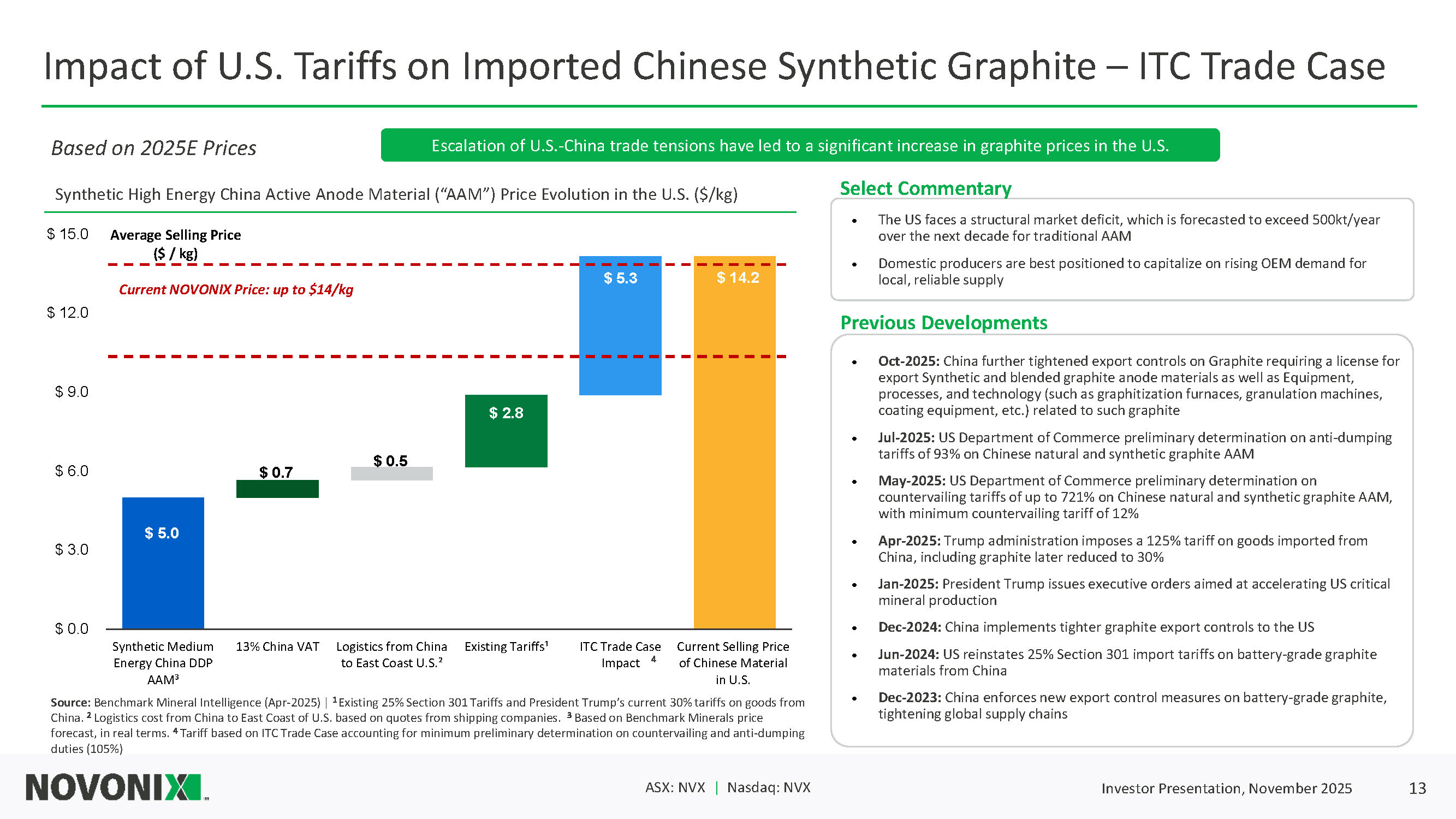

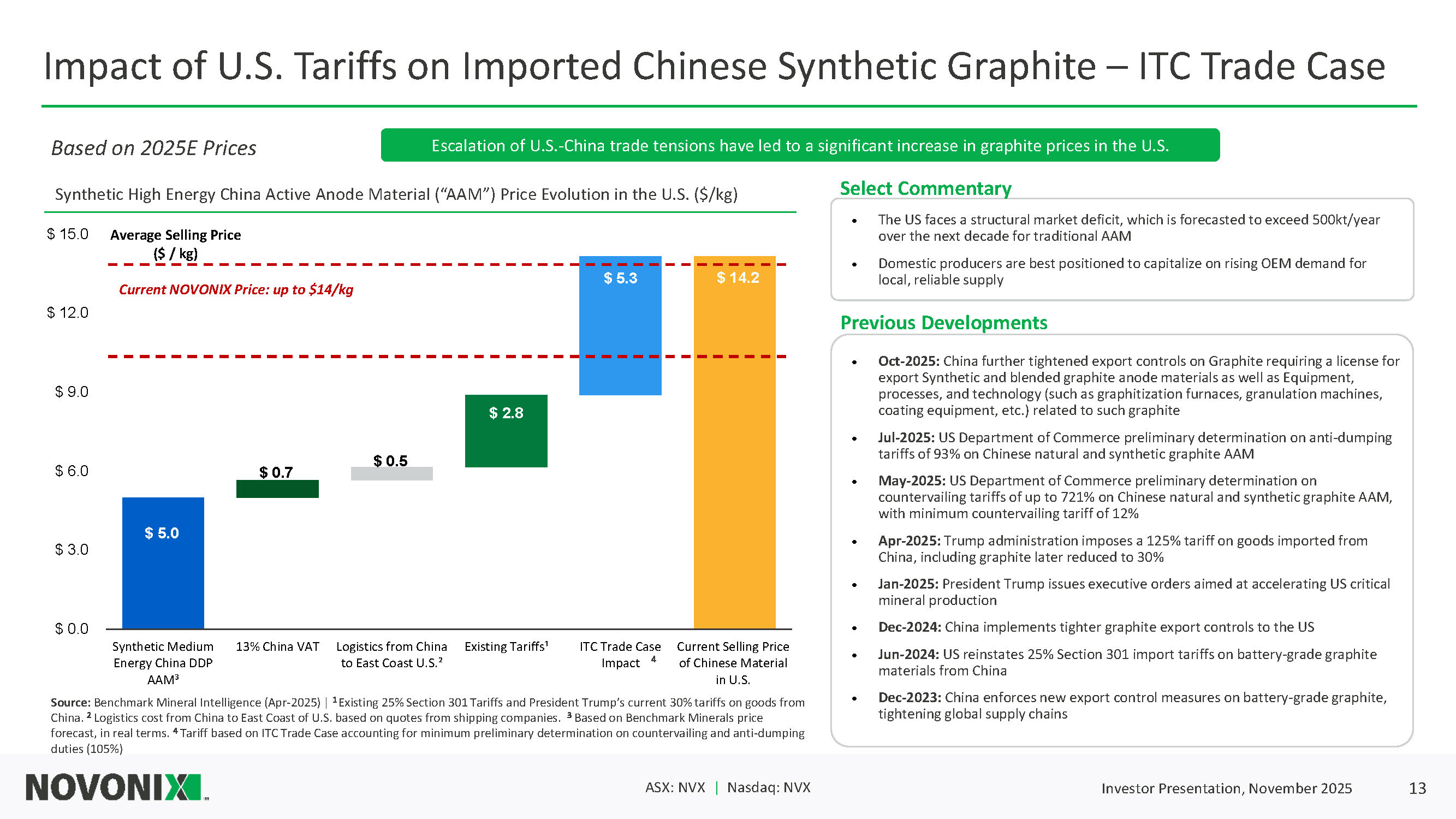

Impact of U.S. Tariffs on Imported Chinese Synthetic Graphite – ITC Trade Case Based on 2025E Prices Escalation of U.S.-China trade tensions have led to a significant increase in graphite prices in the U.S. Synthetic High Energy China Active Anode Material (“AAM”) Price Evolution in the U.S. ($/kg) The US faces a structural market deficit, which is forecasted to exceed 500kt/year over the next decade for traditional AAM Domestic producers are best positioned to capitalize on rising OEM demand for local, reliable supply $ 15.0 $ 12.0 $ 9.0 $ 6.0 $ 3.0 $0.0 $ 5.0 $ 0.7 $ 0.5 $ 2.8 $ 5.3 $ 14 2 Oct-2025: China further tightened export controls on Graphite requiring a license for export Synthetic and blended graphite anode materials as well as Equipment, processes, and technology (such as graphitization furnaces, granulation machines, coating equipment, etc.) related to such graphite Jul-2025: US Department of Commerce preliminary determination on anti-dumping tariffs of 93% on Chinese natural and synthetic graphite AAM May-2025: US Department of Commerce preliminary determination on countervailing tariffs of up to 721% on Chinese natural and synthetic graphite AAM, with minimum countervailing tariff of 12% Apr-2025: Trump administration imposes a 125% tariff on goods imported from China, including graphite later reduced to 30% Jan-2025: President Trump issues executive orders aimed at accelerating US critical mineral production Dec-2024: China implements tighter graphite export controls to the US Jun-2024: US reinstates 25% Section 301 import tariffs on battery-grade graphite materials from China Dec-2023: China enforces new export control measures on battery-grade graphite, tightening global supply chains Synthetic Medium Energy China DDP AAM³ 13% China VAT Logistics from China to East Coast U.S.² Existing Tariffs¹ ITC Trade Case Impact 4 Current Selling Price of Chinese Material in U.S. Source: Benchmark Mineral Intelligence (Apr-2025) | 1 Existing 25% Section 301 Tariffs and President Trump’s current 30% tariffs on goods from China. 2 Logistics cost from China to East Coast of U.S. based on quotes from shipping companies. 3 Based on Benchmark Minerals price forecast, in real terms. 4 Tariff based on ITC Trade Case accounting for minimum preliminary determination on countervailing and anti-dumping duties (105%)

Progress Towards Industrialization

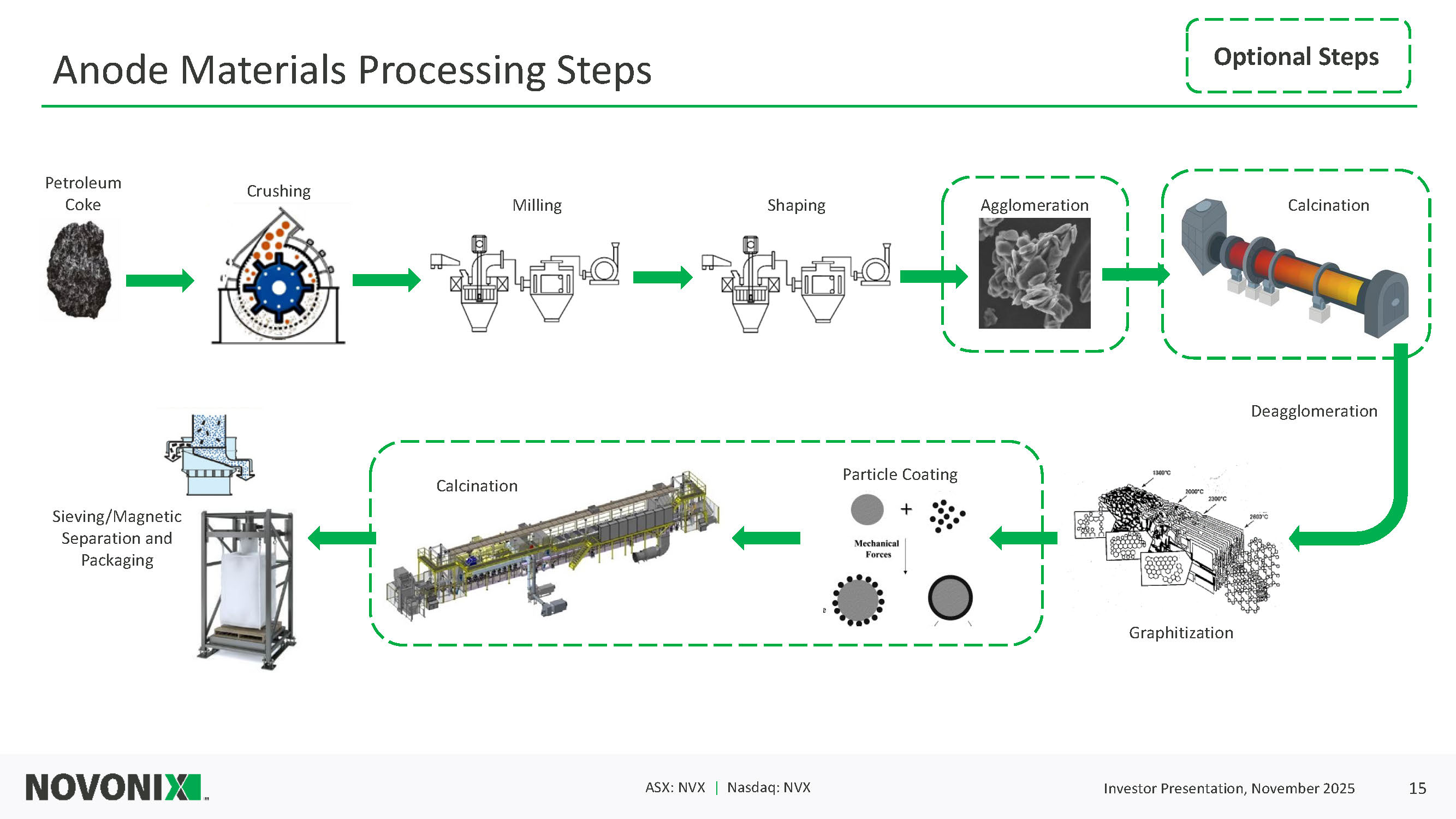

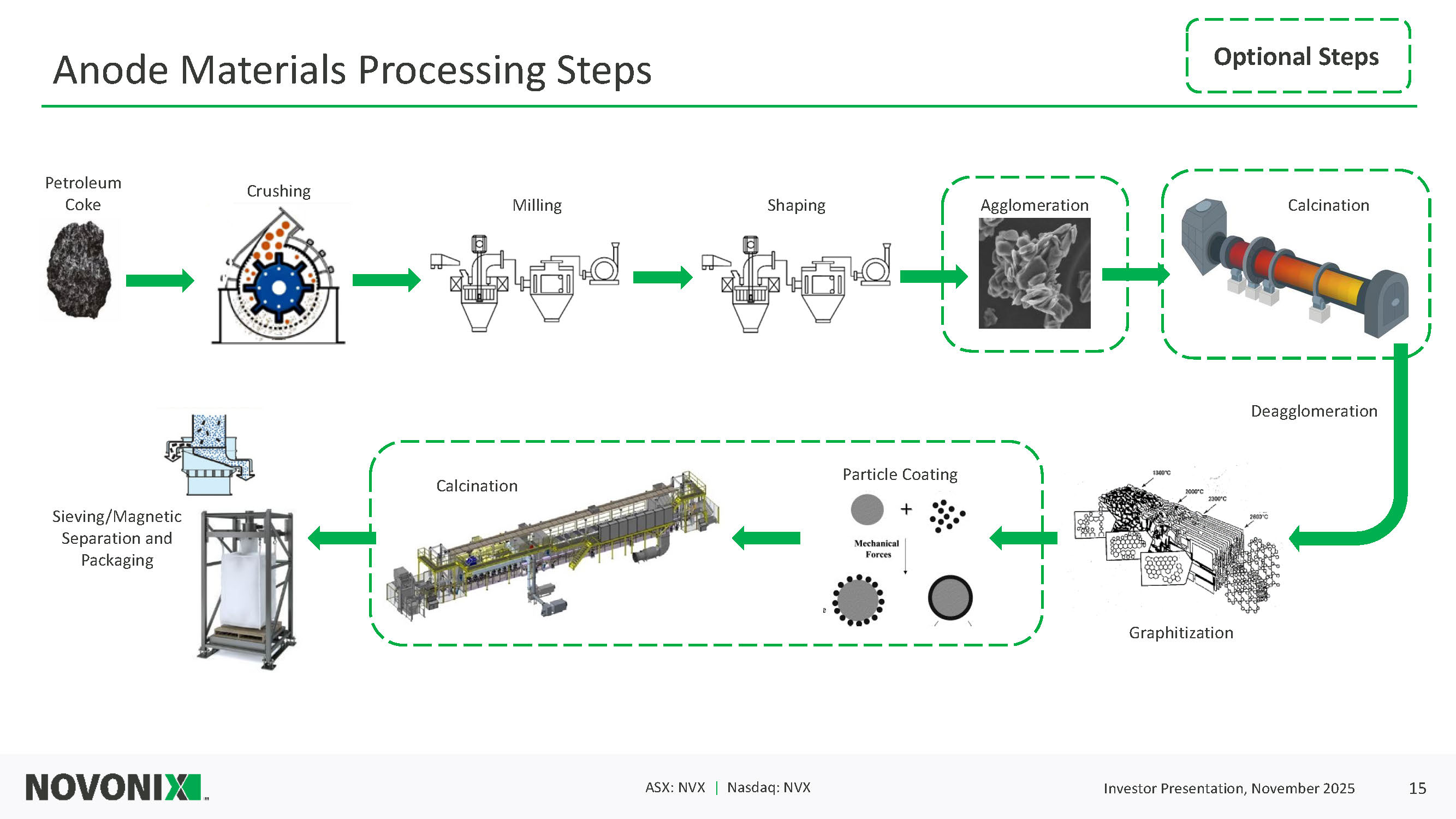

Anode Materials Processing Steps Optional Steps Petroleum Coke Crushing Milling Shaping Agglomeration Calcination Sieving/Magnetic Separation and Packaging Calcination Particle Coating Deagglomeration Graphitization

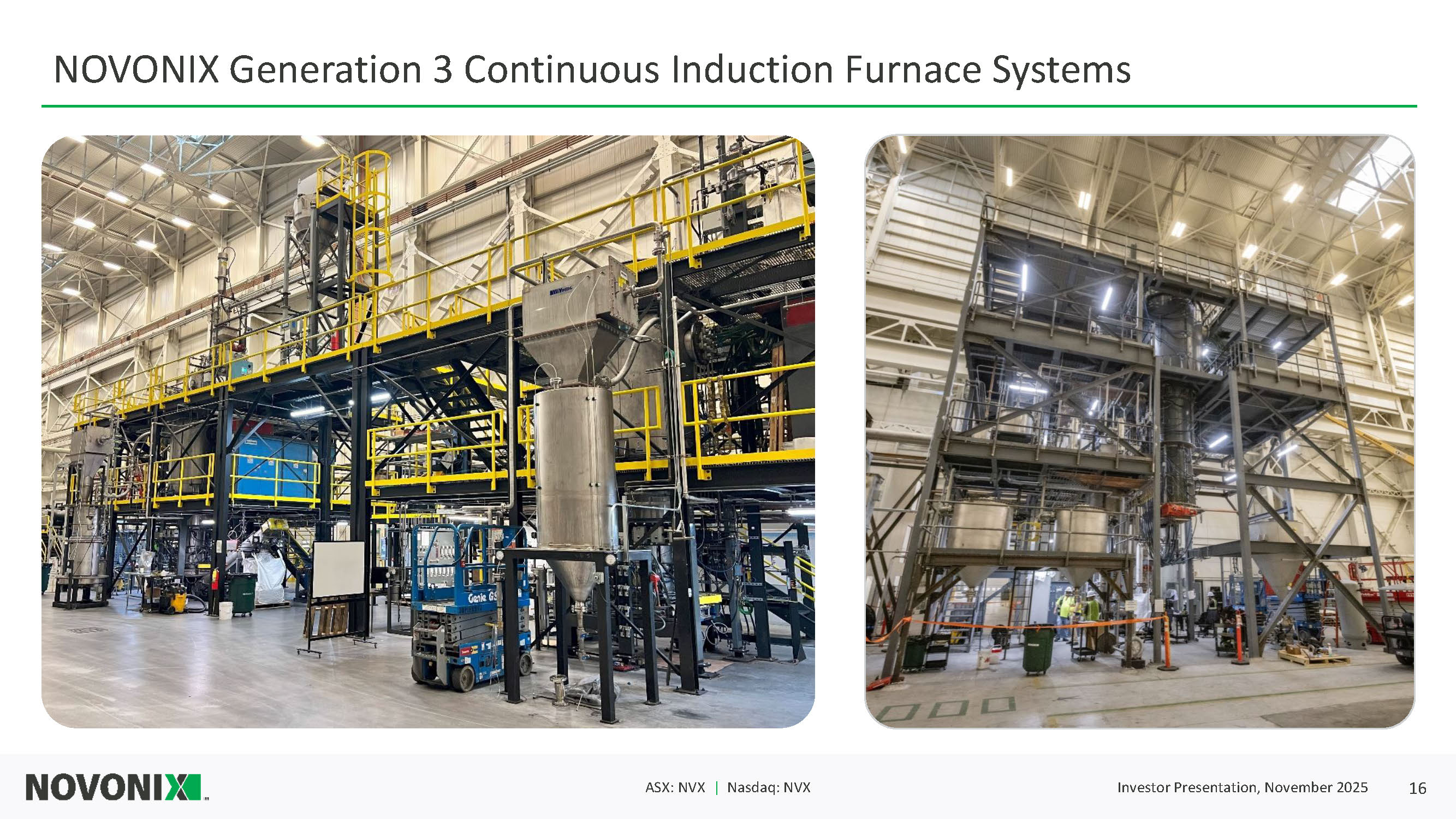

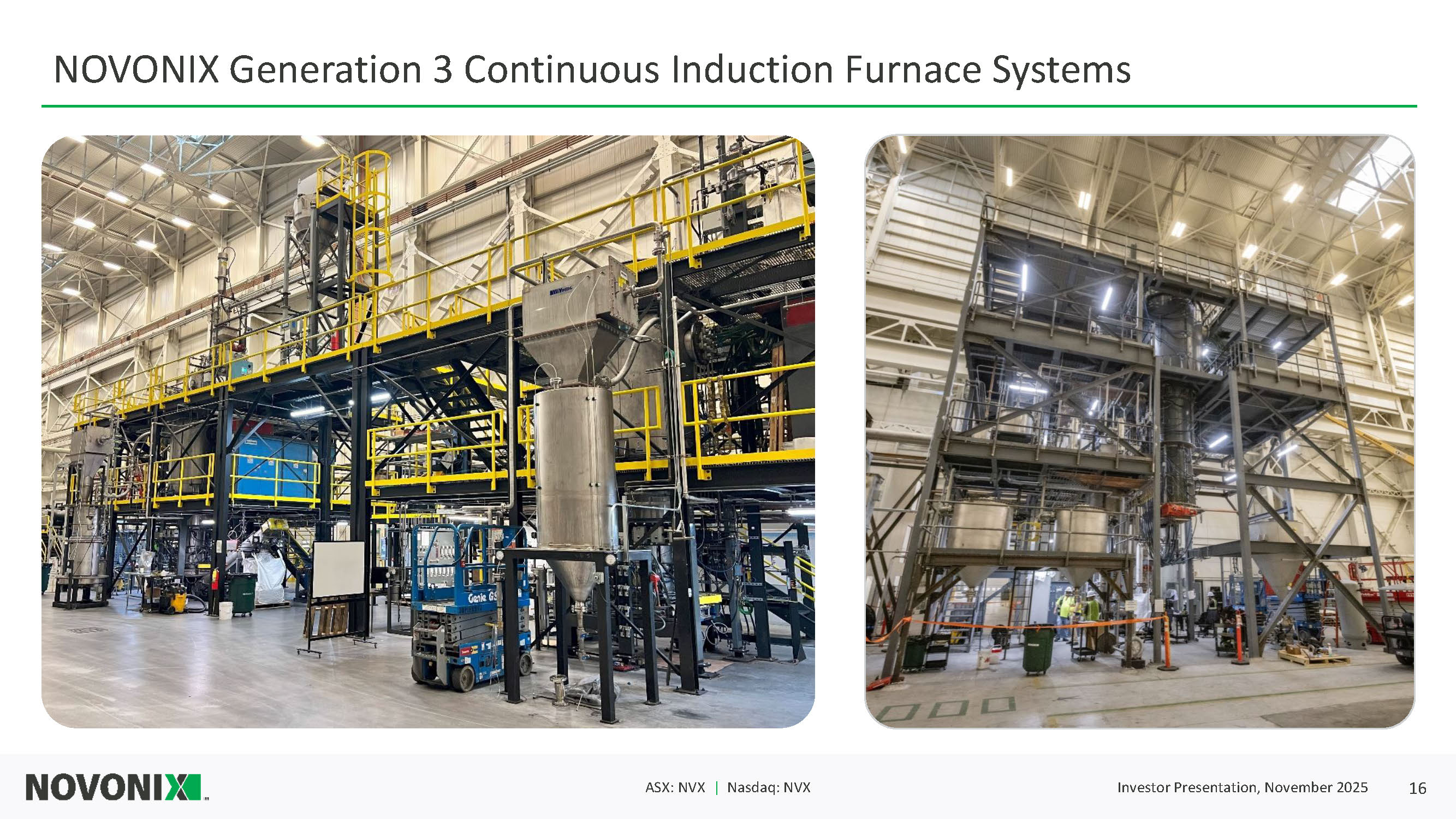

NOVONIX Generation 3 Continuous Induction Furnace Systems

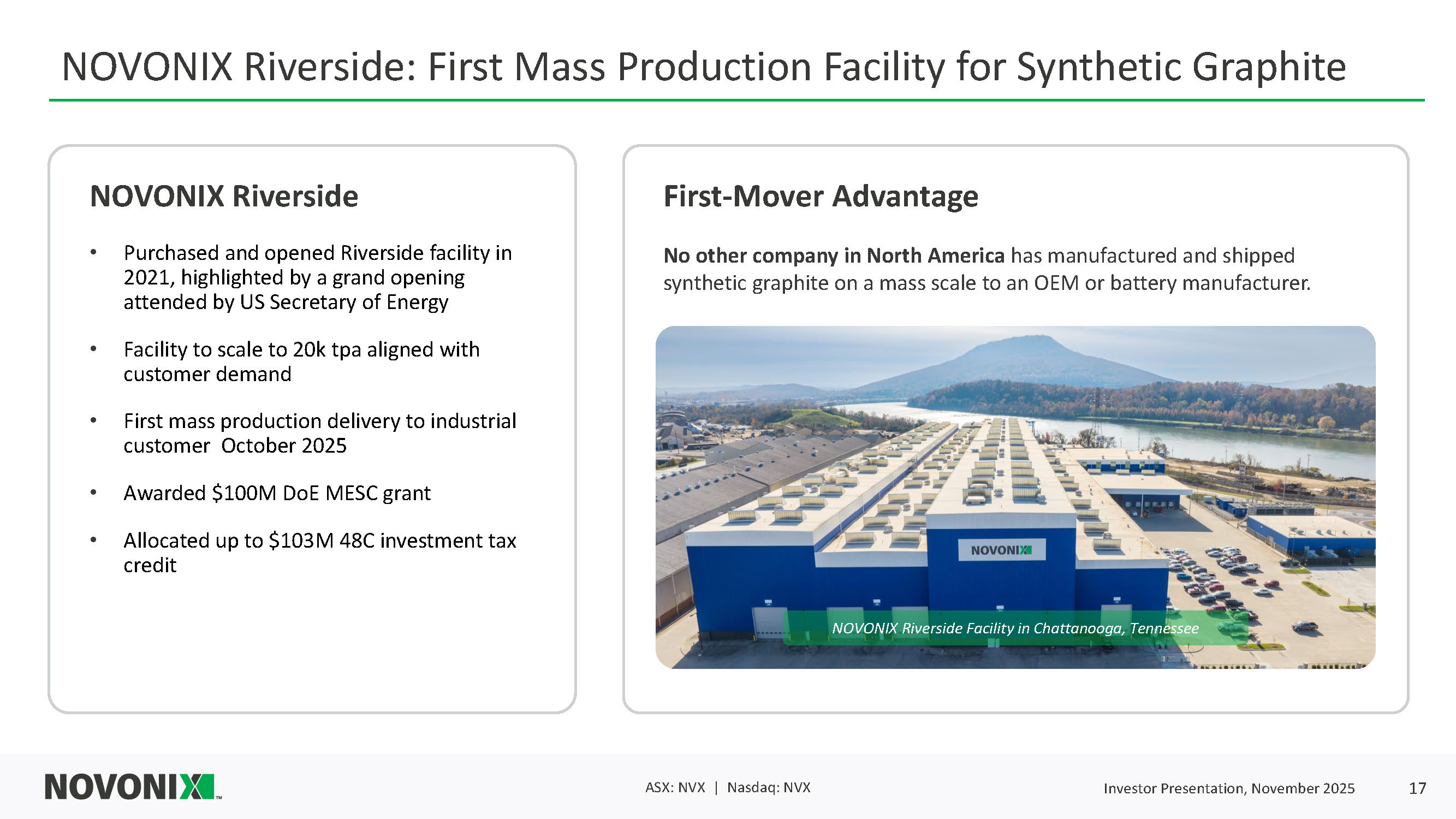

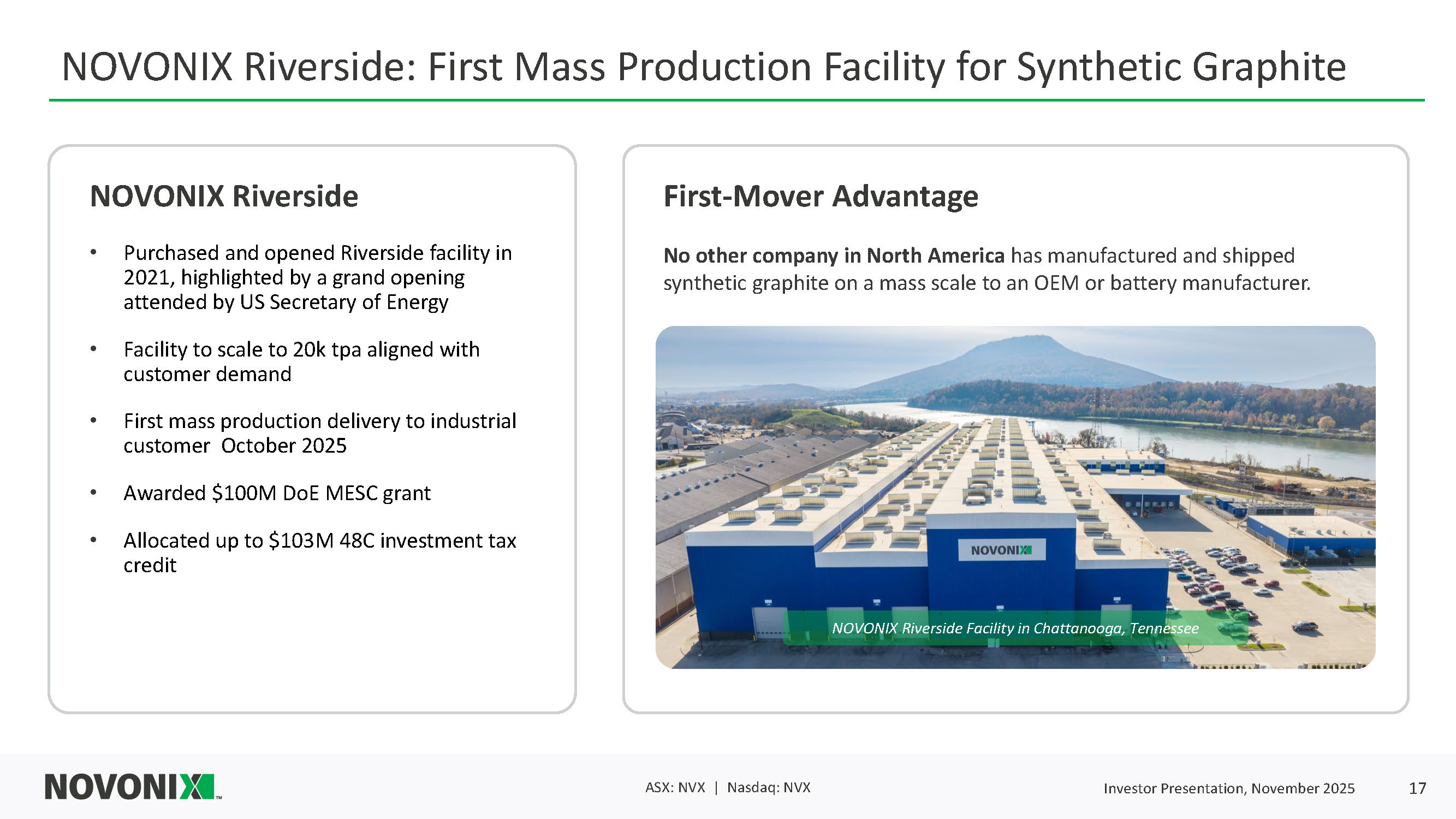

NOVONIX Riverside: First Mass Production Facility for Synthetic Graphite NOVONIX Riverside Purchased and opened Riverside facility in 2021, highlighted by a grand opening attended by US Secretary of Energy Facility to scale to 20k tpa aligned with customer demand First mass production delivery to industrial customer October 2025 Awarded $100M DoE MESC grant Allocated up to $103M 48C investment tax Credit First-Mover Advantage No other company in North America has manufactured and shipped synthetic graphite on a mass scale to an OEM or battery manufacturer.

NOVONIX Enterprise South: Our Next Phase of Growth NOVONIX Enterprise South NOVONIX Enterprise South is expected to have full production capacity of 31.5k tpa This facility, together with NOVONIX’s existing 20k tpa Riverside facility in Chattanooga, will bring the Company’s total production capacity to over 50k tpa Offered Conditional Commitment for a US$754 Million Loan from the U.S. Department of Energy Eligible for potential tax credits under the Advanced Manufacturing Production Tax Credit (Section 45X) Received tax benefits from Chattanooga and Hamilton County of ~$54M Site Rendering Proposed NOVONIX Enterprise South rendering located on 182 acres in the Enterprise South Industrial Park in Chattanooga, Tennessee. In March 2025, NOVONIX received unanimous approval from both the City of Chattanooga and Hamilton County for the land purchase. Enterprise South will be acquired for approximately US$5 million. The Company also received an estimated US$54 million in net tax and other benefits to be realized over a 15-year period, subject to the satisfaction of conditions.

Commercial Traction

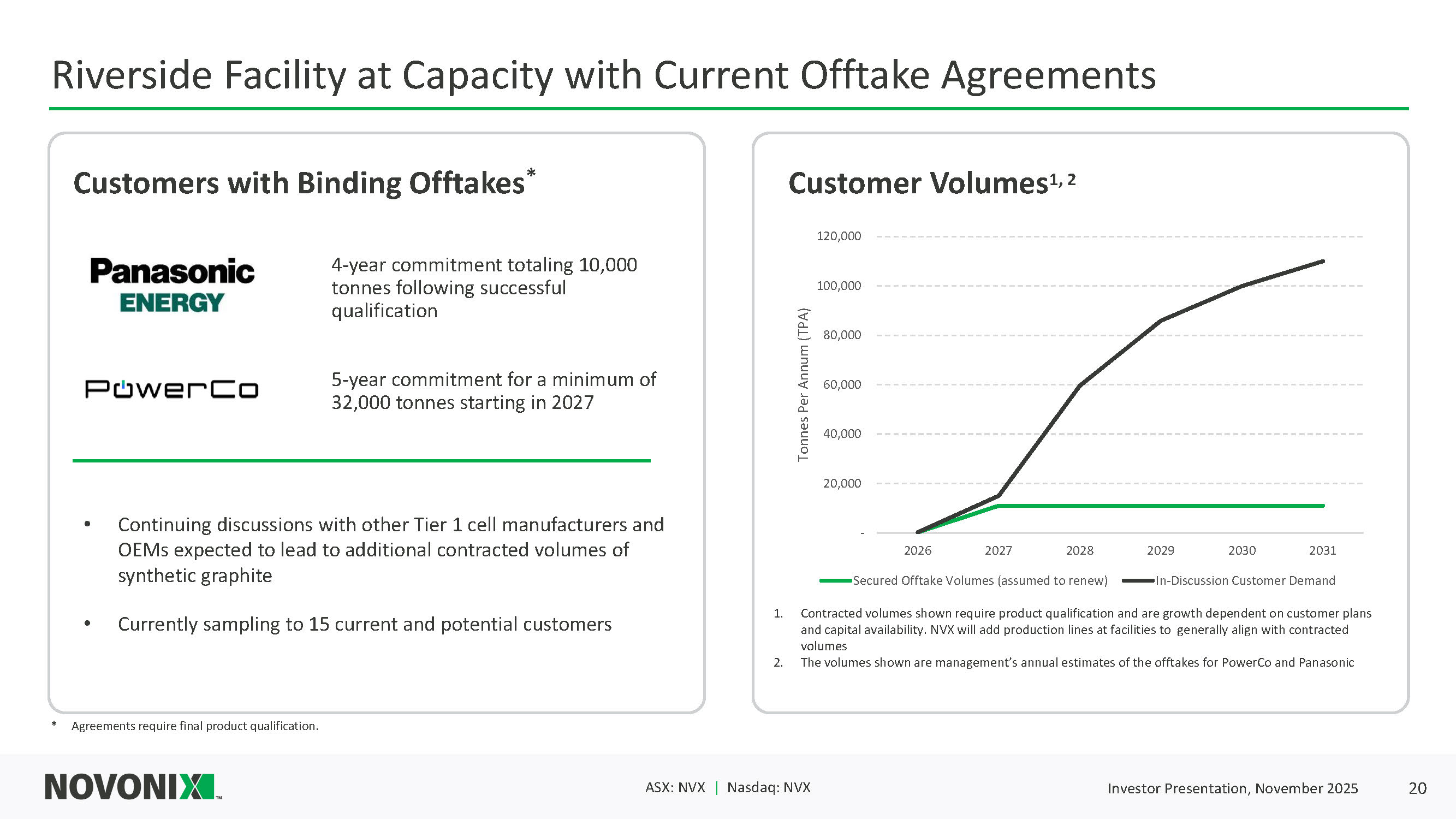

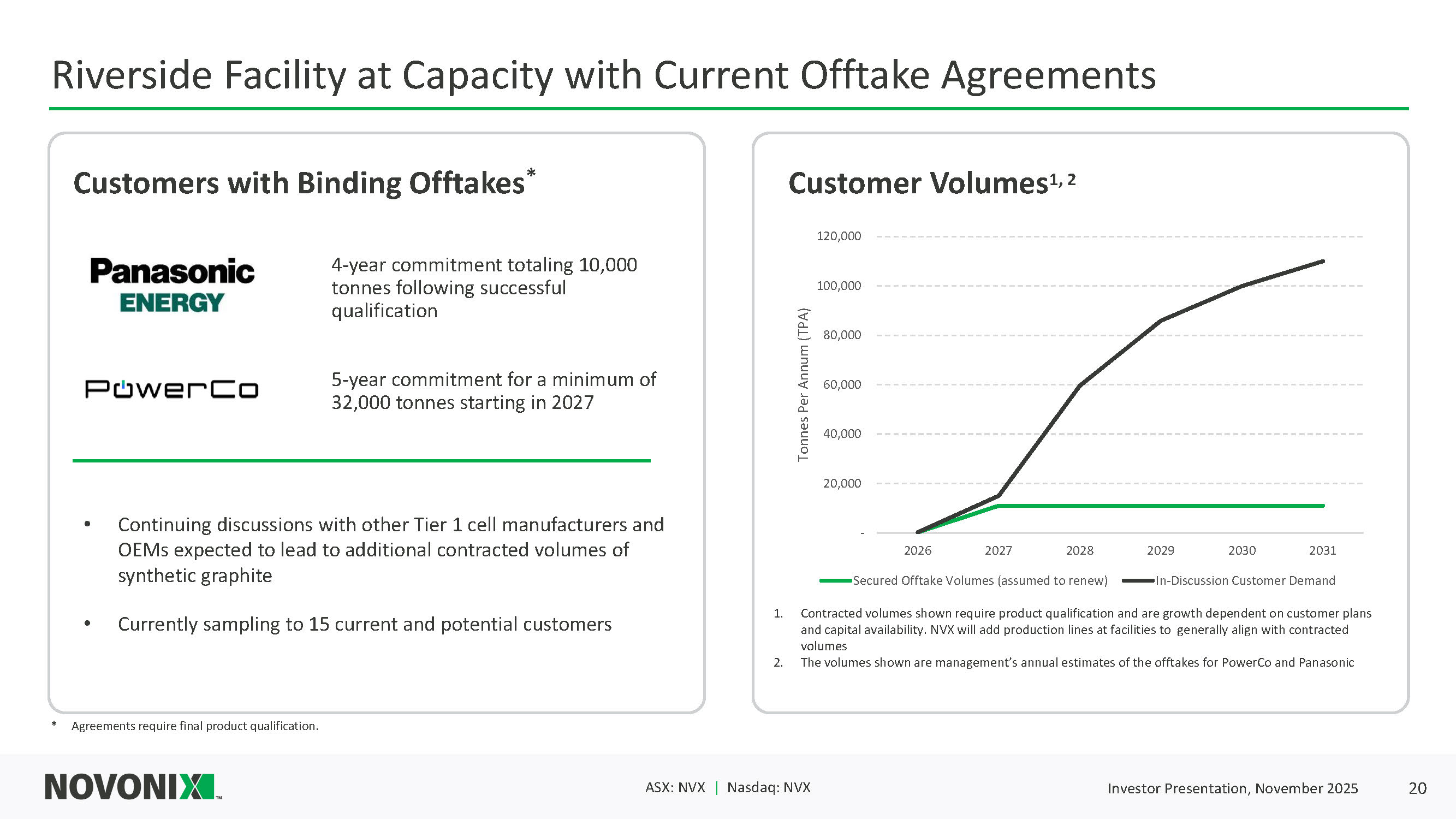

Riverside Facility at Capacity with Current Offtake Agreements Customers with Binding Offtakes* 4-year commitment totaling 10,000 tonnes following successful qualification 5-year commitment for a minimum of 32,000 tonnes starting in 2027 Continuing discussions with other Tier 1 cell manufacturers and OEMs expected to lead to additional contracted volumes of synthetic graphite Currently sampling to 15 current and potential customers Customer Volumes1, 2 120,000 100,000 80,000 60,000 40,000 20,000 Tonnes Per Annum (TPA) 2026 2027 2028 2029 2030 2031 Secured Offtake Volumes (assumed to renew) In-Discussion Customer Demand Contracted volumes shown require product qualification and are growth dependent on customer plans and capital availability. NVX will add production lines at facilities to generally align with contracted volumes The volumes shown are management’s annual estimates of the offtakes for PowerCo and Panasonic * Agreements require final product qualification.

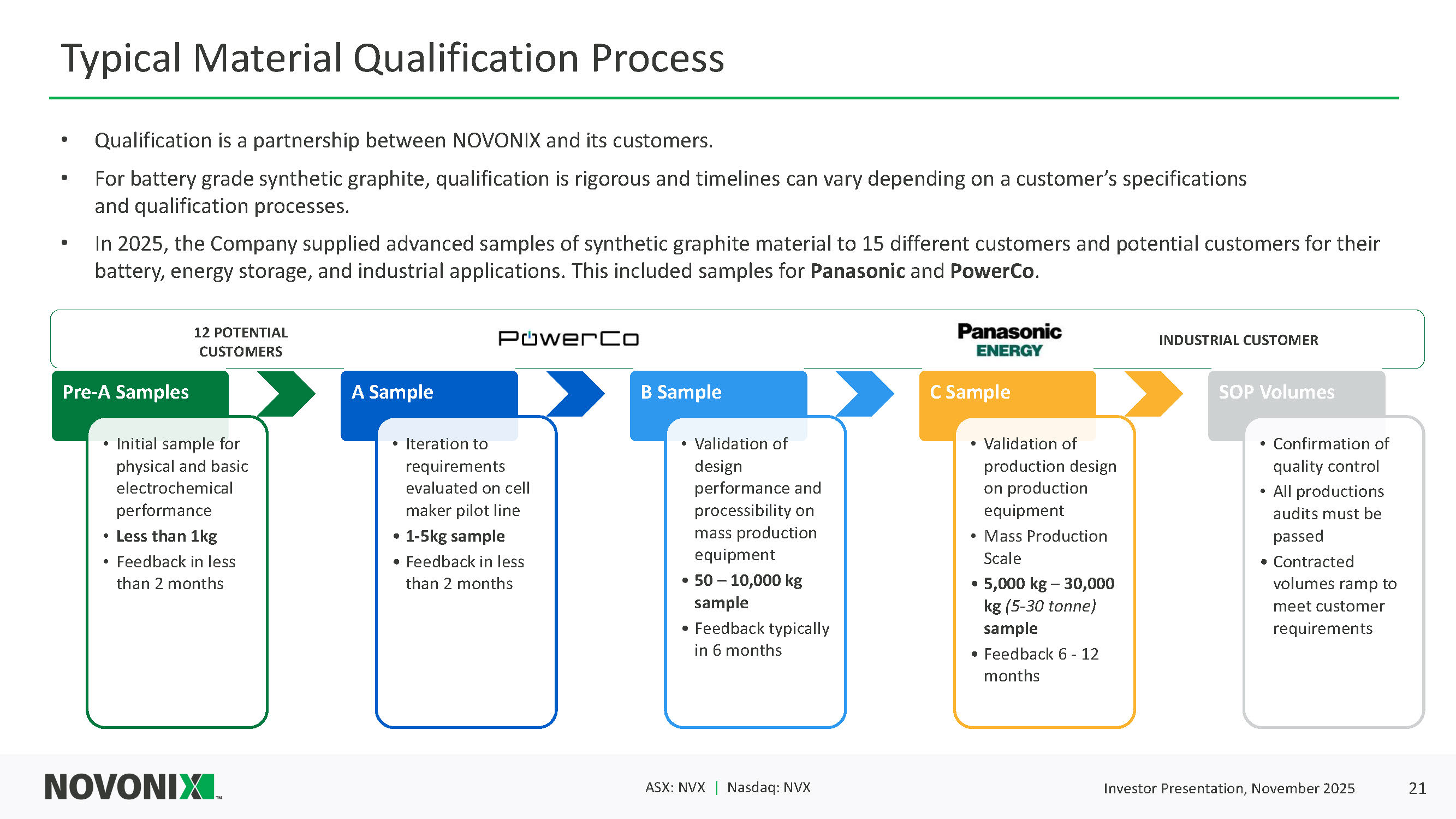

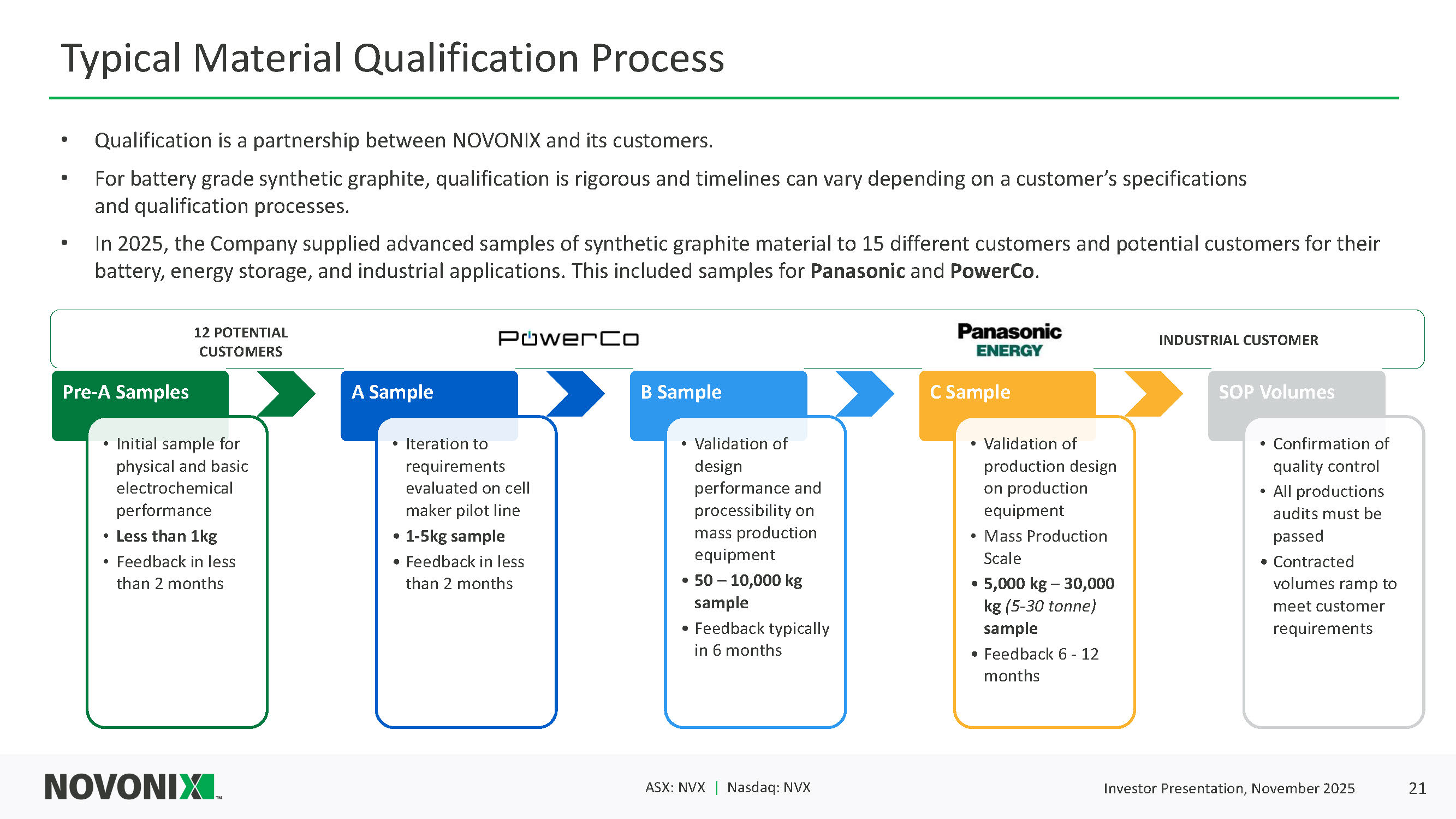

Typical Material Qualification Process Qualification is a partnership between NOVONIX and its customers. For battery grade synthetic graphite, qualification is rigorous and timelines can vary depending on a customer’s specifications and qualification processes. In 2025, the Company supplied advanced samples of synthetic graphite material to 15 different customers and potential customers for their battery, energy storage, and industrial applications. This included samples for Panasonic and PowerCo. 12 POTENTIAL CUSTOMERS INDUSTRIAL CUSTOMER Pre-A Samples A Sample B Sample C Sample SOP Volumes Initial sample for physical and basic electrochemical performance Less than 1kg Feedback in less than 2 months Iteration to requirements evaluated on cell maker pilot line 1-5kg sample Feedback in less than 2 months Validation of design performance and processibility on mass production equipment 50 – 10,000 kg sample Feedback typically in 6 months Validation of production design on production equipment Mass Production Scale 5,000 kg – 30,000 kg (5-30 tonne) sample Feedback 6 - 12 months Confirmation of quality control All productions audits must be passed Contracted volumes ramp to meet customer requirements

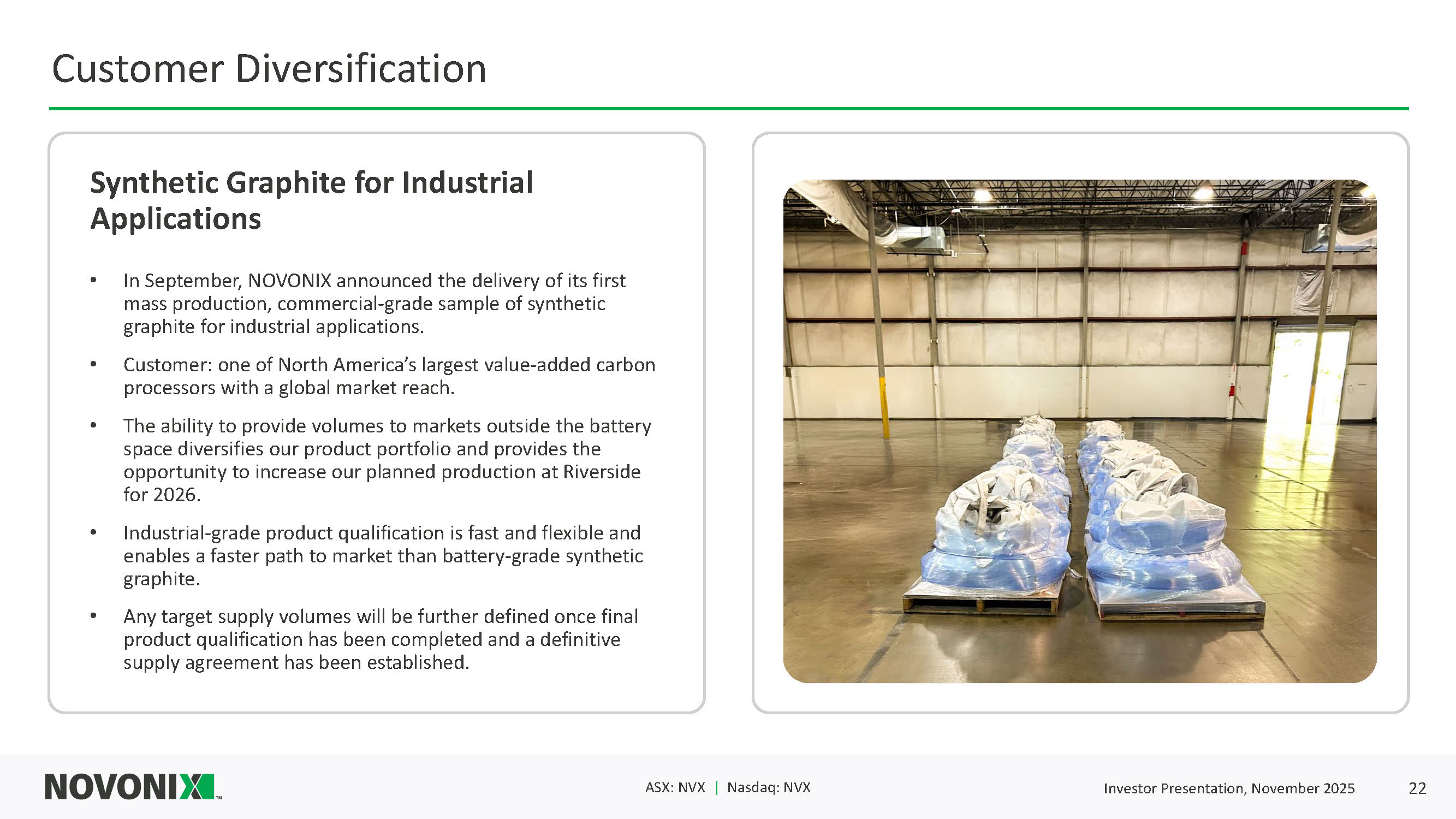

Customer Diversification Synthetic Graphite for Industrial Applications In September, NOVONIX announced the delivery of its first mass production, commercial-grade sample of synthetic graphite for industrial applications. Customer: one of North America’s largest value-added carbon processors with a global market reach. The ability to provide volumes to markets outside the battery space diversifies our product portfolio and provides the opportunity to increase our planned production at Riverside for 2026. Industrial-grade product qualification is fast and flexible and enables a faster path to market than battery-grade synthetic graphite. Any target supply volumes will be further defined once final product qualification has been completed and a definitive supply agreement has been established.

Strategic Partnership with Phillips 66 NOVONIX uses petroleum coke, a byproduct of U.S. oil refining, as feedstock for our synthetic graphite products, ensuring a stable, domestic raw material supply chain while reducing waste. In 2017, NOVONIX began testing P66 petroleum coke as feedstock for battery-grade synthetic graphite anode materials. In September 2021, P66 invested $150 million for a ~15% ownership stake in NOVONIX to align with the battery value chain. Along with the initial investment, P66 received a seat on our Board of Directors. In January 2022, NOVONIX and P66 agreed to a Technology Development Agreement to identify improved feedstocks in current or future P66 product portfolios. In January 2025, P66 participated in our follow-on equity offering, investing an additional $5 million. Lake Charles, LA, P66 refining facility

Looking Forward

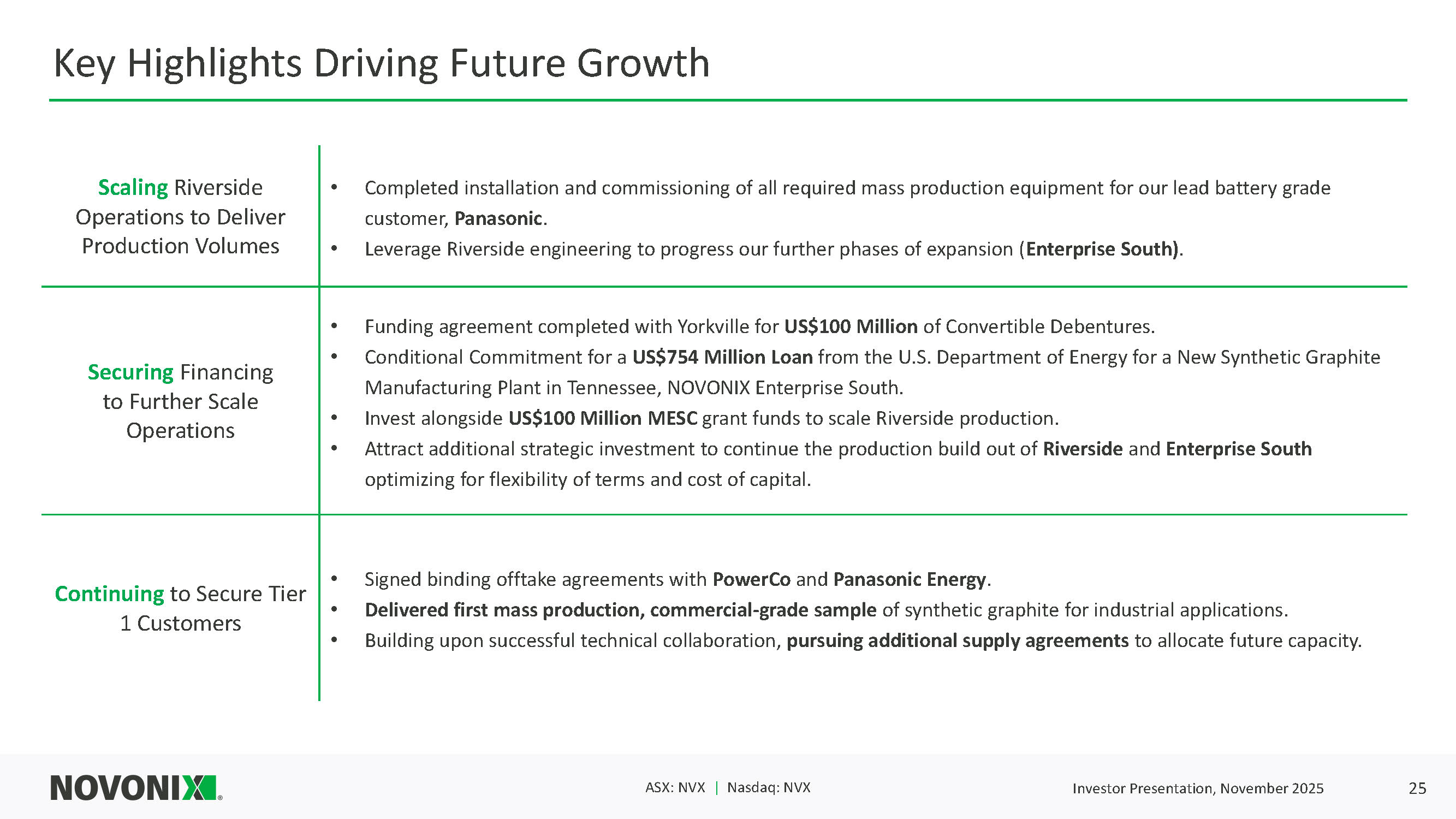

Key Highlights Driving Future Growth Scaling Riverside Operations to Deliver Production Volumes Securing Financing to Further Scale Operations Continuing to Secure Tier 1 Customers Completed installation and commissioning of all required mass production equipment for our lead battery grade customer, Panasonic. Leverage Riverside engineering to progress our further phases of expansion (Enterprise South). Funding agreement completed with Yorkville for US$100 Million of Convertible Debentures. Conditional Commitment for a US$754 Million Loan from the U.S. Department of Energy for a New Synthetic Graphite Manufacturing Plant in Tennessee, NOVONIX Enterprise South. Invest alongside US$100 Million MESC grant funds to scale Riverside production. Attract additional strategic investment to continue the production build out of Riverside and Enterprise South optimizing for flexibility of terms and cost of capital. ASX: NVX | Nasdaq: NVX Investor Presentation, November 2025

Contact Information Corporate Mike O’Kronley, CEO Robert Long, CFO Dwayne Johnson, COO Kimberly Heimert, CLRO Suzanne Yeates, Secretary Investor Relations: IR@novonixgroup.com Media Relations: media@novonixgroup.com NOVONIX Limited (ASX:NVX) ACN 157 690 830 1029 West 19th Street Chattanooga, Tennessee USA, 37408 353 Corporate Place Chattanooga, Tennessee USA, 37419 177 Bluewater Road Bedford, Nova Scotia Canada, B4B 1H1 110 Simmonds Drive Dartmouth, Nova Scotia Canada, B3B 1N9 ASX: NVX | Nasdaq: NVX Investor Presentation, November 2025 26

Novonix