UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 30, 2025

STRATEGY INC

(Exact name of registrant as specified in its charter)

| Delaware | 001-42509 | 51-0323571 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

| 1850 Towers Crescent Plaza Tysons Corner, Virginia |

22182 | |||

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (703) 848-8600

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Trading |

Name of Each Exchange on which Registered |

||

| 10.00% Series A Perpetual Strife Preferred Stock, $0.001 par value per share | STRF | The Nasdaq Global Select Market | ||

| Variable Rate Series A Perpetual Stretch Preferred Stock, $0.001 par value per share | STRC | The Nasdaq Global Select Market | ||

| 8.00% Series A Perpetual Strike Preferred Stock, $0.001 par value per share | STRK | The Nasdaq Global Select Market | ||

| 10.00% Series A Perpetual Stride Preferred Stock, $0.001 par value per share | STRD | The Nasdaq Global Select Market | ||

| Class A common stock, $0.001 par value per share | MSTR | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 8.01 | Other Events. |

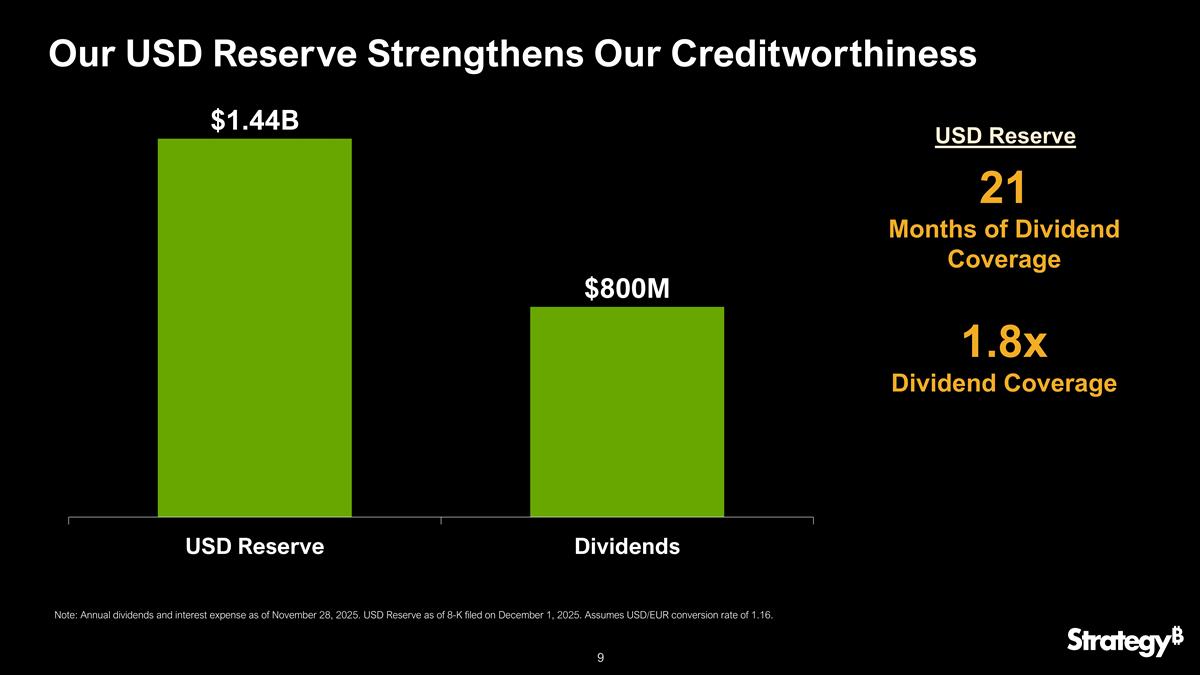

Establishment of Cash Reserve

On December 1, 2025, Strategy Inc (“Strategy”) announced that it has established a US dollar reserve (“USD Reserve”) of $1.44 billion to support the payment of dividends on its preferred stock and interest on its outstanding indebtedness (“Dividends”). The USD Reserve was funded using proceeds from the sale of shares of class A common stock under Strategy’s at-the-market (“ATM”) offering program. Strategy’s current intention is to maintain a USD Reserve in an amount sufficient to fund at least twelve months of Dividends, and Strategy intends to strengthen the USD Reserve over time, with the goal of ultimately covering 24 months or more of its Dividends. The maintenance of this USD Reserve, as well as its terms and amount, remain subject to Strategy’s sole and absolute discretion and Strategy may adjust the USD Reserve from time-to-time based on market conditions, liquidity needs and other factors.

ATM Update

On December 1, 2025, Strategy announced an update with respect to sales made under its ATM of the following securities:

| During Period November 17, 2025 to November 30, 2025 |

As of November 30, 2025 |

|||||||||||||||

| Security |

Shares Sold (1) | Notional Value (in millions) (2) |

Net Proceeds (in millions) (3) |

Available for Issuance and Sale (in millions) |

||||||||||||

| STRF Stock |

— | — | — | $ | 1,637.3 | |||||||||||

| 10.00% Series A Perpetual Strife Preferred Stock |

||||||||||||||||

| STRC Stock |

— | — | — | $ | 4,042.4 | |||||||||||

| Variable Rate Series A Perpetual Stretch Preferred Stock |

||||||||||||||||

| STRK Stock |

— | — | — | $ | 20,335.7 | |||||||||||

| 8.00% Series A Perpetual Strike Preferred Stock |

||||||||||||||||

| STRD Stock |

— | — | — | $ | 4,132.8 | |||||||||||

| 10.00% Series A Perpetual Stride Preferred Stock |

||||||||||||||||

| MSTR Stock |

8,214,000 | — | $ | 1,478.1 | $ | 14,374.8 | ||||||||||

| Class A Common Stock |

||||||||||||||||

|

|

|

|||||||||||||||

| Total |

$ | 1,478.1 | ||||||||||||||

|

|

|

|||||||||||||||

| (1) | Includes shares sold but unsettled as of November 30, 2025. |

| (2) | The total face value of the shares of preferred stock sold, which is used to calculate dividends thereon. |

| (3) | Net proceeds are presented net of sales commission. |

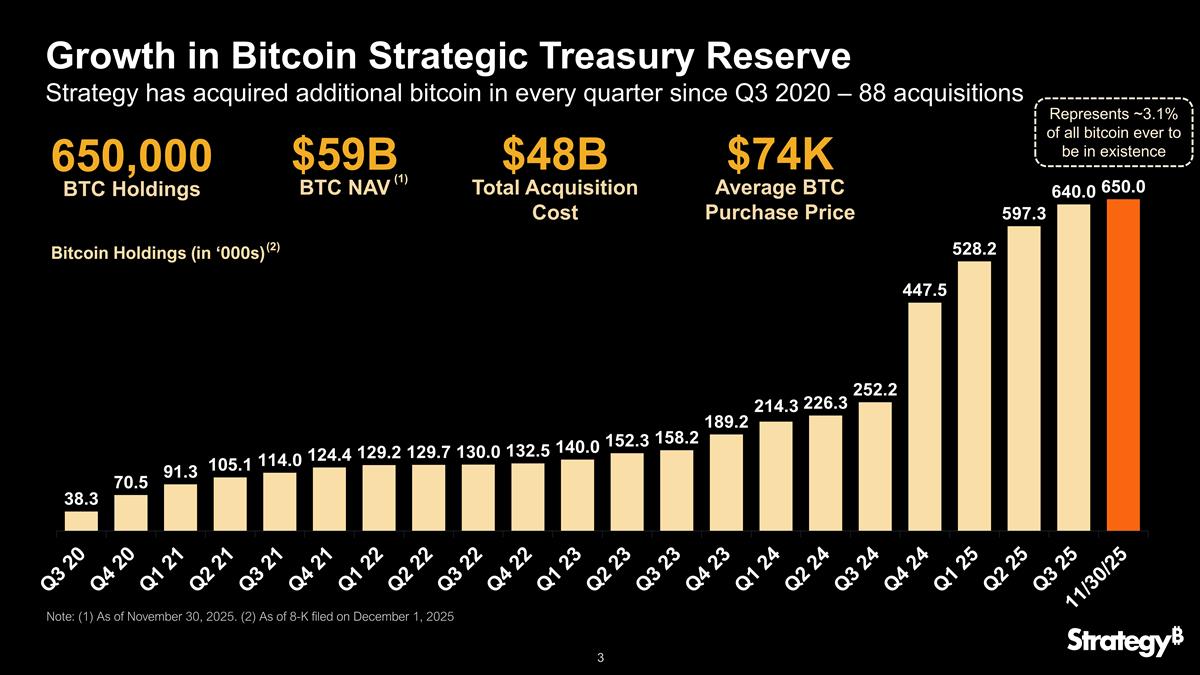

BTC Update

On December 1, 2025, Strategy announced updates with respect to its bitcoin holdings:

| During Period November 17, 2025 to November 30, 2025 | As of November 30, 2025 | |||||||||||||||||||||

| BTC Acquired (1) | Aggregate Purchase Price (in millions) (2) |

Average Purchase Price (2) |

Aggregate BTC Holdings |

Aggregate Purchase Price (in billions) (2) |

Average Purchase Price (2) |

|||||||||||||||||

| 130 | $ | 11.7 | $ | 89,960 | 650,000 | $ | 48.38 | $ | 74,436 | |||||||||||||

| (1) | The bitcoin purchases were made using proceeds from the sale of shares of MSTR Stock under Strategy’s ATM. |

| (2) | Aggregate and average purchase prices are inclusive of fees and expenses. |

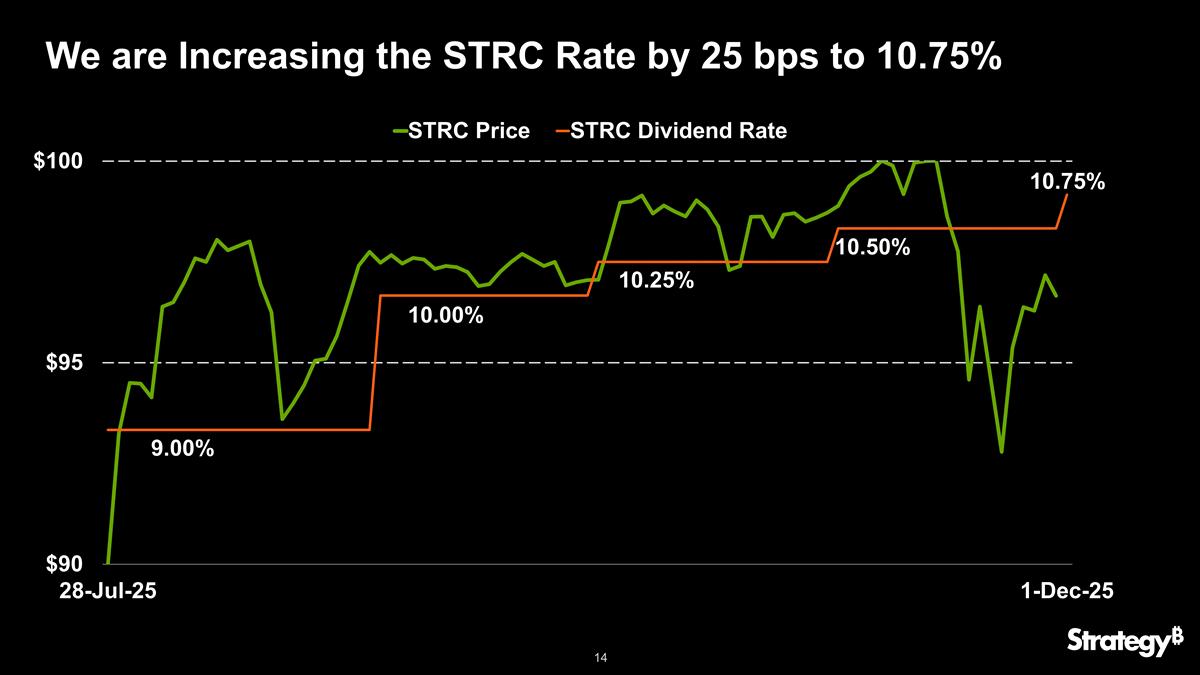

Adjustment to Dividend Rate on Variable Rate Series A Perpetual Stretch Preferred Stock

On November 30, 2025, Strategy increased the regular dividend rate per annum on the STRC Stock effective for monthly periods commencing on or after December 1, 2025 from 10.50% to 10.75%. Strategy announced this new rate via its website, www.strategy.com/strc.

Cash Dividend Declaration

On December 1, 2025, Strategy announced that its board of directors had declared the following cash dividends, payable on December 31, 2025 (or, if such day is not a business day, the next business day) to stockholders of record as of 5:00 p.m., New York City time, or, in the case of STRE, as of 5:00 p.m., London time, on December 15, 2025:

| Preferred Stock |

Ticker |

Period |

Cash Dividend Per Share |

|||||

| 10.00% Series A Perpetual Strife Preferred Stock |

STRF | Quarter ending December 31, 2025 | $ | 2.50 | ||||

| Variable Rate Series A Perpetual Stretch Preferred Stock |

STRC | Month ending December 31, 2025 | $ | 0.896 | (1) | |||

| 10.00% Series A Perpetual Stream Preferred Stock |

STRE | Quarter ending December 31, 2025 | € | 1.333 | (2) | |||

| 8.00% Series A Perpetual Strike Preferred Stock |

STRK | Quarter ending December 31, 2025 | $ | 2.00 | ||||

| 10.00% Series A Perpetual Stride Preferred Stock |

STRD | Quarter ending December 31, 2025 | $ | 2.50 | ||||

|

(1) The cash dividend declared on STRC Stock for the month ending December 31, 2025 represents a per annum dividend rate of 10.75%. The amount set forth above is rounded to the nearest thousandth. The exact amount of such per share dividend is $0.895833333. |

||||||

| (2) The calculation of the quarterly dividend for shares of STRE represents the dividend accrued from, and including, November 13, 2025, the initial issuance date of STRE, through December 31, 2025. The amount set forth above is rounded to the nearest thousandth. The exact amount of such per share dividend is €1.333333333. |

||||||

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On December 1, 2025, Strategy announced the appointment of Thomas C. Chow as its Executive Vice President & General Counsel and Corporate Secretary, effective immediately.

Thomas Chow brings more than 20 years of legal, policy, and operational leadership across digital asset, fintech, and software companies. Before joining Strategy, he was Chief Legal Officer at Chia Network and Permuto Capital, and before that, General Counsel at PubMatic (NASDAQ: PUBM). He also previously held senior legal roles at Snap Inc. and Exponential Interactive. Earlier in his career, Thomas worked in IT systems and network operations. He holds a B.A. in Sociology, with honors, from the University of California, Berkeley, and a J.D. from the University of California College of the Law, San Francisco.

As previously disclosed on July 1, 2025, Wei-Ming Shao, Strategy’s then Executive Vice President & General Counsel and Corporate Secretary, had informed Strategy of his intention to retire on December 31, 2025. On December 1, 2025, in connection with Mr. Chow’s appointment as Executive Vice President & General Counsel and Corporate Secretary of Strategy, Strategy announced that Wei-Ming Shao retired from those same positions with Strategy, effective immediately. To assist Strategy in the transition of his duties and other related matters, Mr. Shao will serve in a non-executive employee advisory role reporting to Strategy’s President & Chief Executive Officer, Phong Le, from December 1, 2025 until December 31, 2025. During such period, Mr. Shao will receive the same base salary and benefits he received immediately prior to his retirement.

| Item 7.01 | Regulation FD Disclosure. |

Guidance Updates

On December 1, 2025, Strategy issued a press release and presentation announcing updates to its previously disclosed fiscal year 2025 earnings guidance and fiscal year 2025 bitcoin key performance indicator targets (as well as the establishment of its USD Reserve discussed above).

Copies of the press release and presentation issued in connection with the announcement are attached and furnished as Exhibits 99.1 and 99.2, respectively, to this Current Report on Form 8-K and incorporated herein by reference.

Strategy Dashboard

Strategy also maintains a dashboard on its website (www.strategy.com) as a disclosure channel for providing broad, non-exclusionary distribution of information regarding Strategy to the public, including information regarding market prices of its outstanding securities, bitcoin purchases and holdings, certain key performance indicator metrics and other supplemental information, and as one means of disclosing non-public information in compliance with its disclosure obligations under Regulation FD. Investors and others are encouraged to regularly review the information that Strategy makes public via the website dashboard.

Furnished Information

The information disclosed pursuant to Item 7.01 in this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Forward-Looking Statements

Statements in this Current Report on Form 8-K (including Exhibits 99.1 and 99.2 attached hereto) about future expectations, plans, and prospects, as well as any other statements regarding matters that are not historical facts, may constitute “forward-looking statements” within the meaning of The Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, estimates of future business prospects or financial results, including our fiscal year 2025 earnings guidance and fiscal year 2025 bitcoin key performance indicator targets, statements regarding the circumstances under which we will issue class A common stock or preferred securities, and statements regarding our intentions for our USD Reserve. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” “would,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Actual results may differ materially from those indicated by such forward-looking statements as a result of various important factors, including the risk that the price of a bitcoin as of December 31, 2025 may be substantially different than $85,000 to $110,000, which would cause our actual results to vary substantially from the target ranges provided herein relating to future operating income (loss), net income (loss), and diluted earnings (loss) per share; fluctuations in the market price of bitcoin and any associated unrealized gains or losses on digital assets that Strategy may record in its financial statements as a result of a change in the market price of bitcoin from the value at which Strategy’s bitcoins are carried on its balance sheet; the availability of debt and equity financing on favorable terms; gains or losses on any sales of bitcoins; changes in the accounting treatment relating to Strategy’s bitcoin holdings; changes in securities laws or other laws or regulations, or the adoption of new laws or regulations, relating to bitcoin that adversely affect the price of bitcoin or Strategy’s ability to transact in or own bitcoin; the impact of the availability of spot exchange traded products and other investment vehicles for bitcoin and other digital assets; a decrease in liquidity in the markets in which bitcoin is traded; security breaches, cyberattacks, unauthorized access, loss of private keys, fraud or other circumstances or events that result in the loss of Strategy’s bitcoins; impacts to the price and rate of adoption of bitcoin associated with financial difficulties and bankruptcies of various participants in the digital asset industry; the level and terms of Strategy’s substantial indebtedness and its ability to service such debt; fluctuations in tax benefits or provisions; changes in the market price of bitcoin as of period-end and their effect on our deferred tax assets, related valuation allowance, and tax expense; other potentially adverse tax consequences; competitive factors; general economic conditions, including levels of inflation and interest rates; currency fluctuations; and the other factors discussed under the caption “Risk Factor Updates” in Strategy’s Current Report on Form 8-K filed with the SEC on October 6, 2025 and under the caption “Risk Factors” in Strategy’s Quarterly Report on Form 10-Q filed with the SEC on November 3, 2025 and the risks described in other filings that Strategy may make with the SEC. Any forward-looking statements contained in this Current Report on Form 8-K (including Exhibits 99.1 and 99.2 attached hereto) speak only as of the date hereof, and Strategy specifically disclaims any obligation to update any forward-looking statement, whether as a result of new information, future events, or otherwise.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

| Exhibit No. |

Description |

|

| 99.1 | Press release of Strategy, dated December 1, 2025. | |

| 99.2 | Presentation of Strategy, December 1, 2025. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: December 1, 2025 | Strategy Inc (Registrant) |

|||||

| By: | /s/ Andrew Kang |

|||||

| Name: | Andrew Kang | |||||

| Title: | Executive Vice President & Chief Financial Officer | |||||

Exhibit 99.1

Strategy Announces Establishment of $1.44 Billion USD Reserve and Updates FY 2025 Guidance

TYSONS CORNER, Va. – (BUSINESS WIRE) – December 1, 2025 – Strategy Inc (Nasdaq: STRF/STRC/STRK/STRD/MSTR; LuxSE: STRE) today announced the establishment of a US dollar reserve (“USD Reserve”) of $1.44 billion and updates to its assumptions underlying its previously issued forward guidance and bitcoin key performance indicator (“KPI”) targets for the fiscal year ending December 31, 2025, which were published on October 30, 2025.

Establishment of USD Reserve

Strategy today announced that it has established a USD Reserve of $1.44 billion to support the payment of dividends on its preferred stock and interest on its outstanding indebtedness (“Dividends”). The USD Reserve was funded using proceeds from the sale of shares of class A common stock under Strategy’s at-the-market offering program. Strategy’s current intention is to maintain a USD Reserve in an amount sufficient to fund at least twelve months of its Dividends, and Strategy intends to strengthen the USD Reserve over time, with the goal of ultimately covering 24 months or more of its Dividends. The maintenance of this USD Reserve, as well as its amount, terms and conditions, remains subject to Strategy’s sole and absolute discretion and Strategy may adjust the USD Reserve from time to time based on market conditions, liquidity needs and other factors.

“Establishing a USD Reserve to complement our BTC Reserve marks the next step in our evolution, and we believe it will better position us to navigate short-term market volatility while delivering on our vision of being the world’s leading issuer of Digital Credit,” said Michael Saylor, Founder and Executive Chairman.

“Strategy now holds 650,000 bitcoin, about 3.1% of the 21 million bitcoin that will ever exist. In recognition of the important role we play in the broader Bitcoin ecosystem, and to further reinforce our commitment to our credit investors and shareholders, we have established a USD Reserve that currently covers 21 months of Dividends. We intend to use this reserve to pay our Dividends and grow it over time.” said Phong Le, President and Chief Executive Officer.

Updates to FY 2025 Earnings Guidance and Bitcoin KPI Targets

Strategy today announced updates to its assumptions underlying its previously issued forward guidance and Bitcoin KPI targets for the fiscal year ending December 31, 2025 (“FY2025”), previously published on October 30, 2025. That guidance assumed a bitcoin price of $150,000 as of December 31, 2025, based on the approximate consensus midpoint of third-party research analyst year-end bitcoin price estimates available as of that date. Bitcoin is a highly volatile asset, and the trading price of bitcoin has declined from approximately $111,612 as of October 30, 2025 to as low as $80,660 on November 21, 2025.

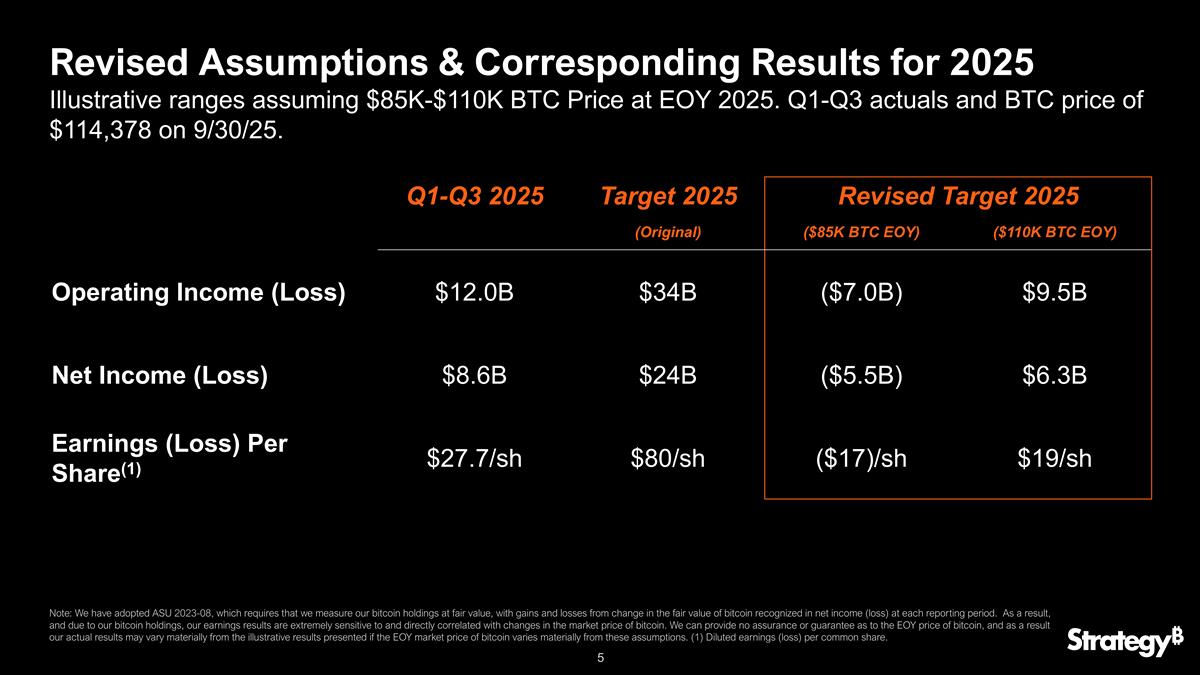

In light of the recent trading prices of bitcoin, Strategy is updating its assumptions for the price of bitcoin as of year-end 2025 to reflect a range of prices consistent with the recent trading history of bitcoin and is providing corresponding ranges for FY2025 Operating Income, Net Income and Diluted Earnings Per Share as set forth below that would result if the price of bitcoin on December 31, 2025 is within such range.

Update to FY 2025 Earnings Guidance

Based on an assumed year-end 2025 bitcoin price range of $85,000 to $110,000, the target ranges for Strategy’s FY2025 Operating Income, Net Income and Diluted Earnings Per Share are as follows:

| • | FY2025 Operating Income (Loss): between approximately $(7.0) billion and $9.5 billion; |

| • | FY2025 Net Income (Loss): between approximately $(5.5) billion and $6.3 billion; and |

| • | FY2025 Diluted Earnings (Loss) Per Share: between approximately $(17.0) per share of common stock and $19.0 per share of common stock. |

These ranges also assume the successful completion of capital raises to achieve Strategy’s FY2025 Bitcoin Yield Target (discussed below) and the deployment of proceeds from such raises to the purchase of bitcoin.

Strategy has adopted Accounting Standards Update No. 2023-08, Intangibles—Goodwill and Other—Crypto Assets (Subtopic 350-60): Accounting for and Disclosure of Crypto Assets, which requires that Strategy measure its bitcoin holdings at fair value, with gains and losses from changes in the fair value of bitcoin recognized in net income (loss) at each reporting period. As a result, and due to Strategy’s significant bitcoin holdings, Strategy’s earnings results are extremely sensitive to and directly correlated with changes in the market price of bitcoin. Strategy can provide no assurance or guarantee as to the price of bitcoin as of December 31, 2025, and as a result Strategy’s actual results may vary materially from the ranges of results set forth above if the market price of bitcoin as of December 31, 2025 varies materially from this assumed range of bitcoin prices. Strategy undertakes no obligation to update this guidance, other than as may be required by applicable law. Investors are cautioned not to place undue reliance on this guidance.

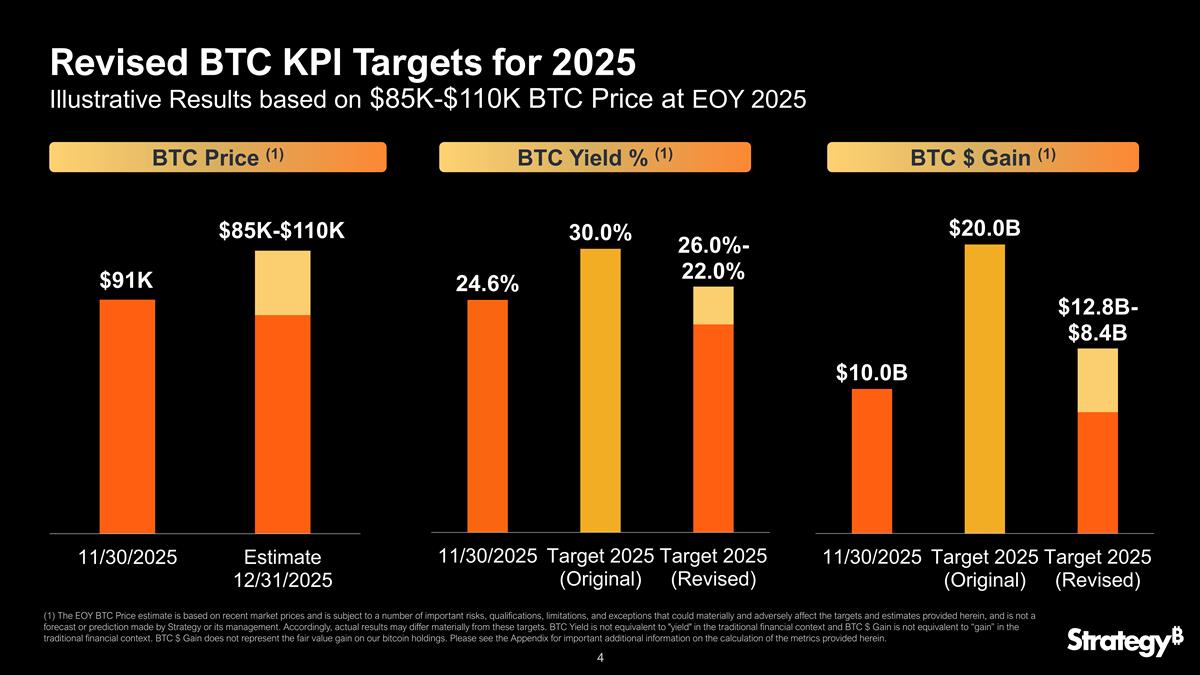

Updates to FY 2025 Bitcoin KPI Targets

Also based on the same assumed year-end 2025 bitcoin price range of $85,000 to $110,000, and after giving effect to Strategy’s anticipated common stock issuances to maintain its USD Reserve, Strategy’s updated FY2025 Bitcoin KPI targets are as follows:

| • | FY2025 BTC Yield Target: between 22.0% and 26.0%; and |

| • | FY2025 BTC $ Gain Target: between $8.4 billion and $12.8 billion. |

Strategy expects to achieve these targets through preferred stock offerings, disciplined common stock issuances, and the resulting increase in its bitcoin holdings.

Additional information about Strategy’s KPIs, including their purposes and limitations, is available at www.strategy.com.

About Strategy

Strategy Inc (Nasdaq: STRF/STRC/STRK/STRD/MSTR; LuxSE: STRE) is the world’s first and largest Bitcoin Treasury Company. We are a publicly traded company that has adopted Bitcoin as our primary treasury reserve asset. By using proceeds from equity and debt financings, as well as cash flows from our operations, we strategically accumulate Bitcoin and advocate for its role as digital capital. Our treasury strategy is designed to provide investors varying degrees of economic exposure to Bitcoin by offering a range of securities, including equity and fixed-income instruments. In addition, we provide industry-leading AI-powered enterprise analytics software, advancing our vision of Intelligence Everywhere. We leverage our development capabilities to explore innovation in Bitcoin applications, integrating analytics expertise with our commitment to digital asset growth. We believe our combination of operational excellence, strategic Bitcoin reserve, and focus on technological innovation positions us as a leader in both the digital asset and enterprise analytics sectors, offering a unique opportunity for long-term value creation.

Strategy, MicroStrategy, and Intelligence Everywhere are either trademarks or registered trademarks of Strategy Inc in the United States and certain other countries. Other product and company names mentioned herein may be the trademarks of their respective owners.

Forward-Looking Statements

Statements in this press release about future expectations, plans, and prospects, as well as any other statements regarding matters that are not historical facts, may constitute “forward-looking statements” within the meaning of The Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, estimates of future business prospects or financial results, including our guidance relating to our future operating income, net income, diluted earnings per share, our targets for our BTC Yield and BTC $ Gain KPIs, statements regarding the circumstances under which we will issue class A common stock or preferred securities, and statements regarding our intentions for our USD Reserve. The words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” “would,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Actual results may differ materially from those indicated by such forward-looking statements as a result of various important factors, including the risk that the price of bitcoin as of December 31, 2025 may be substantially different from the assumed range of $85,000 to $110,000, which would cause our actual results to vary substantially from the target ranges provided herein relating to future operating income (loss), net income (loss), and diluted earnings (loss) per share; fluctuations in the market price of bitcoin and any associated unrealized gains or losses on digital assets that Strategy may record in its financial statements as a result of a change in the market price of bitcoin from the value at which Strategy’s bitcoins are carried on its balance sheet; the availability of debt and equity financing on favorable terms; gains or losses on any sales of bitcoins; changes in the accounting treatment relating to Strategy’s bitcoin holdings; changes in securities laws or other laws or regulations, or the adoption of new laws or regulations, relating to bitcoin that adversely affect the price of bitcoin or Strategy’s ability to transact in or own bitcoin; the impact of the availability of spot exchange traded products and other investment vehicles for bitcoin and other digital assets; a decrease in liquidity in the markets in which bitcoin is traded; security breaches, cyberattacks, unauthorized access, loss of private keys, fraud or other circumstances or events that result in the loss of Strategy’s bitcoins; impacts to the price and rate of adoption of bitcoin associated with financial difficulties and bankruptcies of various participants in the digital asset industry; the level and terms of Strategy’s substantial indebtedness and its ability to service such debt; fluctuations in tax benefits or provisions; changes in the market price of bitcoin as of period-end and their effect on our deferred tax assets, related valuation allowance, and tax expense; other potentially adverse tax consequences; competitive factors; general economic conditions, including levels of inflation and interest rates; currency fluctuations; and the other factors discussed under the caption “Risk Factor Updates” in Strategy’s Current Report on Form 8-K filed with the SEC on October 6, 2025 and under the caption “Risk Factors” in Strategy’s Quarterly Report on Form 10-Q filed with the SEC on November 3, 2025 and the risks described in other filings that Strategy may make with the SEC. Any forward-looking statements contained in this press release speak only as of the date hereof, and Strategy specifically disclaims any obligation to update any forward-looking statement, whether as a result of new information, future events, or otherwise.

Strategy

Shirish Jajodia

Corporate Treasurer

ir@strategy.com

December 1, 2025 2025 Company Update Exhibit 99.2

Strategy Company Update Safe Harbor Statement Some of the information we provide in this presentation regarding our future expectations, plans, guidance, and prospects may constitute forward-looking statements, including, without limitation, our updated assumptions for the price of Bitcoin at year end and the corresponding indicative ranges with respect to operating income (loss), net income (loss), and diluted earnings (loss) per share and our KPIs contained in this presentation. Actual results may differ materially from these forward-looking statements due to various important factors, including fluctuations in the price of Bitcoin and the risk factors discussed in our most recent Quarterly Report on Form 10-Q filed with the SEC on November 3, 2025, and our Current Report on Form 8-K filed with the SEC on October 6, 2025. We assume no obligation to update these forward-looking statements, which speak only as of today. FORWARD-LOOKING STATEMENTS

Growth in Bitcoin Strategic Treasury Reserve Strategy has acquired additional bitcoin in every quarter since Q3 2020 – 88 acquisitions Bitcoin Holdings (in ‘000s) Note: (1) As of November 30, 2025. (2) As of 8-K filed on December 1, 2025 Represents ~3.1% of all bitcoin ever to be in existence 650,000 BTC Holdings $59B BTC NAV $74K Average BTC Purchase Price $48B Total Acquisition Cost (1) (2)

Illustrative Results based on $85K-$110K BTC Price at EOY 2025 Revised BTC KPI Targets for 2025 (1) The EOY BTC Price estimate is based on recent market prices and is subject to a number of important risks, qualifications, limitations, and exceptions that could materially and adversely affect the targets and estimates provided herein, and is not a forecast or prediction made by Strategy or its management. Accordingly, actual results may differ materially from these targets. BTC Yield is not equivalent to "yield" in the traditional financial context and BTC $ Gain is not equivalent to “gain” in the traditional financial context. BTC $ Gain does not represent the fair value gain on our bitcoin holdings. Please see the Appendix for important additional information on the calculation of the metrics provided herein. BTC Yield % (1) BTC $ Gain (1) BTC Price (1)

Revised Assumptions & Corresponding Results for 2025 Note: We have adopted ASU 2023-08, which requires that we measure our bitcoin holdings at fair value, with gains and losses from change in the fair value of bitcoin recognized in net income (loss) at each reporting period. As a result, and due to our bitcoin holdings, our earnings results are extremely sensitive to and directly correlated with changes in the market price of bitcoin. We can provide no assurance or guarantee as to the EOY price of bitcoin, and as a result our actual results may vary materially from the illustrative results presented if the EOY market price of bitcoin varies materially from these assumptions. (1) Diluted earnings (loss) per common share. Illustrative ranges assuming $85K-$110K BTC Price at EOY 2025. Q1-Q3 actuals and BTC price of $114,378 on 9/30/25. Q1-Q3 2025 Target 2025 Revised Target 2025 (Original) ($85K BTC EOY) ($110K BTC EOY) Operating Income (Loss) $12.0B $34B ($7.0B) $9.5B Net Income (Loss) $8.6B $24B ($5.5B) $6.3B Earnings (Loss) Per Share(1) $27.7/sh $80/sh ($17)/sh $19/sh

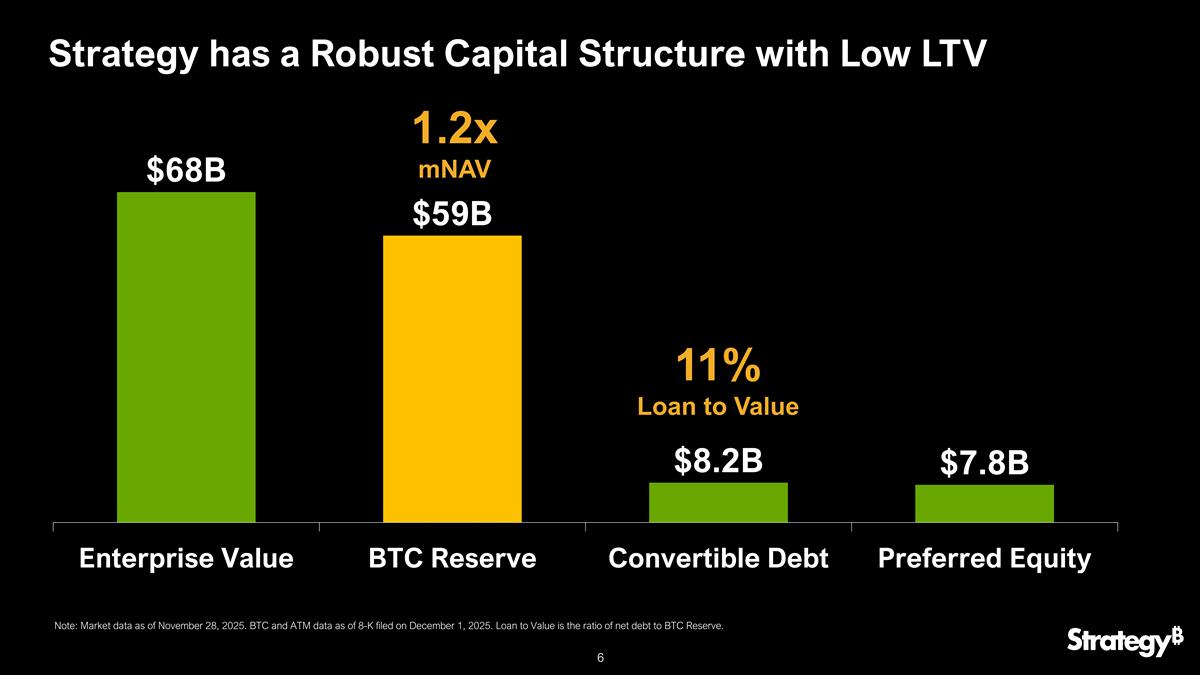

Strategy has a Robust Capital Structure with Low LTV Note: Market data as of November 28, 2025. BTC and ATM data as of 8-K filed on December 1, 2025. Loan to Value is the ratio of net debt to BTC Reserve. 1.2x mNAV 11% Loan to Value

Our BTC Reserve Creates Long-Term Durability Note: Annual dividends and interest expenses as of November 28, 2025. BTC data as of 8-K filed on December 1, 2025. Assumes USD/EUR conversion rate of 1.16. (1) Years of coverage includes interest payments on all current debt senior to the our preferred stock, and assumes that we will refinance all such debt on substantially similar terms without any principal repayment. (2) The ratio of the sum of annual dividends and interest expenses to the market value of our bitcoin holdings. 74 Years of Dividend Coverage(1) 1.35% BTC Breakeven ARR (2) BTC Reserve

Strategy announces a $1.44B USD Reserve Strategy USD reserve will be primary means of funding our Dividends(1) We will target the reserve at a minimum of 12 months of Dividends We intend to strengthen the reserve, with the goal of ultimately covering 24+ months of Dividends We believe this improves the quality and attractiveness of our preferreds, debt, and common equity Process $1.44B is 2.2% of our enterprise value, 2.8% of our equity value, and 2.4% of our bitcoin value We raised $1.44B in 8.5 trading days, at 4.6% trading volume, selling MSTR We sold MSTR at an average mNAV of 1.17x, equating to a USD Gain(2) of $207M (1) Dividends are defined as dividends on preferred stock and interest on outstanding indebtedness. (2) USD Gain represents the % of capital raised that is attributable to being raised at an mNAV greater than 1x. USD Gain is not a gain in the traditional financial context.

Our USD Reserve Strengthens Our Creditworthiness Note: Annual dividends and interest expense as of November 28, 2025. USD Reserve as of 8-K filed on December 1, 2025. Assumes USD/EUR conversion rate of 1.16. 21 Months of Dividend Coverage 1.8x Dividend Coverage USD Reserve

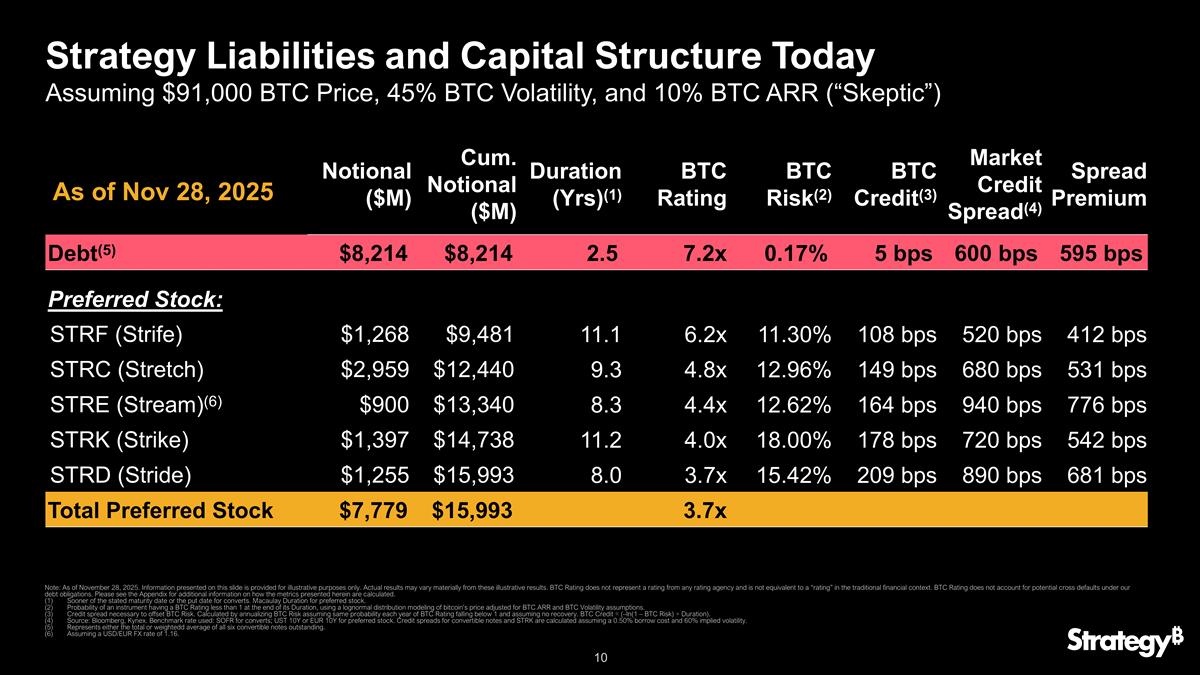

Strategy Liabilities and Capital Structure Today Notional ($M) Cum. Notional ($M) Duration (Yrs)(1) BTC Rating BTC Risk(2) BTC Credit(3) Market Credit Spread(4) Spread Premium Debt(5) $8,214 $8,214 2.5 7.2x 0.17% 5 bps 600 bps 595 bps Preferred Stock: STRF (Strife) $1,268 $9,481 11.1 6.2x 11.30% 108 bps 520 bps 412 bps STRC (Stretch) $2,959 $12,440 9.3 4.8x 12.96% 149 bps 680 bps 531 bps STRE (Stream)(6) $900 $13,340 8.3 4.4x 12.62% 164 bps 940 bps 776 bps STRK (Strike) $1,397 $14,738 11.2 4.0x 18.00% 178 bps 720 bps 542 bps STRD (Stride) $1,255 $15,993 8.0 3.7x 15.42% 209 bps 890 bps 681 bps Total Preferred Stock $7,779 $15,993 3.7x Assuming $91,000 BTC Price, 45% BTC Volatility, and 10% BTC ARR (“Skeptic”) Note: As of November 28, 2025. Information presented on this slide is provided for illustrative purposes only. Actual results may vary materially from these illustrative results. BTC Rating does not represent a rating from any rating agency and is not equivalent to a “rating” in the traditional financial context. BTC Rating does not account for potential cross defaults under our debt obligations. Please see the Appendix for additional information on how the metrics presented herein are calculated. Sooner of the stated maturity date or the put date for converts. Macaulay Duration for preferred stock. Probability of an instrument having a BTC Rating less than 1 at the end of its Duration, using a lognormal distribution modeling of bitcoin’s price adjusted for BTC ARR and BTC Volatility assumptions. Credit spread necessary to offset BTC Risk. Calculated by annualizing BTC Risk assuming same probability each year of BTC Rating falling below 1 and assuming no recovery. BTC Credit = (–ln(1 – BTC Risk) ÷ Duration). Source: Bloomberg, Kynex. Benchmark rate used: SOFR for converts; UST 10Y or EUR 10Y for preferred stock. Credit spreads for convertible notes and STRK are calculated assuming a 0.50% borrow cost and 60% implied volatility. Represents either the total or weightedd average of all six convertible notes outstanding. Assuming a USD/EUR FX rate of 1.16. As of Nov 28, 2025

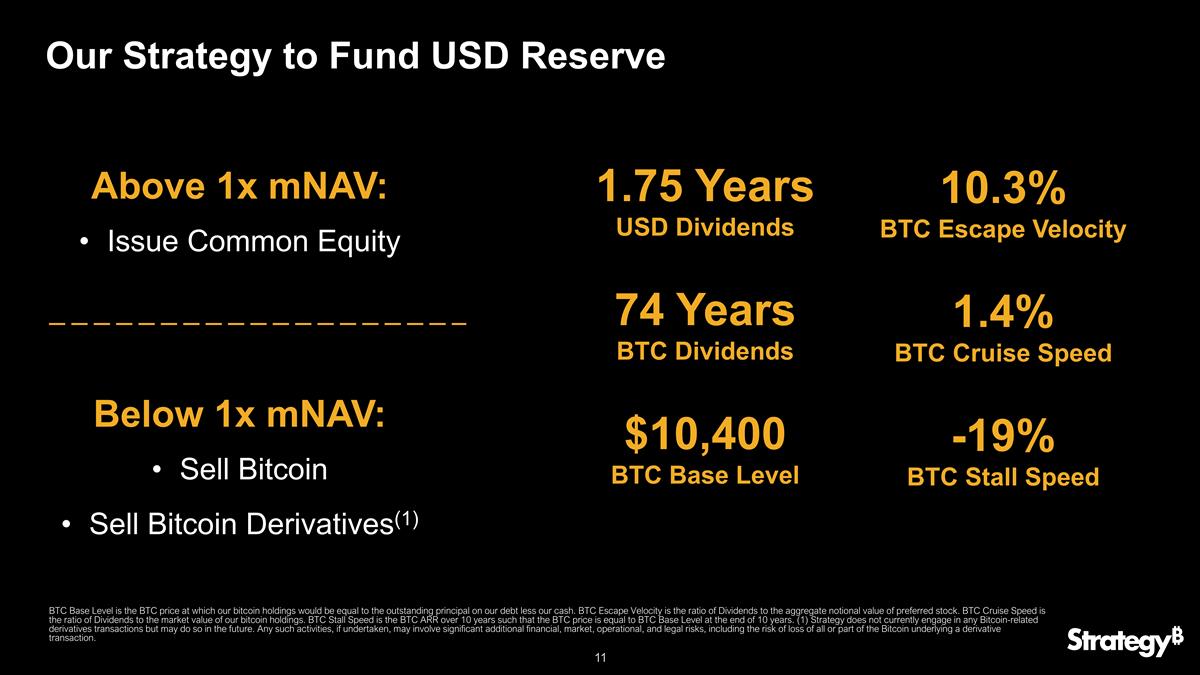

Our Strategy to Fund USD Reserve Above 1x mNAV: Issue Common Equity Below 1x mNAV: Sell Bitcoin Sell Bitcoin Derivatives(1) 1.75 Years USD Dividends 74 Years BTC Dividends $10,400 BTC Base Level 10.3% BTC Escape Velocity 1.4% BTC Cruise Speed -19% BTC Stall Speed BTC Base Level is the BTC price at which our bitcoin holdings would be equal to the outstanding principal on our debt less our cash. BTC Escape Velocity is the ratio of Dividends to the aggregate notional value of preferred stock. BTC Cruise Speed is the ratio of Dividends to the market value of our bitcoin holdings. BTC Stall Speed is the BTC ARR over 10 years such that the BTC price is equal to BTC Base Level at the end of 10 years. (1) Strategy does not currently engage in any Bitcoin-related derivatives transactions but may do so in the future. Any such activities, if undertaken, may involve significant additional financial, market, operational, and legal risks, including the risk of loss of all or part of the Bitcoin underlying a derivative transaction.

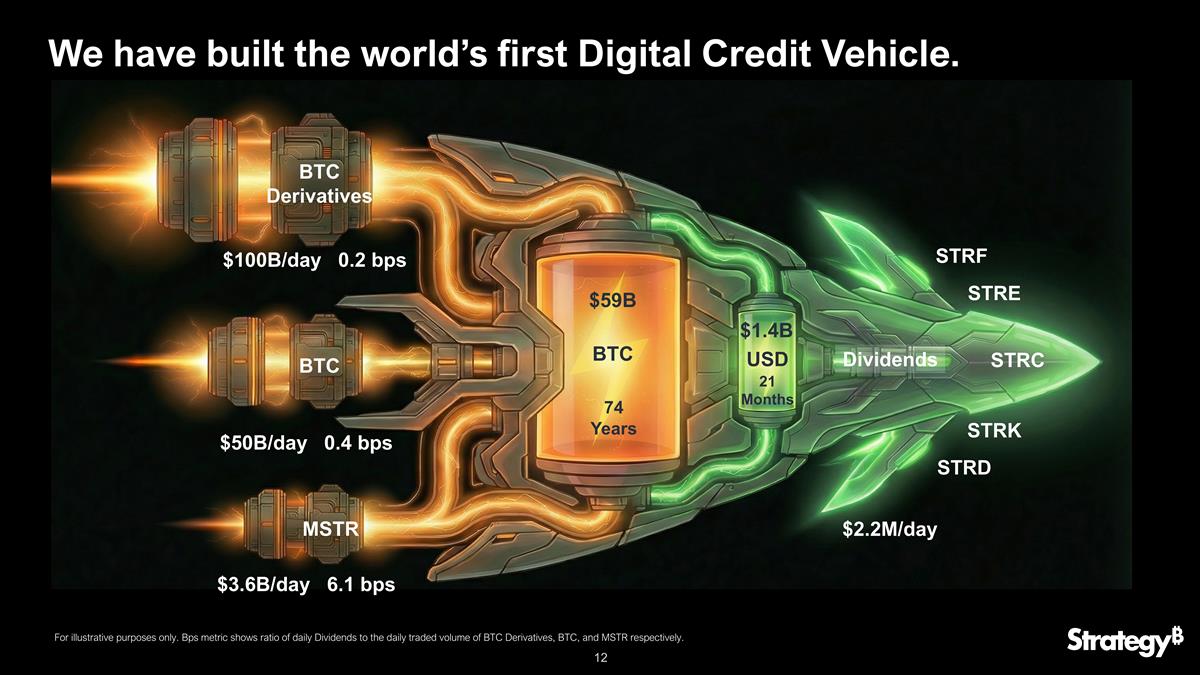

We have built the world’s first Digital Credit Vehicle. BTC Derivatives BTC MSTR $100B/day 0.2 bps $50B/day 0.4 bps $3.6B/day 6.1 bps Dividends STRC STRE STRF STRK STRD BTC USD $59B 74 Years 21 Months $1.4B For illustrative purposes only. Bps metric shows ratio of daily Dividends to the daily traded volume of BTC Derivatives, BTC, and MSTR respectively. $2.2M/day

Appendix

We are Increasing the STRC Rate by 25 bps to 10.75% 9.00% 10.00% 10.25% 10.50% 10.75%

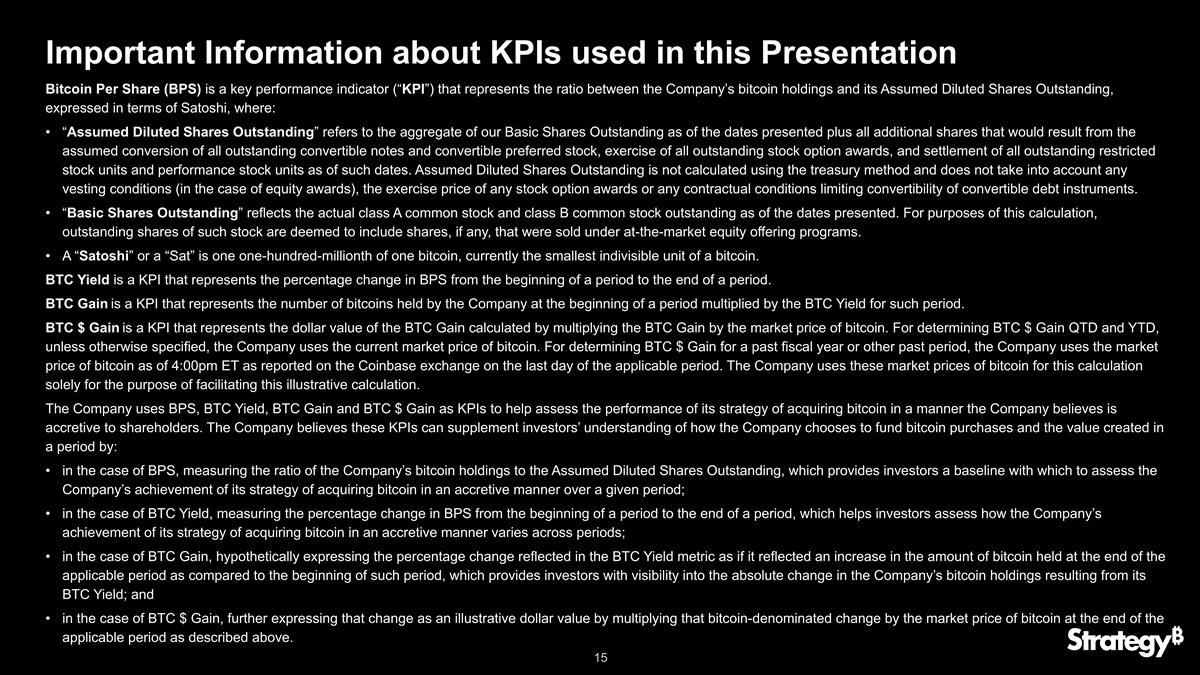

Important Information about KPIs used in this Presentation Bitcoin Per Share (BPS) is a key performance indicator (“KPI”) that represents the ratio between the Company’s bitcoin holdings and its Assumed Diluted Shares Outstanding, expressed in terms of Satoshi, where: “Assumed Diluted Shares Outstanding” refers to the aggregate of our Basic Shares Outstanding as of the dates presented plus all additional shares that would result from the assumed conversion of all outstanding convertible notes and convertible preferred stock, exercise of all outstanding stock option awards, and settlement of all outstanding restricted stock units and performance stock units as of such dates. Assumed Diluted Shares Outstanding is not calculated using the treasury method and does not take into account any vesting conditions (in the case of equity awards), the exercise price of any stock option awards or any contractual conditions limiting convertibility of convertible debt instruments. “Basic Shares Outstanding” reflects the actual class A common stock and class B common stock outstanding as of the dates presented. For purposes of this calculation, outstanding shares of such stock are deemed to include shares, if any, that were sold under at-the-market equity offering programs. A “Satoshi” or a “Sat” is one one-hundred-millionth of one bitcoin, currently the smallest indivisible unit of a bitcoin. BTC Yield is a KPI that represents the percentage change in BPS from the beginning of a period to the end of a period. BTC Gain is a KPI that represents the number of bitcoins held by the Company at the beginning of a period multiplied by the BTC Yield for such period. BTC $ Gain is a KPI that represents the dollar value of the BTC Gain calculated by multiplying the BTC Gain by the market price of bitcoin. For determining BTC $ Gain QTD and YTD, unless otherwise specified, the Company uses the current market price of bitcoin. For determining BTC $ Gain for a past fiscal year or other past period, the Company uses the market price of bitcoin as of 4:00pm ET as reported on the Coinbase exchange on the last day of the applicable period. The Company uses these market prices of bitcoin for this calculation solely for the purpose of facilitating this illustrative calculation. The Company uses BPS, BTC Yield, BTC Gain and BTC $ Gain as KPIs to help assess the performance of its strategy of acquiring bitcoin in a manner the Company believes is accretive to shareholders. The Company believes these KPIs can supplement investors’ understanding of how the Company chooses to fund bitcoin purchases and the value created in a period by: in the case of BPS, measuring the ratio of the Company’s bitcoin holdings to the Assumed Diluted Shares Outstanding, which provides investors a baseline with which to assess the Company’s achievement of its strategy of acquiring bitcoin in an accretive manner over a given period; in the case of BTC Yield, measuring the percentage change in BPS from the beginning of a period to the end of a period, which helps investors assess how the Company’s achievement of its strategy of acquiring bitcoin in an accretive manner varies across periods; in the case of BTC Gain, hypothetically expressing the percentage change reflected in the BTC Yield metric as if it reflected an increase in the amount of bitcoin held at the end of the applicable period as compared to the beginning of such period, which provides investors with visibility into the absolute change in the Company’s bitcoin holdings resulting from its BTC Yield; and in the case of BTC $ Gain, further expressing that change as an illustrative dollar value by multiplying that bitcoin-denominated change by the market price of bitcoin at the end of the applicable period as described above.

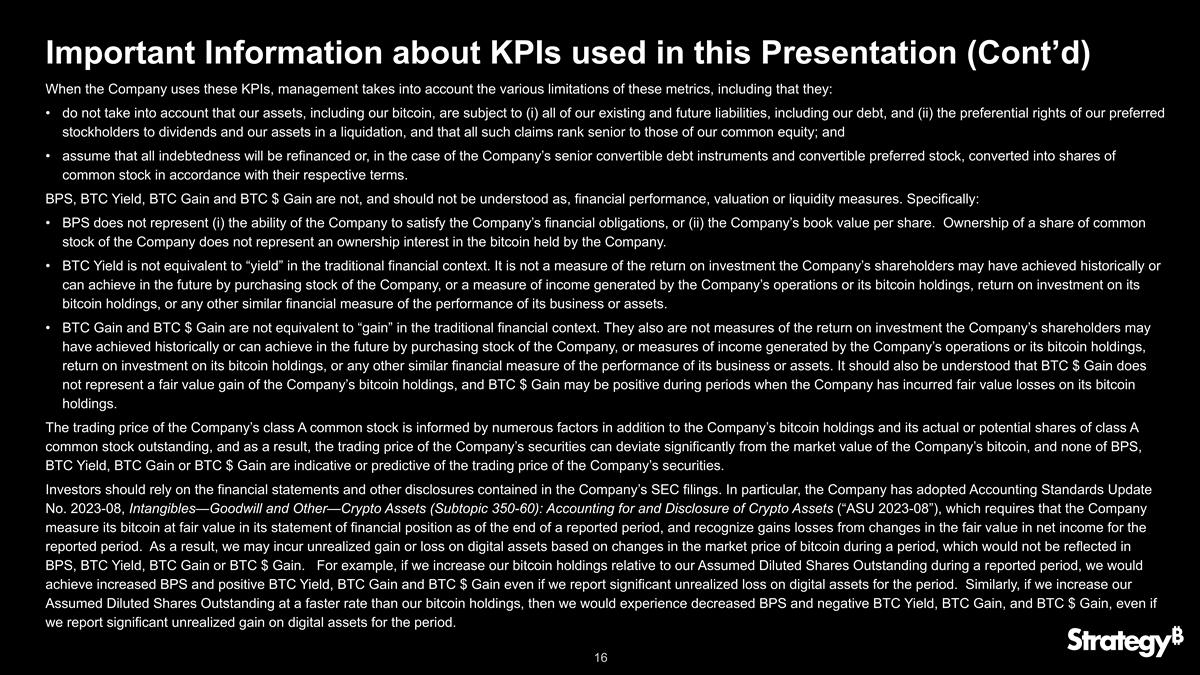

Important Information about KPIs used in this Presentation (Cont’d) When the Company uses these KPIs, management takes into account the various limitations of these metrics, including that they: do not take into account that our assets, including our bitcoin, are subject to (i) all of our existing and future liabilities, including our debt, and (ii) the preferential rights of our preferred stockholders to dividends and our assets in a liquidation, and that all such claims rank senior to those of our common equity; and assume that all indebtedness will be refinanced or, in the case of the Company’s senior convertible debt instruments and convertible preferred stock, converted into shares of common stock in accordance with their respective terms. BPS, BTC Yield, BTC Gain and BTC $ Gain are not, and should not be understood as, financial performance, valuation or liquidity measures. Specifically: BPS does not represent (i) the ability of the Company to satisfy the Company’s financial obligations, or (ii) the Company’s book value per share. Ownership of a share of common stock of the Company does not represent an ownership interest in the bitcoin held by the Company. BTC Yield is not equivalent to “yield” in the traditional financial context. It is not a measure of the return on investment the Company’s shareholders may have achieved historically or can achieve in the future by purchasing stock of the Company, or a measure of income generated by the Company’s operations or its bitcoin holdings, return on investment on its bitcoin holdings, or any other similar financial measure of the performance of its business or assets. BTC Gain and BTC $ Gain are not equivalent to “gain” in the traditional financial context. They also are not measures of the return on investment the Company’s shareholders may have achieved historically or can achieve in the future by purchasing stock of the Company, or measures of income generated by the Company’s operations or its bitcoin holdings, return on investment on its bitcoin holdings, or any other similar financial measure of the performance of its business or assets. It should also be understood that BTC $ Gain does not represent a fair value gain of the Company’s bitcoin holdings, and BTC $ Gain may be positive during periods when the Company has incurred fair value losses on its bitcoin holdings. The trading price of the Company’s class A common stock is informed by numerous factors in addition to the Company’s bitcoin holdings and its actual or potential shares of class A common stock outstanding, and as a result, the trading price of the Company’s securities can deviate significantly from the market value of the Company’s bitcoin, and none of BPS, BTC Yield, BTC Gain or BTC $ Gain are indicative or predictive of the trading price of the Company’s securities. Investors should rely on the financial statements and other disclosures contained in the Company’s SEC filings. In particular, the Company has adopted Accounting Standards Update No. 2023-08, Intangibles—Goodwill and Other—Crypto Assets (Subtopic 350-60): Accounting for and Disclosure of Crypto Assets (“ASU 2023-08”), which requires that the Company measure its bitcoin at fair value in its statement of financial position as of the end of a reported period, and recognize gains losses from changes in the fair value in net income for the reported period. As a result, we may incur unrealized gain or loss on digital assets based on changes in the market price of bitcoin during a period, which would not be reflected in BPS, BTC Yield, BTC Gain or BTC $ Gain. For example, if we increase our bitcoin holdings relative to our Assumed Diluted Shares Outstanding during a reported period, we would achieve increased BPS and positive BTC Yield, BTC Gain and BTC $ Gain even if we report significant unrealized loss on digital assets for the period. Similarly, if we increase our Assumed Diluted Shares Outstanding at a faster rate than our bitcoin holdings, then we would experience decreased BPS and negative BTC Yield, BTC Gain, and BTC $ Gain, even if we report significant unrealized gain on digital assets for the period.

Important Information about KPIs used in this Presentation (Cont’d) As noted above, these KPIs are narrow in their purpose and are used by management to assist it in assessing whether the Company is raising and deploying capital in a manner accretive to shareholders solely as it pertains to its bitcoin holdings. In calculating these KPIs, the Company does not consider the source of capital used for the acquisition of its bitcoin. When the Company purchases bitcoin using proceeds from offerings of non-convertible notes or non-convertible preferred stock, or convertible notes or preferred stock that carry conversion prices above the current trading price of the Company's common stock or conversion rights that are not then exercisable, such transactions have the effect of increasing the BPS, BTC Yield, BTC Gain and BTC $ Gain, while also increasing the Company’s indebtedness and senior claims of holders of instruments other than class A common stock with respect to dividends and to the Company’s assets, including its bitcoin, in a manner that is not reflected in these metrics. If any of the Company’s convertible notes mature or are redeemed without being converted into common stock, or if the Company elects to redeem or repurchase its non-convertible instruments, the Company may be required to sell shares of its class A common stock or bitcoin to generate sufficient cash proceeds to satisfy those obligations, either of which would have the effect of decreasing BPS, BTC Yield, BTC Gain and BTC $ Gain, and adjustments for such decreases are not contemplated by the assumptions made in calculating these metrics. Accordingly, these metrics might overstate or understate the accretive nature of the Company’s use of capital to buy bitcoin because not all bitcoin is purchased using proceeds of issuances of class A common stock, and not all proceeds from issuances of class A common stock are used to purchase bitcoin. In addition, we are required to pay dividends with respect to our perpetual preferred stock in perpetuity. We could pay these dividends with cash or, in the case of STRK Stock, by issuing shares of class A common stock. We have issued shares of class A common stock for cash to fund the payment of cash dividends, and we may in the future issue shares of class A common stock in lieu of paying dividends on STRK Stock. As a result, we have experienced, and may experience in the future, increases in Assumed Diluted Shares Outstanding without corresponding increases in our bitcoin holdings, resulting in decreases in BPS, BTC Yield, BTC Gain and BTC $ Gain for the periods in which such issuance of shares of class A common stock occurred. The Company has historically not paid any dividends on its shares of class A common stock, and by presenting these KPIs the Company makes no suggestion that it intends to do so in the future. Ownership of the Company’s securities, including its class A common stock and preferred stock, does not represent an ownership interest in or a redemption right with respect to the bitcoin the Company holds. The Company determines its KPI targets based on its history and future goals. The Company’s ability to maintain any given level of BPS, or achieve positive BTC Yield, BTC Gain, or BTC $ Gain may depend on a variety of factors, including factors outside of its control, such as the price of bitcoin, and the availability of debt and equity financing on favorable terms. Past performance is not indicative of future results. These KPIs are merely supplements, not substitutes, to the financial statements and other disclosures contained in the Company’s SEC filings. They should be used only by sophisticated investors who understand their limited purpose and many limitations.

Important Information about other Terms used in this Presentation The following terms used in this presentation provide a conceptual framework for how management views its securities and capital financing decisions in the context of the Company’s bitcoin strategy. These terms are presented for illustrative purposes only, and do not constitute investment advice, and should not be used to form the basis for an investment decision. Please review these definitions carefully to understand the limitations of these illustrative metrics, and please refer to the Company’s SEC filings and financial statements for information about the Company, its business, securities, strategy, bitcoin holdings and similar matters. BTC Valuation BTC $ Income is the dollar value of the unrealized gain or loss on bitcoin acquired with any given financing, net of associated dividend or interest costs, and multiplied by, in the case of a net gain, the BTC Spread, or, in the case of a net loss, 100%, over the applicable period. For any debt or liability with a maturity, the redemption of such debt or liability, excluding any dilution already assumed in the original calculation of BTC Gain, is treated as a cost, similar to dividend or interest costs. BTC $Income is presented for illustrative purposes only, and it does not represent "income" in the traditional financial context. BTC $ Value is the sum of BTC $ Gain and BTC $ Income. BTC $ Value is presented for illustrative purposes only, and it does not represent “value” in the traditional financial context. BTC $ Equity is BTC NAV less BTC $ Value. BTC $ Equity is presented for illustrative purposes only, and it does not represent “equity” in the traditional financial context. BTC Torque is the ratio of BTC $ Value to BTC Capital. BTC Multiple is the ratio of BTC NAV to BTC $ Equity. Tax Tax-Equivalent Yield, with respect to any preferred security, is the annualized stated interest rate that would be required on a corporate bond trading at par for a U.S. individual investor to receive after-tax cash interest payments equivalent to the cash distributions he or she would receive from the applicable preferred security divided by the current market price of the preferred security, assuming that (i) the stated interest payments under the hypothetical corporate bond are subject to a 37% marginal U.S. federal income tax rate, (ii) such stated interest payments and cash distributions are not subject to any other federal, state or local taxes (which may vary depending on an investor's particular circumstances), (iii) the current dividend rate for such preferred security remains constant for 12 months and dividends on such preferred security are declared and paid in full for such period, and (iv) distributions on such preferred security remain classified as a non-taxable “return of capital,” and are not as taxable dividends, for U.S. federal income and state and local tax purposes. Upon disposition or redemption of the preferred security, an investor will be subject to tax on all prior “return of capital” distributions at the applicable capital gains rate. Upon depletion of an investor's basis in the preferred security, any further distribution is taxable as capital gain. Investors should consult their tax advisors.

Important Information about other Terms used in this Presentation BTC Credit BTC Rating is the ratio of our Bitcoin NAV and the sum of the notional values of the instruments being rated and all instruments that are senior to and, if any liabilities share an equal claim to our assets, such instruments with a stated maturity date sooner than or that may become due upon an exercise of a repurchase right at the option of the holder sooner than, the liability being rated. BTC Rating does not represent a rating from any rating agency and is not equivalent to a "rating" in the traditional financial context. BTC Rating also does not account for potential cross-defaults under our debt obligations that would result in debt obligations with stated maturities later than the liability being rated becoming due sooner than the liability being rated. This metric is presented for illustrative purposes only and should not form the basis for an investment decision. BTC Risk is the probability of an instrument having a BTC Rating less than 1 at the end of its Duration. This probability is derived from a lognormal distribution modeling of bitcoin’s price, adjusted for BTC ARR and BTC Volatility assumptions. BTC Risk does not represent an actuarial risk rating or a rating from any rating agency, and it is not a risk rating in the traditional financial context. This metric is presented for illustrative purposes only and should not form the basis for an investment decision. Actual results may vary materially from these illustrative results. BTC Credit is the credit spread necessary to offset BTC Risk for a given security. It is calculated by annualizing BTC Risk assuming the same probability each year of the BTC Rating of such security falling below 1 each year and assuming no recovery. This metric is presented for illustrative purposes only and should not form the basis for an investment decision. Duration for a convertible bond is the sooner of the stated maturity date or the date it may become due upon an exercise of a repurchase right at the option of the holder. Duration for a preferred stock is the Macaulay Duration of such preferred stock. Macaulay Duration of a preferred stock is the quotient obtained by dividing the sum of 1 and the Effective Yield of such stock by the Effective Yield of such stock. Effective Yield is the annualized yield on an asset based on its fixed dividend rate and the current price of such asset. Equity Component Equity Component % is the ratio between the value of 1/10th of a share of MSTR and the value of one share of STRK.

Important Information about other Terms used in this Presentation BTC Treasury BTC Capital is the proceeds used from capital raised for the purpose of acquiring bitcoin. BTC Spread is the BTC Gain with respect to a given financing represented as a percentage of BTC Capital. BTC Spread is presented for illustrative purposes only, and it does not represent “spread” in the traditional financial context. BTC NAV represents the total number of bitcoin the Company holds as of a specified date multiplied by the current market price of one bitcoin (or the price of one bitcoin as of the date indicated). It does not take into account or include the Company’s indebtedness or the liquidation value of its perpetual preferred stock. As such, it is not equivalent to “net asset value” or “NAV” or any similar metric in the traditional financial context. Although it incorporates the label “NAV,” it is not a measure of either the net asset value of the Company or the value of the bitcoin held by the Company net of indebtedness, perpetual preferred stock liquidation preference and other obligations. Moreover, this Bitcoin NAV metric is not comparable to either net asset value or NAV metrics that may be reported by other companies, including ETFs, ETPs and mutual funds. Investors should rely on the financial statements and other disclosures contained in the Company’s SEC filings. This metric is merely a supplement, not a substitute, to the financial statements and other disclosures contained in the Company’s SEC filings. It should be used only by sophisticated investors who understand its limited purpose and many limitations. mNAV represents a multiple of Bitcoin NAV, as of the specified date, calculated as the Company’s enterprise value (as we define it) divided by Bitcoin NAV. The Company’s enterprise value is calculated as the sum of (A) the total market value of all outstanding MSTR common stock, including class A common stock and class B common stock, calculated by multiplying the number of outstanding shares of class A common stock and class B common stock by the closing price of the class A common stock on the Nasdaq Global Select Market on the applicable date, (B) the aggregate principal amount of the Company’s indebtedness and (C) the aggregate notional value of the Company’s outstanding perpetual preferred stock, less (D) the Company’s most recently reported cash balance value. As with Bitcoin NAV, although mNAV incorporates the label “NAV,” it is not equivalent to “net asset value” or “NAV” or any similar metric in the traditional financial context. Additionally, it is not a measure of the amount by which the enterprise value exceeds net asset value in the traditional financial sense of those terms. Investors should rely on the financial statements and other disclosures contained in the Company’s SEC filings. This metric is merely a supplement, not a substitute, to the financial statements and other disclosures contained in the Company’s SEC filings. It should be used only by sophisticated investors who understand their limited purpose and many limitations. BTC Factor is the ratio of ending BPS to starting BPS in respect of any period. USD Capital is the portion of a capital raise that is not BTC Capital. USD Gain is the dollar value of USD Capital raised from selling MSTR equal to 1 minus the inverse of the mNAV at the time such shares were sold. This represents the percent of capital raised for a given transaction that is attributable to being raised at an mNAV greater than 1x. USD Gain is not a gain in the traditional financial context.

Important Information about other Terms used in this Presentation BTC Treasury (cont’d) Dividends are our annualized obligation for dividends on our preferred stock and interest on our outstanding indebtedness. Years of Dividend Coverage is the ratio of BTC NAV to the sum of annual dividends and interest expenses, expressed in number of years. This assumes that we will refinance all current debt senior to our preferred stock on substantially similar terms without any principal repayment. This metric is provided for illustrative purposes only, is not a measure prepared in accordance with GAAP, and should not be construed as a liquidation analysis, solvency measure or assurance of the Company’s ability to pay dividends. In an actual stress or liquidation scenario, claims of creditors and other liabilities, including the full principal amount of senior indebtedness, would reduce the assets available to satisfy Dividend obligations. Any use of our bitcoin holdings to satisfy our dividend obligations will have a negative impact on our instruments’ BTC Rating. Net Debt is the outstanding principal of our debt less our cash. BTC Breakeven ARR (BTC Cruise Speed) is the ratio of Dividends to BTC NAV. BTC Base Level is the BTC Price at which our bitcoin holdings would be equal to our Net Debt. BTC Escape Velocity is the ratio of Dividends to the aggregate notional value of preferred stock, assuming that all convertible debt equitizes immediately. This represents the BTC ARR necessary to exceed our cost of capital in respect of our preferred stock. BTC Stall Speed is the BTC ARR necessary for a 10-year period such that the BTC Price would be equal to BTC Base Level at the end of such period. BTC Forecast BTC ARR is an assumed annualized rate of return on bitcoin expressed as a percentage. This metric is presented for illustrative purposes only, and no prediction as to the price of bitcoin is being made. BTC Volatility is the assumed standard deviation of annual return of bitcoin expressed as a percentage. This metric is presented for illustrative purposes only, and no prediction as to the volatility of bitcoin is being made. BTC Price is the current market price of one bitcoin.

Additional Information Strategy is not a registered money market fund under the Investment Company Act of 1940, as amended, is not subject to the same protections as a registered money market fund, and does not operate as registered money market fund. Among other things, unlike money market funds, we (i) do not price STRC Stock or our other securities based on our net asset value, (ii) are not required to hold any assets to back the STRC Stock or our other preferred stock, (iii) are not required by regulation to maintain any particular pricing or stable value, and (iv) are not subject to the same liquidity requirements as money market funds. Investors in STRC or our other securities will not receive the same investor protections as investors in registered money market funds. Strategy is not an exchange traded product (“ETP”) or an exchange-traded fund (“ETF”) registered under the Investment Company Act of 1940, as amended, is not subject to the same rules and regulations as an ETP or an ETF, and does not operate as an ETP or ETF. In particular, unlike spot bitcoin ETPs, we (i) do not seek for our shares of Class A common stock to track the value of the underlying bitcoin we hold before payment of expenses and liabilities, (ii) do not benefit from various exemptions and relief under the Securities Exchange Act of 1934, as amended, including Regulation M, and other securities laws, which enable spot bitcoin ETPs to continuously align the value of their shares to the price of the underlying bitcoin they hold through share creation and redemption, (iii) are a Delaware corporation rather than a statutory trust, and do not operate pursuant to a trust agreement that would require us to pursue one or more stated investment objectives, (iv) are subject to federal income tax at the entity level and the other risk factors applicable to an operating business, such as ours, and (v) are not required to provide daily transparency as to our bitcoin holdings or our daily NAV. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. No representations are made regarding the tax consequences of any actions taken based on the information provided. Investors should consult their own tax, legal and accounting advisors for any such advice.