false0001674862--09-30FYhttp://fasb.org/us-gaap/2025#AccountingStandardsUpdate202307Memberhttp://fasb.org/us-gaap/2025#AccountsReceivableNetCurrenthttp://fasb.org/us-gaap/2025#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2025#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2025#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2025#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2025#CostOfRevenuehttp://fasb.org/us-gaap/2025#CostOfRevenuehttp://fasb.org/us-gaap/2025#CostOfRevenuehttp://fasb.org/us-gaap/2025#PropertyPlantAndEquipmentNethttp://fasb.org/us-gaap/2025#PropertyPlantAndEquipmentNethttp://fasb.org/us-gaap/2025#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2025#OtherLiabilitiesNoncurrenthttp://investor.ashland.com/20250930#OtherDefinedBenefitPlanNetPeriodicBenefitIncomeExpensehttp://investor.ashland.com/20250930#OtherDefinedBenefitPlanNetPeriodicBenefitIncomeExpensehttp://investor.ashland.com/20250930#OtherDefinedBenefitPlanNetPeriodicBenefitIncomeExpensehttp://investor.ashland.com/20250930#OtherDefinedBenefitPlanNetPeriodicBenefitIncomeExpensehttp://investor.ashland.com/20250930#OtherDefinedBenefitPlanNetPeriodicBenefitIncomeExpensehttp://investor.ashland.com/20250930#OtherDefinedBenefitPlanNetPeriodicBenefitIncomeExpensehttp://investor.ashland.com/20250930#OtherDefinedBenefitPlanNetPeriodicBenefitIncomeExpensehttp://investor.ashland.com/20250930#OtherDefinedBenefitPlanNetPeriodicBenefitIncomeExpensehttp://investor.ashland.com/20250930#OtherDefinedBenefitPlanNetPeriodicBenefitIncomeExpensehttp://investor.ashland.com/20250930#OtherDefinedBenefitPlanNetPeriodicBenefitIncomeExpensehttp://investor.ashland.com/20250930#OtherDefinedBenefitPlanNetPeriodicBenefitIncomeExpensehttp://investor.ashland.com/20250930#OtherDefinedBenefitPlanNetPeriodicBenefitIncomeExpensehttp://investor.ashland.com/20250930#OtherDefinedBenefitPlanNetPeriodicBenefitIncomeExpensehttp://investor.ashland.com/20250930#OtherDefinedBenefitPlanNetPeriodicBenefitIncomeExpensehttp://investor.ashland.com/20250930#OtherDefinedBenefitPlanNetPeriodicBenefitIncomeExpensehttp://investor.ashland.com/20250930#OtherDefinedBenefitPlanNetPeriodicBenefitIncomeExpensehttp://investor.ashland.com/20250930#OtherDefinedBenefitPlanNetPeriodicBenefitIncomeExpensehttp://investor.ashland.com/20250930#OtherDefinedBenefitPlanNetPeriodicBenefitIncomeExpensehttp://investor.ashland.com/20250930#OtherDefinedBenefitPlanNetPeriodicBenefitIncomeExpensehttp://investor.ashland.com/20250930#OtherDefinedBenefitPlanNetPeriodicBenefitIncomeExpensehttp://fasb.org/us-gaap/2025#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2025#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2025#SellingGeneralAndAdministrativeExpensehttp://fasb.org/us-gaap/2025#SellingGeneralAndAdministrativeExpensehttp://fasb.org/us-gaap/2025#SellingGeneralAndAdministrativeExpenseP1YP1YOne year1.51.51.5http://fasb.org/us-gaap/2025#PerformanceSharesMemberhttp://investor.ashland.com/20250930#ChairAndChiefExecutiveOfficerMember0001674862us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2025-09-300001674862us-gaap:OperatingSegmentsMember2022-10-012023-09-300001674862us-gaap:OtherCurrentAssetsMember2025-09-3000016748622022-10-012023-09-300001674862ash:ValvolineIncMember2023-10-012024-09-300001674862us-gaap:IntellectualPropertyMember2025-09-300001674862ash:SpecialtyAdditivesMember2022-10-012023-09-300001674862us-gaap:OtherCurrentLiabilitiesMemberash:AshlandGlobalHoldingsIncMember2025-09-300001674862ash:GlobalIntangibleLowTaxedIncomeMember2022-10-012023-09-300001674862us-gaap:StockCompensationPlanMembersrt:MinimumMember2024-10-012025-09-300001674862ash:USAccountsReceivableSalesProgramMember2024-10-012025-09-3000016748622021-10-012021-12-310001674862us-gaap:CustomerRelationshipsMember2025-09-300001674862us-gaap:PensionPlansDefinedBenefitMember2024-10-012025-09-300001674862us-gaap:OtherLiabilitiesMemberus-gaap:ForeignExchangeContractMember2024-09-300001674862us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2025-09-300001674862ash:RestructuringSeveranceCostsMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2023-10-012024-09-300001674862us-gaap:SellingGeneralAndAdministrativeExpensesMemberash:RestructuringSeveranceCostsMember2024-10-012025-09-300001674862us-gaap:FairValueInputsLevel2Member2025-09-300001674862us-gaap:USGovernmentDebtSecuritiesMember2024-09-300001674862us-gaap:DebtSecuritiesMember2024-09-300001674862us-gaap:StockCompensationPlanMember2025-09-300001674862ash:AshlandGlobalHoldingsIncMember2022-10-012023-09-300001674862us-gaap:OtherCurrentLiabilitiesMemberash:AshlandGlobalHoldingsIncMember2024-09-300001674862us-gaap:MachineryAndEquipmentMember2024-09-300001674862us-gaap:RetainedEarningsMember2022-10-012023-09-300001674862us-gaap:PensionPlansDefinedBenefitMemberus-gaap:SegmentContinuingOperationsMember2024-10-012025-09-300001674862ash:SpecialtyAdditivesMembersrt:AsiaPacificMember2024-10-012025-09-300001674862us-gaap:BuildingMember2025-09-300001674862us-gaap:LandAndBuildingMemberash:CompositesSegmentAndIntermediatesAndSolventsMarlFacilityMember2023-09-300001674862us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-10-012024-09-300001674862ash:PersonalCareMemberash:AvocaBusinessMember2024-10-012025-09-300001674862ash:CashSettledNonvestedStockAwardsMember2025-09-300001674862us-gaap:SellingGeneralAndAdministrativeExpensesMember2024-10-012025-09-300001674862ash:IntermediatesAndSolventsMember2023-10-012024-09-300001674862ash:IntermediatesMembersrt:NorthAmericaMember2024-10-012025-09-300001674862us-gaap:StateAndLocalJurisdictionMember2024-10-012025-09-300001674862ash:PersonalCareMember2024-10-012025-09-300001674862ash:StockRepurchaseProgram2023Member2023-10-012024-09-300001674862us-gaap:TradeAccountsReceivableMember2024-09-300001674862us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommodityContractMember2025-09-3000016748622024-04-012024-06-300001674862us-gaap:StockAppreciationRightsSARSMember2024-10-012025-09-300001674862ash:HerculesLimitedLiabilityCompanyMember2024-09-300001674862srt:MinimumMemberus-gaap:BuildingMember2025-09-300001674862ash:LifeSciencesMembersrt:AsiaPacificMember2024-10-012025-09-300001674862us-gaap:OtherDebtSecuritiesMembersrt:MinimumMember2025-09-300001674862ash:RestrictedSecuritiesMember2025-09-300001674862us-gaap:DebtSecuritiesMembersrt:MaximumMember2025-09-300001674862ash:IntermediatesMembersrt:AsiaPacificMember2022-10-012023-09-300001674862us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel1Member2024-09-3000016748622024-10-012025-09-300001674862ash:TwoThousandTwentyFiveRestructuringProgramMember2024-09-300001674862us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2023-09-300001674862us-gaap:OperatingSegmentsMemberash:PersonalCareAndHouseholdMember2023-10-012024-09-300001674862ash:CompositesOrMarlFacilityMember2023-10-012024-09-300001674862ash:AsbestosTrustMember2024-09-300001674862us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2025-09-300001674862ash:AshlandGlobalHoldingsIncMembersrt:MaximumMember2025-09-3000016748622025-09-300001674862us-gaap:FairValueInputsLevel1Memberash:InsuranceContractsMember2025-09-300001674862us-gaap:FairValueInputsLevel3Memberus-gaap:USGovernmentDebtSecuritiesMember2025-09-300001674862ash:ValvolineIncMember2022-10-012023-09-300001674862ash:IntermediatesMember2023-10-012024-09-300001674862us-gaap:MachineryAndEquipmentMembersrt:MaximumMember2025-09-300001674862us-gaap:StateAndLocalJurisdictionMember2023-09-300001674862us-gaap:FairValueInputsLevel2Memberash:InsuranceContractsMember2024-09-300001674862ash:PersonalCareMembersrt:EuropeMember2024-10-012025-09-300001674862ash:CellulosicsMemberus-gaap:SalesRevenueNetMemberus-gaap:ProductConcentrationRiskMember2024-10-012025-09-300001674862ash:UnallocatedAndOtherMember2024-10-012025-09-300001674862us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommodityContractMember2025-09-300001674862us-gaap:RetainedEarningsMember2022-09-300001674862us-gaap:AdditionalPaidInCapitalMember2022-10-012023-09-3000016748622023-10-012023-12-310001674862us-gaap:AllowanceForCreditLossMember2023-10-012024-09-300001674862us-gaap:StockAppreciationRightsSARSMember2025-09-300001674862us-gaap:CashAndCashEquivalentsMember2024-09-3000016748622024-01-012024-03-310001674862ash:SixPointFiveZeroPercentageJuniorSubordinatedNotesDue2029Member2024-10-012025-09-300001674862ash:SupplyChainFinanceProgramMember2024-10-012025-09-300001674862ash:TwoThousandTwentyThreeRestructuringProgramMember2023-09-300001674862us-gaap:OperatingSegmentsMemberash:IntermediatesAndSolventsMember2024-10-012025-09-300001674862us-gaap:TradeAccountsReceivableMember2025-09-300001674862us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2024-10-012025-09-300001674862ash:IntermediatesMember2025-09-300001674862us-gaap:FairValueInputsLevel1Memberash:ListedRealAssetsMember2025-09-300001674862us-gaap:AccountsReceivableMemberash:AshlandGlobalHoldingsIncMember2025-09-300001674862us-gaap:CommonStockMember2024-09-300001674862us-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2024-10-012025-09-300001674862us-gaap:IntellectualPropertyMembersrt:MaximumMember2025-09-300001674862ash:TwoPointZeroZeroPercentageSeniorNotesDue2028Member2024-10-012025-09-300001674862us-gaap:BuildingMembersrt:MaximumMember2025-09-300001674862ash:PersonalCareMemberash:LatinAmericaAndOtherMember2024-10-012025-09-300001674862us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2023-10-012024-09-300001674862ash:TwoThousandTwentyFiveRestructuringProgramMember2023-09-300001674862ash:LifeSciencesMember2022-10-012023-09-300001674862us-gaap:USGovernmentDebtSecuritiesMember2025-09-300001674862us-gaap:TrademarksAndTradeNamesMemberash:AvocaBusinessMemberus-gaap:DiscontinuedOperationsHeldforsaleMember2025-09-300001674862ash:HerculesLimitedLiabilityCompanyMember2023-10-012024-09-300001674862ash:AshlandGlobalHoldingsIncMember2024-10-012025-09-300001674862ash:LifeSciencesMember2025-09-300001674862us-gaap:StockCompensationPlanMember2024-10-012025-09-300001674862ash:PersonalCareAndHouseholdMember2024-10-012025-09-300001674862us-gaap:SegmentContinuingOperationsMemberus-gaap:PensionPlansDefinedBenefitMember2023-10-012024-09-300001674862ash:HerculesLimitedLiabilityCompanyMemberus-gaap:AccountsReceivableMember2024-09-300001674862us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberash:CreditAgreementMember2024-10-012025-09-300001674862us-gaap:AdditionalPaidInCapitalMember2025-09-300001674862us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-10-012024-09-300001674862us-gaap:SellingGeneralAndAdministrativeExpensesMemberash:RestructuringSeveranceCostsMember2022-10-012023-09-300001674862ash:PerformanceAdhesivesMember2024-10-012025-09-300001674862us-gaap:FairValueInputsLevel3Memberus-gaap:EquitySecuritiesMember2025-09-300001674862us-gaap:CostOfSalesMember2024-10-012025-09-300001674862ash:IntermediatesMember2024-09-300001674862ash:IntermediatesMembersrt:AsiaPacificMember2024-10-012025-09-300001674862ash:TwoPointZeroZeroPercentageSeniorNotesDue2028Member2025-09-300001674862country:US2022-10-012023-09-300001674862ash:USAccountsReceivableSalesProgramMember2022-10-012023-09-300001674862us-gaap:SegmentContinuingOperationsMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-10-012024-09-300001674862us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMember2024-09-300001674862ash:TwoThousandTwentyThreeRestructuringProgramMember2024-09-300001674862us-gaap:PensionPlansDefinedBenefitMember2024-09-300001674862ash:IntermediatesMembersrt:EuropeMember2022-10-012023-09-300001674862us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2024-09-300001674862us-gaap:FairValueInputsLevel2Member2024-09-300001674862us-gaap:EquitySecuritiesMember2025-09-300001674862us-gaap:PensionPlansDefinedBenefitMember2025-09-300001674862ash:OperatingLeaseAssetsNetMemberus-gaap:DiscontinuedOperationsHeldforsaleMember2024-10-012025-09-300001674862us-gaap:RetainedEarningsMember2024-09-300001674862ash:LifeSciencesMemberus-gaap:OperatingSegmentsMember2022-10-012023-09-300001674862ash:TwoThousandTwentyFiveRestructuringProgramMember2023-10-012024-09-300001674862us-gaap:SegmentContinuingOperationsMemberus-gaap:PensionPlansDefinedBenefitMember2024-09-300001674862us-gaap:IntersegmentEliminationMember2022-10-012023-09-300001674862country:US2025-09-300001674862us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2025-09-300001674862us-gaap:SalesRevenueNetMemberus-gaap:ProductConcentrationRiskMemberash:CellulosicsAndPolyvinylpyrrolidonesMember2022-10-012023-09-300001674862ash:SpecialtyAdditivesMembersrt:EuropeMember2024-10-012025-09-300001674862us-gaap:OtherCurrentLiabilitiesMemberash:HerculesLimitedLiabilityCompanyMember2024-09-300001674862ash:CompositesOrMarlFacilityMember2022-10-012023-09-300001674862us-gaap:SalesRevenueNetMemberus-gaap:ProductConcentrationRiskMembersrt:MinimumMember2024-10-012025-09-300001674862ash:PersonalCareMembersrt:NorthAmericaMember2022-10-012023-09-300001674862us-gaap:RealEstateMember2024-10-012025-09-300001674862ash:PersonalCareAndHouseholdMember2025-09-300001674862ash:SpecialtyAdditivesMembersrt:AsiaPacificMember2022-10-012023-09-300001674862country:US2024-09-300001674862us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2024-10-012025-09-300001674862us-gaap:StockAppreciationRightsSARSMembersrt:MaximumMember2024-10-012025-09-300001674862ash:PlanAssetFairValueHeirarchyMember2024-10-012025-09-300001674862us-gaap:MachineryAndEquipmentMembersrt:MinimumMember2025-09-300001674862ash:CashSettledNonvestedStockAwardsMember2023-10-012024-09-300001674862us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2025-09-300001674862us-gaap:FairValueInputsLevel3Member2024-09-300001674862ash:CreditAgreementMemberash:EuriborMember2025-09-300001674862ash:StockRepurchaseProgram2022Member2022-10-012023-09-300001674862ash:AshlandGlobalHoldingsIncMember2023-10-192023-10-190001674862us-gaap:FairValueMeasurementsRecurringMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-09-300001674862us-gaap:InventoryValuationReserveMember2024-09-300001674862ash:PersonalCareAndHouseholdMember2023-10-012024-09-300001674862ash:AvocaMember2024-10-012025-09-300001674862ash:PersonalCareMember2022-10-012023-09-300001674862ash:IntermediatesAndSolventsMember2024-09-300001674862us-gaap:SalesRevenueNetMemberus-gaap:ProductConcentrationRiskMemberash:CellulosicsAndPolyvinylpyrrolidonesMember2024-10-012025-09-300001674862us-gaap:DiscontinuedOperationsHeldforsaleMemberash:SpecialtyAdditivesFacilityMember2022-09-300001674862ash:RestrictedSecuritiesMember2024-09-300001674862ash:UnsecuredRevolvingCreditFacilityMemberash:TwoThousandTwentyTwoCreditAgreementMember2022-07-012022-07-310001674862us-gaap:OperatingSegmentsMember2024-10-012025-09-300001674862us-gaap:AccountsReceivableMemberus-gaap:CommodityContractMember2024-09-300001674862us-gaap:StockCompensationPlanMember2023-09-300001674862ash:SixPointEightSevenFivePercentageNotesDue2043Member2023-10-012024-09-300001674862us-gaap:CustomerRelationshipsMember2024-09-300001674862ash:TwoThousandTwentyFiveRestructuringProgramMember2024-10-012025-09-300001674862ash:CashSettledPerformanceSharesMember2024-10-012025-09-300001674862us-gaap:FairValueInputsLevel1Memberus-gaap:EquitySecuritiesMember2024-09-300001674862ash:IntermediatesMemberash:LatinAmericaAndOtherMember2022-10-012023-09-300001674862ash:WaterTechnologiesMember2024-10-012025-09-300001674862us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommodityContractMember2025-09-300001674862us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-10-012023-09-300001674862us-gaap:FairValueInputsLevel3Memberus-gaap:CashAndCashEquivalentsMember2025-09-300001674862ash:PerformanceAdhesivesMember2022-10-012023-09-300001674862ash:IntermediatesAndSolventsMember2025-09-300001674862us-gaap:TrademarksAndTradeNamesMember2024-09-300001674862us-gaap:SalesRevenueNetMemberus-gaap:ProductConcentrationRiskMemberash:PolyvinylpyrrolidonesMember2022-10-012023-09-300001674862us-gaap:OperatingSegmentsMemberash:PersonalCareAndHouseholdMember2022-10-012023-09-300001674862us-gaap:FairValueInputsLevel3Memberus-gaap:CashAndCashEquivalentsMember2024-09-300001674862ash:USAccountsReceivableSalesProgramMember2021-03-172021-03-170001674862us-gaap:StateAndLocalJurisdictionMember2023-10-012024-09-300001674862us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-10-012025-09-300001674862us-gaap:StockAppreciationRightsSARSMember2023-09-300001674862ash:PersonalCareMemberash:LatinAmericaAndOtherMember2023-10-012024-09-300001674862ash:SpecialtyAdditivesMember2024-10-012025-09-300001674862ash:NutraceuticalsBusinessMemberus-gaap:IntellectualPropertyMemberus-gaap:DiscontinuedOperationsHeldforsaleMember2024-09-300001674862us-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2023-10-012024-09-300001674862us-gaap:USGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2024-09-300001674862ash:ExercisePriceRange2Member2024-10-012025-09-300001674862srt:MinimumMemberus-gaap:CustomerRelationshipsMember2025-09-300001674862ash:OtherDebtMember2025-09-300001674862us-gaap:DiscontinuedOperationsHeldforsaleMemberus-gaap:OtherCurrentAssetsMember2024-10-012025-09-300001674862us-gaap:OperatingSegmentsMemberash:IntermediatesAndSolventsMember2022-10-012023-09-300001674862ash:IntermediatesAndSolventsMember2022-10-012023-09-300001674862ash:USAccountsReceivableSalesProgramMemberash:BetweenSeptemberThirteenTwoThousandTwentyFourToAndIncludingDecemberThirtyOneTwoThousandTwentyFourMember2024-09-132024-09-130001674862us-gaap:FairValueInputsLevel1Member2025-09-300001674862us-gaap:BuildingMember2024-09-300001674862ash:InsuranceContractsMember2024-09-300001674862us-gaap:OtherPensionPlansPostretirementOrSupplementalPlansDefinedBenefitMember2023-10-012024-09-300001674862ash:SixPointFiveZeroPercentageJuniorSubordinatedNotesDue2029Member2024-09-300001674862us-gaap:OtherDebtSecuritiesMember2024-09-300001674862us-gaap:StockCompensationPlanMembersrt:MaximumMember2024-10-012025-09-300001674862us-gaap:PerformanceSharesMember2023-09-300001674862us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-10-012024-09-300001674862ash:TwoThousandTwentyThreeRestructuringProgramMember2023-10-012024-09-300001674862us-gaap:OtherDebtSecuritiesMembersrt:MaximumMember2025-09-300001674862ash:AvocaBusinessMemberus-gaap:CustomerRelationshipsMemberus-gaap:DiscontinuedOperationsHeldforsaleMember2025-09-300001674862us-gaap:EquitySecuritiesMember2024-09-300001674862ash:TwoThousandTwentyFiveRestructuringProgramMember2025-09-3000016748622022-04-012022-06-300001674862ash:IntermediatesMemberash:AvocaBusinessMember2024-10-012025-09-300001674862srt:MaximumMemberash:AffiliatesMember2025-09-300001674862ash:SpecialtyAdditivesMember2023-09-300001674862ash:PersonalCareMembersrt:EuropeMember2023-10-012024-09-300001674862srt:MaximumMember2025-09-300001674862us-gaap:PerformanceSharesMembersrt:MinimumMember2024-10-012025-09-300001674862ash:IntermediatesMembersrt:NorthAmericaMember2023-10-012024-09-300001674862country:US2024-10-012025-09-300001674862us-gaap:LandAndBuildingMemberash:CompositesSegmentAndIntermediatesAndSolventsMarlFacilityMember2025-09-300001674862ash:InsuranceContractsMember2024-10-012025-09-300001674862ash:SubpartFMember2023-10-012024-09-300001674862ash:SpecialtyAdditivesMembersrt:NorthAmericaMember2024-10-012025-09-300001674862us-gaap:NonUsMember2025-09-300001674862ash:CreditAgreementMembersrt:MinimumMemberash:EuriborMember2025-09-300001674862ash:USAccountsReceivableSalesProgramMemberash:FromJanuaryOneTwoThousandTwentyFiveThroughTheTerminationDateOfTheAgreementMember2024-09-132024-09-130001674862us-gaap:StockCompensationPlanMember2024-09-300001674862us-gaap:StockCompensationPlanMember2022-09-300001674862us-gaap:DiscontinuedOperationsHeldforsaleMemberash:SpecialtyAdditivesFacilityMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2022-10-012023-09-300001674862us-gaap:FairValueInputsLevel2Memberus-gaap:CashAndCashEquivalentsMember2024-09-300001674862ash:LifeSciencesMemberash:LatinAmericaAndOtherMember2022-10-012023-09-300001674862us-gaap:FairValueInputsLevel3Memberus-gaap:EquitySecuritiesMember2024-09-300001674862us-gaap:OtherPensionPlansPostretirementOrSupplementalPlansDefinedBenefitMember2025-09-300001674862us-gaap:FairValueInputsLevel3Memberash:ListedRealAssetsMember2024-09-300001674862ash:ListedRealAssetsMember2024-09-300001674862ash:TwoPointZeroZeroPercentageSeniorNotesDue2028Member2024-09-300001674862ash:LifeSciencesMembersrt:NorthAmericaMember2022-10-012023-09-300001674862us-gaap:StockAppreciationRightsSARSMember2024-09-300001674862ash:CreditAgreementMembersrt:MaximumMemberash:EuriborMember2025-09-300001674862us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommodityContractMember2024-09-3000016748622023-07-012023-09-300001674862ash:TwoThousandTwentyThreeRestructuringProgramMember2025-09-300001674862us-gaap:CorporateDebtSecuritiesMember2025-09-300001674862us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2022-10-012023-09-300001674862us-gaap:ForeignCountryMember2025-09-300001674862ash:AsbestosTrustMember2025-09-300001674862ash:AshlandGlobalHoldingsIncMember2023-09-300001674862ash:LifeSciencesMemberus-gaap:OperatingSegmentsMember2024-10-012025-09-300001674862us-gaap:FairValueInputsLevel2Memberus-gaap:CashAndCashEquivalentsMember2025-09-300001674862us-gaap:OtherLiabilitiesMemberus-gaap:ForeignExchangeContractMember2025-09-300001674862us-gaap:ConstructionInProgressMember2025-09-300001674862us-gaap:GoodwillMemberus-gaap:DiscontinuedOperationsHeldforsaleMember2024-10-012025-09-300001674862ash:AsbestosTrustMember2014-10-012015-09-300001674862ash:NutraceuticalsBusinessMemberus-gaap:CustomerRelationshipsMemberus-gaap:DiscontinuedOperationsHeldforsaleMember2024-09-300001674862ash:ListedRealAssetsMember2025-09-300001674862us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-09-300001674862ash:LifeSciencesMember2024-09-300001674862us-gaap:ConstructionInProgressMember2024-09-300001674862us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-09-300001674862us-gaap:RetainedEarningsMember2024-10-012025-09-300001674862ash:PersonalCareMemberash:LatinAmericaAndOtherMember2022-10-012023-09-300001674862ash:PersonalCareMembersrt:AsiaPacificMember2024-10-012025-09-300001674862us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2025-09-300001674862us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2022-10-012023-09-300001674862us-gaap:CommodityContractMember2022-10-012023-09-300001674862us-gaap:StockAppreciationRightsSARSMember2022-09-300001674862us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2024-09-300001674862ash:AshlandGlobalHoldingsIncMember2023-10-012024-09-300001674862country:AR2024-10-012025-09-3000016748622023-09-300001674862us-gaap:DemandDepositsMember2024-09-300001674862srt:MinimumMemberash:AffiliatesMember2025-09-300001674862us-gaap:FairValueInputsLevel2Memberus-gaap:EquitySecuritiesMember2024-09-300001674862us-gaap:OperatingSegmentsMember2023-10-012024-09-300001674862ash:SubpartFMember2022-10-012023-09-300001674862us-gaap:DebtSecuritiesMember2025-09-300001674862us-gaap:SubsequentEventMember2025-10-012025-10-310001674862ash:CompositesOrMarlFacilityMember2024-10-012025-09-300001674862ash:IntermediatesMembersrt:AsiaPacificMember2023-10-012024-09-300001674862ash:ExercisePriceRange1Member2024-10-012025-09-300001674862ash:HerculesLimitedLiabilityCompanyMember2025-09-300001674862us-gaap:AdditionalPaidInCapitalMember2024-10-012025-09-300001674862us-gaap:DebtSecuritiesMembersrt:MinimumMember2025-09-300001674862ash:InsuranceContractsMember2025-09-300001674862us-gaap:CommonStockMember2025-09-300001674862ash:AshlandGlobalHoldingsIncMembersrt:MaximumMember2024-09-300001674862ash:LifeSciencesMembersrt:AsiaPacificMember2023-10-012024-09-300001674862us-gaap:SalesRevenueNetMemberus-gaap:ProductConcentrationRiskMemberash:CellulosicsAndPolyvinylpyrrolidonesMember2023-10-012024-09-300001674862us-gaap:CommonStockMember2023-09-300001674862us-gaap:LandMember2025-09-300001674862ash:EnvironmentalTrustMember2024-09-300001674862us-gaap:OtherLiabilitiesMemberus-gaap:CommodityContractMember2025-09-3000016748622023-04-012023-06-300001674862ash:USAccountsReceivableSalesProgramMemberash:BetweenAprilAndOctoberOfEachYearMember2023-04-142023-04-140001674862us-gaap:FairValueInputsLevel2Memberash:InsuranceContractsMember2025-09-300001674862ash:IntermediatesMember2024-10-012025-09-300001674862us-gaap:AllowanceForCreditLossMember2022-09-300001674862us-gaap:AllowanceForCreditLossMembersrt:MaximumMember2023-10-012024-09-300001674862country:US2024-10-012025-09-3000016748622023-01-012023-03-310001674862us-gaap:ForeignPlanMember2024-10-012025-09-300001674862ash:CashSettledNonvestedRestrictedStockAwardsMember2023-10-012024-09-300001674862ash:TwoThousandTwentyThreeRestructuringProgramMember2024-10-012025-09-300001674862ash:CellulosicsMemberus-gaap:SalesRevenueNetMemberus-gaap:ProductConcentrationRiskMember2022-10-012023-09-300001674862us-gaap:TrademarksAndTradeNamesMembersrt:MaximumMember2025-09-300001674862ash:USAccountsReceivableSalesProgramMember2023-10-012024-09-300001674862country:US2023-10-012024-09-300001674862ash:UnsecuredRevolvingCreditFacilityMemberash:TwoThousandTwentyTwoCreditAgreementMember2022-07-310001674862ash:CashSettledNonvestedStockAwardsMember2024-10-012025-09-300001674862ash:NutraceuticalsBusinessMemberash:PersonalCareMember2023-10-012024-09-300001674862us-gaap:FairValueInputsLevel3Member2025-09-300001674862us-gaap:SegmentContinuingOperationsMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2025-09-300001674862ash:USAccountsReceivableSalesProgramMembersrt:MaximumMember2025-09-300001674862us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2025-09-300001674862ash:USAccountsReceivableSalesProgramMembersrt:MaximumMember2024-09-300001674862us-gaap:FairValueInputsLevel3Memberus-gaap:USGovernmentDebtSecuritiesMember2024-09-3000016748622024-07-012024-09-300001674862srt:MaximumMember2024-09-300001674862ash:ValvolineIncMember2024-10-012025-09-300001674862us-gaap:FairValueInputsLevel3Memberash:InsuranceContractsMember2025-09-300001674862us-gaap:AccountsReceivableMemberus-gaap:ForeignExchangeContractMember2024-09-300001674862us-gaap:NonUsMember2024-10-012025-09-300001674862us-gaap:StockAppreciationRightsSARSMembersrt:MinimumMember2024-10-012025-09-300001674862ash:PersonalCareMember2025-09-300001674862us-gaap:StockAppreciationRightsSARSMember2022-10-012023-09-300001674862us-gaap:LandMember2024-09-300001674862us-gaap:FairValueInputsLevel2Memberus-gaap:EquitySecuritiesMember2025-09-300001674862us-gaap:PropertyPlantAndEquipmentMemberus-gaap:DiscontinuedOperationsHeldforsaleMember2023-10-012024-09-300001674862ash:SpecialtyAdditivesMembersrt:AsiaPacificMember2023-10-012024-09-3000016748622022-01-012022-03-310001674862us-gaap:CorporateDebtSecuritiesMember2024-09-300001674862ash:AlternateBaseRateMemberash:CreditAgreementMembersrt:MinimumMember2025-09-300001674862ash:TwoPointZeroZeroPercentageSeniorNotesDue2028Member2023-10-012024-09-300001674862us-gaap:TrademarksAndTradeNamesMember2025-09-300001674862us-gaap:DemandDepositsMember2025-09-300001674862us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-09-300001674862ash:NutraceuticalsBusinessMemberash:LifeSciencesMember2023-10-012024-09-300001674862ash:HerculesLimitedLiabilityCompanyMember2023-09-300001674862ash:PersonalCareAndHouseholdMember2022-10-012023-09-300001674862us-gaap:OperatingSegmentsMemberash:IntermediatesAndSolventsMember2023-10-012024-09-300001674862ash:PersonalCareAndHouseholdMember2024-09-300001674862ash:LifeSciencesMember2024-10-012025-09-3000016748622024-10-012024-12-310001674862us-gaap:FixedIncomeSecuritiesMember2024-09-300001674862us-gaap:FairValueInputsLevel3Memberash:InsuranceContractsMember2024-09-300001674862us-gaap:SegmentContinuingOperationsMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2024-09-300001674862ash:USAccountsReceivableSalesProgramMember2023-04-142023-04-140001674862us-gaap:SalesRevenueNetMemberus-gaap:ProductConcentrationRiskMemberash:PolyvinylpyrrolidonesMember2024-10-012025-09-300001674862us-gaap:IntersegmentEliminationMember2024-10-012025-09-300001674862ash:IntermediatesMembersrt:EuropeMember2024-10-012025-09-300001674862ash:AshlandGlobalHoldingsIncMember2022-09-300001674862us-gaap:CommodityContractMember2023-10-012024-09-300001674862ash:ExercisePriceRange2Member2025-09-300001674862ash:LifeSciencesMemberash:RestructuringSeveranceCostsMember2024-10-012025-09-300001674862ash:AshlandDistributionMember2024-10-012025-09-300001674862us-gaap:FairValueInputsLevel2Memberus-gaap:USGovernmentDebtSecuritiesMember2025-09-3000016748622025-07-012025-09-300001674862us-gaap:AdditionalPaidInCapitalMember2022-09-300001674862ash:SpecialtyAdditivesMember2025-09-300001674862ash:CashSettledNonvestedRestrictedStockAwardsMember2024-10-012025-09-300001674862ash:PersonalCareMembersrt:AsiaPacificMember2023-10-012024-09-3000016748622024-08-302024-08-300001674862ash:GlobalIntangibleLowTaxedIncomeMember2023-10-012024-09-300001674862ash:LifeSciencesMembersrt:NorthAmericaMember2023-10-012024-09-300001674862us-gaap:OtherCurrentLiabilitiesMemberash:HerculesLimitedLiabilityCompanyMember2025-09-300001674862us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommodityContractMember2024-09-300001674862us-gaap:AccountsReceivableMemberus-gaap:CommodityContractMember2025-09-300001674862us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-09-300001674862us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2022-09-300001674862ash:SpecialtyAdditivesMember2023-10-012024-09-300001674862ash:AshlandGlobalHoldingsIncMember2024-09-3000016748622022-07-012022-09-300001674862us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-300001674862ash:SixPointFiveZeroPercentageJuniorSubordinatedNotesDue2029Member2025-09-300001674862ash:SpecialtyAdditivesMemberus-gaap:OperatingSegmentsMember2023-10-012024-09-300001674862ash:PlanassetallocationbyassettypeMember2024-10-012025-09-300001674862us-gaap:AsbestosIssueMember2023-10-012024-09-300001674862ash:TwoThousandTwentyThreeStockRepurchaseProgramMember2025-09-300001674862us-gaap:OperatingSegmentsMemberash:PersonalCareAndHouseholdMember2024-10-012025-09-3000016748622025-04-012025-06-300001674862ash:LifeSciencesMember2023-10-012024-09-300001674862ash:SpecialtyAdditivesMemberash:AvocaBusinessMember2024-10-012025-09-300001674862us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2025-09-300001674862ash:SpecialtyAdditivesMembersrt:NorthAmericaMember2022-10-012023-09-300001674862ash:LifeSciencesMemberus-gaap:OperatingSegmentsMember2023-10-012024-09-300001674862us-gaap:NonUsMember2023-10-012024-09-300001674862us-gaap:IntellectualPropertyMemberash:AvocaBusinessMemberus-gaap:DiscontinuedOperationsHeldforsaleMember2025-09-300001674862us-gaap:FairValueInputsLevel1Memberus-gaap:CorporateDebtSecuritiesMember2025-09-300001674862us-gaap:IntellectualPropertyMember2024-09-300001674862ash:SpecialtyAdditivesMemberash:LatinAmericaAndOtherMember2023-10-012024-09-300001674862ash:LifeSciencesMemberash:LatinAmericaAndOtherMember2023-10-012024-09-300001674862us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommodityContractMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-09-300001674862us-gaap:DiscontinuedOperationsHeldforsaleMember2023-10-012024-09-300001674862ash:IntermediatesMember2023-09-300001674862us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel1Member2025-09-300001674862ash:ThreePointThreeSevenFivePercentageSeniorNotesDue2031Member2024-09-300001674862ash:ThreePointThreeSevenFivePercentageSeniorNotesDue2031Member2025-09-300001674862us-gaap:AllowanceForCreditLossMember2025-09-300001674862us-gaap:ForeignPlanMember2023-10-012024-09-300001674862us-gaap:FairValueInputsLevel1Member2024-09-300001674862us-gaap:InventoryValuationReserveMember2025-09-300001674862us-gaap:InventoryValuationReserveMember2023-09-300001674862us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-09-300001674862ash:IntermediatesMember2022-10-012023-09-300001674862ash:UnallocatedAndOtherMember2023-10-012024-09-300001674862us-gaap:PerformanceSharesMember2024-09-300001674862ash:LifeSciencesMembersrt:AsiaPacificMember2022-10-012023-09-300001674862ash:AshlandGlobalHoldingsIncMembersrt:MaximumMember2024-10-012025-09-300001674862ash:NutraceuticalsBusinessMember2023-10-012024-09-300001674862ash:EnvironmentalTrustMember2025-09-300001674862ash:SpecialtyAdditivesMember2024-09-300001674862us-gaap:IntersegmentEliminationMember2023-10-012024-09-300001674862ash:SpecialtyAdditivesMemberash:LatinAmericaAndOtherMember2022-10-012023-09-300001674862ash:LifeSciencesMemberash:LatinAmericaAndOtherMember2024-10-012025-09-3000016748622025-03-310001674862us-gaap:EquityFundsMember2025-09-300001674862ash:AshlandDistributionMember2022-10-012023-09-300001674862us-gaap:CommonStockMember2022-09-300001674862ash:ThreePointThreeSevenFivePercentageSeniorNotesDue2031Member2024-10-012025-09-300001674862us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommodityContractMember2024-09-300001674862ash:OtherDebtMember2024-09-300001674862country:US2023-10-012024-09-300001674862ash:BetweenFebruaryAndOctoberOfEachYearMemberash:USAccountsReceivableSalesProgramMember2021-03-172021-03-170001674862ash:SubpartFMember2024-10-012025-09-300001674862us-gaap:FairValueInputsLevel1Memberash:InsuranceContractsMember2024-09-300001674862ash:CellulosicsMemberus-gaap:SalesRevenueNetMemberus-gaap:ProductConcentrationRiskMember2023-10-012024-09-300001674862ash:SixPointEightSevenFivePercentageNotesDue2043Member2024-09-300001674862ash:SpecialtyAdditivesMembersrt:EuropeMember2022-10-012023-09-300001674862ash:AvocaBusinessMember2024-10-012025-09-300001674862us-gaap:CustomerRelationshipsMembersrt:MaximumMember2025-09-300001674862us-gaap:AccountsReceivableMemberash:AshlandGlobalHoldingsIncMember2024-09-300001674862ash:IntermediatesMemberash:LatinAmericaAndOtherMember2023-10-012024-09-300001674862ash:IntermediatesMembersrt:NorthAmericaMember2022-10-012023-09-300001674862us-gaap:GoodwillMemberus-gaap:DiscontinuedOperationsHeldforsaleMember2023-10-012024-09-300001674862country:US2025-09-300001674862us-gaap:FairValueInputsLevel1Memberash:ListedRealAssetsMember2024-09-300001674862ash:SpecialtyAdditivesMembersrt:NorthAmericaMember2023-10-012024-09-300001674862us-gaap:PropertyPlantAndEquipmentMember2024-09-300001674862us-gaap:OtherPensionPlansPostretirementOrSupplementalPlansDefinedBenefitMember2024-09-300001674862ash:NutraceuticalsBusinessMemberash:SpecialtyAdditivesMember2023-10-012024-09-300001674862us-gaap:MachineryAndEquipmentMember2025-09-300001674862us-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2022-10-012023-09-300001674862us-gaap:AdditionalPaidInCapitalMember2023-09-300001674862ash:PersonalCareMembersrt:NorthAmericaMember2024-10-012025-09-300001674862ash:IntermediatesMemberash:LatinAmericaAndOtherMember2024-10-012025-09-300001674862us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-10-012023-09-300001674862ash:SixPointEightSevenFivePercentageNotesDue2043Member2024-10-012025-09-300001674862ash:CreditAgreementMembersrt:MaximumMember2024-10-012025-09-300001674862us-gaap:AllowanceForCreditLossMember2023-09-300001674862us-gaap:RetainedEarningsMember2023-09-300001674862us-gaap:OtherLiabilitiesMemberus-gaap:CommodityContractMember2024-09-300001674862us-gaap:AllowanceForCreditLossMember2024-10-012025-09-300001674862us-gaap:StateAndLocalJurisdictionMember2025-09-300001674862us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2024-09-300001674862us-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2025-09-300001674862us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommodityContractMember2025-09-300001674862us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-09-3000016748622023-10-012024-09-300001674862srt:MinimumMemberus-gaap:EquitySecuritiesMember2025-09-300001674862us-gaap:FixedIncomeSecuritiesMember2025-09-300001674862ash:GlobalIntangibleLowTaxedIncomeMember2024-10-012025-09-300001674862us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2024-09-3000016748622022-09-300001674862ash:NutraceuticalsBusinessMemberash:IntermediatesMember2023-10-012024-09-300001674862ash:LifeSciencesMembersrt:EuropeMember2024-10-012025-09-300001674862ash:WaterTechnologiesMember2022-10-012023-09-300001674862ash:UnsecuredRevolvingCreditFacilityMemberash:TwoThousandTwentyTwoCreditAgreementMember2025-09-300001674862us-gaap:RetainedEarningsMember2025-09-300001674862us-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2024-09-300001674862srt:MinimumMemberus-gaap:IntellectualPropertyMember2025-09-3000016748622021-10-012022-09-300001674862us-gaap:LandAndBuildingMemberash:CompositesSegmentAndIntermediatesAndSolventsMarlFacilityMember2024-10-012025-09-300001674862ash:PerformanceAdhesivesMember2023-10-012024-09-300001674862us-gaap:EquitySecuritiesMembersrt:MaximumMember2025-09-300001674862ash:HerculesLimitedLiabilityCompanyMember2022-09-300001674862us-gaap:FairValueInputsLevel1Memberus-gaap:CorporateDebtSecuritiesMember2024-09-300001674862us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommodityContractMember2024-09-300001674862ash:AshlandDistributionMember2023-10-012024-09-300001674862us-gaap:LetterOfCreditMemberash:TwoThousandTwentyTwoCreditAgreementMember2025-09-300001674862us-gaap:ForeignPlanMember2025-09-300001674862us-gaap:NonUsMember2024-09-300001674862ash:UnallocatedAndOtherMember2025-09-300001674862ash:StockRepurchaseProgram2023Member2024-10-012025-09-300001674862ash:NutraceuticalsMember2023-10-012024-09-3000016748622024-09-300001674862us-gaap:PropertyPlantAndEquipmentMemberus-gaap:DiscontinuedOperationsHeldforsaleMember2024-10-012025-09-300001674862us-gaap:OtherIntangibleAssetsMemberus-gaap:DiscontinuedOperationsHeldforsaleMember2023-10-012024-09-300001674862us-gaap:PerformanceSharesMember2024-10-012025-09-300001674862ash:ForeignAccountsReceivableSalesProgramMember2024-10-012025-09-300001674862us-gaap:RealEstateMember2023-10-012024-09-300001674862ash:HerculesLimitedLiabilityCompanyMember2022-10-012023-09-300001674862ash:CashSettledNonvestedStockAwardsMember2022-10-012023-09-300001674862ash:LifeSciencesMembersrt:EuropeMember2022-10-012023-09-300001674862us-gaap:PerformanceSharesMember2022-09-300001674862ash:AshlandGlobalHoldingsIncMembersrt:MaximumMember2023-10-012024-09-300001674862us-gaap:PerformanceSharesMember2023-10-012024-09-300001674862ash:WaterTechnologiesMember2023-10-012024-09-300001674862ash:ThreePointThreeSevenFivePercentageSeniorNotesDue2031Member2023-10-012024-09-300001674862ash:UnallocatedAndOtherMember2024-09-300001674862us-gaap:OtherDebtSecuritiesMember2025-09-300001674862ash:SpecialtyAdditivesMemberash:LatinAmericaAndOtherMember2024-10-012025-09-300001674862ash:LifeSciencesMember2023-09-300001674862us-gaap:LandAndBuildingMemberash:CompositesSegmentAndIntermediatesAndSolventsMarlFacilityMember2022-10-012023-09-300001674862us-gaap:AdditionalPaidInCapitalMember2023-10-012024-09-300001674862us-gaap:DiscontinuedOperationsHeldforsaleMember2024-10-012025-09-300001674862ash:CashSettledPerformanceSharesMember2022-10-012023-09-300001674862ash:SpecialtyAdditivesMemberash:RestructuringSeveranceCostsMember2023-10-012024-09-300001674862ash:CreditAgreementMembersrt:MinimumMember2024-10-012025-09-300001674862us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-10-012023-09-300001674862us-gaap:StockCompensationPlanMember2022-10-012023-09-300001674862us-gaap:StockAppreciationRightsSARSMember2023-10-012024-09-300001674862us-gaap:InventoryValuationReserveMember2024-10-012025-09-300001674862us-gaap:InventoryValuationReserveMember2022-10-012023-09-300001674862us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommodityContractMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2025-09-3000016748622025-10-310001674862us-gaap:NonUsMember2022-10-012023-09-300001674862us-gaap:TrademarksAndTradeNamesMembersrt:MinimumMember2025-09-300001674862ash:SpecialtyAdditivesMemberus-gaap:OperatingSegmentsMember2024-10-012025-09-300001674862ash:PersonalCareMembersrt:AsiaPacificMember2022-10-012023-09-300001674862us-gaap:FairValueInputsLevel1Memberus-gaap:USGovernmentDebtSecuritiesMember2025-09-300001674862us-gaap:RetainedEarningsMember2023-10-012024-09-300001674862ash:AlternateBaseRateMemberash:CreditAgreementMembersrt:MaximumMember2025-09-300001674862us-gaap:AsbestosIssueMember2022-10-012023-09-300001674862ash:TwoThousandTwentyThreeStockRepurchaseProgramMember2023-06-280001674862ash:UnallocatedAndOtherMember2022-10-012023-09-300001674862us-gaap:PerformanceSharesMembersrt:MaximumMember2024-10-012025-09-300001674862us-gaap:FairValueInputsLevel2Memberash:ListedRealAssetsMember2025-09-300001674862ash:NutraceuticalsBusinessMemberus-gaap:TrademarksAndTradeNamesMemberus-gaap:DiscontinuedOperationsHeldforsaleMember2024-09-300001674862us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMember2025-09-300001674862ash:PersonalCareMemberash:RestructuringSeveranceCostsMember2024-10-012025-09-300001674862ash:ForeignAccountsReceivableSalesProgramMember2023-10-012024-09-300001674862us-gaap:OtherIntangibleAssetsMemberus-gaap:DiscontinuedOperationsHeldforsaleMember2024-10-012025-09-300001674862us-gaap:PensionPlansDefinedBenefitMember2022-10-012023-09-300001674862us-gaap:FairValueInputsLevel2Memberus-gaap:USGovernmentDebtSecuritiesMember2024-09-300001674862ash:PersonalCareMember2023-09-300001674862ash:HerculesLimitedLiabilityCompanyMemberus-gaap:AccountsReceivableMember2025-09-300001674862ash:PersonalCareMembersrt:NorthAmericaMember2023-10-012024-09-300001674862ash:TwoThousandTwentyTwoSockRepurchaseProgramMember2023-06-280001674862ash:SixPointFiveZeroPercentageJuniorSubordinatedNotesDue2029Member2023-10-012024-09-300001674862us-gaap:OtherPensionPlansPostretirementOrSupplementalPlansDefinedBenefitMember2024-10-012025-09-300001674862us-gaap:AsbestosIssueMember2024-10-012025-09-300001674862us-gaap:AllowanceForCreditLossMember2022-10-012023-09-300001674862ash:ExercisePriceRange1Member2025-09-300001674862ash:CashSettledPerformanceSharesMembersrt:MaximumMember2023-10-012024-09-300001674862us-gaap:FairValueInputsLevel1Memberus-gaap:EquitySecuritiesMember2025-09-300001674862us-gaap:StockCompensationPlanMember2023-10-012024-09-300001674862srt:MaximumMemberash:SpecialtyAdditivesFacilityMemberus-gaap:DiscontinuedOperationsHeldforsaleMember2023-09-300001674862ash:SixPointEightSevenFivePercentageNotesDue2043Member2025-09-300001674862us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2023-09-300001674862us-gaap:SegmentContinuingOperationsMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2024-10-012025-09-300001674862ash:SpecialtyAdditivesMembersrt:EuropeMember2023-10-012024-09-300001674862ash:AshlandGlobalHoldingsIncMember2025-09-3000016748622022-10-012022-12-310001674862ash:CreditAgreementMember2024-10-012025-09-300001674862us-gaap:SegmentContinuingOperationsMemberus-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-09-300001674862us-gaap:CashAndCashEquivalentsMember2025-09-300001674862ash:SpecialtyAdditivesMemberash:RestructuringSeveranceCostsMember2024-10-012025-09-300001674862us-gaap:SalesRevenueNetMemberus-gaap:ProductConcentrationRiskMemberash:PolyvinylpyrrolidonesMember2023-10-012024-09-300001674862us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2024-10-012025-09-300001674862us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300001674862ash:CashSettledNonvestedRestrictedStockAwardsMember2022-10-012023-09-300001674862us-gaap:FairValueInputsLevel2Memberash:ListedRealAssetsMember2024-09-300001674862ash:LifeSciencesMembersrt:EuropeMember2023-10-012024-09-300001674862us-gaap:InventoryValuationReserveMember2022-09-300001674862us-gaap:OtherPensionPlansPostretirementOrSupplementalPlansDefinedBenefitMember2022-10-012023-09-300001674862srt:MinimumMember2025-09-300001674862ash:AlternateBaseRateMemberash:CreditAgreementMember2025-09-300001674862ash:IntermediatesAndSolventsMember2024-10-012025-09-300001674862ash:SpecialtyAdditivesMemberus-gaap:OperatingSegmentsMember2022-10-012023-09-300001674862us-gaap:CommodityContractMember2024-10-012025-09-300001674862us-gaap:SegmentContinuingOperationsMemberus-gaap:PensionPlansDefinedBenefitMember2025-09-300001674862us-gaap:ForeignExchangeContractMemberus-gaap:AccountsReceivableMember2025-09-300001674862us-gaap:PensionPlansDefinedBenefitMember2023-10-012024-09-300001674862us-gaap:PerformanceSharesMember2022-10-012023-09-300001674862ash:LifeSciencesMemberash:AvocaBusinessMember2024-10-012025-09-300001674862us-gaap:SegmentContinuingOperationsMemberus-gaap:PensionPlansDefinedBenefitMember2023-09-300001674862us-gaap:EquityFundsMember2024-09-300001674862us-gaap:AllowanceForCreditLossMember2024-09-300001674862us-gaap:CostOfSalesMember2023-10-012024-09-300001674862us-gaap:PerformanceSharesMember2025-09-3000016748622025-07-012025-07-010001674862ash:IntermediatesMembersrt:EuropeMember2023-10-012024-09-300001674862us-gaap:CostOfSalesMember2022-10-012023-09-300001674862us-gaap:OtherNoncurrentAssetsMember2025-09-300001674862ash:PersonalCareMember2024-09-300001674862ash:PersonalCareMember2023-10-012024-09-300001674862us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2023-10-012024-09-300001674862ash:PersonalCareFacilityMemberash:RestructuringSeveranceCostsMember2023-10-012024-09-300001674862ash:HerculesLimitedLiabilityCompanyMember2024-10-012025-09-300001674862us-gaap:FairValueInputsLevel3Memberash:ListedRealAssetsMember2025-09-300001674862ash:PersonalCareMembersrt:EuropeMember2022-10-012023-09-300001674862us-gaap:InventoryValuationReserveMember2023-10-012024-09-3000016748622025-01-012025-03-310001674862ash:LifeSciencesMembersrt:NorthAmericaMember2024-10-012025-09-30iso4217:EURash:Claimxbrli:pureiso4217:USDxbrli:sharesash:Sitexbrli:sharesash:Employeeash:ServiceStationPropertyash:Facilityash:Propertyiso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

|

|

☑ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended September 30, 2025

OR

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________ to ___________

Commission file number 333-211719

ASHLAND INC.

|

|

|

Delaware

(State or other jurisdiction of incorporation or organization)

|

81-2587835

(I.R.S. Employer Identification No.)

|

8145 Blazer Drive

Wilmington, Delaware 19808

Telephone Number (302) 995-3000

Securities Registered Pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol |

Name of each exchange on which registered |

Common Stock, par value $.01 per share |

ASH |

New York Stock Exchange |

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

Large Accelerated Filer ☑ |

Accelerated Filer ☐ |

Non-Accelerated Filer ☐ |

Smaller Reporting Company ☐ |

Emerging Growth Company ☐ |

|

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant has filed a report on attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under section 404(b) of the Sarbanes-Oxley Act (15 U.S.C 7262 (b)) by the registered public accounting firm that prepared or issued its audit report. Yes ☑ No ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the Registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the Registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

As of March 31, 2025, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $2.7 billion based on the closing price as reported on the New York Stock Exchange.

As of October 31, 2025, there were 45,718,113 shares of Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of Registrant’s proxy statement for its 2026 Annual Meeting of Stockholders are incorporated by reference into Part III of this Form 10-K to the extent described herein.

PART I

ITEM 1. BUSINESS

GENERAL

Ashland Inc. is a global additives and specialty ingredients company with a conscious and proactive mindset for sustainability. Our common stock is listed on the New York Stock Exchange (“NYSE”) under the ticker symbol “ASH”. The terms “Ashland,” the “Company,” “we” and “our” used herein refer to Ashland Inc., a Delaware Corporation, and its predecessors, and its consolidated subsidiaries, except where the context indicates otherwise.

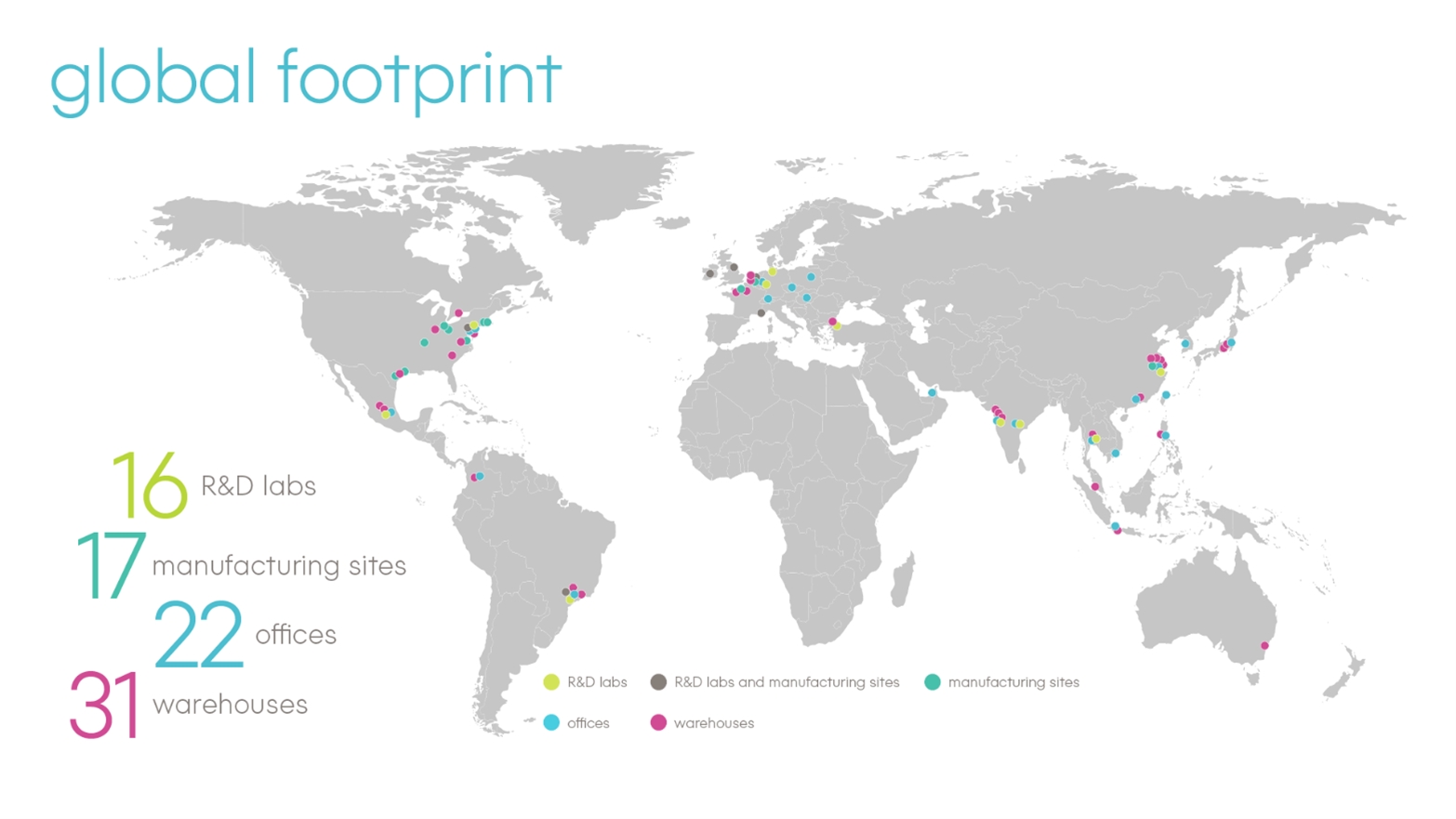

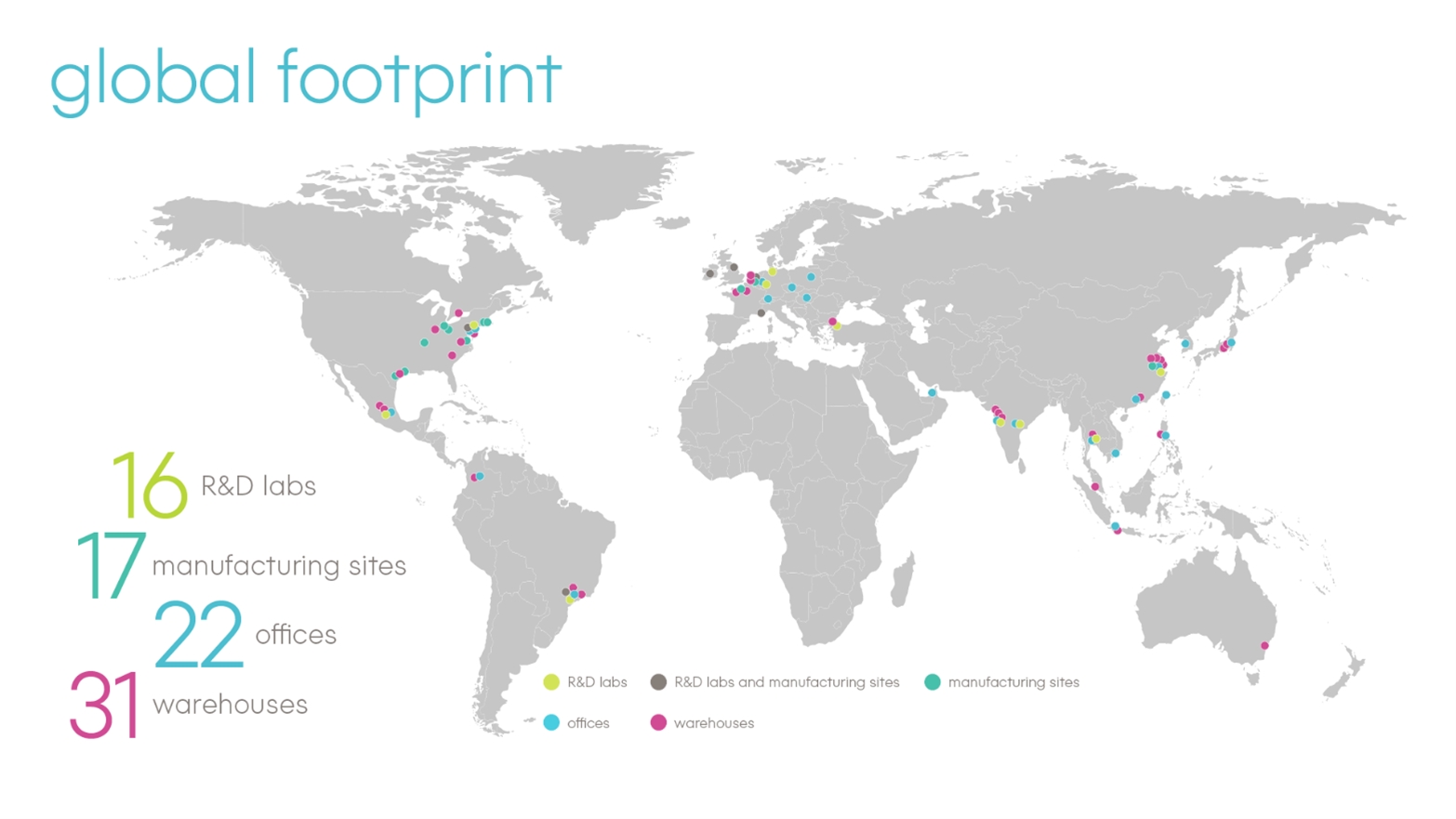

The Company serves customers in a wide range of consumer and industrial markets including, architectural coatings, construction, energy, food and beverage, personal care and pharmaceutical. With approximately 2,900 employees worldwide, Ashland serves customers in more than 100 countries.

Ashland’s reportable operating segments ("reportable segments") include: Life Sciences; Personal Care; Specialty Additives; and Intermediates. Unallocated and Other includes corporate governance activities and certain legacy matters.

Life Sciences is comprised of pharmaceuticals, nutrition, agricultural chemicals, diagnostic films (formerly known as advanced materials) and fine chemicals. Pharmaceutical solutions include controlled release polymers, disintegrants, tablet coatings, thickeners, solubilizers and tablet binders. Nutrition solutions include thickeners, stabilizers, emulsifiers and additives for enhancing mouthfeel, controlling moisture migration, reducing oil uptake and binding structured foods. Customers include pharmaceutical, food, beverage, hospitals and radiologists manufacturers. The nutraceuticals business was sold in August 2024.

Personal Care is comprised of biofunctionals, microbial protectants (preservatives), skin care, sun care, oral care, hair care and household solutions. These businesses have a broad range of natural, nature-derived, biodegradable, and high-performance ingredients for customer-driven solutions to help protect, renew, moisturize and revitalize skin and hair, and provide solutions for toothpastes, mouth washes and rinses, denture cleaning and care for teeth. Personal Care supplies nature-derived rheology ingredients, biodegradable surface wetting agents, performance encapsulates, and specialty polymers for household, industrial and institutional cleaning products. Customers include formulators at large multinational branded consumer products companies and smaller, independent boutique companies.

Specialty Additives is comprised of rheology and performance-enhancing additives serving the architectural coatings, construction, energy, automotive and various industrial markets. Solutions include coatings additives for architectural paints, finishes and lacquers, cement- and gypsum-based dry mortars, ready-mixed joint compounds, synthetic plasters for commercial and residential construction, and specialty materials for industrial applications. Products include rheology modifiers (cellulosic and associative thickeners), foam control agents, surfactants and wetting agents, pH neutralizers, advanced ceramics used in catalytic converters, and environmental filters, ingredients that aid the manufacturing process of ceramic capacitors, plasma display panels and solar cells, ingredients for textile printing, thermoplastic metals and alloys for welding. Products help improve desired functional outcomes through rheology modification and control, water retention, workability, adhesive strength, binding power, film formation, deposition and suspension and emulsification. Customers include, but are not limited to, global paint manufacturers, electronics and automotive manufacturers, textile mills, the construction industry and welders.

Intermediates is comprised of the production of 1,4 butanediol ("BDO") and related derivatives, including n-methylpyrrolidone. These products are used as chemical intermediates in the production of engineering polymers and polyurethanes, and as specialty process solvents in a wide array of applications including electronics, agriculture, pharmaceuticals, water filtration membranes and more. BDO is also supplied to Life Sciences, Personal Care, and Specialty Additives reportable segments for use as a raw material.

Unallocated and Other generally includes items such as certain significant company-wide restructuring activities, corporate governance costs and legacy costs or activities that relate to divested businesses that are no longer operated by Ashland.

Available Information -

Our principal executive offices are located at 8145 Blazer Drive, Wilmington, Delaware 19808.

On the Investor Relations section of our website, www.ashland.com, you may obtain additional information about us, free of charge, including:

•

our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and other documents as soon as reasonably practicable after we file them with or furnish them to the Securities and Exchange Commission ("SEC");

•

beneficial ownership reports filed by officers, directors, and principal security holders under Section 16(a) of the Securities exchange Act of 1934, as amended (or the “Exchange Act”); and

•

corporate governance information that includes our:

o

corporate governance guidelines,

o

audit committee charter,

o

compensation committee charter,

o

environmental, health, safety and quality committee charter,

o

governance and nominating committee charter, and

o

director independence standards.

We also provide printed copies of any of these documents to any stockholder free of charge upon request. The SEC also maintains a website (www.sec.gov) that contains reports, proxy and information statements and other information that is filed electronically with the SEC.

LIFE SCIENCES

Life Sciences is a leading supplier of excipients and tablet coating systems to the pharmaceutical and nutrition industries. Excipients include a comprehensive range of polymers for use as tablet binders, super disintegrants, sustained-release agents and drug solubilizers, as well as a variety of coating formulations for immediate, delayed, and sustained release applications. Core products include cellulosics and vinyl pyrrolidone polymers which are used primarily in oral solid dosage drug formulations. Its nutrition portfolio provides functional benefits in areas such as thickening, texture control, thermal gelation, structure enhancement, water binding, clarification and stabilization. Its core products include cellulose gums and vinyl pyrrolidone polymers which are used in a wide range of offerings for bakery, beverage, dairy, desserts, meat products, pet food, prepared foods, sauces and savory products.

Life Sciences operates throughout the Americas, Europe and Asia Pacific. It has 11 manufacturing and lab facilities in nine countries which serve its various end markets. It has manufacturing facilities and labs in the United States in Wilmington, Delaware and Bridgewater Township, New Jersey; and internationally in Brazil; China; Germany; India; Ireland; Mexico; Thailand; and Turkey.

Life Science markets and distributes its products in the Americas, Europe, the Middle East, Africa and Asia Pacific.

For fiscal 2025, the following Life Sciences product categories were 10% or greater of Ashland’s total consolidated sales:

|

|

|

Product |

% of Life Sciences sales |

% of Ashland total consolidated sales |

Cellulosics |

43% |

39% |

Polyvinylpyrrolidones (PVP) |

42% |

25% |

PERSONAL CARE

The Personal Care portfolio of oral care products delivers active ingredients in toothpaste and mouthwashes; provides bioadhesive functionality for dentures; delivers flavor, texture and other functional properties; and provides product binding to ensure form and function throughout product lifecycle.

The Personal Care portfolio of hair care products includes advanced styling polymers, fixatives, conditioning polymers, emulsifiers, preservatives, rheology modifiers and biofunctional actives.

The Personal Care portfolio of ingredients and solutions for skin care, sun care, and cosmetics focuses on natural and sustainable solutions. Personal Care includes biofunctional actives, preservatives, and specialty polymers to provide functionality such as water resistance and rheology. Ashland’s natural ingredients include a wide range of cellulose, guar, and cassia derivatives; unique active ingredients derived from botanical sources using exclusive Ashland technologies such as Zeta FractionTM and plant small RNAs ("PSR") technology; emollients based on natural chemistries; encapsulation technology derived from alginates; and efficacious preservative blends inspired by nature.

The Personal Care portfolio of products and technologies is used in many types of cleaning and fragrance applications, including fabric care, home care and dishwashing. Personal Care products are used in a variety of applications for viscosity enhancement, particle suspension, rheology modification, stabilization and fragrance enhancement.

Personal Care operates throughout the Americas, Europe and Asia Pacific. It has 9 manufacturing and lab facilities in ten countries which serve its various end markets and participates in one joint venture. It has manufacturing facilities and labs in the United States in Bridgewater Township, New Jersey; and internationally in Brazil; China; France; Germany; India; Mexico; Netherlands; Thailand; and the United Kingdom.

Personal Care markets and distributes its products in the Americas, Europe, the Middle East, Africa and Asia Pacific.

For fiscal 2025, the following Personal Care product categories were 10% or greater of Ashland’s total consolidated sales:

|

|

|

Product |

% of Personal Care sales |

% of Ashland total consolidated sales |

Cellulosics |

20% |

39% |

Polyvinylpyrrolidones (PVP) |

23% |

25% |

SPECIALTY ADDITIVES

Specialty Additives offers industry-leading products, technologies and resources for solving formulation and product-performance challenges. Using synthetic and semisynthetic polymers derived from polyester and polyurethane-based adhesives, and plant and seed extract, Specialty Additives offers comprehensive and innovative solutions for industrial applications.

Key customers include manufacturers of paint, coatings and construction materials; packaging and converting companies; and oilfield service companies.

The areas of expertise include organic and synthetic chemistry, colloid science, rheology, structural analysis and microbiology.

The solutions provide an array of properties, including thickening and rheology control, binding power, film formation, conditioning and deposition, colloid stabilization and suspension.

Specialty Additives is composed of various end use markets. Many of the products of the end markets are produced in shared manufacturing facilities, to better manage capacity and achieve desired returns.

Specialty Additives provides products and services to over 30 industries. Ashland offers a broad spectrum of organo- and water-soluble polymers that are derived from both natural and synthetic resources. Product lines include derivatized cellulose polymers, synthetics, and vinyl pyrrolidone polymers that impart effective functionalities to serve a variety of industrial markets and specialized applications. Many of the products within Specialty Additives function as performance additives that deliver high levels of end-user value in formulated products. In other areas, such as plastics and textiles, Specialty Additives’ products function as a processing aid, improving the quality of end products and reducing manufacturing costs.

Specialty Additives is a recognized leader in rheology solutions for waterborne architectural paint and coatings. Products include hydroxyethylcellulose ("HEC"), which provides thickening and application properties for interior and exterior paints, and nonionic synthetic associative thickeners ("NSATs"), which are APEO-free liquid synthetics for high-performance paint and industrial coatings. The Specialty Additives market complements its rheology offering with a broad portfolio of performance foam-control agents, surfactants and wetting agents, dispersants and pH neutralizers.

Specialty Additives is a major producer and supplier of cellulose ethers and companion products for the construction industry. These products control properties such as water retention, open time, workability, adhesion, stabilization, pumping, sag resistance, rheology, strength, appearance and performance in dry-mortar formulations.

Specialty Additives is a leading global manufacturer of synthetic- and cellulosic-based products for drilling fluids, oil-well cement slurries, completion and workover fluids, fracturing fluids and production chemicals. Specialty Additives offers the oil and gas industry solutions for drilling, stimulation, completion, cementing and production applications.

Specialty Additives operates throughout the Americas, Europe and Asia Pacific. It has 8 manufacturing and lab facilities in eight countries which serve its various end markets. Specialty Additives has manufacturing facilities and labs in the United States in Wilmington, Delaware and internationally in Brazil; China; Germany; India; Netherlands; Singapore and the United Kingdom.

Specialty Additives markets and distributes its products in the Americas, Europe, the Middle East, Africa and Asia Pacific.

For fiscal 2025, the following Specialty Additives products were 10% or greater of Ashland’s total consolidated sales:

|

|

|

Product |

% of Specialty Additives sales |

% of Ashland total consolidated sales |

Cellulosics |

62% |

39% |

Polyvinylpyrrolidones (PVP) |

7% |

25% |

INTERMEDIATES

Intermediates is a leading producer of BDO and related derivatives, including n-methylpyrrolidone. These products are used as chemical intermediates in the production of engineering polymers and polyurethanes, and as specialty process solvents in a wide array of applications including electronics, agriculture, pharmaceuticals, water filtration membranes and more. BDO is also supplied to Life Sciences, Personal Care and Specialty Additives for use as a raw material.

Key customers include Ashland’s Life Sciences, Personal Care and Specialty Additives segments, general industrial manufacturers, plastics and polymers producers, pharmaceutical companies, agricultural firms and producers of electronic components and systems.

Intermediates has a manufacturing facility in Lima, Ohio, while some derivatives are produced at Life Sciences facilities in Texas City, Texas and Calvert City, Kentucky. Intermediates markets and distributes its products in the Americas, Europe, and Asia Pacific.

MISCELLANEOUS

Environmental Matters

Ashland maintains a company-wide environmental policy overseen by the Sustainability and Productivity Committee of Ashland’s Board of Directors (the "Board"). Ashland’s Environmental, Health, Safety, Quality and Regulatory Affairs ("EHSQ&RA") department has the responsibility to ensure that Ashland’s businesses worldwide maintain environmental compliance in accordance with applicable laws and regulations. This responsibility is carried out via training; widespread communication of EHSQ&RA policies; information and regulatory updates; formulation of relevant policies, procedures and work practices; design and implementation of EHSQ&RA management systems; internal auditing; monitoring of legislative and regulatory developments that may affect Ashland’s operations; assistance to the businesses in identifying compliance issues and opportunities for voluntary actions that go beyond compliance; and incident response planning and implementation.

Federal, state and local laws and regulations relating to the protection of the environment have a significant impact on how Ashland conducts its businesses. In addition, Ashland’s operations outside the United States are subject to the environmental laws of the countries in which they are located. These laws include regulation of air emissions and water discharges, waste handling, remediation and product inventory, registration and regulation. New laws and regulations may be enacted or adopted by various regulatory agencies globally. The costs of compliance with any new laws or regulations cannot be estimated until the manner in which they will be implemented has been more precisely defined.

At September 30, 2025, Ashland’s reserves for environmental remediation and related environmental litigation amounted to $226 million, reflecting Ashland’s estimates of the most likely costs that will be incurred over an extended period to remediate identified conditions for which the costs are reasonably estimable, without regard to any third-party recoveries. Engineering studies, historical experience and other factors are used to identify and evaluate remediation alternatives and their related costs in determining the estimated reserves for environmental remediation. Environmental remediation reserves are subject to uncertainties that affect Ashland’s ability to estimate its share of the costs. Such uncertainties involve the nature and extent of contamination at each site and the extent of required cleanup efforts under existing environmental regulations. Although it is not possible to predict with certainty the ultimate costs of environmental remediation, Ashland currently estimates that the upper end of the reasonably possible range of future costs for identified sites could be as high as approximately $495 million. The largest reserve for any site is 21% of the total environmental remediation reserves. Ashland regularly adjusts its reserves as environmental remediation continues. Environmental remediation expense, net of insurance receivables, amounted to $48 million in 2025 compared to $56 million in 2024 and $59 million in 2023.

Product Control, Registration and Inventory - Many of Ashland’s products and operations are subject to chemical control laws of the countries in which they are located. These laws include regulation of chemical substances and inventories under the Toxic Substances Control Act ("TSCA") in the United States and the Registration, Evaluation and Authorization of Chemicals ("REACH") regulation in Europe as well as new cosmetic ingredients filings in China under the Cosmetics Supervision and Administration Regulation ("CSAR"). Under TSCA, REACH, and CSAR additional testing requirements, documentation, risk assessments and registrations are occurring and will continue to occur and may adversely affect Ashland’s costs of products produced in or imported into the European Union ("EU"). Examples of other product control regulations include right to know laws under the Global Harmonized System ("GHS") for hazard communication, regulation of chemicals used in the manufacture of pharmaceuticals and personal care products and that contact food under the Food, Drug and Cosmetics Act in the United States, the Framework Regulation in Europe and other product control requirements for chemical weapons, drug precursors and import/export. The Green Deal in the EU, specifically Chemicals Strategy for Sustainability, will require additional information to be developed on hazard communication and risk assessment of both chemical substances and finished products. New laws and regulations may be enacted or adopted by various regulatory agencies globally. The costs of compliance with any new laws or regulations cannot be estimated until the manner in which they will be implemented has been more precisely defined.

Remediation - Ashland currently operates, and in the past has operated, various facilities at which, during the normal course of business, releases of hazardous substances have occurred. Additionally, Ashland has known or alleged potential environmental liabilities at a number of third-party sites. Federal and state laws, including but not limited to the Resource Conservation and Recovery Act ("RCRA"), the Comprehensive Environmental Response, Compensation and Liability Act of 1980 ("CERCLA") and various other remediation laws, require that contamination caused by hazardous substance releases be assessed and, if necessary, remediated to meet applicable standards. Some of these laws also provide for liability for related damage to natural resources, and claims for alleged property and personal injury damage which can also arise related to contaminated sites. Laws in other jurisdictions in which Ashland operates require that contamination caused by such releases at these sites be assessed and, if necessary, remediated to meet applicable standards.

Air - In the United States, the Clean Air Act ("CAA") imposes stringent limits on facility air emissions, establishes a federally mandated operating permit program, allows for civil and criminal enforcement actions and sets limits on the volatile or toxic content of many types of industrial materials and consumer products. The CAA establishes national ambient air quality standards ("NAAQS") with attainment deadlines and control requirements based on the severity of air pollution in a given geographical area. Various state clean air acts implement, complement and, in many instances, add to the requirements of the federal CAA. The requirements of the CAA and its state counterparts have a significant impact on the daily operation of Ashland’s businesses and, in many cases, on product formulation and other long-term business decisions. Other countries where Ashland operates also have laws and regulations relating to air quality. Ashland maintains numerous permits and emission control devices pursuant to these clean air laws.

The United States Environmental Protection Agency ("USEPA") has increased its frequency in reviewing the NAAQS. The USEPA has stringent standards for particulate matter, ozone and sulfur dioxide. Throughout 2023, 2024 and 2025, state and local agencies continued to implement options for meeting the newest standards. Particulate matter strategies include dust control measures for construction sites and reductions in emission rates allowed for industrial operations. Options for ozone include emission controls for certain types of sources, reduced limits on the volatile organic compound content of industrial materials and consumer products, and requirements on the transportation sector.

Most options for sulfur dioxide focus on coal and diesel fuel combustion sources. It is not possible at this time to estimate the potential financial impact that these newest standards may have on Ashland’s operations or products. Ashland will continue to monitor and evaluate these standards to meet these and all air quality requirements.

Solid Waste - Ashland is subject to various laws relating to and establishing standards for the management of hazardous and solid waste. In the United States, Ashland’s facilities are subject to RCRA and its regulations governing generators of hazardous waste. Ashland has implemented systems to oversee compliance with the RCRA regulations. In addition to regulating current waste disposal practices, RCRA also addresses the environmental effects of certain past waste disposal operations, the recycling of wastes and the storage of regulated substances in underground tanks. Ashland has the remediation liability for certain facilities subject to these regulations. Other countries where Ashland operates also have laws and regulations relating to hazardous and solid waste, and Ashland has systems in place to oversee compliance.

Water - Ashland maintains numerous discharge permits. In the United States, such permits may be required by the National Pollutant Discharge Elimination System of the Clean Water Act and similar state programs. Other countries have similar laws and regulations requiring permits and controls relating to water discharge.

Climate Change and Related Regulatory Developments - Ashland has been collecting energy use data and calculating greenhouse gas ("GHG") emissions for many years. Ashland evaluates the physical and transitional risks and opportunities from both climate change and the anticipated GHG regulations to facilities, products and other business interests, as well as the strategies commonly considered by the industrial sector to reduce the potential impact of these risks. These risks are generally grouped as impacts from legislative, regulatory and international developments, impacts from business and investment trends and impacts to Company assets from the physical effects of climate change. North American, European and other regional regulatory developments (most notably the pending SEC and approved Corporate Sustainability Reporting Directive ("CSRD") climate disclosure regulations) are monitored continuously for material impacts to Ashland’s operations, and some facilities and subsidiaries are subject to promulgated rules. Proposed and pending climate legislation is monitored for impact and Ashland is taking steps to strengthen climate reporting to meet anticipated disclosure requirements. Other requirements requiring additional product level climate disclosures or supply chain transparency are also approved and in draft or finalized status and could impact the requirements for disclosure and restrictions on sourcing of raw materials. Regulations such as the PFAS restrictions and microplastics ban in the EU have potential business interruption impacts where they limit the type and availability of raw materials that may be used.

Business and investment trends are expected to drive an increase in the demand for products that improve energy efficiency, reduce energy use and increase the use of renewable resources. At this time, Ashland cannot estimate the impact of this expected demand increase to its businesses. Physical effects from climate change have the potential to affect Ashland’s assets in areas prone to sea level rise or extreme weather events much as they do the general public and other businesses. Due to the uncertainty of these matters, Ashland cannot estimate the impact at this time of GHG-related developments on its operations or financial condition.

Competition

Ashland competes in the highly fragmented additives and specialty ingredients industries. The participants in these industries offer a varied and broad array of product lines designed to meet specific customer requirements. Participants compete with service and product offerings on a global, regional and/or local level subject to the nature of the businesses and products, as well as the end-markets and customers served. Competition is based on several key criteria, including product performance and quality, product price, product availability and security of supply, responsiveness of product development in cooperation with customers, customer service, industry knowledge and technical capability. Certain key competitors are significantly larger than Ashland and have greater financial resources, leading to greater operating and financial flexibility. The industry has become increasingly global as participants have focused on establishing and maintaining leadership positions outside of their home markets. Many of these segments’ product lines face domestic and international competition, due to industry consolidation, pricing pressures and competing technologies. Through a more focused approach, the Company is leveraging the Ashland brand and global scale to combine operational agility with disciplined investment in targeted areas, while expanding beyond its core technologies with differentiated new technology platforms to support the introduction of new product lines and applications.

Intellectual Property

Ashland has a broad intellectual property portfolio which is an important component of its business. Ashland relies on patents, trade secrets, formulae and know-how to protect and differentiate its products and technologies. In addition, the reportable segments own valuable trademarks which identify and differentiate their products from Ashland's competitors. Ashland also uses licensed intellectual property rights from third-parties.

Raw Materials and Energy