false000188865400018886542025-11-152025-11-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 15, 2025 |

5E ADVANCED MATERIALS, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-41279 |

87-3426517 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

9329 Mariposa Road, Suite 210 |

|

Hesperia, California |

|

92344 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (442) 221-0225 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common stock, $0.01 par value per share |

|

FEAM |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒ Item 7.01 Regulation FD Disclosure On November 19, 2025, 5E Advanced Materials, Inc. (the “Company” or “5E”) issued a press release announcing the disclosure of an updated mineral resource estimate, effective November 15, 2025, for its 5E Boron Americas (Fort Cady) Complex located in the Mojave Desert near Newberry Springs, California (the “Project”). A copy of the Company’s press release dated November 19, 2025 relating to the updated mineral resource estimate is furnished as Exhibit 99.1 to this Form 8-K. The information contained in Exhibit 99.1 hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing. Item 8.01 Other Events. Updated Mineral Resource Estimate On November 15, 2025, the Company received an updated mineral resource estimate for the Project. The updated mineral resource estimate was prepared by Mr. Steven Kerr of Escalante Geological Services, LLC, one of the Qualified Persons with respect to the Company’s Preliminary Feasibility Study Technical Report Summary (the “PFS”) filed with the U.S. Securities and Exchange Commission (the “SEC”) on Form 8-K on August 7, 2025. The new mineral resource estimate updates the prior estimate dated March 10, 2025, and incorporates mineral resource from additional lode claims the Company staked and filed with the U.S. Bureau of Land Management and recorded in San Bernardino County in August 2025. The updated mineral resource estimate identified 61.9 million short tons of measured ore, containing 9.1 million short tons of in-situ boric acid (H3BO3), with an average grade of 8.34% (B2O3), and 138.6 million short tons of indicated ore, containing 19.2 million short tons of in-situ boric acid (H3BO3), with an average grade of 7.97% (B2O3). On a combined basis, measured plus indicated mineral resource represent 28.3 million tons of boric acid, with an average grade of 8.09% (B2O3), which represents an increase of 10.8 million tons, or 61%, as compared to the prior resource estimate. The updated mineral resource estimate also identified an aggregate measured plus indicated mineral resource estimate of 328 thousand tons of lithium carbonate equivalent (“LCE”), with an average grade of 0.17% LCE, an increase of 115 thousand tons, or 54%, as compared to the prior resource estimate. Each of these increases relate exclusively to the addition of mineral resource that resulted from the aforementioned additional lode claims. The mineral reserves and Project economics previously disclosed in the Company’s PFS are unchanged as a result of the updated mineral resource estimate and remain current and valid as of the date of this Form 8-K. Additionally, the mineral resource assumptions, methodology, pricing assumptions, cut-off grade and other assumptions and estimates with respect to the Company’s mineral resource estimate, each as described in Part I, Items 1 and 2, of the Company’s Form 10-K filed with the SEC on September 29, 2025 remain consistent and accurate as of the date of this Form 8-K. Mineral Resource Definitions Regulation S-K 1300 defines a “mineral resource” as a concentration or occurrence of material of economic interest in or on the Earth’s crust in such form, grade or quality, and quantity that there are reasonable prospects for economic extraction. A mineral resource is a reasonable estimate of mineralization, considering relevant factors such as cut-off grade, likely mining dimensions, location, or continuity, that, with the assumed and justifiable technical and economic conditions, is likely to, in whole or in part, become economically extractable. It is not merely an inventory of all mineralization drilled or sampled. A “measured mineral resource” is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of conclusive geological evidence and sampling. The level of geological certainty associated with a measured mineral resource is sufficient to allow a qualified person to apply modifying factors, as defined in this section, in sufficient detail to support detailed mine planning and final evaluation of the economic viability of the deposit. Because a measured mineral resource has a higher level of confidence than the level of confidence of either an indicated mineral resource or an inferred mineral resource, a measured mineral resource may be converted to a proven mineral reserve or to a probable mineral reserve. An “indicated mineral resource” is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of adequate geological evidence and sampling. The level of geological certainty associated with an indicated mineral resource is sufficient to allow a qualified person to apply modifying factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Because an indicated mineral resource has a lower level of confidence than the level of confidence of a measured mineral resource, an indicated mineral resource may only be converted to a probable mineral reserve. An “inferred mineral resource” is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. The level of geological uncertainty associated with an inferred mineral resource is too high

to apply relevant technical and economic factors likely to influence the prospects of economic extraction in a manner useful for evaluation of economic viability. Because an inferred mineral resource has the lowest level of geological confidence of all mineral resources, which prevents the application of the modifying factors in a manner useful for evaluation of economic viability, an inferred mineral resource considered when assessing the economic viability of a mining project must be presented along with economic viability excluding inferred resources and may not be converted to a mineral reserve.

Fort Cady Mineral Resource Estimate as of November 15, 2025

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Thick |

|

B203 |

|

H3BO3 |

|

LCE |

|

|

|

|

|

|

Resource Classification Tons |

|

|

Product Tons - Measured |

|

|

Product Tons - Indicated |

|

|

Product Tons - Inferred |

|

Property |

Bed(1) |

(m) |

|

(%) |

|

(%) |

|

(%) |

|

Tonnes |

|

Tons |

|

|

Measured |

|

Indicated |

|

Inferred |

|

|

B2O3 |

|

H3BO3 |

|

LCE |

|

|

B2O3 |

|

H3BO3 |

|

LCE |

|

|

B2O3 |

|

H3BO3 |

|

LCE |

|

|

UMH |

|

2.09 |

|

|

7.73 |

|

|

13.72 |

|

|

0.14 |

|

|

5,389,673 |

|

|

5,941,096 |

|

|

|

2,673,493 |

|

|

3,267,603 |

|

- |

|

|

|

206,580 |

|

|

366,886 |

|

3729 |

|

|

|

252,486 |

|

|

448,416 |

|

|

4,557 |

|

|

|

— |

|

|

— |

|

|

— |

|

Unpatented |

MMH |

|

9.26 |

|

|

8.99 |

|

|

15.97 |

|

|

0.20 |

|

|

23,883,154 |

|

|

26,326,663 |

|

|

|

11,846,998 |

|

|

14,479,665 |

|

- |

|

|

|

1,065,024 |

|

|

1,891,483 |

|

|

23,585 |

|

|

|

1,301,696 |

|

|

2,311,812 |

|

|

28,826 |

|

|

|

— |

|

|

— |

|

|

— |

|

Lode Claims |

IMH |

|

11.40 |

|

|

8.02 |

|

|

14.24 |

|

|

0.18 |

|

|

29,390,585 |

|

|

32,397,565 |

|

|

|

14,578,904 |

|

|

17,818,661 |

|

- |

|

|

|

1,169,139 |

|

|

2,076,390 |

|

|

26,385 |

|

|

|

1,428,947 |

|

|

2,537,810 |

|

|

32,249 |

|

|

|

— |

|

|

— |

|

|

— |

|

|

LMH |

|

8.38 |

|

|

9.02 |

|

|

16.02 |

|

|

0.12 |

|

|

21,607,951 |

|

|

23,818,683 |

|

|

|

10,718,407 |

|

|

13,100,275 |

|

- |

|

|

|

966,856 |

|

|

1,717,136 |

|

13237 |

|

|

|

1,181,713 |

|

|

2,098,722 |

|

|

16,178 |

|

|

|

— |

|

|

— |

|

|

— |

|

Sub-Total |

|

|

80,271,363 |

|

|

88,484,007 |

|

|

|

39,817,802 |

|

|

48,666,204 |

|

- |

|

|

|

3,407,599 |

|

|

6,051,895 |

|

|

66,936 |

|

|

|

4,164,842 |

|

|

7,396,760 |

|

|

81,810 |

|

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fee Land |

UMH |

|

2.96 |

|

|

6.60 |

|

|

11.72 |

|

|

0.13 |

|

|

5,239,482 |

|

|

5,775,538 |

|

|

|

1,443,885 |

|

|

4,216,143 |

|

|

115,511 |

|

|

|

95,296 |

|

|

169,246 |

|

|

1,926 |

|

|

|

278,265 |

|

|

494,199 |

|

|

5,624 |

|

|

|

7,624 |

|

|

13,540 |

|

154.1 |

|

|

MMH |

|

15.25 |

|

|

8.23 |

|

|

14.62 |

|

|

0.17 |

|

|

26,950,960 |

|

|

29,708,340 |

|

|

|

7,427,085 |

|

|

21,687,088 |

|

|

594,167 |

|

|

|

611,249 |

|

|

1,085,578 |

|

|

12,770 |

|

|

|

1,784,847 |

|

|

3,169,889 |

|

|

37,289 |

|

|

|

48,900 |

|

|

86,846 |

|

|

1,022 |

|

|

IMH |

|

6.09 |

|

|

7.24 |

|

|

12.85 |

|

|

0.19 |

|

|

10,770,455 |

|

|

11,872,391 |

|

|

|

2,968,098 |

|

|

8,666,845 |

|

|

237,448 |

|

|

|

214,781 |

|

|

381,451 |

|

|

5,520 |

|

|

|

627,160 |

|

|

1,113,837 |

|

|

16,119 |

|

|

|

17,182 |

|

|

30,516 |

|

441.6 |

|

|

LMH |

|

8.11 |

|

|

8.63 |

|

|

15.33 |

|

|

0.12 |

|

|

14,330,824 |

|

|

15,797,025 |

|

|

|

3,949,256 |

|

|

11,531,828 |

|

|

315,941 |

|

|

|

340,831 |

|

|

605,316 |

|

|

4,686 |

|

|

|

995,227 |

|

|

1,767,523 |

|

|

13,682 |

|

|

|

27,266 |

|

|

48,425 |

|

374.8 |

|

Sub-Total |

|

|

57,291,720 |

|

|

63,153,293 |

|

|

|

15,788,323 |

|

|

46,101,904 |

|

|

1,263,066 |

|

|

|

1,262,157 |

|

|

2,241,592 |

|

|

24,902 |

|

|

|

3,685,500 |

|

|

6,545,448 |

|

|

72,714 |

|

|

|

100,973 |

|

|

179,327 |

|

|

1,992 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Power Corridor |

UMH |

|

2.57 |

|

|

5.91 |

|

|

10.50 |

|

|

0.00 |

|

|

2,094,642 |

|

|

2,308,947 |

|

|

|

415,611 |

|

|

1,731,711 |

|

|

161,626 |

|

|

|

24,563 |

|

|

43,623 |

|

5.906827 |

|

|

|

102,344 |

|

|

181,763 |

|

24.61178 |

|

|

|

9,552 |

|

|

16,965 |

|

2.297 |

|

|

MMH |

|

22.06 |

|

|

7.83 |

|

|

13.91 |

|

|

0.15 |

|

|

17,965,945 |

|

|

19,804,059 |

|

|

|

3,564,731 |

|

|

14,853,044 |

|

|

1,386,284 |

|

|

|

279,118 |

|

|

495,714 |

|

|

5,256 |

|

|

|

1,162,993 |

|

|

2,065,476 |

|

|

21,900 |

|

|

|

108,546 |

|

|

192,778 |

|

|

2,044 |

|

|

IMH |

|

4.40 |

|

|

5.09 |

|

|

9.04 |

|

|

0.15 |

|

|

3,580,525 |

|

|

3,946,852 |

|

|

|

710,433 |

|

|

2,960,139 |

|

|

276,280 |

|

|

|

36,168 |

|

|

64,234 |

|

|

1,055 |

|

|

|

150,699 |

|

|

267,642 |

|

|

4,396 |

|

|

|

14,065 |

|

|

24,980 |

|

410.3 |

|

|

LMH |

|

4.25 |

|

|

7.83 |

|

|

13.90 |

|

|

0.13 |

|

|

3,461,337 |

|

|

3,815,470 |

|

|

|

686,785 |

|

|

2,861,603 |

|

|

267,083 |

|

|

|

53,754 |

|

|

95,466 |

|

913.9386 |

|

|

|

223,973 |

|

|

397,776 |

|

|

3,808 |

|

|

|

20,904 |

|

|

37,126 |

|

355.4 |

|

Sub-Total |

|

|

27,102,450 |

|

|

29,875,328 |

|

|

|

5,377,559 |

|

|

22,406,496 |

|

|

2,091,273 |

|

|

|

393,602 |

|

|

699,038 |

|

|

7,231 |

|

|

|

1,640,010 |

|

|

2,912,658 |

|

|

30,129 |

|

|

|

153,068 |

|

|

271,848 |

|

|

2,812 |

|

Total |

|

|

164,665,533 |

|

|

181,512,629 |

|

|

|

60,983,684 |

|

|

117,174,605 |

|

|

3,354,339 |

|

|

|

5,063,359 |

|

|

8,992,524 |

|

|

99,069 |

|

|

|

9,490,352 |

|

|

16,854,865 |

|

|

184,653 |

|

|

|

254,040 |

|

|

451,175 |

|

|

4,804 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CA Surface |

UMH |

|

4.78 |

|

|

6.99 |

|

|

12.41 |

|

|

0.17 |

|

|

3,788,533 |

|

|

4,176,141 |

|

|

|

167,046 |

|

|

3,842,050 |

|

|

167,046 |

|

|

|

11,676 |

|

|

20,737 |

|

278.531 |

|

|

|

268,559 |

|

|

476,961 |

|

|

6,406 |

|

|

|

11,676 |

|

|

20,737 |

|

278.5 |

|

Section 36 |

MMH |

|

14.02 |

|

|

6.76 |

|

|

12.01 |

|

|

0.20 |

|

|

11,109,308 |

|

|

12,245,912 |

|

|

|

489,836 |

|

|

11,266,239 |

|

|

489,836 |

|

|

|

33,113 |

|

|

58,809 |

|

980.3712 |

|

|

|

761,598 |

|

|

1,352,598 |

|

|

22,549 |

|

|

|

33,113 |

|

|

58,809 |

|

980.4 |

|

(Uncontrolled) |

IMH |

|

4.88 |

|

|

3.66 |

|

|

6.50 |

|

|

0.18 |

|

|

3,869,439 |

|

|

4,265,325 |

|

|

|

170,613 |

|

|

3,924,099 |

|

|

170,613 |

|

|

|

6,243 |

|

|

11,088 |

|

309.0668 |

|

|

|

143,590 |

|

|

255,016 |

|

|

7,109 |

|

|

|

6,243 |

|

|

11,088 |

|

309.1 |

|

|

LMH |

|

2.98 |

|

|

6.18 |

|

|

10.98 |

|

|

0.25 |

|

|

2,358,930 |

|

|

2,600,274 |

|

|

|

104,011 |

|

|

2,392,252 |

|

|

104,011 |

|

|

|

6,431 |

|

|

11,422 |

|

257.9632 |

|

|

|

147,921 |

|

|

262,708 |

|

|

5,933 |

|

|

|

6,431 |

|

|

11,422 |

|

258 |

|

Uncontrolled Total |

|

|

21,126,210 |

|

|

23,287,653 |

|

|

|

931,506 |

|

|

21,424,641 |

|

|

931,506 |

|

|

|

57,464 |

|

|

102,056 |

|

|

1,826 |

|

|

|

1,321,669 |

|

|

2,347,283 |

|

|

41,996 |

|

|

|

57,464 |

|

|

102,056 |

|

|

1,826 |

|

Total |

|

|

185,791,742 |

|

|

204,800,282 |

|

|

|

61,915,191 |

|

|

138,599,245 |

|

|

4,285,845 |

|

|

|

5,120,823 |

|

|

9,094,580 |

|

|

100,895 |

|

|

|

10,812,020 |

|

|

19,202,149 |

|

|

226,649 |

|

|

|

311,504 |

|

|

553,231 |

|

|

6,630 |

|

Table prepared using a 2.0% B2O3 cut-off grade and no lithium cut-off grade.

(1)

“UMH” is Upper Mineralized Horizon, “MMH” is Major Mineralized Horizon, “IMH” is Intermediate Mineralized Horizon, and, and “LMH” is Lower Mineralized Horizon.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. All statements contained in this Current Report on Form 8-K that do not relate to matters of historical fact should be considered forward-looking statements, including without limitation statements regarding the Project’s mineral resource and reserve estimates and assumptions; the economic potential of the Project; our ability to establish or defend our mineral tenure; and our ability to produce boron, lithium or their related byproducts. These statements are based on management’s current assumptions and are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause the Company’s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. For other important factors that could cause actual results to differ materially from the forward-looking statements in this Current Report on Form 8-K, please see the risks and uncertainties identified under the heading “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended June 30, 2025, as updated by the Company’s other filings with the SEC, including the Company’s Forms 10-Q and Forms 8-K, as well as in its filings with the Australian Securities Exchange. All forward-looking statements reflect the Company’s beliefs and assumptions only as of the date of this Current Report on Form 8-K. The Company undertakes no obligation to update forward-looking statements to reflect future events or circumstances.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

5E Advanced Materials, Inc. |

|

|

|

|

Date: |

November 19, 2025 |

By: |

/s/ Paul Weibel |

|

|

|

Paul Weibel

Chief Executive Officer |

EX-99.1

2

feam-ex99_1.htm

EX-99.1

EX-99.1

Exhibit 99.1

5E Advanced Materials Announces Substantial Resource Upgrade; Total Measured and Indicated Borate Resources Increase 61% and Lithium Resources Increase 54%

Upgraded Resources unlocks expansion optionality at Fort Cady

HESPERIA, CA / ACCESS Newswire / November 19, 2025 / 5E Advanced Materials, Inc. (“5E” or the “Company”) (Nasdaq: FEAM) (ASX: 5EA), a development stage company focused on becoming a vertically integrated global leader and supplier of refined borates, advanced boron derivative materials, and critical minerals, today announced a material increase to its borate and lithium resources for the Company’s Fort Cady Project (the “Project”) located in the Mojave Desert, near the town of Newberry Springs, California.

The mineral resources upgrade demonstrates the largest reported measured and indicated borate resources in the United States and further positions the Company to become the next commercial borate producer.

Highlights of the Resource Upgrade

●

Total Measured and Indicated Mineral Resources of boric acid increased 61% from 17.5M tons to 28.3M tons with grade of 8.09% (B2O3), an increase of 10.8M tons.

●

Total Measured Mineral Resources of boric acid increased 170% from 3.3M tons to 9.1M tons with grade of 8.34% (B2O3), an increase of 5.8M tons.

●

Total Indicated Mineral Resources of boric acid increased 35% from 14.2M tons to 19.2M tons with grade of 7.97% (B2O3), an increase of 5.0M tons.

●

Total Measured and Indicated Mineral Resources of Lithium Carbonate Equivalent (LCE) increased 54% from 213K tons to 328K tons with 0.17% LCE.

●

Implied resource life of 217 years using first phase of production (130K ST per annum) and excludes inferred resources.

●

Project retains optionality for future expansion phases of additional production tonnage.

“Combined with boron’s recent designation as a U.S. critical mineral, this resource upgrade reinforces Fort Cady’s potential to anchor a secure domestic boron supply chain for generations to come,” said Paul Weibel, CEO of 5E Advanced Materials. “With the milestones we have achieved, 5E is now well-positioned to unlock the strategic optionality and long-term value of this asset as we advance our vision of becoming America’s next leading boron supplier.

The Company’s borate mineralization is colemanite, a mudstone that formed from lacustrine lakebed sediments, fixed in place, continuous, and sufficiently distinct from the surrounding mineralization. After consultation with mineral experts, the Company determined federal lode claims are the appropriate instrument to establish mineral tenure. In July 2025, the Company staked lode claims for the remaining areas that were open for colemanite mineralization and in August 2025, the Company filed the lode claims with the United States Bureau of Land Management which were subsequently recorded in the official records of San Bernardino County. The Company now holds 28 federal lode claims that encompass the entire Project mineralization detailed in Figure 1.

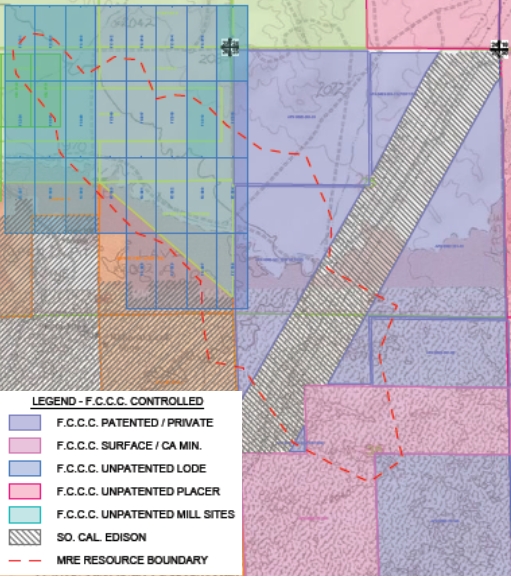

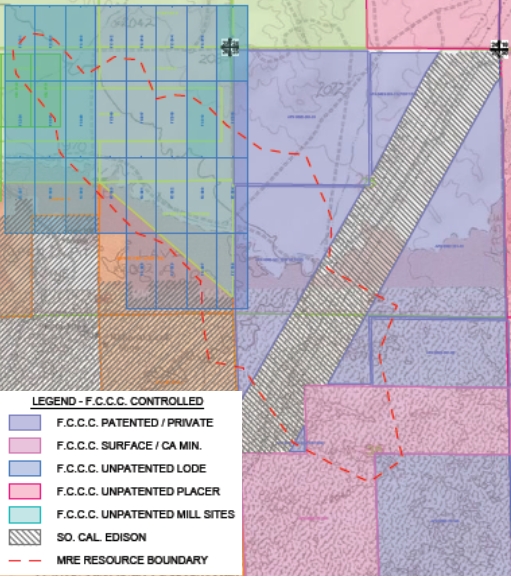

Figure 1. Fort Cady Project Mineral Tenure

Comparison of Pre-Feasibility Technical Report Resources to Upgraded Mineral Resources

The mineral reserves and project economics disclosed in the Company’s Preliminary Feasibility Study Technical Report Summary, previously filed with the Securities and Exchange Commission, and filed as an exhibit to 5E’s Annual Report on Form 10-K on September 29, 2025, have not changed and all disclosures remain current with the exception of mineral resources which will be disclosed on Form 8-K filed with the Securities and Exchange Commission. Table 1 below highlights and compares the mineral resources disclosed in the Company’s pre-feasibility study with the upgraded resources.

Table 1. Mineral Resources Comparison

|

|

|

|

|

Description |

Units |

Pre-Feasibility Study |

Upgraded Resources |

% Change |

Resource Tons |

Tons (short) |

135,774,350 |

204,800,282 |

+51% |

Measured H3BO3 (tonnage) |

Tons (short) |

3,366,296 |

9,094,580 |

+170% |

Indicated H3BO3 (tonnage) |

Tons (short) |

14,178,532 |

19,202,149 |

+35% |

Inferred H3BO3 (tonnage) |

Tons (short) |

553,231 |

553,231 |

No Change |

Measured LCE (tonnage) |

Tons (short) |

38,012 |

100,895 |

+165% |

Indicated LCE (tonnage) |

Tons (short) |

174,564 |

226,649 |

+30% |

Inferred LCE (tonnage) |

Tons (short) |

6,630 |

6,630 |

No Change |

Mineral Resources

The mineral resources after the resource upgrade now include 61.9 million short tons of measured ore containing 9.1 million short tons of in-situ boric acid, with an average grade of 8.34% B₂O₃. The indicated category now comprises 138.6 million short tons of ore containing 16.8 million short tons of in-situ boric acid, with an average grade of 7.97% B₂O₃. Mineral resources were estimated using a 2.0% B2O3 cut-off grade and Table 2 summarizes the mineral resources.

Table 2. Fort Cady Project Mineral Resources Summary, November 15, 2025

|

|

|

|

|

*Mineral Resources |

|

Short Tons (MST) |

B2O3 (wt. %) |

B2O3 (MST) |

H3BO3 (MST) |

Measured |

61.92 |

8.34 |

5.12 |

9.09 |

Indicated |

138.60 |

7.97 |

10.81 |

19.20 |

Total Measured + Indicated |

200.52 |

8.09 |

15.93 |

28.29 |

Total Inferred |

4.29 |

7.45 |

0.31 |

0.55 |

*Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Under S-K 1300, inferred mineral resources are not considered economically recoverable within the current mine plan and are excluded from the production schedule and economic analysis. Inferred Mineral Resources include areas not currently under mineral tenure control. These are disclosed for transparency but excluded from the mine plan and economic model. The Company makes no assurance that mineral rights to these areas will be secured.

Notes to Mineral Resources:

1.

The Mineral Resources in this estimate were independently prepared, including estimation and classification, by Steven Kerr, P.G., C.P.G, Escalante Geological Services, LLC, and are reported in accordance with the definition for Mineral Resources in S-K 1300.

2.

The Mineral Resources were completed using a gridded seam model with Carlson Mining™ software.

3.

The Mineral Resources are current as of November 15, 2025.

4.

Mineral Resources are constrained assuming in-situ leaching and are reported at a cutoff grade of 2.0% B2O3, assume mineralized horizons exhibit lateral continuity that supports in-situ leaching mining methods and based on exploration data, there is reasonable continuity of colemanite mineralization throughout the deposit, respectively.

About 5E Advanced Materials, Inc.

5E Advanced Materials, Inc. (Nasdaq: FEAM) (ASX:5EA) is focused on becoming a vertically integrated global leader and supplier of refined borates and advanced boron materials, complemented by calcium-based co-products, and potentially other by-products such as lithium carbonate. The Company's mission is to become a supplier of these critical materials to industries addressing global decarbonization, energy independence, food, national security, and the defense sector. The Company believes factors such as government regulation and incentives focused on domestic manufacturing and supply chains and capital investments across industries will drive demand for end-use applications like solar and wind energy infrastructure, neodymium-ferro-boron magnets, defense applications, lithium-ion batteries, and other critical material applications. The business is based on the Company's large domestic boron resource, a mineral which was added to the U.S. Department of the Interior's 2025 Critical Minerals List. The project is located in Southern California and designated as Critical Infrastructure by the U.S. Department of Homeland Security.

Forward Looking Statements

Statements in this press release may contain "forward-looking statements" that are subject to substantial risks and uncertainties. Forward-looking statements contained in this press release may be identified by the use of words such as "may," "will," "should," "expect," "plan," "anticipate," "could," "intend," "target," "project," "contemplate," "believe," "estimate," "predict," "potential" or "continue" or the negative of these terms or other similar expressions, and include, but are not limited to, statements regarding the Company's ability to progress, full-scale product testing, advance customer qualifications, enter into offtake agreements, achieve key milestones on the path toward a potential Final Investment Decision, and become a vertically integrated global leader in borates and advanced boron materials. Any forward-looking statements are based on 5E's current expectations, forecasts, and assumptions and are subject to a number of risks and uncertainties that could cause actual outcomes and results to differ materially and adversely from those set forth in or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to, statements regarding the Company's mineral resource and reserve estimates and assumptions; the economic potential of the Project; our ability to establish or defend our mineral tenure; and our ability to produce boron, lithium or their related byproducts. For a discussion of other risks and uncertainties, and other important factors, any of which could cause our actual results to differ from those contained in the forward-looking statements, see the section entitled ‘Risk Factors' in 5E's most recent Annual Report on Form 10-K and its other reports filed with the SEC. Forward-looking statements contained in this announcement are based on information available to 5E as of the date hereof and are made only as of the date of this release. 5E undertakes no obligation to update such information except as required under applicable law. These forward-looking statements should not be relied upon as representing 5E's views as of any date subsequent to the date of this press release. In light of the foregoing, investors are urged not to rely on any forward-looking statement in reaching any conclusion or making any investment decision about any securities of 5E.

For further information contact:

Michael MacMillan or Paola Ashton

PRA Communications

team@pracommunications.com

Ph: +1 (604) 681-1407