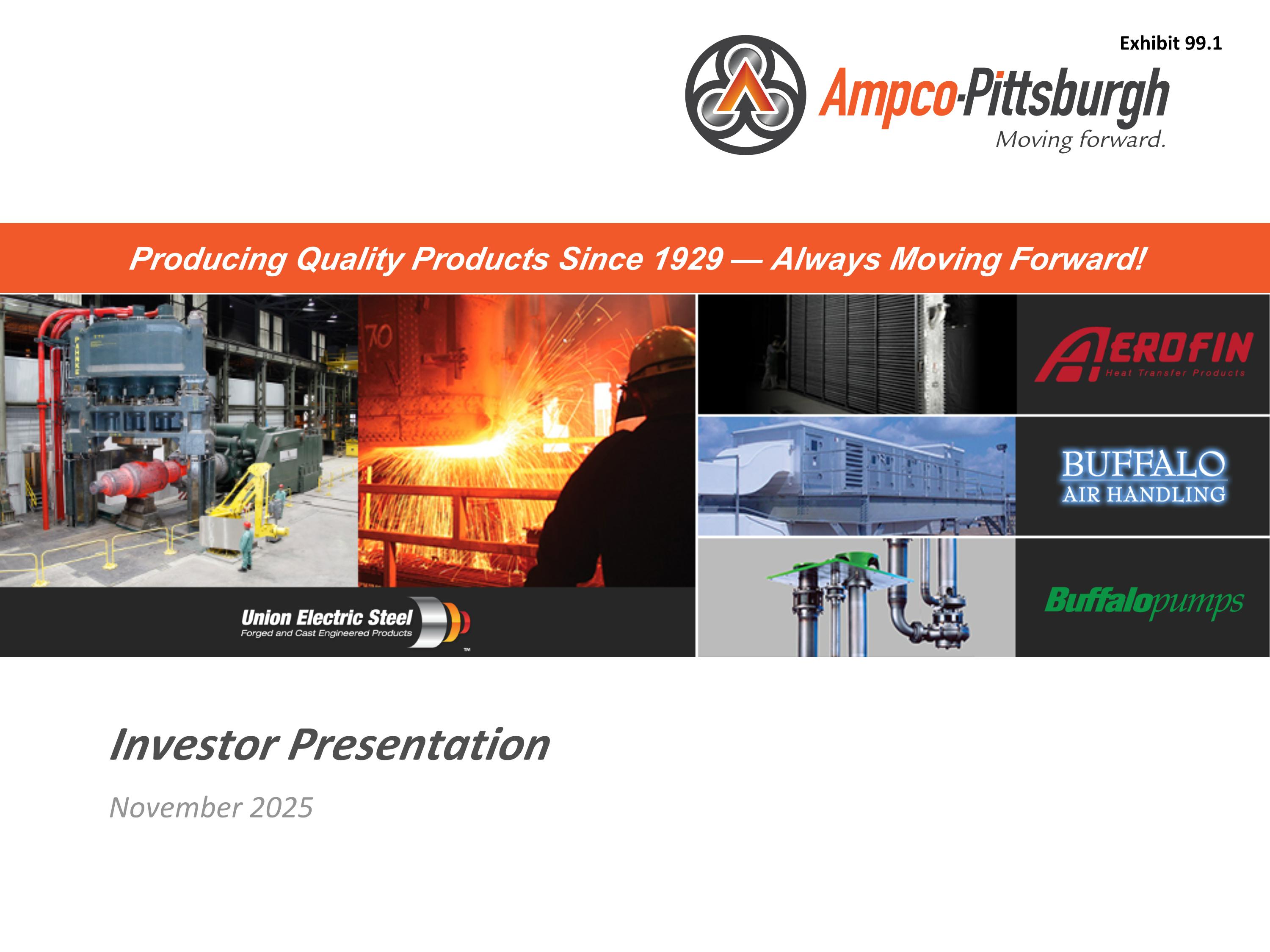

Investor Presentation November 2025 Exhibit 99.1

Disclaimer November 2025 Ampco-Pittsburgh Investor Presentation Forward-Looking Statements – The Private Securities Litigation Reform Act of 1995 (the “Act”) provides a safe harbor for forward-looking statements made by us or on behalf of Ampco-Pittsburgh Corporation and its subsidiaries (collectively, “we,” “us,” “our,” or the “Corporation”). This presentation may include, but is not limited to, statements about operating performance, trends and events the Corporation expects or anticipates will occur in the future, statements about sales and production levels, timing of orders for products, restructurings, the impact from pandemics and geopolitical conflicts, profitability and anticipated expenses, inflation, the global supply chain, the continued impact of tariffs, global trade conditions, and cash outflows. All statements in this document other than statements of historical fact are statements that are, or could be, deemed “forward-looking statements” within the meaning of the Act and words such as “may,” “will,” “intend,” “believe,” “expect,” “anticipate,” “estimate,” “project,” “target,” “goal,” “forecast,” and other terms of similar meaning that indicate future events and trends are also generally intended to identify forward-looking statements. Forward-looking statements speak only as of the date on which such statements are made, are not guarantees of future performance or expectations, and involve risks and uncertainties. For the Corporation, these risks and uncertainties include, but are not limited to: inability to maintain adequate liquidity to meet our operating cash flow requirements, repay maturing debt and meet other financial obligations as they become due; economic downturns, cyclical demand for our products and insufficient demand for our products; excess global capacity in the steel industry; inability to successfully restructure our operations and/or invest in operations that will yield the best long-term value to our shareholders; changes in the global economic environment, inflation, the ongoing impact of tariffs, elevated interest rates, recessions or prolonged periods of slow economic growth, global instability, and actual and threatened geopolitical conflict, liability of our subsidiaries for claims alleging personal injury from exposure to asbestos-containing components historically used in certain products of our subsidiaries; inability to obtain necessary capital or financing on satisfactory terms to acquire capital expenditures that may be necessary to support our growth strategy; inoperability of certain equipment on which we rely; increases in commodity prices or insufficient hedging against increases in commodity prices, reductions in electricity and natural gas supply or shortages of key production materials for us or our customers; inability to satisfy the continued listing requirements of the New York Stock Exchange; potential attacks on information technology infrastructure and other cyber-based business disruptions; fluctuations in the value of the U.S. dollar relative to other currencies; changes in the existing regulatory environment; consequences of pandemics and geopolitical conflicts; work stoppage or another industrial action on the part of any of our unions; failure to maintain an effective system of internal control; and those discussed more fully elsewhere, particularly in Item 1A, Risk Factors, in Part I of the Corporation’s latest Annual Report on Form 10-K and Part II of subsequent Quarterly Reports on Form 10-Q. The Corporation cannot guarantee any future results, levels of activity, performance or achievements. In addition, there may be events in the future that we are not able to predict accurately or control which may cause actual results to differ materially from expectations expressed or implied by forward-looking statements. Except as required by applicable law, we assume no obligation, and disclaim any obligation, to update forward-looking statements whether as a result of new information, events or otherwise. Additionally, as it relates to the insolvency proceedings of Union Electric Steel UK Limited (“UES-UK”), an indirect wholly owned subsidiary of the Corporation, any forward-looking statements are subject to risks and uncertainties related to such proceedings, including but not limited to: the actions of the certain insolvency practitioners of FRP Advisory Trading Limited (“FRP”) as administrators of UES-UK (collectively, the “Administrators”) and the High Court of Justice, Business and Property Courts at Leeds (the “Insolvency Court”); the interpretation and application of U.K. insolvency law; potential claims by creditors or other stakeholders; the ability to recover assets; and the broader impact on the Corporation’s condensed consolidated financial condition, results of operations, and strategic plans.

Disclaimer, cont’d November 2025 Ampco-Pittsburgh Investor Presentation Industry Information - Unless otherwise indicated, information contained in this presentation concerning the Corporation’s industry, competitive position and the markets in which it operates is based on information from independent and research organizations, other third-party sources and management estimates. Management estimates are derived from publicly available information released by independent industry analysts and other third-party sources, as well as data from the Corporation’s internal research, and are based on assumptions made by the Corporation upon reviewing such data, and the Corporation’s experience in, and knowledge of, such industry and markets, which the Corporation believes to be reasonable. In addition, projections, assumptions and estimates of the future performance of the industry in which the Corporation operates, and the Corporation’s future performance are necessarily subject to uncertainty and risk due to a variety of factors, which could cause results to differ materially from those expressed in the estimates made by the independent parties and by the Corporation. Trademarks - This presentation may contain trademarks, service marks, trade names and copyrights of other companies, which are the property of their respective owners. Solely for convenience, some of the trademarks, service marks, trade names and copyrights referred to in this presentation may be listed without the TM, SM, © or ® symbols, but we will assert, to the fullest extent under applicable law, the rights of the applicable owners, if any, to these trademarks, service marks, trade names and copyrights. Non-GAAP Financial Measures – The Corporation presents non-GAAP adjusted EBITDA, non-GAAP net debt and non-GAAP net debt to adjusted EBITDA ratio. Non-GAAP adjusted EBITDA is calculated as net income (loss) excluding interest expense, other expense (income) - net, income tax provision, depreciation and amortization, and stock-based compensation along with significant charges or credits that are one-time charges or credits, unrelated to the Corporation’s ongoing results of operations, or beyond its control. Non-GAAP net debt is calculated as total debt less cash and cash equivalents. Non-GAAP net debt to adjusted EBITDA ratio is non-GAAP net debt divided by non-GAAP adjusted EBITDA. These non-GAAP financial measures are not based on any standardized methodology prescribed by accounting principles generally accepted in the United States of America (“GAAP”). The Corporation has presented non-GAAP adjusted EBITDA because it is a key measure used by the Corporation's management and Board of Directors to understand and evaluate the operating performance of the Corporation and its segments. While this non-GAAP measure may not be directly comparable to similarly titled measures presented by other companies, the Corporation's management and Board of Directors believes this non-GAAP measure enhances comparability to companies in its stated industry peer group. The Corporation has presented non-GAAP net debt and non-GAAP net debt to adjusted EBITDA ratio because the Corporation’s management believes these metrics are common investor metrics which enhance comparability to companies in its stated industry peer group. The Corporation believes these non-GAAP financial measures help identify underlying trends in its business that otherwise could be masked by the effect of the items it excludes from adjusted EBITDA. The Corporation also believes these non-GAAP financial measure provides useful information to management, shareholders and investors, and others in understanding and evaluating its operating results, enhancing the overall understanding of its past performance and future prospects and allowing for greater transparency with respect to key financial metrics used by the Corporation’s management in its financial and operational decision-making. In particular, the Corporation believes the exclusion of the foreign energy credit received, the change in employee benefit policy, refund of excess COVID-19 subsidies, receipt of employee-retention credits, severance and other exit costs, and asbestos-related charges (benefits) can provide a useful measure for period-to-period comparisons of the Corporation’s core business performance. Non-GAAP adjusted EBITDA, non-GAAP net debt and non-GAAP net debt to adjusted EBITDA ratio are not prepared in accordance with GAAP and should not be considered in isolation of, or as an alternative to, measures prepared in accordance with GAAP. There are limitations related to the use of non-GAAP adjusted EBITDA, non-GAAP net debt and non-GAAP net debt to adjusted EBITDA ratio, rather than net income (loss), total debt or total debt to net income (loss) ratio which are the nearest GAAP equivalents. Among other things, there can be no assurance that additional expenses similar to the foreign energy credit received, the change in employee benefit policy, refund of excess COVID-19 subsidies, receipt of employee-retention credits, severance and other exit costs, and asbestos-related charges (benefits) will not occur in future periods.

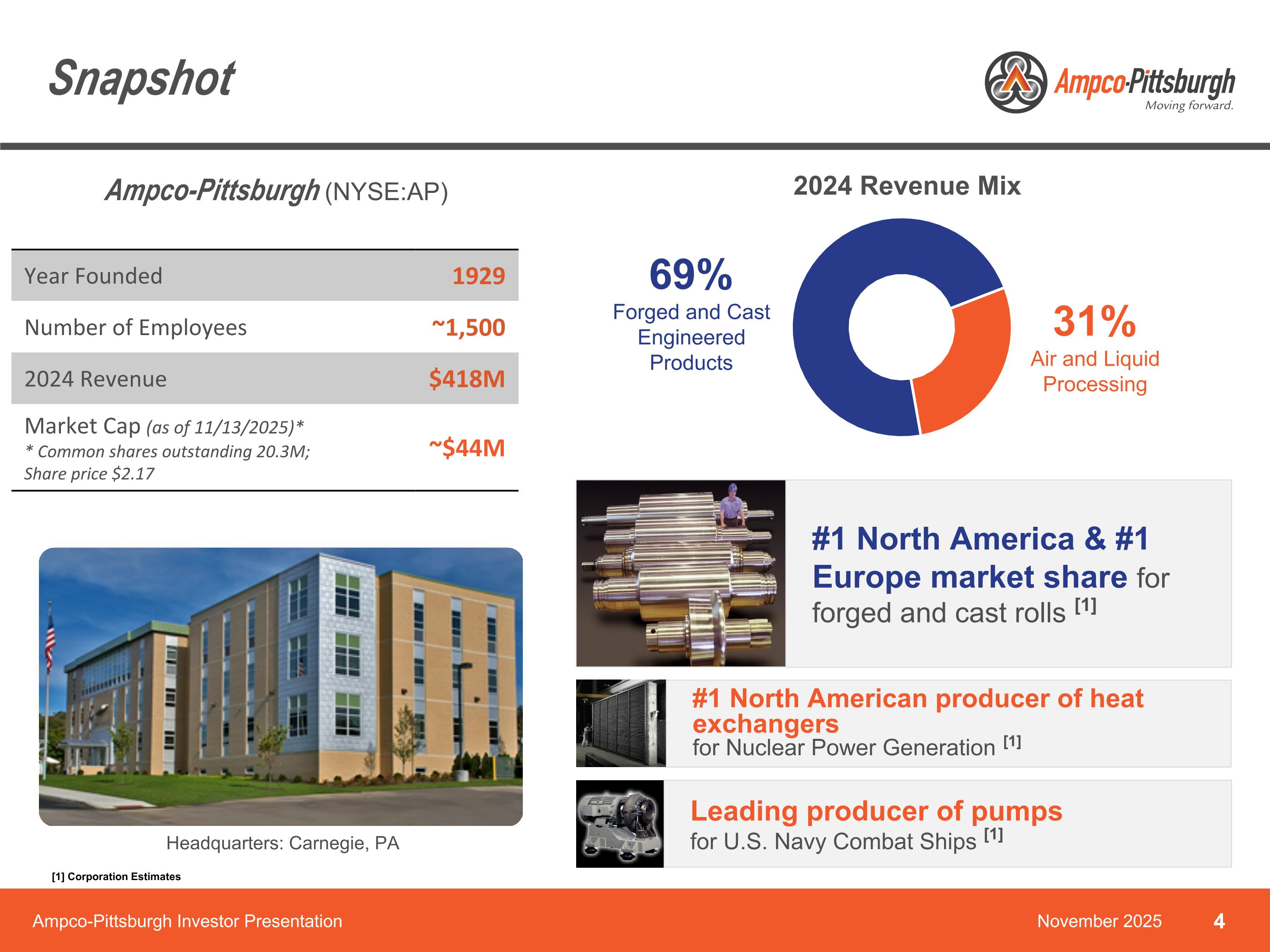

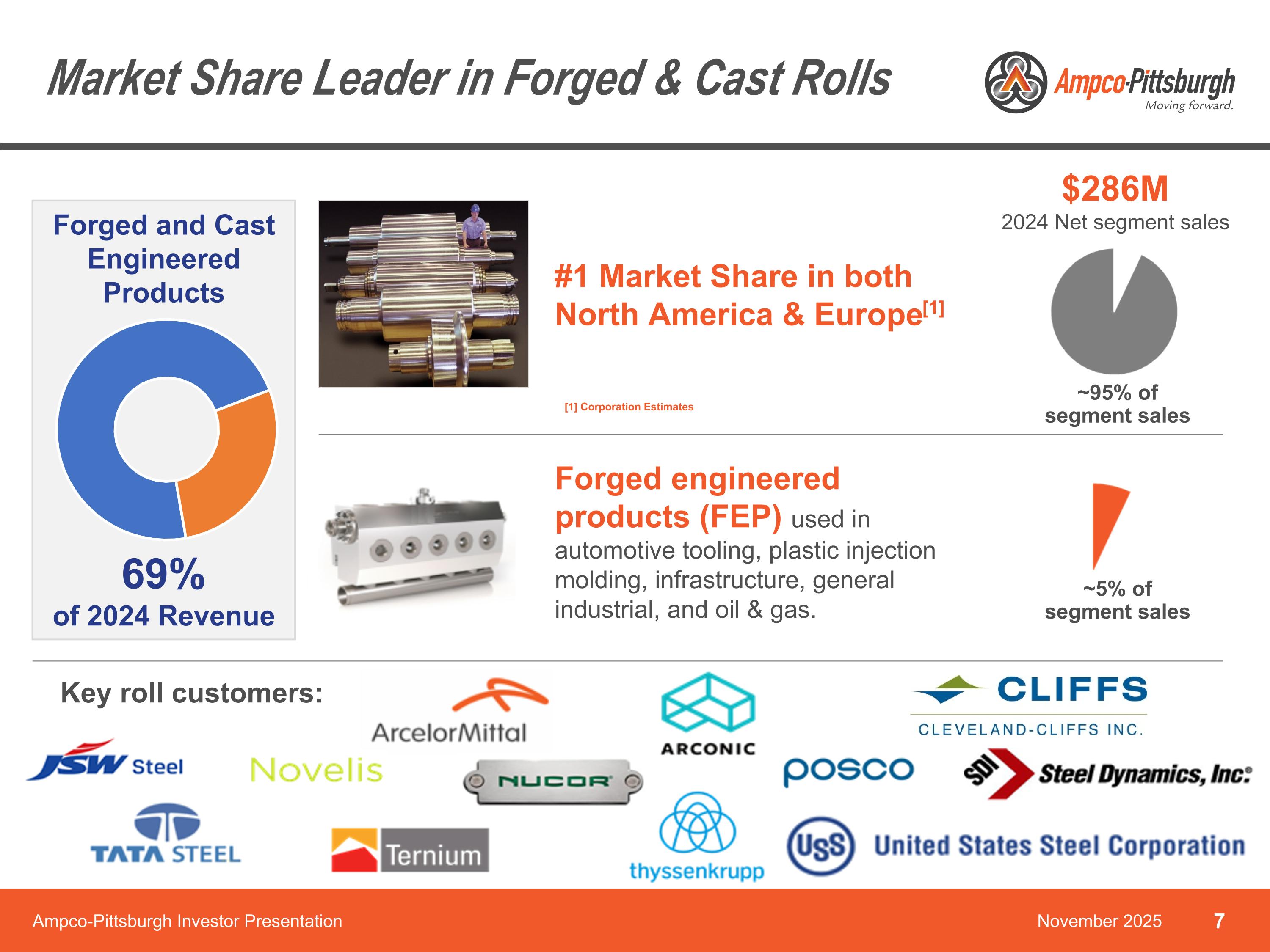

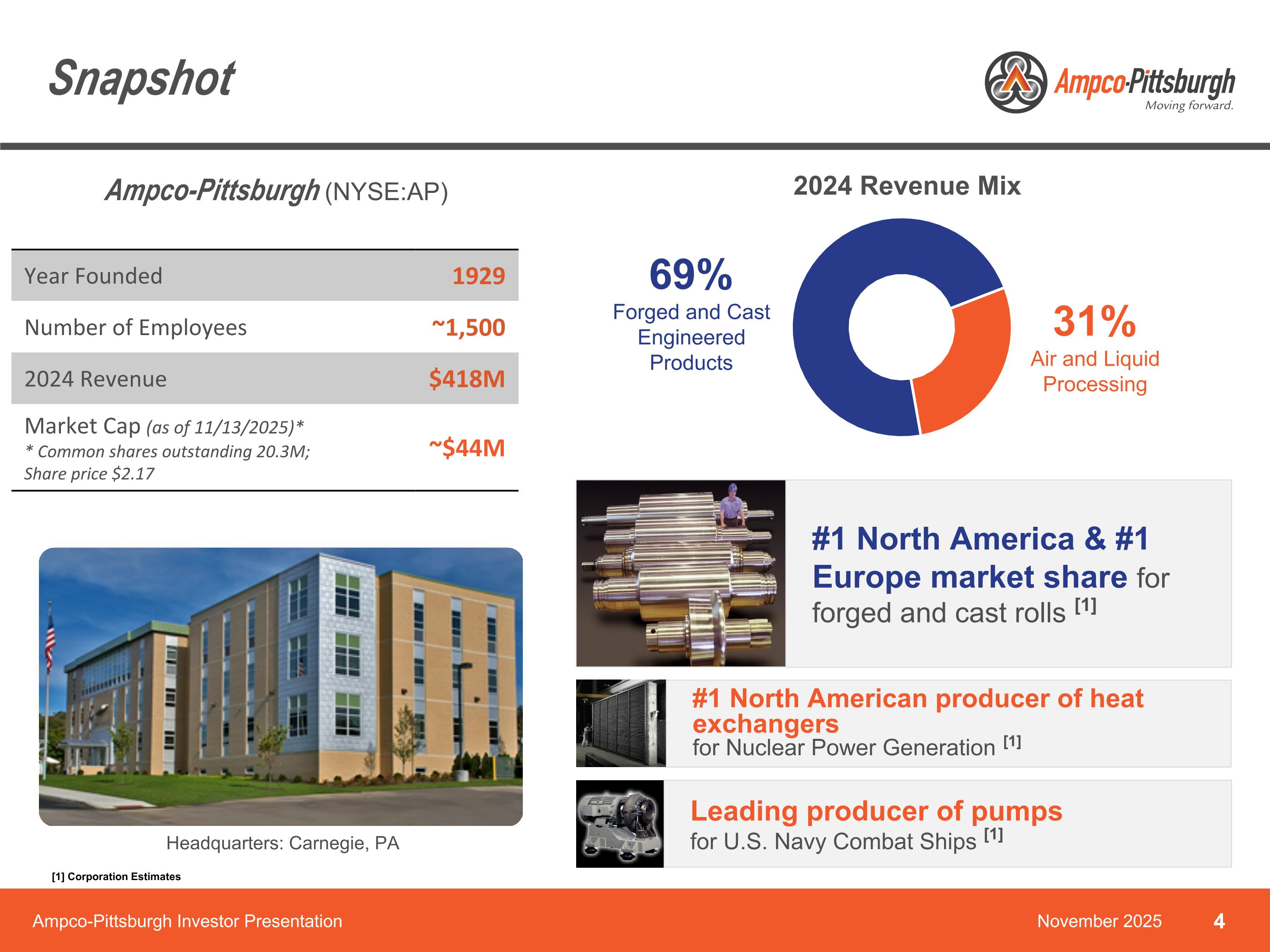

Snapshot Ampco-Pittsburgh (NYSE:AP) 69% Forged and Cast Engineered Products 31% Air and Liquid Processing 2024 Revenue Mix #1 North America & #1 Europe market share for forged and cast rolls [1] #1 North American producer of heat exchangers for Nuclear Power Generation [1] Leading producer of pumps for U.S. Navy Combat Ships [1] Ampco-Pittsburgh Investor Presentation Year Founded 1929 Number of Employees ~1,500 2024 Revenue $418M Market Cap (as of 11/13/2025)* * Common shares outstanding 20.3M; Share price $2.17 ~$44M November 2025 Headquarters: Carnegie, PA [1] Corporation Estimates

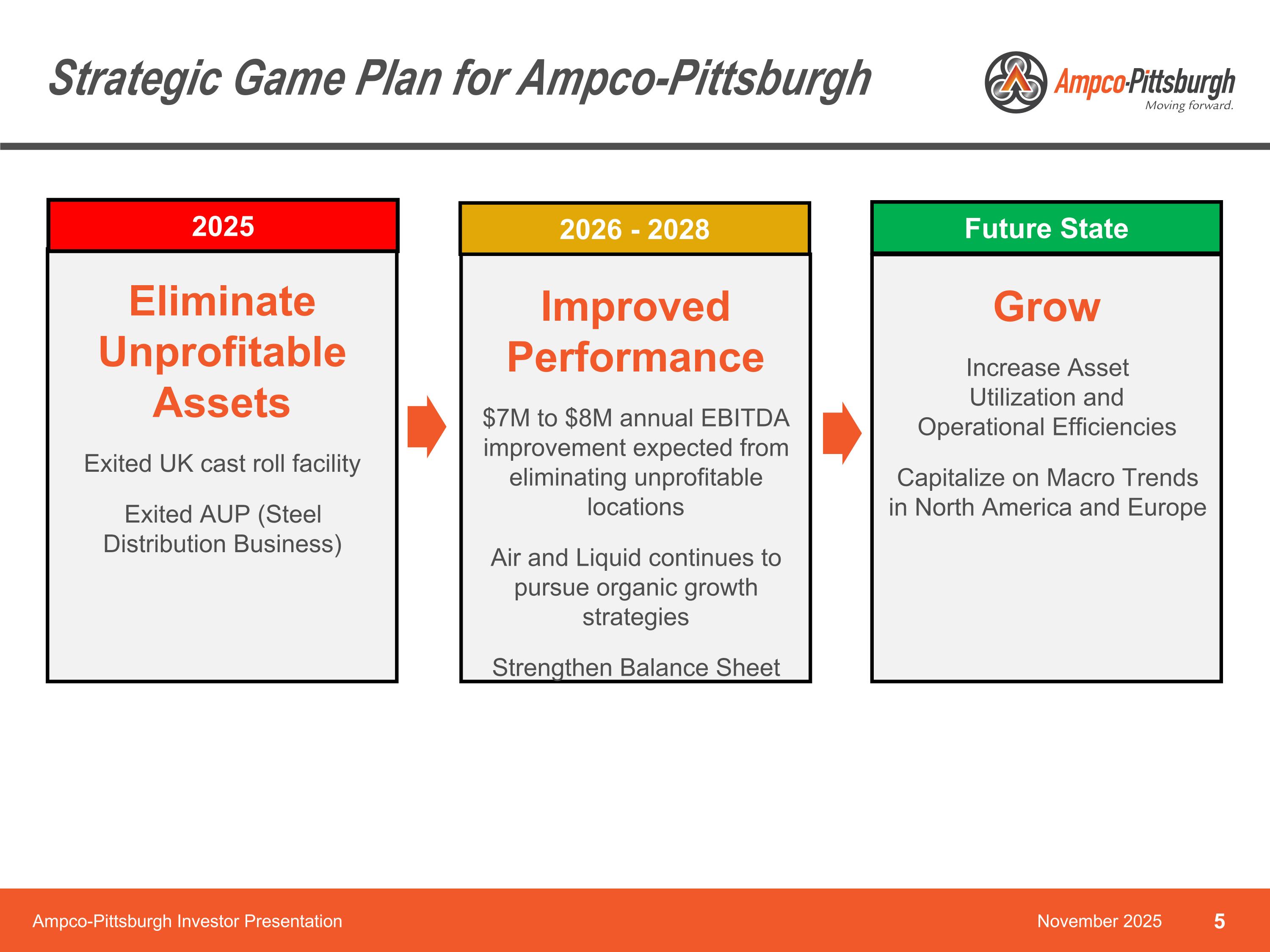

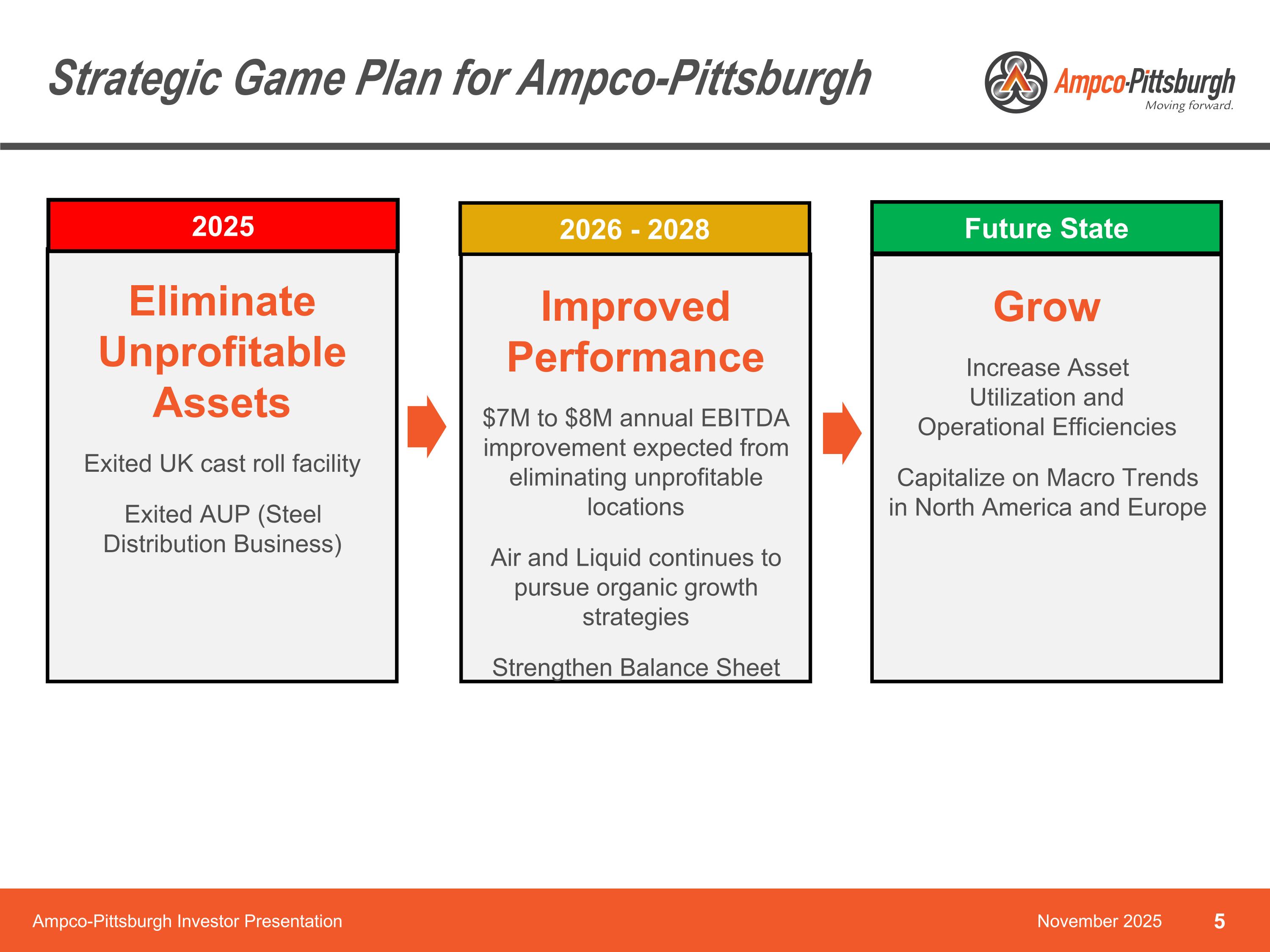

Strategic Game Plan for Ampco-Pittsburgh Eliminate Unprofitable Assets Exited UK cast roll facility Exited AUP (Steel Distribution Business) Improved Performance $7M to $8M annual EBITDA improvement expected from eliminating unprofitable locations Air and Liquid continues to pursue organic growth strategies Strengthen Balance Sheet Grow Increase Asset Utilization and Operational Efficiencies Capitalize on Macro Trends in North America and Europe 2025 2026 - 2028 Future State Ampco-Pittsburgh Investor Presentation November 2025

Forged and Cast Engineered Products Segment Ampco-Pittsburgh Investor Presentation November 2025

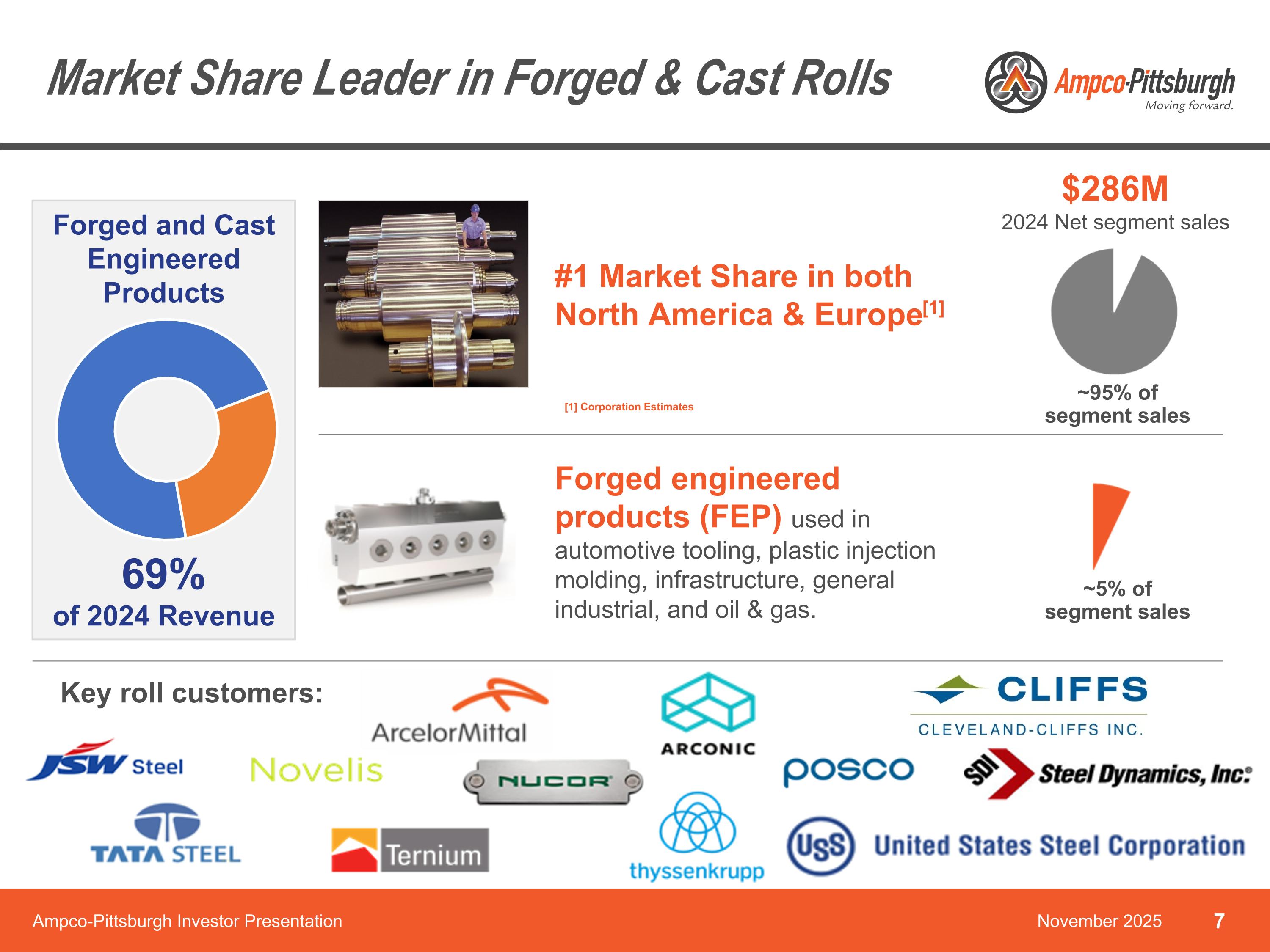

Market Share Leader in Forged & Cast Rolls $286M 2024 Net segment sales Forged engineered products (FEP) used in automotive tooling, plastic injection molding, infrastructure, general industrial, and oil & gas. ~5% of segment sales ~95% of segment sales Key roll customers: #1 Market Share in both North America & Europe[1] Forged and Cast Engineered Products 69% of 2024 Revenue Ampco-Pittsburgh Investor Presentation November 2025 [1] Corporation Estimates

Global operations Manufacturing Facility* Carnegie, PA Burgettstown, PA Valparaiso, IN Erie, PA Ravne, Slovenia Styckebruk, SW Taiyuan, China Maanshan, China *Manufacturing facilities also serve as additional sales offices. Source: Company Management, Public Filings Ampco-Pittsburgh Investor Presentation November 2025

Chinese Joint Ventures ATR – Managed by UES Taiyuan, Shanxi Province Maanshan, Anhui Province Beijing Shanghai Hong Kong Joint venture between Baowu and Åkers AB, a non-operating subsidiary of UES, that produces cast rolls for hot strip mills, steckel mills and medium plate mills Located in Taiyuan, Shanxi Province, China Åkers AB holds a 59.88% interest in the joint venture Investment in two new furnaces will yield increased profit Anhui Baochang Roll Co., Ltd. – UES has No Operational Role Joint venture among UES, Magang (Group) Holding Co., Ltd. and Jiangsu Gong-Chang Roll Co., Ltd. that produces large forged backup rolls for hot and cold strip mills Located in Maanshan, Anhui Province, China Union Electric Steel (Hong Kong) Limited, a non-operating subsidiary of UES, holds a 33% interest in the joint venture Source: Company Management, Public Filings Ampco-Pittsburgh Investor Presentation November 2025

Roll overview 1 1 2 2 2 Work Roll 1 Backup Roll Starting Material: Billet Bloom Slab Main End-Products: Hot Rolled Coil Cold Rolled Coil Plate Rail, Sheet Pile, Shape, Bar Wire Rod Rolls are large, cylindrical metal objects used in mills to squeeze and shape steel for rolled steel and aluminum production Average Roll Life Roll Sizes Global Roll Demand Back-up Roll: 5-10 Years Work Roll: 6-12 months Replacement needed when diameter wears below a certain threshold or surface imperfections form which can’t be corrected Back-up Roll: 30-40 MT Work Roll: 10-20 MT ~$2bn annually 66% of global demand is for cast rolls 33% of global demand is for forged rolls Over 3,900 rolling mills globally 75% of all steel and aluminum produced is rolled at some point Source: Company Management, Public Filings Ampco-Pittsburgh Investor Presentation November 2025

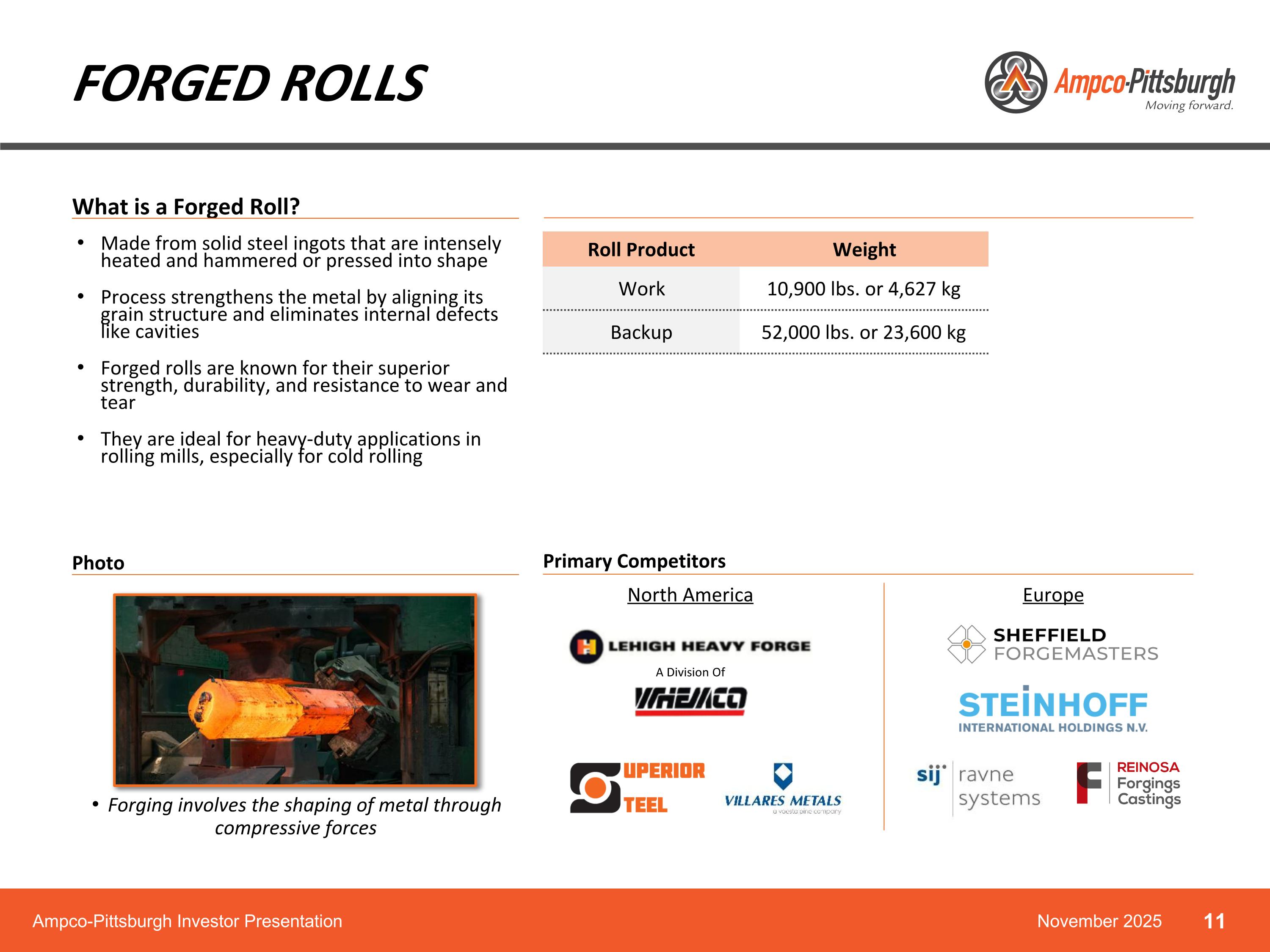

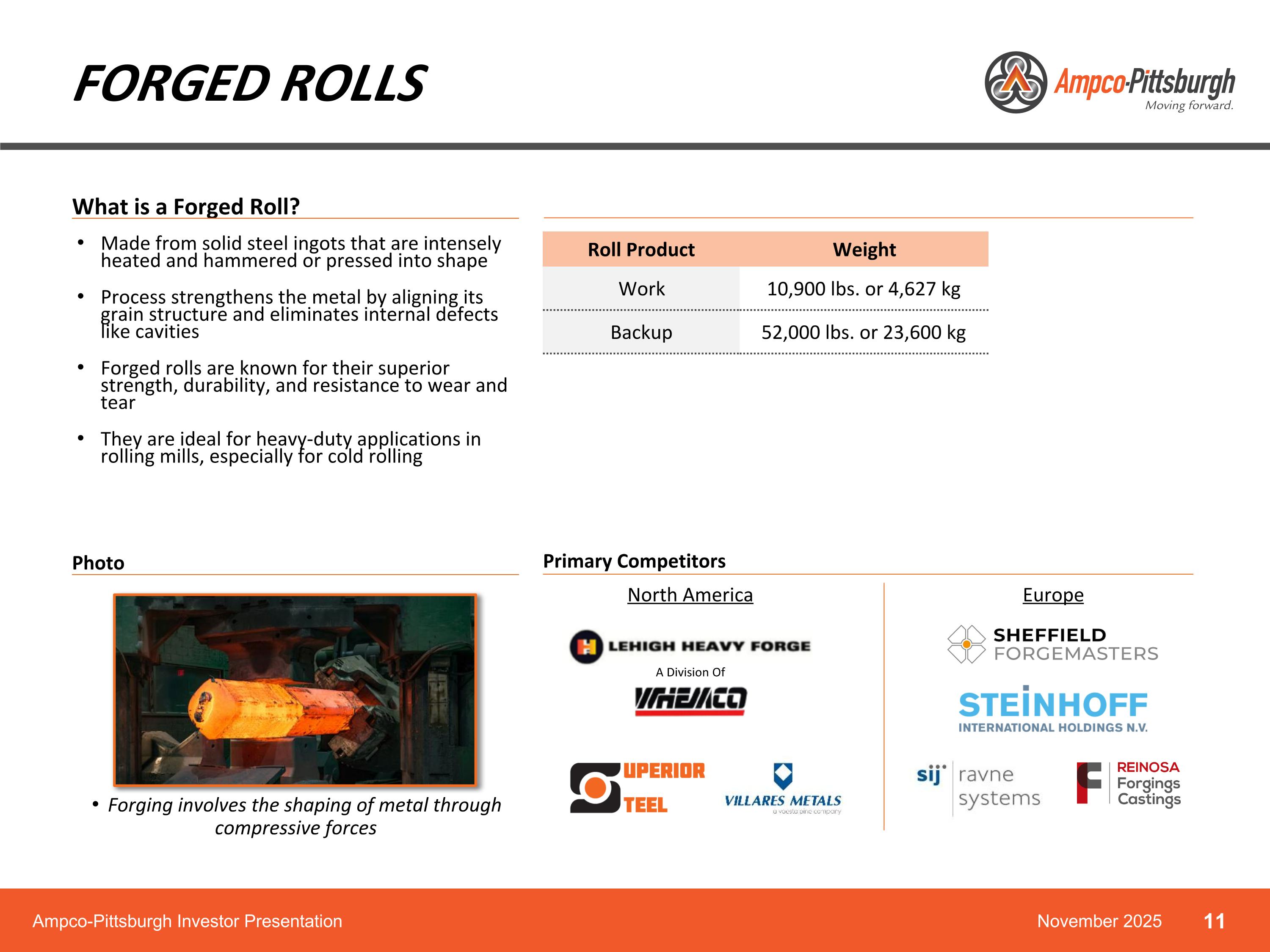

Forged Rolls What is a Forged Roll? Made from solid steel ingots that are intensely heated and hammered or pressed into shape Process strengthens the metal by aligning its grain structure and eliminates internal defects like cavities Forged rolls are known for their superior strength, durability, and resistance to wear and tear They are ideal for heavy-duty applications in rolling mills, especially for cold rolling Roll Product Weight Work 10,900 lbs. or 4,627 kg Backup 52,000 lbs. or 23,600 kg Photo Primary Competitors A Division Of North America Europe Forging involves the shaping of metal through compressive forces Ampco-Pittsburgh Investor Presentation November 2025

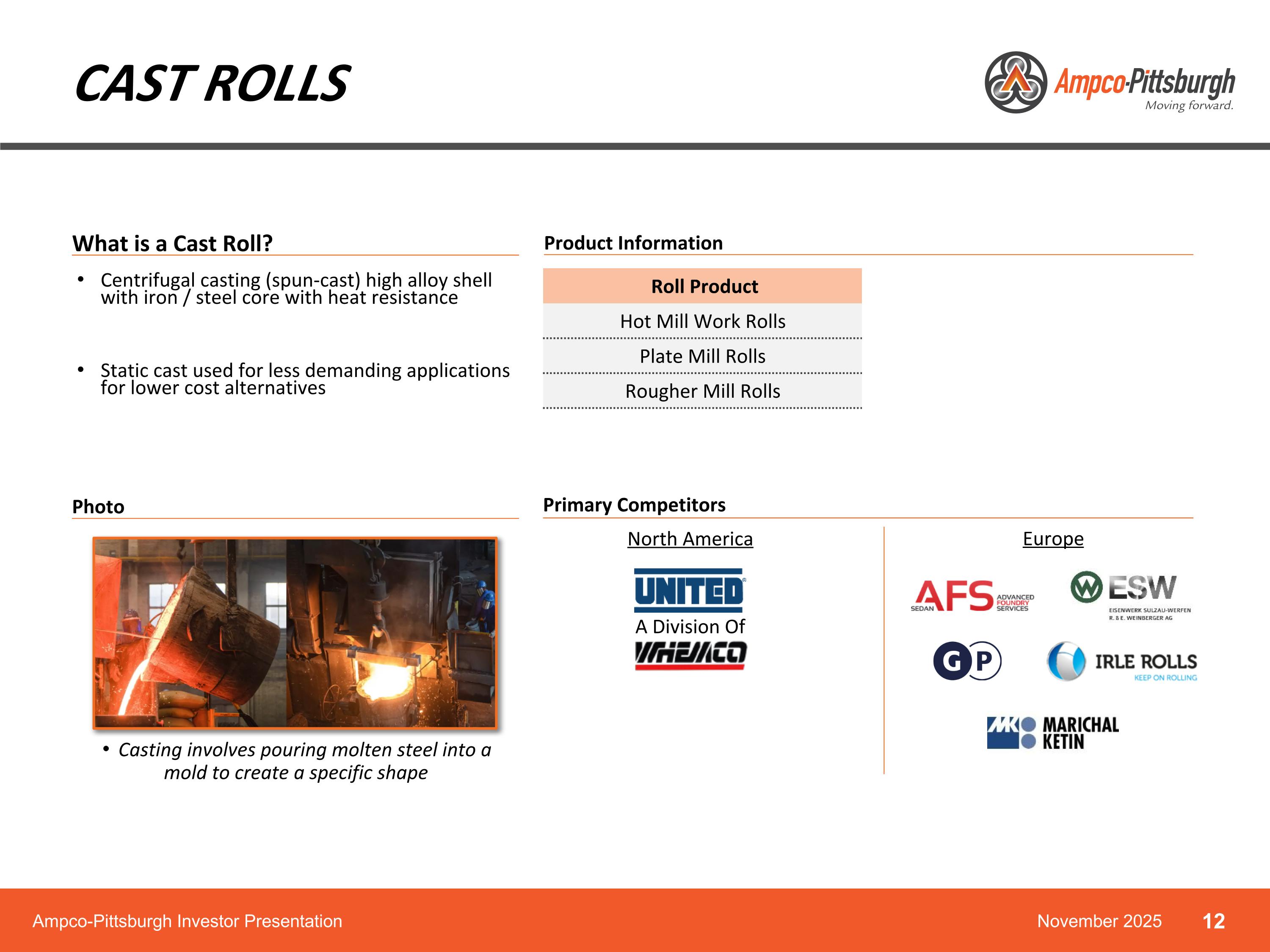

Cast Rolls What is a Cast Roll? Centrifugal casting (spun-cast) high alloy shell with iron / steel core with heat resistance Static cast used for less demanding applications for lower cost alternatives Product Information Roll Product Hot Mill Work Rolls Plate Mill Rolls Rougher Mill Rolls Primary Competitors North America Europe A Division Of Photo Casting involves pouring molten steel into a mold to create a specific shape Ampco-Pittsburgh Investor Presentation November 2025

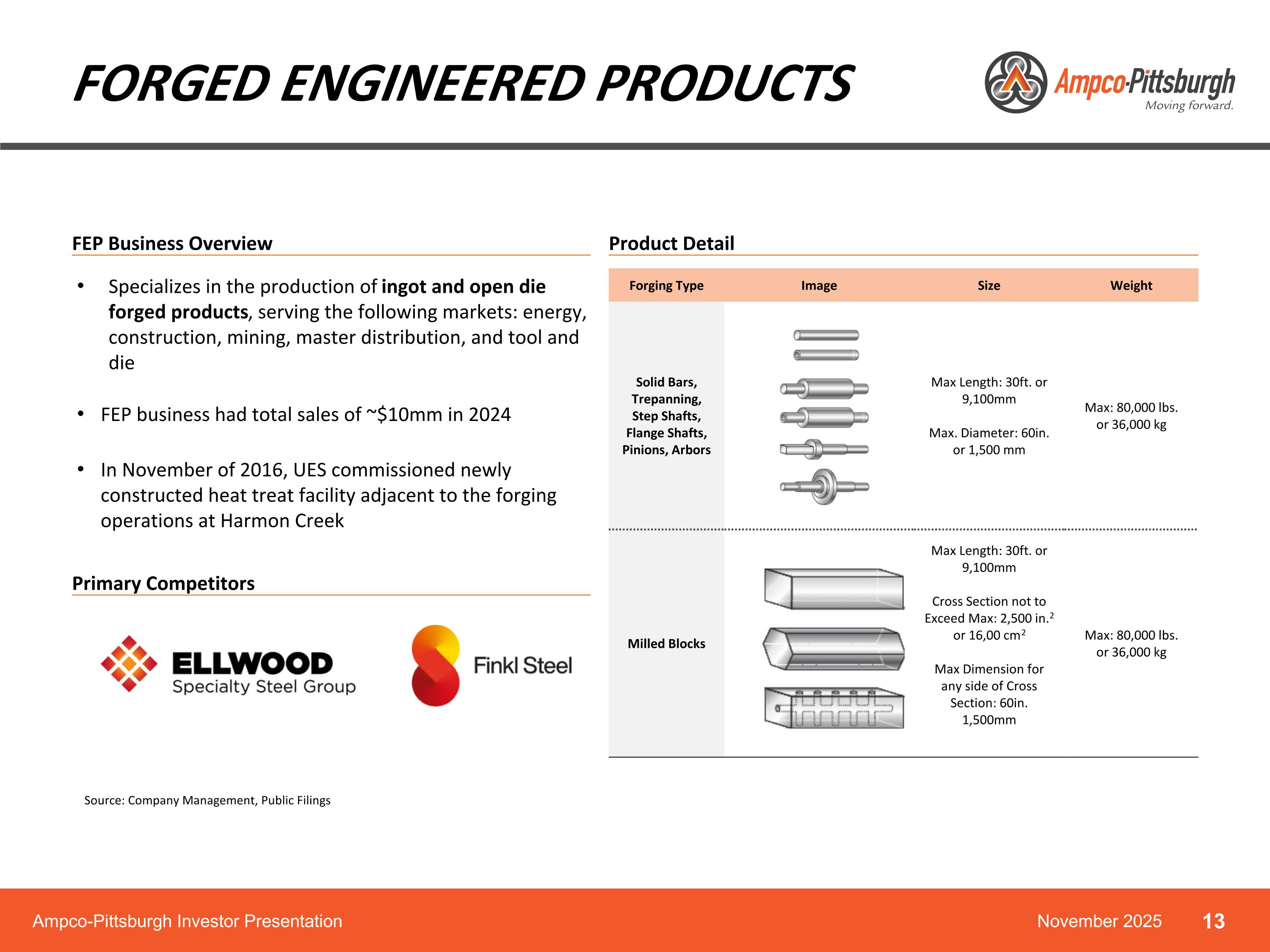

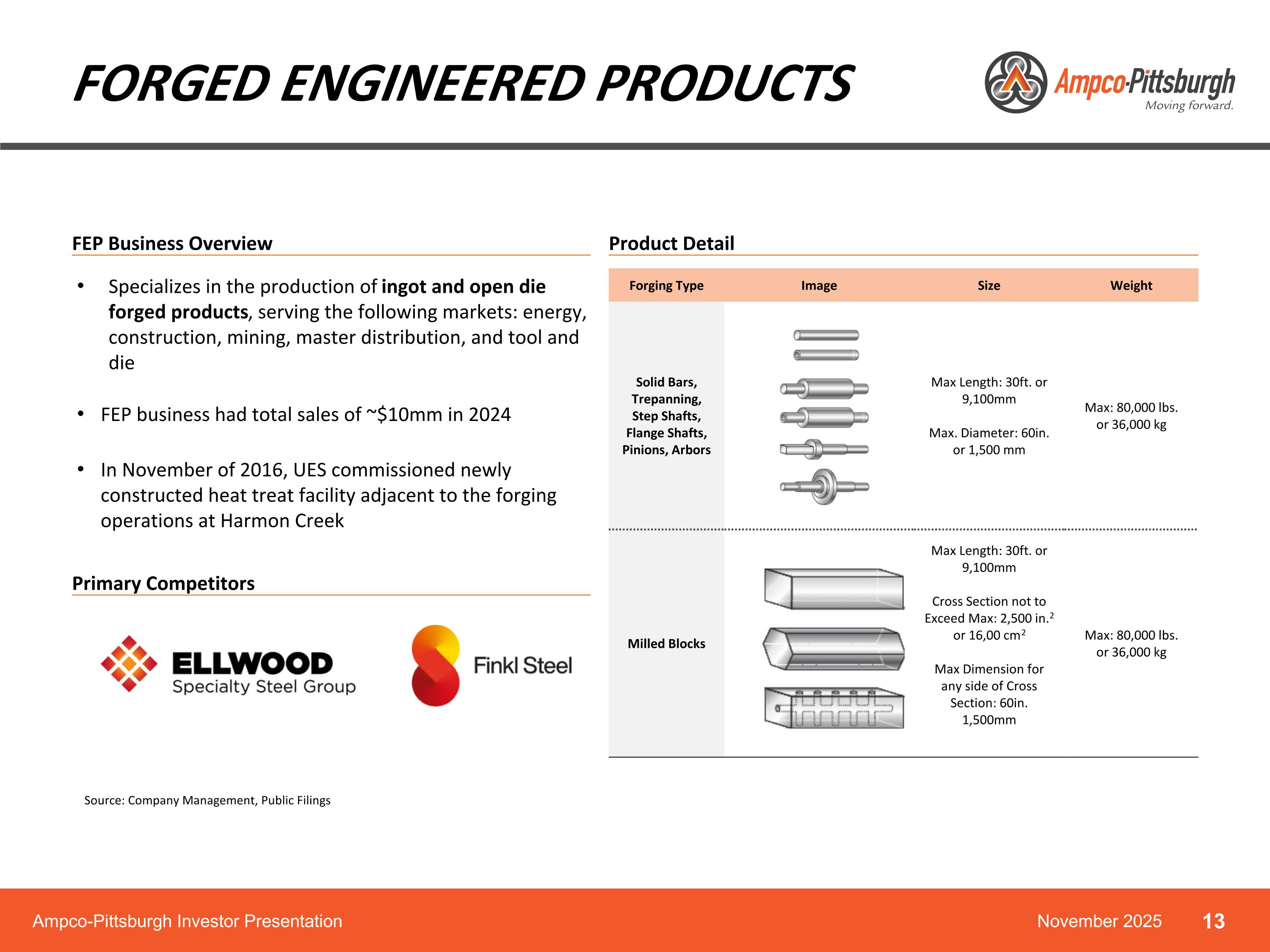

Forged Engineered Products FEP Business Overview Specializes in the production of ingot and open die forged products, serving the following markets: energy, construction, mining, master distribution, and tool and die FEP business had total sales of ~$10mm in 2024 In November of 2016, UES commissioned newly constructed heat treat facility adjacent to the forging operations at Harmon Creek Primary Competitors Product Detail Forging Type Image Size Weight Solid Bars, Trepanning, Step Shafts, Flange Shafts, Pinions, Arbors Max Length: 30ft. or 9,100mm Max. Diameter: 60in. or 1,500 mm Max: 80,000 lbs. or 36,000 kg Milled Blocks Max Length: 30ft. or 9,100mm Cross Section not to Exceed Max: 2,500 in.2 or 16,00 cm2 Max Dimension for any side of Cross Section: 60in. 1,500mm Max: 80,000 lbs. or 36,000 kg Source: Company Management, Public Filings Ampco-Pittsburgh Investor Presentation November 2025

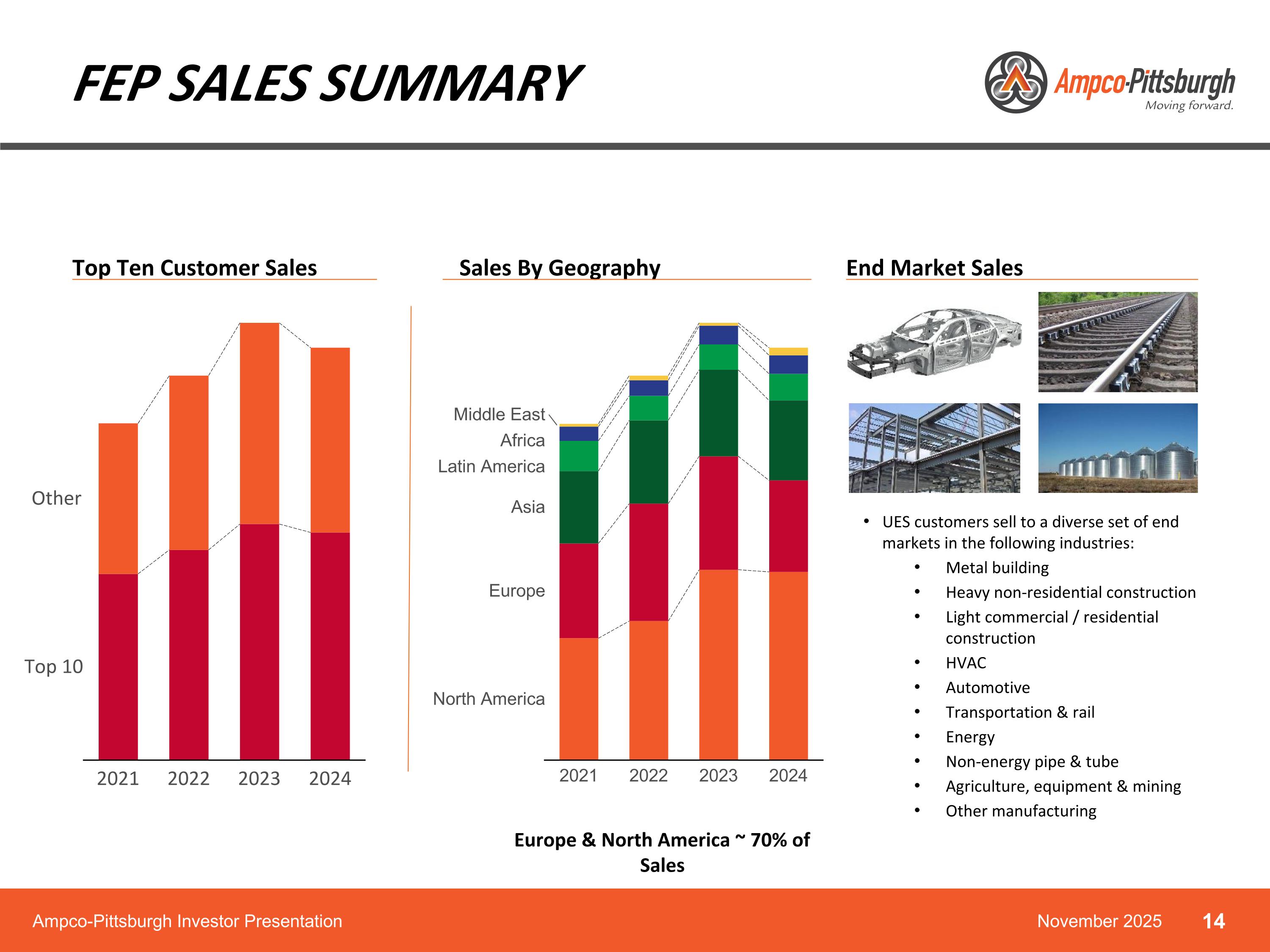

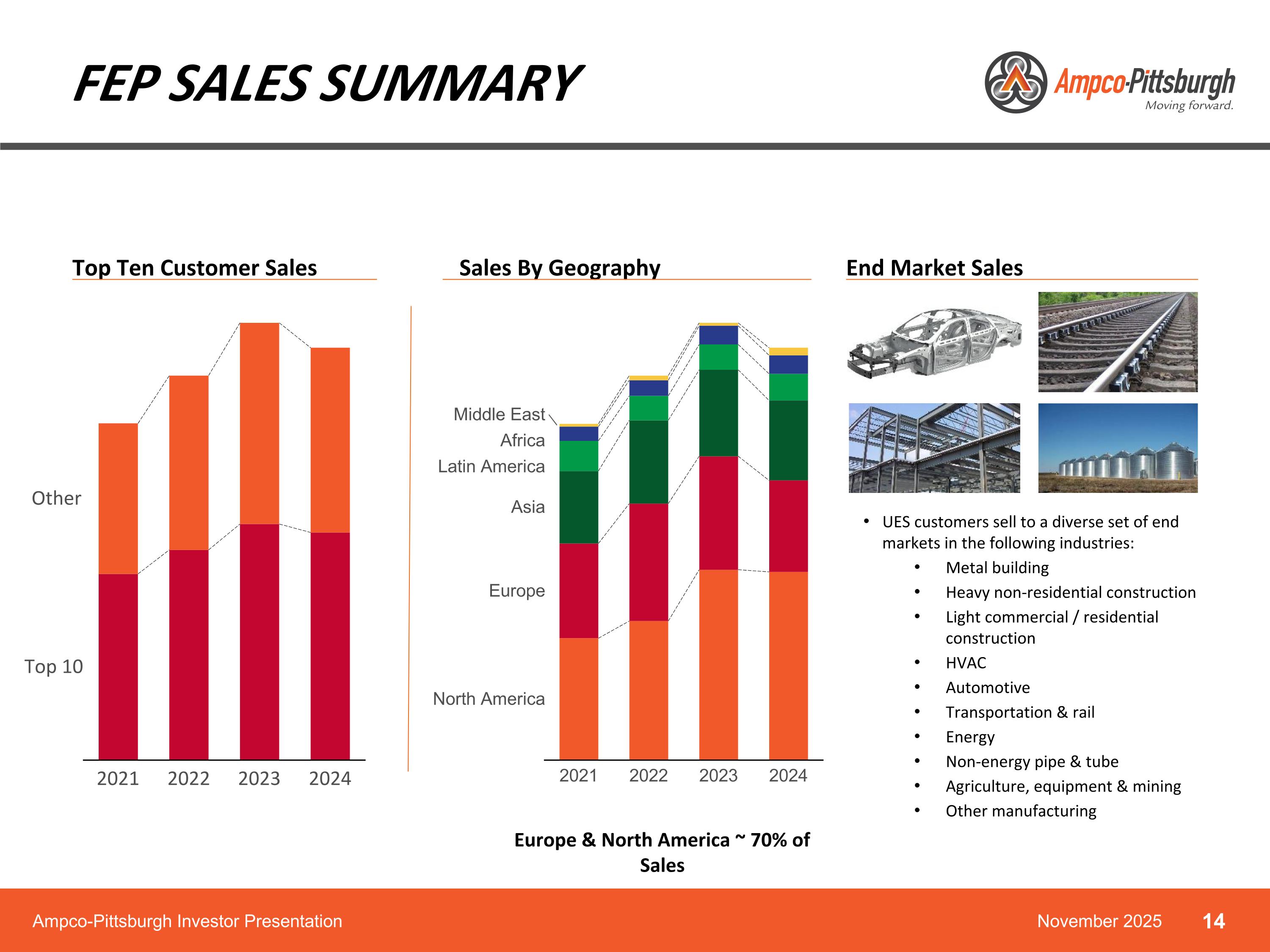

FEP Sales Summary Europe & North America ~ 70% of Sales Top Ten Customer Sales End Market Sales Sales By Geography UES customers sell to a diverse set of end markets in the following industries: Metal building Heavy non-residential construction Light commercial / residential construction HVAC Automotive Transportation & rail Energy Non-energy pipe & tube Agriculture, equipment & mining Other manufacturing 2021 Top 10 Other 2024 2023 2022 Europe Asia Latin America Africa Middle East North America 2024 2023 2022 2021 Ampco-Pittsburgh Investor Presentation November 2025

Recent equipment MODERNIZATION Recent Capital Expenditures UES recently purchased six machine tools and two new furnaces Including the foundation, building and cranes to support this new equipment, UES spent nearly $26mm upgrading US forged assets In Ravne, Slovenia a milling machine and grinder were purchased to support business’ continued profitability ~$30mm investment upgrading current equipment and purchasing new hardware Benefits of Investment Investment in new machinery improved reliability for production Furnace investment also allows UES to increase overall FEP production New Roughing Machine - Burgettstown Finish Multiturn Machine - Carnegie Source: Company Management Ampco-Pittsburgh Investor Presentation November 2025

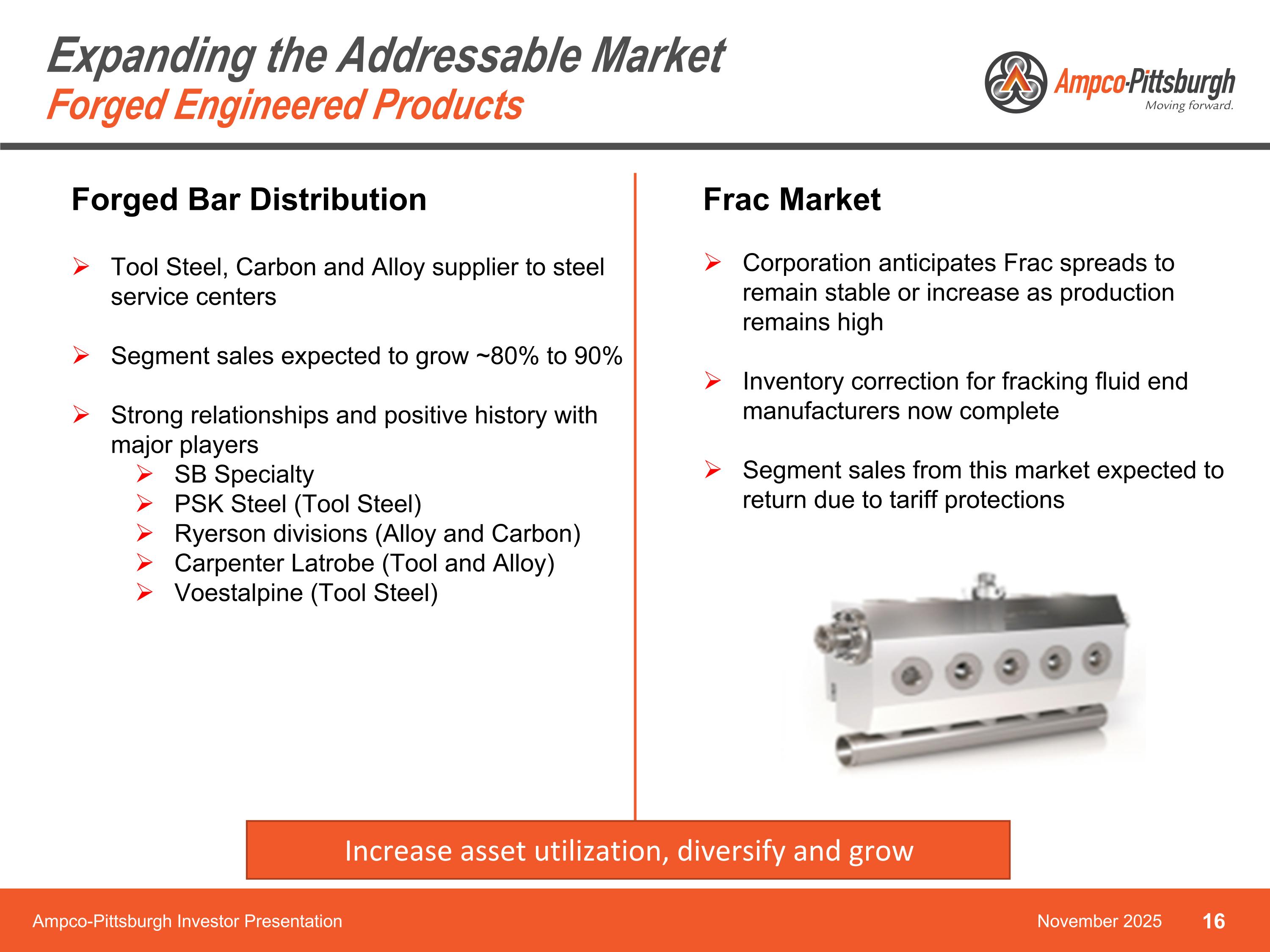

Expanding the Addressable MarketForged Engineered Products Ampco-Pittsburgh Investor Presentation November 2025 Frac Market Corporation anticipates Frac spreads to remain stable or increase as production remains high Inventory correction for fracking fluid end manufacturers now complete Segment sales from this market expected to return due to tariff protections Forged Bar Distribution Tool Steel, Carbon and Alloy supplier to steel service centers Segment sales expected to grow ~80% to 90% Strong relationships and positive history with major players SB Specialty PSK Steel (Tool Steel) Ryerson divisions (Alloy and Carbon) Carpenter Latrobe (Tool and Alloy) Voestalpine (Tool Steel) Increase asset utilization, diversify and grow

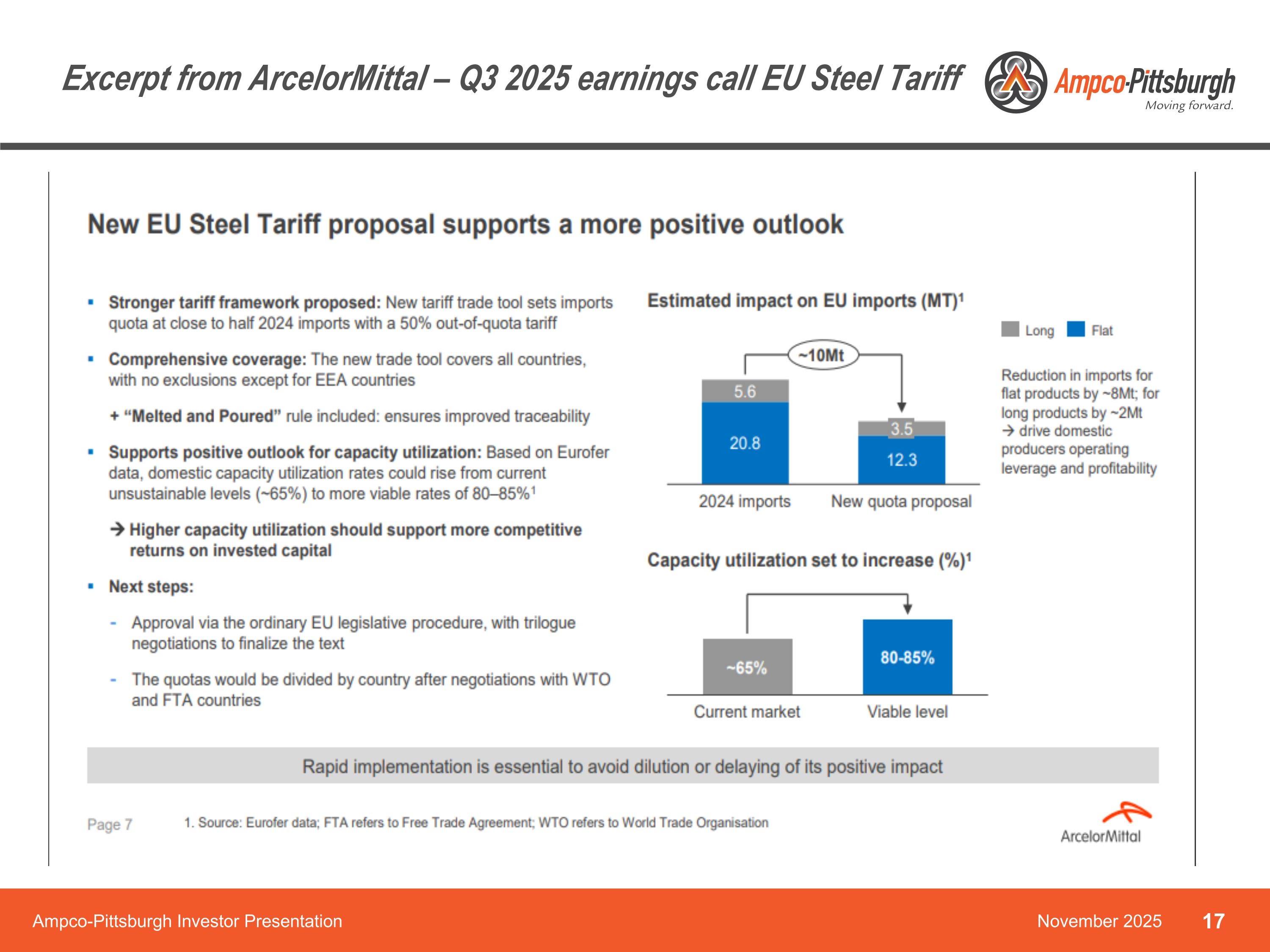

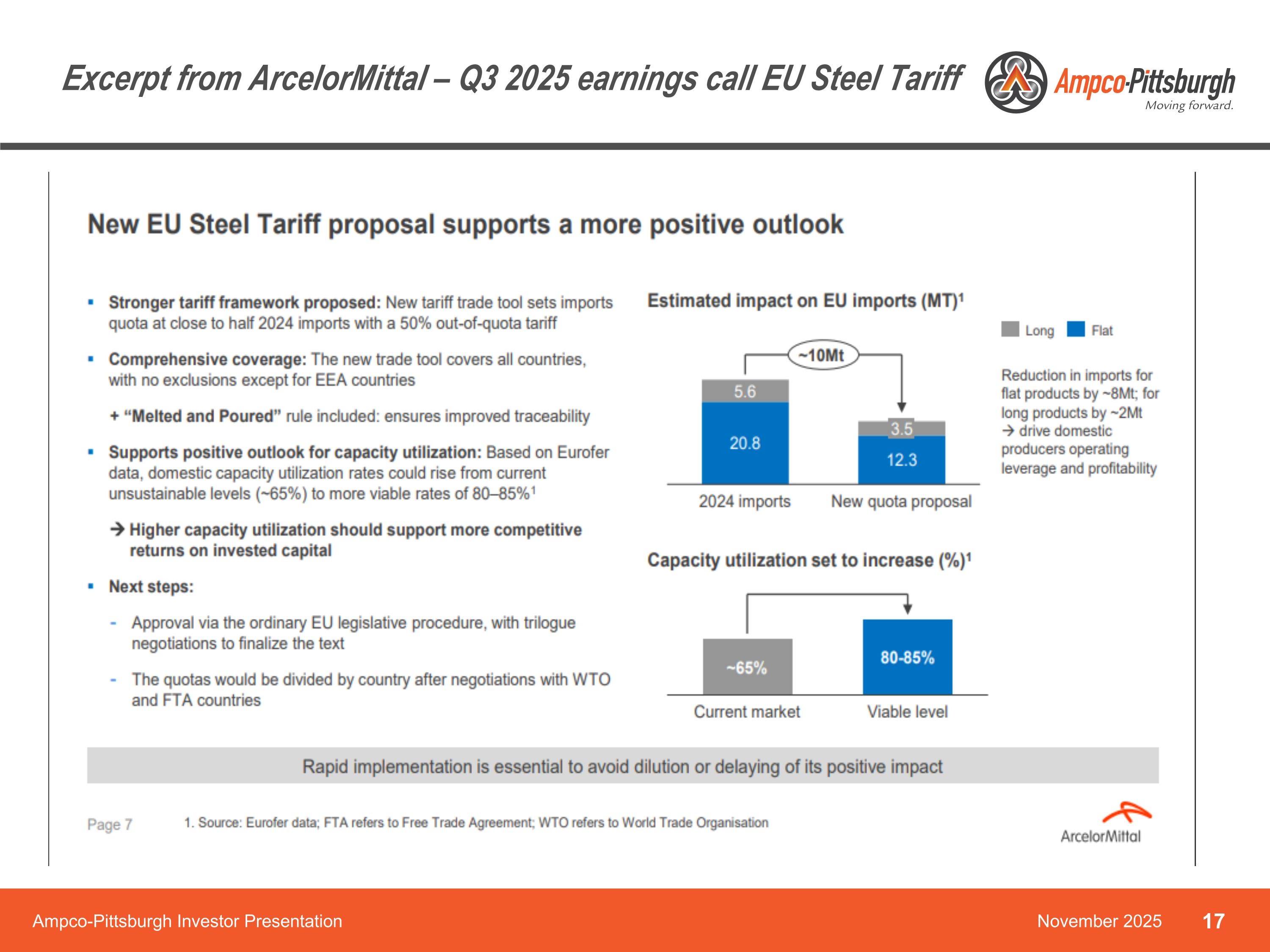

Excerpt from ArcelorMittal – Q3 2025 earnings call EU Steel Tariff November 2025 Ampco-Pittsburgh Investor Presentation

Key End Markets & Growth Rates Looking Forward Market / Region 2024 2030 2025-30 CAGR NA Construction Spend (US$B) 2,138 2,520 +2.8% EU Construction Output (Index) 99.5 106.0 +1.0% NA Light-Vehicle Prod. (m) 10.6 14.4 +4.6% EU Light-Vehicle Prod. (m) 12.0 18.2 +3.8% NA Can-Sheet Demand (kt) 1,310 1,700 +4.9% EU Can-Sheet Demand (kt) 1,130 1,450 +4.2% Construction: NA stimulus-driven surge tapers; EU regains baseline but stays sub-1% real growth. Automotive: Semiconductor recovery & EV capacity shift both regions from contraction to mid-single-digit growth. Can-Sheet: Secular winner; NA slows but still outpaces GDP, EU ramps on plastic-to-can substitution. * Sources listed in appendix November 2025 Ampco-Pittsburgh Investor Presentation

2025: Strategic Reset for Future Profitability Executed Structural Changes UES-UK Exit: Exited the UES-UK cast facility, successfully eliminating a recurring annual loss AUP Facility Exit: Executing the closure of a small non-core steel distribution facility Navigated Market & Tariff Volatility Managed Section 232 Headwinds: 100% passthrough of tariffs Absorbed Temporary Inventory Drawdown: Market uncertainty led to a one-off customer trend of drawing down existing inventory rather than placing new orders The US increase in Section 232 is a tailwind for FEP business Positioned for Strong 2026 Rebound Structural Drags Removed Demand Normalization Expected: As customer inventory levels deplete, we anticipate a return to normalized order patterns and a recovery in demand Europe Addressing Dumping: Europe is adopting significant new trade restrictions on imported steel products 19 November 2025 Ampco-Pittsburgh Investor Presentation

Air and Liquid Processing Segment Ampco-Pittsburgh Investor Presentation November 2025

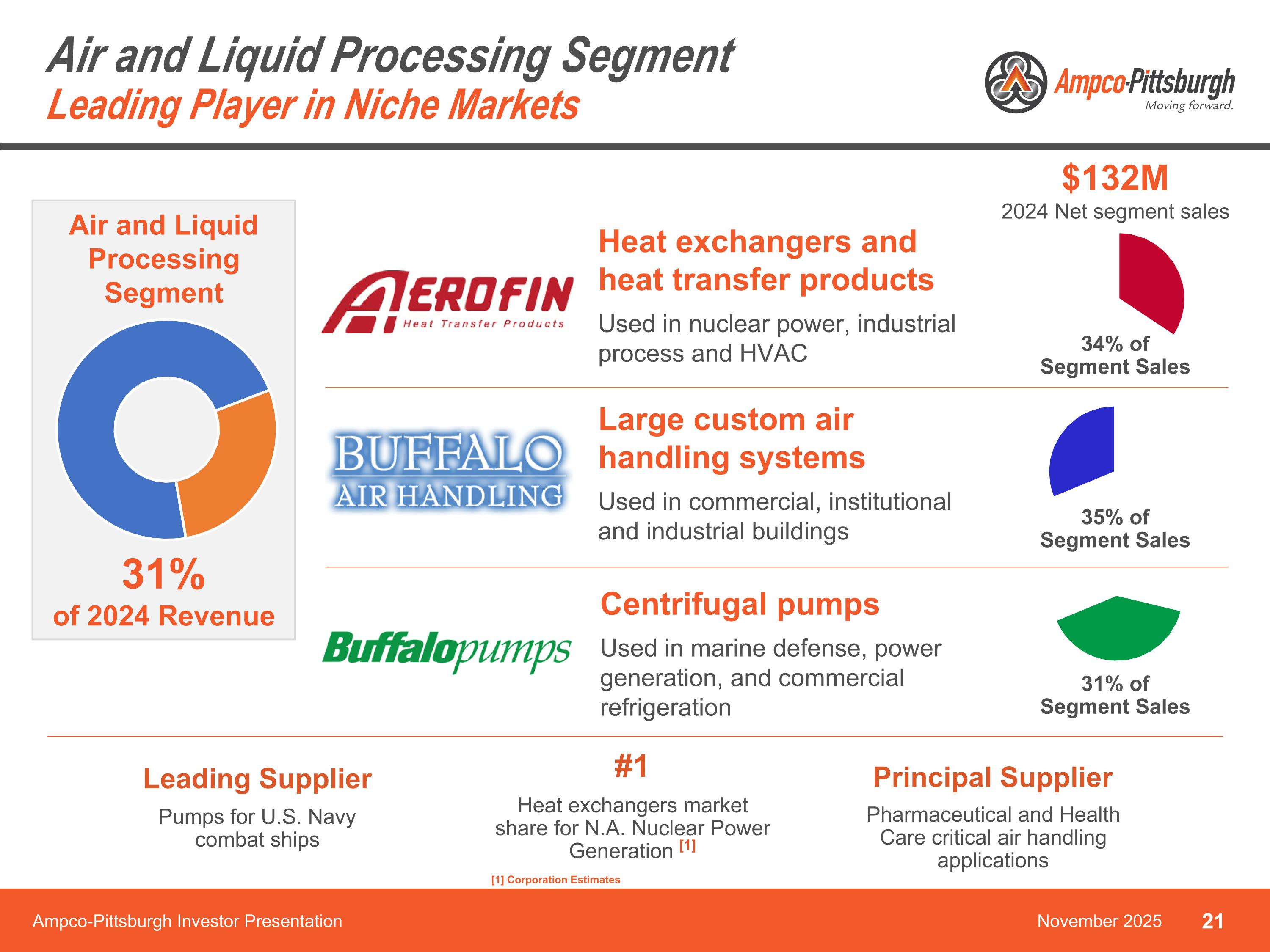

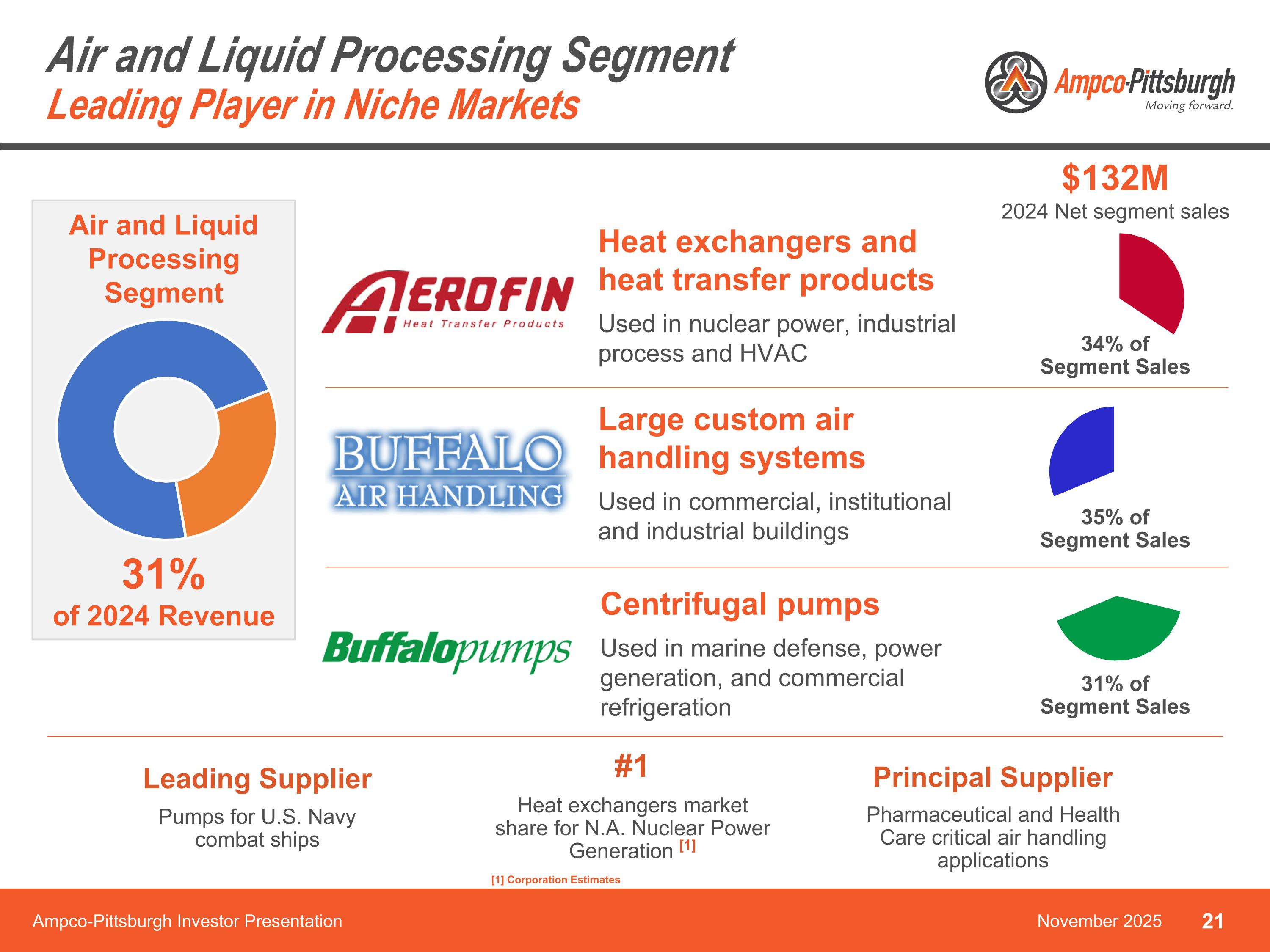

Air and Liquid Processing SegmentLeading Player in Niche Markets Heat exchangers and heat transfer products Used in nuclear power, industrial process and HVAC Large custom air handling systems Used in commercial, institutional and industrial buildings 34% of Segment Sales Centrifugal pumps Used in marine defense, power generation, and commercial refrigeration Principal Supplier Pharmaceutical and Health Care critical air handling applications Leading Supplier Pumps for U.S. Navy combat ships #1 Heat exchangers market share for N.A. Nuclear Power Generation [1] Ampco-Pittsburgh Investor Presentation Air and Liquid Processing Segment 31% of 2024 Revenue $132M 2024 Net segment sales 35% of Segment Sales 31% of Segment Sales November 2025 [1] Corporation Estimates

Air and Liquid Processing SegmentKey Customers Ampco-Pittsburgh Investor Presentation November 2025

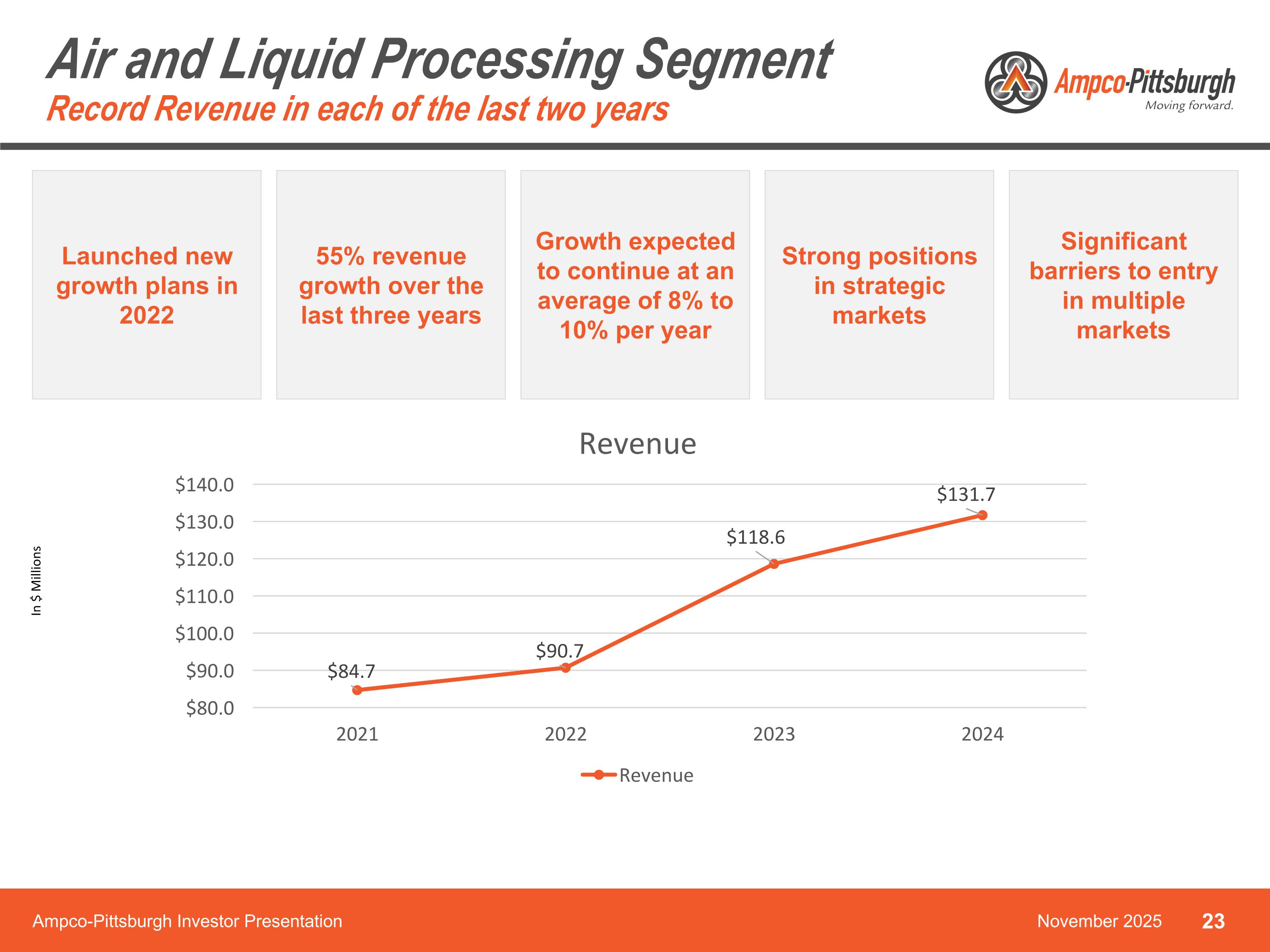

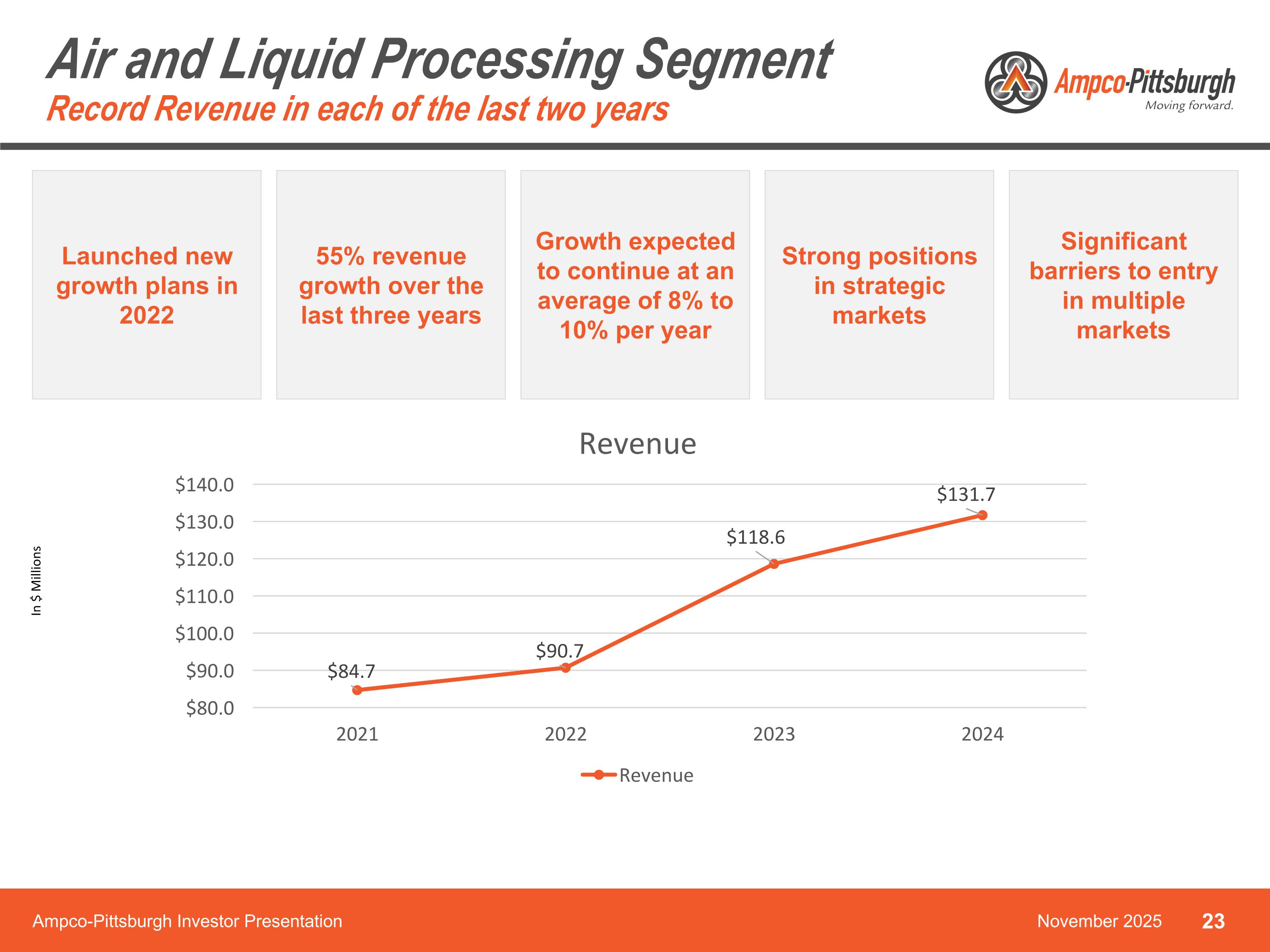

Air and Liquid Processing SegmentRecord Revenue in each of the last two years Ampco-Pittsburgh Investor Presentation Launched new growth plans in 2022 55% revenue growth over the last three years Growth expected to continue at an average of 8% to 10% per year Strong positions in strategic markets Significant barriers to entry in multiple markets In $ Millions November 2025

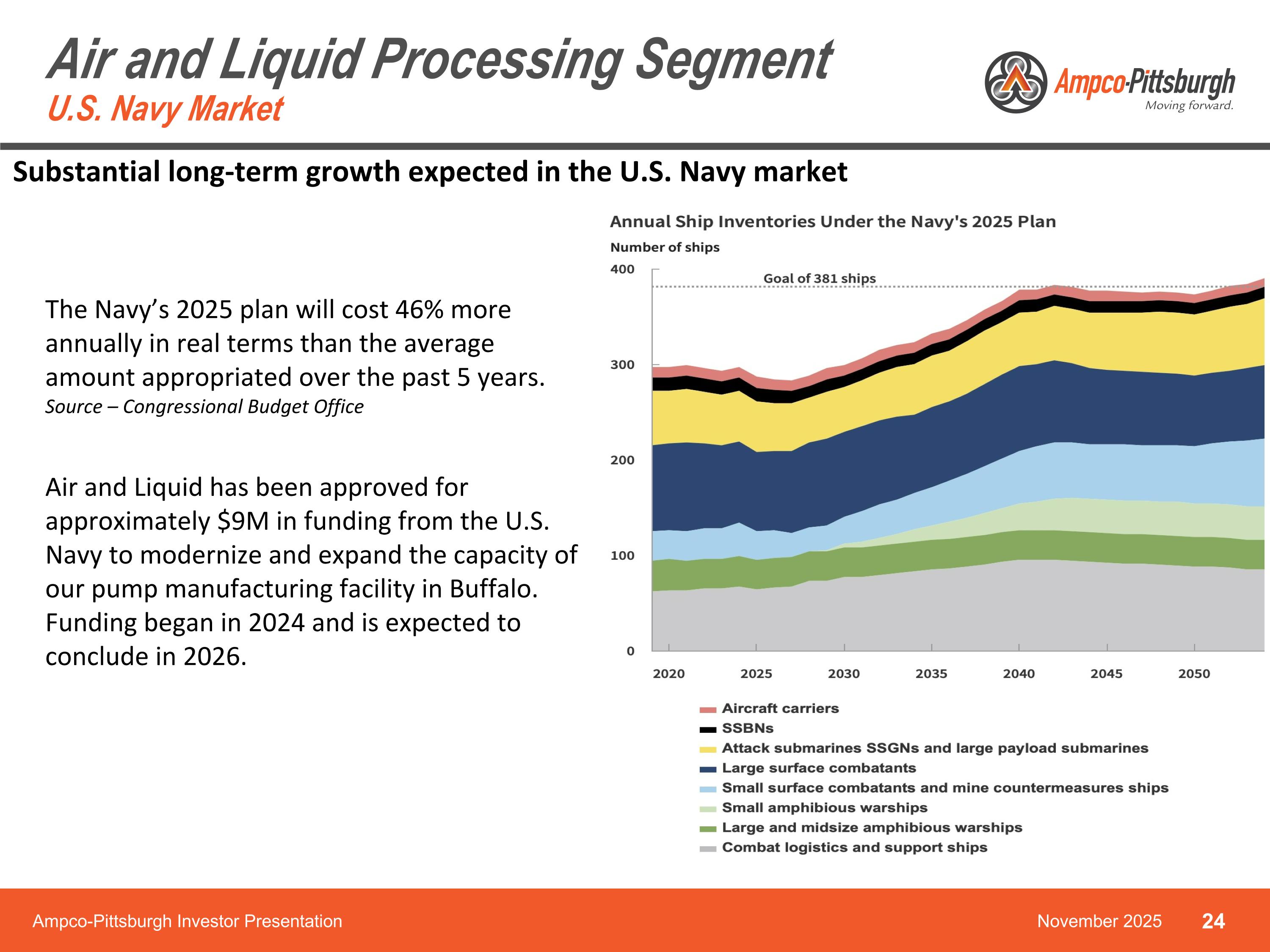

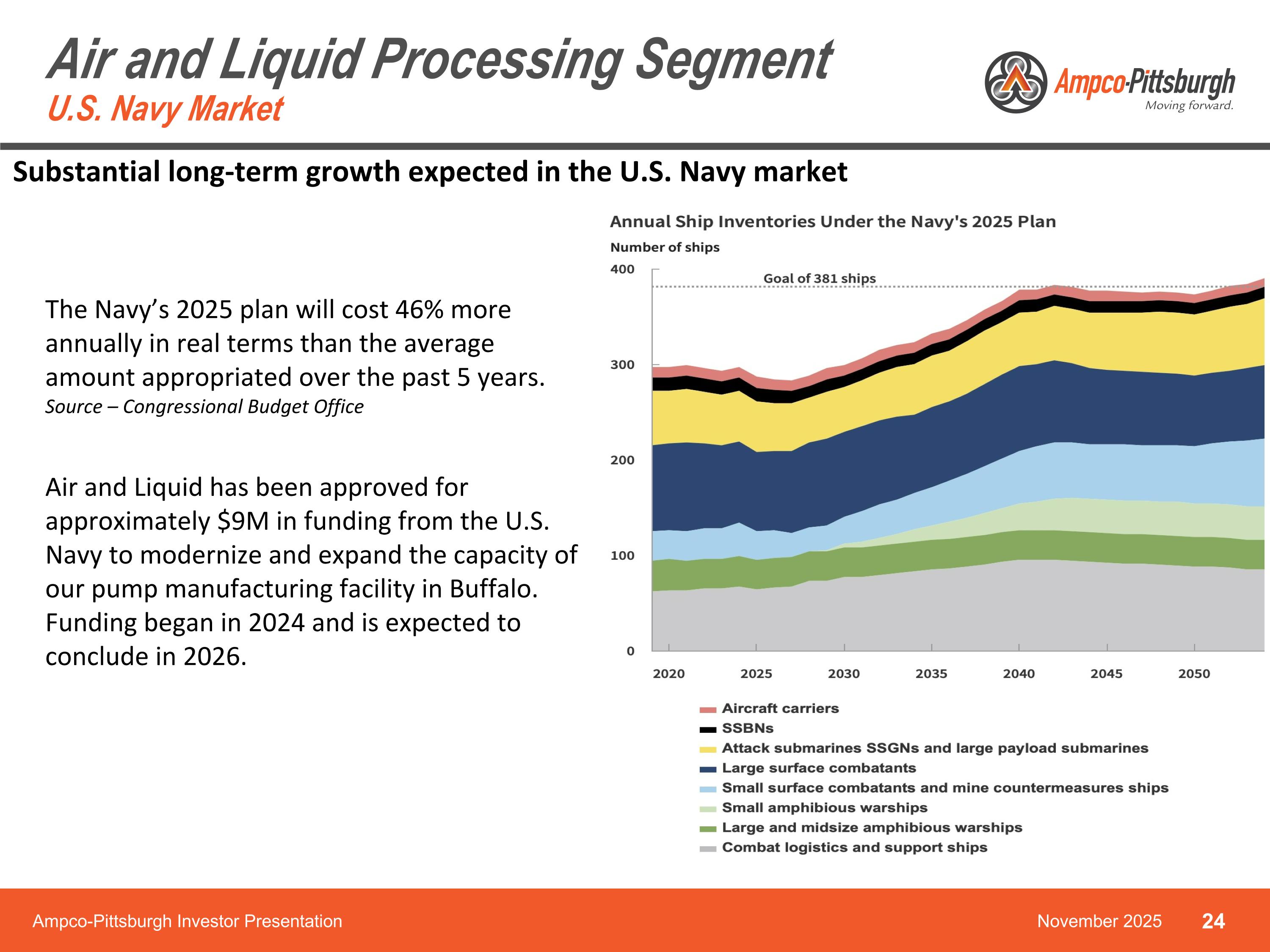

Air and Liquid Processing SegmentU.S. Navy Market Ampco-Pittsburgh Investor Presentation November 2025 Substantial long-term growth expected in the U.S. Navy market The Navy’s 2025 plan will cost 46% more annually in real terms than the average amount appropriated over the past 5 years. Source – Congressional Budget Office Air and Liquid has been approved for approximately $9M in funding from the U.S. Navy to modernize and expand the capacity of our pump manufacturing facility in Buffalo. Funding began in 2024 and is expected to conclude in 2026.

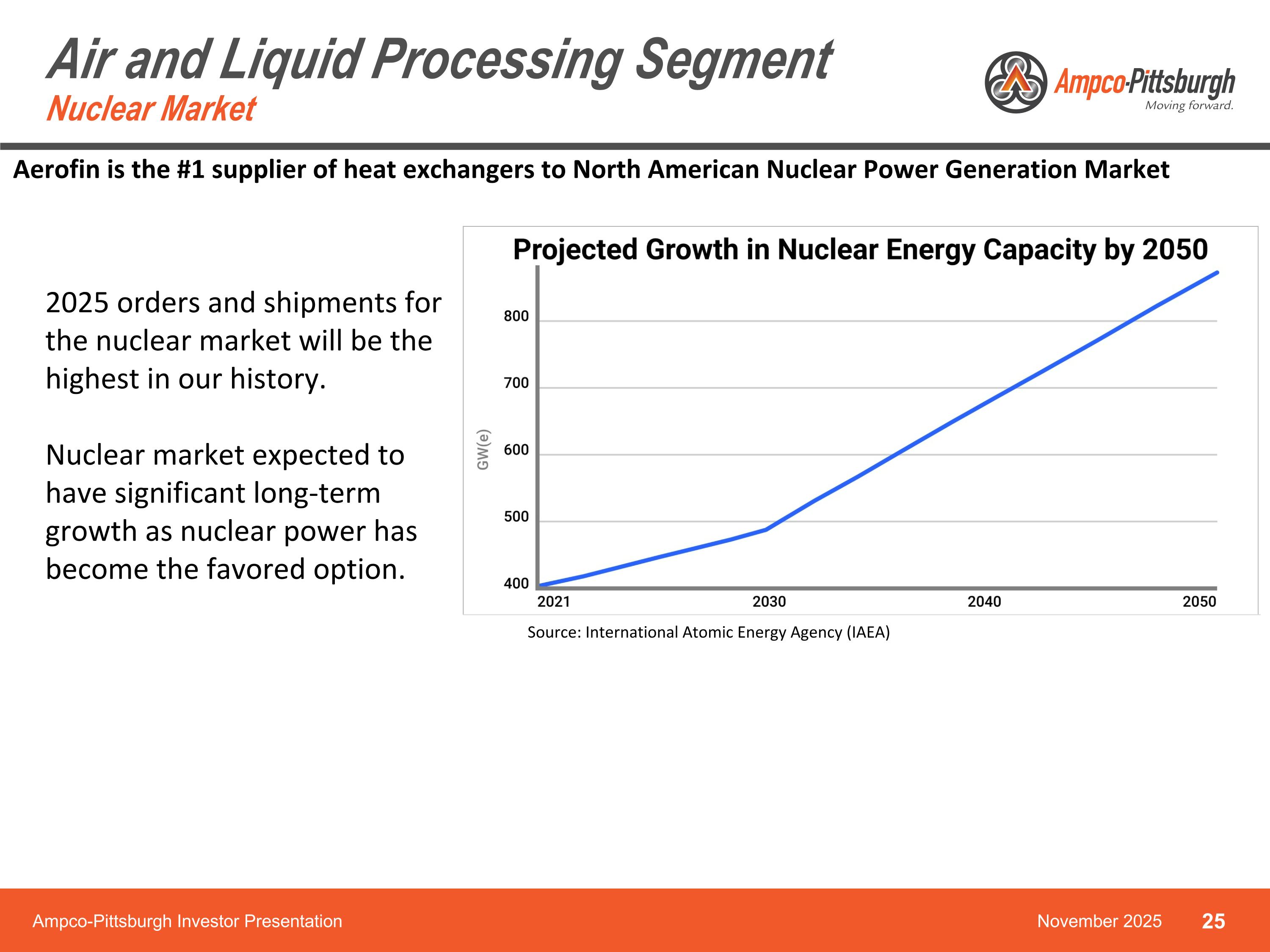

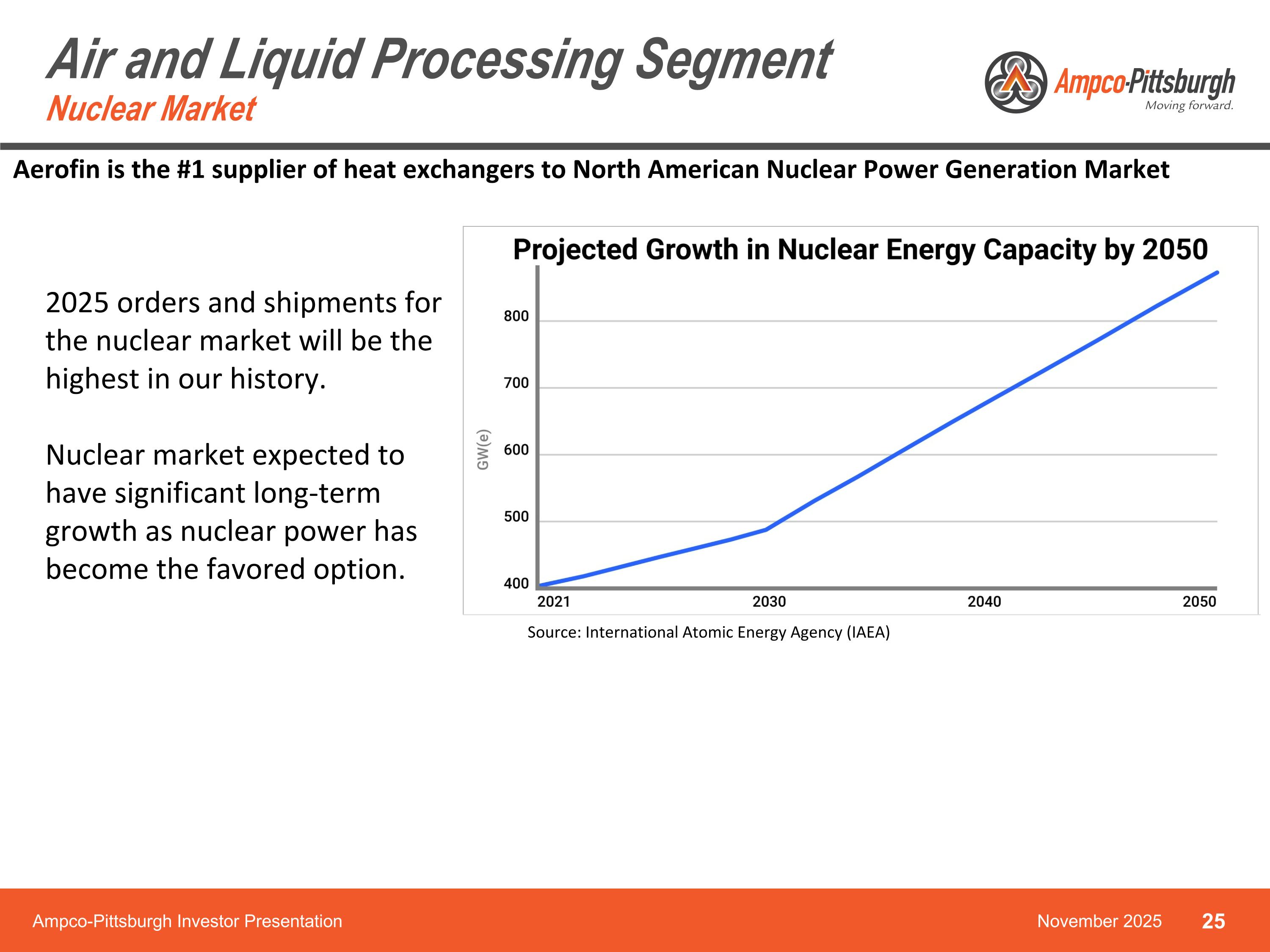

Air and Liquid Processing SegmentNuclear Market Ampco-Pittsburgh Investor Presentation November 2025 Aerofin is the #1 supplier of heat exchangers to North American Nuclear Power Generation Market 2025 orders and shipments for the nuclear market will be the highest in our history. Nuclear market expected to have significant long-term growth as nuclear power has become the favored option. Source: International Atomic Energy Agency (IAEA)

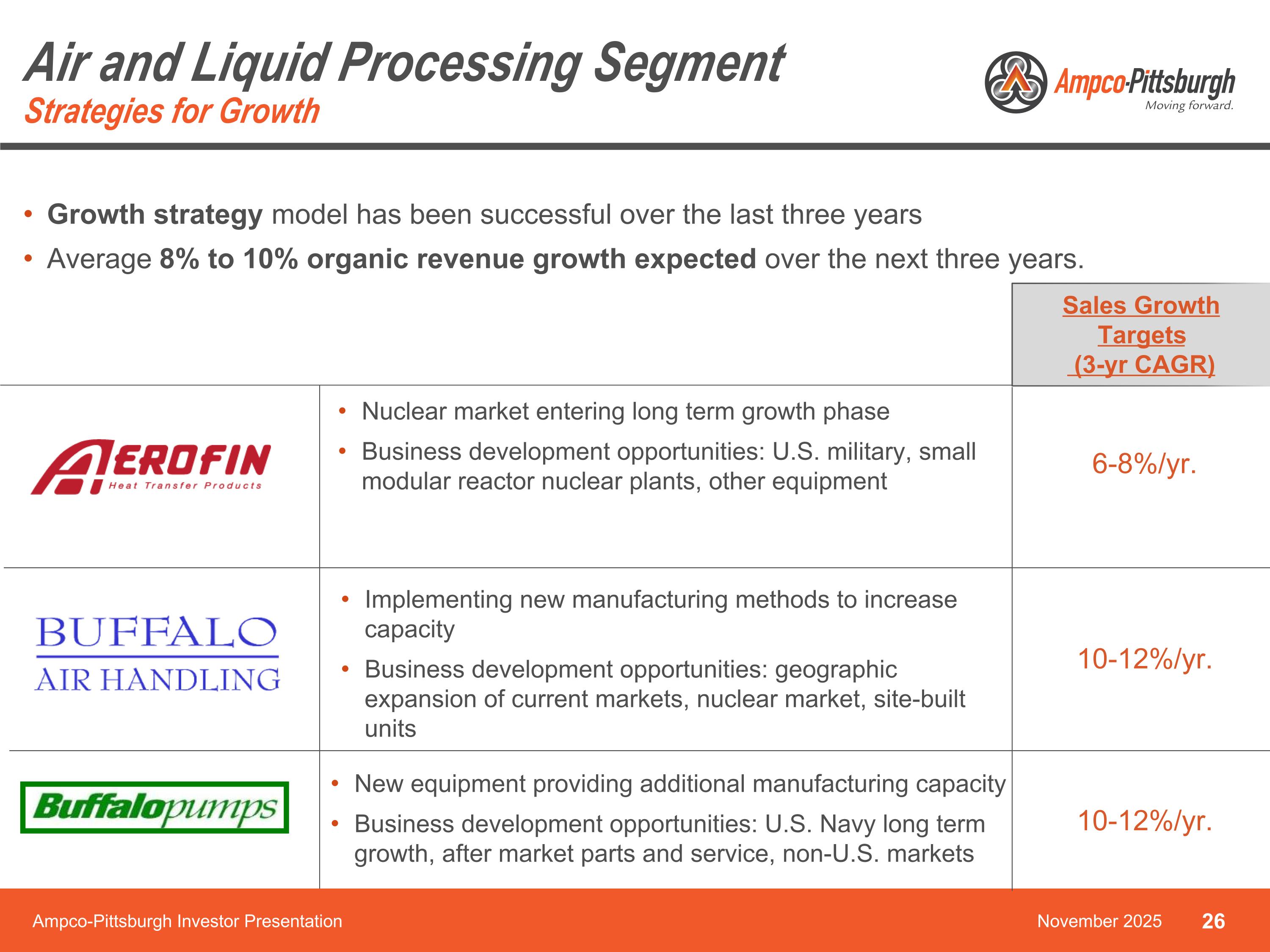

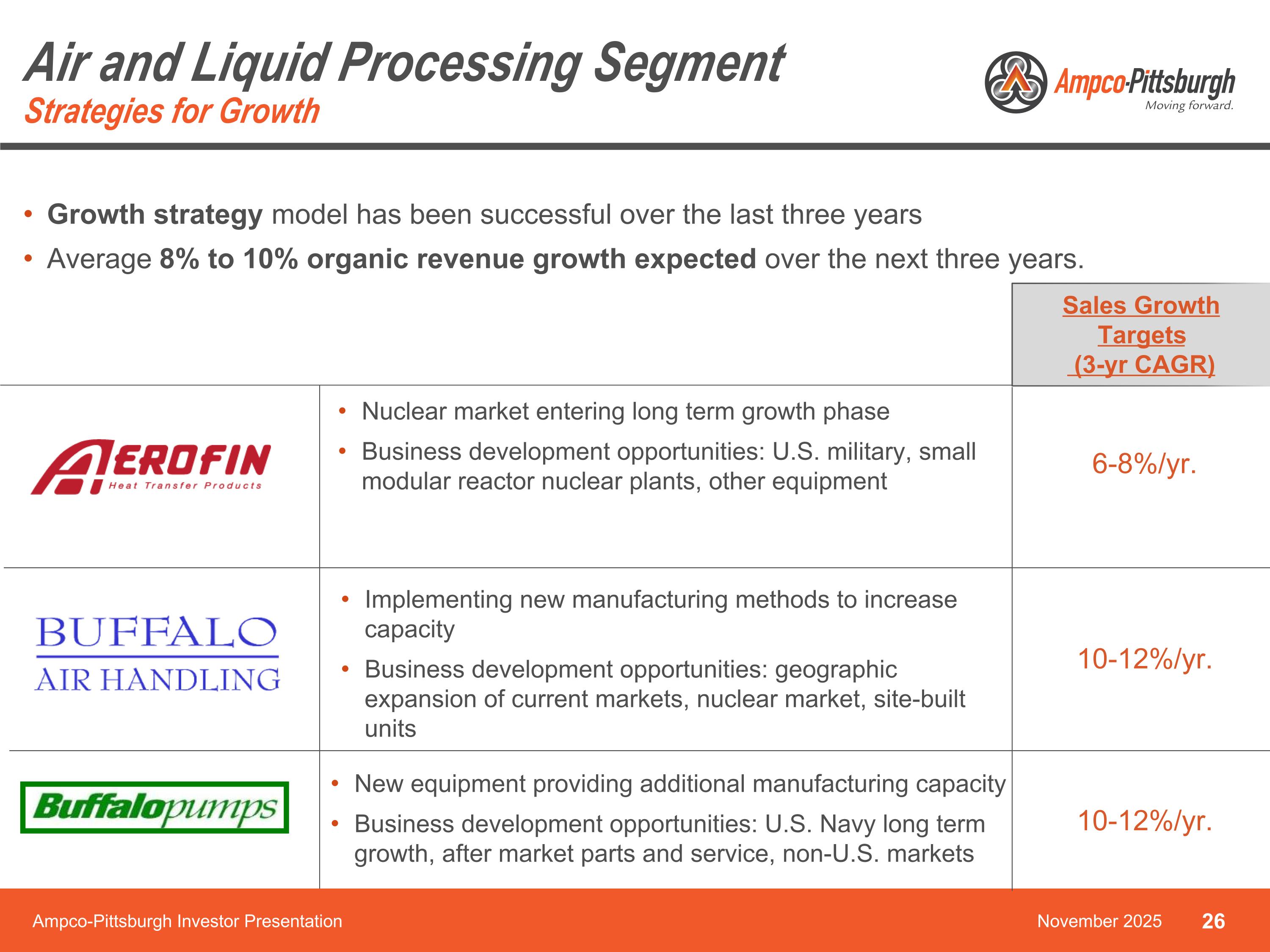

Ampco-Pittsburgh Investor Presentation November 2025 Growth strategy model has been successful over the last three years Average 8% to 10% organic revenue growth expected over the next three years. New equipment providing additional manufacturing capacity Business development opportunities: U.S. Navy long term growth, after market parts and service, non-U.S. markets Implementing new manufacturing methods to increase capacity Business development opportunities: geographic expansion of current markets, nuclear market, site-built units Nuclear market entering long term growth phase Business development opportunities: U.S. military, small modular reactor nuclear plants, other equipment Air and Liquid Processing SegmentStrategies for Growth Sales Growth Targets (3-yr CAGR) 6-8%/yr. 10-12%/yr. 10-12%/yr.

Financials Ampco-Pittsburgh Investor Presentation November 2025

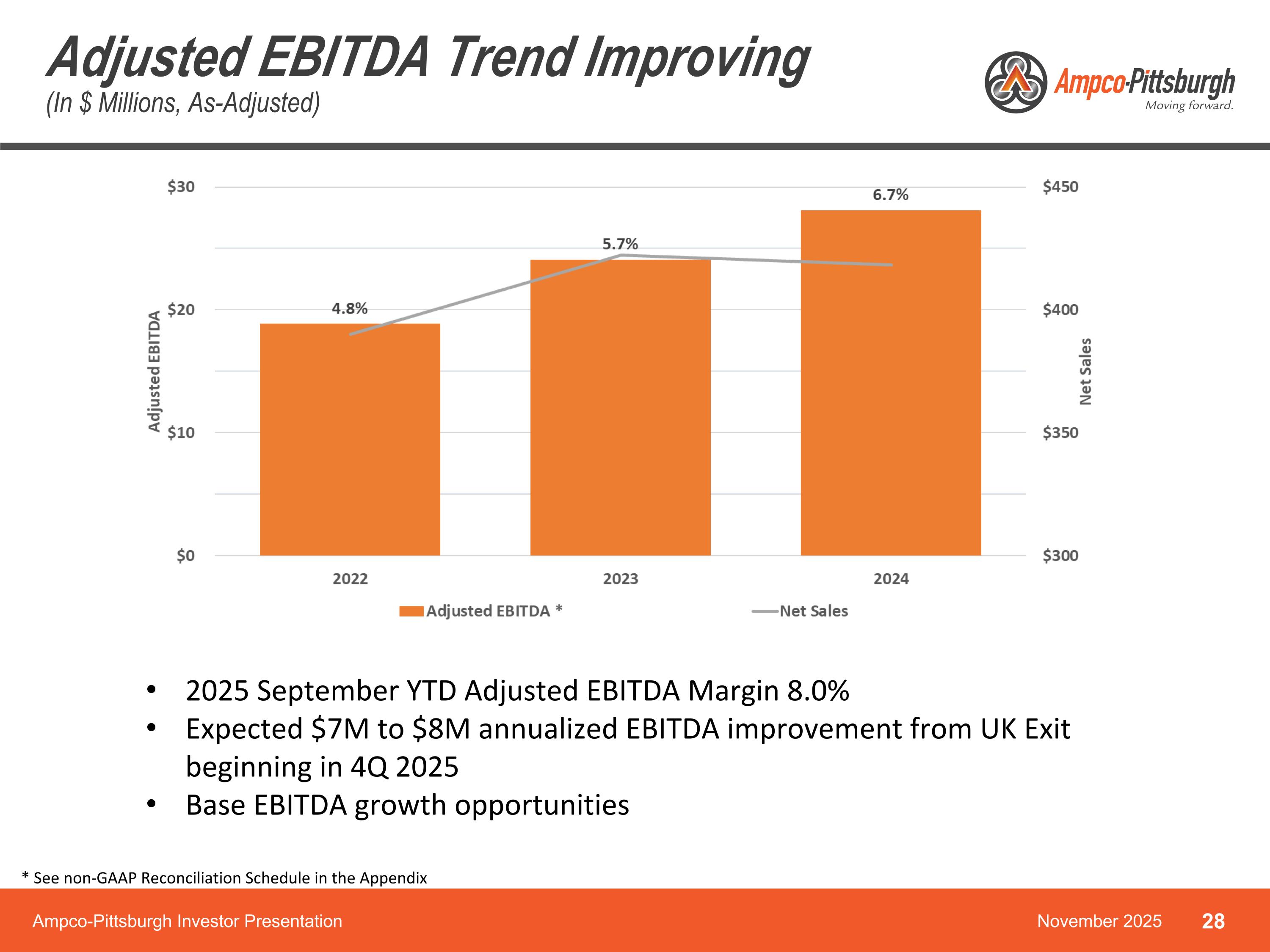

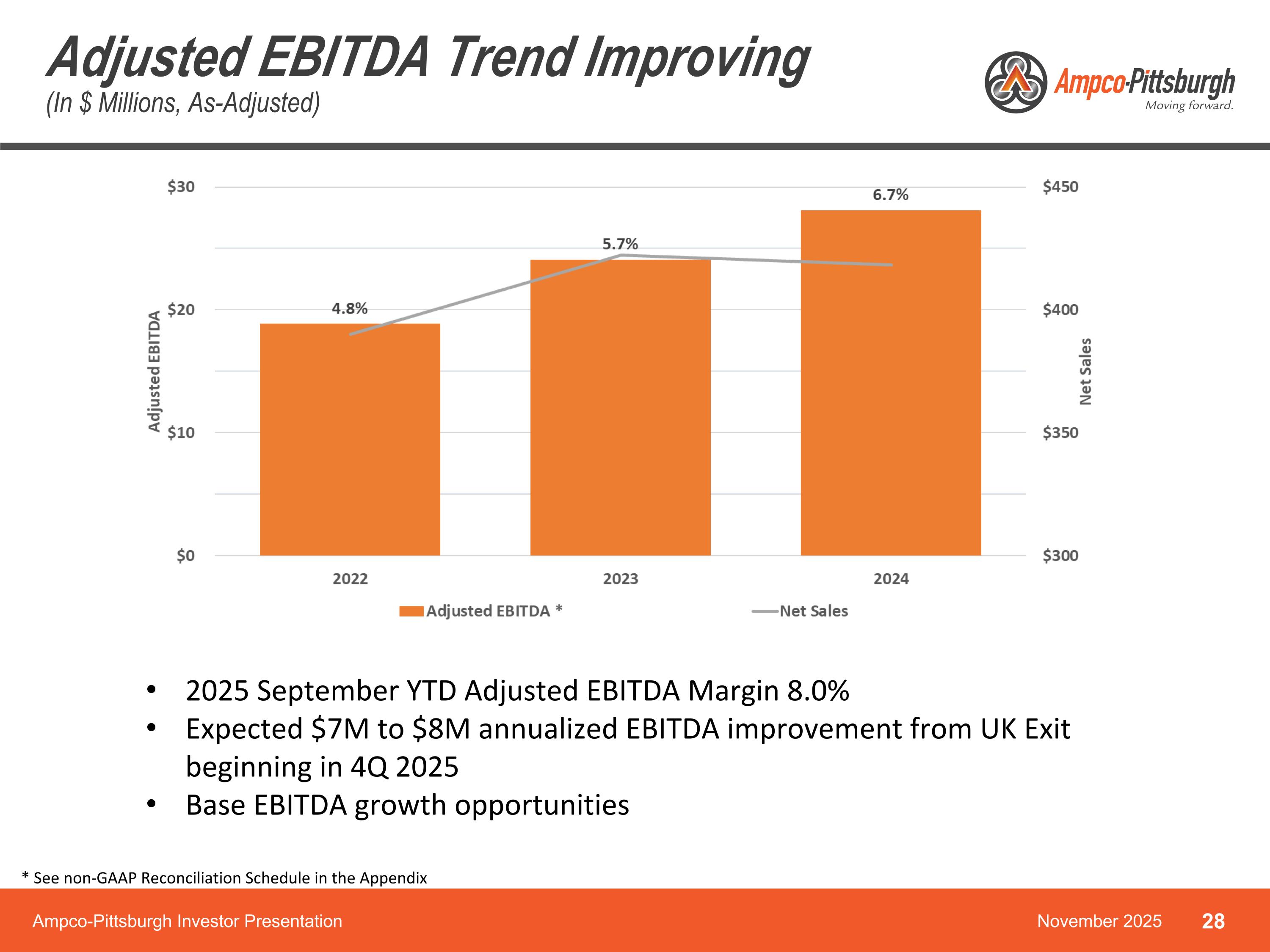

Adjusted EBITDA Trend Improving(In $ Millions, As-Adjusted) Ampco-Pittsburgh Investor Presentation November 2025 * See non-GAAP Reconciliation Schedule in the Appendix 2025 September YTD Adjusted EBITDA Margin 8.0% Expected $7M to $8M annualized EBITDA improvement from UK Exit beginning in 4Q 2025 Base EBITDA growth opportunities

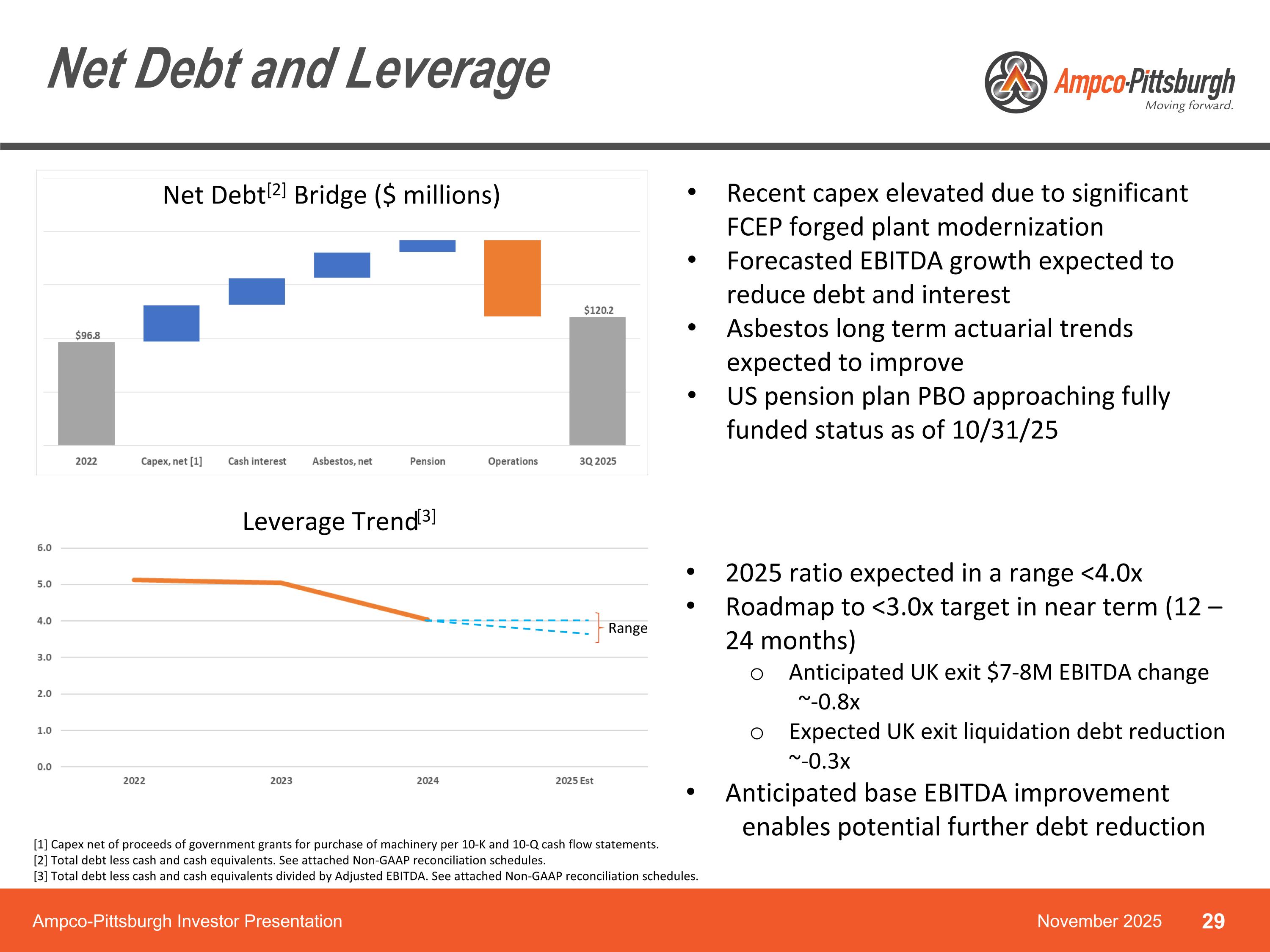

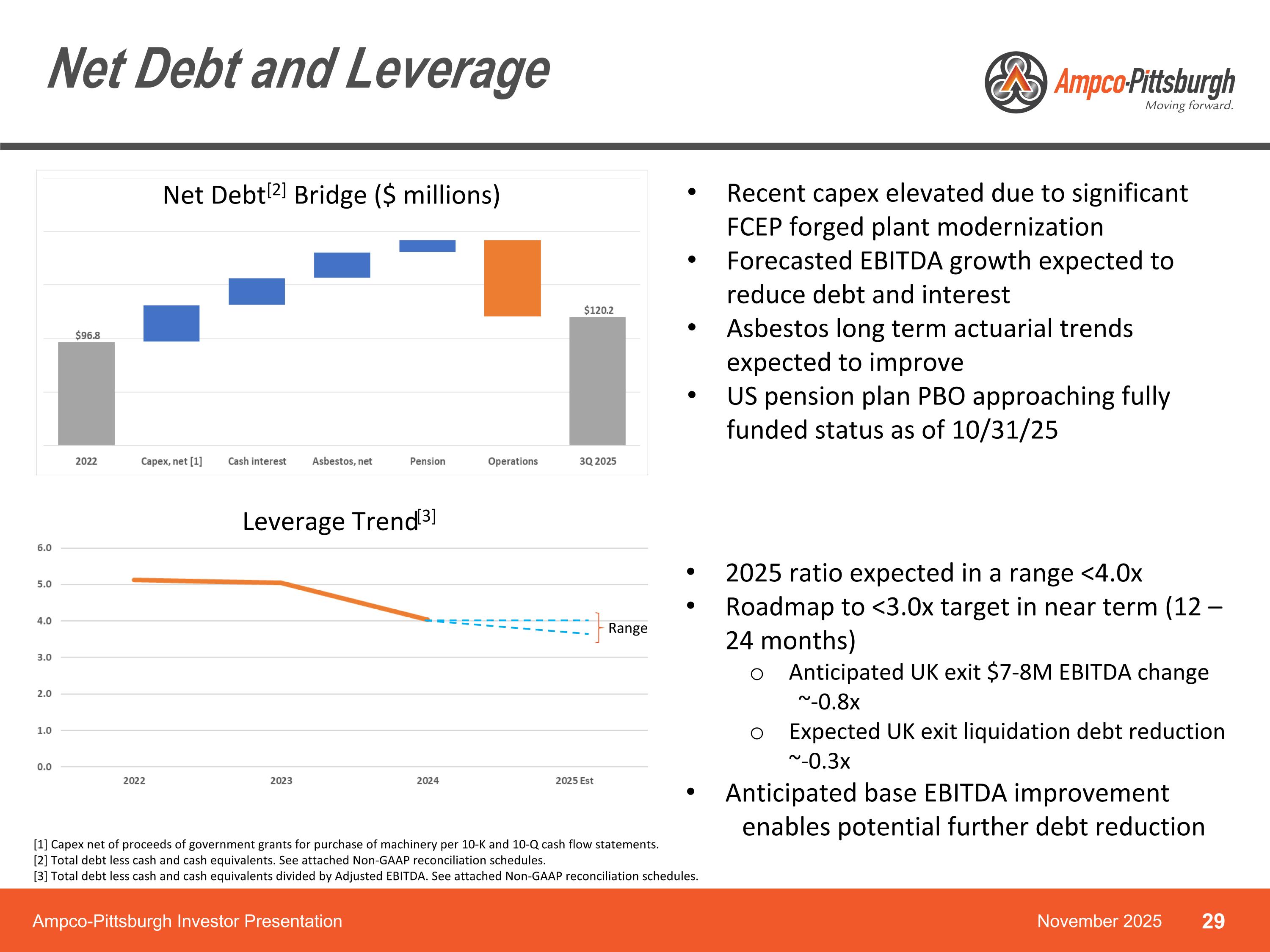

Net Debt and Leverage November 2025 Ampco-Pittsburgh Investor Presentation Recent capex elevated due to significant FCEP forged plant modernization Forecasted EBITDA growth expected to reduce debt and interest Asbestos long term actuarial trends expected to improve US pension plan PBO approaching fully funded status as of 10/31/25 [1] Capex net of proceeds of government grants for purchase of machinery per 10-K and 10-Q cash flow statements. [2] Total debt less cash and cash equivalents. See attached Non-GAAP reconciliation schedules. [3] Total debt less cash and cash equivalents divided by Adjusted EBITDA. See attached Non-GAAP reconciliation schedules. 2025 ratio expected in a range <4.0x Roadmap to <3.0x target in near term (12 – 24 months) Anticipated UK exit $7-8M EBITDA change ~-0.8x Expected UK exit liquidation debt reduction ~-0.3x Anticipated base EBITDA improvement enables potential further debt reduction Leverage Trend[3] Net Debt[2] Bridge ($ millions) Range

Ampco-Pittsburgh Investment Thesis November 2025 Ampco-Pittsburgh Investor Presentation Forged & Cast Engineered Products Exited underperforming assets A stricter quota and tariff system proposed in mid-2026 in Europe End markets are projected to grow in the mid-single digits for the next 5 years Air & Liquid Processing 55% revenue growth over the last three years Significant barriers to entry Long-term growth for both U.S. Navy and Nuclear markets U.S. Navy investing $9M to modernize our manufacturing facility Ampco-Pittsburgh Expected earnings improvement enables debt reduction and realization of tax assets US defined benefit plan approaching 100% funded status Free cash flow generation

Thank You ampcopgh.com Ampco-Pittsburgh Investor Presentation November 2025

Appendix Ampco-Pittsburgh Investor Presentation November 2025

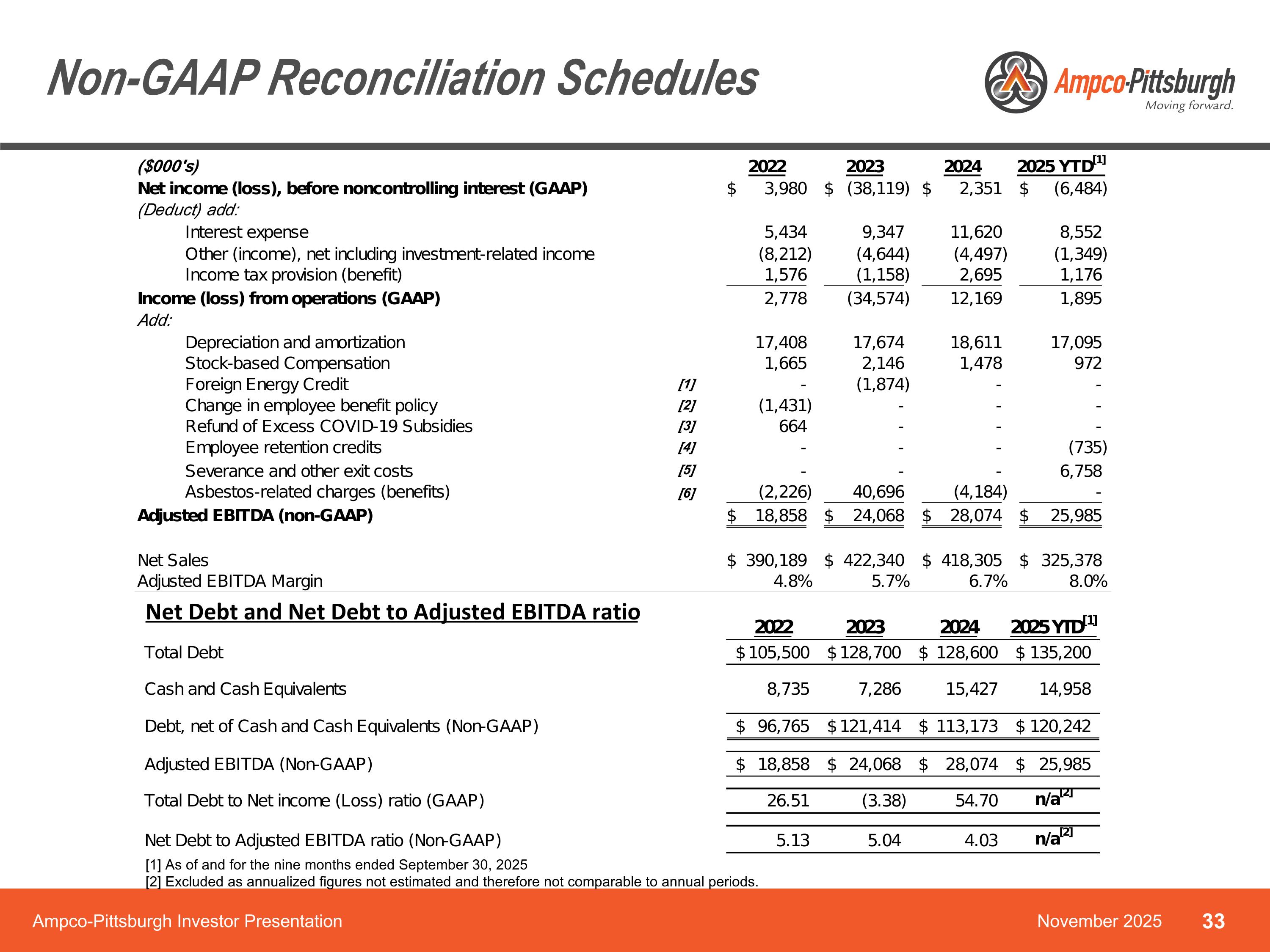

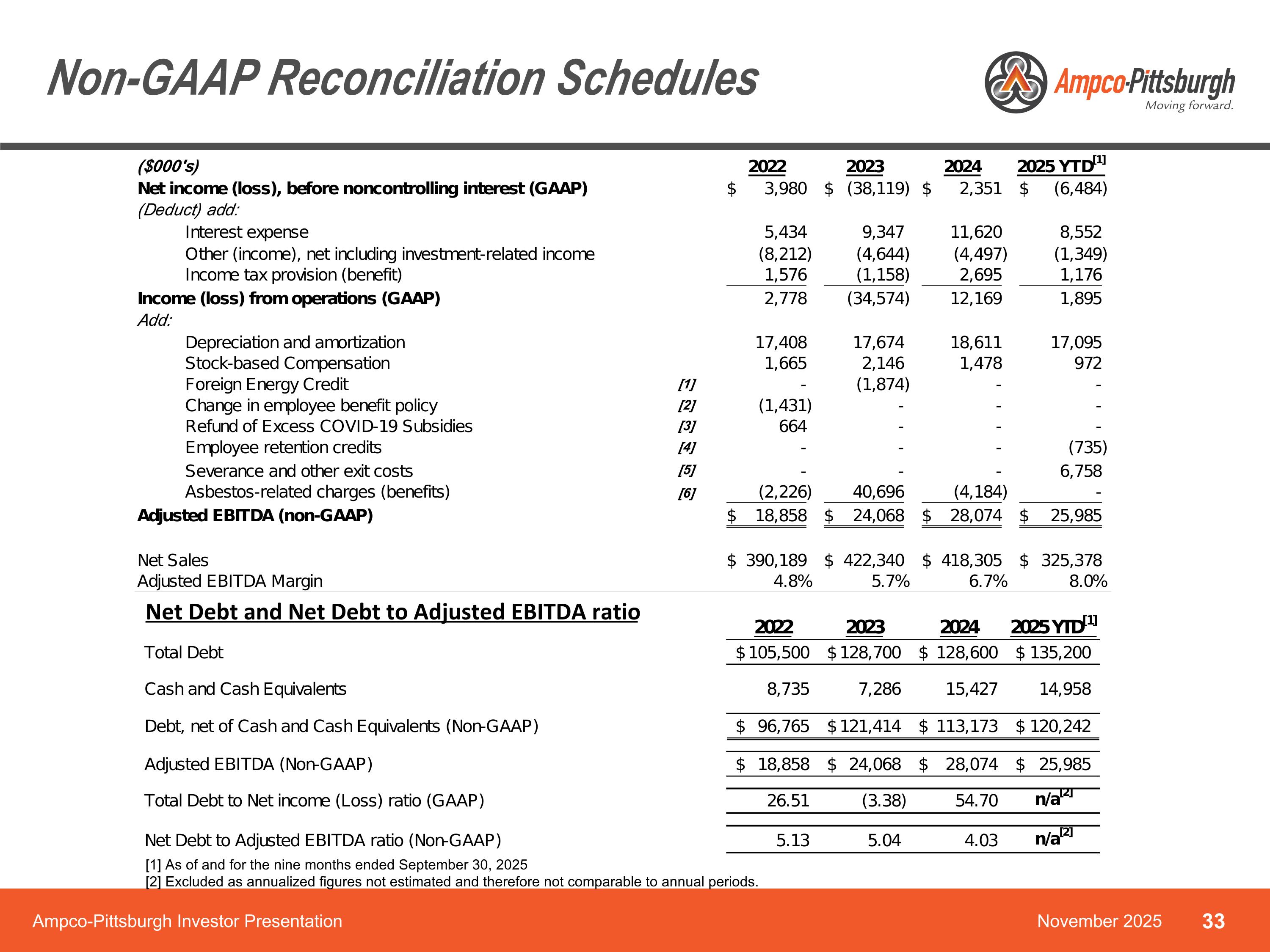

Non-GAAP Reconciliation Schedules November 2025 Ampco-Pittsburgh Investor Presentation [1] As of and for the nine months ended September 30, 2025 [2] Excluded as annualized figures not estimated and therefore not comparable to annual periods. Net Debt and Net Debt to Adjusted EBITDA ratio

Non-GAAP Reconciliation Footnotes November 2025 Ampco-Pittsburgh Investor Presentation [1] Represents reimbursement of past energy costs at one of the Corporation’s foreign operations by its local government. [2] Represents an accounting benefit resulting from the change in the method by which certain employees earn certain benefits. [3] Represents excess COVID-19 subsidies received in 2020 returned in 2022. [4] Represents employee-retention credits, which are refundable employer payroll taxes for certain eligible businesses affected by the COVID-19 pandemic received from the Internal Revenue Service in 2025. [5] Represents charges for severance and other exit costs associated with exiting UES-UK and closing a non-core steel distribution facility. Depreciation and amortization expense for the nine months ended September 30, 2025 includes accelerated depreciation of $3,061 associated with exiting UES-UK and closing a non-core steel distribution facility. [6] For 2022, represents a credit for a change in the estimated defense-to-indemnity cost ratio from 70% to 65%. For 2023, represents an increase in the estimated settlement costs of pending and future asbestos claims, net of additional insurance recoveries and a reduction in the estimated defense-to-indemnity cost ratio from 65% to 60%. For 2024, the credit for asbestos litigation represents primarily a decrease in the estimated settlement costs of pending and future asbestos claims, net of additional insurance recoveries, and a benefit from the reduction in the estimated defense-to-indemnity cost ratio from 60% to 55%.

Key End Markets & Growth Rates Looking Forward Sources November 2025 Ampco-Pittsburgh Investor Presentation Sources [PDF] North American Automotive Industry Outlook https://thinkkc.com/docs/default-source/non-index-files/automotive-industry-outlook_plante-moran_2025.pdf [PDF] North America Light Vehicle Outlook https://myscma.com/wp-content/uploads/2024/02/Bill-Rinna-NA-Light-Vehicle-Outlook.pdf Europe Automotive Vehicle Market Forecast 2024-2030 https://www.renub.com/europe-automotive-vehicle-market-p.php Europe's automotive industry at a crossroads | T&E https://www.transportenvironment.org/articles/europes-automotive-industry-at-a-crossroads North America Construction Market Analysis | 2025-2030 https://www.nextmsc.com/report/north-america-construction-market Future of Construction - Oxford Economics https://www.oxfordeconomics.com/resource/future-of-construction/ Europe Construction Market Value Analysis | 2025-2030 https://www.nextmsc.com/report/europe-construction-market Demand for aluminum cans is rising in North America ... - UACJ https://www.uacj.co.jp/english/ir/library/pdf/2021/09_2021uacjr.pdf North America's aluminum cans market to grow at a CAGR of 3.3 ... https://www.alcircle.com/news/north-americas-aluminium-cans-market-to-grow-at-a-cagr-of-3-3-during-2023-32-111236 List of countries by motor vehicle production - Wikipedia https://en.wikipedia.org/wiki/List_of_countries_by_motor_vehicle_production Global automotive sales growth positive, but slows in North America ... https://www.automotivelogistics.media/news/automotive-market-faces-slower-growth-and-capacity-challenges-amid-electrification-shift-sp-globals-mike-wall-reveals/192933 July 2025 Light Vehicle Production Forecast - S&P Global https://www.spglobal.com/automotive-insights/en/blogs/2025-light-vehicle-production-forecast Automotive market crisis: global demand shrinking through 2030 https://www.rinnovabili.net/business/mobility-transportation-business/automotive-market-crisis-global-demand-decline/ North America Building Construction Market By Type (Residential ... https://www.techsciresearch.com/report/north-america-building-construction-market/27784.html Europe Construction Market By Size Share and Forecast 2030F https://www.techsciresearch.com/report/europe-construction-market/27733.html [PDF] Contents – April 3, 2025 https://www.autosinnovate.org/posts/papers-reports/Reading%20the%20Meter%204-3-2025.pdf European EV Sales Resuming Growth, But Too Slowly For EU 2030 ... https://www.forbes.com/sites/neilwinton/2025/01/09/european-ev-sales-resuming-growth-but-too-slowly-for-eu-2030-targets/ North America aluminum market forecast 2022-2030 https://www.inkwoodresearch.com/reports/north-america-aluminum-market/ Europe Commercial Green Construction Market Size & Outlook, 2030 https://www.grandviewresearch.com/horizon/outlook/commercial-green-construction-market/europe The Future of the Global Automotive Industry 2024-2030: OEM https://www.globenewswire.com/news-release/2024/07/09/2910089/0/en/The-Future-of-the-Global-Automotive-Industry-2024-2030-OEM-Landscape-Connected-Vehicles-Autonomous-Driving-Technologies-Electric-Vehicles-Innovations-in-Battery-Technology-Powertra.html