UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) November 18, 2025

AXALTA COATING SYSTEMS LTD.

(Exact name of registrant as specified in its charter)

| Bermuda | 001-36733 | 98-1073028 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

1050 Constitution Avenue, Philadelphia, PA 19112

(Address of principal executive offices) (Zip Code)

(855) 547-1461

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Common Shares, $1.00 par value | AXTA | New York Stock Exchange | ||

| (Title of class) | (Trading symbol) |

(Exchange on which registered) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

Merger Agreement

On November 18, 2025, Axalta Coating Systems Ltd., an exempted company incorporated under the laws of Bermuda (“Axalta” or the “Company”), entered into a Merger Agreement (the “Merger Agreement”) with Akzo Nobel N.V., a public company with limited liability (naamloze vennootschap) incorporated under the laws of the Netherlands (“AkzoNobel” and, after giving effect to the Merger, “MergeCo”).

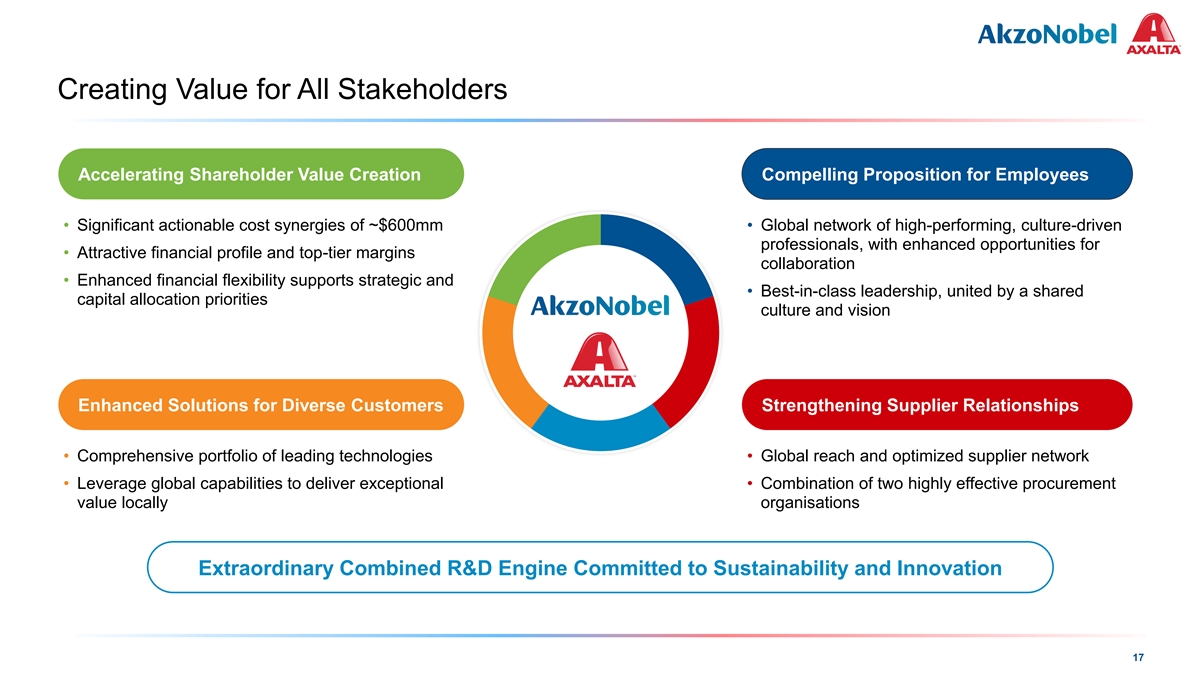

The Merger Agreement provides for, among other things, the combination of Axalta and AkzoNobel in an all-stock merger of equals upon the terms and subject to the conditions set forth therein. The board of directors of the Company (the “Company Board”) and both the supervisory board and the board of management of AkzoNobel (collectively, the “AkzoNobel Boards”) have each unanimously approved the Merger Agreement, the Merger (as defined below) and the other transactions contemplated by the Merger Agreement, including, in the case of AkzoNobel, the issuance of AkzoNobel Ordinary Shares (as defined below) as Merger Consideration (as defined below) and, in the case of Axalta, the amendment to the Company’s Second Amended and Restated Bye-laws as set forth in the Merger Agreement. MergeCo will be dual-headquartered in Amsterdam, the Netherlands and Philadelphia, Pennsylvania and listed on the New York Stock Exchange and Euronext Amsterdam (with delisting from Euronext Amsterdam to be effected on or as soon as practicable following the effective time of the Merger (the “Effective Time”)).

Subject to the terms and conditions set forth in the Merger Agreement, (i) AkzoNobel will incorporate an exempted company under the laws of Bermuda as a wholly owned subsidiary (“Merger Sub”), (ii) Merger Sub will be merged with and into the Company (the “Merger”), with the Company continuing as the surviving company of the Merger (the “Surviving Company”) and as a wholly owned subsidiary of AkzoNobel, and (iii) at the Effective Time, each outstanding and issued ordinary share of the Company, par value $1.00 per share (a “Company Ordinary Share”) (other than any Company Ordinary Shares owned by the Company as treasury shares and any Company Ordinary Shares owned by AkzoNobel, Merger Sub or any other direct or indirect wholly owned subsidiary of AkzoNobel), will be automatically converted into the right to receive 0.6539 (the “Exchange Ratio”) duly authorized, validly issued and fully paid AkzoNobel ordinary shares, par value of €0.50 per share (“AkzoNobel Ordinary Shares”) (such AkzoNobel Ordinary Shares, the “Merger Consideration”).

Subject to the terms and conditions set forth in the Merger Agreement, prior to the Effective Time, AkzoNobel will declare and pay a special cash dividend (the “Pre-Completion Distribution”) to AkzoNobel shareholders. The aggregate amount of the Pre-Completion Distribution will be €2.5 billion minus the aggregate amount of any regular annual and interim dividends of €1.98 per Akzo Nobel Ordinary Share per year declared by AkzoNobel after the date of the Merger Agreement and with record dates in 2026 prior to the record date of the Pre-Completion Distribution, subject to any applicable withholding tax.

Under the terms of the Merger Agreement, each equity award of the Company, consisting of stock options, restricted stock units and performance share units, that is outstanding immediately prior to the Effective Time will generally be converted into an equivalent AkzoNobel equity award subject to the same terms and conditions as applied prior to the Effective Time, except that performance share units will be converted into solely time-vesting restricted stock units. The number of AkzoNobel Ordinary Shares subject to each converted equity award will be equal to the number of Company Ordinary Shares subject to such award immediately prior to the Effective Time, with the number of Company Ordinary Shares subject to any performance share unit determined based on the greater of target and actual performance measured through the Effective Time, multiplied by the Exchange Ratio, and the exercise price of each converted stock option will be equal to the exercise price of the Company stock option divided by the Exchange Ratio. Notwithstanding the foregoing, each restricted stock unit or performance share unit of the Company that (i) is vested as of immediately prior to the Effective Time, (ii) is held by a non-employee member of the Company Board or a former service provider of the Company, or (iii) is subject to a performance period that has been completed as of immediately prior to the Effective Time, in each case, will instead be converted into the right to receive the Merger Consideration, with any performance conditions deemed achieved, (a) in the case of awards held by former service providers for which the performance period has not yet been completed, at the greater of target and actual performance measured through the Effective Time, and (b) in the case of awards for which the performance period has been completed, based on actual performance. Furthermore, each stock option that is held by a former service provider of the Company will be converted into the right to receive a number of AkzoNobel Ordinary Shares equal to the number of Company Ordinary Shares subject to such stock option immediately prior to the Effective Time (less the number of shares with a value equal to the aggregate exercise price of such stock option) multiplied by the Exchange Ratio, with any such stock option that has a per share exercise price that is equal to or greater than the closing price of a Company Ordinary Share on the trading day immediately preceding the Effective Time cancelled without consideration.

Additionally, under the terms of the Merger Agreement, each AkzoNobel equity award, consisting of restricted stock units, performance share units and conditional rights under AkzoNobel’s share matching program, that is outstanding immediately prior to the Effective Time will remain outstanding on and following the Effective Time and will generally be subject to the same terms and conditions as applied prior to the Effective Time, except that performance share units will be converted into solely time-vesting restricted stock units, with the performance conditions deemed achieved at the greater of target and actual performance measured through the Effective Time.

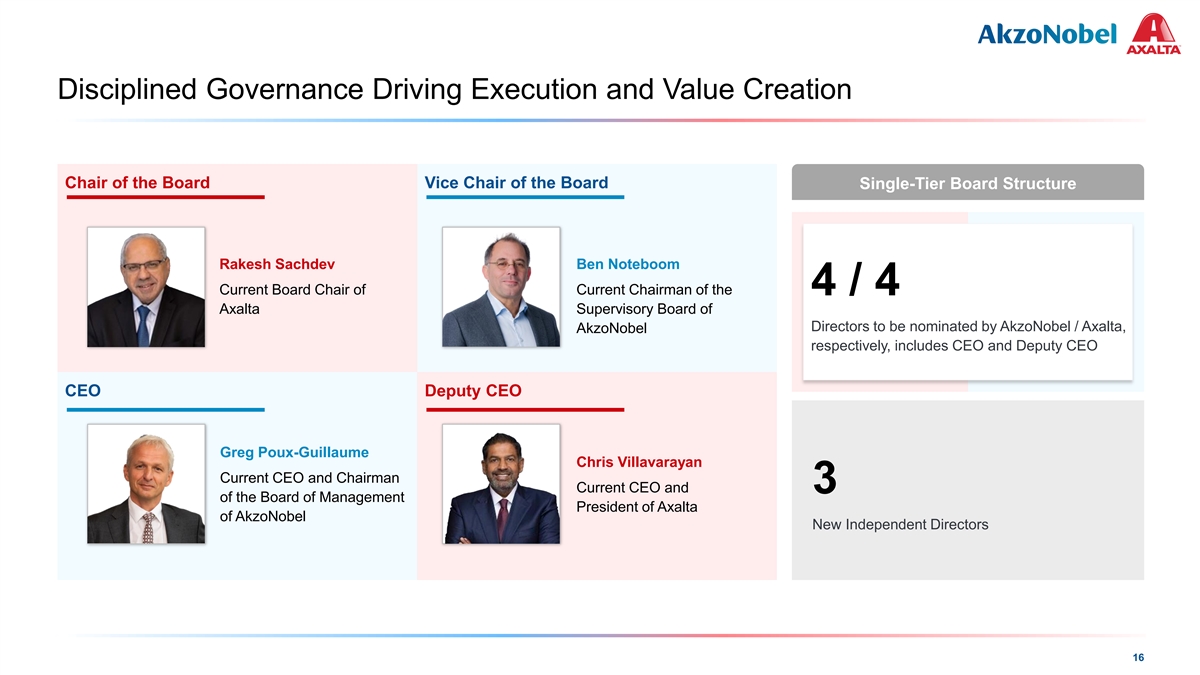

Pursuant to the terms of the Merger Agreement, immediately following the Effective Time, MergeCo will have a one-tier board of directors (the “MergeCo Board”) comprised of eleven directors, consisting of (i) four directors to be nominated by Axalta (the “Axalta Nominees”), one of whom shall be Rakesh Sachdev and one of whom shall be Chris Villavarayan, (ii) four directors to be nominated by AkzoNobel (the “AkzoNobel Nominees”), one of whom shall be Ben Noteboom and one of whom shall be Grégoire Poux-Guillaume and (iii) three independent directors to be jointly nominated by Axalta and AkzoNobel (the “Joint Nominees”, and, together with the Axalta Nominees and the AkzoNobel Nominees, the “MergeCo Board Nominees”). Each of the MergeCo Board Nominees will be nominated to serve an initial three-year term (with the end of such term adjusted as necessary to coincide with the date of the first annual general meeting of MergeCo’s shareholders held after the third anniversary of closing). At such general meeting of MergeCo’s shareholders (i) the Axalta Nominees (or their replacements) and the AkzoNobel Nominees (or their replacements) will be put up for election to serve a two-year term and (ii) the Joint Nominees (or their replacements) will be put up for election to serve a one-year term. At the annual general meeting of MergeCo’s shareholders held after the fourth anniversary of closing, the Joint Nominees (or their replacements) will be put up for election to serve another one-year term. As of and following the first annual general meeting of MergeCo’s shareholders held after the fifth anniversary of closing, all directors will be put up for election to serve a one-year term (without restricting the MergeCo Board from deciding otherwise).

Mr. Poux-Guillaume, the current chief executive officer of AkzoNobel, will be appointed to serve as the chief executive officer of MergeCo, Mr. Sachdev, the current chair of the board of directors of the Company, will be appointed to serve as the non-executive chair of the MergeCo Board, Mr. Villavarayan, the current chief executive officer of the Company, will be appointed to serve as the deputy chief executive officer of MergeCo, Mr. Noteboom, the current chairman of the supervisory board of AkzoNobel, will be appointed to serve as the non-executive vice-chair of the MergeCo Board, and Carl Anderson, the Company’s current senior vice president and chief financial officer, will be appointed to serve as the chief financial officer of MergeCo.

The Company and AkzoNobel each have made customary representations, warranties and covenants in the Merger Agreement, in each case generally subject to customary qualifications. Among other things, each of the Company and AkzoNobel has agreed, subject to certain exceptions, to use its reasonable best efforts to conduct its business in the ordinary course of business, from the date of the Merger Agreement until the Effective Time, and (i) not to take certain actions prior to the Effective Time without the prior written consent of the other party, (ii) not to solicit proposals relating to alternative business combination transactions and (iii) subject to customary exceptions, not to engage in discussions or negotiations regarding, or provide confidential information in connection with, any such alternative business combination transactions. In addition, the parties have agreed to use their respective reasonable best efforts to take any and all actions reasonably necessary to obtain each regulatory approval necessary to complete the Merger (the “Regulatory Clearances”) as soon as reasonably practicable. In addition, each party has agreed to consent to any divestiture, sale, disposition or other structural or conduct remedy unless such actions would be materially burdensome to such party.

The obligations of the Company and AkzoNobel to consummate the Merger are conditioned on the satisfaction or waiver of certain conditions, including (i) at a general meeting of the shareholders of the Company, (a) the approval and adoption of the Merger, the Merger Agreement, the Bermuda statutory merger agreement and the transactions contemplated thereby and (b) the approval of the amendment to the bye-laws of the Company, (ii) at a general meeting of shareholders of AkzoNobel, (a) the approval of AkzoNobel entering into the Merger and the other actions contemplated by the Merger Agreement, (b) the approval of the amendment of AkzoNobel’s articles of association to reflect the governance terms set forth in the Merger Agreement, with effect as of immediately following the Effective Time, (c) the approval of issuance of the Merger Consideration and exclusion of pre-emption rights in connection therewith, and (d) the appointment or reappointment, as applicable, of the MergeCo Board Nominees, with effect as of immediately following the Effective Time, in the case of each of clauses (a) through (d), by holders of ordinary shares of AkzoNobel, (iii) declaration and payment of the Pre-Completion Distribution, (iv) completion of the consultation process with AkzoNobel’s central works council in accordance with the terms of the Merger Agreement, (v) the approval of the Merger Consideration for listing on the New York Stock Exchange, (vi) AkzoNobel having made publicly available a document in accordance with Regulation (EU) 2017/1129 as required in connection with the listing on Euronext Amsterdam of the AkzoNobel ordinary shares to be issued in the Merger, (vii) the registration statement on Form F-4 with respect to the Merger Consideration having been declared effective by the U.S.

Securities and Exchange Commission (“SEC”), (viii) the expiration or termination of the applicable waiting periods under the Hart-Scott-Rodino Act and the receipt of certain other clearances, approvals and consents under certain applicable foreign antitrust and regulatory laws, in each case, without the imposition of any terms, conditions or consequences that are materially burdensome, and (ix) other customary conditions for a transaction of this type, such as (a) the absence of any legal restraint prohibiting the consummation of the transactions contemplated by the Merger Agreement, (b) the accuracy of the Company and AkzoNobel’s representations and warranties, subject to customary qualifications, (c) compliance by the Company and AkzoNobel, respectively, in all material respects with its obligations under the Merger Agreement and (d) the absence of a material adverse effect on the Company or AkzoNobel.

The Merger Agreement contains certain termination rights for the Company and AkzoNobel, including (i) if the Merger is not consummated on or before the “outside date” of May 18, 2027 (subject to extension to November 18, 2027 under certain circumstances in the event that any Regulatory Clearance has not been obtained), (ii) if the required approval of the Company shareholders or the AkzoNobel shareholders is not obtained, (iii) subject to compliance with certain terms of the Merger Agreement, in order to enter into a definitive agreement providing for a superior proposal, (iv) if the other party materially breaches its representations, warranties or covenants and fails to cure such breach, (v) if any injunction or order permanently prohibiting the Merger has become final and non-appealable or (vi) if, prior to the applicable shareholders’ meeting, the Company Board or either of the AkzoNobel Boards, as applicable, changes its recommendation or fails to reaffirm such recommendation in certain circumstances.

In the event of a termination of the Merger Agreement under certain specified circumstances, including (i) termination by the Company to enter into an agreement providing for a superior proposal, (ii) a termination by AkzoNobel following a change in recommendation by the Company Board or (iii) the Company has entered into an agreement providing for a superior proposal within twelve months following the termination of the Merger Agreement in certain circumstances, the Company may be required to pay AkzoNobel a termination fee equal to €150 million. In the event of a termination of the Merger Agreement under certain specified circumstances, including (i) termination by AkzoNobel to enter into an agreement providing for a superior proposal, (ii) a termination by the Company following a change in recommendation by either of the AkzoNobel Boards or (iii) AkzoNobel has entered into an agreement providing for a superior proposal within twelve months following the termination of the Merger Agreement in certain circumstances, AkzoNobel may be required to pay the Company a termination fee equal to €150 million.

The foregoing description of the Merger Agreement is only a summary, does not purport to be complete and is subject to, and qualified in its entirety by reference to, the full text of the Merger Agreement, which is attached as Exhibit 2.1 to this report and incorporated by reference herein. The Merger Agreement and the above description have been included to provide investors and security holders with information regarding the terms of the Merger Agreement. They are not intended to provide any other factual information about the Company, AkzoNobel or their respective subsidiaries or affiliates or equityholders. The representations, warranties and covenants contained in the Merger Agreement were made only for purposes of that agreement and as of specific dates; were solely for the benefit of the parties to the Merger Agreement; and may be subject to limitations agreed upon by the parties, including being qualified by confidential disclosures made by each contracting party to the other for the purposes of allocating contractual risk between them that differ from those applicable to investors. Investors should be aware that the representations, warranties and covenants or any description thereof may not reflect the actual state of facts or condition of the Company, AkzoNobel or any of their respective subsidiaries, affiliates, businesses, or equityholders and investors should not rely on them as statements of fact. Moreover, information concerning the subject matter of the representations, warranties, and covenants may change after the date of the Merger Agreement, which subsequent information may or may not be fully reflected in public disclosures by the Company or AkzoNobel. Accordingly, investors should read the representations and warranties of the Company or AkzoNobel and their respective subsidiaries in the Merger Agreement not in isolation, but only in conjunction with the other information that the respective companies include in reports, statements and other filings they make with the SEC.

Stichting Support Agreement

In connection with the Merger Agreement, AkzoNobel and the Company have entered into that certain Support Agreement (the “Support Agreement”) with Stichting AkzoNobel, an entity that holds all of the issued and outstanding AkzoNobel priority shares, par value of €400 per share (“AkzoNobel Priority Shares”). Under the Support Agreement, Stichting AkzoNobel has irrevocably agreed, among other things and subject to the terms and conditions of the Support Agreement, to cooperate with the implementation of the Merger where required, including to (i) give its prior approval to the proposal to amend AkzoNobel’s articles of association in accordance with the MergeCo articles of association, pursuant to which, among other things, the AkzoNobel Priority Shares will be converted into AkzoNobel Ordinary Shares and all rights that accrue to Stichting AkzoNobel as sole holder of the AkzoNobel Priority Shares will lapse and (ii) vote all of the AkzoNobel Priority Shares in favour of the resolutions to be presented to AkzoNobel shareholders at the general meeting of AkzoNobel shareholders to be held in connection with the Merger (including to approve the Merger) and against any resolution or other vote that would, or would reasonably be expected to, delay, prevent, condition or impede, in whole or in part, the consummation of the transactions contemplated by the Merger Agreement, including the Merger.

The foregoing description of the Support Agreement is only a summary, does not purport to be complete and is subject to, and qualified in its entirety by reference to, the full text of the Support Agreement, which is included as Schedule 2 of the Merger Agreement attached as Exhibit 2.1 to this report and incorporated by reference herein.

Item 8.01 Other Events

On November 18, 2025, the Company and AkzoNobel issued a joint press release to announce the execution of the Merger Agreement. A copy of the press release is attached hereto as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

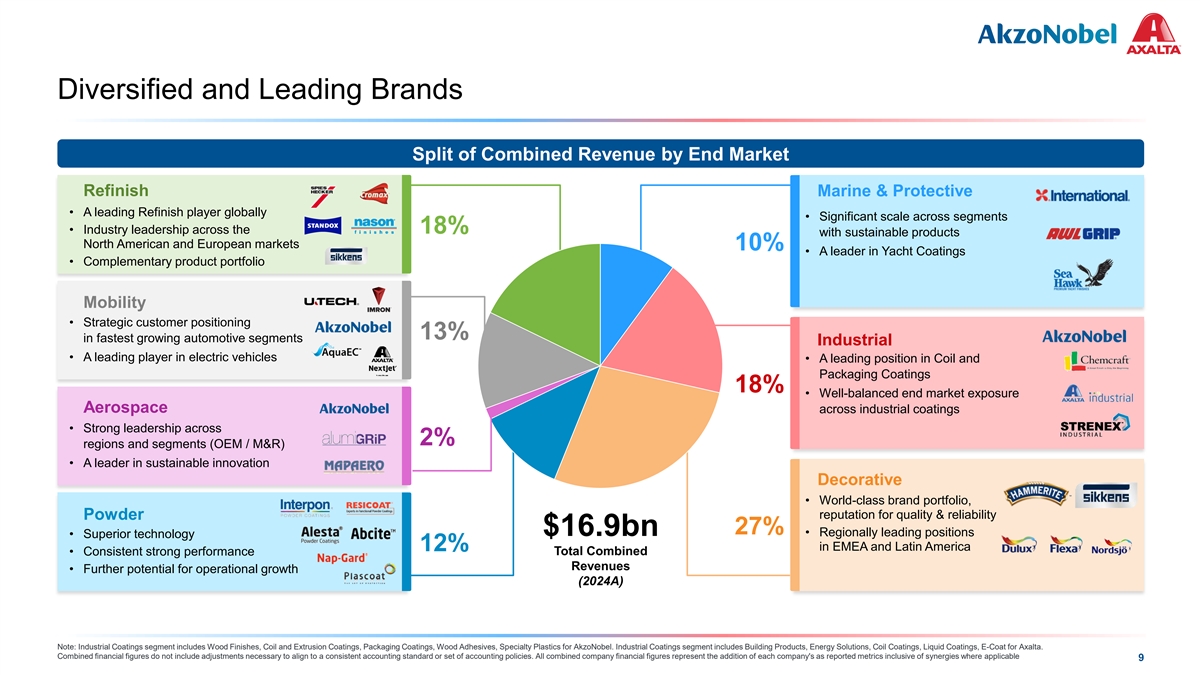

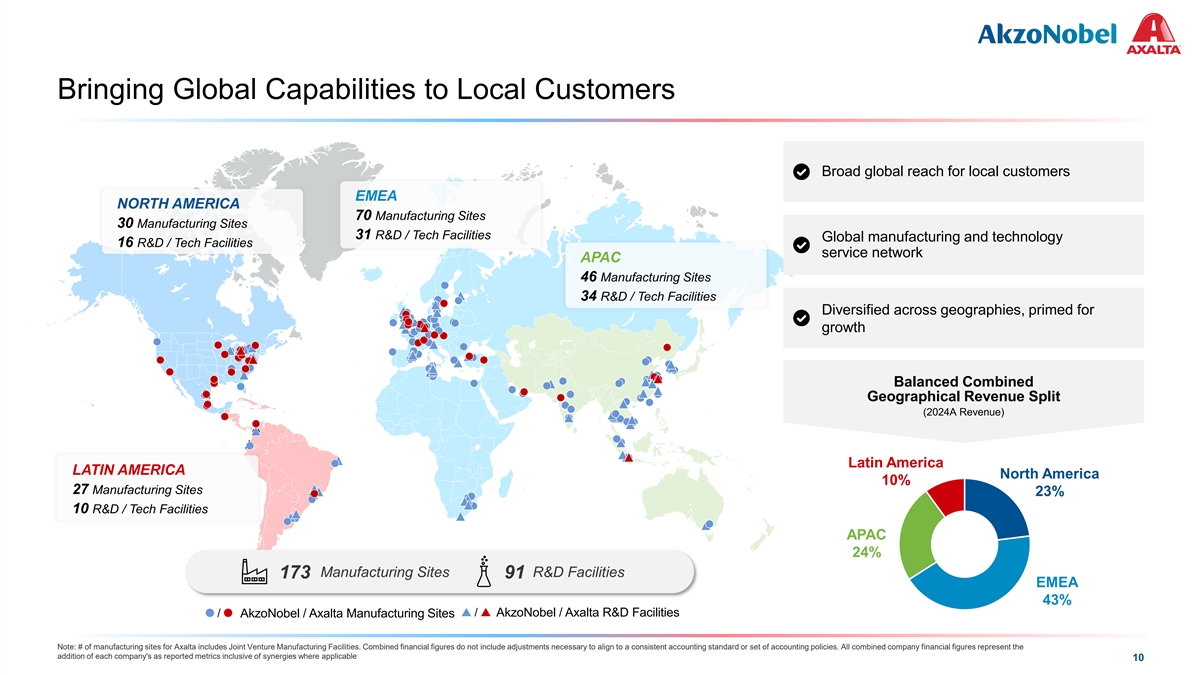

Additionally, on November 18, 2025, the Company and AkzoNobel issued a joint investor presentation, a copy of which is attached hereto as Exhibit 99.2 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

| (d) | Exhibits |

| Exhibit Number |

Description |

|

| 2.1 | Merger Agreement, by and among Akzo Nobel N.V., and Axalta Coating Systems Ltd., dated November 18, 2025.* | |

| 99.1 | Joint Press Release of Axalta Coating Systems Ltd. and Akzo Nobel N.V., dated November 18, 2025. | |

| 99.2 | Joint Investor Presentation of Axalta Coating Systems Ltd. and Akzo Nobel N.V. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). | |

| * | Certain schedules have been omitted pursuant to Item 601(b)(2) of Regulation S-K. Axalta Coating Systems Ltd. hereby agrees to furnish supplementally a copy of any omitted schedule to the SEC upon request. |

General restrictions

This communication is not for release, publication, or distribution, in whole or in part, in or into, directly or indirectly, any jurisdiction in which such release, publication, or distribution would be unlawful.

This communication is not a prospectus and the information in this communication is not intended to be complete. This communication is for informational purposes only and is not intended to be and shall not constitute a solicitation of any vote or approval, or an offer to buy or sell, or the solicitation of an offer to buy or sell, any securities, or an invitation or recommendation to subscribe for, acquire or buy securities of AkzoNobel or Axalta or any other financial products or securities, in any place or jurisdiction, nor shall there be any offer, solicitation or sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended (the “Securities Act”).

Any decision to purchase, subscribe for, otherwise acquire, sell or otherwise dispose of any securities must be made only on the basis of the information contained in and incorporated by reference into the prospectus with respect to the shares to be allotted by AkzoNobel in the proposed transaction once published. A prospectus in relation to the proposed transaction described in this communication is expected to be published in due course.

The distribution of this communication may, in some countries, be restricted by law or regulation. Accordingly, persons who come into possession of this document should inform themselves of and observe these restrictions. To the fullest extent permitted by applicable law, AkzoNobel and Axalta disclaim any responsibility or liability for the violation of any such restrictions by any person. Neither AkzoNobel, nor Axalta, nor any of their advisors assume any responsibility for any violation by any person of any of these restrictions. Shareholders of AkzoNobel and Axalta, respectively, with any doubt as to their position should consult an appropriate professional advisor without delay.

This communication is addressed to and directed only at, persons who are outside the United Kingdom or, in the United Kingdom, at persons who are: (i) persons having professional experience in matters relating to investments falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”), (ii) persons falling within Article 49(2)(a) to (d) of the Order, or (iii) persons to whom it may otherwise lawfully be communicated pursuant to the Order (all such persons together being referred to as, “Relevant Persons”). This communication is directed only at Relevant Persons. Other persons should not act or rely on this communication or any of its contents. Any investment or investment activity to which this communication relates is available only to Relevant Persons and will be engaged in only with such persons. Solicitations resulting from this communication will only be responded to if the person concerned is a Relevant Person.

Additional Information and Where to Find It

In connection with the proposed transaction between AkzoNobel and Axalta, AkzoNobel will file with the U.S. Securities and Exchange Commission (the “SEC”) a registration statement on Form F-4, which will include a proxy statement of Axalta that also constitutes a prospectus with respect to the shares to be offered by AkzoNobel in the proposed transaction. The definitive proxy statement/prospectus will be sent to the shareholders of Axalta. Each of AkzoNobel and Axalta will also file other relevant documents in connection with the proposed transaction. This communication is not a substitute for any registration statement, proxy statement/prospectus or other documents AkzoNobel and/or Axalta may file with the SEC or any other competent regulator in connection with the proposed transaction. This communication does not contain all the information that should be considered concerning the proposed transaction and is not intended to form the basis of any investment decision or any other decision in respect of the proposed transaction. BEFORE MAKING ANY VOTING OR INVESTMENT DECISIONS, INVESTORS, STOCKHOLDERS AND SHAREHOLDERS OF AKZONOBEL AND AXALTA ARE URGED TO READ CAREFULLY AND IN THEIR ENTIRETY THE PROXY STATEMENT/PROSPECTUS, AS APPLICABLE, AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, IN CONNECTION WITH THE PROPOSED TRANSACTION WHEN THEY BECOME AVAILABLE, AS THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT AKZONOBEL, AXALTA, THE PROPOSED TRANSACTION AND RELATED MATTERS. The registration statement and proxy statement/prospectus and other relevant documents filed by AkzoNobel and Axalta with the SEC, when filed, will be available free of charge at the SEC’s website at www.sec.gov. In addition, investors and shareholders will be able to obtain free copies of the proxy statement/prospectus and other documents filed with the SEC from Axalta’s investor relations webpage at https://ir.axalta.com/sec-filings/all-sec-filings or from AkzoNobel’s investor relations webpage at https://www.akzonobel.com/en/investors.

The contents of this communication should not be construed as financial, legal, business, investment, tax or other professional advice. Each recipient should consult with its own professional advisors for any such matter and advice.

Participants in the Solicitation

This communication is not a solicitation of proxies in connection with the proposed transaction. However, under SEC rules, AkzoNobel, Axalta and certain of their respective directors and executive officers and other members of their respective management and employees may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of proxies in connection with the proposed transaction, including a description of their direct or indirect interests in the proposed transaction, by security holdings or otherwise, will be set forth in the proxy statement/prospectus and other relevant materials when it is filed with the SEC. Information regarding the directors and executive officers of Axalta is contained in Axalta’s proxy statement for its 2025 annual meeting of stockholders, filed with the SEC April 22, 2025, its Annual Report on Form 10-K for the fiscal year ended December 31, 2024, which was filed with the SEC on February 13, 2025, subsequent statements of beneficial ownership on file with the SEC, including the Initial Statements of Beneficial Ownership on Form 3, Statements of Change in Ownership on Form 4 or Annual Statements of Beneficial Ownership on Form 5 filed with the SEC on: 2/19/2025, 2/19/25, 2/19/2025, 2/19/25, 2/19/2025, 3/4/2025, 3/4/2025, 3/4/2025, 3/4/2025, 3/4/2025, 3/4/2025, 3/4/2025, 3/4/2025, 3/4/2025, 3/4/2025, 3/4/2025, 3/4/2025, 3/4/2025, 3/4/2025, 3/6/2025, 3/6/2025, 3/6/2025, 3/6/2025, 3/6/2025, 3/6/2025, 3/6/2025, 3/6/2025, 3/6/2025, 3/6/2025, 3/6/2025, 3/6/2025, 3/6/2025, 3/6/2025, 3/6/2025, 3/6/2025, 8/5/2025, 8/18/2025, 8/21/2025, 9/23/2025 and 9/23/2025, and other filings made from time to time with the SEC. Information about AkzoNobel’s supervisory board members and members of the board of management is set forth in AkzoNobel’s latest annual report, as filed with the AFM, the Dutch trader register and on its website at https://www.akzonobel.com/en/investors/results-center, and as updated from time to time via filings made by AkzoNobel with the AFM.

Additional information regarding the interests of persons who may, under the rules of the SEC, be deemed participants in the solicitation of Axalta security holders in connection with the proposed transaction, which may, in some cases, be different than those of Axalta’s shareholders generally, including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the proxy statement/prospectus and other relevant materials when they are filed with the SEC. These documents can be obtained free of charge from the sources indicated above.

Cautionary Statement Concerning Forward-Looking Statements

This communication contains forward-looking statements as that term is defined in Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended by the Private Securities Litigation Reform Act of 1995, regarding, among other things, statements about management’s expectations of AkzoNobel’s and Axalta’s future operating and financial performance, product development, market position, and business strategy. Such forward-looking statements can sometimes be identified by the use of forward-looking terms such as “believes,” “expects,” “may,” “will,” “shall,” “should,” “would,” “could,” “potential,” “seeks,” “aims,” “projects,” “predicts,” “is optimistic,” “intends,” “plans,” “estimates,” “targets,” “anticipates,” “continues” or other comparable terms or negatives of these terms, but not all forward-looking statements include such identifying words. You are cautioned not to rely on these forward-looking statements. Forward-looking statements are based upon current plans, estimates and expectations that are subject to risks, uncertainties and assumptions. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by such forward-looking statements. We can give no assurance that such plans, estimates or expectations will be achieved and therefore, actual results may differ materially from any plans, estimates or expectations in such forward-looking statements. Important factors that could cause actual results to differ materially from such plans, estimates or expectations include: a condition to the closing of the proposed transaction may not be satisfied; the occurrence of any event that can give rise to termination of the proposed transaction; a regulatory approval that may be required for the proposed transaction is delayed, is not obtained or is obtained subject to conditions that are not anticipated; AkzoNobel and Axalta are unable to achieve the synergies and value creation contemplated by the proposed transaction; AkzoNobel and Axalta are unable to promptly and effectively integrate their businesses; management’s time and attention is diverted on transaction related issues; the possibility that competing offers or acquisition proposals may be made; disruption from the proposed transaction makes it more difficult to maintain business, contractual and operational relationships; the credit ratings of AkzoNobel or Axalta decline following the proposed transaction; legal proceedings are instituted against AkzoNobel or Axalta, including resulting expense or delay; AkzoNobel or Axalta is unable to retain or hire key personnel; the communication or the consummation of the proposed acquisition has a negative effect on the market price of the capital stock of AkzoNobel or Axalta or on AkzoNobel’s or Axalta’s operating results; evolving legal, regulatory and tax regimes; changes in economic, financial, political and regulatory conditions, in the Netherlands, the United States and elsewhere, and other factors that contribute to uncertainty and volatility, natural and man-made disasters, civil unrest, pandemics (e.g., the coronavirus (COVID-19) pandemic), geopolitical uncertainty, and conditions that may result from legislative, regulatory, trade and policy changes associated with the current or subsequent United States or Netherlands administration; the ability of AkzoNobel or Axalta to successfully recover from a disaster or other business continuity problem due to a hurricane, flood, earthquake, terrorist attack, war, pandemic, security breach, cyber-attack, power loss, telecommunications failure or other natural or man-made event, including the ability to function remotely during long-term disruptions; the impact of public health crises, such as pandemics and epidemics and any related company or governmental policies and actions to protect the health and safety of individuals or governmental policies or actions to maintain the functioning of national or global economies and markets, including any quarantine, “shelter in place,” “stay at home,” workforce reduction, social distancing, shut down or similar actions and policies; actions by third parties, including government agencies; the risk that disruptions from the proposed transaction will harm AkzoNobel’s or Axalta’s business, including current plans and operations and/or divert management’s attention from AkzoNobel’s or Axalta’s ongoing business operations; certain restrictions during the pendency of the acquisition that may impact AkzoNobel’s or Axalta’s ability to pursue certain business opportunities or strategic transactions; AkzoNobel’s or Axalta’s ability to meet expectations regarding the accounting and tax treatments of the proposed transaction; the risks and uncertainties discussed in AkzoNobel’s latest annual report as filed with the AFM, the Dutch trader register and on its website at https://www.akzonobel.com/en/investors/results-center; and the risks and uncertainties discussed in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections in Axalta’s reports filed with the SEC. These risks, as well as other risks associated with the proposed transaction, will be more fully discussed in the proxy statement/prospectus. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. We caution you not to place undue reliance on any of these forward-looking statements as they are not guarantees of future performance or outcomes and that actual performance and outcomes, including, without limitation, our actual results of operations, financial condition and liquidity, and the development of new markets or market segments in which we operate, may differ materially from those made in or suggested by the forward-looking statements contained in this communication. Except as required by law, neither AkzoNobel nor Axalta assumes any obligation to update or revise the information contained herein, which speaks only as of the date hereof.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| AXALTA COATING SYSTEMS LTD. | ||||||

| Date: November 18, 2025 | By: | /s/ Alex Tablin-Wolf |

||||

| Alex Tablin-Wolf | ||||||

| Senior Vice President, General Counsel & Corporate Secretary | ||||||

Exhibit 2.1

Execution Version

MERGER AGREEMENT

between

Akzo Nobel N.V.

and

Axalta Coating Systems Ltd.

Dated 18 November 2025

Contents

| Clause | Page | |||

| 1 DEFINITIONS AND CONSTRUCTION |

3 | |||

| 1.1 Definitions |

3 | |||

| 2 THE MERGER |

3 | |||

| 2.1 The Merger |

3 | |||

| 2.2 The Effective Time |

4 | |||

| 2.3 Pre-Completion Distribution |

4 | |||

| 2.4 Completion |

5 | |||

| 2.5 Branding of MergeCo |

5 | |||

| 3 MERGER CONDITIONS |

5 | |||

| 3.1 Merger Conditions |

5 | |||

| 3.2 Beneficiary of Conditions; Waiver |

7 | |||

| 3.3 Regulatory Clearances |

8 | |||

| 3.4 Other regulatory approvals |

10 | |||

| 3.5 Commitments in respect of Regulatory Clearances |

10 | |||

| 3.6 Employee Consultation |

11 | |||

| 3.7 NYSE listing |

15 | |||

| 3.8 Reasonable Best Efforts |

15 | |||

| 4 EXTRAORDINARY GENERAL MEETINGS |

16 | |||

| 4.1 Convocation of the AkzoNobel EGM |

16 | |||

| 4.2 AkzoNobel Resolutions |

16 | |||

| 4.3 AkzoNobel EGM Materials |

16 | |||

| 4.4 AkzoNobel Recommendation |

17 | |||

| 4.5 AkzoNobel Adverse Recommendation Change |

17 | |||

| 4.6 AkzoNobel Intervening Event |

19 | |||

| 4.7 Other matters in respect of the AkzoNobel EGM |

20 | |||

| 4.8 Convocation of the Axalta EGM |

21 | |||

| 4.9 Axalta Resolutions |

21 | |||

| 4.10 Axalta EGM Materials |

21 | |||

| 4.11 Axalta Recommendation |

22 | |||

| 4.12 Axalta Adverse Recommendation Change |

22 | |||

| 4.13 Axalta Intervening Event |

24 | |||

| 4.14 Other matters in respect of the Axalta EGM |

25 | |||

| 4.15 Certain Filings; SEC and AFM Matters |

26 | |||

| 4.16 Fairness Opinions |

29 | |||

| 5 REPRESENTATIONS AND WARRANTIES OF AKZONOBEL |

30 | |||

| 6 REPRESENTATIONS AND WARRANTIES OF AXALTA |

30 | |||

| 7 POST-MERGER CORPORATE GOVERNANCE |

30 | |||

| 7.1 MergeCo Governance |

30 | |||

| 7.2 MergeCo Board Composition |

31 | |||

| 7.3 MergeCo Tax residency |

33 | |||

| 8 DELISTING FROM EURONEXT AMSTERDAM |

33 | |||

| 9 INDEMNIFICATION AND INSURANCE |

33 | |||

| 9.1 Indemnification |

33 | |||

| 9.2 Insurance |

34 | |||

| 9.3 Third-Party Beneficiaries |

35 | |||

| 10 DEBT FINANCING AND REFINANCING |

35 | |||

| 10.1 Debt Financing |

35 | |||

| 10.2 Refinancing |

36 | |||

| 10.3 Debt Financing and Refinancing Cooperation |

36 | |||

| 10.4 Cost Allocation |

37 | |||

| 11 EQUITY PLANS |

37 | |||

| 11.1 Axalta Equity Plans |

37 | |||

| 11.2 AkzoNobel Equity Plans |

41 | |||

| 11.3 Post-Completion Equity Plans |

42 | |||

| 11.4 Tax |

43 | |||

| 12 INTERIM PERIOD AND FURTHER UNDERTAKINGS |

43 | |||

| 12.1 Conduct during Interim Period |

43 | |||

| 12.2 Third party consents |

44 | |||

| 12.3 Merger Planning |

44 | |||

| 12.4 MergeCo Remuneration Policy |

46 | |||

| 13 EXCLUSIVITY |

46 | |||

| 13.1 Exclusivity |

46 | |||

| 14 SUPERIOR PROPOSAL |

48 | |||

| 14.1 Superior Proposal |

48 | |||

| 15 TERMINATION |

51 | |||

| 15.1 Termination by AkzoNobel or Axalta |

51 | |||

| 15.2 Consequence of Termination |

53 | |||

| 16 TERMINATION PAYMENT |

54 | |||

| 16.1 Termination Payment AkzoNobel |

54 | |||

| 16.2 Termination Payment Axalta |

55 | |||

| 16.3 Payment of Termination Payment |

56 | |||

| 16.4 Tax |

57 | |||

| 16.5 Specific Performance and Related Provisions |

57 | |||

| 17 CONFIDENTIALITY AND PUBLIC ANNOUNCEMENTS |

58 | |||

| 17.1 Announcement, Filings and Other Public Statements |

58 | |||

| 17.2 Confidentiality Agreement |

59 | |||

| 18 TAX MATTERS |

60 | |||

| 18.1 Withholding |

60 | |||

| 18.2 U.S. Tax Matters |

60 | |||

| 18.3 Pillar 2 and CAMT |

61 | |||

| 19 EMPLOYEE MATTERS |

62 | |||

| 20 MISCELLANEOUS |

64 | |||

| 20.1 Assignment |

64 | |||

| 20.2 Costs |

64 | |||

| 20.3 No waiver |

64 | |||

| 20.4 No recission |

64 | |||

| 20.5 Further assurances |

64 | |||

| 20.6 Invalidity |

65 | |||

| 20.7 Third party rights |

65 | |||

| 20.8 Entire agreement and amendment |

65 | |||

| 20.9 Notices |

65 | |||

| 20.10 Counterparts |

67 | |||

| 20.11 Governing law and forum |

67 | |||

| 20.12 Rules of Construction |

69 | |||

| Schedules | ||

| Schedule 1 | Definitions | |

| Schedule 2 | Stichting Support Agreement | |

| Schedule 3 | Joint Announcement | |

| Schedule 4 | Merger | |

| Schedule 5 | AkzoNobel Resolutions | |

| Schedule 6 | Axalta Resolutions | |

| Schedule 7 | Interim Period: AkzoNobel | |

| Schedule 8 | Interim Period: Axalta | |

| Schedule 9 | Representations and Warranties of AkzoNobel | |

| Schedule 10 | Representations and Warranties of Axalta | |

| Schedule 11 | MergeCo Governance | |

| Schedule 12 | Bermuda Statutory Merger Agreement | |

| Schedule 13 | AkzoNobel Sub Joinder Agreement | |

MERGER AGREEMENT

THIS AGREEMENT IS DATED 18 NOVEMBER 2025 AND MADE BETWEEN:

| (1) | Akzo Nobel N.V. (“AkzoNobel”); |

and

| (2) | Axalta Coating Systems Ltd. (“Axalta”), |

AkzoNobel and Axalta each a “Party” and together the “Parties”.

BACKGROUND:

| (A) | AkzoNobel, a public company with limited liability (naamloze vennootschap) incorporated under the laws of the Netherlands, is a global paints and coatings company with its corporate seat and headquarters in Amsterdam, the Netherlands, and a listing on Euronext Amsterdam. |

| (B) | Axalta, an exempted company incorporated under the laws of Bermuda, is a global coatings company with its headquarters in Philadelphia, Pennsylvania, the United States, and a listing on the New York Stock Exchange (the “NYSE”). |

| (C) | AkzoNobel and Axalta have entered into a confidentiality and non-disclosure agreement dated 30 August 2024 and a clean team agreement dated 11 October 2024 (together, as amended, the “Confidentiality Agreement”) to discuss a potential combination of their respective businesses. |

| (D) | AkzoNobel and Axalta now have agreed to combine, via a merger of equals, the respective businesses of AkzoNobel and Axalta under a single listed parent company. AkzoNobel will serve as a vehicle hereto (AkzoNobel, upon the completion of the Merger, “MergeCo”), which will have dual headquarters in Amsterdam, the Netherlands, and Philadelphia, Pennsylvania, the United States, its corporate seat in the Netherlands, its Tax residency in the Netherlands and its ordinary shares listed on the NYSE. AkzoNobel and Axalta intend to effect the combination of their respective businesses through a merger (the “Merger”) under the laws of Bermuda between Axalta and a wholly-owned subsidiary of AkzoNobel to be incorporated as an exempted company under the laws of Bermuda (“AkzoNobel Sub”), on the terms and subject to the conditions in this Agreement. |

| (E) | Prior to completion of the Merger, AkzoNobel will declare and pay the Pre-Completion Distribution. |

1

| (F) | Following completion of the Merger, subject to the terms of this Agreement and based on the outstanding share capital of AkzoNobel and the issued share capital of Axalta as of the date of this Agreement, respectively, MergeCo will have a single class of ordinary shares and, without prejudice to the Exchange Ratio, the existing Axalta shareholders are expected to hold approximately forty-five per cent (45%) of the issued and outstanding shares in MergeCo and the existing AkzoNobel shareholders are expected to hold approximately fifty-five per cent (55%) of the issued and outstanding shares in MergeCo. |

| (G) | The board of directors of Axalta (the “Axalta Board”) unanimously approved this Agreement, determined that the transactions contemplated by this Agreement, including the Merger, are in the best interest of Axalta and its shareholders, determined that the AkzoNobel Share Consideration constitutes fair value in accordance with the Companies Act and recommends the shareholders of Axalta adopt the Axalta Resolutions subject to the terms and conditions set out in this Agreement. |

| (H) | The board of management of AkzoNobel (the “AkzoNobel Board of Management”) and the supervisory board of AkzoNobel (the “AkzoNobel Supervisory Board”, and together with the AkzoNobel Board of Management, the “AkzoNobel Boards”) each unanimously approved this Agreement, determined that the transactions contemplated by this Agreement, including the Merger, are in the best interest of AkzoNobel and its business, promoting the sustainable success and the sustainable long-term value creation of its business, taking into account the interests of its stakeholders, including the AkzoNobel shareholders and its employees, and recommend the shareholders of AkzoNobel adopt the AkzoNobel Resolutions subject to the terms and conditions set out in this Agreement. |

| (I) | Stichting Akzo Nobel has executed a support agreement (attached to this Agreement as Schedule 2 (Stichting Support Agreement), the “Stichting Support Agreement”), pursuant to which, among other things, Stichting Akzo Nobel irrevocably agreed to (a) approve the proposal of the AkzoNobel Board of Management to amend AkzoNobel’s articles of association in accordance with the MergeCo Articles of Association, including the conversion of all AkzoNobel Priority Shares into AkzoNobel Ordinary Shares (such AkzoNobel Ordinary Shares, the “Stichting Converted Shares”), (b) vote all AkzoNobel Priority Shares in favour of the AkzoNobel Resolutions and against any resolution or other vote (stemming) that would, or would reasonably be expected to, delay, prevent, condition or impede, in whole or in part, the consummation of the transactions contemplated by this Agreement, including the Merger, (c) waive its rights to make binding nominations in respect of the MergeCo Board Nominees, (d) transfer the Stichting Converted Shares to AkzoNobel for no consideration with effect immediately after the implementation of the MergeCo Articles of Association, and (e) waive and relinquish any rights Stichting Akzo Nobel may have with respect to AkzoNobel Priority Shares and AkzoNobel. |

2

| (J) | The terms and conditions and the mutual understanding of AkzoNobel and Axalta with respect to the Merger are set out in this merger agreement (this “Agreement”). |

THE PARTIES AGREE AS FOLLOWS:

| 1 | DEFINITIONS AND CONSTRUCTION |

| 1.1 | Definitions |

Certain terms used in this Agreement are defined in Schedule 1 (Definitions).

| 2 | THE MERGER |

| 2.1 | The Merger |

| 2.1.1 | As soon as reasonably practicable after the date of this Agreement, and in any event prior to the filing of the Form F-4 in accordance with clause 4.15, AkzoNobel shall incorporate AkzoNobel Sub as an exempted company under the laws of Bermuda. Promptly following the incorporation of AkzoNobel Sub: |

| (a) | AkzoNobel shall deliver to Axalta a complete and correct copy of the organizational or other governing documents of AkzoNobel Sub; |

| (b) | The board of directors of AkzoNobel Sub shall approve this Agreement, determine that the transactions contemplated by this Agreement, including the Merger, are in the best interest of AkzoNobel Sub and its shareholder, and the shareholder of AkzoNobel Sub shall approve this Agreement and the Merger, in each case, in accordance with applicable Bermuda laws and subject to the terms and conditions set out in this Agreement; and |

| (c) | AkzoNobel shall cause AkzoNobel Sub to execute and deliver to Axalta a joinder to this Agreement, in the form attached hereto as Schedule 13 (AkzoNobel Sub Joinder Agreement) (the “Joinder Agreement”). Upon the execution and delivery of the Joinder Agreement, (i) the Joinder Agreement shall be deemed to be part of this Agreement and (ii) AkzoNobel Sub and AkzoNobel shall together be deemed to be a “Party” to this Agreement. The representations, warranties, covenants and agreements of, or with respect to, AkzoNobel Sub herein and in the Joinder Agreement shall take effect as of and after the execution and delivery of the Joinder Agreement. |

3

| 2.1.2 | On the terms and subject to the conditions set out in this Agreement, AkzoNobel and Axalta shall, and AkzoNobel shall procure that AkzoNobel Sub shall, implement the Merger by merging AkzoNobel Sub with and into Axalta, with Axalta as the surviving company, in accordance with the terms set out in Schedule 4 (Merger), pursuant to which: |

| (a) | at the Effective Time, each Axalta Ordinary Share shall be automatically converted into the right to receive 0.6539 AkzoNobel Ordinary Shares, as further set out in paragraph 2 of Schedule 4 (Merger); and |

| (b) | immediately following the Effective Time, the Parties shall procure that the Exchange Agent will, solely for the account and benefit of the former Axalta Registered Shareholders as of immediately prior to the Effective Time, contribute the issued and outstanding Axalta Ordinary Shares held by such former Axalta Registered Shareholders to AkzoNobel as a contribution in kind (the “Contribution”) and, in consideration of the Contribution, AkzoNobel shall issue and deliver to the Exchange Agent, solely for the account and benefit of such former Axalta Registered Shareholders, the relevant number of AkzoNobel Ordinary Shares, |

all in accordance with the terms set out in Schedule 4 (Merger).

| 2.2 | The Effective Time |

The Merger shall become effective upon the issuance of the Certificate of Merger by the Registrar, or at such other time and date as shall be set forth in the Certificate of Merger (such date and time, the “Effective Time”).

| 2.3 | Pre-Completion Distribution |

Prior to the Effective Time, AkzoNobel shall declare and pay a special cash dividend for an aggregate amount of EUR 2,500,000,000 (two billion five hundred million euro) minus the aggregate amount of any 2026 Pre-Completion Distribution AkzoNobel Dividends (the “Pre-Completion Distribution”), subject to Applicable Law and any applicable withholding Tax. AkzoNobel shall use reasonable best efforts to (x) as promptly as practicable during the Interim Period, obtain the Debt Financing Commitment and (y) consummate such borrowings on or before the Effective Time to provide AkzoNobel necessary funds for the Pre-Completion Distribution, in the case of each of clauses (x) and (y), in accordance with clause 10.1. AkzoNobel shall deduct and withhold from the Pre-Completion Distribution such amounts as AkzoNobel may be required to deduct and withhold with respect to any such payments under Applicable Law.

4

To the extent such amounts are so withheld and paid by AkzoNobel to the appropriate Governmental Authority, they shall be treated as having been paid to such Person in respect of which such deduction and withholding was made.

| 2.4 | Completion |

Completion shall commence at 14:00 Amsterdam, Netherlands time on the fifth (5th) Business Day after the satisfaction or waiver of the last Merger Condition in accordance with this Agreement (other than those Merger Conditions that by their nature are to be satisfied at Completion, but subject to the satisfaction or (to the extent permitted by Applicable Law) waiver of those Merger Conditions at Completion), or such other date and time as agreed in writing between AkzoNobel and Axalta.

| 2.5 | Branding of MergeCo |

| 2.5.1 | The Parties shall discuss in good faith and mutually agree on the name, ticker symbol and branding strategy of MergeCo as soon as reasonably practicable after the date of this Agreement, and in any event prior to the initial filing of the Form F-4. The Parties acknowledge and agree that the name of MergeCo shall not be exclusively “AkzoNobel” or “Axalta” (but may include one or both of such names in combination with other words as mutually agreed by the Parties). |

| 2.5.2 | As of the Amendment Time, AkzoNobel shall cause the name and ticker symbol of MergeCo to be changed to such name and ticker symbol as mutually agreed pursuant to this clause 2.5. |

| 3 | MERGER CONDITIONS |

| 3.1 | Merger Conditions |

| 3.1.1 | Notwithstanding any other provision of this Agreement, the obligations of AkzoNobel, on the one hand, and Axalta, on the other hand, to consummate the Merger are subject to the satisfaction (or waiver by AkzoNobel or Axalta in accordance with clause 3.2) of the conditions set forth in this clause 3.1 (the “Merger Conditions”): |

| (a) | all Regulatory Clearances in relation to the Merger having been obtained as set out in clause 3.3.1; |

| (b) | the AkzoNobel Works Council Consultation having been deemed completed in accordance with clause 3.6; |

| (c) | (i) there not being an AkzoNobel Material Warranty Breach and (ii) AkzoNobel and AkzoNobel Sub having complied with or performed in all material respects all obligations and covenants required to be complied with or performed by them under this Agreement at or prior to the Completion Date; |

5

| (d) | (i) there not being an Axalta Material Warranty Breach and (ii) Axalta having complied with or performed in all material respects all obligations and covenants required to be complied with or performed by it under this Agreement at or prior to the Completion Date; |

| (e) | the AkzoNobel Completion Resolutions having been validly adopted at the AkzoNobel EGM and being in full force and effect; |

| (f) | the Axalta Completion Resolution having been validly adopted at the Axalta EGM and being in full force and effect; |

| (g) | the registration statement on Form F-4 (which shall include the Proxy Statement/Prospectus) (together with all amendments and supplements thereto, the “Form F-4”) relating to the registration of AkzoNobel Ordinary Shares to be issued to shareholders of Axalta having been declared effective by the SEC under the U.S. Securities Act of 1933, as amended (the “Securities Act”), no stop order suspending the effectiveness of the Form F-4 being in effect and no proceedings for such purposes being pending before the SEC; |

| (h) | AkzoNobel having made publicly available a document (the “Prospectus Regulation Document”) in accordance with Regulation (EU) 2017/1129, as amended from time to time (the “Prospectus Regulation”), as required in connection with the listing on Euronext Amsterdam of the AkzoNobel Ordinary Shares to be issued in the Merger; |

| (i) | AkzoNobel Ordinary Shares issuable in the Merger having been authorized for listing on NYSE, subject only to official notice of issuance; |

| (j) | the Pre-Completion Distribution having been declared and paid by AkzoNobel; |

| (k) | (i) no stay or other Order having been issued by any Governmental Authority of competent jurisdiction that remains in force and effect at Completion: |

| (A) | in an Applicable Jurisdiction, to the extent related to a Competition Law or Foreign Investment Law; or |

| (B) | in a Material Business Jurisdiction, to the extent clause 3.1.1(k)(i)(A) does not apply; and |

6

(ii) no statute, rule, regulation or other Applicable Law of any Governmental Authority of competent jurisdiction having been enacted that remains in force and effect at Completion:

| (A) | in an Applicable Jurisdiction, to the extent related to a Competition Law or Foreign Investment Law; or |

| (B) | in a Material Business Jurisdiction, to the extent clause 3.1.1(k)(ii)(A) does not apply, |

which in any case of clause (k)(i) or (k)(ii), prohibits the consummation of the Merger, in whole or in part, in accordance with this Agreement;

| (l) | AkzoNobel not being subject to a voluntary or involuntary liquidation, administration order, suspension of payments or any other insolvency proceeding in any jurisdiction at Completion; |

| (m) | Axalta not being subject to a voluntary or involuntary liquidation, administration order, suspension of payments or any other insolvency proceeding in any jurisdiction at Completion; |

| (n) | between the date of this Agreement and Completion, there not having occurred a Material Adverse Effect in relation to AkzoNobel; and |

| (o) | between the date of this Agreement and Completion, there not having occurred a Material Adverse Effect in relation to Axalta. |

| 3.1.2 | No Party may invoke any Merger Condition if such Party’s breach of any provision of this Agreement has been the proximate cause of the non-satisfaction of such Merger Condition. |

| 3.2 | Beneficiary of Conditions; Waiver |

| 3.2.1 | The Merger Conditions set out in clause 3.1, subclauses (d), (m) and (o) are for the sole benefit of AkzoNobel and accordingly AkzoNobel may, to the extent permitted by the Applicable Law, waive each of these Merger Conditions (either in whole or in part) at any time by giving written notice to Axalta. |

| 3.2.2 | The Merger Conditions set out in clause 3.1, subclauses (c), (l) and (n) are for the sole benefit of Axalta and accordingly Axalta may, to the extent permitted by the Applicable Law, waive each of these Merger Conditions (either in whole or in part) at any time by giving written notice to AkzoNobel. |

7

| 3.2.3 | The Merger Conditions set out in clause 3.1, subclauses (a), (b), (e), (f), (g), (h), (i), (j) and (k) are for the benefit of both AkzoNobel and Axalta and may, to the extent permitted by the Applicable Law, only be waived (either in whole or in part) by both AkzoNobel and Axalta jointly in writing; provided, however, that, to the extent the AkzoNobel Boards determine in good faith (after consultation with their outside legal counsel and financial advisors) that the failure to waive (either in whole or in part) the Merger Condition set out in clause 3.1, subclause (j) would be inconsistent with the fiduciary duties of the AkzoNobel Boards under the Laws of the Netherlands, the Merger Condition set out in clause 3.1, subclause (j) may be waived solely by AkzoNobel to such extent by giving written notice to Axalta (provided that AkzoNobel first consults in good faith with Axalta and takes into account any reasonable comments that Axalta may have). |

| 3.3 | Regulatory Clearances |

| 3.3.1 | The Merger Condition set out in clause 3.1.1(a) will be considered to be satisfied upon, with respect to each Regulatory Clearance: |

| (a) | the Regulatory Clearance having been obtained without conditions or with conditions meeting the requirements of clause 3.5.1 that have been addressed or fulfilled to the satisfaction of the Regulatory Authorities; |

| (b) | the waiting and other time periods (and any extensions thereof) applicable to the Merger under the relevant Applicable Law having expired, lapsed or terminated; or |

| (c) | the applicable Regulatory Authority taking a decision or otherwise informing AkzoNobel or Axalta that the Merger does not fall within the scope of the relevant Applicable Law, or that the applicable Regulatory Authority does not have further questions and does not intend to commence an investigation under the Applicable Law with respect to the Merger. |

| 3.3.2 | AkzoNobel and Axalta shall, or shall cause their respective Affiliates to, jointly, or if legally required separately but in close consultation with one another, make all filings, unless otherwise agreed between AkzoNobel and Axalta, to obtain the Regulatory Clearances set out in paragraph 1 of Part C of the Disclosure Letter (Regulatory Clearances) and any other Regulatory Clearances mutually agreed to by AkzoNobel and Axalta pursuant to clauses 3.3 (Regulatory Clearances) and 3.4 (Other regulatory approvals) as soon as permitted and practicably feasible after the date of this Agreement, but in any event within applicable mandatory deadlines; and cooperate fully with one another and, without prejudice to clause 3.5 (Commitments in respect of Regulatory Clearances), use their respective reasonable best efforts to take any and all actions reasonably necessary to obtain the Regulatory Clearances and to respond as promptly as practicable to any requests for information from any Regulatory Authority of competent jurisdiction. |

8

| 3.3.3 | Without prejudice to the generality of clauses 3.3.2 and 3.5 (Commitments in respect of Regulatory Clearances), and subject to Competition Laws relating to the exchange of information: |

| (a) | AkzoNobel and Axalta shall reasonably consult and cooperate with one another, including by (to the extent legally permissible) providing to the other in advance a reasonable opportunity to review, providing to the other comments within a reasonable period and considering in good faith the views of one another in connection with any analyses, presentations, memoranda, briefs, arguments, opinions, proposals or other substantive written communications made or submitted by or on behalf of AkzoNobel or Axalta, in connection with the proceedings relating to any of the Regulatory Clearances. AkzoNobel and Axalta shall have joint responsibility for determining the strategy and liaising with all Regulatory Authorities in relation to the Merger, with the assistance of their respective advisers; |

| (b) | each of AkzoNobel and Axalta shall assist and furnish the other with any reasonably necessary information, documentation and assistance reasonably requested in connection with obtaining the Regulatory Clearances; and |

| (c) | each of AkzoNobel and Axalta shall: |

| (i) | to the extent practicable and permitted by Applicable Law, give each other reasonable advance notice of all meetings, oral communications or other material discussions with any Regulatory Authority relating to the Regulatory Clearances; |

| (ii) | to the extent practicable and permitted by Applicable Law, give each other (or their respective outside counsel) timely notice of, and opportunity to participate in, each of such meetings, oral communications or other material discussions; |

| (iii) | if any Regulatory Authority initiates a substantive oral communication regarding any Regulatory Clearance and the other Party (or their respective outside counsel) did not participate in such communication, to the extent permitted by Applicable Law, promptly thereafter notify such other Party of the substance of such communication; and |

| (iv) | to the extent permitted by Applicable Law, provide each other with copies of all substantive written communications received from any Governmental Authority relating to the Regulatory Clearances, |

9

provided that any disclosures or provision of copies by AkzoNobel or Axalta, as applicable, to the other pursuant to this clause 3.3.3 may be made on an outside counsel basis or pursuant to the procedures set forth in the Confidentiality Agreement, if appropriate.

| (d) | Subject to clause 3.5 (Commitments in respect of Regulatory Clearances), each of AkzoNobel and Axalta shall, and shall procure that each of their respective Affiliates shall, refrain from carrying out any action that would reasonably be expected to cause material delay to, materially hinder, prevent or materially prejudice satisfaction of the Merger Condition set out in clause 3.1.1(a). |

| (e) | All filing fees incurred in relation to any filing required to be made in any jurisdiction in connection with the obtainment of the Regulatory Clearances shall be split equally by AkzoNobel and Axalta. |

| 3.4 | Other regulatory approvals |

If, after the date of this Agreement, both AkzoNobel and Axalta agree in writing that other approvals required by Applicable Law apply to the Merger, AkzoNobel and Axalta shall use their respective reasonable best efforts to promptly secure such additional approval(s), unless agreed in writing otherwise between AkzoNobel and Axalta, including by submitting any required filings. In that case, clause 3.5 (Commitments in respect of Regulatory Clearances) applies mutatis mutandis to such newly introduced approvals. For the avoidance of doubt, except as set forth in paragraph 1.1.4(b) of Part C of the Disclosure Letter (Regulatory Clearances), any approval that AkzoNobel and Axalta agree to pursue pursuant to this clause 3.4 shall be deemed not to be a Regulatory Clearance for purposes of the Merger Condition set out in clause 3.1.1(a) of the Agreement.

| 3.5 | Commitments in respect of Regulatory Clearances |

| 3.5.1 | AkzoNobel and Axalta shall jointly determine the strategy, shall consult and cooperate with one another and shall consider in good faith the views of one another with respect to all Regulatory Authorities in relation to any and all aspects concerning the actions contemplated in this clause 3.5 (Commitments in respect of Regulatory Clearances). Each of AkzoNobel and Axalta shall use its reasonable best efforts to take, and to cause each of its Affiliates to take, any and all actions reasonably necessary to obtain the Regulatory Clearances as soon as reasonably practicable after the date of this Agreement, and, without limiting the foregoing, each of AkzoNobel and Axalta shall, and shall cause each of its Affiliates to, consent to any divestiture, sale, disposition or other structural or conduct remedy, provided that: |

| (a) | any such action shall be conditional on Completion; |

10

| (b) | AkzoNobel and Axalta will determine jointly what actions, individually or in the aggregate, are considered the most appropriate and will also, to the best of their knowledge and understanding, adequately address any applicable Regulatory Authority’s concerns; |

| (c) | without limiting any other subclause of this clause 3.5.1, AkzoNobel or Axalta may undertake, and Axalta or AkzoNobel, as applicable, shall reasonably cooperate with the other in connection with, any such divestiture, sale, disposition or other structural or conduct remedy with respect to its own businesses, assets or properties, unless such actions, individually or in the aggregate, are materially burdensome as set out in paragraph 2 of Part C of the Disclosure Letter (Regulatory Clearances); |

| (d) | AkzoNobel and Axalta shall not be required to take any actions to the extent such actions, individually or in the aggregate, are materially burdensome as set out in paragraph 2 of Part C of the Disclosure Letter (Regulatory Clearances); and |

| (e) | without the prior written consent of the other Party (such consent not to be unreasonably withheld, conditioned or delayed), AkzoNobel and Axalta shall not, and shall procure that their respective Affiliates shall not, take any actions to the extent such actions, individually or in the aggregate, are materially burdensome as set out in paragraph 2 of Part C of the Disclosure Letter (Regulatory Clearances). |

| 3.6 | Employee Consultation |

| 3.6.1 | Each of AkzoNobel and Axalta shall, or shall procure, that the notification and consultation procedure with respect to the Merger, and any other consultation matters in relation to the Merger or required to give performance to this Agreement, are performed: |

| (a) | in accordance with the SER’s Merger code 2015 (SER Fusiegedragsregels 2015, the “Merger Code”), which procedure shall be initiated after execution of this Agreement and simultaneously with, or immediately prior to, announcement of the Merger with reasonable best efforts taken to ensure confidentiality; |

| (b) | with respect to the consultation with the AkzoNobel Works Council, in accordance with the Dutch Works Council Act (Wet op de Ondernemingsraden, the “WCA”), which procedure shall be initiated as soon as practicable (and in any event no later than fifteen (15) Business Days) after execution of this Agreement; |

11

| (c) | with respect to the consultation with AkzoNobel’s European works council, such that such procedure shall be initiated as soon as practicable (and in any event no later than ten (10) Business Days) after execution of this Agreement and in accordance with clause 3.6.7; and |

| (d) | with respect to the Other Employee Procedures pursuant to clause 3.6.7, such that such procedures shall be initiated as soon as practicable after execution of this Agreement |

(each of (a) through (d) in accordance with this clause 3.6.1 (the “Employee Consultation”)).

AkzoNobel Works Council Consultation

| 3.6.2 | The required consultation with the AkzoNobel Works Council (the “AkzoNobel Works Council Consultation”) will be deemed completed upon the AkzoNobel Board of Management adopting a resolution in accordance with the relevant advice, and: |

| (a) | the AkzoNobel Works Council having rendered an unconditional advice permitting the Parties to pursue the Merger; or |

| (b) | the AkzoNobel Works Council having rendered an advice with conditions acceptable to each of AkzoNobel and Axalta, acting reasonably. |

| 3.6.3 | To the extent neither of the situations described in clause 3.6.2 occurs, the AkzoNobel Works Council Consultation will be deemed completed upon the AkzoNobel Board of Management adopting a resolution that deviates from the relevant advice, if rendered, and: |

| (a) | the AkzoNobel Works Council having unconditionally waived (i) the applicable waiting period in accordance with article 25 paragraph 6 of the Dutch Works Councils Act and (ii) its right to initiate legal proceedings pursuant to article 26 of the Dutch Works Councils Act; |

| (b) | the applicable waiting period pursuant to article 25 paragraph 6 of the Dutch Works Council Act having expired without the AkzoNobel Works Council having initiated legal proceedings pursuant to the Dutch Works Council Act; or |

| (c) | following the initiation of legal proceedings pursuant to article 26 of the Dutch Works Councils Act, the AkzoNobel Works Council having withdrawn from such legal proceedings or the Enterprise Chamber having dismissed the AkzoNobel Works Council’s appeal to the effect that no measures obstructing the Merger are imposed and the dismissal of the Enterprise Chamber of the Amsterdam Court of Appeals (Ondernemingskamer van het gerechtshof Amsterdam) having immediate effect (uitvoerbaar bij voorrraad) or such legal proceedings having been concluded otherwise in a manner that does not prohibit the Merger from proceeding. |

12

Completion of the AkzoNobel Works Council Consultation process

| 3.6.4 | AkzoNobel and Axalta shall use their respective reasonable best efforts to complete the AkzoNobel Works Council Consultation process, it being understood that AkzoNobel will have the primary responsibility for, and take all steps reasonably necessary to, in close consultation with Axalta and its advisors, as soon as practicably possible following the date of this Agreement, initiate, conduct and complete the AkzoNobel Works Council Consultation. AkzoNobel and Axalta shall consult with each other closely with a view to seeking and obtaining the AkzoNobel Works Council’s advice and completing the AkzoNobel Works Council Consultation, including by discussing in good faith to expeditiously resolve any relevant issues raised by the AkzoNobel Works Council during the AkzoNobel Works Council Consultation, including discussion of any potential changes to this Agreement and the documents relating hereto requested by the AkzoNobel Works Council (bearing in mind the intent and purpose of the terms and conditions set forth in this Agreement); provided that in no event shall any Party be required pursuant to this clause 3.6.4 to agree to amend, modify or waive any terms or conditions of this Agreement. AkzoNobel shall keep Axalta informed on a continuing basis on all material correspondence and consultations in respect of the AkzoNobel Works Council Consultation, including providing Axalta with advance notice of any meetings with the AkzoNobel Works Council and the anticipated agenda for such meeting. AkzoNobel shall give (representatives of) Axalta the opportunity to attend meetings with (representatives of) the AkzoNobel Works Council if requested by the AkzoNobel Works Council and, if not requested by the AkzoNobel Works Council, consult with Axalta regarding (representatives of) Axalta attending such meetings. AkzoNobel shall not send the request for advice or any other material communication (including responses to questions raised by the AkzoNobel Works Council and any commitments) to the AkzoNobel Works Council without Axalta’s prior written consent, such consent not to be unreasonably withheld, conditioned or delayed. As soon as practicable following the occurrence of any one of the events described in clause 3.6.2(a) or (b) or 3.6.3(a), (b) or (c), the AkzoNobel Board of Management shall meet to adopt the resolution contemplated by clause 3.6.2 or 3.6.3, as applicable, which adoption shall not be unreasonably withheld, conditioned or delayed. |

13

Merger Code Process

| 3.6.5 | AkzoNobel will, in close consultation with Axalta and its advisors and on behalf of all relevant Persons, make notifications (the “Merger Code Notifications”) under the Merger Code to the SER and the relevant Dutch trade unions within the meaning of the Merger Code (the “Trade Unions”) with respect to the Merger in accordance with the Merger Code, including clauses 3 (2) and 8 (1) of the Merger Code. If, within two (2) weeks following the submission of the Merger Code Notifications, AkzoNobel has not received any written questions from the SER or any of the Trade Unions or any written requests for a consultation meeting by any of the Trade Unions in connection with the Merger Code Notifications, the process under the Merger Code shall be deemed completed. |

| 3.6.6 | If the SER or any of the Trade Unions submit any written questions to AkzoNobel in connection with the Merger Code Notifications within two (2) weeks following submission of the Merger Code Notifications, AkzoNobel shall promptly provide Axalta with a copy thereof. AkzoNobel shall, in close consultation with Axalta, answer such questions, if any, within three (3) weeks of the submission of the Merger Code Notifications. If one or more of the Trade Unions request a consultation meeting with AkzoNobel within two (2) weeks following submission of the Merger Code Notifications, AkzoNobel shall schedule such meeting promptly and give (representatives of) Axalta the opportunity to attend such meetings with (representatives of) the relevant Trade Unions if requested by (one of) the Trade Unions and, if not requested by (one of) the Trade Unions, consult with Axalta regarding (representatives of) Axalta attending such meetings. If the SER or any of the Trade Unions express any views in opposition of the Merger insofar as it may affect employees’ interests as referred to in the Merger Code or requests any commitment, in each case, in any questions or during any consultation meeting contemplated by this clause 3.6.6, AkzoNobel and Axalta shall consult with each other closely with a view to resolving any such comments, including discussing in good faith to expeditiously resolve any relevant issues raised by the SER or (one of) the Trade Unions, provided that in no event shall any Party be required pursuant to this clause 3.6.6 to agree to amend, modify or waive any terms or conditions of this Agreement and AkzoNobel shall not make any commitment to the SER or any Trade Union without Axalta’s prior written consent. |

Other Employee Procedures

| 3.6.7 | Prior to the Completion, each of AkzoNobel and Axalta, as applicable, shall fully comply with all notice, consultation, effects bargaining or other bargaining obligations (other than the AkzoNobel Works Council Consultation and the Merger Code process) (together, the “Other Employee Procedures”) to any labour union, labour organization, works council or group of employees of such |

14

| Party and its group in connection with the Merger and any other transactions as contemplated in or required to give performance to this Agreement. Each of AkzoNobel and Axalta shall use its reasonable best efforts to ensure that the Other Employee Procedures are completed as promptly as practicable following the date of this Agreement. Each of AkzoNobel and Axalta will have the primary responsibility for the conduct and completion of all of its Other Employee Procedures. AkzoNobel and Axalta will keep each other informed on the preparation of the information and consultation meetings and on all material correspondence related to the Other Employee Procedures, and will consult each other closely with a view to completing the Other Employee Procedures. Each of AkzoNobel and Axalta will attend meetings related to the Other Employee Procedures with representatives of, as applicable, Axalta’s or AkzoNobel’s employees upon the requesting party’s or the relevant employees’ request. |

| 3.7 | NYSE listing |