UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE MONTH OF NOVEMBER 2025

COMMISSION FILE NUMBER 001-38976

Genmab A/S

(Exact name of Registrant as specified in its charter)

Carl Jacobsens Vej 30

2500 Valby

Denmark

+45 70 20 27 28

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| GENMAB A/S | ||

| BY: | /s/ Anthony Pagano |

|

| Name: Anthony Pagano | ||

| Title: Executive Vice President & Chief Financial Officer | ||

DATE: NOVEMBER 12, 2025

Exhibit 99.1

Genmab Announces Proposed Private Offering of Senior Secured Notes and Senior Unsecured Notes and Syndication of New Senior Secured Term Loan Facility

Media Release

COPENHAGEN, Denmark; November 10, 2025

Genmab A/S (Nasdaq: GMAB) (“Genmab”) announced today that it and its wholly owned subsidiary Genmab Finance LLC (“Genmab Finance”) intend to offer, subject to market and other conditions, $1.5 billion of senior secured notes due 2032 (the “Secured Notes”) and $1.0 billion of senior unsecured notes due 2033 (the “Unsecured Notes,” and together with the Secured Notes, the “Notes”).

Genmab also launched the syndication of a new $2.0 billion senior secured term loan “B” facility, which term loan “B” facility is in addition to a $1.0 billion senior secured term loan “A” facility and $500 million senior secured revolving credit facility (collectively, the “New Credit Facilities”) that Genmab previously syndicated to certain lenders as part of the financing for the pending acquisition (the “Acquisition”) of Merus N.V. (“Merus”).

Genmab intends to use the net proceeds from this offering of the Notes, together with borrowings under the New Credit Facilities and cash on hand, to fund the consideration payable in connection with the Acquisition of Merus and related fees and expenses in connection with the Acquisition, the borrowings under the New Credit Facilities and the issuance of the Notes.

Prior to the Acquisition closing, the Notes and the related guarantees from Genmab subsidiaries will be secured solely by segregated securities accounts of Genmab in which the gross proceeds of the Notes will be held. Following the purchase of all Merus common shares tendered in the previously announced tender offer by Genmab, the Secured Notes will be secured by a first priority security interest in certain assets of Genmab and its subsidiaries that will guarantee the obligations under the New Credit Facilities, in accordance with certain customary practices in the relevant jurisdictions, and subject to certain thresholds, exceptions and permitted liens. The Secured Notes will be unconditionally guaranteed on a senior secured basis and the Unsecured Notes will be unconditionally guaranteed on a senior unsecured basis by certain subsidiaries of Genmab that will guarantee the obligations under the New Credit Facilities.

The indentures governing the Notes are expected to contain customary covenants that, among other things, restrict, with certain exceptions, the ability of each of Genmab and its subsidiaries to incur additional debt, pay dividends, make certain other restricted payments, incur debt secured by liens, dispose of assets, engage in consolidations and mergers or sell or transfer all or substantially all of its assets.

The Notes will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), or any state or other securities laws and may not be offered or sold in the United States absent an effective registration statement or an applicable exemption from the registration requirements of or in a transaction not subject to the Securities Act and any state or other applicable securities laws. Accordingly, the offering of the Notes is available only to persons who are either (1) reasonably believed to be “qualified institutional buyers” as defined in Rule 144A under the Securities Act or (2) non-U.S. persons outside the United States pursuant to Regulation S under the Securities Act. The Notes will be subject to restrictions on transferability and resale and may not be transferred or resold except in compliance with the registration requirements of the Securities Act or pursuant to an exemption therefrom and in compliance with any state or other applicable securities laws.

| Genmab A/S Carl Jacobsens Vej 30 2500 Valby, Denmark |

Tel: +45 7020 2728 www.genmab.com |

Media Release no. 22 Page 1 CVR no. 2102 3884 LEI Code 529900MTJPDPE4MHJ122 |

Genmab Announces Proposed Private Offering of Senior Secured Notes and Senior Unsecured Notes and Syndication of New Senior Secured Term Loan Facility

This announcement shall not constitute an offer to sell or a solicitation of an offer to purchase any securities and shall not constitute an offer, solicitation or sale in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful. The offering of the Notes may be made only by means of an offering memorandum.

Contact:

Marisol Peron, Senior Vice President, Global Communications & Corporate Affairs

T: +1 609 524 0065; E:mmp@genmab.com

Andrew Carlsen, Vice President, Head of Investor Relations

T: +45 3377 9558; E:acn@genmab.com

Forward-looking Statements

In this announcement, we make statements concerning our expectations, beliefs, plans, objectives, goals, strategies, and future events or performance, including, but not limited to, the statements about the proposed offering of Notes, our intention to issue the Notes and the expected use of proceeds. Genmab cautions investors that any forward-looking statements or projections made by Genmab, including those made in this announcement, are subject to risks and uncertainties that may cause actual results to differ materially from those projected. Such factors include, but are not limited to, those described in Genmab’s filings with the SEC, including those included in Genmab’s most recent Annual Report on Form 20-F, which is available at www.genmab.com and www.sec.gov. Genmab is providing the information in this announcement as of this date, and Genmab does not undertake any obligation to update any forward-looking statements as a result of new information, future events or otherwise.

Genmab A/S and/or its subsidiaries own the following trademarks: Genmab®; the Y-shaped Genmab logo®; Genmab in combination with the Y-shaped Genmab logo®; HuMax®; DuoBody®; HexaBody®; DuoHexaBody®, HexElect® and KYSO®.

| Genmab A/S Carl Jacobsens Vej 30 2500 Valby, Denmark |

Tel: +45 7020 2728 www.genmab.com |

Media Release no. 22 Page 2 CVR no. 2102 3884 LEI Code 529900MTJPDPE4MHJ122 |

Exhibit 99.2

Genmab Provides Certain Information Disclosed in Connection with Proposed Private Offering of Senior Secured Notes and Senior Unsecured Notes

Media Release

COPENHAGEN, Denmark; November 10, 2025

Genmab A/S (“Genmab”) announced on November 10, 2025, that it and its wholly owned subsidiary Genmab Finance LLC intend to offer, subject to market and other conditions, $1.5 billion of senior secured notes due 2032 (the “Secured Notes”) and $1.0 billion of senior unsecured notes due 2033 (the “Unsecured Notes,” and together with the Secured Notes, the “Notes”). Genmab also launched the syndication of a new $2.0 billion senior secured term loan “B” facility, which term loan “B” facility is in addition to a $1.0 billion senior secured term loan “A” facility and $500 million senior secured revolving credit facility (collectively, the “New Credit Facilities”) that Genmab previously syndicated to certain lenders as part of the financing for the pending acquisition (the “Acquisition”) of Merus N.V. (“Merus”).

In connection with the proposed offering of the Notes, Genmab is providing potential investors with a preliminary offering memorandum, dated November 10, 2025 (the “Preliminary Offering Memorandum”). The Preliminary Offering Memorandum contains (i) certain information not previously disclosed by Genmab, attached as Exhibit A to this Company Announcement; (ii) unaudited pro forma condensed combined financial information giving effect to the Acquisition of Merus, the borrowings under the New Credit Facilities and the issuance of the Notes as of and for the nine months ended September 30, 2025 and for the year ended December 31, 2024, attached as Exhibit B to this Company Announcement; and (iii) the audited consolidated financial statements of Genmab as of and for the years ended December 31, 2024, 2023 and 2022 and the related notes thereto, originally prepared in Danish Kroner and retranslated into United States Dollars for all periods presented, attached as Exhibit C to this Company Announcement.

This Company Announcement, including Exhibit A, Exhibit B and Exhibit C, does not constitute an offer to sell, or a solicitation of an offer to buy, any security. No offer, solicitation, or sale will be made in any jurisdiction in which such an offer, solicitation, or sale would be unlawful. The Notes will not be registered under the Securities Act of 1933, as amended, or the securities laws of any state or other jurisdiction, and, unless so registered, may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements.

Contact:

Marisol Peron, Senior Vice President, Global Communications & Corporate Affairs

T: +1 609 524 0065; E:mmp@genmab.com

Andrew Carlsen, Vice President, Head of Investor Relations

T: +45 3377 9558; E:acn@genmab.com

Forward-looking Statements

In this announcement, we make statements concerning our expectations, beliefs, plans, objectives, goals, strategies, and future events or performance, including, but not limited to, the statements about the proposed offering of Notes and our intention to issue the Notes. Genmab cautions investors that any forward-looking statements or projections made by Genmab, including those made in this announcement, are subject to risks and uncertainties that may cause actual results to differ materially from those projected. Such factors include, but are not limited to, those described in Genmab’s filings with the SEC, including those included in Genmab’s most recent Annual Report on Form 20-F, which is available at www.genmab.com and www.sec.gov. Genmab is providing the information in this Company Announcement as of this date, and Genmab does not undertake any obligation to update any forward- looking statements as a result of new information, future events or otherwise.

| Genmab A/S Carl Jacobsens Vej 30 2500 Valby, Denmark |

Tel: +45 7020 2728 www.genmab.com |

Media Release no. 23 Page 1 CVR no. 2102 3884 LEI Code 529900MTJPDPE4MHJ122 |

Genmab Provides Certain Information Disclosed in Connection with Proposed Private Offering of Senior Secured Notes and Senior Unsecured Notes

Genmab A/S and/or its subsidiaries own the following trademarks: Genmab®; the Y-shaped Genmab logo®; Genmab in combination with the Y-shaped Genmab logo®; HuMax®; DuoBody®; HexaBody®; DuoHexaBody®, HexElect® and KYSO®.

| Genmab A/S Carl Jacobsens Vej 30 2500 Valby, Denmark |

Tel: +45 7020 2728 www.genmab.com |

Media Release no. 23 Page 2 CVR no. 2102 3884 LEI Code 529900MTJPDPE4MHJ122 |

Exhibit 99.3

EXHIBIT A

EXCERPTS FROM THE PRELIMINARY OFFERING MEMORANDUM

SUMMARY

The following summary highlights certain information contained elsewhere in this offering memorandum and is qualified in its entirety by the more detailed information and historical financial statements included herein. Because this is a summary, it is not complete and may not contain all of the information that may be important to you in making a decision to invest in the Notes. Before making an investment decision, you should carefully read this entire offering memorandum, including the information presented under “Risk Factors,” “—Summary Historical Financial Information,” “Unaudited Pro Forma Condensed Combined Financial Information” and the historical financial statements included in this offering memorandum.

Our Company

Genmab is an international biotechnology company with a core purpose of improving the lives of patients with innovative and differentiated antibody therapeutics. For more than 25 years, its passionate, innovative and collaborative team has invented next-generation antibody technology platforms and leveraged translational, quantitative and data sciences, resulting in a proprietary pipeline including bispecific T-cell engagers, antibody-drug conjugates, next-generation immune checkpoint modulators and effector function-enhanced antibodies. Genmab’s antibody technology platforms have given rise to eight commercialised products and a pipeline of novel antibody-based products and product candidates designed to address medical needs and improve treatment outcomes for patients with cancer and other serious diseases. Our pipeline includes both wholly owned and partnered programs, with several compounds in late-stage clinical development. Our goal in building our pipeline is to bring medicines to market ourselves in geographic areas where we believe we will be able to maximize their value. By 2030, our vision is to transform the lives of people with cancer and other serious diseases with knock-your-socks-off antibody medicines®.

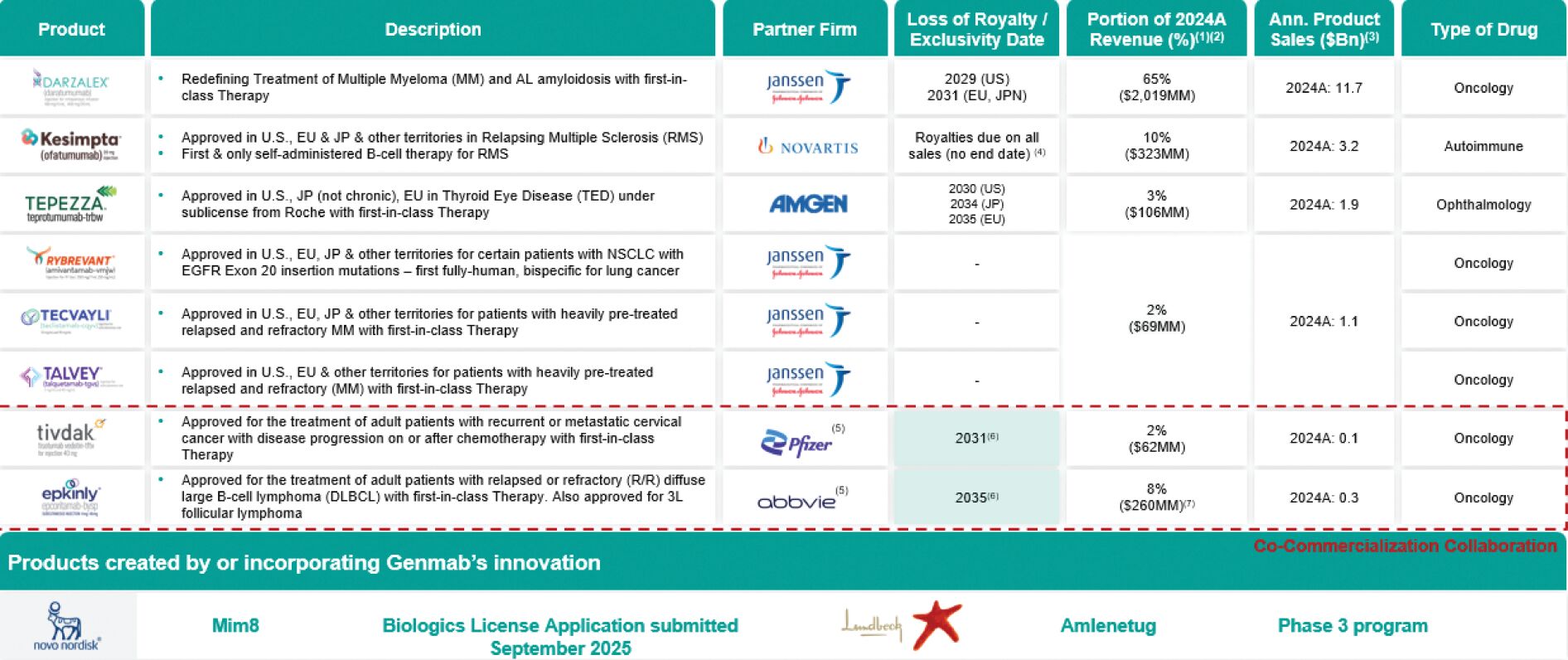

Since Genmab’s founding in 1999 we have been dedicated to creating innovative and differentiated antibody therapeutics, initially as a research and development (“R&D”) innovation powerhouse out-licensing novel candidates to large cap pharma partners, including Janssen Biotech, Inc (“Janssen”), F. Hoffmann-La Roche AG (“Roche”), GlaxoSmithKline (“GSK”) and Novo Nordisk A/S (“Novo Nordisk”), for upfront, milestone and royalty payments. Early partnerships yielded six U.S. Food and Drug Administration (“FDA”) approved, commercialized, royalty-bearing products: DARZALEX, Kesimpta, TEPEZZA, RYBREVANT, TALVEY, and TECVAYLI. In full-year 2024, these products generated approximately $18 billion in aggregate partner net sales, providing a strong, recurring royalty revenue foundation for Genmab. Given the constantly evolving oncology landscape, our antibody platforms and our expertise and know-how in antibody development, we have shifted our model into a fully integrated biotech company through commercialization and co-commercialization of proprietary products such as EPKINLY and Tivdak in certain geographies, allowing Genmab to retain a greater share of the economic potential of these products. We are focused on the development of our proprietary, wholly owned pipeline, including through high potential growth opportunities such as our acquisition of ProfoundBio, Inc. (“ProfoundBio”) in 2024 and the Acquisition, which has resulted in a significant portfolio that incorporates the next wave of innovation in oncology indications with high medical needs.

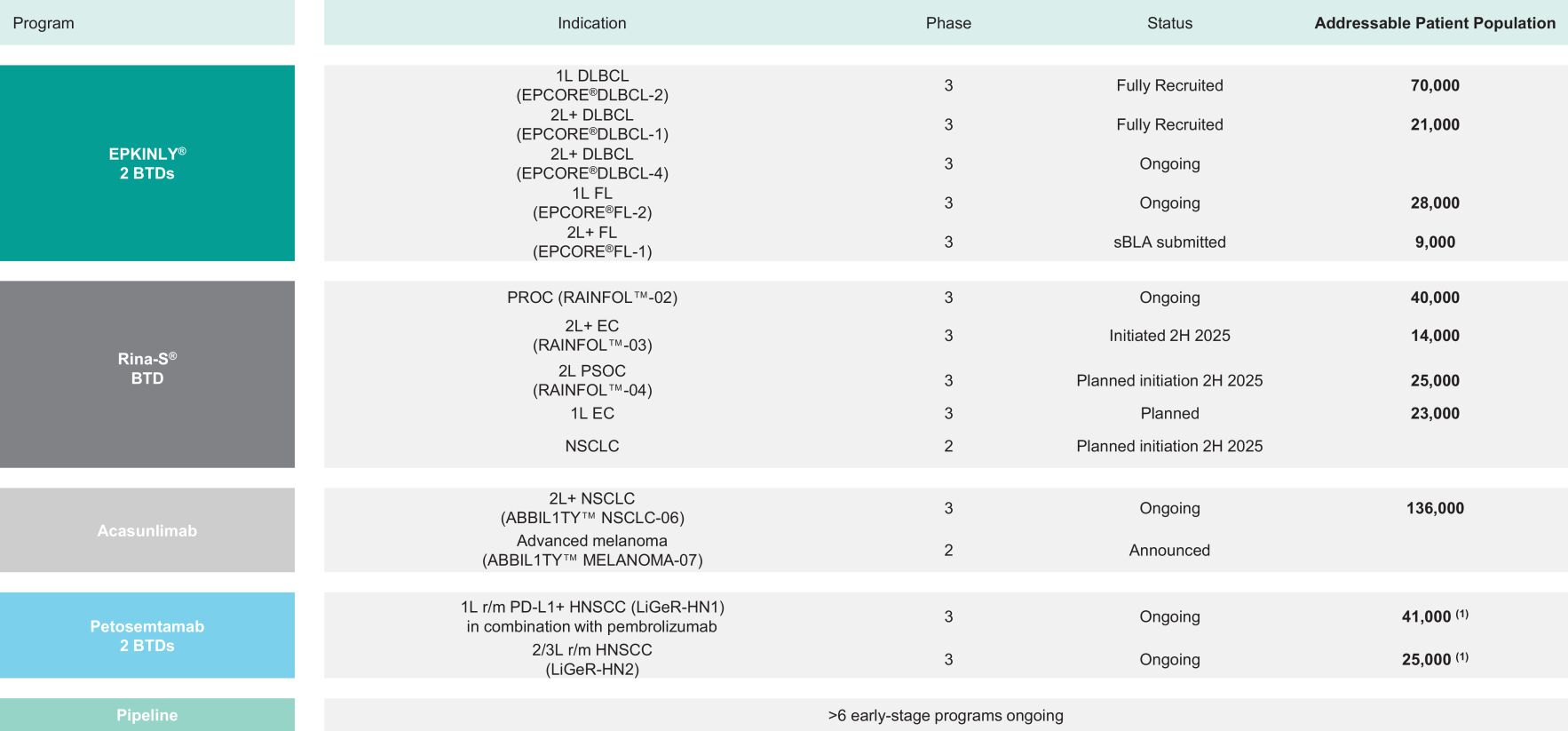

Our current priorities are the commercial or late-stage programs epcoritamab and wholly owned rinatabart sesutecan (“Rina-S”) and acasunlimab. Epcoritamab, marketed as EPKINLY in the U.S. and Japan and as TEPKINLY outside of those territories, is being developed and commercialized in collaboration with AbbVie Inc. (“AbbVie”).

Epcoritamab is the only bispecific antibody approved with a dual indication for the treatment of certain B-cell malignancies in the U.S., Europe and Japan. Rina-S entered Phase III clinical development for platinum-resistant ovarian cancer (“PROC”) in 2024 and Endometrial Cancer (“EC”) in 2025, and acasunlimab entered Phase III clinical development for Non-Small Cell Lung Cancer (“NSCLC”) in 2024.

8

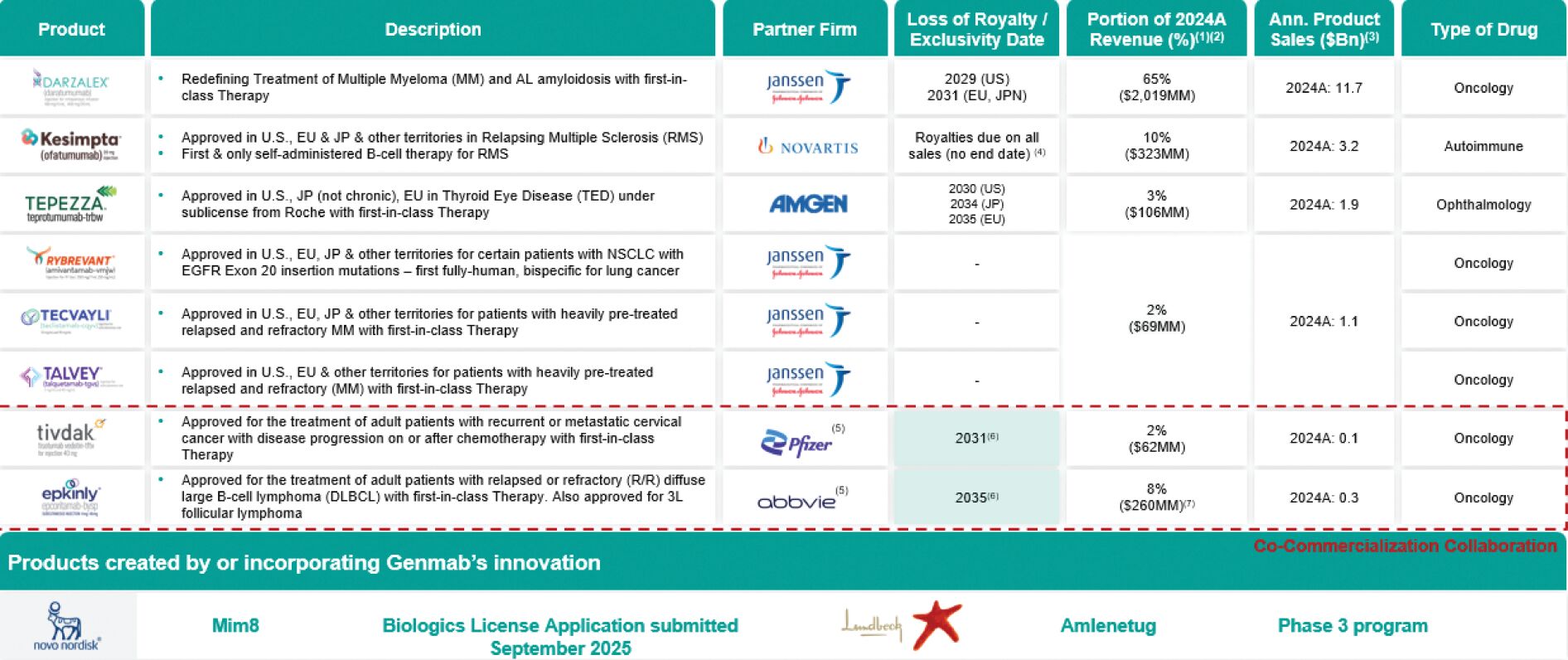

The table below summarizes key data points on our six approved royalty products and our two approved proprietary products, respectively.

| (1) | To the extent available and reported; RYBREVANT®, TECVAYLI® and TALVEY® are not owned products. |

| (2) | Remaining 10% of revenue attributable to milestones and reimbursements and licensing. |

| (3) | Source: For DARZALEX® and TECVAYLI® 2024 sales, Johnson & Johnson (“J&J”) FY 2024 financial results; for KESIMPTA® 2024 sales, Novartis AG (“Novartis”) FY 2024 financial results; for TEPEZZA® 2024 sales, Amgen Inc. (“Amgen”) FY 2024 results; for TIVDAK® and EPKINLY® 2024 sales, GMAB FY 2024 presentation. |

| (4) | Exclusivity protection provided by Genmab patents (exp. 2031) and Novartis owned patents (exp. 2037). Royalties continue to be paid on all sales after patent expirations. |

| (5) | Co-commercialization collaboration. |

| (6) | U.S., European and Japanese patents for EPKINLY® and TIVDAK® do not begin to expire until the dates shown, however requests for patent term extensions have been filed for both which, if approved, would provide protection beyond the displayed end dates. |

| (7) | Includes $253M in EPKINLY® net product sales and $7M in TEPKINLY® royalties. |

Innovation and Proprietary Technology Platform

Our portfolio includes five proprietary antibody technology platforms: (i) our DuoBody platform, which can be used for the creation and development of bispecific antibodies; (ii) our HexaBody platform, which can be used to increase the potential potency of antibodies through hexamerization; (iii) our DuoHexaBody platform, which enhances the potential potency of bispecific antibodies through hexamerization; (iv) our HexElect platform, which combines two HexaBody molecules to maximize potential potency while minimizing potential toxicity by more selective binding to desired target cells; and (v) our antibody drug conjugate (“ADC”) platforms, acquired through the purchase of ProfoundBio in May 2024. Antibody products created with these technologies may be used in a wide variety of indications including cancer as well as autoimmune, central nervous system and infectious diseases. These platforms play a key role in building our product pipeline, enhancing our collaborations and generating revenue. We selectively enter into collaborations with other biotechnology and pharmaceutical companies that build our network in the biotechnology space and give us access to complementary novel technologies or products that move us closer to achieving our vision and fulfilling our core purpose.

9

Our innovation and proprietary technology platforms are used in the pipelines of global pharmaceutical and biotechnology companies. These companies are running clinical development programs with antibodies created by Genmab or created using Genmab’s proprietary DuoBody bispecific antibody technology platform. The six approved medicines created by Genmab or that incorporate Genmab’s innovation or technology platforms are: daratumumab, marketed by J&J as DARZALEX (intravenous (“IV”) formulation) and DARZALEX FASPRO or DARZALEX SC (SC formulation), approved in the U.S., Europe, Japan and other territories for the treatment of certain indications of MM and AL amyloidosis; amivantamab, marketed in the U.S., Europe, Japan and other territories by J&J as RYBREVANT for the treatment of certain adult patients with locally-advanced or metastatic NSCLC with epidermal growth factor receptor (“EGFR”) exon 20 insertion mutations; teclistamab, marketed in the U.S., Europe, Japan and other territories by J&J as TECVAYLI for certain indications of MM; talquetamab, marketed in the U.S., Europe, Japan and other territories by J&J as TALVEY for certain indications of MM; SC ofatumumab, marketed in the U.S., Europe, Japan and other territories as Kesimpta by Novartis for the treatment of relapsing multiple sclerosis (“RMS”); and teprotumumab, marketed in the U.S. and Japan as TEPEZZA by Amgen for the treatment of thyroid eye disease (“TED”). Under the agreements for these products we are entitled to certain royalties based on net sales and potential milestone payments.

Our proprietary commercial products are EPKINLY and Tivdak. Net Sales from these products continue to grow and strengthen.

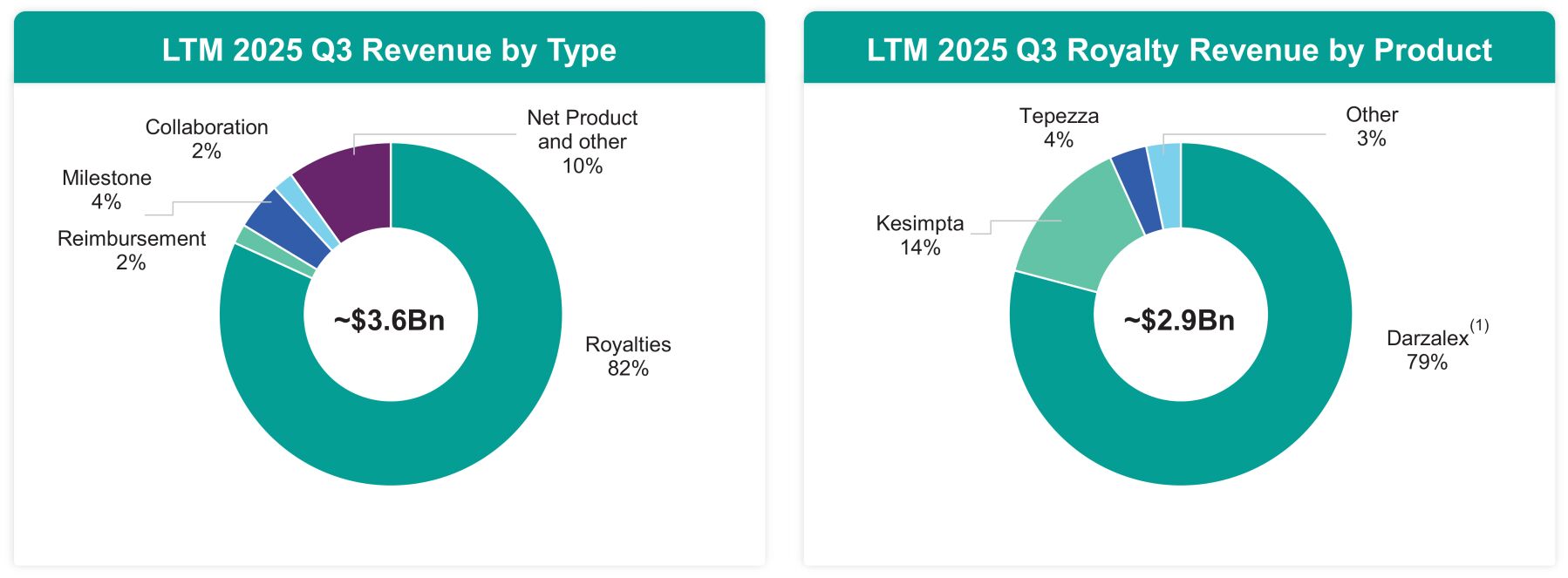

For the twelve months ended September 30, 2025, Genmab generated approximately $3.6 billion of revenue, of which $2.9 billion were royalty revenues, $1.5 billion of net income (loss), and $1.5 billion of Adjusted EBITDA. Adjusted EBITDA is a non-IFRS measure. See “Use of Non-IFRS and Non-GAAP Financial Information” and “Summary Historical Financial Information—Company Summary Financial Information—Company Adjusted EBITDA” for a discussion of the limitations of Adjusted EBITDA and a reconciliation to Net Profit.

| (1) | “DARZALEX®” refers to both DARZALEX® and DARZALEX FASPRO® (trade name in the U.S.)/DARZALEX SC (trade name in Europe). |

Business Strategy

Key elements of our strategy to achieve our vision and fulfill our core purpose include:

| • | Actively advance and expand our proprietary product pipeline. We are actively advancing our promising proprietary product candidates, and specifically our commercial or late-stage programs epcoritamab, Rina-S and acasunlimab, through development and commercialization. |

10

| • | Grow our commercialization capabilities. We are continuing to develop and expand our commercialization capabilities to enable us to bring our own products to market for the indications and in the geographies that we determine are most likely to create value for patients and our investors. Our primary focus for commercialization has been in the U.S. and in Japan, with the commercialization of Tivdak and EPKINLY. More recently, we have expanded our commercial footprint to the EU. |

| • | Strengthen our product portfolio with strategic collaborations and acquisitions. We enter into strategic product and technology collaborations to build our network in the biotechnology space and to strengthen our portfolio with complementary technologies and products, and we seek to expand our proprietary product pipeline by developing new products in-house and through selective collaborations. We monitor for potential collaborations and acquisitions that would advance our overall strategy, such as the Acquisition and our 2024 acquisition of ProfoundBio. |

| • | Leverage our proprietary technology platforms. Our leading proprietary antibody technology platforms play a key role in building our product pipeline, enhancing our collaborations and generating revenue. Multiple new product candidates are currently being developed by us using our technology platforms, including proprietary product candidates created with our DuoBody and ADC technologies. We actively seek collaboration partners interested in developing potential antibody therapeutics using our technologies. |

| • | Leverage recurring revenue streams from collaborations. There are six medicines on the market, developed and commercialized by partners, that were created by Genmab or created using our DuoBody technology. Under the agreements for these medicines, Genmab is entitled to certain royalties and potential milestone payments. Originally, this strategy allowed us to bring our innovative products to the market and create a stable revenue stream. Over time, it has allowed us to build and expand our own proprietary pipeline. |

Transaction Overview

On September 29, 2025, we agreed to acquire Merus pursuant to a Transaction Agreement (as defined herein) among Merus, the Purchaser (as defined herein), and us. Pursuant to the Transaction Agreement, on October 21, 2025, the Purchaser commenced the Offer (as defined herein) to purchase any and all of the issued and outstanding common shares of Merus at a purchase price of $97.00 per share, payable in cash, less any applicable withholding taxes and without interest. The Offer will expire at 5:00 p.m. New York City time on December 11, 2025, unless earlier terminated or extended in accordance with the Transaction Agreement.

Merus is a clinical-stage biotechnology company with a late-stage breakthrough therapy asset, petosemtamab, which is in Phase III development. The Acquisition, if consummated, will further strengthen our late-stage product pipeline with the addition of petosemtamab where we believe our expertise and leadership in antibody-based innovations will assist in unlocking petosemtamab’s full potential.

Merus N. V.

Merus is an oncology company developing innovative antibody therapeutics. Merus’ lead product candidate is MCLA-158 (petosemtamab), in clinical development for the potential treatment of solid tumors, including first line (“1L”) programmed death-ligand 1 positive (“PD-L1+”) recurrent/metastatic (“r/m”) head and neck squamous cell carcinoma (“HNSCC”) in combination with pembrolizumab, and second line (“2L”) or third line (“3L”) r/m HNSCC as monotherapy; and in metastatic colorectal cancer (“mCRC”) in 1L and 2L in combination with standard chemotherapy and 3L+ mCRC as monotherapy. Merus has also developed BIZENGRI® (zenocutuzumab-zbco), the first and only FDA-approved treatment indicated for adults with pancreatic adenocarcinoma or NSCLC that are advanced, unresectable or metastatic and harbor a neuregulin 1 (“NRG1”)

11

gene fusion who have disease progression on or after prior systemic therapy. Merus has a pipeline of full-length human multispecific antibody candidates generated from its proprietary technology platforms, Biclonics and Triclonics.

Strategic Rationale for the Acquisition

We believe that the Acquisition further strengthens our position as a leader in the biotechnology space, and is underpinned by the following four strategic rationales:

| • | Enhancing Genmab’s late-stage pipeline with a high-potential asset. Acquiring Merus adds its lead asset, petosemtamab, to Genmab’s late-stage pipeline, an EGFRxLGR5 bispecific antibody with the potential to become the first and best-in-class therapy for head and neck cancer. There are two petosemtamab Phase III trials ongoing, one in 1L and one in 2L and 3L head and neck. The product candidate has demonstrated meaningful clinical benefits in 1L and later line settings with the FDA granting BTD (as defined herein) for both the 1L PD-L1+ and 2L+ recurrent or metastatic head and neck cancer. |

| • | Meaningfully accelerating Genmab’s shift to a 100% owned model. The Acquisition is in line with and advances our long-term strategy of transitioning from a royalty-based business to an end-to-end biotech company that fully owns, develops, and commercializes medicines. With the addition of petosemtamab to EPKINLY and Rina-S, Genmab strengthens its position as an antibody-driven biotechnology powerhouse, supported by a robust, diverse, wholly owned late-stage portfolio. |

| • | Driving sustainable and profitable growth. As launch revenues build and investment levels stabilize, we expect meaningful growth for petosemtamab in the medium term, subject to clinical results and regulatory approvals. We expect the Acquisition to provide a high-potential wholly owned revenue stream that supports continued investment in our innovative R&D pipeline. We believe this strategic positioning will enable us to build a robust foundation for sustainable growth and profitability into the next decade and beyond. |

| • | Leveraging Genmab’s expertise in antibody innovation and clinical development. We believe our established leadership in antibody-based therapeutics and proven track record in rapid, broad clinical development are central to unlocking the full value of petosemtamab. Our strong commercial infrastructure in the U.S., Japan and Europe provides a robust platform for the launch and expansion of petosemtamab and positions us to maximize the impact of this high-potential asset, supporting both patient outcomes and long-term value creation. |

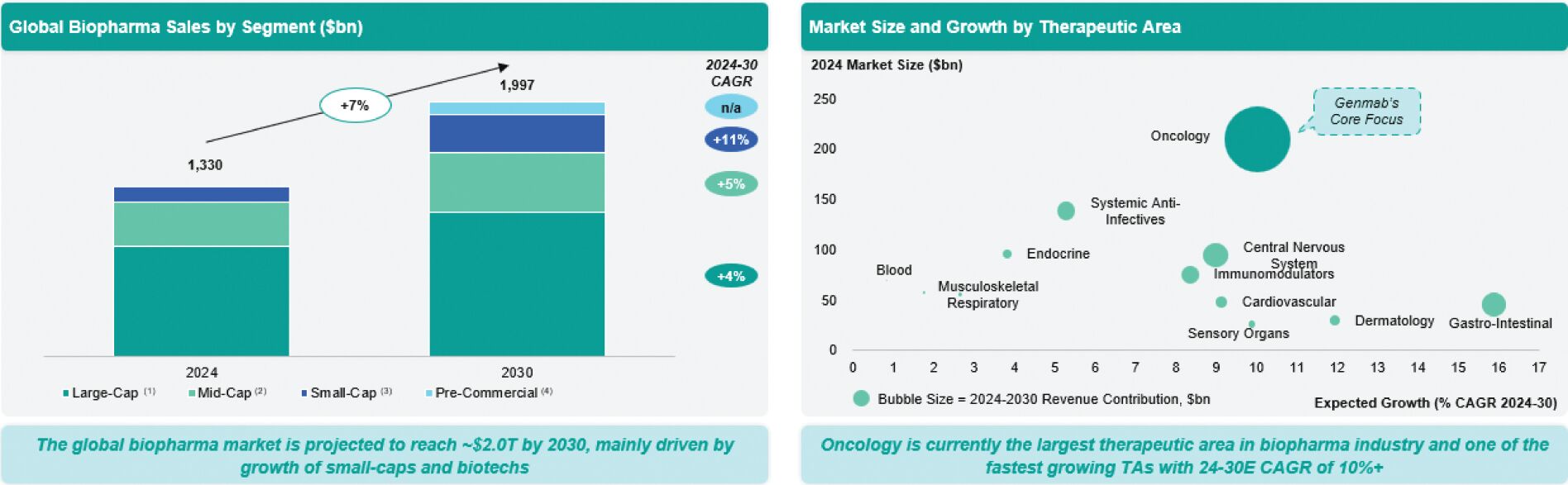

Industry Overview

The biotechnology and pharmaceutical industries generally, and the cancer drug sector specifically, are characterized by evolving understanding of causes of disease, rapidly advancing technologies, intense competition and a strong emphasis on intellectual property. Both sectors are subject to significant regulatory oversight and substantial investment in R&D. Within this landscape, oncology remains one of the most dynamic and innovative therapeutic areas, driven by unmet medical needs, scientific breakthroughs, and robust market growth.

The Oncology Biopharmaceuticals Industry

We operate within the global oncology biopharmaceutical sector, which is one of the largest and fastest-growing segments of the pharmaceutical industry. The oncology market is driven by several secular trends, including an aging population, increased cancer incidence, and ongoing innovation in targeted therapies, immuno-oncology, and antibody-based treatments. According to Evaluate Pharma, the global biopharma market is projected to reach $1.8 trillion by 2030, driven largely by innovation from small-cap and biotech companies.

12

Per Evaluate Pharma, oncology remains the largest therapeutic area, expected to grow at a compound annual growth rate of over 10% through 2030 to $350 billion driven by the launch of novel therapies and expanded indications for existing drugs.

Generally, the sector is marked by:

| • | Rapid innovation. Advances in antibody engineering, bispecifics, cell therapy, and precision medicine are transforming the treatment paradigm for many cancers. |

| • | Regulatory complexity. Oncology drugs often benefit from expedited regulatory pathways, such as breakthrough therapy or fast track designation and accelerated approval, but must demonstrate meaningful clinical benefit above available therapy and a tolerable safety profile. |

| • | Intense competition. Large multinational pharmaceutical companies and innovative biotechs compete for leadership in key indications, with significant investment in R&D and business development. |

Merus’ Industry: Head and Neck Squamous Carcinoma and Colorectal Cancer

Merus’ lead asset petosemtamab is being evaluated in two Phase III trials for head and neck squamous cell carcinoma, with expansion opportunities for colorectal cancer in three Phase II trials.

Key characteristics of Merus’ target market include:

| • | The addressable market for head and neck squamous cell cancer has a significant unmet need. HNSCC remains an area of high unmet medical need. Despite advances in standard of care, prognosis for recurrent or metastatic HNSCC remains poor, with limited effective treatment options and high rates of disease progression. According to results from the KEYNOTE-048 trial, pembrolizumab, the 1L standard of care, achieved median progression free survival of 3.2 months and overall survival of approximately one year. Based on internal market research, we believe there are nearly 70,000 patients with locally advanced or metastatic head and neck cancer in the U.S., the European Union (“EU”) and Japan combined. We believe there are approximately 41,000 patients in the U.S., EU and Japan eligible for 1L treatment. For 2L treatment and beyond, we believe there are an approximate additional 25,000 patients in the U.S., EU and Japan. In the Phase II trial in the 1L setting, petosemtamab demonstrated an overall response rate and median progression free survival of approximately three times better than pembrolizumab monotherapy. |

| • | Innovation in bispecifics. EGFRxLGR5 bispecific antibodies, such as petosemtamab, offer the potential for enhanced efficacy by simultaneously targeting multiple pathways. Petosemtamab has demonstrated a significant clinical benefit in both 1L and 2L+ HNSCC, with a 63% overall response rate and nine months median progression-free survival in combination with pembrolizumab, and a 36% overall response rate as monotherapy in later lines. |

| • | Regulatory momentum. Therapies addressing high unmet need in head and neck cancer, such as petosemtamab, may benefit from expedited regulatory review. Petosemtamab has received BTD from the FDA for both 1L and 2L+ HNSCC indications, reflecting the promise of its clinical data and the urgency of the need. |

| • | Competitive landscape. The late-stage development landscape in HNSCC includes programmes with limited clinical evidence or focus on subpopulations, providing an opportunity for differentiation for bispecific antibodies like petosemtamab. Success in this field depends on clinical differentiation, safety, and the ability to demonstrate meaningful benefit over existing therapies. |

13

| • | Expansion into colorectal cancer. Petosemtamab is also being developed for colorectal cancer, with ongoing Phase II studies in 1L, 2L and 3L settings, representing further expansion opportunities in solid tumours with significant unmet need. |

Our Competitive Strengths

We are a leader in antibody innovation, with a portfolio of wholly owned and partnered assets addressing high unmet medical needs in hematological malignancies and solid tumours. Our focus on proprietary, differentiated antibody platforms and our track record of successful product launches positions us to capture value in a market that rewards innovation, clinical differentiation, and commercial execution.

Top Player in Oncology, One of the Fastest Growing Segments Within Pharma

Genmab is a leading antibody company and one of the largest European biotechs. It stands out as a strong player in oncology, one of the most dynamic and fastest-growing segments within the pharmaceutical industry; and has established itself as a leader in antibody innovation, with a portfolio of wholly owned and partnered assets addressing high unmet needs in hematological malignancies and solid tumors. Genmab’s focus on proprietary, differentiated antibody platforms and its track record of successful product launches position it to capture value in a market that rewards innovation, clinical differentiation, and commercial execution. We believe we are uniquely positioned to capitalize on the momentum of the industry, leveraging our deep expertise in B-cell lymphomas and multiple myeloma, diseases that primarily affect older populations. Our leadership in antibody engineering and bispecific platforms has yielded four late-stage assets, collectively earning three BTDs.

| (1) | Companies with 2024 sales >$10bn. |

| (2) | Companies with 2024 sales $10bn-$1bn. |

| (3) | Companies with 2024 sales $1-$0bn. |

| (4) | Companies with no sales in 2024. |

World-Class R&D Powerhouse with an Innovation Track-Record

We are a world-class leader with antibody R&D and commercialization expertise, distinguished by our consistent track record of innovation and successful delivery of transformative antibody-based therapies. With approximately 1,840 of our 2,681 employees dedicated to R&D as of September 30, 2025, we offer a fully integrated value chain—from early-stage discovery to global commercialization—designed to maximize innovation, ensure product quality, and optimize market reach. We have built a streamlined enterprise that coordinates antibody discovery, preclinical testing, clinical development, contractual manufacturing, and regulatory submissions across our international footprint. We continue to expand our scientific capabilities by integrating data science and artificial intelligence to identify novel targets and biomarkers, enhancing our precision medicine and translational research efforts.

14

Our suite of pioneering antibody platforms, including DuoBody, enables the creation of differentiated, potentially first- or best-in-class investigational medicines with the potential to significantly improve patient outcomes.

With the successful launches of Tivdak (2021, with Pfizer Inc. (“Pfizer”)) and EPKINLY/TEPKINLY (2023, with AbbVie) and two wholly owned Phase III programs (Rina-S and acasunlimab), we continue to transform into a fully integrated biotech innovator.

Strong and Differentiated Pipeline of Potential Best-in-Class and First-in-Class Therapies

Our full pipeline includes bispecific T-cell engagers, next-generation immune checkpoint modulators, effector function enhanced antibodies and ADCs. We currently have nine proprietary products or product candidates in clinical development, which comprise programs where we retain at least 50% of product rights in collaboration with partners. Our key, late-stage clinical programs are EPKINLY, Rina-S and acasunlimab.

Substantial Cash Flow Generation from Royalty Income

Genmab continues to demonstrate substantial cash flow generation, underpinned by a long-standing track record of profitable growth and revenue diversification. For the twelve months ended September 30, 2025, Genmab had revenues of approximately $3.6 billion and Adjusted EBITDA of $1.5 billion, reflecting a strong Adjusted EBITDA margin of 42.2%. Genmab also achieved Free Cash Flow of $1.2 billion. Adjusted EBITDA, Adjusted EBITDA margin and Free Cash Flow are non-IFRS measures. See “Use of Non-IFRS and Non-GAAP Financial Information” and “Summary Historical Financial Information—Company Summary Financial Information—Company Adjusted EBITDA” and “Summary Historical Financial Information—Company Summary Financial Information—Company Free Cash Flow” for discussions of the limitations of Adjusted EBITDA, Adjusted EBITDA Margin and Free Cash Flow and a reconciliation to Net Profit and Net Cash Provided by Operating Activities. We expect this robust financial performance to enable Genmab to service and reduce its debt obligations while continuing to invest significantly in R&D to drive innovation. Importantly, our growth is de-risked by recurring royalty income from DARZALEX, which is currently the second-largest oncology drug worldwide by net sales, providing a stable and high-margin income stream that supports long-term strategic initiatives.

15

Founder-led and Experienced Management Team with Significant Tenure in Biotech

Our management team is led by our visionary founder and Chief Executive Officer, Jan van de Winkel, whose leadership has been instrumental in shaping Genmab’s strategic direction and global success. The team brings deep industry expertise, having held senior roles across leading biotech and pharmaceutical organizations, and has successfully executed large-scale M&A transactions while building a high-performing, innovation-driven organization. To maintain its competitive edge, we have consistently recruited and retained top talent, forming a deep bench of experienced leaders. This includes Anthony Pagano, Chief Financial Officer; Judith Klimovsky, Chief Development Officer; Martine J. van Vugt, Chief Strategy Officer; Bradley Bailey, Chief Commercial Officer; Tahamtan Ahmadi, Chief Medical Officer; Greg Mueller, General Counsel & Chief Legal Officer; Rayne Waller, Chief Technical Operations Officer and Christopher Cozic, Chief People Officer—each contributing to our continued growth and operational excellence. Their collective expertise enables us to remain at the forefront of antibody therapeutics and global biotech innovation.

The Transactions

The Acquisition

The Tender Offer

On September 29, 2025, Genmab agreed to acquire (the “Acquisition”) Merus pursuant to a Transaction Agreement (the “Transaction Agreement”) among Merus, Genmab Holding II B.V., a private limited liability company organized under the laws of the Netherlands and a wholly owned subsidiary of Genmab (the “Purchaser”), and us. Pursuant to the Transaction Agreement, on October 21, 2025, the Purchaser commenced a tender offer (the “Offer”) to purchase any and all of the issued and outstanding common shares of Merus at a purchase price of $97.00 per share, payable in cash, less any applicable withholding taxes and without interest. The Offer will expire at 5:00 p.m. New York City time on December 11, 2025, unless earlier terminated or extended in accordance with the Transaction Agreement.

The Offer is subject to the satisfaction or waiver of various customary conditions for similar transactions, including the valid tendering in accordance with the terms of the Offer, and not properly withdrawing, of a number of Merus common shares that, together with the common shares then owned by us, the Purchaser and our respective affiliates, and any common shares irrevocably and unconditionally (or conditionally only on the closing of the Offer having occurred) sold and committed to be transferred, but not yet transferred, to the Purchaser in writing, representing at least 80% of Merus’ issued and outstanding share capital immediately prior to the expiration of the Offer. Under certain circumstances, the Purchaser may reduce this condition to 75% of the Merus issued and outstanding share capital. The conditions also include receipt of required approvals relating to U.S. and foreign competition filings, or the expiration or termination of their respective waiting periods (including under the Hart-Scott-Rodino Antitrust Improvements Act of 1976). Finally, the conditions include, among other matters, the adoption of resolutions by shareholders of Merus at an extraordinary meeting convened for this purpose approving certain transactions relating to the Offer, including the Back-End Transactions described below.

If all of the conditions to the completion of the Offer have been satisfied or waived, the Purchaser expects to purchase all Merus common shares tendered in the Offer prior to the expiration time promptly following the expiration time. We refer to this as the “Acquisition Closing” and the date of purchase as the “Acquisition Closing Date”.

Following the Acquisition Closing, the Purchaser will commence a subsequent offering period for a period of at least ten business days to purchase additional Merus common shares at the same price as during the initial offer period.

16

The Back-End Transactions

We expect that, promptly following completion of the subsequent offering period, Merus will become an indirect wholly owned subsidiary of Genmab through certain back-end reorganization transactions involving Genmab, the Purchaser, Merus and their subsidiaries. The form that such back-end reorganization transactions take will depend on the receipt of a certain tax ruling as set forth in the Transaction Agreement. Assuming receipt of such tax ruling by the completion of the subsequent offer period described above, the back-end mechanics will be implemented by means of a Dutch legal merger of Merus with and into a newly formed wholly owned Dutch subsidiary of Merus, followed by the cancellation of all outstanding class A shares of such subsidiary to be issued to the remaining minority shareholders other than Genmab in such merger in exchange for a cancellation consideration in cash equal to the price per share paid in the Offer, less any applicable withholding taxes and without interest. If such tax ruling is not obtained prior to the completion of the subsequent offer period described above, Merus will, if necessary, issue such number of additional common shares to the Purchaser at an issue price per share equal to the price paid in the Offer in order to permit the Purchaser to commence statutory buy-out proceedings under Dutch law and obtain ownership of all Merus common shares not tendered pursuant to the Offer (including during the subsequent offering period). In that case, holders of those Merus common shares will receive an amount per share determined in court proceedings under Dutch law. We refer to the foregoing merger and cancellation transactions or share issuance and buy-out proceedings, as applicable, as the “Back-End Transactions” and to the completion of those transactions as the “Back-End Closing.”

Financing Transactions

In connection with the Acquisition Closing, we intend to enter into new senior secured credit facilities consisting of (i) a $1 billion senior secured term loan “A” facility (the “Term Loan A Facility”), (ii) a $2 billion senior secured term loan “B” facility (the “Term Loan B Facility” and, together with the Term Loan A Facility, the “Term Facilities”), and (iii) a $500 million senior secured revolving credit facility (the “New Revolving Facility” and, together with the Term Facilities, the “New Senior Secured Credit Facilities”).

There can be no assurance that these financing transactions will be completed on the terms we anticipate, or at all. The terms and conditions of these financing transactions described herein have not been finalized and are therefore subject to change. Investors are encouraged not to place undue reliance on the descriptions in deciding to invest in the Notes offered hereby, as changes may be made after the date of this offering memorandum.

For further details regarding the New Senior Secured Credit Facilities, see “Description of Certain Other Indebtedness.”

We plan to fund the total consideration payable in the Acquisition and related fees and expenses through a combination of cash on hand, including from the liquidation of substantially all of our marketable securities portfolio, from borrowings under the Term Facilities and from the proceeds of the Notes offered hereby. See “Use of Proceeds.” We refer to the Acquisition, including the Back-End Transactions, the borrowings under the Term Facilities and the issuance of the Notes offered hereby and the use of the proceeds therefrom, together with cash on hand as described above, to fund the consideration payable in the Acquisition and related fees and expenses collectively as the “Transactions.”

We are currently party to that certain facility agreement, dated as of October 24, 2024, by and among Genmab, the Arrangers (as defined therein), the Coordinator (as defined therein), the Original Lenders (as defined therein) and Dansk Bank A/S as the Agent (the “Existing Credit Agreement”), which provides for $300 million in commitments of revolving borrowings. We are seeking consent under the Existing Credit Agreement to permit the consummation of this offering. If this consent is obtained, we expect to terminate the Existing Credit Agreement at the Acquisition Closing Date. If this consent is not obtained, we will terminate the Existing Credit Agreement on the date of the settlement of this offering.

17

The table below sets forth the estimated sources and uses of funds in connection with the Acquisition. Actual amounts will vary from the estimated amounts shown below. You should read the following in conjunction with the information included under the sections entitled “Capitalization” and “Summary—Summary Historical Financial Information” included elsewhere in this offering memorandum. See “Use of Proceeds” for further details on the table below, including additional notes to each source and use.

| Sources of funds |

Uses of funds |

|||||||||

| ($ in millions) | ||||||||||

| Term Loan A Facility(1) |

$ | 1,000 | Acquisition Consideration(5) | $ | 8,014 | |||||

| Term Loan B Facility(1) |

2,000 | Acquisition Fees and Expenses(6) | 381 | |||||||

| Secured Notes Offered Hereby(2) |

1,500 | |||||||||

| Unsecured Notes Offered Hereby(3) |

1,000 | |||||||||

| Cash from Balance Sheet(4) |

2,895 | |||||||||

|

|

|

|

|

|||||||

| Total Sources of Funds |

8,395 | Total uses of funds | 8,395 | |||||||

|

|

|

|

|

|||||||

| (1) | Concurrently with the closing of the Acquisition, the Issuers expect to enter into the Term Loan A Facility and the Term Loan B Facility, as further described in “Summary—The Transactions—Financing Transactions”, each of which will be fully drawn at the closing of the Acquisition. |

| (2) | Represents the aggregate principal amount of Secured Notes offered hereby. Assumes the Secured Notes are issued at par. If we do not consummate the Acquisition, the Secured Notes will be subject to a special mandatory redemption. See “Description of the Secured Notes—Segregation of Proceeds; Special Mandatory Redemption.” |

| (3) | Represents the aggregate principal amount of Unsecured Notes offered hereby. Assumes the Unsecured Notes are issued at par. If we do not consummate the Acquisition, the Unsecured Notes will be subject to a special mandatory redemption. See “Description of the Unsecured Notes—Segregation of Proceeds; Special Mandatory Redemption.” |

| (4) | Represents estimated cash on our balance sheet immediately prior to the closing of the Acquisition, including from the liquidation of substantially all of our marketable securities. The actual amount of cash and cash equivalents and marketable securities that will be used as a source of funds in connection with the Acquisition will vary depending on, among other things, our cash balance on the Acquisition Closing Date, transaction fees and expenses and the timing of the Acquisition Closing Date. |

| (5) | Represents the estimated aggregate consideration payable to equity holders of Merus pursuant to the Acquisition, calculated based on Genmab’s offer of $97.00 per Merus common share pursuant to the tender offer. |

| (6) | Represents estimated fees and expenses associated with the Acquisition, including financing fees, advisory fees and other costs and legal, accounting and other professional fees relating to the Acquisition. Actual fees and expenses may vary. To the extent any fees and expenses exceed the estimated amounts, we expect to fund such amounts with cash on our balance sheet at the closing of the Acquisition. |

18

SUMMARY HISTORICAL FINANCIAL INFORMATION

Company Summary Financial Information

The following tables summarize certain of our consolidated financial data for the periods ended on and as of the dates indicated below and are presented in U.S. dollars.

We have extracted our summary financial information (i) as of January 1, 2023, December 31, 2023 and December 31, 2024 and for the years ended December 31, 2022, 2023 and 2024 from the audited consolidated financial statements (the “Genmab Consolidated Financial Statements”) which have been updated as described in notes 1.1, 1.4, 4.2 and 4.5 in the Genmab Consolidated Financial Statements, which are included in this offering memorandum, and reissued compared to the previously announced consolidated financial statements as of the end of and for such years and (ii) as of and for the nine months ended September 30, 2024 and 2025 from the unaudited interim condensed consolidated financial statements (the “Genmab Unaudited Interim Condensed Consolidated Financial Statements”), which are included in this offering memorandum, each prepared in accordance with International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board (“IASB”) and as endorsed by the EU (“IFRS Accounting Standards”) and IAS 34 Financial Information, respectively.

Our historical results are not necessarily indicative of our future results, and our results for any interim period are not necessarily indicative of the results to be expected for a full year.

The summary financial information below includes Adjusted EBITDA, Adjusted EBITDA Margin and Free Cash Flow, which are non-IFRS measures that we believe are widely used by investors as supplemental measures of performance or, in the case of Free Cash Flow, liquidity. Adjusted EBITDA, Adjusted EBITDA Margin, Free Cash Flow and our unaudited historical financial information for the twelve months ended September 30, 2025 are not an accounting measures presented in accordance with IFRS and therefore should not be considered a substitute for, or superior to, measures of our operating performance and liquidity presented in accordance with IFRS. Our unaudited historical financial information for the twelve months ended September 30, 2025 has been calculated by adding together (i) the audited financial information for the year ended December 31, 2024 and (ii) the unaudited interim condensed consolidated financial information for the nine months ended September 30, 2025 and then subtracting the unaudited interim condensed consolidated financial information for the nine months ended September 30, 2024. See “Presentation of Financial and Other Information—Use of Non-IFRS And Non-GAAP Financial Information”.

Prospective investors should read the summary financial information presented below in conjunction with “Presentation of Financial and Other Information,” “Use of Proceeds,” “Capitalization,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Genmab Consolidated Financial Statements and the Genmab Unaudited Interim Condensed Consolidated Financial Statements, included elsewhere in this offering memorandum.

28

Select Consolidated Income Statement Data of the Company

| Year Ended December 31, | Nine Months Ended September 30, |

Last Twelve Months Ended September 30, |

||||||||||||||||||||||

| ($ million) | 2022* Restated |

2023* Restated |

2024* Restated |

2024* Restated |

2025 | 2025 | ||||||||||||||||||

| Revenue |

$ | 2,031 | $ | 2,390 | $ | 3,121 | $ | 2,198 | $ | 2,662 | 3,585 | |||||||||||||

| Cost of product sales |

— | (33 | ) | (143 | ) | (95 | ) | (157 | ) | (205 | ) | |||||||||||||

| Research and development expenses |

(787 | ) | (1,107 | ) | (1,414 | ) | (1,032 | ) | (1,080 | ) | (1,462 | ) | ||||||||||||

| Selling, general and administrative expenses |

(379 | ) | (478 | ) | (549 | ) | (370 | ) | (418 | ) | (597 | ) | ||||||||||||

| Acquisition and integration related charges |

— | — | (43 | ) | (39 | ) | — | (4 | ) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total costs and operating expenses |

$ | (1,166 | ) | $ | (1,618 | ) | $ | (2,149 | ) | $ | (1,536 | ) | $ | (1,655 | ) | $ | (2,268 | ) | ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Operating profit |

$ | 865 | $ | 772 | $ | 972 | $ | 662 | $ | 1,007 | $ | 1,317 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Financial income |

443 | 299 | 645 | 328 | 312 | 629 | ||||||||||||||||||

| Financial expenses |

(347 | ) | (254 | ) | (291 | ) | (181 | ) | (170 | ) | (280 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net profit before tax |

961 | 817 | 1,326 | 809 | 1,149 | 1,666 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Corporate tax |

(211 | ) | (186 | ) | (193 | ) | (228 | ) | (217 | ) | (182 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net profit |

$ | 750 | $ | 631 | $ | 1,133 | $ | 581 | $ | 932 | $ | 1,484 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| * | Genmab changed its presentation currency from DKK to USD effective January 1, 2025. Accordingly, management has translated the consolidated financial statements and related notes into USD for all periods presented. Refer to the Genmab Consolidated Financial Statements for more information. |

Select Consolidated Balance Sheet Data of the Company

| As of January 1, |

As of December 31, | As of September 30, | ||||||||||||||||||

| ($ million) | 2023* Restated |

2023* Restated |

2024* Restated |

2024 | 2025 | |||||||||||||||

| Marketable securities |

$ | 1,783 | $ | 1,967 | $ | 1,574 | $ | 1,648 | $ | 1,650 | ||||||||||

| Cash and cash equivalents |

1,419 | 2,204 | 1,380 | 952 | 1,761 | |||||||||||||||

| Total non-current assets |

273 | 320 | 2,514 | 2,397 | 2,550 | |||||||||||||||

| Shareholders’ equity |

3,915 | 4,687 | 5,137 | 4,793 | 5,751 | |||||||||||||||

| Share capital |

10 | 10 | 10 | 10 | 10 | |||||||||||||||

| * | Genmab changed its presentation currency from DKK to USD effective January 1, 2025. Accordingly, management has translated the consolidated financial statements and related notes into USD for all periods presented. Refer to the Genmab Consolidated Financial Statements for more information. |

29

Company Adjusted EBITDA

| Year Ended December 31, | Nine Months Ended September 30, |

Last Twelve Months Ended September 30, |

||||||||||||||||||||||

| ($ million) | 2022 | 2023 | 2024 | 2024 | 2025 | 2025 | ||||||||||||||||||

| Adjusted EBITDA(1) |

$ | 978 | $ | 900 | $ | 1,197 | $ | 833 | $ | 1,150 | $ | 1,514 | ||||||||||||

| (1) | We present Adjusted EBITDA because we believe that it is widely used by investors as a supplemental measure of performance. We believe that Adjusted EBITDA provides useful information to investors about our results of operations because it allows a comparison of our results across periods on a consistent basis by removing the effects on our operating performance of our asset base and capital investment cycle (such as depreciation and amortization) and items largely outside the control of management (such as corporate taxes). We calculate Adjusted EBITDA as net profit for the period as adjusted for corporate tax, depreciation, amortization, share-based compensation expense, impairment charges, acquisition and integration related charges, financial income and financial expense. In addition, you should be aware that we may incur expenses similar to the adjustments in this presentation in the future and that certain of these items could be considered recurring in nature. Our presentation of Adjusted EBITDA should not be construed as an implication that our future results will be unaffected by unusual or non-recurring items. Adjusted EBITDA should not be considered in isolation or as a substitute for measures of our operating performance presented in accordance with IFRS. For a description of the limitations of Adjusted EBITDA, see “Presentation of Financial and Other Information—Use of Non-IFRS and Non-GAAP Financial Information.” The following table reconciles our Net Profit to Adjusted EBITDA for the periods indicated below: |

| Year Ended December 31, | Nine Months Ended September 30, |

Last Twelve Months Ended September 30, |

||||||||||||||||||||||

| ($ million) | 2022 | 2023 | 2024 | 2024 | 2025 | 2025 | ||||||||||||||||||

| Net profit |

$ | 750 | $ | 631 | $ | 1,133 | $ | 581 | $ | 932 | $ | 1,484 | ||||||||||||

| Plus: Corporate tax |

211 | 186 | 193 | 228 | 217 | 182 | ||||||||||||||||||

| Plus: Depreciation |

30 | 40 | 49 | 36 | 39 | 52 | ||||||||||||||||||

| Plus: Amortization |

20 | 3 | 11 | 7 | 11 | 15 | ||||||||||||||||||

| Plus: Share-based-compensation expense |

63 | 85 | 105 | 78 | 92 | 119 | ||||||||||||||||||

| Plus: Impairment charges |

— | — | 17 | 11 | 1 | 7 | ||||||||||||||||||

| Plus: Acquisition and integration related charges |

— | — | 43 | 39 | — | 4 | ||||||||||||||||||

| Less: Financial income |

(443 | ) | (299 | ) | (645 | ) | (328 | ) | (312 | ) | (629 | ) | ||||||||||||

| Plus: Financial expense |

347 | 254 | 291 | 181 | 170 | 280 | ||||||||||||||||||

| Adjusted EBITDA |

$ | 978 | $ | 900 | $ | 1,197 | $ | 833 | $ | 1,150 | $ | 1,514 | ||||||||||||

| Divided by: Revenue |

$ | 2,031 | $ | 2,390 | $ | 3,121 | $ | 2,198 | $ | 2,662 | 3,585 | |||||||||||||

| Adjusted EBITDA Margin |

48 | % | 38 | % | 38 | % | 38 | % | 43 | % | 42 | % | ||||||||||||

30

Company Free Cash Flow

| Year Ended December 31, | Nine Months Ended September 30, |

Last Twelve Months Ended September 30, |

||||||||||||||||||

| ($ million) | 2022 | 2023 | 2024 | 2025 | 2025 | |||||||||||||||

| Cash from Operating Activities |

$ | 555 | $ | 1,071 | $ | 1,126 | $ | 885 | $ | 1,274 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Less: Tangible Capital Expenditures |

(45 | ) | (53 | ) | (27 | ) | (24 | ) | (38 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Free Cash Flow(2) |

510 | 1,018 | 1,099 | 861 | 1,236 | |||||||||||||||

| (2) | We present Free Cash Flow because we believe that it is widely used by investors as a supplemental measure of performance. We also believe Free Cash Flow is a meaningful measure as it is utilized by management and investors to assess our ability to generate cash flow from business operations to repay debt and return capital to our shareholders. We believe Free Cash Flow provides useful information to investors about our results of operations. We calculate Free Cash Flow as cash from operating activities minus tangible capital expenditures. Free Cash Flow should not be considered in isolation or as a substitute for measures of our operating performance presented in accordance with IFRS. For a description of the limitations of Free Cash Flow, see “Presentation of Financial and Other Information—Use of Non-IFRS and Non-GAAP Financial Information.” |

Merus Summary Financial Information

The following tables summarize certain financial information of Merus for the periods indicated below and are presented in U.S. dollars. We have extracted Merus’ summary financial information (i) as of and for the years ended December 31, 2023 and 2024 from Merus’ audited consolidated financial statements (“Merus’ Consolidated Financial Statements”) and (ii) as of and for the nine months ended September 30, 2024 and 2025 from Merus’ unaudited interim condensed consolidated financial statements (“Merus’ Unaudited Interim Condensed Consolidated Financial Statements”), each prepared in accordance with accounting principles generally accepted in the United States (“U.S. GAAP”) and set forth elsewhere in this offering memorandum.

The unaudited historical financial information for Merus for the twelve months ended September 30, 2025 has been calculated by adding together (i) the financial information for the year ended December 31, 2024 and (ii) the unaudited interim condensed consolidated financial information for the nine months ended September 30, 2025 and then subtracting the unaudited interim condensed consolidated financial information for the nine months ended September 30, 2024 from Merus’ Unaudited Interim Condensed Consolidated Financial Statements.

The summary financial information below includes Adjusted EBITDA, which is a non-GAAP measure that we believe is widely used by investors as a supplemental measure of performance. Adjusted EBITDA is not an accounting measure presented in accordance with U.S. GAAP and therefore should not be considered a substitute for, or superior to, measures of Merus’ operating performance presented in accordance with U.S. GAAP. See “Presentation of Financial and Other Information—Use of Non-IFRS and Non-GAAP Financial Information.”

Prospective investors should read the summary financial information of Merus presented below in conjunction with Merus’ Consolidated Financial Statements included elsewhere in this Offering Memorandum.

31

Select Consolidated Income Statement Data of Merus

| Year Ended December 31, | Nine Months Ended September 30, |

Last Twelve Months Ended September 30, |

||||||||||||||||||

| ($ thousands) | 2023 | 2024 | 2024 | 2025 | 2025 | |||||||||||||||

| Commercial material revenue |

$ | — | $ | — | $ | — | $ | 13,331 | $ | 13,331 | ||||||||||

| Collaboration revenue |

43,947 | 36,133 | 26,993 | 33,843 | 42,983 | |||||||||||||||

| Royalty revenue |

— | — | — | 292 | 292 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total revenue |

$ | 43,947 | $ | 36,133 | $ | 26,993 | $ | 47,466 | $ | 56,606 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating expenses: |

||||||||||||||||||||

| Research and development |

140,658 | 225,368 | 150,942 | 254,059 | 328,485 | |||||||||||||||

| General and administrative |

59,836 | 82,832 | 59,466 | 75,975 | 99,341 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating expenses |

$ | 200,494 | $ | 308,200 | $ | 210,408 | $ | 330,034 | $ | 427,826 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating loss |

$ | (156,547 | ) | $ | (272,067 | ) | $ | (183,415 | ) | $ | (282,568 | ) | $ | (371,220 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Other income (loss), net: |

||||||||||||||||||||

| Interest income, net |

14,510 | 30,789 | 22,301 | 23,152 | 31,640 | |||||||||||||||

| Foreign exchange (losses) gains, net |

(9,710 | ) | 34,103 | (16,897 | ) | (78,342 | ) | (27,342 | ) | |||||||||||

| Other (losses) gains, net |

— | — | — | (2,912 | ) | (2,912 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total other income (loss), net |

$ | 4,800 | $ | 64,892 | $ | 5,404 | $ | (58,102 | ) | $ | 1,386 | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loss before income tax expense |

$ | (151,747 | ) | $ | (207,175 | ) | $ | (178,011 | ) | $ | (340,670 | ) | $ | (369,834 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income tax expense |

3,192 | 8,151 | 6,392 | 9,542 | 11,301 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss |

$ | (154,939 | ) | $ | (215,326 | ) | $ | (184,403 | ) | $ | (350,212 | ) | $ | (381,135 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Select Consolidated Balance Sheet Data of Merus

| As of December 31, | As of September 30, | |||||||||||

| ($ thousands) | 2023 | 2024 | 2025 | |||||||||

| Cash and cash equivalents |

$ | 204,246 | $ | 293,294 | $ | 367,491 | ||||||

| Marketable securities |

150,130 | 243,733 | 268,441 | |||||||||

| Total current assets |

368,814 | 569,072 | 691,929 | |||||||||

| Total non-current assets |

86,680 | 213,621 | 212,267 | |||||||||

| Total assets |

455,494 | 782,693 | 904,196 | |||||||||

| Total liabilities |

99,151 | 134,766 | 129,264 | |||||||||

| Total shareholders’ equity |

356,343 | 647,927 | 774,932 | |||||||||

32

Merus Adjusted EBITDA

| Year Ended December 31, | Nine Months Ended September 30, |

Last Twelve Months Ended September 30, |

||||||||||||||||||

| ($ thousands) | 2023 | 2024 | 2024 | 2025 | 2025 | |||||||||||||||

| Adjusted EBITDA(1) |

(127,781 | ) | (223,762 | ) | (151,562 | ) | (224,566 | ) | (296,766 | ) | ||||||||||

| (1) | Merus does not report Adjusted EBITDA in its public disclosures and it is calculated differently than Adjusted EBITDA of Genmab. Genmab is presenting this measure using U.S. GAAP measures reported in Merus’ public disclosures and based on corresponding adjustments that Genmab applies to its own Adjusted EBITDA. We present Adjusted EBITDA because we believe that it is widely used by investors as a supplemental measure of performance. We believe that Adjusted EBITDA provides useful information to investors about Merus’ results of operations because it allows a comparison of Merus’ results across periods on a consistent basis by removing the effects on Merus’ operating performance of its asset base and capital investment cycle (such as depreciation and amortization) and items largely outside the control of management (such as income taxes). We calculate Merus Adjusted EBITDA as net loss for the period as adjusted for income tax expense, depreciation of property and equipment, amortization of intangible assets, share-based compensation expense and total other income (loss), net. Adjusted EBITDA is not an accounting measure presented in accordance with U.S. GAAP and therefore should not be considered in isolation or as a substitute for measures of Merus’ operating performance presented in accordance with U.S. GAAP. For a description of the limitations of Adjusted EBITDA, see “Presentation of Financial and Other Information—Use of Non-IFRS and Non-GAAP Financial Information.” The following table reconciles Merus’ net loss to Adjusted EBITDA for the periods indicated below: |

| Year Ended December 31, |

Nine Months Ended September 30, |

Last Twelve Months Ended September 30, |

||||||||||||||||||

| ($ thousands) | 2023 | 2024 | 2024 | 2025 | 2025 | |||||||||||||||

| Net loss |

$ | (154,939 | ) | $ | (215,326 | ) | $ | (184,403 | ) | $ | (350,212 | ) | $ | (381,135 | ) | |||||

| Plus: Income tax expense |

3,192 | 8,151 | 6,392 | 9,542 | 11,301 | |||||||||||||||

| Plus: Depreciation of property and equipment |

2,325 | 2,294 | 1,749 | 1,720 | 2,265 | |||||||||||||||

| Plus: Amortization of intangible assets |

215 | 177 | 133 | 139 | 183 | |||||||||||||||

| Plus: Share-based compensation expense |

26,226 | 45,834 | 29,971 | 56,143 | 72,006 | |||||||||||||||

| Plus/(Less): Total other income (loss), net(1) |

(4,800 | ) | (64,892 | ) | (5,404 | ) | 58,102 | (1,386 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA |

$ | (127,781 | ) | $ | (223,762 | ) | $ | (151,562 | ) | $ | (224,566 | ) | $ | (296,766 | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (1) | Total other income (loss), net includes net interest income and foreign exchange loss. |

33

Risks Related to the Acquisition

The pending Acquisition may not be completed on the currently contemplated timeline or terms, or at all.

The consummation of the Acquisition is subject to the satisfaction or waiver of certain conditions. Satisfaction of a number of the conditions is not within our control, and it is possible that such conditions may prevent or delay or otherwise materially adversely affect our ability to complete the Acquisition. These conditions include (i) the expiration or termination of the relevant waiting period (as it may be extended) under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 and the rules and regulations promulgated thereunder, (ii) a ‘no further questions’ response following submission of a briefing paper to the UK Competition and Markets Authority (the “UK CMA”), if this is the most recent response from the UK CMA as at the date all other conditions to the Offer are satisfied or, alternatively, clearance from the UK CMA following the submission of a notice to the CMA in the prescribed form as contemplated by Section 96 of the Enterprise Act 2002 in relation to the Offer, (iii) the valid tendering of a sufficient number of Merus common shares and (iv) adoption of resolutions by shareholders of Merus at an extraordinary meeting convened for the purpose of approving certain transactions related to the Offer, including the Back-End Transactions. Neither we nor Merus can provide assurance that the conditions to completing the Acquisition will be satisfied or waived, and accordingly, that the Acquisition will be completed on the timeline that the parties anticipate or at all. If any condition to the Acquisition is not satisfied, it could delay or prevent the Acquisition from occurring, which could negatively impact us and our growth prospects.

63

We may not realize the anticipated benefits from the pending Acquisition.

The Acquisition involves the combination of two companies that currently operate as independent companies. While we and Merus will continue to operate independently until the Acquisition Closing Date, the success of the Acquisition will depend, in part, on our ability to realize the anticipated benefits from successfully combining our and Merus’ businesses after closing. We plan on devoting substantial management attention and resources to integrating our and Merus’ businesses so that we can fully realize the anticipated benefits of the Acquisition. Nonetheless, the acquired Merus business, including petosemtamab, may not be successful, may require greater resources and investments than originally anticipated or may result in the assumption of unknown or contingent liabilities, which could have an adverse effect on us or our results of operations.

Potential difficulties we may encounter following closing include the following:

| • | the inability to successfully combine our and Merus’ businesses in a manner that permits us to realize the anticipated benefits of the Acquisition in the timeframe currently anticipated, or at all; |

| • | the failure to integrate internal systems, programs and internal controls, or applying different accounting policies, assumptions or judgments to Merus’ operational results than Merus applied in the past; |

| • | effectively and efficiently integrating information technology and other systems; |

| • | issues not discovered as part of the transactional due diligence process or unanticipated liabilities or contingencies of Merus, including employment or severance-related obligations under applicable law or other benefits arrangements, claims by or amounts owed to vendors or other commercial disputes, cyber incidents and information technology failures or delays, matters related to data privacy, data localization and the handling of personally identifiable information, and other unknown or contingent liabilities; |

| • | preserving the important licensing, marketing, and other commercial relationships of Merus; |

| • | the complexities associated with managing the combined company; |

| • | the failure to retain key employees of either of the two companies who may be difficult to replace; |

| • | the disruption of each company’s ongoing businesses or inconsistencies in services, standards, controls, procedures and policies; |

| • | potential unknown liabilities and unforeseen increased expenses, delays or regulatory conditions associated with the Acquisition; and |

| • | performance shortfalls at one or both of the two companies as a result of the diversion of management’s attention caused by completing the Acquisition and integrating our and Merus’ operations. |

Any of these risks could adversely affect our ability to maintain relationships with collaboration partners, vendors, employees and other commercial relationships or adversely affect our or Merus’ future operational results. As a result, the anticipated benefits of the Acquisition may not be realized or at all or may take longer to realize or cost more than expected, which could adversely affect our business, financial condition, results of operations and growth prospects. In addition, changes in laws and regulations could adversely impact our business, financial condition, results of operations and growth prospects after the Acquisition.

The pendency of the Acquisition could adversely affect our and/or Merus’ businesses and operations.

In connection with the pending Acquisition, some collaboration partners, vendors or other parties with commercial relationships with either of us or Merus may delay or defer decisions, which could adversely affect the revenues, earnings, cash flows and expenses of us or Merus, regardless of whether the Acquisition is completed.

64

In addition, due to operating covenants in the Transaction Agreement, Merus may be unable (without our prior written consent), during the pendency of the Acquisition, to pursue strategic transactions, undertake significant capital projects or otherwise pursue other actions outside the ordinary course, even if such actions would prove beneficial.

We expect to incur material expenses related to the Acquisition.

We expect to incur material expenses in connection with the Acquisition and the subsequent integration of the business, operations, practices, policies and procedures of Merus. These additional expenses could have an adverse effect on us or our results of operations. While we have assumed that a certain level of transaction and integration expenses would be incurred, there are a number of factors beyond our control that could affect the total amount or the timing of integration expenses. Many of the expenses that will be incurred, by their nature, are difficult to estimate accurately at the present time.

The Transaction Agreement and related documents may be amended or modified without your consent.

Between the time of the issuance of the notes and the consummation of the Acquisition, the parties to the Transaction Agreement may agree to modify or waive the terms or conditions of such documents without noteholder consent. The terms of the notes will not preclude the parties to the Transaction Agreement from making certain changes to the terms of the Acquisition or from waiving certain conditions to the Acquisition, which may adversely affect your investment in the notes.

Genmab’s ability to realize the anticipated benefits of the Acquisition will depend on its ability to effectively conduct clinical development of, obtain regulatory approvals for, and profitably commercialize, petosemtamab.

We may fail to realize the anticipated benefits of the Acquisition if we are unable to successfully develop, obtain regulatory approval for, and commercialize petosemtamab on the currently anticipated timeline, for all of the currently anticipated therapeutic indications, or at all.