Corporate Presentation November 2025 Exhibit 99.2

This presentation contains “forward-looking” statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including, but not limited to, anticipated discovery, preclinical and clinical development activities for Prelude’s product candidates and milestones, the potential safety, efficacy, benefits and addressable market for Prelude Therapeutic Incorporated's (the "Company") product candidates. Any statements contained herein or provided orally that are not statements of historical fact may be deemed to be forward-looking statements. In some cases, you can identify forward-looking statements by such terminology as ‘‘believe,’’ ‘‘may,’’ ‘‘will,’’ ‘‘potentially,’’ ‘‘estimate,’’ ‘‘continue,’’ ‘‘anticipate,’’ ‘‘intend,’’ ‘‘could,’’ ‘‘would,’’ ‘‘project,’’ ‘‘plan,’’ ‘‘expect’’ and similar expressions that convey uncertainty of future events or outcomes, although not all forward-looking statements contain these words. Statements, including forward-looking statements, speak only to the date they are provided (unless an earlier date is indicated). This presentation shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of securities of the Company in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or other jurisdiction, or pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act of 1933, as amended, and any other applicable securities laws. These forward-looking statements are based on the beliefs of our management as well as assumptions made by and information currently available to us. Although we believe the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. If such assumptions do not fully materialize or prove incorrect, the events or circumstances referred to in the forward-looking statements may not occur. We undertake no obligation to update publicly any forward-looking statements for any reason after the date of this presentation to conform these statements to actual results or to changes in our expectations, except as required by law. Accordingly, readers are cautioned not to place undue reliance on these forward-looking statements. Additional risks and uncertainties that could affect our business are included under the caption “Risk Factors” in our filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the year ended December 31, 2024. Forward Looking Statements & Disclaimers

We are on a mission to extend the promise of precision medicine to every cancer patient in need Select the best modality to precisely target oncogenic mechanisms Strive for first- or best-in-class and anchor to patient unmet need Draw on decades of experience and proven leadership to drive innovation

Kris Vaddi, PhD Chief Executive Officer Andrew Combs, PhD Chief Chemistry Officer Sean Brusky, MBA Chief Business Officer Peggy Scherle, PhD Chief Scientific Officer Bryant Lim, J.D. Chief Financial Officer,Chief Legal Officer, Secretary Dr. Victor Sandor, former CMO at Array BioPharma and current member of our Board of Directors, will serve as a senior medical advisor, providing strategic and operational leadership for our clinical development programs Experienced Leadership Team With Proven Track Records

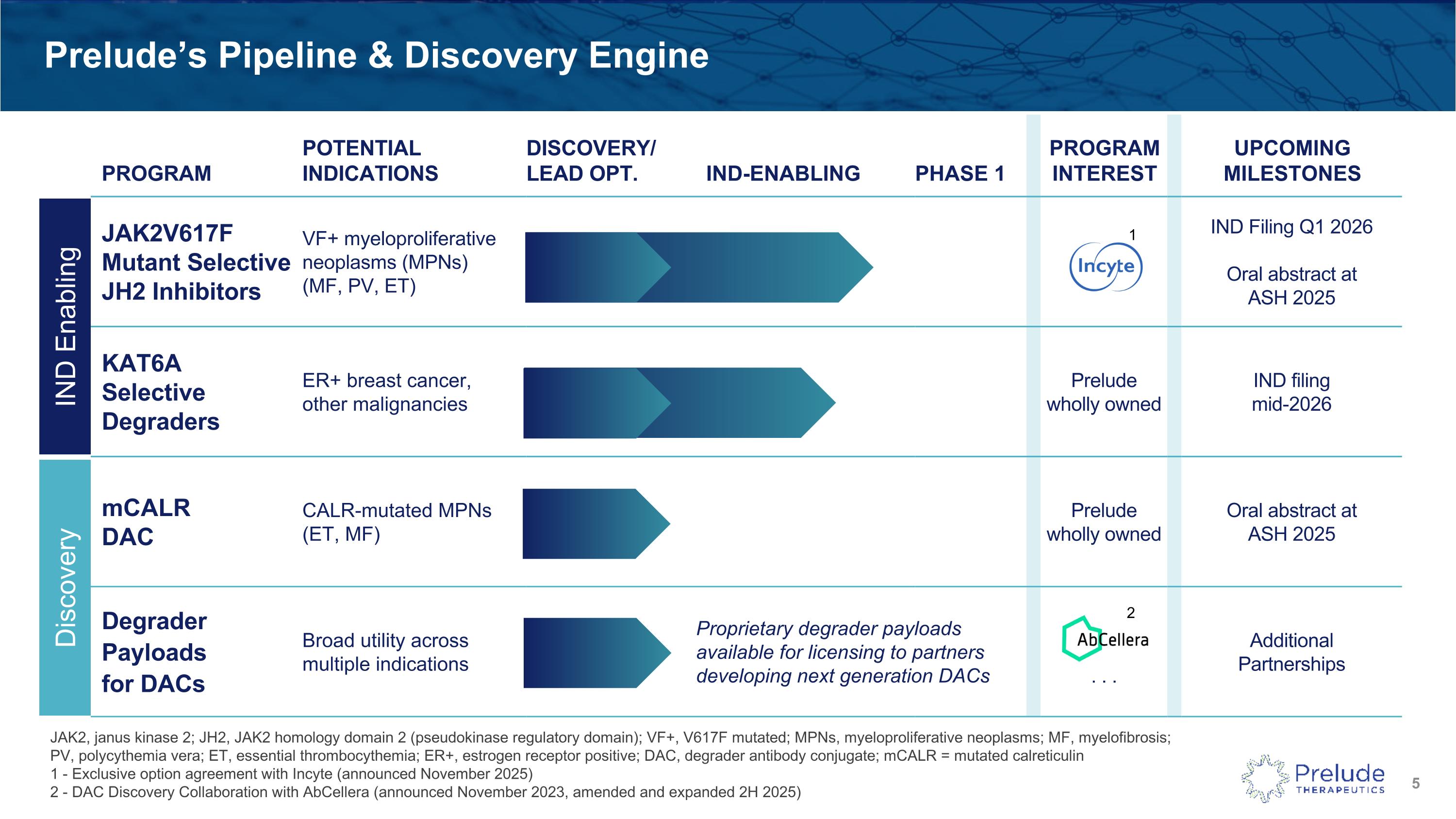

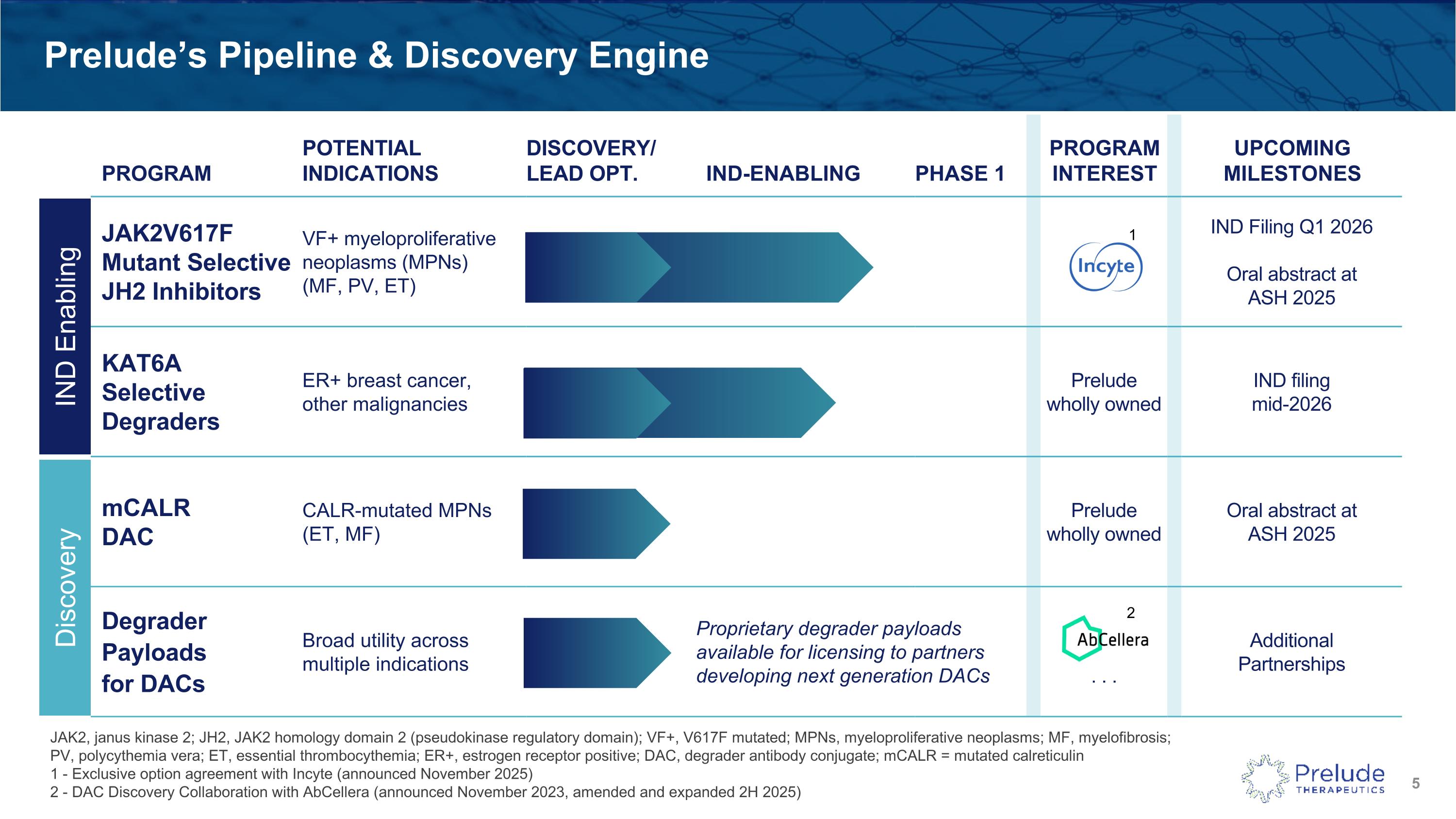

PROGRAM POTENTIAL INDICATIONS DISCOVERY/LEAD OPT. IND-ENABLING PHASE 1 PROGRAMINTEREST UPCOMING MILESTONES JAK2V617FMutant SelectiveJH2 Inhibitors VF+ myeloproliferative neoplasms (MPNs)(MF, PV, ET) IND Filing Q1 2026 Oral abstract at ASH 2025 KAT6ASelective Degraders ER+ breast cancer, other malignancies Prelude wholly owned IND filing mid-2026 mCALR DAC CALR-mutated MPNs (ET, MF) Prelude wholly owned Oral abstract at ASH 2025 Degrader Payloads for DACs Broad utility across multiple indications . . . Additional Partnerships Prelude’s Pipeline & Discovery Engine JAK2, janus kinase 2; JH2, JAK2 homology domain 2 (pseudokinase regulatory domain); VF+, V617F mutated; MPNs, myeloproliferative neoplasms; MF, myelofibrosis; PV, polycythemia vera; ET, essential thrombocythemia; ER+, estrogen receptor positive; DAC, degrader antibody conjugate; mCALR = mutated calreticulin1 - Exclusive option agreement with Incyte (announced November 2025) 2 - DAC Discovery Collaboration with AbCellera (announced November 2023, amended and expanded 2H 2025) IND Enabling Discovery Proprietary degrader payloads available for licensing to partners developing next generation DACs 1 2

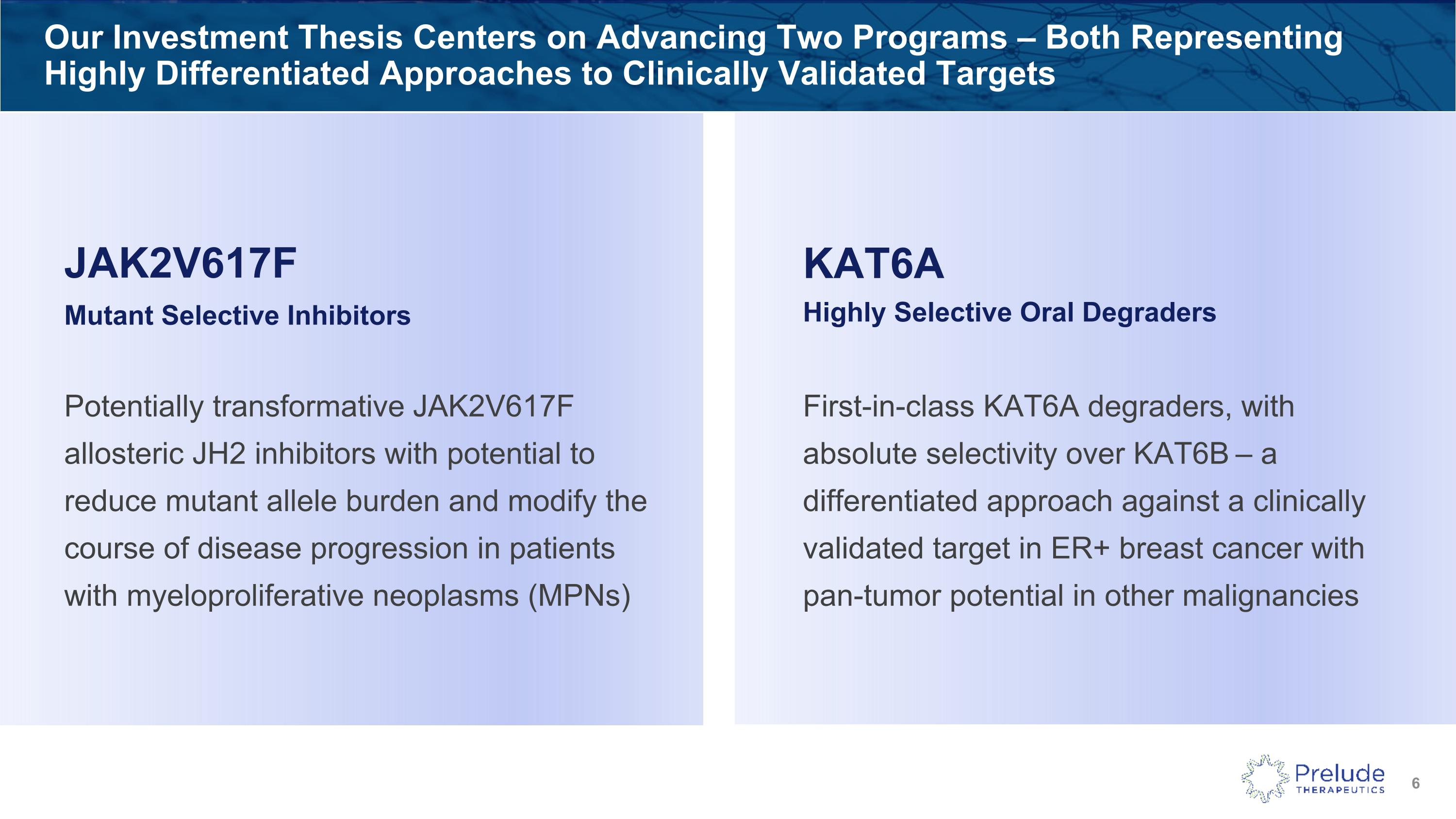

Our Investment Thesis Centers on Advancing Two Programs – Both Representing Highly Differentiated Approaches to Clinically Validated Targets KAT6AHighly Selective Oral Degraders JAK2V617FMutant Selective Inhibitors First-in-class KAT6A degraders, with absolute selectivity over KAT6B – a differentiated approach against a clinically validated target in ER+ breast cancer with pan-tumor potential in other malignancies Potentially transformative JAK2V617F allosteric JH2 inhibitors with potential to reduce mutant allele burden and modify the course of disease progression in patients with myeloproliferative neoplasms (MPNs)

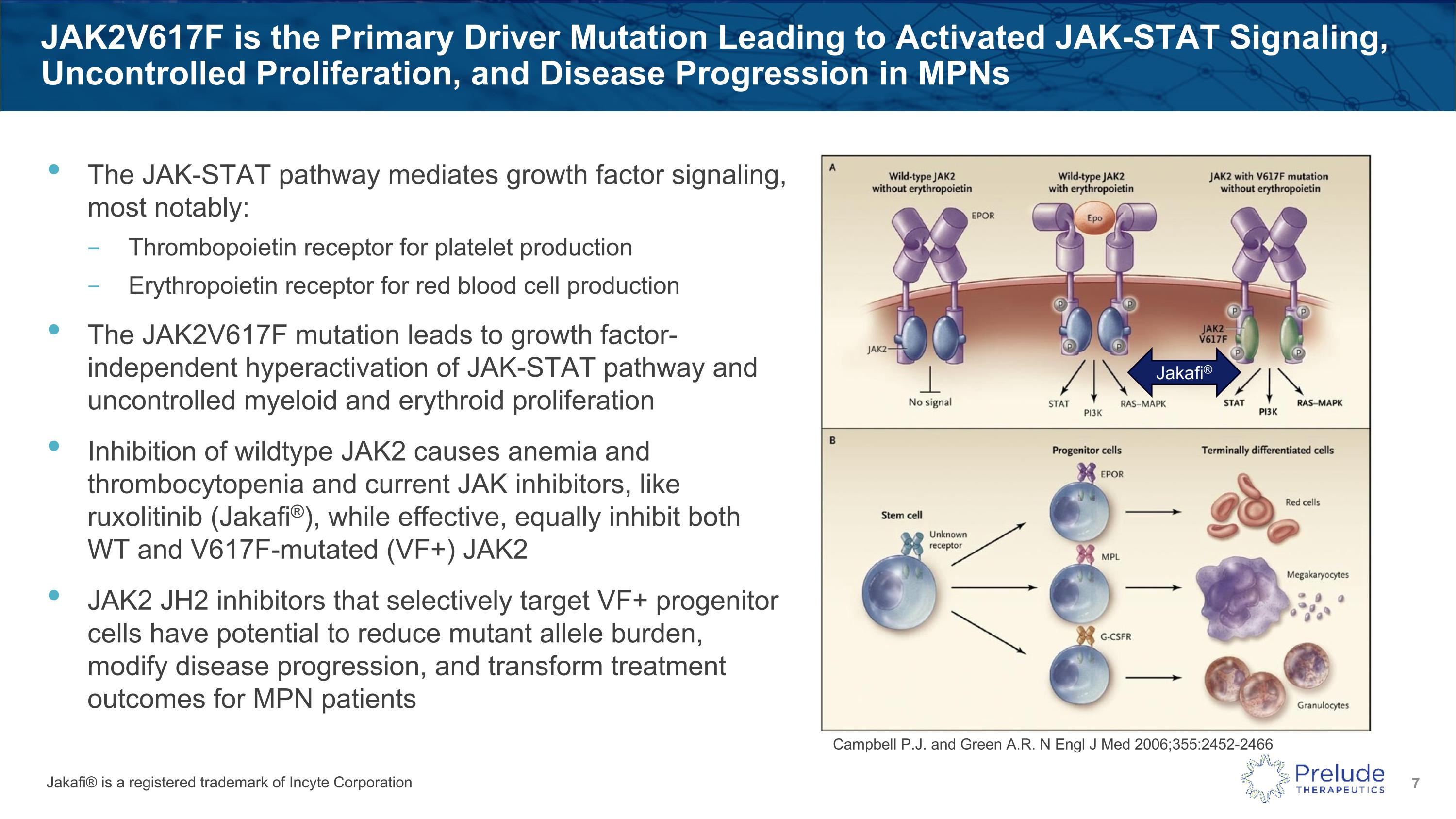

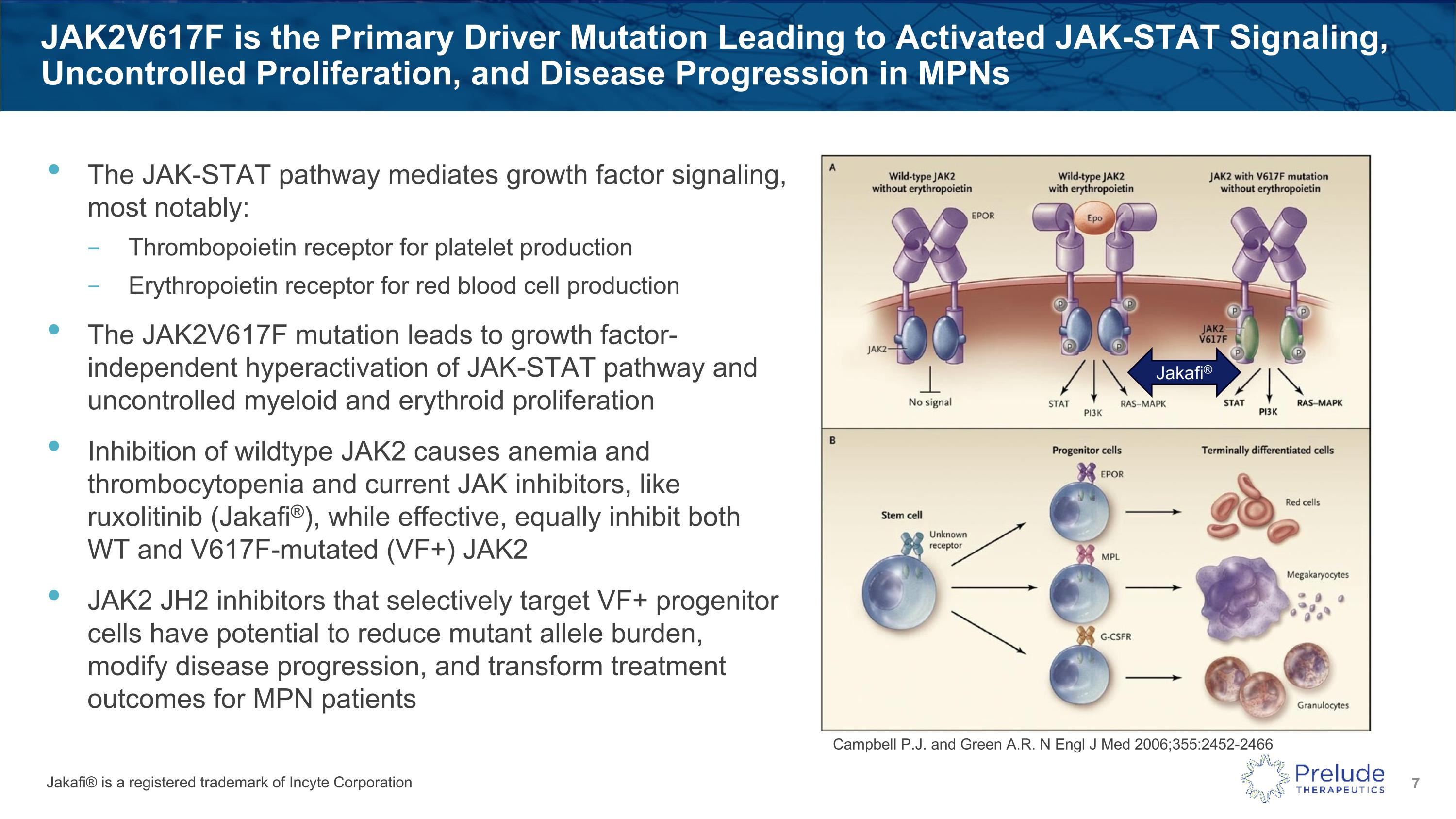

JAK2V617F is the Primary Driver Mutation Leading to Activated JAK-STAT Signaling, Uncontrolled Proliferation, and Disease Progression in MPNs The JAK-STAT pathway mediates growth factor signaling, most notably: Thrombopoietin receptor for platelet production Erythropoietin receptor for red blood cell production The JAK2V617F mutation leads to growth factor-independent hyperactivation of JAK-STAT pathway and uncontrolled myeloid and erythroid proliferation Inhibition of wildtype JAK2 causes anemia and thrombocytopenia and current JAK inhibitors, like ruxolitinib (Jakafi®), while effective, equally inhibit both WT and V617F-mutated (VF+) JAK2 JAK2 JH2 inhibitors that selectively target VF+ progenitor cells have potential to reduce mutant allele burden, modify disease progression, and transform treatment outcomes for MPN patients Jakafi® is a registered trademark of Incyte Corporation Jakafi® Campbell P.J. and Green A.R. N Engl J Med 2006;355:2452-2466

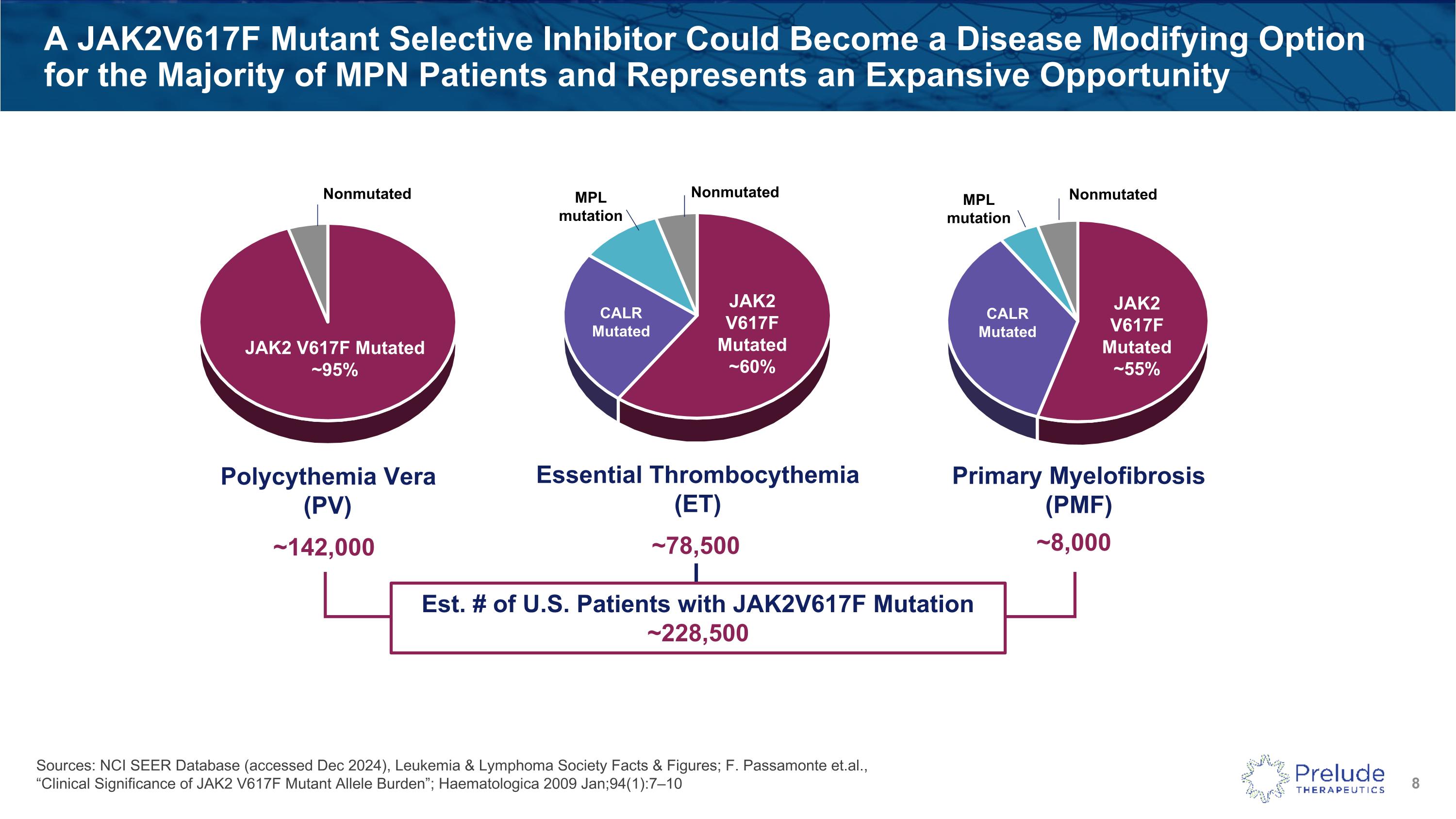

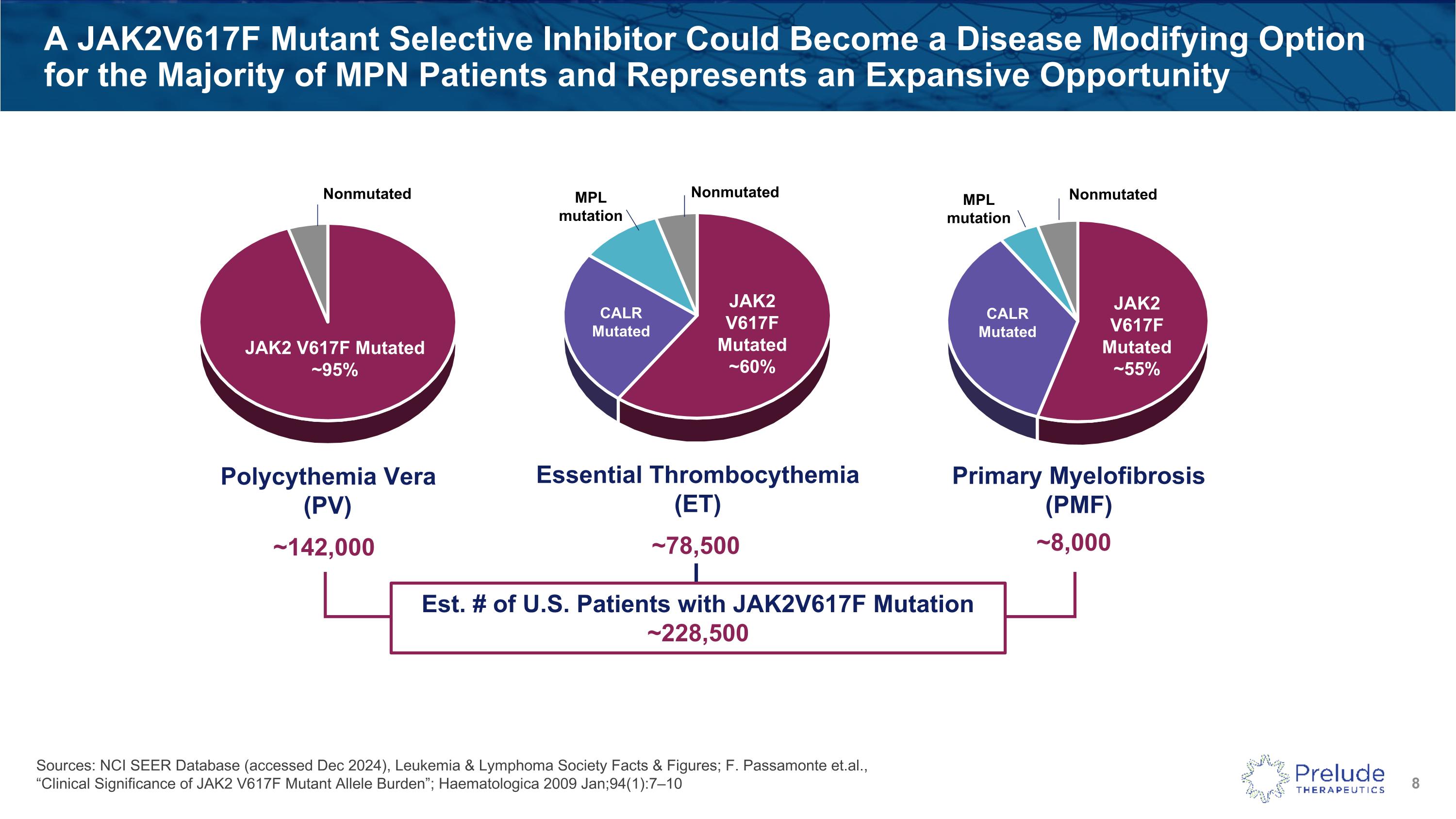

A JAK2V617F Mutant Selective Inhibitor Could Become a Disease Modifying Option for the Majority of MPN Patients and Represents an Expansive Opportunity Essential Thrombocythemia(ET) Polycythemia Vera(PV) JAK2 V617F Mutated~95% JAK2 V617F Mutated~60% CALRMutated MPL mutation Nonmutated Nonmutated ~78,500 ~142,000 Est. # of U.S. Patients with JAK2V617F Mutation~228,500 Primary Myelofibrosis (PMF) JAK2V617F Mutated~55% CALRMutated MPL mutation Nonmutated ~8,000 Sources: NCI SEER Database (accessed Dec 2024), Leukemia & Lymphoma Society Facts & Figures; F. Passamonte et.al., “Clinical Significance of JAK2 V617F Mutant Allele Burden”; Haematologica 2009 Jan;94(1):7–10

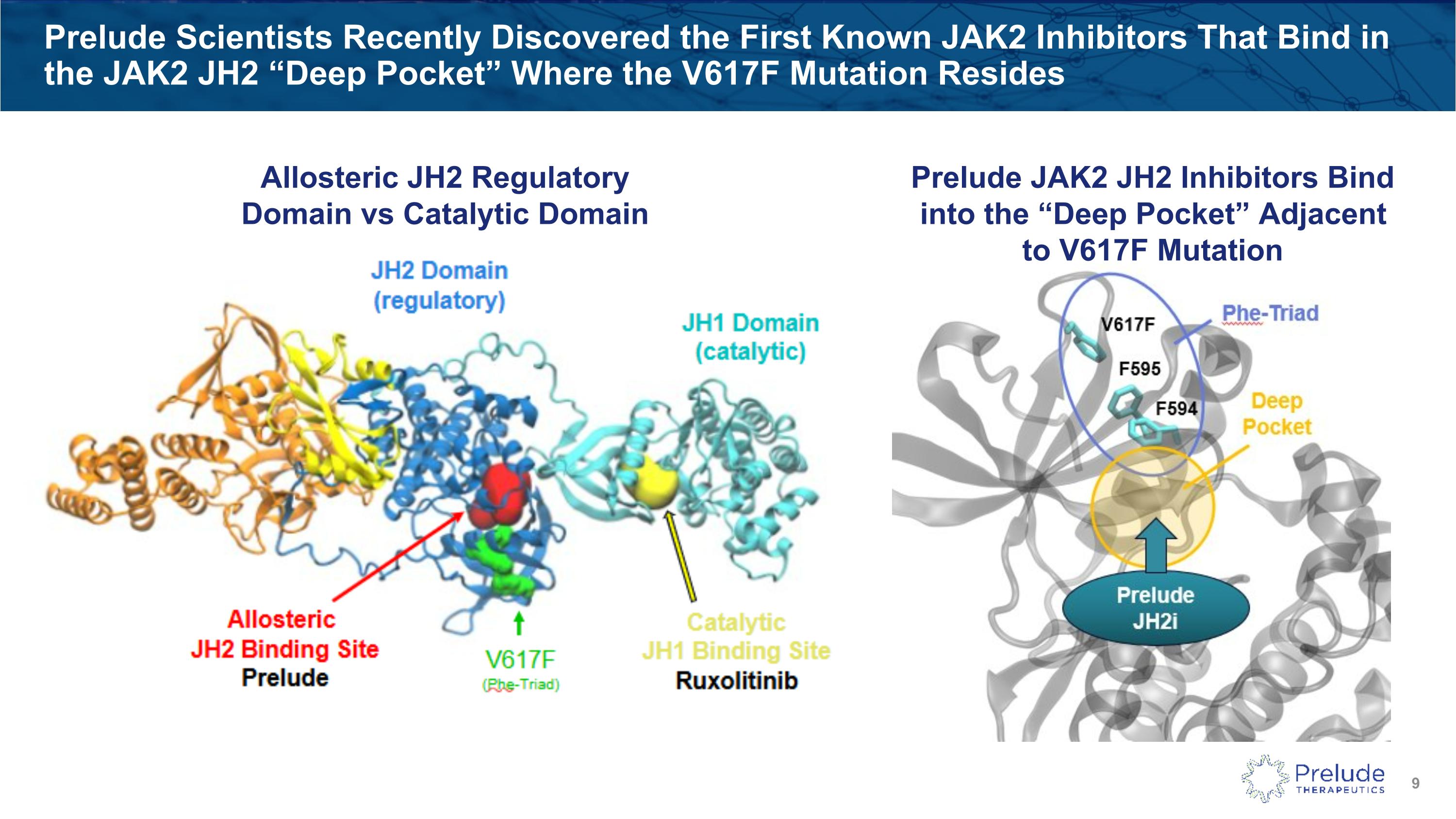

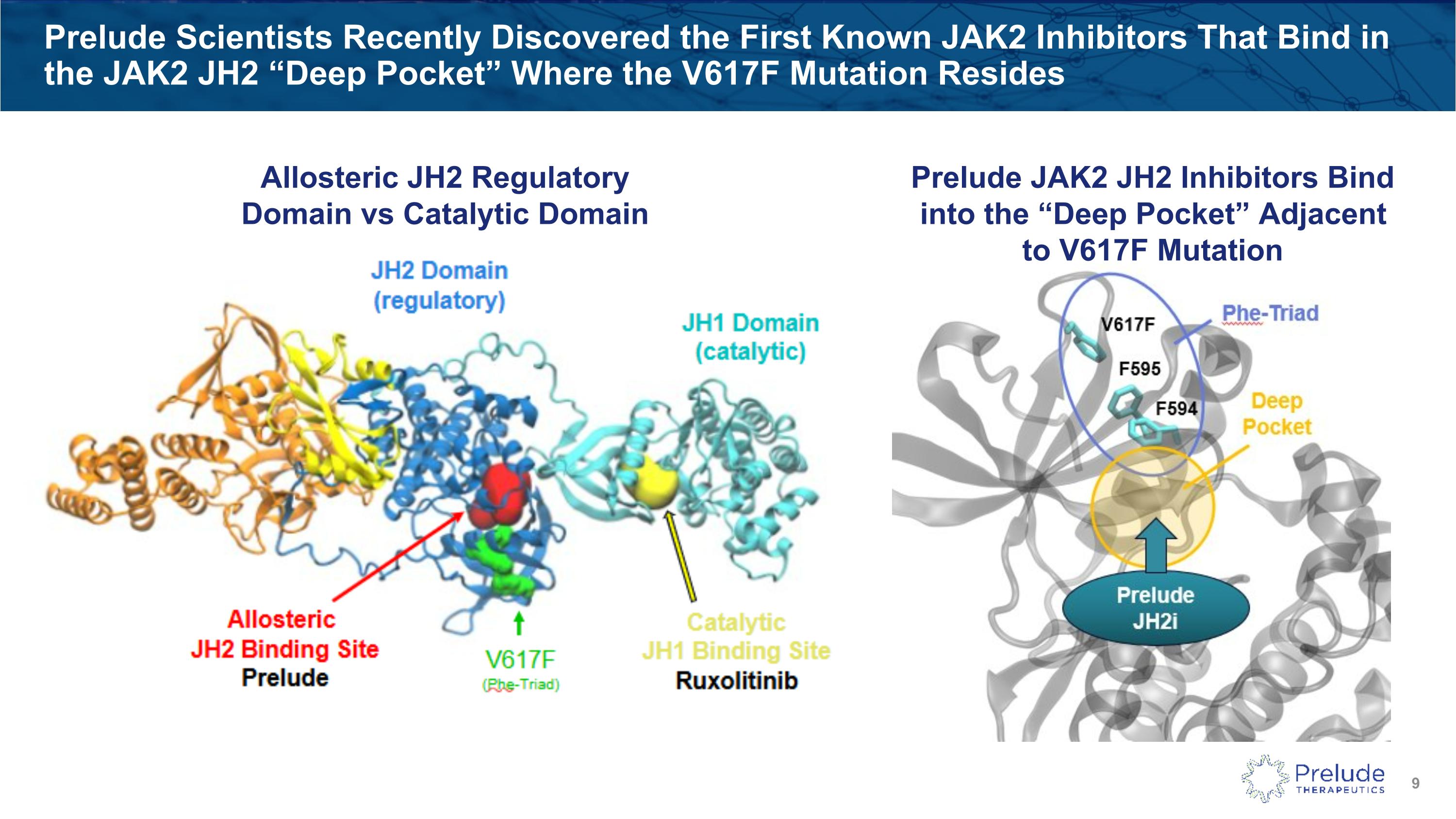

Prelude Scientists Recently Discovered the First Known JAK2 Inhibitors That Bind in the JAK2 JH2 “Deep Pocket” Where the V617F Mutation Resides Prelude JAK2 JH2 Inhibitors Bind into the “Deep Pocket” Adjacent to V617F Mutation Allosteric JH2 Regulatory Domain vs Catalytic Domain

Global sales of ruxolitinib (Jakafi® /Jakavi®) alone grew to over $4.5B in 20241,2 Continuing strong sales growth for ruxolitinib in PV First generation JAK inhibitors have delivered transformative efficacy for MF patients Highly effective at reducing symptoms and spleen size However, toxicities from wild-type activity limit ability to reach maximal efficacy Ruxolitinib is the only JAK inhibitor approved in PV (2L only) and none are approved in ET Prelude’s JAK2V617F mutant selective inhibitors demonstrate: Potent and selective reduction in JAK2V617F cells in vitro compared to WT cells Improved efficacy, reduced toxicity, and rapid reduction of mutant alleles in vivo Potential for transformative efficacy and disease modification in PV, ET and MF JAK2V617F Mutant Selective Inhibitors Are Highly Differentiated From 1st Generation JAK Inhibitors in a Large and Growing Market 1 - Incyte Pharmaceuticals (Q4 2024 Financial Results and Corporate Update Presentation, February 10, 2025); Jakafi is a registered trademark of Incyte2 - Novartis Pharmaceuticals (Full Year 2024 Product Sales, Accessed August 2025; Jakavi is a registered trademark of Novartis 3 - Abstract can be found on the ASH 2025 website: ASH Annual Meeting & Exposition - Hematology.org. First Public Disclosure of Preclinical Data on Prelude’s JAK2V617F Program Accepted for Oral Presentation at ASH 2025 3

JAK2V617F Program1: Phase 1 Study Design (Illustrative) MPNs 2026 2027 2028 2029 Phase 1b/2 Expansion Phase 1 (MPNs) First Look at Spleen/Symptoms/CHR Mutant Allele Burden Phase 1a Dose Escalation Expansion Cohorts DL(n) (N=3-6) DL1 (N=3-6) DL2 (N=3-6) Expansion ~50 hrPV, hrET & MF at Dose OBJECTIVE CHR rate, Durability (24 week) and Molecular Response Rate (allele burden reduction) Spleen and symptom benefit Data generation in preparation for first registrational trial(s) 1 - Subject to exclusive option agreement with Incyte (announced November 2025) MPNs, myeloproliferative neoplasms; MF, myelofibrosis; hrPV, high risk polycythemia vera; hrET, high risk essential thrombocythemia; CHR, complete hematologic response; DL, dose level

Exclusive option agreement with Incyte (announced November 2025) Option Agreement With Incyte Provides Significant Capital to Further Advance Our JAK2V617F and KAT6A Programs

Our Investment Thesis Centers on Advancing Two Programs – Both Representing Highly Differentiated Approaches to Clinically Validated Targets KAT6AHighly Selective Oral Degraders JAK2V617FMutant Selective Inhibitors First-in-class KAT6A degraders, with absolute selectivity over KAT6B – a differentiated approach against a clinically validated target in ER+ breast cancer with pan-tumor potential in other malignancies Potentially transformative JAK2V617F allosteric JH2 inhibitors with potential to reduce mutant allele burden and modify the course of disease progression in patients with myeloproliferative neoplasms (MPNs)

KAT6 is a clinically validated mechanism in ER+ breast cancer A KAT6A/B dual inhibitor is now in pivotal phase 3 trials in combination with fulvestrant, after progression on a CDK4/6 inhibitor1 Demonstrated compelling efficacy in post CDK4/6 inhibitor setting in a broad population of ER+ BC1 Clinically relevant safety observations including dysgeusia and grade 3/4 neutropenia are challenging and may limit dosing to maximal benefit in combination with SoC treatments (e.g., CDK4/6 inhibitors)1 Our KAT6A program aims to demonstrate a superior clinical profile Optimal efficacy Lower hematological toxicity Improved combinability profile with other agents (e.g., oral SERDs, AIs, CDK4/6is, PI3Kis) ER+ breast cancer treatment market is projected to reach $42B by 20332 Most common type of breast cancer, representing 70% of all cases 1 - P LoRusso, et. al,, Dose optimization of PF-07248144, a first-in-class KAT6 inhibitor, in patients (pts) with ER+/HER2− metastatic breast cancer (mBC): Results from phase 1 study to support the recommended phase 3 dose (RP3D) ASCO 2025 Annual Meeting, J Clin Oncol 43, 1020(2025) 2 - Vision Research Reports; "Estrogen Receptor Positive Breast Cancer Treatment Market Forecast 2024-2033. ER+ Breast Cancer Treatment Market Size | Companies Prelude’s First-In-Class Oral KAT6A Selective Degraders

Selectively Degrading KAT6A is a Novel Approach with Potential to Deliver Differentiated Safety and Efficacy Over Non-Selective KAT6A/B Inhibitors Dual Inhibition May Lead to More Bone Marrow Toxicity* KAT6A Amplification and Overexpression in Cancer Leads to Increased Activity 1 3

Our Lead KAT6A Selective Degrader Development Candidate Prelude Data on File Lead DC is a Potent KAT6A Degrader in Preclinical Models Absolute kinetic selectivity for 6A/6B (>1000-fold) Global proteomics demonstrates selective KAT6A degradation Excellent oral PK across species Compelling in vivo efficacy as monotherapy in multiple models Reduced effect on neutrophils in preclinical models Non-GLP DRF studies complete IND-enabling studies initiated Absolute Degradation Selectivity (KAT6A vs KAT6B) ZR-75 Breast Cancer CDX Model In Vivo Efficacy KAT6A Lead DC KAT6A Lead DC

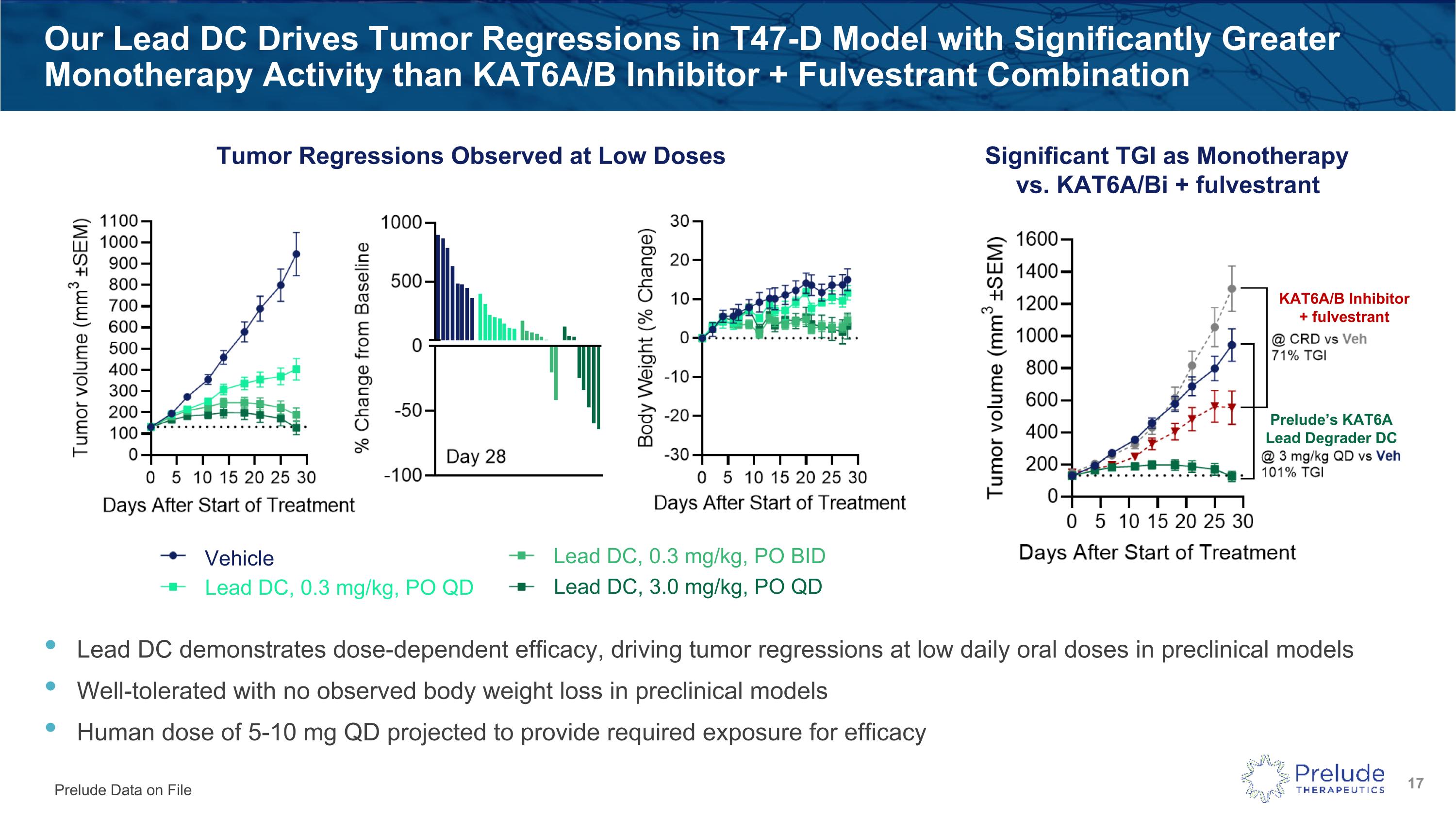

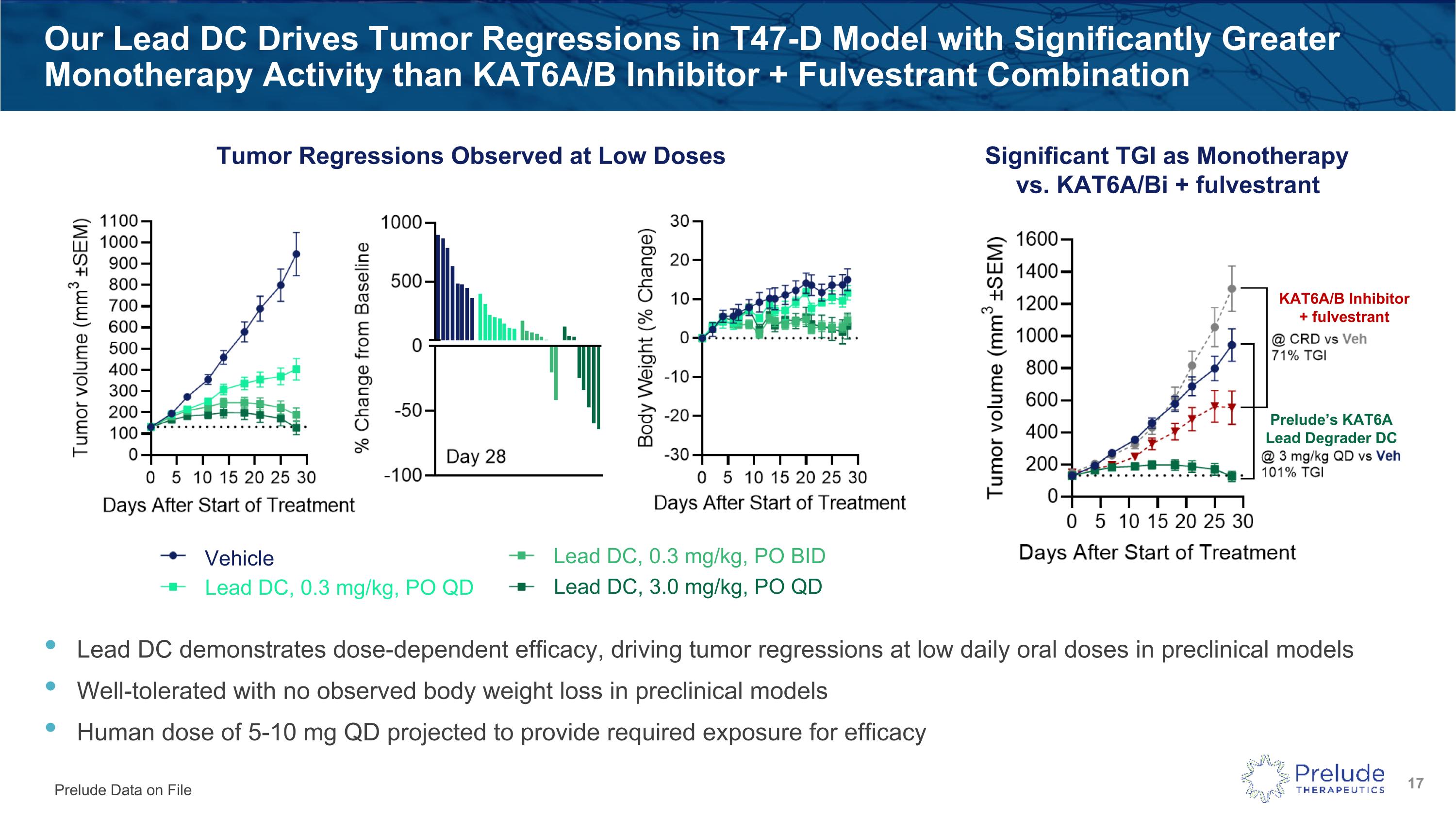

Lead DC demonstrates dose-dependent efficacy, driving tumor regressions at low daily oral doses in preclinical models Well-tolerated with no observed body weight loss in preclinical models Human dose of 5-10 mg QD projected to provide required exposure for efficacy Our Lead DC Drives Tumor Regressions in T47-D Model with Significantly Greater Monotherapy Activity than KAT6A/B Inhibitor + Fulvestrant Combination Significant TGI as Monotherapy vs. KAT6A/Bi + fulvestrant Tumor Regressions Observed at Low Doses Prelude Data on File Vehicle Lead DC, 0.3 mg/kg, PO QD Lead DC, 0.3 mg/kg, PO BID Lead DC, 3.0 mg/kg, PO QD Prelude’s KAT6A Lead Degrader DC KAT6A/B Inhibitor + fulvestrant

KAT6A Selective Degraders Show Potential for Lower Bone Marrow Toxicity in Preclinical Models Compared to KAT6A/B Dual Inhibitors Neutrophils Day 5 Dose Response of CFU-GM Low Dose High Dose High Dose Low Dose KAT6A degrader KAT6A degrader Ex vivo and in vivo studies with KAT6A selective degraders show limited effects on neutrophils in contrast to dual KAT6A/B inhibitors or degraders Prelude Data on File

Prelude has discovered and developed multiple first-in-class, highly selective KAT6A degraders which demonstrate favorable preclinical results KAT6A degraders show potential to achieve best-in-class efficacy and ability to differentiate on safety and combinability early in clinical development Lead DC has completed dosing in non-GLP studies in rats and dogs On-track to advance to IND filing in mid-2026 Phase 1 start expected 2H 2026 KAT6A Selective Degrader Program Summary

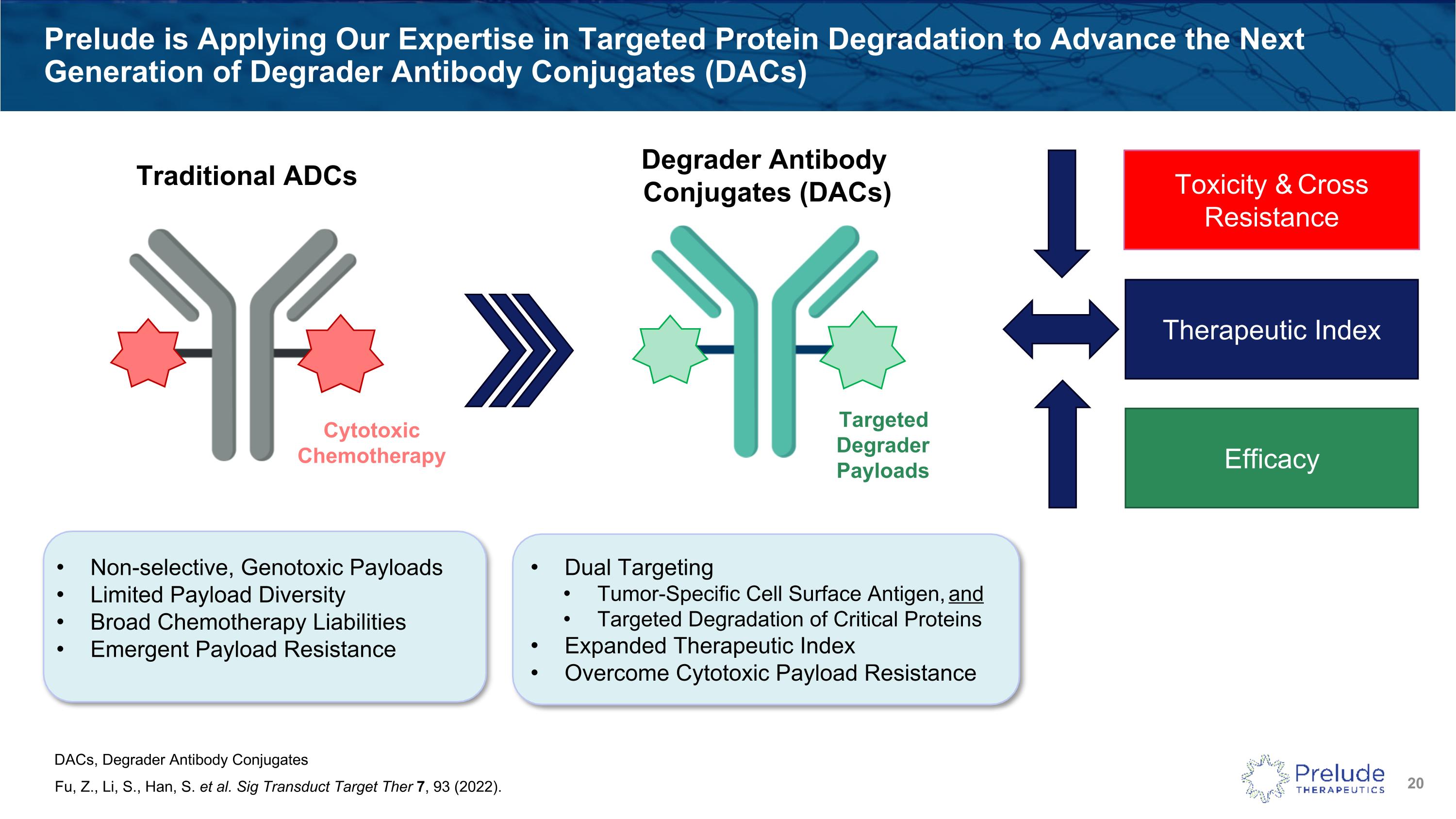

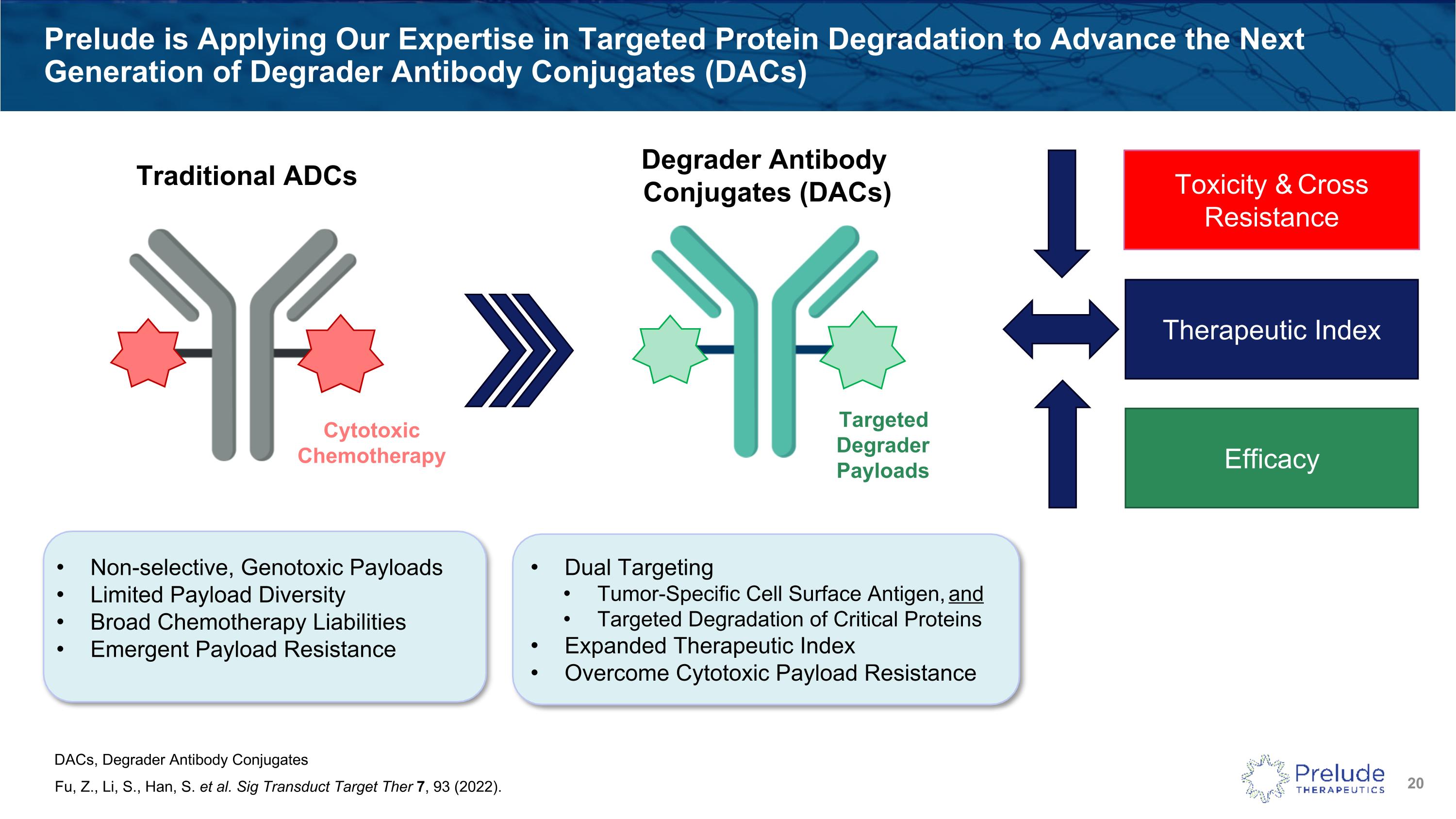

Prelude is Applying Our Expertise in Targeted Protein Degradation to Advance the Next Generation of Degrader Antibody Conjugates (DACs) Fu, Z., Li, S., Han, S. et al. Sig Transduct Target Ther 7, 93 (2022). Toxicity & Cross Resistance Efficacy Therapeutic Index Non-selective, Genotoxic Payloads Limited Payload Diversity Broad Chemotherapy Liabilities Emergent Payload Resistance Dual Targeting Tumor-Specific Cell Surface Antigen, and Targeted Degradation of Critical Proteins Expanded Therapeutic Index Overcome Cytotoxic Payload Resistance TargetedDegrader Payloads Traditional ADCs Degrader Antibody Conjugates (DACs) Cytotoxic Chemotherapy DACs, Degrader Antibody Conjugates

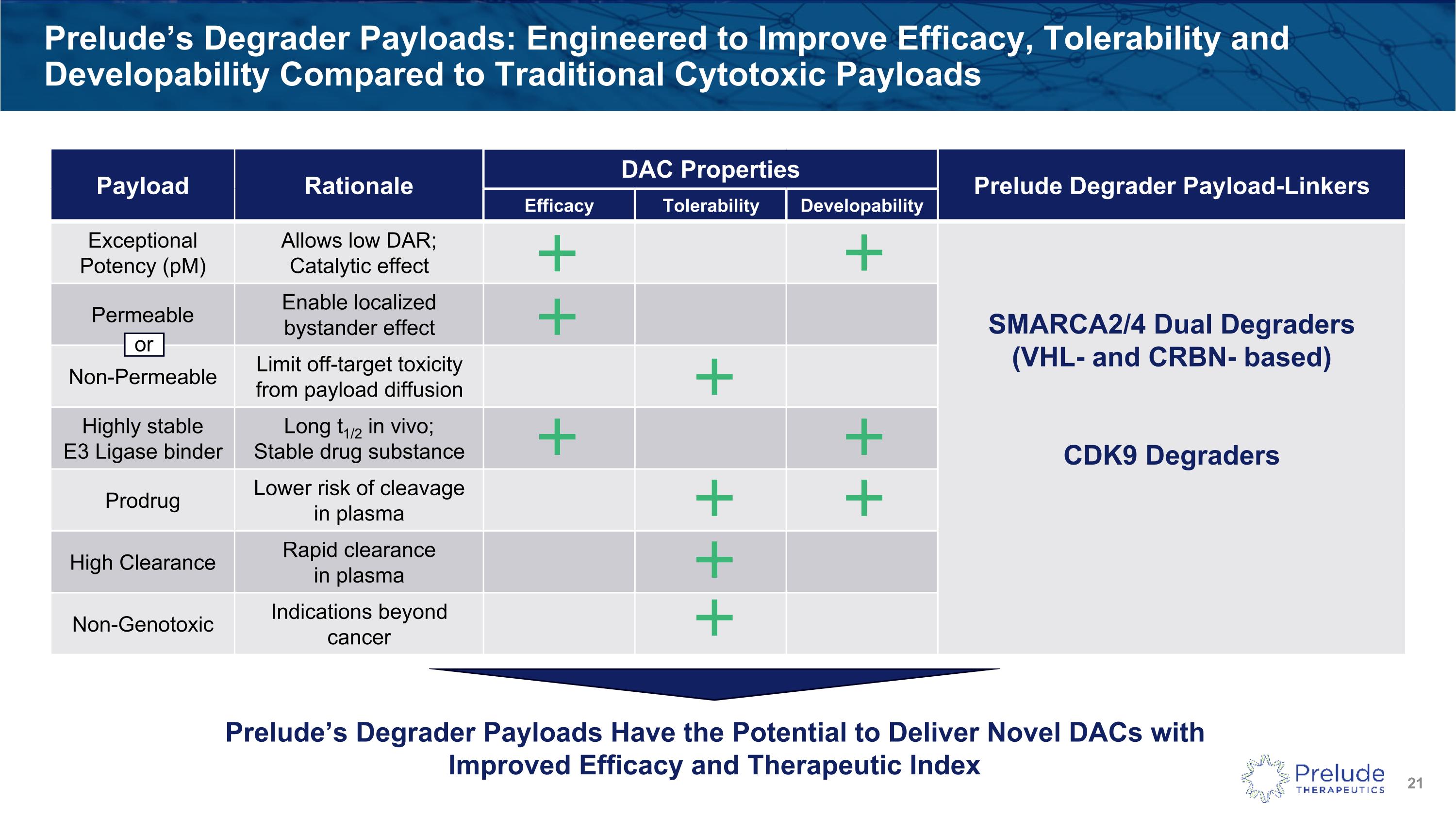

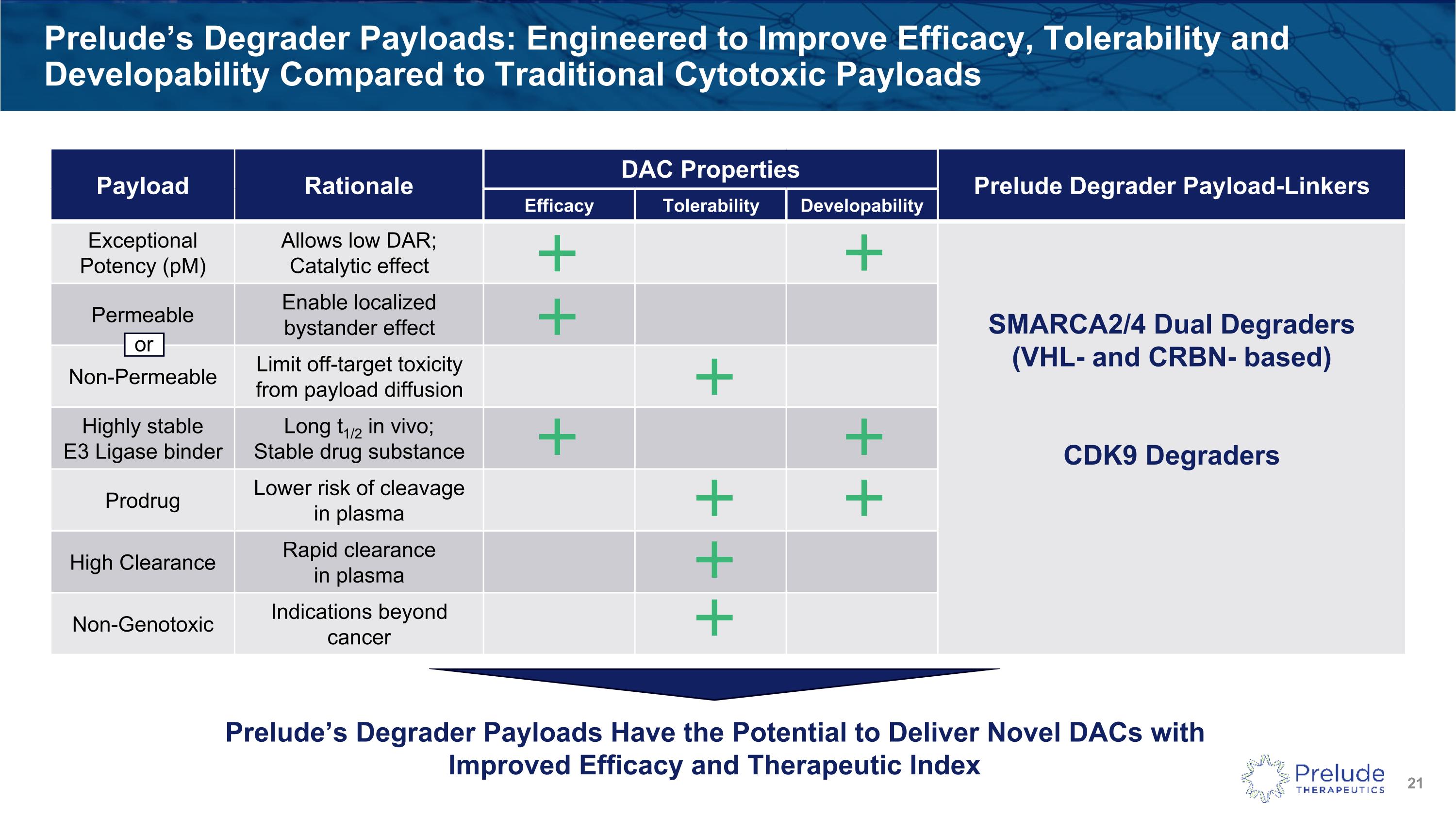

Prelude’s Degrader Payloads: Engineered to Improve Efficacy, Tolerability and Developability Compared to Traditional Cytotoxic Payloads Payload Rationale DAC Properties Prelude Degrader Payload-Linkers Efficacy Tolerability Developability Exceptional Potency (pM) Allows low DAR; Catalytic effect SMARCA2/4 Dual Degraders(VHL- and CRBN- based) CDK9 Degraders Permeable Enable localized bystander effect Non-Permeable Limit off-target toxicity from payload diffusion Highly stable E3 Ligase binder Long t1/2 in vivo; Stable drug substance Prodrug Lower risk of cleavage in plasma High Clearance Rapid clearance in plasma Non-Genotoxic Indications beyond cancer Prelude’s Degrader Payloads Have the Potential to Deliver Novel DACs with Improved Efficacy and Therapeutic Index or

Mutated Calreticulin (mCALR) Represents a Promising Target for Next Generation DACs Mutant CALR is a neoantigen presented on the cell surface of malignant cells but not normal cells and is found in 25-35% of patients with Myelofibrosis (MF) and ET SMARCA2/4 and CDK9 degraders are both highly active in CALR mutated MPN cell lines and can be used as payloads for mCALR-targeted DACs mCALR-targeted DACs, delivering Prelude’s degrader payloads to disease-initiating clones have the potential to be first-in-class, disease modifying therapies Primary Myelofibrosis (PMF) Essential Thrombocythemia(ET) Polycythemia Vera(PV) JAK2 V617F Mutated~95% MPL mutation MPL mutation Nonmutated Nonmutated mCALR is emerging as a clinically validated target in MPNs with disease modifying potential Nonmutated ~5,000 ~32,500 N/A Est. # of US Pts. with CALR Mutation Sources: NCI SEER Database (accessed Dec 2024), Leukemia & Lymphoma Society Facts & Figures; J.How et. al., Mutant calreticulin in myeloproliferative neoplasms, Blood (2019) 134 (25): 2242–2248 JAK2 V617F Mutated~95% JAK2 V617F Mutated~60% JAK2V617F Mutated~55% CALRMutated ~35% CALRMutated ~25%

CALR x SMARCA2/4 DACs Demonstrate Robust and Selective Target Degradation and Cytotoxicity in CALR Mutant Cells and Robust Tumor Growth Inhibition In Vivo >68x Ba/F3 CALRins5 Ba/F3 CALRWT 0 .05 0.5 1 10 SMARCA2 0 .05 0.5 1 10 GAPDH SMARCA4 CALR DAC µg/ml Degradation Assay, 48h Anti-proliferation Assay SMARCA2/4 Degrader Robust Tumor Growth Inhibition in vivo Fultang N., et al., EHA2025 Oral Abstract, 12 June 25; Discovery Of First-in-class Precision ADCs Targeting Mutant Calreticulin For The Treatment Of MPNs. (Link) 1 - Abstract now available: ASH Annual Meeting & Exposition - Hematology.org CALR x SMARCA2/4 DAC CALR x SMARCA2/4 DAC CALR x CDK9 DAC Abstract Accepted for Oral Presentation at ASH20251

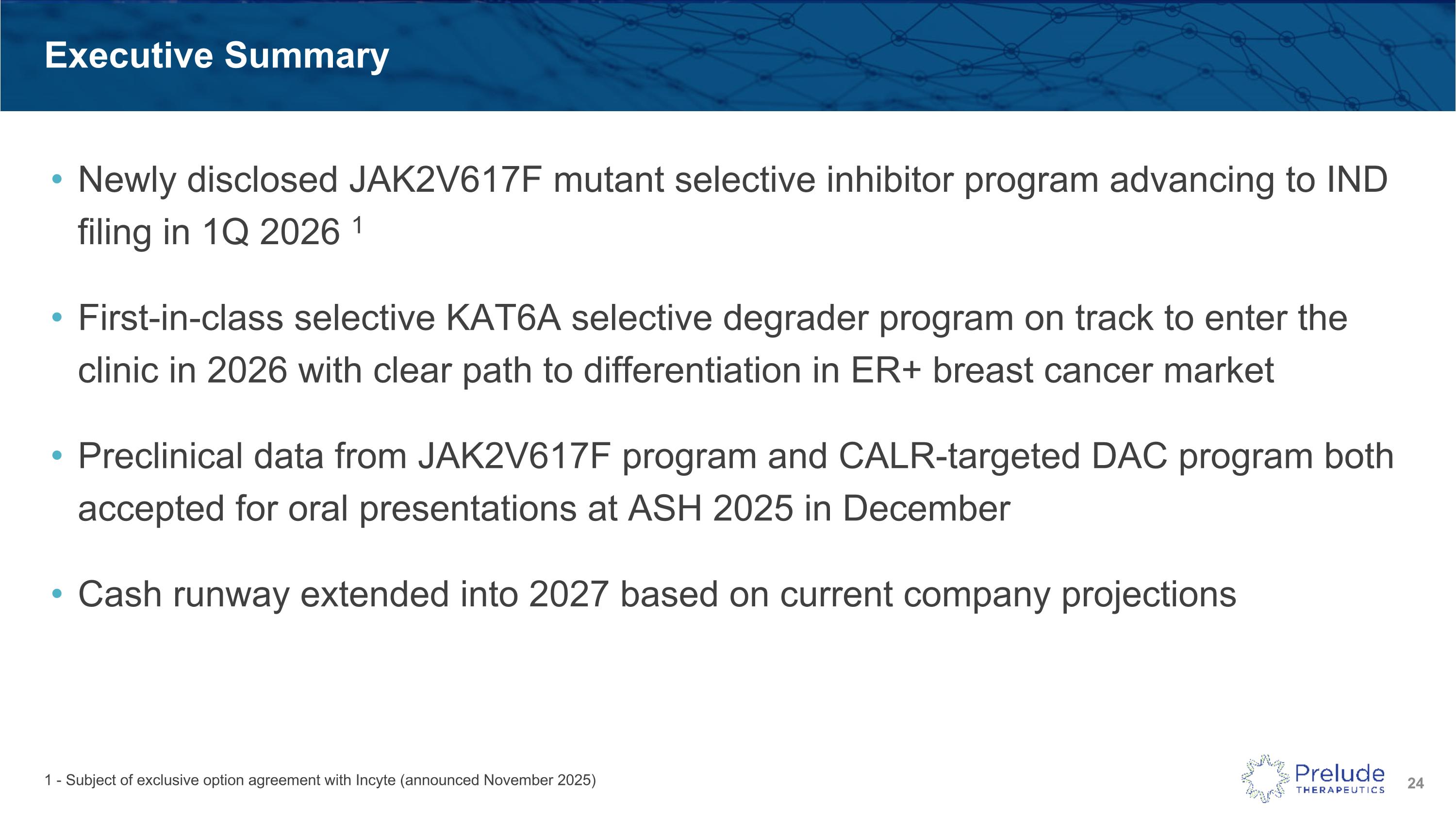

Executive Summary Newly disclosed JAK2V617F mutant selective inhibitor program advancing to IND filing in 1Q 2026 1 First-in-class selective KAT6A selective degrader program on track to enter the clinic in 2026 with clear path to differentiation in ER+ breast cancer market Preclinical data from JAK2V617F program and CALR-targeted DAC program both accepted for oral presentations at ASH 2025 in December Cash runway extended into 2027 based on current company projections 1 - Subject of exclusive option agreement with Incyte (announced November 2025)

Thank YouContact Us: Robert DoodySVP, Investor Relationsrdoody@preludetx.com