November 2025 Industry Leading Provider of Outsourced Semiconductor Assembly, Test & Bumping Services 3Q25 Results Conference Exhibit 99.2

Safe Harbor Notice This presentation contains certain forward-looking statements. These forward-looking statements may be identified by words such as ‘believes,’ ‘expects,’ ‘anticipates,’ ‘projects,’ ‘intends,’ ‘should,’ ‘seeks,’ ‘estimates,’ ‘future’ or similar expressions or by discussion of, among other things, strategies, goals, plans or intentions. These statements may include financial projections and estimates and their underlying assumptions, statements regarding current macroeconomic conditions, including the impacts of high inflation, foreign exchange rates and risk of recession, on demand for our products, consumer confidence and financial markets generally; changes in trade regulations, policies, and agreements and the imposition of tariffs that affect our products or operations, including potential new tariffs that may be imposed and our ability to mitigate with respect to future operations, products and services, and statements regarding future performance. Actual results may differ materially in the future from those reflected in forward-looking statements contained in this document, based on a number of important factors and risks, which are more specifically identified in the Company’s most recent U.S. Securities and Exchange Commission (the “SEC”) filings. Further information regarding these risks, uncertainties and other factors are included in the Company’s most recent Annual Report on Form 20-F filed with the SEC and in its other filings with the SEC.

Agenda Welcome 3Q25 Operating Results S.J. Cheng 3Q25 Financial Results Silvia Su Business Outlook S.J. Cheng Q&A

4 3Q25 Operating Results

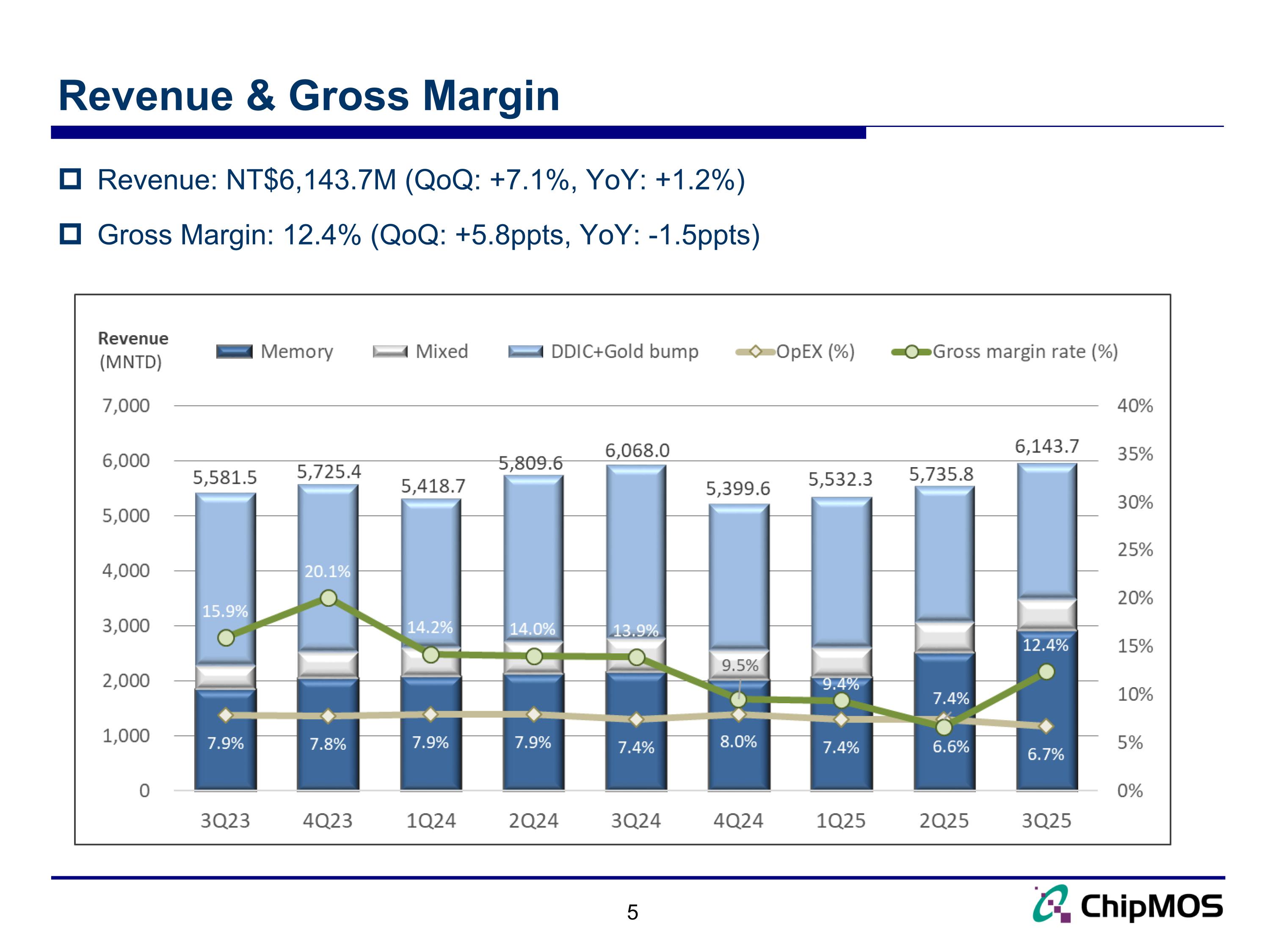

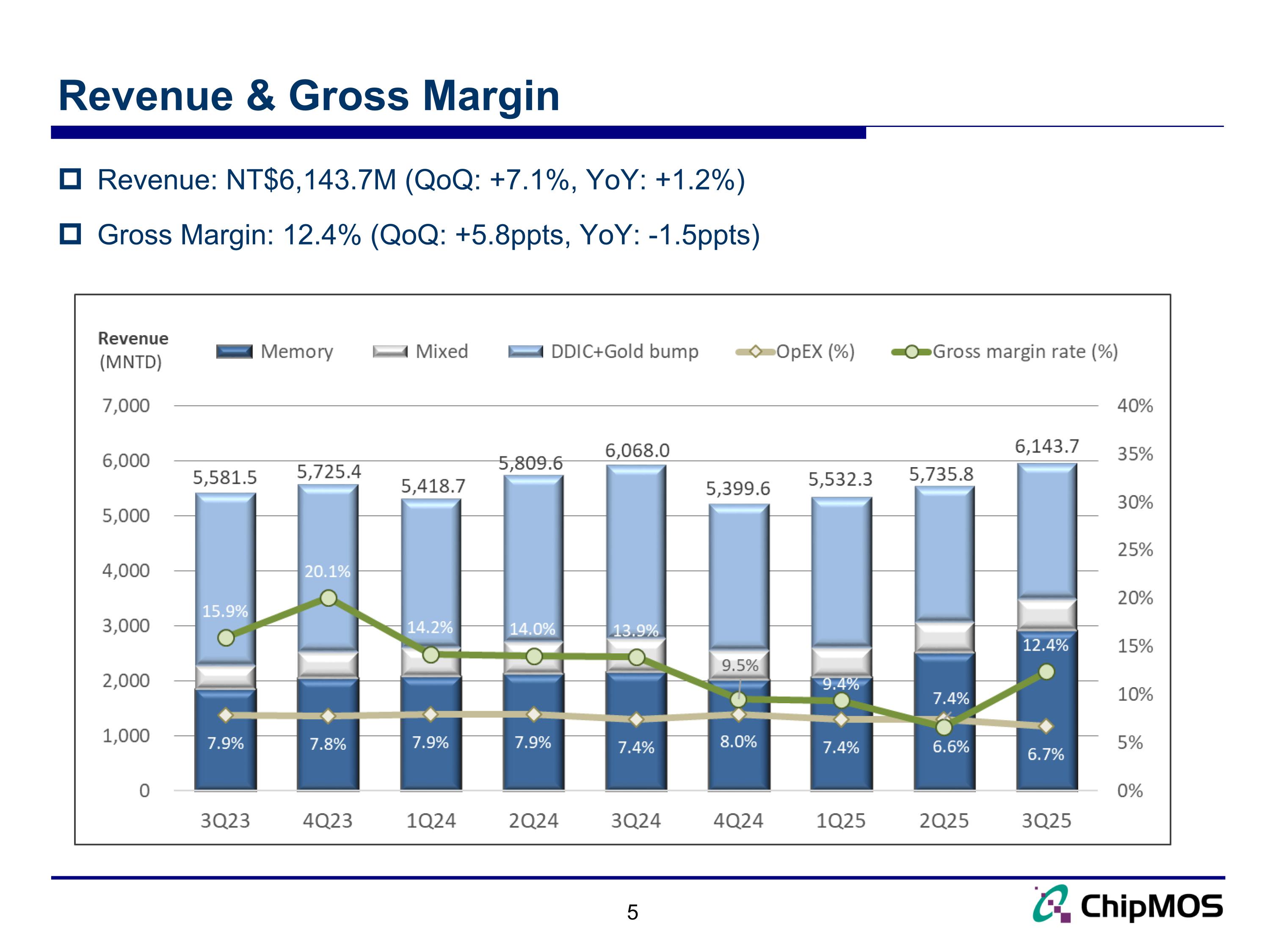

Revenue: NT$6,143.7M (QoQ: +7.1%, YoY: +1.2%) Gross Margin: 12.4% (QoQ: +5.8ppts, YoY: -1.5ppts) Revenue & Gross Margin 5

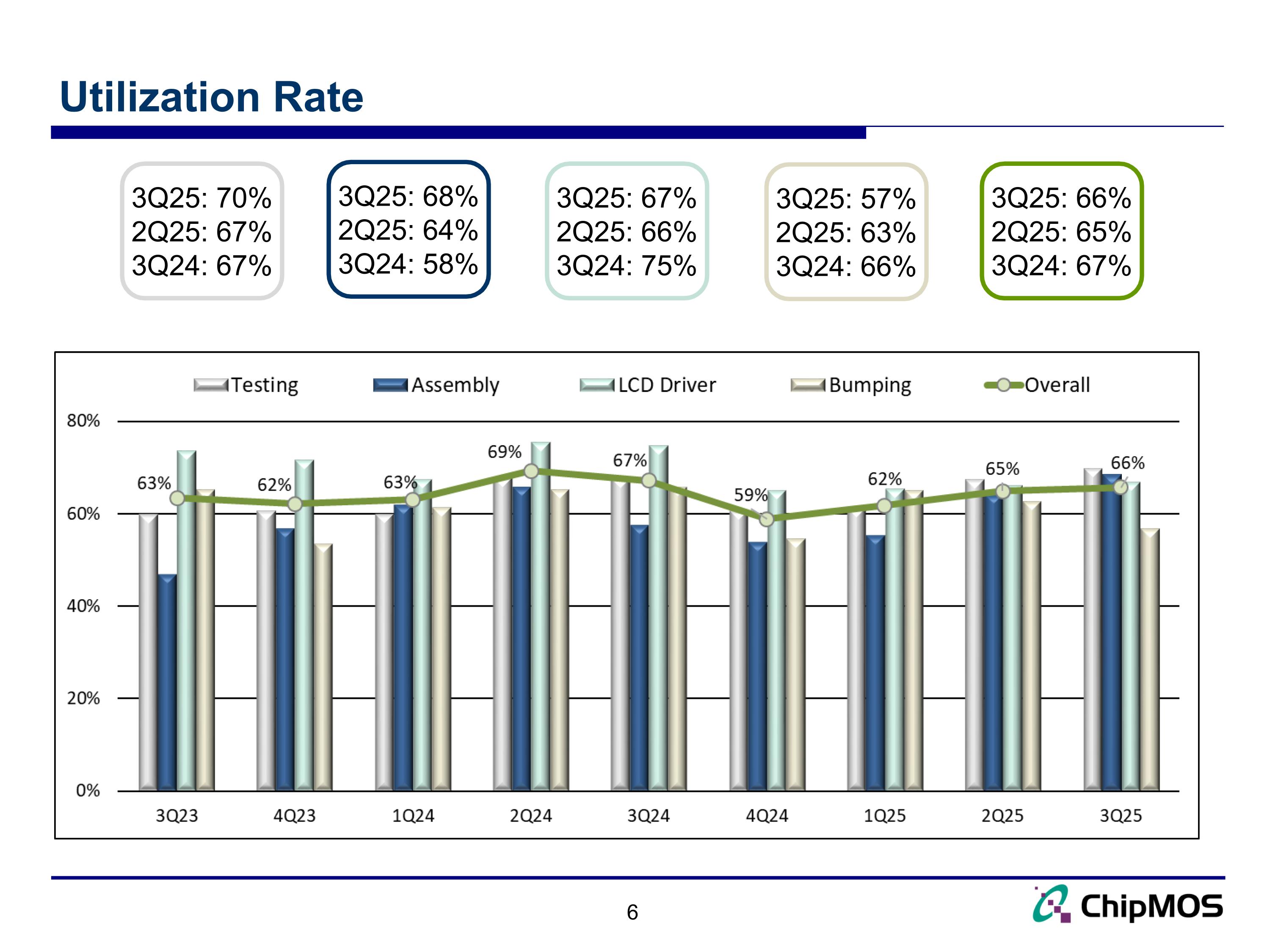

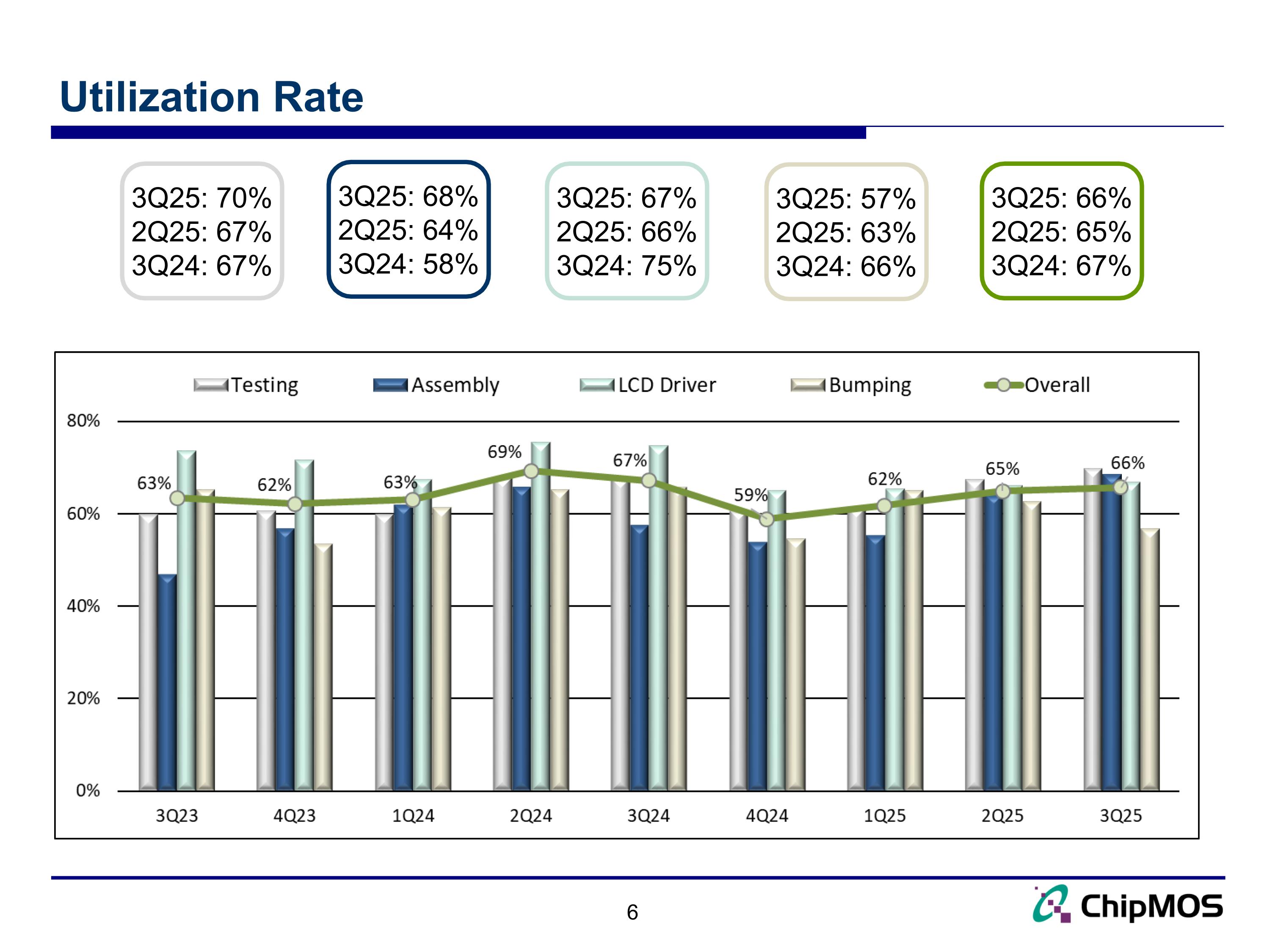

Utilization Rate 6 3Q25: 68% 2Q25: 64% 3Q24: 58% 3Q25: 57% 2Q25: 63% 3Q24: 66% 3Q25: 67% 2Q25: 66% 3Q24: 75% 3Q25: 66% 2Q25: 65% 3Q24: 67% 3Q25: 70% 2Q25: 67% 3Q24: 67%

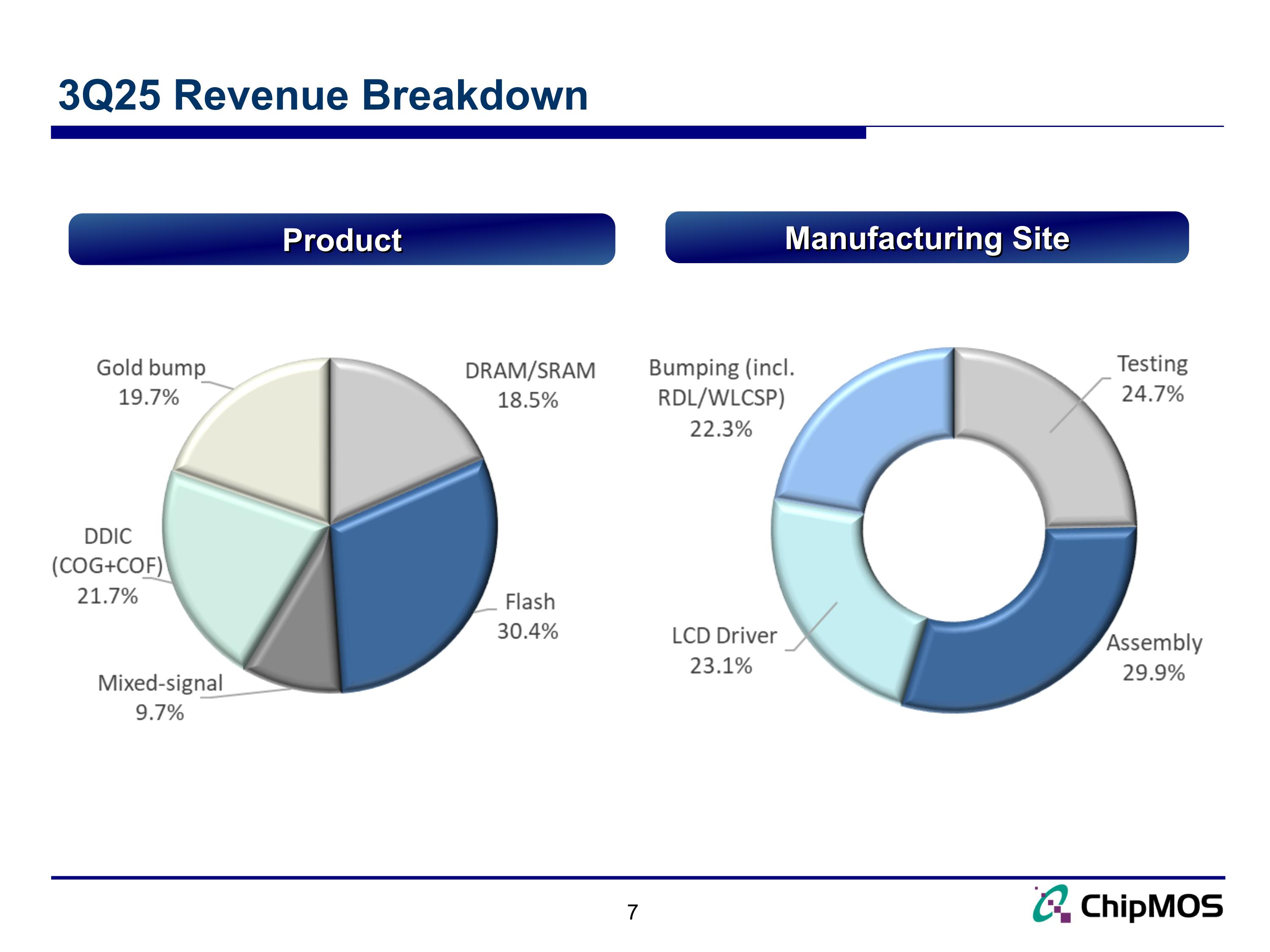

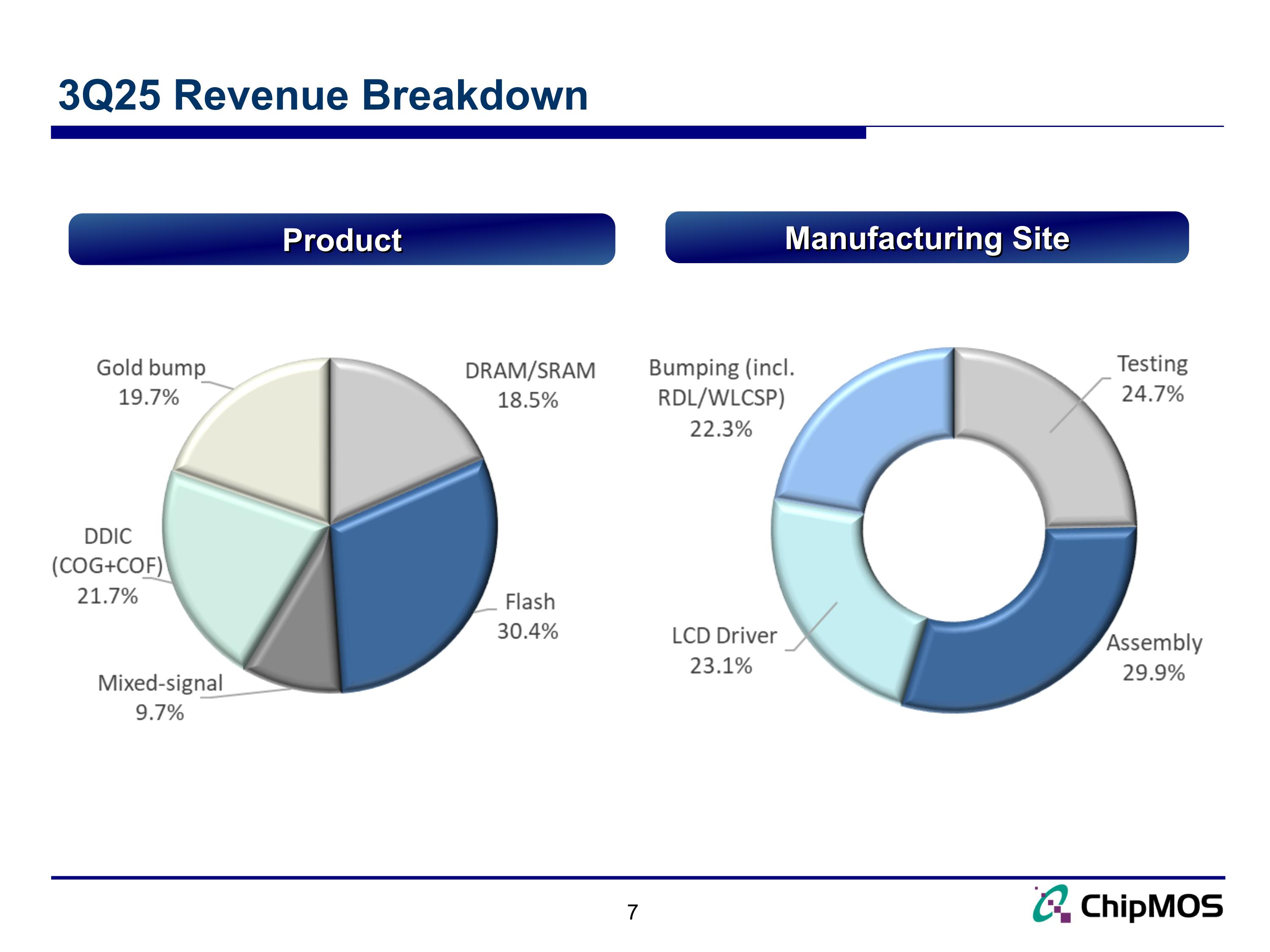

3Q25 Revenue Breakdown Product Manufacturing Site

Revenue Breakdown - Memory 8 3Q25: 48.9% (QoQ: +16.0%, YoY: +34.9%)

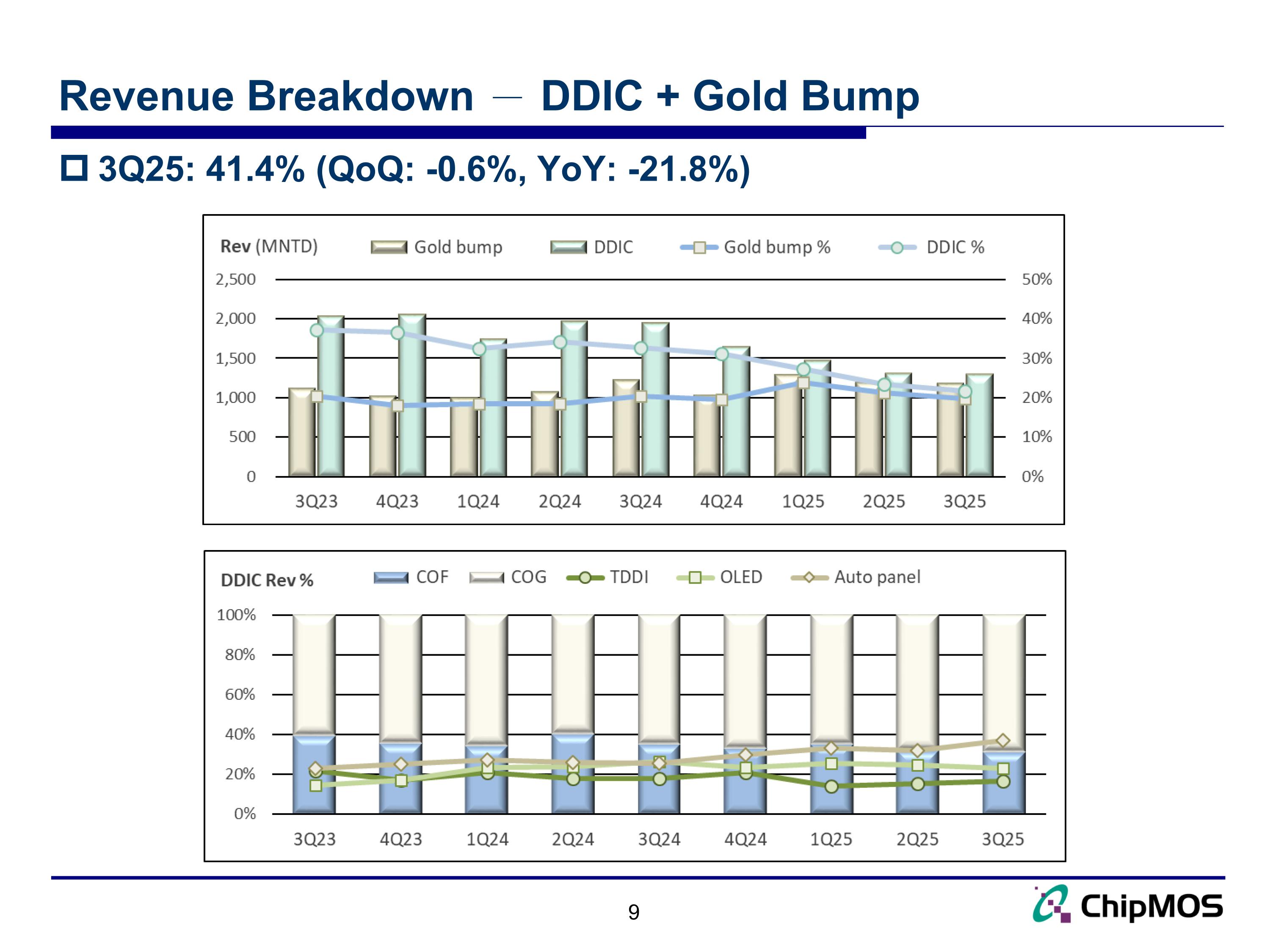

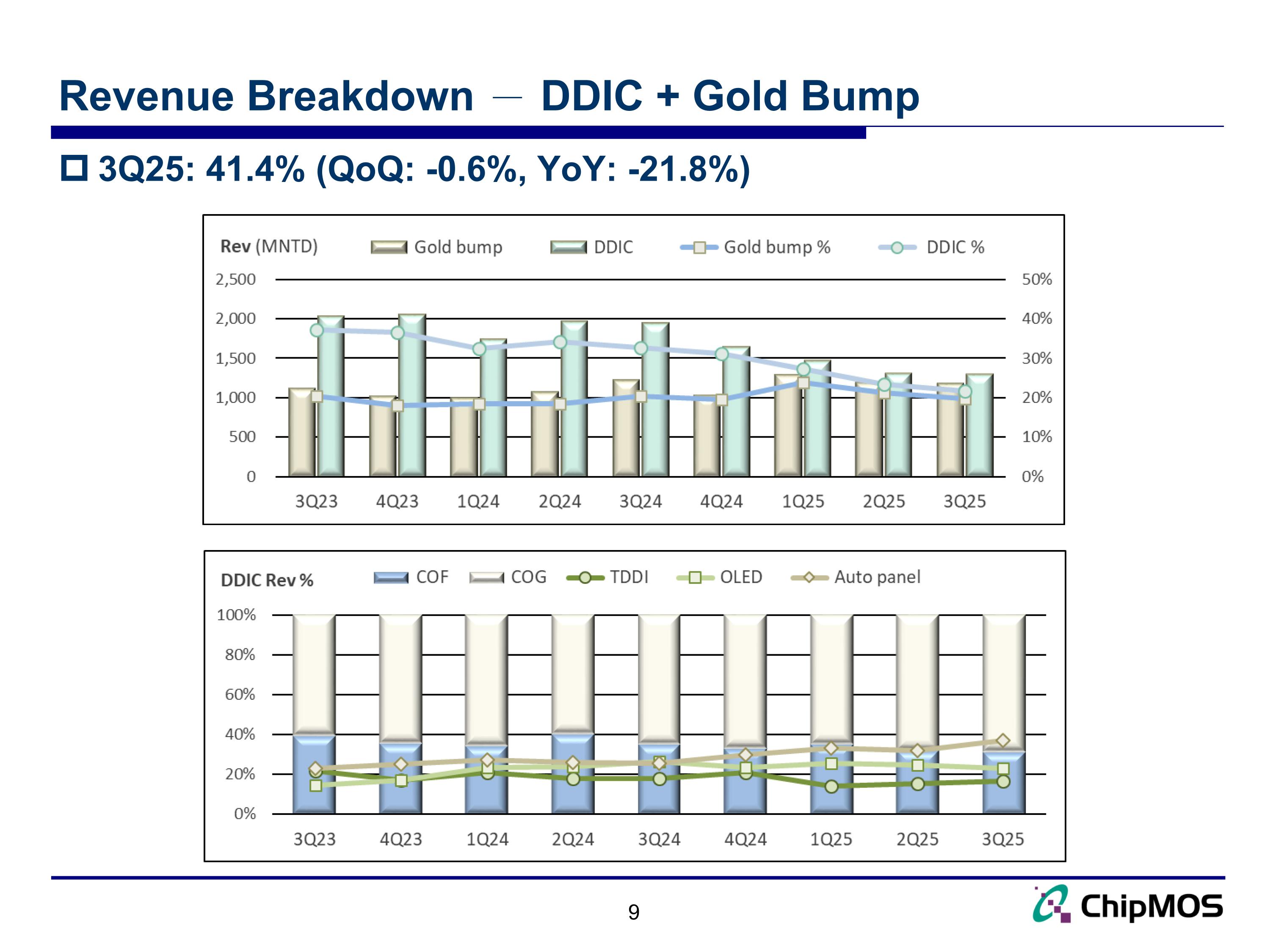

Revenue Breakdown - DDIC + Gold Bump 9 3Q25: 41.4% (QoQ: -0.6%, YoY: -21.8%)

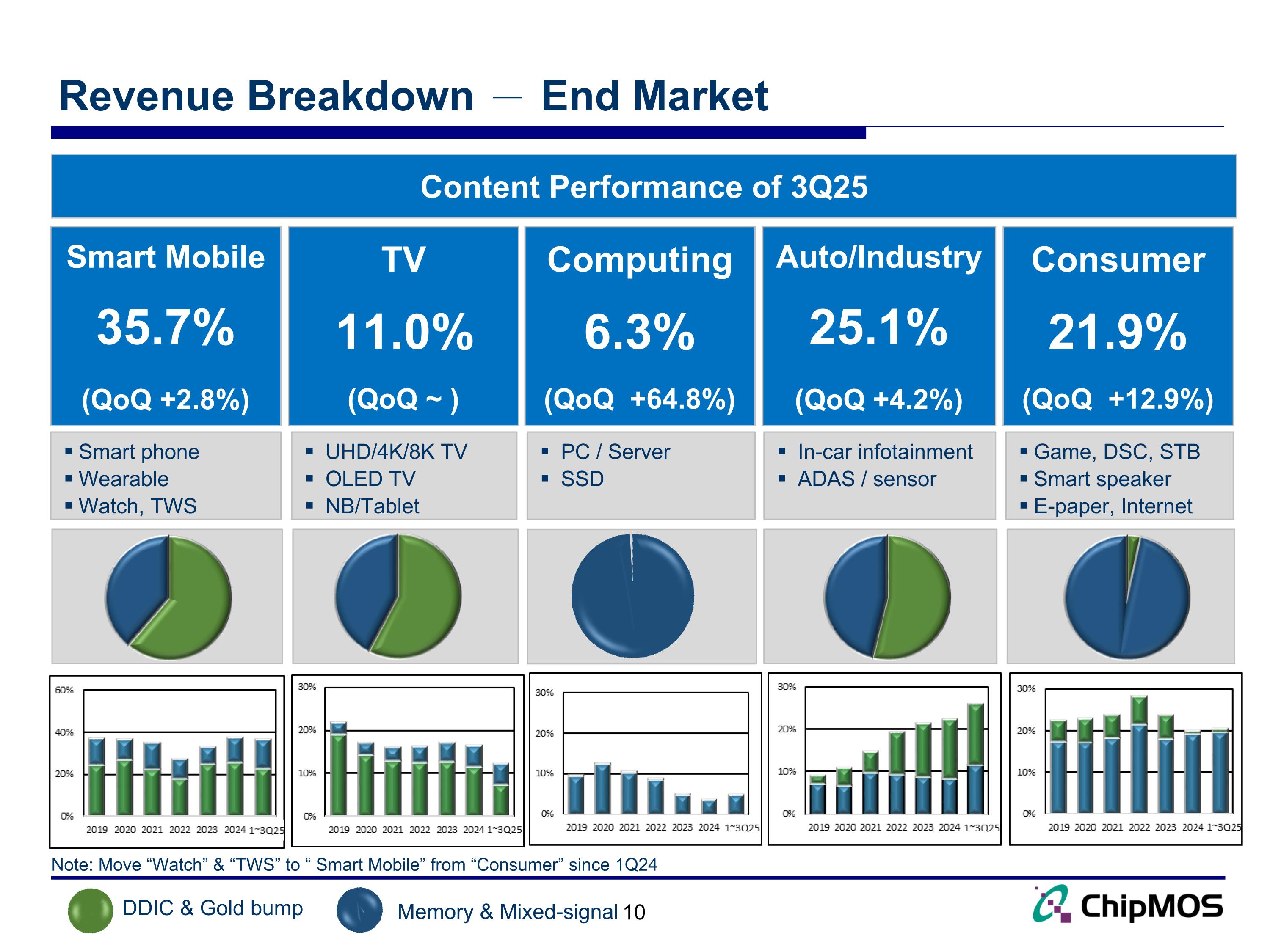

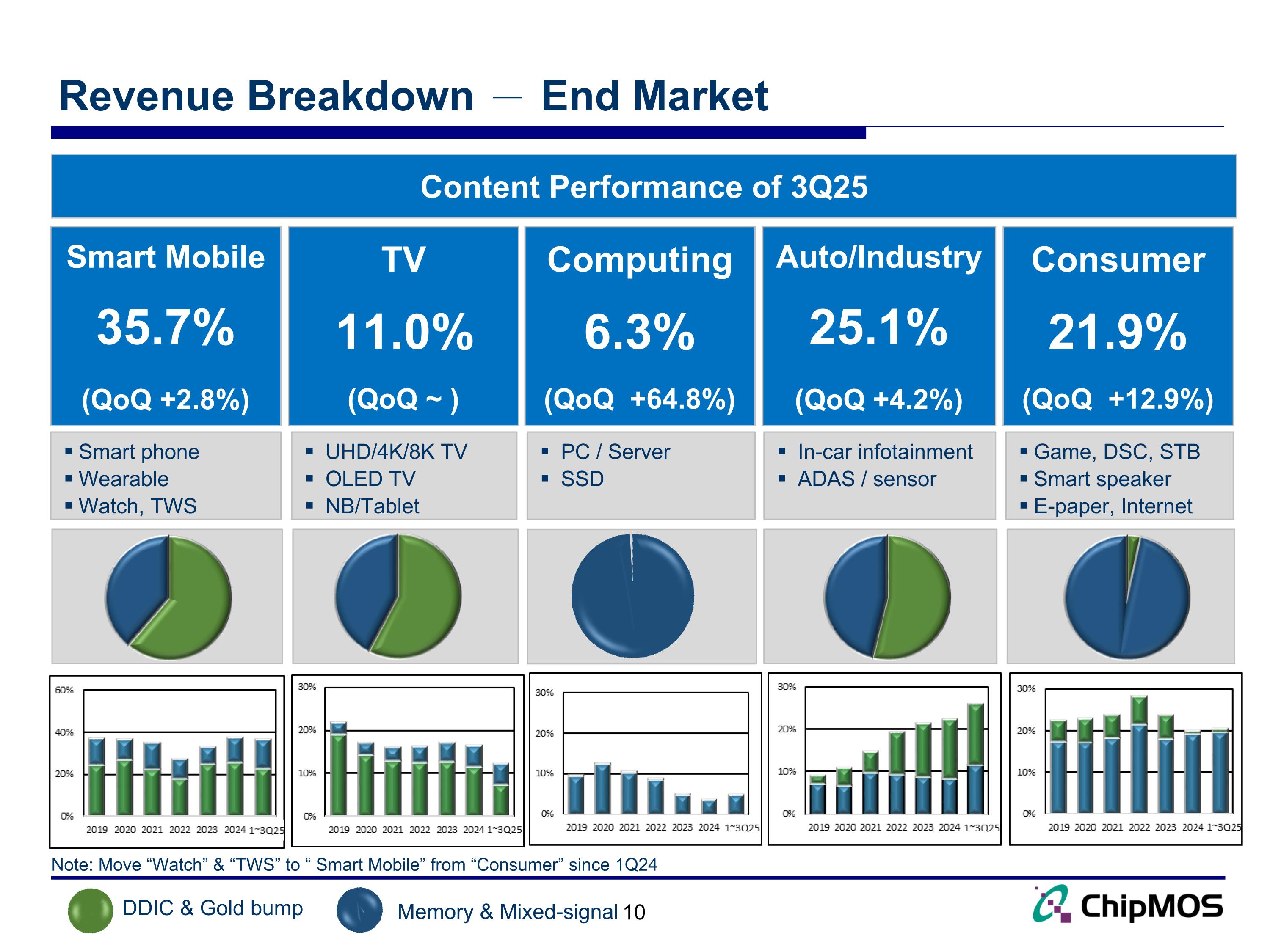

Revenue Breakdown - End Market 10 DDIC & Gold bump Memory & Mixed-signal Content Performance of 3Q25 Smart Mobile 35.7% (QoQ +2.8%) TV 11.0% (QoQ ~ ) Computing 6.3% (QoQ +64.8%) Auto/Industry 25.1% (QoQ +4.2%) Consumer 21.9% (QoQ +12.9%) Smart phone Wearable Watch, TWS UHD/4K/8K TV OLED TV NB/Tablet PC / Server SSD In-car infotainment ADAS / sensor Game, DSC, STB Smart speaker E-paper, Internet Note: Move “Watch” & “TWS” to “ Smart Mobile” from “Consumer” since 1Q24

11 3Q25 Financial Results

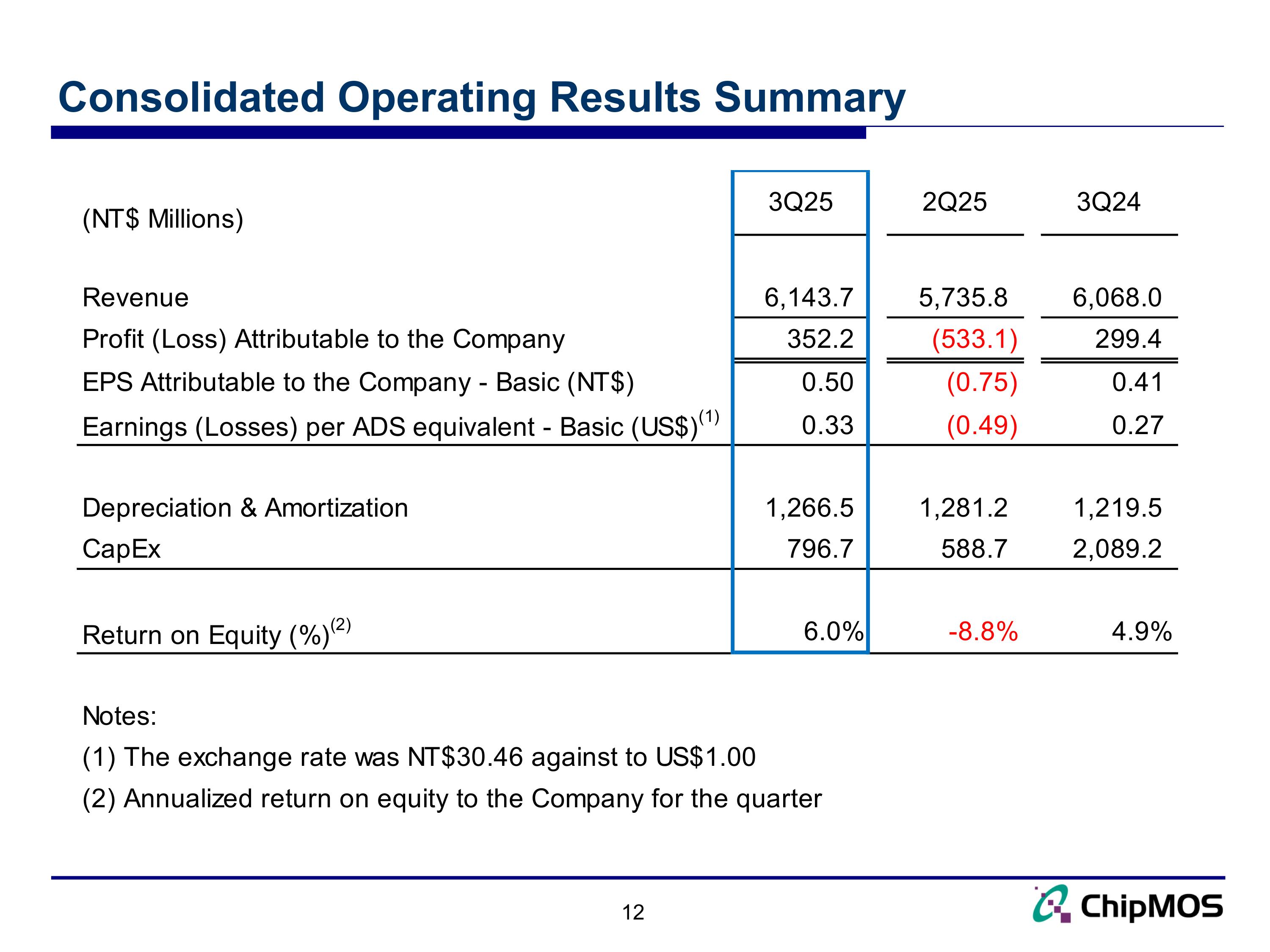

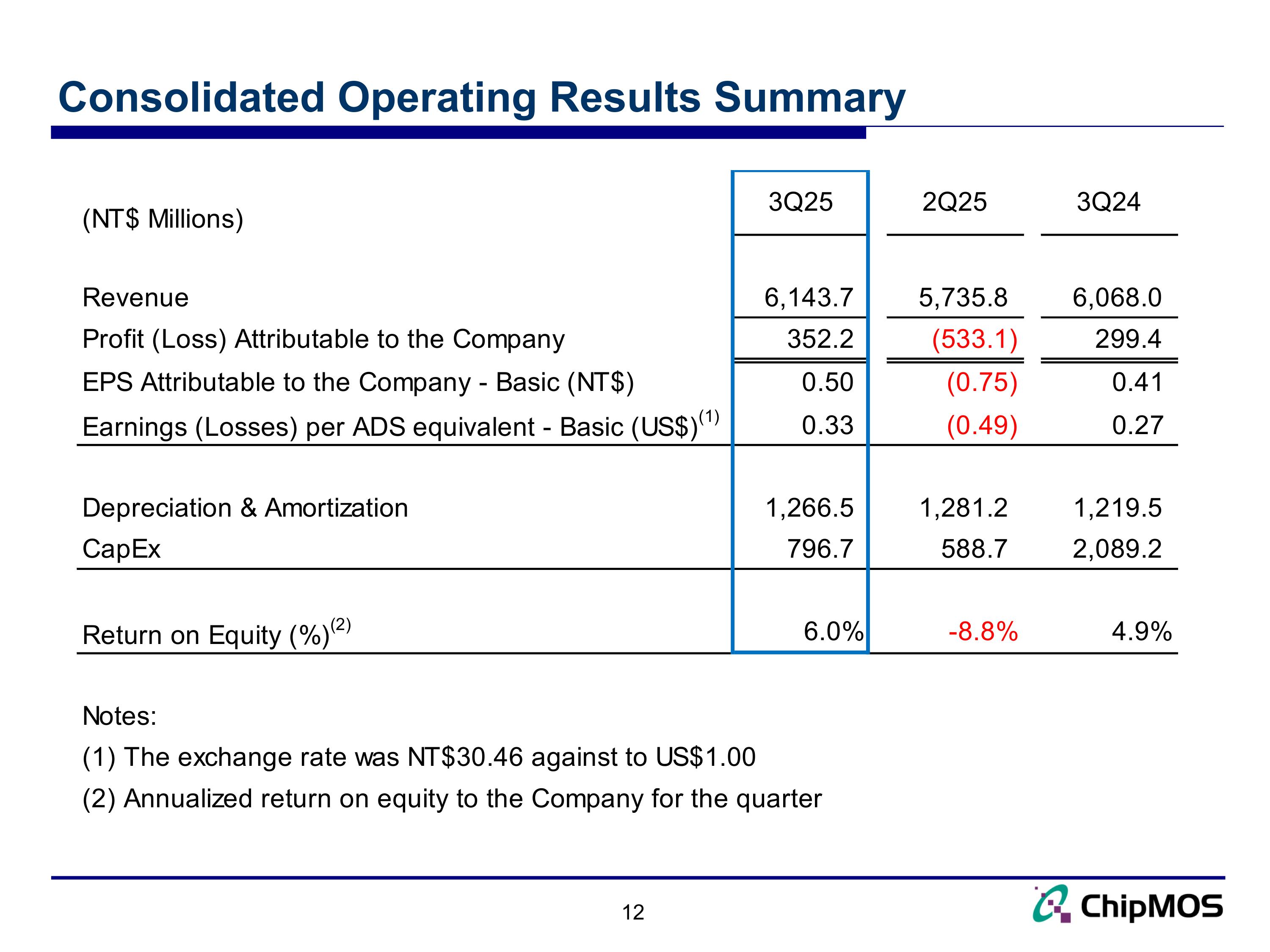

Consolidated Operating Results Summary

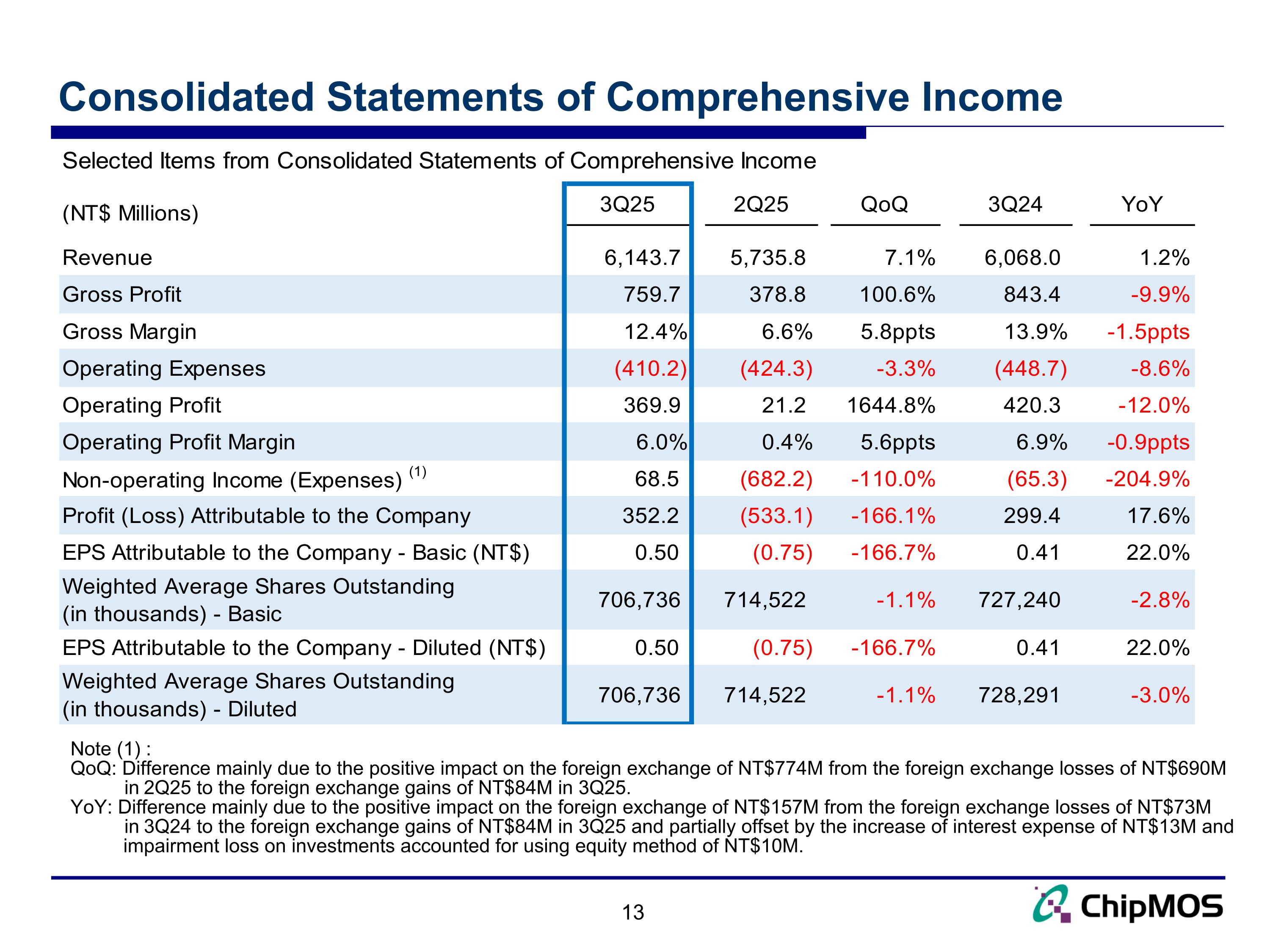

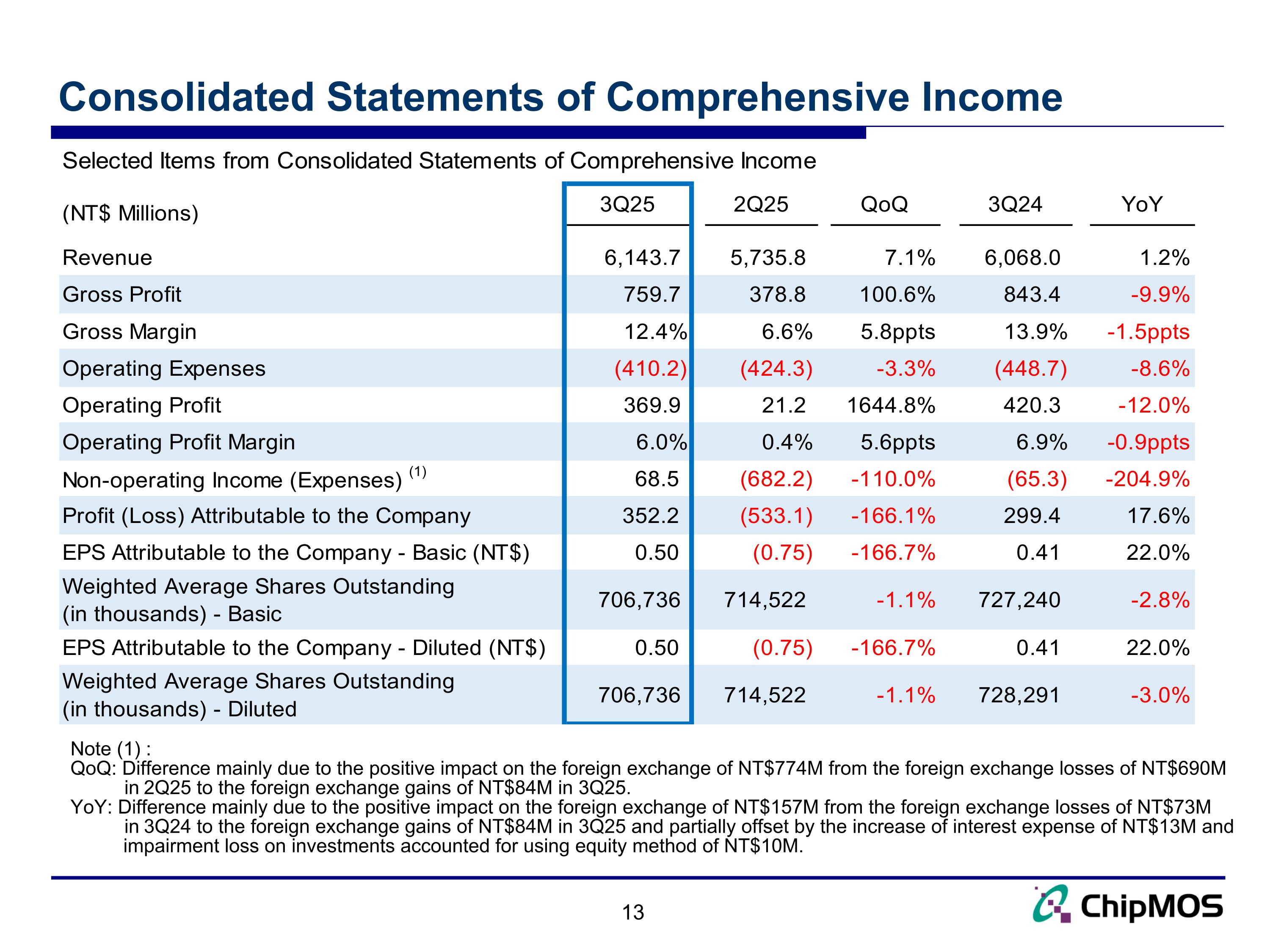

Consolidated Statements of Comprehensive Income Note (1) : QoQ: Difference mainly due to the positive impact on the foreign exchange of NT$774M from the foreign exchange losses of NT$690M in 2Q25 to the foreign exchange gains of NT$84M in 3Q25. YoY: Difference mainly due to the positive impact on the foreign exchange of NT$157M from the foreign exchange losses of NT$73M in 3Q24 to the foreign exchange gains of NT$84M in 3Q25 and partially offset by the increase of interest expense of NT$13M and impairment loss on investments accounted for using equity method of NT$10M.

Consolidated Statements of Financial Position & Key Indices

Consolidated Statements of Cash Flows Notes : Free cash flow was calculated by adding depreciation, amortization, interest income together with operating profit and then subtracting CapEx, interest expense, income tax expense and dividend from the sum. (2) Difference mainly due to the decrease of CapEx of NT$1,625M, cash dividend paid of NT$436M, the increase of the depreciation expenses of NT$271M, the income tax change of NT$208M from the income tax expense of NT$188M in 1Q-3Q24 to income tax benefit of NT$20M in 1Q-3Q25, and partially offset by the decrease of operating profit of NT$650M.

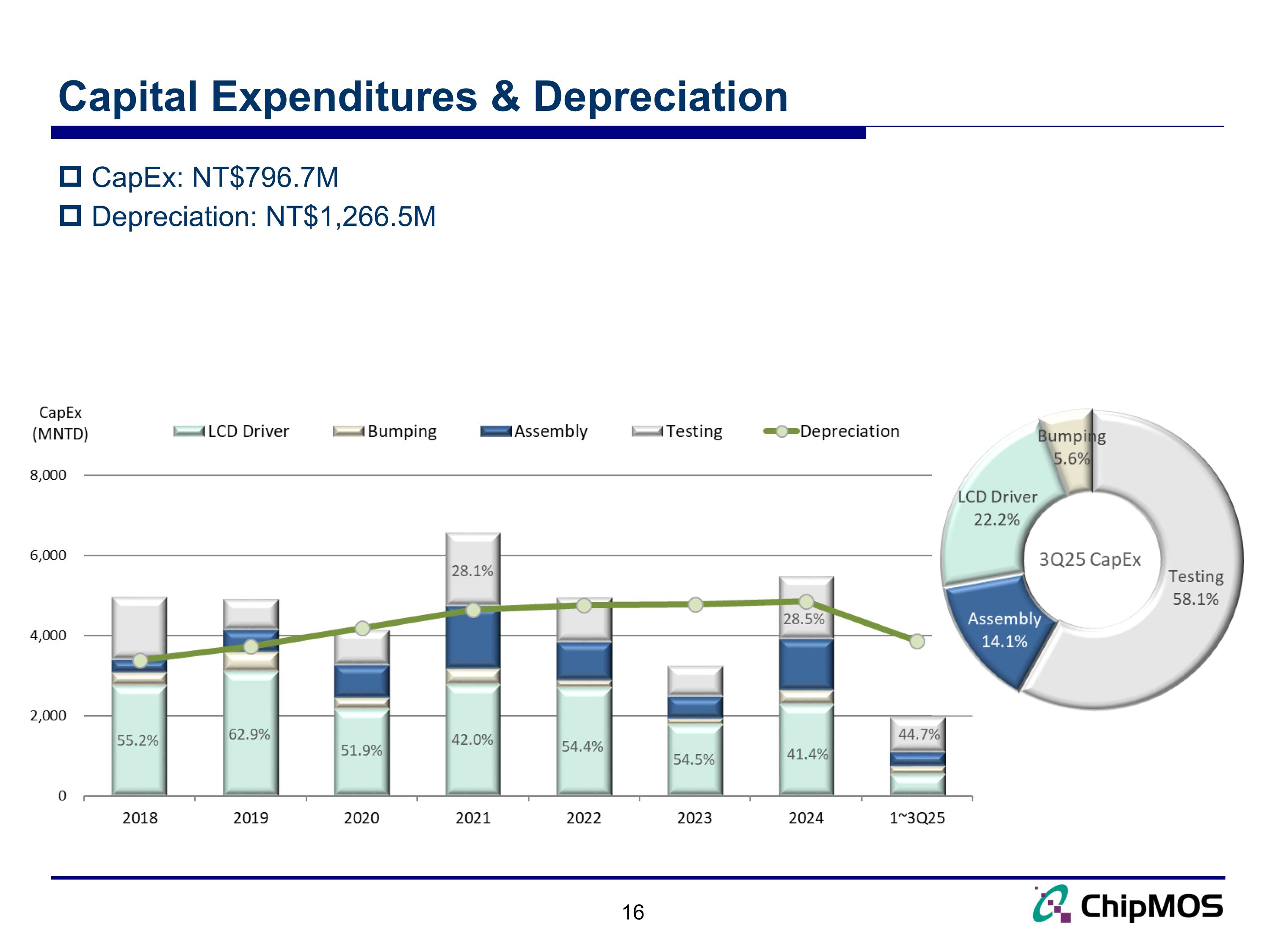

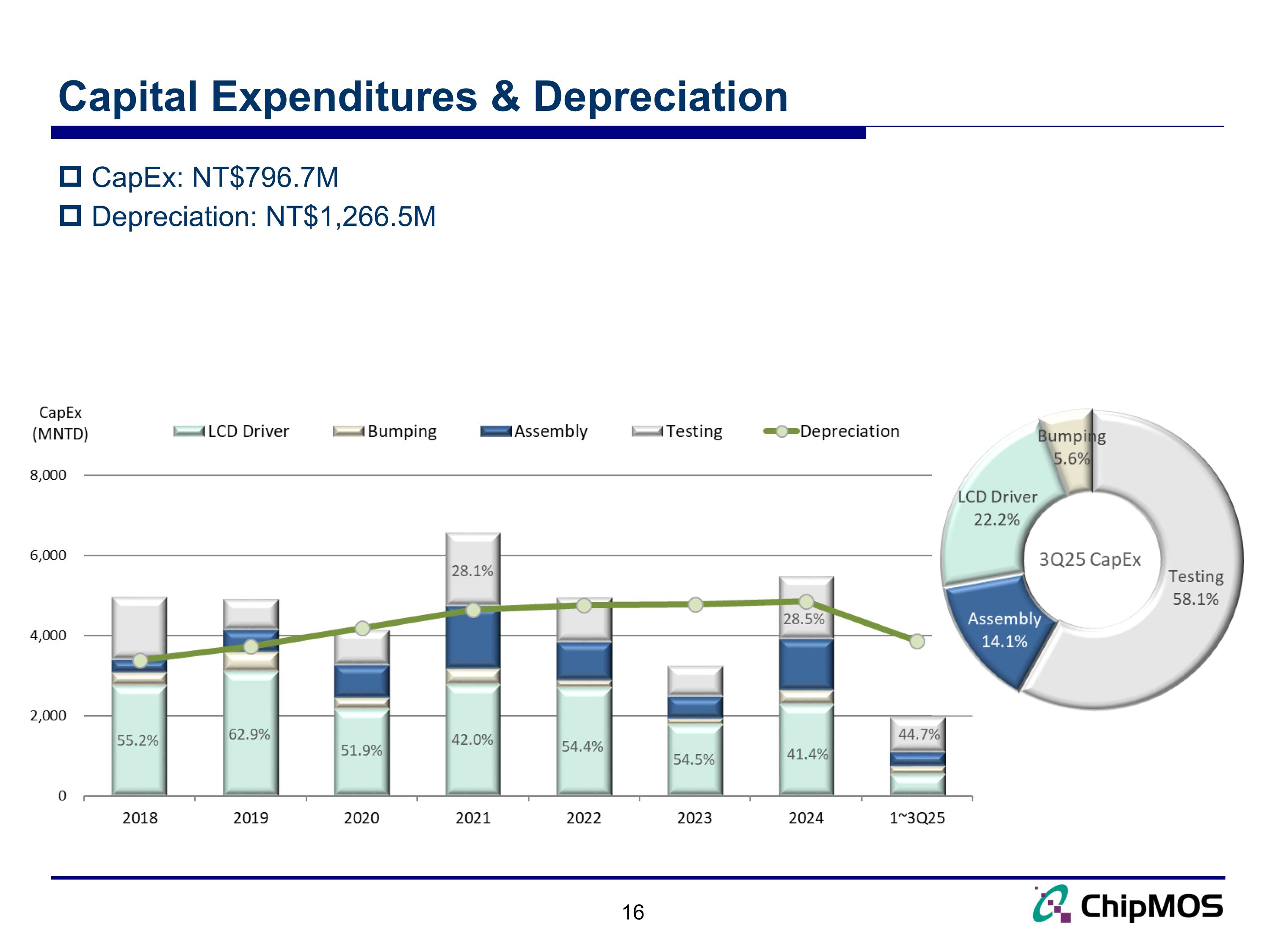

Capital Expenditures & Depreciation 16 CapEx: NT$796.7M Depreciation: NT$1,266.5M

17 Business Outlook

Market & Business Outlook Strong memory product demand offsetting pockets of macro softness Focused on higher margin mix improvement, cost controls, monetizing idle assets and prioritizing support for customers Memory: Momentum expected to be better than DDIC led by customers’ re-stocking and solid demand DRAM demand continues to rebound Flash momentum slightly slow down DDIC: Softness consumer end-demand Auto panel momentum is stable compared with other DDIC products Mixed-signal: Enhancing long-term growth momentum by aligning with strategic customers’ product roadmaps Product portfolio expansion to MEMS and TV SOC products to include PMIC of DDR5 modules, and logic product for smart devices. Plan to support ASIC for AI related application products

Q&A www.chipmos.com