EX-99.1

Exhibit 99.1

Vroom Announces Third Quarter 2025 Results

Continued Investment in our Long-Term Strategic Plan

NEW YORK – November 10, 2025 – Vroom, Inc. (Nasdaq:VRM) today announced financial results for the third quarter ended September 30, 2025.

HIGHLIGHTS OF THIRD QUARTER 2025

•

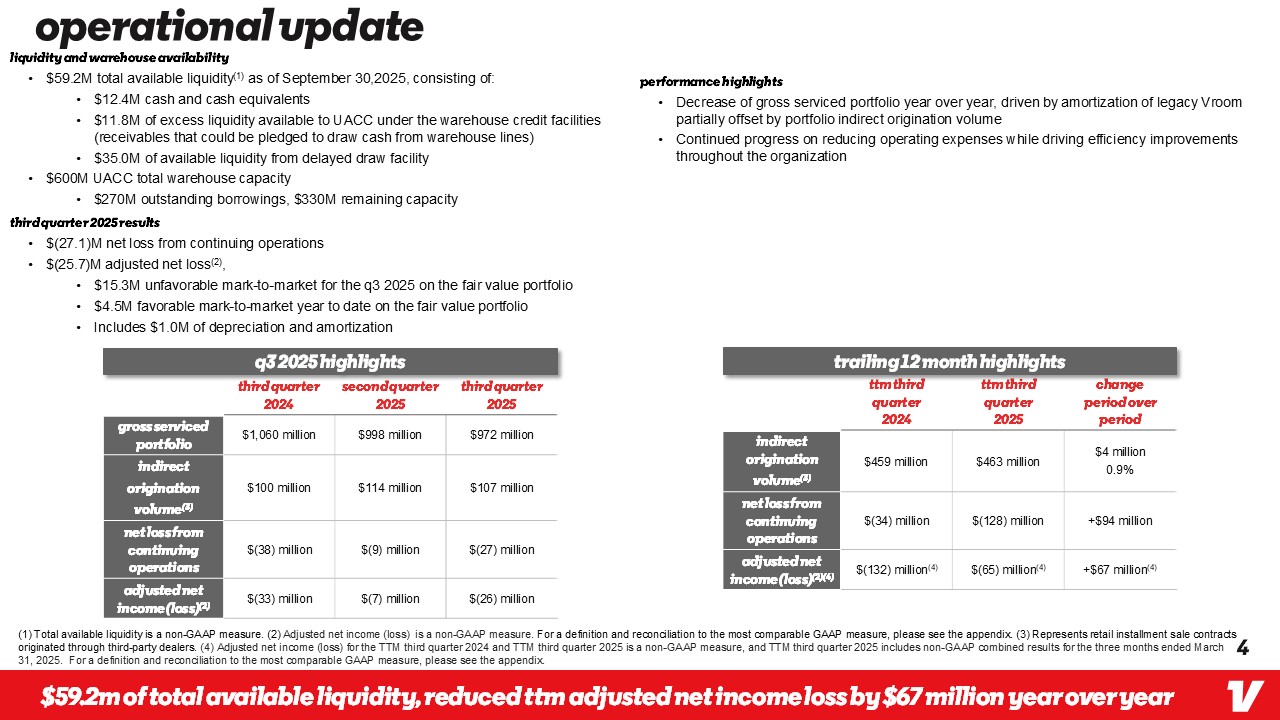

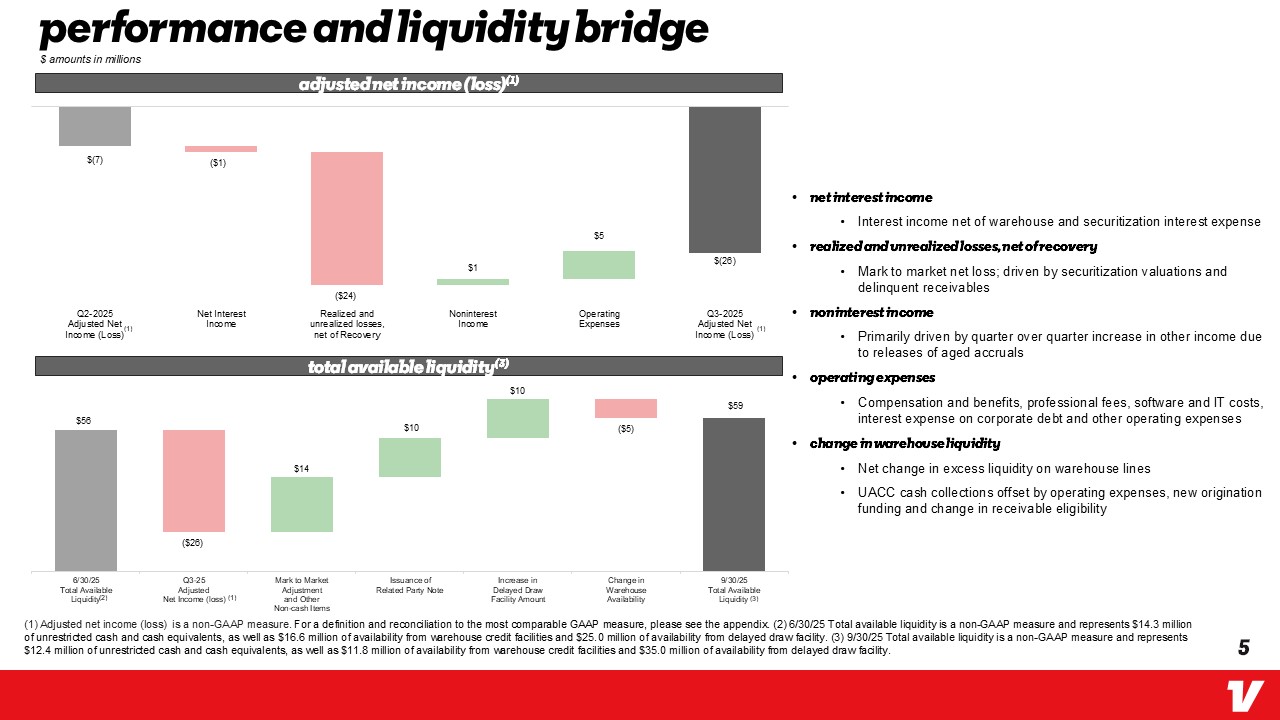

$59.2 million consolidated total available liquidity(1) as of September 30, 2025, consisting of:

o

$12.4 million cash and cash equivalents

o

$11.8 million of liquidity available to UACC under the warehouse credit facilities

o

$35.0 million of available liquidity from delayed draw facility, further strengthening our liquidity position to execute our long-term strategy

•

$(27.1) million net loss from continuing operations for the three months ended September 30, 2025

•

$(25.7) million adjusted net loss(2) for the three months ended September 30, 2025

o

$(15.3) million unfavorable mark-to-market for the three months ended September 30, 2025 on the fair value portfolio

o

$4.5 million favorable mark-to-market year to date on the fair value portfolio

•

$94.3 million improvement in net loss and $66.8 million improvement in adjusted net loss(2) for the trailing twelve months ended September 30, 2025 compared to trailing twelve months ended September 30, 2024

•

Stockholders' equity was $126.6 million as of September 30, 2025 and tangible book value(3) was $113.8 million as of September 30, 2025

•

Full year expectations are in line with our original beginning of the year adjusted net loss plan of approximately $(56) million, prior to favorable mark-to-market movement in Q1 2025, now substantially offset by unfavorable mark-to-market movement in Q3 2025

|

|

|

(1)

|

Total available liquidity is a non-GAAP measure and represents $12.4 million of unrestricted cash and cash equivalents, as well as $11.8 million of availability from warehouse credit facilities and $35.0 million of availability from delayed draw facility |

(2) |

Adjusted net income (loss) is a non-GAAP measure. For definitions and a reconciliation to the most comparable GAAP measure, please see Non-GAAP Financial Measures section below. |

(3) |

Tangible book value is a non-GAAP measure and represents total stockholders' equity of $126.6 million, excluding intangible assets of $12.8 million as of September 30, 2025. |

Tom Shortt, Chief Executive Officer of Vroom, said, “In the third quarter of 2025, our net loss and adjusted net loss decreased year-over-year, driven by our continued focus on our Long-Term Strategic Plan. During the third quarter, our team significantly improved our business intelligence engine and modernized our credit decision engine.”

Fresh Start Accounting

As a result of emerging from a voluntary proceeding (the “Prepackaged Chapter 11 Case”) under Chapter 11 of the United States Code, 11 U.S.C. §§ 101-1532, as amended from time to time, on January 14, 2025, (the "Effective Date") and qualifying for the application of fresh-start accounting, at the Effective Date, Vroom’s assets and liabilities were recorded at their estimated fair values which, in some cases, are significantly different than amounts included in our financial statements prior to the Effective Date. Accordingly, our condensed consolidated financial statements after the Effective Date are not comparable with our condensed consolidated financial statements on or before that date. References to “Successor” relate to our financial position and results of operations after the Effective Date. References to “Predecessor” refer to our financial position and results of operations on or before the Effective Date.

The combined results (referenced as “Non-GAAP Combined” or “Combined”) for the nine months ended September 30, 2025, represent the sum of the reported amounts for the Predecessor period from January 1, 2025, through January 14, 2025, and the Successor period from January 15, 2025, through September 30, 2025.

These combined results are not considered to be prepared in accordance with U.S. generally accepted accounting principles ("GAAP") and have not been prepared as pro forma results per applicable regulations. The combined operating results do not reflect the actual results we would have achieved absent our emergence from the Prepackaged Chapter 11 Case and are not necessarily indicative of future results. Accordingly, the results for the combined nine months ended September 30, 2025, (prepared on a Non-GAAP basis) and nine months ended September 30, 2024, (prepared on a GAAP basis) may not be comparable, particularly for statement of operations line items significantly impacted by the reorganization transactions and the impact of fresh start accounting.

THIRD QUARTER 2025 FINANCIAL DISCUSSION

All financial comparisons are on a year-over-year basis unless otherwise noted. The following financial information is unaudited.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Successor |

|

|

|

Predecessor |

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

|

Three Months Ended September 30, |

|

|

|

|

|

|

2025 |

|

|

|

2024 |

|

|

$ Change |

|

|

|

|

|

|

|

(in thousands) |

|

|

|

|

Interest income |

|

$ |

44,829 |

|

|

|

$ |

50,213 |

|

|

$ |

(5,384 |

) |

|

|

|

|

|

|

|

|

|

|

|

Interest expense: |

|

|

|

|

|

|

|

|

|

|

Warehouse credit facility |

|

|

4,544 |

|

|

|

|

6,251 |

|

|

|

(1,707 |

) |

Securitization debt |

|

|

8,771 |

|

|

|

|

9,096 |

|

|

|

(325 |

) |

Total interest expense |

|

|

13,315 |

|

|

|

|

15,347 |

|

|

|

(2,032 |

) |

Net interest income |

|

|

31,514 |

|

|

|

|

34,866 |

|

|

|

(3,352 |

) |

|

|

|

|

|

|

|

|

|

|

|

Realized and unrealized losses, net of recoveries |

|

|

43,202 |

|

|

|

|

38,346 |

|

|

|

4,856 |

|

Net interest income after losses and recoveries |

|

|

(11,688 |

) |

|

|

|

(3,480 |

) |

|

|

(8,208 |

) |

|

|

|

|

|

|

|

|

|

|

|

Noninterest income: |

|

|

|

|

|

|

|

|

|

|

Servicing income |

|

|

1,088 |

|

|

|

|

1,495 |

|

|

|

(407 |

) |

Warranties and GAP income (loss), net |

|

|

3,152 |

|

|

|

|

3,917 |

|

|

|

(765 |

) |

CarStory revenue |

|

|

1,347 |

|

|

|

|

2,890 |

|

|

|

(1,543 |

) |

Other income |

|

|

3,924 |

|

|

|

|

2,419 |

|

|

|

1,505 |

|

Total noninterest income |

|

|

9,511 |

|

|

|

|

10,721 |

|

|

|

(1,210 |

) |

|

|

|

|

|

|

|

|

|

|

|

Expenses: |

|

|

|

|

|

|

|

|

|

|

Compensation and benefits |

|

|

16,287 |

|

|

|

|

25,365 |

|

|

|

(9,078 |

) |

Professional fees |

|

|

1,538 |

|

|

|

|

1,587 |

|

|

|

(49 |

) |

Software and IT costs |

|

|

3,062 |

|

|

|

|

3,360 |

|

|

|

(298 |

) |

Depreciation and amortization |

|

|

998 |

|

|

|

|

7,105 |

|

|

|

(6,107 |

) |

Interest expense on corporate debt |

|

|

706 |

|

|

|

|

1,601 |

|

|

|

(895 |

) |

Impairment charges |

|

|

— |

|

|

|

|

2,407 |

|

|

|

(2,407 |

) |

Other expenses |

|

|

2,230 |

|

|

|

|

3,436 |

|

|

|

(1,206 |

) |

Total expenses |

|

|

24,821 |

|

|

|

|

44,861 |

|

|

|

(20,040 |

) |

|

|

|

|

|

|

|

|

|

|

|

Loss from continuing operations before provision for income taxes |

|

|

(26,998 |

) |

|

|

|

(37,620 |

) |

|

|

10,622 |

|

Provision (benefit) for income taxes from continuing operations |

|

|

144 |

|

|

|

|

124 |

|

|

|

20 |

|

Net loss from continuing operations |

|

$ |

(27,142 |

) |

|

|

$ |

(37,744 |

) |

|

$ |

10,602 |

|

Net income (loss) from discontinued operations |

|

$ |

366 |

|

|

|

$ |

(1,999 |

) |

|

$ |

2,365 |

|

Net loss |

|

$ |

(26,776 |

) |

|

|

$ |

(39,743 |

) |

|

$ |

12,967 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Successor |

|

|

|

Predecessor |

|

|

Non-GAAP Combined |

|

|

Predecessor |

|

|

|

|

|

|

|

Period from January 15 through September 30, |

|

|

|

Period from January 1 through January 14, |

|

|

Nine Months Ended

September 30, |

|

|

Nine Months Ended

September 30, |

|

|

Non-GAAP |

|

|

|

|

2025 |

|

|

|

2025 |

|

|

2025 |

|

|

2024 |

|

|

$ Change |

|

|

|

|

|

|

|

|

(in thousands) |

|

|

|

|

|

|

|

|

Interest income |

|

$ |

127,734 |

|

|

|

$ |

7,183 |

|

|

$ |

134,917 |

|

|

$ |

153,152 |

|

|

$ |

(18,235 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Warehouse credit facility |

|

|

12,421 |

|

|

|

|

1,017 |

|

|

|

13,438 |

|

|

|

22,708 |

|

|

|

(9,270 |

) |

|

Securitization debt |

|

|

25,202 |

|

|

|

|

1,178 |

|

|

|

26,380 |

|

|

|

21,960 |

|

|

|

4,420 |

|

|

Total interest expense |

|

|

37,623 |

|

|

|

|

2,195 |

|

|

|

39,818 |

|

|

|

44,668 |

|

|

|

(4,850 |

) |

|

Net interest income |

|

|

90,111 |

|

|

|

|

4,988 |

|

|

|

95,099 |

|

|

|

108,484 |

|

|

|

(13,385 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Realized and unrealized losses, net of recoveries |

|

|

73,802 |

|

|

|

|

6,792 |

|

|

|

80,594 |

|

|

|

87,894 |

|

|

|

(7,300 |

) |

|

Net interest income after losses and recoveries |

|

|

16,309 |

|

|

|

|

(1,804 |

) |

|

|

14,505 |

|

|

|

20,590 |

|

|

|

(6,085 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Servicing income |

|

|

3,601 |

|

|

|

|

192 |

|

|

|

3,793 |

|

|

|

5,101 |

|

|

|

(1,308 |

) |

|

Warranties and GAP income (loss), net |

|

|

10,876 |

|

|

|

|

307 |

|

|

|

11,183 |

|

|

|

(4,347 |

) |

|

|

15,530 |

|

|

CarStory revenue |

|

|

5,585 |

|

|

|

|

432 |

|

|

|

6,017 |

|

|

|

8,782 |

|

|

|

(2,765 |

) |

|

Other income |

|

|

8,472 |

|

|

|

|

113 |

|

|

|

8,585 |

|

|

|

8,344 |

|

|

|

241 |

|

|

Total noninterest income |

|

|

28,534 |

|

|

|

|

1,044 |

|

|

|

29,578 |

|

|

|

17,880 |

|

|

|

11,698 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensation and benefits |

|

|

53,445 |

|

|

|

|

2,823 |

|

|

|

56,268 |

|

|

|

76,651 |

|

|

|

(20,383 |

) |

|

Professional fees |

|

|

8,898 |

|

|

|

|

297 |

|

|

|

9,195 |

|

|

|

6,418 |

|

|

|

2,777 |

|

|

Software and IT costs |

|

|

8,884 |

|

|

|

|

457 |

|

|

|

9,341 |

|

|

|

12,018 |

|

|

|

(2,677 |

) |

|

Depreciation and amortization |

|

|

2,315 |

|

|

|

|

1,057 |

|

|

|

3,372 |

|

|

|

21,963 |

|

|

|

(18,591 |

) |

|

Interest expense on corporate debt |

|

|

1,884 |

|

|

|

|

176 |

|

|

|

2,060 |

|

|

|

4,541 |

|

|

|

(2,481 |

) |

|

Impairment charges |

|

|

4,156 |

|

|

|

|

— |

|

|

|

4,156 |

|

|

|

5,159 |

|

|

|

(1,003 |

) |

|

Other expenses |

|

|

7,433 |

|

|

|

|

371 |

|

|

|

7,804 |

|

|

|

12,853 |

|

|

|

(5,049 |

) |

|

Total expenses |

|

|

87,015 |

|

|

|

|

5,181 |

|

|

|

92,196 |

|

|

|

139,603 |

|

|

|

(47,407 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from continuing operations before reorganization items and provision for income taxes |

|

|

(42,172 |

) |

|

|

|

(5,941 |

) |

|

|

(48,113 |

) |

|

|

(101,133 |

) |

|

|

53,020 |

|

|

Reorganization items, net |

|

|

— |

|

|

|

|

51,036 |

|

|

|

51,036 |

|

|

|

— |

|

|

|

51,036 |

|

|

Income (loss) from continuing operations before provision for income taxes |

|

|

(42,172 |

) |

|

|

|

45,095 |

|

|

|

2,923 |

|

|

|

(101,133 |

) |

|

|

104,056 |

|

|

Provision for income taxes from continuing operations |

|

|

353 |

|

|

|

|

5 |

|

|

|

358 |

|

|

|

393 |

|

|

|

(35 |

) |

|

Net income (loss) from continuing operations |

|

$ |

(42,525 |

) |

|

|

$ |

45,090 |

|

|

$ |

2,565 |

|

|

$ |

(101,526 |

) |

|

$ |

104,091 |

|

|

Net income (loss) from discontinued operations |

|

$ |

878 |

|

|

|

$ |

(4 |

) |

|

$ |

874 |

|

|

$ |

(27,024 |

) |

|

$ |

27,898 |

|

|

Net income (loss) |

|

$ |

(41,647 |

) |

|

|

$ |

45,086 |

|

|

$ |

3,439 |

|

|

$ |

(128,550 |

) |

|

$ |

131,989 |

|

|

Results by Segment

UACC

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Successor |

|

|

|

|

|

Predecessor |

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

|

|

|

Three Months Ended September 30, |

|

|

|

|

|

|

|

|

2025 |

|

|

|

|

|

2024 |

|

|

Change |

|

|

% Change |

|

|

|

|

|

|

|

|

(in thousands) |

|

|

|

|

|

|

|

Interest income |

$ |

44,829 |

|

|

|

|

|

$ |

50,801 |

|

|

$ |

(5,972 |

) |

|

|

(11.8 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Warehouse credit facility |

|

4,544 |

|

|

|

|

|

|

6,251 |

|

|

|

(1,707 |

) |

|

|

(27.3 |

)% |

Securitization debt |

|

8,771 |

|

|

|

|

|

|

9,096 |

|

|

|

(325 |

) |

|

|

(3.6 |

)% |

Total interest expense |

|

13,315 |

|

|

|

|

|

|

15,347 |

|

|

|

(2,032 |

) |

|

|

(13.2 |

)% |

Net interest income |

|

31,514 |

|

|

|

|

|

|

35,454 |

|

|

|

(3,940 |

) |

|

|

(11.1 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Realized and unrealized losses, net of recoveries |

|

43,550 |

|

|

|

|

|

|

30,117 |

|

|

|

13,433 |

|

|

|

44.6 |

% |

Net interest income after losses and recoveries |

|

(12,036 |

) |

|

|

|

|

|

5,337 |

|

|

|

(17,373 |

) |

|

|

(325.5 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Servicing income |

|

1,088 |

|

|

|

|

|

|

1,495 |

|

|

|

(407 |

) |

|

|

(27.2 |

)% |

Warranties and GAP income, net |

|

2,855 |

|

|

|

|

|

|

2,074 |

|

|

|

781 |

|

|

|

37.7 |

% |

Other income |

|

1,883 |

|

|

|

|

|

|

1,698 |

|

|

|

185 |

|

|

|

10.9 |

% |

Total noninterest income |

|

5,826 |

|

|

|

|

|

|

5,267 |

|

|

|

559 |

|

|

|

10.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensation and benefits |

|

14,072 |

|

|

|

|

|

|

19,819 |

|

|

|

(5,747 |

) |

|

|

(29.0 |

)% |

Professional fees |

|

826 |

|

|

|

|

|

|

875 |

|

|

|

(49 |

) |

|

|

(5.6 |

)% |

Software and IT costs |

|

2,502 |

|

|

|

|

|

|

2,346 |

|

|

|

156 |

|

|

|

6.6 |

% |

Depreciation and amortization |

|

887 |

|

|

|

|

|

|

5,505 |

|

|

|

(4,618 |

) |

|

|

(83.9 |

)% |

Interest expense on corporate debt |

|

664 |

|

|

|

|

|

|

681 |

|

|

|

(17 |

) |

|

|

(2.5 |

)% |

Impairment charges |

|

— |

|

|

|

|

|

|

2,407 |

|

|

|

(2,407 |

) |

|

|

(100.0 |

)% |

Other expenses |

|

1,736 |

|

|

|

|

|

|

1,991 |

|

|

|

(255 |

) |

|

|

(12.8 |

)% |

Total expenses |

|

20,687 |

|

|

|

|

|

|

33,624 |

|

|

|

(12,937 |

) |

|

|

(38.5 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Benefit for income taxes from continuing operations |

|

— |

|

|

|

|

|

|

99 |

|

|

|

(99 |

) |

|

|

(100.0 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted net loss |

$ |

(25,784 |

) |

|

|

|

|

$ |

(19,857 |

) |

|

$ |

(5,927 |

) |

|

|

29.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock compensation expense |

$ |

1,112 |

|

|

|

|

|

$ |

834 |

|

|

$ |

278 |

|

|

|

33.3 |

% |

Severance |

$ |

- |

|

|

|

|

|

$ |

20 |

|

|

$ |

(20 |

) |

|

|

(100.0 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Successor |

|

|

|

|

|

Predecessor |

|

|

Non-GAAP Combined |

|

|

Predecessor |

|

|

Non-GAAP |

|

|

Non-GAAP |

|

|

Period from January 15 through September 30, |

|

|

|

|

|

Period from January 1 through January 14, |

|

|

Nine Months Ended

September 30, |

|

|

Nine Months Ended

September 30, |

|

|

|

|

|

|

|

|

2025 |

|

|

|

|

|

2025 |

|

|

2025 |

|

|

2024 |

|

|

Change |

|

|

% Change |

|

|

|

|

|

|

|

|

(in thousands) |

|

|

|

|

|

|

|

|

|

|

Interest income |

$ |

127,734 |

|

|

|

|

|

$ |

7,254 |

|

|

$ |

134,988 |

|

|

$ |

154,731 |

|

|

$ |

(19,743 |

) |

|

|

(12.8 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Warehouse credit facility |

|

12,421 |

|

|

|

|

|

|

1,017 |

|

|

|

13,438 |

|

|

|

22,708 |

|

|

|

(9,270 |

) |

|

|

(40.8 |

)% |

Securitization debt |

|

25,202 |

|

|

|

|

|

|

1,178 |

|

|

|

26,380 |

|

|

|

21,960 |

|

|

|

4,420 |

|

|

|

20.1 |

% |

Total interest expense |

|

37,623 |

|

|

|

|

|

|

2,195 |

|

|

|

39,818 |

|

|

|

44,668 |

|

|

|

(4,850 |

) |

|

|

(10.9 |

)% |

Net interest income |

|

90,111 |

|

|

|

|

|

|

5,059 |

|

|

|

95,170 |

|

|

|

110,063 |

|

|

|

(14,893 |

) |

|

|

(13.5 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Realized and unrealized losses, net of recoveries |

|

75,123 |

|

|

|

|

|

|

7,647 |

|

|

|

82,770 |

|

|

|

77,460 |

|

|

|

5,310 |

|

|

|

6.9 |

% |

Net interest income (loss) after losses and recoveries |

|

14,988 |

|

|

|

|

|

|

(2,588 |

) |

|

|

12,400 |

|

|

|

32,603 |

|

|

|

(20,203 |

) |

|

|

(62.0 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Servicing income |

|

3,601 |

|

|

|

|

|

|

192 |

|

|

|

3,793 |

|

|

|

5,101 |

|

|

|

(1,308 |

) |

|

|

(25.6 |

)% |

Warranties and GAP income, net |

|

10,099 |

|

|

|

|

|

|

390 |

|

|

|

10,489 |

|

|

|

5,324 |

|

|

|

5,165 |

|

|

|

97.0 |

% |

Other income |

|

6,096 |

|

|

|

|

|

|

66 |

|

|

|

6,162 |

|

|

|

6,266 |

|

|

|

(104 |

) |

|

|

(1.7 |

)% |

Total noninterest income |

|

19,796 |

|

|

|

|

|

|

648 |

|

|

|

20,444 |

|

|

|

16,691 |

|

|

|

3,753 |

|

|

|

22.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensation and benefits |

|

45,209 |

|

|

|

|

|

|

2,398 |

|

|

|

47,607 |

|

|

|

59,146 |

|

|

|

(11,539 |

) |

|

|

(19.5 |

)% |

Professional fees |

|

5,328 |

|

|

|

|

|

|

172 |

|

|

|

5,500 |

|

|

|

2,326 |

|

|

|

3,174 |

|

|

|

136.5 |

% |

Software and IT costs |

|

7,276 |

|

|

|

|

|

|

367 |

|

|

|

7,643 |

|

|

|

8,048 |

|

|

|

(405 |

) |

|

|

(5.0 |

)% |

Depreciation and amortization |

|

1,994 |

|

|

|

|

|

|

817 |

|

|

|

2,811 |

|

|

|

17,156 |

|

|

|

(14,345 |

) |

|

|

(83.6 |

)% |

Interest expense on corporate debt |

|

1,842 |

|

|

|

|

|

|

85 |

|

|

|

1,927 |

|

|

|

1,781 |

|

|

|

146 |

|

|

|

8.2 |

% |

Impairment charges |

|

3,479 |

|

|

|

|

|

|

— |

|

|

|

3,479 |

|

|

|

5,159 |

|

|

|

(1,680 |

) |

|

|

(32.6 |

)% |

Other expenses |

|

5,558 |

|

|

|

|

|

|

262 |

|

|

|

5,820 |

|

|

|

7,569 |

|

|

|

(1,749 |

) |

|

|

(23.1 |

)% |

Total expenses |

|

70,686 |

|

|

|

|

|

|

4,101 |

|

|

|

74,787 |

|

|

|

101,185 |

|

|

|

(26,398 |

) |

|

|

(26.1 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes from continuing operations |

|

39 |

|

|

|

|

|

|

— |

|

|

|

39 |

|

|

|

301 |

|

|

|

(262 |

) |

|

|

(87.0 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted net loss |

$ |

(29,913 |

) |

|

|

|

|

$ |

(5,910 |

) |

|

$ |

(35,823 |

) |

|

$ |

(44,652 |

) |

|

$ |

8,829 |

|

|

|

19.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock compensation expense |

$ |

2,521 |

|

|

|

|

|

$ |

127 |

|

|

$ |

2,647 |

|

|

$ |

1,867 |

|

|

$ |

780 |

|

|

|

41.8 |

% |

Severance |

$ |

28 |

|

|

|

|

|

$ |

4 |

|

|

$ |

31 |

|

|

$ |

513 |

|

|

$ |

(482 |

) |

|

|

(93.9 |

)% |

CarStory

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Successor |

|

|

|

|

|

Predecessor |

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

|

|

|

Three Months Ended September 30, |

|

|

|

|

|

|

|

|

2025 |

|

|

|

|

|

2024 |

|

|

Change |

|

|

% Change |

|

|

|

|

|

|

|

(in thousands) |

|

|

|

|

|

Noninterest income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CarStory revenue |

$ |

1,347 |

|

|

|

|

|

$ |

2,890 |

|

|

$ |

(1,543 |

) |

|

|

(53.4 |

)% |

Other income |

|

35 |

|

|

|

|

|

|

199 |

|

|

|

(164 |

) |

|

|

(82.4 |

)% |

Total noninterest income |

|

1,382 |

|

|

|

|

|

|

3,089 |

|

|

|

(1,707 |

) |

|

|

(55.3 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensation and benefits |

|

1,378 |

|

|

|

|

|

|

3,127 |

|

|

|

(1,749 |

) |

|

|

(55.9 |

)% |

Professional fees |

|

(108 |

) |

|

|

|

|

|

(112 |

) |

|

|

4 |

|

|

|

3.6 |

% |

Software and IT costs |

|

(4 |

) |

|

|

|

|

|

17 |

|

|

|

(21 |

) |

|

|

(123.5 |

)% |

Depreciation and amortization |

|

111 |

|

|

|

|

|

|

1,600 |

|

|

|

(1,489 |

) |

|

|

(93.1 |

)% |

Other expenses |

|

100 |

|

|

|

|

|

|

127 |

|

|

|

(27 |

) |

|

|

(21.3 |

)% |

Total expenses |

|

1,477 |

|

|

|

|

|

|

4,759 |

|

|

|

(3,282 |

) |

|

|

(69.0 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes from continuing operations |

|

24 |

|

|

|

|

|

|

25 |

|

|

|

(1 |

) |

|

|

(4.0 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted net income (loss) |

$ |

(72 |

) |

|

|

|

|

$ |

(1,636 |

) |

|

$ |

1,564 |

|

|

|

95.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock compensation expense |

$ |

47 |

|

|

|

|

|

$ |

59 |

|

|

$ |

(12 |

) |

|

|

(20.6 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Successor |

|

|

|

|

|

Predecessor |

|

|

Non-GAAP Combined |

|

|

Predecessor |

|

|

Non-GAAP |

|

|

Non-GAAP |

|

|

Period from January 15 through September 30, |

|

|

|

|

|

Period from January 1 through January 14, |

|

|

Nine Months Ended

September 30, |

|

|

Nine Months Ended

September 30, |

|

|

|

|

|

|

|

|

2025 |

|

|

|

|

|

2025 |

|

|

2025 |

|

|

2024 |

|

|

Change |

|

|

% Change |

|

|

|

|

|

|

|

|

(in thousands) |

|

|

|

|

|

|

|

|

|

|

Noninterest income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CarStory revenue |

$ |

5,585 |

|

|

|

|

|

$ |

432 |

|

|

$ |

6,017 |

|

|

$ |

8,782 |

|

|

$ |

(2,765 |

) |

|

|

(31.5 |

)% |

Other income |

|

132 |

|

|

|

|

|

|

13 |

|

|

|

145 |

|

|

|

562 |

|

|

|

(417 |

) |

|

|

(74.2 |

)% |

Total noninterest income |

|

5,717 |

|

|

|

|

|

|

445 |

|

|

|

6,162 |

|

|

|

9,344 |

|

|

|

(3,182 |

) |

|

|

(34.1 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensation and benefits |

|

4,319 |

|

|

|

|

|

|

326 |

|

|

|

4,645 |

|

|

|

7,802 |

|

|

|

(3,157 |

) |

|

|

(40.5 |

)% |

Professional fees |

|

(175 |

) |

|

|

|

|

|

13 |

|

|

|

(162 |

) |

|

|

90 |

|

|

|

(252 |

) |

|

|

(280.0 |

)% |

Software and IT costs |

|

(1 |

) |

|

|

|

|

|

2 |

|

|

|

1 |

|

|

|

205 |

|

|

|

(204 |

) |

|

|

(99.5 |

)% |

Depreciation and amortization |

|

321 |

|

|

|

|

|

|

240 |

|

|

|

561 |

|

|

|

4,807 |

|

|

|

(4,246 |

) |

|

|

(88.3 |

)% |

Other expenses |

|

374 |

|

|

|

|

|

|

20 |

|

|

|

394 |

|

|

|

300 |

|

|

|

94 |

|

|

|

31.3 |

% |

Total expenses |

|

4,838 |

|

|

|

|

|

|

601 |

|

|

|

5,439 |

|

|

|

13,204 |

|

|

|

(7,765 |

) |

|

|

(58.8 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes from continuing operations |

|

73 |

|

|

|

|

|

|

5 |

|

|

|

78 |

|

|

|

92 |

|

|

|

(14 |

) |

|

|

(15.2 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted net income (loss) |

$ |

890 |

|

|

|

|

|

$ |

(153 |

) |

|

$ |

737 |

|

|

$ |

(3,618 |

) |

|

$ |

4,355 |

|

|

|

120.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock compensation expense |

$ |

81 |

|

|

|

|

|

$ |

8 |

|

|

$ |

89 |

|

|

$ |

334 |

|

|

$ |

(246 |

) |

|

|

(73.5 |

)% |

Corporate

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Successor |

|

|

|

|

|

Predecessor |

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

|

|

|

Three Months Ended September 30, |

|

|

|

|

|

|

|

|

2025 |

|

|

|

|

|

2024 |

|

|

Change |

|

|

% Change |

|

|

|

|

|

|

|

(in thousands) |

|

|

|

|

|

Interest expense |

$ |

— |

|

|

|

|

|

$ |

(588 |

) |

|

$ |

588 |

|

|

|

100.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Realized and unrealized losses, net of recoveries |

|

(348 |

) |

|

|

|

|

|

8,229 |

|

|

|

(8,577 |

) |

|

|

(104.2 |

)% |

Net interest loss after losses and recoveries |

|

348 |

|

|

|

|

|

|

(8,817 |

) |

|

|

9,165 |

|

|

|

103.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Warranties and GAP income, net |

|

297 |

|

|

|

|

|

|

1,843 |

|

|

|

(1,546 |

) |

|

|

(83.9 |

)% |

Other income |

|

2,006 |

|

|

|

|

|

|

522 |

|

|

|

1,484 |

|

|

|

284.3 |

% |

Total noninterest income |

|

2,303 |

|

|

|

|

|

|

2,365 |

|

|

|

(62 |

) |

|

|

(2.6 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensation and benefits |

|

837 |

|

|

|

|

|

|

2,419 |

|

|

|

(1,582 |

) |

|

|

(65.4 |

)% |

Professional fees |

|

820 |

|

|

|

|

|

|

824 |

|

|

|

(4 |

) |

|

|

(0.5 |

)% |

Software and IT costs |

|

564 |

|

|

|

|

|

|

997 |

|

|

|

(433 |

) |

|

|

(43.4 |

)% |

Interest expense on corporate debt |

|

42 |

|

|

|

|

|

|

920 |

|

|

|

(878 |

) |

|

|

(95.4 |

)% |

Other expenses |

|

394 |

|

|

|

|

|

|

1,318 |

|

|

|

(924 |

) |

|

|

(70.1 |

)% |

Total expenses |

|

2,657 |

|

|

|

|

|

|

6,478 |

|

|

|

(3,821 |

) |

|

|

(59.0 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes from continuing operations |

|

120 |

|

|

|

|

|

|

— |

|

|

|

120 |

|

|

|

100.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Successor |

|

|

|

|

|

Predecessor |

|

|

Non-GAAP Combined |

|

|

Predecessor |

|

|

Non-GAAP |

|

|

Non-GAAP |

|

|

Period from January 15 through September 30, |

|

|

|

|

|

Period from January 1 through January 14, |

|

|

Nine Months Ended

September 30, |

|

|

Nine Months Ended

September 30, |

|

|

|

|

|

|

|

|

2025 |

|

|

|

|

|

2025 |

|

|

2025 |

|

|

2024 |

|

|

Change |

|

|

% Change |

|

|

|

|

|

|

|

|

(in thousands) |

|

|

|

|

|

|

|

|

|

|

Interest income (expense) |

$ |

— |

|

|

|

|

|

$ |

(71 |

) |

|

$ |

(71 |

) |

|

$ |

(1,579 |

) |

|

$ |

1,508 |

|

|

|

95.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Realized and unrealized losses (gains), net of recoveries |

|

(1,321 |

) |

|

|

|

|

|

(855 |

) |

|

|

(2,176 |

) |

|

|

10,434 |

|

|

|

(12,610 |

) |

|

|

(120.9 |

)% |

Net interest income after losses and recoveries |

|

1,321 |

|

|

|

|

|

|

784 |

|

|

|

2,105 |

|

|

|

(12,013 |

) |

|

|

14,119 |

|

|

|

117.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest (loss) income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Warranties and GAP income (loss), net |

|

777 |

|

|

|

|

|

|

(83 |

) |

|

|

694 |

|

|

|

(9,671 |

) |

|

|

10,365 |

|

|

|

107.2 |

% |

Other income |

|

2,244 |

|

|

|

|

|

|

34 |

|

|

|

2,278 |

|

|

|

1,516 |

|

|

|

762 |

|

|

|

50.2 |

% |

Total noninterest (loss) income |

|

3,021 |

|

|

|

|

|

|

(49 |

) |

|

|

2,972 |

|

|

|

(8,155 |

) |

|

|

11,127 |

|

|

|

136.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensation and benefits |

|

3,917 |

|

|

|

|

|

|

99 |

|

|

|

4,016 |

|

|

|

9,703 |

|

|

|

(5,687 |

) |

|

|

(58.6 |

)% |

Professional fees |

|

3,745 |

|

|

|

|

|

|

112 |

|

|

|

3,857 |

|

|

|

4,002 |

|

|

|

(145 |

) |

|

|

(3.6 |

)% |

Software and IT costs |

|

1,609 |

|

|

|

|

|

|

88 |

|

|

|

1,697 |

|

|

|

3,765 |

|

|

|

(2,068 |

) |

|

|

(54.9 |

)% |

Interest expense on corporate debt |

|

42 |

|

|

|

|

|

|

91 |

|

|

|

133 |

|

|

|

2,760 |

|

|

|

(2,627 |

) |

|

|

(95.2 |

)% |

Impairment expense |

|

677 |

|

|

|

|

|

|

— |

|

|

|

677 |

|

|

|

— |

|

|

|

677 |

|

|

|

100.0 |

% |

Other expenses |

|

1,501 |

|

|

|

|

|

|

89 |

|

|

|

1,590 |

|

|

|

4,984 |

|

|

|

(3,394 |

) |

|

|

(68.1 |

)% |

Total expenses |

|

11,491 |

|

|

|

|

|

|

479 |

|

|

|

11,970 |

|

|

|

25,214 |

|

|

|

(13,244 |

) |

|

|

(52.5 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes from continuing operations |

|

241 |

|

|

|

|

|

|

— |

|

|

|

241 |

|

|

|

— |

|

|

|

241 |

|

|

|

100.0 |

% |

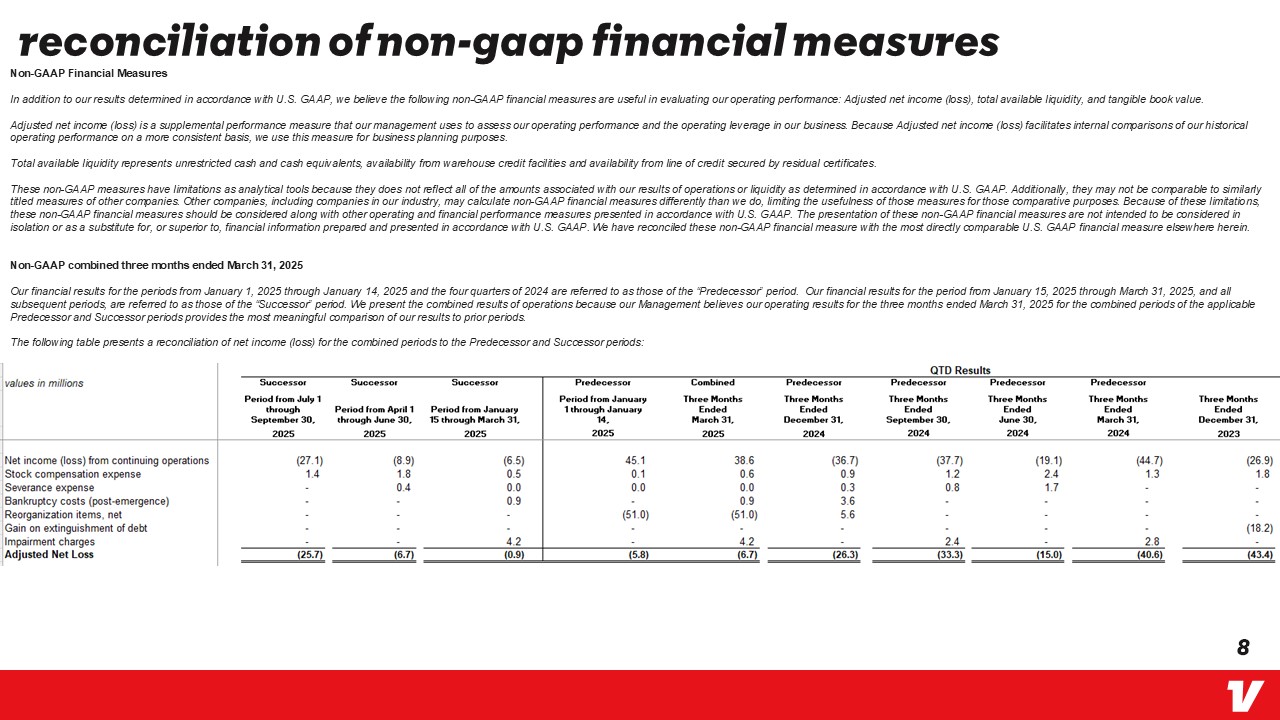

Non-GAAP Financial Measures

In addition to our results determined in accordance with GAAP, we believe the following non-GAAP financial measures are useful in evaluating our operating performance: Adjusted net income (loss), total available liquidity, and tangible book value.

Adjusted net income (loss) is a supplemental performance measure that our management uses to assess our operating performance and the operating leverage in our business. Because Adjusted net income (loss) facilitates internal comparisons of our historical operating performance on a more consistent basis, we use this measure for business planning purposes.

Tangible book value is calculated as stockholders' equity in accordance with GAAP, after subtracting intangible assets. A reconciliation of stockholders' equity to tangible book value is included above.

Total available liquidity represents unrestricted cash and cash equivalents, availability from warehouse credit facilities and availability from line of credit secured by residual certificates.

These non-GAAP measures have limitations as analytical tools because they do not reflect all of the amounts associated with our results of operations or liquidity as determined in accordance with GAAP. Additionally, they may not be comparable to similarly titled measures of other companies. Other companies, including companies in our industry, may calculate non-GAAP financial measures differently than we do, limiting the usefulness of those measures for those comparative purposes. Because of these limitations, these non-GAAP financial measures should be considered along with other operating and financial performance measures presented in accordance with GAAP. The presentation of these non-GAAP financial measures are not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with GAAP. We have reconciled these non-GAAP financial measures with the most directly comparable GAAP financial measures elsewhere herein.

Non-GAAP Combined Nine Months Ended September 30, 2025

Our financial results for the periods from January 1, 2025 through January 14, 2025 and the three and nine months ended September 30, 2024 are referred to as those of the “Predecessor” periods. Our financial results for the periods from January 15, 2025 through September 30, 2025 and the three months ended September 30, 2025 are referred to as those of the “Successor” periods. Our results of operations as reported in our Condensed Consolidated Financial Statements for these periods are prepared in accordance with GAAP. Although GAAP requires that we report our results for the period from January 1, 2025 through January 14, 2025 and the period from January 15, 2025 through September 30, 2025, separately, management views our operating results for the nine months ended September 30, 2025 by combining the results of the applicable Predecessor and Successor periods because such presentation provides the most meaningful comparison of our results to prior periods. We believe we cannot adequately benchmark the operating results of the period from January 15, 2025 through September 30, 2025 against any of the previous periods reported in our Condensed Consolidated Financial Statements without combining it with the period from January 1, 2025 through January 14, 2025 and we do not believe that reviewing the results of this period in isolation would be useful in identifying trends in or reaching conclusions regarding our overall operating performance. Management believes that the key performance metrics for the Successor period when combined with the Predecessor period provide more meaningful comparisons to other periods and are useful in identifying current business trends. Accordingly, in addition to presenting our results of operations as reported in our Condensed Consolidated Financial Statements in accordance with GAAP, the tables and discussion below also present the combined results for the nine months ended September 30, 2025. The combined results for the nine months ended September 30, 2025 represent the sum of the reported amounts for the Predecessor period from January 1, 2025 through January 14, 2025 and the Successor period from January 15, 2025 through September 30, 2025. These combined results are not considered to be prepared in accordance with GAAP and have not been prepared as pro forma results per applicable regulations. The combined operating results do not reflect the actual results we would have achieved absent our emergence from the Prepackaged Chapter 11 Case and are not necessarily indicative of future results. Accordingly, the results for the combined nine months ended September 30, 2025 (prepared on a Non-GAAP basis) and nine months ended September 30, 2024 (prepared on a GAAP basis) may not be comparable, particularly for statement of operations line items significantly impacted by the reorganization transactions and the impact of fresh start accounting.

Adjusted net loss

We calculate Adjusted net loss as net income (loss) from continuing operations adjusted for stock compensation expense, severance expense, bankruptcy costs (which represent professional fees incurred related to the bankruptcy prior to filing of the petition and post-emergence), reorganization items, net (which relate to certain charges incurred during the bankruptcy proceedings, such as legal and professional fees incurred directly as a result of the bankruptcy proceeding, the write-off of deferred financing costs and discount on debt subject to compromise and other related charges), operating lease right-of-use assets impairment and long-lived asset impairment charges.

The following table presents a reconciliation of Adjusted net income (loss) to net income (loss) from continuing operations, which is the most directly comparable GAAP measure (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

Successor |

|

|

|

Predecessor |

|

|

|

Three Months Ended September 30, |

|

|

|

Three Months Ended September 30, |

|

|

|

2025 |

|

|

|

2024 |

|

Net loss from continuing operations |

|

$ |

(27,142 |

) |

|

|

$ |

(37,744 |

) |

Adjusted to exclude the following: |

|

|

|

|

|

|

|

Stock compensation expense |

|

|

1,444 |

|

|

|

|

1,244 |

|

Severance expense |

|

|

— |

|

|

|

|

763 |

|

Impairment charges |

|

|

— |

|

|

|

|

2,407 |

|

Adjusted net loss |

|

$ |

(25,698 |

) |

|

|

$ |

(33,330 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Successor |

|

|

|

Predecessor |

|

|

Non-GAAP Combined |

|

|

Predecessor |

|

|

|

Period from January 15 through September 30, |

|

|

|

Period from January 1 through January 14, |

|

|

Nine Months Ended

September 30, |

|

|

Nine Months Ended

September 30, |

|

|

|

2025 |

|

|

|

2025 |

|

|

2025 |

|

|

2024 |

|

|

|

|

|

|

|

(in thousands) |

|

|

|

|

Net income (loss) from continuing operations |

|

$ |

(42,525 |

) |

|

|

$ |

45,090 |

|

|

$ |

2,565 |

|

|

$ |

(101,526 |

) |

Adjusted to exclude the following: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock compensation expense |

|

|

3,771 |

|

|

|

|

144 |

|

|

|

3,915 |

|

|

|

5,014 |

|

Severance expense |

|

|

388 |

|

|

|

|

4 |

|

|

|

392 |

|

|

|

2,448 |

|

Bankruptcy costs (post-emergence) |

|

|

913 |

|

|

|

|

— |

|

|

|

913 |

|

|

|

— |

|

Reorganization items, net |

|

|

— |

|

|

|

|

(51,036 |

) |

|

|

(51,036 |

) |

|

|

— |

|

Impairment charges |

|

|

4,156 |

|

|

|

|

— |

|

|

|

4,156 |

|

|

|

5,159 |

|

Adjusted net loss |

|

$ |

(33,297 |

) |

|

|

$ |

(5,798 |

) |

|

$ |

(39,095 |

) |

|

$ |

(88,905 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Successor |

|

|

Successor |

|

|

Successor |

|

|

|

Predecessor |

|

|

Non-GAAP Combined |

|

|

Predecessor |

|

|

Predecessor |

|

|

Predecessor |

|

|

Predecessor |

|

|

Predecessor |

|

|

|

Period from July 1 through September 30, |

|

|

Period from April 1 through June 30, |

|

|

Period from January 15 through March 31, |

|

|

|

Period from January 1 through January 14, |

|

|

Three Months Ended

March 31, |

|

|

Three Months Ended

December 31, |

|

|

Three Months Ended

September 30, |

|

|

Three Months Ended

June 30, |

|

|

Three Months Ended

March 31, |

|

|

Three Months Ended

December 31, |

|

|

|

2025 |

|

|

2025 |

|

|

2025 |

|

|

|

2025 |

|

|

2025 |

|

|

2024 |

|

|

2024 |

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) from continuing operations |

|

|

(27,142 |

) |

|

|

(8,932 |

) |

|

|

(6,450 |

) |

|

|

|

45,090 |

|

|

|

38,640 |

|

|

|

(36,716 |

) |

|

|

(37,744 |

) |

|

|

(19,104 |

) |

|

|

(44,676 |

) |

|

|

(26,904 |

) |

Stock compensation expense |

|

|

1,444 |

|

|

|

1,836 |

|

|

|

491 |

|

|

|

|

144 |

|

|

|

635 |

|

|

|

935 |

|

|

|

1,244 |

|

|

|

2,446 |

|

|

|

1,324 |

|

|

|

1,767 |

|

Severance expense |

|

|

- |

|

|

|

367 |

|

|

|

21 |

|

|

|

|

4 |

|

|

|

25 |

|

|

|

287 |

|

|

|

763 |

|

|

|

1,685 |

|

|

|

- |

|

|

|

- |

|

Bankruptcy costs (post-emergence) |

|

|

- |

|

|

|

- |

|

|

|

913 |

|

|

|

|

- |

|

|

|

913 |

|

|

|

3,582 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

Reorganization items, net |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

|

(51,036 |

) |

|

|

(51,036 |

) |

|

|

5,564 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

Gain on extinguishment of debt |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(18,238 |

) |

Impairment charges |

|

|

- |

|

|

|

- |

|

|

|

4,156 |

|

|

|

|

- |

|

|

|

4,156 |

|

|

|

- |

|

|

|

2,407 |

|

|

|

- |

|

|

|

2,752 |

|

|

|

- |

|

Adjusted Net Loss |

|

|

(25,698 |

) |

|

|

(6,729 |

) |

|

|

(869 |

) |

|

|

|

(5,798 |

) |

|

|

(6,667 |

) |

|

|

(26,348 |

) |

|

|

(33,330 |

) |

|

|

(14,973 |

) |

|

|

(40,600 |

) |

|

|

(43,375 |

) |

About Vroom (Nasdaq: VRM)

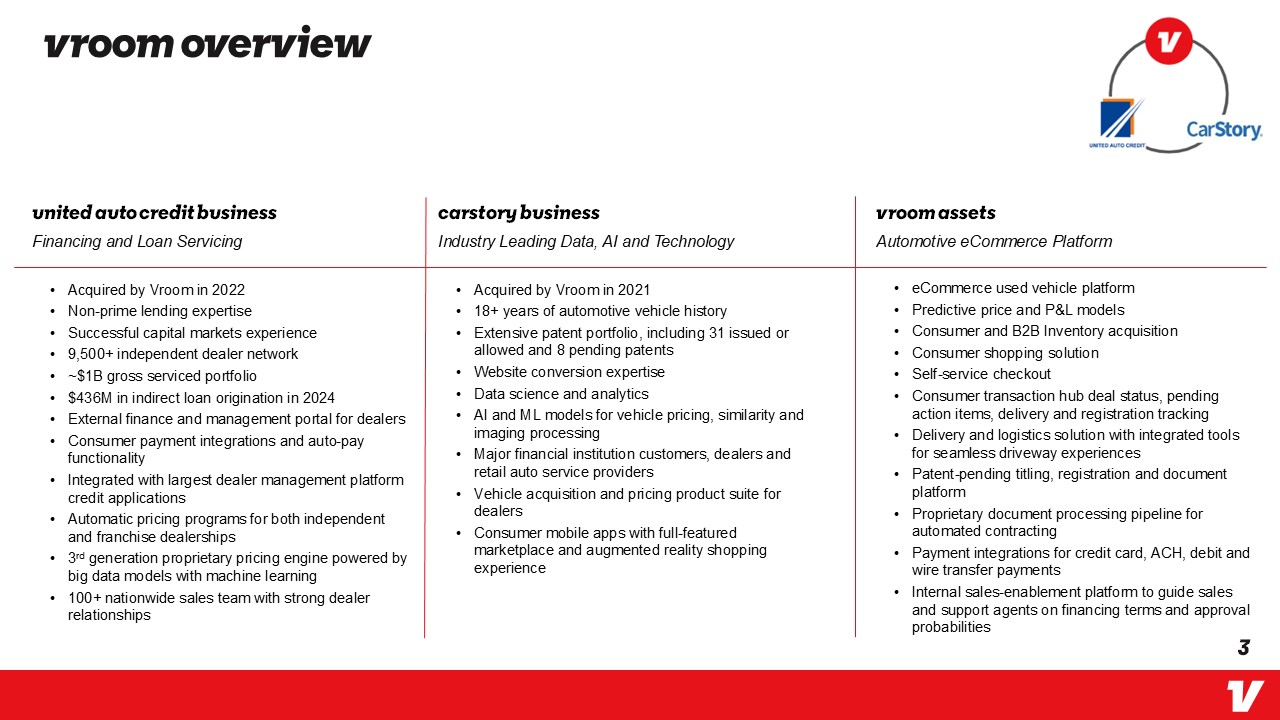

Vroom owns and operates United Auto Credit Corporation (UACC), a leading indirect automotive lender serving the independent and franchise dealer market nationwide, and CarStory, a leader in AI-powered analytics and digital services for automotive retail. Prior to January 2024, Vroom also operated an end-to-end ecommerce platform to buy and sell used vehicles. Pursuant to its previously announced Value Maximization Plan, Vroom discontinued its ecommerce operations and used vehicle dealership business.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this press release that do not relate to matters of historical fact should be considered forward-looking statements, including without limitation statements regarding our internal adjusted net income plan, the restructuring, including its impact and intended benefits, our strategic initiatives and long-term strategy, future results of operations and financial position, adjusted net income (loss) and our total available liquidity, and the timing of any of the foregoing. These statements are based on management’s current assumptions and are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. For factors that could cause actual results to differ materially from the forward-looking statements in this press release, please see the risks and uncertainties identified under the heading "Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2024, which is available on our Investor Relations website at ir.vroom.com and on the SEC website at www.sec.gov. All forward-looking statements reflect our beliefs and assumptions only as of the date of this press release. We undertake no obligation to update forward-looking statements to reflect future events or circumstances.

Investor Relations:

Vroom

Jon Sandison

investors@vroom.com

VROOM, INC.

CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share amounts)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

Successor |

|

|

|

Predecessor |

|

|

|

As of

September 30, |

|

|

|

As of

December 31, |

|

|

|

2025 |

|

|

|

2024 |

|

ASSETS |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

12,412 |

|

|

|

$ |

29,343 |

|

Restricted cash (including restricted cash of consolidated VIEs of $54.3 million and $48.1 million, respectively) |

|

|

55,026 |

|

|

|

|

49,026 |

|

Finance receivables at fair value (including finance receivables of consolidated VIEs of $794.6 million and $467.3 million, respectively) |

|

|

817,711 |

|

|

|

|

503,848 |

|

Finance receivables held for sale, net (including finance receivables of consolidated VIEs of $0.0 and $310.0 million, respectively) |

|

|

— |

|

|

|

|

318,192 |

|

Interest receivable (including interest receivables of consolidated VIEs of $12.5 million and $13.3 million, respectively) |

|

|

12,825 |

|

|

|

|

14,067 |

|

Property and equipment, net |

|

|

5,636 |

|

|

|

|

4,064 |

|

Intangible assets, net |

|

|

12,846 |

|

|

|

|

104,869 |

|

Operating lease right-of-use assets |

|

|

6,065 |

|

|

|

|

6,872 |

|

Other assets (including other assets of consolidated VIEs of $11.6 million and $10.8 million, respectively) |

|

|

26,667 |

|

|

|

|

35,472 |

|

Assets from discontinued operations |

|

|

— |

|

|

|

|

943 |

|

Total assets |

|

$ |

949,188 |

|

|

|

$ |

1,066,696 |

|

LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) |

|

|

|

|

|

|

|

Warehouse credit facilities of consolidated VIEs |

|

$ |

269,773 |

|

|

|

$ |

359,912 |

|