UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

November 6, 2025

ALPHABET INC.

(Exact name of registrant as specified in its charter)

| Delaware | 001-37580 | 61-1767919 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

1600 Amphitheatre Parkway

Mountain View, CA 94043

(Address of principal executive offices, including zip code)

(650) 253-0000

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

||

| Class A Common Stock, $0.001 par value | GOOGL | Nasdaq Stock Market LLC | ||

| (Nasdaq Global Select Market) | ||||

| Class C Capital Stock, $0.001 par value | GOOG | Nasdaq Stock Market LLC | ||

| (Nasdaq Global Select Market) | ||||

| 2.500% Senior Notes due 2029 | — | Nasdaq Stock Market LLC | ||

| 3.000% Senior Notes due 2033 | — | Nasdaq Stock Market LLC | ||

| 3.375% Senior Notes due 2037 | — | Nasdaq Stock Market LLC | ||

| 3.875% Senior Notes due 2045 | — | Nasdaq Stock Market LLC | ||

| 4.000% Senior Notes due 2054 | — | Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01. Other Events.

Alphabet Inc. Euro and U.S. Dollar Senior Notes Offering

On November 6, 2025, Alphabet Inc. (“Alphabet”) closed its concurrent underwritten public offerings of $17.5 billion aggregate principal amount of U.S. dollar-denominated senior notes (the “U.S. Notes”) and €6.5 billion aggregate principal amount of euro-denominated senior notes (the “Euro Notes” and, collectively with the U.S. Notes, the “Notes”) pursuant to Alphabet’s registration statement on Form S-3 (File No. 333-286752). The Notes were issued pursuant to an Indenture (the “Indenture”), dated as of February 12, 2016, between Alphabet and The Bank of New York Mellon Trust Company, N.A., as trustee.

The Euro Notes consist of €1,000,000,000 aggregate principal amount of 2.375% notes due 2028, €1,000,000,000 aggregate principal amount of 2.875% notes due 2031, €1,000,000,000 aggregate principal amount of 3.125% notes due 2034, €1,000,000,000 aggregate principal amount of 3.500% notes due 2038, €1,250,000,000 aggregate principal amount of 4.000% notes due 2044 and €1,250,000,000 aggregate principal amount of 4.375% notes due 2064.

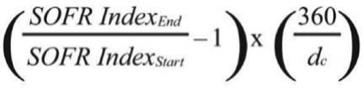

The U.S. Notes consist of $500,000,000 aggregate principal amount of floating rate notes due 2028, $1,000,000,000 aggregate principal amount of 3.875% notes due 2028, $2,500,000,000 aggregate principal amount of 4.100% notes due 2030, $1,250,000,000 aggregate principal amount of 4.375% notes due 2032, $3,500,000,000 aggregate principal amount of 4.700% notes due 2035, $2,000,000,000 aggregate principal amount of 5.350% notes due 2045, $4,000,000,000 aggregate principal amount of 5.450% notes due 2055 and $2,750,000,000 aggregate principal amount of 5.700% notes due 2075.

The foregoing description of the Indenture is qualified in its entirety by the terms of such agreement, which is filed hereto as Exhibit 4.1 and incorporated herein by reference. The foregoing descriptions of the Notes is qualified in its entirety by reference to the full text of the respective forms of the Notes filed as Exhibits 4.2-4.15 hereto and each is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d)Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| ALPHABET INC. | ||

| Date: November 6, 2025 |

/S/ ANAT ASHKENAZI |

|

| Anat Ashkenazi | ||

| Senior Vice President, Chief Financial Officer | ||

Exhibit 4.2

GLOBAL SECURITY

THIS NOTE IS A GLOBAL SECURITY WITHIN THE MEANING OF THE INDENTURE HEREINAFTER REFERRED TO AND IS REGISTERED IN THE NAME OF THE DEPOSITARY OR A NOMINEE OF THE DEPOSITARY, WHICH MAY BE TREATED BY THE COMPANY, THE TRUSTEE AND ANY AGENT THEREOF AS OWNER AND HOLDER OF THIS NOTE FOR ALL PURPOSES. UNLESS AND UNTIL IT IS EXCHANGED IN WHOLE OR IN PART FOR THE INDIVIDUAL SECURITIES REPRESENTED HEREBY, THIS GLOBAL SECURITY MAY NOT BE TRANSFERRED EXCEPT AS A WHOLE BY THE DEPOSITARY TO A NOMINEE OF THE DEPOSITARY OR BY A NOMINEE OF THE DEPOSITARY TO THE DEPOSITARY OR ANOTHER NOMINEE OF THE DEPOSITARY OR BY THE DEPOSITARY OR ANY SUCH NOMINEE TO A SUCCESSOR DEPOSITARY OR A NOMINEE OF SUCH SUCCESSOR DEPOSITARY.

UNLESS THIS CERTIFICATE IS PRESENTED BY AN AUTHORIZED REPRESENTATIVE OF EUROCLEAR BANK, S.A./N.V. OR CLEARSTREAM BANKING, SOCIÉTÉ ANONYME (EACH, A “DEPOSITARY”) TO THE COMPANY OR ITS AGENT FOR REGISTRATION OF TRANSFER, EXCHANGE, OR PAYMENT, AND ANY CERTIFICATE ISSUED IS REGISTERED IN THE NAME OF THE BANK OF NEW YORK DEPOSITARY (NOMINEES) LIMITED, AS NOMINEE OF THE BANK OF NEW YORK MELLON, LONDON BRANCH, OR IN SUCH OTHER NAME AS IS REQUESTED BY AN AUTHORIZED REPRESENTATIVE OF THE DEPOSITARY (AND ANY PAYMENT IS MADE TO THE BANK OF NEW YORK DEPOSITARY (NOMINEES) LIMITED OR TO SUCH OTHER ENTITY AS IS REQUESTED BY AN AUTHORIZED REPRESENTATIVE OF THE DEPOSITARY), ANY TRANSFER, PLEDGE, OR OTHER USE HEREOF FOR VALUE OR OTHERWISE BY OR ANY PERSON IS WRONGFUL INASMUCH AS THE REGISTERED OWNER HEREOF, THE BANK OF NEW YORK DEPOSITARY (NOMINEES) LIMITED, HAS AN INTEREST HEREIN.

ALPHABET INC.

2.375% Notes Due 2028

PRINCIPAL AMOUNT: €1,000,000,000

CUSIP: 02079K BH9

ISIN NUMBER: XS3226478918

COMMON CODE: 322647891

No.: A-1

ALPHABET INC., a Delaware corporation (the “Company”, which term includes any successor thereto under the Indenture referred to on the reverse hereof), for value received, hereby promises to pay to The Bank of New York Depositary (Nominees) Limited, as nominee of The Bank of New York Mellon, London Branch, as common depositary for Clearstream

Banking, S.A. (“Clearstream”) and Euroclear Bank S.A./N.V. (“Euroclear”), or their registered assigns, at the office or agency of the Paying Agent maintained for such purpose, which shall initially be the corporate trust office of the Paying Agent, the principal sum of ONE BILLION EUROS (€1,000,000,000) (or such other principal amount as shall be set forth in the Schedule of Increases or Decreases in Note attached hereto) on November 6, 2028, and to pay interest thereon from November 6, 2025 or from the next preceding Interest Payment Date in respect of which interest has been paid or duly provided for, annually in arrears on November 6 of each year, beginning on November 6, 2026 on said principal sum, at the rate of 2.375% per annum, on the basis of the actual number of days in the period for which interest is being calculated and the actual number of days from and including the last date on which interest was paid (or November 6, 2025 if no interest has been paid), to, but not including, the next scheduled Interest Payment Date, until the principal hereof is paid or duly provided for or made available for payment and (to the extent that the payment of such interest shall be legally enforceable) at such rate on any overdue principal and premium and on any overdue installment of interest.

The interest so payable, and punctually paid or duly provided for, on any Interest Payment Date will, as provided in the Indenture, be paid to the Person in whose name this Security (or one or more Predecessor Securities) is registered at the close of business on the Record Date for such interest, which shall be the close of business on the date that is the Clearing System Business Day immediately preceding each Interest Payment Date. A Clearing System Business Day is every Monday to Friday inclusive, except December 25th and January 1st. Any such interest not so punctually paid or duly provided for will forthwith cease to be payable to the Holder on such Record Date and may either be paid to the person in whose name this Security (or one or more Predecessor Securities) is registered at the close of business on a Special Record Date for the payment of such Defaulted Interest to be fixed by the Trustee, notice whereof shall be given to Holders of Securities of this series not less than 10 days prior to such Special Record Date, or be paid at any time in any other lawful manner not inconsistent with the requirements of any securities exchange on which the Securities of this series may be listed, and upon such notice as may be required by such exchange, all as, more fully provided in said Indenture.

As used in this Security, the term “Business Day” means any day, other than a Saturday or Sunday, (1) which is not a day on which banking institutions in the City of New York or the City of London are authorized or required by law or executive order to close and (2) on which the Trans-European Automated Real-time Gross Settlement Express Transfer system (the TARGET2 system), or any successor thereto, operates.

Initially, The Bank of New York Mellon, London Branch, will act as Paying Agent. The Company may change the Paying Agent without notice to any Holder. Payment of the principal, premium, if any, and interest on the Securities of this series will be made at the office or agency maintained for that purpose in London (initially the corporate trust office of the Paying Agent); provided that payment of interest may be made at the option of the Company by check mailed to the address of the person entitled thereto as such address shall appear on the Register or by wire transfer as provided in the Indenture.

The term “euros,” “the euro” or “€” means the currency of the member states of the European Monetary Union that have adopted or that adopt the single currency in accordance with the treaty establishing the European Community, as amended by the Treaty on European Union.

All payments on the Securities of this series will be payable in euros; provided that if on or after November 3, 2025, the euro is unavailable to the Company due to the imposition of exchange controls or other circumstances beyond its control or if the euro is no longer being used by the then member states of the European Monetary Union that have adopted the euro as their currency or for the settlement of transactions by public institutions of or within the international banking community, then all payments in respect of the Securities of this series will be made in U.S. dollars until the euro is again available to the Company or so used. The amount payable on any date in euros will be converted into U.S. dollars at the rate mandated by the U.S. Federal Reserve Board as of the close of business on the second Business Day prior to the relevant payment date or, in the event the U.S. Federal Reserve Board has not mandated a rate of conversion, on the basis of the most recent U.S. Dollar/euro exchange rate published in The Wall Street Journal on or prior to the second Business Day prior to the relevant payment date. Any payment in respect of the Securities of this series so made in U.S. dollars will not constitute an event of default under the Securities of this series or the Indenture. Neither the Trustee nor the Paying Agent will have any responsibility for any calculation or conversion in connection with the foregoing.

Reference is made to the further provisions of this Security set forth on the reverse hereof. Such further provisions shall for all purposes have the same effect as though fully set forth at this place.

This Security shall not be valid or become obligatory for any purpose until the certificate of authentication hereon shall have been manually signed by the Trustee under the Indenture referred to on the reverse hereof.

IN WITNESS WHEREOF, ALPHABET INC. has caused this instrument to be duly executed.

| ALPHABET INC. |

||

| By: | ||

| Name: Juan Rajlin Title: Treasurer |

||

CERTIFICATE OF AUTHENTICATION

This is one of the Securities of the series designated therein referred to in the within-mentioned Indenture.

Date of authentication:

| THE BANK OF NEW YORK MELLON TRUST COMPANY, N.A. as Trustee |

||

| By: | ||

| Authorized Signatory |

||

REVERSE OF SECURITY

ALPHABET INC.

2.375% Notes Due 2028

This Security is one of a duly authorized issue of securities of the Company (hereinafter called the “Securities”) of the series hereinafter specified, all issued or to be issued under and pursuant to an Indenture, dated as of February 12, 2016 (the “Indenture”), duly executed and delivered by the Company to The Bank of New York Mellon Trust Company, N.A., as Trustee (the “Trustee,” which term includes any successor trustee), to which the Indenture and all indentures supplemental thereto reference is hereby made for a description of the rights, limitations of rights, obligations, duties and immunities thereunder of the Trustee, the Company and the Holders of the Securities. The Securities may be issued in one or more series, which different series may be issued in various aggregate principal amounts, may mature at different times, may bear interest (if any) at different rates, may be subject to different redemption provisions (if any), may be subject to different sinking, purchase or analogous funds (if any) and may otherwise vary as in the Indenture provided. This Security is one of a series designated as the 2.375% Notes due 2028 of the Company, limited in aggregate principal amount to €1,000,000,000; provided, however, that the Company, without notice to or consent of the Holders, may issue additional Securities of this series and thereby increase such principal amount in the future, on the same terms and conditions (except for the issue date, public offering price and, if applicable, the date from which interest accrues and the first Interest Payment Date). Any additional Securities shall be issued under one or more separate CUSIP, ISIN or other identifying number unless such additional Securities are issued pursuant to a “qualified reopening,” are otherwise treated as part of the same “issue” of debt instruments as the original series or are issued with less than a de minimis amount of original issue discount, in each case for U.S. federal income tax purposes.

Interest on the Securities of this series will be computed on the basis of the actual number of days in the period for which interest is being calculated and the actual number of days from and including the last date on which interest was paid on the Securities of this series (or November 6, 2025 if no interest has been paid on the Securities of this series), to, but not including, the next scheduled Interest Payment Date. This payment convention is referred to as ACTUAL/ACTUAL (ICMA) as defined in the rulebook of the International Capital Markets Association. The Company shall pay interest on overdue principal, premium, if any, and, to the extent lawful, on overdue installments of interest at the rate per annum borne by this Security. If any Interest Payment Date, the Stated Maturity or any Redemption Date falls on a day that is not a Business Day, the related payment of principal, premium, if any, or interest will be made on the next succeeding Business Day as if it were made on the date such payment was due, and no interest will accrue on the amounts so payable for the period from and after such date to the next succeeding Business Day.

In case an Event of Default (as defined in the Indenture) with respect to the 2.375% Notes due 2028 shall have occurred and be continuing, the principal hereof and the interest accrued hereon, if any, may be declared, and upon such declaration shall become, due and payable, in the manner, with the effect and subject to the conditions provided in the Indenture.

The Indenture contains provisions that provide that the Company and the Trustee may enter into an indenture or indentures supplemental hereto for the purpose of amending any provisions of the Indenture or of modifying in any manner the rights of the Holders of the Securities of such series to be affected with the written consent of the Holders of a majority in principal amount of the Outstanding Securities of such series affected by such amendment voting separately; provided that, without the consent of each Holder of the Securities of each series affected thereby, an amendment may not: (i) extend the Stated Maturity of the principal of, or any installment of interest on, such Holder’s Security, or reduce the principal amount thereof or the interest thereon or any premium payable upon redemption thereof, or change the Currency in which the principal of and premium, if any, or interest on such Security is denominated or payable, or reduce the amount of the principal of an Original Issue Discount Security that would be due and payable upon a declaration of acceleration of the Maturity thereof, or impair the right to institute suit for the enforcement of any payment on or after the Stated Maturity thereof (or, in the case of redemption, on or after the Redemption Date), or materially adversely affect the economic terms of the Holder’s right to convert or exchange any Security as may be provided in the Indenture; (ii) reduce the percentage in principal amount of the Outstanding Securities of any series, the consent of whose Holders is required for any supplemental indenture, or the consent of whose Holders is required for any waiver of compliance with certain provisions of the Indenture or certain Defaults hereunder and their consequences provided for in the Indenture; (iii) modify any of the provisions of the Indenture governing amendments or waivers with the consent of Holders except to increase any such percentage or to provide that certain other provisions of the Indenture cannot be modified or waived without the consent of the Holder of each Outstanding Security affected thereby; or (iv) modify, without the written consent of the Trustee, the rights, duties or immunities of the Trustee.

It is also provided in the Indenture that, subject to certain conditions and exceptions, the Holders of a majority in aggregate principal amount of a series of Securities at the time Outstanding may on behalf of the Holders of all of the Securities of such series waive any past Default or Event of Default hereunder and its consequences except a Default in the payment of interest or any premium on or the principal of the Securities of such series or a Default in respect of a covenant or provision of the Indenture that cannot be modified or amended without the consent of the Holder of each Outstanding Security of such series. Upon any such waiver, the Company, the Trustee and the Holders of the Securities of such series shall be restored to their former positions and rights under the Indenture, respectively; provided that no such waiver shall extend to any subsequent or other Default or Event of Default or impair any right consequent thereon.

No reference herein to the Indenture and no provision of this Security or of the Indenture shall alter or impair the obligation of the Company, which is absolute and unconditional, to pay the principal of and interest on this Security in the manner, at the place, at the respective times, at the rate and in the coin or currency herein prescribed.

The Securities of this series will be issued in fully registered form without coupons in minimum denominations of €100,000 and multiples of €1,000 in excess thereof and are transferable and exchangeable at the office or agency of the Company maintained for such purpose, which shall initially be the Corporate Trust Office of the Trustee, and in the manner and subject to the limitations provided in the Indenture.

The Securities of this series are redeemable prior to November 6, 2028 at the Company’s option in whole or in part at any time or from time to time. Prior to October 6, 2028, the Company may redeem the Securities of this series by paying a Redemption Price equal to the greater of (i) 100% of the principal amount of the Securities to be redeemed and (ii) the sum of the present values of the remaining scheduled payments of principal and interest on the Securities to be redeemed (exclusive of interest accrued to the Redemption Date), discounted to the Redemption Date on an annual basis (ACTUAL/ACTUAL (ICMA)), at the applicable Comparable Government Bond Rate described below plus 10 basis points plus, in either case, accrued and unpaid interest, if any, to, but not including, the Redemption Date. On or after October 6, 2028, the Company may redeem the Securities of this series by paying a Redemption Price equal to 100% of the principal amount of the Securities to be redeemed plus accrued and unpaid interest, if any, to, but not including, the Redemption Date.

For the purposes of determining the Redemption Price, “Comparable Government Bond Rate” means, with respect to any Redemption Date, the rate per annum equal to the yield to maturity, expressed as a percentage (rounded to three decimal places, with 0.0005 being rounded upwards), on the third Business Day prior to the date fixed for redemption, calculated in accordance with customary financial practice in pricing new issues of comparable corporate debt securities paying interest on an annual basis (ACTUAL/ACTUAL (ICMA)) of the Comparable Government Bond (as defined below), assuming a price for the Comparable Government Bond (expressed as a percentage of its principal amount) equal to the Comparable Government Bond Price for such Redemption Date. “Comparable Government Bond” means, in relation to any Comparable Government Bond Rate calculation, the German government bond (Bundesanleihe) selected by an Independent Investment Banker as having an actual or interpolated maturity comparable to the remaining term of the Securities to be redeemed that would be utilized, at the time of selection and in accordance with customary financial practice, in pricing new issues of euro-denominated corporate debt securities of a comparable maturity to the remaining term of such Securities. “Independent Investment Banker” means one of the Reference Government Bond Dealers selected by the Company. “Comparable Government Bond Price” means, with respect to any Redemption Date, (1) the arithmetic average of the Reference Government Bond Dealer Quotations for such Redemption Date, after excluding the highest and lowest such Reference Government Bond Dealer Quotations, or (2) if the Company obtains fewer than four such Reference Government Bond Dealer Quotations, the arithmetic average of all such quotations. “Reference Government Bond Dealer Quotations” means, with respect to each Reference Government Bond Dealer and any Redemption Date, the arithmetic average, as determined by the Company, of the bid and asked prices for the Comparable Government Bond (expressed in each case as a percentage of its principal amount) quoted in writing to the Company by such Reference Government Bond Dealer at 11:00 a.m., Central European Time (CET), on the third Business Day preceding such Redemption Date. “Reference Government Bond Dealer” means (i) each of Goldman Sachs & Co. LLC, HSBC Bank plc, J.P. Morgan Securities plc, BNP PARIBAS, Crédit Agricole Corporate and Investment Bank and Deutsche Bank AG, London Branch, or any of their affiliates that are primary European government securities dealers, and their respective successors; provided that if any of the foregoing or any of their affiliates shall cease to be a primary European government securities dealer (“Primary Dealer”), the Company shall substitute therefor another Primary Dealer and (ii) two other Primary Dealers selected by the Company.

Notice of redemption will be mailed or electronically delivered (or otherwise transmitted in accordance with Clearstream or Euroclear procedures, as applicable) at least 10 but not more than 60 days before the Redemption Date to each holder of record of the Securities of this series. Notice of any redemption of the Securities of this series in connection with a transaction or an event may, at the Company’s discretion, be given prior to the completion or the occurrence thereof. Any redemption or notice may, at the Company’s discretion, be subject to one or more conditions precedent, including, but not limited to, completion or occurrence of a related transaction or event. At the Company’s discretion, the Redemption Date may be delayed until such time as any or all such conditions shall be satisfied, or such redemption may not occur and such notice may be rescinded in the event that any or all such conditions shall not have been satisfied by the Redemption Date, or by the Redemption Date as so delayed. The Company will provide written notice to the Trustee prior to the close of business two Business Days prior to the Redemption Date if any such redemption has been rescinded or delayed, and upon receipt the Trustee will provide such notice to each holder of the Securities to be redeemed in the same manner in which the notice of redemption was given.

No Securities of this series of a principal amount of €1,000 or less will be redeemed in part. If this Security is to be redeemed in part only, the notice of redemption that relates to this Security will state the portion of the principal amount of this Security to be redeemed. A new security in a principal amount equal to the unredeemed portion of this Security will be issued in the name of the holder of the Security upon surrender for cancellation of the original Security. For so long as the Securities of this series are held by Clearstream or Euroclear, as applicable, the redemption and the selection of Securities to be redeemed shall be in accordance with the policies and procedures of the applicable clearing system.

Unless the Company defaults in payment of the Redemption Price, on and after the Redemption Date, interest will cease to accrue on the Securities of this series or portions thereof called for redemption.

Subject to the exceptions and limitations set forth below, the Company will pay as additional interest on the Securities of this series such additional amounts as are necessary in order that the net payment by the Company or a paying agent of the principal, premium, if any, and interest with respect to the Securities of this series to the beneficial owner that is not a United States person (as defined below), after withholding or deduction for any present or future tax, assessment or other governmental charge imposed by the United States or a taxing authority in the United States, will not be less than the amount provided in this Security to be then due and payable; provided, however, that the foregoing obligation to pay additional amounts will not apply:

| 1. | to any tax, assessment or other governmental charge that would not have been imposed but for the holder, a fiduciary, settlor, beneficiary, member or shareholder of the holder, or a person holding a power over an estate or trust administered by a fiduciary holder, being treated as: |

| a. | being or having been present in, or engaged in a trade or business in, the United States, being treated as having been present in, or engaged in a trade or business in, the United States, or having or having had a permanent establishment in the United States; |

| b. | having a current or former connection with the United States (other than a connection arising solely as a result of the ownership of the Securities, the receipt of any payment in respect of the Securities or the enforcement of any rights under the Indenture), including being or having been a citizen or resident of the United States or treated as being or having been a resident thereof; |

| c. | being or having been a personal holding company, a passive foreign investment company or a controlled foreign corporation for U.S. federal income tax purposes, a foreign tax exempt organization, or a corporation that has accumulated earnings to avoid United States federal income tax; |

| d. | being or having been a “10-percent shareholder”, as defined in section 871(h)(3) of the United States Internal Revenue Code of 1986, as amended (the “Code”) or any successor provision, of us; or |

| e. | being a bank receiving payments on an extension of credit made pursuant to a loan agreement entered into in the ordinary course of its trade or business, within the meaning of section 881(c)(3) of the Code or any successor provision; |

| 2. | to any holder that is not the sole beneficial owner of the Securities, or a portion of the Securities, or that is a fiduciary, partnership or limited liability company, but only to the extent that a beneficiary or settlor with respect to the fiduciary, a beneficial owner or member of the partnership or limited liability company would not have been entitled to the payment of an additional amount had the beneficiary, settlor, beneficial owner or member received directly its beneficial or distributive share of the payment; |

| 3. | to any tax, assessment or other governmental charge that would not have been imposed but for the failure of the holder or any other person to comply with certification, identification or information reporting requirements concerning the nationality, residence, identity or connection with the United States of the holder or beneficial owner of the Securities, if compliance is required by statute, by regulation of the United States or any taxing authority therein or by an applicable income tax treaty to which the United States is a party as a precondition to exemption from such tax, assessment or other governmental charge; |

| 4. | to any tax, assessment or other governmental charge that is imposed otherwise than by withholding by the Company or a paying agent from the payment; |

| 5. | to any estate, inheritance, gift, sales, excise, transfer, wealth, capital gains or personal property tax or similar tax, assessment or other governmental charge; |

| 6. | to any tax, assessment or other governmental charge that would not have been imposed but for the presentation by the holder of any Security, where presentation is required, for payment on a date more than 30 days after the date on which payment became due and payable or the date on which payment thereof is duly provided for, whichever occurs later; |

| 7. | to any tax, assessment or other governmental charge required to be withheld or deducted that is imposed on a payment pursuant to Sections 1471 through 1474 of the Code (or any amended or successor version of such Sections that is substantively comparable and not materially more onerous to comply with), any U.S. Treasury regulations promulgated thereunder, or any other official interpretations thereof (collectively, “FATCA”), any agreement (including any intergovernmental agreement) entered into in connection therewith, or any law, regulation or other official guidance enacted in any jurisdiction implementing FATCA or an intergovernmental agreement in respect of FATCA; |

| 8. | to any tax, assessment or other governmental charge that is imposed or withheld solely by reason of a change in law, regulation, or administrative or judicial interpretation that becomes effective more than 15 days after the payment becomes due or is duly provided for, whichever occurs later; |

| 9. | to any tax, assessment or other governmental charge imposed by reason of the failure of the beneficial owner to fulfill the statement requirements of Section 871(h) or Section 881(c) of the Code; |

| 10. | to any tax imposed pursuant to Section 871(h)(6) or 881(c)(6) of the Code (or any amended or successor provisions); or |

| 11. | to any tax imposed as a result of any combination of items (1) through (10). |

Except as specifically provided above, the Company will not be required to pay additional amounts in respect of any tax, assessment or other governmental charge. References in this Security to any payment on the Securities include the related payment of additional amounts, as applicable.

The term “United States” means the United States of America, any state thereof, and the District of Columbia, and the term “United States person” means (i) any individual who is a citizen or resident of the United States for U.S. federal income tax purposes, (ii) a corporation, partnership or other entity created or organized in or under the laws of the United States, any state thereof or the District of Columbia (other than a partnership that is not treated as a United States person for U.S. federal income tax purposes), (iii) any estate the income of which is subject to U.S. federal income taxation regardless of its source, or (iv) any trust if a U.S. court can exercise primary supervision over the administration of the trust and one or more United States persons can control all substantial trust decisions, or if a valid election is in place to treat the trust as a United States person.

If, as a result of any change in, or amendment to, the laws of the United States or the official interpretation thereof that is announced or becomes effective on or after April 29, 2025, the Company becomes or, based upon a written opinion of independent counsel selected by the Company, will become obligated to pay additional amounts as described above with respect to the Securities of this series, then the Company may at any time at its option redeem, in whole, but not in part, the Securities of this series on not less than 10 nor more than 60 days’ prior notice, at a Redemption Price equal to 100% of their principal amount, plus accrued and unpaid interest, if any, on the Securities to be redeemed to, but not including, the Redemption Date.

Solely with respect to Securities of this series, Section 12.02 of the Indenture is amended and restated as follows:

“This Indenture, with respect to the Securities of this series, shall, upon Company Order, cease to be of further effect (except as to any surviving rights of registration of transfer or exchange of the Securities expressly provided for in the Indenture and rights to receive payments of principal of, premium, if any, and interest on, such Securities) and the Trustee, at the expense of the Company, shall execute proper instruments acknowledging satisfaction and discharge of the Indenture, when,

(a) either:

(i) all Securities of this series theretofore authenticated and delivered (other than (A) Securities that have been destroyed, lost or stolen and that have been replaced or paid as provided in Section 3.07 of the Indenture and (B) Securities for whose payment money has theretofore been deposited in trust or segregated and held in trust by the Company and thereafter repaid to the Company or discharged from such trust, as provided in Section 6.03 of the Indenture) have been delivered to the Trustee for cancellation; or

(ii) all Securities of this series not theretofore delivered to the Trustee for cancellation,

(A) have become due and payable, or

(B) shall become due and payable at their Stated Maturity within one year, or

(C) are to be called for redemption within one year under arrangements satisfactory to the Trustee for the giving of notice by the Trustee in the name, and at the expense, of the Company,

and in the case of (A), (B) or (C) above, the Company has deposited or caused to be deposited with the Trustee or Paying Agent as trust funds in trust (i) funds in trust for the purpose an amount in the Currency in which the Securities are denominated, (ii) Foreign Government Securities that through the payment of interest and principal in respect thereof in accordance with their terms shall provide, not later than one day before the due date of any payment, money in an amount, or (iii) a combination of (i) and (ii), sufficient to pay and discharge the entire Indebtedness on such Securities for principal and premium, if any, and interest to the date of such deposit (in the case of Securities that have become due and payable) or to the Stated Maturity or Redemption Date, as the case may be; provided, however, in the event a petition for relief under the Bankruptcy Code or any applicable state bankruptcy, insolvency or other similar law, is filed with respect to the Company within 91 days after the deposit and the Trustee is required to return the moneys then on deposit with the Trustee to the Company, the obligations of the Company under this Indenture with respect to such Securities shall not be deemed terminated or discharged;

(b) the Company has paid or caused to be paid all other sums payable hereunder by the Company; and

(c) the Company has delivered to the Trustee an Officer’s Certificate and an Opinion of Counsel each stating that all conditions precedent herein provided for relating to the satisfaction and discharge of this Indenture with respect to such series have been complied with. Notwithstanding the satisfaction and discharge of this Indenture, the obligations of the Company to the Trustee under Section 11.01 of the Indenture and, if money shall have been deposited with the Trustee pursuant to subclause (B) of clause (a)(i) above, the obligations of the Trustee under Section 12.07 and Section 6.03(e) of the Indenture shall survive such satisfaction and discharge.

For purposes of the provisions relating to satisfaction and discharge above, “Foreign Government Securities” means securities that are (i) direct obligations of the government that issued or caused to be issued such currency for the payment of which obligations its full faith and credit is pledged or (ii) obligations of a Person controlled or supervised by and acting as an agency or instrumentality of such government the timely payment of which is unconditionally guaranteed as a full faith and credit obligation by such government, which, in either case under clause (i) or (ii), are not callable or redeemable at the option of the issuer thereof.”

Upon due presentment for registration of transfer of this Security at the office or agency of the Company maintained for such purpose, which shall initially be the Corporate Trust Office of the Trustee, a new Security or Securities of authorized denominations for an equal aggregate principal amount shall be issued to the transferee in exchange therefor, subject to the limitations provided in the Indenture, without charge except for any tax or other governmental charge imposed in connection therewith.

The Company, the Trustee and any agent of the Company or the Trustee may deem and treat the registered Holder hereof as the absolute owner of this Security (whether or not this Security shall be overdue and notwithstanding any notation of ownership or other writing hereon), for the purpose of receiving payment of, or on account of, the principal hereof and, subject to the provisions hereof, interest hereon, and for all other purposes, and neither the Company nor the Trustee nor any agent of the Company or the Trustee shall be affected by any notice to the contrary.

No recourse under or upon any obligation, covenant or agreement contained in the Indenture or any indenture supplemental thereto or in any Security, or because of any indebtedness evidenced thereby, shall be had against any incorporator as such, or against any past, present or future stockholder, officer, director or employee, as such, of the Company or of any successor, either directly or through the Company or any successor, under any rule of law, statute or constitutional provision or by the enforcement of any assessment or by any legal or equitable proceeding or otherwise, all such liability being expressly waived and released by the acceptance hereof and as part of the consideration for the issue hereof.

Terms used herein that are defined in the Indenture and not otherwise defined herein shall have the respective meanings assigned thereto in the Indenture.

The laws of the State of New York (without regard to conflicts of laws principles thereof) shall govern this Security.

ASSIGNMENT

FOR VALUE RECEIVED, the undersigned hereby sell(s), assign(s) and transfer(s) unto

[PLEASE INSERT SOCIAL SECURITY OR OTHER IDENTIFYING NUMBER OF ASSIGNEE]

[PLEASE PRINT OR TYPE NAME AND ADDRESS, INCLUDING ZIP CODE, OF ASSIGNEE]

the within Security and all rights thereunder, hereby irrevocably constituting and appointing ____________________________________________________________ Attorney to transfer such Security on the books of the Issuer, with full power of substitution in the premises.

| Signature: | ||||||

| Dated: |

|

|||||

| NOTICE: The signature to this assignment must correspond with the name as written upon the face of the within Security in every particular without alteration or enlargement or any change whatsoever. | ||||||

SIGNATURE GUARANTEE

[Signatures must be guaranteed by an “eligible guarantor institution” meeting the requirements of the Registrar, which requirements include membership or participation in the Security Transfer Agent Medallion Program (“STAMP”) or such other “signature guarantee program” as may be determined by the Registrar in addition to, or in substitution for, STAMP, all in accordance with the Securities Exchange Act of 1934, as amended.]

SCHEDULE OF INCREASES OR DECREASES IN NOTE

The initial principal amount of this Note is €1,000,000,000. The following increases or decreases in a part of this Note have been made:

| Date |

Amount of decrease in principal amount of this Note |

Amount of increase in principal amount of this Note |

Principal amount of this Note following such decrease |

Signature of authorized signatory of Trustee |

Exhibit 4.3

GLOBAL SECURITY

THIS NOTE IS A GLOBAL SECURITY WITHIN THE MEANING OF THE INDENTURE HEREINAFTER REFERRED TO AND IS REGISTERED IN THE NAME OF THE DEPOSITARY OR A NOMINEE OF THE DEPOSITARY, WHICH MAY BE TREATED BY THE COMPANY, THE TRUSTEE AND ANY AGENT THEREOF AS OWNER AND HOLDER OF THIS NOTE FOR ALL PURPOSES. UNLESS AND UNTIL IT IS EXCHANGED IN WHOLE OR IN PART FOR THE INDIVIDUAL SECURITIES REPRESENTED HEREBY, THIS GLOBAL SECURITY MAY NOT BE TRANSFERRED EXCEPT AS A WHOLE BY THE DEPOSITARY TO A NOMINEE OF THE DEPOSITARY OR BY A NOMINEE OF THE DEPOSITARY TO THE DEPOSITARY OR ANOTHER NOMINEE OF THE DEPOSITARY OR BY THE DEPOSITARY OR ANY SUCH NOMINEE TO A SUCCESSOR DEPOSITARY OR A NOMINEE OF SUCH SUCCESSOR DEPOSITARY.

UNLESS THIS CERTIFICATE IS PRESENTED BY AN AUTHORIZED REPRESENTATIVE OF EUROCLEAR BANK, S.A./N.V. OR CLEARSTREAM BANKING, SOCIÉTÉ ANONYME (EACH, A “DEPOSITARY”) TO THE COMPANY OR ITS AGENT FOR REGISTRATION OF TRANSFER, EXCHANGE, OR PAYMENT, AND ANY CERTIFICATE ISSUED IS REGISTERED IN THE NAME OF THE BANK OF NEW YORK DEPOSITARY (NOMINEES) LIMITED, AS NOMINEE OF THE BANK OF NEW YORK MELLON, LONDON BRANCH, OR IN SUCH OTHER NAME AS IS REQUESTED BY AN AUTHORIZED REPRESENTATIVE OF THE DEPOSITARY (AND ANY PAYMENT IS MADE TO THE BANK OF NEW YORK DEPOSITARY (NOMINEES) LIMITED OR TO SUCH OTHER ENTITY AS IS REQUESTED BY AN AUTHORIZED REPRESENTATIVE OF THE DEPOSITARY), ANY TRANSFER, PLEDGE, OR OTHER USE HEREOF FOR VALUE OR OTHERWISE BY OR ANY PERSON IS WRONGFUL INASMUCH AS THE REGISTERED OWNER HEREOF, THE BANK OF NEW YORK DEPOSITARY (NOMINEES) LIMITED, HAS AN INTEREST HEREIN.

ALPHABET INC.

2.875% Notes Due 2031

PRINCIPAL AMOUNT: €1,000,000,000

CUSIP: 02079K BC0

ISIN NUMBER: XS3224609290

COMMON CODE: 322460929

No.: B-1

ALPHABET INC., a Delaware corporation (the “Company”, which term includes any successor thereto under the Indenture referred to on the reverse hereof), for value received, hereby promises to pay to The Bank of New York Depositary (Nominees) Limited, as nominee of The Bank of New York Mellon, London Branch, as common depositary for Clearstream

Banking, S.A. (“Clearstream”) and Euroclear Bank S.A./N.V. (“Euroclear”), or their registered assigns, at the office or agency of the Paying Agent maintained for such purpose, which shall initially be the corporate trust office of the Paying Agent, the principal sum of ONE BILLION EUROS (€1,000,000,000) (or such other principal amount as shall be set forth in the Schedule of Increases or Decreases in Note attached hereto) on November 6, 2031, and to pay interest thereon from November 6, 2025 or from the next preceding Interest Payment Date in respect of which interest has been paid or duly provided for, annually in arrears on November 6 of each year, beginning on November 6, 2026 on said principal sum, at the rate of 2.875% per annum, on the basis of the actual number of days in the period for which interest is being calculated and the actual number of days from and including the last date on which interest was paid (or November 6, 2025 if no interest has been paid), to, but not including, the next scheduled Interest Payment Date, until the principal hereof is paid or duly provided for or made available for payment and (to the extent that the payment of such interest shall be legally enforceable) at such rate on any overdue principal and premium and on any overdue installment of interest.

The interest so payable, and punctually paid or duly provided for, on any Interest Payment Date will, as provided in the Indenture, be paid to the Person in whose name this Security (or one or more Predecessor Securities) is registered at the close of business on the Record Date for such interest, which shall be the close of business on the date that is the Clearing System Business Day immediately preceding each Interest Payment Date. A Clearing System Business Day is every Monday to Friday inclusive, except December 25th and January 1st. Any such interest not so punctually paid or duly provided for will forthwith cease to be payable to the Holder on such Record Date and may either be paid to the person in whose name this Security (or one or more Predecessor Securities) is registered at the close of business on a Special Record Date for the payment of such Defaulted Interest to be fixed by the Trustee, notice whereof shall be given to Holders of Securities of this series not less than 10 days prior to such Special Record Date, or be paid at any time in any other lawful manner not inconsistent with the requirements of any securities exchange on which the Securities of this series may be listed, and upon such notice as may be required by such exchange, all as, more fully provided in said Indenture.

As used in this Security, the term “Business Day” means any day, other than a Saturday or Sunday, (1) which is not a day on which banking institutions in the City of New York or the City of London are authorized or required by law or executive order to close and (2) on which the Trans-European Automated Real-time Gross Settlement Express Transfer system (the TARGET2 system), or any successor thereto, operates.

Initially, The Bank of New York Mellon, London Branch, will act as Paying Agent. The Company may change the Paying Agent without notice to any Holder. Payment of the principal, premium, if any, and interest on the Securities of this series will be made at the office or agency maintained for that purpose in London (initially the corporate trust office of the Paying Agent); provided that payment of interest may be made at the option of the Company by check mailed to the address of the person entitled thereto as such address shall appear on the Register or by wire transfer as provided in the Indenture.

The term “euros,” “the euro” or “€” means the currency of the member states of the European Monetary Union that have adopted or that adopt the single currency in accordance with the treaty establishing the European Community, as amended by the Treaty on European Union.

All payments on the Securities of this series will be payable in euros; provided that if on or after November 3, 2025, the euro is unavailable to the Company due to the imposition of exchange controls or other circumstances beyond its control or if the euro is no longer being used by the then member states of the European Monetary Union that have adopted the euro as their currency or for the settlement of transactions by public institutions of or within the international banking community, then all payments in respect of the Securities of this series will be made in U.S. dollars until the euro is again available to the Company or so used. The amount payable on any date in euros will be converted into U.S. dollars at the rate mandated by the U.S. Federal Reserve Board as of the close of business on the second Business Day prior to the relevant payment date or, in the event the U.S. Federal Reserve Board has not mandated a rate of conversion, on the basis of the most recent U.S. Dollar/euro exchange rate published in The Wall Street Journal on or prior to the second Business Day prior to the relevant payment date. Any payment in respect of the Securities of this series so made in U.S. dollars will not constitute an event of default under the Securities of this series or the Indenture. Neither the Trustee nor the Paying Agent will have any responsibility for any calculation or conversion in connection with the foregoing.

Reference is made to the further provisions of this Security set forth on the reverse hereof. Such further provisions shall for all purposes have the same effect as though fully set forth at this place.

This Security shall not be valid or become obligatory for any purpose until the certificate of authentication hereon shall have been manually signed by the Trustee under the Indenture referred to on the reverse hereof.

IN WITNESS WHEREOF, ALPHABET INC. has caused this instrument to be duly executed.

| ALPHABET INC. |

||

| By: | ||

| Name: Juan Rajlin Title: Treasurer |

||

CERTIFICATE OF AUTHENTICATION

This is one of the Securities of the series designated therein referred to in the within-mentioned Indenture.

Date of authentication:

| THE BANK OF NEW YORK MELLON TRUST COMPANY, N.A. as Trustee |

||

| By: | ||

| Authorized Signatory |

||

REVERSE OF SECURITY

ALPHABET INC.

2.875% Notes Due 2031

This Security is one of a duly authorized issue of securities of the Company (hereinafter called the “Securities”) of the series hereinafter specified, all issued or to be issued under and pursuant to an Indenture, dated as of February 12, 2016 (the “Indenture”), duly executed and delivered by the Company to The Bank of New York Mellon Trust Company, N.A., as Trustee (the “Trustee,” which term includes any successor trustee), to which the Indenture and all indentures supplemental thereto reference is hereby made for a description of the rights, limitations of rights, obligations, duties and immunities thereunder of the Trustee, the Company and the Holders of the Securities. The Securities may be issued in one or more series, which different series may be issued in various aggregate principal amounts, may mature at different times, may bear interest (if any) at different rates, may be subject to different redemption provisions (if any), may be subject to different sinking, purchase or analogous funds (if any) and may otherwise vary as in the Indenture provided. This Security is one of a series designated as the 2.875% Notes due 2031 of the Company, limited in aggregate principal amount to €1,000,000,000; provided, however, that the Company, without notice to or consent of the Holders, may issue additional Securities of this series and thereby increase such principal amount in the future, on the same terms and conditions (except for the issue date, public offering price and, if applicable, the date from which interest accrues and the first Interest Payment Date). Any additional Securities shall be issued under one or more separate CUSIP, ISIN or other identifying number unless such additional Securities are issued pursuant to a “qualified reopening,” are otherwise treated as part of the same “issue” of debt instruments as the original series or are issued with less than a de minimis amount of original issue discount, in each case for U.S. federal income tax purposes.

Interest on the Securities of this series will be computed on the basis of the actual number of days in the period for which interest is being calculated and the actual number of days from and including the last date on which interest was paid on the Securities of this series (or November 6, 2025 if no interest has been paid on the Securities of this series), to, but not including, the next scheduled Interest Payment Date. This payment convention is referred to as ACTUAL/ACTUAL (ICMA) as defined in the rulebook of the International Capital Markets Association. The Company shall pay interest on overdue principal, premium, if any, and, to the extent lawful, on overdue installments of interest at the rate per annum borne by this Security. If any Interest Payment Date, the Stated Maturity or any Redemption Date falls on a day that is not a Business Day, the related payment of principal, premium, if any, or interest will be made on the next succeeding Business Day as if it were made on the date such payment was due, and no interest will accrue on the amounts so payable for the period from and after such date to the next succeeding Business Day.

In case an Event of Default (as defined in the Indenture) with respect to the 2.875% Notes due 2031 shall have occurred and be continuing, the principal hereof and the interest accrued hereon, if any, may be declared, and upon such declaration shall become, due and payable, in the manner, with the effect and subject to the conditions provided in the Indenture.

The Indenture contains provisions that provide that the Company and the Trustee may enter into an indenture or indentures supplemental hereto for the purpose of amending any provisions of the Indenture or of modifying in any manner the rights of the Holders of the Securities of such series to be affected with the written consent of the Holders of a majority in principal amount of the Outstanding Securities of such series affected by such amendment voting separately; provided that, without the consent of each Holder of the Securities of each series affected thereby, an amendment may not: (i) extend the Stated Maturity of the principal of, or any installment of interest on, such Holder’s Security, or reduce the principal amount thereof or the interest thereon or any premium payable upon redemption thereof, or change the Currency in which the principal of and premium, if any, or interest on such Security is denominated or payable, or reduce the amount of the principal of an Original Issue Discount Security that would be due and payable upon a declaration of acceleration of the Maturity thereof, or impair the right to institute suit for the enforcement of any payment on or after the Stated Maturity thereof (or, in the case of redemption, on or after the Redemption Date), or materially adversely affect the economic terms of the Holder’s right to convert or exchange any Security as may be provided in the Indenture; (ii) reduce the percentage in principal amount of the Outstanding Securities of any series, the consent of whose Holders is required for any supplemental indenture, or the consent of whose Holders is required for any waiver of compliance with certain provisions of the Indenture or certain Defaults hereunder and their consequences provided for in the Indenture; (iii) modify any of the provisions of the Indenture governing amendments or waivers with the consent of Holders except to increase any such percentage or to provide that certain other provisions of the Indenture cannot be modified or waived without the consent of the Holder of each Outstanding Security affected thereby; or (iv) modify, without the written consent of the Trustee, the rights, duties or immunities of the Trustee.

It is also provided in the Indenture that, subject to certain conditions and exceptions, the Holders of a majority in aggregate principal amount of a series of Securities at the time Outstanding may on behalf of the Holders of all of the Securities of such series waive any past Default or Event of Default hereunder and its consequences except a Default in the payment of interest or any premium on or the principal of the Securities of such series or a Default in respect of a covenant or provision of the Indenture that cannot be modified or amended without the consent of the Holder of each Outstanding Security of such series. Upon any such waiver, the Company, the Trustee and the Holders of the Securities of such series shall be restored to their former positions and rights under the Indenture, respectively; provided that no such waiver shall extend to any subsequent or other Default or Event of Default or impair any right consequent thereon.

No reference herein to the Indenture and no provision of this Security or of the Indenture shall alter or impair the obligation of the Company, which is absolute and unconditional, to pay the principal of and interest on this Security in the manner, at the place, at the respective times, at the rate and in the coin or currency herein prescribed.

The Securities of this series will be issued in fully registered form without coupons in minimum denominations of €100,000 and multiples of €1,000 in excess thereof and are transferable and exchangeable at the office or agency of the Company maintained for such purpose, which shall initially be the Corporate Trust Office of the Trustee, and in the manner and subject to the limitations provided in the Indenture.

The Securities of this series are redeemable prior to November 6, 2031 at the Company’s option in whole or in part at any time or from time to time. Prior to September 6, 2031, the Company may redeem the Securities of this series by paying a Redemption Price equal to the greater of (i) 100% of the principal amount of the Securities to be redeemed and (ii) the sum of the present values of the remaining scheduled payments of principal and interest on the Securities to be redeemed (exclusive of interest accrued to the Redemption Date), discounted to the Redemption Date on an annual basis (ACTUAL/ACTUAL (ICMA)), at the applicable Comparable Government Bond Rate described below plus 10 basis points plus, in either case, accrued and unpaid interest, if any, to, but not including, the Redemption Date. On or after September 6, 2031, the Company may redeem the Securities of this series by paying a Redemption Price equal to 100% of the principal amount of the Securities to be redeemed plus accrued and unpaid interest, if any, to, but not including, the Redemption Date.

For the purposes of determining the Redemption Price, “Comparable Government Bond Rate” means, with respect to any Redemption Date, the rate per annum equal to the yield to maturity, expressed as a percentage (rounded to three decimal places, with 0.0005 being rounded upwards), on the third Business Day prior to the date fixed for redemption, calculated in accordance with customary financial practice in pricing new issues of comparable corporate debt securities paying interest on an annual basis (ACTUAL/ACTUAL (ICMA)) of the Comparable Government Bond (as defined below), assuming a price for the Comparable Government Bond (expressed as a percentage of its principal amount) equal to the Comparable Government Bond Price for such Redemption Date. “Comparable Government Bond” means, in relation to any Comparable Government Bond Rate calculation, the German government bond (Bundesanleihe) selected by an Independent Investment Banker as having an actual or interpolated maturity comparable to the remaining term of the Securities to be redeemed that would be utilized, at the time of selection and in accordance with customary financial practice, in pricing new issues of euro-denominated corporate debt securities of a comparable maturity to the remaining term of such Securities. “Independent Investment Banker” means one of the Reference Government Bond Dealers selected by the Company. “Comparable Government Bond Price” means, with respect to any Redemption Date, (1) the arithmetic average of the Reference Government Bond Dealer Quotations for such Redemption Date, after excluding the highest and lowest such Reference Government Bond Dealer Quotations, or (2) if the Company obtains fewer than four such Reference Government Bond Dealer Quotations, the arithmetic average of all such quotations. “Reference Government Bond Dealer Quotations” means, with respect to each Reference Government Bond Dealer and any Redemption Date, the arithmetic average, as determined by the Company, of the bid and asked prices for the Comparable Government Bond (expressed in each case as a percentage of its principal amount) quoted in writing to the Company by such Reference Government Bond Dealer at 11:00 a.m., Central European Time (CET), on the third Business Day preceding such Redemption Date. “Reference Government Bond Dealer” means (i) each of Goldman Sachs & Co. LLC, HSBC Bank plc, J.P. Morgan Securities plc, BNP PARIBAS, Crédit Agricole Corporate and Investment Bank and Deutsche Bank AG, London Branch, or any of their affiliates that are primary European government securities dealers, and their respective successors; provided that if any of the foregoing or any of their affiliates shall cease to be a primary European government securities dealer (“Primary Dealer”), the Company shall substitute therefor another Primary Dealer and (ii) two other Primary Dealers selected by the Company.

Notice of redemption will be mailed or electronically delivered (or otherwise transmitted in accordance with Clearstream or Euroclear procedures, as applicable) at least 10 but not more than 60 days before the Redemption Date to each holder of record of the Securities of this series. Notice of any redemption of the Securities of this series in connection with a transaction or an event may, at the Company’s discretion, be given prior to the completion or the occurrence thereof. Any redemption or notice may, at the Company’s discretion, be subject to one or more conditions precedent, including, but not limited to, completion or occurrence of a related transaction or event. At the Company’s discretion, the Redemption Date may be delayed until such time as any or all such conditions shall be satisfied, or such redemption may not occur and such notice may be rescinded in the event that any or all such conditions shall not have been satisfied by the Redemption Date, or by the Redemption Date as so delayed. The Company will provide written notice to the Trustee prior to the close of business two Business Days prior to the Redemption Date if any such redemption has been rescinded or delayed, and upon receipt the Trustee will provide such notice to each holder of the Securities to be redeemed in the same manner in which the notice of redemption was given.

No Securities of this series of a principal amount of €1,000 or less will be redeemed in part. If this Security is to be redeemed in part only, the notice of redemption that relates to this Security will state the portion of the principal amount of this Security to be redeemed. A new security in a principal amount equal to the unredeemed portion of this Security will be issued in the name of the holder of the Security upon surrender for cancellation of the original Security. For so long as the Securities of this series are held by Clearstream or Euroclear, as applicable, the redemption and the selection of Securities to be redeemed shall be in accordance with the policies and procedures of the applicable clearing system.

Unless the Company defaults in payment of the Redemption Price, on and after the Redemption Date, interest will cease to accrue on the Securities of this series or portions thereof called for redemption.

Subject to the exceptions and limitations set forth below, the Company will pay as additional interest on the Securities of this series such additional amounts as are necessary in order that the net payment by the Company or a paying agent of the principal, premium, if any, and interest with respect to the Securities of this series to the beneficial owner that is not a United States person (as defined below), after withholding or deduction for any present or future tax, assessment or other governmental charge imposed by the United States or a taxing authority in the United States, will not be less than the amount provided in this Security to be then due and payable; provided, however, that the foregoing obligation to pay additional amounts will not apply:

| 1. | to any tax, assessment or other governmental charge that would not have been imposed but for the holder, a fiduciary, settlor, beneficiary, member or shareholder of the holder, or a person holding a power over an estate or trust administered by a fiduciary holder, being treated as: |

| a. | being or having been present in, or engaged in a trade or business in, the United States, being treated as having been present in, or engaged in a trade or business in, the United States, or having or having had a permanent establishment in the United States; |

| b. | having a current or former connection with the United States (other than a connection arising solely as a result of the ownership of the Securities, the receipt of any payment in respect of the Securities or the enforcement of any rights under the Indenture), including being or having been a citizen or resident of the United States or treated as being or having been a resident thereof; |

| c. | being or having been a personal holding company, a passive foreign investment company or a controlled foreign corporation for U.S. federal income tax purposes, a foreign tax exempt organization, or a corporation that has accumulated earnings to avoid United States federal income tax; |

| d. | being or having been a “10-percent shareholder”, as defined in section 871(h)(3) of the United States Internal Revenue Code of 1986, as amended (the “Code”) or any successor provision, of us; or |

| e. | being a bank receiving payments on an extension of credit made pursuant to a loan agreement entered into in the ordinary course of its trade or business, within the meaning of section 881(c)(3) of the Code or any successor provision; |

| 2. | to any holder that is not the sole beneficial owner of the Securities, or a portion of the Securities, or that is a fiduciary, partnership or limited liability company, but only to the extent that a beneficiary or settlor with respect to the fiduciary, a beneficial owner or member of the partnership or limited liability company would not have been entitled to the payment of an additional amount had the beneficiary, settlor, beneficial owner or member received directly its beneficial or distributive share of the payment; |

| 3. | to any tax, assessment or other governmental charge that would not have been imposed but for the failure of the holder or any other person to comply with certification, identification or information reporting requirements concerning the nationality, residence, identity or connection with the United States of the holder or beneficial owner of the Securities, if compliance is required by statute, by regulation of the United States or any taxing authority therein or by an applicable income tax treaty to which the United States is a party as a precondition to exemption from such tax, assessment or other governmental charge; |

| 4. | to any tax, assessment or other governmental charge that is imposed otherwise than by withholding by the Company or a paying agent from the payment; |

| 5. | to any estate, inheritance, gift, sales, excise, transfer, wealth, capital gains or personal property tax or similar tax, assessment or other governmental charge; |

| 6. | to any tax, assessment or other governmental charge that would not have been imposed but for the presentation by the holder of any Security, where presentation is required, for payment on a date more than 30 days after the date on which payment became due and payable or the date on which payment thereof is duly provided for, whichever occurs later; |

| 7. | to any tax, assessment or other governmental charge required to be withheld or deducted that is imposed on a payment pursuant to Sections 1471 through 1474 of the Code (or any amended or successor version of such Sections that is substantively comparable and not materially more onerous to comply with), any U.S. Treasury regulations promulgated thereunder, or any other official interpretations thereof (collectively, “FATCA”), any agreement (including any intergovernmental agreement) entered into in connection therewith, or any law, regulation or other official guidance enacted in any jurisdiction implementing FATCA or an intergovernmental agreement in respect of FATCA; |

| 8. | to any tax, assessment or other governmental charge that is imposed or withheld solely by reason of a change in law, regulation, or administrative or judicial interpretation that becomes effective more than 15 days after the payment becomes due or is duly provided for, whichever occurs later; |

| 9. | to any tax, assessment or other governmental charge imposed by reason of the failure of the beneficial owner to fulfill the statement requirements of Section 871(h) or Section 881(c) of the Code; |

| 10. | to any tax imposed pursuant to Section 871(h)(6) or 881(c)(6) of the Code (or any amended or successor provisions); or |

| 11. | to any tax imposed as a result of any combination of items (1) through (10). |

Except as specifically provided above, the Company will not be required to pay additional amounts in respect of any tax, assessment or other governmental charge. References in this Security to any payment on the Securities include the related payment of additional amounts, as applicable.

The term “United States” means the United States of America, any state thereof, and the District of Columbia, and the term “United States person” means (i) any individual who is a citizen or resident of the United States for U.S. federal income tax purposes, (ii) a corporation, partnership or other entity created or organized in or under the laws of the United States, any state thereof or the District of Columbia (other than a partnership that is not treated as a United States person for U.S. federal income tax purposes), (iii) any estate the income of which is subject to U.S. federal income taxation regardless of its source, or (iv) any trust if a U.S. court can exercise primary supervision over the administration of the trust and one or more United States persons can control all substantial trust decisions, or if a valid election is in place to treat the trust as a United States person.

If, as a result of any change in, or amendment to, the laws of the United States or the official interpretation thereof that is announced or becomes effective on or after April 29, 2025, the Company becomes or, based upon a written opinion of independent counsel selected by the Company, will become obligated to pay additional amounts as described above with respect to the Securities of this series, then the Company may at any time at its option redeem, in whole, but not in part, the Securities of this series on not less than 10 nor more than 60 days’ prior notice, at a Redemption Price equal to 100% of their principal amount, plus accrued and unpaid interest, if any, on the Securities to be redeemed to, but not including, the Redemption Date.

Solely with respect to Securities of this series, Section 12.02 of the Indenture is amended and restated as follows:

“This Indenture, with respect to the Securities of this series, shall, upon Company Order, cease to be of further effect (except as to any surviving rights of registration of transfer or exchange of the Securities expressly provided for in the Indenture and rights to receive payments of principal of, premium, if any, and interest on, such Securities) and the Trustee, at the expense of the Company, shall execute proper instruments acknowledging satisfaction and discharge of the Indenture, when,

(a) either:

(i) all Securities of this series theretofore authenticated and delivered (other than (A) Securities that have been destroyed, lost or stolen and that have been replaced or paid as provided in Section 3.07 of the Indenture and (B) Securities for whose payment money has theretofore been deposited in trust or segregated and held in trust by the Company and thereafter repaid to the Company or discharged from such trust, as provided in Section 6.03 of the Indenture) have been delivered to the Trustee for cancellation; or

(ii) all Securities of this series not theretofore delivered to the Trustee for cancellation,

(A) have become due and payable, or

(B) shall become due and payable at their Stated Maturity within one year, or

(C) are to be called for redemption within one year under arrangements satisfactory to the Trustee for the giving of notice by the Trustee in the name, and at the expense, of the Company,

and in the case of (A), (B) or (C) above, the Company has deposited or caused to be deposited with the Trustee or Paying Agent as trust funds in trust (i) funds in trust for the purpose an amount in the Currency in which the Securities are denominated, (ii) Foreign Government Securities that through the payment of interest and principal in respect thereof in accordance with their terms shall provide, not later than one day before the due date of any payment, money in an amount, or (iii) a combination of (i) and (ii), sufficient to pay and discharge the entire Indebtedness on such Securities for principal and premium, if any, and interest to the date of such deposit (in the case of Securities that have become due and payable) or to the Stated Maturity or Redemption Date, as the case may be; provided, however, in the event a petition for relief under the Bankruptcy Code or any applicable state bankruptcy, insolvency or other similar law, is filed with respect to the Company within 91 days after the deposit and the Trustee is required to return the moneys then on deposit with the Trustee to the Company, the obligations of the Company under this Indenture with respect to such Securities shall not be deemed terminated or discharged;

(b) the Company has paid or caused to be paid all other sums payable hereunder by the Company; and

(c) the Company has delivered to the Trustee an Officer’s Certificate and an Opinion of Counsel each stating that all conditions precedent herein provided for relating to the satisfaction and discharge of this Indenture with respect to such series have been complied with. Notwithstanding the satisfaction and discharge of this Indenture, the obligations of the Company to the Trustee under Section 11.01 of the Indenture and, if money shall have been deposited with the Trustee pursuant to subclause (B) of clause (a)(i) above, the obligations of the Trustee under Section 12.07 and Section 6.03(e) of the Indenture shall survive such satisfaction and discharge.

For purposes of the provisions relating to satisfaction and discharge above, “Foreign Government Securities” means securities that are (i) direct obligations of the government that issued or caused to be issued such currency for the payment of which obligations its full faith and credit is pledged or (ii) obligations of a Person controlled or supervised by and acting as an agency or instrumentality of such government the timely payment of which is unconditionally guaranteed as a full faith and credit obligation by such government, which, in either case under clause (i) or (ii), are not callable or redeemable at the option of the issuer thereof.”

Upon due presentment for registration of transfer of this Security at the office or agency of the Company maintained for such purpose, which shall initially be the Corporate Trust Office of the Trustee, a new Security or Securities of authorized denominations for an equal aggregate principal amount shall be issued to the transferee in exchange therefor, subject to the limitations provided in the Indenture, without charge except for any tax or other governmental charge imposed in connection therewith.

The Company, the Trustee and any agent of the Company or the Trustee may deem and treat the registered Holder hereof as the absolute owner of this Security (whether or not this Security shall be overdue and notwithstanding any notation of ownership or other writing hereon), for the purpose of receiving payment of, or on account of, the principal hereof and, subject to the provisions hereof, interest hereon, and for all other purposes, and neither the Company nor the Trustee nor any agent of the Company or the Trustee shall be affected by any notice to the contrary.

No recourse under or upon any obligation, covenant or agreement contained in the Indenture or any indenture supplemental thereto or in any Security, or because of any indebtedness evidenced thereby, shall be had against any incorporator as such, or against any past, present or future stockholder, officer, director or employee, as such, of the Company or of any successor, either directly or through the Company or any successor, under any rule of law, statute or constitutional provision or by the enforcement of any assessment or by any legal or equitable proceeding or otherwise, all such liability being expressly waived and released by the acceptance hereof and as part of the consideration for the issue hereof.