Q3’25Earnings November 6, 2025

Disclaimer Forward-Looking Statements Certain statements in this presentation may be considered forward-looking statements within the meaning of the federal securities laws, including statements regarding the expected future performance of Advantage's business and projected financial results. Forward-looking statements generally relate to future events or Advantage’s future financial or operating performance. These forward-looking statements generally are identified by the words “may”, “should”, “expect”, “intend”, “will”, “would”, “could”, “estimate”, “anticipate”, “believe”, “predict”, “confident”, “potential”, “guidance”, or “continue”, or the negatives of these terms or variations of them or similar terminology. Such forward-looking statements are predictions, projections, and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward looking statements. These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by Advantage and its management at the time of such statements, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include, but are not limited to, market-driven wage changes or changes to labor laws or wage or job classification regulations, including minimum wage; a future pandemic or health epidemic; the impact from tariffs; Advantage’s ability to continue to generate significant operating cash flow; client procurement strategies and consolidation of Advantage’s clients’ industries creating pressure on the nature and pricing of its services; consumer goods manufacturers and retailers reviewing and changing their sales, retail, marketing, and technology programs and relationships; Advantage’s ability to successfully develop and maintain relevant omni-channel services for our clients in an evolving industry and to otherwise adapt to significant technological change; Advantage’s ability to maintain proper and effective internal control over financial reporting in the future; potential and actual harms to Advantage’s business arising from the Take 5 Matter; Advantage’s substantial indebtedness and our ability to refinance at favorable rates; and other risks and uncertainties set forth in the section titled “Risk Factors” in the Annual Report on Form 10-K filed by the company with the Securities and Exchange Commission (the “SEC”) on March 7, 2025, and in its other filings made from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Advantage assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. Non-GAAP Financial Measures and Related Information This presentation includes certain financial measures not presented in accordance with generally accepted accounting principles (“GAAP”), Adjusted EBITDA from Continuing Operations, Adjusted EBITDA by Segment, Adjusted EBITDA margin, Revenues net of reimbursable expenses, Net Debt, Adjusted Unlevered Free Cash Flow, and Adjusted Unlevered Free Cash Flow and net debt as a percentage of LTM Adjusted EBITDA from Continuing and Discontinued Operations. These are not measures of financial performance calculated in accordance with GAAP and may exclude items that are significant in understanding and assessing Advantage’s financial results. Therefore, the measures are in addition to, and not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP, and should not be considered in isolation or as an alternative to net income, cash flows from operations or other measures of profitability, liquidity or performance under GAAP. You should be aware that Advantage’s presentation of these measures may not be comparable to similarly-titled measures used by other companies. Reconciliations of historical non-GAAP measures to their most directly comparable GAAP counterparts are included in this document. Advantage believes these non-GAAP measures provide useful information to management and investors regarding certain financial and business trends relating to Advantage’s financial condition and results of operations. Advantage believes that the use of Adjusted EBITDA from Continuing Operations, Adjusted EBITDA by Segment, Adjusted EBITDA margin, Revenues net of reimbursable expenses, Net Debt, Adjusted Unlevered Free Cash Flow and Adjusted Unlevered Free Cash Flow, and net debt as a percentage of LTM Adjusted EBITDA from Continuing Operations provides an additional tool for investors to use in evaluating ongoing operating results, trends, and in comparing Advantage’s financial measures with other similar companies, many of which present similar non-GAAP financial measures to investors. Non-GAAP financial measures are subject to inherent limitations as they reflect the exercise of judgments by management about which expense and income are excluded or included in determining these non-GAAP financial measures. Additionally, other companies may calculate non-GAAP measures differently or may use other measures to calculate their financial performance, and therefore Advantage’s non-GAAP measures may not be directly comparable to similarly titled measures of other companies. Adjusted EBITDA from Continuing Operations mean net (loss) income before (i) interest expense (net), (ii) provision for (benefit from) income taxes, (iii) depreciation, (iv) amortization of intangible assets, (v) impairment of goodwill, (vi) changes in fair value of warrant liability, (vii) stock-based compensation expense, (viii) equity-based compensation of Karman Topco L.P., (ix) fair value adjustments of contingent consideration related to acquisitions, (x) acquisition and divestiture related expenses, (xi) (gain) loss on divestitures, (xii) restructuring expenses, (xiii) reorganization expenses, (xiv) litigation expenses (recovery), (xv) COVID-19 benefits received, (xvi) costs associated with (recovery from) the Take 5 Matter, (xvii) EBITDA for economic interests in investments, and (xviii) other adjustments that management believes are helpful in evaluating our operating performance. Adjusted EBITDA Margin means Adjusted EBITDA divided by total Revenues and Revenues net of reimbursable expenses. Adjusted EBITDA by Segment means, with respect to each segment, operating income (loss) from continuing operations before (i) depreciation, (ii) amortization of intangible assets, (iii) impairment of goodwill, (iv) stock-based compensation expense, (v) equity-based compensation of Karman Topco L.P., (vi) fair value adjustments of contingent consideration related to acquisitions, (vii) acquisition and divestiture related expenses, (viii) restructuring expenses, (ix) reorganization expenses, (x) litigation expenses (recovery), (xi) COVID-19 benefits received, (xii) costs associated with (recovery from) the Take 5 Matter, (xiii) EBITDA for economic interests in investments, and (xiii) other adjustments that management believes are helpful in evaluating our operating performance, in each case, attributable to such segment. Adjusted EBITDA Margin with respect to the applicable segment means Adjusted EBITDA by Segment divided by total Segment Revenues and Revenues net of reimbursable expenses. Revenues net of reimbursable expenses and Revenues net of reimbursable expenses by segment means revenues less reimbursable expenses that are paid by Advantage's clients, including media, product samples, retailer fees, and other marketing and production costs. Net Debt represents the sum of current portion of long-term debt and long-term debt, less cash, cash equivalents, and debt issuance costs. With respect to Net Debt, cash and cash equivalents are subtracted from the GAAP measure, total debt, because they could be used to reduce the debt obligations. We present Net Debt because we believe this non-GAAP measure provides useful information to management and investors regarding certain financial and business trends relating to the Company’s financial condition and to evaluate changes to the Company's capital structure and credit quality assessment. Adjusted Unlevered Free Cash Flow represents net cash provided by (used in) operating activities from continuing and discontinued operations less purchase of property, equipment, and software as disclosed in the Statements of Cash Flows further adjusted by (i) cash payments for interest, (ii) cash received from interest rate derivatives, (iii) cash paid for income taxes; (iv) cash paid for acquisition and divestiture related expenses, (v) cash paid for restructuring expenses, (vi) cash paid for reorganization expenses, (vii) cash paid for contingent earnout payments included in operating cash flow, (viii) COVID-19 benefits received, (ix) costs associated with (recovery from) the Take 5 Matter, (x) net effect of foreign currency fluctuations on cash, and (xi) other adjustments that management believes are helpful in evaluating our operating performance. Adjusted Unlevered Free Cash Flow as a percentage of Adjusted EBITDA means Adjusted Unlevered Free Cash Flow divided by Adjusted EBITDA from Continuing Operations and Adjusted EBITDA from Discontinued Operations. Due to rounding, numbers presented throughout this document may not add up precisely to the totals provided and percentages may not precisely reflect the absolute figures. 2

Q3’25: Disciplined Execution and Strong Cash Generation Revenues and Adjusted EBITDA modestly down YoY. Sequential growth from Q2 Adjusted UFCF of $98.1M, ~100% of EBITDA; net leverage ratio down to 4.4x and ended the quarter with $201 million in cash and cash equivalents Double-digit growth in Experiential Services EBITDA as staffing and execution rates of >90% drove strong incremental margin expansion. Branded faced ongoing headwinds and Retailer impacted largely by timing Demonstrated operating agility in labor businesses—redeploying labor in real time to capture demand and enhance profitability New Instacart partnership provides value-added service aiding execution at retail and visibility Revenues(1) -2.6% YOY $781M Adjusted EBITDA(2) -1.4% YOY $100M Adjusted Unlevered Free Cash Flow(3) $98M Net Leverage Ratio(4) 4.4x (1) From continuing operations excluding reimbursable expenses (2) Reflects Adjusted EBITDA (Earnings before Interest, Taxes, Depreciation, Amortization, and non-recurring items) from continuing operations, which is a non-GAAP measure (3) Reflects Adjusted Unlevered Free Cash Flow from continuing and discontinued operations, which is a non-GAAP measure. The Appendix has a reconciliation of non-GAAP measures to the most directly comparable GAAP measure (4) Net Leverage Ratio calculated as Net Debt divided by trailing-twelve months (TTM) Adjusted EBITDA 3

New Partnerships and Systems Enabling Real Time Execution at Scale Expanding Our Partnerships Modernizing Our Systems Combines Instacart’s 600K+ shopper network with Advantage’s in-store execution Live shelf audits trigger real-time alerts on pricing, availability, and display issues Advantage teams fix issues same-day, improving compliance and driving higher ROI for brands 200-store pilot produced encouraging early results; scaling into additional markets anticipated in 2026 Leveraging new capabilities Data-driven and AI-based tools enabling workforce efficiency through improved recruitment, deployment and scheduling Driving sales for our manufacturing clients through data integration and AI-powered analytics through our Pulse™ selling platform Visibility into performance, with our ERP systems improving accuracy and predictability The remaining phases of our SAP and Workday implementations will continue over the next 15 months 4 Real-time execution at scale to enhance capabilities and operational reach Investments in technology driving faster and more consistent execution and better outcomes for clients

Centralized labor model supporting retention, utilization, and execution consistency across our labor network A more efficient, higher-performing labor engine that enhances execution, client experience, and cash flow Continuing to Advance Workforce Optimization Establishing centralized labor management, overseeing all labor operations, and starting to integrate labor across retailers Moving from pilot program to rollout across part of our Experiential business. Expect to rollout more fully throughout 2026 Driving tangible improvements across operational efficiency metrics and stronger execution Combined with ongoing cost discipline, our centralized labor model is improving utilization and strengthening retention Driving efficiencies in overall talent acquisition cost, use of third-party labor and other labor-related expenses 5

Business Segment Updates Retailer Services Branded Services Experiential Services Macro pressure resulted in continued softness for commission-based and omni-commerce revenues Investing to strengthen value proposition, advance key relationships, and drive better consistency in execution Expect continued pressure near term; entering Q4 with larger pipeline of new business opportunities Strong performance driven by healthy event demand, up 7% on an underlying basis, improved retention, and >90% execution rates Higher staffing supported a 7% sequential increase in events, resulting in solid revenue growth and strong incremental margins versus the prior year quarter Expect a stronger Q4 with increased event frequency at key customers A tough comparison and project timing weighed on results versus the prior year quarter Staffing and execution improved through the period, strengthening coverage Stronger staffing levels should support incremental project work in Q4 supporting revenue growth 6 Leveraging structurally diversified businesses, pulling levers in real-time across our high-volume labor businesses

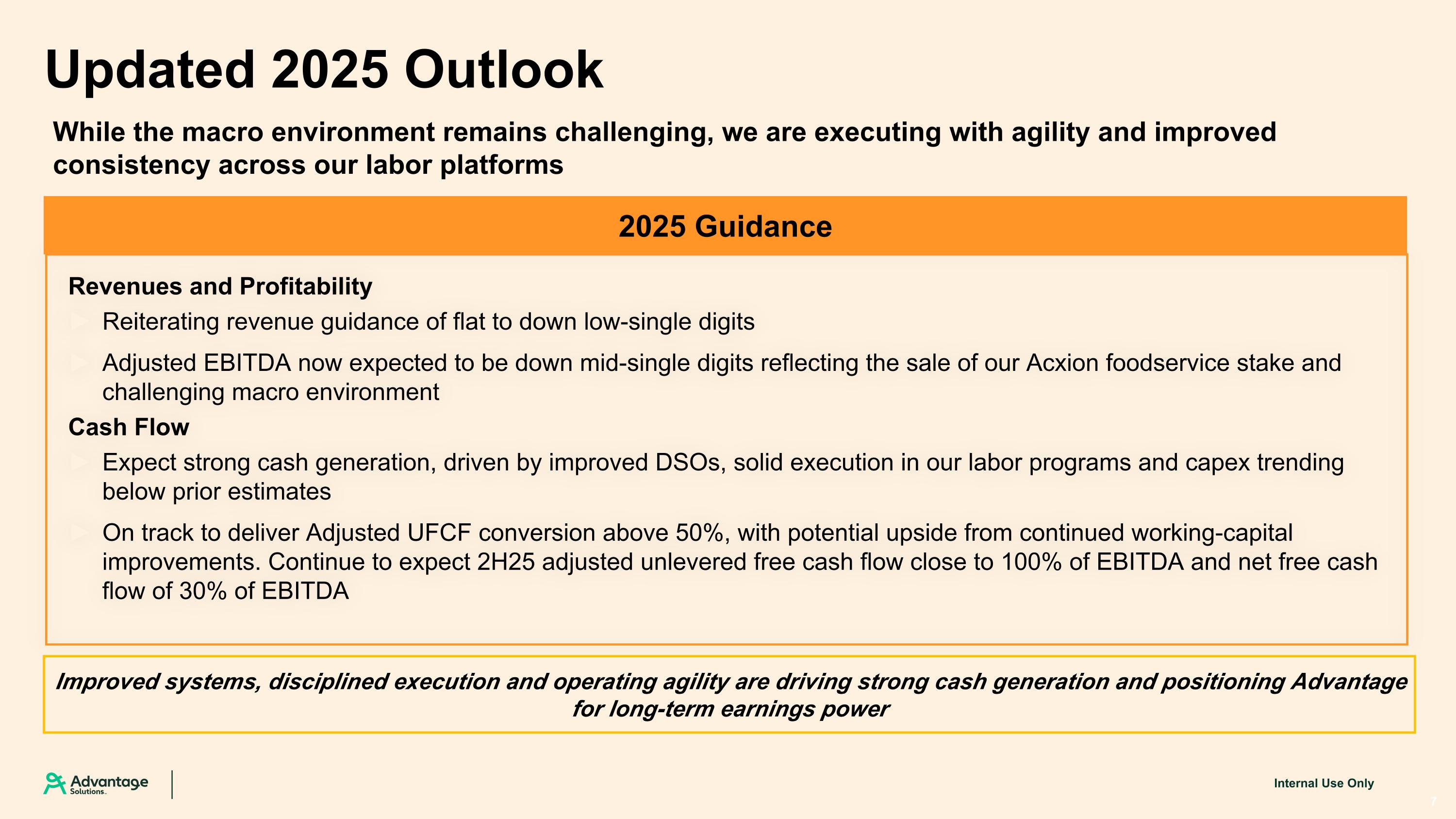

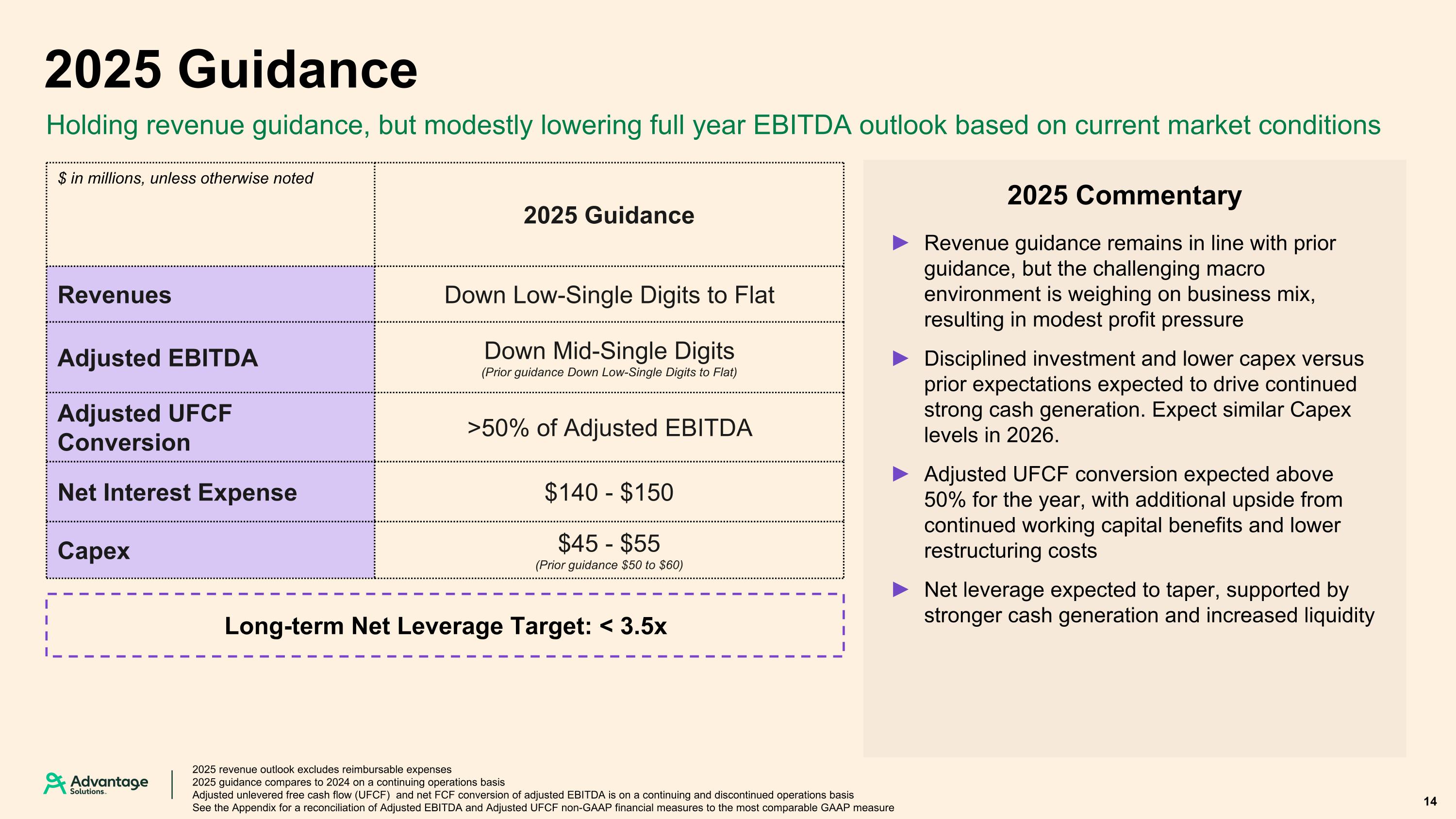

Revenues and Profitability Reiterating revenue guidance of flat to down low-single digits Adjusted EBITDA now expected to be down mid-single digits reflecting the sale of our Acxion foodservice stake and challenging macro environment Cash Flow Expect strong cash generation, driven by improved DSOs, solid execution in our labor programs and capex trending below prior estimates On track to deliver Adjusted UFCF conversion above 50%, with potential upside from continued working-capital improvements. Continue to expect 2H25 adjusted unlevered free cash flow close to 100% of EBITDA and net free cash flow of 30% of EBITDA 2025 Guidance 7 Updated 2025 Outlook Improved systems, disciplined execution and operating agility are driving strong cash generation and positioning Advantage for long-term earnings power While the macro environment remains challenging, we are executing with agility and improved consistency across our labor platforms

Results driven by strength in Experiential, partially offsetting decline in Branded and Retailer segments Revenue performance generally in line with internal expectations although business mix varied Modest EBITDA decline represents a continued sequential improvement since Q1 Leveraged structurally diversified platforms with high-volume labor businesses in Retailer and Experiential Improved staffing levels and rapidly deploying labor to meet growing demand. Strong incremental margin expansion in Experiential segment Improved Execution And Operating Agility Revenues and Adjusted EBITDA margins exclude reimbursable expenses Adjusted EBITDA (Earnings before Interest, Taxes, Depreciation, Amortization, and non-recurring items) is a non-GAAP financial measure See the appendix for a reconciliation of non-GAAP financial measures to most directly comparable GAAP measures Totals may not add due to rounding $915.0 $939.3 (1.4)% Revenues Net of Reimbursable Expenses Reimbursable Expenses Highlights 8 (2.6)%(1) Revenues (Continuing Operations) $ in millions Y/Y growth % margin(1) $ in millions Y/Y growth Adjusted EBITDA (Continuing Operations)

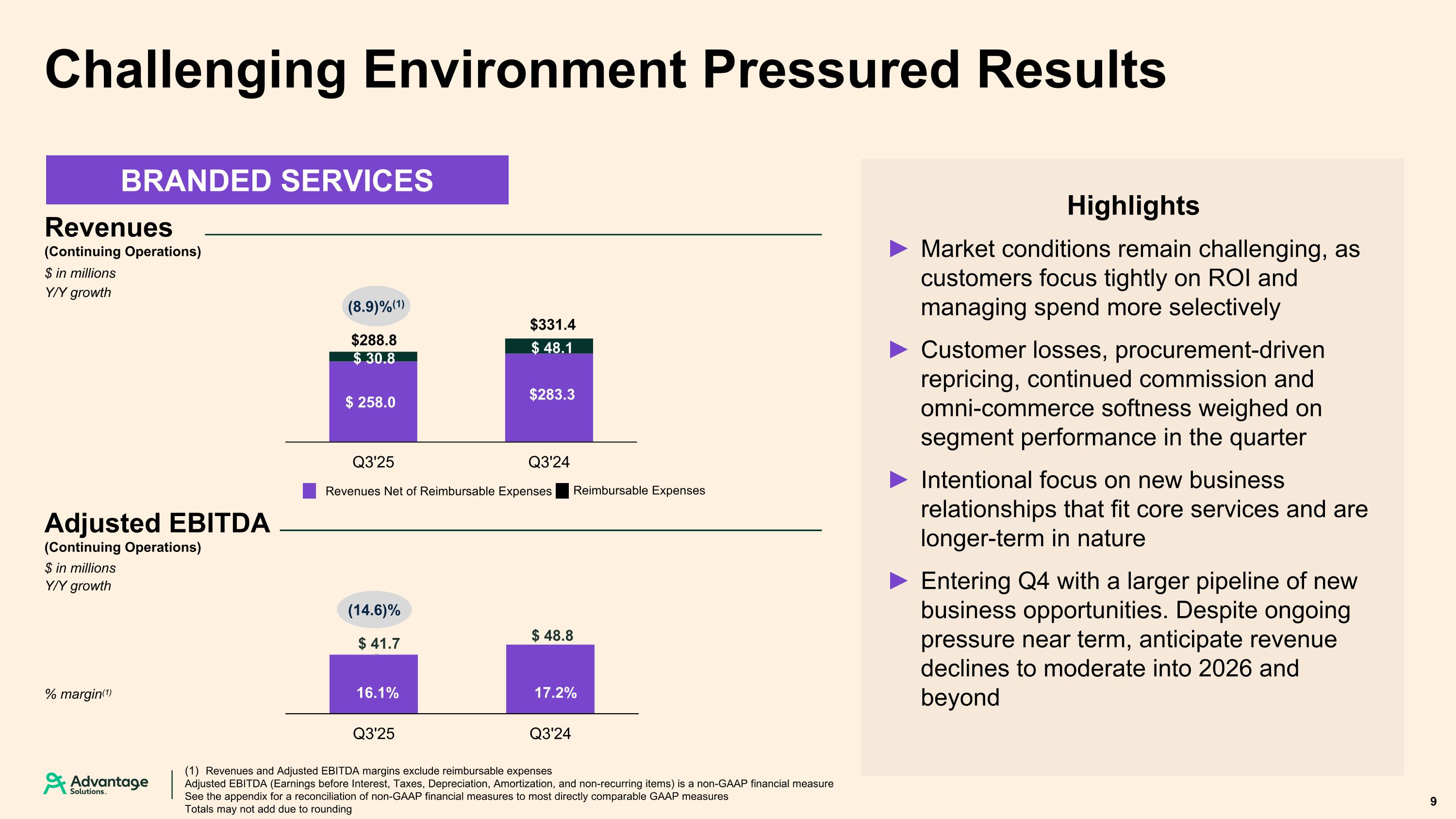

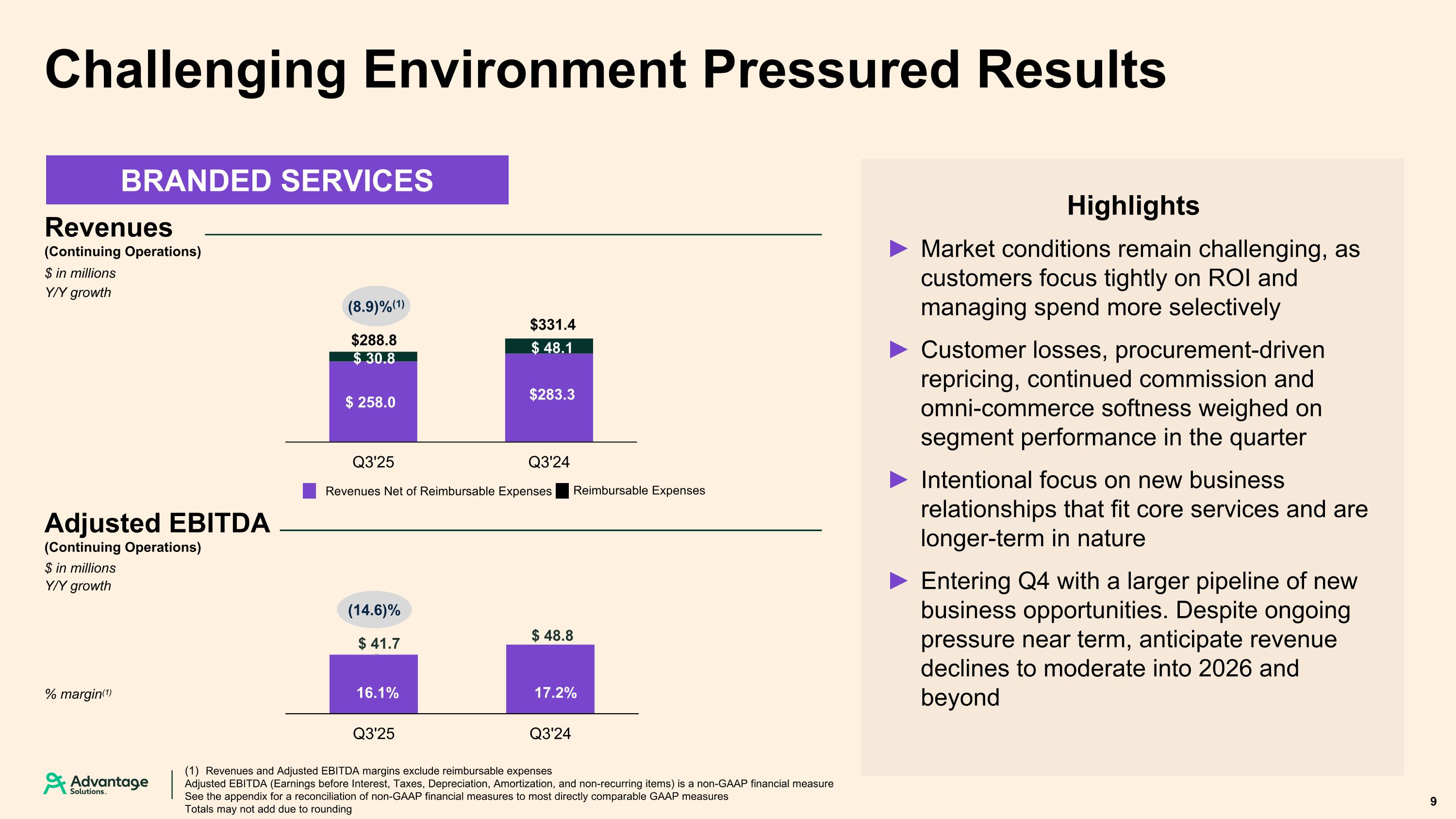

Revenues and Adjusted EBITDA margins exclude reimbursable expenses Adjusted EBITDA (Earnings before Interest, Taxes, Depreciation, Amortization, and non-recurring items) is a non-GAAP financial measure See the appendix for a reconciliation of non-GAAP financial measures to most directly comparable GAAP measures Totals may not add due to rounding (14.6)% % margin(1) Challenging Environment Pressured Results Highlights $ in millions Y/Y growth Adjusted EBITDA (Continuing Operations) BRANDED SERVICES $288.8 $331.4 $ in millions Y/Y growth 9 Revenues (Continuing Operations) Market conditions remain challenging, as customers focus tightly on ROI and managing spend more selectively Customer losses, procurement-driven repricing, continued commission and omni-commerce softness weighed on segment performance in the quarter Intentional focus on new business relationships that fit core services and are longer-term in nature Entering Q4 with a larger pipeline of new business opportunities. Despite ongoing pressure near term, anticipate revenue declines to moderate into 2026 and beyond Revenues Net of Reimbursable Expenses Reimbursable Expenses (8.9)%(1)

Revenues and adjusted EBITDA margins exclude reimbursable expenses Adjusted EBITDA (Earnings before Interest, Taxes, Depreciation, Amortization, and non-recurring items) is a non-GAAP financial measure See the appendix for a reconciliation of non-GAAP financial measures to most directly comparable GAAP measures Totals may not add due to rounding +8.2%(1) +51.6% % margin(1) Strong Demand and Execution Drove Results Adjusted EBITDA (Continuing Operations) $377.7 $342.7 $ in millions Y/Y growth $ in millions Y/Y growth 10 EXPERIENTIAL SERVICES Highlights Revenues (Continuing Operations) Events per day grew 7% on an underlying basis and grew 7% sequentially. Improved staffing supported strong execution and volume in the quarter Execution rates remained >90%, driving improved performance and consistent in-store delivery Incremental margins approached ~50%, reflecting efficient labor activation and strong operational leverage Higher retention and better coverage contributed to stronger execution across key banners Momentum expected to continue into Q4 and 2026, with similar-to-accelerating growth, as demand trends remain favorable Revenues Net of Reimbursable Expenses Reimbursable Expenses

Adjusted EBITDA (Earnings before Interest, Taxes, Depreciation, Amortization, and non-recurring items) is a non-GAAP financial measure See the appendix for a reconciliation of non-GAAP financial measures to most directly comparable GAAP measures Totals may not add due to rounding (21.7)% (6.3)% % margin Improved Execution Offset by Tough Comparison and Shift in Project Timing Adjusted EBITDA (Continuing Operations) 11 $ in millions Y/Y growth $ in millions Y/Y growth RETAILER SERVICES Highlights Revenues (Continuing Operations) As expected, Retailer encountered a tough comparison and some shift in project work Channel-mix shifts continued to pressure advisory and agency services, consistent with recent trends Staffing and execution rates improved through the quarter Visibility and pipeline support a stronger setup for Q4 revenues, as our labor-driven merchandising business is expected to perform well Retailer expected to return to growth in revenue and EBITDA terms in 2026

1L Term Loan Sr. Secured Notes $ in millions $1,542(3) Healthy Balance Sheet and Liquidity Position As of September 30, 2025 $ in millions Maturity Rate Outstanding First Lien Term Loan 2027 S+4.25%(2) $1,096 Senior Secured Notes 2028 6.50% 595 Total Gross Debt $1,691 Less: Cash and Cash Equivalents (201) Total Net Debt(1) $1,490 Net Debt Overview Maturity Schedule Net debt is a non-GAAP financial measure. For a reconciliation of net debt to total debt, the most directly comparable GAAP counterpart, please see the appendix attached hereto First Lien Term Loan rate subject to 0.75% SOFR floor plus 0.26% SOFR spread. In April 2024, the Company's Term Loan Facility was amended to reduce the applicable interest rate margin on the term loan by 0.25% (a) from 4.50% to 4.25% for SOFR loans or (b) from 3.50% to 3.25% for base rate loans First Lien Term Loan amortizes at 1% per annum, paid quarterly. Illustratively showing full $1,099M obligation in 2027E maturity as of 06/30/25, $500M of Revolving Credit borrowing capacity was reduced by $54M due to outstanding letters of credit. 12 $446M of gross availability under credit facility (no meaningful maturities until Q4’27) 4.4x Net Debt / LTM Adj. EBITDA; ~76% hedged / fixed (inclusive of discontinued operations) $446

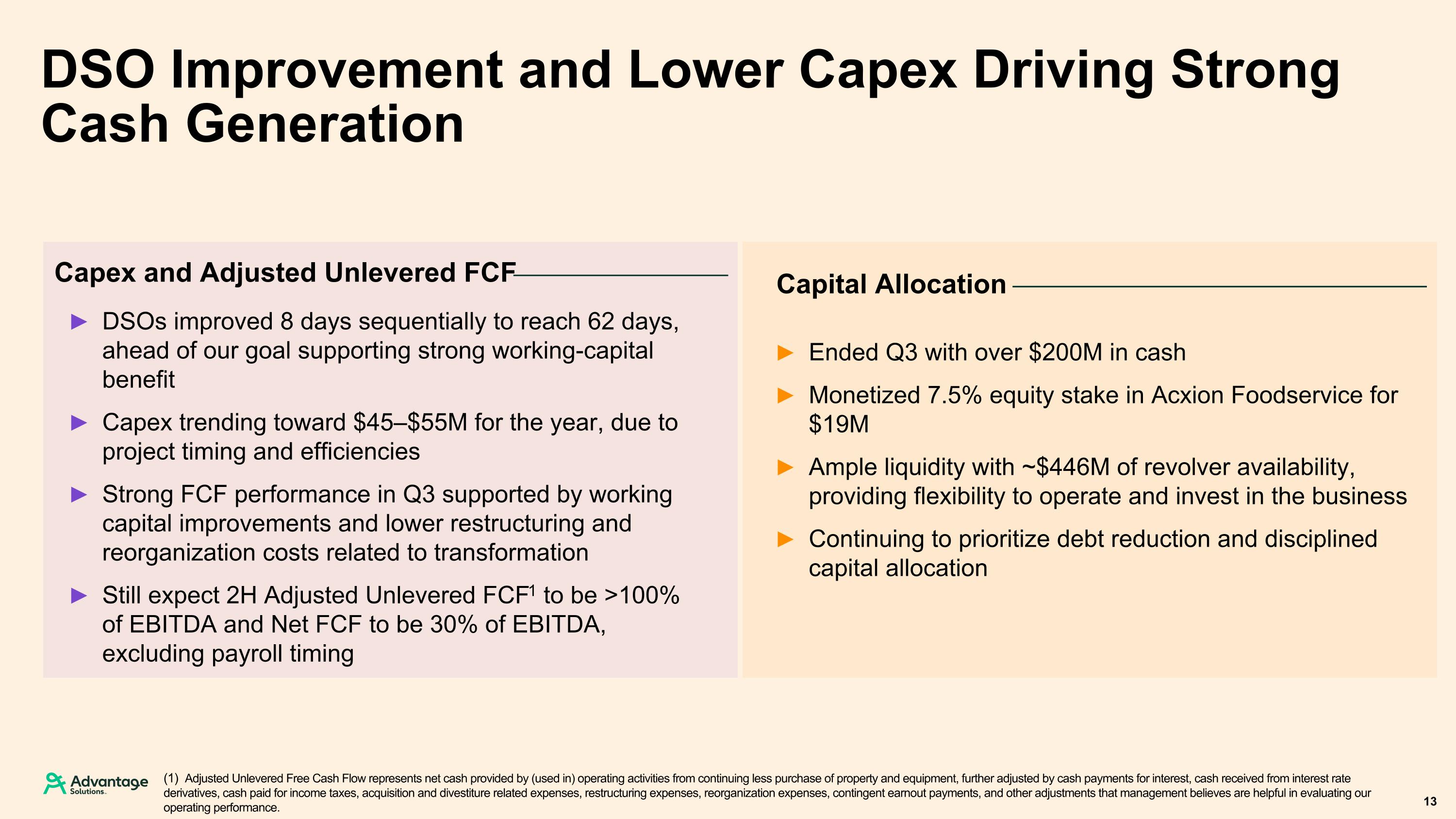

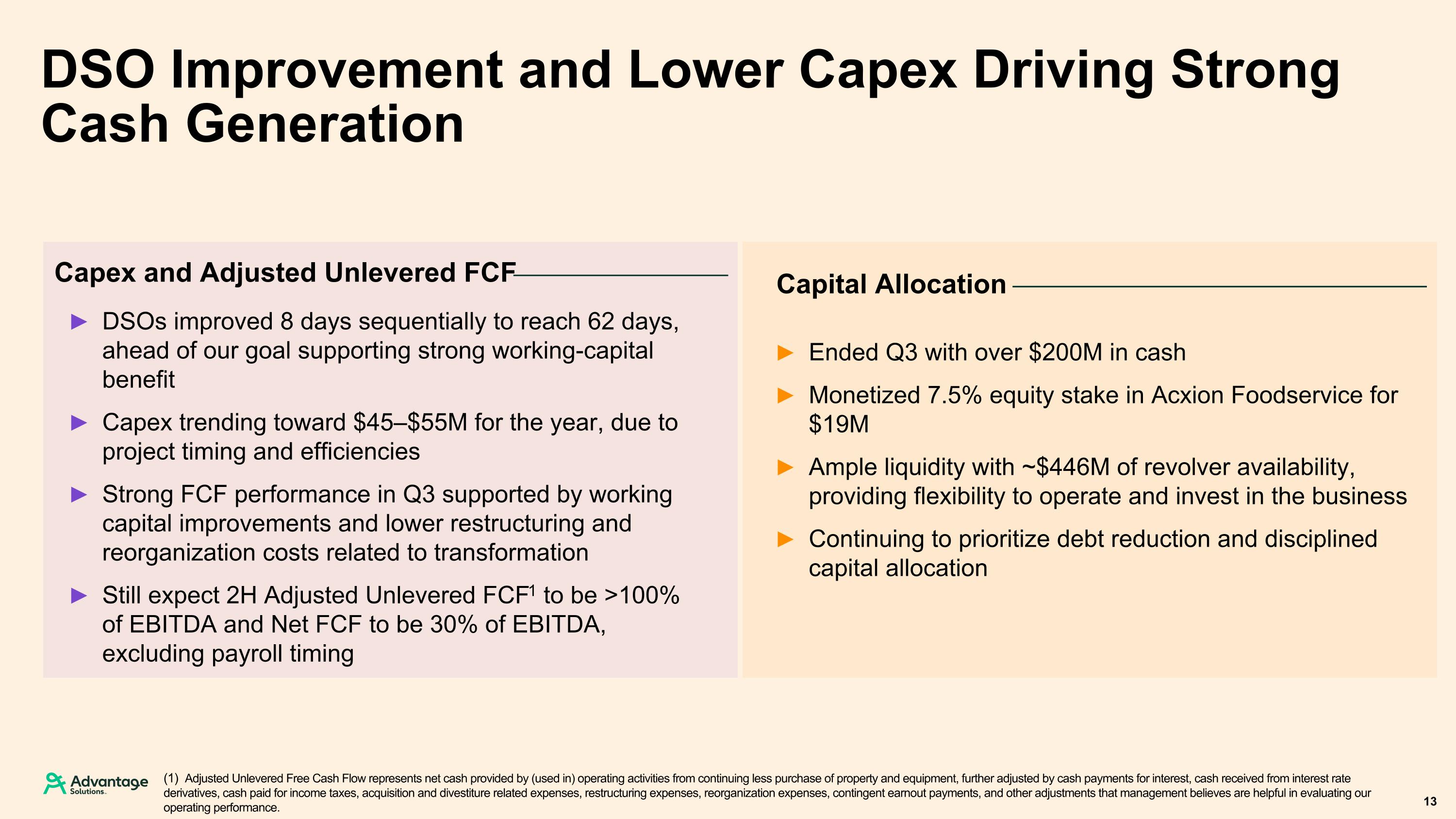

DSO Improvement and Lower Capex Driving Strong Cash Generation Capital Allocation Ended Q3 with over $200M in cash Monetized 7.5% equity stake in Acxion Foodservice for $19M Ample liquidity with ~$446M of revolver availability, providing flexibility to operate and invest in the business Continuing to prioritize debt reduction and disciplined capital allocation Capex and Adjusted Unlevered FCF DSOs improved 8 days sequentially to reach 62 days, ahead of our goal supporting strong working-capital benefit Capex trending toward $45–$55M for the year, due to project timing and efficiencies Strong FCF performance in Q3 supported by working capital improvements and lower restructuring and reorganization costs related to transformation Still expect 2H Adjusted Unlevered FCF1 to be >100% of EBITDA and Net FCF to be 30% of EBITDA, excluding payroll timing 13 Adjusted Unlevered Free Cash Flow represents net cash provided by (used in) operating activities from continuing less purchase of property and equipment, further adjusted by cash payments for interest, cash received from interest rate derivatives, cash paid for income taxes, acquisition and divestiture related expenses, restructuring expenses, reorganization expenses, contingent earnout payments, and other adjustments that management believes are helpful in evaluating our operating performance.

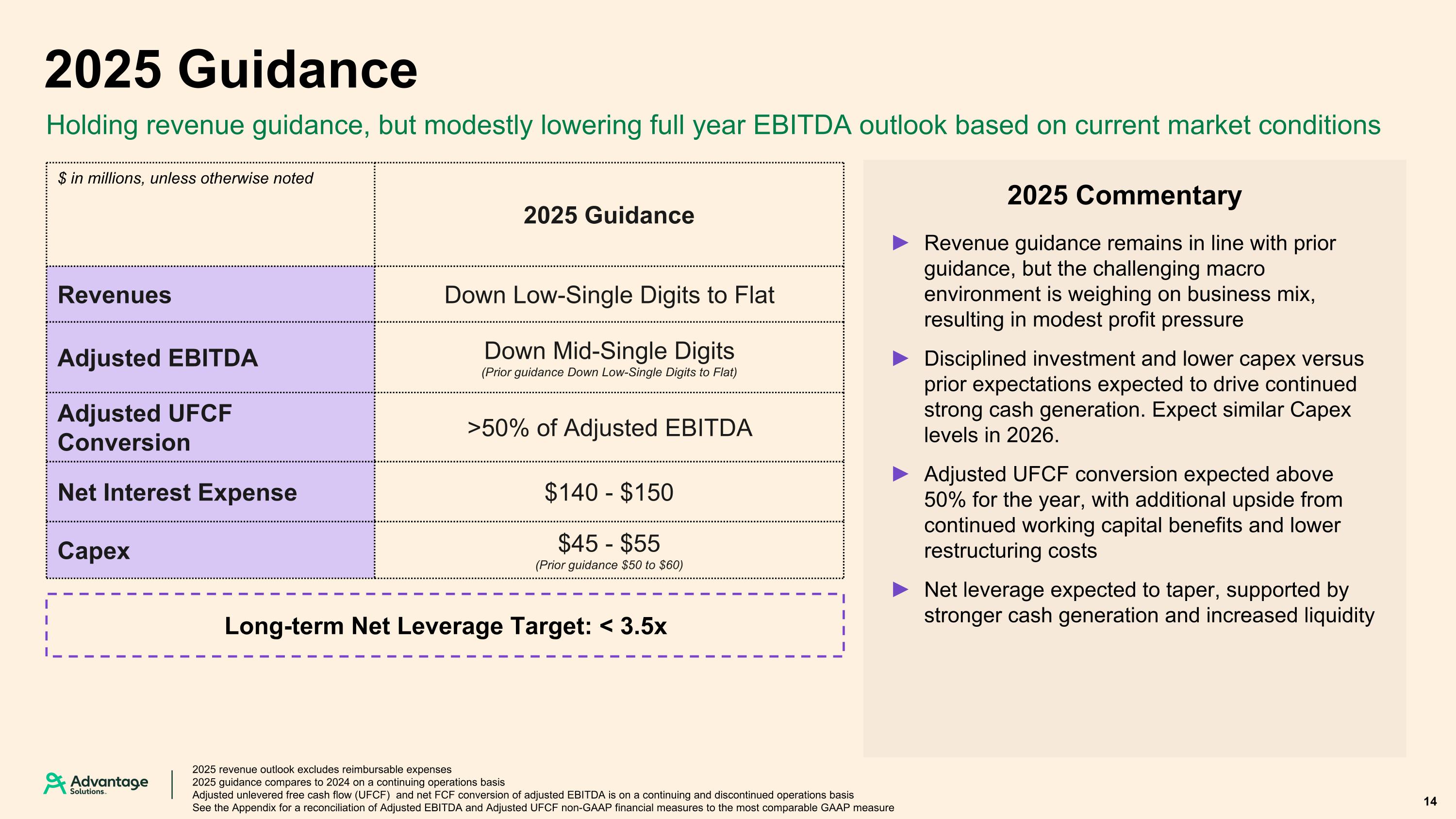

2025 Guidance Holding revenue guidance, but modestly lowering full year EBITDA outlook based on current market conditions $ in millions, unless otherwise noted 2025 Guidance Revenues Down Low-Single Digits to Flat Adjusted EBITDA Down Mid-Single Digits (Prior guidance Down Low-Single Digits to Flat) Adjusted UFCF Conversion >50% of Adjusted EBITDA Net Interest Expense $140 - $150 Capex $45 - $55 (Prior guidance $50 to $60) 2025 revenue outlook excludes reimbursable expenses 2025 guidance compares to 2024 on a continuing operations basis Adjusted unlevered free cash flow (UFCF) and net FCF conversion of adjusted EBITDA is on a continuing and discontinued operations basis See the Appendix for a reconciliation of Adjusted EBITDA and Adjusted UFCF non-GAAP financial measures to the most comparable GAAP measure 14 Long-term Net Leverage Target: < 3.5x 2025 Commentary Revenue guidance remains in line with prior guidance, but the challenging macro environment is weighing on business mix, resulting in modest profit pressure Disciplined investment and lower capex versus prior expectations expected to drive continued strong cash generation. Expect similar Capex levels in 2026. Adjusted UFCF conversion expected above 50% for the year, with additional upside from continued working capital benefits and lower restructuring costs Net leverage expected to taper, supported by stronger cash generation and increased liquidity

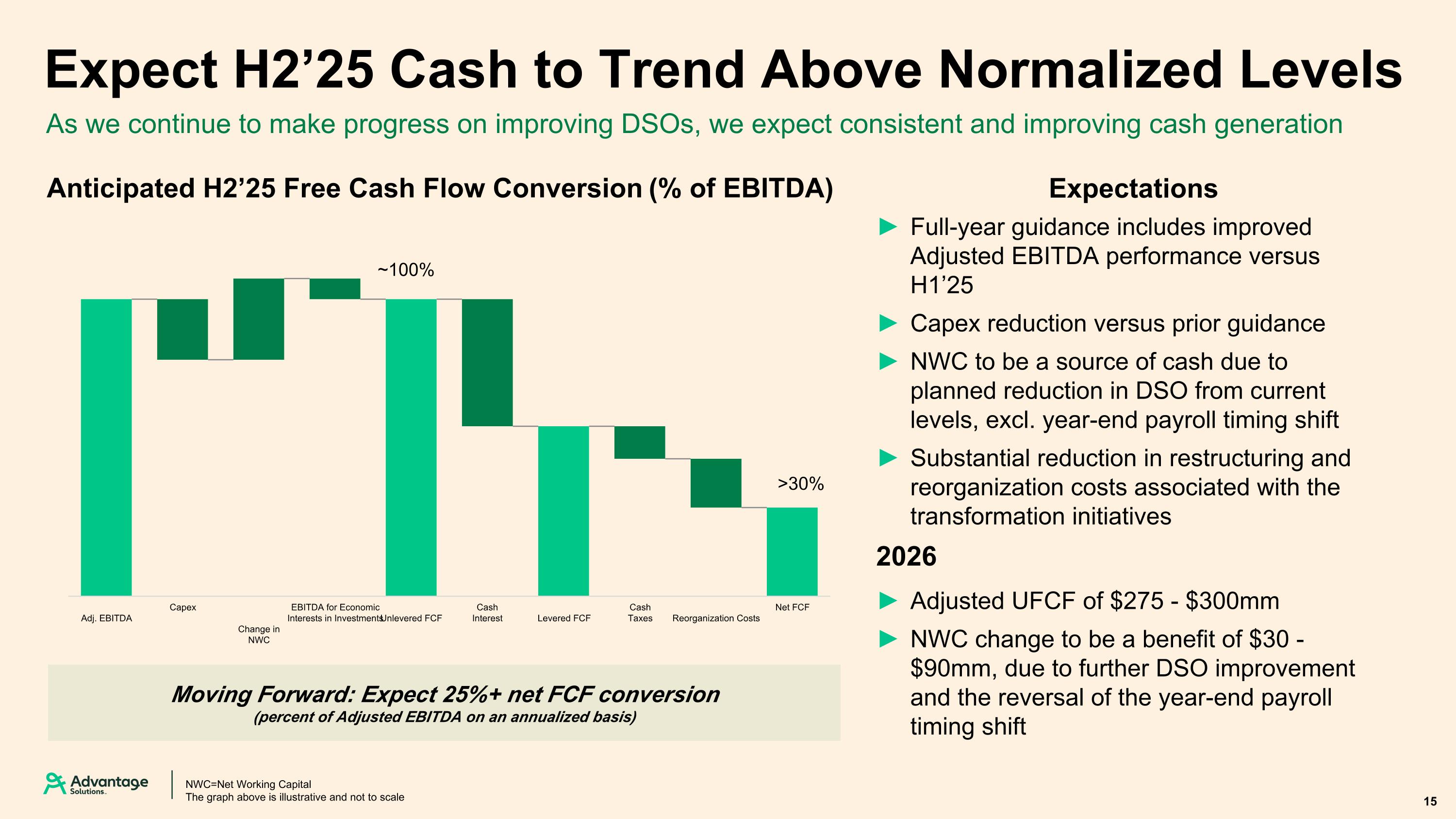

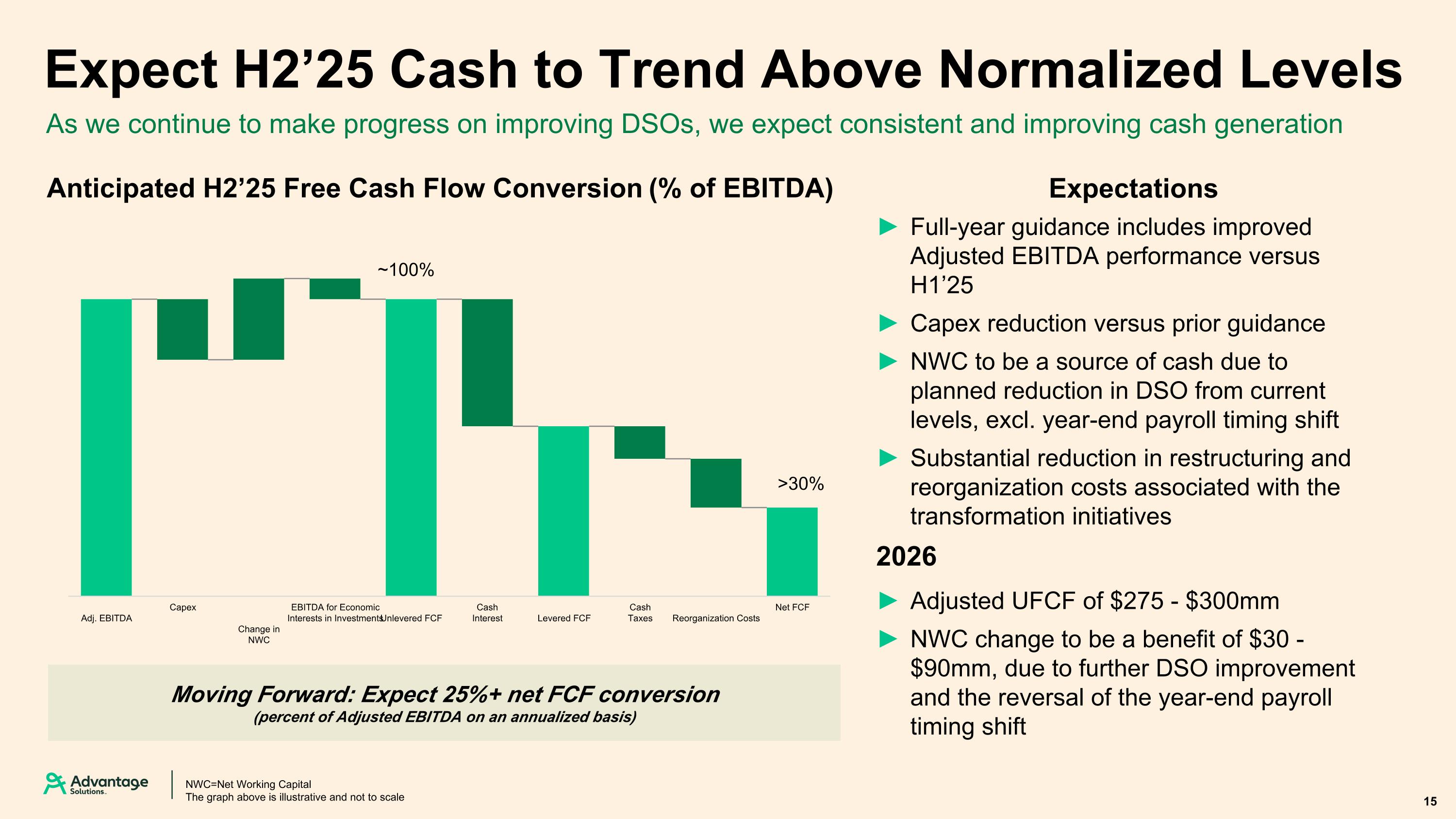

Anticipated H2’25 Free Cash Flow Conversion (% of EBITDA) Expect H2’25 Cash to Trend Above Normalized Levels ~100% >30% As we continue to make progress on improving DSOs, we expect consistent and improving cash generation Moving Forward: Expect 25%+ net FCF conversion (percent of Adjusted EBITDA on an annualized basis) 15 NWC=Net Working Capital The graph above is illustrative and not to scale Full-year guidance includes improved Adjusted EBITDA performance versus H1’25 Capex reduction versus prior guidance NWC to be a source of cash due to planned reduction in DSO from current levels, excl. year-end payroll timing shift Substantial reduction in restructuring and reorganization costs associated with the transformation initiatives 2026 Adjusted UFCF of $275 - $300mm NWC change to be a benefit of $30 - $90mm, due to further DSO improvement and the reversal of the year-end payroll timing shift Expectations

Appendix 16

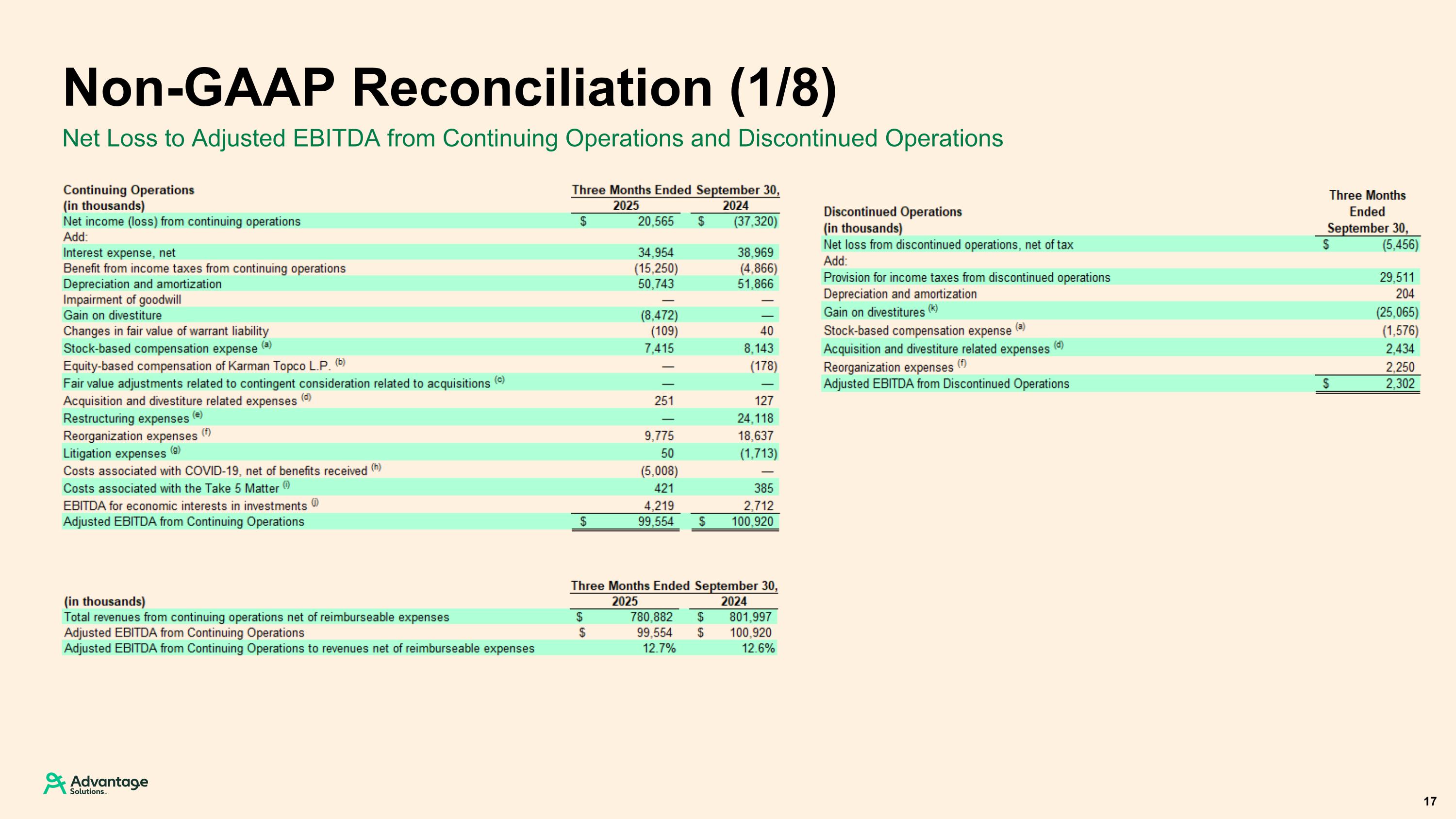

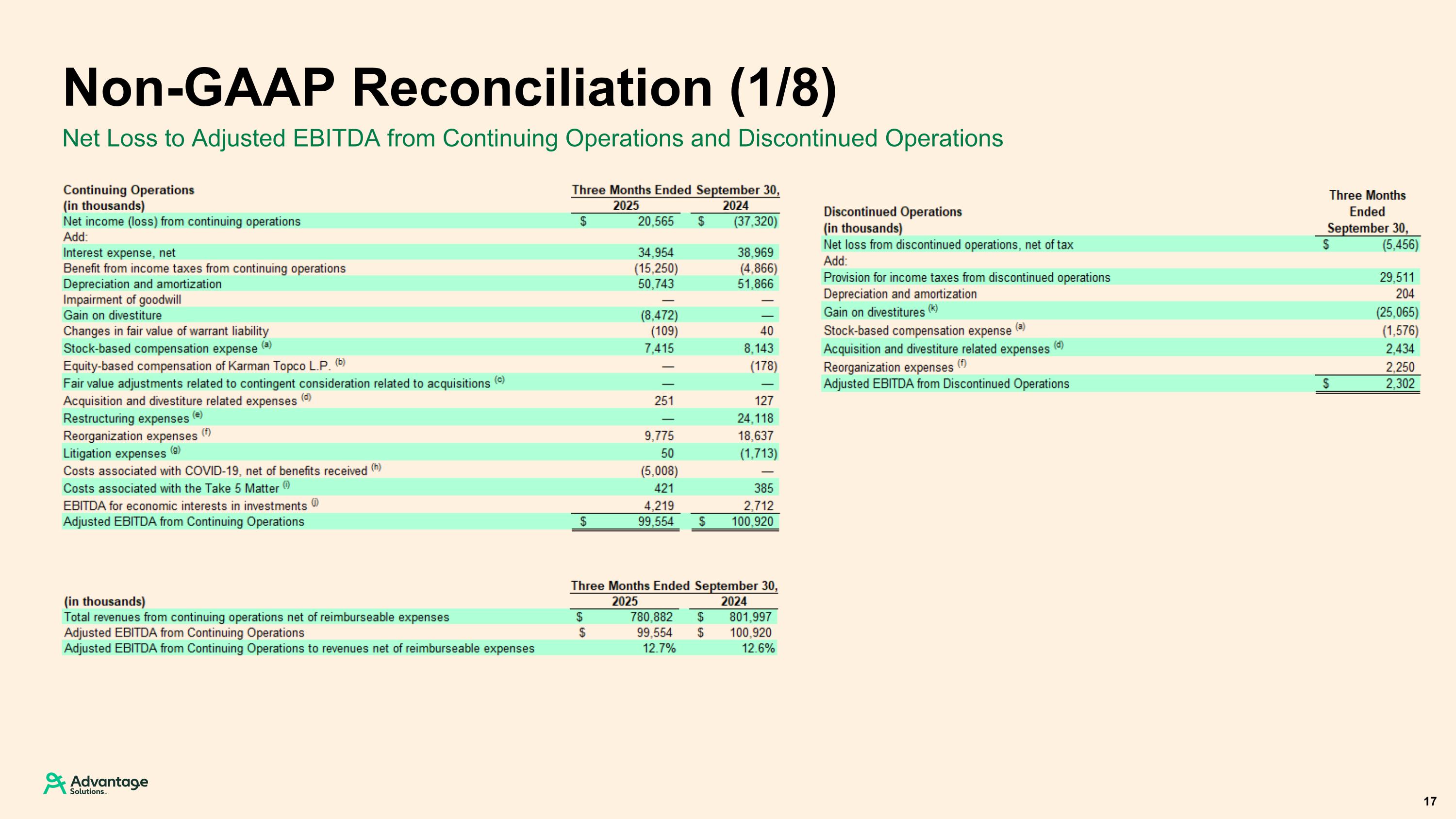

Net Loss to Adjusted EBITDA from Continuing Operations and Discontinued Operations Non-GAAP Reconciliation (1/8) 17

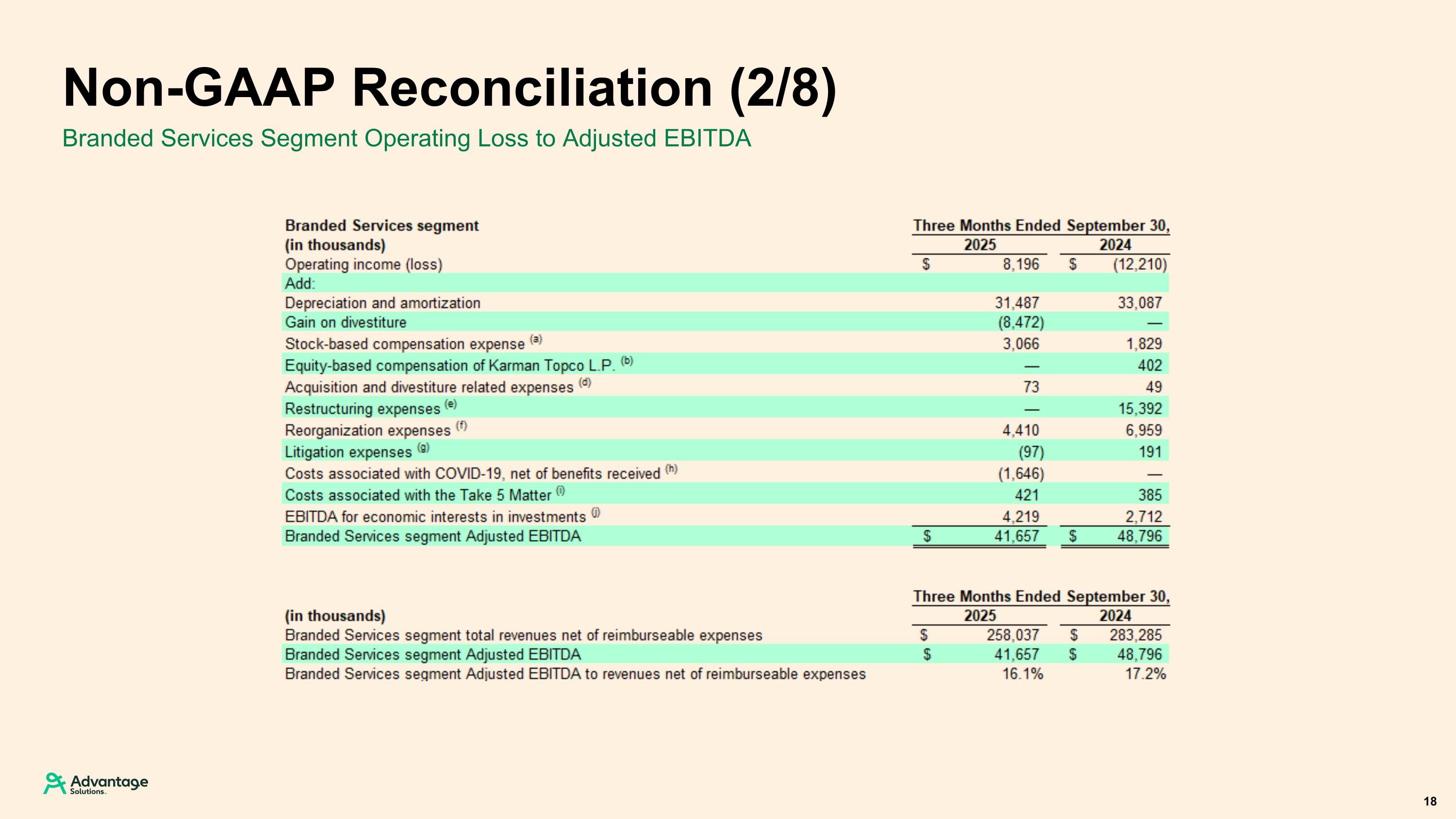

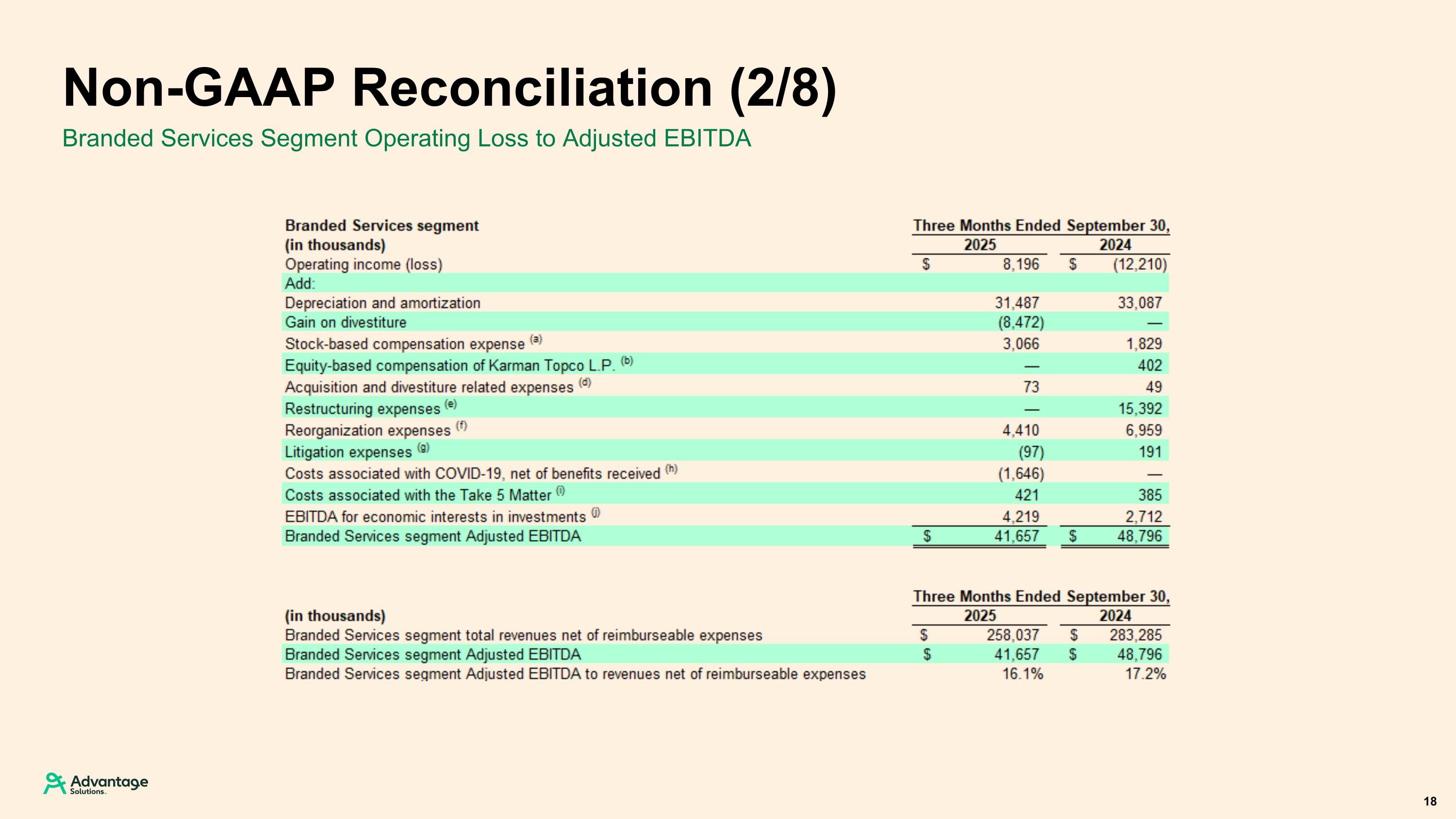

Branded Services Segment Operating Loss to Adjusted EBITDA Non-GAAP Reconciliation (2/8) 18

Experiential Services Segment Operating Loss to Adjusted EBITDA Non-GAAP Reconciliation (3/8) 19

Retailer Services Segment Operating Income/(Loss) to Adjusted EBITDA Non-GAAP Reconciliation (4/8) 20

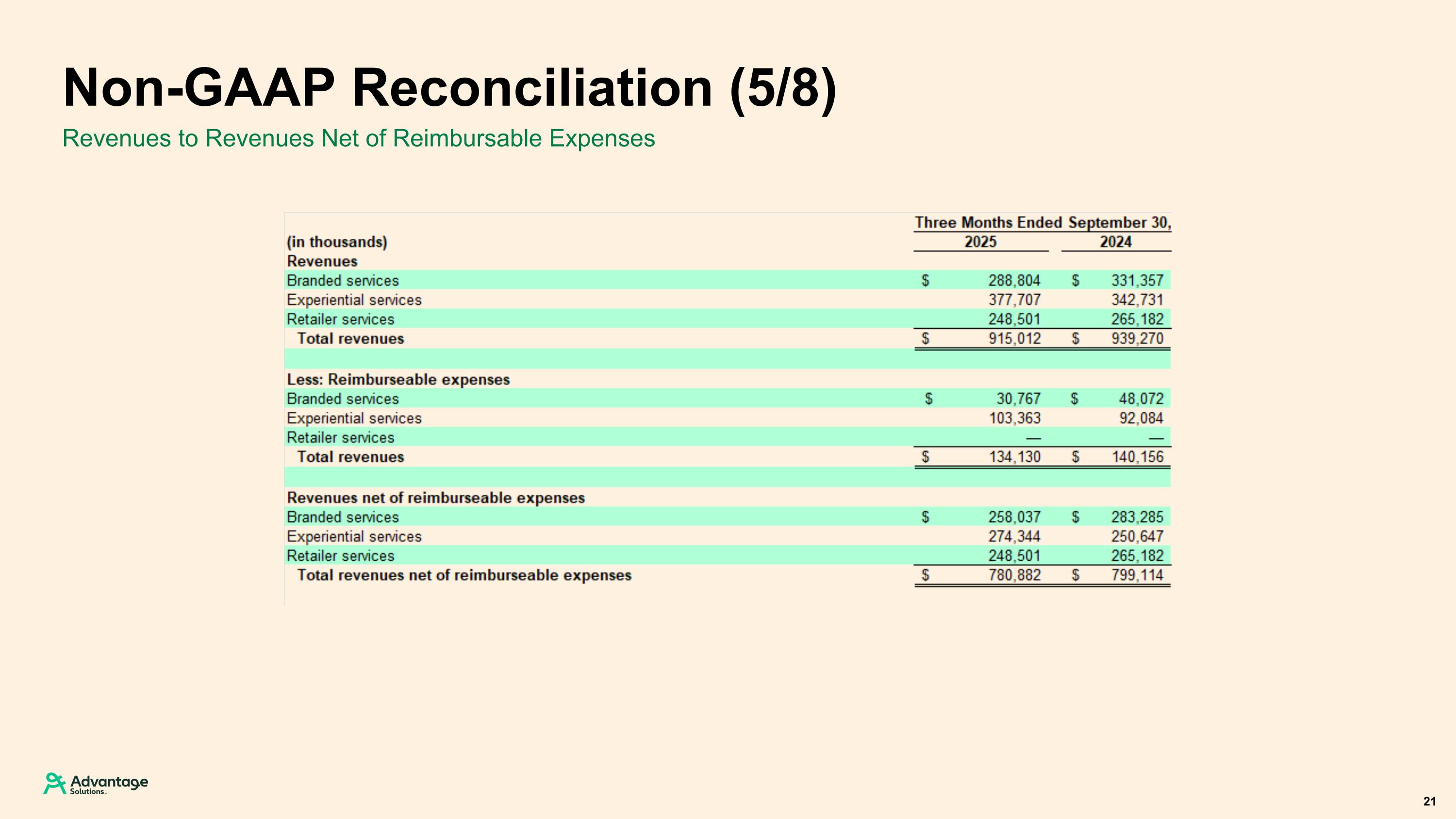

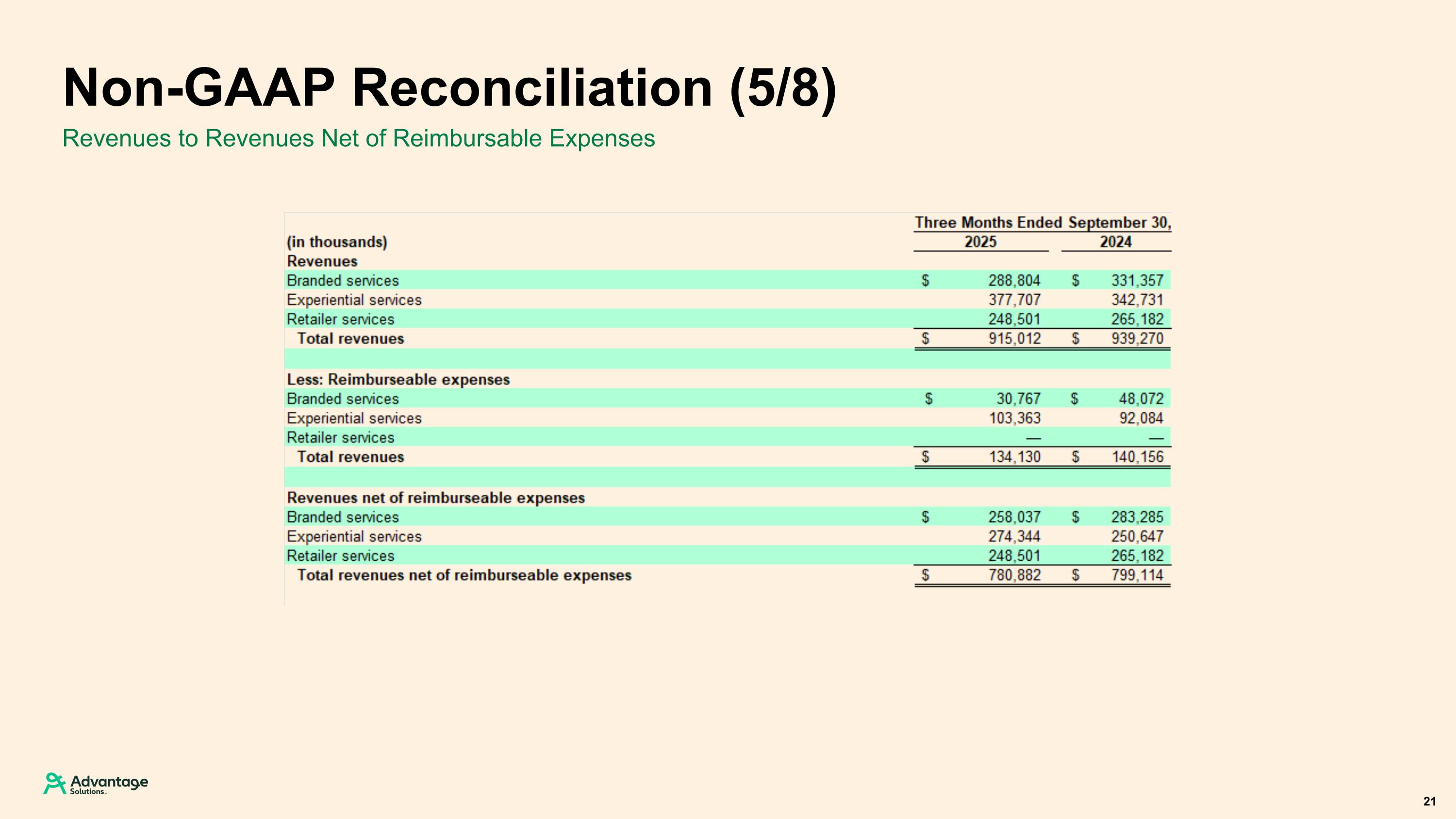

Revenues to Revenues Net of Reimbursable Expenses Non-GAAP Reconciliation (5/8) 21

Adjusted Unlevered Free Cash Flow Non-GAAP Reconciliation (6/8) 22

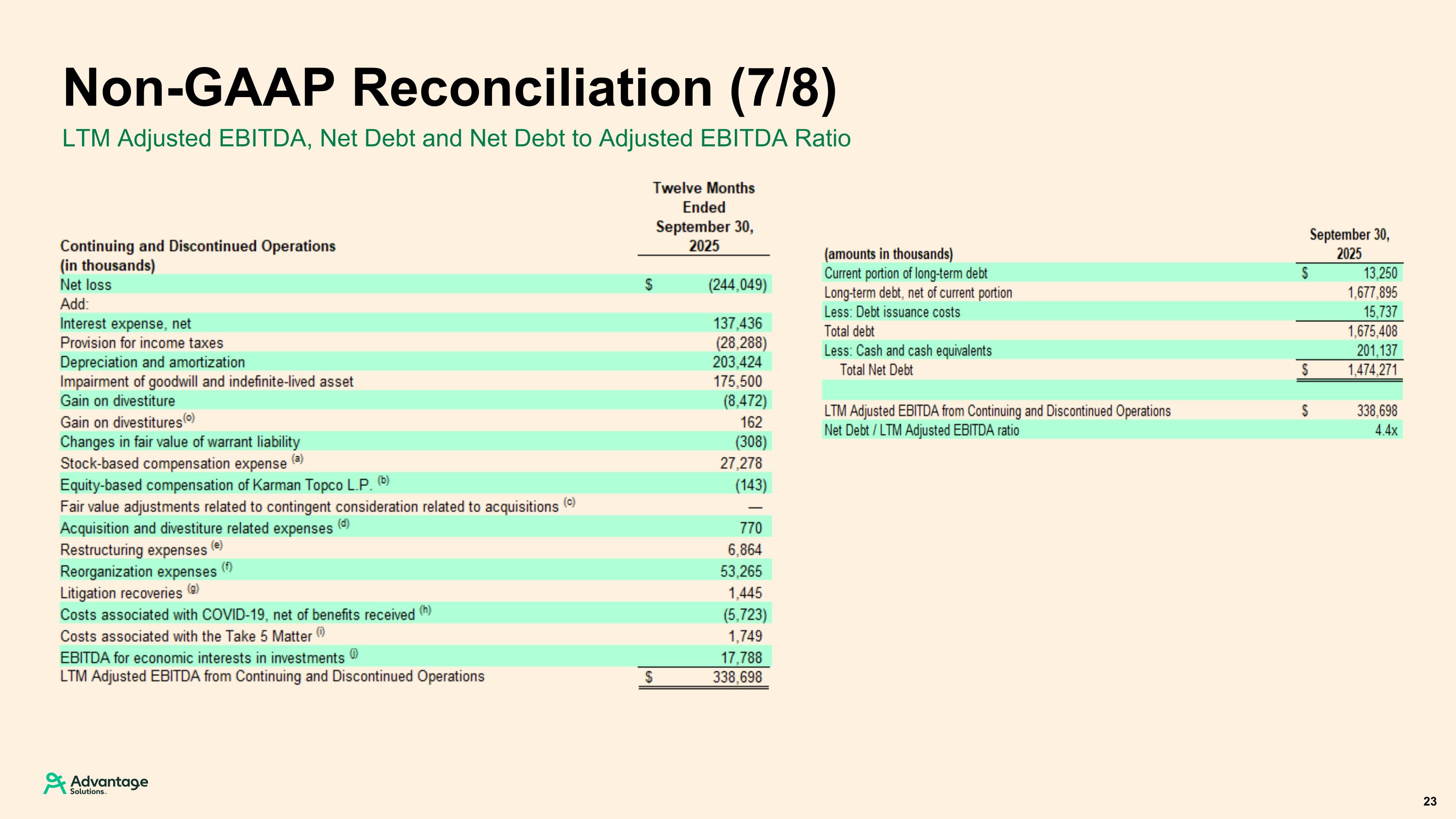

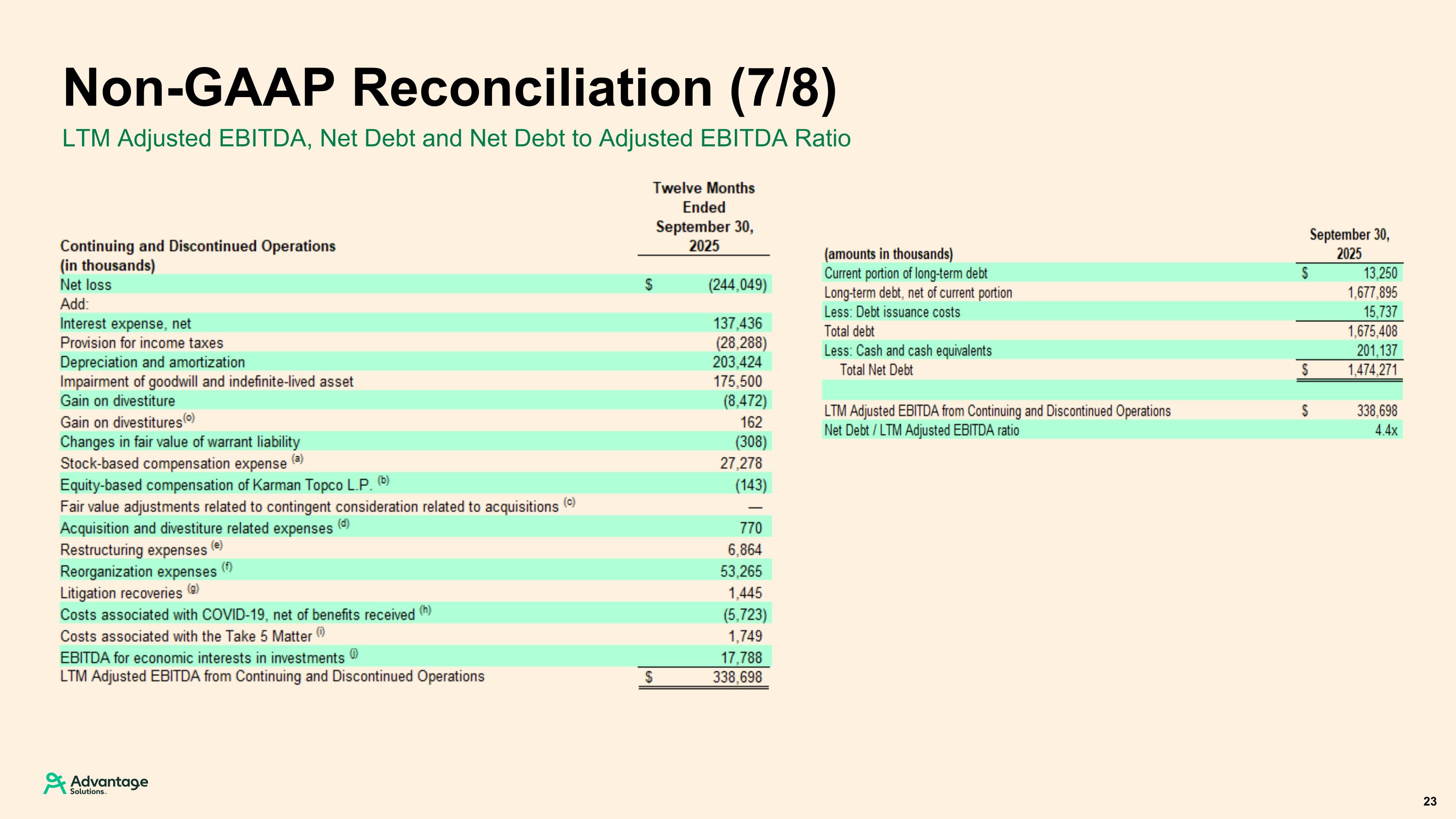

LTM Adjusted EBITDA, Net Debt and Net Debt to Adjusted EBITDA Ratio Non-GAAP Reconciliation (7/8) 23

Footnotes Non-GAAP Reconciliation (8/8) 24 (a) Represents non-cash compensation expense related to performance stock units, restricted stock units, and stock options under the 2020 Advantage Solutions Incentive Award Plan and the Advantage Solutions 2020 Employee Stock Purchase Plan. (b) Represents expenses related to equity-based compensation expense associated with grants of Common Series D Units of Karman Topco L.P. made to one of the sponsors of the Company. (c) Represents adjustments to the estimated fair value of our contingent consideration liabilities related to our acquisitions, for the applicable periods. (d) Represents fees and costs associated with activities related to our acquisitions, divestitures, and related activities, including professional fees, due diligence, and integration activities. (e) Restructuring charges including programs designed to integrate and reduce costs intended to further improve efficiencies in operational activities and align cost structures consistent with revenue levels associated with business changes. Restructuring expenses include costs associated with the VERP and employee termination benefits associated with the 2024 RIF and other optimization initiatives. (f) Represents fees and costs associated with various internal reorganization activities, including professional fees, lease exit costs, severance, and nonrecurring compensation costs. (g) Represents legal settlements, reserves, and expenses that are unusual or infrequent costs associated with our operating activities. (h) Represents benefits received from government grants for COVID-19 relief. (i) Represents costs associated with collection and remediation activities related to the Take 5 Matter, primarily professional fees and other related costs. (j) Represents additions to reflect our proportional share of Adjusted EBITDA related to our equity method investments and reductions to remove the Adjusted EBITDA related to the minority ownership percentage of the entities that we fully consolidate in our financial statements. (k) Represents cash paid for fees and costs associated with activities related to our acquisitions, divestitures and reorganization activities including professional fees, due diligence, and integration activities. (l) Represents cash paid for restructuring charges including programs designed to integrate and reduce costs intended to further improve efficiencies in operational activities and align cost structures consistent with revenue levels associated with business changes. Restructuring expenses include costs associated with the VERP and employee termination benefits associated with the 2024 RIF and other optimization initiatives. (m) Represents cash paid for fees and costs associated with various reorganization activities, including professional fees, lease exit costs, severance, and nonrecurring compensation costs. (n) Represents cash paid for costs associated with the Take 5 Matter, primarily, professional fees and other related costs. (o) Represents gains and losses on disposal of assets related to divestitures and losses on sale of businesses and assets held for sale, less cost to sell.