Thomson Reuters CorporationNotes to Consolidated Financial Statements (unaudited)

(unless otherwise stated, all amounts are in millions of U.S. dollars)

Note 1: Business Description and Basis of Preparation

General business description

Thomson Reuters Corporation is an Ontario, Canada corporation with common shares listed on the Toronto Stock Exchange ("TSX") and on the U.S. stock exchange, Nasdaq Global Select Market (“Nasdaq”), under the ticker symbol “TRI”, and its Series II preference shares are listed on the TSX.

Unless otherwise indicated or the context otherwise requires, references in these consolidated financial statements to the “Company” and “Thomson Reuters” are to Thomson Reuters Corporation and its subsidiaries.

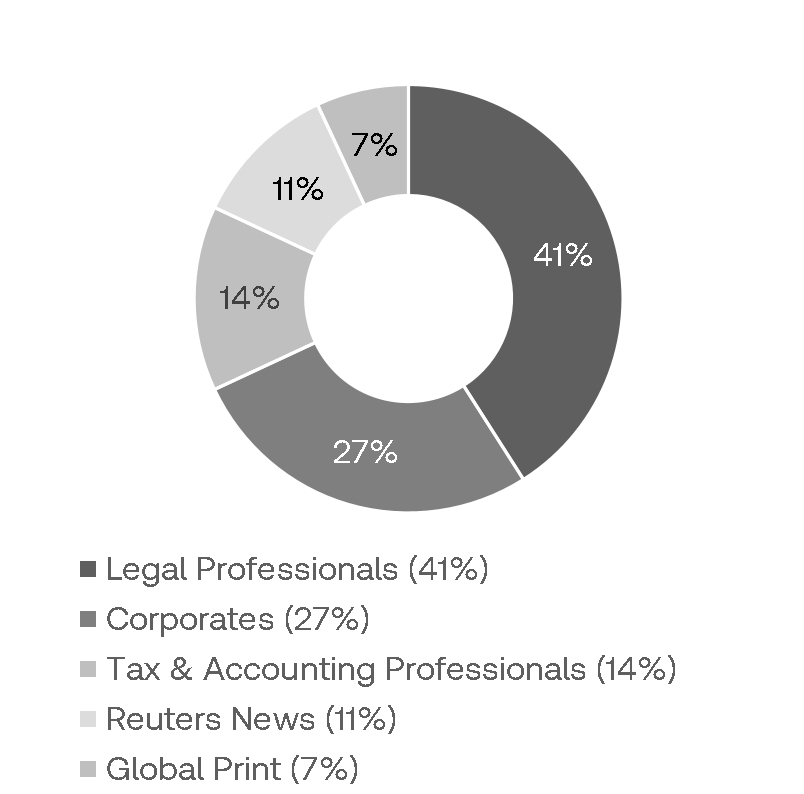

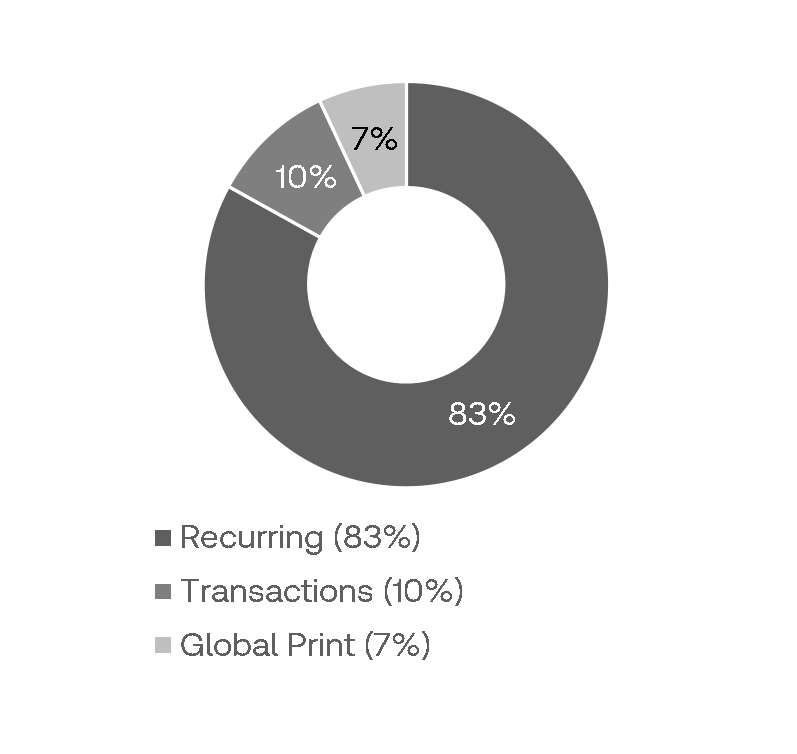

The Company serves professionals across legal, tax, audit, accounting, compliance, government, and media. Its products combine highly specialized software and insights to empower professionals with the data, intelligence, and solutions needed to make informed decisions, and to help institutions in their pursuit of justice, truth and transparency. Reuters, part of Thomson Reuters, is a world leading provider of trusted journalism and news.

These unaudited interim consolidated financial statements (“interim financial statements”) were approved by the Audit Committee of the Board of Directors of the Company on November 3, 2025.

Basis of preparation

The interim financial statements were prepared using the same accounting policies and methods as those used in the Company’s consolidated financial statements for the year ended December 31, 2024, except as described below. The interim financial statements comply with International Accounting Standard 34, Interim Financial Reporting (“IAS 34”). Accordingly, certain information and footnote disclosure normally included in annual financial statements prepared in accordance with International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board ("IASB"), have been omitted or condensed.

The preparation of financial statements in accordance with IAS 34 requires the use of certain critical accounting estimates. It also requires management to exercise judgment in applying the Company’s accounting policies. The areas involving more judgment or complexity, or areas where assumptions and estimates are significant to the consolidated financial statements have been disclosed in note 2 of the consolidated financial statements for the year ended December 31, 2024.

The Company continues to operate in an uncertain macroeconomic environment, reflecting ongoing geopolitical risk, uneven economic growth, and an evolving interest rate and inflationary backdrop, among other factors. While the Company is closely monitoring these conditions to assess potential impacts on its businesses, some of management’s estimates and judgments may be more variable and may change materially in the future due to the significant uncertainty created by these circumstances.

The accompanying interim financial statements include all adjustments, composed of normal recurring adjustments, considered necessary by management to fairly state the Company’s results of operations, financial position and cash flows. The operating results for interim periods are not necessarily indicative of results that may be expected for any other interim period or for the full year. These interim financial statements should be read in conjunction with the Company’s consolidated financial statements for the year ended December 31, 2024, which are included in the Company’s 2024 annual report.

References to “$” are to U.S. dollars, references to “C$” are to Canadian dollars, references to “£” are to British pounds sterling and references to SEK are to Swedish Kronor.

Changes in accounting policies

IAS 21, The Effect of Changes in Foreign Exchange Rates

In August 2023, the IASB issued amendments to IAS 21, which provide guidance on the determination of an exchange rate to translate transactions and financial statements denominated or presented in a currency that is not exchangeable into another currency. The amendments were effective for reporting periods beginning January 1, 2025 and did not have a material impact on the Company’s financial statements.

Recent accounting pronouncements

IFRS 18, Presentation and Disclosure in Financial Statements and associated amendments to IAS 7, Statement of Cash Flows

In April 2024, the IASB issued IFRS 18 and amendments to IAS 7. IFRS 18 will replace IAS 1, Presentation of Financial Statements. Both IFRS 18 and amendments to IAS 7 are effective for reporting periods beginning January 1, 2027.