Clear Course for Profitable Growth Investor Presentation November 2025

Forward-Looking Statements This presentation contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended, relating to our business and financial outlook, which are based on our current beliefs, assumptions, intentions, plans, expectations, estimates, forecasts and projections. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “projects,” “intends,” “predicts,” “potential,” “positioned,” “deliver,” or “continue” or other comparable terminology. Forward-looking statements in this presentation include the Company's expectations regarding net sales, adjusted EBITDA, and free cash flow for the year ended December 31, 2025. Forward-looking statements are not guarantees of our future performance, are based on our current expectations and assumptions regarding our business, the economy and other future conditions, and are subject to risks, uncertainties and changes in circumstances that are difficult to predict, including the risks described in Part I, Item 1A under the heading Risk Factors in our Annual Report on Form 10-K for the year ended December 31, 2024, and in Part II, Item 1A under the heading Risk Factors in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2025. Factors that could cause future results to differ from those expressed by forward-looking statements include, but are not limited to, (i) our ability to maintain operations to support our customers and patients in the near-term and to capitalize on future growth opportunities, (ii) risks associated with acceptance of surgical products and procedures by surgeons and hospitals, (iii) development and acceptance of new products or product enhancements, (iv) clinical and statistical verification of the benefits achieved via the use of our products, (v) our ability to adequately manage inventory, (vi) our ability to successfully optimize our commercial channels, (vii) our success in defending legal proceedings brought against us, and (viii) the other risks and uncertainties more fully described in our periodic filings with the Securities and Exchange Commission (the “SEC”). As a result of these various risks, our actual outcomes and results may differ materially from those expressed in these forward-looking statements. Further, any forward-looking statement speaks only as of the date hereof, unless it is specifically otherwise stated to be made as of a different date. The Company undertakes no obligation to update, and expressly disclaims any duty to update, its forward-looking statements, whether as a result of circumstances or events that arise after the date hereof, new information, or otherwise, except as required by law. The Company is unable to provide expectations of GAAP net income (loss), the closest comparable GAAP measures to adjusted EBITDA (which is a non-GAAP measure), on a forward-looking basis because the Company is unable to predict, without unreasonable efforts, the ultimate outcome of matters (including acquisition-related expenses, accounting fair value adjustments, and other such items) that will determine the quantitative amount of the items excluded in calculating adjusted EBITDA, which items are further described in the reconciliation tables and related descriptions below. These items are uncertain, depend on various factors, and could be material to the Company’s results computed in accordance with GAAP.

Non-GAAP Financial Measures Management uses certain non-GAAP financial measures in this presentation, most specifically Adjusted EBITDA, Adjusted Gross Margin, Adjusted Net Income and Free Cash Flow, as a supplement to GAAP financial measures to further evaluate the Company’s operating performance period over period, analyze the underlying business trends, assess performance relative to competitors and establish operational objectives. Management believes it is important to provide investors with the same non-GAAP metrics it uses to evaluate the performance and underlying trends of the Company’s business operations to facilitate comparisons to its historical operating results and evaluate the effectiveness of its operating strategies. Disclosure of these non-GAAP financial measures also facilitates comparisons of the Company’s underlying operating performance with other companies in the industry that also supplement their GAAP results with non-GAAP financial measures. Unless noted otherwise, full-year guidance is based on the current foreign currency exchange rates and does not take into account any additional potential exchange rate changes that may occur this year. These non-GAAP financial measures should not be considered in isolation from, or as replacements for, the most directly comparable GAAP financial measures, as these measures are not prepared in accordance with U.S. GAAP. Reconciliations between GAAP and non‐GAAP results are included at the end of this presentation and represent the most comparable GAAP measure(s) to the applicable non-GAAP measure(s) shown in the table. For further information regarding the nature of these exclusions, why the Company believes that these non-GAAP financial measures provide useful information to investors, the specific manner in which management uses these measures, and some of the limitations associated with the use of these measures, please refer to the Company's Current Report on Form 8-K regarding its third quarter 2025 press release filed on November 4, 2025 with the SEC and available on the SEC's website at www.sec.gov and on the “Investors” page of the Company’s website at www.orthofix.com. The Company’s non-GAAP financial measures for the three and nine months ended September 30, 2025, and 2024, have been adjusted to eliminate the financial effects of the Company’s decision to discontinue its M6™ product lines. Accordingly, previously reported figures for 2024 have been recast to reflect the financial impact of this decision. Amounts may not add due to rounding.

Key Themes Disciplined, Profitable Growth to Maximize Value Creation Building on a strong foundation as a leading global med tech company with a comprehensive portfolio of innovative spinal hardware, bone growth therapies, biologics, specialized orthopedic limb reconstruction solutions, and an advanced surgical navigation system (7D FLASH™) Driving meaningful and sustainable, above-market growth with broad, differentiated technologies, extensive commercial reach, and improving financial strength Delivering significant value to shareholders, surgeons, patients and employees and setting new standards of innovation through our products and extensive solutions Executing a clear strategy for profitable growth led by an established, world-class management team Advancing toward our 2027 financial targets to build on positive momentum, increase transparency, and maximize value creation 05 03 04 02 01

Commitment to Disciplined, Profitable Growth to Deliver Life-Changing Solutions and Maximize Value Creation The New Orthofix

Building on a Strong Foundation – Transformation Focused on Accelerating Excellence Entering a New Phase in our Journey, Driven by Strategic, Operational and Financial Discipline RECENT ACCOMPLISHMENTS AND TRANSFORMATIVE ACTIONS Building on clear competitive advantages Delivering consistent performance – achieved profitability objectives, including 7 consecutive quarters of adjusted EBITDA margin expansion and positive free cash flow (FCF) for 2H24, 2Q25 and 3Q25 Supporting profitable growth with disciplined capital deployment Completing the successful integration of SeaSpine Driving a culture of execution and accountability through established, world-class management team CONTINUED LEADERSHIP FOCUS AREAS –MULTIPLE LEVERS FOR PROFITABLE GROWTH Innovation FocusContinued development of differentiated products to meet diverse surgeon preferences Commercial Strategy EnhancementDeeper market penetration through comprehensive portfolio offerings Technology LeadershipHarnessing advanced systems for improved surgical outcomes and efficiency Growth SustainabilityEmphasis on high-quality revenue streams and operational excellence Cash Flow ManagementStrategic financial planning to sustain positive FCF

Reinvigorated and Aligned Around Our New Vision and Mission Vision The unrivaled partner in med tech, delivering exceptional experiences and life-changing solutions Mission We provide medical technologies that heal musculoskeletal pathologies. We enable our teams through opportunities for growth, ownership of responsibilities, and empowerment to execute. We do this for patients and the healthcare professionals who treat them. We collaborate with world-class surgeons and other partners to bring to market highly innovative, cost-effective, and user-friendly medical technologies through excellent customer service. We do this to improve people’s quality of life, and in doing so, create exceptional value for our customers, employees and stockholders.

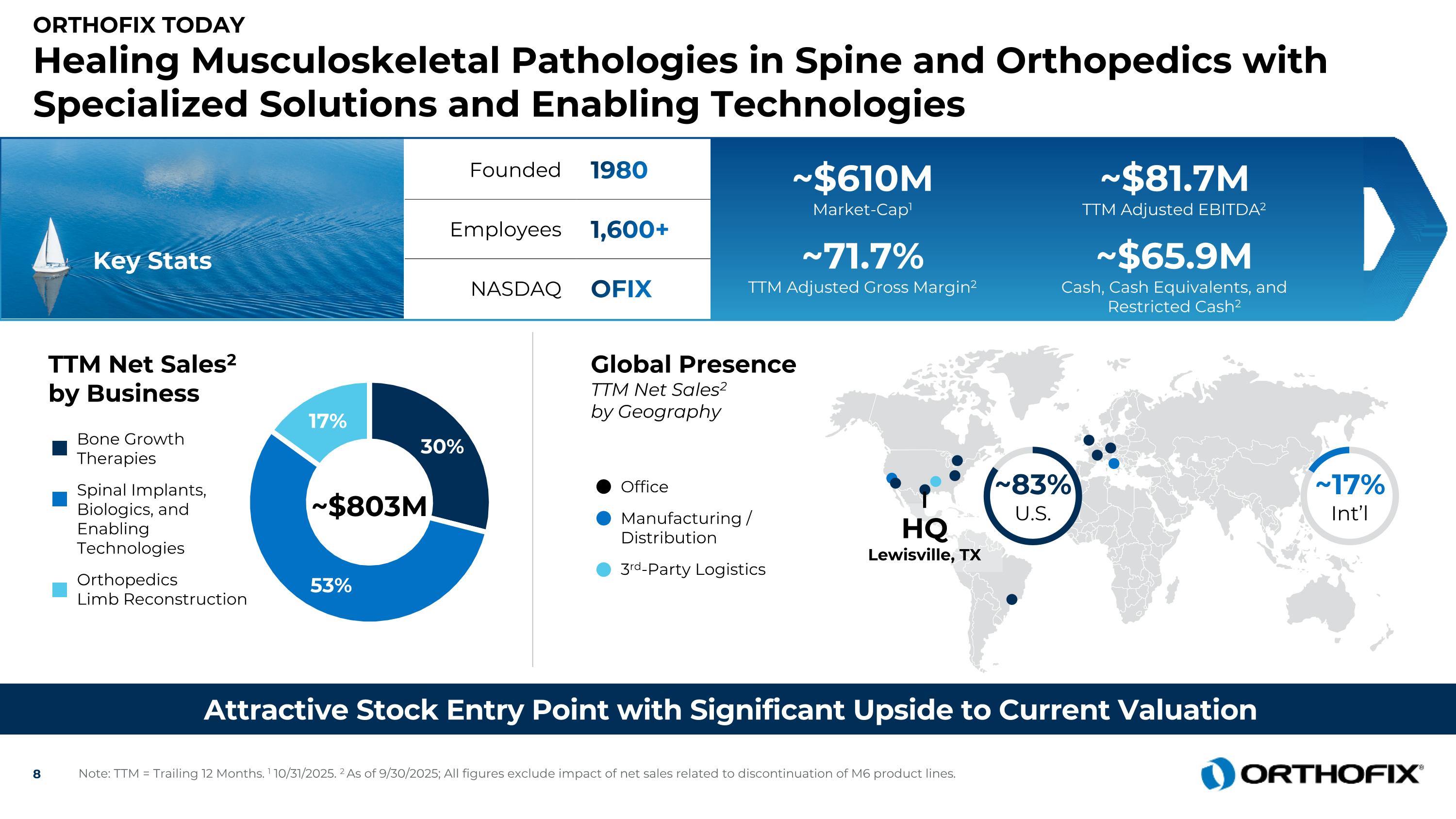

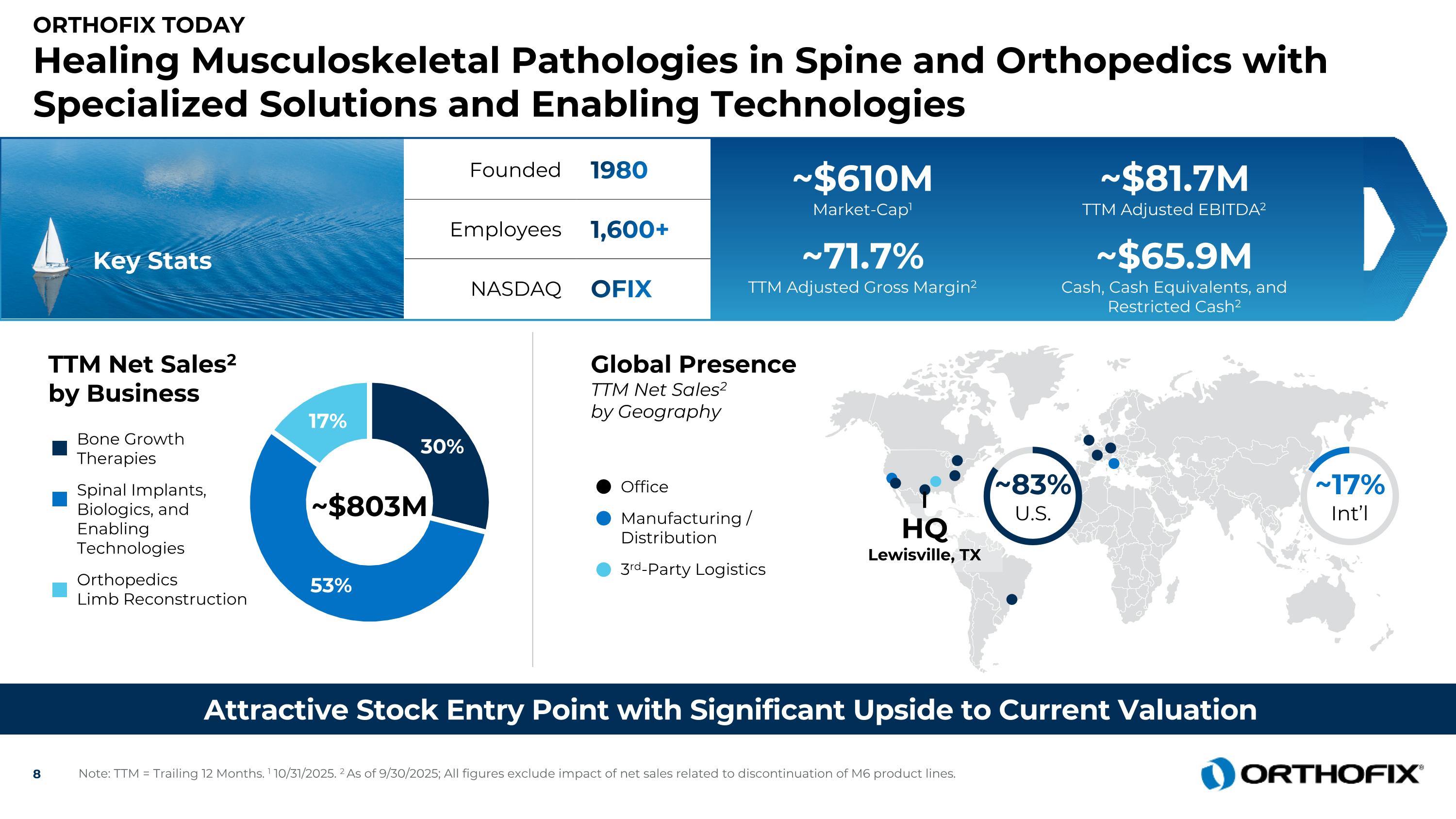

Orthofix Today Healing Musculoskeletal Pathologies in Spine and Orthopedics with Specialized Solutions and Enabling Technologies Attractive Stock Entry Point with Significant Upside to Current Valuation Key Stats TTM Net Sales2 by Business ~$803M Bone Growth Therapies Spinal Implants, Biologics, and Enabling Technologies Orthopedics Limb Reconstruction ~17% Int’l HQLewisville, TX ~83% U.S. Founded 1980 Employees 1,600+ NASDAQ OFIX Office Manufacturing /Distribution 3rd-Party Logistics Global Presence TTM Net Sales2by Geography ~$610M Market-Cap1 ~$81.7M TTM Adjusted EBITDA2 ~71.7% TTM Adjusted Gross Margin2 ~$65.9M Cash, Cash Equivalents, and Restricted Cash2 Note: TTM = Trailing 12 Months. 1 10/31/2025. 2 As of 9/30/2025; All figures exclude impact of net sales related to discontinuation of M6 product lines.

Comprehensive Portfolio of Transformative Solutions Improved Clinical Efficiencies and Economic Value with 7D Enabling Technology EstablishedDistribution Channels and Extensive Global Commercial Reach Large Addressable Markets with High-Growth Opportunities Across Continuum of Care World-Class, Visionary Leadership Team with Deep Sector Expertise Expanding and Deepening Customer Relationships 9 Capitalizing on Clear Competitive Advantages

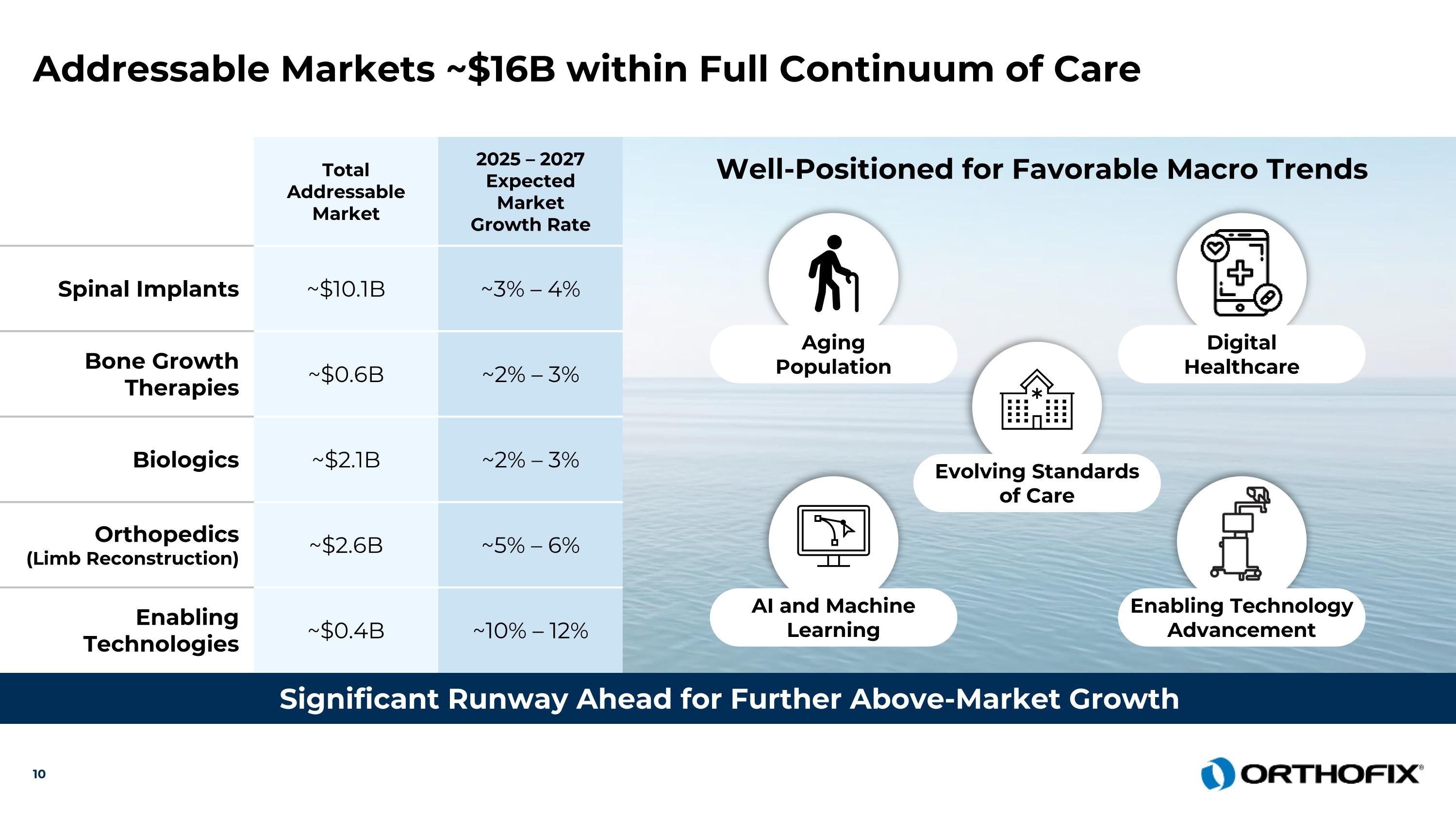

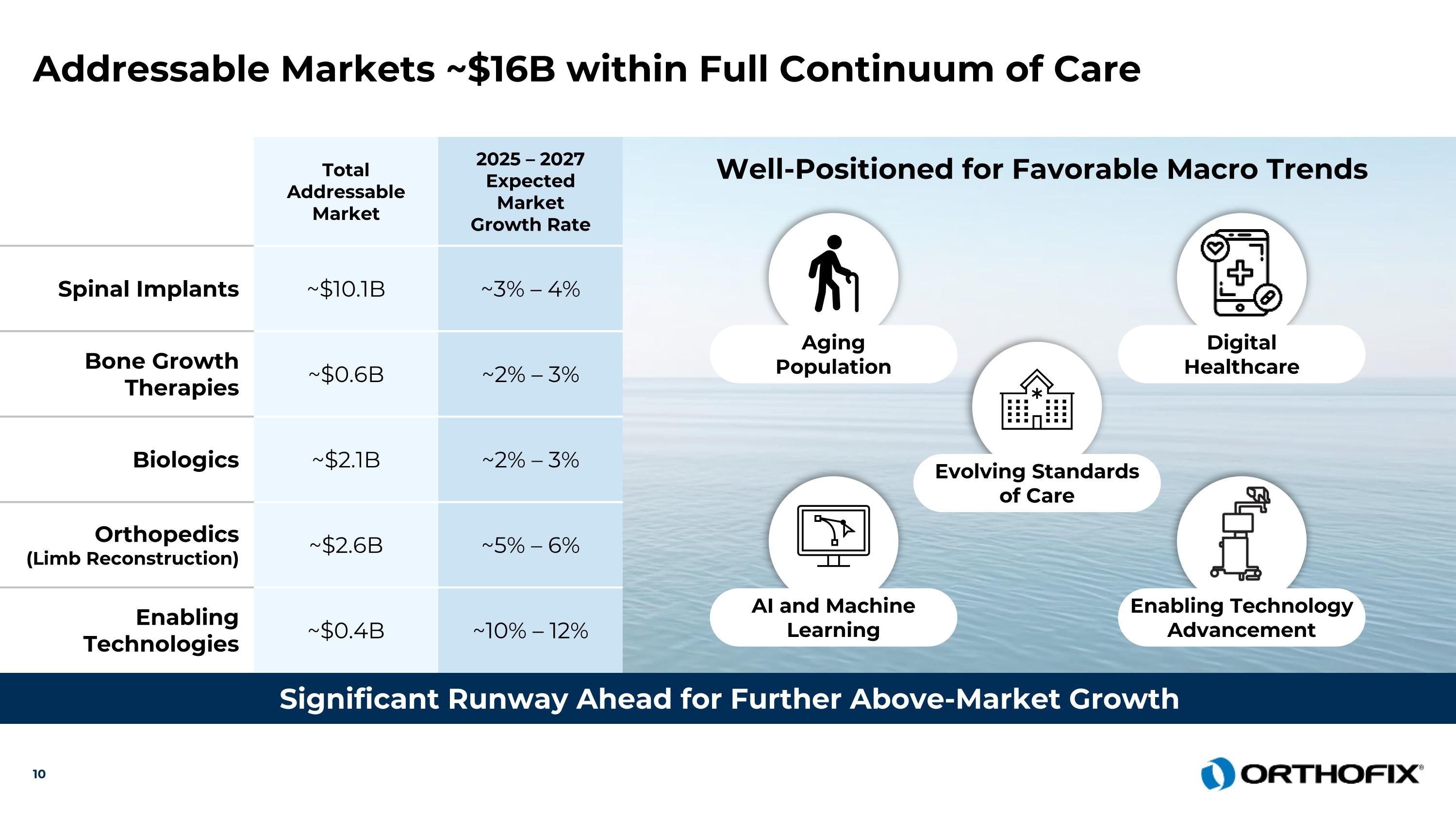

Total Addressable Market 2025 – 2027 Expected Market Growth Rate Spinal Implants ~$10.1B ~3% – 4% Bone Growth Therapies ~$0.6B ~2% – 3% Biologics ~$2.1B ~2% – 3% Orthopedics (Limb Reconstruction) ~$2.6B ~5% – 6% Enabling Technologies ~$0.4B ~10% – 12% Addressable Markets ~$16B within Full Continuum of Care Significant Runway Ahead for Further Above-Market Growth Well-Positioned for Favorable Macro Trends Aging Population Digital Healthcare AI and Machine Learning Enabling Technology Advancement Evolving Standards of Care

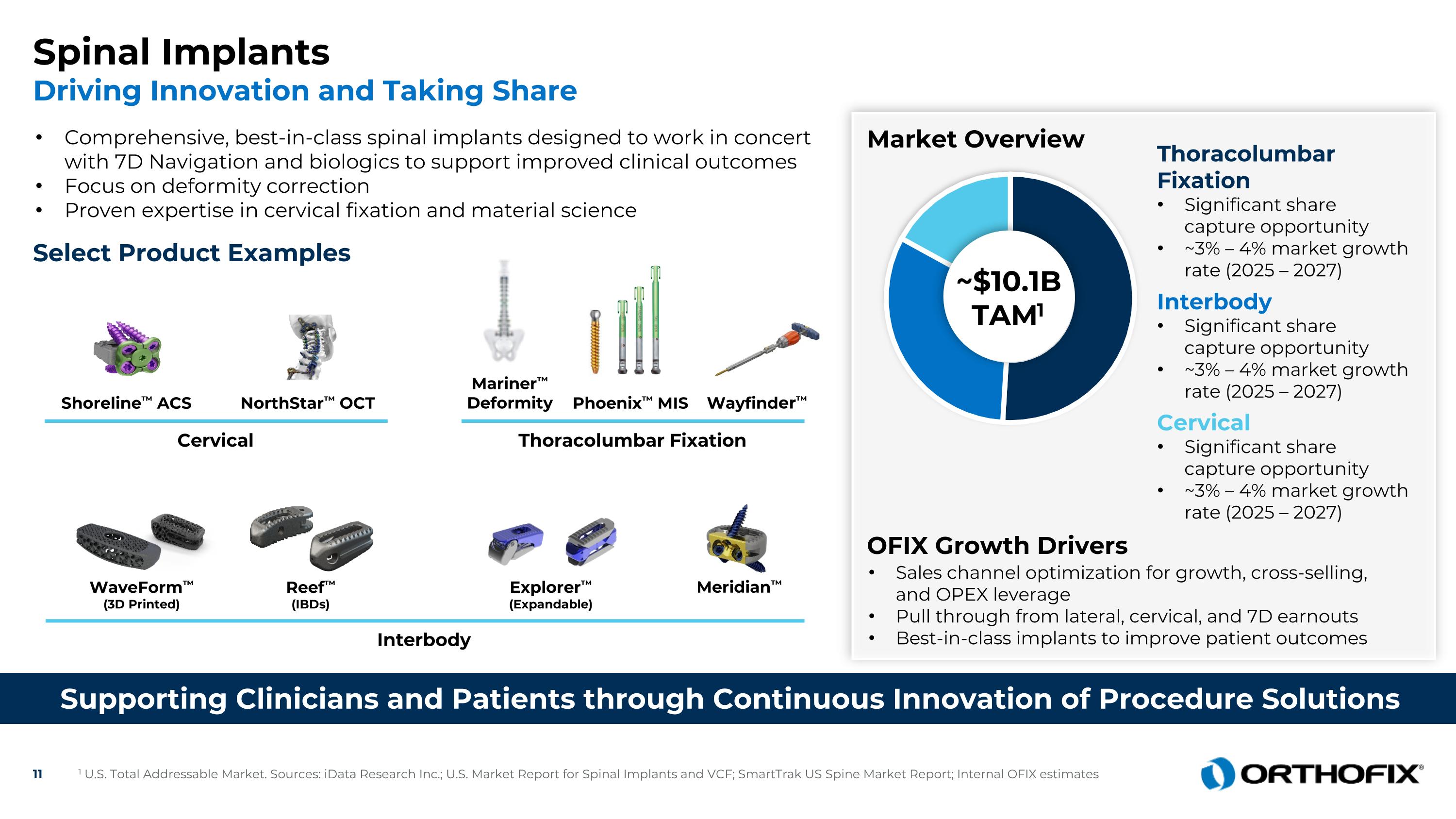

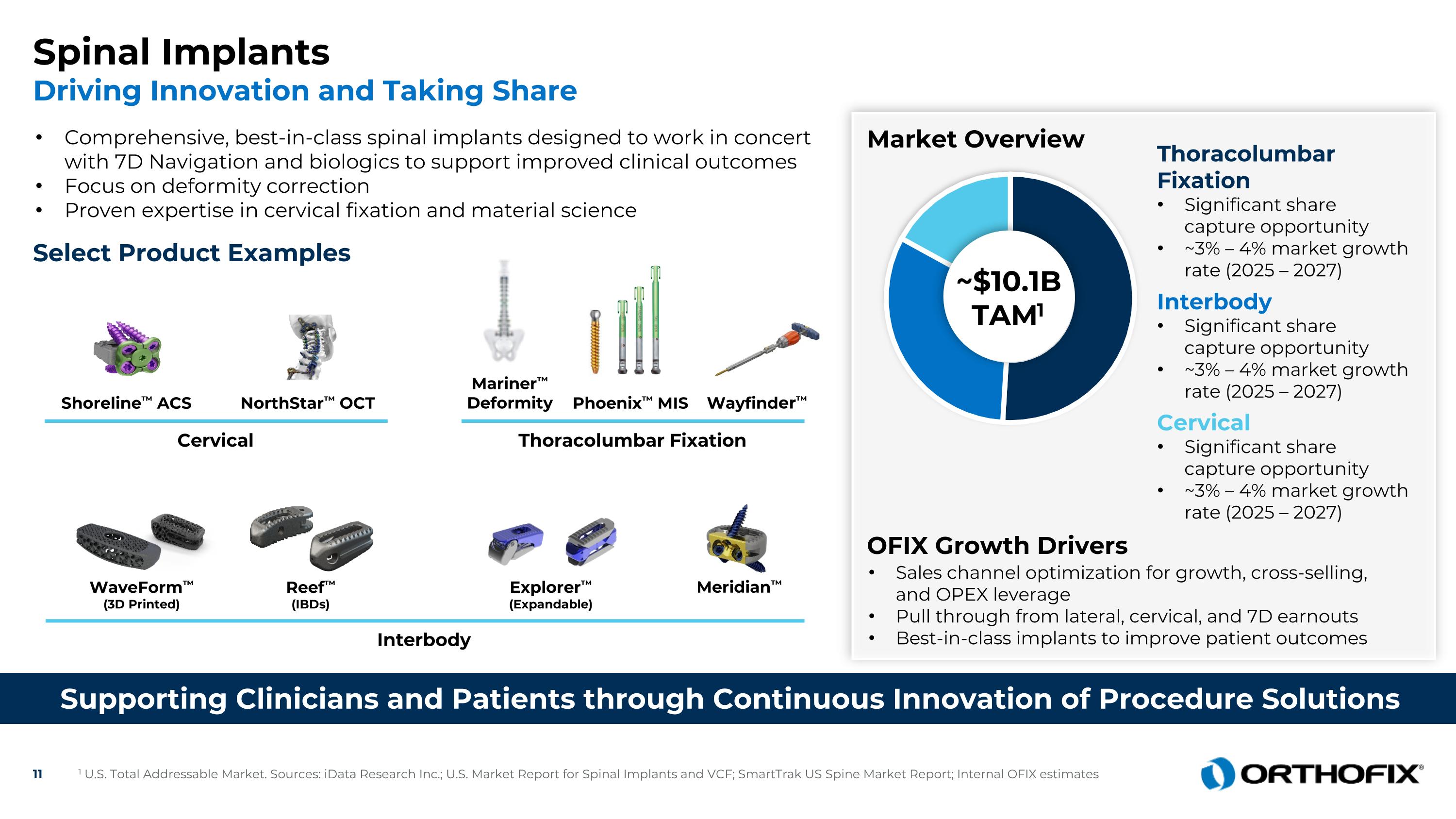

Spinal Implants Driving Innovation and Taking Share Select Product Examples Market Overview Sales channel optimization for growth, cross-selling, and OPEX leverage Pull through from lateral, cervical, and 7D earnouts Best-in-class implants to improve patient outcomes Interbody Cervical Thoracolumbar Fixation NorthStar™ OCT Mariner™ Deformity WaveForm™ (3D Printed) Explorer™ (Expandable) Reef™ (IBDs) ~$10.1BTAM1 Thoracolumbar Fixation Significant share capture opportunity ~3% – 4% market growth rate (2025 – 2027) Interbody Significant share capture opportunity ~3% – 4% market growth rate (2025 – 2027) Cervical Significant share capture opportunity ~3% – 4% market growth rate (2025 – 2027) OFIX Growth Drivers Shoreline™ ACS Wayfinder™ Phoenix™ MIS Meridian™ 1 U.S. Total Addressable Market. Sources: iData Research Inc.; U.S. Market Report for Spinal Implants and VCF; SmartTrak US Spine Market Report; Internal OFIX estimates Supporting Clinicians and Patients through Continuous Innovation of Procedure Solutions Comprehensive, best-in-class spinal implants designed to work in concert with 7D Navigation and biologics to support improved clinical outcomes Focus on deformity correction Proven expertise in cervical fixation and material science

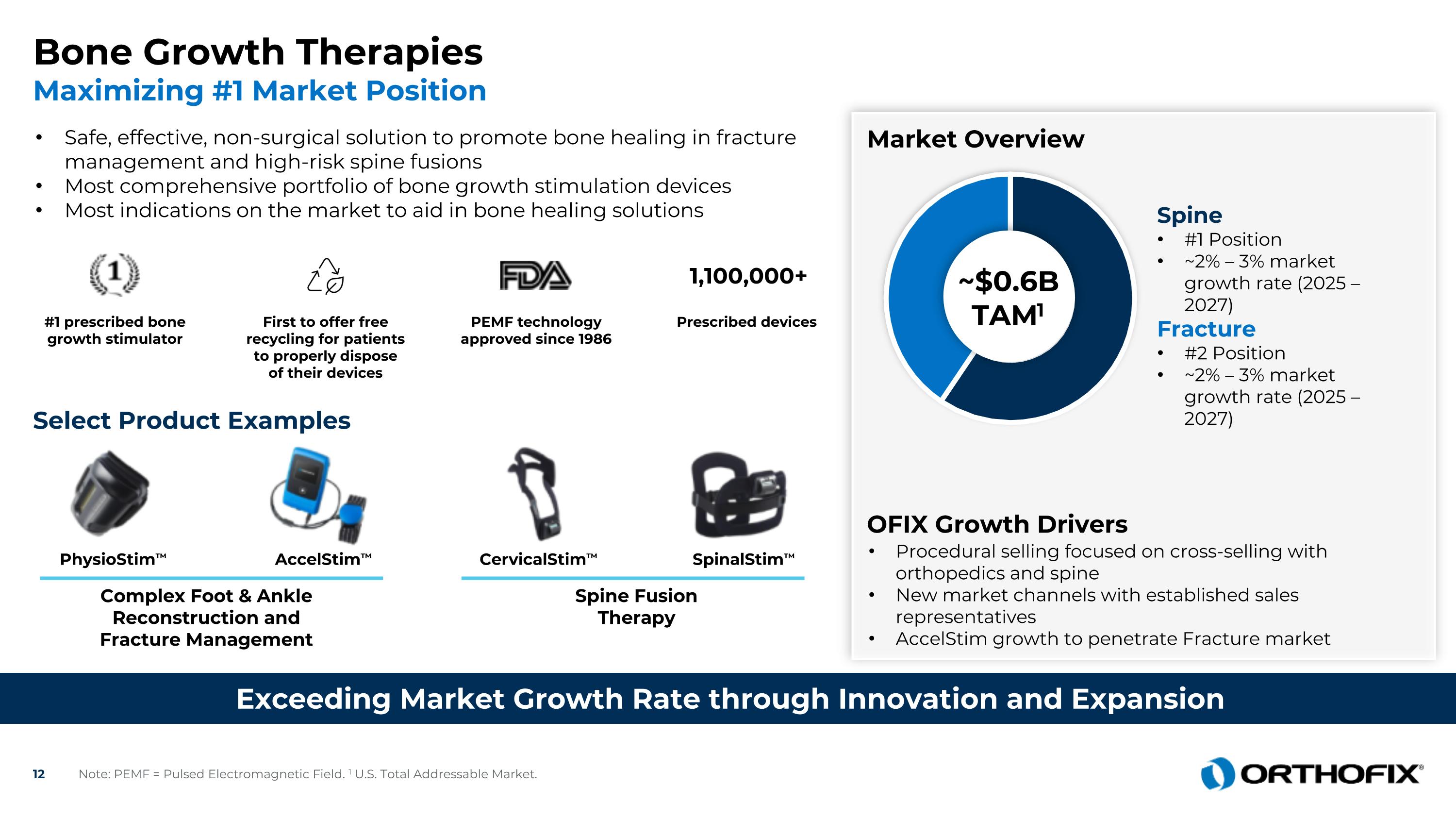

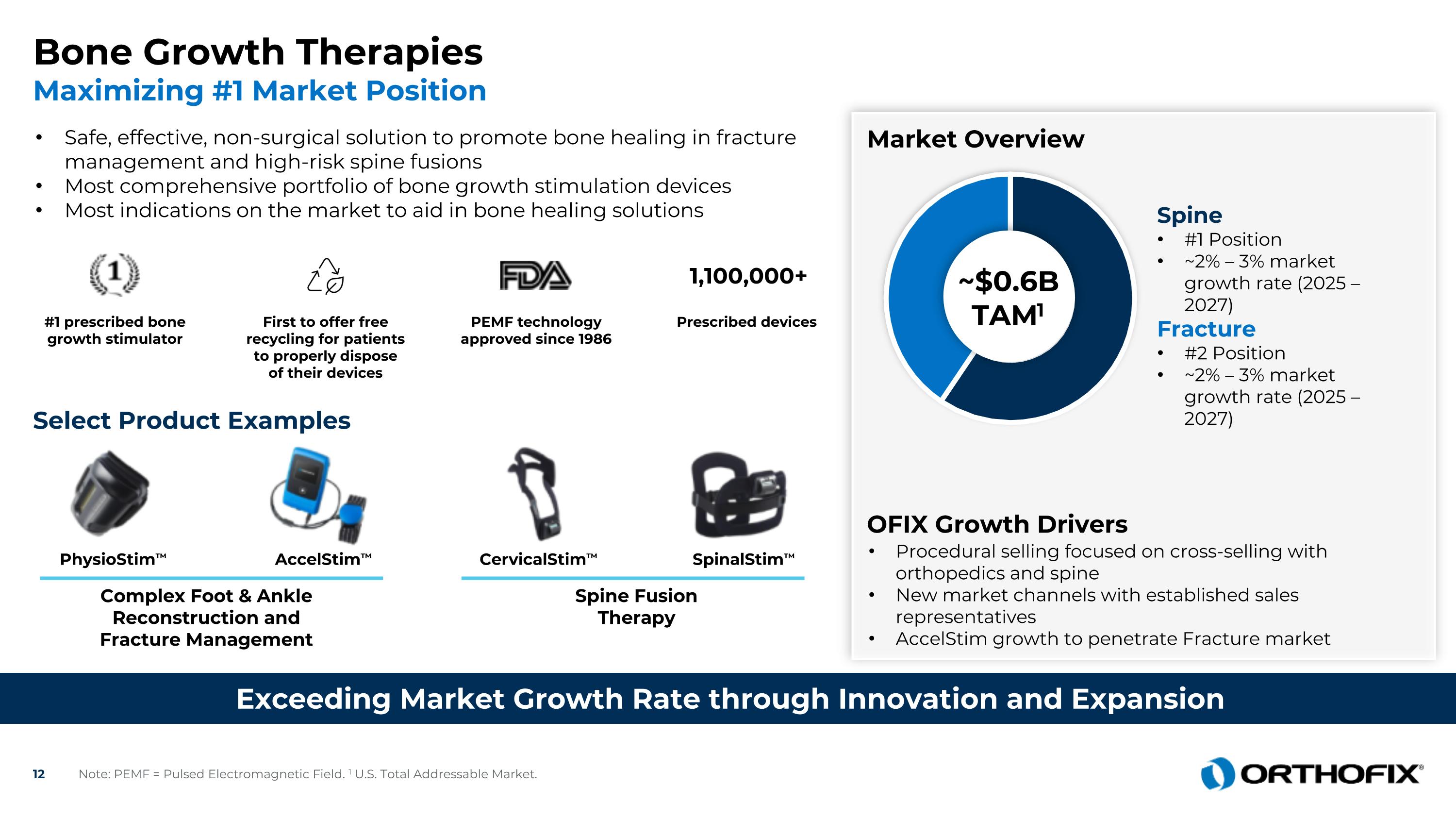

AccelStim™ SpinalStim™ PhysioStim™ CervicalStim™ Complex Foot & Ankle Reconstruction and Fracture Management Bone Growth Therapies Maximizing #1 Market Position Exceeding Market Growth Rate through Innovation and Expansion Safe, effective, non-surgical solution to promote bone healing in fracture management and high-risk spine fusions Most comprehensive portfolio of bone growth stimulation devices Most indications on the market to aid in bone healing solutions Select Product Examples #1 prescribed bone growth stimulator First to offer free recycling for patients to properly dispose of their devices PEMF technology approved since 1986 Prescribed devices 1,100,000+ Spine Fusion Therapy Market Overview Procedural selling focused on cross-selling with orthopedics and spine New market channels with established sales representatives AccelStim growth to penetrate Fracture market ~$0.6BTAM1 Spine #1 Position ~2% – 3% market growth rate (2025 – 2027) Fracture #2 Position ~2% – 3% market growth rate (2025 – 2027) OFIX Growth Drivers Note: PEMF = Pulsed Electromagnetic Field. 1 U.S. Total Addressable Market.

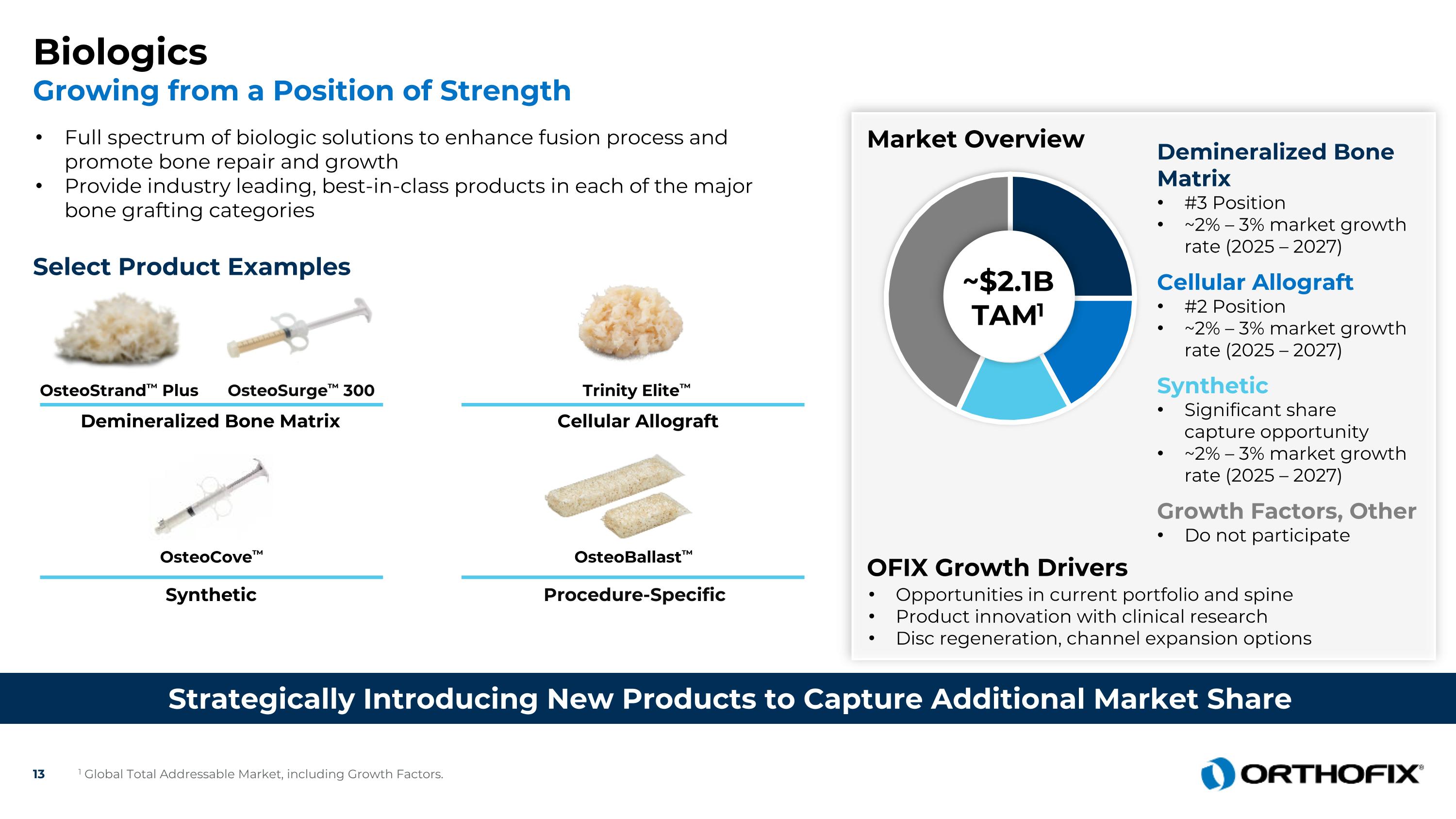

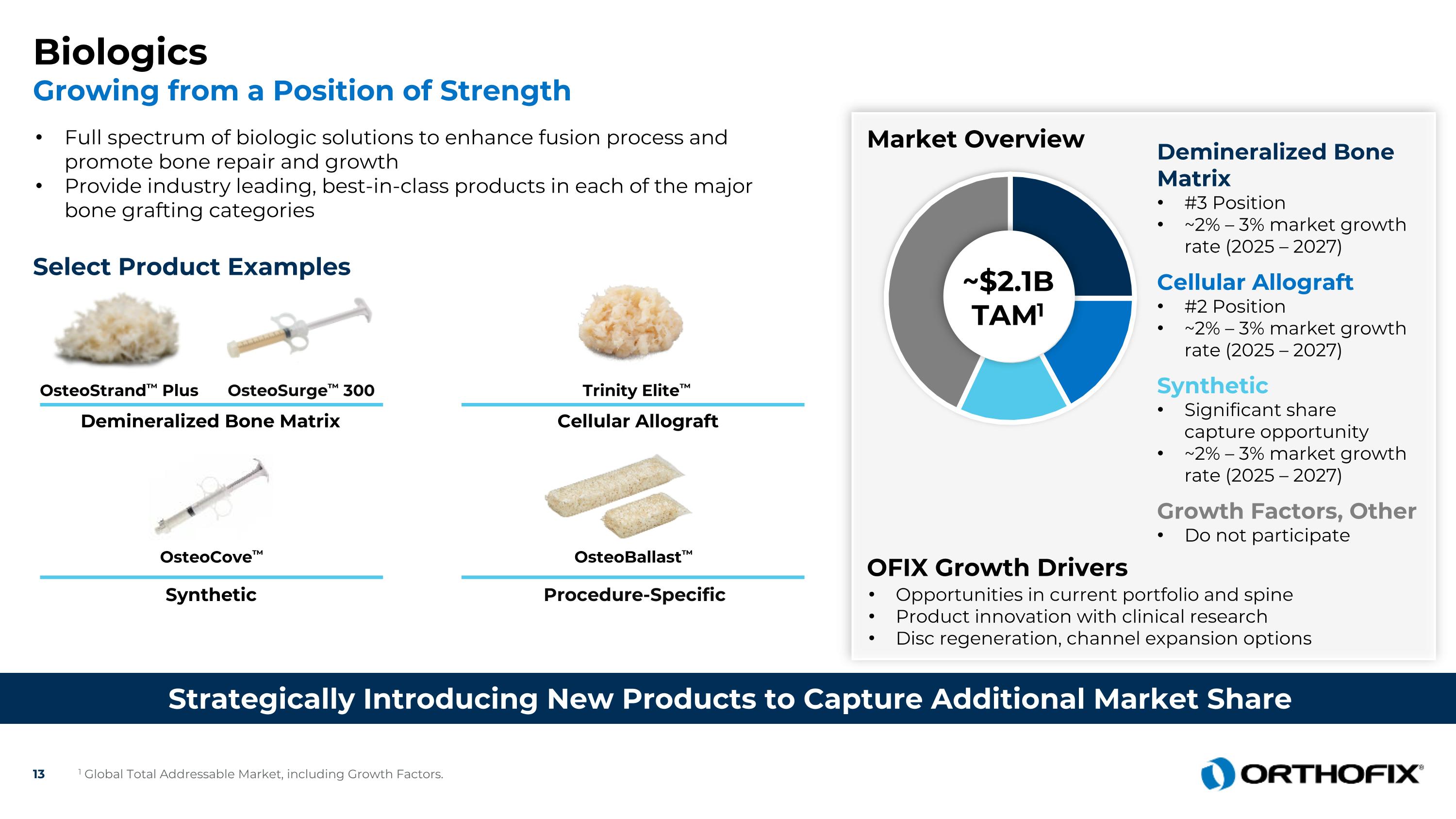

Biologics Growing from a Position of Strength Strategically Introducing New Products to Capture Additional Market Share Full spectrum of biologic solutions to enhance fusion process and promote bone repair and growth Provide industry leading, best-in-class products in each of the major bone grafting categories Select Product Examples Demineralized Bone Matrix OsteoSurge™ 300 OsteoStrand™ Plus Synthetic Procedure-Specific OsteoCove™ OsteoBallast™ Market Overview Opportunities in current portfolio and spine Product innovation with clinical research Disc regeneration, channel expansion options ~$2.1BTAM1 Synthetic Significant share capture opportunity ~2% – 3% market growth rate (2025 – 2027) Cellular Allograft #2 Position ~2% – 3% market growth rate (2025 – 2027) OFIX Growth Drivers Trinity Elite™ Cellular Allograft Growth Factors, Other Do not participate 1 Global Total Addressable Market, including Growth Factors. Demineralized Bone Matrix #3 Position ~2% – 3% market growth rate (2025 – 2027)

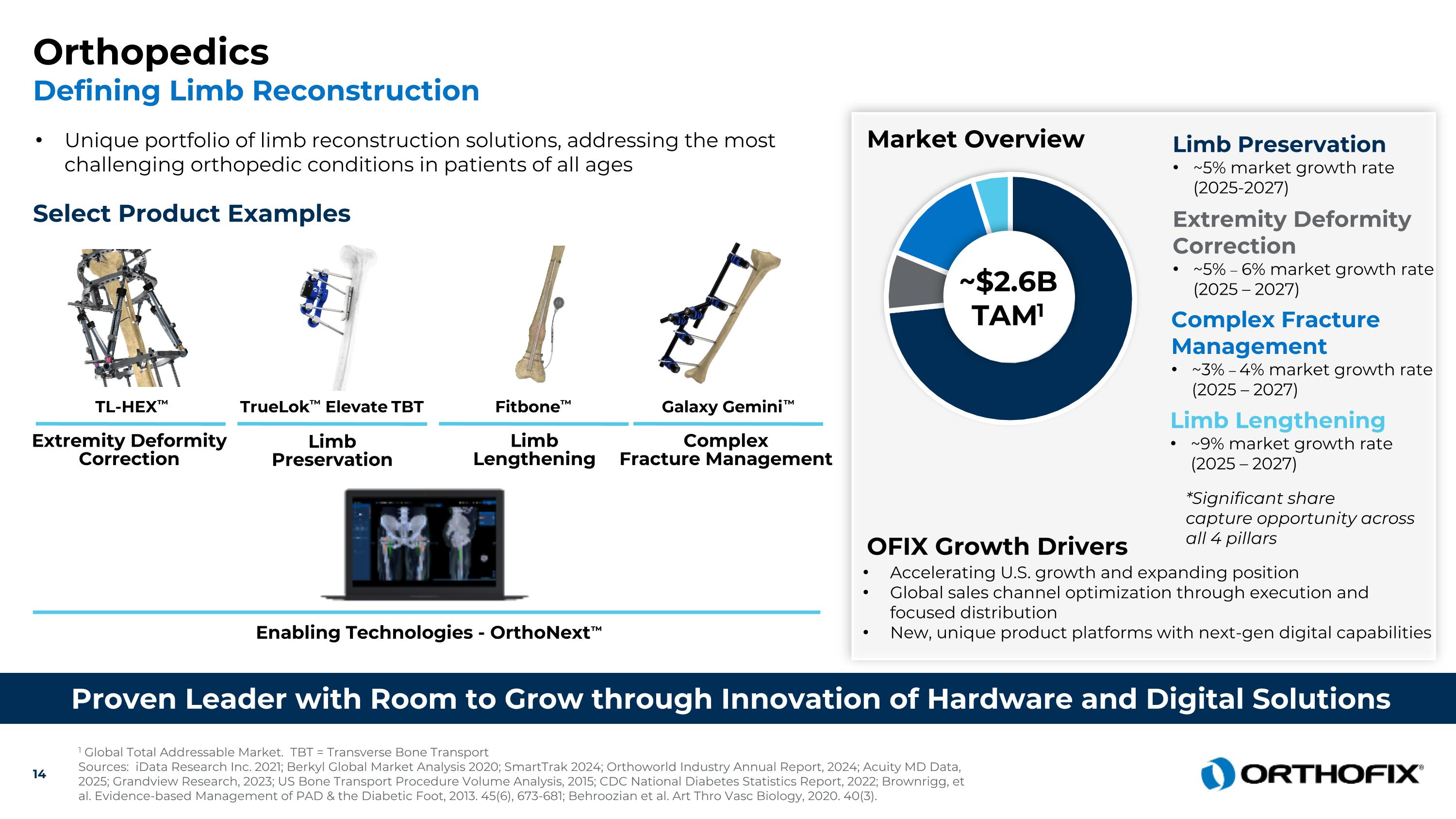

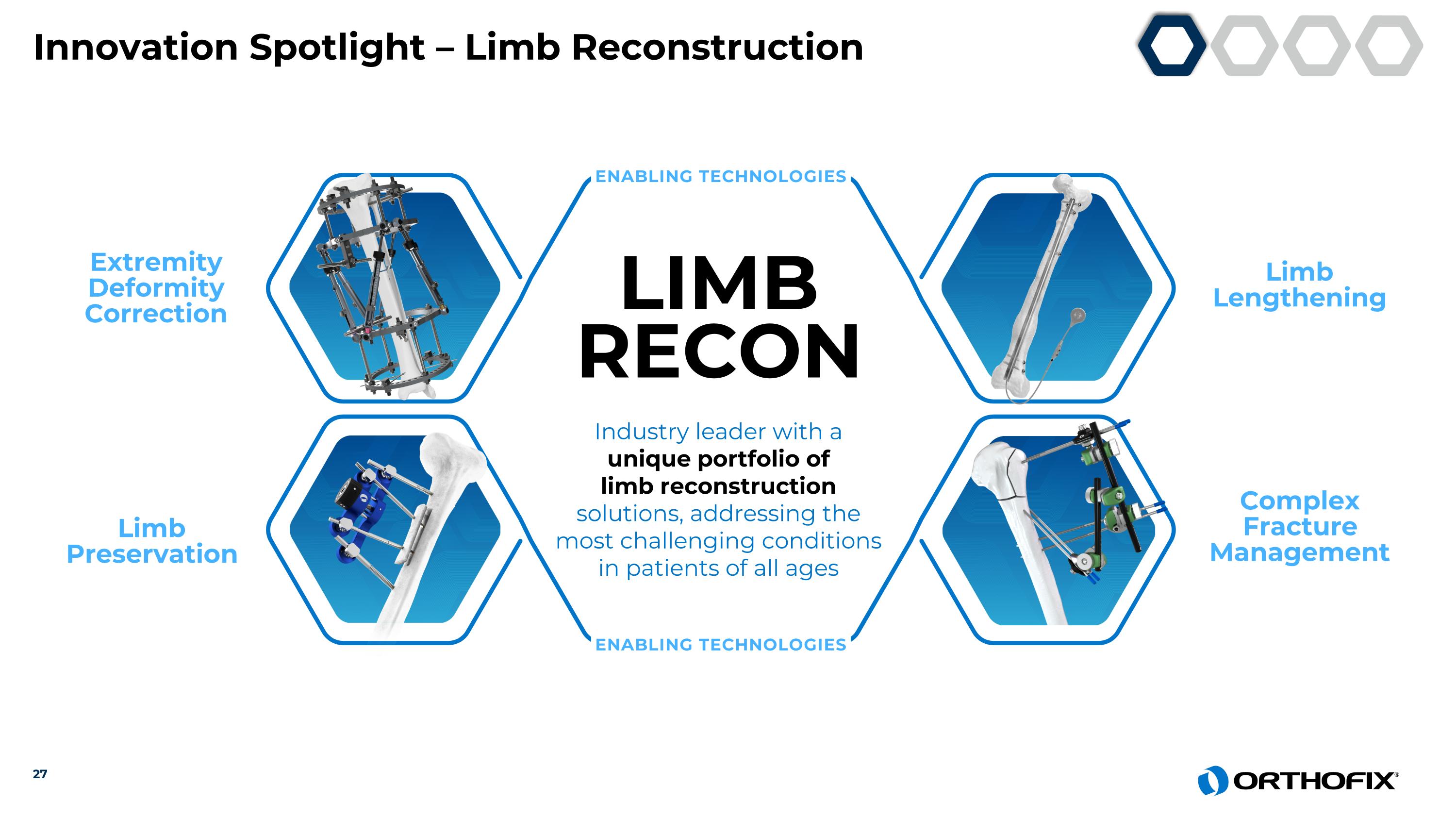

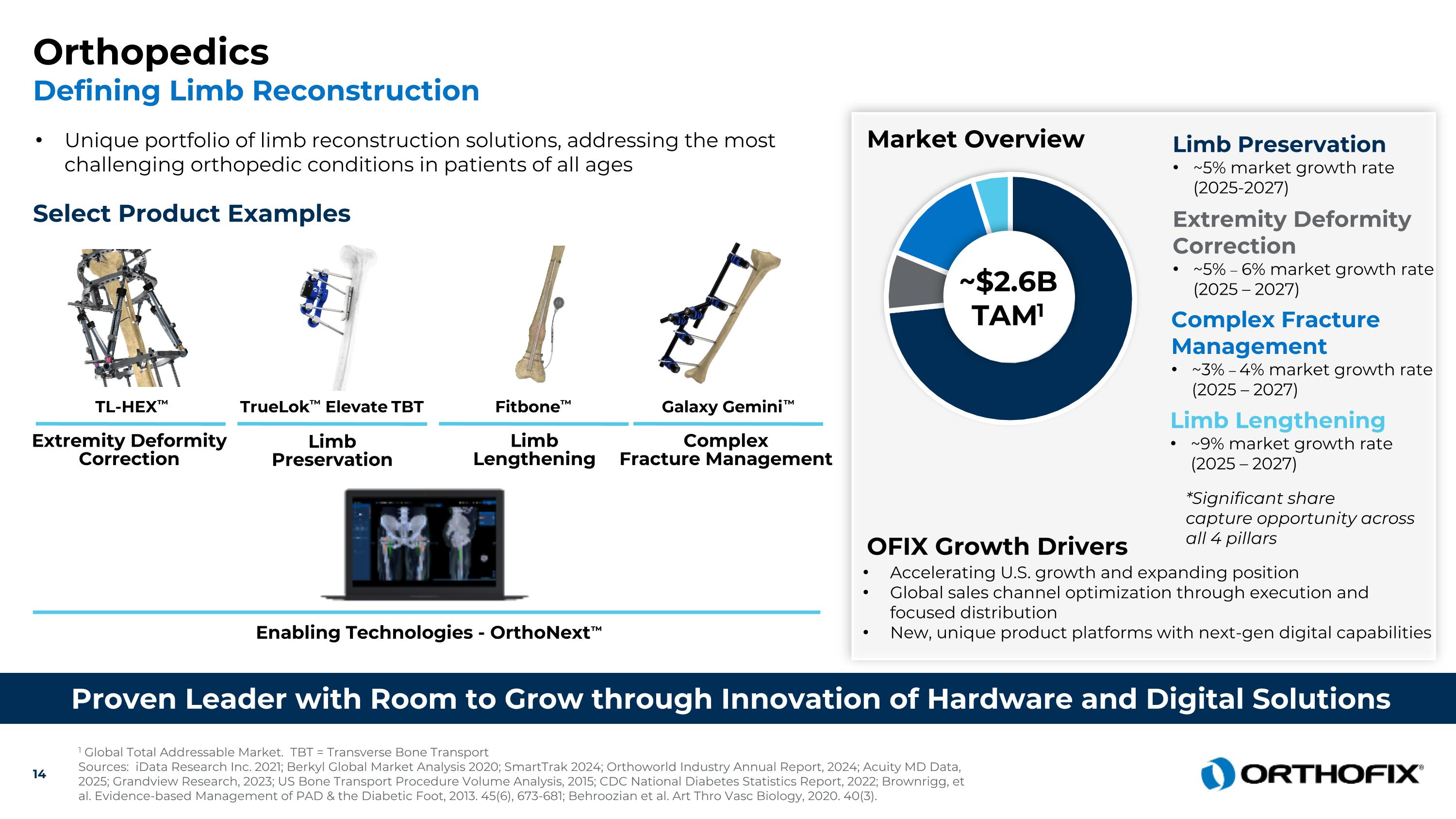

Proven Leader with Room to Grow through Innovation of Hardware and Digital Solutions Enabling Technologies - OrthoNext™ 1 Global Total Addressable Market. TBT = Transverse Bone Transport Sources: iData Research Inc. 2021; Berkyl Global Market Analysis 2020; SmartTrak 2024; Orthoworld Industry Annual Report, 2024; Acuity MD Data, 2025; Grandview Research, 2023; US Bone Transport Procedure Volume Analysis, 2015; CDC National Diabetes Statistics Report, 2022; Brownrigg, et al. Evidence-based Management of PAD & the Diabetic Foot, 2013. 45(6), 673-681; Behroozian et al. Art Thro Vasc Biology, 2020. 40(3). Select Product Examples Unique portfolio of limb reconstruction solutions, addressing the most challenging orthopedic conditions in patients of all ages Galaxy Gemini™ ComplexFracture Management Fitbone™ Limb Lengthening TL-HEX™ Extremity Deformity Correction TrueLok™ Elevate TBT Market Overview Accelerating U.S. growth and expanding position Global sales channel optimization through execution and focused distribution New, unique product platforms with next-gen digital capabilities OFIX Growth Drivers ~$2.6BTAM1 Complex Fracture Management ~3% – 4% market growth rate (2025 – 2027) Limb Lengthening ~9% market growth rate (2025 – 2027) Limb Preservation ~5% market growth rate (2025-2027) Extremity Deformity Correction ~5% – 6% market growth rate (2025 – 2027) Limb Preservation *Significant share capture opportunity across all 4 pillars Orthopedics Defining Limb Reconstruction

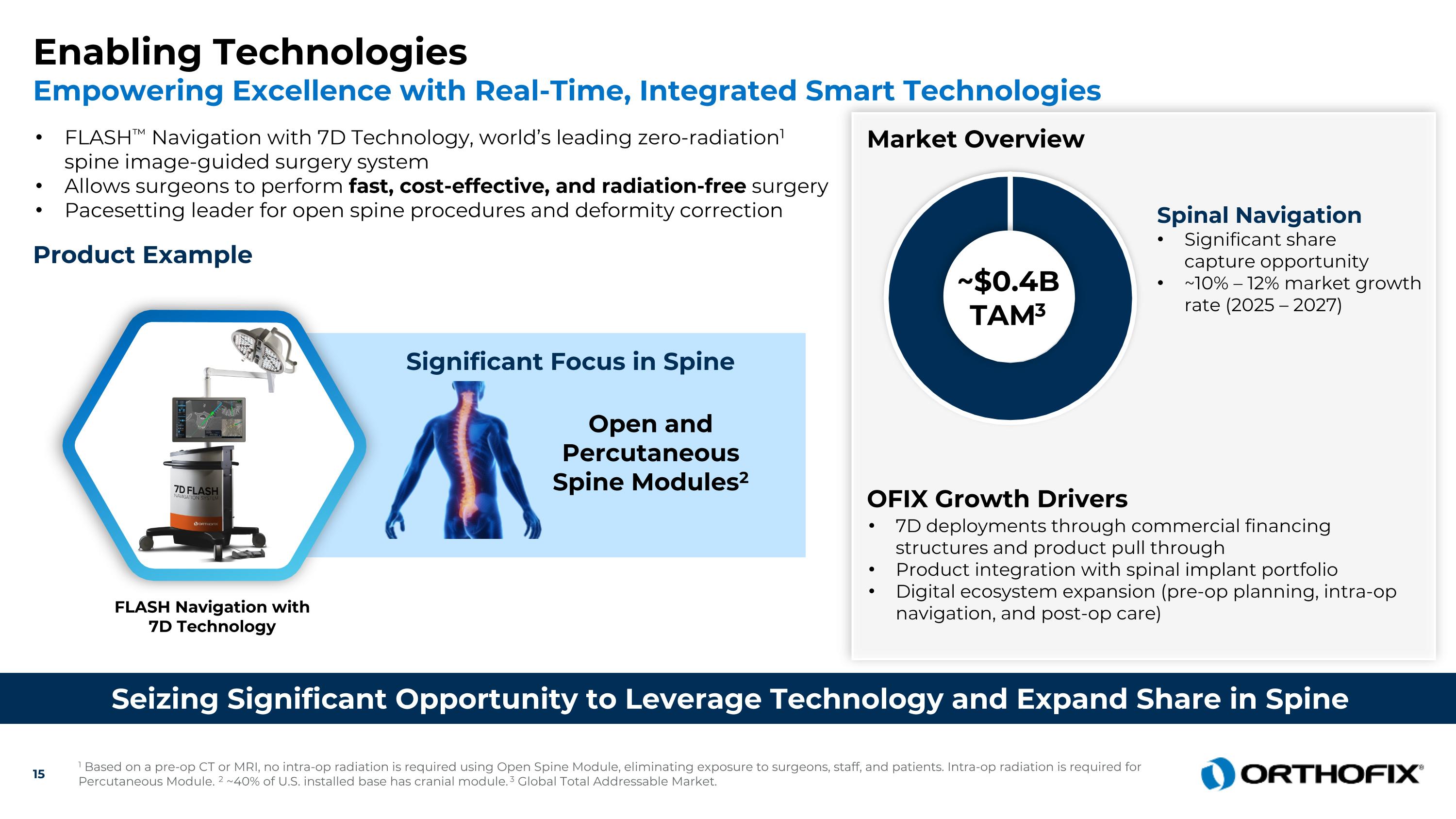

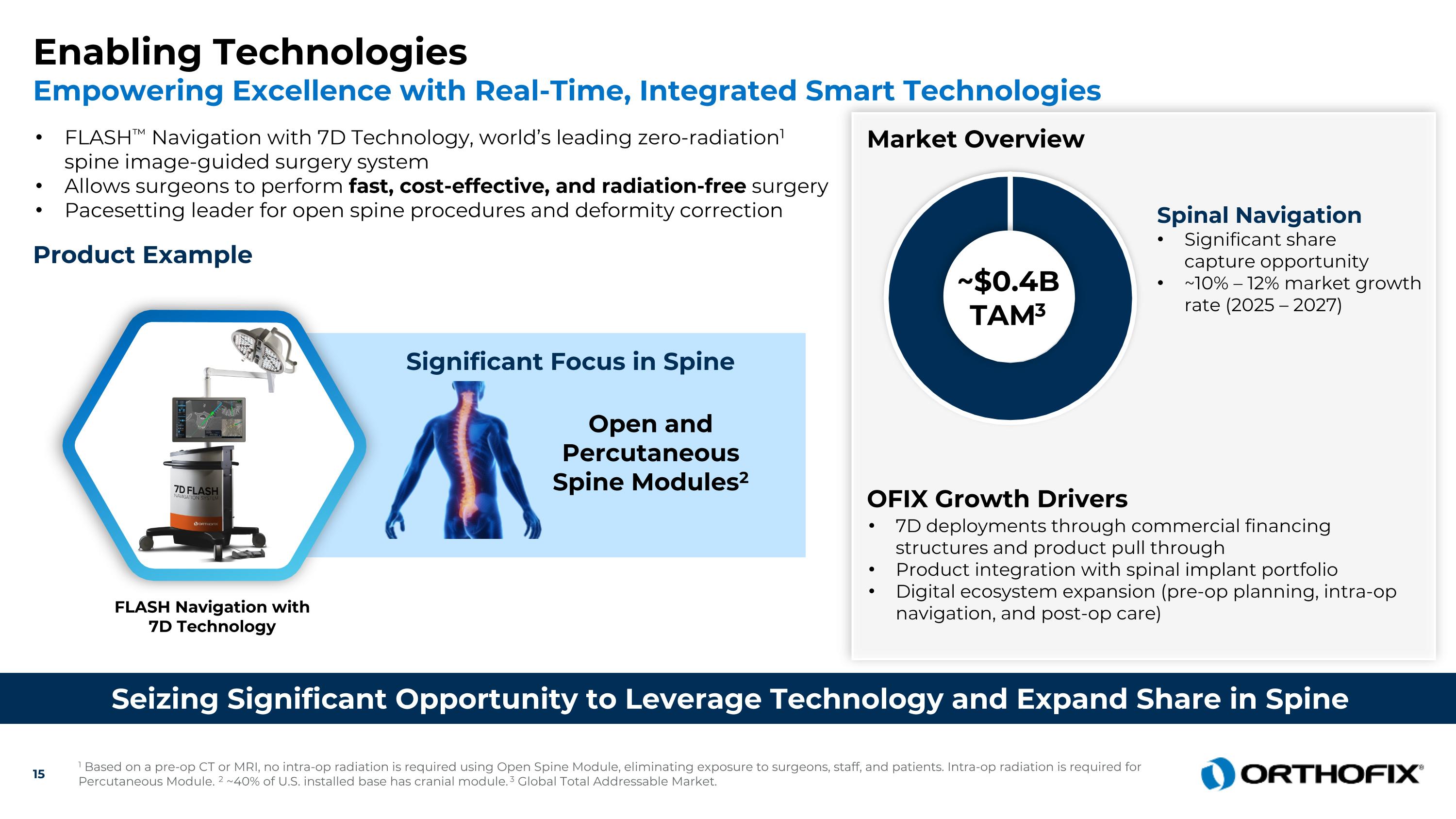

Enabling Technologies Empowering Excellence with Real-Time, Integrated Smart Technologies Seizing Significant Opportunity to Leverage Technology and Expand Share in Spine FLASH™ Navigation with 7D Technology, world’s leading zero-radiation1 spine image-guided surgery system Allows surgeons to perform fast, cost-effective, and radiation-free surgery Pacesetting leader for open spine procedures and deformity correction Open and Percutaneous Spine Modules2 Market Overview OFIX Growth Drivers 7D deployments through commercial financing structures and product pull through Product integration with spinal implant portfolio Digital ecosystem expansion (pre-op planning, intra-op navigation, and post-op care) ~$0.4BTAM3 Spinal Navigation Significant share capture opportunity ~10% – 12% market growth rate (2025 – 2027) FLASH Navigation with 7D Technology Product Example Significant Focus in Spine 1 Based on a pre-op CT or MRI, no intra-op radiation is required using Open Spine Module, eliminating exposure to surgeons, staff, and patients. Intra-op radiation is required for Percutaneous Module. 2 ~40% of U.S. installed base has cranial module. 3 Global Total Addressable Market.

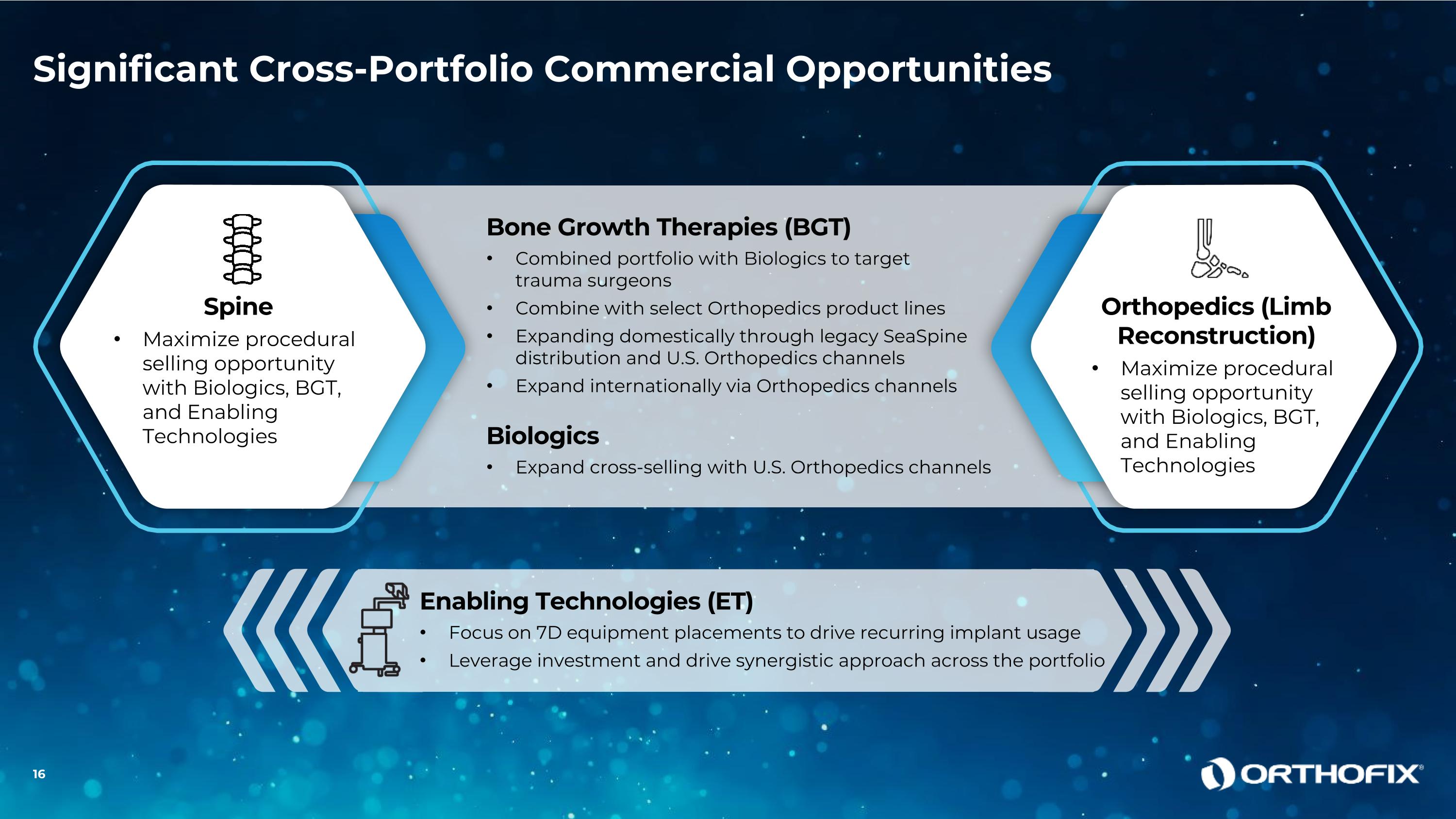

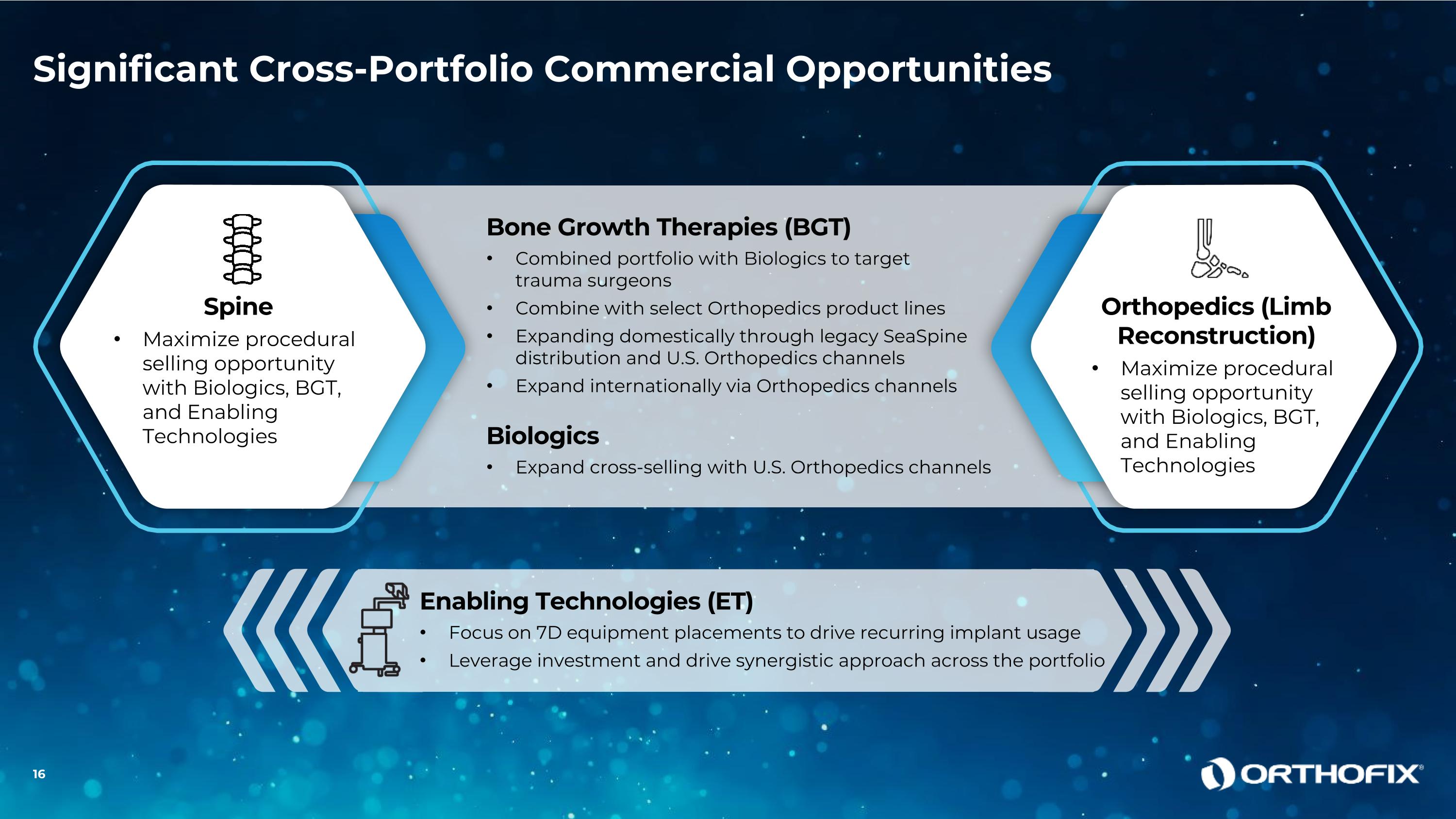

Significant Cross-Portfolio Commercial Opportunities Bone Growth Therapies (BGT) Combined portfolio with Biologics to target trauma surgeons Combine with select Orthopedics product lines Expanding domestically through legacy SeaSpine distribution and U.S. Orthopedics channels Expand internationally via Orthopedics channels Biologics Expand cross-selling with U.S. Orthopedics channels Spine Maximize procedural selling opportunity with Biologics, BGT, and Enabling Technologies Orthopedics (Limb Reconstruction) Maximize procedural selling opportunity with Biologics, BGT, and Enabling Technologies Enabling Technologies (ET) Focus on 7D equipment placements to drive recurring implant usage Leverage investment and drive synergistic approach across the portfolio

Clear Progress on Our Three-Year Plan to Transform the Business Q3 2025 Results

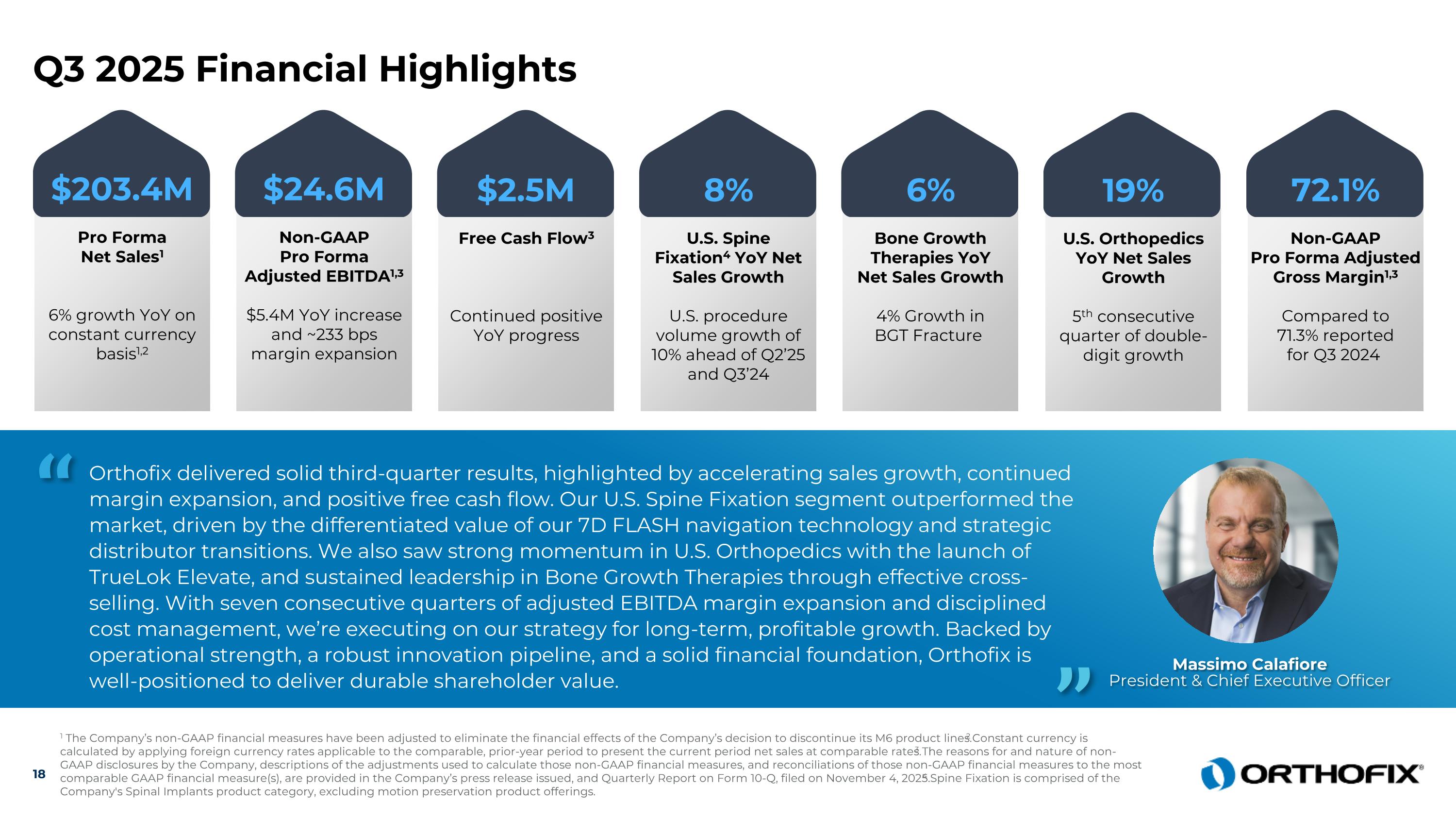

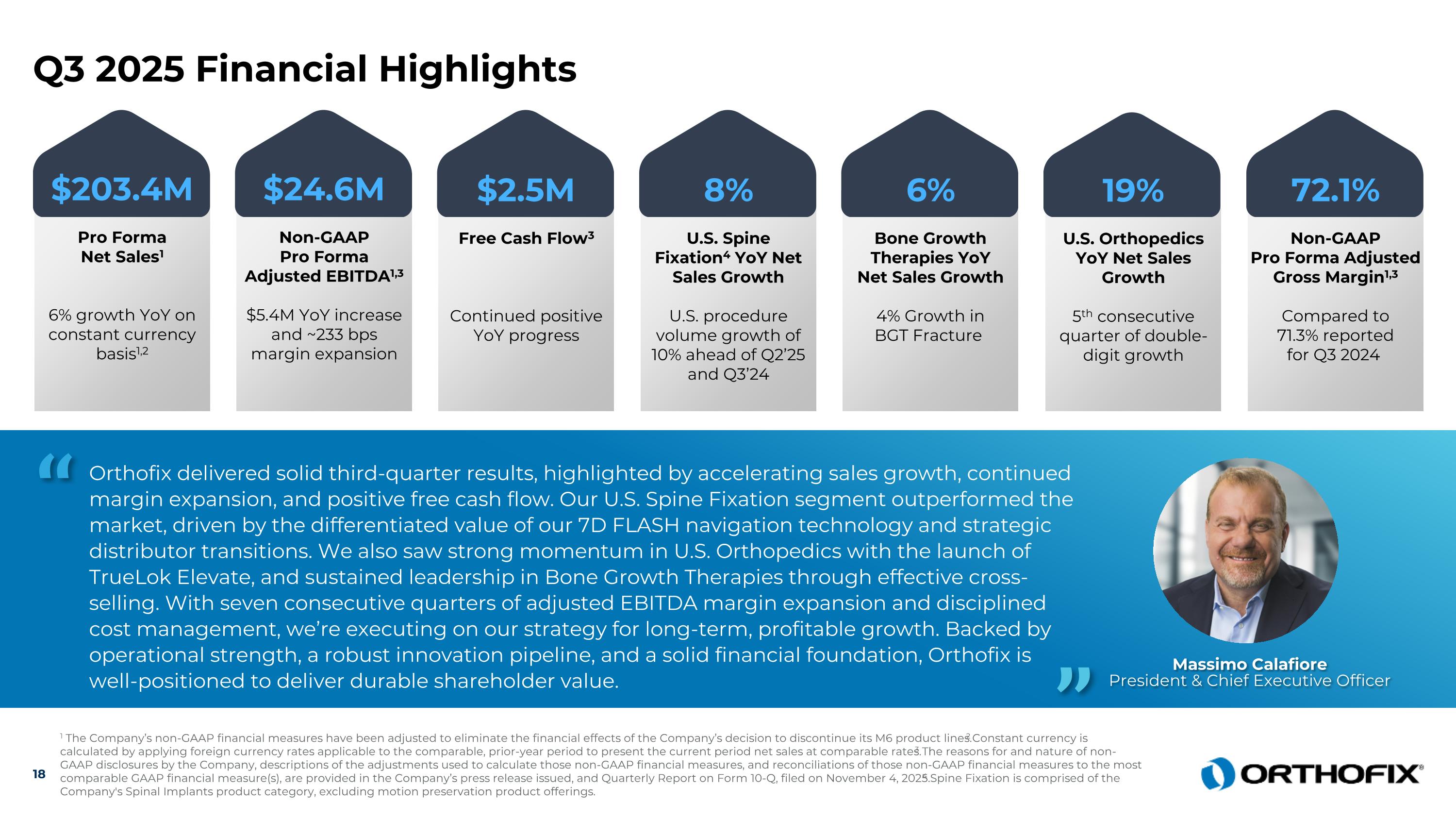

Orthofix delivered solid third-quarter results, highlighted by accelerating sales growth, continued margin expansion, and positive free cash flow. Our U.S. Spine Fixation segment outperformed the market, driven by the differentiated value of our 7D FLASH navigation technology and strategic distributor transitions. We also saw strong momentum in U.S. Orthopedics with the launch of TrueLok Elevate, and sustained leadership in Bone Growth Therapies through effective cross-selling. With seven consecutive quarters of adjusted EBITDA margin expansion and disciplined cost management, we’re executing on our strategy for long-term, profitable growth. Backed by operational strength, a robust innovation pipeline, and a solid financial foundation, Orthofix is well-positioned to deliver durable shareholder value. “ Massimo Calafiore President & Chief Executive Officer ” 18 1 The Company’s non-GAAP financial measures have been adjusted to eliminate the financial effects of the Company’s decision to discontinue its M6 product lines. 2 Constant currency is calculated by applying foreign currency rates applicable to the comparable, prior-year period to present the current period net sales at comparable rates. 3 The reasons for and nature of non-GAAP disclosures by the Company, descriptions of the adjustments used to calculate those non-GAAP financial measures, and reconciliations of those non-GAAP financial measures to the most comparable GAAP financial measure(s), are provided in the Company’s press release issued, and Quarterly Report on Form 10-Q, filed on November 4, 2025.4 Spine Fixation is comprised of the Company's Spinal Implants product category, excluding motion preservation product offerings. Q3 2025 Financial Highlights $24.6M Non-GAAP Pro Forma Adjusted EBITDA1,3 $5.4M YoY increase and ~233 bps margin expansion $2.5M Free Cash Flow3 Continued positive YoY progress 8% U.S. Spine Fixation4 YoY Net Sales Growth U.S. procedure volume growth of 10% ahead of Q2’25 and Q3’24 6% Bone Growth Therapies YoY Net Sales Growth 4% Growth in BGT Fracture 72.1% Non-GAAP Pro Forma Adjusted Gross Margin1,3 Compared to 71.3% reported for Q3 2024 $203.4M Pro Forma Net Sales1 6% growth YoY on constant currency basis1,2 19% U.S. Orthopedics YoY Net Sales Growth 5th consecutive quarter of double-digit growth

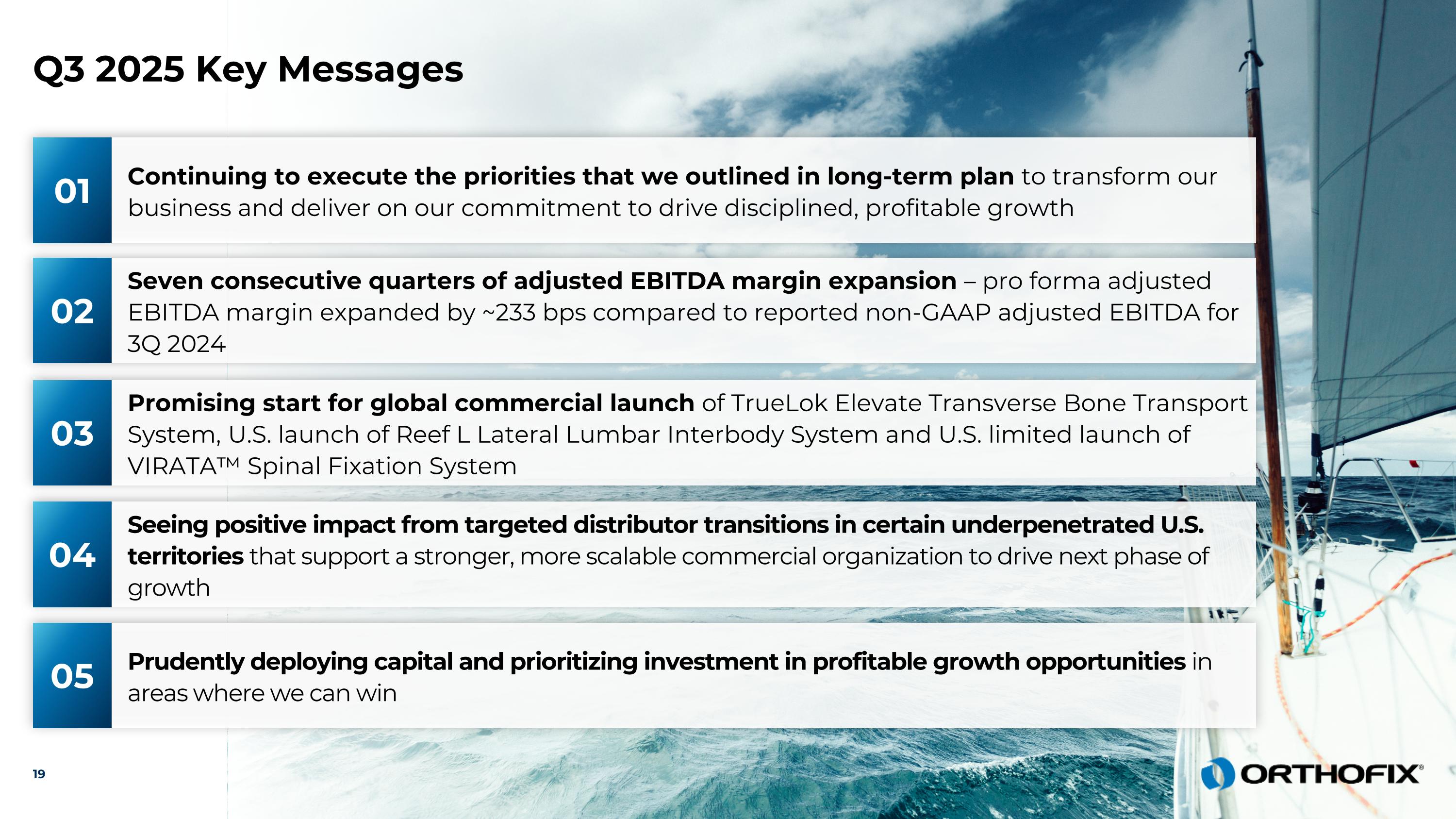

19 Continuing to execute the priorities that we outlined in long-term plan to transform our business and deliver on our commitment to drive disciplined, profitable growth 01 Seven consecutive quarters of adjusted EBITDA margin expansion – pro forma adjusted EBITDA margin expanded by ~233 bps compared to reported non-GAAP adjusted EBITDA for 3Q 2024 02 Promising start for global commercial launch of TrueLok Elevate Transverse Bone Transport System, U.S. launch of Reef L Lateral Lumbar Interbody System and U.S. limited launch of VIRATA™ Spinal Fixation System 03 Seeing positive impact from targeted distributor transitions in certain underpenetrated U.S. territories that support a stronger, more scalable commercial organization to drive next phase of growth 04 Prudently deploying capital and prioritizing investment in profitable growth opportunities in areas where we can win 05 Q3 2025 Key Messages

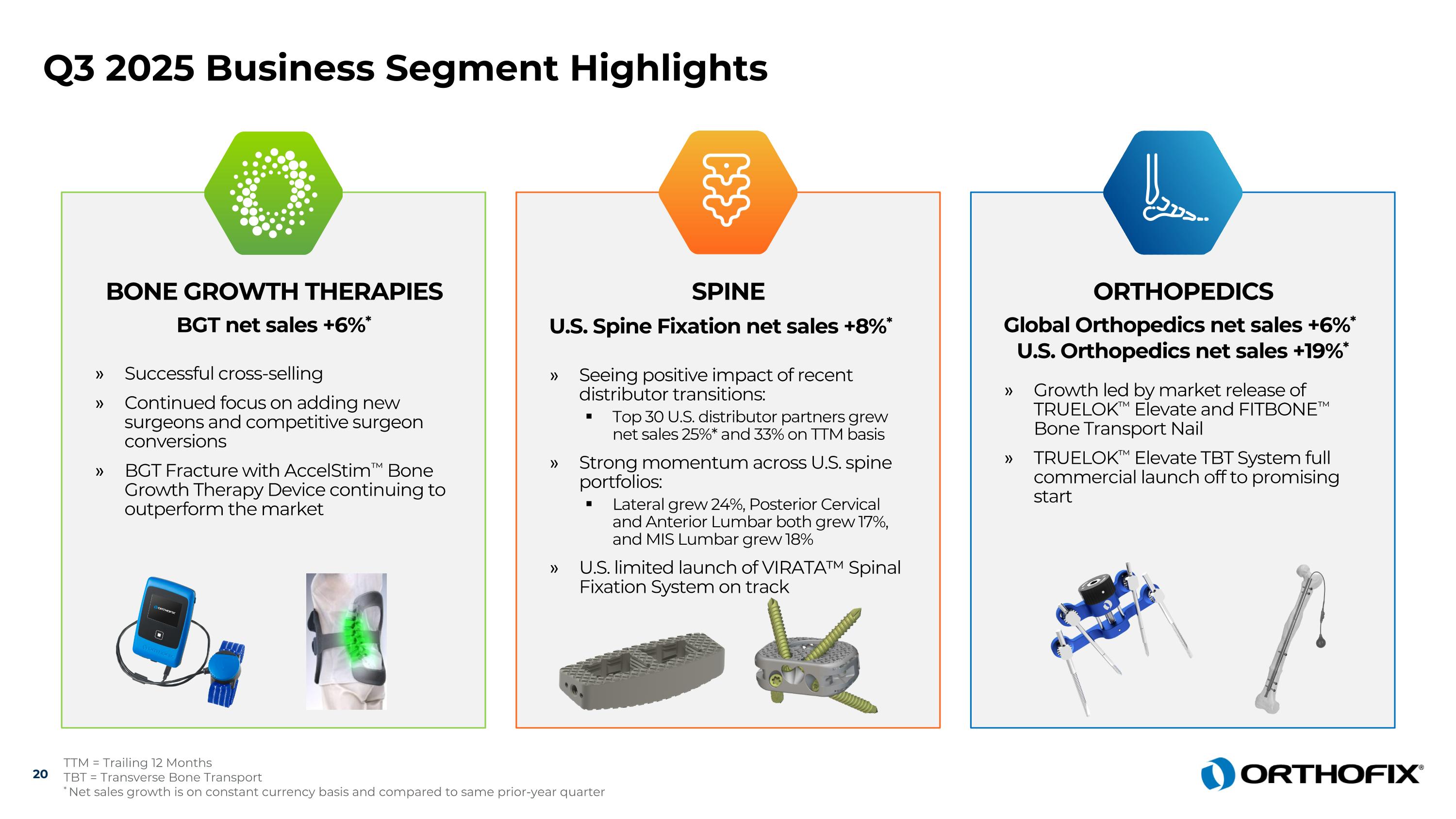

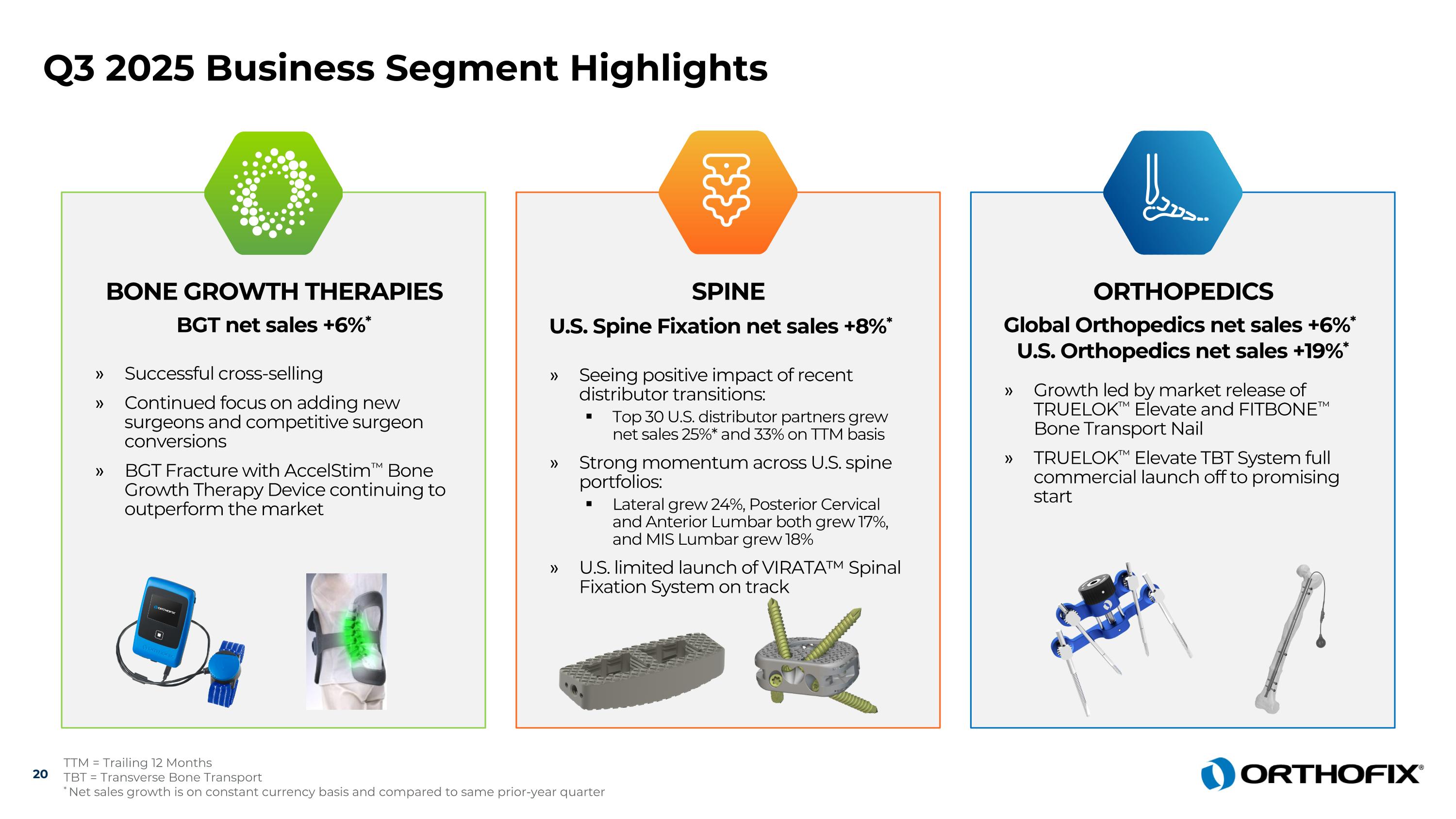

Q3 2025 Business Segment Highlights 20 TTM = Trailing 12 Months TBT = Transverse Bone Transport * Net sales growth is on constant currency basis and compared to same prior-year quarter BONE GROWTH THERAPIES BGT net sales +6%* Successful cross-selling Continued focus on adding new surgeons and competitive surgeon conversions BGT Fracture with AccelStim™ Bone Growth Therapy Device continuing to outperform the market ORTHOPEDICS Global Orthopedics net sales +6%* U.S. Orthopedics net sales +19%* Growth led by market release of TRUELOK™ Elevate and FITBONE™ Bone Transport Nail TRUELOK™ Elevate TBT System full commercial launch off to promising start SPINE U.S. Spine Fixation net sales +8%* Seeing positive impact of recent distributor transitions: Top 30 U.S. distributor partners grew net sales 25%* and 33% on TTM basis Strong momentum across U.S. spine portfolios: Lateral grew 24%, Posterior Cervical and Anterior Lumbar both grew 17%, and MIS Lumbar grew 18% U.S. limited launch of VIRATA™ Spinal Fixation System on track

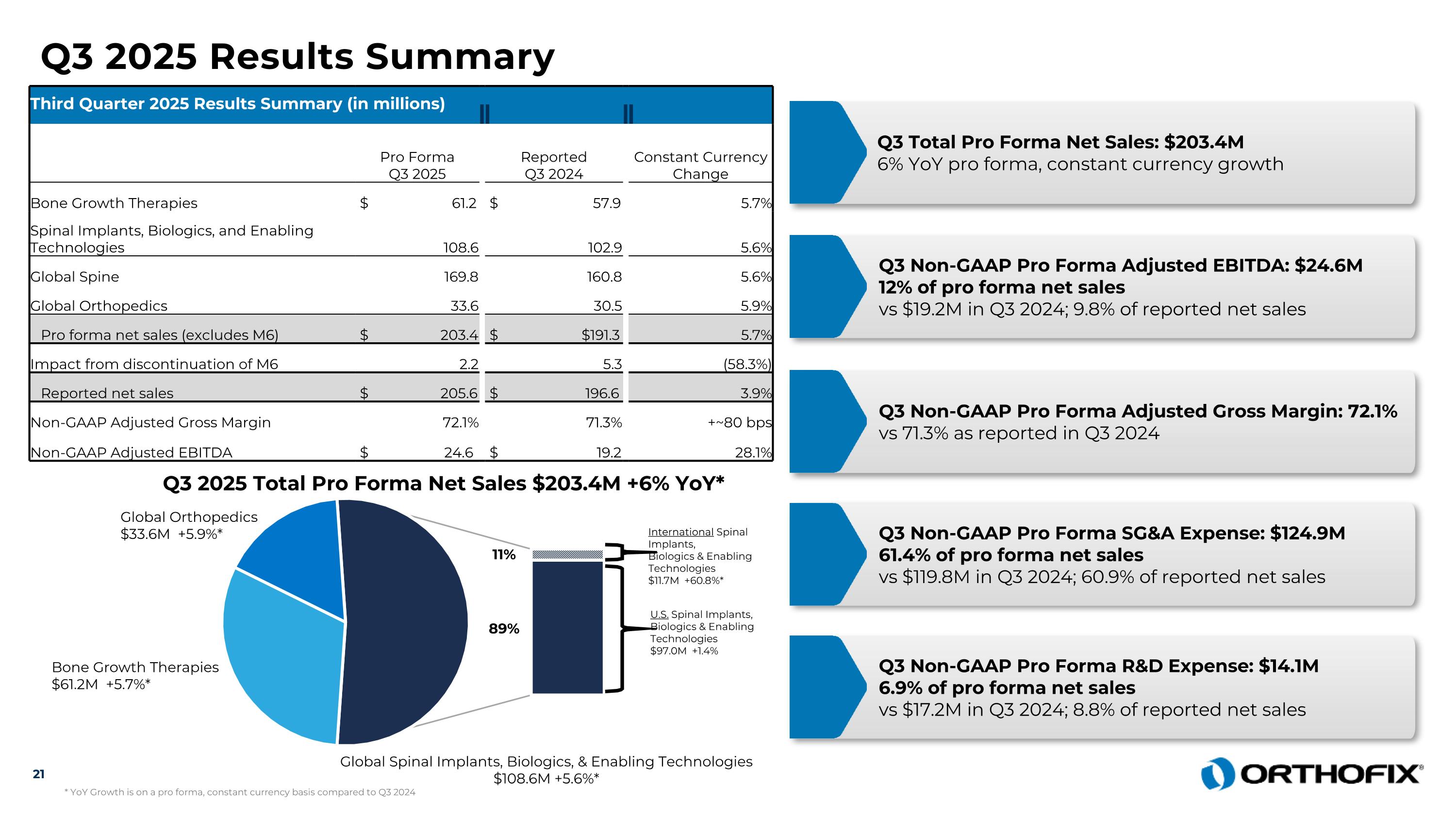

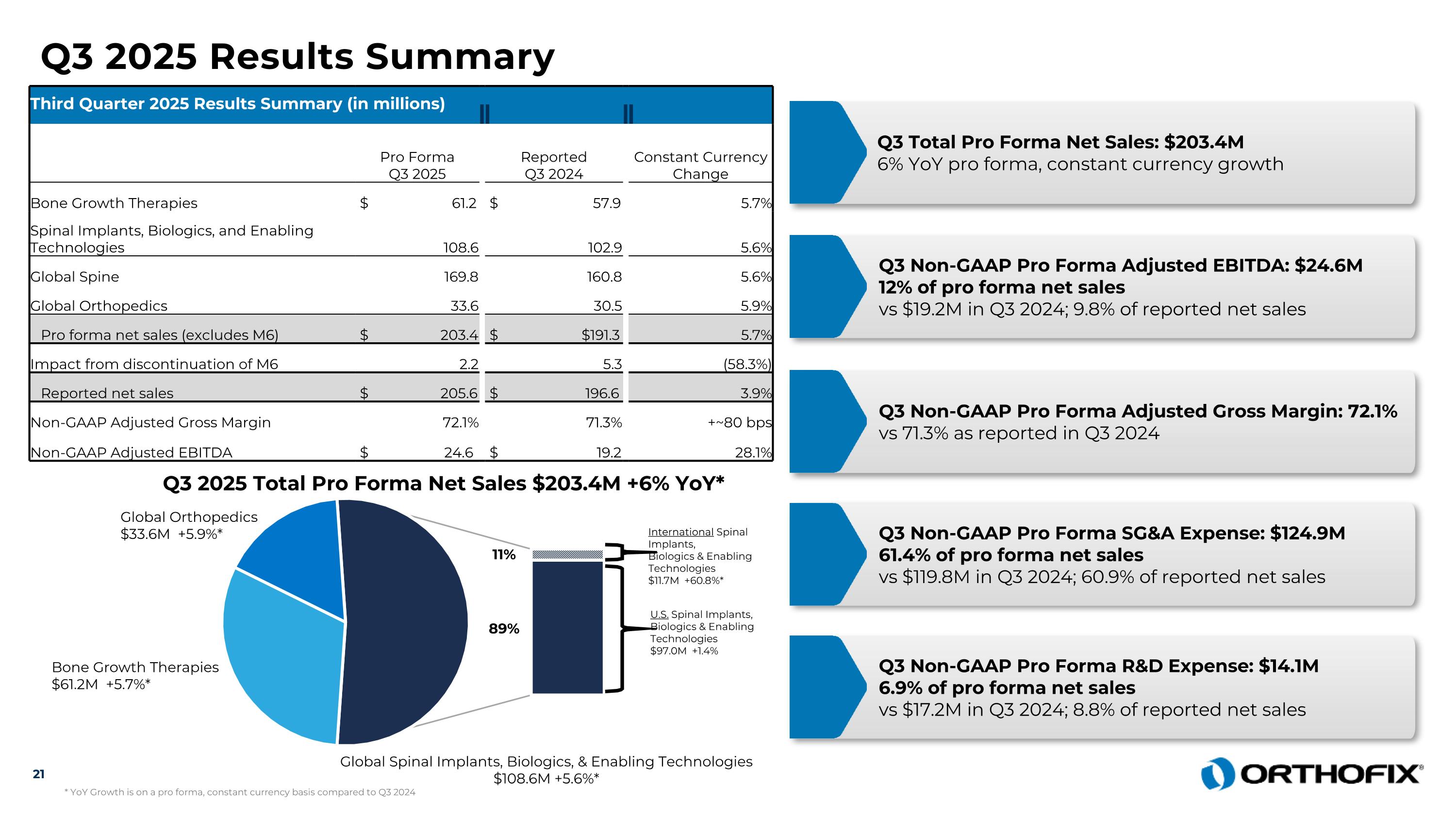

Q3 2025 Results Summary Third Quarter 2025 Results Summary (in millions) Pro Forma Q3 2025 Reported Q3 2024 Constant Currency Change Bone Growth Therapies $ 61.2 $ 57.9 5.7% Spinal Implants, Biologics, and Enabling Technologies 108.6 102.9 5.6% Global Spine 169.8 160.8 5.6% Global Orthopedics 33.6 30.5 5.9% Pro forma net sales (excludes M6) $ 203.4 $ $191.3 5.7% Impact from discontinuation of M6 2.2 5.3 (58.3%) Reported net sales $ 205.6 $ 196.6 3.9% Non-GAAP Adjusted Gross Margin 72.1% 71.3% +~80 bps Non-GAAP Adjusted EBITDA $ 24.6 $ 19.2 28.1% Q3 Total Pro Forma Net Sales: $203.4M6% YoY pro forma, constant currency growth Q3 Non-GAAP Pro Forma Adjusted EBITDA: $24.6M 12% of pro forma net sales vs $19.2M in Q3 2024; 9.8% of reported net sales Q3 Non-GAAP Pro Forma Adjusted Gross Margin: 72.1% vs 71.3% as reported in Q3 2024 Q3 Non-GAAP Pro Forma SG&A Expense: $124.9M 61.4% of pro forma net sales vs $119.8M in Q3 2024; 60.9% of reported net sales Q3 Non-GAAP Pro Forma R&D Expense: $14.1M 6.9% of pro forma net sales vs $17.2M in Q3 2024; 8.8% of reported net sales 21 Q3 2025 Total Pro Forma Net Sales $203.4M +6% YoY* Bone Growth Therapies $61.2M +5.7%* Global Orthopedics $33.6M +5.9%* Global Spinal Implants, Biologics, & Enabling Technologies $108.6M +5.6%* International Spinal Implants, Biologics & Enabling Technologies $11.7M +60.8%* U.S. Spinal Implants, Biologics & Enabling Technologies $97.0M +1.4% 89% 11% * YoY Growth is on a pro forma, constant currency basis compared to Q3 2024

Full-Year 2025 Guidance1 $810M –$814M Pro Forma Net Sales $84M –$86M Pro Forma Adj. EBITDA Positive Free Cash Flowfor 2025² 1 As of the Company’s Q3 2025 Earnings Call hosted on 11/4/2025. Inclusion of this information in this presentation is not a confirmation or an update of, and should not be construed or otherwise assumed to reflect any confirmation or update of, that guidance by Orthofix leadership as of any date other than 11/4/2025. Pro forma net sales range excludes sales from the discontinued M6 product lines and assumes a $5 million negative impact from U.S. funded non-governmental organization (NGO) business as compared to the full-year 2024. This guidance range is based on current foreign currency exchange rates and does not take into account any additional potential exchange rate changes that may occur this year. 2 Excluding impact of restructuring charges related to the discontinuation of the M6 product lines

Uniquely Positioned to Accelerate Our Profitable Growth Engine Looking Forward

Looking Forward – Accelerating Our Profitable Growth Engine Advancing Toward Our Goals for Consistent Above-Market Growth,Improved Profitability, and Positive Free Cash Flow Invest inDifferentiatedTechnologies in Areas Where We Can Win and Lead Innovation Capitalize on Multiple Access Points to Grow Business at Sustained, Above-Market Rates Operate with Discipline for Margin Expansion Build Financial Resilienceand Unlock Strong, Consistent Free Cash Flow

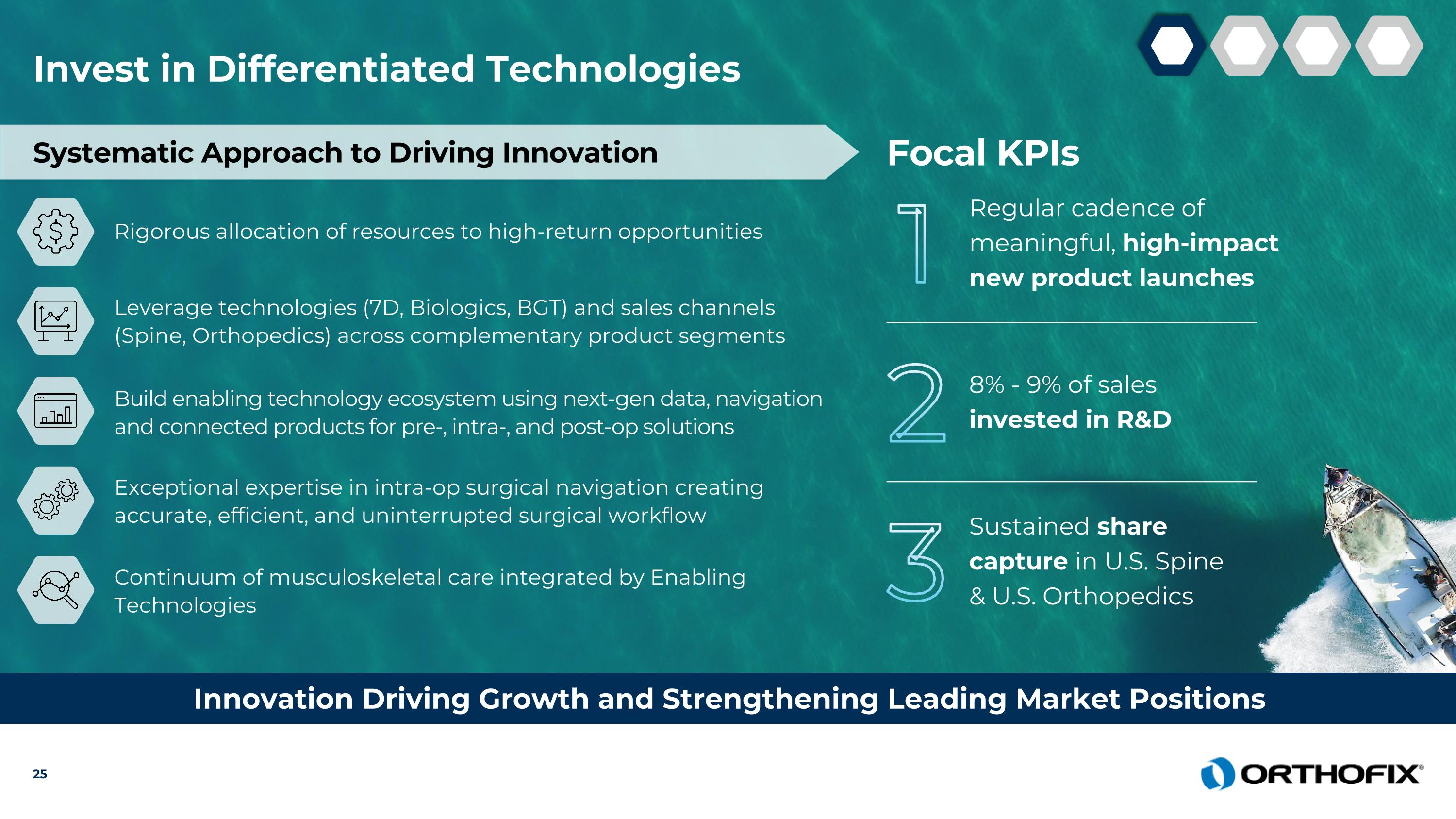

Invest in Differentiated Technologies Innovation Driving Growth and Strengthening Leading Market Positions Systematic Approach to Driving Innovation Rigorous allocation of resources to high-return opportunities Leverage technologies (7D, Biologics, BGT) and sales channels (Spine, Orthopedics) across complementary product segments Build enabling technology ecosystem using next-gen data, navigation and connected products for pre-, intra-, and post-op solutions Exceptional expertise in intra-op surgical navigation creating accurate, efficient, and uninterrupted surgical workflow Continuum of musculoskeletal care integrated by Enabling Technologies Focal KPIs 1 Regular cadence of meaningful, high-impact new product launches 2 8% - 9% of salesinvested in R&D 3 Sustained sharecapture in U.S. Spine & U.S. Orthopedics

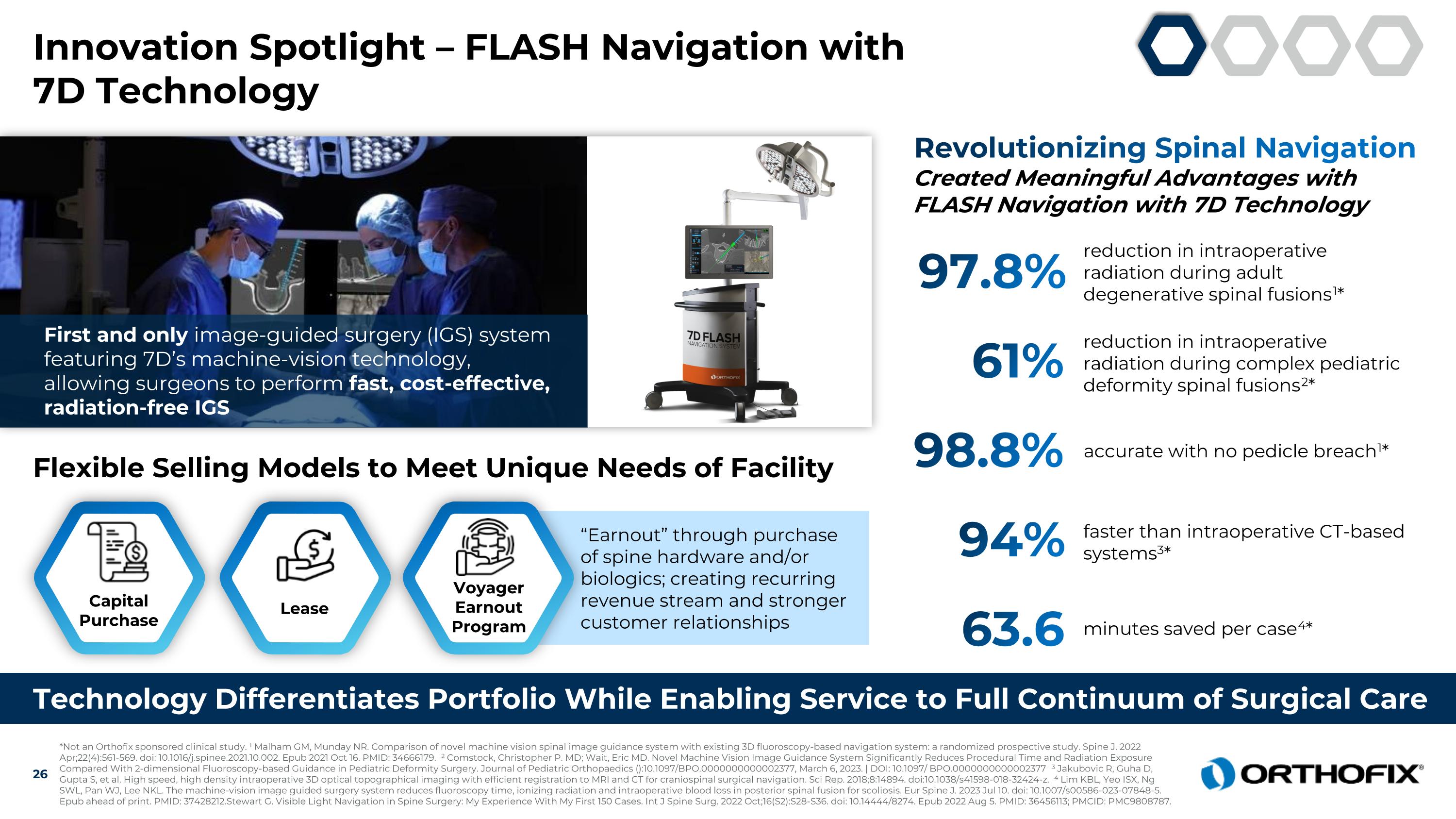

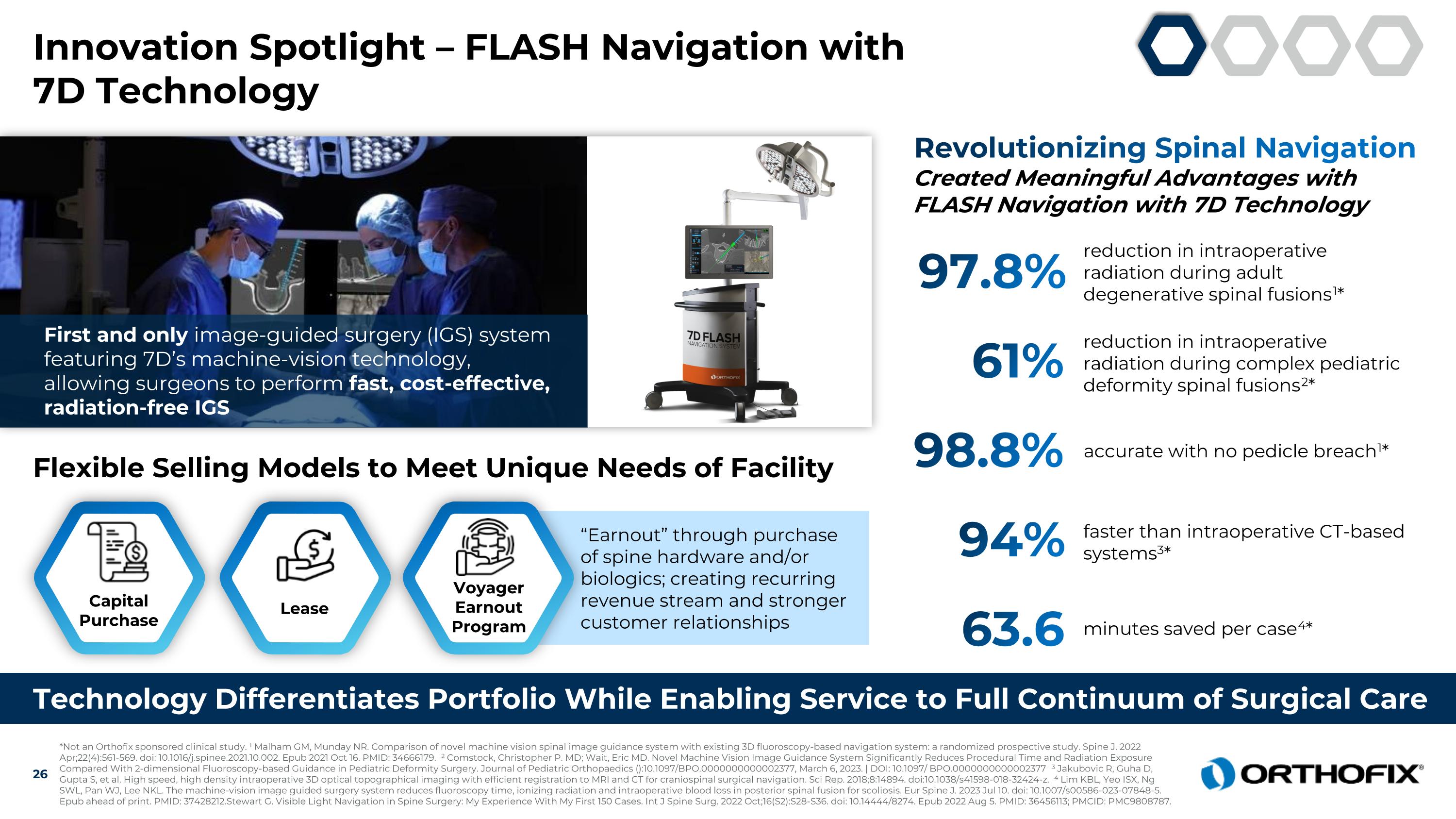

Innovation Spotlight – FLASH Navigation with 7D Technology Technology Differentiates Portfolio While Enabling Service to Full Continuum of Surgical Care 97.8% reduction in intraoperative radiation during adult degenerative spinal fusions1* Revolutionizing Spinal Navigation Created Meaningful Advantages with FLASH Navigation with 7D Technology 61% reduction in intraoperative radiation during complex pediatric deformity spinal fusions2* 98.8% accurate with no pedicle breach1* 94% faster than intraoperative CT-based systems3* 63.6 minutes saved per case4* Flexible Selling Models to Meet Unique Needs of Facility First and only image-guided surgery (IGS) system featuring 7D’s machine-vision technology, allowing surgeons to perform fast, cost-effective, radiation-free IGS Capital Purchase Lease “Earnout” through purchase of spine hardware and/or biologics; creating recurring revenue stream and stronger customer relationships Voyager Earnout Program *Not an Orthofix sponsored clinical study. 1 Malham GM, Munday NR. Comparison of novel machine vision spinal image guidance system with existing 3D fluoroscopy-based navigation system: a randomized prospective study. Spine J. 2022 Apr;22(4):561-569. doi: 10.1016/j.spinee.2021.10.002. Epub 2021 Oct 16. PMID: 34666179. 2 Comstock, Christopher P. MD; Wait, Eric MD. Novel Machine Vision Image Guidance System Significantly Reduces Procedural Time and Radiation Exposure Compared With 2-dimensional Fluoroscopy-based Guidance in Pediatric Deformity Surgery. Journal of Pediatric Orthopaedics ():10.1097/BPO.0000000000002377, March 6, 2023. | DOI: 10.1097/ BPO.0000000000002377 3 Jakubovic R, Guha D, Gupta S, et al. High speed, high density intraoperative 3D optical topographical imaging with efficient registration to MRI and CT for craniospinal surgical navigation. Sci Rep. 2018;8:14894. doi:10.1038/s41598-018-32424-z. 4 Lim KBL, Yeo ISX, Ng SWL, Pan WJ, Lee NKL. The machine-vision image guided surgery system reduces fluoroscopy time, ionizing radiation and intraoperative blood loss in posterior spinal fusion for scoliosis. Eur Spine J. 2023 Jul 10. doi: 10.1007/s00586-023-07848-5. Epub ahead of print. PMID: 37428212.Stewart G. Visible Light Navigation in Spine Surgery: My Experience With My First 150 Cases. Int J Spine Surg. 2022 Oct;16(S2):S28-S36. doi: 10.14444/8274. Epub 2022 Aug 5. PMID: 36456113; PMCID: PMC9808787.

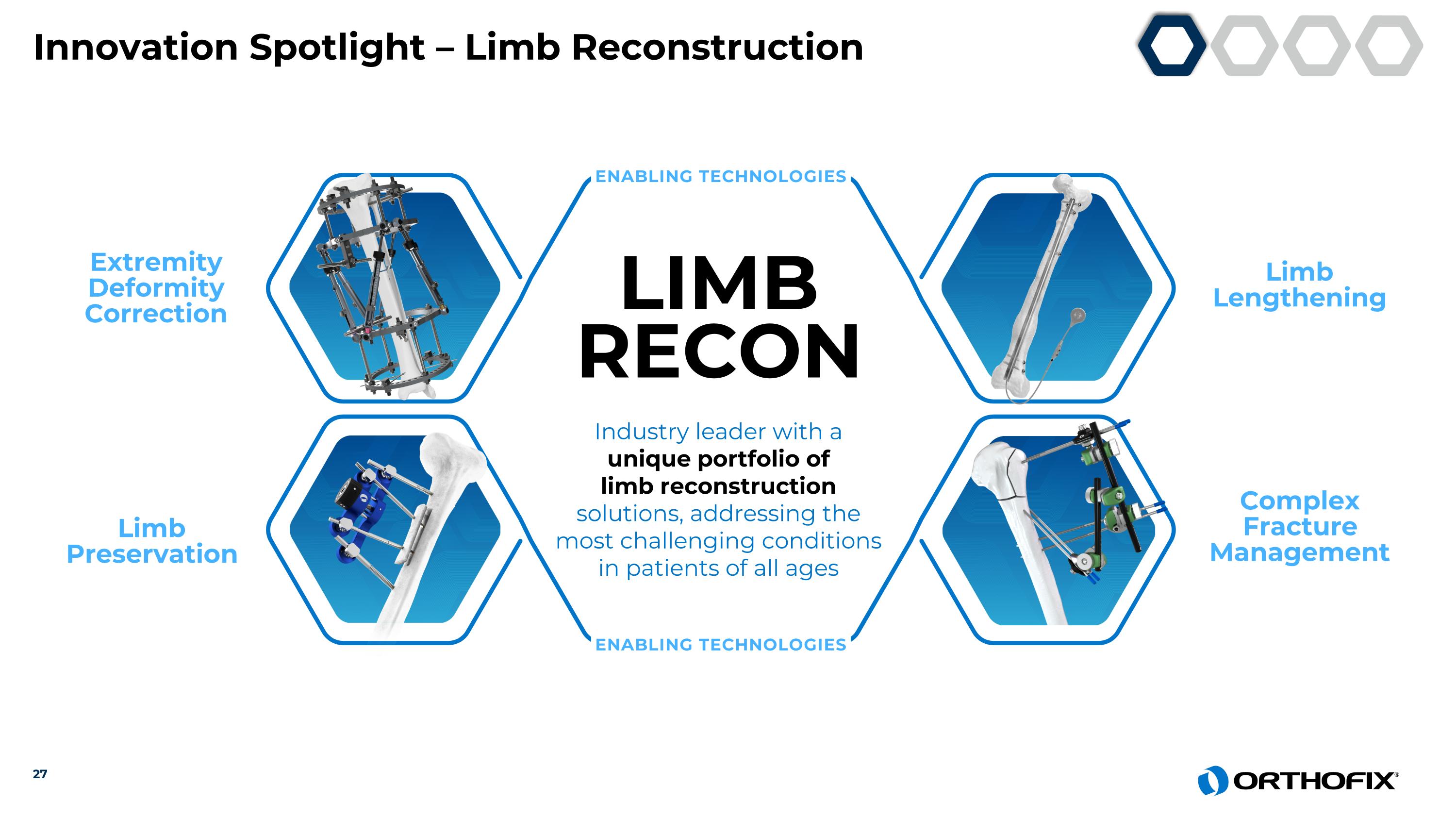

Complex Fracture Management Limb Lengthening Limb Preservation Extremity Deformity Correction LIMB RECON Industry leader with a unique portfolio of limb reconstruction solutions, addressing the most challenging conditions in patients of all ages ENABLING TECHNOLOGIES ENABLING TECHNOLOGIES 27 Innovation Spotlight – Limb Reconstruction

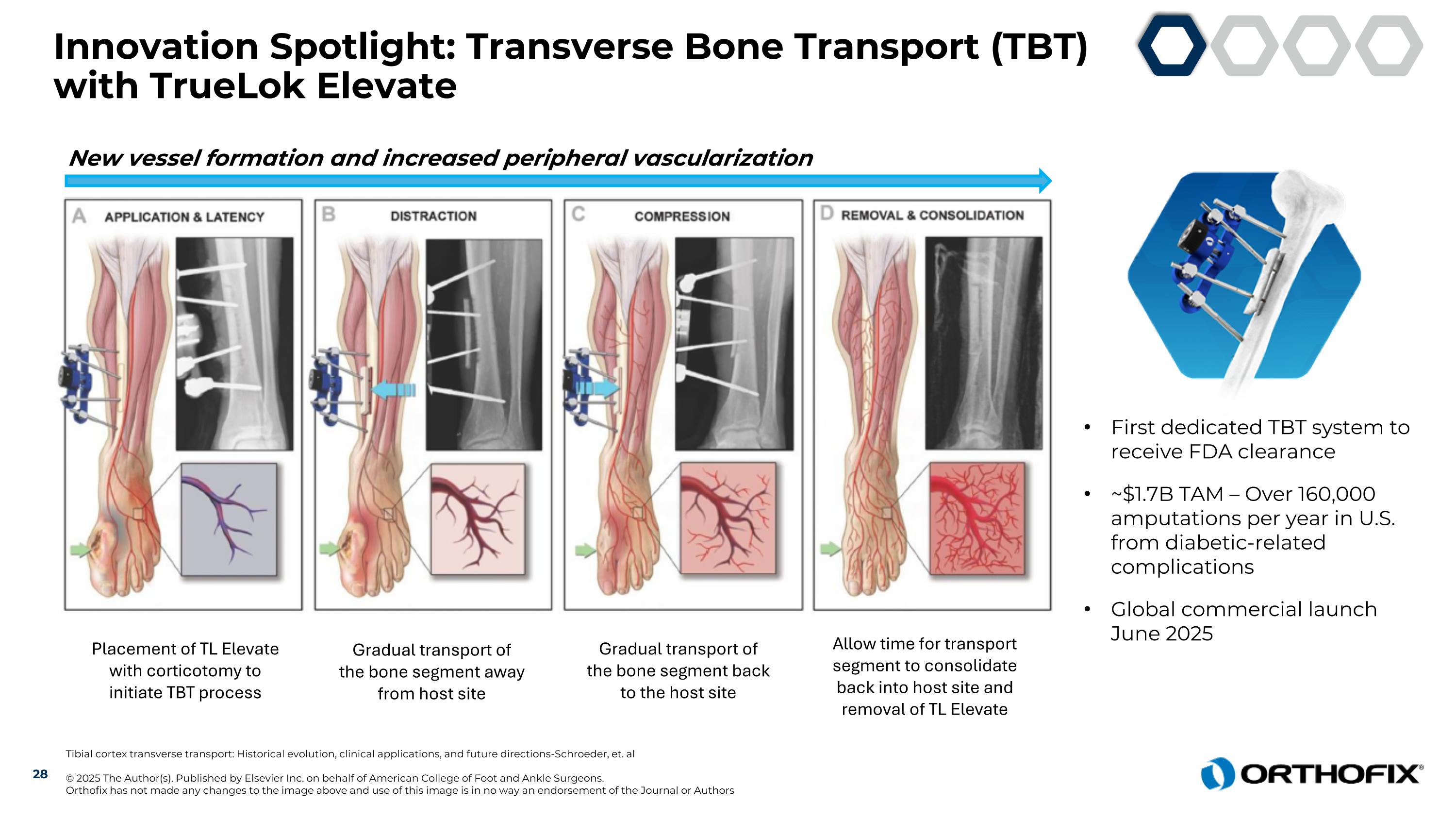

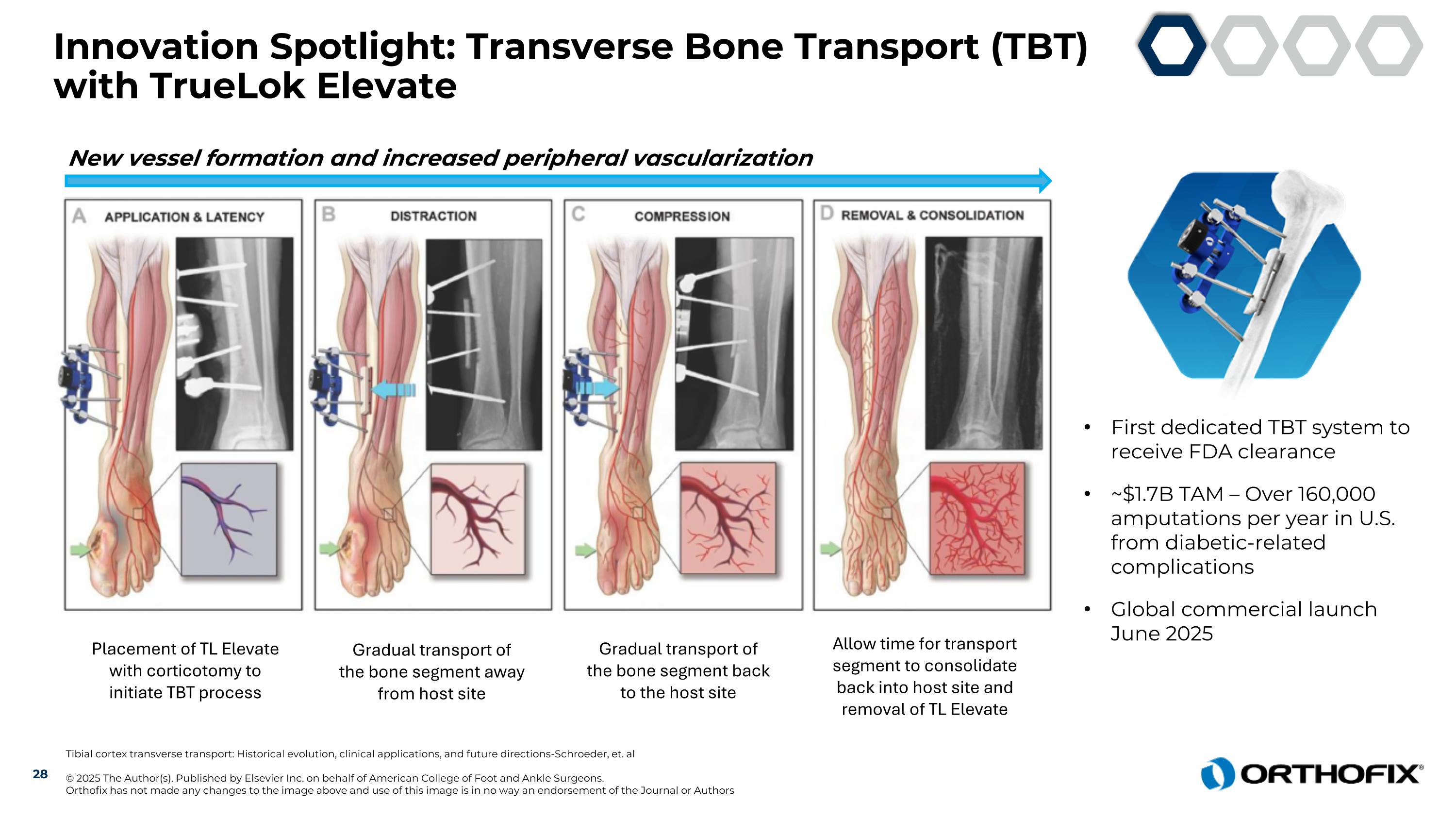

Innovation Spotlight: Transverse Bone Transport (TBT) with TrueLok Elevate Tibial cortex transverse transport: Historical evolution, clinical applications, and future directions-Schroeder, et. al © 2025 The Author(s). Published by Elsevier Inc. on behalf of American College of Foot and Ankle Surgeons. Orthofix has not made any changes to the image above and use of this image is in no way an endorsement of the Journal or Authors Placement of TL Elevate with corticotomy to initiate TBT process Gradual transport of the bone segment away from host site Gradual transport of the bone segment back to the host site Allow time for transport segment to consolidate back into host site and removal of TL Elevate First dedicated TBT system to receive FDA clearance ~$1.7B TAM – Over 160,000 amputations per year in U.S. from diabetic-related complications Global commercial launch June 2025 New vessel formation and increased peripheral vascularization 28

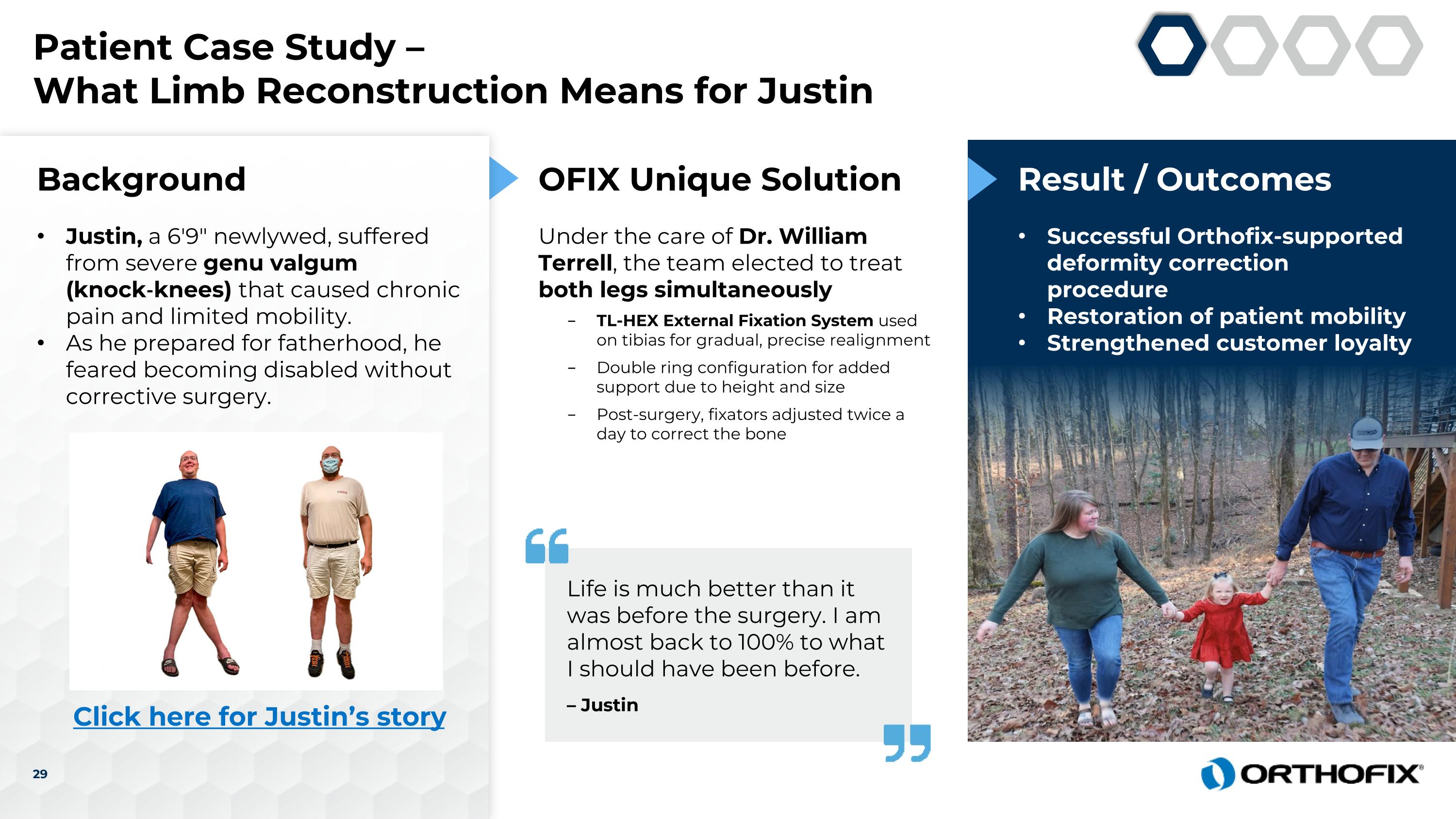

Patient Case Study – What Limb Reconstruction Means for Justin Background Justin, a 6'9" newlywed, suffered from severe genu valgum (knock‑knees) that caused chronic pain and limited mobility. As he prepared for fatherhood, he feared becoming disabled without corrective surgery. OFIX Unique Solution Under the care of Dr. William Terrell, the team elected to treat both legs simultaneously TL-HEX External Fixation System used on tibias for gradual, precise realignment Double ring configuration for added support due to height and size Post-surgery, fixators adjusted twice a day to correct the bone Result / Outcomes Successful Orthofix-supported deformity correction procedure Restoration of patient mobility Strengthened customer loyalty Life is much better than it was before the surgery. I am almost back to 100% to what I should have been before. – Justin Click here for Justin’s story

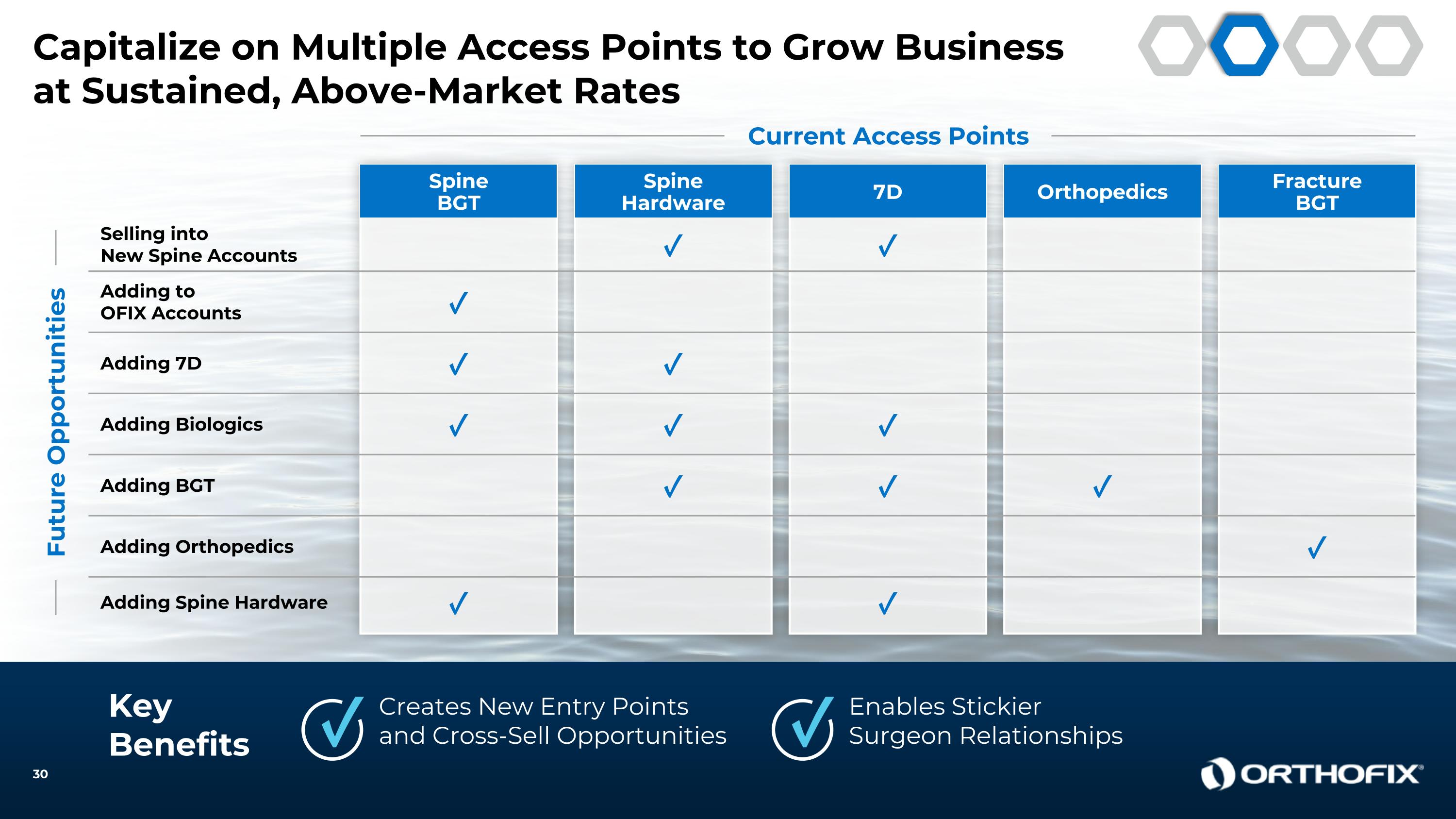

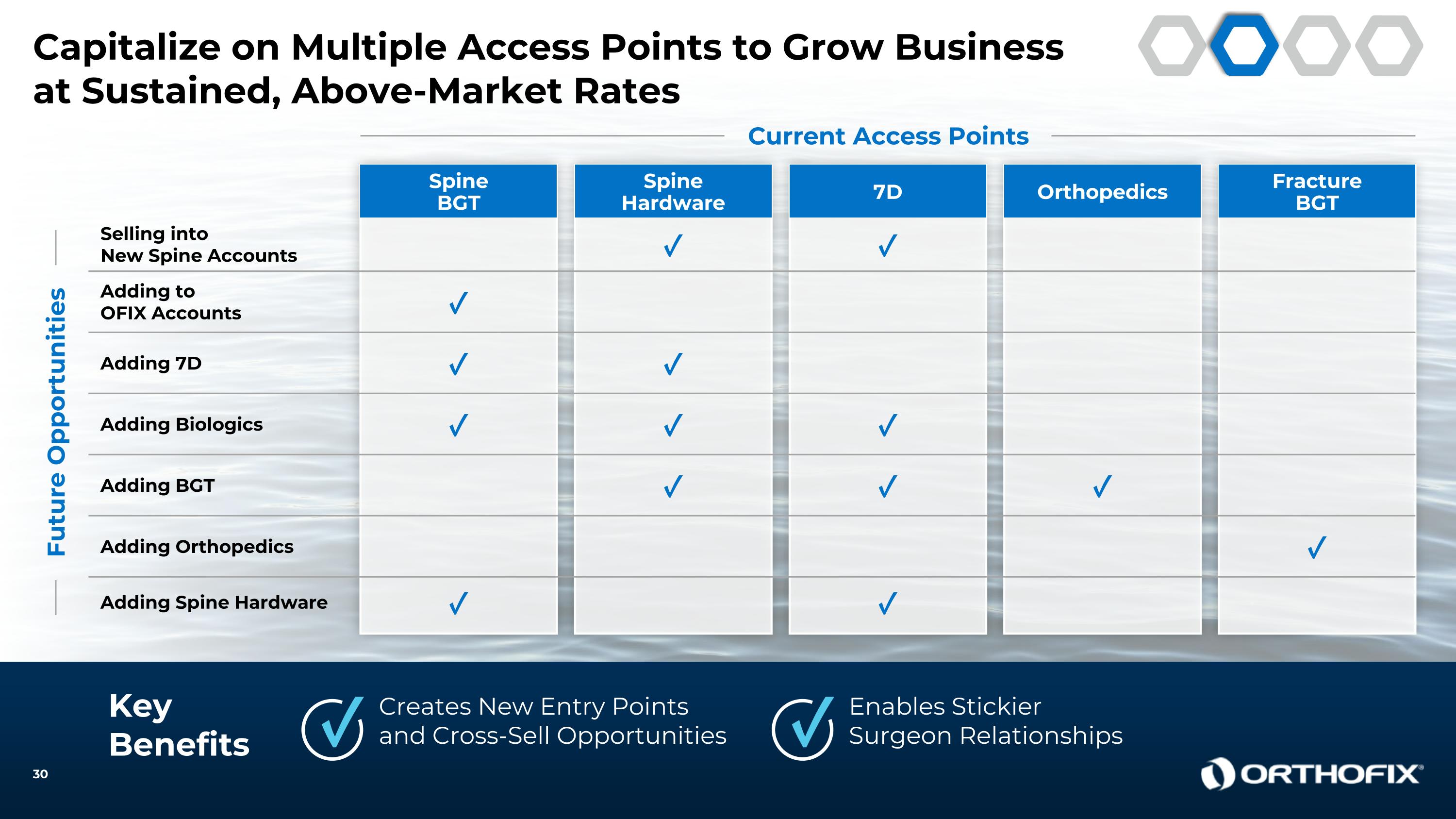

Capitalize on Multiple Access Points to Grow Business at Sustained, Above-Market Rates KeyBenefits Creates New Entry Points and Cross-Sell Opportunities Enables StickierSurgeon Relationships ✓ ✓ Current Access Points Spine BGT Adding to OFIX Accounts ✓ Spine Hardware 7D Selling into New Spine Accounts ✓ ✓ Adding Spine Hardware ✓ ✓ Adding Biologics ✓ ✓ ✓ Orthopedics Adding BGT ✓ ✓ ✓ Fracture BGT Adding Orthopedics ✓ Future Opportunities Adding 7D ✓ ✓

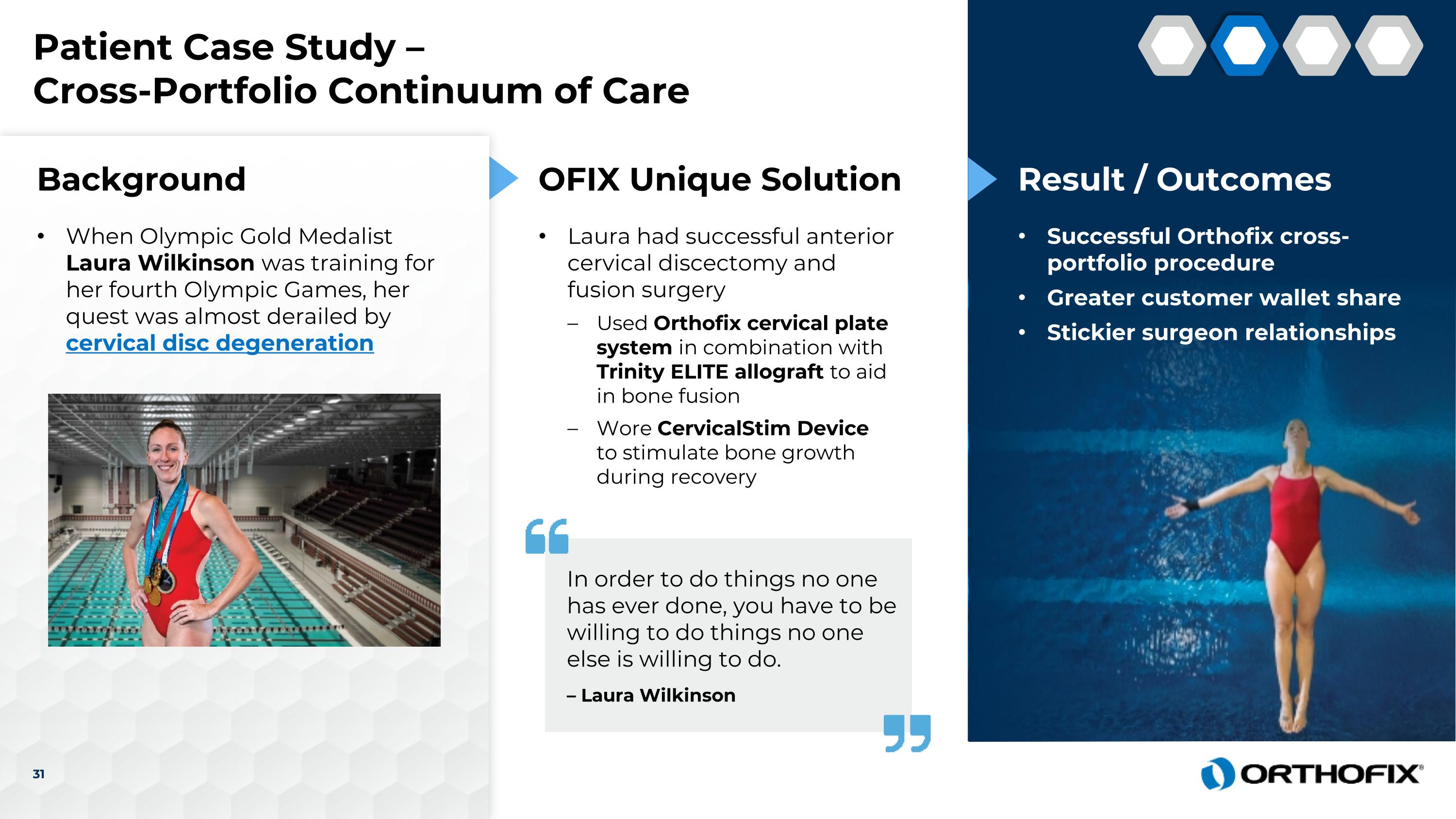

Patient Case Study – Cross-Portfolio Continuum of Care Background When Olympic Gold Medalist Laura Wilkinson was training for her fourth Olympic Games, her quest was almost derailed by cervical disc degeneration OFIX Unique Solution Laura had successful anterior cervical discectomy and fusion surgery Used Orthofix cervical plate system in combination with Trinity ELITE allograft to aid in bone fusion Wore CervicalStim Device to stimulate bone growth during recovery Result / Outcomes Successful Orthofix cross-portfolio procedure Greater customer wallet share Stickier surgeon relationships In order to do things no one has ever done, you have to be willing to do things no one else is willing to do. – Laura Wilkinson

On a Faster Path to Profitability with a Stronger Financial Profile Advancing Toward Our 2027 Financial Goals

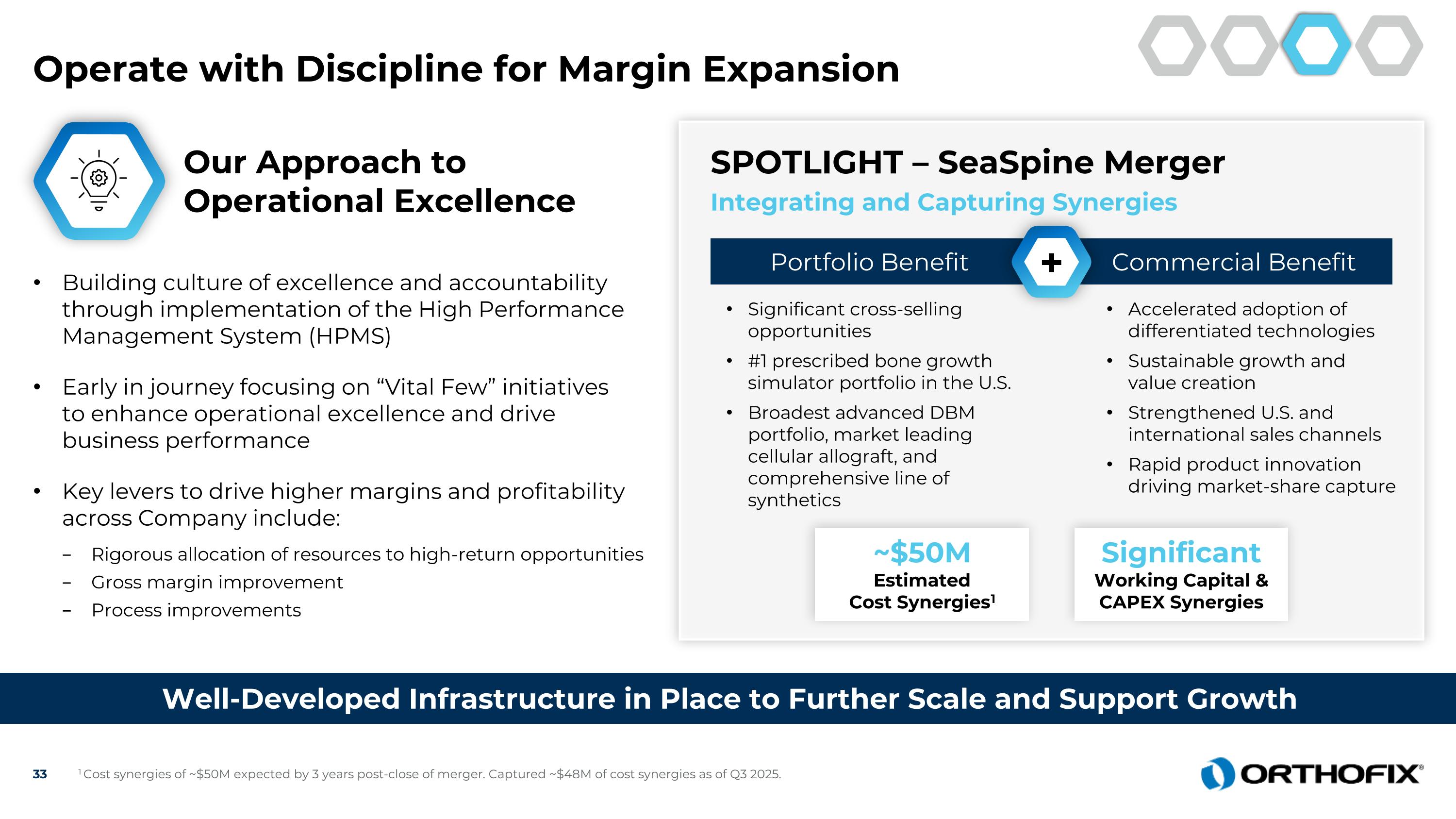

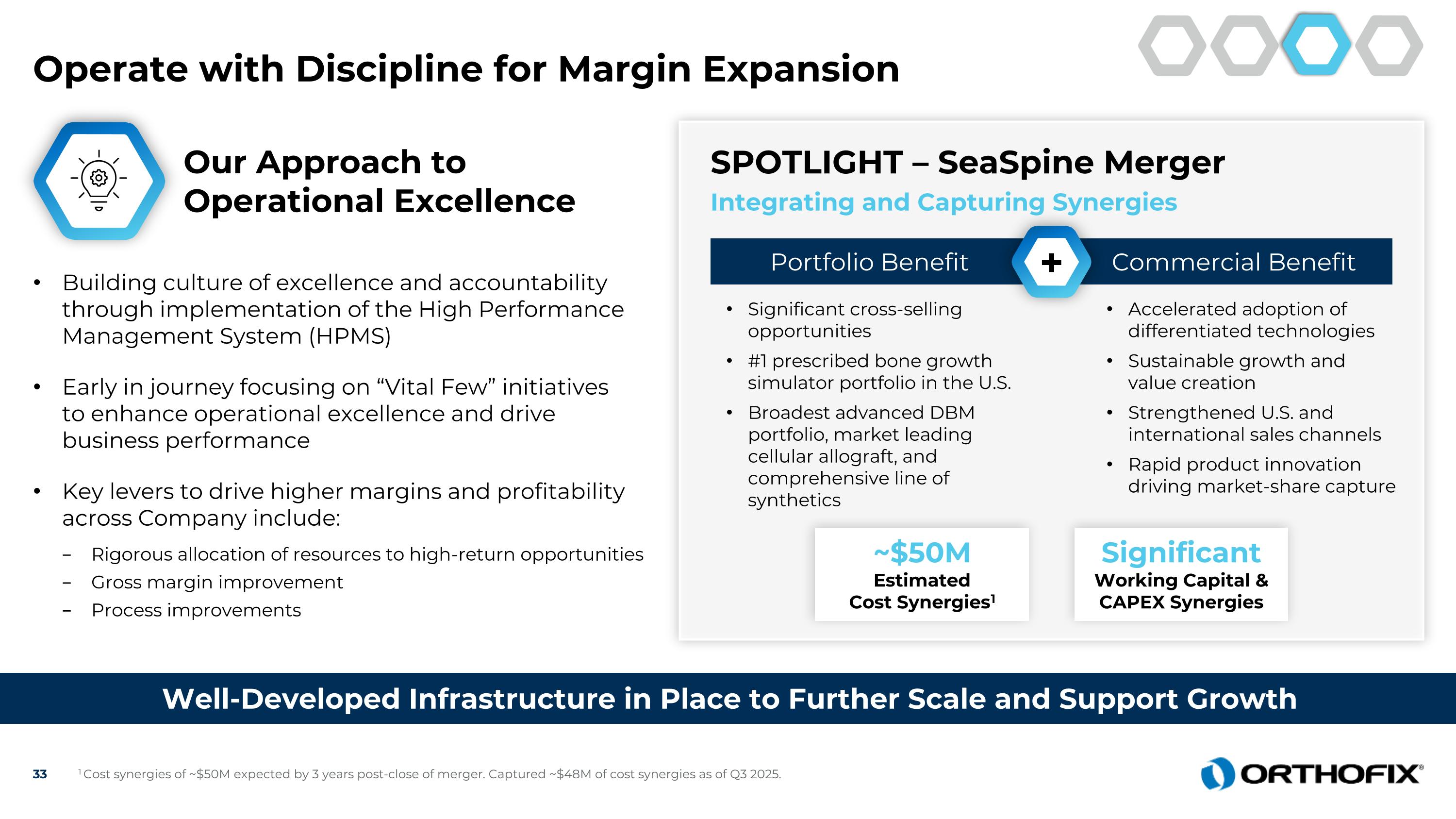

Operate with Discipline for Margin Expansion Well-Developed Infrastructure in Place to Further Scale and Support Growth ~$50M Estimated Cost Synergies1 Significant Working Capital & CAPEX Synergies Our Approach to Operational Excellence Building culture of excellence and accountability through implementation of the High Performance Management System (HPMS) Early in journey focusing on “Vital Few” initiatives to enhance operational excellence and drive business performance Key levers to drive higher margins and profitability across Company include: Rigorous allocation of resources to high-return opportunities Gross margin improvement Process improvements SPOTLIGHT – SeaSpine Merger Integrating and Capturing Synergies Commercial Benefit Portfolio Benefit + Significant cross-selling opportunities #1 prescribed bone growth simulator portfolio in the U.S. Broadest advanced DBM portfolio, market leading cellular allograft, and comprehensive line of synthetics Accelerated adoption of differentiated technologies Sustainable growth and value creation Strengthened U.S. and international sales channels Rapid product innovation driving market-share capture 1 Cost synergies of ~$50M expected by 3 years post-close of merger. Captured ~$48M of cost synergies as of Q3 2025.

Enhancing Financial Strength and Increasing Balance Sheet Flexibility Seeks to Further Optimize the Company’s Capital Structure to Support Long-Term, Profitable Growth 1 $65M at borrower’s option from 1/1/25 through 6/30/26; $50M at lender’s discretion through 1/1/29. Entered into New Agreement on 11/7/2024 ~$275M term loan ~$160M funded up front ~$115M available after 1/1/251 Improves Financial Strength Lower interest rate with better terms Extra capacity to bolster the Company’s access to capital Shores up liquidity Outcomes New Term Loan Established, Which Allows for Extra Capacity and Increased Flexibility Ran competitive process to replace existing term loan with goal to secure better terms and strengthen financial flexibility ✓ ✓

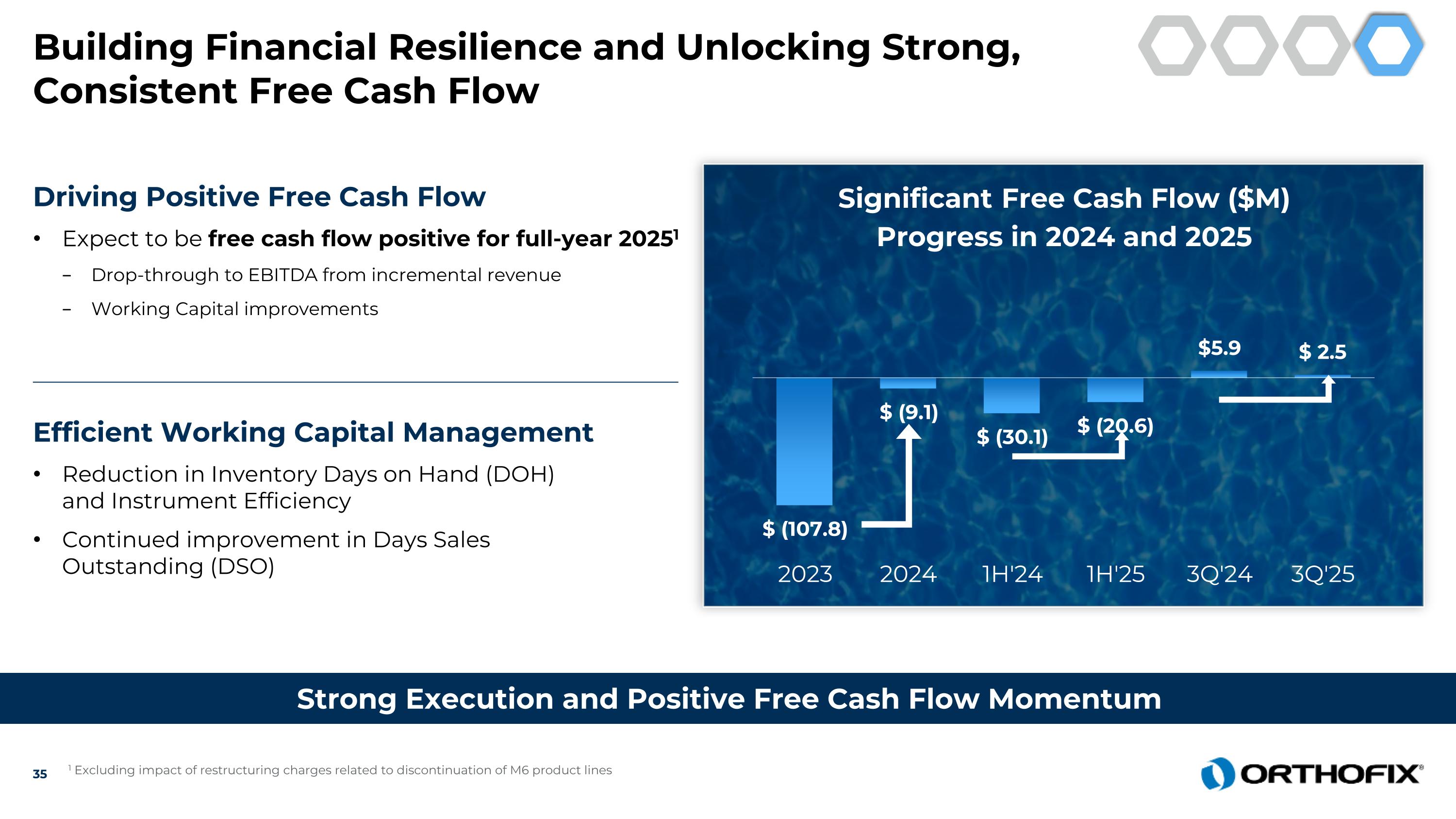

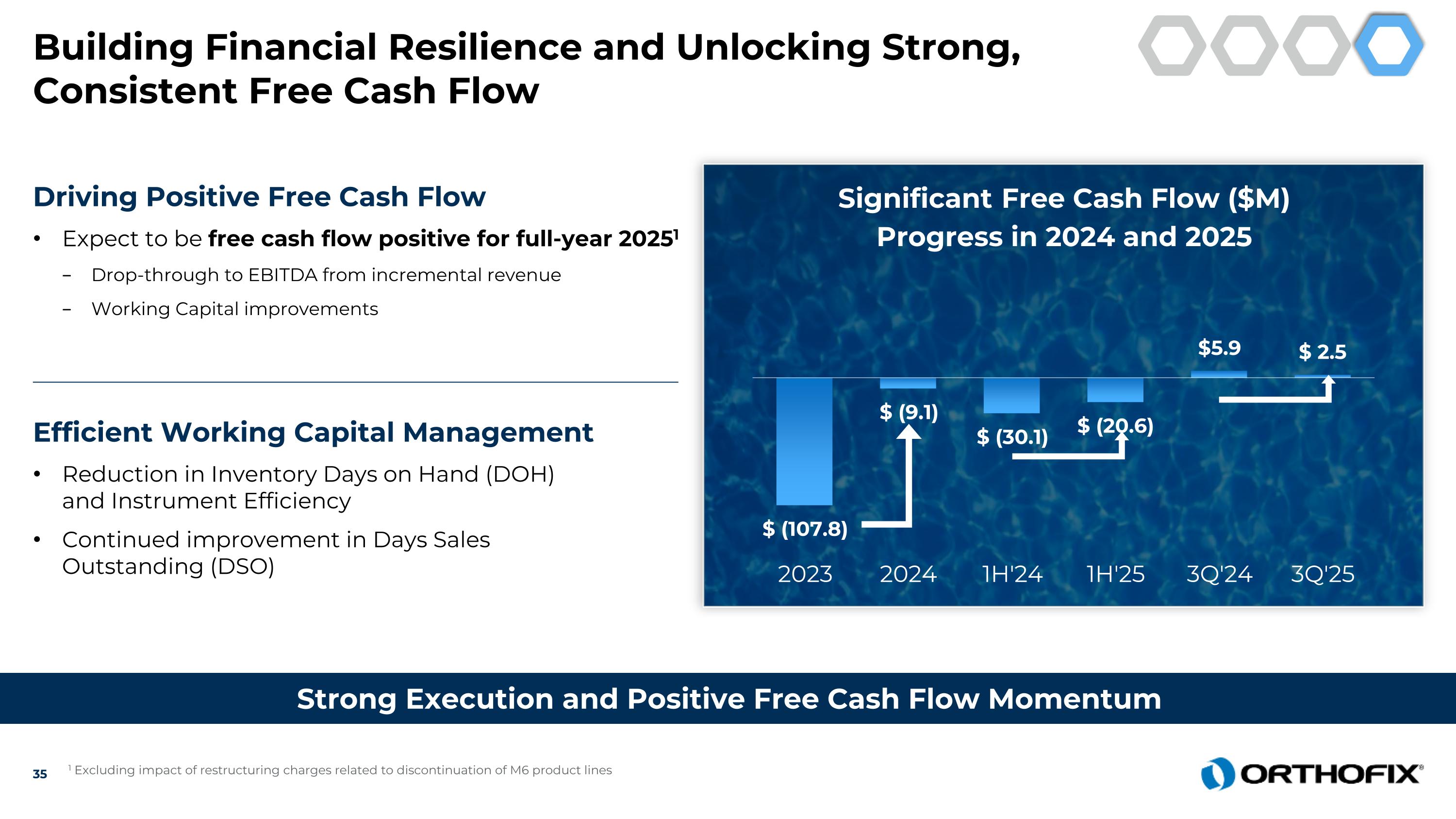

Building Financial Resilience and Unlocking Strong, Consistent Free Cash Flow Strong Execution and Positive Free Cash Flow Momentum Driving Positive Free Cash Flow Expect to be free cash flow positive for full-year 20251 Drop-through to EBITDA from incremental revenue Working Capital improvements Efficient Working Capital Management Reduction in Inventory Days on Hand (DOH)and Instrument Efficiency Continued improvement in Days Sales Outstanding (DSO) 1 Excluding impact of restructuring charges related to discontinuation of M6 product lines

Strategy is Driving Long-Term Profitable Growth GrowthEngine Pillars Assumptions 6.5% – 7.5% Net Sales CAGR1 (2025 – 2027) Mid-Teens Adj. EBITDA (Full-year 2027) Positive Free Cash Flow Generation1 (2025 – 2027) Sustained market demand: weighted average market growth of ~4% to 5% Includes negative pricing impact of 1% to 2% No material change in reimbursement or regulatory environment ~300 bps of Gross Margin expansion over period Capture remaining merger synergies Fixed cost leverage, moderating expense growth Driven by continued Adj. EBITDA improvement Reduction in inventory DOH Improved instrument utilization DifferentiatedTechnologies Multiple Access Points MarginExpansion StrongCash Flow 2027 Financial Targets 1 Excluding impact of restructuring charges related to discontinuation of M6 product lines

Capital Allocation Priorities Investing to drive future profitable growth 1 Organic Growth Reinvest in business; enhance commercial channel; target capital spend levels at ~5% of sales 2 Inorganic Growth Tuck-in M&A to enhance growth & margin profile, support category leadership 3 Capital Structure Debt paydown and fortify balance sheet 4 Return of Capital In the absence of value-creating opportunities

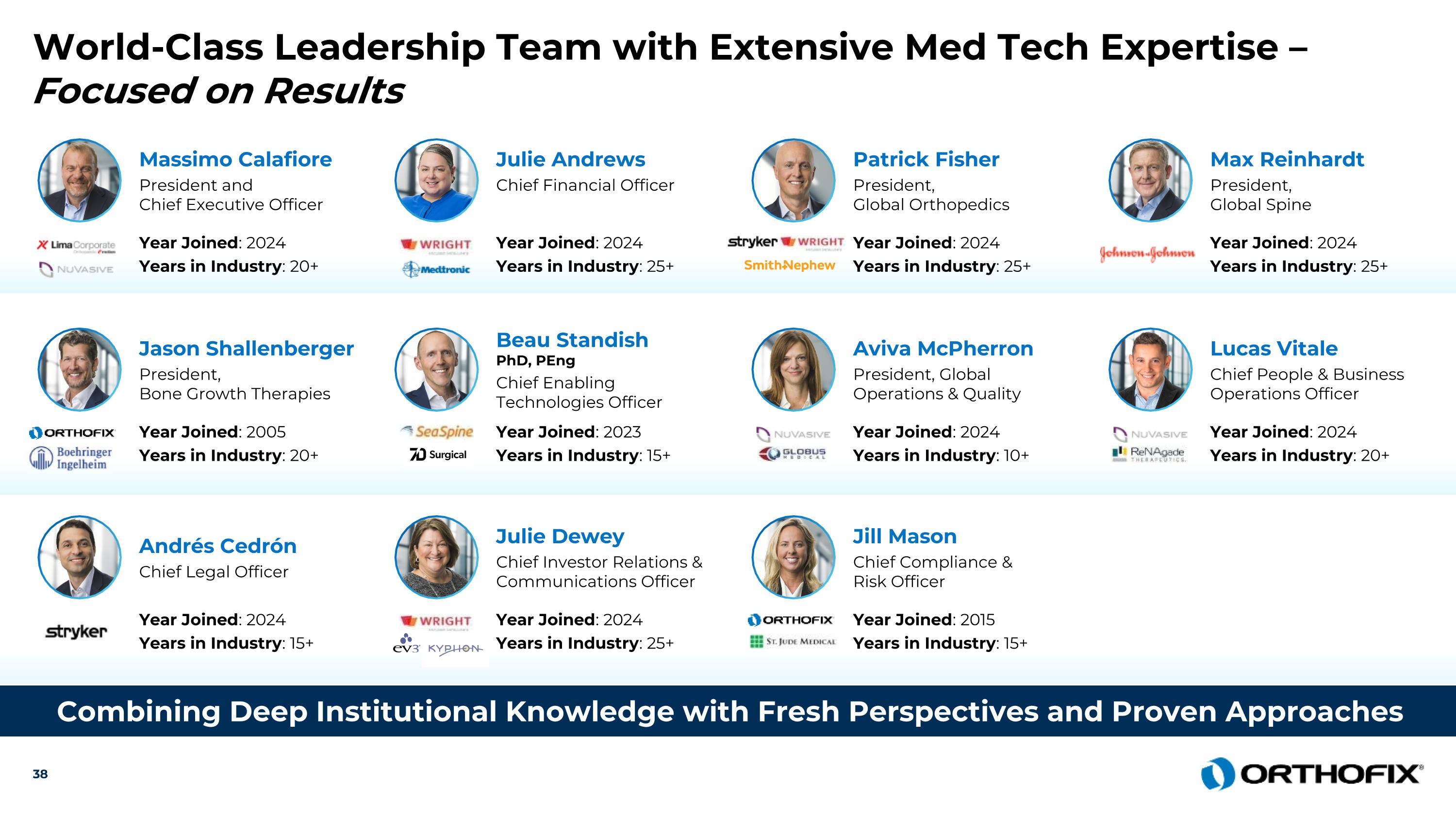

World-Class Leadership Team with Extensive Med Tech Expertise – Focused on Results Combining Deep Institutional Knowledge with Fresh Perspectives and Proven Approaches Massimo Calafiore President and Chief Executive Officer Patrick Fisher President, Global Orthopedics Max Reinhardt President, Global Spine Julie Andrews Chief Financial Officer Year Joined: 2024 Years in Industry: 20+ Year Joined: 2024 Years in Industry: 25+ Year Joined: 2024 Years in Industry: 25+ Year Joined: 2024 Years in Industry: 25+ Jason Shallenberger President,Bone Growth Therapies Aviva McPherron President, Global Operations & Quality Lucas Vitale Chief People & Business Operations Officer Beau StandishPhD, PEng Chief EnablingTechnologies Officer Year Joined: 2005 Years in Industry: 20+ Year Joined: 2023 Years in Industry: 15+ Year Joined: 2024 Years in Industry: 10+ Year Joined: 2024 Years in Industry: 20+ Andrés Cedrón Chief Legal Officer Jill Mason Chief Compliance & Risk Officer Julie Dewey Chief Investor Relations & Communications Officer Year Joined: 2024 Years in Industry: 15+ Year Joined: 2024 Years in Industry: 25+ Year Joined: 2015 Years in Industry: 15+

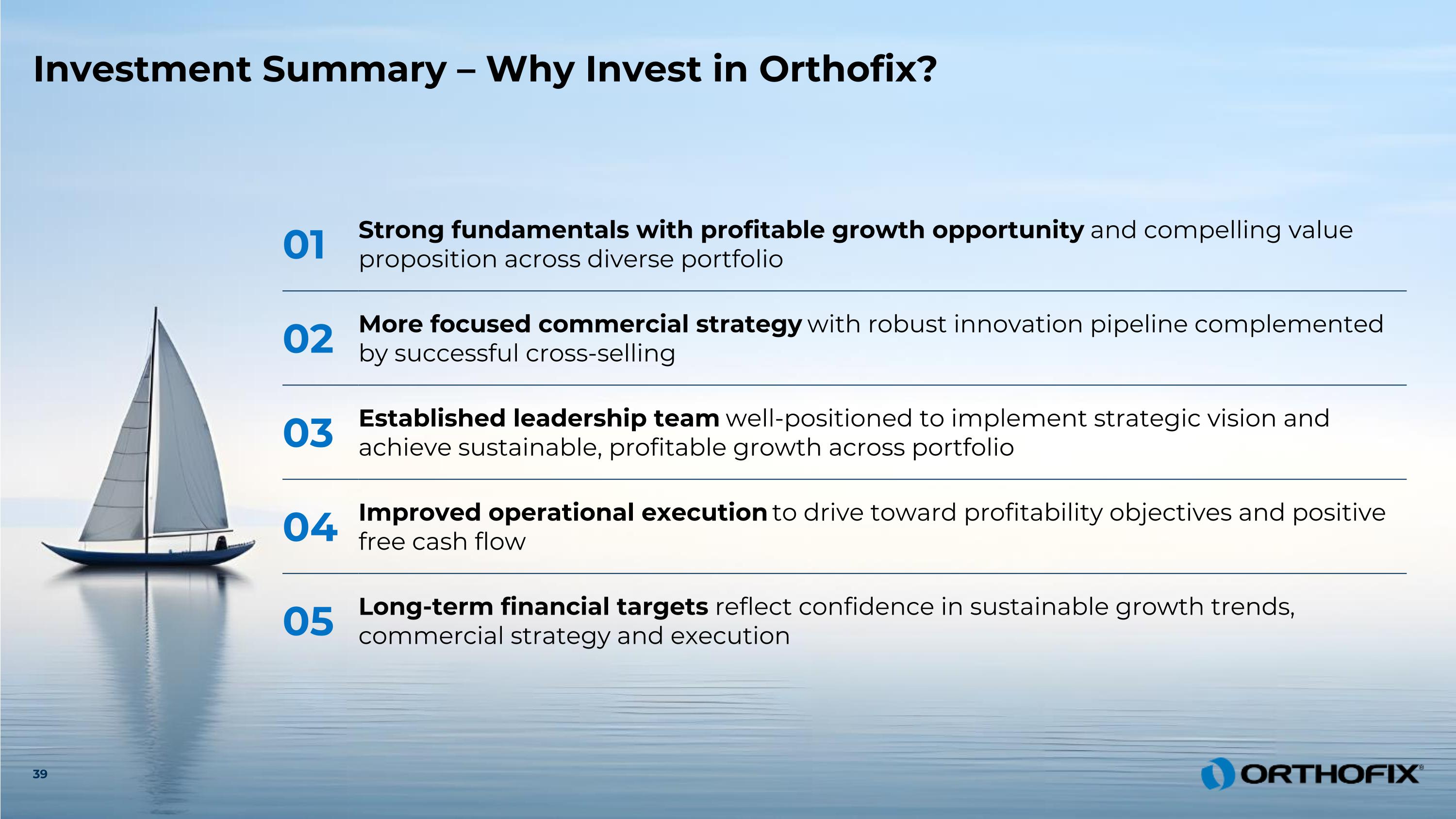

Investment Summary – Why Invest in Orthofix? 01 Strong fundamentals with profitable growth opportunity and compelling value proposition across diverse portfolio 02 More focused commercial strategy with robust innovation pipeline complemented by successful cross-selling 03 Established leadership team well-positioned to implement strategic vision and achieve sustainable, profitable growth across portfolio 04 Improved operational execution to drive toward profitability objectives and positive free cash flow 05 Long-term financial targets reflect confidence in sustainable growth trends, commercial strategy and execution

For additional information, please contact: Julie Dewey, IRC Chief IR & Communications Officer juliedewey@orthofix.com 209-613-6945 www.Orthofix.com NASDAQ: OFIX

Financial and Non-GAAP Reconciliation Tables Appendix

Net Sales by Major Product Category by Reporting Segment * Results above for each of Spinal Implants, Biologics, and Enabling Technologies; Global Spine; and pro forma net sales exclude the impact from discontinuation of the M6 product lines. Since pro forma net sales represent a non-GAAP measure, see the reconciliation above of the Company’s pro forma net sales to its reported figures under U.S. GAAP. The Company’s reported figures under U.S. GAAP represent each of the pro forma line items discussed above plus the impact from discontinuation of the M6 product lines. Three Months Ended September 30, (Unaudited, U.S. Dollars, in millions) 2025 2024 Change ConstantCurrencyChange Bone Growth Therapies $ 61.2 $ 57.9 5.7 % 5.7 % Spinal Implants, Biologics and Enabling Technologies* 108.6 102.9 5.6 % 5.6 % Global Spine* 169.8 160.8 5.6 % 5.6 % Global Orthopedics 33.6 30.5 10.1 % 5.9 % Pro forma net sales* 203.4 191.3 6.3 % 5.7 % Impact from discontinuation of M6 product lines 2.2 5.3 (58.5 %) (58.6 %) Reported net sales $ 205.6 $ 196.6 4.6 % 3.9 %

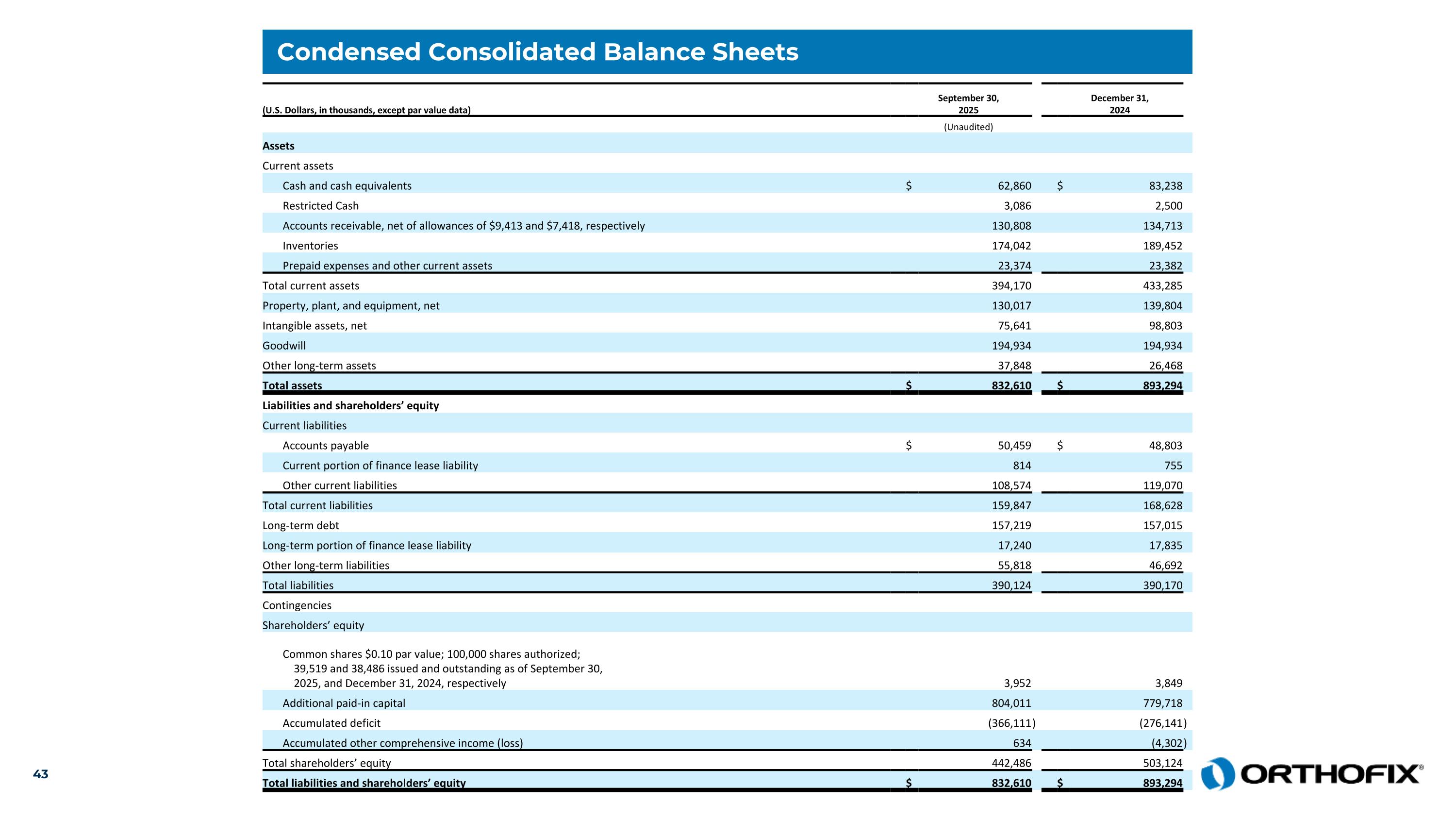

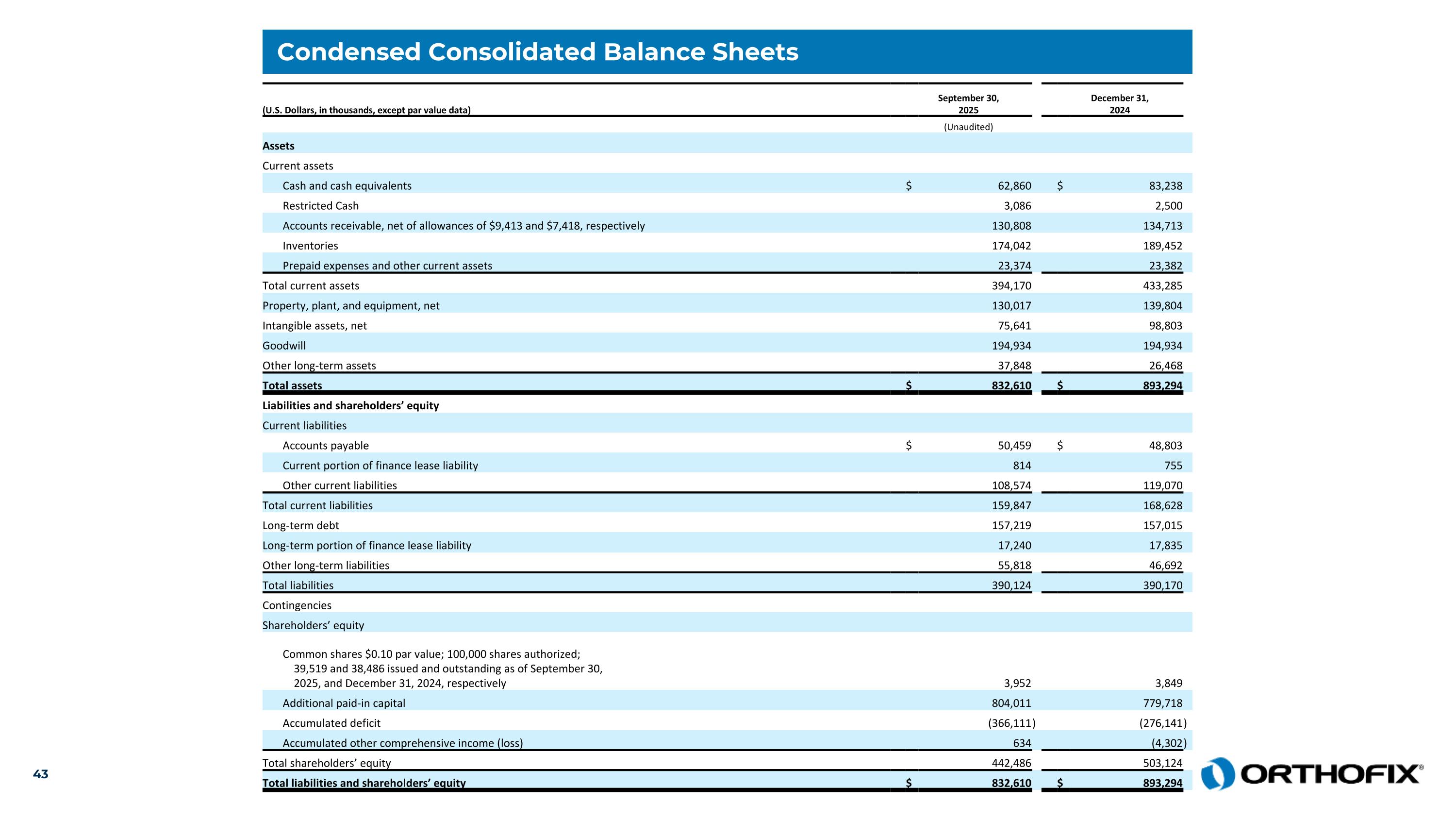

Condensed Consolidated Balance Sheets (U.S. Dollars, in thousands, except par value data) September 30,2025 December 31,2024 (Unaudited) Assets Current assets Cash and cash equivalents $ 62,860 $ 83,238 Restricted Cash 3,086 2,500 Accounts receivable, net of allowances of $9,413 and $7,418, respectively 130,808 134,713 Inventories 174,042 189,452 Prepaid expenses and other current assets 23,374 23,382 Total current assets 394,170 433,285 Property, plant, and equipment, net 130,017 139,804 Intangible assets, net 75,641 98,803 Goodwill 194,934 194,934 Other long-term assets 37,848 26,468 Total assets $ 832,610 $ 893,294 Liabilities and shareholders’ equity Current liabilities Accounts payable $ 50,459 $ 48,803 Current portion of finance lease liability 814 755 Other current liabilities 108,574 119,070 Total current liabilities 159,847 168,628 Long-term debt 157,219 157,015 Long-term portion of finance lease liability 17,240 17,835 Other long-term liabilities 55,818 46,692 Total liabilities 390,124 390,170 Contingencies Shareholders’ equity Common shares $0.10 par value; 100,000 shares authorized; 39,519 and 38,486 issued and outstanding as of September 30, 2025, and December 31, 2024, respectively 3,952 3,849 Additional paid-in capital 804,011 779,718 Accumulated deficit (366,111 ) (276,141 ) Accumulated other comprehensive income (loss) 634 (4,302 ) Total shareholders’ equity 442,486 503,124 Total liabilities and shareholders’ equity $ 832,610 $ 893,294

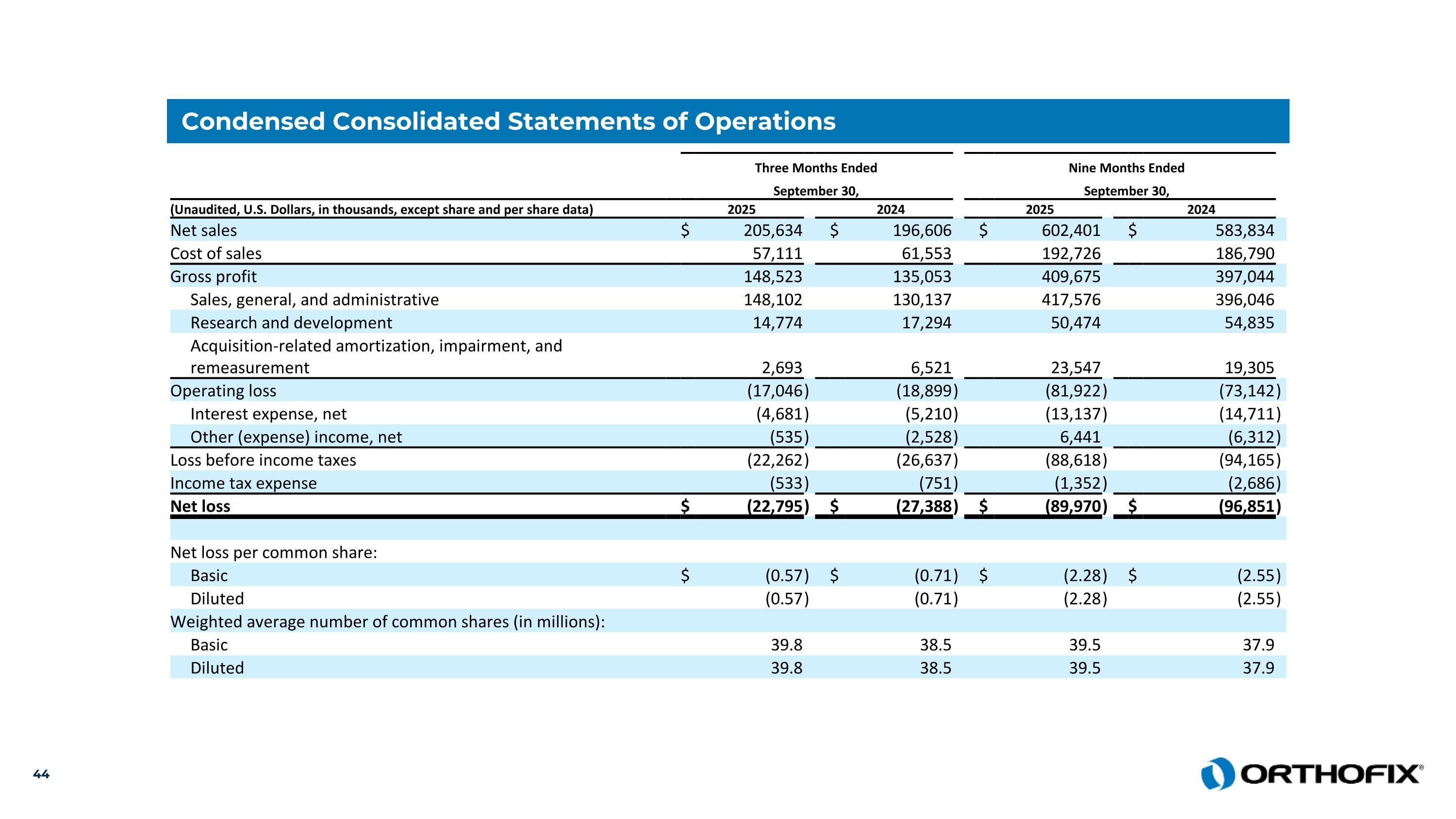

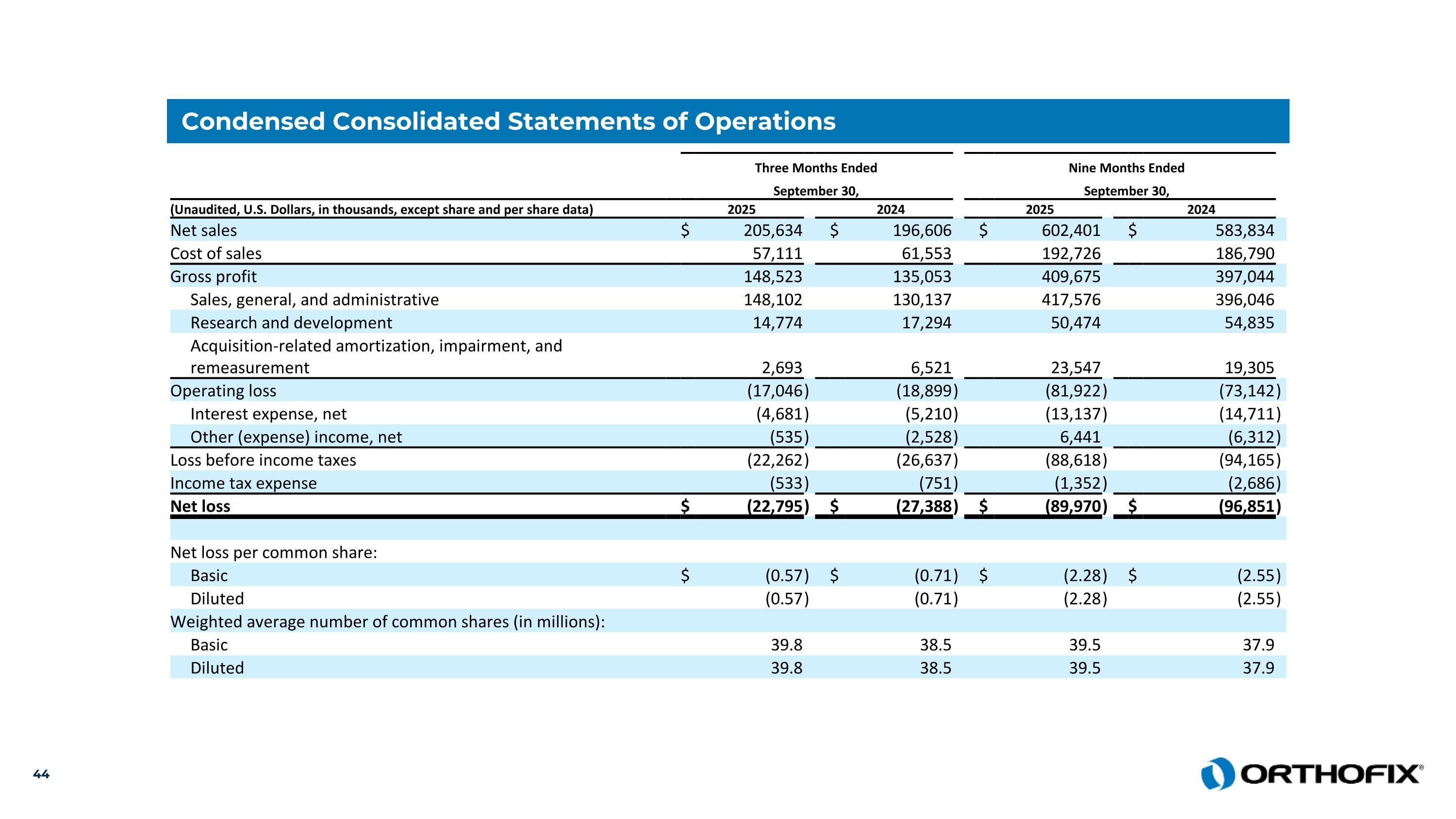

Condensed Consolidated Statements of Operations Three Months Ended Nine Months Ended September 30, September 30, (Unaudited, U.S. Dollars, in thousands, except share and per share data) 2025 2024 2025 2024 Net sales $ 205,634 $ 196,606 $ 602,401 $ 583,834 Cost of sales 57,111 61,553 192,726 186,790 Gross profit 148,523 135,053 409,675 397,044 Sales, general, and administrative 148,102 130,137 417,576 396,046 Research and development 14,774 17,294 50,474 54,835 Acquisition-related amortization, impairment, and remeasurement 2,693 6,521 23,547 19,305 Operating loss (17,046 ) (18,899 ) (81,922 ) (73,142 ) Interest expense, net (4,681 ) (5,210 ) (13,137 ) (14,711 ) Other (expense) income, net (535 ) (2,528 ) 6,441 (6,312 ) Loss before income taxes (22,262 ) (26,637 ) (88,618 ) (94,165 ) Income tax expense (533 ) (751 ) (1,352 ) (2,686 ) Net loss $ (22,795 ) $ (27,388 ) $ (89,970 ) $ (96,851 ) Net loss per common share: Basic $ (0.57 ) $ (0.71 ) $ (2.28 ) $ (2.55 ) Diluted (0.57 ) (0.71 ) (2.28 ) (2.55 ) Weighted average number of common shares (in millions): Basic 39.8 38.5 39.5 37.9 Diluted 39.8 38.5 39.5 37.9

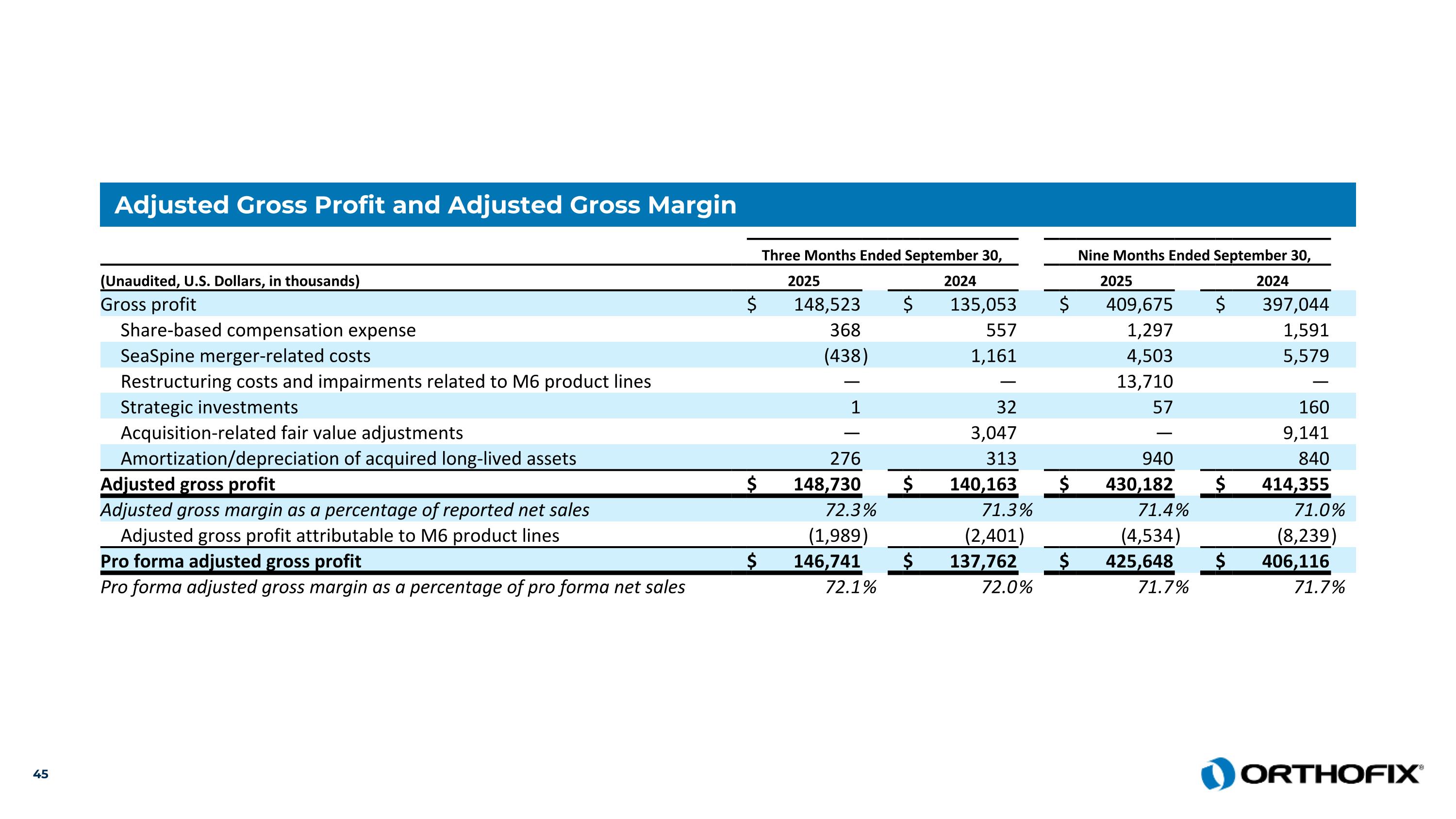

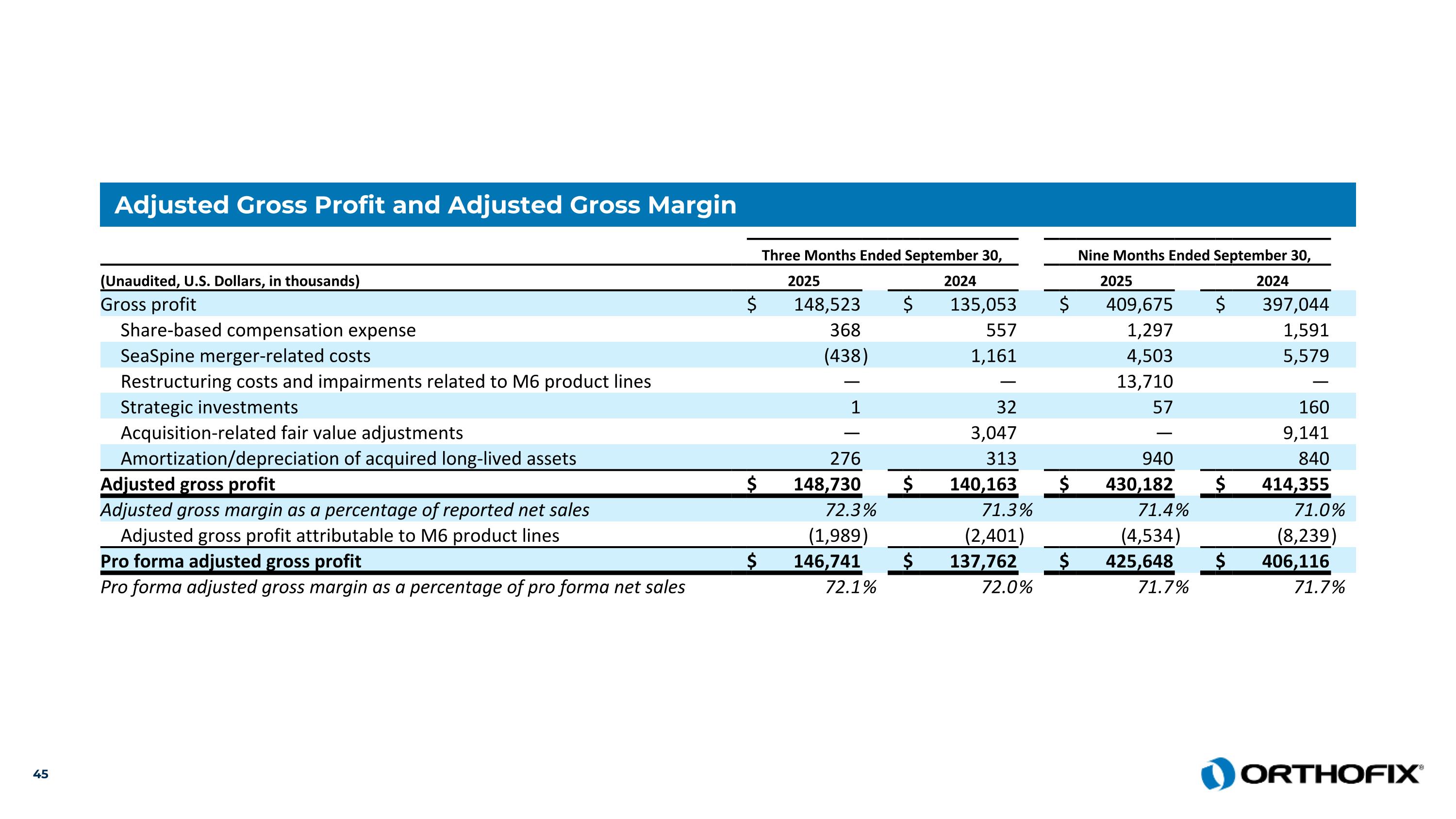

Adjusted Gross Profit and Adjusted Gross Margin Three Months Ended September 30, Nine Months Ended September 30, (Unaudited, U.S. Dollars, in thousands) 2025 2024 2025 2024 Gross profit $ 148,523 $ 135,053 $ 409,675 $ 397,044 Share-based compensation expense 368 557 1,297 1,591 SeaSpine merger-related costs (438 ) 1,161 4,503 5,579 Restructuring costs and impairments related to M6 product lines — — 13,710 — Strategic investments 1 32 57 160 Acquisition-related fair value adjustments — 3,047 — 9,141 Amortization/depreciation of acquired long-lived assets 276 313 940 840 Adjusted gross profit $ 148,730 $ 140,163 $ 430,182 $ 414,355 Adjusted gross margin as a percentage of reported net sales 72.3 % 71.3 % 71.4 % 71.0 % Adjusted gross profit attributable to M6 product lines (1,989 ) (2,401 ) (4,534 ) (8,239 ) Pro forma adjusted gross profit $ 146,741 $ 137,762 $ 425,648 $ 406,116 Pro forma adjusted gross margin as a percentage of pro forma net sales 72.1 % 72.0 % 71.7 % 71.7 %

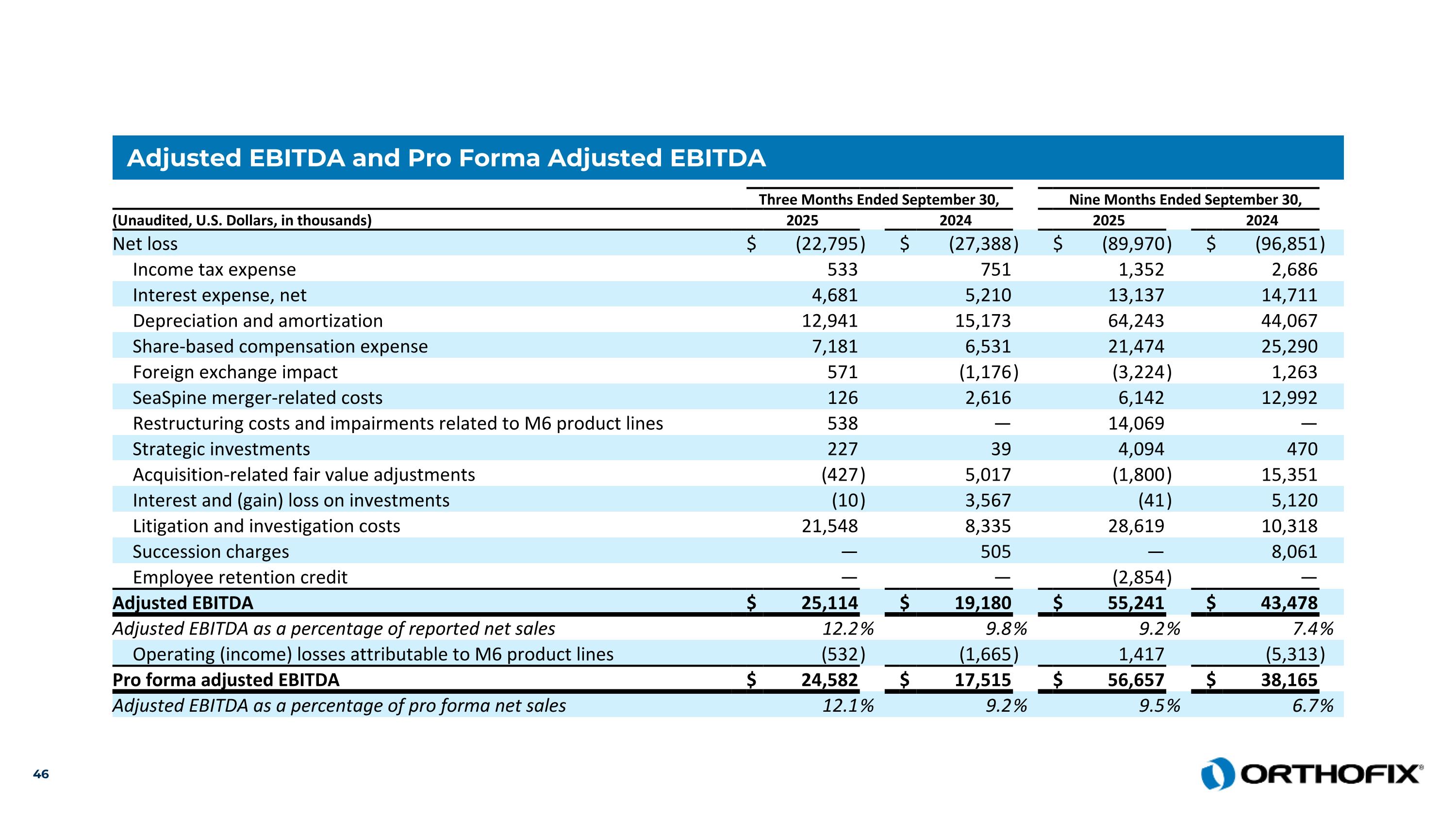

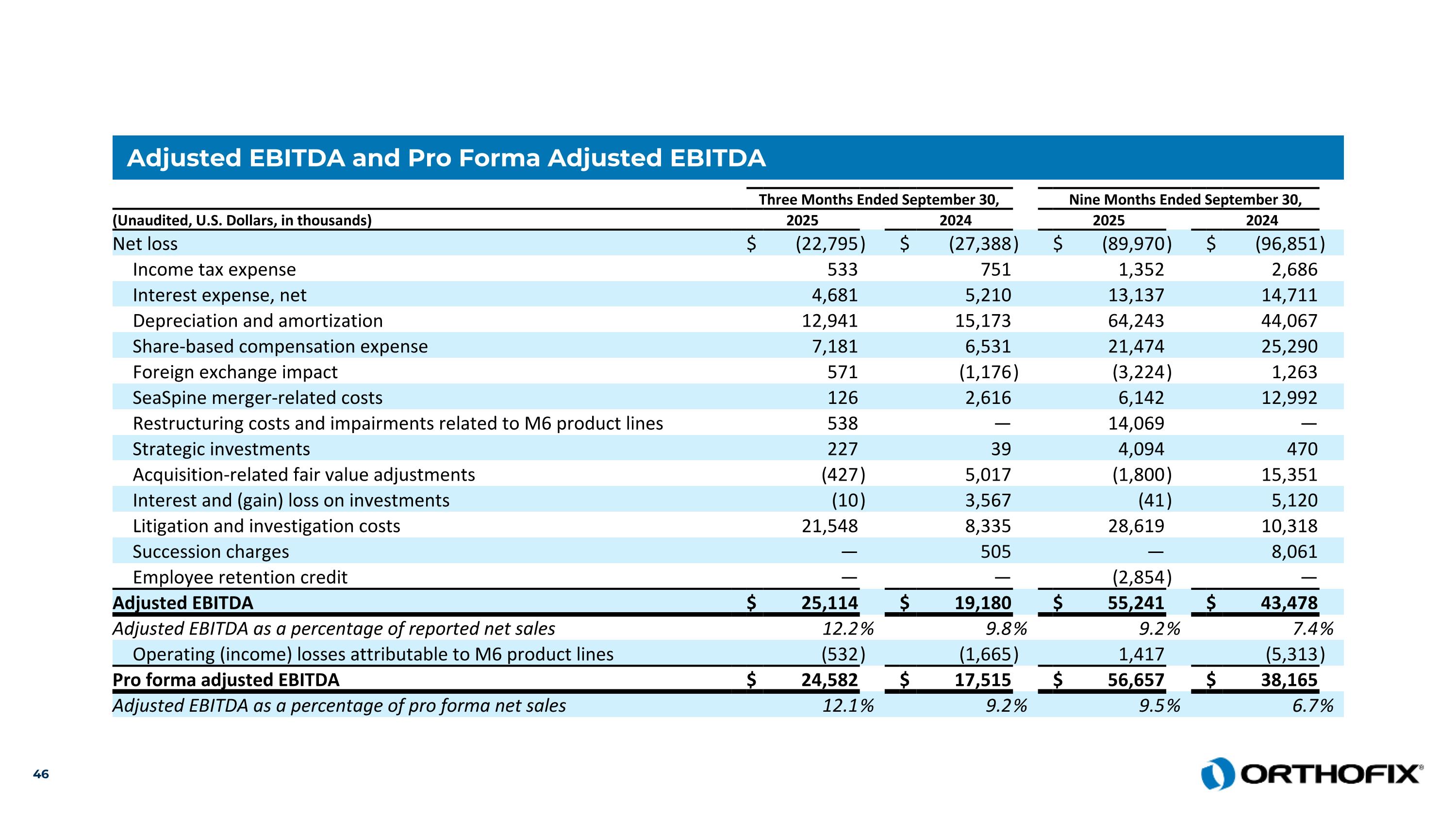

Adjusted EBITDA and Pro Forma Adjusted EBITDA Three Months Ended September 30, Nine Months Ended September 30, (Unaudited, U.S. Dollars, in thousands) 2025 2024 2025 2024 Net loss $ (22,795 ) $ (27,388 ) $ (89,970 ) $ (96,851 ) Income tax expense 533 751 1,352 2,686 Interest expense, net 4,681 5,210 13,137 14,711 Depreciation and amortization 12,941 15,173 64,243 44,067 Share-based compensation expense 7,181 6,531 21,474 25,290 Foreign exchange impact 571 (1,176 ) (3,224 ) 1,263 SeaSpine merger-related costs 126 2,616 6,142 12,992 Restructuring costs and impairments related to M6 product lines 538 — 14,069 — Strategic investments 227 39 4,094 470 Acquisition-related fair value adjustments (427 ) 5,017 (1,800 ) 15,351 Interest and (gain) loss on investments (10 ) 3,567 (41 ) 5,120 Litigation and investigation costs 21,548 8,335 28,619 10,318 Succession charges — 505 — 8,061 Employee retention credit — — (2,854 ) — Adjusted EBITDA $ 25,114 $ 19,180 $ 55,241 $ 43,478 Adjusted EBITDA as a percentage of reported net sales 12.2 % 9.8 % 9.2 % 7.4 % Operating (income) losses attributable to M6 product lines (532 ) (1,665 ) 1,417 (5,313 ) Pro forma adjusted EBITDA $ 24,582 $ 17,515 $ 56,657 $ 38,165 Adjusted EBITDA as a percentage of pro forma net sales 12.1 % 9.2 % 9.5 % 6.7 %

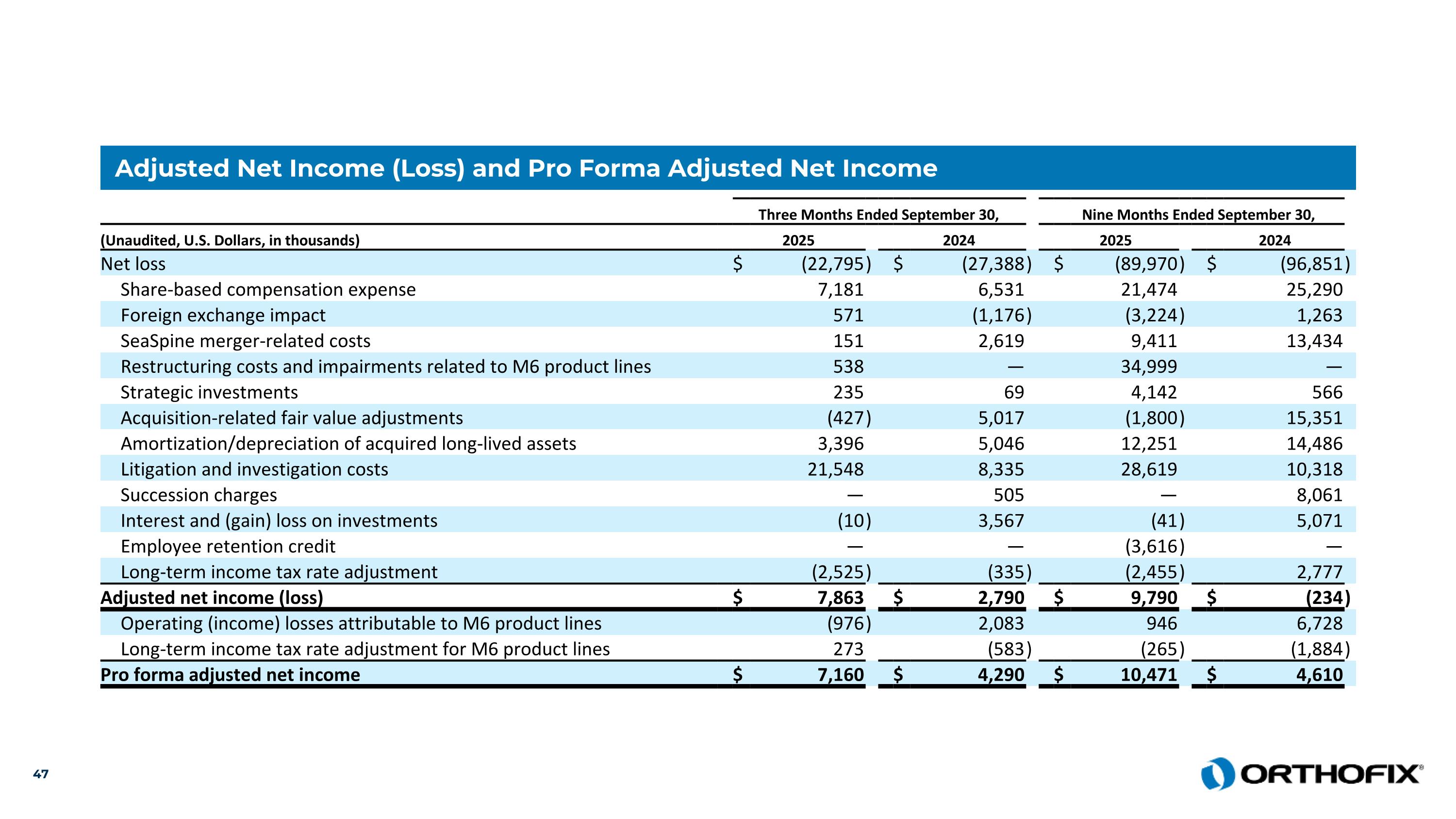

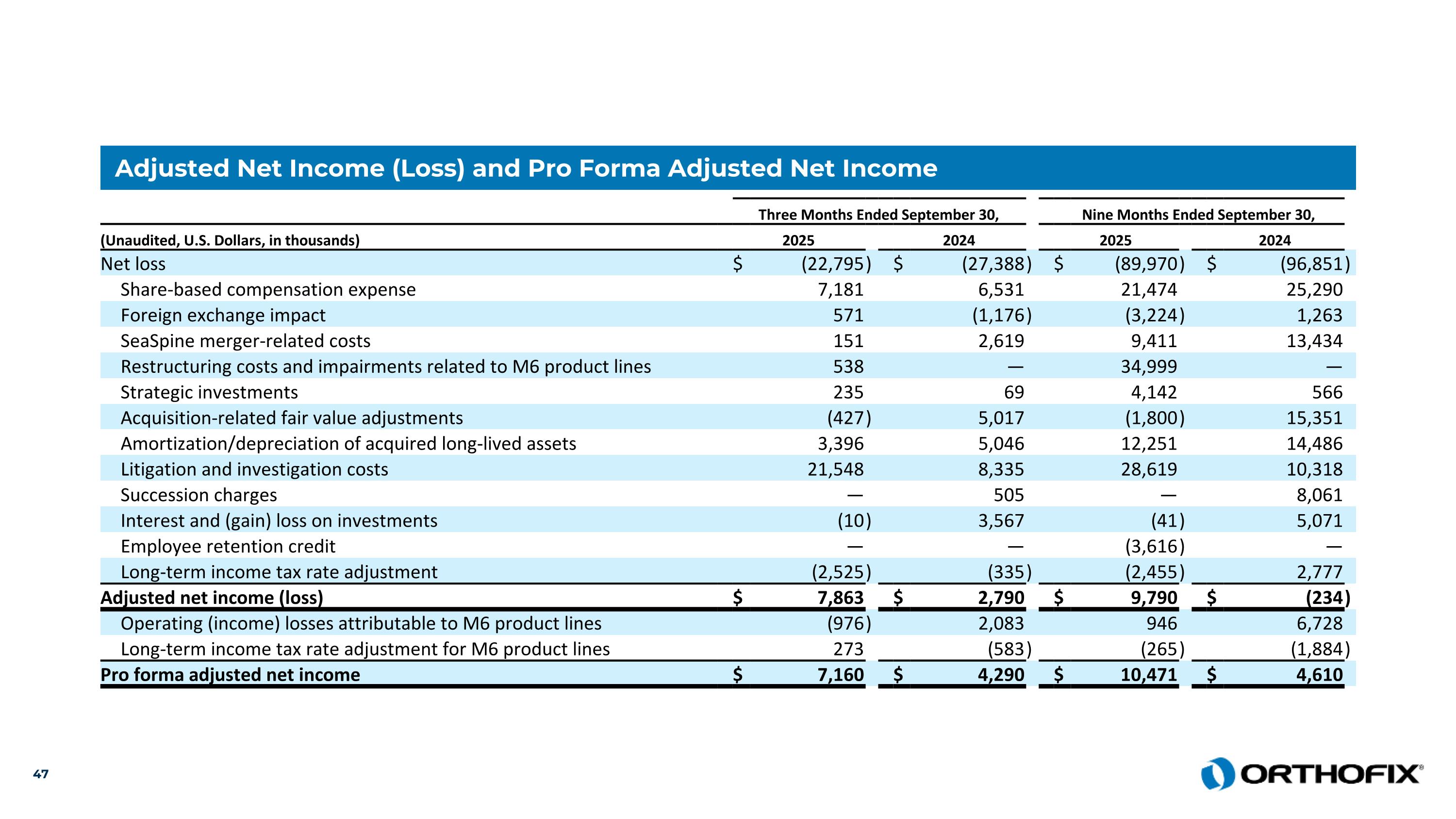

Adjusted Net Income (Loss) and Pro Forma Adjusted Net Income Three Months Ended September 30, Nine Months Ended September 30, (Unaudited, U.S. Dollars, in thousands) 2025 2024 2025 2024 Net loss $ (22,795 ) $ (27,388 ) $ (89,970 ) $ (96,851 ) Share-based compensation expense 7,181 6,531 21,474 25,290 Foreign exchange impact 571 (1,176 ) (3,224 ) 1,263 SeaSpine merger-related costs 151 2,619 9,411 13,434 Restructuring costs and impairments related to M6 product lines 538 — 34,999 — Strategic investments 235 69 4,142 566 Acquisition-related fair value adjustments (427 ) 5,017 (1,800 ) 15,351 Amortization/depreciation of acquired long-lived assets 3,396 5,046 12,251 14,486 Litigation and investigation costs 21,548 8,335 28,619 10,318 Succession charges — 505 — 8,061 Interest and (gain) loss on investments (10 ) 3,567 (41 ) 5,071 Employee retention credit — — (3,616 ) — Long-term income tax rate adjustment (2,525 ) (335 ) (2,455 ) 2,777 Adjusted net income (loss) $ 7,863 $ 2,790 $ 9,790 $ (234 ) Operating (income) losses attributable to M6 product lines (976 ) 2,083 946 6,728 Long-term income tax rate adjustment for M6 product lines 273 (583 ) (265 ) (1,884 ) Pro forma adjusted net income $ 7,160 $ 4,290 $ 10,471 $ 4,610

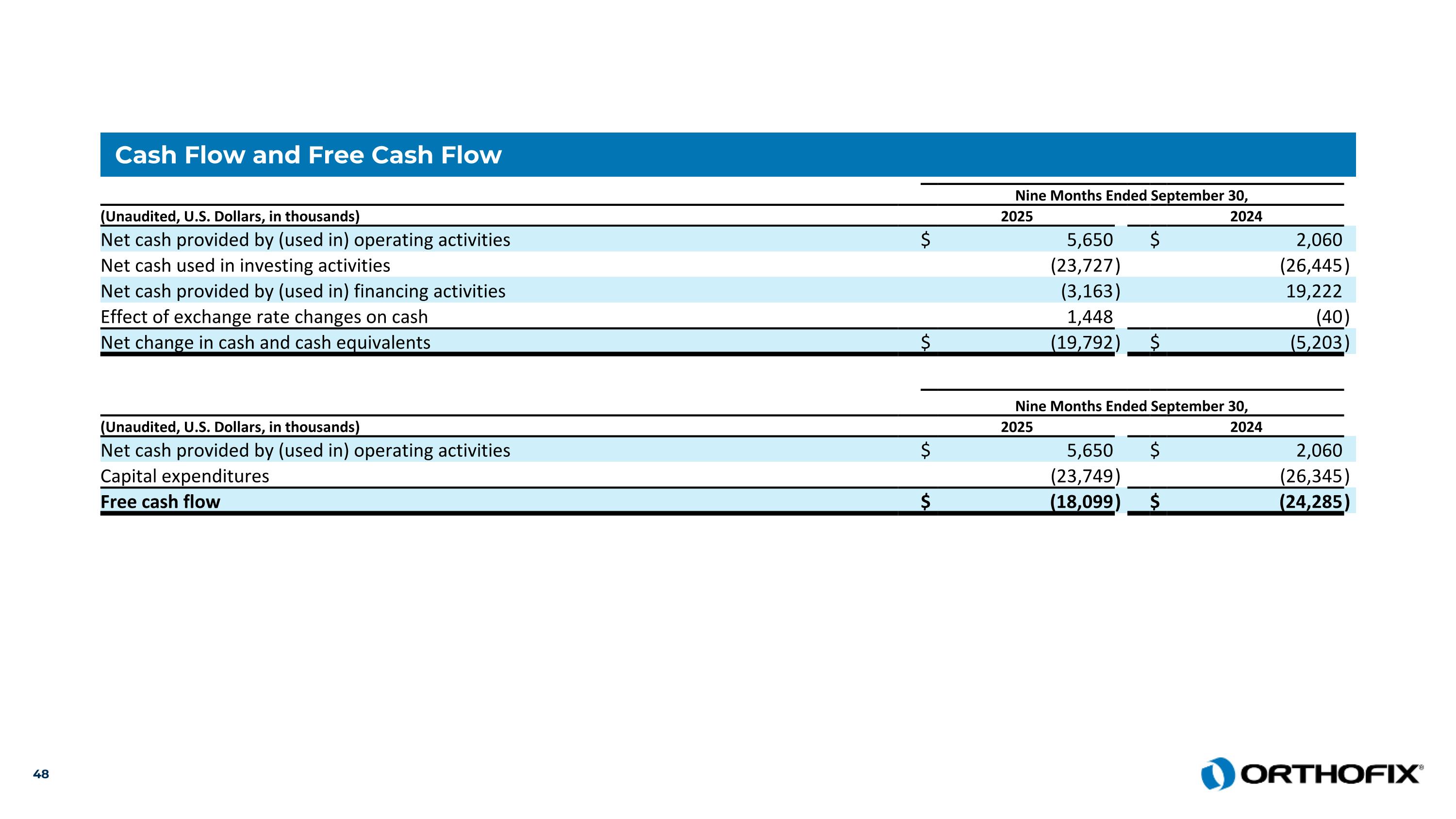

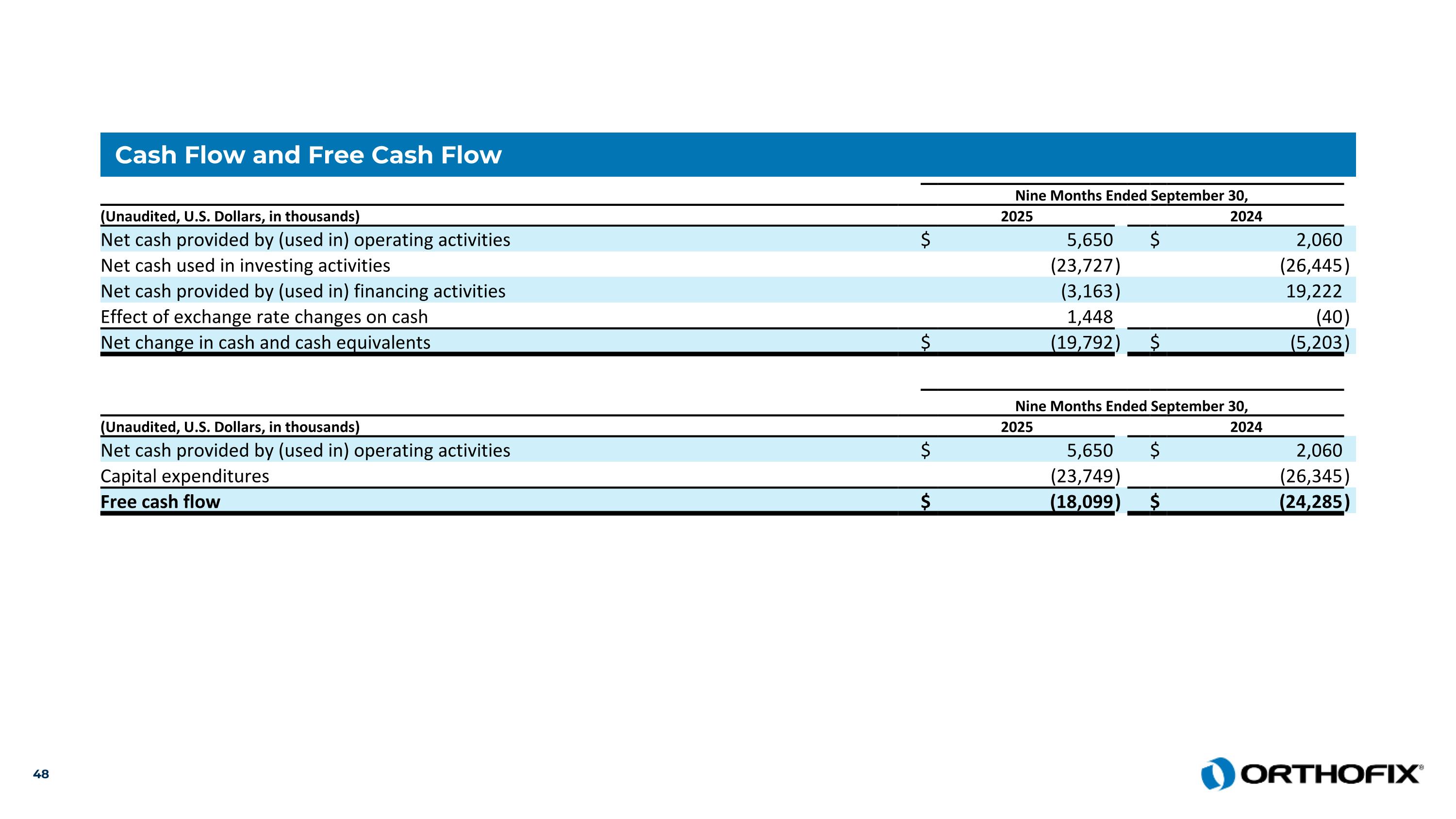

Cash Flow and Free Cash Flow Nine Months Ended September 30, (Unaudited, U.S. Dollars, in thousands) 2025 2024 Net cash provided by (used in) operating activities $ 5,650 $ 2,060 Net cash used in investing activities (23,727 ) (26,445 ) Net cash provided by (used in) financing activities (3,163 ) 19,222 Effect of exchange rate changes on cash 1,448 (40 ) Net change in cash and cash equivalents $ (19,792 ) $ (5,203 ) Nine Months Ended September 30, (Unaudited, U.S. Dollars, in thousands) 2025 2024 Net cash provided by (used in) operating activities $ 5,650 $ 2,060 Capital expenditures (23,749 ) (26,345 ) Free cash flow $ (18,099 ) $ (24,285 )

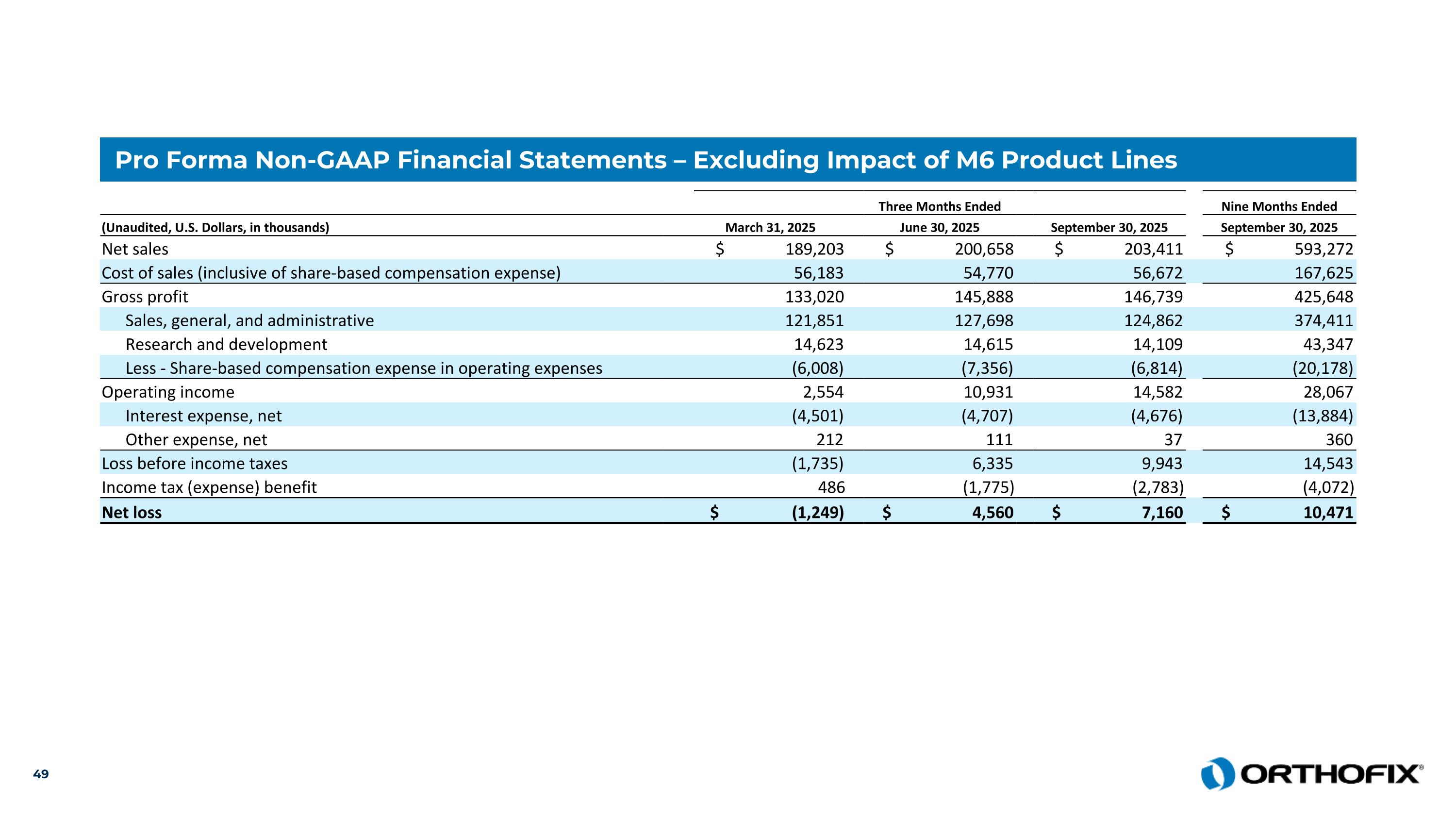

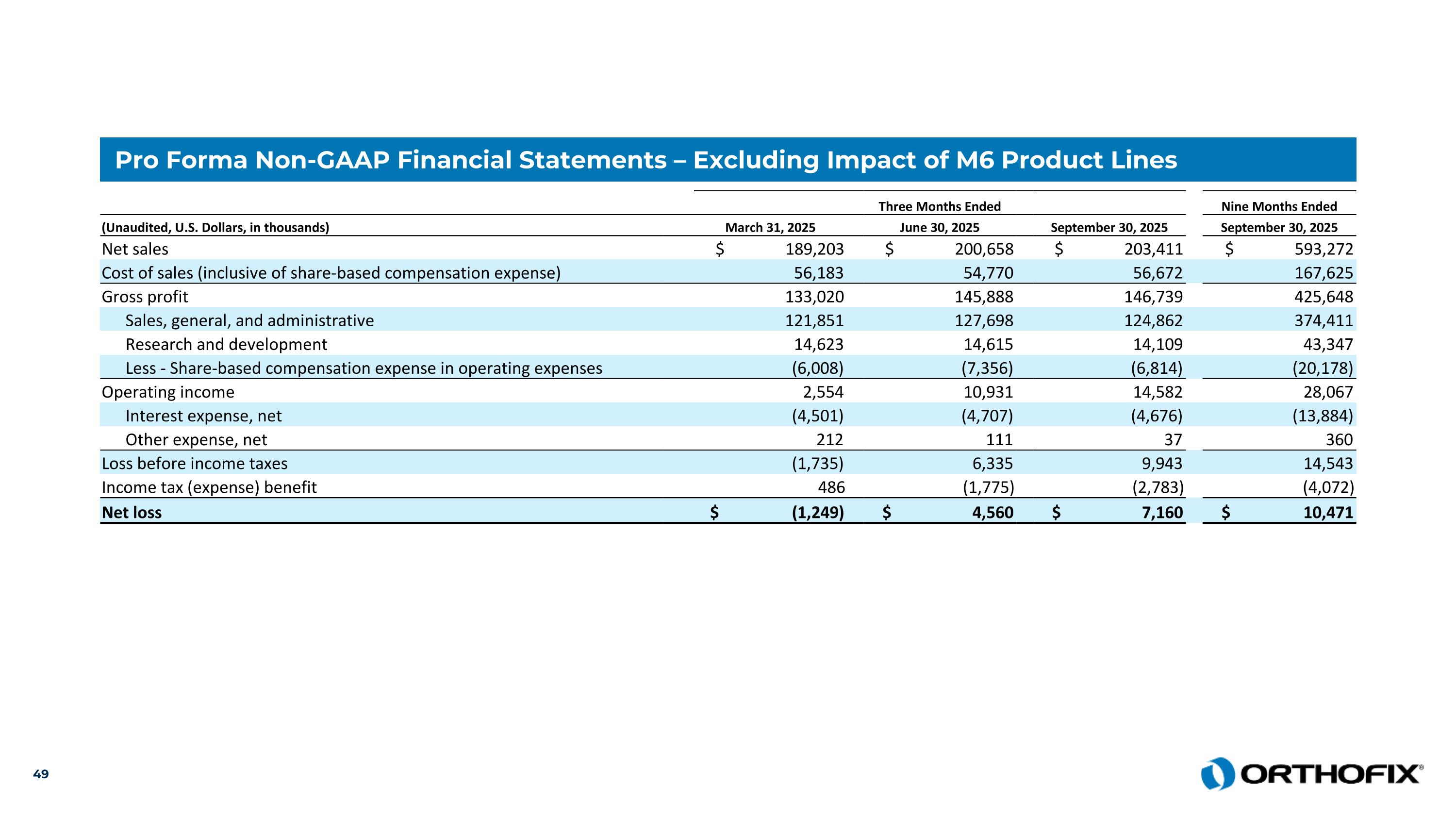

Pro Forma Non-GAAP Financial Statements – Excluding Impact of M6 Product Lines Three Months Ended Nine Months Ended (Unaudited, U.S. Dollars, in thousands) March 31, 2025 June 30, 2025 September 30, 2025 September 30, 2025 Net sales $ 189,203 $ 200,658 $ 203,411 $ 593,272 Cost of sales (inclusive of share-based compensation expense) 56,183 54,770 56,672 167,625 Gross profit 133,020 145,888 146,739 425,648 Sales, general, and administrative 121,851 127,698 124,862 374,411 Research and development 14,623 14,615 14,109 43,347 Less - Share-based compensation expense in operating expenses (6,008) (7,356) (6,814) (20,178) Operating income 2,554 10,931 14,582 28,067 Interest expense, net (4,501) (4,707) (4,676) (13,884) Other expense, net 212 111 37 360 Loss before income taxes (1,735) 6,335 9,943 14,543 Income tax (expense) benefit 486 (1,775) (2,783) (4,072) Net loss $ (1,249) $ 4,560 $ 7,160 $ 10,471

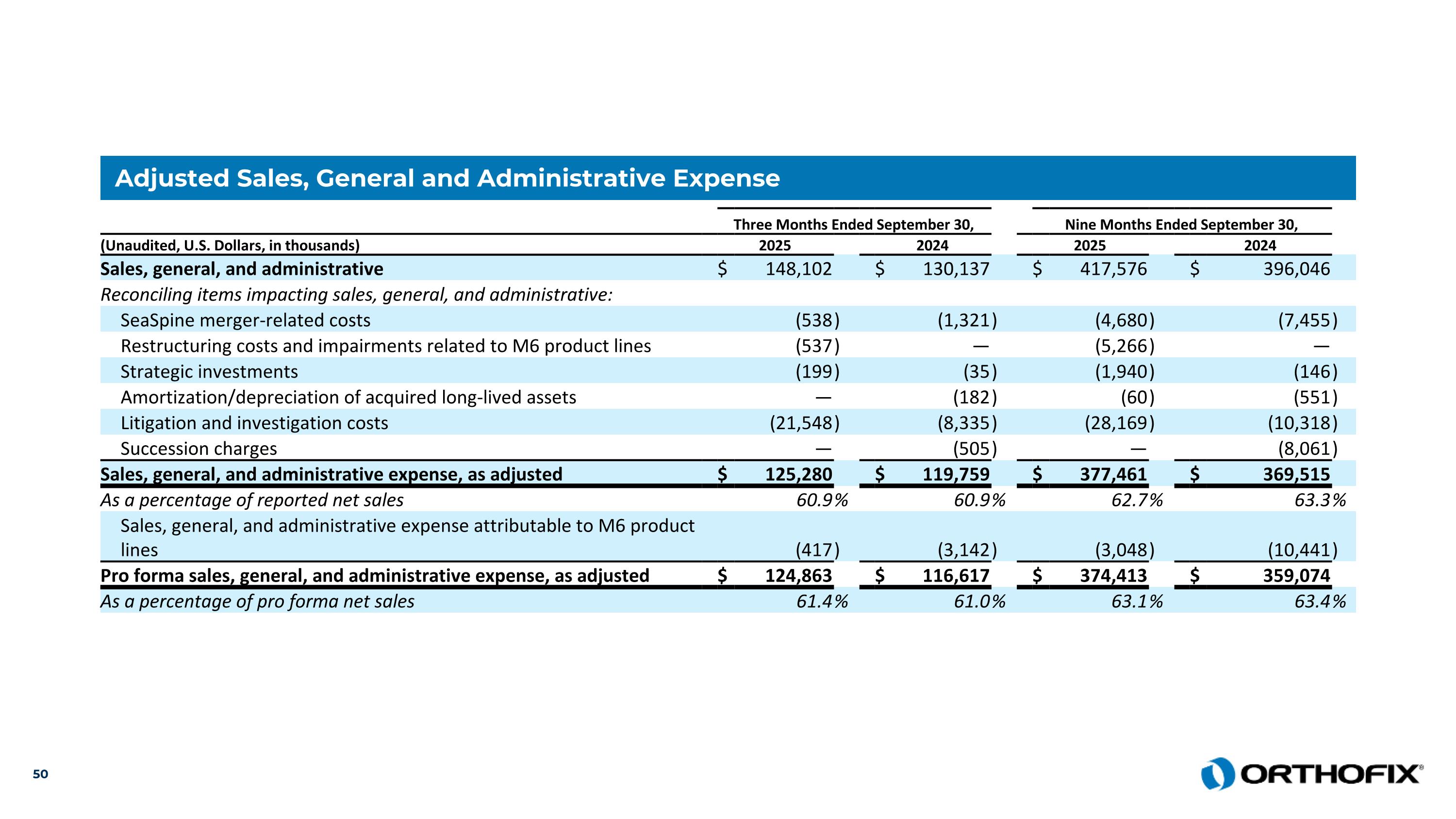

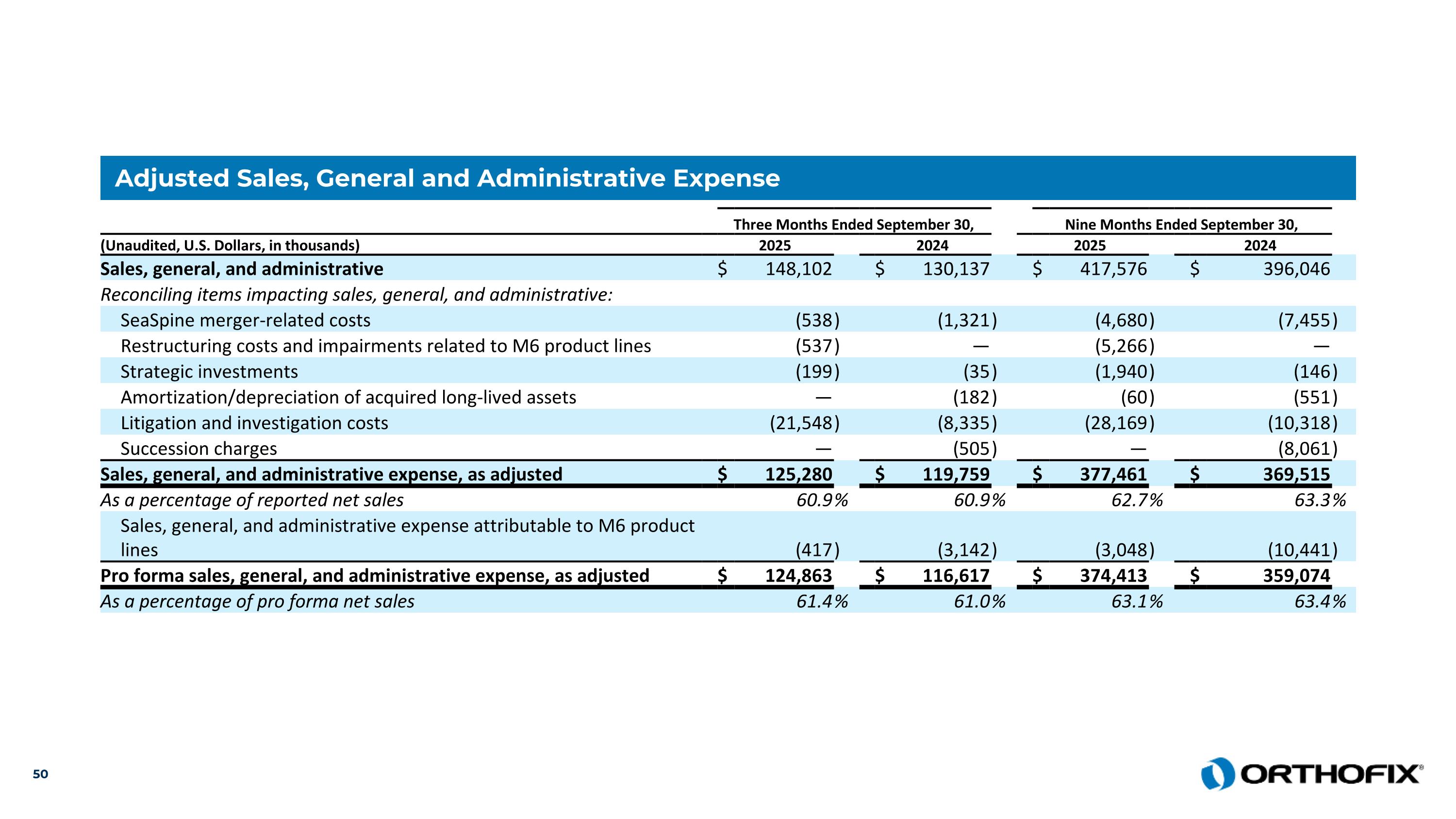

Adjusted Sales, General and Administrative Expense Three Months Ended September 30, Nine Months Ended September 30, (Unaudited, U.S. Dollars, in thousands) 2025 2024 2025 2024 Sales, general, and administrative $ 148,102 $ 130,137 $ 417,576 $ 396,046 Reconciling items impacting sales, general, and administrative: SeaSpine merger-related costs (538 ) (1,321 ) (4,680 ) (7,455 ) Restructuring costs and impairments related to M6 product lines (537 ) — (5,266 ) — Strategic investments (199 ) (35 ) (1,940 ) (146 ) Amortization/depreciation of acquired long-lived assets — (182 ) (60 ) (551 ) Litigation and investigation costs (21,548 ) (8,335 ) (28,169 ) (10,318 ) Succession charges — (505 ) — (8,061 ) Sales, general, and administrative expense, as adjusted $ 125,280 $ 119,759 $ 377,461 $ 369,515 As a percentage of reported net sales 60.9 % 60.9 % 62.7 % 63.3 % Sales, general, and administrative expense attributable to M6 product lines (417 ) (3,142 ) (3,048 ) (10,441 ) Pro forma sales, general, and administrative expense, as adjusted $ 124,863 $ 116,617 $ 374,413 $ 359,074 As a percentage of pro forma net sales 61.4 % 61.0 % 63.1 % 63.4 %

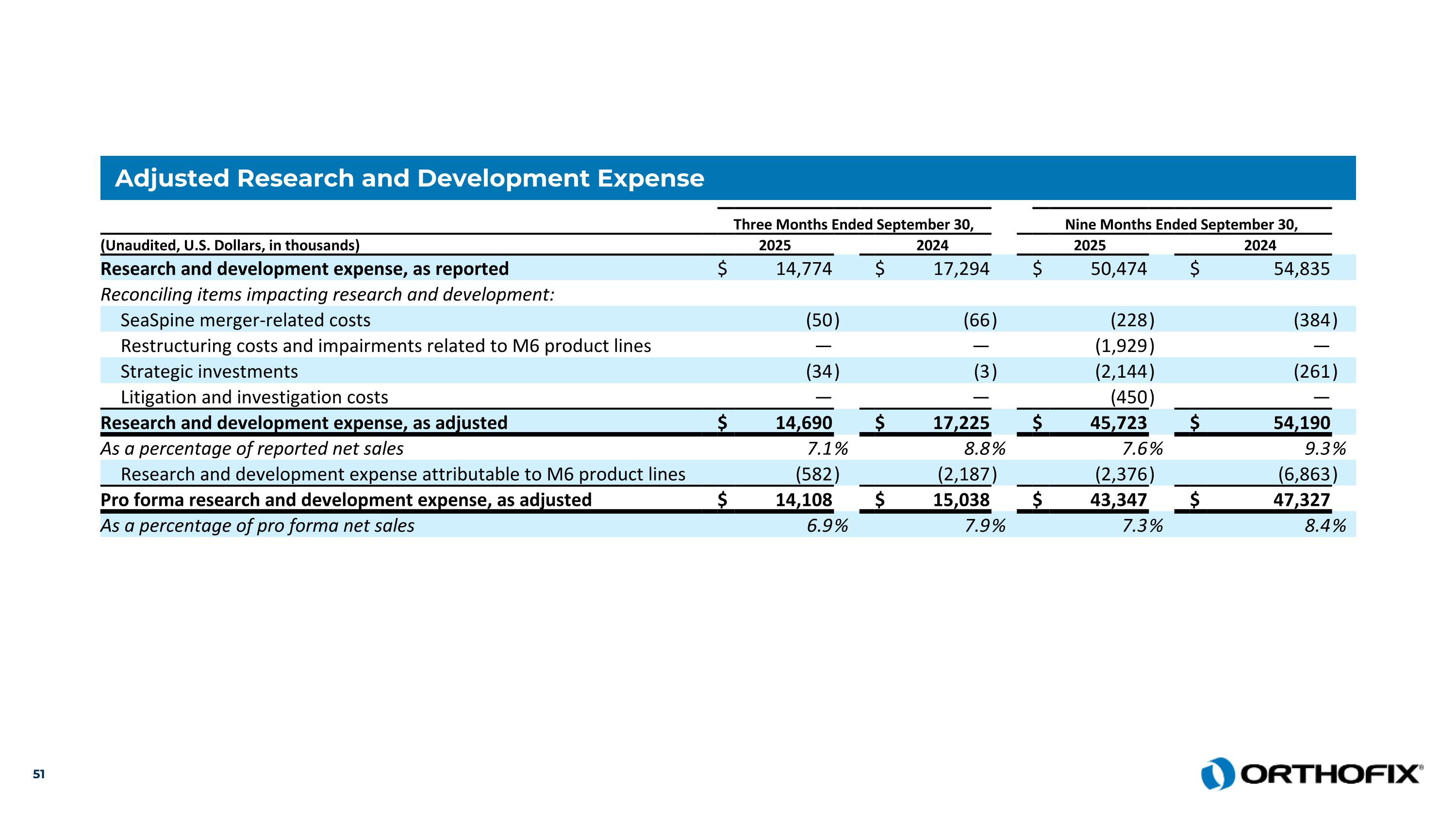

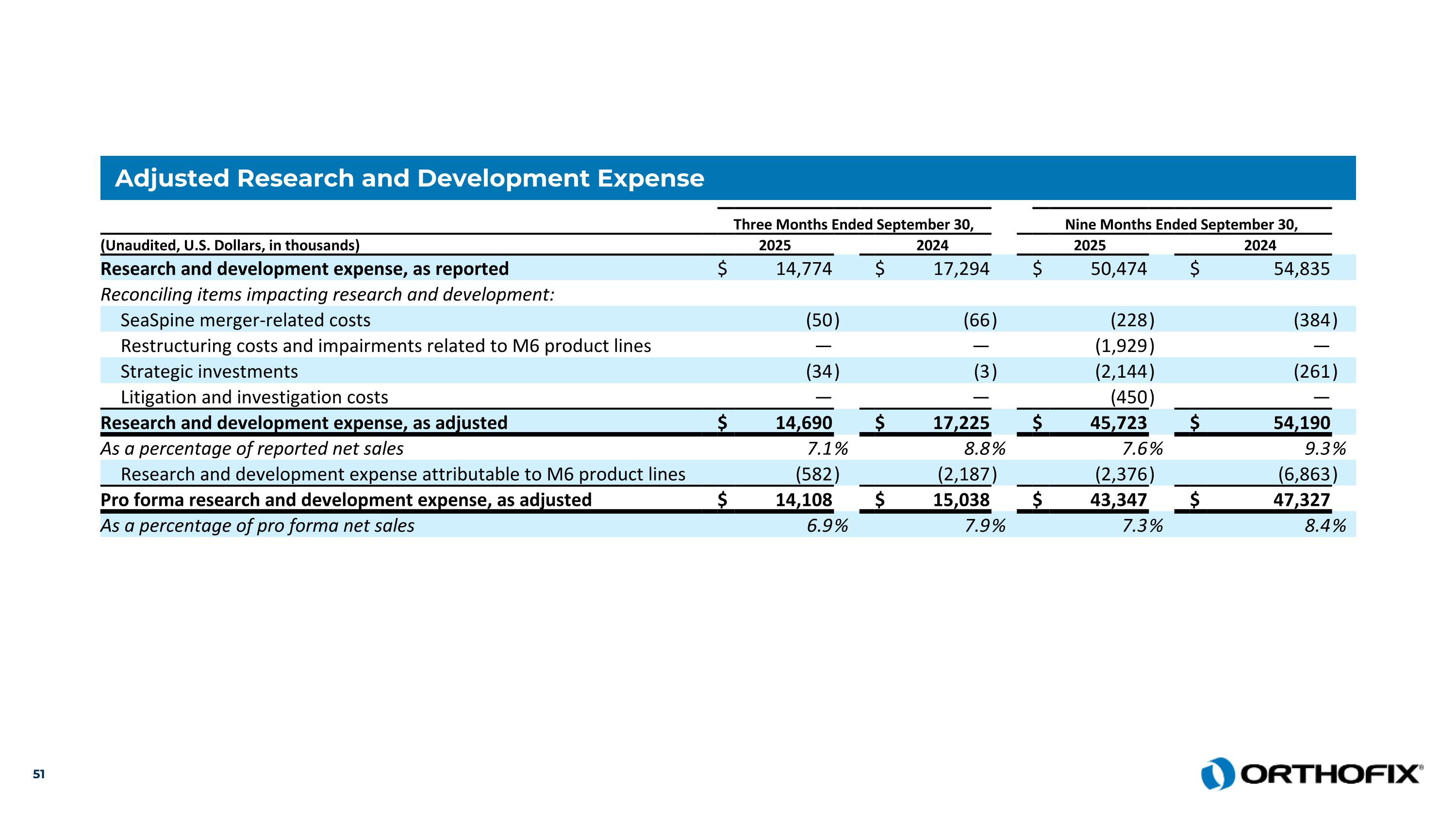

Adjusted Research and Development Expense Three Months Ended September 30, Nine Months Ended September 30, (Unaudited, U.S. Dollars, in thousands) 2025 2024 2025 2024 Research and development expense, as reported $ 14,774 $ 17,294 $ 50,474 $ 54,835 Reconciling items impacting research and development: SeaSpine merger-related costs (50 ) (66 ) (228 ) (384 ) Restructuring costs and impairments related to M6 product lines — — (1,929 ) — Strategic investments (34 ) (3 ) (2,144 ) (261 ) Litigation and investigation costs — — (450 ) — Research and development expense, as adjusted $ 14,690 $ 17,225 $ 45,723 $ 54,190 As a percentage of reported net sales 7.1 % 8.8 % 7.6 % 9.3 % Research and development expense attributable to M6 product lines (582 ) (2,187 ) (2,376 ) (6,863 ) Pro forma research and development expense, as adjusted $ 14,108 $ 15,038 $ 43,347 $ 47,327 As a percentage of pro forma net sales 6.9 % 7.9 % 7.3 % 8.4 %

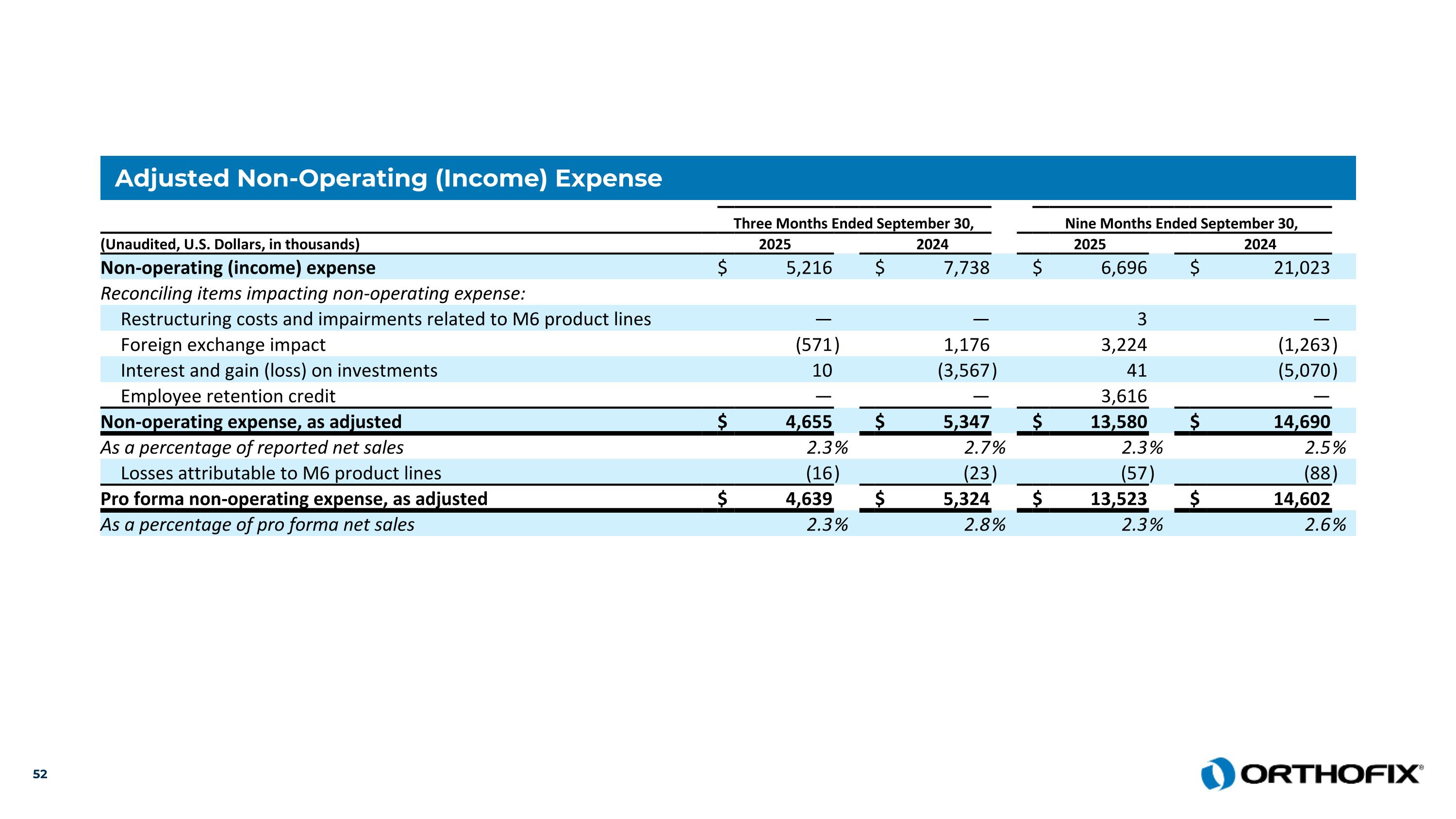

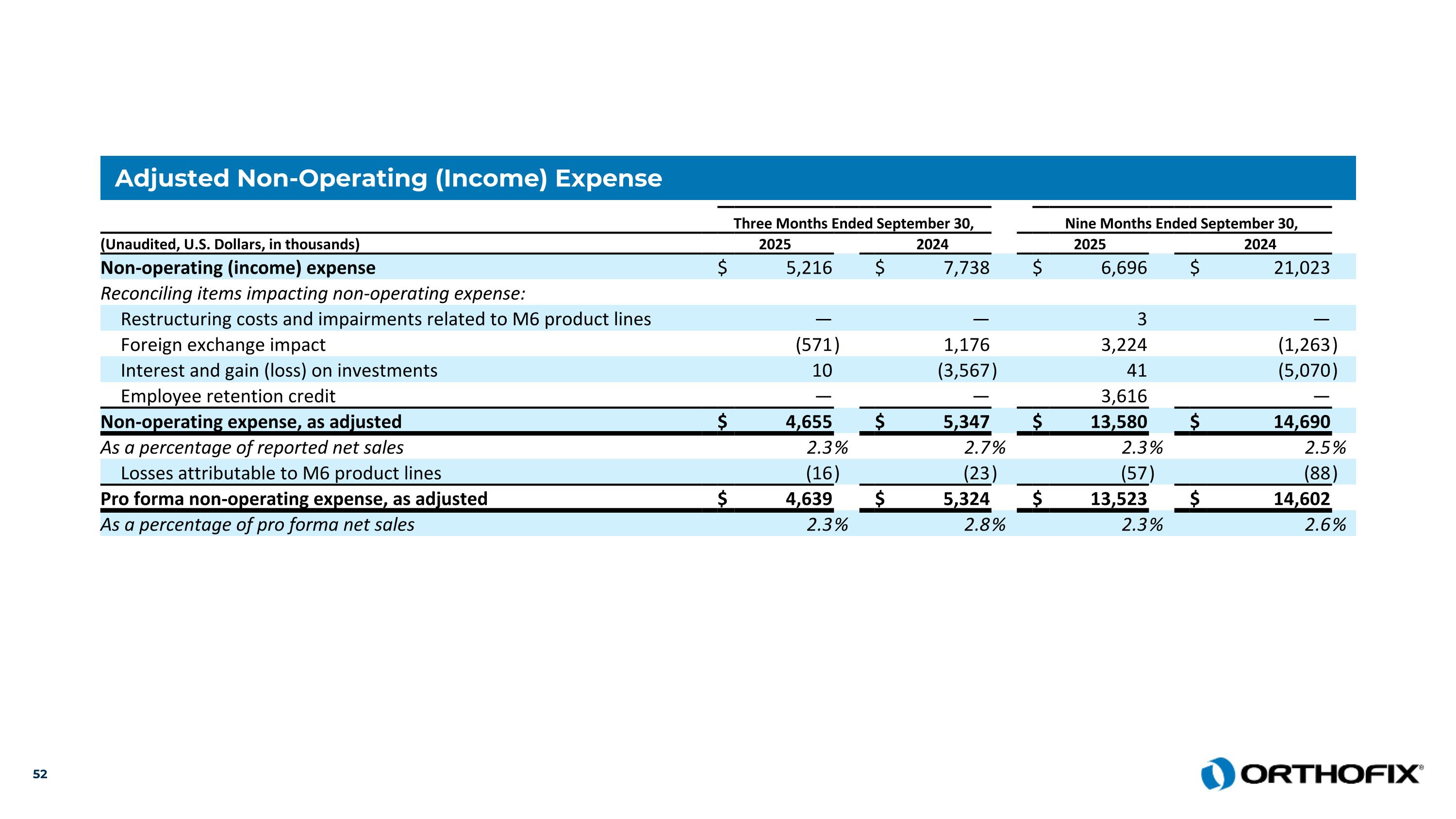

Adjusted Non-Operating (Income) Expense Three Months Ended September 30, Nine Months Ended September 30, (Unaudited, U.S. Dollars, in thousands) 2025 2024 2025 2024 Non-operating (income) expense $ 5,216 $ 7,738 $ 6,696 $ 21,023 Reconciling items impacting non-operating expense: Restructuring costs and impairments related to M6 product lines — — 3 — Foreign exchange impact (571 ) 1,176 3,224 (1,263 ) Interest and gain (loss) on investments 10 (3,567 ) 41 (5,070 ) Employee retention credit — — 3,616 — Non-operating expense, as adjusted $ 4,655 $ 5,347 $ 13,580 $ 14,690 As a percentage of reported net sales 2.3 % 2.7 % 2.3 % 2.5 % Losses attributable to M6 product lines (16 ) (23 ) (57 ) (88 ) Pro forma non-operating expense, as adjusted $ 4,639 $ 5,324 $ 13,523 $ 14,602 As a percentage of pro forma net sales 2.3 % 2.8 % 2.3 % 2.6 %

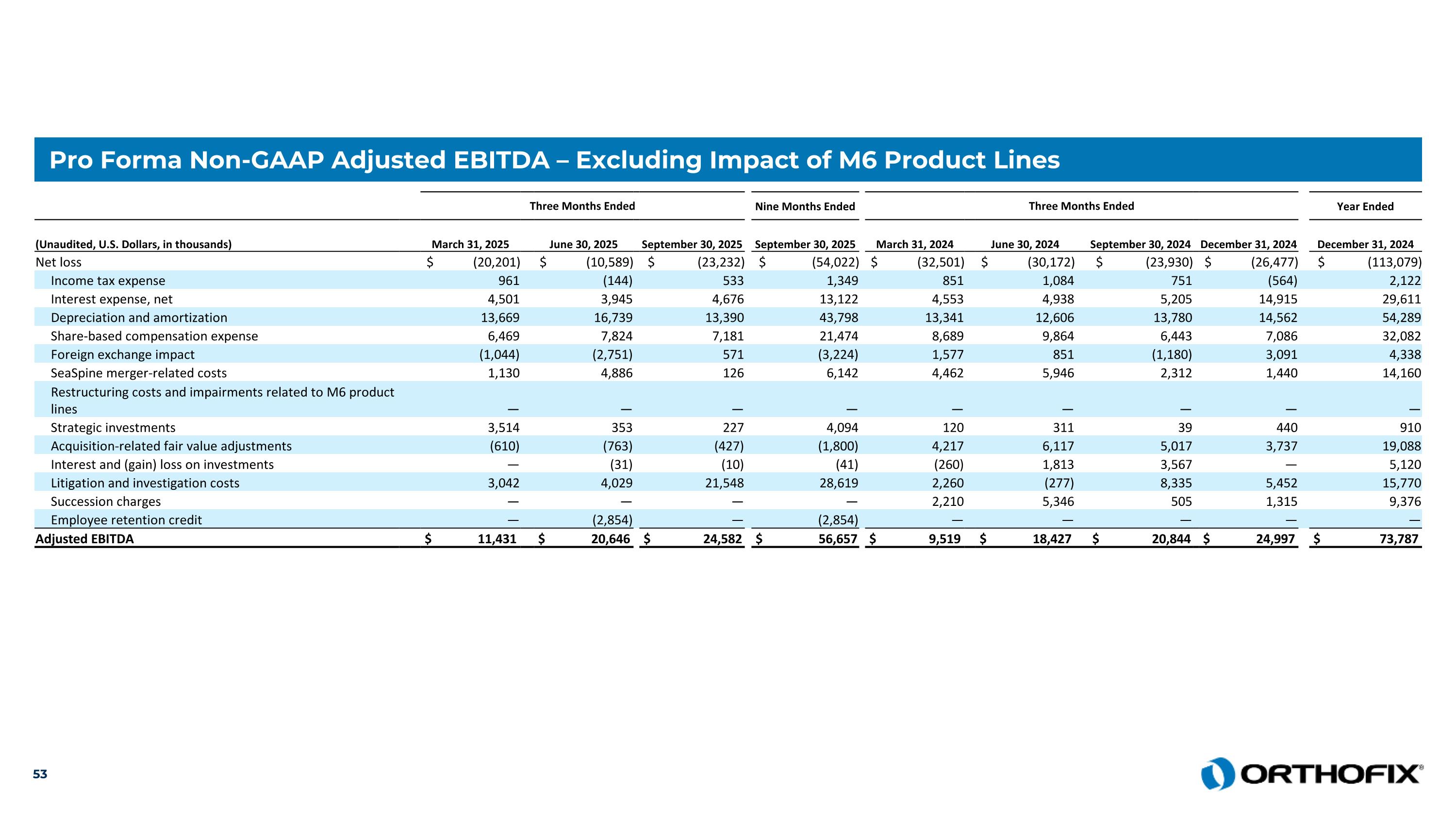

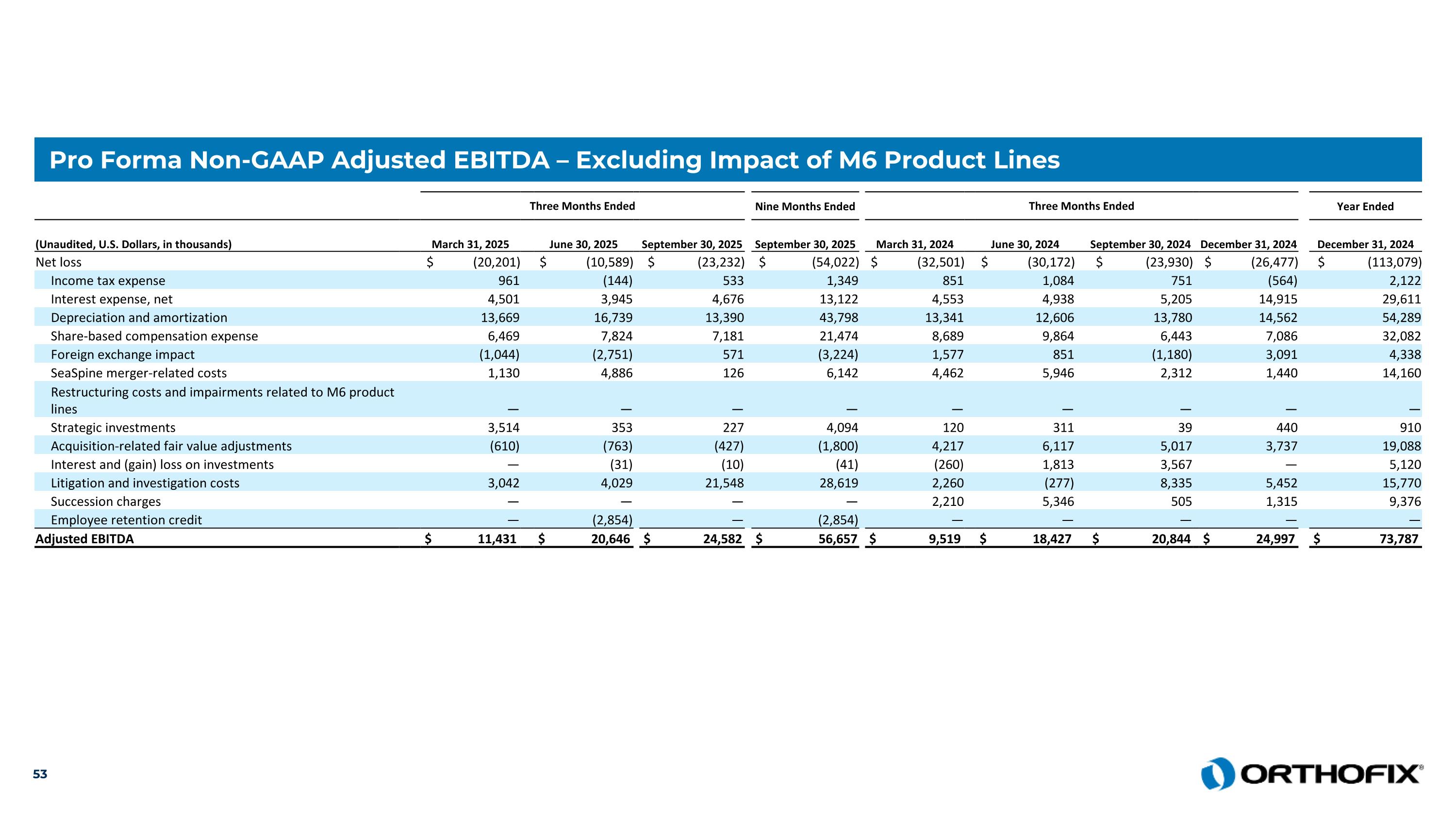

Pro Forma Non-GAAP Adjusted EBITDA – Excluding Impact of M6 Product Lines Three Months Ended Nine Months Ended Three Months Ended Year Ended (Unaudited, U.S. Dollars, in thousands) March 31, 2025 June 30, 2025 September 30, 2025 September 30, 2025 March 31, 2024 June 30, 2024 September 30, 2024 December 31, 2024 December 31, 2024 Net loss $ (20,201) $ (10,589) $ (23,232) $ (54,022) $ (32,501) $ (30,172) $ (23,930) $ (26,477) $ (113,079) Income tax expense 961 (144) 533 1,349 851 1,084 751 (564) 2,122 Interest expense, net 4,501 3,945 4,676 13,122 4,553 4,938 5,205 14,915 29,611 Depreciation and amortization 13,669 16,739 13,390 43,798 13,341 12,606 13,780 14,562 54,289 Share-based compensation expense 6,469 7,824 7,181 21,474 8,689 9,864 6,443 7,086 32,082 Foreign exchange impact (1,044) (2,751) 571 (3,224) 1,577 851 (1,180) 3,091 4,338 SeaSpine merger-related costs 1,130 4,886 126 6,142 4,462 5,946 2,312 1,440 14,160 Restructuring costs and impairments related to M6 product lines — — — — — — — — — Strategic investments 3,514 353 227 4,094 120 311 39 440 910 Acquisition-related fair value adjustments (610) (763) (427) (1,800) 4,217 6,117 5,017 3,737 19,088 Interest and (gain) loss on investments — (31) (10) (41) (260) 1,813 3,567 — 5,120 Litigation and investigation costs 3,042 4,029 21,548 28,619 2,260 (277) 8,335 5,452 15,770 Succession charges — — — — 2,210 5,346 505 1,315 9,376 Employee retention credit — (2,854) — (2,854) — — — — — Adjusted EBITDA $ 11,431 $ 20,646 $ 24,582 $ 56,657 $ 9,519 $ 18,427 $ 20,844 $ 24,997 $ 73,787

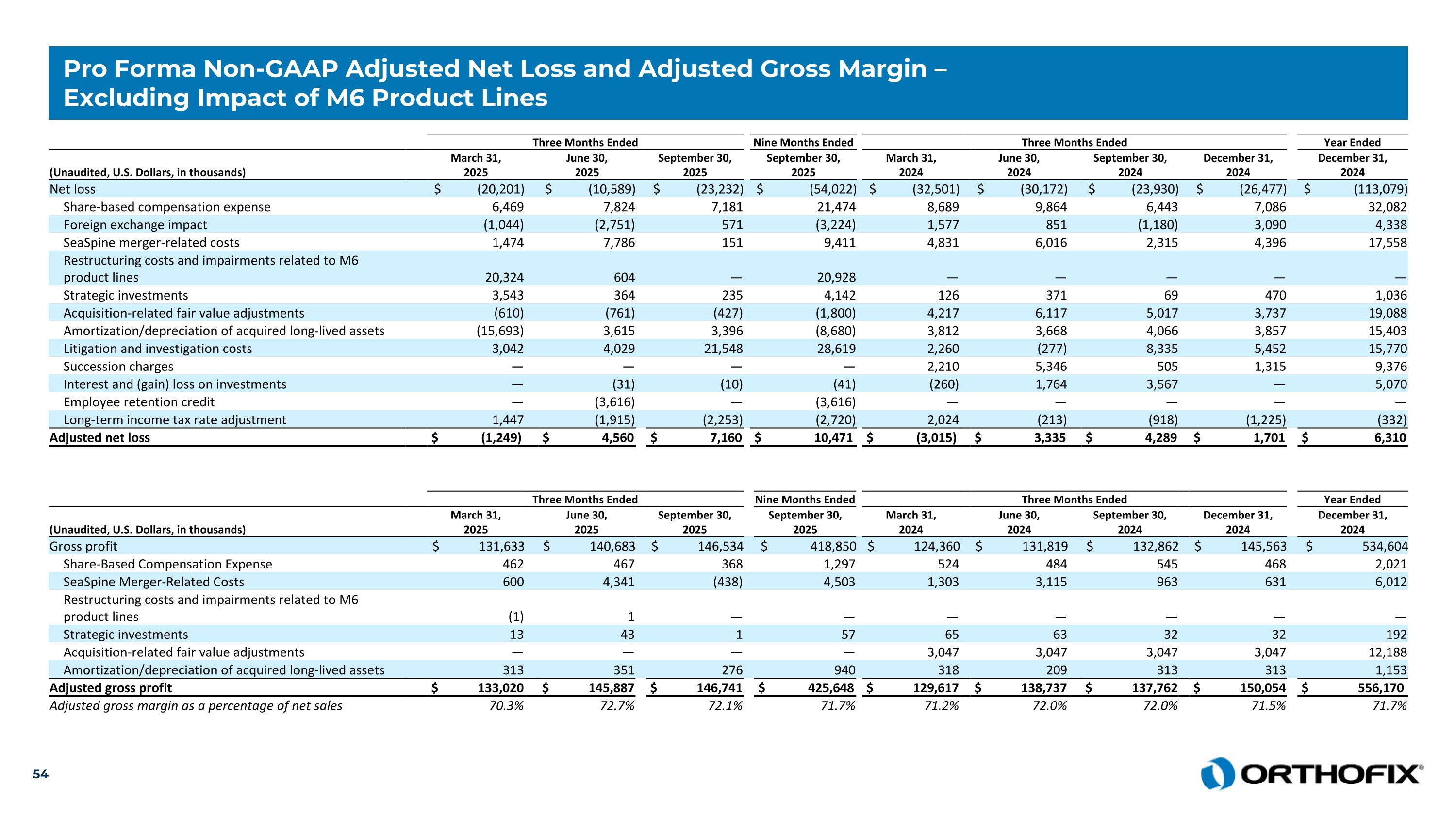

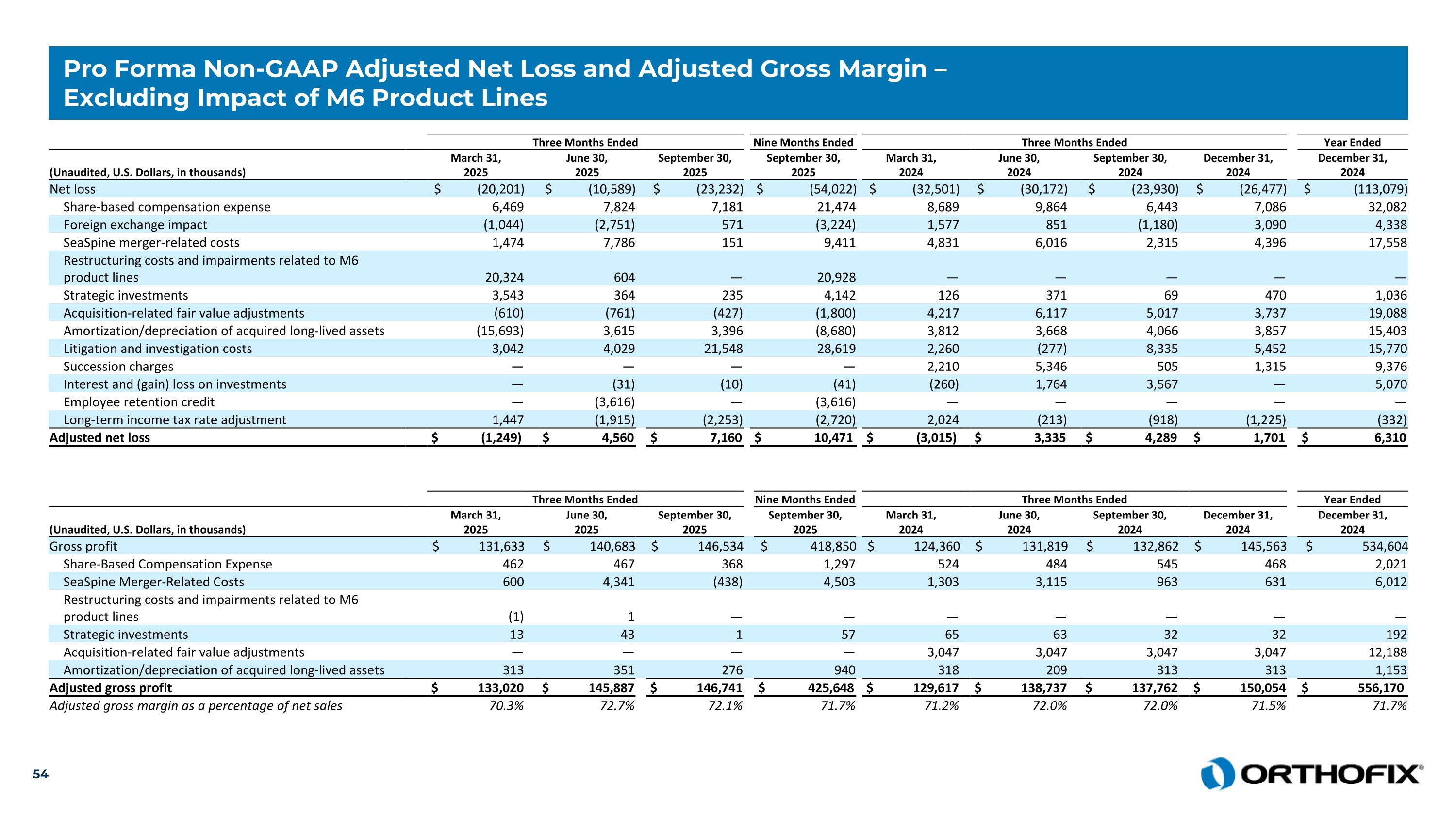

Pro Forma Non-GAAP Adjusted Net Loss and Adjusted Gross Margin – Excluding Impact of M6 Product Lines Three Months Ended Nine Months Ended Three Months Ended Year Ended (Unaudited, U.S. Dollars, in thousands) March 31, 2025 June 30, 2025 September 30, 2025 September 30, 2025 March 31, 2024 June 30, 2024 September 30, 2024 December 31, 2024 December 31, 2024 Net loss $ (20,201) $ (10,589) $ (23,232) $ (54,022) $ (32,501) $ (30,172) $ (23,930) $ (26,477) $ (113,079) Share-based compensation expense 6,469 7,824 7,181 21,474 8,689 9,864 6,443 7,086 32,082 Foreign exchange impact (1,044) (2,751) 571 (3,224) 1,577 851 (1,180) 3,090 4,338 SeaSpine merger-related costs 1,474 7,786 151 9,411 4,831 6,016 2,315 4,396 17,558 Restructuring costs and impairments related to M6 product lines 20,324 604 — 20,928 — — — — — Strategic investments 3,543 364 235 4,142 126 371 69 470 1,036 Acquisition-related fair value adjustments (610) (761) (427) (1,800) 4,217 6,117 5,017 3,737 19,088 Amortization/depreciation of acquired long-lived assets (15,693) 3,615 3,396 (8,680) 3,812 3,668 4,066 3,857 15,403 Litigation and investigation costs 3,042 4,029 21,548 28,619 2,260 (277) 8,335 5,452 15,770 Succession charges — — — — 2,210 5,346 505 1,315 9,376 Interest and (gain) loss on investments — (31) (10) (41) (260) 1,764 3,567 — 5,070 Employee retention credit — (3,616) — (3,616) — — — — — Long-term income tax rate adjustment 1,447 (1,915) (2,253) (2,720) 2,024 (213) (918) (1,225) (332) Adjusted net loss $ (1,249) $ 4,560 $ 7,160 $ 10,471 $ (3,015) $ 3,335 $ 4,289 $ 1,701 $ 6,310 Three Months Ended Nine Months Ended Three Months Ended Year Ended (Unaudited, U.S. Dollars, in thousands) March 31, 2025 June 30, 2025 September 30, 2025 September 30, 2025 March 31, 2024 June 30, 2024 September 30, 2024 December 31, 2024 December 31, 2024 Gross profit $ 131,633 $ 140,683 $ 146,534 $ 418,850 $ 124,360 $ 131,819 $ 132,862 $ 145,563 $ 534,604 Share-Based Compensation Expense 462 467 368 1,297 524 484 545 468 2,021 SeaSpine Merger-Related Costs 600 4,341 (438) 4,503 1,303 3,115 963 631 6,012 Restructuring costs and impairments related to M6 product lines (1) 1 — — — — — — — Strategic investments 13 43 1 57 65 63 32 32 192 Acquisition-related fair value adjustments — — — — 3,047 3,047 3,047 3,047 12,188 Amortization/depreciation of acquired long-lived assets 313 351 276 940 318 209 313 313 1,153 Adjusted gross profit $ 133,020 $ 145,887 $ 146,741 $ 425,648 $ 129,617 $ 138,737 $ 137,762 $ 150,054 $ 556,170 Adjusted gross margin as a percentage of net sales 70.3% 72.7% 72.1% 71.7% 71.2% 72.0% 72.0% 71.5% 71.7%