Company Update October 2025 EXHIBIT 99.2

1 LIMITATIONS ON THE USE OF INFORMATION This presentation has been prepared by Tiptree Inc. and its consolidated subsidiaries (“Tiptree", "the Company" or "we”) solely for informational purposes, and not for the purpose of updating any information or forecast with respect to Tiptree, its subsidiaries or any of its affiliates or any other purpose. Tiptree reports a non-controlling interest in certain operating subsidiaries that are not wholly owned. Unless otherwise noted, all information is of Tiptree on a consolidated basis before non-controlling interest. Neither Tiptree nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein and no such party shall have any liability for such information. These materials and any related oral statements are not all-inclusive and shall not be construed as legal, tax, investment or any other advice. You should consult your own counsel, accountant or business advisors. Performance information is historical and is not indicative of, nor does it guarantee future results. There can be no assurance that similar performance may be experienced in the future. ADDITIONAL INFORMATION AND WHERE TO FIND IT In connection with the Merger, Tiptree filed with the U.S Securities and Exchange Commission (the “SEC”) a preliminary proxy statement of Tiptree (the “Proxy Statement”). Tiptree plans to mail to its stockholders a definitive Proxy Statement in connection with the Merger. Tiptree may also file other documents with the SEC regarding the Merger. This presentation is not a substitute for the Proxy Statement, the definitive Proxy Statement or any other document that may be filed by Tiptree with the SEC. TIPTREE URGES YOU TO READ THE PROXY STATEMENT AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY AS THEY BECOME AVAILABLE BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT TIPTREE, THE MERGER AND RELATED MATTERS. Any vote in respect of resolutions to be proposed at a Tiptree stockholder meeting to approve the Merger or related matters, or other responses in relation to the proposed transaction, should be made only on the basis of the information contained in the Proxy Statement. You will be able to obtain a free copy of the Proxy Statement and other related documents filed by Tiptree with the SEC at the website maintained by the SEC at www.sec.gov. You also will be able to obtain a free copy of the Proxy Statement and other documents filed by Tiptree with the SEC by accessing the Investor Relations section of Tiptree’s website at https://investors.tiptreeinc.com. The proposed transaction will be implemented solely pursuant to the Merger Agreement, which contains the full terms and conditions of the proposed transaction. PARTICIPANTS IN THE SOLICITATION Tiptree and certain of its directors, executive officers and certain employees and other persons may be deemed to be participants in the solicitation of proxies from Tiptree’s stockholders in connection with the Merger. Security holders may obtain information regarding the names, affiliations and interests of Tiptree’s directors and executive officers in Tiptree’s definitive proxy statement on Schedule 14A for its 2025 Annual Meeting of Stockholders, which was filed with the SEC on March 17, 2025 and in Tiptree’s Current Report on Form 8-K filed with the SEC on May 1, 2025. Additional information concerning the interests of Tiptree’s participants in the solicitation, which may, in some cases, be different than those of Tiptree’s stockholders generally, is set forth in the Proxy Statement and other materials that may be filed with the SEC in connection with the Merger when they become available. These documents (when available) may be obtained free of charge from the SEC’s website at www.sec.gov and the Investor Relations section of Tiptree’s website at https://investors.tiptreeinc.com. SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS AND PROJECTIONS This document contains "forward-looking statements" which involve risks, uncertainties and contingencies, many of which are beyond Tiptree's control, which may cause actual results, performance, or achievements to differ materially from anticipated results, performance, or achievements. All statements contained herein that are not clearly historical in nature are forward-looking, and the words "anticipate," "believe," "estimate," "expect,“ “intend,” “may,” “might,” "plan," “project,” “should,” "target,“ “will,” “view,” “confident,” or similar expressions are intended to identify forward-looking statements. Such forward-looking statements include, but are not limited to, statements about Tiptree's plans, objectives, expectations and intentions. The forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, many of which are beyond the company’s control, are difficult to predict and could cause actual results to differ materially from those expressed or forecast in the forward-looking statements. Actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including, but not limited to those described in the section entitled “Risk Factors” in Tiptree’s Annual Report on Form 10-K, and as described in the Tiptree’s other filings with the SEC. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as to the date of this release. The factors described therein are not necessarily all of the important factors that could cause actual results or developments to differ materially from those expressed in any of the forward-looking statements. Other unknown or unpredictable factors also could affect the forward-looking statements provided. Consequently, actual performance could be materially different from the results described or anticipated by the forward-looking statements. Given these uncertainties, one should not place undue reliance on these forward-looking statements. Except as required by the federal securities laws, Tiptree Inc. undertakes no obligation to update any forward-looking statements. In light of the risks and uncertainties inherent in all projections, the inclusion of forward-looking statements and projections in this presentation should not be considered as a representation by us or any other person that our objectives or plans will be achieved. Numerous factors, including those described in Tiptree’s Annual Report on Form 10‐K or in Tiptree’s other filings with the SEC, could cause our actual results to differ materially from those expressed or implied in forward-looking statements. MARKET AND INDUSTRY DATA This document does not constitute an offer or invitation for the sale or purchase of securities or to engage in any other transaction with Tiptree, its subsidiaries or its affiliates. The information in this document is not targeted at the residents of any particular country or jurisdiction and is not intended for distribution to, or use by, any person in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Disclaimers

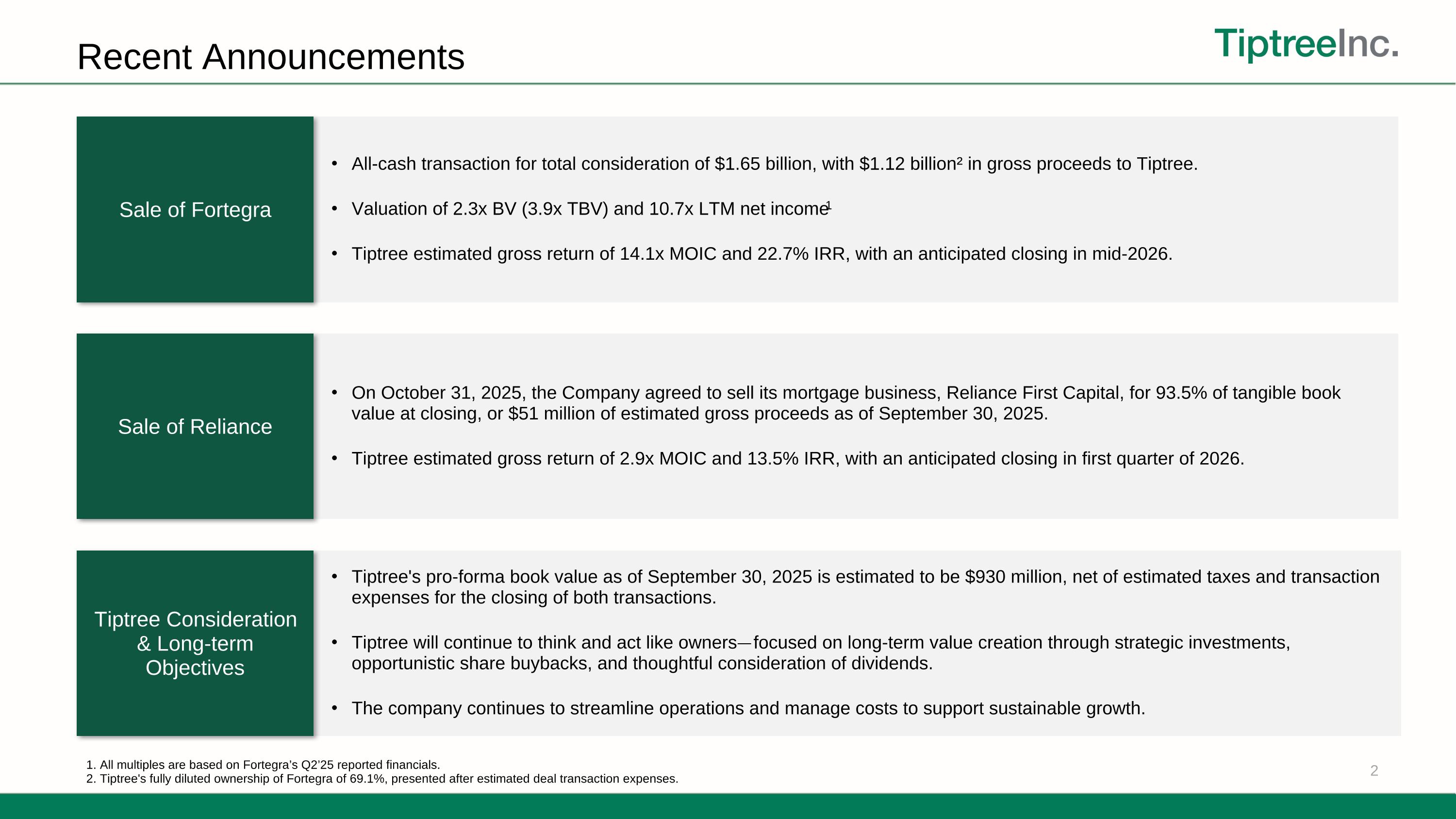

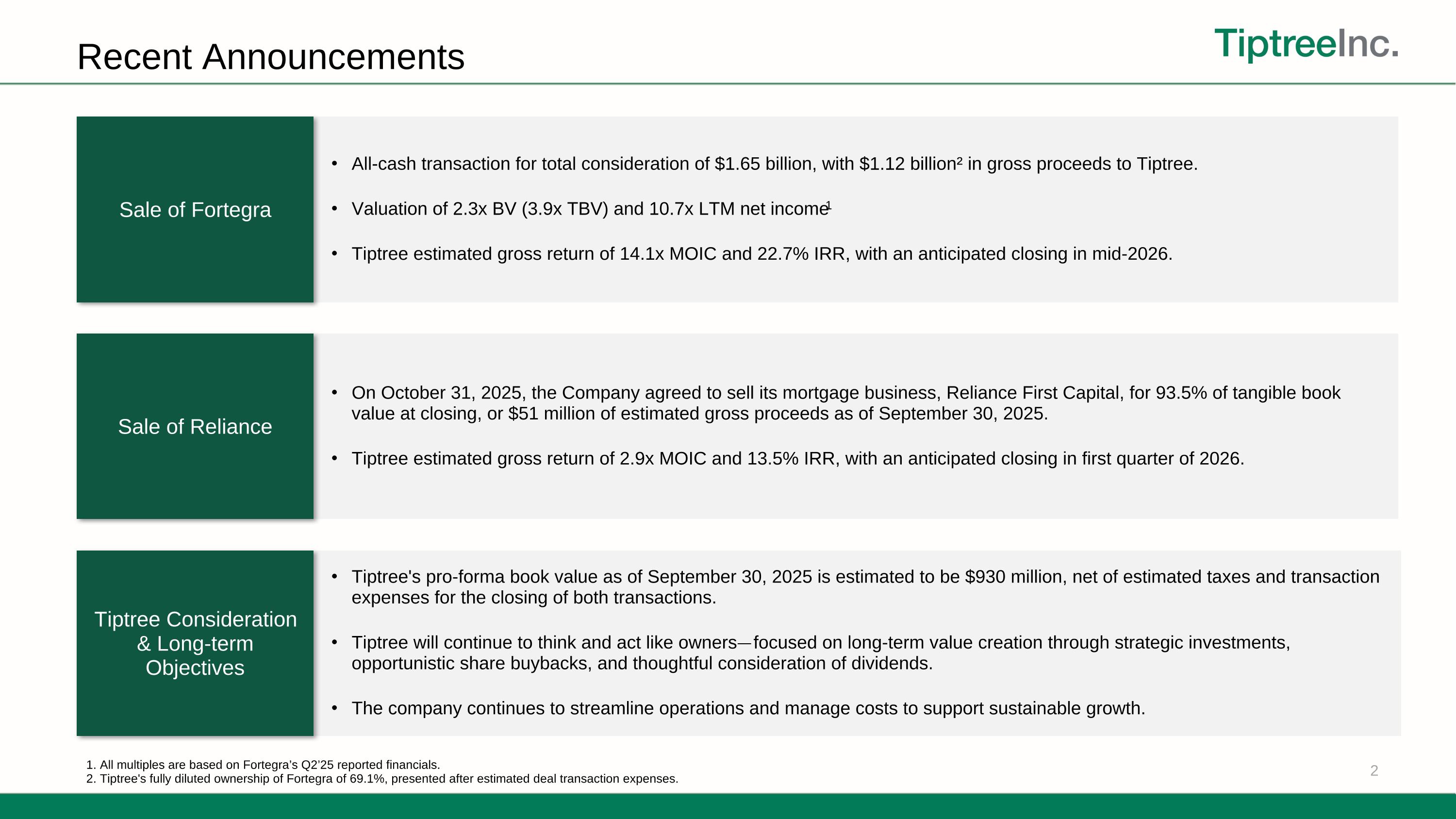

2 Recent Announcements All-cash transaction for total consideration of $1.65 billion, with $1.12 billion² in gross proceeds to Tiptree. Valuation of 2.3x BV (3.9x TBV) and 10.7x LTM net income1 Tiptree estimated gross return of 14.1x MOIC and 22.7% IRR, with an anticipated closing in mid-2026. Sale of Fortegra Tiptree's pro-forma book value as of September 30, 2025 is estimated to be $930 million, net of estimated taxes and transaction expenses for the closing of both transactions. Tiptree will continue to think and act like owners—focused on long-term value creation through strategic investments, opportunistic share buybacks, and thoughtful consideration of dividends. The company continues to streamline operations and manage costs to support sustainable growth. Tiptree Consideration & Long-term Objectives On October 31, 2025, the Company agreed to sell its mortgage business, Reliance First Capital, for 93.5% of tangible book value at closing, or $51 million of estimated gross proceeds as of September 30, 2025. Tiptree estimated gross return of 2.9x MOIC and 13.5% IRR, with an anticipated closing in first quarter of 2026. Sale of Reliance 1. All multiples are based on Fortegra’s Q2’25 reported financials. 2. Tiptree's fully diluted ownership of Fortegra of 69.1%, presented after estimated deal transaction expenses.

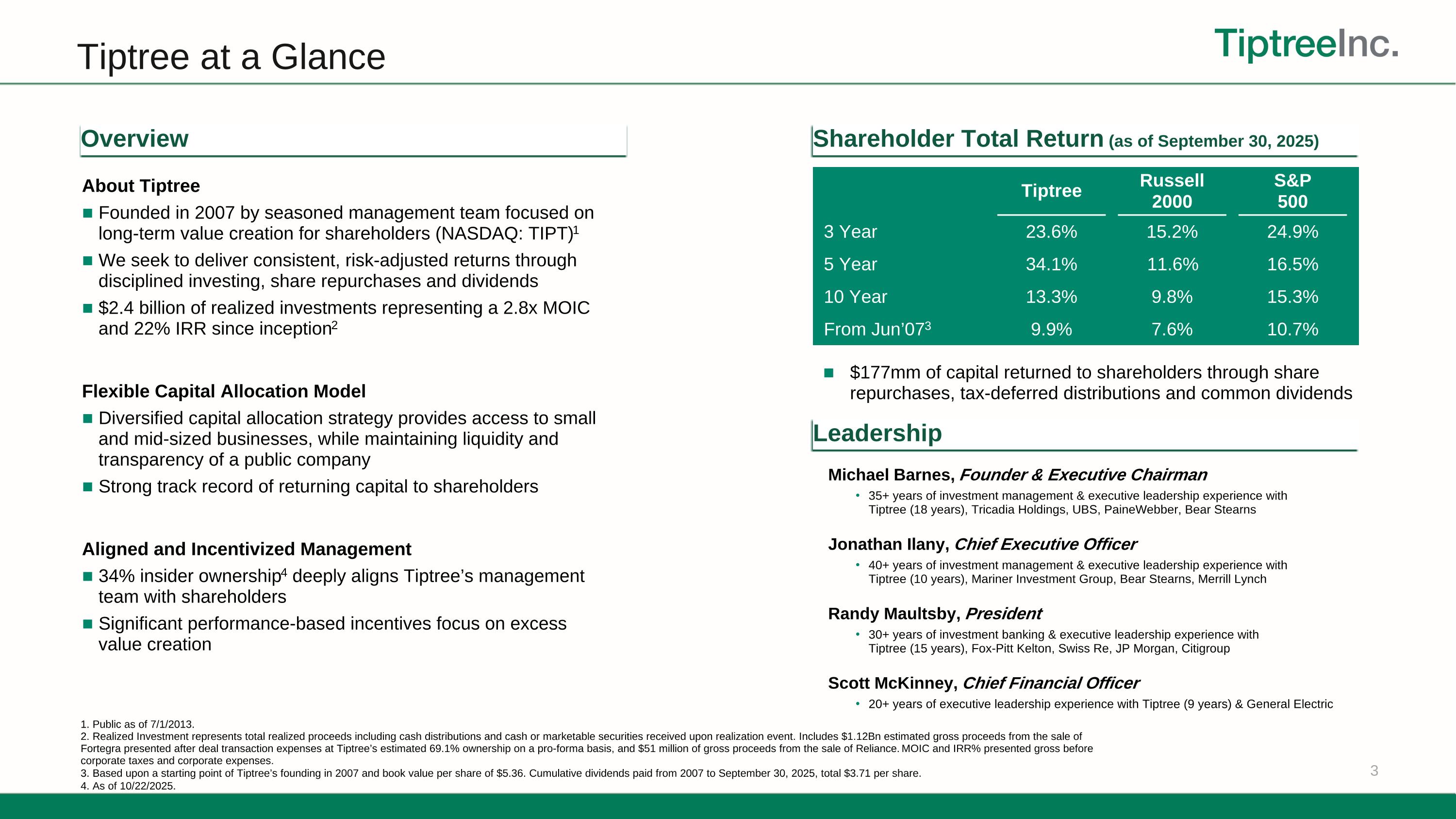

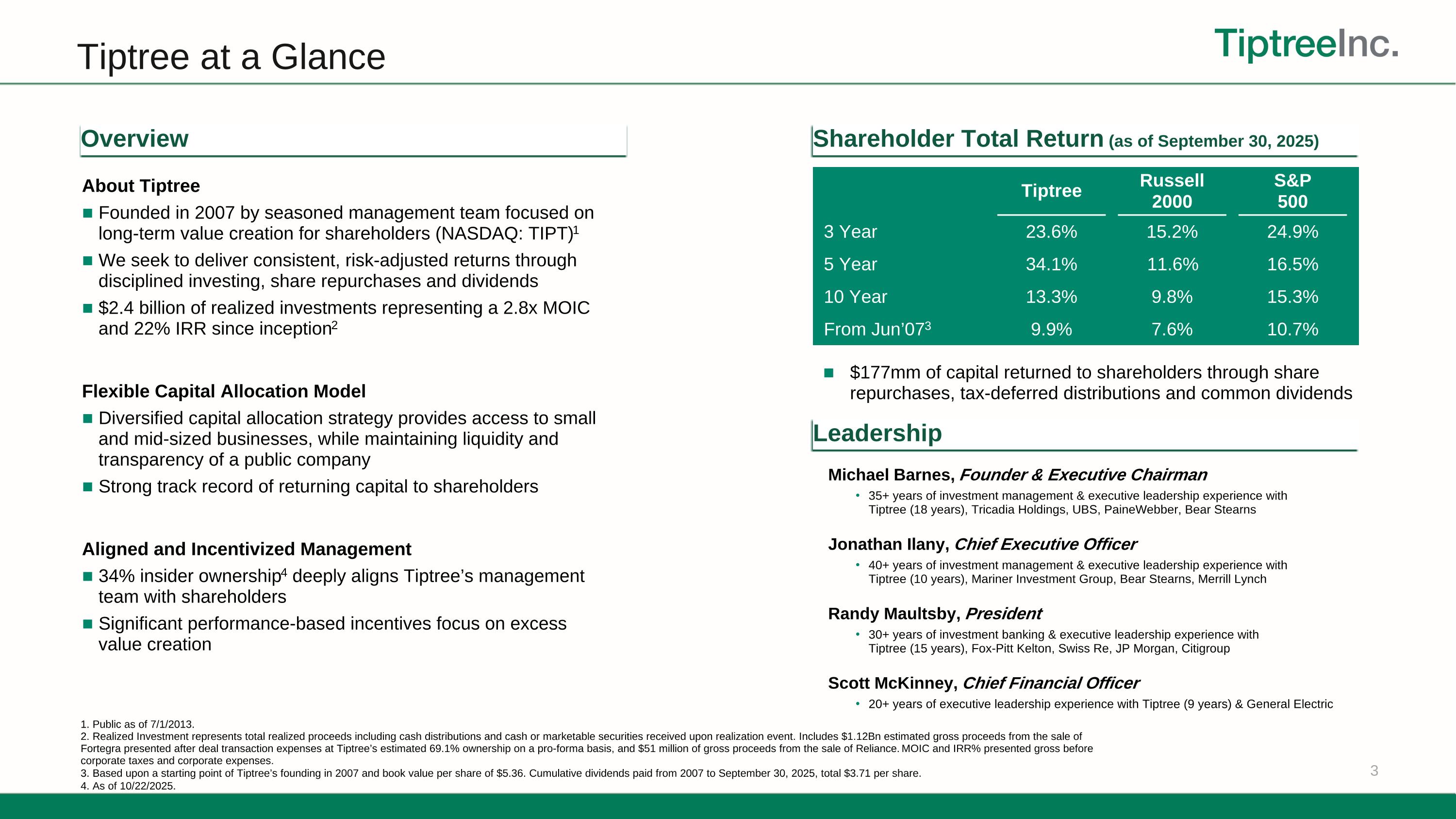

Tiptree at a Glance 3 Michael Barnes, Founder & Executive Chairman 35+ years of investment management & executive leadership experience with Tiptree (18 years), Tricadia Holdings, UBS, PaineWebber, Bear Stearns Jonathan Ilany, Chief Executive Officer 40+ years of investment management & executive leadership experience with Tiptree (10 years), Mariner Investment Group, Bear Stearns, Merrill Lynch Randy Maultsby, President 30+ years of investment banking & executive leadership experience with Tiptree (15 years), Fox-Pitt Kelton, Swiss Re, JP Morgan, Citigroup Scott McKinney, Chief Financial Officer 20+ years of executive leadership experience with Tiptree (9 years) & General Electric Overview About Tiptree Founded in 2007 by seasoned management team focused on long-term value creation for shareholders (NASDAQ: TIPT)1 We seek to deliver consistent, risk-adjusted returns through disciplined investing, share repurchases and dividends $2.4 billion of realized investments representing a 2.8x MOIC and 22% IRR since inception2 Flexible Capital Allocation Model Diversified capital allocation strategy provides access to small and mid-sized businesses, while maintaining liquidity and transparency of a public company Strong track record of returning capital to shareholders Aligned and Incentivized Management 34% insider ownership4 deeply aligns Tiptree’s management team with shareholders Significant performance-based incentives focus on excess value creation Leadership Shareholder Total Return (as of September 30, 2025) Tiptree Russell 2000 S&P 500 3 Year 23.6% 15.2% 24.9% 5 Year 34.1% 11.6% 16.5% 10 Year 13.3% 9.8% 15.3% From Jun’073 9.9% 7.6% 10.7% $177mm of capital returned to shareholders through share repurchases, tax-deferred distributions and common dividends 1. Public as of 7/1/2013. 2. Realized Investment represents total realized proceeds including cash distributions and cash or marketable securities received upon realization event. Includes $1.12Bn estimated gross proceeds from the sale of Fortegra presented after deal transaction expenses at Tiptree’s estimated 69.1% ownership on a pro-forma basis, and $51 million of gross proceeds from the sale of Reliance. MOIC and IRR% presented gross before corporate taxes and corporate expenses. 3. Based upon a starting point of Tiptree’s founding in 2007 and book value per share of $5.36. Cumulative dividends paid from 2007 to September 30, 2025, total $3.71 per share. 4. As of 10/22/2025.

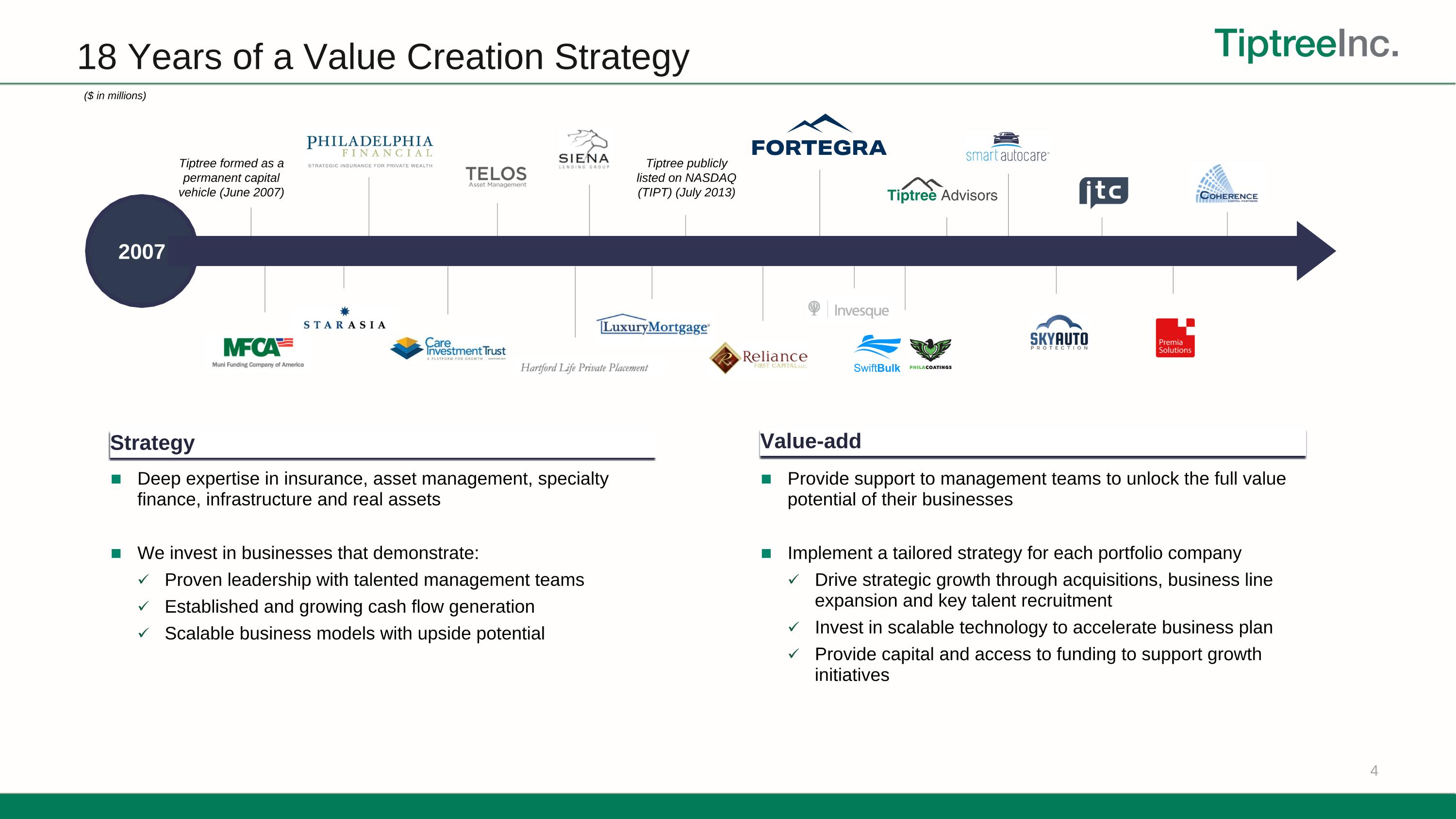

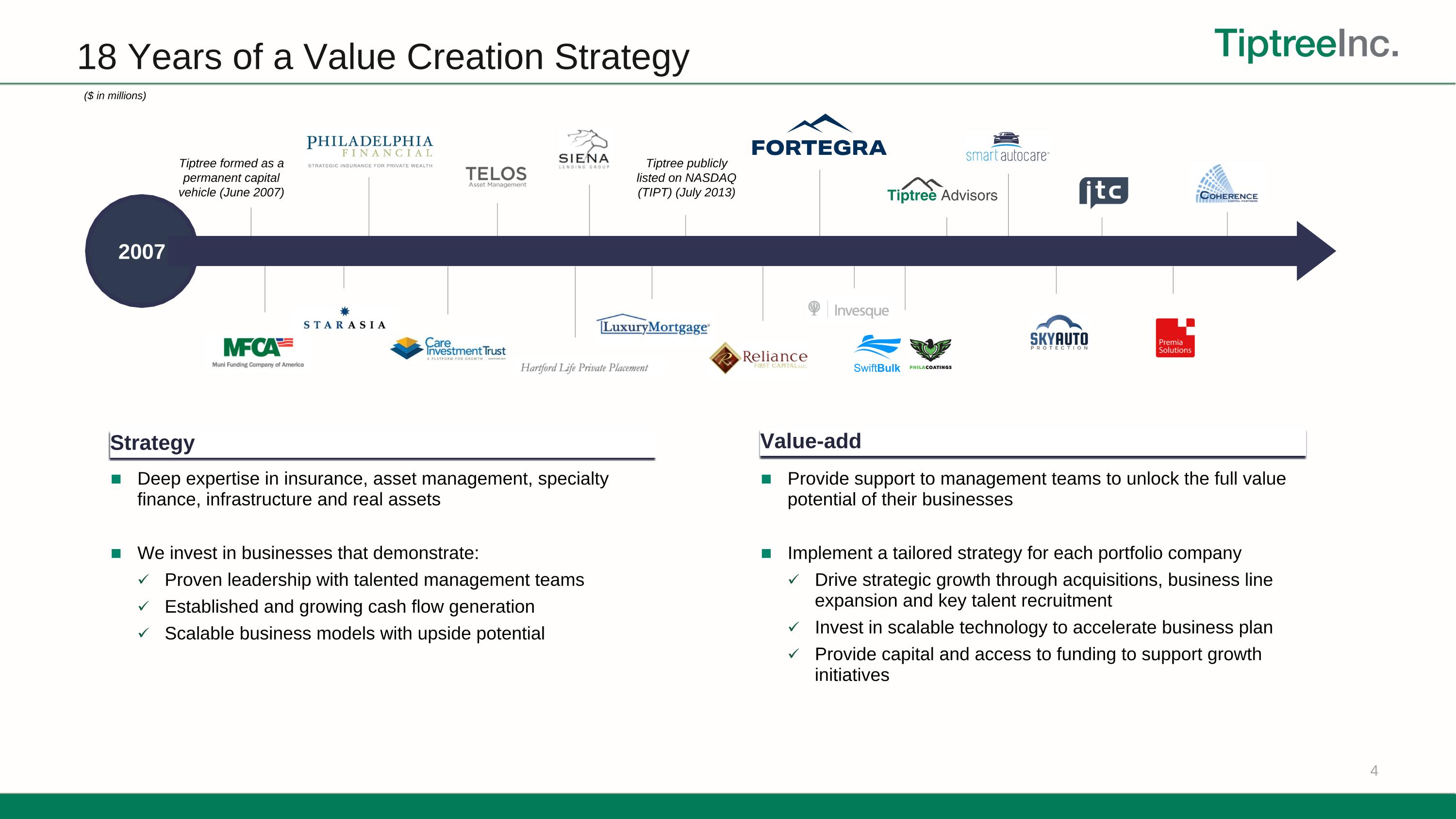

18 Years of a Value Creation Strategy 4 ($ in millions) 2007 Tiptree formed as a permanent capital vehicle (June 2007) Strategy Deep expertise in insurance, asset management, specialty finance, infrastructure and real assets We invest in businesses that demonstrate: Proven leadership with talented management teams Established and growing cash flow generation Scalable business models with upside potential Tiptree publicly listed on NASDAQ (TIPT) (July 2013) Value-add Provide support to management teams to unlock the full value potential of their businesses Implement a tailored strategy for each portfolio company Drive strategic growth through acquisitions, business line expansion and key talent recruitment Invest in scalable technology to accelerate business plan Provide capital and access to funding to support growth initiatives

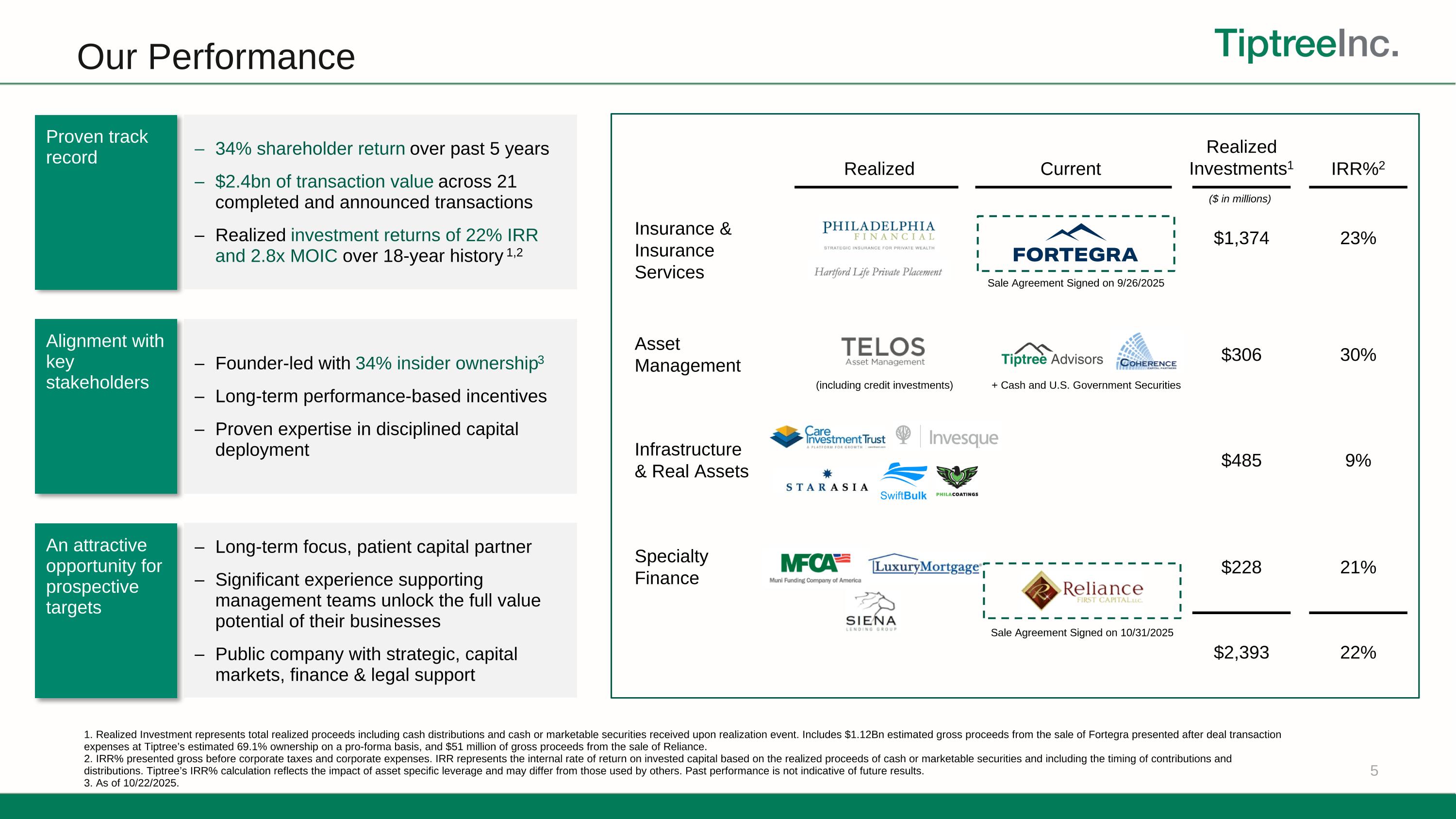

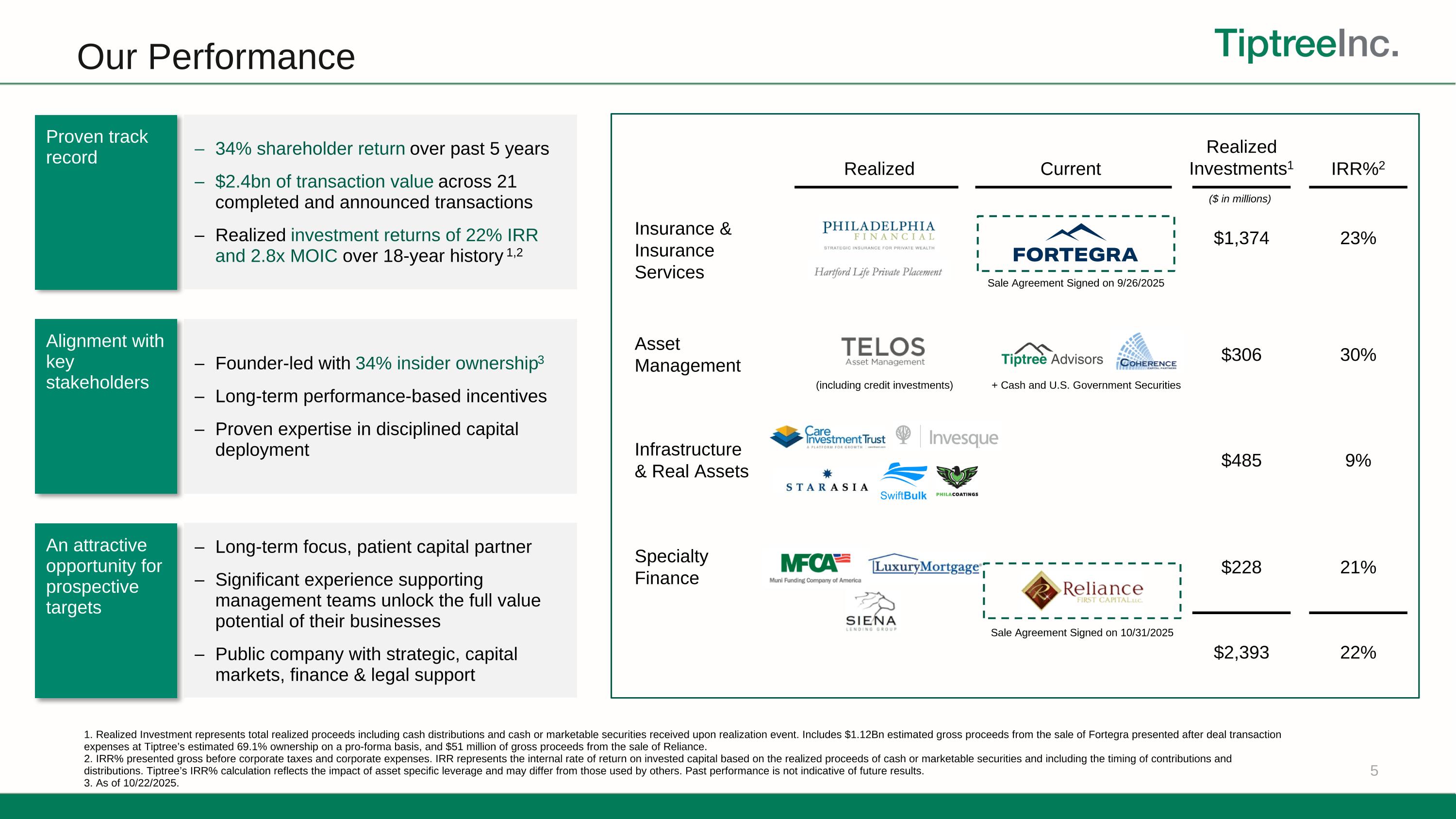

5 Our Performance 1. Realized Investment represents total realized proceeds including cash distributions and cash or marketable securities received upon realization event. Includes $1.12Bn estimated gross proceeds from the sale of Fortegra presented after deal transaction expenses at Tiptree’s estimated 69.1% ownership on a pro-forma basis, and $51 million of gross proceeds from the sale of Reliance. 2. IRR% presented gross before corporate taxes and corporate expenses. IRR represents the internal rate of return on invested capital based on the realized proceeds of cash or marketable securities and including the timing of contributions and distributions. Tiptree’s IRR% calculation reflects the impact of asset specific leverage and may differ from those used by others. Past performance is not indicative of future results. 3. As of 10/22/2025. Insurance & Insurance Services Asset Management Infrastructure & Real Assets Specialty Finance Realized Investments1 IRR%2 $1,374 23% $306 30% $485 9% $228 21% Realized Current + Cash and U.S. Government Securities (including credit investments) $2,393 22% ($ in millions) Proven track record Alignment with key stakeholders An attractive opportunity for prospective targets 34% shareholder return over past 5 years $2.4bn of transaction value across 21 completed and announced transactions Realized investment returns of 22% IRR and 2.8x MOIC over 18-year history 1,2 Founder-led with 34% insider ownership3 Long-term performance-based incentives Proven expertise in disciplined capital deployment Long-term focus, patient capital partner Significant experience supporting management teams unlock the full value potential of their businesses Public company with strategic, capital markets, finance & legal support Sale Agreement Signed on 9/26/2025 Sale Agreement Signed on 10/31/2025

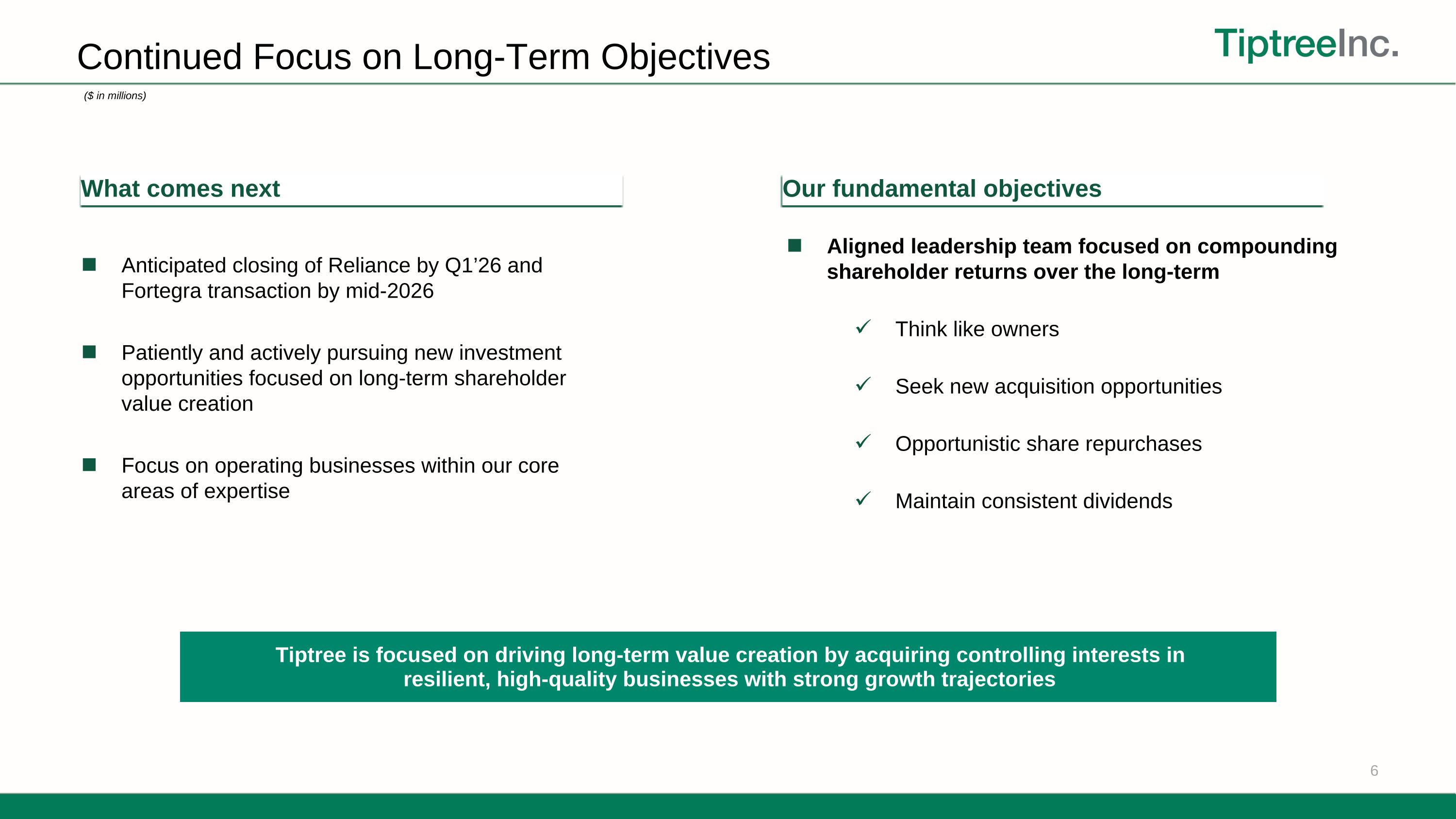

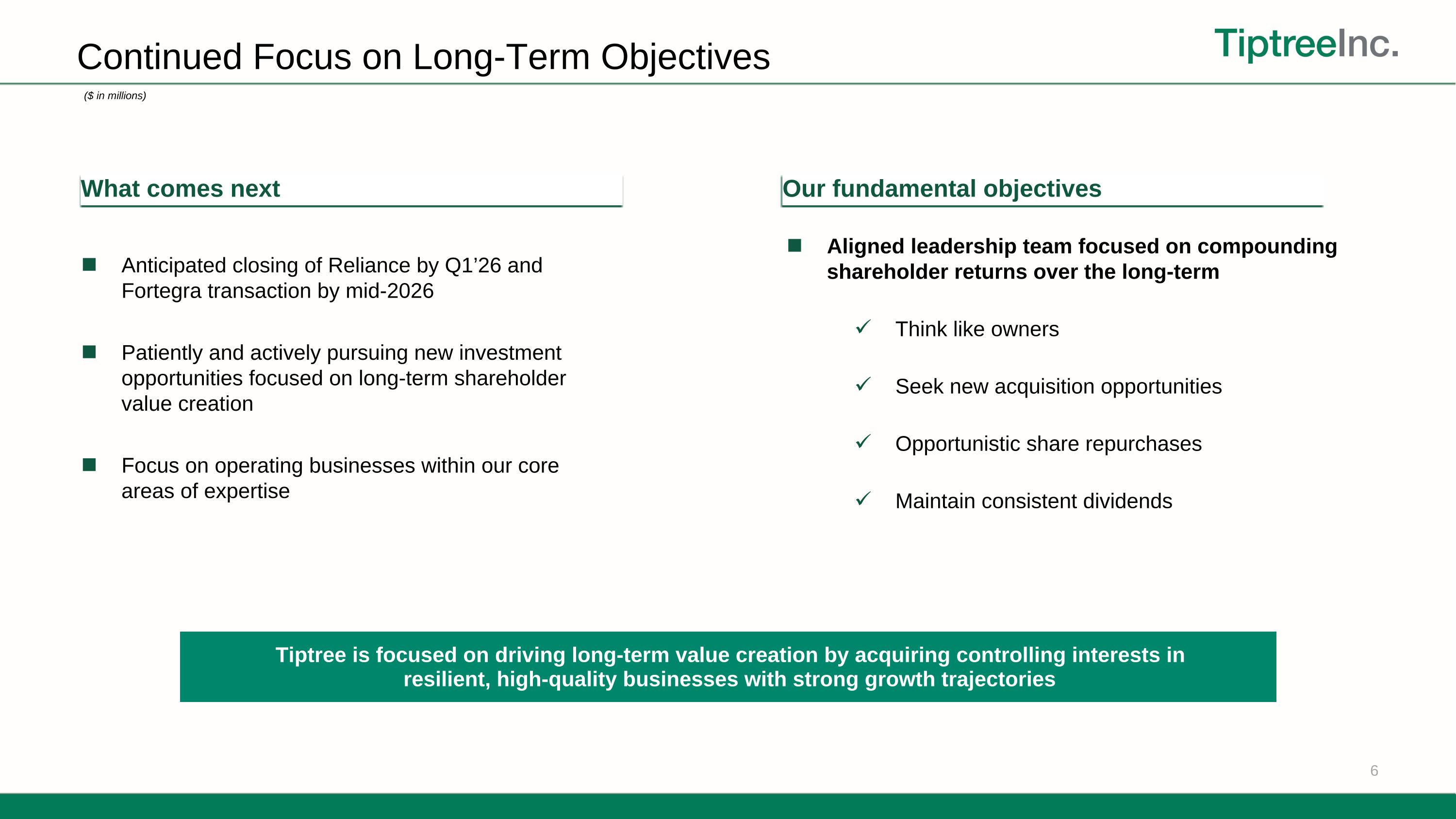

6 ($ in millions) Aligned leadership team focused on compounding shareholder returns over the long-term Think like owners Seek new acquisition opportunities Opportunistic share repurchases Maintain consistent dividends Continued Focus on Long-Term Objectives What comes next Our fundamental objectives Anticipated closing of Reliance by Q1’26 and Fortegra transaction by mid-2026 Patiently and actively pursuing new investment opportunities focused on long-term shareholder value creation Focus on operating businesses within our core areas of expertise Tiptree is focused on driving long-term value creation by acquiring controlling interests in resilient, high-quality businesses with strong growth trajectories

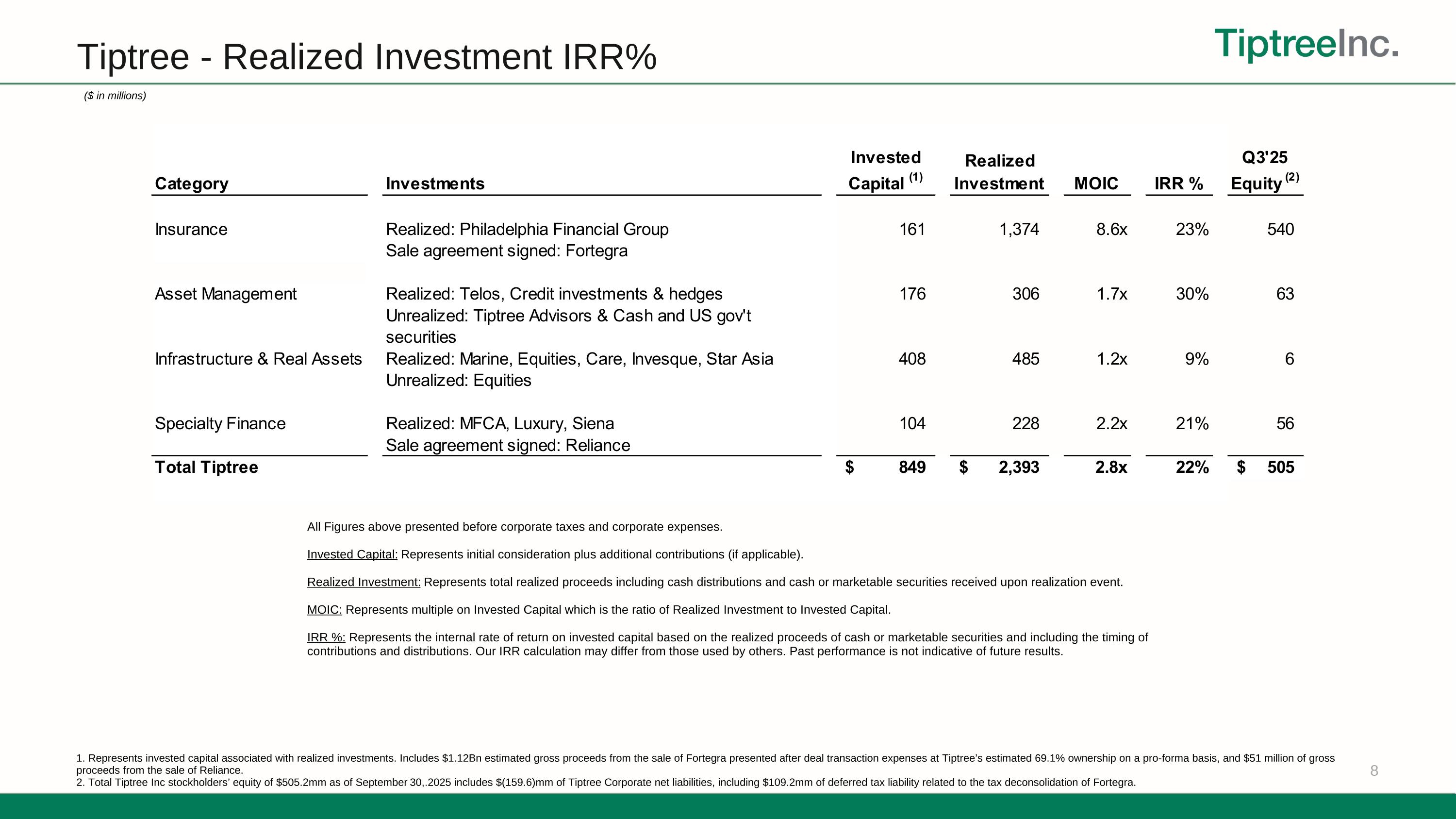

Appendix Tiptree - Realized Investment IRR%

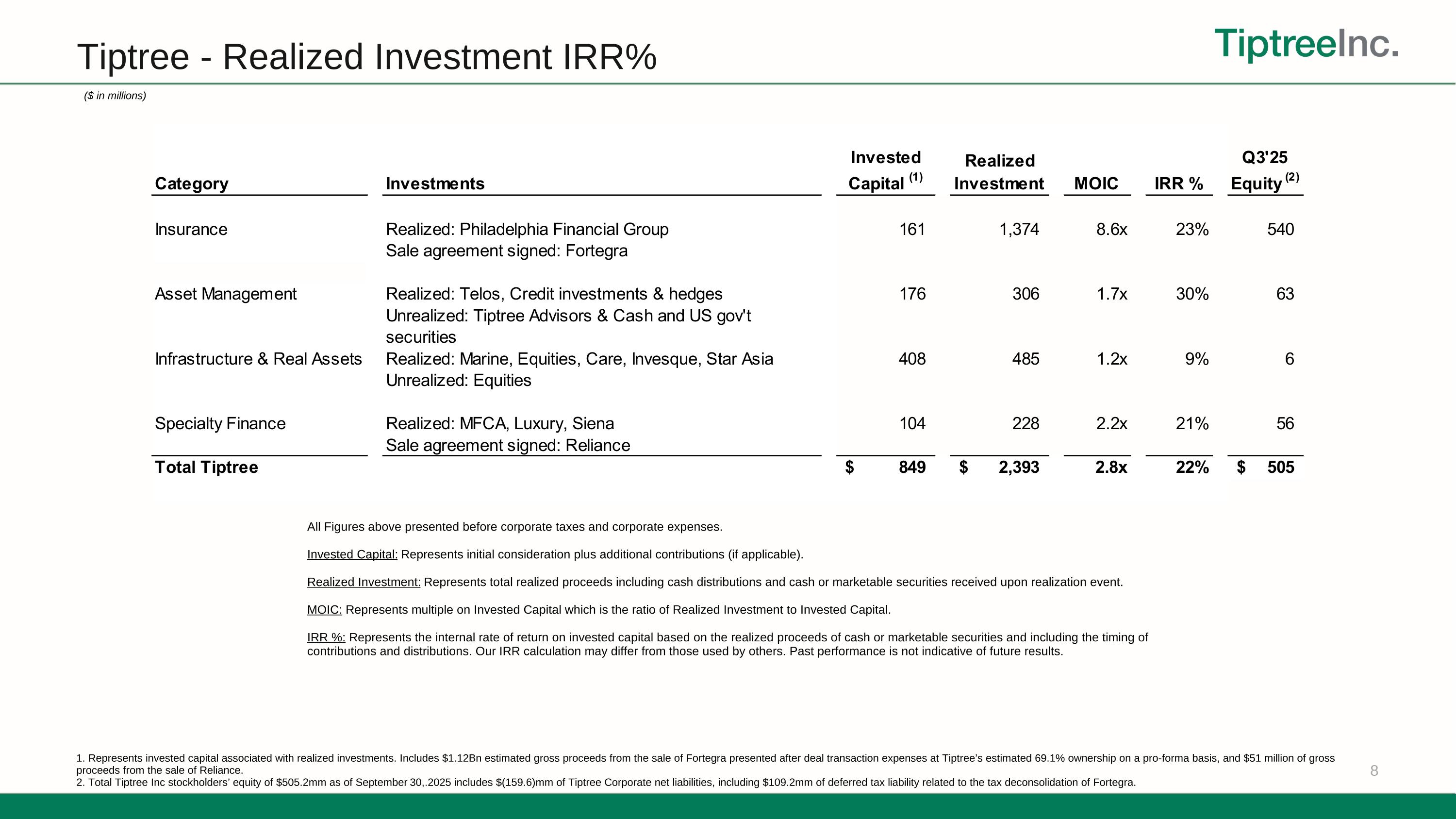

8 ($ in millions) All Figures above presented before corporate taxes and corporate expenses. Invested Capital: Represents initial consideration plus additional contributions (if applicable). Realized Investment: Represents total realized proceeds including cash distributions and cash or marketable securities received upon realization event. MOIC: Represents multiple on Invested Capital which is the ratio of Realized Investment to Invested Capital. IRR %: Represents the internal rate of return on invested capital based on the realized proceeds of cash or marketable securities and including the timing of contributions and distributions. Our IRR calculation may differ from those used by others. Past performance is not indicative of future results. 1. Represents invested capital associated with realized investments. Includes $1.12Bn estimated gross proceeds from the sale of Fortegra presented after deal transaction expenses at Tiptree’s estimated 69.1% ownership on a pro-forma basis, and $51 million of gross proceeds from the sale of Reliance. 2. Total Tiptree Inc stockholders’ equity of $505.2mm as of September 30,.2025 includes $(159.6)mm of Tiptree Corporate net liabilities, including $109.2mm of deferred tax liability related to the tax deconsolidation of Fortegra. Tiptree - Realized Investment IRR%

ir@tiptreeinc.com