UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): October 30, 2025

ALLISON TRANSMISSION HOLDINGS, INC.

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 001-35456 | 26-0414014 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| One Allison Way, Indianapolis, Indiana | 46222 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (317) 242-5000

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

||

| Common stock, $0.01 par value | ALSN | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 17 CFR (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01 | Regulation FD Disclosure. |

On October 30, 2025, Allison Transmission Holdings, Inc. (the “Company”) announced that Allison Transmission, Inc. (“ATI”), the Company’s wholly owned subsidiary, is seeking to enter into an amendment (the “Credit Agreement Amendment”) to the Second Amended and Restated Credit Agreement, dated as of March 29, 2019, as amended October 11, 2019, November 19, 2020, February 28, 2023 and March 13, 2024, among ATI, as borrower, the Company, Citibank, N.A., as administrative agent, Citicorp North America, Inc., as collateral agent, and the other lenders and letter of credit issuers party thereto, which, among other things, provides for a senior secured first-lien incremental term loan facility (the “Incremental Term Facility”) in an aggregate principal amount equal to $1.2 billion.

To the extent the Company elects to proceed with the entry into the Credit Agreement Amendment, the Company intends to use the net proceeds from borrowings under the Incremental Term Facility and its revolving credit facility, together with cash on hand and other potential sources, to finance the consummation of the Company’s previously announced acquisition of the off-highway business of Dana Incorporated and to pay related fees and expenses. There can be no assurance that ATI will be able to enter into the Credit Agreement Amendment on terms and conditions favorable to it or at all.

The Company is making available certain portions of a lender presentation to be used in discussions with prospective lenders under the Incremental Term Facility, which portions are attached hereto as Exhibit 99.1.

This Current Report on Form 8-K, including the information contained in Exhibit 99.1, does not constitute an offer to sell or the solicitation of an offer to buy any securities and shall not constitute an offer, solicitation or sale of any security in any jurisdiction in which such offering, solicitation or sale would be unlawful.

The information contained in this Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except as expressly set forth by specific reference in such filing.

Forward-Looking Statements

This Current Report on Form 8-K contains certain forward-looking statements, which are subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, including expectations regarding consummation of the Company’s previously announced acquisition of the off-highway business of Dana Incorporated, the ability to enter into the Credit Agreement Amendment on terms and conditions favorable to it or at all, and the expected use of proceeds to finance the acquisition. Statements regarding future events are based on the parties’ current expectations and are necessarily subject to associated risks related to, among other things, that the acquisition may not be completed in a timely manner or at all, that the financing intended to fund the acquisition, including the Credit Agreement Amendment, may not be obtained, and general economic conditions. Therefore, actual results may differ materially and adversely from those expressed in any forward-looking statements. For information regarding other related risks, see the “Risk Factors” section of the Company’s most recent annual report on Form 10-K and quarterly reports on Form 10-Q. The forward-looking statements included herein are made only as of the date hereof, and the Company undertakes no obligation to revise or update any forward-looking statements, except as required by applicable law.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| Exhibit No. | Description |

|

| 99.1 | Portions of the Lender Presentation related to the Incremental Term Facility. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Allison Transmission Holdings, Inc. | ||||||

| Date: October 30, 2025 | ||||||

| By: | /s/ Eric C. Scroggins |

|||||

| Name: | Eric C. Scroggins | |||||

| Title: | Vice President, General Counsel and Secretary | |||||

Exhibit 99.1

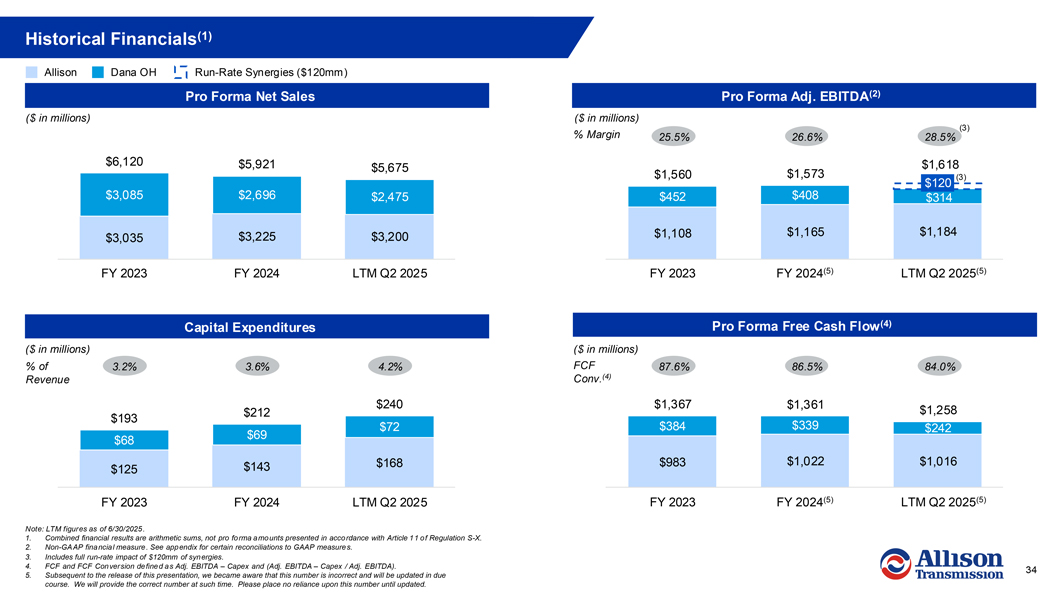

Historical Financials(1) Allison Dana OH Run-Rate Synergies ($120mm) Pro Forma Net Sales Pro Forma Adj. EBITDA(2) ($ in millions) ($ in millions) % Margin 25.5% 26.6% 28.5%(3) $6,120 $5,921 $5,675 $1,618 $1,560 $1,573 $120(3) $3,085 $2,696 $2,475 $452 $408 $314 $3,035 $3,225 $3,200 $1,108 $1,165 $1,184 FY 2023 FY 2024 LTM Q2 2025 FY 2023 FY 2024(5) LTM Q2 2025(5) Capital Expenditures Pro Forma Free Cash Flow(4) ($ in millions) % of Revenue 3.2% 3.6% 4.2% ($ in millions) FCF Conv.(4) 87.6% 86.5% 84.0% $240 $1,367 $1,361 $193 $212 $1,258 $72 $339 $242 $68 $$69 $125 $143 $168 $983 $1,022 $1,016 FY 2023 FY 2024(5) LTM Q2 2025 FY 2023 FY 2024 LTM Q2 2025(5) Note: LTM figures as of 6/30/2025. 1. Combined financial results are arithmetic sums, not pro forma amounts presented in accordance with Article 11 of Regulation S-X. 2. Non-GAAP financial measure. See appendix for certain reconciliations to GAAP measures. 3. Includes full run-rate impact of $120mm of synergies. 4. FCF and FCF Conversion defined as Adj. EBITDA - Capex and (Adj. EBITDA - Capex / Adj. EBITDA). 5. Subsequent to the release of this presentation, we became aware that this number is incorrect and will be updated in due course. We will provide the correct number at such time. Please place no reliance upon this number until updated.

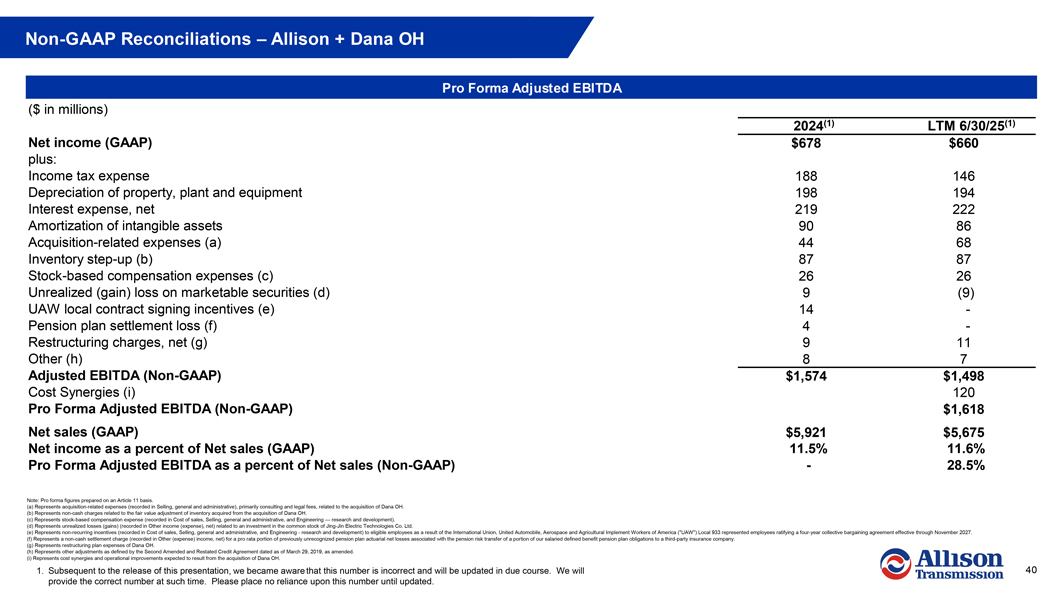

Non-GAAP Reconciliations - Allison + Dana OH Pro Forma Adjusted EBITDA ($ in millions) Net income (GAAP) plus: Income tax expense Depreciation of property, plant and equipment Interest expense, net Amortization of intangible assets Acquisition-related expenses (a) Inventory step-up (b) Stock-based compensation expenses (c) Unrealized (gain) loss on marketable securities (d) UAW local contract signing incentives (e) Pension plan settlement loss (f) Restructuring charges, net (g) Other (h) Adjusted EBITDA (Non-GAAP) Cost Synergies (i) Pro Forma Adjusted EBITDA (Non-GAAP) Net sales (GAAP) Net income as a percent of Net sales (GAAP) Pro Forma Adjusted EBITDA as a percent of Net sales (Non-GAAP) 2024(1) $678 LTM 6/30/25 $660 188 146 198 219 90 86 44 68 87 26 9 194 222 - - 87 26 (9) 14 4 9 11 8 7 $1,574 $1,498 120 $1,618 $5,921 $5,675 11.5% 11.6% 28.5% - Note: Pro forma figures prepared on an Article 11 basis. (a) Represents acquisition-related expenses (recorded in Selling, general and administrative), primarily consulting and legal fees, related to the acquisition of Dana OH. (b) Represents non-cash charges related to the fair value adjustment of inventory acquired from the acquisition of Dana OH. (c) Represents stock-based compensation expense (recorded in Cost of sales, Selling, general and administrative, and Engineering — research and development). (d) Represents unrealized losses (gains) (recorded in Other income (expense), net) related to an investment in the common stock of Jing-Jin Electric Technologies Co. Ltd. (e) Represents non-recurring incentives (recorded in Cost of sales, Selling, general and administrative, and Engineering - research and development) to eligible employees as a result of the International Union, United Automobile, Aerospace and Agricultural Implement Workers of America (“UAW”) Local 933 represented employees ratifying a four-year collective bargaining agreement effective through November 2027. (f) Represents a non-cash settlement charge (recorded in Other (expense) income, net) for a pro rata portion of previously unrecognized pension plan actuarial net losses associated with the pension risk transfer of a portion of our salaried defined benefit pension plan obligations to a third-party insurance company. (g) Represents restructuring plan expenses of Dana OH. (h) Represents other adjustments as defined by the Second Amended and Restated Credit Agreement dated as of March 29, 2019, as amended. (i) Represents cost synergies and operational improvements expected to result from the acquisition of Dana OH. 1. Subsequent to the release of this presentation, we became aware that this number is incorrect and will be updated in due course. We will provide the correct number at such time. Please place no reliance upon this number until updated. Allison Transmission 40

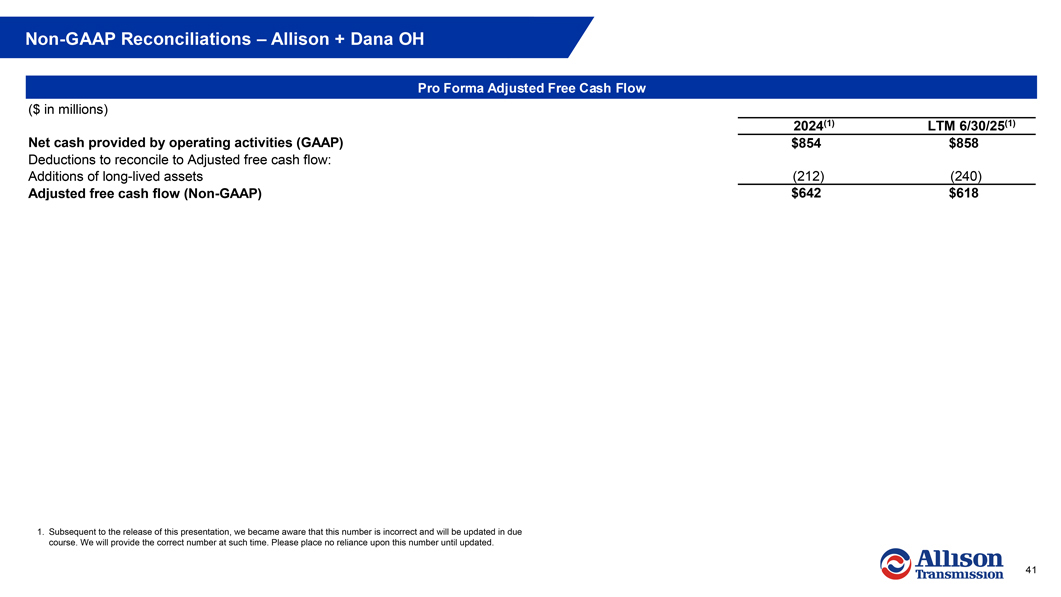

Non-GAAP Reconciliations – Allison + Dana OH Pro Forma Adjusted Free Cash Flow ($ in millions) Net cash provided by operating activities (GAAP)Deductions to reconcile to Adjusted free cash flow: Additions of long-lived assets Adjusted free cash flow (Non-GAAP) 2024(1) LTM 6/30/25(1) $854 $858 (212) (240) $642 $618 1. Subsequent to the release of this presentation, we became aware that this number is incorrect and will be updated in due course. We will provide the correct number at such time. Please place no reliance upon this number until updated. Allison Transmission 41

Safe Harbor Statement The following information contains, or may be deemed to contain, “forward-looking statements” (as defined in the U.S. Private Securities Litigation Reform Act of 1995) including, without limitation, statements regarding our incremental annual revenue opportunities, growth expectations of our addressable markets and statements regarding the Facilities and the pro forma impact thereof on our financial condition. The words “believe,” “expect,” “anticipate,” “intend,” “estimate” and other expressions that are predictions of or indicate future events and trends and that do not relate to historical matters identify forward-looking statements. You should not place undue reliance on these forward-looking statements. Although forward-looking statements reflect management’s good faith beliefs, reliance should not be placed on forward-looking statements because they involve known and unknown risks, uncertainties and other factors, which may cause actual results, performance or achievements to differ materially from anticipated future results, performance or achievements ex pressed or implied by such forward-looking statements. Forward-looking statements speak only as of the date the statements are made. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, changed circumstances or otherwise. These forward-looking statements are subject to numerous risks and uncertainties, including, but not limited to: our participation in markets that are competitive; our ability to prepare for, respond to and successfully achieve our objectives relating to technological and market developments, competitive threats and changing customer needs, including with respect to electric hybrid and fully electric commercial vehicles; increases in cost, disruption of supply or shortage of labor, freight, raw materials, energy or components used to manufacture or transport our products or those of our customers or suppliers, including as a result of geopolitical risks, wars and pandemics; global economic volatility; general economic and industry conditions, including the risk of recession; labor strikes, work stoppages or similar labor disputes, which could significantly disrupt our operations or those of our principal customers or suppliers; the highly cyclical industries in which certain of our end users operate; uncertainty in the global regulatory and business environments in which we operate; the concentration of our net sales in our top five customers and the loss of any one of these; the failure of markets outside North America to increase adoption of fully automatic transmissions; the success of our research and development efforts, the outcome of which is uncertain; U.S. and foreign defense spending and the timing of defense programs; risks associated with our international operations, including acts of war and increased trade protectionism; the discovery of defects in our products, resulting in delays in new model launches, recall campaigns and/or increased warranty costs and reduction in future sales or damage to our brand and reputation; our ability to identify, consummate and effectively integrate acquisitions and collaborations; and risks related to our indebtedness. Allison Transmission cannot assure you that the assumptions made in preparing any of the forward-looking statements will prove accurate or that any long-term financial goals will be realized. All forward-looking statements included in this presentation speak only as of the date made, and Allison Transmission undertakes no obligation to update or revise publicly any such forward-looking statements, whether as a result of new information, future events, or otherwise. In particular, Allison Transmission cautions you not to place undue weight on certain forward-looking statements pertaining to potential growth opportunities or long-term financial goals set forth herein. Actual results may vary significantly from these statements. Allison Transmission’s business is subject to numerous risks and uncertainties, which may cause future results of operations to vary significantly from those presented herein. Important factors that could cause actual results to differ materially are discussed in Allison Transmission’s Quarterly Report on Form 10-Q for the fiscal quarter ended June 30, 2025. Allison Transmission 2

Notice to and Undertaking by Recipients (Cont’d) IV. Non-GAAP Financial Information This Lender Presentation includes the following non-GAAP financial measures: Pro Forma Adjusted EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Leverage, Pro Forma Free Cash Flow, and Adjusted Free Cash Flow. These non-GAAP financial measures are not measures of financial performance in accordance with GAAP and may exclude items that are significant in understanding and assessing the Company’s or the OH Business’s financial results, as applicable. We believe these non-GAAP financial measures allow management to better understand our consolidated financial performance from period to period and better project our future financial performance as forecasts are developed at a level of detail different from that used to prepare GAAP-based financial measures. Moreover, we believe these non-GAAP financial measures provide our stakeholders with useful information to help them evaluate our operating results by facilitating an enhanced understanding of our operating performance and enabling them to make more meaningful period-to-period comparisons. The Recipient should be aware that because not all companies calculate non-GAAP financial information identically (or at all), this presentation herein may not be comparable to other similarly titled measures used by other companies. Further, such non-GAAP financial information of the Company or the OH Business, as applicable, should not be considered in isolation or as a substitute for the information contained in the historical financial information of the Company, if any, prepared in accordance with GAAP included herein. The adjustments made to calculate these non-GAAP financial measures are significant components in understanding and evaluating our financial performance and liquidity. Allison Transmission 5