NASDAQ: FBIZ Earnings Release SupplementThird Quarter 2025

When used in this presentation, and in any other oral statements made with the approval of an authorized executive officer, the words or phrases “may,” “could,” “should,” “hope,” “might,” “believe,” “expect,” “plan,” “assume,” “intend,” “estimate,” “anticipate,” “project,” “likely,” or similar expressions are intended to identify “forward‐looking statements” within the meaning of such term in the Private Securities Litigation Reform Act of 1995. Such statements are subject to risks and uncertainties, including among other things: (i) Adverse changes in the economy or business conditions, either nationally or in our markets, including, without limitation, inflation, economic downturn, labor shortages, wage pressures, and the adverse effects of public health events on the global, national, and local economy; (ii) Uncertainty created by potential federal government actions relating to the authority of regulatory agencies (including bank regulators), international trade policy, prolonged shutdown of the federal government, and other significant matters;(iii) Competitive pressures among depository and other financial institutions nationally and in our markets; (iv) Increases in defaults by borrowers and other delinquencies; (v) Our ability to manage growth effectively, including the successful expansion of our client support, administrative infrastructure, and internal management systems; (vi) Fluctuations in interest rates and market prices; (vii) Changes in legislative or regulatory requirements applicable to us and our subsidiaries; (viii) Changes in tax requirements, including tax rate changes, new tax laws, and revised tax law interpretations; (ix) Fraud, including client and system failure or breaches of our network security, including our internet banking activities; (x) Failure to comply with the applicable SBA regulations in order to maintain the eligibility of the guaranteed portions of SBA loans. (xi) Ongoing volatility in the banking sector may result in new legislation, regulations or policy changes that could subject the Corporation and the Bank to increased government regulation and supervision, (xii) the proportion of the Corporation’s deposit account balances that exceed FDIC insurance limits may expose the Bank to enhanced liquidity risk, and (xiii) The Corporation may be subject to increases in FDIC insurance assessments. These risks could cause actual results to differ materially from what FBIZ has anticipated or projected. These risks could cause actual results to differ materially from what we have anticipated or projected. These risk factors and uncertainties should be carefully considered by our shareholders and potential investors. For further information about the factors that could affect the Corporation’s future results, please see the Corporation’s annual report on Form 10‐K for the year ended December 31, 2024 and other filings with the Securities and Exchange Commission. Investors should not place undue reliance on any such forward‐looking statement, which speaks only as of the date on which it was made. The factors described within the filings could affect our financial performance and could cause actual results for future periods to differ materially from any opinions or statements expressed with respect to future periods. Where any such forward‐looking statement includes a statement of the assumptions or bases underlying such forward‐looking statement, FBIZ cautions that, while its management believes such assumptions or bases are reasonable and are made in good faith, assumed facts or bases can vary from actual results, and the differences between assumed facts or bases and actual results can be material, depending on the circumstances. Where, in any forward‐looking statement, an expectation or belief is expressed as to future results, such expectation or belief is expressed in good faith and believed to have a reasonable basis, but there can be no assurance that the statement of expectation or belief will be achieved or accomplished. FBIZ does not intend to, and specifically disclaims any obligation to, update any forward‐looking statements. Forward-Looking Statements

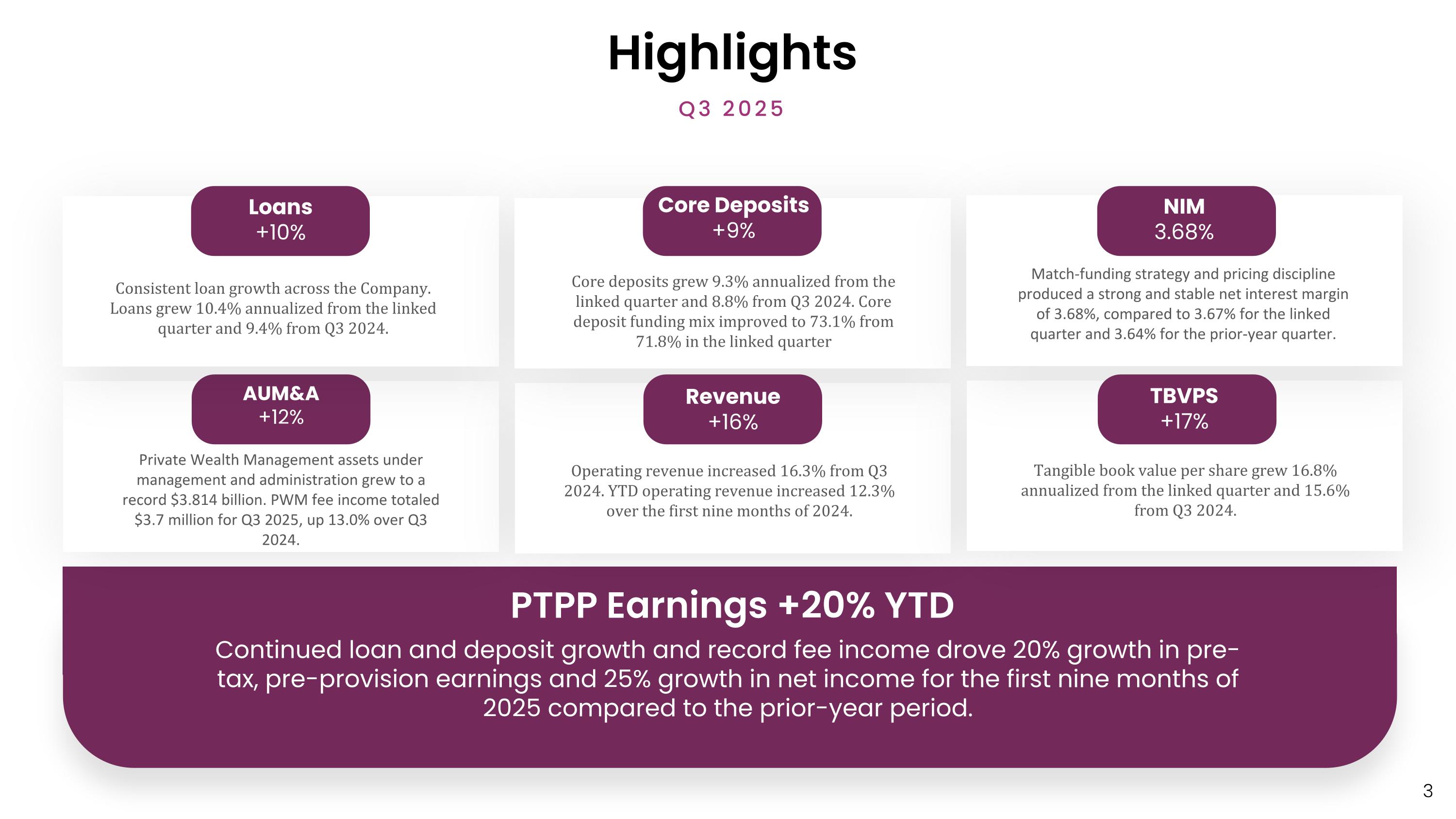

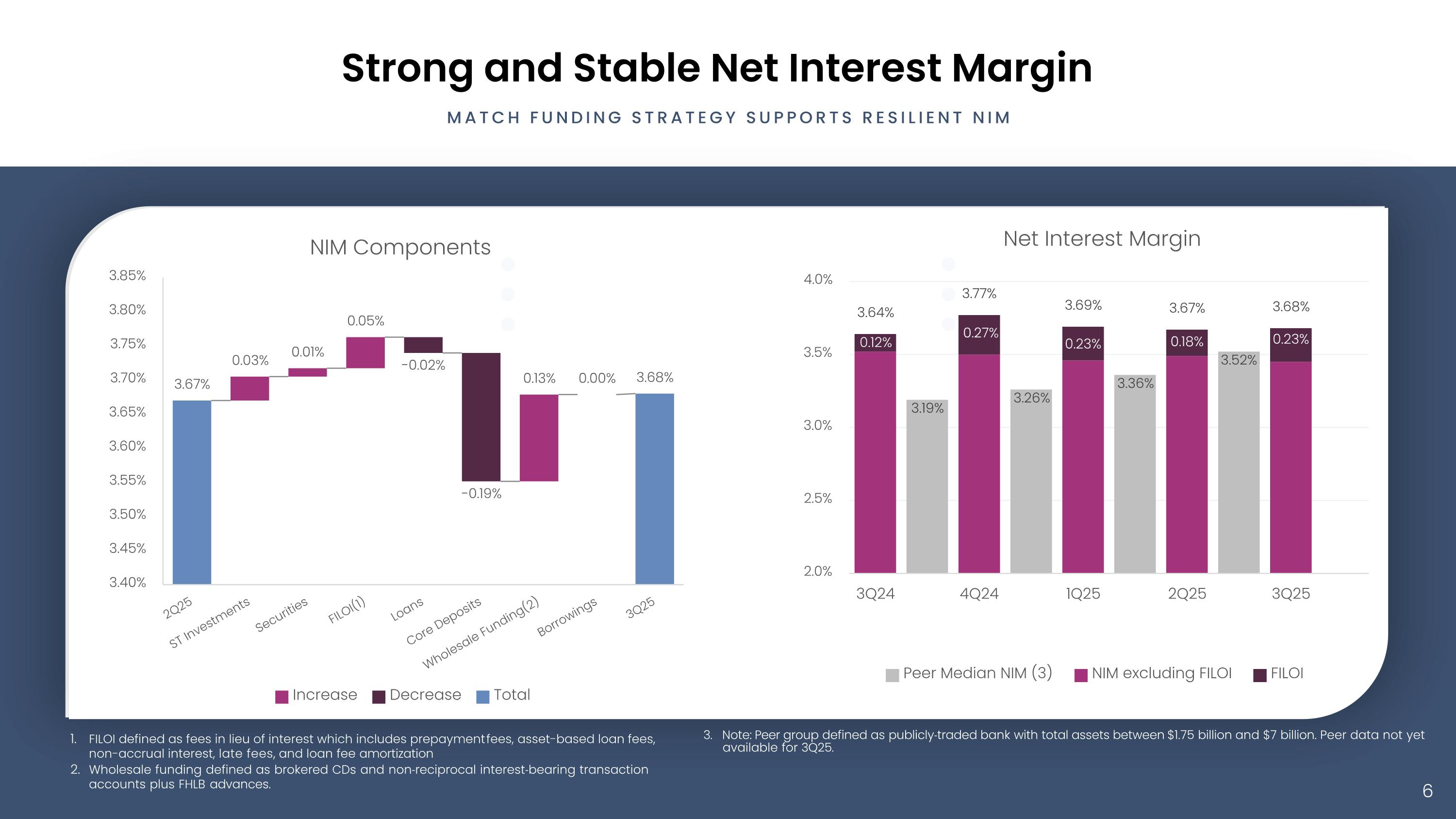

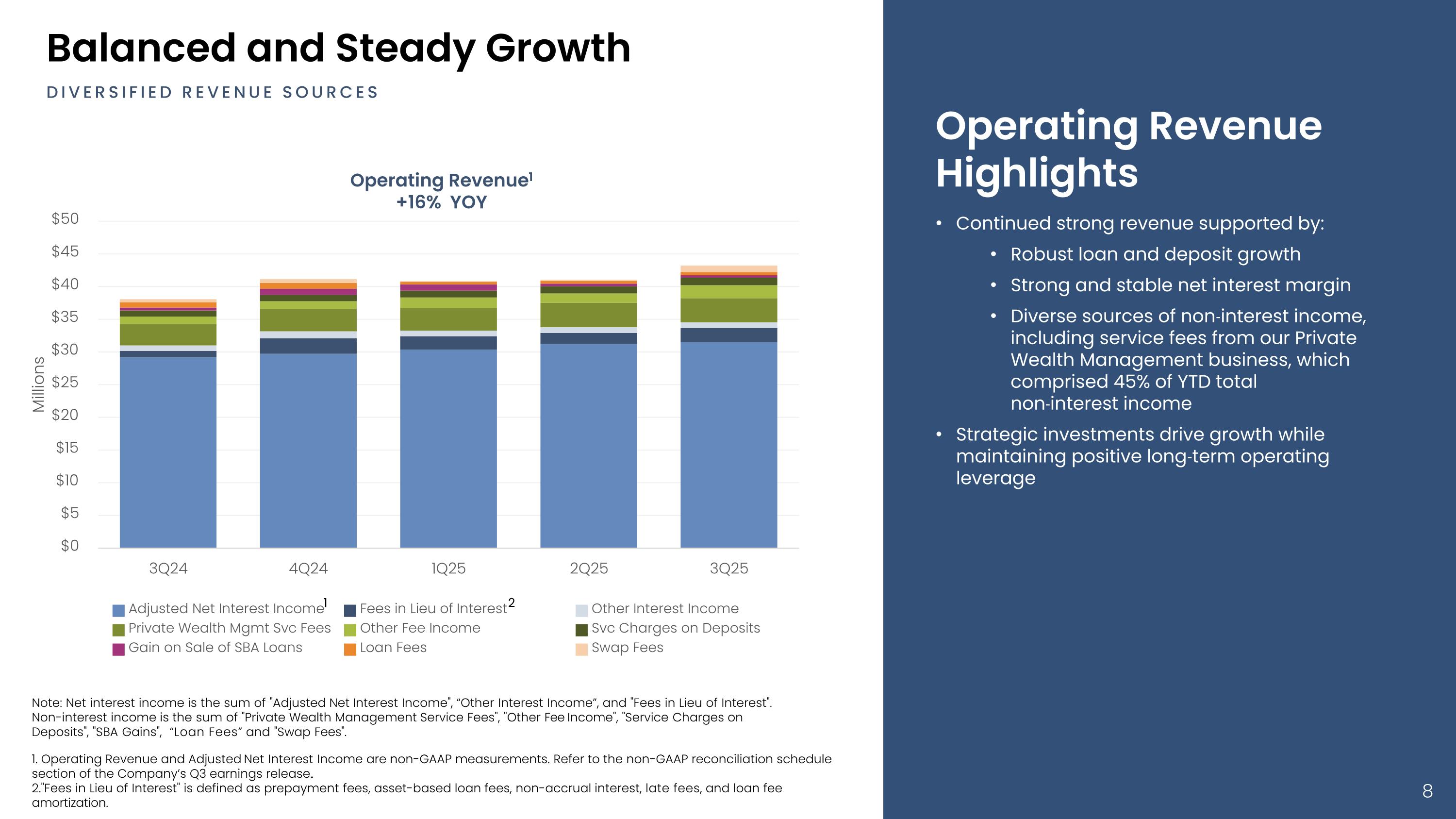

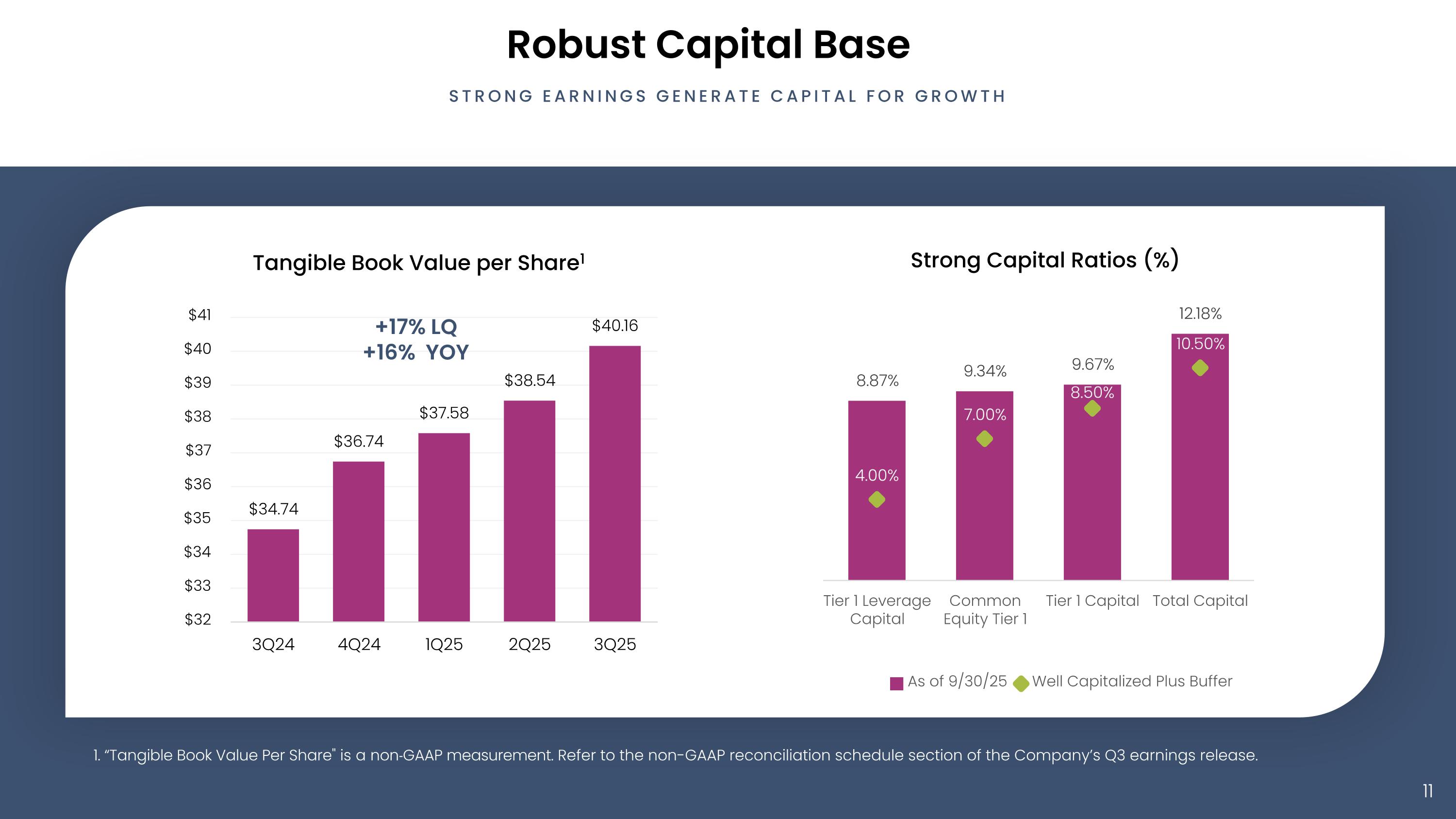

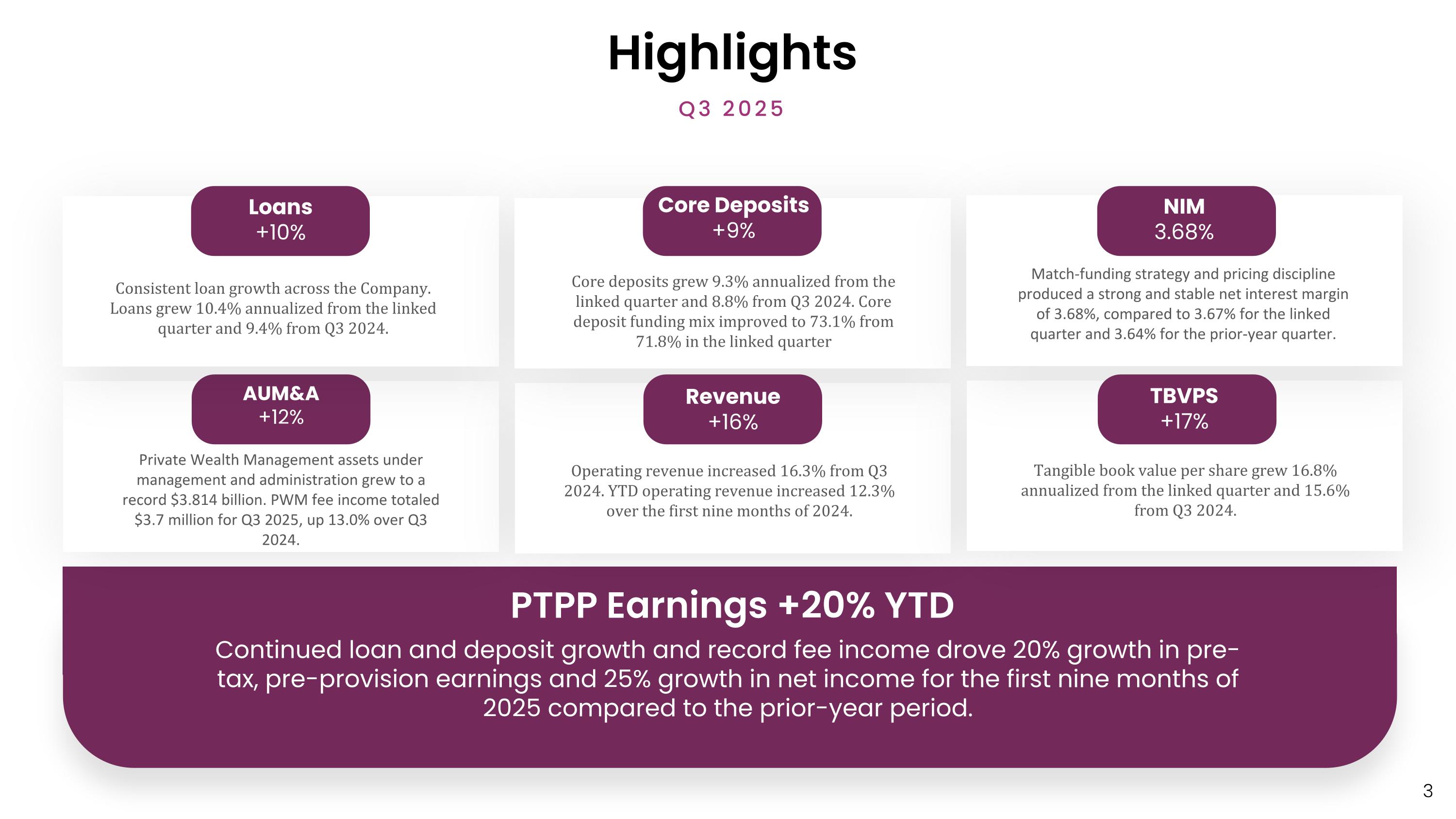

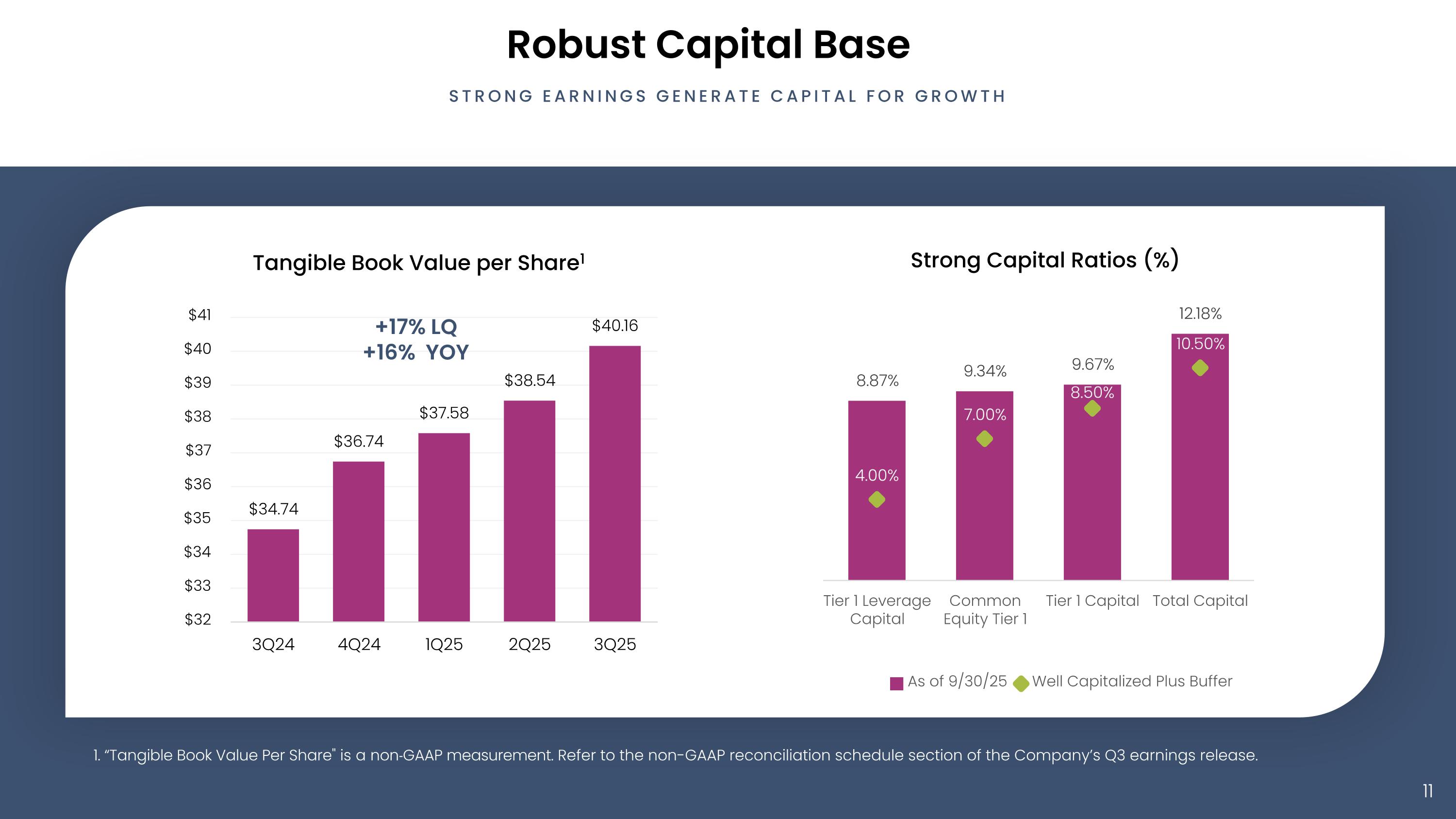

Highlights Q3 2025 PTPP Earnings +20% YTD Continued loan and deposit growth and record fee income drove 20% growth in pre-tax, pre-provision earnings and 25% growth in net income for the first nine months of 2025 compared to the prior-year period. AUM&A +12% Private Wealth Management assets under management and administration grew to a record $3.814 billion. PWM fee income totaled $3.7 million for Q3 2025, up 13.0% over Q3 2024. Core Deposits +9% Consistent loan growth across the Company. Loans grew 10.4% annualized from the linked quarter and 9.4% from Q3 2024. Loans +10% Core deposits grew 9.3% annualized from the linked quarter and 8.8% from Q3 2024. Core deposit funding mix improved to 73.1% from 71.8% in the linked quarter NIM 3.68% Match-funding strategy and pricing discipline produced a strong and stable net interest margin of 3.68%, compared to 3.67% for the linked quarter and 3.64% for the prior-year quarter. TBVPS +17% Tangible book value per share grew 16.8% annualized from the linked quarter and 15.6% from Q3 2024. Revenue +16% Operating revenue increased 16.3% from Q3 2024. YTD operating revenue increased 12.3% over the first nine months of 2024.

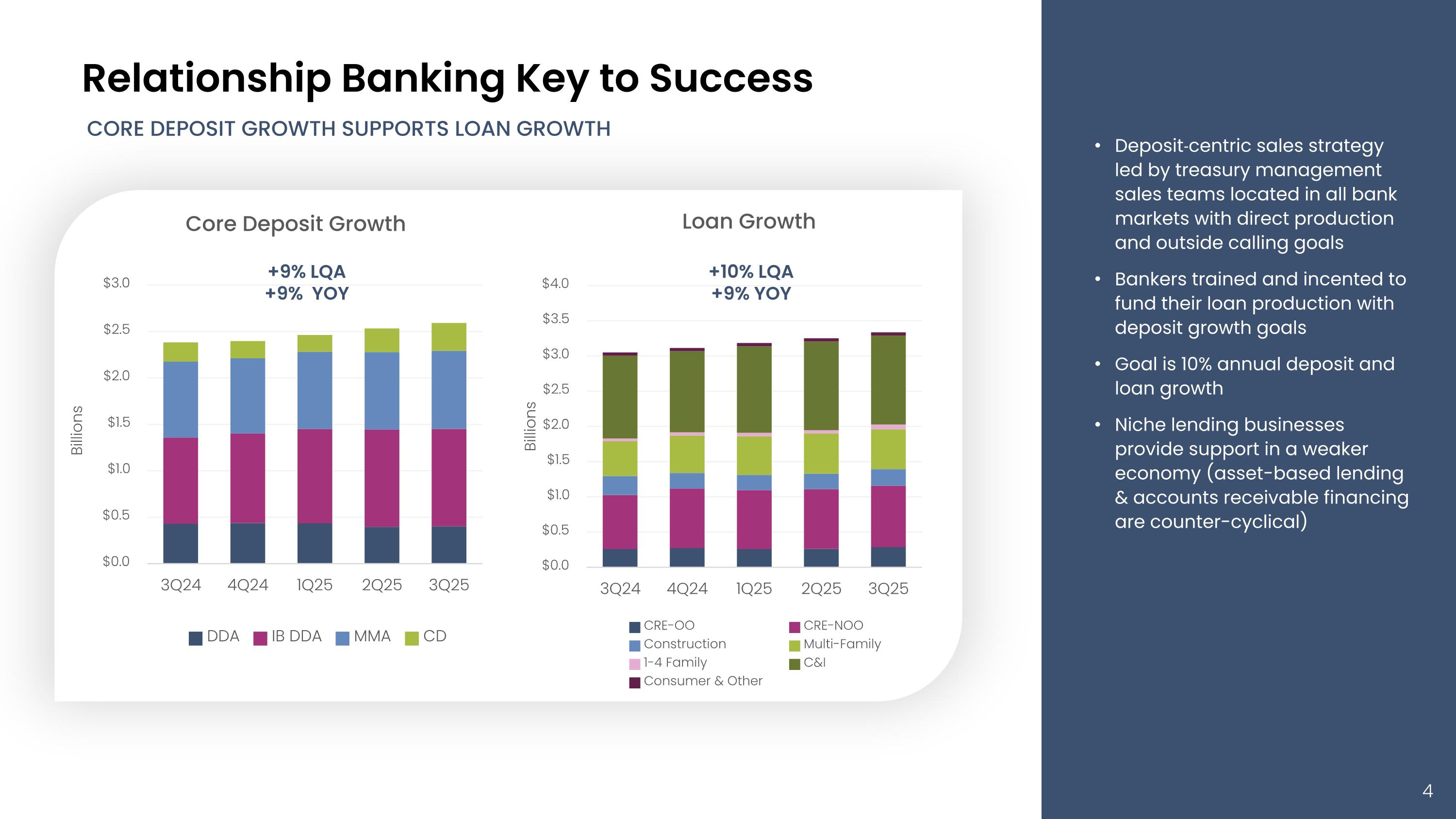

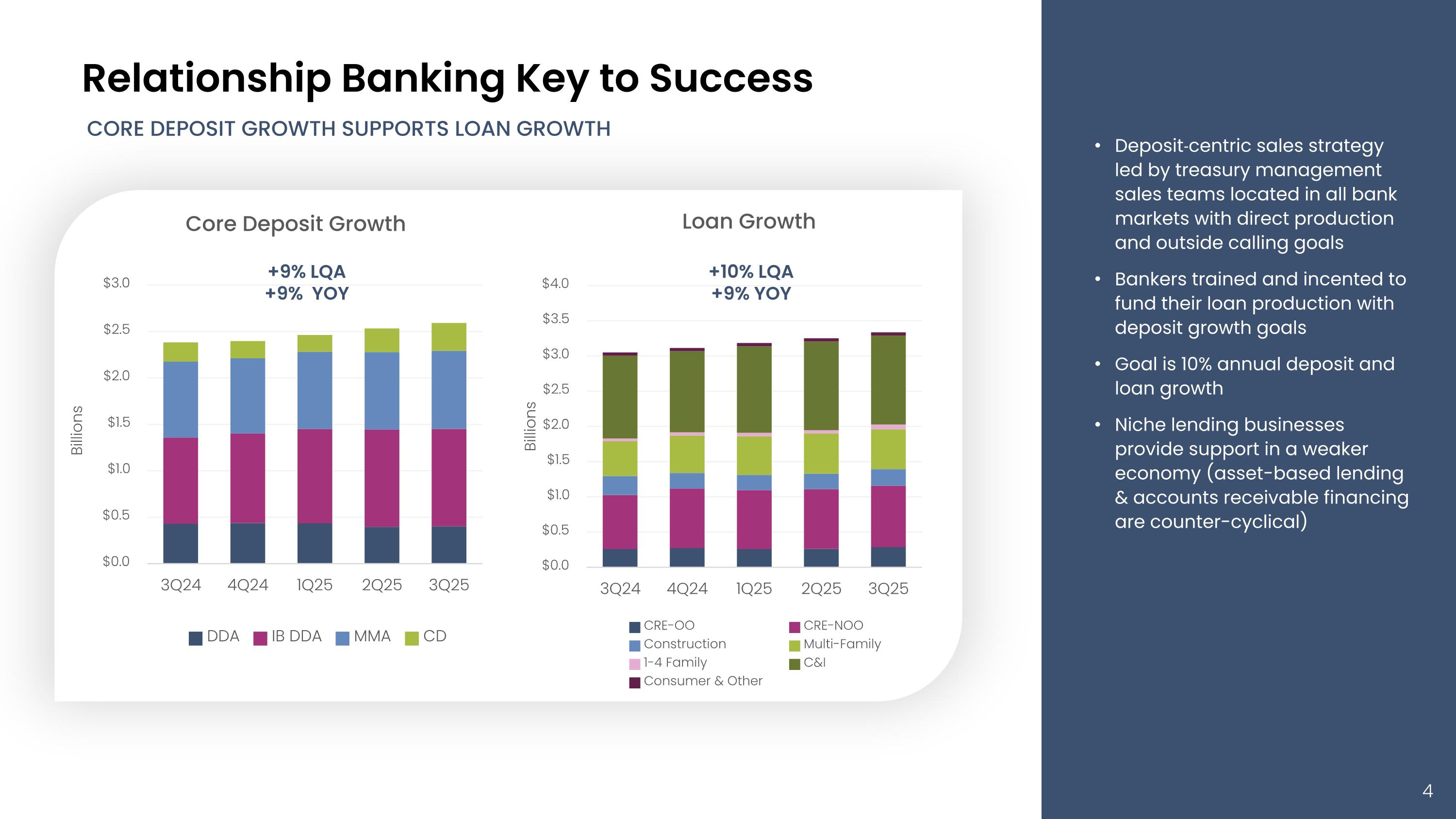

Relationship Banking Key to Success Deposit‐centric sales strategy led by treasury management sales teams located in all bank markets with direct production and outside calling goals Bankers trained and incented to fund their loan production with deposit growth goals Goal is 10% annual deposit and loan growth Niche lending businesses provide support in a weaker economy (asset-based lending & accounts receivable financing are counter-cyclical) core deposit growth supports loan growth +9% LQA +9% YOY +10% LQA +9% YOY

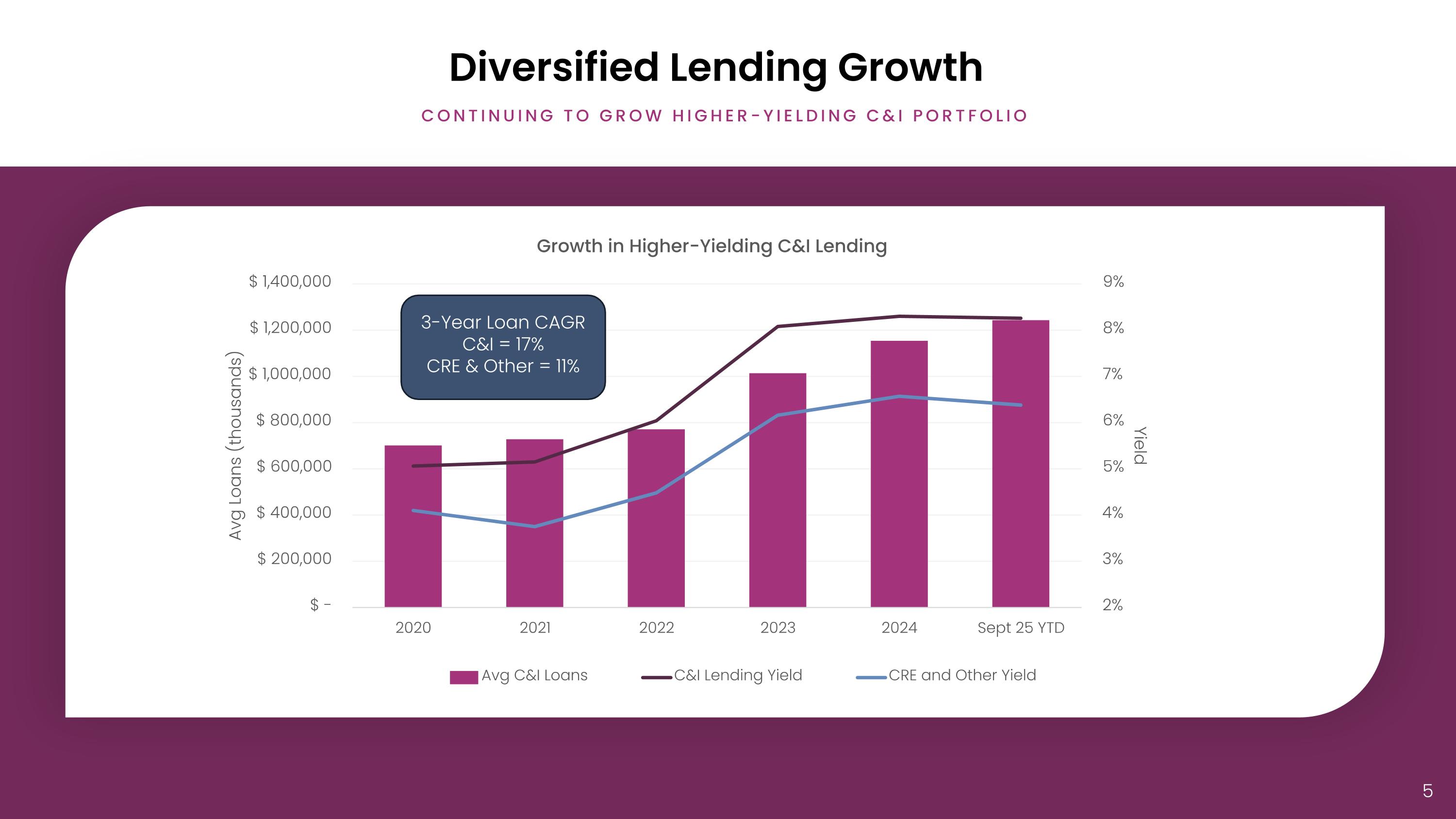

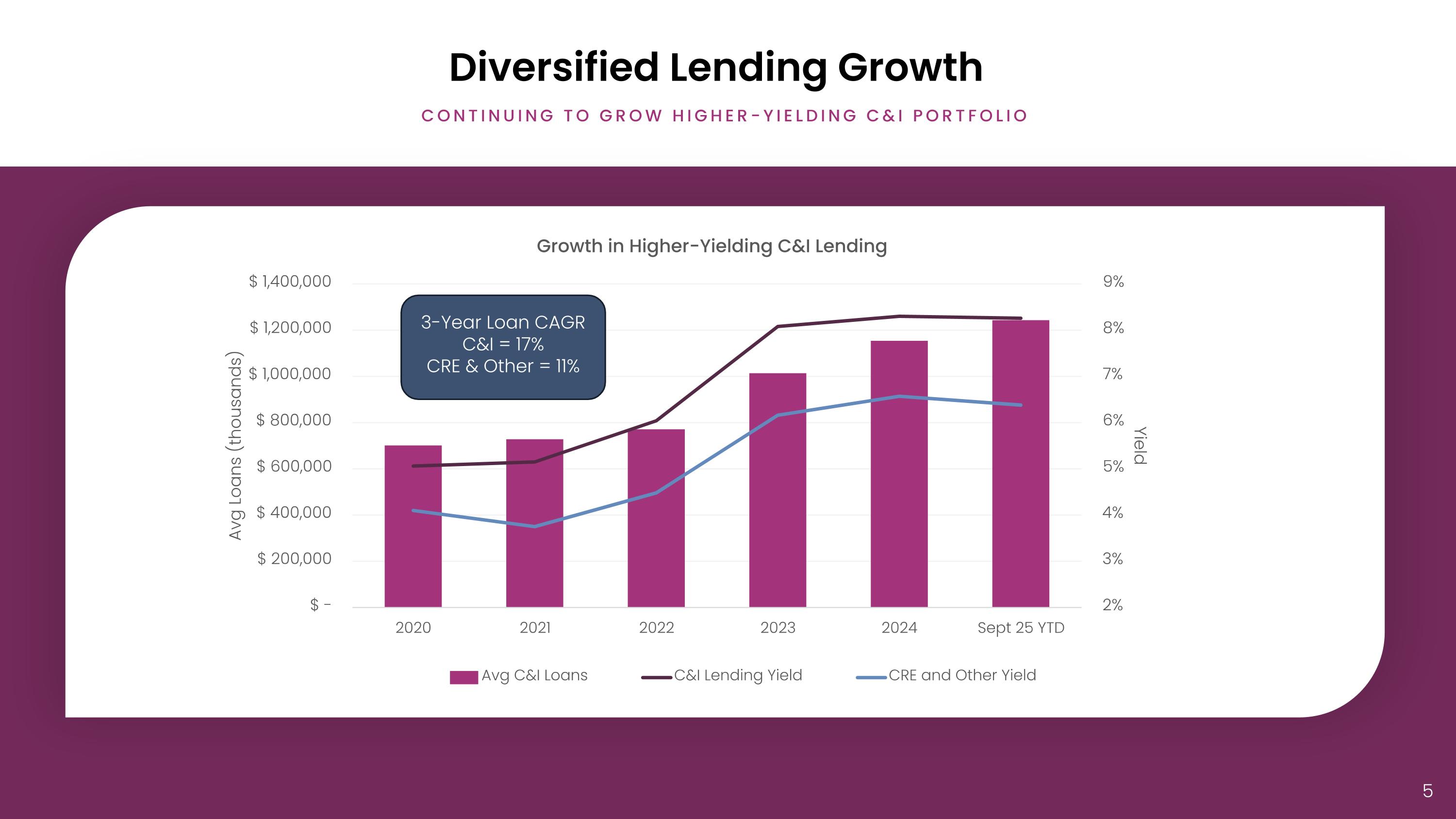

Diversified Lending Growth Continuing To Grow Higher-Yielding C&I PORTFOLIO 3-Year Loan CAGR C&I = 17% CRE & Other = 11%

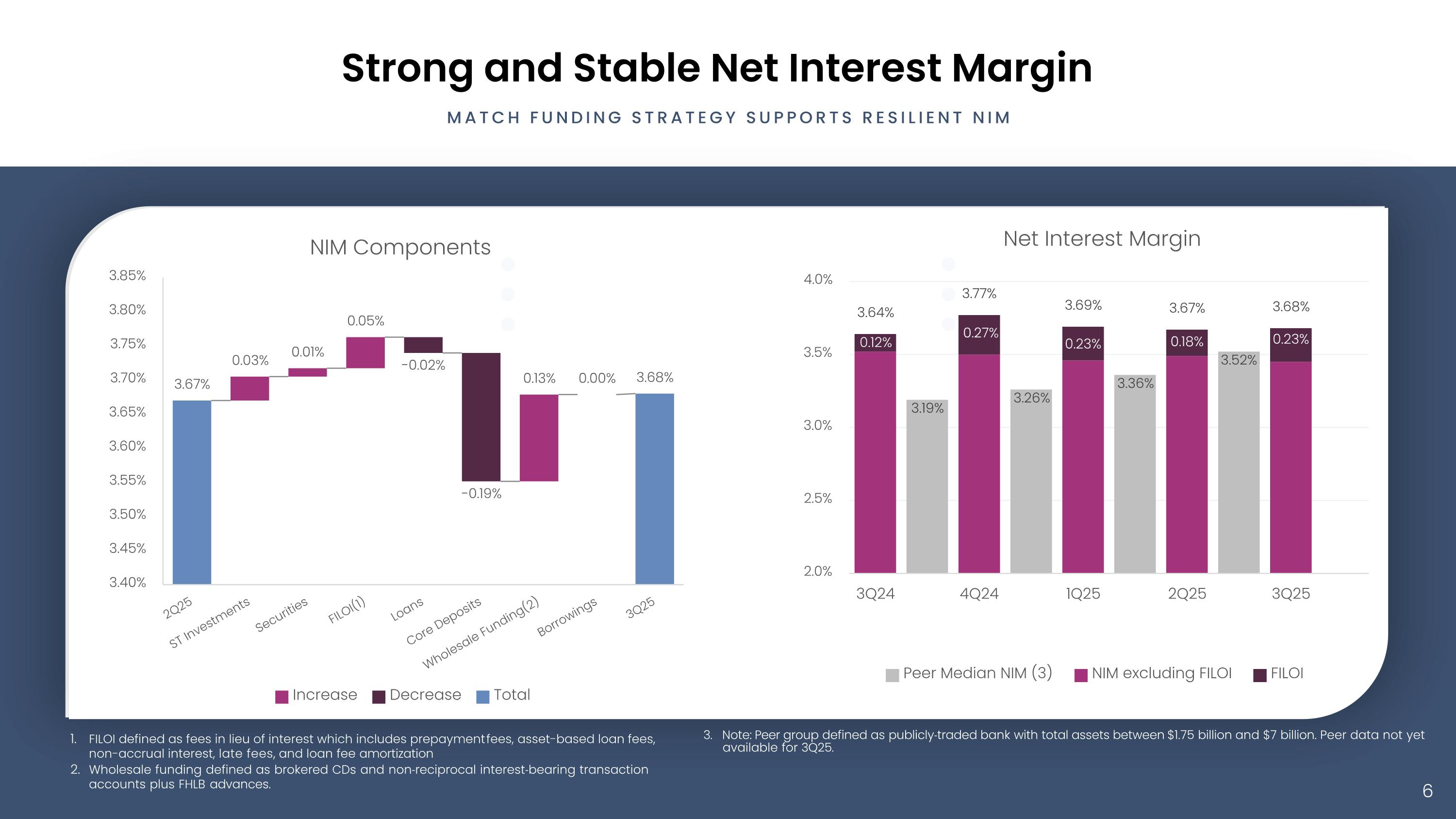

Strong and Stable Net Interest Margin FILOI defined as fees in lieu of interest which includes prepayment fees, asset-based loan fees, non-accrual interest, late fees, and loan fee amortization Wholesale funding defined as brokered CDs and non‐reciprocal interest‐bearing transaction accounts plus FHLB advances. 3. Note: Peer group defined as publicly‐traded bank with total assets between $1.75 billion and $7 billion. Peer data not yet available for 3Q25. MATCH FUNDING STRATEGY SUPPORTS RESILIENT NIM

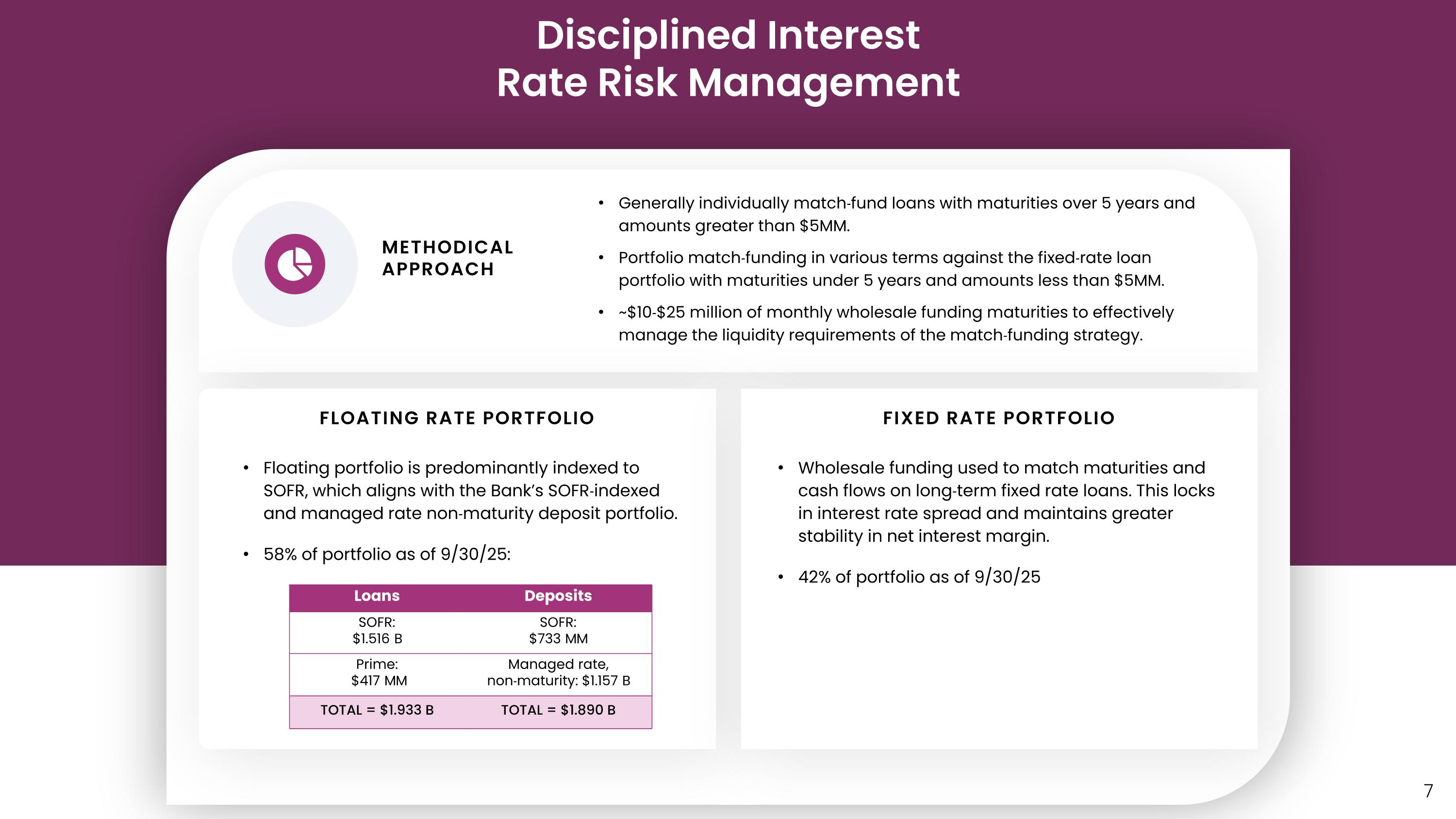

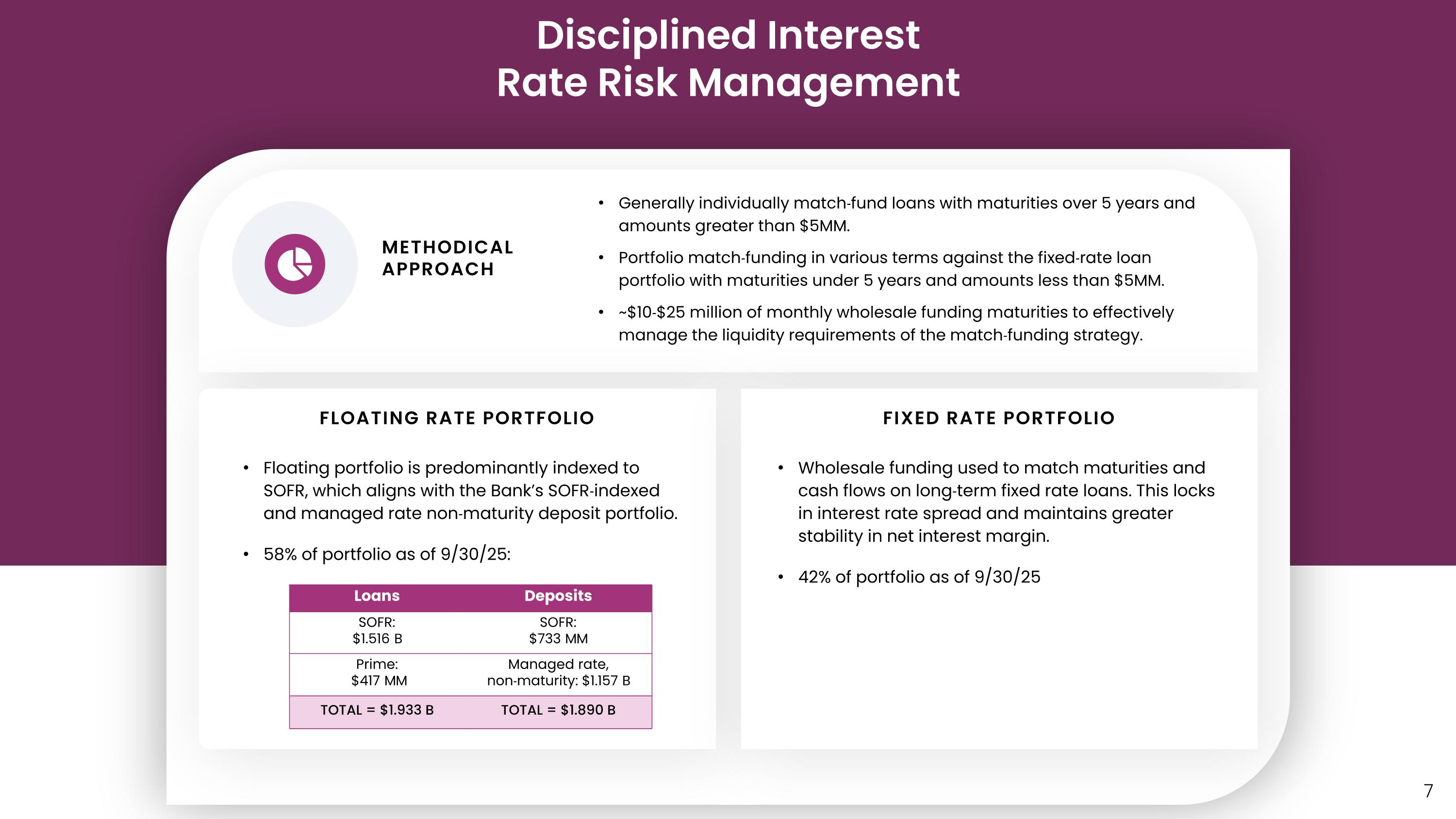

Disciplined Interest Rate Risk Management FLOATING RATE PORTFOLIO Floating portfolio is predominantly indexed to SOFR, which aligns with the Bank’s SOFR‐indexed and managed rate non‐maturity deposit portfolio. 58% of portfolio as of 9/30/25: METHODICAL APPROACH Generally individually match‐fund loans with maturities over 5 years and amounts greater than $5MM. Portfolio match‐funding in various terms against the fixed‐rate loan portfolio with maturities under 5 years and amounts less than $5MM. ~$10‐$25 million of monthly wholesale funding maturities to effectively manage the liquidity requirements of the match‐funding strategy. Loans Deposits SOFR: $1.516 B SOFR: $733 MM Prime: $417 MM Managed rate, non‐maturity: $1.157 B TOTAL = $1.933 B TOTAL = $1.890 B FIXED RATE PORTFOLIO Wholesale funding used to match maturities and cash flows on long‐term fixed rate loans. This locks in interest rate spread and maintains greater stability in net interest margin. 42% of portfolio as of 9/30/25

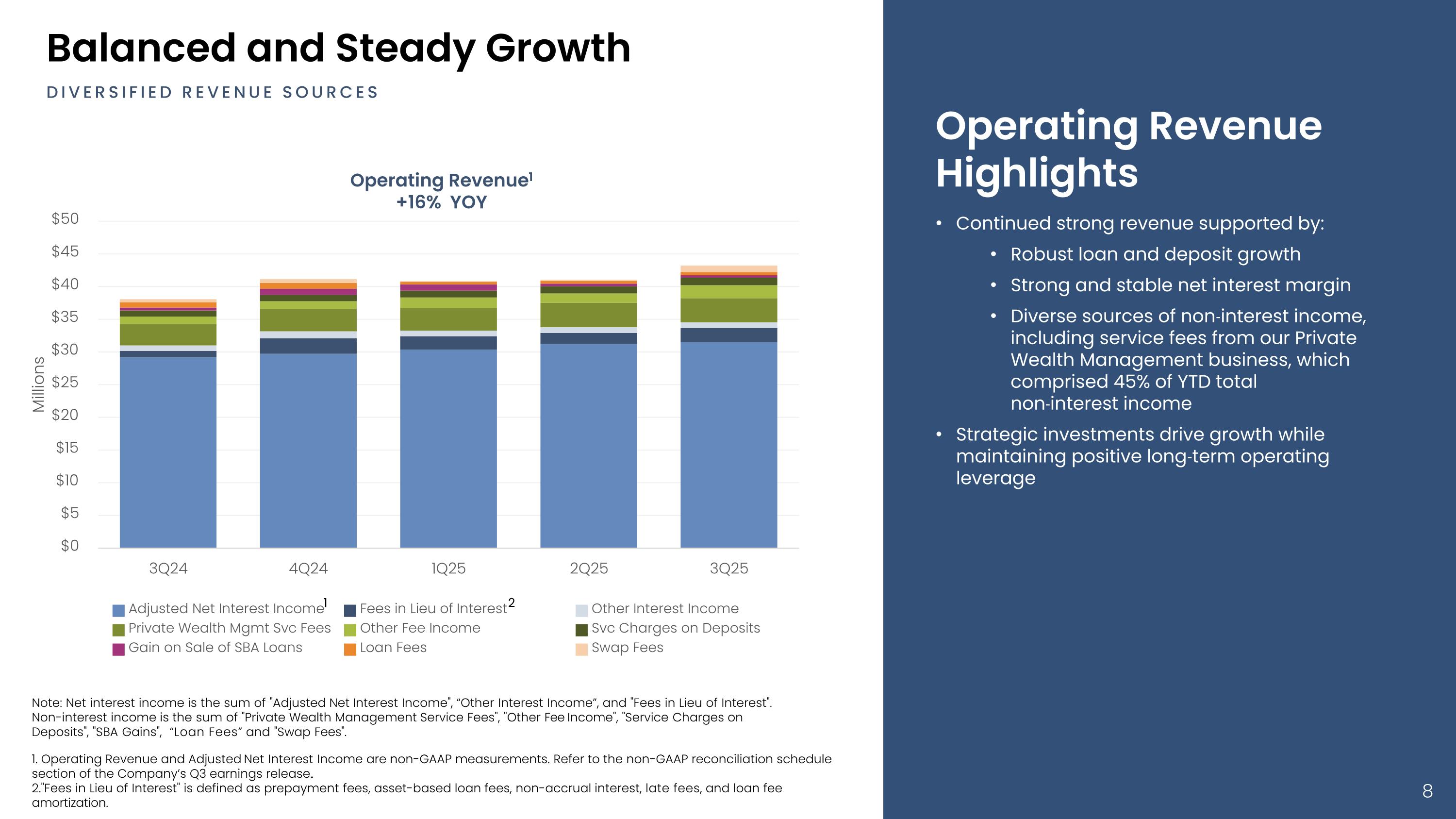

Operating Revenue Highlights Continued strong revenue supported by: Robust loan and deposit growth Strong and stable net interest margin Diverse sources of non‐interest income, including service fees from our Private Wealth Management business, which comprised 45% of YTD total non‐interest income Strategic investments drive growth while maintaining positive long‐term operating leverage 1. Operating Revenue and Adjusted Net Interest Income are non-GAAP measurements. Refer to the non-GAAP reconciliation schedule section of the Company’s Q3 earnings release.. 2."Fees in Lieu of Interest" is defined as prepayment fees, asset-based loan fees, non-accrual interest, late fees, and loan fee amortization. Balanced and Steady Growth DIVERSIFIED REVENUE SOURCES 2 Operating Revenue1 +16% YOY Note: Net interest income is the sum of "Adjusted Net Interest Income", “Other Interest Income”, and "Fees in Lieu of Interest". Non-interest income is the sum of "Private Wealth Management Service Fees", "Other Fee Income", "Service Charges on Deposits", "SBA Gains", “Loan Fees” and "Swap Fees". 1

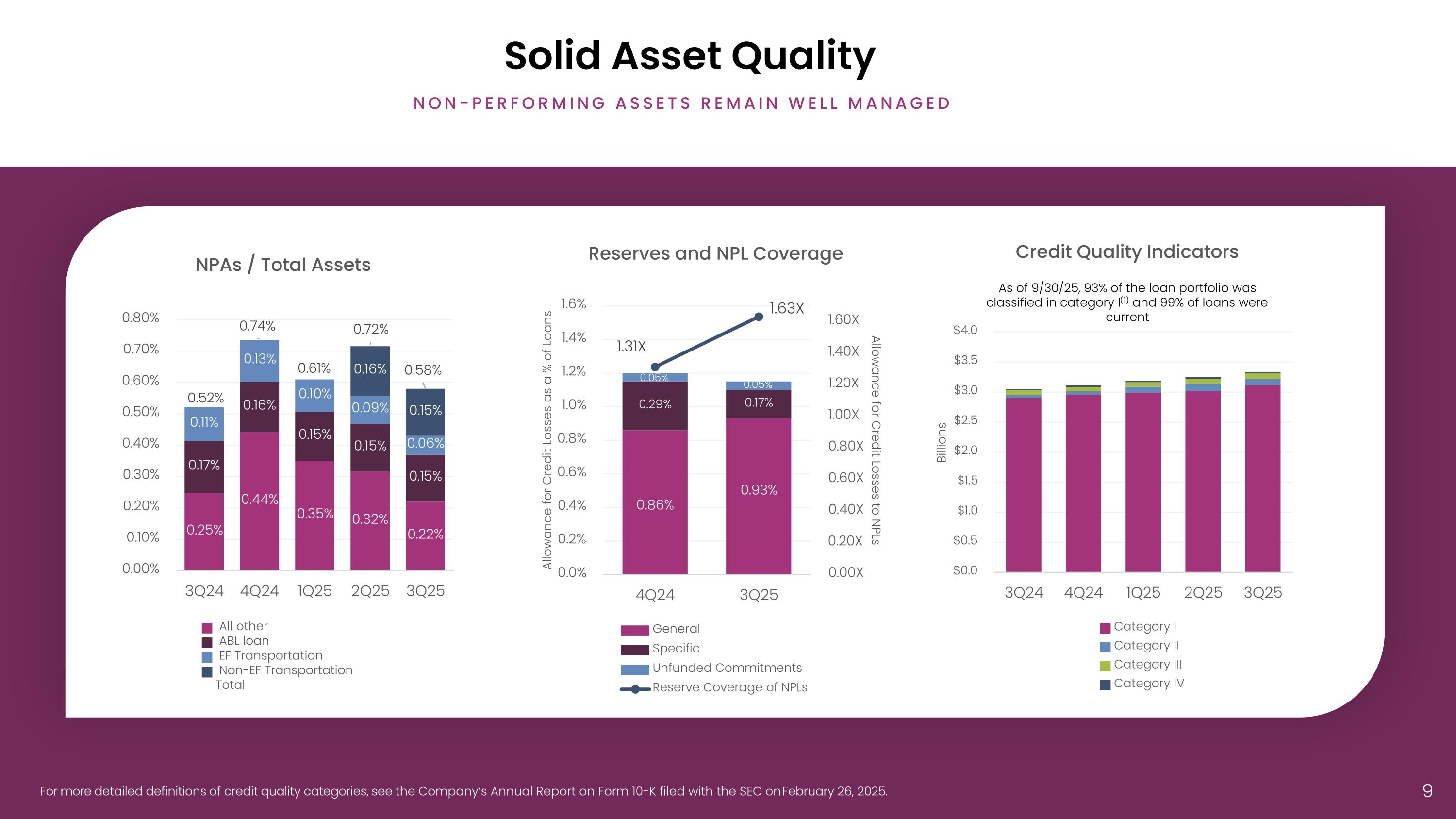

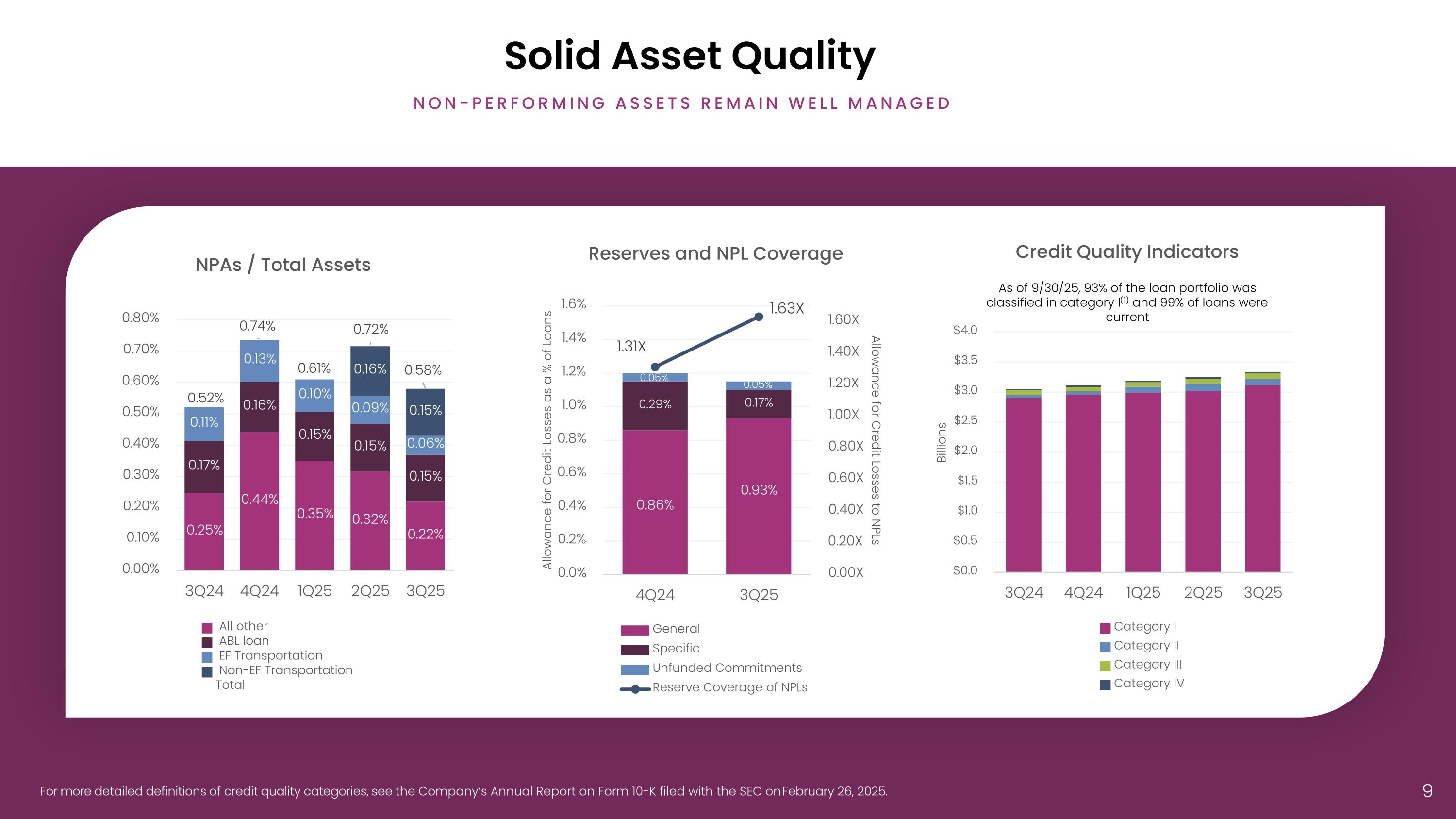

Solid Asset Quality NON-PERFORMING ASSETS REMAIN WELL MANAGED For more detailed definitions of credit quality categories, see the Company’s Annual Report on Form 10-K filed with the SEC on February 26, 2025. As of 9/30/25, 93% of the loan portfolio was classified in category I(1) and 99% of loans were current

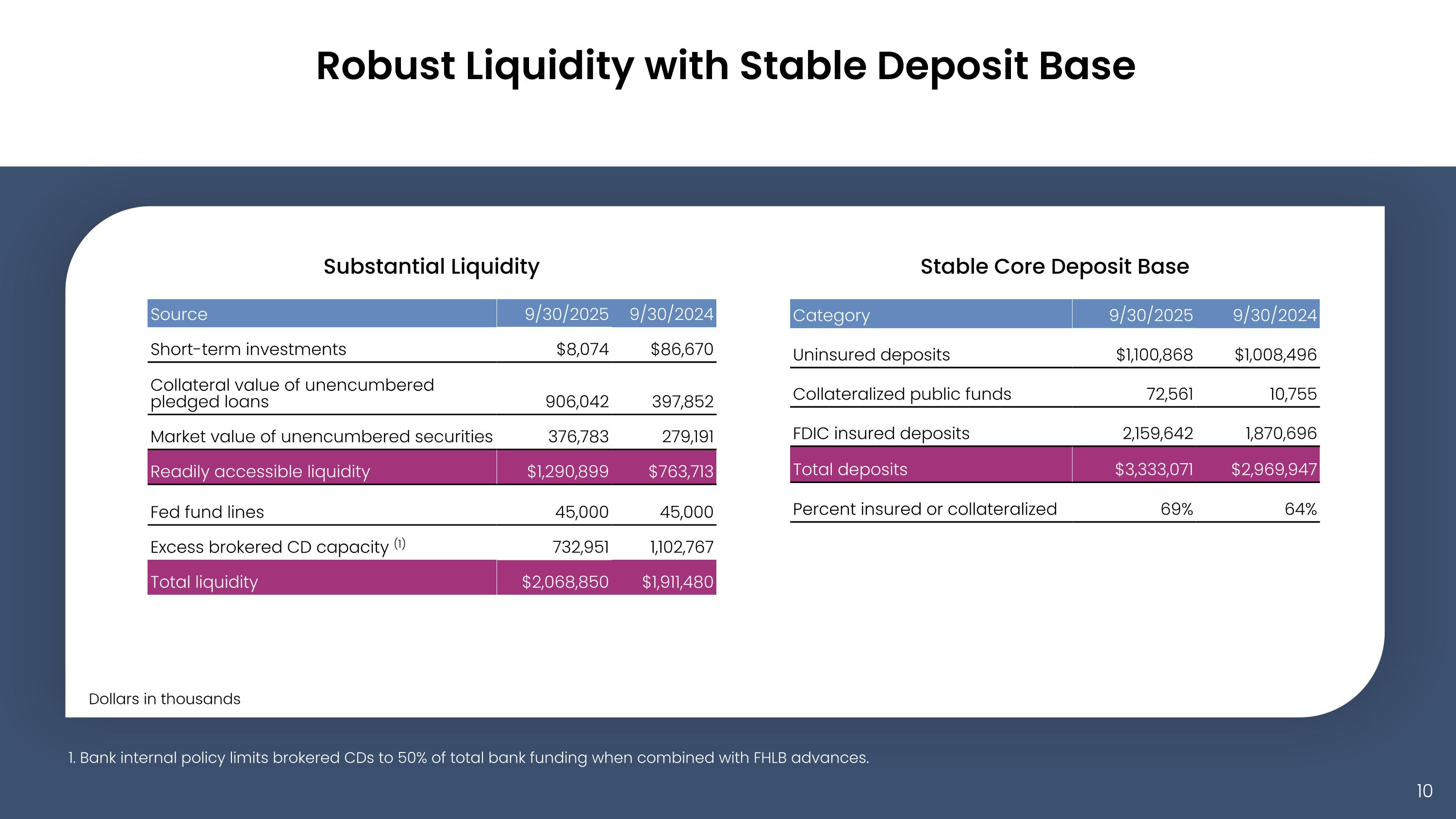

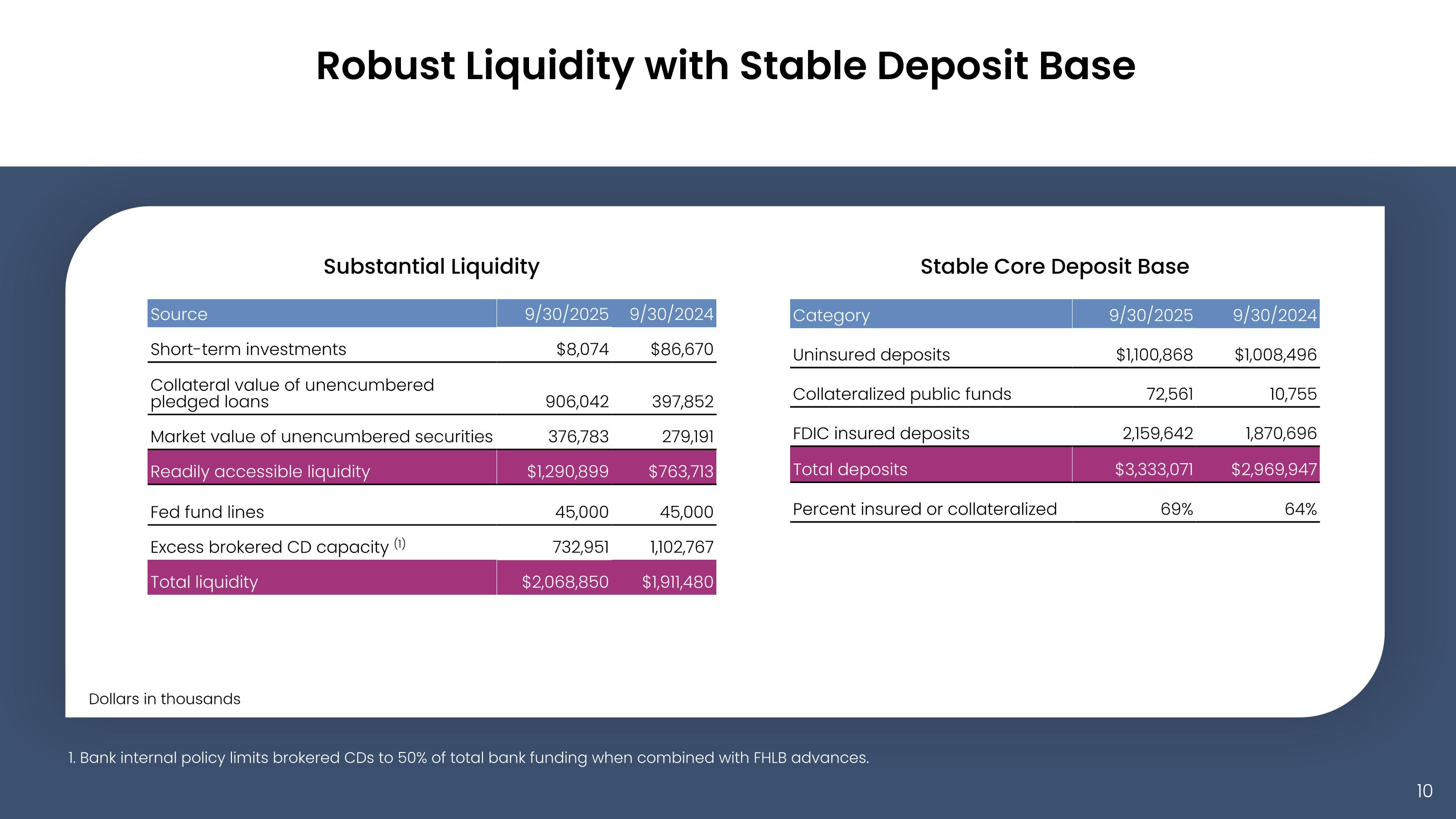

Robust Liquidity with Stable Deposit Base Stable Core Deposit Base Substantial Liquidity Source 9/30/2025 9/30/2024 Short-term investments $8,074 $86,670 Collateral value of unencumbered pledged loans 906,042 397,852 Market value of unencumbered securities 376,783 279,191 Readily accessible liquidity $1,290,899 $763,713 Fed fund lines 45,000 45,000 Excess brokered CD capacity (1) 732,951 1,102,767 Total liquidity $2,068,850 $1,911,480 1. Bank internal policy limits brokered CDs to 50% of total bank funding when combined with FHLB advances. Dollars in thousands Category 9/30/2025 9/30/2024 Uninsured deposits $1,100,868 $1,008,496 Collateralized public funds 72,561 10,755 FDIC insured deposits 2,159,642 1,870,696 Total deposits $3,333,071 $2,969,947 Percent insured or collateralized 69% 64%

Robust Capital Base Strong Capital Ratios (%) +17% LQ +16% YOY STRONG EARNINGS GENERATE CAPITAL FOR GROWTH 1. “Tangible Book Value Per Share" is a non‐GAAP measurement. Refer to the non-GAAP reconciliation schedule section of the Company’s Q3 earnings release.

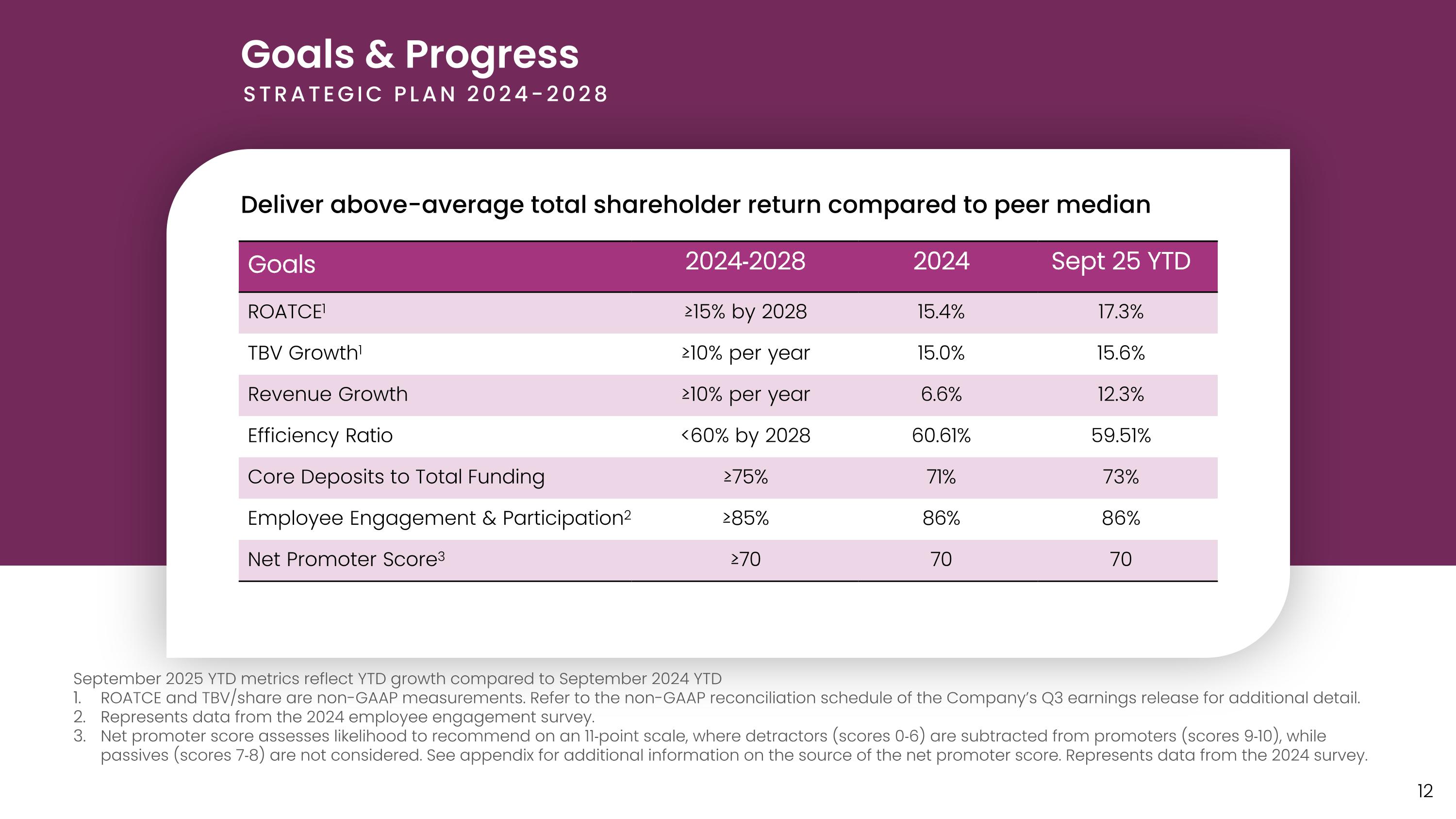

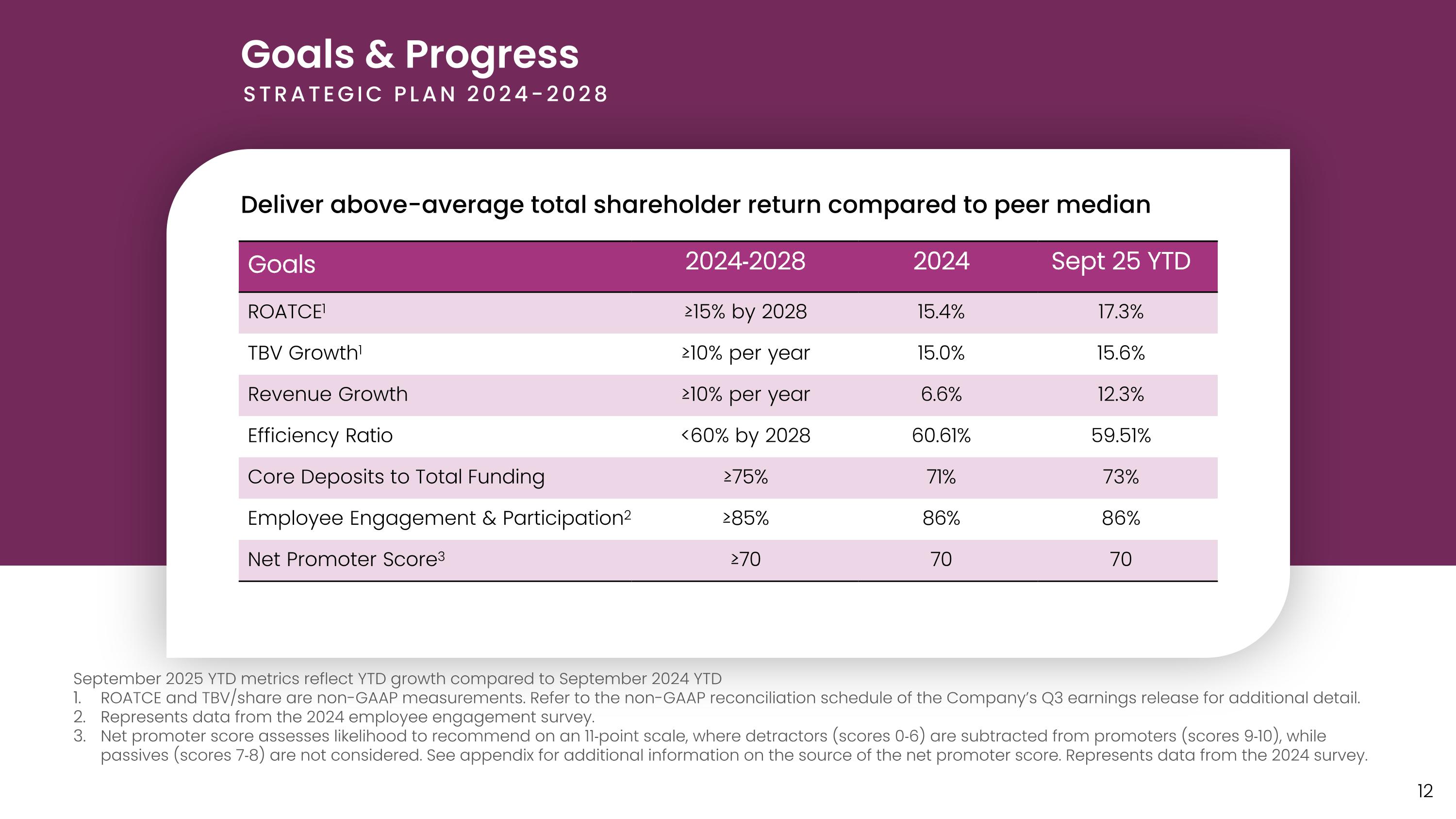

Deliver above-average total shareholder return compared to peer median September 2025 YTD metrics reflect YTD growth compared to September 2024 YTD ROATCE and TBV/share are non-GAAP measurements. Refer to the non-GAAP reconciliation schedule of the Company’s Q3 earnings release for additional detail. Represents data from the 2024 employee engagement survey. Net promoter score assesses likelihood to recommend on an 11‐point scale, where detractors (scores 0‐6) are subtracted from promoters (scores 9‐10), while passives (scores 7‐8) are not considered. See appendix for additional information on the source of the net promoter score. Represents data from the 2024 survey. Goals & Progress STRATEGIC PLAN 2024-2028 Goals 2024‐2028 2024 Sept 25 YTD ROATCE1 ≥15% by 2028 15.4% 17.3% TBV Growth1 ≥10% per year 15.0% 15.6% Revenue Growth ≥10% per year 6.6% 12.3% Efficiency Ratio <60% by 2028 60.61% 59.51% Core Deposits to Total Funding ≥75% 71% 73% Employee Engagement & Participation2 ≥85% 86% 86% Net Promoter Score3 ≥70 70 70