Q3’25 Earnings Presentation October 30, 2025 Exhibit 99.1

Statements in this release that are not historical are forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements, which are subject to known and unknown risks, uncertainties and assumptions about us, include, but are not limited to, statements regarding: our business strategy; anticipated future operating results and operating expenses, cash flows, capital resources and liquidity; trends, opportunities and risks affecting our business, industry and financial results; our ability to successfully leverage our existing business platform and portfolio of assets to produce low carbon products; the impact of trade policy on our business; the availability of raw materials; production volumes at our production facilities; and the anticipated cost and timing of our capital projects, including turnarounds. Forward-looking statements can generally be identified by words or phrases such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “will,” “may,” “plan,” “potential,” “should,” “would,” and similar words or phrases, as well as by discussions of strategy, plans or intentions. These statements are only predictions based on our current expectations and projections about future events. There are important factors that could cause our actual results, level of activity, performance or actual achievements to differ materially from the results, level of activity, performance or anticipated achievements expressed or implied by the forward-looking statements. Significant risks and uncertainties relate to, but are not limited to, business and market disruptions; market conditions and price volatility for our products and feedstocks; global and regional economic downturns that adversely affect the demand for our end-use products; disruptions in production at our manufacturing facilities; increased competitive pressures; our ability to fund the working capital and expansion of our businesses; recruiting and retaining skilled and qualified personnel; our ability to obtain necessary raw materials and purchased components; material increases in cost of raw materials; obtaining and maintaining necessary permits; and other financial, economic, competitive, environmental, political, legal and regulatory factors, including tariffs. These and other risk factors are discussed in the Company’s filings with the Securities and Exchange Commission, including but not limited to our most recent Annual Report on Form 10-K. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible for our management to predict all risks and uncertainties, nor can management assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, level of activity, performance or achievements. Neither we nor any other person assumes responsibility for the accuracy or completeness of any of these forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. Unless otherwise required by applicable laws, we undertake no obligation to update or revise any forward-looking statements, whether because of new information or future developments. Forward-Looking Statements

Stockholder Rights Plan Our Section 382 Stockholder Rights Plan as amended and restated (the “Rights Plan”), is intended to protect our substantial net operating losses (“NOLs”), carryforwards and other tax attributes. We can generally use our NOLs and other tax attributes to reduce federal and state income tax that would be paid in the future. Our ability to use our NOLs could be substantially limited if we experience an “ownership change,” as defined under Section 382 of the Internal Revenue Code of 1986, as amended (the “Code”), and the Rights Plan has been designed to help prevent such an “ownership change.” The Rights Plan provides that if any person becomes the beneficial owner (as defined in the Code) of 4.9% or more of our common stock, stockholders other than the triggering stockholder will be entitled to acquire shares of common stock at a 50% discount or LSB may exchange each right held by such holders for one share of common stock. Under the Rights Plan, any person who currently owns 4.9% or more of LSB’s common stock may continue to own its shares of common stock but may not acquire any additional shares without triggering the Rights Plan. Our Board of Directors has the discretion to exempt any person or group from the provisions of the Rights Plan. The Rights Plan is in effect until August 22, 2026, unless terminated earlier in accordance with its terms. In Place to Preserve Substantial NOL’s

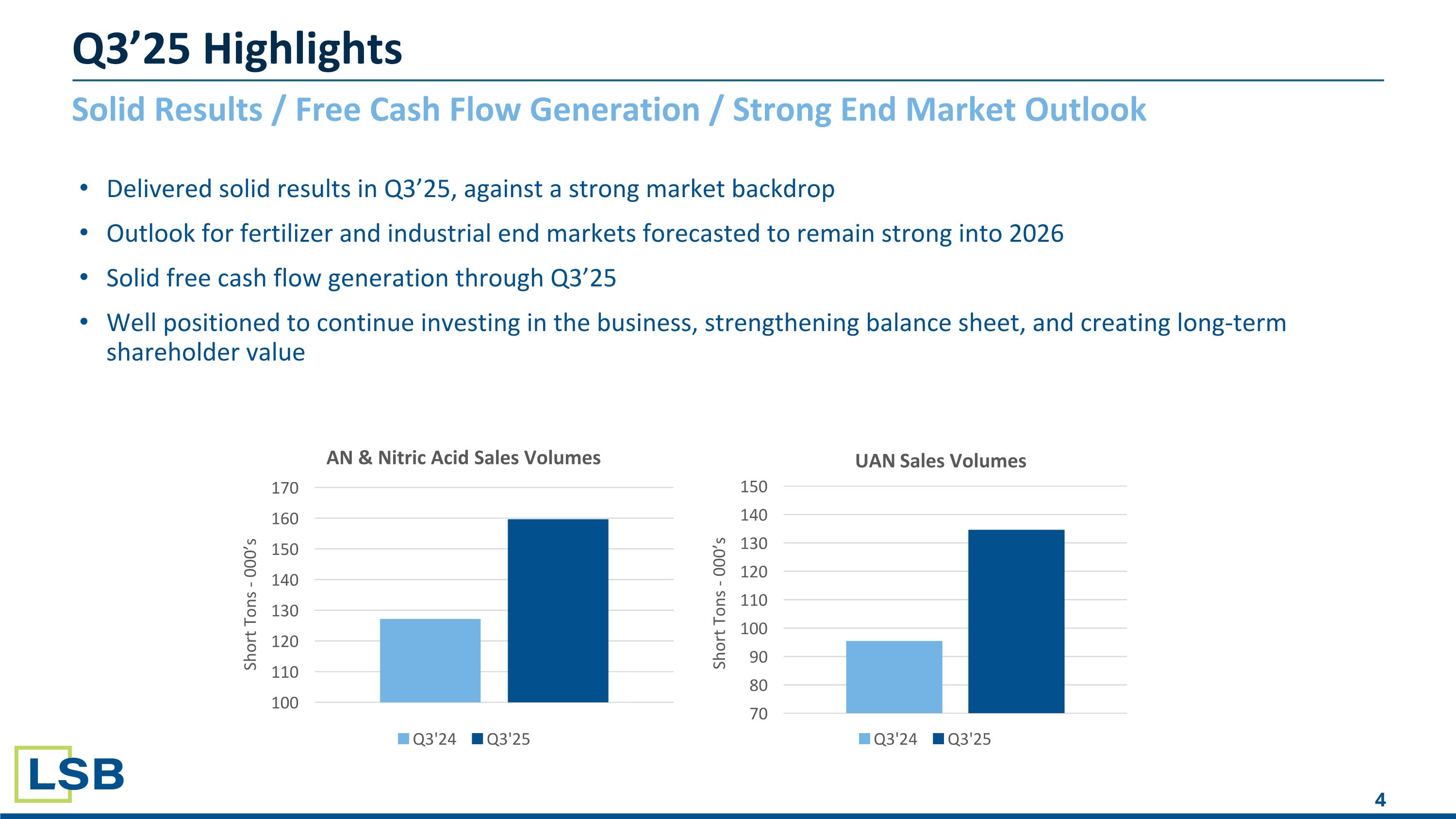

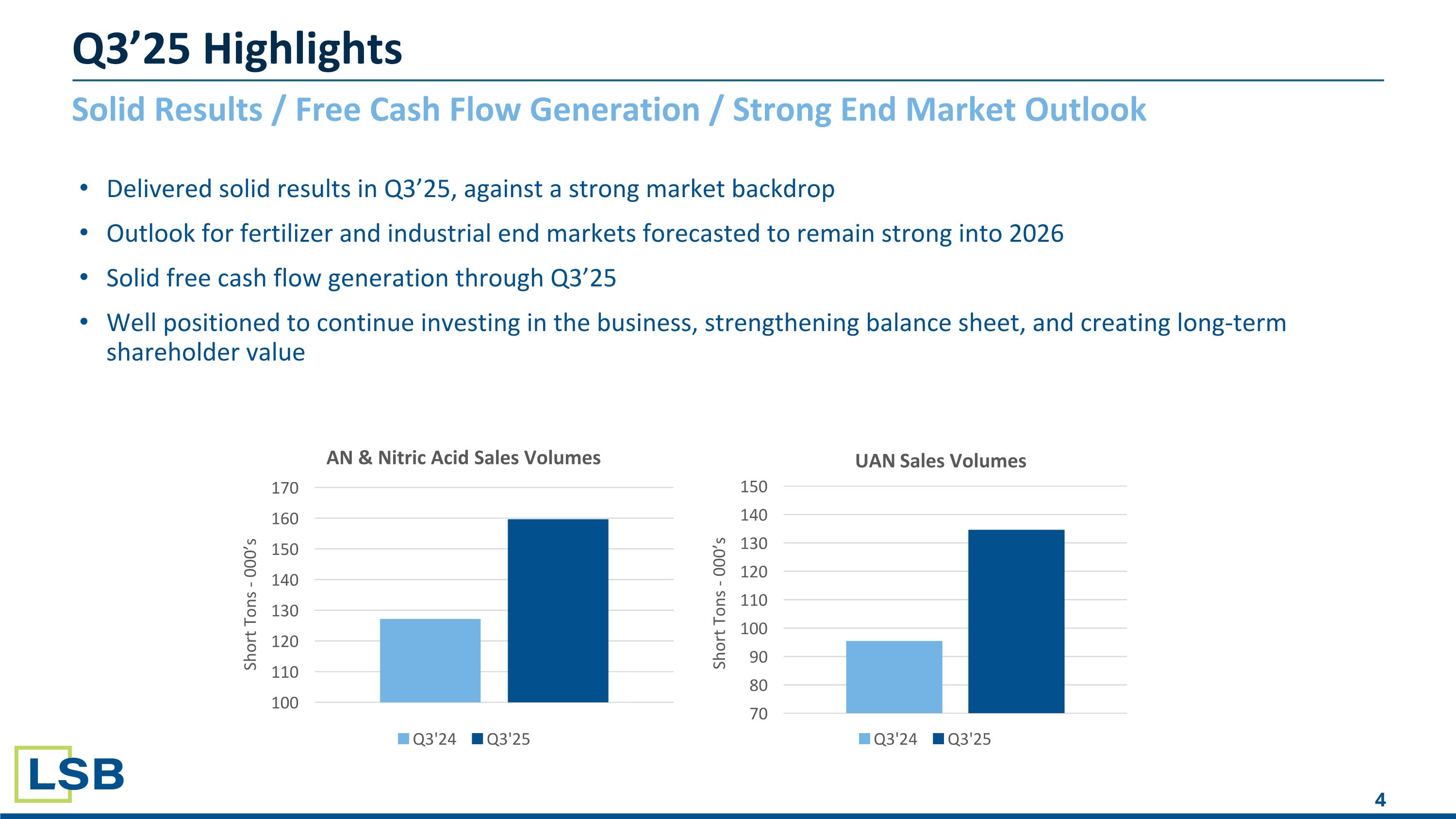

Solid Results / Free Cash Flow Generation / Strong End Market Outlook Q3’25 Highlights Delivered solid results in Q3’25, against a strong market backdrop Outlook for fertilizer and industrial end markets forecasted to remain strong into 2026 Solid free cash flow generation through Q3’25 Well positioned to continue investing in the business, strengthening balance sheet, and creating long-term shareholder value

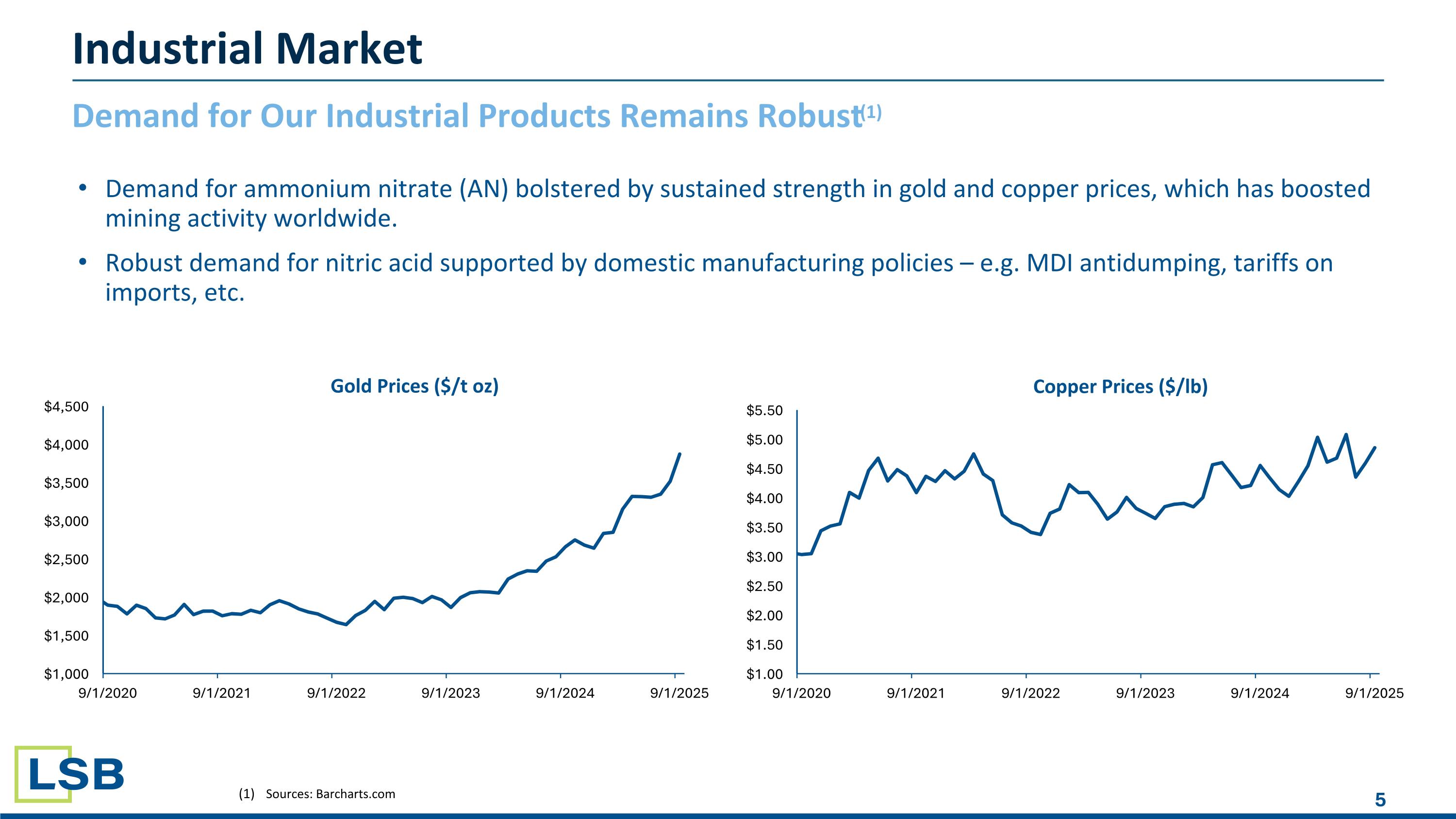

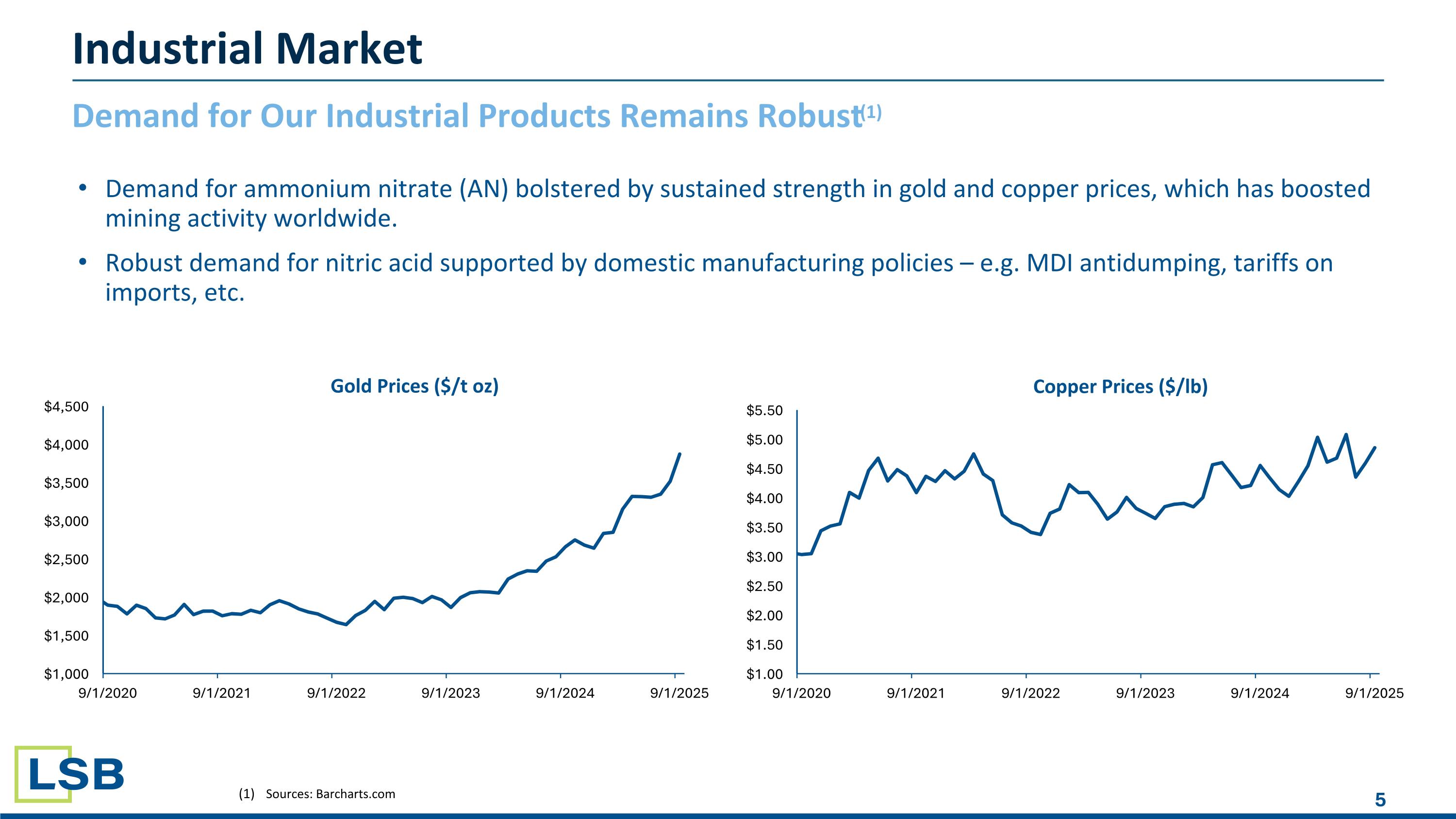

Demand for ammonium nitrate (AN) bolstered by sustained strength in gold and copper prices, which has boosted mining activity worldwide. Robust demand for nitric acid supported by domestic manufacturing policies – e.g. MDI antidumping, tariffs on imports, etc. Demand for Our Industrial Products Remains Robust(1) Sources: Barcharts.com Industrial Market

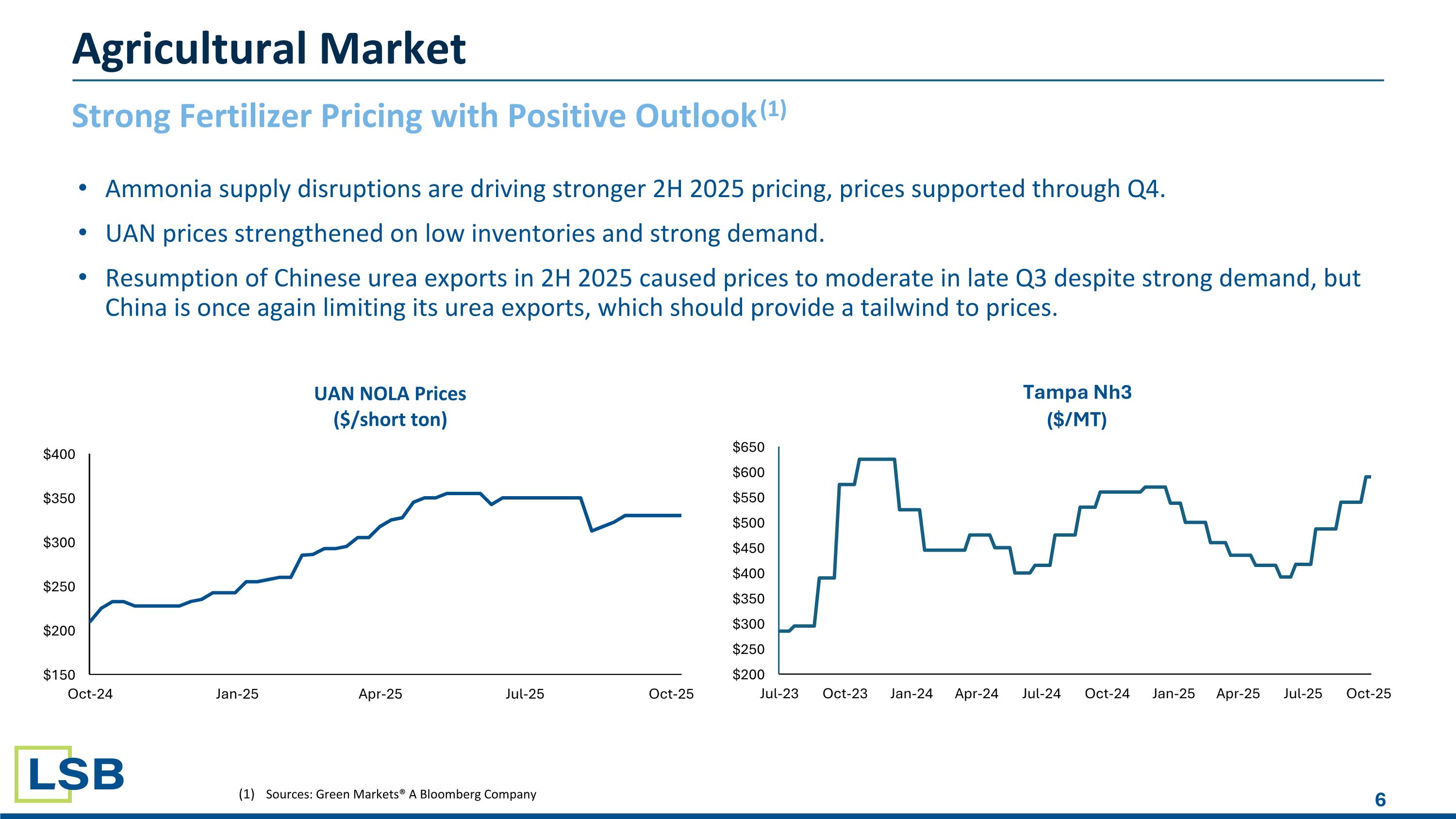

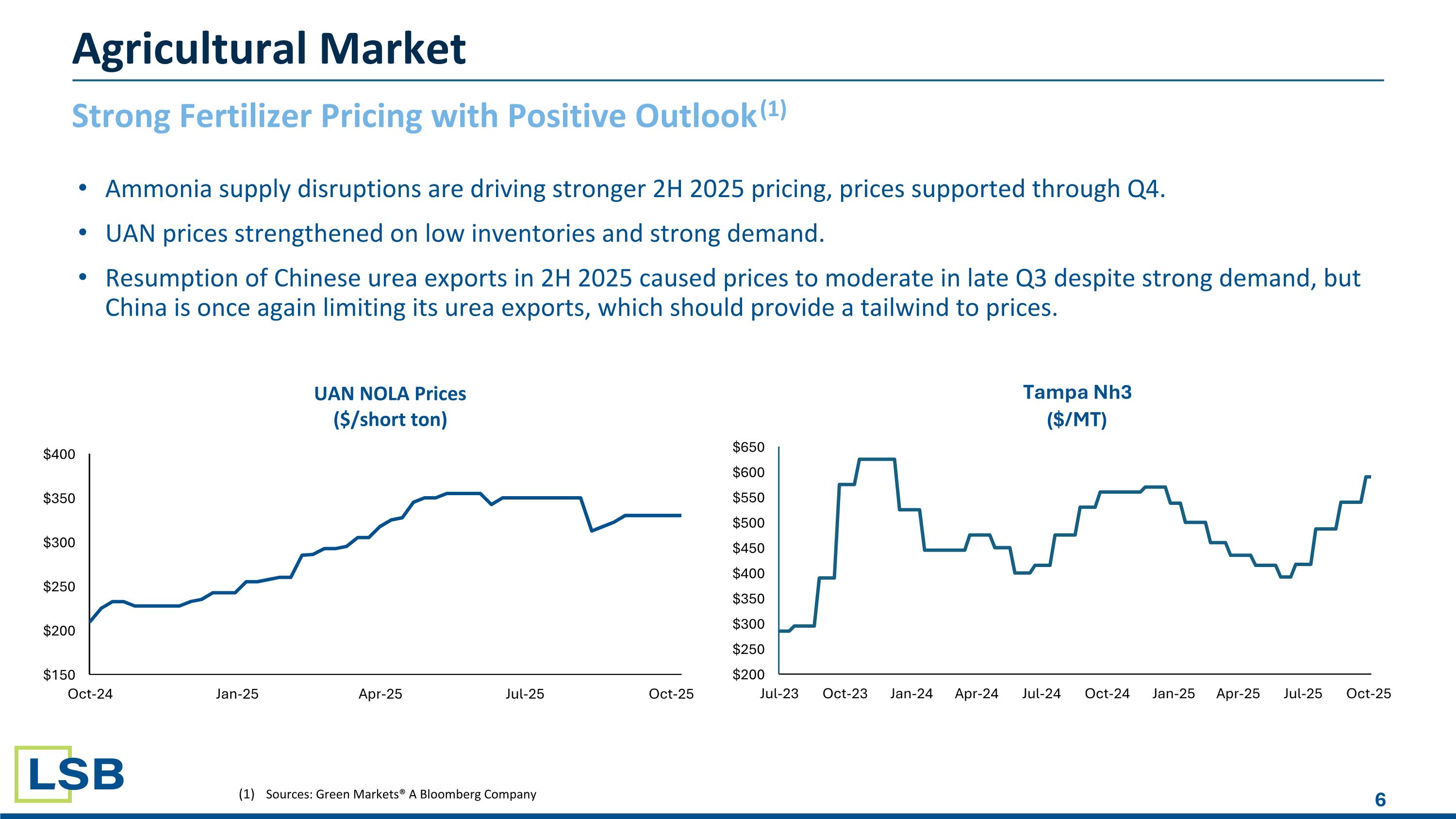

Strong Fertilizer Pricing with Positive Outlook (1) Sources: Green Markets® A Bloomberg Company Agricultural Market Ammonia supply disruptions are driving stronger 2H 2025 pricing, prices supported through Q4. UAN prices strengthened on low inventories and strong demand. Resumption of Chinese urea exports in 2H 2025 caused prices to moderate in late Q3 despite strong demand, but China is once again limiting its urea exports, which should provide a tailwind to prices.

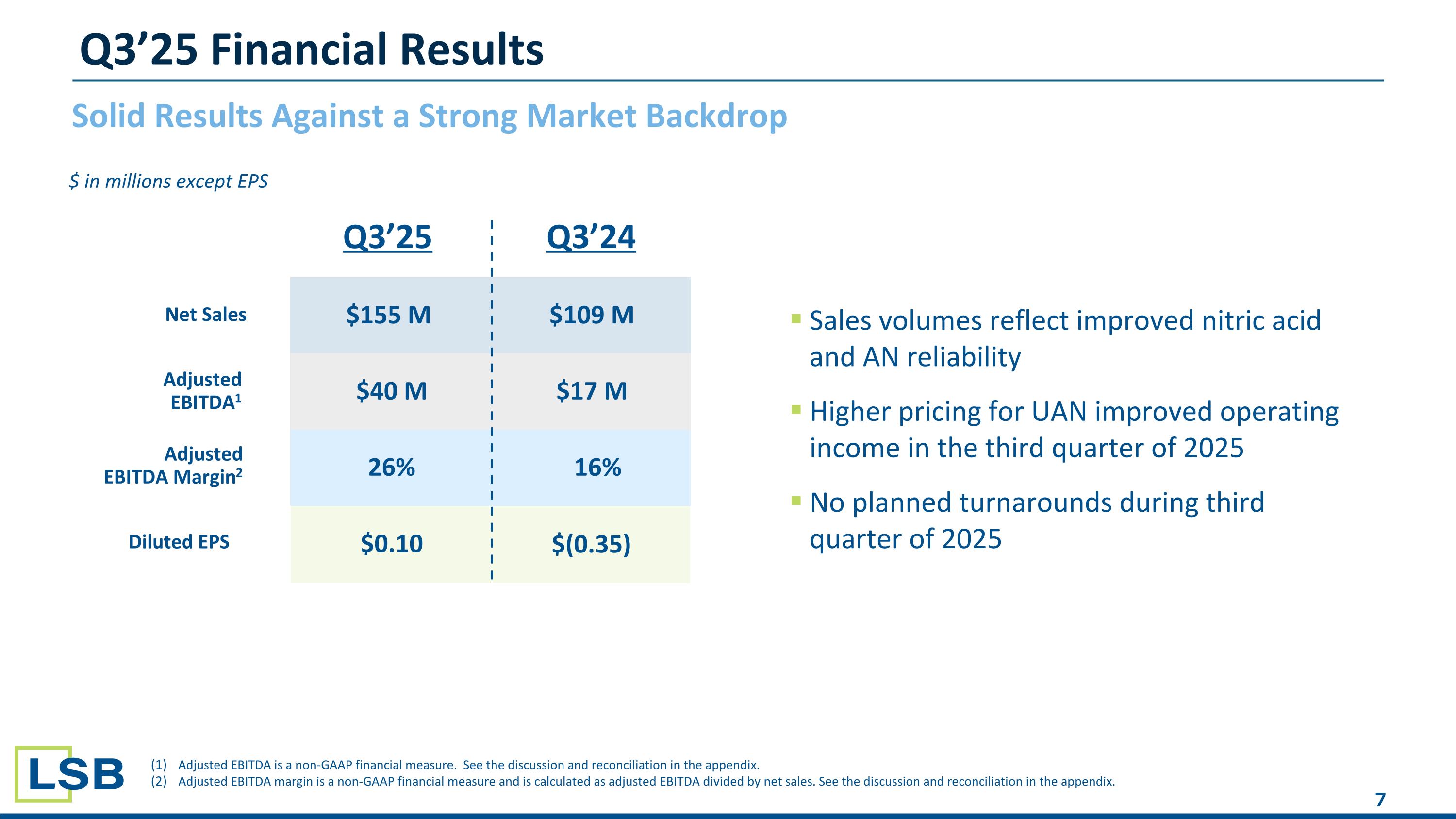

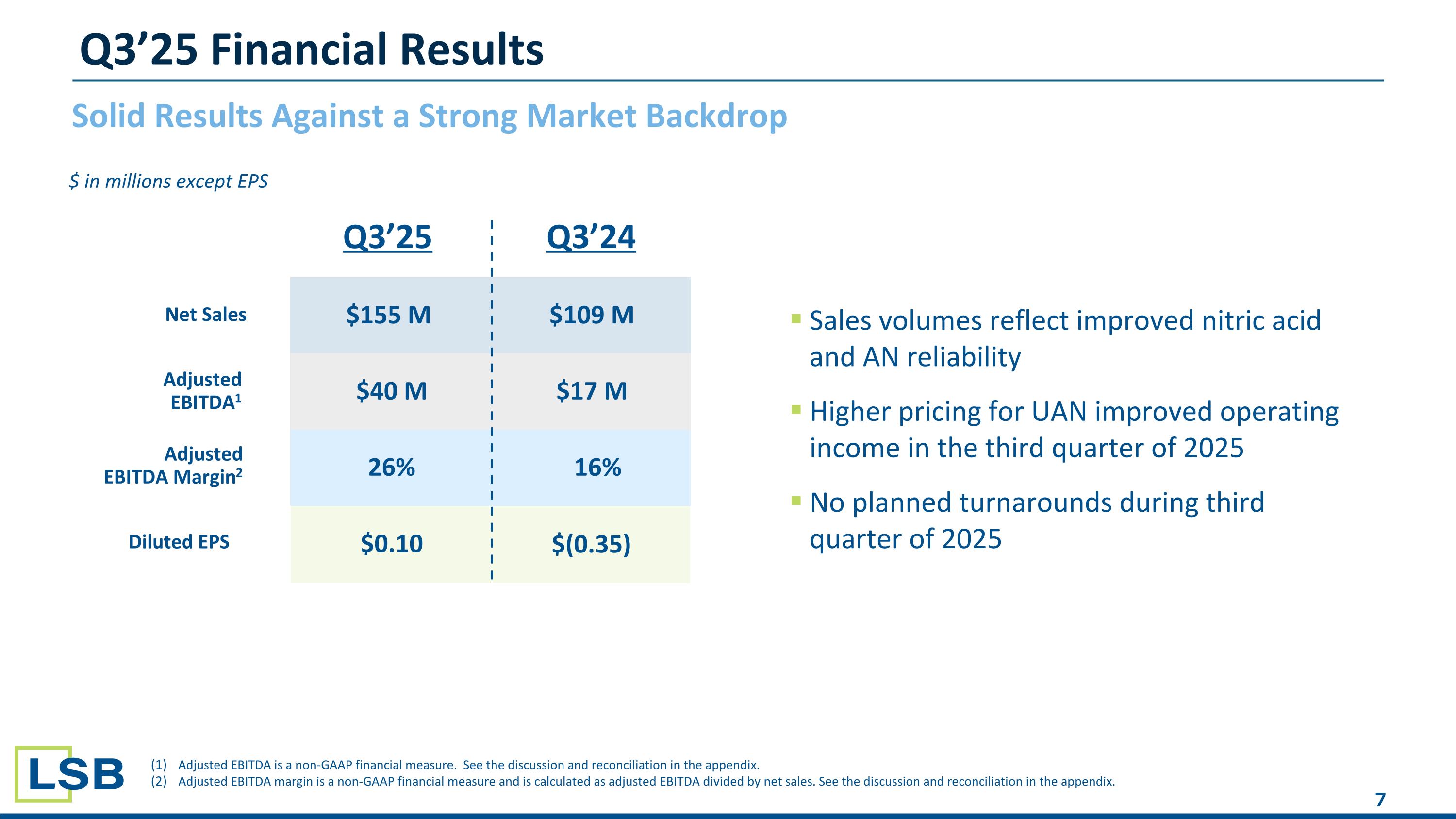

Solid Results Against a Strong Market Backdrop Adjusted EBITDA is a non-GAAP financial measure. See the discussion and reconciliation in the appendix. Adjusted EBITDA margin is a non-GAAP financial measure and is calculated as adjusted EBITDA divided by net sales. See the discussion and reconciliation in the appendix. Q3’25 Q3’24 Net Sales Adjusted EBITDA1 Adjusted EBITDA Margin2 $155 M $109 M $40 M $17 M 26% 16% $0.10 $(0.35) Diluted EPS Sales volumes reflect improved nitric acidand AN reliability Higher pricing for UAN improved operating income in the third quarter of 2025 No planned turnarounds during thirdquarter of 2025 Q3’25 Financial Results $ in millions except EPS

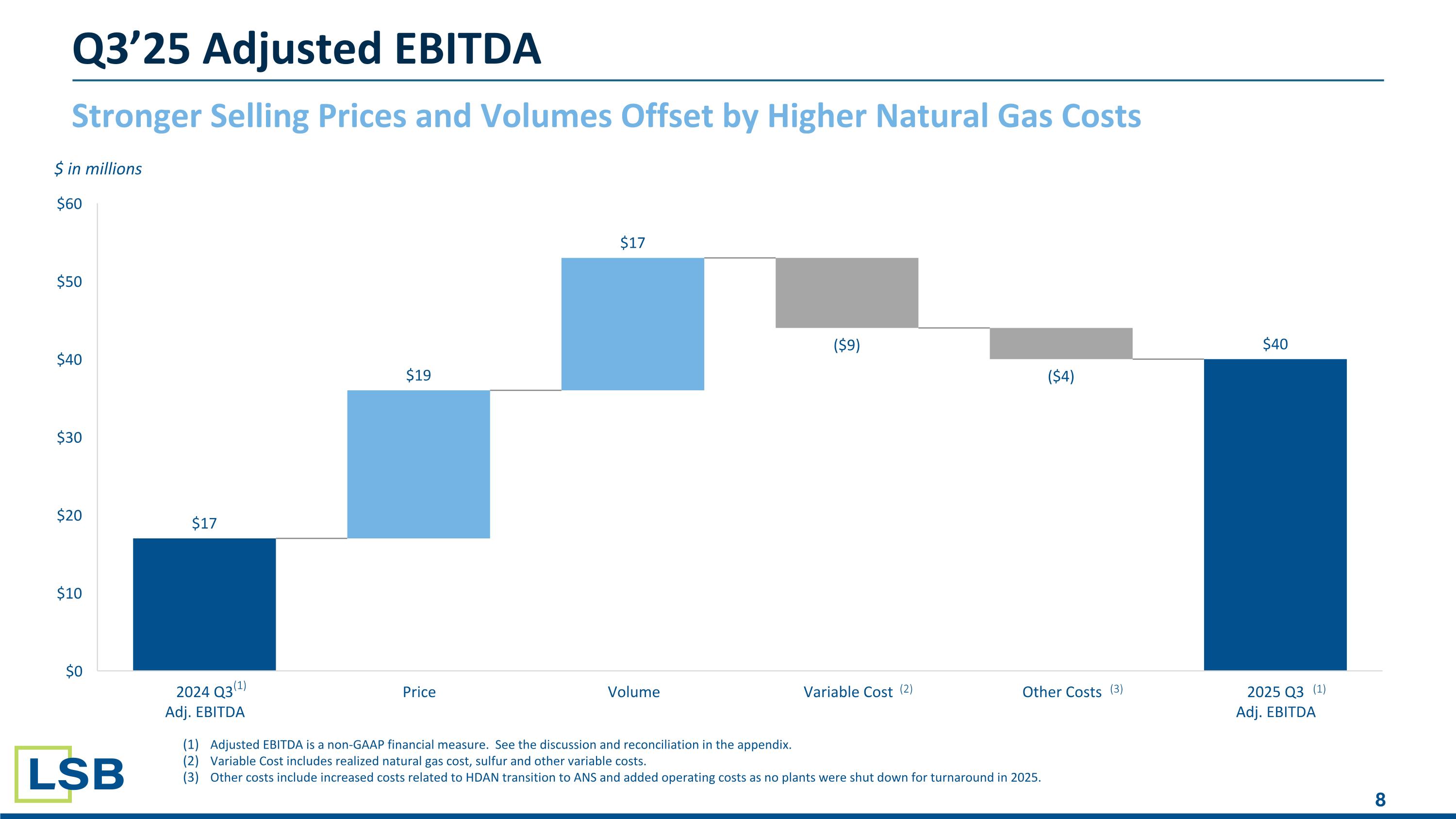

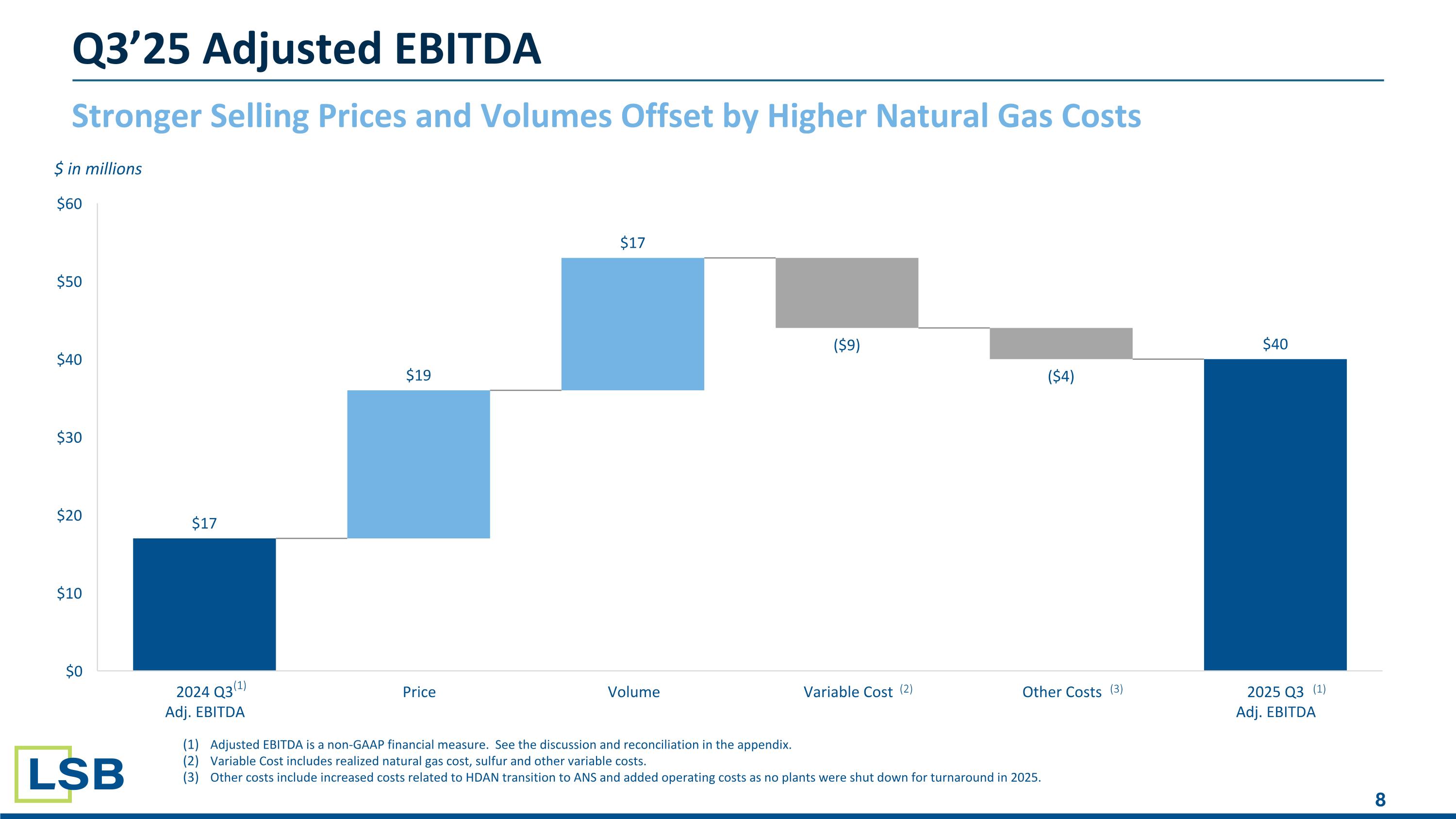

Stronger Selling Prices and Volumes Offset by Higher Natural Gas Costs Q3’25 Adjusted EBITDA (1) Adjusted EBITDA is a non-GAAP financial measure. See the discussion and reconciliation in the appendix. Variable Cost includes realized natural gas cost, sulfur and other variable costs. Other costs include increased costs related to HDAN transition to ANS and added operating costs as no plants were shut down for turnaround in 2025. (2) $ in millions (3) (1)

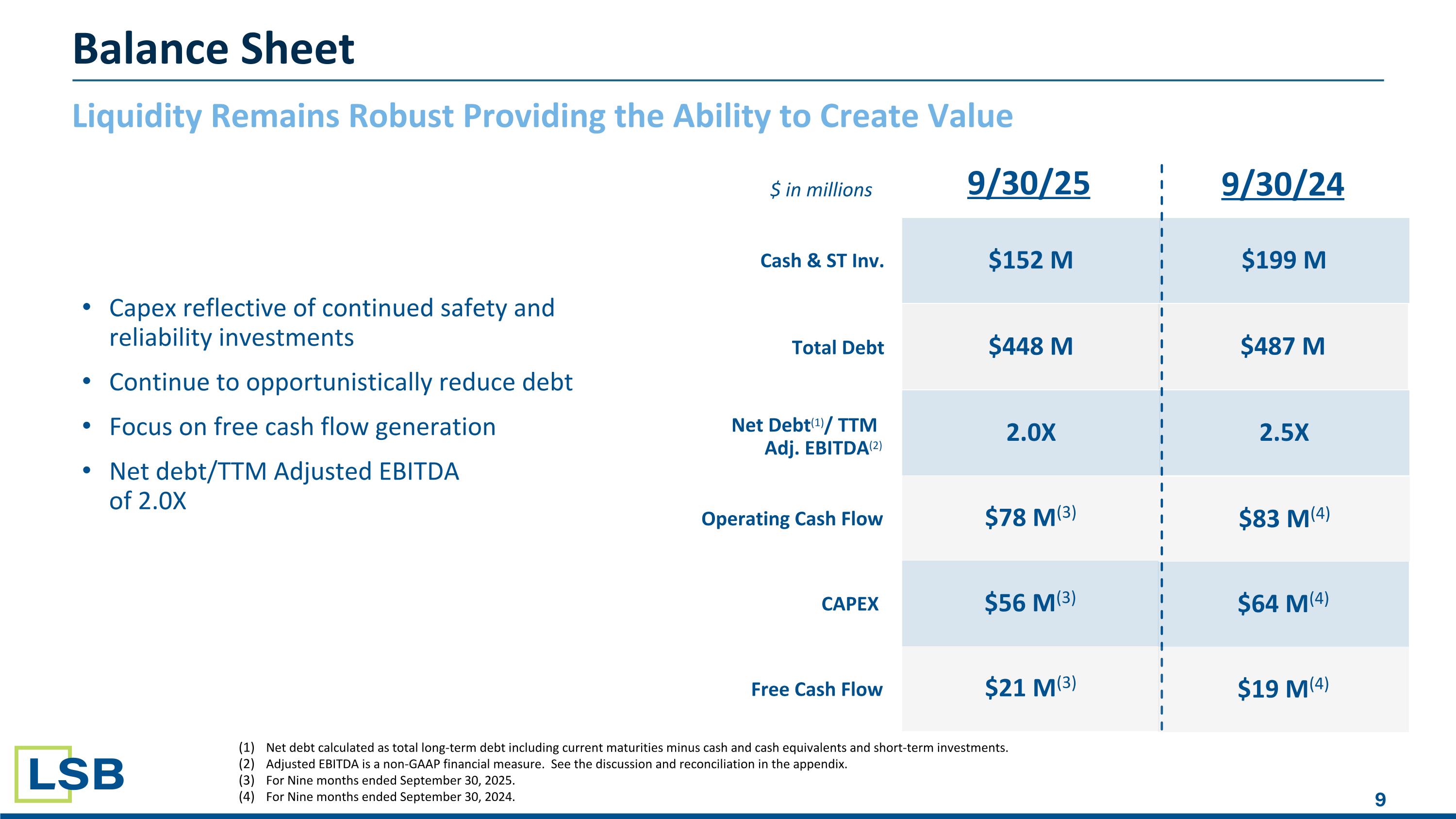

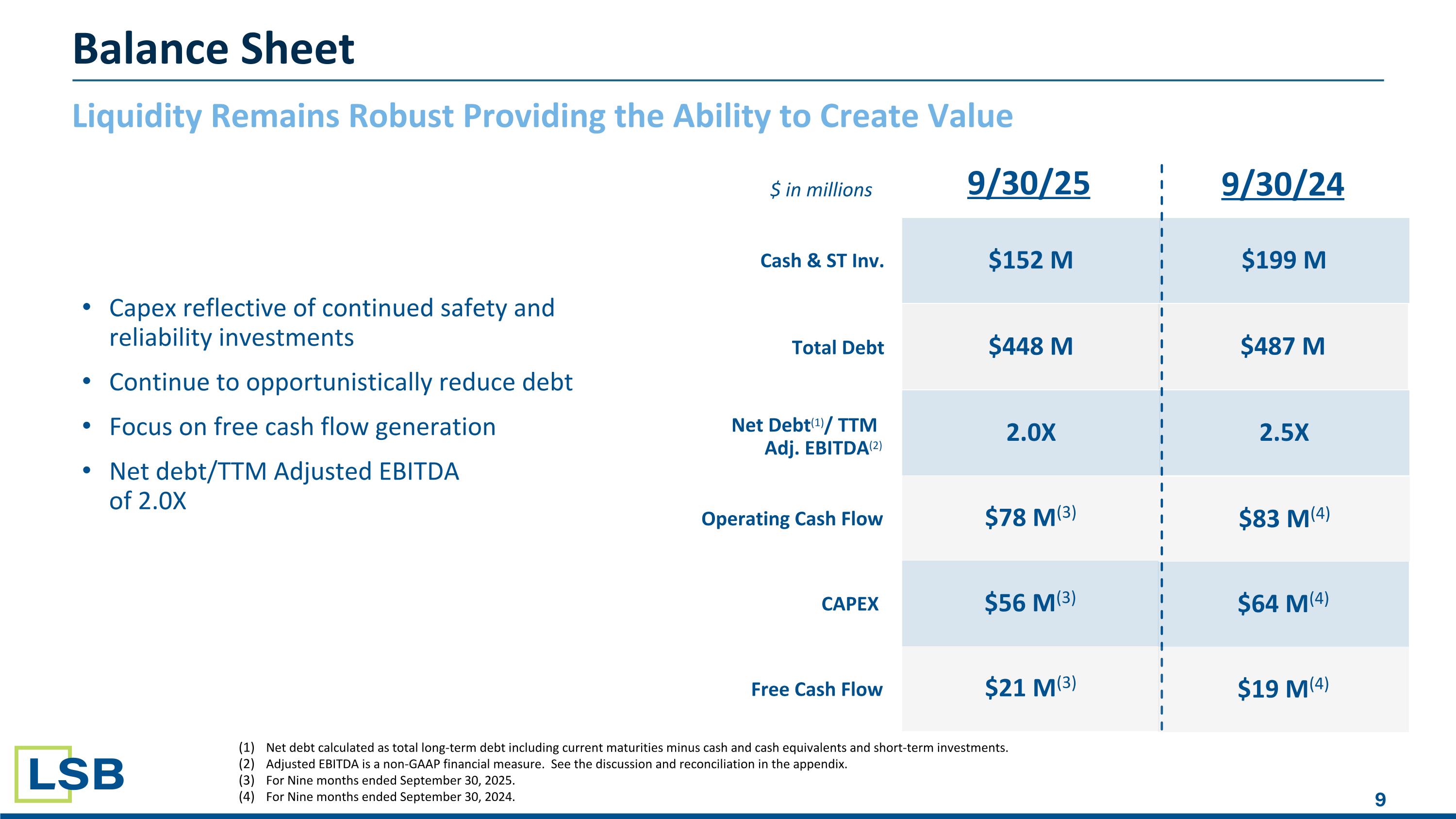

Capex reflective of continued safety andreliability investments Continue to opportunistically reduce debt Focus on free cash flow generation Net debt/TTM Adjusted EBITDAof 2.0X Net debt calculated as total long-term debt including current maturities minus cash and cash equivalents and short-term investments. Adjusted EBITDA is a non-GAAP financial measure. See the discussion and reconciliation in the appendix. For Nine months ended September 30, 2025. For Nine months ended September 30, 2024. Liquidity Remains Robust Providing the Ability to Create Value Balance Sheet $78 M(3) $152 M $199 M $448 M $487 M $56 M(3) $64 M(4) $83 M(4) 2.0X 2.5X 9/30/25 9/30/24 Cash & ST Inv. Total Debt CAPEX Operating Cash Flow Net Debt(1)/ TTM Adj. EBITDA(2) $ in millions $21 M(3) $19 M(4) Free Cash Flow

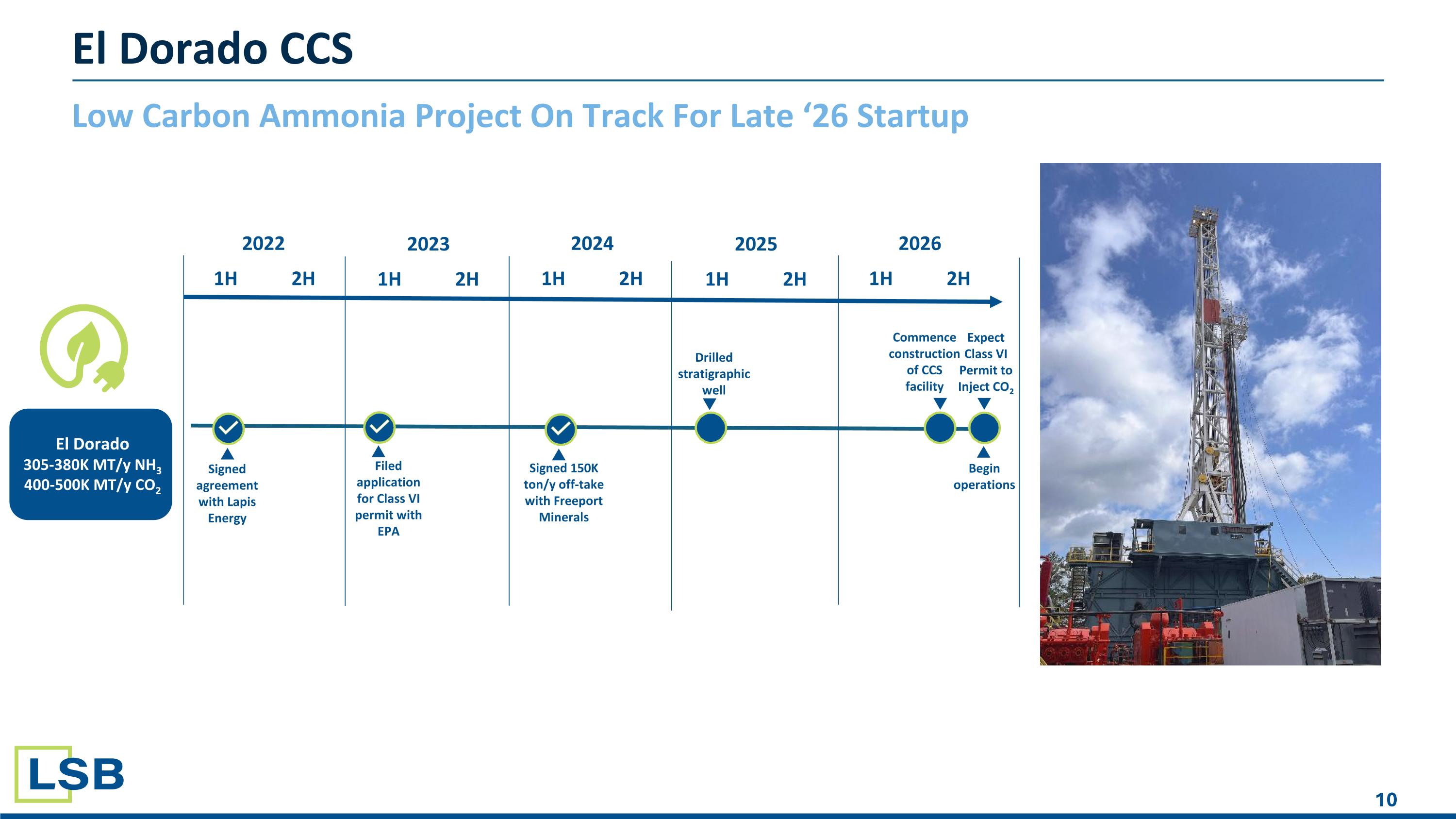

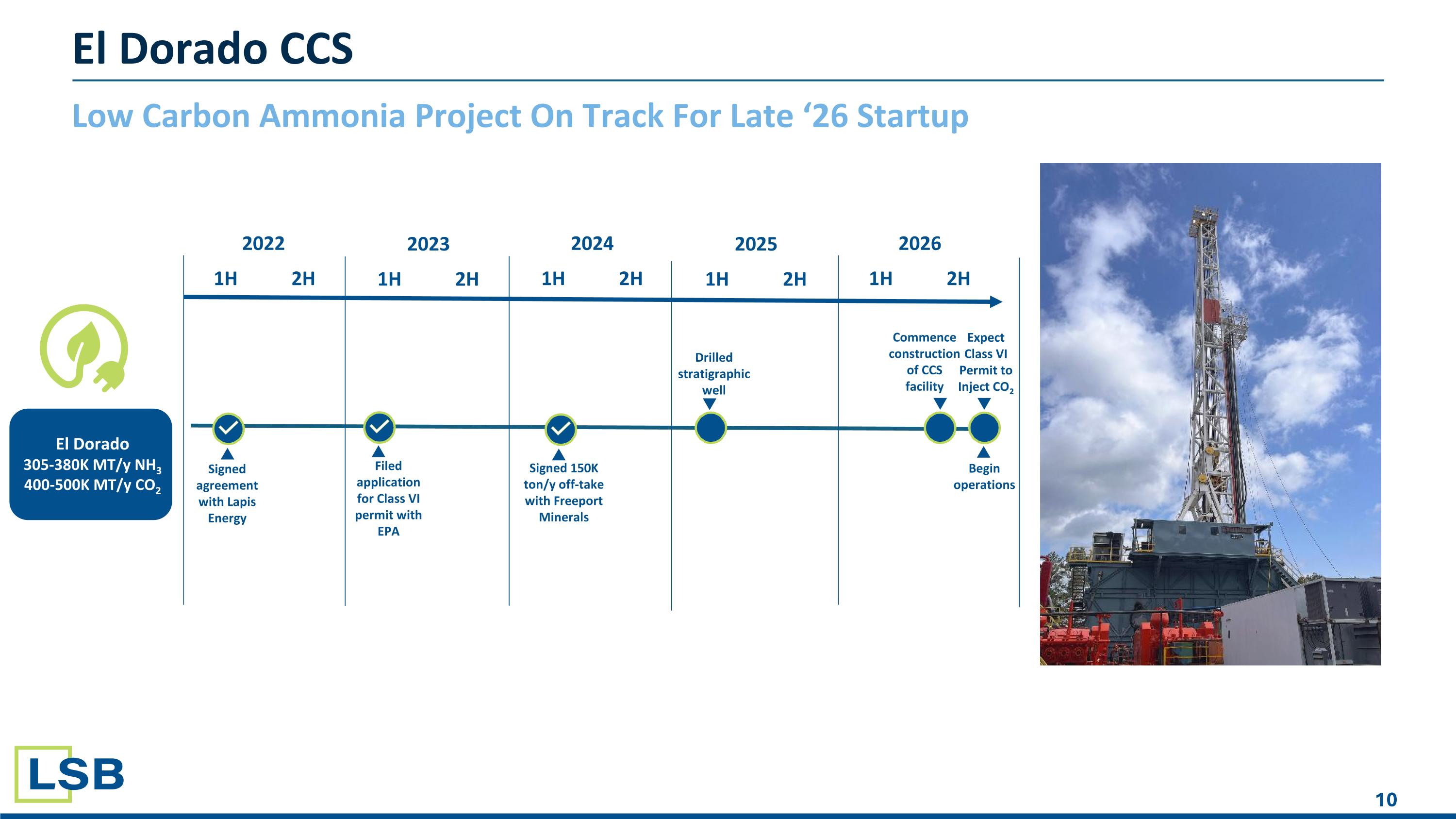

Commence construction of CCS facility Drilled stratigraphic well Signed 150K ton/y off-take with Freeport Minerals Filed application for Class VI permit with EPA Low Carbon Ammonia Project On Track For Late ‘26 Startup 2022 1H 2H El Dorado 305-380K MT/y NH3 400-500K MT/y CO2 Signed agreement with Lapis Energy 2023 1H 2H 2024 1H 2H 2025 1H 2H 2026 1H 2H Begin operations Expect Class VI Permit to Inject CO2 El Dorado CCS

Appendix

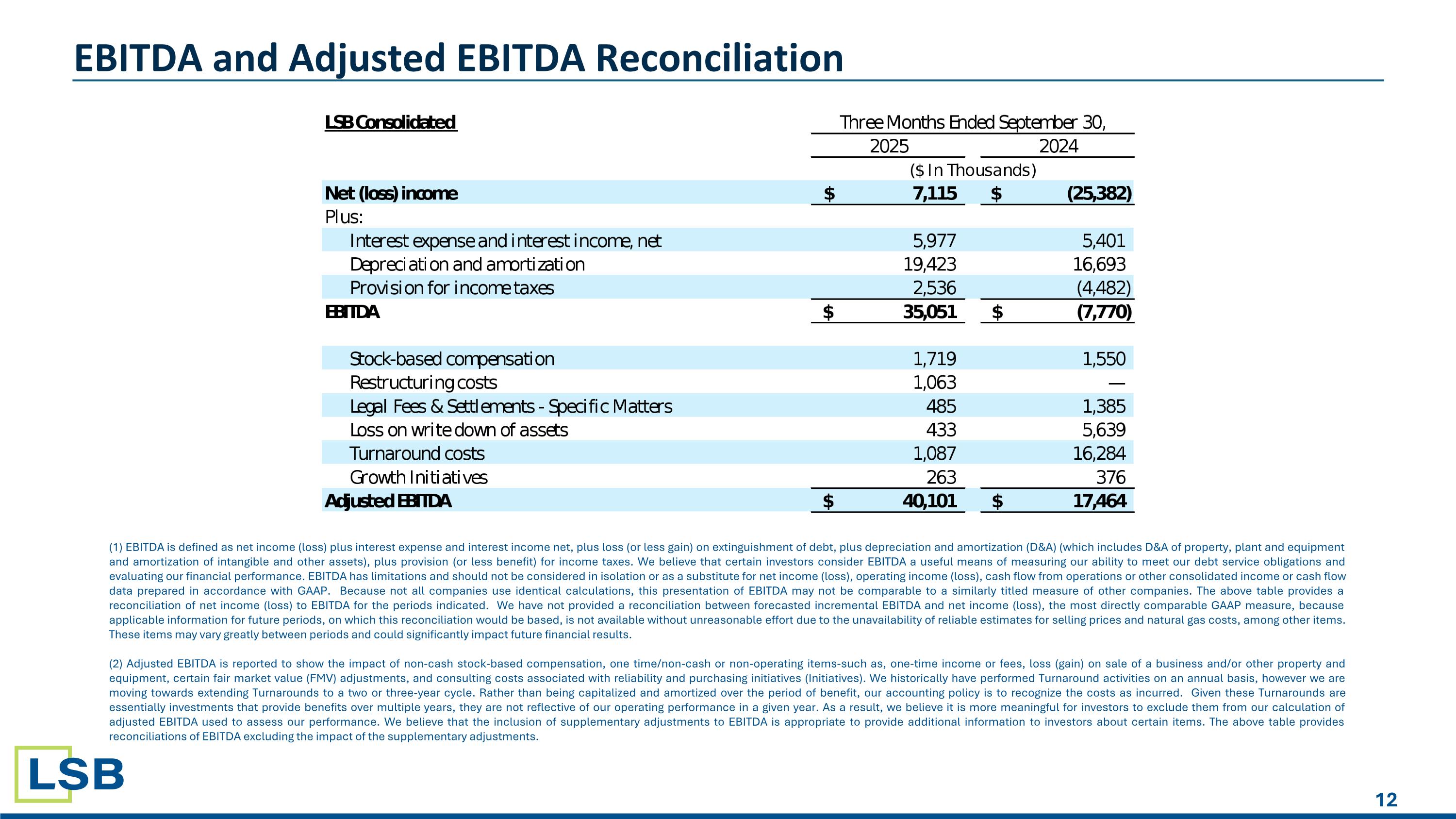

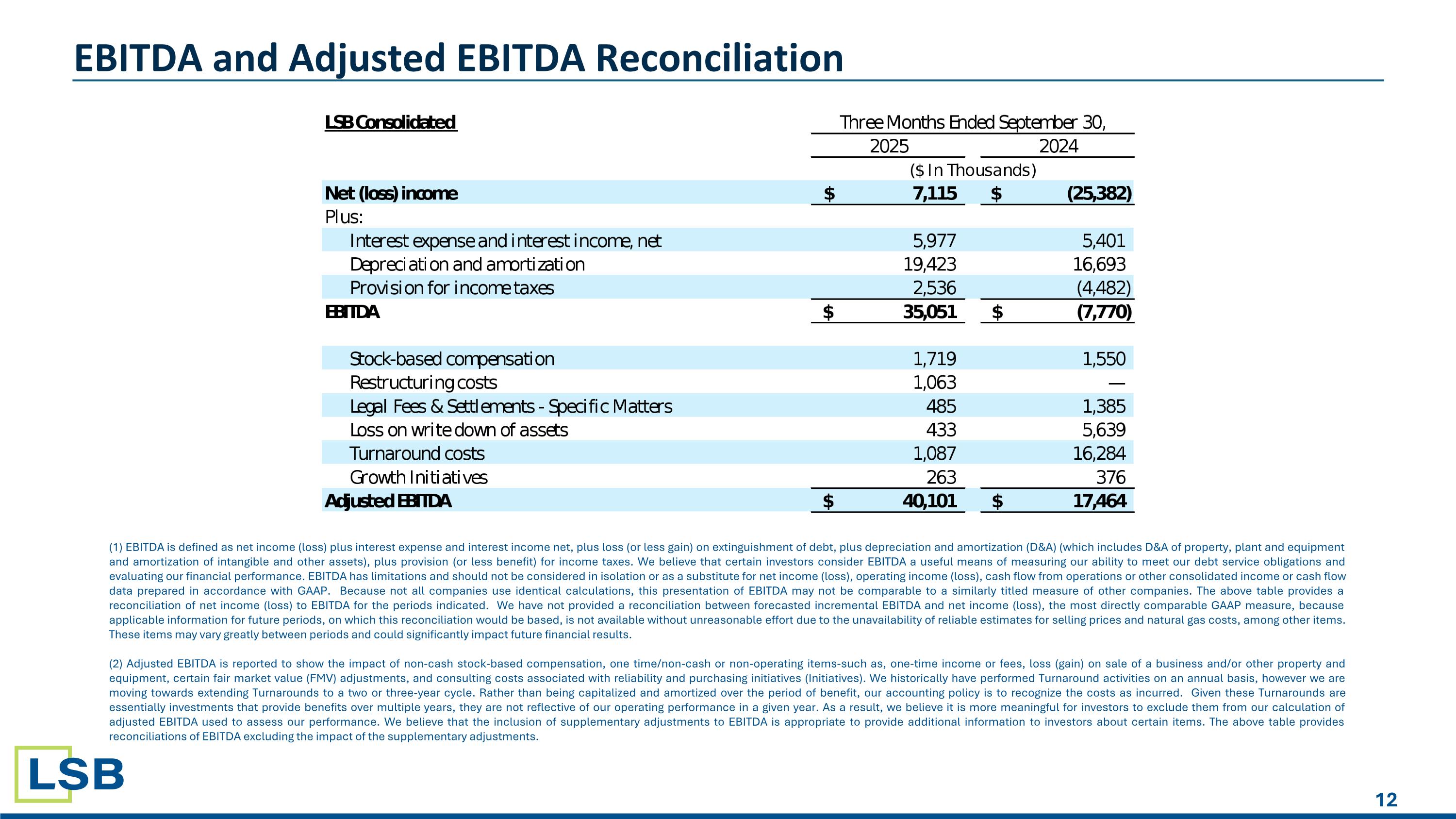

EBITDA and Adjusted EBITDA Reconciliation (1) EBITDA is defined as net income (loss) plus interest expense and interest income net, plus loss (or less gain) on extinguishment of debt, plus depreciation and amortization (D&A) (which includes D&A of property, plant and equipment and amortization of intangible and other assets), plus provision (or less benefit) for income taxes. We believe that certain investors consider EBITDA a useful means of measuring our ability to meet our debt service obligations and evaluating our financial performance. EBITDA has limitations and should not be considered in isolation or as a substitute for net income (loss), operating income (loss), cash flow from operations or other consolidated income or cash flow data prepared in accordance with GAAP. Because not all companies use identical calculations, this presentation of EBITDA may not be comparable to a similarly titled measure of other companies. The above table provides a reconciliation of net income (loss) to EBITDA for the periods indicated. We have not provided a reconciliation between forecasted incremental EBITDA and net income (loss), the most directly comparable GAAP measure, because applicable information for future periods, on which this reconciliation would be based, is not available without unreasonable effort due to the unavailability of reliable estimates for selling prices and natural gas costs, among other items. These items may vary greatly between periods and could significantly impact future financial results. (2) Adjusted EBITDA is reported to show the impact of non-cash stock-based compensation, one time/non-cash or non-operating items-such as, one-time income or fees, loss (gain) on sale of a business and/or other property and equipment, certain fair market value (FMV) adjustments, and consulting costs associated with reliability and purchasing initiatives (Initiatives). We historically have performed Turnaround activities on an annual basis, however we are moving towards extending Turnarounds to a two or three-year cycle. Rather than being capitalized and amortized over the period of benefit, our accounting policy is to recognize the costs as incurred. Given these Turnarounds are essentially investments that provide benefits over multiple years, they are not reflective of our operating performance in a given year. As a result, we believe it is more meaningful for investors to exclude them from our calculation of adjusted EBITDA used to assess our performance. We believe that the inclusion of supplementary adjustments to EBITDA is appropriate to provide additional information to investors about certain items. The above table provides reconciliations of EBITDA excluding the impact of the supplementary adjustments.

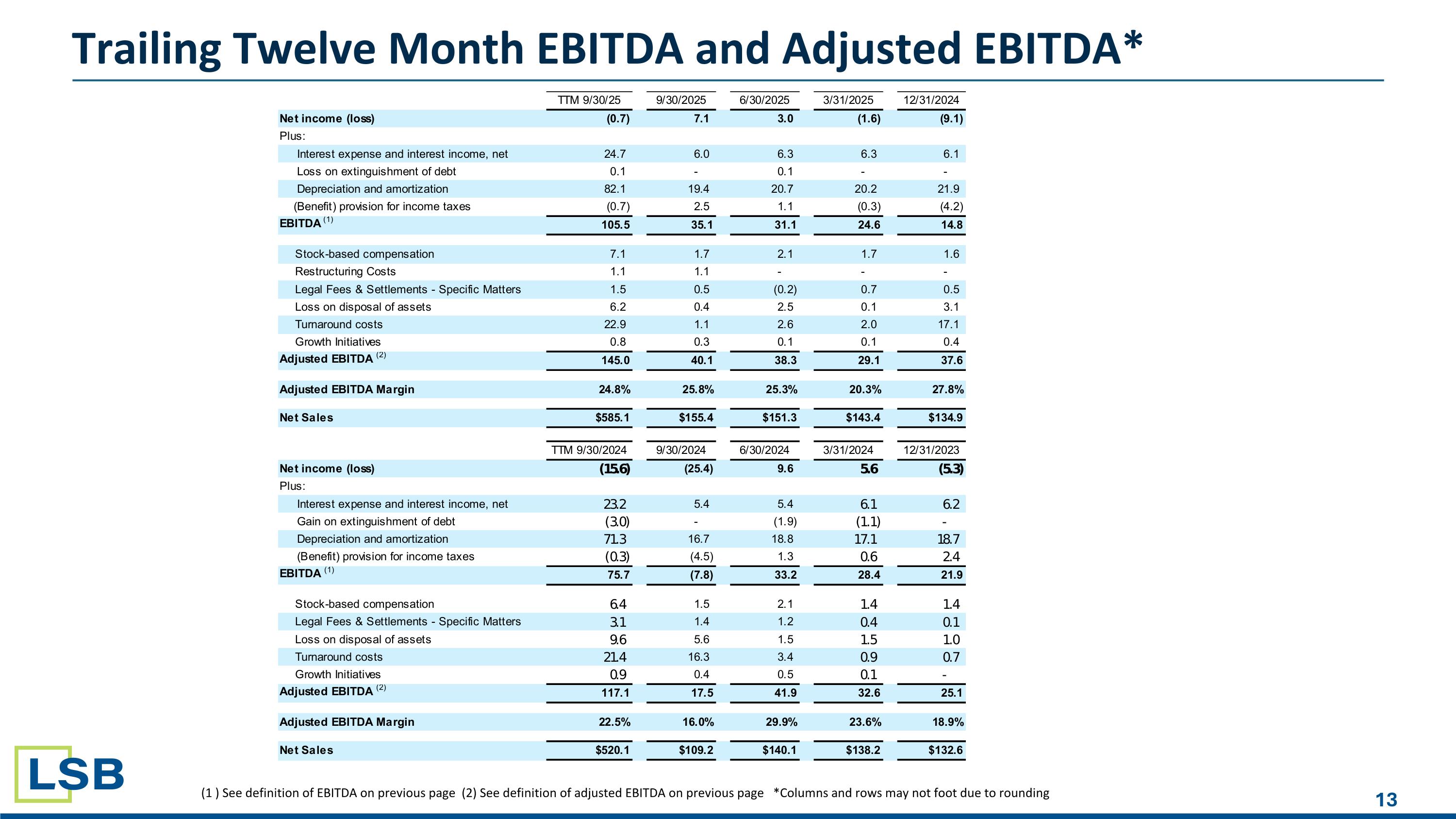

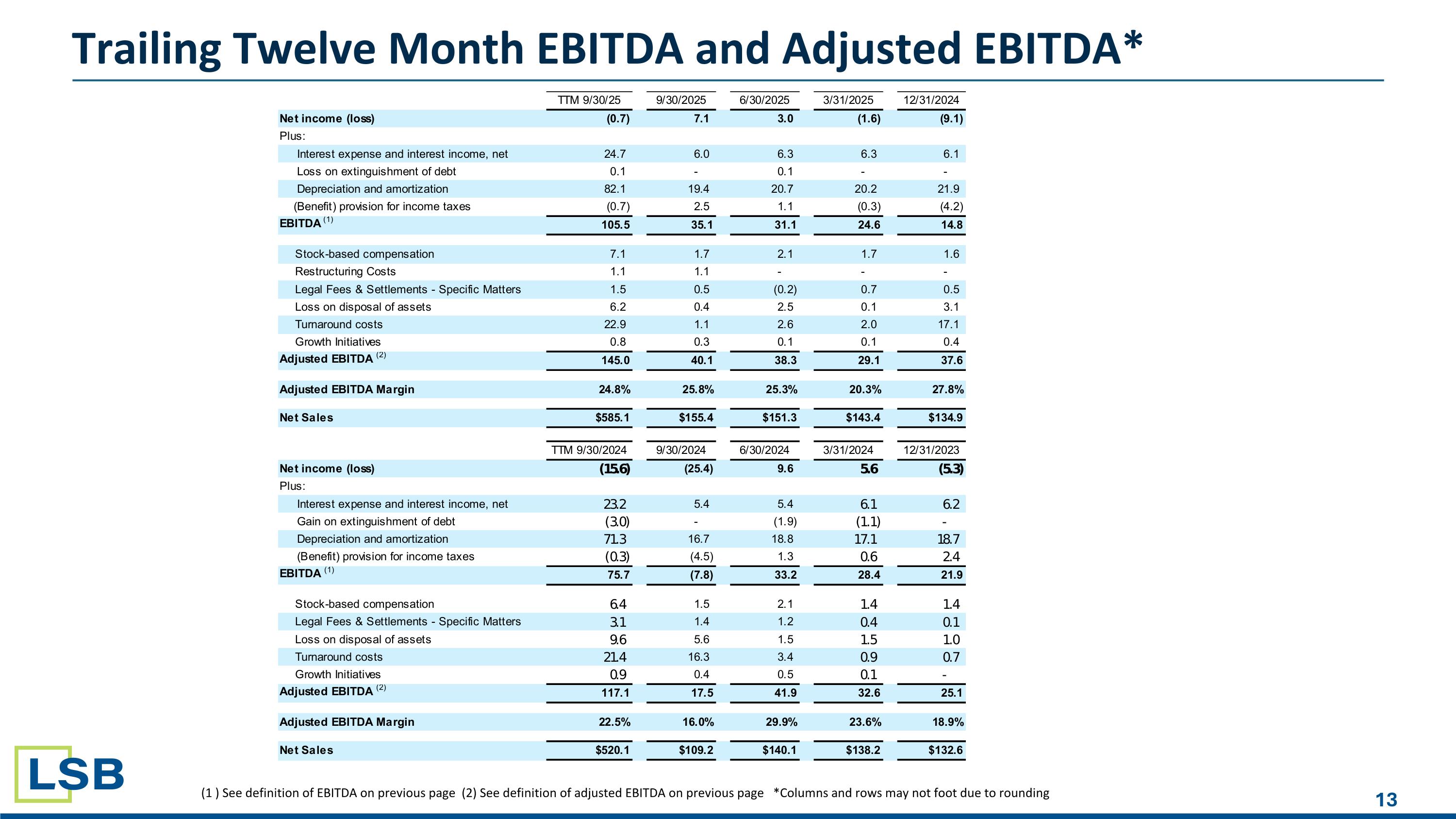

(1 ) See definition of EBITDA on previous page (2) See definition of adjusted EBITDA on previous page *Columns and rows may not foot due to rounding Trailing Twelve Month EBITDA and Adjusted EBITDA*