EX-99.1

Exhibit 99.1

|

|

NEWS |

Contact: Amie D'Ambrosio (713) 375-3826 |

FOR IMMEDIATE RELEASE

NOVREPORTS THIRD QUARTER 2025 RESULTS AND APPOINTMENT OF JOSE BAYARDO TO BOARD OF DIRECTORS

•

Bookings of $951 million, representing a book-to-bill of 141%

•

Revenues of $2.18 billion

•

Net Income of $42 million, or $0.11 per share

•

Adjusted EBITDA* of $258 million

•

Cash flow from operations of $352 million and free cash flow* of $245 million

•

Returned $108 million of capital to shareholders through share repurchases and dividends

*Free Cash Flow, Excess Free Cash Flow and Adjusted EBITDA are non-GAAP measures, see “Non-GAAP Financial Measures,” “Reconciliation of Cash Flows from Operating Activities to Free Cash Flow and Excess Free Cash Flow” and “Reconciliation of Net Income to Adjusted EBITDA” below.

HOUSTON, TX, October 27, 2025 NOV Inc. (NYSE: NOV) today reported third quarter 2025 revenues of $2.18 billion, a decrease of one percent compared to the third quarter of 2024. Net income decreased 68 percent to $42 million, or $0.11 per share, and operating profit decreased 45 percent to $107 million, or 4.9 percent of sales. The Company recorded $65 million within Other Items during the third quarter of 2025 (see Corporate Information for additional details). Adjusted EBITDA decreased 10 percent year-over-year to $258 million, or 11.9 percent of sales. Sequentially, revenue declined less than one percent, net income declined 61 percent, and Adjusted EBITDA increased two percent.

“NOV's operational performance improved sequentially in the third quarter,” stated Clay Williams, Chairman and CEO. “Strong execution on our offshore production backlog, disciplined cost control efforts, and continued efficiency improvements helped NOV maintain steady revenue and margins sequentially despite lower activity in energy and industrial markets. These efforts, combined with improved working capital management, drove robust free cash flow of $245 million during the quarter.

“Demand for NOV’s production equipment remains strong as the offshore upcycle gains momentum and global natural gas development expands. Bookings more than doubled sequentially, resulting in a book-to-bill ratio of 141%.

“While near-term industry fundamentals remain challenged, and inflationary pressures are prompting reassessments of both energy and industrial projects, the breadth and resilience of NOV’s portfolio continue to underpin our performance. We are encouraged by the resurgence in offshore investment and the emergence of unconventional development in new regions as these trends will rely on NOV’s differentiated tools and technologies.

“Our longstanding commitment to technology leadership and our diverse portfolio provide strength through cycles and opportunities for growth. Along with ongoing actions to improve our cost structure and better leverage our global platform, NOV is positioned to increase profitability, generate strong cash flow, and unlock long-term shareholder value.”

As part of its long-term succession plan, the Company also announced that its board of directors (the “Board”) had increased its size by one and appointed Jose Bayardo, President and Chief Operating Officer, to the Board. Mr. Bayardo served as Senior Vice President and Chief Financial Officer since joining the Company in 2015, until his promotion to his current position earlier this year. Mr. Bayardo holds a Bachelor of Science in Chemical Engineering from the University of Texas at Austin, a Master of Engineering Management and Master of Business Administration from Northwestern University.

Energy Products and Services

Energy Products and Services generated revenues of $971 million in the third quarter of 2025, a decrease of three percent from the third quarter of 2024. Operating profit decreased $76 million from the prior year to $38 million, or 3.9 percent of sales, and included $41 million in Other Items. Adjusted EBITDA decreased $37 million from the prior year to $135 million, or 13.9 percent of sales. Revenue declined due to lower global drilling activity levels and delays in infrastructure projects affecting the timing of capital equipment orders. Profitability was negatively impacted by a less favorable sales mix, as well as tariffs and other inflationary pressures.

Energy Equipment

Energy Equipment generated revenues of $1,247 million in the third quarter of 2025, an increase of two percent from the third quarter of 2024. Operating profit increased $1 million from the prior year to $130 million, or 10.4 percent of sales, and included $21 million in Other Items. Adjusted EBITDA increased $21 million from the prior year to $180 million, or 14.4 percent of sales, representing thirteen consecutive quarters of year-over-year Adjusted EBITDA margin growth. Higher revenue from the segment’s growing backlog of offshore production-related equipment more than offset reduced demand for aftermarket spare parts and services. Improved profitability was the result of solid execution on the segment’s backlog, cost controls and increased operational efficiencies.

New orders booked during the quarter totaled $951 million, representing a book-to-bill of 141 percent when compared to $674 million of orders shipped from backlog. As of September 30, 2025, backlog for capital equipment orders for Energy Equipment totaled $4.56 billion, an increase of $77 million from the third quarter of 2024.

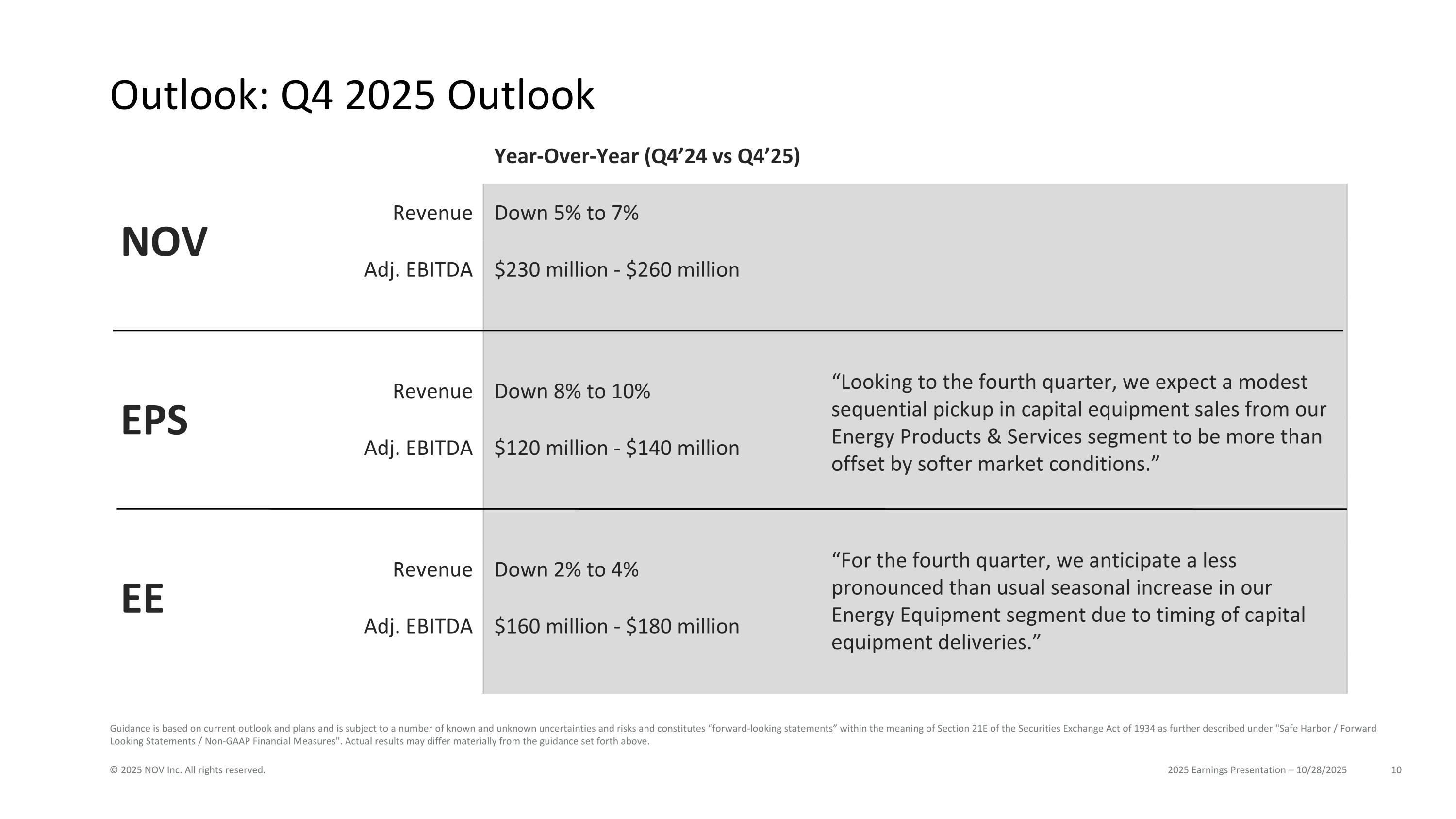

Q4 2025 Outlook

The Company is providing financial guidance for the fourth quarter of 2025, which constitutes “forward-looking statements” as described further below under “Cautionary Note Regarding Forward-Looking Statements.”

For the fourth quarter of 2025 management expects year-over-year consolidated revenues to decline between five to seven percent with Adjusted EBITDA expected to be between $230 million and $260 million.

Corporate Information

NOV repurchased approximately 6.2 million shares of common stock for $80 million and paid $28 million in dividends during the third quarter, resulting in a total of $108 million in capital returned to shareholders.

During the third quarter of 2025, NOV recorded $65 million in Other Items, primarily related to the write-down of certain long-lived assets and inventory, and severance charges associated with facility consolidations and other restructuring activities (see Reconciliation of Net Income to Adjusted EBITDA).

As of September 30, 2025, the Company had total debt of $1.73 billion, with $1.50 billion available on its primary revolving credit facility, and $1.21 billion in cash and cash equivalents.

Significant Achievements

NOV secured a contract to supply a monoethylene glycol (MEG) reclamation system for operation in the Black Sea with a national oil and gas company. The system will be integrated into the production facilities of a newbuild FPSO under construction in Asia by a leading EPC contractor. This award follows a series of recent project wins supporting natural gas developments across the Middle East, Eastern Mediterranean, and Black Sea regions.

NOV’s success with offshore drilling automation continues to expand. A deepwater floater operating offshore Guyana with NOV’s latest NOVOS™ and Multi Machine Control (MMC) automation systems achieved more than 17% improvement in connection time compared to the rig’s prior campaign. Additionally, NOV secured contracts to upgrade three ultra-deepwater floaters with advanced rig automation and safety systems. The projects include NOVOS, MMC, Pipe Interlock Management systems, and Red Zone Manager™ (RZM) safety technology, and an active Crown Mounted Compensator system.

NOV’s ATOM™ RTX robotic technology was deployed on a land rig in the Permian Basin, marking the first installation of this system in the U.S. land market. Building on proven results from offshore operations as well as more than a year of operations onshore Canada, the system enhances safety by reducing manual work in the red zone while maintaining high levels of consistency and drilling performance. Results show improved connection and tripping efficiency, supporting faster and more predictable well delivery.

NOV secured several orders for flexible riser and flowline systems supporting deepwater production projects in the Black Sea, Guyana, and Brazil. The awards include a second contract for NOV’s Active Heated flexible riser system, which combines flexible pipe and heating technology to address flow assurance challenges in deepwater environments.

NOV secured a second order for its APL™ Submerged Swivel and Yoke (SSY) system to support a floating LNG (FLNG) project in the San Matías Gulf, Argentina. The project will allow LNG exports from a consortium of regional gas producers. An innovative offshore system, the APL SSY system enables safe mooring of an FLNG vessel and continuous gas transfer through a subsea pipeline while reducing topside infrastructure and project complexity.

NOV was selected to supply double-wall fiberglass-reinforced plastic fuel storage tanks for a major financial institution’s data center expansion in the Northeast United States. The project includes two 40,000-gallon tanks that will provide additional backup fuel capacity to support growing data storage and power resiliency requirements.

NOV supported drilling and completion of the first tight gas unconventional well drilled by an international operator in Bahrain with a suite of downhole drilling and completions technologies. Vector™ drilling motors with ERT™ power sections were used to drill multiple hole sections while a 7-inch by 9⅝-inch GSP liner hanger with a 7-inch PureFlow™ stage cementing tool was used to install and cement the intermediate liner string.

NOV secured an award to deploy its Max™ Platform technology stack in support of a next-generation remote operating center for a major U.S. operator. The implementation advances a “managed-by-exception” model designed to increase efficiency and performance across drilling operations. Powered by Max Platform Services and Max Drilling technology, the edge-to-cloud system leverages real-time data, smart alarms, and AI-driven insights to streamline oversight and focus expertise where it creates the most value.

NOV secured two major wireline intervention package orders in the Middle East. The awards include projects for an international service company operating offshore Qatar and a project supporting Abu Dhabi onshore development, and encompass crane winch trucks, masts, wireline pressure control equipment, and control modules, among other intervention equipment.

NOV achieved record drilling performance in Weld County, Colorado, where an integrated downhole assembly reached total depth in a single 19,000-ft run in the Wattenberg Field. The system combined a ReedHycalog™ TKC59 Tektonic™ drill bit, a DAYTONA 25 motor, and the new Agitator™ Rage tool, NOV’s most powerful friction reduction tool to date. Designed to harness higher downhole pressures, the Agitator Rage tool leverages high-specification rig capabilities to produce greater friction reduction energy for drilling longer, more consistent laterals in the most demanding environments.

NOV ReedHycalog’s 8½-inch RH63-A1 Pegasus™ drill bit delivered record performance for an operator drilling in Devonian-age formations in the Central Basin Platform of the Permian Basin. These deep, hard formations are known for challenging drilling conditions, where bit durability and efficiency are critical. The dual-diameter bit design eliminated multiple trips and achieved a 110% increase in rate of penetration and 31% longer intervals compared to prior wells drilled in the region. These gains reduced days on well and delivered the lowest well construction costs the operator has recorded in the area.

Third Quarter Earnings Conference Call

NOV will hold a conference call to discuss its third quarter 2025 results on October 28, 2025 at 10:00 AM Central Time (11:00 AM Eastern Time). The call will be broadcast simultaneously at www.nov.com/investors. A replay will be available on the website for 30 days.

About NOV

NOV (NYSE: NOV) delivers technology-driven solutions to empower the global energy industry. For more than 150 years, NOV has pioneered innovations that enable its customers to safely and efficiently produce abundant energy while minimizing environmental impact. NOV powers the industry that powers the world.

Visit www.nov.com for more information.

Non-GAAP Financial Measures

This press release contains certain non-GAAP financial measures that management believes are useful tools for internal use and the investment community in evaluating NOV’s overall financial performance. These non-GAAP financial measures are broadly used to value and compare companies in the oilfield services and equipment industry. Not all companies define these measures in the same way. In addition, these non-GAAP financial measures are not a substitute for financial measures prepared in accordance with GAAP and should therefore be considered only as supplemental to such GAAP financial measures. Additionally, Free Cash Flow and Excess Free Cash Flow do not represent the Company’s residual cash flow available for discretionary expenditures, as the calculation of these measures does not account for certain debt service requirements or other non-discretionary expenditures. Please see the attached schedules for reconciliations of the differences between the non-GAAP financial measures used in this press release and the most directly comparable GAAP financial measures.

This press release contains certain forward-looking non-GAAP financial measures, including Adjusted EBITDA. The Company has not provided a reconciliation of projected Adjusted EBITDA. Management cannot predict with a reasonable degree of accuracy certain of the necessary components of net income, such as other income (expense), which includes fluctuations in foreign currencies. As such, a reconciliation of projected net income to projected Adjusted EBITDA is not available without unreasonable effort. The actual amount of other income (expense), provision (benefit) for income taxes, equity income (loss) in unconsolidated affiliates, depreciation and amortization, and other amounts excluded from Adjusted EBITDA could have a significant impact on net income.

Cautionary Note Regarding Forward-Looking Statements

This document contains, or has incorporated by reference, statements that are not historical facts, including estimates, projections, and statements relating to our business plans, objectives, and expected operating results that are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements often contain words such as “may,” “can,” “likely,” “believe,” “plan,” “predict,” “potential,” “will,” “intend,” “think,” “should,” “expect,” “anticipate,” “estimate,” “forecast,” “expectation,” “goal,” “outlook,” “projected,” “projections,” “target,” and other similar words, although some such statements are expressed differently. Other oral or written statements we release to the public may also contain forward-looking statements. Forward-looking statements involve risk and uncertainties and reflect our best judgment based on current information. You should be aware that our actual results could differ materially from results anticipated in such forward-looking statements due to a number of factors, including but not limited to changes in oil and gas prices, customer demand for our products, potential catastrophic events related to our operations, protection of intellectual property rights, compliance with laws, and worldwide economic activity, including matters related to recent Russian sanctions and changes in U.S. trade policies, including the imposition of tariffs and retaliatory tariffs and their related impacts on the economy. Given these uncertainties, current or prospective investors are cautioned not to place undue reliance on any such forward-looking statements. We undertake no obligation to update any such factors or forward-looking statements to reflect future events or developments. You should also consider carefully the statements under “Risk Factors,” as disclosed in our most recent Annual Report on Form 10-K, as updated in Part II, Item 1A of our most recent Quarterly Report on Form 10-Q, and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of our most recent Annual Report on Form 10-K, which address additional factors that could cause our actual results to differ from those set forth in such forward-looking statements, as well as additional disclosures we make in our press releases and other securities filings. We also suggest that you listen to our quarterly earnings release conference calls with financial analysts.

Certain prior period amounts have been reclassified in this press release to be consistent with current period presentation.

CONTACT:

Amie D'Ambrosio

Director, Investor Relations

(713) 375-3826

Amie.DAmbrosio@nov.com

NOV INC.

CONSOLIDATED STATEMENTS OF INCOME (Unaudited)

(In millions, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

|

September 30, |

|

|

June 30, |

|

|

September 30, |

|

|

|

|

2025 |

|

|

2024 |

|

|

2025 |

|

|

2025 |

|

|

2024 |

|

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Energy Products and Services |

|

$ |

971 |

|

|

$ |

1,003 |

|

|

$ |

1,025 |

|

|

$ |

2,988 |

|

|

$ |

3,070 |

|

|

Energy Equipment |

|

|

1,247 |

|

|

|

1,219 |

|

|

|

1,207 |

|

|

|

3,600 |

|

|

|

3,601 |

|

|

Eliminations |

|

|

(42 |

) |

|

|

(31 |

) |

|

|

(44 |

) |

|

|

(121 |

) |

|

|

(109 |

) |

|

Total revenue |

|

|

2,176 |

|

|

|

2,191 |

|

|

|

2,188 |

|

|

|

6,467 |

|

|

|

6,562 |

|

|

Gross profit |

|

|

412 |

|

|

|

469 |

|

|

|

446 |

|

|

|

1,305 |

|

|

|

1,517 |

|

|

Gross profit % |

|

|

18.9 |

% |

|

|

21.4 |

% |

|

|

20.4 |

% |

|

|

20.2 |

% |

|

|

23.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general, and administrative |

|

|

305 |

|

|

|

275 |

|

|

|

303 |

|

|

|

903 |

|

|

|

848 |

|

|

Operating profit |

|

|

107 |

|

|

|

194 |

|

|

|

143 |

|

|

|

402 |

|

|

|

669 |

|

|

Interest expense, net |

|

|

(11 |

) |

|

|

(10 |

) |

|

|

(12 |

) |

|

|

(34 |

) |

|

|

(40 |

) |

|

Equity income (loss) in unconsolidated affiliates |

|

|

(11 |

) |

|

|

— |

|

|

|

1 |

|

|

|

(10 |

) |

|

|

37 |

|

|

Other expense, net |

|

|

(12 |

) |

|

|

(10 |

) |

|

|

(17 |

) |

|

|

(49 |

) |

|

|

(34 |

) |

|

Income before income taxes |

|

|

73 |

|

|

|

174 |

|

|

|

115 |

|

|

|

309 |

|

|

|

632 |

|

|

Provision for income taxes |

|

|

29 |

|

|

|

44 |

|

|

|

1 |

|

|

|

77 |

|

|

|

158 |

|

|

Net income |

|

|

44 |

|

|

|

130 |

|

|

|

114 |

|

|

|

232 |

|

|

|

474 |

|

|

Net income (loss) attributable to noncontrolling interests |

|

|

2 |

|

|

|

— |

|

|

|

6 |

|

|

|

9 |

|

|

|

(1 |

) |

|

Net income attributable to Company |

|

$ |

42 |

|

|

$ |

130 |

|

|

$ |

108 |

|

|

$ |

223 |

|

|

$ |

475 |

|

|

Per share data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.11 |

|

|

$ |

0.33 |

|

|

$ |

0.29 |

|

|

$ |

0.59 |

|

|

$ |

1.21 |

|

|

Diluted |

|

$ |

0.11 |

|

|

$ |

0.33 |

|

|

$ |

0.29 |

|

|

$ |

0.59 |

|

|

$ |

1.20 |

|

|

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

370 |

|

|

|

392 |

|

|

|

375 |

|

|

|

375 |

|

|

|

394 |

|

|

Diluted |

|

|

371 |

|

|

|

395 |

|

|

|

376 |

|

|

|

377 |

|

|

|

397 |

|

|

NOV INC.

CONSOLIDATED BALANCE SHEETS

(In millions)

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

|

December 31, |

|

|

|

2025 |

|

|

2024 |

|

ASSETS |

|

(Unaudited) |

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

1,207 |

|

|

$ |

1,230 |

|

Receivables, net |

|

|

1,871 |

|

|

|

1,819 |

|

Inventories, net |

|

|

1,886 |

|

|

|

1,932 |

|

Contract assets |

|

|

576 |

|

|

|

577 |

|

Prepaid and other current assets |

|

|

222 |

|

|

|

212 |

|

Total current assets |

|

|

5,762 |

|

|

|

5,770 |

|

|

|

|

|

|

|

|

Property, plant and equipment, net |

|

|

2,025 |

|

|

|

1,922 |

|

Lease right-of-use assets |

|

|

532 |

|

|

|

549 |

|

Goodwill and intangibles, net |

|

|

2,089 |

|

|

|

2,138 |

|

Other assets |

|

|

930 |

|

|

|

982 |

|

Total assets |

|

$ |

11,338 |

|

|

$ |

11,361 |

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

798 |

|

|

$ |

837 |

|

Accrued liabilities |

|

|

760 |

|

|

|

861 |

|

Contract liabilities |

|

|

564 |

|

|

|

492 |

|

Current portion of lease liabilities |

|

|

101 |

|

|

|

102 |

|

Current portion of long-term debt |

|

|

34 |

|

|

|

37 |

|

Accrued income taxes |

|

|

7 |

|

|

|

18 |

|

Total current liabilities |

|

|

2,264 |

|

|

|

2,347 |

|

|

|

|

|

|

|

|

Long-term debt |

|

|

1,692 |

|

|

|

1,703 |

|

Lease liabilities |

|

|

528 |

|

|

|

544 |

|

Other liabilities |

|

|

342 |

|

|

|

339 |

|

Total liabilities |

|

|

4,826 |

|

|

|

4,933 |

|

|

|

|

|

|

|

|

Total stockholders’ equity |

|

|

6,512 |

|

|

|

6,428 |

|

Total liabilities and stockholders’ equity |

|

$ |

11,338 |

|

|

$ |

11,361 |

|

NOV INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

(In millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

September 30, |

|

|

September 30, |

|

|

|

2025 |

|

|

2025 |

|

|

2024 |

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

44 |

|

|

$ |

232 |

|

|

$ |

474 |

|

Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

89 |

|

|

|

265 |

|

|

|

255 |

|

Working capital, net |

|

|

120 |

|

|

|

(15 |

) |

|

|

(89 |

) |

Other operating items, net |

|

|

99 |

|

|

|

196 |

|

|

|

73 |

|

Net cash provided by operating activities |

|

|

352 |

|

|

|

678 |

|

|

|

713 |

|

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

Purchases of property, plant and equipment |

|

|

(107 |

) |

|

|

(274 |

) |

|

|

(233 |

) |

Business acquisitions, net of cash acquired |

|

|

— |

|

|

|

— |

|

|

|

(252 |

) |

Business divestitures, net of cash disposed |

|

|

— |

|

|

|

— |

|

|

|

176 |

|

Other |

|

|

3 |

|

|

|

8 |

|

|

|

1 |

|

Net cash used in investing activities |

|

|

(104 |

) |

|

|

(266 |

) |

|

|

(308 |

) |

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

Borrowings against lines of credit and other debt |

|

|

2 |

|

|

|

2 |

|

|

|

419 |

|

Payments against lines of credit and other debt |

|

|

(4 |

) |

|

|

(17 |

) |

|

|

(422 |

) |

Cash dividends paid |

|

|

(28 |

) |

|

|

(163 |

) |

|

|

(79 |

) |

Share repurchases |

|

|

(80 |

) |

|

|

(230 |

) |

|

|

(117 |

) |

Other |

|

|

(8 |

) |

|

|

(43 |

) |

|

|

(36 |

) |

Net cash used in financing activities |

|

|

(118 |

) |

|

|

(451 |

) |

|

|

(235 |

) |

Effect of exchange rates on cash |

|

|

(3 |

) |

|

|

16 |

|

|

|

(1 |

) |

Increase (decrease) in cash and cash equivalents |

|

|

127 |

|

|

|

(23 |

) |

|

|

169 |

|

Cash and cash equivalents, beginning of period |

|

|

1,080 |

|

|

|

1,230 |

|

|

|

816 |

|

Cash and cash equivalents, end of period |

|

$ |

1,207 |

|

|

$ |

1,207 |

|

|

$ |

985 |

|

NOV INC.

RECONCILIATION OF CASH FLOWS FROM OPERATING ACTIVITIES TO FREE CASH FLOW AND EXCESS FREE CASH FLOW (Unaudited)

(In millions)

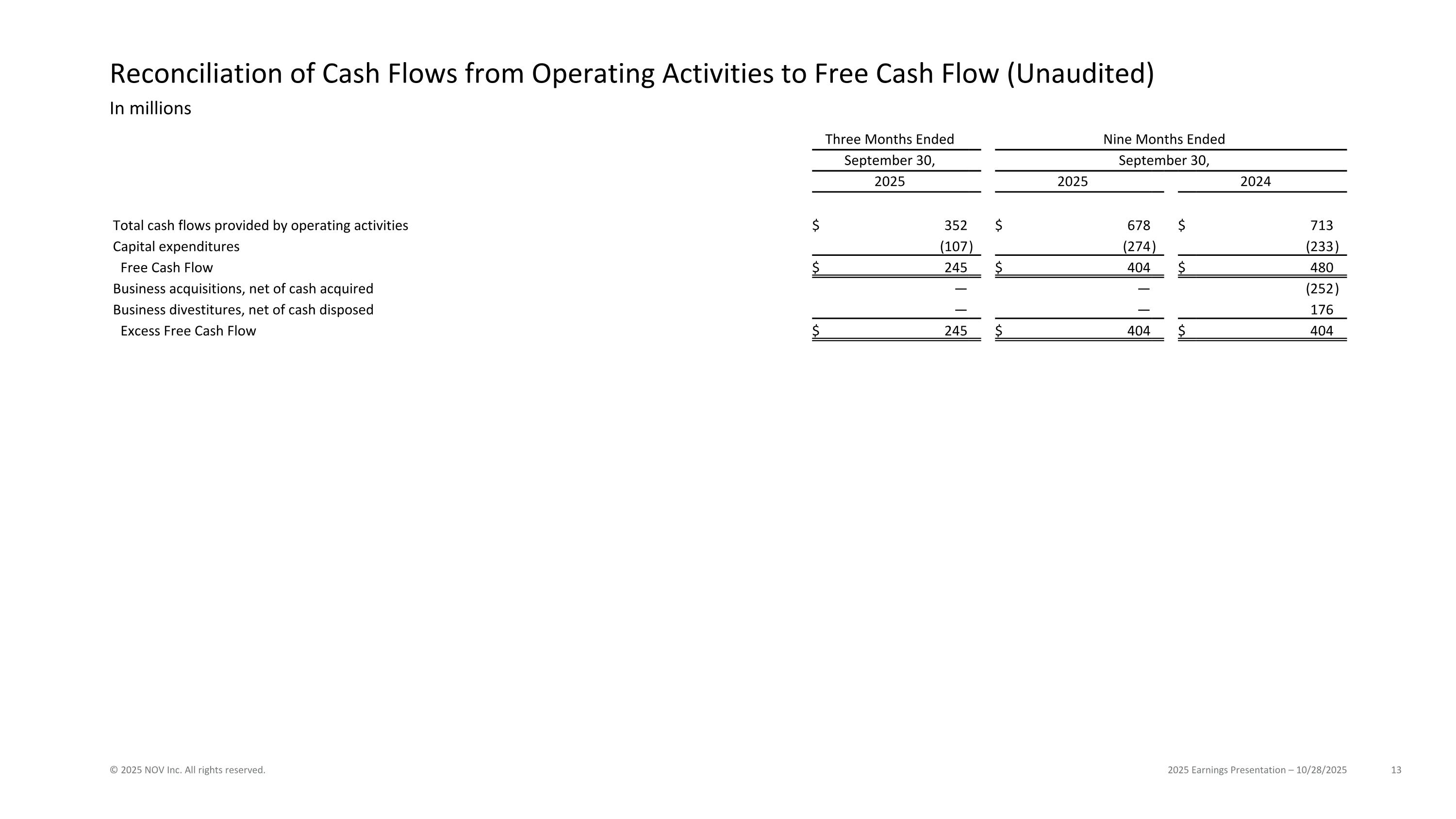

Presented below is a reconciliation of cash flow from operating activities to “Free Cash Flow”. The Company defines Free Cash Flow as cash flow from operating activities less purchases of property, plant and equipment, or “capital expenditures” and Excess Free Cash Flow as cash flows from operations less capital expenditures and other investments, including acquisitions and divestitures. Management believes this is important information to provide because it is used by management to evaluate the Company’s operational performance and trends between periods and manage the business. Management also believes this information may be useful to investors and analysts to gain a better understanding of the Company’s results of ongoing operations. Free Cash Flow and Excess Free Cash Flow are not intended to replace GAAP financial measures.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

September 30, |

|

|

September 30, |

|

|

|

2025 |

|

|

2025 |

|

|

2024 |

|

|

|

|

|

|

|

|

|

|

|

Total cash flows provided by operating activities |

|

$ |

352 |

|

|

$ |

678 |

|

|

$ |

713 |

|

Capital expenditures |

|

|

(107 |

) |

|

|

(274 |

) |

|

|

(233 |

) |

Free Cash Flow |

|

$ |

245 |

|

|

$ |

404 |

|

|

$ |

480 |

|

Business acquisitions, net of cash acquired |

|

|

— |

|

|

|

— |

|

|

|

(252 |

) |

Business divestitures, net of cash disposed |

|

|

— |

|

|

|

— |

|

|

|

176 |

|

Excess Free Cash Flow |

|

$ |

245 |

|

|

$ |

404 |

|

|

$ |

404 |

|

NOV INC.

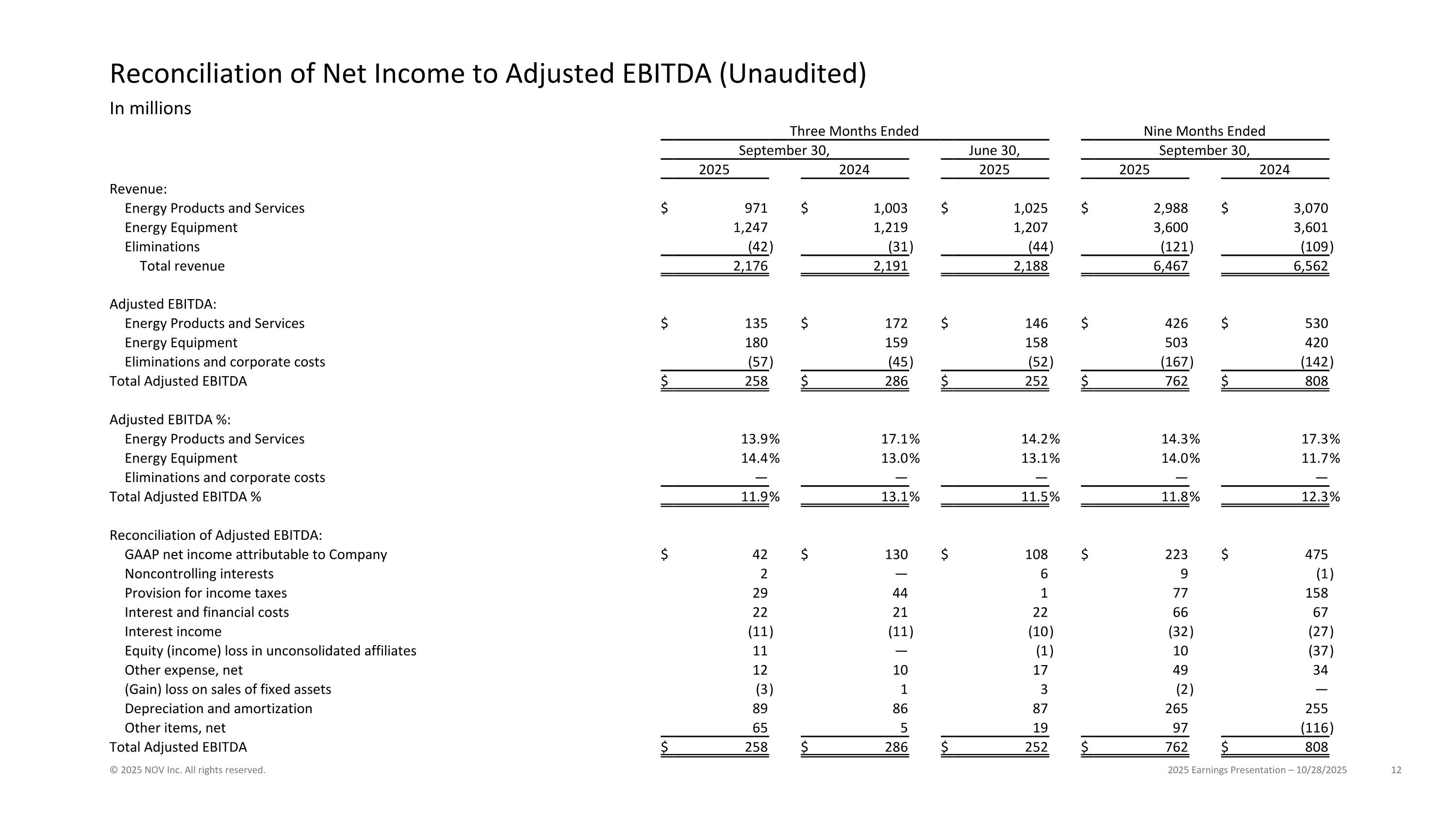

RECONCILIATION OF NET INCOME TO ADJUSTED EBITDA (Unaudited)

(In millions)

Presented below is a reconciliation of Net Income to Adjusted EBITDA. The Company defines Adjusted EBITDA as Operating Profit excluding Depreciation, Amortization, Gains and Losses on Sales of Fixed Assets, and, when applicable, Other Items. Adjusted EBITDA % is a ratio showing Adjusted EBITDA as a percentage of sales. Management believes this is important information to provide because it is used by management to evaluate the Company’s operational performance and trends between periods and manage the business. Management also believes this information may be useful to investors and analysts to gain a better understanding of the Company’s results of ongoing operations. Adjusted EBITDA and Adjusted EBITDA % are not intended to replace GAAP financial measures, such as Net Income and Operating Profit %. Other Items include gain on business divestiture, impairment, restructure, severance, facility closure costs and inventory charges and credits.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

September 30, |

|

|

June 30, |

|

|

September 30, |

|

|

|

2025 |

|

|

2024 |

|

|

2025 |

|

|

2025 |

|

|

2024 |

|

Operating profit: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Energy Products and Services |

|

$ |

38 |

|

|

$ |

114 |

|

|

$ |

83 |

|

|

$ |

204 |

|

|

$ |

363 |

|

Energy Equipment |

|

|

130 |

|

|

|

129 |

|

|

|

122 |

|

|

|

386 |

|

|

|

456 |

|

Eliminations and corporate costs |

|

|

(61 |

) |

|

|

(49 |

) |

|

|

(62 |

) |

|

|

(188 |

) |

|

|

(150 |

) |

Total operating profit |

|

$ |

107 |

|

|

$ |

194 |

|

|

$ |

143 |

|

|

$ |

402 |

|

|

$ |

669 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating profit %: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Energy Products and Services |

|

|

3.9 |

% |

|

|

11.4 |

% |

|

|

8.1 |

% |

|

|

6.8 |

% |

|

|

11.8 |

% |

Energy Equipment |

|

|

10.4 |

% |

|

|

10.6 |

% |

|

|

10.1 |

% |

|

|

10.7 |

% |

|

|

12.7 |

% |

Eliminations and corporate costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Total operating profit % |

|

|

4.9 |

% |

|

|

8.9 |

% |

|

|

6.5 |

% |

|

|

6.2 |

% |

|

|

10.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other items, net: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Energy Products and Services |

|

$ |

41 |

|

|

$ |

3 |

|

|

$ |

6 |

|

|

$ |

52 |

|

|

$ |

4 |

|

Energy Equipment |

|

|

21 |

|

|

|

1 |

|

|

|

9 |

|

|

|

33 |

|

|

|

(122 |

) |

Corporate |

|

|

3 |

|

|

|

1 |

|

|

|

4 |

|

|

|

12 |

|

|

|

2 |

|

Total other items |

|

$ |

65 |

|

|

$ |

5 |

|

|

$ |

19 |

|

|

$ |

97 |

|

|

$ |

(116 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Gain) loss on sales of fixed assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Energy Products and Services |

|

$ |

(2 |

) |

|

$ |

1 |

|

|

$ |

— |

|

|

$ |

(4 |

) |

|

$ |

— |

|

Energy Equipment |

|

|

(1 |

) |

|

|

— |

|

|

|

(1 |

) |

|

|

(2 |

) |

|

|

— |

|

Corporate |

|

|

— |

|

|

|

— |

|

|

|

4 |

|

|

|

4 |

|

|

|

— |

|

Total (gain) loss on sales of fixed assets |

|

$ |

(3 |

) |

|

$ |

1 |

|

|

$ |

3 |

|

|

$ |

(2 |

) |

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation & amortization: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Energy Products and Services |

|

$ |

58 |

|

|

$ |

54 |

|

|

$ |

57 |

|

|

$ |

174 |

|

|

$ |

163 |

|

Energy Equipment |

|

|

30 |

|

|

|

29 |

|

|

|

28 |

|

|

|

86 |

|

|

|

86 |

|

Corporate |

|

|

1 |

|

|

|

3 |

|

|

|

2 |

|

|

|

5 |

|

|

|

6 |

|

Total depreciation & amortization |

|

$ |

89 |

|

|

$ |

86 |

|

|

$ |

87 |

|

|

$ |

265 |

|

|

$ |

255 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Energy Products and Services |

|

$ |

135 |

|

|

$ |

172 |

|

|

$ |

146 |

|

|

$ |

426 |

|

|

$ |

530 |

|

Energy Equipment |

|

|

180 |

|

|

|

159 |

|

|

|

158 |

|

|

|

503 |

|

|

|

420 |

|

Eliminations and corporate costs |

|

|

(57 |

) |

|

|

(45 |

) |

|

|

(52 |

) |

|

|

(167 |

) |

|

|

(142 |

) |

Total Adjusted EBITDA |

|

$ |

258 |

|

|

$ |

286 |

|

|

$ |

252 |

|

|

$ |

762 |

|

|

$ |

808 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA %: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Energy Products and Services |

|

|

13.9 |

% |

|

|

17.1 |

% |

|

|

14.2 |

% |

|

|

14.3 |

% |

|

|

17.3 |

% |

Energy Equipment |

|

|

14.4 |

% |

|

|

13.0 |

% |

|

|

13.1 |

% |

|

|

14.0 |

% |

|

|

11.7 |

% |

Eliminations and corporate costs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Total Adjusted EBITDA % |

|

|

11.9 |

% |

|

|

13.1 |

% |

|

|

11.5 |

% |

|

|

11.8 |

% |

|

|

12.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Adjusted EBITDA: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP net income attributable to Company |

|

$ |

42 |

|

|

$ |

130 |

|

|

$ |

108 |

|

|

$ |

223 |

|

|

$ |

475 |

|

Noncontrolling interests |

|

|

2 |

|

|

|

— |

|

|

|

6 |

|

|

|

9 |

|

|

|

(1 |

) |

Provision for income taxes |

|

|

29 |

|

|

|

44 |

|

|

|

1 |

|

|

|

77 |

|

|

|

158 |

|

Interest and financial costs |

|

|

22 |

|

|

|

21 |

|

|

|

22 |

|

|

|

66 |

|

|

|

67 |

|

Interest income |

|

|

(11 |

) |

|

|

(11 |

) |

|

|

(10 |

) |

|

|

(32 |

) |

|

|

(27 |

) |

Equity (income) loss in unconsolidated affiliates |

|

|

11 |

|

|

|

— |

|

|

|

(1 |

) |

|

|

10 |

|

|

|

(37 |

) |

Other expense, net |

|

|

12 |

|

|

|

10 |

|

|

|

17 |

|

|

|

49 |

|

|

|

34 |

|

(Gain) loss on sales of fixed assets |

|

|

(3 |

) |

|

|

1 |

|

|

|

3 |

|

|

|

(2 |

) |

|

|

— |

|

Depreciation and amortization |

|

|

89 |

|

|

|

86 |

|

|

|

87 |

|

|

|

265 |

|

|

|

255 |

|

Other items, net |

|

|

65 |

|

|

|

5 |

|

|

|

19 |

|

|

|

97 |

|

|

|

(116 |

) |

Total Adjusted EBITDA |

|

$ |

258 |

|

|

$ |

286 |

|

|

$ |

252 |

|

|

$ |

762 |

|

|

$ |

808 |

|