Company Presentation October 2025

Disclaimer 1. The Board of Directors of the Company approved the new company name of NovaBridge, and this is subject to the shareholders’ approval. Legal Disclaimer. This presentation has been prepared by I-Mab (the “Company”)1 solely for informational purposes. Certain of the information included herein was obtained from various sources, including certain third parties, and has not been independently verified by the Company. By viewing or accessing the information contained in this presentation, you hereby acknowledge and agree that no representations, warranties, or undertakings, express or implied, are made by the Company or any of its directors, shareholders, employees, agents, affiliates, advisors, or representatives (the “Company Relevant Persons”), or any sponsor, underwriter, placing agent, financial advisor, capital market intermediary or any of their respective directors, shareholders, employees, agents, affiliates, advisors, or representatives (collectively with the Company Relevant Persons, the “Relevant Persons”) as to, and no reliance should be placed on the truth, accuracy, fairness, completeness, or reasonableness of the information or opinions presented or contained in, and omission from, this presentation. None of the Relevant Persons shall be responsible or liable whatsoever (in negligence or otherwise) for any loss, howsoever arising from any information presented or contained in this presentation or otherwise arising in connection with the presentation, except to the extent required by applicable law. The information presented or contained in this presentation speaks only as of the date hereof and is subject to change without notice. This presentation includes statistical and other industry and market data that we obtained from industry publications and research, surveys, and studies conducted by third parties, and our own estimates of potential market opportunities. All of the market data used in this presentation involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such data. Industry publications and third-party research, surveys and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee, and the accuracy or completeness of such information has not been independently verified. Our estimates of the potential market opportunities for our product candidates include several key assumptions based on our industry knowledge, industry publications, third-party research, and other surveys, which may be based on a small sample size and may fail to accurately reflect market opportunities. While we believe that our internal assumptions are reasonable, no independent source has verified such assumptions. Forward Looking Statements. This presentation contains forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “future”, “promising”, “may”, “plans”, “potential”, “will”, “could position”, “promise”, “advance”, “target”, “design”, “strategy”, “pipeline”, and “project”, and similar terms or the negative thereof. Statements that are not historical facts, including statements about I-Mab's beliefs and expectations, are forward-looking statements. The forward-looking statements in this presentation include, without limitation, statements regarding the following: the Company’s pipeline and capital strategy; the design and potential benefits, advantages, promise, attributes, and target usage of givastomig, ragistomig, uliledlimab and VIS-101; the projected development and advancement of the Company’s portfolio and anticipated clinical milestones, results and related timing; the Company’s expectation regarding the potential market opportunity of gastric cancer, pancreatic ductal adenocarcinoma, cholangiocarcinoma, neovascular age-related macular degeneration and diabetic macular edema; the market opportunity and I-Mab’s potential next steps (including the potential expansion, differentiation, or commercialization) for givastomig, ragistomig, uliledlimab and VIS-101; the Company’s expectations regarding the impact of data from past, ongoing and future studies and trials; the benefits of the Company’s collaboration with development partners; the timing and progress of studies (including with respect to patient enrollment and dosing); the availability of data and information from ongoing studies; and the Company’s expectations regarding its anticipated cash runway and future use of its cash position. These forward-looking statements involve inherent risks and uncertainties that could cause actual results to differ materially from those expressed or implied in such forward-looking statements. These risks and uncertainties include, but are not limited to, the following: I-Mab’s ability to demonstrate the safety and efficacy of its drug candidates; the clinical results for its drug candidates, which may or may not support further development or new drug application/biologics license application approval; the content and timing of decisions made by the relevant regulatory authorities regarding regulatory approval of I-Mab’s drug candidates; I-Mab’s ability to achieve commercial success for its drug candidates, if approved; I-Mab’s ability to obtain and maintain protection of intellectual property for its technology and drugs; I-Mab’s reliance on third parties to conduct drug development, manufacturing and other services; I-Mab’s limited operating history and I-Mab’s ability to obtain additional funding for operations and to complete the development and commercialization of its drug candidates; and discussions of potential risks, uncertainties, and other important factors in I-Mab’s most recent annual report on Form 20-F and I-Mab’s subsequent filings with the U.S. Securities and Exchange Commission (the “SEC”). I-Mab may also make written or oral forward-looking statements in its periodic reports to the SEC, in its annual report to shareholders, in press releases and other written materials, and in oral statements made by its officers, directors, or employees to third parties. All forward-looking statements are based on information currently available to I-Mab. I-Mab undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as may be required by law.

A Global Biotechnology Platform Bringing Paradigm-shifting Innovations Globally 01 Company Overview

Emerging Biopharma Ecosystems Spearheaded by China Rise as Global Innovation Powerhouse Source: PharmaCube Clinical Trials Registration for Innovative Drugs China Biopharma Out-licensing Transactions China out-licensing deals account for ~60% of global licensing deal value in 1Q25

NovaBridge1 Marks Our Evolution into the Next Stage 38-98-139 50-169-225 36-139-196 63-151-49 124-188-39 109-203-93 2020-2023 2023-2024 2025 onwards Immuno-oncology Autoimmune disorders 11 assets CD47 mAb / CD73 mAb / αGM-CSF Fast-to-market China strategy Fast-to-PoC (proof of concept) global strategy Precision immune-oncology 3 assets CLDN18.2x4-1BB BsAb / PD-L1x4-1BB BsAb / CD73 mAb Fast-to-market ex-China strategy 2.0 1.0 Clinical-stage China Biotech 3.0 Clinical-stage US Biotech Global Biotechnology Platform Therapeutic area-agnostic 4 assets CLDN18.2x4-1BB BsAb / VEGFxang-2 BsAb / PD-L1x4-1BB BsAb / CD73 mAb Global business development strategy Fast-to-PoC global strategy Pivot & Focus Asset-based Model Global Vision Platform Model 1. The name has been approved by the Board but subject to EGM approval We are a global biotechnology platform company dedicated to bringing paradigm-shifting innovative treatments to the global markets

We are the FIRST and ONLY listed hub-and-spoke platform specializing in bridging Asian innovations to the global markets Business Development Capability (BD-in and BD-out) Clinical Development Capability Existing Partners Co-co collaboration Acquisitions NewCo Licensing in/out NovaBridge1 is a Hub-and-Spoke Gateway Connecting Global Markets 1. The name has been approved by the Board but subject to EGM approval …

Our Platform-based Business Model Emerging innovation for asset sourcing Attractive exit/spin-off Deeply rooted in emerging innovation ecosystem for long-time, with incomparable understanding of team capabilities and quality of assets from local innovators Strong exit through acquisition or robust options of financing to fuel continued growth and value creation Driving Accelerated Development and Value Creation of Innovations in a TA Focused Way Accelerated innovative asset development with at scale value creation Scientific Translation Clinical De-risking I-MAB Platform IO Co Ophthal Co xx Co Givastomig (CLDN18.2 x 4-1BB BsAb) Ragistomig (PD-L1 x 4-1BB BsAb) Uliledlimab (CD73 mAb) … VIS-101 (VEGF x ANG2 BsAb) Asset 1 Asset 2 … …

BD-out Long standing presence in US with strong capability to provide bespoke solutions for biotech/MNCs BD-in Unparalleled healthcare ecosystem access powered by CBC Group Clinical development / translational development capabilities Unique strategies for accelerated asset development Cross-functional drug development expertise and experience Highly efficient operational execution We have the Core Capabilities for the Success of Novel Business Model

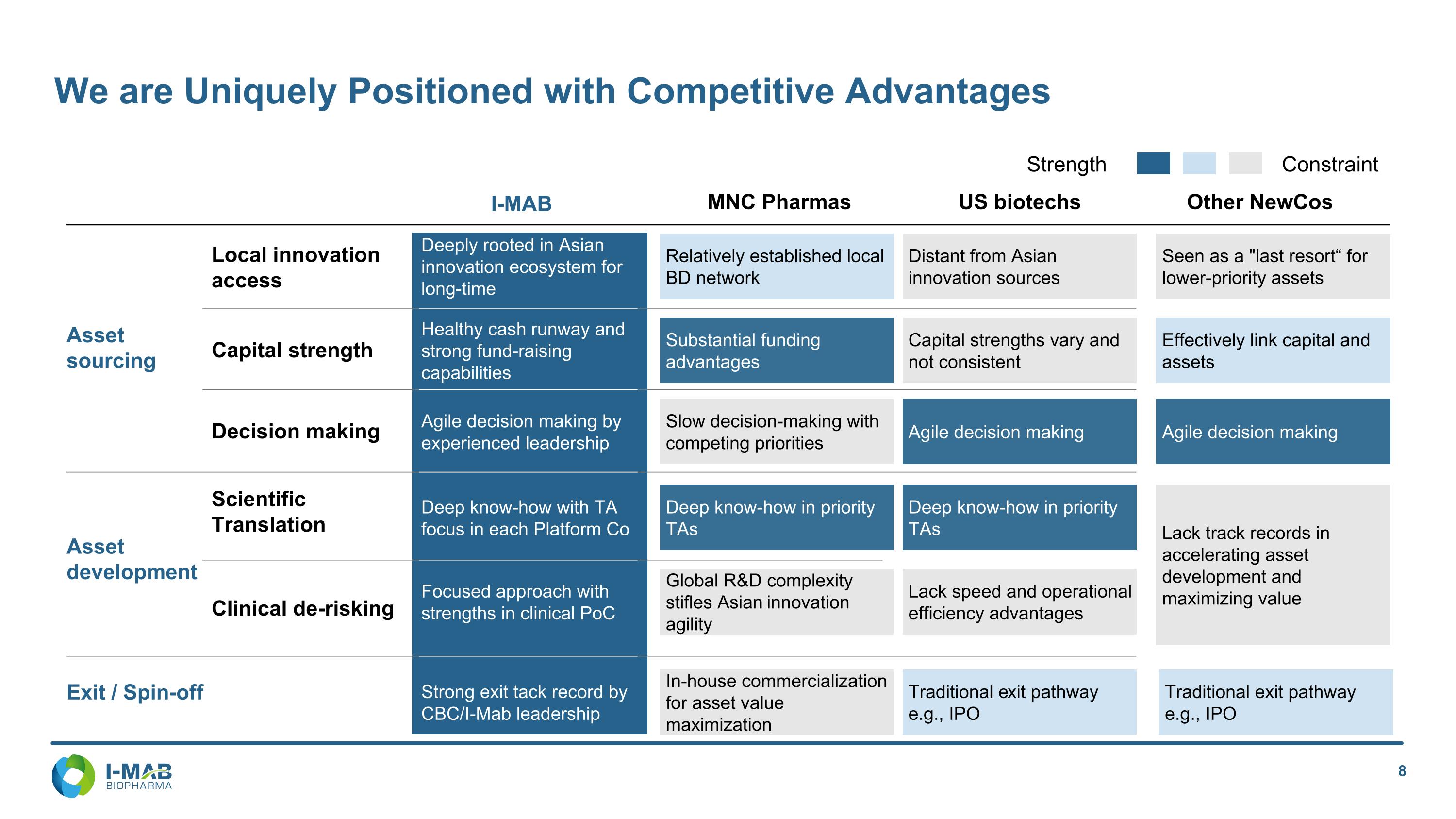

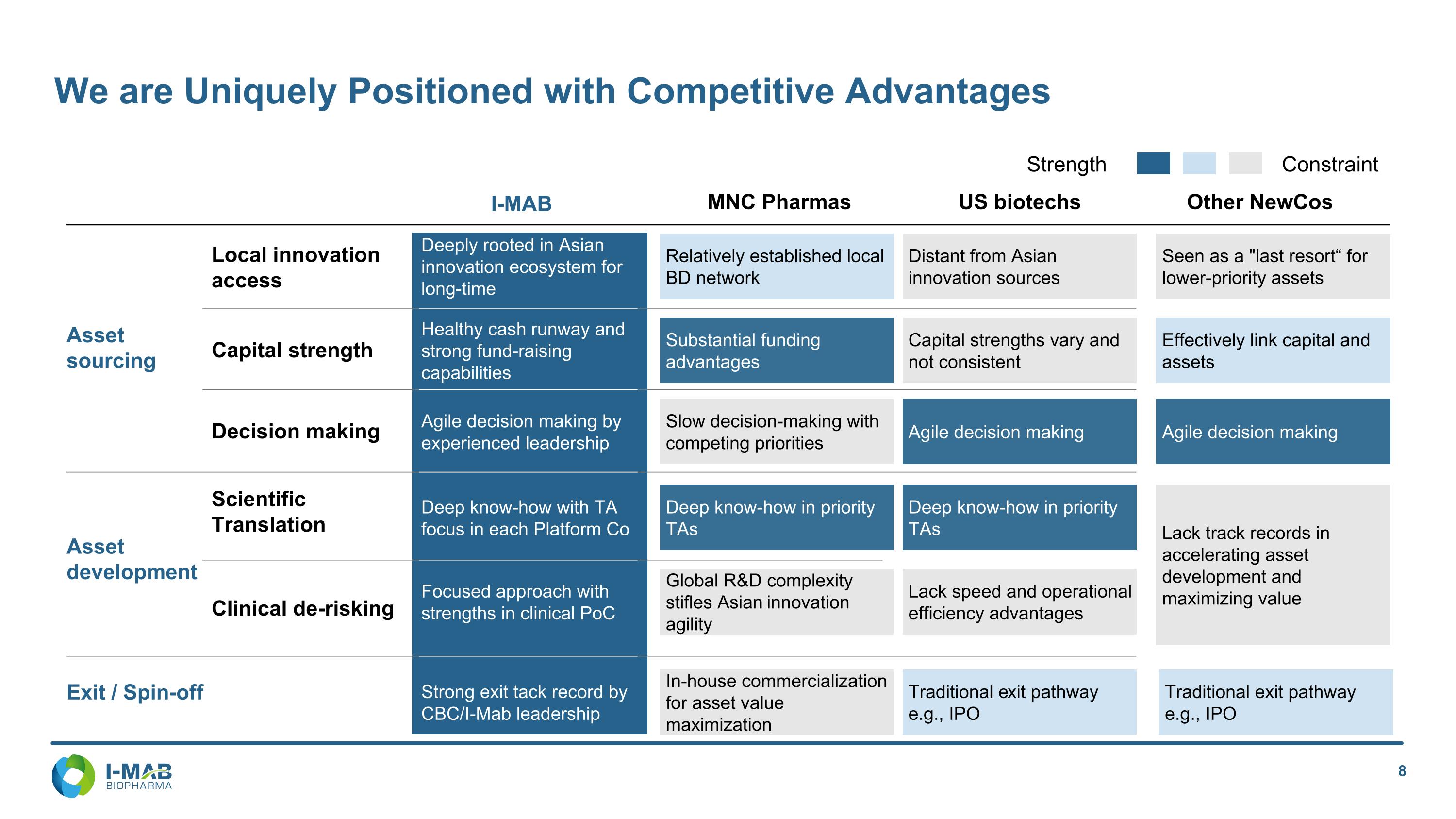

We are Uniquely Positioned with Competitive Advantages Strength Constraint Asset sourcing MNC Pharmas Clinical de-risking Scientific Translation Deep know-how in priority TAs Deep know-how in priority TAs US biotechs Relatively established local BD network Distant from Asian innovation sources Lack track records in accelerating asset development and maximizing value Seen as a "last resort“ for lower-priority assets Capital strength Substantial funding advantages Capital strengths vary and not consistent Effectively link capital and assets Decision making Local innovation access Slow decision-making with competing priorities Agile decision making Agile decision making Asset development Global R&D complexity stifles Asian innovation agility Lack speed and operational efficiency advantages Other NewCos I-MAB Exit / Spin-off In-house commercialization for asset value maximization Traditional exit pathway e.g., IPO Traditional exit pathway e.g., IPO Deep know-how with TA focus in each Platform Co Deeply rooted in Asian innovation ecosystem for long-time Healthy cash runway and strong fund-raising capabilities Agile decision making by experienced leadership Focused approach with strengths in clinical PoC Strong exit tack record by CBC/I-Mab leadership

We Focus on the Most Significant Value Creation Step along the Biopharma Innovation Value Chain Discovery Pre-clinical development Clinical PoC Late phase development Registration Commerciali-zation Extended value creation step of I-Mab model Core value creation step of I-Mab model Not our focus: Increasingly commoditized activities within emerging markets’ highly active discovery and pre-clinical innovation ecosystem 5-10X value creation Acquire early-stage assets (clinical and IND-enabling) with well-defined PoC pathway Leverage deep translation expertise to unleash asset competitiveness with the right development strategy Drive assets efficiently to clinical POC with I-MAB’s scientific underwriting and resource orchestration capabilities 2-3X value creation Selectively engage in late-stage development, leveraging I-MAB’s world-class clinical execution capabilities and scale / efficiency of China’s clinical infrastructure Maintain flexibility for strategic collaborations Not our focus: Global commercialization predominantly driven by established MNCs with deep commercial networks and sales infrastructures Asset value Givastomig VIS-101 Accelerated PoC in mono / combo 1L therapies Achieved efficacy and safety in Ph1b trials Patient recruitment rate outpaced global benchmark Completed Ph1 trials for nAMD and DME; ongoing Ph2 trials in nAMD Final Ph2 readout in 4Q25 Partnered with ABL Bio at preclinical stage Built oncology team with deep GC expertise Partnered with AffaMed / ASKGene at early clinical stage Second-in-market, potential BIC in nAMD / DME

Our New Management Framework Years of Industry Experience We assembled a seasoned management team composed of industry veterans with extensive regional and functional expertise Sean Fu PhD, MBA Chief Executive Officer Fu Wei Director and Executive Chairman of our Board 11 24 Claire Xu MD, PhD Senior Vice President, Clinical Development 17 Kyler Lei Chief Financial Officer 7 Source: Company Filings, Company Website # Phillip Dennis MD, PhD Chief Medical Officer 27 Change

A New Wave of Growth with Highly Differentiated Assets 02 Pipeline Overview

2.1 Givastomig

Givastomig: A Potential Best-in-class CLDN18.2 Therapeutic Unique Molecular Design to Balance Anti-Tumor Efficacy and Safety Notes: scFv = single chain Fragment-variable region; TME = tumor microenvironment; 1 L = first line; CLDN18.2 = Claudin 18.2; MHC = major histocompatibility complex; mAb = monoclonal antibody. Highly Potent CLDN18.2 mAb Higher affinity than zolbetuximab Binds to tumor cells with a wide range of CLDN18.2 expression Silenced FC: IgG1 (N297A) No ADCC or CDC Designed to minimize unintended systemic immune activation driven by FcgR-mediated 4-1 BB clustering Conditional 4-1 BB agonist Localized T cell activation in TME leading to tumor killing and minimal 4-1 BB-mediated liver toxicity or systemic immune response Favorable safety profile in combo setting underpins the 1st line potential and broad therapeutic window Superior efficacy highlights the significant clinical value by improving the current standard of care Encouraging data in Claudin18.2 low patients shows the pan-tumor potential Potential paradigm shifting therapeutic Givastomig’s Key Competitive Advantages

Givastomig: Favorable Safety Profile in Combo Setting Underpins the 1st Line Potential and Broad Therapeutic Window 1. Janjigian 2021; The Lancet, Volume 398, Issue 10294, 27 - 40 2. Shitara et al. 2023; The Lancet, Volume 401, Issue 10389, 1655 - 1668 Givastomig in Combination Immuno-chemotherapy vs. Other 1L Combinations in GC Givastomig incombination withimmunochemotherapyexhibits similarsafety profile toimmunochemotherapyalone (nivolumab +mFOLFOX6) Data cutoff as of June 10, 2025 Notes: TEAE = treatment emergent adverse event; TRAE = treatment related adverse event (any drug); ALT = alanine transaminase; AST = aspartate aminotransferase; NR = not reported; IRR = infusion related reaction; 1L = first line; GC = gastric cancers; SoC = standard of care Givastomig + nivolumab +mFOLFOX6(All doses, escalation combo, n=17) Nivolumab +mFOLFOX6(CHECKMATE-6491, n=782) Zolbetuximab +mFOLFOX6(SPOTLIGHT2, n=279) Safety All Grades(TEAE) Grade>=3(TEAE) All Grades(TRAE) Grade>=3(TRAE) All Grades(TRAE) Grade>=3(TRAE) All Grades(TEAE) Grade>=3(TEAE) AST increased 3 (18%) 1 (6%) 2 (12%) 1 (6%) 16% 2% 18% 1% ALT increased 3 (18%) 2 (12%) 2 (12%) 1 (6%) 11% 1% 12% 1% Neutropenia 12 (71%) 6 (35%) 12 (71%) 6 (35%) 45% 26% 71% 53% Nausea 10 (59%) 0% 9 (53%) 0% 41% 3% 82% 16% Vomiting 7 (41%) 0% 6 (35%) 0% 25% 2% 67% 16% IRR 7 (41%) 1 (6%) 7 (41%) 1 (6%) NR NR NR NR

Givastomig: Superior Efficacy Highlights the Significant Clinical Value by Improving the Current Standard of Care Nivolumab + mFOLFOX6(CHECKMATE-6491, n=782) 47% Zolbetuximab + mFOLFOX6 (SPOTLIGHT2, n=279) 40% Givastomig + nivolumab + mFOLFOX6 (All doses, escalation combo,n=17) 71% ORR (%) comparison vs. current 1L SoC Notes: Data cutoff as of May 15, 2025; PD-L1 assays:22C3 pharmDX, or local test; CLDN: Ventana SP455 or 43-14A; SD = stable disease; PR = confirmed partial response; ORR = objective response rate; CPS = combined positive score; PD-L1 = programmed death-ligand 1; CLDN18.2 = Claudin 18.2; CLDN = Claudin 18.2 vs Biomarker ORR: % (n) All Escalation(n=17) ExpansionCohorts (8 & 12mg/kg) (n=12) Total 71 (12/17) 83 (10/12) PD-L1 ≥5 82 (9/11) 89 (8/9) <1 50 (3/6) 67 (2/3) ≥1 73 (11/15) 82 (9/11) <1 50 (1/2) 100 (1/1) CLDN18.2 < 75 67 (8/12) 78 (7/9) < 75 80 (4/5) 100 (3/3) ORR: % (n) PD-L1 ≥5 PD-L1 <5 CLDN18.2 ≥ 75 80 (8/10) 0 (0/2) CLDN18.2 < 75 100 (1/1) 75 (3/4) CPS 5 0 1 30 40 5 30 5 10 2 8 3 10 20 10 0 3 CLDN 99 60 95 75 90 100 60 90 98 100 90 7 98 96 90 30 1 1. Janjigian 2021; The Lancet, Volume 398, Issue 10294, 27 – 40 2. Shitara et al. 2023; The Lancet, Volume 401, Issue 10389, 1655 – 1668 Givastomig + Nivolumab + mFOLFOX6 Achieved an ORR of 71% in Combination with Immuno-chemotherapy Encouraging data in Claudin18.2 low patients shows the pan-tumor potential

Givastomig: Clinical Development Plan Overall Clinical Development Plan Notes: mNSCLC = metastatic non-small cell lung cancer; Ab = antibody; mAb = monoclonal antibody, 1L = first line; IIT = investigator-initiated trials; nivo = nivolumab; CLDN18.2 Low = CLDN18.2 <75%; PD-L1 Low = CPS<1; CPI = checkpoint inhibitor; BTC = biliary tract cancer; PDAC = pancreatic ductal adenocarcinoma; FPI = first patient in; GC = gastric cancer; GEJ = gastroesophageal junction; EAC = esophageal adenocarcinoma; Q2W = every two weeks; Q3W = every three weeks; Giva = givastomig; ORR = objective response rate; DoR = duration of response; DCR = disease control rate; PFS = progression free survival; OS = overall survival; 1L = first line; PD-L1 = programmed death-ligand 1; CPS = combined positive score Program Phase 1 Phase 2 Phase 3 AnticipatedMilestones Partners Gastric CancersCLDN18.2+ Topline DataQ1 2026 FPI Q1 2026 FPI Q4 2025 FPI 1H 2026 Other GIMalignancies CLDN18.2+ FPI 1H 2026 FPI 2H 2026 FPI 1H 2026 1L Dose Expansion (Giva+ Nivo+ Chemo) 1L Randomized Phase 2 (Giva + Nivo + Chemo) vs. (Nivo + Chemo) 1L CLDN18.2 Low and PD -L1 Low (Giva + Chemo) IIT – Neoadjuvant Locally Advanced (Giva + CPI + Chemo) 1L BTC (Giva + CPI + Chemo) 1L PDAC (Giva + Chemo) IIT – Neoadjuvant PDAC (Giva + Chemo) Randomized Phase 2 Study Design of Givastomig Combined with Immuno-chemotherapy with PFS Data Expected in 2027 Study Design: Multi-center, three-arm randomized Phase 2 study Enrolling globally Eligibility: 1L unresectable or metastatic GC/GEJ/EAC (GEA) HER2-negative CLDN18.2 ≥ 1+ on ≥ 1% of tumor cells PD-L1 CPS ≥ 1 Stratification: mFOLFOX6 vs. CapeOX CLDN18.2 (above and below 75%) n=1801:1:1 Global Randomized Phase 2 Study Arm 1 (n=60) Giva 8 mg/kg + nivolumab + mFOLFOX6 Q2W (or for Q3W – Giva 12 mg/kg + nivolumab + CapeOX) Arm 2 (n=60) Giva 12 mg/kg + nivolumab + mFOLFOX6 Q2W (or for Q3W – Giva 18 mg/kg + nivolumab + CapeOX) Endpoints: Primary: PFS Secondary: ORR, OS, DoR, DCR Safety, Biomarker Control Arm (n=60) nivolumab + mFOLFOX6 Q2W (or for Q3W – nivolumab + CapeOX)

Givastomig: Significant Market Opportunity in Gastric Cancers and Beyond Significant Market Opportunity in Gastric Cancers and Beyond 1. Markets include U.S., five E.U. countries, and Japan in 2025 based on Frost & Sullivan; 2. HER2-negative status of ~78-80% based on Frost & Sullivan; 3. CLDN18.2 positive status of ~73% based on Frost & Sullivan; 4. VYLOY (zolbetuximab-clzb) FDA label; 5. Markets include U.S., 5 E.U., and Japan by 2030 based on Frost & Sullivan; 6. Represents CLDN18.2 prevalence within population; Ventana Assay Validation Report on file; 7. Ventana Assay Validation Report on file. Gastric Cancer (“GC”) Promising peak sales potential Currently, 182k1 patients diagnosed with gastric cancer globally, among which about 105k2,3 as HER2-negative & CLDN18.2-positive Givastomig as the first asset vs. IO-chemotherapy standard of care in 1L GC in US GivastomigPotentially FIC & BIC Givastomig Potentially BIC Zolbetuximab4 100% 10% 1% >1% ≥75% CLDN18.2 Level PD-L1 CPS 1 L HER2-negative GCTherapeutic Landscape Estimated global peak sales* of Givastomig ~$2.0Bn 1L GC Only GC and beyond Market potential in by 2030, % as prevalence of CLDN18.2 expression 1L Gastric Cancers ~$4.4Bn5 >70%6 1L Pancreatic Ductal Adenocarcinoma ~$3.7Bn5 60-85%7 1L Biliary Tract Carcinoma ~$1.2Bn5 ~70%7 ~$3.5Bn Across 1L GC / BTC / PDAC * Gross sales numbers without considering gross-to-net, POS, or revenue split adjustments.

2.2 VIS-101

VIS-101: Significant Unmet Needs Remain in nAMD and DME Treatments Source: Frost & Sullivan nAMD and DME as major ophthalmology diseases and unmet needs Disease Overview Global Patient population1 Neovascular age-related macular degeneration (nAMD) One of the most common causes of significant visual impairment and permanent loss of central vision in aging patients Diabetic macular edema (DME) A severe complication of diabetic retinopathy (DR) and the most common cause of vision impairment in individuals with diabetes MoA Approval Indication Treatment Peak Sales(USD) VEGF 2006 nAMD, RVO, DME Q4W VEGF 2011 nAMD Q8W (4W for 1st 2m) VEGF 2023 nAMD, DME, DR Q8-16W(4W for 1st 3m) VEGF x ANG-2 2022 nAMD, DME Q8-16W(4W for 1st 4m) All major anti-VEGF drugs approved have achieved / will achieve USD5-10Bn topline Lucentis Eylea Eylea HD Vabysmo ~$10B ~$10B ~$5B Increases in durability have rapidly propelled revenue growth for successive generations of agents (Elyea HD and Vabysmo) Unmet needs remain as patients become non-response over time and may not be compliant due to frequent dosing schedule through intravitreal injection Global Market Size of Innovative Anti-VEGF Drugs1 Forecast Global Market Size of Innovative Anti-VEGF Drugs in 2034 and CAGR from 2024 to 2034 Forecast Global Epidemiology of nAMD and DME in 2034 and CAGR from 2024 to 2034 59.3 Mn ~2.1% CAGR 31.9 Bn ~4.9% CAGR Global Epidemiology of nAMD and DME1 1st Line Therapy Unmet Needs Ranibizumab (Lucentis), Aflibercept(Eylea), Faricimab(Vabysmo), Bevacizumab(Avastin, off label) 3-dozes loading then monthly or PRN retreatment guided by OCT/VA Regimes Burden of injection frequency Limitations of sustained efficacy Better durability and long lasting Rapid and sustained improvement in visual acuity Ranibizumab (Lucentis), Aflibercept(Eylea), Faricimab(Vabysmo) In 2024, the prevalence of nAMD reached 21.5 million, with a CAGR of 2.2% from 2020 to 2024 In 2024, the prevalence of DME reached 26.8 million, with a CAGR of 2.1% from 2020 to 2024

VIS-101: Next generation SOC with Longer Durability, Less Priming Dose and Efficacy on Pre-treated Patients Strong Growth of Anti-VEGF-A Ophthalmology Drug Market Global revenue for anti-VEGF ophthalmology drugs is projected to grow to >$20B by 2030. VabysmoTM (faricimab) is the first VEGF/ANG-2 bispecific approved (2022) for nAMD and has longer durability than Eylea. VabysmoTM revenues were $2.4B in its first full-year of launch and is projected to soon exceed $8B annually for all indications Increased revenue of anti-VEGF–A ophthalmology drugs are correlated with improvements in durability LucentisTM Q4W EyleaTM Q8W VabysmoTM Q8-16W Eylea HDTM Q8-16W Revenue 2y from Launch $1.8B $2.8B $4.4B $1.5B VIS-101 Q20-24W (longer durability) Efficacy on pre-treated patients Next-Gen SOC Less priming dose Source: Global data & Evaluate Pharma; sales revenue forecasts for Lucentis, Eylea, Vabysmo and Eylea HD

VIS-101: China Randomized Phase 2 Interim Analysis Shows BIC Potential In an ongoing Phase 2a study, 24 nAMD patients previously treated and treatment-naïve received 3 doses of 6mg of intravitreal injection of VIS-101 at Day 0, Week 4, and Week 8. Interim analysis showed a rapid and sustained effects on BCVA, beginning as early as Day 7. The effect was sustained for more than 12 weeks following the last dose of VIS-101. Final study results, including long-term (36 week) durability data, will be available Q4 2025. 6mg VIS-101 - BCVA changes from baseline 50% Naïve, 50% Pre-Treated BCVA (ETDRS Letters) Naïve Pre-treated 12 12 12 12 12 12 11 12 11 12 7 11 7 6 Patients (n): interim Analysis, study ongoing (results available in Q4 2025) 3 Intravitreal injections Follow-up for 28 weeks post last injection 6mg - Subtotal 24 24 24 23 23 18 13 Ranibizumab Faricimab Q12W Faricimab Q16W 16 24 31 16 24 31 15 24 30 16 23 30 16 23 30 16 23 30 16 23 30 Patients (n): treatment naïve patients – no rescue allowed 6mg Vabysmo (Phase 2 Stairway) 100% Naïve Patients Faricimab: 4 Intravitreal injections Q12W or Q16W Treatment Free: 16 weeks Treatment Free: 12 weeks # no disease activity @W24 15 17 19 Effective on pre-treated patients Less priming dose Longer durability

VIS-101: Speed-to-Market as 2nd in Class & BIC Potential Source: Frost & Sullivan Clinical Plan of VIS-101 2025Q3: Phase II ongoing 2026-2027Q4: Phase III head-to-head comparison to Vabysmo 2028-2029/30: Randomized Phase 3 trial readouts BLA filing nAMD Tier 1 – Marketed Faricimab (Vabysmo) Tier 2 – Phase II VIS-101 BI 836880 Tier 3 – Other Pipelines EXG102-031 BI 836880 intravitreal IBI324/OLN324 EB-105 Speed to Market as 2nd in Class with Me-better Positioning Potential of a successful second launch and best-in-class market positioning, seizing a competitive advantage in market share

The Ophth NewCo Led by an Exceptional and Experienced Leadership Team Transaction Structure Visara, Inc. (NewCo) NovaBridge AffaMed ESOP 65% 30% 5% NewCo Leadership NovaBridge to contribute cash in exchange for 65% of the equity interest in Visara AffaMed to contribute its rights and interests in VIS-101 to Visara in exchange for 30% of the equity interest in Visara The remaining 5% equity interest in Visara will be reserved for an ESOP Upon completion, VIS-101-related rights will be transferred to Visara Emmett Cunningham MD, PhD, MPH Co-Founder and Executive Chairman World-renowned ophthalmologist; Former Senior Managing Director, Blackstone Group 25+ years of experience as an entrepreneur and investor Co-founder of 5+ companies, with a track record of serial entrepreneurial successes (IPO or acquired by MNCs) Internationally recognized specialist in infectious and inflammatory eye disease with over 450 publications Led the development of Macugen®: a first-in-class VEGF-A inhibitor for AMD and DME

2.3 Other Products

Ragistomig: Novel Bispecific PD-L1 x 4-1BB with Differentiated Molecular Design and Compelling Phase 1 Clinical Data Ragistomig: A novel bispecific integrates PD-L1 as a tumor engager and 4-1BB as a conditional T cell activator Compelling Clinical Data in Phase 1, Including Significant Checkpoint Inhibitor Exposed Patients Safety Data in Phase 1 Trial4 PD-L1 IgG 4-1BB scFv Molecular Design: Molecule binds to PD-L1 for activation of 4-1BB in the TME Implications: Mitigation of liver toxicity and systemic immune response Enhancement of anti-tumor immunity and re-invigoration of exhausted T cells1 Development: Co-development with ABL Bio Combinations will require maximizing the therapeutic index Implications: Further testing of additional doses and interval administration to maximize the therapeutic index Ragistomig (ABL503)2 Acasunlimab (GEN1046)3 Diagnosis Advanced or refractory solid tumors Advanced or refractory solid tumors Treatment Monotherapy0.7 mg – 10 mg/kg, Q2W Monotherapy25 –1,200 mg, Q3W Efficacy Evaluable 26 (sum of 3 mg/kg and 5 mg/kg) 61 (25 – 1,200 mg)30 (80 – 200 mg) ORR 26.9% (7/26) 6.6% (4/61)13.3% (4/30, 80 – 200 mg) Prior PD-(L)1 exposure of responders 71.4% (5/7) 50% (2/4) DCR (CR+PR+SD) Safety 69.2% (18/26) 65.6% (40/61) 24.5% (13/53)Grade 3 AST / ALT 10% Grade 3 AST / ALT Ragistomig (ABL503) differentiation Potential BIC PD-L1 x 4-1BB with better ORR data in Phase 1 as monotherapy Compelling clinical data in checkpoint inhibitor relapsed/refractory and PD-(L)1 naïve patients All Grades Grade≥3 Any TRAE 40 (75.5%) 22 (41.5%) TRAE in >= 10% of patients ALT Increased 17 (32.1%) 12 (22.6%) AST Increased 16 (30.2%) 11 (20.8%) Pyrexia 8 (15.1%) 1 (1.9%) Nausea 7 (13.2%) - Rash 7 (13.2%) 2 (3.8%) Fatigue 6 (11.3%) 1 (1.9%) Platelet Count Decreased 6 (11.3%) 1 (1.9%) Notes: scFv = single chain Fragment-variable region; TME = tumor microenvironment; Notes: ORR = objective response rate; DCR = disease control rate; CR complete response; PR = partial response; SD = stable di sease; AST = aspartate aminotransferase; ALT = alanine aminotransferase; Q2W = every two weeks; BIC = best in class. Note that the comparisons in the table above are not based on data from head-to-head trials and are not direct comparisons. Differences in trial designs, patient groups, trial endpoints, study sizes, and other factors may impact the comparisons 1. JITC 2021; 2. Ragistomig poster ASCO 2024; 3. Cancer Discovery 2022; 4. ASCO 2024 poster, Table 2.

Uliledlimab: A Potential Best-in-class CD73 Therapeutic Uliledlimab: A Potential Best-in-class CD73 Therapeutic Uliledlimab + Toripalimab Data Support Patient Selection Based on CD73 Expression and Show Manageable Toxicity Anti-CD73 CD73 Biology: CD73 is the rate-limiting enzyme and a promising target in the adenosine immunosuppressive pathway Key Advantages: Uliledlimab completely inhibits CD73 activity and the production of adenosine without the “hook effect”1 Development: Coordinated global development with TJ Bio Status: I-Mab development paused pending positive data from TJ Bio’s ongoing doublet study in 1L CD73+ NSCLC Dose-dependent CD73 Inhibition without the “Hook Effect”2 CD73 Enzyme Activity Inhibition Uliledlimab Concentration Uliledlimab CD73 dimer CD73 Enzyme Activity Inhibition Oleclumab CD73 dimer Oleclumab Concentration ORR% (n) PD-L1 All PD-L1>1% CD73High 53% (10/19) 63% (10/16) CD73Low 18% (8/45) 20% (5/25) Pembro (KN-042) PD-L1>1% NA 27% (174/637) Phase 2 ORR Data from Front-line NSCLC Cohort* Safety profile of combination comparable to CPI monotherapy studies Well tolerated up to the highest doses tested (45mg/kg Q3W), without MTD Most TRAEs/AEs were Grade 1 or 2 Safety Observations for Uliledlimab, Administered to >200 Patients in Combination Studies with CPIs Notes: ORR = objective response rate; MTD = maximally tolerated dose; Q3W = every three weeks; AE = adverse events; CPI = checkpoint inhibitors; TRAEs = treatment-related adverse events; ASCO 2023 = the American Society of Clinical Oncology 2023 Annual Meeting; toripalimab (used in this study) = Approved/China and the US (Shanghai Junshi Biosciences/Coherus Biosciences) *Patient disposition based on ASCO 2023 Poster from a cohort of 70 enrolled patients with unresectable/metastatic disease, including 67 efficacy evaluable and 64 patients who received at least one post baseline tumor assessment per iRECIST. Overall study (up to n=190) enrolled 5 cohorts (3 NSCLC sub-types, 1 ovarian, 1 all comers): data in this deck are from the treatment naïve, Stage IV NSCLC patients

Accelerating Value Creation with Shareholder Expertise and Ecosystem 03 Strategic Advantage

CBC is a Steadfast Investor-Operator Differentiating from Peers Asia’s largest and most impactful healthcare-dedicated asset manager Investor-Operator approach Build deep expertise in value-creation levers and hands-on portfolio management, securing significantly greater exposures to top-tier assets compared with peers CBC is well positioned with global resources and validated recipe for fast scaling healthcare companies Partnering with the world's top scientists and entrepreneurs, CBC's unique investor-operator approach has empowered leading global healthcare companies to widen access to quality and affordable medical care, catalyze innovations worldwide, and provide better healthcare for all AUM US$10.5b, Buy-out investment US$3.5b One of the largest and most dynamic healthcare ecosystems across all major healthcare verticals: 30+ healthcare portfolio companies , 20+ controlled healthcare companies, 40+ innovative drug pipeline assets and 20+ early-stage pipeline assets 40+ BD deals within the last 5 years with 20+ global MNCs and partners with assets at different stages of development and transaction types Global talent pool with 100+ senior operating talents, 2,000+ candidates and 1,000+ experts available Proper governance Learn together with management while ensuring proper governance to drive the right behaviors and manage risk Talent warehousing Build and maintain a robust network of experienced science / operating partners Extensive global network and coverage Leverage dynamic healthcare ecosystems to identify high potential assets and valuable investment targets worldwide Intra-Portfolio integration Maximize synergies within expansive portfolio and consolidate at arm’s length manner

Highly Experienced World-Class Team to Support Global Strategy Regional Coverage Leads Sean LU Senior Managing Director Greater China Billy CHO Senior Managing Director Korea Vijay KARWAL Managing Director SEA Global Investment Team Managing Directors Directors / Vice Presidents Neo ZHANG Managing Director Hao YIN Managing Director Ray JIN Managing Director Qiuyi LIU Director Sangsoo KIM Director Sam LIAO Director Henry QU Vice President Mars LIN Director Paul QI Vice President Randy YEO Vice President Harry SUN Managing Director Denny CHU Managing Director US Japan Local-for-Local Approach with Centralized Underwriting Support

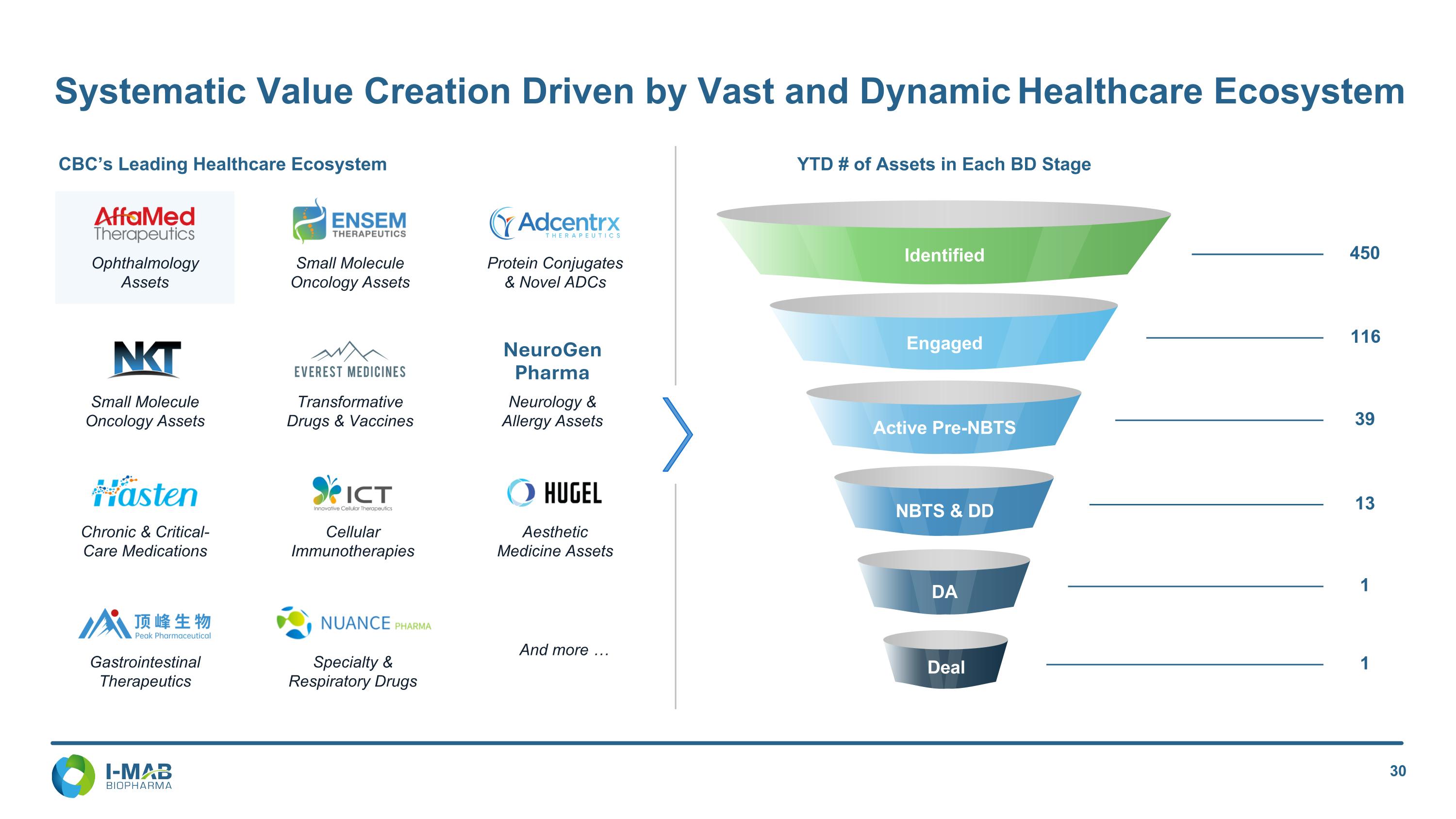

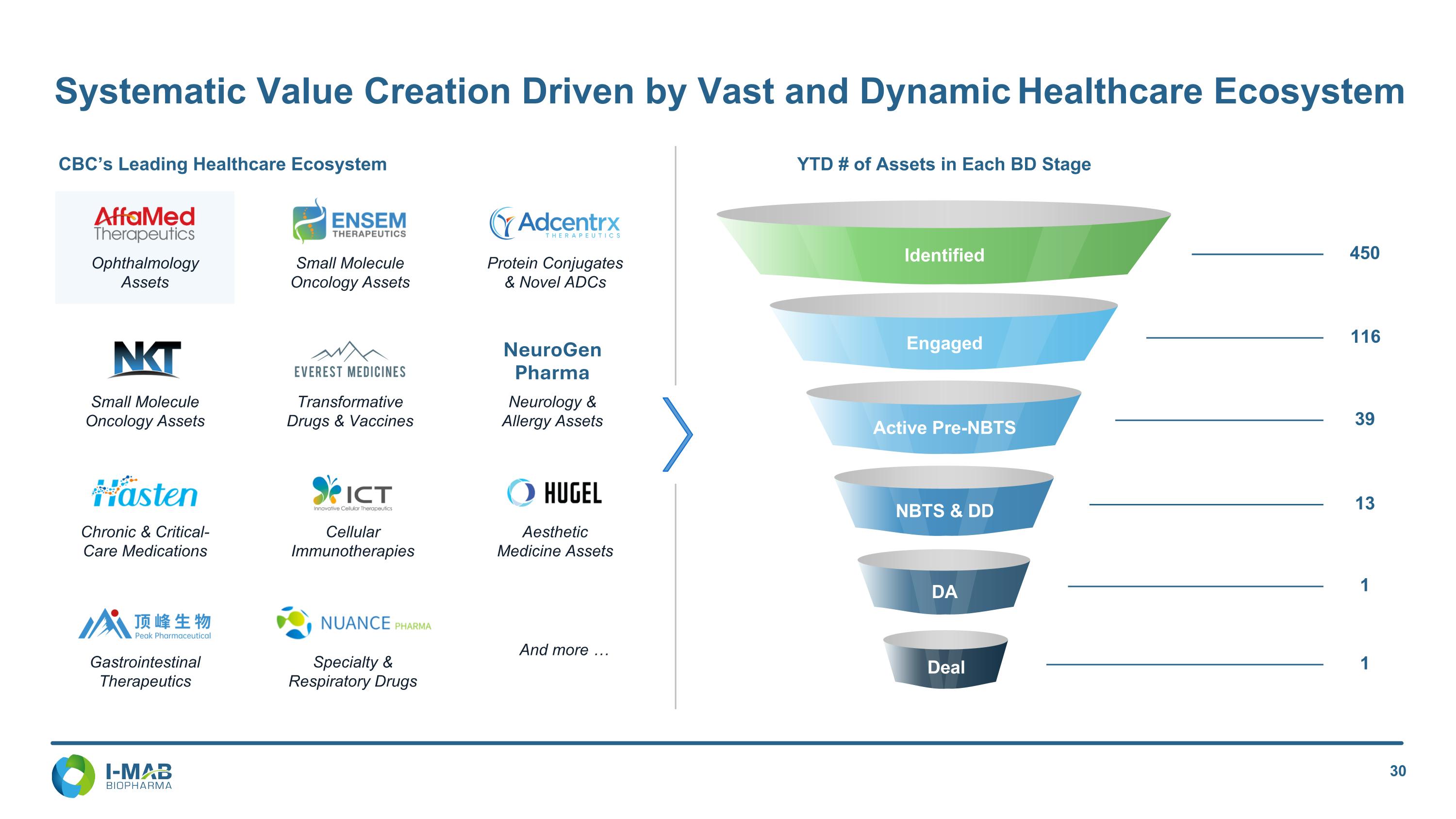

Systematic Value Creation Driven by Vast and Dynamic Healthcare Ecosystem Ophthalmology Assets Small Molecule Oncology Assets Protein Conjugates & Novel ADCs Small Molecule Oncology Assets Transformative Drugs & Vaccines Neurology & Allergy Assets NeuroGen Pharma And more … Gastrointestinal Therapeutics Specialty & Respiratory Drugs Chronic & Critical-Care Medications Cellular Immunotherapies Aesthetic Medicine Assets CBC’s Leading Healthcare Ecosystem YTD # of Assets in Each BD Stage Identified Engaged 450 116 Active Pre-NBTS 39 NBTS & DD 13 DA 1 1 Deal