UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 3, 2025

Jade Biosciences, Inc.

(Exact name of Registrant as specified in its charter)

| Nevada | 001-40544 | 83-1377888 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 221 Crescent St., Building 23 | ||

| Suite 105 | ||

| Waltham, MA | 02453 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (781) 312-3013

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

||

| Common Stock, $0.0001 par value per share | JBIO | The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒ On October 6, 2025, Jade Biosciences, Inc., a Nevada corporation (the “Company”), entered into a Securities Purchase Agreement (the “Purchase Agreement”) for a private placement (the “Private Placement”) with certain institutional and accredited investors (each, a “Purchaser” and collectively, the “Purchasers”).

Item 1.01 Entry into a Material Definitive Agreement.

Private Placement

The closing of the Private Placement (the “Closing”) is expected to occur on October 8, 2025.

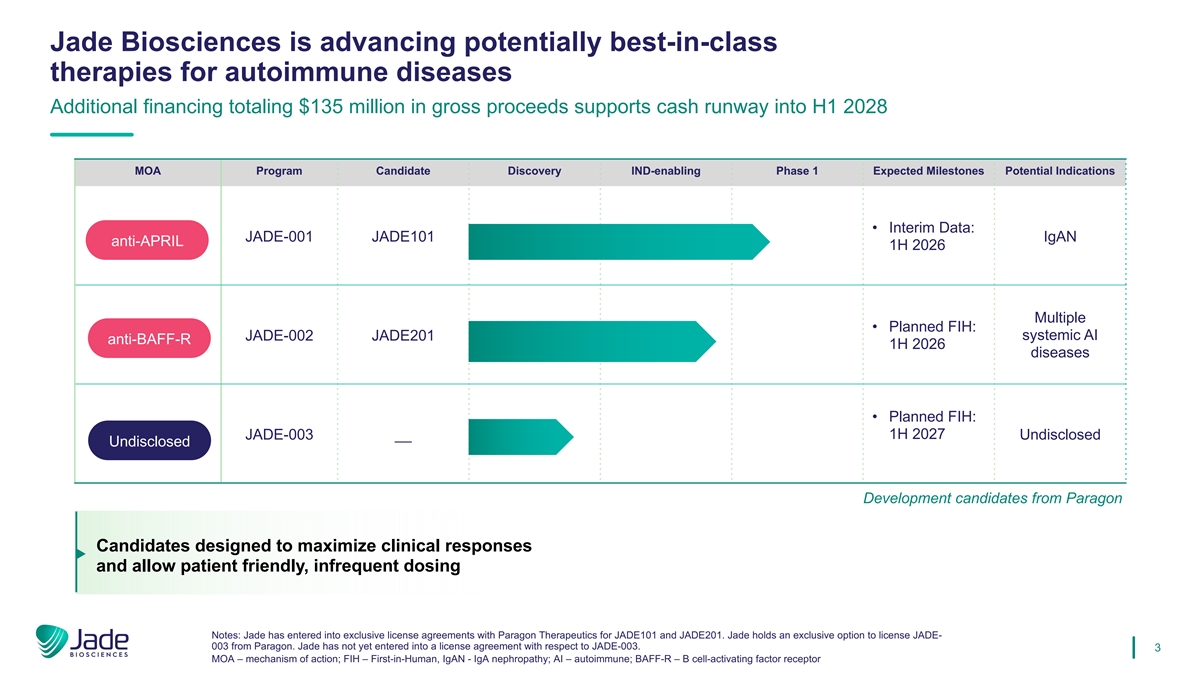

Pursuant to the Purchase Agreement, the Purchasers have agreed to purchase, for an aggregate purchase price of approximately $135 million, (i) an aggregate of 13,368,164 shares (the “Common Shares”) of the Company’s common stock, par value $0.0001 per share (the “Common Stock”), at a price per share of $9.14, and (ii) pre-funded warrants (the “Pre-Funded Warrants”) to purchase an aggregate of 1,402,092 shares of Common Stock at a purchase price of $9.1399 per Pre-Funded Warrant, which represents the per share purchase price of the Common Shares less the $0.0001 per share exercise price for each Pre-Funded Warrant. The shares of Common Stock issuable upon exercise of the Pre-Funded Warrants are referred to herein as the “Warrant Shares”.

The Pre-Funded Warrants will be exercisable at any time after the date of issuance. A holder of Pre-Funded Warrants may not exercise the warrant if the holder, together with its affiliates, would beneficially own more than 4.99% or 9.99%, as applicable, of the number of shares of Common Stock outstanding immediately after giving effect to such exercise. A holder of Pre-Funded Warrants may increase or decrease this percentage to a percentage not in excess of 19.99% by providing at least 61 days’ prior notice to the Company.

The Purchase Agreement contains customary representations and warranties of the Company, on the one hand, and the Purchasers, on the other hand, and customary conditions to closing.

Also on October 6, 2025, the Company entered into a Registration Rights Agreement (the “Registration Rights Agreement”) with the Purchasers, which provides that the Company will register the resale of the Common Shares and Warrant Shares. The Company is required to prepare and file a registration statement with the Securities and Exchange Commission no later than the earlier of (a) 45 days following the Closing and (b) the business day following the date on which the Company files it Periodic Report on Form 10-Q for the quarter ended September 30, 2025, and to use its reasonable best efforts to have the registration statement declared effective 75 days thereafter, subject to certain exceptions and specified penalties if timely effectiveness is not achieved.

The Company has also agreed to, among other things, indemnify the Purchasers and each of their directors, officers, shareholders, members, partners, employees, agents, advisors, representatives (and other persons with a functionally equivalent role) and each person, if any, who controls each Purchaser and each of their directors, officers, shareholders, members, partners, employees, agents, advisors, representatives (and other persons with a functionally equivalent role) from certain liabilities and pay all fees and expenses (excluding any legal fees of the selling holder(s), and any underwriting discounts and selling commissions) incident to the Company’s obligations under the Registration Rights Agreement.

The securities to be issued and sold to the Purchasers under the Purchase Agreement will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act, or under any state securities laws. The Company relied on this exemption from registration based in part on representations made by the Purchasers. The securities may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements. Neither this Current Report on Form 8-K, nor the exhibits attached hereto, is an offer to sell or the solicitation of an offer to buy the securities described herein.

The Company has engaged Jefferies LLC, TD Securities (USA) LLC, Stifel, Nicolaus & Company, Incorporated and Wedbush & Co., LLC as placement agents for the Private Placement. The Company has agreed to pay customary placement fees and reimburse certain expenses of the placement agents.

The foregoing summary of the Purchase Agreement, the Registration Rights Agreement and the Pre-Funded Warrants do not purport to be complete and are qualified in their entirety by reference to the Purchase Agreement, the form of Registration Rights Agreement and the form of Pre-Funded Warrant, copies of which are filed as Exhibits 10.1, 10.2 and 4.1 to this Current Report on Form 8-K, respectively, and are incorporated by reference herein.

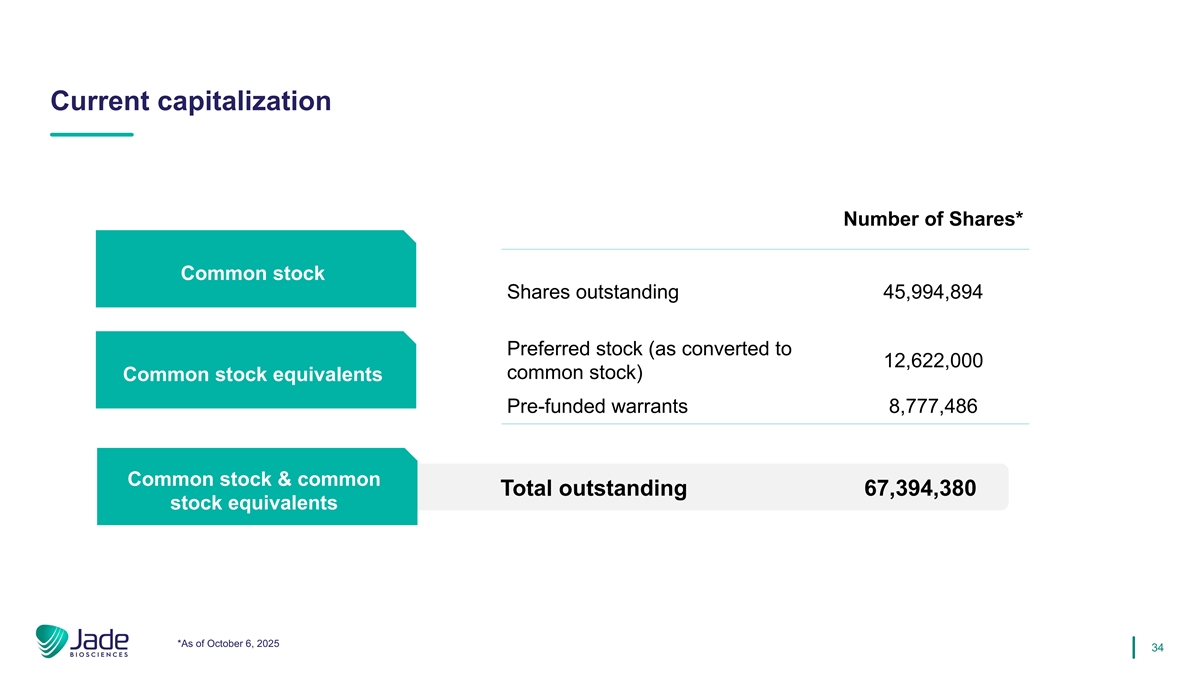

Following the closing of the Private Placement, the Company expects to have 45,994,894 shares of Common Stock issued and outstanding and approximately 67.4 million shares of Common Stock issued and outstanding on a pro forma basis, which gives effect to the full conversion of the Series A non-voting convertible preferred stock, par value $0.0001 per share, and assumes the exercise of all outstanding pre-funded warrants, in each case without regard to beneficial ownership limitations.

BAFF-R License Agreement

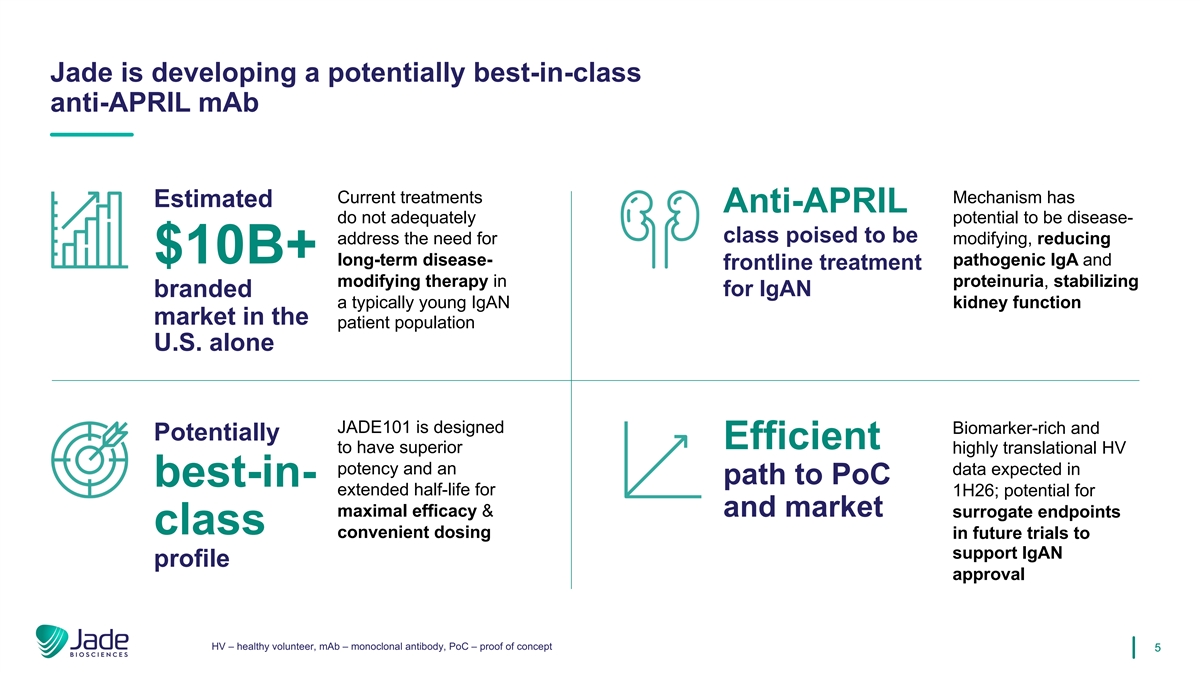

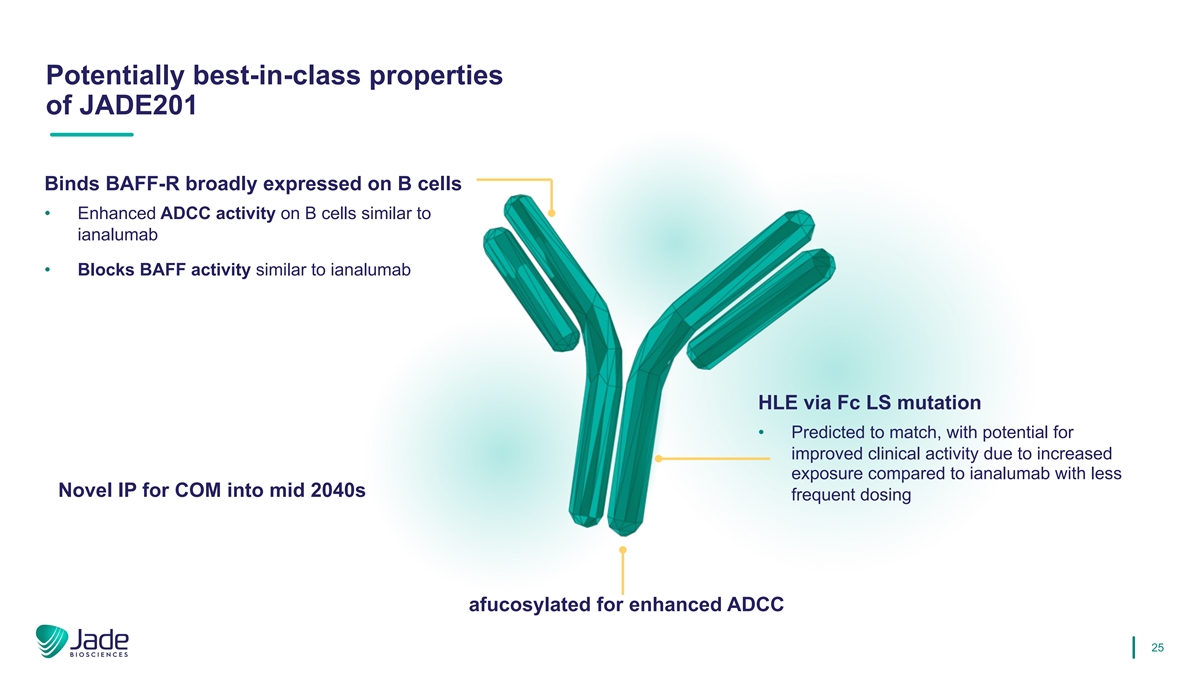

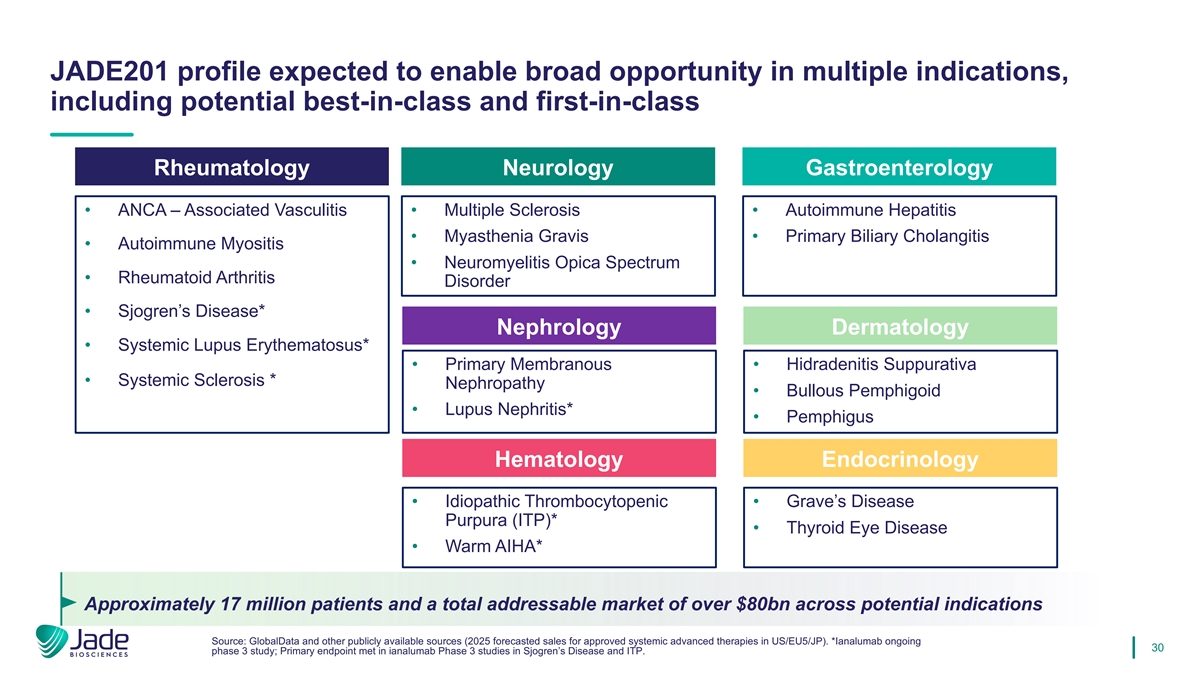

On October 3, 2025, the Company and Paragon Therapeutics, Inc. (“Paragon”), entered into a license agreement (the “License Agreement”), pursuant to which Paragon granted the Company a royalty-bearing, world-wide, exclusive license to develop, manufacture, commercialize or otherwise exploit certain antibodies and products targeting BAFF-R in the field of prophylaxis, palliation, treatment and diagnosis of human disease and disorders in all therapeutic areas (the “Field”).

Under the terms of the License Agreement, the Company is obligated to pay Paragon up to $22.0 million based on specific development, regulatory and clinical milestones for the first Company product to reach such milestones, including a $1.5 million fee for nomination of a development candidate (or initiation of an IND-enabling toxicology study), which was paid by the Company in April 2025, and a further milestone payment of $2.5 million upon the first dosing of a human patient in a Phase 1 trial. In addition, the following summarizes other key terms of the License Agreement:

| • | Paragon granted the Company an exclusive license in the Field to its patents covering the related antibodies, their method of use and their method of manufacture. |

| • | Paragon will not conduct any new campaigns that generate anti-BAFF-R monospecific antibodies in the Field for at least 5 years. |

| • | The Company will pay Paragon a low to mid-single-digit percentage royalty for antibody products. |

| • | There is a royalty step-down if there is no Paragon patent in effect during the royalty term. |

| • | The royalty term ends on the later of (i) the last-to-expire licensed patent or Company patent directed to the manufacture, use or sale of a licensed antibody in the country at issue or (ii) 12 years from the date of first sale of a Company product. |

| • | The Agreement may be terminated on 60 days’ notice by the Company; on material breach without cure; and to the extent permitted by law, on a party’s insolvency or bankruptcy. |

The foregoing is a summary description of certain terms of the License Agreement, does not purport to be complete and is qualified in its entirety by reference to the full text of the License Agreement to be filed as an exhibit to the Company’s Annual Report on Form 10-K for the year ending December 31, 2025.

Item 3.02 Unregistered Sales of Equity Securities.

To the extent required by Form 8-K, the disclosures in Item 1.01 above are incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

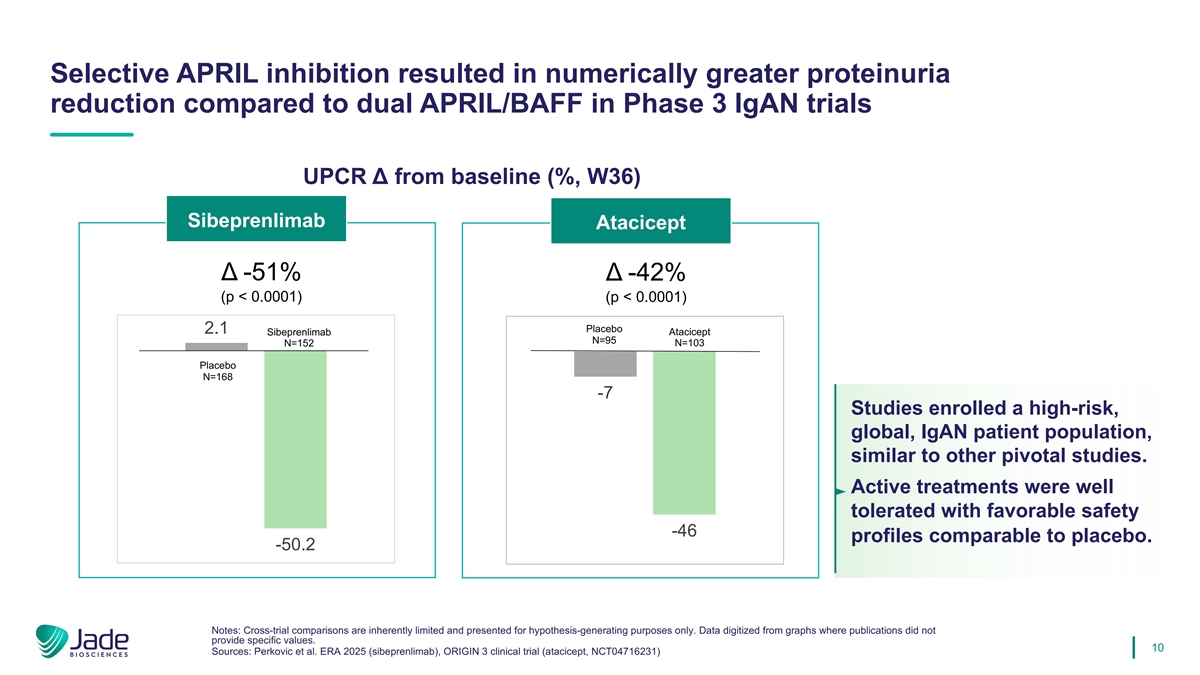

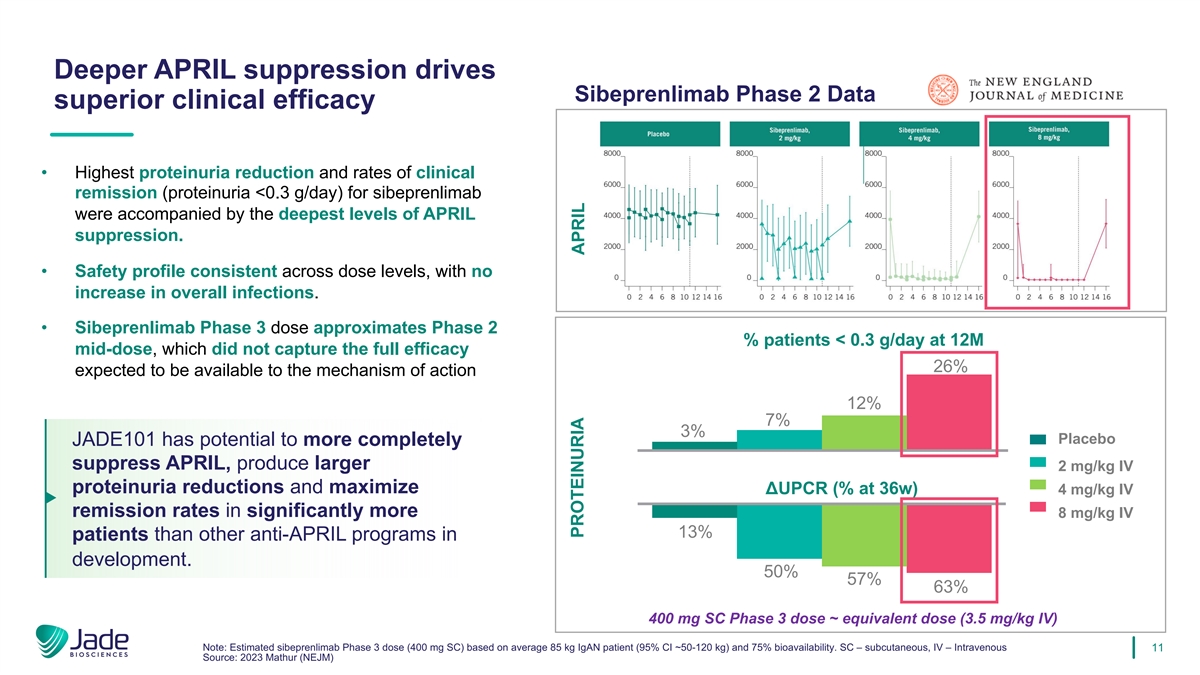

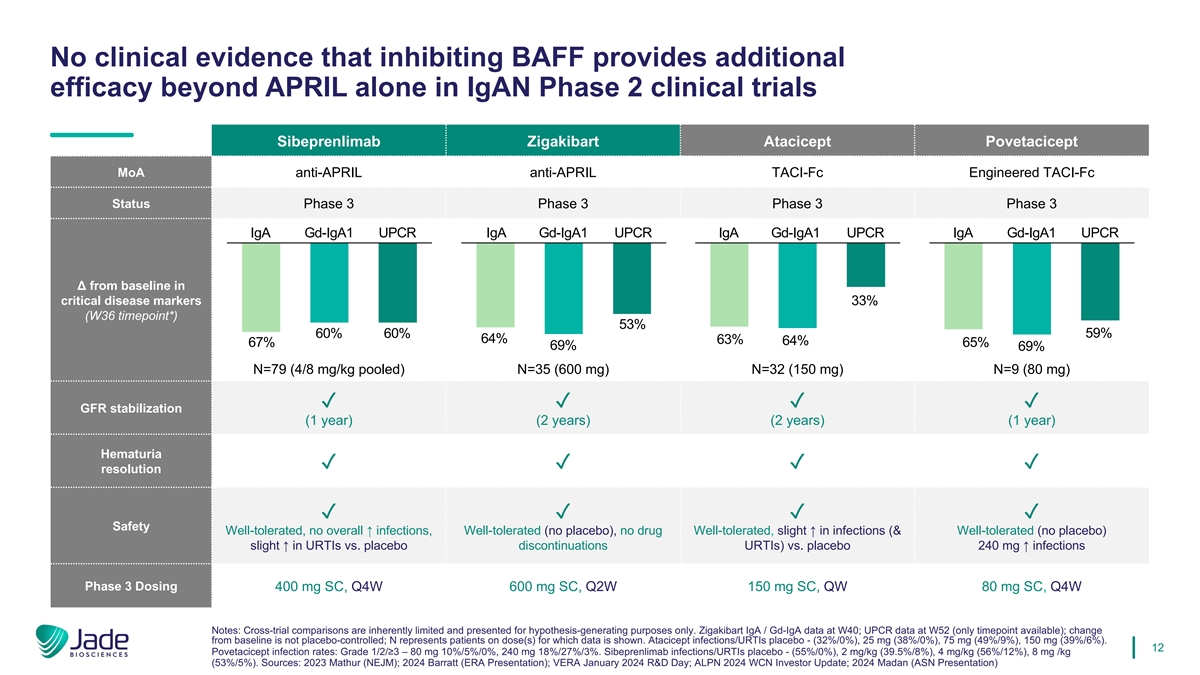

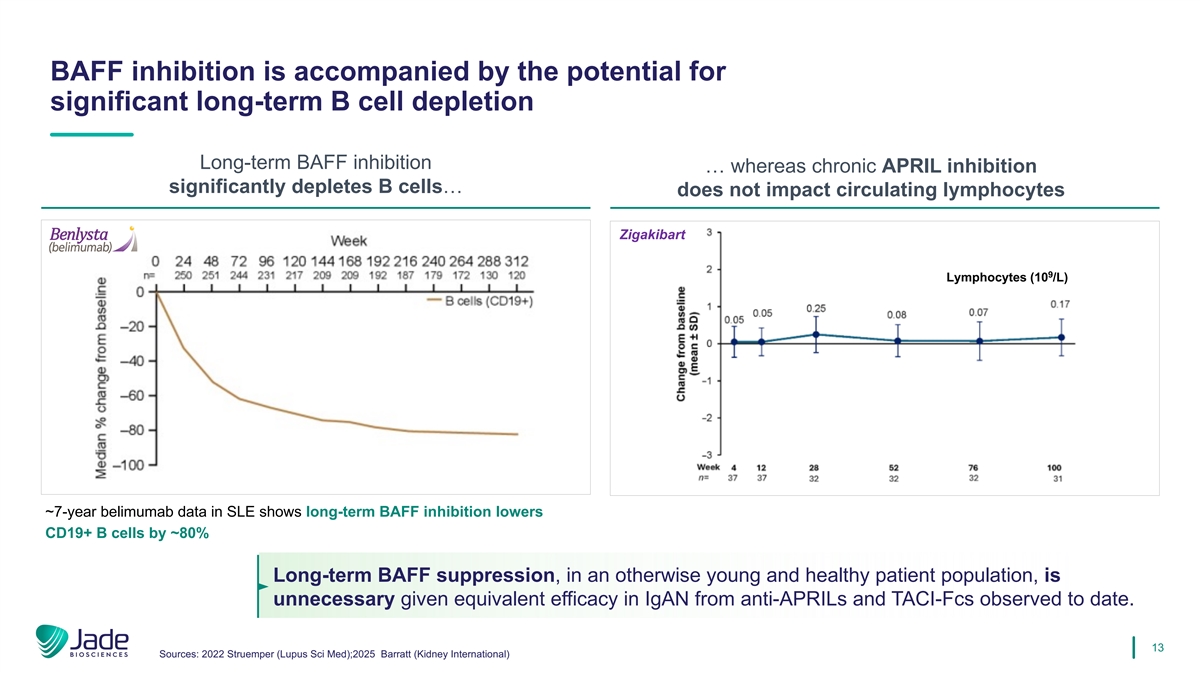

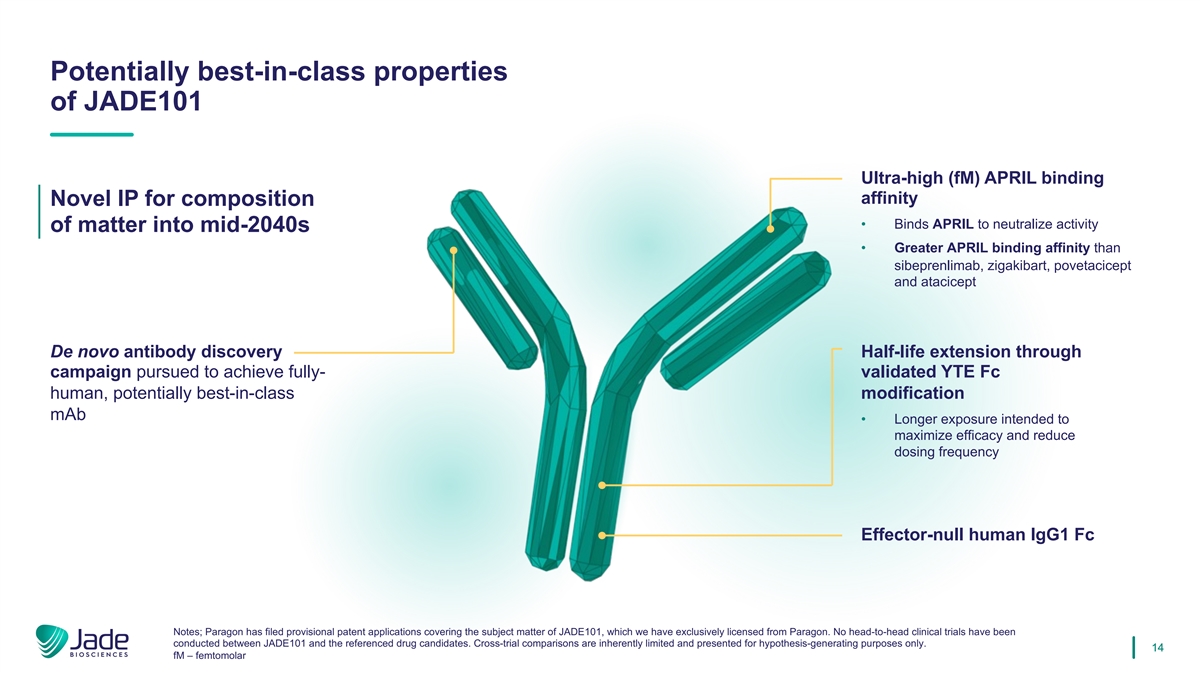

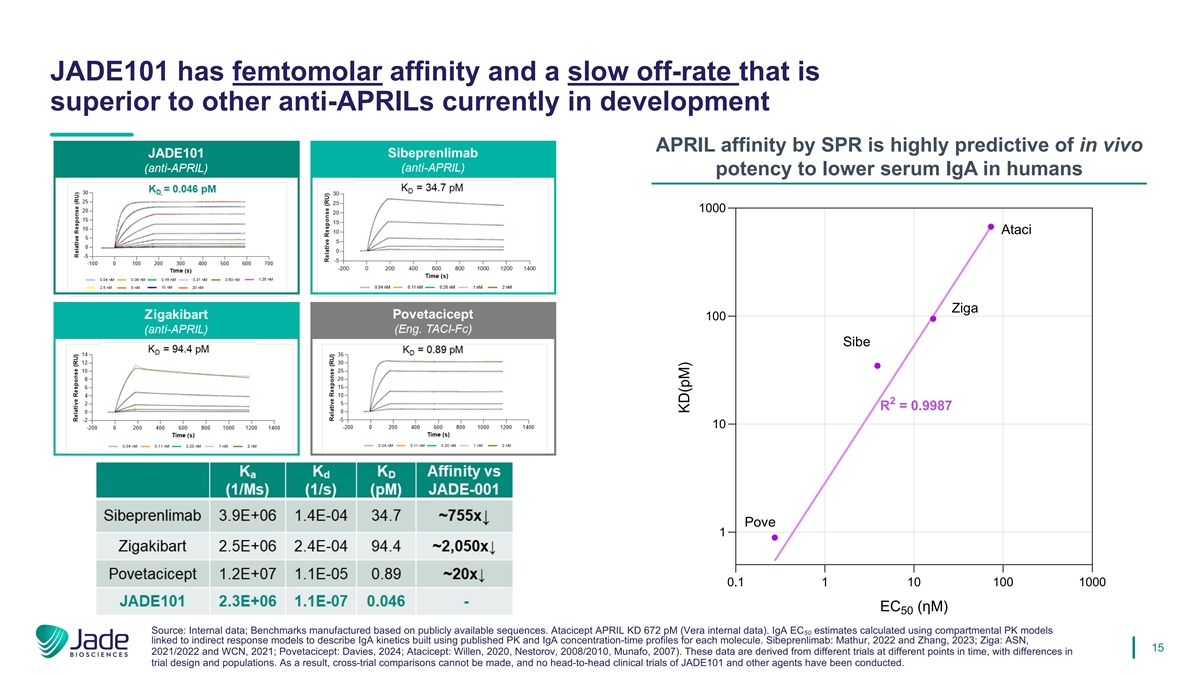

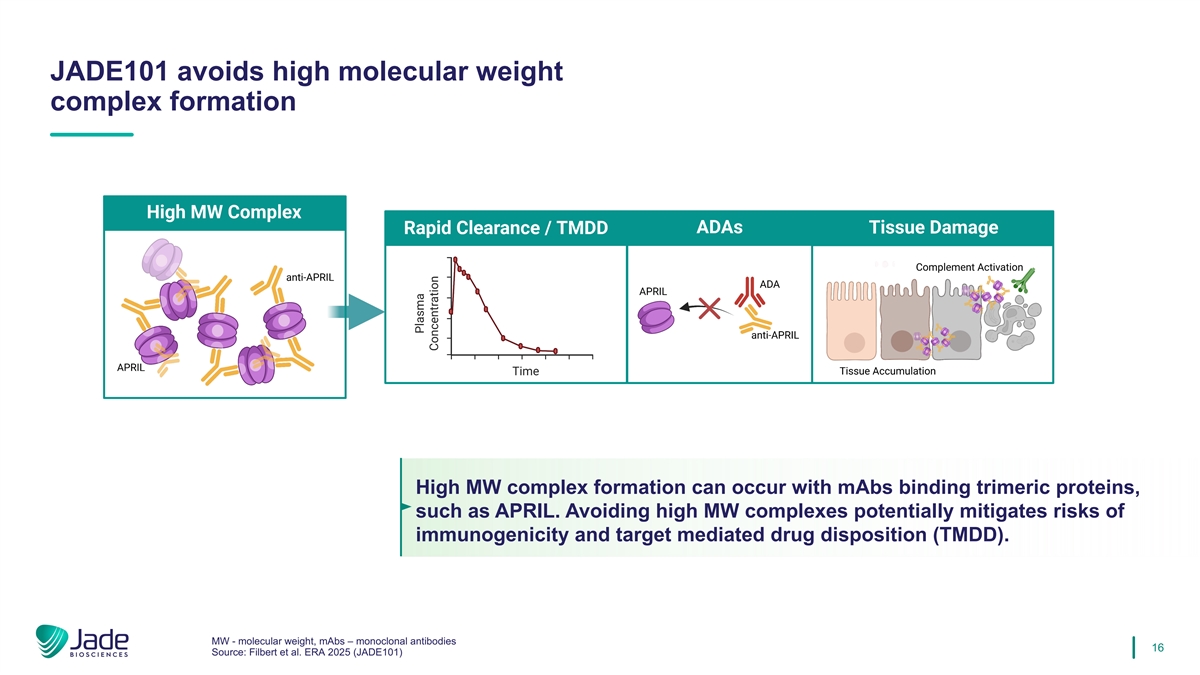

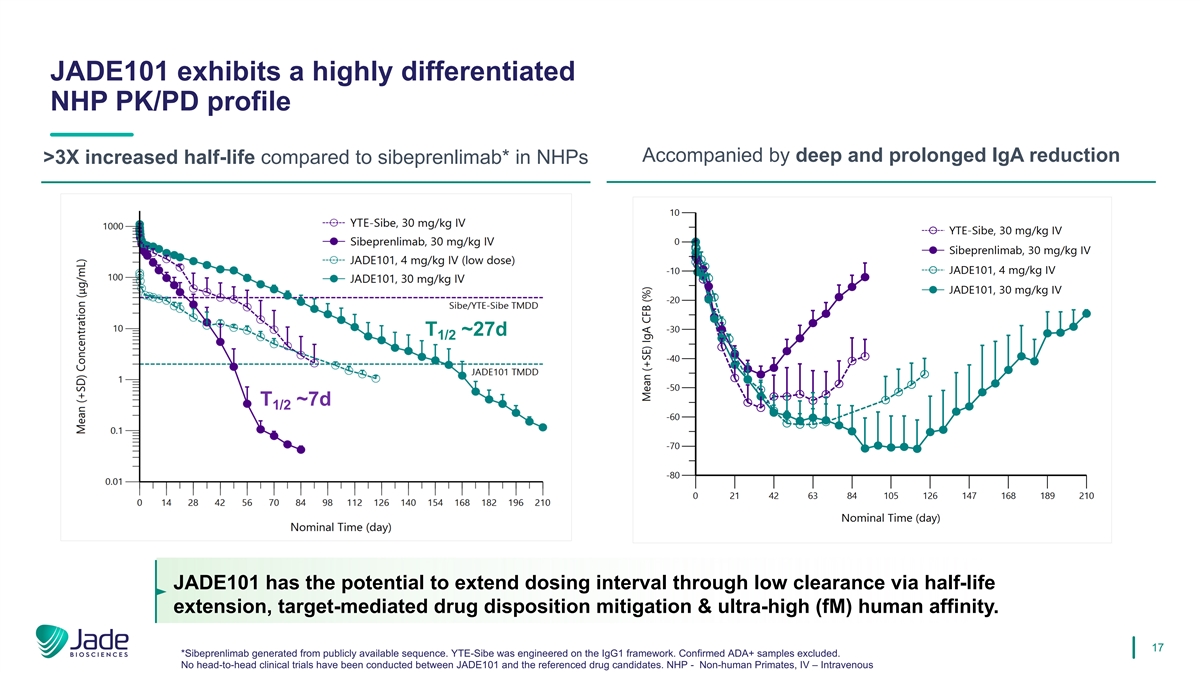

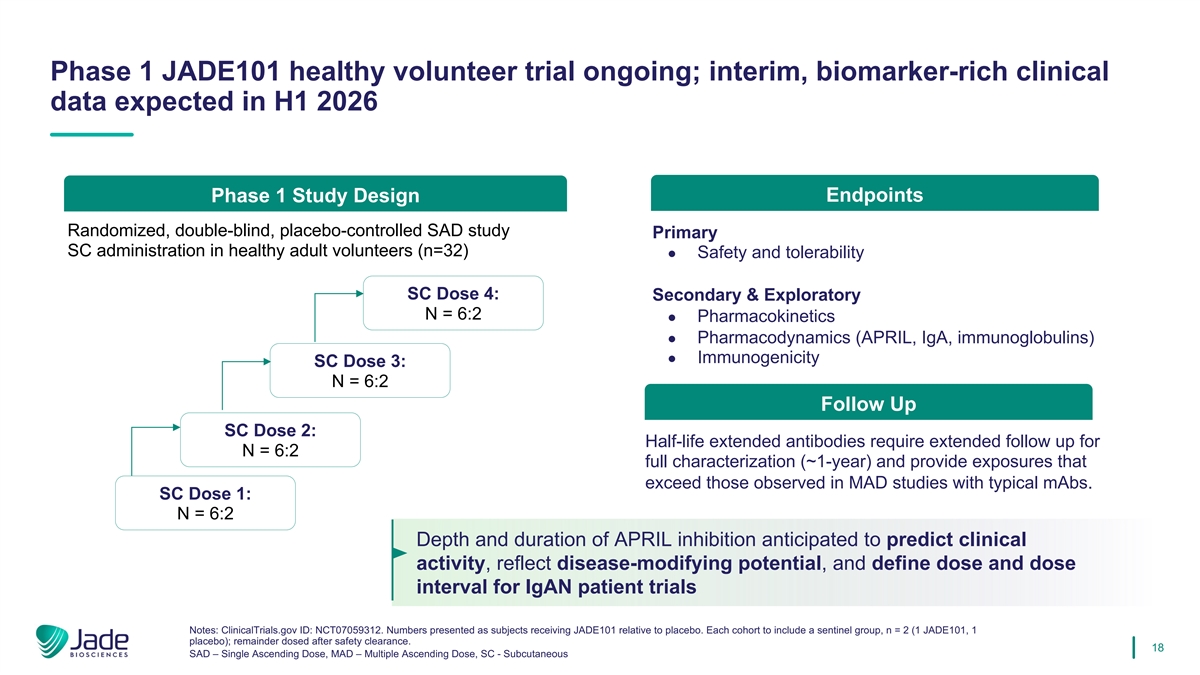

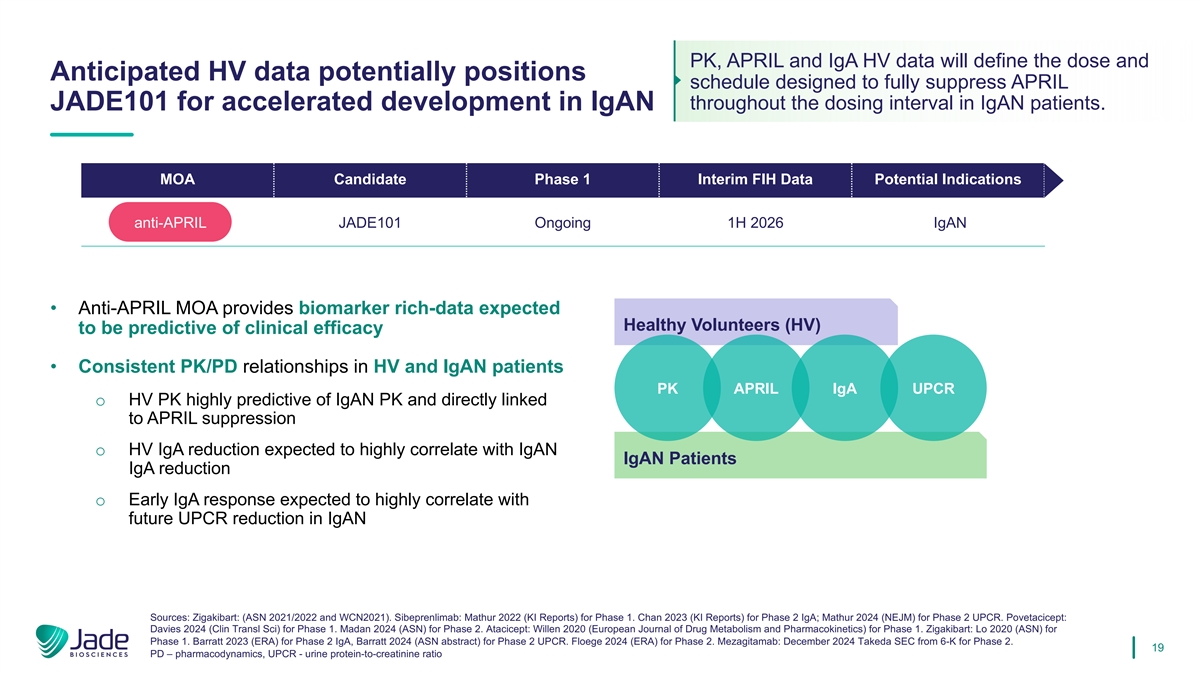

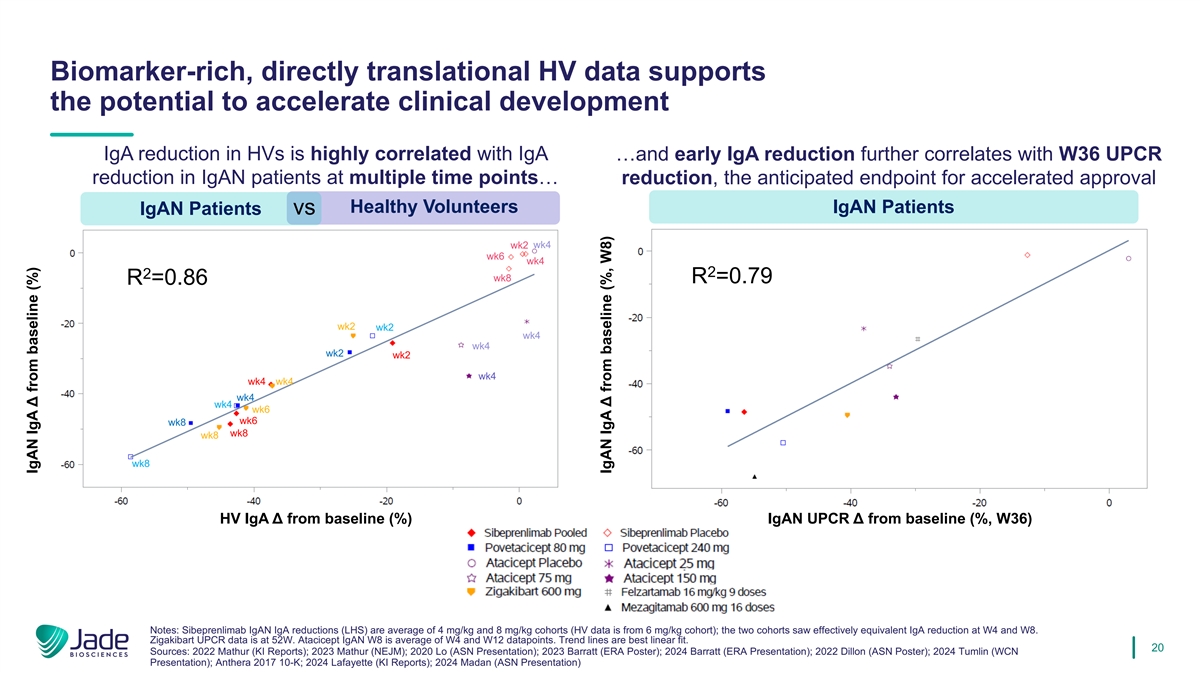

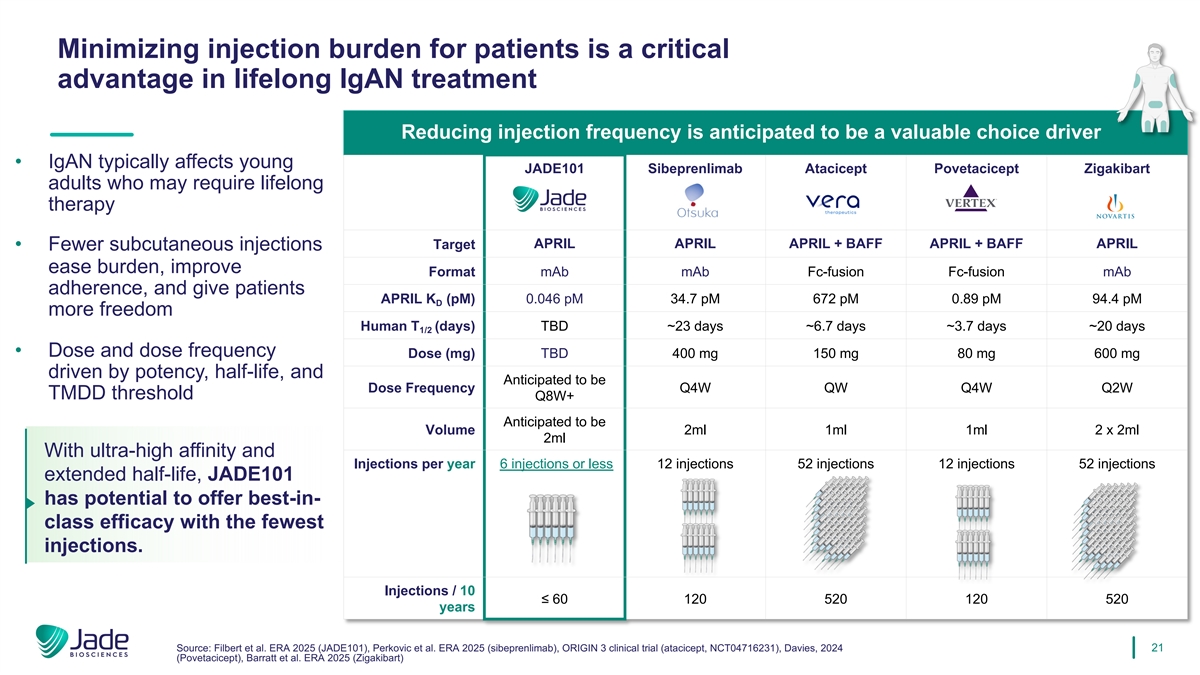

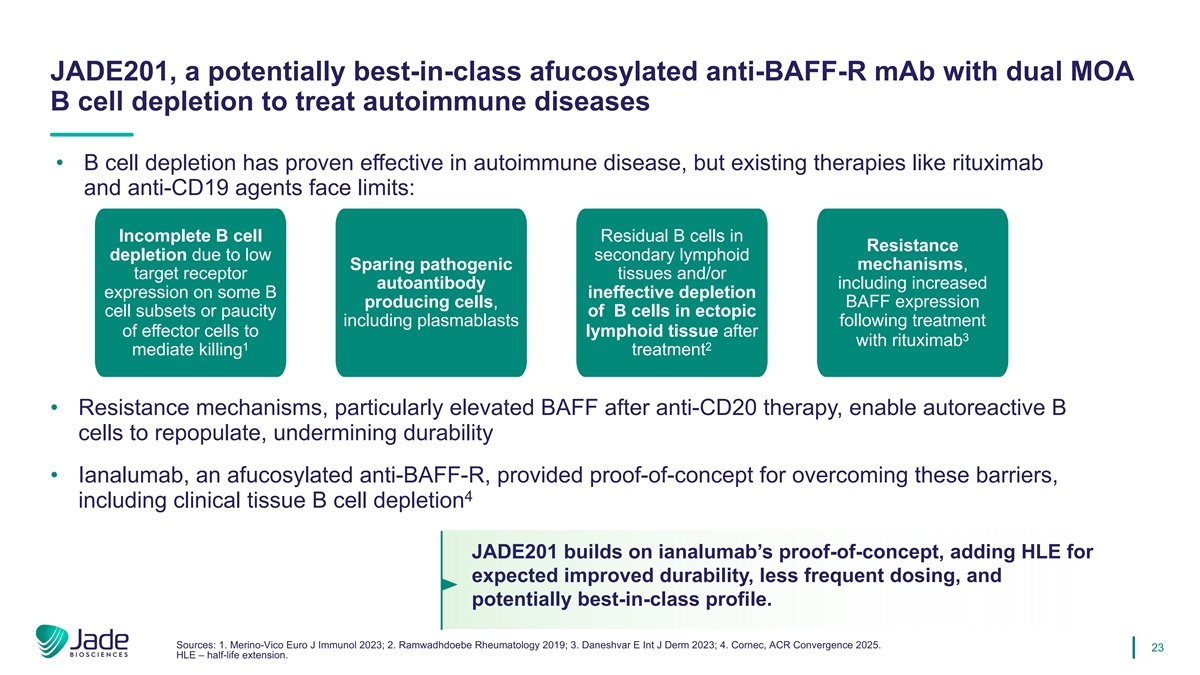

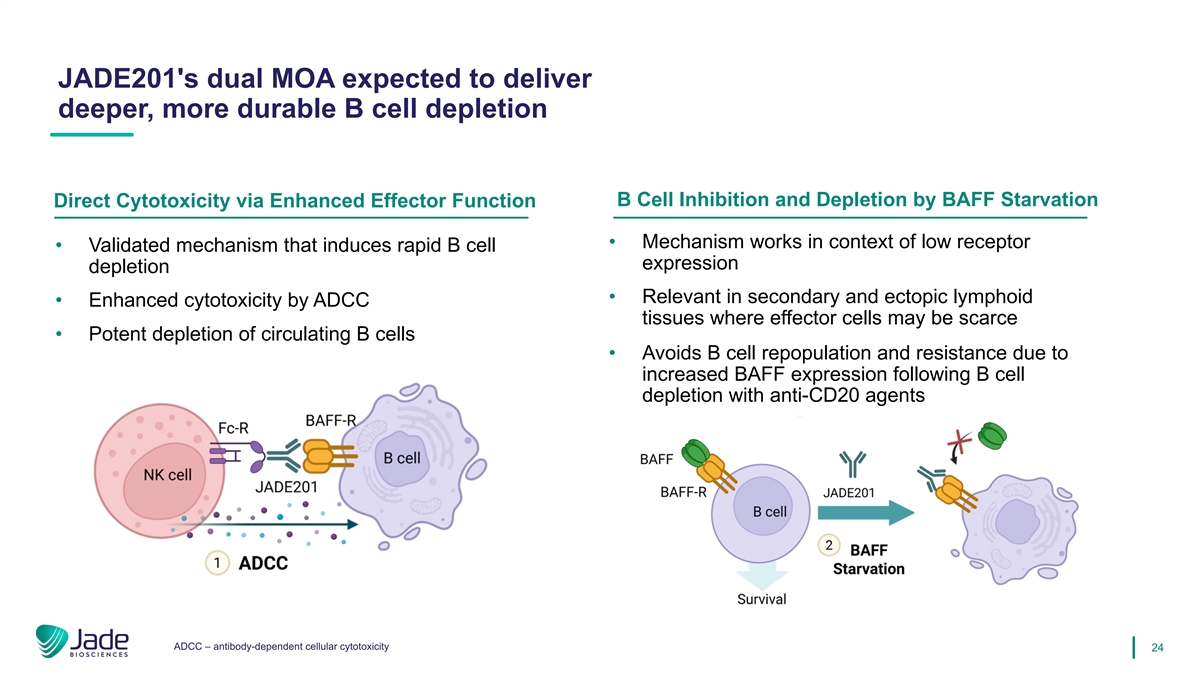

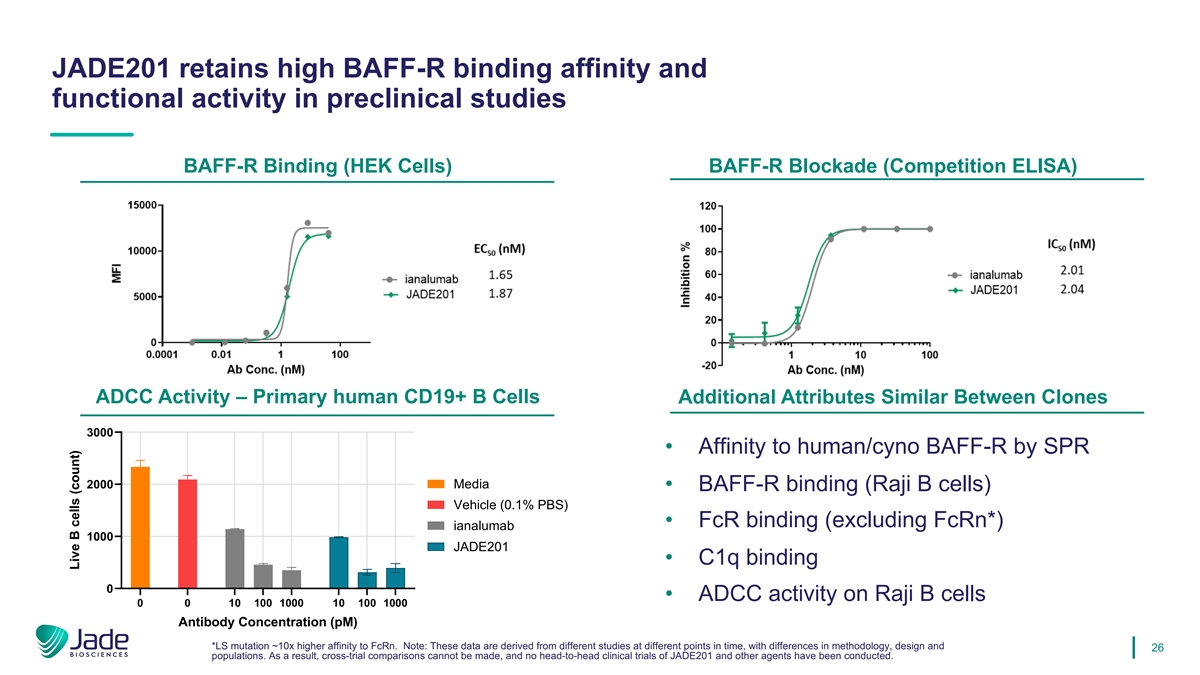

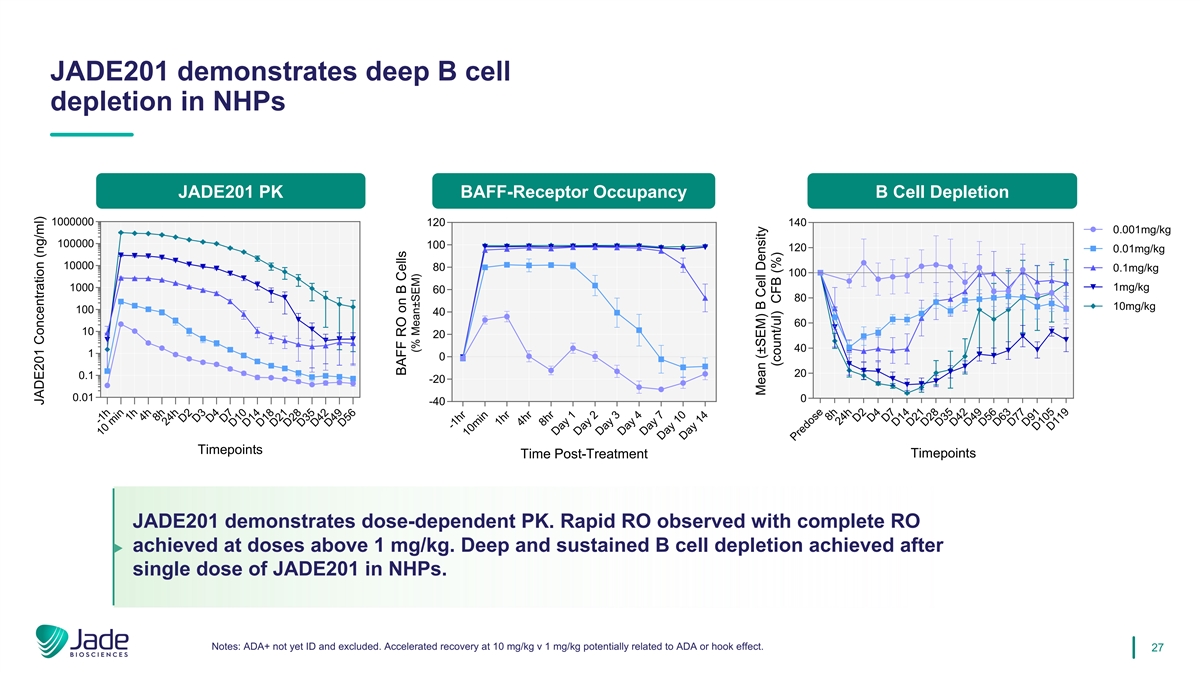

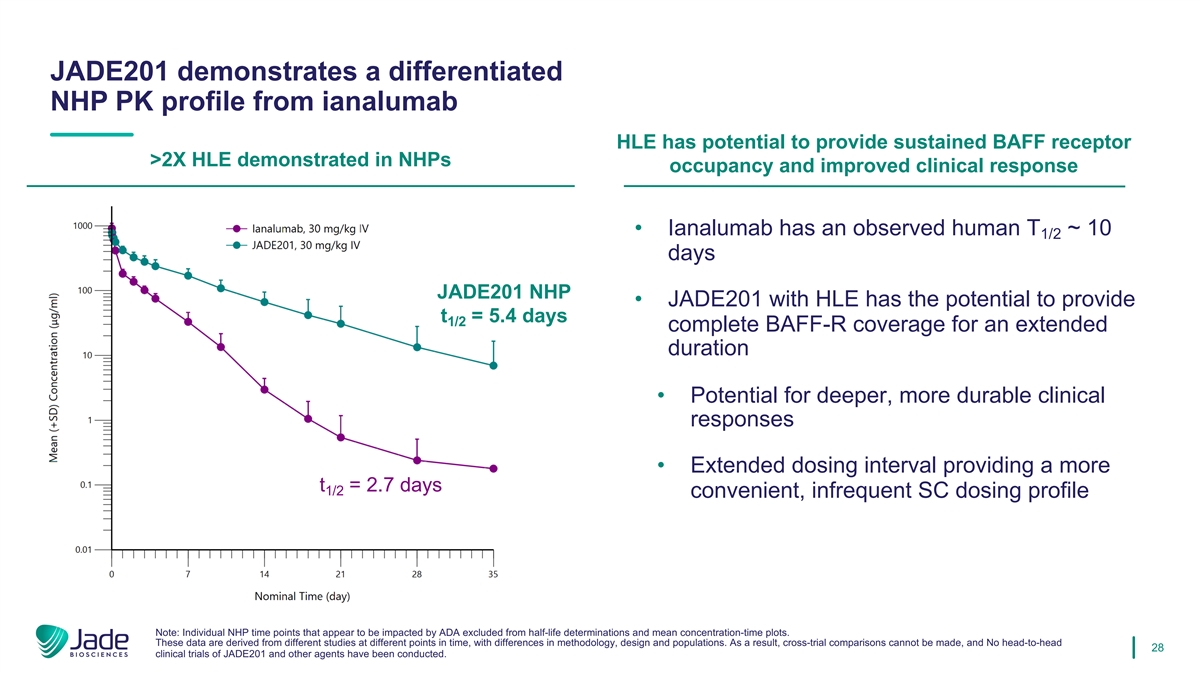

On October 7, 2025, the Company made available a press release announcing the Private Placement. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein. Also on October 7, 2025, the Company made available a press release announcing its candidate targeting BAFF-R, JADE201, and made available an updated corporate presentation on the Company’s website. A copy of the press release and corporate presentation are furnished as Exhibit 99.2 and Exhibit 99.3 to this Current Report on Form 8-K and are incorporated by reference herein.

The information in Item 7.01 of this Current Report on Form 8-K, including the information in the press releases attached as Exhibit 99.1 and Exhibit 99.2 to this Current Report on Form 8-K and the corporate presentation attached as Exhibit 99.3 to this Current Report on Form 8-K, is furnished pursuant to Item 7.01 of Form 8-K and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. Furthermore, the information in Item 7.01 of this Current Report on Form 8-K, including the information in the press releases attached as Exhibit 99.1 and Exhibit 99.2 to this Current Report on Form 8-K and the corporate presentation attached as Exhibit 99.3 to this Current Report on Form 8-K, shall not be deemed to be incorporated by reference in the filings of the Company under the Securities Act.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| Exhibit No. |

Description |

|

| 4.1 | Form of Pre-Funded Warrant. | |

| 10.1†* | Securities Purchase Agreement, dated October 6, 2025, by and among Jade Biosciences, Inc. and each purchaser identified on Annex A thereto. | |

| 10.2† | Form of Registration Rights Agreement. | |

| 99.1 | Press Release, dated October 7, 2025. | |

| 99.2 | Press Release, dated October 7, 2025. | |

| 99.3 | Corporate Presentation, dated October 7, 2025. | |

| 104 | Cover page interactive data file (embedded within the inline XBRL document) | |

| † | Exhibits and/or schedules have been omitted pursuant to Item 601(a)(5) of Regulation S-K. The registrant hereby undertakes to furnish supplementally copies of any of the omitted exhibits and schedules upon request by the Securities and Exchange Commission; provided, however, that the registrant may request confidential treatment pursuant to Rule 24b-2 under the Exchange Act for any exhibits or schedules so furnished. |

| * | Portions of this exhibit (indicated by “[***]”) have been omitted in accordance with the rules of the Securities and Exchange Commission. |

SIGNATURES

Pursuant to the requirements of the Exchange Act, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Jade Biosciences, Inc. | ||||||

| Date: October 7, 2025 | By: | /s/ Tom Frohlich |

||||

| Name: | Tom Frohlich | |||||

| Title: | Chief Executive Officer | |||||

Exhibit 4.1

THIS WARRANT AND THE SHARES OF COMMON STOCK ISSUABLE UPON THE EXERCISE OF THIS WARRANT (THE “SECURITIES”) HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR THE SECURITIES LAWS OF ANY STATE OF THE UNITED STATES. THE SECURITIES HAVE BEEN ACQUIRED FOR INVESTMENT AND MAY NOT BE SOLD, TRANSFERRED OR ASSIGNED UNLESS (I) SUCH SECURITIES HAVE BEEN REGISTERED FOR SALE PURSUANT TO THE SECURITIES ACT, (II) SUCH SECURITIES MAY BE SOLD PURSUANT TO RULE 144 UNDER THE SECURITIES ACT, (III) THE COMPANY HAS RECEIVED AN OPINION OF COUNSEL REASONABLY SATISFACTORY TO IT THAT SUCH TRANSFER MAY LAWFULLY BE MADE WITHOUT REGISTRATION UNDER THE SECURITIES ACT, OR (IV) THE SECURITIES ARE TRANSFERRED WITHOUT CONSIDERATION TO AN AFFILIATE OF SUCH HOLDER OR A CUSTODIAL NOMINEE (WHICH FOR THE AVOIDANCE OF DOUBT SHALL REQUIRE NEITHER CONSENT NOR THE DELIVERY OF AN OPINION).

FORM OF PRE-FUNDED WARRANT TO PURCHASE COMMON STOCK

| Number of Shares: [•] (subject to adjustment) |

||

| Warrant No. [•] | Original Issue Date: October [•], 2025 | |

Jade Biosciences, Inc., a Nevada corporation (the “Company”), hereby certifies that, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, [•] or its registered assigns (the “Holder”), is entitled, subject to the terms set forth below, to purchase from the Company up to a total of [•] shares of common stock, $0.0001 par value per share (the “Common Stock”), of the Company (each such share, a “Warrant Share” and all such shares, the “Warrant Shares”) at an exercise price per share equal to $0.0001 (the “Exercise Price”), in each case as adjusted from time to time as provided in Section 9, upon surrender of this Pre-Funded Warrant to Purchase Common Stock (including any Warrants to Purchase Common Stock issued in exchange, transfer or replacement hereof, the “Warrant”) at any time and from time to time on or after the date hereof (the “Original Issue Date”), subject to the following terms and conditions:

This Warrant is one of a series of similar warrants issued pursuant to that certain Securities Purchase Agreement, dated October 6, 2025, by and among the Company and the Investors identified therein (the “Purchase Agreement”).

1. Definitions. For purposes of this Warrant, the following terms shall have the

following meanings:

“Affiliate” means, with respect to any Person, any other Person that, directly or indirectly through one or more intermediates, controls, is controlled by or is under common control with such Person.

“Attribution Parties” means, collectively, the following Persons and entities: (i) any direct or indirect Affiliates of the Holder, (ii) any investment vehicle, including, any funds, feeder funds or managed accounts, currently, or from time to time after the date hereof, directly or indirectly managed or advised by the Holder’s investment manager, (iii) any Person acting or who could be deemed to be acting as a Group together with the Holder or any Attribution Parties and (iv) any other Persons whose beneficial ownership of the Company’s Common Stock would or could be aggregated with the Holder’s and/or any other Attribution Parties for purposes of Section 13(d) or Section 16 of the Exchange Act. For clarity, the purpose of the foregoing is to subject collectively the Holder and all other Attribution Parties to the Maximum Percentage.

“Closing Sale Price” means, for any security as of any date, the last trade price for such security on the Principal Trading Market for such security, as reported by Bloomberg Financial Markets, or, if such Principal Trading Market begins to operate on an extended hours basis and does not designate the last trade price, then the last trade price of such security prior to 4:00 P.M., New York City time, as reported by Bloomberg Financial Markets, or if the foregoing do not apply, the last trade price of such security in the over-the-counter market on the electronic bulletin board for such security as reported by Bloomberg Financial Markets. If the Closing Sale Price cannot be calculated for a security on a particular date on any of the foregoing bases, the Closing Sale Price of such security on such date shall be the fair market value as mutually determined by the Company and the Holder. If the Company and the Holder are unable to agree upon the fair market value of such security, then the Board of Directors of the Company shall use its good faith judgment to determine the fair market value. The Board of Directors’ determination shall be binding upon all parties absent demonstrable error. All such determinations shall be appropriately adjusted for any stock dividend, stock split, stock combination or other similar transaction during the applicable calculation period.

“Commission” means the U.S. Securities and Exchange Commission.

“Exchange Act” means the U.S. Securities Exchange Act of 1934, as amended, and all of the rules and regulations promulgated thereunder.

“Group” shall have the meaning ascribed to it in Section 13(d) of the Exchange Act, and all related rules, regulations and jurisprudence.

“Person” means an individual, partnership, corporation, limited liability company, business trust, joint stock company, trust, incorporated or unincorporated association, joint venture, government (or an agency or subdivision thereof) or any other entity or organization.

“Principal Trading Market” means the national securities exchange or other trading market on which the Common Stock is primarily listed on and quoted for trading, which, as of the Original Issue Date, shall be the Nasdaq Capital Market.

“Securities Act” means the U.S. Securities Act of 1933, as amended, and all of the rules and regulations promulgated thereunder.

“Standard Settlement Period” means the standard settlement period, expressed in a number of Trading Days, for the Principal Trading Market with respect to the Common Stock that is in effect on the date of delivery of an applicable Exercise Notice, which as of the Original Issue Date was “T+1.”

“Trading Day” means any weekday on which the Principal Trading Market is normally open for trading.

“Transfer Agent” means Computershare Trust Company, N.A., the Company’s transfer agent and registrar for the Common Stock, and any successor appointed in such capacity.

2. Issuance of Securities; Registration of Warrants. The Company shall register ownership of this Warrant, upon records to be maintained by the Company for that purpose (the “Warrant Register”), in the name of the record Holder (which shall include the initial Holder or, as the case may be, any assignee to which this Warrant is permissibly assigned hereunder) from time to time. The Company may deem and treat the registered Holder of this Warrant as the absolute owner hereof for the purpose of any exercise hereof or any distribution to the Holder, and for all other purposes, absent actual notice to the contrary.

3. Registration of Transfers. This Warrant and all rights hereunder (including, without limitation, any registration rights) are transferable, in whole or in part, upon surrender of this Warrant at the principal office of the Company or its designated agent, together with a written assignment of this Warrant substantially in the form attached hereto as Schedule 1 duly executed by the Holder or its agent or attorney and funds sufficient to pay any transfer taxes payable upon the making of such transfer. Subject to compliance with all applicable securities laws, the Company shall, or will cause its Transfer Agent to, register the transfer of all or any portion of this Warrant in the Warrant Register, upon surrender of this Warrant and delivery of such written assignment, and payment for all applicable transfer taxes (if any). Upon any such registration or transfer, a new warrant to purchase Common Stock in substantially the form of this Warrant (any such new warrant, a “New Warrant”) evidencing the portion of this Warrant so transferred shall be issued to the transferee, and a New Warrant evidencing the remaining portion of this Warrant not so transferred, if any, shall be issued to the transferring Holder. The acceptance of the New Warrant by the transferee thereof shall be deemed the acceptance by such transferee of all of the rights and obligations in respect of the New Warrant that the Holder has in respect of this Warrant. The Company shall, or will cause its Transfer Agent to, prepare, issue and deliver at the Company’s own expense any New Warrant under this Section 3. Until due presentment for registration of transfer, the Company may treat the registered Holder hereof as the owner and holder for all purposes, and the Company shall not be affected by any notice to the contrary.

4. Exercise of Warrants.

(a) All or any part of this Warrant shall be exercisable by the registered Holder in any manner permitted by this Warrant (including Section 11) at any time and from time to time on or after the Original Issue Date, and such rights shall not expire until exercised in full.

(b) The Holder may exercise this Warrant by delivering to the Company (i) an exercise notice, in the form attached as Schedule 2 hereto (the “Exercise Notice”), completed and duly signed, and (ii) payment of the Exercise Price for the number of Warrant Shares as to which this Warrant is being exercised (which may take the form of a “cashless exercise” if so indicated in the Exercise Notice pursuant to Section 10 below), and the date on which the last of such items is delivered to the Company (as determined in accordance with the notice provisions hereof) is an “Exercise Date.” The Holder shall not be required to deliver the original Warrant in order to effect an exercise hereunder. Execution and delivery of the Exercise Notice shall have the same effect as cancellation of the original Warrant and issuance of a New Warrant evidencing the right to purchase the remaining number of Warrant Shares, if any.

The delivery by (or on behalf of) the Holder of the Exercise Notice and the applicable Exercise Price as provided above shall constitute the Holder’s certification to the Company that its representations contained in Sections 4.1 and 4.3 through 4.14 of the Purchase Agreement are true and correct as of the Exercise Date as if remade in their entirety (or, in the case of any transferee Holder that is not a party to the Purchase Agreement, such transferee Holder’s certification to the Company that such representations are true and correct as to such transferee Holder as of the Exercise Date).

(c) The Holder and any assignee, by acceptance of this Warrant, acknowledge and agree that, by reason of the provisions of this section, following the purchase of a portion of the Warrant Shares hereunder, the number of Warrant Shares available for purchase hereunder at any given time may be less than the amount stated on the face hereof.

5. Delivery of Warrant Shares.

(a) Upon exercise of this Warrant, the Company shall promptly (but in no event later than the number of Trading Days comprising the Standard Settlement Period following the Exercise Date), upon the request of the Holder, cause the Transfer Agent to credit such aggregate number of shares of Common Stock specified by the Holder in the Exercise Notice and to which the Holder is entitled pursuant to such exercise (the “Exercise Shares”) to (i) the Holder’s or its designee’s balance account with The Depository Trust Company (“DTC”) through its Deposit Withdrawal At Custodian system or (ii) in book-entry form via a direct registration system (“DRS”) maintained by or on behalf of the Transfer Agent, in each case, so long as either (A) there is an effective registration statement permitting the issuance of the Warrant Shares to or the resale of such Warrant Shares by the Holder or (B) the Exercise Shares are eligible for resale by the Holder without volume or manner-of-sale restrictions pursuant to Rule 144 promulgated under the Securities Act (assuming cashless exercise of this Warrant). If (A) and (B) above are not true, the Company shall cause the Transfer Agent to either (i) record the Exercise Shares in the name of the Holder or its designee on the certificates reflecting the Exercise Shares with an appropriate legend regarding restriction on transferability, which shall be issued and dispatched by overnight courier to the address as specified in the Exercise Notice, and on the Company’s share register or (ii) issue such Exercise Shares in the name of the Holder or its designee in restricted book-entry form in the Company’s share register. The Holder, or any Person so designated by the Holder to receive Warrant Shares, shall be deemed to have become the holder of record of such Warrant Shares as of the Exercise Date, irrespective of the date such Warrant Shares are credited to the Holder’s DTC account, the date of the book entry positions or the date of delivery of the certificates evidencing such Exercise Shares, as the case may be.

(b) In addition to any other rights available to the Holder, if the Company fails to cause the Transfer Agent to deliver to the Holder or its designee Exercise Shares in the manner required pursuant to Section 5(a) within the Standard Settlement Period following the Exercise Date (other than a failure caused by incorrect or incomplete information provided by Holder to the Company) and the Holder or the Holder’s broker on its behalf purchases (in an open market transaction or otherwise) shares of Common Stock to deliver in satisfaction of a sale by the Holder of the Warrant Shares which the Holder anticipated receiving upon such exercise (a “Buy-In”) but did not receive within the Standard Settlement Period, then the Company shall, within two Trading Days after the Holder’s request and in the Holder’s sole discretion, promptly honor its obligation to deliver to the Holder or its designee the Exercise Shares pursuant to Section 5(a) and pay cash to the Holder in an amount equal to the excess (if any) of the Holder’s total purchase price (including brokerage commissions, if any) for the shares of Common Stock so purchased in the Buy-In, less the product of (A) the number of shares of Common Stock purchased in the Buy-In, times (B) the Closing Sale Price of a share of Common Stock on the Exercise Date.

The Holder shall provide the Company written notice promptly after the occurrence of a Buy-In, indicating the amounts payable to the Holder in respect of the Buy-In together with applicable confirmations and other evidence reasonably requested by the Company.

(c) To the extent permitted by law and subject to Section 5(b), the Company’s obligations to issue and deliver Warrant Shares in accordance with and subject to the terms hereof (including the limitations set forth in Section 11 below) are absolute and unconditional, irrespective of any action or inaction by the Holder to enforce the same, any waiver or consent with respect to any provision hereof, the recovery of any judgment against any Person or any action to enforce the same, or any setoff, counterclaim, recoupment, limitation or termination, or any breach or alleged breach by the Holder or any other Person of any obligation to the Company or any violation or alleged violation of law by the Holder or any other Person, and irrespective of any other circumstance that might otherwise limit such obligation of the Company to the Holder in connection with the issuance of Warrant Shares. Subject to Section 5(b), nothing herein shall limit the Holder’s right to pursue any other remedies available to it hereunder, at law or in equity including, without limitation, a decree of specific performance and/or injunctive relief with respect to the Company’s failure to timely deliver Exercise Shares; provided, however, that the Holder shall not be entitled to both (i) require the Company to reinstate the portion of the Warrant and equivalent number of Warrant Shares for which such exercise was not timely honored and (ii) receive the number of shares of Common Stock that would have been issued if the Company had timely complied with its delivery requirements under Section 5(a).

6. Charges, Taxes and Expenses. Issuance and delivery of Exercise Shares shall be made without charge to the Holder for any issue or transfer tax, transfer agent fee or other incidental tax or expense (excluding any applicable stamp duties) in respect of the issuance of such shares, all of which taxes and expenses shall be paid by the Company; provided, however, that the Company shall not be required to pay any tax that may be payable in respect of any transfer involved in the registration of any Warrant Shares or the Warrant in a name other than that of the Holder or an Affiliate thereof. The Holder shall be responsible for all other tax liability that may arise as a result of holding or transferring this Warrant or receiving Warrant Shares upon exercise hereof.

7. Replacement of Warrant. If this Warrant is mutilated, lost, stolen or destroyed, the Company shall issue or cause to be issued in exchange and substitution for and upon cancellation hereof, or in lieu of and substitution for this Warrant, a New Warrant, but only upon receipt of evidence reasonably satisfactory to the Company of such loss, theft or destruction (in such case) and, in each case, a customary and reasonable contractual indemnity, if requested by the Company. If a New Warrant is requested as a result of a mutilation of this Warrant, then the Holder shall deliver such mutilated Warrant to the Company as a condition precedent to the Company’s obligation to issue the New Warrant.

8. Reservation of Warrant Shares. The Company covenants that it will, at all times while this Warrant is outstanding, reserve and keep available out of the aggregate of its authorized but unissued and otherwise unreserved Common Stock, solely for the purpose of enabling it to issue Warrant Shares upon exercise of this Warrant as herein provided, the number of Warrant Shares that are initially issuable and deliverable upon the exercise of this entire Warrant, free from preemptive rights or any other contingent purchase rights of persons other than the Holder (taking into account the adjustments and restrictions of Section 9). The Company covenants that all Warrant Shares so issuable and deliverable shall, upon issuance and the payment of the applicable Exercise Price in accordance with the terms hereof, be duly and validly authorized, issued and fully paid and non-assessable. The Company will take all such action as may be reasonably necessary to assure that such shares of Common Stock may be issued as provided herein without violation of any applicable law or regulation, or of any requirements of any securities exchange or automated quotation system upon which the Common Stock may be listed. The Company further covenants that it will not, without the prior written consent of the Holder, take any actions to increase the par value of the Common Stock at any time while this Warrant is outstanding.

9. Certain Adjustments. The Exercise Price and number of Warrant Shares issuable upon exercise of this Warrant (the “Number of Warrant Shares”) are subject to adjustment from time to time as set forth in this Section 9.

(a) Stock Dividends and Splits. If the Company, at any time while this Warrant is outstanding, (i) pays a stock dividend on its Common Stock or otherwise makes a distribution on any class of capital stock issued and outstanding on the Original Issue Date and in accordance with the terms of such stock on the Original Issue Date or as amended, that is payable in shares of Common Stock, (ii) subdivides its outstanding shares of Common Stock into a larger number of shares of Common Stock, (iii) combines its outstanding shares of Common Stock into a smaller number of shares of Common Stock or (iv) issues by reclassification of shares of capital stock any additional shares of Common Stock of the Company, then in each such case the Number of Warrant Shares shall be multiplied by a fraction, the numerator of which shall be the number of shares of Common Stock outstanding immediately after such event and the denominator of which shall be the number of shares of Common Stock outstanding immediately before such event. Any adjustment made pursuant to clause (i) of this paragraph shall become effective immediately after the record date for the determination of stockholders entitled to receive such dividend or distribution, provided, however, that if such record date shall have been fixed and such dividend is not fully paid on the date fixed therefor, the Number of Warrant Shares shall be recomputed accordingly as of the close of business on such record date and thereafter the Number of Warrant Shares shall be adjusted pursuant to this paragraph as of the time of actual payment of such dividends. Any adjustment pursuant to clause (ii), (iii) or (iv) of this paragraph shall become effective immediately after the effective date of such subdivision, combination or issuance.

(b) Pro Rata Distributions.

If, on or after the Original Issue Date, the Company shall declare or make any dividend or other pro rata distribution of its assets (or rights to acquire its assets) to holders of shares of Common Stock, by way of return of capital or otherwise (including, without limitation, any distribution of cash, stock or other securities, property, options, evidence of indebtedness or any other assets by way of a dividend, spin off, reclassification, corporate rearrangement, scheme of arrangement or other similar transaction, but, for the avoidance of doubt, excluding any distribution of shares of Common Stock subject to Section 9(a), any distribution of Purchase Rights (as defined below) subject to Section 9(c) and any Fundamental Transaction (as defined below) subject to Section 9(d)) (a “Distribution”) then, in each such case, the Holder shall be entitled to participate in such Distribution to the same extent that the Holder would have participated therein if the Holder had held the number of shares of Common Stock acquirable upon complete exercise of this Warrant (without regard to any limitations or restrictions on exercise of this Warrant, including without limitation, the Maximum Percentage (as defined below)) immediately before the date on which a record is taken for such Distribution, or, if no such record is taken, the date as of which the record holders of shares of Common Stock are to be determined for the participation in such Distribution; provided, that to the extent that the Holder’s right to participate in any such Distribution would result in the Holder and the other Attribution Parties exceeding the Maximum Percentage, then the Holder shall not be entitled to participate in such Distribution to such extent (and shall not be entitled to beneficial ownership of such shares of Common Stock as a result of such Distribution to such extent) and the portion of such Distribution shall be held in abeyance for the benefit of the Holder until such time or times as its right thereto would not result in the Holder and the other Attribution Parties exceeding the Maximum Percentage, at which time or times the Holder shall be granted such Distribution (and any Distributions declared or made on such initial Distribution or on any subsequent Distribution held similarly in abeyance) to the same extent as if there had been no such limitation.

(c) Purchase Rights. If at any time on or after the Original Issue Date, the Company grants, issues or sells any Options, Convertible Securities or rights to purchase stock, warrants, securities or other property, in each case pro rata to the record holders of any class of Common Stock (the “Purchase Rights”), then the Holder will be entitled to acquire, upon the terms applicable to such Purchase Rights, the aggregate Purchase Rights which the Holder could have acquired if the Holder had held the number of shares of Common Stock acquirable upon complete exercise of this Warrant (without regard to any limitations or restrictions on exercise of this Warrant, including without limitation, the Maximum Percentage) immediately before the date on which a record is taken for the grant, issuance or sale of such Purchase Rights, or, if no such record is taken, the date as of which the record holders of Common Stock are to be determined for the grant, issuance or sale of such Purchase Rights; provided, that to the extent that the Holder’s right to participate in any such Purchase Right would result in the Holder and the other Attribution Parties exceeding the Maximum Percentage, then the Holder shall not be entitled to participate in such Purchase Right to such extent (and shall not be entitled to beneficial ownership of such Common Stock as a result of such Purchase Right (and beneficial ownership) to such extent) and at the Holder’s election, in its sole discretion, either (1) such Purchase Right to such extent shall be held in abeyance for the benefit of the Holder until such time or times as its right thereto would not result in the Holder and the other Attribution Parties exceeding the Maximum Percentage, at which time or times the Holder shall be granted such right (and any Purchase Right granted, issued or sold on such initial Purchase Right or on any subsequent Purchase Right to be held similarly in abeyance) to the same extent as if there had been no such limitation or (2) the Company shall offer the Holder the right upon exercise of such Purchase Right to acquire a security (e.g. a pre-funded warrant) that would not result in the Holder and the other Attribution Parties exceeding the Maximum Percentage but will otherwise to the extent possible have economic and other rights, preferences and privileges substantially consistent and on par with the securities or other property issuable upon exercise of the originally offered Purchase Rights. As used in this Section 9(c), (i) “Options” means any rights, warrants or options to subscribe for or purchase shares of Common Stock or Convertible Securities and (ii) “Convertible Securities” mean any stock or securities (other than Options) directly or indirectly convertible into or exercisable or exchangeable for shares of Common Stock.

(d) Fundamental Transactions. If, at any time while this Warrant is outstanding (i) the Company effects any merger or consolidation of the Company with or into another Person, in which the Company is not the surviving entity or in which the stockholders of the Company immediately prior to such merger or consolidation do not own, directly or indirectly, at least 50% of the voting power of the surviving entity immediately after such merger or consolidation, (ii) the Company effects any sale to another Person of all or substantially all of its assets in one or a series of related transactions, (iii) pursuant to any tender offer or exchange offer (whether by the Company or another Person), holders of capital stock tender shares representing more than 50% of the voting power of the capital stock of the Company and the Company or such other Person, as applicable, accepts such tender for payment, (iv) the Company consummates a stock purchase agreement or other business combination (including, without limitation, a reorganization, recapitalization, spin-off or scheme of arrangement) with another Person whereby such other Person acquires more than 50% of the voting power of the capital stock of the Company (except for any such transaction in which the stockholders of the Company immediately prior to such transaction maintain, in substantially the same proportions, the voting power of such Person immediately after the transaction) or (v) the Company effects any reclassification of the Common Stock or any compulsory share exchange pursuant to which the Common Stock is effectively converted into or exchanged for other securities, cash or property (other than as a result of a subdivision or combination of shares of Common Stock covered by Section 9(a) above) (in any such case, a “Fundamental Transaction”), then following such Fundamental Transaction the Holder shall have the right to receive, upon exercise of this Warrant, the same amount and kind of securities, cash or property as it would have been entitled to receive upon the occurrence of such Fundamental Transaction if it had been, immediately prior to such Fundamental Transaction, the holder of the number of Warrant Shares then issuable upon exercise in full of this Warrant (including any Distributions or Purchase Rights then held in abeyance pursuant to Sections 9(b) or 9(c) above) without regard to any limitations on exercise contained herein (the “Alternate Consideration”). The Company shall not effect any Fundamental Transaction in which the Company is not the surviving entity or the Alternate Consideration includes securities of another Person unless (i) the Alternate Consideration is solely cash and the Company provides for the simultaneous “cashless exercise” of this Warrant pursuant to Section 10 below or (ii) prior to or simultaneously with the consummation thereof, any successor to the Company, surviving entity or other Person (including any purchaser of assets of the Company) shall assume the obligation to deliver to the Holder such Alternate Consideration as, in accordance with the foregoing provisions, the Holder may be entitled to receive, and the other obligations under this Warrant. The provisions of this paragraph (d) shall similarly apply to subsequent transactions analogous to a Fundamental Transaction type.

(e) Number of Warrant Shares. Simultaneously with any adjustment to the Number of Warrant Shares pursuant to Section 9, the Exercise Price shall be increased or decreased proportionately, so that after such adjustment the aggregate Exercise Price payable hereunder for the increased or decreased Number of Warrant Shares shall be the same as the aggregate Exercise Price in effect immediately prior to such adjustment. Notwithstanding the foregoing, in no event may the Exercise Price be adjusted below the par value of the Common Stock then in effect.

(f) Calculations. All calculations under this Section 9 shall be made to the nearest one-tenth of one cent or the nearest share, as applicable.

(g) Notice of Adjustments. Upon the occurrence of each adjustment pursuant to this Section 9, the Company at its expense will, at the written request of the Holder, promptly compute such adjustment, in good faith, in accordance with the terms of this Warrant and prepare a certificate setting forth such adjustment, including a statement of the adjusted Exercise Price and adjusted number or type of Warrant Shares or other securities issuable upon exercise of this Warrant (as applicable), describing the transactions giving rise to such adjustments and showing in detail the facts upon which such adjustment is based. Upon written request, the Company will promptly deliver a copy of each such certificate to the Holder and to the Company’s transfer agent.

(h) Notice of Corporate Events. If, while this Warrant is outstanding, the Company (i) declares a dividend or any other distribution of cash, securities or other property in respect of its Common Stock, including, without limitation, any granting of rights or warrants to subscribe for or purchase any capital stock of the Company or any subsidiary, (ii) authorizes or approves, enters into any agreement contemplating or solicits stockholder approval for any Fundamental Transaction or (iii) authorizes the voluntary dissolution, liquidation or winding up of the affairs of the Company, then the Company shall deliver to the Holder a notice of such transaction at least ten days prior to the applicable record or effective date on which a Person would need to hold Common Stock in order to participate in or vote with respect to such transaction; provided, however, that the failure to deliver such notice or any defect therein shall not affect the validity of the corporate action required to be described in such notice. In addition, if while this Warrant is outstanding, the Company authorizes or approves, enters into any agreement contemplating or solicits stockholder approval for any Fundamental Transaction contemplated by Section 9(d), other than a Fundamental Transaction under clause (iii) of Section 9(d), the Company shall deliver to the Holder a notice of such Fundamental Transaction at least 30 days prior to the date such Fundamental Transaction is consummated. Holder agrees to maintain any information disclosed pursuant to this Section 9(h) in confidence until such information is publicly available, and shall comply with applicable law with respect to trading in the Company’s securities following receipt of any such information.

10. Payment of Exercise Price. Notwithstanding anything contained herein to the contrary, the Holder may, in its sole discretion, satisfy its obligation to pay the Exercise Price through a “cashless exercise”, in which event the Company shall issue to the Holder the number of Warrant Shares in an exchange of securities effected pursuant to Section 3(a)(9) of the Securities Act, determined as follows:

X = Y [(A-B)/A]

where:

“X” equals the number of Warrant Shares to be issued to the Holder;

“Y” equals the total number of Warrant Shares with respect to which this Warrant is then being exercised;

“A” equals the Closing Sale Price of the shares of Common Stock (as reported by Bloomberg Financial Market) as of the Trading Day on the date immediately preceding the Exercise Date; and “B” equals the Exercise Price then in effect for the applicable Warrant Shares at the time of such exercise.

For purposes of Rule 144 promulgated under the Securities Act, it is intended, understood and acknowledged that the Warrant Shares issued in a “cashless exercise” transaction shall be deemed to have been acquired by the Holder, and the holding period for the Warrant Shares shall be deemed to have commenced, on the Original Issue Date (provided that the Commission continues to take the position that such treatment is proper at the time of such exercise). In the event that a registration statement registering the issuance of Warrant Shares is, for any reason, not effective at the time of exercise of this Warrant, then this Warrant may only be exercised through a cashless exercise, as set forth in this Section 10. If the Warrant Shares are issued in such a cashless exercise, the Company acknowledges and agrees that, in accordance with Section 3(a)(9) of the Securities Act, the Exercise Shares issued in such exercise shall take on the registered characteristics of the Warrant being exercised and may be tacked on to the holding period of the Warrant being exercised. Except as set forth in Section 5(b) (Buy-In Remedy) and Section 12 (No Fractional Shares), in no event will the exercise of this Warrant be settled in cash.

11. Limitations on Exercise.

(a) Notwithstanding anything to the contrary contained herein, the Company shall not effect the exercise of any portion of this Warrant, and the Holder of this Warrant shall not have the right to exercise any portion of the Warrant, and any such exercise shall be null and void ab initio and treated as if the exercise had not been made, to the extent that immediately prior to or following such exercise, the Holder, together with the Attribution Parties, beneficially owns or would beneficially own as determined in accordance with Section 13(d) of the Exchange Act and the rules promulgated thereunder, in excess of [4.99][9.99]% (the “Maximum Percentage”) of the Common Stock that would be issued and outstanding following such exercise. For purposes of calculating beneficial ownership for determining whether the Maximum Percentage is or will be exceeded, the aggregate number of shares of Common Stock held and/or beneficially owned by the Holder together with the Attribution Parties, shall include the number of shares of Common Stock held and/or beneficially owned by the Holder together with the Attribution Parties plus the number of shares of Common Stock issuable upon exercise of the relevant Warrant with respect to which the determination is being made but shall exclude the number of shares of Common Stock which would be issuable upon (i) exercise of the remaining, unexercised Warrant held and/or beneficially owned by the Holder or the Attribution Parties and (ii) exercise or conversion of the unexercised or unconverted portion of any other securities of the Company held and/or beneficially owned by such Holder or any Attribution Party (including, without limitation, any convertible notes, convertible stock or warrants) that are subject to a limitation on conversion or exercise analogous to the limitation contained herein. For purposes of this Paragraph 11(a), beneficial ownership of the Holder or the Attribution Parties shall, except as set forth in the immediately preceding sentence, be calculated and determined in accordance with Section 13(d) of the Exchange Act and the rules promulgated thereunder. For purposes of this Warrant, in determining the number of outstanding shares of Common Stock, a Holder of this Warrant may rely on the number of outstanding shares of Common Stock as reflected in (1) the Company’s most recent Form 10-K, Form 10-Q, Current Report on Form 8-K or other public filing with the Securities and Exchange Commission, as the case may be, (2) a more recent public announcement by the Company or (3) any other notice by the Company or the Company’s transfer agent setting forth the number of shares of Common Stock outstanding (such issued and outstanding shares, the “Reported Outstanding Share Number”).

For any reason at any time, upon the written or oral request of the Holder, the Company shall within one business day confirm orally and in writing or by electronic mail to the Holder the number of shares of Common Stock then outstanding. The Holder shall disclose to the Company the number of shares of Common Stock that it, together with the Attribution Parties holds and/or beneficially owns and has the right to acquire through the exercise of derivative securities and any limitations on exercise or conversion analogous to the limitation contained herein contemporaneously or immediately prior to submitting an Exercise Notice for the relevant Warrant. If the Company receives an Exercise Notice from the Holder at a time when the actual number of outstanding shares of Common Stock is less than the Reported Outstanding Share Number, the Company shall (i) notify the Holder in writing of the number of shares of Common Stock then outstanding and, to the extent that such Exercise Notice would otherwise cause the Holder’s, together with the Attribution Parties’, beneficial ownership, as determined pursuant to this Section 11(a), to exceed the Maximum Percentage, the Holder must notify the Company of a reduced number of Warrant Shares to be purchased pursuant to such Exercise Notice (the number of shares by which such purchase is reduced, the “Reduction Shares”) and (ii) as soon as reasonably practicable, the Company shall return to the Holder any exercise price paid by the Holder for the Reduction Shares. In any case, the number of outstanding shares of Common Stock shall be determined after giving effect to the conversion or exercise of securities of the Company, including this Warrant, by the Holder and the Attribution Parties since the date as of which the Reported Outstanding Share Number was reported. In the event that the issuance of Common Stock to the Holder upon exercise of this Warrant results in the Holder, together with the Attribution Parties, being deemed to beneficially own, in the aggregate, more than the Maximum Percentage of the number of outstanding shares of Common Stock (as determined under Section 13(d) of the Exchange Act), the number of shares so issued by which the Holder’s, together with the Attribution Parties’, aggregate beneficial ownership exceeds the Maximum Percentage (the “Excess Shares”) shall be deemed null and void and shall be cancelled ab initio, and the Holder and/or the Attribution Parties shall not have the power to vote or to transfer the Excess Shares. As soon as reasonably practicable after the issuance of the Excess Shares has been deemed null and void, the Company shall return to the Holder the exercise price paid by the Holder for the Excess Shares. By written notice to the Company, a Holder of this Warrant may from time to time increase or decrease the Maximum Percentage to any other percentage not in excess of 19.99% specified in such notice; provided that any increase in the Maximum Percentage will not be effective until the 61st day after such notice is delivered to the Company and shall not negatively affect any partial exercise effected prior to such change.

(b) This Section 11 shall not restrict the number of shares of Common Stock which a Holder or the Attribution Parties may receive or beneficially own in order to determine the amount of securities or other consideration that such Holder or the Attribution Parties may receive in the event of a Fundamental Transaction as contemplated in Section 9(c) of this Warrant. For purposes of clarity, the shares of Common Stock issuable pursuant to the terms of this Warrant in excess of the Maximum Percentage shall not be deemed to be beneficially owned by the Holder or the Attribution Parties for any purpose including for purposes of Section 13(d) of the Exchange Act and the rules promulgated thereunder or Section 16 of the Exchange Act and the rules promulgated thereunder, including Rule 16a-1(a)(1). No prior inability to exercise this Warrant pursuant to this paragraph shall have any effect on the applicability of the provisions of this paragraph with respect to any subsequent determination of exercisability.

The provisions of this paragraph shall be construed and implemented in a manner otherwise than in strict conformity with the terms of this Section 11 to the extent necessary to correct this paragraph or any portion of this paragraph which may be defective or inconsistent with the intended beneficial ownership limitation contained in this Section 11 or to make changes or supplements necessary or desirable to properly give effect to such limitation. The limitation contained in this paragraph may not be waived and shall apply to a successor holder of this Warrant.

12. No Fractional Shares. No fractional Warrant Shares will be issued in connection with any exercise of this Warrant. In lieu of any fractional shares that would otherwise be issuable, the number of Warrant Shares to be issued shall be rounded down to the next whole number and the Company shall pay the Holder in cash the fair market value (based on the Closing Sale Price) for any such fractional shares.

13. Notices. Any and all notices or other communications or deliveries hereunder (including, without limitation, any Exercise Notice) shall be in writing and shall be deemed given and effective on the earliest of (i) the date of transmission, if such notice or communication is delivered confirmed e-mail at the e-mail address specified in the books and records of the Transfer Agent prior to 5:30 P.M., New York City time, on a Trading Day, (ii) the next Trading Day after the date of transmission, if such notice or communication is delivered via confirmed e-mail at the e-mail address specified in the books and records of the Transfer Agent on a day that is not a Trading Day or later than 5:30 P.M., New York City time, on any Trading Day, (iii) the Trading Day following the date of mailing, if sent by nationally recognized overnight courier service specifying next business day delivery, or (iv) upon actual receipt by the Person to whom such notice is required to be given, if by hand delivery.

14. Warrant Agent. The Company shall initially serve as warrant agent under this Warrant. Upon 30 days’ notice to the Holder, the Company may appoint a new warrant agent. Any corporation into which the Company or any new warrant agent may be merged or any corporation resulting from any consolidation to which the Company or any new warrant agent shall be a party or any corporation to which the Company or any new warrant agent transfers substantially all of its corporate trust or shareholders services business shall be a successor warrant agent under this Warrant without any further act. Any such successor warrant agent shall promptly cause notice of its succession as warrant agent to be mailed (by first class mail, postage prepaid) to the Holder at the Holder’s last address as shown on the Warrant Register.

15. Miscellaneous.

(a) No Rights as a Stockholder. Except as otherwise set forth in this Warrant, the Holder, solely in such Person’s capacity as a holder of this Warrant, shall not be entitled to vote or receive dividends or be deemed the holder of share capital of the Company for any purpose, nor shall anything contained in this Warrant be construed to confer upon the Holder, solely in such Person’s capacity as the Holder of this Warrant, any of the rights of a stockholder of the Company or any right to vote, give or withhold consent to any corporate action (whether any reorganization, issue of stock, reclassification of stock, consolidation, merger, amalgamation, conveyance or otherwise), receive notice of meetings, receive dividends or subscription rights, or otherwise, prior to the issuance to the Holder of the Warrant Shares which such Person is then entitled to receive upon the due exercise of this Warrant. In addition, nothing contained in this Warrant shall be construed as imposing any liabilities on the Holder to purchase any securities (upon exercise of this Warrant or otherwise) or as a stockholder of the Company, whether such liabilities are asserted by the Company or by creditors of the Company.

(b) Further Assurances. Except and to the extent as waived or consented to by the Holder, the Company shall not by any action, including, without limitation, amending its certificate or articles of incorporation or through any reorganization, transfer of assets, consolidation, merger, dissolution, issue or sale of securities or any other voluntary action, avoid or seek to avoid the observance or performance of any of the terms of this Warrant, but will at all times in good faith assist in the carrying out of all such terms and in the taking of all such actions as may be necessary or appropriate to protect the rights of Holder as set forth in this Warrant against impairment. Without limiting the generality of the foregoing, the Company will (a) not increase the par value of any Warrant Shares above the amount payable therefor upon such exercise immediately prior to such increase in par value, (b) take all such action as may be necessary or appropriate in order that the Company may validly and legally issue fully paid and non-assessable Warrant Shares upon the exercise of this Warrant, and (c) use commercially reasonable efforts to obtain all such authorizations, exemptions or consents from any public regulatory body having jurisdiction thereof as may be necessary to enable the Company to perform its obligations under this Warrant. Before taking any action which would result in an adjustment in the number of Warrant Shares for which this Warrant is exercisable or in the Exercise Price, the Company shall obtain all such authorizations or exemptions thereof, or consents thereto, as may be necessary from any public regulatory body or bodies having jurisdiction thereof.

(c) Successors and Assigns. Subject to compliance with applicable securities laws, this Warrant may be assigned by the Holder. This Warrant may not be assigned by the Company without the written consent of the Holder, except to a successor in the event of a Fundamental Transaction. This Warrant shall be binding on and inure to the benefit of the Company and the Holder and their respective successors and assigns. Subject to the preceding sentence, nothing in this Warrant shall be construed to give to any Person other than the Company and the Holder any legal or equitable right, remedy or cause of action under this Warrant.

(d) Amendment and Waiver. This Warrant may be amended only in writing signed by the Company and the Holder, or their successors and assigns. Except as otherwise provided herein, the Company may take any action herein prohibited, or omit to perform any act herein required to be performed by it, only if the Company has obtained the written consent of the Holder.

(e) Acceptance. Receipt of this Warrant by the Holder shall constitute acceptance of and agreement to all of the terms and conditions contained herein.

(f) Governing Law; Jurisdiction. ALL QUESTIONS CONCERNING THE CONSTRUCTION, VALIDITY, ENFORCEMENT AND INTERPRETATION OF THIS WARRANT SHALL BE GOVERNED BY AND CONSTRUED AND ENFORCED IN ACCORDANCE WITH THE LAWS OF THE STATE OF NEW YORK WITHOUT REGARD TO THE PRINCIPLES OF CONFLICTS OF LAW THEREOF. EACH OF THE COMPANY AND THE HOLDER HEREBY IRREVOCABLY SUBMITS TO THE EXCLUSIVE JURISDICTION OF THE STATE AND FEDERAL COURTS SITTING IN THE CITY OF NEW YORK, BOROUGH OF MANHATTAN, FOR THE ADJUDICATION OF ANY DISPUTE HEREUNDER OR IN CONNECTION HEREWITH OR WITH ANY TRANSACTION CONTEMPLATED HEREBY OR DISCUSSED HEREIN (INCLUDING WITH RESPECT TO THE ENFORCEMENT OF ANY OF THE TRANSACTION DOCUMENTS), AND HEREBY IRREVOCABLY WAIVES, AND AGREES NOT TO ASSERT IN ANY SUIT, ACTION OR PROCEEDING, ANY CLAIM THAT IT IS NOT PERSONALLY SUBJECT TO THE JURISDICTION OF ANY SUCH COURT.

EACH OF THE COMPANY AND THE HOLDER HEREBY IRREVOCABLY WAIVES PERSONAL SERVICE OF PROCESS AND CONSENTS TO PROCESS BEING SERVED IN ANY SUCH SUIT, ACTION OR PROCEEDING BY MAILING A COPY THEREOF VIA REGISTERED OR CERTIFIED MAIL OR OVERNIGHT DELIVERY (WITH EVIDENCE OF DELIVERY) TO SUCH PERSON AT THE ADDRESS IN EFFECT FOR NOTICES TO IT AND AGREES THAT SUCH SERVICE SHALL CONSTITUTE GOOD AND SUFFICIENT SERVICE OF PROCESS AND NOTICE THEREOF. NOTHING CONTAINED HEREIN SHALL BE DEEMED TO LIMIT IN ANY WAY ANY RIGHT TO SERVE PROCESS IN ANY MANNER PERMITTED BY LAW. EACH OF THE COMPANY AND THE HOLDER HEREBY WAIVES ALL RIGHTS TO A TRIAL BY JURY.

(g) Headings. The headings herein are for convenience only, do not constitute a part of this Warrant and shall not be deemed to limit or affect any of the provisions hereof.

(h) Severability. If any part or provision of this Warrant is held unenforceable or in conflict with the applicable laws or regulations of any jurisdiction, the invalid or unenforceable part or provisions shall be replaced with a provision which accomplishes, to the extent possible, the original business purpose of such part or provision in a valid and enforceable manner, and the remainder of this Warrant shall remain binding upon the parties hereto.

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

IN WITNESS WHEREOF, the Company has caused this Warrant to be duly executed by its authorized officer as of the date first indicated above.

| JADE BIOSCIENCES, INC. | ||

| By: | ||

| Name: | ||

| Title: | ||

SCHEDULE 1

FORM OF PRE-FUNDED WARRANT ASSIGNMENT

Reference is made to the Pre-Funded Warrant to Purchase Common Stock, issued by Jade Biosciences, Inc. (the “Company”) to [•] (the “Holder”), dated as of [•], 2025 (the “Warrant”), which Warrant entitles the Holder, subject to the terms and conditions set forth therein, to purchase from the Company up to [•] shares of the Company’s common stock, par value $0.0001 per share (the “Warrant Shares”).

In accordance with Section 3 of the Warrant, the Holder hereby assigns [the entirety of the Warrant][the Warrant in part], representing the right to purchase [•] Warrant Shares, to:

| Name of Assignee: |

[•] | |||||||

| Assignee Address: |

[•] | |||||||

| Assignee Email: |

[•] | |||||||

| Dated: |

[•] | |||||||

| Holder’s Signature: |

[•] | |||||||

| By: | ||||||||

| Name: | [•] | |||||||

| Title: | [•] | |||||||

| Holder’s Address: |

[•] | |||||||

| Attn: [•] | ||||||||

| Email: [•] | ||||||||

SCHEDULE 2

FORM OF EXERCISE NOTICE

[To be executed by the Holder to purchase shares of Common Stock under the Warrant]

Ladies and Gentlemen:

(1) The undersigned is the Holder of Warrant No. __ (the “Warrant”) issued by Jade Biosciences, Inc., a Nevada corporation (the “Company”). Capitalized terms used herein and not otherwise defined herein have the respective meanings set forth in the Warrant.

(2) The undersigned hereby exercises its right to purchase _____ Warrant Shares pursuant to the Warrant.

(3) The Holder intends that payment of the Exercise Price shall be made as (check one):

| ☐ | Cash Exercise |

| ☐ | “Cashless Exercise” under Section 10 of the Warrant |

(4) If the Holder has elected a Cash Exercise, the Holder shall pay the sum of $ _____ in immediately available funds to the Company in accordance with the terms of the Warrant.

(5) Pursuant to this Exercise Notice, the Company shall deliver to the Holder Warrant Shares determined in accordance with the terms of the Warrant. The Warrant Shares shall be delivered (check one):

| ☐ | to the following DWAC Account Number: _______________________________ |

| ☐ | in book-entry form via a direct registration system |

| ☐ | by physical delivery of a certificate to: ______________________________________________________ |

|

______________________________________________________ |

| ☐ | in restricted book-entry form in the Company’s share register |

(6) By its delivery of this Exercise Notice, the undersigned represents and warrants to the Company that in giving effect to the exercise evidenced hereby the Holder (i) the Holder is an “accredited investor” as defined in Regulation D promulgated under the Securities Act of 1933, as amended and (ii) will not beneficially own in excess of the number of shares of Common Stock (as determined in accordance with Section 13(d) of the Securities Exchange Act of 1934, as amended) permitted to be owned under Section 11(a) of the Warrant to which this notice relates.

| Dated: | ||

| Name of Holder: | ||

| By: | ||

| Name: | ||

| Title: | ||

(Signature must conform in all respects to name of Holder as specified on the face of the Warrant)

Exhibit 10.1

SECURITIES PURCHASE AGREEMENT

This SECURITIES PURCHASE AGREEMENT (this “Agreement”) is dated as of October 6, 2025, by and among Jade Biosciences, Inc., a Nevada corporation (the “Company”), and each of the Persons listed on Exhibit A attached to this Agreement (each, an “Investor” and together, the “Investors”).

WHEREAS, the Company and the Investors are executing and delivering this Agreement in reliance upon the exemption from securities registration afforded by Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”);

WHEREAS, the Company desires to sell to the Investors, and each Investor desires to purchase from the Company, severally and not jointly, upon the terms and subject to the conditions stated in this Agreement, (A) shares (the “Initial Shares”) of the Company’s common stock, par value $0.0001 per share (the “Common Stock”) and/or (B) pre-funded warrants to purchase shares of Common Stock substantially in the form attached hereto as Exhibit B (the “Pre-Funded Warrants”). The Initial Shares and the Pre-Funded Warrants are collectively referred to herein as the “Securities”; and

WHEREAS, contemporaneously with the sale of the Securities, the parties hereto will execute and deliver a Registration Rights Agreement, in the form attached hereto as Exhibit C, pursuant to which the Company will agree to provide certain registration rights in respect of the Shares (as defined below) under the Securities Act and applicable state securities laws.

NOW THEREFORE, in consideration of the mutual agreements, representations, warranties and covenants herein contained, the Company and each Investor, severally and not jointly, agree as follows:

1. Definitions. As used in this Agreement, the following terms shall have the following respective meanings:

“Affiliate” means, with respect to any Person, any other Person that, directly or indirectly through one or more intermediaries, controls, is controlled by or is under common control with such Person.

“Agreement” has the meaning set forth in the recitals.

“Articles of Incorporation” means the articles of incorporation of the Company, as currently in effect and as in effect on the Closing Date.

“Benefit Plan” or “Benefit Plans” means employee benefit plans as defined in Section 3(3) of ERISA and all other employee benefit practices or arrangements, including, without limitation, any such practices or arrangements providing severance pay, sick leave, vacation pay, salary continuation for disability, retirement benefits, deferred compensation, bonus pay, incentive pay, stock options or other stock-based compensation, hospitalization insurance, medical insurance, life insurance, scholarships or tuition reimbursements, maintained by the Company or to which the Company or any of its subsidiaries is obligated to contribute for employees or former employees of the Company and its subsidiaries.

“Board of Directors” means the board of directors of the Company.

“Business Day” means any day except any Saturday, any Sunday, any day which is a federal legal holiday in the United States or any day on which banking institutions in the State of New York are authorized or required by law or other governmental action to close.

“Bylaws” means the bylaws of the Company, as currently in effect and as in effect on the Closing Date.

“Closing” has the meaning set forth in Section 2.1.

“Closing Date” has the meaning set forth in Section 2.1.

“Code” means the U.S. Internal Revenue Code of 1986, as amended.

“Common Stock” has the meaning set forth in the recitals.

“Common Stock Equivalents” means any securities of the Company that would entitle the holder thereof to acquire at any time Common Stock, including, without limitation, any debt, preferred stock, rights, options, warrants or other instrument that is at any time convertible into or exchangeable for, or otherwise entitles the holder thereof to receive, Common Stock.

“Company” has the meaning set forth in the recitals.

“Confidential Data” has the meaning set forth in Section 3.32.

“Disclosure Document” has the meaning set forth in Section 5.3.

“Drug Regulatory Agency” means the U.S. Food and Drug Administration (“FDA”) or other foreign, state, local or comparable governmental authority responsible for regulation of the research, development, testing, manufacturing, processing, storage, labeling, sale, marketing, advertising, distribution and importation or exportation of drug or biological products and drug or biological product candidates.

“Environmental Laws” has the meaning set forth in Section 3.15.

“ERISA” means the U.S. Employee Retirement Income Security Act of 1974, as amended.

“Exchange Act” means the U.S. Securities Exchange Act of 1934, as amended, and all of the rules and regulations promulgated thereunder.

“Financial Statements” has the meaning set forth in Section 3.8(b).

“Fundamental Representations” means the representations and warranties made by the Company in Sections 3.1 (Organization and Power), 3.2 (Capitalization), 3.4 (Authorization), 3.5 (Valid Issuance), 3.6 (No Conflict), 3.7 (Consents), 3.8 (SEC Filings; Financial Statements), 3.18 (Nasdaq Stock Market), 3.19 (Sarbanes-Oxley Act), 3.23 (Price Stabilization of Common Stock), 3.24 (Investment Company Act), 3.25 (General Solicitation; No Integration or Aggregation), 3.26 (Brokers and Finders), 3.27 (Reliance by the Investors), and 3.30 (No Additional Agreements).

2

“GAAP” has the meaning set forth in Section 3.8(b).

“GDPR” has the meaning set forth in Section 3.33.

“Governmental Authorizations” has the meaning set forth in Section 3.11.

“Health Care Laws” has the meaning set forth in Section 3.21.

“HIPAA” has the meaning set forth in Section 3.32.

“Indemnified Persons” has the meaning set forth in Section 5.9.

“Initial Shares” has the meaning set forth in the recitals hereof.

“Intellectual Property” has the meaning set forth in Section 3.12.

“Investor” and “Investors” have the meanings set forth in the recitals.

“Investor Majority” means, prior to the Closing, the Investors committed to purchase at least a majority of the Securities (provided that such majority shall include each Investor that committed an Aggregate Purchase Amount (as defined below) of no less than $16.5 million (including the Aggregate Purchase Amount of such Investor’s Affiliates and related funds)).

“IT Systems” has the meaning set forth in Section 3.32.

“Material Adverse Effect” means any change, event, circumstance, development, condition, occurrence or effect that, individually or in the aggregate, (a) was, is, or would reasonably be expected to be, materially adverse to the business, financial condition, properties, assets, liabilities, stockholders’ equity or results of operations of the Company and its subsidiaries, taken as a whole, or (b) materially delays or materially impairs the ability of the Company to timely comply, or prevents the Company from timely complying, with its obligations under this Agreement, the other Transaction Agreements, or with respect to the Closing, or would reasonably be expected to do so; provided, however, that none of the following will be deemed in themselves, either alone or in combination, to constitute, and that none of the following will be taken into account in determining whether there has been or will be, a Material Adverse Effect under subclause (a) of this definition:

| (i) | any change generally affecting the economy, financial markets or political, economic or regulatory conditions in the United States or any other geographic region in which the Company conducts business, provided that the Company is not disproportionately affected thereby; |

| (ii) | general financial, credit or capital market conditions, including interest rates or exchange rates, or any changes therein, provided that the Company is not disproportionately affected thereby; |

3

| (iii) | any change that generally affects industries in which the Company and its subsidiaries conduct business, provided that the Company is not disproportionately affected thereby; |

| (iv) | earthquakes, hurricanes, tsunamis, tornadoes, floods, mudslides, fires or other natural disasters, weather conditions, global pandemics, including the COVID-19 pandemic and related strains, epidemic or similar health emergency, and other force majeure events in the United States or any other location, provided that the Company is not disproportionately affected thereby; |

| (v) | national or international political or social conditions (or changes in such conditions), whether or not pursuant to the declaration of a national emergency or war, or the occurrence of any military or terrorist attack, provided that the Company is not disproportionately affected thereby; |

| (vi) | material changes in laws after the date of this Agreement; and |

| (vii) | in and of itself, any material failure by the Company to meet any published or internally prepared estimates of drug development timelines (it being understood that the facts and circumstances giving rise to such failure may be deemed to constitute, and may be taken into account in determining whether there has been, a Material Adverse Effect to the extent that such facts and circumstances are not otherwise described in clauses (i)-(v) of this definition). |

“Nasdaq” means the Nasdaq Stock Market LLC.

“National Exchange” means any of the following markets or exchanges on which the Common Stock is listed or quoted for trading on the date in question, together with any successor thereto: the NYSE American, The New York Stock Exchange, The Nasdaq Global Market, The Nasdaq Global Select Market and The Nasdaq Capital Market.

“Person” means an individual, partnership, corporation, limited liability company, business trust, joint stock company, trust, unincorporated association, joint venture or any other entity or organization.

“Personal Data” has the meaning set forth in Section 3.32.

“Placement Agent” means each of Jefferies LLC, TD Securities (USA) LLC, Stifel, Nicolaus & Company, Incorporated, and Wedbush & Co., LLC.

“Pre-Funded Warrant Price” means $9.1399.

“Pre-Funded Warrant Shares” has the meaning set forth in Section 3.4.

“Pre-Funded Warrants” has the meaning set forth in the recitals.

“Privacy Laws” has the meaning set forth in Section 3.33.

4

“Privacy Statements” has the meaning set forth in Section 3.33.

“Process” or “Processing” has the meaning set forth in Section 3.33.

“Registration Rights Agreement” has the meaning set forth in Section 6.1(j).

“Regulatory Agencies” has the meaning set forth in Section 3.20.

“Rule 144” means Rule 144 promulgated by the SEC pursuant to the Securities Act, as such rule may be amended from time to time, or any similar rule or regulation hereafter adopted by the SEC having substantially the same effect as such rule.

“SEC” means the U.S. Securities and Exchange Commission.