UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of: September 2025

Commission File Number: 001-34984

FIRST MAJESTIC SILVER CORP.

(Translation of registrant’s name into English)

Suite 1800 – 925 West Georgia Street

Vancouver, British Columbia V6C 3L2

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☒

DOCUMENTS FILED AS PART OF THIS FORM 6-K

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| FIRST MAJESTIC SILVER CORP. |

| (Registrant) |

| /s/ Samir Patel |

| Samir Patel |

| General Counsel & Corporate Secretary |

| September 26, 2025 |

Exhibit 99.1

San Dimas Silver/Gold Mine

Durango and Sinaloa States, Mexico

NI 43-101 Technical Report on

Mineral Resource and Mineral Reserve Estimates

| Qualified Persons: | Gonzalo Mercado, P.Geo. David Rowe, CPG Michael Jarred Deal, RM SME Andrew Pocock, P.Eng. María Elena Vázquez Jaimes, P.Geo. |

| Report Prepared For: | First Majestic Silver Corp. |

| Effective Date: | August 31, 2025 | |

| Report Date: | September 24, 2025 | |

| San Dimas Silver/Gold Mine Durango and Sinaloa States, Mexico NI-43-101 Technical Report on Mineral Resource and Mineral Reserve Estimates |

|

Table of Contents

| 1. SUMMARY |

1 | |||

| 1.1. Introduction |

1 | |||

| 1.2. Property Description, Location and Access |

1 | |||

| 1.3. History |

3 | |||

| 1.4. Geological Setting, Mineralization and Deposit Types |

3 | |||

| 1.5. Exploration |

5 | |||

| 1.6. Drilling |

5 | |||

| 1.7. Sampling, Analysis and Data Verification |

6 | |||

| 1.8. Mineral Processing and Metallurgical Testing |

7 | |||

| 1.9. Mineral Resource and Mineral Reserve Estimates |

7 | |||

| 1.9.1. Mineral Resource Estimates |

7 | |||

| 1.9.2. Mineral Reserve Estimates |

11 | |||

| 1.10. Mining Operations |

14 | |||

| 1.11. Recovery Methods |

16 | |||

| 1.12. Infrastructure, Permitting and Compliance Activities |

16 | |||

| 1.13. Capital and Operating Costs |

18 | |||

| 1.14. Conclusions |

20 | |||

| 1.15. Recommendations |

20 | |||

| 2. INTRODUCTION |

21 | |||

| 2.1. Technical Report Issuer |

21 | |||

| 2.2. Terms of Reference |

21 | |||

| 2.3. Cut-off and Effective Dates |

21 | |||

| 2.4. Qualified Persons |

21 | |||

| 2.5. Site Visits |

22 | |||

| 2.6. Sources of Information |

23 | |||

| 2.7. Previously Filed Technical Reports |

23 | |||

| 2.8. Units, Currency, and Abbreviations |

23 | |||

| 3. RELIANCE ON OTHER EXPERTS |

25 | |||

| 4. PROPERTY DESCRIPTION AND LOCATION |

26 | |||

| 4.1. Property Location |

26 | |||

| 4.2. Ownership |

26 | |||

| 4.3. Mineral Tenure |

26 | |||

| 4.4. Royalties |

35 | |||

| 4.5. Surface Rights |

35 | |||

| 4.6. Permitting Considerations |

36 | |||

| 4.7. Environmental Considerations |

36 | |||

| 4.8. Existing Environmental Liabilities |

36 | |||

| 4.9. Significant Factors and Risks |

36 | |||

| 5. ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE, AND PHYSIOGRAPHY |

37 | |||

| 5.1. Accessibility |

37 | |||

| 5.2. Climate |

38 |

| i | September 2025 |

| San Dimas Silver/Gold Mine Durango and Sinaloa States, Mexico NI-43-101 Technical Report on Mineral Resource and Mineral Reserve Estimates |

|

| 5.3. Local Resources and Infrastructure |

39 | |||

| 5.4. Physiography |

40 | |||

| 5.5. Comment on Section 5 |

40 | |||

| 6. HISTORY |

42 | |||

| 6.1. Ownership History |

42 | |||

| 6.2. Exploration History |

44 | |||

| 6.3. Production History |

47 | |||

| 7. GEOLOGICAL SETTING AND MINERALIZATION |

48 | |||

| 7.1. Regional Geology |

48 | |||

| 7.1.1. Stratigraphy |

50 | |||

| 7.1.2. Lower Volcanic Complex (LVC) |

51 | |||

| 7.1.3. Upper Volcanic Group (UVG) |

52 | |||

| 7.1.4. Intrusive Rocks |

52 | |||

| 7.1.5. Structural Geology |

52 | |||

| 7.2. Mineralization |

54 | |||

| 7.3. Deposit Descriptions |

57 | |||

| 7.3.1. West Block |

60 | |||

| 7.3.2. Graben Block |

62 | |||

| 7.3.3. Central Block |

63 | |||

| 7.3.4. Tayoltita Block |

63 | |||

| 7.3.5. Santa Rita Area |

64 | |||

| 7.3.6. El Cristo Area |

65 | |||

| 7.3.7. Alto De Arana Area |

67 | |||

| 7.3.8. San Vicente Area |

68 | |||

| 7.3.9. Ventanas Prospect |

69 | |||

| 7.4. Comments on Section 7 |

69 | |||

| 8. MINERAL DEPOSIT TYPES |

70 | |||

| 8.1. Geological Setting |

70 | |||

| 8.2. Mineralization |

70 | |||

| 8.3. Alteration |

71 | |||

| 8.4. Applicability of the Low-Sulphidation Epithermal Model to San Dimas |

71 | |||

| 8.5. Comments on Section 8 |

73 | |||

| 9. EXPLORATION |

74 | |||

| 9.1. Introduction |

74 | |||

| 9.2. Grids and Surveys |

75 | |||

| 9.3. Geological Mapping |

75 | |||

| 9.3.1. Surface Geological Mapping |

75 | |||

| 9.3.2. Underground Geological Mapping |

77 | |||

| 9.4. Geochemical Sampling |

78 | |||

| 9.5. Geophysics |

81 | |||

| 9.6. Remote Sensing |

82 | |||

| 9.7. Tunnelling |

83 | |||

| 9.8. Petrology, Mineralogy, and Research studies |

85 | |||

| 9.9. Exploration Potential |

85 |

| ii | September 2025 |

| San Dimas Silver/Gold Mine Durango and Sinaloa States, Mexico NI-43-101 Technical Report on Mineral Resource and Mineral Reserve Estimates |

|

| 10. DRILLING |

86 | |||

| 10.1. Drill Methods |

86 | |||

| 10.2. Core Handling and Storage |

88 | |||

| 10.3. Data Collection |

88 | |||

| 10.4. Drill Hole Logging Procedure |

89 | |||

| 10.5. Core Recovery |

89 | |||

| 10.6. Collar Survey |

89 | |||

| 10.7. Downhole Survey |

89 | |||

| 10.8. Geotechnical Drilling |

89 | |||

| 10.9. Specific Gravity and Bulk Density |

90 | |||

| 10.10. Drill Core Interval Length/True Thickness |

90 | |||

| 10.11. Comments on Section 10 |

91 | |||

| 11. SAMPLE PREPARATION, ANALYSES AND SECURITY |

92 | |||

| 11.1. Sampling Methods |

92 | |||

| 11.1.1. Core Sampling |

92 | |||

| 11.1.2. Underground Production Channel Sampling |

92 | |||

| 11.2. Analytical Laboratories |

93 | |||

| 11.3. Sample Preparation and Analysis |

93 | |||

| 11.3.1. San Dimas Laboratory |

93 | |||

| 11.3.2. SGS Durango |

94 | |||

| 11.3.3. Central Laboratory |

94 | |||

| 11.3.4. ALS |

94 | |||

| 11.4. Quality Assurance and Quality Control (QAQC) |

95 | |||

| 11.4.1. Materials and Insertion Rates |

95 | |||

| 11.4.2. Transcription and Sample Handling Errors |

96 | |||

| 11.4.3. Accuracy Assessment |

96 | |||

| 11.4.4. Contamination Assessment |

98 | |||

| 11.4.5. Precision Assessment |

100 | |||

| 11.4.6. Between-Laboratory Bias Assessment |

101 | |||

| 11.5. Databases |

103 | |||

| 11.6. Sample Security |

103 | |||

| 11.6.1. Channel Samples |

103 | |||

| 11.6.2. Drill Core Samples |

103 | |||

| 11.7. Author’s Opinion and Other Comments on section 11 |

103 | |||

| 12. DATA VERIFICATION |

105 | |||

| 12.1. Data Entry Error Checks |

105 | |||

| 12.2. Visual Data Inspection |

105 | |||

| 12.3. Review QA/QC Assay Results |

106 | |||

| 12.4. Site Visits |

106 | |||

| 12.5. QP’s Opinion and Other Comments on Section 12 |

106 | |||

| 13. MINERAL PROCESSING AND METALLURGICAL TESTING |

107 | |||

| 13.1. Overview |

107 | |||

| 13.2. Metallurgical Testing |

107 | |||

| 13.2.1. Mineralogy |

107 |

| iii | September 2025 |

| San Dimas Silver/Gold Mine Durango and Sinaloa States, Mexico NI-43-101 Technical Report on Mineral Resource and Mineral Reserve Estimates |

|

| 13.2.2. Monthly Composite Samples |

108 | |||

| 13.2.3. Sample Preparation |

108 | |||

| 13.3. Comminution Evaluations |

108 | |||

| 13.4. Cyanidation, Reagent and Grind Size Evaluations |

110 | |||

| 13.5. Optimizing Process Studies |

111 | |||

| 13.6. Recovery Estimates |

113 | |||

| 13.7. Metallurgical Variability |

114 | |||

| 13.8. Deleterious Elements |

119 | |||

| 14. MINERAL RESOURCE ESTIMATES |

120 | |||

| 14.1. Introduction |

120 | |||

| 14.2. Mineral Resource Estimation Process |

120 | |||

| 14.2.1. Sample Database |

121 | |||

| 14.2.2. Geological Interpretation and Modeling |

123 | |||

| 14.2.3. Exploratory Sample Data Analysis |

124 | |||

| 14.2.4. Boundary Analysis |

125 | |||

| 14.2.5. Compositing |

125 | |||

| 14.2.6. Evaluation of Composite Sample Outlier Values |

126 | |||

| 14.2.7. Composite Sample Statistics |

128 | |||

| 14.2.8. Metal Trend and Spatial Analysis: Variography |

129 | |||

| 14.2.9. Bulk Density |

130 | |||

| 14.2.10. Block Model Setup |

130 | |||

| 14.2.11. Resource Estimation Procedure |

131 | |||

| 14.2.12. Block Model Validation |

132 | |||

| 14.2.13. Reconciliation |

136 | |||

| 14.2.14. Mineral Resource Classification |

137 | |||

| 14.2.15. Reasonable Prospects for Eventual Economic Extraction |

139 | |||

| 14.2.16. Mining Depletion |

140 | |||

| 14.3. Statement of Mineral Resource Estimates |

140 | |||

| 14.4. Factors that May Affect the Mineral Resource Estimate |

142 | |||

| 14.5. Comments on Section 14 |

142 | |||

| 15. MINERAL RESERVES ESTIMATES |

143 | |||

| 15.1. Methodology |

143 | |||

| 15.2. Net Smelter Return |

144 | |||

| 15.3. Block Model Preparation |

147 | |||

| 15.4. Dilution |

148 | |||

| 15.5. Mining Loss |

150 | |||

| 15.6. Mineral Reserve Estimates |

153 | |||

| 15.7. Statement of Mineral Reserve Estimates |

153 | |||

| 15.8. Factors that May Affect the Mineral Reserve Estimates |

155 | |||

| 15.9. Comments on Section 15 |

155 | |||

| 16. MINING METHODS |

156 | |||

| 16.1. General Description |

156 | |||

| 16.2. Mining Methods and Mine Design |

157 | |||

| 16.2.1. Geotechnical Considerations |

157 |

| iv | September 2025 |

| San Dimas Silver/Gold Mine Durango and Sinaloa States, Mexico NI-43-101 Technical Report on Mineral Resource and Mineral Reserve Estimates |

|

| 16.2.2. Hydrogeological Considerations |

158 | |||

| 16.2.3. Development and Access |

158 | |||

| 16.2.4. Mining Methods and Stope Design |

160 | |||

| 16.2.5. Ore and Waste Haulage |

165 | |||

| 16.3. Mine Infrastructure |

166 | |||

| 16.3.1. Mine Access and Underground Facilities |

166 | |||

| 16.3.2. Ventilation |

166 | |||

| 16.3.3. Backfill |

169 | |||

| 16.3.4. Dewatering |

169 | |||

| 16.3.5. Mine Water Supply |

170 | |||

| 16.3.6. Power Supply |

170 | |||

| 16.3.7. Compressed Air |

171 | |||

| 16.3.8. Explosives |

171 | |||

| 16.4. Development Schedule |

171 | |||

| 16.5. Production Schedule |

171 | |||

| 16.6. Equipment and Manpower |

172 | |||

| 17. RECOVERY METHODS |

175 | |||

| 17.1. Introduction |

175 | |||

| 17.2. Process Flowsheet |

175 | |||

| 17.3. Processing Plant Configuration |

177 | |||

| 17.3.1. Plant Feed |

177 | |||

| 17.3.2. Crushing |

177 | |||

| 17.3.3. Grinding |

177 | |||

| 17.3.4. Cyanide Leaching Circuit |

178 | |||

| 17.3.5. Counter Current Decantation (CCD) System |

179 | |||

| 17.3.6. Merrill Crowe Zinc Precipitation and Smelting |

179 | |||

| 17.3.7. Tailings Filtration and Management |

180 | |||

| 17.3.8. Sampling |

180 | |||

| 18. PROJECT INFRASTRUCTURE |

182 | |||

| 18.1. Local Infrastructure |

182 | |||

| 18.2. Transportation and Logistics |

183 | |||

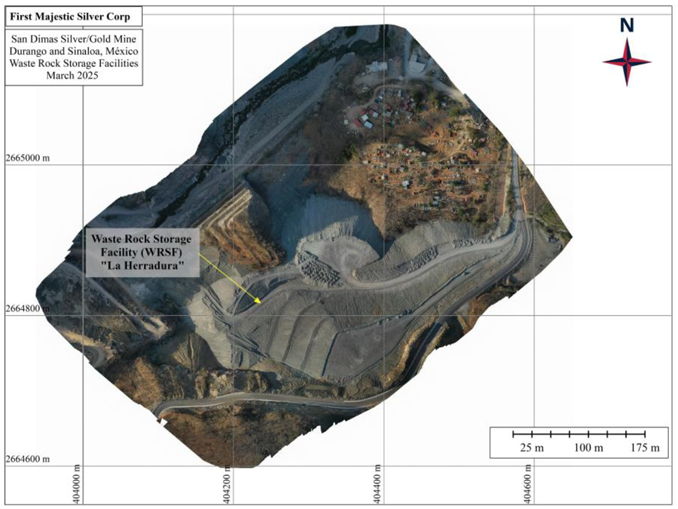

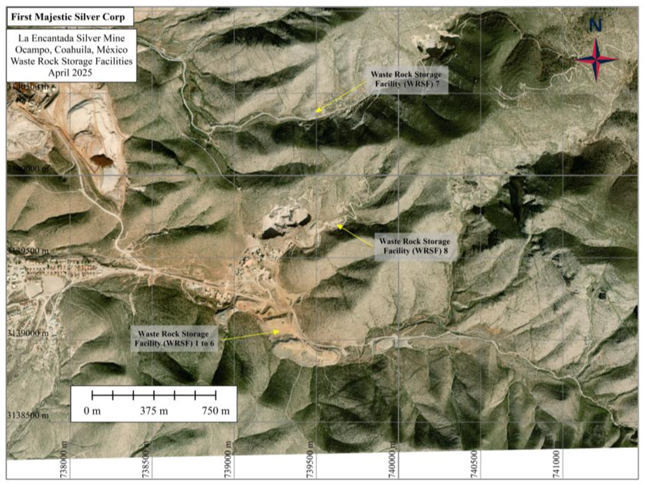

| 18.3. Waste Rock Storage Facilities |

183 | |||

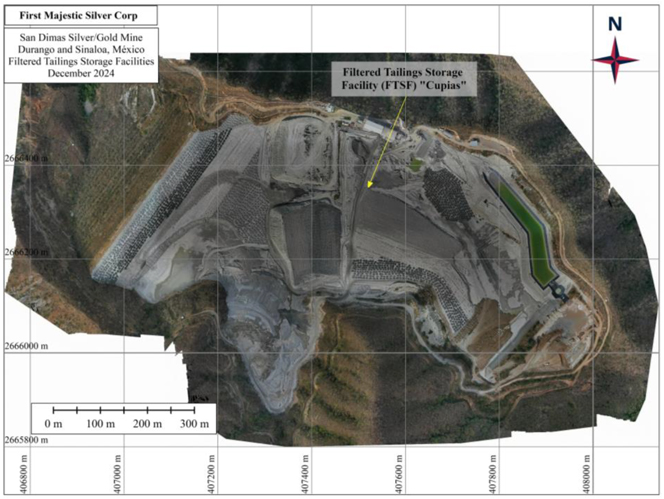

| 18.4. Tailings Storage Facilities |

185 | |||

| 18.5. Camps and Accommodation |

187 | |||

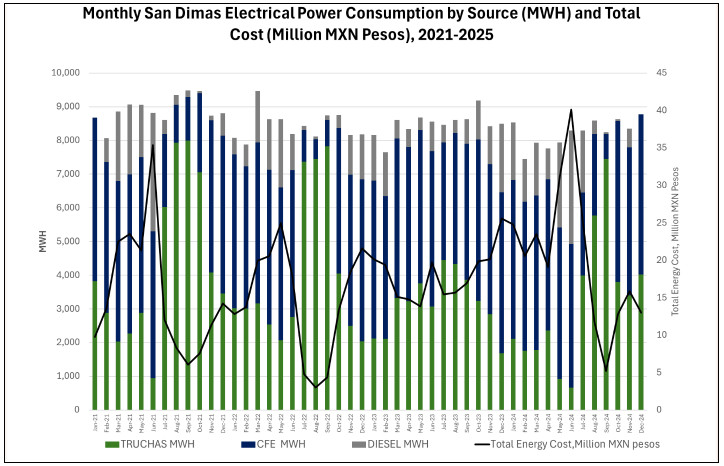

| 18.6. Power and Electrical |

187 | |||

| 18.7. Communications |

189 | |||

| 18.8. Water Supply |

189 | |||

| 19. MARKET CONSIDERATION AND CONTRACTS |

190 | |||

| 19.1. Market Considerations |

190 | |||

| 19.2. Commodity Price Guidance |

190 | |||

| 19.3. Product and Sales Contracts |

190 | |||

| 19.4. Streaming Agreement |

191 | |||

| 19.5. Deleterious Elements |

191 | |||

| 19.6. Supply and Services Contracts |

191 |

| v | September 2025 |

| San Dimas Silver/Gold Mine Durango and Sinaloa States, Mexico NI-43-101 Technical Report on Mineral Resource and Mineral Reserve Estimates |

|

| 19.7. Comments on Section 19 |

192 | |

| 20. ENVIRONMENTAL STUDIES, PERMITTING, AND SOCIAL OR COMMUNITY IMPACT |

193 | |

| 20.1. Environmental Aspects, Studies and Permits |

193 | |

| 20.2. General |

193 | |

| 20.3. Environmental Compliance in Mexico |

193 | |

| 20.4. Existing Environmental Conditions |

194 | |

| 20.5. Environmental Studies, Permits and Issues |

194 | |

| 20.5.1. Surface Hydrology |

194 | |

| 20.5.2. Surface Water Geochemistry |

195 | |

| 20.5.3. Hydrogeology |

195 | |

| 20.5.4. Soil |

195 | |

| 20.5.5. Air Quality |

195 | |

| 20.5.6. Noise |

196 | |

| 20.5.7. Flora and Fauna |

196 | |

| 20.5.8. Social and Cultural Baseline Studies |

196 | |

| 20.5.9. Historical and Cultural Aspects |

198 | |

| 20.6. Tailings Handling and Disposal |

198 | |

| 20.7. Waste Material Handling and Disposal |

199 | |

| 20.8. Mine Effluent Management |

199 | |

| 20.9. Process Water Management |

199 | |

| 20.10. Hazardous Waste Management |

200 | |

| 20.11. Monitoring |

200 | |

| 20.12. Environmental Obligations |

200 | |

| 20.13. Permits |

201 | |

| 20.14. Closure Plan |

204 | |

| 20.15. Corporate Social Responsibility |

205 | |

| 20.15.1. Ejidos |

205 | |

| 21. CAPITAL AND OPERATING COST |

207 | |

| 21.1. Capital Costs |

207 | |

| 21.2. Operating Costs |

207 | |

| 22. ECONOMIC ANALYSIS |

209 | |

| 23. ADJACENT PROPERTIES |

209 | |

| 24. OTHER RELEVANT DATA AND INFORMATION |

209 | |

| 25. INTERPRETATION AND CONCLUSIONS |

210 | |

| 25.1. Mineral Tenure, Surface Rights and Agreements |

210 | |

| 25.2. Geology and Mineralization |

210 | |

| 25.3. Exploration and Drilling |

210 | |

| 25.4. Data Analysis |

210 | |

| 25.5. Metallurgical Testwork |

211 | |

| 25.6. Mineral Resource Estimates |

211 | |

| 25.7. Mineral Reserve Estimates |

211 | |

| 25.8. Mine Plan |

212 | |

| 25.9. Processing |

212 | |

| 25.10. Markets and Contracts |

213 |

| vi | September 2025 |

| San Dimas Silver/Gold Mine Durango and Sinaloa States, Mexico NI-43-101 Technical Report on Mineral Resource and Mineral Reserve Estimates |

|

| 25.11. Permitting, Environmental and Social Considerations |

213 | |||

| 25.12. Capital and Operating Cost Estimates |

213 | |||

| 25.13. Economic Analysis Supporting Mineral Reserve Declaration |

213 | |||

| 25.14. Conclusions |

214 | |||

| 26. RECOMMENDATIONS |

215 | |||

| 26.1.1. Exploration |

215 | |||

| 26.1.2. Plant Leaching - Oxygen Addition |

215 | |||

| 26.1.3. Costs |

216 | |||

| 26.1.4. Mine Plan Compliance |

216 | |||

| 27. REFERENCES |

217 | |||

| 28. CERTIFICATES OF QUALIFIED PERSON |

220 |

| vii | September 2025 |

| San Dimas Silver/Gold Mine Durango and Sinaloa States, Mexico NI-43-101 Technical Report on Mineral Resource and Mineral Reserve Estimates |

|

Index of Tables

| Table 1-1: San Dimas Measured and Indicated Mineral Resource Estimate (effective date December 31, 2024) |

10 | |||

| Table 1-2: San Dimas Inferred Mineral Resource Estimate (effective date December 31, 2024) |

10 | |||

| Table 1-3: Economic Parameters assumed for calculation of NSR |

11 | |||

| Table 1-4: San Dimas Mineral Reserves Statement (Effective Date December 31, 2024) |

13 | |||

| Table 1-5 San Dimas Life of Mine Development Schedule |

15 | |||

| Table 1-6 San Dimas Life of Mine Production Schedule |

16 | |||

| Table 1-7: San Dimas Mining Sustaining Capital Costs Summary ($Million) |

19 | |||

| Table 1-8: San Dimas Operating Costs |

19 | |||

| Table 1-9: San Dimas Annual Operating Costs ($Million) |

20 | |||

| Table 2-1: List of Abbreviations and Units |

24 | |||

| Table 4-1: Summary of the Six Concession Groups, San Dimas Property |

32 | |||

| Table 4-2: San Dimas Concessions Group List |

32 | |||

| Table 4-3: Candelero Concessions Group List |

34 | |||

| Table 4-4: Ventanas Concession Group List |

34 | |||

| Table 4-5: Lechuguillas Concessions Group List |

35 | |||

| Table 4-6: Cebollas Concessions Group List |

35 | |||

| Table 4-7: Truchas Concessions Group List |

35 | |||

| Table 6-1: Summary History of San Dimas Property |

44 | |||

| Table 7-1: List of Major Veins by Mine Zone in the San Dimas Property District |

58 | |||

| Table 11-1: Analytical Laboratories |

93 | |||

| Table 11-2: Analytical Methods |

95 | |||

| Table 11-3: Summary of Inter-Laboratory Bias Check Results |

101 | |||

| Table 13-1: Grindability Test Results for Different Composite Samples (2025) |

109 | |||

| Table 13-2: Metallurgical Recoveries achieved in San Dimas 2021-2024 |

113 | |||

| Table 14-1: Diamond Drill Hole and Production Channel Data by Mine Zone, San Dimas |

121 | |||

| Table 14-2: San Dimas - West Block Domain Names and Mine Codes |

124 | |||

| Table 14-3: West Block Composite Sample Lengths by Domain |

126 | |||

| Table 14-4: San Dimas Example - West Block, Composite Sample Capping by Domain |

128 | |||

| Table 14-5: San Dimas Example - West Block, Remaining Metal content by Domain after Capping |

128 | |||

| Table 14-6: Summary of Ag-Au Estimation Parameters for the Perez Block Model |

132 | |||

| Table 14-7: Input Parameters for Evaluation of Reasonable Prospects of Eventual Economic Extraction. |

139 | |||

| Table 14-8: San Dimas Measured and Indicated Mineral Resource Estimate (effective date December 31, 2024) |

141 | |||

| Table 14-9: San Dimas Inferred Mineral Resource Estimate (effective date December 31, 2024) |

141 | |||

| Table 15-1: Economic Parameters Assumed for Calculation of NSR |

145 | |||

| Table 15-2: Initial NSR Cut-Off Value Applied to Longhole |

146 | |||

| Table 15-3: Initial NSR Cut-Off Value Applied to Cut-and-Fill |

147 | |||

| Table 15-4: Dilution and Mining Loss Parameters |

153 |

| viii | September 2025 |

| San Dimas Silver/Gold Mine Durango and Sinaloa States, Mexico NI-43-101 Technical Report on Mineral Resource and Mineral Reserve Estimates |

|

| Table 15-5: San Dimas Proven and Probable Mineral Reserve Estimates (effective date December 31, 2024) |

154 | |||

| Table 16-1: San Dimas Geotechnical Units |

157 | |||

| Table 16-2: Development Profiles |

159 | |||

| Table 16-3: San Dimas Development 2018 to 2024 |

160 | |||

| Table 16-4: Fresh Air Requirement |

169 | |||

| Table 16-5: San Dimas Life of Mine Development Schedule |

171 | |||

| Table 16-6: San Dimas Life of Mine Production Schedule |

172 | |||

| Table 16-7: Breakdown of Personnel as of May 2025 |

174 | |||

| Table 16-8: Equipment Summary as of December 2020 |

174 | |||

| Table 19-1: Metal Prices Used for the December 31, 2024, Mineral Resource and Mineral Reserve Estimates |

190 | |||

| Table 20-1: Summary of Surface Hydrology Studies |

195 | |||

| Table 20-2: Summary of Surface Water Studies |

195 | |||

| Table 20-3: Summary of Soil Sampling Studies |

195 | |||

| Table 20-4: Air Quality Studies |

196 | |||

| Table 20-5: Noise Impact Studies |

196 | |||

| Table 20-6: Flora and Fauna Studies |

196 | |||

| Table 20-7: Summary of Social Studies |

198 | |||

| Table 20-8: Tailings and Waste Rock Studies |

199 | |||

| Table 20-9: Environmental Monitoring Activities |

200 | |||

| Table 20-10: Major Permits Issued |

203 | |||

| Table 20-11: Permits in Process |

204 | |||

| Table 21-1: San Dimas Mining Sustaining Capital Costs Summary |

207 | |||

| Table 21-2: San Dimas Operating Costs Used in the LOM Plan |

208 | |||

| Table 21-3: San Dimas Annual Operating Costs |

208 |

| ix | September 2025 |

| San Dimas Silver/Gold Mine Durango and Sinaloa States, Mexico NI-43-101 Technical Report on Mineral Resource and Mineral Reserve Estimates |

|

Index of Figures

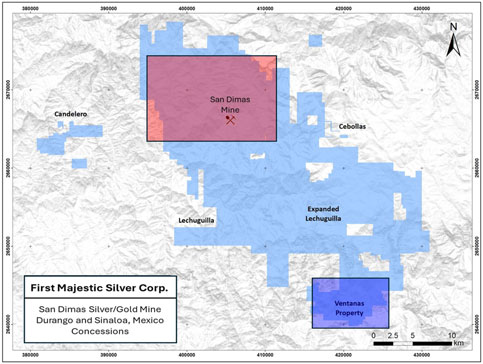

| Figure 4-1: Location Map, San Dimas Property |

26 | |||

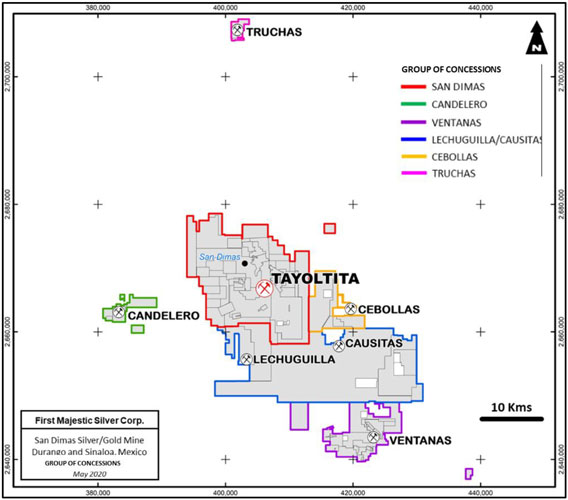

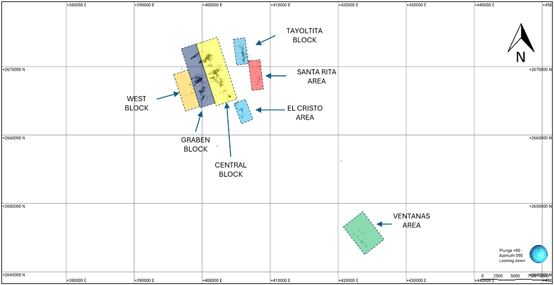

| Figure 4-2: Map of the Concession Outlines for the San Dimas Property |

27 | |||

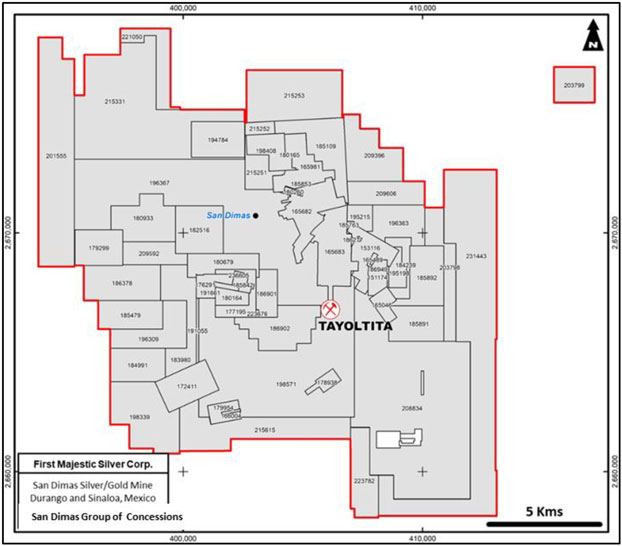

| Figure 4-3: Map of the San Dimas Concessions Group |

28 | |||

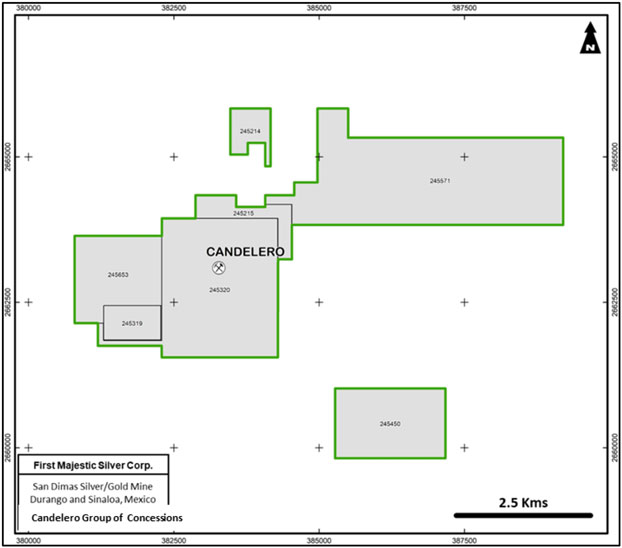

| Figure 4-4: Map of the Candelero Concessions Group |

29 | |||

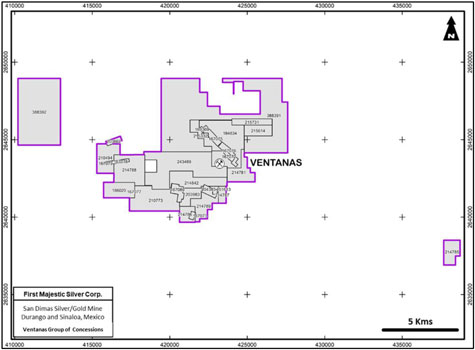

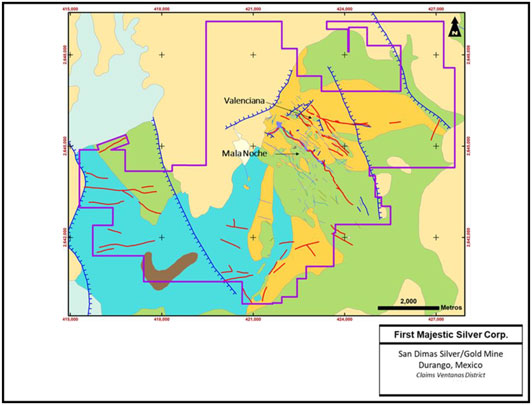

| Figure 4-5: Map of the Ventanas Concessions Group |

30 | |||

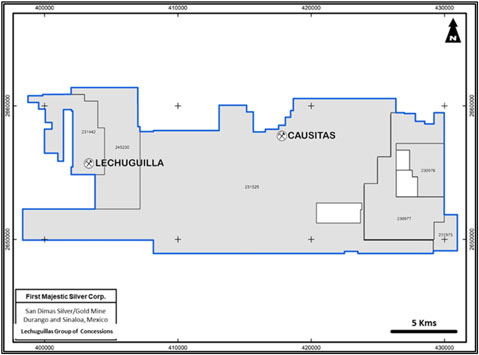

| Figure 4-6: Map of the Lechuguillas Concessions Group |

30 | |||

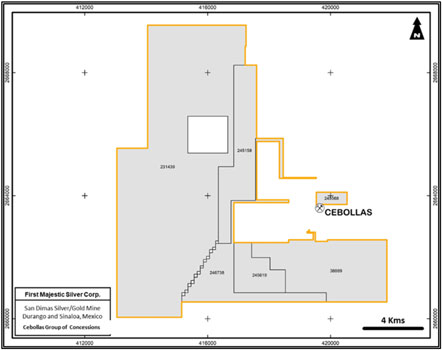

| Figure 4-7: Map of the Cebollas Concessions Group |

31 | |||

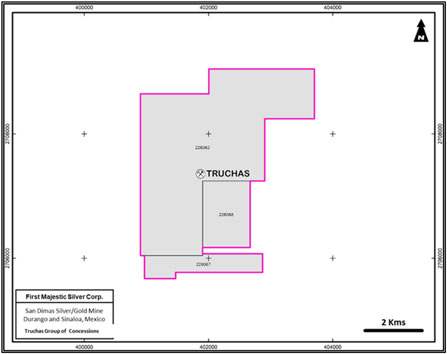

| Figure 4-8: Map of the Truchas Concessions Group |

31 | |||

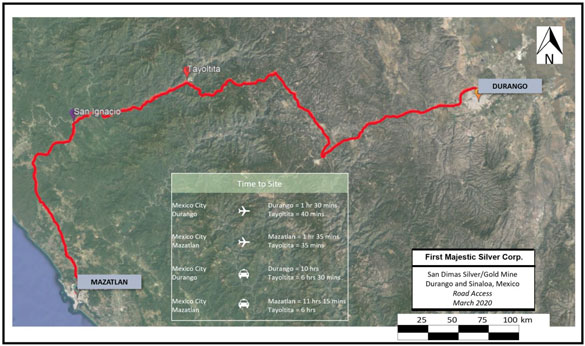

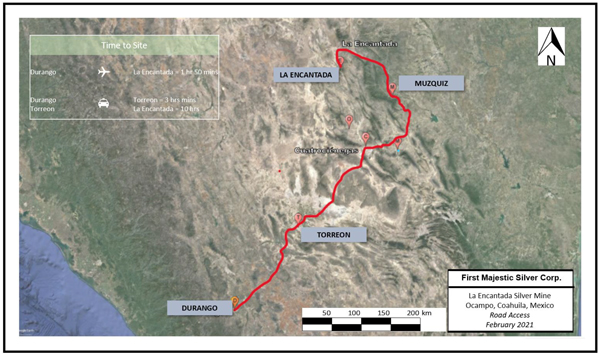

| Figure 5-1: Road Access to the San Dimas Property, near Tayoltita |

38 | |||

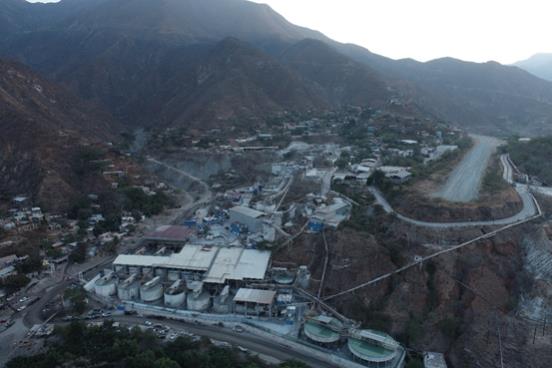

| Figure 5-2: Processing Plant, Airstrip and Rugged Terrain, Aerial View looking East |

40 | |||

| Figure 6-1: Map showing Mining Tunnels at the Time Wheaton River Acquired the Property |

46 | |||

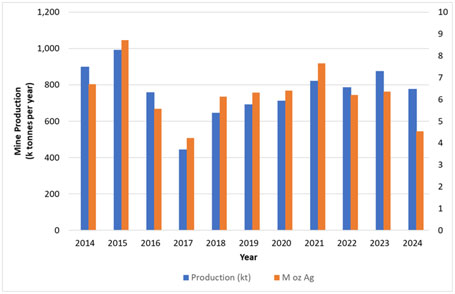

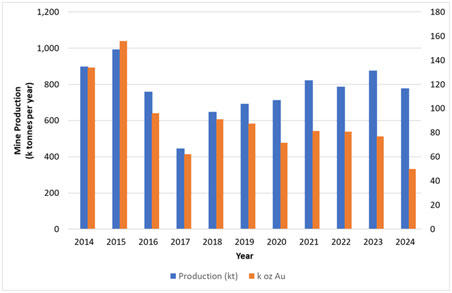

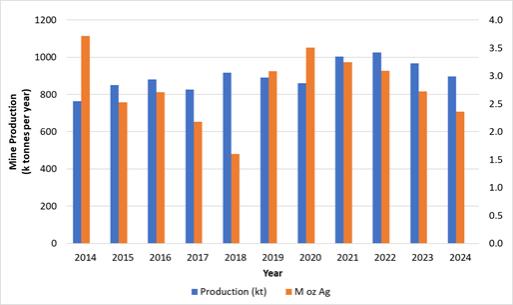

| Figure 6-2: San Dimas Production from 2014 to 2024 |

47 | |||

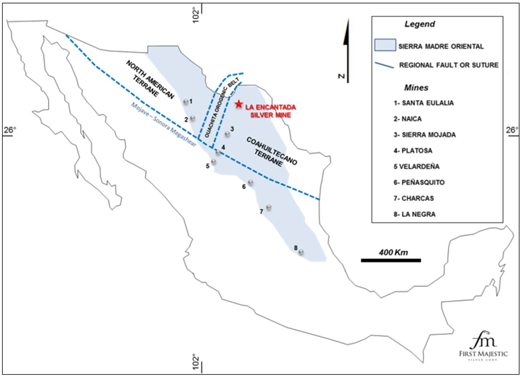

| Figure 7-1: Physiographic Provinces around the San Dimas District |

48 | |||

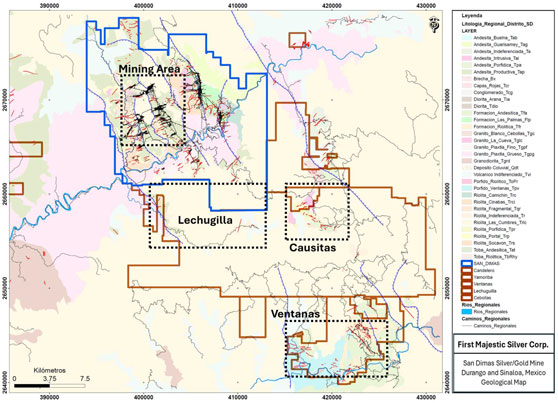

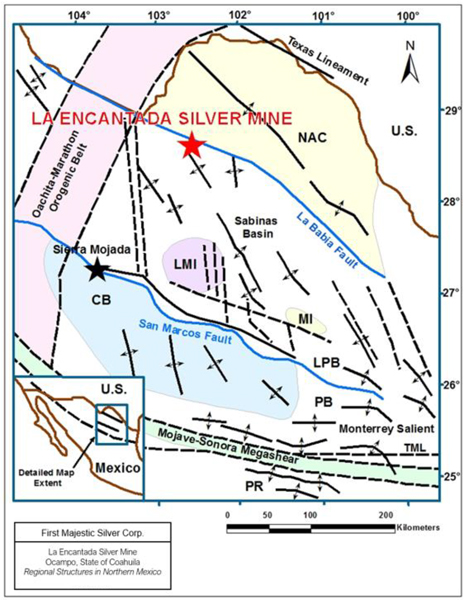

| Figure 7-2: Regional Geological Map of Central Sierra Madre Occidental |

49 | |||

| Figure 7-3: Stratigraphic Column, San Dimas District |

50 | |||

| Figure 7-4: Geological Map of San Dimas Property |

51 | |||

| Figure 7-5: San Dimas Structural Map |

53 | |||

| Figure 7-6: Regional Geological Section Across the San Dimas Property |

54 | |||

| Figure 7-7: The Jessica Vein Within the Favourable Zone, Vertical Section |

55 | |||

| Figure 7-8: Paragenetic Vein Sequence, San Dimas |

56 | |||

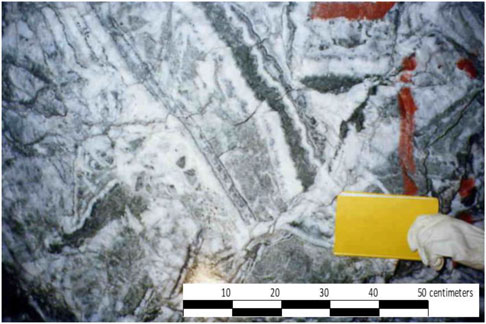

| Figure 7-9: Roberta Vein, Central Block, San Dimas |

57 | |||

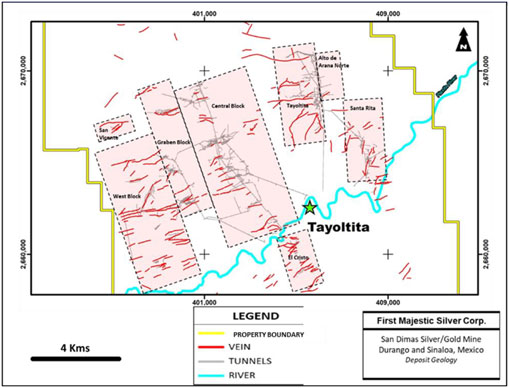

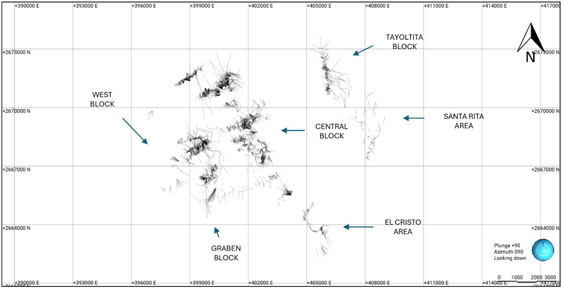

| Figure 7-10: San Dimas Vein Distribution by Mine Zone |

59 | |||

| Figure 7-11: Vein Map, San Dimas |

60 | |||

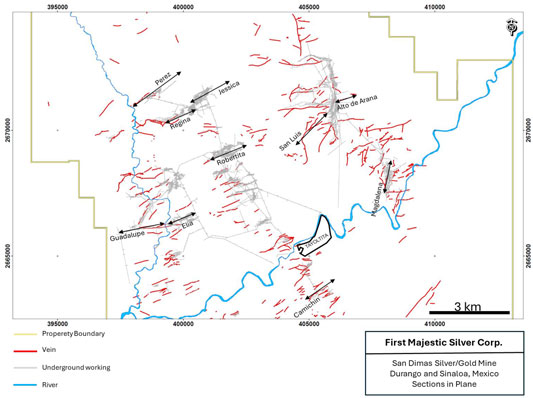

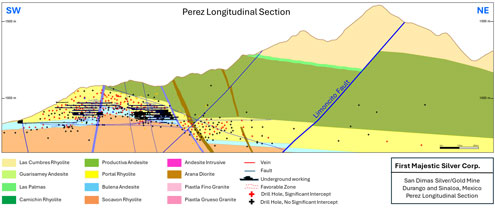

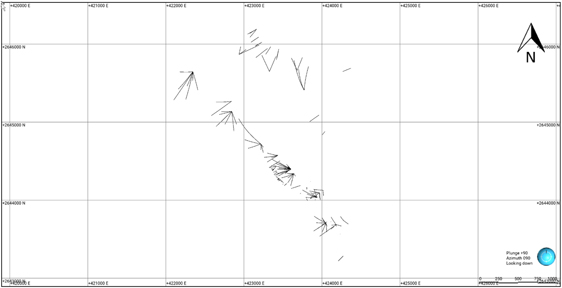

| Figure 7-12: Longitudinal section, Guadalupe and Perez Veins, West Block, San Dimas |

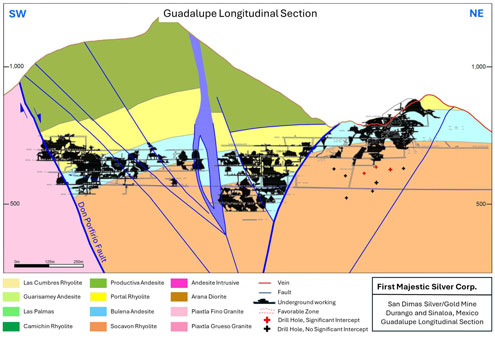

61 | |||

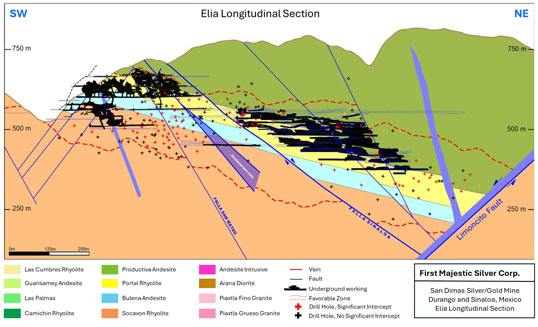

| Figure 7-13: Longitudinal Section, Elia Veins, Graben Block, San Dimas |

62 | |||

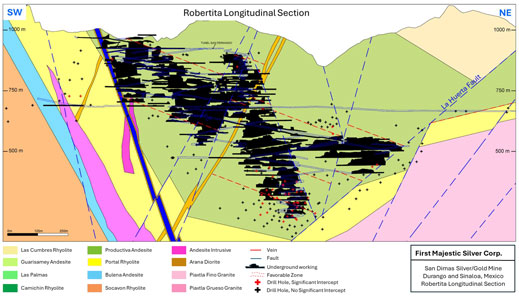

| Figure 7-14: Longitudinal Section, Robertita Vein, Central Block, San Dimas |

63 | |||

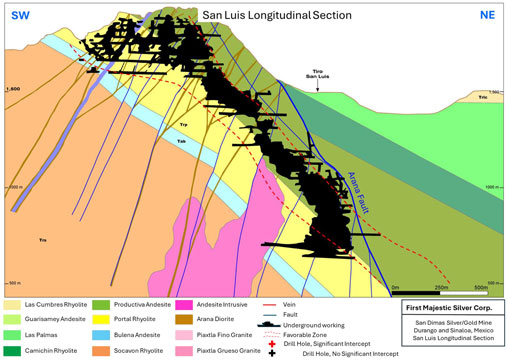

| Figure 7-15: Longitudinal Section, San Luis Vein, Tayoltita Block, San Dimas |

64 | |||

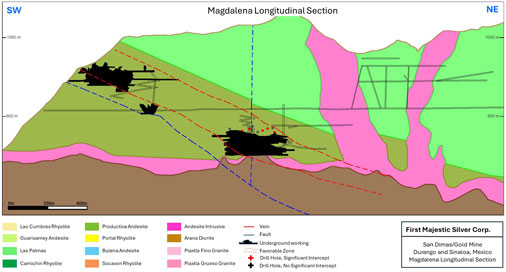

| Figure 7-16: Longitudinal Section, Magdalena Vein, Santa Rita Area, San Dimas |

65 | |||

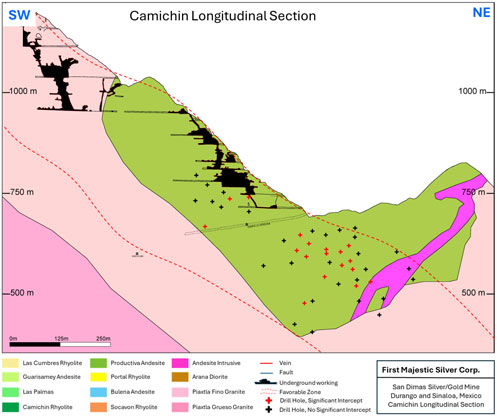

| Figure 7-17: Longitudinal Section, Camichin Vein, El Cristo Area, San Dimas |

66 | |||

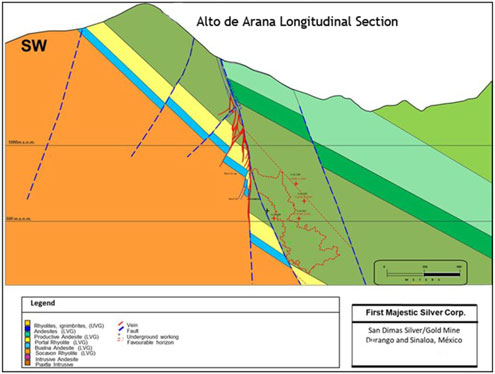

| Figure 7-18: Longitudinal Section, Alto de Arana Vein, Alto de Arana Area, San Dimas |

67 | |||

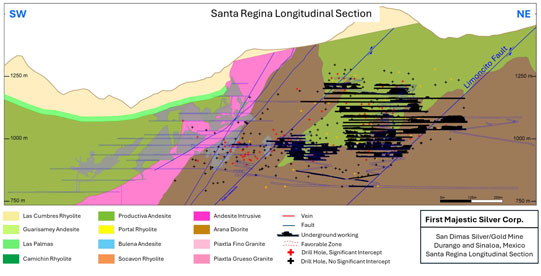

| Figure 7-19: Longitudinal section, Santa Regina - San Vicente Vein, San Vicente Area, San Dimas |

68 | |||

| Figure 8-1: Genetic Model for Epithermal Deposits |

71 | |||

| Figure 8-2: Geochemical Zonation model San Dimas |

72 | |||

| Figure 8-3: Example Section of the Favourable Zone for Mineralization, San Dimas |

73 | |||

| Figure 9-1: Location of Exploration Activities within the San Dimas Property |

74 | |||

| Figure 9-2: San Dimas Property, Areas Explored since 2020 |

75 | |||

| Figure 9-3: Geological Map of the San Dimas Property |

76 | |||

| Figure 9-4: Geological Map, Ventanas Area |

77 | |||

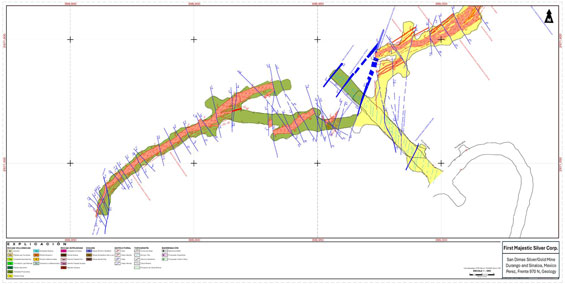

| Figure 9-5: Geology Map generated during normal course of operation, Perez Vein |

78 | |||

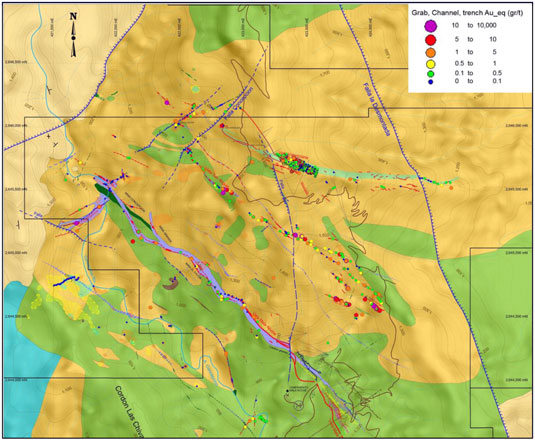

| Figure 9-6: Surface rock chip sampling, silver results map, San Dimas |

79 | |||

| Figure 9-7: Geological Map and Gold-Equivalent Anomalies, Ventanas Area |

80 |

| x | September 2025 |

| San Dimas Silver/Gold Mine Durango and Sinaloa States, Mexico NI-43-101 Technical Report on Mineral Resource and Mineral Reserve Estimates |

|

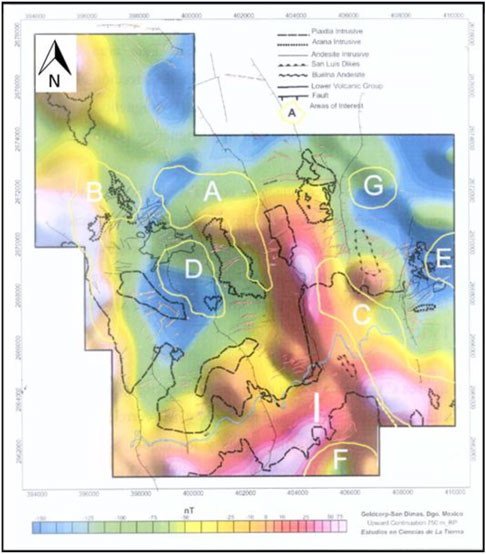

| Figure 9-8: Magnetic Field Reduced to Pole, San Dimas |

82 | |||

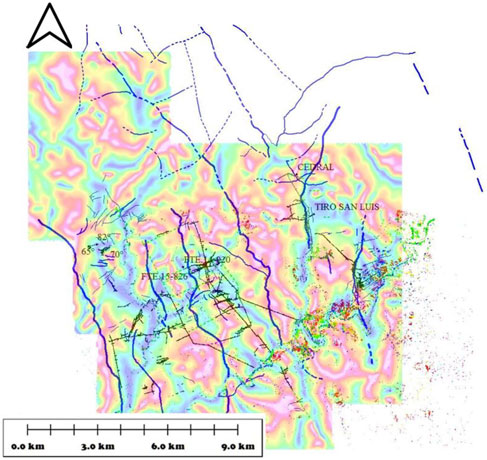

| Figure 9-9: Satellite Image Magnetic Tilt Derivative Inversion and Alteration, San Dimas |

83 | |||

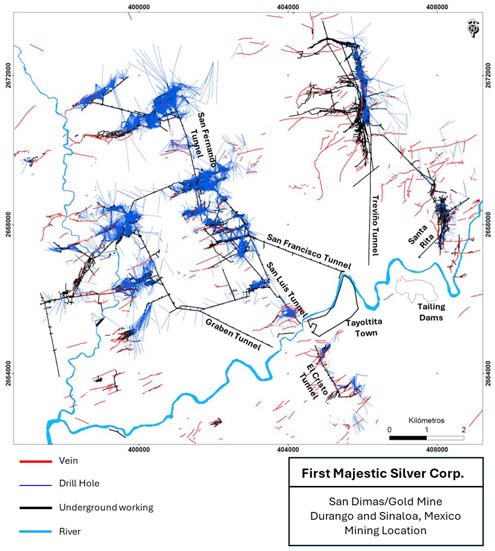

| Figure 9-10: Main Mining Tunnels and Drill Hole Traces, San Dimas |

84 | |||

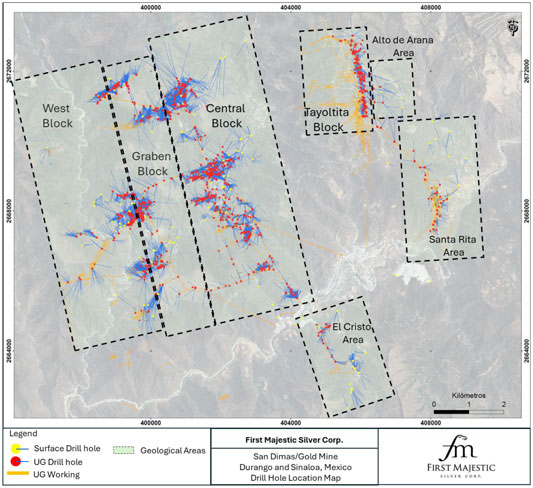

| Figure 10-1: Plan view of drilling at San Dimas |

87 | |||

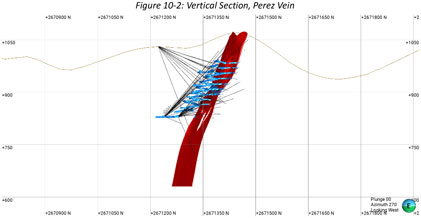

| Figure 10-2: Vertical Section, Perez Vein |

88 | |||

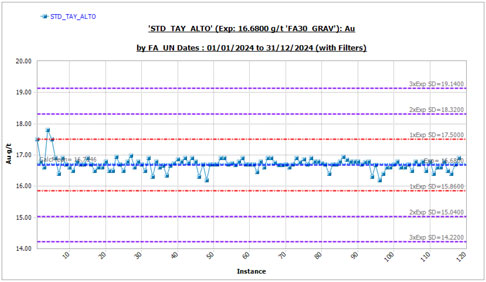

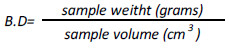

| Figure 11-1: Example of 2024 High-Grade SRM Gold and Silver Standard Charts, San Dimas Laboratory |

98 | |||

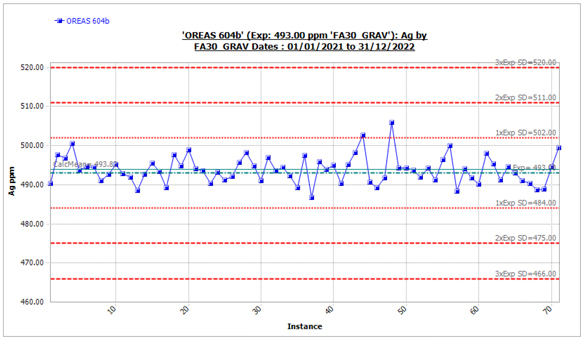

| Figure 11-2: Example of 2024 Time Sequence Pulp Blank Performance Charts, San Dimas Laboratory |

100 | |||

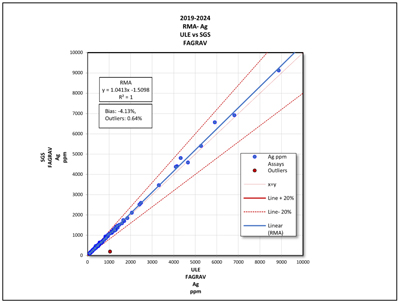

| Figure 11-3: Between-Laboratory Bias Check, San Dimas and SGS Laboratories |

102 | |||

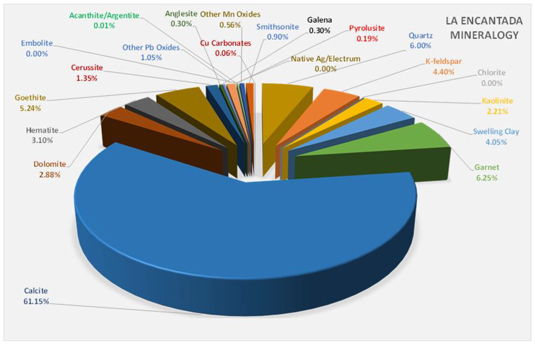

| Figure 13-1: Typical Distribution of Minerals |

108 | |||

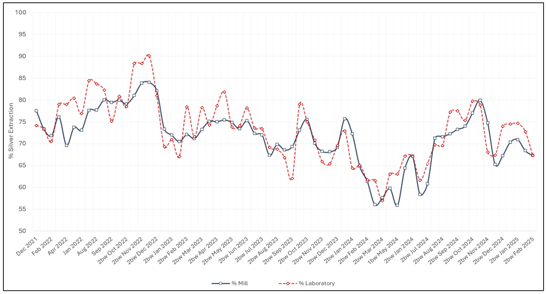

| Figure 13-2: Comparison of Au Extractions Between Mill and Laboratory Performances |

110 | |||

| Figure 13-3: Comparison of Ag Extractions Between Mill and Laboratory Performances |

111 | |||

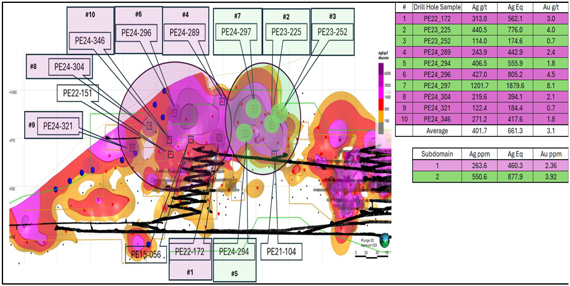

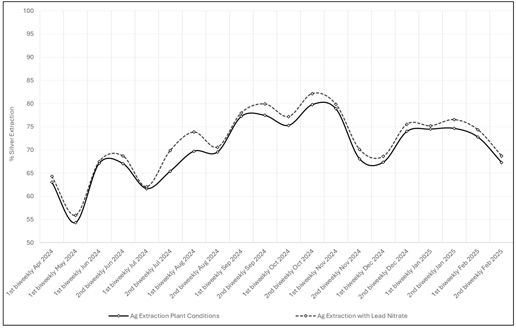

| Figure 13-4: Pérez Domain – Drilling Program |

112 | |||

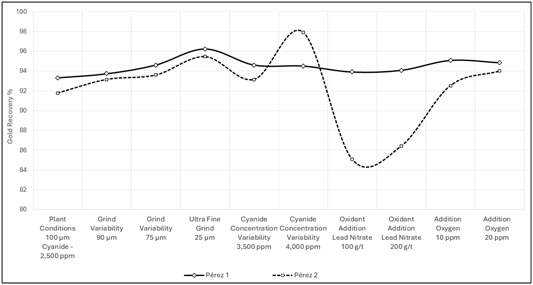

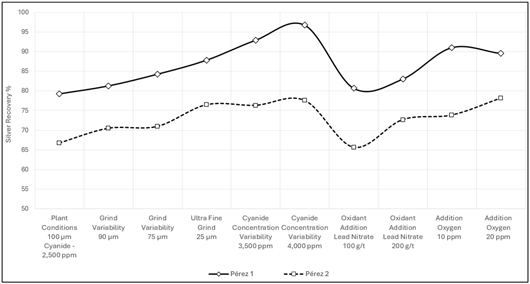

| Figure 13-5: Comparison of Au Extractions Between Perez 1 & Perez 2 |

112 | |||

| Figure 13-6: Comparison of Ag Extractions Between Perez 1 & Perez 2 |

113 | |||

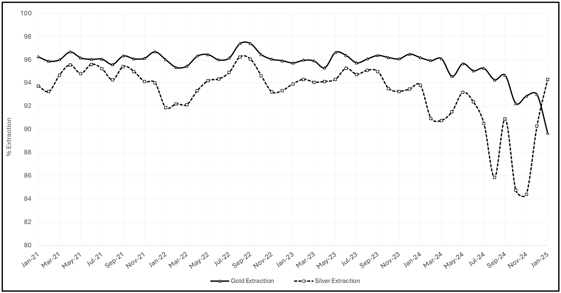

| Figure 13-7: Historical Monthly Metallurgical Recovery of Gold and Silver from January 2021 to January 2025 |

114 | |||

| Figure 13-8: San Dimas Box Plot of Gold Head Grades 2023 |

115 | |||

| Figure 13-9: San Dimas Box Plot of Gold Recoveries Grades 2023 |

115 | |||

| Figure 13-10: San Dimas Box Plot of Silver Head Grades 2023 |

116 | |||

| Figure 13-11: San Dimas Box Plot of Silver Recoveries 2023 |

116 | |||

| Figure 13-12: San Dimas Box Plot of Gold Head Grades 2024 |

117 | |||

| Figure 13-13: San Dimas Box Plot of Gold Recoveries 2024 |

117 | |||

| Figure 13-14: San Dimas Box Plot of Silver Head Grades 2024 |

118 | |||

| Figure 13-15: San Dimas Box Plot of Silver Recoveries 2024 |

118 | |||

| Figure 13-16: San Dimas Monthly Historical Doré Purity (Gold + Silver), 2021–2024 |

119 | |||

| Figure 14-1: San Dimas Drill Hole and Sample Data Location, Plan View |

122 | |||

| Figure 14-2: San Dimas Drill Hole and Sample Data Location, Plan View of Ventanas Mine Area |

122 | |||

| Figure 14-3: Plan-view Location of Estimation Domains by Mine Zone |

123 | |||

| Figure 14-4: Faulted Geological Model for the Perez Vein, Vertical and Plan Views |

124 | |||

| Figure 14-5: Example of Hard Boundary Contact Analysis for Silver for the Perez Vein |

125 | |||

| Figure 14-6: Sample Interval Lengths, Composited vs. Uncomposited, Perez Vein |

126 | |||

| Figure 14-7: Global Capping Analysis for Gold Composite Samples for the Perez Vein with capping at 5,785 g/t |

127 | |||

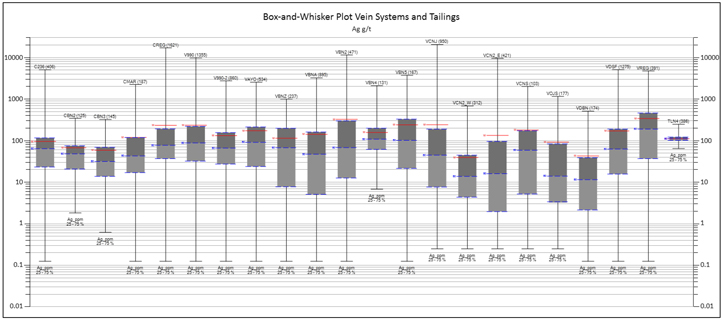

| Figure 14-8: Box and Whisker Plots for Gold and Silver declustered composite statistics for resource domains in the West Block |

129 | |||

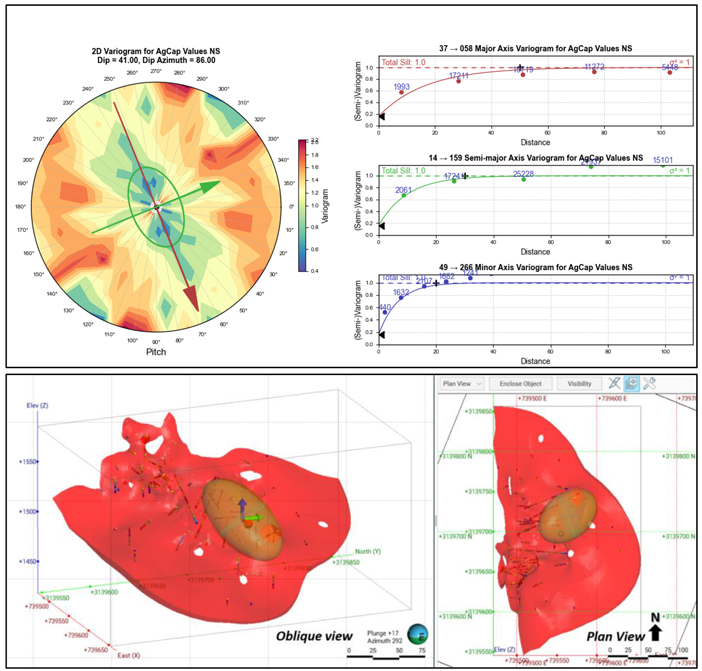

| Figure 14-9: Variogram Model for the Perez Vein |

130 | |||

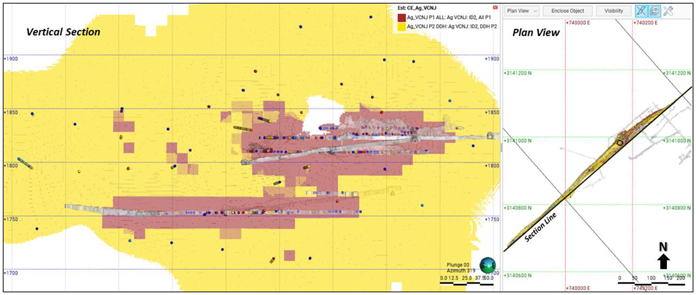

| Figure 14-10: Block Model Estimation Passes for the Perez Domain, Vertical Section |

132 | |||

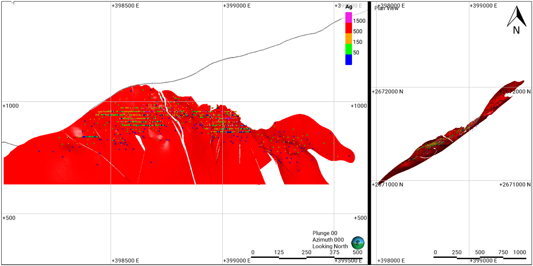

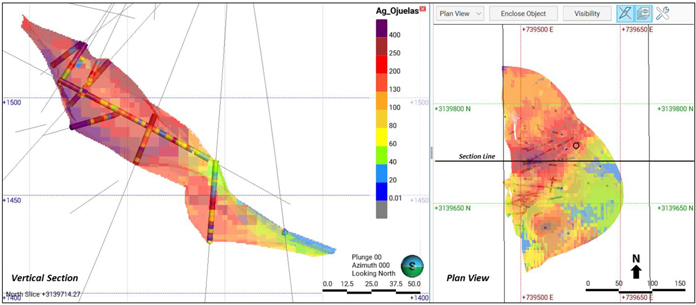

| Figure 14-11: Perez Ag g/t Block Model and Composite Sample Values, Vertical Section |

133 | |||

| Figure 14-12: Perez Au g/t Block Model and Composite Sample Values, Vertical Section |

134 | |||

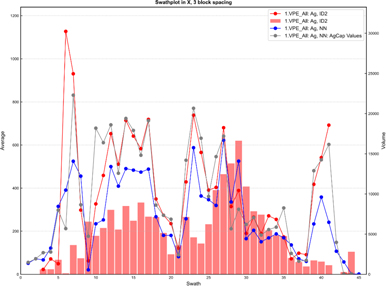

| Figure 14-13: Swath Plot in X across the Perez Vein, Ag Values |

135 | |||

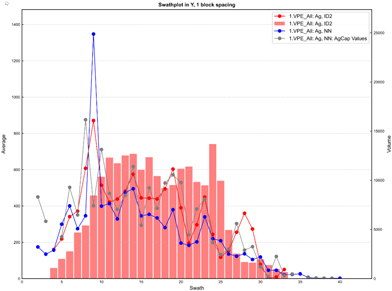

| Figure 14-14: Swath Plot in Y across the Perez Vein, Ag Values |

135 | |||

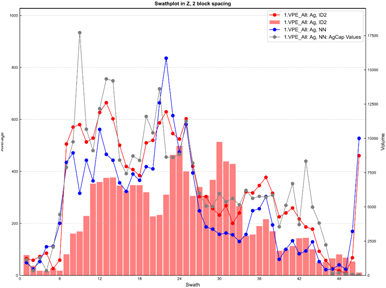

| Figure 14-15: Swath Plot in Z across the Perez Vein, Ag Values |

136 |

| xi | September 2025 |

| San Dimas Silver/Gold Mine Durango and Sinaloa States, Mexico NI-43-101 Technical Report on Mineral Resource and Mineral Reserve Estimates |

|

| Figure 14-16: San Dimas Mine Block Model Ag and Au Estimates (yellow) compared to mine reported production (green) on a monthly basis over a 12-month period ending December 15, 2024 |

137 | |||

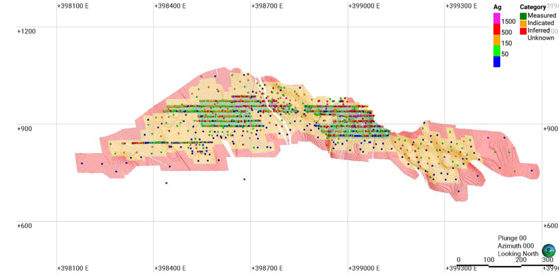

| Figure 14-17: Measured, Indicated, and Inferred Mineral Resource Confidence Assignments, Perez Vein |

139 | |||

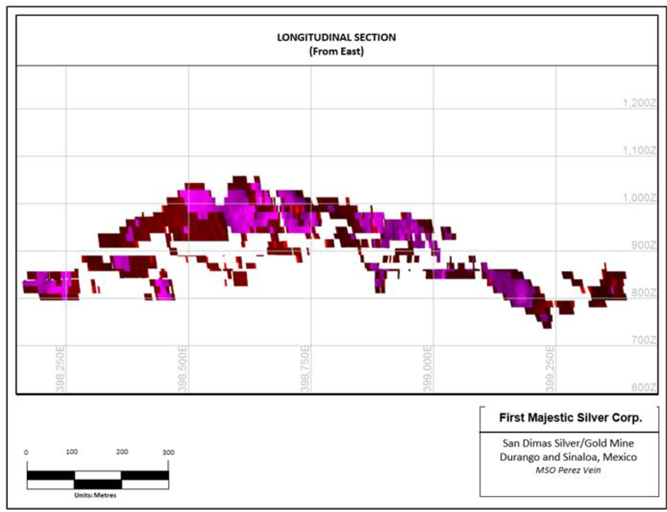

| Figure 15-1: MSO Mineable Shapes for the Perez Vein |

148 | |||

| Figure 15-2: Schematic Example of Dilution |

150 | |||

| Figure 15-3: Dilution and Mining Loss (longhole mining methods) |

151 | |||

| Figure 15-4: Dilution and Ore Loss (cut-and-fill mining method) |

152 | |||

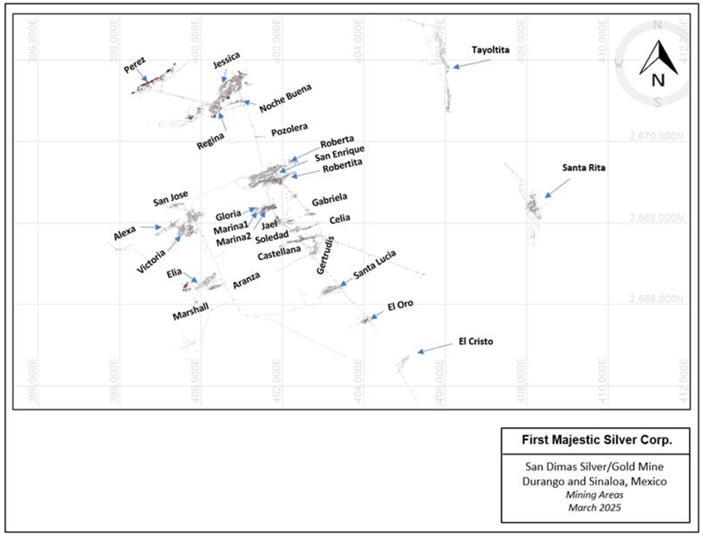

| Figure 16-1: San Dimas Mining Areas |

156 | |||

| Figure 16-2: Typical Ground Support Patterns |

158 | |||

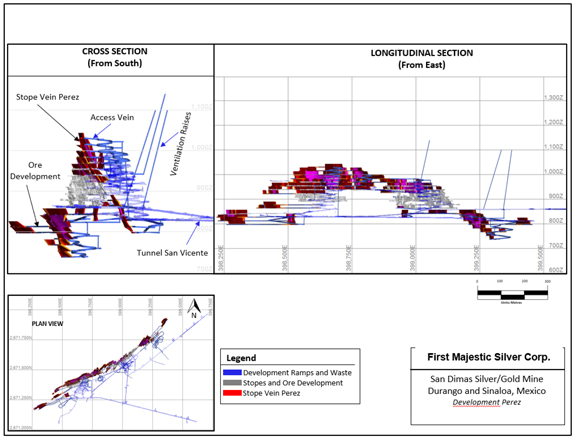

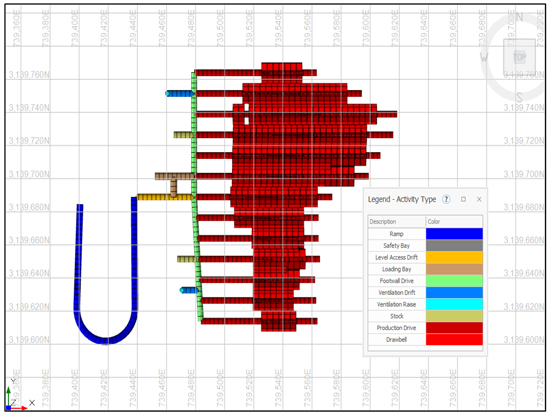

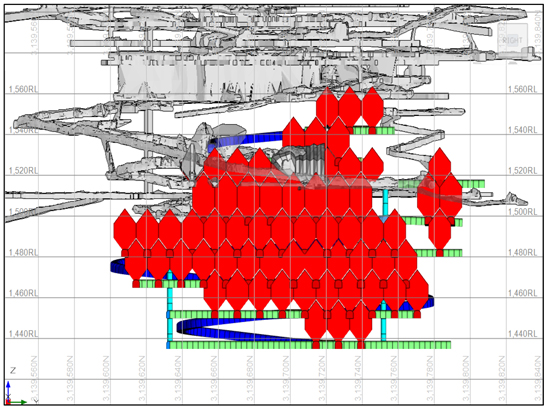

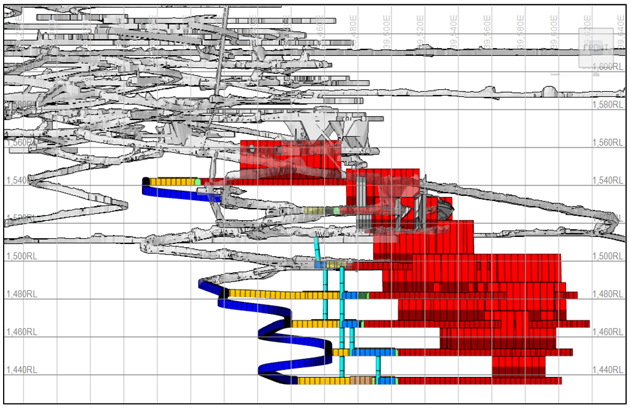

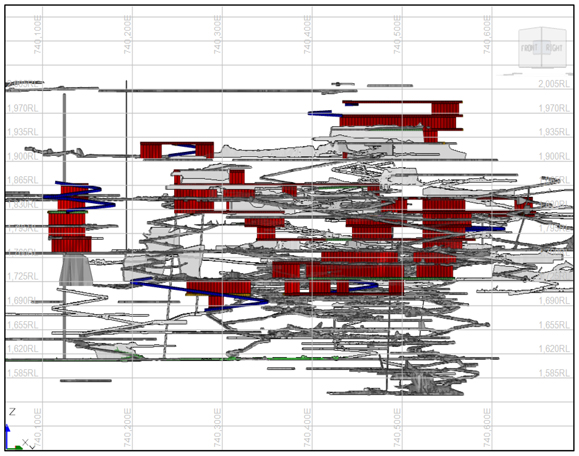

| Figure 16-3: Perez Vein Development and Production |

159 | |||

| Figure 16-4: Cut-and-Fill Long Section Schematic |

161 | |||

| Figure 16-5: Schematic of Longhole Stoping |

162 | |||

| Figure 16-6: Section of Typical Drill Layout for a Production Stope |

163 | |||

| Figure 16-7: Longhole Uphole Stope Section |

164 | |||

| Figure 16-8: Ore Development Blast Drill Plan |

165 | |||

| Figure 16-9: Ventilation System |

167 | |||

| Figure 16-10: Pumps Station Typical Arrangement |

170 | |||

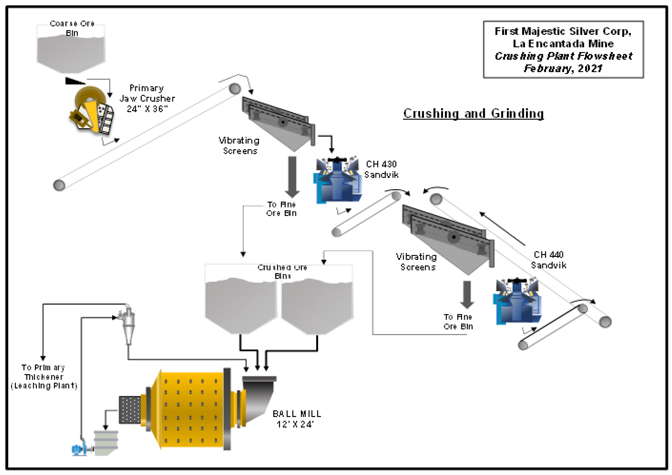

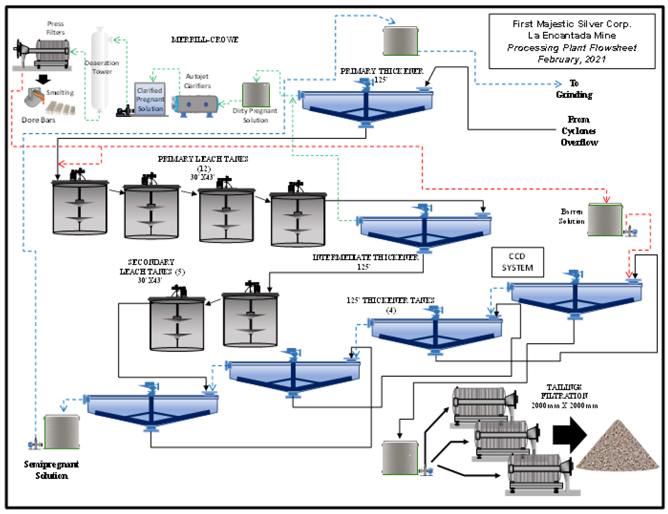

| Figure 17-1: San Dimas Schematic Crushing Plant Flowsheet |

176 | |||

| Figure 17-2: San Dimas Processing Plant Flowsheet |

176 | |||

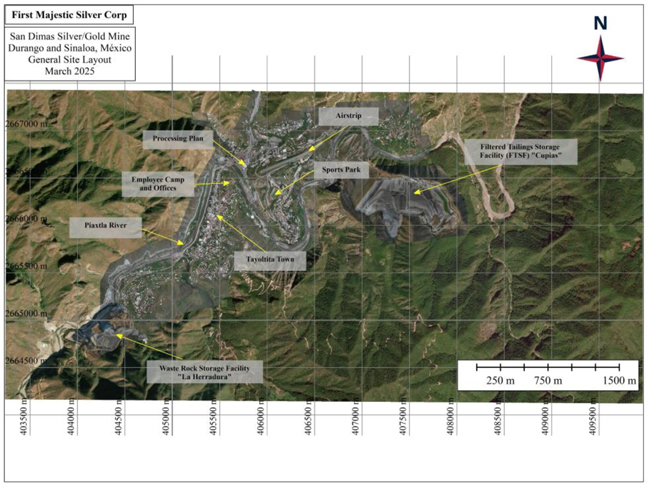

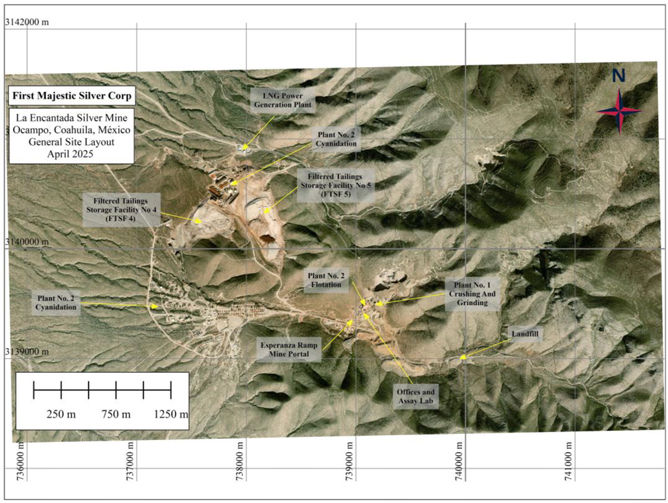

| Figure 18-1: San Dimas Infrastructure Map |

182 | |||

| Figure 18-2 : Waste Rock Storage Facility |

184 | |||

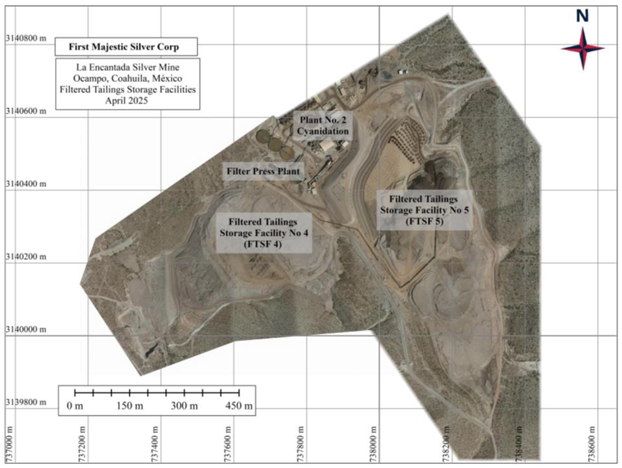

| Figure 18-3: Filtered Tailings Storage Facility – Overall Plan Site |

186 | |||

| Figure 18-4: Las Truchas Hydroelectric Plant |

187 | |||

| Figure 18-5: San Dimas Energy Consumption |

188 |

| xii | September 2025 |

| San Dimas Silver/Gold Mine Durango and Sinaloa States, Mexico NI-43-101 Technical Report on Mineral Resource and Mineral Reserve Estimates |

|

| 1. | SUMMARY |

| 1.1. | Introduction |

The San Dimas Silver/Gold Mine (San Dimas) is owned and operated by Primero Empresa Minera, S.A. de C.V. (Primero Empresa), which is an indirectly wholly owned subsidiary of First Majestic Silver Corp. (First Majestic). First Majestic acquired San Dimas from Primero Mining Corp. in May 2018. San Dimas operations consist of an operating underground mine, a processing plant, and tailings management facilities (TMF).

The Technical Report provides information on Mineral Resource and Mineral Reserve estimates, as well as mine and process operations and planning. The Mineral Resource and Mineral Reserve estimates are reported in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards for Mineral Resources and Mineral Reserves (May 2014; the 2014 CIM Definition Standards).

The effective date of the Mineral Resource and Mineral Reserve estimates presented in this Technical Report is December 31, 2024, which represents the cut-off date for the most relevant scientific and technical information used in the Report. The effective date for this Technical Report is August 31, 2025.

In the opinion of the undersigned Qualified Person(s) (QP), the scientific and technical information contained in this Technical Report is current as of the Technical Report’s effective date. The Mineral Resource and Mineral Reserve estimates are supported by data and interpretations valid as of December 31, 2024, and no material changes have occurred between that date and the Technical Report’s effective date that would impact the conclusions herein.

This Technical Report has been prepared by employees of First Majestic under the supervision of Gonzalo Mercado, P.Geo., Vice President of Exploration and Technical Services, David Rowe, CPG, Director of Mineral Development, Michael Jarred Deal, RM SME, Vice President of Metallurgy & Innovation, Andrew Pocock, P.Eng., Director of Reserves, and Ms. María Elena Vázquez Jaimes, P. Geo., Geological Database Manager.

| 1.2. | Property Description, Location and Access |

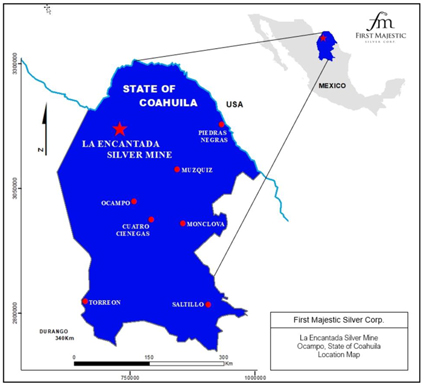

San Dimas is an actively producing mining complex located near the town of Tayoltita on the borders of the States of Durango and Sinaloa, approximately 125 km northeast of Mazatlán, Sinaloa. The mine is operated by First Majestic’s indirectly wholly owned subsidiary Primero Empresa Minera, S.A. de C.V. (Primero Empresa).

Mining operations can be conducted year-round.

| 1 | September 2025 |

| San Dimas Silver/Gold Mine Durango and Sinaloa States, Mexico NI-43-101 Technical Report on Mineral Resource and Mineral Reserve Estimates |

|

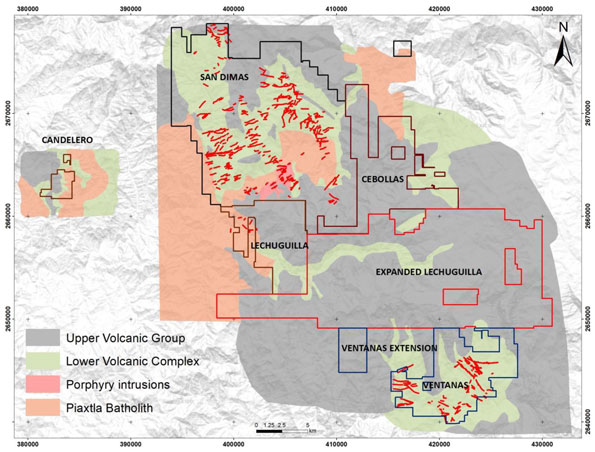

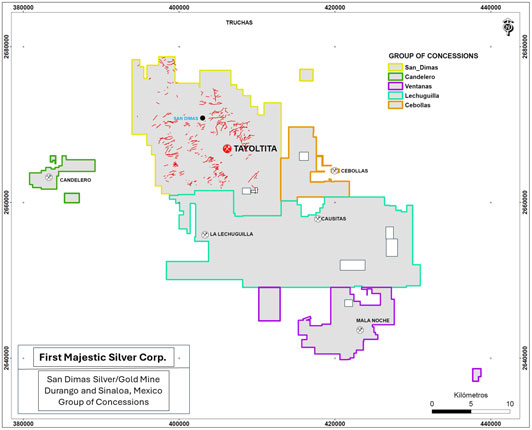

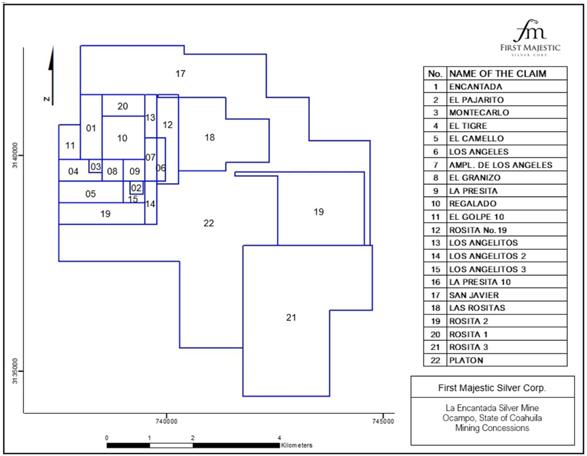

San Dimas consists of 119 individual concessions covering 71,867 ha in total that have been organized into six groups of concessions: the San Dimas, Candelero, Ventanas, Lechuguillas, Cebollas and Truchas concessions groups.

In 2013, the Mexican Federal government introduced a mining royalty, effective January 1, 2014, based on 7.5% of taxable earnings before interest and depreciation. In addition, precious metal mining companies must pay a 0.5% royalty on revenues from gold, silver, and platinum. In 2025, the Mexican Federal Government amended the law and increased the rights from 7.5% to 8.5% of the taxable earnings before interest and depreciation and from 0.5% to 1% royalty on revenues from gold, silver, and platinum.

First Majestic is party to a purchase (streaming) agreement with Wheaton Precious Metals which entitles Wheaton Precious Metals to receive 25% of the gold equivalent production from the San Dimas mine converted at a fixed exchange ratio of silver to gold at 70 to 1 in exchange for ongoing payments equal to the lesser of $639.91 per ounce (as of December 31, 2024, increasing every May 10th by 1%) and the prevailing market price for each gold equivalent ounce delivered under the agreement. The exchange ratio includes a provision to adjust the gold to silver ratio if the average gold to silver ratio moves above or below 90:1 or 50:1, respectively, for a period of six months. Effective April 30, 2025, the six-month average gold/silver price ratio reached 90:1 and therefore the payable gold equivalent reference to 70 was amended to 90.

Surface rights in Mexico are separate from mineral rights. First Majestic (and its predecessor companies) secured surface rights by either acquisition of private and public land or by entering into temporary occupation agreements with surrounding Ejido communities. The surface right agreements in place with the communities provide for use of surface land for exploration activities and mine-related ventilation infrastructure. Current agreements cover the operation for the Life of Mine (LOM) plan presented in the Report.

The Company has material permits for the current operations. The Company is waiting on final resolution documents for select new environmental permits requested to the competent authorities in connection with specific projects/upgrades.

San Dimas is located near the town of Tayoltita, a town with approximately 10,000 inhabitants. Access to San Dimas is by air or road from the city of Durango and Mazatlán. Flights from either Mazatlán or Durango to the town of Tayoltita require approximately 40 minutes. Road access from Durango is through a 112 km paved road plus 120 km service road to Tayoltita, this trip requires about six and a half hours. Road access from Mazatlán is through a newly constructed ~240km paved road, this trip requires approximately 4 hours to complete.

Mining activities throughout San Dimas are performed by a combination of First Majestic personnel and contract workers.

Water for the mining operations is obtained from wells, underground dewatering, recycled from processing activities and from the Piaxtla River. The main infrastructure consists of roads, a townsite, an

| 2 | September 2025 |

| San Dimas Silver/Gold Mine Durango and Sinaloa States, Mexico NI-43-101 Technical Report on Mineral Resource and Mineral Reserve Estimates |

|

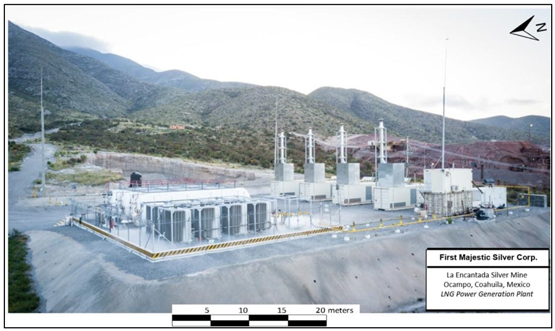

airport, the Tayoltita mill crushing and processing facilities, the Tayoltita/Cupias dry-stack tailings facilities, the Las Truchas hydroelectric generation facilities, four LNG 1 MW generators recently installed in 2025, and a backup portable diesel power generation site. The main administrative offices and employee houses, the warehouses, assay laboratory, core shack and other facilities are located in Tayoltita.

San Dimas is located in the central part of the Sierra Madre Occidental, a mountain range characterized by rugged topography with steep, often vertical, walled valleys, and narrow canyons. Elevations vary from 2,400 metres above mean sea level (masl) on the high peaks to elevations of 400 masl in the valley floor of the Piaxtla River.

| 1.3. | History |

The San Dimas property contains a series of epithermal gold silver veins that have been mined intermittently since 1757. Modern mining began in the 1880s, by the American-owned San Luis Mining Company and the Mexican-owned Candelaria Company.

In 1961, Minas de San Luis, a company owned by Mexican interests, acquired 51% of the San Dimas group of properties and assumed operations of the mine. In 1978, the remaining 49% interest in the mine was obtained by Luismin S.A. de C.V (Luismin). In 2002, Wheaton River Minerals Ltd. (Wheaton River) acquired the property from Luismin and in 2005 Wheaton River merged with Goldcorp Inc. (Goldcorp). Under its prior name Mala Noche Inc., Primero Mining Corp. (Primero) acquired San Dimas from subsidiaries of Goldcorp in August 2010. In May 2018, First Majestic acquired 100% interest in San Dimas property through acquisition of Primero.

Historical production through December 2024 from San Dimas is estimated at more than 766 Moz of silver and more than 11.1 Moz of gold, placing the district third in Mexico for precious metal production after Pachuca and Guanajuato. The majority of this production was prior to First Majestic’s acquisition of the property. The average production rate by First Majestic during 2019–2024 was approximately 2,100 tonnes per day (tpd).

| 1.4. | Geological Setting, Mineralization and Deposit Types |

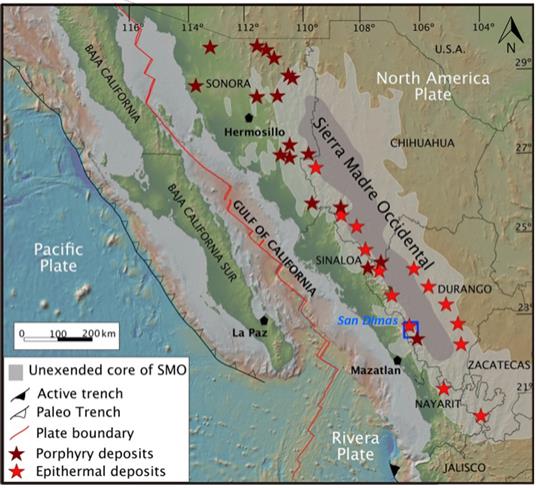

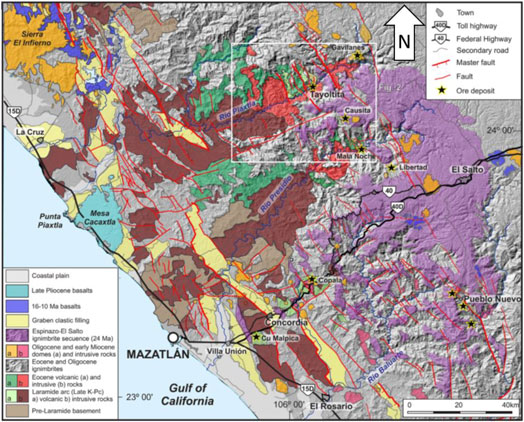

The San Dimas property is located in the central part of the Sierra Madre Occidental (SMO), near the Sinaloa-Durango state border, which has an average elevation exceeding 2000 m above sea level, extending from the Mexico-US border to the Trans-Mexican Volcanic Belt. Numerous epithermal deposits have been found along the SMO.

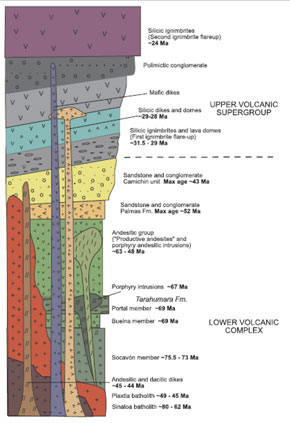

The SMO consists of Late Cretaceous to early Miocene igneous rocks including two major volcanic successions totalling approximately 3,500 m in thickness and are separated by erosional and depositional unconformities: the Lower Volcanic Complex (LVC) and Upper Volcanic Group (UVG).

| 3 | September 2025 |

| San Dimas Silver/Gold Mine Durango and Sinaloa States, Mexico NI-43-101 Technical Report on Mineral Resource and Mineral Reserve Estimates |

|

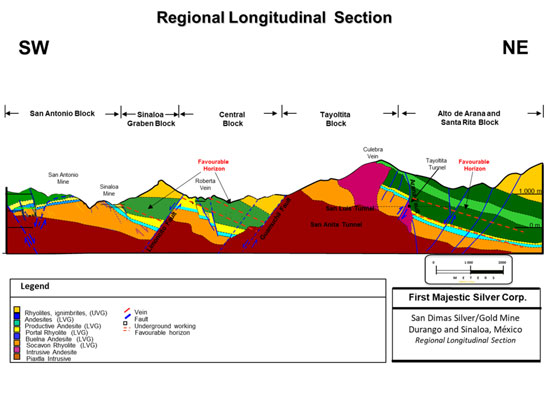

The LVC consists of predominantly intermediate volcanic and intrusive rocks formed between approximately 100 and 50 Ma. The LVC has traditionally been divided into local geological units based on field observations. The lower part of the sequence consists of the more than 700 m thick Socavón rhyolite, which is host to several productive veins in the district. This overlain by the Buelna andesite and the Portal Rhyolite which range from 50-250 m in thickness.

The lower sequence of rhyolitic rocks is unconformably overlain by a succession of andesitic lava flows and volcanogenic sedimentary rocks including the Productive Andesite (> 750 m thick), Las Palmas rhyo-andesite tuffs and flows (>300 m thick), and the volcanogenic sedimentary unit the Camichin Unit.

The UVG sits unconformably on the LVC and consists of the lower Guarisamey andesite and the Capping Rhyolite. The Capping Rhyolite consists of rhyolitic ash flows and air-fall tuffs and may reach as much as 1,500 m in thickness in the eastern part of the district.

The LVC and UVG volcanic rocks are intruded by intermediate rocks, consisting of the Arana intrusive andesite and the Arana intrusive diorite, and a felsic suite comprising the Piaxtla granite and the Santa Lucia, Bolaños, and Santa Rita dikes. The basic dikes intrude both the LVC and the UVG.

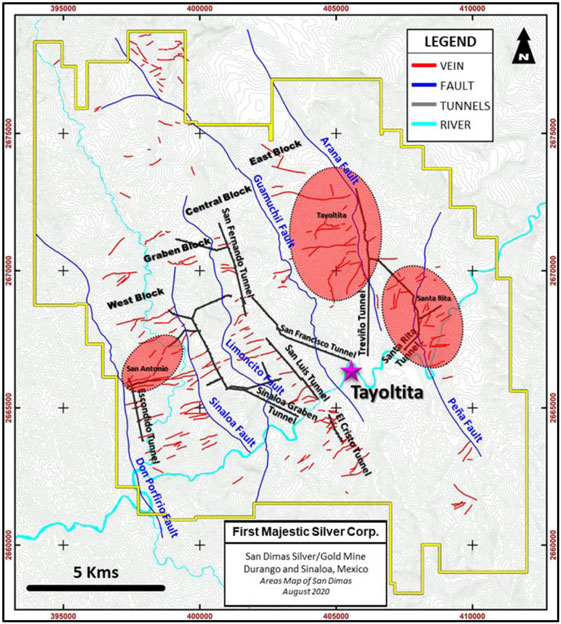

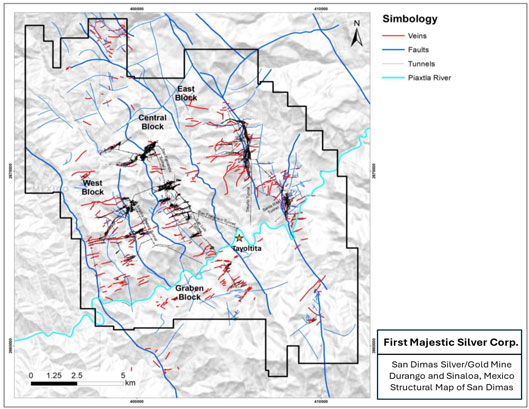

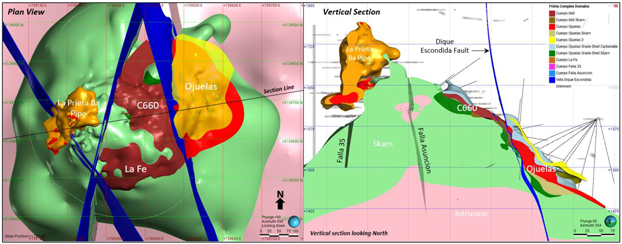

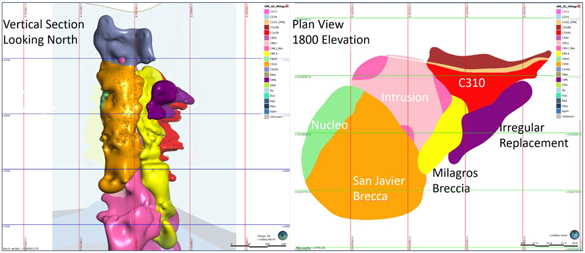

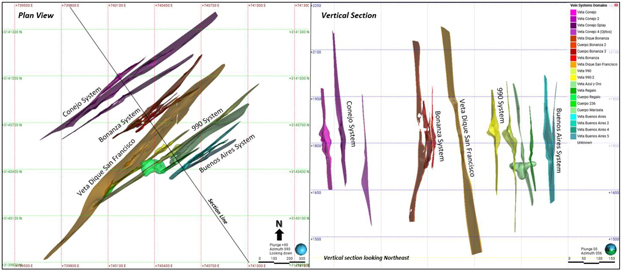

The most prominent structures are major north–northwest-trending normal faults with opposite vergence that divide the district into five fault-bounded blocks that are tilted to the east–northeast or west–northwest. East–west to west–southwest–east–northeast striking fractures, perpendicular to the major normal faults, are often filled by quartz veins, dacite porphyry dikes, and pebble dikes. The veins are generally west–southwest–east-northeast-oriented, within a corridor approximately 10 km wide. The veins are often truncated by the north–northwest–south–southeast-trending major faults, separating the original veins into segments. These segments are named as individual veins and grouped within the mine zones by fault block.

The mine zone groupings of veins are, from west to east: West Block, Graben Block, Central Block, Tayoltita Block, Alto de Arana Block (also known as Arana HW), San Vicente, El Cristo and Santa Rita.

Three deformational events are related to the development of the major faults, hydrothermal veins, and dikes.

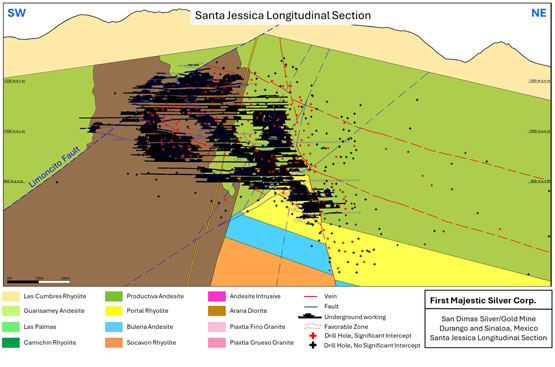

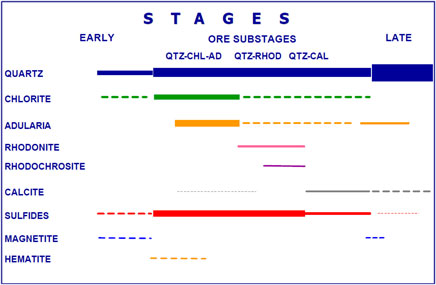

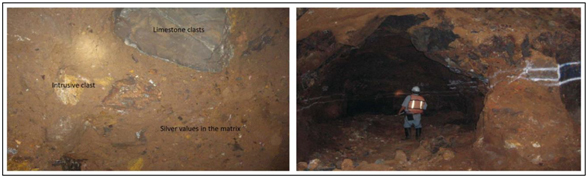

Within the San Dimas property, the mineralization is typical of epithermal vein structures with banded and drusy textures. Epithermal-style veins occupy east–west-trending fractures, except in the southern part of the Tayoltita Block where they strike mainly northeast, and in the Santa Rita area where they strike north–northwest. The metal rich stage consists primarily of white to light grey, medium-to-coarse-grained crystalline quartz. The quartz contains intergrowths of base metal sulphides (sphalerite, chalcopyrite, and galena) as well as pyrite, argentite, polybasite, stromeyerite, native silver, and electrum.

Mine geologists observed that bonanza grades along the San Luis vein in the Tayoltita Block were spatially related to the Productive andesite unit and/or to the interface between the Productive andesite and the Portal rhyolite and/or the Buelna andesite. This spatial association of vein-hosted mineralization with a

| 4 | September 2025 |

| San Dimas Silver/Gold Mine Durango and Sinaloa States, Mexico NI-43-101 Technical Report on Mineral Resource and Mineral Reserve Estimates |

|

favorable host-rock zone within the volcanic sequence is now recognized in other fault blocks and constitutes a major exploration criterion for the district.

More than 125 mineralized quartz veins have been recognized across the San Dimas property. The silver and gold rich quartz veins have been followed underground from a few metres in strike-length to more than 1,500 m. One of these veins, the Jessica Vein, extends for more than 1,000 m in the Central Block. The vein-hosted mineral deposits within the San Dimas district are considered to be examples of silver- and gold-bearing epithermal quartz veins that formed in a low-sulphidation setting.

| 1.5. | Exploration |

The San Dimas property has been the subject of modern exploration and mine development activities since the early 1970s, and a considerable information database has been developed from both exploration and mining activities. Exploration uses information from surface and underground mapping, sampling, and drilling together with extensive underground mine tunneling to help identify targets. Other exploration activities include prospecting, geochemical surface sampling, geophysical, predictive artificial intelligence, and remote sensing surveys.

Most of the exploration activities carried out within the San Dimas property were centered around the Piaxtla River where exposures of silver–gold veins were found. Outside of this area, the Lechuguilla and Ventana areas were explored to some extent during 2008 and 2015–16. The remainder of the property had limited exploration due to post-mineral cover by a thick layer of ignimbrites.

The exploration potential remains open in the areas surrounding the mine zones. As the mine was developed to the north, new veins were found. South of the Piaxtla River, the El Cristo area has potential for new quartz vein discoveries. The West Block is currently being explored by drilling and tunnelling. Opportunities to intercept the projection of fault-offset quartz veins from the Graben Block are considered good.

| 1.6. | Drilling |

Drilling in the San Dimas property is focused on the identification and delineation of vein-hosted silver and gold resources by using structural and stratigraphic knowledge of the district, and preferred vein trends. Since the “favourable horizon” for mineral deposits concept emerged in 1975, the exploration drilling strategy has focused on core drilling perpendicular to the preferred vein orientation within the mine zones, which has proven to be the most effective method of exploration in the area. Core drilling is predominantly done from underground stations, as the rugged topography and the great drilling distance from surface locations to the target(s) makes surface drilling challenging and expensive. Over 1,413,000 m of core drilling has been completed since 2000.

| 5 | September 2025 |

| San Dimas Silver/Gold Mine Durango and Sinaloa States, Mexico NI-43-101 Technical Report on Mineral Resource and Mineral Reserve Estimates |

|

| 1.7. | Sampling, Analysis and Data Verification |

Diamond drill core is delivered to the core logging facility where San Dimas geologists select and mark sample intervals according to lithological contacts, mineralization, alteration, and structural features.

Drill core intervals selected for sampling are cut in half using a diamond saw. One half of the core is retained in the core box for further inspection and the other half is placed in a sample bag. For smaller diameter delineation drill core (TT-46) “termite” the entire core is sampled for analysis.

The sample number is printed with a marker on the core box beside the sampled interval, and a sample tag is inserted into the sample bag. Sample bags are tied with string and placed in rice bags for shipping.

Since 2013, underground mine production channel samples for ore control and channel samples for resource estimation have been collected at San Dimas. Earlier channel samples were taken either across the roof of developments or across the face in developments. From 2016 to present, production channel samples for ore control and channel samples for resource estimation are routinely taken across the mine development face and within stopes.

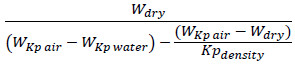

Bulk density measurements are systematically taken on drill core. From 2016 to 2023, specific gravity measurements were collected on 10 cm or longer whole core vein samples using the unsealed water immersion method. Based on this method, an average bulk density value of 2.6 t/m3 was determined.

Quality control samples such as duplicates, checks and standards are included with all samples.

Since 2004, four different laboratories have been used for sample preparation and analysis. These include, First Majestic’s San Dimas Laboratory, SGS Durango, ALS-Chemex Zacatecas, and First Majestic’s ISO9001 certified Central Lab facility located at the Company’s Santa Elena operation in Sonora, Mexico.

Channel samples and drill core samples were dried, crushed, and pulverized.

In general, samples were analyzed for gold by a 30 g FA atomic absorption spectroscopy (AAS) method. Silver was analyzed by a 2 g, three-acid digestion AAS method. A multi-element suite was analyzed by a 0.25 g, aqua regia digestion inductively coupled plasma (ICP) optical emission spectroscopy (OES) method.

From 2013 to 2018, the QAQC program for the San Dimas laboratory samples included insertion of a standard reference material (SRM) and a blank in every batch of 20 samples. From 2013 to 2018, the QAQC program for channel and core samples included insertion of a SRM and a blank in every batch of 20 samples. In 2013, 5% of the coarse reject and pulp duplicates from core samples were randomly selected for analysis at SGS Durango and 5% of pulp checks from core samples were analyzed at ALS laboratory. Since 2022, the QAQC samples inserted in the core sampling include field, coarse reject, and pulp duplicates, CRMs, and coarse and pulp blanks.

The data verification included data entry error checks, visual inspections of data, and a review of QA/QC assay results was completed. Several site visits were completed as part of the data verification process. No significant differences were observed.

| 6 | September 2025 |

| San Dimas Silver/Gold Mine Durango and Sinaloa States, Mexico NI-43-101 Technical Report on Mineral Resource and Mineral Reserve Estimates |

|

| 1.8. | Mineral Processing and Metallurgical Testing |

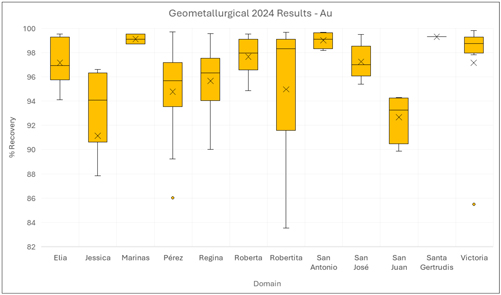

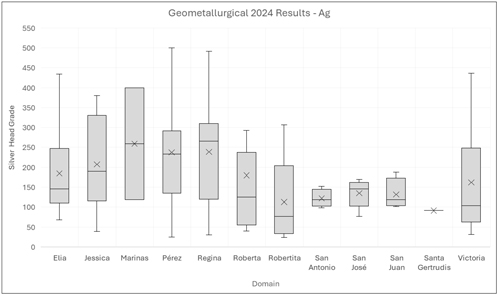

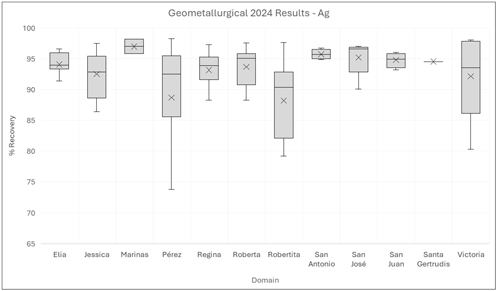

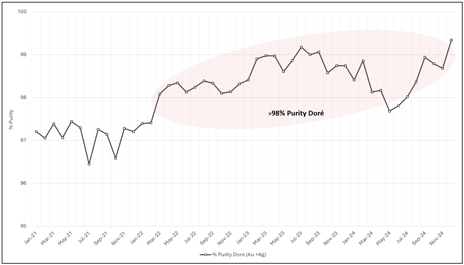

San Dimas operation is made up of several operating underground mines within the property boundaries, which all feed a central milling operation. The metallurgical test work data used to support the initial plant design has been consistently validated and reinforced by years of operational results, complemented by more recent metallurgical studies. Metallurgical testing and mineralogical investigations are routinely conducted to support ongoing performance optimization. The plant continuously performs tests to optimize metal recoveries and reduce operating costs, even when current performance falls within expected parameters. This test work is conducted by the on-site metallurgical laboratory.

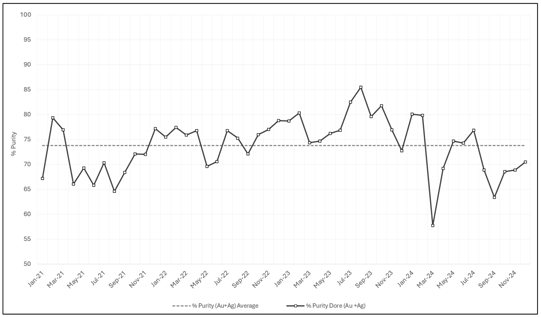

The metallurgical recovery projections outlined in the LOM plan are supported by the historical performance of the processing plant and metallurgical testing of future ore. Based on plant performance data from 2021 to 2024, the estimated metal recoveries for the LOM plan and financial analysis are 92.6% for silver and 95.6% for gold. The last two years (2023 and 2024) were used in the LOM based on future material type and corresponding metallurgical testing. San Dimas doré consistently exceeds 97% purity (Au + Ag) and incurs no refinery penalties. Since March 2023, purity has surpassed 98% due to process improvements, including higher-purity zinc powder and optimized flux blends.

| 1.9. | Mineral Resource and Mineral Reserve Estimates |

| 1.9.1. | Mineral Resource Estimates |

The geological modelling, data analysis, and block model Mineral Resource estimates for San Dimas were completed under the supervision of David Rowe, CPG, a First Majestic employee.

The block model Mineral Resource estimates are based on the database of exploration drill holes and production channel samples, underground level geological mapping, geological interpretations and models, as well as surface topography and underground mining development wireframes available as of the December 31, 2024, cut-off date for scientific and technical data supporting the estimates.

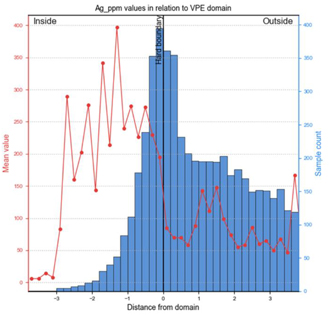

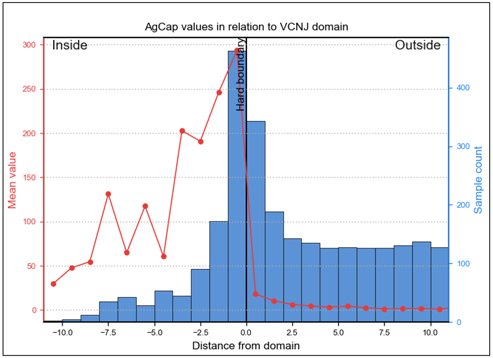

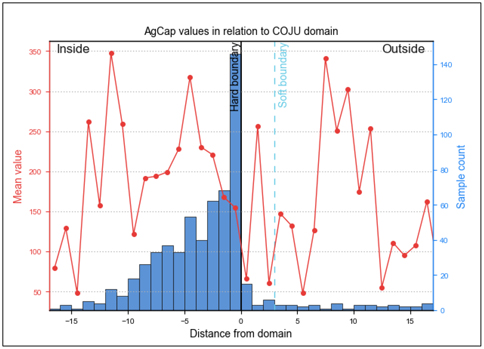

Exploratory data analysis was completed for gold and silver assay sample values to assess the statistical and spatial character of the sample data. Boundary analysis was completed to review the change in metal grade across the domain contacts Hard boundaries were used during the creation of composite samples during mineral resource estimation.

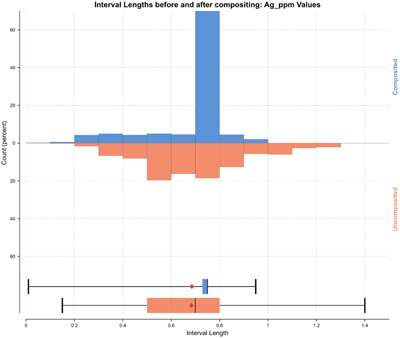

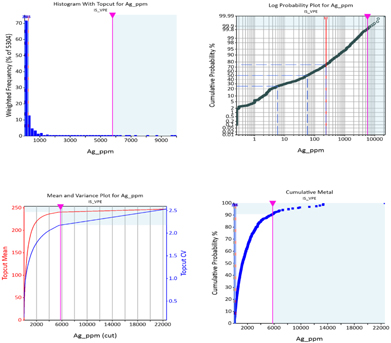

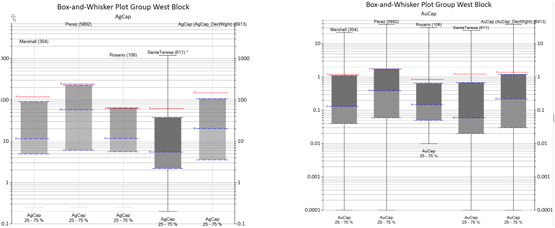

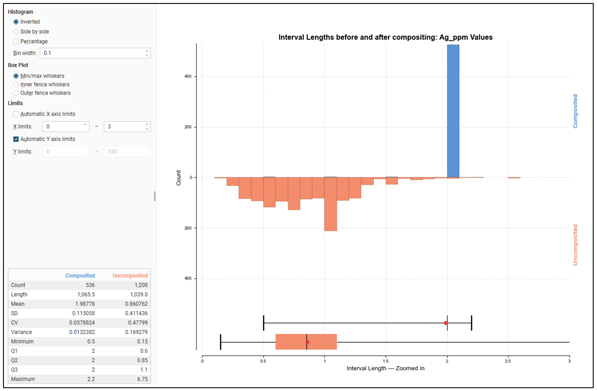

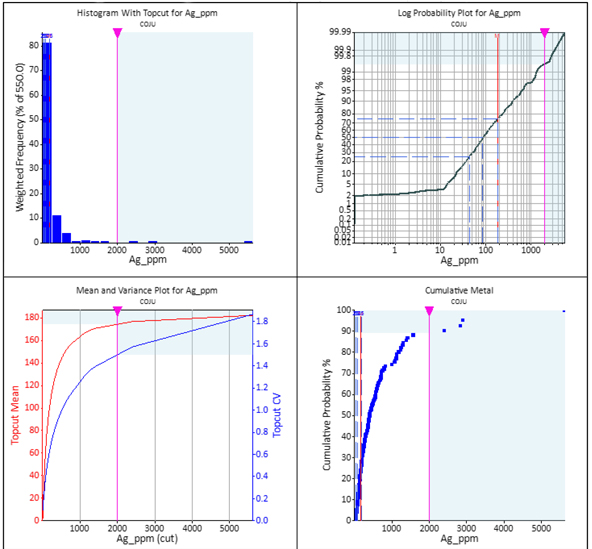

To assess the statistical character of the composite samples within each of domains, data were declustered to account for over-sampling in certain regions. The selected composite sample length varied by domain with the most common composite sample length being 1.0 m. The assay sample intervals were composited within the limits of the domain boundaries and then tagged with the appropriate domain code. Drill hole and channel composite samples were evaluated for high-grade outliers and those outliers were capped to values considered appropriate for each domain.

| 7 | September 2025 |

| San Dimas Silver/Gold Mine Durango and Sinaloa States, Mexico NI-43-101 Technical Report on Mineral Resource and Mineral Reserve Estimates |

|

Mineral Resources were estimated into sub-block models rotated parallel to the resource domain trend. Parent block grades were estimated using inverse distance weighting interpolation. The block estimates were made with multiple passes to limit the influence the channel production samples at longer ranges. Pass 1 was a restrictive short-range pass that used channel and drill hole composite samples, and subsequent less restrictive passes used drill hole samples only. An average bulk density value of 2.6 t/m3 was used in estimation for all resource domains.

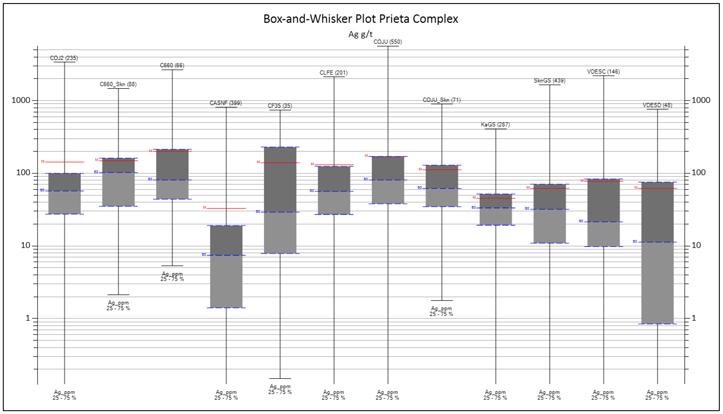

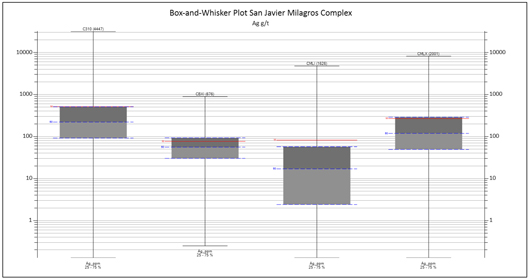

Validation was completed for each of the resource estimation domains in multiple steps including visual inspection, global grade bias checks, and swath plots. Overall, the block model validations demonstrated that the current Mineral Resource estimates are a reasonable representation of the primary input sample data. The Mineral Resource estimates were classified into Measured, Indicated, or Inferred based on the confidence in the geological interpretation and models, the confidence in the continuity of metal grades, the sample support for the estimation and reliability of the sample data, and on the presence of underground mining development providing detailed mapping and production channel sample support.

The Mineral Resource estimates were evaluated for reasonable prospects for eventual economic extraction by application of input parameters based on mining and processing information from the last 2 years of operations. Deswik Stope Optimizer software was used to identify the blocks representing mineable volumes that exceed the cut-off value while complying with the aggregate of economic parameters.

The Mineral Resource estimates for San Dimas are summarized in

| 8 | September 2025 |

| San Dimas Silver/Gold Mine Durango and Sinaloa States, Mexico NI-43-101 Technical Report on Mineral Resource and Mineral Reserve Estimates |

|

Table 1-1 and Table 1-2 using a Net Smelter Return (NSR) cut-off value of $174/t. Measured and Indicated Mineral Resources are reported inclusive of Mineral Reserves and have an effective date of December 31, 2024. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

| 9 | September 2025 |

| San Dimas Silver/Gold Mine Durango and Sinaloa States, Mexico NI-43-101 Technical Report on Mineral Resource and Mineral Reserve Estimates |

|

Table 1-1: San Dimas Measured and Indicated Mineral Resource Estimate

(effective date December 31, 2024)

| Category / Area |

Mineral Type |

Tonnage |

Grades | Metal Content | ||||||||||||||||||||||||||

| k tonnes |

Ag (g/t) |

Au (g/t) |

Ag-Eq (g/t) |

Ag (k Oz) |

Au (k Oz) |

Ag-Eq (k Oz) |

||||||||||||||||||||||||

| Measured Central Block |

Sulphides | 1,169 | 355 | 4.79 | 778 | 13,320 | 180 | 29,240 | ||||||||||||||||||||||

| Measured Sinaloa Graben |

Sulphides | 478 | 360 | 4.84 | 789 | 5,540 | 74 | 12,120 | ||||||||||||||||||||||

| Measured Other Areas |

Sulphides | 205 | 399 | 3.80 | 735 | 2,630 | 25 | 4,850 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total Measured |

Sulphides | 1,851 | 361 | 4.69 | 776 | 21,490 | 279 | 46,210 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Indicated Central Block |

Sulphides | 1,326 | 248 | 2.79 | 494 | 10,550 | 119 | 21,070 | ||||||||||||||||||||||

| Indicated Sinaloa Graben |

Sulphides | 543 | 245 | 3.07 | 517 | 4,280 | 54 | 9,030 | ||||||||||||||||||||||

| Indicated Tayoltita |

Sulphides | 158 | 326 | 4.04 | 684 | 1,660 | 21 | 3,480 | ||||||||||||||||||||||

| Indicated Other Areas |

Sulphides | 997 | 335 | 3.00 | 600 | 10,730 | 96 | 19,240 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total Indicated |

Sulphides | 3,025 | 280 | 2.97 | 543 | 27,220 | 289 | 52,820 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| M+I Central Block |

Sulphides | 2,494 | 298 | 3.72 | 627 | 23,870 | 299 | 50,300 | ||||||||||||||||||||||

| M+I Sinaloa Graben |

Sulphides | 1,021 | 299 | 3.90 | 645 | 9,820 | 128 | 21,160 | ||||||||||||||||||||||

| M+I Tayoltita |

Sulphides | 158 | 326 | 4.04 | 684 | 1,660 | 21 | 3,480 | ||||||||||||||||||||||

| M+I Other Areas |

Sulphides | 1,202 | 346 | 3.14 | 623 | 13,360 | 121 | 24,080 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total M+I |

Sulphides | 4,876 | 311 | 3.63 | 632 | 48,710 | 569 | 99,020 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

Table 1-2: San Dimas Inferred Mineral Resource Estimate (effective date December 31, 2024)

| Category / Area |

Mineral Type |

Tonnage |

Grades | Metal Content | ||||||||||||||||||||||||||

|

|

k tonnes |

Ag (g/t) |

Au (g/t) |

Ag-Eq (g/t) |

Ag (k Oz) |

Au (k Oz) |

Ag-Eq (k Oz) |

|||||||||||||||||||||||

| Inferred Central Block |

Sulphides | 1,897 | 251 | 3.02 | 518 | 15,330 | 184 | 31,610 | ||||||||||||||||||||||

| Inferred Sinaloa Graben |

Sulphides | 526 | 382 | 5.20 | 842 | 6,470 | 88 | 14,260 | ||||||||||||||||||||||

| Inferred Tayoltita |

Sulphides | 506 | 261 | 3.10 | 536 | 4,250 | 50 | 8,710 | ||||||||||||||||||||||

| Inferred Other Areas |

Sulphides | 2,400 | 217 | 2.24 | 415 | 16,760 | 173 | 32,050 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total Inferred |

Sulphides | 5,329 | 250 | 2.89 | 506 | 42,810 | 495 | 86,630 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| (1) | Mineral Resource estimates are classified per CIM Definition Standards (2014) and NI 43-101. |

| (2) | Mineral Resource estimates are based on internal estimates with an effective date of December 31, 2024. |

| (3) | Mineral Resource estimates were supervised or reviewed by David Rowe, CPG, Internal Qualified Person for First Majestic, per NI 43-101. |

| (4) | Silver-equivalent grade (Ag-Eq) is calculated as follows: |

Ag-Eq = Ag Grade + (Au Grade x Au Recovery x Au Payable x Au Price) / (Ag Recovery x Ag Payable x Ag Price).

| (5) | Metal prices for Mineral Resources estimates were $28.0/oz Ag and $2,400/oz Au. Metallurgical recovery used was 92.6% for silver and 95.6% for gold. Metal payable used was 99.95% for silver and gold. |

| (6) | NSR cutoff value considered to constrain resources assumed an underground operation was $174/t and was based on actual and budgeted operating and sustaining costs. |

| (7) | Mineral Resources are reported within mineable stope shapes using the NSR cutoff value calculated using the stated metal prices and metal recoveries. The NSR cutoff includes mill recoveries and payable metal factors appropriate to the existing processing circuit. |

| (8) | No dilution was applied to the Mineral Resource which are reported on an in-situ basis. |

| (9) | Tonnage is expressed in thousands of tonnes; metal content is expressed in thousands of ounces. Totals may not add up due to rounding. |

| 10 | September 2025 |

| San Dimas Silver/Gold Mine Durango and Sinaloa States, Mexico NI-43-101 Technical Report on Mineral Resource and Mineral Reserve Estimates |

|

| (10) | Measured and Indicated Mineral Resources are reported inclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. |

Risk factors that may materially impact the Mineral Resource estimates include: changes to the assumptions used to generate the NSR cut-off value including metal price and exchange rates; changes to interpretations of mineralization geometry and continuity; changes to geotechnical, mining, and metallurgical recovery assumptions; assumptions as to the continued ability to access the site, retain mineral and surface rights titles, maintain environment and other regulatory permits, and maintain the social license to operate.

| 1.9.2. | Mineral Reserve Estimates |

The Mineral Reserves estimation process consists of converting Mineral Resources into Mineral Reserves by identifying material that exceeds the mining cut-off grades and conforms to the geometrical constraints defined by the selected mining method. Modifying factors, such as mining methods, mining recovery, dilution, sterilization, depletion, cutoff grades, geotechnical conditions, metallurgical factors, infrastructure, operability, safety, environmental, regulatory, saleability of products, social and legal factors. These factors were applied to produce mineable stope shapes. If the Mineral Resources comply with the previous constraints, Measured Resources could be converted to Proven Reserves and Indicated Resources could be converted to Probable Reserves, in some instances Measured Resources could be converted to Probable Reserves if any or more of the modifying factors reduces the confidence of the estimates.

The NSR is the variable that was used as indicator to segregate if the revenue from the mineralized material in a block, which is part of the Measured and Indicated Mineral Resources, exceeds the operating and capital costs. NSR formulas were derived from the assumed economic parameters shown in

Table 1-3.

Table 1-3: Economic Parameters assumed for calculation of NSR

| Concept |

Units | Values | ||||

| Metal Price Ag |

$/oz Ag | 26.00 | ||||

| Metal Price Au |

$/oz Au | 2,200 | ||||

| Metallurgical Recovery Ag |

% | 92.60 | ||||

| Metallurgical Recovery Au |

% | 95.60 | ||||

| Metal Payable Ag and Au |

% | 99.95 | ||||

| Dore Transport Cost |

$/oz Dore | 0.166 | ||||

| Insurance and Representation Cost |

$/oz Dore | 0.046 | ||||

| Refining Change Ag |

$/oz Ag | 0.225 | ||||

| Refining Change Au |

$/oz Au | 0.500 | ||||

Three types of cut-off values (COV) have been determined for San Dimas: general COV, incremental COV, and marginal COV. The COVs are expressed in $/tonne, reflecting the value that the run-of-mine (ROM) material will carry before is fed to the processing plant.

| 11 | September 2025 |

| San Dimas Silver/Gold Mine Durango and Sinaloa States, Mexico NI-43-101 Technical Report on Mineral Resource and Mineral Reserve Estimates |

|

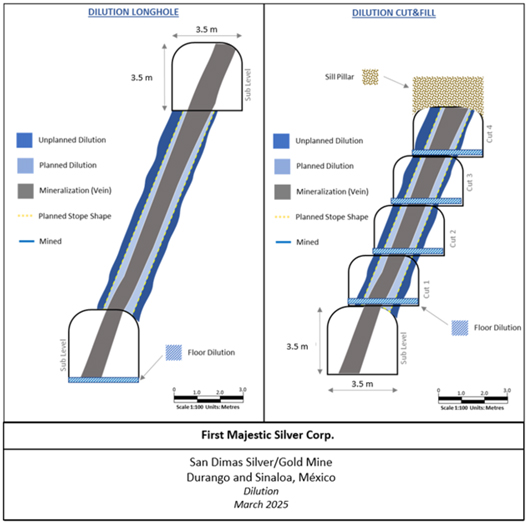

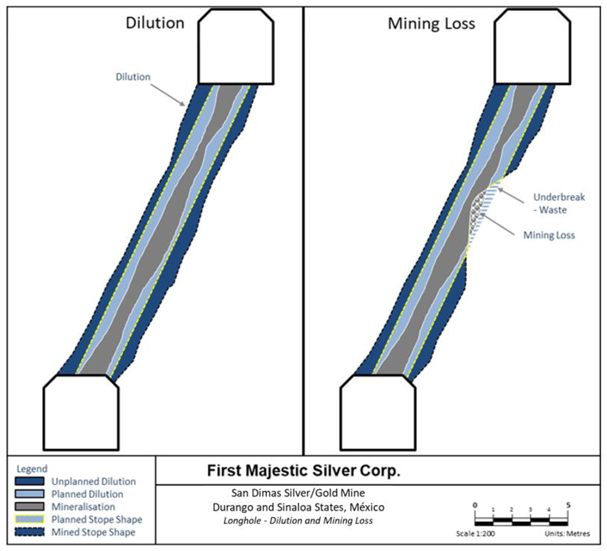

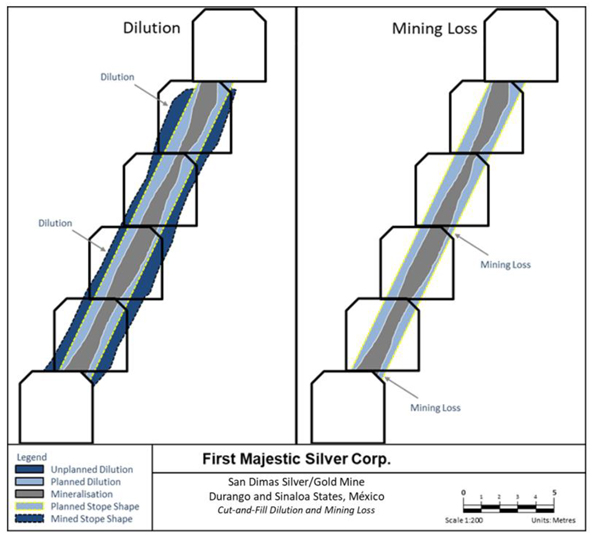

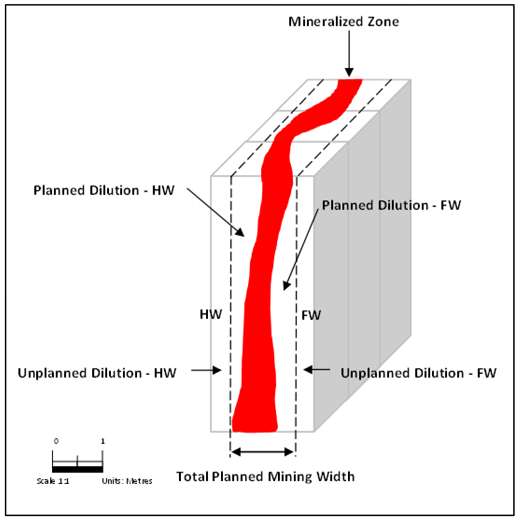

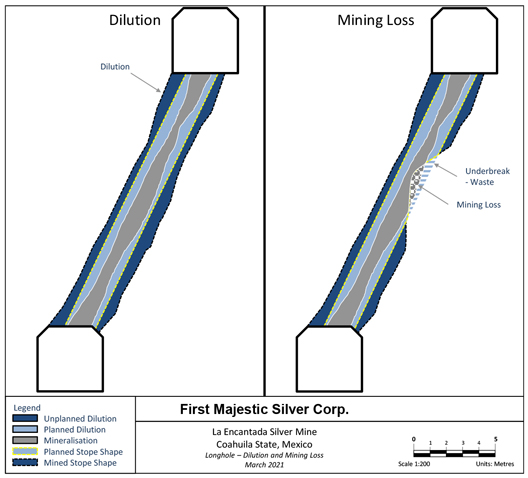

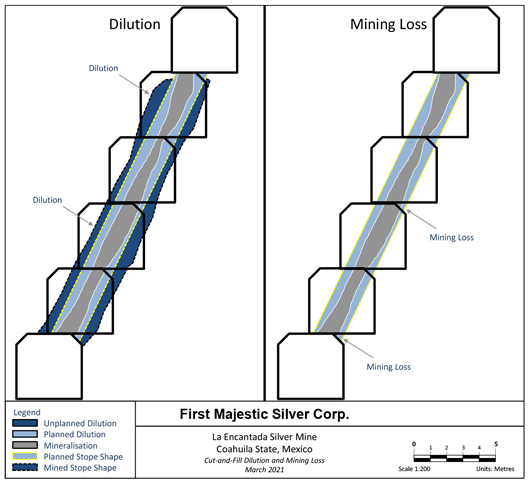

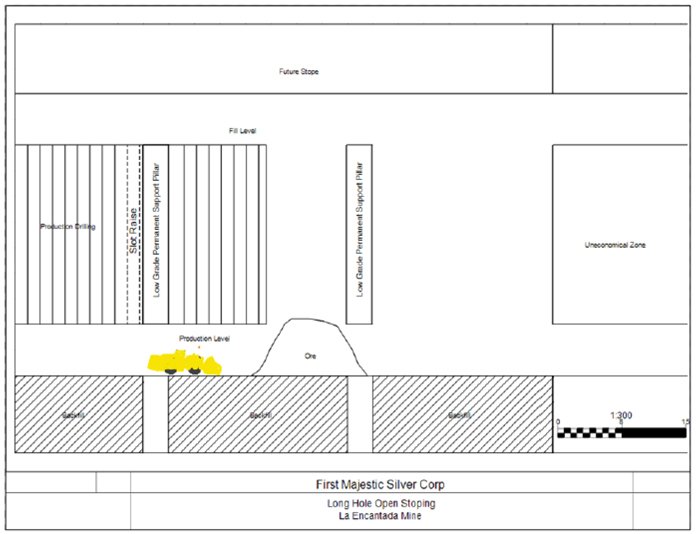

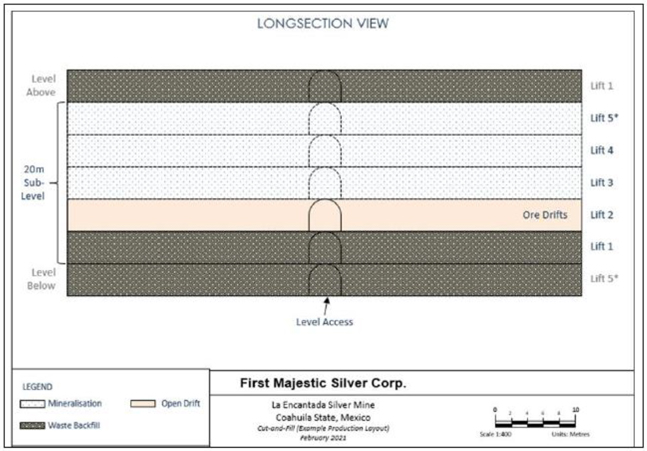

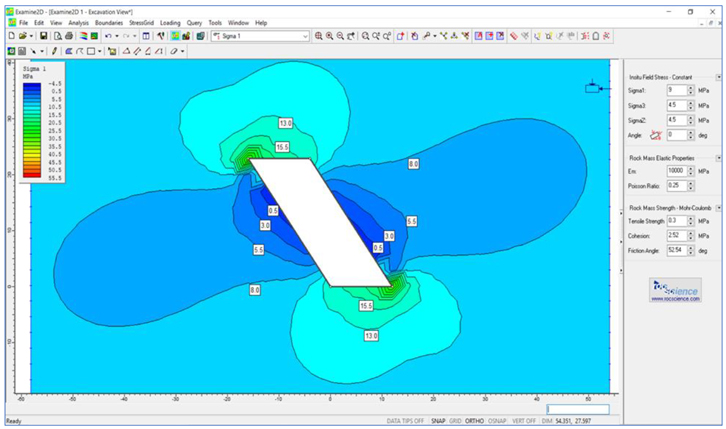

The planned dilution assumes a minimum mining width, which will depend on the applied mining method. The minimum mining width for cut-and-fill using jackleg drills was 0.8 m, while when using jumbo drills was 3.5 m. In the case of longhole mining, the minimum mining width assumed was 1.2 m.

The estimated overbreak in each side of the designed stope is 0.2 m for the two mining methods, longhole and cut-and-fill. An extra dilution from the backfill floor of 0.3 m for longhole and 0.2 m for cut-and-fill is also assumed. The unplanned dilution assumed was an additional 8% of the extracted material before becoming plant-feed.

Other than for sill mining, average mining loss throughout each mining block for both cut-and-fill and longhole mining has been assumed to be 5%. A factor of 25% has been used for sill pillars.

San Dimas Mineral Reserves are presented in Table 1-4.

| 12 | September 2025 |

| San Dimas Silver/Gold Mine Durango and Sinaloa States, Mexico NI-43-101 Technical Report on Mineral Resource and Mineral Reserve Estimates |

|

Table 1-4: San Dimas Mineral Reserves Statement (Effective Date December 31, 2024)

| Category / Area |

Mineral Type |

Tonnage |

Grades | Metal Content | ||||||||||||||||||||||||||

| k tonnes |

Ag (g/t) |

Au (g/t) |

Ag-Eq (g/t) |

Ag (k Oz) |

Au (k Oz) |

Ag-Eq (k Oz) |

||||||||||||||||||||||||

| Proven Central Block |

Sulphides | 780 | 255 | 3.47 | 557 | 6,390 | 87 | 13,980 | ||||||||||||||||||||||

| Proven Sinaloa Graben |

Sulphides | 293 | 222 | 2.67 | 455 | 2,090 | 25 | 4,290 | ||||||||||||||||||||||

| Proven Tayoltita |

Sulphides | 0 | 0 | 0.00 | 0 | 0 | 0 | 0 | ||||||||||||||||||||||

| Proven Other Areas |

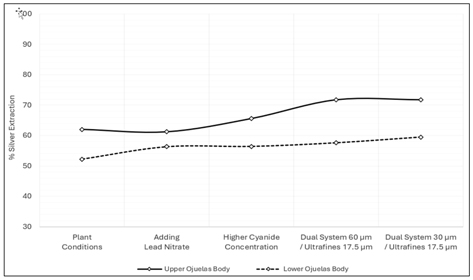

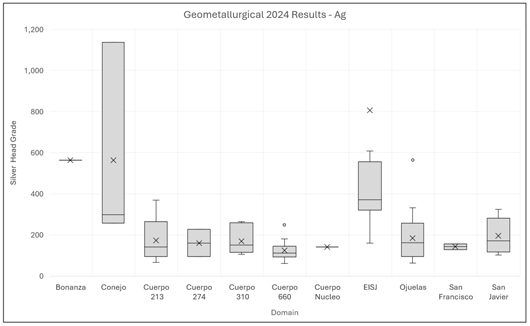

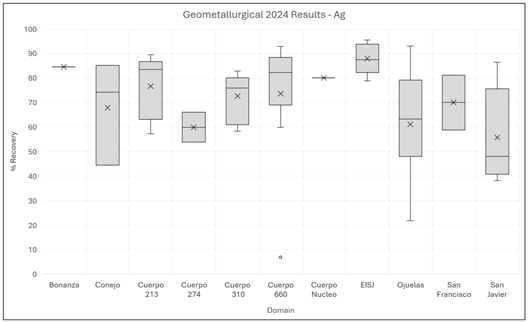

Sulphides | 184 | 297 | 2.65 | 528 | 1,750 | 16 | 3,120 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total Proven |

Sulphides | 1,257 | 253 | 3.16 | 529 | 10,230 | 128 | 21,390 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Probable Central Block |

Sulphides | 732 | 228 | 2.74 | 467 | 5,370 | 65 | 11,010 | ||||||||||||||||||||||

| Probable Sinaloa Graben |

Sulphides | 381 | 211 | 2.66 | 443 | 2,580 | 33 | 5,430 | ||||||||||||||||||||||

| Probable Tayoltita |

Sulphides | 133 | 206 | 2.74 | 445 | 880 | 12 | 1,900 | ||||||||||||||||||||||

| Probable Other Areas |

Sulphides | 726 | 275 | 2.48 | 492 | 6,420 | 58 | 11,470 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total Probable |

Sulphides | 1,972 | 241 | 2.63 | 470 | 15,250 | 167 | 29,810 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| P+P Central Block |

Sulphides | 1,512 | 242 | 3.11 | 514 | 11,760 | 151 | 24,990 | ||||||||||||||||||||||

| P+P Sinaloa Graben |

Sulphides | 674 | 216 | 2.67 | 448 | 4,670 | 58 | 9,720 | ||||||||||||||||||||||

| P+P Tayoltita |

Sulphides | 133 | 206 | 2.74 | 445 | 880 | 12 | 1,900 | ||||||||||||||||||||||

| P+P Other Areas |

Sulphides | 910 | 279 | 2.51 | 499 | 8,170 | 74 | 14,590 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total P+P |

Sulphides | 3,229 | 245 | 2.84 | 493 | 25,480 | 294 | 51,200 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| (1) | Mineral Reserves are classified per CIM Definition Standards (2014) and NI 43-101. |

| (2) | Mineral Reserves are effective December 31, 2024, are derived from Measured & Indicated Resources, account for depletion to that date, and are reported with a reference point of mined ore delivered to the plant. |

| (3) | Mineral Reserve estimates were supervised or reviewed by Andrew Pocock, P.Eng., Internal Qualified Person for First Majestic per NI 43-101. |

| (4) | Silver-equivalent grade (Ag-Eq) is calculated as follows: |

Ag-Eq Grade = Ag Grade + Au Grade *(Au Recovery * Au Payable * Au Price) / (Ag Recovery * Ag Payable * Ag Price)

| (5) | Metal prices for Reserves: $26/oz Ag, $2,200/oz Au. Other key assumptions and parameters include Metallurgical recoveries of 92.6% Ag, 95.6% Au; metal payable of 99.95% Ag & Au, costs ($/t): direct mining $61.91 longhole stoping and $96.55 cut & fill, processing $39.37 mill feed, indirect/G&A $65.51 and sustaining $35.88 for longhole stoping and cut & fill. |

| (6) | A two-step cutoff approach was used per mining method: A general cutoff grade defines mining areas covering all associated costs; and a 2nd pass incremental cutoff includes adjacent material covering only its own costs, excluding shared general development access & infrastructure costs which are covered by the general cutoff material. |

| (7) | Modifying factors for conversion of resources to reserves include but are not limited to consideration for mining methods, mining recovery, dilution, sterilization, depletion, cutoff grades, geotechnical conditions, metallurgical factors, infrastructure, operability, safety, environmental, regulatory, social, and legal factors. These factors were applied to produce mineable stope shapes. |

| (8) | Tonnage in thousands of tonnes, metal content in thousands of ounces, prices/costs in USD. Numbers are rounded per guidelines; totals may not sum due to rounding. |

The QP is not aware of any known mining, metallurgical, environmental, permitting, legal, title, taxation, socio-economic, marketing, political, or other relevant factors that could materially affect the Mineral Reserve estimates, other than discussed herein.

| 13 | September 2025 |

| San Dimas Silver/Gold Mine Durango and Sinaloa States, Mexico NI-43-101 Technical Report on Mineral Resource and Mineral Reserve Estimates |

|

| 1.10. | Mining Operations |

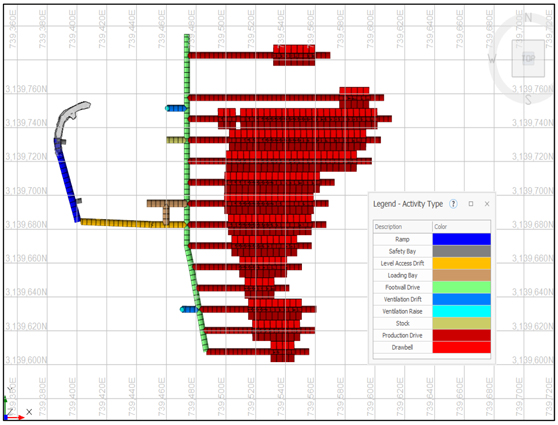

San Dimas includes five underground gold and silver mining areas: West Block (San Antonio, Perez mine), Sinaloa Graben Block (Graben Block), Central Block, Tayoltita Block, and the Arana Hanging-wall Block (Santa Rita mine).

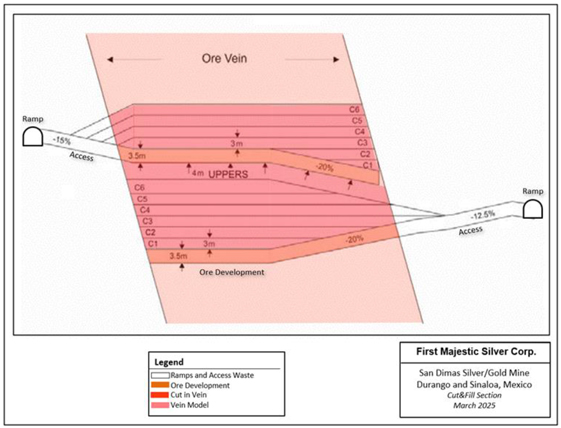

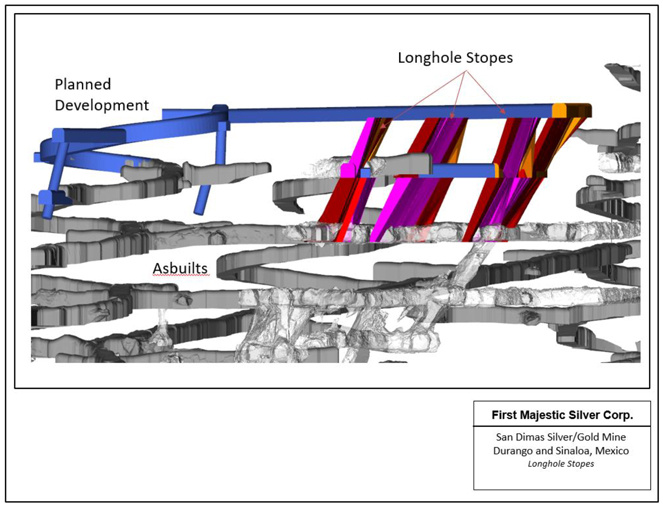

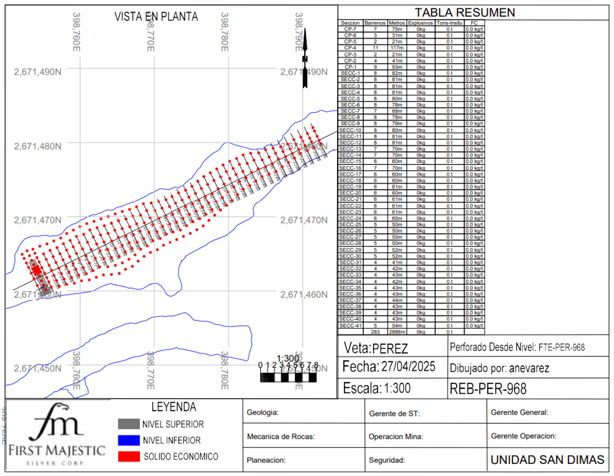

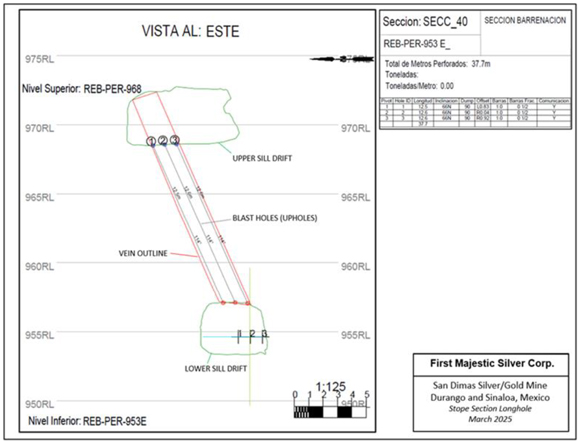

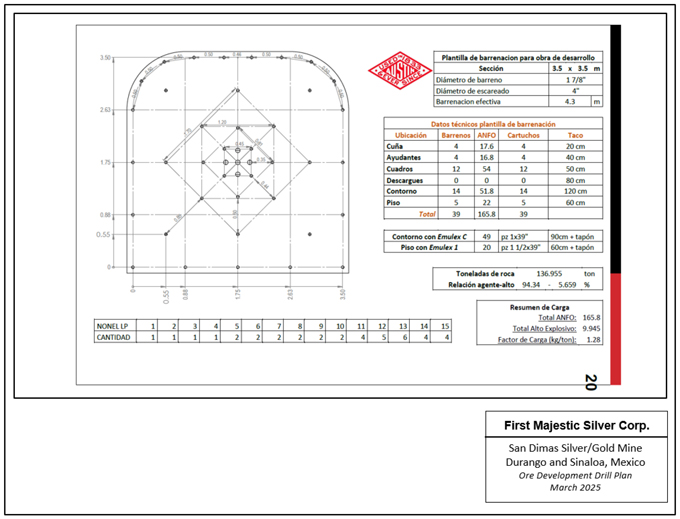

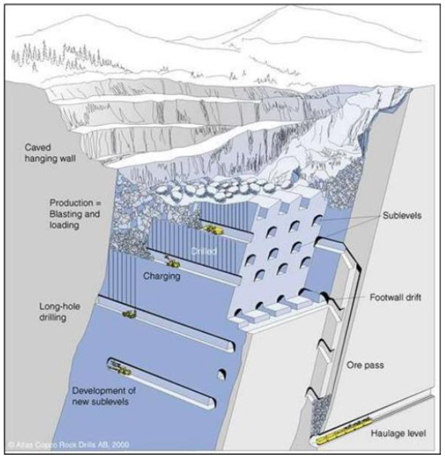

Both First Majestic and contractor personnel conduct mining activities. Two mining methods are currently being used at San Dimas, cut-and-fill, and Longhole mining. Cut-and-fill is carried out by either jumbo or jackleg drills, whereas Longhole is carried out with pneumatic and electro-hydraulic drills. Primary access is provided by adits and internal ramps.

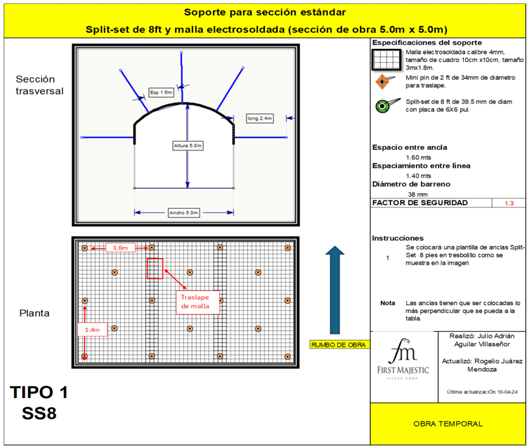

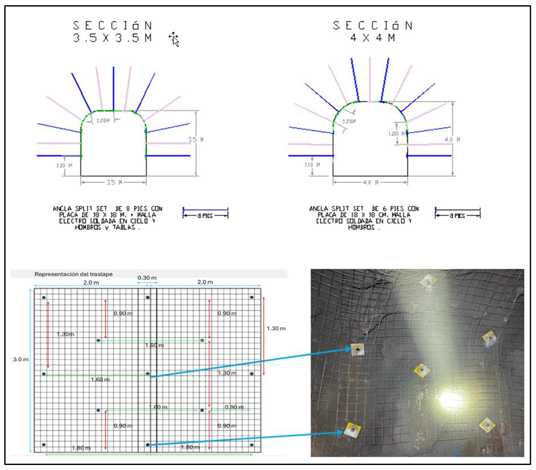

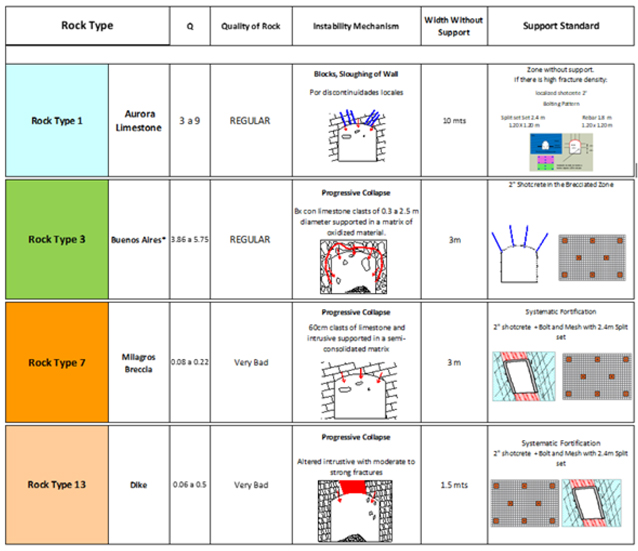

Ground conditions throughout most of the San Dimas underground workings are considered good. Bolting is used systematically in the main haulage ramps, drifts, and underground infrastructure. For those sectors that present unfavorable rock quality, shotcrete, mesh, and/or steel arches are used.

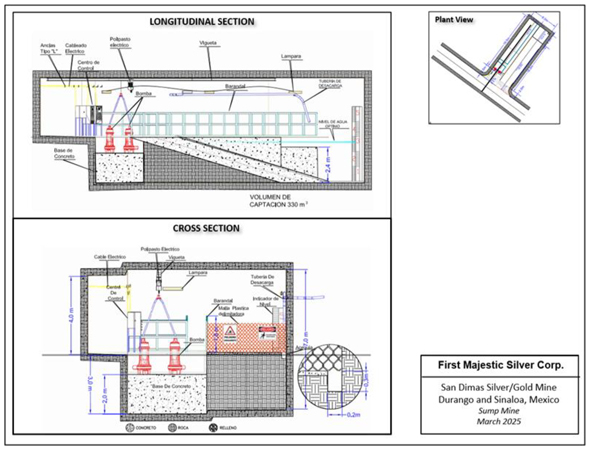

Groundwater inflow has not been a significant concern within San Dimas. Dewatering systems in San Dimas consist of main and auxiliary pumps in place at each of the mine areas.

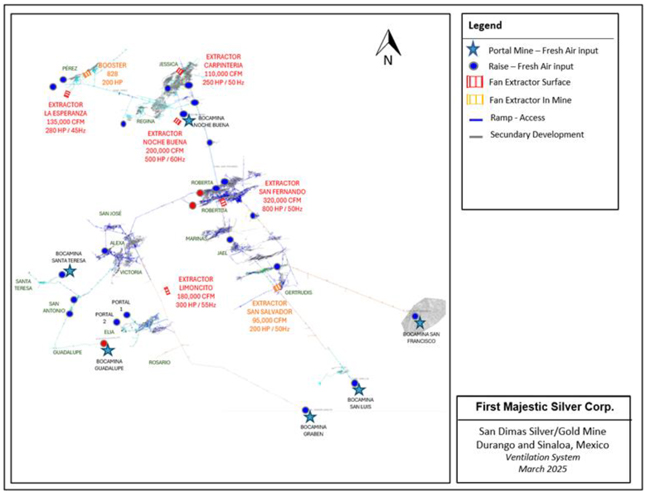

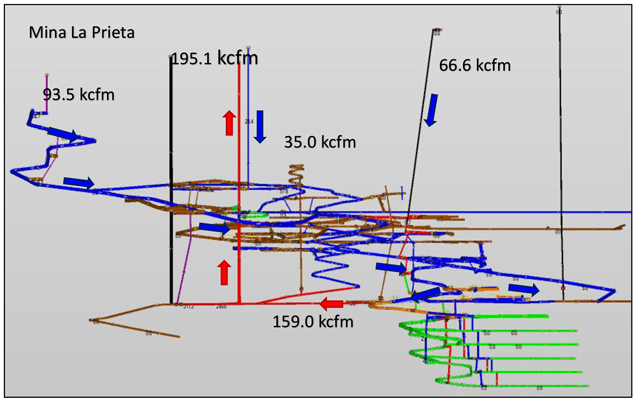

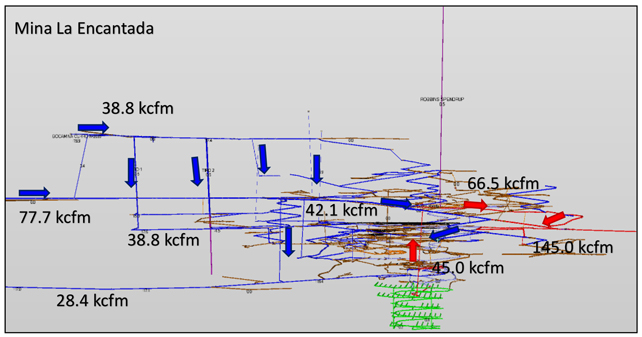

The San Dimas ventilation system consists of an exhaust air extraction system through its main fans located on surface. These fans generate the necessary pressure change for fresh air to enter through the portals and ventilation raises.

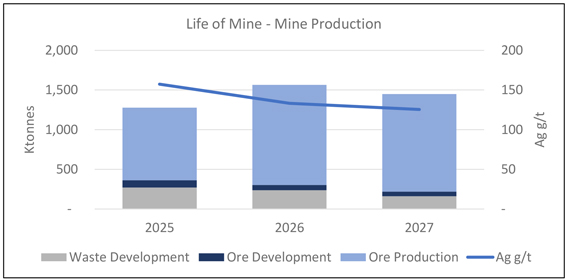

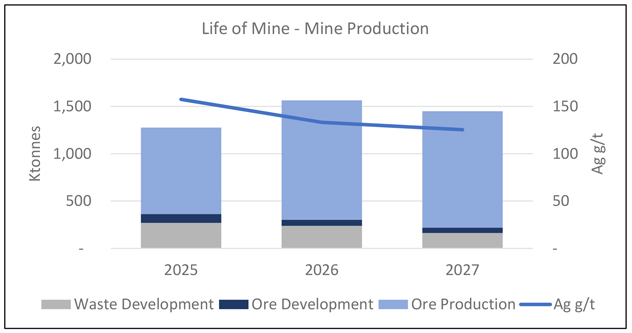

The development schedule for the LOM plan is presented in Table 1-5. The production schedule for the LOM plan is presented in

| 14 | September 2025 |

| San Dimas Silver/Gold Mine Durango and Sinaloa States, Mexico NI-43-101 Technical Report on Mineral Resource and Mineral Reserve Estimates |

|

Table 1-6.

Table 1-5 San Dimas Life of Mine Development Schedule

| Type |

Units | Size (m) | 2025 | 2026 | 2027 | 2028 | 2029 | Total | ||||||||||||||||||||

| Main Access Ramp |

m | 4.5x4.5 | 2,378 | 2,385 | 2,385 | 2,578 | 586 | 10,313 | ||||||||||||||||||||

| Main Level Access |

m | 4.5x4.5 | 2,101 | 2,107 | 2,107 | 2,277 | 518 | 9,109 | ||||||||||||||||||||

| Ancillary |

m | 3.5x3.5 | 1,229 | 1,232 | 1,232 | 1,332 | 303 | 5,328 | ||||||||||||||||||||

| Drifting for Exploration |

m | 4.5x4.5 | 1,821 | 1,826 | 1,826 | 2,016 | 469 | 7,958 | ||||||||||||||||||||

| Ventilation Raises |

m | 2.5 diam | 1,009 | 1,067 | 580 | 446 | 51 | 3,153 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total Waste Development |

m | 8,538 | 8,617 | 8,130 | 8,649 | 1,926 | 35,860 | |||||||||||||||||||||

| Ore Development |

m | 3.5x3.5 | 6,783 | 6,802 | 6,802 | 6,326 | 3,353 | 30,066 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Total Development |

m | 15,321 | 15,418 | 14,932 | 14,975 | 5,279 | 65,926 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| 15 | September 2025 |

| San Dimas Silver/Gold Mine Durango and Sinaloa States, Mexico NI-43-101 Technical Report on Mineral Resource and Mineral Reserve Estimates |

|

Table 1-6 San Dimas Life of Mine Production Schedule

| Type |

Units | 2025 | 2026 | 2027 | 2028 | 2029 | Total | |||||||||||||||||||

| ROM Production / Plant Feed |

kt | 629 | 631 | 631 | 630 | 708 | 3,229 | |||||||||||||||||||

| Silver Grade |

g/t Ag | 285 | 285 | 285 | 230 | 153 | 245 | |||||||||||||||||||

| Gold Grade |

g/t Au | 2.83 | 2.83 | 2.83 | 2.83 | 2.86 | 2.84 | |||||||||||||||||||

| Silver-Equivalent Grade |

g/t Ag-Eq | 532 | 532 | 532 | 477 | 403 | 493 | |||||||||||||||||||

| Contained Silver |

M oz Ag | 5.8 | 5.8 | 5.8 | 4.7 | 3.5 | 25 | |||||||||||||||||||

| Contained Gold |

k oz Au | 57 | 57 | 57 | 57 | 65 | 294 | |||||||||||||||||||

| Contained Silver-Equivalent |

M oz Ag-Eq | 10.8 | 10.8 | 10.8 | 9.7 | 9.2 | 51 | |||||||||||||||||||

| Metallurgical Recovery Silver |

% | 94.9 | % | 92.6 | % | 92.6 | % | 92.6 | % | 92.6 | % | 93.1 | % | |||||||||||||

| Metallurgical Recovery Gold |

% | 95.1 | % | 95.6 | % | 95.6 | % | 95.6 | % | 95.6 | % | 95.5 | % | |||||||||||||

| Produced Silver |

M oz Ag | 5.5 | 5.4 | 5.4 | 4.3 | 3.2 | 24 | |||||||||||||||||||

| Produced Gold |

k oz Au | 54 | 55 | 55 | 55 | 62 | 281 | |||||||||||||||||||

| Produced Silver-Equivalent |

M oz Ag-Eq | 10.2 | 10.1 | 10.1 | 9.1 | 8.7 | 48 | |||||||||||||||||||

A total of 3.2 Mt of ore is considered to be mined and processed with grades of 245 g/t Ag and 2.84 g/t Au. Total metal produced is estimated at 25 Moz Ag and 294 Koz Au.

| 1.11. | Recovery Methods |

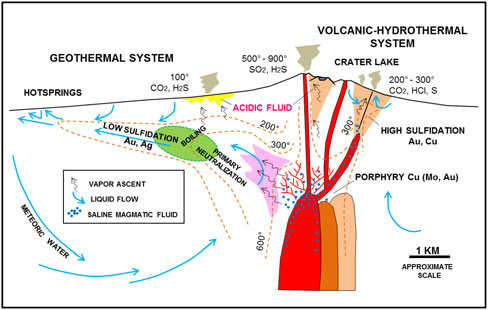

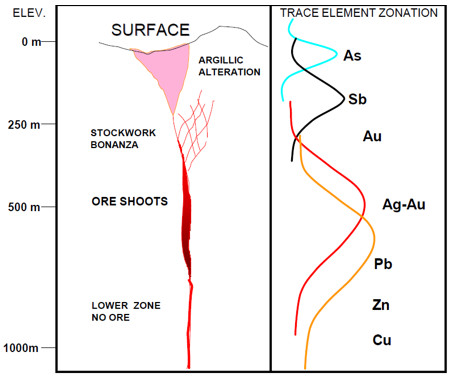

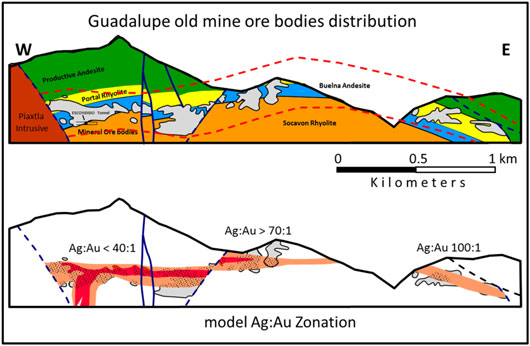

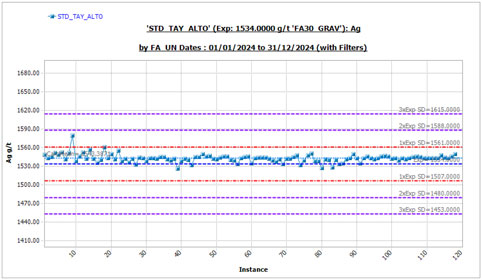

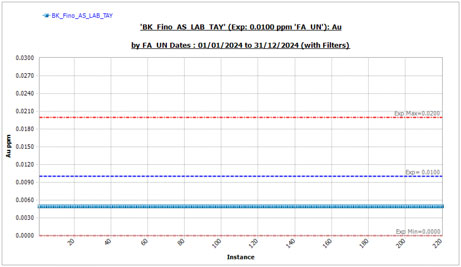

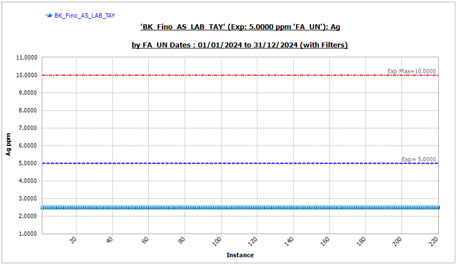

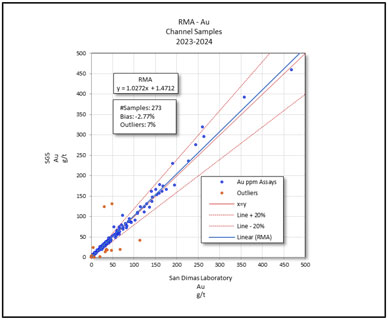

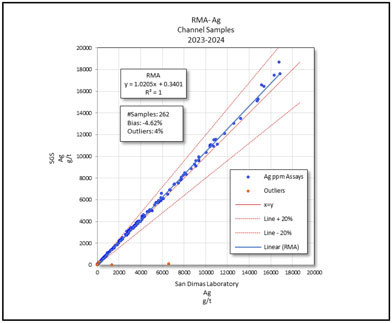

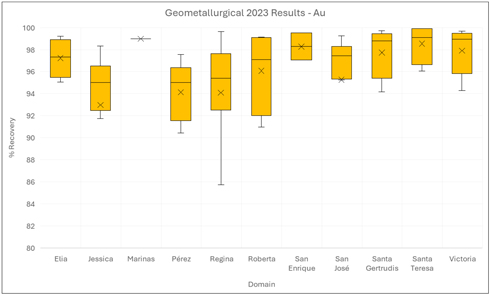

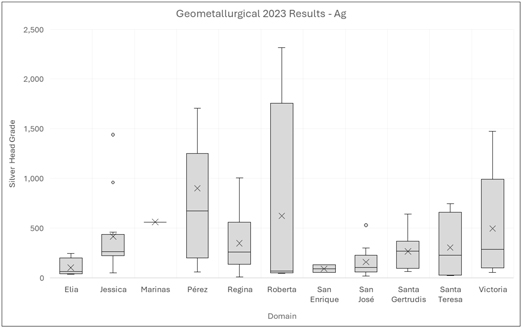

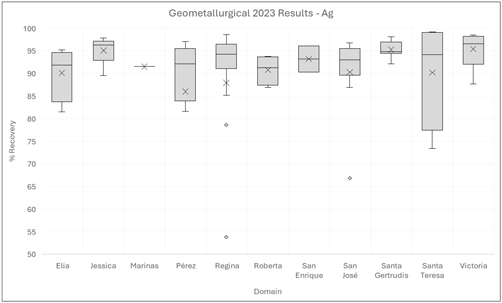

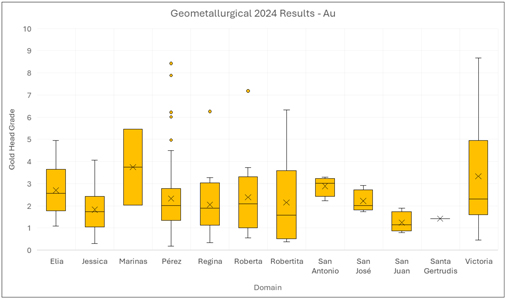

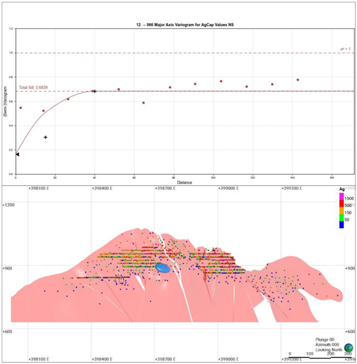

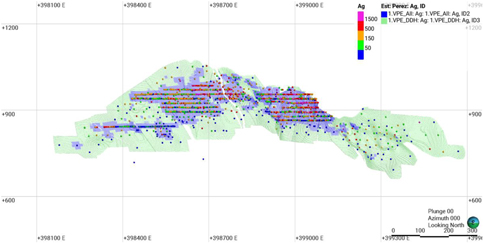

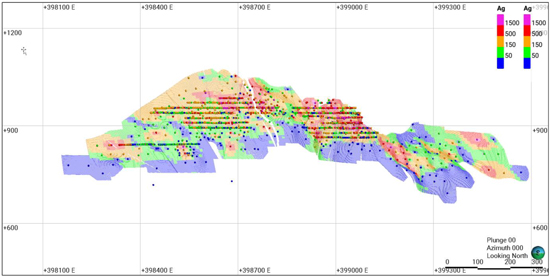

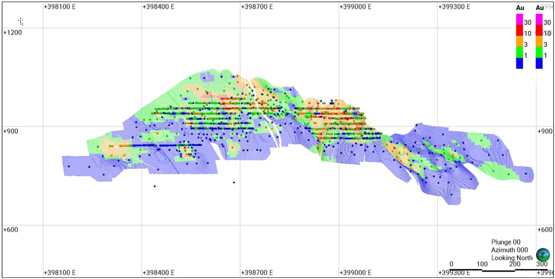

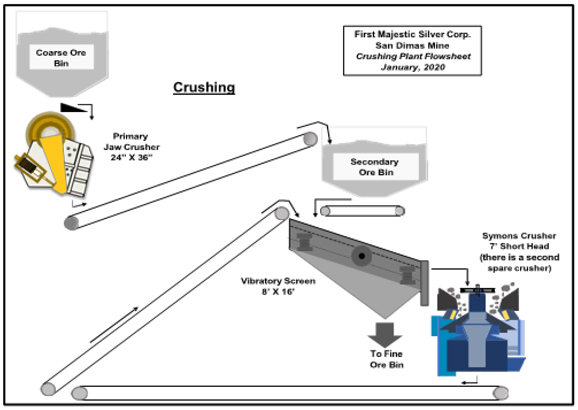

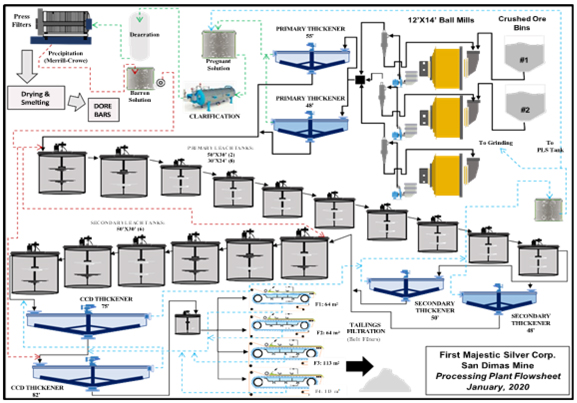

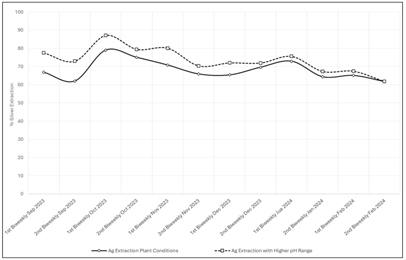

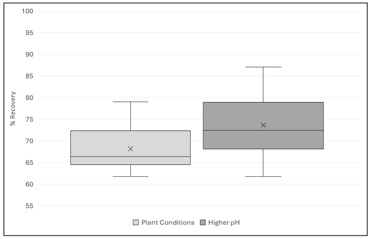

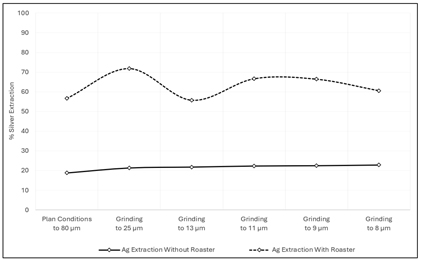

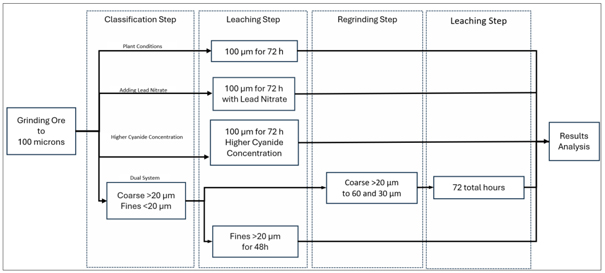

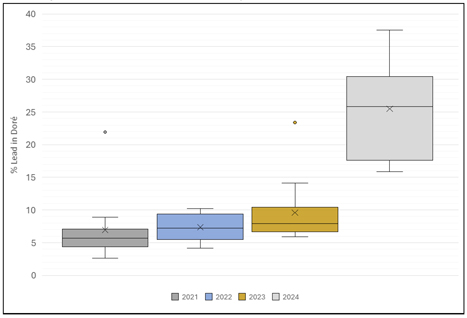

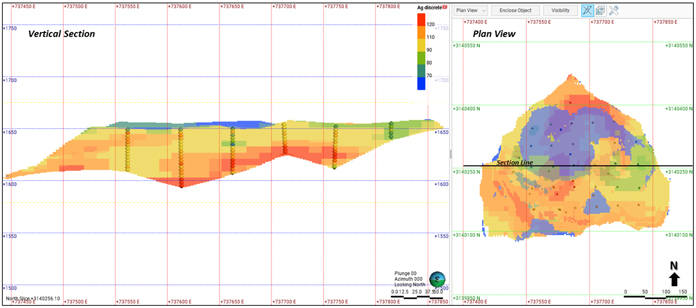

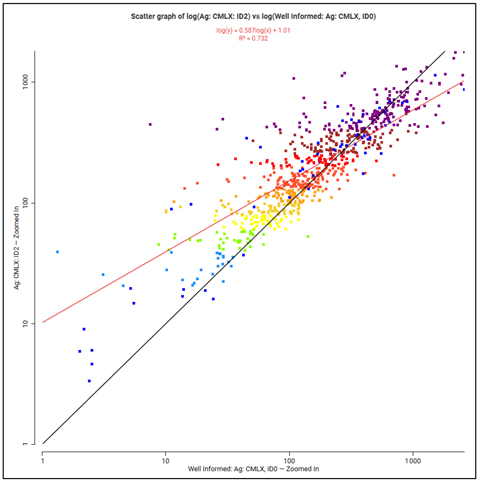

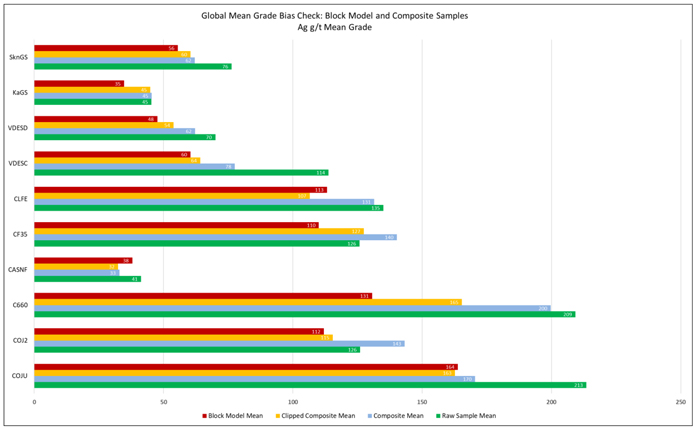

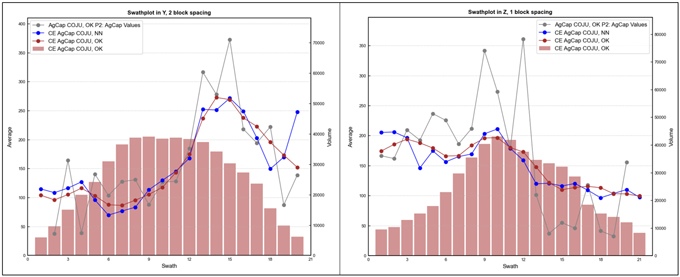

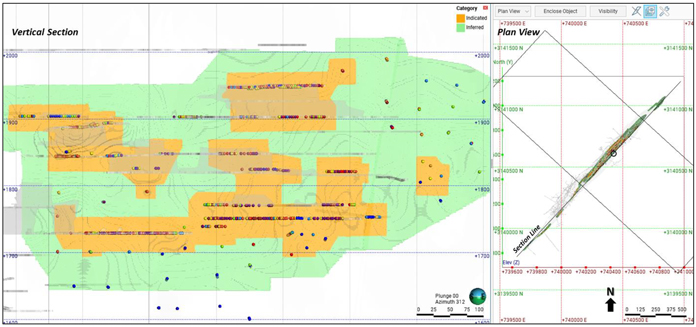

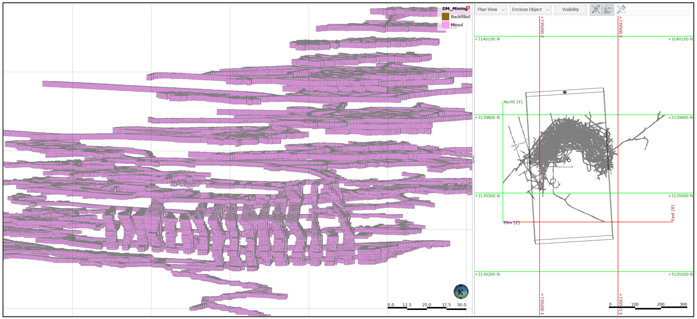

The San Dimas processing plant has been in successful operation for several years, consistently achieving high recoveries based on both historical performance and recent metallurgical testing. The plant operates on a conventional cyanide leaching and Merrill-Crowe process to produce silver-gold doré bars, with an installed capacity of 3,000 tpd.