UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of report (Date of earliest event reported): September 17, 2025

Radian Group Inc.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 001-11356 | 23-2691170 | ||

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

550 East Swedesford Road, Suite 350

Wayne, Pennsylvania, 19087

(Address of Principal Executive Offices, and Zip Code)

(215) 231-1000

(Registrant’s Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading |

Name of each exchange |

||

| Common Stock, $0.001 par value per share | RDN | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01. | Entry Into a Material Definitive Agreement. |

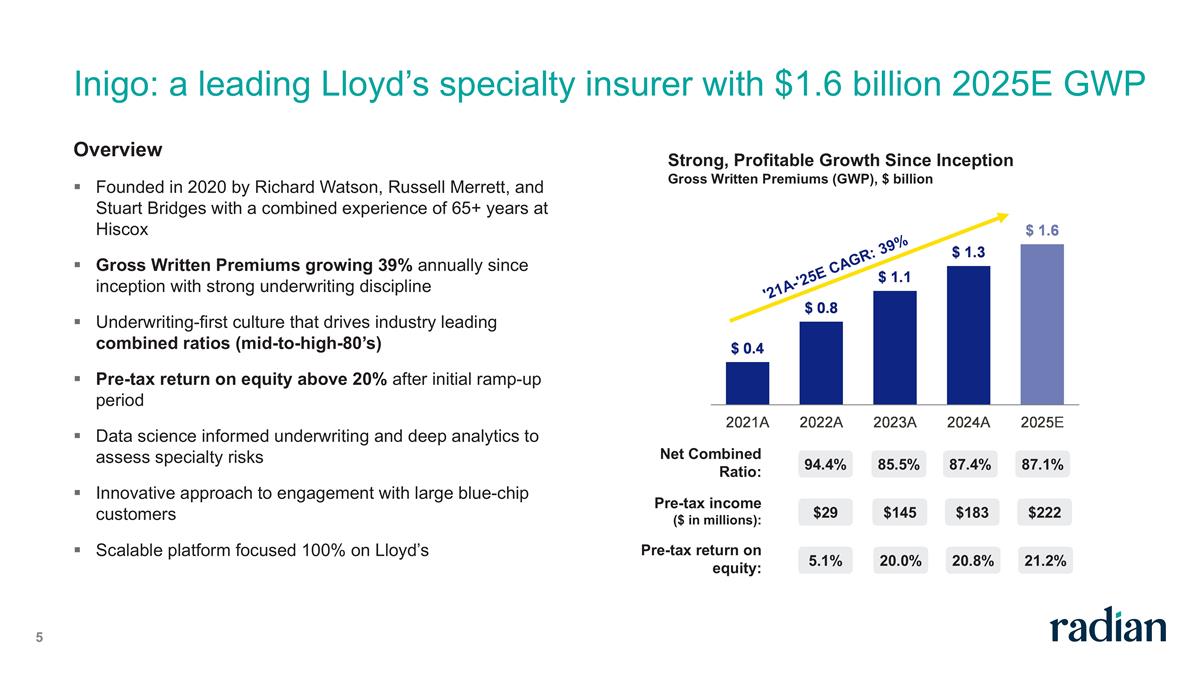

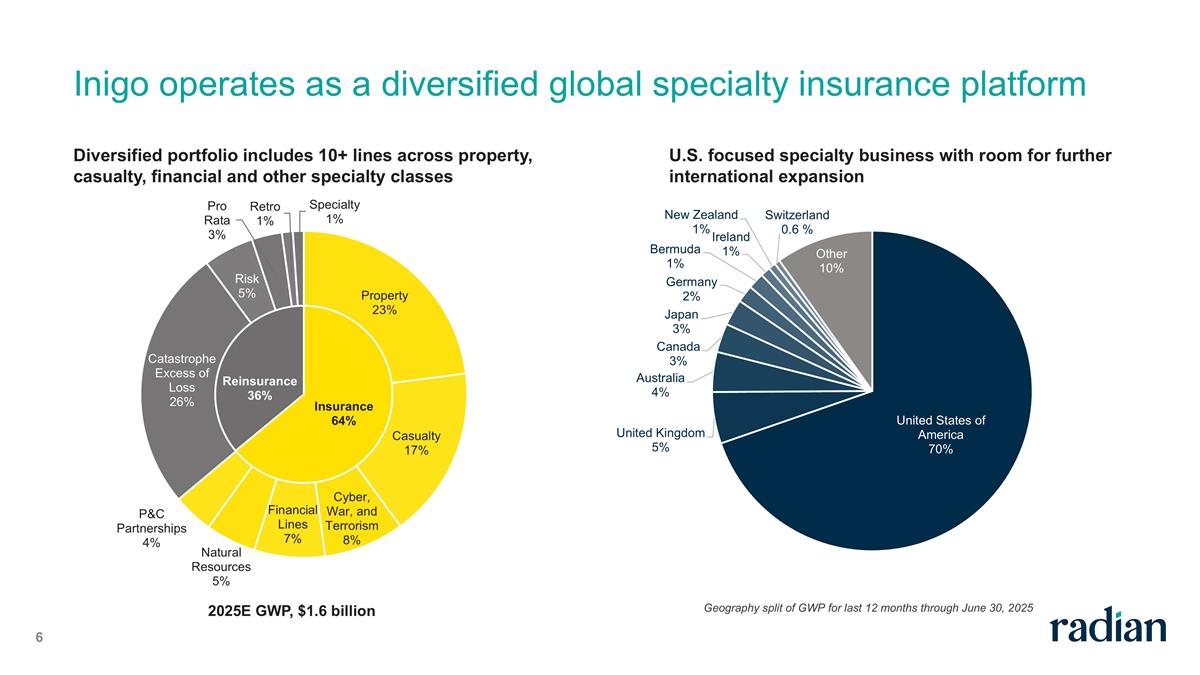

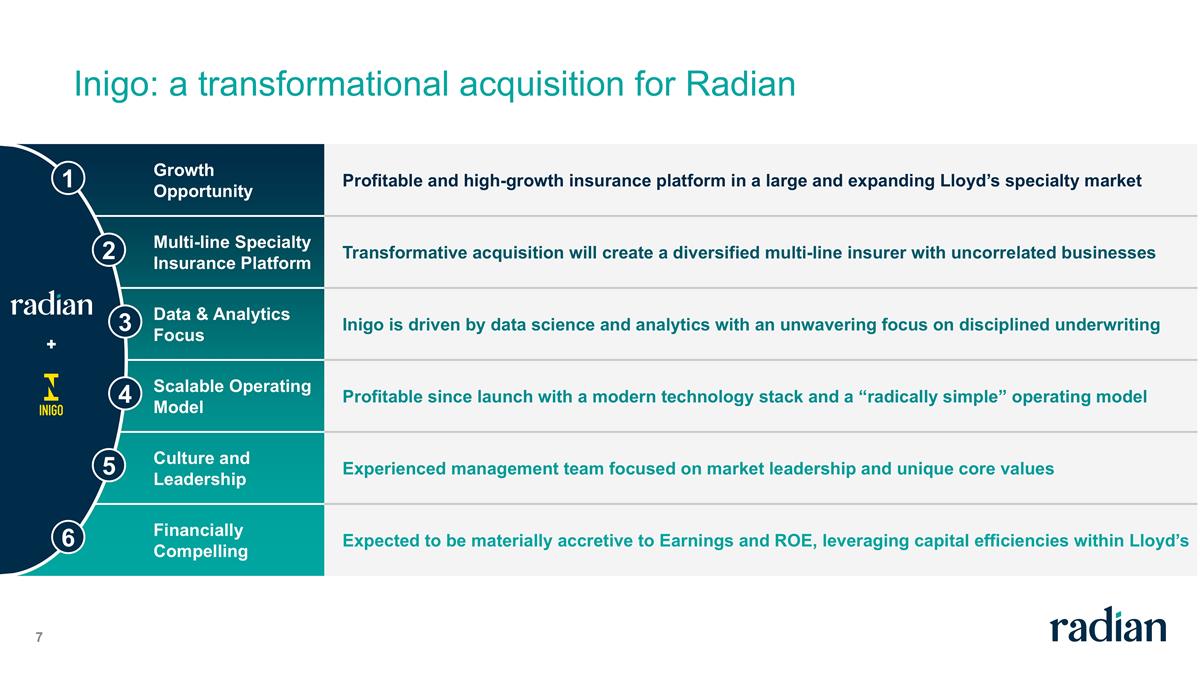

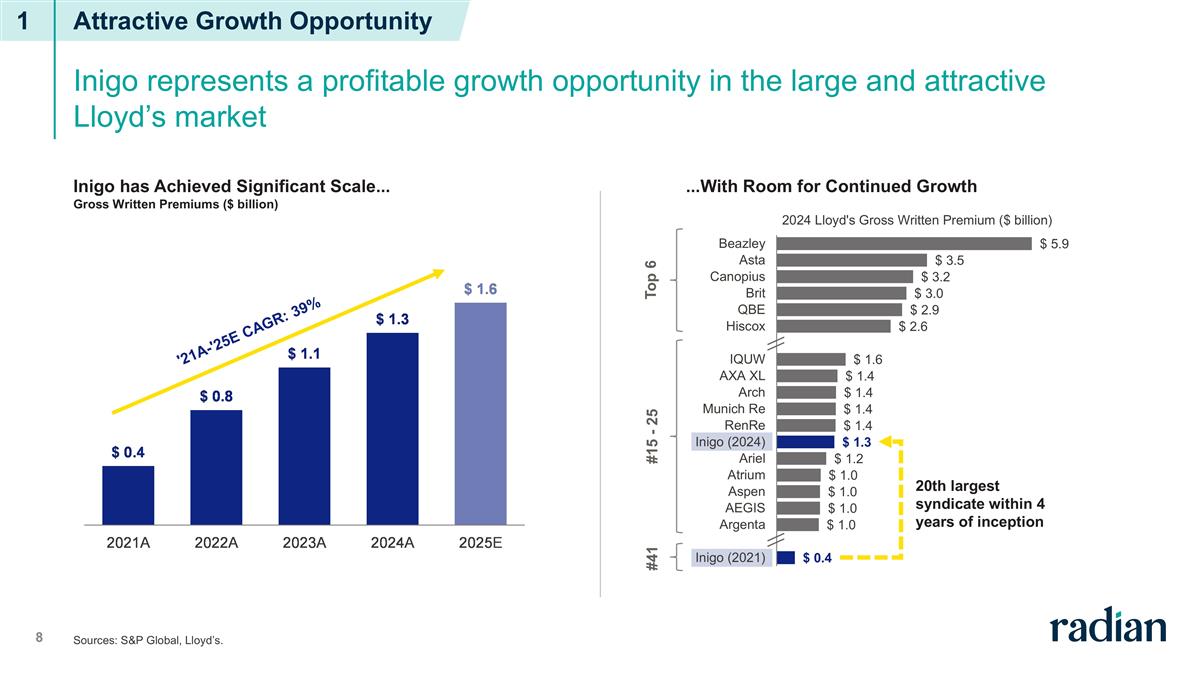

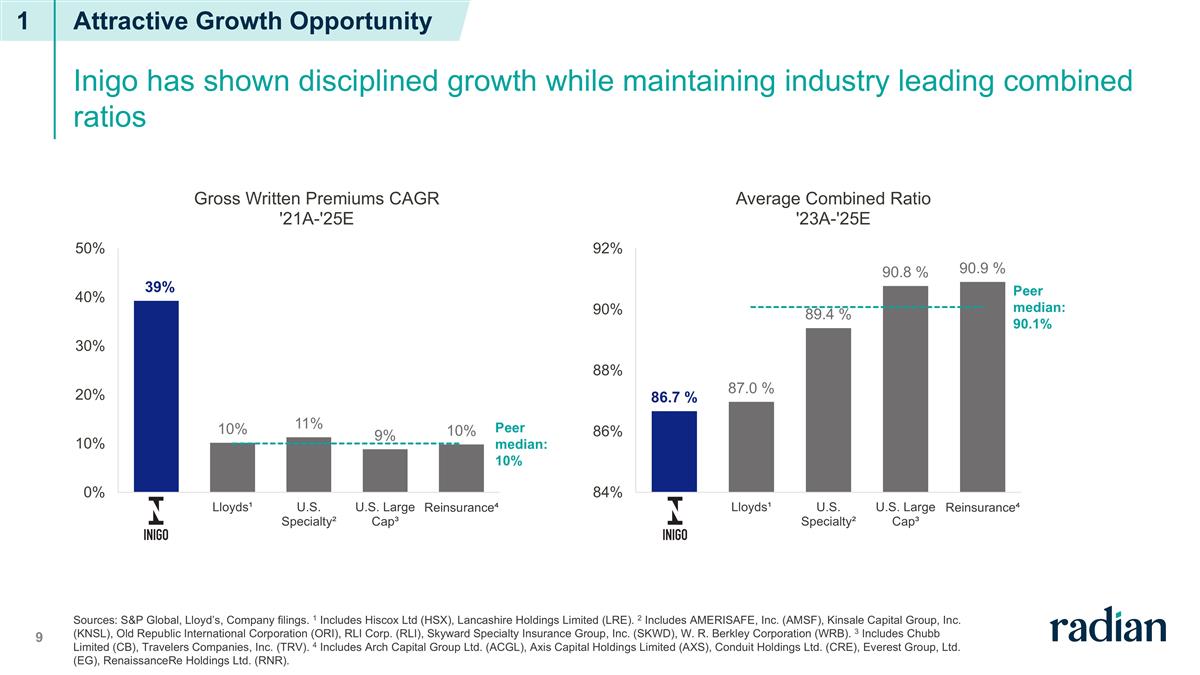

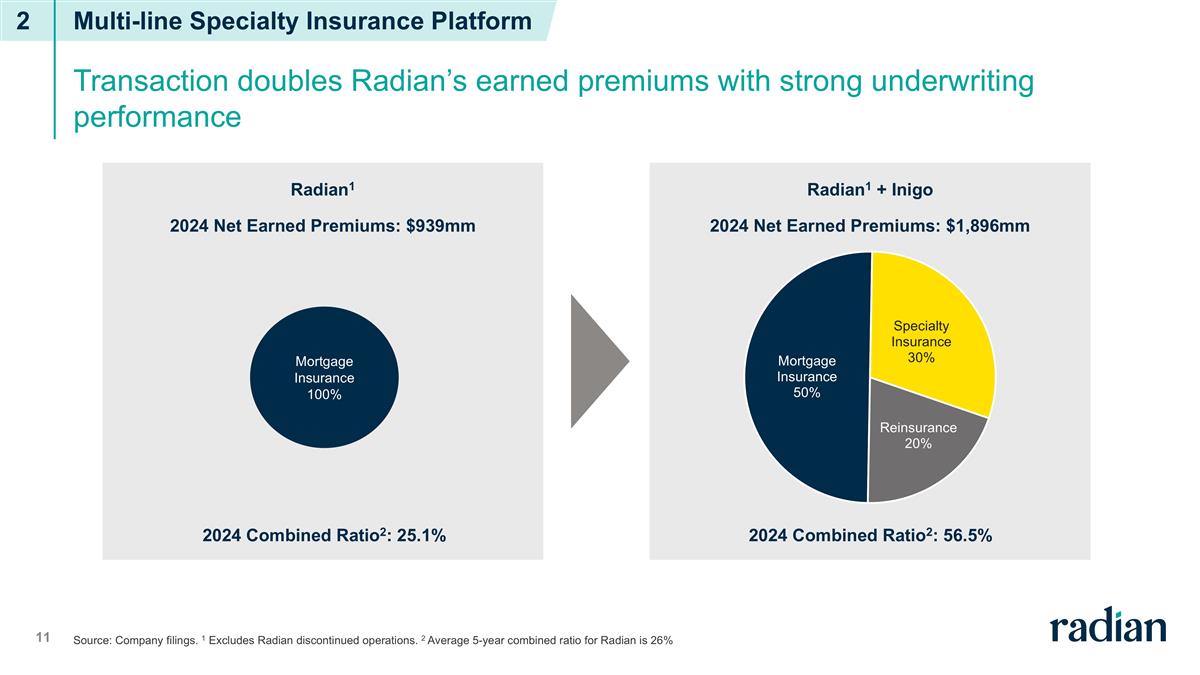

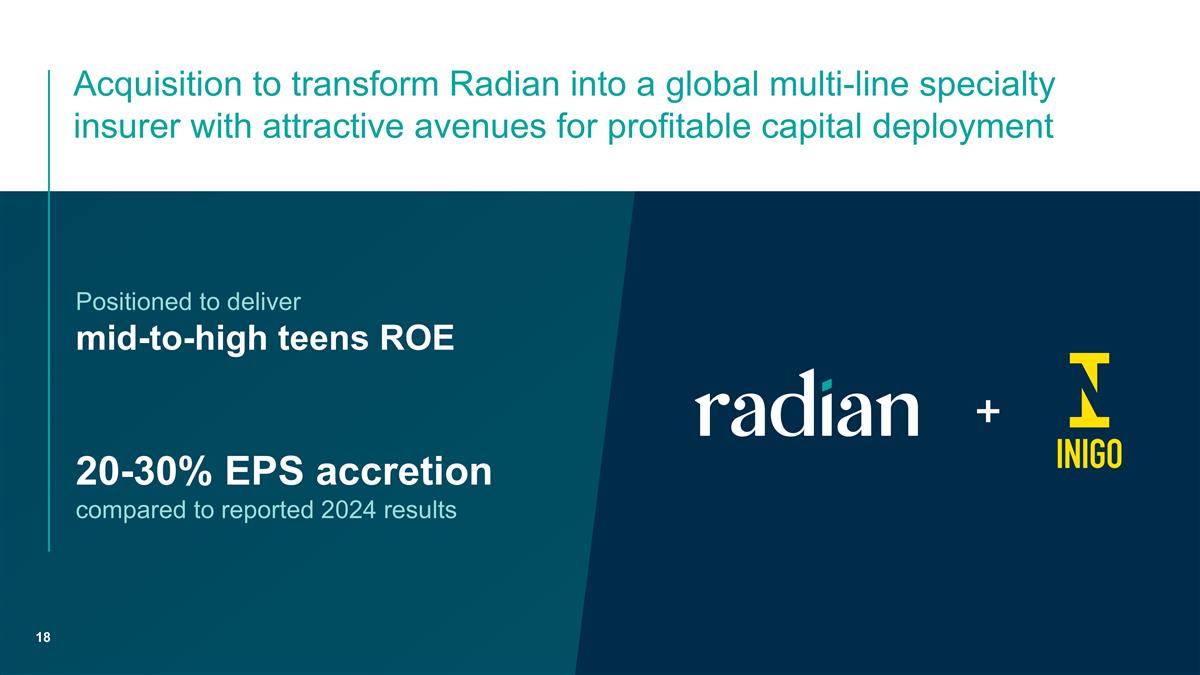

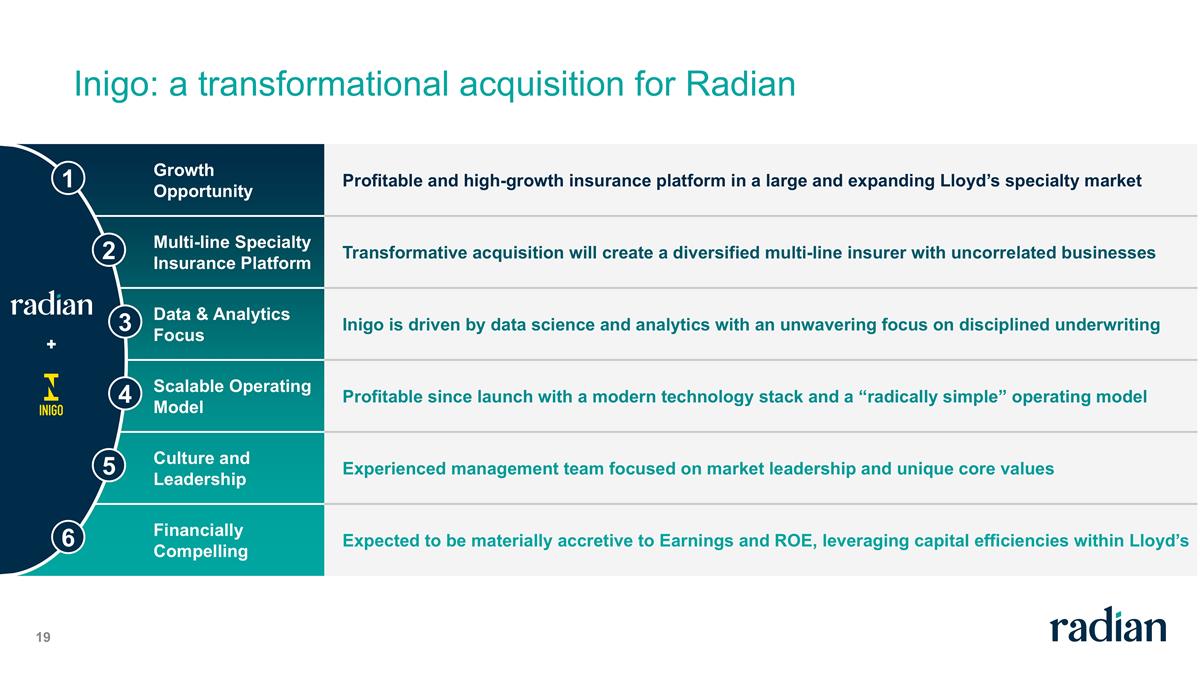

On September 18, 2025, Radian Group Inc., a Delaware corporation (the “Company”), and Radian US Holdings Inc., a Delaware corporation and wholly-owned subsidiary of the Company (“Radian US”), entered into a share purchase deed (the “Share Purchase Deed”) with the A Share Sellers (as defined therein), the B Share Management Sellers (as defined therein) and the Zedra Trust Company (Guernsey) Limited, a company incorporated in Guernsey, acting in its capacity as trustee of the employee benefit trust and nominee for each B Share Management Seller (together with the B Share Management Sellers and the A Share Sellers, the “Sellers”) pursuant to which Radian US has agreed to acquire all of the shares of Inigo Limited, a limited liability company incorporated in England and Wales (“Inigo” and together with its subsidiaries “Inigo Group”), from the Sellers (collectively, the “Shares”) for aggregate consideration of $1.7 billion (the “Purchase Price”), subject to certain adjustments described in the paragraph below.

The Purchase Price will be subject to adjustment based on the tangible net asset value (as defined in the Share Purchase Deed) in respect of the Inigo Group as of the month-end preceding satisfaction of all closing conditions (or if closing conditions are satisfied after the fifteenth business day of a calendar month, as of the month-end immediately following satisfaction of all closing conditions) (the “Measurement Date”). If the tangible net asset value in respect of the Inigo Group is in the aggregate less than $1.033 billion as of the Measurement Date, Radian US may, in its sole discretion, pay a Purchase Price of $1.65 billion or terminate the Share Purchase Deed. If the tangible net asset value in respect of the Inigo Group is in the aggregate less than $1.083 billion but equal to or greater than $1.033 billion as of the Measurement Date, the Purchase Price will be reduced, on a dollar-for-dollar basis, in an amount equal to the difference between such tangible net asset value and $1.083 billion. If the tangible net asset value in respect of the Inigo Group is in the aggregate equal to or less than $1.183 billion as of the Measurement Date, but equal to or greater than $1.083 billion, there will be no adjustment to the Purchase Price. If the tangible net asset value in respect of the Inigo Group is in the aggregate greater than $1.183 billion as of the Measurement Date, the A Share Sellers will be entitled to a cash dividend payable out of Inigo’s cash assets in an amount equal to the difference between $1.183 billion and the tangible net asset value, and Radian US will pay a Purchase Price of $1.7 billion. If the Purchase Price (inclusive of any other adjustments to the Purchase Price in accordance with the Share Purchase Deed) plus any amount of Consideration WHT (as defined in the Share Purchase Deed) payable by Radian US exceeds $1.7 billion, Radian US will be entitled to terminate the Share Purchase Deed at any time prior to the closing of the sale and purchase of the Shares in accordance with the Share Purchase Deed (the “Closing”).

To align interests with the Company going forward, certain of the B Share Management Sellers have agreed to be issued shares of the Company’s common stock in lieu of cash as part of the consideration they receive (between 15% and 25% of their total gross consideration, which number of shares in the aggregate the Company anticipates will constitute less than 1% of the Company’s outstanding common stock) at the Closing. In addition to the Purchase Price, the Company has agreed to fund an employee cash retention pool of $25 million at the Closing to be allocated among the B Share Management Sellers and earned over a two-year period.

The obligations of the parties to consummate the transactions contemplated by the Share Purchase Deed and the other transaction documents (the “Transactions”) are subject to the satisfaction of certain closing conditions, including that Radian US obtain the following: (i) the UK Prudential Regulation Authority, following consultation with the UK Financial Conduct Authority, having approved, or being treated as having approved, Radian US to acquire control of Inigo Managing Agent Limited, a limited liability company incorporated in England and Wales (the “Managing Agent”), a subsidiary of Inigo; (ii) the Society and Corporation of Lloyd’s having approved or given notice that it has no objection to Radian US’ acquisition of control of the Managing Agent and of Inigo Corporate Member Limited, a limited liability company incorporated in England and Wales (the “Corporate Member”), a subsidiary of Inigo; and (iii) the Texas Department of Insurance providing its approval or non-disapproval in relation to the acquisition of control of Motion Specialty, Inc., a Delaware corporation in which Inigo holds a minority interest.

In addition to the regulatory approvals described above, the consummation of the Transactions will be subject to the Sellers having delivered to Radian US a letter from the facility agent under the letter of credit facility agreement dated November 3, 2021 among others, Inigo (as guarantor), the Corporate Member (as borrower), Barclays Bank PLC (as agent) and Barclays Bank PLC (as security agent) (the “L/C Facility Agreement”), which letters of credit are used to satisfy a portion of the Inigo Group’s capital requirements, pursuant to which the facility agent waives, on behalf of each lender under the L/C Facility Agreement, their respective rights under the change of control clause of the L/C Facility Agreement that would otherwise arise as a result of the sale and purchase of the Shares in accordance with the Share Purchase Deed.

The Closing will take place on the first business day of the next month immediately following the Completion Statement Date (as defined in the Share Purchase Deed) or such later date as may be agreed between the parties in writing, provided that in no event will the Closing take place prior to January 1, 2026.

Pursuant to the terms of the Share Purchase Deed, on September 18, 2025, Radian US also entered into a Warranty Deed with the Management Warrantors (as defined therein) relating to the Transactions (the “Warranty Deed”), pursuant to which the Management Warrantors provide certain warranties and covenants to Radian US customary for transactions of this type, including with respect to: (i) solvency; (ii) books and records; (iii) accounts and financial information; (iv) financial obligations; (v) assets; (vi) commercial agreements and arrangements; and (vii) obligations to pay certain taxes.

2

In connection with the Warranty Deed, the Company has secured a customary warranty and indemnity insurance policy from a third-party insurer.

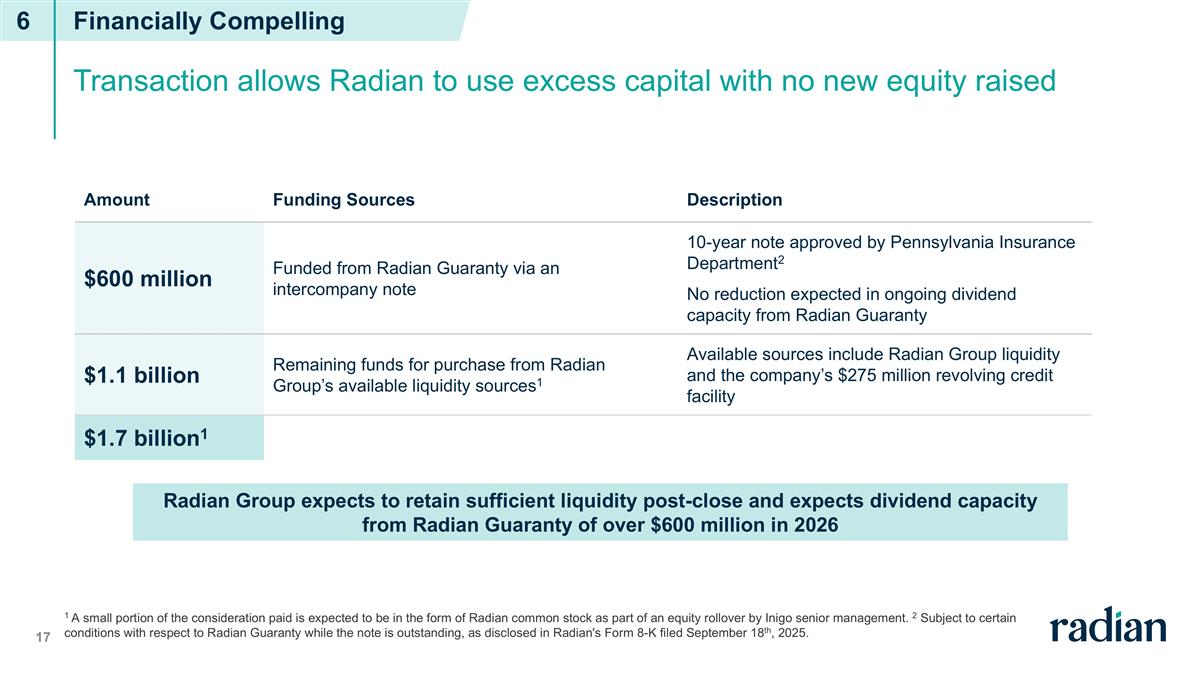

The Company will guarantee Radian US’s consideration payment and other obligations under the Share Purchase Deed. In the Share Purchase Deed, the Company and Radian US undertake that they will take all actions to ensure availability of necessary cash resources enabling Radian US to make all consideration payments under the Share Purchase Deed at the Closing, and Radian US warrants that at the Closing it will have, subject only to the Closing taking place, the necessary funds to meet its obligations under the Share Purchase Deed. Among other things, the Company plans to pay a portion of the cash consideration for the Transactions with proceeds of a borrowing to be made by the Company from Radian Guaranty Inc., its wholly-owned subsidiary (“RGI”), pursuant to a $600 million note (the “Intercompany Note”) that has been approved by the Pennsylvania Insurance Department (the “Department”). The Intercompany Note, which is planned to be entered into on or before the Closing, will have a ten-year term and bear interest at a rate of 6.50% per annum. As a condition to receiving approval of the Department, the Company has agreed to provide certain enhanced reporting to the Department while the Intercompany Note is outstanding and to prepay the Intercompany Note prior to maturity, in whole or in part, if RGI needs additional liquidity to meet its policyholder obligations. Additionally, RGI will be required to comply with certain conditions while the Intercompany Note is outstanding, including, most notably, obtaining prior approval from the Department for all dividends paid by RGI for a period of three years (which the Company may request to be reduced or the Department may, in certain circumstances, extend for up to five years) and maintaining a minimum policyholders’ surplus of $500 million, among other conditions. In addition to the proceeds of the Intercompany Note, the Company may use borrowings under its revolving credit facility, as well as cash or liquid investments on its balance sheet, or the Company may obtain other sources of financing or use other available funding, to pay a portion of the cash consideration for the Transactions.

The foregoing does not constitute a complete summary of the terms of the Share Purchase Deed, the Warranty Deed or the Transactions, and is qualified in its entirety by reference to the complete text of the Share Purchase Deed and the Warranty Deed, which are filed as Exhibits 2.1 and 2.2, respectively and, are incorporated herein by reference.

The Share Purchase Deed and the Warranty Deed are being filed to provide investors with information regarding the terms of these agreements, but they are not intended to provide any other factual information about the Company, Radian US or Inigo. In particular, warranties contained in the Share Purchase Deed and the Warranty Deed were made only for the purposes of those agreements as of specific dates, may have been qualified by confidential disclosures, and employ a contractual standard of materiality different from those generally applicable to disclosures made to stockholders, among other limitations. The warranties were made for purposes of allocating contractual risk between the parties and investors are not third-party beneficiaries of the agreements and should not rely upon the warranties as disclosure of factual information relating to the Company, Radian US or Inigo, or any of their respective subsidiaries or affiliates. Moreover, information concerning the subject matter of the warranties may change after the date of the Share Purchase Deed and the Warranty Deed, which subsequent information may or may not be fully reflected in the Company’s public disclosures. The Company does not believe that schedules or disclosure letters omitted from this filing contain information that is material to the Company’s stockholders.

| Item 5.03 | Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

On September 17, 2025, the board of directors of the Company (the “Board”) approved an amendment to the Company’s Fourth Amended and Restated By-laws (the “Amended and Restated By-laws”), effective September 17, 2025. The Amended and Restated By-laws add a forum selection by-law that provides that the Court of Chancery of the State of Delaware is the sole and exclusive forum (or, if no such state court has jurisdiction, the federal district court for the District of Delaware) for any (i) derivative action or proceeding brought on behalf of the Company, (ii) action asserting a claim of breach of any duty (including any fiduciary duty) owed by any current or former director, officer, stockholder, employee or agent of the Company to the Company or the Company’s stockholders, (iii) action asserting a claim against the Company or any current or former director, officer, stockholder, employee or agent of the Company arising out of or relating to any provision of the Delaware General Corporation Law (“GCL”) or the Company’s certificate of incorporation or by-laws (each, as in effect from time to time), (iv) action asserting a claim against the Company or any current or former director, officer, stockholder, employee or agent of the Company governed by the internal affairs doctrine of the State of Delaware or (v) other action asserting an internal corporate claim, as defined in Section 115 of the GCL. The forum selection by-law further provides that the federal district courts of the United States of America will be the exclusive forum for the resolution of any complaint asserting a cause of action arising under the Securities Act of 1933, as amended (the “Securities Act”).

The foregoing description of the Amended and Restated By-laws is only a summary of the principal features of the revisions made to the Amended and Restated By-laws, does not purport to be complete and is qualified in its entirety by reference to the Amended and Restated By-laws, a copy of which is filed as Exhibit 3.1 and a marked copy of which showing the amendments is filed as Exhibit 3.2, each of which is incorporated herein by reference.

3

| Item 7.01. | Regulation FD Disclosure. |

On September 18, 2025, the Company issued a press release and posted on its Investor Relations website an investor presentation related to the Transactions and the plans described below in Item 8.01. A copy of the press release and a copy of the investor presentation are furnished and attached as Exhibit 99.1 and Exhibit 99.2, respectively.

The information in this Item 7.01, including Exhibits 99.1 and 99.2, is being furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in any such filing.

| Item 8.01. | Other Events. |

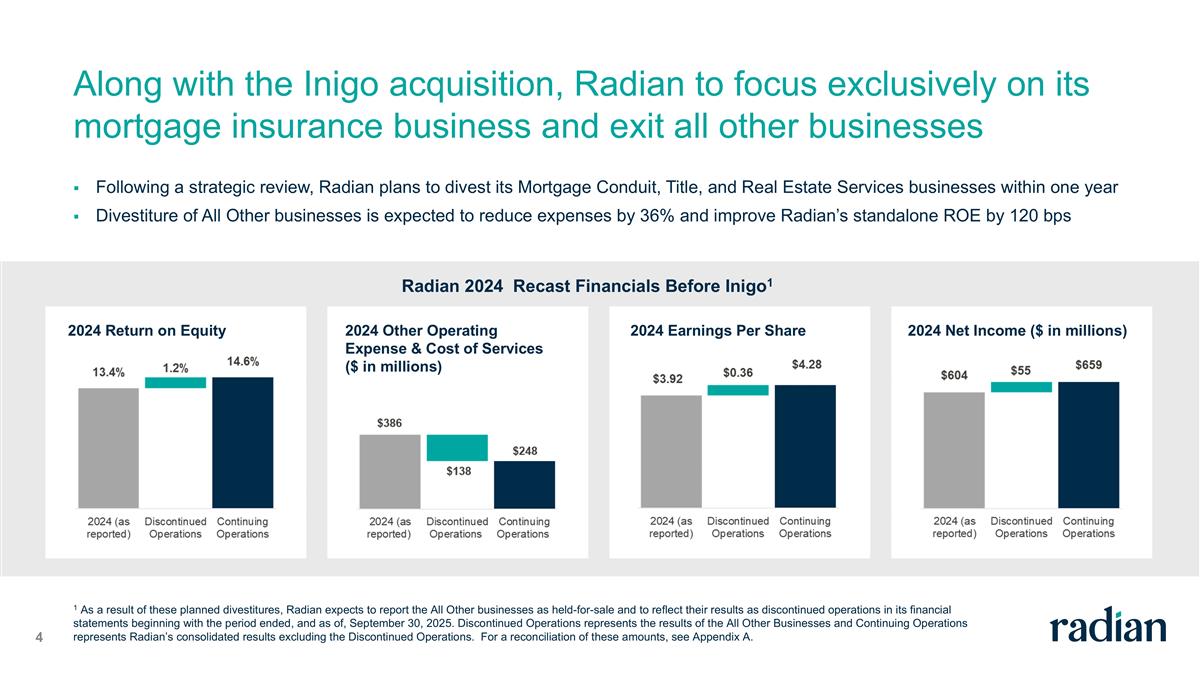

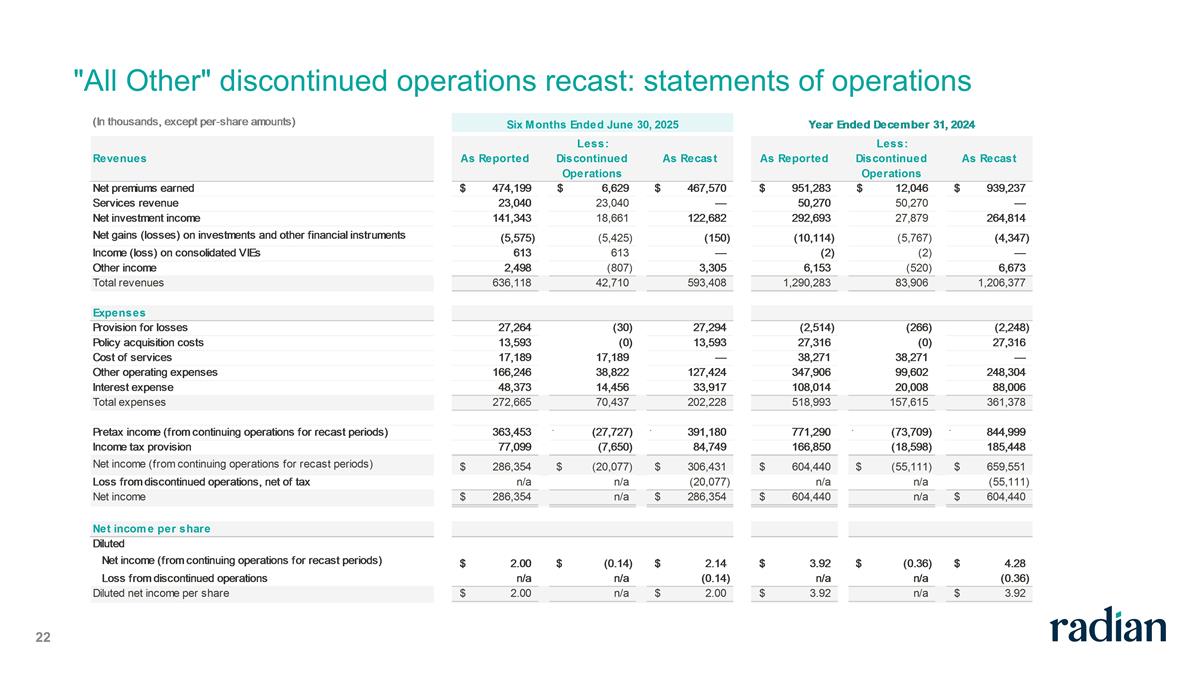

On September 18, 2025, the Company announced that, following a review of the Company’s strategic direction and current business portfolio, the Board has approved a plan to divest the Company’s mortgage conduit, title and real estate services businesses (the “All Other Businesses”). An active program is underway to identify buyers for these businesses, which is expected to be completed within one year. The Company is in the process of engaging financial advisors to assist with the planned divestitures. As a result of actions taken related to the planned divestitures, the Company expects to report these businesses as held-for-sale and to reflect their results as discontinued operations in its financial statements, through the period of their divestiture, beginning with the period ended, and as of, September 30, 2025.

Cautionary Note Regarding Forward-Looking Statements

All statements in this Current Report on Form 8-K, or related oral statements made by management or other representatives of the Company, that address events, developments or results that the Company expects or anticipates may occur in the future are “forward-looking statements” within the meaning of Section 27A of the Securities Act, Section 21E of the Exchange Act and the U.S. Private Securities Litigation Reform Act of 1995. In most cases, forward-looking statements may be identified by words such as “anticipate,” “may,” “will,” “could,” “should,” “would,” “expect,” “intend,” “plan,” “goal,” “pursue,” “contemplate,” “believe,” “estimate,” “predict,” “project,” “potential,” “continue,” “seek,” “strategy,” “future,” “likely” or the negative or other variations on these words and other similar expressions. These statements, which may include, without limitation, statements regarding the expected completion, financing and timing of the Transactions, statements regarding the expected impact of the Transactions on the Company’s earnings, return on equity, revenue and debt-to-capital ratio, as well as its deployment of capital, statements regarding the planned divestitures of certain businesses, including their expected completion, timing and reporting, and other statements and information related to the Transactions and the planned divestitures, are made on the basis of management’s current views and assumptions with respect to future events. These statements speak only as of the date they were made, and the Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. The Company operates in a changing environment where new risks emerge from time to time and it is not possible to predict all risks that may affect the Company. The forward-looking statements are not guarantees of future performance, and the forward-looking statements, as well as the Company’s prospects as a whole, are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in the forward-looking statements. These risks and uncertainties include:

| • | risks associated with the Transactions, including: (a) the parties’ ability to complete the Transactions, on the anticipated timeline or at all, including uncertainty related to securing the necessary regulatory approvals without a burdensome remedy; (b) the occurrence of any event, change or other circumstance that could give rise to the termination of the Share Purchase Deed; (c) risks related to diverting the attention of either party’s management from ongoing business operations; (d) the possibility that the anticipated benefits of the Transactions are not realized when expected, or at all; (e) significant unknown or inestimable liabilities associated with Inigo; (f) risks related to the uncertainty of expected future financial performance and results of Inigo and its businesses following completion of the Transactions; (g) risks related to the availability of sufficient cash resources to make the consideration payment under the Share Purchase Deed or Radian’s ability to raise new funds; (h) risks related to limitations and compliance with the Intercompany Note; and (i) risks associated with the Company’s ability to successfully execute on its strategic shift to become a multi-line insurer; and |

| • | risks associated with the Company’s decision to divest the All Other Businesses, including: (a) the ability to complete any or all of the divestiture transactions, on the anticipated timeline or at all, including risks and uncertainties related to securing necessary regulatory and third-party approvals and consents; (b) any impact of the decision to divest the All Other Businesses on the Company’s ability to attract, hire, and retain key and highly skilled personnel; (c) any disruption of current plans and operations caused by the announcement of the decision to divest the All Other Businesses, making it more difficult to conduct business as usual or maintain relationships with current or future service providers, customers, employees, vendors and financing sources; and (d) the terms, timing, structure, benefits and costs of any divestiture transaction for each of the All Other Businesses. |

4

For more information regarding these risks and uncertainties as well as certain additional risks that the Company faces, you should refer to “Item 1A. Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2024, and to subsequent reports and registration statements filed from time to time with the U.S. Securities and Exchange Commission. The Company cautions you not to place undue reliance on these forward-looking statements, which are current only as of the date on which this Current Report on Form 8-K has been filed. The Company does not intend to, and disclaims any duty or obligation to, update or revise any forward-looking statements to reflect new information or future events or for any other reason.

5

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

| * | Certain schedules and exhibits have been omitted pursuant to Item 601(a)(5) of Regulation S-K. The Company agrees to furnish supplementally copies of any of the omitted schedules or exhibits to the Securities and Exchange Commission upon request. |

6

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| RADIAN GROUP INC. | ||||||

| (Registrant) | ||||||

| Date: September 18, 2025 | ||||||

| By: | /s/ Edward J. Hoffman |

|||||

| Edward J. Hoffman | ||||||

| General Counsel | ||||||

7

EXHIBIT 2.1

EXECUTION VERSION

DATED 18 SEPTEMBER 2025

(1) THE A SHARE SELLERS (AS DEFINED HEREIN)

AND

(2) THE B SHARE MANAGEMENT SELLERS (AS DEFINED HEREIN)

AND

(3) ZEDRA TRUST COMPANY (GUERNSEY) LIMITED

AND

(4) THE BUYER (AS DEFINED HEREIN)

AND

(5) THE BUYER GUARANTOR (AS DEFINED HEREIN)

SHARE PURCHASE DEED

FOR THE SALE AND PURCHASE OF SHARES IN

INIGO LIMITED

CONTENTS

| Clause | Page | |||||

| 1. |

Definitions and Interpretation | 1 | ||||

| 2. |

Sale and Purchase of Shares | 26 | ||||

| 3. |

Conditions | 27 | ||||

| 4. |

Consideration | 32 | ||||

| 5. |

Management Equity | 47 | ||||

| 6. |

Position Pending Completion | 49 | ||||

| 7. |

Completion | 53 | ||||

| 8. |

Access to Information | 54 | ||||

| 9. |

Seller’s Warranties | 56 | ||||

| 10. |

Limitations on the Sellers’ Liability | 57 | ||||

| 11. |

Buyer Warranties, Acknowledgements and Undertakings | 57 | ||||

| 12. |

Buyer Guarantor | 59 | ||||

| 13. |

Seller Waiver of Claims | 61 | ||||

| 14. |

Restrictive Covenants | 61 | ||||

| 15. |

Confidential Information | 64 | ||||

| 16. |

Announcements | 66 | ||||

| 17. |

Notices | 67 | ||||

| 18. |

Termination | 69 | ||||

| 19. |

Costs and General | 69 | ||||

| 20. |

Assignment | 70 | ||||

| 21. |

Further Assurances | 71 | ||||

| 22. |

Cumulative Rights | 71 | ||||

| 23. |

Effect of Completion | 71 | ||||

| 24. |

Waiver and Variation | 71 | ||||

| 25. |

Severance | 72 | ||||

| 26. |

Entire Agreement | 72 | ||||

| 27. |

No Action Against Employees and Seller’s Affiliates | 72 | ||||

| 28. |

Contracts (Rights of Third Parties) Act 1999 | 73 | ||||

| 29. |

Counterparts | 73 | ||||

| 30. |

Law and Jurisdiction | 73 | ||||

| 31. |

Appointment of Process Agent | 73 | ||||

| 32. |

Management Sellers’ Representative | 74 | ||||

| 33. |

280G | 75 | ||||

- i -

| Schedule 1 Completion Requirements | 77 | |||

| Part A Sellers’ Obligations |

77 | |||

| Part B Buyer’s Obligations |

79 | |||

| Schedule 2 Seller Warranties |

80 | |||

| Schedule 3 Limitations on the Sellers’ Liability |

82 | |||

| Schedule 4 Buyer Warranties |

90 | |||

| Schedule 5 Completion Statement and Accounting Policies |

92 | |||

| Part A Accounting Policies |

92 | |||

| Part B Form of Completion TNAV Statement |

92 | |||

| Schedule 6 Voting Power of Attorney |

93 | |||

| Schedule 7 Conduct of Business Pending Completion |

94 | |||

| Schedule 8 Allocation of Consideration |

100 | |||

| Part A Allocation of Consideration Among A Share Sellers |

100 | |||

| Part B Allocation of Consideration Among B Share Management Sellers |

101 | |||

| Schedule 9 Management Rollover Tables |

102 | |||

| Schedule 10 Restricted Period |

103 | |||

| Schedule 11 Details of the Group Entities |

104 | |||

| Part A Company, Subsidiaries and LB Cell |

104 | |||

| Part B Other Entities |

104 | |||

Agreed Form Documents

| 1. | Share Transfer Forms |

| 2. | Indemnity in respect of Seller’s share certificates |

| 3. | Letters of resignation of the applicable directors of the members of the Group |

| 4. | Data Room Index |

| 5. | Deed of Adherence |

| 6. | Escrow Agreement |

| 7. | Officer Certificate |

| 8. | Agreed Announcements |

- ii -

THIS DEED is made on 18 September 2025.

BETWEEN:

| (1) | THE SEVERAL PERSONS whose names and addresses are set out in column 1 of Part A of Schedule 8 (collectively, the “A Share Sellers”); |

| (2) | THE SEVERAL PERSONS whose names and addresses are set out in column 1 of Part B of Schedule 8 (collectively, the “B Share Management Sellers”); |

| (3) | ZEDRA TRUST COMPANY (GUERNSEY) LIMITED, a company incorporated in Guernsey (registered no. 24531), whose registered office is First Floor, Le Marchant House, St. Peter Port, Guernsey, GY1 1GR, Channel Islands acting in its capacity as trustee of the EBT (“EBT Trustee”) and nominee for each B Share Management Seller (the “Nominee” and together with the B Share Management Sellers, the “B Share Sellers”); |

| (4) | RADIAN US HOLDINGS INC., a Delaware corporation whose principal executive office is at 550 East Swedesford Rd., Suite 350, Wayne, PA 19087 (the “Buyer”); and |

| (5) | RADIAN GROUP INC., a Delaware corporation whose principal executive office is at 550 East Swedesford Rd., Suite 350, Wayne, PA 19087(the “Buyer Guarantor”). |

RECITALS:

| (A) | The Company is wholly owned by the Sellers. |

| (B) | The Sellers have agreed to sell or procure the sale of, and the Buyer has agreed to purchase, the Shares (as defined below) upon the terms of, and subject to the conditions of, this Deed (the “Transaction”). |

| (C) | The Buyer Guarantor will benefit from the execution, delivery and performance of this Deed and therefore has agreed to guarantee the performance of certain obligations of the Buyer under this Deed. |

IT IS AGREED as follows:

| 1. | DEFINITIONS AND INTERPRETATION |

| 1.1 | In this Deed, the following words and expressions shall, unless otherwise specified or the context otherwise requires, have the following meanings: |

“2025 Lloyd’s Syndicate Business Plan” means the business plan for the Syndicate for the 2025 Year of Account as approved by the Council of Lloyd’s;

“2026 Lloyd’s Syndicate Business Plan” means the business plan for the Syndicate for the 2026 Year of Account as shall be finally approved by the Council of Lloyd’s after the date of this Deed;

“A Ordinary Shares” means the fully paid issued A ordinary shares of US$ 0.01 each in the Company; “A Share Sellers” has the meaning given to it in the preamble of this Deed;

1

“Accounting Period” means any period by reference to which any Income, Profits or Gains, or any other amounts relevant for the purposes of Tax, are measured or determined;

“Accredited Investor” has the meaning given to it in Rule 501(a) under the rules and regulations adopted by United States Securities and Exchange Commission under the Securities Act of 1933, as amended;

“Act” means the Companies Act 2006;

“Actual Completion TNAV” means the Completion TNAV as set out in the Final Completion Statement as finally determined in accordance with this Deed;

“Adjusted Base Consideration” has the meaning set forth in Clause 4.1.2;

“Affiliate” means, with respect to any specified person, any other person that, at the time of determination, directly or indirectly through one or more intermediaries, controls, is controlled by or is under common control with such specified person; provided that any portfolio company of any Investor Seller or Minority Shareholder shall not be deemed an Affiliate of such Investor Seller or Minority Shareholder and for the purposes of this definition, “control” shall mean, with respect to any other person, the possession, directly or indirectly, of power to direct or cause the direction of management or policies of such person (whether through ownership of voting securities or partnership or other ownership interests, by contract or otherwise), and the term “controlled” should be construed accordingly. For the avoidance of doubt, in relation to the Investor Sellers and Minority Shareholders, an Affiliate shall also include:

| (a) | any Investment Fund of which: (i) that Investor Seller or Minority Shareholder (or any group undertaking of, or any (direct or indirect) shareholder in, that Investor Seller or Minority Shareholder); or (ii) that Investor Seller’s or Minority Shareholder’s (or any group undertaking of that Investor Seller’s or Minority Shareholder’s) general partner, trustee, nominee, manager or adviser, is a general partner, trustee, nominee, manager or adviser; |

| (b) | any separate accounts managed by that Investor Seller or Minority Shareholder; |

| (c) | any group undertaking of that Investor Seller or Minority Shareholder or of that Investor Seller’s or Minority Shareholder’s general partner, trustee, nominee, manager, adviser; |

| (d) | any general partner, trustee, nominee, operator, arranger or manager of, adviser to that Investor Seller or Minority Shareholder (or of, to or in any group undertaking of that Investor Seller or Minority Shareholder) or of, to or in any Fund referred to in (a) above or of, to or in any group undertaking referred to in (c) above; or |

| (e) | any subsidiary or person directly or indirectly Controlled by the Investor Seller or Minority Shareholder from time to time, |

2

in each case excluding any portfolio company or operating company (or any investee company or holding company incorporated for the purposes of holding an investment in such portfolio or operating company) other than Enstar Group Limited and its group undertakings;

“Agreed Announcements” means the announcements in relation to the Transaction to be issued by each of the Buyer and the Company on or after the date of this Deed in the agreed form;

“Allocation Table” means each table in the form set out in Part A and Part B of Schedule 8;

“All-In Option” means an option granted under the Share Option Plan that is identified as “All-In” in the relevant award letter;

“All-In Option Cash Amount” means an amount equal to the number of Shares subject to All-In Options granted under the Share Option Plan which are outstanding as at the date of this Deed, and have not lapsed in accordance with their terms immediately prior to Completion, multiplied by the notional value which the holders of such All-In Options would have received if they had exercised their All-In Options to the greatest extent possible, acquired Shares and sold them under the terms of this Deed plus any amount of any employer National Insurance contributions and apprenticeship levy (or any non-UK equivalent) payable by the Group in respect of the payment of such amount;

“All-In Option Net Cash Amount” means a value equal to the number of Shares subject to All-In Options granted under the Share Option Plan which are outstanding immediately prior to Completion, multiplied by the notional value which the optionholders would have received if they had exercised their All-In Options to the greatest extent possible, acquired Shares and sold them under the terms of this Deed;

“Articles” means the articles of association of the Company as amended from time to time;

“B Ordinary Shares” means the fully paid issued B ordinary shares of US$ 0.01 each in the Company;

“B Share Management Sellers” has the meaning given to it in the preamble of this Deed;

“Base Consideration Amount” has the meaning given to it Clause 4.1;

“Burdensome Remedy” means any condition, term or undertaking required by a Governmental Authority that would require the Buyer or any of its Affiliates to contribute, pay, assume or otherwise provide (directly or indirectly) additional investment, cost (including assumption of liabilities) or capital contribution to the Group which, as at the date of issuance of such condition, term or undertaking, is quantifiable and in excess of $50 million (whether some or all of such amount is to be contributed, paid, assumed or otherwise provided on such date and/or a commitment is required from the Buyer to do so on another date(s) in the future), provided that, where any amount of such investment, cost (including assumption of liabilities) or capital contribution is not specifically quantifiable as at the date of issuance of such condition, term or undertaking, such amount shall be calculated on a best estimate basis and agreed by the Buyer and the Investor Sellers (each acting reasonably) in consultation with the Company provided that Clauses 3.3.1 to 3.3.9 shall apply if the Buyer and Investor Sellers are unable to agree such amount within 10 Relevant Business Days of the condition, term or undertaking being imposed (for the avoidance of doubt such quantifiable and non-quantifiable costs shall not exceed $50 million in the aggregate);

3

“Business Day” means a day other than a day on which banks generally are not open for business or for inter-bank business in any of the following:

| (a) | New York, United States of America; |

| (b) | England and Wales; |

| (c) | Quebec, for as long as an Investor Seller or a parent undertaking of an Investor Seller has its registered office, or is incorporated, in such jurisdiction; |

| (d) | Luxembourg, for as long as an Investor Seller or a parent undertaking of an Investor Seller has its registered office, or is incorporated, in such jurisdiction; or |

| (e) | Qatar, for as long as an Investor Seller or a parent undertaking of an Investor Seller has its registered office, or is incorporated, in such jurisdiction; |

“Business Plan” means, as the context requires, the 2025 Lloyd’s Syndicate Business Plan or the 2026 Lloyd’s Syndicate Business Plan;

“Buyer” has the meaning set forth in the preamble to this Deed;

“Buyer Conditions” has the meaning set forth in Clause 3.1;

“Buyer Guarantor” has the meaning given to it in the preamble of this Deed;

“Buyer Nominated Account” means the bank account notified by the Buyer to the Investor Sellers (including bank account details and wire instructions) at least three (3) days before the relevant payment date;

“Buyer Warranties” means the warranties contained in Schedule 4 (and references to a “Buyer Warranty” shall be construed accordingly);

“Buyer’s Group” means the Buyer and its Affiliates (and a reference to a “member of the Buyer’s Group” shall be construed as a reference to any of them). References to the Buyer’s Group shall exclude the Group prior to Completion but shall include the Group upon and following Completion, as the context requires;

“Buyer’s Knowledge Persons” means Richard Thornberry, Sumita Pandit, Edward Hoffman, Daniel Kobell, Mary Dickerson and Elizabeth Diffley;

“Buyer’s Solicitors” means Skadden, Arps, Slate, Meagher & Flom (UK) LLP of 22 Bishopsgate, London EC2N 4BQ; “Cash Award” means a conditional right to a cash payment granted and paid in accordance with Clause 5.4;

4

“Code” means the United States Internal Revenue Code of 1986, as amended;

“Company” means Inigo Limited, a limited liability company incorporated in England and Wales, with further details of the Company set out in Schedule 11;

“Company Account” means the bank account for the Company notified in writing to the Buyer in the Completion Statement;

“Completion” means completion of the sale and purchase of the Shares in accordance with the provisions of this Deed;

“Completion Date” has the meaning given to it in Clause 7.1;

“Completion Dividend Amount” has the meaning given to it in Clause 4.5.1;

“Completion Share Proportion” means, with respect to each relevant Seller, the percentage value set out in column 4 of each Allocation Table as set out in the Completion Statement;

“Completion Statement” means the Draft Completion Statement as accepted by the Buyer, agreed during the Initial Consultation Period, or determined by the Buyer Expert (as applicable) in accordance with Clause 4.3;

“Completion Statement Date” means the date of acceptance, agreement or determination (as applicable) of the Completion Statement in accordance with Clause 4.3 (as applicable);

“Completion TNAV” means the tangible net asset value in respect of the Group as at the Month End Date, as calculated in accordance with Schedule 5 and in the form set out in Part B of Schedule 5;

“Conditions” has the meaning set forth in Clause 3.1;

“Conditions Satisfaction Date” means the date (being no later than the Longstop Date) on which the last of the Conditions is satisfied;

“Confidential Information” has the meaning set forth in Clause 15.1;

“Connected Person” means, in respect of an individual person:

| (a) | the spouse or civil partner, parents and siblings (including step-siblings and half-siblings) and direct descendants of such individual and their respective spouses or civil partners, parents and siblings (including step-siblings and half-siblings) and direct descendants (together, the “Connected Person’s Family”); |

| (b) | any trust established by or for the benefit of that individual or a member of that individual’s Connected Person’s Family; |

5

| (c) | any undertaking which that individual or that individual’s Connected Person’s Family is able to exercise or control the exercise of a majority of the votes able to be cast at general meetings, or to appoint or remove directors holding a majority of voting rights at board meetings, in each case on all, or substantially all, matters; |

| (d) | any undertaking whose directors are accustomed to act in accordance with the directions or instructions of that individual or a member of that individual’s Connected Person’s Family; |

| (e) | any undertaking (other than any Group Company) of which that individual or a member of that individual’s Connected Person’s Family is a director; |

| (f) | any partnership or undertaking (other than any Group Company) in which that individual or a member of that individual’s Connected Person’s Family has a direct or indirect economic interest; and |

| (g) | any nominee, trustee or agent or any other person acting on behalf of any person referred to in this definition; |

“Consideration” has the meaning set forth in Clause 4.1.1;

“Consideration WHT” has the meaning set forth in Clause 19.5;

“Corporate Member” means Inigo Corporate Member Limited, a limited liability company incorporated in England and Wales, with further details set out in Schedule 11;

“Cut-Off Date” has the meaning given to it in Appendix 5 of the Lloyd’s Membership & Underwriting Conditions and Requirements (M&URs);

“Cut-Off Time” means 23:59 on 16 September 2025;

“Data Room” means the Project Arabella virtual data room hosted by Intralinks containing the documents (including Q&A, correspondence and information) made available by or on behalf of the Sellers for inspection by or on behalf of the Buyer (including the Buyer’s agents and advisers through such virtual data room) in relation to, or in connection with, the Group and its business as at the Cut-Off Time;

“Data Room Index” means the index of the contents of the Data Room as at the Cut-Off Time in the agreed form;

“Declared Dividend Amount” means an amount equal to:

| (a) | the difference between $1.183 billion and the Estimated Completion TNAV as set out in the Completion Statement; plus |

| (b) | the Dividend Buffer; |

“Deed of Adherence” means a deed of adherence to this Deed in the agreed form pursuant to which any person becomes a party to this Deed following the date of this Deed; “Disclosed” means disclosed with sufficient detail to enable a reasonable purchaser of the Company to identify the nature and the scope of the matter concerned;

6

“Disclosed Seller Transaction Costs” means the disclosed Seller Transaction Costs, the details of which are set out in the Completion Statement;

“Disclosed Seller Transaction Costs Amount” means the aggregate amount of any Disclosed Seller Transaction Costs;

“Disclosure Letter” means the letter from the Management Warrantors delivered to the Buyer contemporaneously with the execution of this Deed by the parties relating to the warranties given by the Management Warrantors under the Management Warranty Deed and documents attached or annexed thereto in such letter;

“Dividend Buffer” means an amount equal to the higher of (i) 5% of the difference between $1.183 billion and the Estimated Completion TNAV as set out in the Completion Statement; and (ii) $5,000,000;

“Dividend Conditions” means the following conditions:

| (a) | compliance with applicable Laws, in respect of the payment and distribution of dividends including: |

| (i) | the Company having sufficient available profits (as determined in accordance with the Act) to declare a dividend; |

| (ii) | the Company having sufficient immediately available cash resources to pay a dividend; |

| (iii) | the fiduciary and statutory duties of the directors of the Company in respect of the declaration and payment of dividends; and |

| (iv) | any other applicable rules and regulations of any Governmental Authority, including Lloyd’s with regards to the declaration and payment of dividends by corporate members at Lloyd’s, |

but excluding, in each case, any matter relating specifically to the FAL or other working capital requirements of the Group in respect of the 2027 Year of Account; and

| (b) | the Company has taken into account all costs and liabilities payable by a Group Company on Completion as a result of the transactions contemplated by this Deed prior to declaring and paying any such dividend; |

“Dividend Overpayment Amount” means the amount by which the aggregate amount of any Pre-Completion Dividend and Post-Completion Dividend actually paid to the A Share Sellers exceeds, as a result of the adjustment process set out in Clause 4.7, the Completion Dividend Amount;

“Draft 2026 Lloyd’s Syndicate Business Plan” means the current version of the 2026 Lloyd’s Syndicate Business Plan as at the date of this Deed, a copy of which has been included in the Data Room; “Draft Completion Statement” has the meaning set forth in Clause 4.2.1;

7

“EBT” means the Inigo Employee Benefit Trust established by a deed of trust dated 8 February 2023 between the Company and the EBT Trustee;

“EBT Consideration” means the Consideration in respect of any unallocated Shares held by the EBT Trustee (which, for the avoidance of doubt will not include any Shares which it holds in its capacity as Nominee);

“EBT Loan” means the amount which is outstanding as at the Completion Date under the loan facility provided by the Company (as lender) to the EBT Trustee (as borrower) under the terms of a letter dated 8 February 2023;

“EBT Loan Amount” has the meaning given to it in Clause 4.6.3;

“EBT Transaction Bonuses” means the transaction bonuses payable on or following Completion, using the EBT Consideration, to the EBT Transaction Bonus Recipients in such amounts as the Company shall recommend to the EBT Trustee no later than one Business Day following the Completion Statement Date and in the aggregate amount as set out in the Completion Statement;

“EBT Transaction Bonus Recipients” means such Employees who will be paid an EBT Transaction Bonus and notified by the Sellers to the Buyer in the Completion Statement;

“EBT Transaction Bonus Tax Amount” means the amount of any employer National Insurance contributions and apprenticeship levy (or any non-UK equivalent) payable by the Group as a result of the payment of any EBT Transaction Bonuses;

“Employee” means a director or officer (whether or not employed by a member of the Group) or employee of a member of the Group;

“Encumbrance” means a mortgage, charge, pledge, lien, option, restriction, deed of trust, hypothecation, right of first refusal, right of pre-emption or other third party right, interest or claim of any kind, or any other third-party right, encumbrance or security interest of any kind (including any liability imposed or right conferred by or under any legislation) or any other type of preferential arrangement (including a title transfer or retention arrangement) having similar effect or an agreement, arrangement or obligation to create any of the foregoing;

“Enstar” means Cavello Bay Reinsurance Limited of A.S. Cooper Building, 26 Reid Street, Hamilton HM11, a subsidiary of Enstar Group Limited;

“Escrow Account” means the bank account operated by the Escrow Agent as set out in the Escrow Agreement;

“Escrow Agent” means Wilmington Trust (London) Limited, a company registered in England and Wales with number 05650152 whose registered office is at Third Floor, 1 King’s Arms Yard, London, EC2R 7AF;

“Escrow Amount” means the lower of: (a) $50 million; and (b) if the Estimated Completion TNAV as set out in the Completion Statement is less than $1.083 billion but equal to or greater than $1.033 billion, the difference between the Adjusted Base Consideration and $1.65 billion; “Escrow Agreement” means the agreement in the agreed form between the Buyer, the Investor Sellers and the Management Sellers’ Representative and the Escrow Agent in relation to the Escrow Account;

8

“Estimated Completion TNAV” means the Completion TNAV as set out in the Draft Completion Statement or the Completion Statement (as applicable);

“Event Response Protocol” means the event response protocol as uploaded to the Data Room at document 3.20.1;

“Excess Amount” has the meaning given to it in Clause 4.5.2;

“Expert” means an independent reputable firm of actuaries or accountants of international standing to be agreed by the Buyer and the Investor Sellers in writing or, failing such agreement, appointed by the President for the time being of the Institute of Chartered Accountants in England and Wales;

“FAL” or “Funds at Lloyd’s” means “funds at Lloyd’s” which has the meaning given to that expression in paragraph 16 of the Lloyd’s Membership Byelaw (No. 5 of 2005);

“Financing” shall have the meaning given to it in Clause 6.6;

“FCA” means the U.K.’s Financial Conduct Authority;

“FCA Handbook” means the FCA Handbook of Rules and Guidance;

“Final Completion Statement” means the Completion Statement as finally determined in accordance with this Deed and which sets out, among other things, the Actual Completion TNAV and the Consideration;

“FSMA” means the Financial Services & Markets Act 2000;

“Fundamental Warranties” means the warranties given by the Sellers as contained in Schedule 2 (and references to a “Fundamental Warranty” shall be construed accordingly);

“Fundamental Warranty Claim” has the meaning given to it in paragraph 3.1.2 of Schedule 3;

“Funds” has the meaning given in Clause 11.3;

“Governmental Authority” means any applicable competent governmental (including any Government-Sponsored Enterprise), legislative, administrative, supervisory, regulatory (including Lloyd’s), judicial, determinative, disciplinary, enforcement or tax raising body (including any Tax Authority), authority, instrumentality, commission, agency, board, department, court, tribunal or judicial or arbitral body of any applicable jurisdiction and whether supranational, national, regional or local; “Government-Sponsored Enterprise” means the Federal Home Loan Mortgage Corporation, the Federal National Mortgage Association, the Federal Housing Finance Agency, and any other financial services entity established by any Governmental Authority and engaged in the purchase of mortgage loans;

9

“Group” means the Company, each of its Subsidiaries, the LB Cell (the details of which are set out in Part A of Schedule 11), and “member of the Group” and “Group Company” shall be construed accordingly;

“Group Accounts” means the audited consolidated financial statements of the Company and its Subsidiaries prepared in accordance with UK GAAP as at 31 December 2024;

“Income, Profits or Gains” means income, profits or gains and references to “Profits earned, accrued or received” include Profits deemed to have been earned, accrued or received for Tax purposes;

“Individual Cash Consideration Amount” means, in respect of a Seller set out in column (1) of each Allocation Table, the amount set out opposite such Seller’s name in column (5) of the Allocation Tables set out in the Completion Statement (being for the avoidance of doubt, an amount equal to such Seller’s (i) Completion Share Proportion multiplied by the Consideration minus (ii) such Seller’s Management Rollover Amount);

“Initial Consideration” has the meaning set forth in Clause 4.6;

“Inside Date” means 1 January 2026;

“Insolvency Act” means the Insolvency Act 1986;

“Insolvency Proceedings” means any formal insolvency proceedings, whether in or out of court, including proceedings or steps leading to any form of bankruptcy, liquidation, administration, receivership, arrangement or scheme with creditors, moratorium, stay or limitation of creditors’ rights, interim or provisional supervision by a court or court appointee, winding-up or striking-off, or any distress, execution or other process levied, or any event analogous to any such events in any jurisdiction outside England and Wales;

“Insurance Contracts” means the insurance and inward reinsurance policies and contracts, together with all binders, slips, certificates, endorsements, amendments and riders thereto issued or entered into that are underwritten by any member of the Group (including, for the avoidance of doubt, as a member of a Lloyd’s syndicate or in the case of Inigo Managing Agent Limited as managing agent on behalf of the member(s) of a Lloyd’s syndicate);

“Investment Fund” means any unit trust, investment trust, investment company, limited partnership, general partnership, collective investment scheme, pension fund, insurance company, authorised person under FSMA or any body corporate or other entity, in each case the assets of which are managed professionally for investment purposes;

“Investor Sellers” means together QIA, La Caisse, Oak Hill Advisors and J.C. Flowers; “J.C.

10

Flowers” means Bridge (Cayman) Holdings Ltd. of 190 Elgin Avenue, George Town, Grand Cayman, KY1-9008, Cayman Islands;

“Known Leakage Amount” has the meaning set forth in Clause 4.10.3;

“La Caisse” means CDP Investissements Inc. of 1000, place Jean-Paul-Riopelle, Montréal, Quebec H2Z 2B3, Canada;

“LB Cell” means Cell 16 of London Bridge 2 PCC Limited;

“LB Cell Uncertain Tax Provision Amount” means an amount equal to the UK corporation Tax that would be chargeable on the Income, Profits or Gains of the LB Cell, at the applicable UK corporation Tax rate for any Accounting Period or part of an Accounting Period ending on or prior to the Month End Date (being 25% at the date of this Deed) as if regulation 4 of the RTTR 2017 were not applicable to the LB Cell;

“LB Cell Uncertain Tax Provision” has the meaning given to it in Clause 4.12;

“Law” or “Laws” means all applicable legislation, statutes, directives, regulations (including any acts, byelaws or requirements made under byelaws of Lloyd’s), judgments, decisions, decrees, orders, instruments, by-laws, and other legislative measures or decisions having the force of law, treaties, conventions and other agreements between states, or between states and the European Union or other supranational bodies, rules of common law, customary law and equity and all civil or other codes and all other laws of, or having effect in, any applicable jurisdiction from time to time;

“Leakage” means:

| (a) | in each case (A) by any member of the Group or Motion to on behalf of or for the benefit of any Investor Seller, or any Investor Seller’s Affiliate, any Management Seller or B Share Management Seller, or any Connected Person of any Management Seller or B Share Management Seller, the Nominee or any Nominee Connected Person and (B) save as set out below, during the period from (but excluding) the Month End Date to (and including) the Completion Date: |

| (i) | any dividend or distribution (whether in cash or in kind) or any payments in lieu of any dividend or distribution, in each case declared, paid or made; |

| (ii) | any redemption, repurchase, repayment or return of shares, loan capital or other securities, or any other return of capital (whether by reduction of capital or otherwise and whether in cash or in kind), including any payments (in cash or in kind) made to any leavers under any Share Option Plan, in each case from the date of this Deed to (and including) the Completion Date; |

| (iii) | any consultant, advisory, management, monitoring, service, shareholder or other fees, charges or compensation of a similar nature paid or incurred; |

11

| (iv) | any payments or transaction of any kind other than on arm’s length third-party terms; |

| (v) | any waiver, discount, deferral, discharge or release (whether conditional or not) of any amount, right, value, benefit, liability or obligation owed or due to any member of the Group or Motion; |

| (vi) | any liability or obligation (contingent or otherwise) assumed or discharged; |

| (vii) | any guarantee, indemnity, surety for liability or Encumbrance provided by, or over the assets of any member of the Group or Motion; |

| (viii) | any transfer or surrender of assets, rights or other benefits, or any liability or obligation assumed or incurred otherwise than on arm’s length terms; |

| (ix) | any Seller Transaction Costs incurred or paid, or unaccrued but declared to be treated as incurred or paid, in each case, by any member of the Group or Motion in each case at any time prior to the Completion Date; |

| (x) | any Transaction Related Incentives in each case incurred, paid or made at any time prior to the Completion Date; and |

| (xi) | any Dividend Overpayment Amount, to extent such amount has not been returned to the Buyer in accordance with Clause 4.8.2; |

| (b) | during the period from (but excluding) the Month End Date to (and including) the Completion Date (or such other period as set out above); |

| (i) | any agreement or other commitment by any member of the Group or Motion to enter into or carry out any of the actions or transactions referred to in paragraphs above entered into during the period from (but excluding) the Month End Date to (and including) the Completion Date (or such other period as set out above); and |

| (ii) | any Tax paid or payable at any time by any Group Company directly as a consequence of any of the matters referred to above, |

but in each case not including any Permitted Leakage and without double counting any matter in paragraphs (a) and (b) (inclusive) above;

“Leakage Tax Saving” means, in relation to any Leakage, the aggregate of any amount equal to any:

| (a) | part of any Leakage in respect of or which represents VAT for which a Group Company is entitled to recover by repayment or credit by any Group Company within twelve (12) months of Completion; and |

12

| (b) | actual cash payment of corporation tax that has, in the reasonable determination of the relevant Group Company, been saved (or that will be saved following Completion) by a Group Company in respect of the accounting period in which the relevant Leakage occurs, solely and exclusively as a result of the successful utilisation of a Relief arising wholly as a result of the matter giving rise to the relevant Leakage (“Leakage Relief”) against any Income, Profits or Gains (whether actually earned, received or accrued or deemed to be earned, received or accrued) of such Group Company that is chargeable to corporation tax, |

provided that in determining whether a payment of corporation tax has been or will be saved at limb (b) above: (i) where there are other Reliefs available or that may be made available to the Group Company to utilise against the relevant Income, Profits or Gains, such Reliefs shall be treated as being utilised in priority to make such saving of corporation tax over the Leakage Relief, and (ii) an actual cash payment of corporation tax shall be treated as having been or will be saved where there has been or will be a reduction or elimination of a liability of a Group Company to make an actual cash payment of corporation tax;

“Leaver Provisions” means the provisions in the Shareholders’ Agreement applicable to a Leaver (as defined in the Shareholders’ Agreement) and the treatment of any B Ordinary Shares or interest in such B Ordinary Shares held by a Leaver;

“Lloyd’s” means the Society and Corporation of Lloyd’s incorporated under the Lloyd’s Act of 1871 to 1982 of England and Wales, or any successor thereto;

“Lloyd’s Regulations” means the Lloyd’s Acts 1871 to 1982, byelaws, regulations, codes of practice, bulletins and mandatory directions and requirements governing the conduct and management of underwriting business at Lloyd’s from time to time;

“Longstop Date” means on or before 5:00 p.m. on 30 June 2026 or such other date as the Buyer, each Investor Seller and the Management Sellers’ Representative agree in writing;

“Loss” means, in relation to any matter, all liabilities, losses, claims, reasonably incurred costs (including reasonably incurred costs of enforcement and reasonably and properly incurred legal costs and expenses), damages, awards, charges, demands, proceedings, Taxes, penalties, fines, expenses and/or any other liabilities incurred or sustained relating to that matter, but excluding any indirect or consequential loss and/or loss of profit (and “Losses” shall be construed accordingly);

“LTIP Option” means an option granted under the Share Option Plan that is identified as “LTIP” in the relevant award letter;

“LTIP Cash Amount” means US$7,000,000, which is equal to 50 per cent. of the total value of RSUs to be granted pursuant to Clause 5.2.2 plus an amount equal to the employer’s national insurance contributions which would be payable on such amount had such amount been paid as employment income;

“L/C Bank” means each Lender (as defined in the L/C Facility Agreement);

“L/C Facility Agent” means the person appointed as facility agent of the other Finance Parties (as defined in the L/C Facility Agreement) under the L/C Facility Agreement from time to time, being Barclays Bank plc as at the date of this Deed; “L/C Facility Agreement” means the letter of credit facility agreement originally dated 3 November 2021 (as amended and/or amended and restated from time to time) between, among others, the Company (as guarantor), the Corporate Member (as borrower), Barclays Bank PLC (as agent) and Barclays Bank PLC (as security agent);

13

“L/C Facility Extension Documents” has the meaning given in Clause 6.5.4;

“L/C Finance Party” means each Finance Party (as defined in the L/C Facility Agreement);

“Management Rollover Amount” means, in respect of each Management Rollover Seller, the amount of the Consideration they receive in the form of Rollover Consideration Securities calculated in accordance with the Management Wrapper Agreement and in each case as set out beside such Management Rollover Seller’s name in column (4) of the Management Rollover Tables set out in the Completion Statement (for the avoidance of doubt, being such Management Rollover Seller’s Consideration (such Consideration, for the avoidance of doubt, excluding any Escrow Amount) multiplied by their Management Rollover Percentage);

“Management Rollover Percentage” means, in respect of each Management Rollover Seller, the percentage set out beside such Management Rollover Seller’s name in column (3) of the Management Rollover Table as at the date of this Deed;

“Management Rollover Sellers” means those Management Sellers and B Share Management Sellers listed in Schedule 9 who have agreed to be issued Rollover Consideration Securities as part of the Consideration due to them pursuant to the terms of this Deed and who are (or become) party to the Management Wrapper Agreement;

“Management Rollover Tables” means each table set out in the form of Schedule 9;

“Management Sellers” means the Sellers listed in rows 11 – 14 of Part A of Schedule 8 and Part B of Schedule 8 together with any other person who adheres to this Deed as a Management Seller between the date of this Deed and the Completion Date by delivering a fully executed Deed of Adherence to the Buyer, the Investor Sellers and the Management Sellers’ Representative;

“Management Sellers’ Representative” means Richard Watson or such other person designated by the Management Sellers to serve as their representative in accordance with Clause 32 from time to time;

“Management Warrantors” has the meaning given to such term in the Management Warranty Deed;

“Management Warranty Deed” means the management warranty deed to be entered into on around the date of this Deed between the Management Warrantors and the Buyer;

“Management Wrapper Agreement” means the equity wrapper agreement entered into between the Buyer, the Management Rollover Sellers and the relevant members of the Buyer’s Group dated on or about the date of this Deed; “Material Contracts” means a Material Reinsurance Contract and any other contract to which any Group Company is a party or is otherwise obligated (other than Insurance Contracts or Material IT Contracts), in each case that:

14

“Material Completion Obligation” means:

| (a) | with respect to the Sellers, the obligations set out in paragraphs 1.1, 2.1.1, 2.3.1, 2.3.3, 2.3.4 and 2.3.5 of Part A of Schedule 1; |

| (b) | with respect to the Buyer, the obligations set out in paragraphs 1 and 2.1 of Part B of Schedule 1; |

| (a) | involves aggregate payments by any Group Company in excess of $1,000,000 during the 12-month period prior to the date of this Deed or would reasonably be expected to involve aggregate payments in excess of such amount in any 12-month period that includes the date hereof (excluding any outwards reinsurance agreements which are between any member of the Group (whether as a member of the Syndicates or otherwise) and a reinsurer); |

| (b) | involves receipt of payments by any Group Company in excess of, or any property with a fair market value in excess of, $1,000,000 during the 12-month period ended 30 June 2025 or that would reasonably be expected to involve aggregate payments in excess of such amount in any 12-month period that includes the date hereof (excluding any outwards reinsurance agreements which are between any member of the Group (whether as a member of the Syndicates or otherwise) and a reinsurer); and/or |

| (c) | is, in the reasonable opinion of the Company, otherwise material to the conduct of the business of the Group (including with respect to the administration, claims, underwriting or other insurance policy administration functions, including any collateral arrangements of a Group Company); |

“Material IT Contracts” has the meaning given to that term in the Management Warranty Deed;

“Material Reinsurance Contracts” means an in-force outwards reinsurance agreement between the Syndicate and each of the Group’s “Top 10” outwards reinsurance partners (as identified on page 105 of the “Arabella – Information Pack (DRAFT 20 May 2025)” at 10.1.1 of the Data Room, and which are disclosed in the Data Room;

“Member” means a person who has been duly admitted to membership of Lloyd’s pursuant to the Membership Byelaw (No. 5 of 2005);

“Minority Shareholder” means each of the following:

| (a) | Enstar; |

| (b) | each Stone Point Fund, acting through its manager Stone Point Capital LLC; |

15

| (c) | Dowling Capital Partners I, L.P. of 660 Beachland Blvd, Suite 201, Vero Beach, FL 32963; and |

| (d) | Capital City Partners LLC of 660 Beachland Blvd, Suite 201, Vero Beach, FL 32963; |

“Month End Date” means, subject to clause 4.2.2, the last day of the calendar month immediately preceding the calendar month in which the Conditions Satisfaction Date falls, save that where the Conditions Satisfaction Date is after the fifteenth (15th) Business Day of a calendar month, Month End Date shall be the last day of the calendar month in which the Conditions Satisfaction Date falls, or such other date as may be agreed by the Buyer, each Investor Seller and the Management Sellers’ Representative in writing;

“Motion” means Motion Speciality, Inc., a Delaware corporation;

“New Articles” means the new articles of association of the Company, in a form agreed between the Buyer and the Management Sellers’ Representative prior to Completion;

“Nominee Connected Person” means any beneficiary of the Nominee holding interests in Shares at any time during the period from and including the date of this Deed to and excluding the Completion Date and:

| (a) | where such beneficiary is an entity, any subsidiary undertaking of such beneficiary, any parent undertaking of that beneficiary and any subsidiary undertaking of any such parent undertaking, in each case whether direct or indirect; or |

| (b) | where such beneficiary is an individual, any Connected Person of such beneficiary, in each case together with any nominee, trustee, agent or any other person acting on behalf of any such person; |

“Oak Hill Advisors” means INS-UK Premium S.à r.l. of 51, boulevard Grande Duchesse Charlotte, L-1331 Luxembourg;

“Ordinary Course Bonus Cap” means an amount equal to 125% of the target bonus pool for the calendar year 2025 as set out in the employee census as at 1 September 2025 as set out in the Data Room at document 9.2.3, plus any employer National Insurance contributions and apprenticeship levy (or any non-UK equivalent) payable by the Group in respect of such target bonus;

“Ordinary Course Bonus Excess Amount” means any payments in respect of bonuses granted in the ordinary and usual course of business which are due to be paid by the Company or any Group Company (including any associated payroll Taxes and any employer National Insurance contributions and apprenticeship levy (or any non-UK equivalent)) on or after Completion made to, or in respect of services provided by, employees, workers, directors, officers or consultants of the Company or any Group Company in the period before and up to Completion, in each case in excess of the amount specifically accounted for in relation to such items as costs and/or liabilities in the Completion TNAV up to the Ordinary Course Bonus Cap, and excluding any Transaction Related Incentives and any sign-on bonuses made to newly hired employees of the Company or any Group Company in the ordinary course of business consistent with past practice; “Outgoing Board Member” means such individuals from the board of directors of the Company as shall be identified by the Buyer to the Investor Sellers and the Management Sellers’ Representative in writing no less than ten (10) Business Days prior to Completion and which shall include, at a minimum:

16

| (a) | Ralph Christian Friedwagner; |

| (b) | Steven Bennett Gruber; |

| (c) | Tim John Hanford; and |

| (d) | Peter Jurdjevic; |

“Paid Dividend Amount” means the amount of any Pre-Completion Dividend and/or Post-Completion Dividend paid to the A Share Sellers in accordance with Clause 4.5;

“Paying Agent” means Wilmington Trust (London) Limited;

“Paying Agent Account” means the bank account operated by the Paying Agent as set out in the Paying Agent Agreement and notified by the Investor Sellers and the Management Sellers’ Representative to the Buyer in the Completion Statement;

“Paying Agent Agreement” means the agreement in the agreed form between the Investor Sellers, the Management Sellers’ Representative and the Paying Agent in relation to the Paying Agent Account;

“Permitted Leakage” means:

| (a) | save as otherwise set out below, any payments or other types of Leakage expressly provided for under the terms of the Transaction Documents (including, in each case, any Taxes paid or payable by any member of the Group as a direct consequence of such payment or other type of Leakage) or the payment of any Pre-Completion Dividend (excluding any Dividend Overpayment Amount); |

| (b) | any directors’ or officers’ fees (including expenses) and/or consultancy fees incurred, paid or agreed to be paid or payable to the Management Sellers or the B Share Management Sellers or to any Employee or consultant of any member of the Group pursuant to their current employment, director and/or consulting agreements with any Group Company (in each case to the extent Disclosed) but only consistent with past practice and in the ordinary course of business including, in each case, any income tax, national insurance contributions and apprenticeship levy (or the equivalent in any jurisdiction) paid or payable by any member of the Group as a direct consequence of such fees), and disregarding for these purposes any modification or amendment to such agreements or arrangements since the Month End Date; |

| (c) | any premium paid or agreed to be paid or incurred or owing by any Group Company in connection with any “run-off” directors’ and officers’ liability insurance policy providing coverage to any resigning director of the Group in connection with Clause 11.6.2 to the extent that the premium value does not exceed the D&O Premium Cap and subject to the terms of Clause 11.6.2; |

17

| (d) | the salaries and other remuneration (including expenses) and bonuses, emoluments, benefits, pension contributions and other entitlements incurred, paid or agreed to be paid or payable to the Management Sellers or the B Share Management Sellers or to any Employee or consultant of any member of the Group in accordance with their current employment agreements, director and/or consulting agreements with any Group Company but only as consistent with past practice and in the ordinary course of business, including the Ordinary Course Bonus Excess Amount (including, in each case, any income tax, national insurance contributions and apprenticeship levy (or the equivalent in any jurisdiction) paid or payable by any member of the Group as a direct consequence of such salaries, other remuneration, bonuses, emoluments, benefits, contributions or other entitlements); |

| (e) | any payments and/or actions contemplated by Clauses 5.2.2 and 5.2.3 of this Deed (including, in each case, any income tax, national insurance contributions and apprenticeship levy (or the equivalent in any jurisdiction) paid or payable by any member of the Group as a direct consequence of such payments or actions provided a reasonable estimate of each such income tax, national insurance contributions and apprenticeship levy has been Disclosed or otherwise expressly notified to the Buyer); |

| (f) | any amounts incurred, paid or agreed to be paid or payable or liability, cost or expense (including any Tax paid or payable by any Group Company as a direct consequence of such amounts) incurred in connection with any matter undertaken at the written request of the Buyer; |

| (g) | any amounts incurred, paid or agreed to be paid or payable or liability, cost or expense incurred in connection with the prior written consent of the Buyer (including any Tax paid or payable by any Group Company as a direct consequence of such amounts provided such amounts of Tax paid or payable has been Disclosed or otherwise expressly notified to the Buyer in obtaining the Buyer’s written consent); |

| (h) | any amounts incurred, paid or agreed to be paid or payable or agreed to be made in the ordinary course of the Group’s trading activities (and any Tax paid or payable by any Group Company as a direct consequence of such amounts), on arm’s length terms and consistent with past practice in the twelve (12) month period prior to the date of this Deed by any member of the Group to any Investor Seller’s Affiliate; |

| (i) | any Leakage (for these purposes excluding any Seller Transaction Costs, Transaction Related Incentives and any Leakage under item (a)(ii) of the definition of Leakage) reflected or taken into account in the calculation of the Consideration including any Leakage expressly and specifically accrued, reserved for, or provisioned for as part of the calculation of the Completion TNAV and any other amounts to be deducted from the Base Consideration pursuant to Clause 4.1.1 (excluding any Known Leakage Amount); |

18

| (j) | any Leakage refunded to the relevant member of the Group on or prior to Completion; and |

| (k) | any Disclosed Seller Transaction Costs incurred, paid or agreed to be paid or payable, or unaccrued but declared to be treated as incurred or paid, in each case, by any member of the Group; |

“PRA” means the U.K.’s Prudential Regulation Authority;

“Pre-Completion Event” has the meaning set forth in Clause 11.6.2;

“Pre-Completion Dividend” has the meaning set forth in Clause 4.5.2(a);

“Pre-contractual Statement” has the meaning set forth in Clause 26.2;

“Premium Trust Fund” means a premium trust fund as such term is defined in the Definitions Byelaw (No. 7 of 2005) as it relates to the Syndicate;

“Proceedings” means any action or proceedings before a court or tribunal or a statutory, governmental or regulatory body (including an arbitration);

“QIA” means Casualty Holding Limited, a subsidiary of the Qatar Investment Authority;

“QMR” as the meaning set forth in Clause 8.1.2(f);

“Relevant Business Day” means a day other than a day on which banks generally are not open for business or for inter-bank business in New York or London;

“Relevant Claim” means any claim, proceeding, suit or action against any Seller arising out of or in connection with this Deed (except, for the avoidance of doubt, any claim, proceeding, suit or action against any Management Warrantor under the Management Warranty Deed);

“Relevant Contracts” means those contracts at 3.2.8.6, 3.18.1, 3.18.2, 3.18.3, 3.18.4, 3.18.5, 3.18.6, 3.18.8, 3.18.9, 3.18.10, 3.18.11, 3.18.12, 3.18.13, 3.18.14, 3.18.15, 5.8.2 and 5.8.3 of the Data Room;

“Relief” means any loss, relief, allowance, exemption, set-off, deduction, right to repayment or credit or other relief of a similar nature granted by or available in relation to Tax pursuant to any legislation or otherwise;

“Representatives” means, in respect of a person, the directors, officers, employees, consultants, advisers, agents, accountants, investment bankers or other representatives of such person; in each case as carried on during the 12 months prior to Completion and any new business line of the Group or Motion set out in the 2026 Lloyd’s Syndicate Business Plan in respect of which the relevant Seller is aware or has been involved in any material respect in the development of, in the 12 months prior to Completion;

19

“Restricted Business” means:

| (a) | with respect to Richard Watson, Russell Merrett, Stuart Bridges and Craig Knightley, any part of the business of the Group or Motion, namely an underwriter (either as an insurer, reinsurer and/ or retrocessionaire, or on the basis of delegated underwriting authority), broker or other distributor of specialty insurance, reinsurance and/ or retrocession, irrespective of the line of insurance, reinsurance and/or retrocession business but including, without limitation, the following lines of insurance, reinsurance and/ or retrocession business: commercial property, general liability, energy liability, marine liability, auto liability, financial lines, directors and officers liability, financial institutions, political violence and terrorism, cyber, aviation war, natural resources and onshore energy; and |