SMHI LISTED NYSE SEACOR Marine Holdings Inc.32nd Annual Pareto Securities Energy Conference John Gellert President & Chief Executive Officer 10 September 2025 Exhibit 99.1

Forward-Looking Statements Forward-Looking Statements discussed in this release as well as in other reports, materials and oral statements that SEACOR Marine Holdings Inc. (“SEACOR Marine” or the “Company”) releases from time to time to the public constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Generally, words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “believe,” “plan,” “target,” “forecast” and similar expressions are intended to identify forward-looking statements and includes the information on Slide 26. Such forward-looking statements concern management's expectations, strategic objectives, business prospects, anticipated economic performance and financial condition and other similar matters. Forward-looking statements are inherently uncertain and subject to a variety of assumptions, risks and uncertainties such as the completion of our financial close process for the quarter, that could cause actual results to differ materially from those anticipated or expected by the management of the Company. These statements are not guarantees of future performance and actual events or results may differ significantly from these statements. Actual events or results are subject to significant known and unknown risks, uncertainties and other important factors, many of which are beyond the Company's control. It should be understood that it is not possible to predict or identify all such factors. Investors and analysts should not place undue reliance on forward-looking statements. Forward-looking statements speak only as of the date of the document in which they are made. The Company disclaims any obligation or undertaking to provide any updates or revisions to any forward-looking statement to reflect any change in the Company's expectations or any change in events, conditions or circumstances on which the forward-looking statement is based, except as required by law. It is advisable, however, to consult any further disclosures the Company makes on related subjects in its filings with the U.S. Securities and Exchange Commission, including Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K (if any). These statements constitute the Company's cautionary statements under the Private Securities Litigation Reform Act of 1995. Non-GAAP Financial Measures This presentation includes certain non-GAAP financial measures. Direct Vessel Profit (defined as operating revenues less operating costs and expenses including major repairs and drydocking expenses, “DVP”), when applied to individual vessels, fleet categories or the combined fleet. DVP is a critical financial measure used by the Company to analyze and compare the operating performance of its individual vessels, fleet categories, regions and combined fleet, without regard to financing decisions (depreciation for owned vessels vs. leased-in expense for leased-in vessels). DVP is also useful when comparing the Company’s fleet performance against those of our competitors who may have differing fleet financing structures. DVP has material limitations as an analytical tool in that it does not reflect all of the costs associated with the ownership and operation of our fleet, and it should not be considered in isolation or used as a substitute for our results as reported under GAAP. Adjusted EBITDA is defined as DVP less general and administrative expenses and lease expenses. We believe that the presentation of Adjusted EBITDA provides useful information to investors and management uses it to assess our on-going operations. Our use of Adjusted EBITDA should not be viewed as an alternative to measures calculated in accordance with GAAP. Adjusted EBITDA has limitations as analytical tool such as: (i) Adjusted EBITDA does not reflect the impact of earnings or charges that we consider not to be indicative of our on-going operations, (ii) Adjusted EBITDA does not reflect interest and income tax expense; and (iii) other companies, including other companies in our industry, may calculate Adjusted EBITDA differently than we do. Net Debt is defined as total debt (the most comparable GAAP measure, calculated as long-term debt plus current portion of long-term debt excluding discount and issuance costs) less cash and cash equivalents (including restricted cash). We believe that the presentation of Net Debt provides useful information to investors and management uses it to compare total debt less cash and cash equivalents across periods on a consistent basis. Reconciliation for each of these non-GAAP measures are included as an appendix to this presentation.

I. Company Overview

SEACOR Marine – Global OSV Owner with Modern Fleet Company Overview Leading provider of marine and support transportation services to offshore energy facilities worldwide with one of the youngest fleets in the industry Headquartered in Houston, TX, and listed on the NYSE (ticker: SMHI) with a market capitalization of $176M (1) Owns and operates a fleet of 47 offshore support vessels (“OSVs”) including Platform Supply Vessels (“PSVs”), Fast Support Vessels (“FSVs”) and Liftboats that provides crew transportation, supply, accommodation and maintenance support Global footprint with presence in all major offshore basins outside of Asia, serving a diverse range of customers in the oil and gas and offshore wind sectors As part of its asset rotation strategy, the Company entered a newbuild program for two high-specification PSVs in late 2024, and announced several transactions related to the divestment out of older, lower specification assets, and to reduce exposure to the liftboat asset class: December 2024: Announced the sale of two Anchor Handling Towing and Supply vessels (“AHTSs”) for total proceeds of $22.5M and exiting the AHTS asset class and simultaneously announced newbuild program for two high-spec PSVs Q1 2025: Announced the sale of one Liftboat stacked for five years for total proceeds of $7.5M Q2 2025: Announced the sale of two shallow draft PSVs and one older FSV for total proceeds of $33.4M August 2025: Announced definitive agreements for the sale of two 335’ Liftboats for total proceeds of $76.0M In April 2025, the Company also announced a securities repurchase from The Carlyle Group, representing 9.1% of the outstanding shares of common stock (2) for an aggregate purchase price of approx. $12.9M Global Presence SEACOR Marine locations 12 vessels 6 vessels 11 vessels 18 vessels Middle East & Asia West Africa & Europe Latin America United States Fleet Composition (3) 47 Vessels – Average Age of 10.4 Years Region / Asset Type PSV FSV Liftboat United States (primarily Gulf of America) 3 3 5 Latin America 4 2 - Africa & Europe 8 10 - Middle East & Asia 4 6 2 Total 19 21 7 33 international flag / 14 U.S. flag (Jones Act compliant) Bloomberg, as of market close on September 8, 2025. Assuming the full exercise of repurchased warrants. Fleet Composition as of June 30, 2025. Fleet Composition excludes one FSV and one AHTS managed for third-parties.

High-Quality and Young Fleet 47 OSVs plus 2 Newbuild PSVs under Construction (1) PSVs FSVs Liftboats (3) 19 PSVs and 2 newbuilds under construction (+ 4 options) Average age of 6.9 years Newbuilds with deck space of 1,000m2 and integrated hybrid power Fleet Composition: (2) 21 FSVs Average age of 11.9 years Aluminum hulls, DP-2 or DP-3, up to 150 passengers 25-40 knots speed Fleet Composition: 7 Liftboats Average age of 13.4 years Working water depth up to 275 feet Accommodation up to 150 passengers Fleet Composition: Excludes one FSV and one AHTS managed for third-parties. Fleet Composition for PSVs includes includes newbuilds under construction. In addition, SEACOR Marine has two remaining planned PSV conversions to hybrid power. On August 7, 2025, the Company announced definitive agreements for the sale of two 335’ Liftboats for total proceeds of $76.0M. Number Deck Space Avg. Age Hybrid Power 13 PSVs > 800m2 5.4 years 11 8 PSVs < 700m2 9.4 years - Number Type Avg. Age Horsepower 15 FSVs Monohull 11.6 years 7-14k 6 FSVs Catamarans 12.7 years 13-16k Number Type Avg. Age Leg Length 4 Liftboats Premium 10.5 years 300-335 feet 3 Liftboats Standard 17.2 years 235-245 feet

Shallow water and deepwater activities Delivery of cargo, drilling fluids, fuel and water to rigs Construction, maintenance support and standby Accommodation and walk-to-work Offshore wind support Support drilling and production operations High-speed cargo transport to offshore facilities Transport of personnel at high-speed and comfort Walk-to-work capable Emergency response services Self-elevating and self-propelled work platforms Accommodation, offshore wind support Well workover, maintenance and production enhancement Decommissioning, plug and abandonment Midstream: commissioning and repair of pipelines and offshore gas facilities Diversified Asset Base Working Across the Energy Universe PSVs FSVs Liftboats Crew Transfer Maintenance Production Development Drilling Exploration Drilling Plug & Abandonment Decommissioning Offshore Wind PSV X X X X X FSV X X X X X Liftboat X X X X X

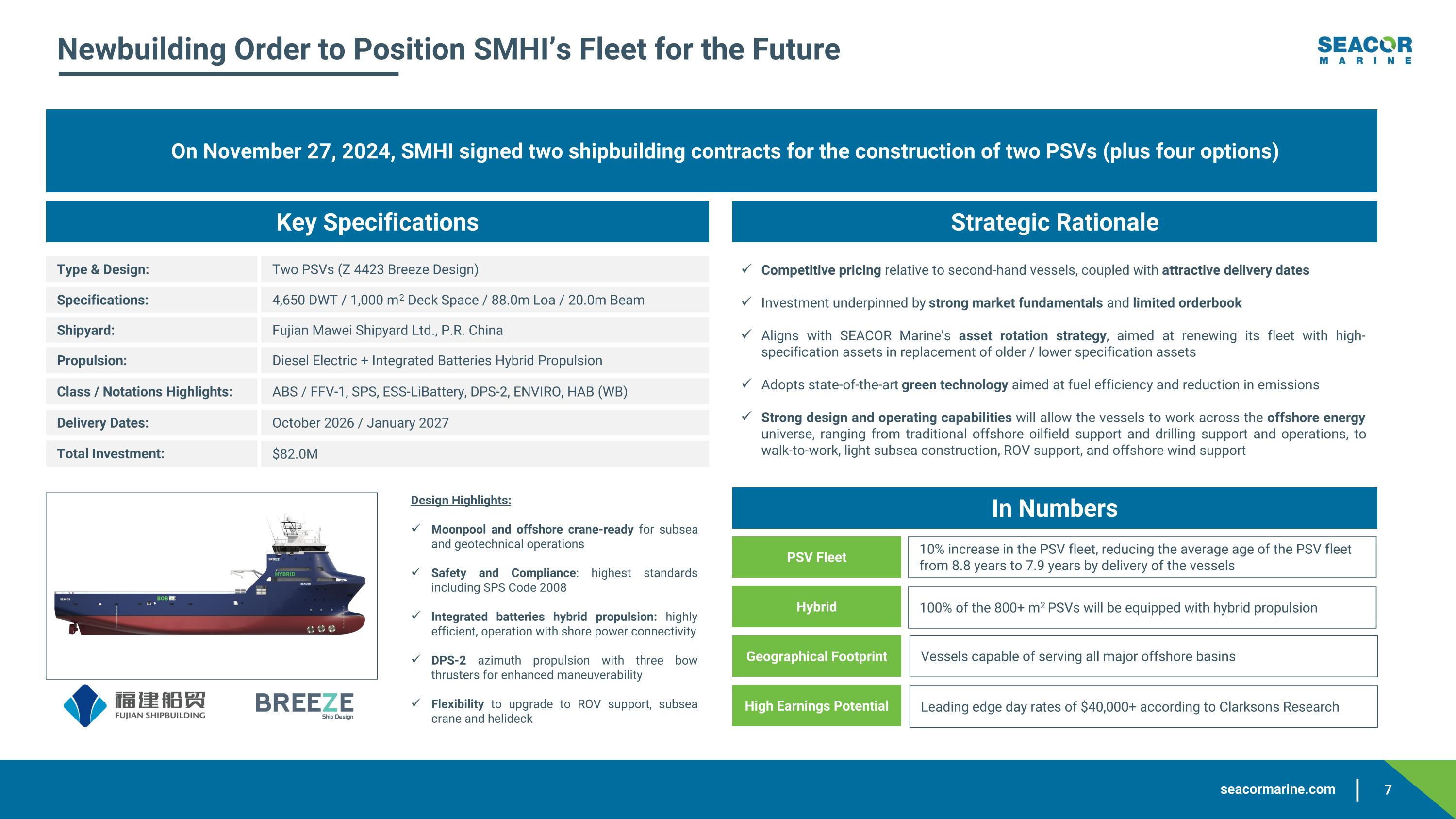

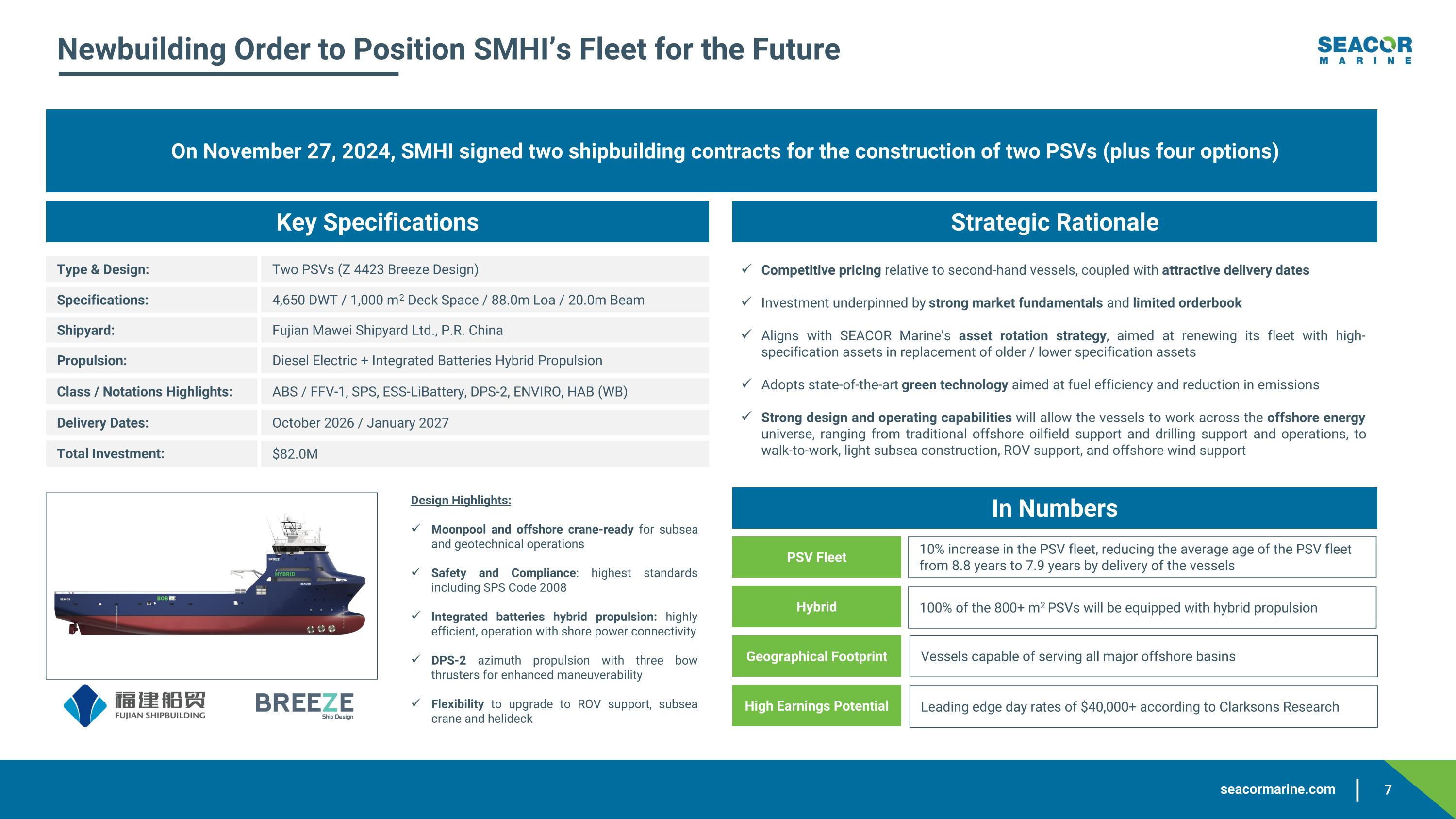

Newbuilding Order to Position SMHI’s Fleet for the Future Type & Design: Specifications: Shipyard: Propulsion: Delivery Dates: Total Investment: Two PSVs (Z 4423 Breeze Design) 4,650 DWT / 1,000 m2 Deck Space / 88.0m Loa / 20.0m Beam Fujian Mawei Shipyard Ltd., P.R. China Diesel Electric + Integrated Batteries Hybrid Propulsion October 2026 / January 2027 $82.0M On November 27, 2024, SMHI signed two shipbuilding contracts for the construction of two PSVs (plus four options) Key Specifications Strategic Rationale Class / Notations Highlights: ABS / FFV-1, SPS, ESS-LiBattery, DPS-2, ENVIRO, HAB (WB) Competitive pricing relative to second-hand vessels, coupled with attractive delivery dates Investment underpinned by strong market fundamentals and limited orderbook Aligns with SEACOR Marine’s asset rotation strategy, aimed at renewing its fleet with high-specification assets in replacement of older / lower specification assets Adopts state-of-the-art green technology aimed at fuel efficiency and reduction in emissions Strong design and operating capabilities will allow the vessels to work across the offshore energy universe, ranging from traditional offshore oilfield support and drilling support and operations, to walk-to-work, light subsea construction, ROV support, and offshore wind support Design Highlights: Moonpool and offshore crane-ready for subsea and geotechnical operations Safety and Compliance: highest standards including SPS Code 2008 Integrated batteries hybrid propulsion: highly efficient, operation with shore power connectivity DPS-2 azimuth propulsion with three bow thrusters for enhanced maneuverability Flexibility to upgrade to ROV support, subsea crane and helideck In Numbers PSV Fleet Hybrid Geographical Footprint High Earnings Potential 10% increase in the PSV fleet, reducing the average age of the PSV fleet from 8.8 years to 7.9 years by delivery of the vessels 100% of the 800+ m2 PSVs will be equipped with hybrid propulsion Vessels capable of serving all major offshore basins Leading edge day rates of $40,000+ according to Clarksons Research

Funding of Newbuild Program Back-Loaded Payment Terms Capex Funding Bridge (1) The sale of non-core AHTSs funded the first milestone payment for both vessels in Q1 2025 The new senior secured term loan is available to fund up to 50% of the total contract price; $8.2M was drawn in Q2 2025 to fund the second milestone payment for one vessel in Q2 2025 Previously concluded asset sales generated $32.7M in restricted cash to be used against future milestone payments, of which $16.5M is remaining (1) The remaining unfunded capex of $8.1M will be funded from cash flow from operations Flexibility built into the new senior secured credit facility to use proceeds from asset sales towards funding newbuild capex Milestone Hull MW628-1 Hull MW628-2 Signing Q4 2024 Q4 2024 Steel Cutting Q2 2025 Q3 2025 Keel Laying Q4 2025 Q1 2026 Launch Q2 2026 Q3 2026 Delivery Q4 2026 Q1 2027 % of Contract Cost 20% 20% 10% 10% 40% Total Capex $16.4M $16.4M $8.2M $8.2M $32.8M Remaining restricted cash from previously announced asset sales as of June 30, 2025. Construction Progress On Time and On Budget Steel cutting milestone for Hull MW628-1 has been achieved on May 15, 2025 (expected in September 2025 for Hull MW628-2) (1) Left: Block Fabrication Right: Factory Acceptance Test for Bow Thrusters

II. Market Outlook

Supportive Industry Fundamentals Global Offshore Project Capex by FID Year Commentary: 2024 and H1 2025 saw a decline in offshore project capex leading to a dip in OSV demand across most offshore basins Global offshore project capex expected to increase significantly over the next 18-24 months which provides a supportive environment for the OSV sector in the long-term Source: Clarksons Research Services, Rystad Energy. Commentary: Outlook for offshore oil and gas projects remains positive, with forecasted stable offshore exploration capex over the next several years Capex allocation towards deepwater regions, likely to drive demand for larger, high-spec OSVs and subsea Offshore Exploration Capex by Region

Balance Supply / Demand Current demand decline is <1% from the 2024 peak Adjusted utilization remains ~90% despite “weakness” Supply and demand balance remains tight: Demand remains high with adjusted utilization close to 90%, which is supportive of a 2026 rate rebound Utilization, when adjusted for stacked PSVs, is in practice 14-15% higher than total utilization Source: Clarksons Research Services, Clarksons Securities.

Continued Supply Side Constraints Stacked supply and stacking length PSV orderbook at ~5% of fleet Supply is Driving the Cycle: Supply side constraints continue to drive utilization for PSVs for market activity in general higher than anticipated year-to-date “Real” sideline capacity is less than 4% of the fleet and the orderbook indicates “zero” fleet growth going forward Source: Clarksons Research Services, Clarksons Securities.

Dayrates remain robust, but regional bifurcations more pronounced Dayrates remain resilient: large PSVs increase due to South America – small vessel fixtures on the lower side Average LTM fixtures across vessel classes at ~$26k per day – North Sea on the low side, with South America on top Source: Clarksons Research Services, Clarksons Securities.

III. Financial Highlights

Financial Highlights FY 2023 FY 2024 Fleet Average Utilization Fleet Average Day Rate Revenues Direct Vessel Profit (2) 75% 67% $16,375 $18,989 $279.5M $271.4M $119.9M $74.1M LTM Q2 2025 Fleet Count / Average Age (1) 55 / 9.4 years 51 / 10.3 years Adjusted EBITDA (3) $67.9M $27.7M 67% $19,072 $255.0M $64.0M 47 / 10.4 years $17.2M LTM Q2 2025 saw continued growth in average day rates driven by PSVs and FSVs; Utilization remained stable because of several vessels down for repair and the layup of three FSVs Fleet Count and Average Age excludes 3 managed vessels and includes 1 leased-in vessel in 2023. 2024 excludes 3 managed vessels. LTM Q2 2025 excludes 2 managed vessels. Direct Vessel Profit is a non-GAAP financial measure. See Slide 2 for a discussion of Direct Vessel Profit and the Appendix to this presentation for a reconciliation to GAAP. Adjusted EBITDA is a non-GAAP financial measure. See Slide 2 for a discussion of Adjusted EBITDA and the Appendix to this presentation for a reconciliation to GAAP.

Key Financial Metrics Total Revenue, DVP (1) & DVP Margin Total Debt, Cash & Cash Equivalents & Equity Ratio Commentary Direct Vessel Profit is a non-GAAP financial measure. See Slide 2 for a discussion of Direct Vessel Profit and the Appendix to this presentation for a reconciliation to GAAP. Net Debt is a non-GAAP financial measure. See Slide 2 for a discussion of Net Debt and the Appendix to this presentation for a reconciliation to GAAP. LTM Q2 2025 Total Revenue of $255.0M, down 6.0% vs. FY 2024, with higher average day rates at $19,072 and utilization at 67%. Increased utilization for PSVs and Liftboats offset by increased number of maintenance days and three FSVs in layup LTM Q2 2025 Gain on Asset Dispositions driven by sale of three AHTSs, two PSVs, one FSV and one Liftboat resulting in $42.2M gains, offset by $3.7M impairment charge on one hull under construction previously deferred indefinitely and now abandoned Net Debt (2) position of $294.1M, inclusive of a $8.2M draw under Tranche B for the funding of the second milestone payment Equity Ratio of 39% Day Rate and Utilization Progression FY 2023 FY 2024 LTM Q2 2025 Day Rate $16,375 $18,989 $19,072 Utilization 75% 67% 67% Gains on Asset Dispositions $21.4M $13.5M $38.4M Operating Income (Loss) $35.5M -$10.4M $4.9M Net Income (Loss) -$9.3M -$78.1M -$64.8M

DVP Breakdown by Asset Class & Region FY 2023 FY 2024 H1 2025 PSV Day Rate $18,031 $19,888 $20,919 Utilization 77% 62% 62% PSV - Direct Vessel Profit (1) $39.5M $21.6M $9.8M FSV Day Rate $11,273 $12,901 $13,633 Utilization 84% 76% 69% FSV - Direct Vessel Profit (1) $34.2M $24.0M $14.2M Liftboat Day Rate $37,523 $42,665 $35,118 Utilization 50% 58% 55% Liftboat - Direct Vessel Profit (1) $43.5M $26.2M $0.7M AHTS Day Rate $9,201 $9,156 - Utilization 70% 60% - AHTS - Direct Vessel Profit (1) $0.4M -$0.5M -$0.3M Miscellaneous - Direct Vessel Profit (1) $2.3M $2.8M $0.5M Average Fleet Day Rate $16,375 $18,989 $19,291 Average Fleet Utilization 75% 67% 64% Total - Direct Vessel Profit (1) $119.9M $74.1M $24.9M DVP (1) Breakdown by Asset Class Direct Vessel Profit is a non-GAAP financial measure. See Slide 2 for a discussion of Direct Vessel Profit and the Appendix to this presentation for a reconciliation to GAAP. DVP (1) Breakdown by Region FY 2023 FY 2024 H1 2025 United States (primarily Gulf of America) Day Rate $20,967 $23,076 $24,749 Utilization 45% 38% 36% Direct Vessel Profit (1) $17.1M -$10.7M -$5.7M Africa and Europe Day Rate $14,612 $17,453 $18,246 Utilization 87% 75% 74% Direct Vessel Profit (1) $38.7M $42.2M $15.6M Middle East and Asia Day Rate $15,003 $17,285 $16,735 Utilization 76% 78% 74% Direct Vessel Profit (1) $31.8M $20.6M $3.8M Latin America Day Rate $18,937 $23,462 $22,891 Utilization 88% 66% 67% Direct Vessel Profit (1) $32.3M $22.0M $11.2M Average Fleet Day Rate $16,375 $18,989 $19,291 Average Fleet Utilization 75% 67% 64% Total - Direct Vessel Profit (1) $119.9M $74.1M $24.9M

Fleet Maintenance and Capital Expenditures Historical Major Repairs and Drydocking Expenses Fleet Age Distribution (1) Capital Expenditures as of June 30, 2025 Fleet Age Distribution as of June 30, 2025. Fleet Age Distribution includes two PSVs under construction to be delivered in 2026/2027 and excludes one FSV and one AHTS managed for third-parties. Capital Commitments H2 2025 2026 2027 Newbuilding program – 2x PSVs $12M $31M $16M Hybrid battery power systems – 2x PSVs - - $2M DP-2 upgrade – 1x Liftboat - $3M - Miscellaneous Equipment $1M - - Total $13M $34M $18M

IV. Appendix

Financials – Income and Loss Statement Income and Loss Statement (in $ thousands) Source: Company filings. H1 2025 FY 2024 FY 2023 Operating Revenues 116,309 271,361 279,511 Costs and Expenses: Operating 91,421 197,252 159,650 Administrative and General 23,484 44,713 49,183 Lease Expense 662 1,678 2,748 Depreciation and Amortization 24,900 51,628 53,821 140,467 295,271 265,402 Gains (Losses) on Asset Dispositions and Impairments, Net 24,972 13,481 21,409 Operating Income (Loss) 814 (10,429) 35,518 Other Income (Expense): Interest Income 808 1,768 1,444 Interest Expense (18,430) (40,627) (37,504) Gains (Losses) on Debt Extinguishment (31,923) (2,004) Derivative Gains (Losses), Net 212 (908) 608 Foreign Currency Gains (Losses), Net (3,315) (1,049) (2,133) Other, Net 121 - (20,725) (72,618) (39,589) Income (Loss) from Continuing Operations Before Tax Expense (Benefit) and Equity in Earnings (Losses) of 50% or Less Owned Companies (19,911) (83,047) (4,071) Income Tax Expense (Benefit): Current 7,119 11,067 13,860 Deferred (3,707) (13,682) (5,061) 3,412 (2,615) 8,799 Income (Loss) Before Equity in Earnings (Losses) of 50% or Less Owned Companies (23,323) (80,432) (12,870) Equity in Earnings (Losses) of 50% or Less Owned Companies, Net of Tax 1,107 2,308 3,556 Net Income (Loss) (22,216) (78,124) (9,314) Net Income (Loss) Attributable to Noncontrolling Interests in Subsidiaries - - - Net Income (Loss) attributable to SEACOR Marine Holdings Inc. (22,216) (78,124) (9,314)

Assets H1 2025 FY 2024 FY 2023 Current Assets: Cash and Cash Equivalents, including Restricted Cash 51,555 76,140 84,131 Other Current Assets 81,488 97,511 80,555 Total Current Assets 133,043 173,651 164,686 Property and Equipment, net of Depreciation 510,143 532,966 594,682 Construction in Progress 31,772 11,904 10,362 Net Property and Equipment 541,915 544,870 605,044 Leases and Other Assets 5,072 8,590 10,606 Total Assets 680,030 727,111 780,336 Liabilities and Equity H1 2025 FY 2024 FY 2023 Current Liabilities: Current Portion of Lease Liabilities 554 623 1,626 Current Portion of Long-Term Debt 30,000 27,500 28,365 Other Current Liabilities 50,919 56,919 47,095 Total Current Liabilities 81,473 85,042 77,086 Long-Term Lease Liabilities 826 3,002 3,535 Long-Term Debt 310,980 317,339 287,544 Other Long-Term Liabilities 18,955 23,406 37,947 Total Liabilities 412,234 428,789 406,112 Total Equity 267,796 298,322 374,224 Total Liabilities and Equity 680,030 727,111 780,336 Financials – Balance Sheet and Debt Overview Balance Sheet (in $ thousands) Debt Overview (in $ thousands) Assumes $41.0M newbuilding tranche (Tranche B) to be fully drawn by the delivery date of the two newbuild PSVs. Source: Company filings. Debt Facility Final Maturity Principal Outstanding 2024 SMFH Credit Facility December 2029 345,700 Total Debt 345,700 Discount / Issuance Costs (1) (4,720) Total Debt net of Discount / Issuance Costs 340,980 (1)

Financials – Cash Flow Statement Cash Flow Statement (in $ thousands) H1 2025 FY 2024 FY 2023 Cash Flows from Continuing Operating Activities: Net Income (Loss) (22,216) (78,124) (9,314) Adjustments to Reconcile Net Income (Loss) to Net Cash Provided by (used in) Operating Activities: Depreciation and Amortization 24,900 51,628 53,821 Debt Discount and Deferred Financing Cost Amortization 544 8,923 8,340 Stock-based Compensation Expense 3,137 6,458 6,000 Allowance for Credit Losses (620) 202 3,519 (Gains) Losses from Equipment Sales, Retirements or Impairments, Investments in 50% or Less Owned Companies (24,972) (13,481) (21,409) (Gains) Losses on Debt Extinguishment - 28,252 177 Derivative (Gains) Losses (212) 908 (608) Interest on Finance Lease 2 3 202 Settlements on Derivative Transactions, Net (373) 164 577 Currency (Gains) Losses 3,315 1,049 2,133 Deferred Income Taxes (3,707) (13,682) (5,061) Equity (Earnings) Losses (1,107) (2,308) (3,556) Dividends Received from Equity Investees 3,199 2,916 2,241 Changes in Operating Assets and Liabilities: Accounts Receivables 5,617 (4,600) (17,215) Other Assets 220 (1,315) 2,288 Accounts Payable and Accrued Liabilities (1,270) 2,745 (13,188) Net Cash provided by (used in) Operating Activities (13,543) (10,262) 8,947 Cash Flows from Continuing Investing Activities: Purchases of Property and Equipment (31,008) (7,294) (10,604) Proceeds/Cash Impact from Disposition/Sale of Property and Equipment 40,064 24,858 44,730 Principal Payments on Notes due from Others - - 15,000 Net Cash provided by Investing Activities 9,056 17,564 49,126 Source: Company filings.

Financials – Cash Flow Statement (Continued) Cash Flow Statement (in $ thousands) H1 2025 FY 2024 FY 2023 Cash Flows from Continuing Financing Activities: Payments on Long-Term Debt (12,500) (24,312) (29,165) Payments on Debt Extinguishment - (328,712) (131,604) Payments on Debt Extinguishment Costs - (3,671) (1,827) Proceeds from issuance of Long-Term Debt, net of Issue Costs 7,701 345,192 148,475 Proceeds from issuance of Common Stock, net of Issue Costs - - 24 Payment for repurchase of Common Stock and Warrants (13,757) - - Proceeds from Exercise of Stock Options and Warrants - 140 6 Payments on Finance Lease (13) (41) (531) Acquisition of Common Shares for Tax Withholding Obligations (1,529) (3,889) (2,368) Net Cash used in Financing Activities (20,098) (15,293) (16,990) Effects of Exchange Rates - - 3 Net Increase (Decrease) in Cash, Cash Equivalents and Restricted Cash (24,585) (7,991) 41,086 Cash, Cash Equivalents and Restricted Cash, Beginning of Period 76,140 84,131 43,045 Cash, Cash Equivalents and Restricted Cash, End of Period 51,555 76,140 84,131 Source: Company filings.

Financial Reconciliations Adjusted EBITDA Reconciliation (in $ thousands) H1 2025 FY 2024 FY 2023 Net Income (Loss) attributable to SEACOR Marine Holdings Inc. (22,216) (78,124) (9,314) Depreciation and Amortization 24,900 51,628 53,821 Interest Expense 18,430 40,627 37,504 Interest Income (808) (1,768) (1,444) Taxes 3,412 (2,615) 8,799 Earnings before Interest, Taxes, Depreciation and Amortization (EBITDA) 23,718 9,748 89,366 (Gains) Losses on Asset Dispositions and Impairments, Net (24,972) (13,481) (21,409) (Gains) Losses on Debt Extinguishment - 31,923 2,004 Derivative (Gains) Losses, Net (212) 908 (608) Foreign Currency (Gains) Losses, Net 3,315 1,049 2,133 Other, Net - (121) - Equity in (Earnings) Losses of 50% or Less Owned Companies (1,107) (2,308) (3,556) Net Income (Loss) attributable to Noncontrolling Interests in Subsidiaries - - - Adjusted EBITDA 742 27,718 67,930 DVP Reconciliation (in $ thousands) H1 2025 FY 2024 FY 2023 Operating Income (Loss) 814 (10,429) 35,518 (Gains) Losses on Asset Dispositions and Impairments, Net (24,972) (13,481) (21,409) Depreciation and Amortization 24,900 51,628 53,821 Lease Expense 662 1,678 2,748 Administrative and General 23,484 44,713 49,183 Direct Vessel Profit (DVP) 24,888 74,109 119,861 Source: Company filings.

Financial Reconciliations (continued) Net Debt Reconciliation (in $ thousands) H1 2025 FY 2024 FY 2023 Current Portion of Long-Term Debt 30,000 27,500 28,365 Long-Term Debt 310,980 317,339 287,544 Discount and Issuance Costs 4,720 5,161 37,115 Total Debt 345,700 350,000 353,024 Cash and Cash Equivalents, including Restricted Cash 51,555 76,140 84,131 Net Debt 294,145 273,860 268,893 DVP to Adjusted EBITDA Reconciliation (in $ thousands) H1 2025 FY 2024 FY 2023 Operating Revenues 116,309 271,361 279,511 Operating Expenses 91,421 197,252 159,650 Direct Vessel Profit (DVP) 24,888 74,109 119,861 Administrative and General 23,484 44,713 49,183 Lease Expense 662 1,678 2,748 Adjusted EBITDA 742 27,718 67,930 Source: Company filings.