UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 27, 2025

KOHL’S CORPORATION

(Exact name of Registrant as Specified in Its Charter)

| Wisconsin | 001-11084 | 39-1630919 | ||

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| N56 W17000 Ridgewood Drive | ||

| Menomonee Falls, Wisconsin | 53051 | |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: 262 703-7000

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading |

Name of each exchange |

||

| Common Stock, $.01 par value | KSS | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 27, 2025, Kohl’s Corporation (the “Company”) issued a press release reporting its earnings for the quarter ended August 2, 2025 and updating earnings guidance for fiscal 2025. A copy of the press release is attached as Exhibit 99.1 and incorporated by reference herein. A copy of the presentation materials for the August 27, 2025 quarterly earnings conference call is attached as Exhibit 99.2 and incorporated by reference herein.

Item 7.01 Regulation FD Disclosure.

See Item 2.02.

The information in Items 2.02 and 7.01, including the exhibits attached hereto, is furnished solely pursuant to Items 2.02 and 7.01 of Form 8-K. Consequently, such information is not deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liabilities of that section. Further, the information in Items 2.02 and 7.01, including the exhibits, shall not be deemed to be incorporated by reference into the filings of the registrant under the Securities Act of 1933.

Item 8.01 Other Events.

As previously announced, on August 12, 2025, the Board of Directors of the Company declared a quarterly cash dividend of $0.125 per share. The dividend will be paid on September 24, 2025, to all shareholders of record at the close of business on September 10, 2025.

Cautionary Statement Regarding Forward-Looking Information and Non-GAAP Measures

This current report on Form 8-K contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The Company intends forward-looking terminology such as “believes,” “expects,” “may,” “will,” “should,” “could,” “intends,” “anticipates,” “estimates,” “plans,” or similar expressions to identify forward-looking statements. Forward-looking statements include, but are not limited to, the information under “2025 Financial and Capital Allocation Outlook,” “2025 Outlook,” comments about Kohl’s adequacy of capital resources, statements regarding our 2025 areas of focus and future initiatives, and statements regarding the impact of macroeconomic events and our response to such events, including tariffs. Such statements are based on current assumptions, expectations, and beliefs and are subject to certain risks and uncertainties, which could cause the Company’s actual results to differ materially from those anticipated by the forward-looking statements. These risks and uncertainties include, but are not limited to, risks described more fully in Item 1A in the Company’s Annual Report on Form 10-K and Item 1A of Part II of the Company’s Quarterly Report on Form 10-Q for the first quarter of fiscal 2025, which are expressly incorporated herein by reference, and other factors as may periodically be described in the Company’s filings with the SEC. Forward-looking statements relate to the date initially made, and the Company undertakes no obligation to update them.

The attached press release and presentation materials contain certain financial measures that are not prepared in accordance with generally accepted accounting principles (GAAP), including adjusted operating income, adjusted net income, adjusted diluted earnings per share, adjusted EBITDA, adjusted EBITDAR, our leverage ratio (expressed as net debt + leases / EBITDAR) and adjusted free cash flow. These non-GAAP financial measures are provided as additional insight into our operational performance and do not purport to be substitutes for, or superior to, operating income, net income, diluted earnings per share, total debt and lease liabilities as reported on the balance sheet, or operating cash flow as measures of operating performance or liquidity. We believe these adjusted measures are useful, as they are more representative of our core business, enhance comparability across reporting periods and to industry peers, and align with the measures used by management to evaluate the Company’s performance. We caution investors that non-GAAP measures should not be viewed in isolation and should be evaluated in addition to, and not as an alternative for, our results reported in accordance with GAAP. Because companies may use different calculation methods, these measures may not be comparable to other similarly titled measures reported by other companies. A reconciliation of each referenced non-GAAP measure to the most directly comparable GAAP measure is included in the press release and presentation materials attached hereto as Exhibit 99.1 and Exhibit 99.2 respectively.

Item 9.01 Financial Statements and Exhibits.

| Exhibit No. |

Description |

|

| 99.1 | Press Release dated August 27, 2025 | |

| 99.2 | Presentation Materials for August 27, 2025 Quarterly Earnings Conference Call | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| KOHL’S CORPORATION | ||||||

| Date: August 27, 2025 | By: | /s/ Jennifer Kent |

||||

| Jennifer Kent Senior Executive Vice President, Chief Legal Officer and Corporate Secretary |

||||||

Exhibit 99.1

Kohl’s Reports Second Quarter Fiscal 2025 Financial Results

MENOMONEE FALLS, Wis.—(BUSINESS WIRE)—August 27, 2025—Kohl’s Corporation (NYSE:KSS) today reported results for the second quarter ended August 2, 2025.

| • | Net sales decreased 5.1% and comparable sales decreased 4.2% |

| • | Gross margin increased 28 basis points |

| • | Diluted earnings per share (“EPS”) of $1.35 and adjusted diluted EPS of $0.56 (a) |

| • | Raises full year 2025 financial outlook |

Michael Bender, Kohl’s Interim Chief Executive Officer, said “Kohl’s second quarter performance is a testament to the progress we are making against our 2025 initiatives. This resulted in sales performance that came in ahead of our expectations. While it is clear that these initiatives are beginning to resonate with our customers, our team remains focused on delivering progressive improvement throughout the remainder of the year against a challenging economic backdrop.

In addition to our top line progress, we managed the business with great discipline in the quarter. We were able to expand our gross margins, reduce our inventory, and lower our expenses, leading to solid second quarter earnings. I continue to be impressed with our entire team at Kohl’s and am thankful for all their hard work.” Bender continued.

Second Quarter 2025 Results

Comparisons refer to the 13-week period ended August 2, 2025 versus the 13-week period ended August 3, 2024

| • | Net sales decreased 5.1% year-over-year, to $3.3 billion, with comparable sales down 4.2%. |

| • | Gross margin as a percentage of net sales was 39.9%, an increase of 28 basis points. |

| • | Selling, general & administrative (SG&A) expenses decreased 4.1% year-over-year, to $1.2 billion. As a percentage of total revenue, SG&A expenses were 33.8%, an increase of 32 basis points year-over-year. |

| • | Gain on legal settlement was $129 million from a credit card interchange fee lawsuit settlement. |

| • | Operating income was $279 million compared to $166 million in the prior year. As a percentage of total revenue, operating income was 7.9%, an increase of 343 basis points year-over-year. Adjusted operating income was $161 million compared to $166 million in the prior year. As a percentage of total revenue, adjusted operating income was 4.6%. (a) |

| • | Net income was $153 million, or $1.35 per diluted share, and adjusted net income of $64 million, or $0.56 per adjusted diluted share. This compares to net income of $66 million, or $0.59 per diluted share, in the prior year. (a) |

| • | Inventory was $3.0 billion, a decrease of 5% year-over-year. |

| • | Operating cash flow was $598 million compared to $254 million in the prior year. |

| • | Current portion of long-term debt was reduced by $353 million through repayment of the 4.25% notes due July 2025 at maturity. |

| • | Borrowings under revolving credit facility were $75 million, a decrease of $335 million year-over-year. |

| • | Long-term debt increased $347 million through issuance of $360 million of 10.000% senior secured notes due 2030. |

Six Months Fiscal Year 2025 Results

Comparisons refer to the 26-week period ended August 2, 2025 versus the 26-week period ended August 3, 2024

| • | Net sales decreased 4.6% year-over-year, to $6.4 billion, with comparable sales down 4.0%. |

| • | Gross margin as a percentage of net sales was 39.9%, an increase of 33 basis points. |

| • | Selling, general & administrative (SG&A) expenses decreased 4.7% year-over-year, to $2.4 billion. As a percentage of total revenue, SG&A expenses were 34.9%, an increase of 2 basis points year-over-year. |

| • | Gain on legal settlement was $129 million from a credit card interchange fee lawsuit settlement. |

| • | Operating income was $339 million compared to $209 million in the prior year. As a percentage of total revenue, operating income was 5.0%, an increase of 207 basis points year-over-year. Adjusted operating income was $221 million compared to $209 million in the prior year. As a percentage of total revenue, adjusted operating income was 3.3%. (a) |

| • | Net income was $139 million, or $1.23 per diluted share, and adjusted net income of $50 million, or $0.44 per adjusted diluted share. This compares to net income of $39 million, or $0.35 per diluted share, in the prior year. (a) |

| • | Operating cash flow was $506 million compared to $247 million in the prior year. |

| • | Current portion of long-term debt was reduced by $353 million through repayment of the 4.25% notes due July 2025 at maturity. |

| • | Borrowings under revolving credit facility were $75 million, a decrease of $335 million year-over-year. |

| • | Long-term debt increased $347 million due to issuance of $360 million of 10.000% senior secured notes due 2030. |

2025 Financial and Capital Allocation Outlook

For the full year 2025, the Company currently expects the following, excluding the impact of items not representative of our core operating performance:

| • | Net sales: A decrease of (5%) to a decrease of (6%) |

| • | Comparable sales: A decrease of (4%) to a decrease of (5%) |

| • | Adjusted operating margin: In the range of 2.5% to 2.7% (a) |

| • | Adjusted diluted EPS: In the range of $0.50 to $0.80 (a) |

| • | Capital Expenditures: Approximately $400 million |

| • | Dividend: On August 12, 2025, Kohl’s Board of Directors declared a quarterly cash dividend on the Company’s common stock of $0.125 per share. The dividend is payable September 24, 2025 to shareholders of record at the close of business on September 10, 2025. |

| (a) | Non-GAAP financial measures. Please see the “RECONCILIATION OF NON-GAAP FINANCIAL MEASURES” for a reconciliation of operating income to adjusted operating income, net income to adjusted net income, and diluted earnings per share to adjusted diluted earnings per share. |

Second Quarter 2025 Earnings Conference Call

Kohl’s will host its quarterly earnings conference call at 9:00 am ET on August 27, 2025. A webcast of the conference call and the related presentation materials will be available via the Company’s web site at investors.kohls.com, both live and after the call.

Cautionary Statement Regarding Forward-Looking Information and Non-GAAP Measures

This press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The Company intends forward-looking terminology such as “believes,” “expects,” “may,” “will,” “should,” “anticipates,” “plans,” or similar expressions to identify forward-looking statements. Forward-looking statements include the information under “2025 Financial and Capital Allocation Outlook.” Such statements are subject to certain risks and uncertainties, which could cause the Company’s actual results to differ materially from those anticipated by the forward-looking statements. These risks and uncertainties include, but are not limited to, risks described more fully in Item 1A in the Company’s Annual Report on Form 10-K and Item 1A of Part II of the Company’s Quarterly Report on Form 10-Q for the first quarter of fiscal 2025, which are expressly incorporated herein by reference, and other factors as may periodically be described in the Company’s filings with the SEC. Forward-looking statements relate to the date initially made, and the Company undertakes no obligation to update them.

This press release contains certain financial measures that are not prepared in accordance with generally accepted accounting principles (GAAP), including adjusted operating income, adjusted net income and adjusted diluted earnings per share. These non-GAAP financial measures are provided as additional insight into our operational performance and do not purport to be substitutes for, or superior to, operating income, net income, or diluted earnings per share as a measure of operating performance. We believe these adjusted measures are useful, as they are more representative of our core business, enhance comparability across reporting periods and to industry peers, and align with the measures used by management to evaluate the Company’s performance. We caution investors that non-GAAP measures should not be viewed in isolation and should be evaluated in addition to, and not as an alternative for, our results reported in accordance with GAAP. Because companies may use different calculation methods, these measures may not be comparable to other similarly titled measures reported by other companies. A reconciliation of each non-GAAP measure to the most directly comparable GAAP measure is included in this release.

About Kohl’s

Kohl’s (NYSE: KSS) is a leading omnichannel retailer built on a foundation that combines great brands, incredible value and convenience for our customers. Kohl’s is uniquely positioned to deliver against its long-term strategy and its purpose to take care of families’ realest moments. Kohl’s serves millions of families in its more than 1,100 stores in 49 states, online at Kohls.com, and through the Kohl’s App. With a large national footprint, Kohl’s is committed to making a positive impact in the communities it serves. For a list of store locations or to shop online, visit Kohls.com. For more information about Kohl’s impact in the community or how to join our winning team, visit Corporate.Kohls.com.

Contacts

Investor Relations:

Trevor Novotny, (262) 703-1617, trevor.novotny@kohls.com

Media:

Jen Johnson, (262) 703-5241, jen.johnson@kohls.com

KOHL’S CORPORATION

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| Three Months Ended | Six Months Ended | |||||||||||||||

| (Dollars in Millions, Except per Share Data) |

August 2, 2025 | August 3, 2024 | August 2, 2025 | August 3, 2024 | ||||||||||||

| Net sales |

$ | 3,347 | $ | 3,525 | $ | 6,396 | $ | 6,703 | ||||||||

| Other revenue |

199 | 207 | 383 | 411 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total revenue |

3,546 | 3,732 | 6,779 | 7,114 | ||||||||||||

| Cost of merchandise sold |

2,011 | 2,128 | 3,845 | 4,051 | ||||||||||||

| Gross margin rate |

39.9 | % | 39.6 | % | 39.9 | % | 39.6 | % | ||||||||

| Operating expenses: |

||||||||||||||||

| Selling, general, and administrative |

1,199 | 1,250 | 2,363 | 2,478 | ||||||||||||

| As a percent of total revenue |

33.8 | % | 33.5 | % | 34.9 | % | 34.8 | % | ||||||||

| Depreciation and amortization |

175 | 188 | 350 | 376 | ||||||||||||

| Impairments, store closing, and other costs |

11 | — | 11 | — | ||||||||||||

| (Gain) on legal settlement |

(129 | ) | — | (129 | ) | — | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating income |

279 | 166 | 339 | 209 | ||||||||||||

| Interest expense, net |

78 | 86 | 154 | 169 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income before income taxes |

201 | 80 | 185 | 40 | ||||||||||||

| Provision for income taxes |

48 | 14 | 46 | 1 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income |

$ | 153 | $ | 66 | $ | 139 | $ | 39 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Average number of shares: |

||||||||||||||||

| Basic |

112 | 111 | 112 | 111 | ||||||||||||

| Diluted |

114 | 112 | 113 | 112 | ||||||||||||

| Earnings per share: |

||||||||||||||||

| Basic |

$ | 1.37 | $ | 0.59 | $ | 1.24 | $ | 0.35 | ||||||||

| Diluted |

$ | 1.35 | $ | 0.59 | $ | 1.23 | $ | 0.35 | ||||||||

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

(Unaudited)

| (Dollars in Millions, Except per Share Data) |

Operating Income | Net Income | Diluted Earnings per Share |

|||||||||

| Three Months Ended August 2, 2025 |

||||||||||||

| GAAP |

$ | 279 | $ | 153 | $ | 1.35 | ||||||

| Impairments, store closing, and other costs |

11 | 11 | 0.10 | |||||||||

| (Gain) on legal settlement |

(129 | ) | (129 | ) | (1.14 | ) | ||||||

| Income tax impact of items noted above |

— | 29 | 0.25 | |||||||||

|

|

|

|

|

|

|

|||||||

| Adjusted (non-GAAP) |

$ | 161 | $ | 64 | $ | 0.56 | ||||||

|

|

|

|

|

|

|

|||||||

| Three Months Ended August 3, 2024 |

||||||||||||

| GAAP |

$ | 166 | $ | 66 | $ | 0.59 | ||||||

| Impairments, store closing, and other costs |

— | — | — | |||||||||

| (Gain) on legal settlement |

— | — | — | |||||||||

| Income tax impact of items noted above |

— | — | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Adjusted (non-GAAP) |

$ | 166 | $ | 66 | $ | 0.59 | ||||||

|

|

|

|

|

|

|

|||||||

| Six Months Ended August 2, 2025 |

||||||||||||

| GAAP |

$ | 339 | $ | 139 | $ | 1.23 | ||||||

| Impairments, store closing, and other costs |

11 | 11 | 0.10 | |||||||||

| (Gain) on legal settlement |

(129 | ) | (129 | ) | (1.14 | ) | ||||||

| Income tax impact of items noted above |

— | 29 | 0.25 | |||||||||

|

|

|

|

|

|

|

|||||||

| Adjusted (non-GAAP) |

$ | 221 | $ | 50 | $ | 0.44 | ||||||

|

|

|

|

|

|

|

|||||||

| Six Months Ended August 3, 2024 |

||||||||||||

| GAAP |

$ | 209 | $ | 39 | $ | 0.35 | ||||||

| Impairments, store closing, and other costs |

— | — | — | |||||||||

| (Gain) on legal settlement |

— | — | — | |||||||||

| Income tax impact of items noted above |

— | — | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Adjusted (non-GAAP) |

$ | 209 | $ | 39 | $ | 0.35 | ||||||

|

|

|

|

|

|

|

|||||||

KOHL’S CORPORATION

CONSOLIDATED BALANCE SHEETS

(Unaudited)

| (Dollars in Millions) |

August 2, 2025 | August 3, 2024 | ||||||

| Assets |

||||||||

| Current assets: |

||||||||

| Cash and cash equivalents |

$ | 174 | $ | 231 | ||||

| Merchandise inventories |

2,994 | 3,151 | ||||||

| Other |

306 | 331 | ||||||

|

|

|

|

|

|||||

| Total current assets |

3,474 | 3,713 | ||||||

| Property and equipment, net |

7,113 | 7,502 | ||||||

| Operating leases |

2,363 | 2,507 | ||||||

| Other assets |

441 | 458 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 13,391 | $ | 14,180 | ||||

|

|

|

|

|

|||||

| Liabilities and Shareholders’ Equity |

||||||||

| Current liabilities: |

||||||||

| Accounts payable |

$ | 1,134 | $ | 1,317 | ||||

| Accrued liabilities |

1,159 | 1,185 | ||||||

| Borrowings under revolving credit facility |

75 | 410 | ||||||

| Current portion of: |

||||||||

| Long-term debt |

— | 353 | ||||||

| Finance leases and financing obligations |

84 | 81 | ||||||

| Operating leases |

96 | 92 | ||||||

|

|

|

|

|

|||||

| Total current liabilities |

2,548 | 3,438 | ||||||

| Long-term debt |

1,520 | 1,173 | ||||||

| Finance leases and financing obligations |

2,409 | 2,574 | ||||||

| Operating leases |

2,672 | 2,795 | ||||||

| Deferred income taxes |

54 | 95 | ||||||

| Other long-term liabilities |

261 | 275 | ||||||

| Shareholders’ equity: |

3,927 | 3,830 | ||||||

|

|

|

|

|

|||||

| Total liabilities and shareholders’ equity |

$ | 13,391 | $ | 14,180 | ||||

|

|

|

|

|

|||||

KOHL’S CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| Six Months Ended | ||||||||

| (Dollars in Millions) |

August 2, 2025 | August 3, 2024 | ||||||

| Operating activities |

||||||||

| Net income |

$ | 139 | $ | 39 | ||||

| Adjustments to reconcile net income to net cash provided by operating activities: |

||||||||

| Depreciation and amortization |

350 | 376 | ||||||

| Share-based compensation |

17 | 16 | ||||||

| Deferred income taxes |

28 | (15 | ) | |||||

| Impairments, store closing, and other costs |

11 | — | ||||||

| Non-cash lease expense |

43 | 44 | ||||||

| Other non-cash items |

3 | 11 | ||||||

| Changes in operating assets and liabilities: |

||||||||

| Merchandise inventories |

(48 | ) | (269 | ) | ||||

| Other current and long-term assets |

31 | (59 | ) | |||||

| Accounts payable |

93 | 183 | ||||||

| Accrued and other long-term liabilities |

(105 | ) | (25 | ) | ||||

| Operating lease liabilities |

(56 | ) | (54 | ) | ||||

|

|

|

|

|

|||||

| Net cash provided by operating activities |

506 | 247 | ||||||

|

|

|

|

|

|||||

| Investing activities |

||||||||

| Acquisition of property and equipment |

(200 | ) | (239 | ) | ||||

| Proceeds from sale of real estate |

21 | — | ||||||

| Other |

— | 2 | ||||||

|

|

|

|

|

|||||

| Net cash used in investing activities |

(179 | ) | (237 | ) | ||||

|

|

|

|

|

|||||

| Financing activities |

||||||||

| Proceeds from issuance of debt, net of discount |

357 | — | ||||||

| Deferred financing costs |

(8 | ) | — | |||||

| Net (repayments) borrowings under revolving credit facility |

(215 | ) | 318 | |||||

| Shares withheld for taxes on vested restricted shares |

(4 | ) | (9 | ) | ||||

| Dividends paid |

(28 | ) | (111 | ) | ||||

| Repayment of long-term borrowings |

(353 | ) | (113 | ) | ||||

| Premium paid on redemption of debt |

— | (5 | ) | |||||

| Finance lease and financing obligation payments |

(46 | ) | (42 | ) | ||||

| Proceeds from financing obligations |

10 | — | ||||||

|

|

|

|

|

|||||

| Net cash (used in) provided by financing activities |

(287 | ) | 38 | |||||

|

|

|

|

|

|||||

| Net increase in cash and cash equivalents |

40 | 48 | ||||||

| Cash and cash equivalents at beginning of period |

134 | 183 | ||||||

|

|

|

|

|

|||||

| Cash and cash equivalents at end of period |

$ | 174 | $ | 231 | ||||

|

|

|

|

|

|||||

Exhibit 99.2 Q2 Results Presentation August 27, 2025 1

Cautionary Statement Regarding Forward-Looking Information This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The Company intends forward-looking terminology such as “believes,” “expects,” “may,” “will,” “should,” “anticipates,” “plans,” or similar expressions to identify forward-looking statements. Forward-looking statements include, but are not limited to, statements regarding our 2025 areas of focus and future initiatives, the information under 2025 Outlook, comments about Kohl's adequacy of capital resources, and statements regarding the impact of macroeconomic events and our response to such events, including tariffs. Such statements are subject to certain risks and uncertainties, which could cause the Company's actual results to differ materially from those anticipated by the forward-looking statements. These risks and uncertainties include, but are not limited to, risks described more fully in Item 1A in the Company’s Annual Report on Form 10-K and Item 1A of Part II of the Company’s Quarterly Report on Form 10-Q for the first quarter of fiscal 2025, which are expressly incorporated herein by reference and other factors as may periodically be described in the Company’s filings with the SEC. Any number of risks and uncertainties could cause actual results to differ materially from those Kohl’s expresses in its forward-looking statements. Forward-looking statements relate to the date initially made, and Kohl’s undertakes no obligation to update them. Non-GAAP Financial Measures This presentation contains certain financial measures that are not prepared in accordance with generally accepted accounting principles (GAAP), including Adjusted Operating Income, Adjusted Net Income, Adjusted Diluted Earnings Per Share, Adjusted EBITDA, Adjusted EBITDAR, our Leverage Ratio (expressed as Net Debt + Leases / EBITDAR), and Adjusted Free Cash Flow. These non-GAAP financial measures are provided as additional insight into our operational performance and do not purport to be substitutes for, or superior to net income, total debt and lease liabilities as reported on the balance sheet, or operating cash flow as measures of operating performance or liquidity. We believe these adjusted measures are useful, as they are more representative of our core business, enhance comparability across reporting periods and to industry peers, and align with the measures used by management to evaluate the Company’s performance. We caution investors that non-GAAP measures should not be viewed in isolation and should be evaluated in addition to, and not as an alternative for, our results reported in accordance with GAAP. Because companies may use different calculation methods, these measures may not be comparable to other similarly titled measures reported by other companies. A reconciliation of each non-GAAP measure to the most directly comparable GAAP measure is included in this presentation. 2

Table of Contents 2025 Areas of Focus 6 Q2 2025 Results 10 2025 Outlook 15 3

“Kohl’s second quarter performance is a testament to the progress we are making against our 2025 initiatives. This resulted in sales performance that came in ahead of our expectations. While it is clear that these initiatives are beginning to resonate with our customers, our team remains focused on delivering progressive improvement throughout the remainder of the year against a challenging economic backdrop. “In addition to our top line progress, we managed the business with great discipline in the quarter. We were able to expand our gross margins, reduce our inventory, and lower our expenses, leading to solid second quarter earnings. I continue to be impressed with our entire team at Kohl’s and am thankful for all their hard work.” INTERIM CHIEF EXECUTIVE OFFICER 4

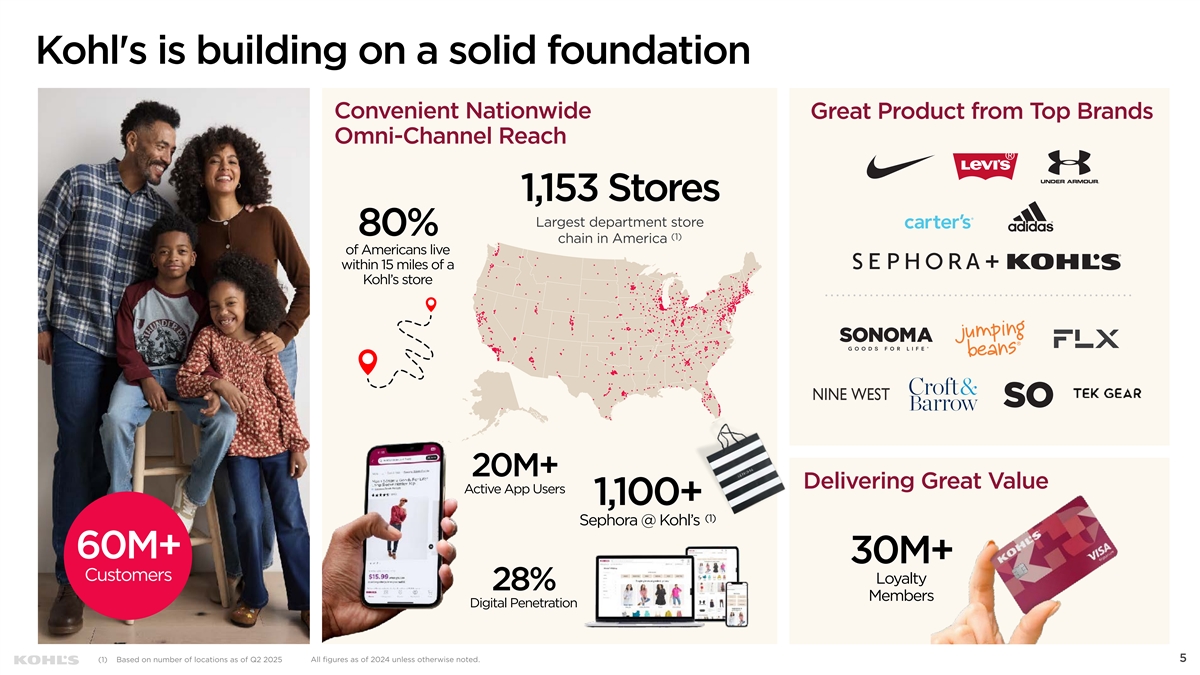

Kohl's is building on a solid foundation Convenient Nationwide Great Product from Top Brands Omni-Channel Reach 1,153 Stores Largest department store 80% (1) chain in America of Americans live within 15 miles of a Kohl’s store 20M+ Delivering Great Value Active App Users 1,100+ (1) Sephora @ Kohl’s 60M+ 30M+ Customers Loyalty 28% Members Digital Penetration (1) Based on number of locations as of Q2 2025 All figures as of 2024 unless otherwise noted. 5

2025 AREAS OF FOCUS 6

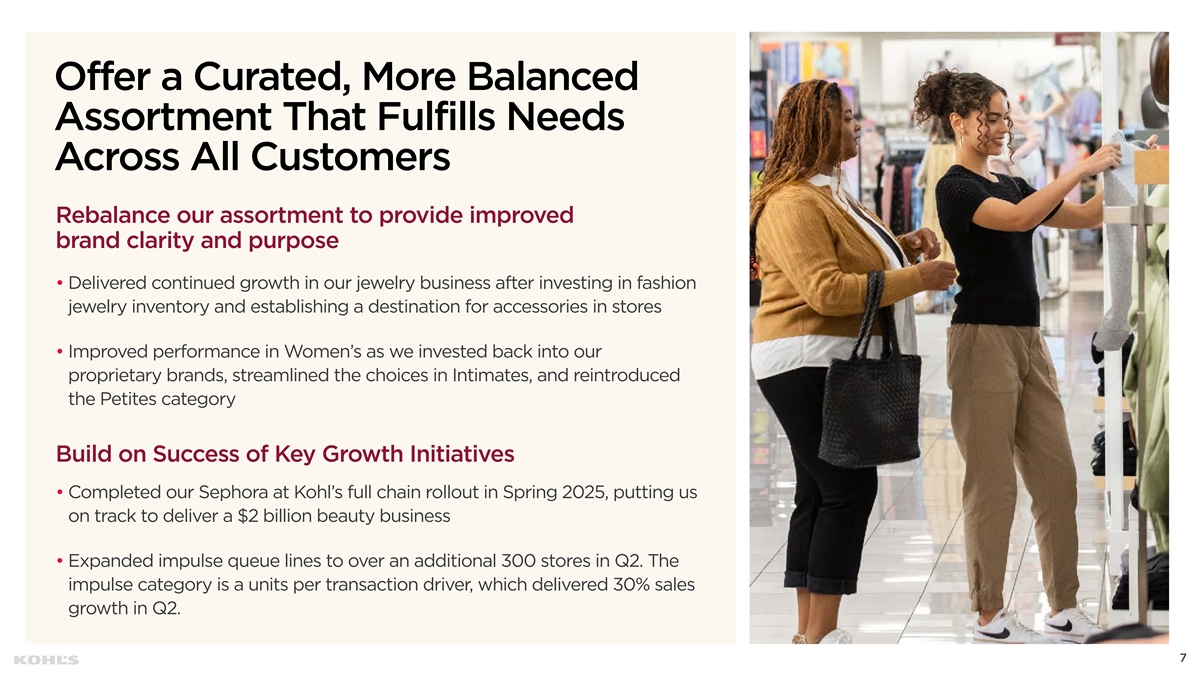

Offer a Curated, More Balanced Assortment That Fulfills Needs Across All Customers Rebalance our assortment to provide improved brand clarity and purpose • Delivered continued growth in our jewelry business after investing in fashion jewelry inventory and establishing a destination for accessories in stores • Improved performance in Women’s as we invested back into our proprietary brands, streamlined the choices in Intimates, and reintroduced the Petites category Build on Success of Key Growth Initiatives • Completed our Sephora at Kohl’s full chain rollout in Spring 2025, putting us on track to deliver a $2 billion beauty business • Expanded impulse queue lines to over an additional 300 stores in Q2. The impulse category is a units per transaction driver, which delivered 30% sales growth in Q2. 7

Reestablish Kohl’s as a Leader in Value and Quality Elevating our Proprietary Brands • Proprietary brands play an instrumental role in our value proposition, offering quality products at a great value • Proprietary Brands outperformed the company in Q2, showing 500 basis points of progressive improvement from Q1 • Build on strength of existing proprietary brands while finding opportunities to introduce new brands such as Miryana, Hotelier, and Mingle & Co. in Home Enhancing our Promotional Strategy • Expanded our coupon eligible offerings following improved performance from brands rolled out in our initial wave • Simplify value messaging and offer compelling value through our Kohl's Rewards and Kohl's Cash programs 8

Enhance our Omni-Channel Platform to Deliver a Frictionless Experience Optimizing Our Store Layout • Continue to enhance customer proposition by adjusting product flows and adjacencies • Capitalized on cross-shopping opportunities in Accessories & Juniors following store layout adjustments • Relocated our active apparel in our Men’s and Women’s floorpads Restoring Trip Assurance • Reestablish Kohl’s as a destination customers can rely on for basics and essentials by improving in-stock levels • Accelerated sales performance from Q1 in our intimates business by 300 basis points after streamlining choice counts and investing into inventory depth for key sizes Increasing Our Inspiration in Stores and Online • Elevate customer inspiration by adding brand support, in store marketing, and visual presentation 9

Q2 2025 RESULTS 10

Q2 2025 Summary Key Takeaways • Q2 Net Sales decreased (5.1%) versus Q2 2024 and Comparable Sales declined (4.2%) • Gross Margin increased 28 bps to last year driven by greater penetration of proprietary brands, category mix benefit and strong inventory management • SG&A expense declined (4.1%) to last year benefiting from tightly managed expenses primarily in stores and marketing. Additional benefit from credit expense shifting to Other Revenue • Adjusted Operating Income of $161 million and Adjusted Net Income of $64 million or $0.56 of Adjusted Earnings Per Diluted Share 11 Adjusted operating Income, Adjusted Net Income and adjusted diluted EPS are non-GAAP financial measures. Please refer to the reconciliation included in the Appendix for more information. 11

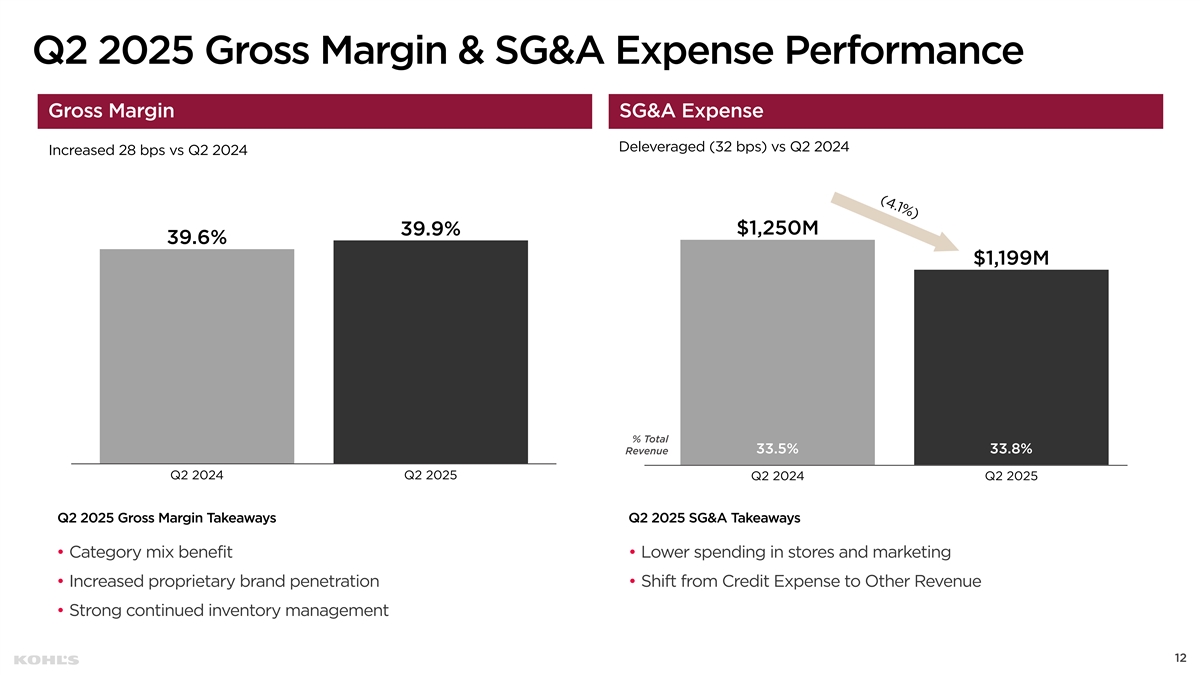

(4.1%) Q2 2025 Gross Margin & SG&A Expense Performance Gross Margin SG&A Expense Deleveraged (32 bps) vs Q2 2024 Increased 28 bps vs Q2 2024 $1,250M 39.9% 39.6% $1,199M % Total 33.5% 33.8% Revenue Q2 2024 Q2 2025 Q2 2024 Q2 2025 Q2 2025 Gross Margin Takeaways Q2 2025 SG&A Takeaways • Category mix benefit • Lower spending in stores and marketing • Increased proprietary brand penetration • Shift from Credit Expense to Other Revenue • Strong continued inventory management 12

Adjusted Leverage Kohl’s reset leases on the balance sheet following the investment to roll out Sephora to all of our Stores (1) Net Debt + Leases to EBITDAR Leverage Rolling 12 months as of Q2 2025 • Current Balance Sheet / Lease Accounting is inflating our (Dollars in Millions) Unadjusted Adjusted Leverage Ratio (1) Adjusted EBITDA $ 1,238 $ 1,238 Rent Expense 273 273 Adjusted EBITDAR 1,511 1,511 • The balance sheet lease liability of $5.3B currently reflects the lease Current portion of long-term Debt 0 0 periods probable to be exercised, Borrowings under revolving credit facility 75 75 which averages 19 years Long-term Debt 1,520 1,520 Debt 1,595 1,595 • The lease payments for periods Less: Cash & Cash Equivalents (174) (174) actually exercised, is $2.5B, which Net Debt 1,421 1,421 averages 5 years Net Debt / EBITDA Leverage 1.1x 1.1x Contractually obligated payments for Finance & Financing Obligation Leases Current and long-term Fin Leases & Fin Obs 2,493 1,279 • When adjusting for the actual lease Contractually obligated payments for Current and long-term Operating Leases 2,768 1,186 Operating Leases periods exercised Kohl's Leverage Net Debt + Leases $ 6,682 $ 3,886 Ratio is reduced to 2.6x, down from the Unadjusted Ratio of 4.4x Net Debt + Leases / EBITDAR Leverage 4.4x 2.6x 13 (1) Adjusted EBITDA, Adjusted EBITDAR, and our Leverage Ratio (expressed as Net Debt + Leases / EBITDAR) are non-GAAP financial measures of liquidity. Refer to the Appendix for a reconciliation of Adjusted EBITDA to the most directly comparable GAAP measure.

Three Months Ended Consolidated Statement of Operations (Dollars in Millions) August 2, 2025 August 3, 2024 Net Sales $ 3,347 $ 3,525 Total Revenue 3,546 3,732 Gross Margin Rate 39.9% 39.6% SG&A 1,199 1,250 Depreciation 175 188 1 Adjusted Operating Income (Non-GAAP) 161 166 Interest Expense, net 78 86 Provision for Income Taxes 19 14 1 Adjusted Net Income (Non-GAAP) 64 66 1 Adjusted Diluted EPS (Non-GAAP) $ 0.56 $ 0.59 Net Income 153 66 Diluted EPS $ 1.35 $ 0.59 Q2 2025 Key Balance Sheet Items (Dollars in Millions) August 2, 2025 August 3, 2024 Key Metrics $ 174 $ 231 Cash and Cash Equivalents Merchandise Inventories 2,994 3,151 Accounts Payable 1,134 1,317 Borrowings under revolving credit facility 75 410 Current portion of Long-term debt 0 353 Long-term Debt 1,520 1,173 August 2, 2025 August 3, 2024 Key Cash Flow items (Dollars in Millions) Six Months Ended Six Months Ended Operating Cash Flow $ 506 $ 247 Capital Expenditures (200) (239) Free Cash Flow 306 8 Finance lease and Financing Obligations (46) (42) Proceeds from Financing Obligations 10 0 1 Adjusted Free Cash Flow (Non-GAAP) $ 270 $ (34) 14 (1) Adjusted Operating Income, Adjusted Net Income, Adjusted Diluted EPS, and Adjusted Free Cash Flow are non-GAAP financial measures. Reconciliations for these measures can be found in the appendix. Reconciliation for Adjusted Free Cash Flow is above.

2025 OUTLOOK 15

Updated 2025 Financial Outlook METRIC FULL YEAR GUIDANCE Net Sales (5%) to (6%) vs. 2024 Comp Sales (4%) to (5%) Adjusted 2.5% to 2.7% 1 Operating Margin Adjusted $0.50 to $0.80 1 Diluted EPS Capital Allocation Outlook • Capex: Approximately $400 million • Dividend: $0.125 dividend payable on September 24, 2025 • Debt: Refinanced July 2025 maturities Updated 2025 Financial Outlook excludes the impact of items not representative of our core operating performance. 16 (1) Adjusted Operating Income and Adjusted Diluted EPS are non-GAAP financial measures.

Capital allocation priorities support our goals of optimizing balance sheet flexibility Invest in the Business Capex of approximately $400 million will include investments to complete the Sephora rollout, expand impulse queuing fixtures, and enhance omni- channel experience Optimizing Return of Cash The Board has reduced the annual cash dividend to $0.50 per share. Although we remain committed to returning capital to shareholders, this reduction allows for greater balance sheet flexibility Reduce Debt Our focus is on rebuilding our cash balance, reducing our reliance on the revolver and capitalizing on opportunities to further reduce our debt and overall leverage Share Repurchases Resume share repurchases over the long-term with excess cash flow following improvement in overall leverage 17

APPENDIX 18

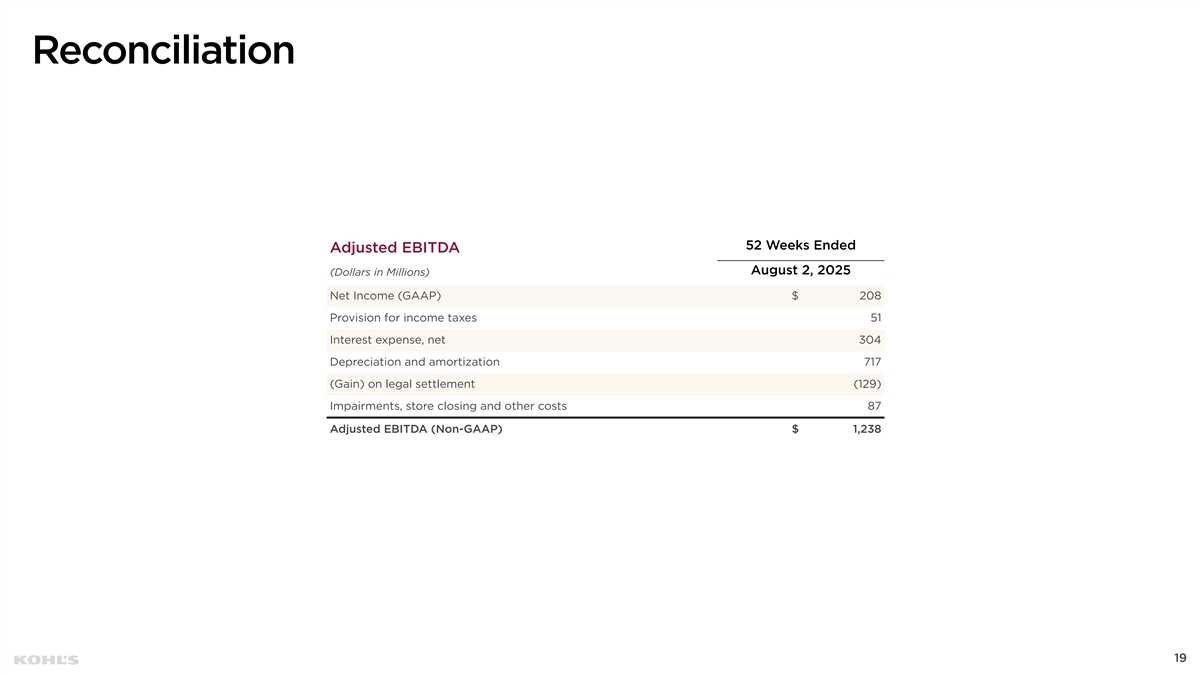

Reconciliation 52 Weeks Ended Adjusted EBITDA August 2, 2025 (Dollars in Millions) Net Income (GAAP) $ 208 Provision for income taxes 51 Interest expense, net 304 Depreciation and amortization 717 (Gain) on legal settlement (129) Impairments, store closing and other costs 87 Adjusted EBITDA (Non-GAAP) $ 1,238 19

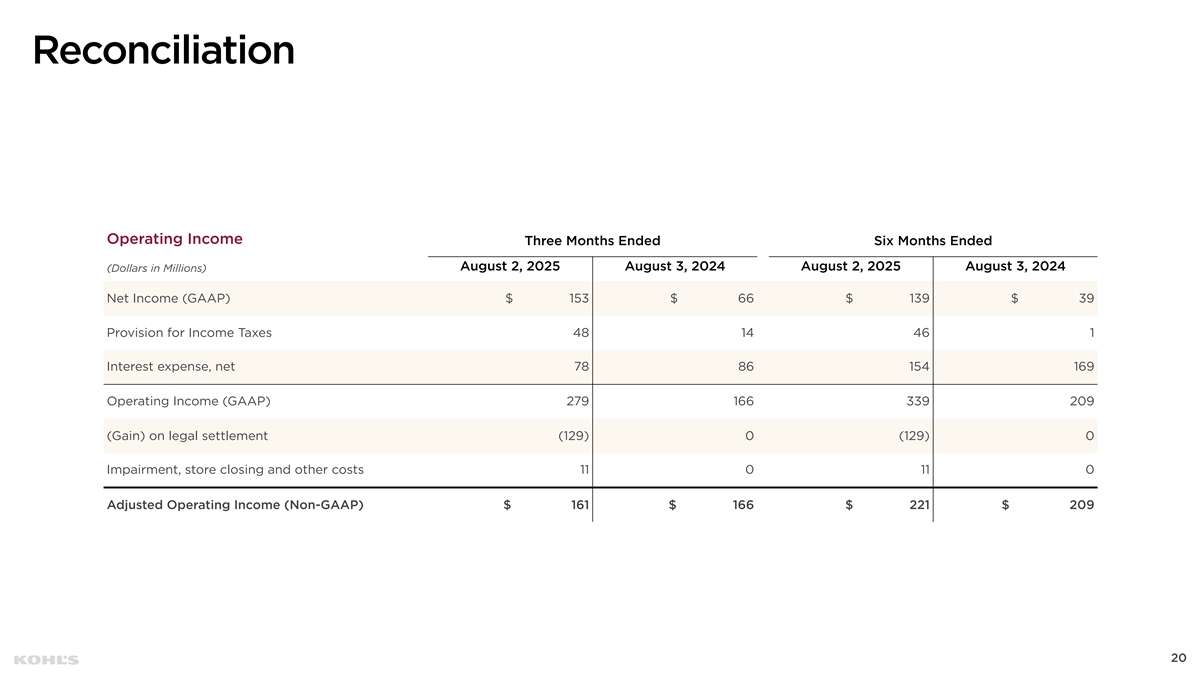

Reconciliation Operating Income Three Months Ended Six Months Ended August 2, 2025 August 3, 2024 August 2, 2025 August 3, 2024 (Dollars in Millions) Net Income (GAAP) $ 153 $ 66 $ 139 $ 39 Provision for Income Taxes 48 14 46 1 Interest expense, net 78 86 154 169 Operating Income (GAAP) 279 166 339 209 (Gain) on legal settlement (129) 0 (129) 0 Impairment, store closing and other costs 11 0 11 0 Adjusted Operating Income (Non-GAAP) $ 161 $ 166 $ 221 $ 209 20

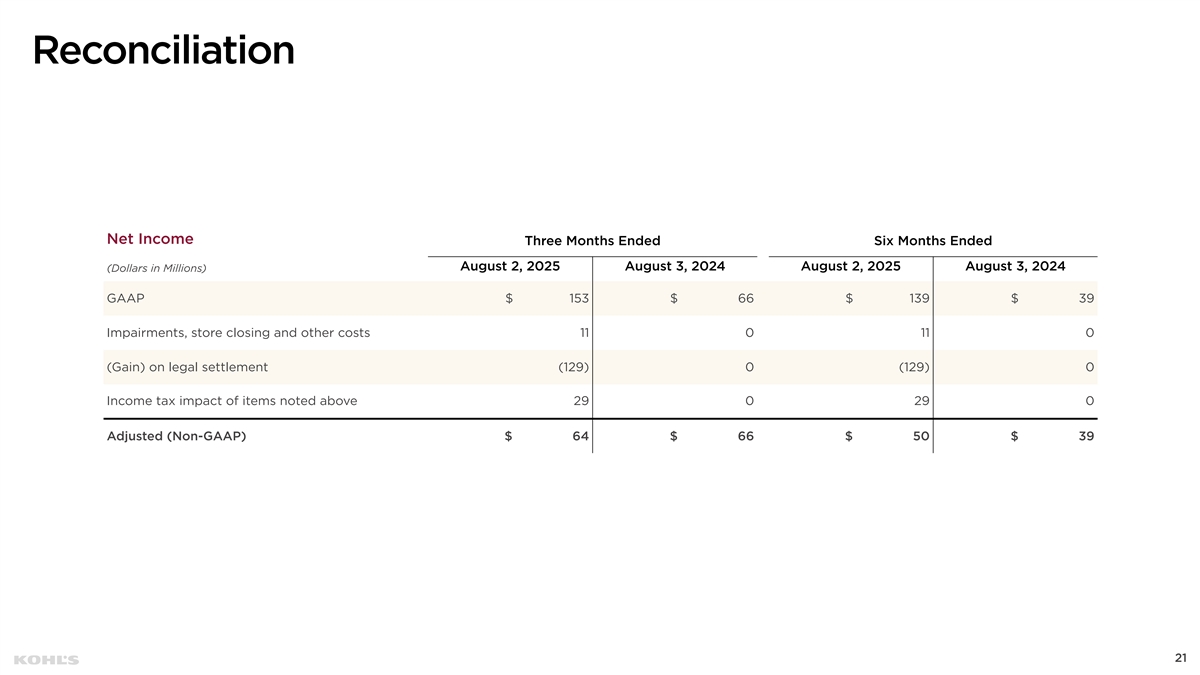

Reconciliation Net Income Three Months Ended Six Months Ended August 2, 2025 August 3, 2024 August 2, 2025 August 3, 2024 (Dollars in Millions) GAAP $ 153 $ 66 $ 139 $ 39 Impairments, store closing and other costs 11 0 11 0 (Gain) on legal settlement (129) 0 (129) 0 Income tax impact of items noted above 29 0 29 0 Adjusted (Non-GAAP) $ 64 $ 66 $ 50 $ 39 21

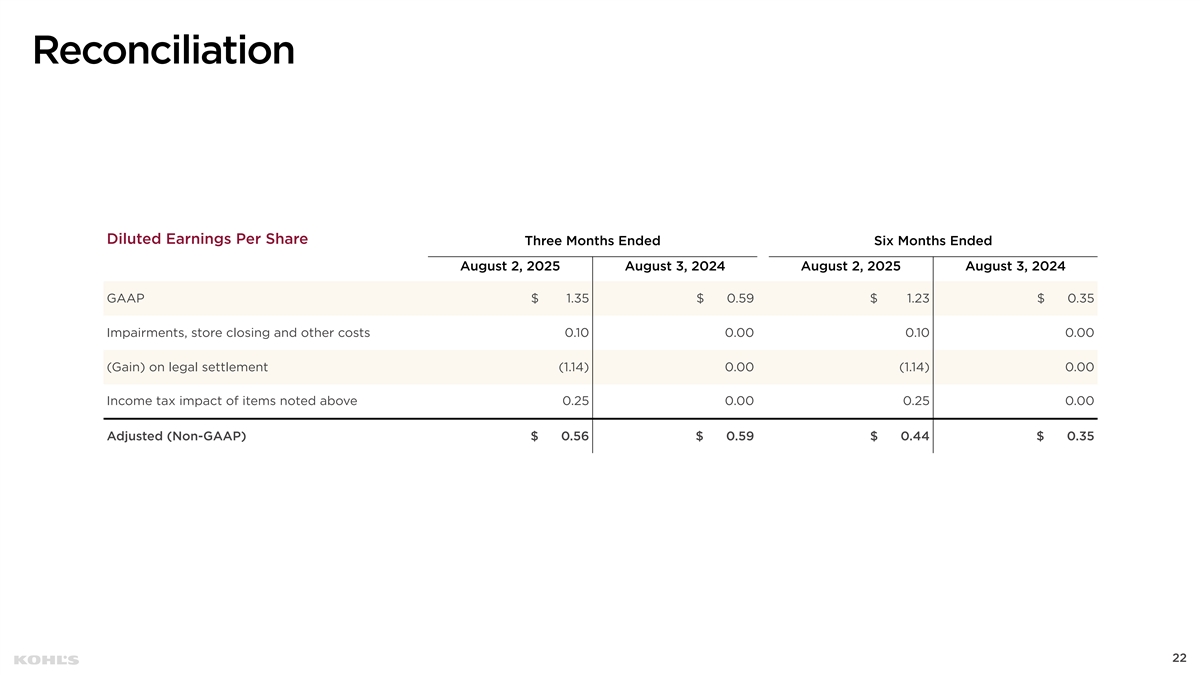

Reconciliation Diluted Earnings Per Share Three Months Ended Six Months Ended August 2, 2025 August 3, 2024 August 2, 2025 August 3, 2024 GAAP $ 1.35 $ 0.59 $ 1.23 $ 0.35 Impairments, store closing and other costs 0.10 0.00 0.10 0.00 (Gain) on legal settlement (1.14) 0.00 (1.14) 0.00 Income tax impact of items noted above 0.25 0.00 0.25 0.00 Adjusted (Non-GAAP) $ 0.56 $ 0.59 $ 0.44 $ 0.35 22