| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| ☐ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File No.: 001-09526 |

BHP GROUP LIMITED |

(ABN 49 004 028 077) |

(Exact name of Registrant as specified in its charter) |

N/A |

(Translation of Registrant’s name into English) |

VICTORIA, |

(Jurisdiction of incorporation or organization) |

| 171 COLLINS STREET MELBOURNE, VICTORIA 3000 (Address of principal executive offices) |

| STEFANIE WILKINSON BHP GROUP LIMITED 171 COLLINS STREET MELBOURNE VIC 3000 TELEPHONE AUSTRALIA 1300 55 47 57 TELEPHONE INTERNATIONAL +61 3 9609 3333 FACSIMILE +61 3 9609 3015 (Name, telephone, e-mail and/or facsimile number and address of company contact person) |

| Title of each class |

Trading symbol |

Name of each exchange on which registered | ||

| American Depositary Shares* |

BHP |

New York Stock Exchange | ||

| Ordinary Shares** |

BHP |

New York Stock Exchange | ||

| * | Evidenced by American Depositary Receipts. Each American Depositary Receipt represents two ordinary shares of BHP Group Limited. |

| ** | Not for trading, but only in connection with the listing of the American Depositary Shares. |

BHP Group Limited | ||

| Ordinary Shares |

5,075,992,235 |

| Large accelerated filer | ☒ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☐ | Emerging growth company | ☐ | |||

| U.S. GAAP ☐ |

International Financial Reporting Standards as issued by the International Accounting Standards Board ☒ | Other ☐ |

Company details

BHP Group Limited’s registered office and global headquarters are at 171 Collins Street, Melbourne, Victoria 3000, Australia.

‘BHP’, the ‘Company’, the ‘Group’, ‘BHP Group’, ‘our business’, ‘organisation’, ‘we’, ‘us’, ‘our’ and ‘ourselves’ refer to BHP Group Limited, and except where the context otherwise requires, our subsidiaries.

Refer to Financial Statements note 28 ‘Subsidiaries’ for a list of our significant subsidiaries and to Exhibit 8.1 – List of Subsidiaries for a list of our subsidiaries. Those terms do not include non-operated assets.

This Report covers functions and assets (including those under exploration, projects in development or execution phases, sites and operations that are closed or in the closure phase) that have been wholly owned and operated by BHP or that have been owned as a joint venture(1) operated by BHP (referred to in this Report as ‘operated assets’ or ‘operations’) from 1 July 2024 to 30 June 2025 unless otherwise stated. Certain sections of this Report present data for comparative periods, which in relation to the Daunia and Blackwater mines (divested during FY2024) is shown stated otherwise.

BHP also holds interests in assets that are owned as a joint venture but not operated by BHP (referred to in this Report as ‘non-operated joint ventures’ or ‘non-operated assets’). Notwithstanding that this Report may include production, financial and other information from non-operated assets, non-operated assets are not included in the BHP Group and, as a result, statements regarding our operations, assets and values apply only to our operated assets unless stated otherwise.

BHP Group Limited has a primary listing on the Australian Securities Exchange. BHP holds an international secondary listing on the London Stock Exchange, a secondary listing on the Johannesburg Stock Exchange and an ADR program listed on the New York Stock Exchange.

Introduction

This document is our annual report on Form 20-F for the year ended 30 June 2025 (this “Annual Report”). Reference is made to our Australian Annual Report for the year ended 30 June 2025, which has been furnished to the U.S. Securities and Exchange Commission (the “SEC”) on a Report on Form 6-K on 22 August 2025, which includes information that has been omitted from this Form 20-F. Only information that is included in, or expressly incorporated by reference into, this Form 20-F shall be deemed to form a part of this Annual Report

The SEC maintains an Internet website that contains reports and other information regarding issuers that file electronically with the SEC. Our filings with the SEC are available to the public through the SEC’s website at http://www.sec.gov.

Materiality, as used in the context of climate and sustainability-related disclosures may differ from the materiality standards applied by other reporting regimes, including as defined for SEC reporting purposes. Any issues identified as material for purposes of sustainability in this document are therefore not necessarily material for SEC reporting purposes.

All references to websites in this Annual Report are intended to be inactive textual references for information only and any information contained in or accessible through any such website does not form a part of this Annual Report.

Forward-looking statements

This Report contains forward-looking statements, which involve risks and uncertainties. Forward-looking statements include all statements, other than statements of historical or present facts, including: statements regarding trends in commodity prices and currency exchange rates; demand for commodities; global market conditions; reserves and resources estimates; development and production forecasts; guidance; expectations, plans, strategies and objectives of management; climate scenarios; approval of projects and consummation of transactions; closure, divestment, acquisition or integration of certain assets, ventures, operations or facilities (including associated costs or benefits); anticipated production or construction commencement dates; capital costs and scheduling; operating costs and availability of materials and skilled employees; anticipated productive lives of projects, mines and facilities; the availability, implementation and adoption of new technologies, including artificial intelligence; provisions and contingent liabilities; and tax, legal and other regulatory developments.

Forward-looking statements may be identified by the use of terminology, including, but not limited to, ‘aim’, ‘ambition’, ‘anticipate’, ‘aspiration’, ‘believe’, ‘commit’, ‘continue’, ‘could’, ‘desire’, ‘ensure’, ‘estimate’, ‘expect’, ‘forecast’, ‘goal’, ‘guidance’, ‘intend’, ‘likely’, ‘may’, ‘milestone’, ‘must’, ‘need’, ‘objective’, ‘outlook’, ‘pathways’, ‘plan’, ‘project’, ‘schedule’, ‘seek’, ‘should’, ‘strategy’, ‘target’, ‘trend’, ‘will’, ‘would’, or similar words. These statements discuss future expectations or performance, or provide other forward-looking information.

| 1 | References in this Annual Report to a ‘joint venture’ are used for convenience to collectively describe assets that are not wholly owned by BHP. Such references are not intended to characterise the legal relationship between the owners of the asset. |

i

Examples of forward-looking statements contained in this Report include, without limitation, statements describing (i) our strategy, Our Values and how we define our success; (ii) our expectations regarding future demand for certain commodities, in particular copper, nickel, iron ore, steelmaking coal, potash and steel and our intentions, commitments or expectations with respect to our supply of certain commodities, including copper, nickel, iron ore, potash, uranium and gold; (iii) our future exploration and partnership plans and perceived benefits and opportunities, including our focus to grow our copper and potash assets; (iv) our business outlook, including our outlook for long-term economic growth and other macroeconomic and industry trends; (v) our projected and expected production and performance levels and development projects; (vi) our expectations regarding our investments, including in potential growth options and technology and innovation, and perceived benefits and opportunities; (vii) our reserves and resources estimates; (viii) our plans for our major projects and related budget and capital allocations; (ix) our expectations, commitments and objectives with respect to sustainability, decarbonisation, natural resource management, climate change and portfolio resilience and timelines and plans to seek to achieve or implement such objectives, including our approach to equitable change and transitions, our Climate Transition Action Plan, climate change adaptation strategy and goals, targets, pathways and strategies to seek to reduce or support the reduction of greenhouse gas emissions, and related perceived costs, benefits and opportunities for BHP; (x) the assumptions, beliefs and conclusions in our climate change related statements and strategies, for example, in respect of future temperatures, energy consumption and greenhouse gas emissions, and climate-related impacts; (xi) our commitment to social value and our 2030 goals; (xii) our commitments to sustainability reporting, frameworks, standards and initiatives; (xiii) our commitments to improve or maintain safe tailings storage management; (xiv) our commitments to achieve certain inclusion and diversity targets, aspirations and outcomes; (xv) our commitments to achieve certain targets and outcomes with respect to Indigenous peoples and the communities where we operate; (xvi) our commitments to achieve certain water-related targets and outcomes; and (xvii) our commitments to achieve certain health and safety targets and outcomes.

Forward-looking statements are based on management’s expectations and reflect judgements, assumptions, estimates and other information available, as at the date of this Report. These statements do not represent guarantees or predictions of future financial or operational performance and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control and which may cause actual results to differ materially from those expressed in the statements contained in this Report. BHP cautions against reliance on any forward-looking statements.

For example, our future revenues from our assets, projects or mines described in this Report will be based, in part, on the market price of the commodities produced, which may vary significantly from current levels or those reflected in our reserves and resources estimates. These variations, if materially adverse, may affect the timing or the feasibility of the development of a particular project, the expansion of certain facilities or mines, or the continuation of existing assets.

Other factors that may affect our future operations and performance, including the actual construction or production commencement dates, revenues, costs or production output and anticipated lives of assets, mines or facilities include: (i) our ability to profitably produce and deliver the products extracted to applicable markets; (ii) the development and use of new technologies and related risks; (iii) the impact of economic and geopolitical factors, including foreign currency exchange rates on the market prices of the commodities we produce and competition in the markets in which we operate; (iv) activities of government authorities in or impacting the countries where we sell our products and in the countries where we are exploring or developing projects, facilities or mines, including increases in taxes and royalties or implementation or expansion of trade or export restrictions; (v) changes in environmental and other regulations; (vi) political or geopolitical uncertainty and conflicts; (vii) labour unrest; (viii) weather, climate variability or other manifestations of climate change; and (ix) other factors identified in the risk factors set out in OFR 11.

In addition, there are limitations with respect to scenario analysis, including any climate-related scenario analysis, and it is difficult to predict which, if any, of the scenarios might eventuate. Scenario analysis is not an indication of probable outcomes and relies on assumptions that may or may not prove to be correct or eventuate.

Except as required by applicable regulations or by law, BHP does not undertake to publicly update or review any forward-looking statements, whether as a result of new information or future events.

Past performance cannot be relied on as a guide to future performance.

Emissions and energy consumption data

Due to the inherent uncertainty and limitations in measuring GHG emissions and operational energy consumption under the calculation methodologies used in the preparation of such data, all GHG emissions and operational energy consumption data or references to GHG emissions and operational energy consumption volumes (including ratios or percentages) in this Report are estimates. There may also be differences in the manner that third parties calculate or report GHG emissions or operational energy consumption data compared to BHP, which means third-party data may not be comparable to our data.

ii

Form 20-F Cross Reference Table

| Item Number |

Description |

Report section reference |

||||

| 1. |

Identity of Directors, Senior Management and Advisors | Not applicable | ||||

| 2. |

Offer Statistics and Expected Timetable | Not applicable | ||||

| 3. |

Key Information | |||||

| A | [Reserved] | Not applicable | ||||

| B | Capitalization and indebtedness | Not applicable | ||||

| C | Reasons for the offer and use of proceeds | Not applicable | ||||

| D | Risk factors | Operating and Financial Review 11 | ||||

| 4. |

Information on the Company | |||||

| A | History and development of the company | Cover page, Company details, Chair’s review, Chief Executive Officer’s review, Operating and Financial Review 1 to 4, 6, 10, 12, Additional information 1, 4 to 9.4 | ||||

| B | Business overview | Operating and Financial Review 1 to 6, 12, Additional information 1, 4 to 8, 9.9 and Note 1 to the Financial Statements | ||||

| C | Organizational structure | Additional information 9.3 and Note 30 to the Financial Statements, Exhibit 8.1 | ||||

| D | Property, plants and equipment | Operating and Financial Review 5, 6, 9, 10, 12, Additional information 1, 4, 5 and Notes 11, 15 and 22 to the Financial Statements | ||||

| 4A. |

Unresolved Staff Comments | None | ||||

| 5. |

Operating and Financial Review and Prospects | |||||

| A | Operating results | Operating and Financial Review 5, 6, 12, Additional information 2 and 4 | ||||

| B | Liquidity and capital resources | Operating and Financial Review 5, Financial Statements 1.4, Notes 11, 21 to 24 and 39 to the Financial Statements | ||||

| C | Research and development, patents and licenses, etc. | Operating and Financial Review 4, 6, 11, Corporate Governance Statement 10, Directors’ Report 10, Additional information 5 and Notes 11 and 15 to the Financial Statements | ||||

| D | Trend information | Chair’s review, Chief Executive Officer’s review, Operating and Financial Review 1 to 6, 12, Additional information 2, to 7 | ||||

| E | Critical Accounting Estimates | IFRS is applied in the Financial Statements as issued by the IASB | ||||

| 6. |

Directors, Senior Management and Employees | |||||

| A | Directors and senior management | Corporate Governance Statement 4.1, 6.1, Directors’ Report 2 | ||||

| B | Compensation | Remuneration Report | ||||

| C | Board practices | Corporate Governance Statement 4.1, 4.7, 5.2, 5.4, Remuneration Report | ||||

| D | Employees | Operating and Financial Review 9.5, Additional information 7 | ||||

| E | Share ownership | Remuneration Report, Directors’ Report 3, 4 and Notes 17, 18 and 26 to the Financial Statements | ||||

| F | Erroneously Awarded Compensation | Not applicable | ||||

| 7. |

Major Shareholders and Related Party Transactions | |||||

| A | Major shareholders | Additional information 9.5 | ||||

| B | Related party transactions | Remuneration Report and Notes 25 and 33 to the Financial Statements | ||||

| C | Interests of experts and counsel | Not applicable | ||||

| 8. |

Financial Information | |||||

| A | Consolidated Statements and Other Financial Information | Operating and Financial Review 10, Additional information 8, 9.6, Financial Statements beginning on page F-1 in this Annual Report and Financial Statements 1A | ||||

| B | Significant Changes | Note 35 to the Financial Statements | ||||

| 9. |

The Offer and Listing | |||||

| A | Offer and listing details | Additional information 9.2 | ||||

| B | Plan of distribution | Not applicable | ||||

| C | Markets | Additional information 9.2 | ||||

| D | Selling shareholders | Not applicable | ||||

| E | Dilution | Not applicable | ||||

| F | Expenses of the issue | Not applicable | ||||

iii

| Item Number |

Description |

Report section reference |

||||

| 10. |

Additional Information | |||||

| A | Share capital | Not applicable | ||||

| B | Memorandum and articles of association | Additional information 9.4 | ||||

| C | Material contracts | Legal proceedings 8 (regarding the Settlement Agreement) | ||||

| D | Exchange controls | Additional information 9.9 | ||||

| E | Taxation | Additional information 9.10 | ||||

| F | Dividends and paying agents | Not applicable | ||||

| G | Statement by experts | Not applicable | ||||

| H | Documents on display | Additional information 9.4 | ||||

| I | Subsidiary information | Note 30 to the Financial Statements and Exhibit 8.1 | ||||

| J | Annual Report to Security Holders | Not applicable | ||||

| 11. |

Quantitative and Qualitative Disclosures About Market Risk | Note 24 to the Financial Statements | ||||

| 12. |

Description of Securities Other than Equity Securities | |||||

| A | Debt Securities | Not applicable | ||||

| B | Warrants and Rights | Not applicable | ||||

| C | Other Securities | Not applicable | ||||

| D | American Depositary Shares | Additional information 9.7 and Exhibit 2.1 | ||||

| 13. |

Defaults, Dividend Arrearages and Delinquencies | Not applicable | ||||

| 14. |

Material Modifications to the Rights of Security Holders and Use of Proceeds | Not applicable | ||||

| 15. |

Controls and Procedures | Corporate Governance Statement 9.2 and Financial Statements 1A | ||||

| 16A. |

Audit committee financial expert | Corporate Governance Statement 5.2 | ||||

| 16B. |

Code of Ethics | Corporate Governance Statement 8 | ||||

| 16C. |

Principal Accountant Fees and Services | Corporate Governance Statement 9.2 and Note 36 to the Financial Statements | ||||

| 16D. |

Exemptions from the Listing Standards for Audit Committees | Not applicable | ||||

| 16E. |

Purchases of Equity Securities by the Issuer and Affiliated Purchasers | Directors’ Report 4 | ||||

| 16F. |

Change in Registrant’s Certifying Accountant | Not applicable | ||||

| 16G. |

Corporate Governance | Corporate Governance Statement | ||||

| 16H. |

Mine Safety Disclosure | Not applicable | ||||

| 16I. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | Not applicable | ||||

| 16J. |

Insider Trading Policies | Corporate Governance Statement 10, Exhibit 11.1 | ||||

| 16K. |

Cybersecurity | Operating and Financial Review 7, 11, Additional information 9.8 | ||||

| 17. |

Financial Statements | Not applicable | ||||

| 18. |

Financial Statements | Financial Statements begin on page F1 in this Annual Report | ||||

| 19. |

Exhibits | Exhibits | ||||

iv

“In FY2025, we made good progress on strengthening our pipeline of attractive growth options in copper and potash, and delivered another strong year of operational and financial performance.”

Mike Henry

Chief Executive Officer

v

Contents

| 1 | ||||||||||

| 3 | ||||||||||

| 1. | 5 | |||||||||

| 2. | 8 | |||||||||

| 2.1 | 8 | |||||||||

| 2.2 | 10 | |||||||||

| 3. | 11 | |||||||||

| 4. | 14 | |||||||||

| 5. | 16 | |||||||||

| 5.1 | 16 | |||||||||

| 5.2 | 16 | |||||||||

| 5.3 | 18 | |||||||||

| 5.4 | 20 | |||||||||

| 6. | 22 | |||||||||

| 6.1 | 22 | |||||||||

| 6.2 | 26 | |||||||||

| 6.3 | 28 | |||||||||

| 6.4 | 30 | |||||||||

| 6.5 | 31 | |||||||||

| 6.6 | 31 | |||||||||

| 7. | 33 | |||||||||

| 8. | 36 | |||||||||

| 9. | 40 | |||||||||

| 9.1 | 40 | |||||||||

| 9.2 | 41 | |||||||||

| 9.3 | 42 | |||||||||

| 9.4 | 44 | |||||||||

| 9.5 | 47 | |||||||||

| 9.6 | 51 | |||||||||

| 9.7 | 55 | |||||||||

| 9.8 | 57 | |||||||||

| 9.9 | 70 | |||||||||

| 9.10 | 77 | |||||||||

| 9.11 | 78 | |||||||||

| 9.12 | 81 | |||||||||

| 9.13 | 84 | |||||||||

| 9.14 | Independent Assurance Report to the Management and Directors of BHP Group Limited (‘BHP’) |

85 | ||||||||

| 10. | 86 | |||||||||

| 11. | 89 | |||||||||

| 11.1 | 89 | |||||||||

| 11.2 | 95 | |||||||||

| 12. | 100 | |||||||||

| 12.1 | 100 | |||||||||

| 12.2 | 102 | |||||||||

| 12.3 | 103 | |||||||||

| 12.4 | 104 | |||||||||

| 12.5 | 105 | |||||||||

vi

| 13. | 106 | |||||||||

| 13.1 | Definition and calculation of non-IFRS financial information |

116 | ||||||||

| 13.2 | 118 | |||||||||

| 14. | 119 | |||||||||

| 14.1 | 119 | |||||||||

| 14.2 | 119 | |||||||||

| 119 | ||||||||||

| 1. | 120 | |||||||||

| 2. | 121 | |||||||||

| 3. | 122 | |||||||||

| 4. | 124 | |||||||||

| 4.1 | 124 | |||||||||

| 4.2 | 129 | |||||||||

| 4.3 | 129 | |||||||||

| 4.4 | 130 | |||||||||

| 4.5 | 130 | |||||||||

| 4.6 | 132 | |||||||||

| 4.7 | 133 | |||||||||

| 5. | 134 | |||||||||

| 5.1 | 134 | |||||||||

| 5.2 | 135 | |||||||||

| 5.3 | 135 | |||||||||

| 5.4 | 135 | |||||||||

| 6. | 136 | |||||||||

| 6.1 | 136 | |||||||||

| 6.2 | 137 | |||||||||

| 6.3 | 137 | |||||||||

| 7. | 138 | |||||||||

| 7.1 | 138 | |||||||||

| 7.2 | 140 | |||||||||

| 8. | 141 | |||||||||

| 9. | 142 | |||||||||

| 9.1 | 142 | |||||||||

| 9.2 | 143 | |||||||||

| 10. | 145 | |||||||||

| 146 | ||||||||||

| 1. | Review of operations, principal activities and state of affairs |

146 | ||||||||

| 2. | 146 | |||||||||

| 3. | 147 | |||||||||

| 4. | 148 | |||||||||

| 5. | 148 | |||||||||

| 6. | 149 | |||||||||

vii

viii

| 6.4.10 | Geology and mineralisation | 216 | ||||||||

| 6.4.11 | Mineral resources and mineral reserves | 217 | ||||||||

| 6.4.12 | Changes to mineral resources and mineral reserves | 217 | ||||||||

| 6.4.13 | Material assumptions and criteria | 217 | ||||||||

| 6.5 | 218 | |||||||||

| 6.6 | 219 | |||||||||

| 6.7 | 220 | |||||||||

| 6.8 | 221 | |||||||||

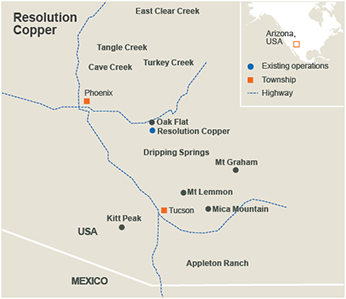

| 6.8.1 | Property description | 221 | ||||||||

| 6.8.2 | Infrastructure | 221 | ||||||||

| 6.8.3 | Mineral tenure | 222 | ||||||||

| 6.8.4 | Registrant interest | 222 | ||||||||

| 6.8.5 | Present condition of property | 222 | ||||||||

| 6.8.6 | Physical condition | 222 | ||||||||

| 6.8.7 | Book value | 222 | ||||||||

| 6.8.8 | History of previous operations | 223 | ||||||||

| 6.8.9 | Significant encumbrances | 223 | ||||||||

| 6.8.10 | Geology and mineralisation | 223 | ||||||||

| 6.8.11 | Mineral resources and mineral reserves | 223 | ||||||||

| 6.8.12 | Changes to mineral resources and mineral reserves | 223 | ||||||||

| 6.8.13 | Material assumptions and criteria | 223 | ||||||||

| 7. | 224 | |||||||||

| 8. | 226 | |||||||||

| 9. | 230 | |||||||||

| 9.1 | 230 | |||||||||

| 9.2 | 230 | |||||||||

| 9.3 | 230 | |||||||||

| 9.4 | 230 | |||||||||

| 9.5 | 233 | |||||||||

| 9.6 | 235 | |||||||||

| 9.7 | 236 | |||||||||

| 9.8 | 237 | |||||||||

| 9.9 | 238 | |||||||||

| 9.10 | 239 | |||||||||

| 10. | 243 | |||||||||

| 10.1 | 243 | |||||||||

| 10.2 | 248 | |||||||||

| 10.3 | 251 | |||||||||

| 263 | ||||||||||

ix

x

Chair’s review

Dear Shareholders,

I am pleased to provide BHP’s Annual Report for FY2025.

It is an honour and a privilege to be your new Chair. Your Board and I are excited about the future of this great company.

I want to acknowledge the contribution of my predecessor, Ken MacKenzie, who led the Board as Chair for seven years. I thank Ken for his outstanding service to the Board and BHP during his tenure. Ken leaves a lasting legacy at BHP.

In times of global uncertainty, stability and resilience matter. BHP has stood for both for 140 years.

What we do matters. The world needs more of the materials we produce to develop, decarbonise and digitalise.

BHP has a substantial role to play in producing the vital materials the world needs and in contributing to the success of the global economy.

We remain well positioned to meet global demand for the commodities we produce in order to create long-term value for our shareholders, local communities, customers, suppliers and partners.

Rewarding shareholders

BHP has a simple, clear strategy that is resilient amid any operating environment. Executing this strategy has allowed us to perform well through mining and economic cycles.

The company performed strongly in FY2025, generating significant cash flow. Healthy cash returns are important for shareholders, including the hundreds of thousands of retail shareholders who rely on BHP to support their income and retirement. Over the past five years, BHP has delivered more than US$50 billion in cash dividends to our shareholders.

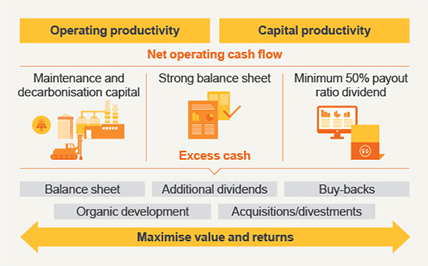

Our Capital Allocation Framework (CAF) promotes discipline in all our capital decisions and prioritises capital for safety and maintenance, balance sheet strength and a minimum dividend payout ratio of 50 per cent of underlying attributable profit at every reporting period.

For FY2025, your Board determined dividends totalling 110 US cents a share. This represents a total distribution to shareholders of US$5.6 billion.

Building for the future

Our performance allows us to plan for and invest in value adding growth projects. BHP has a strong growth pipeline of organic and greenfield projects in copper, iron ore and potash.

Our growth strategy generates greater exposure to commodities that the world needs to reduce greenhouse gas emissions and as the population grows, continues to urbanise and seeks higher living standards.

Continuing to evolve

As we have for the past 140 years, we continued to position BHP’s portfolio to align to the global trends shaping our future. We have reshaped BHP’s portfolio to increase our exposure to future-facing commodities and higher-quality steelmaking materials.

Our iron ore business is a critical part of our future and we have extended our lead as the lowest-cost major iron ore producer globally. We have achieved a world-leading position in copper, which is key to renewable energy, electric vehicles and data centres.

We are developing a position in potash that will contribute to food security and more sustainable land use. We have focused our steelmaking coal portfolio on higher-quality coals preferred by our customers to produce steel for cities and infrastructure for decarbonisation.

Today, we have a portfolio and options for growth, that leave us well positioned to provide the commodities the world will need more of in the decades to come.

1

Looking ahead

Your company is well placed to meet the challenges of our rapidly changing world. It is the combination of our outstanding people, world-class assets and execution excellence that creates long-term value for our shareholders and for the communities where we live. In FY2025, we showed that the consistent execution of our clear and simple strategy delivers results.

BHP is an outstanding business in great shape and I am confident we can continue to create value for you, our partners and many other stakeholders in the year ahead and for decades to come.

I look forward to meeting you at our Annual General Meeting.

Thank you for your continued support.

/s/ Ross McEwan

Ross McEwan

Chair

2

Chief Executive Officer’s review

Dear Shareholders,

In FY2025, we made good progress on strengthening our pipeline of attractive growth options in copper and potash, and delivered another strong year of operational and financial performance.

Most importantly, we did so safely. Nothing matters more than the safety of our people. We had no fatalities, and our total recordable injury and high potential injury frequency measures were both lower than the prior year.

This improvement has been driven by significant investments in engineering controls through our Fatality Elimination Program, continuous improvement of how leaders support their teams through Field Leadership and the operating discipline delivered through the BHP Operating System.

Executing well and delivering on our promises builds trust. Combined with the quality of our assets and the attractiveness of our chosen commodities, this gives us resilience and the foundation for long-term value growth.

Mining now in the global spotlight

We’re seeing an increasing focus on critical minerals supply and supply chain security across the globe. This is happening against a backdrop of growing geopolitical and trade tensions, and reflects a growing understanding and acceptance of the critical role mining will play in supporting national security, energy transitions and technology development.

There is also a clearer recognition of the significant economic opportunity that accompanies investment in resources projects. Many resources producing nations are taking aggressive steps to improve competitiveness and to attract global capital to invest in new resource project opportunities.

We continue to advocate for policies that drive productivity, encourage investment and spur economic growth. We engage with political leaders, policymakers and industry counterparts regularly, making the case for the settings to unlock resources for the shared benefit of nations, our sector and your company.

Creating social value

Our approach to social value and sustainability differentiates BHP and is essential to the creation of long-term shareholder value.

We’re seeing practical challenges affect the pace of the global energy transition, including the development of the necessary technology at competitive cost. BHP’s climate commitments remain unchanged and we remain on track to meet our FY2030 operational decarbonisation target.

We continue to partner with First Nations and Indigenous peoples around the world. Over 90 per cent of BHP’s operations are located on or near the traditional lands of Indigenous peoples – and we seek to build long-term relationships based on trust and mutual benefit. The significant uplift in our spend with Indigenous businesses during the year is a clear demonstration of this. We’re focused on building multi-year partnerships that enable Indigenous businesses to secure investment, grow with confidence and build their capability to provide goods and services to large companies like BHP.

A culture and system for high performance

Everything we achieve starts with our 90,000 strong workforce.

This year we reached our global employee gender balance ambition of 40 per cent female representation early, and improved year-on-year performance against our Indigenous employee participation targets in Australia, Canada and Chile. Our efforts to build a better BHP, with a more inclusive, collaborative and respectful culture, have underpinned this achievement, and contributed to a safer, more productive and more reliable BHP.

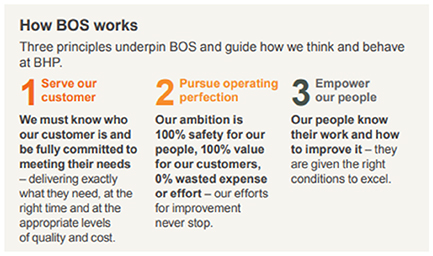

We have built a track record of operational excellence over recent years, underpinned by the BHP Operating System.

In FY2025, we achieved copper production of over 2 million tonnes for the first time – and have lifted copper production by 28 per cent since FY2022. In steelmaking coal, improved operational productivity helped us increase production at BMA, excluding Blackwater and Daunia which were divested in April 2024. At Western Australia Iron Ore, we achieved record production while maintaining our position as the world’s lowest cost major iron ore producer, now for the sixth year in a row.

3

Project delivery

We are embedding the BHP Operating System in the way we plan and execute our capital projects as well. We recognise that reliable, capital efficient development of assets and infrastructure is critical to enabling our growth and to maximising shareholder returns.

On Jansen Stage 1, a combination of inflation and cost escalation, design development and scope changes, and lower productivity on certain aspects of the project have resulted in a revision of our costs for construction. This is disappointing. It is not representative of the performance we have seen on BHP projects more broadly, nor what we aspire to.

We’re taking steps to improve performance on Jansen Stage 1 and we’ll be applying what we learn to strengthen project delivery across the board at BHP.

Winning strategy, clear path for growth

Our simple, clear strategy drives strong results and long-term value growth.

We’ve reshaped our portfolio in anticipation of the megatrends playing out around us, including our position in copper. A much greater proportion of our EBITDA – 45 per cent in FY2025 – now comes from copper. And we’re pursuing more copper growth from our existing assets and through strategic partnerships, including our newly formed Vicuña joint venture which holds copper deposits on the Argentina-Chile border.

Through the disciplined application of our Capital Allocation Framework, we seek to sustain our assets, maintain a strong balance sheet and balance attractive shareholder returns and investment in our growth.

The quality of our assets and our pipeline of compelling growth prospects gives us added optionality. This allows us to deliberately and strategically choose how we grow value for shareholders.

To support our growth, we’re putting our strong balance sheet to work. We’ve optimised our net debt target range to US$10 billion to US$20 billion. This reflects the significant improvement in our operational performance and portfolio since it was last set.

A clear future

We have world-leading assets and we operate them well – underpinned by the sustained focus and capability building that comes through the BHP Operating System.

This allows us to deliver industry-leading margins, high returns and funds for our growth – a unique combination that underpins our strength, consistency and resilience through the cycle.

I am confident that BHP is positioned to deliver attractive value and growth for you in the years ahead. Thank you for your continued support.

/s/ Mike Henry

Mike Henry

Chief Executive Officer

4

1. Why BHP

13 August 2025 marked 140 years since seven ordinary people gathered on a small plot of ground at Broken Hill in outback New South Wales, Australia. They had no idea the silver, lead and zinc mine they had established would become one of the world’s biggest companies and a global leader in the resources industry, BHP.

Since then, BHP has produced many of the vital resources the world needs to grow and develop. Materials integral to what we use and do every day.

Over the last 140 years our business has remained steadfastly resilient through mining cycles regardless of what has been happening in the world around us. We have done this by continually evolving our portfolio, by our ongoing drive to be the world’s best mining operator and by applying financial discipline to the decisions we make.

We have built our business by investing, expanding and reshaping it to meet the changing demands of the world. Providing rewarding jobs and careers for hundreds of thousands of people. Making valuable contributions to the countries, regions and communities where we operate. Rewarding our shareholders with dividends and strong returns.

Today, BHP is the world’s largest mining company by market capitalisation.1 We have world-leading operations across the globe producing materials vital for a better world. And we are positioned and ready to meet the challenges of the decades to come.

How we operate is important

The keys to our successful past and exciting future are the same – our people, capabilities, scale, portfolio and, in more recent times, the unique overarching way we work through the BHP Operating System (BOS). BOS differentiates our approach, makes improvement central to everyone’s role and provides for sustainable operating excellence year after year.

We seek to use our capital carefully and effectively. We operate our assets efficiently. We have an overriding focus on safety. We embrace technology and innovation.

We have a clear strategy and proven record of execution against it. We grow value through our large, long-life, quality assets in materials that improve standards of living and support decarbonisation and digitalisation, and through our differentiated focus on social value, which is integral to how we operate. We seek to extract materials as efficiently and effectively as we can while seeking to appropriately manage impacts on the planet. We choose to partner with peers, suppliers and customers where we believe we can innovate or create value together.

Our products are vital for a better world

Copper, iron ore, steelmaking coal and potash support the pursuit of a very basic human instinct – to improve our lives and those of the generations that come after us. Copper for renewable power, to rewire our energy system and to enable digitalisation. Steelmaking materials to build better, safer and more liveable cities and renewables infrastructure. Potash for food security and more sustainable land use.

These are building blocks for a better world. Billions of people seeking higher standards of living is an enduring source of demand for commodities that BHP is proud to play a part in supplying.

We have multiple growth options

As new large, low-cost ore bodies become harder to find and develop, the scale and quality of our portfolio positions us well. We hold some of the world’s largest resources and lowest-cost assets.

One of our biggest growth levers is productivity and unlocking more value from the assets we operate. We seek to improve productivity through the capabilities of our people and our culture of continuous improvement, and the use of technology and innovation to extract more from what we do every day.

The scale of our assets provides growth options. In copper, we are advancing multiple options in Chile and we are studying growth options at our copper province in South Australia. We are seeking to produce more iron ore in Western Australia. We are working to improve productivity at our steelmaking coal operations in Queensland. We have sanctioned the second stage of our Jansen potash project in Canada, which we believe will double Jansen’s expected production capacity once complete.

We are always on the lookout for the right opportunities. In the last financial year, we formed the Vicuña joint venture with Canada’s Lundin Mining, which holds the Josemaria and Filo del Sol copper deposits on the Argentina-Chile border. The Vicuña joint venture will create a long-term partnership between BHP and Lundin Mining to jointly develop an emerging copper district with world-class potential. The Filo del Sol deposit is one of the largest copper deposit discoveries in the last 30 years.

5

We are a partner with Rio Tinto in the Resolution Copper Project in the United States, which is also one of the largest undeveloped copper projects in the world and has the potential to be a significant copper producer in North America.

Our focus on social value generates business value

Social value is what we call our positive contribution to society. It helps underpin stable operations, reduces risk and opens doors to opportunities, partnerships, talent and capital. It delivers business value.

We are proud to have achieved our long-term aspirational goal of gender balance within our employee workforce during FY2025. We define gender balance as a minimum 40 per cent women and 40 per cent men, consistent with the definitions used by entities such as the International Labour Organization. Female employee representation reached 41.3 per cent at financial year end, from 17.6 per cent when we began this journey nine years ago.

We are the first global, listed mining company to achieve this milestone, which has not only made BHP a better, more inclusive business for our workforce, it has helped make us a better place to work. A more inclusive culture has underpinned both female representation and better safety and operational performance.

We see enormous opportunity before us

The opportunity for BHP and what we can contribute for the world is profound. The development, decarbonisation and digitalisation of the globe involve pathways that require a significant increase in production of the key materials we produce.

We seek to meet this demand and grow value for our partners and stakeholders, driving attractive returns and long-term value for our shareholders.

BHP has been bringing people and resources together to build a better world for the last 140 years. Our resilient business is well positioned to fulfil our aspiration to deliver value for our shareholders and those around us for many more to come.

Footnote

| 1. | Market capitalisation as at 30 June 2025, sourced from Bloomberg. |

6

7

2. Our business

2.1 Our portfolio

A resource mix for today – and for the future

We have copper, which is used in electrification and renewable power and is important for digitalisation. We have iron ore, which is essential for making steel needed for construction, including renewables infrastructure. Our higher-quality steelmaking coal is used in the blast furnace process for making steel. We are developing a world-class potash asset. Potash is used in fertilisers to assist with food security for a growing population and more sustainable land use. We are also a major producer of uranium and gold, which are by-products of our copper production.

Copper

Record group copper production

2.02 Mt

^8% on FY2024

We are one of the world’s largest copper producers. We continue to pursue our strategy to increase our exposure to copper by effective capital allocation to grow our existing assets and through exploration, acquisition and early-stage options. We are using technical innovation, such as new flotation technology, to help control energy costs and unlock value.

Our copper production rose 8 per cent in FY2025 to a record of over 2 million tonnes (Mt). We have grown annual copper production by 28 per cent since FY2022.

Escondida in Chile is the world’s largest copper mine and achieved its highest production in 17 years. Spence in Chile achieved record production, while in Australia, Copper SA finished the year strongly with copper production records in June and for the second half of the year.

In FY2025, we increased our early-stage options in copper by forming the Vicuña joint venture with Canada’s Lundin Mining to hold the Josemaria and Filo del Sol copper prospects on the Argentina-Chile border. This joint venture provides an exciting opportunity to jointly develop an emerging copper district with world-class potential.

Group copper production for FY2026 is expected to remain strong at between 1.8 Mt and 2 Mt on a consolidated basis. As we look ahead to the 2030s, we have a number of projects in execution and under study that we estimate could deliver 2 million tonnes per annum (Mtpa) of attributable copper production during the decade.1

>For more information refer to OFR 6.1

Iron ore

Third-consecutive full-year production record

263 Mt

^1% on FY2024

Western Australia Iron Ore (WAIO) is the lowest-cost major iron ore producer globally2 and has one of the lowest greenhouse gas (GHG) emission production intensities of benchmarked iron ore operations.3

WAIO set multiple records in FY2025, including for full-year production of 257 Mt (290 Mt on a 100 per cent basis). South Flank exceeded its name plate capacity production of 80 Mt (100 per cent basis) in its first full year of operation after being delivered on time and on budget in FY2024. The efficiency of our infrastructure hubs continued to strengthen performance, with rail, port and technology investments delivering tangible production outcomes.

Production for FY2026 is expected to be between 284 and 296 Mt (100 per cent basis) incorporating the planned renewal of Car Dumper 3 in the first half of FY2026 and the ongoing tie-in activities for the Rail Technology Programme. Production increased by 34 per cent at Samarco in Brazil to 6.4 Mt (12.8 Mt 100 per cent basis) in FY2025 following the ramp up of a second concentrator ahead of schedule.

>For more information refer to OFR 6.2

Steelmaking coal

Focusing on higher-quality product

18 Mt

i 19% on FY2024

8

We continue to focus our steelmaking coal operations in Queensland on higher-quality product and have one of the lowest GHG emission production intensities of benchmarked export steelmaking coal mines.3

Excluding the contribution of the Blackwater and Daunia mines, which were divested in FY2024, production increased 5 per cent to 18 Mt in FY2025 (36 Mt 100 per cent basis). Raw coal inventory levels increased 12 per cent. The strong performance was underpinned by improved truck productivity and led to increased production across all open-cut mines.

Our focus on rebuilding raw coal inventory enabled us to stabilise operating performance across the asset and increase production despite geotechnical challenges at Broadmeadow and a 36 per cent year-on-year increase in rainfall.

Production for FY2026 is expected to increase to between 18 and 20 Mt (36 and 40 Mt on a 100 per cent basis), weighted to the second half, while unit costs are expected to decrease with guidance between US$116/t and US$128/t as we push to further improve productivity.

Our focus on improving value chain stability will continue into CY2027 as we continue to rebuild raw coal inventory to sustainable levels and normalising strip ratios.

>For more information refer to OFR 6.3

Potash

Major global producer by the end of the decade

US$7.0bn - US$7.4bn

Estimated capital expenditure for Jansen Stage 1

We are developing one of the world’s largest potash mines in Canada. Jansen will increase our product diversification, customer base and operating footprint, and expand our business into a future growth market.

Jansen Stage 1 (JS1) was 68 per cent complete by the end of FY2025.

In July 2025, we announced updates relating to the Jansen potash project.

We estimate capital expenditure for JS1 to increase from our original estimate of US$5.7 billion to be in the range of US$7.0 billion to US$7.4 billion including contingencies, and first production to revert back to the original schedule of mid-CY2027.

We expect to update the market on JS1’s timing and optimised capital expenditure estimate in the second half of FY2026.

We have decided to extend the execution of JS2 by two years, shifting first production from FY2029 to FY2031, as part of our regular review of capex sequencing under the Capital Allocation Framework.

JS2’s capital expenditure remains under review and we expect to update the market on JS2’s optimised capital expenditure estimate in the second half of FY2026.

Jansen is a world-class asset and is expected to have operating costs at the low end of the cost curve when fully ramped up.

9

>For more information refer to OFR 6.4

Footnotes

| 1. | Represents our current aspiration for BHP group attributable copper production, and not intended to be a projection, forecast or production target and investors should not rely on this aspirational statement when making any investment decisions. The statement is aspirational as it is contingent on potential increases in production rates, as well as potential from non-operated joint ventures and exploration programs (which are uncertain and may not be realised). The pathway is subject to the completion of technical studies to support Mineral Resource and Mineral Reserves estimates, capital allocation, regulatory approvals, market capacity and, in certain cases, the development of exploration assets, in which factors are uncertain. |

| 2. | BHP internal analysis based on WAIO C1 reported unit costs compared to publicly available unit costs reported by major competitors (including Fortescue, Rio Tinto and Vale), adjusted based on publicly available financial information. |

| 3. | For CY2024, the GHG emissions intensity of our production of our commodities is estimated to rank in the first quartile for our iron ore and sitting across first and second quartiles for copper and steelmaking coal mines of global mining operations analysed by CRU. This analysis is based on CY2024 data from CRU (as CRU data is prepared on a calendar year basis) and includes CRU’s assumptions and estimates of BHP’s operations. For more information on how the GHG emission intensity for our iron ore, and copper and steelmaking coal mines has been calculated and compared refer to the BHP ESG Standards and Databook 2025 available at bhp.com/ESGSD2025. |

2.2 Where we operate

10

3. Our key differentiators

BHP is in the right commodities. We hold great resources. We operate them excellently. And we apply discipline in how we allocate capital. The combination of these factors underpins enduring value creation. They also enable our resilience through the mining cycle.

There are many factors that contribute to our business stability, each of which is vital. It’s the unique combination of these factors that sets BHP apart.

Our people

We have more than 90,000 employees and contractors globally.1 We strive to offer an engaging and supportive workplace, which empowers our people to find safer and more productive ways of working. To do this, we provide tools and opportunities in our working environment to allow our people to perform at their best. Our people are empowered daily in their work by the BHP Operating System (BOS).

Safety

BHP Operating System

BOS is our unique overarching management system that enables the right culture, routines, behaviours and leadership to deliver operating excellence and leading safety performance. It provides us with a competitive edge.

BOS drives continuous improvement through the application of BOS tools and practices. It helps strengthen our culture and enables us to set ambitious targets where our people can learn and enjoy what they are doing. It makes improvement central to everyone’s role. BOS helps us focus on leadership development, capability and engagement, and creates better-planned, more stable work processes.

Social value

We are committed to social value and the responsible provision of commodities the world needs to develop, decarbonise and digitise. Social value creates business value.

11

In FY2025, we continued to refine our approach to social value. We have a 2030 social value scorecard to monitor our progress. Each year since first publishing the social value scorecard in June 2022, we have reported performance against key metrics and the milestones for that year and set out new short-term milestones for the next year, to demonstrate the pathway to FY2030.

>For more information on our 2030 social value scorecard refer to OFR 9.4

Financial excellence

We use our Capital Allocation Framework (CAF) to assess the most effective and efficient way to deploy capital. Since we last revised our net debt target range in FY2022, our underlying portfolio fundamentals have improved, with materially higher copper production, improved operational stability, an industry-leading cost position at WAIO and lower unit costs at our operated copper assets leading to improved debt service capacity.

Our balance sheet remains strong, and we are putting it to work to assist in funding our suite of attractive organic growth projects while we continue to deliver attractive shareholder returns. As a result, we have increased our net debt target range to between US$10 billion and US$20 billion (from between US$ 5 billion and US$15 billion).

Our Capital Allocation Framework

Exceptional performance

Operating excellence

Enabled by BOS, operational excellence underpins strong returns and investment growth. FY2025 was a standout year for BHP, marked by record production, continued sector-leading margins and disciplined capital allocation.

We are the world’s lowest-cost major iron ore producer and have been for six years, and we have the best track record of delivering production against guidance amongst our competitors.

Operating and financial strength

The strength of our portfolio, our operating excellence and financial rigour from our disciplined application of the CAF enable us to deliver strong and consistent returns. We achieved net operating cash flow of US$18.7 billion in FY2025. Our net operating cash flow has been more than US$15 billion for all but one of the past 16 years. Over the past decade, our EBITDA margin has averaged 55 per cent and it is approximately 10 percentage points above our closest major competitor.

Project excellence

Project excellence is a major focus and we continue to build strong capability in this area. We have a disciplined approach to the execution of projects with focus on predictability and efficiency, as shown through our delivery of the South Flank mine and the Port Debottlenecking Project 1 at WAIO, and the Spence Growth Option in Chile.

12

Technology and innovation

In FY2025, we launched a refreshed Technology Strategy to accelerate the role of technology as a key enabler of our business. This strategy positions us to harness data, digital solutions and innovation to improve safety, enhance productivity and unlock long-term value across our global operations.

Technology supports every part of our value chain – from exploration and processing to production and logistics. We use automation, artificial intelligence (AI) and data analytics to manage risk, improve asset performance and support our decision-making. Our systems achieve critical technology service availability nearly 100 per cent of the time, supporting the safe and continuous operation of our operated assets and functions.

From a safety perspective, our strategy involves assessing new technologies, such as proximity and edge detection systems on mobile equipment and vehicles. AI is also expected to play an increasingly prominent role in our operations and business.

By improving how we use data and digital tools, we aim to shorten innovation cycles, reduce operational variability and accelerate value creation. These efforts are already delivering results in areas such as maintenance optimisation, supply chain planning and frontline safety.

Footnotes

| 1. | Based on a ‘point-in-time’ snapshot of employees as at 30 June 2025, including employees on extended absence. Contractor data is collected from internal organisation systems and averaged for a 10-month period, July 2024 to April 2025. |

| 2. | Combined employee and contractor frequency per 1 million hours worked. Excludes former OZ Brazil assets. |

13

4. Positioning for growth

With our clear strategy and focus on creating and sustaining the right portfolio of the best assets with enhanced growth optionality, BHP is well placed to capitalise on the changes shaping our world.

Our global copper growth program

Our biggest near-term growth levers are improving productivity at our existing assets and unlocking more of their potential. We have significant opportunities in our world-leading copper portfolio. These projects have potential to enable significant total annual copper production through the 2030s.

In Chile, we have a strong pipeline of organic growth options with attractive returns across our Escondida and Pampa Norte assets, which we expect will enable copper production in Chile to average ~1.4 Mtpa through the 2030s.

In South Australia, we are assessing the pathway to deliver >500 kilotonnes per annum (ktpa) of copper production (>700 ktpa CuEq), and a strategy to deliver up to 650 ktpa copper production from the 100 per cent-owned Copper South Australia. During FY2025, we have further optimised the sequence of this growth program.

Vicuña: an exciting new venture

BHP is pleased to be partnering with Canada’s Lundin Mining in the Vicuña joint venture, an exciting new copper growth opportunity for both companies in Argentina and Chile. In January 2025, BHP and Lundin Mining formed the Vicuña joint venture to hold the combined Josemaria and Filo del Sol projects located on the Argentina-Chile border.

The joint venture will create a long-term partnership between BHP and Lundin Mining to jointly develop an emerging copper district with world-class potential. The proximity of Josemaria and Filo del Sol allows for infrastructure to be shared between the deposits, with greater economies of scale and increased optionality for staged expansions, as well as the incorporation of future exploration as the development matures.

Unlocking further iron ore growth at WAIO

WAIO has been the world’s lowest-cost major iron ore producer for the last six years. WAIO was designed with an initial capacity of 240 Mtpa (100 per cent basis). In FY2025, WAIO produced a record 290 Mt (100 per cent basis) demonstrating supply chain excellence from pit to port.

We have approved the commissioning of a sixth car dumper (CD6) and related infrastructure at Port Hedland for a total investment of ~US$0.9 billion.1 CD6 will create capacity to maintain production of >305 Mtpa (100 per cent basis) from Q4 FY2028 through a period of planned major CD renewals beginning in FY2029. It will also improve our ore blending and screening capability at the port.

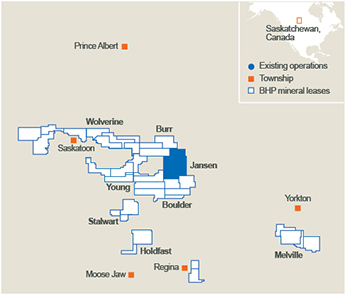

Our position in potash

Potash is a fertiliser and can enable more efficient and sustainable farming. We believe potash is going to be increasingly required for agricultural use as a growing population seeks more and better food production from constrained farmable land.

We are developing what we expect will be a best-in-class new potash mine in Canada capable of generating strong cash flow through the cycle. Jansen has the potential to deliver long-term value for shareholders, local communities and First Nations, and positions BHP to be one of the leaders in the global potash industry.

>For more information refer to OFR 6.4

Creating and accelerating longer-term options

BHP Ventures

BHP Ventures is our dedicated venture capital unit. It invests in companies developing game-changing technologies with the potential to make BHP’s global operations safer, more productive and more sustainable.

Investments in FY2025 included technologies covering ore characterisation, industrial robotics and physical artificial intelligence systems, subsurface mapping and ammonia cracking for maritime decarbonisation. Further investments were made in Boston Metal and Electra, portfolio companies supporting our electrochemical reduction pathway. Through our investments, we aim to accelerate the development of technology - such as early-stage leaching technologies - to benefit not only our business and value chain, but that of our broader industry.

14

Think & Act Differently

Think & Act Differently is BHP’s team set up to find and accelerate leading mining technology solutions to support our ambitions to deliver commodities the world needs in new ways.

In FY2025, successful pilots were conducted for Hydrofloat and Jameson cells, both flotation technologies that could help us recover more metal from the ore we process. A flame emissions probe, which is a slag temperature and characteristic monitoring tool, was developed, seeking to improve control and enhance safety in the Olympic Dam smelter. We also trialled automated drill rigs to improve efficiency.

Collaboration with vendors also led to advancements in 3D seismic and muon tomography technologies for better ore body knowledge. Through our open innovation program, we supported 40 innovators in FY2025 providing them with mentoring, funding, data and samples to help develop options for the future.

Growth through exploration, focused on copper

Exploration

In FY2025, we continued to strengthen our exploration portfolio, focusing primarily on copper opportunities. Our efforts spanned early-stage greenfield exploration, strategic alliances and the expansion of our Xplor accelerator program.

Global greenfield exploration: expanding our footprint

Our greenfield exploration is focused on the discovery of material new copper resources. We advanced greenfield exploration activities in Australia, Botswana, Canada, Chile, Norway, Peru, Serbia, Sweden and the United States.

Copper South Australia: exploration and resource drilling

In August 2024, we announced an Inferred Mineral Resource at Oak Dam. We also had promising brownfield exploration drilling results at OD Deeps, which included intercepts exceeding 1.0 per cent copper. Exploration drilling continued throughout FY2025, targeting resource expansion and further delineation of high-grade zones.

BHP Xplor

Established in FY2023, BHP Xplor continues to serve as our accelerator for early-stage critical mineral exploration. The program offers equity-free grants of up to US$500,000 and access to BHP’s expert network, enabling selected companies to rapidly test geological concepts and mature their projects. To date, Xplor has supported 21 companies, with several companies advancing to longer-term commercial arrangements – demonstrating a clear pathway from concept to partnership.

In January 2025, we announced the largest and most geographically diverse Xplor cohort to date, chosen based on the high quality of their exploration programs, strong leadership and innovative approaches to leveraging leading-edge technologies and data. The eight selected companies span seven countries – the United States, Argentina, Canada, Saudi Arabia, Serbia, Peru and Germany – and are primarily focused on copper.

Exploration expenditure

Our total metals exploration expenditure was US$396 million in FY2025, a 13 per cent decrease on FY2024. Our resource assessment exploration expenditure decreased by 25 per cent to US$250 million, while our greenfield expenditure increased by 18 per cent to US$146 million.

For more information on our exploration expenditure refer to Additional information 3 – Financial information by commodity.

Footnote

| 1. | Estimated capital expenditure is BHP equity share |

Chief Financial Officer’s review

Not required for US reporting.

15

5. Financial review

5.1 Group overview

We prepare our Consolidated Financial Statements in accordance with International Financial Reporting Standards (IFRS), as issued by the International Accounting Standards Board. We publish our Consolidated Financial Statements in US dollars. All Consolidated Income Statement, Consolidated Balance Sheet and Consolidated Cash Flow Statement information below has been derived from audited Consolidated Financial Statements.

>For more information refer to Financial Statements

We use various non-IFRS financial information to reflect our underlying financial performance. Non-IFRS financial information is not defined or specified under the requirements of IFRS, however is derived from the Group’s Consolidated Financial Statements prepared in accordance with IFRS. The non-IFRS financial information is consistent with how management reviews the financial performance of the Group with the Board and the investment community. OFR 13 ‘Non-IFRS financial information’ includes our non-IFRS financial information and OFR 13.1 ‘Definition and calculation of non-IFRS financial information’ outlines why we believe non-IFRS financial information is useful and the relevant calculation methodology. We believe non-IFRS financial information provides useful information, however it should not be considered as an indication of, or as a substitute for, statutory measures as an indicator of actual operating performance (such as profit or net operating cash flow) or any other measure of financial performance or position presented in accordance with IFRS, or as a measure of a company’s profitability, liquidity or financial position.

Summary of financial measures

| Year ended 30 June US$M |

2025 | 2024 | ||||||

| Consolidated Income Statement (Financial Statements 1.1) |

||||||||

| Revenue |

51,262 | 55,658 | ||||||

| Profit/(loss) after taxation |

11,143 | 9,601 | ||||||

| Profit/(loss) after taxation attributable to BHP shareholders |

9,019 | 7,897 | ||||||

| Dividends per ordinary share – paid during the period (US cents) |

124.0 | 152.0 | ||||||

| Dividends per ordinary share – determined in respect of the period (US cents) |

110.0 | 146.0 | ||||||

| Basic earnings/(loss) per ordinary share (US cents) |

177.8 | 155.8 | ||||||

|

|

||||||||

| Consolidated Balance Sheet (Financial Statements 1.3) |

||||||||

| Total assets |

108,790 | 102,362 | ||||||

| Net assets |

52,218 | 49,120 | ||||||

|

|

||||||||

| Consolidated Cash Flow Statement (Financial Statements 1.4) |

||||||||

| Net operating cash flows |

18,692 | 20,665 | ||||||

| Capital and exploration and evaluation expenditure |

9,794 | 9,273 | ||||||

|

|

||||||||

| Other financial information (OFR 13) |

||||||||

| Net debt |

12,924 | 9,120 | ||||||

| Underlying attributable profit |

10,157 | 13,660 | ||||||

| Underlying EBITDA |

25,978 | 29,016 | ||||||

| Underlying basic earnings per share (US cents) |

200.2 | 269.5 | ||||||

| Underlying return on capital employed (per cent) |

20.6 | 27.2 | ||||||

|

|

||||||||

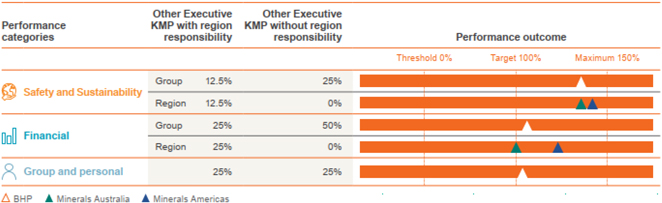

5.2 Key performance indicators

Our key performance indicators (KPIs) enable us to measure our development and financial performance. These KPIs are used to assess performance of our people throughout the Group.

>For information on our approach to performance and reward refer to Remuneration Report

>For information on our overall approach to executive remuneration, including remuneration policies and remuneration outcomes refer to Remuneration Report

16

Reconciling our financial results to our key performance indicators

| Profit | Earnings | Cash | Returns | |||||||||||||||||||||||||||||||||||||||||||

| US$M | US$M | US$M | US$M | |||||||||||||||||||||||||||||||||||||||||||

| Measure |

Profit after taxation | 11,143 | Profit after taxation | 11,143 | Net operating cash flows | 18,692 | Profit after taxation | 11,143 | ||||||||||||||||||||||||||||||||||||||

| Made up of |

Profit after taxation | Profit after taxation | |

Cash generated by the Group’s consolidated operations, after dividends received, interest, proceeds and settlements of cash management related instruments, taxation and royalty-related taxation. It excludes cash flows relating to investing and financing activities. |

|

Profit after taxation | ||||||||||||||||||||||||||||||||||||||||

| Adjusted for |

|

Exceptional items before taxation |

|

|

1,234 |

|

|

Exceptional items before taxation |

|

|

1,234 |

|

Exceptional items after taxation | 1,138 | ||||||||||||||||||||||||||||||||

|

|

Tax effect of |

|

|

(96) |

|

|

Tax effect of exceptional items |

|

|

(96 |

) |

|

Net finance costs excluding |

|

|

653 |

|

|||||||||||||||||||||||||||||

|

|

Exceptional items |

|

|

– |

|

|

Depreciation and amortisation |

|

|

5,540 |

|

|

Income tax expense on net finance |

|

|

(224) |

|

|||||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|

Exceptional items |

|

|

1,138 |

|

|

Impairments of property, |

|

198 |

|

Profit after taxation excluding net |

|

|

12,710 |

|

|||||||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

| |

Profit after taxation attributable to non-controlling interests |

|

|

(2,124 |

) |

|

Net finance costs excluding |

|

653 | |

Net assets at the beginning of the period |

|

|

49,120 |

|

|||||||||||||||||||||||||||||||

|

|

Taxation expense excluding |

|

7,306 |

|

Net debt at the beginning |

|

9,120 | |||||||||||||||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

| |

Capital employed at the beginning of the period |

|

58,240 | |||||||||||||||||||||||||||||||||||||||||||

| |

Net assets at the end of the period |

|

52,218 | |||||||||||||||||||||||||||||||||||||||||||

| |

Net debt at the end of the period |

|

12,924 | |||||||||||||||||||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

| |

Capital employed at the end of the period |

|

65,142 | |||||||||||||||||||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

| Average capital employed | 61,691 | |||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||

| To reach our KPIs |

Underlying attributable profit |

10,157 | Underlying EBITDA | 25,978 | Net operating cash flows | 18,692 | Underlying return on capital employed |

20.6% | ||||||||||||||||||||||||||||||||||||||

| Why do we use it? | |

Underlying attributable profit allows the comparability of underlying financial performance by excluding the impacts of exceptional items. |

|

|

Underlying EBITDA is used to help assess current operational profitability excluding the impacts of sunk costs (i.e. depreciation from initial investment). It is a measure that management uses internally to assess the performance of the Group’s segments and make decisions on the allocation of resources. |

|

|

Net operating cash flows provide insights into how we are managing costs and increasing productivity across BHP. |

|

|

Underlying return on capital employed is an indicator of the Group’s capital efficiency. It is provided on an underlying basis to allow comparability of underlying financial performance by excluding the impacts of exceptional items. |

|

||||||||||||||||||||||||||||||||||

17

5.3 Financial results

The following table provides more information on the revenue and expenses of the Group in FY2025.

| Year ended 30 June |

2025 US$M |

2024 US$M |

2023 US$M |

|||||||||

| Revenue1 |

51,262 | 55,658 | 53,817 | |||||||||

| Other income |

368 | 1,285 | 394 | |||||||||

| Expenses excluding net finance costs |

(32,319 | ) | (36,750 | ) | (31,873 | ) | ||||||

| Profit/(loss) from equity accounted investments, related impairments and expenses |

153 | (2,656 | ) | 594 | ||||||||

|

|

|

|

|

|

|

|||||||

| Profit from operations |

19,464 | 17,537 | 22,932 | |||||||||

|

|

|

|

|

|

|

|||||||

| Net finance costs |

(1,111 | ) | (1,489 | ) | (1,531 | ) | ||||||

| Total taxation expense |

(7,210 | ) | (6,447 | ) | (7,077 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Profit after taxation |

11,143 | 9,601 | 14,324 | |||||||||

|

|

|

|

|

|

|

|||||||

| Attributable to non-controlling interests |

2,124 | 1,704 | 1,403 | |||||||||

| Attributable to BHP shareholders |

9,019 | 7,897 | 12,921 | |||||||||

|

|

|

|

|

|

|

|||||||

| 1. | Includes the sale of third-party products. |

Profit after taxation attributable to BHP shareholders of US$9.0 billion includes an exceptional loss of US$1.1 billion (after tax) and compares to US$7.9 billion in FY2024 which included an exceptional loss of US$5.8 billion (after tax). The FY2025 exceptional loss comprises US$0.9 billion (after tax) relating to Samarco dam failure impacts and US$0.2 billion (after tax) costs associated with the transition of Western Australia Nickel (WAN) into temporary suspension. The FY2024 exceptional loss included US$3.8 billion (after tax) relating to Samarco dam failure impacts, US$2.7 billion (after tax) impairment in relation to WAN assets, partially offset by US$0.7 billion (after tax) gain on divestment of the Blackwater and Daunia mines.

>For more information on Exceptional items refer to Financial Statements note 3 ‘Exceptional items’

Revenue of US$51.3 billion decreased by US$4.4 billion, or 8 per cent from FY2024. This decrease was mainly due to lower average realised prices for iron ore and coal combined with the transition of WAN into temporary suspension in December 2024 and the divestment of Blackwater and Daunia in April 2024. The decrease was partially offset by higher average realised prices for copper combined with higher copper sales volumes.

Higher sales volumes were driven by record copper production primarily due to Escondida higher concentrator feed grade and throughput due to operational improvements, mine sequencing and productive movement and record production at Spence from improved operating performance. Although WAIO also achieved a production record, sales volumes were lower due to increased weather impacts from Tropical Cyclone Zelia and Tropical Storm Sean.

>For information on our average realised prices and production of our commodities refer to OFR 12

Other income of US$0.4 billion decreased by US$0.9 billion, or 71 per cent from FY2024 largely reflecting the exceptional US$0.9 billion (before tax) gain on divestment of Blackwater and Daunia recognised in FY2024.

Total expenses excluding net finance costs of US$32.3 billion decreased by US$4.4 billion, or 12 per cent from FY2024. This primarily reflected the prior period impact of the US$3.8 billion (before tax) impairment of WAN assets combined with lower government royalties of US$1.0 billion in the current year due to lower realised iron ore and coal prices. Raw materials and consumables costs decreased by US$0.6 billion, mainly due to the transition of WAN into temporary suspension in December 2024 and the divestment of Blackwater and Daunia in April 2024. These were partially offset by net inventory movements of US$0.7 billion across the Group and higher wages and salaries of US$0.4 billion primarily due to inflation.

Profit from equity accounted investments, related impairments and expenses of US$0.2 billion increased by US$2.8 billion from a loss of US$2.7 billion in FY2024 predominantly due to Samarco dam failure impacts in the prior period.

>For more information on the total impact of the Samarco dam failure provision and impairment charges connected with equity accounted investments refer to Financial Statements note 3 ‘Exceptional items’ and Financial Statements note 13 ‘Impairment of non-current assets’ respectively

Net finance costs of US$1.1 billion decreased by US$0.4 billion, or 25 per cent, from FY2024 primarily reflecting the impact of lower interest rates on the unwind of discounting on provisions combined with higher capitalised interest, mainly in relation to Potash projects.

>For more information on net finance costs refer to Financial Statements note 23 ‘Net finance costs’

Total taxation expense of US$7.2 billion increased by US$0.8 billion, or 12 per cent from FY2024 primarily due to the non-recurrence of a tax benefit of US$1.1 billion in relation to the impairment of WAN assets recognised in the prior period, the impact of a full year of higher Chilean mining taxes (effective 1 January 2024) and also higher tax in line with higher Chilean profits.

>For more information on income tax expense refer to Financial Statements note 6 ‘Income tax expense’ The following table and commentary describe the impact of the principal factors1 that affected Underlying EBITDA for FY2025 compared with FY2024.

18

Principal factors that affect Underlying EBITDA

| US$M | ||||

| Year ended 30 June 2024 |

29,016 | |||

| Net price impact: |

||||

| Change in sales prices |

(4,580) | Lower average realised prices for iron ore and coal, partially offset by higher average realised prices for copper. | ||

| Price-linked costs |