UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 21, 2025

Dynavax Technologies Corporation

(Exact name of Registrant as Specified in Its Charter)

| Delaware | 001-34207 | 33-0728374 | ||

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 2100 Powell Street, Suite 720 | ||

| Emeryville, California | 94608 | |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (510) 848-5100

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

Trading |

Name of each exchange |

||

| Common Stock, $0.001 par value | DVAX | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01 | Regulation FD Disclosure. |

On August 21, 2025, Dynavax Technologies Corporation (“Dynavax” or the “Company”) issued a press release announcing topline results from Part 1 of its randomized, observer-blinded, and active-controlled Phase 1/2 clinical trial of Z-1018, the Company’s novel shingles vaccine candidate, head-to-head versus Shingrix in participants aged 50 to 69 years. The Company has also updated its corporate presentation to include information regarding the Phase 1/2 clinical trial. Copies of the press release and the presentation are attached as Exhibit 99.1 and Exhibit 99.2 to this Current Report on Form 8-K, respectively.

All of the information furnished in this Current Report on Form 8-K, including the accompanying Exhibits, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained in this Current Report on Form 8-K and in the accompanying exhibits shall not be incorporated by reference into any filing with the U.S. Securities and Exchange Commission made by Dynavax, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

| Exhibit |

Description |

|

| 99.1 | Press release dated August 21, 2025 | |

| 99.2 | Corporate Presentation | |

| 104 | Cover Page Interactive Data (embedded within the Inline XBRL document). | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| Dynavax Technologies Corporation | ||||||

| Date: August 21, 2025 | By: | /s/ RYAN SPENCER |

||||

| RYAN SPENCER Chief Executive Officer |

||||||

Exhibit 99.1

|

Dynavax Announces Positive Topline Phase 1/2 Results Supporting

Potential Best-in-Class Shingles Vaccine Profile

| • | At all doses and formulations evaluated in Part 1 of the trial, Z-1018 was well-tolerated and demonstrated a favorable tolerability profile, including lower solicited local and systemic post-injection reactions, versus Shingrix |

| • | Z-1018 demonstrated robust immune responses in all dose arms, including a 100% humoral vaccine response rate at the dose selected for advancement, with comparable immunogenicity to Shingrix |

| • | Dynavax selects the optimal dose of Z-1018 for advancement to Part 2 of Phase 1/2 trial in adults 70 years of age and older, expected to initiate in 2H 2025 |

EMERYVILLE, CA – August 21, 2025 – Dynavax Technologies Corporation (Nasdaq: DVAX), a commercial-stage biopharmaceutical company developing and commercializing innovative vaccines, today announced positive topline results from Part 1 of its randomized, observer-blinded, and active-controlled Phase 1/2 clinical trial of Z-1018, the Company’s novel shingles vaccine candidate, head-to-head versus Shingrix in participants aged 50 to 69 years. Based on these results, Dynavax intends to advance Z-1018 into Part 2 of the Phase 1/2 program in adults 70 years of age and older, expected to initiate in the second half of 2025.

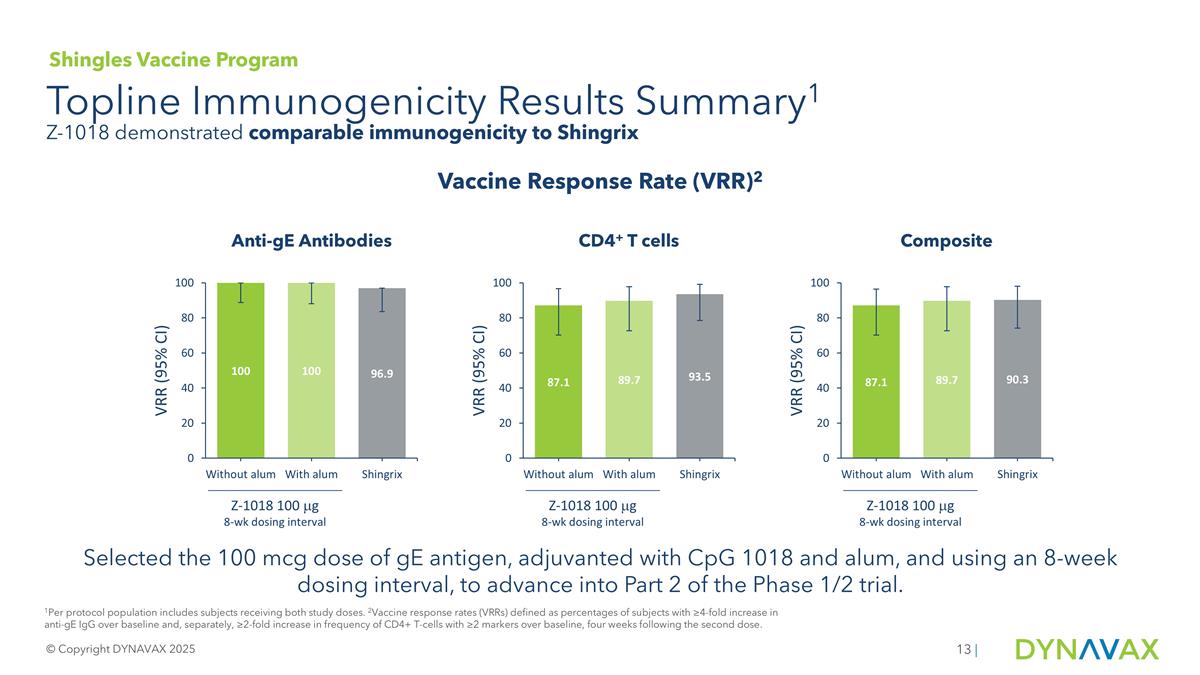

In Part 1 of the trial at one month after the second vaccine dose, Z-1018 demonstrated antibody and CD4+ T cell vaccine responses similar to those observed in the comparator arm receiving Shingrix, the currently licensed shingles vaccine, with a favorable tolerability profile. At the dose formulation and regimen chosen for advancing to Part 2 of the trial, Z-1018 achieved a 100.0% humoral vaccine response rate (antibody production) compared to Shingrix at 96.9%, and an 89.7% cellular immune vaccine response rate (CD4+ T-cell response) compared to Shingrix at 93.5%, resulting in a composite vaccine response rate of 89.7% for the Z-1018 group and 90.3% for Shingrix.

Z-1018 was also well-tolerated with a favorable safety profile in the study. Z-1018 exhibited low rates of grade 2 and 3 solicited local and systemic post-injection reactions (PIRs) in all dose, formulation, and dosing regimen arms. At the dose formulation and regimen chosen for advancement to Part 2 of the trial, 12.5% of participants receiving Z-1018 reported grade 2 or 3 local PIRs and 27.5% reported grade 2 or 3 systemic PIRs, versus 52.6% and 63.2% for Shingrix, respectively. No safety concerns have been identified in this ongoing blinded study that has oversight by a safety monitoring committee.

“These positive data mark an important inflection point for our novel shingles vaccine program as we strive to develop a product with a potential best-in-class profile with the aim to disrupt the multi-billion-dollar shingles vaccine market, which is currently dominated by one product,” said Ryan Spencer, Chief Executive Officer of Dynavax. “We met our goal for this study, as the results show immune responses comparable to Shingrix, along with a favorable tolerability profile, and provide the basis for selecting the dose and regimen to advance into further development. Based on these findings, plans are underway to initiate Part 2 of the Phase 1/2 trial in the 70 and older population, an opportunity to further de-risk this program ahead of Phase 3 development.”

Z-1018 is an investigational shingles vaccine utilizing the Dynavax-manufactured glycoprotein E (gE) antigen and is adjuvanted with CpG 1018, Dynavax’s proprietary vaccine adjuvant. Part 1 of the Phase 1/2 trial was a randomized, observer-blinded, active-controlled, dose escalation, multicenter trial to evaluate the safety, tolerability, and immunogenicity of Z-1018 compared to Shingrix in healthy adult participants aged 50 through 69 years. A key objective of Part 1 was to evaluate three different dose levels of gE antigen (50 mcg, 100 mcg, 200 mcg) with two different adjuvant formulations (one with CpG 1018 alone and one with CpG 1018 plus alum), as well as 8-week and 12-week dosing regimens. The key safety endpoint was solicited local and systemic post-injection reactions (PIRs), measured for up to seven days following each dose. The key immunogenicity endpoints included vaccine response rates (VRR) for anti-gE IgG antibodies and gE-specific CD4+ T cells, assessed four weeks after the second study injection. VRRs were defined as participants with >4-fold increase in anti-gE IgG concentration and, separately, >2-fold increase in CD4⁺ T-cell frequency over baseline. A composite VRR comprised of participants with immune responses that met both antibody and T-cell criteria.

|

“We are very encouraged by the magnitude and consistency of the immune responses observed, particularly the robust CD4+ T cell activity for Z-1018 compared to Shingrix,” said Robert Janssen, M.D., Chief Medical Officer of Dynavax. “Shingles is a painful disease driven by cellular immune decline with age. A vaccine that provides a strong immune response alongside favorable tolerability, compared to the current standard of care, could provide an important new option for protection against this debilitating disease.”

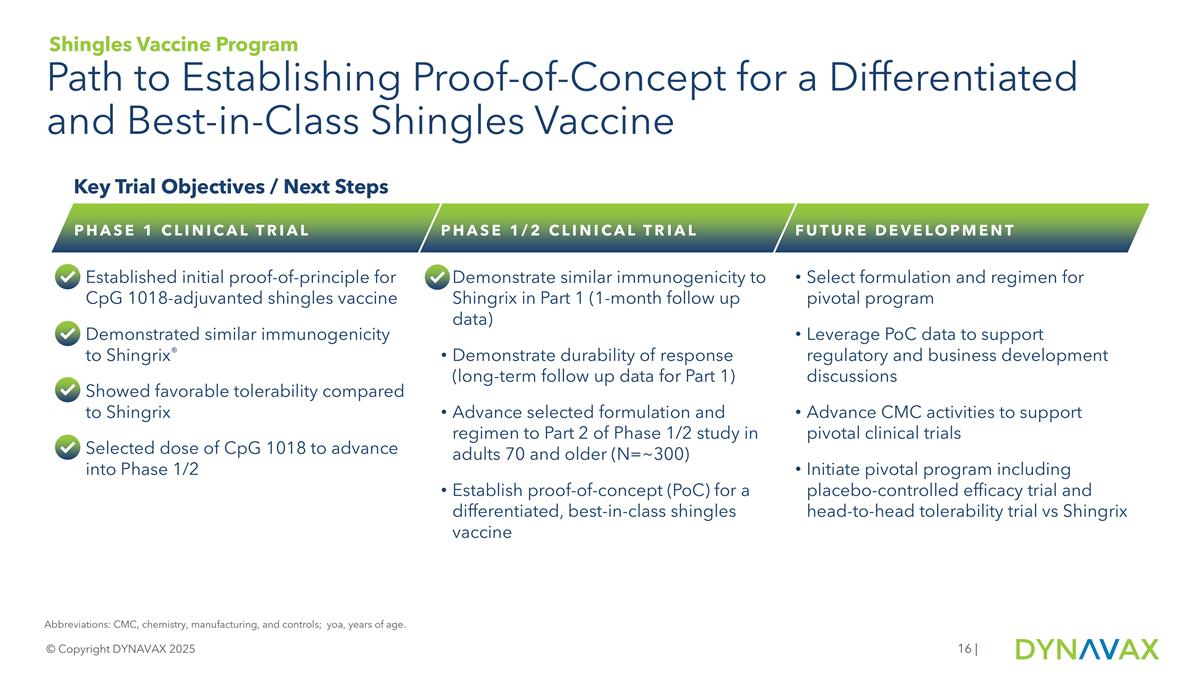

Based on these results, Dynavax has selected the 100 mcg dose of gE antigen, adjuvanted with CpG 1018 and alum, and using an 8-week dosing interval, to advance into Part 2 of the Phase 1/2 trial. This study will evaluate adults 70 years of age and older to generate clinical proof-of-concept head-to-head versus Shingrix in this key population ahead of advancement into the pivotal program.

The table below summarizes topline immunogenicity results for the Z-1018 arms with the 100 mcg gE formulation, and 8-week dosing interval, compared to Shingrix:

Topline Immunogenicity Results Summary (1-Month Following Second Vaccine Dose)1

| Outcome: |

Z-1018 100mcg 8-week dosing interval (n = 31) |

Z-1018 100mcg/alum 8-week dosing interval (n = 29) |

Shingrix (n = 32) |

|||

| Vaccine Response Rate, Anti-gE Antibodies (95% CI) |

100.0% (88.8 - 100.0) |

100.0% (88.1 - 100.0) |

96.9% (83.8 - 99.9) |

|||

| Vaccine Response Rate, CD4+ T-cells (95% CI) |

87.1% (70.2 - 96.4) |

89.7% (72.6 - 97.8) |

93.5% (78.6 - 99.2) |

|||

| Vaccine Response Rate, Composite (95% CI) |

87.1% (70.2 - 96.4) |

89.7% (72.6 - 97.8) |

90.3% (74.2 - 98.0) |

|||

| Geometric Mean Concentration of Anti-gE Antibodies, IU/mL (95% CI) |

63.5 (51.0 - 79.1) |

73.8 (59.4 - 91.7) |

71.7 (58.7 - 87.5) |

|||

| Geometric Mean Fold Increase of Anti-gE Antibody Concentration (95% CI) |

49.6 (39.8 - 61.8) |

57.7 (46.4 - 71.6) |

56.0 (45.9 - 68.4) |

|||

| Median Frequency of Activated gE-specific CD4+ T-cells, per 106 T-cells (Q1,Q3) |

903.3 (558.4, 1359.7) |

1256.7 [709.7, 1609] |

1428.3 [891.2, 2318.5] |

| 1 | Per Protocol Population includes participants receiving both study doses |

|

Topline tolerability results for these study arms are outlined in the following table:

Topline Tolerability Results Summary2

| Rate of Participants with Grade 2 or Grade 3 Post Injection

Reactions |

Z-1018 100mcg 8-week dosing interval (n=40) |

Z-1018 100mcg/alum 8-week dosing interval (n=40) |

Shingrix (n=38) |

|||

| Local PIRs |

7 (17.5%) |

5 (12.5%) |

20 (52.6%) |

|||

| Systemic PIRs |

7 (17.5%) |

11 (27.5%) |

24 (63.2%) |

| 2 | Safety Population includes all subjects receiving at least one study dose |

About Shingles

Herpes zoster, or shingles, is caused by reactivation of the varicella-zoster virus and affects approximately 1 in 3 people in their lifetime. The disease is characterized by a painful rash and can lead to serious complications, particularly in older adults. Despite the availability of an effective vaccine, there remains a need for broader access and improved tolerability.

About Z-1018

Z-1018 is an investigational non-live, recombinant subunit vaccine in development for the prevention of shingles in adults 50 and over. It combines an antigen, glycoprotein E, with Dynavax’s proprietary adjuvant system, CpG 1018, and alum and may help overcome the natural age-related decline in responses to immunization that contributes to the challenge of protecting adults aged 50 and over from shingles.

About Dynavax

Dynavax is a commercial-stage biopharmaceutical company developing and commercializing innovative vaccines to help protect the world against infectious diseases. Dynavax has two commercial products, HEPLISAV-B® vaccine [Hepatitis B Vaccine (Recombinant), Adjuvanted], which is approved in the U.S., the European Union and the United Kingdom for the prevention of infection caused by all known subtypes of hepatitis B virus in adults 18 years of age and older, and CpG 1018® adjuvant, currently used in HEPLISAV-B and multiple adjuvanted COVID-19 vaccines. For more information about Dynavax’s marketed products and development pipeline, visit www.dynavax.com.

Forward-Looking Statements

This press release contains “forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to a number of risks and uncertainties. All statements that are not historical facts are forward-looking statements. Forward-looking statements can generally be identified by the use of words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “intend,” “will,” “may,” “plan,” “potential,” “would” and similar expressions, or the negatives thereof, or they may use future dates. Forward-looking statements made in this document include statements regarding the expected initiation of Part 2 of the Phase 1/2 trial and anticipated benefits from Part 2, the potential for Z-1018 to have a best-in-class profile and possibly disrupt the shingles vaccine market, and the possibility that a vaccine that provides a strong immune response alongside favorable tolerability, compared to the current standard of care, could provide an important new option for protection against shingles.

|

Actual results may differ materially from those set forth in this press release due to the risks and uncertainties inherent in Dynavax’s business, including, the risk risks related to the timing of initiation, completion and results of planned clinical studies, risks related to the development and pre-clinical and clinical testing of vaccines containing CpG 1018 adjuvant, as well as other risks detailed in the “Risk Factors” section of its Quarterly Report on Form 10-Q for the three months ended June 30, 2025 and periodic filings made thereafter, as well as discussions of potential risks, uncertainties and other important factors in its other filings with the U.S. Securities and Exchange Commission. These forward-looking statements are made as of the date hereof, are qualified in their entirety by this cautionary statement and Dynavax undertakes no obligation to revise or update information herein to reflect events or circumstances in the future, even if new information becomes available. Information on Dynavax’s website at www.dynavax.com is not incorporated by reference in its current periodic reports with the SEC.

For Investors/Media:

Paul Cox

pcox@dynavax.com

510-665-0499

Nicole Arndt

narndt@dynavax.com

510-665-7264

Corporate Presentation Using Proven, Innovative Adjuvant Technology to Help Protect the World Against Infectious Diseases August 2025 Nasdaq: DVAX Exhibit 99.2

Statements contained in this presentation regarding matters that are not historical facts are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including statements about Dynavax's financial results and market share as of and for the quarter ended June 30, 2025, expectations regarding expected financial results and full year guidance, future growth, growth rates and market shares, expectations for vaccine markets, the company's strategic priorities, and expectations regarding the timing of IND filings, initiation and completion of clinical studies, including expected initiation of Part 2 of the Phase 1/2 shingles trial and anticipated benefits from Part 2, potential of its clinical and pre-clinical pipeline, including the potential for Z-1018 to have a best-in-class profile and possibly disrupt the shingles vaccine market, expected timing for data readouts, and interaction with regulators. These forward-looking statements are based upon management’s current expectations, are subject to known and unknown risks and uncertainties, and involve assumptions that may never materialize or may prove to be incorrect. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of various risks and uncertainties, including, without limitation; risks related to Dynavax’s ability to successfully commercialize and supply HEPLISAV-B and grow market share, which among other things will require Dynavax to successfully negotiate and enter into contracts with wholesalers, distributors, group purchasing organizations, and other parties, and maintain those contractual relationships, maintain and build its commercial infrastructure, and access prescribers and other key health care providers to discuss HEPLISAV-B; risks related to market adoption and competing products; risks related to whether payors will cover and provide timely and adequate reimbursement for HEPLISAV-B; risks related to the completion, timing of initiation, completion and results of our clinical studies; the risk that we may not adequately obtain or be able to enforce proprietary rights relating to our CpG 1018 adjuvant; and risks associated with the development, pre-clinical and clinical testing, and commercialization of vaccines containing CpG 1018 adjuvant, including vaccines for COVID-19, shingles, plague, pandemic influenza and Lyme disease. These and other risks and uncertainties are described in Dynavax’s Quarterly Report on Form 10-Q for the year ended June 30, 2025, or any subsequent periodic filing made by us, under the heading “Risk Factors”. Dynavax undertakes no obligation to revise or update information herein to reflect events or circumstances in the future, even if new information becomes available. Forward-Looking Statements © Copyright DYNAVAX 2025 |

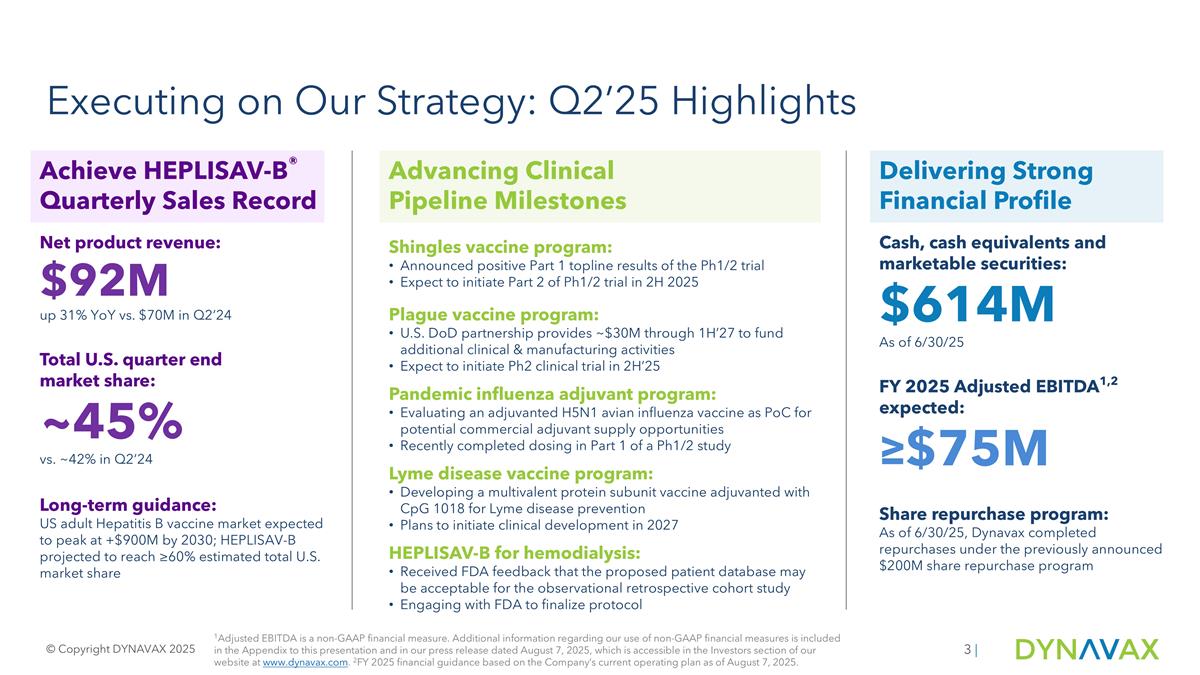

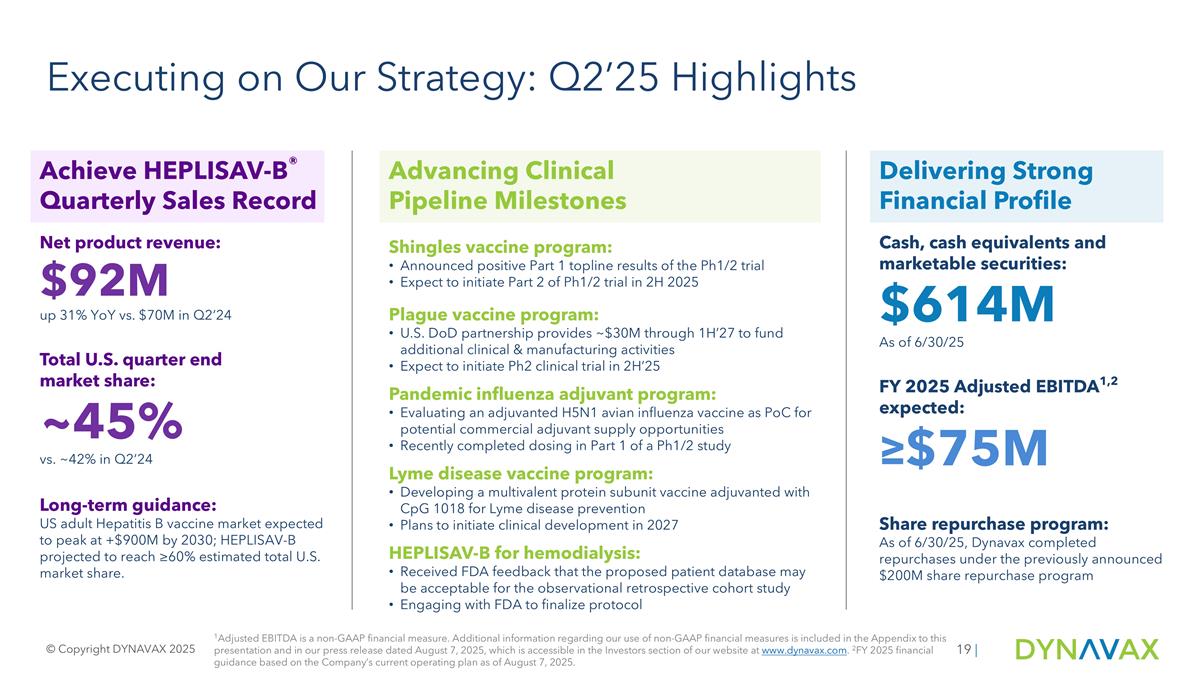

Executing on Our Strategy: Q2’25 Highlights Achieve HEPLISAV-B® Quarterly Sales Record Net product revenue: $92M up 31% YoY vs. $70M in Q2’24 Total U.S. quarter end market share: ~45% vs. ~42% in Q2’24 Long-term guidance: US adult Hepatitis B vaccine market expected to peak at +$900M by 2030; HEPLISAV-B projected to reach ≥60% estimated total U.S. market share Advancing Clinical Pipeline Milestones Shingles vaccine program: Announced positive Part 1 topline results of the Ph1/2 trial Expect to initiate Part 2 of Ph1/2 trial in 2H 2025 Plague vaccine program: U.S. DoD partnership provides ~$30M through 1H’27 to fund additional clinical & manufacturing activities Expect to initiate Ph2 clinical trial in 2H’25 Pandemic influenza adjuvant program: Evaluating an adjuvanted H5N1 avian influenza vaccine as PoC for potential commercial adjuvant supply opportunities Recently completed dosing in Part 1 of a Ph1/2 study Lyme disease vaccine program: Developing a multivalent protein subunit vaccine adjuvanted with CpG 1018 for Lyme disease prevention Plans to initiate clinical development in 2027 HEPLISAV-B for hemodialysis: Received FDA feedback that the proposed patient database may be acceptable for the observational retrospective cohort study Engaging with FDA to finalize protocol Delivering Strong Financial Profile Cash, cash equivalents and marketable securities: $614M As of 6/30/25 FY 2025 Adjusted EBITDA1,2 expected: ≥$75M Share repurchase program: As of 6/30/25, Dynavax completed repurchases under the previously announced $200M share repurchase program © Copyright DYNAVAX 2025 | 1Adjusted EBITDA is a non-GAAP financial measure. Additional information regarding our use of non-GAAP financial measures is included in the Appendix to this presentation and in our press release dated August 7, 2025, which is accessible in the Investors section of our website at www.dynavax.com. 2FY 2025 financial guidance based on the Company’s current operating plan as of August 7, 2025.

Maximizing HEPLISAV-B’s Commercial Potential Achieve at least 60% total market share by 2030 Maximize total addressable market focused on top retailers and IDNs based on the ACIP Universal Recommendation Leverage foundational commercial asset to support company growth and pipeline development Advancing Diversified Vaccine Pipeline With CpG 1018® Adjuvant Deliver on our innovative and diversified pipeline leveraging CpG 1018 adjuvant with proven antigens Build adult vaccine portfolio of best-in-class products Advance innovative pre-clinical and discovery efforts leveraging collaborations Continue Balanced Allocation of Capital to Accelerate Growth Deliver long-term value through internal and external innovation Evaluate external opportunities with high synergy assets in vaccines, or other modalities in infectious diseases, to further leverage our expertise and capabilities OUR CORE STRATEGIC PRIORITIES © Copyright DYNAVAX 2025 |

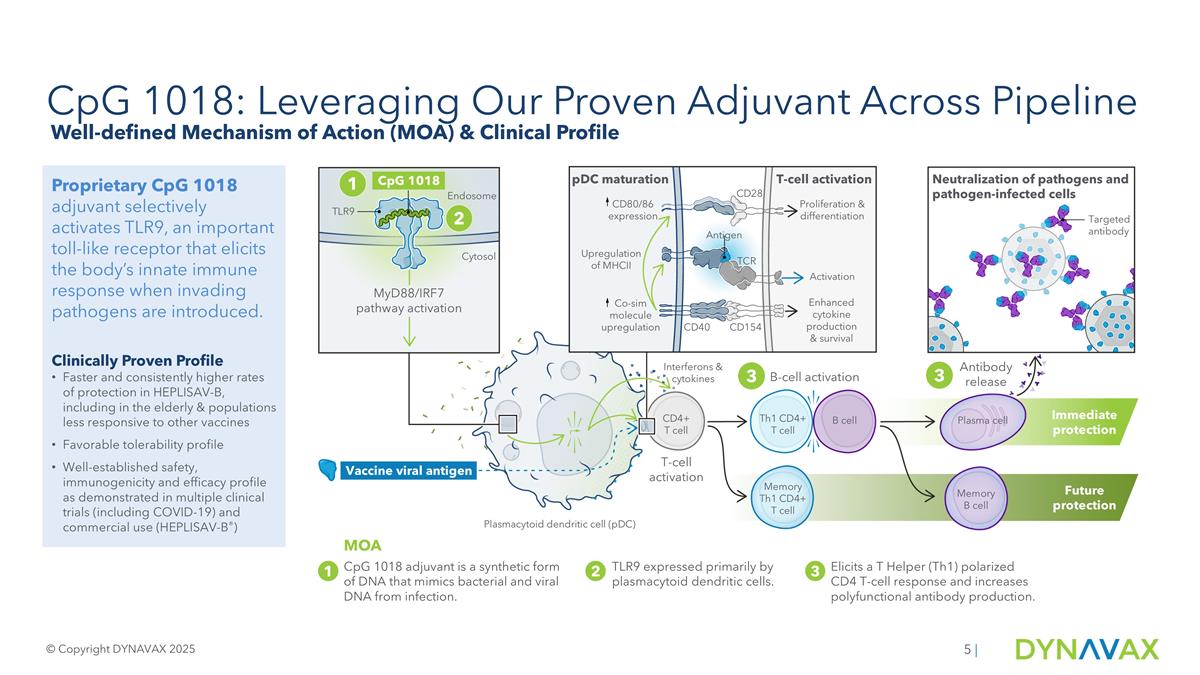

CpG 1018: Leveraging Our Proven Adjuvant Across Pipeline Proprietary CpG 1018 adjuvant selectively activates TLR9, an important toll-like receptor that elicits the body’s innate immune response when invading pathogens are introduced. Clinically Proven Profile Faster and consistently higher rates of protection in HEPLISAV-B, including in the elderly & populations less responsive to other vaccines Favorable tolerability profile Well-established safety, immunogenicity and efficacy profile as demonstrated in multiple clinical trials (including COVID-19) and commercial use (HEPLISAV-B®) © Copyright DYNAVAX 2025 | CpG 1018 adjuvant is a synthetic form of DNA that mimics bacterial and viral DNA from infection. MOA 1 2 3 TLR9 expressed primarily by plasmacytoid dendritic cells. Elicits a T Helper (Th1) polarized CD4 T-cell response and increases polyfunctional antibody production. TLR9 Endosome Cytosol Plasmacytoid dendritic cell (pDC) MyD88/IRF7 pathway activation CpG 1018 Vaccine viral antigen pDC maturation T-cell activation Upregulation of MHCII CD28 TCR Antigen CD40 CD154 Proliferation & differentiation Activation Enhanced cytokine production & survival T-cell activation B-cell activation Antibody release Interferons & cytokines CD4+ T cell Th1 CD4+ T cell Memory Th1 CD4+ T cell B cell Plasma cell Memory B cell Neutralization of pathogens and pathogen-infected cells Targeted antibody Immediate protection Future protection CD80/86 expression Co-sim molecule upregulation 1 2 3 3 Well-defined Mechanism of Action (MOA) & Clinical Profile

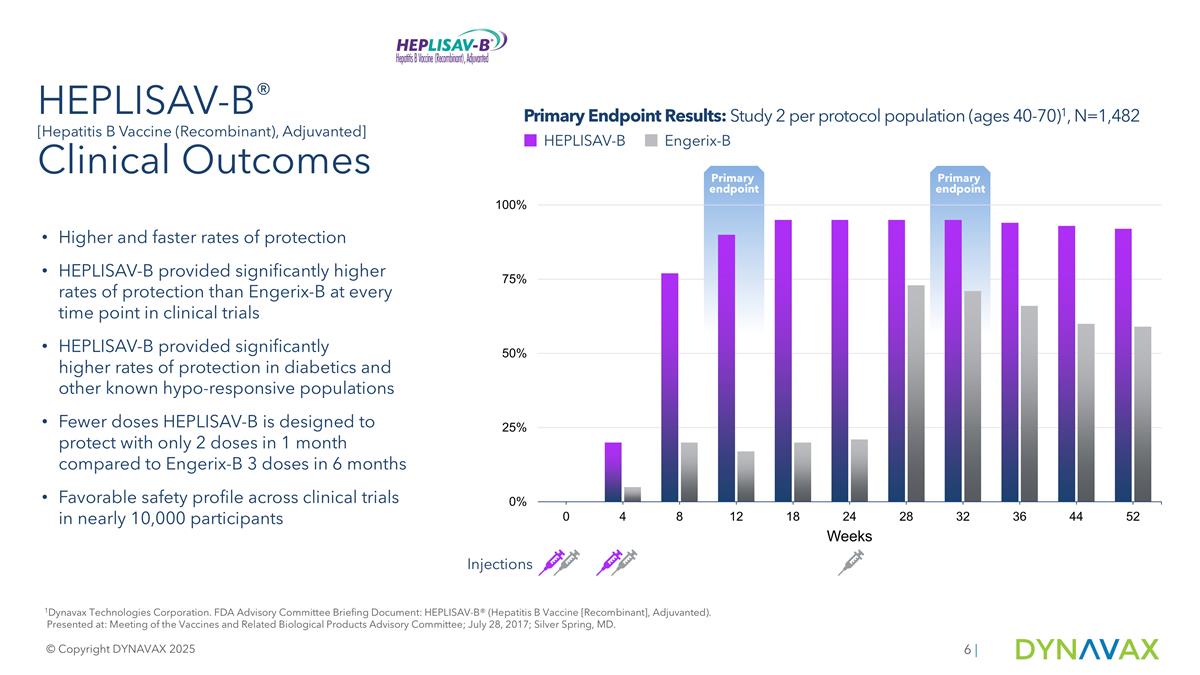

Primary endpoint Primary endpoint HEPLISAV-B® [Hepatitis B Vaccine (Recombinant), Adjuvanted] Clinical Outcomes Higher and faster rates of protection HEPLISAV-B provided significantly higher rates of protection than Engerix-B at every time point in clinical trials HEPLISAV-B provided significantly higher rates of protection in diabetics and other known hypo-responsive populations Fewer doses HEPLISAV-B is designed to protect with only 2 doses in 1 month compared to Engerix-B 3 doses in 6 months Favorable safety profile across clinical trials in nearly 10,000 participants Primary Endpoint Results: Study 2 per protocol population (ages 40-70)1, N=1,482 HEPLISAV-B 1Dynavax Technologies Corporation. FDA Advisory Committee Briefing Document: HEPLISAV-B® (Hepatitis B Vaccine [Recombinant], Adjuvanted). Presented at: Meeting of the Vaccines and Related Biological Products Advisory Committee; July 28, 2017; Silver Spring, MD. Injections Engerix-B © Copyright DYNAVAX 2025 |

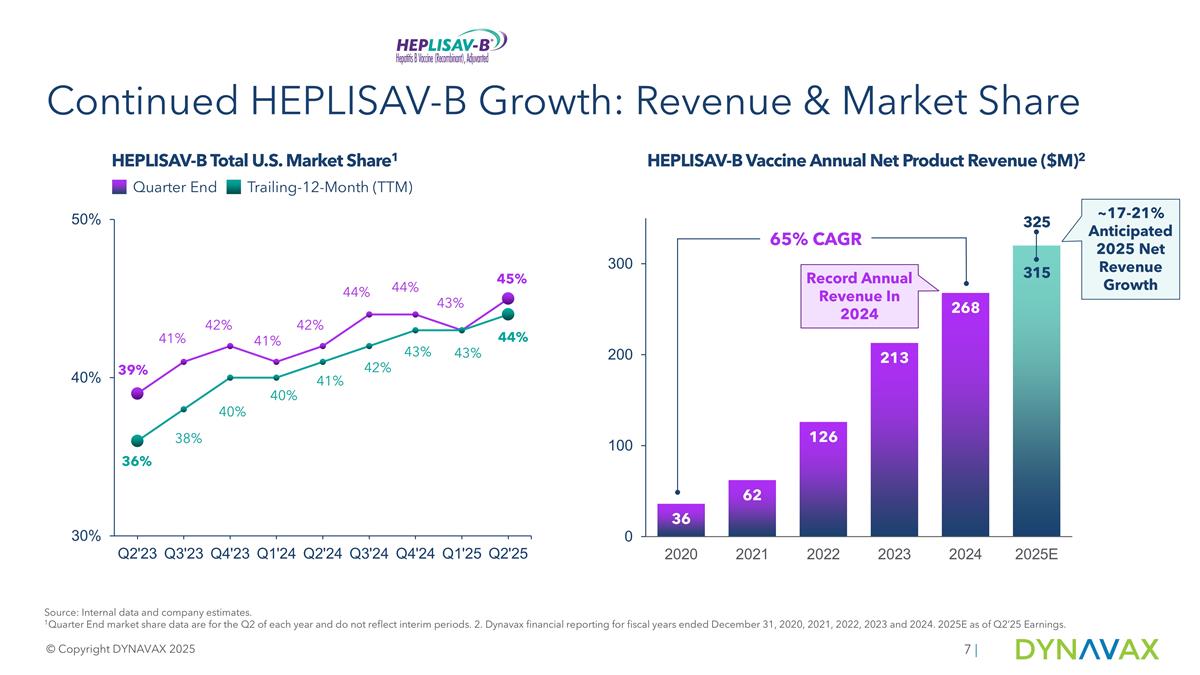

Continued HEPLISAV-B Growth: Revenue & Market Share HEPLISAV-B Vaccine Annual Net Product Revenue ($M)2 Record Annual Revenue In 2024 Source: Internal data and company estimates. 1Quarter End market share data are for the Q2 of each year and do not reflect interim periods. 2. Dynavax financial reporting for fiscal years ended December 31, 2020, 2021, 2022, 2023 and 2024. 2025E as of Q2’25 Earnings. © Copyright DYNAVAX 2025 | 65% CAGR 325 315 ~17-21% Anticipated 2025 Net Revenue Growth HEPLISAV-B Total U.S. Market Share1 Quarter End Trailing-12-Month (TTM)

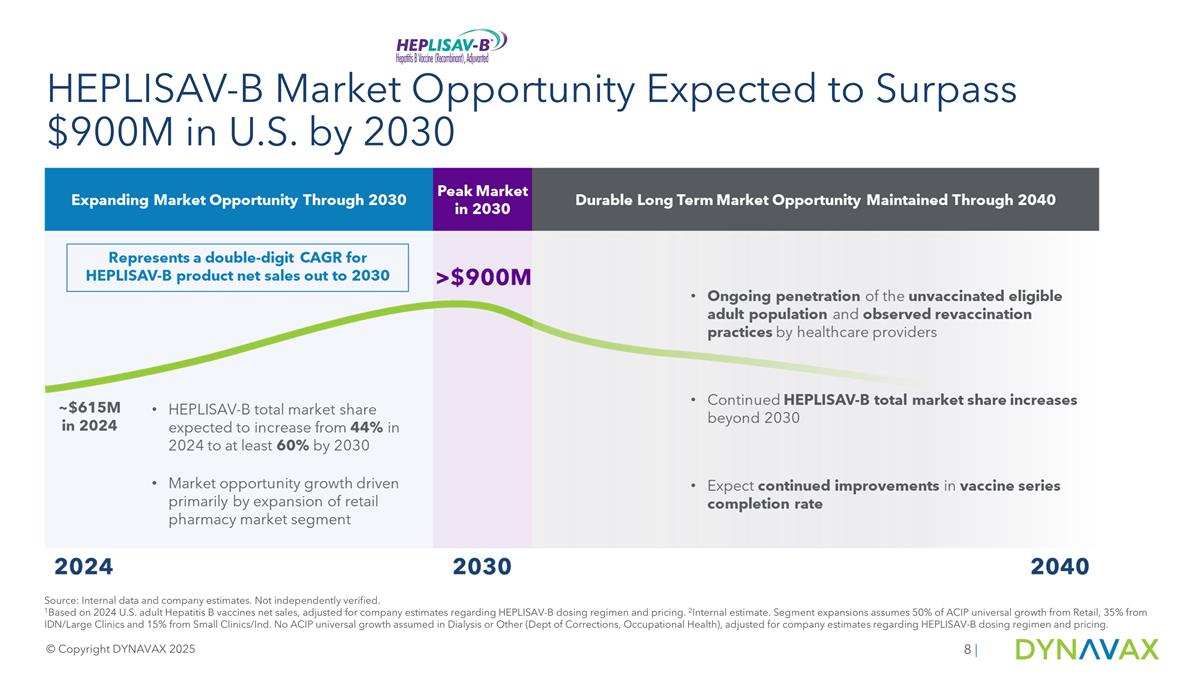

Source: Internal data and company estimates. Not independently verified. 1Based on 2024 U.S. adult Hepatitis B vaccines net sales, adjusted for company estimates regarding HEPLISAV-B dosing regimen and pricing. 2Internal estimate. Segment expansions assumes 50% of ACIP universal growth from Retail, 35% from IDN/Large Clinics and 15% from Small Clinics/Ind. No ACIP universal growth assumed in Dialysis or Other (Dept of Corrections, Occupational Health), adjusted for company estimates regarding HEPLISAV-B dosing regimen and pricing. HEPLISAV-B Market Opportunity Expected to Surpass $900M in U.S. by 2030 © Copyright DYNAVAX 2025 |

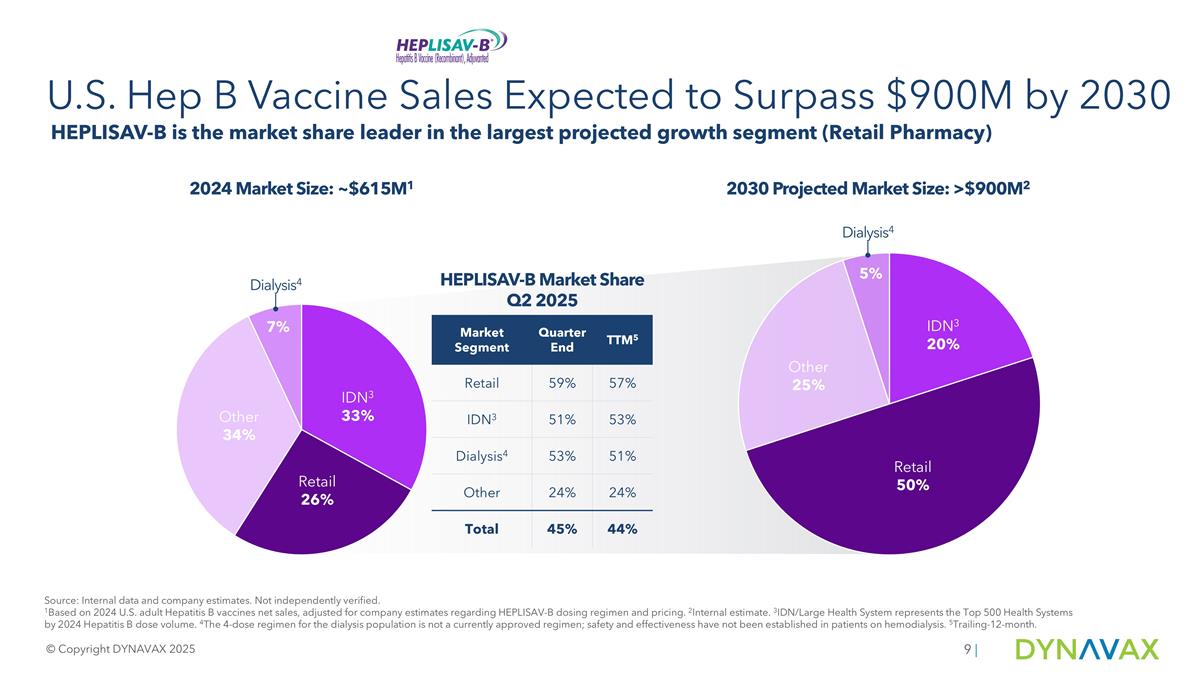

U.S. Hep B Vaccine Sales Expected to Surpass $900M by 2030 HEPLISAV-B is the market share leader in the largest projected growth segment (Retail Pharmacy) © Copyright DYNAVAX 2025 2030 Projected Market Size: >$900M2 2024 Market Size: ~$615M1 Dialysis4 Dialysis4 | HEPLISAV-B Market Share Q2 2025 Market Segment Quarter End TTM5 Retail 59% 57% IDN3 51% 53% Dialysis4 53% 51% Other 24% 24% Total 45% 44% Source: Internal data and company estimates. Not independently verified. 1Based on 2024 U.S. adult Hepatitis B vaccines net sales, adjusted for company estimates regarding HEPLISAV-B dosing regimen and pricing. 2Internal estimate. 3IDN/Large Health System represents the Top 500 Health Systems by 2024 Hepatitis B dose volume. 4The 4-dose regimen for the dialysis population is not a currently approved regimen; safety and effectiveness have not been established in patients on hemodialysis. 5Trailing-12-month.

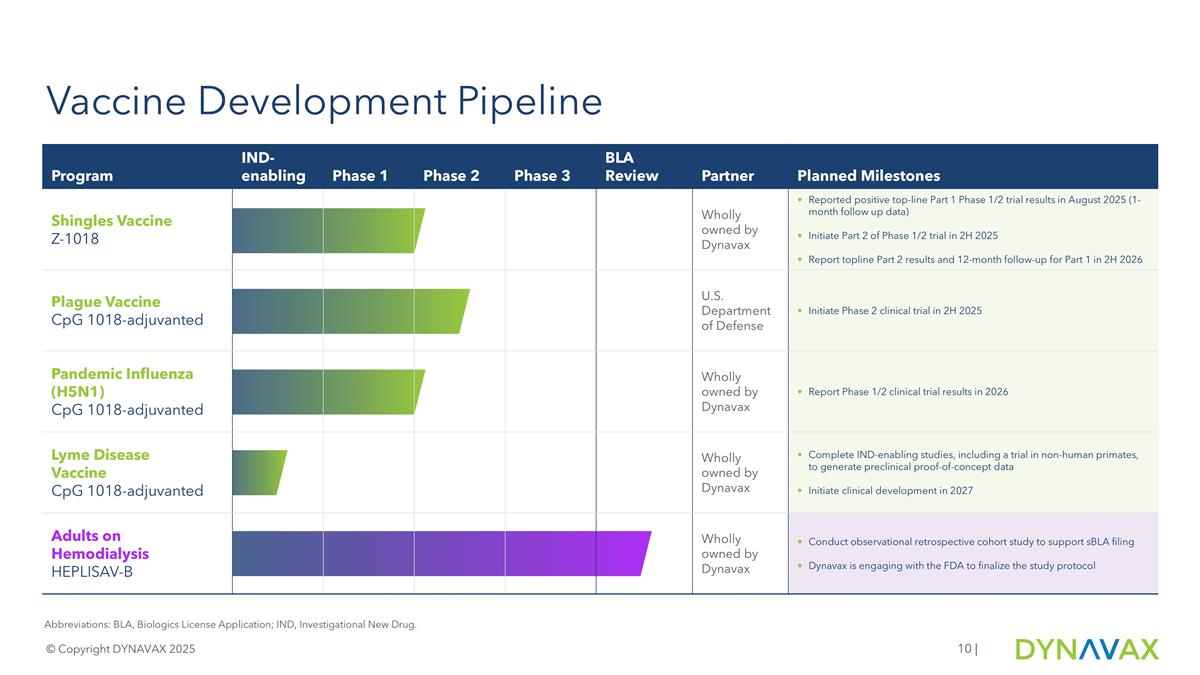

Vaccine Development Pipeline © Copyright DYNAVAX 2025 | Abbreviations: BLA, Biologics License Application; IND, Investigational New Drug. Program IND-enabling Phase 1 Phase 2 Phase 3 BLA Review Partner Planned Milestones Shingles Vaccine Z-1018 Wholly owned by Dynavax Reported positive top-line Part 1 Phase 1/2 trial results in August 2025 (1-month follow up data) Initiate Part 2 of Phase 1/2 trial in 2H 2025 Report topline Part 2 results and 12-month follow-up for Part 1 in 2H 2026 Plague Vaccine CpG 1018-adjuvanted U.S. Department of Defense Initiate Phase 2 clinical trial in 2H 2025 Pandemic Influenza (H5N1) CpG 1018-adjuvanted Wholly owned by Dynavax Report Phase 1/2 clinical trial results in 2026 Lyme Disease Vaccine CpG 1018-adjuvanted Wholly owned by Dynavax Complete IND-enabling studies, including a trial in non-human primates, to generate preclinical proof-of-concept data Initiate clinical development in 2027 Adults on Hemodialysis HEPLISAV-B Wholly owned by Dynavax Conduct observational retrospective cohort study to support sBLA filing Dynavax is engaging with the FDA to finalize the study protocol

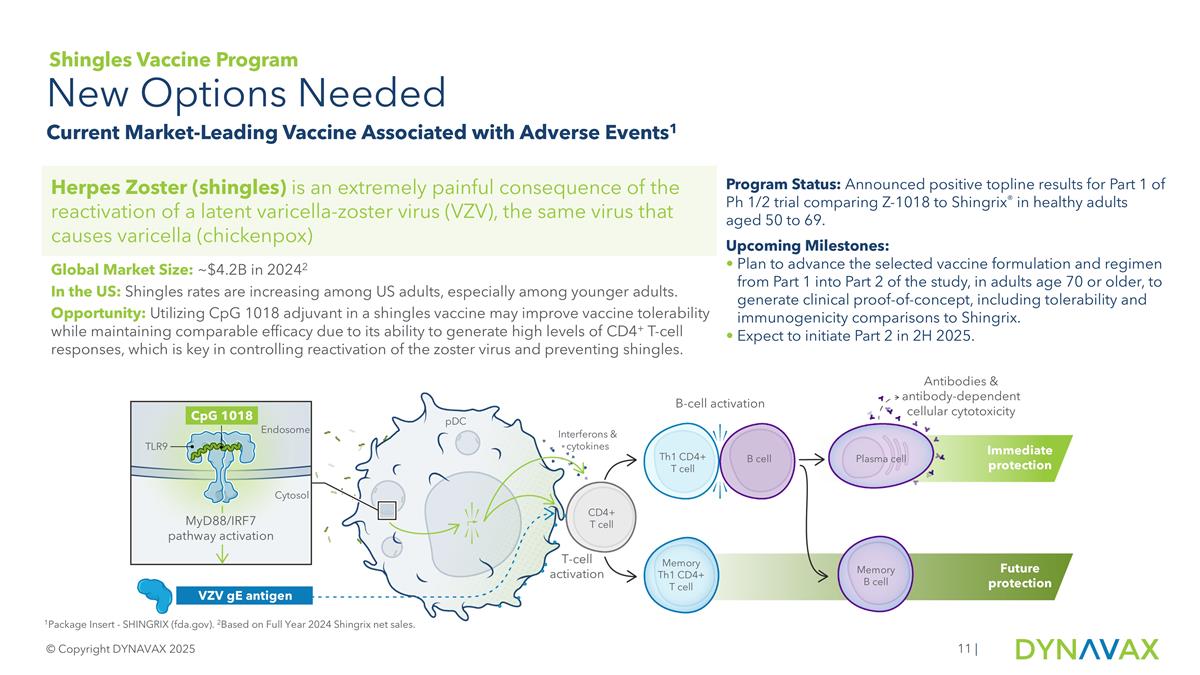

| 1Package Insert - SHINGRIX (fda.gov). 2Based on Full Year 2024 Shingrix net sales. New Options Needed Current Market-Leading Vaccine Associated with Adverse Events1 © Copyright DYNAVAX 2025 Herpes Zoster (shingles) is an extremely painful consequence of the reactivation of a latent varicella-zoster virus (VZV), the same virus that causes varicella (chickenpox) Program Status: Announced positive topline results for Part 1 of Ph 1/2 trial comparing Z-1018 to Shingrix® in healthy adults aged 50 to 69. Upcoming Milestones: Plan to advance the selected vaccine formulation and regimen from Part 1 into Part 2 of the study, in adults age 70 or older, to generate clinical proof-of-concept, including tolerability and immunogenicity comparisons to Shingrix. Expect to initiate Part 2 in 2H 2025. Global Market Size: ~$4.2B in 20242 In the US: Shingles rates are increasing among US adults, especially among younger adults. Opportunity: Utilizing CpG 1018 adjuvant in a shingles vaccine may improve vaccine tolerability while maintaining comparable efficacy due to its ability to generate high levels of CD4+ T-cell responses, which is key in controlling reactivation of the zoster virus and preventing shingles. Shingles Vaccine Program pDC T-cell activation B-cell activation Interferons & cytokines CD4+ T cell Th1 CD4+ T cell Memory Th1 CD4+ T cell B cell Plasma cell Memory B cell Immediate protection Future protection TLR9 Endosome Cytosol MyD88/IRF7 pathway activation CpG 1018 VZV gE antigen Antibodies & antibody-dependent cellular cytotoxicity

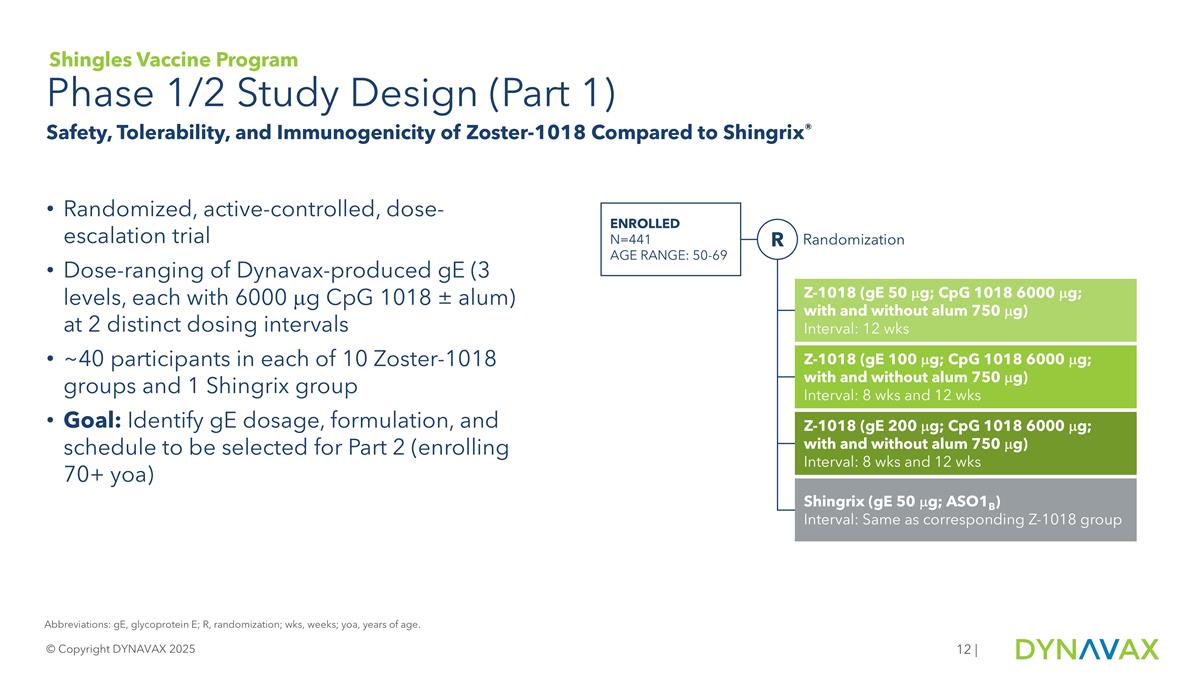

Phase 1/2 Study Design (Part 1) © Copyright DYNAVAX 2025 | Shingles Vaccine Program Safety, Tolerability, and Immunogenicity of Zoster-1018 Compared to Shingrix® Randomized, active-controlled, dose-escalation trial Dose-ranging of Dynavax-produced gE (3 levels, each with 6000 mg CpG 1018 ± alum) at 2 distinct dosing intervals ~40 participants in each of 10 Zoster-1018 groups and 1 Shingrix group Goal: Identify gE dosage, formulation, and schedule to be selected for Part 2 (enrolling 70+ yoa) Abbreviations: gE, glycoprotein E; R, randomization; wks, weeks; yoa, years of age. Enrolled N=441 Age range: 50-69 Randomization R Z-1018 (gE 50 mg; CpG 1018 6000 mg; with and without alum 750 mg) Interval: 12 wks Z-1018 (gE 100 mg; CpG 1018 6000 mg; with and without alum 750 mg) Interval: 8 wks and 12 wks Z-1018 (gE 200 mg; CpG 1018 6000 mg; with and without alum 750 mg) Interval: 8 wks and 12 wks Shingrix (gE 50 mg; ASO1B) Interval: Same as corresponding Z-1018 group

Selected the 100 mcg dose of gE antigen, adjuvanted with CpG 1018 and alum, and using an 8-week dosing interval, to advance into Part 2 of the Phase 1/2 trial. Topline Immunogenicity Results Summary1 © Copyright DYNAVAX 2025 | Vaccine Response Rate (VRR)2 Anti-gE Antibodies CD4+ T cells Composite Z-1018 100 mg 8-wk dosing interval Z-1018 100 mg 8-wk dosing interval Z-1018 100 mg 8-wk dosing interval 1Per protocol population includes subjects receiving both study doses. 2Vaccine response rates (VRRs) defined as percentages of subjects with ≥4-fold increase in anti-gE IgG over baseline and, separately, ≥2-fold increase in frequency of CD4+ T-cells with ≥2 markers over baseline, four weeks following the second dose. Shingles Vaccine Program Z-1018 demonstrated comparable immunogenicity to Shingrix

Topline Immunogenicity Results Summary1 (cont.) © Copyright DYNAVAX 2025 | Anti-gE IgG Antibodies Geometric Mean Concentration Anti-gE IgG Antibodies Geometric Mean Fold Increase Activated CD4+ T-cells Median Frequencies Z-1018 100 mg 8-wk dosing interval Without alum With alum Shingrix Z-1018 100 mg 8-wk dosing interval Without alum With alum Shingrix Z-1018 100 mg 8-wk dosing interval Without alum With alum Shingrix 1Per protocol population includes subjects receiving both study doses. Shingles Vaccine Program Z-1018 demonstrated comparable immunogenicity to Shingrix Selected the 100 mcg dose of gE antigen, adjuvanted with CpG 1018 and alum, and using an 8-week dosing interval, to advance into Part 2 of the Phase 1/2 trial.

Topline Tolerability Results Summary1 © Copyright DYNAVAX 2025 | Local PIRs, (%) Systemic PIRs, (%) Z-1018 100 mg (n=40) Z-1018 100 mg + alum (n=40) Shingrix (n=38) Z-1018 100 mg (n=40) Z-1018 100 mg + alum (n=40) Shingrix (n=38) 7 (17.5%) 5 (12.5%) 20 (52.6%) 7 (17.5%) 11 (27.5%) 24 (63.2%) Tolerability Rate of Moderate/Severe Post Injection Reactions (PIRs)2 1Safety population includes all subjects receiving at least one study dose. 2Solicited local and systemic post-injection reactions (PIRs) for up to 7 days following each dose. At all doses and formulations evaluated in Part 1 of the trial, Z-1018 was well-tolerated and demonstrated a favorable tolerability profile, including lower solicited local and systemic PIRs versus Shingrix Shingles Vaccine Program

| Path to Establishing Proof-of-Concept for a Differentiated and Best-in-Class Shingles Vaccine © Copyright DYNAVAX 2025 Key Trial Objectives / Next Steps PHASE 1 CLINICAL TRIAL Established initial proof-of-principle for CpG 1018-adjuvanted shingles vaccine Demonstrated similar immunogenicity to Shingrix® Showed favorable tolerability compared to Shingrix Selected dose of CpG 1018 to advance into Phase 1/2 PHASE 1/2 CLINICAL TRIAL Demonstrate similar immunogenicity to Shingrix in Part 1 (1-month follow up data) Demonstrate durability of response (long-term follow up data for Part 1) Advance selected formulation and regimen to Part 2 of Phase 1/2 study in adults 70 and older (N=~300) Establish proof-of-concept (PoC) for a differentiated, best-in-class shingles vaccine FUTURE DEVELOPMENT Select formulation and regimen for pivotal program Leverage PoC data to support regulatory and business development discussions Advance CMC activities to support pivotal clinical trials Initiate pivotal program including placebo-controlled efficacy trial and head-to-head tolerability trial vs Shingrix Abbreviations: CMC, chemistry, manufacturing, and controls; yoa, years of age. Shingles Vaccine Program

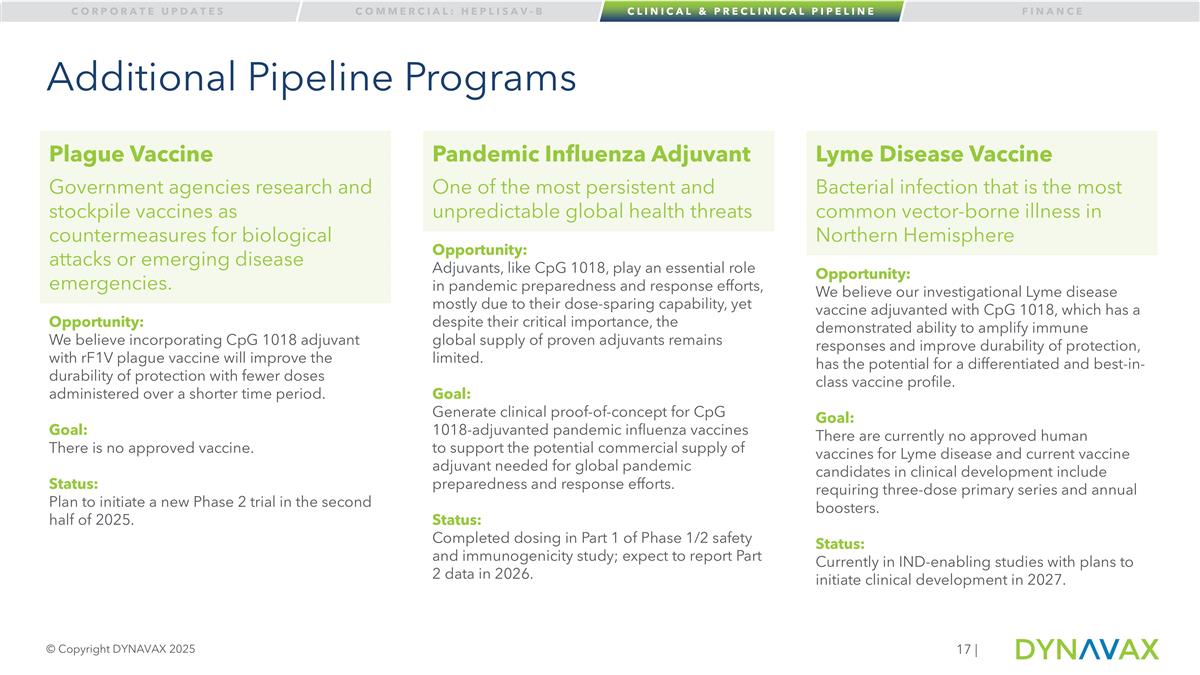

Additional Pipeline Programs © Copyright DYNAVAX 2025 | Corporate updates Clinical & Preclinical Pipeline finance Commercial: hepLisav-B Pandemic Influenza Adjuvant One of the most persistent and unpredictable global health threats Opportunity: Adjuvants, like CpG 1018, play an essential role in pandemic preparedness and response efforts, mostly due to their dose-sparing capability, yet despite their critical importance, the global supply of proven adjuvants remains limited. Goal: Generate clinical proof-of-concept for CpG 1018-adjuvanted pandemic influenza vaccines to support the potential commercial supply of adjuvant needed for global pandemic preparedness and response efforts. Status: Completed dosing in Part 1 of Phase 1/2 safety and immunogenicity study; expect to report Part 2 data in 2026. Lyme Disease Vaccine Bacterial infection that is the most common vector-borne illness in Northern Hemisphere Opportunity: We believe our investigational Lyme disease vaccine adjuvanted with CpG 1018, which has a demonstrated ability to amplify immune responses and improve durability of protection, has the potential for a differentiated and best-in-class vaccine profile. Goal: There are currently no approved human vaccines for Lyme disease and current vaccine candidates in clinical development include requiring three-dose primary series and annual boosters. Status: Currently in IND-enabling studies with plans to initiate clinical development in 2027. Plague Vaccine Government agencies research and stockpile vaccines as countermeasures for biological attacks or emerging disease emergencies. Opportunity: We believe incorporating CpG 1018 adjuvant with rF1V plague vaccine will improve the durability of protection with fewer doses administered over a shorter time period. Goal: There is no approved vaccine. Status: Plan to initiate a new Phase 2 trial in the second half of 2025.

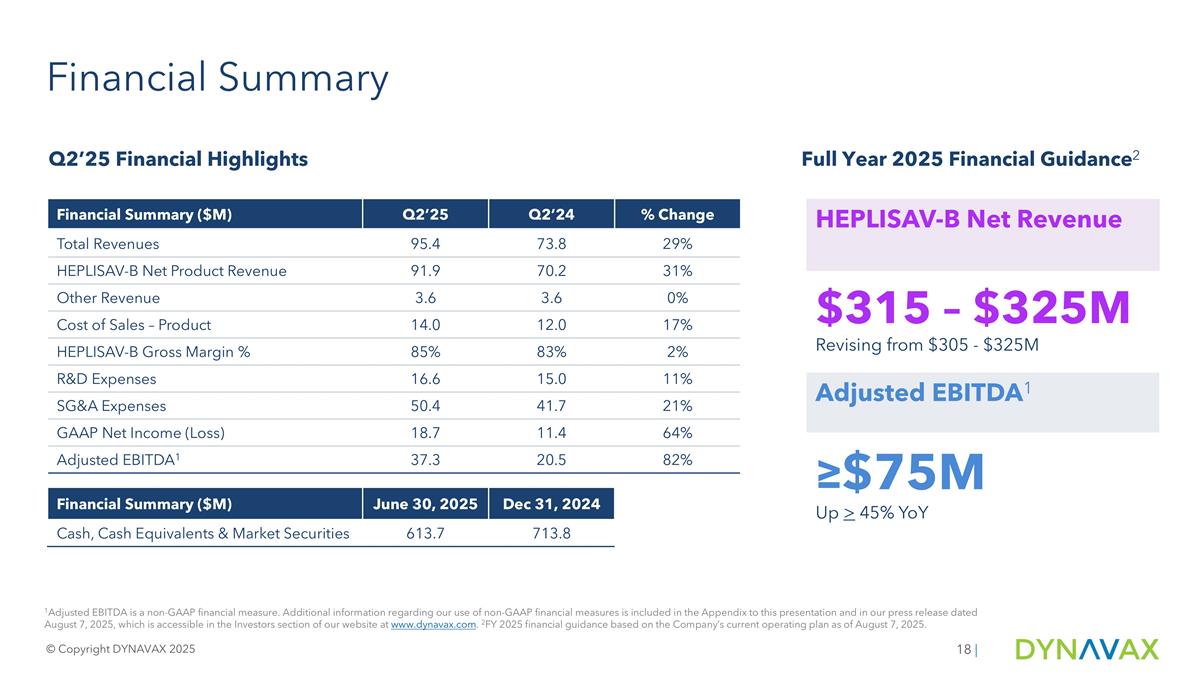

Financial Summary 1Adjusted EBITDA is a non-GAAP financial measure. Additional information regarding our use of non-GAAP financial measures is included in the Appendix to this presentation and in our press release dated August 7, 2025, which is accessible in the Investors section of our website at www.dynavax.com. 2FY 2025 financial guidance based on the Company’s current operating plan as of August 7, 2025. Financial Summary ($M) Q2’25 Q2’24 % Change Total Revenues 95.4 73.8 29% HEPLISAV-B Net Product Revenue 91.9 70.2 31% Other Revenue 3.6 3.6 0% Cost of Sales – Product 14.0 12.0 17% HEPLISAV-B Gross Margin % 85% 83% 2% R&D Expenses 16.6 15.0 11% SG&A Expenses 50.4 41.7 21% GAAP Net Income (Loss) 18.7 11.4 64% Adjusted EBITDA1 37.3 20.5 82% Financial Summary ($M) June 30, 2025 Dec 31, 2024 Cash, Cash Equivalents & Market Securities 613.7 713.8 HEPLISAV-B Net Revenue $315 – $325M Revising from $305 - $325M Adjusted EBITDA1 ≥$75M Up > 45% YoY © Copyright DYNAVAX 2025 | Q2’25 Financial Highlights Full Year 2025 Financial Guidance2

Executing on Our Strategy: Q2’25 Highlights © Copyright DYNAVAX 2025 | Achieve HEPLISAV-B® Quarterly Sales Record Net product revenue: $92M up 31% YoY vs. $70M in Q2’24 Total U.S. quarter end market share: ~45% vs. ~42% in Q2’24 Long-term guidance: US adult Hepatitis B vaccine market expected to peak at +$900M by 2030; HEPLISAV-B projected to reach ≥60% estimated total U.S. market share. Advancing Clinical Pipeline Milestones Shingles vaccine program: Announced positive Part 1 topline results of the Ph1/2 trial Expect to initiate Part 2 of Ph1/2 trial in 2H 2025 Plague vaccine program: U.S. DoD partnership provides ~$30M through 1H’27 to fund additional clinical & manufacturing activities Expect to initiate Ph2 clinical trial in 2H’25 Pandemic influenza adjuvant program: Evaluating an adjuvanted H5N1 avian influenza vaccine as PoC for potential commercial adjuvant supply opportunities Recently completed dosing in Part 1 of a Ph1/2 study Lyme disease vaccine program: Developing a multivalent protein subunit vaccine adjuvanted with CpG 1018 for Lyme disease prevention Plans to initiate clinical development in 2027 HEPLISAV-B for hemodialysis: Received FDA feedback that the proposed patient database may be acceptable for the observational retrospective cohort study Engaging with FDA to finalize protocol Delivering Strong Financial Profile Cash, cash equivalents and marketable securities: $614M As of 6/30/25 FY 2025 Adjusted EBITDA1,2 expected: ≥$75M Share repurchase program: As of 6/30/25, Dynavax completed repurchases under the previously announced $200M share repurchase program 1Adjusted EBITDA is a non-GAAP financial measure. Additional information regarding our use of non-GAAP financial measures is included in the Appendix to this presentation and in our press release dated August 7, 2025, which is accessible in the Investors section of our website at www.dynavax.com. 2FY 2025 financial guidance based on the Company’s current operating plan as of August 7, 2025.

Thank you August 2025 Nasdaq: DVAX

To supplement our financial results presented on a GAAP basis, we have included information about Adjusted EBITDA, a non-GAAP financial measure. We believe the presentation of this non-GAAP financial measure, when viewed with our results under GAAP and the accompanying reconciliation, provide analysts, investors and other third parties with insights into how we evaluate normal operational activities, including our ability to generate cash from operations, on a comparable year-over-year basis and manage our budgeting and forecasting. In our quarterly and annual reports, earnings press releases and conference calls, we may discuss Adjusted EBITDA to supplement our consolidated financial statements presented on a GAAP basis. Adjusted EBITDA Adjusted EBITDA is a non-GAAP financial measure that represents GAAP net income or loss, adjusted to exclude interest expense, interest income, the benefit from or provision for income taxes, depreciation, amortization, stock-based compensation, and other adjustments to reflect changes that occur in our business but do not represent ongoing operations, including loss on debt extinguishment and proxy contest costs. Adjusted EBITDA, as used by us, may be calculated differently from, and therefore may not be comparable to, similarly titled measures used by other companies. There are several limitations related to the use of adjusted EBITDA rather than net income or loss, which is the nearest GAAP equivalent, such as: adjusted EBITDA excludes depreciation and amortization, and, although these are non-cash expenses, the assets being depreciated or amortized may have to be replaced in the future, the cash requirements for which are not reflected in adjusted EBITDA; adjusted EBITDA does not reflect changes in, or cash requirements for, working capital needs; adjusted EBITDA does not reflect the benefit from or provision for income taxes or the cash requirements to pay taxes; adjusted EBITDA does not reflect historical cash expenditures or future requirements for capital expenditures or contractual commitments; we exclude stock-based compensation expense from adjusted EBITDA although: (i) it has been, and will continue to be for the foreseeable future, a significant recurring expense for our business and an important part of our compensation strategy; and (ii) if we did not pay out a portion of our compensation in the form of stock-based compensation, the cash salary expense included in operating expenses would be higher, which would affect our cash position; we may exclude other expenses, from time to time, that are episodic in nature and do not directly correlate to the cost of operating our business on an ongoing basis. Reconciliation of each historical non-GAAP financial measure to Adjusted EBITDA can be found in the table accompanying this presentation. The Company has not provided a reconciliation of its full-year 2025 guidance for Adjusted EBITDA to the most directly comparable forward-looking GAAP measures because the Company is unable to predict, without unreasonable efforts, the timing and amount of items that would be included in such a reconciliation, including, but not limited to, stock-based compensation expense, income tax expense or provision for income taxes. These items are uncertain and depend on various factors that are outside of the Company’s control or cannot be reasonably predicted. While the Company is unable to address the probable significance of these items, they could have a material impact on GAAP net income for the guidance period. A reconciliation of Adjusted EBITDA would imply a degree of precision and certainty as to these future items that does not exist and could be confusing to investors. | Non-GAAP Financial Measures © Copyright DYNAVAX 2025

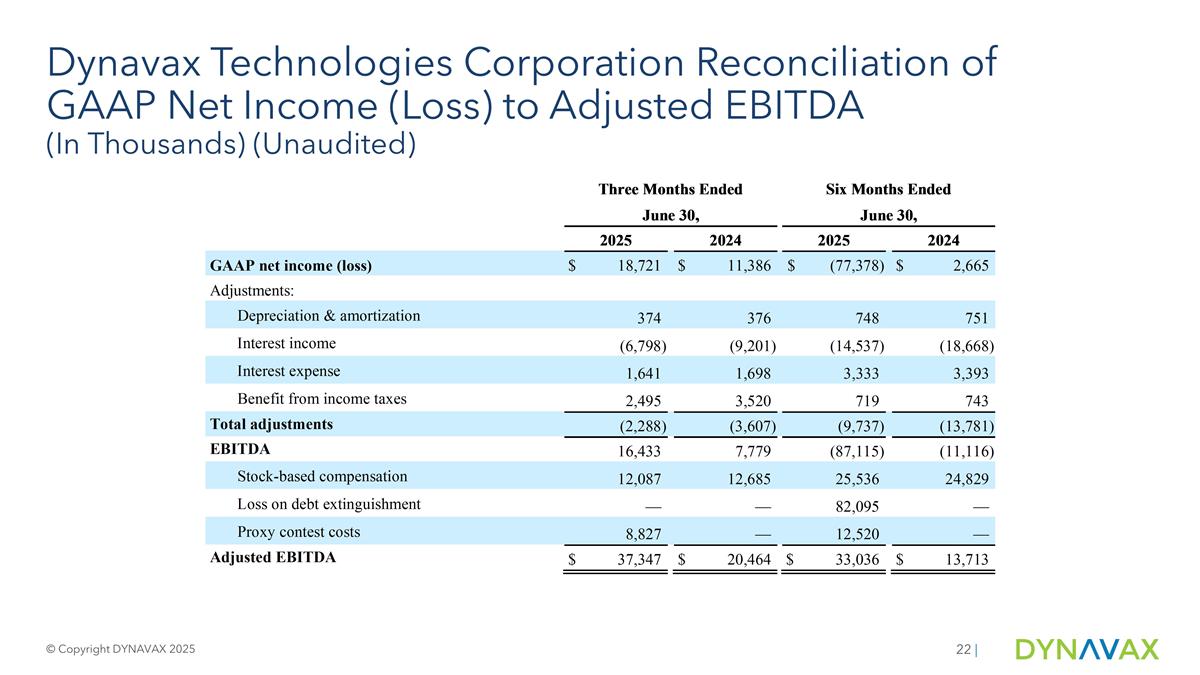

Dynavax Technologies Corporation Reconciliation of GAAP Net Income (Loss) to Adjusted EBITDA (In Thousands) (Unaudited) © Copyright DYNAVAX 2025 |